UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 30, 2024

CNB FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| Pennsylvania |

001-39472 | 25-1450605 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

1 South Second Street

PO Box 42

Clearfield, Pennsylvania 16830

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code: (814) 765-9621

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, no par value | CCNE | The NASDAQ Stock Market LLC | ||

| Depositary Shares (each representing a 1/40th interest in a share of 7.125% Series A Non-Cumulative, perpetual preferred stock) | CCNEP | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

CNB Financial Corporation (NASDAQ: CCNE), the parent company of CNB Bank, intends to use the materials furnished herewith in one or more meetings with investors beginning on January 31, 2024. The presentation will also be posted on the Corporation’s website at https://cnbbank.q4ir.com/events-and-presentations. A copy of the investor presentation is furnished hereto as Exhibit 99.1 and is hereby incorporated by reference herein.

The information contained in this Item 7.01, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information or exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits |

| (d) | Exhibits |

| Exhibit Number |

Description |

|

| 99.1 | Investor Presentation, dated January 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CNB FINANCIAL CORPORATION | ||||||

| Date: January 30, 2024 | By: | /s/ Tito L. Lima |

||||

| Tito L. Lima | ||||||

| Treasurer | ||||||

84 87 90 164 30 52 230 228 229 Discussion Materials Investor Presentation January 2024 164 30 52 164 30 52 164 30 52 Exhibit 99.1

Certain Important information CAUTION REGARDING FORWARD LOOKING STATEMENTS This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to CNB’s financial condition, liquidity, results of operations, future performance and business. These forward-looking statements are intended to be covered by the safe harbor for "forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors (some of which are beyond CNB’s control). Forward-looking statements often include the words "believes," "expects," "anticipates," "estimates," "forecasts," "intends," "plans," "targets," "potentially," "probably," "projects," "outlook" or similar expressions or future conditional verbs such as "may," "will," "should," "would" and "could." CNB’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Such known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the statements, include, but are not limited to, (i) adverse changes or conditions in capital and financial markets, including actual or potential stresses in the banking industry; (ii) changes in the interest rate environment, including significant market-driven impacts to deposit and loan pricing; (iii) the credit risks of lending activities, including our ability to estimate credit losses and the allowance for credit losses, as well as the effects of changes in the level of, and trends in, loan delinquencies and write-offs; (iv) effectiveness of our data security controls in the face of cyber attacks and any reputational risks following a cybersecurity incident; (v) the duration and scope of a pandemic, including the lingering impacts of the COVID-19 pandemic, and the local, national and global impact of a pandemic; (vi) changes in general business, industry or economic conditions or competition; (vii) changes in any applicable law, rule, regulation, policy, guideline or practice governing or affecting financial holding companies and their subsidiaries or with respect to tax or accounting principles or otherwise; (viii) higher than expected costs or other difficulties related to integration of combined or merged businesses; (ix) the effects of business combinations and other acquisition transactions, including the inability to realize our loan and investment portfolios; (x) changes in the quality or composition of our loan and investment portfolios; (xi) the adequacy of the allowance for credit losses, including estimations of reserves on both specific credits and portfolio segments; (xii) increased competition; (xiii) loss of certain key officers; (xiv) deposit attrition; (xv) rapidly changing technology; (xvi) unanticipated regulatory or judicial proceedings and liabilities and other costs; (xvii) changes in the cost of funds, demand for loan products or demand for financial services; and (xviii) other economic, competitive, governmental or technological factors affecting our operations, markets, products, services and prices. For more information about factors that could cause actual results to differ from those discussed in the forward-looking statements, please refer to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of and the forward-looking statement disclaimers in CNB’s annual and quarterly reports filed with the SEC. The forward-looking statements contained herein are based upon management’s beliefs and assumptions. Any forward-looking statement made herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. CNB undertakes no obligation to publicly update or revise any forward-looking statements included in this presentation or to update the reasons why the actual results could differ from those contained in such statements, whether as a result of new information, future events or otherwise, except to the extent required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this presentation might not occur and you should not put undue reliance on any forward-looking statements. NON-GAAP FINANCIAL MEASURES This report contains references to financial measures that are not defined in GAAP. Management uses non-GAAP financial information in its analysis of the Corporation’s performance. Management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Corporation’s management believes that investors may use these non-GAAP measures to analyze the Corporation’s financial performance without the impact of unusual items or events that may obscure trends in the Corporation’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. Limitations associated with non-GAAP financial measures include the risks that persons might disagree as to the appropriateness of items included in these measures and that different companies might calculate these measures differently. Non-GAAP measures reflected within the presentation include: Tangible common equity/tangible assets, Return on average tangible common equity, Net interest margin (fully tax equivalent basis), Efficiency ratio (fully tax equivalent) and Tangible book value per share.

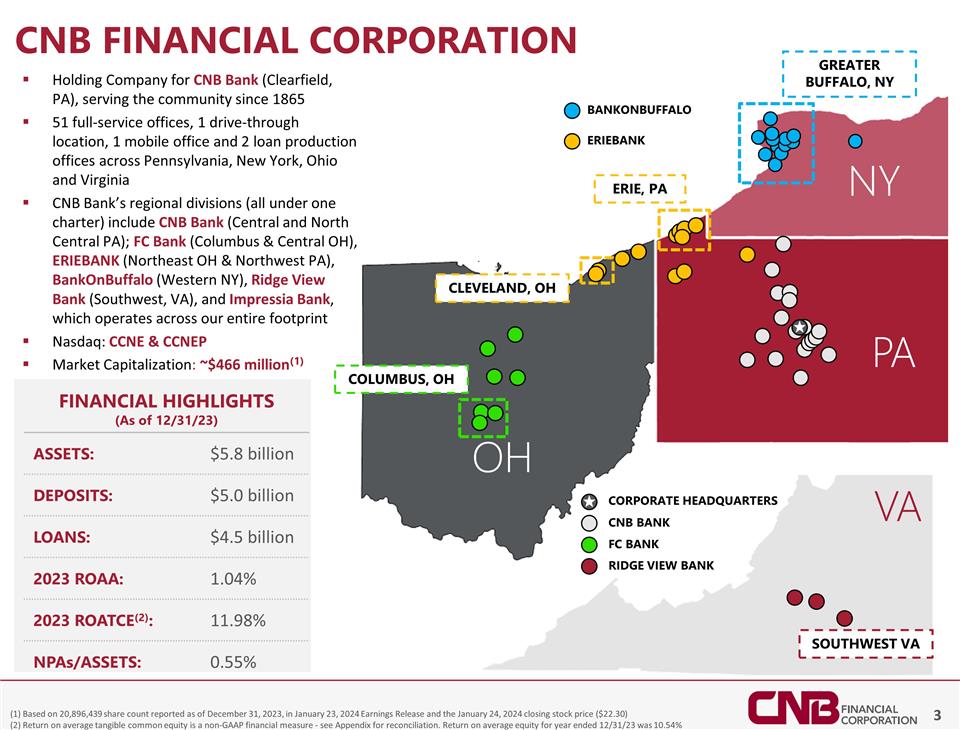

CNB Financial Corporation (1) Based on 20,896,439 share count reported as of December 31, 2023, in January 23, 2024 Earnings Release and the January 24, 2024 closing stock price ($22.30) (2) Return on average tangible common equity is a non-GAAP financial measure - see Appendix for reconciliation. Return on average equity for year ended 12/31/23 was 10.54% NY PA OH ERIEBANK BANKONBUFFALO FC BANK CNB BANK COLUMBUS, OH CLEVELAND, OH ERIE, PA RIDGE VIEW BANK VA SOUTHWEST VA GREATER BUFFALO, NY Holding Company for CNB Bank (Clearfield, PA), serving the community since 1865 51 full-service offices, 1 drive-through location, 1 mobile office and 2 loan production offices across Pennsylvania, New York, Ohio and Virginia CNB Bank’s regional divisions (all under one charter) include CNB Bank (Central and North Central PA); FC Bank (Columbus & Central OH), ERIEBANK (Northeast OH & Northwest PA), BankOnBuffalo (Western NY), Ridge View Bank (Southwest, VA), and Impressia Bank, which operates across our entire footprint Nasdaq: CCNE & CCNEP Market Capitalization: ~$466 million(1) Corporate Headquarters FINANCIAL HIGHLIGHTS (As of 12/31/23) Assets: $5.8 billion Deposits: $5.0 billion Loans: $4.5 billion 2023 ROAA: 1.04% 2023 ROATCE(2): 11.98% NPAs/Assets: 0.55%

