Delaware |

1-9924 |

52-1568099 |

||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

388 Greenwich Street , New York ,New York |

10013 |

|

(Address of principal executive offices) |

(Zip Code) |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits:

|

| Exhibit

No. |

Description

|

|

| 1.01 | Terms Agreement, dated February 6, 2024, among Citigroup Inc. (the “Company”) and the underwriters named therein, relating to the offer and sale of the Company’s 5.174% Fixed Rate / Floating Rate Callable Senior Notes due February 13, 2030. | |

| 4.01 | Form of Note for the Company’s 5.174% Fixed Rate / Floating Rate Callable Senior Notes due February 13, 2030. | |

| 5.01 | Opinion of Karen Wang, Esq. | |

| 99.01 | Citigroup Inc. securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 as of the filing date. | |

| 104 | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. |

|

| Dated: February 13, 2024 | CITIGROUP INC. | |||||

| By: | /s/ Karen Wang

|

|||||

| Karen Wang | ||||||

| Assistant Secretary | ||||||

Exhibit 1.01

Execution Version

TERMS AGREEMENT

February 6, 2024

Citigroup Inc.

388 Greenwich Street

New York, New York 10013

Attention: Assistant Treasurer

Ladies and Gentlemen:

We understand that Citigroup Inc., a Delaware corporation (the “Company”), proposes to issue and sell US$3,000,000,000 aggregate principal amount of its 5.174% Fixed Rate / Floating Rate Senior Notes Due 2030 (the “Securities”). Subject to the terms and conditions set forth herein or incorporated by reference herein, we, the entities listed on Annex A hereto, as underwriters (the “Underwriters”), offer to purchase, severally and not jointly, the principal amount of the Securities set forth opposite our respective names on the list attached as Annex A hereto at 99.675% of the principal amount thereof, plus accrued interest, if any, from the date of issuance. The Closing Date shall be February 13, 2024, at 9:30 a.m. (Eastern Time). The closing shall take place at the offices of Cleary Gottlieb Steen & Hamilton LLP located at One Liberty Plaza, New York, New York 10006.

The Securities shall have the terms set forth in Annex B hereto. The Securities shall be issuable as Registered Securities only. The Securities will be initially represented by one or more global Securities registered in the name of The Depository Trust Company (“DTC”) or its nominees, as described in the Prospectus relating to the Securities. Beneficial interests in the Securities will be shown on, and transfers thereof will be effected only through, records maintained by DTC, Euroclear Bank SA/NV and Clearstream Banking S.A. and their respective participants. Owners of beneficial interests in the Securities will be entitled to physical delivery of Securities in certificated form only under the limited circumstances described in the Prospectus. Principal and interest on the Securities shall be payable in United States dollars, and the record date for the Securities shall be the business day immediately preceding each interest payment date. Sections 12.02 and 12.03 of the indenture, dated as of November 13, 2013, between the Company and The Bank of New York Mellon, as trustee (the “Trustee”) (as amended from time to time, the “Indenture”) relating to defeasance and discharge and covenant defeasance, respectively, shall apply to the Securities.

All the provisions contained in the document entitled “Citigroup Inc.— Amended and Restated Debt Securities — Underwriting Agreement — Basic Provisions” dated March 7, 2023 (the “A&R Basic Provisions”), a copy of which you have previously received, are herein incorporated by reference in their entirety and shall be deemed to be a part of this Terms Agreement to the same extent as if the A&R Basic Provisions had been set forth in full herein

Terms defined in the Basic Provisions are used herein as therein defined. The Execution Time means 3:20 p.m. (Eastern Time).

The Underwriters hereby agree in connection with the underwriting of the Securities to comply with the requirements set forth in any applicable sections of Rule 5121 of the Financial Industry Regulatory Authority, Inc.

Selling Restrictions:

European Economic Area

Each Underwriter represents and agrees that no Securities which are the subject of the offering contemplated by the Prospectus Supplement may be offered, sold or otherwise made available to any retail investor in the European Economic Area. For the purposes of this provision:

(a) the expression “retail investor” means a person who is one (or more) of the following:

(1) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (“MiFID II”); or

(2) a customer within the meaning of Directive (EU) 2016/97 (the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or

(3) not a qualified investor as defined in the Regulation (EU) 2017/1129 (the “Prospectus Regulation”); and

(b) the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Securities to be offered so as to enable an investor to decide to purchase or subscribe the Securities.

United Kingdom

Each Underwriter represents and agrees that no Securities which are the subject of the offering contemplated by the Prospectus Supplement may be offered, sold or otherwise made available to any retail investor in the United Kingdom. For the purposes of this provision:

(a) the expression “retail investor” means a person who is one (or more) of the following:

(1) a retail client as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”); or

(2) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (the “FSMA”) and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or

(b) the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Securities to be offered so as to enable an investor to decide to purchase or subscribe the Securities.

2

(3) not a qualified investor as defined in the Prospectus Regulation as it forms part of domestic law by virtue of the EUWA; and Additionally, in the United Kingdom, the Prospectus Supplement and the accompanying Prospectus is being distributed only to, and is directed only at qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive who are, (i) persons who have professional experience in matters relating to investments falling within Article 19 (5) of the FSMA (Financial Promotion) Order 2005, as amended, or the Order, and/or (ii) high net worth companies (or persons to whom it may otherwise be lawfully communicated) falling within Article 49(2)(a) to (d) of the Order, which persons together we refer to in this prospectus as “relevant persons.” Accordingly, each Underwriter represents and agrees that such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The Prospectus Supplement and the accompanying Prospectus must not be acted on or relied on in the United Kingdom by persons who are not relevant persons. In the United Kingdom, any investment or investment activity to which the Prospectus Supplement and the accompanying Prospectus relates is only available to, and will be engaged in with, relevant persons only.

Hong Kong

Each Underwriter:

(a) has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any Securities other than to (i) “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (ii) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and

(b) has not issued or had in its possession for the purposes of issue, and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the Securities, which is directed at, or the contents of which are or are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under securities laws of Hong Kong) other than with respect to Securities which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance.

Japan

The Securities have not been and will not be registered under the Financial Instruments and Exchange Law of Japan (the “FIEA”). Each Underwriter represents and agrees that it has not and will not offer or sell, directly or indirectly, any of the Securities in Japan or to, or for the account or benefit of, any resident of Japan (including any corporation or other entity organized under the laws of Japan), or to, or for the account or benefit of, any resident of Japan for reoffering or resale, directly or indirectly, in Japan or to, or for the account or benefit of, any resident of Japan except (1) pursuant to an exemption from the registration requirements of, or otherwise in compliance with, the FIEA and (2) in compliance with the other applicable laws, regulations and governmental guidelines of Japan.

