| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13(a) or 15(d) of THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023 |

Commission File Number 001-11444

|

Title of each class |

Name of each exchange on which registered |

|

Common Shares |

New York Stock Exchange |

| ☒ Annual Information Form |

☒ Audited Annual Financial Statements |

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

| Auditor Name: Deloitte LLP | Auditor Location: Toronto, Canada | Auditor Firm ID: 1208 |

| 1. | ANNUAL INFORMATION FORM |

The Registrant’s Annual Information Form for the year ended December 31, 2023 is attached as Exhibit 1 (the “Annual Information Form”) to this annual report on Form 40-F and is incorporated by reference herein.

| 2. | AUDITED ANNUAL FINANCIAL STATEMENTS |

The Registrant’s consolidated audited financial statements as at and for the fiscal years ended December 31, 2023 and December 31, 2022, including the reports of independent registered public accounting firm, prepared by Deloitte LLP (“Deloitte”) with respect thereto, are included in Exhibit 2 attached to this annual report on Form 40-F and are incorporated by reference herein.

| 3. | MANAGEMENT’S DISCUSSION AND ANALYSIS |

The Registrant’s Management’s Discussion and Analysis of Operations and Financial Position for the year ended December 31, 2023 is included in Exhibit 3 attached to this annual report on Form 40-F and is incorporated by reference herein.

| 4. | WEBSITE INFORMATION |

Notwithstanding any reference to the Registrant’s website on the World Wide Web in the Annual Information Form or in the documents attached or incorporated as exhibits hereto, the information contained in the Registrant’s website, or any other site on the World Wide Web referred to in the Registrant’s website, is not a part of this annual report on Form 40-F and, therefore, is not filed with the Commission.

| 5. | FORWARD-LOOKING STATEMENTS |

The Registrant has made in the documents filed as part of this annual report on Form 40-F, and from time to time may otherwise make “forward-looking statements”, within the meaning of Section 21E under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the U.S. Securities Act of 1933, and related assumptions concerning its operations, economic performance and financial matters. Actual results or events could differ materially from those set forth in, or implied by, the forward-looking statements and the related assumptions due to a variety of factors. Reference is made to the section titled “Forward-Looking Statements” on page 2 of the Annual Information Form for a discussion of such factors.

| 6. | CONTROLS AND PROCEDURES |

The Registrant’s Chief Executive Officer and its Executive Vice-President and Chief Financial Officer are responsible for establishing and maintaining the Registrant’s disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) and internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act).

Disclosure Controls and Procedures

The disclosure provided under the heading Controls and Procedures – Disclosure Controls and Procedures included in Exhibit 3: Management’s Discussion and Analysis is incorporated by reference herein.

Internal Control Over Financial Reporting

The disclosure provided under the heading Controls and Procedures – Management’s Annual Report on Internal Control Over Financial Reporting included in Exhibit 3: Management’s Discussion and Analysis is incorporated by reference herein.

Changes in Internal Controls Over Financial Reporting

The disclosure provided under the heading Controls and Procedures – Changes in Internal Controls Over Financial Reporting included in Exhibit 3: Management’s Discussion and Analysis is incorporated by reference herein.

| 7. | AUDIT COMMITTEE MEMBERS AND AUDIT COMMITTEE FINANCIAL EXPERT |

The Registrant has a separately designated standing audit committee of its Board of Directors (the “Audit Committee”), which is currently comprised of the following members of the Registrant’s Board of Directors: Peter G. Bowie (Chair), Jan R. Hauser, Jay K. Kunkel and Mary Lou Maher.

The Registrant’s Board of Directors has determined that each of Mr. Bowie, Ms. Hauser, Mr. Kunkel and Ms. Maher, is an “audit committee financial expert” and that each member of the Audit Committee is “independent” and “financially literate”, as such terms are defined in the listing standards of the New York Stock Exchange and Exchange Act Rule 10A-3.

| 8. | CODE OF ETHICS |

The Registrant has adopted a code of ethics that applies to all of its employees, including its Chief Executive Officer, its Chief Financial Officer, its Controller and other persons performing similar functions. The full text of such code of ethics is available on the Registrant’s website at www.magna.com under the Leadership & Governance section.

| 9. | CORPORATE GOVERNANCE |

As a “foreign private issuer” listed on The New York Stock Exchange (the “NYSE”), the Registrant is required to disclose the significant ways in which its corporate governance practices differ from those to be followed by U.S. domestic issuers under the NYSE listing standards. There is only one significant difference between the Registrant’s corporate governance practices and those required of U.S. domestic companies under NYSE listing standards. NYSE listing standards require shareholder approval of all “equity compensation plans” and material revisions to these types of plans (with limited exceptions). The rules of the Toronto Stock Exchange (the “TSX”) require shareholder approval of “security-based compensation arrangements,” which are plans that involve newly issued shares, or specified amendments to such plans. The Registrant follows the TSX rules and has previously obtained shareholder approval for the following security-based compensation arrangements:

| • | Treasury PSU Plan approved by shareholders on May 3, 2022; and |

| • | Amended and Restated 2009 Stock Option Plan approved by shareholders on May 6, 2010. |

The Registrant also has two equity compensation arrangements which involve the purchase of its common shares in the secondary trading market at market prices:

| • | Performance Stock Unit Plan approved by the Registrant’s Board of Directors on August 7, 2018; and |

| • | Restricted Stock Unit arrangements. |

The rules of the TSX do not require shareholder approval for these equity compensation arrangements and accordingly the Registrant has not sought shareholder approval of either.

| 10. | PRINCIPAL ACCOUNTANT FEES AND SERVICES |

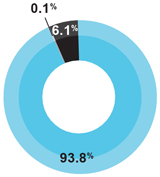

The table below shows the fees for professional services rendered by our principal accountant, Deloitte, for the fiscal years ended December 31, 2023 and December 31, 2022.

| Fiscal 2023 | Fiscal 2022 | |||||||||||||||

| Type of Services |

Fees | % of Total | Fees | % of Total | ||||||||||||

| Audit Fees |

10,199,000 | 52% | 9,773,000 | 57% | ||||||||||||

| Audit-Related Fees |

8,198,000 | 42% | 6,589,000 | 39% | ||||||||||||

| Tax Fees |

1,069,000 | 6% | 685,000 | 4% | ||||||||||||

| All Other Fees |

7,000 | <1% | 48,000 | <1% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

19,473,000 | 100.00% | 17,095,000 | 100.00% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The services comprising the “Audit Fees” category for each of the last two fiscal years were performed by Deloitte to comply with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), including integrated audit of the consolidated financial statements and quarterly reviews. In some cases, fees in this category may include an appropriate allocation of fees for tax services or accounting consultations, to the extent such services were necessary to comply with the standards of the PCAOB. This category includes fees incurred in connection with the audit of our internal control over financial reporting for purposes of Section 404 of the Sarbanes-Oxley Act of 2002.

The services comprising the “Audit-Related Fees” category consists of fees paid in respect of assurance and related services, including such things as due diligence relating to mergers and acquisitions, accounting consultations and audits in connection with acquisitions, services related to statutory audits of certain foreign subsidiaries, attest services that are not required by statute or regulation and consultation concerning financial accounting and reporting standards. Audit-related services actually provided by Deloitte in each of fiscal 2023 and fiscal 2022 consisted of: services related to statutory audits of certain foreign subsidiaries, assurance services and procedures related to attest engagements not required by statute or regulation, due diligence relating to mergers and acquisitions and other assurance services.

The services comprising the “Tax Fees” category consists of all fees paid in respect of tax compliance, planning and advisory services performed by Deloitte’s tax professionals, except those services required in order to comply with the standards of the PCAOB which are included under “Audit Services”. The tax services actually provided by Deloitte in each of fiscal 2023 and fiscal 2022 consisted of: domestic and international tax advisory, compliance and research services, as well as transfer pricing advisory services.

The category “All Other Fees” captures fees in respect of all permitted services not falling under any of the previous categories.

