UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

| For the month of: March 2024 |

Commission File Number: 1-8481 |

BCE Inc.

(Translation of Registrant’s name into English)

1, carrefour Alexander-Graham-Bell, Verdun, Québec, Canada H3E 3B3,

(514) 870-8777

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

Only the Notice of 2024 Annual General Shareholder Meeting and Management Proxy Circular furnished with this Form 6-K as Exhibit 99.1 is incorporated by reference in the registration statements filed by BCE Inc. with the Securities and Exchange Commission on Form F-3 (Registration Statement No. 333-12130) and Form S-8 (Registration Statement Nos. 333-12780 and 333-12802) and the joint registration statement filed by BCE Inc. and Bell Canada with the Securities and Exchange Commission on Form F-10 (Registration Statement Nos. 333-263337 and 333-263337-01). Except for the foregoing, no other document or portion of document furnished with this Form 6-K is incorporated by reference in BCE Inc.’s registration statements. Notwithstanding any reference to BCE Inc.’s Web site on the World Wide Web in the documents attached hereto, the information contained in BCE Inc.’s site or any other site on the World Wide Web referred to in BCE Inc.’s site is not a part of this Form 6-K and, therefore, is not furnished to the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BCE Inc. | ||||

| By: | (signed) Martin Cossette | |||

|

|

||||

| Martin Cossette | ||||

| Senior Vice-President, Corporate Strategy (M&A) and Corporate Secretary |

||||

| Date: March 26, 2024 | ||||

EXHIBIT INDEX

| 99.1 |

Notice of 2024 Annual General Shareholder Meeting and Management Proxy Circular | |

| 99.2 |

Notice of 2024 Annual General Shareholder Meeting and Notice of Availability of Meeting Materials | |

| 99.3 |

Proxy Form (Registered Shareholders) | |

| 99.4 |

Notice of Availability of BCE Inc.’s Fighting Against Forced and Child Labour Report |

Exhibit 99.1

NOTICE OF 2024 ANNUAL GENERAL SHAREHOLDER MEETING AND MANAGEMENT PROXY CIRCULAR ANNUAL GENERAL MEETING MAY 2, 2024

| 1 | Notice of 2024 annual general shareholder meeting and meeting materials |

4 | ||

| 2 | 5 | |||

| 3 | 8 | |||

| 4 | 9 | |||

| 5 | 17 | |||

| 6 | 19 | |||

| 7 | 34 | |||

| 41 | ||||

|

|

||||||

| 8 |

42 | |||||

|

|

||||||

| 9 |

46 | |||||

|

|

||||||

| 10 |

58 | |||||

|

|

||||||

|

11 |

61 | |||||

| 12 | 79 | |||

| 13 | 81 | |||

Five ways

to vote

by proxy

Voting by proxy is the easiest way to vote

Please refer to the proxy form or voting instruction form provided to you or to section 2, entitled About voting your shares, for more information on the voting methods available to you. If you elect to vote on the Internet or by telephone, you do not need to return your proxy form or voting instruction form.

Letter from the Chair of the Board

and the President and Chief Executive Officer

| Dear fellow shareholders,

To align with our core communications business, our ESG standards and our journey from a traditional telco to a tech services and digital media leader, and to enable more people to attend and participate in the meeting, the 2024 BCE Annual General Shareholder Meeting will be available via live video webcast only at https://bce.lumiconnect.com/404404049 at 9:30 a.m. (Eastern time) on Thursday, May 2, 2024. Please refer to section 2.1, entitled How to participate and vote, under the headings Attending and participating at the meeting and How to ask questions, for further details.

As a shareholder, you have the right to vote your shares on all items that come before the meeting. Your vote is important and we facilitate voting by enabling you to vote by proxy at any time prior to the meeting. We encourage you to do so and have enabled voting online, by phone, by email, by fax or by mail. You can also vote by attending the virtual meeting online. Please refer to the instructions in section 2.1, entitled How to participate and vote, for further details.

This circular provides details about all the items for consideration at the meeting, such as information about nominated directors and their compensation, the auditors, our corporate governance practices, and reports from the standing committees of the Board. The circular also contains detailed information about our philosophy, policies and programs for executive compensation and how the Board receives input from shareholders on these matters.

At the meeting, we will review our strategy, financial position, business operations and the value we deliver to shareholders. We also look forward to responding to your questions.

Thank you for your continued confidence in BCE.

Sincerely,

|

|

|||

|

|

|

|||

| Gordon M. Nixon

|

Mirko Bibic

|

|||

| Chair of the Board |

President and CEO |

|||

|

March 7, 2024 |

||||

| 1 |

Summary

Below are highlights of some of the important information you will find in this management proxy circular (circular). These highlights do not contain all the information that you should consider. You should therefore read the circular in its entirety before voting.

Shareholder voting matters

| Board vote recommendation |

Page reference for

more information |

|||

| Election of 13 Directors |

FOR each nominee | 8 and 9 | ||

| Appointing Deloitte LLP as Auditors |

FOR | 8 and 9 | ||

| Advisory Resolution on Executive Compensation |

FOR | 9 and 41 | ||

| Our director nominees |

Committee memberships |

|||||||||||||||||||||||||||

|

|

|

|

|

Board and committee attendance 2023 | ||||||||||||||||||||||||

|

Other public boards |

||||||||||||||||||||||||||||

|

Age | Director Since |

Position | Top four competencies | ||||||||||||||||||||||||

| M. Bibic Ontario |

|

56 | 2020 | President and CEO – Bell Canada |

100% | 1 |

• CEO/Senior Management • Government/Regulatory Affairs |

• Media/Content • Telecommunications |

||||||||||||||||||||

| R.P. Dexter Nova Scotia

|

|

72 | 2014 | Chair and CEO – Maritime Travel Inc. |

✓ | ✓ | 100% | 1 |

• Governance • Human Resources/Compensation |

• Retail/Customer • Risk Management |

||||||||||||||||||

| K. Lee Ontario

|

|

60 | 2015 | Corporate Director | ✓ | ✓ | 100% | 1 |

• Accounting/Finance • CEO/Senior Management |

• Governance • Risk Management |

||||||||||||||||||

| M.F. Leroux Québec

|

|

69 | 2016 | Corporate Director | ✓ | C | 100% | 2 |

• Accounting/Finance • CEO/Senior Management |

• Corporate Responsibility • Governance |

||||||||||||||||||

| S.A. Murray Ontario

|

|

68 | 2020 | Corporate Director | ✓ | ✓ | 100% | 2 |

• CEO/Senior Management • Governance |

• Human Resources/Compensation • Investment Banking/Mergers & Acquisitions |

||||||||||||||||||

| G.M. Nixon Ontario

|

|

67 | 2014 | Corporate Director – Chair of the Board – BCE Inc. and Bell Canada |

100% | 2 |

• CEO/Senior Management • Governance |

• Human Resources/Compensation • Investment Banking/Mergers & Acquisitions |

||||||||||||||||||||

| L.P. Pagnutti Ontario

|

|

65 | 2020 | Corporate Director | C | ✓ | 100% | 0 |

• Accounting/Finance • CEO/Senior Management |

• Governance • Risk Management |

||||||||||||||||||

| C. Rovinescu Ontario

|

|

68 | 2016 | Corporate Director | ✓ | C | 100% | 1 |

• CEO/Senior Management • Human Resources/Compensation |

• Retail/Customer • Risk Management |

||||||||||||||||||

| K. Sheriff Ontario

|

|

66 | 2017 | Corporate Director | ✓ | ✓ | 100% | 1 |

• CEO/Senior Management • Risk Management |

• Technology • Telecommunications |

||||||||||||||||||

| J. Tory Ontario

|

|

68 | 2021 | Corporate Director | ✓ | ✓ | 100% | 1 |

• CEO/Senior Management • Corporate Responsibility |

• Human Resources/Compensation • Retail/Customer |

||||||||||||||||||

| L. Vachon Québec

|

|

61 | 2022 | Operating Partner – J.C. Flowers & Co. |

✓ | ✓ | 100% | 2 |

• CEO/Senior Management • Human Resources/Compensation |

• Retail/Customer • Risk Management |

||||||||||||||||||

| J. Wibergh Barbados

|

|

60 | 2023 | Corporate Director | 100% | 1 |

• CEO/Senior Management • Risk Management |

• Technology • Telecommunications |

||||||||||||||||||||

| C. Wright Ontario

|

|

50 | 2021 | President – Wittington Investments, Limited | ✓ | ✓ | 100% | 3 (1) | • Corporate Responsibility • Governance |

