UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 8, 2024

JEFFERIES FINANCIAL GROUP INC.

(Exact name of registrant as specified in its charter)

| New York | 001-05721 | 13-2615557 | ||

| (State of other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS. Employer Identification No.) |

| 520 Madison Ave., New York, New York | 10022 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 212-284-2300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2, below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Exchange Act: |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, par value $1.00 per share |

JEF |

New York Stock Exchange |

||

| 4.850% Senior Notes Due 2027 |

JEF 27A |

New York Stock Exchange |

||

| 5.875% Senior Notes Due 2028 |

JEF 28 |

New York Stock Exchange |

||

| 2.750% Senior Notes Due 2032 |

JEF 32A |

New York Stock Exchange |

||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure |

We posted our annual letter to shareholders to our website, www.jefferies.com, on January 8, 2024. The letter is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing or other document under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing or document.

| Item 9.01 | Financial Statements and Exhibits |

(d)

| Exhibit |

Description | |

| 99.1 | January 8, 2024 annual letter to shareholders | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: January 8, 2024 | JEFFERIES FINANCIAL GROUP INC. | |||||

| /s/ Michael J. Sharp |

||||||

| Michael J. Sharp | ||||||

| Executive Vice President and General Counsel | ||||||

Exhibit 99.1

2023 Shareholder Letter

JANUARY 8, 2024

Dear Fellow Shareholders,

2023 was a transition year in the economy, in capital markets, in our industry and at Jefferies. It was accompanied by the challenges and sadness of geopolitical turmoil. In the face of this, Jefferies performed reasonably well and eked out a modest return on equity during what we believe to be the bottom of the current cycle.

As we discussed last year, the process of reestablishing real interest rates appears to have been accomplished. We give credit to the Federal Reserve for standing firm in the fight to calm inflation, while also navigating a path that keeps unemployment low and, for the most part, the economy maintaining decent momentum. It’s quite a hat trick if it holds! It isn’t surprising that some who thought the prior ebullient “free money” period was “normal” did not make it through the transition.

For Jefferies, the pain of this transition was felt primarily in Investment Banking, where curtailed new capital markets issuance was compounded by a dampening of merger and acquisition activity among our corporate and sponsor clients. Fortunately, our Equities, Fixed Income and Asset Management

businesses performed well despite uncertainty, turmoil and volatility.

Jefferies’ competitive playing field has changed markedly again over these last several years. Credit Suisse and several large U.S. regional banks will no longer be with us. Beyond the Credit Suisse collapse, other competitors face challenges with their businesses. We believe this creates real opportunity for Jefferies to continue our historical growth trajectory.

While we made some profit and were vigilant on our risk during this complicated year, we are most proud of our team, who focused on our clients and enabled us to aggressively and strategically expand our capabilities. We are able to play strong offense in downturns because we have had a multi-decade consistent strategy and a culture that encourages this contrarian approach. It is one thing to make it through a transition year(s) intact. It is entirely another to come through such a period with a significantly enhanced market position, broader geographic reach, a credit rating upgrade, enhanced human capital and an even stronger brand–all of which Jefferies achieved in 2023.

| 2023 SHAREHOLDER LETTER | 1 | JEFFERIES |

Our existing team has helped us recruit our new partners. Politics and self-serving attitudes are not tolerated. The common bond between our veterans and new joiners is a shared belief in teamwork, prioritizing clients, integrity, humility and work ethic. When you join Jefferies, no matter how senior you are, you learn quickly that your most important priority is figuring out “what can you do to help our clients succeed and enable Jefferies to become even more successful.” With the long-term stability of our strategy and culture, we have proven we can scale our operation significantly over the decades without sacrificing the core values that have made Jefferies special since inception.

