UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

|

|

CURRENT REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| Date of Report (Date of earliest event reported): January 16, 2024 |

||

The Goldman Sachs Group, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-14965

| Delaware | 13-4019460 | |

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) |

|

| 200 West Street, New York, N.Y. | 10282 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 902-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol |

Exchange on which registered |

||

| Common stock, par value $.01 per share | GS | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series A | GS PrA | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series C | GS PrC | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series D | GS PrD | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of 6.375% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series K | GS PrK | NYSE | ||

| 5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital II | GS/43PE | NYSE | ||

| Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital III | GS/43PF | NYSE | ||

| Medium-Term Notes, Series F, Callable Fixed and Floating Rate Notes due March 2031 of GS Finance Corp. | GS/31B | NYSE | ||

| Medium-Term Notes, Series F, Callable Fixed and Floating Rate Notes due May 2031 of GS Finance Corp. | GS/31X | NYSE | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 16, 2024, The Goldman Sachs Group, Inc. (Group Inc. and, together with its consolidated subsidiaries, the firm) reported its earnings for the fourth quarter and year ended December 31, 2023. A copy of Group Inc.’s press release containing this information is attached as Exhibit 99.1 to this Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On January 16, 2024, at 9:30 a.m. (ET), the firm will hold a conference call to discuss the firm’s financial results, outlook and related matters. A copy of the presentation for the conference call is attached as Exhibit 99.2 to this Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 |

The quotation on page 1 of Exhibit 99.1 and the information under the caption “Annual Highlights” on the following page (Excluded Sections) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (Exchange Act) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Group Inc. under the Securities Act of 1933 or the Exchange Act. The information included in Exhibit 99.1, other than in the Excluded Sections, shall be deemed “filed” for purposes of the Exchange Act.

| 99.2 | Presentation of Group Inc. dated January 16, 2024, for the conference call on January 16, 2024. |

Exhibit 99.2 is being furnished pursuant to Item 7.01 of Form 8-K and the information included therein shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Group Inc. under the Securities Act of 1933 or the Exchange Act.

| 101 | Pursuant to Rule 406 of Regulation S-T, the cover page information is formatted in iXBRL (Inline eXtensible Business Reporting Language). |

| 104 | Cover Page Interactive Data File (formatted in iXBRL in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THE GOLDMAN SACHS GROUP, INC. |

||||||||||

| (Registrant) |

||||||||||

| Date: January 16, 2024 |

By: |

/s/ Denis P. Coleman III |

||||||||

| Name: Denis P. Coleman III |

||||||||||

| Title: Chief Financial Officer |

||||||||||

Exhibit 99.1

|

Full Year and

Fourth Quarter 2023

Earnings Results

Media Relations: Tony Fratto 212-902-5400 Investor Relations: Carey Halio 212-902-0300

|

||

|

The Goldman Sachs Group, Inc. 200 West Street | New York, NY 10282

|

Full Year and Fourth Quarter 2023 Earnings Results

Goldman Sachs Reports Earnings Per Common Share of $22.87 for 2023

Fourth Quarter Earnings Per Common Share was $5.48

|

“This was a year of execution for Goldman Sachs. With everything we achieved in 2023 coupled with our clear and simplified strategy, we have a much stronger platform for 2024. Our strategic objectives underscore our relentless commitment to serve our clients with excellence, further strengthen our leading client franchise and continue to deliver for shareholders.” |

|

- David Solomon, Chairman and Chief Executive Officer

|

Financial Summary

|

|

|

|||||||

|

Net Revenues

|

Net Earnings

|

EPS

|

||||||

|

2023 $46.25 billion

4Q23 $11.32 billion

|

2023 $8.52 billion

4Q23 $2.01 billion

|

2023 $22.87

4Q23 $5.48

|

||||||

|

ROE1

|

ROTE1

|

Book Value Per Share

|

||||||

|

2023 7.5%

4Q23 7.1%

|

2023 8.1%

4Q23 7.6%

|

2023 $313.56

2023 Growth 3.3%

|

||||||

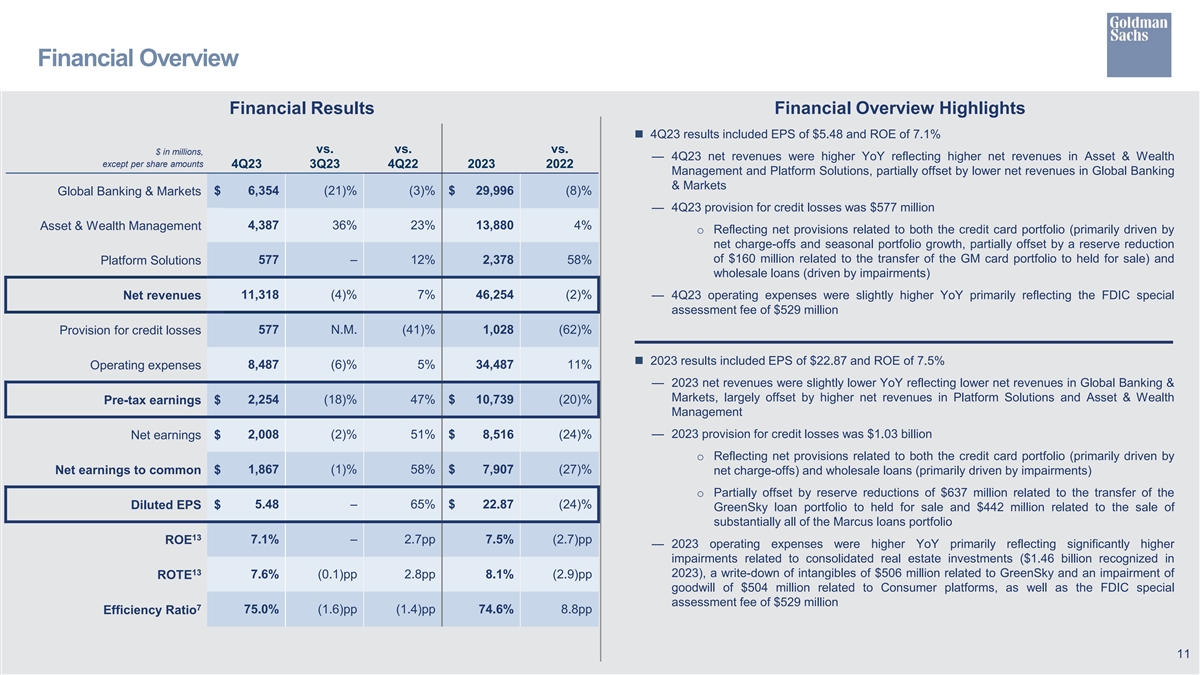

NEW YORK, January 16, 2024 – The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $46.25 billion and net earnings of $8.52 billion for the year ended December 31, 2023. Net revenues were $11.32 billion and net earnings were $2.01 billion for the fourth quarter of 2023.

Diluted earnings per common share (EPS) was $22.87 for the year ended December 31, 2023 compared with $30.06 for the year ended December 31, 2022, and was $5.48 for the fourth quarter of 2023 compared with $3.32 for the fourth quarter of 2022 and $5.47 for the third quarter of 2023.

Return on average common shareholders’ equity (ROE)1 was 7.5% for 2023 and annualized ROE was 7.1% for the fourth quarter of 2023. Return on average tangible common shareholders’ equity (ROTE)1 was 8.1% for 2023 and annualized ROTE was 7.6% for the fourth quarter of 2023.

1

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

Annual Highlights

| ◾ | During the year, the firm supported clients and continued to execute on strategic priorities, which contributed to the firm’s third highest annual net revenues of $46.25 billion. |

| ◾ | Global Banking & Markets generated net revenues of $30.00 billion, driven by strong performances in both Fixed Income, Currency and Commodities (FICC), which included the second highest net revenues in FICC financing, and Equities, which included record net revenues in Equities financing. |

| ◾ | The firm ranked #1 in worldwide announced and completed mergers and acquisitions, equity and equity-related offerings, and common stock offerings for the year.2 |

| ◾ | Asset & Wealth Management generated net revenues of $13.88 billion, including record Management and other fees and record Private banking and lending net revenues. |

| ◾ | Assets under supervision3 increased 10% during the year to a record $2.81 trillion. |

Net Revenues

|

Full Year |

||||

| Net revenues were $46.25 billion for 2023, 2% lower compared with 2022, reflecting lower net revenues in Global Banking & Markets, largely offset by higher net revenues in Platform Solutions and Asset & Wealth Management. |

|

2023 Net Revenues

|

||

|

$46.25 billion

|

||||

|

Fourth Quarter |

||||

| Net revenues were $11.32 billion for the fourth quarter of 2023, 7% higher than the fourth quarter of 2022 and 4% lower than the third quarter of 2023. The increase compared with the fourth quarter of 2022 reflected higher net revenues in Asset & Wealth Management and Platform Solutions, partially offset by lower net revenues in Global Banking & Markets. |

4Q23 Net Revenues

|

|||

|

$11.32 billion

|

||||

2

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

|

|

Global Banking & Markets |

|

| Full Year |

||||||

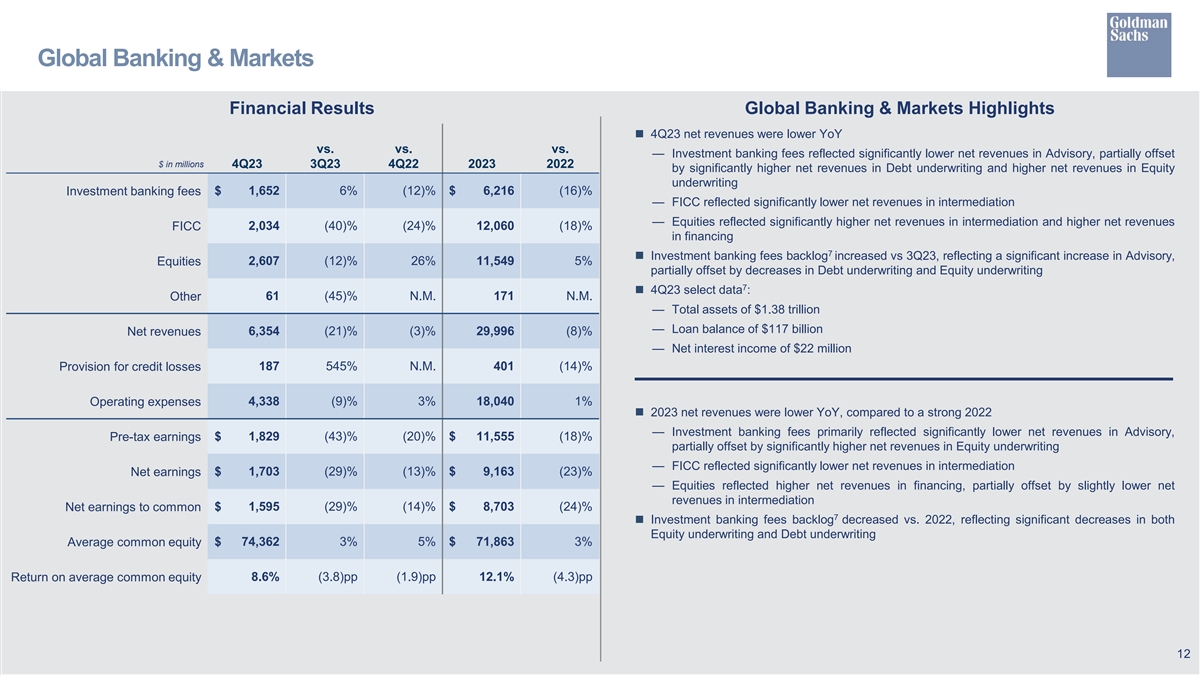

| Net revenues in Global Banking & Markets were $30.00 billion for 2023, 8% lower than a strong 2022.