• Government/Regulatory Affairs • Investment Banking/ Mergers & Acquisitions |

||||||||||||||||||

| (1) | In connection with being President of Wittington Investments, Limited, the controlling shareholder of George Weston Limited, Loblaw Companies Limited and Choice Properties REIT, C. Wright is a director of each of these companies, which are all affiliates in the Weston group. |

| 2 | BCE INC. 2024 PROXY CIRCULAR |

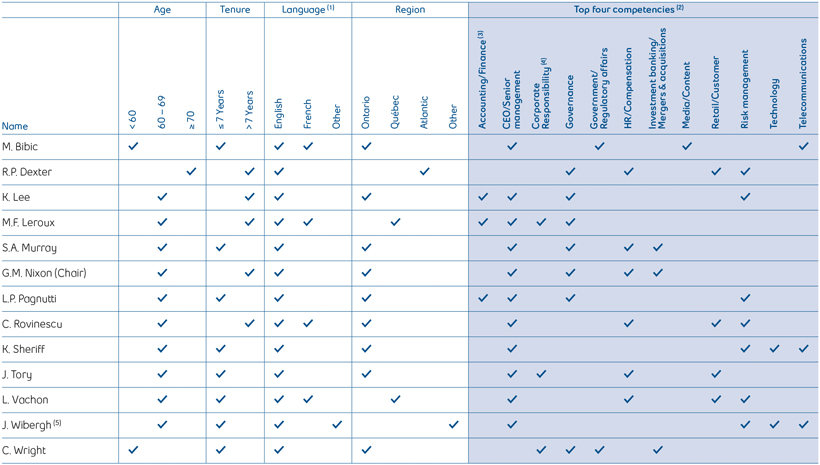

Corporate governance

BCE’s Board of Directors (Board) and management believe that strong corporate governance practices contribute to superior results in creating and maintaining shareholder value. That is why we continually seek to strengthen our corporate governance practices and ethical business conduct by aiming to adopt best practices, and providing full transparency and accountability to our shareholders. The Board is responsible for the supervision of the business and affairs of the Corporation.

Board information and governance best practices

| 15 | Size of Board | |

| 14 | Independent Directors | |

| 99.6% | 2023 Board and Committee Director Attendance Record | |

| ✓ | Board Committee Members Are All Independent | |

| ✓ | Board Diversity Policy and Target for Gender Representation | |

| ✓ | Annual Election of All Directors | |

| ✓ | Directors Elected Individually | |

| ✓ | Majority Voting for Directors | |

| ✓ | Separate Chair and CEO | |

| ✓ | Board Interlocks Guidelines | |

| ✓ | Directors’ Tenure Guidelines | |

| ✓ | Board Renewal: 7 Non-Executive Director Nominees ≤7 Years Tenure | |

| ✓ | Share Ownership Guideline for Directors and Executives | |

| ✓ | Code of Business Conduct and Ethics Program | |

| ✓ | Annual Advisory Vote on Executive Compensation | |

| ✓ | Formal Board Evaluation Process | |

| ✓ | Board Risk Oversight Practices | |

| ✓ | ESG Strategy Reviewed by Board | |

| ✓ | Robust Succession Planning | |

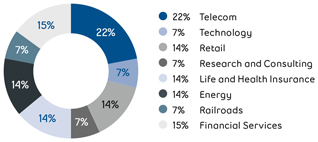

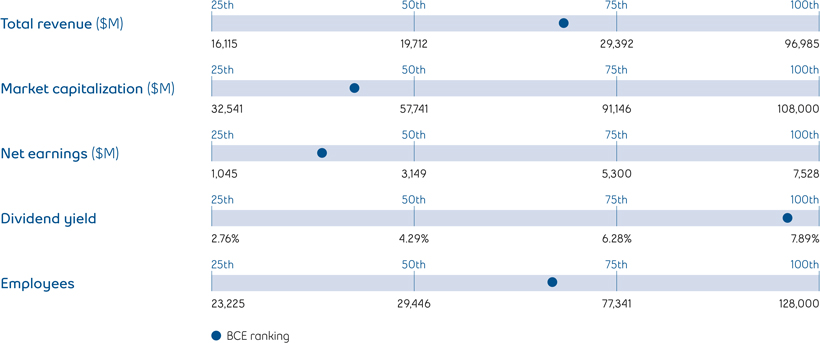

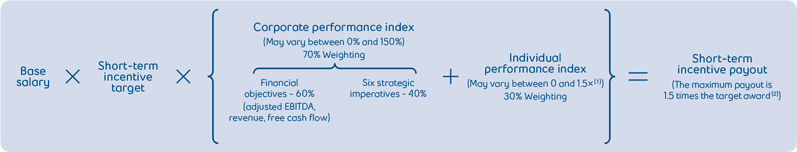

Executive compensation

BCE is focused on a pay-for-performance approach for all team members, including our executives. In order to attract, motivate and retain top talent, the Corporation offers a competitive total compensation package, with target positioning at the 60th percentile of the comparator group for strong performers.

| • | BASE SALARY: rewards the scope and responsibilities of a position, with target positioning at the median of our comparator group. |

| • | ANNUAL INCENTIVE: encourages strong performance against yearly corporate and individual objectives. |

| • | LONG-TERM INCENTIVE: aligns with long-term interests of shareholders. |

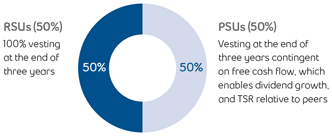

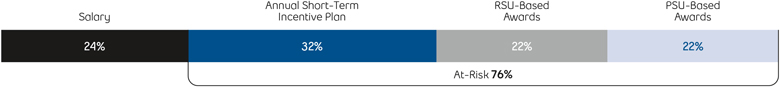

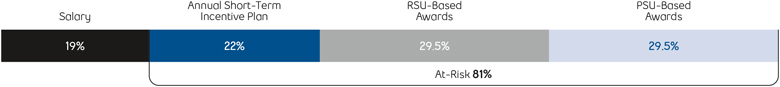

The mix of vehicles awarded under the long-term incentive plan favours the execution of multiple objectives. They are structured to create sustainable value for shareholders by attracting, motivating and retaining the executive officers needed to drive the business strategy, and rewarding them for delivering on our goal of advancing how Canadians connect with each other and the world, through the successful execution of our six strategic imperatives. As noted in the Compensation Discussion & Analysis, the Long-term incentive plan (LTIP) is comprised of 50% Restricted share units (RSUs) and 50% Performance share units (PSUs), and no changes were made to the LTIP program for 2023. No stock options have been granted since 2020.

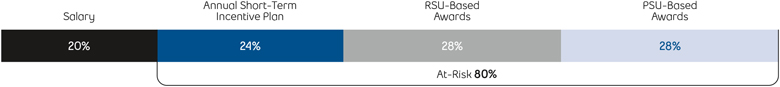

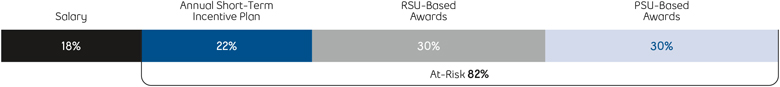

2023 Target pay at risk (1)

| (1) | Based on 2023 target base salary. Pay at risk is annual short-term incentive plan, RSU awards and PSU awards. At-risk components are based on target levels. Excludes pension and other compensation elements. |

Highlights

| • | Gender diverse directors represent 38% of director nominees. Details on page 23. |

| • | Members of visible minorities / racialized persons represent 15% of director nominees. Details on page 23. |

| • | Conducted a comprehensive assessment of the effectiveness and performance of the Board and its committees. Details on page 25. |

| • | Approved our strategic plan, taking into account the opportunities and risks of the business units for the upcoming year. Details on page 19. |

Overview of executive compensation

best practices adopted by BCE

| • | Stringent share ownership requirements. |

| • | Emphasis on pay at risk for executive compensation. |

| • | Double trigger change-in-control policy. |

| • | Anti-hedging policy on share ownership and incentive compensation. |

| • | Clawbacks for the President & CEO and all EVPs as well as all option holders. |

| • | Caps on BCE Supplemental Executive Retirement Plans (SERP) and annual bonus payouts, in addition to long-term incentive grants. |

| • | Vesting criteria aligned to shareholder interests. Details on page 49. |

| 3 |

Notice of 2024 annual general shareholder meeting and meeting materials 1

| 1 | Notice of 2024 annual general shareholder meeting and meeting materials |

|

Your vote is important |

As a shareholder, it is very important that you read this material carefully and then vote your shares, either by proxy or online at the virtual meeting.