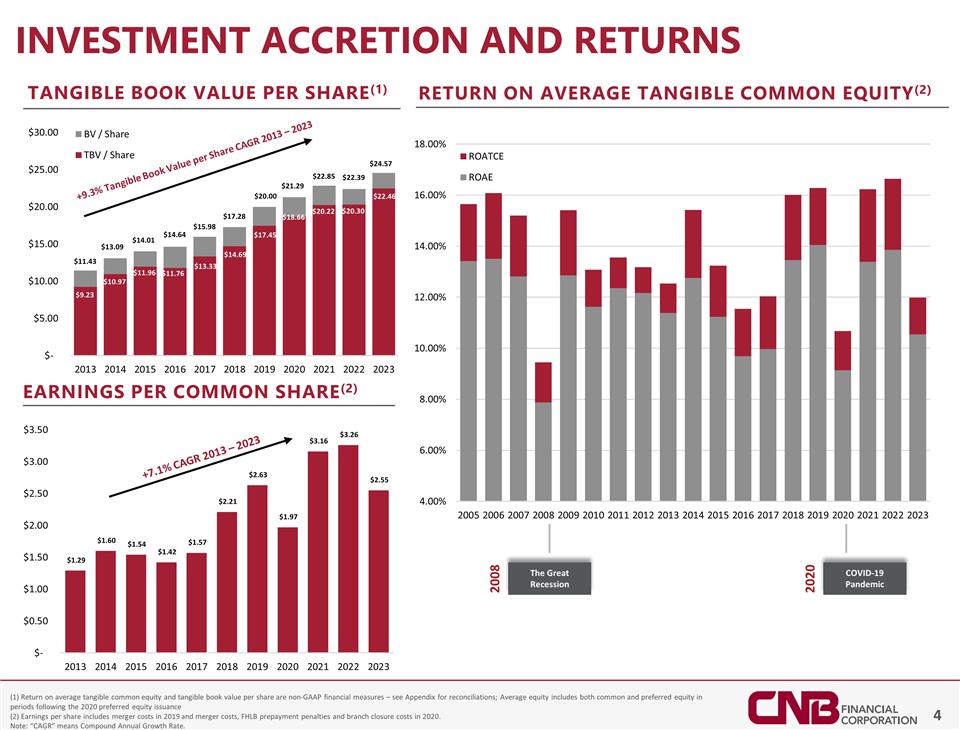

Investment Accretion and Returns The Great Recession 2008 COVID-19 Pandemic 2020 Return on Average tangible common equity(2) (1) Return on average tangible common equity and tangible book value per share are non-GAAP financial measures – see Appendix for reconciliations; Average equity includes both common and preferred equity in periods following the 2020 preferred equity issuance (2) Earnings per share includes merger costs in 2019 and merger costs, FHLB prepayment penalties and branch closure costs in 2020. Note: “CAGR” means Compound Annual Growth Rate. Earnings per Common share(2) +7.1% CAGR 2013 – 2023 Tangible book value per share(1) +9.3% Tangible Book Value per Share CAGR 2013 – 2023

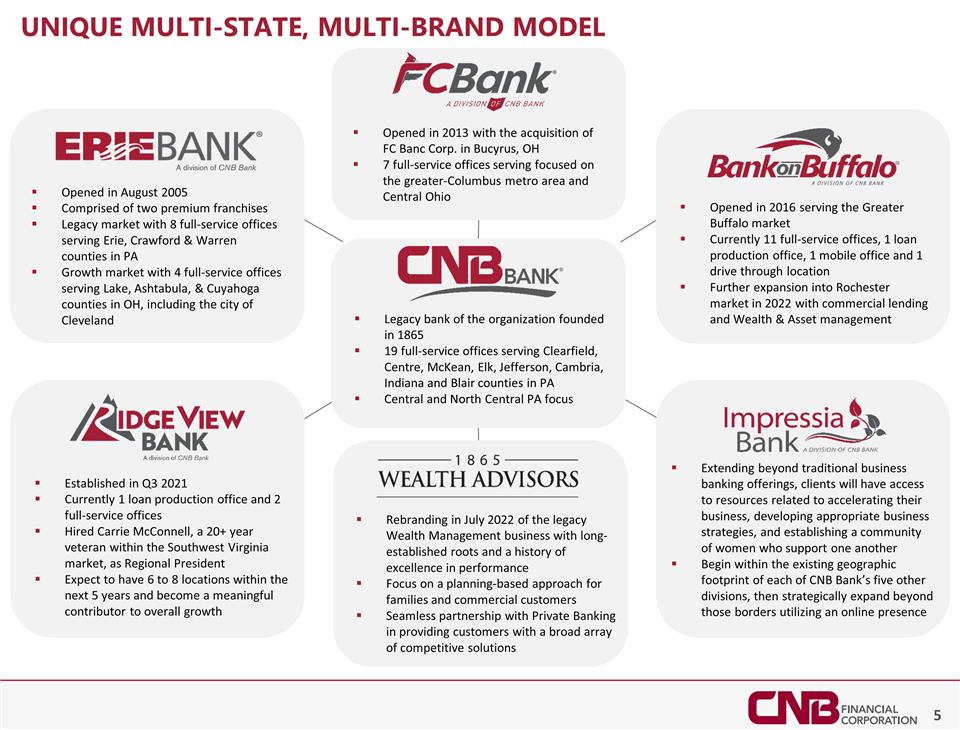

Legacy bank of the organization founded in 1865 19 full-service offices serving Clearfield, Centre, McKean, Elk, Jefferson, Cambria, Indiana and Blair counties in PA Central and North Central PA focus Opened in August 2005 Comprised of two premium franchises Legacy market with 8 full-service offices serving Erie, Crawford & Warren counties in PA Growth market with 4 full-service offices serving Lake, Ashtabula, & Cuyahoga counties in OH, including the city of Cleveland Opened in 2013 with the acquisition of FC Banc Corp. in Bucyrus, OH 7 full-service offices serving focused on the greater-Columbus metro area and Central Ohio Opened in 2016 serving the Greater Buffalo market Currently 11 full-service offices, 1 loan production office, 1 mobile office and 1 drive through location Further expansion into Rochester market in 2022 with commercial lending and Wealth & Asset management Established in Q3 2021 Currently 1 loan production office and 2 full-service offices Hired Carrie McConnell, a 20+ year veteran within the Southwest Virginia market, as Regional President Expect to have 6 to 8 locations within the next 5 years and become a meaningful contributor to overall growth Rebranding in July 2022 of the legacy Wealth Management business with long-established roots and a history of excellence in performance Focus on a planning-based approach for families and commercial customers Seamless partnership with Private Banking in providing customers with a broad array of competitive solutions Extending beyond traditional business banking offerings, clients will have access to resources related to accelerating their business, developing appropriate business strategies, and establishing a community of women who support one another Begin within the existing geographic footprint of each of CNB Bank’s five other divisions, then strategically expand beyond those borders utilizing an online presence Unique Multi-state, multi-brand model

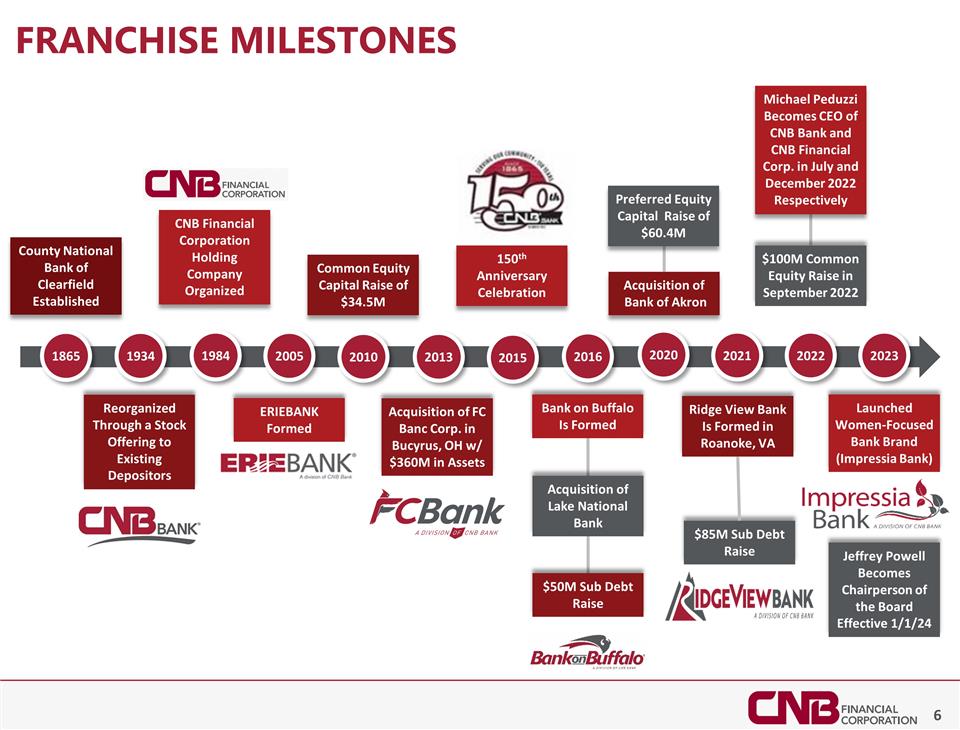

FRANCHISE Milestones 2020 Acquisition of Bank of Akron 2013 2010 2005 1934 Reorganized Through a Stock Offering to Existing Depositors 1984 1865 County National Bank of Clearfield Established 2015 2016 2021 CNB Financial Corporation Holding Company Organized ERIEBANK Formed Common Equity Capital Raise of $34.5M Acquisition of FC Banc Corp. in Bucyrus, OH w/ $360M in Assets 150th Anniversary Celebration Bank on Buffalo Is Formed Acquisition of Lake National Bank $50M Sub Debt Raise Ridge View Bank Is Formed in Roanoke, VA $85M Sub Debt Raise Preferred Equity Capital Raise of $60.4M 2022 Michael Peduzzi Becomes CEO of CNB Bank and CNB Financial Corp. in July and December 2022 Respectively $100M Common Equity Raise in September 2022 2023 Launched Women-Focused Bank Brand (Impressia Bank) Jeffrey Powell Becomes Chairperson of the Board Effective 1/1/24