In order to protect Deloitte’s independence, the Audit Committee has a process for pre-approving all services provided by, and related fees to be paid to, Deloitte. This process includes reviewing, on a quarterly basis, the details and associated costs of the services expected to be provided by Deloitte. Audit Committee approval is required for any services that have not previously been approved by the Audit Committee. In assessing the impact of any proposed services on auditor independence, the Audit Committee considers whether:

| • | the services are consistent with applicable auditor independence rules; |

| • | the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Registrant’s business, people, culture, accounting systems and risk profile; and |

| • | the services enhance the Registrant’s ability to manage or control risks and improve audit quality. |

None of the services provided by Deloitte in 2023 were treated as exempt from pre-approval pursuant to the de minimis provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

| 11. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS |

The tabular disclosure regarding the Registrant’s known contractual obligations provided under the heading Financial Condition, Liquidity and Capital Resources – Contractual Obligations included in Exhibit 3: Management’s Discussion and Analysis is incorporated by reference herein.

| 12. | RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION |

The Registrant has adopted a policy on recovery of erroneously awarded incentive-based compensation, which is consistent with the NYSE Listing Standards implementing Section 954 of the Dodd-Frank Act.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

| A. | Undertaking |

Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

| B. | Consent to Service of Process |

A Form F-X signed by the Registrant and its agent for service of process was previously filed with the Commission.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Registrant: | MAGNA INTERNATIONAL INC. | |

| By (Signature and Title): | /s/ “Bassem Shakeel” | |

| Bassem A. Shakeel, | ||

| Vice-President, Associate General Counsel and Corporate Secretary |

||

| Date: | March 28, 2024. | |

EXHIBIT INDEX

Exhibit 1

2024 Annual Information Form March 27, 2024 Magna International Inc.

| Contents

|

| Annual Information Form |

| 2 | Forward-Looking Statements | |

| 4 | Corporate Structure | |

| 4 | About Magna | |

| 6 | Our Industry | |

| 9 | Our Business & Strategy | |

| 18 | Risk Factors | |

| 26 | Description of the Business | |

| 38 | Innovation and Research & Development | |

| 42 | Capital Structure, Financings & Credit Ratings | |

| 46 | Directors & Executive Officers | |

| 49 | Legal Proceedings | |

| 50 | Other Information | |

| 51 | Schedules | |

| A-1 | Appendix 1 – Sustainability Report FY 2023 |

Important Information About this Document

This Annual Information Form (“AIF”) provides information about Magna International Inc. (“Magna”), including its industry, corporate structure, strategy, risk factors relating to its business and operations, products and services, sustainability activities, and other information related to its business activities.

Readers should note that in this AIF:

| ◾ | we use the terms “you” and “your” to refer to the shareholder, potential investor, or reader while “we”, “us”, “our”, “company” and “Magna” refer to Magna International Inc. and, where applicable, its subsidiaries; |

| ◾ | we use the term “Executive Management” to refer to our Chief Executive Officer, together with our Presidents and our corporate Executive Vice-Presidents; |

| ◾ | we use the term “Operating Group management” to refer to the senior management within each of our product-based business units corresponding to the capabilities described in “Section 6 – Description of the Business – Products & Services” in this AIF; |

| ◾ | dollar amounts in this AIF are stated in U.S. dollars, unless otherwise indicated; |

| ◾ | a reference to “fiscal year” is a reference to the fiscal or financial year from January 1 to December 31 of the year stated; |

| ◾ | sales figures disclosed have been prepared in accordance with United States Generally Accepted Accounting Principles (U.S. GAAP); |

| ◾ | where we have referred to specific customers or competitors, the reference includes the customers’ or competitors’ operating divisions and subsidiaries, unless otherwise stated; |

| ◾ | facility and employee figures include certain equity-accounted operations, unless otherwise indicated; |

| ◾ | references to our “Circular” refer to our Management Information Circular/Proxy Statement dated March 27, 2024 for our virtual-only 2024 Annual Meeting of Shareholders to be held on May 9, 2024 (the “Meeting”); and |

| ◾ | information is current as of March 27, 2024, unless otherwise indicated. |

Forward-Looking Statements

We disclose “forward-looking information” or “forward-looking statements” (collectively, “forward-looking statements”) to provide information about management’s current expectations and plans. Such forward-looking statements may not be appropriate for other purposes.

Forward-looking statements may include financial and other projections, as well as statements regarding our future plans, objectives or economic performance, or the assumptions underlying any of the foregoing, and other statements that are not recitations of historical fact. We use words such as “may”, “would”, “could”, “should”, “will”, “likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “aim”, “forecast”, “outlook”, “project”, “estimate”, “future” “target” and similar expressions suggesting future outcomes or events to identify forward-looking statements.

Forward-looking statements in this AIF include, but are not limited to, statements relating to:

| ◾ | implementation of our business strategy, including: increasing capital deployment toward high-growth/megatrend areas aligned with the “Car of the Future”; driving operational excellence; and unlocking new business models and markets; |

| ◾ | implementation of our segment-specific strategic initiatives; |

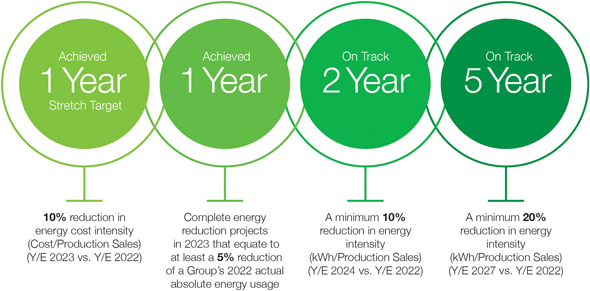

| ◾ | implementation of our sustainability strategy and initiatives, and achievement of sustainability targets/commitments; |

| ◾ | our approach to capital structure, including; maintenance of a strong balance sheet; preservation of strong investment grade ratings; delivering strong Return on Invested Capital; investing for growth; achieving our target leverage ratio; future returns of capital to our shareholders through dividends; and repurchasing shares with excess liquidity; |

| ◾ | implementation of our supply chain initiatives; and |

| ◾ | estimates of future environmental clean-up and remediation costs. |

Forward-looking statements are based on information currently available to us and are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

While we believe we have a reasonable basis for making such forward-looking statements, they are not a guarantee of future performance or outcomes. Whether actual results and developments conform to our expectations and predictions is subject to a number of risks, assumptions, and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict, including, without limitation:

2 Annual Information Form

Macroeconomic, Geopolitical and Other Risks

| ◾ | inflationary pressures; |

| ◾ | interest rate levels; |

| ◾ | geopolitical risks; |

Risks Related to the Automotive Industry

| ◾ | economic cyclicality; |

| ◾ | regional production volume declines; |

| ◾ | deteriorating vehicle affordability; |

| ◾ | misalignment between Electric Vehicles (“EVs”) production and sales; |

| ◾ | intense competition; |

Strategic Risks

| ◾ | alignment with the “Car of the Future”; |

| ◾ | evolving business risk profile; |

| ◾ | technology and innovation; |

| ◾ | investments in mobility and technology companies; |

Customer-Related Risks

| ◾ | customer concentration; |

| ◾ | growth of EV-focused original equipment manufacturers (“OEMs”); |

| ◾ | growth with Asian customers; |

| ◾ | risks of conducting business with newer EV-focused OEMs; |

| ◾ | Fisker’s ability to continue as a going concern; |

| ◾ | dependence on outsourcing; |

| ◾ | OEM cooperation and consolidation; |

| ◾ | market shifts; |

| ◾ | consumer “take rates” shifts; |

| ◾ | quarterly sales fluctuations; |

| ◾ | customer purchase orders; |

| ◾ | potential OEM production-related disruptions; |

Supply Chain Risks

| ◾ | semiconductor chip supply disruptions and price increases; |

| ◾ | supply chain disruptions; |

| ◾ | regional energy supply and pricing; |

| ◾ | supply base condition; |

Manufacturing/Operational Risks

| ◾ | product launch; |

| ◾ | operational underperformance; |

| ◾ | restructuring costs; |

| ◾ | impairments; |

| ◾ | labour disruptions; |

| ◾ | skilled labour attraction/retention; |

| ◾ | leadership expertise and succession; |

Pricing Risks

| ◾ | quote/pricing assumptions; |

| ◾ | customer pricing pressure/contractual arrangements; |

| ◾ | commodity price volatility; |

| ◾ | scrap steel/aluminum price volatility; |

Warranty/Recall Risks

| ◾ | repair/replacement costs; |

| ◾ | warranty provisions; |

| ◾ | product liability; |

Climate Change Risks

| ◾ | transition risks and physical risks; |

| ◾ | strategic and other risks; |

IT Security/Cybersecurity Risks

| ◾ | IT/cybersecurity breach; |

| ◾ | product cybersecurity breach; |

Acquisition Risks

| ◾ | acquisition of strategic targets; |

| ◾ | inherent merger and acquisition risks; |

| ◾ | acquisition integration and synergies; |

Other Business Risks

| ◾ | joint ventures; |

| ◾ | intellectual property; |

| ◾ | risks of doing business in foreign markets; |

| ◾ | relative foreign exchange rates; |

| ◾ | currency devaluation in Argentina; |

| ◾ | pension risks; |

| ◾ | tax risks; |

| ◾ | financial flexibility; |

| ◾ | returns on capital investments; |

| ◾ | credit ratings changes; |

| ◾ | stock price fluctuation; |

| ◾ | payment of dividends; |

Legal, Regulatory and Other Risks

| ◾ | antitrust proceedings; |

| ◾ | legal and regulatory proceedings; |

| ◾ | changes in laws; |

| ◾ | free trade agreements; |

| ◾ | trade disputes/tariffs; and |

| ◾ | environmental compliance. |

In evaluating forward-looking statements or forward-looking information, we caution readers not to place undue reliance on any forward-looking statement, and readers should specifically consider the various factors which could cause actual events or results to differ materially from those indicated by such forward-looking statements, including the risks, assumptions, and uncertainties above that are discussed in greater detail in this AIF under “Section 5 – Risk Factors”.

Magna International Inc. 3

| 1. | Corporate Structure |

Issuer

Magna was originally incorporated under the laws of the Province of Ontario, Canada on November 16, 1961. Our charter documents currently consist of amended and restated articles of incorporation dated December 31, 2017, which were issued pursuant to the Business Corporations Act (Ontario).

Our registered and head office is located at 337 Magna Drive, Aurora, Ontario, Canada L4G 7K1. Our Common Shares trade on the Toronto Stock Exchange (“TSX”) under the trading symbol “MG”, and the New York Stock Exchange (“NYSE”) under the trading symbol “MGA”. For a list of our principal subsidiaries and investments, please refer to Schedule A.

| 2. | About Magna |

Overview

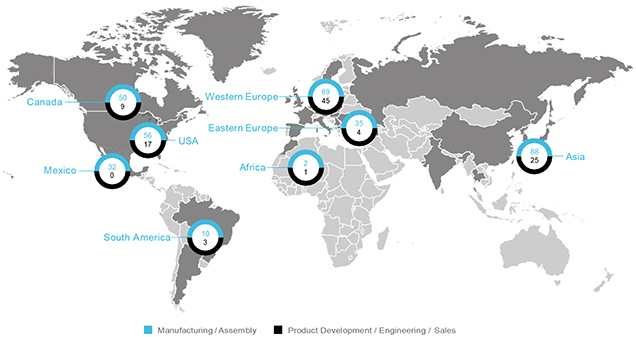

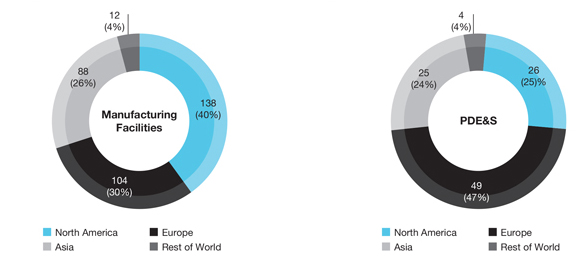

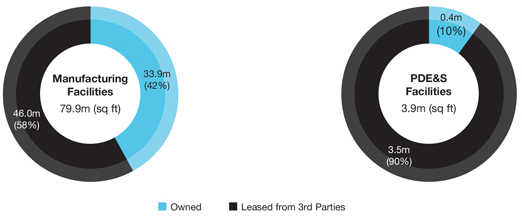

Magna is more than one of the world’s largest Tier 1 suppliers in the automotive space. We are a mobility technology company with more than 179,000 entrepreneurial-minded employees(1), 342 manufacturing and assembly operations and 104 product development, engineering, and sales (“PDE&S”) centres in 28 countries(2), as follows:

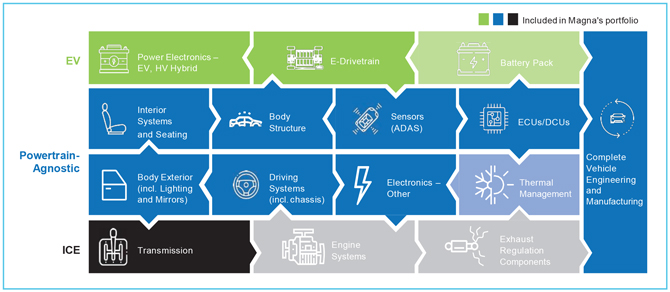

Our systems approach to design, engineering, and manufacturing touches nearly every aspect of the vehicle. We have complete vehicle engineering and contract manufacturing expertise, as well as product capabilities which include body, chassis, exterior, seating, powertrain, active driver assistance, electronics, mechatronics, mirrors, lighting, and roof systems. Magna also has electronic and software capabilities across many of these areas. In addition, we are leveraging our capabilities and platform technologies in areas such as battery management, software stack, and sensors to enter growing adjacent mobility markets such as micromobility.

Our business is managed under four operating segments which have been determined on the basis of technological opportunities, product similarities, as well as market and operating factors, as follows:

| ◾ | Body Exteriors & Structures |

| ◾ | Power & Vision |

| ◾ | Seating Systems |

| ◾ | Complete Vehicles |

Our internal financial reporting is aligned with the way our business is managed. Accordingly, we present key internal operating performance measures for the reporting segments described above to our chief operating decision maker to use in the assessment of operating performance, allocation of resources, and to help plan our long-term strategic direction and future global growth.

| (1) | Number of employees includes over 166,000 employees at our wholly owned or controlled entities and over 13,000 employees at certain operations accounted for under the equity method. |

| (2) | Manufacturing operations and PDES centres include certain operations accounted for under the equity method. |

4 Annual Information Form

Our Corporate Culture

At Magna’s foundation is an entrepreneurial, decentralized, fair enterprise culture, the key elements of which are as follows:

Entrepreneurialism and Decentralization

We follow a corporate policy of functional and operational decentralization, which we believe increases flexibility, customer responsiveness and productivity.

| ◾ | Our manufacturing and assembly operations are conducted through “Divisions”, each of which is an autonomous business unit operating within pre-determined guidelines. Each Division is a separate profit centre under the authority of a general manager who has the discretion to determine rates of pay, hours of work and sources of supply, within the framework of our Employee’s Charter, our Global Labour Standards Policy and our Operational Principles (each as described below), as well as our corporate policies. |

| ◾ | Divisions are aligned globally by product area in Operating Groups. Operating Group management is responsible for overseeing the Divisions within its product area(s), including approval of Divisional business plans and preparation of Operating Group business plans for presentation to Executive Management. Our Operating Groups are aligned under four reporting segments overseen by members of Executive Management to ensure that the Operating Groups are: taking advantage of cross-Group synergies; sharing research and development and best practices; and consistently approaching technology trends that impact their business and our customers. |

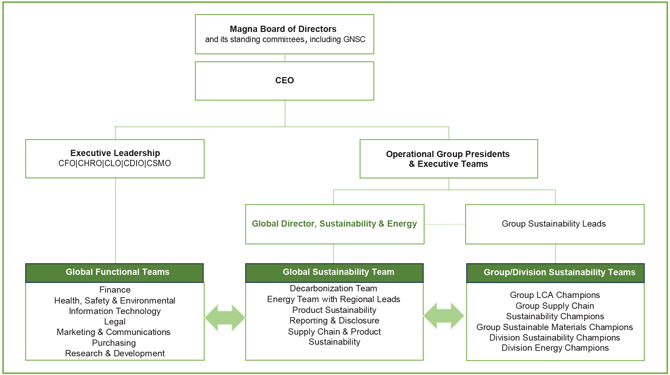

| ◾ | Our Executive Management team, led by our CEO, interfaces with the investment community and is responsible for our long-term strategic planning and future growth, as well as monitoring the performance of Operating Group management. In addition, our Executive Management: allocates capital; oversees mergers, acquisitions and strategic alliances; manages global marketing and customer strategies; develops employee policies and programs; manages leadership training, development and succession planning; oversees and supports our sustainability and environmental, social and governance (“ESG”) strategy, targets and global initiatives; and develops common finance, internal controls, compliance, IT, quality, environmental, health & safety, ergonomics and other policies, programs or global standards. |

Employee’s Charter & Global Labour Standards Policy

We are committed to operating our business in a way that is based on fairness and concern for our employees. Our Employee’s Charter sets out key principles outlining this commitment. Our Global Labour Standards Policy further articulates our Fair Enterprise Culture and provides a framework for our commitment to fundamental human rights and international labour relations. See “Appendix 1 – Sustainability Report – Section 4.2 Fairness and Concern for Employees” for a description of our human resource principles, including our Employee’s Charter, as well as the details of our Global Labour Standards Policy and the key commitments that it sets out.