Investment banking fees were $6.22 billion, 16% lower than 2022, due to significantly lower net revenues in Advisory, reflecting a significant decline in industry-wide completed mergers and acquisitions transactions, and slightly lower net revenues in Debt underwriting, partially offset by significantly higher net revenues in Equity underwriting, primarily reflecting increased activity from secondary offerings. The firm’s Investment banking fees backlog3 was lower compared with the end of 2022.

Net revenues in FICC were $12.06 billion, 18% lower than a strong 2022, reflecting significantly lower net revenues in FICC intermediation, driven by significantly lower net revenues in currencies and commodities and slightly lower net revenues in interest rate products, partially offset by significantly higher net revenues in mortgages and higher net revenues in credit products. Net revenues in FICC financing were slightly lower.

Net revenues in Equities were $11.55 billion, 5% higher than 2022, due to higher net revenues in Equities financing (reflecting significantly higher net revenues in prime financing), partially offset by slightly lower net revenues in Equities intermediation (reflecting lower net revenues in cash products).

Net revenues in Other were $171 million compared with $(537) million for 2022, reflecting the absence of net mark-downs on acquisition financing activities included in the prior year and net gains from direct investments compared with net losses in the prior year. These improvements were partially offset by significantly higher net losses on hedges.

|

2023 Global Banking & Markets

|

|||||

|

$30.00 billion

|

||||||

| Advisory |

$ 3.30 billion |

|||||

|

Equity underwriting |

$ 1.15 billion |

|||||

|

Debt underwriting |

$ 1.76 billion |

|||||

|

Investment banking fees |

$ 6.22 billion |

|||||

|

FICC intermediation |

$ 9.32 billion |

|||||

|

FICC financing |

$ 2.74 billion |

|||||

|

FICC |

$12.06 billion |

|||||

|

Equities intermediation |

$ 6.49 billion |

|||||

|

Equities financing |

$ 5.06 billion |

|||||

|

Equities |

$11.55 billion |

|||||

|

Other |

$ 171 million |

|||||

| Fourth Quarter |

||||||

| Net revenues in Global Banking & Markets were $6.35 billion for the fourth quarter of 2023, 3% lower than the fourth quarter of 2022 and 21% lower than the third quarter of 2023.

Investment banking fees were $1.65 billion, 12% lower than the fourth quarter of 2022, due to significantly lower net revenues in Advisory, reflecting a decline in industry-wide completed mergers and acquisitions volumes, partially offset by significantly higher net revenues in Debt underwriting, primarily driven by leveraged finance activity, and higher net revenues in Equity underwriting, primarily from secondary offerings. The firm’s Investment banking fees backlog3 was higher compared with the end of the third quarter of 2023.

Net revenues in FICC were $2.03 billion, 24% lower than the fourth quarter of 2022, reflecting significantly lower net revenues in FICC intermediation, driven by significantly lower net revenues in interest rate products and currencies and lower net revenues in commodities and credit products, partially offset by higher net revenues in mortgages. Net revenues in FICC financing were slightly higher.

Net revenues in Equities were $2.61 billion, 26% higher than the fourth quarter of 2022, due to significantly higher net revenues in Equities intermediation (reflecting significantly higher net revenues in derivatives) and higher net revenues in Equities financing (reflecting higher net revenues from prime financing).

Net revenues in Other were $61 million compared with $(114) million for the fourth quarter of 2022, primarily reflecting lower net losses on hedges. |

4Q23 Global Banking & Markets

|

|||||

|

$6.35 billion

|

||||||

| Advisory |

$ 1.01 billion |

|||||

|

Equity underwriting |

$ 252 million |

|||||

|

Debt underwriting |

$ 395 million |

|||||

|

Investment banking fees |

$ 1.65 billion |

|||||

|

FICC intermediation |

$ 1.30 billion |

|||||

|

FICC financing |

$ 739 million |

|||||

|

FICC |

$ 2.03 billion |

|||||

|

Equities intermediation |

$ 1.50 billion |

|||||

|

Equities financing |

$ 1.11 billion |

|||||

|

Equities |

$ 2.61 billion |

|||||

|

Other

|

$ 61 million

|

|||||

3

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

|

|

Asset & Wealth Management |

|

| Full Year |

||||||

| Net revenues in Asset & Wealth Management were $13.88 billion for 2023, 4% higher than 2022, reflecting higher Management and other fees and higher net revenues in Debt investments and Private banking and lending, partially offset by significantly lower net revenues in Equity investments and significantly lower Incentive fees.

The increase in Management and other fees primarily reflected the impact of higher average assets under supervision, including the impact of acquiring NN Investment Partners. The increase in Debt investments net revenues reflected significantly lower net mark-downs compared with the prior year (despite a challenging environment for real estate investments in the current year), partially offset by lower net interest income due to a reduction in the debt investments balance sheet. The increase in Private banking and lending net revenues primarily reflected higher deposit spreads and balances, partially offset by the impact of the sale of substantially all of the Marcus loans portfolio in the year. The decrease in Equity investments reflected significantly lower net gains from investments in private equities, primarily due to net losses from real estate investments, partially offset by significantly lower net losses from investments in public equities. The decrease in Incentive fees was driven by more significant harvesting in the prior year.

|

2023 Asset & Wealth Management |

|||||

|

$13.88 billion

|

||||||

|

Management and other fees |

$9.49 billion | |||||

| Incentive fees |

$161 million | |||||

| Private banking and lending |

$2.58 billion | |||||

| Equity investments |

$342 million | |||||

|

|

Debt investments

|

$1.32 billion

|

||||

| Fourth Quarter |

||||||

| Net revenues in Asset & Wealth Management were $4.39 billion for the fourth quarter of 2023, 23% higher than the fourth quarter of 2022 and 36% higher than the third quarter of 2023. The increase compared with the fourth quarter of 2022 primarily reflected significantly higher net revenues in Equity investments and Debt investments and higher Management and other fees, partially offset by lower net revenues in Private banking and lending.

The increase in Equity investments net revenues reflected net gains from investments in public equities compared with significant net losses in the prior year period. Net gains from investments in private equities were slightly higher, due to a gain of $349 million related to the sale of Personal Financial Management, partially offset by significantly lower net gains from real estate investments. The increase in Management and other fees primarily reflected the impact of higher average assets under supervision. The increase in Debt investments net revenues reflected net mark-ups compared with net mark-downs in the prior year period, partially offset by lower net interest income due to a reduction in the debt investments balance sheet. The decrease in Private banking and lending net revenues primarily reflected the impact of the sale of substantially all of the Marcus loans portfolio earlier in the year. |

4Q23 Asset & Wealth Management |

|||||

|

$4.39 billion

|

||||||

|

Management and other fees |

$2.45 billion | |||||

| Incentive fees |

$ 59 million | |||||

| Private banking and lending |

$661 million | |||||

| Equity investments |

$838 million | |||||

| Debt investments

|

$384 million

|

|||||

4

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

|

|

Platform Solutions |

|

| Full Year |

|

|||||

|

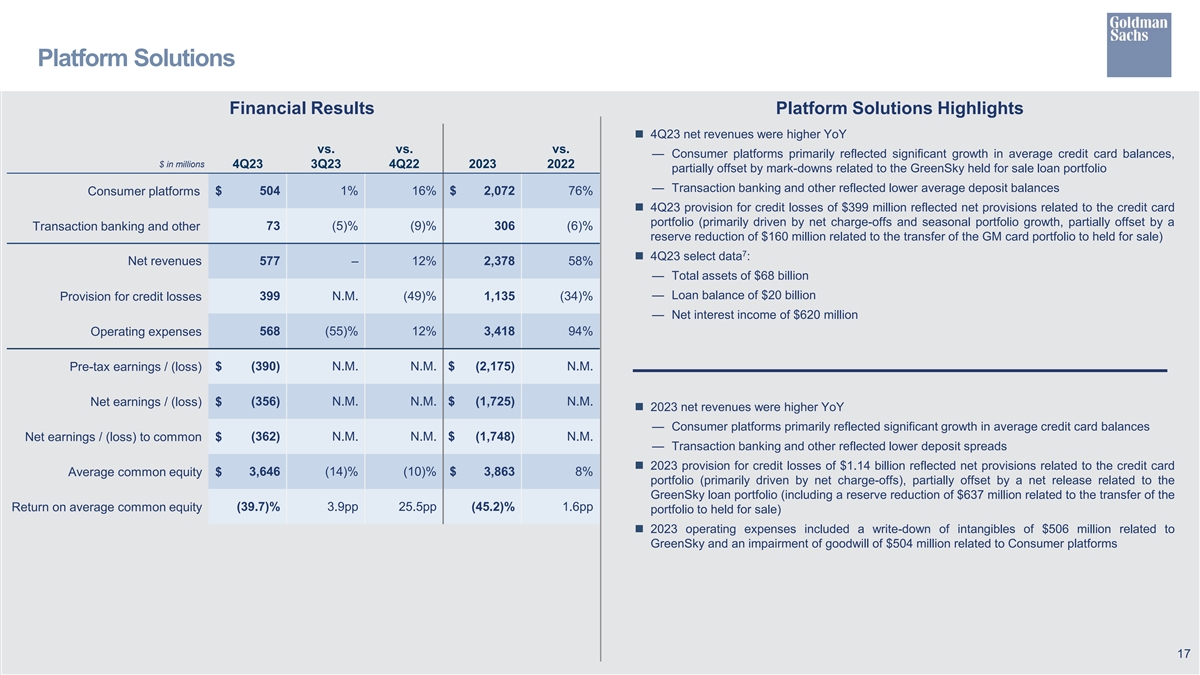

Net revenues in Platform Solutions were $2.38 billion for 2023, 58% higher than 2022, reflecting significantly higher net revenues in Consumer platforms.

