UNITED STATES

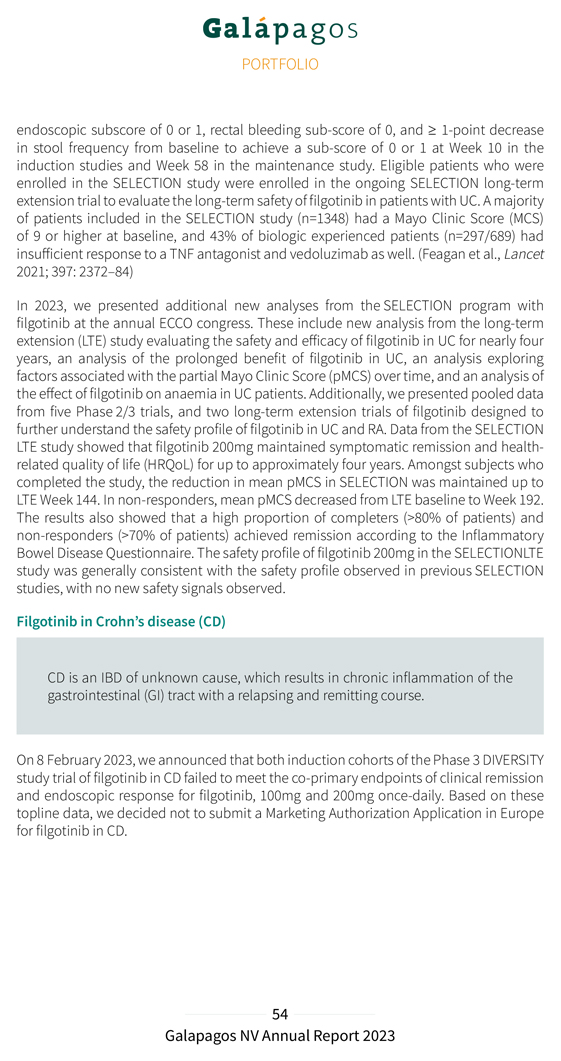

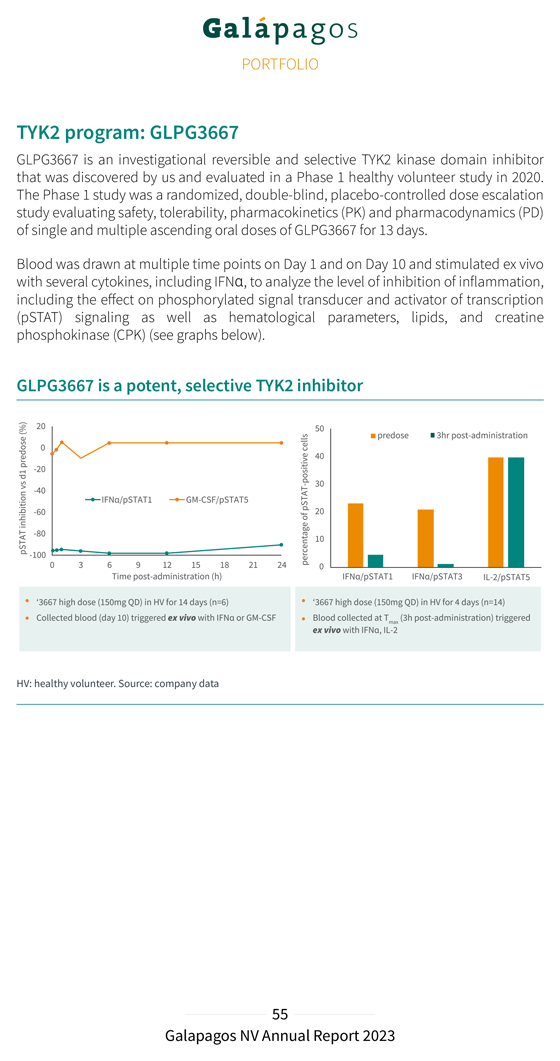

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024.

Commission File Number: 001-37384

GALAPAGOS NV

(Translation of registrant’s name into English)

Generaal De Wittelaan L11 A3

2800 Mechelen, Belgium

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

EXPLANATORY NOTE

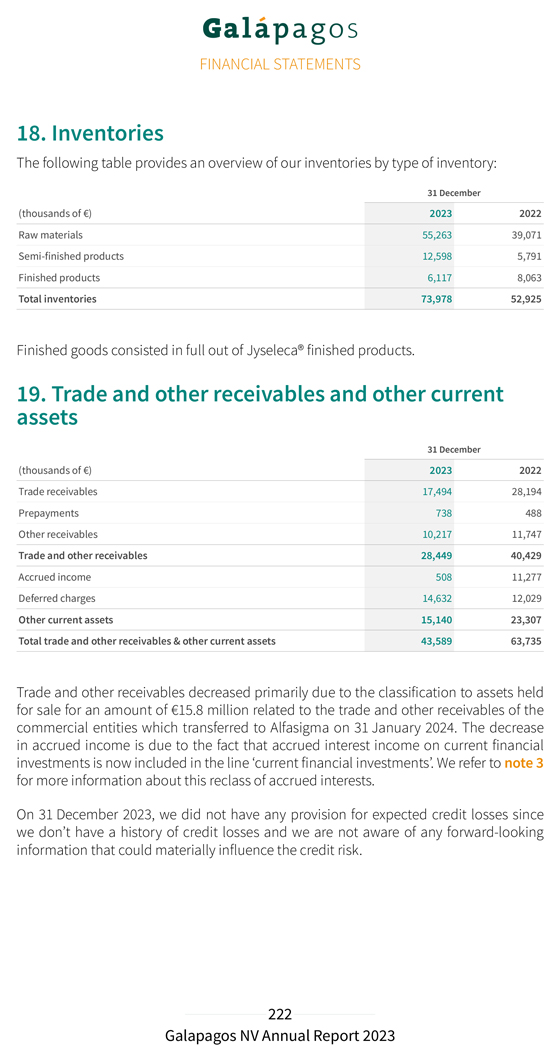

Enclosed hereto are copies of the following items in connection with Galapagos NV’s (the “Company”) annual report for the financial year 2023 and its Annual and Extraordinary Shareholders’ Meetings that will be held sequentially on Tuesday, April 30, 2024 at 2:00 p.m. (CET) and 3:00 p.m. (CET), respectively, at the registered office of Galapagos NV.

The information contained in this Form 6-K, including, Exhibits 99.2, 99.3, 99.4, 99.5, 99.6, 99.7, 99.8, 99.9, 99.10, 99.11, 99.12, 99.13, 99.14 and 99.15 is hereby incorporated by reference into the Company’s Registration Statements on Form S-8 (File Nos. 333-204567, 333-208697, 333-211834, 333-215783, 333-218160, 333-225263, 333-231765, 333-249416, 333-260500, 333-268756 and 333-275886). The information contained in Exhibit 99.1 to this Form 6-K is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

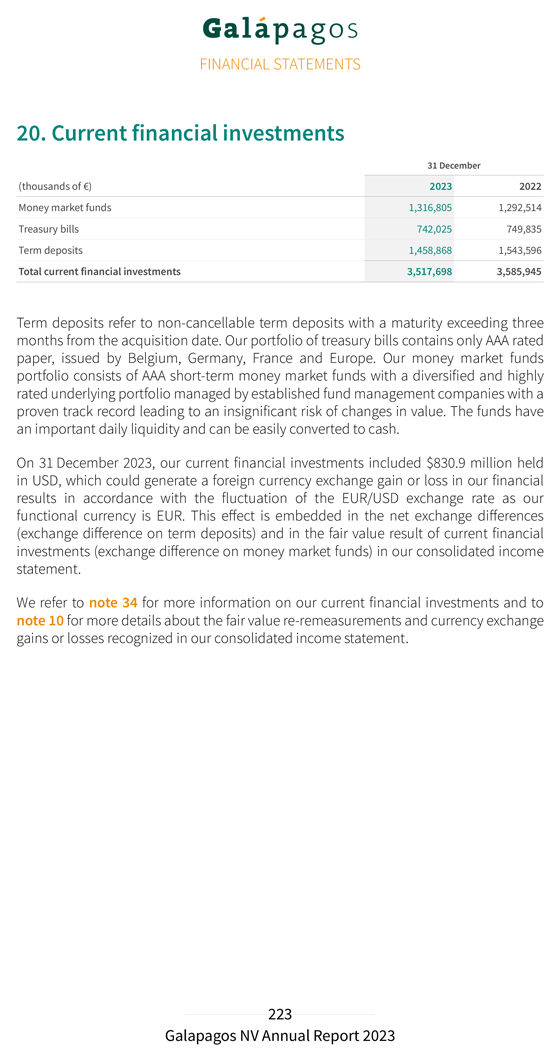

SIGNATURES

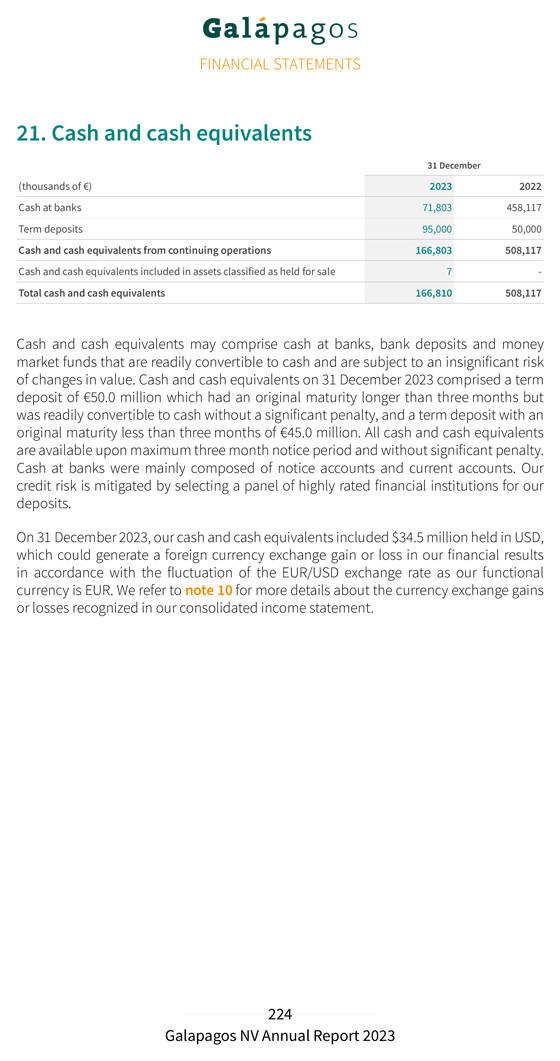

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GALAPAGOS NV |

||

| (Registrant) | ||

| Date: March 29, 2024 | /s/ Annelies Denecker |

|

| Annelies Denecker Company Secretary |

||

Exhibit 99.1

Galapagos publishes 2023 annual report and announces Annual and Extraordinary Shareholders’ Meetings

| • | Publication of annual report for financial year 2023 |

| • | Annual Shareholders’ Meeting resolutions include approval of revised Remuneration Policy and (re)appointment of Board members |

| • | Extraordinary Shareholders’ Meeting resolutions include approval of renewal of authorized capital and issuance of Gilead Subsequent Warrant B |

Mechelen, Belgium; 28 March 2024, 21.01 CET; regulated information – Galapagos NV (Euronext & NASDAQ: GLPG) today publishes its annual report for the financial year 2023 and announces its Annual and Extraordinary Shareholders’ Meetings (AGM and EGM) to be held sequentially on Tuesday, 30 April 2024 at 2:00 pm (CET) and 3:00 pm (CET), respectively, at the registered office of the Company.

The annual report for the financial year 2023, including a review of figures and performance, is available online at https://www.glpg.com/financial-reports and can also be downloaded as PDF. Our annual 2023 Form 20-F filing with the SEC is available at www.sec.gov/edgar.

Galapagos has the honor to invite its shareholders, holders of subscription rights, Board members, and statutory auditor to its Annual (ordinary) and Extraordinary Shareholders’ Meetings that will be held sequentially on Tuesday 30 April 2024 at 2:00 pm (CET) and 3:00 pm (CET), respectively, at the Company’s registered office.

The items on the agenda of the Annual and Extraordinary Shareholders’ Meetings include, amongst other items: (i) the approval of a revised Remuneration Policy, (ii) the reappointment of Dr. Elisabeth Svanberg as Non-Executive Independent Director, (iii) the appointments of Dr. Susanne Schaffert and Mr. Simon Sturge as Non-Executive Independent Directors, and Mr. Andrew Dickinson as Non-Executive Director, (iv) the approval of the issuance of a warrant for the benefit of Gilead Therapeutics A1 Unlimited Company (“Subsequent Warrant B”), and (v) the approval of the renewal of the Company’s authorized capital by up to 20% of the share capital.

In order to be admitted to the Shareholders’ Meetings to be held on 30 April 2024, the holders of securities issued by the Company must comply with article 7:134 of the Belgian Code of Companies and Associations and article 23 of the Company’s articles of association, and fulfil the formalities described in the convening notice. The convening notice and other documents pertaining to the Annual and Extraordinary Shareholders’ Meetings can be consulted on our website at www.glpg.com/shareholders-meetings.

Biographies of proposed Board members

The biographies of Dr. Elisabeth Svanberg, Dr. Susanne Schaffert, Mr. Simon Sturge and Mr. Andrew Dickinson can be found on our website.

About Galapagos

We are a biotechnology company with operations in Europe and the US dedicated to developing transformational medicines for more years of life and quality of life. Focusing on high unmet medical needs, we synergize compelling science, technology, and collaborative approaches to create a deep pipeline of best-in-class small molecules, CAR-T therapies and biologics in oncology and immunology. With capabilities from lab to patient, including a decentralized, point-of-care CAR-T manufacturing network, we are committed to challenging the status quo and delivering results for our patients, employees and shareholders. For additional information, please visit www.glpg.com or follow us on LinkedIn or X (formerly Twitter).

1

| Contact |

||

| Media inquiries: |

Investor inquiries: | |

| Marieke Vermeersch |

Sofie Van Gijsel | |

| +32 479 490 603 |

+1 781 296 1143 | |

| media@glpg.com |

ir@glpg.com | |

| Sandra Cauwenberghs | ||

| +32 495 58 46 63 | ||

| ir@glpg.com | ||

Forward-looking statements

This release may contain forward-looking statements. Such forward-looking statements are not guarantees of future results. These statements speak only as of the date of publication of this release. We expressly disclaim any obligation to update any forward-looking statements in this release, unless specifically required by law or regulation.

Disclaimer

The contents of our website, including the annual report for the financial year 2023 and the reports prepared by the Board of Directors and the statutory auditor at the occasion of the Extraordinary Shareholders’ Meeting, and any other website that may be accessed from our website, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933.

2

Exhibit 99.2

Pioneering science patient to transform outcomes Annual Report 2023

TABLE OF CONTENTS Table of Contents Our Business Disclaimer and other information 4 Our Company 7 Key achievements in 2023 15 Outlook 2024 27 Going concern statement 27 Risk management and internal control 28 Portfolio Portfolio 31 Oncology 32 Immunology 50 Risk factors Detailed description of the risk factors in Form 20-F 61 Risks related to product development and regulatory approval 61 Risks related to commercialization 65 Risks related to our financial position and need for additional capital 66 Risks related to our reliance on third parties 67 Risks related to our intellectual property 71 Risks related to our competitive position 73 Risks related to our organization, structure and operation 74 Market risks relating to the Galapagos shares 79 General statement about Galapagos’ risks 80 Sustainability report Our Sustainability Commitment – Forward, Sustainably 82 Our Ambition 83 Our Sustainability Governance 84 Our Double Materiality Assessment 84 Our Pillars 86 Reporting 99 Appendix 104 Corporate governance Galapagos’ corporate governance policies 114 Board of Directors of Galapagos NV 117 Committees 130 Executive Committee of Galapagos NV 134 Galapagos NV’s share capital and shares 140 Shareholders 144 Our Remuneration Policy 148 Remuneration Report 149 Conflict of interests and related parties 168 Code of Conduct 171 Statement by the Board of Directors 172 Financial statements Consolidated financial statements 174 Notes to the consolidated financial statements 179 Overview statutory results of Galapagos NV 254 Report of the statutory auditor Report of the statutory auditor 258 Other information Glossary 266 Financial calendar 277 Colophon 278 Contact 279 2 Galapagos NV Annual Report 2023

Our Business Overview of our company, our strategy, and 2023 key achievements Pioneering science to transform patient outcomes

OUR BUSINESS Disclaimer and other information This report contains the information required under Belgian law. Galapagos NV is a limited liability company organized under the laws of Belgium, with its registered office at Generaal De Wittelaan L11 A3, 2800 Mechelen, Belgium and registered with the Crossroads Enterprise Database (RPR Antwerp – division Mechelen) under number 0466.460.429. Throughout this report, the term “Galapagos NV” refers solely to the non-consolidated Belgian company, and references to “we,” “our,” “the group” or “Galapagos” include Galapagos NV together with its subsidiaries. This report is published in Dutch and English. Galapagos will use reasonable efforts to ensure the translation and conformity between the Dutch and English versions. In case of inconsistency between the Dutch and English versions, the Dutch version shall prevail. This document is the printed or PDF version of the Annual Report 2023 and is a free translation of the official Dutch language version in the European single electronic format (ESEF) of the Annual Report 2023. The official Dutch language ESEF version of the report prevails and is available on our website (www.glpg.com). This report, as well as the statutory financial statements of Galapagos NV, are available free of charge and upon request to be addressed to: Galapagos NV Investor Relations Generaal De Wittelaan L11 A3 2800 Mechelen, Belgium Tel: +32 15 34 29 00 Email: ir@glpg.com A digital version of this report, as well as the statutory financial statements of Galapagos NV, are available on our website (www.glpg.com). We will use our reasonable efforts to ensure the accuracy of the digital version, but do not assume responsibility if inaccuracies or inconsistencies with the printed or PDF document arise as a result of any electronic transmission. Other information on our website, or on other websites, does not form a part of this report. As a U.S. listed company, we are also subject to the reporting requirements of the U.S. Securities and Exchange Commission, or SEC. An annual report will be filed with the SEC on Form 20-F. Our annual report on Form 20-F is available in the SEC’s EDGAR database (https://www.sec.gov/edgar.shtml), and a link thereto is posted on our website. With the exception of filgotinib’s approval as Jyseleca® for the treatment of moderate to severe rheumatoid arthritis and ulcerative colitis by the European Commission, Great Britain’s Medicines and Healthcare products Regulatory Agency, and the Japanese

Ministry of Health, Labour and Welfare, our drug candidates mentioned in this report are investigational; their efficacy and safety have not been fully evaluated by any regulatory authority. Forward-looking statements This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than present and historical facts and conditions contained in this annual report, including statements regarding our future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward-looking statements. When used in this annual report, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “is designed to,” “may,” “might,” “plan,” “potential,” “predict,” “objective,” “should,” or the negative of these and similar expressions identify forward-looking statements. Forward-looking statements contained in this report include, but are not limited to, statements related to: the guidance from management regarding our financial results and expected operational use of cash, statements regarding our strategic and capital allocation priorities, statements regarding our regulatory outlook, business strategy and statements regarding preliminary, interim and topline data from our preclinical and clinical studies and any other data or analyses related to programs, and our plans and strategy with respect to such studies, statements about our ability to advance product candidates into, and successfully complete, clinical trials, statements regarding the timing and likelihood of business development projects and external innovation, statements regarding the amount and timing of potential future milestones, opt-in, royalty or other payments, statements regarding our R&D plans, strategy, and outlook, including progress on our oncology or immunology portfolio and our CAR-T portfolio, including any potential changes in such strategy, statements regarding our pipeline and complementary technology platforms facilitating future growth, statements regarding our commercialization efforts for our product candidates and any of our future approved products, if any, statements regarding the potential attributes and benefits of our product candidates, including indications, dosing and treatment modalities, and their potential competitive position with respect to other treatment alternatives, statements regarding the global R&D collaboration with Gilead, and the amendment of our arrangement with Gilead for commercialization and development of filgotinib, statements relating to the development of our commercial organization, commercial sales, and rollout of our products or product candidates (if approved) globally, statements relating to the development of our distributed manufacturing capabilities on a global basis, statements regarding our supply chain, including our reliance on third parties, and statements regarding our sustainability plans. We caution the reader that forward-looking statements are based on our management’s current expectations and beliefs and are not guarantees of any future performance. Forward-looking statements may involve known and unknown risks, uncertainties and other factors which might cause our actual results, financial condition and liquidity, performance or achievements, or the industry in which we operate, to be materially different from any historic or future

results, financial conditions, performance or achievements expressed or implied by such statements. Such risks include, but are not limited to, the risk that our beliefs, guidance, and expectations regarding our 2024 revenues, cash burn, operational expenses, or other financial metrics may be incorrect (including because one or more of our assumptions underlying our revenue or expense expectations may not be realized), the risk that ongoing and future clinical trials may not be completed in the currently envisaged timelines or at all, the inherent risks and uncertainties associated with competitive developments, clinical trials, recruitment of patients, estimated patient populations, product development activities, and regulatory approval requirements (including, but not limited to, the risk that data and timing from our ongoing and planned clinical research programs may not support registration or further development of our product candidates due to safety, or efficacy concerns, or any other reasons), risks related to the potential benefits and risks related to our current collaborations, including our plans and ability to enter into collaborations for additional programs or product candidates, risks related to the acquisitions of CellPoint and AboundBio, including the risk that we may not achieve the anticipated benefits of the acquisitions of CellPoint and AboundBio, the inherent risks and uncertainties associated with target discovery and validation, and drug discovery and development activities, the risk that the preliminary and topline data from our preclinical and clinical studies may not be reflective of the final data, risks related to our reliance on collaborations with third parties (including, but not limited to, Gilead), the risk that we will not be able to continue to execute on our currently contemplated business plan and/or will revise our business plan, including the risk that our plans with respect to CAR-T may not be achieved on the currently anticipated timeline or at all, the risk that our projections and expectations regarding the commercial potential of our product candidates or expectations regarding the revenues and costs associated with the commercialization rights may be inaccurate, the risks related to our strategic transformation exercise, including the risk that we may not achieve the anticipated benefits of such exercise on the currently envisaged timeline or at all, the risk that we will encounter challenges retaining or attracting talent, and risks related to disruption in our operations, supply chain, or ongoing studies due to conflicts or macroeconomic issues. A further list and description of these risks, uncertainties and other risks can be found in our filings and reports with the Securities and Exchange Commission (“SEC”), including in our most recent annual report on Form 20-F filed with the SEC, and our subsequent filings and reports filed with the SEC. We also refer to the “Risk Factors” section of this report. Given these risks and uncertainties, the reader is advised not to place any undue reliance on any such forward-looking statements. In addition, even if our results, performance, financial condition and liquidity, or the industry in which we operate, are consistent with such forward-looking statements, they may not be predictive of results, performance or achievements in future periods. These forward-looking statements speak only as of the date of publication of this report. We expressly disclaim any obligation to update any such statements in this report to reflect any change in our expectations with regard thereto, or any change in events, conditions or circumstances on which any such statements is based, or that may affect

the likelihood that actual results will differ from those set forth in any such statements, unless specifically required by law or regulation. Our Company Our Vision and Mission Our Vision Transforming patient outcomes through life-changing science and innovation for more years of life and quality of life. Our Mission We accelerate transformational innovation through the relentless pursuit of groundbreaking science, our entrepreneurial spirit and a collaborative mindset. Our Forward, Faster Strategy Our goal is to bring transformational medicines to patients across the globe for more years of life and quality of life. Our focus is on conditions with high unmet medical need. To achieve this, we are working to synergize compelling science, technology, and approaches to develop a deep pipeline of potentially best-in-class small molecules, CAR-T therapies and biologics in oncology and immunology. We continue to take steps to transform into an innovative pure-play biotech company by sharpening our focus on our key priority areas. Following the transfer of our entire Jyseleca® (filgotinib) business, we are moving forward with greater focus and flexibility to invest in our key technology platforms and strategic therapeutic areas. We are committed to challenging the status quo and delivering results for patients, employees, and shareholders.

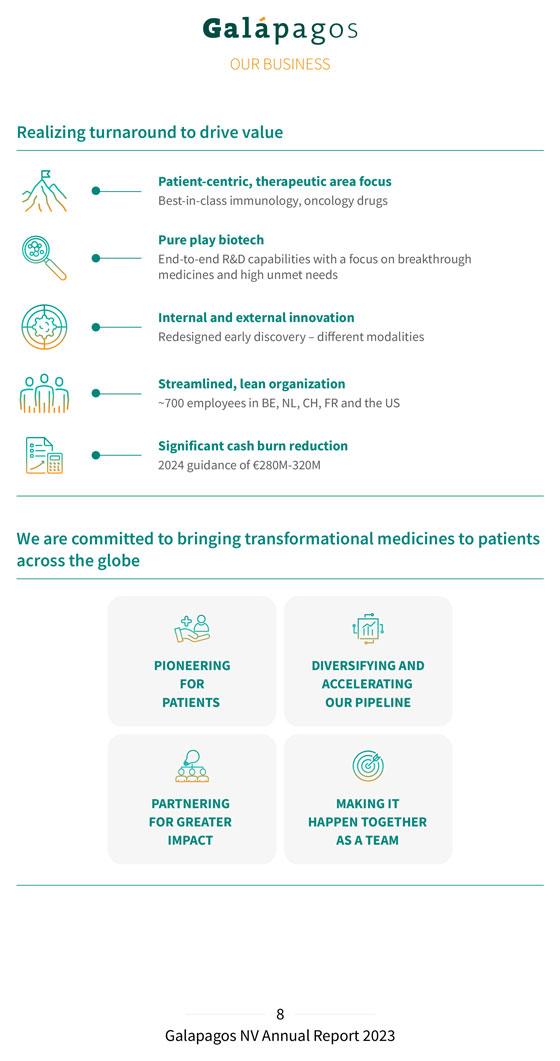

Realizing turnaround to drive value Patient-centric, therapeutic area focus Best-in-class immunology, oncology drugs Pure play biotech End-to-end R&D capabilities with a focus on breakthrough medicines and high unmet needs Internal and external innovation Redesigned early discovery – different modalities Streamlined, lean organization ~700 employees in BE, NL, CH, FR and the US Significant cash burn reduction 2024 guidance of €280M-320M We are committed to bringing transformational medicines to patients across the globe PIONEERING DIVERSIFYING AND FOR ACCELERATING PATIENTS OUR PIPELINE PARTNERING MAKING IT FOR GREATER HAPPEN TOGETHER IMPACT AS A TEAM

We have a clear path to value creation: Pioneering for patients through our targeted R&D approach. At Galapagos, we are focusing on discovering and developing best-in-class medicines in oncology and immunology. We are advancing our current clinical programs. We are developing our unique decentralized CAR-T manufactured programs in hemato-oncology. We are continuing to pursue strategic investments and partnerships to support and expand our pipeline. We are focused on validated targets and next-generation cell therapies and biologics in oncology and immunology. Diversifying our pipeline and making clear portfolio decisions to achieve our vision. We believe we have a greater chance of success by working with multiple drug modalities and combinations across our core therapeutic areas. By 2028, we aim to have: A first medicine available to patients. A robust late-stage pipeline with several programs in pivotal trials. A solid early-stage pipeline of small molecules, next-generation cell therapies and biologics in our core therapeutic areas. Accelerating and building our pipeline through strategic partnerships and M&A. To achieve our ambitious goals, we evaluate and access external innovation. We are scouting for the best science, products, and people to complement our internal assets and capabilities, with the aim of building a balanced portfolio of best-in-class medicines across modalities and development stages in our core therapeutic areas. We are open to finding the best possible deal structure or collaboration model that benefits Galapagos and our stakeholders, with a key focus on expanding and accelerating our pipeline and bringing differentiated medicines to patients. Fostering a strong culture of innovation. Our success is made possible by our incredible teams. Our employees’ relentless drive for innovation, teamwork, and a quality mindset focused on efficiency is what drives our progress. We are committed to creating a purpose-driven, inclusive workplace where our people feel safe and empowered, have opportunities to learn and grow, are recognized for their contributions, and perform at their best as individuals and as a team.

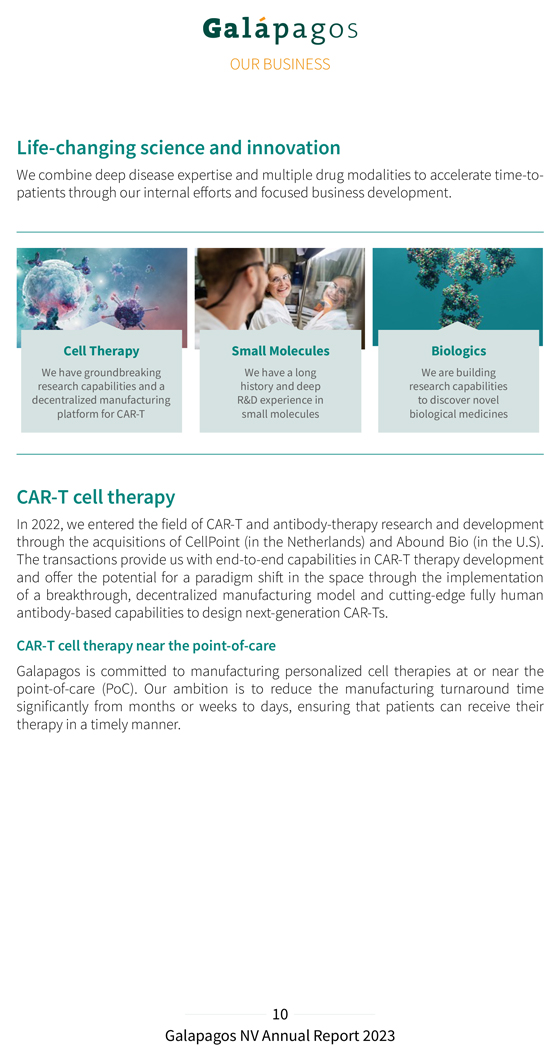

Life-changing science and innovation We combine deep disease expertise and multiple drug modalities to accelerate time-to-patients through our internal efforts and focused business development. Cell Therapy Small Molecules Biologics We have groundbreaking We have a long We are building research capabilities and a history and deep research capabilities decentralized manufacturing R&D experience in to discover novel platform for CAR-T small molecules biological medicines CAR-T cell therapy In 2022, we entered the field of CAR-T and antibody-therapy research and development through the acquisitions of CellPoint (in the Netherlands) and Abound Bio (in the U.S). The transactions provide us with end-to-end capabilities in CAR-T therapy development and offer the potential for a paradigm shift in the space through the implementation of a breakthrough, decentralized manufacturing model and cutting-edge fully human antibody-based capabilities to design next-generation CAR-Ts. CAR-T cell therapy near the point-of-care Galapagos is committed to manufacturing personalized cell therapies at or near the point-of-care (PoC). Our ambition is to reduce the manufacturing turnaround time significantly from months or weeks to days, ensuring that patients can receive their therapy in a timely manner.

