UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2024

CNH Industrial N.V.

(Exact name of registrant as specified in its charter)

| Netherlands | 001-36085 | 98-1125413 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| Cranes Farm Road, Basildon, Essex, SS14 3AD, United Kingdom | N/A | |

| (Address of principal executive offices) | (Zip Code) |

+44 2079 251964

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d 2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Shares, par value €0.01 | CNHI | New York Stock Exchange | ||

| 3.850% Notes due 2027 | CNHI27 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

| ☐ | Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(e) of the Exchange Act ☐

Item 7.01 Regulation FD Disclosure.

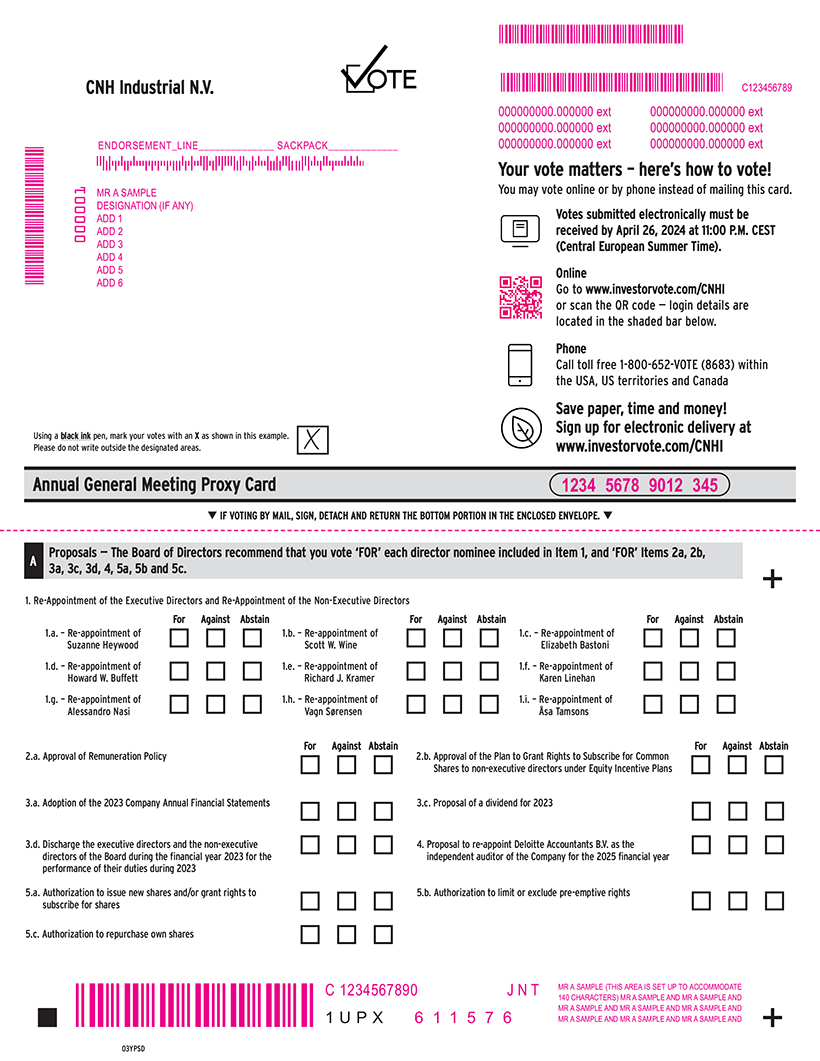

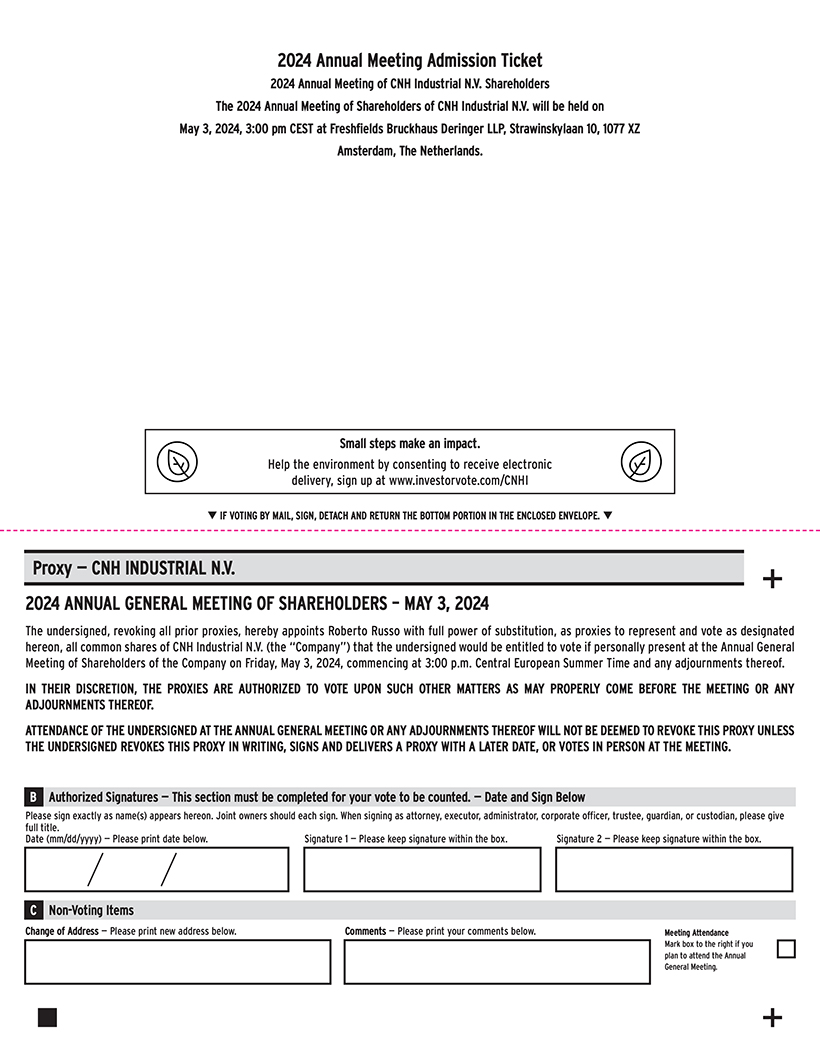

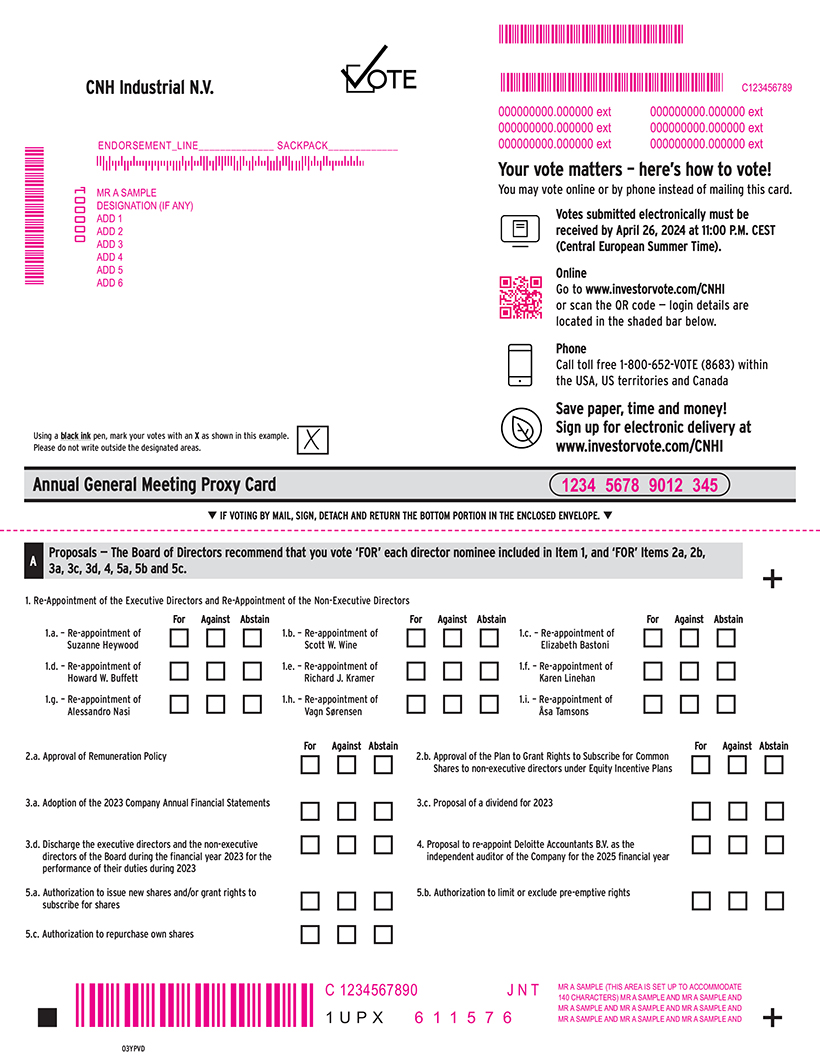

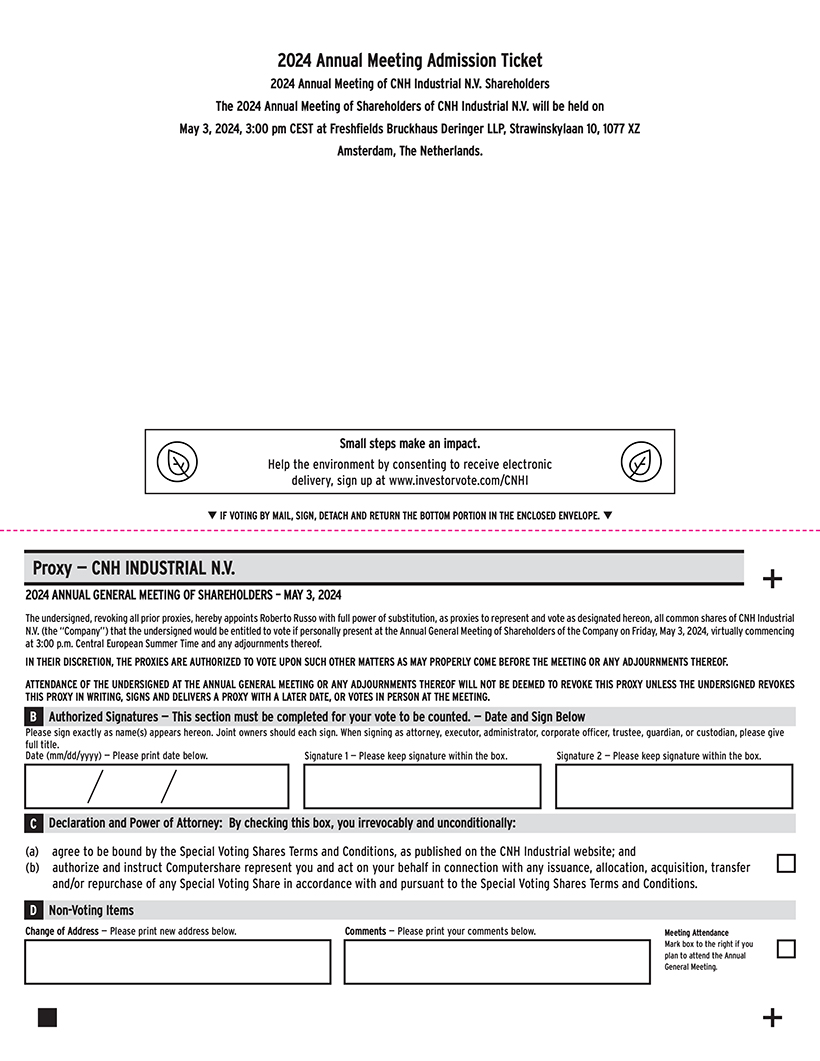

On March 19, 2024, CNH Industrial N.V. (the “Company”) made available to its shareholders its Notice of 2024 Annual General Meeting and Proxy Statement (the “Notice of Meeting and Proxy Statement”) in connection with the Company’s Annual General Meeting of shareholders, which will be held on May 3, 2024, in Amsterdam, The Netherlands. The Notice of Meeting and Proxy Statement and forms of proxy cards are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Notice of 2024 Annual General Meeting and Proxy Statement

99.2 2024 Annual General Meeting of Shareholders Proxy Cards

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| CNH INDUSTRIAL N.V. | ||||||

| Date: March 19, 2024 | By: | /s/ Roberto Russo |

||||

| Name: Roberto Russo | ||||||

| Title: Chief Legal and Compliance Officer | ||||||

3

Exhibit 99.1

NOTICE OF 2024

ANNUAL GENERAL

MEETING AND PROXY

STATEMENT

This document is important and requires your immediate attention.

If you are in any doubt as to any aspect of the proposals referred to in this document or as to the action you should take, you should consult your own broker, bank, solicitor or accountant or other independent professional adviser.

Please review carefully the voting instructions included in this Notice of Meeting and Proxy Statement.

This document should be read as a whole. Your attention is drawn to the letter from our Chair and Chief Executive Officer, which is set out on pages ii to v of this document and which recommends that you vote in favor of each of the Resolutions to be proposed at the 2024 Annual General Meeting.

-i-

A MESSAGE FROM OUR CHAIR & CHIEF

EXECUTIVE OFFICER

Our 2023 saw...

| • | Record-breaking Financial Performance for the Agriculture and Construction segments |

| • | Further ground gained in Tech |

| • | Continued pursuit of Operational Excellence |

March 19, 2024

Dear Shareholders,

We are pleased to invite you to attend the annual general meeting of CNH Industrial N.V. (“CNH”) to be held on Friday, May 3, 2024, at 3:00 p.m. CEST, at the offices of Freshfields Bruckhaus Deringer LLP, Strawinskylaan 10, 1077 XZ Amsterdam, The Netherlands. Details in relation to attending and voting on the items on the agenda for the meeting are set out on pages 2 to 4 of this Notice of Meeting and Proxy Statement.

GENERATING VALUE IN CYCLICAL INDUSTRIES

CNH again delivered record results in 2023. We also enriched our portfolio of award-winning products and developed new easy-to-use technologies that make our customers’ businesses more productive. We would like to thank all our colleagues for their careful management of the business during this period of ongoing turbulence and slowing agricultural markets, especially in Brazil. Our strong earnings performance is due to their excellent execution.

2023 KEY FINANCIAL HIGHLIGHTS

| 1 | See Annex A – Reconciliation of Non-GAAP Measures for the definition and a reconciliation of Free cash flow of Industrial Activities to the most directly comparable GAAP measure. |

-ii-

Our brands launched more than 70 new models in 2023. A particular highlight was the introduction of the New Holland CR11, which will go on sale in 2024. It is the largest, most productive combine harvester ever made and our most high-tech to date, incorporating both artificial intelligence and computer vision. Its development incorporated a century’s worth of industry-leading expertise from our Zedelgem, Belgium site and was based on extensive feedback from our customers, for whom it will deliver higher yields and greater profitability.

CNH has accomplished a great deal since its foundation in 1999, and today continues to build on the nearly two centuries of our brands’ deep industry expertise, yet we must continue to evolve and innovate to win in a competitive market and unlock further value for our customers and shareholders. This last year we have advanced our work on the precision farming, autonomous driving and other key technologies our customers want; simplified our structure and operations; and delivered on our sustainability goals (often while also increasing the productivity of our products). We address each of these efforts below.

ADVANCING OUR WORK ON TECHNOLOGY

CNH is investing organically and making strategic acquisitions to ensure that our ‘Great Tech’ matches our ‘Great Iron.’ By bringing industry experts and core technologies in-house, we are accelerating our technical development. And by keeping those teams close to our customers in our regional R&D centers, we are able to customize solutions for local needs.

