UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number: 1-9059

Barrick Gold Corporation

(Registrant’s name)

Brookfield Place, TD Canada Trust Tower, Suite 3700

161 Bay Street, P.O. Box 212

Toronto, Ontario M5J 2S1 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

INCORPORATION BY REFERENCE

Barrick’s information circular on Form 6-K is incorporated by reference into Barrick’s Registration Statements on Form F-3 (File No. 333-206417), Form S-8 (File Nos. 333-121500, 333-131715, 333-135769, 333-224560) and Form F-10 (File No. 333-271603).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: March 28, 2024 | BARRICK GOLD CORPORATION | |||

| By: | /s/ Joseph Heckendorn |

|||

| Name: | Joseph Heckendorn | |||

| Title: | Vice-President, Corporate Secretary and Associate General Counsel |

|||

EXHIBIT INDEX

| Exhibit | Description | |

| 99.1 | Barrick Gold Corporation’s Notice of Annual Meeting of Shareholders and Information Circular dated March 21, 2024 | |

Exhibit 99.1

| ii | ||||

| iv | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 30 | ||||

| 40 | ||||

| 46 | ||||

| 52 | ||||

| 58 | ||||

| 58 | ||||

| 84 | ||||

| 94 | ||||

| 97 | ||||

| 107 | ||||

| 109 | ||||

| 109 | ||||

| 112 | ||||

| 112 | ||||

| 117 | ||||

| 119 | ||||

| 139 | ||||

| SCHEDULE C: Key Characteristics of the Performance Granted Share Unit (PGSU) Awards | 141 | |||

| SCHEDULE D: Key Characteristics of the Restricted Share Unit (RSU) Awards |

144 | |||

| 145 | ||||

| Barrick Gold Corporation | 2024 Circular

|

I |

|

|

|

|||||

|

March 21, 2024 |

||||||

|

the Chairman

|

Dear Fellow Shareholders

Five years have passed since we merged Barrick and Randgold to create a company with a single focus: the delivery of real value to its stakeholders. We set out our mission in clear terms – to build a business which will lead the mining industry on every front, with a constantly replenished, global asset base of peerless quality, managed by a team with an unparalleled record of recognizing and realizing opportunities while managing the many difficulties inherent in mining and presented by an increasingly complex operating environment.

This Barrick is guided by a long-term, future-facing strategy, finely attuned to the demands and expectations of a rapidly changing world. Its aim is not only to secure the Company’s sustainable profitability but also to make sustainability, in every sense, the core of its activities. In line with this objective, Barrick’s pioneering partnership philosophy, a key component of its commitment to sustainability, has already transformed the once-derelict Tanzanian mines into a complex with Tier One potential; reconstituted the Reko Diq project in Pakistan and is now developing it into one of the world’s largest copper-gold producers; and after three years of negotiation, achieved an agreement for the re-opening of the Porgera gold mine in Papua New Guinea, where mining and processing are due to resume shortly.

Well before this – in fact shortly after the Merger – Barrick scored a major win with the long-overdue merger of its assets in the State of Nevada with those of Newmont. The new company, Nevada Gold Mines, is the largest gold mining complex in the world. Majority-owned and operated by Barrick, it already hosts three Tier One mines in a vast area rich in potential for the further world-class discoveries we are aggressively pursuing.

Of course, these five years have not been without their challenges, internal as well as external. Guided by the Board, however, Barrick’s highly skilled and motivated management overcame these with characteristic tenacity. The Merger’s foundational creed was that the best assets run by the best people would deliver the best returns. Barrick’s focus on Tier One assets and the results they are producing show unquestionably that its management ranks in the forefront of the industry’s leadership. Through continuing investment in human capital, Barrick is recruiting and developing its next generation of high achievers.

Looking back to the Merger, it is clear to me that we have achieved all the initial objectives we set for ourselves. Barrick has been restructured and repurposed as a modern mining business. The renewed emphasis on exploration has placed it in the unique position of more than replenishing the reserves depleted by mining year after year. Major organic growth projects, such as Reko Diq, the current extension of Pueblo Viejo’s Tier One mine life by more than 20 years, and the transformation of Lumwana into one of the world’s major copper mines, will secure Barrick’s production profile well into the future. Expanding the copper portfolio was one of Barrick’s key strategic aims and when the new Lumwana and Reko Diq are commissioned in 2028, Barrick will become a major-league producer. In the meantime, we continue to pursue opportunities for growing our copper portfolio.

Barrick’s balance sheet, once burdened by heavy debt, is now one of the industry’s most robust and our strong operational cash flows ensure that we have the capacity to fund existing and new organic growth projects, as well as to take advantage of any fresh opportunities that meet our stringent investment criteria. We scan a wide horizon for such: because we believe that to be world-class, a business has to be global, Barrick’s footprint is being expanded and currently comprises mines, projects and exploration programs in 18 countries across four continents, covering the main prospective regions for gold and copper.

|

|||||

|

||||||

|

|

||||||

|

|

||||||

| II | Barrick Gold Corporation | 2024 Circular

|

|

Mark Bristow and I have worked closely together to build this new Barrick, to achieve its foundational goals, and to create a clear roadmap for its future growth. I have therefore concluded that this is an appropriate time for me to transition from my position as Executive Chairman to that of Chairman, which became effective February 13, 2024. As Chairman, I will continue to provide leadership to the Board and together we will be the custodians of the strategy of the Company. Mark Bristow remains President and Chief Executive and he will continue to develop the strategy, obtain approval from the Board, and drive its implementation. The Board agrees with me that this structure will best position Barrick for its next growth phase.

I wish to take this opportunity to pay tribute to Gustavo Cisneros, who passed away on December 29, 2023. Gustavo became a valued member of our Board in 2003, bringing with him a wealth of global business experience, which was both broad and deep. He was a towering figure in both the business and cultural landscapes of Latin America. Gustavo was an exceptional businessman as well as a visionary who left an indelible mark on our Board and our Company. His wisdom, grace, and generosity inspired all those fortunate enough to work alongside him. We deeply feel his absence and we extend our heartfelt sympathies, thoughts, and prayers to his beloved wife Patty, and their three children Guillermo, Carolina, and Adriana.

I also note with great sadness the passing of the Chairman of Barrick’s International Advisory Board, the Right Honourable Brian Mulroney, on February 29, 2024. One of the greatest statesmen of his generation, he was a leader with a purpose who accomplished many vital goals and did so with decency and skill. His insightful contribution to geopolitical and other strategic issues will be sorely missed and our deepest sympathies, thoughts and prayers are with his wife Mila and their four children Caroline, Benedict, Mark, and Nicolas.

Finally, on behalf of the Board and management team, I would like to extend our deepest gratitude and appreciation to J. Michael Evans, who will be retiring from the Board effective April 30, 2024. Michael’s invaluable contributions and dedicated service have been integral to the Company’s journey since he joined the Board in 2014. Michael’s leadership and expertise have played a significant role in shaping Barrick’s trajectory. We wish him all the best in his future endeavors and express our heartfelt thanks for his exceptional service.

In conclusion, I have the pleasure of inviting you to the Annual General Meeting of Shareholders on April 30, 2024. This will be a virtual meeting, which provides convenient access for shareholders and, as in prior years, shareholders will be able to vote and ask questions in real time through our virtual meeting platform. Our Information Circular details how to participate, how to vote, and how to contact me, my fellow Directors and the Company.

On behalf of the Board, I thank you for your support during the past year. We look forward to your participation in the meeting.

