UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File No. 001-39974

WEST FRASER TIMBER CO. LTD.

(Translation of registrant’s name into English)

885 West Georgia Street, Suite 1500

Vancouver, British Columbia

Canada V6C 3E8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) [ ]

-2-

SUBMITTED HEREWITH

| Exhibits | ||||

| 99.1 | Notice of Annual General Meeting of Shareholders to be held on April 24, 2024 | |||

| 99.2 | Management Information Circular dated March 6, 2024 | |||

| 99.3 | Form of Proxy | |||

| 99.4 | Financial Statements Request Form (NI 51-102 Mailing List Card) | |||

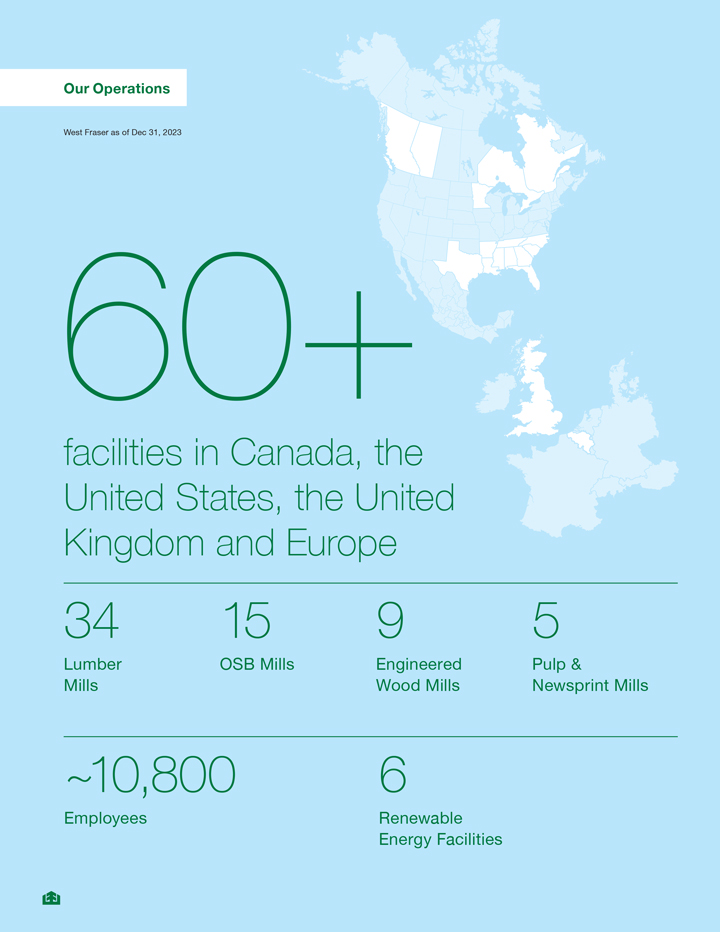

| 99.5 | 2023 Annual Report | |||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: March 19, 2024

WEST FRASER TIMBER CO. LTD.

| /s/ Christopher A. Virostek

|

| Christopher A. Virostek |

| Senior Vice-President, Finance and Chief Financial Officer |

Exhibit 99.1

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

We will hold the Meeting in Quesnel, B.C. Additionally, a live-webcast option will be provided for Shareholders to listen in and view the Meeting and ask questions.

The annual general meeting (the “Meeting”) of shareholders (“Shareholders”) of West Fraser Timber Co. Ltd. (the “Company”) will be held on April 24, 2024 at 11:00 a.m. (Vancouver time). The Meeting will be held at 1250 Brownmiller Road, Quesnel, B.C. Additionally, through our online meeting platform Registered Shareholders (as defined in the accompanying Circular) and duly appointed proxyholders will have a live-webcast option at https://web.lumiagm.com/441482273, password “westfraser2024” (case sensitive), where they can listen in and view the Meeting and ask questions. The Meeting will be held, for the following purposes:

| 1. | to receive the consolidated financial statements of the Company for the financial years ended December 31, 2023 and 2022, together with the Auditor’s report on them; |

| 2. | to fix the number of Directors at twelve; |

| 3. | to elect the Directors to hold office until the close of the next annual meeting of Shareholders; |

| 4. | to appoint an auditor of the Company to serve until the close of the next annual meeting of Shareholders and to authorize the Directors to fix the auditor’s remuneration; and |

| 5. | to consider an advisory (non-binding) resolution on the Company’s approach to executive compensation, as more particularly set out in the section of the accompanying Circular entitled “Advisory Resolution on the Company’s Approach to Executive Compensation (Say on Pay)”. |

No other matters are contemplated for consideration at the Meeting, however any permitted amendment to or variation of any matter identified in this Notice of Annual General Meeting of Shareholders (the “Notice”) may properly be considered at the Meeting. The Meeting may also consider the transaction of such other business as may properly come before the Meeting or any adjournment thereof.

A copy of the annual report of the Company for the financial year ended December 31, 2023 (the “Annual Report”) will accompany this Notice for those Shareholders that had requested a copy of the Annual Report. The Annual Report may also be found on our website (www.westfraser.com) and under our profiles on SEDAR+ (the System for Electronic Document Analysis and Retrieval) at www.sedarplus.ca and on EDGAR (Electronic Data Gathering, Analysis, and Retrieval system) at www.sec.gov/edgar. The Annual Report includes our consolidated financial statements and the Auditor’s report thereon.

Shareholders registered at the close of business on February 29, 2024 will be entitled to receive this Notice and to vote at the Meeting.

2

INFORMATION ON NOTICE AND ACCESS

(You have not been sent a physical copy of the Circular.)

General Information

The Company has prepared this Notice of the Annual General Meeting (the “Notice”) of the Company, which includes Information on Notice and Access, the Circular and a form of proxy relating to the Meeting, and the Circular contains details of the matters to be considered at the Meeting. This Notice has been prepared and mailed to you under the notice and access rules that came into effect on February 11, 2013, pursuant to applicable Canadian securities laws. Notice and access enables issuers to reduce the volume of materials that must be physically mailed to shareholders by posting the information circular and related proxy materials on the Internet. Please call Computershare Investor Services Inc. (“Computershare”) toll-free at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International) if you have any questions about notice and access procedures.

How to Access the Circular and Obtain a Physical Copy

The Circular and related proxy materials are available under our profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar, and on our website at www.westfraser.com. Shareholders are reminded to review these online materials in connection with the Meeting and before voting. Shareholders may obtain a physical copy of the Circular by: (a) calling the Company’s transfer agent, Computershare, toll free at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International); or (b) emailing a request to Computershare at service@computershare.com. A request for a physical copy of the Circular should be sent sufficiently in advance so that it is received by Computershare by April 4, 2024, in order to allow sufficient time for the Company to mail, and the Shareholder to receive, the physical copy of the Circular and return the completed form of proxy before the Proxy Deadline (defined below).

Forms of Proxy and Voting Instruction Forms (“VIFs”)

Registered Shareholders have received a form of proxy with this Notice. To have proxy votes counted in the voting at the Meeting, the deadline for submitting a completed form of proxy is 11:00 a.m. (Vancouver time) on April 22, 2024 (the “Proxy Deadline”). Please complete, date and sign the form of proxy and deliver it before the Proxy Deadline in accordance with the instructions set out in the form of proxy and in the Circular.

Non-registered Shareholders (as defined in the accompanying Circular) have received a voting instruction form with this Notice. The deadline for returning voting instruction forms is specified within the form itself. Voting instruction forms, whether provided by the Company or an intermediary, should be completed and returned in accordance with the specific instructions, and by the deadline specified, within the form. Please ensure you carefully follow the instructions set out in the voting instruction form, including those specifying to where and when the form is to be returned.

3

Please review the Circular before completing your form of proxy or voting instruction form, as the Circular contains additional information about each matter to be voted on at the Meeting. The following guide will assist you in locating the relevant disclosure for each matter.

|

For disclosure about: |

Refer to the following section(s) in the Circular |

|

|

• the fixing of the number of Directors at twelve |

“Fixing the Number and Election of Directors” | |

|

• the election of Directors

|

“Information Regarding Nominees for Election as Directors” | |

|

• the appointment of the Company’s auditor |

“Appointment of the Auditor” | |

|

• the approval of the Company’s approach to executive compensation |

“Advisory Resolution on the Company’s Approach to Executive Compensation (Say on Pay)” | |

A Shareholder who is unable to attend the Meeting in person and who wishes to ensure that such Shareholder’s shares are voted must complete, date and sign an acceptable form of proxy or voting instruction form and deliver it in accordance with the instructions set out in the enclosed form of proxy or voting instruction form and in the Circular.

