UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-41404

Woodside Energy Group Ltd

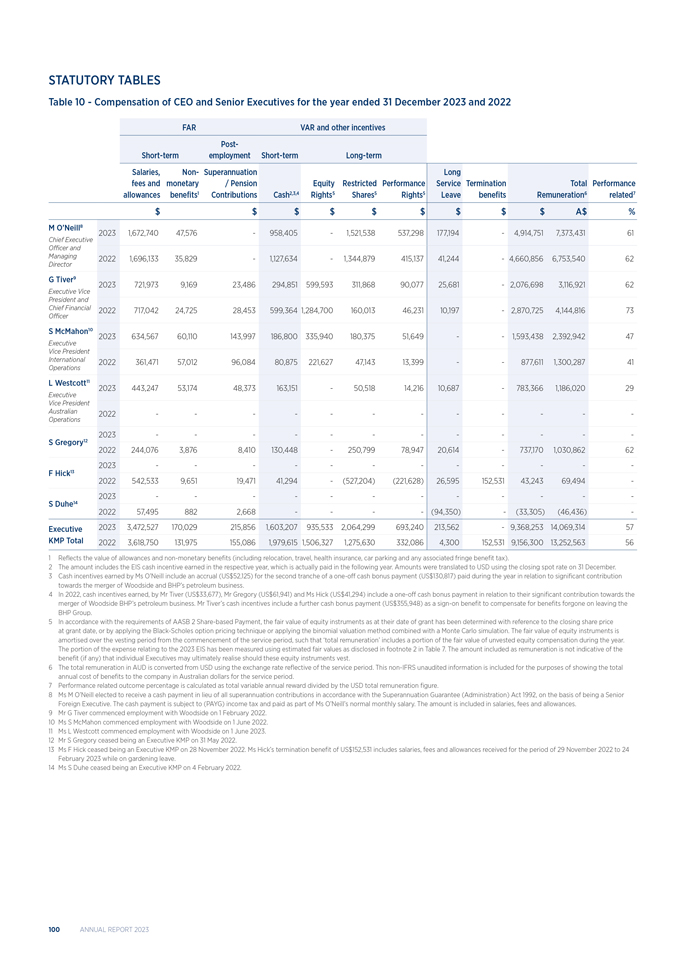

(ABN 55 004 898 962)

(Registrant’s name)

Woodside Energy Group Ltd

Mia Yellagonga, 11 Mount Street

Perth, Western Australia 6000

Australia

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: February 27, 2024

| WOODSIDE ENERGY GROUP LTD | ||

| By: | /s/ Warren Baillie |

|

| Warren Baillie | ||

| Corporate Secretary | ||

Exhibit 99.1

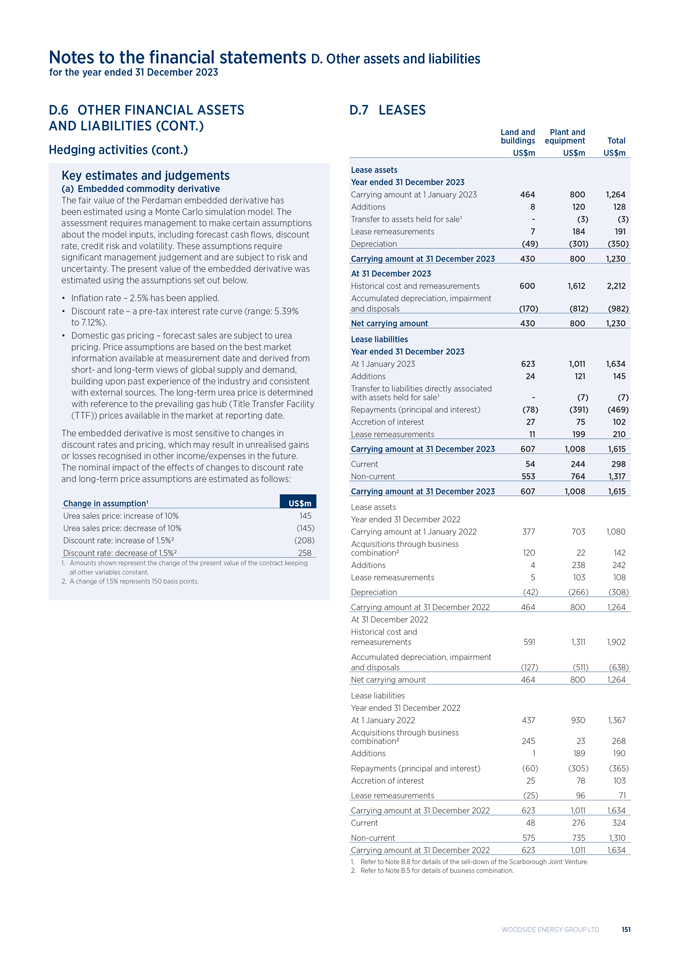

2023 ANNUAL INCORPORATING REPORT APPENDIX 4E

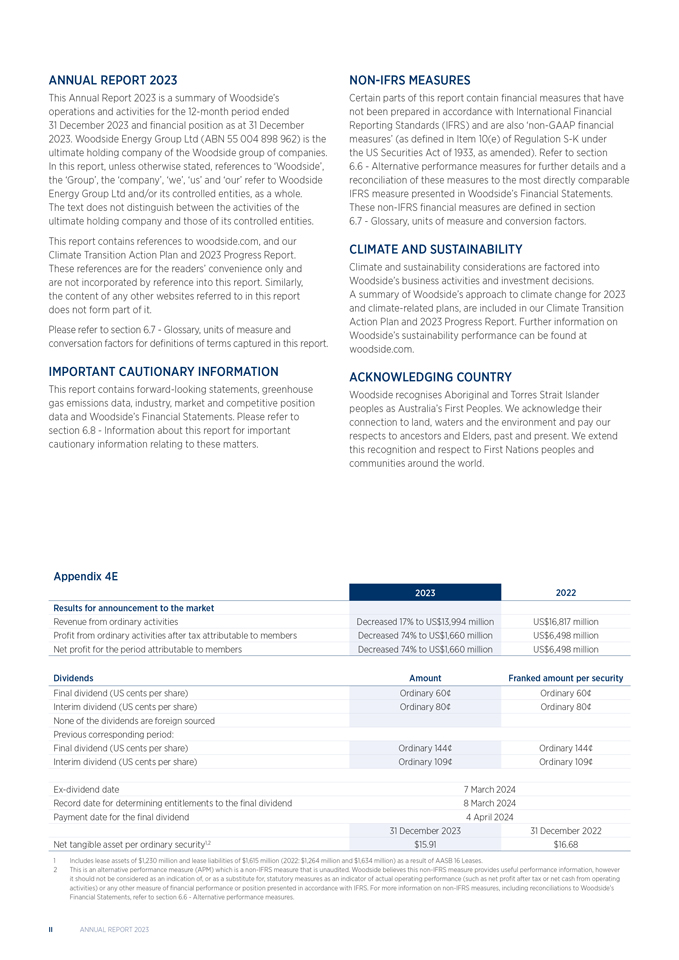

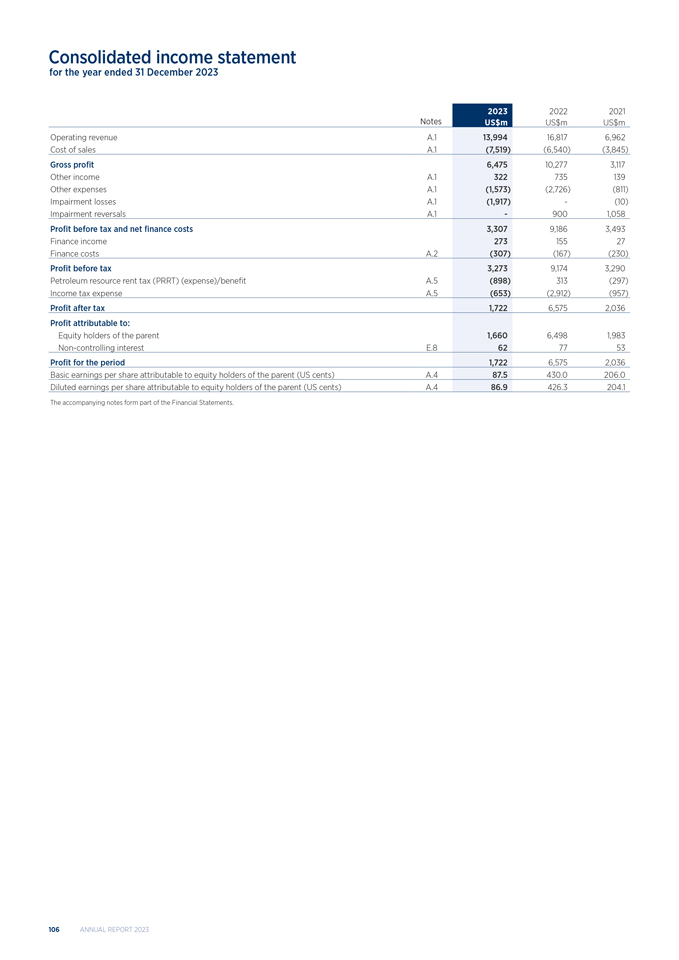

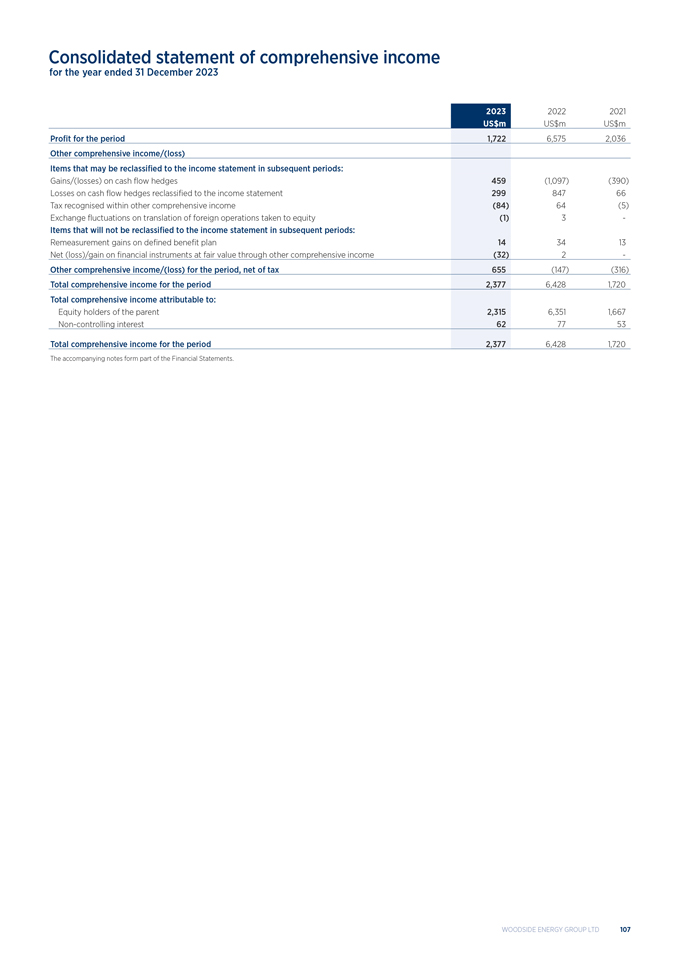

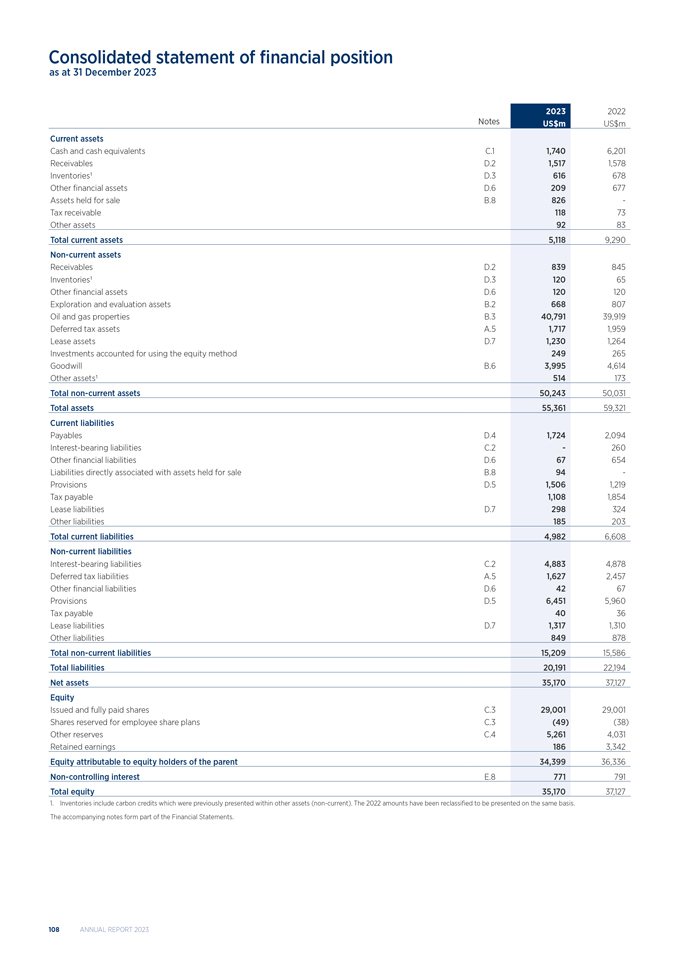

ANNUAL REPORT 2023 This Annual Report 2023 is a summary of Woodside’s operations and activities for the 12-month period ended 31 December 2023 and financial position as at 31 December 2023. Woodside Energy Group Ltd (ABN 55 004 898 962) is the ultimate holding company of the Woodside group of companies. In this report, unless otherwise stated, references to ‘Woodside’, the ‘Group’, the ‘company’, ‘we’, ‘us’ and ‘our’ refer to Woodside Energy Group Ltd and/or its controlled entities, as a whole. The text does not distinguish between the activities of the ultimate holding company and those of its controlled entities. This report contains references to woodside.com, and our Climate Transition Action Plan and 2023 Progress Report. These references are for the readers’ convenience only and are not incorporated by reference into this report. Similarly, the content of any other websites referred to in this report does not form part of it. Please refer to section 6.7—Glossary, units of measure and conversation factors for definitions of terms captured in this report. IMPORTANT CAUTIONARY INFORMATION This report contains forward-looking statements, greenhouse gas emissions data, industry, market and competitive position data and Woodside’s Financial Statements. Please refer to section 6.8—Information about this report for important cautionary information relating to these matters. NON-IFRS MEASURES Certain parts of this report contain financial measures that have not been prepared in accordance with International Financial Reporting Standards (IFRS) and are also ‘non-GAAP financial measures’ (as defined in Item 10(e) of Regulation S-K under the US Securities Act of 1933, as amended). Refer to section 6.6—Alternative performance measures for further details and a reconciliation of these measures to the most directly comparable IFRS measure presented in Woodside’s Financial Statements. These non-IFRS financial measures are defined in section 6.7—Glossary, units of measure and conversion factors. CLIMATE AND SUSTAINABILITY Climate and sustainability considerations are factored into Woodside’s business activities and investment decisions. A summary of Woodside’s approach to climate change for 2023 and climate-related plans, are included in our Climate Transition Action Plan and 2023 Progress Report. Further information on Woodside’s sustainability performance can be found at woodside.com. ACKNOWLEDGING COUNTRY Woodside recognises Aboriginal and Torres Strait Islander peoples as Australia’s First Peoples. We acknowledge their connection to land, waters and the environment and pay our respects to ancestors and Elders, past and present. We extend this recognition and respect to First Nations peoples and communities around the world. Appendix 4E 20232022 Results for announcement to the market Revenue from ordinary activities Decreased 17% to US$13,994 million US$16,817 million Profit from ordinary activities after tax attributable to members Decreased 74% to US$1,660 million US$6,498 million Net profit for the period attributable to members Decreased 74% to US$1,660 million US$6,498 million DividendsAmountFranked amount per security Final dividend (US cents per share) Ordinary 60¢ Ordinary 60¢ Interim dividend (US cents per share) Ordinary 80¢ Ordinary 80¢ None of the dividends are foreign sourced Previous corresponding period: Final dividend (US cents per share) Ordinary 144¢ Ordinary 144¢ Interim dividend (US cents per share) Ordinary 109¢ Ordinary 109¢ Ex-dividend date 7 March 2024 Record date for determining entitlements to the final dividend 8 March 2024 Payment date for the final dividend 4 April 2024 31 December 2023 31 December 2022 Net tangible asset per ordinary security1,2 $15.91 $16.68 1 Includes lease assets of $1,230 million and lease liabilities of $1,615 million (2022: $1,264 million and $1,634 million) as a result of AASB 16 Leases. 2 This is an alternative performance measure (APM) which is a non-IFRS measure that is unaudited. Woodside believes this non-IFRS measure provides useful performance information, however it should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as net profit after tax or net cash from operating activities) or any other measure of financial performance or position presented in accordance with IFRS. For more information on non-IFRS measures, including reconciliations to Woodside’s Financial Statements, refer to section 6.6—Alternative performance measures. II ANNUAL REPORT 2023

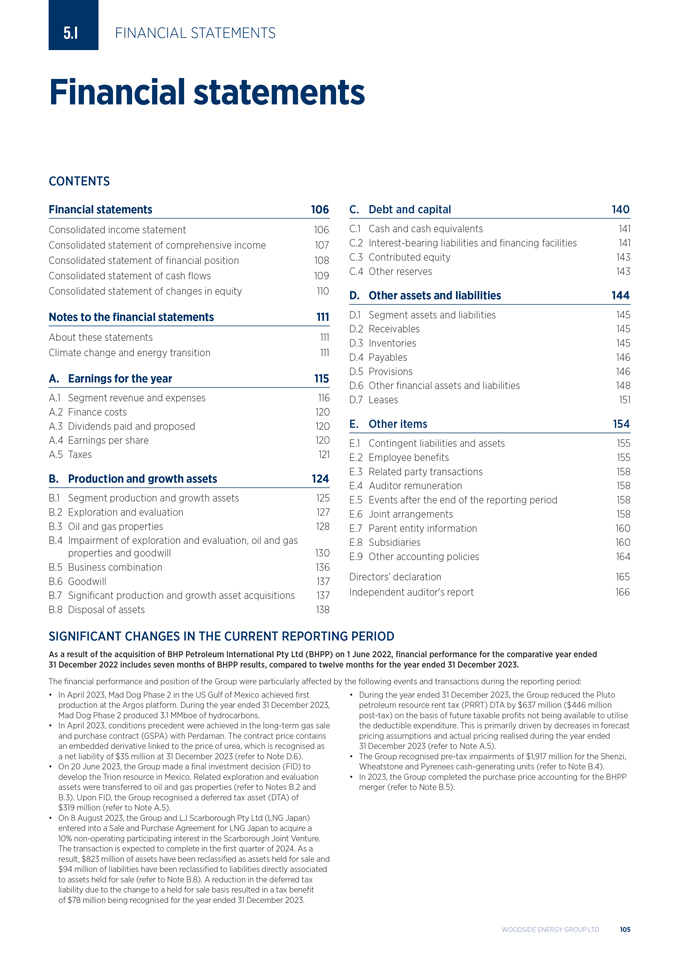

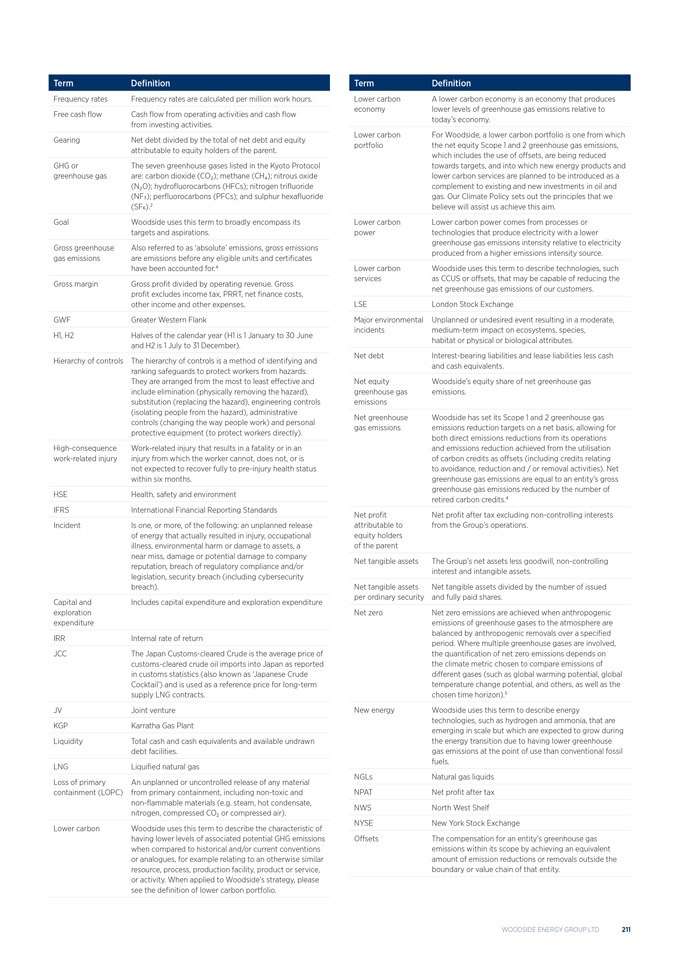

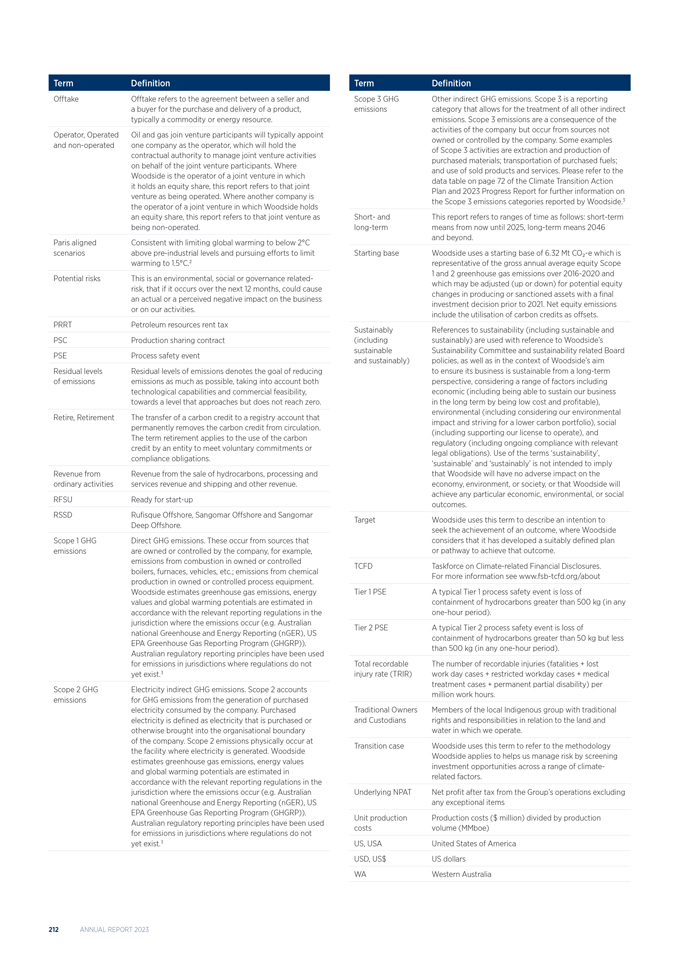

Contents 1. Overview 4 1.1 About Woodside 4 1.2 2023 summary 5 1.3 Chair’s report 8 1.4 Chief Executive Officer’s report 9 1.5 Focus areas 10 2. Strategy and Financial Performance 12 2.1 Woodside’s strategy 12 2.2 Capital management 13 2.3 Financial overview 16 2.4 Energy markets 18 2.5 Business model and value chain 19 3. Our Business 20 3.1 Australian operations 20 3.2 International operations 22 3.3 Marketing and trading 23 3.4 Projects 24 3.5 Decommissioning 26 3.6 Exploration and development 27 3.7 New energy and carbon solutions 28 3.8 Climate and sustainability 29 3.9 Risk factors 40 3.10 Reserves and Resources Statement 48 4. Governance 52 4.1 Corporate Governance Statement 53 Corporate governance at Woodside 53 Board of directors 54 Board committees 62 Executive Leadership Team 65 Promoting responsible and ethical behaviour 67 Risk management and internal control 69 Inclusion and diversity 71 Other governance disclosures 74 Shareholders 75 4.2 Directors’ report 76 4.3 Remuneration Report 80 5. Financial Statements 105 5.1 Financial statements 105 6. Additional Information 172 6.1 Supplementary information on oil and gas—unaudited 172 6.2 Three-year financial analysis 178 6.3 Additional disclosures 183 6.4 Shareholder statistics 195 6.5 Asset facts 203 6.6 Alternative performance measures 207 6.7 Glossary, units of measure and conversion factors 210 6.8 Information about this report 214 6.9 Ten-year comparative data summary 216 WOODSIDE ENERGY GROUP LTD III