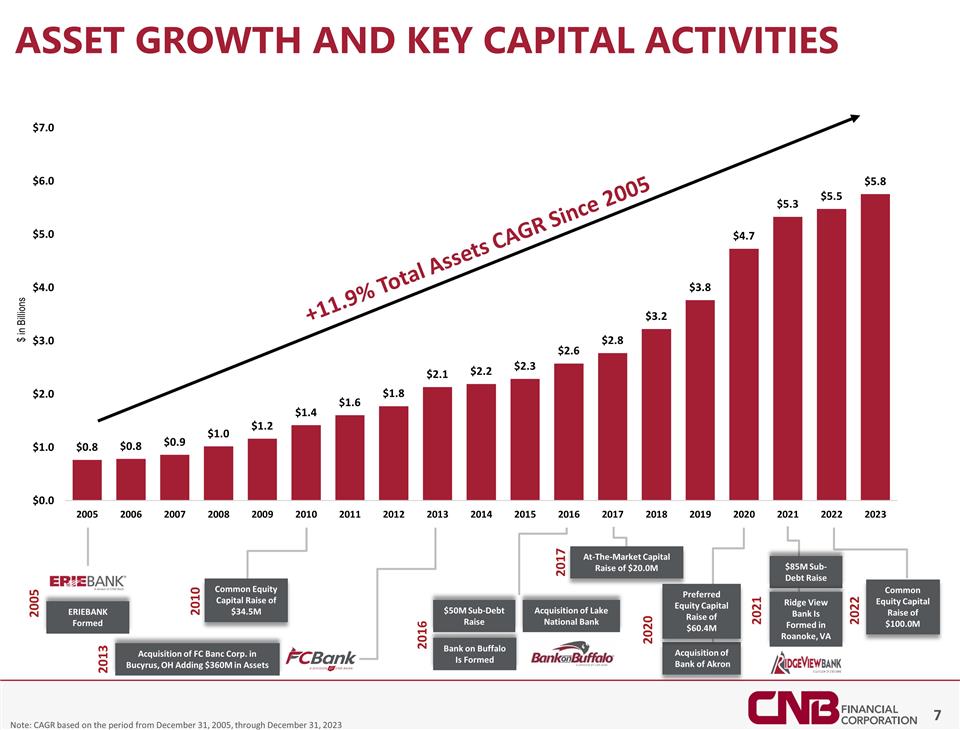

Common Equity Capital Raise of $34.5M Acquisition of FC Banc Corp. in Bucyrus, OH Adding $360M in Assets $50M Sub-Debt Raise Acquisition of Lake National Bank Bank on Buffalo Is Formed Acquisition of Bank of Akron Preferred Equity Capital Raise of $60.4M $85M Sub- Debt Raise Ridge View Bank Is Formed in Roanoke, VA ERIEBANK Formed 2005 2010 2013 2016 2020 2021 $ in Billions +11.9% Total Assets CAGR Since 2005 Note: CAGR based on the period from December 31, 2005, through December 31, 2023 At-The-Market Capital Raise of $20.0M 2017 Common Equity Capital Raise of $100.0M 2022 ASSET GROWTH and key capital activities

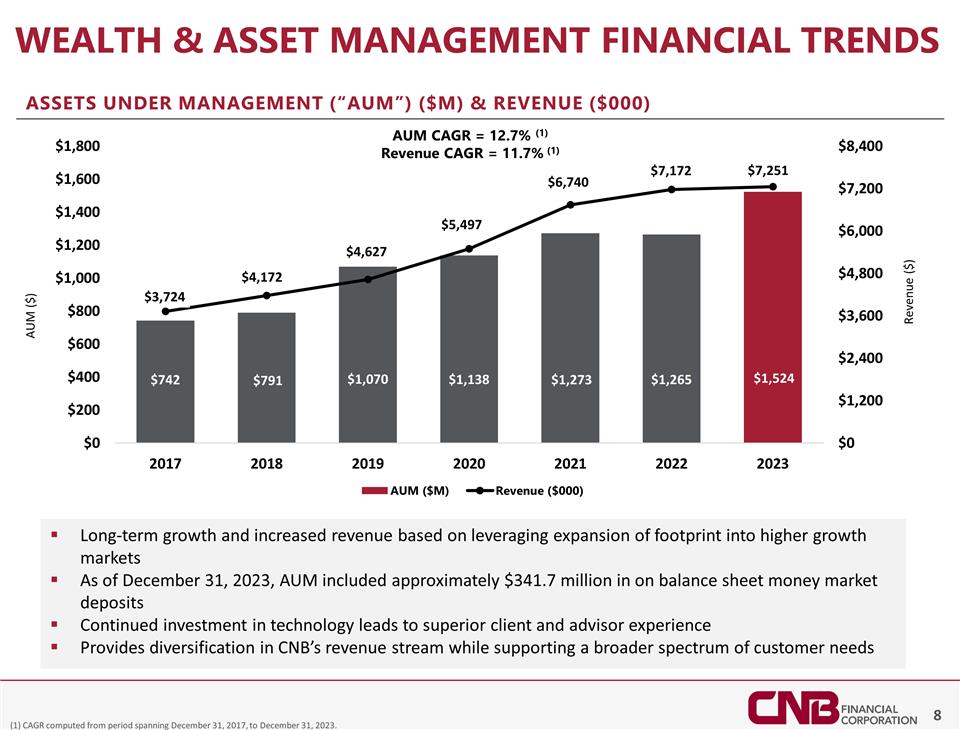

Wealth & asset management financial trends AUM CAGR = 12.7% (1) Revenue CAGR = 11.7% (1) Long-term growth and increased revenue based on leveraging expansion of footprint into higher growth markets As of December 31, 2023, AUM included approximately $341.7 million in on balance sheet money market deposits Continued investment in technology leads to superior client and advisor experience Provides diversification in CNB’s revenue stream while supporting a broader spectrum of customer needs Assets under management (“AUM”) ($M) & revenue ($000) (1) CAGR computed from period spanning December 31, 2017, to December 31, 2023.

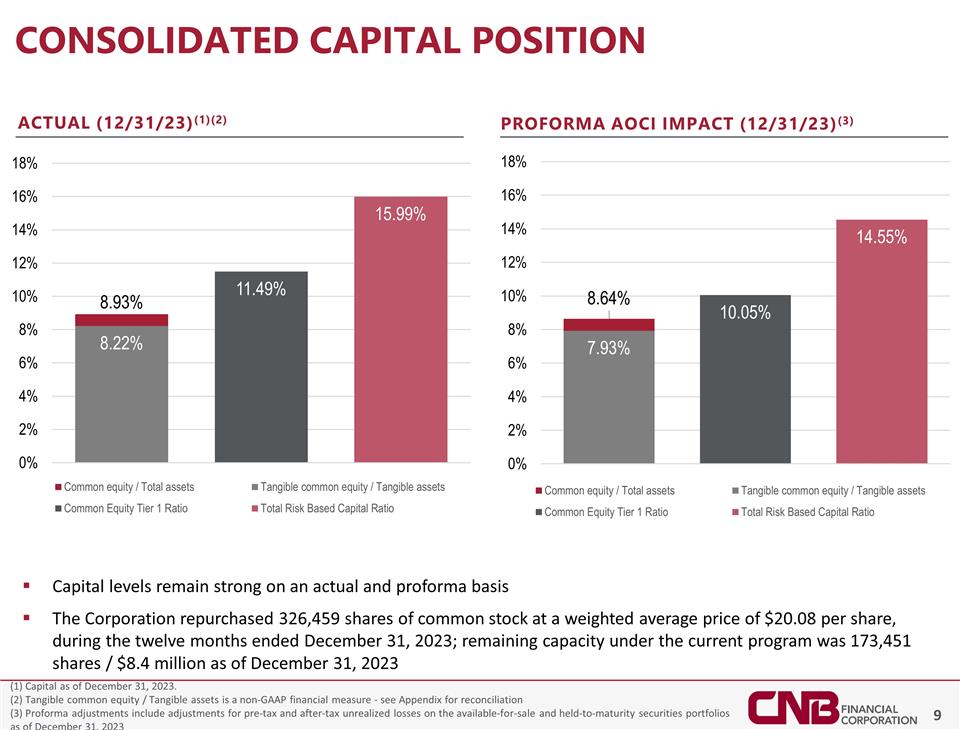

Consolidated Capital Position (1) Capital as of December 31, 2023. (2) Tangible common equity / Tangible assets is a non-GAAP financial measure - see Appendix for reconciliation (3) Proforma adjustments include adjustments for pre-tax and after-tax unrealized losses on the available-for-sale and held-to-maturity securities portfolios as of December 31, 2023 ACTUAL (12/31/23)(1)(2) PROFORMA AOCI IMPACT (12/31/23)(3) Capital levels remain strong on an actual and proforma basis The Corporation repurchased 326,459 shares of common stock at a weighted average price of $20.08 per share, during the twelve months ended December 31, 2023; remaining capacity under the current program was 173,451 shares / $8.4 million as of December 31, 2023

