UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM40-F

[Check one]

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

Commission File Number 001-38336

NUTRIEN LTD.

(Exact name of Registrant as specified in its charter)

Canada

(Province or other jurisdiction of incorporation or organization)

2870

(Primary Standard Industrial Classification Code Number (if applicable))

98-1400416

(I.R.S. Employer Identification Number (if applicable))

|

Suite 1700, 211 19th Street East Saskatoon, Saskatchewan, Canada S7K 5R6 |

(306) 933-8500

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System

28 Liberty St.

New York, NY 10005

(212) 894-8940

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Shares |

NTR |

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Not Applicable

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

Annual information form |

|

Audited annual financial statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

494,551,730 Common Shares outstanding as of December 31, 2023

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes No |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). The following documents have been filed as part of this Annual Report:

This Annual Report on Form 40-F shall be incorporated by reference into the Registration Statements on Form S-8 (File Nos. 333-222384, 333-222385 and 333-226295) of the registrant. In addition, the registrant’s Annual Information Form; Management’s Discussion and Analysis; Audited Annual Consolidated Financial Statements for the fiscal year ended December 31, 2023, including Management’s Annual Report on Internal Control over Financial Reporting; Consent of KPMG LLP, Independent Registered Public Accounting Firm; and Consent of Craig Funk, B.Sc., M.Sc., P.Eng., P.Geo., included as Exhibits 99.1, 99.2, 99.3, 99.4 and 99.8, respectively, to this Annual Report on Form 40-F, are incorporated by reference into and as an exhibit to the registrant’s Registration Statement on Form F-10 (File No. 333-263275).

PRINCIPAL DOCUMENTS

CONTROLS AND PROCEDURES

A. Certifications

The required disclosure is included in Exhibits 99.5, 99.6 and 99.7 to this Annual Report, and is incorporated herein by reference.

B. Evaluation of Disclosure Controls and Procedures

The required disclosure is included in “Controls and Procedures—Disclosure Controls and Procedures” in the 2023 MD&A, filed as Exhibit 99.2 to this Annual Report, and is incorporated herein by reference.

C. Management’s Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining an adequate system of internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as amended. The required disclosure is included in “Management’s Responsibility—Management’s Annual Report on Internal Control over Financial Reporting” that accompanies the 2023 Audited Annual Financial Statements, filed as Exhibit 99.3 to this Annual Report, and is incorporated herein by reference.

D. Attestation Report of the Independent Registered Public Accounting Firm

The required disclosure is included in the “Report of Independent Registered Public Accounting Firm” that accompanies the 2023 Audited Annual Financial Statements, filed as Exhibit 99.3 to this Annual Report, and is incorporated herein by reference.

E. Changes in Internal Control over Financial Reporting

During the period covered by this report, there was no change in Nutrien’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, its internal control over financial reporting. See “Controls and Procedures—Internal Control Over Financial Reporting” in the 2023 MD&A, filed as Exhibit 99.2 to this Annual Report and incorporated herein by reference.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Board has a separately-designated standing audit committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The members of the Audit Committee are Christopher M. Burley, Michael J. Hennigan, Alice D. Laberge, Consuelo E. Madere and Aaron W. Regent.

AUDIT COMMITTEE FINANCIAL EXPERT

The Nutrien Board of Directors (the “Board”) has determined that it has at least one “audit committee financial expert” (as such term is defined in paragraph 8(b) of General Instruction B to Form 40-F) serving on its Audit Committee. Mr. Christopher M. Burley has been determined to be such audit committee financial expert and was “independent” as such term is defined under the Canadian Securities Administrators’ National Instrument 52-110—Audit Committees and the standards of the U.S. Securities and Exchange Commission (the “SEC”) and the New York Stock Exchange (the “NYSE”) relating to the independence of audit committee members.

The Board’s designation of Mr. Christopher M. Burley as an audit committee financial expert does not impose on him any duties, obligations or liability that are greater than the duties, obligations and liability imposed on him as a member of the Audit Committee and Board in the absence of such designation or identification. In addition, the designation of Mr. Christopher M. Burley as an audit committee financial expert does not affect the duties, obligations or liability of any other member of the Audit Committee or Board. See also “Item 17—Audit Committee” of Nutrien’s 2023 AIF, filed as Exhibit 99.1 to this Annual Report, and incorporated herein by reference.

COMPLIANCE WITH NYSE LISTING STANDARDS ON CORPORATE

GOVERNANCE

Our common shares are listed on the NYSE, but as a listed foreign private issuer, the NYSE does not require us to comply with all of its listing standards regarding corporate governance. Notwithstanding this exemption, we are in compliance in all material respects with the NYSE listing standards and we intend to continue to comply with such standards so as to ensure that there are no significant differences between our corporate governance practices and those practices required by the NYSE of other publicly listed companies.

CODE OF CONDUCT AND ETHICS

Nutrien has adopted a “code of ethics” (as that term is defined in Form 40-F), entitled the Nutrien Code of Conduct that applies to all directors, officers, employees and representatives of Nutrien and its subsidiaries (the “Nutrien Code”). A copy of the Nutrien Code is posted on Nutrien’s website at https://www.nutrien.com/what-we-do/governance. Copies may be obtained, free of charge, by contacting Nutrien in writing at 211 19th Street East, Suite 1700, Saskatoon, Saskatchewan, Canada S7K 5R6, by telephone at (306) 933-8500 or on Nutrien’s website at www.nutrien.com. Nutrien intends to post any amendments to and waivers from the Nutrien Code on its website as identified above.

NOTICES PURSUANT TO REGULATION BTR

Not applicable.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table sets out the fees billed to Nutrien by KPMG LLP (PCAOB ID: 85; Calgary, AB, Canada) and its affiliates for professional services rendered during the years ended December 31, 2023 and 2022. During these years, KPMG LLP was the Company’s only external auditor.

Category |

Years Ended December 31, |

|

|

2023 US$ |

2022 US$ |

Audit Fees 1 |

9,481,000 |

8,777,700 |

Audit-Related Fees 2 |

26,600 |

63,000 |

Tax Fees 3 |

74,900 |

168,100 |

All Other Fees 4 |

305,100 |

302,400 |

Total |

9,887,600 |

9,311,200 |

1 For professional services rendered by KPMG LLP for the integrated audit of the Company’s annual financial statements; interim review of the Company’s interim financial statements; audits of statutory financial statements of controlled subsidiaries; attestation reporting in accordance with US environmental agency requirements and consent orders; attestation reports over various Nutrien subsidiaries for the purpose of compliance with local laws and regulations; and work in connection with the renewal of the Company's base shelf prospectus in 2022 and the Company's prospectus supplements relating to the offering of senior notes in 2023 and 2022.

2 For professional services rendered by KPMG LLP for translation of the Company’s annual and quarterly reports in 2022, and in connection with an audit of the financial statements of an employee benefit plan.

3 For professional services rendered by KPMG LLP for assistance with preparation and review of tax filings and related tax compliance, assistance in responding to tax authorities, including reassessments and tax audits, routine tax planning and advice. These amounts include fees paid to KPMG LLP specifically for tax compliance and preparation services rendered in 2023 and 2022 in the amounts of $74,900 and $168,100, respectively.

4 For professional services rendered by KPMG LLP for the preparation of subsidiary statutory financial statements; an assessment of the Company’s cyber security maturity level against a globally recognized framework and a readiness assessment for assurance over the Company’s report on cyber security key performance indicators, and subsequent assurance engagements over key performance indicators; and limited assurance over Nutrien Scope 1 and 2 GHG emissions.

AUDIT COMMITTEE’S PRE-APPROVAL POLICIES AND PROCEDURES

The required disclosure is included in “Item 17—Audit Committee—17.4—Pre-approval Policies and Procedures” of Nutrien’s 2023 AIF, filed as Exhibit 99.1 to this Annual Report, and incorporated herein by reference.

