UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of: March 2024

Commission File Number: 002-09048

THE BANK OF NOVA SCOTIA

(Name of registrant)

40 Temperance Street, Toronto, Ontario, M5H 0B4

Attention: Secretary’s Department (Tel.: (416) 866-3672)

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

This report on Form 6-K shall be deemed to be incorporated by reference in The Bank of Nova Scotia’s registration statements on Form S-8 (File No. 333-199099) and Form F-3 (File No. 333-261476) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| THE BANK OF NOVA SCOTIA | ||||||

| Date: March 7, 2024 | By: | /s/ Nives Gaiotto |

||||

| Name: | Nives Gaiotto | |||||

| Title: | Assistant Corporate Secretary | |||||

EXHIBIT INDEX

| Exhibit |

Description of Exhibit |

|

| 99.1 | Notice of the 192nd Annual Meeting of Shareholders and Management Proxy Circular | |

| 99.2 | Notice of Availability of Annual Shareholder Meeting Materials | |

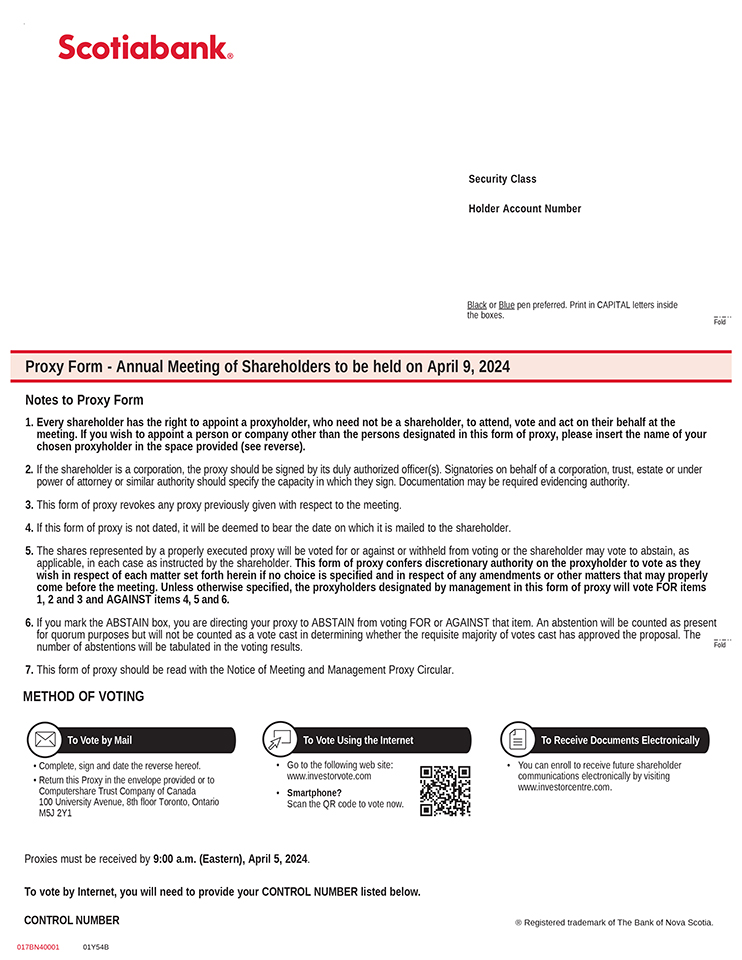

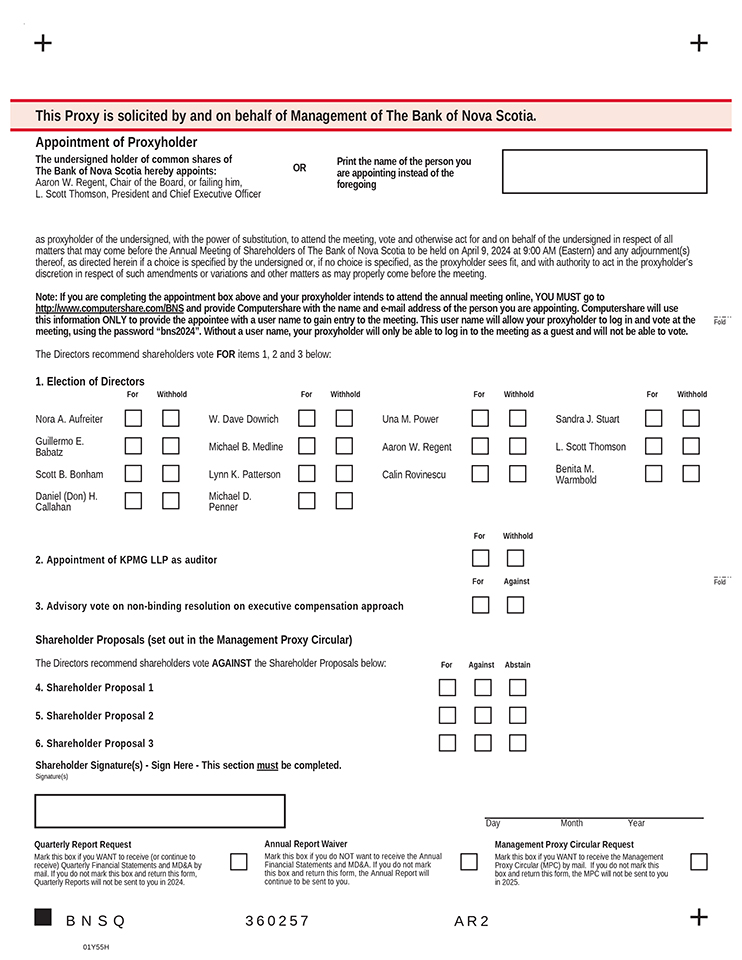

| 99.3 | Form of Proxy | |

| 99.4 | Mandate of the Board of Directors | |

Exhibit 99.1

MANA G E M E N T P R O X Y C I R C U L A R A N N U A L M E E T I N G O F S H A R E H O L D E R S | A P R I L 9 , 2 0 2 4 Y OU R V O T E I S I M P O R T A N T Please take some time to read this management proxy circular for important information about the business of the meeting and to learn more about Scotiabank scotiabank.com/annualmeeting

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

From time to time, our public communications include oral or written forward-looking statements. Statements of this type are included in this document and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission, or in other communications. In addition, representatives of the bank may include forward-looking statements orally to analysts, investors, the media and others. All such statements are made pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. Forward-looking statements may include, but are not limited to, statements made in this document and any document incorporated by reference herein regarding the bank’s financial projections, objectives, visions and goals, regarding the outlook for the bank’s businesses and for the Canadian, U.S. and global economies, and regarding environmental, social and governance (“ESG”), including climate-related, projections, objectives, vision and goals (collectively, our “ESG Objectives”), such as our net-zero and interim emissions targets, our statement on thermal coal, and our climate-related finance target. Such statements are typically identified by words or phrases such as “believe,” “expect,” “aim,” “achieve,” “foresee,” “forecast,” “anticipate,” “intend,” “estimate,” “plan,” “goal,” “strive,” “target,” “project,” “commit,” “objective,” and similar expressions of future or conditional verbs, such as “will,” “may,” “should,” “would,” “might,” “can” and “could” and positive and negative variations thereof.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct and that our financial performance and ESG Objectives will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors, many of which are beyond our control and effects of which can be difficult to predict, could cause our actual results to differ materially from the expectations, targets, estimates or intentions expressed in such forward-looking statements.

