New Jersey |

001-09120 |

22-2625848 |

||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

New Jersey |

001-00973 |

22-1212800 |

||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act ( 17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange

On Which Registered

|

||

Public Service Enterprise Group Incorporated |

||||

| Common Stock without par value | PEG | New York Stock Exchange | ||

Public Service Electric and Gas Company |

||||

| 8.00% First and Refunding Mortgage Bonds, due 2037 | PEG37D | New York Stock Exchange | ||

| 5.00% First and Refunding Mortgage Bonds, due 2037 | PEG37J | New York Stock Exchange | ||

| If an emerging growth company, indicate by check mark if such registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| Exhibit 99 | Press Release dated February 26, 2024 | |

| Exhibit 99.1 | Slideshow Presentation | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED |

||

| (Registrant) | ||

| By: | /s/ Rose M. Chernick |

|

| ROSE M. CHERNICK | ||

| Vice President and Controller | ||

| (Principal Accounting Officer) | ||

PUBLIC SERVICE ELECTRIC AND GAS COMPANY |

||

| (Registrant) | ||

| By: | /s/ Rose M. Chernick |

|

| ROSE M. CHERNICK | ||

| Vice President and Controller | ||

| (Principal Accounting Officer) | ||

EXHIBIT 99

|

Public Service Enterprise Group 80 Park Plaza Newark, NJ 07102 |

PSEG ANNOUNCES 2023 RESULTS

$5.13 PER SHARE NET INCOME

$3.48 PER SHARE NON-GAAP OPERATING EARNINGS

Reaffirms 2024 Non-GAAP Operating Earnings Guidance of $3.60 - $3.70 Per Share

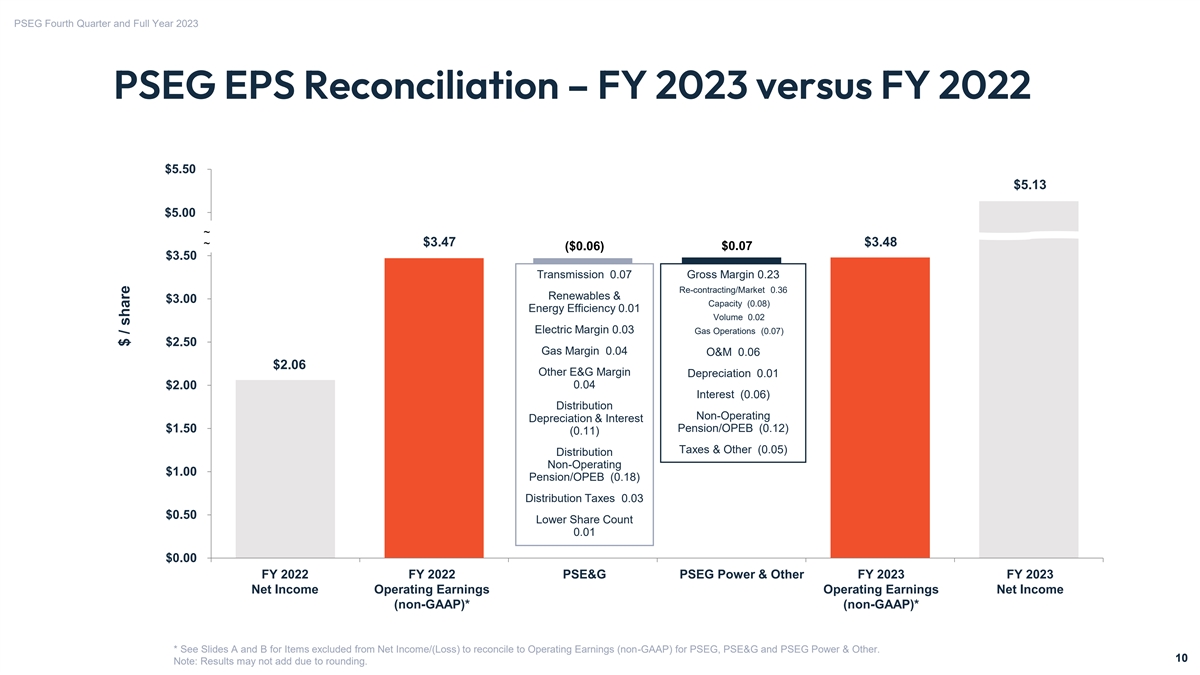

(NEWARK, N.J. – February 26, 2024) Public Service Enterprise Group (NYSE: PEG) reported the following results for the full-year and fourth quarter of 2023:

PSEG Consolidated (unaudited)

Full Year Comparative Results

| Income | Diluted Earnings Per Share |

|||||||||||||||

| ($ millions, except per share amounts) |

FY 2023 | FY 2022 | FY 2023 | FY 2022 | ||||||||||||

| Net Income |

$ | 2,563 | $ | 1,031 | $ | 5.13 | $ | 2.06 | ||||||||

| Reconciling Items |

(821 | ) | 708 | (1.65 | ) | 1.41 | ||||||||||

| Non-GAAP Operating Earnings |

$ | 1,742 | $ | 1,739 | $ | 3.48 | $ | 3.47 | ||||||||

| Average Shares |

500 | 501 | ||||||||||||||

PSEG Consolidated (unaudited)

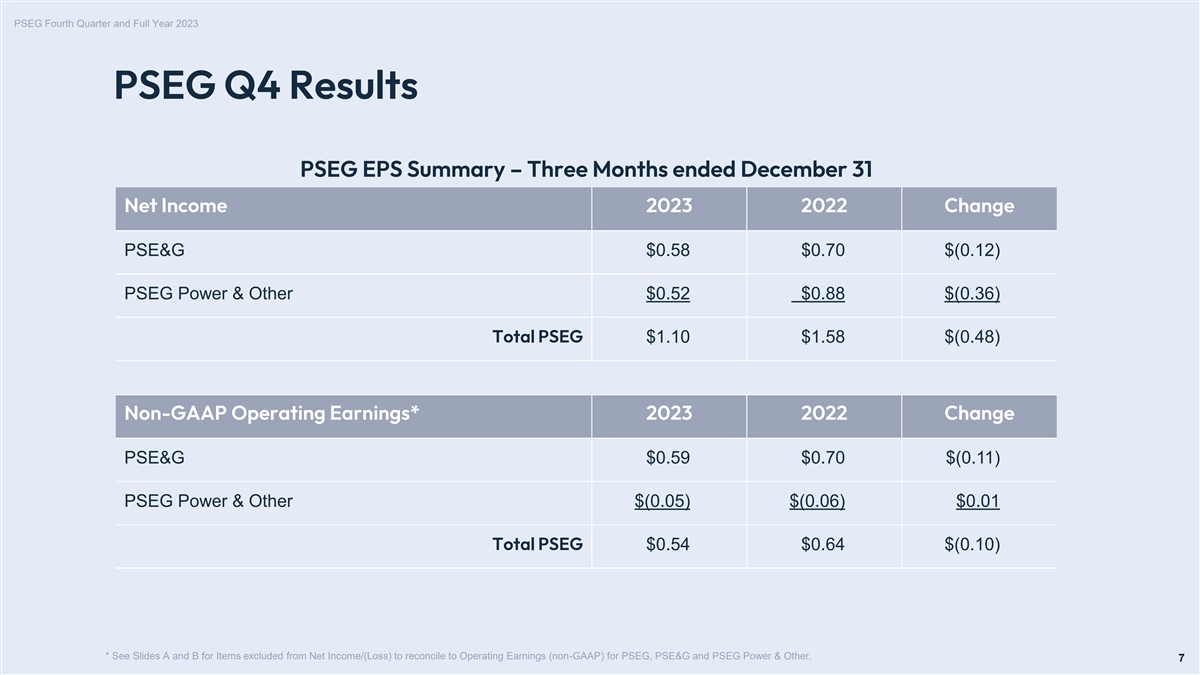

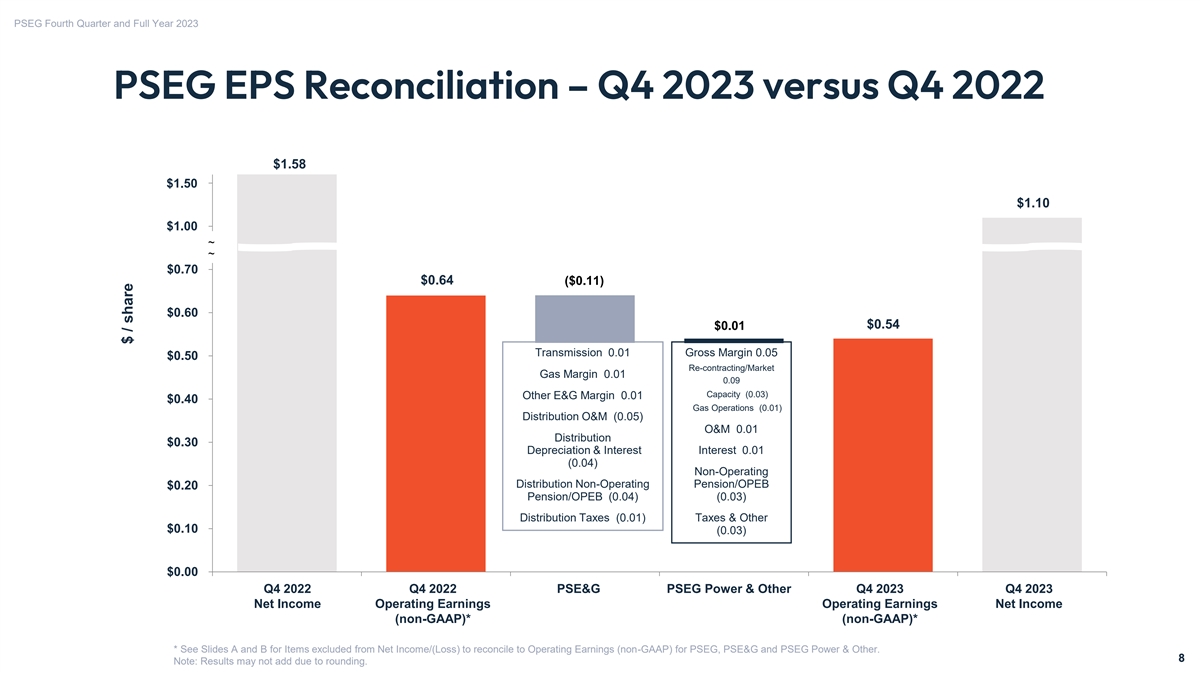

Fourth Quarter Comparative Results

| Income | Diluted Earnings Per Share |

|||||||||||||||

| ($ millions, except per share amounts) |

4Q 2023 | 4Q 2022 | 4Q 2023 | 4Q 2022 | ||||||||||||

| Net Income |

$ | 546 | $ | 788 | $ | 1.10 | $ | 1.58 | ||||||||

| Reconciling Items |

(275 | ) | (470 | ) | (0.56 | ) | (0.94 | ) | ||||||||

| Non-GAAP Operating Earnings |

$ | 271 | $ | 318 | $ | 0.54 | $ | 0.64 | ||||||||

| Average Shares |

500 | 500 | ||||||||||||||

The tables above provide a reconciliation of PSEG’s Net Income to non-GAAP Operating Earnings for the fourth quarter and full year. See Attachments 8 and 9 for a complete list of items excluded from Net Income in the determination of non-GAAP Operating Earnings.