We certainly do not want to jinx ourselves, and we never provide guidance given the complicated world in which we operate, but the two of us could not be more excited to enter 2024 to experience what we can accomplish as a global team. In our combined 55+ years at Jefferies, we have never seen our Firm better positioned, and we have a straightforward path for our unique global franchise to deliver excellent long-term total returns to our shareholders, with lower-risk Investment Banking revenue driving our growth, a diversified sales, trading and research platform serving our clients, and the foundation of a strong alternative asset management business. Critically important,

our front-office effort is complemented by a solid and experienced Support team. It is impossible to estimate with clarity when our opportunity will fully normalize, but it always does, and we are ready! Given the Fed’s statement in December, it may even be sooner than we had expected.

Investing in Our Opportunity

As we have repeatedly said over many years, the strength of Jefferies’ culture allows us to identify the right new partners, convince them to join us and then integrate them into one unified Firm determined to best serve our clients. We have pursued our investment in talent on a global basis as we have expanded throughout Europe, Asia-Pacific, South America, Canada, and the Middle East, as well as in the United States. While our recruiting efforts have largely been in Investment Banking, we have also hired incremental talent in Equities, Fixed Income, Research, Alternative Asset Management and Support.

Specifically, over the last three years, we have added from other firms and through internal promotion 182 Investment Banking Managing Directors, bringing our total senior team to 344 MDs as of Dec 1, 2023 (and 364 today), which over the three years is up 61% overall, 48% in the Americas, 78% in Europe and the

| 2023 SHAREHOLDER LETTER | 2 | JEFFERIES |

Middle East, and 150% in Asia-Pacific.

Some examples of the “even newer and more improved” Jefferies include the 40 professionals in Equities, Research and Investment Banking arriving in our new offices in Canada; our newly hired 13-person “for profit” Municipal Healthcare Investment Banking team; the addition of 90 professionals to our Industrial and Energy Investment Banking team, including increasing our MD headcount in that major sector by 15% year-over-year; the addition of 4 MDs to our 34 MD-led Financial Sponsor team; the addition of a 25-person Private Fund Group focused on private capital fundraising; the expansion of our Investment Banking presence in Italy from 8 to 18 professionals; a similar expansion in Southeast Asia from 9 to 31 professionals; and the addition in 2023 of Investment Banking capability on the ground in Brazil, Israel, South Korea and the UAE. There may have been a slowdown in capital formation during these past two years, but there has been no resting at Jefferies.

As we said above, our confidence to make this large investment in additional talent is fueled by the reality of the competition we face. Our industry has been consolidating since 1975 (deregulation of equity commissions in the U.S.), spurred along further by the Fed’s unleashing the commercial banks onto Wall Street in 1996, as well as the aftermath of the 2008 bank crisis. In these last three years, this trend

and reality accelerated further into what could be the “endgame” in terms of our competitive environment.

There are only a few truly global and full-service competitors still standing, and several of them are showing signs of stress or de-prioritization in areas where we focus. We humbly marvel that we are among these scarce remaining players with global presence and all the hallmarks of a premier investment banking and capital markets firm, including the ability to advise clients strategically, to raise capital, to execute in the capital markets daily and to be informed by the capital markets in all we do. What does this mean for our future? We see our current moment as a generational opportunity to serve our clients, build an evermore durable firm and set the stage to win for decades to come.

Trough Results, Hopefully

We are hopeful that 2023’s results will represent a trough year and, as such, it wasn’t too bad. Our total net revenues of $4.7 billion and net income attributable to common shareholders of $263 million, or a 3.7% return on tangible equity, are an acceptable showing at the bottom of the cycle, even though they are far from our goals or long-term expectations.