The increase in Consumer platforms net revenues primarily reflected significant growth in average credit card balances. Transaction banking and other net revenues were lower, reflecting lower deposit spreads. |

2023 Platform Solutions

|

|||||

|

$2.38 billion

|

||||||

|

Consumer platforms |

$ 2.07 billion | |||||

| Transaction banking and other

|

$306 million

|

|||||

|

Fourth Quarter |

||||||

| Net revenues in Platform Solutions were $577 million for the fourth quarter of 2023, 12% higher than the fourth quarter of 2022 and essentially unchanged compared with the third quarter of 2023. The increase compared with the fourth quarter of 2022 reflected higher net revenues in Consumer platforms.

The increase in Consumer platforms net revenues primarily reflected significant growth in average credit card balances, partially offset by mark-downs related to the GreenSky held for sale loan portfolio. Transaction banking and other net revenues were lower, reflecting lower average deposit balances. |

4Q23 Platform Solutions

|

|||||

|

$577 million

|

||||||

|

Consumer platforms |

$ 504 million | |||||

| Transaction banking and other

|

$73 million

|

|||||

Provision for Credit Losses

| Full Year |

|

|||||

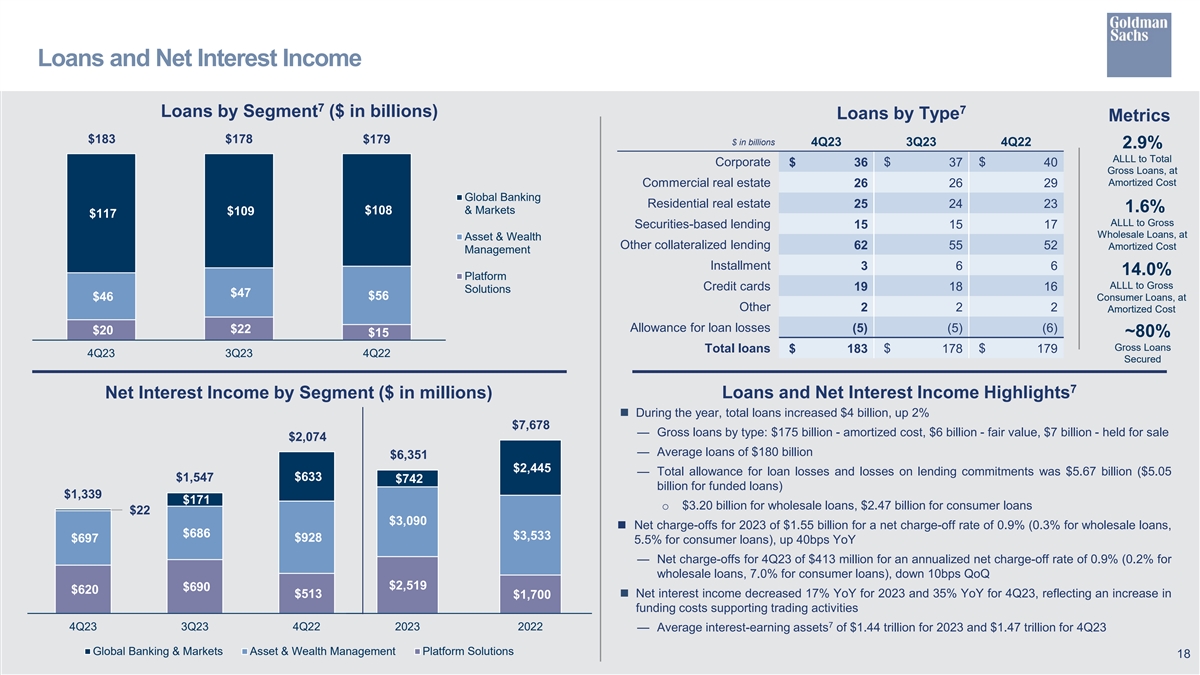

| Provision for credit losses was $1.03 billion for 2023, compared with $2.72 billion for 2022. Provisions for 2023 reflected net provisions related to both the credit card portfolio (primarily driven by net charge-offs) and wholesale loans (primarily driven by impairments). These net provisions were partially offset by reserve reductions of $637 million related to the transfer of the GreenSky loan portfolio to held for sale and $442 million related to the sale of substantially all of the Marcus loans portfolio. Provisions for 2022 primarily reflected growth in the credit card portfolio, the impact of macroeconomic and geopolitical concerns and net charge-offs. |

2023 Provision for Credit Losses |

|||||

|

$1.03 billion

|

||||||

|

Fourth Quarter |

||||||

| Provision for credit losses was $577 million for the fourth quarter of 2023, compared with $972 million for the fourth quarter of 2022 and $7 million for the third quarter of 2023. Provisions for the fourth quarter of 2023 reflected net provisions related to both the credit card portfolio (primarily driven by net charge-offs and seasonal portfolio growth, partially offset by a reserve reduction of $160 million related to the transfer of the General Motors card portfolio to held for sale) and wholesale loans (driven by impairments). Provisions for the fourth quarter of 2022 reflected provisions related to the credit card and point-of-sale loan portfolios, primarily from growth and net charge-offs, and impairments on wholesale loans. |

4Q23 Provision for Credit Losses

|

|||||

|

$577 million

|

||||||

5

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

Operating Expenses

| Full Year |

||||

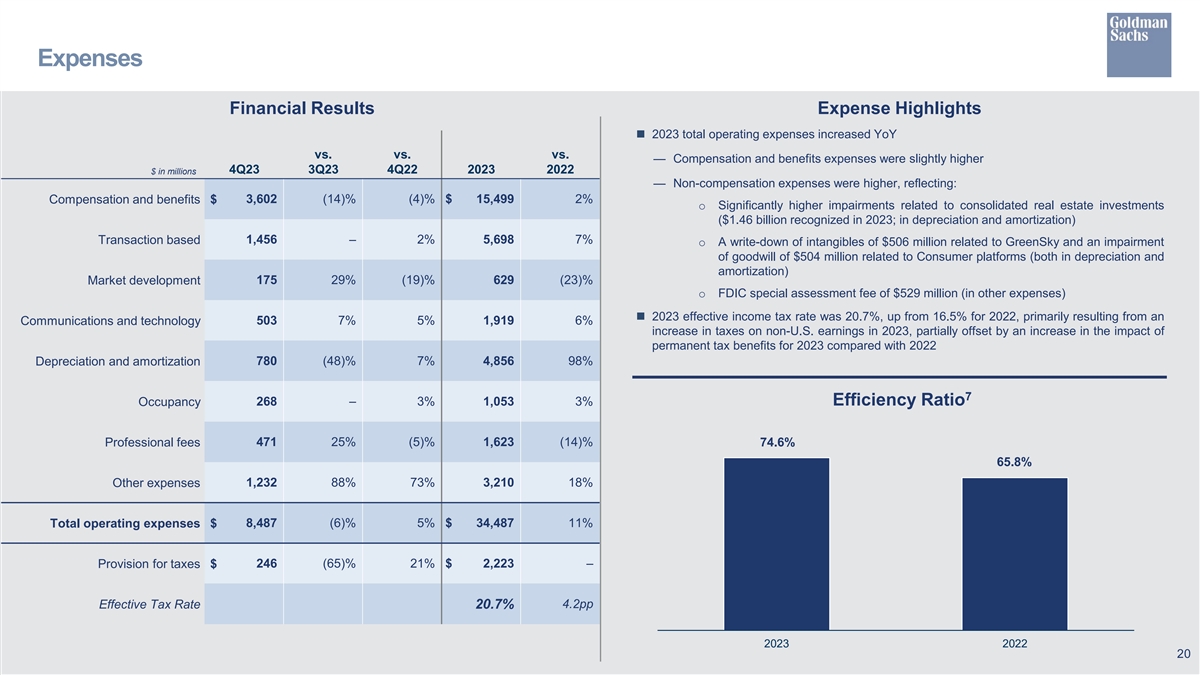

| Operating expenses were $34.49 billion for 2023, 11% higher than 2022. The firm’s efficiency ratio3 was 74.6% for 2023, compared with 65.8% for 2022.

The increase in operating expenses compared with 2022 primarily reflected significantly higher impairments related to consolidated real estate investments ($1.46 billion recognized in 2023), a write-down of intangibles of $506 million related to GreenSky and an impairment of goodwill of $504 million related to Consumer platforms (all in depreciation and amortization), as well as the FDIC special assessment fee of $529 million (in other expenses).

Net provisions for litigation and regulatory proceedings were $115 million for 2023 compared with $576 million for 2022.

Headcount decreased 7% during 2023, primarily reflecting a headcount reduction initiative during the year. |

|

2023 Operating Expenses

|

||

|

$34.49 billion

|

||||

|

2023 Efficiency Ratio

|

||||

|

74.6%

|

||||

|

Fourth Quarter |

||||

| Operating expenses were $8.49 billion for the fourth quarter of 2023, 5% higher than the fourth quarter of 2022 and 6% lower than the third quarter of 2023.

The increase in operating expenses compared with the fourth quarter of 2022 primarily reflected the FDIC special assessment fee of $529 million (in other expenses).