1.1 OVERVIEW About Woodside We are a global energy company founded in Australia, providing reliable and affordable energy to help people lead better lives. Driven by a spirit of innovation and determination, we established the liquefied natural gas (LNG) industry in Australia 35 years ago and today supply a growing base of customers.We have reliably delivered gas to homes and businesses in Australia for decades, supporting the development of local industry and driving economic prosperity. Following our merger with BHP’s petroleum business in 2022, we have become a larger supplier of energy to the world through an expanded global portfolio. We are contributing to the energy transition by leveraging our track record of reliable operations, strong customer relationships and investing in new energy. Our strategy is to thrive through this transition by developing a low cost, lower carbon, profitable, resilient and diversified portfolio.1 Our LNG in particular can help customers in Asia’s major economies meet their energy security needs, while also supporting their decarbonisation goals. We are also investing in new products and services that can help customers reduce or avoid their emissions. We are working to reduce our net equity Scope 1 and 2 greenhouse gas emissions towards our aspiration of net zero by 2050 or sooner.2 Our quality global portfolio and strong balance sheet enables us to execute major projects today, while pursuing opportunities that will deliver Woodside’s next wave of growth. These opportunities are across gas, oil, new energy products and lower carbon services. We balance our pursuit of growth with a disciplined investment approach, focused on financial returns and value for our shareholders. We recognise that to maintain strong operational and financial performance, we need to run our business sustainably. We have a continued focus on safety, environmental and social performance and maintaining meaningful relationships with communities. We are guided by our values, and we believe that our success is underpinned by our people and culture. 1 Please see section 6.7 – Glossary, units of measure and conversion factors for a definition of how Woodside uses the term lower carbon portfolio. 2 Targets and aspiration are for net equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO -e which is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing 2 or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 4 ANNUAL REPORT 2023

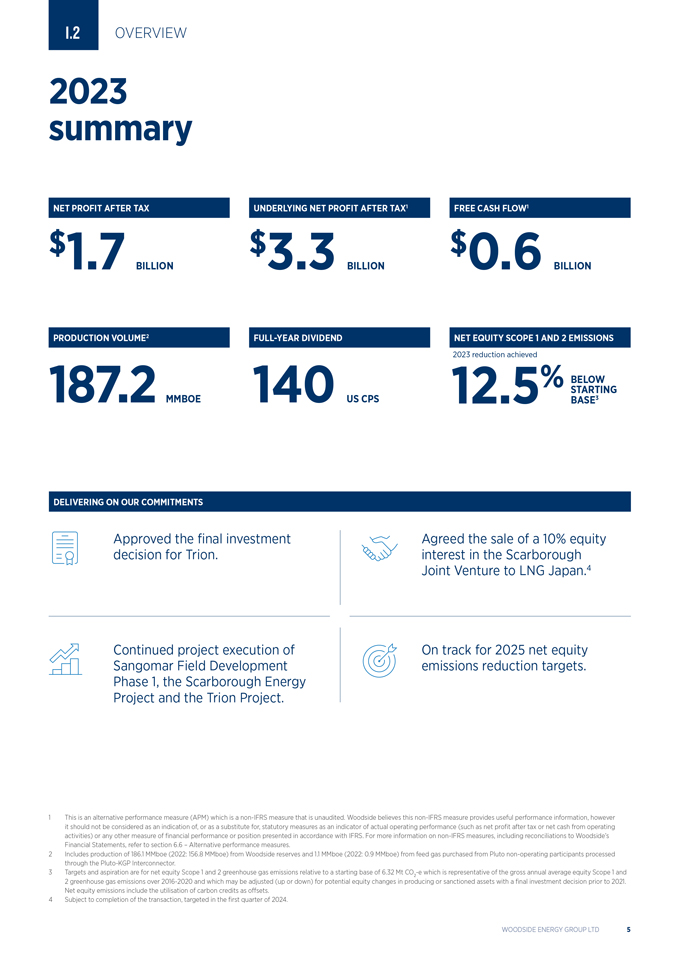

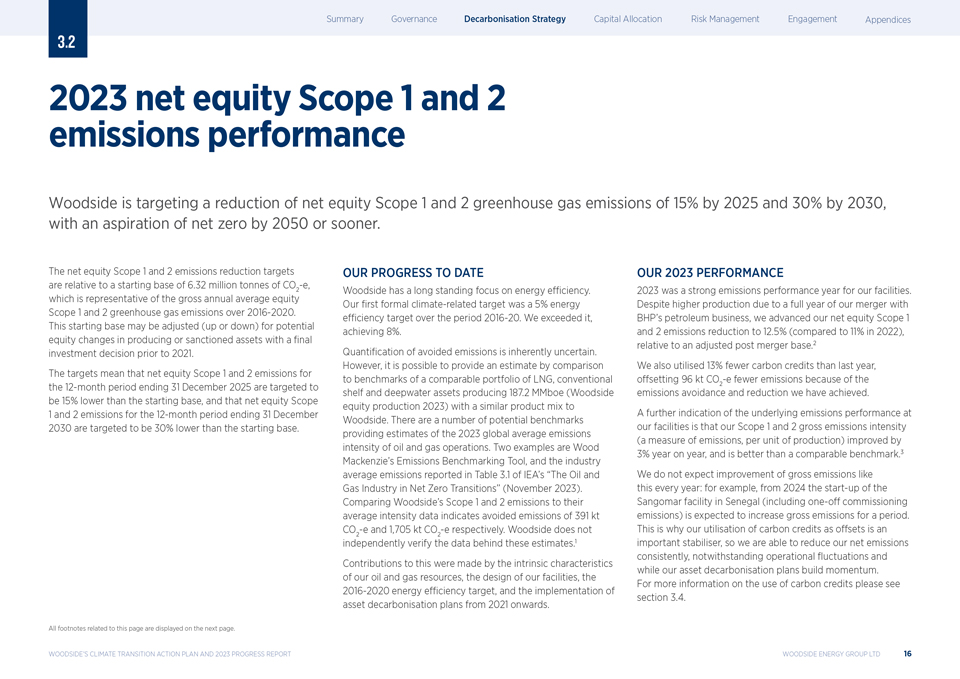

1.2 OVERVIEW 2023 summary NET PROFIT AFTER TAX UNDERLYING NET PROFIT AFTER TAX1 FREE CASH FLOW1 $1.7 BILLION $3.3 BILLIONX% $0.6 BILLION PRODUCTION VOLUME2 FULL-YEAR DIVIDEND NET EQUITY SCOPE 1 AND 2 EMISSIONS 2023 reduction achieved BELOW 187.2 140 12.5% STARTING MMBOE US CPS BASE3 DELIVERING ON OUR COMMITMENTS Approved the final investment Agreed the sale of a 10% equity decision for Trion. interest in the Scarborough Joint Venture to LNG Japan.4 Continued project execution of On track for 2025 net equity Sangomar Field Development emissions reduction targets. Phase 1, the Scarborough Energy Project and the Trion Project. 1 This is an alternative performance measure (APM) which is a non-IFRS measure that is unaudited. Woodside believes this non-IFRS measure provides useful performance information, however it should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as net profit after tax or net cash from operating activities) or any other measure of financial performance or position presented in accordance with IFRS. For more information on non-IFRS measures, including reconciliations to Woodside’s Financial Statements, refer to section 6.6 – Alternative performance measures. 2 Includes production of 186.1 MMboe (2022: 156.8 MMboe) from Woodside reserves and 1.1 MMboe (2022: 0.9 MMboe) from feed gas purchased from Pluto non-operating participants processed through the Pluto-KGP Interconnector. 3 Targets and aspiration are for net equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO -e which is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing 2 or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 4 Subject to completion of the transaction, targeted in the first quarter of 2024. WOODSIDE ENERGY GROUP LTD 5

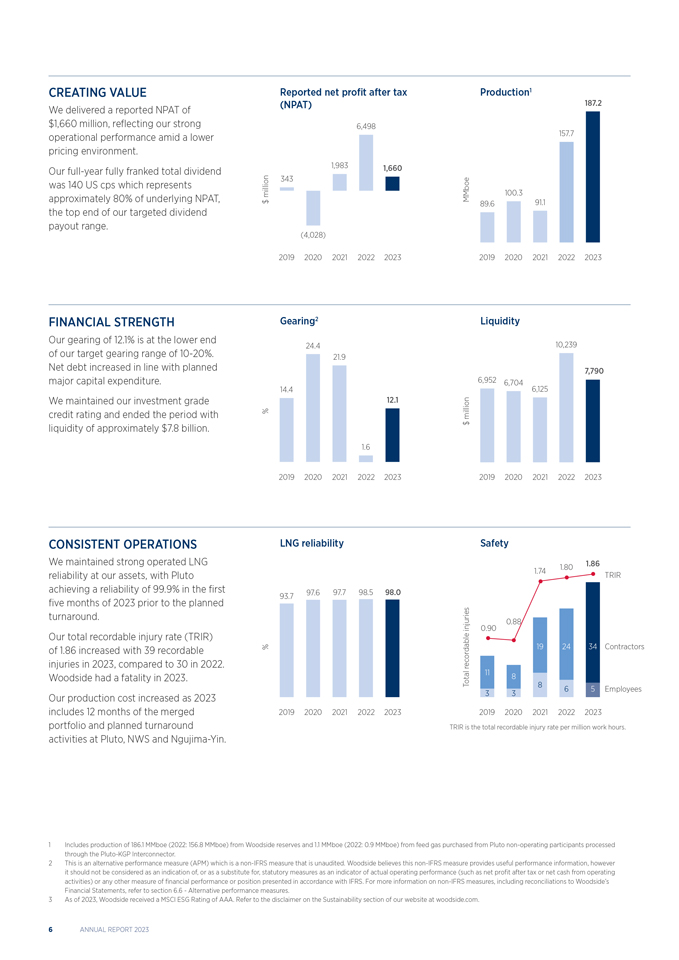

CREATING VALUE Reported net profit after taxProduction1 We delivered a reported NPAT of (NPAT)187.2 $1,660 million, reflecting our strong 6,498 operational performance amid a lower 157.7 pricing environment. Our full-year fully franked total dividend 1,9831,660 was 140 US cps which represents 343 approximately 80% of underlying NPAT, million MMboe100.3 $ 89.691.1 the top end of our targeted dividend payout range. (4,028) 2019 2020 20212022202320192020 202120222023 FINANCIAL STRENGTH Gearing2Liquidity Our gearing of 12.1% is at the lower end 24.410,239 of our target gearing range of 10-20%. 21.9 Net debt increased in line with planned 7,790 major capital expenditure. 6,9526,704 14.4 6,125 We maintained our investment grade 12.1 credit rating and ended the period with % million liquidity of approximately $7.8 billion. $ 1.6 2019 2020 20212022202320192020 202120222023 CONSISTENT OPERATIONS LNG reliabilitySafety We maintained strong operated LNG 1.801.86 reliability at our assets, with Pluto 1.74TRIR achieving a reliability of 99.9% in the first 97.697.798.598.0 93.7 five months of 2023 prior to the planned turnaround. 0.88 injuries0.90 Our total recordable injury rate (TRIR) of 1.86 increased with 39 recordable % 192434 Contractors injuries in 2023, compared to 30 in 2022. recordable Woodside had a fatality in 2023. Total118 865 Employees Our production cost increased as 2023 33 includes 12 months of the merged 2019 202020212022202320192020 202120222023 portfolio and planned turnaround TRIR is the total recordable injury rate per million work hours. activities at Pluto, NWS and Ngujima-Yin. Includes production of 186.1 MMboe (2022: 156.8 MMboe) from Woodside reserves and 1.1 MMboe (2022: 0.9 MMboe) from feed gas purchased from Pluto non-operating participants processed through the Pluto-KGP Interconnector. This is an alternative performance measure (APM) which is a non-IFRS measure that is unaudited. Woodside believes this non-IFRS measure provides useful performance information, however it should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as net profit after tax or net cash from operating activities) or any other measure of financial performance or position presented in accordance with IFRS. For more information on non-IFRS measures, including reconciliations to Woodside’s Financial Statements, refer to section 6.6—Alternative performance measures. As of 2023, Woodside received a MSCI ESG Rating of AAA. Refer to the disclaimer on the Sustainability section of our website at woodside.com. ANNUAL REPORT 2023

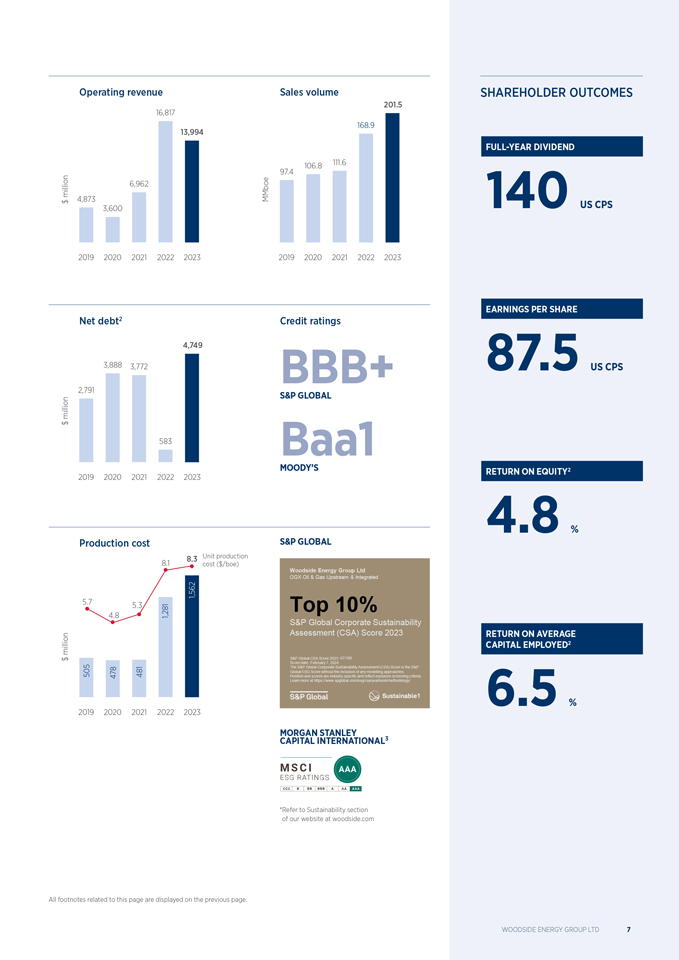

Operating revenue Sales volumeSHAREHOLDER OUTCOMES 201.5 16,817 168.9 13,994 FULL-YEAR DIVIDEND 106.8 111.6 97.4 6,962 million 4,873 MMboe $ 140US CPS 3,600 2019 2020 2021 2022 20232019 2020 2021 2022 2023 EARNINGS PER SHARE Net debt2 Credit ratings 4,749 3,888 3,772BBB+87.5US CPS 2,791 S&P GLOBAL million $ 583Baa1 MOODY’SRETURN ON EQUITY2 2019 2020 2021 2022 2023 4.8 % Production cost S&P GLOBAL 8.3Unit production 8.1cost ($/boe) Woodside Energy Group Ltd OGX Oil & Gas Upstream & Integrated 1,562 5.7 5.3 Top 10% 4.8 1,281 S&P Global Corporate Sustainability Assessment (CSA) Score 2023RETURN ON AVERAGE million CAPITAL EMPLOYED2 $ S&P Global CSA Score 2023: 67/100 Score date: February 7, 2024 The S&P Global Corporate Sustainability Assessment (CSA) Score is the S&P Global ESG Score without the inclusion of any modelling approaches. 505 478 481Position and scores are industry specific and reflect exclusion screening criteria. Learn more at https://www.spglobal.com/esg/csa/yearbook/methodology/6.5 % 2019 2020 2021 2022 2023 MORGAN STANLEY CAPITAL INTERNATIONAL3 *Refer to Sustainability section of our website at woodside.com All footnotes related to this page are displayed on the previous page. WOODSIDE ENERGY GROUP LTD 7

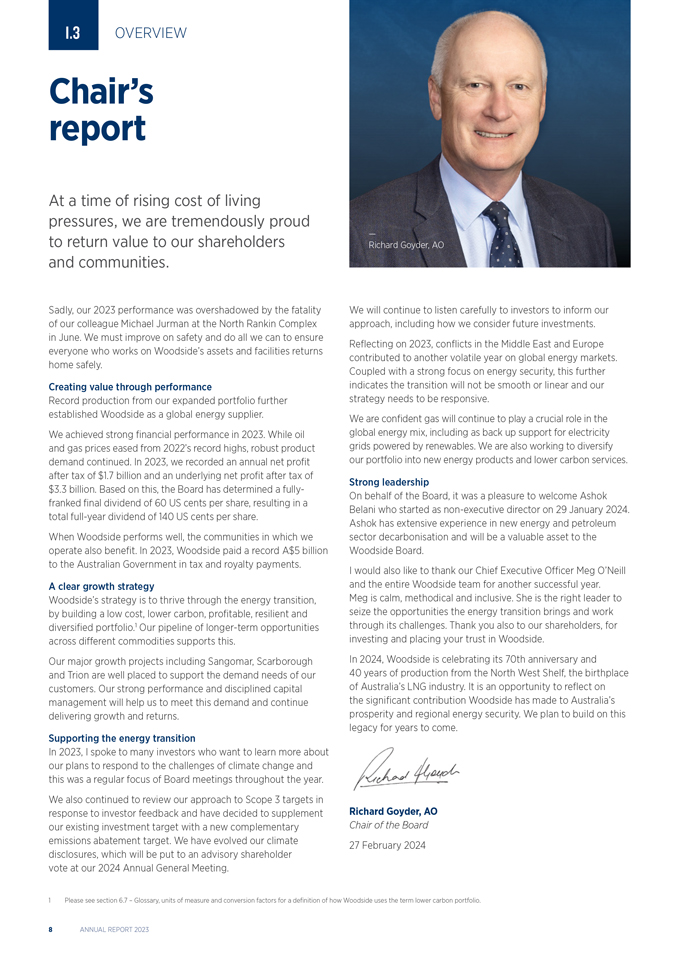

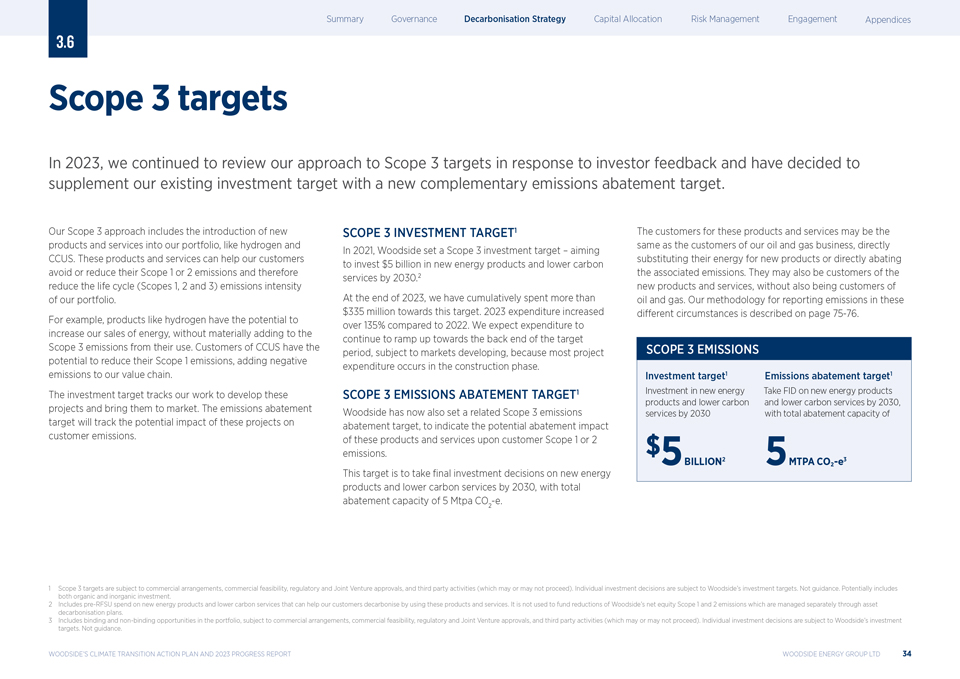

1.3 OVERVIEW Chair’s report At a time of rising cost of living pressures, we are tremendously proud to return value to our shareholders and communities. Sadly, our 2023 performance was overshadowed by the fatality of our colleague Michael Jurman at the North Rankin Complex in June. We must improve on safety and do all we can to ensure everyone who works on Woodside’s assets and facilities returns home safely. Creating value through performance Record production from our expanded portfolio further established Woodside as a global energy supplier. We achieved strong financial performance in 2023. While oil and gas prices eased from 2022’s record highs, robust product demand continued. In 2023, we recorded an annual net profit after tax of $1.7 billion and an underlying net profit after tax of $3.3 billion. Based on this, the Board has determined a fully- franked final dividend of 60 US cents per share, resulting in a total full-year dividend of 140 US cents per share. When Woodside performs well, the communities in which we operate also benefit. In 2023, Woodside paid a record A$5 billion to the Australian Government in tax and royalty payments. A clear growth strategy Woodside’s strategy is to thrive through the energy transition, by building a low cost, lower carbon, profitable, resilient and diversified portfolio.1 Our pipeline of longer-term opportunities across different commodities supports this. Our major growth projects including Sangomar, Scarborough and Trion are well placed to support the demand needs of our customers. Our strong performance and disciplined capital management will help us to meet this demand and continue delivering growth and returns. Supporting the energy transition In 2023, I spoke to many investors who want to learn more about our plans to respond to the challenges of climate change and this was a regular focus of Board meetings throughout the year. We also continued to review our approach to Scope 3 targets in response to investor feedback and have decided to supplement our existing investment target with a new complementary emissions abatement target. We have evolved our climate disclosures, which will be put to an advisory shareholder vote at our 2024 Annual General Meeting. — Richard Goyder, AO We will continue to listen carefully to investors to inform our approach, including how we consider future investments. Reflecting on 2023, conflicts in the Middle East and Europe contributed to another volatile year on global energy markets. Coupled with a strong focus on energy security, this further indicates the transition will not be smooth or linear and our strategy needs to be responsive. We are confident gas will continue to play a crucial role in the global energy mix, including as back up support for electricity grids powered by renewables. We are also working to diversify our portfolio into new energy products and lower carbon services. Strong leadership On behalf of the Board, it was a pleasure to welcome Ashok Belani who started as non-executive director on 29 January 2024. Ashok has extensive experience in new energy and petroleum sector decarbonisation and will be a valuable asset to the Woodside Board. I would also like to thank our Chief Executive Officer Meg O’Neill and the entire Woodside team for another successful year. Meg is calm, methodical and inclusive. She is the right leader to seize the opportunities the energy transition brings and work through its challenges. Thank you also to our shareholders, for investing and placing your trust in Woodside. In 2024, Woodside is celebrating its 70th anniversary and 40 years of production from the North West Shelf, the birthplace of Australia’s LNG industry. It is an opportunity to reflect on the significant contribution Woodside has made to Australia’s prosperity and regional energy security. We plan to build on this legacy for years to come. Richard Goyder, AO Chair of the Board 27 February 2024 Please see section 6.7 – Glossary, units of measure and conversion factors for a definition of how Woodside uses the term lower carbon portfolio. ANNUAL REPORT 2023 1.4 OVERVIEW Officer’s Chief Executive report The past year has seen Woodside deliver record production while laying the foundations for future growth and value.