John L. Thornton Chairman

|

||||

| Barrick Gold Corporation | 2024 Circular

|

III |

|

|

|

|||||

|

March 21, 2024 |

||||||

|

the Lead

Director

|

My Fellow Shareholders

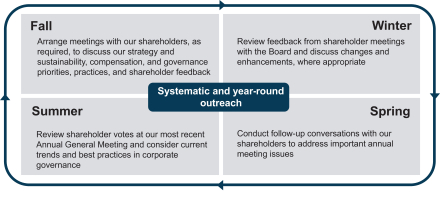

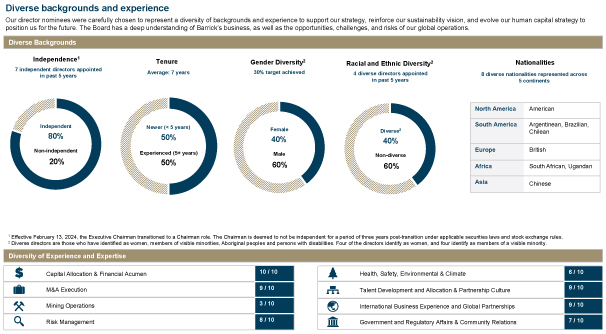

During the past year, your Board of Directors again provided the strategic direction, oversight, and engagement that continue to advance Barrick towards its goal of becoming the world’s most valued gold and copper mining company. Working closely with the Company’s world-class leadership, the Board was again instrumental in ensuring that Barrick’s current performance and future prospects point to the long-term delivery of sustainable growth and profitability.

The Board prioritizes renewal and diversity in its own ranks in order to maintain and enhance its already high level of global business experience, as well as to make its membership more fully representative of the societies in which the company operates. Since the Merger five years ago, seven new members have been appointed, and females now account for 40% of our directors standing for election at the Meeting (50% of the independent directors) while 40% of our directors identify as racially or ethnically diverse.

As you would have noted in the accompanying letter from the Chairman, effective February 13, 2024, John Thornton transitioned from his Executive Chairman role to become our Chairman. At the time of the Merger, the Board continued Barrick’s existing structure that included an Executive Chairman in order to realize the potential of the combined company, leveraging our shared culture and complementary strengths and assets to fulfil the vision of becoming the world’s most valued gold and copper mining business. Today, after five years, the Company has successfully achieved these goals, which has now made it possible for Mr. Thornton to transition to his new role. As Chairman, Mr. Thornton will continue to provide leadership and direction to the Board and, together with our President and Chief Executive Officer Mark Bristow, be the custodian of the Company’s strategy. My fellow directors and I will continue to benefit from the Chairman’s wisdom and leadership as we look to Barrick’s future and the challenges and opportunities ahead of us.

Also as noted in the Chairman’s letter, on December 29, 2023, Gustavo Cisneros, who had been a Barrick director since 2003, passed away. The substantial contribution he made to Barrick’s development will be greatly missed and I join John, the Board, and management of Barrick in extending my condolences to his wife Patty and family.

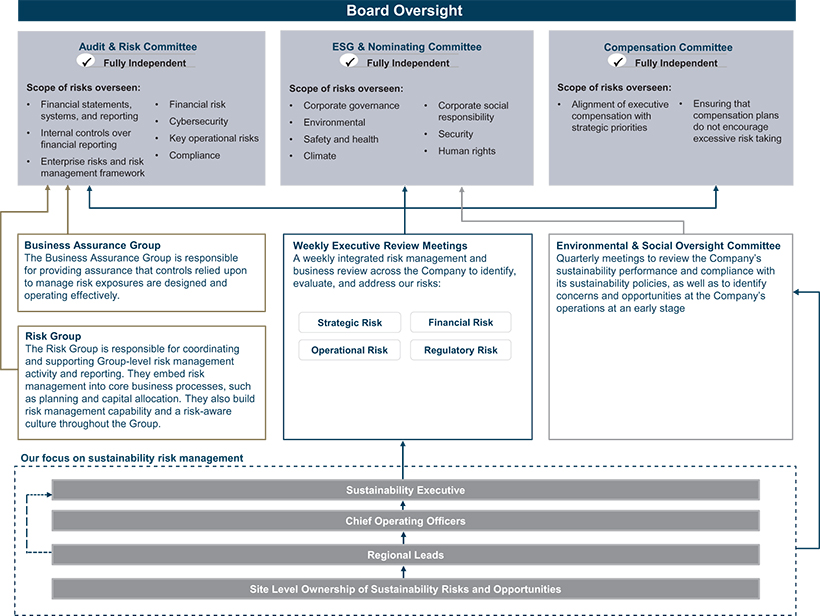

As part of our stewardship of Barrick’s business strategy and the management of key risks, the Board actively oversees the Company’s sustainability policies and performance. Our Environmental, Social, Governance & Nominating Committee reviews regular updates from the President and Chief Executive Officer on matters such as Barrick’s contribution to the social and economic development of its host communities, the health and safety of the workforce, the protection of human rights, and the implementation of the Company’s climate strategy and bio-diversity initiatives.

Board members closely monitor key growth projects. In August, independent directors visited the Pueblo Viejo mine in the Dominican Republic to review progress on the process plant expansion and the new tailings storage facility. The Board also continued to supervise other strategically significant developments such as the reconstitution of the massive Reko Diq copper-gold project and the resumption of gold mining operations at Porgera in Papua New Guinea.

|

|||||

|

|

||||||

| IV | Barrick Gold Corporation | 2024 Circular

|

|

The Audit & Risk Committee received in-depth briefings on key operational and geopolitical risks across the Company’s portfolio. These included regular updates on Barrick’s strategies for mitigating global inflationary pressures, higher energy costs, supply chain disruptions, tax, and other remaining legacy issues. The Committee also reviewed Barrick’s cyber-security strategy and key cyber-related risks as well as its climate disclosures.

In 2023, the Committee oversaw a robust external audit tender process in keeping with our commitment to market-leading corporate governance practices. After a thorough review and evaluation of the firms participating in the tender process against the criteria established by the Audit & Risk Committee, the Committee recommended, and the Board approved, the selection of PwC as Barrick’s auditor. The reappointment of PwC in this role reflects the Board’s determination that PwC is best suited to Barrick and its business across multiple dimensions, including with respect to independence assurance and industry experience and expertise. In addition, the Committee was briefed by management on the company’s financial plan, dividend policy strategy, and share buyback program to ensure that Barrick maintained its liquidity and balance sheet strength while delivering sustainable returns to shareholders.

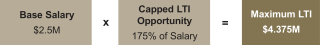

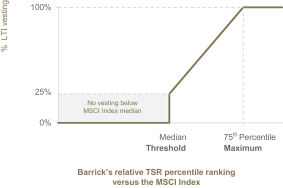

Barrick has a high-performance culture and 100% of all incentive compensation awarded to our executives is performance-based. Since the Merger, the Compensation Committee has continued to refine our long-term incentive (LTI) framework and our unique Performance Granted Share Unit (PGSU) plan to ensure that they support the key pillars of our long-term strategy, transparently reward long-term performance and reinforce our ownership culture.

In 2023, the Committee reviewed the executive compensation framework, taking into consideration shareholder feedback received from our ongoing shareholder outreach, to ensure that it comprises meaningful LTI measures reflecting deliberate management action and long-term value creation:

• PGSUs granted reflect actual multi-year performance against five scorecard categories (previously seven).

• 50% of the long-term scorecard is now tied to returns (share price returns through relative Total Shareholder Return (TSR) and returns generated from disciplined capital allocation through Return on Capital Employed (ROCE)).

• 30% of the scorecard is linked to Barrick’s differentiated growth strategy through reserves replacement (organic growth) and strategic execution (including capital projects and inorganic growth).

• ESG performance accounts for 20% of the long-term scorecard and 10% of the annual incentive criteria to reinforce our commitment to sustainability.

Annual performance incentives for management leaders are based on in-year achievement of personal scorecards tailored to their responsibilities and new for 2023 also include Company and regional measures relating to safety, environment, costs, and production.

In 2023, the Committee also reviewed Barrick’s compensation peer group to ensure that it is aligned with the competitive market for talent. We are committed to continuing to assess and refine our executive compensation framework to align with shareholders’ interests.

|

||||||

|

|

||||||

| Barrick Gold Corporation | 2024 Circular

|

V |

|

Executives and Partners remain subject to market-leading share ownership requirements to align equity retention with the long investment lead times characteristic of the mining industry as well as with our long-term shareholders. Employee ownership at Barrick is broad and deep and the Company’s leaders continue to build on their substantial equity stakes. At the end of the year, the Chairman owned 2.7 million Barrick Shares while the President and Chief Executive Officer and other Named Executive Officers had a collective ownership of more than 7.2 million Barrick Shares.

As we embark on the journey ahead, I am confident in the collective wisdom and expertise of our Board members and leadership team. Together, we will navigate the challenges and opportunities that lie ahead, guided by our shared vision for Barrick’s continued success.