Net provisions for litigation and regulatory proceedings were $9 million for the fourth quarter of 2023 compared with $169 million for the fourth quarter of 2022. |

4Q23 Operating Expenses

|

|||

|

$8.49 billion

|

||||

Provision for Taxes

| The effective income tax rate for 2023 was 20.7%, down from 23.3% for the first nine months of 2023, primarily due to an increase in permanent tax benefits and changes in the geographic mix of earnings. The 2023 effective income tax rate increased from 16.5% for 2022, primarily resulting from an increase in taxes on non-U.S. earnings in 2023, partially offset by an increase in the impact of permanent tax benefits for 2023 compared with 2022. |

2023 Effective Tax Rate

|

|||

|

20.7%

|

||||

6

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

Other Matters

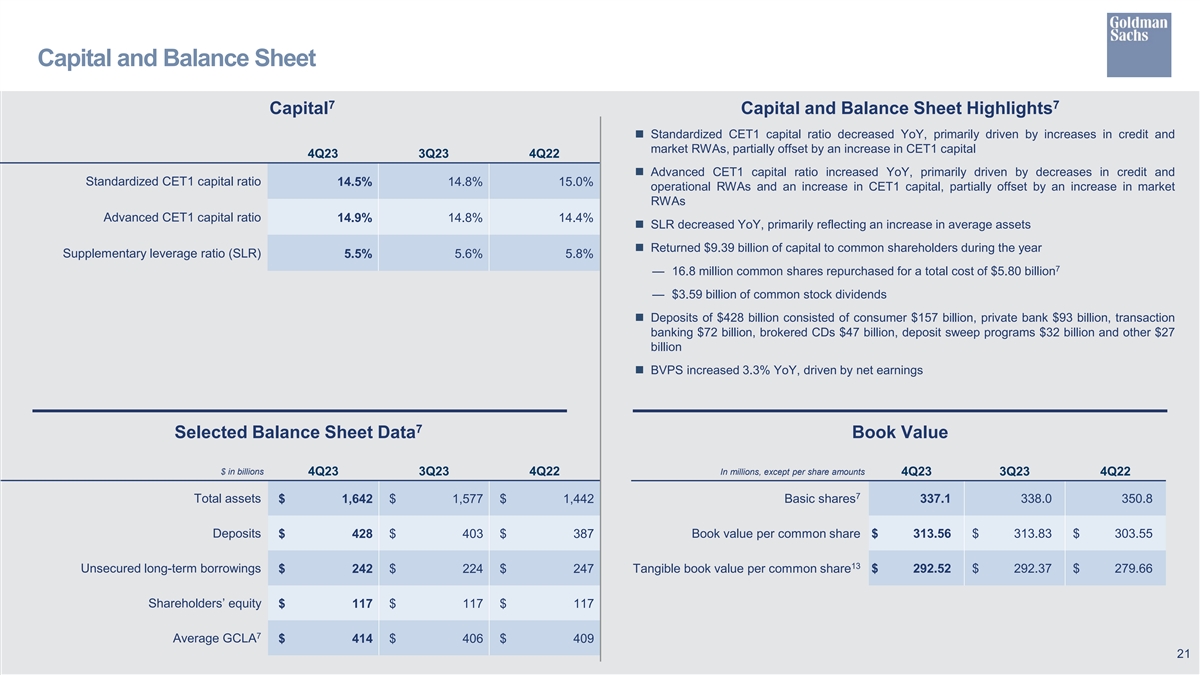

| ◾ On January 12, 2024, the Board of Directors of The Goldman Sachs Group, Inc. declared a dividend of $2.75 per common share to be paid on March 28, 2024 to common shareholders of record on February 29, 2024.

◾ During the year, the firm returned $9.39 billion of capital to common shareholders, including $5.80 billion of common share repurchases (16.8 million shares at an average cost of $345.87) and $3.59 billion of common stock dividends. This included $1.92 billion of capital returned to common shareholders during the fourth quarter, including $1.00 billion of common share repurchases (3.2 million shares at an average cost of $311.10) and $922 million of common stock dividends.3

◾ Global core liquid assets3 averaged $407 billion for 2023, compared with an average of $398 billion for 2022. Global core liquid assets averaged $414 billion for the fourth quarter of 2023, compared with an average of $406 billion for the third quarter of 2023. |

Declared Quarterly Dividend Per Common Share

|

|||

|

$2.75

|

||||

|

Capital Returned

|

||||

|

$9.39 billion in 2023

|

||||

|

Average GCLA

|

||||

|

$407 billion for 2023

|

||||

7

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

The Goldman Sachs Group, Inc. is a leading global financial institution that delivers a broad range of financial services to a large and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

|

|

Cautionary Note Regarding Forward-Looking Statements |

|

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts or statements of current conditions, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results, financial condition and liquidity may differ, possibly materially, from the anticipated results, financial condition and liquidity in these forward-looking statements. For information about some of the risks and important factors that could affect the firm’s future results, financial condition and liquidity, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2022.

Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets and VaR consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements.

Statements about the firm’s Investment banking fees backlog and future results also may constitute forward-looking statements. Such statements are subject to the risk that transactions may be modified or may not be completed at all, and related net revenues may not be realized or may be materially less than expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, an outbreak or worsening of hostilities, including the escalation or continuation of the war between Russia and Ukraine or an escalation of the war in Gaza, volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. For information about other important factors that could adversely affect the firm’s Investment banking fees, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2022.

|

|

Conference Call |

|

A conference call to discuss the firm’s financial results, outlook and related matters will be held at 9:30 am (ET). The call will be open to the public. Members of the public who would like to listen to the conference call should dial 1-888-205-6786 (in the U.S.) or 1-323-794-2558 (outside the U.S.) passcode number 7042022. The number should be dialed at least 10 minutes prior to the start of the conference call. The conference call will also be accessible as an audio webcast through the Investor Relations section of the firm’s website, www.goldmansachs.com/investor-relations. There is no charge to access the call. For those unable to listen to the live broadcast, a replay will be available on the firm’s website beginning approximately three hours after the event. Please direct any questions regarding obtaining access to the conference call to Goldman Sachs Investor Relations, via e-mail, at gs-investor-relations@gs.com.

8

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| YEAR ENDED | % CHANGE FROM | |||||||||||||||

| DECEMBER 31, 2023 |

DECEMBER 31, 2022 |

DECEMBER 31, 2022 |

||||||||||||||

|

GLOBAL BANKING & MARKETS

|

||||||||||||||||

|

Advisory |

|

$ 3,299

|

|

|

$ 4,704

|

|

|

(30) %

|

|

|||||||

| Equity underwriting

|

|

1,153

|

|

|

848

|

|

|

36

|

|

|||||||

| Debt underwriting |

|

1,764

|

|

|

1,808

|

|

|

(2)

|

|

|||||||

|

Investment banking fees |

6,216 | 7,360 | (16) | |||||||||||||

| FICC intermediation

|

|

9,318

|

|

|

11,890

|

|

|

(22)

|

|

|||||||

| FICC financing |

|

2,742

|

|

|

2,786

|

|

|

(2)

|

|

|||||||

|

FICC |

12,060 | 14,676 | (18) | |||||||||||||

| Equities intermediation

|

|

6,489

|

|

|

6,662

|

|

|

(3)

|

|

|||||||

| Equities financing |

|

5,060

|

|

|

4,326

|

|

|

17

|

|

|||||||

|

Equities |

11,549 | 10,988 | 5 | |||||||||||||

| Other

|

171 | (537) | N.M. | |||||||||||||

|

Net revenues

|

|

29,996

|

|

|

32,487

|

|

|

(8)

|

|

|||||||

|

ASSET & WEALTH MANAGEMENT

|

||||||||||||||||

|

Management and other fees

|

|

9,486

|

|

|

8,781

|

|

|

8

|

|

|||||||

| Incentive fees

|

|

161

|

|

|

359

|

|

|

(55)

|

|

|||||||

| Private banking and lending

|

|

2,576

|

|

|

2,458

|

|

|

5

|

|

|||||||

| Equity investments

|

|

342

|

|

|

610

|

|

|

(44)

|

|

|||||||

| Debt investments

|

|

1,315

|

|

|

1,168

|

|

|

13

|

|

|||||||

|

Net revenues

|

|

13,880

|

|

|

13,376

|

|

|

4

|

|

|||||||

|

PLATFORM SOLUTIONS

|

||||||||||||||||

|

Consumer platforms

|

|

2,072

|

|

|

1,176

|

|

|

76

|

|

|||||||

| Transaction banking and other

|

|

306

|

|

|

326

|

|

|

(6)

|

|

|||||||

|

Net revenues

|

|

2,378

|

|

|

1,502

|

|

|

58

|

|

|||||||

|

Total net revenues

|

|

$ 46,254

|

|

|

$ 47,365

|

|

|

(2)

|

|

|||||||

|

Geographic Net Revenues (unaudited)3 $ in millions

|

|

|||||||||||||||

| YEAR ENDED | ||||||||||||||||

| DECEMBER 31, 2023 |

DECEMBER 31, 2022 |

|||||||||||||||

| Americas

|

|

$ 29,335

|

|

|

$ 28,669

|

|

||||||||||

| EMEA

|

|

11,744

|

|

|

12,860

|

|

||||||||||

| Asia

|

|

5,175

|

|

|

5,836

|

|

||||||||||

|

Total net revenues

|

|

$ 46,254

|

|

|

$ 47,365

|

|

||||||||||

| Americas

|

|

64%

|

|

|

61%

|

|

||||||||||

| EMEA

|

|

25%

|

|

|

27%

|

|

||||||||||

| Asia

|

|

11%

|

|

|

12%

|

|

||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

||||||||||

9

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||||||

|

GLOBAL BANKING & MARKETS

|

||||||||||||||||||||||||

| Advisory

|

$ 1,005 | $ 831 | $ 1,408 | 21 % | (29) % | |||||||||||||||||||

| Equity underwriting

|

|

252

|

|

|

308

|

|

|

183

|

|

|

(18)

|

|

|

38

|

|

|||||||||

| Debt underwriting

|

|

395

|

|

|

415

|

|

|

282

|

|

|

(5)

|

|

|

40

|

|

|||||||||

| Investment banking fees |

1,652 | 1,554 | 1,873 | 6 | (12) | |||||||||||||||||||

| FICC intermediation

|

|

1,295

|

|

|

2,654

|

|

|

1,974

|

|

|

(51)

|

|

|

(34)

|

|

|||||||||

| FICC financing

|

|

739

|

|

|

730

|

|

|

713

|

|

|

1

|

|

|

4

|

|

|||||||||

| FICC |

2,034 | 3,384 | 2,687 | (40) | (24) | |||||||||||||||||||

| Equities intermediation |

|

1,502

|

|

|

1,713

|

|

|

1,109

|

|

|

(12)

|

|

|

35

|

|

|||||||||

| Equities financing

|

|

1,105

|

|

|

1,248

|

|

|

964

|

|

|

(11)

|

|

|

15

|

|

|||||||||

| Equities

|

|

2,607

|

|

|

2,961

|

|

|

2,073

|

|

|

(12)

|

|

|

26

|

|

|||||||||

| Other

|

|

61

|

|

|

110

|

|

|

(114)

|

|

|

(45)

|

|

|

N.M.