DATED at Vancouver, B.C., March 6, 2024.

| BY ORDER OF THE BOARD

|

||

|

|

||

| Sean McLaren | ||

| President and Chief Executive Officer | ||

Exhibit 99.2

West Fraser Timber Co. Ltd.

Notice of Annual General

Meeting of Shareholders

To Be Held April 24, 2024

Management Information Circular

Your Participation is Important

Please Take the Time to Vote

WHAT’S INSIDE

| INVITATION TO SHAREHOLDERS |

1 | |||

| NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS |

1 | |||

| MANAGEMENT INFORMATION CIRCULAR |

1 | |||

| DEFINITIONS |

1 | |||

| ADDITIONAL INFORMATION REGARDING THE MEETING |

5 | |||

| FREQUENTLY ASKED QUESTIONS |

7 | |||

| VOTING BY NON-REGISTERED SHAREHOLDERS |

11 | |||

| BUSINESS TO BE TRANSACTED AT THE MEETING |

12 | |||

| INFORMATION REGARDING NOMINEES FOR ELECTION AS DIRECTORS |

13 | |||

| BOARD RENEWAL |

26 | |||

| DIRECTOR COMPENSATION |

29 | |||

| VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS |

33 | |||

| APPOINTMENT OF THE AUDITOR |

34 | |||

| ADVISORY RESOLUTION ON THE COMPANY’S APPROACH TO EXECUTIVE COMPENSATION (SAY ON PAY) |

35 | |||

| OUR CORPORATE GOVERNANCE POLICIES AND PROCEDURES |

36 | |||

| GOVERNANCE POLICY |

36 | |||

| CHAIR OF THE BOARD |

36 | |||

| GOVERNANCE & NOMINATING COMMITTEE |

37 | |||

| MAJORITY VOTING POLICY |

37 | |||

| ADVANCE NOTICE POLICY |

38 | |||

| CODE OF CONDUCT |

38 | |||

| ANTI-TRUST POLICY |

39 | |||

| SUPPLY CHAIN & HUMAN RIGHTS POLICY AND SUPPLIER CODE OF CONDUCT |

39 | |||

| ANTI-BRIBERY AND ANTI-CORRUPTION POLICY |

39 | |||

| CHARTERS |

40 | |||

| MINIMUM EQUITY HOLDING |

40 | |||

| MANDATE OF THE BOARD |

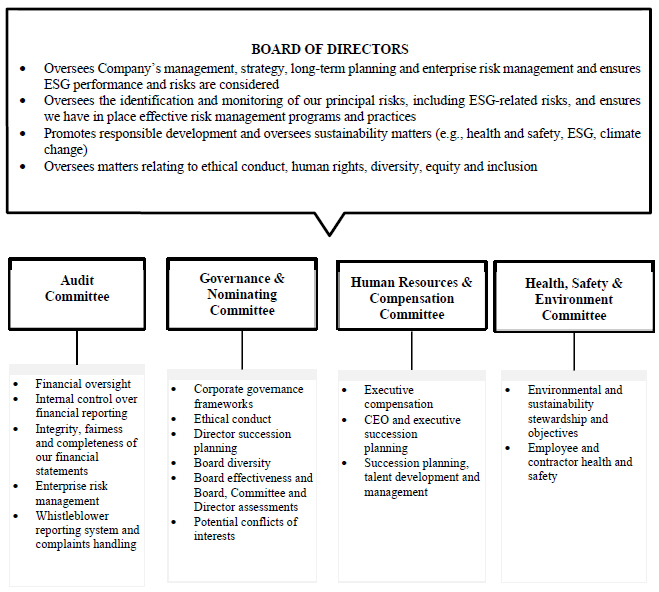

41 | |||

| ESG OVERSIGHT |

42 | |||

| CORPORATE DISCLOSURE POLICY |

44 | |||

| AUDIT COMMITTEE |

45 | |||

| DECISIONS REQUIRING PRIOR APPROVAL BY THE BOARD |

46 | |||

| SHAREHOLDER FEEDBACK AND CONCERNS |

47 | |||

| EXPECTATIONS OF MANAGEMENT |

47 | |||

| COMPOSITION OF THE BOARD |

48 | |||

| BOARD DIVERSITY POLICY |

50 | |||

| SERVING ON OTHER BOARDS |

51 | |||

| COMMITTEES OF THE BOARD |

51 | |||

| ORIENTATION PROGRAM AND CONTINUING EDUCATION |

54 | |||

| MEETING ATTENDANCE RECORD |

57 | |||

| EXECUTIVE COMPENSATION DISCUSSION & ANALYSIS |

58 | |||

| HUMAN RESOURCES & COMPENSATION COMMITTEE RESPONSIBILITY |

58 | |||

| COMPOSITION OF THE HR&C COMMITTEE |

58 | |||

| REPORT ON EXECUTIVE COMPENSATION |

59 | |||

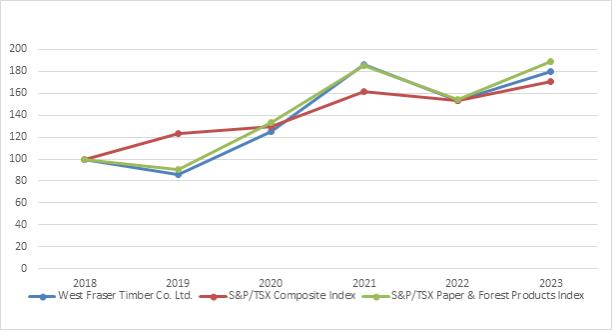

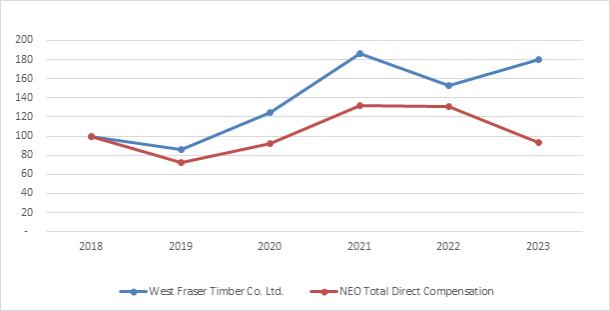

| PERFORMANCE GRAPH |

69 | |||

| EXECUTIVE COMPENSATION |

70 | |||

| SUMMARY COMPENSATION TABLE |

71 | |||

| OPTION GRANTS |

72 | |||

| RS UNITS AND PS UNITS |

77 | |||

| PENSION PLANS |

79 | |||

| SEVERANCE AND CHANGE OF CONTROL AGREEMENTS |

82 | |||

| DIRECTORS’ COMPENSATION AND HOLDINGS |

83 | |||

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

83 | |||

| INDEBTEDNESS OF DIRECTORS, OFFICERS AND EMPLOYEES |

83 | |||

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

84 | |||

| ADDITIONAL INFORMATION |

84 |

INVITATION TO SHAREHOLDERS

We will hold the Meeting in Quesnel, B.C. with a live-webcast option for Shareholders to listen in and view the Meeting and ask questions.

March 6, 2024

Dear Shareholder:

You are invited to attend the annual general meeting (the “Meeting”) of shareholders (“Shareholders”) of West Fraser Timber Co. Ltd. (the “Company”), which will take place on April 24, 2024 at 11:00 a.m. (Vancouver time) at 1250 Brownmiller Road, Quesnel, B.C. Additionally, through the online meeting platform, Registered Shareholders and proxyholders (including non-registered Shareholders who have duly appointed themselves as proxyholder) will have a live-webcast option at https://web.lumiagm.com/441482273, password “westfraser2024” (case sensitive) to be able to listen in and view the Meeting and ask questions.

The items of business to be considered at the Meeting are described in the accompanying notice of annual general meeting (the “Notice”) and management information circular (the “Circular”).

Your participation and views are very important to us. You are encouraged to vote, which can be done by following the instructions enclosed with these materials. Whether or not you plan to attend the Meeting, please submit your vote as soon as possible to ensure your views are represented at the Meeting. You can vote online or by phone, fax, mail or in person at the Meeting.

At the Meeting, in addition to dealing with the matters described in the Notice, we will review the affairs of the Company. Also, you will have an opportunity to ask questions.