OFF-BALANCE SHEET ARRANGEMENTS

The information included in “Other Financial Information—Off-Balance Sheet Arrangements” of the 2023 MD&A, filed as Exhibit 99.2 to this Annual Report, is incorporated herein by reference.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The information included in “Liquidity & Capital Resources—Cash Requirements” of the 2023 MD&A, filed as Exhibit 99.2 to this Annual Report, is incorporated herein by reference.

RESERVE AND RESOURCE ESTIMATES

The disclosure included in or incorporated by reference in this Annual Report uses mineral reserves and mineral resources classification terms that comply with reporting standards in Canada and are made in accordance with National Instrument 43-101—Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

These standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under SEC standards. Accordingly, information included in this Annual Report and the documents incorporated by reference herein that describes the Company’s mineral reserves and mineral resources estimates may not be comparable with information made public by United States companies subject to the SEC’s reporting and disclosure requirements.

MINE SAFETY DISCLOSURE

The information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 16 of General Instruction B to Form 40-F is included in Exhibit 99.9 to this Annual Report.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

Not applicable.

WEBSITE INFORMATION

Notwithstanding any reference to Nutrien’s website or other websites on the World Wide Web in this Annual Report or in the documents attached as exhibits hereto, the information contained in Nutrien’s website or any other website on the World Wide Web referred to in this Annual Report or in the documents attached as exhibits hereto, or referred to in Nutrien’s website, is not a part of this Annual Report and, therefore, is not filed with the SEC.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

The Registrant has previously filed an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities in relation to which the obligation to file the Form 40-F arises. Any change to the name or address of the Registrant’s agent for service of process shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Registrant.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

NUTRIEN LTD.

|

|

By: |

/s/ Robert A. Kirkpatrick |

|

Name: Title: |

Robert A. Kirkpatrick Senior Vice President, General Counsel Securities & Corporate Secretary |

Date: March 1, 2024

EXHIBIT INDEX

Exhibit Number |

Description |

97.1 |

|

99.1 |

Annual Information Form for the fiscal year ended December 31, 2023 |

99.2 |

Management’s Discussion and Analysis for the fiscal year ended December 31, 2023 |

99.3 |

Audited Annual Consolidated Financial Statements for the fiscal year ended December 31, 2023 |

99.4 |

Consent of KPMG LLP, Independent Registered Public Accounting Firm |

99.5 |

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

99.6 |

Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

99.7 |

Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

99.8 |

|

99.9 |

|

101 |

Interactive Data File (formatted as Inline XBRL) |

104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

Exhibit 97.1

RECOUPMENT POLICY

November 2, 2023

Last updated: November 2, 2023

| RECOUPMENT POLICY | ||||||

| The Code of Ethics of Nutrien Ltd. (the “Corporation”) requires all employees of the Corporation to perform their duties in a fair and ethical manner. As required pursuant to the Securities Laws (as defined below), the Board of Directors (the “Board”) of the Corporation has adopted this Compensation Recoupment Policy (the “Policy”) to empower the Corporation to recover Covered Compensation (as defined below) erroneously awarded to any Executive Officer (as defined below) in the event of an Accounting Restatement (as defined below). |

Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

1 |

|

||||

| Recoupment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

2 | |||||||

| Clawback Exceptions . . . . . . . . . . . . . . . . . . . . . . . . |

3 | |||||||

| Prohibitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

3 | |||||||

| Acknowledgement and Consent . . . . . . . . . . . . . . . |

3 | |||||||

| Disclosure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

3 | |||||||

| Administration, Interpretation and Amendment of Policy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 3 | |||||||

Notwithstanding anything in this Policy to the contrary, at all times, this Policy remains subject to interpretation and operation in accordance with the final rules and regulations promulgated by the U.S. Securities and Exchange Commission (the “SEC”), the final listing standards adopted by the Stock Exchange (as defined below), and any applicable SEC or Stock Exchange guidance or interpretations issued from time to time regarding such Covered Compensation recovery requirements (collectively, the “Final Guidance”). Questions regarding this Policy should be directed to the Senior Vice President, Chief Human Resources Officer.

Definitions

“Executive Officer” means any current or former officer of the Corporation within the meaning of Rule 16a-1(f) under the Securities Exchange Act of 1934 (the “Exchange Act”), as determined by the Board or the Human Resources & Compensation Committee of the Board (the “Committee”). Executive Officers include, at a minimum, “executive officers” as defined in Rule 3b-7 under the Exchange Act and identified under Item 401(b) of Regulation S-K.

“Incentive-Based Compensation” means, with respect to an Executive Officer, any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure (as defined below). For purposes of clarity, Incentive-Based Compensation includes compensation that is in any plan, other than tax- qualified retirement plans, including long term disability, life insurance, and supplemental executive retirement plans, and any other compensation that is based on such Incentive-Based Compensation, such as earnings accrued on notional amounts of Incentive-Based Compensation contributed to such plans. Incentive-Based Compensation does not include awards that are subject only to service-based vesting, such as time-vesting restricted stock units, time-vesting stock options, or other time-vesting awards, so long as such awards are not granted or earned based on a Financial Reporting Measure.

“Financial Reporting Measure” is defined as a measure that is determined and presented in accordance with the accounting principles used in preparing the Corporation’s financial statements, and any measures that are derived wholly or in part from such measures. Stock price and total shareholder return are also Financial Reporting Measures.

Incentive-Based Compensation is deemed “Received” in the Corporation’s fiscal period during which the Financial Reporting Measure specified in the Incentive-Based Compensation award is attained, even if the payment or grant of the Incentive-Based Compensation occurs after the end of that period.

“Covered Compensation” means the amount of Incentive-Based Compensation Received during the applicable Recovery Period that exceeds the amount of Incentive-Based Compensation that otherwise would have been Received had it been determined based on the relevant restated amounts, and computed without regard to any taxes paid.

|

Recoupment Policy | 1 |

|

Incentive-Based Compensation Received by an Executive Officer will only qualify as Covered Compensation if: (i) it is Received after October 2, 2023; (ii) it is Received after such Executive Officer begins service as an Executive Officer; (iii) such Executive Officer served as an Executive Officer at any time during the performance period for such Incentive-Based Compensation; and (iv) it is Received while the Corporation has a class of securities listed on a national securities exchange or a national securities association.

For Incentive-Based Compensation based on stock price or total shareholder return, where the amount of erroneously awarded Covered Compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement, the amount of such Incentive-Based Compensation that is deemed to be Covered Compensation will be based on a reasonable estimate of the effect of the Accounting Restatement on the stock price or total shareholder return upon which the Incentive-Based Compensation was Received, and the Corporation will maintain and provide to the Stock Exchange documentation of the determination of such reasonable estimate.

“Recovery Period” means the three completed fiscal years immediately preceding the Trigger Date (as defined below) and, if applicable, any transition period resulting from a change in the Corporation’s fiscal year within or immediately following those three completed fiscal years (provided, however, that if a transition period between the last day of the Corporation’s previous fiscal year end and the first day of its new fiscal year comprises a period of nine to 12 months, such period would be deemed to be a completed fiscal year).

For purposes of this Policy, the “Trigger Date” as of which the Corporation is required to prepare an Accounting Restatement is the earlier to occur of: (i) the date that the Board, applicable Board committee, or officers authorized to take action if Board action is not required, concludes, or reasonably should have concluded, that the Corporation is required to prepare the Accounting Restatement or (ii) the date a court, regulator, or other legally authorized body directs the Corporation to prepare the Accounting Restatement.

“Securities Laws” means all applicable laws, regulations, rules, policies or instruments of any securities commission, stock exchange or like body in Canada and/or the United States, as of the date of this Policy.

“Stock Exchange” means the New York Stock Exchange.

Recoupment

Unless a Clawback Exception exists, the Corporation will recover reasonably promptly from each Executive Officer the Covered Compensation Received by such Executive Officer in the event that the Corporation is required to prepare an accounting restatement due to the material noncompliance of the Corporation with any financial reporting requirement under the Securities Laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (each, an “Accounting Restatement”).

