UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024

Commission File Number: 1-13368

POSCO HOLDINGS INC.

(Translation of registrant’s name into English)

POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 06194

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

To Shareholders

Notice of the 56th Ordinary General Meeting of Shareholders

We hereby notify you that the 56th Ordinary General Meeting of Shareholders will be held pursuant to Article 362 of the Korean Commercial Act and Article 20 of the Company’s Articles of Incorporation as follows.

1. Date: At 9:00 a.m. on March 21, 2024, Korea Standard Time (UTC+9)

2. Place: Art Hall, 4F West Wing, POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea

3. List of Agenda Items

| ● Agenda 1 : | Approval of Financial Statements for the 56th FY |

| (From January 1, 2023 to December 31, 2023) |

| (Year-end dividend per share : KRW 2,500) |

| • | Consolidated Financial Statements: See Appendix 1 |

| • | Separate Financial Statements: See Appendix 2 |

The audit report from the independent auditors of 56th FY Financial Statements, based on KIFRS standards, will be uploaded at POSCO HOLDINGS INC.’s website (http://www.poscoinc.com ) on March 14, 2024.

● Agenda 2: Partial Amendments of the Articles of Incorporation

[Description of the Proposal]

Pursuant to Article 433 of the Korean Commercial Act and Article 24 of the Company’s Articles of Incorporation, we request that the Ordinary General Meeting of Shareholders to approve partial amendments of the Articles of Incorporation.

| Existing Article |

Amendment |

Purpose of Change |

||

| Article 45. Special Committees

① The Company shall have special committees under the control of the Board of Directors as follows:

1. ESG Committee;

2. Director Candidate Recommendation Committee;

3. Evaluation and Compensation Committee;

4. Finance Committee;

5. Audit Committee. |

Article 45. Special Committees

① The Company shall have special committees under the control of the Board of Directors as follows:

1. ESG Committee;

2. Director Candidate Recommendation Committee;

3. Evaluation and Compensation Committee;

4. Finance Committee;

5. Audit Committee;

6. CEO Candidate Pool Management Committee |

To enhance candidate pool management | ||

| Article 29. Appointment of the CEO and the Representative Director

① By resolution of the Board of Directors, the CEO and the Representative Director shall be elected from among the Inside Directors after his qualification is approved by the CEO Candidate Recommendation Committee.

② In the event a candidate for the position of Inside Director is nominated as the CEO and the Representative Director candidate and approved by the CEO Candidate Recommendation Committee, the Board of Directors shall recommend the name of one (1) CEO and the Representative Director candidate at the General Meetings of Shareholders. Where the CEO and the Representative Director candidate is appointed as an Inside Director at General Meetings of Shareholders, the Board of Directors shall appoint the CEO and the Representative Director candidate as the CEO and the Representative Director.

③ Details concerning the composition and operation of the CEO Candidate Recommendation Committee shall be determined by the Board of Directors. |

Article 29. Appointment of the CEO and the Representative Director

① By resolution of the Board of Directors, the CEO and the Representative Director shall be elected from among the Inside Directors after his qualification is approved by the CEO Candidate Recommendation Committee.

② In the event a candidate for the position of Inside Director is nominated as the CEO and the Representative Director candidate and approved by the CEO Candidate Recommendation Committee, the Board of Directors shall recommend the name of one (1) CEO and the Representative Director candidate at the General Meetings of Shareholders. Where the CEO and the Representative Director candidate is appointed as an Inside Director at General Meetings of Shareholders, the Board of Directors shall appoint the CEO and the Representative Director candidate as the CEO and the Representative Director.

③ Details concerning the composition and operation of the CEO Candidate Recommendation Committee shall be determined by the Board of Directors. |

To ensure consistency in rules and terminology across the AoI and internal regulations

|

||

| — | ADDENDA (March 21, 2024)

The amended Articles of Incorporation shall be effective from the date on which they are approved by the resolution at the Ordinary General Meeting of Shareholders for the 56th fiscal year. |

— | ||

● Agenda 3: Election of Inside Directors

[Description of the Proposal]

Pursuant to Article 382 of the Korean Commercial Act and Article 28, 29, 29-2 of the Company’s Articles of Incorporation, we request the Ordinary General Meeting of Shareholders to appoint one(1) Inside Director to be the Representative Director & CEO and other three(3) Inside Directors of the Company as follows.

| • | Number of Inside Directors to be Elected: 4 Directors |

| • | Candidates |

| Name/ Agenda |

Date of Birth |

Professional Experience |

Term |

|||||

| Recommended by |

Period |

Details |

||||||

| Chang, In-Hwa (3-1) |

August 17, 1955 | March 2021 ~ Present |

Senior Corporate Advisor, POSCO | 3 Years | ||||

|

March 2018 ~ February 2021 |

Representative Director, President, Head of Steel Business Unit, POSCO |

|||||||

| Board of Directors |

March 2017 ~ February 2018 |

Board Member, Senior Executive Vice President, Head of Steel Production Division, POSCO |

||||||

|

February 2016 ~ February 2017 |

Senior Executive Vice President, Head of Technology and Investment Division (Head, Technical Research Laboratories), POSCO |

|||||||

|

February 2015 ~ January 2016 |

Senior Executive Vice President, Head of Steel Solution Marketing Department, POSCO |

|||||||

|

March 2014 ~ February 2015 |

Senior Executive Vice President, Head of New Business Development Department |

|||||||

|

January 2011 ~ March 2014

|

Senior Vice President, Head of New Business Department / New Growth Business Department, POSCO

|

|||||||

| Jeong, Ki-Seop (3-2) |

October 4, 1961 | January 2023 ~ Present |

CSO of Chief Strategy Office, President of POSCO HOLDINGS INC. | 1 Year | ||||

|

2020 |

Representative Director, President of POSCO Energy |

|||||||

|

2018 |

Senior Executive Vice President, Head of Corporate Planning Division, POSCO Energy |

|||||||

|

2017 |

Executive Vice President, Head of Domestic Business Management Office, POSCO |

|||||||

| Board of Directors |

2016 |

Senior Vice President, Head of Domestic Business Management Office, POSCO |

||||||

|

2015 |

Senior Vice President, Finance Chief, POSCO |

|||||||

|

2013 |

Senior Vice President, Head of Business Strategy Department, POSCO International |

|||||||

|

2012 |

Senior Vice President, Head of Overseas Management Team, POSCO International |

|||||||

| Kim, Jun-Hyung (3-3) |

November 19, 1962 | February 2024 ~ Present |

Chief, Green Materials & Energy Business Office, POSCO HOLDINGS INC. | 1 Year | ||||

|

January 2023 |

Representative Director, President of POSCO FUTURE M Co., Ltd. |

|||||||

|

January 2021 |

Representative Director, President of SNNC |

|||||||

|

January 2019 |

Head, Energy Material Department, POSCO Chemical Co., Ltd. |

|||||||

| Board of Directors |

January 2018 |

Representative Director, POSCO ESM |

||||||

|

February 2017 |

Board Member, Head of Production Division, Executive Vice President, POSCO ESM |

|||||||

|

February 2016 |

Executive Vice President, Head of New Business Department, POSCO |

|||||||

|

March 2013 |

Senior Vice President, Rolling Mill Sector Deputy Head, Pohang Works, POSCO |

|||||||

| Kim, Ki-Soo (3-4) |

April 18, 1965 |

February 2024 ~ Present

January 2024 |

Head of New Experience of Technology Hub, Group CTO, Senior Executive Vice President, POSCO HOLDINGS INC.

Senior Executive Vice President, Head, Technical Research Laboratories, POSCO

Executive Vice President, Head of Low-Carbon Process R&D Center, POSCO

Senior Vice President, Head of Engineering Solution Office, POSCO

Vice President, Pohang Research Infra Group, POSCO |

1 Year | ||||

| Board of Directors | January 2019

September 2016

June 2014 |

| * | All candidates have no relation with the largest shareholder and no transactions with POSCO HOLDINGS INC. in the past three years. |

| * | All candidates stated and signed that they do not have any legal issues to be qualified for inside directors. |

| • | Recommendation for candidates by the Board of Directors |

| Name/ Agenda |

Grounds |

|

| Chang, In-Hwa (3-1) |

Mr. Chang is a seasoned engineer with proven skills as a business leader. After obtaining both B.S. and M.S. degrees in Naval Architecture from Seoul National University, Chang earned his Ph.D. in Ocean Engineering at MIT (US). In 1988, he joined RIST as a researcher before going on to hold top positions in diverse operational organizations, such as New Business Development, Steel Solution Marketing, Technology and Investment and Production. Through these positions, Chang has acquired unparalleled breadth of experience that range from production technology, R&D and business development to investment and marketing.

In 2018, while serving as Representative Director and CEO of POSCO, the de facto parent company of POSCO Group prior to the spin-off that launched POSCO Holdings, Chang led the operational efforts to develop and market new businesses while expanding the overseas steel business network. Through these efforts, he has demonstrated his skill to strengthen the integrity of POSCO’s steelmaking competence, while adding substance and stability to new businesses, such as EV battery materials and lithium, thereby forging a way forward for the Group.

Profound technological insight, diverse operational experience and his extended tenure at POSCO Group offer undisputed depth of experience and knowledge. Essentially, it is this profound understanding that Mr. Chang has about the POSCO Group that qualifies him as the ideal candidate to serve as Representative Director or POSCO Holdings. He is best suited to continue to keep the steelmaking business strong while exploring new growth opportunities, which are two cardinal growth strategies for POSCO Group. It is our firm belief that Chang, In-Hwa will strengthen POSCO’s global clout through de-carbonization of the steel business and by developing the core competencies in new businesses. |

|

| Jeong, Ki-Seop (3-2) |

Recommendation is based on the breadth of knowledge acquired through first-hand experience at the Group’s affiliated businesses, i.e., POSCO, POSCO-International, POSCO Energy, and with proven experience in business restructuring and as CSO of POSCO Group.

Jeong is expected to make contributions to Group risk management and enhancement of operational competence. |

|

| Kim, Jun-Hyung (3-3) |

Having served as Representative Director at POSCO Future M (incumbent), SNNC, and POSCO ESM, Kim has helped to expand the scope of the rechargeable battery materials business for POSCO Group. Hence, recommendation is based on his broad experience and expertise gained in steelmaking and rechargeable battery materials businesses.

Kim is expected to contribute to managing the portfolio of eco-friendly future materials and engineering synergy across the Group businesses. |

|

| Kim, Ki-Soo (3-4) |

Kim possesses undisputed knowledge and experience in breakthrough technology research that ranges from steel product development and process engineering to AI-assisted plant automation. Hence, his contributions are expected to galvanize R&D skills at the Group level.