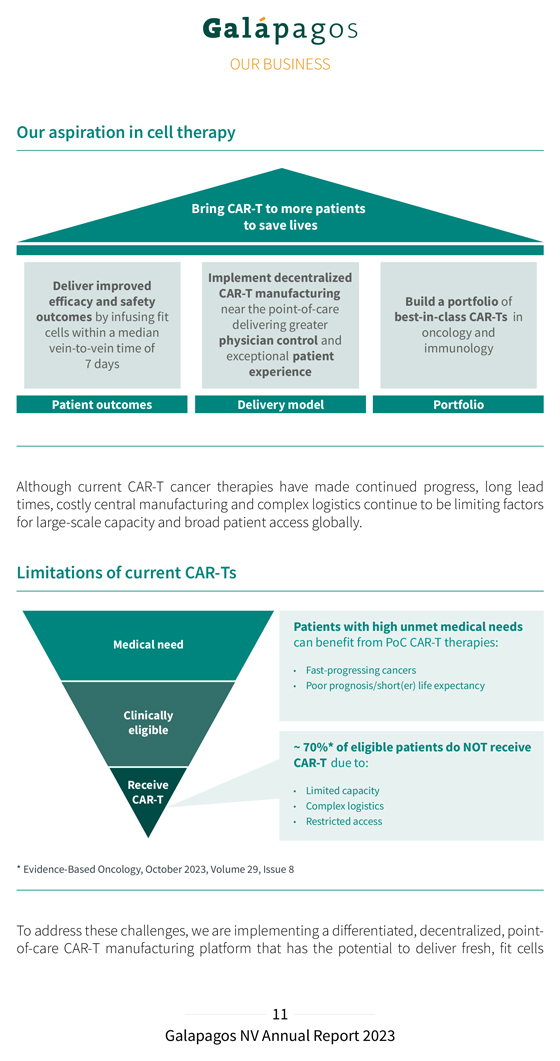

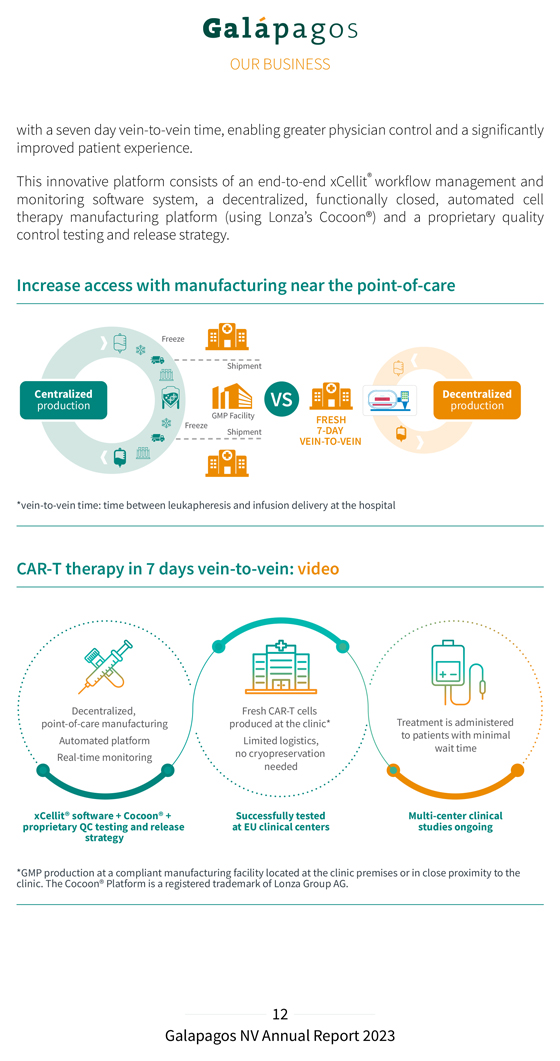

Our aspiration in cell therapy Bring CAR-T to more patients to save lives Implement decentralized Deliver improved CAR-T manufacturing efficacy and safety Build a portfolio of near the point-of-care outcomes by infusing fit best-in-class CAR-Ts in delivering greater cells within a median oncology and physician control and vein-to-vein time of immunology exceptional patient 7 days experience Patient outcomes Delivery model Portfolio Although current CAR-T cancer therapies have made continued progress, long lead times, costly central manufacturing and complex logistics continue to be limiting factors for large-scale capacity and broad patient access globally. Limitations of current CAR-Ts Patients with high unmet medical needs Medical need can benefit from PoC CAR-T therapies: Fast-progressing cancers Poor prognosis/short(er) life expectancy Clinically eligible ~ 70%* of eligible patients do NOT receive CAR-T due to: Receive Limited capacity CAR-T Complex logistics Restricted access * Evidence-Based Oncology, October 2023, Volume 29, Issue 8 To address these challenges, we are implementing a differentiated, decentralized, point-of-care CAR-T manufacturing platform that has the potential to deliver fresh, fit cells

with a seven day vein-to-vein time, enabling greater physician control and a significantly improved patient experience. This innovative platform consists of an end-to-end xCellit® workflow management and monitoring software system, a decentralized, functionally closed, automated cell therapy manufacturing platform (using Lonza’s Cocoon®) and a proprietary quality control testing and release strategy. Increase access with manufacturing near the point-of-care *vein-to-vein time: time between leukapheresis and infusion delivery at the hospital CAR-T therapy in 7 days vein-to-vein: video Decentralized, Fresh CAR-T cells point-of-care manufacturing produced at the clinic* Treatment is administered Automated platform Limited logistics, to patients with minimal wait time Real-time monitoring no cryopreservation needed xCellit® software + Cocoon® + Successfully tested Multi-center clinical proprietary QC testing and release at EU clinical centers studies ongoing strategy *GMP clinic. production The Cocoon® at Platform a compliant is a manufacturing registered trademark facility of located Lonza at Group the clinic AG. premises or in close proximity to the

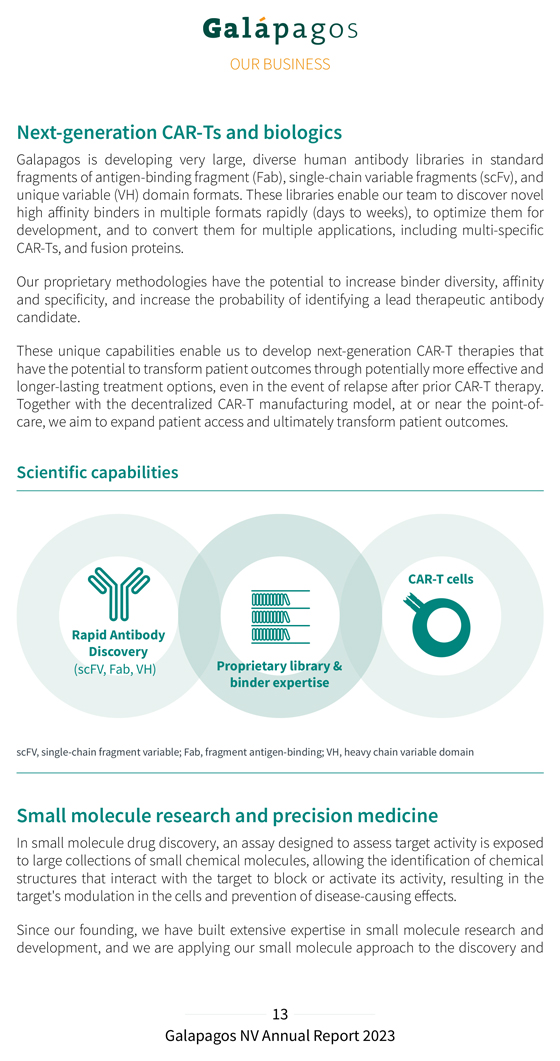

Next-generation CAR-Ts and biologics Galapagos is developing very large, diverse human antibody libraries in standard fragments of antigen-binding fragment (Fab), single-chain variable fragments (scFv), and unique variable (VH) domain formats. These libraries enable our team to discover novel high affinity binders in multiple formats rapidly (days to weeks), to optimize them for development, and to convert them for multiple applications, including multi-specific CAR-Ts, and fusion proteins. Our proprietary methodologies have the potential to increase binder diversity, affinity and specificity, and increase the probability of identifying a lead therapeutic antibody candidate. These unique capabilities enable us to develop next-generation CAR-T therapies that have the potential to transform patient outcomes through potentially more effective and longer-lasting treatment options, even in the event of relapse after prior CAR-T therapy. Together with the decentralized CAR-T manufacturing model, at or near the point-of-care, we aim to expand patient access and ultimately transform patient outcomes. Scientific capabilities CAR-T cells Rapid Antibody Discovery (scFV, Fab, VH) Proprietary library & binder expertise scFV, single-chain fragment variable; Fab, fragment antigen-binding; VH, heavy chain variable domain Small molecule research and precision medicine In small molecule drug discovery, an assay designed to assess target activity is exposed to large collections of small chemical molecules, allowing the identification of chemical structures that interact with the target to block or activate its activity, resulting in the target’s modulation in the cells and prevention of disease-causing effects. Since our founding, we have built extensive expertise in small molecule research and development, and we are applying our small molecule approach to the discovery and

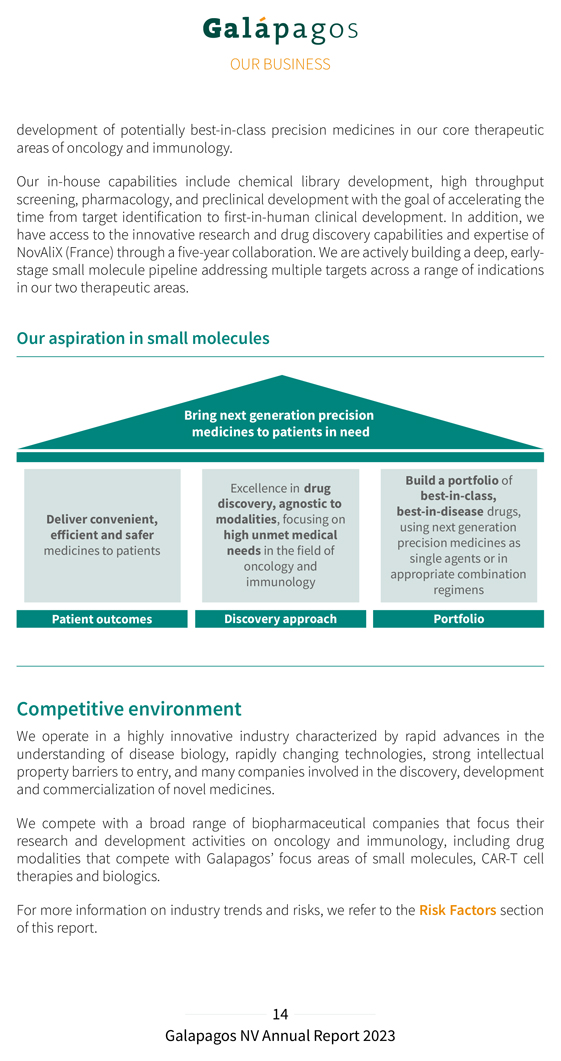

development of potentially best-in-class precision medicines in our core therapeutic areas of oncology and immunology. Our in-house capabilities include chemical library development, high throughput screening, pharmacology, and preclinical development with the goal of accelerating the time from target identification to first-in-human clinical development. In addition, we have access to the innovative research and drug discovery capabilities and expertise of NovAliX (France) through a five-year collaboration. We are actively building a deep, early-stage small molecule pipeline addressing multiple targets across a range of indications in our two therapeutic areas. Our aspiration in small molecules Bring next generation precision medicines to patients in need Excellence in drug Build a portfolio of best-in-class, discovery, agnostic to best-in-disease drugs, Deliver convenient, modalities, focusing on using next generation efficient and safer high unmet medical precision medicines as medicines to patients needs in the field of single agents or in oncology and immunology appropriate combination regimens Patient outcomes Discovery approach Portfolio Competitive environment We operate in a highly innovative industry characterized by rapid advances in the understanding of disease biology, rapidly changing technologies, strong intellectual property barriers to entry, and many companies involved in the discovery, development and commercialization of novel medicines. We compete with a broad range of biopharmaceutical companies that focus their research and development activities on oncology and immunology, including drug modalities that compete with Galapagos’ focus areas of small molecules, CAR-T cell therapies and biologics. For more information on industry trends and risks, we refer to the Risk Factors section of this report.

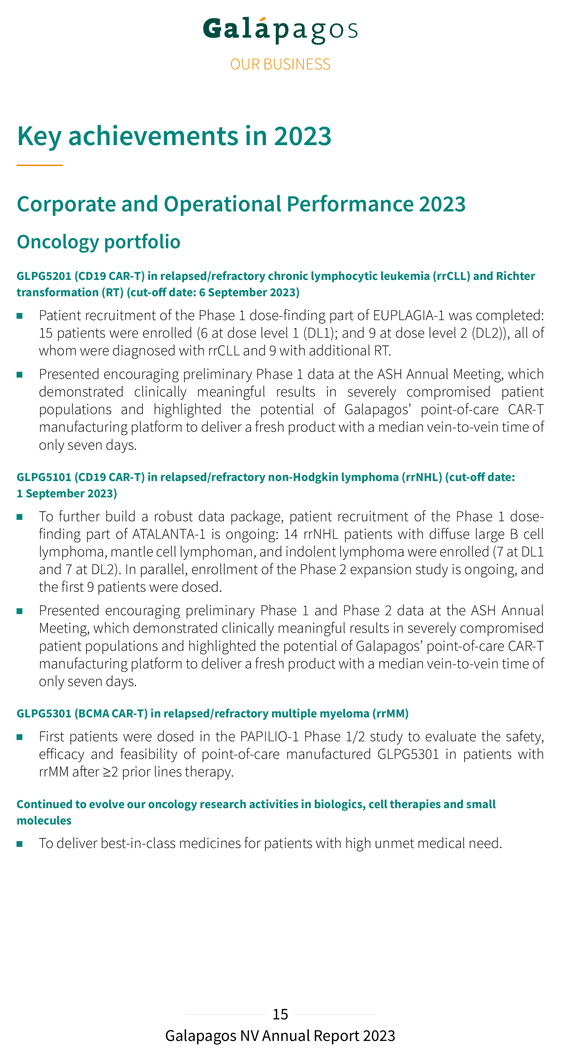

Key achievements in 2023 Corporate and Operational Performance 2023 Oncology portfolio GLPG5201 (CD19 CAR-T) in relapsed/refractory chronic lymphocytic leukemia (rrCLL) and Richter transformation (RT) (cut-off date: 6 September 2023) Patient recruitment of the Phase 1 dose-finding part of EUPLAGIA-1 was completed: 15 patients were enrolled (6 at dose level 1 (DL1); and 9 at dose level 2 (DL2)), all of whom were diagnosed with rrCLL and 9 with additional RT. Presented encouraging preliminary Phase 1 data at the ASH Annual Meeting, which demonstrated clinically meaningful results in severely compromised patient populations and highlighted the potential of Galapagos’ point-of-care CAR-T manufacturing platform to deliver a fresh product with a median vein-to-vein time of only seven days. GLPG5101 (CD19 CAR-T) in relapsed/refractory non-Hodgkin lymphoma (rrNHL) (cut-off date: 1 September 2023) To further build a robust data package, patient recruitment of the Phase 1 dose-finding part of ATALANTA-1 is ongoing: 14 rrNHL patients with diffuse large B cell lymphoma, mantle cell lymphoman, and indolent lymphoma were enrolled (7 at DL1 and 7 at DL2). In parallel, enrollment of the Phase 2 expansion study is ongoing, and the first 9 patients were dosed. Presented encouraging preliminary Phase 1 and Phase 2 data at the ASH Annual Meeting, which demonstrated clinically meaningful results in severely compromised patient populations and highlighted the potential of Galapagos’ point-of-care CAR-T manufacturing platform to deliver a fresh product with a median vein-to-vein time of only seven days. GLPG5301 (BCMA CAR-T) in relapsed/refractory multiple myeloma (rrMM) First patients were dosed in the PAPILIO-1 Phase 1/2 study to evaluate the safety, efficacy and feasibility of point-of-care manufactured GLPG5301 in patients with rrMM after ≥2 prior lines therapy. Continued to evolve our oncology research activities in biologics, cell therapies and small molecules To deliver best-in-class medicines for patients with high unmet medical need.

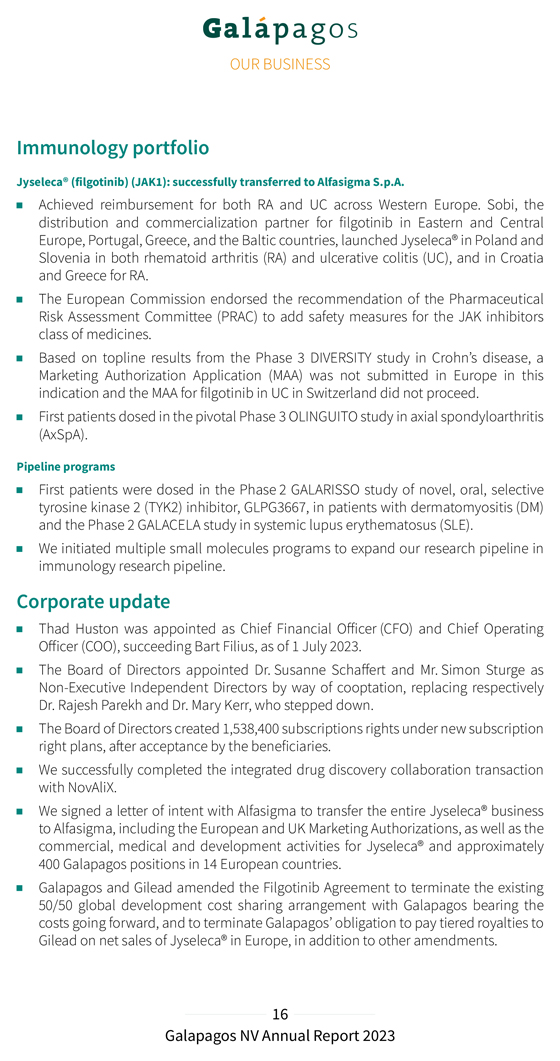

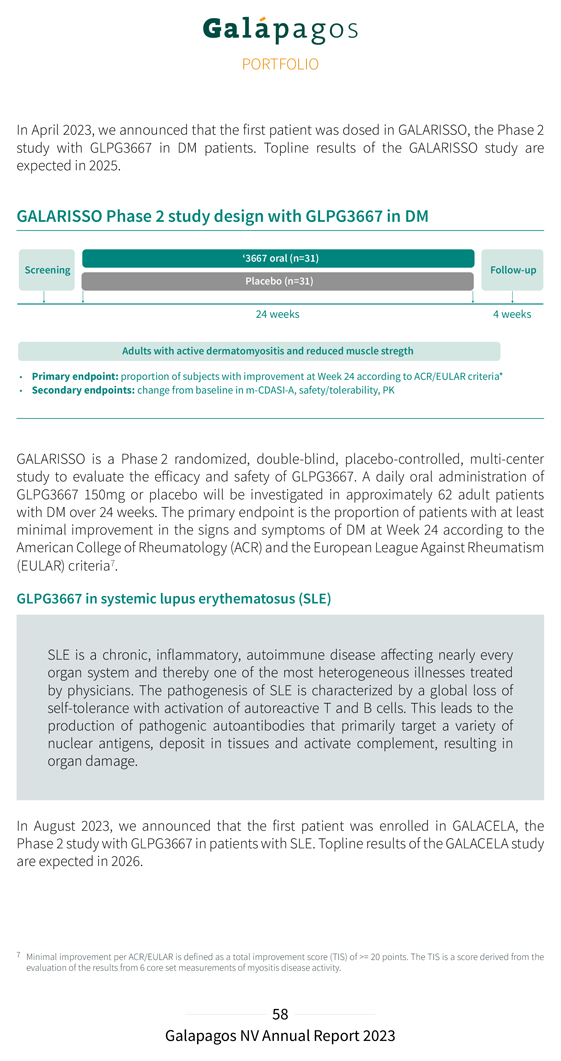

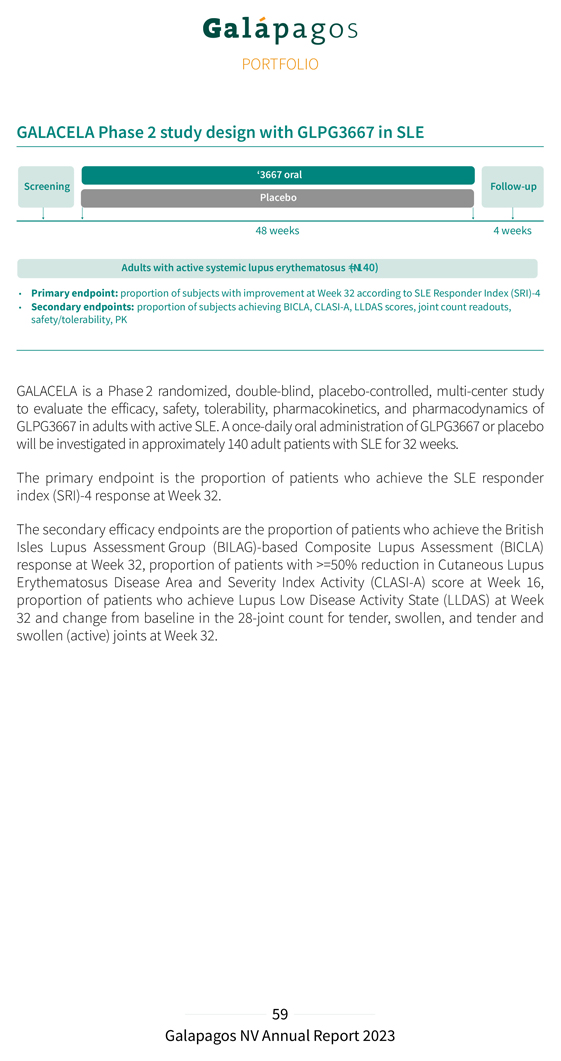

Immunology portfolio Jyseleca® (filgotinib) (JAK1): successfully transferred to Alfasigma S.p.A. Achieved reimbursement for both RA and UC across Western Europe. Sobi, the distribution and commercialization partner for filgotinib in Eastern and Central Europe, Portugal, Greece, and the Baltic countries, launched Jyseleca® in Poland and Slovenia in both rhematoid arthritis (RA) and ulcerative colitis (UC), and in Croatia and Greece for RA. The European Commission endorsed the recommendation of the Pharmaceutical Risk Assessment Committee (PRAC) to add safety measures for the JAK inhibitors class of medicines. Based on topline results from the Phase 3 DIVERSITY study in Crohn’s disease, a Marketing Authorization Application (MAA) was not submitted in Europe in this indication and the MAA for filgotinib in UC in Switzerland did not proceed. First patients dosed in the pivotal Phase 3 OLINGUITO study in axial spondyloarthritis (AxSpA). Pipeline programs First patients were dosed in the Phase 2 GALARISSO study of novel, oral, selective tyrosine kinase 2 (TYK2) inhibitor, GLPG3667, in patients with dermatomyositis (DM) and the Phase 2 GALACELA study in systemic lupus erythematosus (SLE). We initiated multiple small molecules programs to expand our research pipeline in immunology research pipeline. Corporate update Thad Huston was appointed as Chief Financial Officer (CFO) and Chief Operating Officer (COO), succeeding Bart Filius, as of 1 July 2023. The Board of Directors appointed Dr. Susanne Schaffert and Mr. Simon Sturge as Non-Executive Independent Directors by way of cooptation, replacing respectively Dr. Rajesh Parekh and Dr. Mary Kerr, who stepped down. The Board of Directors created 1,538,400 subscriptions rights under new subscription right plans, after acceptance by the beneficiaries. We successfully completed the integrated drug discovery collaboration transaction with NovAliX. We signed a letter of intent with Alfasigma to transfer the entire Jyseleca® business to Alfasigma, including the European and UK Marketing Authorizations, as well as the commercial, medical and development activities for Jyseleca® and approximately 400 Galapagos positions in 14 European countries. Galapagos and Gilead amended the Filgotinib Agreement to terminate the existing 50/50 global development cost sharing arrangement with Galapagos bearing the costs going forward, and to terminate Galapagos’ obligation to pay tiered royalties to Gilead on net sales of Jyseleca® in Europe, in addition to other amendments.

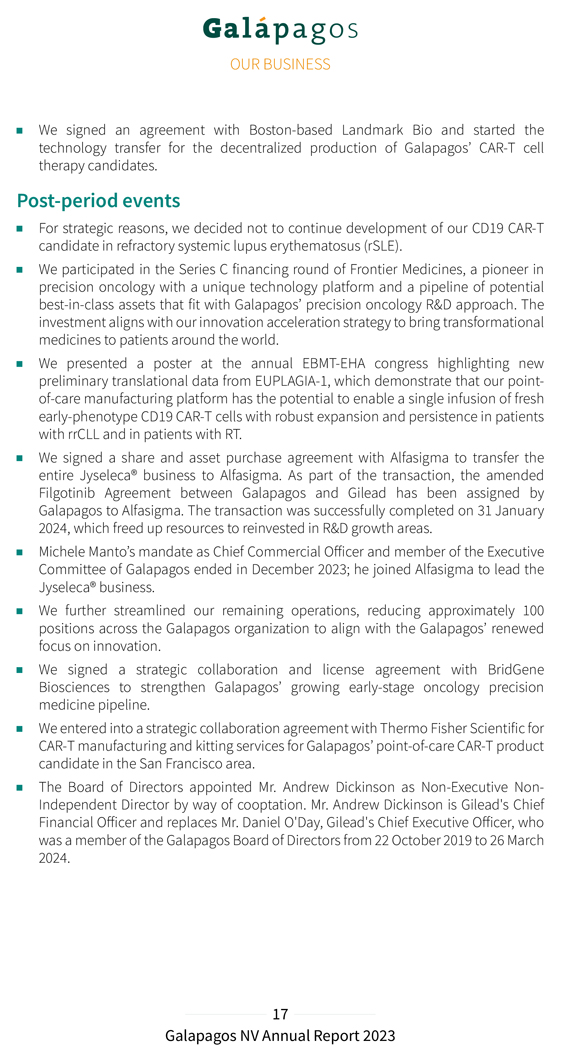

We signed an agreement with Boston-based Landmark Bio and started the technology transfer for the decentralized production of Galapagos’ CAR-T cell therapy candidates. Post-period events For strategic reasons, we decided not to continue development of our CD19 CAR-T candidate in refractory systemic lupus erythematosus (rSLE). We participated in the Series C financing round of Frontier Medicines, a pioneer in precision oncology with a unique technology platform and a pipeline of potential best-in-class assets that fit with Galapagos’ precision oncology R&D approach. The investment aligns with our innovation acceleration strategy to bring transformational medicines to patients around the world. We presented a poster at the annual EBMT-EHA congress highlighting new preliminary translational data from EUPLAGIA-1, which demonstrate that our point-of-care manufacturing platform has the potential to enable a single infusion of fresh early-phenotype CD19 CAR-T cells with robust expansion and persistence in patients with rrCLL and in patients with RT. We signed a share and asset purchase agreement with Alfasigma to transfer the entire Jyseleca® business to Alfasigma. As part of the transaction, the amended Filgotinib Agreement between Galapagos and Gilead has been assigned by Galapagos to Alfasigma. The transaction was successfully completed on 31 January 2024, which freed up resources to reinvested in R&D growth areas. Michele Manto’s mandate as Chief Commercial Officer and member of the Executive Committee of Galapagos ended in December 2023; he joined Alfasigma to lead the Jyseleca® business. We further streamlined our remaining operations, reducing approximately 100 positions across the Galapagos organization to align with the Galapagos’ renewed focus on innovation. We signed a strategic collaboration and license agreement with BridGene Biosciences to strengthen Galapagos’ growing early-stage oncology precision medicine pipeline. We entered into a strategic collaboration agreement with Thermo Fisher Scientific for CAR-T manufacturing and kitting services for Galapagos’ point-of-care CAR-T product candidate in the San Francisco area. The Board of Directors appointed Mr. Andrew Dickinson as Non-Executive Non-Independent Director by way of cooptation. Mr. Andrew Dickinson is Gilead’s Chief Financial Officer and replaces Mr. Daniel O’Day, Gilead’s Chief Executive Officer, who was a member of the Galapagos Board of Directors from 22 October 2019 to 26 March 2024.