Among this new talent, in 2023 we welcomed over 160 people from our acquisitions of Hemisphere and Augmenta. Acquiring Hemisphere, a company that produces industry leading GNSS receivers, gives us ownership of a comprehensive range of positioning and heading technologies, enabling us to control the design and manufacture of our global satellite navigation systems. We are already implementing this technology into our product portfolio. For instance, it has been used to automate the control of blades and buckets on our excavators, helping operators to execute tasks more precisely. Bringing the machine vision company Augmenta into our Raven brand means that our tractors and sprayers can now be equipped with field analyzers that deliver real time Variable Rate Application spraying. This means the machine can automatically ensure that inputs are judiciously applied, minimizing waste, and maximizing crop performance, providing farmers with increased yield and greater sustainability while reducing application time, effort, and input costs.

Of course, the biggest technology acquisition that we have made is our $2.1bn purchase of Raven Industries in 2021. Raven is a leader in digital agriculture, precision farming technology, including auto guidance, and the development of autonomous systems. This acquisition is fundamental to transforming us from a company that produces great iron to one that produces great iron with great tech. Our combined engineering team is focused on advancing our software, such as Raven Cart Automation, a technology that synchronizes the direction and speed of a grain cart being pulled by a tractor alongside a combine harvester. This driverless tractor and trailer combination tracks the combine during the grain unloading process, thereby minimizing losses, and dispensing with the need for a second operator to drive the tractor.

We are also continuing to invest in and collaborate with third parties that develop innovative new technologies. One example of this is Bennamann where we increased our stake to become the majority shareholder. This UK-based company has expertise in capturing methane from slurry on farms and converting it into energy sources. By combining their technology with our award-winning (and first-to-market) methane-powered tractors, we have created a working carbon-negative energy solution that is being used at test farms in the United Kingdom. Other examples include minority stakes in promising soil sensing and robotic picking start-ups.

-iii-

PUTTING THE CUSTOMER FIRST

CNH has a history of producing innovative products for our customers, including the world’s first mass-produced tractor, the first self-tying pick-up baler, and the first self-propelled combine harvester in Europe. Alongside delivering world class products, we are focused on helping our customers get the most out of them. We now monitor our customers’ machines from innovative control rooms and ensure their satisfaction through dedicated dashboards and track our Net Promoter Score (a measurement of customer loyalty and satisfaction) quarterly to ensure accountability and use this to drive continuous improvement across functions. To support this focus on customers, in 2023 we trained thousands of employees around the world and created new roles across CNH that are focused on customer experience.

Adopting this service-centric mindset means that we are increasingly involving customers directly in product development, using their experience in the field to improve productivity, usability and comfort. In addition to testing products on customers’ farms, we are also gathering product feedback through our Connect Rooms. These capture operational data from connected machines and use this to generate alerts and useful insights, which are sent back to the customer and used to improve our products. The Hubs also deliver data to a network of Connect Rooms at dealerships, where the status of customer equipment is monitored so our dealers can offer support when it is needed.

SIMPLIFYING OUR STRUCTURE AND OPERATIONS

Over the last few years, we have taken several steps to simplify our business. This has included spinning out our on-highway businesses in early 2022, which has allowed Iveco Group to pursue its own path while enabling us to focus on our agriculture and construction businesses. We have continued this simplification journey by moving, in January 2024, to a single listing on the New York Stock Exchange. As well as simplifying our company’s profile, this should also enhance our stock’s trading liquidity.

Within the business we have also looked for greater simplification. The Global Leadership Team has been reduced from 18 to 11 leaders to increase accountability and drive more efficient decision making. This includes the appointment of Friedrich ‘Fritz’ Eichler as Chief Technology Officer, who will oversee all our R&D across both equipment and new technologies. We have also been adjusting our cost structure. We intend to reduce our cost of goods sold before the end of 2024 and we are also reducing SG&A expenditures. This includes restructuring our organization; putting in place zero-based budgeting for all non-labor costs; and rationalizing back-office costs. We do not take such actions lightly, but we are committed to making CNH a strong company long-term.

DELIVERING ON OUR SUSTAINABILITY GOALS

We are dedicated to meeting our environmental and social responsibilities while also driving productivity for our customers and for our business. We are doing this through innovations in our products and in the way in which we operate.

