SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March 2024

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form This Form 6-K for YPF S.A. (“YPF” or the “Company”) contains:

40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7):

Yes ☐ No ☒

Exhibit 1: Consolidated Financial Statements (USD)

Exhibit 2: Consolidated Financial Statements (ARS)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| YPF Sociedad Anónima |

||||||

| Date: March 14, 2024 |

By: |

/s/ Margarita Chun |

||||

| Name: |

Margarita Chun |

|||||

| Title: |

Market Relations Officer |

|||||

Exhibit 1

YPF SOCIEDAD ANONIMA

CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023, 2022 AND 2021

|

YPF SOCIEDAD ANONIMA CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

|

CONTENT

| Note |

Description |

F - Page | ||

| F - 1 | ||||

| F - 2 | ||||

| F - 3 | ||||

| F - 4 | ||||

| F - 5 | ||||

| F - 8 | ||||

| Notes to the consolidated financial statements: |

||||

| 1 |

General information, structure and organization of the Group’s business |

F - 9 | ||

| 2 |

Basis of preparation of the consolidated financial statements |

F - 10 | ||

| 3 |

F - 26 | |||

| 4 |

F - 26 | |||

| 5 |

F - 30 | |||

| 6 |

F - 34 | |||

| 7 |

F - 38 | |||

| 8 |

F - 39 | |||

| 9 |

F - 45 | |||

| 10 |

F - 47 | |||

| 11 |

F - 49 | |||

| 12 |

F - 49 | |||

| 13 |

F - 49 | |||

| 14 |

F - 50 | |||

| 15 |

F - 50 | |||

| 16 |

F - 50 | |||

| 17 |

F - 56 | |||

| 18 |

F - 57 | |||

| 19 |

F - 57 | |||

| 20 |

F - 58 | |||

| 21 |

F - 59 | |||

| 22 |

F - 62 | |||

| 23 |

F - 62 | |||

| 24 |

F - 62 | |||

| 25 |

F - 66 | |||

| 26 |

F - 66 | |||

| 27 |

F - 68 | |||

| 28 |

F - 68 | |||

| 29 |

F - 68 | |||

| 30 |

F - 70 | |||

| 31 |

F - 71 | |||

| 32 |

F - 71 | |||

| 33 |

F - 77 | |||

| 34 |

F - 81 | |||

| 35 |

F - 84 | |||

| 36 |

F - 105 | |||

| 37 |

F - 109 | |||

| 38 |

F - 112 |

| F - 1 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 | ||||

| Term |

Definition |

|

| ADR | American Depositary Receipt | |

| ADS | American Depositary Share | |

| AESA | Subsidiary A-Evangelista S.A. | |

| AFIP | Argentine Tax Authority (Administración Federal de Ingresos Públicos) | |

| ANSES | National Administration of Social Security (Administración Nacional de la Seguridad Social) | |

| ASC | Accounting Standards Codification | |

| Associate | Company over which YPF has significant influence as provided for in IAS 28 | |

| B2B | Business to Business | |

| B2C | Business to Consumer | |

| BCRA | Central Bank of the Argentine Republic (Banco Central de la República Argentina) | |

| BNA | Bank of the Argentine Nation (Banco de la Nación Argentina) | |

| BO | Official Gazette of the Argentine Republic (Boletín Oficial de la República Argentina) | |

| CAMMESA | Compañía Administradora del Mercado Mayorista Eléctrico S.A. | |

| CAN | Northern Argentine Basin (Cuenca Argentina Norte) | |

| CDS | Associate Central Dock Sud S.A. | |

| CGU | Cash-generating unit | |

| CNDC | Argentine Antitrust Authority (Comisión Nacional de Defensa de la Competencia) | |

| CNV | Argentine Securities Commission (Comisión Nacional de Valores) | |

| CPI | Consumer Price Index published by INDEC | |

| CSJN | Argentine Supreme Court of Justice (Corte Suprema de Justicia de la Nación Argentina) | |

| CT Barragán | Joint venture CT Barragán S.A. | |

| Eleran | Subsidiary Eleran Inversiones 2011 S.A.U. | |

| ENARGAS | Argentine Gas Regulator (Ente Nacional Regulador del Gas) | |

| ENARSA | Energía Argentina S.A. (formerly Integración Energética Argentina S.A. “IEASA”) | |

| FASB | Financial Accounting Standards Board | |

| FOB | Free on board | |

| Gas Austral | Associate Gas Austral S.A. | |

| GPA | Associate Gasoducto del Pacífico (Argentina) S.A. | |

| Group | YPF and its subsidiaries | |

| IAS | International Accounting Standard | |

| IASB | International Accounting Standards Board | |

| IDS | Associate Inversora Dock Sud S.A. | |

| IFRIC | International Financial Reporting Interpretations Committee | |

| IFRS | International Financial Reporting Standard | |

| INDEC | National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos) | |

| JA | Joint agreement (Unión Transitoria) | |

| Joint venture | Company jointly owned by YPF as provided for in IFRS 11 | |

| LGS | General Corporations Law (Ley General de Sociedades) No. 19,550 | |

| LNG | Liquified natural gas | |

| LPG | Liquefied petroleum gas | |

| MBtu | Million British thermal units | |

| MEGA | Joint venture Compañía Mega S.A. | |

| Metroenergía | Subsidiary Metroenergía S.A. | |

| Metrogas | Subsidiary Metrogas S.A. | |

| MINEM | Former Ministry of Energy and Mining (Ministerio de Energía y Minería) | |

| MLO | West Malvinas Basin (Cuenca Malvinas Oeste) | |

| MTN | Medium-term note | |

| NO | Negotiable obligations | |

| Oiltanking | Associate Oiltanking Ebytem S.A. | |

| OLCLP | Joint venture Oleoducto Loma Campana - Lago Pellegrini S.A. | |

| Oldelval | Associate Oleoductos del Valle S.A. | |

| OPESSA | Subsidiary Operadora de Estaciones de Servicios S.A. | |

| OTA | Joint venture OleoductoTrasandino (Argentina) S.A. | |

| OTC | Joint venture OleoductoTrasandino (Chile) S.A. | |

| PEN | National Executive Branch (Poder Ejecutivo Nacional) | |

| Peso | Argentine peso | |

| PIST | Transportation system entry point (Punto de ingreso al sistema de transporte) | |

| Profertil | Joint venture Profertil S.A. | |

| Refinor | Joint venture Refinería del Norte S.A. | |

| ROD | Record of decision | |

| RTI | Integral Tariff Review (Revisión Tarifaria Integral) | |

| RTT | Transitional Tariff Regime (Régimen Tarifario de Transición) | |

| SE | Secretariat of Energy (Secretaría de Energía) | |

| SEC | U.S. Securities and Exchange Commission | |

| SEE | Secretariat of Electric Energy (Secretaría de Energía Eléctrica) | |

| SGE | Government Secretariat of Energy (Secretaría de Gobierno de Energía) | |

| SRH | Hydrocarbon Resources Secretariat (Secretaría de Recursos Hidrocarburíferos) | |

| SSHyC | Under-Secretariat of Hydrocarbons and Fuels (Subsecretaría de Hidrocarburos y Combustibles) | |

