UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of March 2024

Commission File Number: 001-13928

Royal Bank of Canada

(Translation of registrant’s name into English)

| 200 Bay Street | 1 Place Ville Marie | |

| Royal Bank Plaza | Montreal, Quebec | |

| Toronto, Ontario | Canada H3B 3A9 | |

| Canada M5J 2J5 | Attention: Senior Vice-President, | |

| Attention: Senior Vice-President, | Associate General Counsel | |

| Associate General Counsel | & Secretary | |

| & Secretary |

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F ☐ |

Form 40-F ☒ |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ROYAL BANK OF CANADA | ||||||

| Date: March 7, 2024 | By: | /s/ Karen McCarthy | ||||

| Name: | Karen McCarthy | |||||

| Title: | Senior Vice-President, Associate General Counsel & Secretary | |||||

EXHIBIT INDEX

| Exhibit |

Description of Exhibit |

|

| 99.1 | Notice of Annual Meeting of Common Shareholders and Management Proxy Circular dated February 13, 2024 | |

| 99.2 | Form of Proxy mailed to Common Shareholders on March 7, 2024 | |

| 99.3 | Notice of 2024 Annual Meeting of Common Shareholders and Notice of Availability of Meeting Materials mailed to Common Shareholders on March 7, 2024 | |

| 99.4 | Request for Financial Statements and MD&A | |

| 99.5 | Statement Regarding Modern Slavery 2023 | |

Exhibit 99.1

Caution regarding forward-looking statements

From time to time, Royal Bank of Canada and its subsidiaries (collectively, RBC, the bank, we, us or our) make written or oral forward-looking statements within the meaning of certain securities laws, including the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this management proxy circular (circular), in other filings with Canadian regulators or the U.S. Securities and Exchange Commission, in reports to shareholders, and in other communications. In addition, our representatives may communicate forward-looking statements orally to analysts, investors, the media and others. Forward-looking statements in this circular include, but are not limited to, statements relating to the expected timing and business of the annual meeting of shareholders, our approach to compensation, our approach to managing environmental, social and governance (ESG) matters, including our ESG-related objectives, vision, commitments, goals, metrics and, targets (including our diversity goals, our initial 2030 interim emissions reduction targets (interim targets) and our ultimate goal of achieving net-zero in our lending by 2050, our commitment to help our clients as they transition to net-zero, our commitment to advance net-zero leadership in our own operations and our Purpose Framework), our strategies to identify, mitigate and adapt to ESG-related risks, our approach to ESG-related opportunities, the risk environment and the effectiveness of our risk monitoring and statements made by our President and Chief Executive Officer and our Chair of the Board. The forward-looking statements contained in this circular represent the views of management and are presented for the purpose of assisting our stakeholders in understanding our vision, commitments, goals and targets, as well as the ways we intend to address ESG matters, and may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as “believe”, “expect”, “expectation”, “aim”, “achieve”, “suggest”, “seek”, “foresee”, “forecast”, “schedule”, “anticipate”, “intend”, “estimate”, “goal”, “strive”, “commit”, “target”, “objective”, “plan”, “outlook”, “timeline” and “project” and similar expressions of future or conditional verbs such as “will”, “may”, “might”, “should”, “could”, “can”, “would” or negative or grammatical variations thereof.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, both general and specific in nature, which give rise to the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, that our ESG-related or other objectives, vision and strategic goals will not be achieved, and that our actual results may differ materially from such predictions, forecasts, projections, expectations or conclusions.

We caution readers not to place undue reliance on our forward-looking statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. These factors – many of which are beyond our control and the effects of which can be difficult to predict – include, but are not limited to, the need for more and better ESG-related data and standardization of ESG-related measurements and methodologies (including climate data, diversity metrics, and social indicators); climate-related conditions and weather events; the need for active and continuing participation and action of various stakeholders (including governmental and non-governmental organizations, other financial institutions, businesses and individuals); technological advancements; the evolution of consumer behaviour; evolving social views on ESG-related topics; varying decarbonization efforts across economies; the need for thoughtful climate policies around the world; the challenges of balancing emission reduction targets with an orderly and inclusive transition and geopolitical factors that impact global energy needs; our ability to gather, analyze and verify data; our ability to successfully implement various initiatives (including ESG-related initiatives) throughout the bank under expected time frames, the risk that initiatives will not be completed within a specified period, or at all, or with the results or outcome as originally expected or anticipated by the bank; the compliance of various third parties with agreements, our policies and procedures and their commitments to us; financial market conditions; our business operations; our financial results, condition and objectives; regulatory compliance (which could lead to us being subject to various legal and regulatory proceedings, the potential outcome of which could include regulatory restrictions, penalties and fines); and cyber, strategic, reputation, legal and regulatory environment, competitive, model and systemic risks and other risks discussed in the risk sections of our annual report for the year ended October 31, 2023 (2023 annual report) and the Risk management section of our quarterly report to shareholders for the three-month period ended January 31, 2024 (Q1 2024 report to shareholders). Additional factors that could cause actual results to differ materially from the expectations in such forward-looking statements can be found in the risk sections of our 2023 annual report, as may be updated by subsequent quarterly reports.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also adversely affect our results. When relying on our forward-looking statements to make decisions with respect to us, investors and others should carefully consider the foregoing factors and other uncertainties and potential events, as well as the inherent uncertainty of forward-looking statements.

Material economic assumptions underlying the forward-looking statements contained in this circular are set out in the Economic, market and regulatory review and outlook section and for each business segment under the Strategic priorities and Outlook headings in our 2023 annual report, as updated by the Economic, market and regulatory review and outlook section of our Q1 2024 report to shareholders and as may be updated further by subsequent quarterly reports. Except as required by law, we do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

Additional information about these and other factors can be found in the risk sections of our 2023 annual report and in the Risk management section of our Q1 2024 report to shareholders, which may be updated further by subsequent quarterly reports.

Please see the reverse of the back cover of this circular for an important notice regarding information in this circular about RBC’s ESG-related (including climate- and diversity-related) objectives, vision, commitments, goals, metrics and targets.

Royal Bank of Canada

Royal Bank of Canada

Notice of annual meeting of common shareholders

| When

Thursday, April 11, 2024 9:30 a.m. (Eastern Time)

Where

Via live webcast online:

at web.lumiagm.com/439412600

In person:

Toronto Congress Centre North Building 1020 Martin Grove Road Toronto, Ontario

Please visit our website at rbc.com/annualmeetings in advance of the meeting for the most current information about attending the meeting. |

Business of the meeting

At the meeting, shareholders will:

⬛ Receive our financial statements for the years ended October 31, 2023 and 2022 and the related auditor’s reports

⬛ Elect directors

⬛ Appoint our auditor

⬛ Have a say on our approach to executive compensation

⬛ Consider the shareholder proposals set out in Schedule A of the proxy circular that are properly introduced at the meeting, and

⬛ Transact any other business that may properly come before the meeting.

For more information about how to vote and attend the meeting, see pages 8 to 11 of the proxy circular.

|

|||||

By order of the board of directors,

Karen McCarthy

Senior Vice-President, Associate General Counsel and Secretary

February 13, 2024

|

|

Your vote is important!

We encourage you to read the proxy circular before exercising your vote.