3

Singapore

The Prospectus Supplement and accompanying Prospectus relating to this offering have not been and will not be registered as a prospectus with the Monetary Authority of Singapore under the Securities and Futures Act 2001 (the “SFA”). Accordingly, each Underwriter has not offered or sold any Securities or caused the Securities to be made the subject of an invitation for subscription or purchase and will not offer or sell any Securities or cause the Securities to be made the subject of an invitation for subscription or purchase, and has not circulated or distributed, nor will it circulate or distribute, such Prospectus Supplement and accompanying Prospectus or any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the Securities, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the SFA) pursuant to Section 274 of the SFA or (ii) to an accredited investor (as defined in Section 275(1A), and in accordance with the conditions, specified in Section 275 of the SFA.

Solely for the purposes of its obligations pursuant to sections 309B(1)(a) and 309B(1)(c) of the SFA, the Company has determined, and hereby notifies all relevant persons (as defined in Section 309A of the SFA) that the Securities are “prescribed capital markets products” (as defined in the Securities and Futures (Capital Markets Products) Regulations 2018) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12: Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

Certain of the Underwriters may not be U.S. registered broker-dealers and accordingly will not effect any sales within the United States except in compliance with applicable U.S. laws and regulations, including the rules of the Financial Industry Regulatory Authority. Industrial and Commercial Bank of China (Asia) Limited (“ICBC Bank”) is restricted in its U.S. securities dealings under the United States Bank Holding Company Act and will not underwrite, subscribe, agree to purchase or procure purchasers to purchase securities that are offered or sold in the United States. Accordingly, ICBC Bank shall not be obligated to, and shall not, underwrite, subscribe, agree to purchase or procure purchasers to purchase securities that may be offered or sold by other underwriters in the United States. ICBC Bank shall offer and sell the Securities constituting part of its allotment solely outside the United States.

Karen Wang, Esq., Senior Vice President – Corporate Securities Issuance Legal of the Company, is counsel to the Company. Cleary Gottlieb Steen & Hamilton LLP is special tax counsel to the Company and counsel to the Underwriters.

4

Please accept this offer no later than 9:00 p.m. (Eastern Time) on February 6, 2024 by signing a copy of this Terms Agreement in the space set forth below and returning the signed copy to us, or by sending us a written acceptance in the following form:

“We hereby accept your offer, set forth in the Terms Agreement, dated February 6, 2024, to purchase the Securities on the terms set forth therein.”