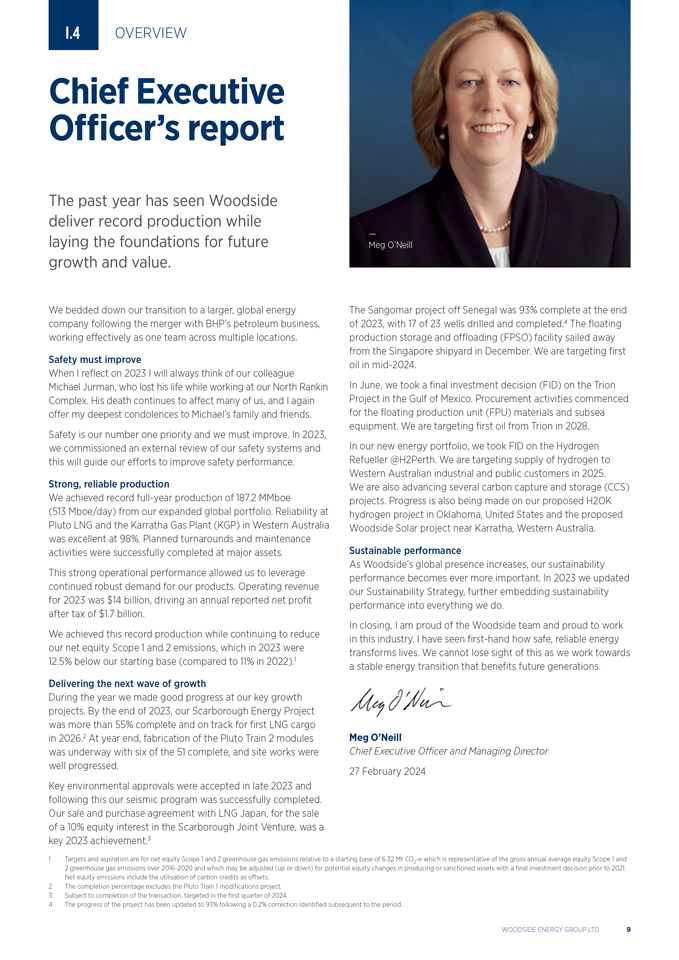

We bedded down our transition to a larger, global energy company following the merger with BHP’s petroleum business, working effectively as one team across multiple locations. Safety must improve When I reflect on 2023 I will always think of our colleague Michael Jurman, who lost his life while working at our North Rankin Complex. His death continues to affect many of us, and I again offer my deepest condolences to Michael’s family and friends. Safety is our number one priority and we must improve. In 2023, we commissioned an external review of our safety systems and this will guide our efforts to improve safety performance. Strong, reliable production We achieved record full-year production of 187.2 MMboe (513 Mboe/day) from our expanded global portfolio. Reliability at Pluto LNG and the Karratha Gas Plant (KGP) in Western Australia was excellent at 98%. Planned turnarounds and maintenance activities were successfully completed at major assets. This strong operational performance allowed us to leverage continued robust demand for our products. Operating revenue for 2023 was $14 billion, driving an annual reported net profit after tax of $1.7 billion. We achieved this record production while continuing to reduce our net equity Scope 1 and 2 emissions, which in 2023 were 12.5% below our starting base (compared to 11% in 2022).1 Delivering the next wave of growth During the year we made good progress at our key growth projects. By the end of 2023, our Scarborough Energy Project was more than 55% complete and on track for first LNG cargo in 2026.2 At year end, fabrication of the Pluto Train 2 modules was underway with six of the 51 complete, and site works were well progressed. Key environmental approvals were accepted in late 2023 and following this our seismic program was successfully completed. Our sale and purchase agreement with LNG Japan, for the sale of a 10% equity interest in the Scarborough Joint Venture, was a key 2023 achievement.3 — Meg O’Neill The Sangomar project off Senegal was 93% complete at the end of 2023, with 17 of 23 wells drilled and completed.4 The floating production storage and offloading (FPSO) facility sailed away from the Singapore shipyard in December. We are targeting first oil in mid-2024. In June, we took a final investment decision (FID) on the Trion Project in the Gulf of Mexico. Procurement activities commenced for the floating production unit (FPU) materials and subsea equipment. We are targeting first oil from Trion in 2028. In our new energy portfolio, we took FID on the Hydrogen Refueller @H2Perth. We are targeting supply of hydrogen to Western Australian industrial and public customers in 2025. We are also advancing several carbon capture and storage (CCS) projects. Progress is also being made on our proposed H2OK hydrogen project in Oklahoma, United States and the proposed Woodside Solar project near Karratha, Western Australia. Sustainable performance As Woodside’s global presence increases, our sustainability performance becomes ever more important. In 2023 we updated our Sustainability Strategy, further embedding sustainability performance into everything we do. In closing, I am proud of the Woodside team and proud to work in this industry. I have seen first-hand how safe, reliable energy transforms lives. We cannot lose sight of this as we work towards a stable energy transition that benefits future generations. Meg O’Neill Chief Executive Officer and Managing Director 27 February 2024 1 Targets and aspiration are for net equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO -e which is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing 2 or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 2 The completion percentage excludes the Pluto Train 1 modifications project. 3 Subject to completion of the transaction, targeted in the first quarter of 2024. 4 The progress of the project has been updated to 93% following a 0.2% correction identified subsequent to the period.

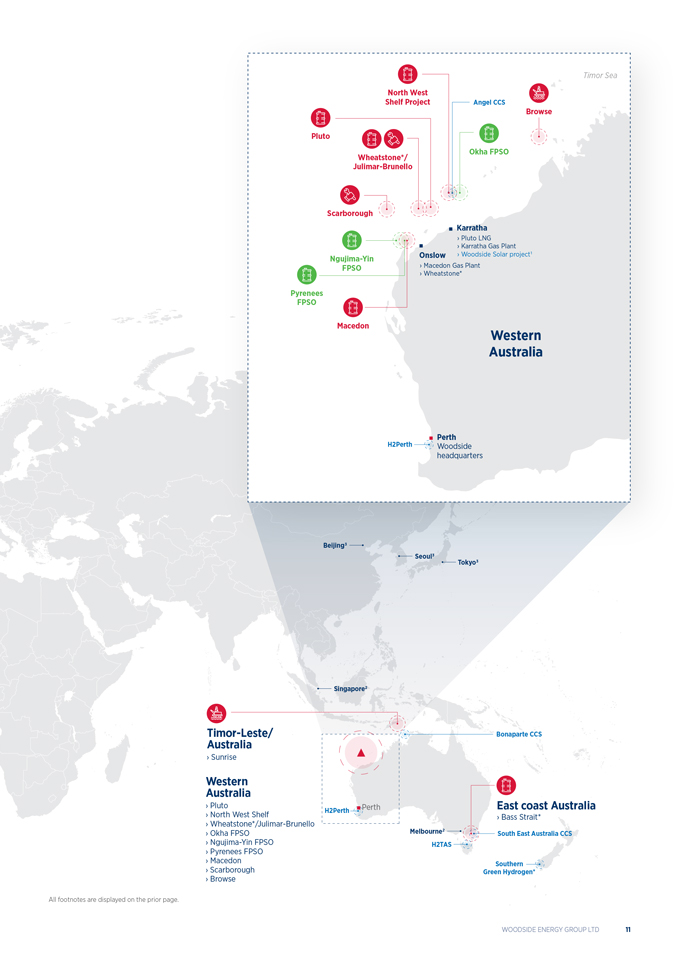

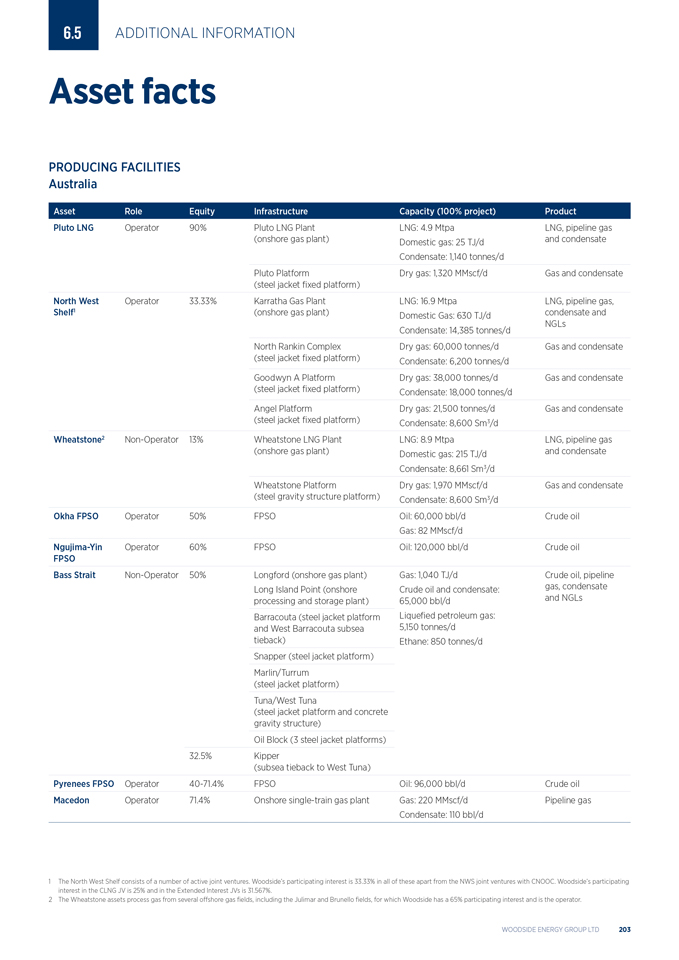

WOODSIDE ENERGY GROUP LTD 9 1.5 OVERVIEW Focus areas Houston Shenzi Atlantis* Mad Dog* Gulf of Mexico Trion Canada › Liard* H2OK Capella* Houston Caribbean Gulf of › Angostura › Ruby Mexico › Calypso › Shenzi › Atlantis* › Mad Dog* › Trion Senegal › Sangomar Key Primary product Phase Gas Producing assets Oil Projects New energy opportunity Developments1 or lower carbon service1 * Non-operated. 1 Subject to FID and/or regulatory approvals. Refer to section 6.5—Asset facts for 2 Denotes marketing offices. 3 Denotes representative and/or liaison offices. further detail on Woodside’s interests.

10 ANNUAL REPORT 2023 Timor Sea North West Shelf Project Angel CCS Browse Pluto Okha FPSO Wheatstone*/ Julimar-Brunello Scarborough Karratha › Pluto LNG › Karratha Gas Plant Onslow › Woodside Solar project• Ngujima-Yin FPSO › Macedon Gas Plant › Wheatstone* Pyrenees FPSO Macedon Western Australia H2Perth Perth Woodside headquarters Beijing‡ Seoul‡ Tokyo‡ Singapore‰ Timor-Leste/ Australia Bonaparte CCS › Sunrise Australia Western › Pluto Perth East coast Australia H2Perth › North West Shelf › Bass Strait* › Wheatstone*/Julimar-Brunello Melbourne‰ › Okha FPSO South East Australia CCS › Ngujima-Yin FPSO H2TAS › Pyrenees FPSO › Macedon Southern › Scarborough Green Hydrogen* › Browse All footnotes are displayed on the prior page.

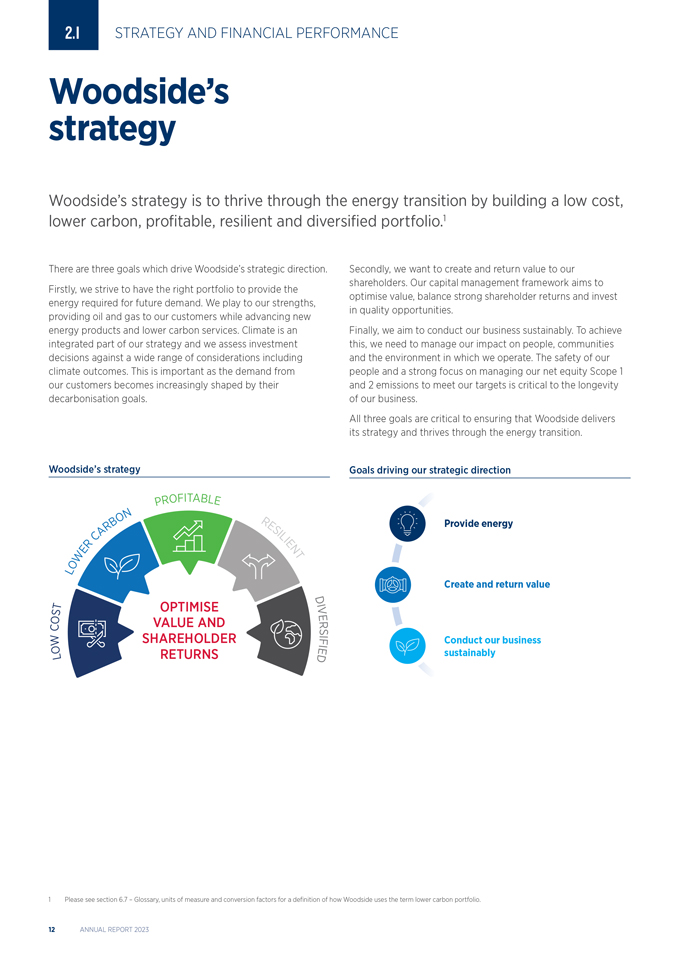

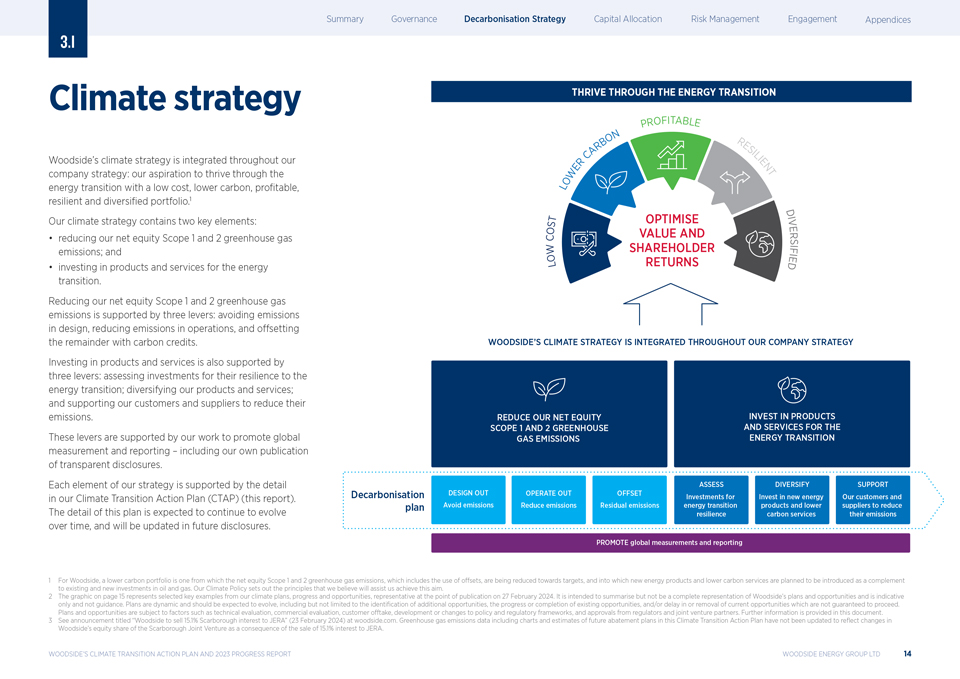

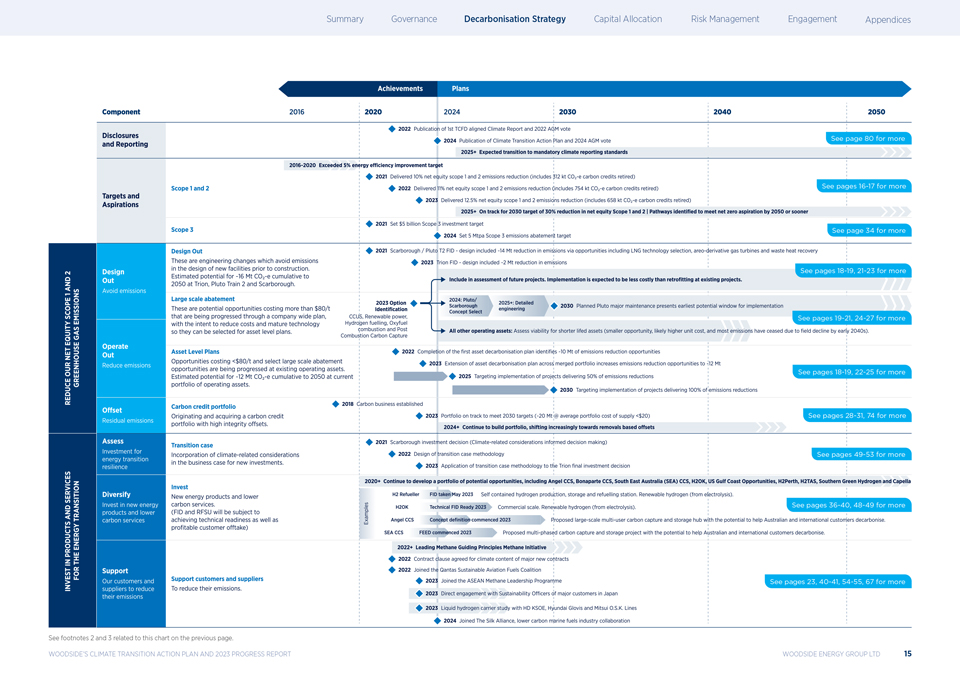

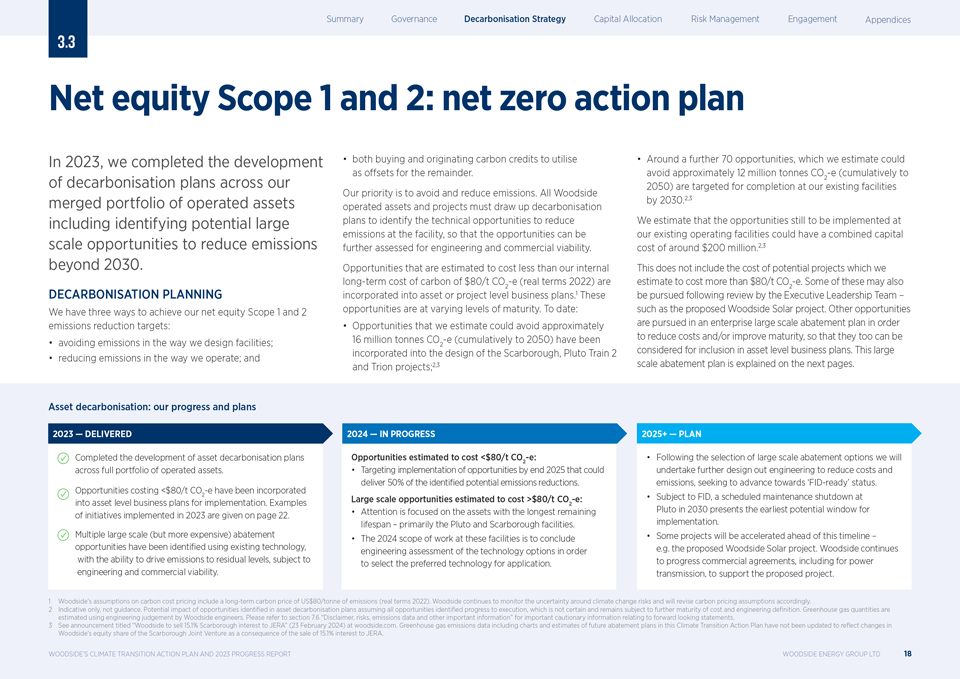

WOODSIDE ENERGY GROUP LTD 11 2.1 STRATEGY AND FINANCIAL PERFORMANCE Woodside’s strategy Woodside’s strategy is to thrive through the energy transition by building a low cost, lower carbon, profitable, resilient and diversified portfolio.1 There are three goals which drive Woodside’s strategic direction. Firstly, we strive to have the right portfolio to provide the energy required for future demand. We play to our strengths, providing oil and gas to our customers while advancing new energy products and lower carbon services. Climate is an integrated part of our strategy and we assess investment decisions against a wide range of considerations including climate outcomes. This is important as the demand from our customers becomes increasingly shaped by their decarbonisation goals. Secondly, we want to create and return value to our shareholders. Our capital management framework aims to optimise value, balance strong shareholder returns and invest in quality opportunities. Finally, we aim to conduct our business sustainably. To achieve this, we need to manage our impact on people, communities and the environment in which we operate. The safety of our people and a strong focus on managing our net equity Scope 1 and 2 emissions to meet our targets is critical to the longevity of our business. All three goals are critical to ensuring that Woodside delivers its strategy and thrives through the energy transition. Woodside’s strategy Goals driving our strategic direction PROFITABLE N R B O RES Provide energy A I L R C I E E NT W L O Create and return value D T OPTIMISE I S V O VALUE AND E C R S W SHAREHOLDER F I Conduct our business O RETURNS E I sustainably L D 1 Please see section 6.7 – Glossary, units of measure and conversion factors for a definition of how Woodside uses the term lower carbon portfolio. 12 ANNUAL REPORT 2023 2.2 STRATEGY AND FINANCIAL PERFORMANCE Capital management Woodside’s capital management framework provides us with the flexibility to optimise value and shareholder returns delivered from our portfolio of opportunities.