| Subsidiary | Company controlled by YPF as provided for in IFRS 10. | |

| Sustentator | Joint venture Sustentator S.A. | |

| Termap | Associate Terminales Marítimas Patagónicas S.A. | |

| Turnover tax | Impuesto a los ingresos brutos | |

| U.S. dollar | United States dollar | |

| UNG | Unaccounted natural gas | |

| US$ | United States dollar | |

| US$/bbl | U.S. dollar per barrel | |

| UVA | Unit of Purchasing Power | |

| VAT | Value added tax | |

| WEM | Wholesale Electricity Market | |

| YPF Brasil | Subsidiary YPF Brasil Comercio Derivado de Petróleo Ltda. | |

| YPF Chile | Subsidiary YPF Chile S.A. | |

| YPF EE | Joint venture YPF Energía Eléctrica S.A. | |

| YPF Gas | Associate YPF Gas S.A. | |

| YPF Holdings | Subsidiary YPF Holdings, Inc. | |

| YPF International | Subsidiary YPF International S.A. | |

| YPF or the Company | YPF S.A. | |

| YPF Perú | Subsidiary YPF E&P Perú S.A.C. | |

| YPF Ventures | Subsidiary YPF Ventures S.A.U. | |

| YTEC | Subsidiary YPF Tecnología S.A. | |

| Y-LUZ | Subsidiary Y-LUZ Inversora S.A.U. controlled by YPF EE |

| F - 2 |

|

|||

| YPF SOCIEDAD ANONIMA |

CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021

Legal address

Macacha Güemes 515 - Ciudad Autónoma de Buenos Aires, Argentina.

Fiscal year

No.47 beginning on January 1, 2023.

Main business of the Company

The Company’s purpose shall be to perform, on its own, through third parties or in association with third parties, the study, exploration, development and production of crude oil, natural gas and other minerals and refining, commercialization and distribution of crude oil and petroleum products and direct and indirect petroleum derivatives, including petrochemicals, chemicals, including those derived from hydrocarbons, and non-fossil fuels, biofuels and their components, as well as production of electric power from hydrocarbons, through which it may manufacture, use, purchase, sell, exchange, import or export them. It shall also be the Company’s purpose to render, directly, through a subsidiary or in association with third parties, telecommunications services in all forms and modalities authorized by the legislation in force after applying for the relevant licenses as required by the regulatory framework, as well as the production, industrialization, processing, commercialization, conditioning, transportation and stockpiling of grains and products derived from grains, as well as any other activity complementary to its industrial and commercial business or any activity which may be necessary to attain its objective. In order to fulfill these objectives, the Company may set up, become associated with or have an interest in any public or private entity domiciled in Argentina or abroad, within the limits set forth in the Bylaws.

Filing with the Public Registry of Commerce

Bylaws filed on February 5, 1991 under No. 404, Book 108, Volume A, Sociedades Anónimas, with the Public Registry of Commerce of Buenos Aires City, in charge of the Argentine Registry of Companies (Inspección General de Justicia); and Bylaws in substitution of previous Bylaws, filed on June 15, 1993, under No. 5,109, Book 113, Volume A, Sociedades Anónimas, with the above mentioned Public Registry.

Duration of the Company

Through June 15, 2093.

Last amendment to the Bylaws

April 30, 2021 registered with the Public Registry of Commerce of Buenos Aires City in charge of the Argentine Registry of Companies (Inspección General de Justicia) on August 5, 2021 under No. 12,049, Book 103 of Corporations. In addition, an amendment approved by Shareholders’ meeting dated January 26, 2024 is in process of registration with the aforementioned Public Registry.

Capital structure

393,312,793 shares of common stock, $10 par value and 1 vote per share.

Subscribed, paid-in and authorized for stock exchange listing (in pesos)

3,933,127,930.

HORACIO DANIEL MARIN

President

| F - 3 |

|

|||

| YPF SOCIEDAD ANONIMA |

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF DECEMBER 31, 2023, 2022 AND 2021

(Amounts expressed in millions of United States dollars)

| Notes | 2023 | 2022 | 2021 | |||||||||||

| ASSETS |

||||||||||||||

| Non-current assets |

||||||||||||||

| Intangible assets |

7 | 367 | 384 | 419 | ||||||||||

| Property, plant and equipment |

8 | 17,712 | 17,510 | 16,003 | ||||||||||

| Right-of-use assets |

9 | 631 | 541 | 519 | ||||||||||

| Investments in associates and joint ventures |

10 | 1,676 | 1,905 | 1,529 | ||||||||||

| Deferred income tax assets, net |

17 | 18 | 17 | 19 | ||||||||||

| Other receivables |

12 | 158 | 205 | 190 | ||||||||||

| Trade receivables |

13 | 31 | 6 | 43 | ||||||||||

| Investments in financial assets |

14 | 8 | 201 | 25 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total non-current assets |

20,601 | 20,769 | 18,747 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Current assets |

||||||||||||||

| Assets held for disposal |

- | - | 1 | |||||||||||

| Inventories |

11 | 1,683 | 1,738 | 1,500 | ||||||||||

| Contract assets |

24 | 10 | 1 | 13 | ||||||||||

| Other receivables |

12 | 381 | 808 | 616 | ||||||||||

| Trade receivables |

13 | 973 | 1,504 | 1,305 | ||||||||||

| Investments in financial assets |

14 | 264 | 319 | 497 | ||||||||||

| Cash and cash equivalents |

15 | 1,123 | 773 | 611 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total current assets |

4,434 | 5,143 | 4,543 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL ASSETS |

25,035 | 25,912 | 23,290 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| SHAREHOLDERS’ EQUITY |

||||||||||||||

| Shareholders’ contributions |

4,504 | 4,507 | 4,535 | |||||||||||

| Retained earnings |

4,445 | 5,947 | 3,649 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Shareholders’ equity attributable to shareholders of the parent company |

8,949 | 10,454 | 8,184 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Non-controlling interest |

102 | 98 | 80 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL SHAREHOLDERS’ EQUITY |

9,051 | 10,552 | 8,264 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| LIABILITIES |

||||||||||||||

| Non-current liabilities |

||||||||||||||

| Provisions |

16 | 2,660 | 2,571 | 2,519 | ||||||||||

| Contract liabilities |

24 | 34 | - | - | ||||||||||

| Deferred income tax liabilities, net |

17 | 1,242 | 1,733 | 1,805 | ||||||||||

| Income tax liability |

17 | 4 | 26 | 29 | ||||||||||

| Taxes payable |

18 | - | 1 | 2 | ||||||||||

| Salaries and social security |

19 | - | 1 | 32 | ||||||||||

| Lease liabilities |

20 | 325 | 272 | 276 | ||||||||||

| Loans |

21 | 6,682 | 5,948 | 6,534 | ||||||||||

| Other liabilities |

22 | 112 | 19 | 9 | ||||||||||

| Accounts payable |

23 | 5 | 6 | 9 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total non-current liabilities |

11,064 | 10,577 | 11,215 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Current liabilities |

||||||||||||||

| Provisions |

16 | 181 | 199 | 188 | ||||||||||

| Contract liabilities |

24 | 69 | 77 | 130 | ||||||||||

| Income tax liability |

17 | 31 | 27 | 13 | ||||||||||

| Taxes payable |

18 | 139 | 173 | 143 | ||||||||||

| Salaries and social security |

19 | 210 | 297 | 229 | ||||||||||

| Lease liabilities |

20 | 341 | 294 | 266 | ||||||||||

| Loans |

21 | 1,508 | 1,140 | 845 | ||||||||||

| Other liabilities |

22 | 122 | 12 | 34 | ||||||||||

| Accounts payable |

23 | 2,319 | 2,564 | 1,963 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total current liabilities |

4,920 | 4,783 | 3,811 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL LIABILITIES |

15,984 | 15,360 | 15,026 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

25,035 | 25,912 | 23,290 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

Accompanying notes are an integral part of these consolidated financial statements.