One example of combining increased productivity with enhanced sustainability is our continued development of alternative propulsion solutions. In 2023 we launched our high horsepower methane tractor as well as our first all-electric utility tractors and light construction equipment to meet customer demand for equipment that allowed them to utilize renewable energy and operate silently to reduce noise pollution.

In manufacturing, our continued implementation of renewable energy sources, including solar panels, to power our facilities, reduced both our reliance on non-renewable energy and our carbon footprint. Our CNH Business System (CBS) focuses on reducing, reusing, and recycling waste and has led to some notable achievements – for example in Brazil all our sites achieved zero waste to landfill in 2023, limiting their environmental impact while delivering cost savings.

-iv-

ACTING RESPONSIBLY FOR A BRIGHTER FUTURE

Across both our agriculture and construction businesses we have seen a softening in end demand. This began in 2023 and we believe it will continue through 2024. We are, however, well placed to manage this cycle, with a simplified and strong business, significant liquidity, strong execution (including continuing to manage inventories proactively, as we did last year in Latin America), and – above all – a set of products that deliver real value to our customers.

CONCLUSION

Our gratitude goes to the global CNH team. Their dedication, hard work, and unwavering loyalty to delivering the best for our customers and dealer partners are the keys to our long-term success. We would also like to thank our shareholders and all readers for their support. With the changes we have outlined here, we believe we have a strong future, and we look forward to sharing that with you.

The Board considers that all of the resolutions set out in the Notice of Meeting and Proxy Statement are in the best interests of shareholders as a whole. Accordingly, the Board unanimously recommends that you vote ‘FOR’ each Resolution, as they intend to do in respect of their own shareholdings.

Sincerely,

Suzanne Heywood

Chair and Executive Director

Scott W. Wine

Chief Executive Officer

-v-

TABLE OF CONTENTS

| Page | ||||

| A MESSAGE FROM OUR CHAIR & CHIEF EXECUTIVE OFFICER | ii | |||

| CNH FISCAL YEAR 2023 SHAREHOLDER DOCUMENTS | 1 | |||

| NOTICE OF 2024 ANNUAL GENERAL MEETING | 2 | |||

| ITEM 1 – RE-APPOINTMENT OF DIRECTORS | 5 | |||

| ITEM 2 – COMPENSATION | 15 | |||

| Item 2A - APPROVAL OF REMUNERATION POLICY (voting item) | 15 | |||

| Item 2B - APPROVAL OF THE PLAN TO GRANT RIGHTS TO SUBSCRIBE FOR COMMON SHARES TO NON-EXECUTIVE DIRECTORS UNDER EQUITY INCENTIVE PLANS (voting item) | 16 | |||

| COMPENSATION DISCUSSION AND ANALYSIS | 18 | |||

| HUMAN CAPITAL AND COMPENSATION COMMITTEE REPORT | 39 | |||

| ITEM 3 – 2023 ANNUAL REPORT | 67 | |||

| Item 3A – Adoption of the 2023 Annual Financial Statements (voting item) | 67 | |||

| Item 3B – Reserves and dividends policy (discussion only item) | 67 | |||

| Item 3C – Proposal of a dividend for 2023 (voting item) | 67 | |||

| ITEM 4 – RE-APPOINTMENT OF INDEPENDENT AUDITOR | 69 | |||

| REPORT OF THE AUDIT COMMITTEE | 69 | |||

| INDEPENDENT PUBLIC ACCOUNTANT FEES AND SERVICES | 70 | |||

| ITEM 5 – AUTHORIZATION TO ISSUE NEW SHARES AND REPURCHASE OWN SHARES (voting item) | 72 | |||

| Item 5A – Authorization to issue new shares and/or grant rights to subscribe for shares (voting item) | 72 | |||

| Item 5B – Authorization to limit or exclude pre-emptive rights (voting item) | 72 | |||

| Item 5C – Authorization to repurchase own shares (voting item) | 73 | |||

| CORPORATE GOVERNANCE | 74 | |||

| SHARE OWNERSHIP INFORMATION | 80 | |||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 83 | |||

| GENERAL INFORMATION | 84 | |||

| ANNEX A - RECONCILIATION OF NON-GAAP MEASURES | A-1 | |||

-vi-

CNH FISCAL YEAR 2023 SHAREHOLDER DOCUMENTS

Following the voluntary delisting of our common shares from Euronext Milan and our decision to begin voluntarily to file periodic reports with the U.S. Securities and Exchange Commission (the “SEC”) on U.S. domestic company forms, our fiscal year 2023 disclosures with respect to the notice of and solicitation of votes for our annual general meeting of shareholders are different from those in previous years.

In place of the Notice of Annual General Meeting and Agenda and Explanatory Notes, shareholders this year are receiving this Notice of Meeting and Proxy Statement, including governance disclosures and executive compensation disclosures. We will also make available our 2023 EU Annual Report (the “Dutch Annual Report”), including our annual consolidated financial statements as of December 31, 2023 and 2022 and for each of the two years in the period ended December 31, 2023, as well as the statutory financial statements of CNH Industrial N.V. as of December 31, 2023 and 2022 and for each of the two years in the period ended December 31, 2023 (the “Company Annual Financial Statements”).

These documents and the proxy forms for the Meeting are available on our website. This documentation is also available at the Company’s principal office at Cranes Farm Road, Basildon, Essex, SS14 3AD, United Kingdom for shareholders, who will receive a copy free of charge upon request.

-1-

NOTICE OF 2024 ANNUAL GENERAL MEETING

|

Date: Friday, May 3, 2024

Time: 3:00 p.m. CEST

Place: The offices of:

Record Date: April 5, 2024

Availability of Materials:

The Notice of Meeting and Proxy Statement, our Annual Report on Form 10-K and our Dutch Annual Report for the year ended December 31, 2023 and the other documents relating to the Meeting are available at www.cnh.com

Live Webcast:

Shareholders can follow the meeting via webcast on the website of the Company (www.cnh.com)

Your vote is important

To make sure your shares are represented, please cast your vote as soon as possible in one of the ways described in this Notice of Meeting and Proxy Statement.

We recommend that you review the further information on the process for, and deadlines applicable to, voting, attending the meeting and appointing a proxy in the General Information section on pages 84-87 of this Notice of Meeting and Proxy Statement.

|

Meeting Agenda and Voting Matters

1. Re-appointment of each of the executive directors and re-appointment of each of the non-executive directors as described in the proxy statement (voting items)

2. Compensation

A. Approval of Remuneration Policy (voting item)

B. Approval of the plan to grant rights to subscribe for Common Shares to non-executive directors under Equity Incentive Plans (voting item)

3. 2023 Annual Report

A. Adoption of the 2023 Company Annual Financial Statements (voting item)

B. Reserves and dividends policy (discussion only item)

C. Proposal of a dividend for 2023 (voting item)

D. Discharge the executive directors and the non-executive directors of the Board during the financial year 2023 for the performance of their duties during 2023 (voting item)

4. Re-appointment of the independent auditor (voting item)

5. Authorization to issue new shares and repurchase own shares

A. Authorization to issue new shares and/or grant rights to subscribe for shares (voting item)

B. Authorization to limit or exclude pre-emptive rights (voting item)

C. Authorization to repurchase own shares (voting item)

The Board unanimously recommends that you vote ‘FOR’ each director nominee included in Item 1, and ‘FOR’ Items 2A, 2B, 3A, 3C, 3D, 4, 5A, 5B and 5C. The full text of these proposals is set out below.

CNH Industrial N.V., March 19, 2024 |

-2-

|

Notice of Meeting

|

| Notice is hereby given that the Annual General Meeting of Shareholders (the “Meeting”) of CNH Industrial N.V. (“CNH”, “we”, “us” or the “Company”) will take place at 3:00 p.m. CEST on Friday, May 3, 2024, at the offices of Freshfields Bruckhaus Deringer LLP, Strawinskylaan 10, 1077 XZ Amsterdam, The Netherlands. The Notice of Meeting and Proxy Statement, our 2023 Annual Report on Form 10-K, our 2023 Dutch Annual Report and other Meeting documents are available at www.cnh.com under Investor Relations – Shareholder Meetings. This documentation is also available at the Company’s principal office at Cranes Farm Road, Basildon, Essex, SS14 3AD, United Kingdom for shareholders, who will receive a copy free of charge upon request.

The Meeting will be conducted in the English language.

|

|

Record Date

|

| In order to be entitled to vote in relation to the voting items on the agenda for the Meeting, shareholders must (i) be registered as of April 5, 2024 (the “Record Date”) in the register established for that purpose by the Board of Directors (the “Board”) after reflecting all debit and credit entries as of the Record Date, regardless of whether the shares are still held by such holders at the date of the Meeting and (ii) request registration in the manner mentioned below under “Voting and Attendance”. For additional information on the Record Date, registration in the register established by the Board, voting procedures and important deadlines, refer to the General Information for instructions.

|

|

Voting and Attendance

|

| Loyalty Shareholders and Registered Shareholders. Computershare will send Meeting materials to Loyalty Shareholders and/or Registered Shareholders at the addresses of such shareholders as they appear from the records maintained by Computershare, including a proxy form that allows shareholders to give their voting instructions. The proxy form will also be available on the Company’s website (www.cnh.com) under Investor Relations – Shareholder Meetings. Loyalty Shareholders and/or Registered Shareholders will be entitled to submit their voting instructions or voting proxy (please note proxy instructions below) for the Meeting by 11:00 p.m. CEST on April 26, 2024, in writing or electronically. They can also cast their vote in advance of the Meeting via the web procedure made available on the Company’s website (www.cnh.com) under Investor Relations – Shareholder Meetings.

Shareholders holding common shares in DTC. Shareholders holding common shares in DTC should give instructions to their bank or broker, as the record holder of their shares, who is required to vote their shares according to their instructions. In order to vote their shares and/or attend the Meeting, they will need to follow the directions provided by their bank or broker.