Kim will help to expand business research collaboration through the industry-academia-R&D network and attract new talent. |

|

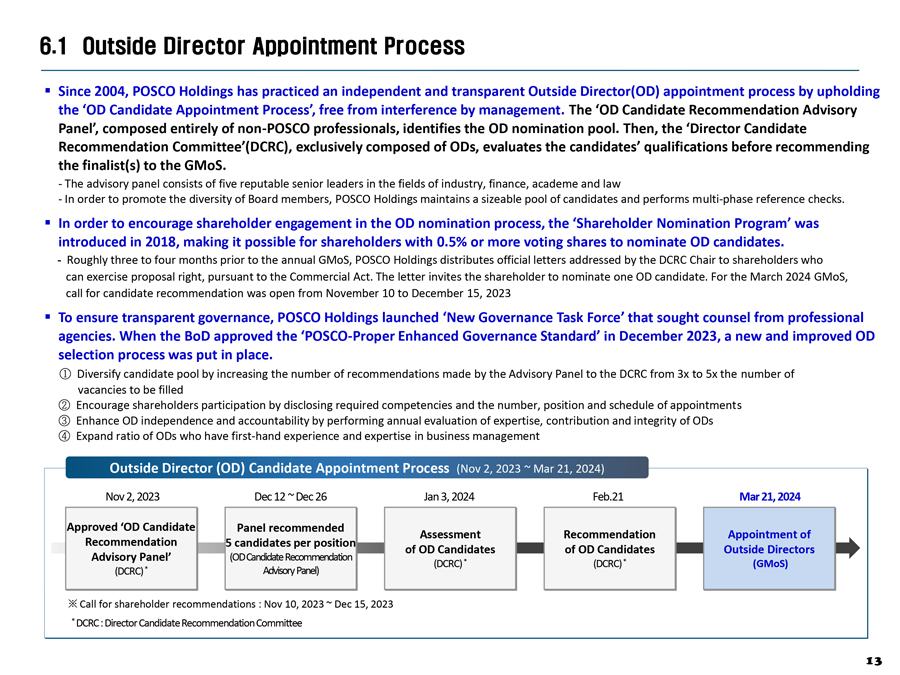

● Agenda 4: Election of Outside Directors

[Description of the Proposal]

Pursuant to Article 382 of the Korean Commercial Act, Article 28 and 30 of the Company’s Articles of Incorporation, we request the Ordinary General Meeting of Shareholders to appoint Outside Directors of the Company as follows.

| • | Number of Outside Directors to be Elected: 2 Directors |

| • | Candidates |

| Name/ Agenda |

Date of Birth |

Professional Experience |

Term |

|||||

| Recommended by |

Period |

Details |

||||||

| Yoo, Young-Sook (4-1) |

May 29, 1955 | January 2020 ~ Present | Chairperson of the Board(non-permanent), Climate Change Center | 3 Years | ||||

| Director Candidate Recommendation Committee |

April 1990 ~ Present

February 2014 ~ January 2021

2014

June 2011 ~ March 2013

|

Senior/Principal/Honorary Research Scientist, Korea Institute of Science and Technology(KIST)

Board Member(non-permanent), Research Institute of Industrial Science & Technology

Co-President, Climate Change Center

Minister, Ministry of Environment

|

||||||

| November 2009 ~ August 2010

|

Vice President, KIST | |||||||

| 2007 ~ October 2009 | Head of Biological Science Research, KIST |

|||||||

| Kwon, Tae-Kyun (4-2) |

November 28, 1955 |

December 2015 ~ June 2021

|

Senior Advisor, Yulchon LLC.

|

3 Years | ||||

| 2014 ~ 2020

|

Outside Director, SAMSUNG ELECTRO-MECHANICS CO., LTD.

|

|||||||

| Director Candidate Recommendation Committee | 2017 ~ 2019

|

Outside Director, MIRAE ASSET DAEWOO CO., LTD.

|

||||||

| 2010 | Ambassador, Korea to the United Arab Emirates | |||||||

|

2009 |

Chief Administrator, Public Procurement Service |

|||||||

|

2008 |

Head of Trade and Investment Office, Ministry of Knowledge Economy |

|||||||

|

2007 |

Deputy Minister for Free Economic Zone Planning, MOFE |

|||||||

|

2006 |

Commissioner, Korea Financial Intelligence Unit, MOFE |

|||||||

|

2005 |

Head of International Finance Bureau, MOFE |

|||||||

|

2001 |

Economic Councilor, OECD Representative Finance and |

|||||||

|

1996 |

Economy Advisor, Office of the President |

|||||||

|

1992 |

Country Officer, Asian Development Bank |

|||||||

| * | The candidates have no relation with the largest shareholder and no transactions with POSCO HOLDINGS INC. for the past three years. |

| - | In the case of the candidate Kwon, Tae-Kyun, there was no dealings with the candidate himself. Dealings existed between POSCO Group and Yulchon. Candidate Kwon resigned from Yulchon in June, 2021, shortly after his appointment as Outside Director at POSCO Holdings in March 2021. As a non-standing advisor, Kwon’s scope of work at Yulchon was limited to offering advice on Middle East regional issues. While intermittent services were provided to POSCO Holdings by Yulchon, candidate Kwon was never involved in those services. |

| * | The candidate stated and signed that he does not have any legal issues to be qualified for outside director. |

| • | Candidates’ plan to fulfill duties as Outside Directors |

| Name |

Working Plan |

|

| Yoo, Young-Sook (4-1) |

With diverse experience in the ESG field, broad domestic and international networks, and information related to the environment as the Minister of Ministry of Environment, Vice president of KIST, and Chair of the Board at the Climate Change Center, she aims to establish business strategy directions, review risks in all aspects of the company’s business, and actively and specifically advise from the perspective of the company’s shareholders and stakeholders.

Based on her experience on the Board of POSCO Holdings over the past three years and her experience serving on special committees such as the ESG, Evaluation and Compensation, and Finance Committee, she aims to provide recommendations to ensure that the company’s governance structure is operated rationally.

As an outside director, she will perform a progressive role in transparent and independent positions to provide reasoned oversight of the company’s operations and promote internal integrity. |

|

| Kwon, Tae- Kyun (4-2) |

Based on various experiences and expertise related to finance, finance and investment, such as ambassadors of the United Arab Emirates, the Administrator of Public Procurement Service and the officer of Asian Development Bank, and public institutions, He intends to check the management risks and provide proactive and specific advice from the perspective of the company’s shareholders and stakeholders.

With his experience serving on the POSCO Holdings Board for the past 3 years, as well as serving as a member of various special committee such as ESG, Finance, Evaluation and Compensation and Director Candidate Recommendation Committee, the candidate intends to make the suggestions for reasonable management of corporate governance structure.

As an outside director, he aims to represent the interests of the company and its shareholders and stakeholders in a transparent and independent manner, ensuring a balanced approach. Kwon also strives to provide rational oversight over the company’s operations and play a progressive role in advancing the integrity within the company. |

|

| • | Recommendation for the candidates by the Board of Directors |

| Name |

Grounds |

|

| Yoo, Young-Sook (4-1) |

Yoo is an ESG expert, buttressed by her professional experience as Minister of Environment, Principal Research Scientist at KIST and as Co-President at the Climate Change Center. With unrivalled subject matter knowledge and experience, for the past 3 years Yoo has already proven her skills in devising policy, monitoring risk and managing the Board.

Her contributions are well appreciated, and with expectations that she will continue to make her mark on the Board and in serving the interest of the company’s future, Yoo is recommended to serve as an independent director on the Board. |

|

| Kwon, Tae- Kyun (4-2) |

Kwon is a finance expert who has served in public finance, e.g., Asian Development Bank, and private finance. It is based on the breadth of his subject matter experience and knowledge that he has proven his skills during his 3-year service on the Board to devise policy, monitor risk, enhance governance and manage the Board.

With firm belief that Kwon will continue to make his mark on the advancement of the Board, he is recommended to serve as an independent director. |

|

● Agenda 5: Election of Outside Director to Serve on the Audit Committee

Pursuant to Article 542-12 of the Korean Commercial Act and Article 48 of the Company’s Articles of Incorporation, we request the Ordinary General Meeting of Shareholders to appoint one Outside Director to serve on the Audit Committee Member of the Company as follows.

| • | Number of Outside Director to be Elected: 1 Director |

| • | Candidate |

| Date of Birth |

Professional Experience |

Term |

||||||

| Name/ Agenda |

Recommended |

Period |

Details |

|||||

| Park, Sung-Wook |

January 8, 1958 | 2022 ~ Present | Chairman, National Academy of Engineering of Korea (NAEK) |

3 Years | ||||

| 2015 ~ Present | Member, National Academy of Engineering of Korea (NAEK) |

|||||||

| Director Candidate Recommendation Committee | 2019 ~ 2022 | Management Advisor and Vice Chairman, SK Hynix Inc. | ||||||

| 2016 ~ 2019 | Chairman, Korea Semiconductor Industry Association (KSIA) | |||||||

| 2013 ~ 2018 | CEO, President ~ Vice Chairman, SK Hynix Inc. | |||||||

| 2005 ~ 2013 | Senior Executive Vice President, Head of Research Institute, Hynix Semiconductor Inc. | |||||||

| 2001 ~ 2005 | Senior Vice President, Head of HSA, Hynix Semiconductor Inc. | |||||||

| 1984 ~ 2001 | Semiconductor R&D Center, Hyundai Electronics Co., Ltd | |||||||

| * | The candidates have no relation with the largest shareholder and no transactions with POSCO HOLDINGS INC. for the past three years. |

| * | The candidate stated and signed that he does not have any legal issues to be qualified for outside director. |

| • | Candidates’ plan to fulfill duties as Outside Directors |

| Name |

Working Plan |

|

| Park, Sung-Wook |

Having worked as a researcher at Hyundai Electronics, Head of Research Institute at Hynix Semiconductor, CTO, and CEO of SK Hynix, as a CEO with an engineering background in the advanced material semiconductor industry, expertise in R&D, and experience in technological innovation, he aims to play a role as a member of the BoD.

Having served as Chair of KSIA and being appointed as Chair of NAEK from 2022, he aims to leverage his extensive domestic and international network in R&D, as well as his understanding and experience in manufacturing, to contribute to the establishment of progressive and innovative polices for the company.

As a candidate, he will adhere to the duties of an outside director, perform his duties in a transparent and independent manner, and contribute to the company’s business risk management, sustainable management through R&D, and technological innovation. |

| • | Recommendation for the candidates by the Board of Directors |

| Name |

Grounds |

|

| Park, Sung-Wook |

Park is a business management, materials, and R&D expert in the manufacturing sector. Currently, he serves as Chair of the National Academy of Engineering of Korea where he continues to engage in a wide variety of research and breakthrough technology activities. He possesses seasoned knowledge and first-hand experience on the ground in managing business and R&D projects.