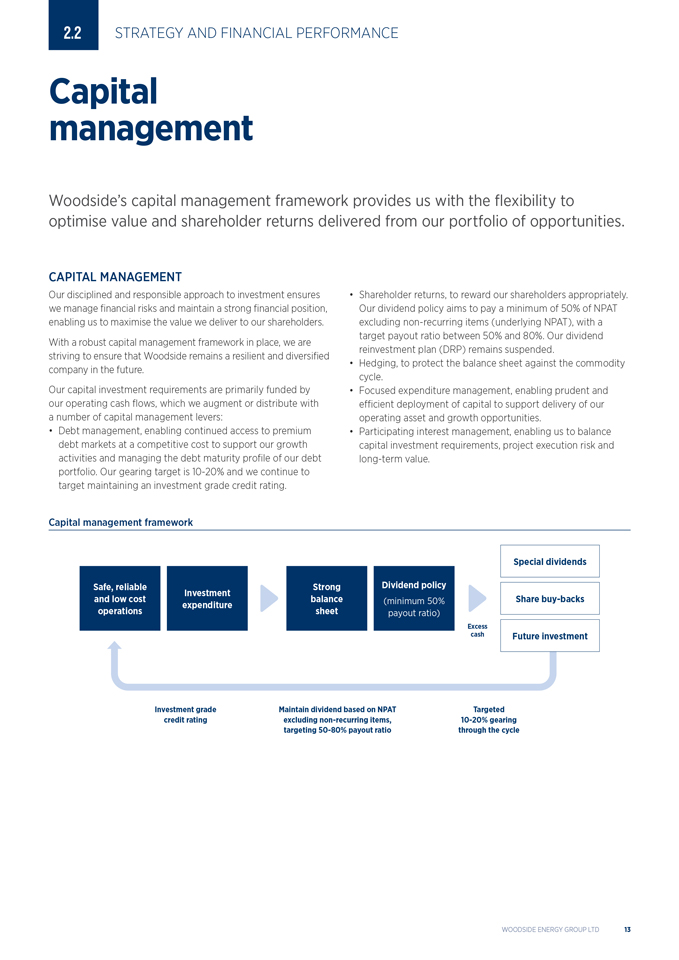

CAPITAL MANAGEMENT Our disciplined and responsible approach to investment ensures we manage financial risks and maintain a strong financial position, enabling us to maximise the value we deliver to our shareholders. With a robust capital management framework in place, we are striving to ensure that Woodside remains a resilient and diversified company in the future. Our capital investment requirements are primarily funded by our operating cash flows, which we augment or distribute with a number of capital management levers: • Debt management, enabling continued access to premium debt markets at a competitive cost to support our growth activities and managing the debt maturity profile of our debt portfolio. Our gearing target is 10-20% and we continue to target maintaining an investment grade credit rating. Shareholder returns, to reward our shareholders appropriately. Our dividend policy aims to pay a minimum of 50% of NPAT excluding non-recurring items (underlying NPAT), with a target payout ratio between 50% and 80%. Our dividend reinvestment plan (DRP) remains suspended. Hedging, to protect the balance sheet against the commodity cycle. Focused expenditure management, enabling prudent and efficient deployment of capital to support delivery of our operating asset and growth opportunities. Participating interest management, enabling us to balance capital investment requirements, project execution risk and long-term value. Capital management framework Special dividends Safe, reliable Strong Dividend policy Investment and low cost balance (minimum 50% Share buy-backs expenditure operations sheet payout ratio) Excess cash Future investment Investment grade Maintain dividend based on NPAT Targeted credit rating excluding non-recurring items, 10-20% gearing targeting 50-80% payout ratio through the cycle WOODSIDE ENERGY GROUP LTD 13 CAPITAL ALLOCATION Woodside’s high margin portfolio is made up of quality assets which have the scale and resilience to deliver ongoing value.

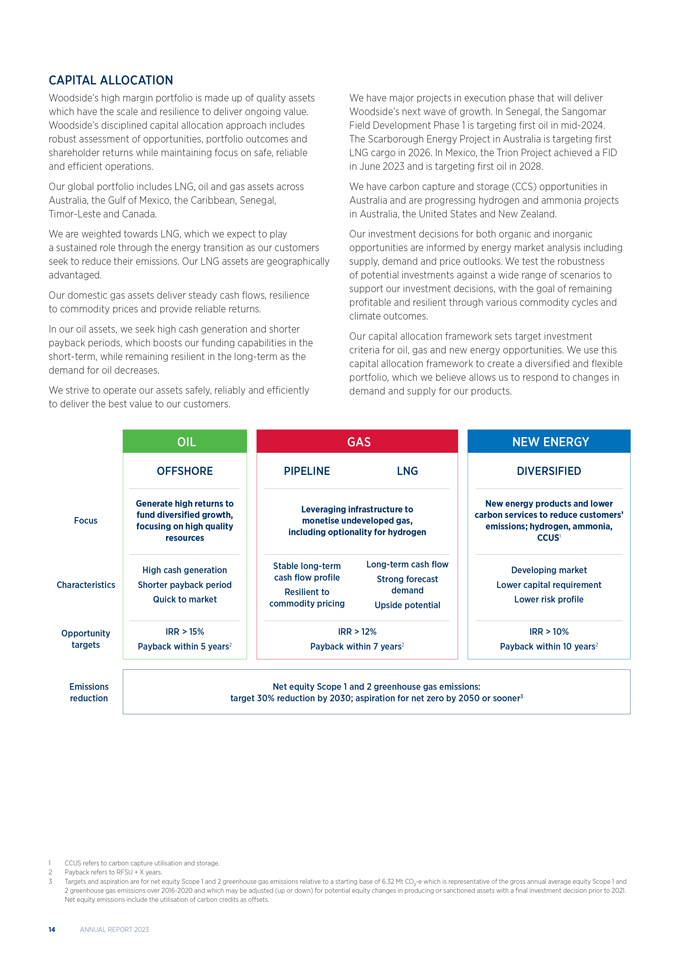

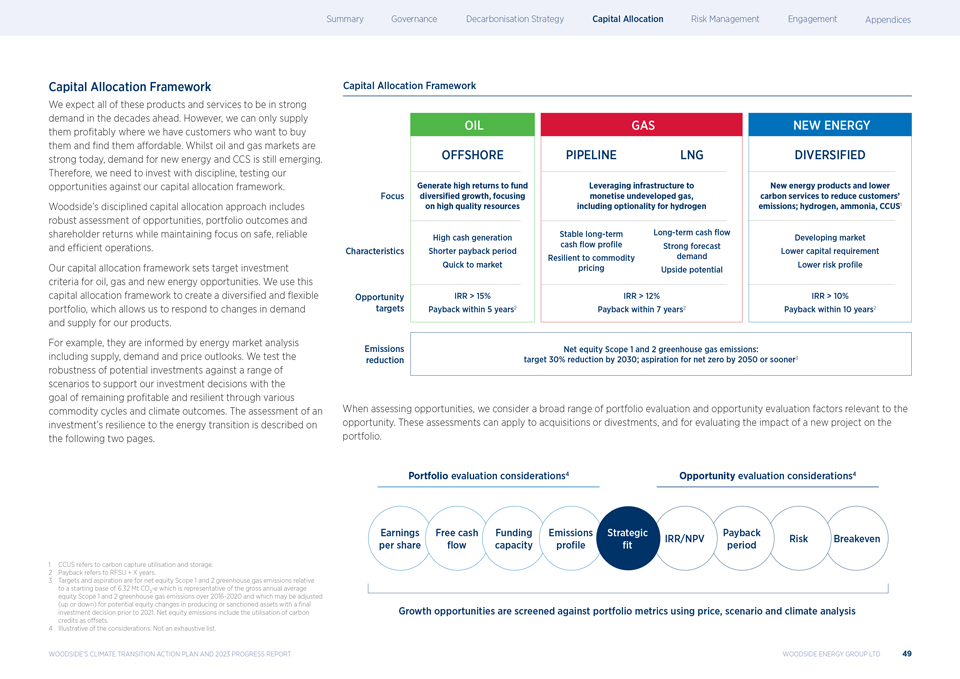

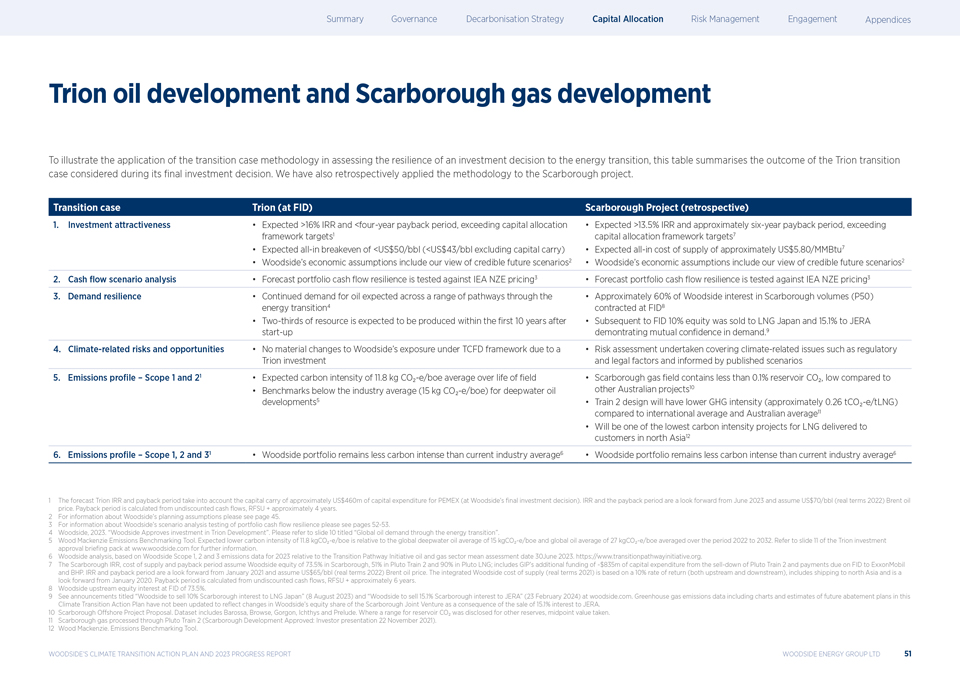

Woodside’s disciplined capital allocation approach includes robust assessment of opportunities, portfolio outcomes and shareholder returns while maintaining focus on safe, reliable and efficient operations. Our global portfolio includes LNG, oil and gas assets across Australia, the Gulf of Mexico, the Caribbean, Senegal, Timor-Leste and Canada. We are weighted towards LNG, which we expect to play a sustained role through the energy transition as our customers seek to reduce their emissions. Our LNG assets are geographically advantaged. Our domestic gas assets deliver steady cash flows, resilience to commodity prices and provide reliable returns. In our oil assets, we seek high cash generation and shorter payback periods, which boosts our funding capabilities in the short-term, while remaining resilient in the long-term as the demand for oil decreases. We strive to operate our assets safely, reliably and efficiently to deliver the best value to our customers. We have major projects in execution phase that will deliver Woodside’s next wave of growth. In Senegal, the Sangomar Field Development Phase 1 is targeting first oil in mid-2024. The Scarborough Energy Project in Australia is targeting first LNG cargo in 2026. In Mexico, the Trion Project achieved a FID in June 2023 and is targeting first oil in 2028. We have carbon capture and storage (CCS) opportunities in Australia and are progressing hydrogen and ammonia projects in Australia, the United States and New Zealand. Our investment decisions for both organic and inorganic opportunities are informed by energy market analysis including supply, demand and price outlooks. We test the robustness of potential investments against a wide range of scenarios to support our investment decisions, with the goal of remaining profitable and resilient through various commodity cycles and climate outcomes. Our capital allocation framework sets target investment criteria for oil, gas and new energy opportunities. We use this capital allocation framework to create a diversified and flexible portfolio, which we believe allows us to respond to changes in demand and supply for our products. OIL GASNEW ENERGY OFFSHORE PIPELINE LNGDIVERSIFIED Generate high returns to New energy products and lower Leveraging infrastructure to fund diversified growth, carbon services to reduce customers’ Focus monetise undeveloped gas, focusing on high quality emissions; hydrogen, ammonia, including optionality for hydrogen resources CCUS1 High cash generation Stable long-term Long-term cash flowDeveloping market cash flow profile Strong forecast Characteristics Shorter payback period Lower capital requirement Resilient to demand Quick to market commodity pricing Upside potentialLower risk profile Opportunity IRR > 15% IRR > 12%IRR > 10% targets Payback within 5 years2 Payback within 7 years2Payback within 10 years2 Emissions Net equity Scope 1 and 2 greenhouse gas emissions: reduction target 30% reduction by 2030; aspiration for net zero by 2050 or sooner3 1 CCUS refers to carbon capture utilisation and storage. 2 Payback refers to RFSU + X years. 3 Targets and aspiration are for net equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO -e which is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing 2 or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 14 ANNUAL REPORT 2023 When assessing opportunities, we consider a broad range of portfolio evaluation and opportunity evaluation factors relevant to the opportunity.

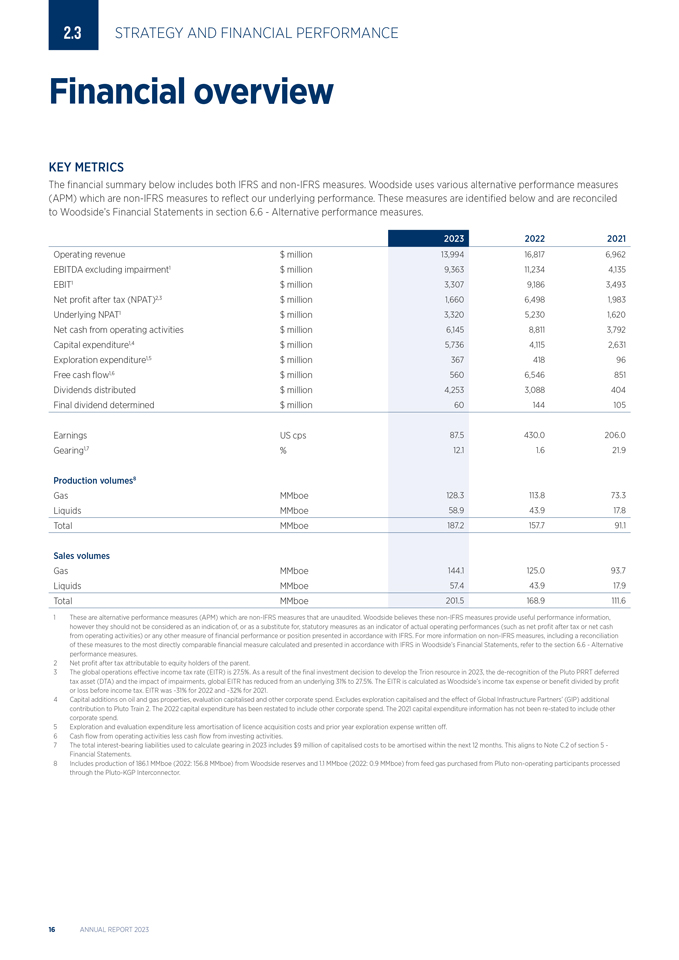

These assessments can apply to acquisitions or divestments, and for evaluating the impact of a new project on the portfolio. Portfolio evaluation considerations1 Opportunity evaluation considerations1 Earnings Free cash FundingEmissionsStrategicPayback IRR/NPVRiskBreakeven per share flow capacityprofilefitperiod Growth opportunities are screened against portfolio metrics using price, scenario and climate analysis SUSTAINABILITY Our Sustainability Strategy supports our Corporate Strategy and Purpose and places an increased focus on those sustainability topics most relevant to our current business activities. We apply a sustainability mindset to guide decision making at all levels of the business. Our Sustainability Strategy aims to embed environment, social and governance performance in everything we do. As described further in section 3.8—Climate and sustainability, in 2023, our sustainability activities and disclosures continued to evolve in response to the strategic importance of sustainability topics, emerging mandatory sustainability standards and investor priorities. 1 Illustrative of the considerations. Not an exhaustive list. WOODSIDE ENERGY GROUP LTD 15 2.3 STRATEGY AND FINANCIAL PERFORMANCE Financial overview KEY METRICS The financial summary below includes both IFRS and non-IFRS measures.

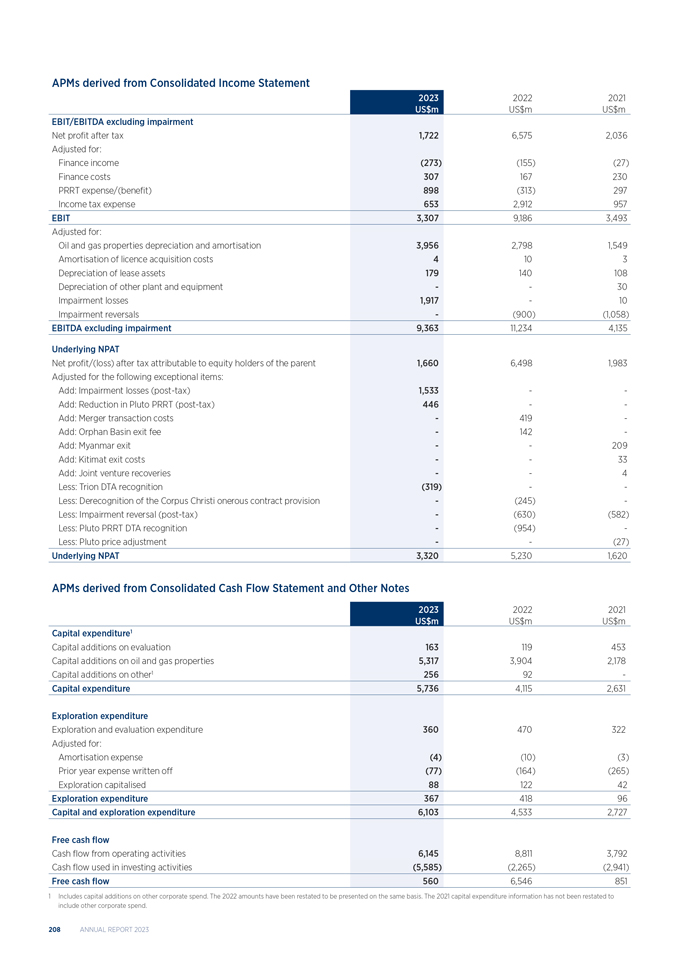

Woodside uses various alternative performance measures (APM) which are non-IFRS measures to reflect our underlying performance. These measures are identified below and are reconciled to Woodside’s Financial Statements in section 6.6—Alternative performance measures. 2023 2022 2021 Operating revenue $ million 13,994 16,817 6,962 EBITDA excluding impairment(1) $ million 9,363 11,234 4,135 EBIT(1) $ million 3,307 9,186 3,493 Net profit after tax (NPAT)(2,3) $ million 1,660 6,498 1,983 Underlying NPAT(1) $ million 3,320 5,230 1,620 Net cash from operating activities $ million 6,145 8,811 3,792 Capital expenditure(1,4) $ million 5,736 4,115 2,631 Exploration expenditure(1,5) $ million 367 418 96 Free cash flow(1,6) $ million 560 6,546 851 Dividends distributed $ million 4,253 3,088 404 Final dividend determined $ million 60 144 105 Earnings US cps 87.5 430.0 206.0 Gearing(1,7) % 12.1 1.6 21.9 Production volumes(8) Gas MMboe 128.3 113.8 73.3 Liquids MMboe 58.9 43.9 17.8 Total MMboe 187.2 157.7 91.1 Sales volumes Gas MMboe 144.1 125.0 93.7 Liquids MMboe 57.4 43.9 17.9 Total MMboe 201.5 168.9 111.6 1 These are alternative performance measures (APM) which are non-IFRS measures that are unaudited. Woodside believes these non-IFRS measures provide useful performance information, however they should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performances (such as net profit after tax or net cash from operating activities) or any other measure of financial performance or position presented in accordance with IFRS. For more information on non-IFRS measures, including a reconciliation of these measures to the most directly comparable financial measure calculated and presented in accordance with IFRS in Woodside’s Financial Statements, refer to the section 6.6—Alternative performance measures. 2 Net profit after tax attributable to equity holders of the parent. 3 The global operations effective income tax rate (EITR) is 27.5%. As a result of the final investment decision to develop the Trion resource in 2023, the de-recognition of the Pluto PRRT deferred tax asset (DTA) and the impact of impairments, global EITR has reduced from an underlying 31% to 27.5%. The EITR is calculated as Woodside’s income tax expense or benefit divided by profit or loss before income tax. EITR was ~31% for 2022 and ~32% for 2021. 4 Capital additions on oil and gas properties, evaluation capitalised and other corporate spend. Excludes exploration capitalised and the effect of Global Infrastructure Partners’ (GIP) additional contribution to Pluto Train 2. The 2022 capital expenditure has been restated to include other corporate spend. The 2021 capital expenditure information has not been re-stated to include other corporate spend. 5 Exploration and evaluation expenditure less amortisation of licence acquisition costs and prior year exploration expense written off. 6 Cash flow from operating activities less cash flow from investing activities. 7 The total interest-bearing liabilities used to calculate gearing in 2023 includes $9 million of capitalised costs to be amortised within the next 12 months. This aligns to Note C.2 of section 5—Financial Statements. 8 Includes production of 186.1 MMboe (2022: 156.8 MMboe) from Woodside reserves and 1.1 MMboe (2022: 0.9 MMboe) from feed gas purchased from Pluto non-operating participants processed through the Pluto-KGP Interconnector. 16 ANNUAL REPORT 2023 CAPITAL MANAGEMENT Final dividend and dividend reinvestment plan A 2023 fully franked final dividend of 60 US cps has been determined.