All of our public documents, including the annual report of the Company for the financial year ended December 31, 2023 and quarterly reports, are available on our website at www.westfraser.com. You are encouraged to access our website during the year for continuous disclosure items, including news releases and investor presentations.

We look forward to your participation at the Meeting.

| Yours sincerely, |

|

|

| Sean McLaren |

| President and Chief Executive Officer |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

We will hold the Meeting in Quesnel, B.C. Additionally, a live-webcast option will be provided for Shareholders to listen in and view the Meeting and ask questions.

The annual general meeting (the “Meeting”) of shareholders (“Shareholders”) of West Fraser Timber Co. Ltd. (the “Company”) will be held on April 24, 2024 at 11:00 a.m. (Vancouver time). The Meeting will be held at 1250 Brownmiller Road, Quesnel, B.C. Additionally, through our online meeting platform Registered Shareholders (as defined in the accompanying Circular) and duly appointed proxyholders will have a live-webcast option at https://web.lumiagm.com/441482273, password “westfraser2024” (case sensitive), where they can listen in and view the Meeting and ask questions. The Meeting will be held, for the following purposes:

| 1. | to receive the consolidated financial statements of the Company for the financial years ended December 31, 2023 and 2022, together with the Auditor’s report on them; |

| 2. | to fix the number of Directors at twelve; |

| 3. | to elect the Directors to hold office until the close of the next annual meeting of Shareholders; |

| 4. | to appoint an auditor of the Company to serve until the close of the next annual meeting of Shareholders and to authorize the Directors to fix the auditor’s remuneration; and |

| 5. | to consider an advisory (non-binding) resolution on the Company’s approach to executive compensation, as more particularly set out in the section of the accompanying Circular entitled “Advisory Resolution on the Company’s Approach to Executive Compensation (Say on Pay)”. |

No other matters are contemplated for consideration at the Meeting, however any permitted amendment to or variation of any matter identified in this Notice of Annual General Meeting of Shareholders (the “Notice”) may properly be considered at the Meeting. The Meeting may also consider the transaction of such other business as may properly come before the Meeting or any adjournment thereof.

A copy of the annual report of the Company for the financial year ended December 31, 2023 (the “Annual Report”) will accompany this Notice for those Shareholders that had requested a copy of the Annual Report. The Annual Report may also be found on our website (www.westfraser.com) and under our profiles on SEDAR+ (the System for Electronic Document Analysis and Retrieval) at www.sedarplus.ca and on EDGAR (Electronic Data Gathering, Analysis, and Retrieval system) at www.sec.gov/edgar. The Annual Report includes our consolidated financial statements and the Auditor’s report thereon.

Shareholders registered at the close of business on February 29, 2024 will be entitled to receive this Notice and to vote at the Meeting.

- 2 -

INFORMATION ON NOTICE AND ACCESS

(You have not been sent a physical copy of the Circular.)

General Information

The Company has prepared this Notice of the Annual General Meeting (the “Notice”) of the Company, which includes Information on Notice and Access, the Circular and a form of proxy relating to the Meeting, and the Circular contains details of the matters to be considered at the Meeting. This Notice has been prepared and mailed to you under the notice and access rules that came into effect on February 11, 2013, pursuant to applicable Canadian securities laws. Notice and access enables issuers to reduce the volume of materials that must be physically mailed to shareholders by posting the information circular and related proxy materials on the Internet. Please call Computershare Investor Services Inc. (“Computershare”) toll-free at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International) if you have any questions about notice and access procedures.

How to Access the Circular and Obtain a Physical Copy

The Circular and related proxy materials are available under our profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar, and on our website at www.westfraser.com. Shareholders are reminded to review these online materials in connection with the Meeting and before voting. Shareholders may obtain a physical copy of the Circular by: (a) calling the Company’s transfer agent, Computershare, toll free at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International); or (b) emailing a request to Computershare at service@computershare.com. A request for a physical copy of the Circular should be sent sufficiently in advance so that it is received by Computershare by April 4, 2024, in order to allow sufficient time for the Company to mail, and the Shareholder to receive, the physical copy of the Circular and return the completed form of proxy before the Proxy Deadline (defined below).

Forms of Proxy and Voting Instruction Forms (“VIFs”)

Registered Shareholders have received a form of proxy with this Notice. To have proxy votes counted in the voting at the Meeting, the deadline for submitting a completed form of proxy is 11:00 a.m. (Vancouver time) on April 22, 2024 (the “Proxy Deadline”). Please complete, date and sign the form of proxy and deliver it before the Proxy Deadline in accordance with the instructions set out in the form of proxy and in the Circular.

Non-registered Shareholders (as defined in the accompanying Circular) have received a voting instruction form with this Notice. The deadline for returning voting instruction forms is specified within the form itself. Voting instruction forms, whether provided by the Company or an intermediary, should be completed and returned in accordance with the specific instructions, and by the deadline specified, within the form. Please ensure you carefully follow the instructions set out in the voting instruction form, including those specifying to where and when the form is to be returned.

- 3 -

Please review the Circular before completing your form of proxy or voting instruction form, as the Circular contains additional information about each matter to be voted on at the Meeting. The following guide will assist you in locating the relevant disclosure for each matter.

|

For disclosure about: |

Refer to the following section(s) in the Circular |

|

|

• the fixing of the number of Directors at twelve |

“Fixing the Number and Election of Directors” | |

|

• the election of Directors

|

“Information Regarding Nominees for Election as Directors” | |

|

• the appointment of the Company’s auditor |

“Appointment of the Auditor” | |

|

• the approval of the Company’s approach to executive compensation |

“Advisory Resolution on the Company’s Approach to Executive Compensation (Say on Pay)” | |

A Shareholder who is unable to attend the Meeting in person and who wishes to ensure that such Shareholder’s shares are voted must complete, date and sign an acceptable form of proxy or voting instruction form and deliver it in accordance with the instructions set out in the enclosed form of proxy or voting instruction form and in the Circular.

DATED at Vancouver, B.C., March 6, 2024.

| BY ORDER OF THE BOARD |

|

|

| Sean McLaren |

| President and Chief Executive Officer |

1

MANAGEMENT INFORMATION CIRCULAR

(As of the Record Date, except as otherwise provided)

This Circular is furnished in connection with the solicitation of proxies by the management of West Fraser for use at the Meeting to be held on April 24, 2024 at 11:00 a.m. (Vancouver time) in Quesnel, B.C. (and at any adjournment thereof) for the purposes set out in the attached Notice.

DEFINITIONS

Unless stated otherwise, in this Circular:

“2024 NCIB” has the meaning set out in “Voting Securities and Principal Shareholders – Share Repurchases”;

“2023 NCIB” has the meaning set out in “Voting Securities and Principal Shareholders – Share Repurchases”;

“$” means Canadian dollars;

“Annual Information Form” means the annual information form of the Company for the financial year ended December 31, 2023;

“Annual Report” means the annual report of the Company for the financial year ended December 31, 2023;

“Articles” means the latest Notice of Articles issued by the British Columbia Registrar of Companies and the corporate Articles of the Company;

“Auditor” means our external auditor, currently PricewaterhouseCoopers LLP;

“B.C.” means British Columbia;

“BCA” means the Business Corporations Act (British Columbia), R.S.B.C. 2002, c.57, as amended;

“Board” or “Board of Directors” means our board of Directors as presently constituted or proposed to be constituted;

“Bonus Plan” has the meaning set out in “Executive Compensation Discussion & Analysis – Report on Executive Compensation – Annual Incentive Bonus Plan”;

“Cash Value Alternative” has the meaning set out in “Executive Compensation Discussion & Analysis – Report on Executive Compensation – Long-Term Incentive Component – Stock Option Plan – Annual Burn Rate”;

“CEO” means our Chief Executive Officer;

“CFO” means our Chief Financial Officer;

“Chair” or “Chair of the Board” has the meaning set out in “Our Corporate Governance Policies and Procedures – Chair of the Board”; “Circular” means this management information circular;

2

“Class B Shares” means the Class B Common shares in the capital of West Fraser;

“Closing Price” has the meaning set out in “Information Regarding Nominees for Election as Directors – Director Compensation – Direct and Indirect Share and Other Holdings of Current and Proposed Directors (as at the Record Date)”;

“Code of Conduct” has the meaning set out in “Our Corporate Governance Policies and Procedures – Code of Conduct”;

“Committees” means the committees of the Board;

“Computershare” means Computershare Investor Services Inc., our transfer agent;