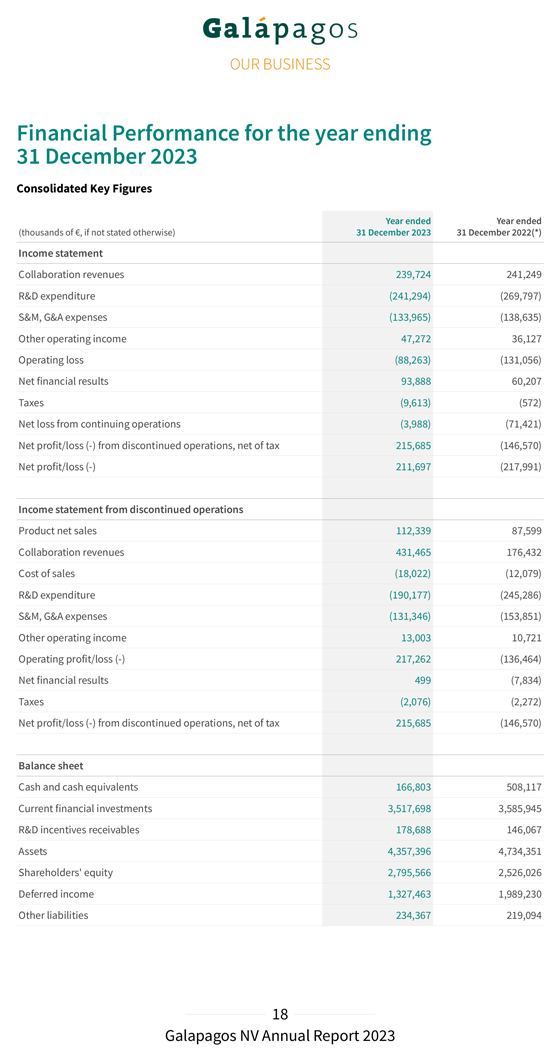

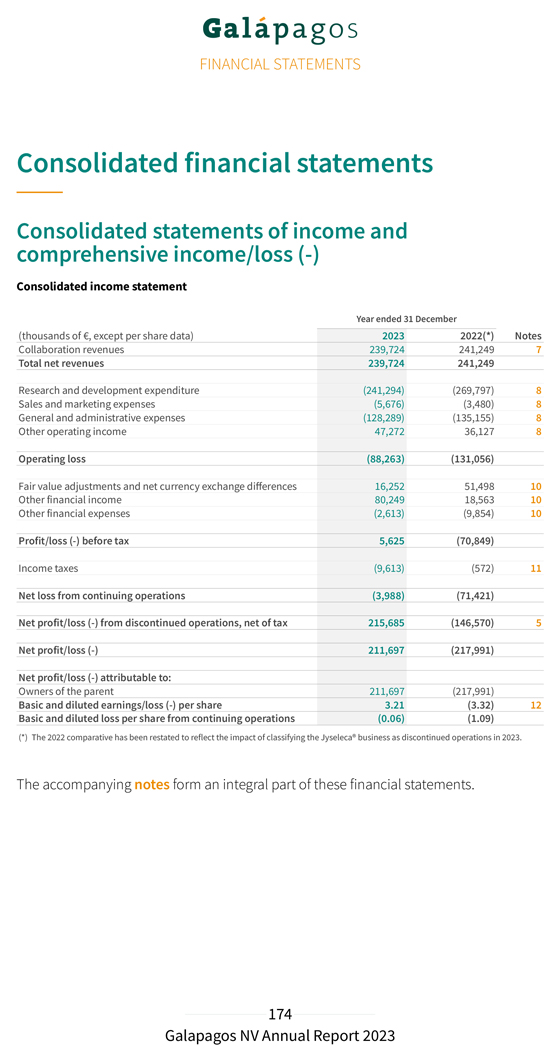

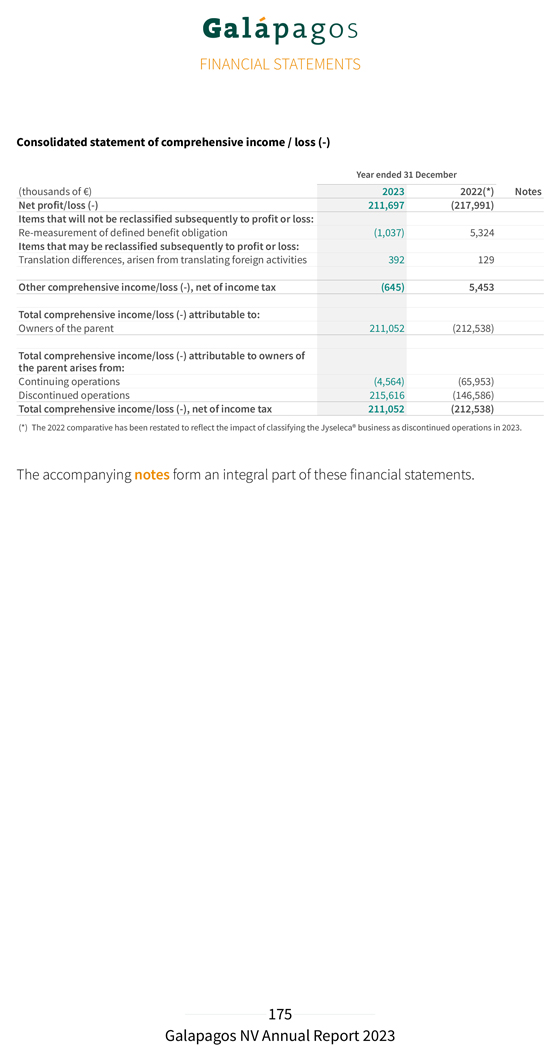

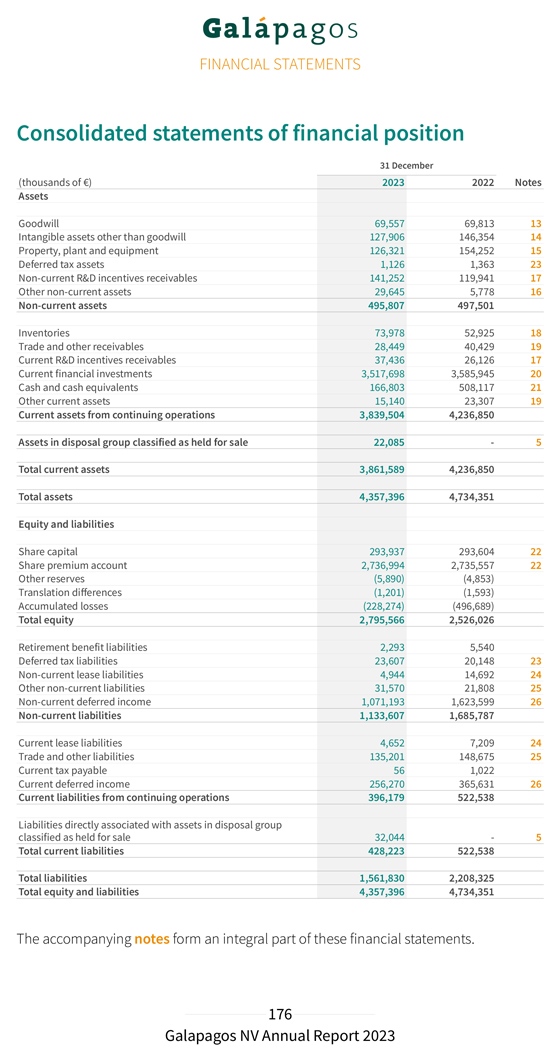

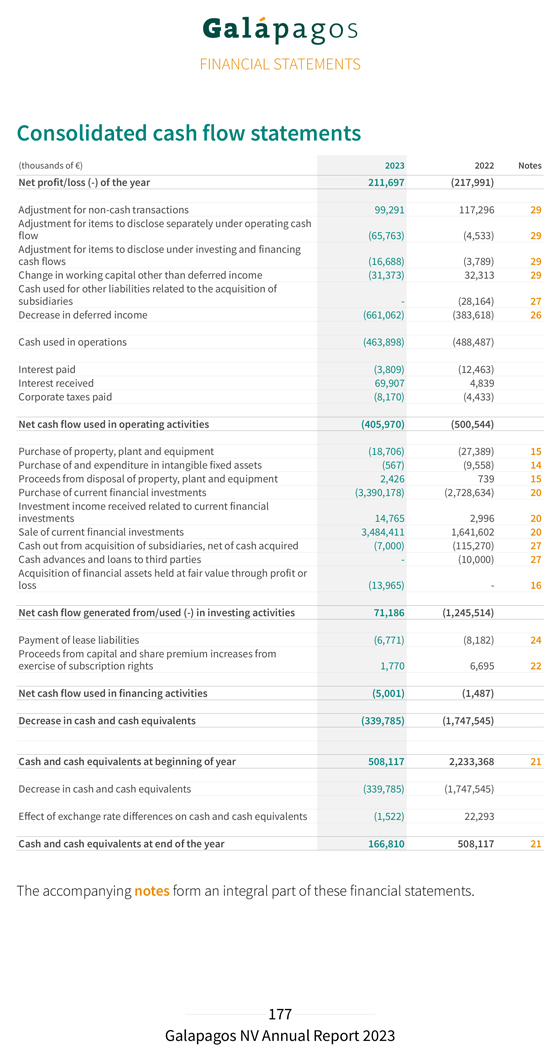

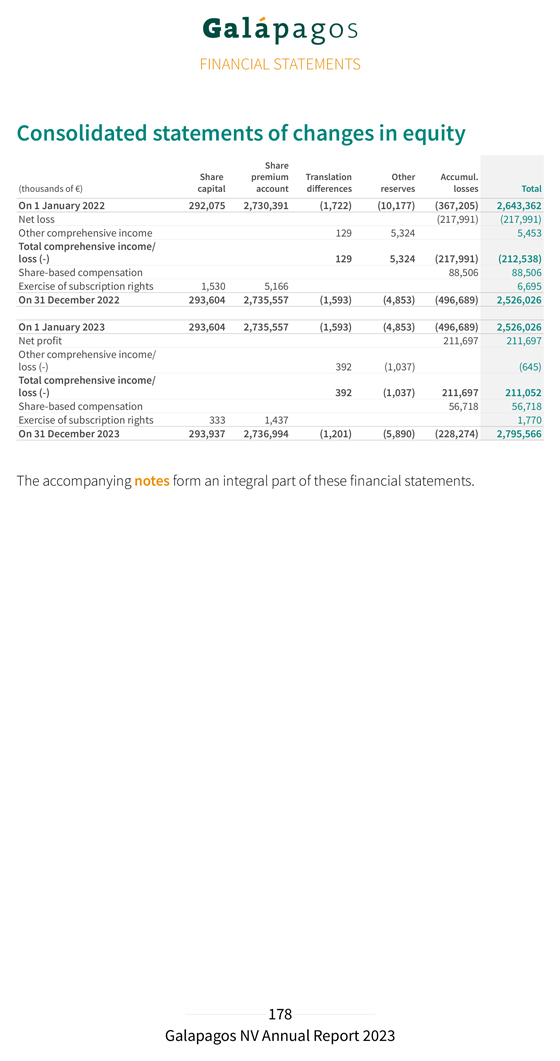

31 Financial December Performance 2023 for the year ending Consolidated Key Figures Year ended Year ended (thousands of €, if not stated otherwise) 31 December 2023 31 December 2022(*) Income statement Collaboration revenues 239,724 241,249 R&D expenditure (241,294) (269,797) S&M, G&A expenses (133,965) (138,635) Other operating income 47,272 36,127 Operating loss (88,263) (131,056) Net financial results 93,888 60,207 Taxes (9,613) (572) Net loss from continuing operations (3,988) (71,421) Net profit/loss (-) from discontinued operations, net of tax 215,685 (146,570) Net profit/loss (-) 211,697 (217,991) Income statement from discontinued operations Product net sales 112,339 87,599 Collaboration revenues 431,465 176,432 Cost of sales (18,022) (12,079) R&D expenditure (190,177) (245,286) S&M, G&A expenses (131,346) (153,851) Other operating income 13,003 10,721 Operating profit/loss (-) 217,262 (136,464) Net financial results 499 (7,834) Taxes (2,076) (2,272) Net profit/loss (-) from discontinued operations, net of tax 215,685 (146,570) Balance sheet Cash and cash equivalents 166,803 508,117 Current financial investments 3,517,698 3,585,945 R&D incentives receivables 178,688 146,067 Assets 4,357,396 4,734,351 Shareholders’ equity 2,795,566 2,526,026 Deferred income 1,327,463 1,989,230 Other liabilities 234,367 219,094

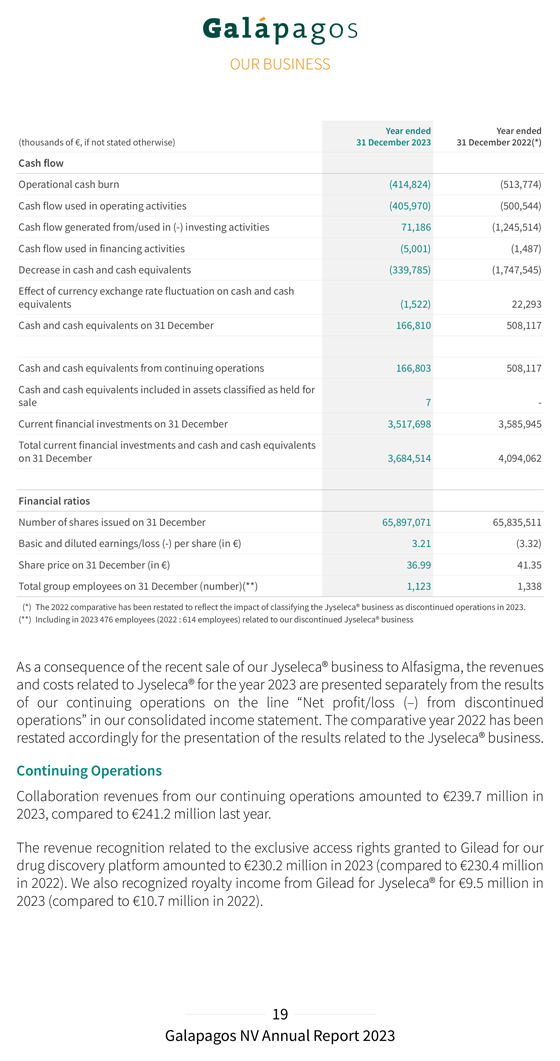

Year ended Year ended (thousands of €, if not stated otherwise) 31 December 2023 31 December 2022(*) Cash flow Operational cash burn (414,824) (513,774) Cash flow used in operating activities (405,970) (500,544) Cash flow generated from/used in (-) investing activities 71,186 (1,245,514) Cash flow used in financing activities (5,001) (1,487) Decrease in cash and cash equivalents (339,785) (1,747,545) Effect of currency exchange rate fluctuation on cash and cash equivalents (1,522) 22,293 Cash and cash equivalents on 31 December 166,810 508,117 Cash and cash equivalents from continuing operations 166,803 508,117 Cash and cash equivalents included in assets classified as held for sale 7—Current financial investments on 31 December 3,517,698 3,585,945 Total current financial investments and cash and cash equivalents on 31 December 3,684,514 4,094,062 Financial ratios Number of shares issued on 31 December 65,897,071 65,835,511 Basic and diluted earnings/loss (-) per share (in €) 3.21 (3.32) Share price on 31 December (in €) 36.99 41.35 Total group employees on 31 December (number)(**) 1,123 1,338 (*) The 2022 comparative has been restated to reflect the impact of classifying the Jyseleca® business as discontinued operations in 2023. (**) Including in 2023 476 employees (2022 : 614 employees) related to our discontinued Jyseleca® business As a consequence of the recent sale of our Jyseleca® business to Alfasigma, the revenues and costs related to Jyseleca® for the year 2023 are presented separately from the results of our continuing operations on the line “Net profit/loss (–) from discontinued operations” in our consolidated income statement. The comparative year 2022 has been restated accordingly for the presentation of the results related to the Jyseleca® business. Continuing Operations Collaboration revenues from our continuing operations amounted to €239.7 million in 2023, compared to €241.2 million last year. The revenue recognition related to the exclusive access rights granted to Gilead for our drug discovery platform amounted to €230.2 million in 2023 (compared to €230.4 million in 2022). We also recognized royalty income from Gilead for Jyseleca® for €9.5 million in 2023 (compared to €10.7 million in 2022).

Our deferred income balance at 31 December 2023 includes €1.3 billion allocated to our drug discovery platform that is recognized linearly over the remaining period of our 10-year collaboration. Our R&D expenditure in 2023 amounted to €241.3 million, compared to €269.8 million in 2022. Depreciation and impairment costs in 2023 amounted to €22.3 million (compared to €51.5 million in 2022). This decrease was primarily due to an impairment of €26.7 million of previously capitalized upfront fees related to our collaboration with Molecure and impairments of €8.9 million of intangible assets related to other discontinued projects, both recorded in 2022. Personnel costs decreased from €115.5 million in 2022 to €95.8 million in 2023 primarily related to lower accelerated non-cash cost recognition for subscription right plans related to good leavers. This was partly offset by an increase in costs from €61.2 million in 2022 to €83.0 million in 2023 following the evolution of our CAR-T programs. Our S&M expenses amounted to €5.7 million in 2023, compared to €3.5 million in 2022. Our G&A expenses amounted to €128.3 million in 2023, compared to €135.2 million in 2022. The cost decrease was explained by a decrease in personnel costs to €66.1 million in 2023 compared €76.5 million to 2022, due to lower accelerated non-cash cost recognition for subscription right plans related to good leavers. Depreciation and impairment expenses increased from €8.5 million in 2022 to €16.0 million in 2023 due to an impairment of €7.6 million on a construction project in Mechelen, Belgium. Other operating income (€47.3 million in 2023 compared to €36.1 million in 2022) increased due to higher grant income (grant from the National Institute for Health and Disability Insurance in 2023 of €6.1 million), higher other operating income (rent income) and higher R&D incentives income. We reported an operating loss amounting to €88.3 million in 2023, compared to an operating loss of €131.1 million in 2022. Net financial income in 2023 amounted to €93.9 million, compared to net financial income of €60.2 million in 2022. Net financial income in 2023 was primarily attributable to €38.3 million of net fair value gains of our current financial investments, partly offset by €20.4 million of unrealized currency exchange losses on our cash and cash equivalents and current financial investments at amortized cost in U.S. dollars. Net interest income amounted to €77.5 million in 2023 as compared to €11.2 million of net interest income in 2022. We had €9.6 million of tax expenses in 2023 (as compared to €0.6 million in 2022). This increase was primarily due to the re-assessment of net deferred tax liabilities and corporate income tax payables as a result of a one-off intercompany transaction. We reported a net loss from continuing operations in 2023 of €4.0 million, compared to a net loss from continuing operations of €71.4 million in 2022.

Discontinued operations Net profit of discontinued operations attributable to the Jyseleca® business amounted to €215.7 million in 2023, compared to €146.6 million net loss of discontinued operations in 2022. Jyseleca® product net sales in Europe amounted to €112.3 million in 2023, compared to €87.6 million in 2022. Cost of sales related to Jyseleca® net sales in Europe amounted to €18.0 million in 2023, compared to €12.1 million for the year 2022. Collaboration revenues in discontinued operations related to revenue recognition of the collaboration agreement with Gilead for the filgotinib development amounted to €429.4 million in 2023 compared to €174.4 million in 2022. This increase was explained by a substantial decrease in our assessment of the remaining costs to complete the filgotinib development following the recent sale of our Jyseleca® business to Alfasigma, including the transfer of the remaining development performance obligation after closing of the transaction. As a consequence, we saw a substantial increase of the percentage of completion of our performance obligation, and a positive catch-up released to revenues. Total operating profit from discontinued operations amounted to €217.3 million in 2023, compared to an operating loss of €136.5 million in 2022. The decrease in R&D expenditures for the development of filgotinib was mainly due to the discontinuation in early 2023 of the DIVERSITY clinical trials in CD. Personnel expenses decreased by €15.0 million, from €74.6 million in 2022 to €59.6 million in 2023, subcontracting costs decreased as well by €39.0 million, from €153.7 million in 2022 to €114.7 million in 2023. The decrease in S&M expenses from €144.1 million in 2022 to €113.4 million in 2023 is reflected in a decrease in personnel costs by €10.8 million, from €70.2 million in 2022 to €59.3 million in 2023 due to lower bonus costs and costs of our subscription right plans, while external outsourcing costs decreased by €17.0 million, from €52.8 million in 2022 to €35.8 million in 2023 primarily explained by lower costs for marketing campaigns and promotional expenses. G&A expenses attributable to the Jyseleca® business increased from €9.8 million in 2022 to €18.0 million in 2023 primarily due to an increase in costs of our subscription right plans; we experienced unusually low costs in 2022 due to a reversal of costs related to voluntary leavers and saw an increase in salaries in 2023. The G&A expenses for the year 2023 also include one-off legal fees related to the transaction with Alfasigma for €3.5 million. Other operating income attributable to the Jyseleca® business increased, mainly due to higher R&D incentives income.

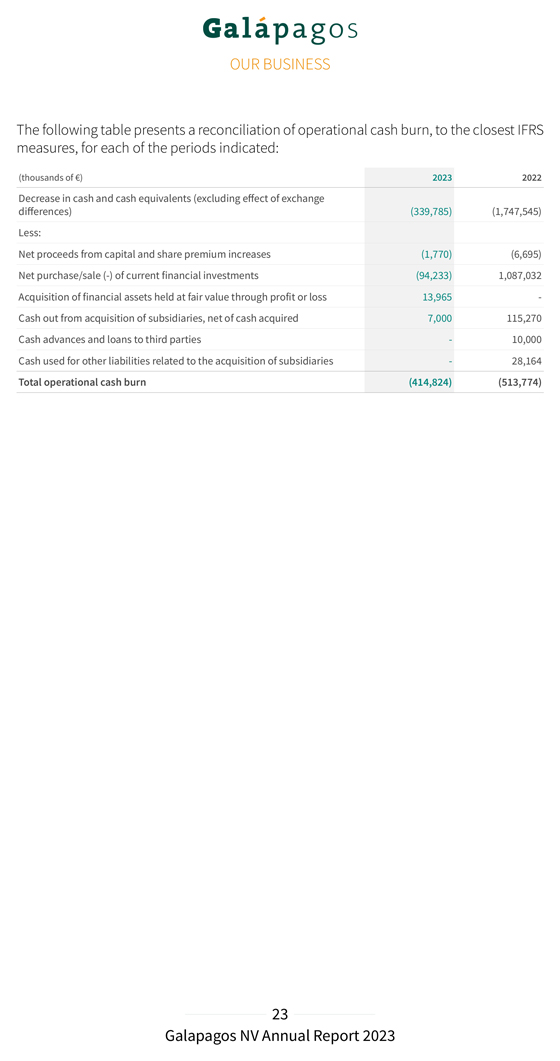

The movement in other financial income/expenses is primarily explained by a lower discounting effect of long-term deferred revenue for the development of filgotinib, because we expect to recognize the remaining revenues in 2024. The financing component related to our filgotinib performance obligation was re-assessed on 31 December 2023, considering the reduced duration and the expected end of the performance obligation for the development of filgotinib. We reported a net profit in 2023 of €211.7 million, compared to a net loss of €218.0 million in 2022. Cash, cash equivalents and current financial investments Current financial investments and cash and cash equivalents totaled €3,684.5 million on 31 December 2023 (including €20.0 million of accrued interest income) as compared to €4,094.1 million on 31 December 2022 (excluding €9.9 million of net accrued interest income). Total net decrease in cash and cash equivalents and current financial investments amounted to €409.6 million in 2023, compared to a net decrease of €609.1 million in 2022. This net decrease was composed of (i) €414.8 million of operational cash burn, (ii) €20.4 million of negative exchange rate differences, (iii) €7.0 million cash-out related to the acquisition of CellPoint B.V., (iv) €14.0 million acquisition of financial assets held at fair value through profit or loss, offset by (v) €24.3 million positive changes in fair value of current financial investments, (vi) €1.8 million of cash proceeds from capital and share premium increase from exercise of subscription rights in 2023, and (vii) €12.9 million of accrued interest income on term deposits and €7.6 million accrued interest income on treasury bills. Operational cash burn (or operational cash flow if this liquidity measure is positive) is a financial measure that is not calculated in accordance with IFRS. Operational cash burn/cash flow is defined as the decrease or increase in our cash and cash equivalents (excluding the effect of exchange rate differences on cash and cash equivalents), minus: 1. the net proceeds, if any, from share capital and share premium increases included in the net cash flow generated from/used in (–) financing activities 2. the net proceeds or cash used, if any, in acquisitions or disposals of businesses and financial assets held at fair value through profit or loss; the movement in restricted cash and movement in current financial investments, if any, the loans and advances given to third parties, if any, included in the net cash flow generated from/used in (–) investing activities 3. the cash used for other liabilities related to the acquisition of businesses, if any, the accrued interest on cash and cash equivalents, if any, included in the net cash flow generated from/used in (–) operating activities. This alternative liquidity measure is, in our view, an important metric for a biotech company in the development stage.

The following table presents a reconciliation of operational cash burn, to the closest IFRS measures, for each of the periods indicated: (thousands of €) 2023 2022 Decrease in cash and cash equivalents (excluding effect of exchange differences) (339,785) (1,747,545) Less: Net proceeds from capital and share premium increases (1,770) (6,695) Net purchase/sale (-) of current financial investments (94,233) 1,087,032 Acquisition of financial assets held at fair value through profit or loss 13,965—Cash out from acquisition of subsidiaries, net of cash acquired 7,000 115,270 Cash advances and loans to third parties—10,000 Cash used for other liabilities related to the acquisition of subsidiaries—28,164 Total operational cash burn (414,824) (513,774)

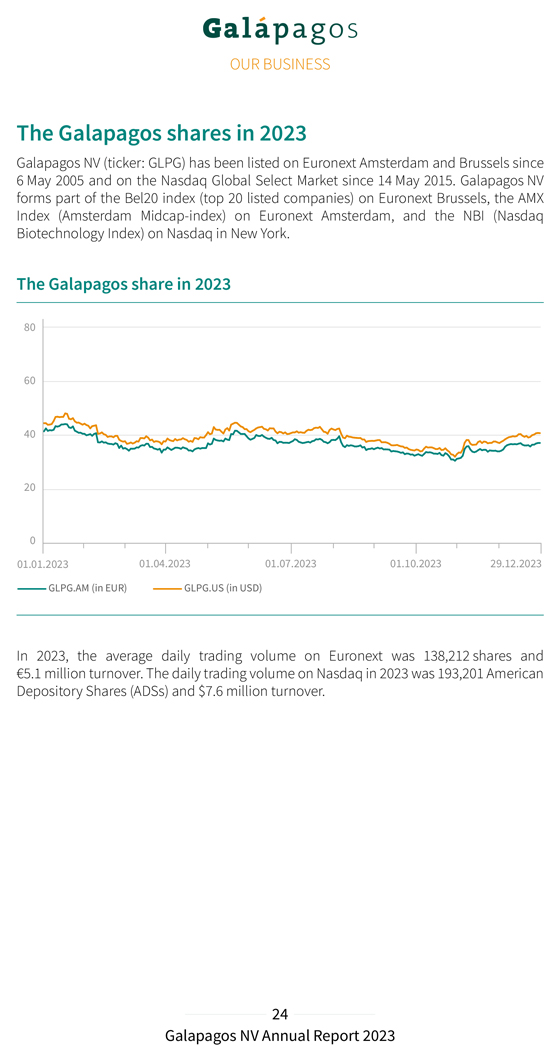

The Galapagos shares in 2023 Galapagos NV (ticker: GLPG) has been listed on Euronext Amsterdam and Brussels since 6 May 2005 and on the Nasdaq Global Select Market since 14 May 2015. Galapagos NV forms part of the Bel20 index (top 20 listed companies) on Euronext Brussels, the AMX Index (Amsterdam Midcap-index) on Euronext Amsterdam, and the NBI (Nasdaq Biotechnology Index) on Nasdaq in New York. The Galapagos share in 2023 In 2023, the average daily trading volume on Euronext was 138,212 shares and €5.1 million turnover. The daily trading volume on Nasdaq in 2023 was 193,201 American Depository Shares (ADSs) and $7.6 million turnover.

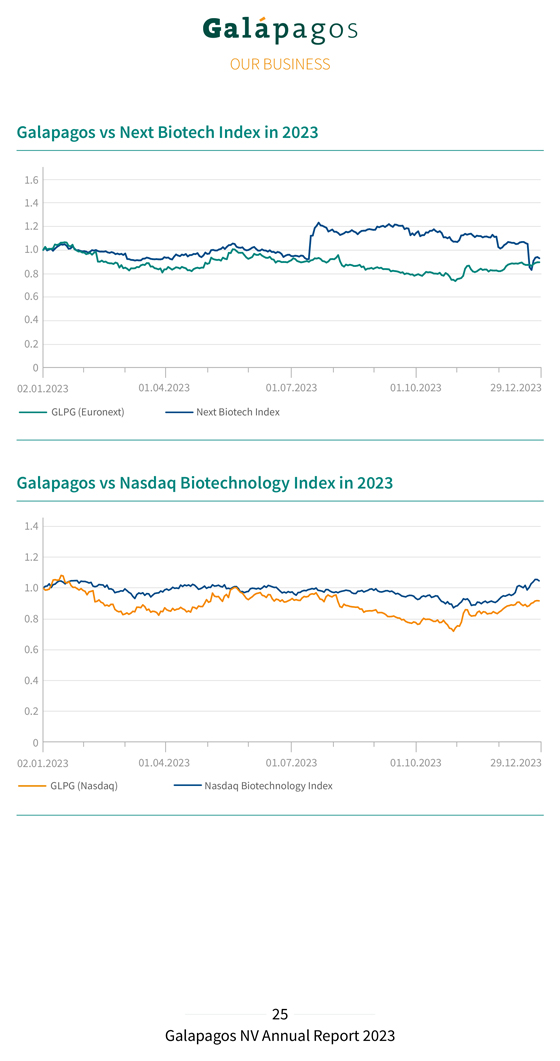

Galapagos vs Next Biotech Index in 2023 Galapagos vs Nasdaq Biotechnology Index in 2023

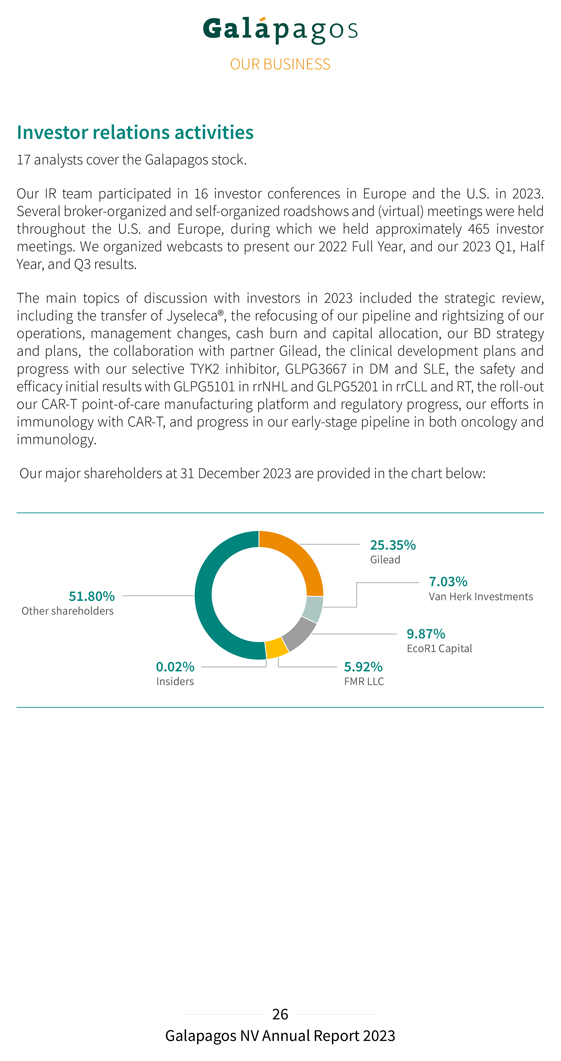

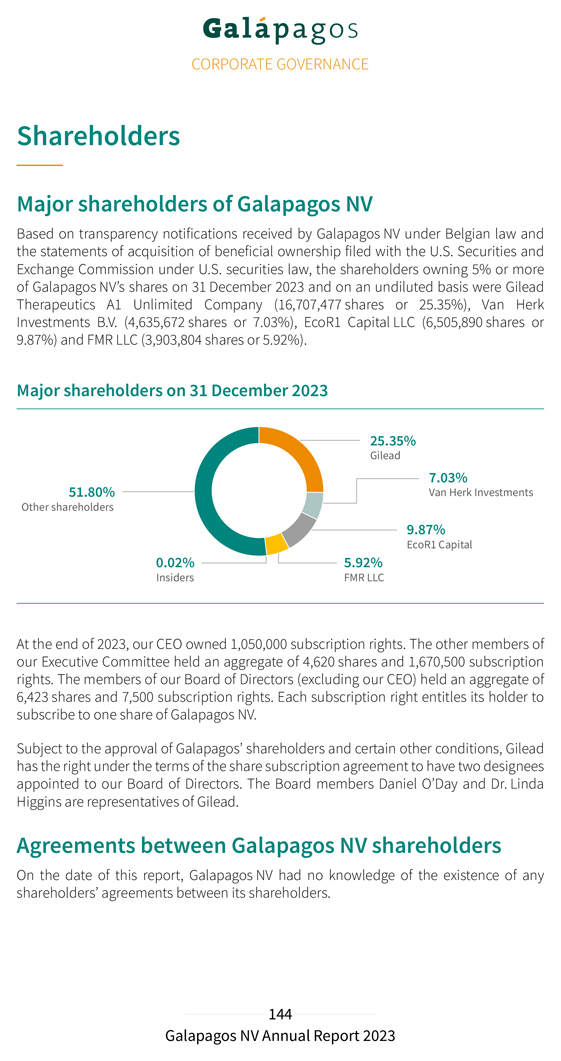

Investor relations activities 17 analysts cover the Galapagos stock. Our IR team participated in 16 investor conferences in Europe and the U.S. in 2023. Several broker-organized and self-organized roadshows and (virtual) meetings were held throughout the U.S. and Europe, during which we held approximately 465 investor meetings. We organized webcasts to present our 2022 Full Year, and our 2023 Q1, Half Year, and Q3 results. The main topics of discussion with investors in 2023 included the strategic review, including the transfer of Jyseleca®, the refocusing of our pipeline and rightsizing of our operations, management changes, cash burn and capital allocation, our BD strategy and plans, the collaboration with partner Gilead, the clinical development plans and progress with our selective TYK2 inhibitor, GLPG3667 in DM and SLE, the safety and efficacy initial results with GLPG5101 in rrNHL and GLPG5201 in rrCLL and RT, the roll-out our CAR-T point-of-care manufacturing platform and regulatory progress, our efforts in immunology with CAR-T, and progress in our early-stage pipeline in both oncology and immunology. Our major shareholders at 31 December 2023 are provided in the chart below:

Outlook 2024 Financial outlook For the full year 2024, we anticipate a further reduction in our cash burn to between €280 million and €320 million (compared to €414.8 million for the full year 2023), not including future potential business development opportunities. R&D Outlook We aim to progress three CAR-T Phase 1/2 studies in hemato-oncology: GLPG5101 in rrNHL; GLPG5201 in rrCLL, with or without RT; and GLPG5301 in rrMM. We expect to file IND applications in the U.S. to begin clinical development of our CAR-T programs in hemato-oncology. We plan to scale up our CAR-T network and operations further in the U.S. and Europe, and potentially in other key regions. Business development We will continue to evaluate multiple product candidates and business development opportunities to leverage our internal capabilities further, and accelerate and expand our pipeline of potential best-in-class investigational medicines in our therapeutic focus areas of immunology and oncology. Going concern statement To date, we have incurred significant operating losses, which are reflected in the consolidated balance sheet showing €228.3 million accumulated losses as at 31 December 2023. We realized a consolidated net profit of €211.7 million for the year ended 31 December 2023. Our existing current financial investments and cash and cash equivalents of €3,684.5 million at 31 December 2023 will enable us to fund our operating expenses and capital expenditure requirements at least for the next 12 months. The Board of Directors is also of the opinion that additional financing could be obtained, if required. Taking this into account, as well as the potential developments of our drug discovery and development activities, the Board of Directors is of the opinion that it can submit the financial statements on a going concern basis. Whilst our current financial investments and cash and cash equivalents are sufficient at least for the next 12 months, the Board of Directors points out that if the R&D activities go well, we may seek additional funding to support the continuing development of our products or to be able to execute other business opportunities.