“PSEG achieved solid operating and financial performance in 2023. Our non-GAAP results for the full year came in at the high-end of our 2023 guidance range and marked the 19th consecutive year that we delivered results that met or exceeded our guidance. PSE&G efficiently completed its largest ever capital investment plan in a single year – totaling $3.7 billion – focused on meeting our customers’ needs by modernizing our system infrastructure, maintaining our best in the state reliability and resiliency, and expanding our energy efficiency offerings to customers at every income level to help them reduce their energy usage and bills,” said Ralph LaRossa, PSEG’s chair, president and CEO.

1

PSEG made significant progress during 2023, executing on its strategy to increase the predictability of the business and the visibility of growth, and providing value to its customers, including:

| • | Streamlining the business mix by retaining our 3,760 MW nuclear fleet (which benefits from the nuclear production tax credit, effective January 1, 2024, and helps us finance regulated growth through 2028 without the need for new equity) and exiting offshore wind generation with recovery of our investment. |

| • | Reaching a $900 million settlement to extend our Gas System Modernization Program through 2025, and a $280 million settlement to extend our award-winning Clean Energy Future-Energy Efficiency (EE) program into mid-2024. |

| • | Enabling the broad expansion of our EE programs through an effective Conservation Incentive Program, which also offset the 2023 volumetric impacts of unseasonably mild winter and summer weather. |

| • | Lowering PSE&G’s gas commodity charge from $0.47 to $0.40 per therm for winter 2024, following the two previous supply charge reductions during the winter of 2023. |

| • | Placing into service over 1.5 million PSE&G smart meters. |

| • | Reaching new multi-year labor agreements with all of our represented employees. |

| • | Achieving a 93% capacity factor at PSEG Nuclear that included a breaker-to-breaker run at Salem Unit 1, and producing approximately 32 TWh of carbon free, base-load power. |

| • | Successfully reducing our pension variability, twice, through the approval of a regulatory accounting order last February and a billion-dollar lift-out in August. |

| • | Being named to the Dow Jones Sustainability North America Index for the 16th year in a row. |

| • | Being recognized as #1 in Customer Satisfaction with Residential and Business Electric Service in the East among Large Utilities by J.D. Power in 2023. |

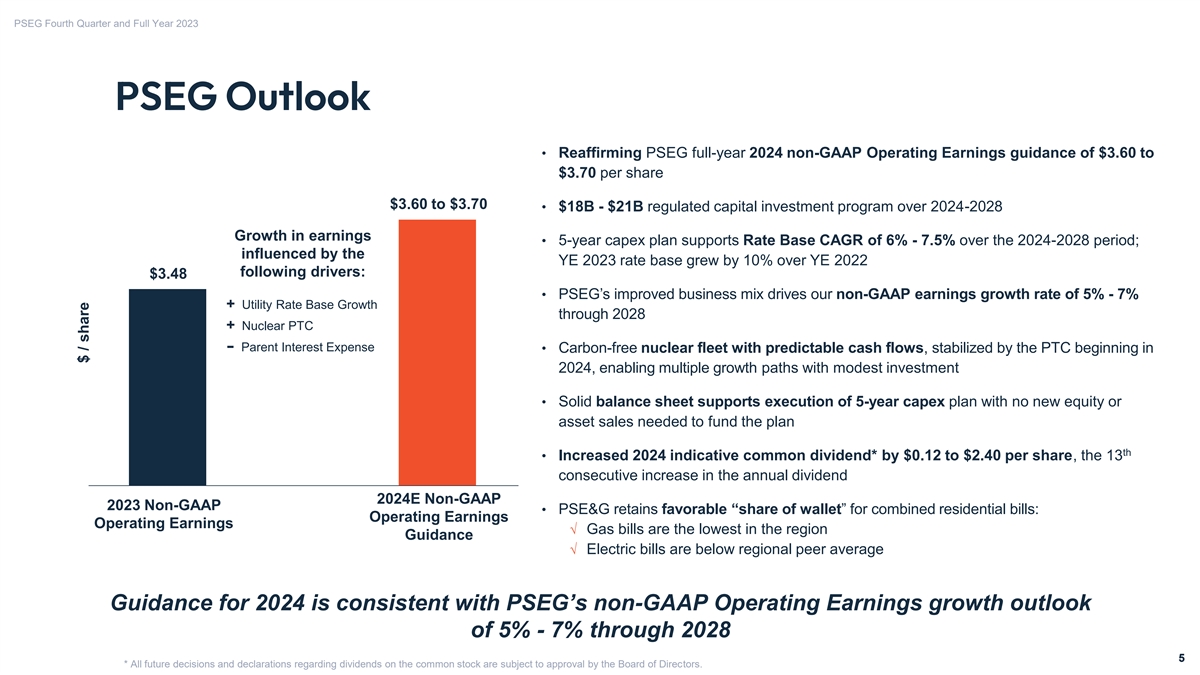

Looking ahead, PSEG recently updated its five-year regulated capital spending plan to $18 billion to $21 billion, which supports our outlook for compound annual growth in rate base (of 6% to 7.5%) and for non-GAAP Operating Earnings (of 5% to 7%) over the 2024 to 2028 period.

2

In December 2023, PSE&G filed its comprehensive electric and gas base rate case, as required, with the New Jersey Board of Public Utilities (BPU). A main component of the case is to recover over $3 billion in capital investments that were made to strengthen and modernize the state’s electric and gas infrastructure since PSE&G’s last rate case in 2018. PSE&G’s request is its first in six years and is among the lowest proposed rate increases filed by a NJ public utility over that time period.

PSE&G also submitted its Clean Energy Future–Energy Efficiency II (CEF-EE II) filing to the BPU. The $3.1 billion proposal is aligned with New Jersey’s updated energy efficiency framework covering the 30-month period from January 2025 through June 2027 and would be spent over a six-year period.

LaRossa added, “For 2024, we are reaffirming our non-GAAP Operating Earnings guidance range of $3.60 to $3.70 per share. The recent $0.12 increase to PSEG’s 2024 indicative annual common dividend rate to $2.40 per share also extends our track record of providing dividend income to our investors for 117 consecutive years.”

PSEG Results by Segment

Public Service Electric and Gas

Fourth Quarter and Full Year Comparative Results

| ($ millions, except per share amounts) |

4Q 2023 | 4Q 2022 | FY 2023 | FY 2022 | ||||||||||||

| Net Income |

$ | 291 | $ | 352 | $ | 1,515 | $ | 1,565 | ||||||||

| Net Income Per Share (EPS) |

$ | 0.58 | $ | 0.70 | $ | 3.03 | $ | 3.12 | ||||||||

| Non-GAAP Operating Earnings |

$ | 296 | $ | 352 | $ | 1,532 | $ | 1,565 | ||||||||

| Non-GAAP Operating EPS |

$ | 0.59 | $ | 0.70 | $ | 3.06 | $ | 3.12 | ||||||||

Consistent with management’s guidance for full-year 2023 non-GAAP earnings, PSE&G’s fourth quarter results benefited from growth in incremental investments in Transmission and Gas Distribution, which were offset by the expected decline in pension income and lower OPEB related credits, as well as higher depreciation, amortization and interest expense resulting from higher investment (not yet reflected in rates), as well as higher O&M costs in the quarter due to timing.

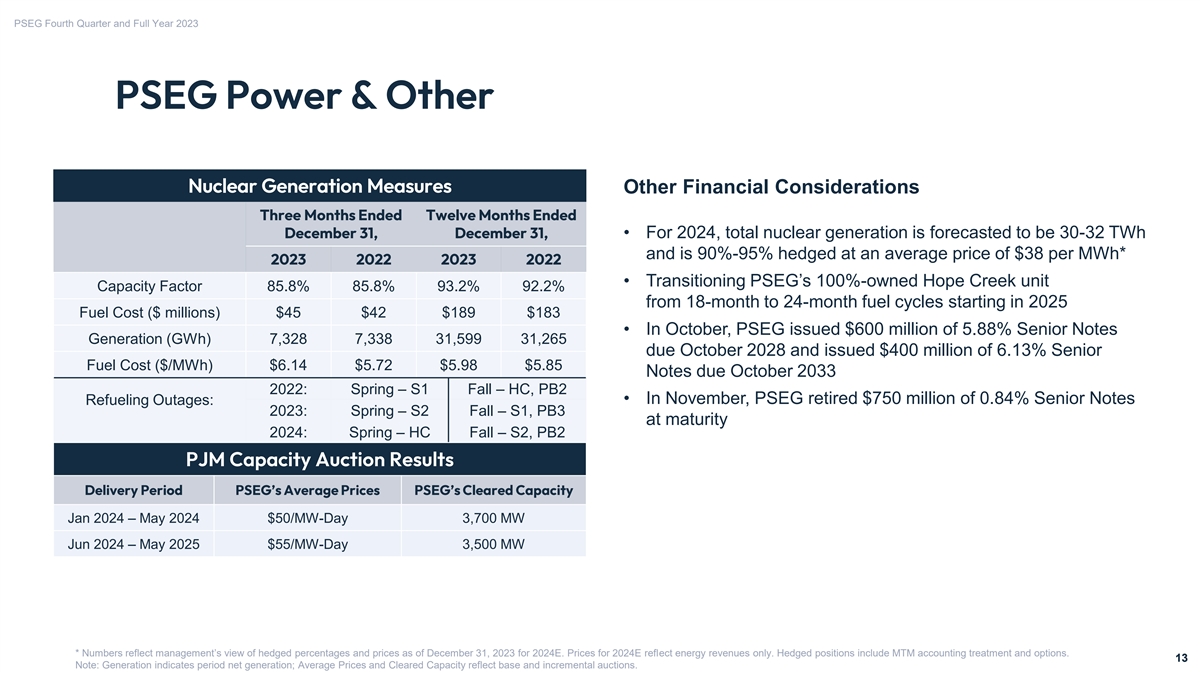

PSEG Power & Other

Fourth Quarter and Full Year Comparative Results

| ($ millions, except per share amounts) |

4Q 2023 | 4Q 2022 | FY 2023 | FY 2022 | ||||||||||||

| Net Income (Loss) |

$ | 255 | $ | 436 | $ | 1,048 | $ | (534 | ) | |||||||

| Net Income (Loss) Per Share (EPS) |

$ | 0.52 | $ | 0.88 | $ | 2.10 | $ | (1.06 | ) | |||||||

| Non-GAAP Operating Earnings |

$ | (25 | ) | $ | (34 | ) | $ | 210 | $ | 174 | ||||||

| Non-GAAP Operating EPS |

$ | (0.05 | ) | $ | (0.06 | ) | $ | 0.42 | $ | 0.35 | ||||||

3

PSEG Power & Other results for the quarter reflect an improvement in energy margin, offset by a reduction in capacity revenues, and expected lower pension income and OPEB credits compared with the fourth quarter of 2022.