| Very truly yours, | ||

| CITIGROUP GLOBAL MARKETS INC., on behalf of the Underwriters named herein |

||

| By: | /s/ Adam D. Bordner |

|

| Name: Adam D. Bordner |

||

| Title: Managing Director | ||

| ACCEPTED: | ||

| CITIGROUP INC. | ||

| By: | /s/ Elissa Steinberg |

|

| Name: Elissa Steinberg | ||

| Title: Assistant Treasurer | ||

ANNEX A

| Name of |

Principal Amount of Securities |

|||

| Citigroup Global Markets Inc. |

$ | 2,100,000,000 | ||

| ANZ Securities, Inc. |

$ | 18,000,000 | ||

| BBVA Securities Inc. |

$ | 18,000,000 | ||

| BMO Capital Markets Corp. |

$ | 18,000,000 | ||

| BNY Mellon Capital Markets, LLC |

$ | 18,000,000 | ||

| Capital One Securities, Inc. |

$ | 18,000,000 | ||

| CastleOak Securities, L.P. |

$ | 18,000,000 | ||

| CIBC World Markets Corp. |

$ | 18,000,000 | ||

| Commerz Markets LLC |

$ | 18,000,000 | ||

| Danske Markets Inc. |

$ | 18,000,000 | ||

| Fifth Third Securities, Inc. |

$ | 18,000,000 | ||

| Intesa Sanpaolo IMI Securities Corp. |

$ | 18,000,000 | ||

| Lloyds Securities Inc. |

$ | 18,000,000 | ||

| Mediobanca - Banca di Credito Finanziario S.p.A. |

$ | 18,000,000 | ||

| MUFG Securities Americas Inc. |

$ | 18,000,000 | ||

| Natixis Securities Americas LLC |

$ | 18,000,000 | ||

| Netrex Capital Markets, LLC |

$ | 18,000,000 | ||

| Nomura Securities International, Inc. |

$ | 18,000,000 | ||

| PNC Capital Markets LLC |

$ | 18,000,000 | ||

| Rabo Securities USA, Inc. |

$ | 18,000,000 | ||

| RBC Capital Markets, LLC |

$ | 18,000,000 | ||

| Roberts & Ryan, Inc. |

$ | 18,000,000 | ||

| Santander US Capital Markets LLC |

$ | 18,000,000 | ||

| Scotia Capital (USA) Inc. |

$ | 18,000,000 | ||

| SG Americas Securities, LLC |

$ | 18,000,000 | ||

| SMBC Nikko Securities America, Inc. |

$ | 18,000,000 | ||

| Standard Chartered Bank |

$ | 18,000,000 | ||

| TD Securities (USA) LLC |

$ | 18,000,000 | ||

| Truist Securities, Inc. |

$ | 18,000,000 | ||

| U.S. Bancorp Investments, Inc. |

$ | 18,000,000 | ||

| ABN AMRO Capital Markets (USA) LLC |

$ | 10,500,000 | ||

| Academy Securities, Inc. |

$ | 10,500,000 | ||

| AmeriVet Securities, Inc. |

$ | 10,500,000 | ||

| Bank of China Limited, London Branch |

$ | 10,500,000 | ||

| Blaylock Van, LLC |

$ | 10,500,000 | ||

| C.L. King & Associates, Inc. |

$ | 10,500,000 | ||

| CaixaBank S.A. |

$ | 10,500,000 | ||

| CAVU Securities LLC |

$ | 10,500,000 | ||

| Citizens JMP Securities, LLC |

$ | 10,500,000 | ||

| Commonwealth Bank of Australia |

$ | 10,500,000 | ||

| Desjardins Securities Inc. |

$ | 10,500,000 | ||

| Erste Group Bank AG |

$ | 10,500,000 | ||

| Huntington Securities, Inc. |

$ | 10,500,000 | ||

| Independence Point Securities LLC |

$ | 10,500,000 | ||

| Industrial and Commercial Bank of China (Asia) Limited |

$ | 10,500,000 | ||

| ING Financial Markets LLC |

$ | 10,500,000 | ||

| KBC Securities USA LLC |

$ | 10,500,000 | ||

| KeyBanc Capital Markets Inc. |

$ | 10,500,000 | ||

| Loop Capital Markets LLC |

$ | 10,500,000 | ||

| M&T Securities, Inc. |

$ | 10,500,000 | ||

| Melvin Securities, LLC |

$ | 10,500,000 | ||

| Mizuho Securities USA LLC |

$ | 10,500,000 | ||

| nabSecurities, LLC |

$ | 10,500,000 | ||

| National Bank of Canada Financial Inc. |

$ | 10,500,000 | ||

| NatWest Markets Securities Inc. |

$ | 10,500,000 | ||

| Nordea Bank Abp |

$ | 10,500,000 | ||

| R. Seelaus & Co., LLC |

$ | 10,500,000 | ||

| RB International Markets (USA) LLC |

$ | 10,500,000 | ||

| Regions Securities LLC |

$ | 10,500,000 | ||

| Security Capital Brokerage, Inc. |

$ | 10,500,000 | ||

| Siebert Williams Shank & Co., LLC |

$ | 10,500,000 | ||

| Swedbank AB (publ) |

$ | 10,500,000 | ||

| Tigress Financial Partners LLC |

$ | 10,500,000 | ||

| UniCredit Capital Markets LLC |

$ | 10,500,000 | ||

| United Overseas Bank Limited |

$ | 10,500,000 | ||

| Westpac Capital Markets LLC |

$ | 10,500,000 | ||

| Total |

$ | 3,000,000,000 |

ANNEX B

CITIGROUP INC.

$3,000,000,000

5.174% FIXED RATE / FLOATING RATE CALLABLE SENIOR NOTES DUE 2030

Terms and Conditions

| Issuer: | Citigroup Inc. | |

| Ratings*: | [Omitted] | |

| Ranking: | Senior | |

| Trade Date: | February 6, 2024 | |

| Settlement Date: | February 13, 2024 (T+5 days) | |

| Maturity: | February 13, 2030 | |

| Par Amount: | $3,000,000,000 | |

| Treasury Benchmark: | 4.000% due January 31, 2029 | |

| Treasury Price: | $99-28+ | |

| Treasury Yield: | 4.024% | |

| Re-offer Spread to Benchmark: | T5+115 bp | |

| Re-offer Yield: | 5.174% | |

| Fixed Rate Coupon & Payment Dates: | 5.174% per annum, payable semiannually in arrears on each February 13 and August 13, beginning on August 13, 2024, from, and including, the Settlement Date to, but excluding, February 13, 2029 (the “fixed rate period”).

Following business day convention during the fixed rate period. Business days during fixed rate period New York. |

|

| Floating Rate Coupon & Payment Dates: | From, and including, February 13, 2029 (the “floating rate period”), an annual floating rate equal to SOFR (as defined in the Issuer’s base prospectus dated March 7, 2023 (the “Prospectus”) and compounding daily over each interest period as described in the Prospectus) plus 1.364%, payable quarterly in arrears, on the second business day following each interest period end date, beginning on May 15, 2029 and ending at Maturity or any earlier redemption date. An “interest period end date” means the 13th of each February, May, August and November, beginning on May 13, 2029 and ending at Maturity or any earlier redemption date.

Modified following business day convention during the floating rate period. Business days during floating rate period New York and U.S. Government Securities Business (as defined in the Prospectus). |

|

| Public Offering Price: | 100.000% | |

| Net Proceeds to Citigroup: | $2,990,250,000 (before expenses) | |

| Day Count: | 30/360 during the fixed rate period, Actual/360 during the floating rate period | |

| Defeasance: | Applicable. Provisions of Sections 12.02 and 12.03 of the Indenture apply | |

| Redemption at Issuer Option: | We may redeem the notes, at our option, in whole at any time or in part from time to time, on or after August 13, 2024 (or if additional notes are issued after February 13, 2024, beginning six months after the issue date of such additional notes) and prior to February 13, 2029 at a redemption price equal to the sum of (i) 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the date of redemption; and (ii) the Make-Whole Amount (as defined in the Prospectus), if any, with respect to such notes. The Reinvestment Rate (as defined in the Prospectus) will equal the Treasury Yield defined therein calculated to February 13, 2029, plus 0.200%.

We may redeem the notes, at our option, (i) in whole, but not in part, on February 13, 2029, or (ii) in whole at any time or in part from time to time, on or after January 13, 2030 at a redemption price equal to the sum of 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the date of redemption. SOFR for each calendar day from, and including, the Rate Cut-Off Date to, but excluding, the redemption date will equal SOFR in respect of the Rate Cut-Off Date. |

|

| Rate Cut-Off Date: | The second U.S. Government Securities Business Day prior to a redemption date and Maturity. | |

| Redemption for Tax Purposes: | We may redeem the notes, at our option, in whole at any time, but not in part at a redemption price equal to 100% of the principal amount of the notes plus accrued and unpaid interest thereon to, but excluding, the date of redemption, if, as a result of changes in U.S. tax law, withholding tax or information reporting requirements are imposed on payments on the notes to non-U.S. persons.

SOFR for each calendar day from, and including, the Rate Cut-Off Date to, but excluding, the redemption date will equal SOFR in respect of the Rate Cut-Off Date. |

|

| Sinking Fund: | Not applicable | |

| Minimum Denominations/Multiples: | $1,000 / multiples of $1,000 in excess thereof | |

| CUSIP: | 172967 PF2 | |

| ISIN: | US172967PF20 | |

| Sole Book Manager | Citigroup Global Markets Inc. | |

| Senior Co-Managers | ANZ Securities, Inc. BBVA Securities Inc. BMO Capital Markets Corp. BNY Mellon Capital Markets, LLC Capital One Securities, Inc. CastleOak Securities, L.P. CIBC World Markets Corp. Commerz Markets LLC Danske Markets Inc. Fifth Third Securities, Inc. Intesa Sanpaolo IMI Securities Corp. Lloyds Securities Inc. Mediobanca - Banca di Credito Finanziario S.p.A. MUFG Securities Americas Inc. Natixis Securities Americas LLC Netrex Capital Markets, LLC Nomura Securities International, Inc. PNC Capital Markets LLC Rabo Securities USA, Inc. RBC Capital Markets, LLC Roberts & Ryan, Inc. Santander US Capital Markets LLC Scotia Capital (USA) Inc. SG Americas Securities, LLC SMBC Nikko Securities America, Inc. Standard Chartered Bank TD Securities (USA) LLC Truist Securities, Inc. U.S. Bancorp Investments, Inc. |