|

|

|||||||||

|

Net revenues

|

|

6,354

|

|

|

8,009

|

|

|

6,519

|

|

|

(21)

|

|

|

(3)

|

|

|||||||||

|

ASSET & WEALTH MANAGEMENT

|

||||||||||||||||||||||||

|

Management and other fees

|

2,445 | 2,405 | 2,248 | 2 | 9 | |||||||||||||||||||

| Incentive fees

|

|

59

|

|

|

24

|

|

|

39

|

|

|

146

|

|

|

51

|

|

|||||||||

| Private banking and lending

|

|

661

|

|

|

687

|

|

|

753

|

|

|

(4)

|

|

|

(12)

|

|

|||||||||

| Equity investments

|

838 | (212) | 287 | N.M. | 192 | |||||||||||||||||||

| Debt investments

|

|

384

|

|

|

326

|

|

|

234

|

|

|

18

|

|

|

64

|

|

|||||||||

|

Net revenues

|

|

4,387

|

|

|

3,230

|

|

|

3,561

|

|

|

36

|

|

|

23

|

|

|||||||||

|

PLATFORM SOLUTIONS

|

||||||||||||||||||||||||

| Consumer platforms |

504 | 501 | 433 | 1 | 16 | |||||||||||||||||||

| Transaction banking and other

|

|

73

|

|

|

77

|

|

|

80

|

|

|

(5)

|

|

|

(9)

|

|

|||||||||

|

Net revenues

|

|

577

|

|

|

578

|

|

|

513

|

|

|

–

|

|

|

12

|

|

|||||||||

|

Total net revenues

|

|

$ 11,318

|

|

|

$ 11,817

|

|

|

$ 10,593

|

|

|

(4)

|

|

|

7

|

|

|||||||||

|

Geographic Net Revenues (unaudited)3 |

|

|||||||||||||||||||||||

| $ in millions | ||||||||||||||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||||||||

|

Americas |

$ 7,770 | $ 7,570 | $ 6,920 | |||||||||||||||||||||

| EMEA

|

2,481 | 2,811 | 2,406 | |||||||||||||||||||||

| Asia

|

|

1,067

|

|

|

1,436

|

|

|

1,267

|

|

|||||||||||||||

|

Total net revenues

|

|

$ 11,318

|

|

|

$ 11,817

|

|

|

$ 10,593

|

|

|||||||||||||||

| Americas

|

69% | 64% | 65% | |||||||||||||||||||||

| EMEA

|

22% | 24% | 23% | |||||||||||||||||||||

| Asia

|

|

9%

|

|

|

12%

|

|

|

12%

|

|

|||||||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

|

100%

|

|

|||||||||||||||

10

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)

In millions, except per share amounts

| YEAR ENDED | % CHANGE FROM | |||||||||||||||||||

| DECEMBER 31, 2023 |

DECEMBER 31, 2022 |

DECEMBER 31, 2022 |

||||||||||||||||||

|

REVENUES

|

||||||||||||||||||||

| Investment banking

|

|

$ 6,218

|

|

|

$ 7,360

|

|

|

(16) %

|

|

|||||||||||

| Investment management

|

|

9,532

|

|

|

9,005

|

|

|

6

|

|

|||||||||||

| Commissions and fees

|

|

3,789

|

|

|

4,034

|

|

|

(6)

|

|

|||||||||||

| Market making

|

|

18,238

|

|

|

18,634

|

|

|

(2)

|

|

|||||||||||

| Other principal transactions

|

|

2,126

|

|

|

654

|

|

|

225

|

|

|||||||||||

|

Total non-interest revenues

|

|

39,903

|

|

|

39,687

|

|

|

1

|

|

|||||||||||

| Interest income

|

|

68,515

|

|

|

29,024

|

|

|

136

|

|

|||||||||||

| Interest expense

|

|

62,164

|

|

|

21,346

|

|

|

191

|

|

|||||||||||

|

Net interest income

|

|

6,351

|

|

|

7,678

|

|

|

(17)

|

|

|||||||||||

|

Total net revenues

|

|

46,254

|

|

|

47,365

|

|

|

(2)

|

|

|||||||||||

|

Provision for credit losses

|

|

1,028

|

|

|

2,715

|

|

|

(62)

|

|

|||||||||||

|

OPERATING EXPENSES

|

||||||||||||||||||||

| Compensation and benefits

|

|

15,499

|

|

|

15,148

|

|

|

2

|

|

|||||||||||

| Transaction based

|

|

5,698

|

|

|

5,312

|

|

|

7

|

|

|||||||||||

| Market development

|

|

629

|

|

|

812

|

|

|

(23)

|

|

|||||||||||

| Communications and technology

|

|

1,919

|

|

|

1,808

|

|

|

6

|

|

|||||||||||

| Depreciation and amortization

|

|

4,856

|

|

|

2,455

|

|

|

98

|

|

|||||||||||

| Occupancy

|

|

1,053

|

|

|

1,026

|

|

|

3

|

|

|||||||||||

| Professional fees

|

|

1,623

|

|

|

1,887

|

|

|

(14)

|

|

|||||||||||

| Other expenses

|

|

3,210

|

|

|

2,716

|

|

|

18

|

|

|||||||||||

|

Total operating expenses

|

|

34,487

|

|

|

31,164

|

|

|

11

|

|

|||||||||||

| Pre-tax earnings

|

|

10,739

|

|

|

13,486

|

|

|

(20)

|

|

|||||||||||

| Provision for taxes

|

|

2,223

|

|

|

2,225

|

|

|

–

|

|

|||||||||||

|

Net earnings

|

|

8,516

|

|

|

11,261

|

|

|

(24)

|

|

|||||||||||

| Preferred stock dividends

|

|

609

|

|

|

497

|

|

|

23

|

|

|||||||||||

|

Net earnings applicable to common shareholders

|

|

$ 7,907

|

|

|

$ 10,764

|

|

|

(27)

|

|

|||||||||||

|

EARNINGS PER COMMON SHARE

|

||||||||||||||||||||

|

Basic3

|

|

$ 23.05

|

|

|

$ 30.42

|

|

|

(24) %

|

|

|||||||||||

| Diluted |

$ 22.87 | $ 30.06 | (24) | |||||||||||||||||

|

AVERAGE COMMON SHARES

|

||||||||||||||||||||

| Basic

|

340.8 | 352.1 | (3) | |||||||||||||||||

| Diluted

|

|

345.8

|

|

|

358.1

|

|

|

(3)

|

|

|||||||||||

11

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)

In millions, except per share amounts and headcount

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||||||

|

REVENUES

|

||||||||||||||||||||||||

| Investment banking

|

|

$ 1,653

|

|

|

$ 1,555

|

|

|

$ 1,873

|

|

|

6 %

|

|

|

(12) %

|

|

|||||||||

| Investment management

|

|

2,478

|

|

|

2,409

|

|

|

2,258

|

|

|

3

|

|

|

10

|

|

|||||||||

| Commissions and fees

|

|

925

|

|

|

883

|

|

|

968

|

|

|

5

|

|

|

(4)

|

|

|||||||||

| Market making

|

|

3,496

|

|

|

4,958

|

|

|

3,051

|

|

|

(29)

|

|

|

15

|

|

|||||||||

| Other principal transactions

|

|

1,427

|

|

|

465

|

|

|

369

|

|

|

207

|

|

|

287

|

|

|||||||||

|

Total non-interest revenues |

9,979 | 10,270 | 8,519 | (3) | 17 | |||||||||||||||||||

| Interest income

|

|

18,484

|

|

|

18,257

|

|

|

12,411

|

|

|

1

|

|

|

49

|

|

|||||||||

| Interest expense |

17,145 | 16,710 | 10,337 | 3 | 66 | |||||||||||||||||||

|

Net interest income |

1,339 | 1,547 | 2,074 | (13) | (35) | |||||||||||||||||||

|

Total net revenues |

11,318 | 11,817 | 10,593 | (4) | 7 | |||||||||||||||||||

|

Provision for credit losses |

577 | 7 | 972 | N.M. | (41) | |||||||||||||||||||

|

OPERATING EXPENSES |

||||||||||||||||||||||||

| Compensation and benefits

|

|

3,602

|

|

|

4,188

|

|

|

3,764

|

|

|

(14)

|

|

|

(4)

|

|

|||||||||

| Transaction based

|

|

1,456

|

|

|

1,452

|

|

|

1,434

|

|

|

–

|

|

|

2

|

|

|||||||||

| Market development

|

|

175

|

|

|

136

|

|

|

216

|

|

|

29

|

|

|

(19)

|

|

|||||||||

| Communications and technology

|

|

503

|

|

|

468

|

|

|

481

|

|

|

7

|

|

|

5

|

|

|||||||||

| Depreciation and amortization

|

|

780

|

|

|

1,512

|

|

|

727

|

|

|

(48)

|

|

|

7

|

|

|||||||||

| Occupancy

|

|

268

|

|

|

267

|

|

|

261

|

|

|

–

|

|

|

3

|

|

|||||||||

| Professional fees

|

|

471

|

|

|

377

|

|

|

495

|

|

|

25

|

|

|

(5)

|

|

|||||||||

| Other expenses

|

|

1,232

|

|

|

654

|

|

|

713

|

|

|

88

|

|

|

73

|

|

|||||||||

|

Total operating expenses |

8,487 | 9,054 | 8,091 | (6) | 5 | |||||||||||||||||||

| Pre-tax earnings

|

|

2,254

|

|

|

2,756

|

|

|

1,530

|

|

|

(18)

|

|

|

47

|

|

|||||||||

| Provision for taxes |

246 | 698 | 204 | (65) | 21 | |||||||||||||||||||

|

Net earnings |

2,008 | 2,058 | 1,326 | (2) | 51 | |||||||||||||||||||

| Preferred stock dividends |

141 | 176 | 141 | (20) | – | |||||||||||||||||||

|

Net earnings applicable to common shareholders |

$ 1,867 | $ 1,882 | $ 1,185 | (1) | 58 | |||||||||||||||||||

|

EARNINGS PER COMMON SHARE |

||||||||||||||||||||||||

|

Basic3

|

|

$ 5.52

|

|

|

$ 5.52

|

|

|

$ 3.35

|

|

|

– %

|

|

|

65 %

|

|

|||||||||

| Diluted |

$ 5.48 | $ 5.47 | $ 3.32 | – | 65 | |||||||||||||||||||

|

AVERAGE COMMON SHARES |

||||||||||||||||||||||||

| Basic |

335.7 | 338.7 | 349.5 | (1) | (4) | |||||||||||||||||||

| Diluted |

340.9 | 343.9 | 356.7 | (1) | (4) | |||||||||||||||||||

|

SELECTED DATA AT PERIOD-END |

||||||||||||||||||||||||

| Common shareholders’ equity

|

|

$ 105,702

|

|

|

$ 106,074

|

|

|

$ 106,486

|

|

|

–

|

|

|

(1)

|

|

|||||||||

| Basic shares3

|

|

337.1

|

|

|

338.0

|

|

|

350.8

|

|

|

–

|

|

|

(4)

|

|

|||||||||

| Book value per common share |

$ 313.56 | $ 313.83 | $ 303.55 | – | 3 | |||||||||||||||||||

| Headcount

|

|

45,300

|

|

|

45,900

|

|

|

48,500

|

|

|

(1)

|

|

|

(7)