The total amount of the final dividend payment is $1,139 million which represents approximately 80% of underlying NPAT for the second half of 2023.1 The dividend reinvestment plan (DRP) remains suspended. Liquidity and debt service Woodside’s primary sources of liquidity are cash and cash equivalents, net cash generated by operating activities, unused borrowing capacity under its bilateral facilities and syndicated facilities, issuances of debt or equity securities and other sources, such as sales of non-strategic assets. During the year, Woodside generated $6,145 million of cash flow from operating activities and delivered positive free cash flow of $560 million.2,3 Woodside increased its standby debt facilities from $4,050 million to $6,050 million and repaid $284 million of maturing debt. At the end of the period, drawn debt was $4,874 million, with no principle debt payable in 2024 and liquidity was $7,790 million. Additional details of Woodside’s credit facilities, including total commitments, maturity and interest and amount outstanding as at 31 December 2023, can be found in section 5—Financial Statements and Note C.2 to the audited Financial Statements of Woodside as at 31 December 2023 and 2022. Woodside’s principal ongoing uses of cash are to meet working capital requirements, fund debt obligations and finance Woodside’s capital expenditure and acquisitions. We believe working capital is sufficient for our present requirements. Woodside’s capital expenditure for 2024 is expected to be between $5,000 million and $5,500 million primarily due to Sangomar, Scarborough and Trion project expenditure. This excludes the impact of any subsequent asset sell-downs, acquisitions or other changes in equity. We are targeting first oil in mid-2024 for Sangomar, first LNG cargo in 2026 for Scarborough and first oil in 2028 for Trion. Woodside has no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on the Woodside’s financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources. Balance sheet Woodside’s commitment to an investment grade credit rating remains unchanged and supports Woodside’s aims of providing sustainable returns to shareholders and investing in future growth opportunities, in accordance with our capital allocation framework. In 2023, Woodside’s credit ratings of BBB+ and Baa1 by S&P Global and Moody’s respectively were both maintained.4 Woodside’s gearing at the end of 2023 was 12.1%, within the lower end of our target range of 10-20%. Woodside’s gearing may at times fall outside the target range of 10-20% as the balance sheet is managed through the investment cycle.5 Commodity price risk management Woodside hedges to protect the balance sheet against downside commodity price risk, particularly during periods of high capital expenditure. Woodside hedged approximately 22 MMboe of 2023 volumes. The realised value of these oil price hedges was a pre-tax expense of approximately $200 million. As at 31 December 2023, Woodside has placed oil price hedges for approximately 29 MMboe of 2024 production at an average price of approximately $76 per barrel. Woodside has also placed hedges for Corpus Christi LNG volumes to protect against downside pricing risk. These hedges are Henry Hub and Title Transfer Facility (TTF) commodity swaps. An average of 63% of 2024 volumes and 17% of 2025 volumes have reduced pricing risk as a result of hedging activities. 1 Underlying NPAT is a non-IFRS measures. Refer to section 6.6—Alternative performance measures for a reconciliation of these measures to Woodside’s Financial Statements. 2 Free cash flow is a non-IFRS measure. Refer to section 6.6- Alternative performance measures for a reconciliation of these measures to Woodside’s Financial Statements. 3 Cash flow from operating activities less cash flow from investing activities. 4 Credit ratings are forward-looking opinions on credit risk. S&P Global’s and Moody’s credit ratings express the opinion of each agency on the ability and willingness of Woodside to meet its financial obligations in full and on time. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to suspension, reduction or withdrawal at any time by an assigning rating agency. Any rating should be evaluated independently of any other information. 5 Gearing and net debt are non-IFRS measures. Refer to section 6.6—Alternative performance measures for a reconciliation of these measures to Woodside’s Financial Statements. WOODSIDE ENERGY GROUP LTD 17 2.4 STRATEGY AND FINANCIAL PERFORMANCE Energy markets Geopolitical events continued to disrupt energy markets throughout 2023, reinforcing the importance of providing customers with reliable, affordable and secure energy.

Recent events, including the energy security situation in Europe and the conflict in the Middle East, have resulted in both positive and negative drivers for the energy transition. Increased demand for oil and natural gas has highlighted the need for continued production of and investment in hydrocarbons, while policy support for renewables and lower carbon services has continued to be robust. MACROECONOMIC The global economy proved resilient in 2023 despite the dual challenges of persistently high inflation levels and rising interest rates; gross domestic product (GDP) grew at 3.0%.1 Hawkish monetary policy from 2022 was adopted, curbing inflation. Many advanced economies are passing peak interest rates; however, longer-term macroeconomic impacts of policy are unknown. China presents uncertainty as the economy struggles with tepid demand, lower confidence and the real estate sector faces liquidity issues. However, recent government stimulus is a positive sign for future growth enabling China to meet its 2023 official GDP growth target of approximately 5%. The world’s population is expected to increase by approximately two billion people by 2050 and GDP is forecast to almost double, driving increased energy demand.2 OIL OPEC+ continues to exert control in balancing oil markets and has committed to further production cuts in 2024.3 However, non-OPEC production volumes, particularly in the US Lower 48, Canada, Brazil and Guyana will continue to grow into 2024 potentially offsetting OPEC+ cuts. Dated Brent averaged US$83/bbl in 2023, 18% below average 2022 prices which were elevated by the energy crisis and 14% above the five-year average.4 Oil prices are expected to remain elevated into 2024 supported by a geopolitical risk premium, OPEC+ production management and a slower growth rate for non-OPEC production. LIQUIFIED NATURAL GAS In 2023, global gas markets began to rebalance but remained tight, exacerbated by Russian LNG sanction uncertainty. Although North East Asian LNG prices averaged half of 2022 average prices at US$14/MMBtu, global gas prices remain robust and consistent with long-term expectations.4 Wood Mackenzie forecasts in its base case scenario that global LNG demand will grow 53% to 2033, supported by growth in Europe (until 2029), China and emerging Asian markets.5 NEW ENERGY PRODUCTS Globally, investment in new energy technology has increased, spurred by government incentives such as REPowerEU and the US Inflation Reduction Act and a common goal to reduce long-term emissions. Subsidies have driven early growth in wind and solar followed by refinement of technology and large-scale manufacturing which has improved affordability. Although the environment for new energy products remains challenged by uncertainty in proving technologies, securing future demand for product, lack of clarity on the application of incentives, and unfavourable project economics, Woodside believes that new energy products will play an important role in the energy transition. AUSTRALIAN DOMESTIC GAS MARKETS The Australian domestic gas market experienced supply shortfalls in 2023 as demand outpaced supply. In Western Australia, demand was supported by the progressive retirement of coal fired power generation, numerous outages and project delays. Demand is expected to exceed supply by up to 11% until 2029 with an increasing supply gap to 2032 as coal supply is retired.6 Despite the Federal government implementing a price cap of A$12/GJ for new supplies in 2023 to improve affordability, further investment in supply and infrastructure will be needed in the future to ensure that demand can be met. International Monetary Fund, January 2024. “World Economic Outlook Update”. Wood Mackenzie, September 2023. “Energy Transition Outlook 2023”. OPEC Monthly Oil Market Report, January 2024. Thompson Reuters Eikon. Wood Mackenzie, October 2023. “Global Gas Investment Horizon Outlook”. Australian Energy Market Operator, 2023. “Western Australian Gas Statement of Opportunities”.

ANNUAL REPORT 2023 2.5 STRATEGY AND FINANCIAL PERFORMANCE Business and value model chain Woodside’s business model seeks to optimise returns across the value chain by prioritising competitive growth opportunities; utilising our operational, development and technological capabilities; and investing in customer relationships. 2023 examples Acquire, divest, explore and develop We manage our portfolio through acquisitions, divestments and exploration, based on a disciplined approach to optimising shareholder value and appropriately managing risk. Took FID on the Trion Project in June 2023. We look for material positions in world-class assets and basins that are aligned with our capabilities and existing portfolio. We are focused on value and look to generate low cost, Achieved the sale of a 10% equity interest lower carbon development opportunities. During the development phases, we aim to optimise in the Scarborough Joint Venture.1 value by selecting the best concept for extracting, processing and delivering energy to our customers. Project execution We are building on decades of project execution expertise, investing in opportunities Continued project execution of Sangomar across the globe. Woodside is benefitting from the increased scope and scale of its projects Field Development Phase 1, Scarborough portfolio through knowledge sharing across projects and our relationships with suppliers and and Trion. contractors. We design and execute projects with a focus on safety, cost and sustainability. Operate Our operations prioritise safety while focusing on strong reliability and environmental performance in remote and challenging locations. In Australia, our operated assets include Achieved reliability of 98% at Pluto LNG, the North West Shelf (NWS) Project and Pluto LNG. We also operate Macedon and three FPSO KGP and reliability above 97% at Shenzi. facilities and have non-operated interests in Bass Strait and Wheatstone. Internationally, Preparing for first oil on Sangomar in 2024. we operate Shenzi in the Gulf of Mexico and Angostura and Ruby in Trinidad and Tobago and have non-operated interests in Atlantis and Mad Dog in the Gulf of Mexico. We endeavour to adopt technology and a continuous improvement mindset to support operational performance and optimise the value of our assets. Market Our relationships with customers have been maintained through a track record of reliable delivery since the NWS Project’s first LNG cargo was delivered to Japan in 1989. We are Signed a sales and purchase agreement (SPA) building scale and flexibility in our portfolio by expanding our global supply presence, with Mexico Pacific Limited to purchase through our own liquefied volumes and offtake agreements with third parties. This creates 1.3 Mtpa of LNG for 20 years from the opportunities to optimise our LNG cargoes and capture short-term trading opportunities. Saguaro Energia LNG Project.2 We continue to look for opportunities to collaborate with our customers on lower carbon energy solutions. Decommission Successfully completed removal of the Decommissioning is integrated into project planning, from the earliest stages of development Nganhurra riser turret mooring (RTM). through to the end of field life. We work with global contractors to safely remove facilities The Enfield plug and abandonment (P&A) and plug and abandon wells that are no longer required for our operations. We work with campaign continued with all 18 wells regulators to deliver our decommissioning commitments. permanently plugged and 16 of the 18 xmas trees removed. Subject to completion of the transaction, targeted in the first quarter of 2024. The SPA is subject to Mexico Pacific taking FID on the proposed third train at the Saguaro Energia LNG Project. The FID is expected in the second half of 2024 and commercial operations are targeted to commence in 2029. WOODSIDE ENERGY GROUP LTD 19 3.1 OUR BUSINESS Australian operations Woodside’s Australian portfolio consists of operated and non-operated oil and gas projects across Australia.

Woodside’s share of production from Australian operations was 145.1 MMboe in 2023, a 6% increase compared to 2022.1 PLUTO LNG Pluto LNG is a gas processing facility in the Pilbara region of Western Australia, comprising an offshore platform and one onshore LNG processing train. Woodside’s share of Pluto production was 51.8 MMboe in 2023, a 1% decrease compared to 2022 due to planned turnaround activities partly offset by the sustained high reliability of 98.2% in 2023.1 Woodside successfully completed a major turnaround on the onshore and offshore facilities in the first half of 2023, executing essential maintenance scopes to support continued safe, reliable and efficient production. The major turnaround included installation of additional tie-in points for potential carbon-to-products value streams and for the potential importation of solar energy from the proposed Woodside Solar project. There was one Tier 1 loss of primary containment process safety event at Pluto LNG. There were no injuries as a result of this event and an investigation was undertaken which identified contributing factors and corrective actions. The Pluto Remote Operations Centre in Perth, Western Australia became fully operational in June 2023 with day-to-day operations of Pluto LNG now being undertaken remotely by the Perth-based team. Woodside is operator and holds a 90% participating interest. Woodside Solar opportunity Woodside is progressing a potential opportunity to reduce gross Scope 1 greenhouse gas emissions at Pluto LNG by utilising solar energy from the proposed Woodside Solar project. The project plans to generate an initial supply of approximately 50 MW of electricity from a large scale solar photovoltaic farm, located approximately 15 km south-west of Karratha, Western Australia, which will be complemented by a battery energy storage system. In 2023, Woodside secured planning approvals and State and Federal environmental approvals for the proposed solar facility and associated infrastructure. In December 2023, Woodside entered into a conditional agreement under which a third-party will develop the proposed solar facility and supply renewable energy from the facility to Woodside. Woodside continues to progress commercial agreements, including for power transmission to support the proposed project. Includes production of 1.1 MMboe (2022: 0.9 MMboe) from feed gas purchased from Pluto non-operating participants processed through the Pluto-KGP Interconnector. ANNUAL REPORT 2023 NORTH WEST SHELF PROJECT The NWS Project consists of three offshore platforms and the onshore KGP, which includes five onshore LNG processing trains.

Woodside’s share of NWS Project production was 40.8 MMboe in 2023. This was an 11% increase compared to 2022, due to the increase of Woodside’s equity share following completion of the merger with BHP Petroleum in June 2022. In 2023, 11.2 MMboe of Pluto gas was processed at KGP through the Pluto-KGP Interconnector. The Interconnector enables gas from Pluto LNG to be transported to KGP for processing. In June 2023, a fatality occurred at the North Rankin Complex. The tragic loss of our colleague, a contractor employee, has led to the implementation of additional operational controls based on preliminary investigation insights into the incident. The external investigations into the incident are ongoing. KGP is expected to have increased ullage in 2024 due to a combination of natural field decline and limited third-party gas processing demand. To optimise utilisation of onshore infrastructure, NWS is planning to take one LNG train offline in 2024. Discussions continue between NWS and other resource owners for the processing of third-party gas and NWS continues to progress the development of infill and nearfield opportunities to utilise ullage at KGP. The NWS Project started processing Waitsia gas in 2023 at low rates and will commence processing at a large scale when the Waitsia Stage 2 facility comes online which is expected in 2024. State and Commonwealth regulatory approval processes continue for the North West Shelf Project Extension, which supports long-term operations and processing of future third-party gas resources at KGP. Woodside successfully completed planned turnaround and maintenance activities on the North Rankin Complex, Goodwyn Platform and KGP in the second half of 2023. Woodside is operator and holds a 33.33% participating interest. WHEATSTONE AND JULIMAR-BRUNELLO Wheatstone is an LNG processing facility near Onslow, Western Australia, comprising an offshore production platform and two onshore LNG processing trains. It processes gas from several offshore gas fields including Julimar and Brunello. Woodside’s share of Wheatstone production was 13.5 MMboe in 2023, an increase from 12.2 MMboe in 2022, which was impacted by a major facility turnaround. The FID on Julimar-Brunello Phase 3 was approved in April 2023. The project involves the drilling of up to four development wells tied-back from the Julimar field to the existing Julimar field production system. Woodside is operator and holds a 65% participating interest in the Julimar-Brunello fields. Woodside holds a 13% non-operated interest in the Wheatstone project. BASS STRAIT Bass Strait is located in the south-east of Australia and produces oil and gas through a network of offshore platforms, pipelines and onshore processing facilities. The Bass Strait assets include the Gippsland Basin Joint Venture (GBJV) and the Kipper Unit Joint Venture (KUJV). Woodside’s share of production from the Bass Strait was 22.8 MMboe in 2023, driven by lower Australian east coast gas market demand due to a number of factors including a warmer winter. All of Woodside’s share of the gas produced by the GBJV is supplied into the eastern Australian domestic gas market, supporting Australia’s energy needs. As production rates decline, progress has been made to optimise facilities through the Gas Asset Streamlining project. This project will support the implementation of a gas focused business. The Kipper Compression project has progressed and is expected to enable continued supply of gas to the domestic market in 2024. Woodside holds a 50% non-operating interest in the GBJV and a 32.5% non-operating interest in the KUJV. OTHER AUSTRALIAN OIL AND GAS ASSETS Woodside operates three FPSO facilities off the north-west coast of Western Australia. These are the Ngujima-Yin FPSO (Woodside interest: 60%), Okha FPSO (Woodside interest: 50%) and Pyrenees FPSO (Woodside interest: 40% in WA-43-L and 71.4% in WA-42-L). Woodside’s share of production from the FPSO assets was 8.0 MMboe, down from 10.6 MMboe in 2022 primarily due to the planned five-yearly Ngujima-Yin FPSO maintenance turnaround. The Ngujima-Yin FPSO turnaround performed in Singapore was completed safely in June 2023. The Pyrenees turnaround is planned for the first half of 2024. Macedon (Woodside interest: 71.4%), also operated by Woodside, is a gas project located near Onslow, Western Australia which produces pipeline gas for the Western Australian domestic gas market. Woodside’s share of production from Macedon in 2023 was 8.2 MMboe. The Macedon facility delivered approximately 17% of the Western Australian domestic gas market supply in 2023. WOODSIDE ENERGY GROUP LTD 21 3.2 OUR BUSINESS International operations Woodside’s international portfolio includes assets in the US Gulf of Mexico and the Caribbean with embedded growth options.

Woodside’s share of production from international operations was 42.1 MMboe in 2023. SHENZI Shenzi is a conventional oil and gas field developed through a tension leg platform (TLP) located in the US Gulf of Mexico. There are 16 producers flowing to the TLP and six water injection wells. In addition, two subsea wells are tied back to the non-operated Marco Polo platform. Shenzi North is a two-well subsea tieback to the Shenzi TLP. The project achieved flowback in September. Production performance has been below expectations due to reservoir connectivity. The Shenzi facility achieved reliability above 97% in 2023. Woodside’s share of production from Shenzi was 10.8 MMboe. Woodside is operator and holds a 72% participating interest. ATLANTIS Atlantis is a conventional oil and gas development and is one of the largest producing fields in the US Gulf of Mexico. The Atlantis development includes a semi-submersible facility with 28 active producer wells and three water injector wells. Two wells (one producer and one injector) were completed in 2023 alongside an extensive well intervention campaign. Woodside’s share of production from Atlantis was 12.6 MMboe in 2023. Woodside holds a 44% non-operating participating interest. — Photo credit: BP MAD DOG Mad Dog is a conventional oil and gas development located in the US Gulf of Mexico. The Phase 1 development includes a spar facility (A-spar) with drilling capability and ten active producer wells. Mad Dog Phase 2 is a development of the southern flank of the Mad Dog field through the new Argos floating production facility. First oil was achieved in April 2023 and production ramped up through the year. A successful appraisal well was drilled in 2023 to extend the field to the southwest. Subsequently, the co-owners have sanctioned a three-well subsea tie back. Woodside’s share of production from Mad Dog was 7.2 MMboe in 2023. Woodside holds a 23.9% non-operating participating interest. GREATER ANGOSTURA Greater Angostura includes the Angostura and Ruby conventional oil and gas fields, located offshore Trinidad and Tobago. The development includes an offshore central processing facility and five wellhead platforms. Woodside is operator and holds a 45% participating interest in the Angostura field and a 68.5% participating interest in the Ruby field. Woodside’s share of production from Greater Angostura was 11.2 MMboe in 2023. Production enhancement activities implemented in 2023 included gas injector-to-producer well conversions, reducing back-pressure on wells and adding well perforations. These enhancements have led to an increase in reserves.

22 ANNUAL REPORT 2023 3.3 OUR BUSINESS Marketing and trading Woodside has a global portfolio with positions in the Asia-Pacific and Atlantic basins and has a proven track record in our integrated shipping, operations, marketing and trading activities across LNG, condensate, crude and natural gas liquid (NGL) cargoes. The marketing segment’s profit before tax in 2023 was $375 million. This reflected the optimisation activities and incremental value generated through the marketing, trading and shipping of Woodside’s oil and gas and through third-party purchased values. Woodside’s LNG portfolio is managed through a mix of short, mid and long-term contracts, supplied with cargoes sourced from producing assets or purchased from third parties. In 2023, Woodside’s exposure of produced LNG to gas hub indices was 30%. Woodside’s LNG trading activities seek to maximise value of our LNG portfolio. Third-party cargoes are purchased from Corpus Christi LNG through a long-term offtake agreement and from the spot market through our relationships with other producers and traders. The marketing of crude, condensate and NGLs is predominantly based on short-term sales and supplemented by term arrangements. In the Gulf of Mexico, crude oil is sold to refiners and traders on the US Gulf Coast. Woodside has also increased its operational flexibility through the ability to export crude oil to international markets. In Trinidad and Tobago, crude oil is sold to international markets and natural gas is sold into the domestic market. Natural gas is sold domestically in both Western Australia and the east coast of Australia. In Western Australia, Woodside’s domestic gas obligations are met from multiple producing assets. All of Woodside’s production from Bass Strait is sold into the east coast domestic market. In 2023, Woodside’s Western Australian assets produced 76 petajoules (PJ) of gas, representing approximately 19% of Western Australia’s domestic gas supply. Woodside’s share of Bass Strait production was 97 PJ and that represented approximately 19% of all gas supplied to the east coast market. Woodside’s marketing and trading portfolio is supported by our shipping capacity which includes six vessels under long-term contract and multiple vessels on short-term charter. Woodside has chartered an additional five new-build LNG ships to support the delivery of Scarborough LNG cargoes and growth in trading activities. The new-build vessels are expected to be delivered between 2024 and 2026. In April 2023, a long-term gas sale and purchase agreement (GSPA) with Perdaman Chemicals and Fertiliser Pty Ltd became unconditional. Supply under the GSPA is for approximately 130 TJ per day of gas over a term of 20 years expected to commence in 2026 or 2027. Woodside also executed several natural gas sale agreements for the combined supply of approximately 128 PJ of pipeline gas to both the east coast and Western Australian domestic customers including retailers and commercial and industrial users. Delivery has commenced and is expected to continue to 2026. In addition, Woodside also signed a SPA with Pilgangoora Operations Pty Ltd, a 100% owned subsidiary of Pilbara Minerals, for the supply of domestic LNG from the Pluto Truck Loading Facility. Supply under the SPA is contracted to commence in 2024 for a period of five years. In August 2023, Woodside and LJ Scarborough Pty Ltd (LNG Japan) entered into a non-binding heads of agreement for the sale and purchase of 12 LNG cargoes per year (approximately 0.9 million tonnes per annum (Mtpa)) for ten years commencing in 2026.1 This agreement is part of a broader strategic relationship with LNG Japan and its parent entities which includes the sale of a 10% non-operating participating interest in Scarborough Joint Venture and collaboration on opportunities in new energy.2 In December 2023, Woodside signed a SPA with Mexico Pacific Limited (Mexico Pacific) for the purchase of 1.3 Mtpa of LNG over 20 years from Mexico Pacific’s Saguaro Energia LNG project on the Pacific coast of Mexico. The SPA is subject to Mexico Pacific taking a FID on the proposed third train which is expected in the second half of 2024. Commercial operations are targeted to commence in 2029. Subsequent to the period, Woodside and JERA entered into a non-binding heads of agreement for the sale and purchase of six LNG cargoes on a delivered ex-ship basis per year for 10 years commencing in 2026 from Woodside’s global portfolio. This agreement is part of a broader strategic relationship with JERA which includes equity in the Scarborough Joint Venture and collaboration on opportunities in new energy and lower carbon services. 1 LJ Scarborough Pty Ltd is currently a wholly owned subsidiary of LNG Japan Corporation, which is a 50:50 joint venture between Sumitomo Corporation and Sojitz Corporation. 2 Subject to completion of the transaction, targeted in the first quarter of 2024. WOODSIDE ENERGY GROUP LTD 23 3.4 OUR BUSINESS Projects Woodside’s portfolio of projects is underpinned by project delivery capability that is focused on safety, low cost and lower carbon solutions.