###

PSEG will host a conference call to review its fourth quarter and full year 2023 results, earnings guidance, and other matters with the financial community at 11:00 a.m. ET today. Please register to access this event by visiting: https://investor.pseg.com/investor-news-and-events.

| Media Relations: | Investor Relations: | |

| 973-430-7734 |

Carlotta Chan | |

| 973-430-6565 | ||

| Carlotta.Chan@pseg.com |

About PSEG

Public Service Enterprise Group (PSEG) (NYSE: PEG) is a predominantly regulated infrastructure company focused on a clean energy future. Guided by its Powering Progress vision, PSEG aims to power a future where people use less energy, and it’s cleaner, safer, and delivered more reliably than ever. PSEG’s commitment to sustainability is demonstrated in our net-zero 2030 climate vision and participation in the U.N. Race to Zero, as well as our inclusion on the Dow Jones Sustainability North America Index. PSEG’s businesses include Public Service Electric and Gas Co. (PSE&G), PSEG Power and PSEG Long Island (https://corporate.pseg.com).

Non-GAAP Financial Measures

Management uses non-GAAP Operating Earnings in its internal analysis, and in communications with investors and analysts, as a consistent measure for comparing PSEG’s financial performance to previous financial results. Non-GAAP Operating Earnings exclude the impact of gains (losses) associated with the Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting and other material infrequent items.

See Attachments 8 and 9 for a complete list of items excluded from Net Income/(Loss) in the determination of non-GAAP Operating Earnings. The presentation of non-GAAP Operating Earnings is intended to complement and should not be considered an alternative to the presentation of Net Income/(Loss), which is an indicator of financial performance determined in accordance with GAAP. In addition, non-GAAP Operating Earnings as presented in this release may not be comparable to similarly titled measures used by other companies.

Due to the forward-looking nature of non-GAAP Operating Earnings guidance, PSEG is unable to reconcile this non-GAAP financial measure to the most directly comparable GAAP financial measure because comparable GAAP measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be required for such reconciliation. Namely, we are not able to reliably project without unreasonable effort MTM and NDT gains (losses), for future periods due to market volatility. These items are uncertain, depend on various factors, and may have a material impact on our future GAAP results.

4

Forward-Looking Statements

Certain of the matters discussed in this report about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences, and all other statements that are not purely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management’s beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in Item 1A. Risk Factors, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), Item 8. Financial Statements and Supplementary Data—Note 13. Commitments and Contingent Liabilities, and other filings we make with the United States Securities and Exchange Commission (SEC), including our subsequent reports on Form 10-Q and Form 8-K. These factors include, but are not limited to:

| • | any inability to successfully develop, obtain regulatory approval for, or construct transmission and distribution, and our nuclear generation projects; |

| • | the physical, financial and transition risks related to climate change, including risks relating to potentially increased legislative and regulatory burdens, changing customer preferences and lawsuits; |

| • | any equipment failures, accidents, critical operating technology or business system failures, natural disasters, severe weather events, acts of war, terrorism or other acts of violence, sabotage, physical attacks or security breaches, cyberattacks or other incidents that may impact our ability to provide safe and reliable service to our customers; |

| • | any inability to recover the carrying amount of our long-lived assets; |

| • | disruptions or cost increases in our supply chain, including labor shortages; |

| • | any inability to maintain sufficient liquidity or access sufficient capital on commercially reasonable terms; |

| • | the impact of cybersecurity attacks or intrusions or other disruptions to our information technology, operational or other systems; |

| • | a material shift away from natural gas toward increased electrification and a reduction in the use of natural gas; |

| • | failure to attract and retain a qualified workforce; |

| • | increases in the costs of equipment, materials, fuel, services and labor; |

| • | the impact of our covenants in our debt instruments and credit agreements on our business; |

| • | adverse performance of our defined benefit plan trust funds and Nuclear Decommissioning Trust Fund and increases in funding requirements and pension costs; |

| • | any inability to extend certain significant contracts on terms acceptable to us; |

| • | development, adoption and use of Artificial Intelligence by us and our third-party vendors; |

| • | fluctuations in, or third-party default risk in wholesale power and natural gas markets, including the potential impacts on the economic viability of our generation units; |

| • | our ability to obtain adequate nuclear fuel supply; |

| • | changes in technology related to energy generation, distribution and consumption and changes in customer usage patterns; |

| • | third-party credit risk relating to our sale of nuclear generation output and purchase of nuclear fuel; |

| • | any inability to meet our commitments under forward sale obligations and Regional Transmission Organization rules; |

| • | the impact of changes in state and federal legislation and regulations on our business, including PSE&G’s ability to recover costs and earn returns on authorized investments; |

| • | PSE&G’s proposed investment projects or programs may not be fully approved by regulators and its capital investment may be lower than planned; |

| • | our ability to receive sufficient financial support for our New Jersey nuclear plants from the markets, production tax credit and/or zero emission certificates program; |

| • | adverse changes in and non-compliance with energy industry laws, policies, regulations and standards, including market structures and transmission planning and transmission returns; |

| • | risks associated with our ownership and operation of nuclear facilities, including increased nuclear fuel storage costs, regulatory risks, such as compliance with the Atomic Energy Act and trade control, environmental and other regulations, as well as operational, financial, environmental and health and safety risks; |

| • | changes in federal and state environmental laws and regulations and enforcement; |

| • | delays in receipt of, or an inability to receive, necessary licenses and permits and siting approvals; and |

| • | changes in tax laws and regulations. |

5

All of the forward-looking statements made in this report are qualified by these cautionary statements and we cannot assure you that the results or developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business, prospects, financial condition, results of operations or cash flows. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this report apply only as of the date of this report. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even in light of new information or future events, unless otherwise required by applicable securities laws.

The forward-looking statements contained in this report are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

From time to time, PSEG and PSE&G release important information via postings on their corporate Investor Relations website at https://investor.pseg.com. Investors and other interested parties are encouraged to visit the Investor Relations website to review new postings. You can sign up for automatic email alerts regarding new postings at the bottom of the webpage at https://investor.pseg.com or by navigating to the Email Alerts webpage here. The information on https://investor.pseg.com and https://investor.pseg.com/resources/email-alerts/default.aspx is not incorporated herein and is not part of this press release or the Form 8-K to which it is an exhibit.

6

Attachment 1

Public Service Enterprise Group Incorporated

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

| Three Months Ended December 31, 2023 | ||||||||||||||||

| PSEG | Eliminations | PSE&G | PSEG Power & Other(a) |

|||||||||||||

| OPERATING REVENUES |

$ | 2,605 | $ | (306 | ) | $ | 1,853 | $ | 1,058 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

743 | (306 | ) | 710 | 339 | |||||||||||

| Operation and Maintenance |

871 | — | 495 | 376 | ||||||||||||

| Depreciation and Amortization |

292 | — | 252 | 40 | ||||||||||||

| Loss on Asset Dispositions and Impairments |

7 | — | — | 7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

1,913 | (306 | ) | 1,457 | 762 | |||||||||||

| OPERATING INCOME |

692 | — | 396 | 296 | ||||||||||||

| Net Gains (Losses) on Trust Investments |

126 | — | — | 126 | ||||||||||||

| Net Other Income (Deductions) |

40 | — | 15 | 25 | ||||||||||||

| Net Non-Operating Pension and OPEB Credits (Costs) |

27 | — | 28 | (1 | ) | |||||||||||

| Interest Expense |

(198 | ) | — | (129 | ) | (69 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME BEFORE INCOME TAXES |

687 | — | 310 | 377 | ||||||||||||

| Income Tax Expense |

(141 | ) | — | (19 | ) | (122 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 546 | $ | — | $ | 291 | $ | 255 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (b) |

(275 | ) | — | 5 | (280 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 271 | $ | — | $ | 296 | $ | (25 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME |

$ | 1.10 | $ | — | $ | 0.58 | $ | 0.52 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (b) |

(0.56 | ) | — | 0.01 | (0.57 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 0.54 | $ | — | $ | 0.59 | $ | (0.05 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three Months Ended December 31, 2022 | ||||||||||||||||

| PSEG | Eliminations | PSE&G | PSEG Power & Other(a) |

|||||||||||||

| OPERATING REVENUES |

$ | 3,139 | $ | (466 | ) | $ | 2,030 | $ | 1,575 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

996 | (466 | ) | 881 | 581 | |||||||||||

| Operation and Maintenance |

868 | — | 489 | 379 | ||||||||||||

| Depreciation and Amortization |

278 | — | 238 | 40 | ||||||||||||

| Losses on Asset Dispositions and Impairments |

33 | — | 1 | 32 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

2,175 | (466 | ) | 1,609 | 1,032 | |||||||||||

| OPERATING INCOME |

964 | — | 421 | 543 | ||||||||||||

| Loss from Equity Method Investments |

(2 | ) | — | — | (2 | ) | ||||||||||

| Net Gains (Losses) on Trust Investments |

87 | — | — | 87 | ||||||||||||

| Net Other Income (Deductions) |

38 | — | 22 | 16 | ||||||||||||

| Net Non-Operating Pension and OPEB Credits (Costs) |

94 | — | 70 | 24 | ||||||||||||

| Interest Expense |

(178 | ) | — | (108 | ) | (70 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME BEFORE INCOME TAXES |

1,003 | — | 405 | 598 | ||||||||||||

| Income Tax Expense |

(215 | ) | — | (53 | ) | (162 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 788 | $ | — | $ | 352 | $ | 436 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income(b) |

(470 | ) | — | — | (470 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 318 | $ | — | $ | 352 | $ | (34 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME |

$ | 1.58 | $ | — | $ | 0.70 | $ | 0.88 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income(b) |

(0.94 | ) | — | — | (0.94 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 0.64 | $ | — | $ | 0.70 | $ | (0.06 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes activities at PSEG Power, PSEG Long Island, Energy Holdings, PSEG Services Corporation and the Parent. |

| (b) | See Attachments 8 and 9 for details of items excluded from Net Income (Loss) to compute Operating Earnings (non-GAAP). |

Attachment 2

Public Service Enterprise Group Incorporated

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

| Year Ended December 31, 2023 | ||||||||||||||||

| PSEG | Eliminations | PSE&G | PSEG Power & Other(a) |

|||||||||||||

| OPERATING REVENUES |

$ | 11,237 | $ | (1,103 | ) | $ | 7,807 | $ | 4,533 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