In this document, you, your and shareholder mean the common shareholders of BCE. We, us, our, Corporation and BCE mean, as the context may require, either BCE Inc., or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates, unless otherwise indicated. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates. The information in this document is provided as at March 7, 2024, unless otherwise indicated.

|

|||

| When | Thursday, May 2, 2024, 9:30 a.m. (Eastern time) |

|||

| Virtual meeting | Virtual-only meeting via live video webcast at https://bce.lumiconnect.com/404404049 |

|||

| What the meeting | 1. |

receiving the financial statements for the year ended December 31, 2023, including the auditors’ reports |

||

| is about | 2. |

electing 13 directors who will serve until the end of the next annual shareholder meeting |

||

| 3. |

appointing the auditors who will serve until the end of the next annual shareholder meeting |

|||

| 4. |

considering an advisory (non-binding) resolution on executive compensation |

|||

| The meeting may also consider other business that properly comes before it. |

||||

| You have the right to vote | You are entitled to receive notice of and vote at our meeting, or any adjournment, if you are a holder of common shares of the Corporation on March 18, 2024. |

|||

| You have the right to vote your shares on items 2 to 4 listed above and any other items that may properly come before the meeting or any adjournment. |

||||

| Meeting materials | As permitted by Canadian securities regulators, we are using notice-and-access to deliver this circular and our annual financial report (meeting materials) to both our registered and non-registered shareholders. This means that the meeting materials are being posted online for you to access, rather than being mailed out. Notice-and-access gives shareholders more choice, substantially reduces our printing and mailing costs, and is environmentally friendly as it reduces paper and energy consumption. |

|||

| You will still receive a form of proxy or a voting instruction form in the mail so you can vote your shares, but, instead of receiving a paper copy of the meeting materials, you will receive a notice with information about how you can access the meeting materials electronically and how to request a paper copy. The meeting materials are available at www.meetingdocuments.com/TSXT/bce, on our website at BCE.ca, on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov. |

||||

| You may request a paper copy of the meeting materials at no cost up to one year from the date the meeting materials were filed on SEDAR+. You may make such a request at any time prior to the meeting at www.meetingdocuments.com/TSXT/bce or by contacting our transfer agent, TSX Trust Company (TSXT), at 1-800-561-0934 (toll free in Canada and the United States) or 416-682-3861 (other countries) and following the instructions. To ensure receipt of the paper copy in advance of the voting deadline and meeting date, we estimate that your request must be received no later than 4:45 p.m. (Eastern time) on April 11, 2024 (this factors the three business day period for processing requests as well as typical mailing times). After the meeting, requests may be made to our Investor Relations Group by calling 1-800-339-6353. |

||||

| Approval of this circular | The Board has approved the content of this circular and authorized it to be sent to shareholders, to each director and to the auditors. |

|||

| By order of the Board, |

||||

|

Martin Cossette Senior Vice-President, Corporate Strategy (M&A) and Corporate Secretary

Montréal, Québec March 7, 2024 |

||||

| 4 | BCE INC. 2024 PROXY CIRCULAR | |

About voting your shares 2

| 2 | About voting your shares |

| 2.1 | How to participate and vote |

The record date for determining shareholders entitled to vote is March 18, 2024. You have one vote for each common share you hold on that date. As at March 7, 2024, 912,275,388 common shares were outstanding.

Registered shareholders

You are a registered shareholder when your name appears on your share certificate or your direct registration statement. Your proxy form tells you whether you are a registered shareholder.

OPTION 1 By proxy (proxy form)

You may give your voting instructions in the following manner:

|

|

Internet Go to www.meeting-vote.com and follow the instructions. |

|

|

|

Telephone Call 1-800-561-0934 (toll free in Canada and the United States) or 416-682-3861 (other countries) from a touch-tone phone for an agent to help you vote online. |

|

|

|

Fax or Email Complete your proxy form and return it by fax to 416-595-9593, |

|

|

|

or scan and email to proxyvote@tmx.com. |

|

|

|

Complete your proxy form and return it in the prepaid envelope provided. |

|

Our transfer agent, TSXT, must receive your proxy form or you must have voted by Internet or telephone before noon (Eastern time) on April 30, 2024.

OPTION 2 At the virtual meeting

Registered shareholders may vote at the meeting by voting online during the meeting, as further described below under Attending and participating at the meeting.

Non-registered shareholders

You are a non-registered shareholder when an intermediary (a bank, trust company, securities broker or other financial institution) holds your shares on your behalf. When you receive a voting instruction form, this tells you that you are a non-registered shareholder.

OPTION 1 By proxy (voting instruction form)

You may give your voting instructions in the following manner:

|

|

Internet Go to www.ProxyVote.com and follow the instructions. You will need the 16-digit Control Number located on your voting instruction form. |

|

|

|

Telephone Call 1-800-474-7493 (English) or 1-800-474-7501 (French). You will need the 16-digit Control Number located on your voting instruction form. If you vote by telephone, you cannot appoint anyone other than the directors named on your voting instruction form as your proxyholder. |

|

|

|

Complete your voting instruction form and return it in the prepaid envelope provided. |

|

Your intermediary must receive your voting instructions with sufficient time for your vote to be processed before noon (Eastern time) on April 30, 2024. If you vote by Internet or telephone, you must do so prior to noon (Eastern time) on April 29, 2024.

Alternatively, you may be a non-registered shareholder who will receive from your intermediary a proxy form that has been pre-authorized by your intermediary indicating the number of shares to be voted, which is to be completed, dated, signed and returned to TSXT by mail, fax or email before noon (Eastern time) on April 30, 2024.

OPTION 2 At the virtual meeting

Non-registered (beneficial) shareholders who have not duly appointed themselves as proxyholder will not be able to participate or vote at the meeting but will be able to attend the meeting as a guest. This is because we and TSXT, our transfer agent, do not have a record of the non-registered shareholders of the company and, as a result, will have no knowledge of your shareholdings or entitlement to participate or vote unless you appoint yourself as proxyholder.

If you are a non-registered shareholder and wish to participate and vote at the meeting, you MUST appoint yourself as proxyholder by inserting your own name in the space provided on the voting instruction form sent to you and you MUST follow all of the applicable instructions, including meeting the deadline, provided by your intermediary. See Appointment of a third party as proxy and Attending and participating at the meeting below.

Appointment of a third party as proxy

The following applies to shareholders who wish to appoint someone as their proxyholder other than the BCE proxyholders named in the form of proxy or voting instruction form. This includes non-registered shareholders who wish to appoint themselves as proxyholder to attend, participate or vote at the meeting.

Shareholders who wish to appoint someone other than the BCE proxyholders as their proxyholder to attend and participate at the meeting as their proxy and vote their shares MUST submit their form of proxy or voting instruction form, as applicable, appointing that person as proxyholder, AND register that proxyholder online or by telephone, as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your form of proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a 13-digit Control Number that is required to participate and vote at the meeting.

STEP 1:

Submit your form of proxy or voting instruction form: To appoint someone other than the BCE proxyholders as proxyholder, insert that person’s name in the blank space provided in the form of proxy or voting instruction form (if permitted) and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed before registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form.

| 5 |

About voting your shares 2

If you are a non-registered shareholder and wish to participate and vote at the meeting, you MUST insert your own name in the space provided on the voting instruction form sent to you by your intermediary, follow all of the applicable instructions provided by your intermediary AND register yourself as your proxyholder, as described below. By doing so, you are instructing your intermediary to appoint you as proxyholder. It is important that you comply with the signature and return instructions provided by your intermediary. Please also see further instructions below under the heading Attending and participating at the meeting.