Operational Excellence

As part of our strategic priority of achieving operational excellence in our facilities globally, each facility is required to adhere to a set of Operational Principles that define a set of common goals and recommended tools/business practices in the following areas: Employee Focus; Safe and Healthful Work Environment; Pride in Craftsmanship and Total Quality; Integrity and Respect; Operational Effectiveness; Scrap and Waste Elimination; Operational Availability; Communication; and Recognition and Rewards. The Magna Operational Principles are linked to our MAFACT assessment system (detailed in “Section 6 – Description of the Business – Manufacturing & Engineering” and “Factory of the Future (FoF) Initiatives” in this AIF) to allow our operations to continually measure their progress in achieving operational excellence.

Incentive-Based Management Compensation

We maintain an incentive-based compensation system for management, which directly links short-term incentive compensation to the operational performance of an applicable business unit, as measured by profitability. In the case of our Divisions and Operating Groups, the short-term incentive formula is based on Divisional or Operating Group EBIT, after taking into account a funds employed charge. For our Executive Management, the short-term incentive is directly linked to Magna’s pre-tax profit and, beginning in 2024, free cash flow. Members of our Operating Group management and Executive Management also receive equity-based incentives tied to metrics such as return on invested capital (ROIC), stock price performance, and relative total shareholder return. Our approach to executive compensation is described in further detail in the sections of our Circular titled “Compensation and Performance Report” and “Compensation Discussion & Analysis”.

Sustainability

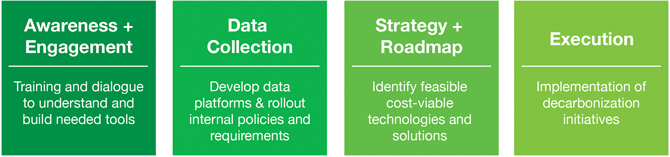

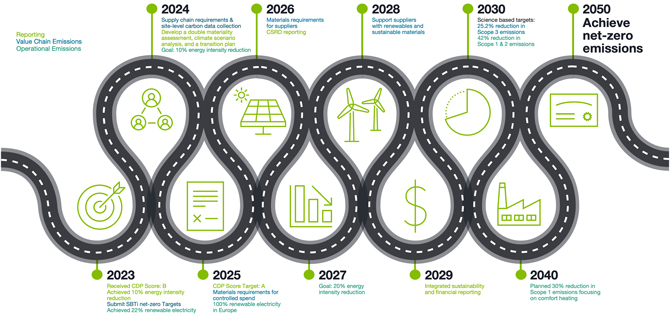

We are committed to being a responsible corporate citizen that conducts business in a manner that balances profits, people, and planet. Magna accepts the reality of climate change and the importance of addressing sustainability in our operations. To this end, we are committed to decarbonization of our operations and have committed to near-term (by 2030) and net-zero (by 2050) science-based targets with respect to Scopes 1, 2 and 3 GHG emissions. In support of these targets, we have committed to achieving 100% renewable electricity usage by 2025 in our European operations, and by 2030 globally. For a full discussion of our sustainability strategy, initiatives, targets, and achievements to date, see “Appendix 1 – Sustainability Report”.

Magna International Inc. 5

| 3. | Our Industry |

General

The global automotive industry is a complex, high-tech manufacturing industry. The industry is rapidly evolving in response to societal, mobility-related, and economic trends, including the transition to a lower carbon economy, which is accelerating the shift from internal combustion to electric propulsion. These trends are detailed in “Section 4 – Our Business & Strategy – Industry Trends”. Tier 1 automotive suppliers (“Tier 1 Suppliers”) design, engineer and manufacture components, assemblies, systems, subsystems, and modules for original equipment manufacturers (“OEMs” or “automobile manufacturers”) of vehicles and light trucks. Tier 1 Suppliers source subcomponents from Tier 2 and other sub-suppliers, which are integrated into the products sold by the Tier 1 Suppliers directly to OEMs.

The global automotive industry is cyclical and is sensitive to a broad range of macroeconomic, political, and other trends as discussed in “Section 4 – Our Business & Strategy” in this AIF. Throughout 2023, the automotive industry continued to experience a number of macroeconomic and industry challenges, although a number of these challenges have moderated compared to prior years:

| ◾ | elevated levels of inflation, with higher commodity, energy, labour, freight, and other production input pricing expected to persist in 2024; |

| ◾ | supply chain disruptions, including the global shortage of semiconductor chips that has had a material adverse effect on global automotive production volumes since 2020 and may continue having some impact in 2024; |

| ◾ | a deterioration in vehicle affordability due to a combination of factors, including: higher prices for Electric Vehicles (“EVs”); costs related to advanced electronic systems; increasing vehicle finance costs due to elevated interest rates; inflationary cost increases impacting the entire bill of materials for a vehicle; and, in some cases, limited vehicle supply; and |

| ◾ | misalignment between EV production and sales as a result of uncertainty as to consumer acceptance of EVs due to issues including: vehicle affordability; availability of government subsidies; concerns regarding battery technologies; driving range anxiety; charging infrastructure concerns; and new EV OEM limited operating/warranty history. |

See “Section 4 – Our Business & Strategy – Macroeconomic, Political and Other Trends” and “Industry Trends” for details of how these trends affect Magna and the automotive industry. See also “Industry Trends” in our Management’s Discussion & Analysis of Results of Operations and Financial Position for the year ended December 31, 2023 (“MD&A”).

Automotive Production Markets

OEMs have historically built their vehicles in the regions where those vehicles are primarily sold and, as a result, many OEMs have established manufacturing facilities in multiple countries. While we believe this historical practice will continue long term; currently some of the China-based, EV-focused OEMs, such as BYD and Geely, are entering the European market with vehicles exported from China, while VinFast, a Vietnam-based, EV-focused OEM, has entered the European and North American markets with vehicles exported from Vietnam. Since OEMs typically use lean manufacturing and supply chain management techniques in their operations, many Tier 1 Supplier facilities are generally located relatively close to OEM facilities to reduce the cost and risks associated with longer supply chains. See “Section 6 – Description of the Business – Manufacturing & Engineering” of this AIF for details of Magna’s global manufacturing footprint.

China, Europe, North America, Japan, India, and South Korea represent the largest automotive production markets in the world, accounting for approximately 89% of vehicles produced globally.(1) China’s approximate 32% share of global production led all markets in 2023, followed by the United States and Japan, with 11% and 10% shares, respectively.(1) The local demand for vehicles in China, India, and certain markets outside of North America and Western Europe has increased over time. This increasing local demand has helped boost the local automotive industry in these countries and attracted investments in manufacturing from North American, European, and Asian-based automobile manufacturers, through stand-alone investments and/or joint ventures with local partners. In the case of China, the increasing migration of component system and vehicle design, development, and engineering, especially for battery electric vehicles (“BEVs”), is expected to further benefit the automotive industry in that market.

Customers

OEMs produced over 90 million light vehicles in 2023, an approximately 10% increase over 2022 production.(1) The top 15 OEMs, representing approximately 80% or approximately 72 million vehicles based on 2023 light vehicle production, were:(1)

1. Toyota Motor Corporation

2. Volkswagen Group

3. Hyundai Motor Group

4. Renault-Nissan-Mitsubishi Alliance

5. Stellantis N.V.

6. General Motors Company

7. Ford Motor Company

8. Honda Motor Company

9. Suzuki Motor Corporation

10. BYD Auto

11. Zhejiang Geely Holding Group

12. BMW AG

13. Mercedes-Benz AG

14. Chang’an Automobile (Group) Co., Ltd.

15. Tesla, Inc.

| (1) | S&P Global Mobility |

6 Annual Information Form

The considerable growth of the Chinese automotive market over the past decade has led to the significant growth of several Chinese OEMs, including BYD Auto, Geely, and Chang’an, as listed above. In addition, the growing trend toward vehicle electrification has led to the emergence of newer EV-focused OEMs, particularly in China. See “Section 5 – Risk Factors – Growth of EV-Focused OEMs; Risks of Conducting Business with Newer EV-Focused OEMs”, and “Fisker’s Ability to Continue as a Going Concern” in this AIF.