J.B. Harvey Lead Director

|

||||||

|

|

||||||

| VI | Barrick Gold Corporation | 2024 Circular

|

|

Meeting Information |

||||

| Date: | April 30, 2024 |

|||

| Time: | 10:00 a.m. (Toronto time) |

|||

|

Location:

|

https://web.lumiagm.com/406457272

|

|||

Fellow Shareholders:

You are invited to attend Barrick’s 2024 Annual Meeting of Shareholders (the Meeting) at which you will be asked to:

| • | Elect 10 director nominees; |

| • | Appoint PricewaterhouseCoopers LLP as our auditor for 2024; |

| • | Approve our non-binding advisory vote on our approach to executive compensation; and |

| • | Consider the shareholder proposal set out in Schedule E of the Circular. |

Shareholders will also transact any other business properly brought before the Meeting.

Barrick’s Board of Directors has approved the contents of this Notice and Circular and the sending of this Notice and Circular to our shareholders, each of our directors, and our auditor.

In order to facilitate engagement with shareholders, Barrick is pleased to host a virtual meeting format for this year’s Meeting that shareholders may attend virtually by way of a live webcast regardless of their geographic location. Registered shareholders, non-registered (or beneficial) shareholders, and their duly appointed proxyholders will be able to participate, ask questions, and vote in “real time” through an online portal that may be accessed at https://web.lumiagm.com/406457272 by following the instructions set out in the Circular. Non-registered shareholders must carefully follow the procedures set out in the Circular in order to vote virtually and ask questions through the online portal. Non-registered shareholders who do not follow the procedures set out in the Circular will nonetheless be able to view a live webcast of the Meeting, but will not be able to ask questions or vote. Please refer to the section of the Circular entitled “Meeting and Voting Information” for additional details.

Your vote is important. As a shareholder, it is very important that you read this material carefully and then vote your common shares of Barrick (Barrick Shares). You are eligible to vote your Barrick Shares if you were a shareholder of record at the close of business on March 1, 2024. You may vote in person, virtually, or by proxy. See page 5 for further instructions on how you can vote.

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor, by telephone at 1-866-851-2571 (toll-free in North America) or 647-251-9704 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

By Order of the Board of Directors,

Joseph Heckendorn

Vice President, Corporate Secretary

and Associate General Counsel

March 21, 2024

|

General Information In this Circular, “you”, “your”, and “shareholder” refer to the holders of common shares of Barrick. “We”, “us”, “our”, the “Group”, the “Company”, and “Barrick” refer to Barrick Gold Corporation, unless otherwise indicated. Information in this Circular is as of March 20, 2024, unless otherwise indicated. All references to US $ or $ are to U.S. dollars and all references to Cdn $ are to Canadian dollars. The annual average exchange rate for 2023 reported by the Bank of Canada was US $1.00 = Cdn $1.3497.

|

| Barrick Gold Corporation | 2024 Circular | 1 |

| After-Tax Shares | Barrick Shares that are purchased on the open market with after-tax compensation proceeds | |||||

| API | Annual Performance Incentive | |||||

| API Scorecards | Annual Performance Incentive Scorecards | |||||

| Articles | The Notice of Articles and the Articles of Continuation of Barrick | |||||

| Audit Services Policy | Policy on Pre-Approval of Audit, Audit-Related, and Non-Audit Services | |||||

| Barrick Shares | Common shares of Barrick | |||||

| BCBCA | Business Corporations Act (British Columbia) | |||||

| Board of Directors or Board | Board of Directors of Barrick | |||||

| Change in Control Plan | Partner Change in Control Severance Plan | |||||

| Circular | This 2024 Information Circular | |||||

| Class 1 Environmental Incident | An incident that causes significant negative impacts on human health or the environment, or an incident that extends onto publicly accessible land and has the potential to cause significant adverse impact to surrounding communities, livestock, or wildlife | |||||

| Clawback Policy | Amended and Restated Incentive Compensation Recoupment Policy | |||||

| Code | Code of Business Conduct and Ethics | |||||

| DSUs | Deferred Share Units | |||||

| E&S Committee | Environmental & Social Oversight Committee | |||||

| ESG | Environmental, Social, and Governance | |||||

| Exchange Act | United States Securities Exchange Act of 1934, as amended | |||||

| Executive Committee | Executives of Barrick including the President and Chief Executive Officer; Senior Executive Vice-President, Chief Financial Officer; Senior Executive Vice-President, Strategic Matters; Chief Operating Officer, Latin America and Asia Pacific; and Chief Operating Officer, Africa and Middle East; and others as may be appointed from time to time | |||||

| GDX | VanEck Gold Miners Exchange Traded Fund | |||||

| GHG | Greenhouse Gas | |||||

| Global Peer Group | Agnico Eagle Mines Limited, Anglo American plc, AngloGold Ashanti Ltd., Antofagasta plc, BHP Group Limited, Cenovus Energy Inc., First Quantum Minerals Ltd., Freeport McMoran Inc., Gold Fields Limited, Kinross Gold Corporation, Newmont Corporation, Rio Tinto Ltd., South32 Limited, Teck Resources Limited, Canadian Natural Resources Ltd., Hess Corporation, Occidental Petroleum Corporation, and Suncor Energy Inc. | |||||

| LTI | Long-Term Incentives | |||||

| LTIFR | Lost-Time Injury Frequency Rate, a ratio calculated as the product of the number of lost-time injuries and 1,000,000 hours, divided by the total number of hours worked | |||||

| Meeting | 2024 Annual Meeting, to be held on April 30, 2024 | |||||

| Merger | The acquisition of Randgold by Barrick on January 1, 2019 | |||||

| Named Executive Officers (NEOs) | President and Chief Executive Officer; Senior Executive Vice-President, Chief Financial Officer; Senior Executive Vice-President, Strategic Matters; Chief Operating Officer, Latin America and Asia Pacific; and Chief Operating Officer, Africa and Middle East | |||||

| Nevada Gold Mines | Nevada Gold Mines LLC, Barrick’s joint venture with Newmont that combined their respective mining operations, assets, reserves, and talent in Nevada, USA | |||||

| NGO | Non-Governmental Organization | |||||

| NYSE | New York Stock Exchange | |||||

| Partners | Individuals who participate in the Partnership Plan | |||||

| Partnership Plan | Provides Partners (including the NEOs) with eligibility for the API Program, the PGSU Plan, and the Change in Control Plan | |||||

| PGSUs | Performance Granted Share Units | |||||

| Randgold | Randgold Resources Limited | |||||

| ROCE | Return on Capital Employed | |||||

| RSUs | Restricted Share Units | |||||

| SEC | U.S. Securities and Exchange Commission | |||||

| Sustainability Scorecard | A scorecard that measures Barrick’s ESG performance based on key performance indicators that are aligned to priority areas set out in Barrick’s strategy | |||||

| 2 | Barrick Gold Corporation | 2024 Circular |

| TCFD | Task Force on Climate-Related Financial Disclosures | |||||

| Tier One Copper Asset | An asset with a $3.00 per pound reserve with potential for five million tonnes or more of contained copper to support a minimum 20-year life, annual production of at least 200,000 tonnes, and with all-in sustaining costs per pound life-of-mine in the lower half of the industry cost curve. Tier One assets must be located in a world class geological district with potential for organic reserve growth and long-term geologically driven value addition | |||||

| Tier One Gold Asset | An asset with a $1,300 per ounce reserve with potential for five million ounces to support a minimum 10-year life, annual production of at least 500,000 ounces of gold and with all-in sustaining costs per ounce life-of-mine that are in the lower half of the industry cost curve. Tier One assets must be located in a world class geological district with potential for organic reserve growth and long-term geologically driven value addition | |||||

| TRIFR | Total Reportable Injury Frequency Rate, a ratio calculated as the product of the number of reportable injuries (which includes fatalities, lost-time injuries, restricted duty injuries, and medically treated injuries) and 1,000,000 hours, divided by the total number of hours worked | |||||

| TSR | Total Shareholder Return | |||||

| TSX | Toronto Stock Exchange | |||||

Non-GAAP Financial Performance Measures

Certain financial performance measures in this Circular – namely EBITDA, Adjusted EBITDA, Adjusted EBIT, Adjusted Net Earnings, Adjusted Net Earnings per Share, Free Cash Flow, Total Cash Costs per ounce, C1 Cash Costs per pound, All-in Sustaining Costs per ounce and All-In Costs per ounce – are not prescribed by IFRS. These non-GAAP financial measures are included because management uses the information to analyze business performance and financial strength. These non-GAAP financial performance measures are intended to provide additional information only and do not have any standardized definition under IFRS and may not be comparable to similar measures presented by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For further details regarding non-GAAP financial performance measures and a detailed reconciliation to the most directly comparable measure under IFRS, see “Other Information – Use of Non-GAAP Financial Performance Measures” on page 112.