“We see our current moment as a generational opportunity to serve our clients, build an evermore durable firm and set the stage to win for decades to come.”

| 2023 SHAREHOLDER LETTER | 3 | JEFFERIES |

2023 2.3B 1.6B 2019 Investment Banking net revenues Investment Banking net revenues 2.2B 1.5B Equities and Fixed Income net revenues Equities and Fixed Income net revenues Returning Capital to Shareholders Our Investment Banking net revenues were $2.3 billion, and our Equities and Fixed Income revenues were Returning capital to shareholders remains one of our $2.2 billion, while our Asset Management and Other overriding priorities. In 2023, we returned an aggregate net revenues totaled about $200 million. These results of $986 million to common shareholders in the form of pale in comparison to the heady period of 2020-21 $816 million in dividends (inclusive of the Vitesse spin-that represented the height of free money and strong off) and the repurchase of 5 million shares for a total of stimulus. We did remind everyone at the time that those $169 million, or $34.66 per share repurchased. results were unique and reflected that passing moment, We have returned $6 billion in total capital to rather than our new run rate. However, if you go back to shareholders over the last six years, representing over 2019, which is more indicative of the last “normal” year 78% of tangible book value at January 1, 2018. in our industry, our current results compare strongly 252 million fully diluted shares remain outstanding with Investment Banking net revenues of $1.6 billion in today versus 373 million six years ago. 2019 and Equities and Fixed Income net revenues of $1.5 billion. We are appreciative of our recent upgrade to BBB+ by Fitch and will constantly strive to improve in this Our goal (not guidance) is for our investments and important fundamental measure with the three major progress of the last several years to position us to ratings agencies. eventually achieve the level of results we achieved during the unique period of free money and strong With the ongoing wind down of our legacy merchant stimulus, but on a durable basis, without relying on banking portfolio, as well as our expectation of better excessive “froth” in the system. We have our work results over the next several years, we expect Jefferies cut out to achieve this, but that is the direction to continue to return capital to shareholders through and objective we are all driving toward. cash dividends and share repurchases.

It’s Been a Journey!

One of us joined Jefferies 34 years ago, the other a mere 22 years ago, and we have had a long journey together building a leading global investment banking and capital markets firm. Needless to say, there have been ups and downs and twists and turns. Along the way, we have heard competitors brag of things like being “bulge bracket” (today, an unambiguous anachronism) or an “elite independent boutique” (whatever that is independent of or elite to). People seem to always want to put labels on themselves that signify they are “in the club,” to the exclusion of others. None of that has ever made any sense to us. We prefer to be “in the club” of those constantly striving to be better at serving our clients. Let’s call it the “Clients First, Always” club. Maybe not as elite or catchy, but that is where we choose to live. Of the dozens and dozens of somewhat name brand firms (“bulge,” “major,” “regional,” “boutique”) with which we competed along the way, we never imagined the vast preponderance would no longer be with us or, in some cases, a fraction of what they once were. We will never allow the “arrogance of a label” or the “false prestige of an elite club” to distract us from our mission to build a firm that will make us all proud.

We have long believed that the essence of a great Wall Street firm is the culture of partnership and collaboration–nothing more, nothing less.

Our culture starts with our selecting the right people to join Jefferies. Intellect and capabilities matter, but we particularly emphasize finding people who are passionate and committed to what we do, aspire to succeed in the long term, are self-motivated, and value being the best. Integrity is never to be compromised. Our team sees their colleagues as collaborators and additive to their personal opportunity. Our own job is to support the team that does the heavy lifting, inspire them to be the best they can be and treat them fairly in all regards. We aren’t perfect and have, at one time or another, made every mistake in the book and then some, but we skip to work each day to further the success of Jefferies and every person who is part of Jefferies.