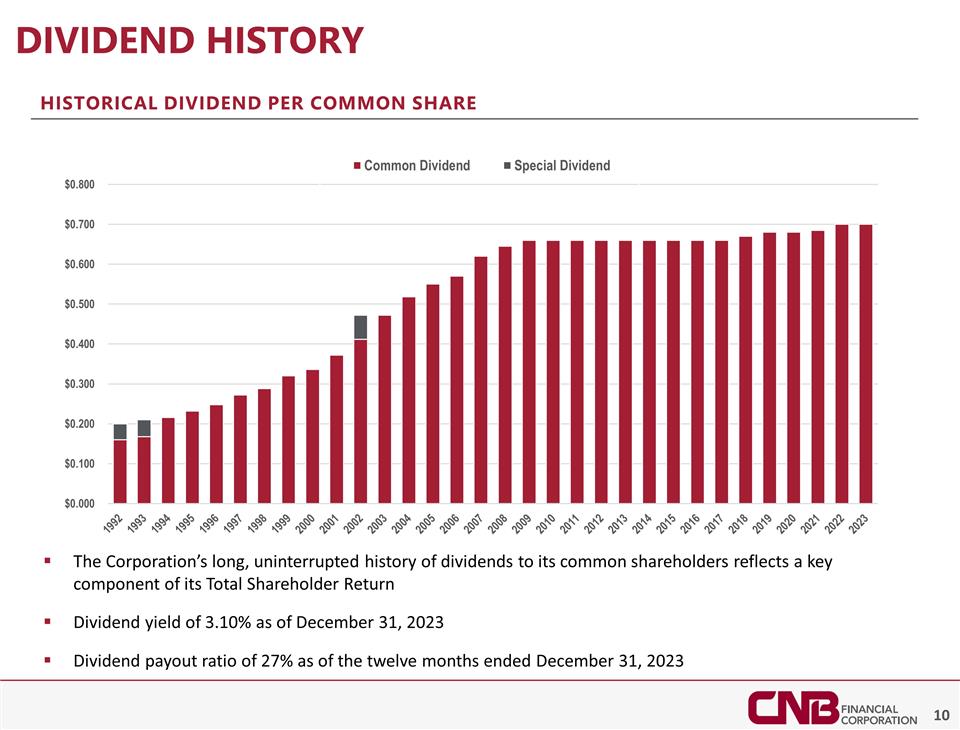

Dividend History Historical dividend per common share The Corporation’s long, uninterrupted history of dividends to its common shareholders reflects a key component of its Total Shareholder Return Dividend yield of 3.10% as of December 31, 2023 Dividend payout ratio of 27% as of the twelve months ended December 31, 2023

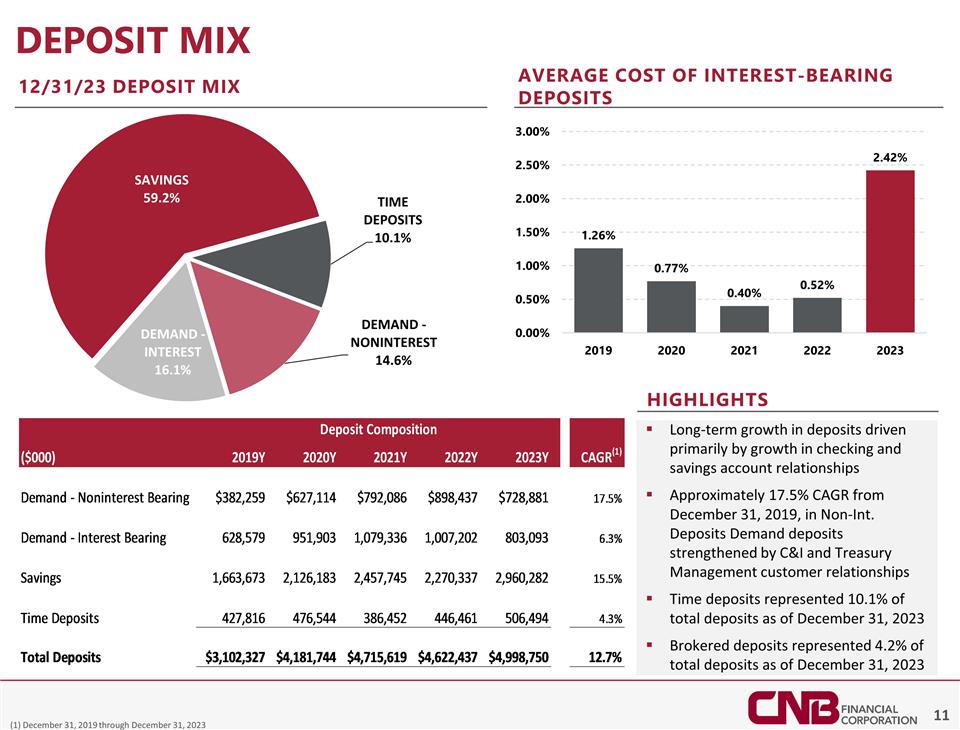

Long-term growth in deposits driven primarily by growth in checking and savings account relationships Approximately 17.5% CAGR from December 31, 2019, in Non-Int. Deposits Demand deposits strengthened by C&I and Treasury Management customer relationships Time deposits represented 10.1% of total deposits as of December 31, 2023 Brokered deposits represented 4.2% of total deposits as of December 31, 2023 Highlights Deposit mix 12/31/23 deposit mix Average Cost of Interest-Bearing Deposits (1) December 31, 2019 through December 31, 2023

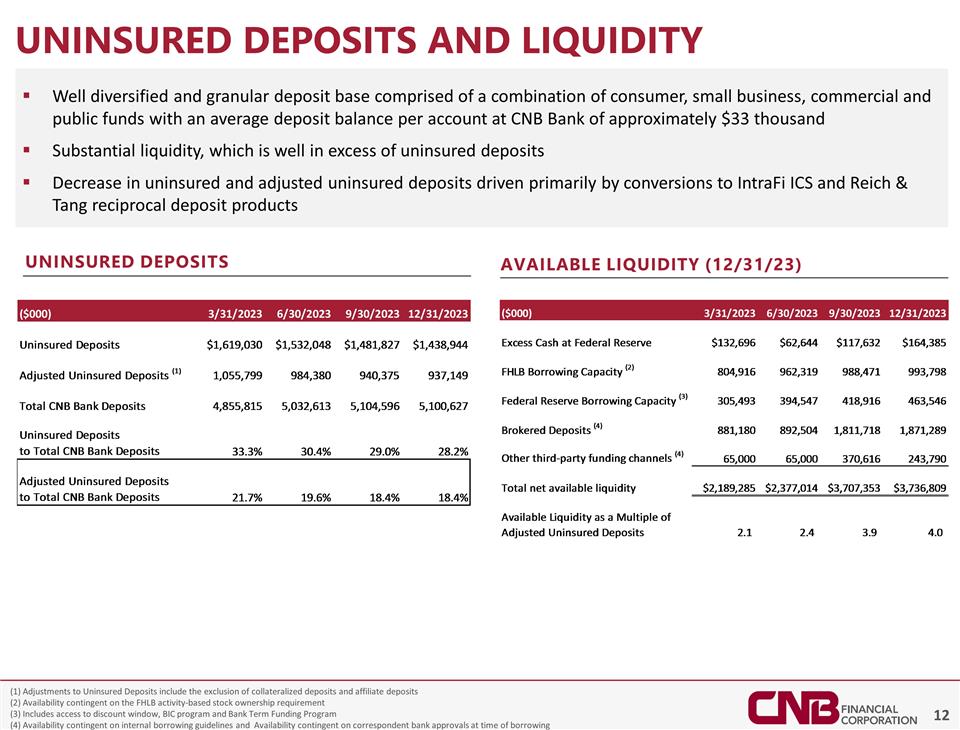

Uninsured deposits and liquidity Well diversified and granular deposit base comprised of a combination of consumer, small business, commercial and public funds with an average deposit balance per account at CNB Bank of approximately $33 thousand Substantial liquidity, which is well in excess of uninsured deposits Decrease in uninsured and adjusted uninsured deposits driven primarily by conversions to IntraFi ICS and Reich & Tang reciprocal deposit products Uninsured deposits Available Liquidity (12/31/23) (1) Adjustments to Uninsured Deposits include the exclusion of collateralized deposits and affiliate deposits (2) Availability contingent on the FHLB activity-based stock ownership requirement (3) Includes access to discount window, BIC program and Bank Term Funding Program (4) Availability contingent on internal borrowing guidelines and Availability contingent on correspondent bank approvals at time of borrowing