Risk management and internal control Risk management is embedded in our strategy and is considered important for achieving our operational targets. To safeguard the proper implementation and execution of the group’s strategy, our Executive Committee has established internal risk management and control systems within Galapagos. The Board of Directors has delegated an active role to the Audit Committee members to monitor the design, implementation and effectiveness of these internal risk management and control systems. The purpose of these systems is to manage in an effective and efficient manner the significant risks to which Galapagos is exposed. The internal risk management and control system is designed to ensure: the careful monitoring of the effectiveness of our strategy Galapagos’ continuity and sustainability, through consistent accounting, reliable financial reporting and compliance with laws and regulations our focus on the most efficient and effective way to conduct our business We have defined our risk tolerance on a number of internal and external factors including: financial strength in the long run, represented by revenue growth and a solid balance sheet liquidity in the short run; cash business performance measures; operational and net profitability scientific risks and opportunities dependence on our alliance partners compliance with relevant rules and regulations reputation The identification and analysis of risks is an ongoing process that is naturally a critical component of internal control. Based on these factors and Galapagos’ risk tolerance, the key controls within Galapagos will be registered and the effectiveness will be monitored. If the assessment shows the necessity to modify the controls we will do so. This could be the situation if the external environment changes, or the laws, regulations, or the strategy of Galapagos change. The financial risks of Galapagos are managed centrally. The finance department of Galapagos coordinates the access to national and international financial markets and considers and continuously manages the financial risks concerning the activities of the group. These relate to the following financial markets risks: credit risk, liquidity risk,

currency and interest rate risk. Our interest rate risk is limited because we have nearly no financial debt. In the event of decreasing interest rates we would face a reinvestment risk on our strong cash position. The group does not buy or trade financial instruments for speculative purposes. For further reference on financial risk management, see note 34 of the notes to the consolidated financial statements. We also refer to the Risk factors section of the annual report for additional details on general risk factors. The company’s internal controls over financial reporting are a subset of internal controls and include those policies and procedures that: pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with IFRS as adopted by the EU, and that our receipts and expenditures are being made only by authorized persons provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements Our internal control over financial reporting includes controls over relevant IT systems that impact financial reporting including accuracy and completeness of our account balances. Since the company has securities registered with the U.S. Securities and Exchange Commission (SEC) and is a large accelerated filer within the meaning of Rule 12b-2 of the U.S Securities Exchange Act of 1934, the company needs to assess the effectiveness of internal control over financial reporting and provide a report on the results of this assessment. In 2023 management has reviewed its internal controls over financial reporting based on criteria established in the Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and engaged an external advisor to help assess the effectiveness of those controls. As described in Section 404 of the U.S. Sarbanes-Oxley Act of 2002 and the rules implementing such act, we will include the management and the statutory auditor’s assessment of the effectiveness of internal control over financial reporting in our annual report on Form 20-F, which is expected to be filed with the SEC on or around the publication date of the present annual report.

Our programs in oncology and immunology Pioneering science to transform patient outcomes

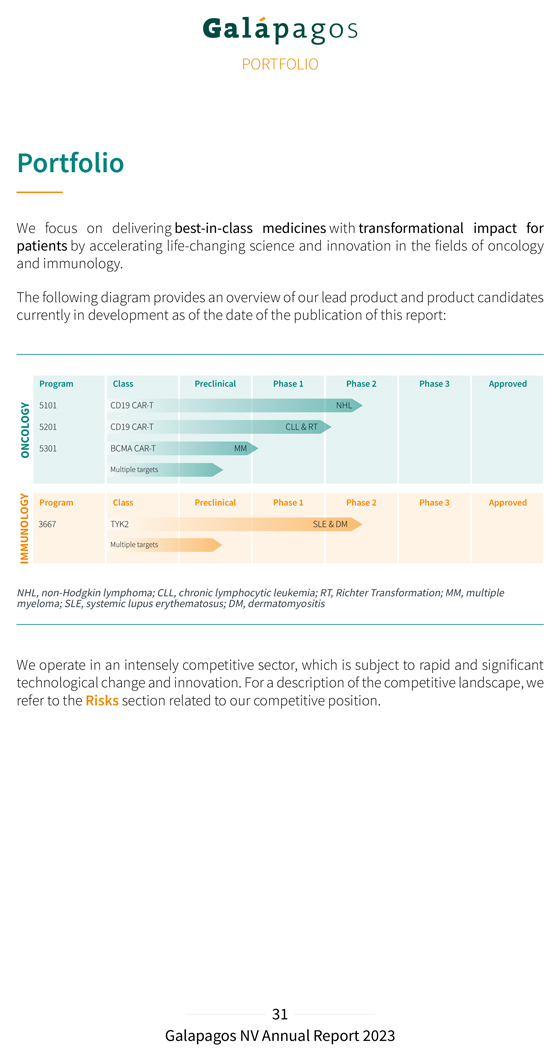

PORTFOLIO Portfolio We focus on delivering best-in-class medicines with transformational impact for patients by accelerating life-changing science and innovation in the fields of oncology and immunology. The following diagram provides an overview of our lead product and product candidates currently in development as of the date of the publication of this report: NHL, myeloma; non- Hodgkin SLE, systemic lymphoma; lupus erythematosus; CLL, chronic lymphocytic DM, dermatomyositis leukemia; RT, Richter Transformation; MM, multiple We operate in an intensely competitive sector, which is subject to rapid and significant technological change and innovation. For a description of the competitive landscape, we refer to the Risks section related to our competitive position.

Oncology Cancer leaves no one untouched, affecting many of us in one way or another. The urgency for effective, broadly accessible treatment options and novel therapies is paramount, as the outlook for patients is often grim, with survival measured in months rather than years. Advances in cancer research stands as our sole beacon of hope in addressing this disease and transforming patient outcomes. We passionately strive to turn cancers into manageable chronic conditions or even curable diseases. Our oncology researchers are determined to rise to the challenge to overcome the devastating impact of cancer by accelerating new ways to target cancer from different angles, whether through small molecules, antibody-based biological therapies, or novel chimeric antigen receptor (CAR-T) cell therapies, coupled with ingenious manufacturing technologies, and other revolutionary approaches. We believe in synergizing the most compelling science and technology from both within and outside our organization to introduce a new multi-faceted treatment paradigm for cancers with significant unmet medical needs. Our current clinical development is focused on hematological cancers for patients in need of additional and improved treatment options: non-Hodgkin’s lymphoma, chronic lymphocytic leukemia with or without Richter transformation, and multiple myeloma.

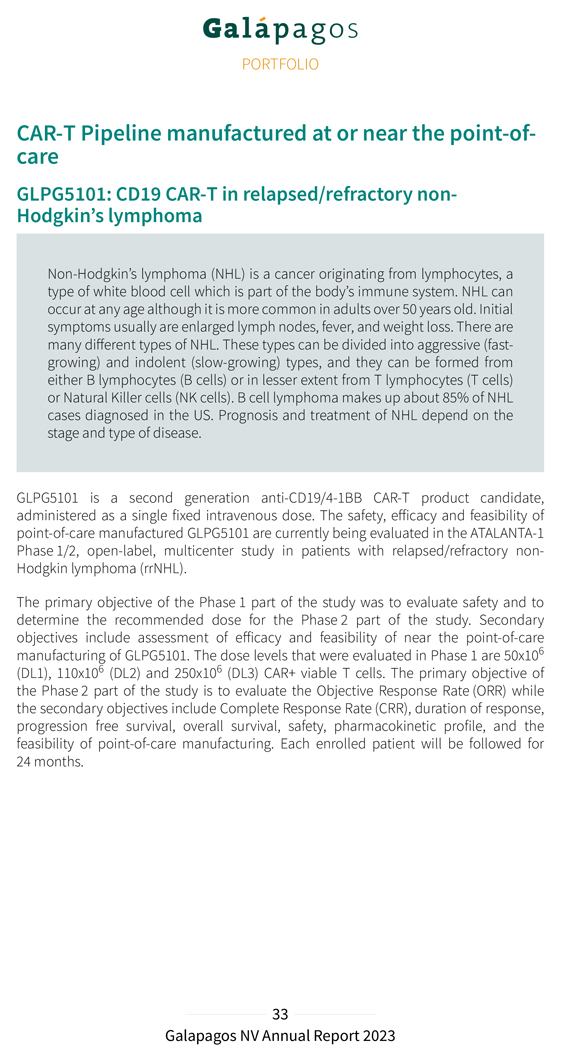

CAR care-T Pipeline manufactured at or near the point-of- GLPG5101: CD19 CAR-T in relapsed/refractory non-Hodgkin’s lymphoma Non-Hodgkin’s lymphoma (NHL) is a cancer originating from lymphocytes, a type of white blood cell which is part of the body’s immune system. NHL can occur at any age although it is more common in adults over 50 years old. Initial symptoms usually are enlarged lymph nodes, fever, and weight loss. There are many different types of NHL. These types can be divided into aggressive (fast-growing) and indolent (slow-growing) types, and they can be formed from either B lymphocytes (B cells) or in lesser extent from T lymphocytes (T cells) or Natural Killer cells (NK cells). B cell lymphoma makes up about 85% of NHL cases diagnosed in the US. Prognosis and treatment of NHL depend on the stage and type of disease. GLPG5101 is a second generation anti-CD19/4-1BB CAR-T product candidate, administered as a single fixed intravenous dose. The safety, efficacy and feasibility of point-of-care manufactured GLPG5101 are currently being evaluated in the ATALANTA-1 Phase 1/2, open-label, multicenter study in patients with relapsed/refractory non-Hodgkin lymphoma (rrNHL). The primary objective of the Phase 1 part of the study was to evaluate safety and to determine the recommended dose for the Phase 2 part of the study. Secondary objectives include assessment of efficacy and feasibility of near the point-of-care manufacturing of GLPG5101. The dose levels that were evaluated in Phase 1 are 50x106 (DL1), 110x106 (DL2) and 250x106 (DL3) CAR+ viable T cells. The primary objective of the Phase 2 part of the study is to evaluate the Objective Response Rate (ORR) while the secondary objectives include Complete Response Rate (CRR), duration of response, progression free survival, overall survival, safety, pharmacokinetic profile, and the feasibility of point-of-care manufacturing. Each enrolled patient will be followed for 24 months.

ATALANTA-1 Phase 1/2 study design of GLPG5101 in rrNHL ‘5101 basket trial in DLBCL, MCL, MZL, FL, BL & PCNSL Ph1—dose escalation (nâ‰^15) Ph2—dose expansion DL1 ‘5101 (50 x10^6 CAR T cells) (nâ‰^30 per indication) DL2 ‘5101 (110 x10^6 CAR T cells) ‘5101 RP2D dose DL3 ‘5101 (250 x10^6 CAR T cells) Key eligibility criteria r/r DLBCL, MCL, MZL, FL, BL & PCNSL population ≥ 2 prior lines of therapy, or primary refractory DLBCL or BL ≥ 1 prior line of therapy for PCNSL Not achieving CR to 2L therapy for BL and PCNSL Patient Incl. transplant ineligible No prior CD19-targeted therapy allowed BL, cell Burkitt lymphoma; lymphoma; MZL, marginal DL, dose zone level; lymphoma; DLBCL, diffuse PCNSL, large primary B-cell central lymphoma; nervous FL, follicular system lymphoma; lymphoma; rrNHL, MCL, mantle relapsed/ refractory conditioning non is- Hodgkin lymphodepleting lymphoma; chemotherapy RP2D, recommended . phase 2 dose. EudraCT 2021-003272-13. Patient

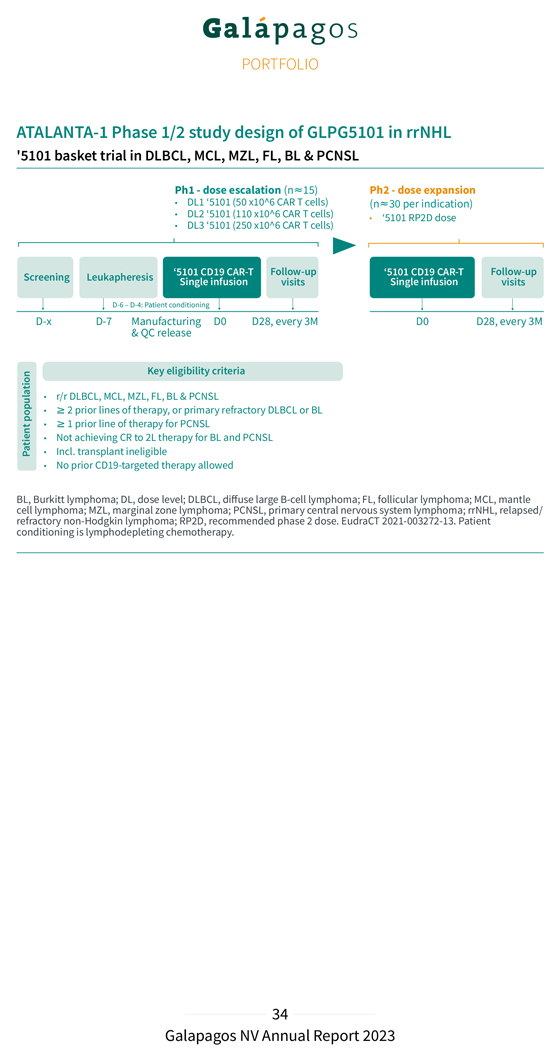

Baseline characteristics ATALANTA-1 Heavily pretreated population of NHL patients Phase 1 Phase 2 (N=14) (N=9) Age, median (range), years 65 (50-77) 69 (46-73) Male, n (%) 11 (79) 4 (44) Disease subtype, n (%) DLBCL 7 (50) 0 FL 3 (21.5) 6 (67) MCL 3 (21.5) 2 (22) MZL 1 (7) 1 (11) IPI/MIPI/FLIPI score; high risk, n (%) 6 (43) 6 (67) No. of prior therapy lines, median (range) 4 (1-7) 4 (2-11) ECOG performance status screening, n (%) 0 6 (43) 4 (44.5) 1 8 (57) 3 (33.5) 2 2 (22) Prior ASCT, n (%) 6 (43) 3 (33) Ann Arbor disease stage III-IV, n (%) 13 (93) 6 (67) Extranodal disease, n (%) 5 (36) 2 (22) Poster presented at the 2023 ASH Annual Meeting and Exposition; December 9-12, 2023; San Diego, CA. ASCT, autologous stem cell transplant; DL, dose level; DLBCL, diffuse large B-cell lymphoma; ECOG, Eastern Cooperative Oncology Group; FL, follicular lymphoma; (M, FL)IPI, (mantle cell lymphoma, follicular lymphoma) international prognostic index; MCL, mantle cell lymphoma; MZL, marginal zone lymphoma; NHL, non-Hodgkin lymphoma To further build a robust data package, patient recruitment of the Phase 1 dose-finding part of ATALANTA-1 is ongoing. As of 1 September 2023 (cut-off date), 14 heavily pre-treated rrNHL patients with diffuse large B cell lymphoma, mantle cell lymphoma and indolent lymphoma were enrolled (7 at DL1 and 7 at DL2). In parallel, enrollment of the Phase 2 expansion study is ongoing, and the first 9 patients have been dosed. In December 2023, we presented promising new preliminary data from the ATALANTA-1 Phase 1 dose-finding part of the study and preliminary data of the Phase 2 expansion part during a poster session at the 65th Annual American Society of Hematology (ASH) Congress San Diego (cut-off date: 1 September 2023). The detailed results are presented below.

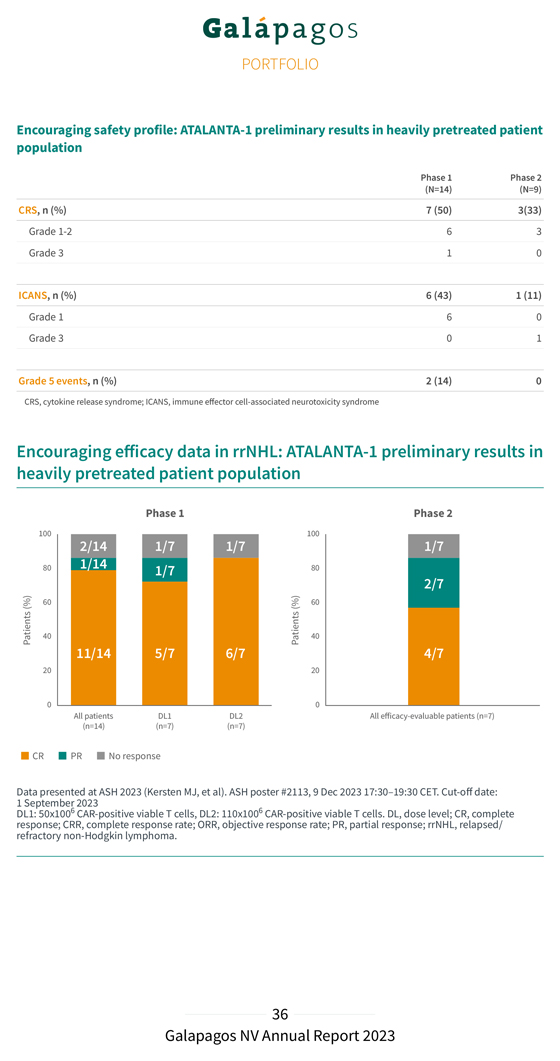

Encouraging safety profile: ATALANTA-1 preliminary results in heavily pretreated patient population Phase 1 Phase 2 (N=14) (N=9) CRS, n (%) 7 (50) 3(33) Grade 1-2 6 3 Grade 3 1 0 ICANS, n (%) 6 (43) 1 (11) Grade 1 6 0 Grade 3 0 1 Grade 5 events, n (%) 2 (14) 0 CRS, cytokine release syndrome; ICANS, immune effector cell-associated neurotoxicity syndrome Encouraging efficacy data in rrNHL: ATALANTA-1 preliminary results in heavily pretreated patient population Data 1 September presented 2023 at ASH 2023 (Kersten MJ, et al). ASH poster #2113, 9 Dec 2023 17:30–19:30 CET. Cut-off date: DL1: 50x1006 CAR-positive viable T cells, DL2: 110x1006 CAR-positive viable T cells. DL, dose level; CR, complete response; refractory CRR, non- Hodgkin complete lymphoma response .rate; ORR, objective response rate; PR, partial response; rrNHL, relapsed/

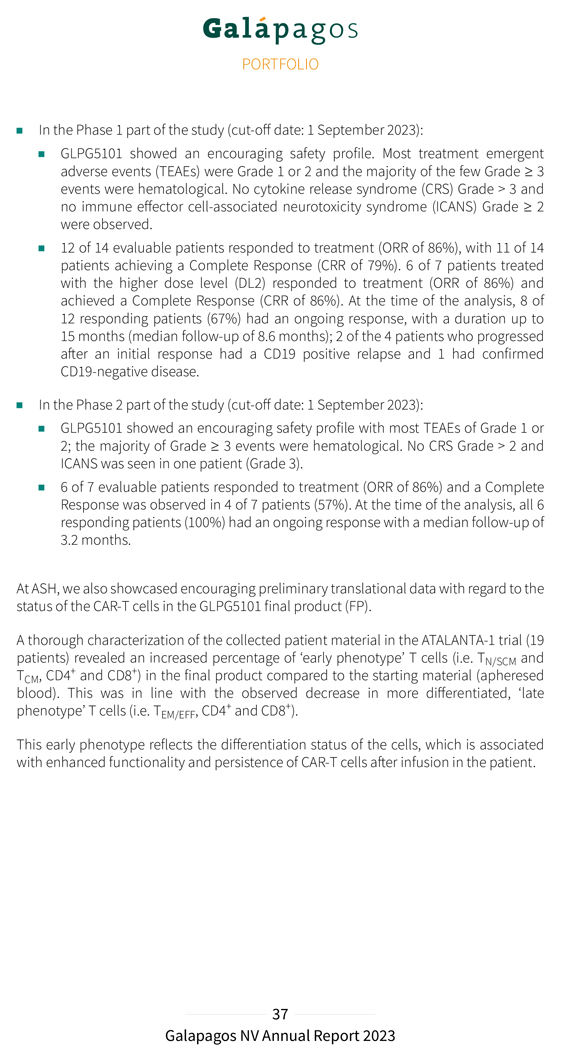

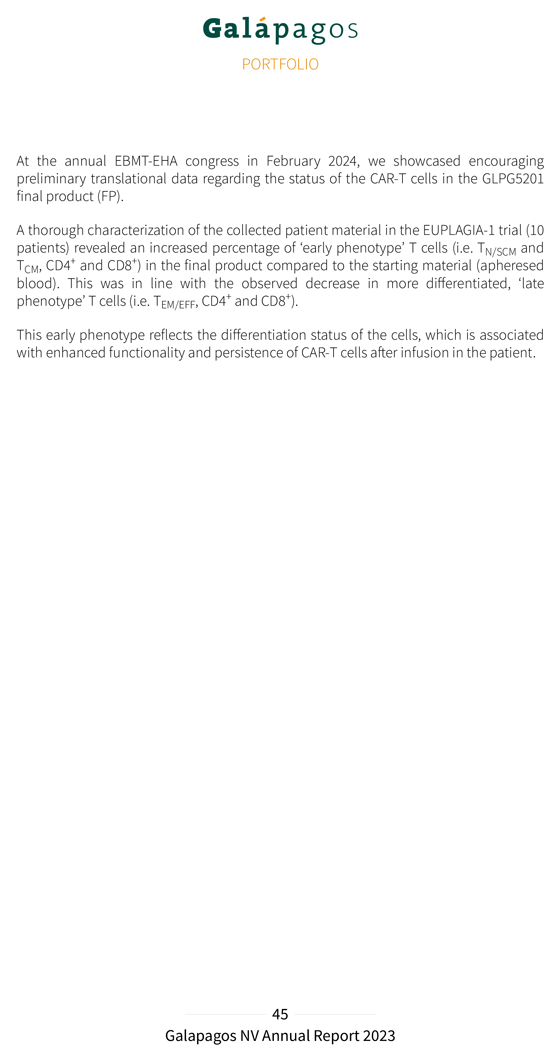

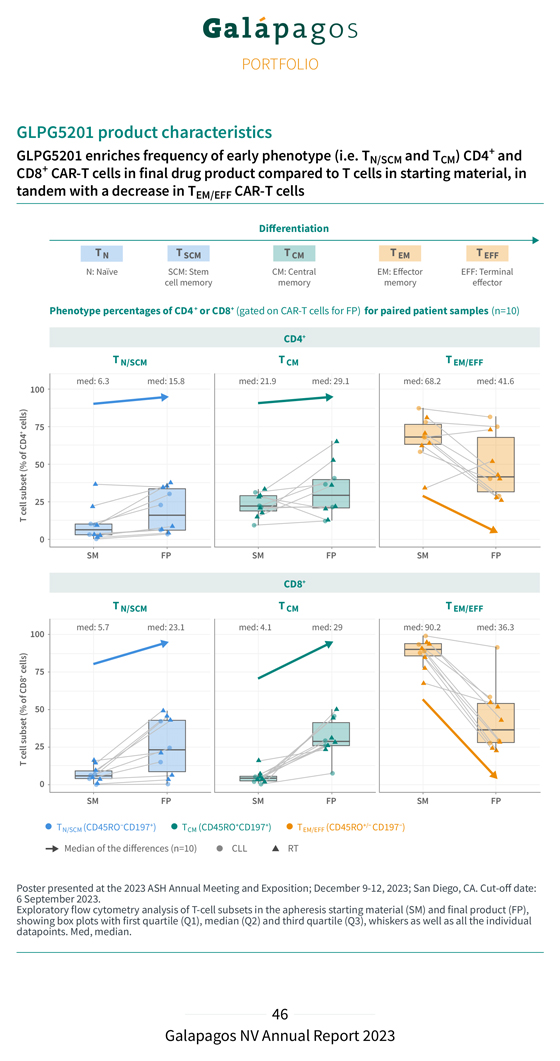

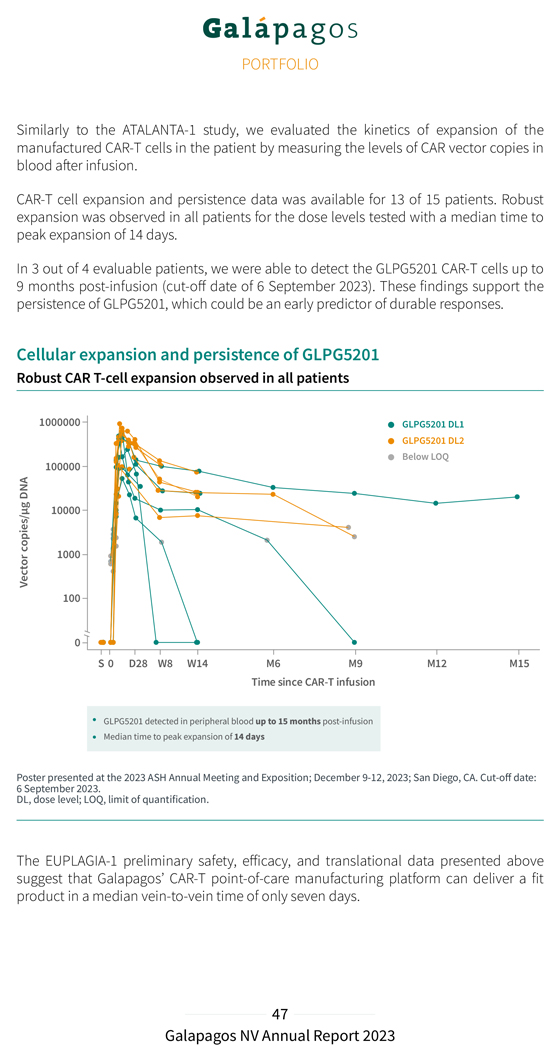

In the Phase 1 part of the study (cut-off date: 1 September 2023): GLPG5101 showed an encouraging safety profile. Most treatment emergent adverse events (TEAEs) were Grade 1 or 2 and the majority of the few Grade 3 events were hematological. No cytokine release syndrome (CRS) Grade > 3 and no immune effector cell-associated neurotoxicity syndrome (ICANS) Grade 2 were observed. 12 of 14 evaluable patients responded to treatment (ORR of 86%), with 11 of 14 patients achieving a Complete Response (CRR of 79%). 6 of 7 patients treated with the higher dose level (DL2) responded to treatment (ORR of 86%) and achieved a Complete Response (CRR of 86%). At the time of the analysis, 8 of 12 responding patients (67%) had an ongoing response, with a duration up to 15 months (median follow-up of 8.6 months); 2 of the 4 patients who progressed after an initial response had a CD19 positive relapse and 1 had confirmed CD19-negative disease. In the Phase 2 part of the study (cut-off date: 1 September 2023): GLPG5101 showed an encouraging safety profile with most TEAEs of Grade 1 or 2; the majority of Grade 3 events were hematological. No CRS Grade > 2 and ICANS was seen in one patient (Grade 3). 6 of 7 evaluable patients responded to treatment (ORR of 86%) and a Complete Response was observed in 4 of 7 patients (57%). At the time of the analysis, all 6 responding patients (100%) had an ongoing response with a median follow-up of 3.2 months. At ASH, we also showcased encouraging preliminary translational data with regard to the status of the CAR-T cells in the GLPG5101 final product (FP). A thorough characterization of the collected patient material in the ATALANTA-1 trial (19 patients) revealed an increased percentage of ‘early phenotype’ T cells (i.e. TN/SCM and T , CD4+ and CD8+) in the final product compared to the starting material (apheresed blood) CM . This was in line with the observed decrease in more differentiated, ‘late phenotype’ T cells (i.e. T , CD4+ and CD8+). EM/EFF This early phenotype reflects the differentiation status of the cells, which is associated with enhanced functionality and persistence of CAR-T cells after infusion in the patient.

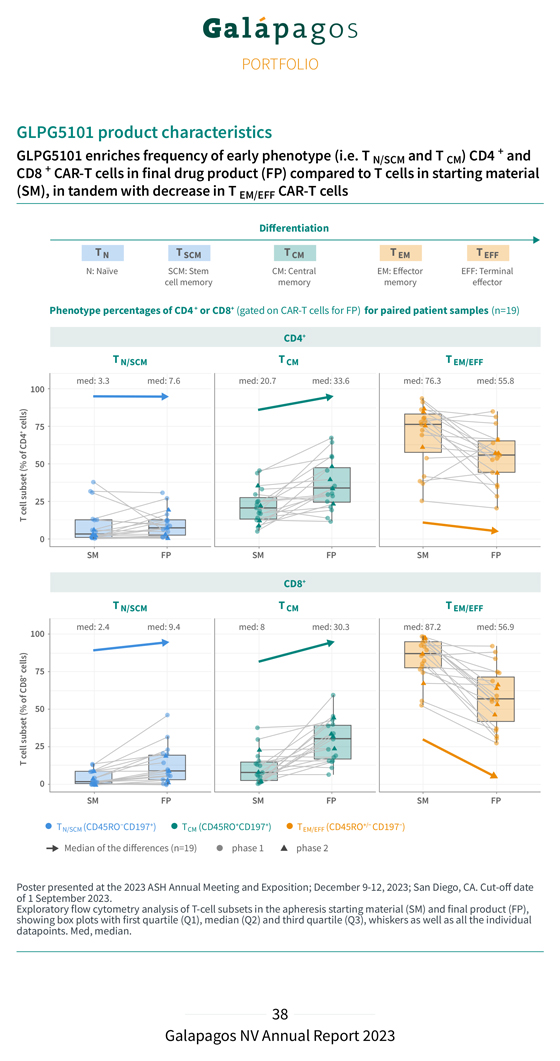

GLPG5101 product characteristics GLPG5101 enriches frequency of early phenotype (i.e. T and T ) CD4 + and N/SCM CM CD8 + CAR-T cells in final drug product (FP) compared to T cells in starting material (SM), in tandem with decrease in T EM/EFF CAR-T cells Differentiation T N T SCM T CM T EM T EFF N: Naïve SCM: Stem CM: Central EM: Effector EFF: Terminal cell memory memory memory effector Phenotype percentages of CD4+ or CD8+ (gated on CAR-T cells for FP) for paired patient samples (n=19) CD4+ CD8+ Poster of 1 September presented 2023 at the . 2023 ASH Annual Meeting and Exposition; December 9-12, 2023; San Diego, CA. Cut-off date showing Exploratory box flow plots cytometry with first analysis quartile of (Q1), T-cell median subsets (Q2) in and the third apheresis quartile starting (Q3), material whiskers (SM) as well and as final all the product individual (FP), datapoints. Med, median.