Forward-Looking Information

This Circular contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Often, but not always, forward-looking information can be identified by the use of words such as “aim”, “aspire”, “strive”, “will”, “expect”, “intend”, “plan”, “believe”, “execute” or similar expressions, as they relate to the Company. In particular, this Circular includes, without limitation, forward-looking information pertaining to: the belief of management that the Company’s ability to implement a business plan that focuses on its 2024 strategic priorities will further Barrick’s aim to be the world’s most valued gold and copper mining business; forward-looking production guidance, including our ability to increase attributable production in gold equivalent ounces by more than 30% by 2030; our ability to convert resources into reserves and replace reserves net of depletion from production; mine life and production rates, including annual production expectations from Pueblo Viejo, Goldrush and Lumwana and anticipated production growth from Barrick’s organic project pipeline and reserve replacement; Barrick’s global exploration strategy and planned exploration activities; our ability to identify new Tier One assets and the potential for existing assets to attain Tier One status; our ability to maintain a 10-year production outlook; Barrick’s copper strategy; our plans and expected completion and benefits of our growth projects; targeted first production for the Reko Diq project; the resumption of operations at the Porgera mine and expected restart of mining and processing in the first quarter of 2024; our pipeline of high confidence projects at or near existing operations; the potential to extend Veladero’s life of mine and the timing for completion of construction of the Phase 7B Leach Pad; Lumwana’s ability to further extend the life of mine through the development of a Super Pit and the targeted timing for a PFS and first production; Barrick’s strategy, plans, targets, and goals in respect of environmental, and social governance issues, including local community relations, economic contributions and education, employment, and procurement initiatives, climate change and biodiversity initiatives; Barrick’s talent management strategy; Barrick’s performance dividend policy and share buyback program; and expectations regarding future price assumptions, financial performance and other outlook or guidance. These statements are based on the reasonable assumptions, estimates, analysis, and opinions of management made in light of management’s experience and perception of trends, current conditions, and expected developments, as well as other factors that management considers to be relevant and reasonable at the date that such statements are made. Forward-looking information involves known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results, performance, or achievements of the Company, as applicable, to be materially different from those anticipated, estimated, or intended. Forward-looking information contained herein is made as of the date of this Circular, and, other than as required by securities law, the Company disclaims any obligation to update any forward-looking information, whether as a result of new information, future events, or results or otherwise unless so required by applicable securities laws.

Future Dividends

The declaration and payment of dividends is at the discretion of the Board, and will depend on the Company’s financial results, cash requirements, future prospects, the number of outstanding Barrick Shares, and other factors deemed relevant by the Board. The Board reserves all powers related to the declaration and payment of dividends. Consequently, in determining any dividends to be declared and paid on Barrick Shares, the Board may revise or terminate the payment level at any time without prior notice. As a result, investors should not place undue reliance on statements relating to future dividends.

Share Buyback Program

The actual number of Barrick Shares that may be purchased by Barrick under the share buyback program, if any, and the timing of any such purchases, will be determined by Barrick based on a number of factors, including the Company’s financial performance, prevailing market prices of the Barrick Shares, the availability of cash flows, and the consideration of other uses of cash, including capital investment opportunities, returns to shareholders, and debt reduction. The share buyback program does not obligate the Company to acquire any particular number of Barrick Shares, and the buyback program may be suspended or discontinued at any time at the Company’s discretion.

| Barrick Gold Corporation | 2024 Circular | 3 |

Meeting and Voting Information

Proxy Solicitation and Meeting Materials

How we will solicit proxies

Your proxy is being solicited on behalf of Barrick’s management in connection with the meeting to be held on April 30, 2024 (the Meeting). Management will solicit proxies primarily by mail, but proxies may also be solicited personally by telephone by employees of the Company. The costs of preparing and distributing the Meeting materials and the cost of soliciting proxies will be borne by the Company.

The Company has retained Kingsdale Advisors to provide a broad array of strategic advisory, governance, strategic communications, digital and investor campaign services on a global retainer basis in addition to certain fees accrued during the life of the engagement upon the discretion and direction of the Company. For 2023, estimated aggregate fees to assist with soliciting proxies by mail and telephone were approximately $50,000, plus distribution costs and other expenses. Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-2571 (toll-free in North America) or 647-251-9704 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

How we use Notice and Access

We distribute our information circular for our annual meeting and related proxy form to our shareholders by sending them a notice of electronic availability of such circular. The notice of electronic availability in respect of the Meeting provides instructions on how to access and review an electronic copy of our 2024 information circular for the Meeting (the Circular) and instructions on voting by proxy at the Meeting. This process is known as Notice and Access.

| • | How Barrick shareholders benefit from Notice and Access: Notice and Access expedites our shareholders’ receipt of these materials, lowers printing and distribution costs, and reduces the environmental impact of our Meeting. |

| • | How to obtain a paper copy of our Circular: Shareholders can request a paper copy of the Circular at www.meetingdocuments.com/TSXT/abx or by calling TSX Trust Company (TSX Trust) toll-free at 1-888-433-6443 from Canada and the United States or by calling collect at 416-682-3801 from other locations or by e-mailing tsxt-fulfilment@tmx.com. If you have previously provided instructions to receive a paper copy of our Circular and do not want to receive a paper copy in the future, please contact your intermediary. |

How meeting materials will be delivered to shareholders

The proxy materials are sent to our registered shareholders through our transfer agent, TSX Trust. We generally do not send our proxy materials directly to non-registered shareholders and instead use the services of Broadridge Investor Communications Corporation (Broadridge) who acts on behalf of intermediaries to send proxy materials. We intend to pay intermediaries to send proxy materials and voting instruction forms to objecting non-registered shareholders.

Non-registered (or beneficial) shareholders are asked to consider signing up for electronic delivery (“E-delivery”) of the Meeting materials. E-delivery has become a convenient way to make distribution of materials more efficient and is an environmentally responsible alternative by eliminating the use of printed paper and the carbon footprint of the associated mail delivery process. Signing up is quick and easy, go to www.proxyvote.com, sign in with your control number, and vote on the matters that come before the Meeting. Following your vote confirmation, you will be able to select the electronic delivery box and provide an email address. Having registered for electronic delivery, going forward you will receive your meeting materials by email and will be able to vote on your device by simply following a link in an email sent to you by your intermediary, provided your intermediary supports this service.

Meeting Procedures

Attending the Meeting

|

Date: |

April 30, 2024 |

||

|

Time: |

10:00 a.m. (Toronto time) |

|||

|

Location: |

https://web.lumiagm.com/406457272 |

|||

Only shareholders of record at the close of business on March 1, 2024 and other permitted attendees may virtually attend the Meeting. Attending the Meeting virtually allows registered shareholders and duly appointed proxyholders, including non-registered shareholders who have duly appointed themselves or a third-party proxyholder in accordance with the procedures set out below under the heading “How can I vote if I am a non-registered shareholder?”, to participate, ask questions, and vote at the Meeting using

| 4 | Barrick Gold Corporation | 2024 Circular |

the LUMI meeting platform. Guests, including non-registered shareholders who have not duly appointed themselves or a third party as proxyholder, can log into the virtual Meeting as a guest. Guests may listen to the Meeting, but will not be entitled to vote or ask questions.

| • | Registered shareholders and duly appointed proxyholders may log in online at https://web.lumiagm.com/406457272, click on “I have a Control Number”, enter the 13-digit Control Number found on the proxy or provided to a duly appointed proxyholder, as applicable, the meeting ID 406-457-272, and the password barrick2024 (case sensitive), then click on the “Login” button. We recommend you log in at least one hour before the Meeting begins. For registered shareholders, the Control Number is located on your form of proxy. For duly appointed proxyholders (including non-registered shareholders who have appointed themselves), your Control Number will be provided by TSX Trust provided that you or your proxyholder has been duly appointed in accordance with the procedures outlined in this Circular. |

| • | Non-registered shareholders may view a live webcast of the Meeting by going to the same URL as above and clicking on “I am a guest” or on our website at www.barrick.com/investors/agm. |

During the Meeting, you must ensure you are connected to the Internet at all times in order to vote when polling is commenced on the resolutions put before the Meeting. It is your responsibility to ensure Internet connectivity. You will also need the latest version of Chrome, Safari, Edge, or Firefox. Please do not use Internet Explorer. As internal network security protocols (such as firewalls and VPN connections) may block access to the LUMI meeting platform, please ensure that you use a network that is not restricted to the security settings of your organization or that you have disabled your VPN setting. It is recommended that you log in at least one hour before the Meeting.