If you are a non-registered shareholder located in the United States and wish to participate and vote at the meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described below under Attending and participating at the meeting, you MUST obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form and the voting instruction form sent to you, or contact your intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to TSXT. Requests for registration from non-registered shareholders located in the United States that wish to participate and vote at the meeting or, if permitted, appoint a third party as their proxyholder must be sent by email or by courier to: proxyvote@tmx.com (if by email), or TSX Trust Company, Attention: Proxy Department, 1170 Birchmount Rd, Scarborough, ON M1P 5E3 (if by courier) and in both cases, must be labelled “Legal Proxy” and received no later than the voting deadline of noon (Eastern Time) on April 30, 2024.

STEP 2:

Register your proxyholder: To register a third-party proxyholder, shareholders MUST complete the online form available at https://www.tsxtrust.com/control-number-request or call TSXT at 1-800-561-0934 (toll free in Canada and the United States) or 416-682-3861 (other countries) by noon (Eastern time) on April 30, 2024, and provide TSXT with the required proxyholder contact information so that TSXT may provide the proxyholder with a 13-digit Control Number via email. Without a 13-digit Control Number, proxyholders will not be able to participate and vote at the meeting but will be able to attend the meeting as a guest.

If you are unsure whether you are a registered or non-registered shareholder, please contact TSXT by email at bce@tmx.com or by telephone at 1-800-561-0934 (in Canada and the United States) or 416-682-3861 (other countries).

If you are an individual shareholder, you or your authorized attorney must sign the proxy or voting instruction form. If you are a corporation or other legal entity, an authorized officer or attorney must sign the proxy or voting instruction form.

Attending and participating

at the meeting

BCE is holding the meeting in a virtual-only format, which will be conducted via live video webcast through the LUMI platform. Shareholders will not be able to attend the meeting in person. Attending the meeting online enables registered shareholders and duly appointed proxyholders, including non-registered (beneficial) shareholders who have duly appointed themselves as proxyholder, to participate at the meeting and ask questions (as well as make motions), all in real time. Registered shareholders and duly appointed proxyholders can vote online at the appropriate times during the meeting.

| • | Log in online at https://bce.lumiconnect.com/404404049. The link will become accessible one hour before the meeting starts. |

| • | If you are a registered shareholder or duly appointed proxyholder, including a non-registered (beneficial) shareholder who has duly appointed yourself as proxyholder, select “I have a login” and then enter your 13-digit Control Number and password bce2024 (case sensitive). |

Registered shareholders: Your 13-digit Control Number is the control number located on the form of proxy or in the email notification you received.

Duly appointed proxyholders: TSXT will provide the proxyholder with a 13-digit Control Number by email after the proxy voting deadline of noon (Eastern time) on April 30, 2024 has passed and the proxyholder has been duly appointed AND registered as described in Appointment of a third party as proxy above.

| • | If you are a guest, including a non-registered (beneficial) shareholder who has not duly appointed yourself as proxyholder, select “I am a guest” and register online. |

Guests can listen to the meeting, but are not able to vote, make motions or ask questions.

It is important that you are connected to the Internet at all times during the meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the meeting. You should allow ample time to check into the meeting online and complete the related procedure. For additional information about attending the meeting online (including technical and logistical matters related to accessing the meeting online), refer to the LUMI AGM user guide available on our website at BCE.ca/AGM2024.

How to ask questions

Only registered shareholders and duly appointed proxyholders, including non-registered (beneficial) shareholders who have duly appointed themselves as proxyholder, can submit questions (or make motions):

| • | In advance of the meeting: (1) through our website at BCE.ca/AGM2024, under Ask a Question; or (2) by contacting the Corporate Secretary by email at corporate.secretariat@bell.ca, by telephone at 514-786-8424, or at the address set out in section 12.4, entitled How to request more information. Questions submitted in advance must be received by 9:30 a.m. (Eastern time) on May 1, 2024, to be addressed at the meeting. |

| • | During the meeting: (1) in writing at https://bce.lumiconnect.com/404404049 by selecting the messaging tab and typing your question within the box at the top of the screen (once finished, press the “send” arrow to the right of the box to submit your question) – a BCE representative will read out the question at the meeting; or (2) by telephone through LUMI’s conference call facilities at 1-888-870-3025 (English) or 1-888-870-4559 (French) – a LUMI representative will dial you into the meeting at the appropriate time for you to ask your question (or make a motion, if applicable) live. Questions can be submitted at any time during the meeting until the chair of the meeting closes the question period. |

It is recommended that shareholders and duly appointed proxyholders attending the meeting online submit their questions in advance of the meeting or as soon as possible during the meeting so that they can be addressed at the appropriate time.

Assuming they have been submitted in sufficient time, questions related to the matters of business to be voted on will be addressed at the time such matter is being discussed, before a vote is held on each matter. Other questions will be addressed during the question period after the formal business of the meeting has been completed. Questions submitted online will be moderated before being sent to the chair of the meeting. Questions on the same topic or otherwise related will be grouped, summarized and addressed at the same time.

Questions should be of interest to all shareholders and not personal in nature. To ensure fairness for all, the chair of the meeting will decide on the order questions are responded to and the amount of time allocated to each question. For more information on procedural matters relating to the meeting (including making motions), please see our code of

| 6 | BCE INC. 2024 PROXY CIRCULAR |

About voting your shares 2

procedures at BCE.ca/AGM2024. If you duly submit a question that is not answered during the meeting (including a question relating to a personal matter), we will communicate with you after the meeting if you have provided your contact information.

A video of the entire webcast (including the question period) will be available on our website following the meeting. If there are any questions that cannot be answered during the meeting due to time constraints, they will be posted on our website with the corresponding answers as soon as practicable after the meeting and will remain available until one week after posting.

LUMI has been facilitating annual shareholder meetings for over 30 years. The LUMI platform has been designed to be intuitive and easy to use for all shareholders. It is a platform for shareholders to ask questions, make

motions and otherwise share feedback, thereby allowing shareholders to engage and participate at meetings. We have used the LUMI platform for the past five annual general shareholder meetings and our Chair is familiar and experienced with the platform.

Accessing technical support

For any technical difficulties experienced during the check-in process or during the meeting, please contact LUMI at support-ca@lumiglobal.com.

For more information, including the LUMI AGM user guide and BCE’s code of procedures, consult BCE.ca/AGM2024.

| 2.2 | How your shares will be voted |

You can choose to vote “For”, “Withhold” or “Against”, depending on the item to be voted on.

When you sign the proxy form or voting instruction form, you authorize Gordon M. Nixon, Mirko Bibic, Robert P. Dexter or Monique F. Leroux, who are all directors, to vote your shares for you at the meeting according to your instructions. If you return your proxy form or voting instruction form and do not tell us how you want to vote your shares, your vote will be counted:

| • | FOR electing the 13 nominated directors listed in the circular |

| • | FOR appointing Deloitte LLP as auditors |

| • | FOR approving the advisory resolution on executive compensation. |

You may appoint another person to attend the virtual meeting online and vote your shares for you. If you wish to do so, follow the instructions set out above in section 2.1, entitled How to participate and vote. This person does not have to be a shareholder. Your proxyholder will vote your shares as your proxyholder sees fit on any amendments to the items to be voted on and on any other items that may properly come before the meeting or any adjournment.

The election of directors, appointment of the auditors and approval of the advisory resolution on executive compensation will each be determined by a majority of votes cast at the meeting by proxy or by attending the virtual meeting online.

| 2.3 | Changing your vote |

You can change a vote you made by proxy by:

| • | voting again on the Internet or by telephone before noon (Eastern time) on April 30, 2024, if you are a registered shareholder, or noon (Eastern time) on April 29, 2024, if you are a non-registered shareholder; |

| • | if you are a registered shareholder, completing a proxy form that is dated later than the proxy form you are changing and sending it by mail, email or fax as instructed on your proxy form so that it is received before noon (Eastern time) on April 30, 2024; or |

| • | if you are a non-registered shareholder, contacting your intermediary to find out what to do. |

If you are a registered shareholder, you can also revoke a vote you made by proxy by sending a notice in writing from you or your authorized attorney to our Corporate Secretary so that it is received before noon (Eastern time) on April 30, 2024.

| 2.4 | Other information |

TSXT counts and tabulates the votes. It does this independently of us to make sure that the votes of individual shareholders are confidential. Proxy forms or voting instruction forms are referred to us only when it is clear that a shareholder wants to communicate with management, the validity of the form is in question or the law requires it.

To help you make an informed decision, please read this circular and our annual financial report for the year ended December 31, 2023, which you can access on our website at BCE.ca, at www.meetingdocuments.com/TSXT/bce, on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov. This circular tells you about the meeting, the nominated directors, the proposed auditors, the Board’s committees, our corporate governance practices, and the compensation of directors and executives.