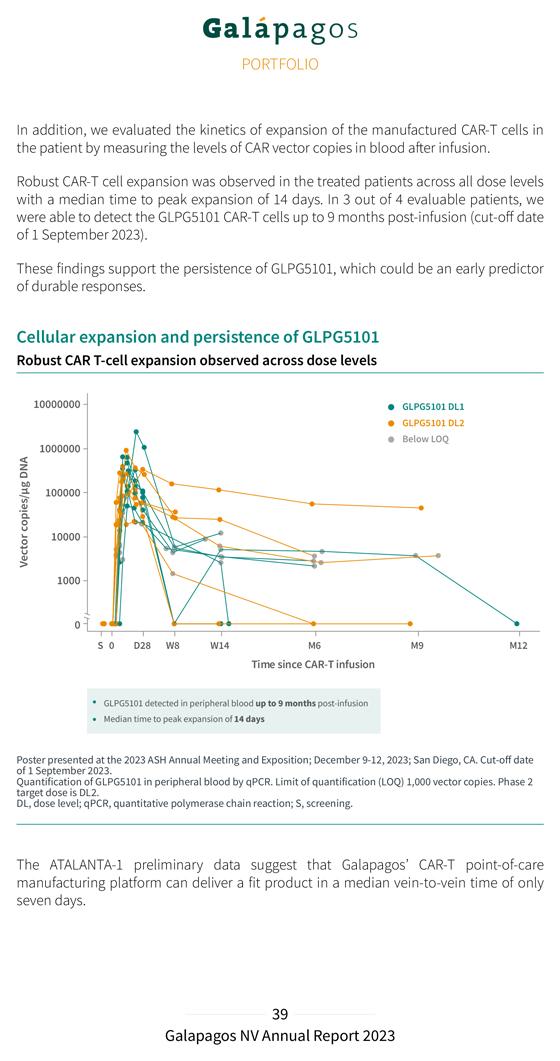

In addition, we evaluated the kinetics of expansion of the manufactured CAR-T cells in the patient by measuring the levels of CAR vector copies in blood after infusion. Robust CAR-T cell expansion was observed in the treated patients across all dose levels with a median time to peak expansion of 14 days. In 3 out of 4 evaluable patients, we were able to detect the GLPG5101 CAR-T cells up to 9 months post-infusion (cut-off date of 1 September 2023). These findings support the persistence of GLPG5101, which could be an early predictor of durable responses. Cellular expansion and persistence of GLPG5101 Robust CAR T-cell expansion observed across dose levels GLPG5101 detected in peripheral blood up to 9 months post-infusion Median time to peak expansion of 14 days Poster of 1 September presented 2023 at the . 2023 ASH Annual Meeting and Exposition; December 9-12, 2023; San Diego, CA. Cut-off date Quantification target dose is DL2 of GLPG5101 . in peripheral blood by qPCR. Limit of quantification (LOQ) 1,000 vector copies. Phase 2 DL, dose level; qPCR, quantitative polymerase chain reaction; S, screening. The ATALANTA-1 preliminary data suggest that Galapagos’ CAR-T point-of-care manufacturing platform can deliver a fit product in a median vein-to-vein time of only seven days.

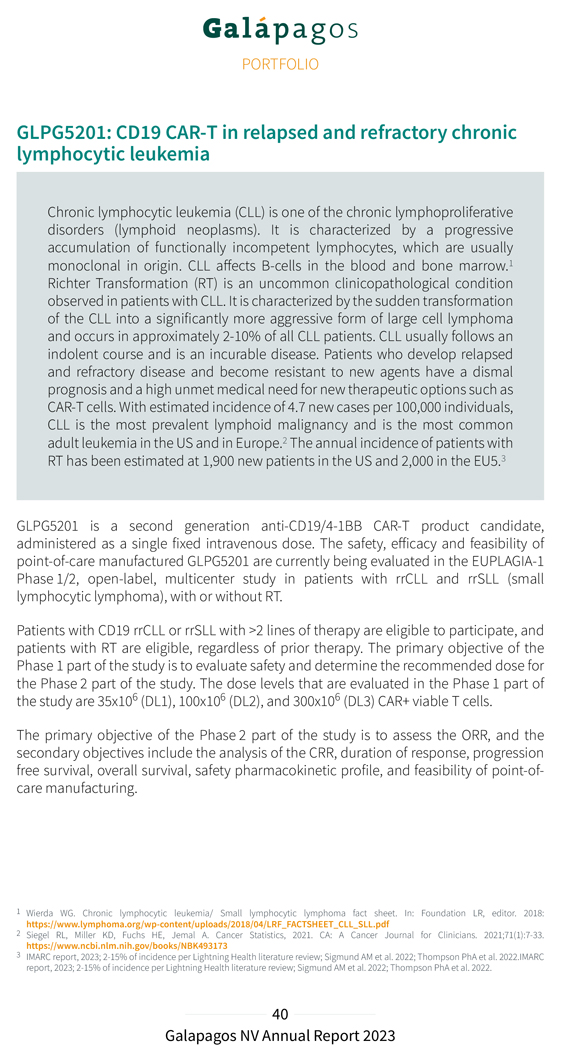

GLPG5201: CD19 CAR-T in relapsed and refractory chronic lymphocytic leukemia Chronic lymphocytic leukemia (CLL) is one of the chronic lymphoproliferative disorders (lymphoid neoplasms). It is characterized by a progressive accumulation of functionally incompetent lymphocytes, which are usually monoclonal in origin. CLL affects B-cells in the blood and bone marrow.1 Richter Transformation (RT) is an uncommon clinicopathological condition observed in patients with CLL. It is characterized by the sudden transformation of the CLL into a significantly more aggressive form of large cell lymphoma and occurs in approximately 2-10% of all CLL patients. CLL usually follows an indolent course and is an incurable disease. Patients who develop relapsed and refractory disease and become resistant to new agents have a dismal prognosis and a high unmet medical need for new therapeutic options such as CAR-T cells. With estimated incidence of 4.7 new cases per 100,000 individuals, CLL is the most prevalent lymphoid malignancy and is the most common adult leukemia in the US and in Europe.2 The annual incidence of patients with RT has been estimated at 1,900 new patients in the US and 2,000 in the EU5.3 GLPG5201 is a second generation anti-CD19/4-1BB CAR-T product candidate, administered as a single fixed intravenous dose. The safety, efficacy and feasibility of point-of-care manufactured GLPG5201 are currently being evaluated in the EUPLAGIA-1 Phase 1/2, open-label, multicenter study in patients with rrCLL and rrSLL (small lymphocytic lymphoma), with or without RT. Patients with CD19 rrCLL or rrSLL with >2 lines of therapy are eligible to participate, and patients with RT are eligible, regardless of prior therapy. The primary objective of the Phase 1 part of the study is to evaluate safety and determine the recommended dose for the Phase 2 part of the study. The dose levels that are evaluated in the Phase 1 part of the study are 35x106 (DL1), 100x106 (DL2), and 300x106 (DL3) CAR+ viable T cells. The primary objective of the Phase 2 part of the study is to assess the ORR, and the secondary objectives include the analysis of the CRR, duration of response, progression free survival, overall survival, safety pharmacokinetic profile, and feasibility of point-of-care manufacturing. 1 Wierda WG. Chronic lymphocytic leukemia/ Small lymphocytic lymphoma fact sheet. In: Foundation LR, editor. 2018: 2 https://www.lymphoma.org/wp-content/uploads/2018/04/LRF_FACTSHEET_CLL_SLL.pdf Siegel RL, Miller KD, Fuchs HE, Jemal A. Cancer Statistics, 2021. CA: A Cancer Journal for Clinicians. 2021;71(1):7-33. 3 https://www.ncbi.nlm.nih.gov/books/NBK493173 IMARC report, 2023; 2-15% of incidence per Lightning Health literature review; Sigmund AM et al. 2022; Thompson PhA et al. 2022.IMARC report, 2023; 2-15% of incidence per Lightning Health literature review; Sigmund AM et al. 2022; Thompson PhA et al. 2022.

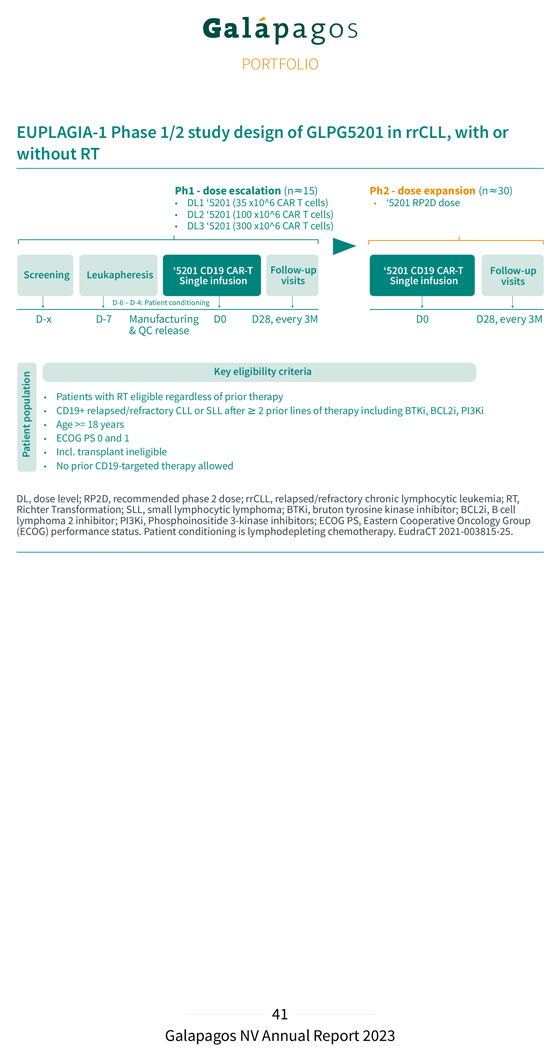

EUPLAGIA-1 Phase 1/2 study design of GLPG5201 in rrCLL, with or without RT Key eligibility criteria Patients with RT eligible regardless of prior therapy population CD19+ relapsed/refractory CLL or SLL after ≥ 2 prior lines of therapy including BTKi, BCL2i, PI3Ki Age >= 18 years ECOG PS 0 and 1 Patient Incl. transplant ineligible No prior CD19-targeted therapy allowed DL, Richter dose Transformation; level; RP2D, recommended SLL, small lymphocytic phase 2 dose; lymphoma; rrCLL, relapsed/refractory BTKi, bruton tyrosine chronic kinase lymphocytic inhibitor; leukemia; BCL2i, B cell RT, lymphoma (ECOG) performance 2 inhibitor; status PI3Ki, . Patient Phosphoinositide conditioning 3- is kinase lymphodepleting inhibitors; ECOG chemotherapy PS, Eastern . EudraCT Cooperative 2021 Oncology -003815-25 Group .

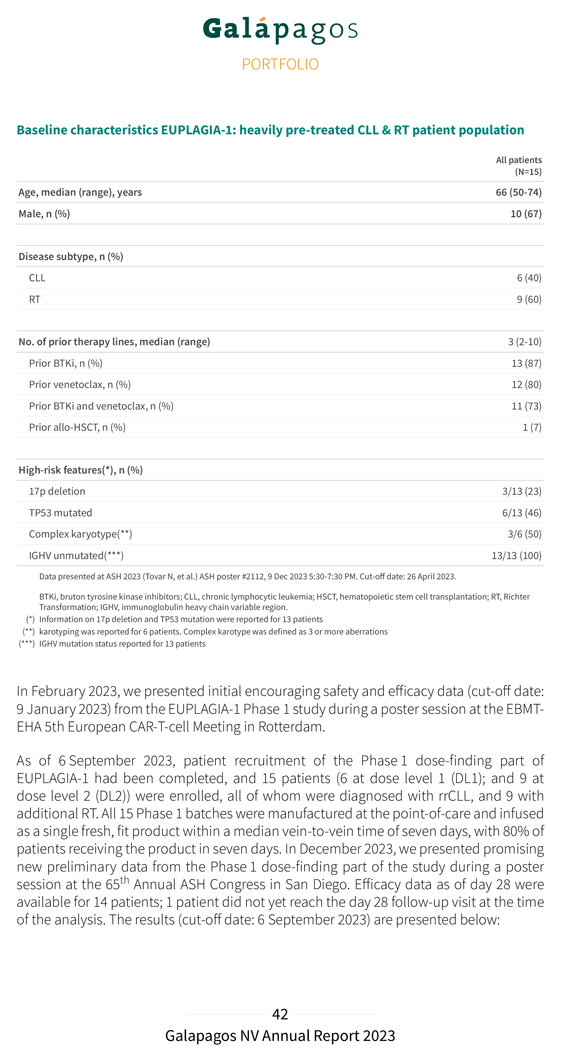

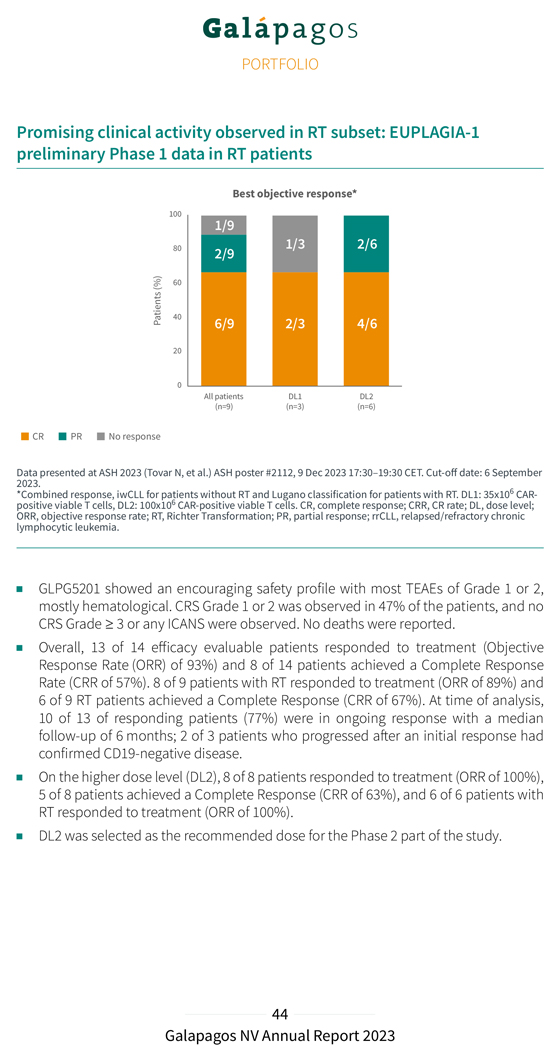

Baseline characteristics EUPLAGIA-1: heavily pre-treated CLL & RT patient population All patients (N=15) Age, median (range), years 66 (50-74) Male, n (%) 10 (67) Disease subtype, n (%) CLL 6 (40) RT 9 (60) No. of prior therapy lines, median (range) 3 (2-10) Prior BTKi, n (%) 13 (87) Prior venetoclax, n (%) 12 (80) Prior BTKi and venetoclax, n (%) 11 (73) Prior allo-HSCT, n (%) 1 (7) High-risk features(*), n (%) 17p deletion 3/13 (23) TP53 mutated 6/13 (46) Complex karyotype(**) 3/6 (50) IGHV unmutated(***) 13/13 (100) Data presented at ASH 2023 (Tovar N, et al.) ASH poster #2112, 9 Dec 2023 5:30-7:30 PM. Cut-off date: 26 April 2023. BTKi, bruton tyrosine kinase inhibitors; CLL, chronic lymphocytic leukemia; HSCT, hematopoietic stem cell transplantation; RT, Richter Transformation; IGHV, immunoglobulin heavy chain variable region. (*) Information on 17p deletion and TP53 mutation were reported for 13 patients (**) karotyping was reported for 6 patients. Complex karotype was defined as 3 or more aberrations (***) IGHV mutation status reported for 13 patients In February 2023, we presented initial encouraging safety and efficacy data (cut-off date: 9 January 2023) from the EUPLAGIA-1 Phase 1 study during a poster session at the EBMT-EHA 5th European CAR-T-cell Meeting in Rotterdam. As of 6 September 2023, patient recruitment of the Phase 1 dose-finding part of EUPLAGIA-1 had been completed, and 15 patients (6 at dose level 1 (DL1); and 9 at dose level 2 (DL2)) were enrolled, all of whom were diagnosed with rrCLL, and 9 with additional RT. All 15 Phase 1 batches were manufactured at the point-of-care and infused as a single fresh, fit product within a median vein-to-vein time of seven days, with 80% of patients receiving the product in seven days. In December 2023, we presented promising new preliminary data from the Phase 1 dose-finding part of the study during a poster session at the 65th Annual ASH Congress in San Diego. Efficacy data as of day 28 were available for 14 patients; 1 patient did not yet reach the day 28 follow-up visit at the time of the analysis. The results (cut-off date: 6 September 2023) are presented below:

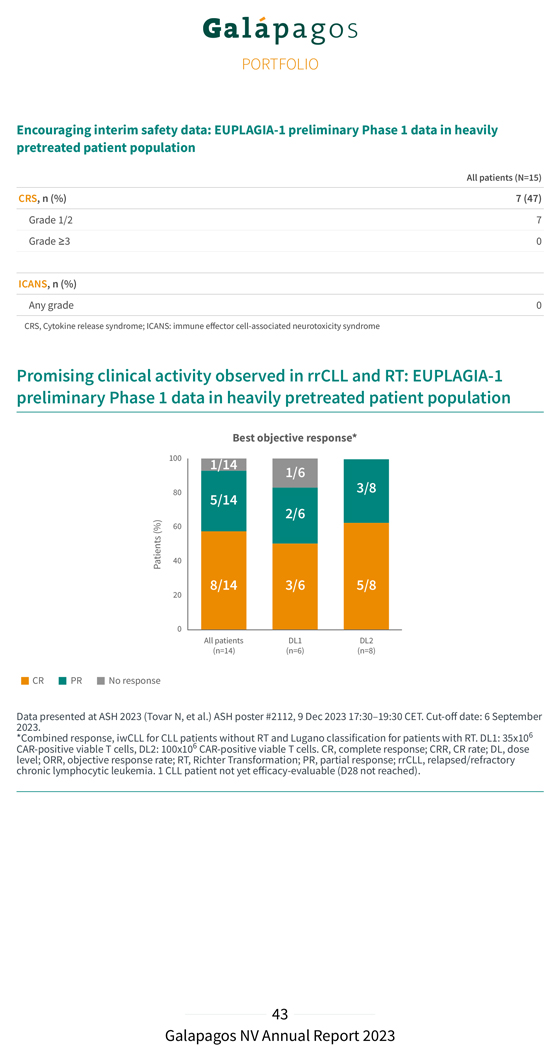

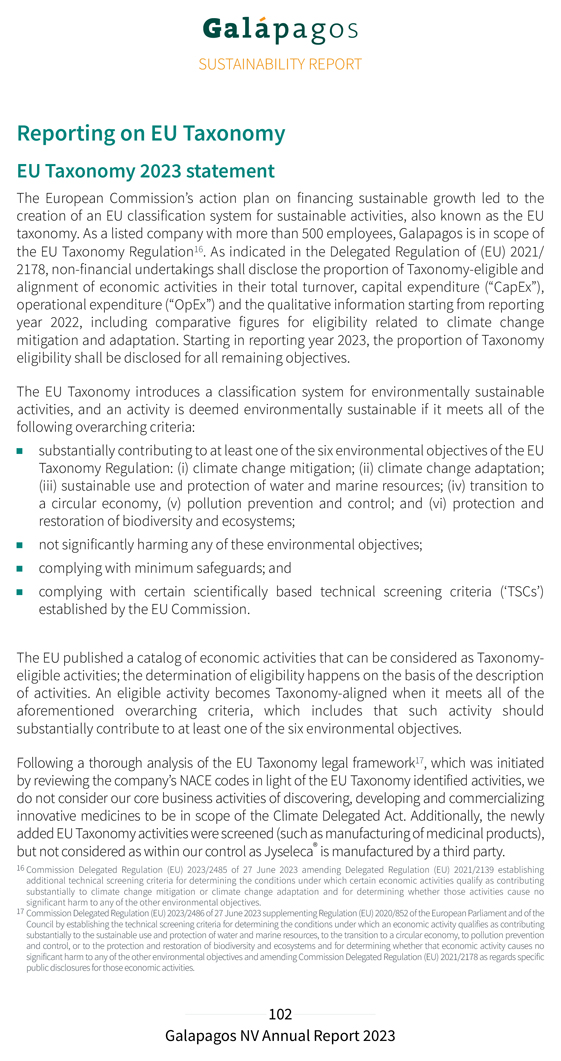

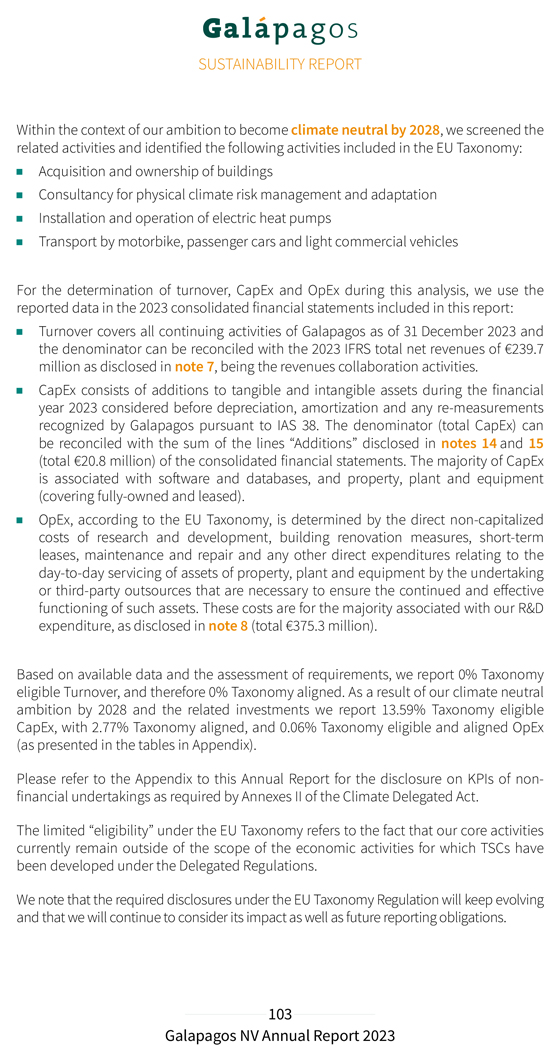

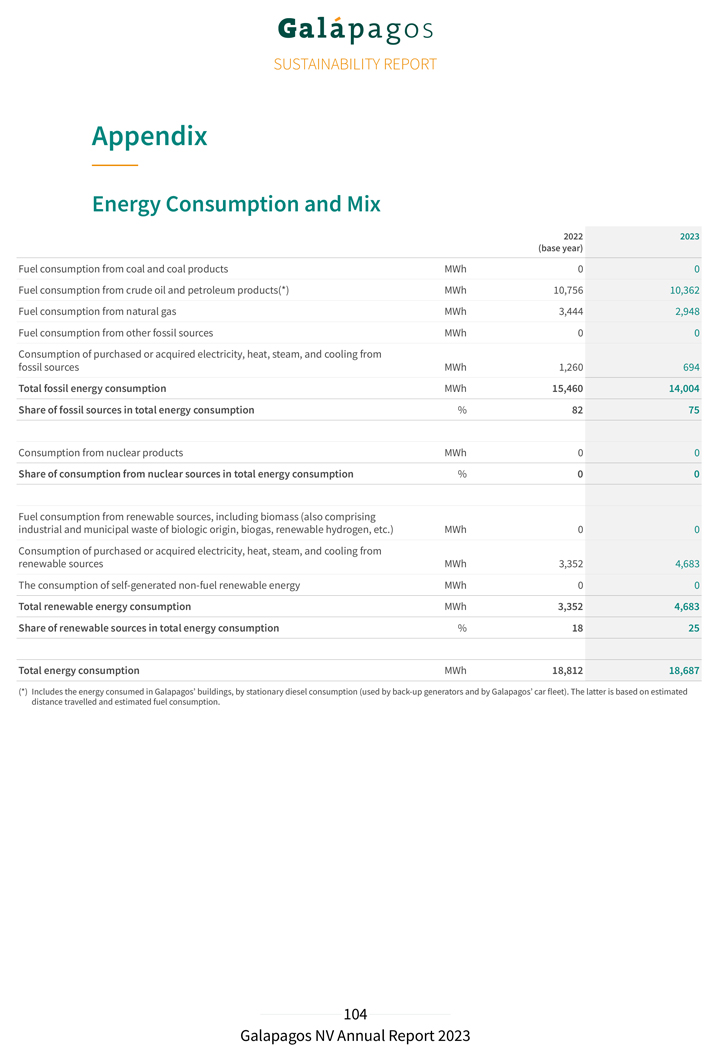

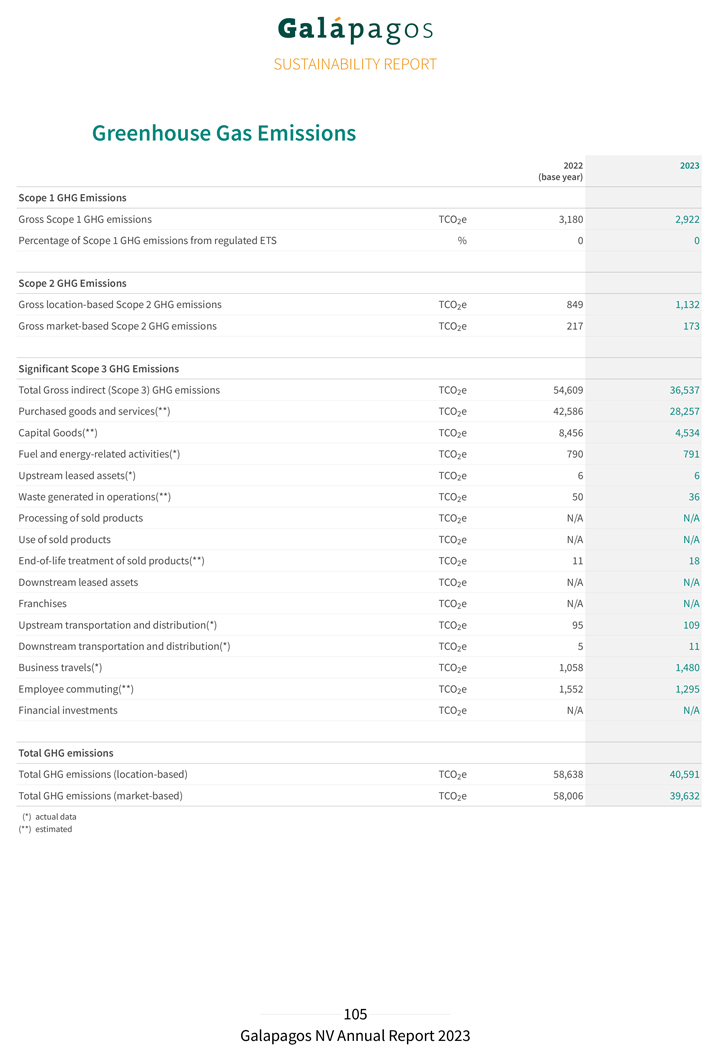

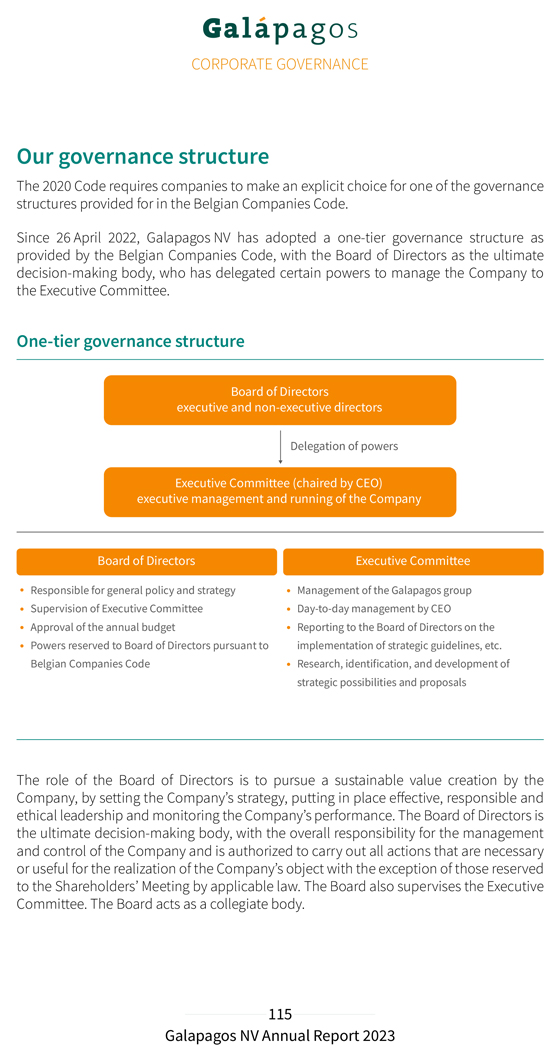

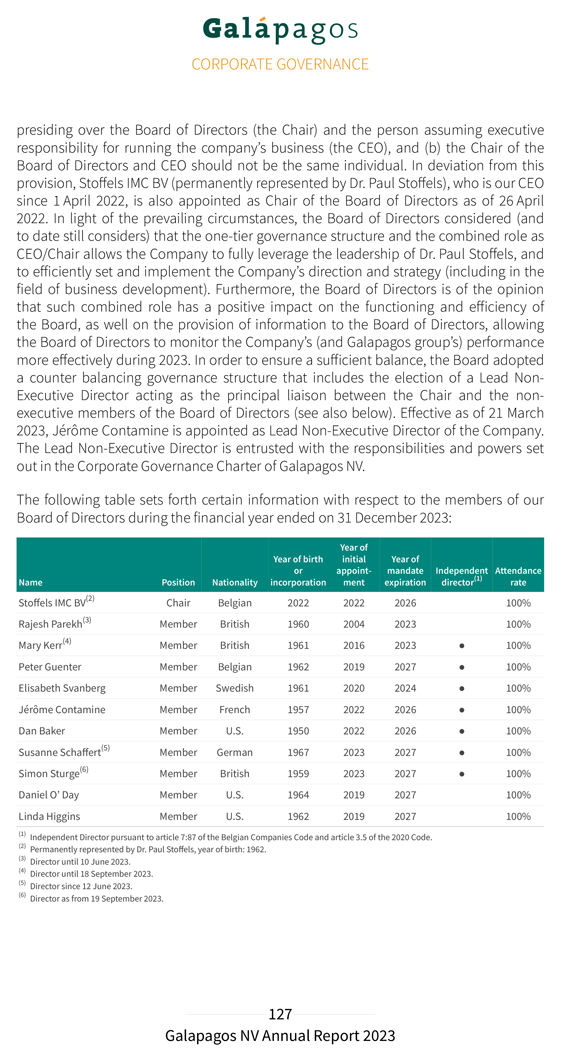

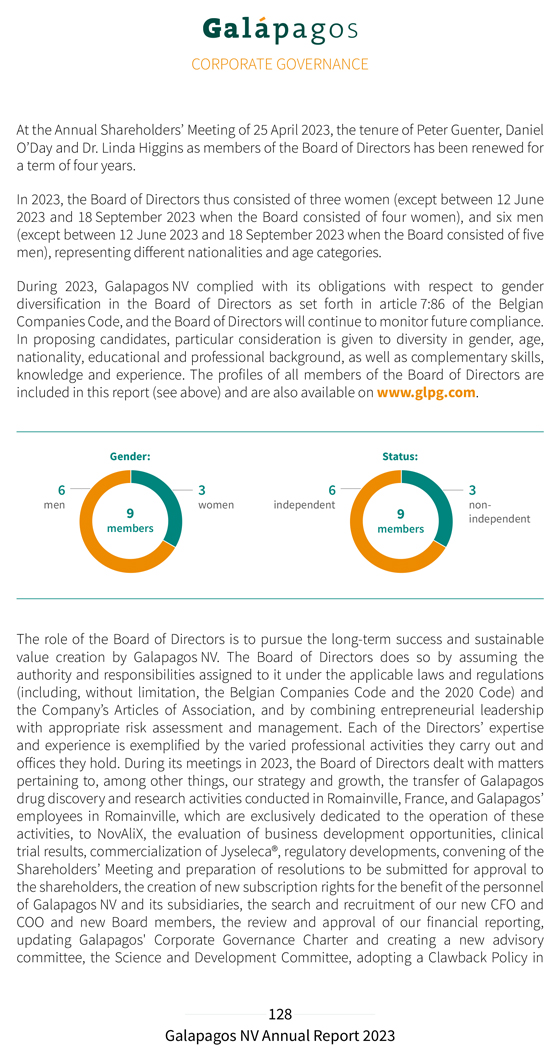

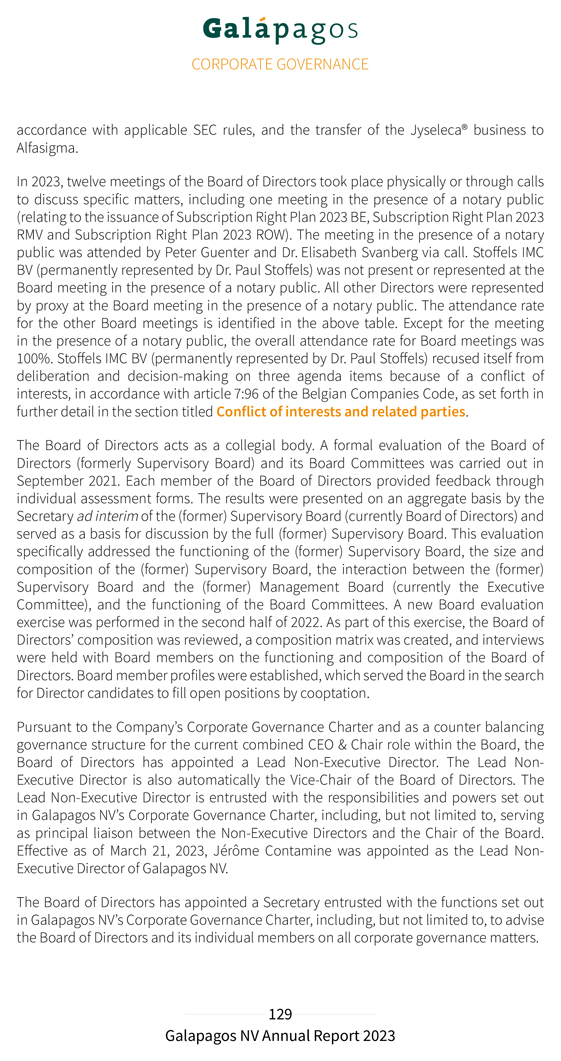

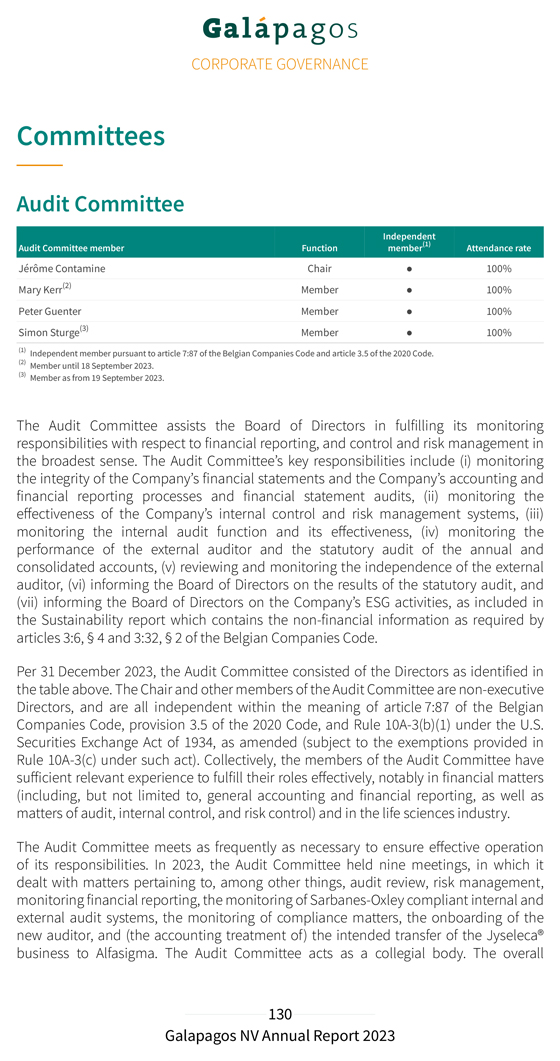

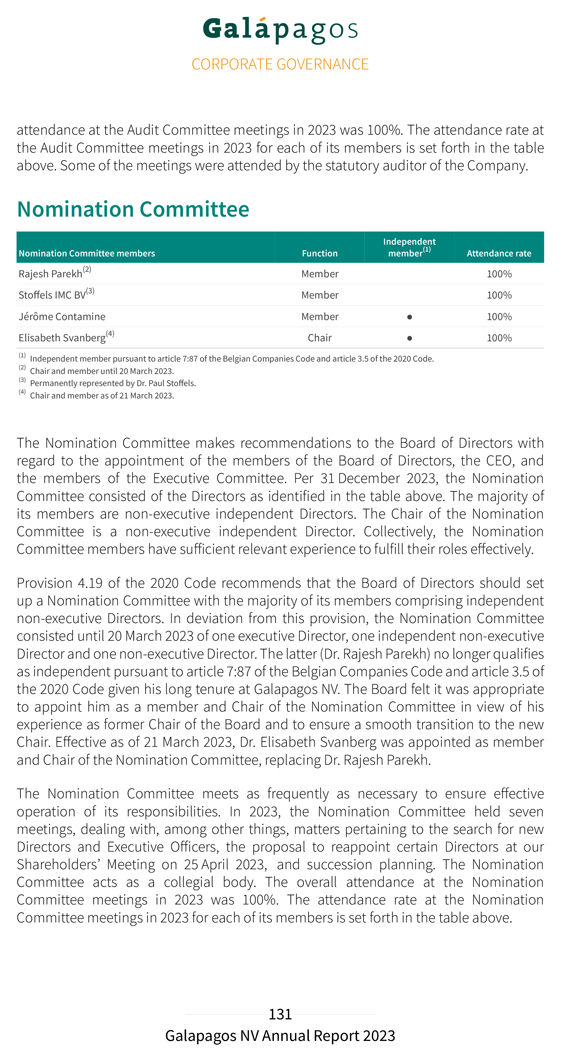

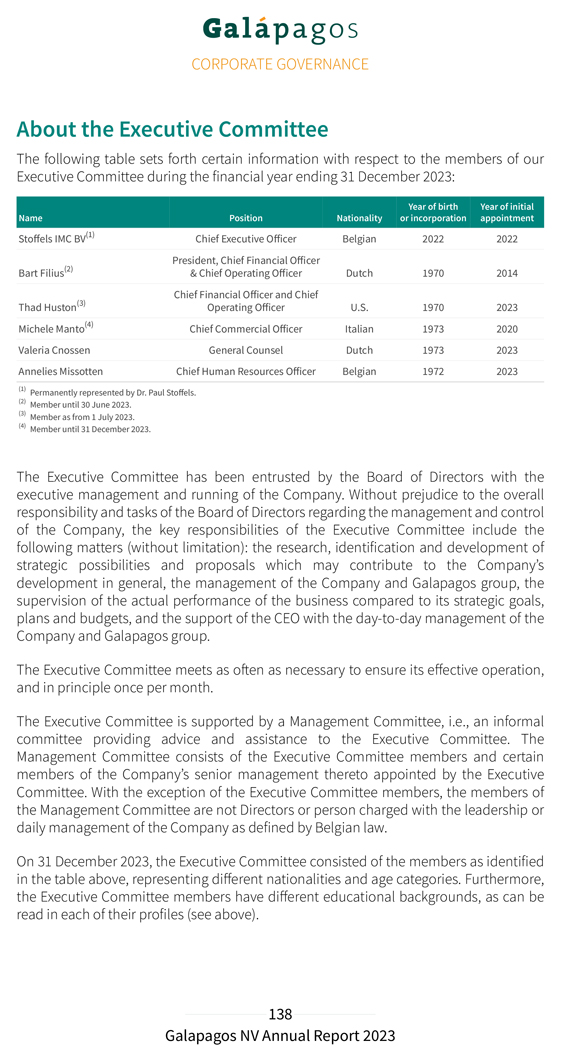

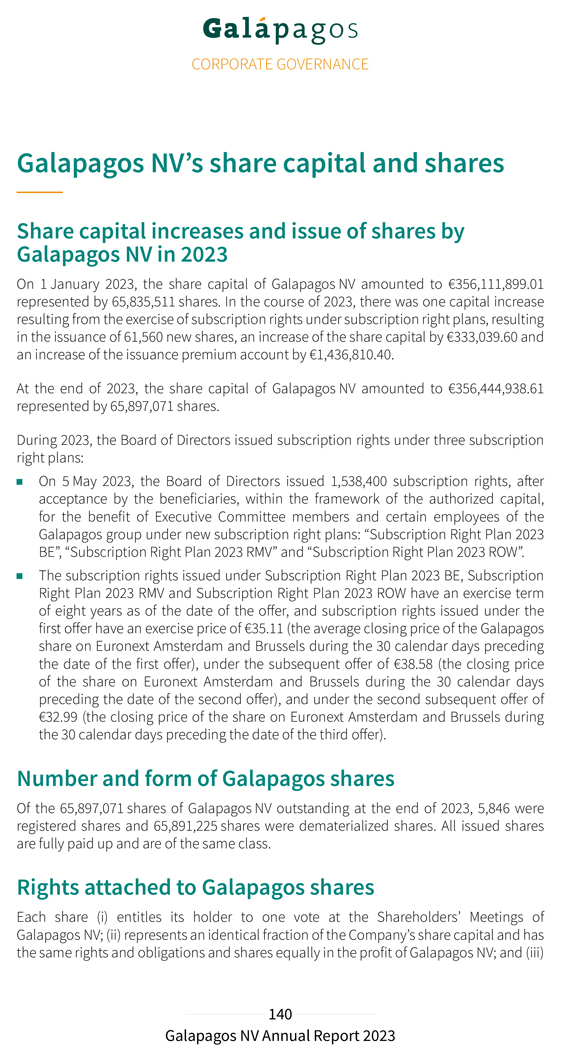

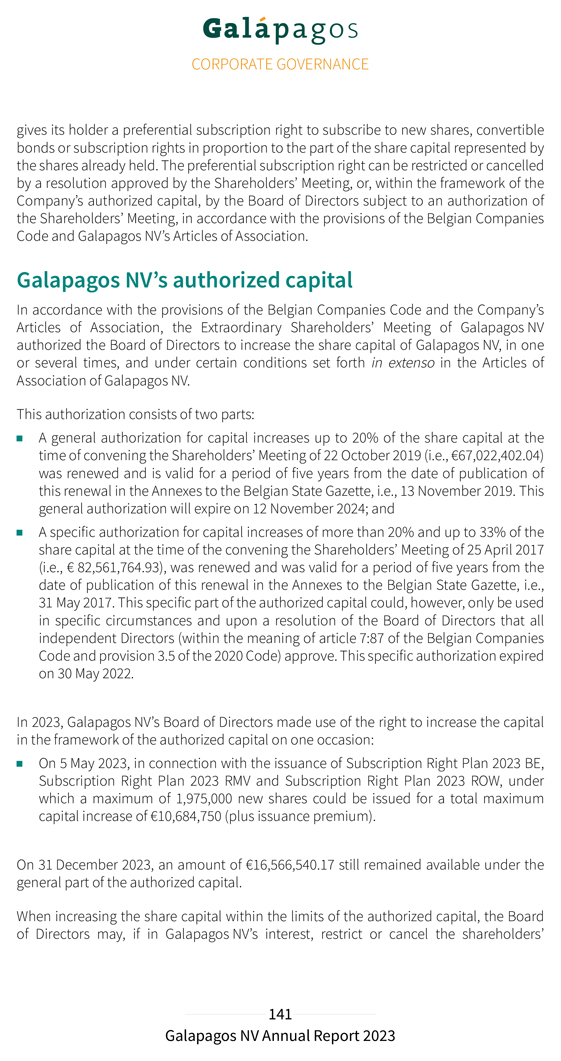

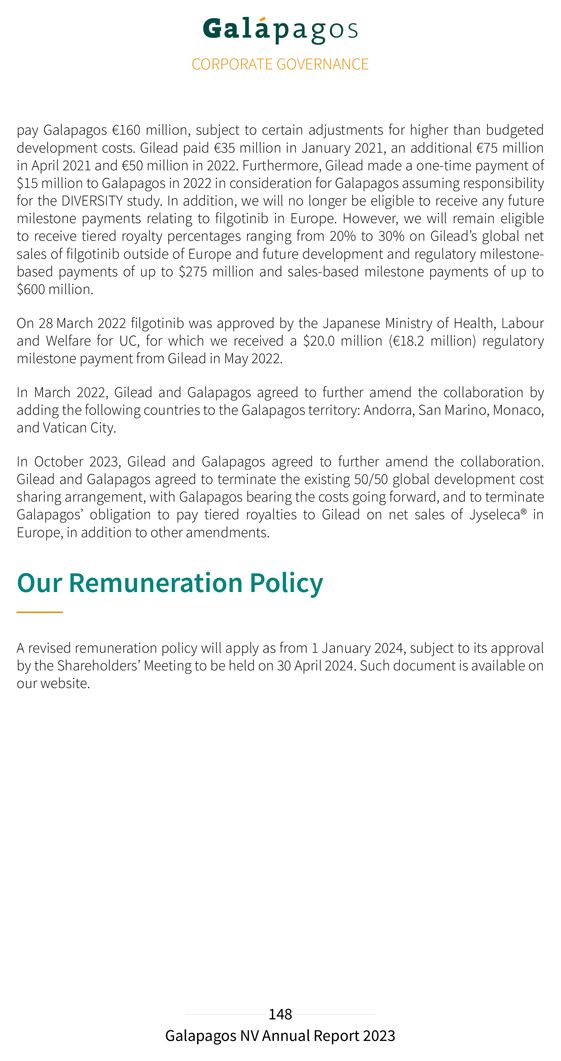

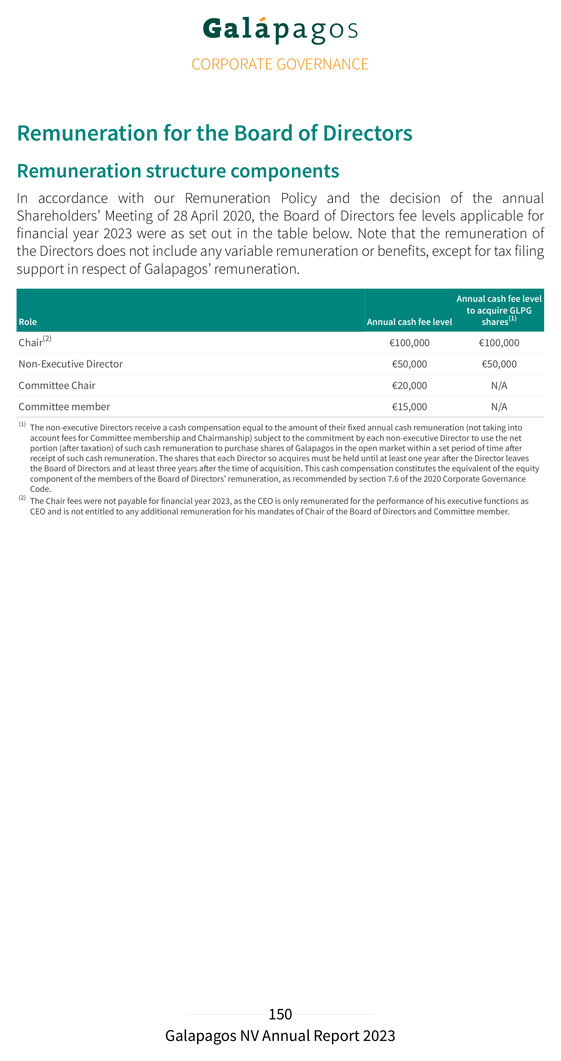

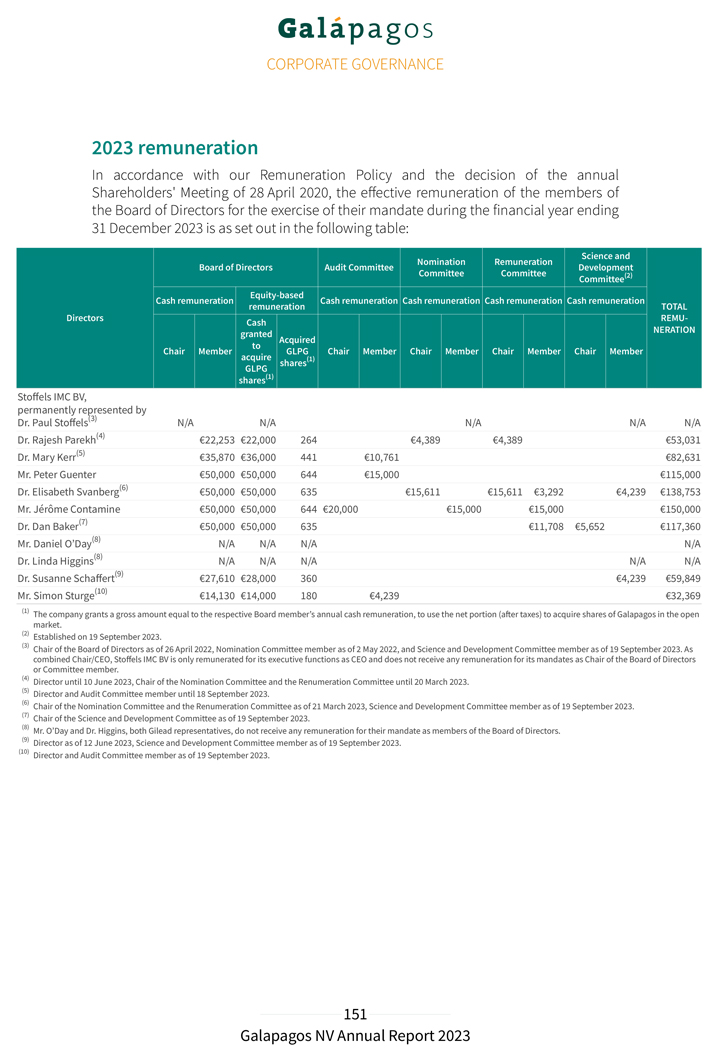

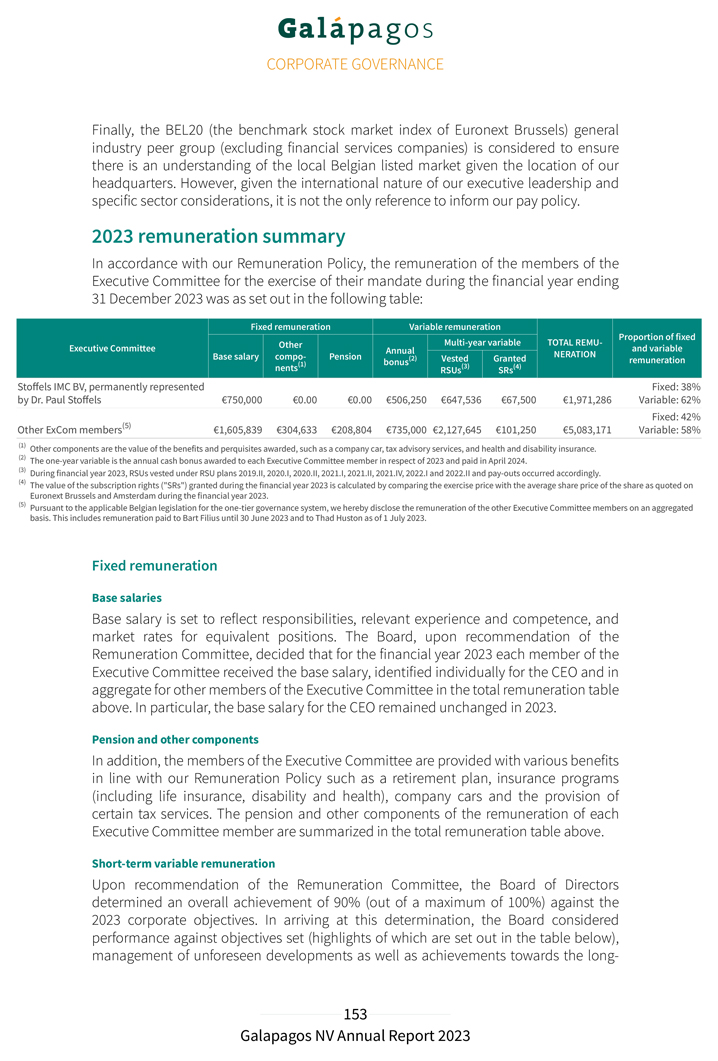

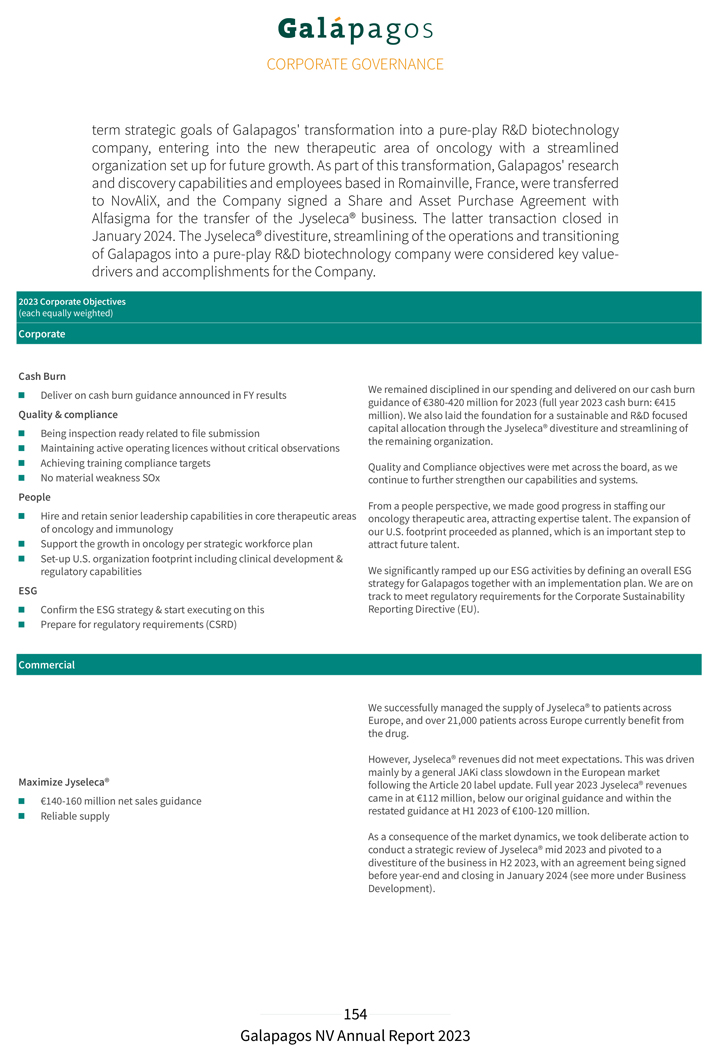

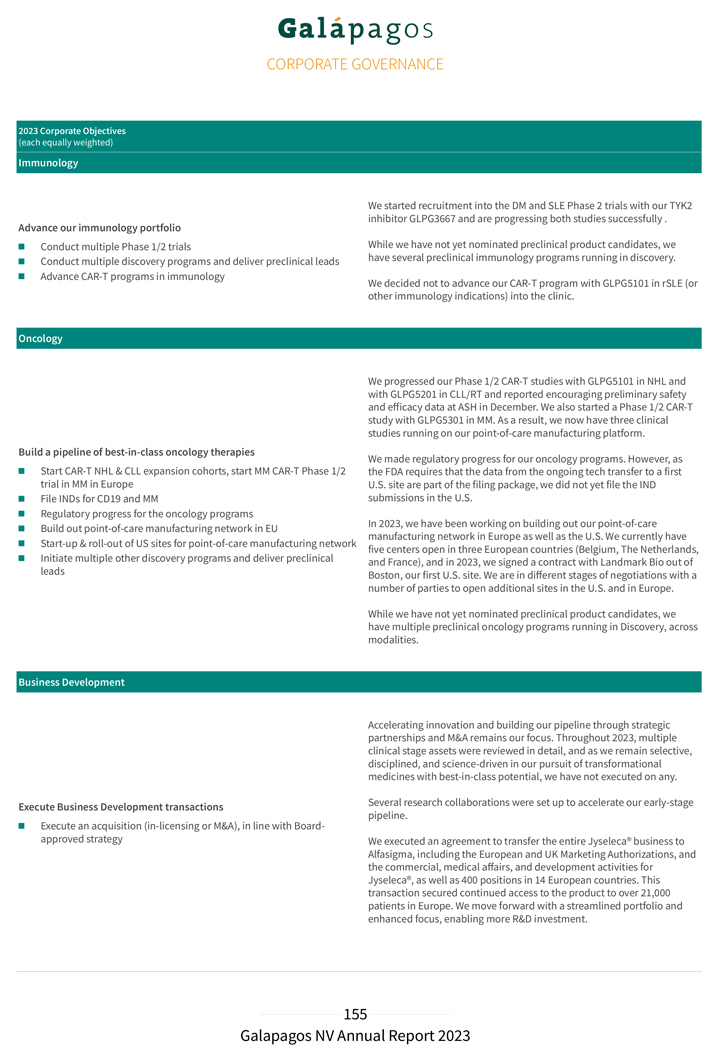

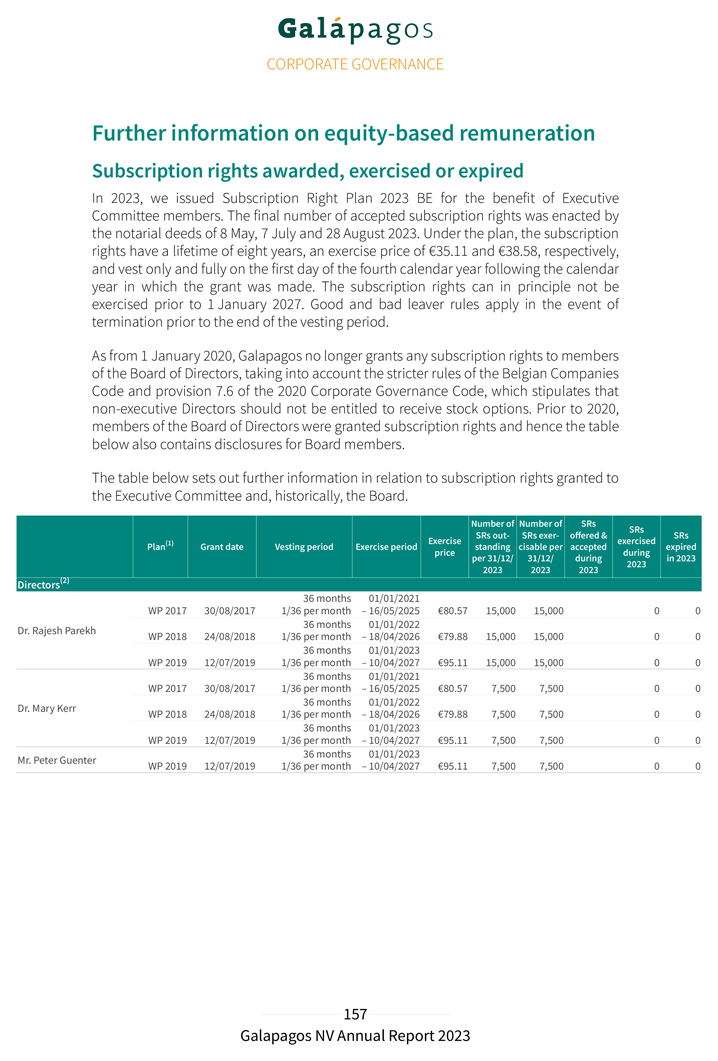

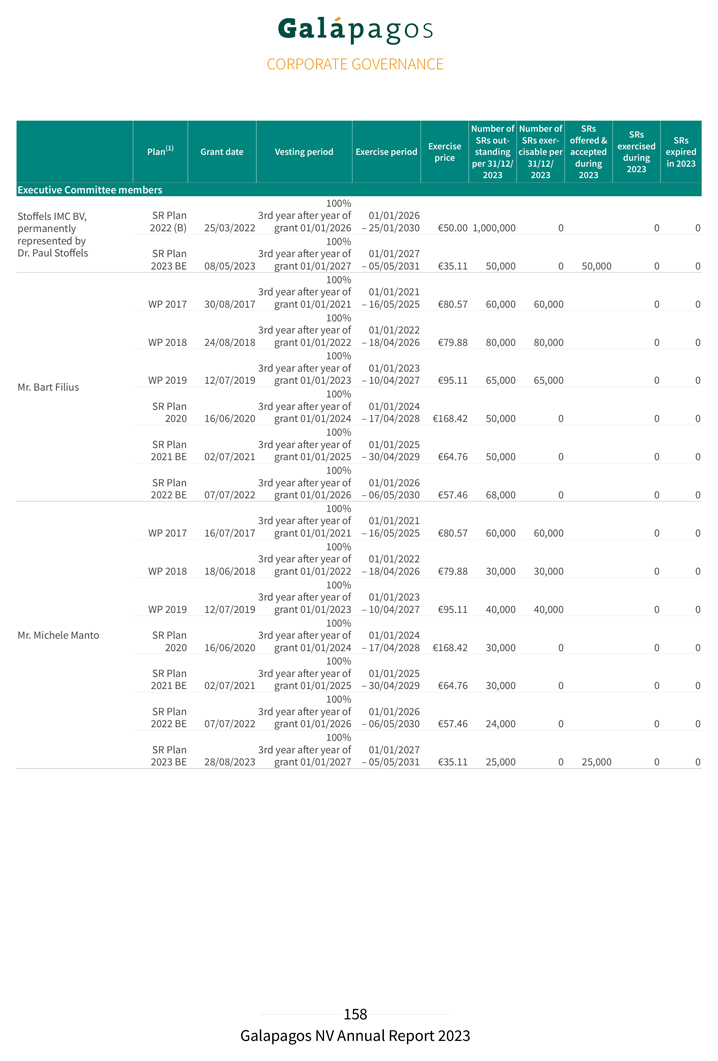

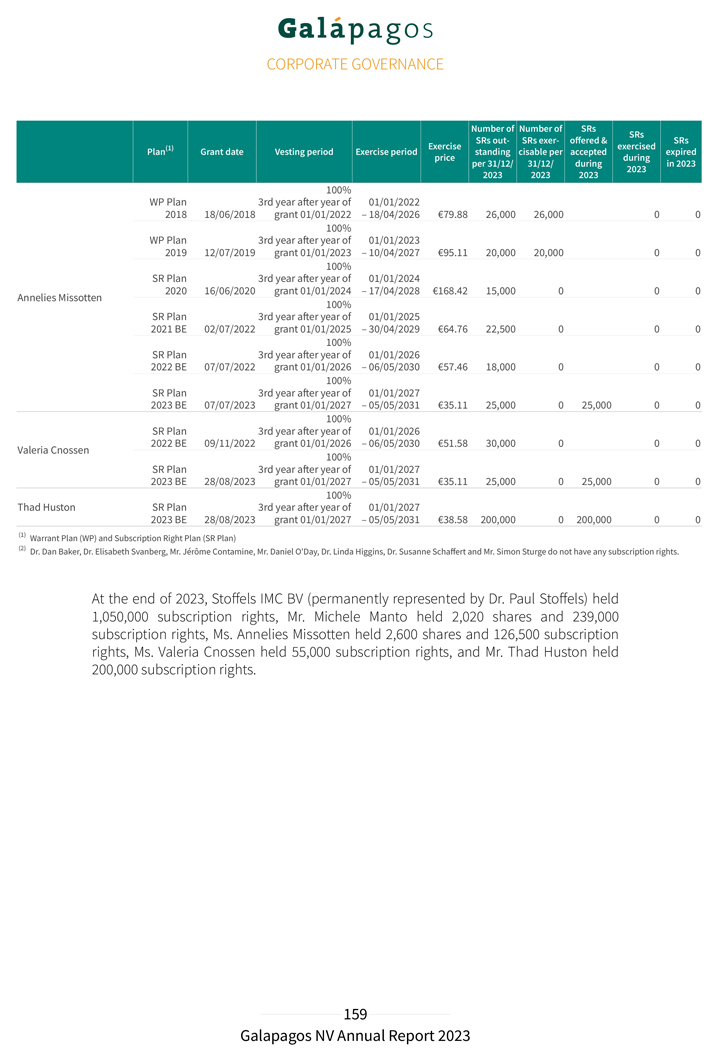

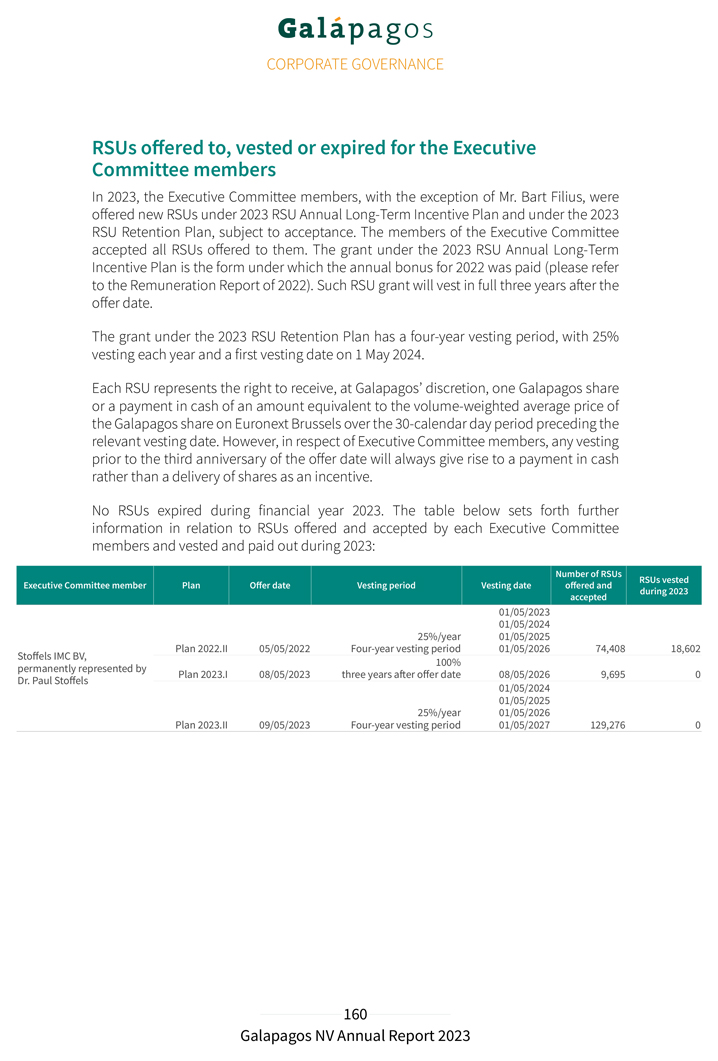

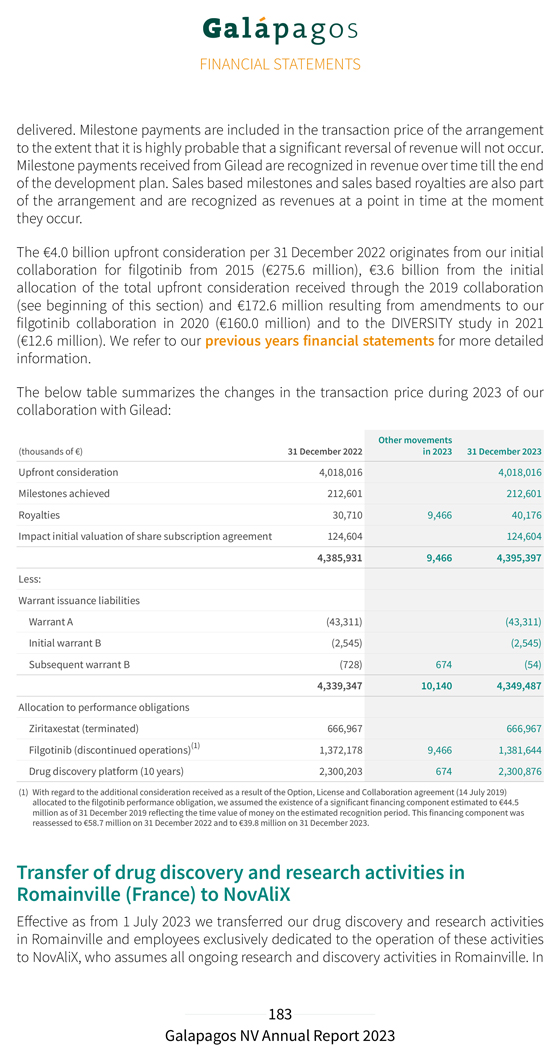

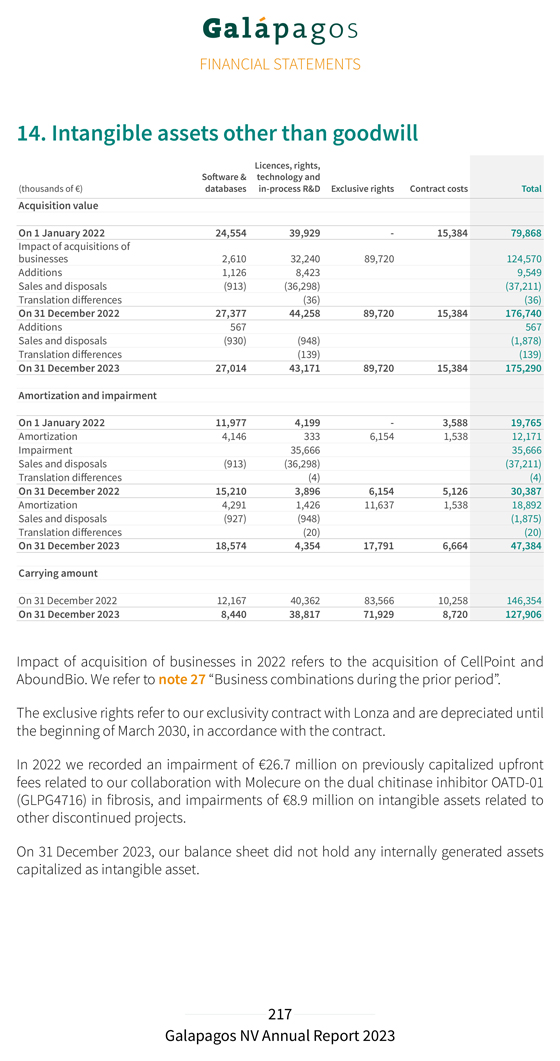

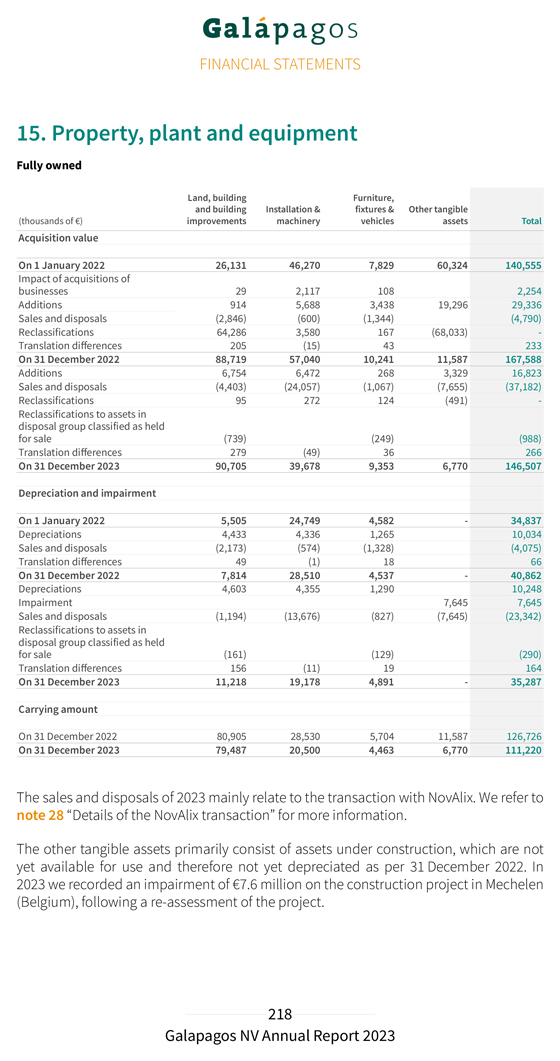