|

|

|||||||||

12

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (unaudited)3

$ in billions

| AS OF | ||||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||

| Cash and cash equivalents

|

$ 242 | $ 240 | $ 242 | |||||||||||||||||

| Collateralized agreements

|

423 | 388 | 414 | |||||||||||||||||

| Customer and other receivables

|

132 | 141 | 136 | |||||||||||||||||

| Trading assets

|

478 | 448 | 301 | |||||||||||||||||

| Investments

|

147 | 145 | 131 | |||||||||||||||||

| Loans

|

183 | 178 | 179 | |||||||||||||||||

| Other assets

|

|

37

|

|

|

37

|

|

|

39

|

|

|||||||||||

|

Total assets

|

|

$ 1,642

|

|

|

$ 1,577

|

|

|

$ 1,442

|

|

|||||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||||||||||||||

| Deposits

|

$ 428 | $ 403 | $ 387 | |||||||||||||||||

| Collateralized financings

|

324 | 295 | 155 | |||||||||||||||||

| Customer and other payables

|

231 | 253 | 262 | |||||||||||||||||

| Trading liabilities

|

200 | 195 | 191 | |||||||||||||||||

| Unsecured short-term borrowings

|

76 | 70 | 61 | |||||||||||||||||

| Unsecured long-term borrowings

|

242 | 224 | 247 | |||||||||||||||||

| Other liabilities

|

|

24

|

|

|

20

|

|

|

22

|

|

|||||||||||

|

Total liabilities

|

|

1,525

|

|

|

1,460

|

|

|

1,325

|

|

|||||||||||

| Shareholders’ equity

|

|

117

|

|

|

117

|

|

|

117

|

|

|||||||||||

|

Total liabilities and shareholders’ equity

|

|

$ 1,642

|

|

|

$ 1,577

|

|

|

$ 1,442

|

|

|||||||||||

|

Capital Ratios and Supplementary Leverage Ratio (unaudited)3 $ in billions

|

|

|||||||||||||||||||

| AS OF | ||||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||||

| Common equity tier 1 capital |

$ 99.5 | $ 98.9 | $ 98.1 | |||||||||||||||||

|

STANDARDIZED CAPITAL RULES

|

||||||||||||||||||||

| Risk-weighted assets

|

$ 684 | $ 667 | $ 653 | |||||||||||||||||

| Common equity tier 1 capital ratio |

14.5% | 14.8% | 15.0% | |||||||||||||||||

|

ADVANCED CAPITAL RULES

|

||||||||||||||||||||

| Risk-weighted assets

|

$ 667 | $ 666 | $ 679 | |||||||||||||||||

| Common equity tier 1 capital ratio |

14.9% | 14.8% | 14.4% | |||||||||||||||||

|

SUPPLEMENTARY LEVERAGE RATIO

|

||||||||||||||||||||

| Supplementary leverage ratio

|

|

5.5%

|

|

|

5.6%

|

|

|

5.8%

|

|

|||||||||||

|

Average Daily VaR (unaudited)3,4 $ in millions

|

|

|||||||||||||||||||

| THREE MONTHS ENDED | YEAR ENDED | |||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

DECEMBER 31, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||

| RISK CATEGORIES

|

||||||||||||||||||||

| Interest rates

|

$ 87 | $ 88 | $ 95 | $ 96 | $ 96 | |||||||||||||||

| Equity prices

|

29 | 28 | 30 | 29 | 35 | |||||||||||||||

| Currency rates

|

18 | 19 | 41 | 24 | 32 | |||||||||||||||

| Commodity prices

|

19 | 18 | 28 | 19 | 47 | |||||||||||||||

| Diversification effect

|

|

(62)

|

|

|

(66)

|

|

|

(92)

|

|

(69)

|

(97)

|

|||||||||

|

Total

|

|

$ 91

|

|

|

$ 87

|

|

|

$ 102

|

|

$ 99

|

$ 113

|

|||||||||

13

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Assets Under Supervision (unaudited)3

$ in billions

| AS OF | ||||||||||||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||||||||||||

|

ASSET CLASS

|

||||||||||||||||||||||||||||

| Alternative investments

|

|

$ 295

|

|

|

$ 267

|

|

|

$ 263

|

|

|||||||||||||||||||

| Equity

|

|

658

|

|

|

607

|

|

|

563

|

|

|||||||||||||||||||

| Fixed income

|

|

1,122

|

|

|

1,031

|

|

|

1,010

|

|

|||||||||||||||||||

|

Total long-term AUS

|

|

2,075

|

|

|

1,905

|

|

|

1,836

|

|

|||||||||||||||||||

| Liquidity products

|

|

737

|

|

|

775

|

|

|

711

|

|

|||||||||||||||||||

|

Total AUS

|

|

$ 2,812

|

|

|

$ 2,680

|

|

|

$ 2,547

|

|

|||||||||||||||||||

| THREE MONTHS ENDED | YEAR ENDED | |||||||||||||||||||||||||||

| DECEMBER 31, 2023 |

SEPTEMBER 30, 2023 |

DECEMBER 31, 2022 |

DECEMBER 31, 2023 |

DECEMBER 31, 2022 |

||||||||||||||||||||||||

|

Beginning balance

|

|

$ 2,680

|

|

|

$ 2,714

|

|

|

$ 2,427

|

|

|

$ 2,547

|

|

|

$ 2,470

|

|

|||||||||||||

| Net inflows / (outflows):

|

||||||||||||||||||||||||||||

| Alternative investments

|

|

23

|

|

|

2

|

|

|

3

|

|

|

25

|

|

|

19

|

|

|||||||||||||

| Equity

|

|

2

|

|

|

–

|

|

|

–

|

|

|

(3)

|

|

|

13

|

|

|||||||||||||

| Fixed income

|

|

26

|

|

|

5

|

|

|

19

|

|

|

52

|

|

|

18

|

|

|||||||||||||

|

Total long-term AUS net inflows / (outflows)

|

|

51

|

|

|

7

|

|

|

22

|

|

|

74

|

|

|

50

|

|

|||||||||||||

| Liquidity products

|

|

(37)

|

|

|

11

|

|

|

11

|

|

|

27

|

|

|

16

|

|

|||||||||||||

|

Total AUS net inflows / (outflows)

|

|

14

|

|

|

18

|

|

|

33

|

|

|

101

|

|

|

66

|

|

|||||||||||||

| Acquisitions / (dispositions)

|

|

(23)

|

|

|

–

|

|

|

–

|

|

|

(23)

|

|

|

316

|

|

|||||||||||||

| Net market appreciation / (depreciation)

|

|

141

|

|

|

(52)

|

|

|

87

|

|

|

187

|

|

|

(305)

|

|

|||||||||||||

|

Ending balance

|

|

$ 2,812

|

|

|

$ 2,680

|

|

|

$ 2,547

|

|

|

$ 2,812

|

|

|

$ 2,547

|

|

|||||||||||||

14

Goldman Sachs Reports

Full Year and Fourth Quarter 2023 Earnings Results

|

Footnotes |

|

|

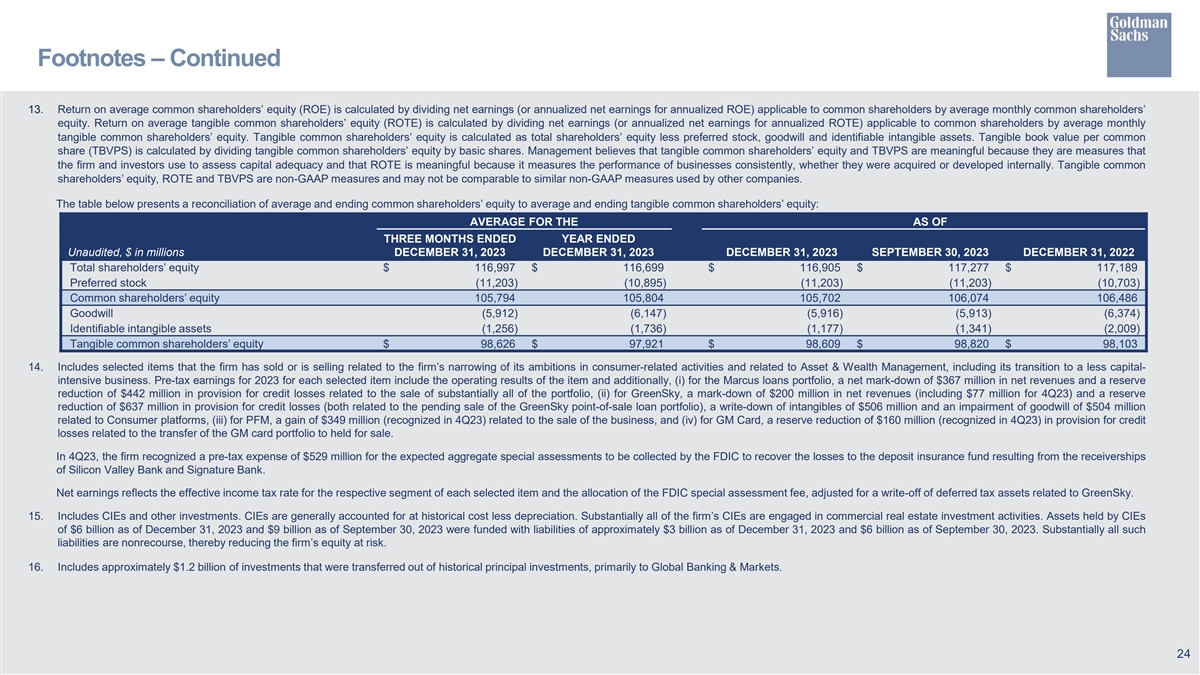

| 1. | ROE is calculated by dividing net earnings (or annualized net earnings for annualized ROE) applicable to common shareholders by average monthly common shareholders’ equity. ROTE is calculated by dividing net earnings (or annualized net earnings for annualized ROTE) applicable to common shareholders by average monthly tangible common shareholders’ equity (tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets). Management believes that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally, and that tangible common shareholders’ equity is meaningful because it is a measure that the firm and investors use to assess capital adequacy. ROTE and tangible common shareholders’ equity are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. |