Shareholders holding common shares in a Monte Titoli Participant Account. Shareholders holding common shares in a Monte Titoli Participant Account (“MT Investors”) who wish to submit voting instructions or a voting proxy for the Meeting should request that their bank or broker issue a statement (the “Notice of |

-3-

| Participation”) confirming their shareholding (including the shareholder’s name and address and the number of shares notified for attendance and held by the relevant shareholder on the Record Date). Banks and brokers must submit the Notice of Participation no later than 11:00 p.m. CEST on April 26, 2024 to Computershare S.p.A. The MT Investors may cast their vote in advance of the Meeting via the web procedure made available on the Company’s website (www.cnh.com) under Investor Relations – Shareholder Meetings.

|

|

Vote by Proxy

|

| To give voting instructions by proxy, the shareholder (a) must have registered his or her shares as set out above and (b) must ensure that their proxy (including voting instructions), will be received by Computershare by 11:00 p.m. CEST on April 26, 2024, in writing or electronically.

|

|

Attendance

|

| Subject to compliance with the above provisions, shareholders can attend and vote at the Meeting in person or by proxy. If you wish to attend the Meeting in person, refer to the General Information section under “How do I attend the Meeting?” on pages 84-85 for instructions.

Shareholders can also follow the meeting via live webcast on the website of the Company (www.cnh.com). |

-4-

ITEM 1 – RE-APPOINTMENT OF DIRECTORS

RE-APPOINTMENT OF THE EXECUTIVE DIRECTORS, AND RE-APPOINTMENT OF THE NON-EXECUTIVE DIRECTORS

PROPOSED RESOLUTIONS:

Item 1A – Re-appointment of Suzanne Heywood (voting item)

Item 1B – Re-Appointment of Scott W. Wine (voting item)

Item 1C – Re-appointment of Elizabeth Bastoni (voting item)

Item 1D – Re-appointment of Howard W. Buffett (voting item)

Item 1E – Re-appointment of Richard J. Kramer (voting item)

Item 1F – Re-appointment of Karen Linehan (voting item)

Item 1G – Re-appointment of Alessandro Nasi (voting item)

Item 1H – Re-appointment of Vagn Sørensen(voting item)

Item 1I – Re-appointment of Åsa Tamsons (voting item)

|

Votes required

Re-appointment of each director nominee requires that a majority of the votes cast at the Meeting be voted ‘FOR’ the relevant resolution. Abstentions and broker non-votes are not considered votes cast and will not impact the outcome of the vote on this proposal.

Shareholders may not cumulate their votes with respect to the re-appointment of directors. A properly executed proxy marked “Abstain” with respect to the re-appointment of one or more directors will not be voted with respect to the director or directors indicated.

|

|

Recommendations

The Board believes that the contribution and performance of the executive directors seeking re-appointment at the Annual General Meeting of shareholders continues to be effective, and that each demonstrate commitment to their respective roles in the Company. Accordingly, the Board unanimously recommends to re-appoint Suzanne Heywood and Scott W. Wine as executive directors.

The Board believes that the contribution and performance of the non-executive directors seeking re-appointment at the Annual General Meeting of shareholders continues to be effective, and that they each demonstrate commitment to their respective roles in the Company. Accordingly, the Board unanimously recommends to re-appoint Elizabeth Bastoni, Howard W. Buffett, Richard J. Kramer, Karen Linehan, Alessandro Nasi, Vagn Sørensen, and Åsa Tamsons. |

-5-

In accordance with the Company’s Articles of Association, the term of office of the executive directors and the non-executive directors will expire at the end of the Annual General Meeting of May 3, 2024. Each executive director and each non-executive director may be re-appointed at any subsequent Annual General Meeting of shareholders.

The composition of the Board should include members with a mix of skills, professional backgrounds and diversity factors, and also be correctly balanced between executive directors, i.e. those who hold responsibility for the day-to-day management and are vested with executive powers, and non-executive directors. In addition, the presence of independent directors is essential in order to protect the interests of all shareholders and third parties. On the basis of the proposal made by the Environmental, Social and Governance Committee (the “ESG Committee”), the Board therefore proposes that the number of directors be set at nine (9), a number deemed appropriate for the effective functioning of the Board and its Committees, and that number of executive directors be confirmed at two (2), a number deemed appropriate for the effective functioning of the Board. Therefore, the Board unanimously recommends: (a) the re-appointment of the current executive directors, Ms. Heywood and Mr. Wine, and (b) the re-appointment of Ms. Bastoni, Mr. Buffett, Mr. Kramer, Ms. Linehan, Mr. Nasi, Mr. Sørensen and Ms. Tamsons as non-executive directors. Both executive directors and all non-executive directors are eligible and have stated their willingness to accept re-appointment. The Company has also determined that Elizabeth Bastoni, Howard W. Buffett, Richard J. Kramer, Karen Linehan, Vagn Sørensen and Åsa Tamsons satisfy the independence requirements prescribed by applicable laws and regulations. Pursuant to the Articles of Association, the new term of office of the directors will expire on the day of the first Annual General Meeting of shareholders that will be held in 2025. The directors’ remuneration will comply with the Remuneration Policy.

Evaluation of potential candidates

The ESG Committee is responsible for screening candidates and recommending director nominees to the full Board. The Board nominates the directors for appointment at each annual meeting of shareholders.

The ESG Committee considers candidates recommended by directors, officers and third-party search firms. Third-party search firms may be used to identify and provide information on director candidates. At this time, the ESG Committee does not have a policy with regards to the consideration of director candidates recommended by shareholders. The ESG Committee believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board. The ESG Committee will consider candidates recommended by shareholders. Shareholders who wish to recommend individuals for consideration by the ESG Committee to become nominees for election to the Board may do so by delivering a written recommendation to the ESG Committee at the following address: Cranes Farm Road, c/o Corporate Secretary, Basildon, Essex, SS14 3AD, United Kingdom. Submissions must include the full name of the proposed nominee, age, business and residence address, current principal occupation or employment of the nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director, the class and number of shares of each class of shares of the Company that are owned by such nominee, and the date or dates on which such shares were acquired and the investment intent of such acquisition. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

-6-

The ESG Committee evaluates all candidates in the same manner, regardless of the source of the recommendation. The ESG Committee evaluates how a potential candidate’s specific expertise and background would complement those of current Directors. Furthermore, to align with our present and anticipated future requirements, the Board assesses whether a candidate possesses a suitable blend of professional experience, particularly experience that is germane to our business, skills, international market exposure, knowledge, diverse perspectives and backgrounds, independence and willingness and ability to participate fully in the work of the Board and to attend meetings. The Board values the introduction of fresh perspectives from new candidates, which may enrich the Board’s discussions through a diverse mix of professional and personal backgrounds and experiences. The Board also takes into consideration the existing makeup and inclusivity of its members, encompassing factors such as race, gender, national origin, and ethnicity. Periodically, the Board revisits these standards and qualifications, with a view to potentially refining them in accordance with leading corporate governance practices and our evolving organizational needs.

-7-

Board Diversity

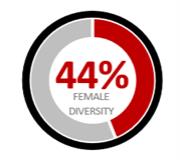

Our director nominees exhibit a diversified mix of skills, experience, cultures, diversity and perspectives:

| GENDER DIVERSITY | BOARD REFRESHMENT | INDEPENDENCE | ||

|

2023: Elizabeth Bastoni

2023: Richard J. Kramer

2022: Karen Linehan

2021: Scott W. Wine |

|

||

| AVERAGE TENURE:(1) | AVERAGE AGE:(1) | |||

| 3.5 YEARS | 54 YEARS | |||

(1) As of the date of this Notice of Meeting and Proxy Statement.

DIVERSE AND BALANCED MIX OF ATTRIBUTES AND EXPERIENCE

|

|

|

|

|

|

|

|

||||||

| GLOBAL EXPERIENCE | CEO / LEADERSHIP | CORPORATE GOVERNANCE / BOARD OF DIRECTORS EXPERIENCE |

FINANCE & ACCOUNTING |

|||||||||

| 100% | 78% | 89% | 78% | |||||||||

|

|

|

|

|

|

|

|

||||||

| GOVERNMENT & REGULATORY AFFAIRS | RISK MANAGEMENT | TECHNOLOGY & INNOVATION |

INDUSTRY | |||||||||

| 44% | 56% | 56% | 78% | |||||||||

-8-

Director Nominees

The nominees for re-appointment as director until the day of the Meeting that will be held in 2025 are:

| Independence (for NYSE and Dutch Code purposes) |

Joined CNH Board |

Committee Memberships | |||||||||||||||||||||

| Name, Age |

Environmental, |

Human Capital and Compensation |

Audit | ||||||||||||||||||||

|

Elizabeth Bastoni, 58 |

INDEPENDENT | 2023 | MEMBER | CHAIRPERSON | ||||||||||||||||||

|

|

Howard W. Buffett, 40 |

INDEPENDENT | 2020 | MEMBER | MEMBER | ||||||||||||||||||

|

|

Suzanne Heywood, 54 |

2016 | |||||||||||||||||||||

|

|

Richard J. Kramer, 61 |

INDEPENDENT | 2023 | MEMBER | |||||||||||||||||||

|

|

Karen Linehan, 65 |

INDEPENDENT | 2022 | CHAIRPERSON | |||||||||||||||||||

|

|

Alessandro Nasi, 49 |

2019 | CHAIRPERSON | MEMBER | |||||||||||||||||||

|

|

Vagn Sørensen, 64 |

INDEPENDENT | 2020 | MEMBER | |||||||||||||||||||

|

|

Åsa Tamsons, 42 |

INDEPENDENT | 2021 | MEMBER | |||||||||||||||||||

|

|

Scott W. Wine, 56 |

CEO | 2021 | ||||||||||||||||||||

-9-

| Suzanne Heywood |

Director Since 2016 | Age: 54 | |

|

Executive Director, Chair |

Suzanne Heywood is the Chief Operating Officer of Exor. She first joined Exor as a Managing Director in 2016. Prior to that she worked at McKinsey & Company which she joined as an associate in 1997 and left as a Senior Partner (Director) in 2016. Suzanne co-led McKinsey’s global service line on organization design for several years and also worked extensively on strategic issues with clients across different sectors. She has published a book, “Reorg,” and multiple articles on these topics. Suzanne started her career in the U.K. Government as a Civil Servant in the U.K. Treasury. At the Treasury she worked as Private Secretary to the Financial Secretary (who is responsible for all direct taxation issues) as well as leading thinking on the Government’s privatization policy and supporting the Chancellor in his negotiations at ECOFIN (the meeting of European Finance Ministers) in Brussels. Prior to that she studied science at Oxford University (BA) and then at Cambridge University (PhD). Lady Heywood is Chair of Iveco Group N.V., and of Shang Xia. She is also a non-executive director of Louboutin and The Economist. She grew up sailing around the world with her family recreating Captain James Cook’s third voyage. Born in 1969, British citizenship. |