The annual financial report gives you a review of our activities for the past year and includes a copy of our annual financial statements and the related management’s discussion and analysis (MD&A). For our caution regarding forward-looking statements, see section 13, entitled Caution regarding forward-looking statements.

Proxy forms, notice-and-access notifications and proxy materials, if applicable, are sent to our registered shareholders through our transfer agent, TSXT. We do not send voting instruction forms, notice-and-access notifications and proxy materials, if applicable, directly to non-registered shareholders and instead use the services of Broadridge Investor Communication Solutions, Canada, who acts on behalf of intermediaries to send such materials.

| 2.5 | Questions |

If you have any questions about the information contained in this document or require assistance in completing your proxy form or voting instruction form, please contact our proxy solicitation agent, TMX Investor Solutions Inc.:

North American toll free phone: 1-866-406-2287

International phone (outside of North America): 201-806-7301

Email: INFO_TMXIS@TMX.com

Your proxy is solicited by management. In addition to solicitation by mail, our employees or agents may solicit proxies by telephone or other ways at a nominal cost. We have retained TMX Investor Solutions Inc. to solicit proxies for us in Canada and the United States at an estimated cost of $40,000. We pay the costs of these solicitations.

| 7 |

What the meeting will cover 3

| 3 | What the meeting will cover |

| 3.1 | Receiving our financial statements |

BCE’s annual audited financial statements are included in our 2023 annual financial report.

| 3.2 | Electing directors |

Please see section 4, entitled About the nominated directors, for more information. Directors appointed at the meeting will serve until the end of the next annual shareholder meeting, or until their resignation, if earlier.

All of the 13 individuals nominated for election as directors are currently members of the Board, and each was elected at our 2023 annual shareholder meeting, held on May 4, 2023, by at least a majority of the votes cast, with the exception of Johan Wibergh, who was appointed to the Board in November 2023. For details of the voting results for the nominees who were elected at our 2023 annual shareholder meeting, please see section 4 About the nominated directors. David F. Denison and Robert C. Simmonds will be retiring at the end of the meeting. At our 2023 annual shareholder meeting, D.F. Denison and R.C. Simmonds received, respectively, 364,645,134 (98.14%) and 366,838,907 (98.73%) votes FOR their election as a director.

The Board recommends that you vote FOR the election of the 13 individuals nominated.

Majority voting

Amendments to the Canada Business Corporations Act (CBCA), which came into force on August 31, 2022, established a majority voting requirement for directors. Specifically, the CBCA requires that, for elections at which there is only one candidate nominated for each position available on the Board, shareholders vote “for” or “against” individual directors (rather than “for” or “withhold”) and each candidate is elected only if they receive a majority of votes cast in their favour. The CBCA provides that if an incumbent director is not elected in those circumstances, the director may continue in office until the earlier of (i) the 90th day after the day of the election, and (ii) the day on which their successor is appointed or elected.

You will be electing the 13 members of your Board

If you do not specify how you want your shares voted, the directors named as proxyholders in the proxy form or voting instruction form intend to cast the votes represented by proxy at the meeting FOR the election of all nominees listed in this circular.

| 3.3 | Appointing the auditors |

The Board, on the advice of the Audit Committee, recommends that you vote FOR the appointment of Deloitte LLP as auditors. At our 2023 annual shareholder meeting, Deloitte LLP received 347,443,400 (87.49%) votes FOR its appointment as auditors. The audit firm appointed at the meeting will serve until the end of the next annual shareholder meeting, or its earlier resignation in connection with the RFP for auditor services described below.

The Audit Committee performs an annual assessment of the quality of the services rendered, their communication and the performance by Deloitte LLP as auditors of the Corporation. This assessment is based, among other things, on the audit plan submitted, the risk areas identified, the nature of the audit findings, the reports presented to the Audit Committee, a review of relevant inspection reports issued by the Canadian Public Accountability Board (CPAB) and the U.S. Public Company Accounting Oversight Board (PCAOB), and a survey of management and the Audit Committee members as it relates to auditor independence, objectivity, professional scepticism, quality of service, quality of the audit engagement team and communications. Further, the Audit Committee evaluates the benefits and risks of having a long-tenured auditor and the controls and processes that ensure their independence, such as mandatory partner rotations every five years.

A more comprehensive review is conducted every five years. The last comprehensive review was performed in 2021 and covered the five-year period ended on December 31, 2020. The scope of the review covered audit quality, including independence, objectivity and professional scepticism, quality of service, communication and Deloitte LLP’s ability to meet BCE’s future needs. As part of the review, the Audit Committee analyzed instances where Deloitte LLP challenged management and clearly demonstrated professional scepticism, conducted interviews with Deloitte LLP’s senior Canadian firm management as well as internal senior management, and reviewed CPAB and PCAOB inspection reports issued from 2015 to 2020.

Given the satisfactory results of the annual assessment regarding the 2023 audit and the comprehensive review performed in 2021 covering the five-year period ended on December 31, 2020, the Board, on the

advice of the Audit Committee, recommends that you vote FOR the appointment of Deloitte LLP as auditors of the Corporation for the financial year ending December 31, 2024.

In keeping with our focus on strong corporate governance practices and given the long tenure of Deloitte LLP as the Corporation’s auditors, the Audit Committee completed a comprehensive request for proposal process for the 2025 external audit engagement (the RFP). After careful consideration, on the advice of the Audit Committee, the Board selected Ernst & Young LLP, subject to shareholder approval. Ernst & Young LLP was selected based on the qualifications of its audit team, staffing model, technology and independence. The Corporation extends its gratitude to Deloitte LLP for the quality of expertise and insight they have provided to the Corporation.

Deloitte LLP will continue as auditors of the Corporation for the financial year ending December 31, 2024. Ernst & Young LLP will commence a transition process with Deloitte LLP during the financial year ending December 31, 2024 in order to ensure an orderly transfer. Deloitte LLP will resign as the Corporation’s auditors effective on the business day following the filing of BCE’s audited consolidated financial statements for the year ending December 31, 2024 and the auditors’ report thereon, and, effective on the same date, the Board will appoint Ernst & Young LLP to fill the vacancy and hold office until the 2025 annual shareholder meeting. BCE intends to propose to shareholders, at its 2025 annual shareholder meeting, that Ernst & Young LLP be appointed as auditors until the end of the next annual shareholder meeting. Additional information and documents related to the change of auditors will be provided in next year’s management proxy circular.

You will be appointing your auditors

If you do not specify how you want your shares voted, the directors named as proxyholders in the proxy form or voting instruction form intend to cast the votes represented by proxy at the meeting FOR the appointment of Deloitte LLP as auditors.

| 8 | BCE INC. 2024 PROXY CIRCULAR |

About the nominated directors 4

External auditors’ fees

The table below shows the fees that BCE’s external auditors, Deloitte LLP, billed to BCE and its subsidiaries for various services in each of the past two fiscal years.

|

2023 (in $ millions) |

2022 (in $ millions) |

|||||||

| Audit fees (1) |

10.1 | 9.8 | ||||||

| Audit-related fees (2) |

3.5 | 3.3 | ||||||

| Tax fees (3) |

0.3 | 0.3 | ||||||

| All other fees (4) |

0.1 | 0.1 | ||||||

| Total (5) |

14.0 | 13.5 | ||||||

| (1) | These fees include professional services provided by the external auditors for statutory audits of the annual financial statements, the audit of the effectiveness of internal control over financial reporting, the review of interim financial reports, the review of financial accounting and reporting matters, the review of securities offering documents, and translation services. |

| (2) | These fees relate to non-statutory audits and due diligence procedures, and other regulatory audits and filings. |

| (3) | These fees include professional services for tax compliance, tax advice and assistance with tax audits. |

| (4) | These fees include any other fees for permitted services not included in any of the above-stated categories. |

| (5) | The amounts of $14.0 million in 2023 and $13.5 million in 2022 reflect fees billed in those fiscal years without taking into account the year to which those services relate. Total fees for services provided for each fiscal year amounted to $10.8 million in 2023 and $10.5 million in 2022. |

| 3.4 | Considering an advisory resolution on executive compensation |

Our executive compensation philosophy, policies and programs are based on the fundamental principle of pay-for-performance to align the interests of our executives with those of our shareholders. This compensation approach allows us to attract and retain high-performing executives who will be strongly incentivized to create value for our shareholders on a sustainable basis. As a shareholder, you are asked to consider the following resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in this management proxy circular provided in advance of the 2024 Annual General Shareholder Meeting.