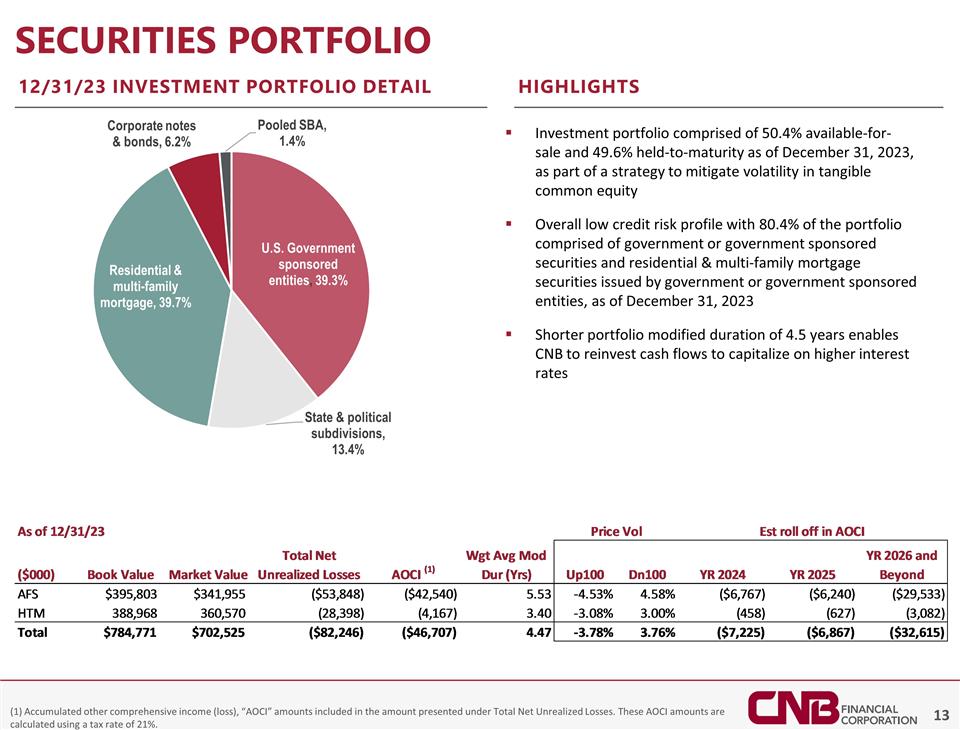

Investment portfolio comprised of 50.4% available-for-sale and 49.6% held-to-maturity as of December 31, 2023, as part of a strategy to mitigate volatility in tangible common equity Overall low credit risk profile with 80.4% of the portfolio comprised of government or government sponsored securities and residential & multi-family mortgage securities issued by government or government sponsored entities, as of December 31, 2023 Shorter portfolio modified duration of 4.5 years enables CNB to reinvest cash flows to capitalize on higher interest rates Securities portfolio 12/31/23 investment portfolio detail HIGHLIGHTS (1) Accumulated other comprehensive income (loss), “AOCI” amounts included in the amount presented under Total Net Unrealized Losses. These AOCI amounts are calculated using a tax rate of 21%.

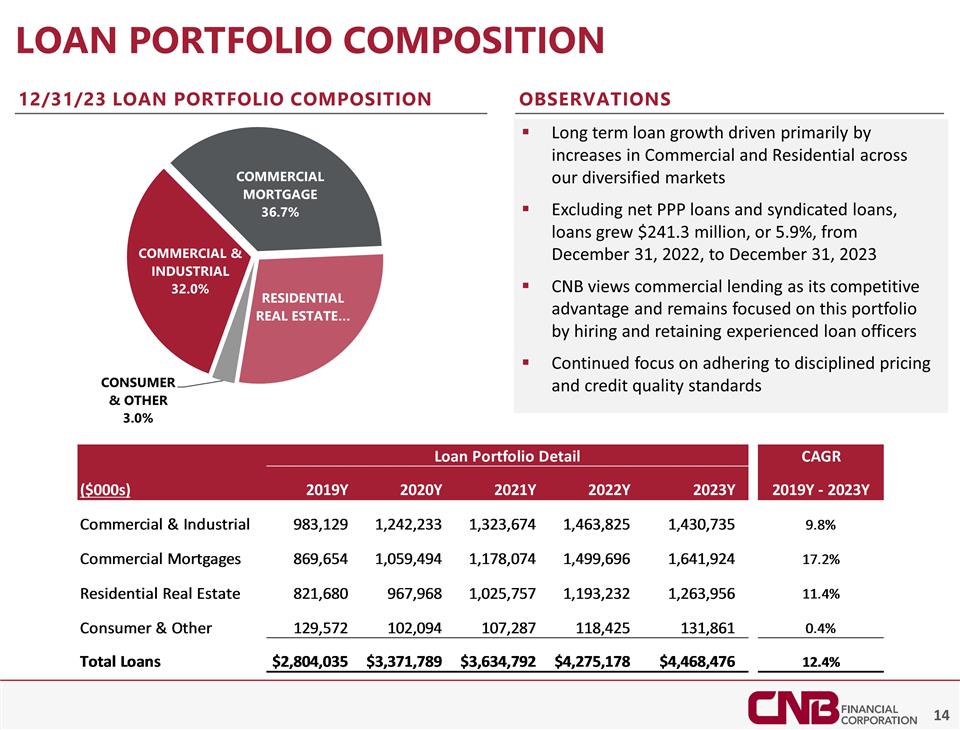

Long term loan growth driven primarily by increases in Commercial and Residential across our diversified markets Excluding net PPP loans and syndicated loans, loans grew $241.3 million, or 5.9%, from December 31, 2022, to December 31, 2023 CNB views commercial lending as its competitive advantage and remains focused on this portfolio by hiring and retaining experienced loan officers Continued focus on adhering to disciplined pricing and credit quality standards Loan portfolio composition 12/31/23 Loan portfolio Composition observations

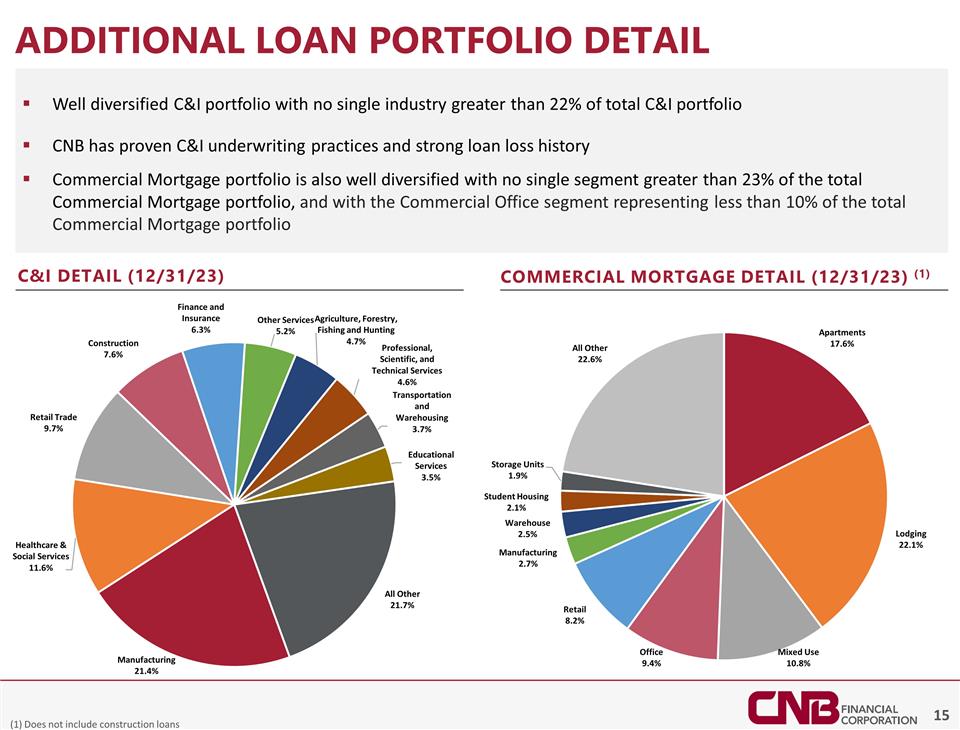

Additional Loan portfolio Detail Well diversified C&I portfolio with no single industry greater than 22% of total C&I portfolio CNB has proven C&I underwriting practices and strong loan loss history Commercial Mortgage portfolio is also well diversified with no single segment greater than 23% of the total Commercial Mortgage portfolio, and with the Commercial Office segment representing less than 10% of the total Commercial Mortgage portfolio C&I Detail (12/31/23) Commercial mortgage detail (12/31/23) (1) (1) Does not include construction loans