Unless you intend to vote at the meeting, please vote as early as possible so your RBC common shares are represented at the meeting. Computershare Trust Company of Canada, our transfer agent, must receive your vote no later than 1:00 p.m. (Eastern Time) on Tuesday, April 9, 2024.

See pages 8 to 10 of the proxy circular for detailed instructions on how to vote.

|

1

Royal Bank of Canada

|

Fellow shareholders,

We are pleased to invite you to this year’s annual meeting, which will be held on April 11, 2024, at 9:30 a.m. (Eastern Time).

|

|

Resiliency and growth

We are living in a time of historic transition as growing geopolitical tensions, the unprecedented pace of technological change and the continuing impact of climate change are all contributing to the increasingly complex environment our society is navigating. At the same time, higher interest rates and the rising cost of living are putting a strain on people and families, contributing to greater inequalities in our communities and putting fiscal spending pressures on governments.

RBC is an all-weather bank that’s built to perform through the economic cycle. Yet resiliency means more than that to us. It means serving as a stabilizing force for our 17+ million clients and the thousands of communities they call home. It means upholding and honouring our foundational role of keeping our economy moving and balancing the needs of four key stakeholders – clients, employees, communities and shareholders – while positioning our franchise to transform in ways that capture growth today and in the future.

In 2023, we generated nearly $15 billion in earnings and a Return on Equity of 14.2 per cent. We also returned $7.4 billion in dividends to our common shareholders.

Our solid financial results reflect the strength of our diversified business model, scale, strong balance sheet and prudent risk management. We maintained market-leading positions in areas of strategic importance and, in many cases, grew market share. In a year of volatility and uncertainty, many turned to RBC as a source of strength and stability. Our Canadian Banking

business added approximately 650,000 net new clients, up more than 60 per cent from last year, a strong reflection of the differentiated experiences and meaningful value we create for those we serve.

We made transformative moves that will provide material long-term benefit for our franchise. The proposed addition of HSBC Bank Canada (HSBC Canada)1 will give us a chance to take our client experience to the next level and further position RBC as the bank of choice for newcomers to Canada and internationally connected Canadian clients. In our second home market – the United States – we are focusing efforts to more deeply integrate our U.S. Wealth Management (including City National Bank) and Capital Markets businesses to deliver a more holistic experience for our clients. And by bringing together the complementary teams of RBC Brewin Dolphin and RBC Wealth Management in Europe, we are positioned to capitalize on the size and scale of one of the largest wealth management firms on the continent.

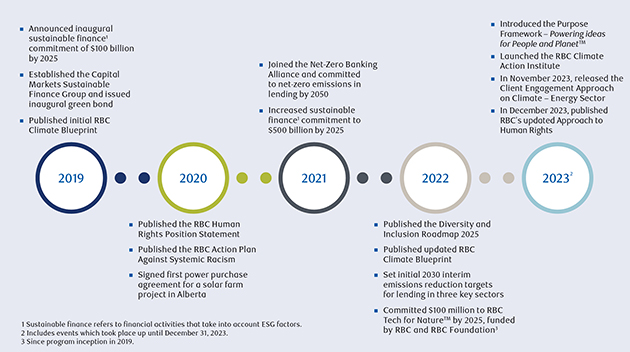

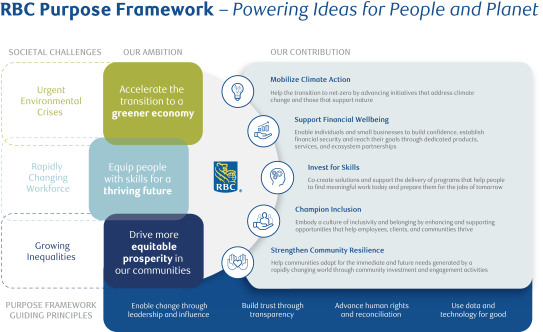

Responsibility for one another

As a trusted partner to clients and communities around the world, RBC and its people are in a position to make progress possible toward a more inclusive, sustainable and prosperous future – but we need to sharpen our focus on where we believe we can make the most positive difference. That’s one reason why we introduced our Purpose Framework – Powering Ideas for People and PlanetTM. It aims to create clarity and structure around three societal ambitions where RBC can have a meaningful

| 1 | The targeted close date for the proposed acquisition of HSBC Canada is March 28, 2024, subject to the satisfaction of customary closing conditions. |

2

Royal Bank of Canada

|

|

impact. Building on existing environmental, social and governance priorities, RBC plans to help accelerate the transition to a greener economy, equip people with skills for a thriving future and drive more equitable prosperity in its communities.

We are progressing well on our commitment to facilitate $500 billion in sustainable finance1 by 2025. In addition, we’re accelerating our strategy by clearly and actively sharing what we’re doing to help get our clients and the communities we serve to transition to net-zero.

In November 2023, we released the Client Engagement Approach on Climate – Energy Sector2, which formalizes RBC Capital Markets’ approach to engagement with its energy sector clients on their plans for the energy transition3.

Earlier in 2023, we also launched the RBC Climate Action Institute, which brings together economists, policy analysts and business strategists to help research and advance ideas that can contribute to Canada’s climate progress. And we continued to make products and services that accelerate the transition to a greener economy accessible to Canadian consumers, including advisory solutions to support the electric vehicle and home retrofit markets in Canada.

Doing the right things, the right way

For the fifth year in a row, RBC was recognized as the most valuable Canadian brand, as well as the fourth most valuable financial services brand in the world4. This distinction signals the progress we continually make towards our vision of being among the world’s most trusted and successful financial institutions, with trust being the operative word.

Earning and maintaining the public’s trust comes down to doing the right things, in the right way. This is at the core of how we approach every deliberation around the boardroom table. The appointments of Barry Perry and Amanda Norton as directors add important perspectives and expertise to the board’s ongoing duties and discussions. We also want to express our gratitude to Bridget van Kralingen, who is retiring from the board after nearly 13 years of service.

Your vote

Join us on April 11 to vote on important matters. Please consider the information set out in this proxy circular and vote online, by phone or by completing and sending in your proxy or voting instruction form prior to the meeting.

We thank you for your continued support and look forward to engaging with you at the meeting.

|

|

|

| Jacynthe Côté Chair of the Board |

Dave McKay President and Chief Executive Officer |

| 1 | Sustainable finance refers to financial activities that take into account environmental, social and governance factors. |

| 2 | Available at rbc.com/esgreporting. |

| 3 | Additional information about the Client Engagement Approach on Climate – Energy Sector is available at the end of Schedule A. |

| 4 | Kantar BrandZ Most Valuable Global Brands. |

3

Royal Bank of Canada

Delivery of meeting materials

Notice-and-access

As permitted by the Canadian Securities Administrators and pursuant to an exemption from the proxy solicitation requirement received from the Office of the Superintendent of Financial Institutions (OSFI), we are using notice-and-access to deliver this proxy circular to our registered and non-registered (beneficial) shareholders. We are also using notice-and-access to deliver our annual report to our non-registered (beneficial) shareholders.

This means that, instead of receiving a paper copy of the meeting materials, you will receive a notice explaining how to access these materials online. Notice-and-access is environmentally friendly as it reduces paper and energy consumption, and it allows for faster access to meeting materials.