|

|

|

||

| Scott W. Wine |

Director Since 2021 | Age: 56 | |

|

Executive Director, Chief Executive Officer |

Scott W. Wine is the Chief Executive Officer of CNH and an executive director on the Company’s Board. Leading a workforce of circa 40,000 across the globe, Mr. Wine assumes complete accountability for the Company’s results, whilst ensuring it delivers them in accordance with the highest ethical standards. His focus is on best supporting CNH’s dealers and customers through a diverse and inclusive workforce, industry leading technology, exceptional safety and quality, and unmatched innovation. Mr. Wine has an exceptional track record as a proven leader, with both considerable international experience across a variety of industries, and extensive mergers and acquisitions expertise in the U.S., Europe and Asia. Prior to joining CNH in 2021, he was Chairman and CEO of Polaris Inc., a manufacturer of off-road vehicles, electric cars, motorcycles, snowmobiles and boats. He joined Polaris in 2008 as Chief Executive Officer and was named Chairman in 2013. In 2007, Mr. Wine joined UTC Fire and Security, a subsidiary of United Technologies Corporation, as President of Fire Safety America. From 2003 to 2007 he held positions of increasing importance across a range of Danaher Corporation companies, serving as President of Jacobs Vehicle Systems, a commercial truck braking systems manufacturer, from 2003 until 2006, when he became President of The VeederRoot Co., a manufacturer of fuel-tank measuring equipment. In 1996 Mr. Wine joined Allied Signal Corp, a US aerospace, automotive and engineering company. Following its 1999 acquisition of Honeywell, in 2001 Wine assumed the role of Managing Director of Honeywell Aerospace GmbH, based in Germany, before being appointed Vice President of the European Engine Services Division. From 1989 to 1996 he served as a supply officer in the United States Navy. Mr. Wine holds an MBA from the University of Maryland and a bachelor’s degree from the United States Naval Academy. He serves on the Boards of US Bancorp (a NYSE-listed company) and the U.S. Naval Academy Foundation. Born in 1967, he holds American citizenship. |

-10-

| Elizabeth Bastoni |

Independent | Director Since 2023 | Age: 58 | |

|

Committees: Environmental, Social and Governance, Human Capital and Compensation (Chairperson) |

Elizabeth Bastoni is respected as a credible voice for decision making in the boardroom. She demonstrates sound business judgment, an ability to focus on critical matters in complex situations and is grounded in the financial information that levers the business. Ms. Bastoni has expertise in establishing governance boundaries; enabling strategy development and execution; and leading effective oversight.

Ms. Bastoni currently serves as Independent Lead-Director and Chair of the Nomination and Compensation Committee for France-based Euroapi, which was spun-out from parent Sanofi in May of 2022. She also serves as a director and Audit Committee member for Portugal based Jerónimo Martins. Elizabeth has also previously held a range of other board and committee leadership roles in Europe and the US. Prior to her Board service, Elizabeth served in C-suite and executive leadership positions at a number of large-scale, global organizations including Carlson, The Coca-Cola Company, Thales, Suez Environment and KPMG.

Ms. Bastoni holds a BA degree with a concentration in Accounting from Providence College, Rhode Island. She has a degree from Paris Sorbonne Université (Paris IV) in French Civilization and studied Art History at the Ecole du Louvre in Paris.

Born in 1965, American citizenship. |

|

|

|

||

| Howard W. Buffett |

Independent | Director Since 2020 | Age: 40 | |

|

Committees: Environmental, Social and Governance, Human Capital and Compensation |

Howard W. Buffett was appointed Director of CNH in April 2020. He is a Professor at Columbia University’s School of International and Public Affairs in New York, U.S.A., with research focused on ESG, sustainability, and impact measurement and management. He previously served on the Advisory Committee on Socially Responsible Investing, which advises the University’s $15 billion endowment on social and environmental investment policies. Earlier in his career, Howard W. Buffett was the Executive Director of the Howard G. Buffett Foundation. He also held a variety of roles in the U.S. government, including in the U.S. Department of Defense, where he oversaw economic stabilization and redevelopment programs in Iraq and Afghanistan. For his work in Afghanistan, he received the Joint Civilian Service Commendation Award. Howard W. Buffett also served as Policy Advisor for the White House Domestic Policy Council and in the Office of the Secretary at the U.S. Department of Agriculture. Howard W. Buffett serves on several Corporate Boards and Advisory Boards including Toyota Motor North America, Inari Agriculture, REEF Technology, StateBook International and Reflection Analytics. He chairs the Advisory Council for Harvard University’s International Negotiation Program and serves on several nonprofit Advisory Boards, including the Daugherty Water for Food Global Institute, the Learning by Giving Foundation, and the Chicago Council on Global Affair’s Center on Global Food and Agriculture Panel of Advisors. Howard W. Buffett is also a former Term Member of the Council on Foreign Relations. A New York Times bestselling author, Howard W. Buffett holds a Bachelor of Science in Communications Science and Political Science from Northwestern University, U.S.A., a Master’s in Public Policy and Administration in Advanced Management and Finance from Columbia University, U.S.A., and executive education certificates from Harvard Business School, U.S.A. Born in 1983, U.S. citizenship. |

-11-

| Richard J. Kramer |

Independent | Director Since 2023 | Age: 60 | |

|

Committees: Audit |

Mr. Kramer served as Chairman of the Board, Chief Executive Officer and President of The Goodyear Tire & Rubber Company (global manufacturer, marketer, and distributor of tires) from 2010 through January 2024. Mr. Kramer joined Goodyear in March 2000 and held various positions at Goodyear, including Chief Operating Officer from June 2009 to April 2010, President, North American Tires from March 2007 to February 2010, Executive Vice President and Chief Financial Officer from June 2004 to August 2007, Senior Vice President, Strategic Planning and Restructuring from August 2003 to June 2004, Vice President, Finance – North American Tires from August 2002 to August 2003, and Vice President - Corporate Finance from March 2000 to August 2002.

Prior to joining Goodyear, Mr. Kramer was with PricewaterhouseCoopers LLP for 13 years, including two years as a partner.

Mr. Kramer is a director of Whirlpool Corporation (a NYSE-listed company) and a member of its Corporate Governance and Nominating Committee and Human Resources Committee. Mr. Kramer also serves as a director of The Federal Reserve Bank of Cleveland, The Cleveland Clinic, The Cleveland Orchestra, and previously served as a director of the Sherwin-Williams Company from 2012 to 2022.

Born in 1963, American citizenship. |

| Karen Linehan |

Independent | Director Since 2022 | Age: 65 | |

|

Committees: Audit (Chairperson) |

Karen Linehan is a former Executive Vice President and General Counsel of Sanofi, a French global healthcare company, a role she held from 2007 – 2021. During this time Ms. Linehan supported multiple acquisitions and divestitures, complex litigations and government investigations as well as being a founding member of Sanofi’s Gender Balance Board. She joined Sanofi in 1991 and held roles of increasing importance including Assistant General Counsel from 1991 – 1996, International Counsel from 1996 – 2000 and Deputy Head of Legal Operations from 2000 – 2007. Prior to joining Sanofi, Karen Linehan was a Corporate Attorney at the New York-based legal firm Townley & Updike. She started her career in the Congressional Office of the Speaker of the US House of Representatives, the Honorable Thomas P. O’Neill, Jr. Ms. Linehan is currently a board member of Aelis Farma (France), a company which specializes in developing drugs targeting diseases of the brain, where she chairs the Audit Committee and serves as a member of the Remuneration Committee. She also sits on the board of Veon Ltd. (The Netherlands), a multinational telecommunication services company, where she serves as a member of the Audit Committee and the Nomination and Governance Committee. Ms. Linehan was a Non-Executive Director of The Global Antibiotic Research and Development Partnership (GARDP) (North America), a Non-Profit Organization which is focused on pursuing the development of treatments for drug resistant infections.