“Corporate Disclosure Policy” has the meaning set out in “Our Corporate Governance Policies and Procedures – Corporate Disclosure Policy”;

“Director” means a director of the Company;

“Disclosure Committee” has the meaning set out in “Our Corporate Governance Policies and Procedures – Corporate Disclosure Policy”;

“DSU Plan” means our Director Deferred Share Unit Plan;

“DS Unit” means a Deferred Share Unit granted under our DSU Plan;

“EDGAR” means the U.S. Securities and Exchange Commission’s Electronic Data Gathering, Analysis, and Retrieval system;

“Equity Holding Requirements Policy” has the meaning set out in “Executive Compensation Discussion & Analysis – Report on Executive Compensation – Executive Equity Holding Requirements”;

“Exchange Ratio” means the exchange ratio of 0.675 of a Common share for each Norbord Share acquired by the Company in connection with the Norbord Acquisition;

“Governance Committee” means the Governance & Nominating Committee of the Board;

“Governance Policy” has the meaning set out in “Our Corporate Governance Policies and Procedures – Governance Policy”;

“HR&C Committee” means the Human Resources & Compensation Committee of the Board;

“Meeting” means the annual general meeting of Shareholders to be held on April 24, 2024 and any adjournment of it;

“NI 52-110” has the meaning set out in “Our Corporate Governance Policies and Procedures – Composition of the Board – Independence”;

“NI 54-101” means National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer; “Non-registered Shareholder” means any Shareholder who is not a Registered Shareholder;

3

“Notice” means the notice of annual general meeting of Shareholders, which accompanies this Circular;

“Norbord” means Norbord Inc.;

“Norbord Acquisition” means the acquisition by the Company of all of the issued and outstanding Norbord Shares, which occurred on February 1, 2021;

“Norbord Continuing Executives” means the holders of Norbord Options, Norbord RSUs and Norbord DSUs who have continued as officers and employees of the Company following completion of the Norbord Acquisition;

“Norbord DSUs” means the outstanding deferred share units credited under certain Norbord deferred share unit plans, which have been adjusted by the Exchange Ratio and are to be paid out in reference to the Common shares following completion of the Norbord Acquisition;

“Norbord Options” means the outstanding options to purchase Norbord Shares granted under or otherwise subject to certain Norbord stock option plans, which have been exchanged for, or are otherwise characterized as, Replacement Options following completion of the Norbord Acquisition;

“Norbord RSUs” means the outstanding restricted share units credited under the Norbord restricted share unit plan, which have been adjusted by the Exchange Ratio and are to be paid out in reference to the Common shares following completion of the Norbord Acquisition;

“Norbord Shares” means the common shares in the capital of Norbord;

“NYSE” means the New York Stock Exchange;

“Options” means share purchase options granted under the Stock Option Plan;

“Phantom Share Unit Plan” means the plan described as set out in “Executive Compensation Discussion & Analysis – Report on Executive Compensation – Long-Term Incentive Component – Phantom Share Unit Plan”;

“PS Unit” or “PSU” means a performance share unit granted under our Phantom Share Unit Plan;

“Record Date” means February 29, 2024;

“Registered Shareholder” means a Shareholder who is in possession of a physical share certificate registered in their name or who appears as the Registered Shareholder in the records of Computershare;

“Replacement Option Plans” has the meaning set out in “Executive Compensation Discussion & Analysis – Option Grants – Description of Replacement Option Plans”;

“Replacement Options” means the options to purchase Common shares that are held by former holders of Norbord Options following completion of the Norbord Acquisition;

“ROSE” has the meaning set out in “Executive Compensation Discussion & Analysis – Report on Executive Compensation – Annual Incentive Bonus Plan”;

“RS Unit” means a restricted share unit granted under our Phantom Share Unit Plan; “SEC” means the U.S. Securities and Exchange Commission;

4

“SEDAR+” means the System for Electronic Document Analysis and Retrieval, a filing system developed for the Canadian securities regulatory authorities;

“Shares” or “Common shares” means the common shares in the capital of West Fraser, as currently constituted and that are currently listed and posted for trading on the TSX and the NYSE under the symbol “WFG”;

“Shareholder” means a holder of any Share or Class B Share, as the context requires;

“Stock Dividend” means the stock dividend of one Common share declared and issued in respect of each issued and outstanding Common share in the capital of the Company and each issued and outstanding Class B Share and paid to Shareholders on January 13, 2014;

“Stock Option Plan” means the West Fraser Timber Co. Ltd. Stock Option Plan, as amended;

“Towers Watson” has the meaning set out in “Executive Compensation Discussion & Analysis – Report on Executive Compensation”;

“TSR” has the meaning set out in “Executive Compensation Discussion & Analysis – Report on Executive Compensation – Long-Term Incentive Component – Phantom Share Unit Plan”;

“TSX” means the Toronto Stock Exchange;

“U.S.” means the United States of America, its territories, any State of the United States and the District of Columbia;

“U.S. ESPP” means the United States Employee Stock Purchase Plan;

“VWAP” means Volume Weighted Average Price; and

“West Fraser”, “Company”, “we”, “us” or “our” means West Fraser Timber Co. Ltd.

5

ADDITIONAL INFORMATION REGARDING THE MEETING

We will hold the Meeting in Quesnel, B.C. Additionally, a live-webcast option will be provided to Shareholders to listen in and view the Meeting and ask questions. Shareholders will be able to access the live-webcast at https://web.lumiagm.com/441482273, password “westfraser2024” (case sensitive), where they can listen in and view the Meeting and ask questions.

Registered Shareholders and duly appointed proxyholders (including Non-registered Shareholders who have duly appointed themselves as proxyholder) will have a live-webcast option where they can listen in and view the Meeting and ask questions, provided they are connected to the Internet and follow the instructions in this Circular. Non-registered Shareholders who have not duly appointed themselves as proxyholder will be able to use the live-webcast option as guests but will not be able to ask questions.

Shareholders who wish to appoint a person other than the management nominees identified in the form of proxy or voting instruction form (including a Non-registered Shareholder who wishes to appoint themselves as their own proxy to use the live webcast) must carefully follow the instructions set out in this Circular and on their form of proxy or voting instruction form. These instructions include the additional step of registering such proxyholder with Computershare, after submitting the form of proxy or voting instruction form. Failure to register the proxyholder with Computershare will result in the proxyholder not receiving a 15-digit control number required to ask questions in the Meeting, which would only allow the proxyholder to attend the Meeting as a guest. Guests will be able only to listen to the Meeting but will not be able to ask questions.

Your vote is important. Good corporate governance begins with Shareholder participation. If you cannot attend the Meeting or if you plan to attend but prefer the convenience of voting in advance, we encourage you to exercise your vote using either of the voting methods described below. Please read pages 7 through 11 for answers to commonly asked questions regarding voting and proxies.

How to Vote

You have two ways to vote:

| 1. | you may vote in person at the Meeting; or |

| 2. | by submitting your form of proxy or voting instruction form in accordance with the instructions set out therein. |

If a Registered Shareholder is a body corporate or association, the form of proxy must be signed by a person duly authorized by that body corporate or association. Completing, signing and returning a form of proxy will not prevent you from attending the Meeting in person. As the Company is relying on notice and access provisions of applicable Canadian securities laws, the Notice and form of proxy is being sent to Registered Shareholders.

How to Ask Questions at the Meeting

Shareholders will have an opportunity to ask questions in person and online (as applicable) by following the procedures set out below.

| 1. | Registered Shareholders and proxyholders (including Non-registered Shareholders who have duly appointed themselves as proxyholder) attending the Meeting in person will have an opportunity to ask questions at the Meeting during the Q&A session. |

6

| 2. | Registered Shareholders and proxyholders (including Non-registered Shareholders who have duly appointed themselves as proxyholder) and are following the Meeting online will have an opportunity to ask questions through the webcast platform. To do so, they will need to obtain a control number by following the instructions provided below. Once they have registered and obtained a control number and are logged into the online platform, they should select the messaging icon and type the question within the chat box at the bottom of the messaging screen. Once satisfied with the question, the Shareholder or proxyholder should click the arrow button to submit the question to the Chair of the Meeting. All submitted questions will be moderated before being sent to the Chair of the Meeting. Questions can be submitted at any time during the Q&A session up until the Chair of the Meeting closes the session. |

It is anticipated that Shareholders will have substantially the same opportunity to ask questions online on matters of business during the Meeting as if they attend the Meeting in person.