You will also receive a form of proxy or a voting instruction form with this notice so you can vote your shares.

How to access the meeting materials online

The meeting materials can be found online at:

| • | our website at rbc.com/annualmeetings |

| • | the website of our transfer agent, Computershare Trust Company of Canada (Computershare), at envisionreports.com/RBC2024 |

| • | SEDAR at sedarplus.ca, and |

| • | EDGAR at sec.gov/edgar. |

How to request a paper copy of the meeting materials

You may request a paper copy of the meeting materials at no cost up to one year from the date the proxy circular is filed on SEDAR as follows:

To receive the meeting materials prior to the voting deadline and the date of the meeting, we must receive your request no later than 5:00 p.m. (Eastern Time) on Tuesday, March 26, 2024. The meeting materials will then be sent to you within three business days of receiving your request. Please note that you will not receive another voting instruction form or form of proxy.

If you submit your request after the meeting, the meeting materials will be sent to you within 10 calendar days of receiving your request.

Who to contact if you have questions about notice-and-access You can receive shareholder materials, including the notice, form of proxy and voting instruction form, by email.

Please call Computershare at

1-866-586-7635 (Canada/U.S.), or

514-982-7555 (International).

4

Royal Bank of Canada

Sign up for eDelivery

eDelivery reduces paper and energy consumption and gets the documents to you faster.

Non-registered (beneficial) shareholders

Go to proxyvote.com and sign up using the control number on your voting instruction form or, after the meeting, contact your intermediary.

Registered shareholders

Go to investorvote.com and sign up using the control number on your proxy form or go to investorcentre.com/rbc and click on “Receive Documents Electronically”.

The information in this proxy circular is as of February 13, 2024, unless stated otherwise. All dollar amounts are in Canadian dollars, unless stated otherwise.

In this circular, “RBC”, “the bank”, “we”, “us” and “our” mean Royal Bank of Canada; “common shares” means RBC common shares unless the context indicates otherwise; and “shareholder” and “you” mean a holder of common shares, unless the context indicates otherwise.

All references to websites are for your information only. The content of any websites referred to in this circular, including via website link, and any other websites they refer to are not incorporated by reference in, and do not form part of, this circular.

5

Royal Bank of Canada

Management proxy circular

What’s inside

7

Royal Bank of Canada

The annual meeting

| ■ |

Receive our financial statements and related auditor’s reports |

The consolidated financial statements and management discussion and analysis for the years ended October 31, 2023 and 2022, together with the auditor’s reports on those financial statements, are in our 2023 annual report at rbc.com/annualmeetings and on Computershare’s website at envisionreports.com/RBC2024; SEDAR at sedarplus.ca and EDGAR at sec.gov/edgar.

| ■ |

Elect directors |

13 nominees are standing for election as directors of RBC. See pages 12 to 20 of this circular for more information on the nominees. Each director will be elected to hold office until the next annual meeting of shareholders. All of the nominees are currently RBC directors.

|

The board recommends voting FOR each nominee.

|

| ■ |

Appoint our auditor |

The board proposes the appointment of PricewaterhouseCoopers LLP (PwC) as our auditor until the next annual meeting of shareholders. Representatives from PwC will be at the meeting to answer your questions. A description of fees paid to our auditor can be found on pages 48 to 49 of this circular.

|

The board recommends voting FOR PwC as our auditor.

|

| ■ |

Have a say on our approach to executive compensation |

Shareholder input is a key aspect of our engagement process, which includes inviting you to have your say on our approach to executive compensation.

If you have any comments or questions about our approach to executive compensation, please contact the chair of the board using the contact information on the back cover of this circular. Please review the section on executive compensation starting on page 53 of this circular, where we describe our approach.

More specifically, the board of directors recommends approving the following advisory resolution:

“RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the board of directors that the shareholders accept the approach to executive compensation disclosed in the management proxy circular delivered in advance of the 2024 annual meeting of common shareholders.”

While this vote is advisory and non-binding, the board will consider the result in future compensation planning.

|

The board recommends voting FOR our approach to executive compensation.

|

| ■ |

Consider shareholder proposals |

The shareholder proposals are set out in Schedule A to this circular starting on page 100.

|

The board recommends voting AGAINST each proposal for the reasons noted in the board’s responses.

|

Shareholder proposals for next year’s annual meeting must be submitted by 5:00 p.m. (Eastern Time) on November 15, 2024.

8

Royal Bank of Canada

The annual meeting

Who can vote?

|

Each share gives you one vote, subject to the voting restrictions explained below.

|

You have the right to vote if you owned common shares on the record date, February 13, 2024. There were 1,408,912,783 outstanding shares that were eligible to vote on that date.

Who cannot vote?

Shares cannot be voted if they are beneficially owned by:

| • | the Canadian government or any of its agencies |

| • | a provincial government or any of its agencies |

| • | the government of a foreign country, any political subdivision of a foreign country or any of its agencies |

| • | any person who has acquired more than 10% of any class of our shares without the approval of the Minister of Finance, or |

| • | any person, or any entity controlled by one of the persons listed above, that represents, in aggregate, more than 20% of the eligible votes. |

As of February 13, 2024, management and the board are unaware of any person who owns or exercises control or direction over more than 10% of our outstanding shares.

How does voting work?

|

You can vote your shares by proxy or at the meeting.

|

A simple majority of the votes cast by proxy or at the meeting will constitute approval of matters voted on at the annual meeting.

Is my vote confidential?

|

Yes, your vote is confidential.

|

To keep your vote confidential, our transfer agent, Computershare, counts all the proxies and does not provide any individual voting information to RBC unless a shareholder clearly intends to communicate their individual position to the board or management or Computershare is legally required to provide this information.

If you submit your vote using the voting instruction form, your intermediary will tabulate your form and communicate only the result of each vote to Computershare.

How do I vote?

There are two ways you can vote: by proxy or at the meeting either online or in person. Shareholders are strongly encouraged to submit their votes in advance of the meeting. Please follow the instructions below based on whether you are a non-registered (beneficial) shareholder or a registered shareholder.

|

Non-registered (beneficial) shareholders

An intermediary such as a securities broker, trustee or financial institution holds your shares. Your intermediary sent you a voting instruction form.

|

Registered shareholders

Your shares are registered directly in your name with our transfer agent, Computershare. A form of proxy was included in your package.

|

|||||||

9

Royal Bank of Canada

The annual meeting

|

Voting by proxy before the meeting

|

||||||||

|

Non-registered (beneficial) shareholders

|

Registered shareholders

|

|||||||

|

Provide your instructions in one of these ways:

|

|

Provide your instructions in one of these ways:

|

||||||

|

|

Visit proxyvote.com and enter your 16-digit control number listed on the enclosed voting instruction form.

English: 1-800-474-7493 French: 1-800-474-7501

Complete your voting instruction form and return it by mail in the envelope provided.

|

|

Visit investorvote.com and enter your 15-digit control number listed on the enclosed form of proxy.

Complete your form of proxy and return it by mail in the envelope provided.