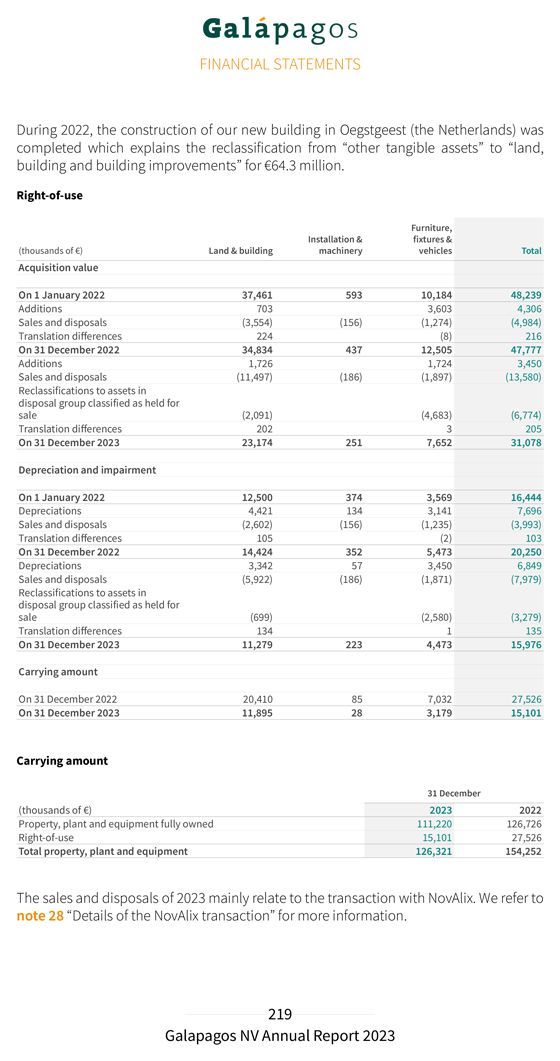

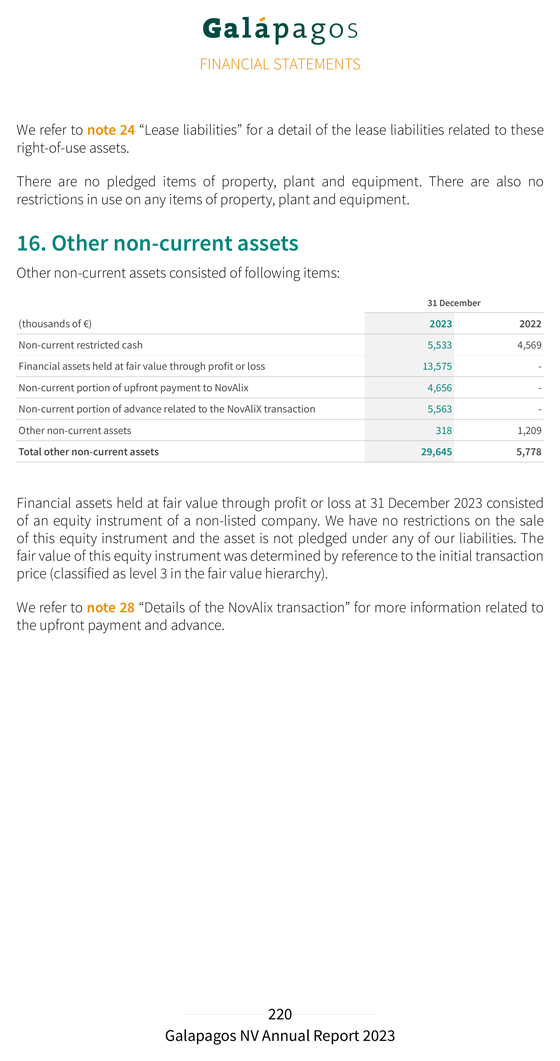

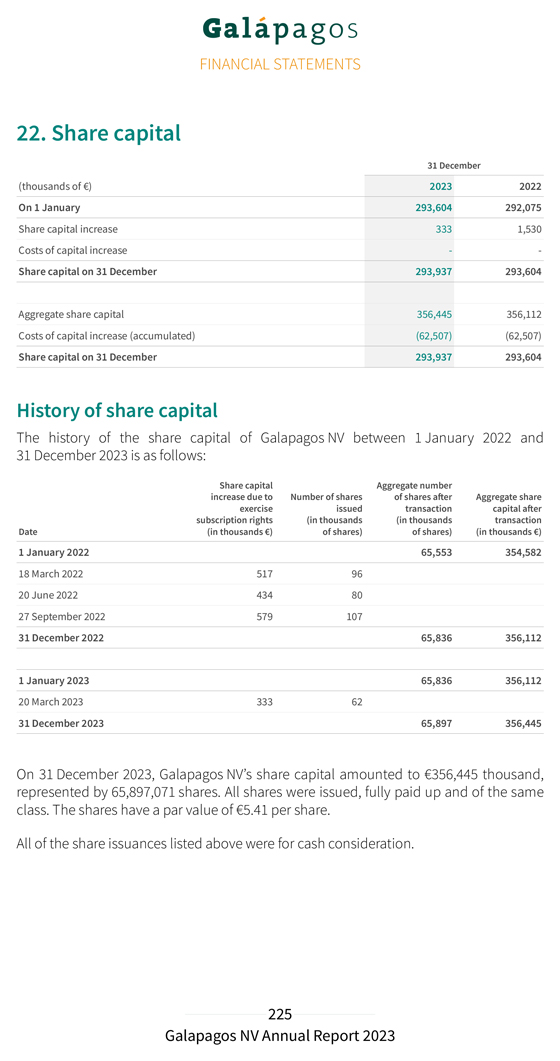

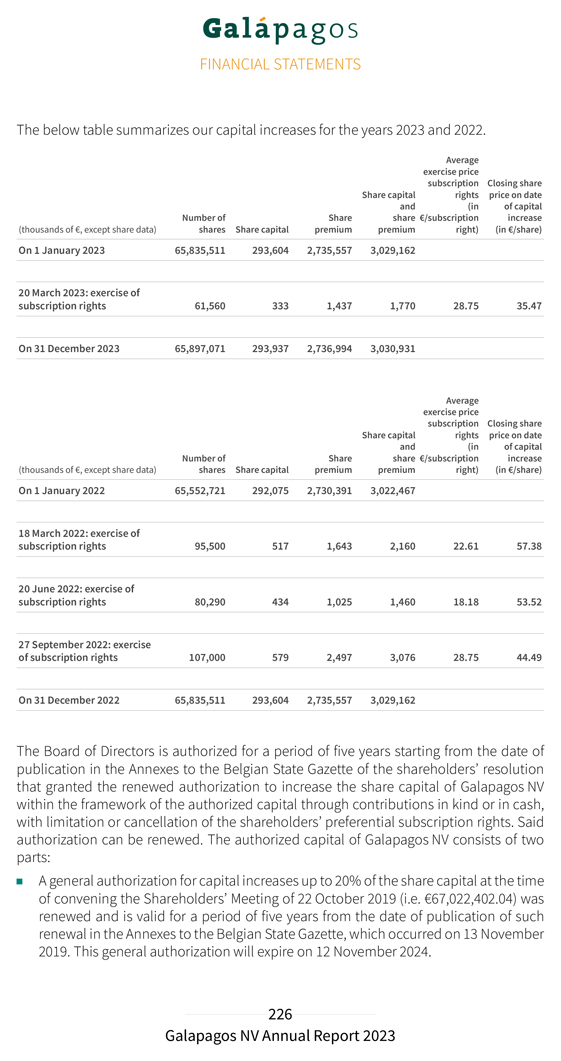

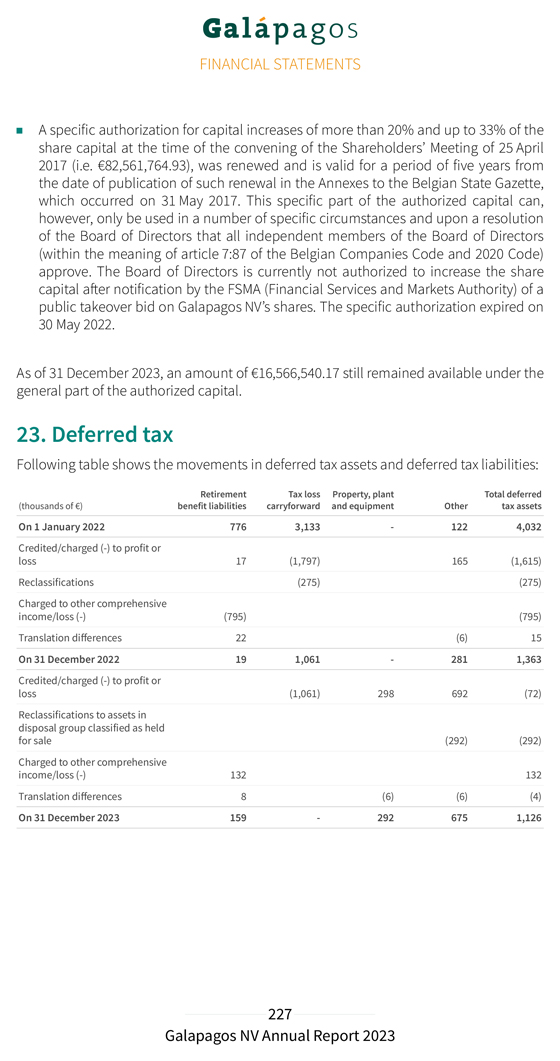

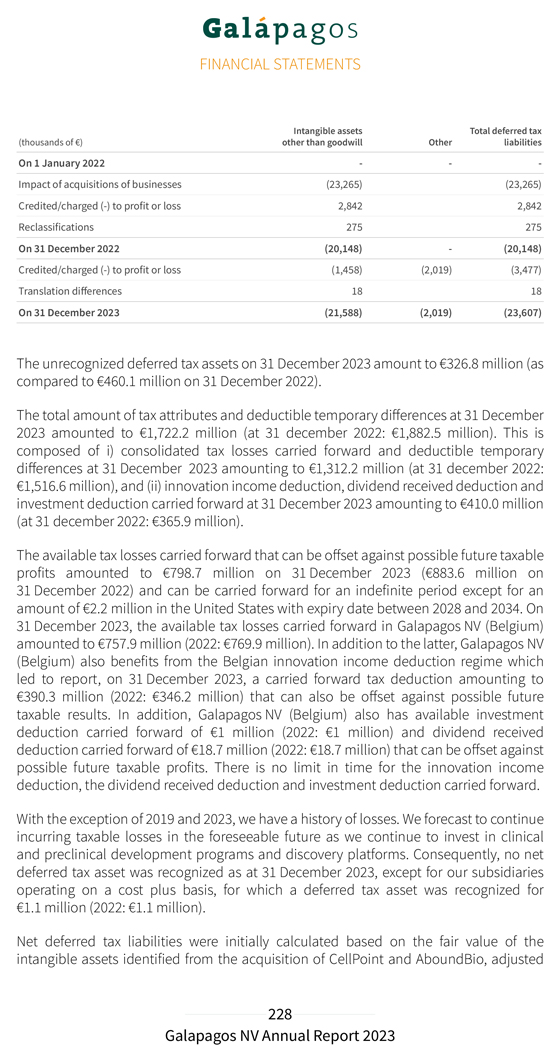

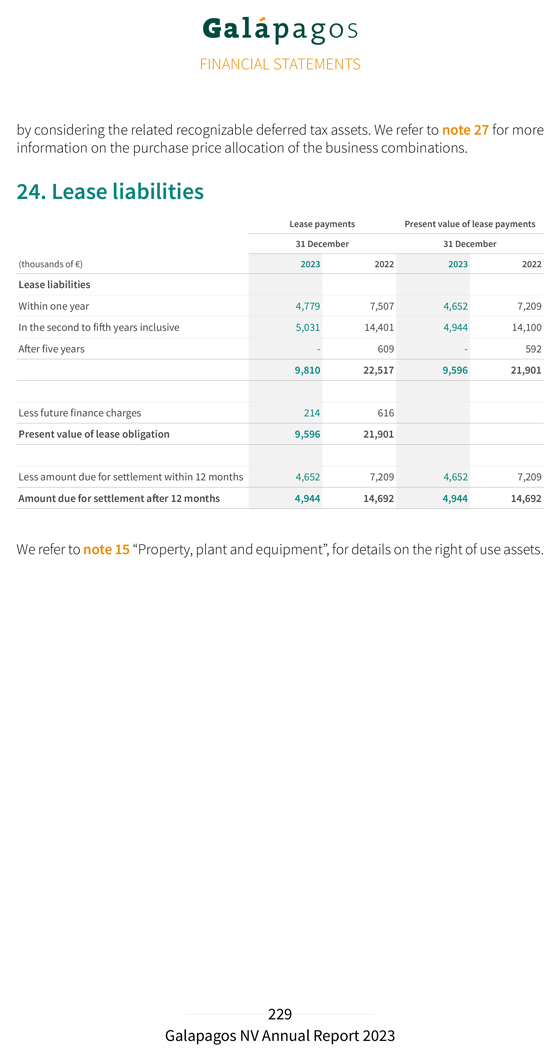

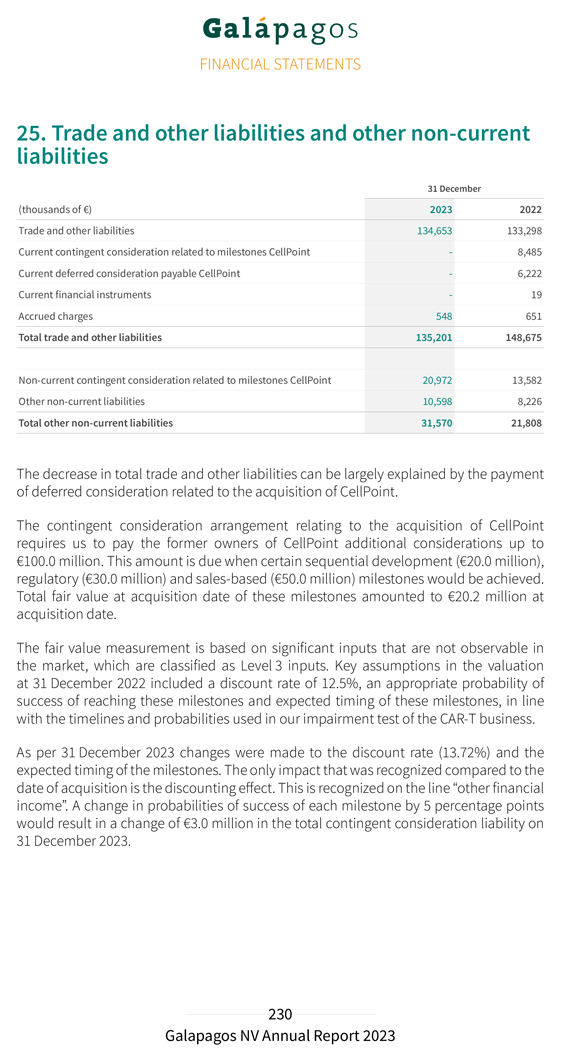

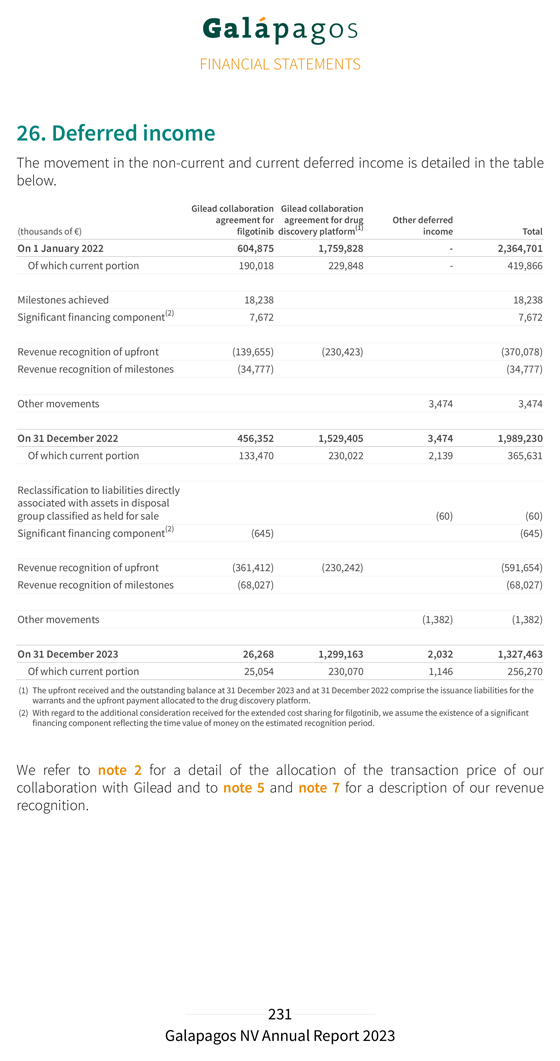

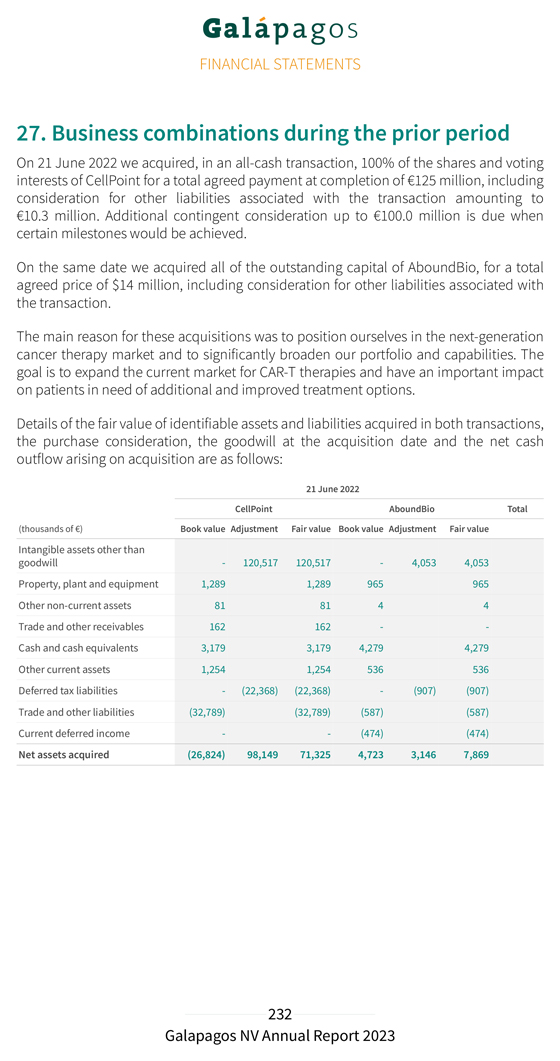

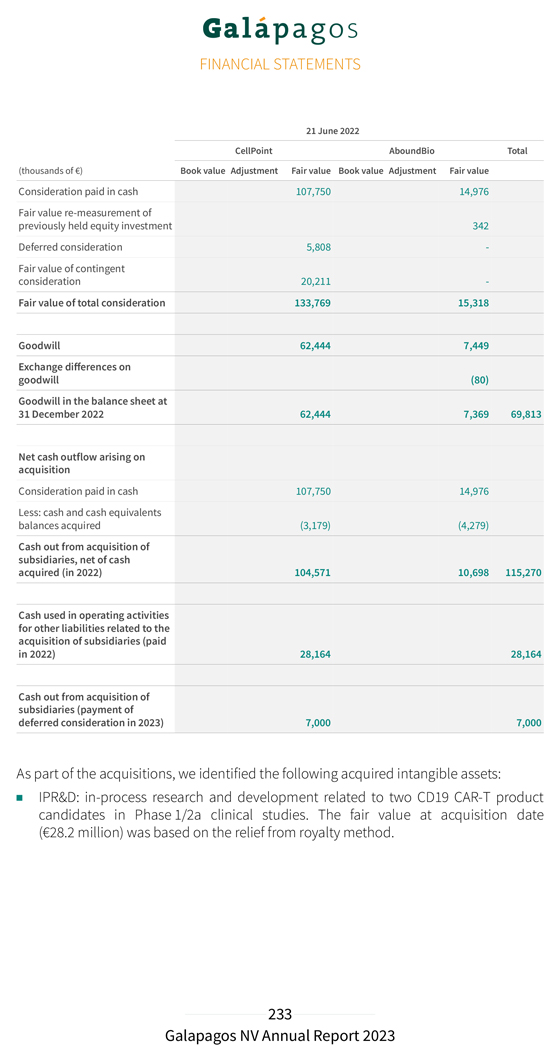

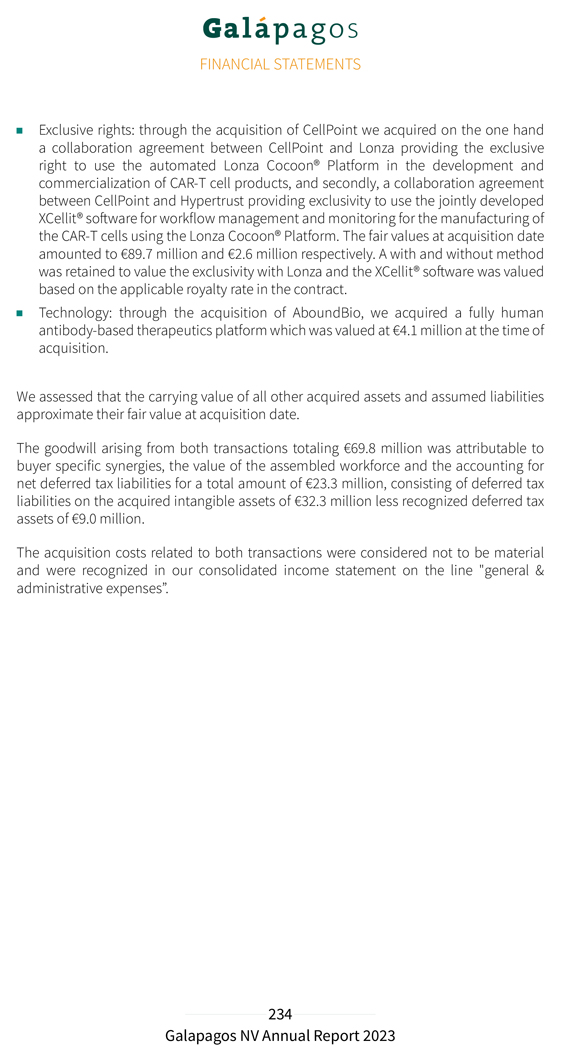

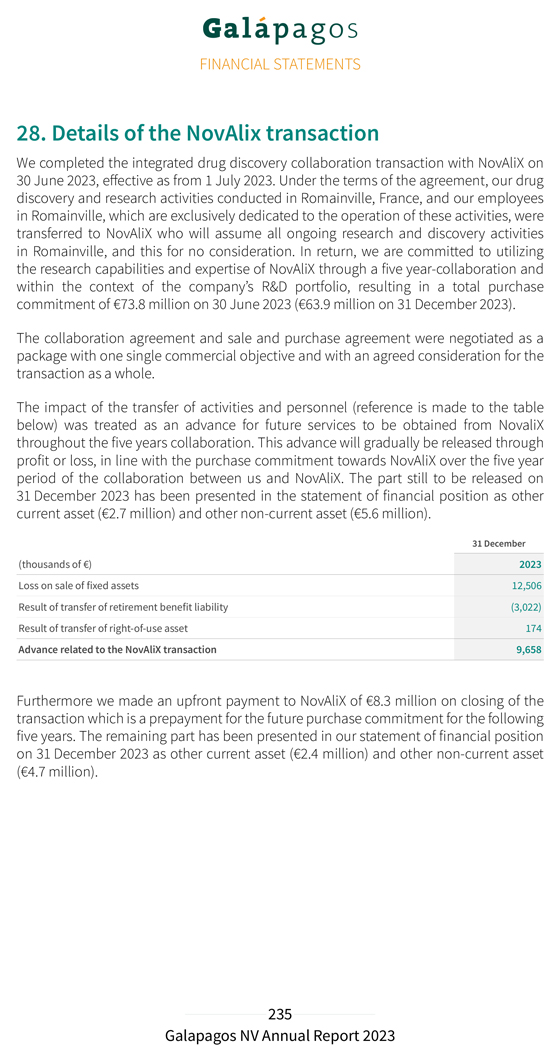

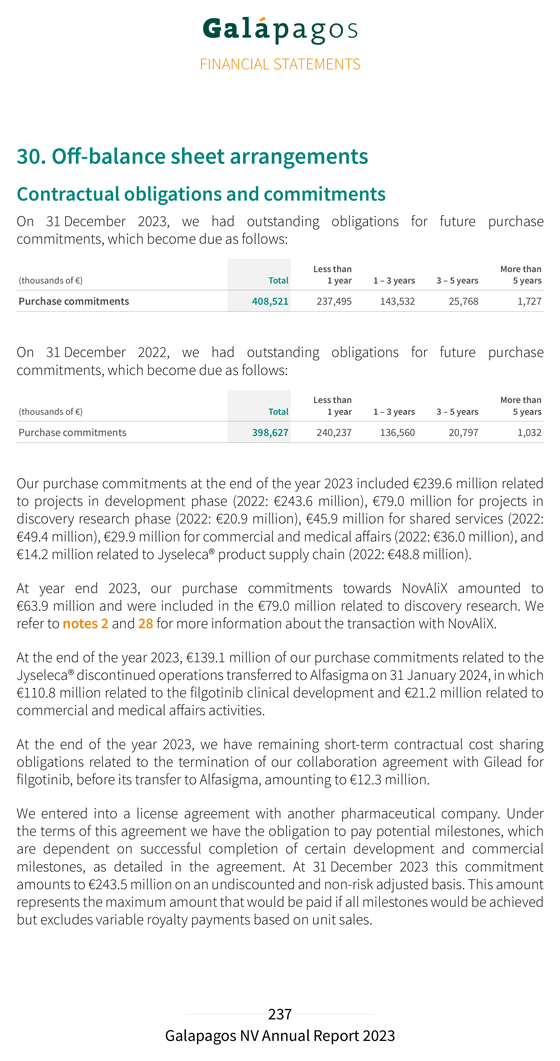

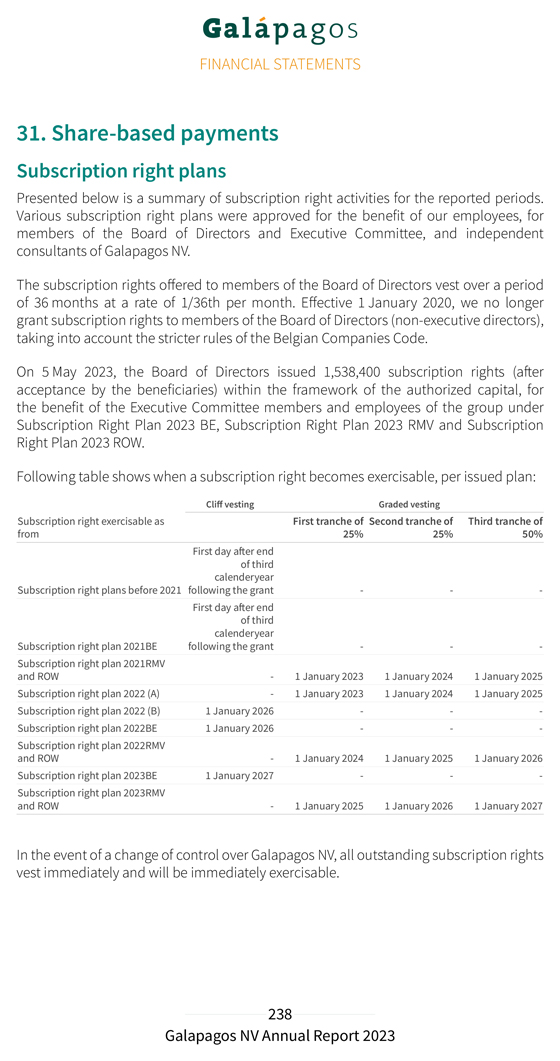

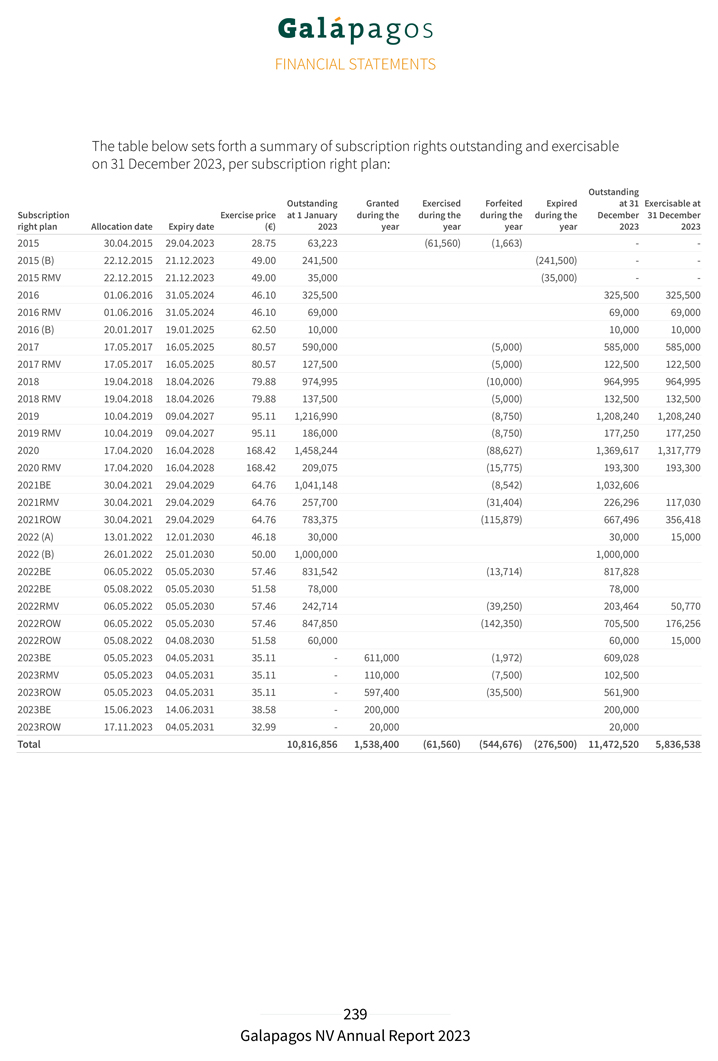

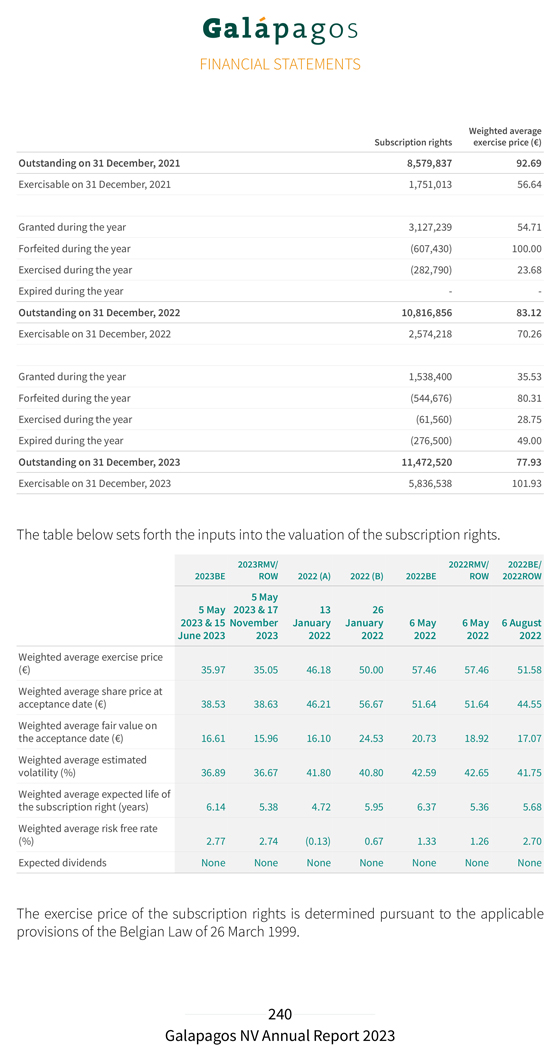

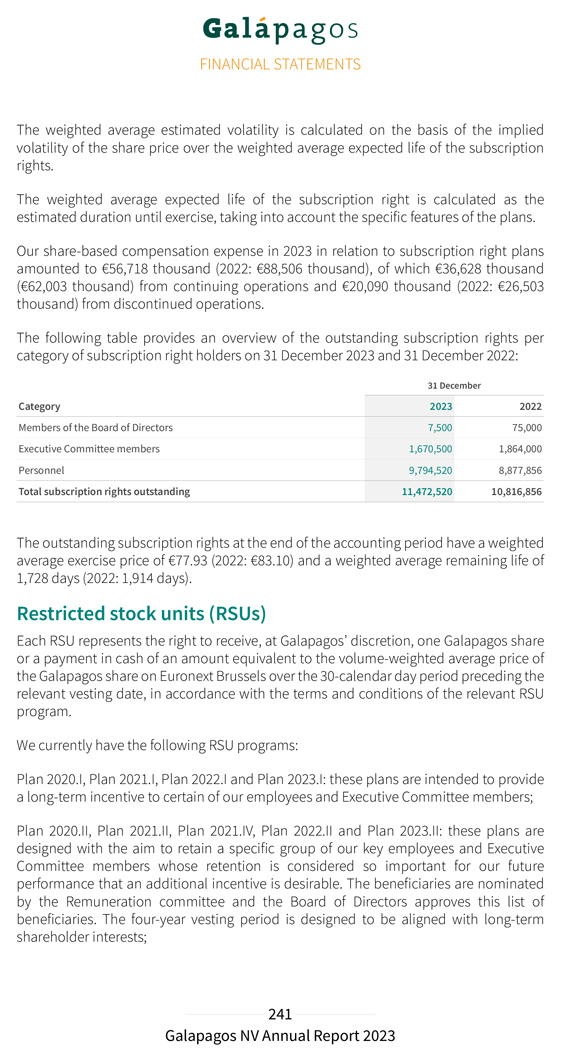

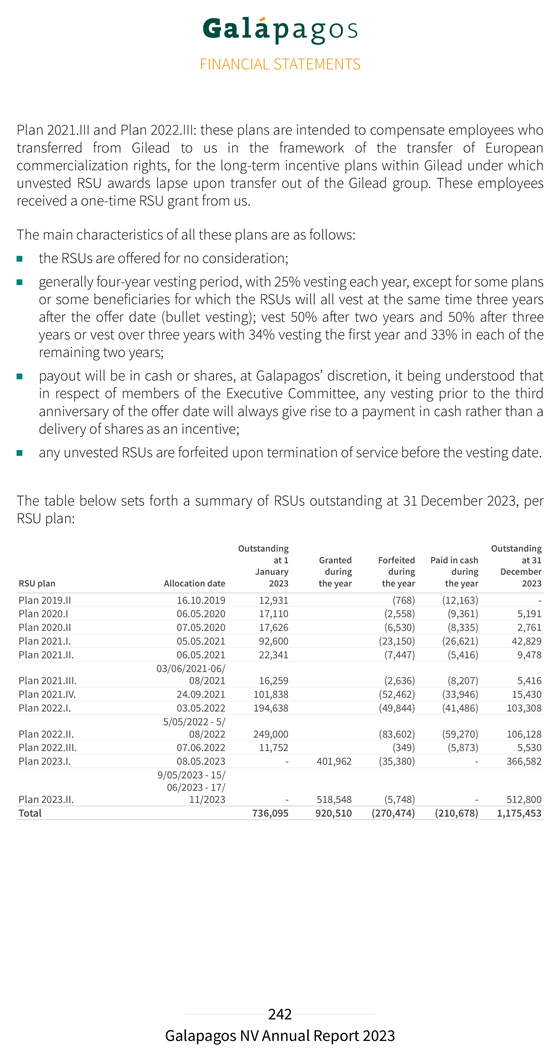

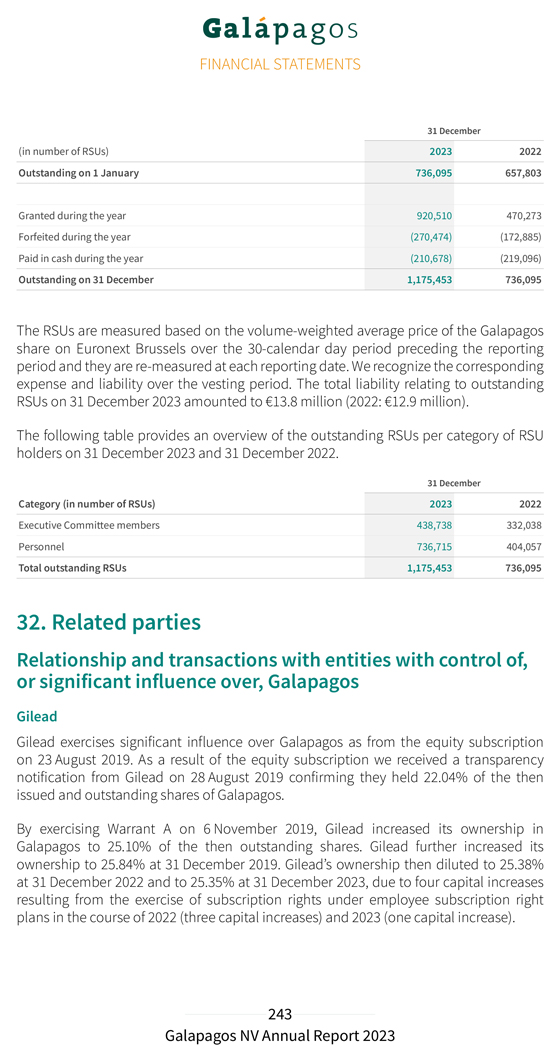

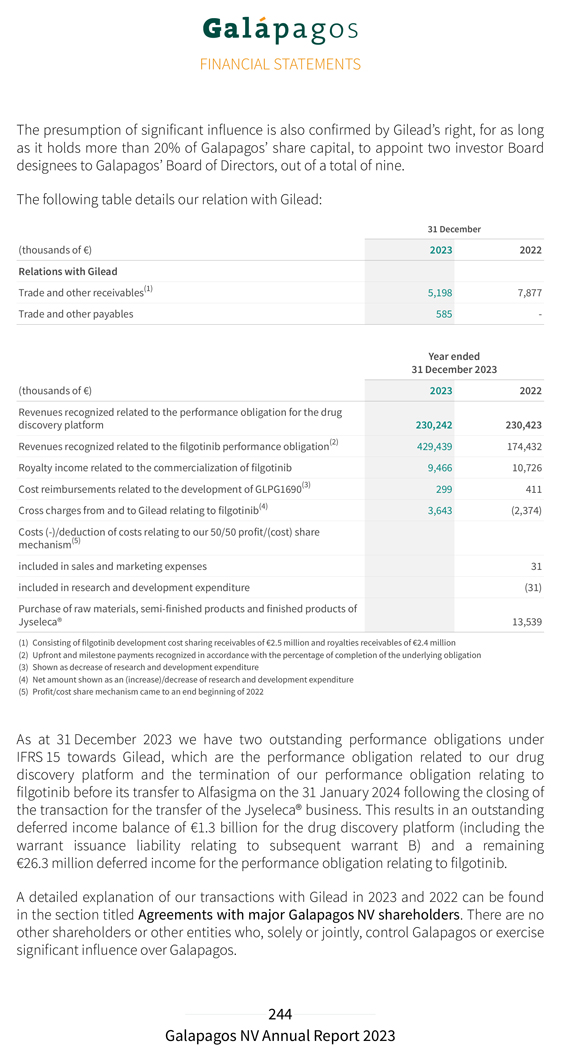

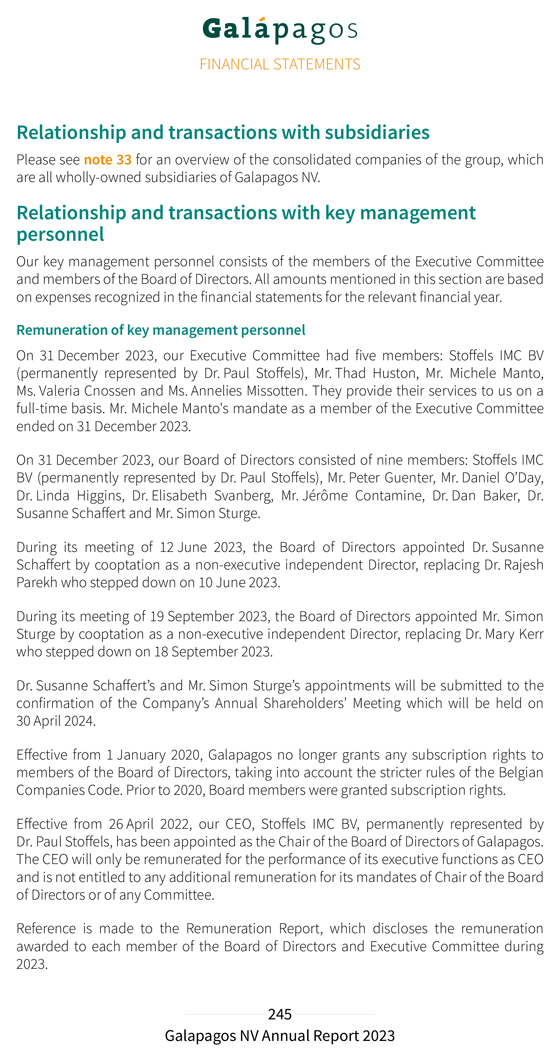

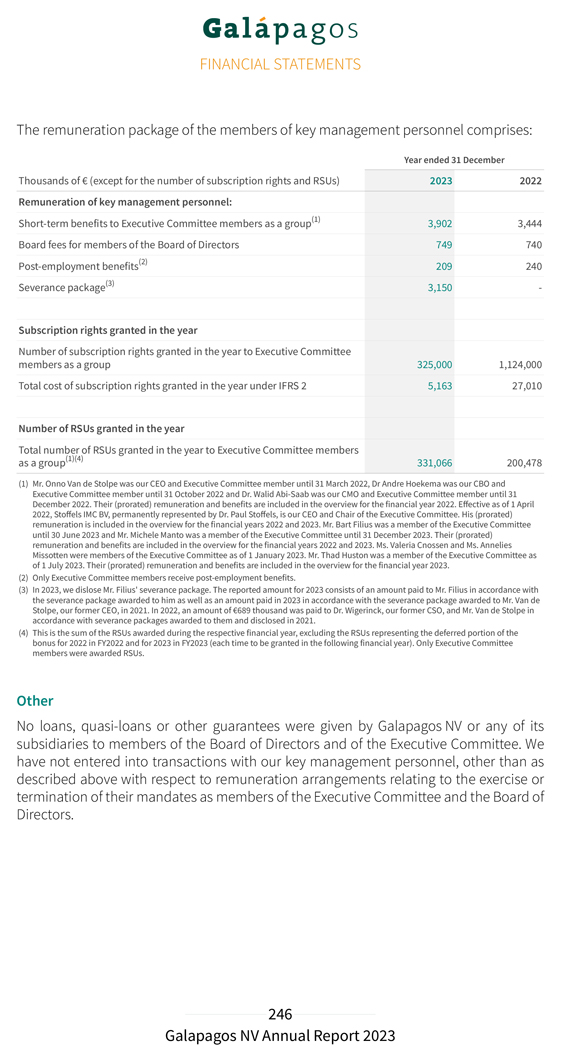

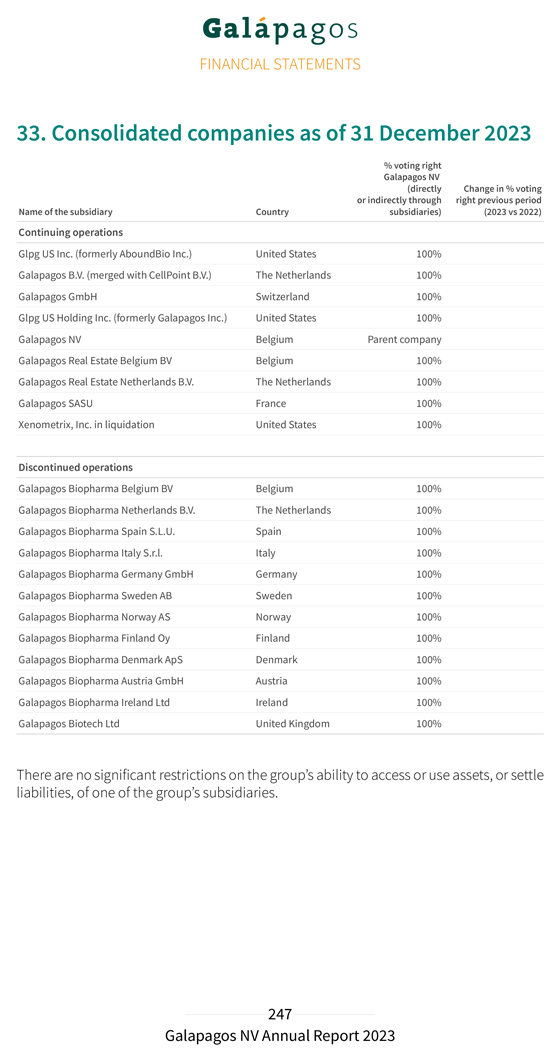

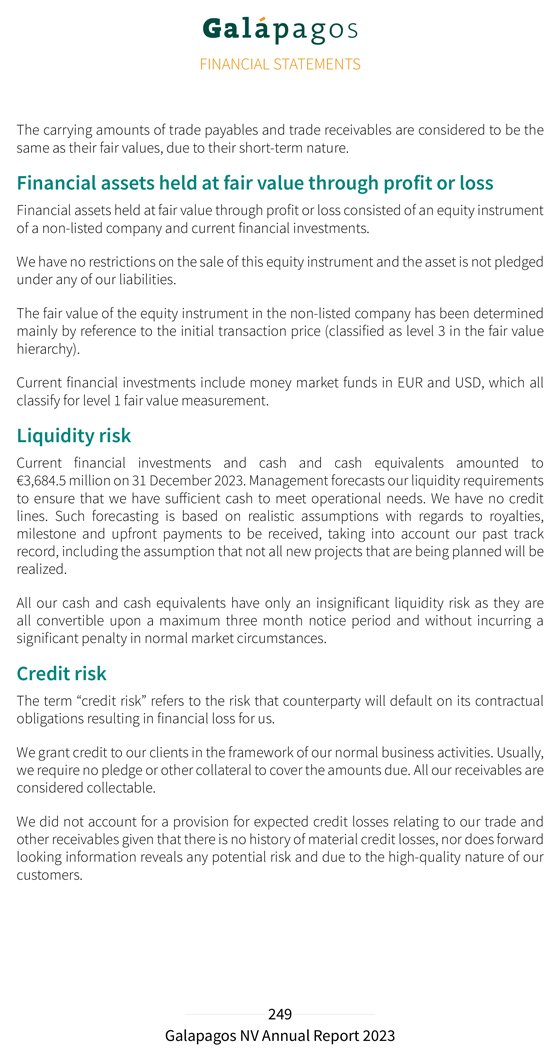

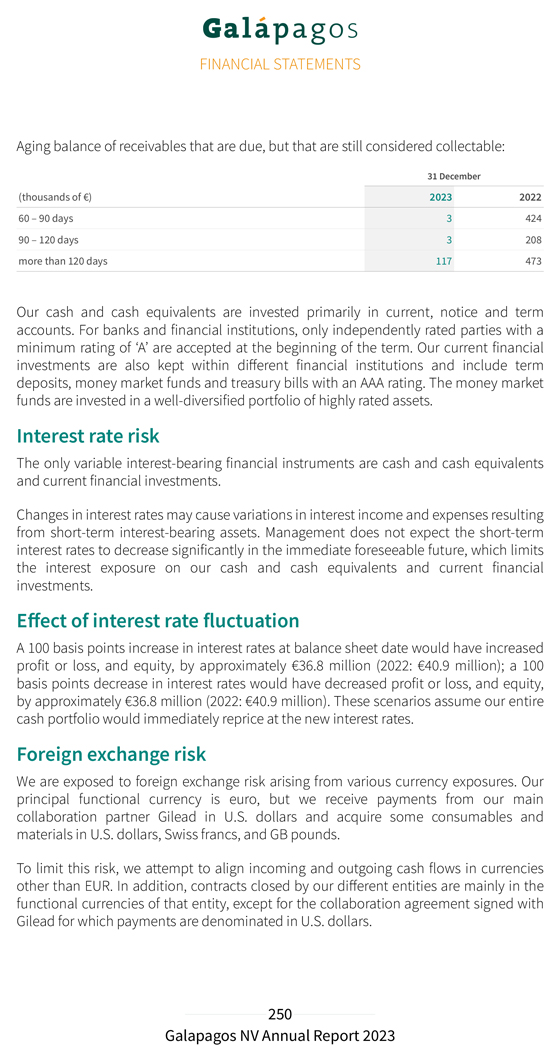

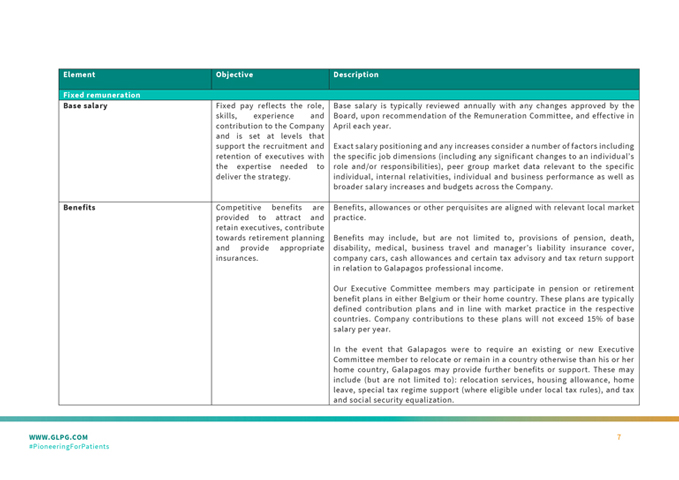