3,260 | (1,103 | ) | 3,010 | 1,353 | |||||||||||

| Operation and Maintenance |

3,150 | — | 1,843 | 1,307 | ||||||||||||

| Depreciation and Amortization |

1,135 | — | 980 | 155 | ||||||||||||

| Loss on Asset Dispositions and Impairments |

7 | — | — | 7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

7,552 | (1,103 | ) | 5,833 | 2,822 | |||||||||||

| OPERATING INCOME |

3,685 | — | 1,974 | 1,711 | ||||||||||||

| Income from Equity Method Investments |

1 | — | — | 1 | ||||||||||||

| Net Gains (Losses) on Trust Investments |

189 | — | — | 189 | ||||||||||||

| Net Other Income (Deductions) |

172 | (4 | ) | 80 | 96 | |||||||||||

| Net Non-Operating Pension and OPEB Credits (Costs) |

(218 | ) | — | 114 | (332 | ) | ||||||||||

| Interest Expense |

(748 | ) | 4 | (493 | ) | (259 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME BEFORE INCOME TAXES |

3,081 | — | 1,675 | 1,406 | ||||||||||||

| Income Tax Expense |

(518 | ) | — | (160 | ) | (358 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 2,563 | $ | — | $ | 1,515 | $ | 1,048 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income(b) |

(821 | ) | — | 17 | (838 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 1,742 | $ | — | $ | 1,532 | $ | 210 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME |

$ | 5.13 | $ | — | $ | 3.03 | $ | 2.10 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (b) |

(1.65 | ) | — | 0.03 | (1.68 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 3.48 | $ | — | $ | 3.06 | $ | 0.42 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Year Ended December 31, 2022 | ||||||||||||||||

| PSEG | Eliminations | PSE&G | PSEG Power & Other(a) |

|||||||||||||

| OPERATING REVENUES |

$ | 9,800 | $ | (1,401 | ) | $ | 7,935 | $ | 3,266 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

4,018 | (1,401 | ) | 3,270 | 2,149 | |||||||||||

| Operation and Maintenance |

3,178 | — | 1,838 | 1,340 | ||||||||||||

| Depreciation and Amortization |

1,100 | — | 935 | 165 | ||||||||||||

| Losses on Asset Dispositions and Impairments |

123 | — | — | 123 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

8,419 | (1,401 | ) | 6,043 | 3,777 | |||||||||||

| OPERATING INCOME |

1,381 | — | 1,892 | (511 | ) | |||||||||||

| Income from Equity Method Investments |

14 | — | — | 14 | ||||||||||||

| Net Gains (Losses) on Trust Investments |

(265 | ) | — | (2 | ) | (263 | ) | |||||||||

| Net Other Income (Deductions) |

124 | (1 | ) | 88 | 37 | |||||||||||

| Net Non-Operating Pension and OPEB Credits (Costs) |

376 | — | 281 | 95 | ||||||||||||

| Interest Expense |

(628 | ) | 1 | (427 | ) | (202 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME (LOSS) BEFORE INCOME TAXES |

1,002 | — | 1,832 | (830 | ) | |||||||||||

| Income Tax Benefit (Expense) |

29 | — | (267 | ) | 296 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME (LOSS) |

$ | 1,031 | $ | — | $ | 1,565 | $ | (534 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (Loss)(b) |

708 | — | — | 708 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 1,739 | $ | — | $ | 1,565 | $ | 174 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings Per Share |

||||||||||||||||

| NET INCOME (LOSS) |

$ | 2.06 | $ | — | $ | 3.12 | $ | (1.06 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items Excluded from Net Income (Loss)(b) |

1.41 | — | — | 1.41 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS (non-GAAP) |

$ | 3.47 | $ | — | $ | 3.12 | $ | 0.35 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes activities at PSEG Power, PSEG Long Island, Energy Holdings, PSEG Services Corporation and the Parent. |

| (b) | See Attachments 8 and 9 for details of items excluded from Net Income (Loss) to compute Operating Earnings (non-GAAP). |

Attachment 3

Public Service Enterprise Group Incorporated

Capitalization Schedule

(Unaudited, $ millions)

| December 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| DEBT |

||||||||

| Commercial Paper and Loans |

$ | 949 | $ | 2,200 | ||||

| Long-Term Debt* |

19,284 | 18,070 | ||||||

|

|

|

|

|

|||||

| Total Debt |

20,233 | 20,270 | ||||||

| STOCKHOLDERS’ EQUITY |

||||||||

| Common Stock |

5,018 | 5,065 | ||||||

| Treasury Stock |

(1,379 | ) | (1,377 | ) | ||||

| Retained Earnings |

12,017 | 10,591 | ||||||

| Accumulated Other Comprehensive Loss |

(179 | ) | (550 | ) | ||||

|

|

|

|

|

|||||

| Total Stockholders’ Equity |

15,477 | 13,729 | ||||||

|

|

|

|

|

|||||

| Total Capitalization |

$ | 35,710 | $ | 33,999 | ||||

|

|

|

|

|

|||||

| * | Includes current portion of Long-Term Debt |

Attachment 4

Public Service Enterprise Group Incorporated

Condensed Consolidated Statements of Cash Flows

(Unaudited, $ millions)

| Year Ended December 31, |

||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

| Net Income |

$ | 2,563 | $ | 1,031 | ||||

| Adjustments to Reconcile Net Income to Net Cash Flows From Operating Activities |

1,243 | 472 | ||||||

|

|

|

|

|

|||||

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES |

3,806 | 1,503 | ||||||

|

|

|

|

|

|||||

| NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES |

(2,958 | ) | (1,101 | ) | ||||

|

|

|

|

|

|||||

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES |

(1,260 | ) | (754 | ) | ||||

|

|

|

|

|

|||||

| Net Change in Cash, Cash Equivalents and Restricted Cash |

(412 | ) | (352 | ) | ||||

| Cash, Cash Equivalents and Restricted Cash at Beginning of Period |

511 | 863 | ||||||

|

|

|

|

|

|||||

| Cash, Cash Equivalents and Restricted Cash at End of Period |

$ | 99 | $ | 511 | ||||

|

|

|

|

|

|||||

Attachment 5

Public Service Electric & Gas Company

Retail Sales

(Unaudited)

December 31, 2023

Electric Sales

| Sales (millions kWh) |

Three Months Ended |

Change vs. 2022 |

Year Ended |

Change vs. 2022 |

||||||||

| Residential |

2,805 | 5% | 13,076 | (6%) | ||||||||

| Commercial & Industrial |

6,181 | (5%) | 25,680 | (3%) | ||||||||

| Other |

96 | (1%) | 337 | (1%) | ||||||||

|

|

|

|

|

|||||||||

| Total |

9,082 | (2%) | 39,093 | (4%) | ||||||||

|

|

|

|

|

|||||||||

Gas Sold and Transported

| Sales (millions therms) |

Three Months Ended |

Change vs. 2022 |

Year Ended |

Change vs. 2022 |

||||||||||||

| Firm Sales |

||||||||||||||||

| Residential Sales |

427 | (9%) | 1,327 | (11%) | ||||||||||||

| Commercial & Industrial |

285 | (9%) | 955 | (11%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total Firm Sales |

712 | (9%) | 2,282 | (11%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Non-Firm Sales* |

||||||||||||||||

| Commercial & Industrial |

234 | 13% | 848 | (13%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total Non-Firm Sales |

234 | 848 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Total Sales |

946 | (4%) | 3,130 | (12%) | ||||||||||||

|

|

|

|

|

|||||||||||||

| * | Contract Service Gas rate included in non-firm sales |

Weather Data*

| Three Months Ended |

Change vs. 2022 |

Year Ended |

Change vs. 2022 |

|||||||||

| THI Hours - Actual |

690 | 103% | 17,820 | (10%) | ||||||||

| THI Hours - Normal |

443 | 17,345 | ||||||||||

| Degree Days - Actual |

1,325 | (13%) | 3,633 | (20%) | ||||||||

| Degree Days - Normal |

1,567 | 4,591 | ||||||||||

| * | Winter weather as defined by heating degree days (HDD) to serve as a measure for the need for heating. For each day, HDD is calculated as HDD = 65°F – the average hourly daily temperature. Summer weather is measured by the temperature-humidity index (THI), which takes into account both the temperature and the humidity to measure the need for air conditioning. Both measures use data provided by the National Oceanic and Atmospheric Administration based on readings from Newark Liberty International Airport. Comparisons to normal are based on twenty years of historic data. |

Attachment 6

Nuclear Generation Measures

(Unaudited)

| GWh Breakdown | GWh Breakdown | |||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Nuclear - NJ |

4,676 | 4,681 | 20,500 | 20,172 | ||||||||||||

| Nuclear - PA |

2,652 | 2,657 | 11,099 | 11,093 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 7,328 | 7,338 | 31,599 | 31,265 | |||||||||||||

Attachment 7

Public Service Enterprise Group Incorporated

Statistical Measures

(Unaudited)

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Weighted Average Common Shares Outstanding (millions) |

||||||||||||||||

| Basic |

498 | 497 | 498 | 498 | ||||||||||||

| Diluted |

500 | 500 | 500 | 501 | ||||||||||||

| Stock Price at End of Period |

$ | 61.15 | $ | 61.27 | ||||||||||||

| Dividends Paid per Share of Common Stock |

$ | 0.57 | $ | 0.54 | $ | 2.28 | $ | 2.16 | ||||||||

| Dividend Yield |

3.7 | % | 3.5 | % | ||||||||||||

| Book Value per Common Share |

$ | 31.07 | $ | 27.63 | ||||||||||||

| Market Price as a Percent of Book Value |

197 | % | 222 | % | ||||||||||||

Attachment 8

Public Service Enterprise Group Incorporated

Consolidated Operating Earnings (non-GAAP) Reconciliation

| Reconciling Items |

Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| ($ millions, Unaudited) | ||||||||||||||||