|

| Junior Co-Managers | ABN AMRO Capital Markets (USA) LLC Academy Securities, Inc. AmeriVet Securities, Inc. Bank of China Limited, London Branch Blaylock Van, LLC C.L. King & Associates, Inc. CaixaBank S.A. CAVU Securities LLC Citizens JMP Securities, LLC Commonwealth Bank of Australia Desjardins Securities Inc. Erste Group Bank AG Huntington Securities, Inc. Independence Point Securities LLC Industrial and Commercial Bank of China (Asia) Limited ING Financial Markets LLC KBC Securities USA LLC KeyBanc Capital Markets Inc. Loop Capital Markets LLC M&T Securities, Inc. Melvin Securities, LLC Mizuho Securities USA LLC nabSecurities, LLC National Bank of Canada Financial Inc. NatWest Markets Securities Inc. Nordea Bank Abp R. Seelaus & Co., LLC RB International Markets (USA) LLC Regions Securities LLC Security Capital Brokerage, Inc. Siebert Williams Shank & Co., LLC Swedbank AB (publ) Tigress Financial Partners LLC UniCredit Capital Markets LLC United Overseas Bank Limited Westpac Capital Markets LLC |

| * | Note: A securities rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. |

Citigroup Inc. has filed a registration statement (including a prospectus) with the Securities and Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and the other documents Citigroup has filed with the SEC for more complete information about Citigroup and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. The file number for Citigroup’s registration statement is No. 333-270327. Alternatively, you can request the prospectus by calling toll-free in the United States 1-800-831-9146.

Exhibit 4.01

This Note is a Global Security within the meaning of the Indenture hereinafter referred to and is registered in the name of the Depository named below or a nominee of the Depository. This Note is not exchangeable for Notes registered in the name of a Person other than the Depository or its nominee except in the limited circumstances described herein and in the Indenture, and no transfer of this Note (other than a transfer of this Note as a whole by the Depository to a nominee of the Depository or by a nominee of the Depository to the Depository or another nominee of the Depository) may be registered except in the limited circumstances described herein.

Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (the “Depository”), to the Company or its agent for registration of transfer, exchange, or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as is requested by an authorized representative of the Depository (and any payment is made to Cede & Co. or to such other entity as is requested by an authorized representative of the Depository), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.

CITIGROUP INC.

5.174% Fixed Rate / Floating Rate Callable Senior Notes due February 13, 2030

| REGISTERED | REGISTERED |

CUSIP: 172967PF2

ISIN: US172967PF20

| No. R-00* | $ |

CITIGROUP INC., a Delaware corporation (the “Company”, which term includes any successor Person under the Indenture), for value received, hereby promises to pay to Cede & Co., or registered assigns, the principal sum of $[ ] on February 13, 2030 (the “Maturity Date”) and to pay interest thereon from and including February 13, 2024 or from the most recent Interest Payment Date to which interest has been paid or duly provided for. The Company shall pay interest (i) from February 13, 2024 to, but excluding, February 13, 2029 (the “Fixed Rate Period”) at a fixed rate of 5.174% per annum semi-annually, on August 13th and February 13th of each year (each such date, a “Fixed Rate Period Interest Payment Date”), commencing August 13, 2024 and (ii) from, and including, February 13, 2029 (the “Floating Rate Period”), at an annual rate equal to Compounded SOFR (and defined on the reverse hereof) plus 1.364% quarterly, on the second business day following each Interest Period End Date (each such business day, a “Floating Rate Period Interest Payment Date” and together with any Fixed Rate Period Payment Date, an “Interest Payment Date”), commencing May 15, 2029, until the principal hereof is paid or made available for payment and provided that the Interest Payment Date with respect to the final Interest Period will be a redemption date or the Maturity Date. An Interest Period End Date is the 13th of each February, May, August, and November, beginning on May 13, 2029 and ending on a redemption date or the Maturity Date.

The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in the Indenture, be paid to the Person in whose name this Note is registered at the close of business on the Record Date for such interest, which shall be the Business Day immediately preceding such Interest Payment Date. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the holder on such Record Date and may either be paid to the Person in whose name this Note is registered at the close of business on a subsequent Record Date, such subsequent Record Date to be not less than ten days prior to the date of payment of such defaulted interest, notice whereof shall be given to holders of Notes of this series not less than ten days prior to such subsequent Record Date, or be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Notes of this series may be listed, and upon such notice as may be required by such exchange, all as more fully provided in the Indenture.

During the Fixed Rate Period, interest hereon will be calculated on the basis of a 360-day year comprised of twelve 30-day months, and an Interest Period shall be the period from and including an Interest Payment Date (or February 13, 2024 in the case of the first Interest Period) to and including the day immediately preceding the next Interest Payment Date. During the Fixed Rate Period, if an Interest Payment Date falls on a day that is not a Business Day, such Interest Payment Date will be the next succeeding Business Day, and no further interest will accrue in respect of such postponement. For these purposes, “Business Day” means any day on which commercial banks settle payments and are open for general business in The City of New York.

During the Floating Rate Period, interest hereon will be calculated on the basis of the actual number of days elapsed in an interest period and a 360-day year, and an Interest Period shall be the period from and including an Interest Period End Date (or February 13, 2029 in the case of the first Interest Period during the Floating Rate Period) to, but excluding, the next succeeding Interest Period End Date; provided that the Interest Period following an election by the Company to redeem the Notes and the final Interest Period will be the period from, and including, the immediately preceding Interest Period End Date to, but excluding, the redemption date or the Maturity Date; and provided further that SOFR for each calendar day from, and including, the Rate Cut-Off Date (as defined on the reverse hereof) to, but excluding, the redemption date or the Maturity Date will equal SOFR in respect of the Rate Cut-Off Date. In the event that any Interest Period End Date (other than a redemption date or the Maturity Date) is not a Business Day, then such date will be postponed to the next succeeding Business Day, unless that day falls in the next calendar month, in which case the interest period end date will be the immediately preceding Business Day. For these purposes, “Business Day” means any day on which commercial banks settle payments and are open for general business in The City of New York and a U.S. Government Securities Business Day (as defined on the reverse hereof)

Dollar amounts resulting from such calculations will be rounded to the nearest cent, with one-half cent being rounded upward. In the event that the Maturity Date or a redemption date is not a Business Day, then such date will be postponed to the next succeeding Business Day, and no further interest will accrue with respect to such postponement. No interest will accrue on any amounts payable for the period from and after the due date for payment of such principal or interest.