Becoming Truly Global

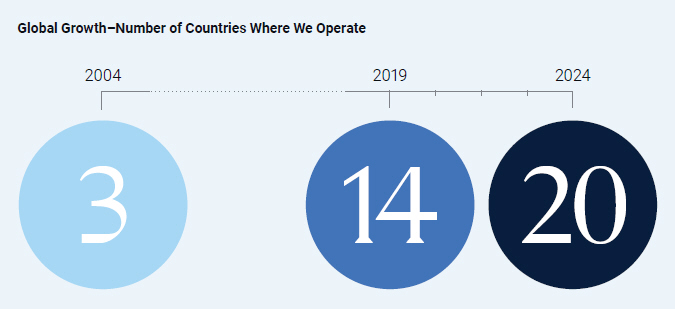

Jefferies began 61 years ago in Los Angeles as an equities broker serving institutions in a differentiated manner. From our historically American roots, we went from being a branch operator in a few countries 15-30 years ago, to being “global enough” with a presence in 14 countries four years ago, to a truly global presence today with operations across 44 offices in 20 countries. We are now present in all major developed economies, as well as the major emerging markets. Our coverage footprint runs throughout the Americas, Europe, the Middle East and Asia-Pacific.

| 2023 SHAREHOLDER LETTER | 5 | JEFFERIES |

“We believe that by attracting and retaining a purposeful team of people who want to do right by society, each of our stakeholders will be rewarded in the long term. If our team has purpose, Jefferies has purpose.”

As two kids from New Jersey (shout out to Bruce Springsteen, who is the hardest working rock star and driven to never disappoint his fans), we particularly marvel at our global reality and are proud that we feel the Jefferies vibe when we visit our offices thousands of miles from our home base. When we visit these offices, we see the very same Jefferies culture and passion that exist in our primary hubs in NYC, London and Hong Kong. It is magic seeing our local leadership around the globe embrace our core values, priorities and teamwork. They know how and are eager to leverage the entire Firm for our clients’ benefit, and this serves to bring the Jefferies capabilities to our clients around the globe as One Firm, Always.

Expanding Our Alliance With SMFG

In July 2021, we entered a Strategic Alliance with Sumitomo Mitsui Financial Group (SMFG) to collaborate on future corporate and investment banking business opportunities. At that time, SMFG provided us and our equity joint venture, Jefferies Finance, with $2.25 billion in long-term financing and purchased in

the open market approximately 4.5% of the issued and outstanding common shares of Jefferies. The initial focus of the Alliance was expanding our leveraged finance origination business, Japanese cross-border M&A, and testing the potential for a joint focus on investment grade companies.

In April 2023, Jefferies and SMFG announced the significant expansion of our Strategic Alliance to support the continued growth of SMFG and Jefferies’ global Commercial Banking and Investment Banking franchises. Included in that expansion is SMFG’s plan to increase its economic ownership in Jefferies to up to 15% on a fully diluted basis through open-market purchases, which will result in SMFG becoming Jefferies’ largest shareholder. SMFG presently holds a 9.1% equity interest in Jefferies on an outstanding share basis and 8.3% on an as-converted, fully diluted basis. Once the 10% threshold is reached, we will be pleased to welcome an SMFG nominee to our Board.

This significant expansion of the Alliance broadens the scope of our collaboration in both M&A advisory services and across the Firms’ Equities and Debt

| 2023 SHAREHOLDER LETTER | 6 | JEFFERIES |

Capital Markets businesses. The expanded Alliance also includes joint coverage of designated investment grade clients that already have banking relationships with SMFG and will also have dedicated Jefferies Investment Banking coverage. The goal of this important next step in our path together is to further coordinate Jefferies’ extensive sector and capital markets knowledge with SMFG’s deep banking and primary investment grade capital markets expertise.

Jefferies has already closed several deals that wouldn’t have happened without our relationship with SMFG, and many more are ahead. We expect this Alliance to produce meaningful, tangible results in 2024 and beyond.

On a very sad note, Jun Ohta, who served as President

and Group CEO of SMFG since April 1, 2019, and who was SMFG’s architect of our Alliance, passed away in late November at the age of 65. Ohta-san was a great leader with deep vision and courage, and a person with endless decency and kindness. We cherished our friendship with him and dedicate the ongoing success of our partnership with SMFG to his memory. Ohta-san was succeeded by his close colleague, Toru Nakashima. Nakashima-san was deeply involved in the discussions that led to our Alliance with SMFG and has stated his commitment to further continuing the vision established by Ohta-san. We look forward to continuing to build our relationship with Nakashima-san and to much success and growth together.

| 2023 SHAREHOLDER LETTER | 7 | JEFFERIES |

“It is magic seeing our local leadership around the globe embrace our core values, priorities and teamwork. They know how and are eager to leverage the entire Firm for our clients’ benefit and this serves to bring the Jefferies capabilities to our clients around the globe as One Firm, Always.”