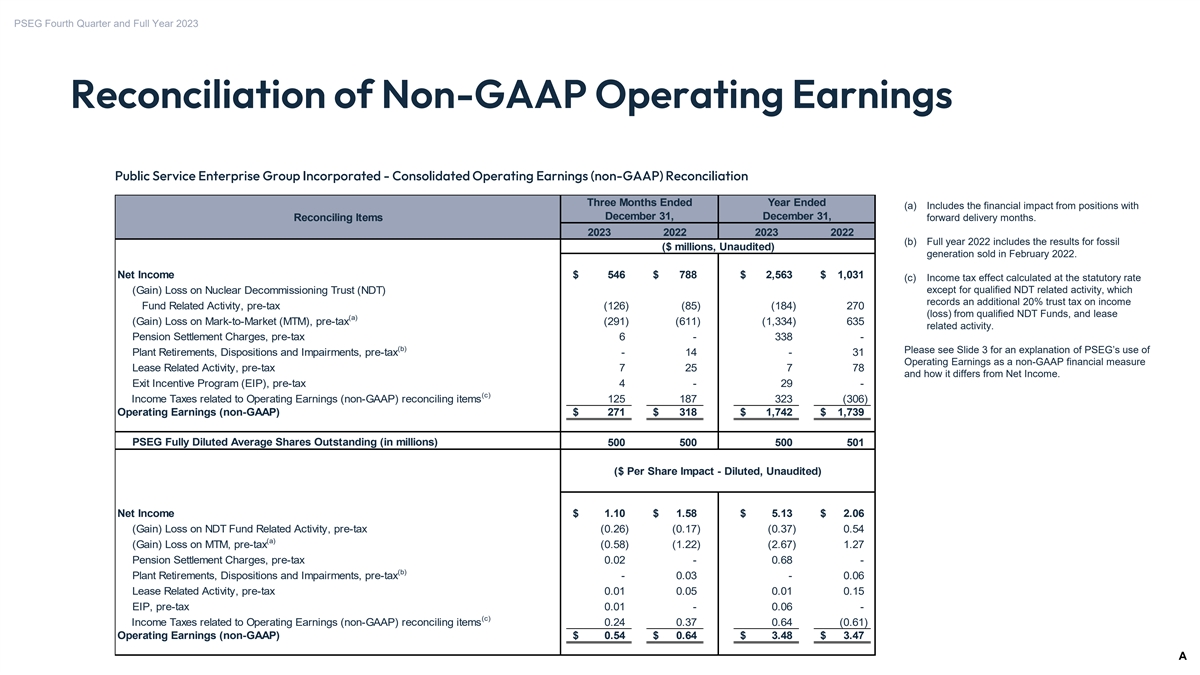

| Net Income |

$ | 546 | $ | 788 | $ | 2,563 | $ | 1,031 | ||||||||

| (Gain) Loss on Nuclear Decommissioning Trust (NDT) |

||||||||||||||||

| Fund Related Activity, pre-tax |

(126 | ) | (85 | ) | (184 | ) | 270 | |||||||||

| (Gain) Loss on Mark-to-Market (MTM), pre-tax(a) |

(291 | ) | (611 | ) | (1,334 | ) | 635 | |||||||||

| Pension Settlement Charges, pre-tax |

6 | — | 338 | — | ||||||||||||

| Plant Retirements, Dispositions and Impairments, pre-tax(b) |

— | 14 | — | 31 | ||||||||||||

| Lease Related Activity, pre-tax |

7 | 25 | 7 | 78 | ||||||||||||

| Exit Incentive Program (EIP), pre-tax |

4 | — | 29 | — | ||||||||||||

| Income Taxes related to Operating Earnings (non-GAAP) reconciling items(c) |

125 | 187 | 323 | (306 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | 271 | $ | 318 | $ | 1,742 | $ | 1,739 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| PSEG Fully Diluted Average Shares Outstanding (in millions) |

500 | 500 | 500 | 501 | ||||||||||||

| ($ Per Share Impact - Diluted, Unaudited) | ||||||||||||||||

| Net Income |

$ | 1.10 | $ | 1.58 | $ | 5.13 | $ | 2.06 | ||||||||

| (Gain) Loss on NDT Fund Related Activity, pre-tax |

(0.26 | ) | (0.17 | ) | (0.37 | ) | 0.54 | |||||||||

| (Gain) Loss on MTM, pre-tax(a) |

(0.58 | ) | (1.22 | ) | (2.67 | ) | 1.27 | |||||||||

| Pension Settlement Charges, pre-tax |

0.02 | — | 0.68 | — | ||||||||||||

| Plant Retirements, Dispositions and Impairments, pre-tax(b) |

— | 0.03 | — | 0.06 | ||||||||||||

| Lease Related Activity, pre-tax |

0.01 | 0.05 | 0.01 | 0.15 | ||||||||||||

| EIP, pre-tax |

0.01 | — | 0.06 | — | ||||||||||||

| Income Taxes related to Operating Earnings (non-GAAP) reconciling items(c) |

0.24 | 0.37 | 0.64 | (0.61 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | 0.54 | $ | 0.64 | $ | 3.48 | $ | 3.47 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes the financial impact from positions with forward delivery months. |

| (b) | Full year 2022 includes the results for fossil generation sold in February 2022. |

| (c) | Income tax effect calculated at the statutory rate except for qualified NDT related activity, which records an additional 20% trust tax on income (loss) from qualified NDT Funds, and lease related activity. |

Attachment 9

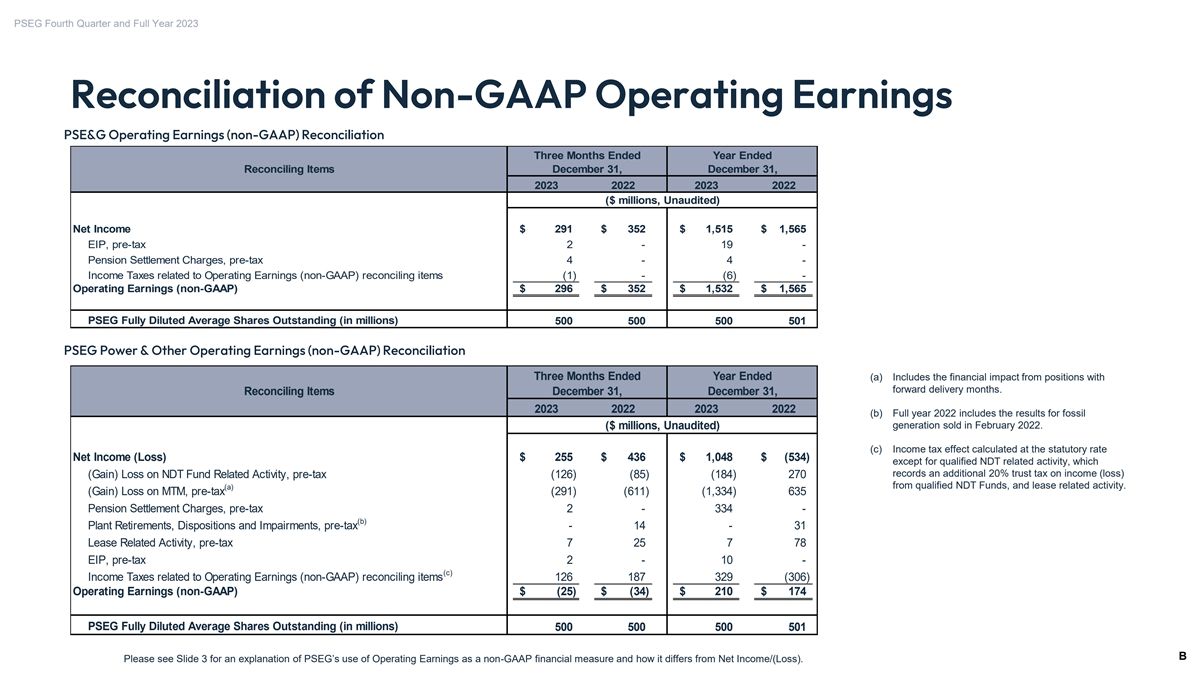

PSE&G Operating Earnings (non-GAAP) Reconciliation

| Reconciling Items |

Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| ($ millions, Unaudited) | ||||||||||||||||

| Net Income |

$ | 291 | $ | 352 | $ | 1,515 | $ | 1,565 | ||||||||

| EIP, pre-tax |

2 | — | 19 | — | ||||||||||||

| Pension Settlement Charges, pre-tax |

4 | — | 4 | — | ||||||||||||

| Income Taxes related to Operating Earnings (non-GAAP) reconciling items |

(1 | ) | — | (6 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | 296 | $ | 352 | $ | 1,532 | $ | 1,565 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| PSEG Fully Diluted Average Shares Outstanding (in millions) |

500 | 500 | 500 | 501 | ||||||||||||

PSEG Power & Other Operating Earnings (non-GAAP) Reconciliation

| Reconciling Items |

Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| ($ millions, Unaudited) | ||||||||||||||||

| Net Income (Loss) |

$ | 255 | $ | 436 | $ | 1,048 | $ | (534 | ) | |||||||

| (Gain) Loss on NDT Fund Related Activity, pre-tax |

(126 | ) | (85 | ) | (184 | ) | 270 | |||||||||

| (Gain) Loss on MTM, pre-tax(a) |

(291 | ) | (611 | ) | (1,334 | ) | 635 | |||||||||

| Pension Settlement Charges, pre-tax |

2 | — | 334 | — | ||||||||||||

| Plant Retirements, Dispositions and Impairments, pre-tax(b) |

— | 14 | — | 31 | ||||||||||||

| Lease Related Activity, pre-tax |

7 | 25 | 7 | 78 | ||||||||||||

| EIP, pre-tax |

2 | — | 10 | — | ||||||||||||

| Income Taxes related to Operating Earnings (non-GAAP) reconciling items(c) |

126 | 187 | 329 | (306 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings (non-GAAP) |

$ | (25 | ) | $ | (34 | ) | $ | 210 | $ | 174 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| PSEG Fully Diluted Average Shares Outstanding (in millions) |

500 | 500 | 500 | 501 | ||||||||||||

| (a) | Includes the financial impact from positions with forward delivery months. |

| (b) | Full year 2022 includes the results for fossil generation sold in February 2022. |

| (c) | Income tax effect calculated at the statutory rate except for qualified NDT related activity, which records an additional 20% trust tax on income (loss) from qualified NDT Funds, and lease related activity. |

Exhibit 99.1 Public Service Enterprise Group FOURTH QUARTER AND FULL YEAR 2023 NYSE: PEG Financial Results Presentation February 26, 2024