Payment of the principal of and interest on this Note will be made at the office or agency of the paying agent maintained for that purpose in The City of New York.

Reference is hereby made to the further provisions of this Note set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee or by an authenticating agent on behalf of the Trustee by manual signature, this Note shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed under its corporate seal.

Dated: February 13, 2024

| CITIGROUP INC. | ||

| By: |

|

|

| ATTEST: | ||

| By: |

|

|

This is one of the Notes of the series issued under the within-mentioned Indenture.

Dated: February 13, 2024

| THE BANK OF NEW YORK MELLON, as Trustee |

||

| By: |

|

|

| -or- | ||

| CITIBANK, N.A., as Authenticating Agent |

||

| By: |

|

|

This Note is one of a duly authorized issue of Securities of the Company (the “Notes”), issued and to be issued in one or more series under the senior debt indenture, dated as of November 13, 2013 (as amended and supplemented from time to time, the “Indenture”), between the Company and The Bank of New York Mellon, as trustee (the “Trustee”, which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee and the holders of the Notes and of the terms upon which the Notes are, and are to be, authenticated and delivered. This Note is one of the series designated on the face hereof, initially limited in aggregate principal to $3,000,000,000.

During the Floating Rate Period, this Note will bear interest for each Interest Period at a rate determined by Citibank, N.A., London Branch, acting as Calculation Agent. The interest rate on this Note for a particular Interest Period during the Floating Rate Period will be a per annum rate equal to Compounded SOFR (as defined below) plus 1.634%. Interest during the Floating Rate Period will be calculated by multiplying the principal amount of the Notes by the product of (i) Compounded SOFR plus 1.364% multiplied by (ii) the quotient of actual number of calendar days in such interest period divided by 360; provided that in no event will the interest payable on the Notes be less than zero. Promptly upon determination, the Calculation Agent will inform the Trustee and the Company of the interest rate for the next Interest Period. Absent manifest error, the determination of the interest rate by the Calculation Agent shall be binding and conclusive on the holders of Notes, the Trustee and the Company.

For the purposes of calculating interest with respect to any Interest Period during the Floating Rate Period:

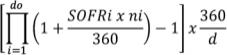

“Compounded SOFR” means a rate of return of a daily compounded interest investment calculated in accordance with the formula below, with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point (0.00000005 being rounded upwards) :

where

“do”, for any Interest Period, is the number of U.S. Government Securities Business Days in the relevant Interest Period.

“i” is a series of whole numbers from one to do, each representing the relevant U.S. Government Securities Business Days in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Interest Period.

“SOFRi”, for any day “i” in the relevant Interest Period, is a reference rate equal to SOFR in respect of that day.

“ni”, for any day “i” in the relevant Interest Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day.

“d” is the number of calendar days in the relevant Interest Period.

“U.S. Government Securities Business Day” means any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association (SIFMA) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

“SOFR” means, with respect to any day, the rate determined by the Calculation Agent in accordance with the following provisions:

(1) the Secured Overnight Financing Rate for trades made on such day that appears at approximately 3:00 p.m. (New York City time) on the NY Federal Reserve’s Website on the U.S. Government Securities Business Day immediately following such day (“SOFR Determination Time”); or

(2) if the rate specified in (1) above does not so appear, unless a Benchmark Transition Event and its related Benchmark Replacement Date have occurred as described in (3) below, the Secured Overnight Financing Rate published on the NY Federal Reserve’s Website for the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the NY Federal Reserve’s Website; or

(3) if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the relevant interest period end date, the Calculation Agent will use the Benchmark Replacement to determine the rate and for all other purposes relating to the Notes.

In connection with the Compounded SOFR definition above, the following definitions apply:

“Benchmark” means, initially, Compounded SOFR; provided that if the Company (or one of its affiliates) determines that on or prior to the Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by Citigroup (or one of its affiliates) as of the Benchmark Replacement Date:

(1) the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark and (b) the Benchmark Replacement Adjustment; or

(2) the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or (3) the sum of: (a) the alternate rate of interest that has been selected by the Company (or one of its affiliates) as the replacement for the then-current Benchmark giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar-denominated floating rate notes at such time and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company (or one of its affiliates) as of the Benchmark Replacement Date:

(1) the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

(2) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment;

(3) the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company (or one of its affiliates) giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time.

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes that the Company (or one of its affiliates) decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company (or such affiliate) decides that adoption of any portion of such market practice is not administratively feasible or if the Company (or such affiliate) determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company (or such affiliate) determines is reasonably necessary).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

(1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or

(2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

(1) a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark;

(2) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or

(3) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

“Business Day” means any weekday that is not a legal holiday in New York City and is not a day on which banking institutions in New York City are authorized or required by law or regulation to be closed and is a U.S. Government Securities Business Day.

“ISDA” means the International Swaps and Derivatives Association, Inc. or any successor thereto.

“ISDA Definitions” means the 2006 ISDA Definitions published by ISDA, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“NY Federal Reserve” means the Federal Reserve Bank of New York.

“NY Federal Reserve’s Website” means the website of the NY Federal Reserve, currently at http://www.newyorkfed.org, or any successor website of the NY Federal Reserve or the website of any successor administrator of the Secured Overnight Financing Rate.

“Rate Cut-Off Date” means the second U.S. Government Securities Business Day prior to a redemption date or the Maturity Date.

“Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is Compounded SOFR, the SOFR Determination Time and (2) if the Benchmark is not Compounded SOFR, the time determined by Citigroup (or one of its affiliates) in accordance with the Benchmark Replacement Conforming Changes.

“Relevant Governmental Body” means the Federal Reserve Board and/or the NY Federal Reserve, or a committee officially endorsed or convened by the Federal Reserve Board and/or the NY Federal Reserve or any successor thereto.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

Upon request from any Noteholder, the Calculation Agent will provide the interest rate in effect on this Note for the current Interest Period during the Floating Rate Period and, if it has been determined, the interest rate to be in effect for the next Interest Period during the Floating Rate Period.