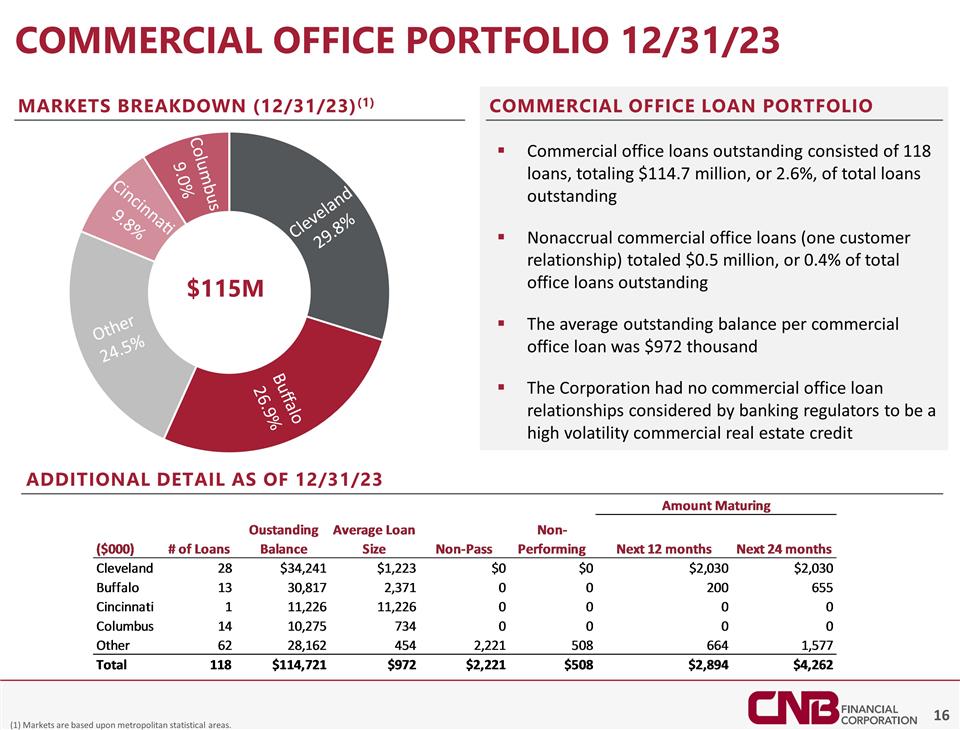

Commercial Office Portfolio 12/31/23 Commercial Office Loan Portfolio Commercial office loans outstanding consisted of 118 loans, totaling $114.7 million, or 2.6%, of total loans outstanding Nonaccrual commercial office loans (one customer relationship) totaled $0.5 million, or 0.4% of total office loans outstanding The average outstanding balance per commercial office loan was $972 thousand The Corporation had no commercial office loan relationships considered by banking regulators to be a high volatility commercial real estate credit Markets Breakdown (12/31/23)(1) Additional Detail As of 12/31/23 $115M (1) Markets are based upon metropolitan statistical areas.

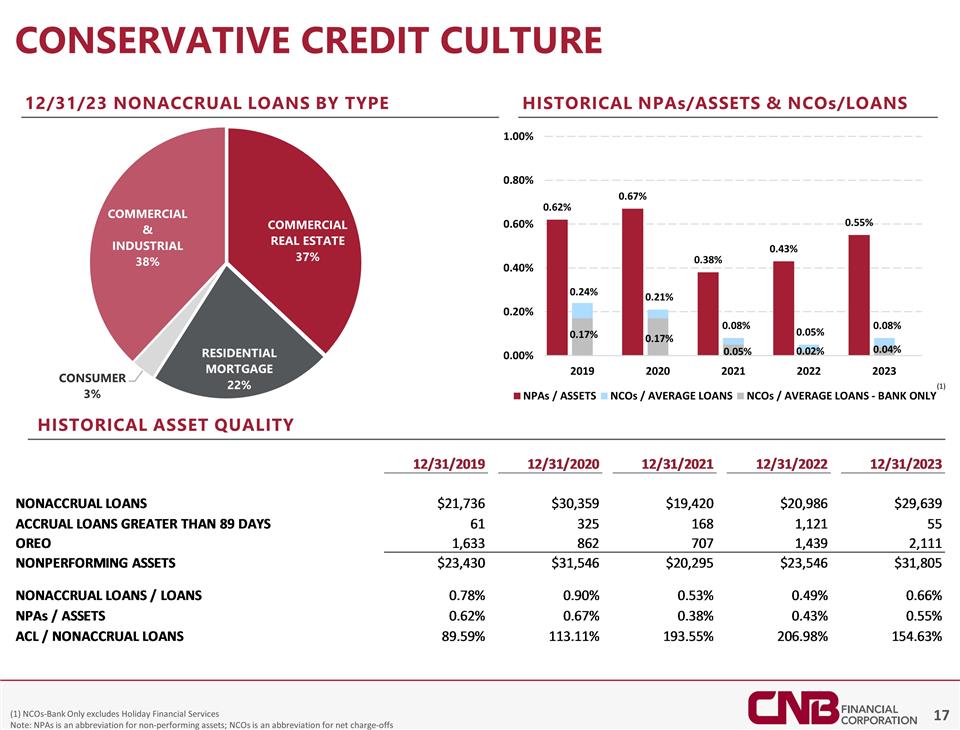

Conservative credit culture 12/31/23 nonaccrual loans by type Historical asset quality Historical NPAs/Assets & Ncos/Loans (1) NCOs-Bank Only excludes Holiday Financial Services Note: NPAs is an abbreviation for non-performing assets; NCOs is an abbreviation for net charge-offs (1)

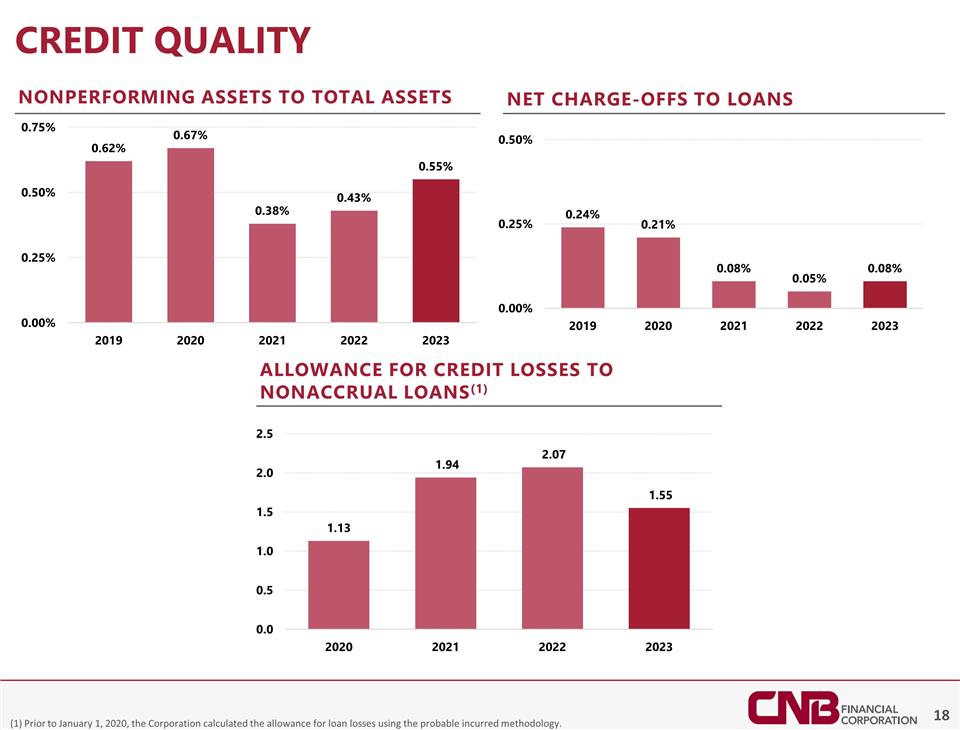

Credit quality NONPERFORMING ASSETS TO TOTAL ASSETS NET CHARGE-OFFS TO LOANS ALLOWANCE FOR CREDIT LOSSES to NONACCRUAL LOANS(1) (1) Prior to January 1, 2020, the Corporation calculated the allowance for loan losses using the probable incurred methodology.

