UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 11, 2024

MBIA INC.

(Exact name of registrant as specified in its charter)

| Connecticut | 001-9583 | 06-1185706 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 1 Manhattanville Road, Suite 301 Purchase, New York |

10577 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

914-273-4545

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

||

| Common Stock, par value $1 per share | MBI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | REGULATION FD DISCLOSURE. |

The following information, including Exhibit 99.1, is being furnished, not filed, pursuant to Item 7.01—Regulation FD Disclosure of Form 8-K.

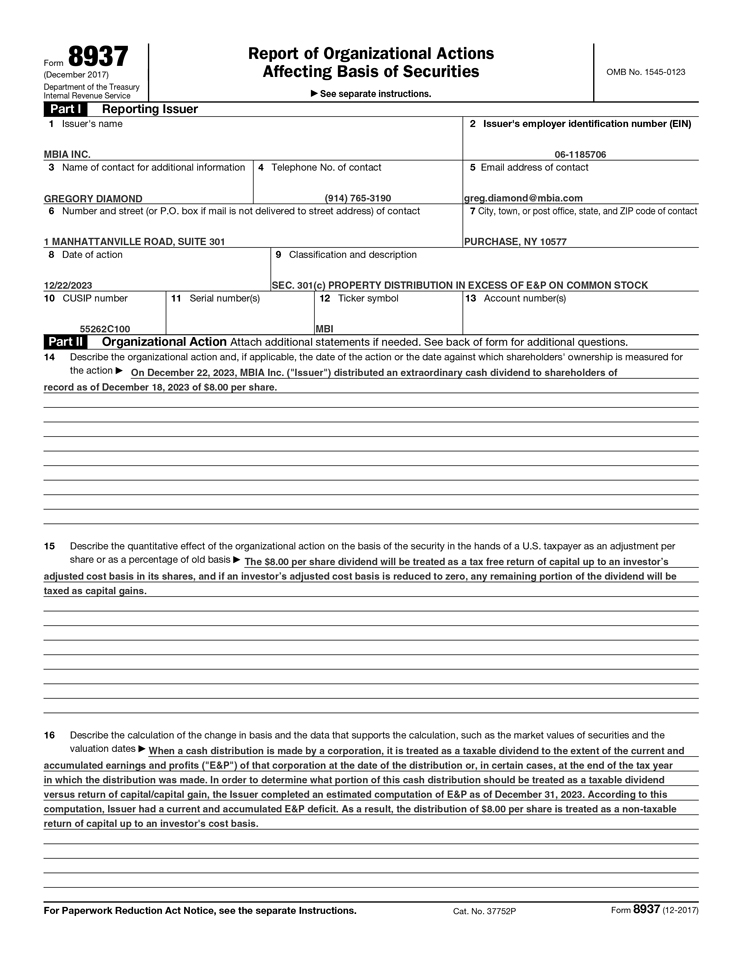

On January 11, 2024, MBIA Inc. (the “Company”) posted IRS Form 8937 “Report of Organizational Actions Affecting Basis of Securities” on its website, www.mbia.com, under the section “Investor Relations – Financial Information” @ https://investor.mbia.com/files/doc_downloads/2024/01/Form-8937.pdf. The Company’s IRS Form 8937 provides an explanation of the tax consequences to shareholders with respect to the Company’s treatment of the extraordinary cash dividend of $8.00 per share paid on December 22, 2023 to shareholders of record as of December 18, 2023. The Company’s IRS Form 8937 indicates that the extraordinary cash dividend is expected to be treated as a tax free return of capital up to an investor’s adjusted cost basis in its shares, and if an investor’s adjusted cost basis is reduced to zero, any remaining portion of the dividend will be taxed as capital gains. A copy of the Company’s IRS Form 8937 is attached as Exhibit 99.1 to this Form 8-K and is incorporated by reference into this Item 7.01 as if fully set forth herein. The Company’s IRS Form 8937 will be updated as necessary following the release of the Company’s full year 2023 financial results, which is tentatively scheduled for February 28, 2024. Shareholders should consult their own tax professionals regarding their receipt of the extraordinary cash dividend.