The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: general economic and market conditions in the countries in which we operate and globally; changes in currency and interest rates; increased funding costs and market volatility due to market illiquidity and competition for funding; the failure of third parties to comply with their obligations to the bank and its affiliates; changes in monetary, fiscal, or economic policy and tax legislation and interpretation; changes in laws and regulations or in supervisory expectations or requirements, including capital, interest rate and liquidity requirements and guidance, and the effect of such changes on funding costs; geopolitical risk; changes to our credit ratings; the possible effects on our business of war or terrorist actions and unforeseen consequences arising from such actions; technological changes and technology resiliency; operational and infrastructure risks; reputational risks; the accuracy and completeness of information the bank receives on customers and counterparties; the timely development and introduction of new products and services, and the extent to which products or services previously sold by the bank require the bank to incur liabilities or absorb losses not contemplated at their origination; our ability to execute our strategic plans, including the successful completion of acquisitions and dispositions, including obtaining regulatory approvals; critical accounting estimates and the effect of changes to accounting standards, rules and interpretations on these estimates; global capital markets activity; the bank’s ability to attract, develop and retain key executives; the evolution of various types of fraud or other criminal behaviour to which the bank is exposed; anti-money laundering; disruptions or attacks (including cyberattacks) on the bank’s information technology, internet connectivity, network accessibility, or other voice or data communications systems or services; which may result in data breaches, unauthorized access to sensitive information, and potential incidents of identity theft; increased competition in the geographic and in business areas in which we operate, including through internet and mobile banking and non-traditional competitors; exposure related to significant litigation and regulatory matters; climate change, sustainability and other ESG risks that may arise, including from the bank’s business activities; the occurrence of natural and unnatural catastrophic events and claims resulting from such events; inflationary pressures; Canadian housing and household indebtedness; the emergence or continuation of widespread health emergencies or pandemics, including their impact on the global economy, financial market conditions and the bank’s business, results of operations, financial condition and prospects; and the bank’s anticipation of and success in managing the risks implied by the foregoing. A substantial amount of the bank’s business involves making loans or otherwise committing resources to specific companies, industries or countries. Unforeseen events affecting such borrowers, industries or countries could have a material adverse effect on the bank’s financial results, businesses, financial condition or liquidity. These and other factors may cause the bank’s actual performance to differ materially from that contemplated by forward-looking statements. Certain statements in this document are based on hypothetical or severely adverse scenarios and assumptions, and these statements should not necessarily be viewed as being representative of current or actual risk or forecasts of expected risk. The bank cautions that the preceding list is not exhaustive of all possible risk factors and other factors could also adversely affect the bank’s results. For more information, please see the “Risk Management” section of the bank’s 2023 annual report, as may be updated by quarterly reports.

Material economic assumptions underlying the forward-looking statements contained in this document are set out in the 2023 annual report under the headings “Outlook”, as updated by quarterly reports. The “Outlook” and “2024 Priorities” sections are based on the bank’s views and the actual outcome is uncertain. Readers should carefully consider the above-noted factors and other uncertainties and potential events, including when relying on forward-looking statements to make decisions with respect to the bank and its securities.

Any forward-looking statements contained in this document represent the views of management only as of the date hereof and are presented for the purpose of assisting shareholders, analysts and other readers in understanding the bank’s financial position, objectives and priorities, anticipated financial performance and ESG Objectives as at and for the periods ended on the dates presented, and may not be appropriate for other purposes. No representation or warranty, express or implied, is or will be made in relation to the accuracy, reliability or completeness of the information contained in this document. Except as required by law, the bank does not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by or on its behalf.

Additional information relating to the bank, including the bank’s annual information form, can be located on the SEDAR+ website at www.sedarplus.ca and on the EDGAR section of the SEC’s website at www.sec.gov.

ADDITIONAL CAUTION REGARDING ESG-RELATED DISCLOSURES

In setting and implementing our ESG Objectives, and in preparing this document, the bank has made various assumptions, including about technological, economic, scientific and legal trends and developments, in light of an evolving policy and regulatory environment. As such, the data, analysis, strategy and other information set out in this document remain under development and subject to evolution, amendment, update and restatement over time. The bank specifically cautions readers of the following:

| • | The terms “ESG”, “net-zero”, “carbon neutral”, “sustainable finance”, “carbon-related finance” and similar terms, taxonomies and criteria are evolving, and the bank’s use of such terms may change to reflect such evolution. Any references to such terms in this document are references to the internally defined criteria of the bank and not to any particular regulatory definition or voluntary standard. |

| • | The bank has assumed continued growth in its clients’ investments in and expenditures on ESG activities. The bank has also assumed ordinary rates of growth and development of the bank’s business, including in the products and services it provides to clients in all sectors, in its own investments, in its subsidiaries and in its geographic footprint. If any of these assumptions prove incorrect, the bank may not be able to meet its ESG Objectives and may need to update or revise them. |

| • | The evolution of the policy and regulatory environment relating to ESG issues, and climate-related issues in particular, may result in updates or revisions to forward-looking statements and other information contained in this document. There could also be changes to the market practices, taxonomies, methodologies, scenarios, frameworks, criteria and standards (collectively, “ESG Standards”) that governmental and non-governmental entities, the financial sector, the bank and its clients use to classify, assess, measure, report on and verify ESG activities, including for inclusion toward the bank’s ESG Objectives. In some cases, applicable ESG Standards may not yet exist. The bank may update its ESG Objectives, its plans to achieve them, its progress toward them, and its estimates of the impact of this progress, as appropriate, in light of new and evolving ESG Standards. |

| • | In setting and implementing its ESG Objectives, the bank relies on data obtained from clients and other third-party sources. The bank’s use of third-party data cannot be taken as an endorsement of the third-party or its data or be construed as granting any form of intellectual property. Although the bank believes these sources are reliable, the bank has not independently verified all third-party data, or assessed the assumptions underlying such data, and cannot guarantee their accuracy. The data used by the bank in connection with its ESG Objectives may be limited in quality, unavailable, or inconsistent across sectors, and we have no guarantee that third parties will comply with our policies and procedures in respect of the collection of this data. Certain third-party data may also change over time as ESG Standards evolve. These factors could have a material effect on the bank’s ESG Objectives and ability to meet them. |

| • | The bank and its clients may need to purchase carbon and clean energy instruments (“Environmental Attributes”) to meet its ESG Objectives. The market for Environmental Attributes is still developing and their availability may be limited. Some Environmental Attributes are also subject to the risk of invalidation or reversal, and the bank provides no assurance of the treatment of any such Environmental Attributes in the future. There may also be changes to applicable regulations and standards that impact the market for Environmental Attributes. The maturity, liquidity and economics of this market may make it more difficult for the bank to achieve its ESG Objectives. |

| • | This document may provide addresses of or contain hyperlinks to websites that are not owned or controlled by the bank. Each such address or hyperlink is provided solely for the recipient’s convenience, and the content of linked third-party websites is not in any way included or incorporated by reference into this document. The bank takes no responsibility for such websites or their content, or for any loss or damage that may arise from their use. If you decide to access any of the third-party websites linked to this document, you do so at your own risk and subject to the terms and conditions of such websites. |

Scotiabank’s vision is to be our clients’ most trusted financial partner, to deliver sustainable, profitable growth and maximize total shareholder return.

Guided by our purpose – for every futureTM – we help our clients, their families and their communities achieve success through a broad range of advice, products and services.

Notice of annual meeting of common shareholders of The Bank of Nova Scotia

| WHEN |

WHERE |

LIVE WEBCAST |

||

| Tuesday, April 9, 2024 |

Scotiabank Centre | https://web.lumiagm.com/404563185 | ||

| 9:00 a.m. (Eastern) |

Scotia Plaza, 40 King Street West, 2nd floor | |||

| Toronto, Ontario M5H 3Y2 | ||||

Our annual meeting will once again be held both in person and online via live webcast, allowing shareholders to attend the meeting, vote their shares, and submit questions using either method.

Please see page 9 for information about attending the meeting, voting and submitting questions.