Fax your completed form of proxy to: Canada/U.S.: 1-866-249-7775 International: 416-263-9524

|

|||||

|

Changed your mind?

|

Changed your mind?

|

|||||||

|

If you have already sent your completed voting instruction form to your intermediary and you change your mind about your voting instructions, contact your intermediary immediately. |

You may revoke your proxy by:

• delivering a written notice to the secretary, or

• completing, signing and returning a new proxy form bearing a later date than the form already returned to Computershare.

The written notice or new proxy form must be received no later than 1:00 p.m. (Eastern Time) on Tuesday, April 9, 2024.

|

|||||||

|

Attending the meeting yourself and voting at the meeting

|

||||||||

|

Non-registered (beneficial) shareholders |

Registered shareholders |

|||||||

|

• Write your own name in the space provided on your voting instruction form to instruct your intermediary to appoint you as proxyholder.

• Sign and return the voting instruction form according to the delivery instructions provided.

• Do not complete the instructions section of the voting instruction form as you will be attending and voting online or in person at the meeting.

• If attending the meeting online, you must also register yourself as your proxyholder with Computershare, as described below under “Appointing a proxyholder to represent you and vote at the meeting”. Failure to do so will mean you will be unable to participate or vote online.

• If attending the meeting in person, please check-in at the registration desk with our transfer agent, Computershare, when you arrive at the meeting.

Non-registered (beneficial) shareholders who have not duly appointed themselves as proxyholder will not be able to vote or participate at the meeting.

|

|

• Do not complete or return your form of proxy as you will be voting at the meeting.

• If attending the meeting online, log in online as a registered shareholder as described below under “Attending the meeting online”.

• If attending the meeting in person, please check-in at the registration desk with our transfer agent, Computershare, when you arrive at the meeting. |

||||||

|

Appointing a proxyholder to represent you and vote at the meeting |

|

The form of proxy or voting instruction form appoints Jacynthe Côté or David McKay, each a director of RBC, as your proxyholder, which gives them the authority to vote your shares at the meeting or any adjournment.

You can choose another person or company, including a person who is not a shareholder, as your proxyholder to vote your shares online or in person at the meeting. To do this, you must appoint that person as proxyholder as described above under “Voting by proxy before the meeting”.

If the proxyholder will be attending the meeting online, you must register this proxyholder online at computershare.com/RBC2024 no later than 1:00 p.m. (Eastern Time) on Tuesday, April 9, 2024 for Computershare to email the proxyholder with a username. Failure to register the proxyholder with Computershare will mean the proxyholder will be unable to register online as a participant or vote online.

If the proxyholder will be attending the meeting in person, the proxyholder will need to check in at the registration desk with our transfer agent, Computershare, when they arrive at the meeting.

|

10

Royal Bank of Canada

The annual meeting

How will my proxyholder vote my shares?

Your proxyholder must follow your voting instructions on how you want your shares voted. You can also elect to have your proxyholder decide for you. If you have not specified voting instructions on a particular matter, your proxyholder can vote your shares as they see fit.

Unless you provide alternative instructions, shares represented by proxies will be voted as follows:

| • | FOR the election of our director nominees |

| • | FOR the appointment of PwC as our auditor |

| • | FOR the advisory resolution on our approach to executive compensation |

| • | FOR management’s proposals generally |

| • | AGAINST the shareholder proposals set out in Schedule A |

What about amendments or other business?

If amendments to the business items described in this circular or other business items properly come before the meeting, your proxyholder will decide how to vote on them, if applicable.

How does RBC solicit proxies?

RBC management solicits proxies for use at our annual meeting on April 11, 2024 or any adjournment primarily by mail. Our directors, officers and employees may also call, write or speak to you to encourage you to vote. We have retained Laurel Hill Advisory Group (Laurel Hill) to help us with this process, among other responsibilities, for a fee of $32,500, for such services, in addition to certain out-of-pocket expenses. Laurel Hill may contact certain non-registered (beneficial) shareholders to assist in exercising their voting rights directly by telephone via Broadridge Investor Communications Corporation’s QuickVoteTM service. We pay all costs associated with soliciting proxies.

Where can I find the voting results?

Following the meeting, we will post the voting results at rbc.com/annualmeetings and file the results with Canadian securities regulators at sedarplus.ca.

How do I attend the meeting online?

If you are a registered shareholder or a proxyholder (including non-registered (beneficial) shareholders who have appointed themselves as proxyholder), you will be able to attend the meeting online, securely vote and participate in real time as follows:

| • | Log in online at web.lumiagm.com/439412600. |

For registered shareholders: Click “I have a login” and then enter your 15-digit control number under username and password: rbc2024 (case sensitive).The 15-digit control number is located on the form of proxy or in the email notification you received with your control number

For proxyholders: Once appointed and registered as proxyholder as described above under “Attending the meeting yourself and voting at the meeting” and “Appointing a proxyholder to represent you and vote at the meeting”, Computershare will provide you with a username by email after 1:00 p.m. (Eastern Time) on Tuesday, April 9, 2024. The password to the meeting is: rbc2024 (case sensitive).

To vote online on the matters put forth at the meeting, you must accept the terms and conditions, thus revoking any and all previously submitted proxies.

If you do not wish to revoke all previously submitted proxies, do not accept the terms and conditions once you log in, in which case you will enter the meeting as a guest and you will not be able to vote online or ask questions at the meeting.

It is important that you are connected to the internet at all times during the meeting in order to vote when balloting commences.

11

Royal Bank of Canada

The annual meeting

If you are a non-registered (beneficial) shareholder and you have not appointed yourself as proxyholder, you will only be able to attend the virtual meeting as a guest as follows:

| • | Log in online at web.lumiagm.com/439412600, click “I am a guest” and register online. |

People attending as guests will not be able to vote online or participate at the meeting.

Registered shareholders, non-registered (beneficial) shareholders and guests can also attend the meeting online at rbc.com/annualmeetings or via telephone at the following numbers:

| • English:

• 1-800-945-9434 (Canada and the U.S.)

• 647-722-6880 (International)

|

• French:

• 1-800-734-8583 (Canada and the U.S.)

• 416-981-9036 (International)

|

People attending online at rbc.com/annualmeetings or via telephone will not be able vote or participate at the meeting.

You should allow at least 15 minutes to check in to the meeting and complete the related registration.

How can a U.S. non-registered (beneficial) shareholder attend the meeting online?

To attend and vote online at the meeting, you must first obtain a legal proxy form from the intermediary that holds your shares and then register in advance of the meeting as follows:

| • | Follow the instructions from your intermediary or contact your intermediary to request a legal proxy form. |

| • | Submit a copy of your legal proxy form to Computershare by mail using the contact information on the back cover of the circular or by email at uslegalproxy@computershare.com to register for the meeting. Requests for registration must be labelled “Legal Proxy” and be received no later than 1:00 p.m. (Eastern Time) on Tuesday, April 9, 2024. |

| • | A confirmation of your registration will be emailed to you after Computershare receives your registration materials. |

| • | Register your appointment at computershare.com/RBC2024. |

Once these steps are completed, you may attend the meeting and vote your shares at web.lumiagm.com/439412600 during the meeting.

Attending the meeting in person

How do I attend the meeting in person?

If you are a registered shareholder or a proxyholder (including non-registered (beneficial) shareholders who have appointed themselves as proxyholder), you have the option to attend the meeting in person after checking-in at the registration desk when you arrive at the meeting.