HORACIO DANIEL MARIN

President

| F - 4 |

|

|||

| YPF SOCIEDAD ANONIMA |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

FOR THE YEARS ENDED DECEMBER 31, 2023, 2022 AND 2021

(Amounts expressed in millions of United States dollars, except per share information expressed in United States dollars)

| Net income |

Notes | 2023 | 2022 | 2021 | ||||||||||||

| Revenues |

24 | 17,311 | 18,757 | 13,682 | ||||||||||||

| Costs |

25 | (13,853) | (13,684) | (10,629) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Gross profit |

3,458 | 5,073 | 3,053 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Selling expenses |

26 | (1,804) | (1,896) | (1,507) | ||||||||||||

| Administrative expenses |

26 | (705) | (657) | (470) | ||||||||||||

| Exploration expenses |

26 | (61) | (65) | (30) | ||||||||||||

| Impairment of property, plant and equipment and intangible assets |

7-8 | (2,288) | (123) | (115) | ||||||||||||

| Other net operating results |

27 | 152 | 150 | (232) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Operating profit or loss |

(1,248) | 2,482 | 699 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Income from equity interests in associates and joint ventures |

10 | 94 | 446 | 287 | ||||||||||||

| Financial income |

28 | 4,489 | 2,188 | 904 | ||||||||||||

| Financial costs |

28 | (3,979) | (2,315) | (1,408) | ||||||||||||

| Other financial results |

28 | 387 | 255 | 233 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net financial results |

28 | 897 | 128 | (271) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net profit or loss before income tax |

(257) | 3,056 | 715 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Income tax |

17 | (1,020) | (822) | (699) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net profit or loss for the year |

(1,277) | 2,234 | 16 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Other comprehensive income |

||||||||||||||||

| Items that may be reclassified subsequently to profit or loss: |

||||||||||||||||

| Translation effect from subsidiaries, associates and joint ventures |

(442) | (194) | (62) | |||||||||||||

| Result from net monetary position in subsidiaries, associates and joint ventures (1) | 221 | 276 | 177 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Other comprehensive income for the year |

(221) | 82 | 115 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Total comprehensive income for the year |

(1,498) | 2,316 | 131 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net profit or loss for the year attributable to: |

||||||||||||||||

| Shareholders of the parent company |

(1,312) | 2,228 | 26 | |||||||||||||

| Non-controlling interest |

35 | 6 | (10) | |||||||||||||

| Other comprehensive income for the year attributable to: |

||||||||||||||||

| Shareholders of the parent company |

(190) | 70 | 98 | |||||||||||||

| Non-controlling interest |

(31) | 12 | 17 | |||||||||||||

| Total comprehensive income for the year attributable to: |

||||||||||||||||

| Shareholders of the parent company |

(1,502) | 2,298 | 124 | |||||||||||||

| Non-controlling interest |

4 | 18 | 7 | |||||||||||||

| Earnings per share attributable to shareholders of the parent company: |

||||||||||||||||

| Basic and diluted |

31 | (3.35) | 5.67 | 0.07 | ||||||||||||

| (1) | Result associated to subsidiaries, associates and joint ventures with the peso as functional currency, see Note 2.b.1). |

Accompanying notes are an integral part of these consolidated financial statements.

HORACIO DANIEL MARIN

President

| F - 5 |

|

|||

| YPF SOCIEDAD ANONIMA |

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2023, 2022 AND 2021

(Amounts expressed in millions of United States dollars)

| 2023 |

||||||||||||||||||||

| Shareholders’ contributions |

||||||||||||||||||||

| Capital |

Treasury shares |

Share-based plans |

Acquisition cost of treasury shares (2) |

Share trading premiums |

Issuance |

Total |

||||||||||||||

| Balance at the beginning of the fiscal year |

3,915 | 18 | 2 | (30) | (38) | 640 | 4,507 | |||||||||||||

| Accrual of share-based benefit plans (3) |

- | - | 3 | - | - | - | 3 | |||||||||||||

| Repurchase of treasury shares |

- | - | - | - | - | - | - | |||||||||||||

| Settlement of share-based benefit plans |

4 | (4) | (4) | - | (2) | - | (6) | |||||||||||||

| Constitution of reserves (5) |

- | - | - | - | - | - | - | |||||||||||||

| Other comprehensive income |

- | - | - | - | - | - | - | |||||||||||||

| Net profit or loss |

- | - | - | - | - | - | - | |||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

| Balance at the end of the fiscal year |

3,919 | 14 | 1 | (30) | (40) | 640 | 4,504 | |||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

| Retained earnings (4) |

Equity attributable to |

|||||||||||||||||||

| Legal reserve |

Reserve for future dividends |

Reserve for investments |

Reserve for purchase of treasury shares |

Other comprehensive income |

Unappropriated retained earnings and losses |

Shareholders |

Non- controlling |

Total |

||||||||||||

| Balance at the beginning of the fiscal year |

787 | - | - | - | (494) | 5,654 | 10,454 | 98 | 10,552 | |||||||||||

| Accrual of share-based benefit plans (3) |

- | - | - | - | - | - | 3 | - | 3 | |||||||||||

| Repurchase of treasury shares |

- | - | - | - | - | - | - | - | - | |||||||||||

| Settlement of share-based benefit plans |

- | - | - | - | - | - | (6) | - | (6) | |||||||||||

| Constitution of reserves (5) |

- | 226 | 5,325 | 35 | - | (5,586) | - | - | - | |||||||||||

| Other comprehensive income |

- | - | - | - | (190) | - | (190) | (31) | (221) | |||||||||||

| Net profit or loss |

- | - | - | - | - | (1,312) | (1,312) | 35 | (1,277) | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Balance at the end of the fiscal year |

787 | 226 | 5,325 | 35 | (684) | (1) | (1,244) | 8,949 | 102 | 9,051 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

| (1) | Includes (1,873) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the U.S. dollar and 1,189 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency. See Note 2.b.1). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 37. |

| (4) | Includes 70 restricted to the distribution of retained earnings. See Note 30. |

| (5) | As decided in Shareholders’ Meeting of April 28, 2023. |

HORACIO DANIEL MARIN

President

| F - 6 |

|

|||

| YPF SOCIEDAD ANONIMA |

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2023, 2022 AND 2021 (cont.)

(Amounts expressed in millions of United States dollars)

| 2022 |

||||||||||||||||||||

| Shareholders’ contributions |

||||||||||||||||||||

| Capital |

Treasury shares |

Share-based benefit plans |

Acquisition cost of treasury shares (2) |

Share trading premiums |

Issuance premiums |

Total |

||||||||||||||

| Balance at the beginning of the fiscal year |

3,931 | 2 | 5 | (5) | (38) | 640 | 4,535 | |||||||||||||

| Accrual of share-based benefit plans (3) |

- | - | 2 | - | - | - | 2 | |||||||||||||

| Repurchase of treasury shares |

(19) | 19 | - | (28) | - | - | (28) | |||||||||||||

| Settlement of share-based benefit plans |

3 | (3) | (5) | 3 | - | - | (2) | |||||||||||||

| Absorption of accumulated losses (5) |

- | - | - | - | - | - | - | |||||||||||||

| Other comprehensive income |

- | - | - | - | - | - | - | |||||||||||||

| Net profit |

- | - | - | - | - | - | - | |||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

| Balance at the end of the fiscal year |

3,915 | 18 | 2 | (30) | (38) | 640 | 4,507 | |||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

| Retained earnings (4) |

Equity attributable to |

|||||||||||||||||||

| Legal reserve |

Reserve for future dividends |

Reserve for investments |

Reserve for purchase of treasury shares |

Other comprehensive income |

Unappropriated retained earnings and losses |

Shareholders of the parent company |

Non- controlling interest |

Total shareholders’ equity |

||||||||||||

| Balance at the beginning of the fiscal year |

787 | - | - | - | (564) | 3,426 | 8,184 | 80 | 8,264 | |||||||||||

| Accrual of share-based benefit plans (3) |

- | - | - | - | - | - | 2 | - | 2 | |||||||||||

| Repurchase of treasury shares |

- | - | - | - | - | - | (28) | - | (28) | |||||||||||

| Settlement of share-based benefit plans |

- | - | - | - | - | - | (2) | - | (2) | |||||||||||

| Absorption of accumulated losses (5) |

- | - | - | - | - | - | - | - | - | |||||||||||

| Other comprehensive income |

- | - | - | - | 70 |

|

- | 70 | 12 | 82 | ||||||||||

| Net profit |

- | - | - | - | - | 2,228 | 2,228 | 6 | 2,234 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Balance at the end of the fiscal year |