Our Purpose

Our goal is to continue to build a premier and trusted global investment banking and capital markets firm by delivering outstanding insight, advice and execution to the best businesses and investors around the world. However, we believe a great firm must also have a broader societal purpose and stand for something important.

We are incredibly proud that the people of Jefferies consistently stand up and give back to society and especially to those less fortunate and in great need. Our firm leads with honesty, transparency and respect for all. When we give back, we do not do it after we assess the political winds or decide if there is something short term “in it” for Jefferies’ businesses. We believe that by attracting and retaining a purposeful team of people who want to do right by society, each of our stakeholders will be rewarded in the long term. If our team has purpose, Jefferies has purpose. And with that purpose we will create something very special for the long term, and the ultimate benefactors will be our clients, employees, shareholders and all other stakeholders.

And if it isn’t crystal clear at this point, while we have a keen sense of urgency at Jefferies, our priority will always be on the long term. We thank our clients, team, directors, shareholders and bondholders for all being aligned in this regard.

Annual Meeting and Investor Meeting

Thanks for hearing us out and for the support all of us at Jefferies feel from our shareholders and every other stakeholder. Our leadership at Jefferies has a solid, realistic grip on our competitive playing field and sees every challenge with honesty and respect. We are optimists at heart, yet realists with a keen sense of urgency.

Evidencing our complete alignment with our shareholders, the two of us, our Chairman, Joe Steinberg, our longstanding strategic partner, Mass Mutual, and our newest strategic partner, SMFG, together will own over 27% of Jefferies. When SMFG increases its stake to 15%, this collective ownership will approach 34%. We have all enthusiastically chosen to put our money where our mouths are because we believe in our team and our mission. We are committed and deeply motivated to serve every constituency to the very best of our abilities, and our priority is to deliver long-term value to you, our shareholders.

We look forward to answering any further questions you may have at our upcoming Annual Meeting on March 28, 2024. We will also hold our annual Jefferies Investor Meeting on October 17, 2024, at which time you will have the opportunity to hear from our senior leaders across the Jefferies platform. We thank all of you–our clients and customers, employee-partners, fellow shareholders, bondholders, vendors and all others associated with our businesses–for your continued partnership, trust and support.

Sincerely,

|

|

|

| Richard B. Handler | Brian P. Friedman | |

| Chief Executive Officer | President |

| 2023 SHAREHOLDER LETTER | 9 | JEFFERIES |

Now, for a further specific update on each of our businesses:

Investment Banking

As discussed above, 2023 presented us with a rare opportunity to meaningfully scale our Investment Banking team. With global investment banking fee pools at their lowest since 2012, idiosyncratic issues at several of our competitors presented us with the opportunity to add 68 new partners, many of whom have long held #1 market positions in their respective fields and have an average investment banking tenure of over 20 years.

The result of these investments is that Jefferies today stands among a small group of global, full-service investment banks that can offer our clients best-in-class sector expertise, scaled local country teams across every major economy, and differentiated capital markets underwriting and distribution–all delivered with our unique culture of immediacy and high-touch client service that our primary bank holding company competitors struggle to replicate. The expansion of our Strategic Alliance with SMFG in April further enhanced our distinct offering, with SMFG serving as a lender and long-term partner to many of our corporate and private equity clients.