To the extent that the Covered Compensation is not paid to the Corporation, in addition to any other legal remedy that the Corporation may have, the Committee may set off any Covered Compensation against any amounts that may be owing from time to time by the Corporation or a subsidiary to the Executive Officer, whether as wages, bonus, Incentive-Based Compensation, deferred compensation, severance entitlement or vacation pay or in the form of any other benefit or for any other reason, in a manner consistent with Section 409A, if applicable.

If a Clawback Exception applies with respect to an Executive Officer, the Corporation may forgo such recovery under this Policy from such Executive Officer.

|

Recoupment Policy | 2 |

|

Clawback Exceptions

The Corporation is required to recover all Covered Compensation Received by an Executive Officer in the event of an Accounting Restatement unless (i) one of the following conditions are met and (ii) the Committee has made a determination that recovery would be impracticable in accordance with Rule 10D-1 under the Exchange Act (under such circumstances, a “Clawback Exception” applies):

| • | the direct expense paid to a third party to assist in enforcing this Policy would exceed the amount to be recovered (and the Corporation has already made a reasonable attempt to recover such erroneously awarded Covered Compensation from such Executive Officer, has documented such reasonable attempt(s) to recover, and has provided such documentation to the Stock Exchange); |

| • | recovery would violate home country law that was adopted prior to November 28, 2022 (and the Corporation has already obtained an opinion of home country counsel, acceptable to the Stock Exchange, that recovery would result in such a violation, and provided such opinion to the Stock Exchange); or |

| • | recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Corporation, to fail to meet the requirements of Section 401(a)(13) or Section 411(a) of the U.S. Internal Revenue Code and regulations thereunder. For purposes of clarity, this Clawback Exception only applies to U.S. tax-qualified retirement plans and does not apply to other plans, including long term disability, life insurance, and supplemental executive retirement plans, or any other compensation that is based on Incentive-Based Compensation in such plans, such as earnings accrued on notional amounts of Incentive-Based Compensation contributed to such plans. |

Prohibitions

The Corporation is prohibited from paying or reimbursing the cost of insurance for, or indemnifying, any Executive Officer against the loss of erroneously awarded Covered Compensation.

Disclosure

This Policy, and any recovery of Covered Compensation by the Corporation pursuant to this Policy that is required to be disclosed in the Corporation’s filings under the Securities Laws, will be disclosed as required by the Securities Act of 1933, as amended, the Exchange Act, and related rules and regulations, including Stock Exchange rules.

Administration, Interpretation and Amendment of Policy

In order to comply with Securities Laws (as the same may be implemented, amended, supplemented, amended and restated, substituted or re-enacted from time to time from and after the date of this Policy), the Committee may at any time in its sole discretion amend, supplement, amend and restate, substitute or repeal this Policy in whole or in part on such terms as the Committee determines in its sole discretion as to be appropriate to comply with such Securities Laws.

The Committee will administer this Policy in accordance with the Final Guidance, and all actions, interpretations and determinations pursuant to this Policy that are taken or made by the Board in good faith will be final, conclusive and binding. This Policy is in addition to and is not intended to change or interpret any Canadian or U.S. federal or state law or regulation, including the Canada Business Corporations Act, the Certificate and Articles of Incorporation of the Corporation, or Bylaw No. 1 of the Corporation. The Committee will review the Policy from time to time and will have full and exclusive authority to take any action it deems appropriate.

|

Recoupment Policy | 3 |

|

This Policy shall not preclude any other compensation recoupment or clawback policies, arrangements or provisions of the Company (“Other Recovery Provisions”); to the extent recovery of compensation is achieved by the Corporation under this Policy, there shall be no duplication of recovery under Other Recovery Provisions, except as may be required by law.

Date of Last Revision: November 2, 2023

|

Recoupment Policy | 4 |

|

Exhibit 99.1

Nutrien Ltd.

Annual Information Form

Year Ended December 31, 2023

1 – Table of Contents

Following is a table of contents of this Annual Information Form (“AIF”) referencing the applicable requirements of Form 51-102F2 – Annual Information Form of the Canadian Securities Administrators. Certain information required to be disclosed in this AIF is contained in Nutrien Ltd.’s management’s discussion and analysis (“2023 MD&A”), and Consolidated Financial Statements for the years ended December 31, 2023 and 2022 (“2023 Consolidated Financial Statements”) and is incorporated by reference herein to the extent noted below and throughout this AIF; these documents are available under Nutrien’s corporate profile on the Canadian Securities Administrators’ SEDAR+ website at sedarplus.ca and on the EDGAR section of the United States (“US”) Securities and Exchange Commission’s (“SEC”) website at sec.gov.

| Annual Information Page Reference |

Incorporated by Reference from the 2023 Consolidated Financial Statements |

|||||||

| 1 Table of Contents |

2-3 | |||||||

| 2 Advisories |

4-6 | |||||||

| 2.1 Forward-Looking Information |

4 | |||||||

| 2.2 Basis of Presentation |

6 | |||||||

| 3 Corporate Structure |

6-7 | |||||||

| 3.1 Name, Address and Incorporation |

6 | |||||||

| 3.2 Intercorporate Relationships |

7 | |||||||

| 4 General Development of the Business |

7-9 | |||||||

| 4.1 Three-Year History |

7 | Notes 13, 14, 17, 18, 23 and 25 | ||||||

| 5 Description of the Business |

9-36 | Notes 3 and 28 | ||||||

| 5.1 Nutrien Ag Solutions (“Retail”) Operations |

10 | |||||||

| 5.2 Potash Operations |

11 | |||||||

| 5.3 Nitrogen Operations |

13 | |||||||

| 5.4 Phosphate Operations |

16 | |||||||

| 5.5 Specialized Skill and Knowledge |

17 | |||||||

| 5.6 Intangible Properties |

18 | Note 14 | ||||||

| 5.7 Seasonality |

18 | |||||||

| 5.8 Environmental Matters |

18 | Notes 22 and 29 | ||||||

| 5.9 Employees |

22 | |||||||

| 5.10 Social and Environmental Policies |

23 | |||||||

| 5.11 Risk Factors |

26 | |||||||

| 5.12 Mineral Projects |

36 | |||||||

| 6 Dividends |

36 | |||||||

| 7 Description of Capital Structure |

36-38 | |||||||

| 7.1 General Description of Capital Structure |

36 | |||||||

| 7.2 Constraints |

37 | |||||||

| 7.3 Debt Ratings |

37 | |||||||

| 8 Market for Securities |

38-39 | |||||||

| 8.1 Trading Price and Volume |

38 | |||||||

| 8.2 Prior Sales |

39 | Notes 5 and 23 | ||||||

| 9 Escrowed Securities and Securities Subject to Contractual Restriction on Transfer

|

39

|

|||||||

2

| 10 Directors and Officers |

39-42 | |||||||||

| 10.1 Name, Occupation and Security Holding |

39 | |||||||||

| 10.2 Cease Trade Orders, Bankruptcies, Penalties or Sanctions |

41 | |||||||||

| 10.3 Conflicts of Interest |

42 | |||||||||

| 11 Promoters |

42 | |||||||||

| 12 Legal Proceedings and Regulatory Actions |

42 | Note 29 | ||||||||

| 13 Interest of Management and Others in Material Transactions |

43 | |||||||||

| 14 Transfer Agent, Registrar and Trustees |

43 | |||||||||

| 15 Material Contracts |

43 | |||||||||

| 16 Interests of Experts |

43 | |||||||||

| 17 Audit Committee |

43-45 | |||||||||

| 17.1 Audit Committee Charter |

43 | |||||||||

| 17.2 Composition of the Audit Committee |

43 | |||||||||

| 17.3 Relevant Education and Experience of Members of the Audit Committee |

43 | |||||||||

| 17.4 Pre-approval Policies and Procedures |

45 | |||||||||

| 17.5 External Auditor Service Fees (by Category) |

45 | |||||||||

| 18 Additional Information |

45 | |||||||||

| Schedule A Audit Committee Charter |

46-52 | |||||||||

| Schedule B Mineral Projects |

53-75 | |||||||||

| a. Material Potash Operations |

53 | |||||||||

| b. Allan Potash Operations |

64 | |||||||||

| c. Cory Potash Operations |

66 | |||||||||

| d. Lanigan Potash Operations |

68 | |||||||||

| e. Rocanville Potash Operations |

70 | |||||||||

| f. Vanscoy Potash Operations |

73

|

|||||||||

3

2 – Advisories

2.1 Forward-Looking Information

Certain statements and other information included in this AIF, including within the documents incorporated by reference, constitute “forward-looking information” or “forward-looking statements” (collectively, “forward-looking statements”) under applicable securities laws (such statements are often accompanied by words such as “anticipate”, “forecast”, “expect”, “believe”, “may”, “will”, “should”, “estimate”, “project”, “intend” or other similar words). All statements in this document, other than those relating to historical information or current conditions, are forward-looking statements, including, but not limited to:

| • | our business strategies, plans, prospects and opportunities, and our sustainability, climate change and Environmental, Social and Governance (“ESG”) initiatives and proposed responses to climate change and ESG policies and regulations; |

| • | expectations regarding performance of our operating segments; |

| • | our projections for cash from operations and expectations regarding our growth and capital allocation intentions and strategies; |

| • | our advancement of strategic growth initiatives; |

| • | capital spending expectations; |

| • | our market outlook for 2024 and our expectations for market conditions and fundamentals, including agriculture and crop nutrient markets, anticipated supply and demand for our products and services, expected market and industry and growing conditions with respect to crop nutrient application rates, planted acres, grower crop investment, crop mix, production volumes and expenses, shipments, natural gas costs and availability, consumption, prices, operating rates and the impact of seasonality, import and export volumes, economic sanctions, inventories, crop development and natural gas curtailments; |

| • | expectations concerning future product offerings; |

| • | expectations regarding continued natural gas curtailments at our Trinidad nitrogen facility and the expected improved natural gas availability and timing of completion of additional natural gas fields in Trinidad; |

| • | expectations regarding changes in the agriculture space, including continued farm consolidation in the US and other developed markets and the continued advancement and adoption of technology and digital innovations, including the use and anticipated effects of more efficient mining, including remote-controlled mobile equipment, new crop input technologies and agronomic capabilities; |

| • | expectations regarding acquisitions and divestitures; |

| • | expectations regarding environmental compliance requirements and costs, including estimates of asset retirement obligations, federal and provincial carbon pricing, permits, approvals and site assessment and remediation costs; |

| • | expectations regarding our sustainability, climate change and greenhouse gas (“GHG”) emissions reduction strategy and related programs and initiatives, including our various sustainability performance goals, targets, costs, capital expenditures, commitments and aspirations as set out in our Feeding the Future Plan and the 2023 ESG Report; |

| • | the expected timing for release of our Global Sustainability Report for the year ended December 31, 2023; |

| • | our evaluation of future opportunities with respect to the suspended Geismar clean ammonia project; |

| • | the negotiation of sales and other contracts, including the anticipated renegotiation and expiry of existing contracts; |

| • | initiatives to promote innovative, sustainable and productive agriculture; |

| • | expectations regarding future changes in our credit ratings; and |

| • | expectations regarding our mineral reserve and resource estimates, and the annual nameplate capacity and annual operational capability of our mines and associated mine life estimates. |

These forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such forward-looking statements. As such, undue reliance should not be placed on these forward-looking statements.

All of the forward-looking statements are qualified by the assumptions that are stated or inherent in such forward-looking statements, including the assumptions referred to below and elsewhere in this document. Although we believe that these assumptions are reasonable, having regard to our experience and our perception of historical trends, the assumptions set forth below are not exhaustive of the factors that may affect any of the forward-looking statements and the reader should not place undue reliance on these assumptions and such forward-looking statements. Current conditions, economic and otherwise, render assumptions, although reasonable when made, subject to greater uncertainty.

4

In respect of our GHG emissions reduction and other sustainability and climate-related initiatives and targets, we have made assumptions with respect to, among other things: that such target is achievable by deploying capital into nitrous oxide (“N2O”) abatement at our nitric acid production facilities, energy efficiency improvements, carbon capture, utilization and storage, use of natural gas to generate electricity and waste heat recovery; our ability to successfully deploy capital and pursue other operational measures, including the successful application to our current and future operations of existing and new technologies; the successful implementation by us of proposed or potential plans in respect thereof; projected capital investment levels, the flexibility of our capital spending plans and the associated sources of funding; our ability to otherwise implement all technology necessary to achieve our GHG emissions reduction and other sustainability and climate-related initiatives and targets; and the development, availability and performance of technology and technological innovations and associated expected future results.

Additional key assumptions that have been made in relation to the operation of our business as currently planned and our ability to achieve our business objectives include, among other things:

| • | assumptions with respect to our ability to successfully complete, integrate and realize the anticipated benefits of our already completed and future acquisitions and divestitures, and that we will be able to implement our standards, controls, procedures and policies in respect of any acquired businesses and realize the expected synergies on the anticipated timeline or at all; |

| • | that future business, regulatory and industry conditions will be within the parameters expected by us, including with respect to prices, expenses, margins, demand, supply, product availability, shipments, consumption, weather conditions, supplier agreements, product distribution agreements, availability, inventory levels, exports, crop development and cost of labor and interest, exchange and effective tax rates; |

| • | assumptions with respect to global economic conditions and the accuracy of our market outlook expectations for 2024 and in the future; |

| • | assumptions related to our calculation of the Retail – South America goodwill and intangible asset impairment; |

| • | assumptions related to the impairment of our Nitrogen and Phosphate property, plant and equipment; |

| • | assumptions related to the calculation of the recoverable amount of our Aurora and White Springs cash generating units, including internal sales and input price forecasts, discount rate, long-term growth rate and end of expected mine life; |

| • | assumptions with respect to our intention to complete share repurchases under our normal course issuer bid programs, including Toronto Stock Exchange (“TSX”) approval, the funding of such share repurchases, existing and future market conditions, including with respect to the price of our common shares, and compliance with respect to applicable limitations under securities laws and regulations and stock exchange policies; |

| • | our expectations regarding the impacts, direct and indirect, of certain geopolitical conflicts, including the war between Ukraine and Russia and the conflict in the Middle East on, among other things, global supply and demand, including for crop nutrients, energy and commodity prices, global interest rates, supply chains and the global macroeconomic environment, including inflation; |

| • | assumption regarding future markets for clean ammonia; |

| • | the adequacy of our cash generated from operations and our ability to access our credit facilities or capital markets for additional sources of financing; |

| • | our ability to identify suitable candidates for acquisitions and divestitures and negotiate acceptable terms; |

| • | our ability to maintain investment grade ratings and achieve our performance targets; |

| • | our ability to successfully negotiate sales and other contracts; and |

| • | our ability to successfully implement new initiatives and programs. |

Events or circumstances could cause actual results to differ materially from those in the forward-looking statements.

With respect to our GHG emissions reduction and other sustainability and climate-related initiatives and targets, such events or circumstances include, but are not limited to: our ability to deploy sufficient capital to fund the necessary expenditures to implement the necessary operational changes to achieve these initiatives and targets; our ability to implement requisite operational changes; our ability to implement some or all of the technology necessary to efficiently and effectively achieve expected future results, including in respect of such GHG emissions reduction target; the availability and commercial viability and scalability of emissions reduction strategies and related technology and products; and the development and execution of implementing strategies to meet such GHG emissions reduction target.