If shareholders (or their duly appointed proxyholders) encounter any difficulties accessing the Meeting during the check-in, they may attend the Meeting by clicking “Guest” and completing the online form. The LUMI meeting platform is fully supported across Internet browsers and devices (desktops, laptops, tablets, and smartphones) running the most updated version of applicable software and plugins. Barrick Shareholders (or their proxyholders) should ensure that they have a strong Internet connection if they intend to attend and/or participate in the Meeting. Participants should allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Meeting. Technical support can also be accessed at support-ca@lumiglobal.com.

For additional information, please see below under “Voting Procedures”.

How many shareholders are needed to reach a quorum?

We need to have at least two people present at the Meeting who hold, or represent by proxy, in aggregate, at least 25% of the issued and outstanding Barrick Shares entitled to be voted at the Meeting. On March 20, 2024, the Company had 1,755,636,101 Barrick Shares outstanding. Each Barrick Share is entitled to one vote. Shareholders who participate in and/or vote at the Meeting virtually are deemed to be present at the Meeting for all purposes, including quorum.

Does any shareholder beneficially own 10% or more of the issued and outstanding Barrick Shares?

To the knowledge of the directors and senior officers of the Company, as of March 20, 2024, no person beneficially owned, directly or indirectly, or exercised control or direction over, voting securities carrying 10% or more of the voting rights attached to the outstanding Barrick Shares.

Will Company employees vote their Barrick Shares at the Meeting?

Employees of Barrick are entitled to vote Barrick Shares beneficially owned by them, including those held in our equity compensation plans, at the Meeting. As of March 20, 2024, less than 1% of Barrick Shares were beneficially owned by employees through our equity compensation plans.

Voting Procedures

How do I vote my Barrick Shares?

|

Please follow the voting instructions based on whether you are a registered or non-registered shareholder:

• You are a registered shareholder if you have a share certificate issued in your name or appear as the registered shareholder on the books of the Company.

• You are a non-registered shareholder if your Barrick Shares are registered in the name of an intermediary (for example, a bank, trust company, investment dealer, clearing agency, or other institution).

If you are not sure whether you are a registered or non-registered shareholder, please contact TSX Trust by email at shareholderinquiries@tmx.com. Alternatively, please call TSX Trust toll-free at 1-800-387-0825 from Canada and the United States or collect at 416-682-3860 from other locations.

|

| Barrick Gold Corporation | 2024 Circular | 5 |

How can I vote if I am a registered shareholder?

| Option 1 – By proxy (proxy form) |

|

|

By Internet:

Go to TSX Trust’s website at www.meeting-vote.com and follow the instructions on screen. You will need your 13-digit Control Number, which can be found on your proxy form.

See below, under the heading “How will my Barrick Shares be voted if I return a proxy?”, for more information. |

|

|

|

By Telephone:

Call 1-888-489-5760 (toll-free in Canada and the United States) from a touch-tone phone and follow the instructions. You will need your 13-digit Control Number, which can be found on your proxy form.

Please note that you cannot appoint anyone other than the directors and officers named on your proxy form as your proxyholder if you vote by telephone. See below, under the heading “How will my Barrick Shares be voted if I return a proxy?”, for more information. |

|

|

|

By Fax:

Complete, sign, and date your proxy form, and send all pages (in one transmission) by fax to 416-595-9593.

See below, under the heading “How will my Barrick Shares be voted if I return a proxy?”, for more information. |

|

|

|

By Mail:

Complete, sign, and date your proxy form, and return it in the envelope provided.

See below, under the heading “How will my Barrick Shares be voted if I return a proxy?”, for more information. |

|

|

|

Appointing another person to attend the Meeting and vote your Barrick Shares for you:

You may appoint a person other than the directors and officers designated by the Company on your proxy form to represent you and vote on your behalf at the Meeting. This person does not have to be a shareholder. To do so, strike out the names of our directors and officers that are printed on the proxy form and write the name of the person you are appointing in the space provided. Complete your voting instructions, sign, and date the proxy form, and return it to TSX Trust as instructed. Please ensure that the person you appoint is aware that he or she has been appointed to attend the Meeting virtually on your behalf.

In order to participate in the virtual Meeting, your proxyholder must request a Control Number for the Meeting from TSX Trust by 5:00 p.m. (Toronto time) on April 29, 2024. Control Numbers can be obtained online by completing an electronic form on TSX Trust’s website, or by contacting TSX Trust by phone: |

|

| Electronic form |

www.tsxtrust.com/control-number-request |

|||

| By phone |

Contact TSX Trust at 1-866-751-6315 (within North America) or 416-682-3860 (outside of North America) |

|||

| This Control Number will allow your proxyholder to log in to the live webcast and vote at the Meeting using the LUMI meeting platform. Without a Control Number, your proxyholder will not be able to vote at the Meeting. TSX Trust will provide your duly appointed proxyholder with a Control Number provided that your proxy has been received by TSX Trust prior to this deadline. Please note that you cannot appoint anyone other than the directors and officers named on your proxy form as your proxyholder if you vote by telephone.

For more information, please see above under the heading “Attending the Meeting” and below under the heading “How will my Barrick Shares be voted if I return a proxy?”. |

||||

| 6 | Barrick Gold Corporation | 2024 Circular |

| Option 2 – In person via Internet Webcast |

||

|

|

Registered shareholders have the ability to participate, ask questions, and vote at the Meeting using the LUMI meeting platform. Eligible registered shareholders may log in at https://web.lumiagm.com/406457272, click on “I have a Control Number”, enter the 13-digit Control Number found on the proxy, the meeting ID 406-457-272, and the password barrick2024 (case sensitive), then click on the “Login” button. During the Meeting, you must ensure you are connected to the Internet at all times in order to vote when polling is commenced on the resolutions put before the Meeting. It is your responsibility to ensure Internet connectivity. You will also need the latest version of Chrome, Safari, Edge, or Firefox. Please do not use Internet Explorer. As internal network security protocols (such as firewalls and VPN connections) may block access to the LUMI meeting platform, please ensure that you use a network that is not restricted to the security settings of your organization or that you have disabled your VPN setting. It is recommended that you log in at least one hour before the Meeting. Non-registered shareholders must follow the procedures outlined below under the heading “How can I vote if I am a non-registered shareholder?” to participate in the Meeting using the LUMI meeting platform. Non-registered shareholders who fail to comply with the procedures outlined below may nonetheless view a live webcast of the Meeting by going to the same URL as above and clicking on “I am a guest” or on our website at www.barrick.com/investors/agm. |

How can I vote if I am a non-registered shareholder?

| Option 1 – By proxy (voting instruction form) |

||

|

You will receive a voting instruction form that allows you to vote on the Internet, by telephone, by fax, or by mail. To vote, you should follow the instructions provided on your voting instruction form. Your intermediary is required to ask for your voting instructions before the Meeting. Please contact your intermediary if you did not receive a voting instruction form.

|

|

| Alternatively, you may receive from your intermediary a pre-authorized proxy form indicating the number of Barrick Shares to be voted, which you should complete, sign, date, and return as directed on the form.