Only registered shareholders and duly appointed proxyholders will be granted access to the in-person meeting. However, non-registered (beneficial) shareholders who have not appointed themselves proxyholders, non-shareholders and other guests will be able to attend the meetings online as described above under “Attending the meetings online”.

Where can I find additional information?

Please contact Computershare at 1-866-586-7635 (Canada/U.S.) or 514-982-7555 (International) if you are not sure whether you are a registered shareholder or non-registered (beneficial) shareholder or for additional information regarding:

| • | voting by proxy before the meeting |

| • | voting at the meeting |

| • | attending the meeting online or in person, or |

| • | other general proxy matters. |

Only registered shareholders and duly appointed proxyholders (including non-registered (beneficial) shareholders who have appointed themselves as proxyholder) will be permitted to participate during the meeting. More information, including the rules of procedure and how to participate at the meeting, will be made available at rbc.com/annualmeetings in advance of the meeting.

For information regarding technical and logistical issues related to accessing the meeting online, please visit web.lumiagm.com/439412600, click on “Technical support/Soutien technique” and follow the instructions.

12

Royal Bank of Canada

The annual meeting

This year, we have 13 nominees standing for election. The following nominee profiles include a summary of each nominee’s career experience, areas of expertise, current board committee memberships and directorships at other public companies over the past five years. All 13 of our director nominees speak English fluently, four speak French fluently and one speaks one or more other languages.1 The information about each director nominee in this circular is current as of February 13, 2024, except as otherwise noted. For more information about our nominees2, see the Directors and Executive Officers section in our annual information form dated November 29, 2023.

Board composition

|

|

38% of our director nominees identify as women

31% of our director nominees identify as Black, Indigenous,

|

|||

|

|

|

|||

|

The average tenure of our director nominees is 5.2 years

|

||||

Equity ownership

This section also includes each nominee’s equity ownership in RBC as at the end of our last two fiscal years, which is comprised of shares and director deferred stock units (DDSUs).

Values of shares and DDSUs are based on $110.76 and $126.05, the closing price of RBC common shares on the Toronto Stock Exchange (TSX) on the last trading days of the 2023 fiscal year (October 31, 2023) and the 2022 fiscal year (October 31, 2022), respectively. None of the nominees hold shares of RBC subsidiaries. The total of RBC securities held as a multiple of the equity ownership requirement for directors is calculated as of October 31, 2023.

Attendance

The attendance figures in each nominee’s profile show the number of board and committee meetings the nominee attended in fiscal 2023 out of the number of meetings that were held while the nominee was a member.

Directors are required to attend a minimum of 75% of board and committee meetings, except where the governance committee determines that factors beyond their control prevented them from achieving this requirement. Overall attendance includes both regularly scheduled and special meetings of the board and its committees. Special meetings and board and committee information sessions are scheduled as needed, often on short notice, on matters that arise between regularly scheduled meetings. In fiscal 2023, the board held four information sessions. Meetings of the committees are open to all directors to attend.

| 1 | The numbers include multiple responses among nominees who can speak more than one language. |

| 2 | The annual information form dated November 29, 2023 does not include information about Amanda Norton, who was appointed to the board effective February 1, 2024. |

| 3 | Throughout this proxy circular we will refer to Black, Indigenous and people of colour. These terms recognize the unique histories of racism that Black and Indigenous people have lived through. Referring to Black, Indigenous and people of colour is not intended to be a catch-all as RBC recognizes that not all racialized people experience racism in the same way. LGBTQ+ is the acronym for Lesbian, Gay, Bisexual, Transgender, Queer, Plus all non-straight, non-cisgender identities. |

13

Royal Bank of Canada

The annual meeting

|

|

Mirko Bibic

Toronto, ON, Canada

Age 56 | Director since 2022

Independent 2023 annual meeting Votes in favour: 99.28%

Areas of expertise • Business-to-consumer • Legal/regulatory • Risk management • Technology/digital

Public board memberships • BCE Inc. (2020–present) |

Mr. Bibic is President and Chief Executive Officer of BCE Inc. and Bell Canada (a communications and media company) since 2020. Since joining BCE Inc. in 2004, he held a variety of senior leadership positions, including Chief Operating Officer, Executive-Vice President, Corporate Development, and Chief Legal and Regulatory Officer.

Mr. Bibic is a director at Bell Canada and Maple Leaf Sports & Entertainment Ltd.

Mr. Bibic holds a Bachelor of Commerce degree from McGill University and a Law degree from the University of Toronto. |

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Governance |

6/6 |

– |

|

|||

| Risk |

7/7 |

1/1 |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|||||||

| 2023 |

2,016 |

3,358 |

5,374 |

$595,248 |

0.4 x |

|||||||

| 2022 |

2,236 |

604 |

2,840 |

$357,940 |

0.3 x |

|||||||

|

|

Andrew A. Chisholm

Toronto, ON, Canada

Age 64 | Director since 2016

Independent 2023 annual meeting Votes in favour: 99.57%

Areas of expertise • Accounting and finance • Financial services • Legal/regulatory • Risk management

Public board memberships • None |

Mr. Chisholm is a corporate director. From 1996 until 2016, he held a variety of senior leadership positions at Goldman Sachs & Co. (a global investment bank) including Head of the Global Financial Institutions Group, Senior Strategy Officer and co-chair of the firm-wide commitments committee. Mr. Chisholm is a director of RBC U.S. Group Holdings LLC. Mr. Chisholm is a director of MaRS Discovery District and chair of the board at Evergreen. He is an advisor to ArcTern Ventures, Novisto, riskthinking.AI and Receptiviti Inc. Mr. Chisholm is a member of the advisory board of the Richard Ivey School of Business at Western University and serves on the advisory board of the Institute for Sustainable Finance of the Smith School of Business at Queen’s University. He is also a member of the climate strategy advisory board at the Institute of Corporate Directors. Mr. Chisholm holds an MBA from the Richard Ivey School of Business at Western University and a Bachelor of Commerce from Queen’s University. |

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Governance |

6/6 |

– |

|

|||

| Risk (chair) |

7/7 |

1/1 |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|||||||

| 2023 |

4,082 |

22,652 |

26,734 |

$2,961,034 |

2.2 x |

|||||||

| 2022 |

3,920 |

16,913 |

20,833 |

$2,626,033 |

1.9 x |

|||||||

14

Royal Bank of Canada

The annual meeting

|

|

Jacynthe Côté

Candiac, QC, Canada

Age 65 | Director since 2014

Independent 2023 annual meeting Votes in favour: 98.13%

Areas of expertise • Accounting and finance • Legal/regulatory • Risk management • Talent management and executive

Public board memberships • CGI Inc. (2024–present) • Transcontinental Inc. (2016–present)

Past public board memberships • Finning International Inc. (2014–2024) |

Ms. Côté is chair of the board of directors of Royal Bank of Canada. She was also the chair of the board of directors of Hydro-Québec from 2018 to May 2023, and was President and Chief Executive Officer of Rio Tinto Alcan (a mining and metallurgical company) from 2009 to 2014. Previously, Ms. Côté was President and Chief Executive Officer of Rio Tinto Alcan’s Primary Metal business unit, after having held various senior management positions during her 26-year career.