How Shareholders and appointees can obtain a control number to ask questions during the Meeting

| ● | Registered Shareholders: Registered Shareholders can find their control number on their proxy form. |

| ● | Non-registered Shareholders and Appointees: Non-registered Shareholders and duly appointed proxyholders must complete the additional step of registering as a proxyholder by calling Computershare at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International) by no later than 11:00 a.m. (Vancouver time) on April 22, 2024. Non-registered Shareholders and proxyholders who have not appointed themselves as proxyholder will not receive a control number, which is required to ask questions at the Meeting. |

Non-registered Shareholders who have not duly appointed themselves as proxyholder and registered with Computershare will not be able to ask questions at the Meeting but will be able to follow the proceedings as a guest.

Technical Assistance

Shareholders with questions regarding the live-webcast platform or requiring assistance accessing the Meeting website should visit the provider’s website at https://www.lumiglobal.com/faq. Furthermore, should a Shareholder wish to speak with a Computershare representative concerning the live-webcast, both a live chat service and a contact ticket system are available through the website above.

If you are accessing the Meeting using the live-webcast, you must remain connected to the Internet at all times during the Meeting in order to listen in, view the Meeting and ask questions. It is your responsibility to ensure Internet connectivity for the duration of the Meeting. Note that if you lose connectivity once the Meeting has commenced, there may be insufficient time to resolve your issue before the Meeting is completed.

7

FREQUENTLY ASKED QUESTIONS

| Q. | Am I entitled to vote? |

A. Holders of Shares at the close of business on the Record Date of February 29, 2024 and their duly appointed representatives are eligible to vote. Each Share is entitled to one vote.

| Q. | How do I vote? |

A. If you are a Registered Shareholder, you may vote your Shares by appointing a proxyholder to attend the Meeting and vote on your behalf. Voting by proxy is the easiest way to vote because you do not have to attend the Meeting. Instead, you appoint the persons named in the form of proxy or another person or entity of your choosing, who need not be a Shareholder, to represent you as a proxyholder and vote your Shares at the Meeting. A proxy will not be valid unless it is dated and signed by the Registered Shareholder or by the Registered Shareholder’s attorney with proof that they are authorized to sign and is completed according to the instructions therein.

There are different ways to submit your voting instructions depending on whether you are a Registered Shareholder or a Non-registered Shareholder. If your Shares are held in an account with a bank, trust company, securities broker, trustee or other intermediary, please refer to “Voting by Non-registered Shareholders”.

See “How to Vote” for further details on how to vote.

| Q. | What am I voting on? |

A. You will be asked to vote on the following matters:

| ● | fixing the number of Directors at 12; |

| ● | the election of Directors to hold office until the close of the next annual meeting of Shareholders; |

| ● | the appointment of PricewaterhouseCoopers LLP as our auditor until the close of the next annual meeting of Shareholders, at a remuneration to be fixed by the Directors; and |

| ● | the advisory (non-binding) resolution on the Company’s approach to executive compensation. |

| Q. | What if amendments are made to these matters or if other matters are brought before the Meeting? |

A. If you attend the Meeting and are eligible to vote, you may vote on such matters as you choose.

If you have completed and returned a proxy in the form enclosed, the persons named in it will have discretionary authority with respect to amendments or variations to matters identified in the Notice and to other matters which properly come before the Meeting. If any other matter properly comes before the Meeting, the persons so named will vote on it in accordance with their best judgment. As of the date of this Circular, our management does not know of any such amendment, variation or other matter expected to come before the Meeting.

8

| Q. | Who is soliciting my proxy? |

A. The management of West Fraser is soliciting your proxy. Solicitation of proxies is done primarily by mail, supplemented by telephone or other contact, by Company employees, and the Company bears all associated costs.

This Circular is prepared under the notice and access rules that came into effect on February 11, 2013 pursuant to applicable Canadian securities laws. Accordingly, this Circular is being posted on the Internet instead of being mailed to either Registered Shareholders or Non-registered Shareholders. This Circular and related proxy materials are available under our profiles on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar, and on our website at www.westfraser.com. Shareholders are reminded to review these materials online in connection with the Meeting and before voting. Shareholders may obtain a physical copy of this Circular by: (a) calling Computershare, toll free at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International); or (b) emailing a request to Computershare at service@computershare.com. A request for a physical copy of this Circular should be sent sufficiently in advance so that it is received by Computershare by April 4, 2024 in order to allow sufficient time for the Shareholder to receive the physical copy of this Circular and return the proxy by its due date.

| Q. | How do I know if I am a “Registered” Shareholder or a “Non-registered” Shareholder? |

A. You may own Shares in one or both of the following ways:

1. If you are in possession of a physical share certificate in your name or you appear as the Registered Shareholder in the records of Computershare, you are a “Registered Shareholder” and your name and address are known to West Fraser through Computershare.

2. If you own Shares through a bank, trust company, securities broker, trustee or other intermediary, you are a “Non-registered Shareholder” and you will not have a physical share certificate. In this case, you will have an account statement from your bank or broker as evidence of your Share ownership.

Most Shareholders are Non-registered Shareholders. The Shares of Non-registered Shareholders are registered in the name of an intermediary, such as a bank, trust company, securities broker, trustee, custodian or other nominee who holds the Shares in a nominee account or in the name of such nominee, or in the name of a clearing agency in which the intermediary is a participant (such as CDS). Intermediaries have obligations to forward Meeting materials to such Non-registered Shareholders unless instructed otherwise by the holder (and as required by regulation in some cases, despite such instructions).

Non-registered Shareholders fall into two categories — those who object to their identity being known to the issuers of the securities which they own (“OBOs”) and those who do not object to their identity being made known to the issuers of the securities which they own (“NOBOs”). Subject to the provisions of NI 54-101, issuers may request and obtain a list of their NOBOs from intermediaries directly or via their transfer agent and may obtain and use the NOBO list for the distribution of proxy-related materials to such NOBOs. These securityholder materials are being sent to both registered and non-registered owners of securities of the Company. If you are a non-registered owner (a NOBO or an OBO) and the Company or its agent has sent the Meeting materials directly to you, your name, address and information about your holdings of Common shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding the Common shares on your behalf. The Company’s OBOs can expect to be contacted by their intermediary. The Company does not intend to pay for intermediaries to deliver the Meeting materials to OBOs and it is the responsibility of such intermediaries to ensure delivery of the Meeting materials to their OBOs.

9

| Q. | Must I use the enclosed form of proxy? |

A. No. If you do not wish to use the enclosed proxy form, you may use any other form of proxy to appoint your proxyholder, although the Articles require that a form of proxy be substantially in the form enclosed.

| Q. | Can I appoint someone to vote my Shares other than persons named in the enclosed form of proxy? |

A. Yes. Shareholders who wish to appoint a person other than the management nominees identified in the form of proxy or voting instruction form (including a Non-registered Shareholder who wishes to appoint themselves as their own proxy to attend the Meeting) must carefully follow the instructions in this Circular and on their form of proxy or voting instruction form. These instructions include the additional step of registering such proxyholder with Computershare, after submitting the form of proxy or voting instruction form. Failure to register the proxyholder with Computershare, which will result in the proxyholder not receiving a 15-digit control number to ask questions in the Meeting and, consequently such proxyholder will only be able to follow the Meeting as a guest. Guests may only listen to the Meeting but will not be able to ask questions.

| Q. | What if my Shares are registered in more than one name or in the name of my company? |

A. If your Shares are registered in more than one name, all those registered must sign the form of proxy. If your Shares are registered in the name of your company or any name other than yours, we may require that you provide documentation that proves you are authorized to sign the form of proxy.

| Q. | What if I plan to attend the Meeting and vote at the Meeting? |

A. If you are a Registered Shareholder and plan to attend the Meeting and you wish to vote your Shares at the Meeting, do not complete or return a form of proxy. Your vote will be taken and counted at the Meeting.

If your Shares are not registered in your name, but you wish to attend the Meeting, please see “Voting by Non-registered Shareholders”.

| Q. | What happens when I sign and return a form of proxy? |

A. You will have given authority to whomever you have appointed as your proxyholder to vote your Shares at the Meeting in accordance with the voting instructions you provide.

| Q. | What do I do with my completed form of proxy? |

A. You must deposit your completed form of proxy (by mail, telephone, fax or online) with Computershare no later than 11:00 a.m. (Vancouver time) on April 22, 2024, or at least 48 hours (excluding Saturdays, Sundays and holidays) prior to the time of any adjournment or postponement of the Meeting. The Chair of the Meeting has the discretion to accept or reject any late proxies, and can waive or extend the deadline for receiving proxy voting instructions without notice. If you hold Shares through an intermediary you should refer to “Voting by Non-registered Shareholders”.