With respect to our business generally and our ability to meet the other targets, commitments, goals, strategies and related milestones and schedules disclosed in this document, such events or circumstances include, but are not limited to:

| • | general global economic, market and business conditions; |

| • | failure to complete announced and future acquisitions or divestitures at all or on the expected terms and within the expected timeline; |

| • | climate change and weather conditions, including impacts from regional flooding and/or drought conditions; |

| • | failure to execute on our strategies related to sustainability matters or to achieve our GHG emission and other related expectations, targets, goals and commitments; |

5

| • | crop planted acreage, yield and prices; |

| • | the supply and demand and price levels for our products; |

| • | governmental and regulatory requirements and actions by governmental authorities, including changes in government policy (including tariffs, trade restrictions and climate change initiatives), government ownership requirements, and changes in environmental, tax, antitrust, and other laws or regulations and the interpretation thereof; |

| • | political or military risks, including civil unrest, actions by armed groups or conflict and malicious acts including terrorism and industrial espionage; |

| • | our ability to access sufficient, cost-effective and timely transportation, distribution and storage of products; |

| • | the occurrence of a major environmental or safety incident or becoming subject to legal or regulatory proceedings; |

| • | innovation and cybersecurity risks related to our systems, including our costs of addressing or mitigating such risks; |

| • | counterparty and sovereign risk; |

| • | delays in completion of turnarounds at our major facilities; |

| • | interruptions of or constraints in availability of key inputs, including natural gas and sulfur; |

| • | any significant impairment of the carrying amount of certain assets; |

| • | the risk that rising interest rates and/or deterioration of business operating results may result in the further impairment of assets or goodwill attributed to certain cash generating units; |

| • | risks related to reputational loss; |

| • | certain complications that may arise in our mining processes; |

| • | the ability to attract, engage and retain skilled employees, and strikes or other forms of work stoppages; |

| • | geopolitical conflicts, including the war between Ukraine and Russia and the conflict in the Middle East, and their potential impact on, among other things, global market conditions and supply and demand, including for crop nutrients, energy and commodity prices, interest rates, supply chains and the global economy generally; and |

| • | other risk factors detailed from time to time in Nutrien reports filed with the Canadian securities regulators and the SEC in the US. |

For additional details regarding the risks listed above, see “Risk Factors” discussed in this AIF for a description of other risk factors affecting forward-looking statements.

The forward-looking statements in this document are made as of the date hereof and we disclaim any intention or obligation to update or revise any forward-looking statements in this AIF as a result of new information or future events, except as may be required under applicable Canadian securities legislation or applicable US federal securities laws.

2.2 Basis of Presentation

Nutrien’s consolidated financial information for 2023, 2022 and 2021 presented and discussed in this AIF is prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. This AIF is dated February 22, 2024, and the information contained herein is current as of such date, unless otherwise specified.

Unless expressly stated, the information contained on, or accessible from, our website or any other website or any other report or document we file with or furnish to applicable Canadian or US securities regulatory authorities is not incorporated by reference into this AIF.

3 – Corporate Structure

In this AIF, unless otherwise specified, the term “Nutrien” refers to Nutrien Ltd. and, unless the context requires otherwise, the terms “we”, “us”, “our”, “Nutrien” and the “Company” refer to Nutrien and its direct and indirect subsidiaries, individually or in any combination, as applicable. Financial information in this AIF is presented in United States dollars and references to “dollars”, “$” and “US$” are to United States dollars and references to “CAD$” are to Canadian dollars.

3.1 Name, Address and Incorporation

Nutrien is a corporation incorporated under the Canada Business Corporations Act (“CBCA”).

Nutrien’s registered head office is Suite 1700, 211 19th Street East, Saskatoon, Saskatchewan, Canada S7K 5R6. We also have corporate offices at 13131 Lake Fraser Drive SE, Calgary, Alberta, Canada T2J 7E8 and 5296 Harvest Lake Drive, Loveland, Colorado, US 80538.

6

3.2 Intercorporate Relationships

| Principal Subsidiaries 1 | Jurisdiction of Incorporation, Formation or Organization |

Ownership | ||

| Potash Corporation of Saskatchewan Inc. (“PotashCorp”) |

Canada |

100% |

||

| Nutrien (Canada) Holdings ULC (“Agrium”) |

British Columbia, Canada |

100% |

||

| Agrium Canada Partnership |

Alberta, Canada |

100% |

||

| Agrium Potash Ltd. |

Canada |

100% |

||

| Nutrien US LLC |

Colorado, US |

100% |

||

| Cominco Fertilizer Partnership |

Texas, US |

100% |

||

| Loveland Products Inc. |

Colorado, US |

100% |

||

| Nutrien Ag Solutions (Canada) Inc. |

Canada |

100% |

||

| Nutrien Ag Solutions, Inc. |

Delaware, US |

100% |

||

| Nutrien Ag Solutions Limited |

Western Australia, Australia |

100% |

||

| PCS Nitrogen Fertilizer, L.P. |

Delaware, US |

100% |

||

| PCS Nitrogen Trinidad Limited |

Trinidad |

100% |

||

| PCS Phosphate Company, Inc. |

Delaware, US |

100% |

||

| PCS Sales (USA), Inc. |

Delaware, US |

100% |

||

| Nutrien Financial US LLC |

Delaware, US |

100% |

1 In aggregate, our remaining subsidiaries not listed herein accounted for less than 20 percent of our consolidated assets and less than 20 percent of our consolidated sales as at and for the year ended December 31, 2023.

4 – General Development of the Business

4.1 Three-Year History

Acquisitions

The table below provides information on our acquisitions of Nutrien Ag Solutions (“Retail”) businesses, including Casa do Adubo S.A. (“Casa do Adubo”), completed during the last three fiscal years.

| Casa do Adubo | Other Acquisitions | |||||||

|

Acquisition date |

October 1, 2022 | 2023 | 2022 | 2021 | ||||

| Purchase price, net of cash and cash equivalents acquired, and amounts held in escrow (US$ millions) | 268 | 153 | 176 | 88 | ||||

| Number of Retail operating locations | 39 retail locations and 10 distribution centers | 23 | 43 | 36 | ||||

| Description | Agriculture retailer in Brazil | Various retail agricultural services in North America, Australia and South America | Various retail agricultural services in North America, Australia and South America and one wholesale warehouse location | Various retail digital agriculture and proprietary products, and retail and agricultural services businesses in North America, South America and Australia | ||||

7

Asset Impairment and Reversals

| Year |

Impairment (US$ |

Description | ||

| 2023 |

233 | Phosphate White Springs non-cash impairment of property, plant and equipment due to the volatility of forecasted phosphate margins |

||

| 2023 |

465 | Retail - South America non-cash impairment of goodwill and intangible assets mainly due to the impact of crop input price volatility, more moderate long-term growth assumptions and higher interest rates |

||

| 2023 |

76 | Nitrogen Trinidad non-cash impairment of property, plant and equipment due to a new natural gas contract and the resulting outlook for higher expected natural gas costs and constrained near-term availability. We expect improved natural gas availability in Trinidad as the development of additional gas fields is anticipated to add new supply starting in 2026. |

||

| 2022 |

(450) | Phosphate Aurora non-cash impairment reversal of property, plant and equipment due to the volatility of forecasted phosphate margins |

||

| 2022 |

(330) | Phosphate White Springs non-cash impairment reversal of property, plant and equipment due to the volatility of forecasted phosphate margins |

Normal Course Issuer Bid (“NCIB”)

The table below provides information on our share repurchase programs.

| Commencement Date |

Expiry | Maximum Shares for Repurchase | ||||

| 2024 NCIB 1 |

March 1, 2024 | February 28, 2025 | 24,728,159 | |||

| 2023 NCIB |

March 1, 2023 | February 29, 2024 | 24,962,194 | |||

| 2022 NCIB 2 |

March 1, 2022 | February 7, 2023 | 55,111,110 | |||

| 2021 NCIB |

March 1, 2021 | February 28, 2022 | 28,468,448 | |||

| 2020 NCIB |

February 27, 2020 | February 26, 2021 | 28,572,458 |

1 On February 21, 2024, our Board of Directors (the “Board”) approved a share repurchase program for up to 5 percent of our outstanding common shares (the “2024 NCIB”). The 2024 NCIB, which is subject to acceptance by the TSX, will expire earlier than the date above if we acquire the maximum number of common shares allowable or otherwise decide not to make any further repurchases.