|

||

| Option 2 – In person via Internet Webcast |

||

|

|

We do not have access to the names or holdings of our non-registered shareholders. That means you can only vote your Barrick Shares virtually at the Meeting if you have (a) previously appointed yourself as the proxyholder for your Barrick Shares, by printing your name in the space provided on your voting instruction form and submitting it as directed on the form, and (b) by no later than 5:00 p.m. (Toronto time) on April 29, 2024, you contacted TSX Trust to request a Control Number. Control Numbers can be obtained online by completing an electronic form on TSX Trust’s website, or by contacting TSX Trust by phone: | |

| Electronic form |

tsxtrust.com/control-number-request |

|||

| By phone |

Contact TSX Trust at 1-866-751-6315 (within North America) or 416-682-3860 (outside of North America) |

| This Control Number will allow you to log in to the live webcast and vote at the Meeting. Without a Control Number, you will not be able to ask questions or vote at the Meeting. During the Meeting, you must ensure you are connected to the Internet at all times in order to vote when polling is commenced on the resolutions put before the Meeting. It is your responsibility to ensure Internet connectivity. You will also need the latest version of Chrome, Safari, Edge, or Firefox. Please do not use Internet Explorer. As internal network security protocols (such as firewalls and VPN Connections) may block access to the LUMI meeting platform, please ensure that you use a network that is not restricted to the security settings of your organization or that you have disabled your VPN setting. It is recommended that you log in at least one hour before the Meeting.

|

||

| You may also appoint someone else as the proxyholder for your Barrick Shares by printing their name in the space provided on your voting instruction form and submitting it as directed on the form. If your proxyholder intends to participate in the Meeting virtually, he or she must contact TSX Trust at 1-866-751-6315 (within North America) or 416-682-3860 (outside of North America) by no later than 5:00 p.m. (Toronto time) on April 29, 2024 to obtain a Control Number for the Meeting.

Your voting instructions must be received in sufficient time to allow your voting instruction form to be forwarded by your intermediary to TSX Trust before 5:00 p.m. (Toronto time) on April 26, 2024. If you plan to participate in the Meeting virtually (or to have your proxyholder attend the Meeting virtually), you or your proxyholder will not be entitled to vote or ask questions online unless the proper documentation is completed and received by your intermediary well in advance of the Meeting to allow them to forward the necessary information to TSX Trust before 5:00 p.m. (Toronto time) on April 26, |

| Barrick Gold Corporation | 2024 Circular | 7 |

| 2024. You should contact your Intermediary well in advance of the Meeting and follow their instructions if you want to participate in the Meeting virtually.

Non-registered shareholders who do not object to their name being made known to the Company may be contacted by Kingsdale Advisors to assist in conveniently voting their Barrick Shares directly by telephone. Barrick may also utilize the Broadridge QuickVote service to assist such shareholders with voting their Barrick Shares. See “How we will solicit proxies” on page 4 for more information.

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-2571 (toll-free in North America) or 647-251-9704 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com. |

Is there a deadline for my proxy to be received?

Yes. Whether you vote by mail, fax, telephone, or Internet, your proxy must be received by no later than 5:00 p.m. (Toronto time) on Friday, April 26, 2024. If the Meeting is adjourned or postponed, your proxy must be received by 5:00 p.m. (Toronto time) on the second-last business day before the reconvened meeting. The time limit for deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice.

As noted above, if you are a non-registered shareholder, all required voting instructions must be submitted to your intermediary sufficiently in advance of this deadline to allow your intermediary time to forward this information to TSX Trust. Barrick reserves the right to accept late proxies and to waive the proxy cut-off deadline, with or without notice, but Barrick is under no obligation to accept or reject any particular late proxy.

Will virtually attending the Meeting impact my ability to participate in the Meeting?

This year, Barrick is pleased to host a virtual Meeting in which shareholders can participate by following the instructions in this Circular and attend regardless of geographic location. The Company values shareholder participation and feedback, and expects that shareholders attending the Meeting virtually will have substantially the same opportunity to participate in the Meeting and ask questions of the Board and management as they would if attending the Meeting in person.

Shareholders will be able to submit their votes by virtual ballot during the Meeting through the LUMI meeting platform. The Chair of the Meeting will indicate the time at which polls open and close, and voting options will be visible on your screen. Shareholders who wish to vote virtually at the Meeting should follow the instructions set out above under the heading “Voting Procedures”.

At the virtual Meeting, registered shareholders, non-registered shareholders, and their duly appointed proxyholders who have followed the instructions in this Circular will be able to ask questions in “real time” through the online Meeting portal by sending a written message to the Chair of the Meeting through the LUMI meeting platform. To ensure you have the ability to ask questions during the Meeting, it is important that you follow the instructions set out above under the headings “Attending the Meeting” and “Voting Procedures”.

Registered shareholders, non-registered shareholders, and their duly appointed proxyholders who wish to ask questions are encouraged to submit their questions as soon as possible during the Meeting. Questions can be submitted in the text box (chat feature) of the LUMI meeting platform. During the Meeting, shareholders will also be able to provide direct feedback to management during the question-and-answer segment of the Meeting by submitting any feedback in the text box (chat feature) of the LUMI meeting platform.

The Chair of the Meeting and members of management present at the Meeting will answer questions relating to matters to be voted on before a vote is held on such matter, if applicable. General questions will be addressed at the end of the Meeting during the question-and-answer segment. Questions will be read aloud before a response is provided. So that as many questions as possible may be answered, shareholders are asked to be brief and concise and to address only one topic per question.

Consistent with an in-person Meeting, the Chair of the Meeting has broad authority and discretion to conduct the Meeting in an orderly manner, including determining the order in which questions are answered, the amount of time devoted to answering any one question, and the appropriateness of a question. While all questions are welcome, the Company does not intend to respond to questions that (a) are irrelevant to the Company’s operations or to the business of the Meeting; (b) relate to non-public information concerning the Company; (c) relate to personal grievances or personal business interests; (d) constitute derogatory references to individuals or that are otherwise offensive to third parties; (e) are repetitious or have already been asked by other shareholders; or (f) are out of order or not otherwise appropriate, as reasonably determined by the Chair of the Meeting. Questions from multiple shareholders on the same topic or that are otherwise related will, to the extent practicable, be summarized and answered together.

For any questions asked but not answered during the Meeting due to time constraints, shareholders may contact the Corporate Secretary at corporatesecretary@barrick.com. A video and audio recording of the Meeting will be available on Barrick’s website shortly following the Meeting.

| 8 | Barrick Gold Corporation | 2024 Circular |

Any shareholder who validly submitted a proposal before the Meeting will be afforded a reasonable opportunity to present the proposal to the Meeting. Shareholders will be able to vote on any validly submitted shareholder proposal in the same manner they would on any item of business that properly comes before the Meeting.

Technical support will be available on the LUMI meeting platform on the day of the Meeting via e-mail at supportca@lumiglobal.com.

How will my Barrick Shares be voted if I return a proxy?

By completing and returning a proxy, you are authorizing the person named in the proxy to attend the Meeting and vote your Barrick Shares on each item of business according to your instructions. If you have appointed the designated directors or officers of Barrick as your proxy and you do not provide them with instructions, they will vote your Barrick Shares as follows:

| • | FOR the election of the 10 nominee directors to the Board; |

| • | FOR the appointment of PricewaterhouseCoopers LLP as the Company’s auditor and the authorization of the directors to fix the auditor’s remuneration; |

| • | FOR the advisory resolution approving the Company’s approach to executive compensation; and |

| • | AGAINST the shareholder proposal set out in Schedule E of this Circular. |

What happens if there are amendments, variations, or other matters brought before the Meeting?

Your proxy authorizes your proxyholder to act and vote for you on any amendment or variation of any of the business of the Meeting and on any other matter that properly comes before the Meeting. Your proxy is effective at any continuation following an adjournment of the Meeting. As of March 20, 2024, no director or officer of the Company is aware of any variation, amendment, or other matter to be presented for a vote at the Meeting.

What if I change my mind after I have submitted my proxy?