If an event of default (as defined in the Indenture) with respect to Notes of this series shall occur and be continuing, the principal of the Notes of this series may be declared due and payable in the manner and with the effect provided in the Indenture.

Sections 12.02 and 12.03 of the Indenture containing provisions for defeasance apply to this Note. At any time the entire indebtedness of this Note may be defeased upon compliance by the Company with certain conditions set forth in Section 12.04 of the Indenture.

The Indenture contains provisions permitting the Company and the Trustee, without the consent of the holders of the Securities, to establish, among other things, the form and terms of any series of Securities issuable thereunder by one or more supplemental indentures, and, with the consent of the holders of a majority in aggregate principal amount of Securities at the time outstanding which are affected thereby, to modify the Indenture or any supplemental indenture or the rights of the holders of Securities of such series to be affected, provided that no such modification will (i) extend the fixed maturity of any Securities, reduce the rate or extend the time of payment of interest thereon, reduce the principal amount thereof or the premium, if any, thereon, reduce the amount of the principal of Original Issue Discount Securities payable on any date, change the currency in which Securities are payable, or impair the right to institute suit for the enforcement of any such payment on or after the maturity thereof, without the consent of the holder of each Security so affected, or (ii) reduce the aforesaid percentage of Securities of any series the consent of the holders of which is required for any such modification without the consent of the holders of all Securities of such series then outstanding, or (iii) modify the rights, duties or immunities of the Trustee unless the Trustee agrees to such modification.

No reference herein to the Indenture and no provision of this Note or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and interest on this Note at the times, place and rate, and in the coin or currency, herein prescribed.

This Note is a Global Security registered in the name of a nominee of the Depository. This Note is exchangeable for Notes registered in the name of a person other than the Depository or its nominee only in the limited circumstances hereinafter described. Unless and until it is exchanged in whole or in part for definitive Notes in certificated form, this Note may not be transferred except as a whole by the Depository to a nominee of the Depository or by a nominee of the Depository to the Depository or another nominee of the Depository.

The Notes represented by this Global Security are exchangeable for definitive Notes in certificated form of like tenor as such Notes in denominations of $1,000 and whole multiples of $1,000 in excess thereof only if (i) the Depository notifies the Company that it is unwilling or unable to continue as Depository for the Notes and the Company is unable to appoint a successor depository or (ii) the Depository ceases to be a clearing agency registered under the Securities Exchange Act of 1934, as amended, or (iii) the Company in its sole discretion decides to allow the Notes to be exchanged for definitive Notes in registered form. Any Notes that are exchangeable pursuant to the preceding sentence are exchangeable for certificated Notes issuable in authorized denominations and registered in such names as the Depository shall direct. As provided in the Indenture and subject to certain limitations therein set forth, the transfer of definitive Notes in certificated form is registrable in the register maintained by the Company in The City of New York for such purpose, upon surrender of the definitive Note for registration of transfer at the office or agency of the registrar, duly endorsed by, or accompanied by a written instrument of transfer in form satisfactory to the Company and the registrar duly executed by, the holder thereof or his attorney duly authorized in writing, and thereupon one or more new Notes of this series and of like tenor, of authorized denominations and for the same aggregate principal amount, will be issued to the designated transferee or transferees. Subject to the foregoing, this Note is not exchangeable, except for a Global Security or Global Securities of this issue of the same principal amount to be registered in the name of the Depository or its nominee.

No service charge shall be made for any such registration of transfer or exchange, but the Company may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

Prior to due presentment of this Note for registration of transfer, the Company, the Trustee and any agent of the Company or the Trustee may treat the Person in whose name this Note is registered as the owner hereof for all purposes, whether or not this Note be overdue, and neither the Company, the Trustee nor any such agent shall be affected by notice to the contrary.

The Company will pay additional amounts (“Additional Amounts”) to the beneficial owner of any Note that is a non-United States person in order to ensure that every net payment on such Note will not be less, due to payment of U.S. withholding tax, than the amount then due and payable. For this purpose, a “net payment” on a Note means a payment by the Company or a paying agent, including payment of principal and interest, after deduction for any present or future tax, assessment or other governmental charge of the United States. These Additional Amounts will constitute additional interest on the Note.

The Company will not be required to pay Additional Amounts, however, in any of the circumstances described in items (1) through (13) below.

(1) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the beneficial owner:

(a) having a relationship with the United States as a citizen, resident or otherwise;

(b) having had such a relationship in the past; or

(c) being considered as having had such a relationship.

(2) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the beneficial owner:

(a) being treated as present in or engaged in a trade or business in the United States;

(b) being treated as having been present in or engaged in a trade or business in the United States in the past; or

(c) having or having had a permanent establishment in the United States.

(3) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld in whole or in part by reason of the beneficial owner being or having been any of the following (as such terms are defined in the Internal Revenue Code of 1986, as amended):

(a) personal holding company;

(b) foreign private foundation or other foreign tax-exempt organization;

(c) passive foreign investment company;

(d) controlled foreign corporation; or

(e) corporation which has accumulated earnings to avoid United States federal income tax.

(4) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the beneficial owner owning or having owned, actually or constructively, 10 percent or more of the total combined voting power of all classes of stock of the Company entitled to vote or by reason of the beneficial owner being a bank that has invested in a Note as an extension of credit in the ordinary course of its trade or business.

For purposes of items (1) through (4) above, “beneficial owner” means a fiduciary, settlor, beneficiary, member or shareholder of the holder if the holder is an estate, trust, partnership, limited liability company, corporation or other entity, or a person holding a power over an estate or trust administered by a fiduciary holder.

(5) Additional Amounts will not be payable to any beneficial owner of a Note that is a:

(a) fiduciary;

(b) partnership;

(c) limited liability company; or

(d) other fiscally transparent entity

or that is not the sole beneficial owner of the Note, or any portion of the Note. However, this exception to the obligation to pay Additional Amounts will only apply to the extent that a beneficiary or settlor in relation to the fiduciary, or a beneficial owner or member of the partnership, limited liability company or other fiscally transparent entity, would not have been entitled to the payment of an Additional Amount had the beneficiary, settlor, beneficial owner or member received directly its beneficial or distributive share of the payment.

(6) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the failure of the beneficial owner or any other person to comply with applicable certification, identification, documentation or other information reporting requirements. This exception to the obligation to pay Additional Amounts will only apply if compliance with such reporting requirements is required by statute or regulation of the United States or by an applicable income tax treaty to which the United States is a party as a precondition to exemption from such tax, assessment or other governmental charge.