787 | - | - | - | (494) | (1) | 5,654 | 10,454 | 98 | 10,552 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

| (1) | Includes (1,431) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the U.S. dollar and 937 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency. See Note 2.b.1). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 37. |

| (4) | Includes 68 restricted to the distribution of retained earnings. |

| (5) | As decided in Shareholders’ Meeting of April 29, 2022. |

HORACIO DANIEL MARIN

President

| F - 7 |

|

|||

| YPF SOCIEDAD ANONIMA |

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2023, 2022 AND 2021 (cont.)

(Amounts expressed in millions of United States dollars)

| 2021 |

||||||||||||||||||||

| Shareholders’ contributions |

||||||||||||||||||||

| Capital |

Treasury shares |

Share-based |

Acquisition cost of treasury shares (2) |

Share trading premiums |

Issuance premiums |

Total |

||||||||||||||

| Balance at the beginning of the fiscal year |

3,926 | 7 | (4) | 7 | (44) | 640 | 4,532 | |||||||||||||

| Accrual of share-based benefit plans (3) |

- | - | 6 | - | - | - | 6 | |||||||||||||

| Repurchase of treasury shares |

- | - | - | - | - | - | - | |||||||||||||

| Settlement of share-based benefit plans |

5 | (5) | 3 | (12) | 6 | - | (3) | |||||||||||||

| Reversal of reserves and absorption of accumulated losses (4) |

- | - | - | - | - | - | - | |||||||||||||

| Other comprehensive income |

- | - | - | - | - | - | - | |||||||||||||

| Net profit or loss |

- | - | - | - | - | - | - | |||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

| Balance at the end of the fiscal year |

3,931 | 2 | 5 | (5) | (38) | 640 | 4,535 | |||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

| Retained earnings |

Equity attributable to |

|||||||||||||||||||

| Legal reserve |

Reserve for future dividends |

Reserve for investments |

Reserve for |

Other |

Unappropriated |

Shareholders |

Non- controlling |

Total |

||||||||||||

| Balance at the beginning of the fiscal year |

787 | 114 | 1,630 | 37 | (662) | 1,619 | 8,057 | 73 | 8,130 | |||||||||||

| Accrual of share-based benefit plans (3) |

- | - | - | - | - | - | 6 | - | 6 | |||||||||||

| Repurchase of treasury shares |

- | - | - | - | - | - | - | - | - | |||||||||||

| Settlement of share-based benefit plans |

- | - | - | - | - | - | (3) | - | (3) | |||||||||||

| Reversal of reserves and absorption of accumulated losses (4) |

- | (114) | (1,630) | (37) | - | 1,781 | - | - | - | |||||||||||

| Other comprehensive income |

- | - | - | - | 98 | - | 98 | 17 | 115 | |||||||||||

| Net profit or loss |

- | - | - | - | - | 26 | 26 | (10) | 16 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Balance at the end of the fiscal year |

787 | - | - | - | (564) | (1) | 3,426 | 8,184 | 80 | 8,264 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

| (1) | Includes (1,237) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the U.S. dollar and 673 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency. See Note 2.b.1). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 37. |

| (4) | As decided in Shareholders’ Meeting of April 30, 2021. |

Accompanying notes are an integral part of these consolidated financial statements.

HORACIO DANIEL MARIN

President

| F - 8 |

|

|||

| YPF SOCIEDAD ANONIMA |

CONSOLIDATED STATEMENTS OF CASH FLOW

FOR THE YEARS ENDED DECEMBER 31, 2023, 2022 AND 2021

(Amounts expressed in millions of United States dollars)

| 2023 | 2022 | 2021 | ||||||||||||||

| Cash flows from operating activities |

||||||||||||||||

| Net profit or loss |

(1,277) | 2,234 | 16 | |||||||||||||

| Adjustments to reconcile net profit or loss to cash flows provided by operating activities: |

||||||||||||||||

| Income from equity interests in associates and joint ventures |

(94) | (446) | (287) | |||||||||||||

| Depreciation of property, plant and equipment |

3,016 | 2,551 | 2,816 | |||||||||||||

| Amortization of intangible assets |

37 | 43 | 51 | |||||||||||||

| Depreciation of right-of-use assets |

220 | 214 | 201 | |||||||||||||

| Retirement of property, plant and equipment and intangible assets and consumption of materials |

383 | 375 | 342 | |||||||||||||

| Charge on income tax |

1,020 | 822 | 699 | |||||||||||||

| Net increase in provisions |

426 | 139 | 510 | |||||||||||||

| Impairment of property, plant and equipment and intangible assets |

2,288 | 123 | 115 | |||||||||||||

| Effect of changes in exchange rates, interest and others |

(692) | (73) | 440 | |||||||||||||

| Share-based benefit plans |

3 | 8 | 6 | |||||||||||||

| Other insurance income |

- | - | (15) | |||||||||||||

| Result from debt exchange |

- | - | (21) | |||||||||||||

| Result from assignment of areas |

- | - | (21) | |||||||||||||

| Result from sale of assets |

- | - | (57) | |||||||||||||

| Changes in assets and liabilities: |

||||||||||||||||

| Trade receivables |

(178) | (397) | 117 | |||||||||||||

| Other receivables |

(178) | (94) | (241) | |||||||||||||

| Inventories |

44 | (232) | (303) | |||||||||||||

| Accounts payable |

736 | 600 | (91) | |||||||||||||

| Taxes payables |

74 | 112 | (33) | |||||||||||||

| Salaries and social security |

231 | 80 | 10 | |||||||||||||

| Other liabilities |

66 | (14) | (92) | |||||||||||||

| Decrease in provisions due to payment/use |

(491) | (159) | (81) | |||||||||||||

| Contract assets |

(12) | 7 | (6) | |||||||||||||

| Contract liabilities |

25 | (29) | 56 | |||||||||||||

| Dividends received |

276 | 94 | 56 | |||||||||||||

| Proceeds from collection of profit loss insurance |

- | 1 | 19 | |||||||||||||

| Income tax payments |

(10) | (266) | (5) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net cash flows from operating activities (1) (2) |

5,913 | 5,693 | 4,201 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Investing activities: (3) |

||||||||||||||||

| Acquisition of property, plant and equipment and intangible assets |

(5,673) | (4,006) | (2,448) | |||||||||||||

| Contributions and acquisitions of interests in associates and joint ventures |

(5) | (2) | - | |||||||||||||

| Loans with related parties, net |

- | (18) | - | |||||||||||||

| Proceeds from sales of financial assets |

583 | 643 | 406 | |||||||||||||

| Payments from purchase of financial assets |

(337) | (740) | (594) | |||||||||||||

| Interest received from financial assets |

85 | 99 | 41 | |||||||||||||

| Proceeds from assignment of areas and sale of assets |

15 | 8 | 48 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net cash flows used in investing activities |