AT THE MEETING YOU WILL BE ASKED TO:

| 1. | Receive our financial statements for the year ended October 31, 2023 and the auditor’s report on the statements |

| 2. | Elect directors |

| 3. | Appoint auditor |

| 4. | Vote on an advisory resolution on our approach to executive compensation |

| 5. | Vote on the shareholder proposals |

| 6. | Consider any other business that may properly come before the meeting |

You can read about each item of business beginning on page 6 of the management proxy circular, which describes the meeting, who can vote, and how to vote.

Holders of common shares on February 13, 2024, the record date, are eligible to vote at the meeting (subject to Bank Act (Canada) restrictions). There were 1,222,132,754 common shares outstanding on this date.

By order of the board,

Julie A. Walsh

Senior Vice President, Corporate Secretary and Chief Corporate Governance Officer

Toronto, Ontario, Canada

February 13, 2024

YOUR VOTE IS

IMPORTANT

As a Scotiabank shareholder, it is important to vote your shares at the upcoming meeting. Detailed voting instructions for registered and non-registered shareholders begin on page 9 of the management proxy circular.

If you cannot attend the meeting, you should complete, sign and return your proxy or voting instruction form to vote your shares. We encourage you to vote your shares prior to the annual meeting. Your vote must be received by our transfer agent, Computershare Trust Company of Canada, by 9:00 a.m. (Eastern) on April 5, 2024.

Welcome to our 192nd annual meeting of shareholders

Aaron W. Regent

Chair of Scotiabank’s

Board of Directors

L. Scott Thomson

President and Chief Executive Officer

Dear fellow shareholders,

We are pleased to invite you to Scotiabank’s annual general meeting in Toronto on April 9, 2024.

This management proxy circular provides shareholders with important information, including the bank’s approach to corporate governance matters and executive compensation, as well as other business that will be conducted at the meeting. We encourage you to review this circular and vote your shares.

Shareholders may choose to attend our annual meeting either in person or online via a live webcast. Both options will allow for full shareholder participation by viewing the meeting, voting their shares and submitting questions.

Amidst a challenging global economic environment, the past year has also been one of transition for Scotiabank as we unveiled our new strategy to deliver sustainable and profitable growth. The bank’s board and leadership team thank you for your continued engagement and confidence in our bank.

We look forward to hearing from our shareholders directly as we welcome you on April 9.

|

|

| 2 | Scotiabank |

| 1 | ||||

|

|

6 |

|

||

|

|

6 |

|

||

|

|

9 |

|

||

|

|

14 |

|

||

|

|

22 |

|

||

|

|

23 |

|

||

|

|

24 |

|

||

|

|

24 |

|

||

|

|

24 |

|

||

|

|

25 |

|

||

| 2 | ||||

|

|

26 |

|

||

|

|

29 |

|

||

|

|

29 |

|

||

|

|

30 |

|

||

|

|

30 |

|

||

|

|

31 |

|

||

|

|

32 |

|

||

|

|

32 |

|

||

|

|

36 |

|

||

|

|

40 |

|

||

|

|

41 |

|

||

|

|

41 |

|

||

|

|

43 |

|

||

|

|

48 |

|

||

|

|

48 |

|

||

|

|

48 |

|

||

|

|

48 |

|

||

|

|

50 |

|

||

|

|

50 |

|

||

|

|

51 |

|

||

|

|

51 |

|

||

|

|

51 |

|

||

|

|

52 |

|

||

|

|

53 |

|

||

|

|

53 |

|

||

|

|

53 |

|

||

|

|

56 |

|

||

|

|

58 |

|

||

| 3 | ||||

|

|

64 |

|

||

| Message from the Chair of the Board and the chair of the human capital and compensation committee |

|

65 |

|

|

|

|

72 |

|

||

|

|

72 |

|

||

|

|

80 |

|

||

|

|

84 |

|

||

|

|

87 |

|

||

|

|

92 |

|

||

|

|

104 |

|

||

|

|

105 |

|

||

|

|

105 |

|

||

|

|

107 |

|

||

|

|

112 |

|

||

|

|

114 |

|

||

| 4 | ||||

|

|

117 |

|

||

|

|

117 |

|

||

|

|

118 |

|

||

|

|

118 |

|

||

|

|

118 |

|

||

|

|

119 |

|

||

|

|

119 |

|

||

| 5 | ||||

|

|

120 |

|

||

|

|

131 |

|

||

| Management proxy circular | 3 |

|

Management proxy circular

You have received this management proxy circular because you owned Scotiabank common shares as of the close of business on February 13, 2024 (the record date) and are entitled to vote at our annual meeting.

Management is soliciting your proxy for the annual meeting on April 9, 2024.

This document tells you about the meeting, governance, executive compensation, other information, and shareholder proposals at Scotiabank. We have organized it into five sections to make it easy to find what you are looking for and to help you vote with confidence.

We pay the cost of proxy solicitation for all registered and non-registered (beneficial) shareholders. We are soliciting proxies mainly by mail, but you may also be contacted by employees of Scotiabank, our transfer agent, Computershare Trust Company of Canada (Computershare), or our proxy solicitation firm, Kingsdale Advisors. We have retained Kingsdale Advisors to help us with this process at an estimated cost of $50,000.

Unless indicated otherwise, information in this management proxy circular (circular) is as of February 7, 2024 and all dollar amounts are in Canadian dollars.

DELIVERY OF MEETING MATERIALS

Notice and access

As permitted by the Canadian Securities Administrators (CSA) and pursuant to an exemption from the proxy solicitation requirement received from the Office of the Superintendent of Financial Institutions (OSFI), we are using “notice and access” to deliver this circular to both our registered and beneficial shareholders. This means that this circular will be posted online for you to access instead of receiving a physical copy in the mail. Notice and access gives shareholders more choice, allows for faster access to this circular, reduces our printing and mailing costs, and is environmentally friendly as it reduces paper and energy consumption.

You will still receive a physical copy of the form of proxy in the mail if you are a registered shareholder or the voting instruction form if you are a beneficial shareholder so that you can vote your shares. However, instead of receiving a physical copy of the circular, you will receive a notice explaining how to access this circular electronically and how to request a physical copy. Physical copies of the circular will also be provided to shareholders who have standing instructions to receive physical copies of meeting materials.

How to access the circular electronically

This circular is available on the website of Computershare (www.envisionreports.com/scotiabank2024), SEDAR+ (www.sedarplus.ca), and on EDGAR (www.sec.gov). |

||

|

|

||

|

In this document:

• we, us, our, the bank and Scotiabank mean The Bank of Nova Scotia • you and your mean holders of our common shares • common shares and shares mean the bank’s common shares • annual meeting, AGM, and meeting mean the annual meeting of common shareholders of the bank

|

||

| 4 | Scotiabank |

| Delivery of the annual report

How we deliver our annual report to you depends on whether you are a registered shareholder or a beneficial shareholder.

You are a registered shareholder if the shares you own are registered directly in your name with Computershare. If this is the case, your name will appear on a share certificate or a statement from a direct registration system confirming your shareholdings. You are a beneficial shareholder if the shares you own are registered for you in the name of an intermediary such as a securities broker, trustee, or financial institution.

Registered shareholders

Registered shareholders who have not opted out of receiving our annual report will receive a physical copy, unless they have consented to electronic delivery. Please refer to “Receiving shareholder materials by email” under “Information about voting” for more information on signing up to receive shareholder materials by email.

Beneficial shareholders

As permitted under securities laws, we are using notice and access to deliver our annual report to beneficial shareholders. You may access the annual report online in the same manner as described in “How to access the circular electronically”. Physical copies of the annual report will also be provided to shareholders who have standing instructions to receive physical copies of meeting materials.

How to request a physical copy of materials provided to you through notice and access

Shareholders may request a physical copy of this circular or our annual report, at no cost, up to one year from the date the circular was filed on SEDAR+. If you would like to receive a physical copy prior to the meeting, please follow the instructions provided in the notice or contact Computershare at the contact information provided on the back cover of this circular. A copy of the requested documents will be sent to you within three business days of your request. If you request a physical copy of any materials, you will not receive a new form of proxy or voting instruction form, so you should keep the original form sent to you in order to vote.