Ms. Linehan holds a Bachelor of American Studies and a Juris Doctor (J.D.) degree in Law, both from Georgetown University in the U.S.A. Born in 1959, American and Irish citizenship. |

-12-

| Alessandro Nasi |

Director Since 2019 | Age: 49 | |

|

Committees: Environmental, Social and Governance (Chairperson), Human Capital and Compensation |

Alessandro Nasi started his career as a financial analyst in several banks, gaining experience at a division of UniCredit in Dublin, Ireland; PricewaterhouseCoopers in Turin, Italy; Merrill Lynch and JP Morgan in New York, U.S.A. He also worked as an Associate in the Private Equity Division of JP Morgan Partners in New York, U.S.A. Mr. Nasi joined the Fiat Group in 2005 as manager of Corporate and Business Development, heading the APAC division and supporting Fiat Group sectors in Asia Pacific. In 2007, Mr. Nasi was appointed Vice President of Business Development and a member of the Steering Committee of Fiat Powertrain Technologies. In 2008, he joined CNH in the role of Senior Vice President of Business Development and from 2009 to 2011 he also served as Senior Vice President of Network Development. In January 2011, he was also appointed Secretary of the Industrial Executive Council of Fiat Industrial, continuing in the role of Executive Coordinator to the successor Group Executive Council of CNH until January 2019. In 2013 he was appointed President Specialty Vehicles, a role he held until January 2019. Mr. Nasi is a Director of EXOR N.V., Chairman of Comau, Director of Iveco Group and Chair of its Environmental, Social, and Governance Committee and member of its Human Capital & Compensations Committee. He is Chairman of Iveco Defence (an affiliate of Iveco Group) and Chairman of Astra Veicoli Industriali (an affiliate of Iveco Group). Since 2019, he is a member of the Advisory Board of the Lego Brand Group and since May 2023 he is Chairman of GVS S.p.A. In October 2022, he was appointed member of the Board of Istituto Italiano di Tecnologia and member of the Strategic Advisory Board of 3 Boomerang Capital LLC. Mr. Nasi obtained a degree in Economics from the University of Turin. Born in 1974, Italian citizenship. |

-13-

| Vagn Sørensen |

Independent | Director Since 2020 | Age: 64 | |

|

Committees: Audit |

Vagn Sørensen was appointed Director of CNH in April 2020. He has spent the majority of his executive career in the aviation industry. After a 17-year career with Scandinavian Airlines, where he held the position of deputy CEO, from 2001 to 2006 he served as the CEO of Austrian Airlines. Following this, he has pursued a career as an Independent Director, primarily in the leisure, hotel and aviation sectors. His appointments, however, also encompass additional sectors including software development, telecommunications and heavy machinery. Mr. Sørensen can draw on over 20 years’ experience in private equity, primarily gained with EQT. Mr. Sørensen is currently Chairman of Vakantie Discounter, Big Bus Tours, Air Canada and Scandlines. He serves as an Independent Director on the Board of Royal Caribbean Cruises. He also sits on the Boards of Parques Reunidos and is a member of the Board of Trustees of the Rock’n Roll Forever Foundation. Mr. Sørensen has previously been the Chairman of F L Smidth A/S, SSP Group Plc, British Midland Airways, Scandic Hotels Group, Automic Software, Bureau van Dijk, KMD and Flying Tiger Copenhagen. He was a Member of the Supervisory Board of Lufthansa Cargo, Deputy Chairman of DFDS, Chairman of the Association of European Airlines, a Member of the Board of the International Air Transport Association (IATA) and was Chairman of TDC A/S, the Danish incumbent telecommunications operator. Mr. Sørensen attended the Aarhus Business School in Denmark, and obtained a Master of Science degree in Economics and Business Administration. Born in 1959, Danish citizenship. |

| Åsa Tamsons |

Independent | Director Since 2021 | Age: 42 | |

|

Committees: Audit |

Åsa Tamsons is a Senior Vice President and Head of Business Area Enterprise Wireless Solutions at Ericsson where she is also a member of the Company’s Executive Team. Ms. Tamsons primary focus is to establish Ericsson’s Enterprise Business and make 5G solutions pervasive in the enterprise segments. Ms. Tamsons’ business portfolio is focused on 5G based networking and security solutions to Enterprises. The business includes Cradlepoint – the US-based market leader in Wireless WAN Edge solutions serving 65,000+ enterprise customers around the world, Ericsson’s Private 5G Network business with products used by industry companies and the public safety sector, and an emerging enterprise security business offering unified SASE solutions to enterprises. Previously, between 2018-2023, Ms. Tamsons held the role as Head of Business Area Technologies and New Businesses at Ericsson, with focus on driving growth in new business areas and creating new revenue streams for Ericsson, with emphasis on SaaS and software centric connectivity offerings. Her business portfolio included Ericsson’s world-leading IPR & Licensing business, the global number portability leaders, iconectiv- and a number of growth businesses in the fintech, adtech, enterprise connectivity and security markets. Between 2018-2020, Ms. Tamsons was also responsible for Ericsson’s Group Strategy, M&A and Corporate Venture Capital investments. Ms. Tamsons joined Ericsson as a Partner from McKinsey where between 2006-2017 she served tech, telecom and industrial companies around the world. She has worked across the world and during her career has been based in Stockholm, Paris, Singapore, San Francisco and Sao Paulo. Ms. Tamsons holds a Master of Science in Business Administration from the Stockholm School of Economics in Sweden. Born in 1981, Swedish citizenship. |

-14-

ITEM 2– COMPENSATION

Item 2A – APPROVAL OF REMUNERATION POLICY (voting item)

|

Votes required

Approval of this item requires that a majority of the votes cast at the Meeting be voted ‘FOR’ such resolution. Abstentions and broker non-votes are not considered votes cast and will not impact the outcome of the vote on this proposal.

|

|

Recommendation

The Board unanimously recommends that shareholders vote FOR the approval of the proposed amendment to the Remuneration Policy.

|

The Remuneration Policy has been revised to provide that non-executive directors are allowed to receive grants of equity awards as part of their compensation. The Company believes that granting shares aligns Board members’ interests with those of shareholders, to support making decisions that create long-term value for the Company. In arriving at the decision to grant equity, the Company considered practices at peer companies. Given the Company’s geographical footprint, the Company believes that equity awards are necessary to attract and retain highly qualified non-executive directors. The Remuneration Policy continues the link to long-term value creation and sustainability, in line with the Company’s strategy and consistent with the Company’s values. The Remuneration Policy is designed to competitively reward the achievement of long-term performance goals and to attract, motivate and retain highly qualified senior executives who are committed to performing their roles in the long-term interests of the Company, its shareholders and other stakeholders in line with our purpose, vision, missions and values.

The Remuneration Policy has also been revised in connection with the Company’s delisting of its shares from Euronext Milan and single listing on the New York Stock Exchange.

The proposed amendment to the Company’s Remuneration Policy is available on the Company’s website (www.cnh.com) under Investor Relations – Shareholder Meetings.

-15-

Item 2B - APPROVAL OF THE PLAN TO GRANT RIGHTS TO SUBSCRIBE FOR COMMON SHARES TO NON-EXECUTIVE DIRECTORS UNDER EQUITY INCENTIVE PLANS (voting item)

|

Votes required

Approval of this item requires that a majority of the votes cast at the Meeting be voted ‘FOR’ such resolution. Abstentions and broker non-votes are not considered votes cast and will not impact the outcome of the vote on this proposal.

|

|

Recommendation

The Board unanimously recommends that shareholders vote FOR the granting of rights to subscribe for common shares to non-executive directors under equity incentive plans

|

The Company’s shareholders previously approved the CNH Industrial N.V. Equity Incentive Program (“EIP”), which permits the grant of, and defines terms and conditions for, equity awards. In March 2024, the Board approved amendments to the EIP to permit our non-executive directors to receive equity awards under the EIP and a directors compensation plan (“DCP”). The DCP is described below.

At CNH, the guiding principles for non-executive director compensation include the following:

| • | Fairly compensate directors for their responsibilities and time commitments. |

| • | Attract and retain highly qualified directors by offering a compensation program consistent with those at companies of similar size, scope, and complexity. |

| • | Align the interests of directors with our shareholders by providing a portion of compensation in equity and requiring directors to continue to own our common stock (or common stock equivalents) throughout their tenure on the Board. |

| • | Provide compensation that is simple and transparent to shareholders. |

The Human Capital and Compensation Committee assessed the form and amount of non-employee director compensation in 2023 and 2024. The HCC Committee was assisted in its review of compensation data and practices by a compensation consultant.

In February 2024, following its review of CNH’s non-executive director compensation structure, the HCC Committee recommended, and the Board approved, an increase in the non-executive director compensation in the form of an annual $60,000 equity grant. The Board believes this change further aligns the DCP with shareholder interests through increased stock ownership.

Our non-executive director nominees have an interest in this proposal as non-executive directors are eligible to receive awards under the EIP in accordance with the DCP.

The Board therefore submits to the General Meeting of shareholders for its approval the requested maximum authorization for rights to subscribe for up to 250,000 common shares to be used for making grants to non-executive directors under the DCP, all in accordance with and under the EIP, the Remuneration Policy, the Articles of Association and Dutch law.

-16-

Equity awards granted under the DCP are made pursuant to and subject to the terms of the EIP, which includes numerous best practice corporate governance features designed to protect shareholder interests and to reflect our Remuneration Policy and our compensation practices, including but not limited to:

| • | Double-Trigger Change in Control Provisions: The default treatment of awards under the EIP in connection with a “change of control” requires that vesting will accelerate only if a change in control occurs and the employees’ employment is terminated involuntarily within 24 months following the change of control (unless awards are terminated in the transaction); |

| • | No Discounted Options: Stock options and stock appreciation rights may not be granted with exercise prices lower than the fair market value of the underlying shares on the date of grant; |

| • | Dividend Equivalents: No payment of dividend equivalents unless the vesting terms, including performance criteria associated with an award are satisfied. |

| • | No Transferability: Awards generally may not be transferred other than by will or the laws of descent and distribution. |

-17-

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion & Analysis (“CD&A”) provides our shareholders and other stakeholders with information about CNH’s performance, compensation framework, compensation decisions and associated governance for our Named Executive Officers (“NEOs”) in 2023. Notwithstanding its status as a foreign private issuer, CNH, as part of a commitment to transparency and shareholder engagements, has voluntarily chosen to include a CD&A that combines the disclosures required under Dutch law and the Dutch Code in the remuneration section of our annual report, with the disclosure of information required of U.S. domestic filers (for example, the compensation of certain executive officers who are not members of our Board).

|

Scott W. Wine |

Oddone Incisa |

Derek Neilson |

Stefano Pampalone

|

Marc Kermisch |

||||

| Chief Executive Officer |

Chief Financial Officer |

President, Agriculture |

President, Construction |

Chief Digital and Information Officer

|

||||

| (“CEO”) (Executive Director on the Board of CNH)

|

(“CFO”) |

Table of Contents

| Year in Review | Performance Highlights | Aligning Pay and Performance | CEO Compensation |

19 | |

| Compensation Design | Compensation Philosophy | Strategic Alignment | Compensation Framework | Compensation Policies and Practices |