Park is expected to contribute to the Board not only from a technological perspective, but also in offering insight on the management of the business and the Board, thereby enhancing the growth and sustainability of the Group’s businesses. |

● Agenda 6: Approval of Director Remuneration Limit (FY2024)

| ☐ | The director remuneration limit (to be approved) in the FY 2024: |

KRW 10.0 billion

| ☐ | The ceiling amount (approved) of the total remuneration in the FY 2023: |

KRW 10.0 billion

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| POSCO HOLDINGS INC. | ||||||

| (Registrant) | ||||||

| Date: February 21, 2024 | By | /s/ Han, Young-Ah |

||||

| (Signature) | ||||||

| Name: Han, Young-Ah | ||||||

| Title: Senior Vice President | ||||||

Appendix 1

POSCO HOLDINGS INC.

(Formerly, POSCO)

and Subsidiaries

Consolidated Financial Statements

December 31, 2023 and 2022

(With Independent Auditors’ Report Thereon)

1

| Page | ||||

| Independent Auditors’ Report |

TBD | |||

| Consolidated Financial Statements |

||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| Notes to the Consolidated Financial Statements |

TBD | |||

2

POSCO HOLDINGS INC. and Subsidiaries

Consolidated Statements of Financial Position

As of December 31, 2023 and 2022

| (in millions of Won) | Notes | December 31, 2023 | December 31, 2022 | |||||||||||||

| Assets |

||||||||||||||||

| Cash and cash equivalents |

4,5,23 | 6,670,879 | 8,053,108 | |||||||||||||

| Trade accounts and notes receivable, net |

6,17,23,30,38 | 11,015,302 | 9,769,553 | |||||||||||||

| Other receivables, net |

7,23,38 | 1,947,529 | 2,112,697 | |||||||||||||

| Other short-term financial assets |

8,23 | 11,403,166 | 10,909,920 | |||||||||||||

| Inventories |

9 | 13,825,514 | 15,472,417 | |||||||||||||

| Current income tax assets |

36 | 101,979 | 243,829 | |||||||||||||

| Assets held for sale |

10 | 406,945 | 12,003 | |||||||||||||

| Other current assets |

16 | 840,984 | 1,075,939 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Total current assets |

46,212,298 | 47,649,466 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Long-term trade accounts and notes receivable, net |

6,23 | 42,516 | 24,033 | |||||||||||||

| Other receivables, net |

7,23,38 | 1,452,445 | 1,520,331 | |||||||||||||

| Other long-term financial assets |

8,23 | 2,708,325 | 2,332,538 | |||||||||||||

| Investments in associates and joint ventures |

11 | 5,020,264 | 4,996,551 | |||||||||||||

| Investment property, net |

13 | 1,616,294 | 1,074,031 | |||||||||||||

| Property, plant and equipment, net |

14 | 35,206,248 | 31,781,195 | |||||||||||||

| Intangible assets, net |

15 | 4,714,784 | 4,838,451 | |||||||||||||

| Defined benefit assets, net |

21 | 464,758 | 520,659 | |||||||||||||

| Deferred tax assets |

36 | 3,334,266 | 3,502,152 | |||||||||||||

| Other non-current assets |

16 | 173,196 | 167,374 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Total non-current assets |

54,733,096 | 50,757,315 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Total assets |

100,945,394 | 98,406,781 | ||||||||||||||

|

|

|

|

|

|||||||||||||

See accompanying notes to the consolidated financial statements

3

POSCO HOLDINGS INC. and Subsidiaries

Consolidated Statements of Financial Position, Continued

As of December 31, 2023 and 2022

| (in millions of Won) | Notes | December 31, 2023 | December 31, 2021 | |||||||||||||

| Liabilities |

||||||||||||||||

| Trade accounts and notes payable |

23,38 | 5,782,825 | 5,520,807 | |||||||||||||

| Short-term borrowings and current installments of long-term borrowings |

4,17,23 | 10,959,217 | 11,915,994 | |||||||||||||

| Other payables |

18,23,38 | 2,737,478 | 2,865,868 | |||||||||||||

| Other short-term financial liabilities |

19,23 | 163,626 | 106,527 | |||||||||||||

| Current income tax liabilities |

36 | 319,096 | 502,685 | |||||||||||||

| Liabilities directly associated with the assets held for sale |

141,890 | 5 | ||||||||||||||

| Provisions |

20 | 419,744 | 515,988 | |||||||||||||

| Other current liabilities |

22,29 | 1,337,642 | 1,760,316 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Total current liabilities |

21,861,518 | 23,188,190 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Long-term trade accounts and notes payable |

23,38 | — | 15 | |||||||||||||

| Long-term borrowings, excluding current installments |

4,17,23 | 15,011,163 | 12,389,667 | |||||||||||||

| Other payables |

18,23 | 873,565 | 790,402 | |||||||||||||

| Other long-term financial liabilities |

19,23 | 153,782 | 87,052 | |||||||||||||

| Defined benefit liabilities, net |

21 | 38,754 | 37,707 | |||||||||||||

| Deferred tax liabilities |

36 | 2,760,234 | 2,924,552 | |||||||||||||

| Long-term provisions |

20 | 468,009 | 579,918 | |||||||||||||

| Other non-current liabilities |

22 | 114,472 | 151,877 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Total non-current liabilities |

19,419,979 | 16,961,190 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Total liabilities |

41,281,497 | 40,149,380 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Equity |

||||||||||||||||

| Share capital |

24 | 482,403 | 482,403 | |||||||||||||

| Capital surplus |

24,28 | 1,663,334 | 1,400,832 | |||||||||||||

| Hybrid bonds |

25 | — | — | |||||||||||||

| Reserves |

26 | 67,256 | (443,990 | ) | ||||||||||||

| Treasury shares |

27 | (1,889,658 | ) | (1,892,308 | ) | |||||||||||

| Retained earnings |

53,857,514 | 52,965,179 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Equity attributable to owners of the controlling company |

54,180,849 | 52,512,116 | ||||||||||||||

| Non-controlling interests |

25 | 5,483,048 | 5,745,285 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Total equity |

59,663,897 | 58,257,401 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Total liabilities and equity |

100,945,394 | 98,406,781 | ||||||||||||||

|

|

|

|

|

|||||||||||||

See accompanying notes to the consolidated financial statements.

4

POSCO HOLDINGS INC. and Subsidiaries

Consolidated Statements of Comprehensive Income

For the years ended December 31, 2023 and 2022

| (in millions of Won, except per share information) | Notes | 2023 | 2022 | |||||||||||

| Revenue |

29,30,38 | 77,127,197 | 84,750,204 | |||||||||||

| Cost of sales |

30,32,35,38 | (70,710,293 | ) | (77,100,912 | ) | |||||||||

|

|

|

|

|

|||||||||||

| Gross profit |

6,416,904 | 7,649,292 | ||||||||||||

| Selling and administrative expenses |

31,35 | |||||||||||||

| Impairment loss on (reversal of) trade accounts and notes receivable |

23 | 17,785 | (24,791 | ) | ||||||||||

| Other administrative expenses |

28,32 | (2,669,687 | ) | (2,479,966 | ) | |||||||||

| Selling expenses |

(233,579 | ) | (294,482 | ) | ||||||||||

|

|

|

|

|

|||||||||||

| Operating profit |

3,531,423 | 4,850,053 | ||||||||||||

| Share of profit of equity-accounted investees, net |

11 | 269,678 | 676,260 | |||||||||||

| Finance income and costs |

23,33 | |||||||||||||

| Finance income |

3,830,746 | 4,834,011 | ||||||||||||

| Finance costs |

(4,202,996 | ) | (5,804,466 | ) | ||||||||||

| Other non-operating income and expenses |

34 | |||||||||||||

| Impairment loss on other receivables |

23 | (283,699 | ) | (9,824 | ) | |||||||||

| Other non-operating income |

394,346 | 592,017 | ||||||||||||

| Other non-operating expenses |

35 | (904,343 | ) | (1,123,685 | ) | |||||||||

|

|

|

|

|

|||||||||||

| Profit before income tax |

2,635,155 | 4,014,366 | ||||||||||||

| Income tax expense |

36 | (789,305 | ) | (453,882 | ) | |||||||||

|

|

|

|

|

|||||||||||

| Profit |

1,845,850 | 3,560,484 | ||||||||||||

| Other comprehensive income (loss) |

||||||||||||||

| Items that will not be reclassified subsequently to profit or loss: |

||||||||||||||

| Capital adjustment arising from investments in equity-accounted investees |

28,745 | 946 | ||||||||||||

| Foreign currency translation differences |

76,433 | (48,702 | ) | |||||||||||

| Remeasurements of defined benefit plans |

21 | (118,548 | ) | 105,769 | ||||||||||

| Net changes in fair value of equity investments at fair value through other comprehensive income |

23 | 257,725 | (10,076 | ) | ||||||||||

| Items that are or may be reclassified subsequently to profit or loss: |

||||||||||||||

| Capital adjustment arising from investments in equity-accounted investees |

207,860 | 132,188 | ||||||||||||

| Foreign currency translation differences |

34,118 | 52,726 | ||||||||||||

| Gains or losses on valuation of derivatives |

23 | (1,292 | ) | 1,023 | ||||||||||

|

|

|

|

|

|||||||||||

| Other comprehensive income, net of tax |

485,041 | 233,874 | ||||||||||||

|

|

|

|

|

|||||||||||

| Total comprehensive income |

2,330,891 | 3,794,358 | ||||||||||||

|

|

|

|

|

|||||||||||

| Profit attributable to: |

||||||||||||||

| Owners of the controlling company |

1,698,092 | 3,144,087 | ||||||||||||

| Non-controlling interests |

147,758 | 416,397 | ||||||||||||

|

|

|

|

|

|||||||||||

| Profit |

1,845,850 | 3,560,484 | ||||||||||||

|

|

|

|

|

|||||||||||

| Total comprehensive income attributable to : |

||||||||||||||

| Owners of the controlling company |

2,131,737 | 3,380,649 | ||||||||||||

| Non-controlling interests |

199,154 | 413,709 | ||||||||||||

|

|

|

|

|

|||||||||||

| Total comprehensive income |

2,330,891 | 3,794,358 | ||||||||||||

|

|

|

|

|

|||||||||||

| Earnings per share (in Won) |

37 | |||||||||||||

| Basic earnings per share (in Won) |

22,382 | 41,456 | ||||||||||||

| Diluted earnings per share (in Won) |

22,382 | 39,126 | ||||||||||||

|

|

|

|

|

|||||||||||

See accompanying notes to the consolidated financial statements.