Ms. Côté is chair of the board of directors of Alloprof, and a director of the CHU Sainte-Justine Foundation. She is a fellow of the Institute of Corporate Directors.

Ms. Côté holds a Bachelor of Science in chemistry from Laval University and was awarded honorary doctorates by Université du Québec à Chicoutimi and Université de Montréal. |

| Attendance1 (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Governance (chair)2 |

4/4 |

– |

|

|||

|

Risk2 |

4/4 |

– |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|||||||

| 2023 |

2,000 |

31,225 |

33,225 |

$3,679,981 |

2.7 x |

|||||||

| 2022 |

2,000 |

26,501 |

28,501 |

$3,592,596 |

3.0 x |

|||||||

| 1 Ms. Côté was appointed as chair of the board effective April 5, 2023. In her capacity as chair, Ms. Côté is not a member of any board committee but attends and participates at committee meetings. Since becoming chair of the board, Ms. Côté has attended 100% of all committee meetings. 2 Effective April 5, 2023, Ms. Côté retired as chair of the governance committee and retired from the risk committee. |

|

|

Toos N. Daruvala

New York, NY, U.S.A.

Age 68 | Director since 2015

Independent 2023 annual meeting Votes in favour: 99.48%

Areas of expertise • Financial services • Legal/regulatory • Risk management • Technology/digital

Public board memberships • OneMain Holdings, Inc. (2022–present) |

Mr. Daruvala is a corporate director. From 2016 to 2021, he was Co-Chief Executive Officer of MIO Partners, Inc. (the in-house asset management arm of McKinsey & Company). In 2016, he served as Senior Advisor and Director Emeritus for McKinsey & Company, concluding a 33-year career at McKinsey during which he advised financial institutions on a broad range of strategic and operational matters and led the risk management and banking and securities practices (both in the Americas). Mr. Daruvala is a director of MIO Partners, Inc. He serves on the advisory board of the Ross School of Business at the University of Michigan and the board of directors of the New York Philharmonic. He is an Adjunct Professor and Executive-in-Residence at the Columbia Business School. Mr. Daruvala holds an MBA from the University of Michigan and a Bachelor of Technology in Electrical Engineering from the Indian Institute of Technology. |

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Audit |

7/7 |

– |

|

|||

| Human resources |

6/6 |

– |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|||||||

| 2023 |

8,754 |

20,928 |

29,682 |

$3,287,597 |

2.4 x |

|||||||

| 2022 |

6,863 |

20,098 |

26,961 |

$3,398,405 |

2.8 x |

|||||||

15

Royal Bank of Canada

The annual meeting

|

|

Cynthia Devine FCPA, FCA

Toronto, ON, Canada

Age 59 | Director since 2020

Independent 2023 annual meeting Votes in favour: 99.49%

Areas of expertise • Accounting and finance • Business-to-consumer • Risk management • Talent management and

Public board memberships • Empire Company

Limited |

Ms. Devine is the President and Chief Executive Officer of Maple Leaf Sports & Entertainment (MLSE) (a professional sports and entertainment company) and will retire from that position in April 2024. Ms. Devine will be an advisor to the board of MLSE until June 2024. She joined MLSE in 2017 as Chief Financial Officer. From 2015 to 2017, she was Executive Vice-President, Chief Financial Officer and Corporate Secretary of RioCan Real Estate Investment Trust and, from 2003 until 2014, Chief Financial Officer of Tim Hortons Inc.

Ms. Devine is a director of Sobeys Inc. She is a member of the advisory board of the Richard Ivey School of Business at Western University.

Ms. Devine holds an honours Business Administration degree from the Richard Ivey School of Business at Western University. She is a fellow of the Chartered Professional Accountants of Ontario. |

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Audit |

7/7 |

– |

|

|||

| Governance |

6/6 |

– |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|||||||

| 2023 |

12,937 |

8,815 |

21,752 |

$2,409,296 |

1.8 x |

|||||||

| 2022 |

12,499 |

5,844 |

18,343 |

$2,312,184 |

1.7 x |

|||||||

|

|

Roberta L. Jamieson OC

Ohsweken, ON, Canada

Age 71 | Director since 2021

Independent 2023 annual meeting Votes in favour: 99.51%

Areas of expertise • Accounting and finance • Business-to-consumer • Legal/regulatory • Risk management

Public board memberships • None |

Ms. Jamieson is a corporate director. From 2004 to 2020, she was the President and Chief Executive Officer of Indspire (a Canadian Indigenous charity that invests in the education of First Nations, Inuit and Métis people). She was Chief of the Six Nations of the Grand River Territory from 2001 to 2004. She also served for ten years as the Ombudsman of Ontario. Ms. Jamieson is a director at Deloitte Canada LLP. She is a director at the Rideau Hall Foundation and also a founding visionary of the Prosperity Project. Ms. Jamieson holds a Bachelor of Laws from Western University. She is the first First Nations woman to have earned a law degree in Canada. She was awarded the Indigenous Peoples’ Counsel designation by the Indigenous Bar Association and is an officer of the Order of Canada. |

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Governance |

6/6 |

– |

|

|||

| Risk |

7/7 |

1/1 |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|||||||

| 2023 |

5,727 |

– |

5,727 |

$634,323 |

0.5 x |

|||||||

| 2022 |

2,901 |

– |

2,901 |

$365,671 |

0.3 x |

|||||||

16

Royal Bank of Canada

The annual meeting

|

|

David McKay O.Ont.

Toronto, ON, Canada

Age 60 | Director since 2014

Not independent (management) 2023 annual meeting Votes in favour: 99.57%

Areas of expertise • Accounting and finance • Business-to-consumer • Financial services • Risk management

Public board memberships • None |

Mr. McKay is President and Chief Executive Officer of Royal Bank of Canada. Prior to his appointment in 2014, he was Group Head, Personal and Commercial Banking. Mr. McKay started his career at RBC in 1988 and held progressively more senior leadership roles since then.

Mr. McKay is a director at the Bank Policy Institute, the Institute of International Finance, the Business Council of Canada and the Business Council (United States). He is also a member of Catalyst Canada’s advisory board and co-chair of the board of the Business + Higher Learning Roundtable.

Mr. McKay holds an MBA from the Richard Ivey School of Business at Western University and a Bachelor of Mathematics from the University of Waterloo. He is a Member of the Order of Ontario. |

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Mr. McKay is not a member of any board committee but attends committee meetings at the invitation of the committees. |

|

|||||

| Securities held as at fiscal year end |

||||||||||||

|

Total as a multiple of equity |

||||||||||||

| Fiscal year |

Shares (#) |

DSUs3 (#) |

Total shares/ DSUs (#) |

Total value of shares/DSUs |

ownership requirement of 8x |

|||||||

| 2023 |

46,985 |

232,8751 |

279,860 |

$30,997,291 |

20.7 x |

|||||||

| 2022 |

44,303 |

232,8952 |

277,198 |

$34,940,729 |

23.3 x |

|||||||

| 1 Represents 211,741 performance-deferred share units under the performance-deferred share unit program

and 21,134 deferred share units under the deferred share unit program for executives (see the description of these programs on 2 Represents 212,600 performance-deferred share units under the performance deferred share unit program and 20,295 deferred share units under the deferred share unit program for executives. 3 Deferred share units (DSU). 4 Mr. McKay does not receive separate compensation for his services as a director. |

|

|

Amanda Norton

Charlotte, NC, U.S.A.