As new partners who have joined us over the last few years (as well as our homegrown and promoted Managing Directors) settle in and their productivity matures, we expect to continue our long-standing track record of expanding our market share and growing our results. In 2023, we sustained the enhanced market position that we have earned in recent years, as Jefferies ranked 7th in Global M&A and ECM. Despite the strength of our market share and overall franchise, our absolute results declined, consistent with the ongoing contraction in global fee pools. Our ECM revenues of $560 million were broadly consistent with our results in 2022, in line with overall fee pools, and our advisory revenues of $1.2 billion declined by 33%, again consistent with broader market trends. Leveraged Finance revenues of $211 million were broadly flat versus 2022, while fee pools in the U.S. (our primarily addressable financing market) declined by 24%, reflecting the strength of our franchise as well as our long-standing, disciplined approach to underwriting and managing risk. While our aggregate $2.3 billion of Investment Banking revenues represented a 21% decline relative to 2022, our results nevertheless represented our third-best year ever, and an increase of 44% relative to $1.6 billion of investment banking revenues in 2019.

“2023 presented us with a rare opportunity to meaningfully scale our Investment Banking team, and we added 68 new partners, many of whom had long held #1 market positions in their respective fields and have an average investment banking tenure of over 20 years.”

| 2023 SHAREHOLDER LETTER | 10 | JEFFERIES |

Jefferies Finance

Jefferies Finance (JFIN), our 50/50 leveraged finance credit joint venture with Mass Mutual, faced a challenging operating environment in 2023, as the Leveraged Loan market was in the doldrums. Although arrangement fees are a pivotal performance driver, JFIN maintains a balanced and diverse revenue mix, also generating significant net interest margin and a growing base of asset management fees. As a result, income contribution from core operations reached nearly $100 million, allowing absorption of several non-cash charges that reduced net income to a level slightly below breakeven.

During 2023, JFIN made significant progress in growing its Asset Management business, having successfully closed several direct lending vehicles, including its first Business Development Company (BDC), which became operational last month. In total, JFIN now manages more than $17 billion of assets, comprising both proprietary and third-party capital, with a very strong pipeline to expand its geographic reach. Overall, JFIN is positioned for continued success and expects to grow market share in both the syndicated loan and private credit markets as it benefits from the competitive advantages it holds thanks to its affiliation with the Jefferies Investment Banking platform.

Berkadia

Berkadia, our commercial real estate finance and investment sales 50/50 joint venture with Berkshire Hathaway, generated $122 million of pretax income and $197 million of cash earnings for 2023. Following a robust period for multi-family transactions, fueled by low interest rates, rate hikes in 2022 and 2023 slowed debt origination and investment sales volume, while increasing Berkadia’s interest income. Net interest income increased 95% to $226 million, partially offsetting a 22% decline in total revenue to $1.0 billion.

Despite reduced originations, Berkadia’s loan-servicing portfolio grew to a new record $402 billion, up 3% from the prior year. The market for debt origination slowed from record levels resulting in Berkadia’s total debt volume declining by 47% to $21 billion. Debt origination volumes with Freddie Mac, Fannie Mae and HUD were $13.3 billion, down 29% from the prior year. Investment sales transactions also slowed from record levels as financing cost uncertainty created a valuation gap between buyers and sellers.

Berkadia’s investment sales volumes were $8.5 billion, down 70% from the prior year. Berkadia continues to build a leading servicing, mortgage banking and investment sales franchise that is well positioned to serve the multi-family market when financing and transaction activity return to normal levels.

| 2023 SHAREHOLDER LETTER | 11 | JEFFERIES |

“Jefferies is now among a select few leaders in global Equities and continues to gain market share across all regions in 2023.”

Capital Markets

Jefferies is now among a select few leaders in global Equities and continues to gain market share across all regions in 2023. Our net revenues of $1.1 billion were fueled by our core pillars of advisory and insight, driven by our equity and macro research, differentiated global distribution and cutting-edge execution capabilities. While encouraged by our results to date, we are enthusiastic about the opportunity available to us to expand revenues as we continue to build additional product capabilities.