5

POSCO HOLDINGS INC. and Subsidiaries

Consolidated Statements of Changes in Equity

For the years ended December 31, 2023 and 2022

| (in millions of Won) | Attributable to owners of the controlling company | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||||

| Share capital |

Capital surplus |

Hybrid bonds |

Reserves | Treasury shares |

Retained earnings |

Subtotal | ||||||||||||||||||||||||||||||||||

| Balance as of January 1, 2022 |

482,403 | 1,387,960 | 199,384 | (666,985 | ) | (2,508,294 | ) | 51,532,887 | 50,427,355 | 4,377,588 | 54,804,943 | |||||||||||||||||||||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||||||||||||||||

| Profit |

— | — | — | — | — | 3,144,087 | 3,144,087 | 416,397 | 3,560,484 | |||||||||||||||||||||||||||||||

| Other comprehensive income |

||||||||||||||||||||||||||||||||||||||||

| Remeasurements of defined benefit plans, net of tax |

— | — | — | — | — | 67,167 | 67,167 | 38,602 | 105,769 | |||||||||||||||||||||||||||||||

| Capital adjustment arising from investments in equity-accounted investees, net of tax |

— | — | — | 126,278 | — | — | 126,278 | 6,856 | 133,134 | |||||||||||||||||||||||||||||||

| Net changes in fair value of equity investments at fair value through other comprehensive income, net of tax |

— | — | — | 49,516 | — | (59,576 | ) | (10,060 | ) | (16 | ) | (10,076 | ) | |||||||||||||||||||||||||||

| Foreign currency translation differences, net of tax |

— | — | — | 52,725 | — | — | 52,725 | (48,701 | ) | 4,024 | ||||||||||||||||||||||||||||||

| Gains or losses on valuation of derivatives, net of tax |

— | — | — | 452 | — | — | 452 | 571 | 1,023 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total comprehensive income |

— | — | — | 228,971 | — | 3,151,678 | 3,380,649 | 413,709 | 3,794,358 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Transactions with owners of the controlling company, recognized directly in equity: |

||||||||||||||||||||||||||||||||||||||||

| Year-end dividends |

— | — | — | — | — | (378,128 | ) | (378,128 | ) | (82,110 | ) | (460,238 | ) | |||||||||||||||||||||||||||

| Interim dividends |

— | — | — | — | — | (758,492 | ) | (758,492 | ) | — | (758,492 | ) | ||||||||||||||||||||||||||||

| Changes in subsidiaries |

— | — | — | — | — | — | — | 422,424 | 422,424 | |||||||||||||||||||||||||||||||

| Changes in ownership interest in subsidiaries |

— | (7,827 | ) | — | — | — | — | (7,827 | ) | 425,871 | 418,044 | |||||||||||||||||||||||||||||

| Interest of hybrid bonds |

— | — | — | — | — | (1,487 | ) | (1,487 | ) | (15,007 | ) | (16,494 | ) | |||||||||||||||||||||||||||

| Variation due to split |

— | — | (199,384 | ) | — | — | — | (199,384 | ) | 199,384 | — | |||||||||||||||||||||||||||||

| Disposal of treasury stock |

— | 9,491 | — | — | 48,512 | — | 58,003 | — | 58,003 | |||||||||||||||||||||||||||||||

| Retirement of treasury stock |

— | — | — | — | 567,474 | (583,485 | ) | (16,011 | ) | — | (16,011 | ) | ||||||||||||||||||||||||||||

| Share-based payment |

— | 12,115 | — | — | — | — | 12,115 | — | 12,115 | |||||||||||||||||||||||||||||||

| Others |

— | (907 | ) | — | (5,976 | ) | — | 2,206 | (4,677 | ) | 3,426 | (1,251 | ) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total transactions with owners of the controlling company |

— | 12,872 | (199,384 | ) | (5,976 | ) | 615,986 | (1,719,386 | ) | (1,295,888 | ) | 953,988 | (341,900 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance as of December 31, 2022 |

482,403 | 1,400,832 | — | (443,990 | ) | (1,892,308 | ) | 52,965,179 | 52,512,116 | 5,745,285 | 58,257,401 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

See accompanying notes to the consolidated financial statements.

6

POSCO HOLDINGS INC. and Subsidiaries

Consolidated Statements of Changes in Equity, Continued

For the years ended December 31, 2023 and 2022

| (in millions of Won) | Attributable to owners of the controlling company | Non- controlling interests |

Total | |||||||||||||||||||||||||||||||||||||

| Share capital |

Capital surplus |

Hybrid bonds |

Reserves | Treasury shares |

Retained earnings |

Subtotal | ||||||||||||||||||||||||||||||||||

| Balance as of January 1, 2023 |

482,403 | 1,400,832 | — | (443,990 | ) | (1,892,308 | ) | 52,965,179 | 52,512,116 | 5,745,285 | 58,257,401 | |||||||||||||||||||||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||||||||||||||||

| Profit |

— | — | — | — | — | 1,698,092 | 1,698,092 | 147,758 | 1,845,850 | |||||||||||||||||||||||||||||||

| Other comprehensive income |

||||||||||||||||||||||||||||||||||||||||

| Remeasurements of defined benefit plans, net of tax |

— | — | — | — | — | (83,148 | ) | (83,148 | ) | (35,400 | ) | (118,548 | ) | |||||||||||||||||||||||||||

| Capital adjustment arising from investments in equity-accounted investees, net of tax |

— | — | — | 225,591 | — | — | 225,591 | 11,014 | 236,605 | |||||||||||||||||||||||||||||||

| Net changes in fair value of equity investments at fair value through other comprehensive income, net of tax |

— | — | — | 257,122 | — | 603 | 257,725 | — | 257,725 | |||||||||||||||||||||||||||||||

| Foreign currency translation differences, net of tax |

— | — | — | 34,118 | — | — | 34,118 | 76,433 | 110,551 | |||||||||||||||||||||||||||||||

| Gains or losses on valuation of derivatives, net of tax |

— | — | — | (641 | ) | — | — | (641 | ) | (651 | ) | (1,292 | ) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total comprehensive income |

— | — | — | 516,190 | — | 1,615,547 | 2,131,737 | 199,154 | 2,330,891 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Transactions with owners of the controlling company, recognized directly in equity: |

||||||||||||||||||||||||||||||||||||||||

| Year-end dividends |

— | — | — | — | — | (151,698 | ) | (151,698 | ) | (94,690 | ) | (246,388 | ) | |||||||||||||||||||||||||||

| Interim dividends |

— | — | — | — | — | (569,072 | ) | (569,072 | ) | — | (569,072 | ) | ||||||||||||||||||||||||||||

| Changes in subsidiaries |

— | — | — | — | — | — | — | 5,805 | 5,805 | |||||||||||||||||||||||||||||||

| Changes in ownership interest in subsidiaries |

— | 250,363 | — | — | — | — | 250,363 | 12,383 | 262,746 | |||||||||||||||||||||||||||||||

| Interest of hybrid bonds |

— | — | — | — | — | — | — | (8,925 | ) | (8,925 | ) | |||||||||||||||||||||||||||||

| Repayment of hybrid bonds |

— | — | — | — | — | — | — | (339,837 | ) | (339,837 | ) | |||||||||||||||||||||||||||||

| Disposal of treasury stock |

— | 2,880 | — | — | 2,650 | — | 5,530 | — | 5,530 | |||||||||||||||||||||||||||||||

| Share-based payment |

— | 6,783 | — | — | — | — | 6,783 | — | 6,783 | |||||||||||||||||||||||||||||||

| Others |

— | 2,476 | — | (4,944 | ) | — | (2,442 | ) | (4,910 | ) | (36,127 | ) | (41,037 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total transactions with owners of the controlling company |

— | 262,502 | — | (4,944 | ) | 2,650 | (723,212 | ) | (463,004 | ) | (461,391 | ) | (924,395 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Balance as of December 31, 2023 |

482,403 | 1,663,334 | — | 67,256 | (1,889,658 | ) | 53,857,514 | 54,180,849 | 5,483,048 | 59,663,897 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

See accompanying notes to the consolidated financial statements.

7

POSCO HOLDINGS INC. and Subsidiaries

Consolidated Statements of Cash Flows

For the years ended December 31, 2023 and 2022

| (in millions of Won) | Notes | 2023 | 2022 | |||||||||||

| Cash flows from operating activities |

||||||||||||||

| Profit |

1,845,850 | 3,560,484 | ||||||||||||

| Adjustments for: |

||||||||||||||

| Depreciation |

3,325,088 | 3,204,743 | ||||||||||||

| Amortization |

498,193 | 488,834 | ||||||||||||

| Finance income |

(1,850,756 | ) | (1,943,661 | ) | ||||||||||

| Finance costs |

2,179,233 | 2,532,735 | ||||||||||||

| Income tax expense |

789,305 | 453,883 | ||||||||||||

| Impairment loss on property, plant and equipment |

275,846 | 213,183 | ||||||||||||

| Gain on disposal of property, plant and equipment |

(9,387 | ) | (18,502 | ) | ||||||||||

| Loss on disposal of property, plant and equipment |

125,823 | 111,082 | ||||||||||||

| Impairment loss on goodwill and other intangible assets |

129,907 | 370,663 | ||||||||||||

| Gain on disposal of investments in subsidiaries, associates and joint ventures |

(197,088 | ) | (13,904 | ) | ||||||||||

| Loss on disposal of investments in subsidiaries, associates and joint ventures |

18,843 | 12,400 | ||||||||||||

| Share of profit of equity-accounted investees |

(269,678 | ) | (676,260 | ) | ||||||||||

| Gain on disposal of assets held for sale |

(1,312 | ) | (55,262 | ) | ||||||||||

| Loss on disposal of assets held for sale |

103,366 | 3,965 | ||||||||||||

| Expenses related to post-employment benefit |

203,967 | 228,611 | ||||||||||||

| Impairment loss on trade and other receivables |

265,914 | 34,615 | ||||||||||||

| Loss on valuation of inventories |

295,032 | 259,678 | ||||||||||||

| Increase to provisions |

10,071 | 289,915 | ||||||||||||

| Insurance money |

(7,682 | ) | (236,344 | ) | ||||||||||

| Others, net |

(38,199 | ) | 28,382 | |||||||||||

|

|

|

|

|

|||||||||||

| 5,846,486 | 5,288,756 | |||||||||||||

|

|

|

|

|

|||||||||||

| Changes in operating assets and liabilities |

40 | (1,017,369 | ) | (335,363 | ) | |||||||||

| Interest received |

447,630 | 249,751 | ||||||||||||

| Interest paid |

(1,037,659 | ) | (560,766 | ) | ||||||||||

| Dividends received |

696,941 | 757,502 | ||||||||||||

| Income taxes paid |

(730,837 | ) | (2,773,599 | ) | ||||||||||

|

|

|

|

|

|||||||||||

| Net cash provided by operating activities |

6,051,042 | 6,186,765 | ||||||||||||

|

|

|

|

|

|||||||||||

See accompanying notes to the consolidated financial statements.