Questions?

If you have questions about notice and access or to request a physical copy of this circular or our annual report after the meeting at no charge, you can contact Computershare at the contact information provided on the back cover of this circular.

|

||

|

FOR MORE INFORMATION

You can find financial information about Scotiabank in our 2023 consolidated financial statements and management’s discussion and analysis (MD&A). Financial information and other information about Scotiabank, including our annual information form (AIF) and quarterly financial statements are available on our website (www.scotiabank.com), SEDAR+ (www.sedarplus.ca), or on the U.S. Securities and Exchange Commission (SEC) website (www.sec.gov).

Copies of these documents, this circular and any document incorporated by reference, are available for free by writing to:

Corporate Secretary of The Bank of Nova Scotia 40 Temperance Street Toronto, Ontario Canada M5H 0B4 corporate.secretary@scotiabank.com

You can also communicate with our board of directors by writing to the Chair of the Board at chair.board@scotiabank.com.

|

||

1

ABOUT THE

MEETING

Read about the items of business and how

to vote your shares

2

GOVERNANCE

Learn about our board’s governance practices

3

EXECUTIVE COMPENSATION

Find out what we paid

our senior executives for 2023 and why

4

OTHER INFORMATION

Read additional disclosure about

the bank

5

SHAREHOLDER PROPOSALS

Read the proposals we received from shareholders and learn how and why we recommend

voting in relation to each

| Management proxy circular | 5 |

| 1. RECEIVE FINANCIAL STATEMENTS

Our consolidated financial statements and MD&A for the year ended October 31, 2023, together with the auditor’s report on those statements, will be presented at the meeting. You will find these documents in our annual report, which is available on our website. |

||

| 2. ELECT DIRECTORS

Under our majority voting policy, you will elect 14 directors individually to serve on our board until the close of the next annual meeting or until their successors are elected or appointed. You can find information about the nominated directors beginning on page 14 and our majority voting policy on page 53. |

The board recommends you vote for each nominated director

The board recommends you vote for KPMG LLP as our independent auditor |

|

| 3. APPOINT AUDITOR

You will vote on appointing the independent auditor. The board recommends that KPMG LLP (KPMG) be re-appointed as the shareholders’ auditor until the close of the next annual meeting. The board assessed the performance and independence of KPMG and confirmed that KPMG is independent of the bank within the meaning of the relevant rules and related interpretations prescribed by the relevant professional bodies in Canada and any applicable legislation or regulation. KPMG was appointed our sole auditor in March 2006 following a comprehensive assessment of our two auditors to determine which firm should be appointed as sole auditor. Last year, the vote was 86.36% for KPMG as auditor. Representatives of KPMG will attend the meeting.

The bank has robust policies and procedures in place to assess auditor performance, objectivity, and independence. The audit and conduct review committee, which is composed entirely of independent directors, oversees and evaluates the external auditor. The committee recognizes the importance of maintaining auditor independence while balancing a need for continuity of institutional knowledge to ensure the auditor has the necessary experience to effectively audit an international organization of significant size and complexity. When assessing auditor independence, the committee considers a number of factors, including an annual performance and independence review of the external auditor, the nature and amount of any non-audit services, mandatory partner rotations, and a comprehensive review of the auditor performed by the bank.

The bank has numerous processes in place in order to ensure auditor independence:

• Audit and Conduct Review Committee Review (Performance): The audit and conduct review committee conducts a fulsome annual assessment on the performance of the auditor as per the bank’s Policy on the Assessment of the External Auditor with inputs from management, prior to its recommendation to the board on the auditor’s proposed appointment. The committee reviews the audit quality, auditor tenure, reasonableness of the audit fees, and the credibility of the auditor in the financial markets and with regulators. • Audit and Conduct Review Committee Review (Independence): The audit and conduct review committee takes into consideration both the high standards of independence that the bank employs in reviewing relationships with the auditor, which further mitigate potential concerns of familiarity due to auditor tenure, and the importance of the auditor’s institutional knowledge. The committee also considers the nature and extent of any non-audit service fees when assessing independence, which only represent 4.55% of the total auditor’s fees in 2023. |

||

| 6 | Scotiabank |

|

• Mandatory Partner Rotations: The mandated rotation of lead and other key engagement partners of KPMG, including partners auditing the different segments of the bank, provides a safeguard against familiarity threats. The lead audit engagement partner and the engagement quality control review partner rotated in 2021, and the corporate engagement partner rotated in 2022. • Comprehensive Review: The audit and conduct review committee also conducts an in-depth comprehensive review of our external auditor every five years using the standardized toolkit developed by CPA Canada, the Canadian Public Accountability Board (CPAB), and the Institute of Corporate Directors (ICD), prior to its recommendation to the board regarding the auditor. This approach is consistent with the conclusions and recommendations from the CPA Canada/CPAB/ICD Enhancing Audit Quality initiative, which state that a committee’s periodic comprehensive review is the preferred alternative to mandatory firm rotation or re-tendering for addressing the institutional familiarity threat and enhancing audit quality. The most recent comprehensive review using the CPA Canada/CPAB/ICD toolkit was conducted in 2020 and raised no significant concerns with KPMG as the bank’s external auditor. • Strong Regulatory Framework: KPMG is an independent registered public accounting firm and is subject to external inspections by the CPAB and the Public Company Accounting Oversight Board (PCAOB), peer reviews, and oversight by the CPAB, PCAOB, the CSA, and the SEC. KPMG shares findings and other relevant matters to these inspections with our audit and conduct review committee. • Regular Review of Committee Membership: The corporate governance committee recommends committee composition (including committee chairs) to the board and reviews committee membership throughout the year and after the annual meeting once the board is elected. The committee also reviews committee chair succession in accordance with their term limits. This review and the committee chair term limits ensure the audit and conduct review committee members have the appropriate skills, experience, and tenure, as well as ensure the committee maintains fresh perspectives and does not develop familiarity issues. |

||

| Based on the audit and conduct review committee’s rigorous assessment of KPMG, the board has concluded that there are no concerns regarding KPMG’s tenure and independence and that KPMG should be recommended for re-appointment to shareholders at this annual meeting. | ||

| Auditor’s fees

The table below lists the services KPMG provides and the fees we paid to them for the fiscal years ended October 31, 2023 and 2022. The increase in audit fees was in line with labour market changes and also driven by an increase in the scope of certain services. The increase in fees associated with mutual funds was driven by an increase in the scope of audit services, as KPMG only audited certain mutual funds in fiscal 2022, and in fiscal 2023 transitioned to audit all mutual funds. The audit and conduct review committee can pre-approve services if they are within the scope of the policies and procedures approved by the committee. |

||

| $ millions | 2023 | 2022 | ||||||

| Audit services |

33.0 | 30.4 | ||||||

| Audit services generally relate to the statutory audits and review of financial statements, regulatory required attestation reports, as well as services associated with registration statements, prospectuses, periodic reports, and other documents filed with securities regulatory bodies or other documents issued in connection with securities offerings. | ||||||||

| Audit-related services |

1.0 | 2.6 | ||||||

| Audit-related services include special attest services not directly linked to the financial statements, review of controls and procedures related to regulatory reporting, audits of employee benefit plans and consultation and training on accounting and financial reporting. | ||||||||

| Tax services outside of the audit scope |

0.4 | – | ||||||

| Tax services outside of the audit scope relate primarily to specified review procedures required by local tax authorities, attestation on tax returns of certain subsidiaries as required by local tax authorities, and review to determine compliance with an agreement with the tax authorities. | ||||||||

| Other non-audit services |

0.9 | 0.4 | ||||||

| Other non-audit services are primarily for the review and translation of English language financial statements into other languages and other services. | ||||||||

| Total Bank and Subsidiaries |

|

35.3 |

|

|

33.4 |

|

||

| Mutual Funds | 3.2 | 1.2 | ||||||

| Total Fees |

|

38.5 |

|

|

34.6 |

|

||

| Management proxy circular | 7 |

|

4. ADVISORY VOTE ON OUR APPROACH TO EXECUTIVE COMPENSATION

You can have a “say on pay” by participating in an advisory vote on our approach to executive compensation.