(5,332) | (4,016) | (2,547) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Financing activities: (3) |

||||||||||||||||

| Payments of loans |

(1,396) | (780) | (1,653) | |||||||||||||

| Payments of interest |

(623) | (543) | (615) | |||||||||||||

| Proceeds from loans |

2,667 | 402 | 963 | |||||||||||||

| Account overdraft, net |

(3) | 71 | 8 | |||||||||||||

| Repurchase of treasury shares |

- | (28) | - | |||||||||||||

| Payments of leases |

(359) | (341) | (302) | |||||||||||||

| Payments of interest in relation to income tax |

(8) | (8) | (1) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net cash flows from / (used in) financing activities |

278 | (1,227) | (1,600) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Effect of changes in exchange rates on cash and cash equivalents |

(509) | (288) | (93) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net Increase (Decrease) in cash and cash equivalents |

350 | 162 | (39) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Cash and cash equivalents at the beginning of the fiscal year |

773 | 611 | 650 | |||||||||||||

| Cash and cash equivalents at the end of the fiscal year |

1,123 | 773 | 611 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| Net Increase (Decrease) in cash and cash equivalents |

350 | 162 | (39) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| (1) | Does not include the effect of changes in exchange rates generated by cash and cash equivalents, which is exposed separately in this statement. |

| (2) | Includes 193, 175 and 119 for the fiscal year ended December 31, 2023, 2022 and 2021, respectively, for payment of short-term leases and payments of the variable charge of leases related to the underlying asset performance and/or use. |

| (3) | The main investing and financing transactions that have not affected cash and cash equivalents correspond to: |

| 2023 | 2022 | 2021 | ||||||||||

| Unpaid acquisitions of property, plant and equipment and intangible assets |

434 | 488 | 357 | |||||||||

| Hydrocarbon wells abandonment costs |

507 | 268 | 32 | |||||||||

| Additions of right-of-use assets |

404 | 306 | 284 | |||||||||

| Capitalization of depreciation of right-of-use assets |

68 | 57 | 44 | |||||||||

| Capitalization of financial accretion for lease liabilities |

13 | 14 | 11 | |||||||||

| Capitalization in associates and joint ventures |

- | 1 | - | |||||||||

Accompanying notes are an integral part of these consolidated financial statements.

HORACIO DANIEL MARIN

President

| F - 9 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

(Amounts expressed in millions of United States dollars, except shares and per shares amounts expressed in United States dollars, and as otherwise indicated)

| 1. | GENERAL INFORMATION, STRUCTURE AND ORGANIZATION OF THE GROUP’S BUSINESS |

General information

YPF S.A. (“YPF” or the “Company”) is a stock corporation (sociedad anónima) incorporated under the Argentine laws, with a registered office at Macacha Güemes 515, in the City of Buenos Aires.

YPF and its subsidiaries (the “Group”) form the leading energy group in Argentina, which operates a fully integrated oil and gas chain with leading market positions across the domestic Upstream, Downstream and Gas and Power businesses.

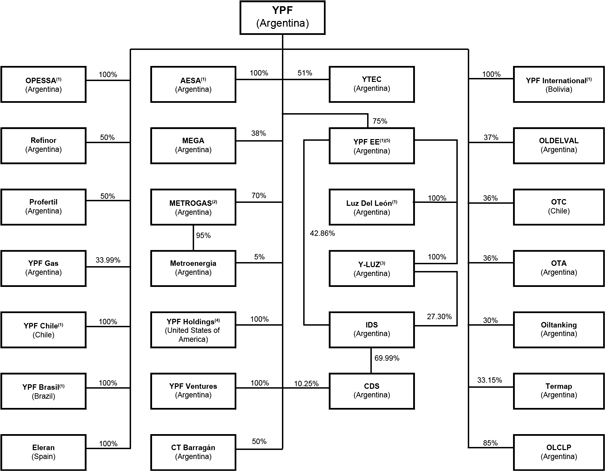

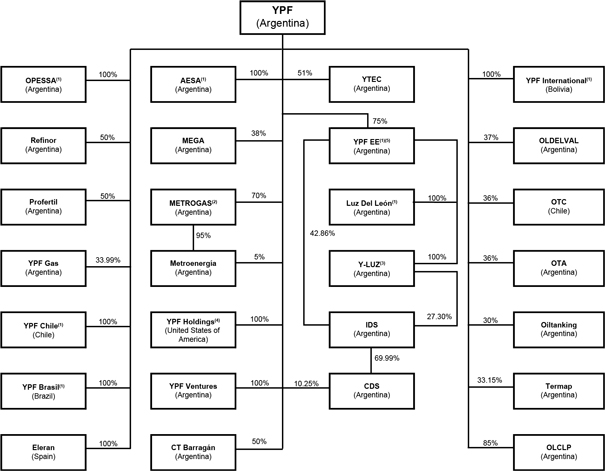

Structure and organization of the economic Group

The following chart shows the organizational structure, including the main companies of the Group, as of December 31, 2023:

| (1) | Held directly and indirectly. |

| (2) | See Note 35.c.3), “Note from ENARGAS related to YPF’s interest in Metrogas” section. |

| (3) | On April 13, 2023, YPF EE, through its subsidiary Y-LUZ, completed the purchase from Enel Américas S.A. of 57.14% of common shares of IDS, taking control of IDS and its subsidiary CDS as of said date. Simultaneously, through a joint purchase agreement signed with Pan American Sur S.A. (“PAS”), Y-LUZ transferred shares representing 29.84% of the capital stock of IDS to PAS. |

| (4) | See Note 3. |

| (5) | As of January 1, 2023, YPF EE merged with the companies Y-GEN Eléctrica S.A.U. and Y-GEN Eléctrica II S.A.U. |

| F - 10 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 1. | GENERAL INFORMATION, STRUCTURE AND ORGANIZATION OF THE GROUP’S BUSINESS (cont.) |

Organization of the business

As of December 31, 2023, the Group carries out its operations in accordance with the following structure:

| - | Upstream |

| - | Downstream |

| - | Gas and Power |

| - | Central Administration and Others |

Activities covered by each business segment are detailed in Note 5.

The operations, properties and clients of the Group are mainly located in Argentina. However, the Group also holds participating interest in exploratory areas in Bolivia and sells jet fuel, natural gas, lubricants and derivatives in Chile and lubricants and derivatives in Brazil.

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS |

2.a) Applicable accounting framework

The consolidated financial statements of the Company for the fiscal year ended December 31, 2023 are presented in accordance with the IFRS as issued by the IASB. The fiscal year of the Company begins on January 1 and ends on December 31, each year.

2.b) Material accounting policies

2.b.1) Basis of preparation and presentation

Functional currency

YPF’s functional currency is the U.S. dollar, which has been determined pursuant to the guidelines set out in IAS 21 “The effects of changes in foreign exchange rates”.

Transactions in currencies other than the functional currency of the Company are considered as transactions in foreign currency and are initially recognized in the functional currency using the exchange rate at the date of the transaction (or, for practical reasons, and when the exchange rate has not changed significantly, the average exchange rate of each month). At the end of each reporting period, or at the date of settlement: (i) monetary items in foreign currency are translated at the exchange rate on such date and the exchange differences arising from such translation are recognized in the “Net financial results” line item in the statement of comprehensive income for the period in which they arise; (ii) and non-monetary items in foreign currency which are measured in terms of its historical cost, as well as results, are valued in functional currency using the exchange rate at the date of the transaction.