Our Fixed Income revenues in 2023 increased 37% against 2022, the second-highest year since 2009. These results reflect the impact of the long-term investments we have made across our franchise, leading to consistent performance over the last five years, despite dramatic changes in market conditions over this period. The intense focus on our strategy over recent years has enabled us to grow into a more global and diversified Fixed Income business, which–together with our continued emphasis on risk, capital and balance sheet discipline–has led to greater durability of revenues and risk-adjusted returns. Our key strength lies in our dedicated focus on credit-related products that are directly aligned with our origination capabilities in Investment Banking. Our results were driven by strong revenues in these businesses both in the U.S. and EMEA, reflecting a disciplined execution of our client-driven strategy. Looking forward, we see further opportunities to expand our product offering globally and continue to grow our market share, with particular focus on our technology-enabled trading capabilities and alternative funding solutions.

Alternative Asset Management

Our Leucadia Asset Management effort continues to grow its overall fee base and increase its reach. 2023 was a particularly challenging fundraising environment, with many institutional investors experiencing losses across their equities, fixed income and privates portfolios in 2022, which had a carryover effect into 2023. Total assets under management of our affiliated managers slightly decreased from $29.8 billion to $28.5 billion (excluding Jefferies Credit Partners), a 4% decrease year-over-year mainly due to redemptions in external revenue sharing strategies. Our marketing team raised $2.3 billion, including capital raised for the Jefferies Finance and the launch of its BDC. Our participation in management fees increased 9% to $55 million, and we are well positioned for future growth. We have seen particular interest in private credit vehicles, such as Point Bonita and Jefferies Credit Partners (part of Jefferies Finance), and other managers with niche offerings. It has been a more challenging market for traditional hedge funds, particularly those in the multi-manager space, with fierce competition for talent. Overall, most of our affiliated managers performed well on a relative and absolute basis, which positions us well to maintain our history of growth.

| 2023 SHAREHOLDER LETTER | 12 | JEFFERIES |

“We thank all of you–our clients and customers, employee-partners, fellow shareholders, bondholders, vendors and all others associated with our businesses–for your continued partnership, trust and support.”