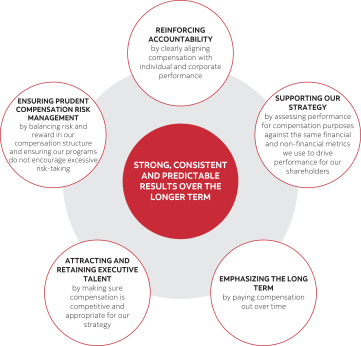

Since 2010, we have held this annual advisory vote to give shareholders the opportunity to provide the board with important feedback. This vote does not diminish the role and responsibility of the board. Last year, the vote was 91.62% for our approach to executive compensation. This vote support reflected the continued enhancements to our disclosure and our extensive engagement strategy throughout the year. You can read more about the bank’s approach to stakeholder engagement beginning on page 41 and our approach to executive compensation in Section 3 – Executive Compensation. Our executive compensation program supports our goal of delivering strong, consistent, and predictable results to shareholders over the longer term. Our practices meet the model policy on “say on pay” for boards of directors developed by the Canadian Coalition for Good Governance (CCGG).

You will be asked to vote on the following advisory resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in this management proxy circular delivered in advance of the 2024 annual meeting of shareholders of the Bank. |

The board recommends you vote for our approach to executive compensation |

| This is an advisory vote, which means the results are not binding on the board. The human capital and compensation committee and the board review the results after the meeting and as they consider future executive compensation decisions. If a significant number of shares are voted against the advisory resolution, the human capital and compensation committee will review our approach to executive compensation in the context of any specific shareholder concerns that have been identified and may make recommendations to the board. We will disclose the human capital and compensation committee’s review process and the outcome of its review within six months of the annual meeting.

|

||

|

The human capital and compensation committee and the board welcome questions and comments about executive compensation at Scotiabank. We maintain an open dialogue with shareholders and consider all feedback. See the back cover for our contact information.

|

||

|

5. SHAREHOLDER PROPOSALS

This year you will be asked to consider three shareholder proposals. You can read the proposals and how and why the board recommends voting in relation to each proposal in Section 5.

|

The board recommends you vote AGAINST the proposals |

|

|

The deadline for submitting proposals to be considered at next year’s annual meeting is November 15, 2024. Proposals should be sent to the Corporate Secretary of The Bank of Nova Scotia, 40 Temperance Street, Toronto, Ontario, Canada M5H 0B4 or corporate.secretary@scotiabank.com.

|

||

|

SHAREHOLDER APPROVAL

Each item being put to a vote requires the approval of a majority of votes cast in person or by proxy at the meeting. Directors are subject to our majority voting policy (see page 53).

You (or your proxyholder) can vote as you (or your proxyholder) wish on any other items of business properly brought before the meeting (or a reconvened meeting if there is an adjournment). As of the date of this circular, we are not aware of other matters that will be brought before the meeting.

Management does not contemplate that any nominated director will be unable to serve as a director. If, however, this does occur for any reason during or prior to the meeting, the individuals named in your proxy form or voting instruction form as your proxyholder can vote for another nominee at their discretion.

|

||

| 8 | Scotiabank |

WHO CAN VOTE

| You are entitled to one vote per common share held on February 13, 2024, the record date.

Shares beneficially owned by the following entities and persons cannot be voted (except in circumstances approved by the Minister of Finance): • the Government of Canada or any of its agencies • the government of a province or any of its agencies • the government of a foreign country or any political subdivision of a foreign country or any of its agencies • any person who has acquired more than 10% of any class of shares of the bank.

Also, if a person, or an entity controlled by a person, beneficially owns shares that in total represent more than 20% of the eligible votes that may be cast, that person or entity may not vote any of the shares unless permitted by the Minister of Finance.

Our directors and officers are not aware of any person or entity who beneficially owns, directly or indirectly, or exercises control or direction over, more than 10% of any class of our outstanding shares, as of the record date.

HOW TO VOTE

You can vote in advance of the annual meeting or during the meeting, or you can appoint someone to attend the meeting and vote your shares for you (called voting by proxy). How you vote depends on whether you are a registered or a beneficial shareholder. You are a beneficial shareholder if the shares you own are registered for you in the name of an intermediary such as a securities broker, trustee, or financial institution. You are a registered shareholder if the shares you own are registered directly in your name with Computershare. If this is the case, your name will appear on a share certificate or a statement from a direct registration system confirming your shareholdings. |

|

Outstanding

1,222,127,412 on

1,222,132,754 on

|

|

|

| Beneficial shareholders |

Registered shareholders |

|||||

|

Your intermediary has sent you a voting instruction form with this package. We may not have records of your shareholdings as a beneficial shareholder, so you must follow the instructions from your intermediary to vote. |

We have sent you a proxy form with this package. A proxy is a document that can authorize someone else to attend the meeting and vote for you. |

|||||

|

Voting in advance of the annual meeting |

Complete the voting instruction form and return it to your intermediary.

Your intermediary may also allow you to do this online or by telephone.

You can either mark your voting instructions on the voting instruction form or you can appoint another person (called a proxyholder) to attend the annual meeting and vote your shares for you. |

To vote online, follow the instructions on the proxy form.

Alternatively, you may complete the paper proxy form and return it to Computershare.

You can either mark your voting instructions on the proxy form or you can appoint another person (called a proxyholder) to attend the annual meeting and vote your shares for you. |

||||

|

Voting at the annual meeting |

Beneficial shareholders who have not duly appointed themselves as proxyholder will not be able to vote at the meeting in person or online. This is because we and Computershare do not have a record of the beneficial shareholders of the bank, and, as a result, will have no knowledge of your shareholdings or entitlement to vote unless you appoint yourself as proxyholder.

If you are a beneficial shareholder and wish to vote at the meeting, you MUST appoint yourself as proxyholder by inserting your own name in the space provided on the voting instruction form sent to you and you MUST follow all the applicable instructions, including the deadline, provided by your intermediary. See “Appointment of a third party as proxy” and “How to attend the meeting” below. |

Registered shareholders may vote in person or online, as applicable, during the meeting, as further described below under “How to attend the meeting”.

Do not complete and return the proxy form in advance. |

||||

| Management proxy circular | 9 |

| Beneficial shareholders |

Registered shareholders |

|||||

|

Returning the form |

The voting instruction form tells you how to return it to your intermediary.

Remember that your intermediary must receive your voting instructions in sufficient time to act on them, generally one day before the proxy deadline below.

Computershare must receive your voting instructions from your intermediary by no later than the proxy deadline, which is 9:00 a.m. (Eastern) on April 5, 2024. |

The enclosed proxy form tells you how to submit your voting instructions.

Computershare must receive your proxy, including any amended proxy, by no later than the proxy deadline which is 9:00 a.m. (Eastern) on April 5, 2024.

You may return your proxy in one of the following ways: • by mail, in the envelope provided. • using the internet. Go to www.investorvote.com and follow the instructions online. |

||||

|

Changing your vote |

If you have provided voting instructions to your intermediary and change your mind about how you want to vote, or you decide to attend and vote at the annual meeting, contact your intermediary to find out what to do.