8

POSCO HOLDINGS INC. and Subsidiaries

Consolidated Statements of Cash Flows, Continued

For the years ended December 31, 2023 and 2022

| (in millions of Won) | Notes | 2023 | 2022 | |||||||||||||

| Cash flows from investing activities |

||||||||||||||||

| Acquisitions of short-term financial instruments |

(39,845,242 | ) | (89,327,182 | ) | ||||||||||||

| Proceeds from disposal of short-term financial instruments |

40,168,560 | 91,539,884 | ||||||||||||||

| Increase in loans |

(1,187,168 | ) | (1,087,409 | ) | ||||||||||||

| Collection of loans |

1,371,072 | 1,086,964 | ||||||||||||||

| Acquisitions of securities |

(382,372 | ) | (493,054 | ) | ||||||||||||

| Proceeds from disposal of securities |

144,464 | 332,724 | ||||||||||||||

| Acquisitions of long-term financial instruments |

(5,362 | ) | (21,638 | ) | ||||||||||||

| Acquisitions of investment in subsidiaries, associates and joint ventures |

(417,603 | ) | (518,158 | ) | ||||||||||||

| Proceeds from disposal of investment in subsidiaries, associates and joint ventures |

142,316 | 169,365 | ||||||||||||||

| Acquisitions of investment property |

(55,833 | ) | (1,561 | ) | ||||||||||||

| Proceeds from disposal of investment property |

404 | 23,401 | ||||||||||||||

| Acquisitions of property, plant and equipment |

(6,721,840 | ) | (4,927,586 | ) | ||||||||||||

| Proceeds from disposal of property, plant and equipment |

(9,100 | ) | 864 | |||||||||||||

| Acquisitions of intangible assets |

(423,605 | ) | (492,873 | ) | ||||||||||||

| Proceeds from disposal of intangible assets |

28,079 | 7,748 | ||||||||||||||

| Proceeds from disposal of assets held for sale |

4,850 | 111,488 | ||||||||||||||

| Collection of lease receivables |

52,657 | 54,614 | ||||||||||||||

| Cash outflows due to business combinations |

(150,201 | ) | (901,223 | ) | ||||||||||||

| Cash inflow due to insurance money |

7,682 | 236,344 | ||||||||||||||

| Others, net |

(7,352 | ) | (12,583 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Net cash used in investing activities |

(7,285,594 | ) | (4,219,871 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Cash flows from financing activities |

40 | |||||||||||||||

| Proceeds from borrowings |

7,787,143 | 4,553,746 | ||||||||||||||

| Repayment of borrowings |

(5,321,696 | ) | (4,138,054 | ) | ||||||||||||

| Proceeds from (repayment of) short-term borrowings, net |

(1,635,917 | ) | 1,764,569 | |||||||||||||

| Capital contribution from non-controlling interests |

299,342 | 577,330 | ||||||||||||||

| Payment of cash dividends |

(815,451 | ) | (1,218,405 | ) | ||||||||||||

| Repayment of hybrid bonds |

(340,000 | ) | — | |||||||||||||

| Payment of interest of hybrid bonds |

(10,043 | ) | (16,494 | ) | ||||||||||||

| Repayment of lease liabilities |

(222,829 | ) | (268,082 | ) | ||||||||||||

| Others, net |

94,881 | 64,798 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Net cash provided by (used in) financing activities |

(164,570 | ) | 1,319,408 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Effect of exchange rate fluctuation on cash held |

16,719 | (8,740 | ) | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net increase in cash and cash equivalents |

(1,382,403 | ) | 3,277,562 | |||||||||||||

| Cash and cash equivalents at beginning of the period |

5,10 | 8,053,282 | 4,775,720 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Cash and cash equivalents at end of the period |

5,10 | 6,670,879 | 8,053,282 | |||||||||||||

|

|

|

|

|

|||||||||||||

See accompanying notes to the consolidated financial statements.

9

Appendix 2

POSCO HOLDINGS INC.

(Formerly, POSCO)

Separate Financial Statements

December 31, 2023 and 2022

(With Independent Auditors’ Report Thereon)

1

Table of Contents

| Page | ||||

| Independent Auditors’ Report |

TBD | |||

| Separate Financial Statements |

||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| Notes to the Separate Financial Statements |

TBD | |||

| Independent Auditors’ Report on Internal Control over Financial Reporting |

TBD | |||

| Report on the Operating Status of Internal Control over Financial Reporting |

TBD | |||

2

POSCO HOLDINGS INC.

Separate Statements of Financial Position

As of December 31, 2023 and 2022

| (in millions of Won) | Notes | December 31, 2023 |

December 31, 2022 |

|||||||||||

| Assets |

||||||||||||||

| Cash and cash equivalents |

4,5,22 | 376,914 | 1,415,201 | |||||||||||

| Trade accounts and notes receivable, net |

6,22,36 | 238,332 | 128,991 | |||||||||||

| Other receivables, net |

7,22,36 | 68,821 | 40,288 | |||||||||||

| Other short-term financial assets |

8,22 | 3,940,743 | 2,515,375 | |||||||||||

| Current income tax assets |

34 | 32,015 | 203,263 | |||||||||||

| Other current assets |

15 | 1,074 | 5,172 | |||||||||||

|

|

|

|

|

|||||||||||

| Total current assets |

4,657,899 | 4,308,290 | ||||||||||||

|

|

|

|

|

|||||||||||

| Other receivables, net |

7,22 | 6,955 | 209,057 | |||||||||||

| Other long-term financial assets |

8,22 | 1,131,074 | 1,062,530 | |||||||||||

| Investments in subsidiaries, associates and joint ventures |

11 | 45,321,370 | 45,187,627 | |||||||||||

| Investment property, net |

12 | 309,900 | 220,699 | |||||||||||

| Property, plant and equipment, net |

13 | 197,787 | 145,006 | |||||||||||

| Intangible assets, net |

14 | 19,341 | 15,902 | |||||||||||

| Other non-current assets |

15 | 1,872 | 8 | |||||||||||

|

|

|

|

|

|||||||||||

| Total non-current assets |

46,988,299 | 46,840,829 | ||||||||||||

|

|

|

|

|

|||||||||||

| Total assets |

51,646,198 | 51,149,119 | ||||||||||||

|

|

|

|

|

|||||||||||

See accompanying notes to the separate financial statements.

3

POSCO HOLDINGS INC.

Separate Statements of Financial Position, Continued

As of December 31, 2023 and 2022

| (in millions of Won) | Notes | December 31, 2023 |

December 31, 2022 |

|||||||||||

| Liabilities |

||||||||||||||

| Short-term borrowings and current installments of long-term borrowings |

4,16,22,38 | 1,756,691 | — | |||||||||||

| Other payables |

17,22,36,38 | 39,739 | 64,597 | |||||||||||

| Other short-term financial liabilities |

18,22,38 | 1,571 | 5,815 | |||||||||||

| Provisions |

19 | 14,983 | 45,388 | |||||||||||

| Other current liabilities |

21 | 6,686 | 3,193 | |||||||||||

|

|

|

|

|

|||||||||||

| Total current liabilities |

1,819,670 | 118,993 | ||||||||||||

|

|

|

|

|

|||||||||||

| Long-term borrowings, excluding current installments |

4,16,22,38 | 1,316 | 1,359,587 | |||||||||||

| Other payables |

17,22,38 | 26,804 | — | |||||||||||

| Other long-term financial liabilities |

18,22,38 | 6,968 | 3,668 | |||||||||||

| Defined benefit liabilities, net |

20 | 4,283 | 3,761 | |||||||||||

| Deferred tax liabilities |

34 | 2,281,500 | 2,480,379 | |||||||||||

| Long-term provisions |

19 | 2,634 | 10,868 | |||||||||||

| Other non-current liabilities |

21 | 3,158 | — | |||||||||||

|

|

|

|

|

|||||||||||

| Total non-current liabilities |

2,326,663 | 3,858,263 | ||||||||||||

|

|

|

|

|

|||||||||||

| Total liabilities |

4,146,333 | 3,977,256 | ||||||||||||

|

|

|

|

|

|||||||||||

| Equity |

||||||||||||||

| Share capital |

23 | 482,403 | 482,403 | |||||||||||

| Capital surplus |

23,26 | 1,370,557 | 1,360,894 | |||||||||||

| Reserves |

24 | 30,678 | (188,801 | ) | ||||||||||

| Treasury shares |

25 | (1,889,658 | ) | (1,892,308 | ) | |||||||||

| Retained earnings |

27 | 47,505,885 | 47,409,675 | |||||||||||

|

|

|

|

|

|||||||||||

| Total equity |

47,499,865 | 47,171,863 | ||||||||||||

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

51,646,198 | 51,149,119 | ||||||||||||

|

|

|

|

|

|||||||||||

See accompanying notes to the separate financial statements.

4

POSCO HOLDINGS INC.

Separate Statements of Comprehensive Income

For the years ended December 31, 2023 and 2022

| (in millions of Won, except per share informations) | Notes | 2023 | 2022 | |||||||||||

| Operating revenue |

28,36 | |||||||||||||

| Revenue |

1,454,079 | 8,589,819 | ||||||||||||

| Operating expenses |

9,33,36 | |||||||||||||

| Cost of sales |

33 | — | (6,463,246 | ) | ||||||||||

| Impairment loss on trade accounts and notes receivable |

— | — | ||||||||||||

| Other administrative expenses |

26,29 | (347,450 | ) | (414,086 | ) | |||||||||

| Selling expenses |

29 | — | (37,594 | ) | ||||||||||

|

|

|

|

|

|||||||||||

| (347,450 | ) | (6,914,926 | ) | |||||||||||

|

|

|

|

|

|||||||||||

| Operating profit |

1,106,629 | 1,674,893 | ||||||||||||

| Finance income and costs |

22,31 | |||||||||||||

| Finance income |

315,828 | 392,984 | ||||||||||||

| Finance costs |

(405,881 | ) | (434,963 | ) | ||||||||||

|

|

|

|

|

|||||||||||

| Other non-operating income and expenses |

||||||||||||||

| Impairment loss on other receivables |

(221,251 | ) | (128 | ) | ||||||||||

| Other non-operating income |

32 | 23,469 | 33,699 | |||||||||||

| Other non-operating expenses |

32,33 | (135,071 | ) | (347,002 | ) | |||||||||

|

|

|

|

|

|||||||||||

| Profit before income tax |

683,723 | 1,319,483 | ||||||||||||

| Income tax expense (benefit) |

34 | 115,854 | (1,787,336 | ) | ||||||||||

|

|

|

|

|

|||||||||||

| Profit (loss) |

799,577 | (467,853 | ) | |||||||||||

| Other comprehensive income (loss) |

||||||||||||||

| Items that will not be reclassified subsequently to profit or loss: |

||||||||||||||

| Remeasurements of defined benefit plans |

20 | (97 | ) | (75,271 | ) | |||||||||

| Net changes in fair value of equity investments at fair value through other comprehensive income |

8,22 | 236,979 | (37,054 | ) | ||||||||||

| Total comprehensive income (loss) |

1,036,459 | (580,178 | ) | |||||||||||

|

|

|

|

|

|||||||||||

| Earnings (loss) per share (in Won) |

35 | |||||||||||||

| Basic earnings (loss) per share (in Won) |

10,539 | (6,185 | ) | |||||||||||

| Diluted earnings (loss) per share (in Won) |

10,539 | (6,649 | ) | |||||||||||

|

|

|

|

|

|||||||||||

See accompanying notes to the separate financial statements.