The Board recommends that you vote FOR this resolution. At our 2023 annual shareholder meeting, 343,801,294 (92.53%) votes were received FOR the advisory resolution on executive compensation.

You will vote on an advisory resolution

on executive compensation

Because your vote is advisory, it will not be binding upon the Board. However, the Management Resources and Compensation Committee (Compensation Committee) will review and analyze the results of the vote and take into consideration such results when reviewing our executive compensation philosophy, policies and programs. Please see section 6.3, entitled Shareholder engagement, for more details on how you can ask questions and provide comments to the Board and the Compensation Committee on executive compensation.

If you do not specify how you want your shares voted, the directors named as proxyholders in the proxy form or voting instruction form intend to cast the votes represented by proxy at the meeting FOR the adoption of the advisory resolution on executive compensation.

| 3.5 | Other business |

At the meeting, we will also:

| • | provide an update on our business operations, and |

| • | invite questions and comments from shareholders. |

If you are not a shareholder, you may view the meeting webcast as a guest.

As of the date of this circular, management is not aware of any changes to these items and does not expect any other items to be brought forward at the meeting. If there are changes or new items, your proxyholder can vote your shares on these items as your proxyholder sees fit.

| 4 | About the nominated directors |

The following pages include a profile of each nominated director, with an explanation of each nominated director’s experience, qualifications, top four areas of expertise, attendance at meetings of the Board and its committees, ownership and value of equity securities of BCE and extent of fulfilment of the five-year BCE share ownership guideline (based on December 31, 2023 ownership), previous voting results, as well as participation on the boards of other public companies (as well as certain private entities). A tabular summary of our directors’ top skills can be found in section 6.1, entitled Board of Directors, under the heading Competency requirements and other information. Current committee memberships and current committee chairpersons can be found under the heading Committees of the Board of Directors in section 6.1. For more information on the compensation paid to non-executive directors, please refer to section 5, entitled Director compensation. For more information on our five-year share ownership guideline, please refer to section 5.3, entitled Share ownership guideline.

The following table discloses the total holdings of BCE common shares and deferred share units (DSUs) of the nominated directors as at December 31, 2023 and 2022. The total value of common shares and DSUs held by non-executive director nominees is determined by multiplying the number of common shares and DSUs of BCE held by each director nominee by the closing price of BCE’s common shares on the Toronto Stock Exchange as at December 29, 2023 and December 30, 2022, being $52.17 and $59.49, respectively.

Total shareholdings of nominated directors

| December 31, 2023 | December 31, 2022 | |||||||

| BCE Common Shares |

121,753 | 106,861 | ||||||

| BCE Deferred Share Units |

512,777 | 412,050 | ||||||

| Total Shares/DSUs |

634,530 | 518,911 | ||||||

| Value ($) |

33,354,497 | 31,125,786 | ||||||

Your directors own a significant shareholding

interest in BCE, aligning their interests with yours

| 9 |

About the nominated directors 4

| Mirko Bibic Toronto (Ontario) Canada

|

President and CEO BCE Inc. and Bell Canada Since January 2020

Age: 56

Status: Not Independent

Joined Board: January 2020

Top 4 Areas of Expertise: • CEO/Senior Management • Government/Regulatory Affairs • Media/Content • Telecommunications

2023 Annual Meeting Votes For: 369,941,369 (99.57%) |

President and Chief Executive Officer of BCE Inc. and Bell Canada since January 2020, M. Bibic leads the Bell group of companies with a strategy to deliver the best networks, champion customer experience, drive service and content innovation, operate with agility and efficiency, and support the Bell team and our communities toward a sustainable future.

M. Bibic was previously Bell’s Chief Operating Officer since October 2018, responsible for all operations of Bell Mobility, Bell Business Markets, and Bell Residential and Small Business. He has also served as Executive Vice President, Corporate Development and as Chief Legal and Regulatory Officer.

M. Bibic joined Bell in 2004 as Senior Vice President, Regulatory and was named Canadian General Counsel of the Year in 2017. He holds a Bachelor of Commerce degree from McGill University and a Law degree from the University of Toronto, and serves on the boards of Royal Bank of Canada and Maple Leaf Sports & Entertainment. He is also co-chair of the Kids Help Phone campaign. Born and raised in the Montréal area, M. Bibic is fluently bilingual.

Board & committee attendance during 2023

| Regular | Special | Total | ||||||||

| Board |

6/6 | 2/2 | 8/8 | |||||||

| Total Board & Committee Attendance |

|

100% | ||||||||

Other public board directorships

| Present boards | ||

| Royal Bank of Canada |

2022–present | |

| Past boards (last five years) | ||

| N/A |

||

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

23,565 | 21,060 | ||||

| BCE DSUs |

162,574 | 136,146 | ||||

| Total Shares/DSUs (#) |

186,139 | 157,206 | ||||

| Total Value ($) |

9,961,938 | 9,607,954 | ||||

Share ownership guidelines

Please see the heading Share ownership requirements on page 56 under section 9.6, entitled 2023 Compensation elements, for more details on M. Bibic’s specific share ownership requirements. Share ownership value is calculated using the higher of acquisition cost and the current market value at December 31.

| Robert P. Dexter Halifax (Nova Scotia) Canada

|

Chair and CEO Maritime Travel Inc. Since July 1979

Age: 72

Status: Independent

Joined Board: November 2014

Top 4 Areas of Expertise: • Governance • Human Resources/Compensation • Retail/Customer • Risk Management

2023 Annual Meeting Votes For: 369,628,887 (99.48%) |

Robert Dexter has been Chair and CEO of Maritime Travel Inc. (an integrated travel company) since 1979. He holds both a bachelor’s degree in Commerce and a bachelor’s degree in Law from Dalhousie University and was appointed Queen’s Counsel in 1995.

Mr. Dexter has over 20 years of experience in the communications sector, having served as a director of Maritime Tel & Tel Limited from 1997 to 1999 prior to joining the Aliant and, later, the Bell Aliant boards until October 2014. Mr. Dexter was also Chair of Sobeys Inc. and Empire Company Limited from 2004 to 2016, and is a director of High Liner Foods Inc.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Compensation Committee |

5/5 | – | 5/5 | |||

| Risk and Pension Fund Committee |

5/5 | – | 5/5 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| High Liner Foods Inc. |

1992–present | |

| Past boards (last five years) | ||

| Wajax Corporation (Chair) |

1988–2022 | |

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

7,526 | 7,526 | ||||

| BCE DSUs |

71,527 | 62,685 | ||||

| Total Shares/DSUs (#) |

79,053 | 70,211 | ||||

| Total Value ($) |

4,124,195 | 4,176,852 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): Met (3.2×)

| 10 | BCE INC. 2024 PROXY CIRCULAR |

About the nominated directors 4

| Katherine Lee (1) Toronto (Ontario) Canada

|

Corporate Director Since March 2018

Age: 60

Status: Independent

Joined Board: August 2015

Top 4 Areas of Expertise: • Accounting/Finance • CEO/Senior Management • Governance • Risk Management

2023 Annual Meeting Votes For: 368,606,578 (99.21%) |

Katherine Lee is a corporate director and, from 2010 to February 2015, served as President and CEO of GE Capital Canada (a leading global provider of financial and fleet management solutions to mid-market companies operating in a broad range of economic sectors).

Prior to this role, Ms. Lee served as CEO of GE Capital Real Estate in Canada from 2002 to 2010, building it to a full debt and equity operating company. Ms. Lee joined GE in 1994, where she held a number of positions, including Director, Mergers & Acquisitions, for GE Capital’s Pension Fund Advisory Services based in San Francisco, and Managing Director of GE Capital Real Estate Korea based in Seoul and Tokyo.

Ms. Lee earned a Bachelor of Commerce degree from the University of Toronto. She is a Chartered Professional Accountant and Chartered Accountant. She is active in the community, championing women’s networks and Asia-Pacific forums.