If your intermediary gives you the option of using the internet to provide your voting instructions, you can also use the internet to change your instructions, as long as your intermediary receives the new instructions in enough time to act on them before the proxy deadline. Contact your intermediary to confirm the deadline. |

If you want to revoke your proxy, you must deliver a signed written notice specifying your instructions to one of the following: • our Corporate Secretary, by 5:00 p.m. (Eastern) on the last business day before the meeting (or any adjourned meeting reconvenes). Deliver to: The Bank of Nova Scotia Executive Offices ATTN: Julie Walsh, Senior Vice President, Corporate Secretary and Chief Corporate Governance Officer 40 Temperance Street Toronto, Ontario, Canada M5H 0B4 Email: corporate.secretary@scotiabank.com • Nicola Ray Smith, Regional Senior Vice President, Atlantic Region, by 5 p.m. (Eastern) on the last business day before the meeting (or any adjourned meeting reconvenes). Deliver to: The Bank of Nova Scotia Head Office ATTN: Nicola Ray Smith, Regional Senior Vice President 1709 Hollis Street Halifax, Nova Scotia, Canada B3J 1W1 • the Chair of the meeting, before the meeting starts or any adjourned meeting reconvenes.

You can also revoke your proxy in any other way permitted by law. You can change your voting instructions by voting again using the internet. Your voting instructions must be received by Computershare by the proxy deadline noted above, or by voting at the meeting. |

||||

If you have questions or need assistance voting, please contact Kingsdale Advisors at 1-855-476-7988 (toll-free in North America) or 1-416-623-2512 (call and text enabled outside North America) or email contactus@kingsdaleadvisors.com.

| 10 | Scotiabank |

| APPOINTMENT OF A THIRD PARTY AS PROXY

Your form of proxy or voting instruction form names Aaron Regent and Scott Thomson, each a director of the bank, as your proxyholder. You may appoint anyone as your proxyholder to represent you at the meeting. Your proxyholder does not have to be a shareholder of the bank. Your proxyholder must attend the meeting and vote for you. Beneficial shareholders who wish to attend the meeting in person or online MUST appoint themselves as proxyholder.

We reserve the right to accept late proxies and to waive or extend the proxy deadline with or without notice but are under no obligation to accept or reject a late proxy.

Additional information for appointing a third party as proxy if attending the meeting online

Shareholders who wish to appoint someone other than the Scotiabank proxyholders as their proxyholder to attend and participate at the meeting online and vote their shares MUST submit their form of proxy or voting instruction form, as applicable, appointing that person as proxyholder AND register that proxyholder as described below. This includes beneficial shareholders who wish to appoint themselves as proxyholder to attend, participate in, or vote at the meeting. Registering your proxyholder is an additional step to be completed AFTER you have submitted your form of proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a user name that is required to vote online at the meeting.

Step 1: Submit your form of proxy or voting instruction form: To appoint someone other than the Scotiabank proxyholders as your proxyholder, insert that person’s name in the blank space provided in the form of proxy or voting instruction form (if permitted), and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed before registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form.

If you are a beneficial shareholder located outside of the United States and wish to vote online during the meeting, you MUST insert your own name in the space provided on the voting instruction form sent to you by your intermediary, follow all the applicable instructions provided by your intermediary, AND register yourself as your proxyholder, as described below. By doing so, you are instructing your intermediary to appoint you as proxyholder. It is important that you comply with the signature and return instructions provided by your intermediary. Please also see further instructions below under the heading “How to attend the meeting.”

If you are a beneficial shareholder located in the United States and wish to vote online during the meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described below under “How to attend the meeting”, you MUST obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form and the voting instruction form sent to you or contact your intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Computershare. Requests for registration from beneficial shareholders located in the United States that wish to vote online at the meeting or, if permitted, appoint a third party as their proxyholder must be sent by email or by courier to: USLegalProxy@computershare.com (if by email), or Computershare, Attention: Proxy Dept., 8th Floor, 100 University Avenue, Toronto, ON M5J 2Y1, Canada (if by courier), and in both cases, must be labeled “Legal Proxy” and received no later than the voting deadline of 9:00 a.m. (Eastern) on April 5, 2024.

Step 2: Register your proxyholder: To register a third-party proxyholder to attend the meeting online, shareholders must visit http://www.computershare.com/BNS by 9:00 a.m. (Eastern) on April 5, 2024 and provide Computershare with the required proxyholder contact information OR follow the instructions provided by your intermediary on your voting instruction form so that Computershare may provide the proxyholder with a user name via email. Without a user name, proxyholders will not be able to vote at the meeting but will be able to participate as a guest.

Shareholders who wish to appoint a proxyholder to attend the meeting in person on their behalf are not required to complete this additional registration process.

HOW TO ATTEND THE MEETING

Scotiabank is holding the meeting at the Scotiabank Centre in downtown Toronto and offering a simultaneous live webcast of the event. Shareholders and their proxyholders will be able to choose to attend the meeting either in person or online. |

| Management proxy circular | 11 |

|

Attending in person

The meeting will take place at the Scotiabank Centre on the second floor of Scotia Plaza at 40 King Street West in Toronto. Only shareholders and duly appointed proxyholders will be granted access to the in-person meeting. All other guests will be able to attend the meeting online as described below under ‘Attending online’. If you are attending the meeting in person, proof that you are a shareholder or a duly appointed proxyholder will be verified at the registration table. Please visit scotiabank.com/annualmeeting in advance of the meeting for the most current information about attending the meeting in person.

Attending online

A simultaneous webcast of the meeting will also be offered to allow shareholders to attend the meeting online, vote their shares and submit questions.

To join the webcast, log in online at https://web.lumiagm.com/404563185. You may log in up to one hour before the meeting starts. • Registered shareholders and duly appointed proxyholders should click “Login” and then enter their control number/user name (see below) and the password “bns2024” (case sensitive). • Guests, including beneficial shareholders who have not duly appointed themselves as proxyholder and who do not have a user name, should click “Guest” and complete the online form.

If you are attending the meeting online, you must log in as a registered shareholder or duly appointed proxyholder to vote and ask questions. If you log in as a guest, you will not be able to vote or ask questions online at the meeting. |

| Duly appointed proxyholders |

Registered shareholders |

|||||

|

Control number/username |

Computershare will provide the proxyholder with a user name by email after the proxy voting deadline has passed and the proxyholder has been duly appointed AND registered as described previously in “Additional information for appointing a third party as proxy if attending the meeting online”. |

The control number located on the form of proxy or in the email notification you received is your control number. |

||||

| If you attend the annual meeting online, it is important that you are connected to the internet at all times during the meeting in order to vote at the designated times. It is your responsibility to ensure connectivity for the duration of the meeting. You should allow ample time to check into the annual meeting and complete the related procedures.

The Lumi platform is supported on Android 9+, iOS 1+, Chrome, Safari, Edge, or Firefox. Internet Explorer is not supported. Internal network security protocols, including firewalls and VPN connections, may block access to the Lumi platform. If you are experiencing any difficulty connecting or watching the meeting, ensure your VPN setting is disabled or use a computer on a network not restricted to the security settings of your organization. For further assistance, you may contact Lumi technical support at support-ca@lumiglobal.com, which is available starting one hour prior to the meeting.

For additional information about attending the meeting online, refer to our AGM user guide which will be available at scotiabank.com/annualmeeting. For general proxy matters or additional shareholder information and questions, contact Computershare at 1-877-982-8767 (toll free) or (514) 982-7555 (international).

In the event of a technical malfunction or other significant problem that disrupts the live webcast of the meeting, the Chair of the meeting will continue the meeting in person, so long as a quorum of shareholders is represented at the meeting. |

||

| VOTING AT THE MEETING Registered shareholders and duly appointed proxyholders can vote at the appropriate times during the meeting if they have not done so in advance of the meeting. Please see “Voting at the annual meeting” set out in the chart in the preceding section “How to vote” for details on how to vote at the meeting. |

||

| SUBMITTING QUESTIONS AT THE MEETING As in years past, the board and senior management will be available for questions from shareholders and duly appointed proxyholders. As part of our ongoing stakeholder engagement, questions may be submitted in advance of the meeting by contacting the Corporate Secretary by email or mail at the contact information provided on the back cover of this circular. Questions submitted in advance must be received by 9:00 a.m. (Eastern) on April 8, 2024 to be included in the meeting.