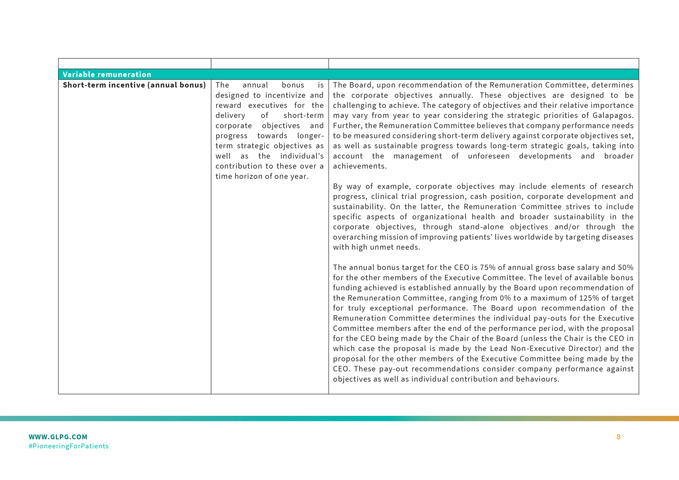

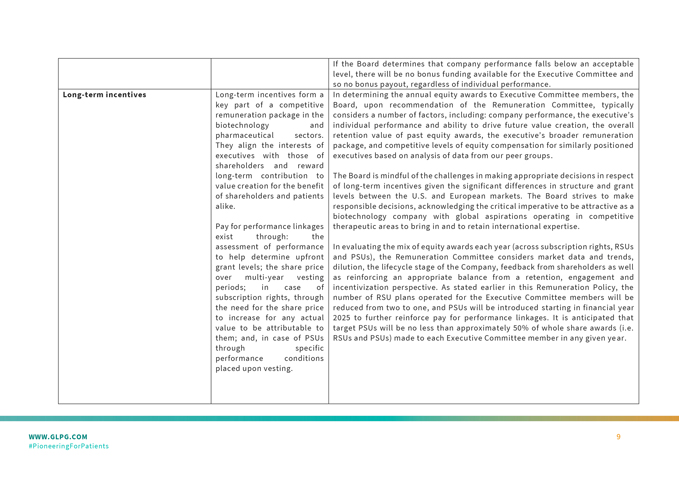

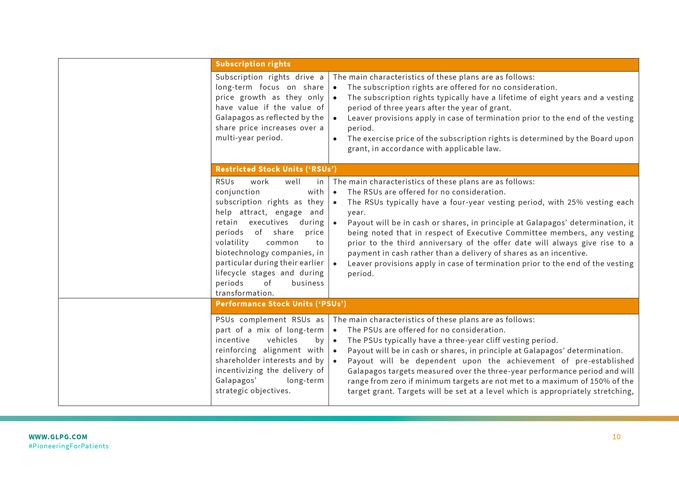

Encouraging interim safety data: EUPLAGIA-1 preliminary Phase 1 data in heavily pretreated patient population All patients (N=15) CRS, n (%) 7 (47) Grade 1/2 7 Grade ≥3 0 ICANS, n (%) Any grade 0 CRS, Cytokine release syndrome; ICANS: immune effector cell-associated neurotoxicity syndrome Promising clinical activity observed in rrCLL and RT: EUPLAGIA-1 preliminary Phase 1 data in heavily pretreated patient population Best objective response* Data 2023.presented at ASH 2023 (Tovar N, et al.) ASH poster #2112, 9 Dec 2023 17:30–19:30 CET. Cut-off date: 6 September *Combined response, iwCLL for CLL patients without RT and Lugano classification for patients with RT. DL1: 35x106 CAR-positive viable T cells, DL2: 100x106 CAR-positive viable T cells. CR, complete response; CRR, CR rate; DL, dose chronic level; ORR, lymphocytic objective leukemia response .rate; 1 CLL RT, patient Richter not Transformation; yet efficacy-evaluable PR, partial (D28 response; not reached) rrCLL, . relapsed/refractory