22 | |

| Compensation Governance | Role of the Human Capital and Compensation Committee | Use of Market Data | Compensation Peer Group | Compensation Risk |

27 | |

| 2023 Compensation Decisions and Outcomes | Base Salary | Annual Cash Incentives |

30 | |

| Additional Information | Human Capital and Compensation Committee Report | Executive Compensation Tables | Benefits | Fiscal 2023 Potential Payments Upon Termination or Change in Control | Fiscal 2023 Pay Versus Performance (PvP) | Fiscal 2023 Pay Ratio | Compensation of Directors | Disclosures According to Dutch Civil Code and Dutch Corporate Governance Code |

39 | |

-18-

| Annual Bonus

|

2023 Equity Awards

|

|

| Based 100% on corporate performance for CEO; based on a combination of corporate and individual performance for other NEOs |

CEO target equity awards are delivered 75% in Performance Share Units (“PSUs”) and 25% in Restricted Share Units (“RSUs”); other NEOs equity awards are delivered 67% in PSUs and 33% in RSUs

|

|

| Corporate performance assessed based on Consolidated Adjusted EBIT Margin %, Consolidated Revenue @CC $, Cash Conversion Ratio %, CO2 Emissions %, and Accident Frequency Rate |

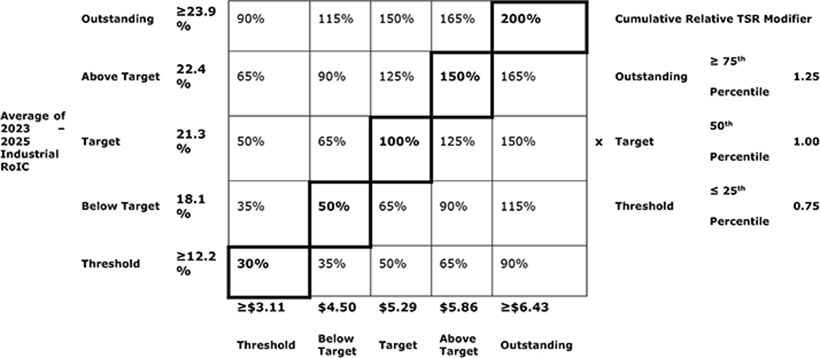

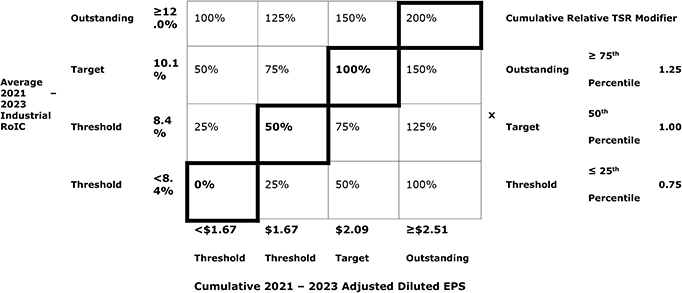

Corporate performance for PSUs assessed based on Cumulative Adjusted Diluted Earnings Per Share (EPS), Average Industrial Return on Invested Capital (RoIC), and Cumulative Relative Total Shareholder Return (TSR)

|

|

|

Awards vest following a three-year performance and/or service period

|

Year in Review

Performance Highlights

In its second full year as a pure-play agriculture and construction business, the Company delivered record full year revenue and EBIT margins across both Agriculture and Construction segments, while the Financial Services segment achieved a record receivable portfolio balance and segment net income, bringing the consolidated company to achieve record net income and earnings per share. Headwinds from a slowing agriculture cycle, higher interest rates, and commodity price fluctuations created lower demand in some key markets, especially in South America. Given these conditions, the Company has been proactive in taking actions to drive cost reductions in the production system, initiated a comprehensive reduction plan to reduce selling, general, and administrative (SG&A) expenses, and drove margin expansion through disciplined commercial execution. Tireless efforts to simplify the company, expand through-cycle margins, and integrate world-class technology with great iron drives operational excellence. Furthermore, the Company prioritized investments in quality improvement and network development. Even in this challenging year, the Company returned an unprecedented $1.2 billion to shareholders through dividends and share repurchases.

-19-

The Company also continues to integrate recent acquisitions and is sustaining elevated investments in R&D relative to prior years, seeking to further its technological advancements and reaffirm a commitment to digital integration and enhancement. The Company launched 72 new products in 2023 and won several significant industry awards including the only Gold Innovation Medal at Agritechnica, seven AE50 awards from the American Society of Agricultural and Biological Engineers, and four Good Design awards. Additionally, the Company placed in the top 5% of over 9,000 companies rated in S&P’s Global Corporate Sustainability Assessment and took second place overall in the Dow Jones World Index in the machinery and electric component category.

Over the last three years, under the leadership of CEO Scott Wine, the Company has achieved strong revenue growth (80th percentile) and net income (90th percentile) relative to companies in both the S&P 500 and S&P 500 Industrials indexes. The Company’s rating was also raised in 2023 to BBB+ by S&P Global Ratings. These results, and the momentum generated for future business cycles, position the Company to continue creating value for shareholders, dealers, end customers, and team members.

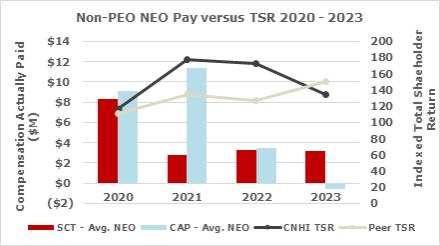

Aligning Pay and Performance

The Company’s business strategy includes enhancing culture, continuously improving productivity, and relentlessly innovating to drive profitable growth for customers, employees, shareholders, and all stakeholders. CNH’s compensation program is designed to motivate employees to execute this strategy.

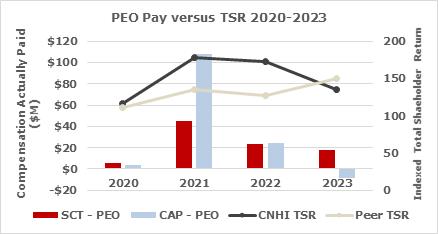

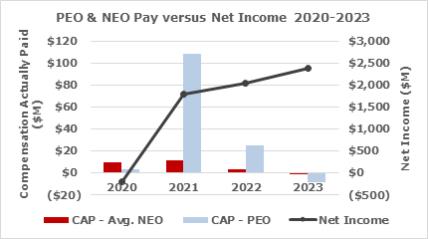

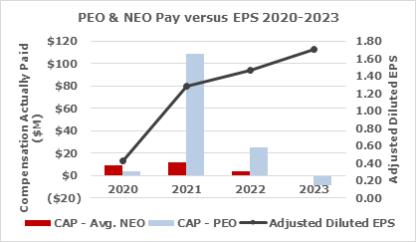

Based on the Scorecard summarized below and detailed further in the balance of this CD&A, the payout factors in respect to 2023 performance was 90.7% of target for the Company Bonus Plan and 183.3% of target for the PSU portion of the 2021-2023 Long-Term Incentive Plan.

| 2023 Company Bonus Plan Measure

|

Weight | Target | Actual |

Actual vs. Target |

Weighted Payout Factor

|

|||||

| Consolidated Adjusted EBIT Margin %

|

40%

|

12.7%

|

13.1%

|

Exceeded Target |

45.0%

|

|||||

| Consolidated Revenues @ CC(1) ($M)

|

20%

|

$25,418

|

$24,651

|

Below Target | 16.6%

|

|||||

| Cash Conversion Ratio %

|

20%

|

70.0%

|

52.6%

|

Below Threshold |

0.0%

|

|||||

| CO2 Emissions %

|

10%

|

-30.0%

|

-35.5%

|

Exceeded Target |

20.0%

|

|||||

| Accident Frequency Rate(2)

|

10%

|

0.141

|

0.100

|

Exceeded Target |

9.0%(3)

|

-20-

| 2023 Company Bonus Plan Measure

|

Weight | Target | Actual |

Actual vs. Target |

Weighted Payout Factor

|

|||||

| Company Performance Payout Factor

|

- | 100.0%

|

- | - |

90.7%

|

| (1) | At constant currency. |

| (2) | Accident Frequency Rate has a declining goal value for maximum payout, so a value lower than target indicates that the achievement level exceeded target. |

| (3) | Discretionary downward adjustment made in Accident Frequency Rate Weighted Payout Factor. |

| 2021-2023 Long-Term Incentive Plan Measures

|

Weighting | Target | Actual |

Actual vs. Target |

Weighted Payout Factor

|

|||||

| Cumulative Adjusted Diluted Earnings per Share (EPS)

|

50%

|

$2.09

|

$4.44

|

Exceeded Target |

100.0%

|

|||||

| Average Industrial Return on Invested Capital (RoIC)

|

50%

|

10.1%

|

18.9%

|

Exceeded Target |

100.0%

|

|||||

| 2021 Relative Total Shareholder Return (TSR)

|

+/-25% Modifier, weighted at 33% |

Ranked at Peer Group Median |

Ranked 1st in Peer Group |

Exceeded Target |

125%

|

|||||

| 2022 - 2023 Cumulative Relative Total Shareholder Return (TSR)

|

+/-25% Modifier, weighted at 67% |

Ranked at Peer Group Median |

Ranked 13th in Peer Group |

Below Target | 75%

|

|||||

| Company Performance Payout Factor

|

- | 100.0%

|

- | - |

183.3%

|

CEO Compensation

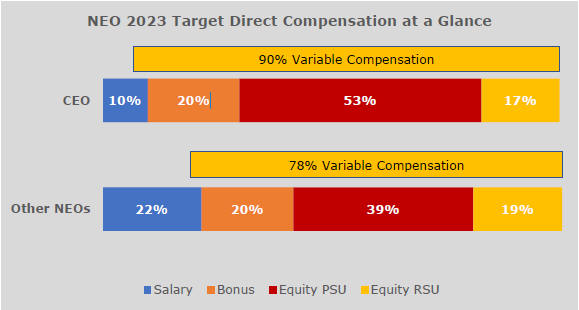

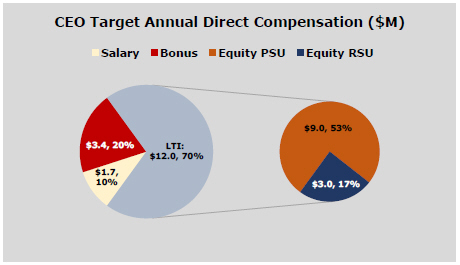

Mr. Wine was appointed as CEO of CNH in 2021 and his target compensation is fixed for a period of five years, with all at-risk variable pay earned based on quantitative, objective, and quantifiable company performance. 90% of Mr. Wine’s target compensation is variable in nature, with 70% of his target compensation coming in equity grants that must be held for a minimum of five years following the date of grant, further solidifying long-term shareholder alignment.