PSEG Fourth Quarter and Full Year 2023 Forward-Looking Statements Certain of the matters discussed in this presentation about our and our subsidiaries’ future • any inability to extend certain significant contracts on terms acceptable to us; • development, adoption and use of Artificial Intelligence by us and our third-party vendors; performance, including, without limitation, future revenues, earnings, strategies, prospects, • fluctuations in, or third-party default risk in wholesale power and natural gas markets, consequences, and all other statements that are not purely historical constitute “forward-looking including the potential impacts on the economic viability of our generation units; statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such • our ability to obtain adequate nuclear fuel supply; forward-looking statements are subject to risks and uncertainties, which could cause actual • changes in technology related to energy generation, distribution and consumption and changes in customer usage patterns; results to differ materially from those anticipated. Such statements are based on management’s • third-party credit risk relating to our sale of nuclear generation output and purchase of beliefs as well as assumptions made by and information currently available to management. nuclear fuel; When used herein, the words “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” • any inability to meet our commitments under forward sale obligations and Regional “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar Transmission Organization rules; • the impact of changes in state and federal legislation and regulations on our business, expressions are intended to identify forward-looking statements. Factors that may cause actual including PSE&G’s ability to recover costs and earn returns on authorized investments; results to differ are often presented with the forward-looking statements themselves. Other factors • PSE&G’s proposed investment projects or programs may not be fully approved by that could cause actual results to differ materially from those contemplated in any forward-looking regulators and its capital investment may be lower than planned; statements made by us herein are discussed in Item 1A. Risk Factors, Item 7. Management’s • our ability to receive sufficient financial support for our New Jersey nuclear plants from the markets, production tax credit and/or zero emission certificates program; Discussion and Analysis of Financial Condition and Results of Operations (MD&A), Item 8. • adverse changes in and non-compliance with energy industry laws, policies, regulations Financial Statements and Supplementary Data—Note 13. Commitments and Contingent and standards, including market structures and transmission planning and transmission Liabilities, and other filings we make with the United States Securities and Exchange Commission returns; • risks associated with our ownership and operation of nuclear facilities, including (SEC), including our subsequent reports on Form 10-Q and Form 8-K. These factors include, but increased nuclear fuel storage costs, regulatory risks, such as compliance with the are not limited to: Atomic Energy Act and trade control, environmental and other regulations, as well as • any inability to successfully develop, obtain regulatory approval for, or construct operational, financial, environmental and health and safety risks; transmission and distribution, and our nuclear generation projects; • changes in federal and state environmental laws and regulations and enforcement; • the physical, financial and transition risks related to climate change, including risks relating • delays in receipt of, or an inability to receive, necessary licenses and permits and siting to potentially increased legislative and regulatory burdens, changing customer preferences approvals; and and lawsuits; • changes in tax laws and regulations. • any equipment failures, accidents, critical operating technology or business system failures, natural disasters, severe weather events, acts of war, terrorism or other acts of All of the forward-looking statements made in this report are qualified by these cautionary violence, sabotage, physical attacks or security breaches, cyberattacks or other incidents statements and we cannot assure you that the results or developments anticipated by that may impact our ability to provide safe and reliable service to our customers; • any inability to recover the carrying amount of our long-lived assets; management will be realized or even if realized, will have the expected consequences to, or • disruptions or cost increases in our supply chain, including labor shortages; effects on, us or our business, prospects, financial condition, results of operations or cash flows. • any inability to maintain sufficient liquidity or access sufficient capital on commercially Readers are cautioned not to place undue reliance on these forward-looking statements in reasonable terms; making any investment decision. Forward-looking statements made in this report apply only as • the impact of cybersecurity attacks or intrusions or other disruptions to our information technology, operational or other systems; of the date of this report. While we may elect to update forward-looking statements from time to • a material shift away from natural gas toward increased electrification and a reduction in time, we specifically disclaim any obligation to do so, even in light of new information or future the use of natural gas; events, unless otherwise required by applicable securities laws. • failure to attract and retain a qualified workforce; • increases in the costs of equipment, materials, fuel, services and labor; The forward-looking statements contained in this report are intended to qualify for the safe • the impact of our covenants in our debt instruments and credit agreements on our harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of business; the Securities Exchange Act of 1934, as amended. • adverse performance of our defined benefit plan trust funds and Nuclear Decommissioning Trust Fund and increases in funding requirements and pension costs; 2 2

PSEG Fourth Quarter and Full Year 2023 GAAP Disclaimer PSEG presents Operating Earnings in addition to its Net Net Income/(Loss), which is an indicator of financial Income/(Loss) reported in accordance with accounting principles performance determined in accordance with GAAP. In addition, generally accepted in the United States (GAAP). Operating non-GAAP Operating Earnings as presented in this release may Earnings is a non-GAAP financial measure that differs from Net not be comparable to similarly titled measures used by other Income/(Loss). Non-GAAP Operating Earnings exclude the companies. impact of gains (losses) associated with the Nuclear Due to the forward-looking nature of non-GAAP Operating Decommissioning Trust (NDT), Mark-to-Market (MTM) Earnings guidance, PSEG is unable to reconcile this non-GAAP accounting and other material infrequent items. The last two financial measure to the most directly comparable GAAP slides in this presentation (Slides A and B) include a list of items financial measure because comparable GAAP measures are not excluded from Net Income/(Loss) to reconcile to non-GAAP reasonably accessible or reliable due to the inherent difficulty in Operating Earnings with a reference to those slides included on forecasting and quantifying measures that would be required for each of the slides where the non-GAAP information appears. such reconciliation. Namely, we are not able to reliably project Management uses non-GAAP Operating Earnings in its internal without unreasonable effort MTM and NDT gains (losses), for analysis, and in communications with investors and analysts, as future periods due to market volatility. These items are a consistent measure for comparing PSEG’s financial uncertain, depend on various factors, and may have a material performance to previous financial results. The presentation of impact on our future GAAP results. non-GAAP Operating Earnings is intended to complement, and should not be considered an alternative to, the presentation of From time to time, PSEG and PSE&G release important information via postings on their corporate Investor Relations website at https://investor.pseg.com. Investors and other interested parties are encouraged to visit the Investor Relations website to review new postings. You can sign up for automatic email alerts regarding new postings at the bottom of the webpage at https://investor.pseg.com or by navigating to the Email Alerts webpage here. The information on https://investor.pseg.com and https://investor.pseg.com/resources/email-alerts/default.aspx is not incorporated herein and is not part of this communication or the Form 8-K to which it is an exhibit. 3 3

PSEG Fourth Quarter and Full Year 2023 PSEG Q4 and Full Year 2023 Highlights Solid Fourth Quarter and Full Year Results • Net Income of $1.10 per share in Q4; Net Income of $5.13 per share in FY 2023 • Non-GAAP Operating Earnings* of $0.54 per share in Q4; Non-GAAP Operating Earnings* of $3.48 per share in FY 2023 th • 2023 marks the 19 consecutive year PSEG has met or exceeded management's non-GAAP Operating Earnings guidance Operational Excellence • #1 in Customer Satisfaction with Residential and Business Electric Service in the East among Large Utilities by J.D. Power in 2023 • 2023 PA Consulting ReliabilityOne® Award for Outstanding Metropolitan Service Area Reliability Performance in the Mid-Atlantic Region nd for 22 consecutive year • Nuclear capacity factor remains strong at approximately 93% for full year 2023 Disciplined Investment • PSE&G successfully executed its largest single year capital investment program in 2023 totaling $3.7 billion, including $1 billion in Q4 • Regulated capital investment program for 2024 - 2028 of $18 billion - $21 billion driven by system modernization and New Jersey’s decarbonization and energy policy goals • PSE&G filed a required distribution rate case with the BPU, its first in nearly six years, primarily to recover prior investments • PSE&G also submitted its CEF-EE II filing to the BPU; the $3.1 billion proposal covers commitments made during the 30-month period from January 2025 through June 2027 * See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP) for PSEG, PSE&G and PSEG Power & Other. 4 4 Note: PSEG Power & Other includes nuclear generating fleet, gas supply operations, PSEG Long Island, Offshore wind lease area, competitively bid regulated transmission investments, potential hydrogen investments, Parent and other.

PSEG Fourth Quarter and Full Year 2023 PSEG Outlook • Reaffirming PSEG full-year 2024 non-GAAP Operating Earnings guidance of $3.60 to $3.70 per share $3.60 to $3.70 • $18B - $21B regulated capital investment program over 2024-2028 Growth in earnings • 5-year capex plan supports Rate Base CAGR of 6% - 7.5% over the 2024-2028 period; influenced by the YE 2023 rate base grew by 10% over YE 2022 following drivers: $3.48 • PSEG’s improved business mix drives our non-GAAP earnings growth rate of 5% - 7% + Utility Rate Base Growth through 2028 + Nuclear PTC - Parent Interest Expense • Carbon-free nuclear fleet with predictable cash flows, stabilized by the PTC beginning in 2024, enabling multiple growth paths with modest investment • Solid balance sheet supports execution of 5-year capex plan with no new equity or asset sales needed to fund the plan th • Increased 2024 indicative common dividend* by $0.12 to $2.40 per share, the 13 consecutive increase in the annual dividend 2024E Non-GAAP 2023 Non-GAAP • PSE&G retains favorable “share of wallet” for combined residential bills: Operating Earnings Operating Earnings √ Gas bills are the lowest in the region Guidance √ Electric bills are below regional peer average Guidance for 2024 is consistent with PSEG’s non-GAAP Operating Earnings growth outlook of 5% - 7% through 2028 5 5 * All future decisions and declarations regarding dividends on the common stock are subject to approval by the Board of Directors. $ / share

PSEG Fourth Quarter and Full Year 2023 Q4 and FY 2023 Review 6

PSEG Fourth Quarter and Full Year 2023 PSEG Q4 Results PSEG EPS Summary – Three Months ended December 31 Net Income 2023 2022 Change PSE&G $0.58 $0.70 $(0.12) PSEG Power & Other $0.52 $0.88 $(0.36) Total PSEG $1.10 $1.58 $(0.48) Non-GAAP Operating Earnings* 2023 2022 Change PSE&G $0.59 $0.70 $(0.11) PSEG Power & Other $(0.05) $(0.06) $0.01 Total PSEG $0.54 $0.64 $(0.10) * See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP) for PSEG, PSE&G and PSEG Power & Other. 7 7

PSEG Fourth Quarter and Full Year 2023 PSEG EPS Reconciliation – Q4 2023 versus Q4 2022 $1.58 $1.50 $0.90 $1.10 $1.00 $0.80 $0.70 $0.64 ($0.11) $0.60 $0.54 $0.01 Transmission 0.01 Gross Margin 0.05 $0.50 Re-contracting/Market Gas Margin 0.01 0.09 Capacity (0.03) Other E&G Margin 0.01 $0.40 Gas Operations (0.01) Distribution O&M (0.05) O&M 0.01 Distribution $0.30 Depreciation & Interest Interest 0.01 (0.04) Non-Operating Distribution Non-Operating Pension/OPEB $0.20 Pension/OPEB (0.04) (0.03) Distribution Taxes (0.01) Taxes & Other $0.10 (0.03) $0.00 Q4 2022 Q4 2022 PSE&G PSEG Power & Other Q4 2023 Q4 2023 Net Income Operating Earnings Operating Earnings Net Income (non-GAAP)* (non-GAAP)* * See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP) for PSEG, PSE&G and PSEG Power & Other. 8 8 Note: Results may not add due to rounding. $ / share ~ ~

PSEG Fourth Quarter and Full Year 2023 PSEG Full Year Results PSEG EPS Summary – Years ended December 31 Net Income/(Loss) 2023 2022 Change PSE&G $3.03 $3.12 $(0.09) PSEG Power & Other $2.10 $(1.06) $3.16 Total PSEG $5.13 $2.06 $3.07 Non-GAAP Operating Earnings* 2023 2022 Change PSE&G $3.06 $3.12 $(0.06) PSEG Power & Other $0.42 $0.35 $0.07 Total PSEG $3.48 $3.47 $0.01 * See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP) for PSEG, PSE&G and PSEG Power & Other. 9 9 Note: Results may not add due to rounding.