The table below presents a reconciliation of average common shareholders’ equity to average tangible common shareholders’ equity:

| AVERAGE FOR THE | ||||||||||||||

| Unaudited, $ in millions

|

THREE MONTHS ENDED DECEMBER 31, 2023 |

|

YEAR ENDED DECEMBER 31, 2023 |

|

||||||||||

| Total shareholders’ equity

|

|

$ 116,997

|

|

|

$ 116,699

|

|

||||||||

| Preferred stock

|

|

(11,203)

|

|

|

(10,895)

|

|

||||||||

|

Common shareholders’ equity

|

|

105,794

|

|

|

105,804

|

|

||||||||

|

Goodwill |

|

(5,912)

|

|

|

(6,147)

|

|

||||||||

| Identifiable intangible assets

|

|

(1,256)

|

|

|

(1,736)

|

|

||||||||

|

Tangible common shareholders’ equity

|

|

$

98,626

|

|

|

$ 97,921

|

|

||||||||

| 2. | Dealogic – January 1, 2023 through December 31, 2023. |

| 3. | For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2023: (i) Investment banking fees backlog – see “Results of Operations – Global Banking & Markets”, (ii) assets under supervision – see “Results of Operations – Asset & Wealth Management – Assets Under Supervision”, (iii) efficiency ratio – see “Results of Operations – Operating Expenses”, (iv) share repurchase program – see “Capital Management and Regulatory Capital – Capital Management”, (v) global core liquid assets – see “Risk Management – Liquidity Risk Management”, (vi) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics” and (vii) VaR – see “Risk Management – Market Risk Management.” |

| For information about the following items, see the referenced sections in Part I, Item 1 “Financial Statements (Unaudited)” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2023: (i) risk-based capital ratios and the supplementary leverage ratio – see Note 20 “Regulation and Capital Adequacy”, (ii) geographic net revenues – see Note 25 “Business Segments” and (iii) unvested share-based awards that have non-forfeitable rights to dividends or dividend equivalents in calculating basic EPS – see Note 21 “Earnings Per Common Share.” |

| Represents a preliminary estimate for the fourth quarter of 2023 for the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets and VaR. These may be revised in the firm’s Annual Report on Form 10-K for the year ended December 31, 2023. |

| 4. | During the first quarter of 2023, the firm added the currency exposure on certain debt and equity positions to VaR and removed certain debt and equity positions (and related hedges) from VaR as management believes that the risk of these positions is more appropriately measured and monitored using 10% sensitivity measures. Prior year amounts for average daily VaR have been conformed to the current presentation. The impact of such changes was not material. See “Risk Management – Market Risk Management” in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2023 for further information about VaR and 10% sensitivity measures. |

15

Exhibit 99.2 Full Year and Fourth Quarter 2023 Earnings Results Presentation January 16, 2024

Our culture and leading client franchise are the foundation of our focused strategy S TRA TE G I C Client Service OBJ EC T I VES Harness One GS to Serve Our Clients with Excellence Partnership Run World-Class, Differentiated, Durable Businesses Integrity Invest to Operate at Scale Excellence 1

Two world-class and interconnected franchises #1 Global Investment Leading Global Active 1 3 Bank Asset Manager One Global Banking & Asset & Wealth Goldman Top 5 Alternative 2 #1 Equities franchise Markets Management 3 Sachs Asset Manager Premier Ultra High Net 2 #3 FICC franchise Worth franchise 2

Solid progress on execution priorities in 2023 Global Banking & Markets Asset & Wealth Management Strengthened client franchise Grew more durable revenues Record Management and other fees of $9.5bn in 2023, up 8% YoY; 4 #1 M&A, #1 ECM, #2 High-Yield Debt Alternatives management and other fees of $2.1bn in 2023, up 15% YoY 5 Top 3 with 117 of the Top 150 FICC & Equities clients in 1H23 vs. 77 in 2019 Record Private banking and lending revenues of $2.6bn in 2023, up 5% YoY 6 Increased financing revenues in FICC and Equities Reduced HPI and surpassed fundraising target 7 HPI reduction of $13bn during the year to $16bn Record financing revenues of $7.8bn in 2023 CAGR of 15% from 2019-2023 Surpassed alternatives fundraising target of $225bn Strong execution on narrowed strategic focus Reached agreement with GM Sale of Marcus loans Sale of Personal Financial Announced sale of GreenSky regarding a process to transition portfolio Management card program 3

Global Banking & Markets: Increased wallet share and financing driving growth and attractive returns Leading diversified franchise (net revenues in $bn) Advisory FICC financing Equity underwriting Equities intermediation Debt underwriting Equities financing FICC intermediation Other Average revenues: $32bn $37 Average ROE: 16% $32 $30 $30 $22 2019 2020 2021 2022 2023 4

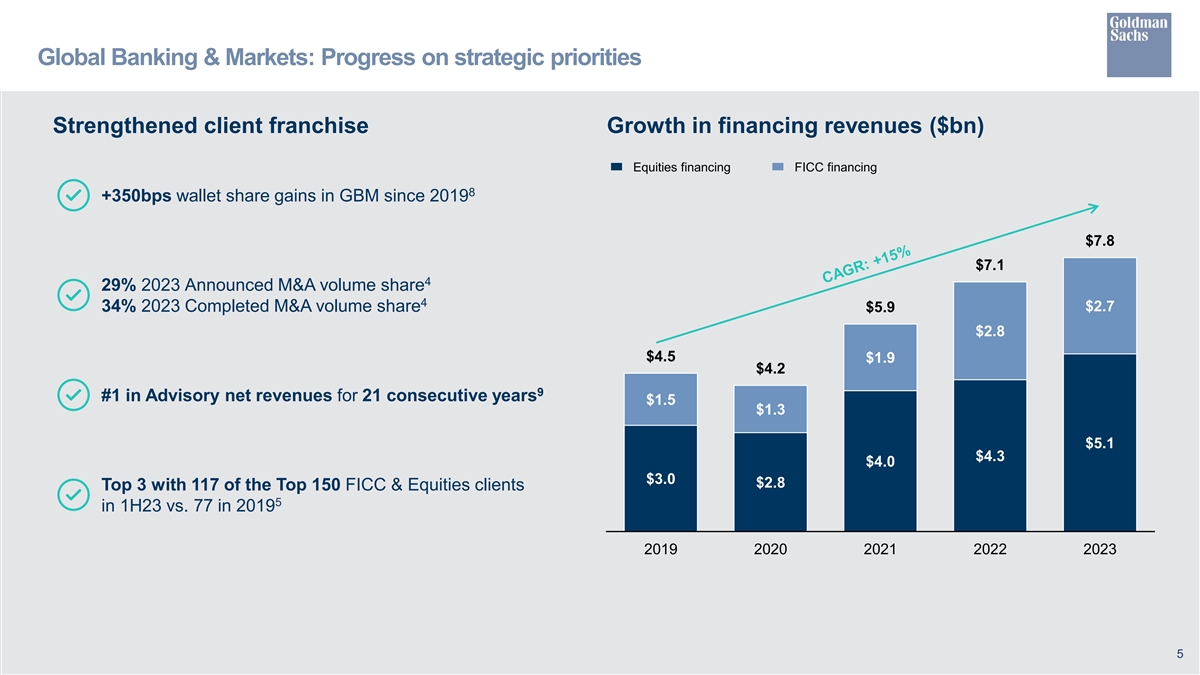

Global Banking & Markets: Progress on strategic priorities Strengthened client franchise Growth in financing revenues ($bn) Equities financing FICC financing 8 +350bps wallet share gains in GBM since 2019 $7.8 $7.1 4 29% 2023 Announced M&A volume share 4 $2.7 34% 2023 Completed M&A volume share $5.9 $2.8 $4.5 $1.9 $4.2 9 #1 in Advisory net revenues for 21 consecutive years $1.5 $1.3 $5.1 $4.3 $4.0 $3.0 $2.8 Top 3 with 117 of the Top 150 FICC & Equities clients 5 in 1H23 vs. 77 in 2019 2019 2020 2021 2022 2023 5

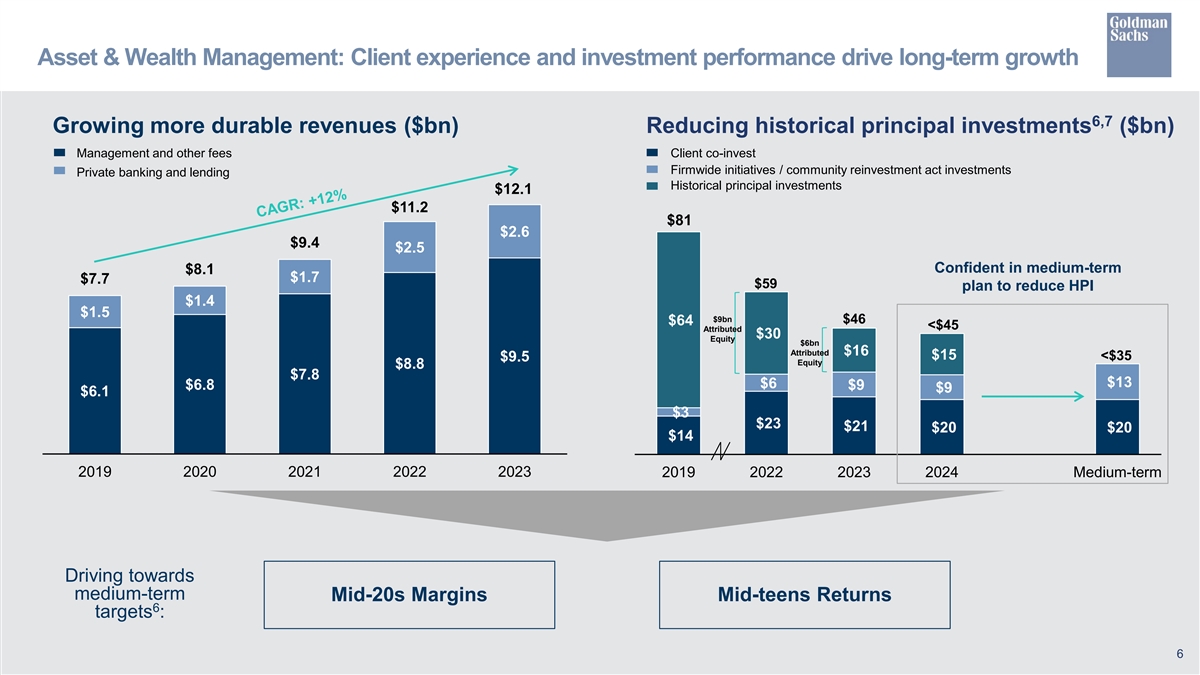

Asset & Wealth Management: Client experience and investment performance drive long-term growth 6,7 Growing more durable revenues ($bn) Reducing historical principal investments ($bn) Management and other fees Client co-invest Firmwide initiatives / community reinvestment act investments Private banking and lending Historical principal investments $12.1 $11.2 $81 $2.6 $9.4 $2.5 Confident in medium-term $8.1 $1.7 $7.7 $59 plan to reduce HPI $1.4 $1.5 $9bn $46 $64 <$45 Attributed $30 Equity $6bn Attributed $16 $15 <$35 $9.5 Equity $8.8 $7.8 $13 $6 $6.8 $9 $9 $6.1 $3 $23 $21 $20 $20 $14 2019 2020 2021 2022 2023 2019 2022 2023 2024 Medium-term Driving towards medium-term Mid-20s Margins Mid-teens Returns 6 targets : 6