10

| Q. | How will my Shares be voted if my proxy is in the enclosed form with no other person named as proxyholder? |

A. The persons named in it will vote or withhold from voting your Shares in accordance with your instructions. In the absence of such instructions, however, your Shares will be voted FOR fixing the number of Directors at 12, FOR the election of the Directors nominated by management, FOR the appointment of the Auditor and FOR the advisory (non-binding) resolution on the Company’s approach to executive compensation.

| Q. | If I change my mind, can I revoke my proxy once I have given it? |

A. In addition to revocation in any other manner permitted by law, a Registered Shareholder who has completed a form of proxy may revoke it by:

| ● | executing a new form of proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder’s authorized attorney in writing or, if the Registered Shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the form of proxy bearing a later date or notice of revocation to Computershare, or to the Company’s registered office at Royal Centre, Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, V6E 4N7, at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the Chair of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or |

| ● | personally attending the Meeting and voting at the Meeting. |

A revocation of a form of proxy will not affect a matter on which a vote is taken before the revocation.

Non-registered Shareholders who wish to change their vote must, within sufficient time in advance of the Meeting, arrange for their respective intermediaries to change their vote.

| Q. | What documents are sent to Shareholders? |

A. Registered Shareholders who have provided us with the required request will receive a package of the usual annual corporate documents (our Annual Report, our consolidated financial statements for the years ended December 31, 2023 and 2022 and Auditor’s report and management’s discussion and analysis thereon), along with the Notice and the form of proxy.

Our Circular may be accessed under our profiles on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov/edgar, and on our website at www.westfraser.com.

Copies of our Annual Report, including our consolidated financial statements and Auditor’s report and management’s discussion and analysis thereon, are filed with Canadian securities regulators and are available under our profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar, and may also be obtained, without charge, upon request by contacting Robert B. Winslow, CFA, Director, Investor Relations & Corporate Development at (416) 777-4426 or by email at shareholder@westfraser.com.

11

| Q. | Who are our Principal Shareholders? |

A. The Principal Shareholders (persons or companies that beneficially own or exercise control or direction over, directly or indirectly, more than 10% of a class of our outstanding Shares) are set out in this Circular under the heading “Voting Securities and Principal Shareholders”.

| Q. | What if I have other questions? |

A. If you have a question regarding the Meeting, please contact our transfer agent as set out below, the Vice-President, General Counsel of the Company at (604) 895-2700 or by email at shareholder@westfraser.com.

| Q. | How can I contact the transfer agent? |

A. You can contact the transfer agent at:

Computershare Investor Services Inc.

8th Floor, 100 University Avenue

Toronto, Ontario M5J 2Y1

Phone: 1-800-564-6253 (North American toll free) or

514-982-7555 (International).

Fax: 1-888-453-0330 (North America toll free or

416-263-9524 (International)

Online: www.computershare.com/service

VOTING BY NON-REGISTERED SHAREHOLDERS

| Q. | If my Shares are not registered in my name, how do I vote my Shares? |

A. Our share register does not list Non-registered Shareholders. The Shares of Non-registered Shareholders are usually held in the name of an intermediary or a “nominee”, such as a trust company, securities broker or other financial institution. If you are a Non-registered Shareholder, there are two ways that you can vote your Shares:

| 1. | By providing voting instructions to your nominee |

Applicable securities laws require institutional nominees to seek voting instructions from you in advance of the Meeting. Accordingly, you will receive, or have already received with these materials, from your nominee, either a voting instruction form or a form of proxy for the number of Shares you hold with that nominee. Every institutional nominee has its own mailing procedures and provides its own signing and return instructions, which you should follow carefully to ensure that your Shares are voted at the Meeting.

As the Company is relying on notice and access provisions of applicable Canadian securities law, the Notice and voting instruction form are being sent to both Non-registered Shareholders and Registered Shareholders.

| 2. | By being appointed as Proxy and attending the Meeting |

The Company generally does not have access to the names of its Non-registered Shareholders. Therefore, if you attend the Meeting, the Company will have no record of your shareholdings or of your entitlement to vote unless you have directed your nominee to appoint you as proxyholder.

12

If you wish to attend the Meeting and vote your Shares, insert your own name in the space provided on the voting instruction form or form of proxy provided by your nominee to appoint yourself as proxyholder. If you are a Non-registered Shareholder and instruct your nominee to appoint yourself as proxyholder, you must follow the additional steps set out above under the headings “Forms of Proxy and Voting Instruction Forms” and “How to Vote – How Shareholders and appointees can obtain a control number to ask questions during the Meeting”.

BUSINESS TO BE TRANSACTED AT THE MEETING

(See Notice of Annual Meeting of Shareholders)

1) Presentation of Financial Statements

The consolidated financial statements of the Company for the financial years ended December 31, 2023 and 2022 and the Auditor’s report thereon will be submitted to Shareholders at the Meeting, but no vote with respect to them is required or proposed to be taken. The consolidated financial statements are included in our Annual Report which is being mailed to those Shareholders who have provided us with the required request.

2) Fixing the Number and Election of Directors

Management is seeking approval to fix the number of Directors at 12 which is the current number of Directors of the Board.

The table of nominees on the following pages sets out the name, background and experience of each person proposed to be nominated for election as a Director, as well as other relevant information. Management of the Company recommends the election of the 12 nominees set out in the table of nominees to fill the 12 positions as Director. The term of office of each current Director will expire at the conclusion of the Meeting. Each Director elected at the Meeting will hold office until the conclusion of the next annual meeting of Shareholders at which a successor Director is elected, unless the Director’s office is earlier vacated in accordance with the Articles or the provisions of the BCA.

The Board of Directors has adopted a majority voting policy, which is described under the heading “Majority Voting Policy”, relating to the election of Directors.

On February 13, 2014, the Board adopted an advance notice policy setting out requirements for Director nominations and elections. On April 29, 2014, our Shareholders approved a special resolution to amend the Articles to include this advance notice requirement, which is described under the heading “Advance Notice Policy”.

The Board of Directors may fill vacancies on the Board resulting from the death, resignation or retirement of Directors. As well, the Board is authorized to appoint up to one-third additional Directors to hold office until not later than the next annual meeting of Shareholders.

3) Appointment of Auditor

The Auditor is to be appointed to serve until the close of the next annual meeting of Shareholders, and the Directors are to be authorized to fix the Auditor’s remuneration.

The Board of Directors and management of the Company, on the advice of the Audit Committee of the Board, recommend that PricewaterhouseCoopers LLP, Vancouver, Canada, be appointed as Auditor, at a remuneration to be fixed by the Board of Directors.

13

4) Advisory Resolution on our Approach to Executive Compensation (Say on Pay)

Our executive compensation philosophy, policies and programs are based on the fundamental principle of pay-for-performance to align the interests of our executives with those of our Shareholders. At the Meeting, Shareholders will be asked to consider and, if deemed advisable, to approve (on an advisory basis), by way of ordinary resolution, the Company’s approach to executive compensation.

INFORMATION REGARDING NOMINEES FOR ELECTION AS DIRECTORS

The following table sets out the name of each person nominated by management for election as a Director, as well as the date that person first became a Director, their age, residence, position in the Company, independence status, principal occupation, background, experience, committee memberships, attendance records and their voting results at the last annual meeting of Shareholders. Additional information concerning compensation and security holdings of such persons is provided elsewhere in the Circular, including in “Direct and Indirect Share and Other Holdings of Current and Proposed Directors.” All of our Directors elected at our last annual meeting of Shareholders are standing for re-election, with the exception of Ray Ferris, our former President and Chief Executive Officer, who retired from the Board on December 31, 2023. Eric Butler, who was appointed a Director effective May 15, 2023 and Sean McLaren, our current President and Chief Executive Officer who was appointed a Director effective January 1, 2024 have been nominated as Directors at the upcoming Meeting.

Unless otherwise indicated, each nominee has held the same or similar principal occupation with the organization set out below, or a predecessor of that organization, for the last five years. The information as to principal occupation and securities beneficially owned or controlled by each nominee has been furnished by the nominee and is not within the knowledge of our management.