| Item 9.01. | EXHIBITS |

| 99.1 | Form 8937 dated January 10, 2024. | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MBIA INC. | ||

| By: | /s/ William J. Rizzo |

|

| William J. Rizzo | ||

| Co-General Counsel | ||

Date: January 11, 2024

Exhibit 99.1

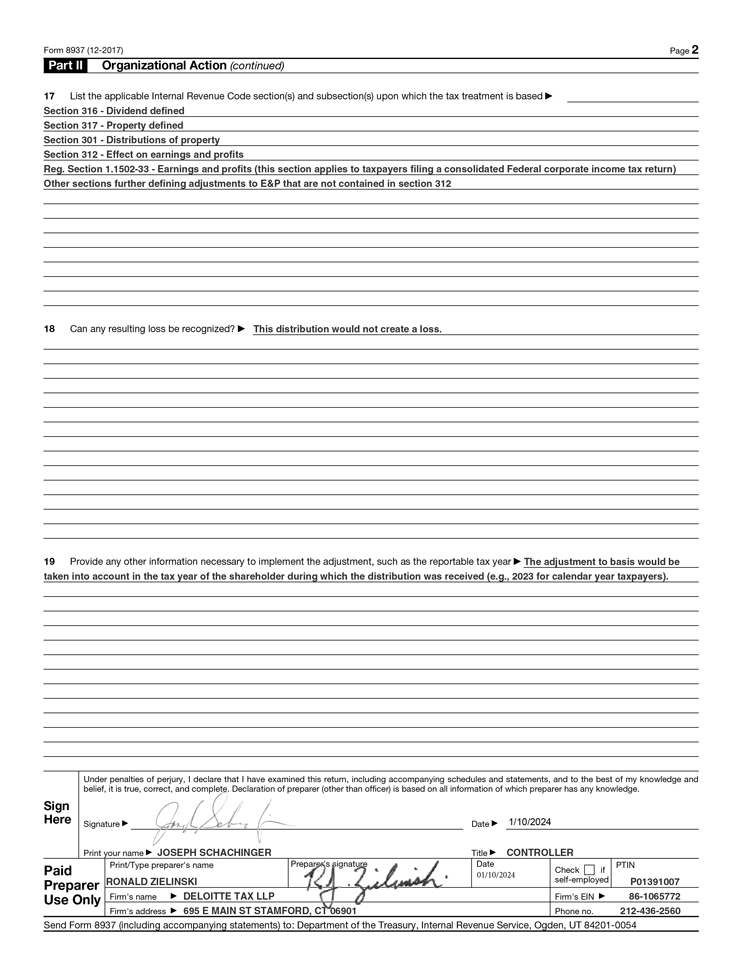

Form 8937 (December 2017) Department of the Treasury Internal Revenue Service Report of Organizational Actions Affecting Basis of Securities See separate instructions. OMB No. 1545-0123 Part I Reporting Issuer 1 Issuer’s name 2 Issuer’s employer identification number (EIN) 3 Name of contact for additional information 4 Telephone No. of contact 5 Email address of contact 6 Number and street (or P.O. box if mail is not delivered to street address) of contact 7 City, town, or post office, state, and ZIP code of contact 8 Date of action 9 Classification and description 10 CUSIP number 11 Serial number(s) 12 Ticker symbol 13 Account number(s) Part II Organizational Action Attach additional statements if needed. See back of form for additional questions. 14 Describe the organizational action and, if applicable, the date of the action or the date against which shareholders’ ownership is measured for the action 15 Describe the quantitative effect of the organizational action on the basis of the security in the hands of a U.S. taxpayer as an adjustment per share or as a percentage of old basis 16 Describe the calculation of the change in basis and the data that supports the calculation, such as the market values of securities and the valuation dates For Paperwork Reduction Act Notice, see the separate Instructions. Cat. No. 37752P Form 8937 (12-2017) MBIA INC. 06-1185706 GREGORY DIAMOND (914) 765-3190 greg.diamond@mbia.com 1 MANHATTANVILLE ROAD, SUITE 301 PURCHASE, NY 10577 12/22/2023 SEC. 301(c) PROPERTY DISTRIBUTION IN EXCESS OF E&P ON COMMON STOCK 55262C100 MBI On December 22, 2023, MBIA Inc. (“Issuer”) distributed an extraordinary cash dividend to shareholders of record as of December 18, 2023 of $8.00 per share. The $8.00 per share dividend will be treated as a tax free return of capital up to an investor’s adjusted cost basis in its shares, and if an investor’s adjusted cost basis is reduced to zero, any remaining portion of the dividend will be taxed as capital gains. When a cash distribution is made by a corporation, it is treated as a taxable dividend to the extent of the current and accumulated earnings and profits (“E&P”) of that corporation at the date of the distribution or, in certain cases, at the end of the tax year in which the distribution was made. In order to determine what portion of this cash distribution should be treated as a taxable dividend versus return of capital/capital gain, the Issuer completed an estimated computation of E&P as of December 31, 2023. According to this computation, Issuer had a current and accumulated E&P deficit. As a result, the distribution of $8.00 per share is treated as a non-taxable return of capital up to an investor’s cost basis. Exhibit 99.1 Form 8937 (12-2017) Page 2 Part II Organizational Action (continued) 17 List the applicable Internal Revenue Code section(s) and subsection(s) upon which the tax treatment is based 18 Can any resulting loss be recognized? 