5

POSCO HOLDINGS INC.

Separate Statements of Changes in Equity

For the years ended December 31, 2023 and 2022

| (in millions of Won) | Share capital |

Capital surplus |

Hybrid bonds |

Reserves | Treasury shares |

Retained earnings |

Total | |||||||||||||||||||||||||

| Balance as of January 1, 2022 |

482,403 | 1,339,289 | 199,384 | (211,849 | ) | (2,508,294 | ) | 49,734,492 | 49,035,425 | |||||||||||||||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||||||||

| Loss |

— | — | — | — | — | (467,852 | ) | (467,852 | ) | |||||||||||||||||||||||

| Other comprehensive income (loss) |

||||||||||||||||||||||||||||||||

| Remeasurements of defined benefit plans, net of tax |

— | — | — | — | — | (75,271 | ) | (75,271 | ) | |||||||||||||||||||||||

| Net changes in fair value of equity investments at fair value through other comprehensive income, net of tax |

— | — | — | 23,048 | — | (60,102 | ) | (37,054 | ) | |||||||||||||||||||||||

| Transactions with owners of the Company, recognized directly in equity: |

||||||||||||||||||||||||||||||||

| Year-end dividends |

— | — | — | — | — | (378,128 | ) | (378,128 | ) | |||||||||||||||||||||||

| Interim dividends |

— | — | — | — | — | (758,492 | ) | (758,492 | ) | |||||||||||||||||||||||

| Interest of hybrid bonds |

— | — | — | — | — | (1,486 | ) | (1,486 | ) | |||||||||||||||||||||||

| Disposal of treasury shares |

— | 9,491 | — | — | 48,512 | — | 58,003 | |||||||||||||||||||||||||

| Retirement of treasury shares |

— | — | — | — | 567,474 | (583,486 | ) | (16,012 | ) | |||||||||||||||||||||||

| Changes from spin-off |

— | — | (199,384 | ) | — | — | — | (199,384 | ) | |||||||||||||||||||||||

| Share-based payment |

— | 12,114 | — | — | — | — | 12,114 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance as of December 31, 2022 |

482,403 | 1,360,894 | — | (188,801 | ) | (1,892,308 | ) | 47,409,675 | 47,171,863 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance as of January 1, 2023 |

482,403 | 1,360,894 | — | (188,801 | ) | (1,892,308 | ) | 47,409,675 | 47,171,863 | |||||||||||||||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||||||||

| Profit |

— | — | — | — | — | 799,577 | 799,577 | |||||||||||||||||||||||||

| Other comprehensive income (loss) |

||||||||||||||||||||||||||||||||

| Remeasurements of defined benefit plans, net of tax |

— | — | — | — | — | (97 | ) | (97 | ) | |||||||||||||||||||||||

| Net changes in fair value of equity investments at fair value through other comprehensive income, net of tax |

— | — | — | 219,479 | — | 17,500 | 236,979 | |||||||||||||||||||||||||

| Transactions with owners of the Company, recognized directly in equity: |

||||||||||||||||||||||||||||||||

| Year-end dividends |

— | — | — | — | — | (151,698 | ) | (151,698 | ) | |||||||||||||||||||||||

| Interim dividends |

— | — | — | — | — | (569,072 | ) | (569,072 | ) | |||||||||||||||||||||||

| Disposal of treasury shares |

— | 2,880 | — | — | 2,650 | — | 5,530 | |||||||||||||||||||||||||

| Share-based payment |

— | 6,783 | — | — | — | — | 6,783 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance as of December 31, 2023 |

482,403 | 1,370,557 | — | 30,678 | (1,889,658 | ) | 47,505,885 | 47,499,865 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

See accompanying notes to the separate financial statements.

6

POSCO HOLDINGS INC.

Separate Statements of Cash Flows

For the years ended December 31, 2023 and 2022

| (in millions of Won) | Notes | 2023 | 2022 | |||||||||||||

| Cash flows from operating activities |

||||||||||||||||

| Profit (loss) |

799,577 | (467,852 | ) | |||||||||||||

| Adjustments for: |

||||||||||||||||

| Expenses related to post-employment benefit |

7,568 | 22,082 | ||||||||||||||

| Depreciation |

11,309 | 393,121 | ||||||||||||||

| Amortization |

1,269 | 17,180 | ||||||||||||||

| Impairment loss on trade and other receivables |

221,251 | 128 | ||||||||||||||

| Finance income |

(308,939 | ) | (346,942 | ) | ||||||||||||

| Dividend income |

(1,254,239 | ) | (909,846 | ) | ||||||||||||

| Finance costs |

401,716 | 369,038 | ||||||||||||||

| Loss on valuation of inventories |

— | 1,722 | ||||||||||||||

| Gain on disposal of property, plant and equipment |

— | (5,464 | ) | |||||||||||||

| Loss on disposal of property, plant and equipment |

2,360 | 20,211 | ||||||||||||||

| Impairment loss on property, plant and equipment |

10,657 | 3 | ||||||||||||||

| Gain on disposal of investments in subsidiaries, associates and joint ventures |

(230 | ) | (13,933 | ) | ||||||||||||

| Impairment loss on investments in subsidiaries, associates and joint ventures |

109,568 | 263,263 | ||||||||||||||

| Loss on disposal of assets held for sale |

998 | — | ||||||||||||||

| Gain on disposal of assets held for sale |

— | (2,706 | ) | |||||||||||||

| Increase (decrease) to provisions |

(7,303 | ) | 55,196 | |||||||||||||

| Income tax expense (benefit) |

(115,854 | ) | 1,787,336 | |||||||||||||

| Employee benefits |

— | 61,603 | ||||||||||||||

| Share-based payments costs |

26 | 5,351 | 4,393 | |||||||||||||

| Others |

(11,631 | ) | (1,350 | ) | ||||||||||||

| Changes in operating assets and liabilities |

38 | (42,934 | ) | (808,142 | ) | |||||||||||

| Interest received |

45,517 | 44,615 | ||||||||||||||

| Interest paid |

— | (50,424 | ) | |||||||||||||

| Dividends received |

1,188,338 | 891,019 | ||||||||||||||

| Income taxes paid (received) |

25,687 | (2,054,488 | ) | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net cash provided by (used in) operating activities |

1,090,036 | (730,237 | ) | |||||||||||||

|

|

|

|

|

|||||||||||||

See accompanying notes to the separate financial statements.

7

POSCO HOLDINGS INC.

Separate Statements of Cash Flows, Continued

For the years ended December 31, 2023 and 2022

| (in millions of Won) | Notes | 2023 | 2022 | |||||||||||

| Cash flows from investing activities |

||||||||||||||

| Decrease in deposits |

890,000 | 450,017 | ||||||||||||

| Proceeds from disposal of short-term financial instruments |

6,255,711 | 28,806,313 | ||||||||||||

| Proceeds from disposal of long-term financial instruments |

— | 5 | ||||||||||||

| Collection of short-term loans |

1,249 | 1,416 | ||||||||||||

| Collection of long-term loans |

2,000 | — | ||||||||||||

| Proceeds from disposal of debt securities |

— | 151,100 | ||||||||||||

| Proceeds from disposal of equity securities |

261,612 | 166,358 | ||||||||||||

| Proceeds from disposal of other securities |

4,501 | 49,961 | ||||||||||||

| Proceeds from disposal of investments in subsidiaries, associates and joint ventures |

957,353 | 804,754 | ||||||||||||

| Proceeds from disposal of intangible assets |

— | — | ||||||||||||

| Proceeds from disposal of assets held for sale |

— | 3,074 | ||||||||||||

| Increase in deposits |

(2,640,000 | ) | (550,571 | ) | ||||||||||

| Acquisition of short-term financial instruments |

(5,717,490 | ) | (25,457,214 | ) | ||||||||||

| Acquisition of long-term financial instruments |

(2 | ) | — | |||||||||||

| Increase in long-term loans |

— | (3,618 | ) | |||||||||||

| Acquisition of debt securities |

— | (50,000 | ) | |||||||||||

| Acquisition of other securities |

(26,282 | ) | (104,197 | ) | ||||||||||

| Acquisition of investments in subsidiaries, associates and joint ventures |

(1,237,817 | ) | (1,042,298 | ) | ||||||||||

| Acquisition of property, plant and equipment |

(102,192 | ) | (359,532 | ) | ||||||||||

| Payment for disposal of property, plant and equipment |

— | (14,447 | ) | |||||||||||

| Acquisition of intangible asstes |

(4,402 | ) | (10,195 | ) | ||||||||||

| Cash outflow for spin-off |

— | (1,910,211 | ) | |||||||||||

| Acquisition of investment properties |

(54,892 | ) | — | |||||||||||

| Payment of short-term guarantee deposits |

(691 | ) | — | |||||||||||

| Net cash provided by (used in) investing activities |

(1,411,342 | ) | 930,715 | |||||||||||

|

|

|

|

|

|||||||||||

| Cash flows from financing activities |

||||||||||||||

| Proceeds from borrowings |

— | 537,165 | ||||||||||||

| Increase in long-term financial liabilities |

3,781 | 15,515 | ||||||||||||

| Repayment of borrowings |

— | (232,977 | ) | |||||||||||

| Decrease in long-term financial liabilities |

— | (279 | ) | |||||||||||

| Repayment of lease liabilities |

— | (7,493 | ) | |||||||||||

| Payment for disposal of derivatives |

— | (7,102 | ) | |||||||||||

| Payment of cash dividends |

(720,762 | ) | (1,136,298 | ) | ||||||||||

|

|

|

|

|

|||||||||||

| Net cash used in financing activities |

39 | (716,981 | ) | (831,469 | ) | |||||||||

|

|

|

|

|

|||||||||||

| Effect of exchange rate fluctuation on cash held |

— | 3,919 | ||||||||||||

| Net decrease in cash and cash equivalents |

(1,038,287 | ) | (627,072 | ) | ||||||||||

| Cash and cash equivalents at beginning of the period |

5 | 1,415,201 | 2,042,273 | |||||||||||

|

|

|

|

|

|||||||||||

| Cash and cash equivalents at end of the period |

5 | 376,914 | 1,415,201 | |||||||||||

|

|

|

|

|

|||||||||||

See accompanying notes to the separate financial statements.