14

|

HENRY H. (HANK) KETCHAM

Director since September 16, 1985

Age: 74

Place of Residence: Vancouver, B.C., Canada

Independent |

Hank Ketcham is the Chair of the Board. Mr. Ketcham was our President until April 2012 and retired from the position of CEO effective March 1, 2013 when his title as Chair of our Board was re-designated as Executive Chair. Effective April 19, 2016, he became our Chair of the Board. He is also a director and minority shareholder of Ketcham Investments, Inc., which owns 3,912,718 Common shares and 1,743,228 Class B Shares of the Company. See “Voting Securities and Principal Shareholders” for a description of such shareholdings. Mr. Ketcham has been actively involved with the Company since 1973. He was formerly a director of The Toronto-Dominion Bank.

Key Areas of Expertise and Experience:

|

|||||

| Strategic Leadership Senior Executive Industry Experience |

Geographic Expertise Government & Stakeholder Relations |

|||||

| Board and Committee memberships and attendance record in 2023:

|

||||||

| Attendance |

% Overall | |||||

|

Board |

6 of 6 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

65,972,655 | 1,907,222 | 97.19 | |||||

| Current Other Public Board Memberships

None

Past Public Board Memberships (2019 – 2023)

None

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

395,896 |

|||||||

| Options |

Nil |

|||||||

| DS Units |

3,128 |

|||||||

| Total market value of securities |

$43,581,401 |

|||||||

|

Meets share ownership target as of December 31, 2023 |

Yes |

|||||||

| 1. Includes Common shares and Class B Shares.

|

||||||||

15

|

DOYLE N. BENEBY

Director since April 18, 2023

Age: 64

Place of Residence: West Palm Beach, Florida, USA

Independent |

Doyle Beneby is a Corporate Director. From November 2018 to October 2022, he served as Chief Executive Officer of Midland Cogeneration Venture. Prior to that, he had been self-employed as a Corporate Director since May 2016. He was formerly the CEO of New Generation Power International, an international independent renewable energy company, from October 2015 to May 2016. Prior to joining New Generation Power International, he was the President and CEO of CPS Energy, the largest municipally-owned gas and electric utility in the U.S., a position he held since August 2010. Mr. Beneby has over 35 years’ experience in various aspects of the electrical power industry. Prior to joining CPS Energy, Mr. Beneby served at Exelon Corporation from 2003 to 2010 in various roles, most recently, as Senior Vice-President of Exelon Power and President of Exelon Corporation from 2009 to 2010. From 2008 to 2009, he served as Vice-President, Generation Operations for Exelon Corporation, and prior to that and from 2005 to 2008, he served as Vice-President, Electric Operations for PECO, a subsidiary of Exelon Corporation. Mr. Beneby holds a Master of Business Administration from the University of Miami, and a Bachelor of Science from Montana Technical College. In 2021, Mr. Beneby was recognized as one of the Most Influential Black Corporate Directors by Savoy Magazine. Mr. Beneby is a member of the Audit Committee and the Health, Safety and Environment Committee.

Key Areas of Expertise and Experience:

|

|||||

| Strategic Leadership Senior Executive Human Resources & Compensation |

Geographic Expertise Environment, Health & Safety Risk Management |

|||||

| Board and Committee memberships and attendance record in 2023: |

||||||

|

Attendance |

% Overall |

|||||

|

Board |

5 of 5 |

100 |

||||

|

Audit |

3 of 3 |

100 |

||||

|

Health, Safety & Environment |

1 of 1 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

67,677,147 | 202,731 | 99.70 | |||||

| Current Other Public Board Memberships

Capital Power Corporation Korn Ferry International Quanta Services

Past Public Board Memberships (2019 – 2023)

None

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

Nil |

|||||||||

| DS Units |

1,315 |

|||||||||

| Total market value of securities |

$143,624 |

|||||||||

| Meets share ownership target as of December 31, 20231 |

No |

|||||||||

|

1. Mr. Beneby was elected a Director at the April 18, 2023 annual and special meeting of Shareholders and is permitted to meet the minimum shareholding requirement within five years of his appointment.

|

||||||||||

16

|

ERIC L. BUTLER

Director since May 15, 2023

Age: 63

Place of Residence: Omaha, Nebraska, USA

Independent |

Eric Butler is a Corporate Director. Following his retirement from a 32-year career with Union Pacific, one of the largest freight rail providers in North America, he is the President and CEO of Aswani-Butler Investment Associates, a private equity firm. Currently, he is a member of the Board of Directors of NiSource Inc., and the Eastman Chemical Company and has served in the past in a number of appointments, including as the former Chair of the Board of the Federal Reserve Bank of Kansas City – Omaha Branch. Mr. Butler retired from Union Pacific in 2017 as Executive Vice President and Chief Administrative Officer, after a career which saw him lead a wide variety of company functions and initiatives, including marketing and sales, purchasing and supply chain, financial planning and analysis, strategic planning, human resources, industrial engineering and transportation. Having studied at the Carnegie Mellon University, Mr. Butler holds both a Bachelor of Science degree in Mechanical Engineering and a Master of Science degree in Industrial Administration from the university. Mr. Butler is a member of the Audit Committee and the Human Resources & Compensation Committee.

Key Areas of Expertise and Experience:

|

|||||

| Senior Executive Financial Literacy Geographic Expertise |

Strategic Leadership Human Resources & Compensation Risk Management |

|||||

| Board and Committee memberships and attendance record in 2023: |

||||||

|

Attendance |

% Overall |

|||||

|

Board |

4 of 4 |

100 |

||||

|

Audit |

1 of 1 |

100 |

||||

|

Human Resources & Compensation |

2 of 2 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

n/a | n/a | n/a | |||||

| Current Other Public Board Memberships

Eastman Chemical Company NiSource Inc.

Past Public Board Memberships (2019 – 2023)

None

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

5,000 |

|||||||

| DS Units |

650 |

|||||||

| Total market value of securities |

$617,093 |

|||||||

|

Meets share ownership target as of December 31, 2023 |

Yes |

|||||||

17

|

REID E. CARTER

Director since April 19, 2016

Age: 67

Place of Residence: West Vancouver, B.C., Canada

Independent |

Reid E. Carter is a Corporate Director. From 2003 to the end of 2018, Mr. Carter was a Managing Partner at Brookfield Asset Management, Inc., a global asset manager, and was President of Brookfield Timberlands Management LP. In this role, Mr. Carter led the acquisition of approximately 3.5 million acres of private timberlands throughout North America and Brazil as well as the teams responsible for all growth and operations aspects of these businesses. From 2010 to 2015, Mr. Carter also served as President and Chief Executive Officer, and until May 2021 as a director, of Acadian Timber Corp. and, from 2006 to 2010, as President and Chief Executive Officer of its predecessor, Acadian Timber Income Fund, which is listed on the TSX. He served as National Bank Financial’s Paper and Forest Products Analyst between 1996 and 2003. Between 1990 and 1996 he served as a resource analyst with TimberWest Forest Corp. Mr. Carter served as a director of Enercare Inc. until the end of 2019. Mr. Carter holds a combined undergraduate degree in Forestry and Biology and a master’s degree in Forest Soils, both from the University of British Columbia. Mr. Carter is the Chair of the Governance & Nominating Committee and a member of the Audit Committee.

Key Areas of Expertise and Experience:

|

|||||

| Senior Executive Financial Literacy Industry Experience |

Geographic Expertise Technology |

|||||

| Board and Committee memberships and attendance record in 2023:

|

||||||

| Attendance |

% Overall | |||||

|

Board |

6 of 6 |

100 |

||||

|

Audit |

4 of 4 |

100 |

||||

|

Governance & Nominating |

3 of 3 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

65,845,948 | 2,033,929 | 97.00 | |||||

| Current Other Public Board Memberships:

None

Past Public Board Memberships (2019 – 2023):

Enercare Inc. Acadian Timber Corp.

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

3,000 |

|||||||

| DS Units |

14,229 |

|||||||

| Total market value of securities |

$1,881,751 |

|||||||

|

Meets share ownership target as of December 31, 2023 |

Yes |

|||||||

18

|

JOHN N. FLOREN

Director since April 19, 2016

Age: 65

Place of Residence: Oakville, Ontario, Canada

Independent |

John N. Floren is the former President and Chief Executive Officer of Methanex Corporation and prior to that appointment he held the position Senior Vice-President, Global Marketing and Logistics of Methanex from June 2005 and, prior to that, Director, Marketing and Logistics, North America from May 2002. He was an employee of Methanex for approximately 23 years and has worked in the chemical industry for over 35 years. Mr. Floren holds a Bachelor of Arts in Economics from the University of Manitoba. He also attended the Harvard Business School’s Program for Management Development and has attended the International Executive Program at INSEAD. He also completed the Directors Education Program at the Institute of Corporate Directors. Mr. Floren is the Chair of the Health, Safety & Environment Committee and a member of the Human Resources & Compensation Committee and the Governance & Nominating Committee.