The effects of translating the results and financial position of subsidiaries, associates and joint ventures with functional currency other than the U.S. dollar are recorded in the “Other comprehensive income” line item in the statement of comprehensive income for the period in which they arise.

In the event of total or partial disposal of a subsidiary (resulting in loss of control), an associate or a joint venture whose functional currency is not the U.S. dollar, the exchange differences accumulated in the “Other comprehensive income” account in the statement of changes in shareholders’ equity are reclassified to profit or loss for the period. In the event of partial disposal of a subsidiary not resulting in loss of control, the proportionate share of the accumulated translation differences is reclassified to the “non-controlling interest” account in the statement of changes in shareholders’ equity.

| F - 11 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Presentation currency

The information included in these consolidated financial statements is presented in U.S. dollars, which is the Company’s functional currency.

The consolidated financial statements used by YPF for statutory, legal and regulatory purposes in Argentina are those in pesos and filed with the CNV and approved by the Board of Directors and authorized to be issued on March 6, 2024.

Financial information of subsidiaries, associates and joint ventures with a functional currency of a hyperinflationary economy

Under IAS 29 “Financial reporting in hyperinflationary economies”, the financial statements of an entity whose functional currency is the currency of a hyperinflationary economy have to be restated in terms of the measuring unit current (“inflation-adjusted currency”) at the end of the reporting period.

IAS 29 describes certain quantitative and qualitative factors to be considered to determine whether or not an economy is hyperinflationary. Based on such evaluation, it was concluded that the application of adjustment for inflation had to be resumed. Besides, Law No. 27,468 published in the BO on December 4, 2018, established that annual financial statements, for interim and special periods closing on or after December 31, 2018, are to be filed with the CNV in inflation-adjusted currency, as set out in IAS 29.

Financial statements of subsidiaries with a functional currency of a hyperinflationary economy are restated in compliance with IAS 29 before they are included in the consolidated financial statements of their parent company whose functional currency is of a non-hyperinflationary economy (U.S. dollar in the case of YPF), without restating the comparative figures.

Subsequently, the results and financial position of such subsidiaries are translated into U.S. dollars at the closing rate of their financial statements. The effect of restatement of comparative figures, which are presented as amounts in inflation-adjusted currency in the financial statements of the previous fiscal year, and which are not adjusted to reflect subsequent variations in general levels of prices or exchange rates are recognized in the “Result from net monetary position in subsidiaries, associates and joint ventures” line under the “Other comprehensive income” line item in the statement of comprehensive income.

These criteria are also applied by the Group for its investments in associates and joint ventures.

When an economy ceases to be hyperinflationary and, therefore, the entity no longer restates its financial statements according to IAS 29, it will use as historical costs the amounts restated to the inflation-adjusted currency at the date the entity ceased restating its financial statements.

Current and non-current classification

The presentation in the statement of financial position makes a distinction between current and non-current assets and liabilities, according to the activities’ operating cycle.

Current assets and liabilities include assets and liabilities that are realized or settled in the 12-month period following the closing date of the period. All other assets and liabilities are classified as non-current.

Accounting criteria

These consolidated financial statements have been prepared under the historical cost approach, considering for the “Property, plant and equipment” and “Intangible assets” line items the attributable cost approach adopted from the date of transition to IFRS (January 1, 2011), except for financial assets measured at fair value through profit or loss (see Note 2.b.7)).

| F - 12 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Non-monetary assets and liabilities of subsidiaries with the peso as functional currency were restated to the closing currency.

Consolidation policies

The Group consolidates in the financial statements all subsidiaries over which it exercises control and eliminates intragroup balances and transactions, which are those between consolidated entities. The Group controls an entity when it is exposed to or is entitled to the variable returns arising from its interest in the entity and has the ability to affect those returns through its power over the entity, as defined in IFRS 10 “Consolidated financial statements”.

For the consolidation, the most recent financial statements available of the subsidiaries as of the end of each period are used, considering significant subsequent events and transactions and/or available management information and the transactions between YPF and the subsidiaries that would have produced changes in the equity of the latter. The publication date of the most recent financial statements of certain companies of the Group may differ from the publication date of those of YPF, mainly for administrative reasons. Additionally, the accounting principles and criteria used by these companies have been homogenized, where appropriate, with those used by YPF, with the aim of presenting the consolidated financial statements based on uniform measurement and presentation standards.

The Company holds 100% of capital of the consolidated companies, with the exception of the holdings in Metrogas (70%) and YTEC (51%). The Company concluded that there are no significant non-controlling interests requiring the disclosure of additional information, as set out in IFRS 12 “Disclosure of interests in other entities”. The main subsidiaries are described in Note 10.

Joint operations

Interests in JA and other similar contracts defined as joint operations when the parties have rights to the assets and obligations for the liabilities relating to the joint arrangement, have been recognized on the basis of the share of assets, liabilities, income and expenses related to each joint arrangement in accordance with IFRS 11 “Joint arrangements”, and are presented in the statement of financial position and in the statement of comprehensive income, depending on their specific nature. The main JA are described in Note 29.

2.b.2) Intangible assets

Intangible assets are measured using the cost model under IAS 38 “Intangible assets”, in which, after initial recognition, the asset is carried at its cost less amortization and any impairment loss.

The estimated useful life and the amortization method of each class of asset are revised annually at the end of each fiscal year and, if appropriate, are adjusted prospectively. The recoverability of these assets is revised as set out in Note 2.b.5).

The Group has no intangible assets with indefinite useful lives as of December 31, 2023, 2022 and 2021.

The main intangible assets of the Group are as follows:

Service concessions

The Group classifies hydrocarbon transportation concessions - granted under the Hydrocarbons Law and meeting the conditions established in IFRIC 12 “Service Concession Arrangements” - as intangible assets (see Note 35.a.1)). These assets are amortized using the straight-line method throughout the term of said concessions.

Since the issuance of Decree No. 115/2019, hydrocarbon transportation concessions granted after the publication of such Decree are classified in the “Property, plant and equipment” line item in the statement of financial position (see Note 35.a.1)).

| F - 13 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Exploration rights

Exploration rights represent the exclusive right to perform all the activities required for the search of hydrocarbons in the area defined in the exploration permit and during the terms specified in each bidding document by the enforcement authority, depending on the purpose of the exploration (conventional or unconventional). See Note 35.a.1).

The Group classifies exploration rights as intangible assets in compliance with IFRS 6 “Exploration for and Evaluation of Mineral Resources”. These assets are not amortized as they are related to investments in fields in evaluation stage.

Exploration costs (geological and geophysical expenses, maintenance costs and other costs relating to the exploration activity), excluding exploratory drilling costs, that are capitalized in the “Exploratory drilling in progress” account of the “Property, plant and equipment” line item in the statement of financial position (see Note 2.b.3)), are charged to net income in the statement of comprehensive income.

When the technical reliability and commercial viability of hydrocarbon field exploitation is demonstrable, these assets are reclassified to the “Mining property, wells and related equipment” account of the “Property, plant and equipment” line item in the statement of financial position.

Other intangible assets

The Group classifies as intangible assets mainly all acquisition costs of software licenses and development costs of computer applications. These assets are amortized using the straight-line method based on the estimated useful life of each type of asset, which is 5 years on average.

2.b.3) Property, plant and equipment

Property, plant and equipment are measured using the cost model under IAS 16 “Property, Plant and Equipment”, in which, after initial recognition, the asset is carried at its cost less any accumulated depreciation and any impairment losses. The initial cost of the asset comprises its cost of acquisition, construction and any other cost directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating, and, if appropriate, the estimate of hydrocarbon wells abandonment costs.