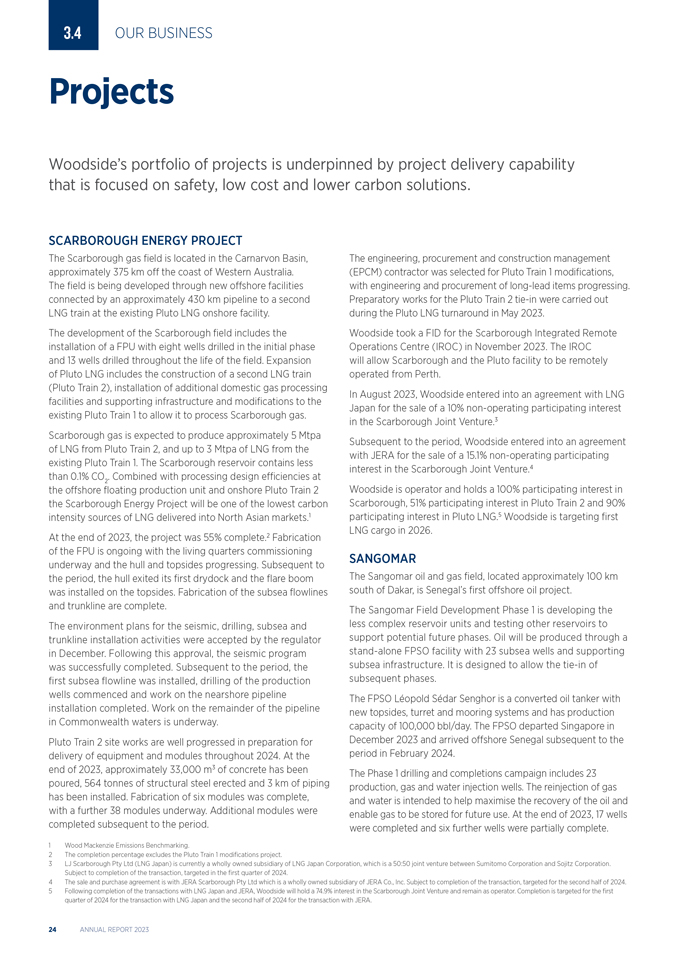

SCARBOROUGH ENERGY PROJECT The Scarborough gas field is located in the Carnarvon Basin, approximately 375 km off the coast of Western Australia. The field is being developed through new offshore facilities connected by an approximately 430 km pipeline to a second LNG train at the existing Pluto LNG onshore facility. The development of the Scarborough field includes the installation of a FPU with eight wells drilled in the initial phase and 13 wells drilled throughout the life of the field. Expansion of Pluto LNG includes the construction of a second LNG train (Pluto Train 2), installation of additional domestic gas processing facilities and supporting infrastructure and modifications to the existing Pluto Train 1 to allow it to process Scarborough gas. Scarborough gas is expected to produce approximately 5 Mtpa of LNG from Pluto Train 2, and up to 3 Mtpa of LNG from the existing Pluto Train 1. The Scarborough reservoir contains less than 0.1% CO . Combined with processing design efficiencies at the offshore floating 2 production unit and onshore Pluto Train 2 the Scarborough Energy Project will be one of the lowest carbon intensity sources of LNG delivered into North Asian markets.1 At the end of 2023, the project was 55% complete.2 Fabrication of the FPU is ongoing with the living quarters commissioning underway and the hull and topsides progressing. Subsequent to the period, the hull exited its first drydock and the flare boom was installed on the topsides. Fabrication of the subsea flowlines and trunkline are complete. The environment plans for the seismic, drilling, subsea and trunkline installation activities were accepted by the regulator in December. Following this approval, the seismic program was successfully completed. Subsequent to the period, the first subsea flowline was installed, drilling of the production wells commenced and work on the nearshore pipeline installation completed. Work on the remainder of the pipeline in Commonwealth waters is underway. Pluto Train 2 site works are well progressed in preparation for delivery of equipment and modules throughout 2024. At the end of 2023, approximately 33,000 m3 of concrete has been poured, 564 tonnes of structural steel erected and 3 km of piping has been installed. Fabrication of six modules was complete, with a further 38 modules underway. Additional modules were completed subsequent to the period. The engineering, procurement and construction management (EPCM) contractor was selected for Pluto Train 1 modifications, with engineering and procurement of long-lead items progressing. Preparatory works for the Pluto Train 2 tie-in were carried out during the Pluto LNG turnaround in May 2023. Woodside took a FID for the Scarborough Integrated Remote Operations Centre (IROC) in November 2023. The IROC will allow Scarborough and the Pluto facility to be remotely operated from Perth. In August 2023, Woodside entered into an agreement with LNG Japan for the sale of a 10% non-operating participating interest in the Scarborough Joint Venture.3 Subsequent to the period, Woodside entered into an agreement with JERA for the sale of a 15.1% non-operating participating interest in the Scarborough Joint Venture.4 Woodside is operator and holds a 100% participating interest in Scarborough, 51% participating interest in Pluto Train 2 and 90% participating interest in Pluto LNG.5 Woodside is targeting first LNG cargo in 2026. SANGOMAR The Sangomar oil and gas field, located approximately 100 km south of Dakar, is Senegal’s first offshore oil project. The Sangomar Field Development Phase 1 is developing the less complex reservoir units and testing other reservoirs to support potential future phases. Oil will be produced through a stand-alone FPSO facility with 23 subsea wells and supporting subsea infrastructure. It is designed to allow the tie-in of subsequent phases. The FPSO Léopold Sédar Senghor is a converted oil tanker with new topsides, turret and mooring systems and has production capacity of 100,000 bbl/day. The FPSO departed Singapore in December 2023 and arrived offshore Senegal subsequent to the period in February 2024. The Phase 1 drilling and completions campaign includes 23 production, gas and water injection wells. The reinjection of gas and water is intended to help maximise the recovery of the oil and enable gas to be stored for future use. At the end of 2023, 17 wells were completed and six further wells were partially complete. Wood Mackenzie Emissions Benchmarking. The completion percentage excludes the Pluto Train 1 modifications project. LJ Scarborough Pty Ltd (LNG Japan) is currently a wholly owned subsidiary of LNG Japan Corporation, which is a 50:50 joint venture between Sumitomo Corporation and Sojitz Corporation. Subject to completion of the transaction, targeted in the first quarter of 2024. The sale and purchase agreement is with JERA Scarborough Pty Ltd which is a wholly owned subsidiary of JERA Co., Inc. Subject to completion of the transaction, targeted for the second half of 2024. Following completion of the transactions with LNG Japan and JERA, Woodside will hold a 74.9% interest in the Scarborough Joint Venture and remain as operator. Completion is targeted for the first quarter of 2024 for the transaction with LNG Japan and the second half of 2024 for the transaction with JERA. ANNUAL REPORT 2023

As at the end of 2023, Phase 1 of the project was approximately 93% complete.1 In May 2023, the Sangomar joint venture approved the drilling of an additional production well to optimise field recovery. As at the end of 2023, drilling of this well was partially complete. Woodside is committed to a robust local content program that includes training initiatives, local employment, supplier business opportunities and capacity building within Senegal. As at June 2023, the main project contractors have reported more than 3,000 jobs fulfilled by Senegalese staff. Capacity building activities are now focusing on the operating phase. Woodside is operator and holds an 82% participating interest in the Sangomar exploitation area and a 90% participating interest in the remaining Rufisque Offshore, Sangomar Offshore and Sangomar Deep Offshore (RSSD) evaluation area. TRION Trion is an oil development located in the Gulf of Mexico, approximately 180 km off the Mexican coastline and 30 km south of the United States/Mexico maritime border at a water depth of approximately 2,500 m. Woodside announced Trion’s FID in June 2023 and the Mexican regulator, Comision Nacional de Hidrocarburos (CNH), approved the Field Development Plan (FDP) in August 2023. Woodside competitively tendered major scopes of the development and at FID, approximately 70% of the forecast capital was underpinned by firm tenders that were lump sum or based on fixed rates. Key contracts have been progressively executed since FID. The FPU engineering, procurement and construction contract was executed with Hyundai Heavy Industries. Procurement activities are progressing, commensurate with the maturity of the engineering performed to date. Advancing these activities will support the lump sum conversion which is planned to occur in 2024. The floating storage and offloading (FSO) vessel front-end engineering and design (FEED) and shipyard engineering has commenced with SBM Offshore. The fully negotiated FSO bare boat charter and operating and maintenance contracts are targeting execution at the conclusion of FEED in 2024. Key contracts have also been awarded across drilling and completions, facilities installation and subsea equipment. Long lead equipment and materials for topsides and subsea facilities have been ordered following contract awards. Transocean was awarded the drilling rig contract in July 2023. The rig will be selected 12 months prior. The project is maturing opportunities across elements of the Trion local content plan and engaging key stakeholders in Mexico to understand local capabilities and establish prioritisation. Woodside is operator and holds a 60% participating interest. 1 The progress of the project has been updated to 93% following a 0.2% correction identified subsequent to the period. WOODSIDE ENERGY GROUP LTD 25