Age 57 | Director since 2024

Independent 2023 annual meeting Not applicable1

Areas of expertise • Accounting and finance • Business-to-consumer • Financial services • Risk management

Public board memberships • None

Past public board memberships • Credit Suisse Group (2022–2023) |

Ms. Norton is a corporate director. She was the Chief Risk Officer of Wells Fargo from 2018 to 2022, and was previously Chief Risk Officer, Consumer and Community Banking at JPMorgan Chase from 2013 to 2018 and Chief Risk Officer, Mortgage Banking at JPMorgan Chase from 2011 to 2013. Before joining JPMorgan Chase, Ms. Norton was Chief Risk Officer, Mortgage and Head Market Risk at Ally Financial Inc. from 2009 to 2011, and also spent 14 years at Bank of America Corporation in various risk management, treasury and portfolio management roles. Ms. Norton is a director at Generation Investment Management and a director at the Risk Management Association. She is a trustee of the Nature Conservancy, North Carolina Chapter. Ms. Norton holds a Bachelor of Science in Mathematics and Statistics (First Class) from the University of Bath, U.K. |

| 1 Effective February 1, 2024, Ms. Norton was appointed a director. |

17

Royal Bank of Canada

The annual meeting

|

|

Barry Perry

St. John’s, NL, Canada

Age 59 | Director since 2023

Independent 2023 annual meeting Votes in favour: not applicable

Areas of expertise • Accounting and finance • Business-to-consumer • Legal/regulatory • Talent management and

Public board memberships • Capital Power Corporation

Past public board memberships • Fortis, Inc. (2015–2020) |

Mr. Perry is a corporate director. He was President and Chief Executive Officer of Fortis, Inc. from 2015 to 2020, and previous to that was Executive Vice-President of Finance and Chief Financial Officer from 2004 to 2014.

Prior to joining Fortis, Mr. Perry was Vice-President of Finance and Chief Financial Officer of Fortis-owned Newfoundland Power and, prior to that, Vice-President and Treasurer of Abitibi-Consolidated.

Mr. Perry is a director at Canada Pension Plan Investment Board.

Mr. Perry holds a Bachelor of Commerce from Memorial University of Newfoundland and is a Chartered Professional Accountant. |

| Attendance1 (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

2/2 |

– |

|

|||

| Audit |

2/2 |

– |

|

|||

| Human resources |

2/2 |

– |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|

||||||

| 2023 |

32,456 |

770 |

33,226 |

$3,680,096 |

2.7 x |

|||||||

| 1 Effective August 1, 2023, Mr. Perry was appointed a director and joined the audit and human resources committees. |

|

|

Maryann Turcke

Toronto, ON, Canada

Age 58 | Director since 2020

Independent 2023 annual meeting Votes in favour: 94.83%

Areas of expertise • Business-to-consumer • Risk management • Talent management and • Technology/digital

Public board memberships • Skyworks Solutions (2023–present) • Frontier Communications

Past public board memberships

• Playmaker Capital (2021–2024) |

Ms. Turcke is a corporate director. Ms. Turcke was a Senior Advisor at Brookfield Infrastructure Partners from 2020 to 2022. She was previously Chief Operating Officer of the National Football League (NFL) and President, NFL Networks from 2017 to 2021. Before joining the NFL in 2017, Ms. Turcke was President, Bell Media after having held a variety of senior leadership roles during her 12 years at Bell Canada. Ms. Turcke is on the advisory board of Georgian and is a director at SickKids Foundation. Ms. Turcke holds an MBA and a Bachelor of Civil Engineering from Queen’s University and a Master of Engineering from the University of Toronto. |

| Attendance1 (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Audit |

7/7 |

– |

|

|||

| Human resources |

3/3 |

– |

|

|||

| Governance (chair) |

2/2 |

– |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|

||||||

| 2023 |

1,000 |

11,304 |

12,304 |

$1,362,747 |

1.0 x |

|||||||

| 2022 |

1,000 |

7,955 |

8,955 |

$1,128,798 |

0.8 x |

|||||||

| 1 Effective April 5, 2023, Ms. Turcke became chair of the governance committee and retired from the human resources committee. |

18

Royal Bank of Canada

The annual meeting

|

|

Thierry Vandal

Mamaroneck, NY, U.S.A.

Age 63 | Director since 2015

Independent 2023 annual meeting Votes in favour: 98.52%

Areas of expertise • Accounting and finance • Legal/regulatory • Risk management • Talent management and

Public board memberships • TC Energy Corporation (2017–present) |

Mr. Vandal is President of Axium Infrastructure U.S. Inc. (an investment management firm). From 2005 to 2015, he was President and Chief Executive Officer of Hydro-Québec. Mr. Vandal is Governor Emeritus of McGill University. Mr. Vandal holds an MBA in finance from Université de Montréal and an engineering degree from École Polytechnique de Montréal. He is a fellow of the Canadian Academy of Engineering. |

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Human resources (chair) |

6/6 |

– |

||||

| Risk |

7/7 |

1/1 |

|

|||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|

||||||

| 2023 |

1,336 |

28,158 |

29,494 |

$3,266,805 |

2.4 x |

|||||||

| 2022 |

1,309 |

23,958 |

25,267 |

$3,184,849 |

2.3 x |

|||||||

|

|

Frank Vettese FCPA, FCBV

Toronto, ON, Canada

Age 60 | Director since 2019

Independent 2023 annual meeting Votes in favour: 99.55%

Areas of expertise • Accounting and finance • Financial services • Risk management • Talent management and

Public board memberships • None

|

Mr. Vettese is co-founder of SummitNorth (a capital and advisory company). He was Managing Partner and Chief Executive Officer of Deloitte Canada from 2012 and a member of Deloitte’s Global Executive from 2007 until June 2019. Over the course of his career with Deloitte, Mr. Vettese served in a number of senior leadership positions, including Chair of the Americas Executive and Global Managing Partner, Financial Advisory. From 2016 to 2019, he also served as Deloitte Canada’s Chief Inclusion Officer. Mr. Vettese is a trustee of the Hospital for Sick Children. He is on the advisory boards of SandboxAQ, Delos Living LLC, as well as on the Dean’s Global Council at the Schulich School of Business at York University. Mr. Vettese holds an MBA and a Bachelor of Business Administration from the Schulich School of Business at York University. He was awarded an Honorary Doctor of Laws from York University. Mr. Vettese is a fellow of the Chartered Professional Accountants of Ontario and the Canadian Institute of Chartered Business Valuators.

|

| Attendance (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Audit (chair) |

7/7 |

– |

||||

| Human resources |

6/6 |

– |

|

|||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|

||||||

| 2023 |

9,570 |

14,348 |

23,918 |

$2,649,184 |

1.9 x |

|||||||

| 2022 |

9,570 |

10,695 |

20,265 |

$2,554,423 |

1.9 x |

|||||||

19

Royal Bank of Canada

The annual meeting

|

|

Jeffery Yabuki

Fox Point, WI, U.S.A.