2 The original expiry date of the 2022 NCIB was February 28, 2023, but we acquired the maximum aggregate number of common shares allowable thereunder on February 7, 2023.

The table below sets forth the number of common shares we have repurchased during the last three fiscal years, in each case, under the applicable NCIB through open market purchases at market prices.

| Common Shares Repurchased | 2023 | 2022 | 2021 | |||

| Total amount (US$ millions) |

1,000 | 4,496 | 1,105 | |||

| Number of shares |

13,378,189 | 53,312,559 | 15,982,154 |

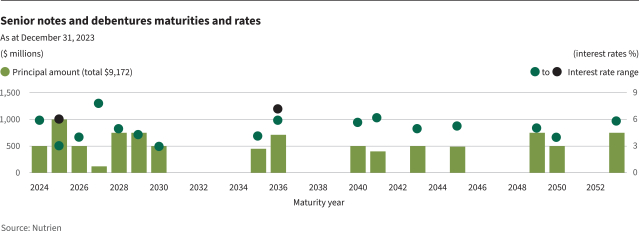

Senior Notes Issuances and Repayments

In 2022, we filed a base shelf prospectus in Canada and the US qualifying the issuance of up to $5 billion of common shares, debt securities and other securities during a period of 25 months from March 11, 2022. On March 27, 2023, we issued $1.5 billion of senior notes and on November 7, 2022, we issued $1.0 billion of senior notes as described below, each such offering pursuant to the base shelf prospectus and the applicable prospectus supplement.

The following tables summarize our long-term debt issuances and repayment activities during the last three fiscal years.

| Senior Notes Issued (Year) | Rate of Interest (%) |

Maturity Date | Amount (US$ millions) |

|||

| 2023 |

4.900 | March 27, 2028 | 750 | |||

| 2023 |

5.800 | March 27, 2053 | 750 | |||

| 2022 |

5.900 | November 7, 2024 | 500 | |||

| 2022 |

5.950 | November 7, 2025 | 500 |

8

The senior notes issued in 2023 and 2022 are unsecured, rank equally with our existing unsecured debt and have no sinking fund requirements prior to maturity. Each series is redeemable and provide for redemption prior to maturity, at our option, at specified prices. We did not issue any senior notes in 2021.

| Senior Notes Repaid (Year) |

Rate of Interest (%) |

Maturity Date | Principal Amount Repaid/Redeemed (US$ millions) |

|||

| 2023 |

1.900 | May 13, 2023 | 500 | |||

| 2022 |

3.150 | October 1, 2022 | 500 | |||

| 2021 1 |

3.500 | June 1, 2023 | 500 | |||

| 2021 1 |

3.625 | March 15, 2024 | 750 | |||

| 2021 1 |

3.375 | March 15, 2025 | 550 |

1 In 2021, we redeemed the entire outstanding principal amount of these senior notes in accordance with the optional redemption provisions provided in the indentures governing these senior notes.

In 2021, we also completed a cash tender offer to purchase the following debentures and senior notes up to a maximum aggregate purchase price of $300 million.

| Rate of Interest (%) |

Maturity Date | Principal Amount (US$ millions) |

||||

| Debentures |

7.800 | February 1, 2027 | 5 | |||

| Senior Notes |

7.125 | May 23, 2036 | 88 | |||

| Senior Notes |

6.125 | January 15, 2041 | 99 | |||

| Senior Notes |

5.250 | January 15, 2045 | 11 |

The 2021 redemption and cash tender offer were funded by using cash on hand and proceeds from the issuance of commercial paper. The total cash spend for the early redemption and tender offer, including accrued interest was $2.2 billion.

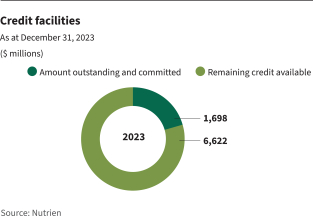

Credit Facilities

| Year

|

Description | |||

| New Facilities

|

Existing Facilities

|

|||

|

2023 |

Unsecured revolving term credit facility - Amended the terms to extend the maturity date from September 13, 2023 to September 10, 2024 - Reduced the facility limit from $2.0 billion to $1.5 billion |

|||

|

2022 |

Entered into $2.0 billion non-revolving term credit facilities in July

Entered into a $2.0 billion unsecured revolving term credit facility, with the same principal covenants and events of default as our existing $4.5 billion unsecured revolving term credit facility |

$2.0 billion unsecured non-revolving term credit facilities - Repaid drawdowns in full and terminated these facilities in September 2022

Uncommitted revolving demand credit facility - Increased our credit limit by $500 million to $1.0 billion

$4.5 billion unsecured revolving term credit facility - Amended the terms to extend the maturity date from June 4, 2026 to September 14, 2027 |

||

|

2021 |

$4.5 billion unsecured revolving term credit facility - Amended the terms to extend the maturity date from April 10, 2023 to June 4, 2026 |

|||

5 – Description of the Business

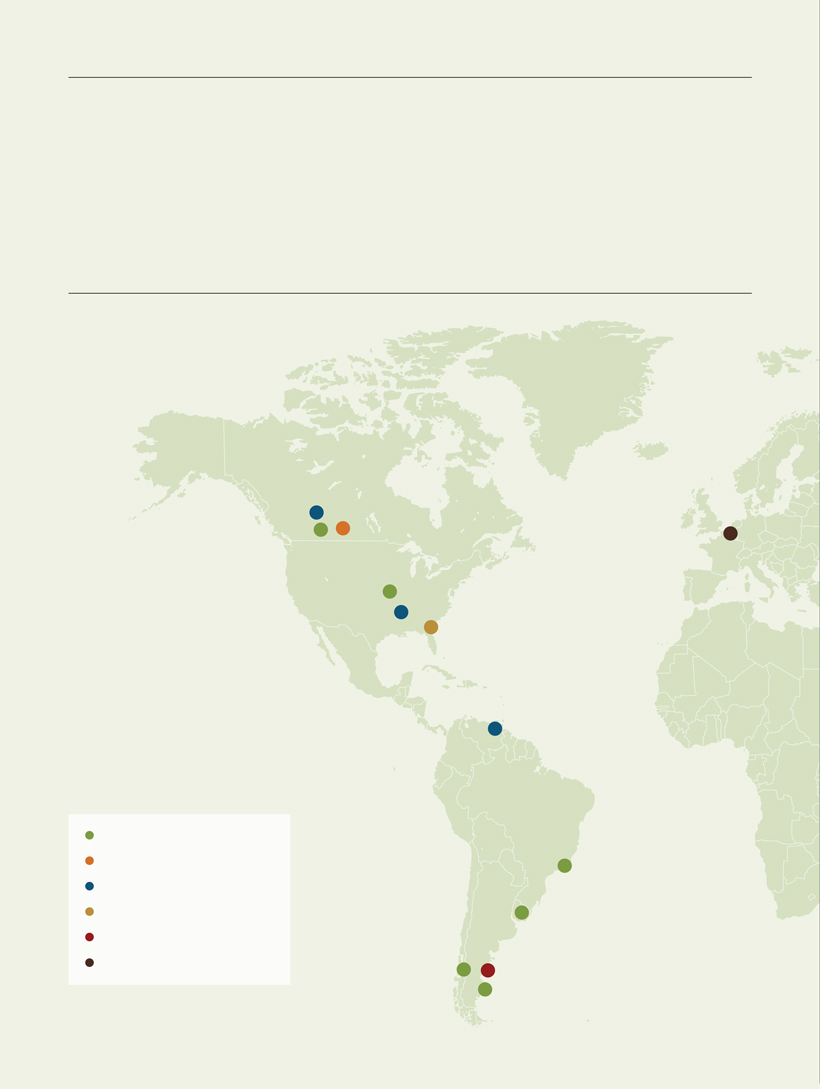

We are an integrated provider of crop inputs and services, playing a critical role in helping growers around the globe increase food production in a sustainable manner. We supply growers through our leading global Retail network – including crop nutrients, crop protection products, seed and merchandise, as well as agronomic and application services. We operate more than 2,000 retail selling locations across the US, Canada, Australia and South America, servicing approximately 500,000 grower accounts.