You can revoke a vote you made by proxy by:

| • | Voting again on the Internet or by telephone before 5:00 p.m. (Toronto time) on April 26, 2024; |

| • | Completing a proxy form or voting instruction form that is dated later than the proxy form or voting instruction form that you are changing, and mailing or faxing it as instructed on your proxy form or voting instruction form, as the case may be, so that it is received before 5:00 p.m. (Toronto time) on April 26, 2024; or |

| • | Any other means permitted by law. |

If you are a registered shareholder, you can also revoke a vote you made by sending a notice in writing from you or your authorized attorney to our Corporate Secretary so that it is received before 5:00 p.m. (Toronto time) on April 26, 2024, or by giving notice in writing from you or your authorized attorney to the Chair of the Meeting, at the Meeting or at any adjournment.

Is my vote by proxy confidential?

Yes. All proxies are received, counted, and tabulated independently by TSX Trust, our transfer agent, or Broadridge, in a way that preserves the confidentiality of shareholder votes, except:

| • | As necessary to permit management and the Board of Directors to discharge their legal obligations to the Company or its shareholders, or to determine the validity of the proxy; |

| • | In the event of a proxy contest; or |

| • | In the event a shareholder has made a written comment on the proxy intended for management or the Board of Directors. |

| Barrick Gold Corporation | 2024 Circular | 9 |

|

Need help casting your vote? |

| For assistance with casting your vote, please contact Kingsdale Advisors at: |

| Kingsdale Advisors |

| Toll-Free within Canada and the United States: |

| 1-866-851-2571 |

| Text and call enabled outside North America: 647-251-9704 |

| Email: contactus@kingsdaleadvisors.com |

|

How can you obtain more information about the proxy voting process? |

| If you have any questions about the proxy voting process, please contact your intermediary (e.g., bank, trust company, investment dealer, clearing agency, or other institution) or our Investor Relations Department at: |

| Toll-Free within Canada and the United States: |

| 1-800-720-7415 |

| Call collect: 416-307-7474 |

| Fax: 416-861-9717 |

|

Email: investor@barrick.com

|

Other Important Information

What is the deadline for making a shareholder proposal at the next annual meeting?

The final date for submission of proposals to shareholders for inclusion in the information circular in connection with next year’s annual shareholders’ meeting is January 30, 2025.

Are any shareholder proposals being considered at the Meeting?

Yes. One shareholder proposal is being considered at the Meeting. For details, please refer to Schedule E of this Circular.

How do I nominate a candidate for election as a director at the Meeting?

Barrick’s Articles set out advance notice procedures for director nominations, which require advance notice to the Company by any shareholder who intends to nominate any person for election as a director of the Company other than pursuant to (a) a requisition of a general meeting made pursuant to the provisions of the BCBCA, (b) a proposal made pursuant to the provisions of the BCBCA, or (c) a nomination by or at the direction of the Board, including pursuant to a notice of the meeting. Among other things, the Articles fix a deadline by which shareholders must notify the Company of their intention to nominate directors and set out the information that shareholders must provide in the notice for it to be valid. These requirements are intended to provide all shareholders with the opportunity to evaluate and review all proposed nominees and vote in an informed and timely manner regarding said nominees. The Articles are available on our website at www.barrick.com, SEDAR+ at www.sedarplus.ca, and EDGAR at www.sec.gov. As of March 20, 2024, the Company has not received any notice of a shareholder’s intention to nominate directors at the Meeting pursuant to the “Nomination of Directors” provisions of the Articles.

Where can I review financial information relating to the Company?

Our financial information is contained in our comparative audited annual financial statements for the year ended December 31, 2023, and related Management Discussion & Analysis, both of which can be found in our 2023 Annual Report on our website at www.barrick.com, on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov.

How do I obtain copies of the Company’s disclosure documents?

If you would like to receive our Annual Report by mail next year, you can do so by checking the appropriate box included on your form of proxy or your voting instruction form.

If you have not previously indicated that you would like to receive our 2023 Annual Report by mail and would like to receive a copy, please contact TSX Trust by email at shareholderinquiries@tmx.com. Alternatively, please call TSX Trust toll-free at 1-800-387-0825 from Canada and the United States or collect at 416-682-3860 from other locations.

Barrick will provide to any person, upon request to our Investor Relations Department, a copy of our 2023 Annual Report, our latest Annual Information Form, and this Circular. Our public disclosure documents are also available on our website at www.barrick.com, on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov.

| 10 | Barrick Gold Corporation | 2024 Circular |

Barrick’s Financial Statements

We will place before the Meeting our consolidated financial statements, including the related auditor’s report, for the year ended December 31, 2023. Our financial statements are included in our 2023 Annual Report. The 2023 Annual Report will be mailed to shareholders who request a copy. Our financial statements are also available on our website at www.barrick.com, on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov.

You will be electing a Board of Directors consisting of 10 members. Please refer to the section entitled “Directors” on page 40 of this Circular for biographies and more information on the nominees. Directors elected at the Meeting will serve until the end of our next annual shareholders’ meeting or until their resignation, if earlier.

|

The Board recommends a vote FOR all the director nominees.

|

If Mark Bristow, John L. Thornton or J. Brett Harvey is your proxyholder and you have not given instructions on how to vote your Barrick Shares, he will vote “FOR” the election of the 10 nominees named in this Circular. If a proposed nominee is unable to serve as a director or withdraws his or her name, the individuals named in your form of proxy or voting instruction form reserve the right to nominate and vote for another individual in their discretion.

Majority Voting

Barrick has adopted a majority voting policy, as described in its Corporate Governance Guidelines available on our website at www.barrick.com/about/governance. Any nominee proposed for election as a director in an uncontested election who receives a greater number of votes withheld than votes in favor of his or her election must promptly tender his or her resignation to the Chairman, or in the case of the Chairman, to the Lead Director. Any such resignation will take effect on acceptance by the Board. This policy applies only to uncontested elections of directors where the number of nominees is equal to the number of directors to be elected. The Environmental, Social, Governance & Nominating Committee (ESG & Nominating Committee) will expeditiously consider the director’s offer to resign and make a recommendation to the Board on whether it should be accepted, provided that the resignation must be accepted absent exceptional circumstances. The Board will have 90 days to make a final decision and will announce such decision by press release, a copy of which will be provided to the TSX in accordance with Barrick’s standard procedure. The affected director will not participate in any Committee or Board deliberations relating to the tendered resignation.

|

The Board recommends a vote FOR the appointment of PwC as Barrick’s auditor.

|

The Board, on the recommendation of the Audit & Risk Committee, recommends that PricewaterhouseCoopers LLP (PwC) be reappointed as auditor and that the Board be authorized to set the auditor’s remuneration. The audit firm appointed at the Meeting will serve until the end of the Company’s next annual shareholders’ meeting.

PwC has been our external auditor since 1983. In keeping with the Company’s commitment to maintain and observe market-leading corporate governance practices and financial reporting standards, Barrick commenced an external audit tender process in February 2023 pursuant to which it received and considered submissions from four leading audit service firms, including PwC. As a result of this process, the Audit & Risk Committee recommended the reappointment of PwC as Barrick’s auditor. See “Auditor Independence and Audit Tender Process” on the following page for additional details of the audit tender process.

If Mark Bristow, John L. Thornton, or J. Brett Harvey is your proxyholder and you have not given instructions on how to vote your Barrick Shares, he will vote “FOR” the appointment of PwC as Barrick’s auditor.

| Barrick Gold Corporation | 2024 Circular | 11 |

What were PwC’s fees for 2023 and 2022? (1)

| In millions of dollars |

2023 | 2022 | ||||||||||

| Audit fees(2) |

$9.9 | $9.7 | ||||||||||

| Audit-related fees(3) |

$0.3 |

|

|

|

$0.2 | |||||||

| Tax compliance and advisory fees(4) |

$0.4 |

|

|

|

$0.6 | |||||||

| All other fees |

$0.0 |

|

|

|

$0.0 | |||||||

| Total |

$10.6 |

|

|

|

$10.5 | |||||||

| (1) | The classification of fees is based on applicable Canadian securities laws and U.S. Securities and Exchange Commission (SEC) definitions. |

| (2) | Audit fees include fees for services rendered by the external auditor in relation to the audit and review of Barrick’s financial statements (inclusive of disbursements), the financial statements of its subsidiaries, and in connection with the Company’s statutory and regulatory filings. |

| (3) | In 2023, audit-related fees primarily related to a number of projects including compliance with regulatory filing requirements in local markets and translation services. |

| (4) | Tax fees mainly related to tax planning, compliance services and audit support for various jurisdictions. |

Auditor Independence and Audit Tender Process

PwC is independent within the meaning of the rules of the Public Company Accounting Oversight Board and, as required by the relevant SEC rules, Barrick’s lead audit partner at PwC rotates every five years (including most recently in February 2021). In addition, the Audit & Risk Committee has adopted a Policy on Pre-Approval of Audit, Audit-Related, and Non-Audit Services (Audit Services Policy) for the pre-approval of services performed by Barrick’s auditor. The objective of the Audit Services Policy is to specify the scope of services permitted to be performed by the Company’s auditor and to ensure that the independence of the Company’s auditor is not compromised through engaging the auditor for other services. All services provided by the Company’s auditor are pre-approved by the Audit & Risk Committee as they arise or through an annual pre-approval of services and related fees. All services performed by Barrick’s auditor comply with the Audit Services Policy and professional standards and securities regulations governing auditor independence. For additional information regarding the mechanisms Barrick has adopted to ensure auditor independence, please see “Procedures for Complaints Regarding Accounting Matters and Auditor Independence Mechanisms” in Schedule A of this Circular.