Ms. Lee is a director of Colliers International Group and Public Sector Pension Investments.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Audit Committee |

5/5 | – | 5/5 | |||

| Governance Committee |

4/4 | – | 4/4 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| Colliers International Group Inc. |

2015–present | |

| Past boards (last five years) | ||

| N/A |

||

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

6,000 | 6,000 | ||||

| BCE DSUs |

29,830 | 25,781 | ||||

| Total Shares/DSUs (#) |

35,830 | 31,781 | ||||

| Total Value ($) |

1,869,251 | 1,890,652 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): Met (1.4×)

| (1) | Audit Committee financial expert and audit financial expert. |

| Monique F. Leroux, C.M., O.Q., FCPA, FCA (1) Montréal (Québec) Canada

|

Corporate Director Since April 2016

Age: 69

Status: Independent

Joined Board: April 2016

Top 4 Areas of Expertise: • Accounting/Finance • CEO/Senior Management • Corporate Responsibility • Governance

2023 Annual Meeting Votes For: 367,207,758 (98.83%) |

Companion of the Canadian Business Hall of Fame and inductee into the Canadian Accounting Hall of Fame and the Investment Industry Hall of Fame, Monique Leroux is a corporate director, who serves as an independent board member of Michelin Group (Michelin) and Alimentation Couche-Tard Inc. As such, she brings to these boards her diverse experience, among others as Audit Partner at Ernst and Young from 1988 to 1995 and Chair of the Board and Chief Executive Officer of Desjardins Group from 2008 to 2016. Ms. Leroux is Chair of Michelin’s Corporate Social Responsibility Committee, which oversees ESG (including climate change) matters for the company.

In 2020, Ms. Leroux acted as Chair of the Industry Strategy Council appointed by the Minister of Innovation, Science and Industry Canada. From 2016 to 2020, she was Chair of the Board of Investissement Québec. She is Vice-Chair of the Orchestre symphonique de Montréal and she is also Chair of the Boards of the University of Sherbrooke and Conservatoire de musique et d’art dramatique du Québec.

Ms. Leroux is a Member of the Order of Canada, an Officer of the Ordre national du Québec, a Chevalier of the Légion d’honneur (France) and a recipient of the Woodrow Wilson Award (United States). She has been awarded Fellowships by the Ordre des comptables professionnels agréés du Québec and the Institute of Corporate Directors and holds honourary doctorates from 10 Canadian universities in recognition of her contributions to the business sector and to the community.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Audit Committee |

5/5 | – | 5/5 | |||

| Governance Committee |

4/4 | – | 4/4 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| Alimentation Couche-Tard Inc. |

2015–present | |

| Michelin Group |

2015–present | |

| Past boards (last five years) | ||

| S&P Global Inc. |

2016–2022 | |

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

2,000 | 2,000 | ||||

| BCE DSUs |

36,811 | 29,804 | ||||

| Total Shares/DSUs (#) |

38,811 | 31,804 | ||||

| Total Value ($) |

2,024,770 | 1,892,020 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): Met (1.6×)

| (1) | Audit Committee financial expert and audit financial expert. |

| 11 |

About the nominated directors 4

| Sheila A. Murray Toronto (Ontario) Canada

|

Corporate Director Since April 2019

Age: 68

Status: Independent

Joined Board: May 2020

Top 4 Areas of Expertise: • CEO/Senior Management • Governance • Human Resources/Compensation • Investment Banking/Mergers & Acquisitions

2023 Annual Meeting Votes For: 369,350,083 (99.41%) |

Sheila Murray is a corporate director and, from 2016 to 2019, served as President of CI Financial Corp. (an investment fund company). Previously, she had been Executive Vice President, General Counsel and Secretary following a 25-year career at Blake, Cassels & Graydon LLP (a law firm), where she practiced securities law with an emphasis on mergers and acquisitions, corporate finance and corporate reorganizations. Ms. Murray played a key role in directing the operations and setting corporate strategy for CI Financial Corp. and its operating companies, including CI Investments Inc. and Assante Wealth Management. Her role included leading CI’s mentoring program, which fosters the advancement of high-potential female employees.

Ms. Murray is past Chair of the Dean’s Council at Queen’s University Law School and is currently a member of the Queen’s University Board of Trustees. She has taught securities regulation at Queen’s University. She has also taught corporate finance at the University of Toronto’s Global Professional LLM in Business Law Program.

Ms. Murray is Chair of the Board of Teck Resources Limited (Teck) and a trustee of Granite REIT, and has been a director of a number of other private and public companies. Ms. Murray received her Bachelor of Commerce, and Law degrees from Queen’s University. In her capacity as Chair of the Board of Teck, a mining company, Ms. Murray oversees significant ESG (including climate change and sustainability) related matters. Ms. Murray is also a member of the Advisory Board of the World Economic Forum’s Climate Governance Initiative and has completed training on board oversight of climate change. She has also completed her Global Competent Board Sustainability & ESG Designation and certificate (GCB.D), which included a session on climate change and biodiversity.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Compensation Committee |

5/5 | – | 5/5 | |||

| Risk and Pension Fund Committee |

5/5 | – | 5/5 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| Teck Resources Limited (Chair) |

2018–present | |

| Granite REIT (Trustee) |

2019–present | |

| Past boards (last five years) | ||

| CI Financial Corp. |

2018–2022 | |

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

4,500 | 4,500 | ||||

| BCE DSUs |

16,413 | 11,022 | ||||

| Total Shares/DSUs (#) |

20,913 | 15,522 | ||||

| Total Value ($) |

1,091,031 | 923,404 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): May 2025 (0.8×)

| Gordon M. Nixon, C.M., O.Ont. Toronto (Ontario) Canada

|

Corporate Director Since September 2014

Age: 67

Status: Independent

Joined Board: November 2014

Top 4 Areas of Expertise: • CEO/Senior Management • Governance • Human Resources/Compensation • Investment Banking/Mergers & Acquisitions

2023 Annual Meeting Votes For: 368,833,321 (99.27%) |

Gordon Nixon has been Chair of the Board of BCE Inc. and Bell Canada since April 2016. He was President and CEO of the Royal Bank of Canada from August 2001 to August 2014. Mr. Nixon first joined RBC Dominion Securities Inc. in 1979, and was Head of the Investment Banking Division when it was acquired by Royal Bank in 1988 and was appointed CEO of RBC Capital Markets in 1999.

Mr. Nixon is a past Chair of MaRS, a Toronto-based network of partners that helps entrepreneurs launch and grow innovative companies, and is a Trustee of the Art Gallery of Ontario. He is a Director and Chair of the Nominating, Governance and Sustainability Committee at BlackRock, Inc. and is Lead Director of George Weston Limited.

Mr. Nixon earned a Bachelor of Commerce degree with Honours from Queen’s University and was awarded honourary Doctorate of Law degrees from Queen’s University and Dalhousie University. He is a Member of the Order of Canada and the Order of Ontario, and was inducted into the Canadian Business Hall of Fame.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board (Chair) |

6/6 | 2/2 | 8/8 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| George Weston Limited |

2014–present | |

| BlackRock, Inc. |

2015–present | |

| Past boards (last five years) | ||

| N/A |

||

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

20,000 | 20,000 | ||||

| BCE DSUs |

82,547 | 68,499 | ||||

| Total Shares/DSUs (#) |

102,547 | 88,499 | ||||

| Total Value ($) |

5,349,877 | 5,264,806 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($2,625,000): Met (2.0×)

| 12 | BCE INC. 2024 PROXY CIRCULAR |

About the nominated directors 4

| Louis P. Pagnutti, FCPA, FCA (1) Toronto (Ontario) Canada

|

Corporate Director Since September 2020

Age: 65

Status: Independent

Joined Board: November 2020

Top 4 Areas of Expertise: • Accounting/Finance • CEO/Senior Management • Governance • Risk Management

2023 Annual Meeting Votes For: 368,223,920 (99.10%) |

Louis Pagnutti is a corporate director and was Global Managing Partner Business Enablement of EY (a professional services firm) and a member of EY’s Global Executive Board until his retirement in September 2020. As Global Managing Partner, he was responsible for EY’s business functions across the globe. He oversaw EY’s strategy and its execution for all functions, including technology, finance, risk management, legal, shared services, and procurement.

Mr. Pagnutti joined EY Assurance in 1981, before moving to EY Tax in 1986. From 2004 until 2010, he was Chair and CEO of EY Canada and a member of the EY Americas Executive Board. He was EY Asia-Pacific Area Managing Partner from 2010 to 2013.