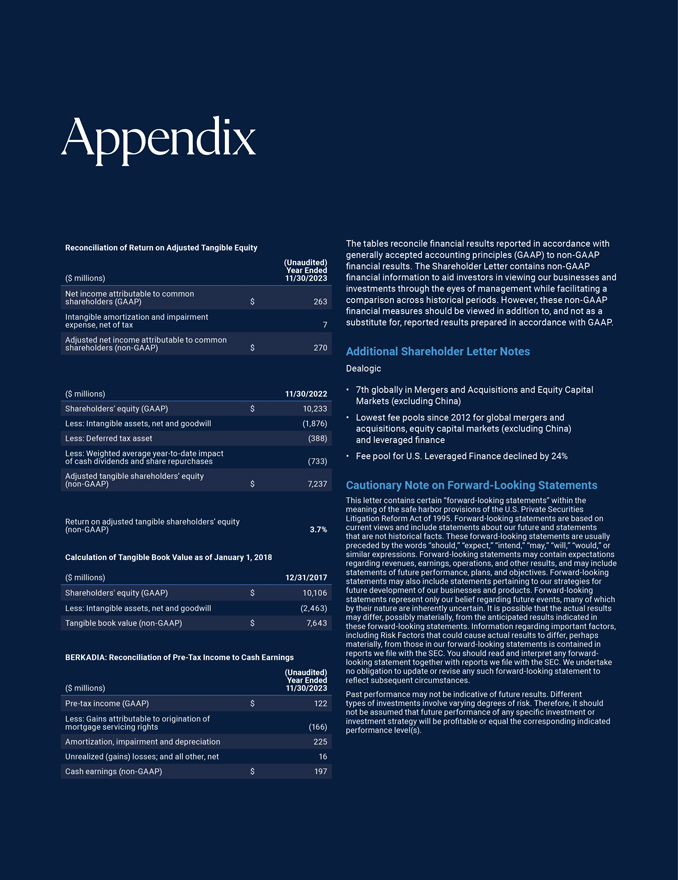

Appendix Reconciliation of Return on Adjusted Tangible Equity The tables reconcile financial results reported in accordance with generally accepted accounting principles (GAAP) to non-GAAP (Unaudited) Year Ended financial results. The Shareholder Letter contains non-GAAP ($ millions) 11/30/2023 financial information to aid investors in viewing our businesses and investments through the eyes of management while facilitating a Net income attributable to common shareholders (GAAP) $ 263 comparison across historical periods. However, these non-GAAP financial measures should be viewed in addition to, and not as a Intangible amortization and impairment expense, net of tax 7 substitute for, reported results prepared in accordance with GAAP. shareholders Adjusted net income (non-GAAP) attributable to common $ 270 Additional Shareholder Letter Notes Dealogic ($ millions) 11/30/2022 7th globally in Mergers and Acquisitions and Equity Capital Markets (excluding China) Shareholders’ equity (GAAP) $ 10,233 Lowest fee pools since 2012 for global mergers and Less: Intangible assets, net and goodwill (1,876) acquisitions, equity capital markets (excluding China) Less: Deferred tax asset (388) and leveraged finance Less: of cash Weighted dividends average and share year-to-date repurchases impact (733) Fee pool for U.S. Leveraged Finance declined by 24% Adjusted (non-GAAP) tangible shareholders’ equity $ 7,237 Cautionary Note on Forward-Looking Statements This letter contains certain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Return on adjusted tangible shareholders’ equity Litigation Reform Act of 1995. Forward-looking statements are based on (non-GAAP) 3.7% current views and include statements about our future and statements that are not historical facts. These forward-looking statements are usually preceded by the words “should,” “expect,” “intend,” “may,” “will,” “would,” or Calculation of Tangible Book Value as of January 1, 2018 similar expressions. Forward-looking statements may contain expectations regarding revenues, earnings, operations, and other results, and may include statements of future performance, plans, and objectives. Forward-looking ($ millions) 12/31/2017 statements may also include statements pertaining to our strategies for Shareholders’ equity (GAAP) $ 10,106 future development of our businesses and products. Forward-looking statements represent only our belief regarding future events, many of which Less: Intangible assets, net and goodwill (2,463) by their nature are inherently uncertain. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in Tangible book value (non-GAAP) $ 7,643 these forward-looking statements. Information regarding important factors, including Risk Factors that could cause actual results to differ, perhaps materially, from those in our forward-looking statements is contained in reports we file with the SEC. You should read and interpret any forward- BERKADIA: Reconciliation of Pre-Tax Income to Cash Earnings looking statement together with reports we file with the SEC. We undertake (Unaudited) no obligation to update or revise any such forward-looking statement to ($ millions) 11/30/2023 Year Ended reflect subsequent circumstances. Past performance may not be indicative of future results. Different Pre-tax income (GAAP) $ 122 types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or Less: mortgage Gains servicing attributable rights to origination of (166) investment strategy will be profitable or equal the corresponding indicated performance level(s). Amortization, impairment and depreciation 225 Unrealized (gains) losses; and all other, net 16 Cash earnings (non-GAAP) $ 197

Principal Executive Office Jefferies Financial Group Inc. 520 Madison Avenue New York, New York 10022 212.284.2300 jefferies.com Registrar and Transfer Agent Equiniti Trust Company, LLC 48 Wall Street, Floor 23 New York, NY 10005 800.937.5449 www.astfinancial.com helpAST@equiniti.com Independent Registered Public Accounting Firm Deloitte & Touche LLP 30 Rockefeller Plaza New York, New York 10112 Our common stock is listed on the New York Stock Exchange (NYSE: JEF)