8

Exhibit 99.1

POSCO HOLDINGS 2024 Ordinary General Meeting of Shareholders - Reference Material – posco HOLDINGS Green Tomorrow, with POSCO

Contents 01 Convocation Notice of Ordinary General Meeting of Shareholders 03 02 2023 Financial & ESG Highlights 04 03 Amendments of the Articles of Incorporation 06 04 Composition of the Board 07 05 CEO Succession Policy & Inside Director Candidates 08 06 Outside Director Appointment Process, Candidates and Board Skills Matrix 13 07 Director Remuneration 18

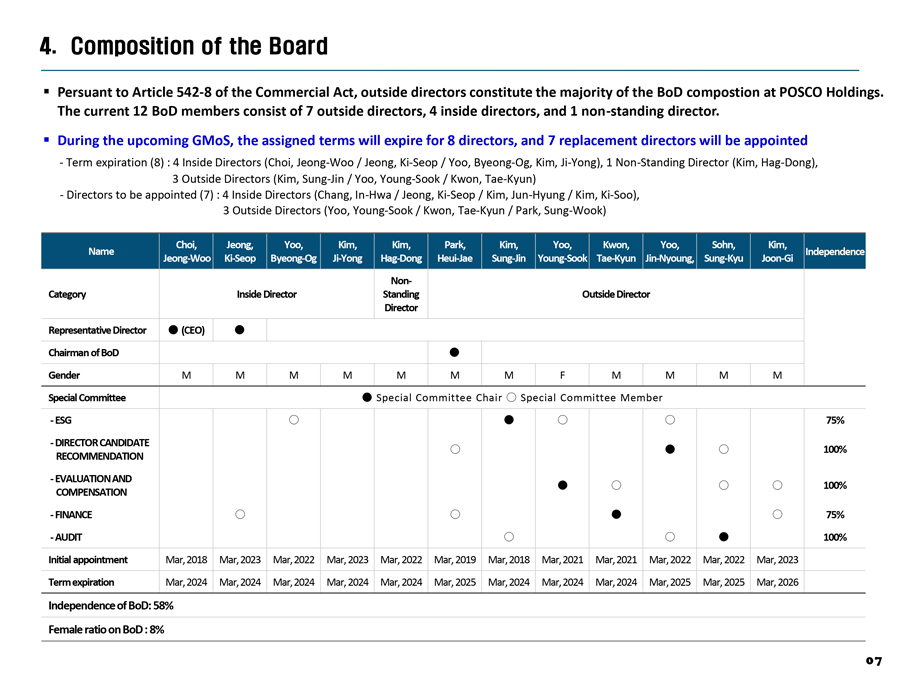

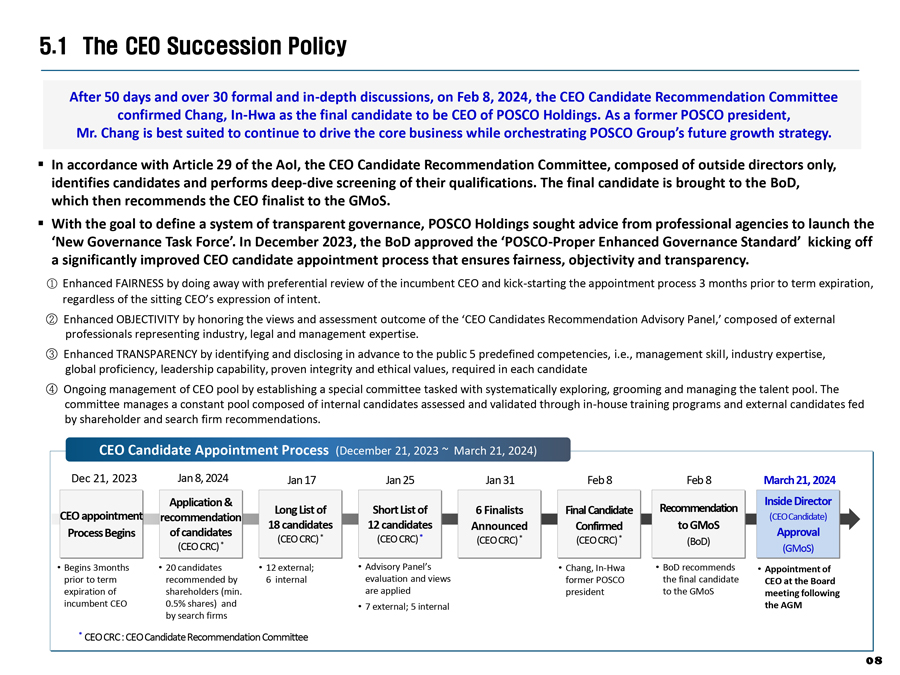

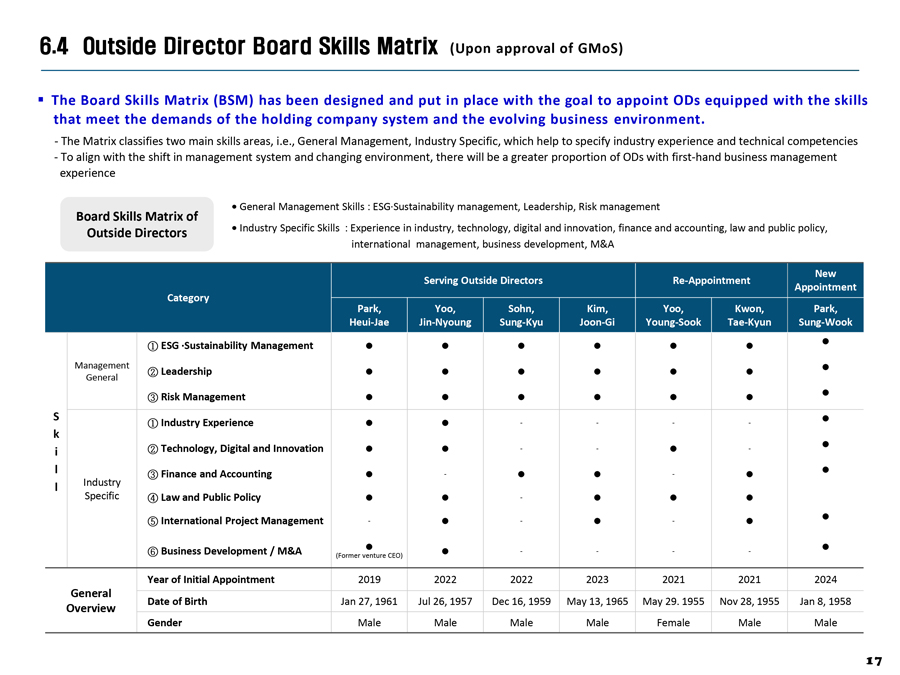

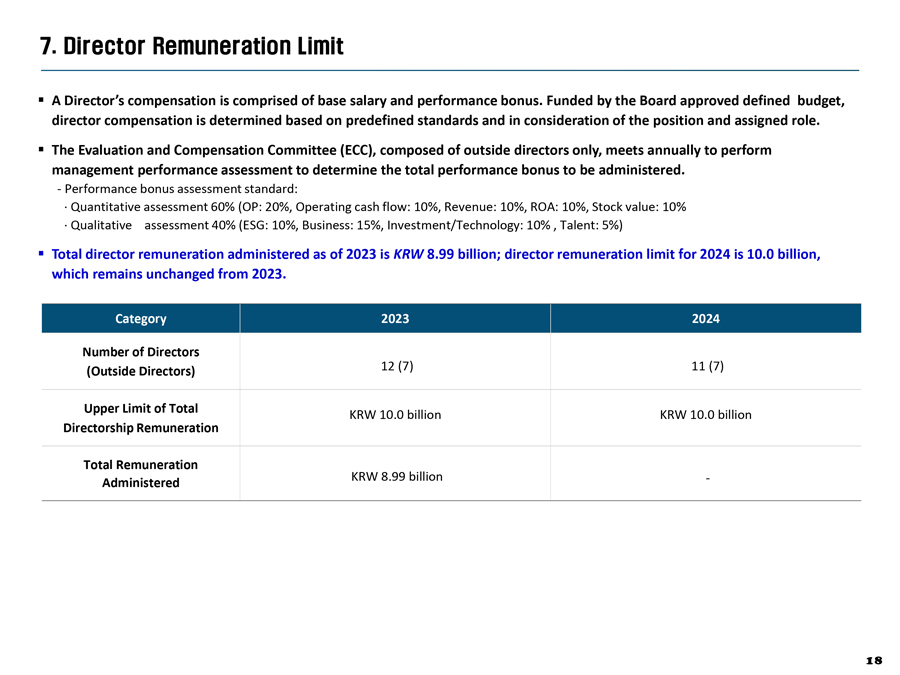

1. Convocation Notice of Ordinary General Meeting of Shareholders With wishes for health and prosperity in the new year, NOTICE IS HEREBY GIVEN that the 56th General Shareholders’ Meeting of POSCO Holdings will convene in accordance with Article 20 of the Articles of Incorporation. Date : At 9:00 a.m. on March 21, 2024, Korea Standard Time (UTC+9) Place : Art Hall, 4F West Wing, POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea Agenda Items Agenda Description Relevant Slide Item 1 Approval of Financial Statements for the 56th FY 04 Item 2 Partial Amendments of the Articles of Incorporation 06 Item 3 Election of Inside Directors 3-1 Election of Chang, In-Hwa as Inside Director (CEO candidate) 08~ 09 3-2 Election of Jeong, Ki-Seop as Inside Director 10 3-3 Election of Kim, Jun-Hyung as Inside Director 11 3-4 Election of Kim, Ki-Soo as Inside Director 12 Item 4 Election of Outside Directors 4-1 Election of Yoo, Young-Sook as Outside Director 14 4-2 Election of Kwon, Tae-Kyun as Outside Director 15 Item 5 Election of Park, Sung-Wook as Outside Director to serve on the Audit Committee 16 Item 6 Approval of Director Remuneration Limit 18 03