For assets requiring long-term construction to bring them to the conditions required for their use, borrowing costs related to third-party financing are capitalized until the asset is ready to be used, in accordance with the Group’s average debt rate.

Subsequent costs allowing to recover service capacity to achieve continued operation, extend the useful life and/or increase the production capacity of the assets are included in the carrying amount of the assets, or are recognized as a separate asset. Major overhauls are capitalized and depreciated by the straight-line method until the next major overhaul.

Repair, conservation and ordinary maintenance expenses are charged to net income in the statement of comprehensive income in the period in which they are incurred.

The recoverability of these assets is revised as set out in Note 2.b.5).

Any gain or loss arising from the disposal of an asset is charged to net income in the statement of comprehensive income in the period in which such asset is derecognized.

Oil and natural gas production activities

The Group recognizes oil and natural gas exploration and production activities using the successful efforts method. Costs arising from the acquisition of exploitation concessions in areas with proved and unproved reserves are capitalized in the “Mining properties, wells and related equipment” account of the “Property, plant and equipment” line item in the statement of financial position. Costs associated with exploration permits are classified as intangible assets.

| F - 14 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Exploration costs, excluding costs associated with exploratory wells, are charged to net income in the statement of comprehensive income. Costs of drilling exploratory wells, including stratigraphic test wells, are capitalized in the “Exploratory drilling in progress” account of the “Property, plant and equipment” line item in the statement of financial position until the existence of proved reserves justifying their commercial development is determined. If such reserves are not found, those drilling costs are charged to net income in the statement of comprehensive income. Occasionally, upon drilling completion, it may be determined that an exploratory well has reserves that cannot yet be classified as proved reserves. In such cases, the drilling cost of the exploratory well remains capitalized if the well has found a volume of reserves that justifies its development as a productive well, and if sufficient progress has been made in assessing the reserves as well as the economic and operating viability of the project. If any of the mentioned conditions is not met, the exploratory well cost is charged to net income in the statement of comprehensive income. In addition to the above, the exploratory activity involves, in many cases, the drilling of multiple wells in the course of several years in order to evaluate projects completely. Therefore, some exploratory wells may be subject to evaluation for prolonged periods, until a conclusion is reached concerning the wells and any additional exploratory activities required to evaluate and quantify the reserves related to each project. The detail of exploratory well costs in evaluation stage is described in Note 8.

Drilling costs of development wells and dry development wells, and installation costs associated with the development of oil and natural gas reserves are capitalized in the “Mining properties, wells and related equipment” account of the “Property, plant and equipment” line item in the statement of financial position.

Depreciation methods and useful lives

The estimated useful life and the depreciation method of each class of asset are revised annually at the end of each fiscal year and, if appropriate, are adjusted prospectively.

Assets related to oil and natural gas production activities are depreciated as follows:

| - | The capitalized costs related to productive activities are depreciated by field, on a unit-of-production method by applying the ratio of produced oil and natural gas to the proved and developed oil and natural gas reserves. |

| - | Capitalized costs related to acquisition of mining property and extension of concessions with proved reserves are depreciated by field, using the unit-of-production method, by applying the ratio of produced oil and natural gas to total proved oil and natural gas reserves. |

Depreciations are adjusted based on changes in the estimates of proved oil and natural gas reserves after the date of disclosure of such changes. The Group revises the estimates of oil and natural gas reserves at least once a year. These estimates are audited by independent third parties based on a 3-year rotation cycle.

All other assets not directly affected to oil and natural gas production are depreciated using the straight-line method calculated based on the estimated useful life of each class of asset, as described below:

| Years of estimated useful life |

||

| Buildings and other constructions |

50 | |

| Refinery equipment and petrochemical plants |

20-25 | |

| Infrastructure for natural gas distribution |

20-50 | |

| Transportation equipment |

5-25 | |

| Furniture, fixtures and installations |

10 | |

| Selling equipment |

10 | |

| Other property |

10 |

Land is classified separately from buildings or facilities that may be located on it, and as it is deemed to have an indefinite useful life, it is not subject to depreciation.

| F - 15 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Costs related to hydrocarbon wells abandonment obligations

Costs related to hydrocarbon wells abandonment obligations are capitalized at discounted values along with their related assets, and are depreciated using the unit-of-production method. In compensation, a liability is recognized for such concept at the same estimated value of the discounted payable amounts. Changes in the estimates of discounted payable amounts are made considering the current costs based on the best internal and external information available. Those changes are recognized pursuant to the guidelines set out in IFRIC 1 “Changes in Existing Decommissioning, Restoration and Similar Liabilities”, which indicates that changes in liabilities will be added to, or deducted from the cost of the asset corresponding to the current period, considering that, if the decrease in liabilities exceeds the carrying amount of the assets, such excess will be recognized in net income in the statement of comprehensive income.

2.b.4) Leases

As lessee, the Group recognizes, measures and discloses lease liabilities and right-of-use assets in compliance with IFRS 16 “Leases”. The definition of lease is mainly related to the concept of control. IFRS 16 distinguishes between lease contracts and service contracts on the basis of whether an identified asset is under the customer’s control, which exists if the customer has the right to: (i) obtain substantially all of the economic benefits from the use the asset, and ii) direct the use of the asset.

Lease liabilities are measured as the aggregate amount of future lease payments discounted at the lessee’s incremental borrowing rate (“discount rate”) at the date of initial recognition of each contract. Subsequently, the Group recalculates the lease liabilities to reflect any lease revision or modification or any revision of the so-called “in-substance” fixed payments, applying, if applicable, a revised discount rate.

Right-of-use assets are measured using the cost model under IAS 16 (see Note 2.b.3)) and are initially recognized as the sum equal to the initial measurement of the lease liability considering prepayments net of lease incentives, initial direct costs and estimated dismantling and restoration costs. Right-of-use assets are depreciated using the straight-line method based on the term of the lease established in each contract, unless the useful life of the underlying asset is shorter or if there is another more representative basis.

The recoverability of right-of-use assets is revised as set out in Note 2.b.5).

The Group continues to recognize short-term leases and leases of low-value underlying assets as expenses in net income in the statement of comprehensive income in accordance with the option specified under IFRS 16, except for those that are capitalized. Variable lease payments related to the underlying asset performance and/or use are recognized in net income in the statement of comprehensive income.

2.b.5) Impairment of property, plant and equipment, intangible assets and right-of-use assets

At the closing date of each period, the Group reviews if there is any indication that these assets may have suffered impairment loss or recovery of an impairment loss recognized in previous periods. If such an indication exists, the recoverable amount of the asset is estimated. To such effect, the Group compares their carrying amount with their recoverable amount.

Such assets are grouped into CGUs, the smallest identifiable group of assets generating cash inflows or cash flows independent from those generated by other assets or groups of assets, taking into account regulatory, economic, operational, and commercial conditions.

The assets of the Group’s main CGUs are grouped into: (i) CGUs separated by basins if they correspond to assets of fields with reserves primarily of gas; (ii) a single CGU if they correspond to assets of fields with reserves primarily of oil; and (iii) a single CGU if they correspond to assets affected to oil refining, production of petrochemical products and their commercialization. Changes in regulatory, economic, operating and commercial conditions may alter the grouping of assets into CGUs. A different grouping of assets may result in different estimates of the recoverable amounts of those assets, and, therefore, generate losses or recoveries of additional impairment losses.

| F - 16 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

If the carrying amount exceeds the recoverable amount of a CGU, an impairment loss is recognized for such excess in value in operating profit or loss in the statement of comprehensive income. Impairment losses are distributed among the CGU’s assets pro rata to their carrying amounts, which are taken into account to calculate depreciation or amortization.