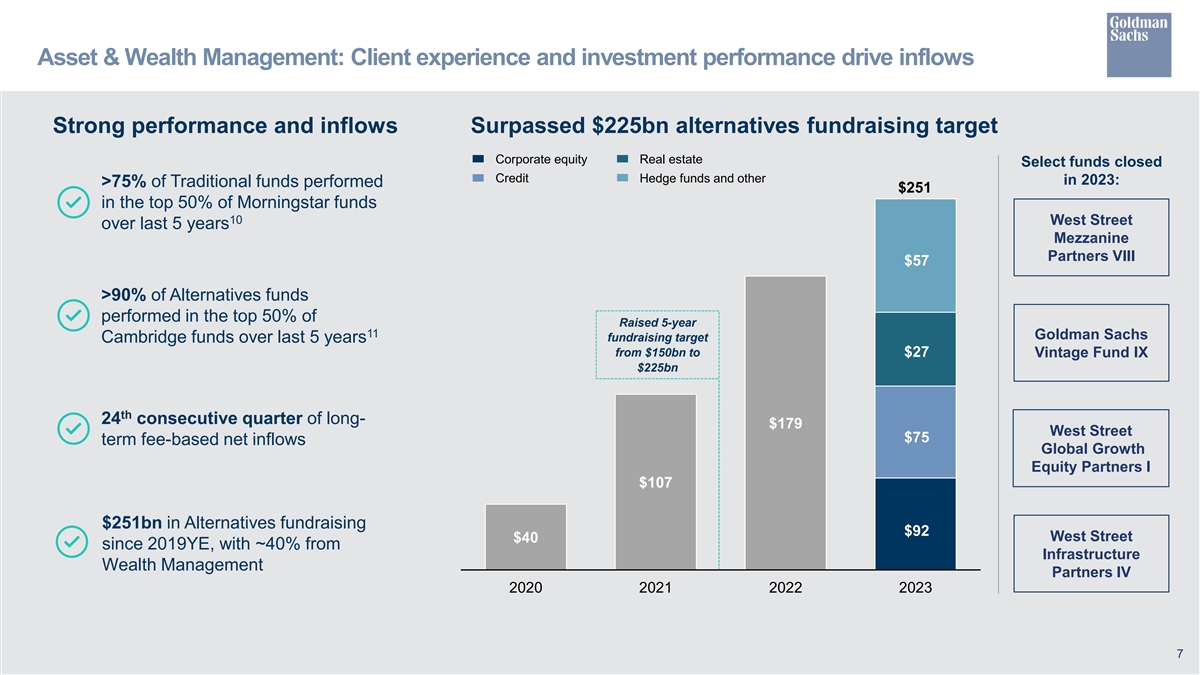

Asset & Wealth Management: Client experience and investment performance drive inflows Strong performance and inflows Surpassed $225bn alternatives fundraising target Corporate equity Real estate Select funds closed Credit Hedge funds and other in 2023: >75% of Traditional funds performed $251 in the top 50% of Morningstar funds 10 West Street over last 5 years Mezzanine Partners VIII $57 >90% of Alternatives funds performed in the top 50% of Raised 5-year 11 Goldman Sachs fundraising target Cambridge funds over last 5 years from $150bn to $27 Vintage Fund IX $225bn th 24 consecutive quarter of long- $179 West Street $75 term fee-based net inflows Global Growth Equity Partners I $107 $251bn in Alternatives fundraising $92 West Street $40 since 2019YE, with ~40% from Infrastructure Wealth Management Partners IV 2020 2021 2022 2023 7

Over 70% of 2023 revenues driven from a consistent baseline and more durable sources 12 GS revenue breakdown ($bn) Baseline revenues $59.3 Solid foundation from More durable revenues 1 baseline revenues with Other incremental revenues opportunity to grow $47.4 $46.3 $44.6 $30.4 3 $12.3 $15.4 $36.5 Growing contribution from $19.4 2 more durable revenue 2 $11.4 sources (+60% since 2019) $19.9 $18.4 $15.3 $12.2 $12.3 1 Power of diversification and 3 $14.1 $13.6 $13.6 consistent ability to capture $12.9 $12.9 upside 2019 2020 2021 2022 2023 8

Executing on a focused set of strategic priorities ST R AT EGI C OBJ EC T I VES Harness One GS to Run World-Class, Differentiated, Invest to Operate Serve Our Clients Durable Businesses at Scale with Excellence 2024 EX EC U T I ON F OC U S AR EAS Achieve Agility, Scale, Efficiency Enhance Client Experience and Engineering Excellence Grow More Durable Revenue Streams Grow Wallet Share Optimize Resource Allocation Invest in People & Culture Maintain and Strengthen Focus on Drive Investment Performance Risk Management O UTCO ME S Strong Total Trusted Advisor to Employer Mid-teens Returns Our Clients of Choice Through-the-Cycle Shareholder Return 9

Results Snapshot Net Revenues Net Earnings EPS 2023 $46.25 billion 2023 $8.52 billion 2023 $22.87 4Q23 $11.32 billion 4Q23 $2.01 billion 4Q23 $5.48 13 13 ROE ROTE Book Value Per Share 2023 7.5% 2023 8.1% 2023 $313.56 4Q23 7.1% 4Q23 7.6% 2023 Growth 3.3% 14 Annual Highlights Selected Items and FDIC Special Assessment Fee $ in millions, except per share amounts 2023 4Q23 4 #1 in M&A, equity & equity-related offerings and common stock offerings Pre-tax earnings: 6 (2,076) (61) AWM historical principal investments $ $ GreenSky (1,227) (154) nd Record Equities financing and 2 highest FICC financing net revenues Marcus loans portfolio 233 (7) Personal Financial Management (PFM) 276 345 General Motors (GM) Card (65) 109 Record Management and other fees of $9.49 billion; FDIC special assessment fee (529) (529) 7 Record AUS of $2.81 trillion Total impact to pre-tax earnings $ (3,388) $ (297) (2,781) (283) Impact to net earnings $ $ (8.04) (0.83) Impact to EPS $ $ Record Private banking and lending net revenues (2.6)pp (1.0)pp Impact to ROE 10

Financial Overview Financial Results Financial Overview Highlights n 4Q23 results included EPS of $5.48 and ROE of 7.1% vs. vs. vs. $ in millions, — 4Q23 net revenues were higher YoY reflecting higher net revenues in Asset & Wealth except per share amounts 4Q23 3Q23 4Q22 2023 2022 Management and Platform Solutions, partially offset by lower net revenues in Global Banking & Markets $ 6,354 (21)% (3)% $ 29,996 (8)% Global Banking & Markets — 4Q23 provision for credit losses was $577 million Asset & Wealth Management 4,387 36% 23% 13,880 4% o Reflecting net provisions related to both the credit card portfolio (primarily driven by net charge-offs and seasonal portfolio growth, partially offset by a reserve reduction of $160 million related to the transfer of the GM card portfolio to held for sale) and 577 – 12% 2,378 58% Platform Solutions wholesale loans (driven by impairments) 11,318 (4)% 7% 46,254 (2)% Net revenues — 4Q23 operating expenses were slightly higher YoY primarily reflecting the FDIC special assessment fee of $529 million 577 N.M. (41)% 1,028 (62)% Provision for credit losses n 2023 results included EPS of $22.87 and ROE of 7.5% 8,487 (6)% 5% 34,487 11% Operating expenses — 2023 net revenues were slightly lower YoY reflecting lower net revenues in Global Banking & Markets, largely offset by higher net revenues in Platform Solutions and Asset & Wealth $ 2,254 (18)% 47% $ 10,739 (20)% Pre-tax earnings Management $ 2,008 (2)% 51% $ 8,516 (24)% — 2023 provision for credit losses was $1.03 billion Net earnings o Reflecting net provisions related to both the credit card portfolio (primarily driven by $ 1,867 (1)% 58% $ 7,907 (27)% Net earnings to common net charge-offs) and wholesale loans (primarily driven by impairments) o Partially offset by reserve reductions of $637 million related to the transfer of the Diluted EPS $ 5.48 – 65% $ 22.87 (24)% GreenSky loan portfolio to held for sale and $442 million related to the sale of substantially all of the Marcus loans portfolio 13 ROE 7.1% – 2.7pp 7.5% (2.7)pp — 2023 operating expenses were higher YoY primarily reflecting significantly higher impairments related to consolidated real estate investments ($1.46 billion recognized in 13 2023), a write-down of intangibles of $506 million related to GreenSky and an impairment of ROTE 7.6% (0.1)pp 2.8pp 8.1% (2.9)pp goodwill of $504 million related to Consumer platforms, as well as the FDIC special assessment fee of $529 million 7 75.0% (1.6)pp (1.4)pp 74.6% 8.8pp Efficiency Ratio 11

Global Banking & Markets Financial Results Global Banking & Markets Highlights n 4Q23 net revenues were lower YoY vs. vs. vs. — Investment banking fees reflected significantly lower net revenues in Advisory, partially offset $ in millions 4Q23 3Q23 4Q22 2023 2022 by significantly higher net revenues in Debt underwriting and higher net revenues in Equity underwriting Investment banking fees $ 1,652 6% (12)% $ 6,216 (16)% — FICC reflected significantly lower net revenues in intermediation — Equities reflected significantly higher net revenues in intermediation and higher net revenues FICC 2,034 (40)% (24)% 12,060 (18)% in financing 7 n Investment banking fees backlog increased vs 3Q23, reflecting a significant increase in Advisory, 2,607 (12)% 26% 11,549 5% Equities partially offset by decreases in Debt underwriting and Equity underwriting 7 n 4Q23 select data : 61 (45)% N.M. 171 N.M. Other — Total assets of $1.38 trillion — Loan balance of $117 billion 6,354 (21)% (3)% 29,996 (8)% Net revenues — Net interest income of $22 million 187 545% N.M. 401 (14)% Provision for credit losses Operating expenses 4,338 (9)% 3% 18,040 1% n 2023 net revenues were lower YoY, compared to a strong 2022 — Investment banking fees primarily reflected significantly lower net revenues in Advisory, Pre-tax earnings $ 1,829 (43)% (20)% $ 11,555 (18)% partially offset by significantly higher net revenues in Equity underwriting — FICC reflected significantly lower net revenues in intermediation Net earnings $ 1,703 (29)% (13)% $ 9,163 (23)% — Equities reflected higher net revenues in financing, partially offset by slightly lower net revenues in intermediation Net earnings to common $ 1,595 (29)% (14)% $ 8,703 (24)% 7 n Investment banking fees backlog decreased vs. 2022, reflecting significant decreases in both Equity underwriting and Debt underwriting Average common equity $ 74,362 3% 5% $ 71,863 3% Return on average common equity 8.6% (3.8)pp (1.9)pp 12.1% (4.3)pp 12