For a list of our top customers on a consolidated basis and within each reporting segment, see “Section 6 – Description of the Business – Products & Services” in this AIF.

Competition

In spite of high barriers to entry in many product areas, as well as the highly capital intensive nature of the global Tier 1 automotive supply industry, competition is fierce and intensifying from many different sources. For most of our Operating Groups, competition comes primarily from automobile manufacturers and from other “traditional” Tier 1 Suppliers, including ones in which one or more automobile manufacturers may have direct or indirect investments. However, with the growing importance of electrification and electronics in the automotive value chain, a number of established electronics and semiconductor chip and manufacturing companies have entered or expanded their presence in the automotive industry, becoming direct competitors to Tier 1 Suppliers, including us. Additionally, disruptive technology innovators are changing the competitive landscape of the automotive industry through the development of high-value product and service offerings, particularly in areas related to vehicle electrification, vehicle autonomy, new mobility, and connectivity, which traditional automotive suppliers may not be able to match. As a result of these trends, some suppliers seek to enhance their competitive positioning by entering into strategic partnerships, joint ventures or collaborations with technology and software companies. Lastly, competition has also intensified as automobile manufacturers have reduced the number of their Tier 1 Suppliers in connection with their strategy to increase the number and range of vehicles built from high-volume global platforms.

The basis on which automobile manufacturers select automotive suppliers for particular programs is determined by a number of factors, which may include, among other factors: price; overall relationship, including historical performance with respect to innovation, quality/ warranty and timeliness of delivery; manufacturing footprint; proprietary technologies; financial strength; ability to test and validate new technologies for application in the automotive industry; scope of in-house engineering and tooling capabilities; carbon footprint and alignment with the customer’s sustainability/ESG goals and targets; existing agreements.

The number of competitors that are asked by automobile manufacturers to bid on any individual product has been reduced in many cases. We expect further reductions as a result of the increasing preference of automobile manufacturers to deal with fewer suppliers and reward those suppliers with earlier and deeper involvement.

Based on 2022 global automotive parts sales to OEMs, the top 10 Tier 1 Suppliers globally were(1):

| Supplier | Key Automotive Products(2) | Supplier | Key Automotive Products(2) | |||

| 1. Robert Bosch | Powertrain solutions, chassis systems control, electrical drives, car multimedia, electronics, aftermarket products, steering | 6. Hyundai Mobis(3) | In-vehicle infotainment systems, braking, steering, lamps, safety, suspension, autonomous driving, electrification systems, advanced driver assistance systems | |||

| 2. Denso Corporation(3) | Thermal systems, powertrain systems, electrification systems, mobility electronics, sensor system & semiconductors | 7. Aisin Corporation(3) | Powertrain, chassis and vehicle safety systems, body electronics, vehicle navigation systems | |||

| 3. ZF Friedrichshafen AG | Electrified powertrain, chassis, driveline, braking systems, steering wheel, autonomous transport systems, electronics & advanced driver assistance systems, active & passive safety systems | 8. Forvia Group | Seating, interiors, clean mobility (exhaust systems), lighting, hydrogen mobility, electrification and energy management, cockpit, electronics & software integration | |||

| 4. Magna International Inc. | Body and chassis, exteriors, powertrain, active driver assistance, electronics, mirrors and lighting, mechatronics, seating systems, vehicle engineering and manufacturing, roof systems | 9. Continental Corporation | Autonomous mobility, passive safety, brake, chassis, motion and motion-controlled systems, tires, rubber, electric mobility, connected mobility | |||

Magna International Inc. 7

| Supplier | Key Automotive Products(2) | Supplier | Key Automotive Products(2) | |||

| 5. Contemporary Amperex Technology Co., Ltd. | Electric vehicle battery systems and services, battery swapping service, building automation, energy management system and facility management, cells, modules and battery pads, battery materials, clean energy storage solutions, battery recycling | 10. Lear Corporation | Seating, electrical distribution and connection systems, battery disconnect systems, electronic systems, software and connected services, electronic control modules, electrification products, connectivity products | |||

Notes:

| (1) | Automotive News (supplement) (June 26, 2023). |

| (2) | Key automotive product descriptions are based on information from each Tier 1 Supplier’s website. |

| (3) | OEM subsidiary or OEM investee. |

While no single Tier 1 Supplier currently supplies a full range of products which compete with ours, a number of Tier 1 Suppliers can produce some or many of the same types of components, assemblies, modules, and systems that we currently produce. Some of our competitors may have greater technical or other resources than we do and some of them may be stronger in markets in which we operate. A list of our key competitors within each product capability in our reporting segments can be found in “Section 6 – Description of the Business – Products & Services” in this AIF. See also the risk factors related to “Intense Competition” and “Technology and Innovation” in “Section 5 – Risk Factors” in this AIF.

Magna’s Foundational Strengths

We believe that we possess a number of foundational strengths that give us a competitive advantage as a Tier 1 Supplier, including our:

| ◾ | decentralized operating model, entrepreneurial culture, and “ownership” mentality; |

| ◾ | manufacturing expertise; |

| ◾ | complete vehicle and broad systems engineering expertise; |

| ◾ | strong balance sheet and emphasis on disciplined, profitable growth; |

| ◾ | depth of talent; |

| ◾ | global scale; |

| ◾ | focus on innovation and our “start-up” mindset, as well as a strategic portfolio of product groups that enable us to provide innovative, complete vehicle solutions to our customers, while: |

| ◾ | generating cash to fund investments in high-growth areas; and |

| ◾ | enabling access to new business models and/or new customers. |

8 Annual Information Form

| 4. | Our Business & Strategy |

Business Drivers

Our business and operating results are primarily dependent on the levels of North American, European, and Chinese car and light truck production by our customers. Ordinarily, OEM vehicle production levels are aligned with vehicle sales levels and thus affected by changes in such levels. While we supply systems and components to every major OEM, we do not supply systems and components for every vehicle, nor is the value of our content consistent from one vehicle to the next. As a result, customer and program mix relative to market trends, as well as the value of our content on specific vehicle production programs, are important drivers of our performance. Key factors impacting production volumes, product/customer mix and content, as well as legislative/regulatory trends are listed below.

| Growth Driver | Factors Potentially Impacting Growth Driver | |

| Vehicle Production Volumes | § Vehicle sales levels, which are affected by: § General macroeconomic and political conditions § Consumer confidence levels, which may be affected by consumer perceptions and general trends related to the job, housing, and stock markets, as well as elevated levels of inflation, and other macroeconomic and political factors § Vehicle affordability § Interest rates and/or availability of credit § Fuel and energy prices § Relative currency values § Regulatory restrictions on the use of vehicles in certain megacities § Uncertainty as to consumer acceptance of EVs, including due to: availability of government subsidies; concern regarding battery technologies; driving range anxiety; adequacy of charging infrastructure; new EV-focused OEMs with little to no operating/ warranty history § Supply chains and infrastructure, including supply chain disruptions § Energy supply disruptions or shortages that could result in unplanned production shutdowns of some of our, our sub-suppliers’ and customers’ manufacturing facilities § Free trade arrangements, trade disputes and tariffs § Availability and relative cost of skilled labour § Labour disruptions § OEM production disruptions § Commodities prices § Relative currency values § Regulatory considerations, including environmental, emissions, and safety standards |

|

| Customer and Program Mix | § OEM outsourcing strategy, as well as their supplier preferences and relationships § OEM decisions to allocate production inputs that are in limited supply, such as semiconductor chips, to certain programs and not others § Our systems level approach and diversified portfolio which provides flexibility in responding to OEM requirements § Business relations between us and each of our OEM customers § Our ability to supply products from multiple production locations for global vehicle platforms § Our capital allocation decisions § Competitiveness of our products, including in megatrend-aligned product areas § Exclusivity of our products due to certain intellectual property rights § OEM cooperation and consolidation § Our ability to grow sales to newer EV OEMs that achieve significant commercial success |