In keeping with the Company’s commitment to maintain and observe market-leading corporate governance practices and uphold the highest financial reporting standards, Barrick commenced an external audit tender process in February 2023 pursuant to which it received and considered submissions from four leading audit services firms, including PwC. The tender process was conducted in accordance with the procedures approved by the Audit & Risk Committee, which also approved the criteria used to invite and evaluate audit services firms to participate in the tender process. The approved procedures were designed to facilitate a fair and efficient process and included, among other things, meetings with the Chair of the Audit & Risk Committee and select members of management with primary responsibility for engaging with Barrick’s auditor, site visits, written proposals, multiple in-person presentations and interviews, and access to a data room containing information relevant to the tender process. The evaluation criteria were chosen to ensure the selection of an audit services firm that is best suited to Barrick and its business across multiple dimensions, including independent assurance, audit approach, firm reputation and quality control, industry experience and expertise, lead audit partner quality, audit team capabilities, global network, technological capabilities and information security, pricing and fee structure, and firm diversity.

Following a thorough review and evaluation of the audit services firms participating in the tender process against the criteria established by the Audit & Risk Committee, the Audit & Risk Committee identified two audit services firms, including PwC, with the best performance in the tender process. Following a focused comparison of these two firms, the Audit & Risk Committee recommended the reappointment of PwC as Barrick’s auditor. In making its recommendation, the Audit & Risk Committee reviewed and considered the following key factors:

| • | Whether the reappointment of PwC as Barrick’s auditor is in the best interests of the Company and its shareholders. |

| • | The results of management’s assessment of each of the participants in the tender process against the criteria established by the Audit Risk Committee. |

| • | The benefits associated with PwC’s continued engagement as Barrick’s auditor in light of its experience and its institutional knowledge of the Company’s business and assets, as well as the past and present quality of audit services provided by PwC, including transparency of communication with the Audit & Risk Committee (including early communication of potential issues), independent judgment, objective audit approach, and professional integrity. |

| • | PwC’s independence from Barrick within the meaning of the rules of the Public Company Accounting Oversight Board, as well as the independence safeguards in place between Barrick and PwC, including the required regulatory rotation of the lead audit partner, the mechanisms Barrick has adopted to ensure auditor independence, including the Audit Services Policy, and the relatively low quantum of PwC’s fees for non-audit services as a proportion of its fees for audit services. |

| 12 | Barrick Gold Corporation | 2024 Circular |

| • | The potential impact on the operation of Barrick’s internal audit function resulting from a transition between auditors, including potential challenges and costs of an orderly and efficient transition. |

| • | PwC’s international reputation and global capabilities, including PwC’s ability to effectively and efficiently deliver audit services to a business with the global breadth, scale, complexity, and unique attributes of our business. |

| • | The results of third-party audit quality analysis, including inspection results from the Canadian Public Accountability Board and the Public Company Accounting Oversight Board. |

| • | The professional qualifications of PwC, the lead audit partner and the proposed audit team, as well as the ability to use technology and subject matter experts and specialists. |

| • | PwC’s internal succession planning for the rotation of engagement partners and the diversity of PwC’s engagement team. |

| • | The desired balance between PwC’s experience and fresh perspectives brought by mandatory lead audit partner rotation. |

| • | The competitiveness and reasonableness of PwC’s proposed audit fees. |

| • | The feedback received from shareholders in the course of Barrick’s shareholder engagement program. |

| • | The significant changes that have taken place on Barrick’s senior management team since 2019 which mitigates the threat of familiarity between the auditor and senior management. |

The Board accepted the recommendation of the Audit & Risk Committee and approved the reappointment of PwC on November 1, 2023.

The Board has adopted a non-binding advisory vote relating to executive compensation to solicit feedback on our approach to executive compensation. The Say on Pay advisory vote held in 2023 was supported with the approval of 77.53% of those shareholders present at our 2023 annual meeting and voting in person, virtually via the live webcast, or by proxy. Shareholders have the opportunity to vote “For” or “Against” the Company’s approach to executive compensation through the following advisory resolution:

“RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in Barrick’s Information Circular relating to the 2024 Annual Meeting of Shareholders.”

Since this vote is advisory, it will not be binding on the Board. The Board remains fully responsible for its compensation decisions and is not relieved of this responsibility by a positive or negative vote. However, the Board and the Compensation Committee will consider the outcome of the vote as part of their ongoing review of executive compensation and shareholder engagement feedback. The Company plans to hold an advisory vote on our approach to executive compensation on an annual basis. See “Why should shareholders approve our Say on Pay?” on page 24 for details regarding the comprehensive review of Barrick’s executive compensation framework undertaken by the Compensation Committee during 2023.

|

The Board recommends a vote FOR the approval of the advisory vote on executive compensation.

|

If Mark Bristow, John L. Thornton, or J. Brett Harvey is your proxyholder and you have not given instructions on how to vote your Barrick Shares, he will vote “FOR” the approval of the advisory vote on executive compensation.

|

The Board recommends a vote AGAINST the shareholder proposal.

|

If Mark Bristow, John L. Thornton, or J. Brett Harvey is your proxyholder and you have not given instructions on how to vote your Barrick Shares, he will vote “AGAINST” the approval of the shareholder proposal.

At the Meeting, shareholders will consider the shareholder proposal set out in Schedule E of this Circular. Following careful consideration of the proposal, as well as engagement with the proposal’s proponents, the Board recommends voting AGAINST the proposal for the reasons set out in the Board’s response in Schedule E.

| Barrick Gold Corporation | 2024 Circular | 13 |

Following the conclusion of the formal business to be conducted at the Meeting, we will invite questions and comments from shareholders and proxyholders attending the Meeting.

As of the date of this Circular, management is not aware of any changes to the items listed above and does not expect any other business to be brought forward at the Meeting. If there are changes or new business, your proxyholder can vote your Barrick Shares on these items as he or she sees fit.

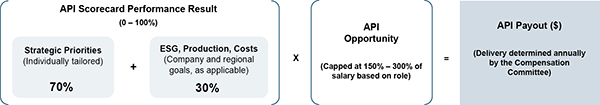

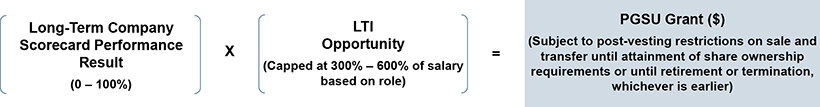

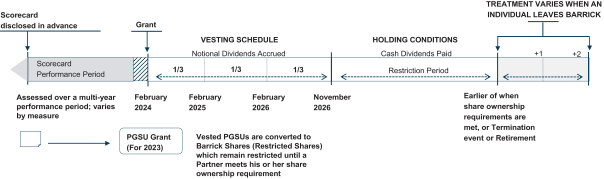

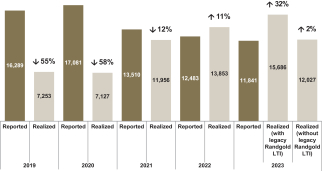

| 14 | Barrick Gold Corporation | 2024 Circular |