-21-

In 2021, Mr. Wine purchased 200,000 common shares of the Company and purchased an additional 150,000 shares in 2022. He held 100% of the 289,119 shares that vested in 2022 and the 289,120 shares that vested in 2023 from LTI grants, electing to pay 1.98 million in cash to cover tax withholding in lieu of selling shares in both 2022 and 2023. In December 2023, he invested an additional $5.54 million under the company’s nonqualified deferred compensation plan. The Company’s share ownership guidelines and executive compensation practices ensure that this alignment with shareholders’ interests will continue over time. Mr. Wine’s share ownership significantly exceeds the threshold required by the guidelines, and investment of his own money in the Company’s stock demonstrates the alignment between Mr. Wine’s and the shareholders’ interests during his tenure.

Mr. Wine’s annual and long-term incentive payouts are based primarily on company performance payout factors, which are comprised of objective quantitative performance goals. Based on the achievements summarized above and detailed further in the CD&A, Mr. Wine earned an annual incentive equivalent to 90.7% of target and a PSU equivalent to 183.3% of target in 2023.

Compensation Design

Compensation Philosophy

CNH has a pay-for-performance culture that drives long-term value creation. Market-competitive pay is offered to recruit, motivate, and retain talent. Challenging strategic goals, aligned with the industry’s cyclical nature, are set to reinforce a commitment to profitable growth, the environment, and sustainability. Executive compensation is highly variable, rewards performance, and aligns with stakeholder interests. Share ownership guidelines build long-term commitment and alignment with shareholders.

The compensation philosophy and programs are designed to instill a strong performance culture through pay for performance, rigorous performance management, and incentives aligned with company goals. The policy is reviewed and updated on a consistent basis to focus on shareholder value creation, ensure alignment with stakeholder interests, perform comparisons against key competitors, and reference market best practices related to compensation design.

-22-

| Principle | How we achieve this at CNH | |

|

Pay for Performance |

Compensation is based on merit, considering Company performance, individual performance, and promotion of Company values.

A majority of NEO compensation is delivered through short and long-term at-risk elements. |

|

|

Provide Competitive Compensation |

Compensation levels are set to be competitive relative to a clearly defined, comparable, market-reference peer group targeting a median revenue broadly aligned with the Company. |

|

|

Support Business Strategy & Goal Alignment |

Compensation is linked to achievement of goals that align with our objectives. |

|

|

Ensure Business Cycle Alignment |

Driving toward alignment with other companies in the industry given the cyclical nature of agriculture and construction businesses. |

|

|

Commitment to Sustainability |

ESG-centric quantitative metrics are incorporated into bonus calculations for salaried participants. LTI participants have sustainability components tied to individual performance goals. Engagement surveys are conducted regularly covering the salaried population, with strategic adjustments and actions taken following results. |

|

|

Align with Stakeholders’ Interests |

Performance goals align with the interests of our shareholders and other stakeholders. LTIs are delivered in Company stock, with PSUs subject to a relative TSR modifier.

Shareholder ownership guidelines reinforce long-term thinking and a focus on sustainable value creation. |

|

|

Comply with Regulations & Policies |

Incentive-based compensation paid to executive officers are subject to the Company’s Compensation Recovery Policy. |

|

|

Support Share Ownership |

Members of the Global Leadership Team (GLT) are subject to share ownership guidelines. Discretionary LTI awards are granted to select individuals in the talent pipeline and technical functions, representing over 35% of participants. |

|

Strategic Alignment

Five priorities underpin the Company’s strategic roadmap and are reflected across our compensation programs. The measures impacting compensation programs, especially regarding annual bonus and PSU awards, seek to align NEO compensation with a commitment to drive results for all stakeholders.

| Strategic Priorities | ||||||||||

| Customer Inspired Innovation |

Technology Leadership |

Brand & Dealer Strength |

Operational Excellence |

Sustainability Stewardship |

||||||

| Financial Measures | ||||||||||

| Annual Bonus | ||||||||||

| Consolidated Adjusted EBIT Margin % |

X | X | X | X | X | |||||

-23-

| Strategic Priorities | ||||||||||

| Measures success in optimizing productivity and focuses on profitable product and services sales mix | ||||||||||

| Consolidated Revenues @ Constant Currency $ Measures success in boosting customer demand for our products |

X | X | X | X | ||||||

| Cash Conversion Ratio % Measures success in working capital management and encourages informed capital expenditure decision-making |

X | X | ||||||||

| PSUs | ||||||||||

| Cumulative Adjusted Diluted EPS Measures success in delivering bottom-line earnings |

X | X | X | X | X | |||||

| Average Industrial Return on Invested Capital Measures success in efficiently using capital |

X | X | X | X | ||||||

| Cumulative Relative TSR Measures success in delivering superior market returns |

X | X | X | X | X | |||||

| Environmental, Social, & Governance (“ESG”) Measures | ||||||||||

| Annual Bonus | ||||||||||

| CO2 Emissions % Measures success in promoting energy efficient operations |

X | X | X | X | ||||||

| Accident Frequency Rate Measures success in improving workplace safety and encourages accountability for preventative action |

X | X | ||||||||

Compensation Framework

The following table summarizes the fundamental purpose and features of our core compensation elements for our NEOs in 2023.

-24-

| 2023 Target Compensation Mix | ||||||

| Element and Purpose | CEO | Other NEOs(1) |

Key Features and Pay for Performance Rationale |

|||

| Base Salary Attract and retain well-qualified executives; provide sufficient fixed pay to discourage inappropriate risk-taking. |

|

|

Fixed cash compensation

Set based on the NEO’s role, market data, skills, geographic scope, and prior experience |

|||

| Annual Bonus Focus and drive near-term business priorities; motivate achievement of objectives critical to annual operating and strategic plans, safety, and sustainability. |

|

|

At risk variable cash compensation

No change from 2022

Earned based on achieving quantifiable performance objectives

For any incentive to be earned, a minimum level of Consolidated Adjusted EBIT Margin % must be achieved

No guaranteed minimum

Threshold provides for 30% of the target opportunity

Maximum capped at 200% of the target opportunity

CEO’s incentive is based 100% on Company performance; other NEOs’ incentives are based on a combination of Company performance and an individual performance modifier range of 0%-125%

Subject to the Compensation Recovery Policy

|

|||

| Long-Term Equity Incentives Encourage achievement of long-term strategic objectives; encourage stock ownership and retention; motivate sustainable value creation; align NEOs’ interests with those of shareholders. |

|

|

Incentive linked to long-term value creation

No change from 2022 in mix of awards, vesting schedule, and maximum payout levels, adjusted 2023-2025 thresholds per market practice

Combination of PSUs (75% CEO; 67% other NEOs) and RSUs (25% CEO; 33% other NEOs)

At-risk variable PSUs earned based on achievement of quantifiable performance objectives, with the maximum number of shares that can be earned capped at 200% of target

CEO awards subject to five-year holding period from the date of grant

Subject to the Compensation Recovery Policy

|

|||

| Benefits and Contractual Agreements Attract and retain well- |

See Benefits Summary table by NEO in the Benefits Section | |||||

-25-

| 2023 Target Compensation Mix | ||||||

| qualified leaders by providing post-employment security and other benefits. |

Alignment with local market norms extended to other employees

Certain provisions and contractual terms for certain Global Leadership Team members |

|||||

| (1) | “Other NEOs” column reflects the average for the non-CEO NEOs calculated in local currency. |

| (2) | No variable remuneration has been clawed-back, and no variable remuneration has been adjusted retroactively from Executive or Non-Executive Directors or Other NEOs as no relevant occurrence was identified. |

Compensation Policies and Practices

The compensation framework is supported by various Company policies and practices that further support the compensation philosophy and reflect CNH’s high corporate governance standards. The policies also reflect the global nature of the executive leadership team and are designed to align with local market norms where relevant.

|

Set challenging performance targets with pre-determined stretch goals set at the beginning of the performance period |

|

Pay for performance, balancing short- and long-term time horizons, conducting scenario analyses to assess alignment |

|

Deliver the majority of NEO compensation in the form of at-risk, performance-based pay |

|

Maintain robust share ownership guidelines |

|

Apply a clawback policy to all incentive pay |

|

Consider pay ratios when establishing NEO compensation |

|

Operate a simple, transparent structure with goals, values and performance management that cascades through the Company |

|

Double trigger equity treatment applies on a change in control |

|

Apply a five-year holding period to CEO equity awards from the date of grant |

|

Encourage prudent risk taking and design programs that do not encourage unnecessary or excessive risk |

|

Apply caps to incentive payouts (200% of target) and permit no payout for performance below threshold |

|

Prohibit guaranteed compensation and loans for NEOs |

|

Avoid excessive compensation practices |

|

Engage with our shareholders to inform decision making |

-26-

Compensation Governance

Role of the HCC Committee

The HCC Committee is comprised of three directors, two of whom are independent; independence of all the members of the Committee is not required per foreign private issuer status. The directors are responsible for oversight of executive compensation, the Company’s remuneration policy, compensation of non-executive directors, and broader human capital management matters, in accordance with Dutch laws and the Dutch Corporate Governance Code (the “Dutch Code”).