PSEG Fourth Quarter and Full Year 2023 PSEG EPS Reconciliation – FY 2023 versus FY 2022 $5.50 $4.50 $5.13 $4.00 $5.00 $3.47 $3.48 ($0.06) $0.07 $3.50 Transmission 0.07 Gross Margin 0.23 Re-contracting/Market 0.36 Renewables & $3.00 Capacity (0.08) Energy Efficiency 0.01 Volume 0.02 Electric Margin 0.03 Gas Operations (0.07) $2.50 Gas Margin 0.04 O&M 0.06 $2.06 Other E&G Margin Depreciation 0.01 0.04 $2.00 Interest (0.06) Distribution Non-Operating Depreciation & Interest $1.50 Pension/OPEB (0.12) (0.11) Taxes & Other (0.05) Distribution Non-Operating $1.00 Pension/OPEB (0.18) Distribution Taxes 0.03 $0.50 Lower Share Count 0.01 $0.00 FY 2022 FY 2022 PSE&G PSEG Power & Other FY 2023 FY 2023 Net Income Operating Earnings Operating Earnings Net Income (non-GAAP)* (non-GAAP)* * See Slides A and B for Items excluded from Net Income/(Loss) to reconcile to Operating Earnings (non-GAAP) for PSEG, PSE&G and PSEG Power & Other. 10 10 Note: Results may not add due to rounding. $ / share ~ ~

PSEG Fourth Quarter and Full Year 2023 PSE&G Q4 and Full Year Highlights Operations Regulatory and Market Environment • Residential Electric and Gas customer count, the driver of margin growth • Filed Distribution base Electric and Gas rate case with BPU in December under the Conservation Incentive Program (CIP), each grew by ~1% in 2023 2023, as required by GSMP II • CIP minimizes margin volatility due to variations in sales, regardless of the • Proposed 6-month extension of existing CEF-EE program investment sales driver (weather, energy efficiency, net-metered solar, economy) of ~$300 million beginning July 2024 • Weather-normalized sales for the year ended December 31, 2023: • Filed CEF-EE II programs for $3.1 billion in commitments starting January 2025 through June 2027 based on BPU’s EE II framework to be spent - Electric sales decreased ~1% over a six-year period - Gas sales increased ~4% • Implemented annual FERC transmission formula rate increase of $58 million effective January 1, 2024, subject to true-up • CEF-EC/AMI installations on schedule and on budget; over 1.5 million of the 2.3 million planned meter replacements in service • Received settlement approval of GSMP II extension in October 2023 authorizing ~$900 million of infrastructure spend through December 2025 • Christine Guhl-Sadovy (D) named BPU President; Michael Bange (R) recently appointed, joining Marian Abdou (R) and Dr. Zenon Christodoulou (D) Financial • PSE&G invested ~$1 billion in Q4, completing its highest ever, capital spending plan of $3.7 billion in a single year 11

PSEG Fourth Quarter and Full Year 2023 PSE&G Base Rate Filing Seeks Recovery of Recent Investments; Cost Control and CEF-EE Programs Help to Keep Bills Affordable ▪ First distribution base rate request in six years since January 2018; 9% overall revenue increase requested New Jersey Gas Utility Costs 2018-2023 New Jersey Electric Utility Costs 2018-2023 (Annual Distribution and Infrastructure Charges 10.6% AVG NJ CAGR Residential Customers with 1,000 Therms per Year) (Annual Distribution and Infrastructure Charges Residential Customers with 7,800 kWh per Year) 5% AVG NJ CAGR 4.3% PSE&G CAGR 1.5% PSE&G CAGR Source: Utility Tariffs Source: Utility Tariffs Electric Gas Requested Return on Equity Common Equity PSE&G has delivered stable ER23120924 GR23120925 distribution rates, paired with award- Revenue Increase $462 Million $364 Million 10.4% 55.5% winning customer satisfaction 12

PSEG Fourth Quarter and Full Year 2023 PSEG Power & Other Nuclear Generation Measures Other Financial Considerations Three Months Ended Twelve Months Ended December 31, December 31, • For 2024, total nuclear generation is forecasted to be 30-32 TWh and is 90%-95% hedged at an average price of $38 per MWh* 2023 2022 2023 2022 • Transitioning PSEG’s 100%-owned Hope Creek unit Capacity Factor 85.8% 85.8% 93.2% 92.2% from 18-month to 24-month fuel cycles starting in 2025 Fuel Cost ($ millions) $45 $42 $189 $183 • In October, PSEG issued $600 million of 5.88% Senior Notes Generation (GWh) 7,328 7,338 31,599 31,265 due October 2028 and issued $400 million of 6.13% Senior Fuel Cost ($/MWh) $6.14 $5.72 $5.98 $5.85 Notes due October 2033 2022: Spring – S1 Fall – HC, PB2 • In November, PSEG retired $750 million of 0.84% Senior Notes Refueling Outages: 2023: Spring – S2 Fall – S1, PB3 at maturity 2024: Spring – HC Fall – S2, PB2 PJM Capacity Auction Results Delivery Period PSEG’s Average Prices PSEG’s Cleared Capacity Jan 2024 – May 2024 $50/MW-Day 3,700 MW Jun 2024 – May 2025 $55/MW-Day 3,500 MW * Numbers reflect management’s view of hedged percentages and prices as of December 31, 2023 for 2024E. Prices for 2024E reflect energy revenues only. Hedged positions include MTM accounting treatment and options. 13 13 Note: Generation indicates period net generation; Average Prices and Cleared Capacity reflect base and incremental auctions.

PSEG Fourth Quarter and Full Year 2023 Appendix 14

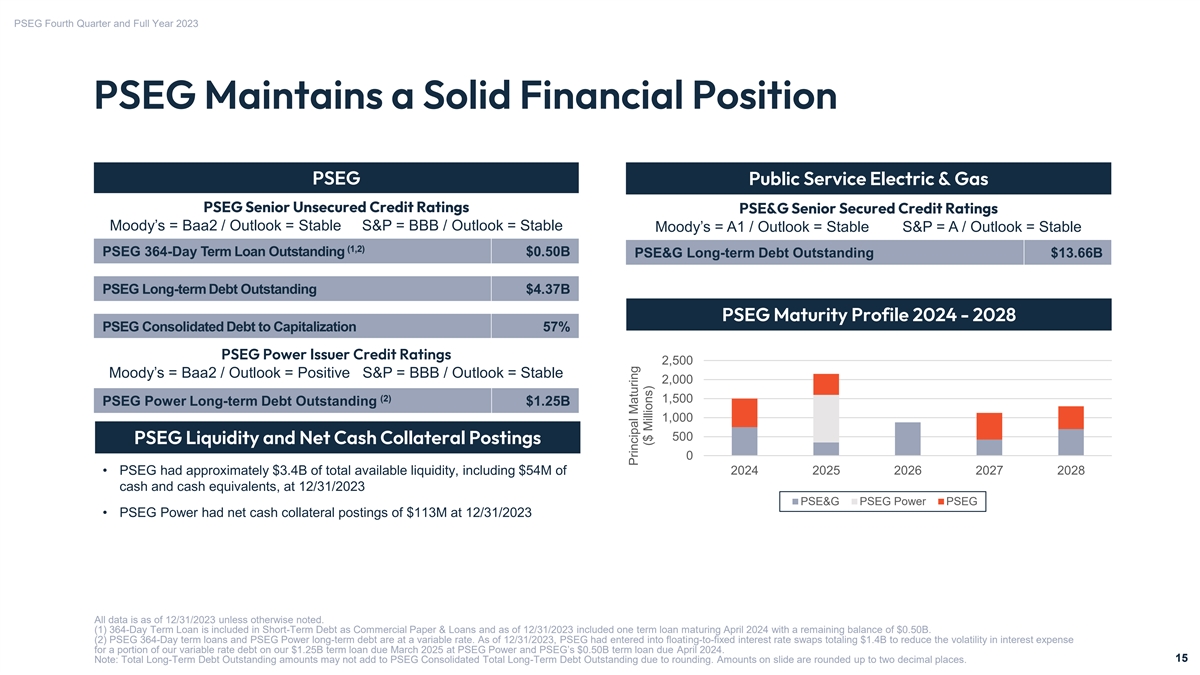

PSEG Fourth Quarter and Full Year 2023 PSEG Maintains a Solid Financial Position PSEG Public Service Electric & Gas PSEG Senior Unsecured Credit Ratings PSE&G Senior Secured Credit Ratings Moody’s = Baa2 / Outlook = Stable S&P = BBB / Outlook = Stable Moody’s = A1 / Outlook = Stable S&P = A / Outlook = Stable (1,2) PSEG 364-Day Term Loan Outstanding $0.50B PSE&G Long-term Debt Outstanding $13.66B PSEG Long-term Debt Outstanding $4.37B PSEG Maturity Profile 2024 - 2028 PSEG Consolidated Debt to Capitalization 57% PSEG Power Issuer Credit Ratings 2,500 Moody’s = Baa2 / Outlook = Positive S&P = BBB / Outlook = Stable 2,000 (2) 1,500 PSEG Power Long-term Debt Outstanding $1.25B 1,000 500 PSEG Liquidity and Net Cash Collateral Postings PSEG Liquidity and Net Cash Collateral Postings 0 • PSEG had approximately $3.4B of total available liquidity, including $54M of 2024 2025 2026 2027 2028 cash and cash equivalents, at 12/31/2023 PSE&G PSEG Power PSEG • PSEG Power had net cash collateral postings of $113M at 12/31/2023 All data is as of 12/31/2023 unless otherwise noted. (1) 364-Day Term Loan is included in Short-Term Debt as Commercial Paper & Loans and as of 12/31/2023 included one term loan maturing April 2024 with a remaining balance of $0.50B. (2) PSEG 364-Day term loans and PSEG Power long-term debt are at a variable rate. As of 12/31/2023, PSEG had entered into floating-to-fixed interest rate swaps totaling $1.4B to reduce the volatility in interest expense for a portion of our variable rate debt on our $1.25B term loan due March 2025 at PSEG Power and PSEG’s $0.50B term loan due April 2024. 15 15 Note: Total Long-Term Debt Outstanding amounts may not add to PSEG Consolidated Total Long-Term Debt Outstanding due to rounding. Amounts on slide are rounded up to two decimal places. Principal Maturing ($ Millions)