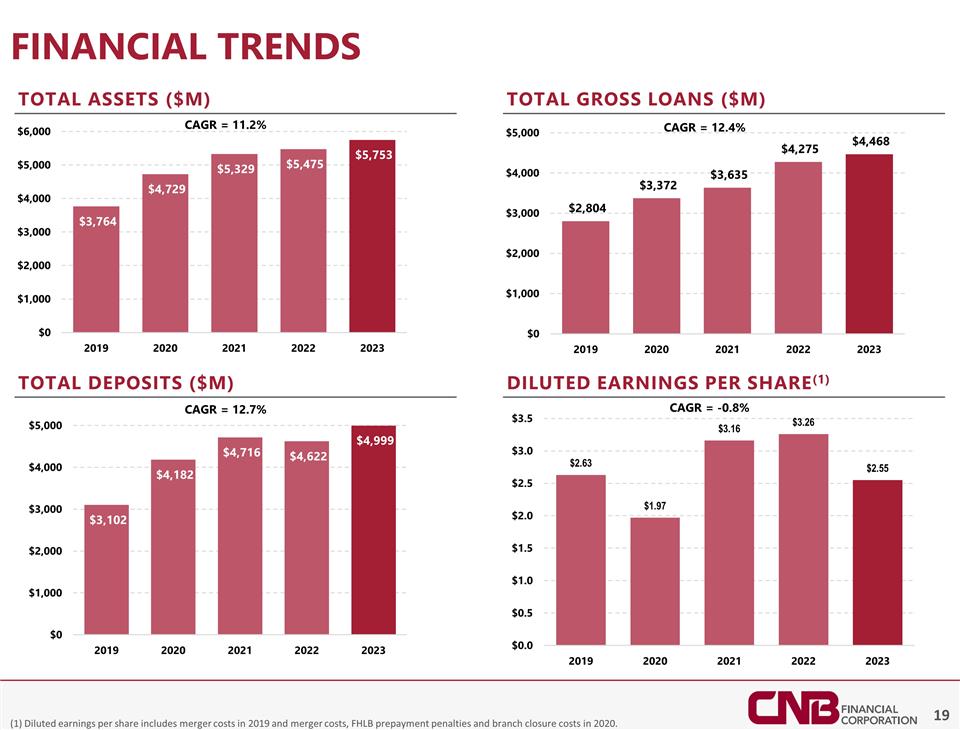

(1) Diluted earnings per share includes merger costs in 2019 and merger costs, FHLB prepayment penalties and branch closure costs in 2020. Financial trends Total Assets ($M) Total Gross Loans ($M) Total Deposits ($M) Diluted Earnings per share(1) CAGR = 11.2% CAGR = 12.4% CAGR = 12.7% CAGR = -0.8%

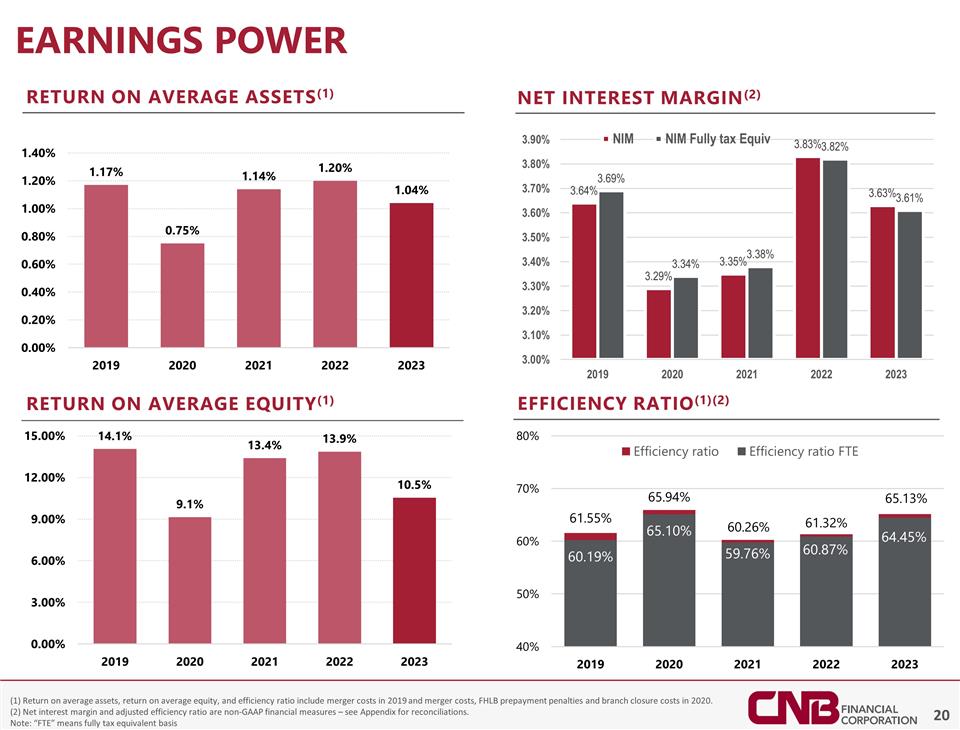

(1) Return on average assets, return on average equity, and efficiency ratio include merger costs in 2019 and merger costs, FHLB prepayment penalties and branch closure costs in 2020. (2) Net interest margin and adjusted efficiency ratio are non-GAAP financial measures – see Appendix for reconciliations. Note: “FTE” means fully tax equivalent basis Earnings power Return on average equity(1) Return on average assets(1) Efficiency Ratio(1)(2) Net Interest Margin(2)