(7) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is collected or imposed by any method other than by withholding from a payment on a Note by the Company or a paying agent.

(8) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld by reason of a change in law, regulation, or administrative or judicial interpretation that becomes effective more than 15 days after the payment becomes due or is duly provided for, whichever occurs later.

(9) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld by reason of the presentation by the beneficial owner of a Note for payment more than 30 days after the date on which such payment becomes due or is duly provided for, whichever occurs later.

(10) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any:

(a) estate tax;

(b) inheritance tax;

(c) gift tax;

(d) sales tax;

(e) excise tax;

(f) transfer tax;

(g) wealth tax;

(h) personal property tax; or

(i) any similar tax, assessment, withholding, deduction or other governmental charge.

(11) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment, or other governmental charge required to be withheld by any paying agent from a payment of principal or interest on a Note if such payment can be made without such withholding by any other paying agent.

(12) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any withholding, deduction, tax, duty assessment or other governmental charge that would not have been imposed but for a failure by the holder or beneficial owner of a Note (or any financial institution through which the holder or beneficial owner holds the Note or through which payment on the Note is made) to take any action (including entering into an agreement with the Internal Revenue Service, or a governmental authority of another jurisdiction if the holder is entitled to the benefits of an intergovernmental agreement between that jurisdiction and the United States) or to comply with any applicable certification, documentation, information or other reporting requirement or agreement concerning accounts maintained by the holder or beneficial owner (or any such financial institution), or concerning ownership of the holder or beneficial owner, or any substantially similar requirement or agreement.

(13) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any combination of items (1) through (12) above.

Except as specifically provided herein, the Company will not be required to make any payment of any tax, assessment or other governmental charge imposed by any government or a political subdivision or taxing authority of such government.

As used in this Note, “United States person” means:

| (a) | any individual who is a citizen or resident of the United States; |

| (b) | any corporation, partnership or other entity created or organized in or under the laws of the United States or any political subdivision thereof; |

| (c) | any estate if the income of such estate falls within the federal income tax jurisdiction of the United States regardless of the source of such income; and |

| (d) | any trust if (i) a United States court is able to exercise primary supervision over its administration and one or more United States persons have the authority to control all of the substantial decisions of the trust; or (ii) it has a valid election in effect under applicable United States Treasury regulations to be treated as a United States person. |

Additionally, “non-United States person” means a person who is not a United States person, and “United States” means the states of the United States of America and the District of Columbia, but excluding its territories and its possessions.

Except as provided below, the Notes may not be redeemed prior to maturity.

| (1) | The Company may, at its option, redeem the Notes if: |

| (a) | the Company becomes or will become obligated to pay Additional Amounts as described above; |

| (b) | the obligation to pay Additional Amounts arises as a result of any change in the laws, regulations or rulings of the United States, or an official position regarding the application or interpretation of such laws, regulations or rulings, which change is announced or becomes effective on or after February 6, 2024; and |

| (c) | the Company determines, in its business judgment, that the obligation to pay such Additional Amounts cannot be avoided by the use of reasonable measures available to it, other than substituting the obligor under the Notes or taking any action that would entail a material cost to the Company. |

| (2) | The Company may also redeem the Notes, at its option, if: |

| (a) | any act is taken by a taxing authority of the United States on or after February 6, 2024 whether or not such act is taken in relation to the Company or any subsidiary, that results in a substantial probability that the Company will or may be required to pay Additional Amounts as described above; |

| (b) | the Company determines, in its business judgment, that the obligation to pay such Additional Amounts cannot be avoided by the use of reasonable measures available to it, other than substituting the obligor under the Notes or taking any action that would entail a material cost to the Company; and |

| (c) | the Company receives an opinion of independent counsel to the effect that an act taken by a taxing authority of the United States results in a substantial probability that the Company will or may be required to pay the Additional Amounts described above, and delivers to the Trustee a certificate, signed by a duly authorized officer, stating that based on such opinion the Company is entitled to redeem the Notes pursuant to their terms. |

Any redemption of the Notes as set forth in clauses (1) or (2) above shall be in whole, and not in part, and will be made at a redemption price equal to 100% of the principal amount of the Notes Outstanding plus accrued and unpaid interest thereon to the date of redemption.

| (3) | The Company may also redeem the Notes, at its option, in whole at any time or in part from time to time, on or after August 13, 2024 (or, if additional notes are issued after February 13, 2024, beginning six months after the issue date of such additional notes) and prior to February 13, 2029, at a redemption price equal to the sum of (i) 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest thereon to, but excluding the date of redemption; and (ii) the Make-Whole Amount, if any, with respect to such Notes. The Reinvestment Rate will equal the Treasury Yield calculated to February 13, 2029, plus 0.200%. |

| • | “Make-Whole Amount” means the excess, if any, of: (i) the aggregate present value as of the date of such redemption of each dollar of principal being redeemed and the amount of interest (exclusive of interest accrued to the date of redemption) that would have been payable in respect of each such dollar if such redemption had not been made, determined by discounting, on a semi-annual basis, such principal and interest at the Reinvestment Rate (as defined below) (determined on the third business day preceding the date that notice of such redemption is given) from the respective dates on which such principal and interest would have been payable if such redemption had not been made, to the date of redemption, over (ii) the aggregate principal amount of the Notes being redeemed. |

| • | “Reinvestment Rate” means the yield on Treasury securities at a constant maturity corresponding to the remaining life (as of the date of redemption, and rounded to the nearest month) to February 13, 2029, of the principal being redeemed (the “Treasury Yield”), plus 0.200%. For purposes of the Notes, the Treasury Yield shall be equal to the arithmetic mean of the yields published in the Statistical Release (as defined below) under the heading “Week Ending” for “U.S. Government Securities — Treasury Constant Maturities” with a maturity equal to such remaining life; provided that if no published maturity exactly corresponds to such remaining life, then the Treasury Yield shall be interpolated or extrapolated on a straight-line basis from the arithmetic means of the yields for the next shortest and next longest published maturities. For purposes of calculating the Reinvestment Rate, the most recent Statistical Release published prior to the date of determination of the Make-Whole Amount shall be used. If the format or content of the Statistical Release changes in a manner that precludes determination of the Treasury Yield in the above manner, then the Treasury Yield shall be determined in the manner that most closely approximates the above manner, as reasonably determined by the Company. |

| • | “Statistical Release” means the statistical release designated “H.15(519)” or any successor publication which is published weekly by the Federal Reserve and which reports yields on actively traded United States government securities adjusted to constant maturities or, if such statistical release is not published at the time of any determination under the Indenture, then such other reasonably comparable index which shall be designated by the Company. |

| (4) | The Company may also redeem the Notes, at its option, (i) in whole, but not in part, on February 13, 2029, or (ii) in whole at any time or in part from time to time, on or after January 13, 2030 at a redemption price equal to 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the date of redemption. |

Holders shall be given not less than 15 days’ nor more than 60 days’ prior notice by the Trustee of the date fixed for such redemption described in (1) and (2) above. Holders shall be given not less than 5 days’ nor more than 30 days’ prior notice by the Trustee of the date fixed for such redemption described in (3) and (4) above.