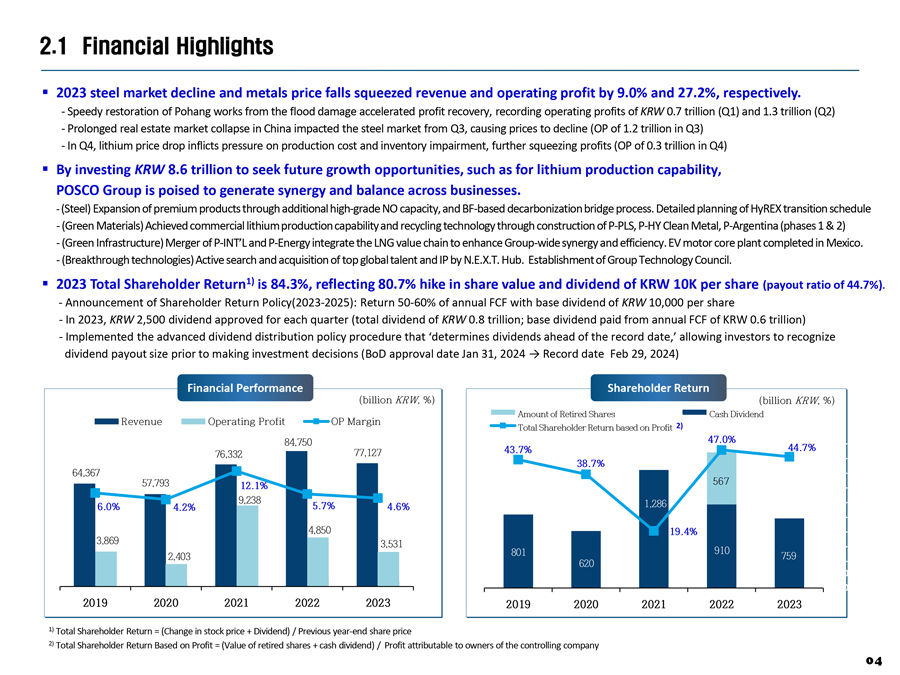

2.1 Financial Highlights 2023 steel market decline and metals price falls squeezed revenue and operating profit by 9.0% and 27.2%, respectively. - Speedy restoration of Pohang works from the flood damage accelerated profit recovery, recording operating profits of KRW0.7 trillion (Q1) and 1.3 trillion (Q2) - Prolonged real estate market collapse in China impacted the steel market from Q3, causing prices to decline (OP of 1.2 trillion in Q3) - In Q4, lithium price drop inflicts pressure on production cost and inventory impairment, further squeezing profits (OP of 0.3 trillion in Q4) By investing KRW 8.6 trillion to seek future growth opportunities, such as for lithium production capability, POSCO Group is poised to generate synergy and balance across businesses. - (Steel) Expansion of premium products through additional high-grade NO capacity, and BF-based decarbonizationbridge process. Detailed planning of HyREX transition schedule - (Green Materials) Achieved commercial lithium production capability and recycling technology through construction of P-PLS, P-HY Clean Metal, P-Argentina (phases 1 & 2) - (Green Infrastructure) Merger of P-INT’L and P-Energy integrate the LNG value chain to enhance Group-wide synergy and efficiency. EV motor core plant completed in Mexico. - (Breakthrough technologies) Active search and acquisition of top global talent and IP by N.E.X.T. Hub. Establishment of Group Technology Council. 2023 Total Shareholder Return1) is 84.3%, reflecting 80.7% hike in share value and dividend of KRW 10K per share (payout ratio of 44.7%). - Announcement of Shareholder Return Policy(2023-2025): Return 50-60% of annual FCF with base dividend of KRW 10,000 per share - In 2023, KRW 2,500 dividend approved for each quarter (total dividend of KRW 0.8 trillion; base dividend paid from annual FCF of KRW 0.6 trillion) - Implemented the advanced dividend distribution policy procedure that ‘determines dividends ahead of the record date,’ allowing investors to recognize dividend payout size prior to making investment decisions (BoD approval date Jan 31, 2024 ® Record date Feb 29, 2024) Financial Performance (billion KRW, %) Revenue Operating Profit OP Margin 64,367 57,793 76,332 84,750 77,127 6.0% 4.2% 12.1% 5.7% 4.6% 3,869 2,403 9,238 4,850 3,531 2019 2020 2021 2022 2023 Shareholder Return (billion KRW, %) Amount of Retired Shares Cash Dividend Total Shareholder Return based on Profit 2) 43.7% 38.7% 19.4% 47.0% 44.7% 801 620 1,286 567 910 759 2019 2020 2021 2022 2023 1) Total Shareholder Return = (Change in stock price + Dividend) / Previous year-end share price 2) Total Shareholder Return Based on Profit = (Value of retired shares + cash dividend) / Profit attributable to owners of the controlling company 04

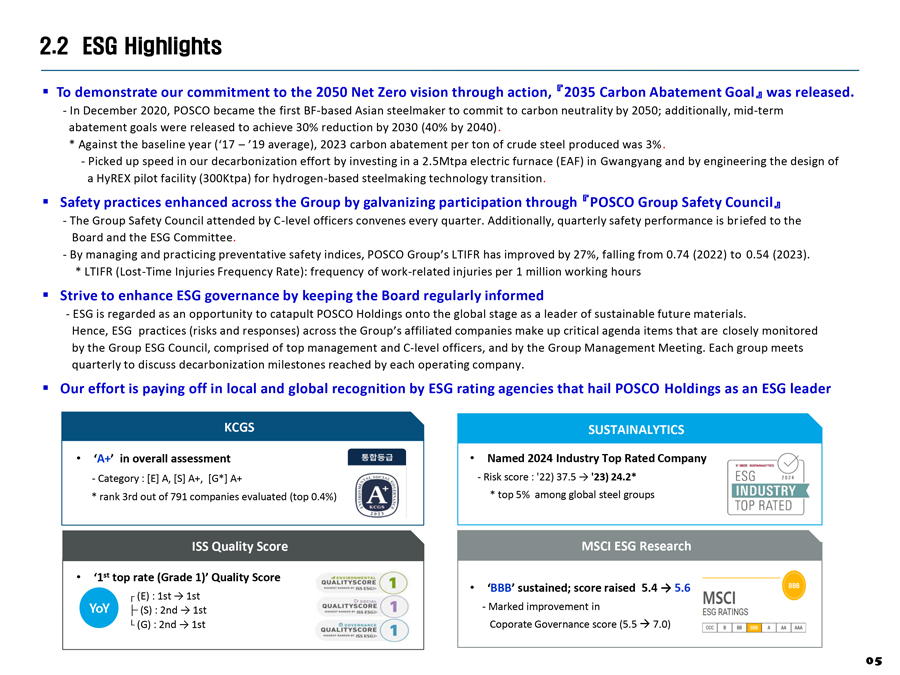

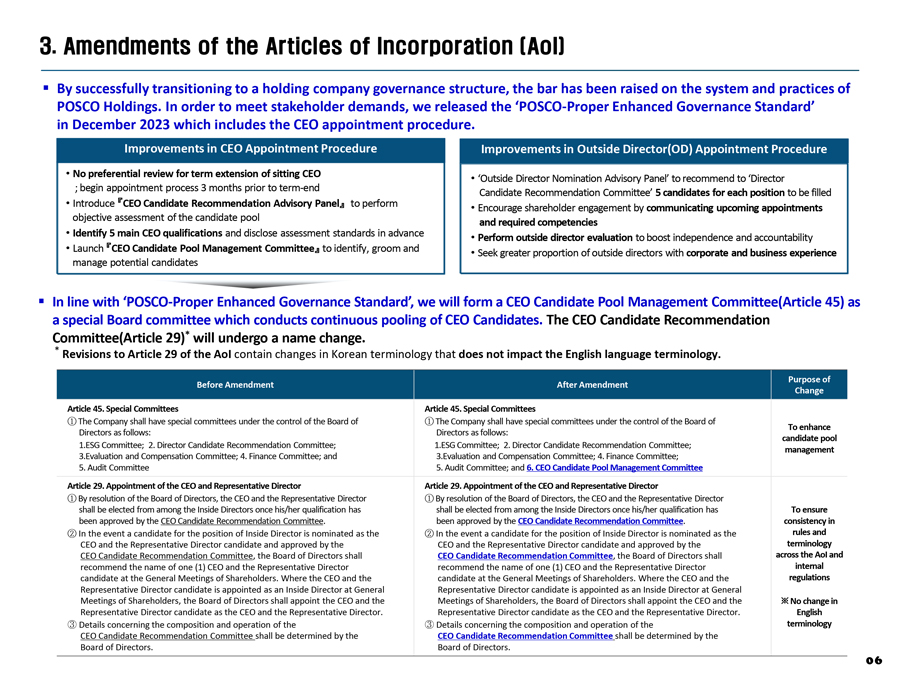

2.2 ESG Highlights To demonstrate our commitment to the 2050 Net Zero vision through action, 2035 Carbon Abatement Goal was released. - In December 2020, POSCO became the first BF-based Asian steelmaker to commit to carbon neutrality by 2050; additionally, mid-term abatement goals were released to achieve 30% reduction by 2030 (40% by 2040) . * Against the baseline year (‘17 – ‘19 average), 2023 carbon abatement per ton of crude steel produced was 3% . - Picked up speed in our decarbonization effort by investing in a 2.5Mtpa electric furnace (EAF) in Gwangyang and by engineering the design of a HyREX pilot facility (300Ktpa) for hydrogen-based steelmaking technology transition. Safety practices enhanced across the Group by galvanizing participation through POSCO Group Safety Council - The Group Safety Council attended by C-level officers convenes every quarter. Additionally, quarterly safety performance is br iefed to the Board and the ESG Committee. - By managing and practicing preventative safety indices, POSCO Group’s LTIFR has improved by 27%, falling from 0.74 (2022) to 0.54 (2023). * LTIFR (Lost-Time Injuries Frequency Rate): frequency of work-related injuries per 1 million working hours Strive to enhance ESG governance by keeping the Board regularly informed - ESG is regarded as an opportunity to catapult POSCO Holdings onto the global stage as a leader of sustainable future materials. Hence, ESG practices (risks and responses) across the Group’s affiliated companies make up critical agenda items that are closely monitored by the Group ESG Council, comprised of top management and C-level officers, and by the Group Management Meeting. Each group meets quarterly to discuss decarbonization milestones reached by each operating company. Our effort is paying off in local and global recognition by ESG rating agencies that hail POSCO Holdings as an ESG leader KCGS ‘A+’ in overall assessment - Category : [E] A, [S] A+, [G*] A+ * rank 3rd out of 791 companies evaluated (top 0.4%) SUSTAINALYTICS Named 2024 Industry Top Rated Company - Risk score : ‘22) 37.5 g ‘23) 24.2* * top 5% among global steel groups ISS Quality Score ‘1st top rate (Grade 1)’ Quality Score (E) : 1st g 1st (S) : 2nd g 1st (G) : 2nd g 1st MSCI ESG Research ‘BBB’ sustained; score raised 5.4 g 5.6 - Marked improvement in Coporate Governance score (5.5 g 7.0) 05