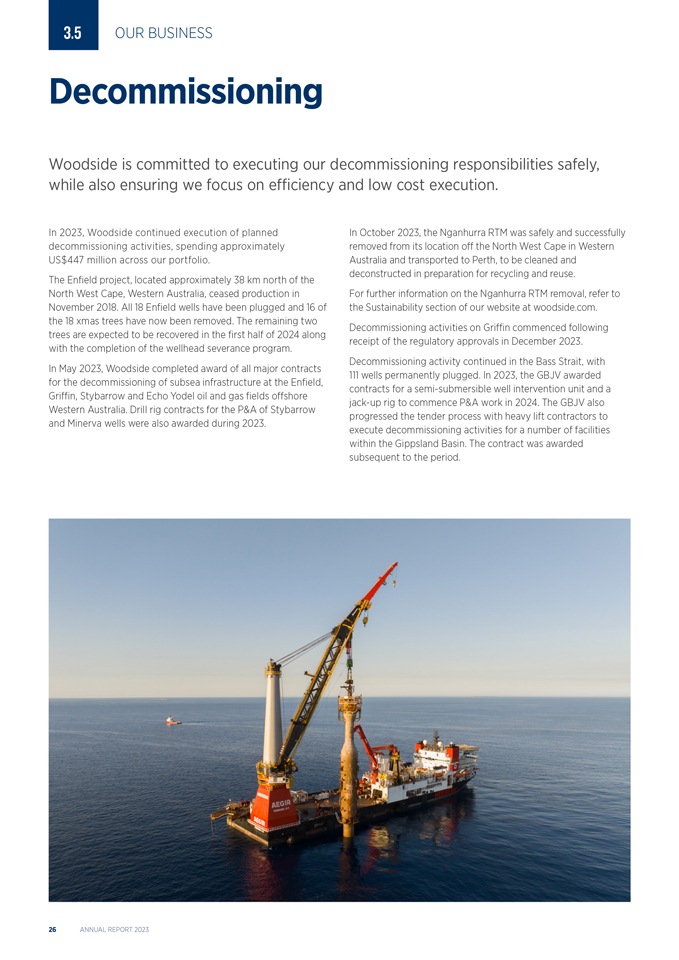

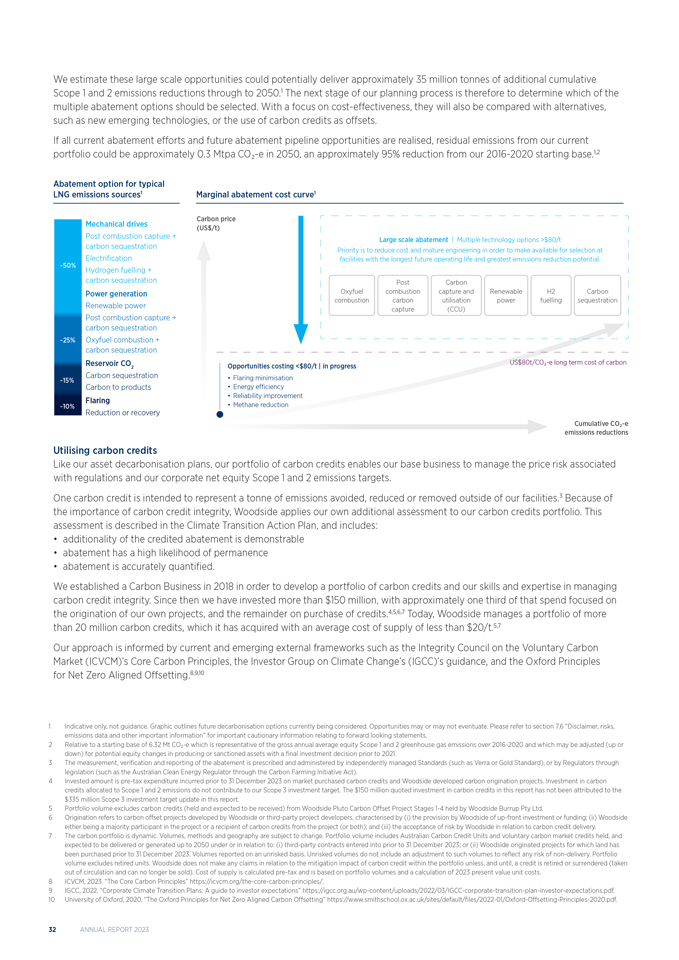

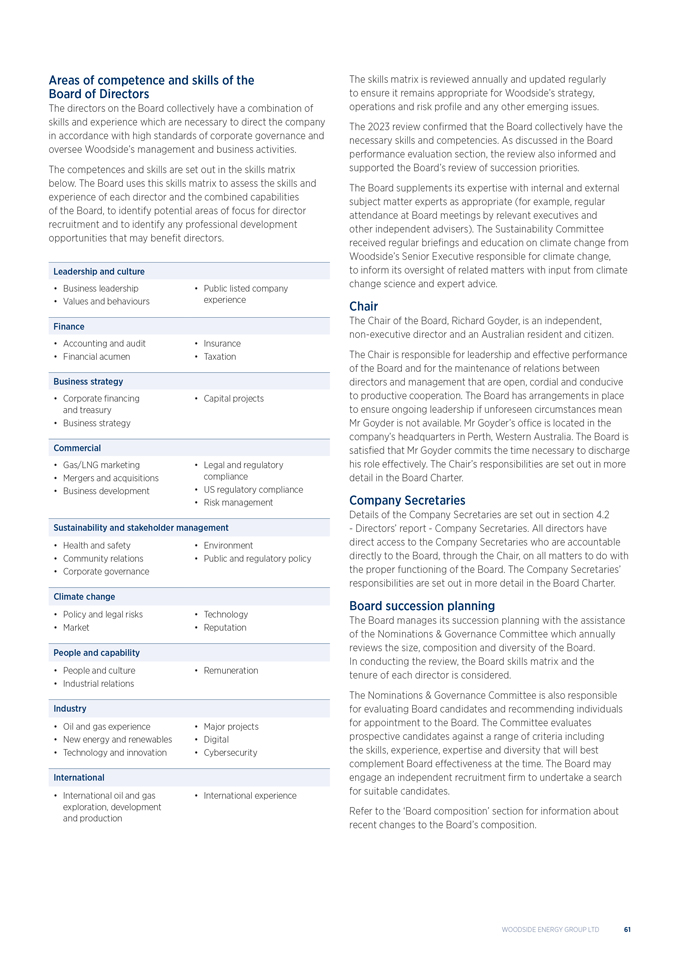

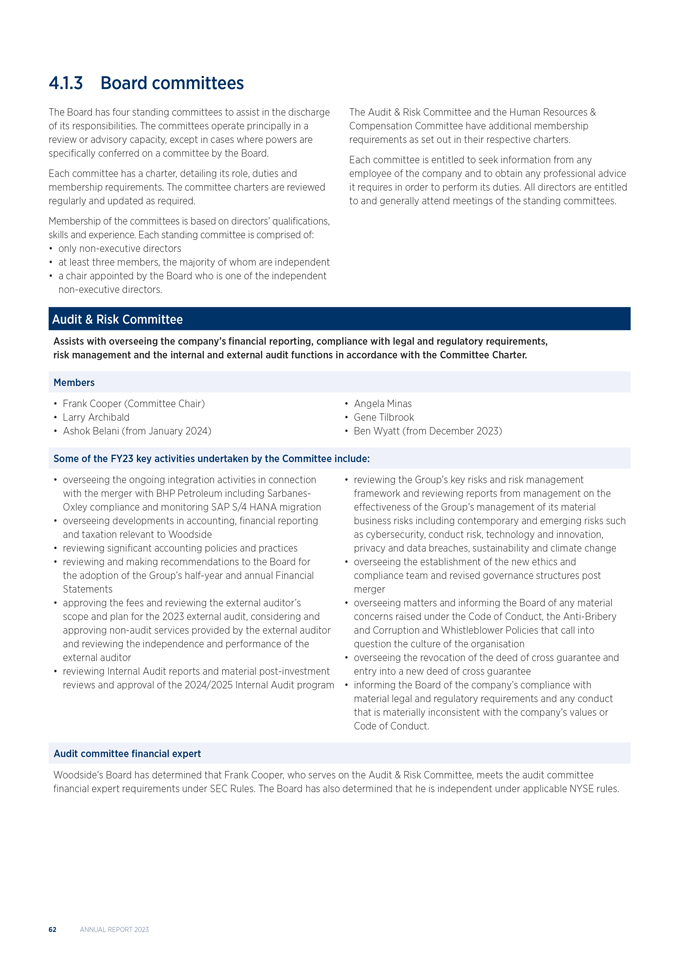

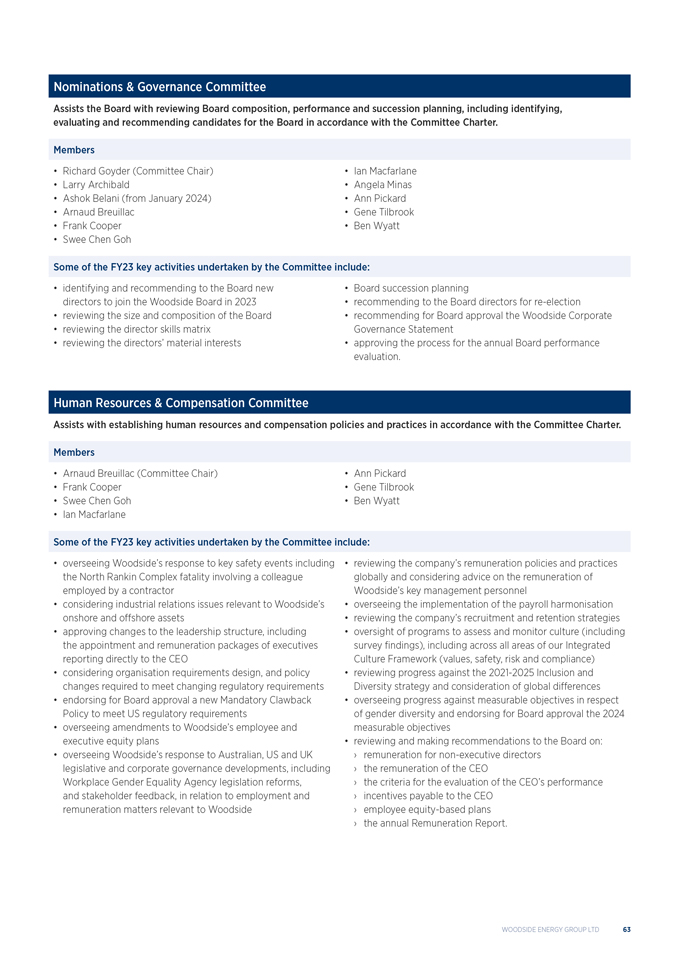

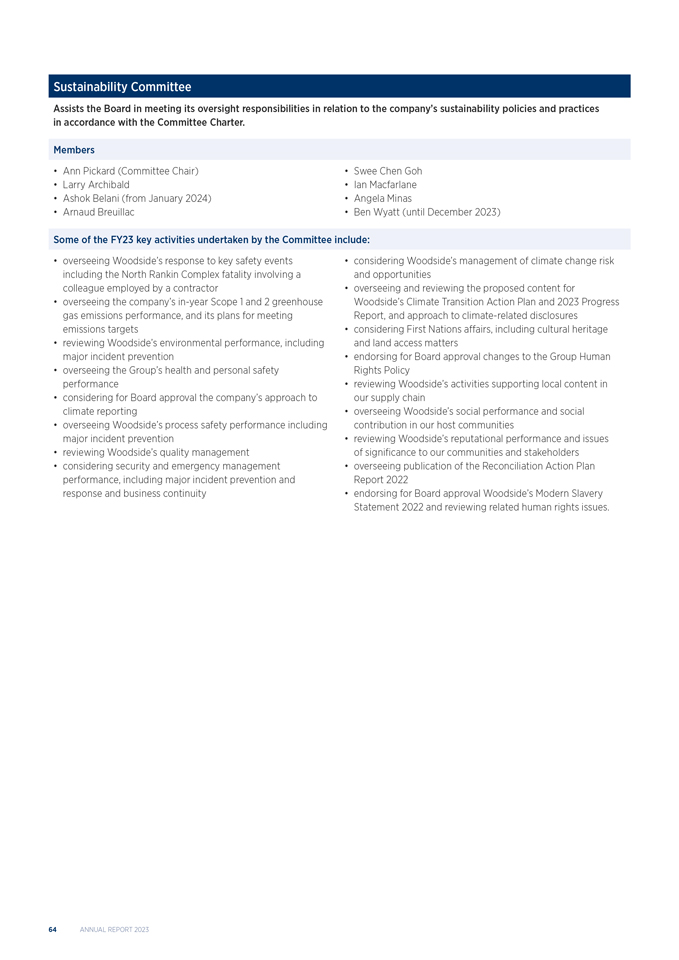

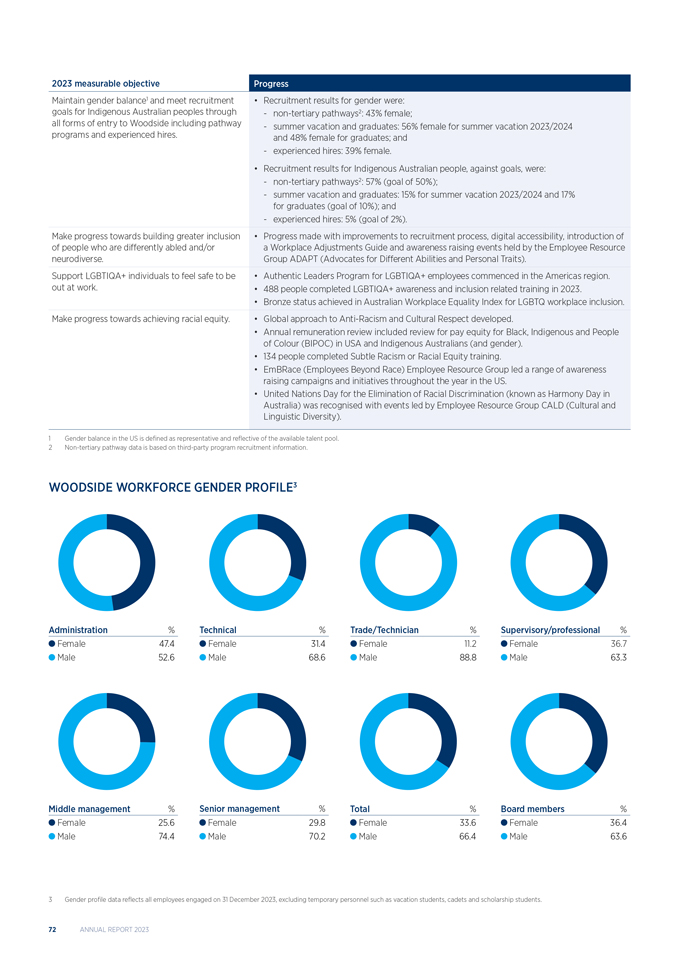

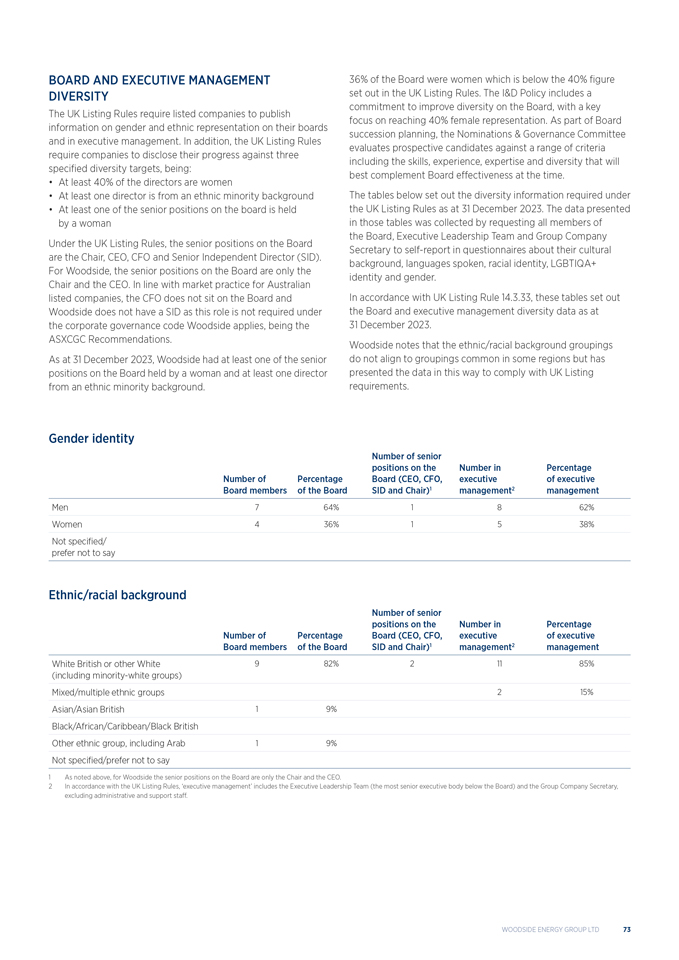

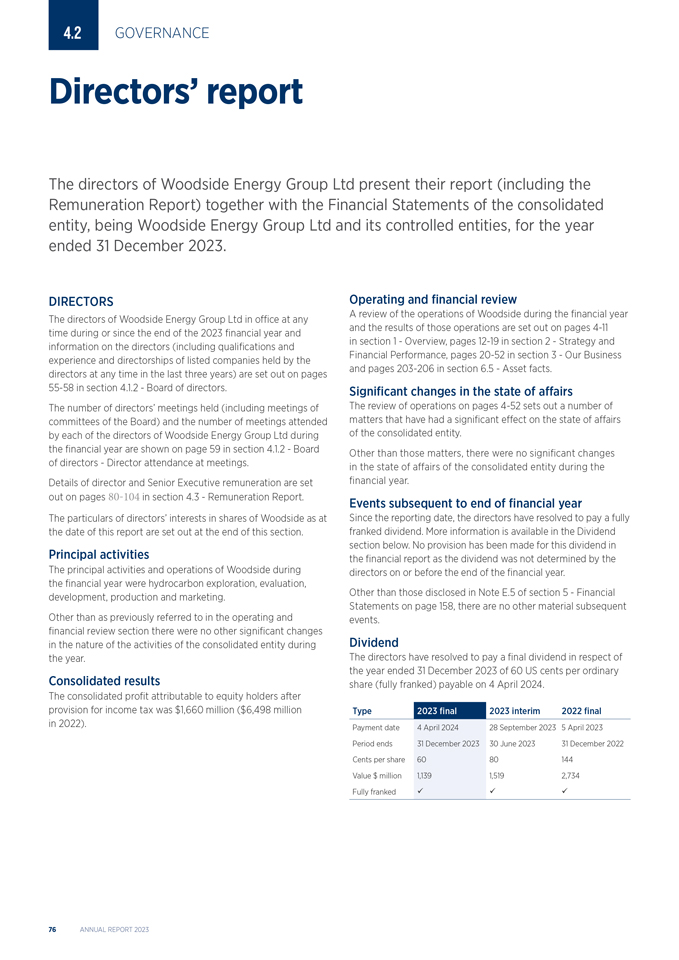

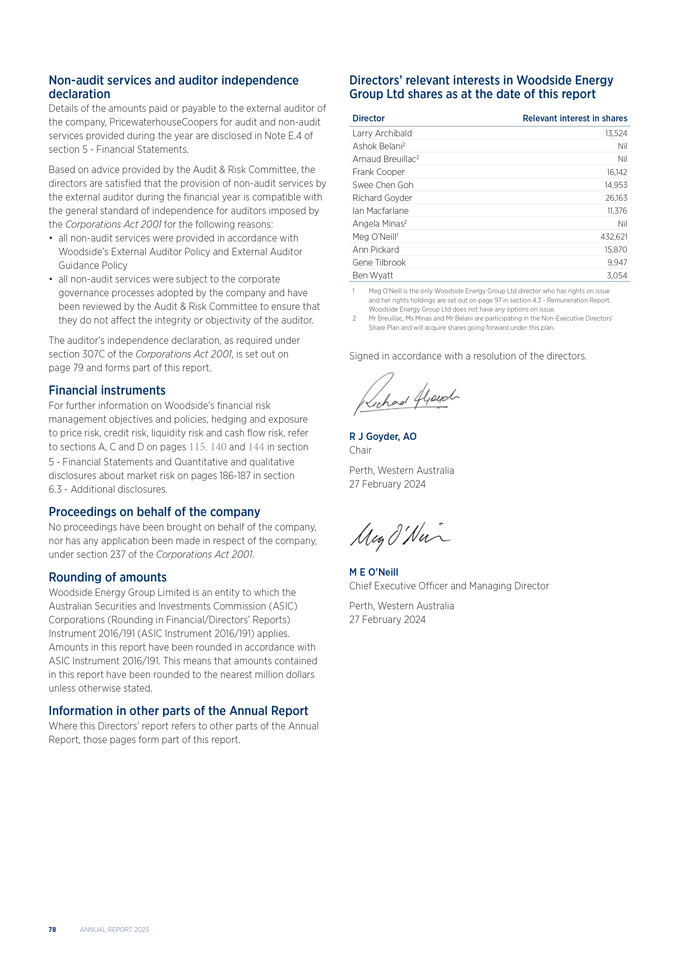

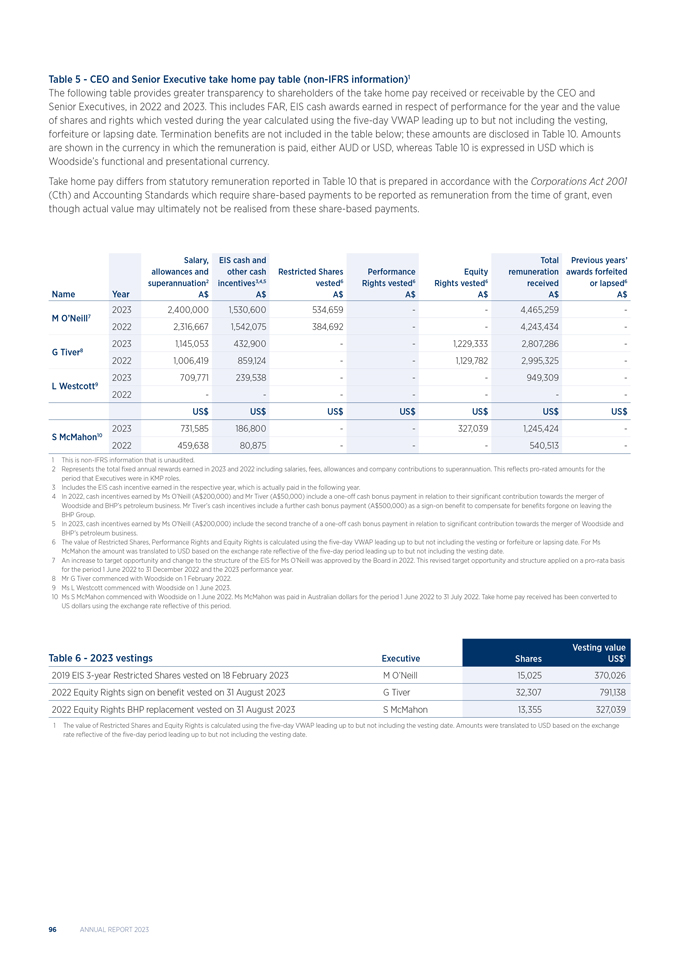

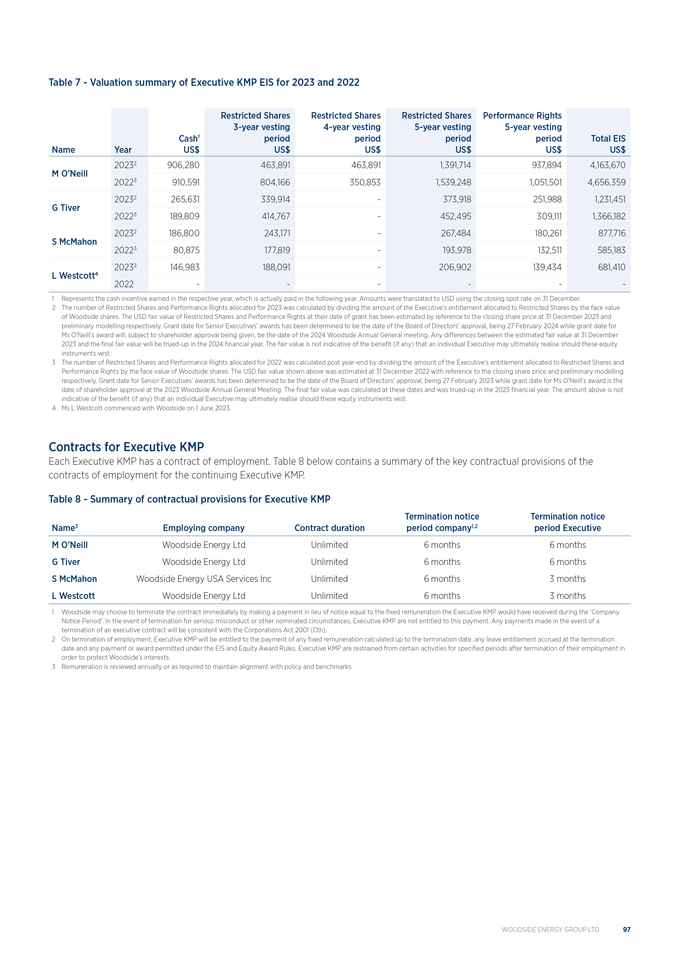

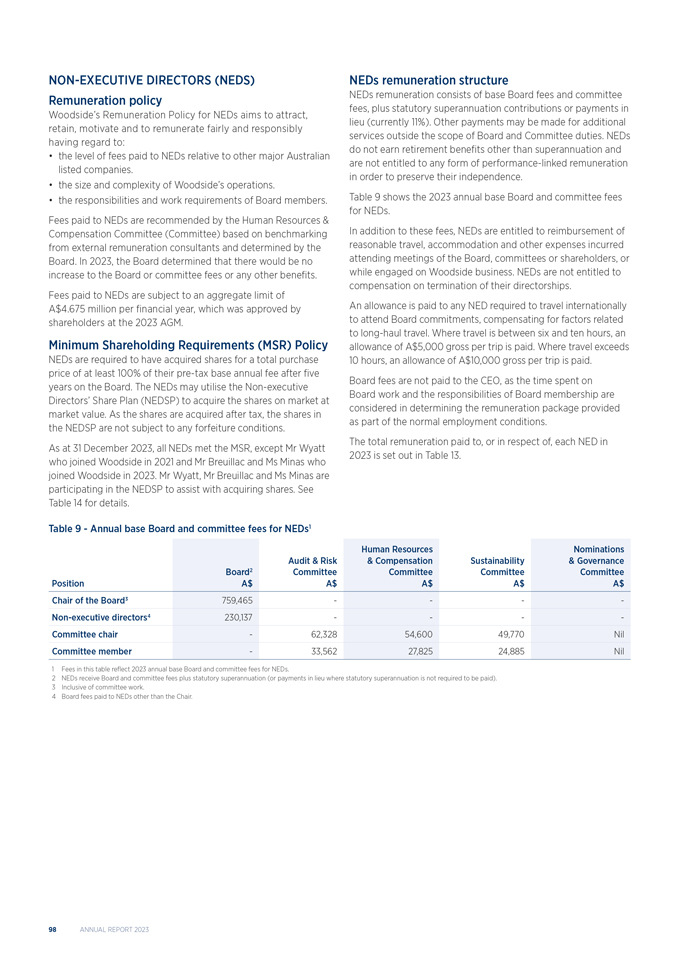

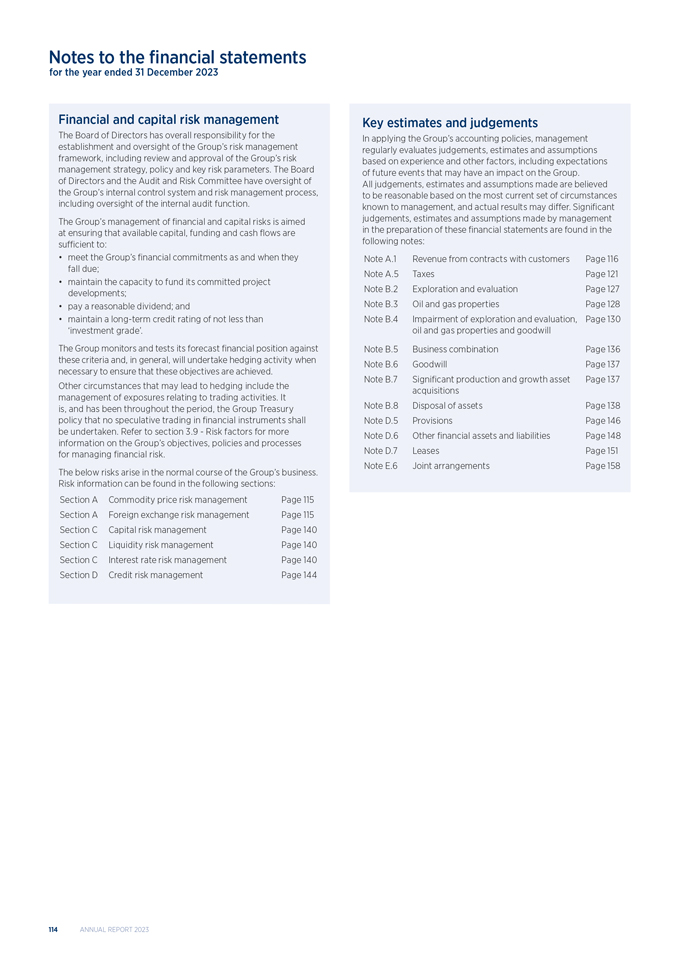

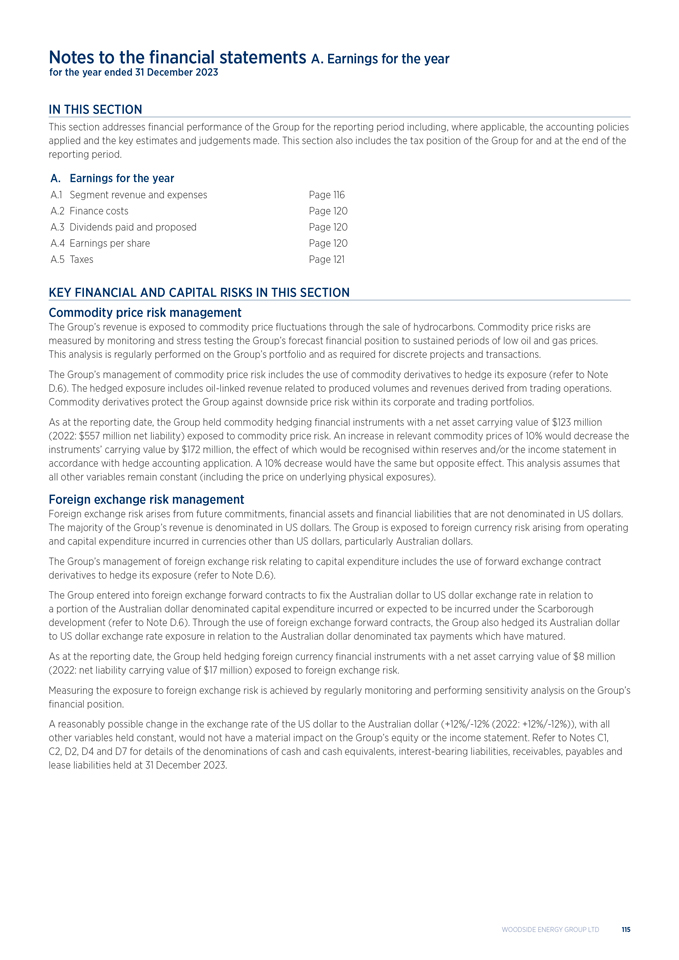

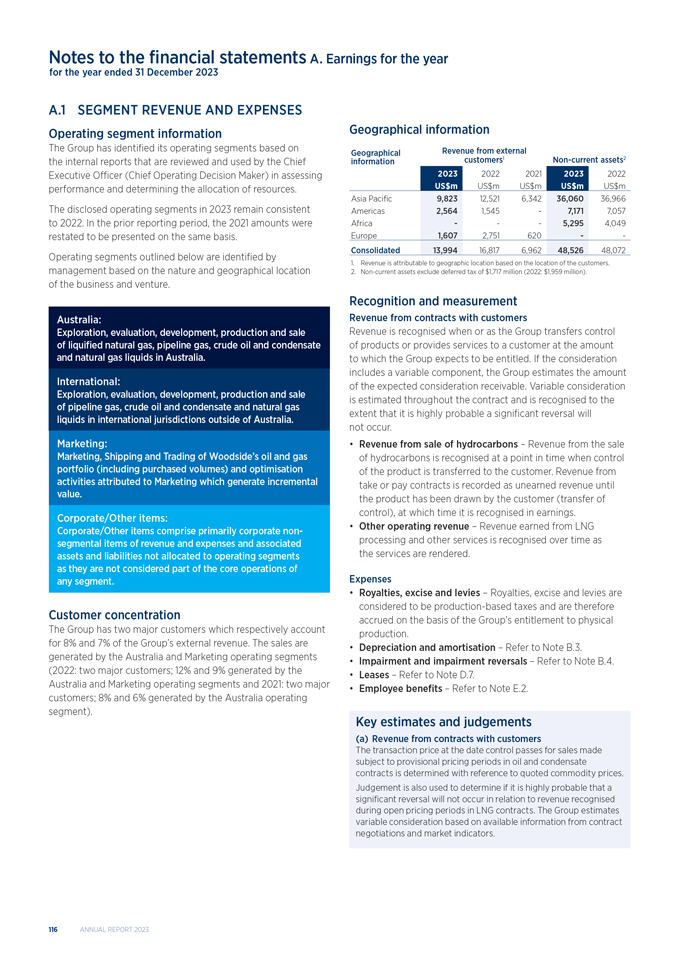

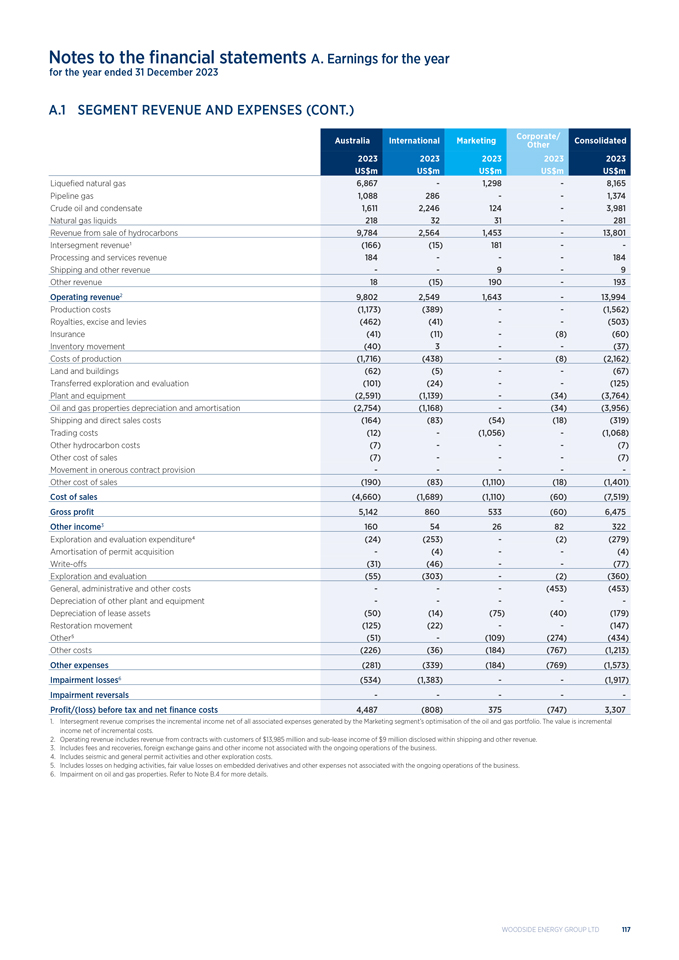

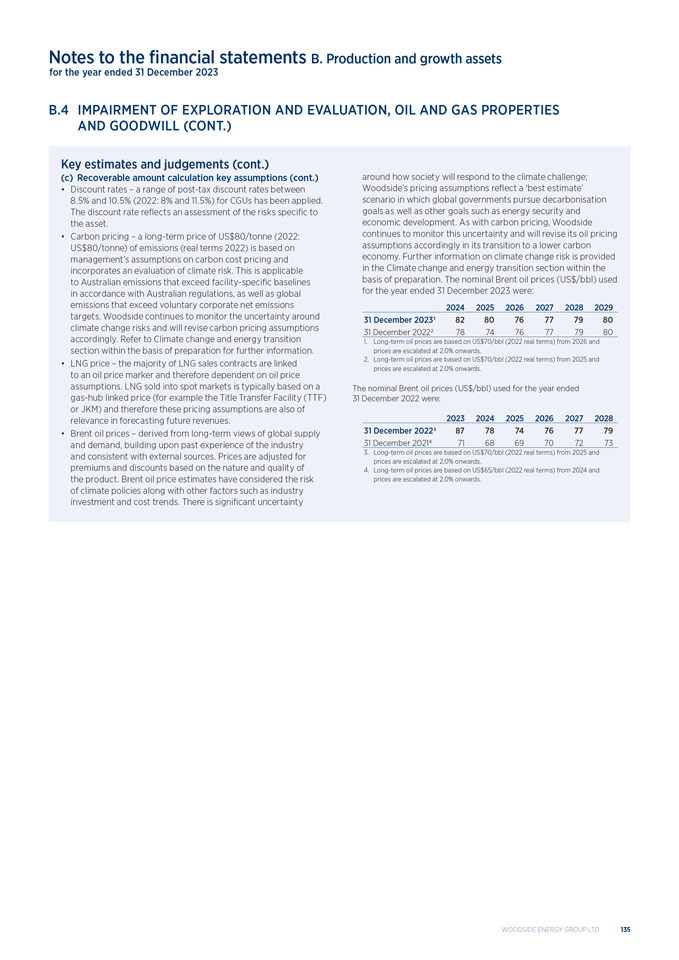

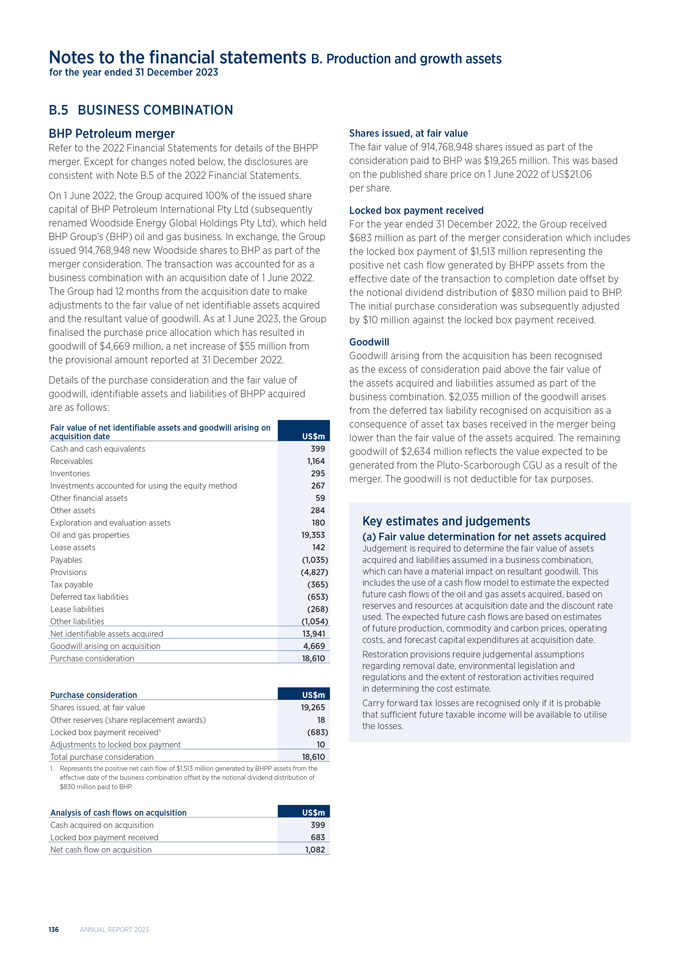

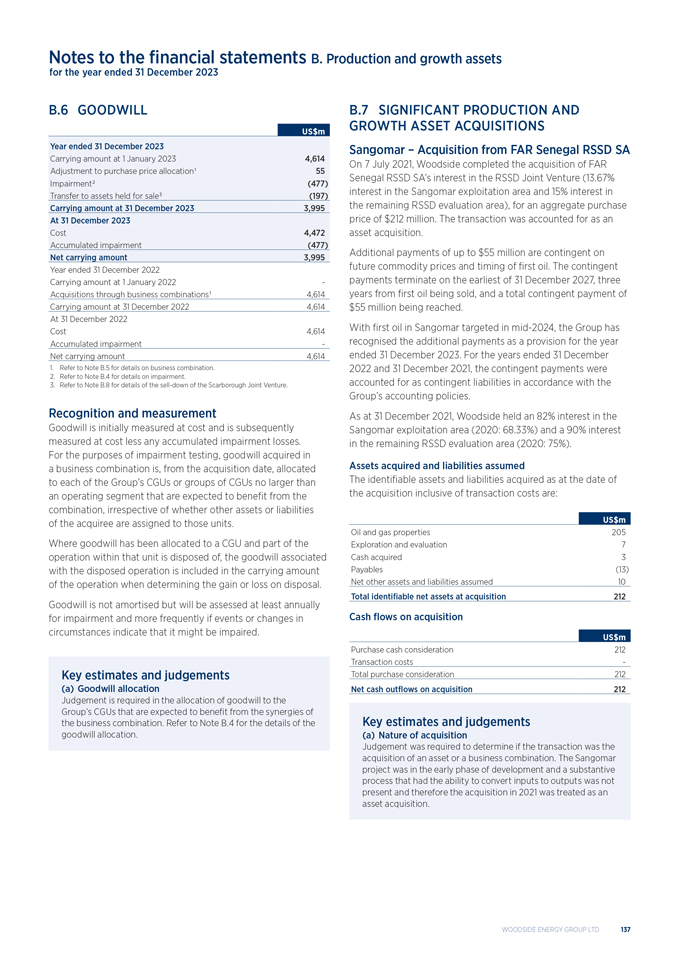

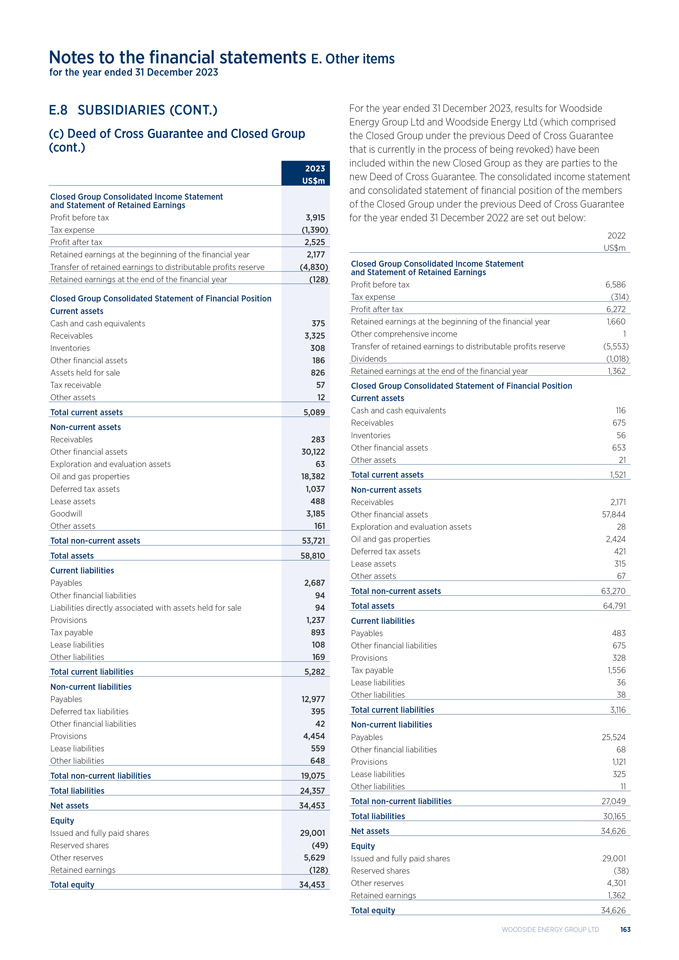

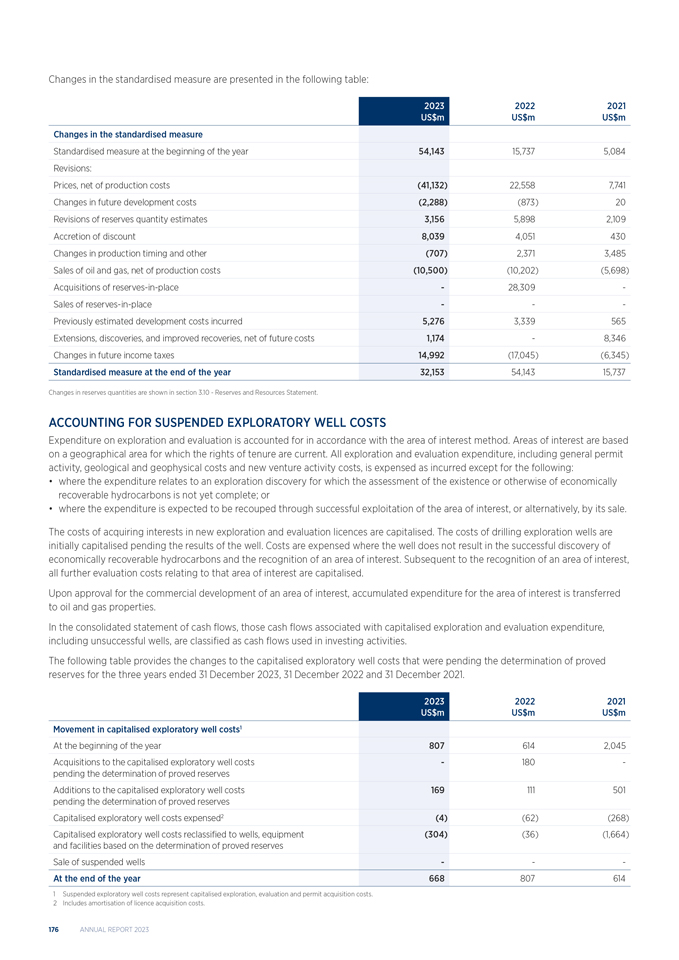

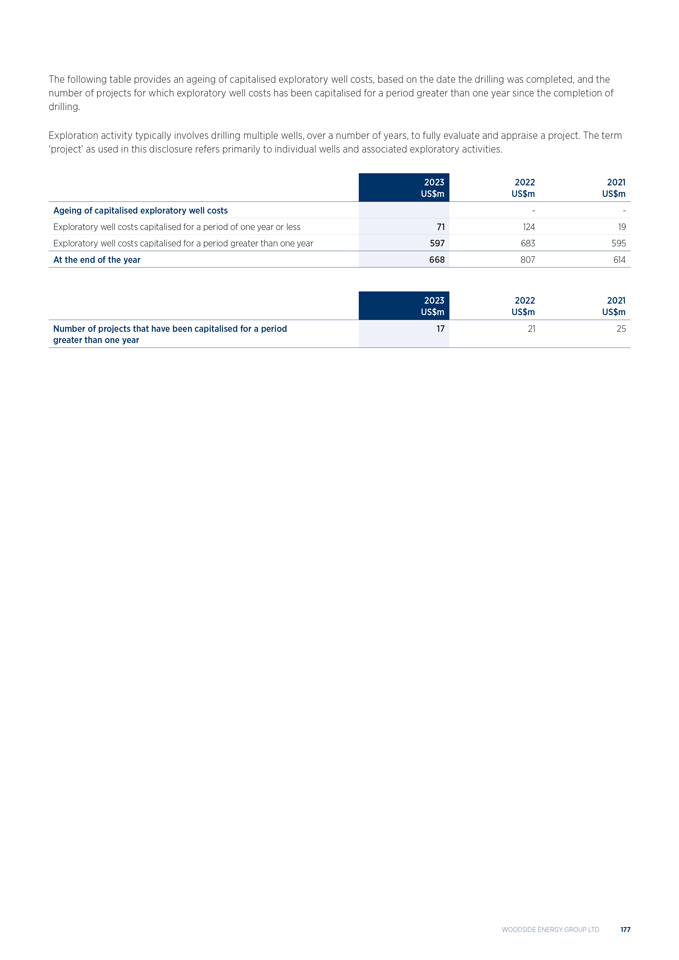

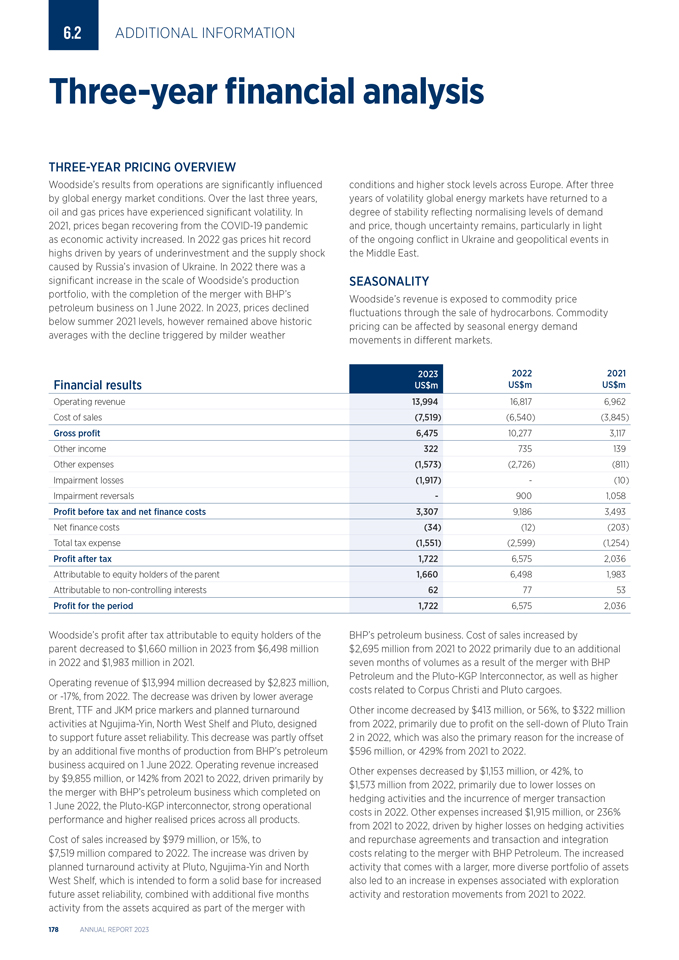

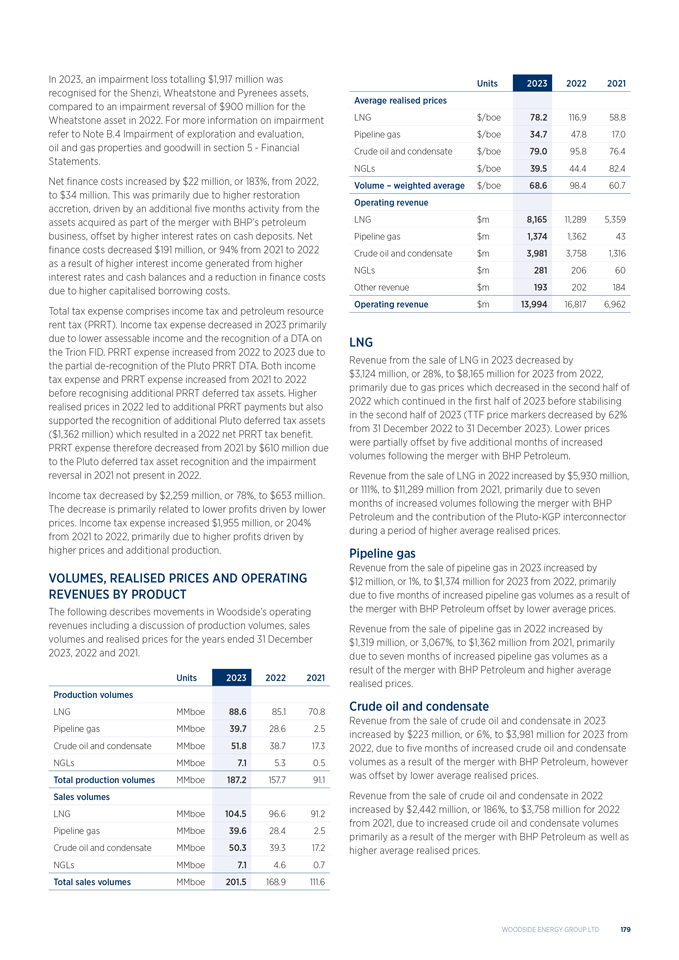

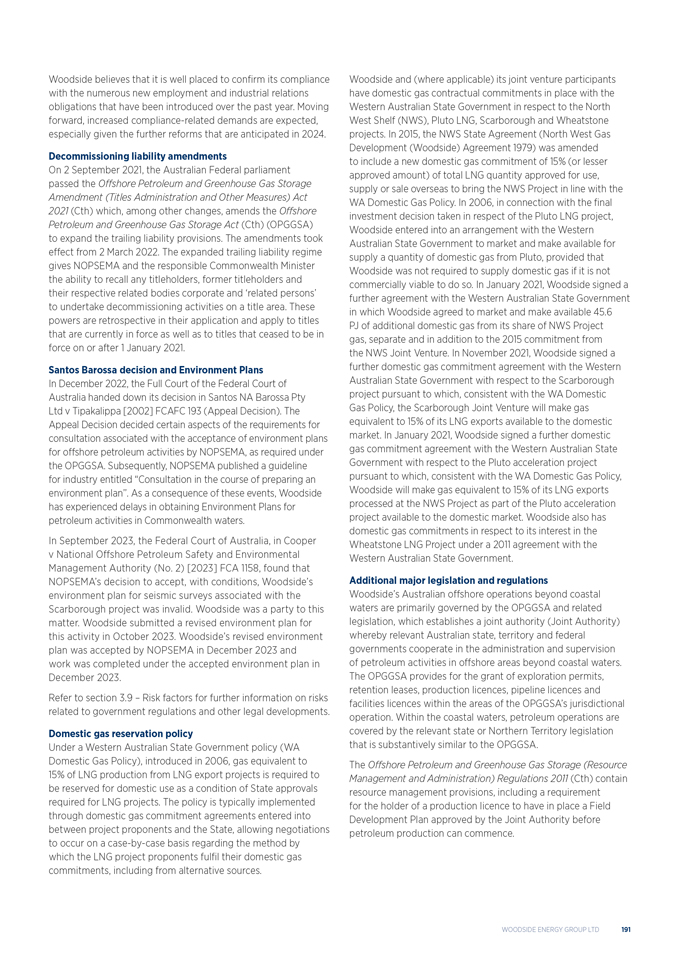

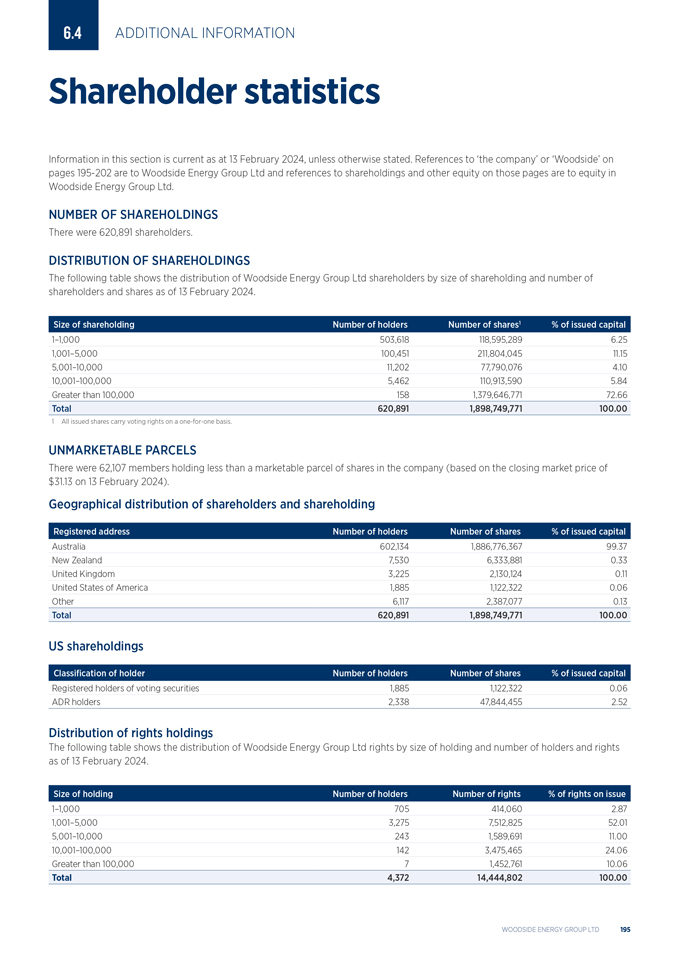

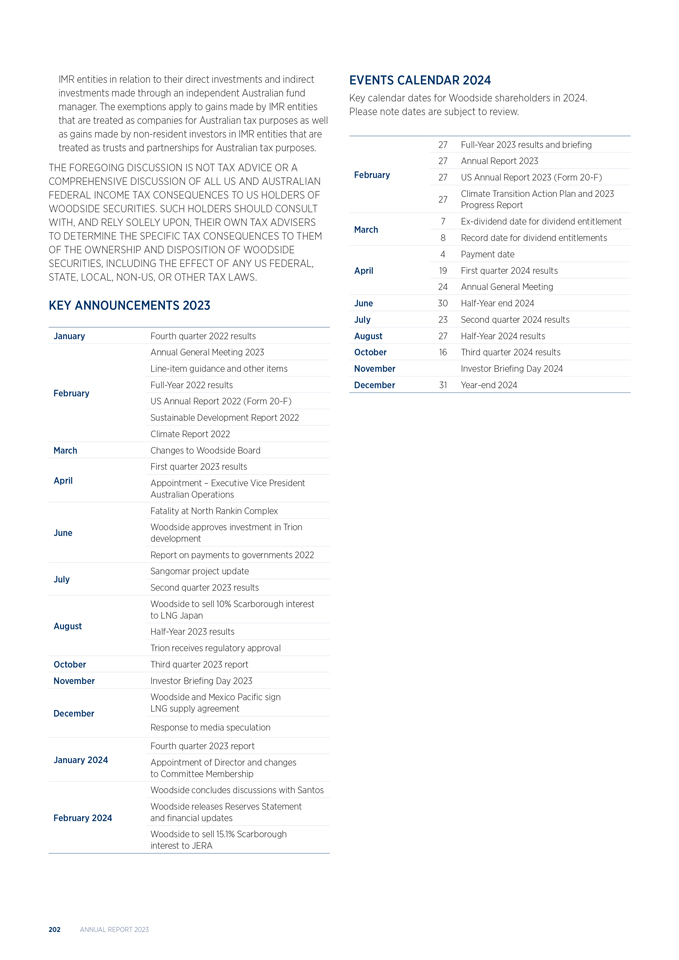

3.5 OUR BUSINESS Decommissioning Woodside is committed to executing our decommissioning responsibilities safely, while also ensuring we focus on efficiency and low cost execution. In 2023, Woodside continued execution of planned decommissioning activities, spending approximately US$447 million across our portfolio. The Enfield project, located approximately 38 