The reversal of an impairment loss is recognized in operating profit or loss in the statement of comprehensive income. To such effect, the carrying amount of the CGU is increased to the revised estimate of its recoverable amount, so that this new amount does not exceed the carrying amount without considering the impairment loss recognized in previous periods.

In compliance with IFRS 6, the recoverability of exploration rights recognized in the “Intangible Assets” line item in the statement of financial position is assessed separately, if any events of circumstances suggest that the carrying amount of those assets may exceed their recoverable amount and/or prior to their reclassification to the “Mining property, wells and related equipment” line item in the statement of financial position when their technical reliability and commercial viability are demonstrable.

Measuring the recoverable amount

The recoverable amount for each CGU is determined as the higher of (i) its fair value less costs of disposal, i.e. the price that would be received in and orderly transaction between market participants to sell the asset, less the costs of disposal of such assets, if such value is available, reasonably reliable and based on recent negotiations with potential buyers or similar transactions, and (ii) its value in use, i.e. the projections of cash flows generated by the exploitation of the assets, based on the best estimates of income and expenses available in relation to the economic conditions that will prevail during the remaining useful life of the assets, using past results and forecasts of business evolution and market development, discounted at a rate that reflects the weighted average cost of the capital employed.

In calculating value in use, the prices for the purchase and sale of hydrocarbons, refined products and petrochemical products, the current regulations and estimates of capital expenditure standout among the most sensitive aspects included in cash flow projections of the main CGUs. The assessment of the particular and variable circumstances used in cash flow projections requires the use of estimates (see Note 2.c)).

2.b.6) Investments in associates and joint ventures

Associates and joint ventures are accounted for using the equity method (see Note 10).

According to this method, the investment is initially recognized at cost in the “Investments in associates and joint ventures” line item in the statement of financial position, and its carrying amount increases or decreases to recognize the investor’s interest in the profit or loss of the associate or joint venture after the acquisition date, which is reflected in the statement of comprehensive income in the “Income from equity interests in associates and joint ventures” line item. Additionally, its carrying amount increases or diminishes to recognize contributions and dividends which have affected the equity of the associate or joint venture. The investment includes, if applicable, the goodwill identified in the acquisition.

Joint arrangements under which the Group has contractually agreed to exercise the joint control with another party are classified either as joint ventures when the parties have rights over the net assets of the joint arrangement, or as joint operations (see Note 2.b.1) “Consolidation policies” section) when the parties have rights over the assets and obligations for the liabilities relating to the joint arrangement.

Investments in entities over which an investor may exert significant influence, but not control or joint control, are classified as associates.

Investments in associates and joint ventures have been valued based on the last financial statements available as of the end of each period, considering significant subsequent events and transactions and/or available management information and transactions between the Group and such related companies that could have produced changes in the equity of the latter. See Note 2.b.1) “Consolidation policies” section.

Interest in companies with negative equity are presented under the “Other liabilities” line item in the statement of financial position.

| F - 17 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

At the closing date of each period, the Group reviews if there is any indication that these investments may have suffered an impairment in value or recovery of an impairment loss recognized in previous periods. If such an indication exists, the recoverable amount of the investment is estimated. If an impairment in value or recovery of an impairment loss is recognized in previous periods, it is recognized in the “Income from equity interests in associates and joint ventures” line item in the statement of comprehensive income.

2.b.7) Financial instruments

The Group’s classification of financial assets is determined by the business model for the management of such assets and the characteristics of contractual cash flows.

A financial asset is measured at amortized cost if the following conditions are met: (i) the objective of the Group’s business model is to hold the asset to collect the contractual cash flows; and (2) the contractual terms establish payments, on specific dates, solely of principal and interest. These financial assets are initially recognized at fair value plus costs of the transaction incurred and are subsequently measured at amortized cost using the effective interest rate method less any impairment losses. Gain (loss) arising from derecognition, modifications, reclassifications at fair value through profit or loss, impairment in value, or from applying the effective interest rate are recognized in the “Net financial results” line item in the statement of comprehensive income.

If a financial asset fails to meet any of the above conditions to be measured at amortized cost, it is measured at fair value through profit or loss. These financial assets are initially recognized at fair value and the costs of the transaction incurred are recognized as expenses in net income in the statement of comprehensive income. Changes in the fair value and results from the sale of these assets are recognized in the “Net financial results” line item in the statement of comprehensive income.

The purchase and sale of financial assets are recognized at the date in which the Group undertakes to purchase or sell those assets. The Group reclassifies financial assets only when the business model used to manage such assets changes.

Financial liabilities are initially recognized at fair value less costs of the transaction incurred and are subsequently measured at amortized cost using the effective interest rate method. Interest on debt instruments is recognized in the “Net financial results” line item in the statement of comprehensive income, except for interest that is capitalized.

In general, the Group uses the transaction price to determine the fair value of a financial instrument on initial recognition.

Impairment of financial assets

The Group evaluates the impairment of its financial assets measured at amortized cost using the expected credit loss model, recognizing in profit or loss for the period the amount of change in the expected credit losses during the lifetime of the financial asset, as an impairment gain or loss in the “Selling expenses” line item in the statement of comprehensive income, and applying the simplified approach allowed under IFRS 9 “Financial instruments” for trade receivables.

Under IFRS 9, expected credit losses are estimated by preparing a matrix based on maturity tranches, grouping the financial assets by type of customer: i) related parties; ii) public sector and iii) private sector. These groups are subsequently divided into sub-groups based on special characteristics indicative of the repayment capacity, such as i) payment defaults; ii) existence of guarantees; and iii) existence of a legal proceeding already initiated or in process of initiation for collection purposes, among others. Once each group is defined, an expected credit loss rate is assigned, which is calculated on the basis of the historical payment performance adjusted to current economic conditions and forecasts of future economic conditions.

Derecognition and offsetting

Financial assets are derecognized when the rights to receive cash flows from such investments and the risks and benefits related to their ownership have expired or have been transferred.

| F - 18 |

|

|||

| YPF SOCIEDAD ANONIMA | ||||

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023, 2022 AND 2021 |

||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Financial liabilities are derecognized when they have extinguished, i.e. when the obligation has been paid or cancelled, or has expired. In addition, the Group will account for an exchange of financial instruments with substantially different terms as an extinguishment of the original financial liability, recognizing a new financial liability. Similarly, the Group will account for a substantial modification in the current terms of a financial liability as an extinguishment of the financial liability and the recognition of a new financial liability.

Financial assets and liabilities offset each other when there is a legally enforceable right to set off such assets and liabilities and there is an intention to settle them on a net basis, or to realize the asset and settle the liability simultaneously.

2.b.8) Inventories

Inventories are valued at the lower of cost and net realizable value. Cost includes costs of purchase (less trade discounts, rebates and other similar items), costs of conversion and other costs, which have been incurred in bringing the inventories to their present location and condition for their sale according to the nature of the asset. The net realizable value is the estimated selling price in the ordinary course of business less costs to sell.

In the case of refined products, costs are allocated in proportion to the selling price of such products (isomargin method) due to the difficulty of recognizing the production costs for each product on an individual basis.

The Group assesses the net realizable value of inventories at the end of each period, charging the corresponding value adjustment to net income in the statement of comprehensive income when it exceeds their net realizable value, and reversing such adjustment when the circumstances that caused it change.

2.b.9) Cash and cash equivalents

In the statement of cash flows, cash and cash equivalents include cash in hand, demand deposits with banks and other short-term highly liquid investments with original maturities of up to 3 months. They do not include bank overdrafts, which are presented as loans.

2.b.10) Shareholder’s equity