Appendix

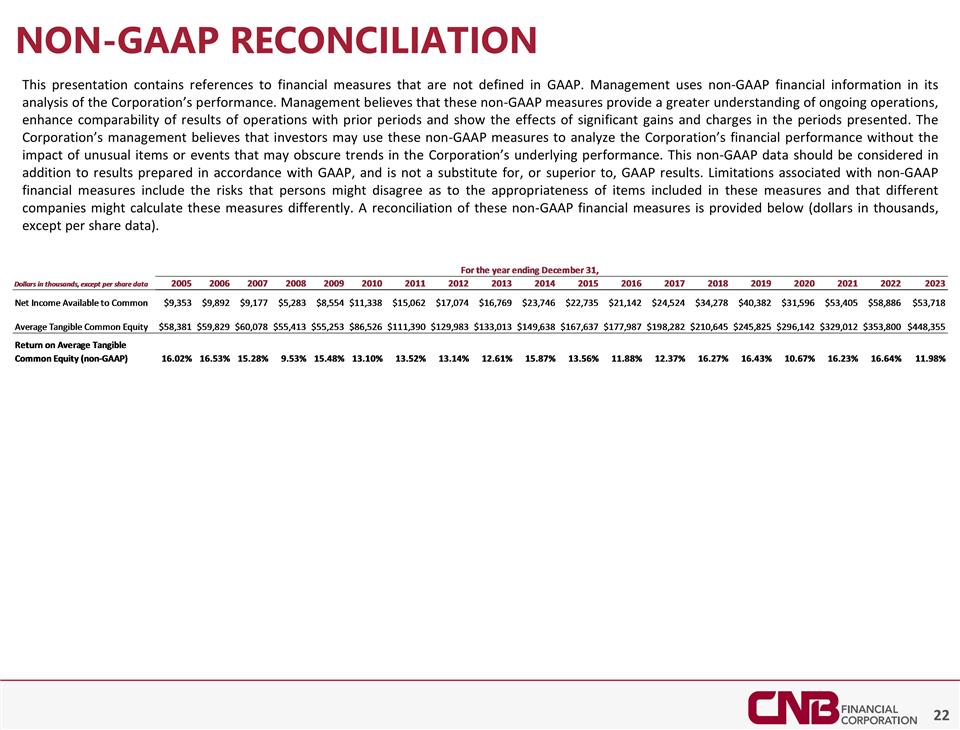

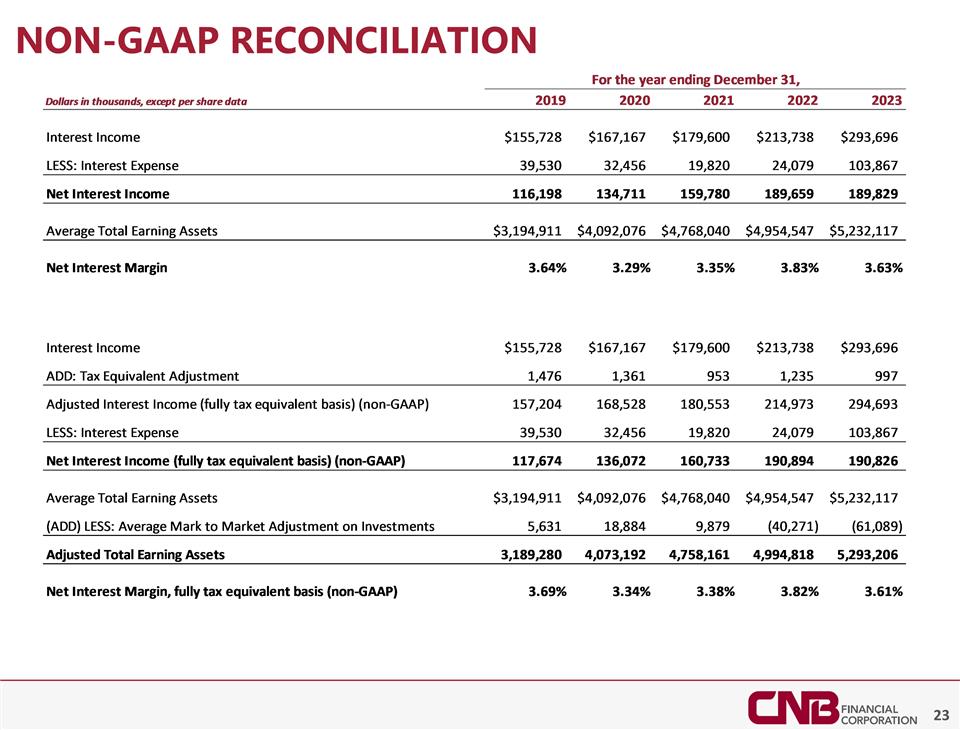

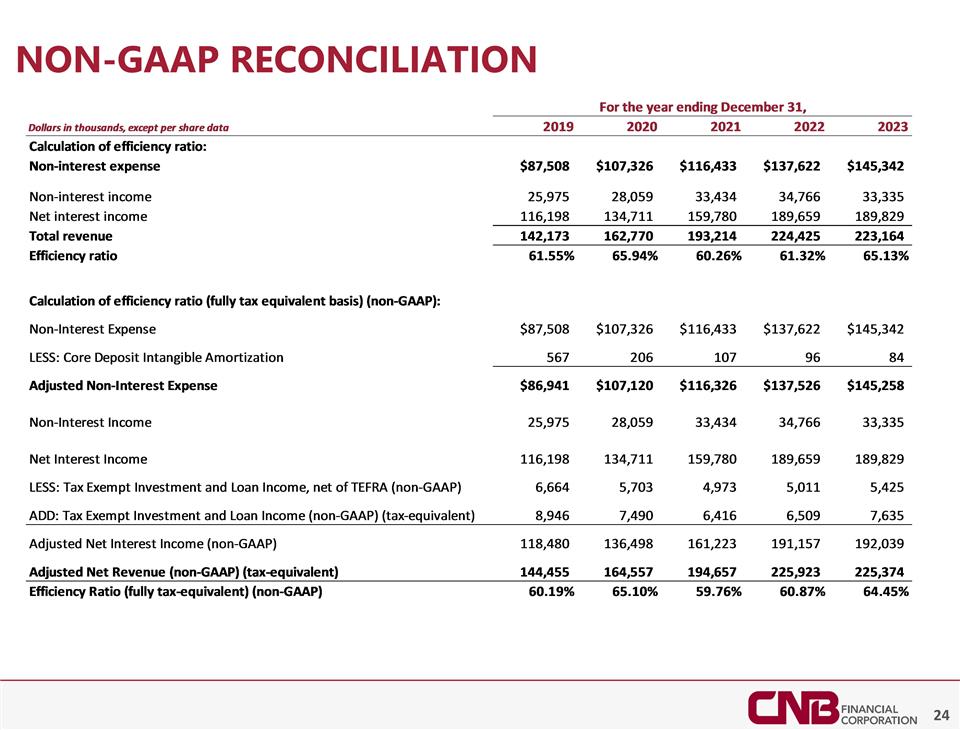

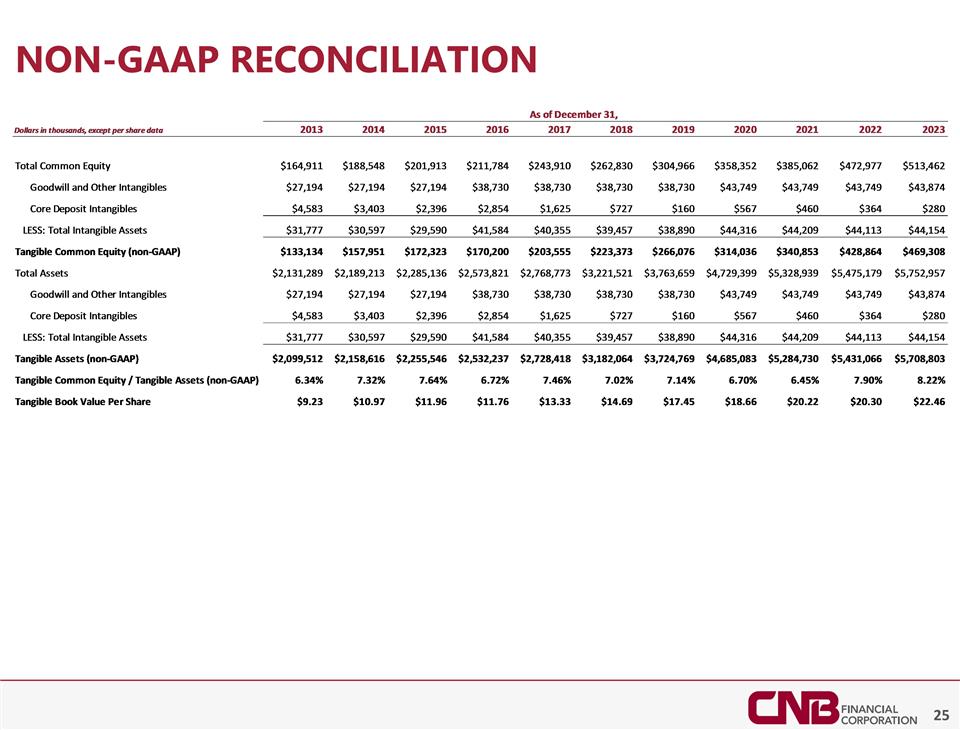

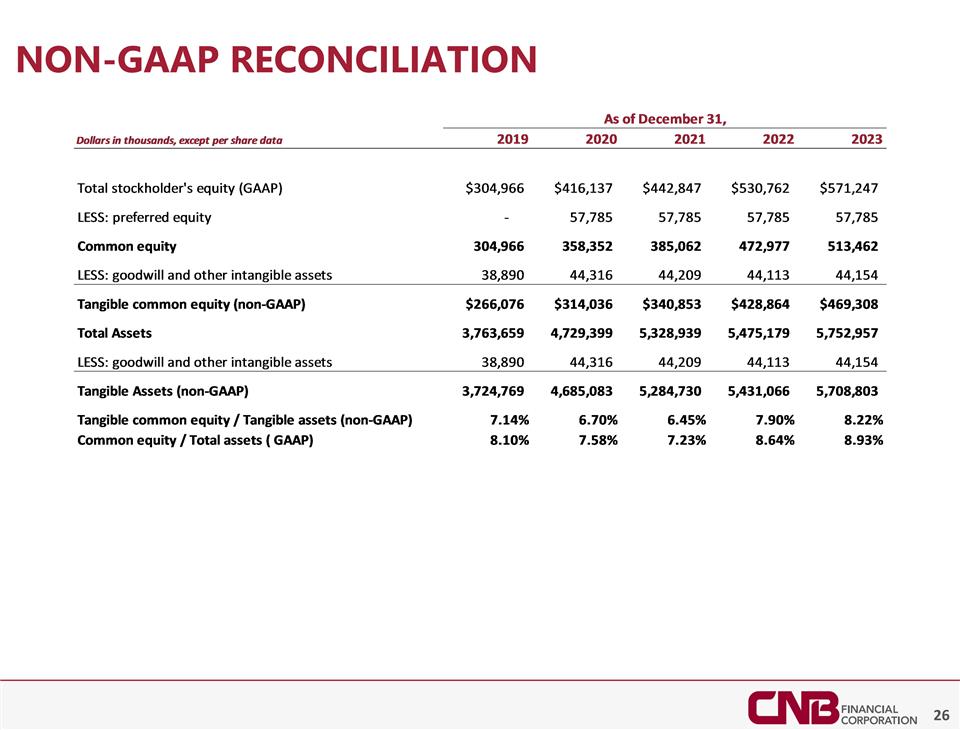

Non-gaap reconciliation This presentation contains references to financial measures that are not defined in GAAP. Management uses non-GAAP financial information in its analysis of the Corporation’s performance. Management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Corporation’s management believes that investors may use these non-GAAP measures to analyze the Corporation’s financial performance without the impact of unusual items or events that may obscure trends in the Corporation’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. Limitations associated with non-GAAP financial measures include the risks that persons might disagree as to the appropriateness of items included in these measures and that different companies might calculate these measures differently. A reconciliation of these non-GAAP financial measures is provided below (dollars in thousands, except per share data).

Non-gaap reconciliation

Non-gaap reconciliation

Non-gaap reconciliation

Non-gaap reconciliation