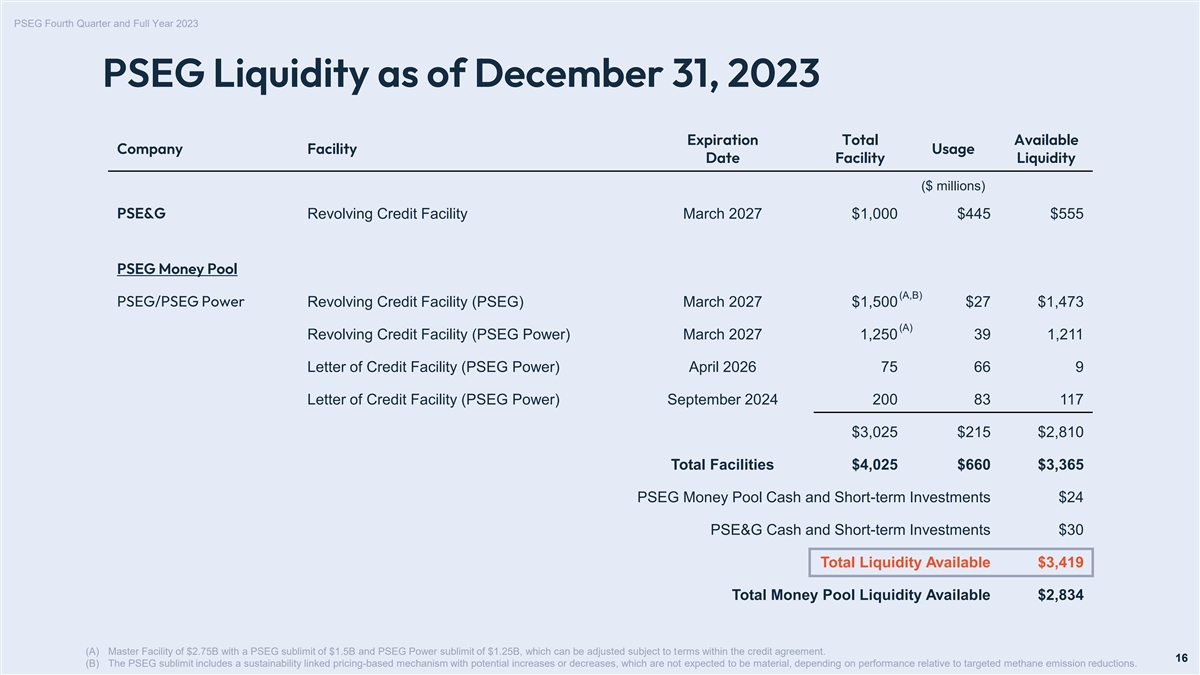

PSEG Fourth Quarter and Full Year 2023 PSEG Liquidity as of December 31, 2023 Expiration Total Available Company Facility Usage Date Facility Liquidity ($ millions) PSE&G Revolving Credit Facility March 2027 $1,000 $445 $555 PSEG Money Pool (A,B) PSEG/PSEG Power Revolving Credit Facility (PSEG) March 2027 $1,500 $27 $1,473 (A) Revolving Credit Facility (PSEG Power) March 2027 1,250 39 1,211 Letter of Credit Facility (PSEG Power) April 2026 75 66 9 Letter of Credit Facility (PSEG Power) September 2024 200 83 117 $3,025 $215 $2,810 Total Facilities $4,025 $660 $3,365 PSEG Money Pool Cash and Short-term Investments $24 PSE&G Cash and Short-term Investments $30 Total Liquidity Available $3,419 Total Money Pool Liquidity Available $2,834 (A) Master Facility of $2.75B with a PSEG sublimit of $1.5B and PSEG Power sublimit of $1.25B, which can be adjusted subject to terms within the credit agreement. 16 16 (B) The PSEG sublimit includes a sustainability linked pricing-based mechanism with potential increases or decreases, which are not expected to be material, depending on performance relative to targeted methane emission reductions.

PSEG Fourth Quarter and Full Year 2023 PSEG Sustainability and ESG Summary PSEG Leadership Policies & Goals Recognition & Memberships • PSEG is a vocal advocate for an economy- • PSE&G’s Clean Energy Future programs have • MSCI rates PSEG at AAA, its highest wide price on carbon and preservation of our invested ~$2B to decarbonize the NJ economy corporate ESG rating existing carbon-free nuclear generating fleet via Energy Efficiency, EV infrastructure, and AMI • Named to the Dow Jones Sustainability • Committed to rigorous oversight of political North America Index for 16 years in a row • Accelerated PSEG’s climate vision for Net Zero contributions and transparency in disclosure GHG emissions to 2030 for Scopes 1 & 2 • Named to Forbes List for America’s Best • PSEG oversight of sustainability and climate Employers for Diversity for 2023 • PSEG submitted proposed emissions reduction initiatives by Board of Directors’ Governance, targets to the Science Based Targets initiative • Named Member of S&P Global’s 2024 Nominating and Sustainability Committee Sustainability Yearbook • PSEG generating fleet is a Top 10 U.S. • Human Rights Policy producer of carbon-free energy • PSE&G received the PA Consulting $0.40 -$0.45 ® • LGBTQ+ Inclusion Pledge ReliabilityOne Award for Outstanding • ~$1B of regulated solar investments Metropolitan Service Area Reliability • PSEG’s business strategy is aligned with Performance in the Mid-Atlantic Region • PSE&G has issued $1.4 billion of Green Bonds many of the United Nations’ Sustainable nd for 22 consecutive year and the 2023 and PSEG sub-limit of master credit facility Development Goals ReliabilityOne® Outstanding Customer includes sustainability-linked pricing mechanism Engagement Award • Link to PSEG’s 2023 Sustainability Report* • PSEG named to 2023 CPA-Zicklin Index “Trendsetters” with a score of 90 out of a possible 100 for Corporate Political Disclosure practices and Accountability * The 2023 Sustainability Report should not be deemed incorporated into or part of these slides. Scope 1 are direct emissions from power generation, vehicle fleets and methane, SF and refrigerant leaks; Scope 2 are indirect emissions from operations from purchased energy of electric and gas and line losses; 6 17 Scope 3 are indirect emissions from our value chain.

PSEG Fourth Quarter and Full Year 2023 Glossary of Terms AMI Automated Metering Infrastructure GAAP Generally Accepted Accounting Principles PSEG Investor Relations 80 Park Plaza BPU New Jersey Board of Public Utilities GHG Greenhouse Gas Newark NJ 07102 GSMP II Gas System Modernization Program II CAGR Compound Annual Growth Rate PSEG-IR-GeneralInquiry@pseg.com HC Hope Creek CEF Clean Energy Future MSCI Morgan Stanley Capital International CIP Conservation Incentive Program Link to PSEG Investor Relations Website O&M Operation & Maintenance E Estimate OPEB Other Postretirement Benefits E&G Electric & Gas EC Energy Cloud PB Peach Bottom Link to PSEG ESG Webpages PJM Pennsylvania New Jersey Maryland EE Energy Efficiency PTC Production Tax Credit EPS Earnings Per Share S Salem ESG Environmental, Social and Governance SF Sulfur Hexafluoride 6 EV Electric Vehicle FERC Federal Energy Regulatory Commission 18 18

PSEG Fourth Quarter and Full Year 2023 Reconciliation of Non-GAAP Operating Earnings Public Service Enterprise Group Incorporated - Consolidated Operating Earnings (non-GAAP) Reconciliation Three Months Ended Year Ended (a) Includes the financial impact from positions with December 31, December 31, Reconciling Items forward delivery months. 2023 2022 2023 2022 (b) Full year 2022 includes the results for fossil ($ millions, Unaudited) generation sold in February 2022. Net Income $ 546 $ 788 $ 2,563 $ 1,031 (c) Income tax effect calculated at the statutory rate (Gain) Loss on Nuclear Decommissioning Trust (NDT) except for qualified NDT related activity, which records an additional 20% trust tax on income Fund Related Activity, pre-tax (126) (85) (184) 270 (loss) from qualified NDT Funds, and lease (a) (Gain) Loss on Mark-to-Market (MTM), pre-tax (291) ( 611) (1,334) 635 related activity. Pension Settlement Charges, pre-tax 6 - 338 - (b) Please see Slide 3 for an explanation of PSEG’s use of Plant Retirements, Dispositions and Impairments, pre-tax - 14 - 31 Operating Earnings as a non-GAAP financial measure Lease Related Activity, pre-tax 7 25 7 78 and how it differs from Net Income. Exit Incentive Program (EIP), pre-tax 4 - 29 - (c) Income Taxes related to Operating Earnings (non-GAAP) reconciling items 125 187 323 (306) Operating Earnings (non-GAAP) $ 271 $ 318 $ 1,742 $ 1,739 PSEG Fully Diluted Average Shares Outstanding (in millions) 500 500 500 501 ($ Per Share Impact - Diluted, Unaudited) Net Income $ 1 .10 $ 1.58 $ 5 .13 $ 2.06 (Gain) Loss on NDT Fund Related Activity, pre-tax (0.26) ( 0.17) (0.37) 0.54 (a) (Gain) Loss on MTM, pre-tax (0.58) ( 1.22) (2.67) 1.27 Pension Settlement Charges, pre-tax 0.02 - 0.68 - (b) Plant Retirements, Dispositions and Impairments, pre-tax - 0.03 - 0.06 Lease Related Activity, pre-tax 0.01 0.05 0.01 0.15 EIP, pre-tax 0.01 - 0.06 - (c) Income Taxes related to Operating Earnings (non-GAAP) reconciling items 0.24 0.37 0.64 ( 0.61) Operating Earnings (non-GAAP) $ 0 .54 $ 0.64 $ 3 .48 $ 3.47 A 19 19

PSEG Fourth Quarter and Full Year 2023 Reconciliation of Non-GAAP Operating Earnings PSE&G Operating Earnings (non-GAAP) Reconciliation Three Months Ended Year Ended Reconciling Items December 31, December 31, 2023 2022 2023 2022 ($ millions, Unaudited) Net Income $ 291 $ 352 $ 1,515 $ 1,565 EIP, pre-tax 2 - 19 - Pension Settlement Charges, pre-tax 4 - 4 - Income Taxes related to Operating Earnings (non-GAAP) reconciling items (1) - (6) - Operating Earnings (non-GAAP) $ 296 $ 352 $ 1,532 $ 1,565 PSEG Fully Diluted Average Shares Outstanding (in millions) 500 500 500 501 PSEG Power & Other Operating Earnings (non-GAAP) Reconciliation Three Months Ended Year Ended (a) Includes the financial impact from positions with forward delivery months. Reconciling Items December 31, December 31, 2023 2022 2023 2022 (b) Full year 2022 includes the results for fossil generation sold in February 2022. ($ millions, Unaudited) (c) Income tax effect calculated at the statutory rate Net Income (Loss) $ 255 $ 436 $ 1,048 $ (534) except for qualified NDT related activity, which records an additional 20% trust tax on income (loss) (Gain) Loss on NDT Fund Related Activity, pre-tax (126) (85) (184) 270 from qualified NDT Funds, and lease related activity. (a) (Gain) Loss on MTM, pre-tax (291) ( 611) (1,334) 635 Pension Settlement Charges, pre-tax 2 - 334 - (b) Plant Retirements, Dispositions and Impairments, pre-tax - 14 - 31 Lease Related Activity, pre-tax 7 25 7 78 EIP, pre-tax 2 - 10 - (c) Income Taxes related to Operating Earnings (non-GAAP) reconciling items 126 187 329 (306) Operating Earnings (non-GAAP) $ (25) $ (34) $ 210 $ 174 PSEG Fully Diluted Average Shares Outstanding (in millions) 500 500 500 501 B Please see Slide 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how it differs from Net Income/(Loss). 20 20