Questions may also be asked by shareholders and duly appointed proxyholders at the meeting. It is recommended that shareholders and duly appointed proxyholders attending the meeting online submit their questions as soon as possible during the meeting so they can be addressed at the appropriate time. Shareholders and duly appointed proxyholders attending the meeting in person will also have the opportunity to ask questions. |

||

| 12 | Scotiabank |

|

As this is a shareholders’ meeting, only shareholders and duly appointed proxyholders may ask a question during the question period.

The board and senior management will answer questions relating to matters to be voted on before a vote is held on each matter, if applicable. General questions will be addressed at the end of the meeting during the question period. |

||

| To answer as many questions as possible, shareholders and duly appointed proxyholders are asked to be brief and concise and to address only one topic per question. Questions dealing with similar topics or issues may be grouped, summarized, and addressed with one response. | ||

|

Shareholders who have submitted proposals for the meeting will have the opportunity to present their proposals at the appropriate time during the meeting.

The Chair of the meeting reserves the right to refuse questions he deems irrelevant to the business of the meeting or otherwise inappropriate. The Chair has broad authority to conduct the meeting in a manner that is fair to all shareholders and may exercise discretion in the order in which questions are asked and the amount of time devoted to any one question. Any questions that cannot be answered during the meeting and that have been properly put before the annual meeting will be answered as soon as practical after the meeting and posted online at scotiabank.com/annualmeeting. |

||

| HOW YOUR PROXYHOLDER WILL VOTE Your proxyholder must vote according to the instructions you provide on your proxy form or voting instruction form. For directors and the appointment of the auditor, you may either vote for or withhold. For the advisory resolution on our approach to executive compensation you may vote for or against. For shareholder proposals, you may vote for, against, or abstain. If you do not specify how you want to vote, your proxyholder can vote your shares as they wish. Your proxyholder will also decide how to vote on any amendment or variation to any item of business in the notice of meeting or any new matters that are properly brought before the meeting, or any postponement or adjournment. |

||

| If you properly complete and return your proxy form or voting instruction form, but do not appoint a different proxyholder and do not specify how you want to vote, Aaron Regent or Scott Thomson will vote for you as follows: • for the election of the nominated directors to the board • for the appointment of the auditor • for the advisory resolution on our approach to executive compensation • against the shareholder proposals.

CONFIDENTIALITY

To keep voting confidential, Computershare counts all proxies. Computershare only discusses proxies with us when legally necessary, when a shareholder clearly intends to communicate with management, or when there is a proxy contest.

QUORUM

A minimum of 25% of all eligible votes must be represented at the meeting for it to take place.

VOTING RESULTS

We will post the voting results (including details about the percentage of support received for each item of business) on our website and file them with securities regulators after the meeting.

RECEIVING SHAREHOLDER MATERIALS BY EMAIL

Shareholders are encouraged to sign up to receive shareholder materials by email, including this circular, as follows: • Beneficial owners may go to www.proxyvote.com, use the control number provided on the voting instruction form and click on ‘Delivery Settings’ to enroll • Registered shareholders who hold share certificates or receive statements from a direct registration system may go to www.investorcentre.com and click on ‘Receive Documents Electronically’ to enroll.

QUESTIONS?

If you have questions or need assistance, please contact: • Computershare – see back cover of this circular for their contact information; or • Kingsdale Advisors at 1-855-476-7988 (toll-free in North America) or 1-416-623-2512 (call and text enabled outside North America) or email contactus@kingsdaleadvisors.com. |

||

| Management proxy circular | 13 |

| This year 14 directors are proposed for election to our board. Each nominee was elected at the last annual meeting of shareholders on April 4, 2023, except Michael Medline and Sandra Stuart, who joined the board on September 1, 2023.

Each director brings a range of skills, experience, and knowledge to the table. As a group, they have been selected based on their integrity, collective skills, and ability to contribute to the broad range of issues the board considers when overseeing our business and affairs. You can learn more about our expectations for directors and how the board functions beginning on page 26.

INDEPENDENCE

Having an independent board is one of the ways we make sure the board can operate independently of management and make decisions in the best interests of Scotiabank. Thirteen of our fourteen (93%) director nominees are independent and have never served as an executive of the bank. As the bank’s President and Chief Executive Officer (President and CEO), Scott Thomson is the only non-independent director.

DIVERSITY

Each director has a wealth of experience in leadership and strategy development. We believe that an important part of board effectiveness includes the unique perspectives of our directors resulting from the combination and diversity of their experience, perspectives, gender, gender identity or gender expression, age, sexual orientation, ethnicity, geographic background, and personal characteristics, along with membership within equity-deserving groups including women, People of Colour, Indigenous peoples, and people with disabilities. Read about our board diversity policy on pages 48 and 49 and how our directors’ skills and experience are represented starting on page 15.

Key skills and experience Language skills2

TENURE AND TERM LIMITS

Balancing the combination of longer-serving directors with newer directors allows the board to have the insight of experience while also being exposed to fresh perspectives. Our average board tenure is 5.6 years (you can read more about tenure and term limits on page 51).

1 Diverse directors include those who identify as women, People of Colour, Indigenous peoples, and/or people with disabilities. Five of the nominated directors identify as women and two identify as People of Colour. 2 Our skills matrix asks directors to identify language skills across 10 languages. Data reflects directors who have identified intermediate or fluent skills within the languages listed. |

|

| 14 | Scotiabank |

DIRECTOR PROFILES

| Each director has provided the information about the Scotiabank shares they own or over which they exercise control or direction. This information and the details about the director deferred share units (DDSUs) they hold are as of October 31, 2023. The value of common shares and DDSUs is calculated using $56.15 (the closing price of our common shares on the Toronto Stock Exchange (TSX) on October 31, 2023) for 2023 and $65.85 (the closing price of our common shares on the TSX on October 31, 2022) for 2022. The equity ownership requirement is five times the equity portion of the annual retainer: $975,000 for directors and $1,750,000 for the Chair. Directors have five years from the date of their appointment to meet this requirement. The Independent Chair has five years from the date of their appointment as Chair to meet this requirement. The multiples in the profiles below are based on the ownership requirement in place in each year.

The attendance figures reflect the number of board and committee meetings held in fiscal 2023 and each nominee’s attendance for the time they served as a director or committee member. |

We have robust director requirements. See

|

|

|

Aaron W. Regent

Toronto, Ontario, Canada Age 58 | Director since 2013 Independent

2023 votes for: 95.76%

Not eligible for re-election in April 2028 |

Aaron Regent is Chair of the Board of Scotiabank. He is the Founder, Chairman, and Chief Executive Officer of Magris Performance Materials Inc., a leading North American performance materials company. He was President and Chief Executive Officer of Barrick Gold Corporation from January 2009 to June 2012. Previously, Mr. Regent was Senior Managing Partner of Brookfield Asset Management, Co-Chief Executive Officer of the Brookfield Infrastructure Group, an asset management company, and President and Chief Executive Officer of Falconbridge Limited. Mr. Regent holds a B.A. from the University of Western Ontario. He is a Chartered Accountant and a Fellow of CPA Ontario.