Nutrien is the world’s largest provider of crop inputs and services, producing potash, nitrogen and phosphate. We sold approximately 26 million metric tonnes of manufactured fertilizer in 2023 from our production facilities in Canada, the US and Trinidad.

9

As of December 31, 2023, we estimate our Potash operations represented 20 percent of global potash nameplate capacity, our Nitrogen operations represented 2 percent of global nitrogen nameplate capacity and our Phosphate operations represented approximately 3 percent of global phosphate nameplate capacity.

We report our results in four operating segments: Retail, Potash, Nitrogen and Phosphate. Our reporting structure reflects how we manage our business. Sales classified by operating segment and applicable category of products and services are provided in

Note 3 of the 2023 Consolidated Financial Statements. Sales or transfers to certain entities in which the Company has an investment that is accounted for under the equity method are provided in Note 3 of the 2023 Consolidated Financial Statements.

Established in late 2022, our global commercial organization is a single point of accountability for delivering customer service, driving supply chain efficiencies, and leading margin optimization opportunities across our integrated network. The Executive Vice President & Chief Commercial Officer also oversees Nutrien’s economics and market research team, as well as commercial development & integration activities, leading operational value creation initiatives across Nutrien’s global network.

5.1 Nutrien Ag Solutions (“Retail”) Operations

Overview

Our Retail segment markets crop nutrients, crop protection products, seed and merchandise, as well as agronomic application services and solutions, including Nutrien Financial, through more than 2,000 retail selling locations across North America, Australia and South America. In 2023, our total Retail sales represented 67 percent of our total consolidated sales (2022 – 56 percent). Retail’s products and services are as follows:

|

Product

|

% of Retail Sales

|

Description

|

||

| Crop nutrients | 2023 – 43 2022 – 47 |

- dry and liquid macronutrient products, which include potash, nitrogen and phosphate, and proprietary liquid micronutrient products, sold globally: ○ custom blended to suit specific nutrient requirements for each grower’s field typically based on soil fertility tests or plant tissue sampling |

||

| Crop protection products | 2023 – 34 2022 – 33 |

- third-party supplier and proprietary products, primarily through our Loveland Products, Inc. brands across North America, South America and Australia, designed to enhance crop quality and manage diseases, weeds, and other pests |

||

| Seed | 2023 – 12 2022 – 10 |

- third-party supplier and proprietary seed product lines, including brands such as Dyna-Gro®, Proven™, and Sementes Goiás, sold globally - seed treatments applied to seeds prior to planting to protect them from pests and disease |

||

| Nutrien Financial | 2023 – 2 2022 – 1 |

- flexible financing solutions offered to our customers in the US and Australia: ○ extended payment terms, typically up to one year, to facilitate alignment of grower crop cycles with cash flows ○ programs are coordinated with both product suppliers and local branch network |

||

| Merchandise | 2023 – 5 2022 – 5 |

- livestock-related merchandise including fencing, feed supplements, animal identification merchandise and various animal health products and services - storage and irrigation equipment and other products - primarily offered in Australia |

||

| Services and other | 2023 – 4 2022 – 4 |

- custom application services, crop scouting and precision agriculture services, soil fertility testing and plant tissue sampling - precision application allowing nutrient application rates to be adjusted when required, based on global positioning system technology and grid soil fertility test results and other data - monitoring of crop disease conditions and irrigation requirements using a system of weather tracking stations - various other services, including wool sales and marketing, livestock marketing and auction services, water services, insurance products, and real estate agency services in Australia - primarily offered in North America and Australia |

Transportation, Storage and Distribution

We have an extensive infrastructure system to store and transport our Retail products, strategically located across distribution points in regions where we operate to serve our customers across the US, Canada, Australia and South America.

10

| Number | Nature | Description | ||

| 98 | Terminals |

- used to receive large quantities of crop nutrients for redistribution to Retail centers and to growers directly |

||

| 33 | Distribution centers |

- used to distribute crop protection products and seed - used to coordinate product supply to Retail centers and allow us to manage inventory levels across our distribution network |

||

| 2,133 | Branches, satellites, plants |

- Retail locations used to provide growers with complete agriculture solutions, including crop and soil nutrients, crop protection, seed, services and digital tools - manufacturing plants used for production of crop inputs |

||

| 30,645 | Vehicles and application equipment |

- variety of on-road and on-farm vehicles used in the distribution, support and application of crop inputs |

Supply chain management, utilizing our extensive storage and distribution network and transportation capabilities, allows us to efficiently deliver crop nutrients and seed products to our customers. As growers have a short application and planting window, the precise timing of such deliveries is unpredictable due to both the seasonal nature of crop planting and the impact of weather. We regularly review our suppliers to maintain critical feedstocks, and we believe we can leverage our diverse retail distribution network and expansive fertilizer terminal network to effectively manage product logistic challenges.

Competitive Position

The market for Nutrien’s Retail products and services is highly competitive in the countries in which we operate. The principal competitors in the retail distribution of crop inputs include agricultural cooperatives, other major agriculture retailers, and smaller independent retailers and distributors. Retail produces a range of high-quality proprietary crop protection, seed and crop nutrient products that generate higher margins for our Retail segment compared to non-proprietary products. Our digital platform supports our core business offering, enhances the customer experience, and includes access to services such as crop planning, customer account management, invoice payment and financing.

5.2 Potash Operations

Overview

Our Potash operations include the mining and processing of potash, which is predominantly used as fertilizer. The Saskatchewan Ministry of Energy and Resources has granted Nutrien the exclusive right to mine potash on approximately 383,000 hectares (or approximately 947,000 acres) of Crown land pursuant to subsurface mineral leases. Of the 383,000 hectares leased from the Crown, approximately 282,000 hectares comprise our Potash operations at the Allan, Cory, Lanigan, Patience Lake, Rocanville and Vanscoy mines. Leases also exist with freehold mineral rights owners within the Crown subsurface mineral lease areas and elsewhere in Saskatchewan.

Subsurface mineral leases with the Province of Saskatchewan are for 21-year terms, renewable at our option at each of our producing mines. Our subsurface mineral leases with other parties are also for 21-year terms. Such other leases are renewable at our option, provided generally that production is continuing and that there is continuation of the applicable lease with the Province of Saskatchewan.

The potash we produce in Canada for sale to destinations outside Canada and the US is sold exclusively to Canpotex Limited (“Canpotex”). Canpotex is owned in equal shares by Nutrien and another potash producer in Canada. Canpotex, which was incorporated in 1970 and commenced operations in 1972, acts as an export company providing integrated sales, marketing and distribution for all Canadian potash produced by its shareholders/producers that is exported to destinations outside the US and Canada. Each shareholder of Canpotex has an equal voting interest as a shareholder and a right to equal representation on the Canpotex board of directors. In 2023, our total Potash sales represented 14 percent of our total consolidated sales (2022 – 22 percent). Our total offshore sales in 2023 represented 50 percent of our total Potash sales (2022 – 66 percent).

In general, Canpotex sales volumes are allocated among Canpotex producers based on production capacity. In 2023, Nutrien supplied approximately 64 percent of Canpotex’s product supply requirements (2022 – approximately 64 percent). Canpotex sells potash to buyers in export markets pursuant to term and spot contracts at agreed upon prices. Canpotex has a long history of being a reliable supplier of potash to international markets and of proven logistics and marketing capabilities. Other major potash exporting countries include Russia, Belarus, Israel and Germany.