Key Areas of Expertise and Experience:

|

|||||

| Strategic Leadership Senior Executive Risk Management |

Environment, Health & Safety Sustainability, Climate Change & Social Responsibility |

|||||

| Board and Committee memberships and attendance record in 2023: |

||||||

|

Attendance |

% Overall |

|||||

|

Board |

6 of 6 |

100 |

||||

|

Human Resources & Compensation |

3 of 3 |

100 |

||||

|

Health, Safety & Environment |

3 of 3 |

100 |

||||

|

Governance & Nominating |

3 of 3 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

66,327,081 | 1,552,796 | 97.71 | |||||

| Current Other Public Board Memberships:

Imperial Oil Limited

Past Public Board Memberships (2019 – 2023):

Methanex Corporation

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

Nil |

|||||||

| DS Units |

8,206 |

|||||||

| Total market value of securities |

$896,259 |

|||||||

|

Meets share ownership target as of December 31, 2023 |

Yes |

|||||||

19

|

ELLIS KETCHAM JOHNSON

Director since April 20, 2021

Age: 60

Place of Residence: Greenwich, Connecticut, USA

Independent |

Ellis Ketcham Johnson is currently the President of a private philanthropic foundation and a member of the Parents Leadership Council of Georgetown University. She previously worked at Imax Corporation in Canada. Ms. Johnson completed her undergraduate degree at Lewis and Clark College and received a graduate degree from Yale University. She recently completed a Directorship Program with an emphasis on Board Governance. Ms. Johnson is a member of the Audit Committee and the Governance and Nominating Committee.

Key Areas of Expertise and Experience:

|

|||||

| Government & Stakeholder Relations Human Resources & Compensation Environment, Health & Safety |

Sustainability, Climate Change & Social Responsibility Financial Literacy |

|||||

| Board and Committee memberships and attendance record in 2023: |

||||||

|

Attendance |

% Overall |

|||||

|

Board |

6 of 6 |

100 |

||||

|

Audit |

4 of 4 |

100 |

||||

|

Governance and Nominating |

2 of 2 |

100 |

||||

|

Health, Safety & Environment |

2 of 2 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

67,553,290 | 326,587 | 99.52 | |||||

| Current Other Public Board Memberships:

None

Past Public Board Memberships (2019 – 2023):

None

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

1,004,990 |

|||||||

| DS Units |

Nil |

|||||||

| Total market value of securities |

$109,765,008 |

|||||||

|

Meets share ownership target as of December 31, 2023 |

Yes |

|||||||

20

|

BRIAN G. KENNING

Director since April 19, 2017

Age: 74

Place of Residence: Vancouver, B.C., Canada

Independent |

Brian G. Kenning is a Corporate Director. He was a Managing Partner of Brookfield Asset Management Inc., a company involved in the real estate, asset management and power generation sectors, from 1995 to 2005. From 1988 to 2005, Mr. Kenning was also Chairman and Managing Partner of B.C. Pacific Capital Corporation, an affiliate of Brookfield Asset Management Inc., active in merchant banking and investing. Over the past 10 years, Mr. Kenning has served as director of a number of public and private corporations. He served as a director of British Columbia Ferry Services Inc. until May 2019, and as a director of Maxar Technologies Ltd. From 2003 to 2019. In addition, Mr. Kenning is a past Governor of the B.C. Business Council and a past Director of the B.C. chapter of the Institute of Corporate Directors. Mr. Kenning graduated from Queen’s University with an MBA in 1973. Mr. Kenning is the Chair of the Human Resources & Compensation Committee and a member of the Governance & Nominating Committee.

Key Areas of Expertise and Experience:

|

|||||

| Financial Literacy Risk Management Capital Markets |

Human Resources & Compensation Board Experience |

|||||

| Board and Committee memberships and attendance record in 2023: |

||||||

|

Attendance |

% Overall |

|||||

|

Board |

6 of 6 |

100 |

||||

|

Human Resources & Compensation |

3 of 3 |

100 |

||||

|

Governance & Nominating |

3 of 3 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

65,771,883 | 2,107,995 | 96.89 | |||||

| Current Other Public Board Memberships

None

Past Public Board Memberships (2019 – 2023)

Maxar Technologies Ltd.

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

1,200 |

|||||||

| DS Units |

8,500 |

|||||||

| Total market value of securities |

$1,059,434 |

|||||||

|

Meets share ownership target as of December 31, 2023 |

Yes |

|||||||

21

|

MARIAN LAWSON

Director since February 1, 2021

Age: 68

Place of Residence: Toronto, Ontario, Canada

Independent |

Marian Lawson retired from Scotiabank in 2018, with over 30 years of experience in banking and capital markets. Ms. Lawson served as a director of Norbord from May 6, 2020 until her resignation and was appointed to the Board of West Fraser on February 1, 2021 in connection with the Norbord Acquisition. During her tenure, Ms. Lawson held numerous senior roles at Scotiabank including Executive Vice-President, Global Head, Financial Institutions and Transaction Banking, Deputy Head of Corporate Banking, Managing Director, Capital Markets, and Vice-President, Internal Audit. The majority of her roles involved assisting management teams in the execution of their strategies, which included acquisitions, expansions, divestitures, refinancings and restructurings. In addition, during the latter part of her career, Ms. Lawson successfully expanded and restructured several businesses. In 2016, Ms. Lawson received the Women in Capital Markets Award for Leadership and the Women’s Executive Network, Top 100 Corporate Executive Award. Ms. Lawson holds a BA in Economics from York University, an MBA (Finance) from McMaster University, and an ICD.D designation. Ms. Lawson is a director of Canadian Tire Bank (2018 to present) and was a board member of 1832 Asset Management LP, a wealth management subsidiary of Scotiabank, from 2016 to 2018. Ms. Lawson is a member of the Human Resources & Compensation Committee and the Health, Safety & Environment Committee.

Key Areas of Expertise and Experience:

|

|||||

| Strategic Leadership Financial Literacy Risk Management |

Capital Markets Board Experience Human Resources & Compensation |

|||||

| Board and Committee memberships and attendance record in 2023: |

||||||

|

Attendance |

% Overall |

|||||

|

Board |

5 of 6 |

83 |

||||

|

Human Resources & Compensation |

3 of 3 |

100 |

||||

|

Health, Safety & Environment |

3 of 3 |

100 |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

67,680,778 | 199,099 | 99.71 | |||||

| Current Other Public Board Memberships

None

Past Public Board Memberships (2019 – 2023)

Norbord Inc.

Securities held and total market value as at the Record Date:

|

||||||||

| Shares |

Nil |

|||||||

| DS Units |

6,410 |

|||||||

| Total market value of securities |

$700,100 |

|||||||

|

Meets share ownership target as of December 31, 2023 |

Yes |

|||||||

22

|

SEAN P. MCLAREN

Director since: January 1, 2024

Age: 55

Place of Residence: Collierville, Tennessee, USA

Non-Independent |

Sean McLaren became our President and Chief Executive Officer on January 1, 2024, following the retirement of Ray Ferris. Mr. McLaren began his career with West Fraser in 2005, as General Manager of the Williams Lake Sawmill, when West Fraser acquired Weldwood. He was Chief Operating Officer from December 7, 2021 to December 31, 2023. Prior thereto, he was President, Solid Wood. Previous roles at West Fraser include Vice-President, U.S. Lumber in February 2016 and Vice-President, U.S. Lumber Operations in October 2010. Mr. McLaren holds a Master of Business Administration from the University of Calgary and is a Chartered Professional Accountant in British Columbia.

Key Areas of Expertise and Experience:

|

|||||

| Strategic Leadership Senior Executive Industry Experience |

Financial Literacy |

|||||

| Board and Committee memberships and attendance record in 2023: |

||||||

|

Attendance |

% Overall |

|||||

|

Board |

n/a |

n/a |

||||

| Voting results of 2023 annual meeting of Shareholders: |

||||||

|

|

Votes for |

Votes withheld |

% Votes For |

|||||

| Number of votes |

n/a | n/a | n/a | |||||