|

| Magna Content on Specific Programs or Platforms |

§ OEM outsourcing strategy, as well as their supplier preferences and relationships § Our ability to supply products from multiple production locations for global vehicle platforms § Our systems level approach and diversified portfolio which provides flexibility in responding to OEM requirements § Our capital allocation decisions § Technological, visual, haptic, and other features/attributes of our products compared to competing products or the overall cost of such products to the end consumer § Pricing of our products relative to competing products § Perception/reputation for product quality, as well as timeliness of delivery § Our product engineering capabilities § Our ability to finance pre-production engineering costs § The scope of our authority relative to the OEM, regarding sourcing of sub-components or |

|

Magna International Inc. 9

| Growth Driver | Factors Potentially Impacting Growth Driver | |

| products which are incorporated into the systems which we supply § Consumer “take rates” for products we sell § Collaboration among our Operating Groups § Our ability to meet OEM customers’ sustainability/ESG criteria embedded in their sourcing decisions for requirements for specific programs, including growing requirements regarding the use of ‘green’ materials for specific programs |

||

| Legislative/regulatory trends promoting sustainability and safety |

§ Regulatory actions towards mandating higher fuel efficiency, lower carbon emissions and/or enhanced safety features § Rise in the number of jurisdictions committing to, or accelerating existing commitments to, phase-out of the sale or registration of new ICE engines over the medium- to long term, which could accelerate OEM development of non-ICE vehicles |

|

Macroeconomic, Political and Other Trends

The global automotive industry is cyclical and, as noted above, vehicle production and/or sales may be affected by a broad range of macroeconomic, political, and other factors. Some such factors which are currently affecting the industry are discussed below.

| Macroeconomic, Political & Other Trends | Description | Potential Impact on Magna | ||

| Inflationary Price Increases |

§ Global markets currently experiencing elevated inflation § Inflationary pressures remained in 2023 and have continued into 2024 |

§ Higher operating costs, including for: commodities; energy; labour; freight; and other production inputs; which may potentially be unrecoverable from customers § Longer-term increases in cost structure as a result of recent increases in wage levels § Sub-supplier pricing pressures which may not be recoverable through continuous improvement actions, customer recoveries, modifications to our products or otherwise |

||

| Elevated Interest Rates |

§ Increasing global inflation rates have spurred a cycle of monetary policy tightening, including through central bank increases to key short-term lending rates § Availability and cost of credit are both factors affecting consumer confidence, which is a critical driver of vehicle sales and thus automotive production |

§ Lower sales as a result of a decrease in consumer demand for vehicles, and in turn, lower production § Higher borrowing costs, at a time when our aggregate debt level is increasing to finance higher capital expenditures in connection with program awards and our continued growth, including in megatrend areas |

||

| Supply Chain Disruptions |

§ Supply chain disruptions, including the continued impact from the global shortage of semiconductor chips that has materially affected global automotive production volumes since 2020 and may continue having some impact in 2024 § Supply chain disruptions caused by geopolitical conflict § Supply chain disruptions caused by extreme weather events growing in frequency |

§ Lower sales § Unrecoverable price increases § Elevated unrecoverable costs such as those for premium freight or re-sourcing of supply § Significant production inefficiencies from our production lines being stopped/restarted § Penalties or business interruption claims from customers § Loss of future business § Reputational damage § Higher inventory levels § Pricing pressures from sub-suppliers negatively impacted by production inefficiencies, premium freight costs and/or other costs and surcharges § Challenges in retaining employees due to production volatility § Financial stress on supply base |

||

10 Annual Information Form

| Macroeconomic, Political & Other Trends | Description | Potential Impact on Magna | ||

| Geopolitical Conflicts |

§ Current military conflicts in Ukraine and Gaza § U.S./China relations § Political pressure to manufacture and source from countries that are geopolitical allies |

§ Potential creation of risks, including: § Disruption of energy supplies (particularly natural gas and oil), shipping/transportation and logistics, vehicle production and/or supply chains; § Weaking of economic growth and consumer confidence; and § Increasing physical and cybersecurity threats § Potential worsening of current risks, including: § inflationary pressures; § Commodities prices; § Relative foreign exchange rates; and § Risks of doing business in foreign markets |

||

| Economic/political uncertainty |

§ Deterioration of consumer confidence, including as a result of: § Impact of elevated levels of inflation § Impact of elevated long-term interest rates § Direct/indirect impacts of geopolitical events, including military conflicts |

§ Potential for lower vehicle sales, and thus lower production volumes § Planning and investment uncertainty § Increasing risk of pricing pressure from OEMs and increasing financial stress on supply base § Potential impact on our sales and profits |

||

| Accelerating focus on impact of climate change |

§ Acceleration of government regulation banning the sale of new vehicles with ICE engines by certain future dates § Governmental authorities, customers, equity investors, lenders, rating agencies, employees and other stakeholders increasing scrutiny of companies’ impact on and resilience to climate change § Focus on energy reduction and transition to renewable / carbon neutral energy sources § Increasing expectations regarding disclosures of ESG metrics § Growth in investment demand for companies demonstrating sustainable strategy and operations § Heightened focus and concern on risk of supply chain disruptions from climate-related events |

§ Opportunities from product strategy aligned with sustainable goals § Potential energy reduction opportunities could reduce operating costs § Decarbonization strategies / commitments could require increased capital spending and/or involve higher operating costs, including higher costs to purchase renewable energy § Potential for increased / decreased demand for Magna’s Common Shares, based on market views as to sustainability of the company § Risk of disruption to automotive supply chains, transportation routes and electricity grids from climate-related events |

||

| Localization of production |

§ Pressure on OEMs to localize production of vehicles in markets in which they are sold § Potential to reduce costs and mitigate risks associated with longer supply chains § Tier 1 Suppliers also increasing localization to meet demands of local market and pace of new products § However, some of the China-based, EV-focused OEMs and Vietnam’s VinFast are exporting vehicles produced domestically into Europe and North American markets |

§ Planning and investment uncertainty § Potential incentives for expansion into local markets § May result in new opportunities for Magna in markets where we have available capacity or are well established § Could also result in duplication of capacity across markets |

||

Magna International Inc. 11

Industry Trends

The automotive industry is being defined by a number of global megatrends that have shaped our long-term strategy, including:

| Megatrend | Impact on Automotive | |||

| Economy |

Globalization

|

Industry built through globalization appears to be undergoing regionalization

|

||

| Environmental Impact | Concern for environment/climate change driving vehicle electrification, including through acceleration of sustainability-related legislation | |||

| Natural Resources & Energy | Access to critical battery minerals and availability of sufficient renewable energy may define success of drive to vehicle electrification | |||

| Society |

Demographic Change

|

Product design will be influenced by aging population

|

||

| Digital Transformation | Connectivity and digitization impact both product and process. New vehicle architectures that connect the subsystems along with software functionality creates additional value to products. Process is also impacted due to increased digitization, driven by increased requirements for productivity and quality | |||

| Individualism | Product design will be influenced by growing individualism, including desire for greater personalized experiences | |||

| Health & Well-Being | Active Driver Assistance Systems (“ADAS”) and autonomy take rates will be driven both by consumer preferences as well as regulatory requirements tied to increased safety | |||

| Mobility |

Urbanization | Continued growth in urban population will lead to changes in mobility as a result of increased density and congestion with an increase in EV adoption and new transport modalities | ||

| New Mobility | Emerging new mobility eco-system offers a range of potential opportunities for new products and services, including automated delivery and mobility solutions | |||

These global megatrends and other factors are driving a number of industry trends, which are discussed below together with their potential impact on Magna.

| Automotive Industry Trends | Description | Potential Impact on Magna | ||

| Continuing focus on reducing vehicle’s energy consumption and CO2 emissions |

§ Sustainability considerations and regulatory action, resulting in push for more efficient, cleaner, and smaller-displacement engines § Trend toward electrified vehicles drives demand for solutions to help extend driving range from single battery charge |

§ Continuing opportunities to support OEM customers’ efforts through lightweighting, more efficient drivetrains, electrification, and active aerodynamics § Magna’s diversified portfolio supports both transition to EV, as well as traditional vehicle architectures — positioning Magna to proactively manage the speed of the transition to EVs |

||

12 Annual Information Form

| Automotive Industry Trends | Description | Potential Impact on Magna | ||

| Demand for electric and hybrid vehicles, as well as investment in vehicle electrification |

§ Sustainability considerations and regulatory actions, including mandatory phase-outs of the sale or registration of new ICE vehicles in the future, driving increased emphasis on electrified powertrains § Interest in electrified solutions, especially in Europe and China § Significant development and engineering costs for OEMs may drive increased outsourcing to suppliers and increased collaboration among OEMs § Number of EVs sold globally growing, but rate of growth has moderated in some markets with a misalignment between EV production/supply and consumer demand for certain models |