11

Transportation, Storage and Distribution

Transportation costs can be a significant component of the total delivered cost of potash. Producers may have an advantage in serving markets close to their sources of supply depending on prevailing transportation costs. International shipping cost variances permit offshore producers to effectively compete with our potash production in many geographies.

Most of our potash for North American customers is shipped by rail. We believe we have a strategic advantage in this market with approximately 300 owned or leased potash distribution points and a fleet of approximately 5,900 owned or leased railcars as at December 31, 2023. We believe this is the most extensive domestic distribution network in the potash business. Shipments are also made by rail from each of our Saskatchewan mines to Thunder Bay, Ontario for shipment by lake vessel to our warehouses and storage facilities in Canada and the US.

In the case of our sales to Canpotex, Canpotex is responsible for managing and directing all aspects of its logistics infrastructure platform, including the transportation of its potash by way of rail to marine facilities where it is handled, stored and loaded onto ocean-going vessels. We have an equity interest in Canpotex Bulk Terminals Limited, which is a part owner of the marine facilities utilized by Canpotex in Vancouver, British Columbia. Canpotex also utilizes marine facilities in Portland, Oregon, Saint John, New Brunswick and Thunder Bay, Ontario. Other facilities may be utilized as required.

Production Methods

We produce potash primarily using conventional mining methods, except for our Patience Lake mine, which was originally a conventional underground mine, but began employing a solution mining method in 1989. In conventional operations, shafts are sunk to the ore body, which is approximately one kilometer below the surface. Mining machines cut the ore, which is then hoisted to the surface for processing. The ore is a mixture of potassium chloride, salt and insoluble particles. In solution mining, the potash is dissolved in warm brine and pumped to the surface for processing. Removing salt and insoluble particles through a milling process produces saleable potash. Six grades of potash (standard, granular, suspension, white granular, soluble and chicklets) are produced to suit different preferences of the agricultural, industrial and feed markets that we serve.

In 2023, our nameplate capacity represented 54 percent of the North American total nameplate capacity (see the table below for further information) and our potash production represented 56 percent of North American production. We allocate production among our mines on the basis of various factors, including cost efficiency and the grades of product that can be produced.

The following table sets forth, for each of the past two years, the production of ore, mill feed grade and finished product for each of our potash mines in Saskatchewan:

| Annual Nameplate Capacity 1

|

Annual Operational

|

|||||||||||||||||

|

2024

|

2023

|

2023 Production

|

2022 Production

|

|||||||||||||||

| Finished Product (millions of tonnes) |

Finished Product (millions of tonnes) |

Finished Product (millions of tonnes) |

Ore of tonnes) |

Grade % K2O |

Finished Product (millions of tonnes) |

Ore of tonnes) |

Grade % K2O |

Finished Product (millions of tonnes) |

||||||||||

|

Rocanville |

6.5 |

5.1 |

5.2 |

16.45 |

21.9 |

4.97 |

16.34 |

21.7 |

4.89 |

|||||||||

|

Allan |

4.0 |

2.4 |

3.0 |

6.70 |

25.1 |

2.39 |

6.96 |

25.0 |

2.50 |

|||||||||

|

Vanscoy |

3.0 |

1.1 |

1.4 |

3.22 |

24.3 |

1.05 |

3.03 |

25.2 |

1.01 |

|||||||||

|

Lanigan |

3.8 |

3.0 |

3.1 |

8.53 |

25.3 |

2.89 |

7.55 |

24.8 |

2.46 |

|||||||||

|

Cory |

3.0 |

2.1 |

2.2 |

5.12 |

22.5 |

1.50 |

6.07 |

23.3 |

1.89 |

|||||||||

|

Patience Lake |

0.3 |

0.3 |

0.3 |

– |

– |

0.20 |

– |

– |

0.26 |

|||||||||

|

Totals 3 |

20.6 |

14.0 |

15.2 |

40.02 |

13.00 |

39.95 |

13.01 |

|||||||||||

1 Represents estimates of capacity as of December 31, 2023. Estimates are based on capacity as per design specifications or Canpotex entitlements once determined. In the case of Patience Lake, estimate reflects current operational capability. Estimates for all other facilities do not necessarily represent operational capability.

2 Estimated annual achievable production based on expected staffing and operational readiness (estimated at the beginning of year, and may vary during the year, and year-to-year, including between our facilities). Estimate does not include inventory-related shutdowns and unplanned downtime.

3 2023 average mineral grade of 23.4 percent potassium oxide (“K2O”) mined and an average grade of 60.9 percent K2O produced. Averages are weighted proportionately to tonnes produced at our conventional mines.

12

The mining of potash is a capital-intensive business subject to the normal risks and capital expenditure requirements associated with mining operations. The production and processing of ore may be subject to delays and costs resulting from mechanical failures and hazards, such as unusual or unexpected geological conditions, subsidence, water inflows, and other conditions involved in mining potash ore.

Competitive Position

Potash is a commodity, characterized by minimal product differentiation, and, consequently, producers compete based on price, quality and service. We price competitively, sell high-quality products and provide high-quality service to our customers. Our service includes maintaining warehouses, leasing railcars and chartering vessels to enhance our delivery capabilities. The high cost of transporting potash affects competition in various geographic areas.

| Major Competitors in 2023 | ||||

| North American markets |

EuroChem Group AG |

The Mosaic Company (“Mosaic”) |

||

| Intrepid Potash Inc. |

ICL Group Ltd. (“ICL”) |

|||

| K+S Group |

PJSC Uralkali |

|||

| Offshore markets – Canpotex |

Arab Potash Company |

PA Belaruskali |

||

| EuroChem Group AG |

ICL |

|||

| K+S Group |

Sociedad Química y Minera de Chile S.A. |

|||

| PJSC Uralkali |

Asia-Potash (Laos) |

|||

In 2022 and the first half of 2023, potash production and exports from Eastern Europe were constrained below 2021 levels due to sanctions on Belarus and restrictions on Russia relating to the war between Ukraine and Russia. In the second half of 2023, global potash prices stabilized as global trade flows adjusted to this disruption and supply from Eastern Europe began to gradually return to pre-war levels.

Sources of Raw Materials

The production of potash requires a sustained fresh water supply for the milling process, which comes from nearby sources including subsurface aquifers, reservoirs and the Saskatchewan River.

5.3 Nitrogen Operations

Overview

We own and operate ammonia production facilities at which we produce and, where applicable, upgrade the following nitrogen products:

| Plant Locations | Nitrogen Products Produced | |

| Augusta, Georgia | Ammonia, urea, urea ammonium nitrate (“UAN”), urea solutions, nitric acid and ammonium nitrate | |

| Borger, Texas | Ammonia, urea and urea solutions | |

| Carseland, Alberta | Ammonia, urea and Environmentally Smart Nitrogen® (“ESN®”) | |

| Fort Saskatchewan, Alberta | Ammonia and urea | |

| Geismar, Louisiana | Ammonia, urea, UAN, urea solutions and nitric acid | |

| Joffre, Alberta | Ammonia | |

| Lima, Ohio | Ammonia, urea, UAN, urea solutions, nitric acid and ammonium nitrate | |

| Point Lisas, Trinidad | Ammonia and urea | |

| Redwater, Alberta | Ammonia, urea, ammonium nitrate liquor, UAN and ammonium sulfate |

We operate a number of facilities that upgrade ammonia and urea to other products such as UAN, ammonium nitrate, nitric acid and ESN®.

| Plant Locations | Nitrogen Products Produced | |

| Granum, Alberta | UAN | |

| Kennewick, Washington | UAN, ammonium nitrate liquor and nitric acid, calcium ammonium nitrate (“CAN”) | |

| New Madrid, Missouri | ESN® | |

| Standard, Alberta | UAN |

13

Our owned and operated facilities have a combined annual gross ammonia nameplate capacity of approximately 7.1 million tonnes.

We also have a 50 percent joint venture ownership in Profertil S.A. (“Profertil”), a joint venture that owns a nitrogen facility in Bahia Blanca, Argentina.

Transportation, Storage and Distribution