All terms used in this Note which are defined in the Indenture shall have the meanings assigned to them in the Indenture. The Notes are governed by the laws of the State of New York.

Schedule 1

Redemptions and Amount of Securities

| Date of partial redemption |

Aggregate principal amount of Securities then redeemed |

Remaining principal amount of this Global Security |

Authorized Signature |

Exhibit 5.01

February 13, 2024

Citigroup Inc.

388 Greenwich Street

New York, New York 10013

Ladies and Gentlemen:

I am a Senior Vice President—Corporate Securities Issuance Legal of Citigroup Inc., a Delaware corporation (the “Company”). I refer to the offering of $3,000,000,000 5.174% Fixed Rate / Floating Rate Callable Senior Notes due February 13, 2034 of the Company (the “Securities”) pursuant to the registration statement on Form S-3ASR (No. 333-270327) and the prospectus dated March 7, 2023, as supplemented by the prospectus supplement dated February 6, 2024 (together, the “Prospectus”). The Securities were issued pursuant to the senior debt indenture dated as of November 13, 2013, as amended (the “Indenture”), between the Company and The Bank of New York Mellon, as the trustee.

I have examined originals or copies, certified or otherwise identified to my satisfaction, of such documents, corporate records, certificates of public officials and other instruments and have conducted such other investigations of fact and law as I have deemed necessary or advisable for the purposes of this opinion. In such examination, I have assumed the legal capacity of all natural persons, the genuineness of all signatures (other than those of officers of the Company), the authenticity of all documents submitted to me as originals, the conformity to original documents of all documents submitted to me as certified or photostatic copies and the authenticity of the original of such copies.

Upon the basis of the foregoing, I am of the opinion that the Securities have been validly authorized and are validly issued and outstanding obligations of the Company enforceable in accordance with their terms and entitled to the benefits of the Indenture (subject, as to enforcement, to applicable bankruptcy, reorganization, insolvency, moratorium or other similar laws affecting creditors’ rights generally and to general principles of equity regardless of whether such enforceability is considered in a proceeding in equity or at law).

Citigroup Inc.

Page 2

My opinion is limited to matters governed by the Federal laws of the United States of America, the laws of the State of New York and the General Corporation Law of the State of Delaware (including the applicable provisions of the Delaware Constitution and the reported judicial decisions interpreting the General Corporation Law of the State of Delaware and such applicable provisions of the Delaware Constitution). I am not admitted to the practice of law in the State of Delaware.

I consent to the filing of this opinion as Exhibit 5.01 to the Company’s Current Report on Form 8-K dated February 13, 2024 and to the reference to my name in the Prospectus under the heading “Legal Matters.” In giving such consent, I do not thereby admit that I come within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations of the Securities and Exchange Commission thereunder.

| Very truly yours, |

| /s/ Karen Wang |

| Name: Karen Wang |

| Title: Senior Vice President— |

| Corporate Securities Issuance Legal |

Title of each class |

Ticker Symbol(s) |

Title for iXBRL |

Name of each exchange on which registered |

|||

| Common Stock, par value $.01 per share | C | Common Stock, par value $.01 per share |

New York Stock Exchange |

|||

| Depositary Shares, each representing 1/1,000th interest in a share of 7.125% Fixed/Floating Rate Noncumulative Preferred Stock, Series J | C Pr J | Dep Shs, represent 1/1,000th interest in a share of 7.125% Fix/Float Rate Noncum Pref Stk, Ser J |

New York Stock Exchange |

|||

| 7.625% Trust Preferred Securities of Citigroup Capital III (and registrant’s guaranty with respect thereto) | C/36Y | 7.625% TRUPs of Cap III (and registrant’s guaranty) |

New York Stock Exchange |

|||

| 7.875% Fixed Rate / Floating Rate Trust Preferred Securities (TruPS ® ) of Citigroup Capital XIII (and registrant’s guaranty with respect thereto) |

C N | 7.875% FXD / FRN TruPS of Cap XIII (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Callable Step-Up Coupon Notes Due March 31, 2036 of CGMHI (and registrant’s guaranty with respect thereto) |

C/36A | MTN, Series N, Callable Step-Up Coupon Notes Due Mar 2036 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Callable Step-Up Coupon Notes Due February 26, 2036 of CGMHI (and registrant’s guaranty with respect thereto) |

C/36 | MTN, Series N, Callable Step-Up Coupon Notes Due Feb 2036 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Callable Fixed Rate Notes Due December 18, 2035 of CGMHI (and registrant’s guaranty with respect thereto) | C/35 | MTN, Series N, Callable Fixed Rate Notes Due Dec 2035 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Floating Rate Notes Due April 26, 2028 of CGMHI (and registrant’s guaranty with respect thereto) | C/28 | MTN, Series N, Floating Rate Notes Due Apr 26, 2028 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Floating Rate Notes Due September 17, 2026 of CGMHI (and registrant’s guaranty with respect thereto) | C/26 | MTN, Series N, Floating Rate Notes Due Sept 2026 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Floating Rate Notes Due September 15, 2028 of CGMHI (and registrant’s guaranty with respect thereto) | C/28A | MTN, Series N, Floating Rate Notes Due Sept 2028 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Floating Rate Notes Due October 6, 2028 of CGMHI (and registrant’s guaranty with respect thereto) | C/28B | MTN, Series N, Floating Rate Notes Due Oct 2028 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||

| Medium-Term Senior Notes, Series N, Floating Rate Notes Due March 21, 2029 of CGMHI (and registrant’s guaranty with respect thereto) | C/29A | MTN, Series N, Floating Rate Notes Due Mar 2029 of CGMHI (and registrant’s guaranty) |

New York Stock Exchange |

|||