km north of the North West Cape, Western Australia, ceased production in November 2018. All 18 Enfield wells have been plugged and 16 of the 18 xmas trees have now been removed. The remaining two trees are expected to be recovered in the first half of 2024 along with the completion of the wellhead severance program. In May 2023, Woodside completed award of all major contracts for the decommissioning of subsea infrastructure at the Enfield, Griffin, Stybarrow and Echo Yodel oil and gas fields offshore Western Australia. Drill rig contracts for the P&A of Stybarrow and Minerva wells were also awarded during 2023. In October 2023, the Nganhurra RTM was safely and successfully removed from its location off the North West Cape in Western Australia and transported to Perth, to be cleaned and deconstructed in preparation for recycling and reuse. For further information on the Nganhurra RTM removal, refer to the Sustainability section of our website at woodside.com. Decommissioning activities on Griffin commenced following receipt of the regulatory approvals in December 2023. Decommissioning activity continued in the Bass Strait, with 111 wells permanently plugged. In 2023, the GBJV awarded contracts for a semi-submersible well intervention unit and a jack-up rig to commence P&A work in 2024. The GBJV also progressed the tender process with heavy lift contractors to execute decommissioning activities for a number of facilities within the Gippsland Basin. The contract was awarded subsequent to the period. ANNUAL REPORT 2023