19 Provide any other information necessary to implement the adjustment, such as the reportable tax year Sign Here Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge. Signature Date Print your name Title Paid Preparer Use Only Print/Type preparer’s name Preparer’s signature Date Check if self-employed PTIN Firm’s name Firm’s address Firm’s EIN Phone no. Send Form 8937 (including accompanying statements) to: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0054 Section 316—Dividend defined Section 317—Property defined Section 301—Distributions of property Section 312—Effect on earnings and profits Reg. Section 1.1502-33—Earnings and profits (this section applies to taxpayers filing a consolidated Federal corporate income tax return) Other sections further defining adjustments to E&P that are not contained in section 312 This distribution would not create a loss. The adjustment to basis would be taken into account in the tax year of the shareholder during which the distribution was received (e.g., 2023 for calendar year taxpayers). JOSEPH SCHACHINGER CONTROLLER RONALD ZIELINSKI P01391007 DELOITTE TAX LLP 695 E MAIN ST STAMFORD, CT 06901 86-1065772 212-436-2560 1/10/2024 01/10/2024

Form 8937 (12-2017) Page 2 Part II Organizational Action (continued) 17 List the applicable Internal Revenue Code section(s) and subsection(s) upon which the tax treatment is based 18 Can any resulting loss be recognized? 19 Provide any other information necessary to implement the adjustment, such as the reportable tax year Sign Here Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge. Signature Date Print your name Title Paid Preparer Use Only Print/Type preparer’s name Preparer’s signature Date Check if self-employed PTIN Firm’s name Firm’s address Firm’s EIN Phone no. Send Form 8937 (including accompanying statements) to: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0054 Section 316—Dividend defined Section 317—Property defined Section 301—Distributions of property Section 312—Effect on earnings and profits Reg. Section 1.1502-33—Earnings and profits (this section applies to taxpayers filing a consolidated Federal corporate income tax return) Other sections further defining adjustments to E&P that are not contained in section 312 This distribution would not create a loss. The adjustment to basis would be taken into account in the tax year of the shareholder during which the distribution was received (e.g., 2023 for calendar year taxpayers). JOSEPH SCHACHINGER CONTROLLER RONALD ZIELINSKI P01391007 DELOITTE TAX LLP 695 E MAIN ST STAMFORD, CT 06901 86-1065772 212-436-2560 1/10/2024 01/10/2024

Contacts

MBIA Inc.

Greg Diamond, 914-765-3190

Managing Director, Head of

Investor and Media Relations

greg.diamond@mbia.com