Age 63 | Director since 2017

Independent 2023 annual meeting Votes in favour: 99.21%

Areas of expertise • Accounting and finance • Financial services • Risk management • Technology/digital

Public board memberships • Nasdaq, Inc. (2023–present) • Sportradar Holding AG (chair)

Past public board memberships • SentinelOne, Inc. (2021–2023) • Fiserv, Inc. (2005–2020) |

Mr. Yabuki is the Chief Executive Officer and chair of InvestCloud, Inc. (a technology company). He was a corporate director from 2020 to 2023.

From 2005 to 2020, Mr. Yabuki held a variety of senior leadership roles at Fiserv Inc., including President and Chief Executive Officer, Chairman and Executive Chairman. Prior to joining Fiserv, he was Executive Vice-President and Chief Operating Officer of H&R Block, Inc., and he was also a senior officer at American Express Co. for 12 years.

Mr. Yabuki is chairman of Motive Partners GP, LLC. He is chair of the board of trustees of the Milwaukee Art Museum and a trustee of the Los Angeles County Museum of Art. He is also a member of the Wisconsin Governor’s Task Force on Workforce and Artificial Intelligence.

Mr. Yabuki holds a Bachelor of Science in Business Administration and Accounting from California State University and was previously licensed as a certified public accountant.

|

| Attendance1 (100% overall) |

|

|||||

|

Board/Committee memberships |

Regular |

Special |

||||

| Board |

8/8 |

– |

|

|||

| Audit |

4/4 |

– |

|

|||

| Human resources |

6/6 |

– |

|

|||

| Risk |

3/3 |

1/1 |

||||

| Securities held as at fiscal year end |

||||||||||||

| Fiscal |

Shares |

DDSUs |

Total shares/ |

Total value of |

Total as a multiple of equity |

|||||||

|

year |

(#) |

(#) |

DDSUs (#) |

shares/DDSUs |

ownership guideline of $1,360,000 |

|

||||||

| 2023 |

6,900 |

17,773 |

24,673 |

$2,732,732 |

2.0 x |

|||||||

| 2022 |

6,900 |

14,446 |

21,346 |

$2,690,693 |

2.0 x |

|||||||

| 1 Effective April 5, 2023, Mr. Yabuki joined the risk committee and retired from the audit committee. |

20

Royal Bank of Canada

The annual meeting

The board maintains a matrix to help identify the competencies and experience it regards as key to the long-term strategic success of RBC. The matrix assists the governance committee and the board in attracting the right talent and expertise against the backdrop of a quickly changing and increasingly competitive global marketplace, a challenging macroeconomic environment and a rapidly evolving regulatory landscape.

As the matrix shows, the director nominees for 2024 present a diverse range of expertise, experience and perspectives, which supports strong and effective oversight of RBC as it pursues its strategic goals and financial objectives. All director nominees are required to have experience and skills acquired from senior-level involvement in major organizations.

To best support the bank in achieving its Purpose to help clients thrive and communities prosper, all director nominees are required to have experience in environmental, social or governance matters, which they have acquired in a variety of ways, including through their professional experience or their educational background. More specifically, they have acquired governance experience as senior leaders in major organizations or as directors and board and committee chairs of public, private and not-for-profit entities. Experience in environmental matters is derived from positions as senior executives, directors or advisors of large utility, energy or natural resources companies, or at organizations focused on climate- or sustainability-related matters. Experience in social matters is acquired through managing or overseeing human resources or diversity and inclusion initiatives either as senior executives, directors or advisors, or through their involvement with charitable and not-for-profit organizations advancing community, diversity and social initiatives. Directors must also share a commitment to the RBC values of integrity, putting the client first, diversity and inclusion, accountability and collaboration.

|

Competencies and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Accounting and finance

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Business-to-consumer

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Financial services

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Legal/regulatory

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Risk management

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Talent management and Executive compensation

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Technology/digital

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Business transformation

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Multi-line responsibility

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

CEO experience

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Environmental, social or governance

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

U.S. expertise

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Directors are asked to identify their top four major competencies in a self-assessment questionnaire, recognizing that they have experience in other major competencies as well. |

Our commitment to a diverse and balanced board

In line with our Board Diversity Policy, as well as our commitment to a balanced and diverse board, the governance committee also considers gender and non-gender diversity, ethnicity, race, ancestral origin, age, geography, background, sexual orientation and other dimensions of diversity in considering candidates to nominate for election or re-election.

21

Royal Bank of Canada

The annual meeting

Our approach to compensation

Experienced, focused and talented directors are essential to achieve our strategic objectives within our risk appetite and provide effective guidance to and oversight of management.

The governance committee is responsible for all aspects of director compensation and annually reviews the amount and form of non-executive director compensation, taking the following into account:

| • | size, complexity and geographic scope of RBC |

| • | expected time commitment of directors |

| • | overall expertise and experience required |

| • | need for compensation that is fair and positions RBC to attract highly qualified directors, and |

| • | alignment of interests between directors and shareholders. |

Decision-making process

The governance committee assesses the design and competitiveness of director compensation in the context of industry best practices and with reference to a core Canadian comparator group of companies (including financial institutions) of similar size, complexity and geographic scope to RBC. It also considers a broader reference group of U.S. and international financial institutions of similar size, complexity, business mix, scale of operations outside their home country and financial condition.

|

|

Canadian comparator group

Financial institutions

• Bank of Montreal

• The Bank of Nova Scotia

• Canadian Imperial Bank of Commerce

• Manulife Financial Corporation

• Sun Life Financial Inc.

• The Toronto-Dominion Bank

|

Non-financial institutions

• BCE Inc.

• Canadian National Railway Company

• Enbridge Inc.

• Nutrien Ltd.

• Suncor Energy

• TC Energy Corporation |

||

|

|

U.S. and international reference group

U.S. financial institutions

• Bank of America Corporation

• Citigroup Inc.

• JPMorgan Chase & Co.

• PNC Financial Services Group, Inc.

• U.S. Bancorp

• Wells Fargo & Company

|

International financial institutions

• Australia and New Zealand Banking Group Limited

• Commonwealth Bank of Australia

• National Australia Bank

• Westpac Banking Corporation |

||

Compensation structure

We believe in a simple and transparent compensation structure. Each non-executive director is paid a flat annual fee covering all of their responsibilities, attendance and work performed during the year, including membership on two board committees. The board chair and the committee chairs each receive an additional retainer.

Directors are also reimbursed for travel and other expenses incurred to attend board, committee and other meetings or business at the request of RBC. Directors do not receive any additional travel or meeting fees and are paid in Canadian dollars, regardless of country of residence.

In fiscal 2023, RBC directors were compensated as follows:

|

Annual retainers

|

($)

|

|||||

| Director

|

340,000

|

|||||

|

Board chair

|

275,000

|

|||||

|

Committee chair

|

60,000

|

|||||

David McKay, as President and Chief Executive Officer (CEO) of RBC, does not receive any director compensation.

Non-executive directors do not receive stock options and do not participate in RBC pension plans.

22

Royal Bank of Canada

The annual meeting

No changes to compensation

There are no changes recommended or approved for 2024.

Alignment of director and shareholder interests