§ Opportunities to grow Magna content and sales in areas such as drivetrain products and battery enclosures § Strong level of investment required to grow or maintain market share could impact short term financial performance § Potential non recovery of certain capital investments if planned production volumes do not materialize due to EV production/ sales misalignment § Pricing pressure on, and migration of value away from, traditional products in order for OEMs to accommodate cost of battery systems and electrified products § Quoting risk and technology risks, as well as lack of warranty experience with electrified products § Increased competition, including from new market entrants providing electrified solutions § Potential risk of OEMs in-sourcing a greater proportion of EV components and systems production § Potential long-term displacement of some mechanical products where there are alternative electrified solutions § Potential challenges in attracting and retaining highly skilled engineering and software personnel |

||

| Continued growth in demand for driver assistance/active safety systems |

§ Growth in demand for driver assistance features/active safety systems driven by tightening safety regulations and continued growth in demand for luxury segment vehicles |

§ Opportunity to grow Magna content and sales, particularly in ADAS products § Continued expenditures for growth in ADAS required to develop Magna’s autonomous driving capabilities could impact short-term financial performance § Quoting risk and technology risks, as well as lack of warranty experience with ADAS products § Potential challenges in attracting and retaining highly skilled engineering and software personnel |

||

| Disruption by new industry entrants offering “mobility as a service” (“MaaS”) |

§ Growth of ride hailing and ride sharing services in urban areas § Potential substitute for personal mobility vehicles, particularly in congested urban centres § May result in lower production volumes of vehicles from traditional OEMs |

§ Alternative revenue streams or new business opportunities for full-vehicle engineering and manufacturing, as well as additional service offerings § Potential loss of business with traditional OEMs, to the extent MaaS adversely impacts OEMs § Potential risks relating to conducting business with new MaaS entrants that may have limited operating history, as well as financial, liquidity/capital, or other resources § Uncertainty with respect to volume of new MaaS product offerings creates risks relating to recovery of engineering/capital investments |

||

Magna International Inc. 13

| Automotive Industry Trends | Description | Potential Impact on Magna | ||

| Emergence of newer EV-focused OEMs |

§ Trend towards vehicle electrification has led to the emergence of EV-focused OEMs |

§ Potential for cooperative relationships and new business opportunities with new EV entrants § Potential risks relating to conducting business with newer OEMs that may have limited: operating history, as well as financial, liquidity/capital, or other resources; as well as untested business models § Uncertainty regarding consumer acceptance of EVs, particularly those made by new OEMs § Potential risks of non-recovery of pre-production and production receivables; inventory; fixed assets and capitalized pre-production expenditures; and third party obligations related to such items § Uncertainty regarding which newer OEMs will succeed in the long-term creates potential customer and/or partnership risk § Failure to grow with those newer OEMs that achieve commercial success could impact our long-term strategy |

||

| Accelerating demand for connected vehicles |

§ Growing demand to include connectivity features in vehicles driven by pervasiveness of digitalization in consumer’s daily lives § Personalization of end user functionality in vehicle experience § Growth in vehicle architectures that connect subsystems and include software functionality |

§ Opportunities to grow Magna high-value content, particularly given our systems capabilities § Potential for establishment of new business models, including software as a service § Potential challenges in attracting and retaining highly skilled engineers and software personnel § Potential product cybersecurity risks related to vehicles connected to external networks, which could impact consumer adoption of connectivity related products/systems |

||

| Significant R&D spending |

§ Large-scale OEM and Tier 1 Supplier investments to comply with tightening emissions regulations § Significant spending by OEMs, new market entrants and Tier 1 Suppliers on vehicle autonomy systems and new mobility solutions § May drive increased collaboration among OEMs |

§ Pricing pressure on, and migration of value away from, traditional products in order for OEMs to accommodate cost of electrification, as well as active safety / autonomous features § OEM inability to achieve planned sales volumes for electrified vehicles could impact suppliers’ ability to recover pre-production costs § Technical challenges to commercialize new technologies in ADAS § Intense competition from established and new market entrants § Risks related to establishing and maintaining intellectual property rights, including potential challenges to intellectual property ownership |

||

14 Annual Information Form

| Automotive Industry Trends | Description | Potential Impact on Magna | ||

| Continuing elevated product warranty expectations and product recall levels |

§ Over the last decade, OEMs have become more inclined to recall vehicles with potentially faulty products § Increased frequency and severity of recalls, together with other factors, have impacted coverage and pricing for recall insurance |

§ Increased OEM pricing pressure, including pressure to assume greater warranty responsibility § Increasing product recall claims and related product replacement cost risk, even where root cause is not agreed with OEM or cannot be determined § Higher self-insured retentions and, reduced coverage limits on recall insurance, as well as increased reluctance by certain sub-suppliers to absorb the full cost of warranty/ recall expenses relating to the failure of their components, create greater net exposure |

||

| OEM cooperative alliances / consolidation |

§ Joint platform development, powertrain sharing, and/or purchasing § Regional joint ventures § Partnerships expanding to new areas of vehicle ecosystem (raw materials/batteries; components/software; infrastructure/aftersales) § OEM consolidation from time to time |

§ Increased OEM pricing pressure § Increase in sales, where Magna has strong relationship with lead OEM § Decrease in sales, where Magna has weaker relationship with lead OEM |

||

| Long-term growth of Chinese OEMs and suppliers aided by China’s accelerated focus on vehicle electrification |

§ Lower cost base of Chinese OEMs on EVs could provide advantage for expansion into global markets § Large number of Chinese OEMs and excess production capacity could result in consolidation § Certain Chinese OEMs targeting expansion into North America and Europe |

§ New business opportunities, including drivetrain, electronics and ADAS products, and full vehicle engineering and assembly § Potential loss of business with traditional OEMs, to the extent new OEMs adversely impact traditional OEMs § Vertical integration risk as a result of Chinese OEMs having a financial / ownership interest in certain suppliers § Potential for consolidation, and/or new partnerships and collaborations |

||

| Chinese policies aimed at growing high-value domestic development/production |

§ Chinese government plans to increase engineering, development and manufacturing of high-value, high-tech products in China |

§ Increased localization of engineering, development, and manufacturing § Uncertainty regarding whether Chinese domestic companies will be preferred over foreign-owned companies operating in China § Potential for increased export control restrictions in the U.S. and Western Europe relating to strategically important and/or technologically advanced products and technology |

||

| Growth of “best-cost” automotive markets |

§ Growth of “best-cost” automotive markets, which are close to larger established manufacturing markets § Migration of manufacturing from traditional automotive markets such as the U.S., Western Europe |

§ Potential new “best-cost” market for engineering talent § Increased level of investment in new markets required § Various risks of doing business in foreign markets |

||

Magna International Inc. 15

Our Corporate Strategy

We have distilled the impacts of the global megatrends into four long-term strategic factors which we see defining the “Car of the Future” – electrification, autonomy, new mobility, and connectivity. We believe we are well-positioned to capitalize on opportunities in each area:

|

We possess an enhanced e-Powertrain portfolio with a range of products that addresses the roadmap for the transition to EVs. We continue to win new EV business. | |

|

We possess full ADAS capability and complete ADAS system expertise. We take a systems level approach in developing ADAS building blocks for OEM customers with a focus up to level 2+/3 ADAS capabilities. | |

|

We have expanded our collaboration ecosystem and continue to look at opportunities to leverage new business models. The breadth of our capabilities make us a key enabler of OEM customers and new entrants in the New Mobility space. | |

|

We possess software-enabled functionality in our electronic control unit-related products. This functionality could help optimize performance and efficiency in connected products, such as our connected powertrains. | |

We have developed our corporate strategy to realize the opportunities from these trends. Key elements of such strategy include:

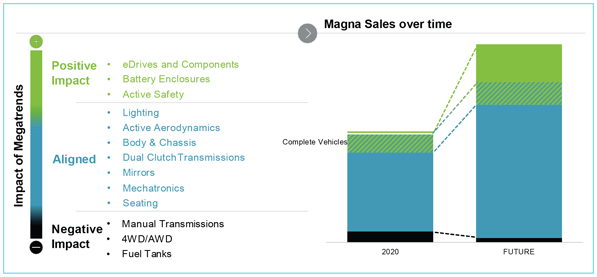

1. Increasing capital deployment toward high-growth areas aligned with the “Car of the Future”

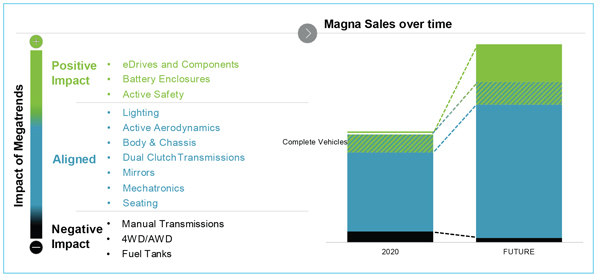

We are proactively managing our portfolio and evolving our product mix based on alignment with the Car of the Future which we see as electrified, connected, assisted/autonomous, personalized, and sustainable. We seek to grow our business and capabilities in areas which are positively impacted by the global megatrends discussed earlier through an approach that emphasizes functionally integrated solutions, systems development, and cross-Operating Group collaboration. Examples of such areas include powertrain electrification, ADAS and battery enclosures, as well as our contract vehicle manufacturing operations. As illustrated below, we believe that a substantial proportion of our product areas are not adversely impacted by the global megatrends, including our body, chassis, lighting, active aerodynamics, dual clutch transmissions, mirrors, mechatronics, and seating products.

Lastly, there are elements of our product portfolio which are negatively impacted by the global megatrends and are expected to be less directly relevant to the Car of the Future. Examples of such products include manual transmissions, mechanical AWD/4WD systems and fuel tank systems. Despite their declining long-term strategic importance, our assets and expertise associated with these products remain relevant to, and can be redeployed for, growing product areas aligned with the Car of the Future.

16 Annual Information Form

2. Driving Operational Excellence

We are committed to manufacturing excellence. We continue to elevate our approach to manufacturing by implementing “factory of the future” initiatives including: enhanced use of big data and analytics; digitization; advanced robotics; additive manufacturing; and augmented reality. The ultimate goal is to achieve greater profitability through further enhanced quality, production efficiency, reduction of floor space and improved return on investments. Critical elements of our approach to operational excellence include our Factory of the Future initiatives and MAFACT operating system, which are discussed in “Section 6 – Description of the Business – Manufacturing & Engineering” in this AIF. Additionally, our sustainability strategy dovetails with our efforts around operational excellence, due to the focus on energy optimization and minimization of water withdrawals, as well as waste streams to landfill. Details of our approach to Sustainability, including emissions, energy, water, and waste reduction targets, can be found in our Sustainability Report, which is Appendix 1 to this AIF.

3. Unlocking New Business Models and Markets

The new mobility landscape, which is generally urban, electrified, autonomous and connected, is creating new business models and markets. We believe that our systems and complete vehicle knowledge, including elements of our portfolio such as EV and ADAS platforms, provide us with an advantage in pursuing such opportunities. In addition, our ability to use capital efficiently, launch programs reliably and help speed products to market, makes Magna a key enabler of new entrants. Additionally, we are using our capabilities and platform technologies to enter the micromobility market. For example, we invested in the Yulu electrified two-wheeler shared mobility business in India and related battery-swapping business and have a number of activities underway involving Magna-developed and third party-developed robots for potential industrial and last-mile delivery applications.

Magna International Inc. 17

| 5. | Risk Factors |

The industry in which we compete and the business we conduct are subject to a number of risks and uncertainties. Our short and medium-term operational success, as well as our ability to create long-term value through our corporate strategy, are subject to a number of risks and uncertainties. These risks and uncertainties, together with a number of assumptions, underlie the forward-looking statements made in this AIF. In order to fully understand these risks, uncertainties, and assumptions, you should carefully consider the following risk factors in addition to other information included in this AIF:

Macroeconomic, Geopolitical and Other Risks

| ◾ | Inflationary Pressures: We continue to experience elevated inflation in all markets in which we operate, with higher commodity, energy, labour, freight, and other production input pricing expected to persist in 2024. While many of these input price increases will moderate over time, the increases in wage levels we are currently experiencing are likely to have a longer-term effect on our cost structure. Additionally, we may continue to experience price increases or surcharges from sub-suppliers in connection with the inflationary pressures they face. The inability to offset inflationary price increases, including through recoveries from our customers, modifications to our products, continuous improvement actions or otherwise, could have a material adverse effect on our profitability. |

| ◾ | Interest Rates: Increasing global inflation rates have spurred a cycle of monetary policy tightening, including through central bank increases to key short-term lending rates. The availability and cost of credit are both factors affecting consumer confidence, which is a critical driver of vehicle sales and thus automotive production. A material, sustained decrease in consumer demand for vehicles could result in further reductions to vehicle production from levels assumed in our business plan, which could have a material adverse effect on our profitability and financial condition. Higher interest rates will have an adverse effect on our borrowing costs, and if prolonged, could have an adverse effect on our profitability. |

| ◾ | Geopolitical Risks: The occurrence of geopolitical crises, including from the current military conflicts in Ukraine and Gaza, could create a number of risks, including: disruption of energy supplies (particularly natural gas and oil), shipping/transportation and logistics, vehicle production and/or supply chains; weakening economic growth and consumer confidence; increasing physical or cybersecurity threats; and/or worsening other risks described elsewhere in these Risk Factors, such as inflationary pressures, commodity prices, relative foreign exchange rates and risks of doing business in foreign markets. An expansion or worsening of existing geopolitical crises, or the occurrence of significant new geopolitical risks, could have a material adverse effect on our business and operations. |

Risks Related to the Automotive Industry

| ◾ | Economic Cyclicality: Ordinarily, the global automotive industry is cyclical, with potential for regional differences in the timing of expansion and contraction of economic cycles. In normal industry cycles, lower consumer confidence typically translates to lower vehicle sales and production volumes. Examples of factors which often reduce consumer confidence include: worsening economic, political, and other conditions; military conflict; increasing inflation (particularly fuel and energy prices); and rising interest rates. A significant decline in vehicle production volumes from levels assumed in our business plan could have a material adverse effect on our profitability and financial condition. |

| ◾ | Regional Production Volume Declines: North America, Europe and China are key automotive producing regions for us, and our operating results are primarily dependent on car and light truck production by our customers in these regions. A significant or sustained decline in vehicle production volumes in any or all these geographic regions could have a material adverse effect on our operations, sales, and profitability. |

| ◾ | Deteriorating Vehicle Affordability: Vehicle affordability to consumers is becoming more challenged due to a combination of factors, including: higher prices for electric vehicles (“EVs”); costs related to advanced electronic systems; increasing vehicle finance costs due to rising interest rates; inflationary cost increases impacting the entire bill of materials for a vehicle; and, in some cases, limited vehicle supply. A material, sustained decrease in consumer demand for vehicles due to deteriorating vehicle affordability could result in reductions to vehicle production from levels assumed in our business plan, which could have a material adverse effect on our profitability and financial condition. |

| ◾ | Misalignment Between EV Production and Sales: The automotive industry is transitioning from vehicles powered by internal combustion engines (“ICE”) to EVs, resulting in significant, industry-wide capital investment in EV-related production capacity. At the same time, there remains some uncertainty as to consumer acceptance of EVs due to issues such as vehicle affordability; availability of government subsidies; concerns regarding evolving battery technologies; anxiety regarding driving range; adequacy of charging infrastructure; the proliferation of new, EV-focused OEMs and/or new EV models with little or no operating and warranty history; and other factors. Although the number of EVs sold globally is growing, the rate of growth has moderated in some markets, with a misalignment between EV production/supply and consumer demand for certain models. If planned production volumes for EV programs do not materialize, we may not be able to recover our capital investments related to such programs, or to recover such investments within the timeframes contemplated. |

| ◾ | Intense Competition: The automotive supply industry is highly competitive and becoming more so. Some of our competitors have higher or more rapidly growing market share than we do in certain product or geographic markets. Additionally, a number of established |

18 Annual Information Form

| electronics, semiconductor chip and contract manufacturing companies have entered or expanded their presence in the automotive industry. At the same time, disruptive technology innovators have been introducing novel product and service solutions which traditional automotive suppliers may not be able to match. Failure to successfully compete with existing or new competitors, including failure to grow our electronics and/or EV content at or above the industry rates of growth for such products, could affect our ability to fully implement our corporate strategy. |

Strategic Risks