Mr. Pagnutti holds an Honours Bachelor of Commerce degree from Laurentian University. He earned his Chartered Accountant designation in 1983 and was honoured with a Fellow Chartered Accountant designation in 2006.

He has served on the Sunnybrook Hospital Foundation and Pathways to Education boards. Mr. Pagnutti initiated EY Canada’s role as National Volunteer Partner of Pathways to Education, a program dedicated to helping high school students from low-income and under-represented groups complete high school and pursue post-secondary education.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Audit Committee |

5/5 | – | 5/5 | |||

| Risk and Pension Fund Committee |

5/5 | – | 5/5 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||||

| N/A |

||||

| Past boards (last five years) | ||||

| N/A |

||||

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

1,625 | 1,050 | ||||

| BCE DSUs |

15,914 | 9,962 | ||||

| Total Shares/DSUs (#) |

17,539 | 11,012 | ||||

| Total Value ($) |

915,010 | 655,104 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): November 2025 (0.7×)

| (1) | Audit Committee financial expert and audit financial expert. |

| Calin Rovinescu, C.M. Toronto (Ontario) Canada

|

Corporate Director Since February 2021

Age: 68

Status: Independent

Joined Board: April 2016

Top 4 Areas of Expertise: • CEO/Senior Management • Human Resources/Compensation • Retail/Customer • Risk Management

2023 Annual Meeting Votes For: 369,460,132 (99.44%) |

Calin Rovinescu is a corporate director, venture capital investor and senior advisor to several corporations. He served as President and Chief Executive Officer of Air Canada from April 2009 until his retirement on February 15, 2021, and also held various senior leadership roles from 2000 to 2004.

From 2004 to 2009, Mr. Rovinescu was a co-founder and Principal of Genuity Capital Markets, an independent investment bank. Prior to 2000, he was the Managing Partner of the law firm Stikeman Elliott in Montréal.

Mr. Rovinescu was Chair of the Star Alliance Chief Executive Board from 2012 to 2016 and Chair of the International Air Transport Association from 2014 to 2015.

He is a member of the Board of Directors of the Bank of Nova Scotia and a senior advisor to Brookfield Asset Management Inc. and Teneo. Mr. Rovinescu holds Bachelor of Laws degrees from Université de Montréal and the University of Ottawa and has been awarded six honourary doctorates from universities in Canada, Europe and the United States. Mr. Rovinescu served as Chancellor of the University of Ottawa from 2015 to 2022. In 2016, Mr. Rovinescu was recognized as Canada’s Outstanding CEO of the Year by the Financial Post Magazine. In 2019, he was recognized as Strategist of the Year and as Canada’s Outstanding CEO of the Year for the second time by The Globe and Mail’s Report on Business magazine. Mr. Rovinescu is a member of the Order of Canada and was inducted into the Canadian Business Hall of Fame in 2021.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Compensation Committee |

5/5 | – | 5/5 | |||

| Risk and Pension Fund Committee |

5/5 | – | 5/5 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| The Bank of Nova Scotia |

2020–present | |

| Past boards (last five years) | ||

| Air Canada |

2009–2021 | |

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

28,030 | 26,290 | ||||

| BCE DSUs |

36,811 | 29,804 | ||||

| Total Shares/DSUs (#) |

64,841 | 56,094 | ||||

| Total Value ($) |

3,382,755 | 3,337,032 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): Met (2.6×)

| 13 |

About the nominated directors 4

| Karen Sheriff Toronto (Ontario) Canada

|

Corporate Director Since October 2016

Age: 66

Status: Independent

Joined Board: April 2017

Top 4 Areas of Expertise: • CEO/Senior Management • Risk Management • Technology • Telecommunications

2023 Annual Meeting Votes For: 368,554,935 (99.19%) |

Karen Sheriff was President and CEO of Q9 Networks Inc. (a data centre services provider) from January 2015 to October 2016. Prior to her role at Q9, she was President and CEO of Bell Aliant (a telecommunications company) from 2008 to 2014, following more than nine years in senior leadership positions at BCE. Ms. Sheriff is a director of Emera Inc., and is also a past director of the Canada Pension Plan Investment Board (an investment management organization).

Early on in her career, Ms. Sheriff spent over 10 years at United Airlines, in the areas of marketing and strategy. Ms. Sheriff holds a master’s degree in Business Administration, with concentrations in Marketing and Finance, from the University of Chicago. She was named one of Canada’s top 25 Women of Influence for both 2013 and 2014 by Women of Influence Inc. In 2012, she was named Woman of the Year by Canadian Women in Communications and Technology, and has been recognized as one of Atlantic Canada’s Top 50 CEOs by Atlantic Business Magazine and one of Canada’s Top 100 Most Powerful Women on multiple occasions.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Governance Committee |

4/4 | – | 4/4 | |||

| Risk and Pension Fund Committee |

5/5 | – | 5/5 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| Emera Inc. |

2021–present | |

| Past boards (last five years) | ||

| WestJet Airlines Ltd. |

2016–2019 | |

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

6,075 | 6,075 | ||||

| BCE DSUs |

30,352 | 24,088 | ||||

| Total Shares/DSUs (#) |

36,427 | 30,163 | ||||

| Total Value ($) |

1,900,397 | 1,794,397 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): Met (1.5×)

| Jennifer Tory, C.M. Toronto (Ontario) Canada

|

Corporate Director Since December 2019

Age: 68

Status: Independent

Joined Board: April 2021

Top 4 Areas of Expertise: • CEO/Senior Management • Corporate Responsibility • Human Resources/Compensation • Retail/Customer

2023 Annual Meeting Votes For: 369,630,420 (99.48%) |

Jennifer Tory is a corporate director who was, until her retirement in December 2019, the Chief Administrative Officer of RBC (a chartered bank), where she held responsibility for Brand, Marketing, Citizenship (ESG) & Communications, Procurement and Real Estate functions globally. Prior to this role, she was Group Head, Personal & Commercial Banking, leading RBC’s retail and commercial customer businesses and operations in Canada and the Caribbean from 2014–2017.

Throughout her 42-year career, Ms. Tory held a number of key senior operating positions across retail distribution and operations, including overseeing digital and cost transformation of the business. An acknowledged community leader and fundraiser, she currently sits on the board of the Sunnybrook Hospital Foundation and is past Chair of the board of the Toronto International Film Festival. A champion of diversity, Ms. Tory is the recipient of numerous awards recognizing her work related to the advancement of women and advocacy for BIPOC and LGBTQ+ communities. She has completed her Global Competent Board Sustainability & ESG Designation and Certificate (GCB.D), which included a session on climate change and biodiversity.

Board & committee attendance during 2023

| Regular | Special | Total | ||||

| Board |

6/6 | 2/2 | 8/8 | |||

| Audit Committee |

5/5 | – | 5/5 | |||

| Compensation Committee |

5/5 | – | 5/5 | |||

| Total Board & Committee Attendance |

100% | |||||

Other public board directorships

| Present boards | ||

| Allied Properties REIT |

2020–present | |

| Past boards (last five years) | ||

| N/A |

||

Ownership and total value of equity

| December 31, 2023 | December 31, 2022 | |||||

| BCE Common Shares |

5,843 | 5,843 | ||||

| BCE DSUs |

11,807 | 6,705 | ||||

| Total Shares/DSUs (#) |

17,650 | 12,548 | ||||

| Total Value ($) |

920,801 | 746,481 | ||||

Share ownership guideline: met or target date to meet

Five-Year Target ($1,290,000): April 2026 (0.7×)

| 14 | BCE INC. 2024 PROXY CIRCULAR |

About the nominated directors 4

| Louis Vachon, C.M., O.Q. Montréal (Québec) Canada

|

Operating Partner J.C. Flowers & Co. Since January 2022

Age: 61

Status: Independent

Joined Board: October 2022

Top 4 Areas of Expertise: • CEO/Senior Management • Human Resources/Compensation • Retail/Customer • Risk Management

2023 Annual Meeting Votes For: 366,267,828 (98.58%) |

Louis Vachon is an Operating Partner at J.C. Flowers & Co. Previously, he was President and Chief Executive Officer of the National Bank of Canada, from June 2007 to November 2021. Mr. Vachon is also a corporate director who serves on the boards of directors of Alimentation Couche-Tard Inc., Groupe CH Inc. and MDA Ltd. and is involved with a number of social and cultural organizations.