|

|

||||||||||||||||||||||||||||||||||

|

KEY SKILLS & EXPERIENCE

|

|

|||||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Environmental, social, and governance (ESG) matters | Human capital management and executive compensation | Risk management |

|

|||||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 36 of 36 / 100%

|

|

|||||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||||

| Board |

13 of 13 / 100% | Audit and conduct review |

5 of 5 / 100% | |||||||||||||||||||||||||||||||||

| Corporate governance |

4 of 4 / 100% | |||||||||||||||||||||||||||||||||||

| Human capital and compensation |

8 of 8 / 100% | |||||||||||||||||||||||||||||||||||

| Risk |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||||

|

EQUITY OWNERSHIP

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

|

|||||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||||

|

|

2023 |

92,422 | 65,233 | 157,655 | $3,662,833 | $8,852,328 | 5.1 | |||||||||||||||||||||||||||||

| 2022 |

92,422 | 53,658 | 146,080 | $3,533,379 | $9,619,368 | 5.5 | ||||||||||||||||||||||||||||||

| Change |

0 | 11,575 | 11,575 | $129,454 | -$767,040 | |||||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||||

| Nutrien Ltd. (2018 – present) |

|

Audit | Human resources and compensation (Chair) | ||||||||||||||||||||||||||||||||||

| Management proxy circular | 15 |

|

Nora A. Aufreiter

Toronto, Ontario, Canada Age 64 | Director since 2014 Independent

2023 votes for: 97.50%

Not eligible for re-election in April 2030 |

Nora Aufreiter is a corporate director and a former senior partner of McKinsey and Company, an international consulting firm. Throughout her 27-year career at McKinsey, she held multiple leadership roles, including Managing Director of McKinsey’s Toronto office and leader of the North American Digital and Omni Channel service line, and was a member of the firm’s global personnel committees. She has worked extensively in Canada, the United States, and internationally, serving her clients in consumer-facing industries including retail, consumer and financial services, energy, and the public sector. Ms. Aufreiter holds a B.A. (Honours) in business administration from the Ivey Business School at the University of Western Ontario and an M.B.A. from Harvard Business School. In 2011, she was recognized by the Women’s Executive Network as one of “Canada’s Most Powerful Women: Top 100”. In June 2018, Ms. Aufreiter was awarded an honorary Doctor of Laws, honoris causa (LLD) at the University of Western Ontario. |

|

||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Environmental, social, and governance (ESG) matters | Financial services | Human capital management and executive compensation | Retail/consumer | Technology |

|

|||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 25 of 25 / 100%

|

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

13 of 13 / 100% | |

Corporate governance Human capital and compensation (Chair) |

|

|

4 of 4 / 100% 8 of 8 / 100% |

|

||||||||||||||||||||||||||

|

EQUITY OWNERSHIP

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

|

|||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2023 |

6,400 | 34,412 | 40,812 | $1,932,234 | $2,291,594 | 2.4 | ||||||||||||||||||||||||||||

| 2022 |

3,200 | 27,390 | 30,590 | $1,803,632 | $2,014,352 | 2.1 | ||||||||||||||||||||||||||||

| Change |

3,200 | 7,022 | 10,222 | $128,602 | $277,242 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| MYT Netherlands Parent B.V. (Chair) (2021 – present) |

|

Audit | Nominating, governance, and sustainability | Compensation | ||||||||||||||||||||||||||||||||

| The Kroger Co. (2014 – present) |

|

Finance | Public responsibilities (Chair) | ||||||||||||||||||||||||||||||||

|

Guillermo E. Babatz

Mexico City, Mexico Age 55 | Director since 2014 Independent

2023 votes for: 98.15%

Not eligible for re-election in April 2029 |

Guillermo Babatz is the Managing Partner of Atik Capital, S.C., an advisory firm that specializes in structuring financial solutions for its clients. Previously, he was the Executive Chairman of Comision Nacional Bancaria y de Valores in Mexico from July 2007 to December 2012. Mr. Babatz holds a B.A. in economics from the Instituto Tecnologico Autonomo de Mexico in Mexico City and a Ph.D. in economics from Harvard University.

|

|

||||||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Financial services | Public policy | Risk management |

|

|||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 27 of 27 / 100%

|

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

13 of 13 / 100% | Human capital and compensation |

8 of 8 / 100% | ||||||||||||||||||||||||||||||

| Risk (Chair) |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||

|

EQUITY OWNERSHIP

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

|

|||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2023 |

2,500 | 29,073 | 31,573 | $1,632,449 | $1,772,824 | 1.8 | ||||||||||||||||||||||||||||

| 2022 |

2,500 | 23,358 | 25,858 | $1,538,124 | $1,702,749 | 1.7 | ||||||||||||||||||||||||||||

| Change |

0 | 5,715 | 5,715 | $94,325 | $70,075 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| Fibra MTY, S.A.P.I. de C.V. (2015 – present) |

|

Corporate practices | Investment | ||||||||||||||||||||||||||||||||

| 16 | Scotiabank |

|

Scott B. Bonham

Atherton, California, U.S.A. Age 62 | Director since 2016 Independent

2023 votes for: 97.13%

Not eligible for re-election in April 2028

|

Scott Bonham is a corporate director and co-founder of Intentional Capital, a privately-held real estate asset management company. From 2000 to 2015, he was co-founder of GGV Capital, an expansion stage venture capital firm with investments in the U.S. and China. Prior to GGV Capital, he served as Vice President of the Capital Group Companies, where he managed technology investments across several mutual funds from 1996 to 2000. Mr. Bonham has a B.Sc. in electrical engineering from Queen’s University and an M.B.A. from Harvard Business School.

|

|

||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Environmental, social, and governance (ESG) matters | Risk management | Technology |

|

|||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 22 of 22 / 100%

|

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

13 of 13 / 100% | |

Audit and conduct review Corporate governance |

|

|

5 of 5 / 100% 4 of 4 / 100% |

|

||||||||||||||||||||||||||

|

EQUITY OWNERSHIP

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

|

|||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2023 |

1,500 | 32,135 | 33,635 | $1,804,380 | $1,888,605 | 1.9 | ||||||||||||||||||||||||||||

| 2022 |

1,500 | 26,004 | 27,504 | $1,712,363 | $1,811,138 | 1.9 | ||||||||||||||||||||||||||||

| Change |

0 | 6,131 | 6,131 | $92,017 | $77,467 | |||||||||||||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| Loblaw Companies Limited (2016 – present) |

|

Audit | Risk and compliance | ||||||||||||||||||||||||||||||||

| Magna International Inc. (2012 – 2021) |

|

— | ||||||||||||||||||||||||||||||||

|

Daniel (Don) H. Callahan

Fairfield, Connecticut, U.S.A. Age 67 | Director since 2021 Independent

2023 votes for: 97.20%

Not eligible for re-election in April 2034 |

Daniel (Don) Callahan is a corporate director and serves as the Non-Executive Chairman of Time USA, LLC. From 2007 until his retirement in December 2018, Mr. Callahan held several officer roles at Citigroup, including most recently as Citigroup’s Chief Administrative Officer and Global Head of Operations, Technology and Shared Services. Prior to joining Citigroup, Mr. Callahan held various senior executive positions at Morgan Stanley and Credit Suisse. Earlier in his career, he spent 12 years at IBM, where he held a number of management positions, including Director of Strategy for IBM Japan. Mr. Callahan holds a B.A. in history from Manhattanville College, where he serves as Trustee Chair Emeritus.

|

|||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||

| Environmental, social, and governance (ESG) matters | Financial services | Human capital management and executive compensation | Risk management | Technology |

||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 22 of 23 / 96%

|

|

|||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||

| Board |

|

12 of 13 / 92% | |

Corporate governance Risk |

|

4 of 4 / 100% 6 of 6 / 100% |

||||||||||||||||||||||||

|

EQUITY OWNERSHIP

|

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

Total value as a multiple of equity ownership target1 |

|||||||||||||||||||

| Year |

|

Common shares |

|

DDSUs | ||||||||||||||||||||||||||

| 2023 |

1,000 | 9,418 | 10,418 | $528,821 | $584,971 | 0.6 |

||||||||||||||||||||||||

| 2022 |

1,000 | 4,710 | 5,710 | $310,154 | $376,004 | 0.4 |

||||||||||||||||||||||||

| Change |

0 | 4,708 | 4,708 | $218,667 | $208,967 | |||||||||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||

| WEX Inc. (2019 – present) |

|