| Title of each class: | Trading symbol: | Name of each exchange on which registered: | ||||||

| Class A subordinate voting shares | GIB | New York Stock Exchange |

||||||

| Fees billed and percentage | ||||||||||||||

| Service retained | 2023 | 2022 | ||||||||||||

| Audit fees | $7,990,697 | 86.44% | $7,708,142 | 76.30% | ||||||||||

Audit related fees(a) |

$515,298 | 5.58% | $942,671 | 9.33% | ||||||||||

Tax fees(b) |

$714,545 | 7.73% | $1,394,072 | 13.80% | ||||||||||

All other fees(c) |

$23,325 | 0.25% | $57,158 | 0.57% | ||||||||||

| Total fees billed | $9,243,865 | 100% | $10,102,043 | 100% | ||||||||||

| 97.0 | Incentive Compensation Clawback Policy | ||||||||||

| 99.1 | Annual Information Form for the fiscal year ended September 30, 2023 | ||||||||||

| 99.2 |

Audited Annual Consolidated Financial Statements for the fiscal years ended September 30, 2023

and September 30, 2022

|

||||||||||

| 99.3 | Management’s Discussion and Analysis of Financial Position and Results of Operations for the fiscal years ended September 30, 2023 and September 30, 2022 | ||||||||||

| 99.4 | Certification of the Registrant’s Chief Executive Officer required pursuant to Rule 13a-14(a) | ||||||||||

| 99.5 | Certification of the Registrant’s Chief Financial Officer required pursuant to Rule 13a-14(a) | ||||||||||

| 99.6 | Certification of the Registrant’s Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | ||||||||||

| 99.7 | Certification of the Registrant’s Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | ||||||||||

| 99.8 | Consent of PricewaterhouseCoopers LLP | ||||||||||

| 101.0 | Interactive Data File (formatted as Inline XBRL) | ||||||||||

| 104.0 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101.0) | ||||||||||

| CGI Inc. | |||||||||||

| Date: December 15, 2023 | |||||||||||

| By: | /s/ Benoit Dubé | ||||||||||

| Name: | Benoit Dubé | ||||||||||

| Title: |

Executive Vice-President,

Legal and Economic Affairs, and Corporate Secretary

|

||||||||||

Exhibit 97.0

CGI INC.

INCENTIVE COMPENSATION CLAWBACK POLICY

| 1. | Purpose |

This incentive compensation clawback policy (the “Policy”) has been adopted by the Board of Directors (the “Board”) of CGI Inc. (the “Company”) in order to allow the Board to require, in specific situations, the reimbursement of short-term or long-term incentive compensation received by a Covered Leader (as defined below).

| 2. | Definitions |

For purposes of this Policy, the following terms shall have the meanings set forth below:

“Applicability Date” shall have the meaning ascribed thereto in Section 7.

“Board” shall have the meaning ascribed thereto in Section 1.

“Company” shall have the meaning ascribed thereto in Section 1.

“Covered Leaders” means the Company’s current or former Chief Executive Officer, President, Chief Financial Officer, Controller, any Vice-President of the Company in charge of a principal business unit, division or function, and any other current or former officer or person who performs a significant policy-making function for the Company, including executive officers of Company subsidiaries who perform such policy-making function, and any other individual designated from time to time by the Board as a “Covered Leader” for the purposes of this Policy;

“Financial Reporting Measure” means any measure that is determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements (including non-GAAP financial measures), and any measure that is derived wholly or in part from such measure;

“Incentive Compensation” means any compensation under the Company’s short-term and long-term incentive plans, including bonuses under the Profit Participation Plan, grants under the Share Option Plan for Employees, Officers and Directors of CGI Inc. and its Subsidiaries, awards under the Performance Share Unit Plan for Designated Participants of CGI Inc., the Performance Share Unit Plan for Designated Leaders of CGI Inc. and its Subsidiaries, and any other compensation that is paid, granted, received, earned or vested from time to time, based wholly or in part upon the attainment of a Financial Reporting Measure;

“Policy” shall have the meaning ascribed thereto in Section 1.

“Restatement” means an accounting restatement of the Company’s financial statements resulting from any material non-compliance with any financial reporting requirements under applicable securities laws (other than the retrospective application of a change or amendment in accounting principles), including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period;

- 2 -

“Restatement Date” means the earlier to occur of (i) the date the Board, a committee of the Board or the officer or officers of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare a Restatement, or (ii) the date a court, regulator or other legally authorized body directs the Company to prepare a Restatement; and

“Rule 10D-1 Clawback Requirements” shall have the meaning ascribed thereto in Section 4.

“Sarbanes-Oxley Clawback Requirements” shall have the meaning ascribed thereto in Section 8.

“Wrongful Act” means any gross negligence, intentional misconduct, theft, embezzlement, fraud or other serious misconduct.

| 3. | Covered Leader; Incentive Compensation |

This Policy applies to Incentive Compensation received by a Covered Leader on or after the Applicability Date (a) after beginning services as a Covered Leader; (b) if that person served as a Covered Leader at any time during the performance period for such Incentive Compensation; and (c) while the Company had a listed class of securities on a recognized securities exchange. For purposes of this Policy, Incentive Compensation is deemed “received” in the Company’s fiscal period during which the financial reporting measure specified in the Incentive Compensation award is attained, even if the payment, grant, earning or vesting of the incentive-based compensation occurs after that period.

| 4. | Recoupment of Incentive Compensation |

In the event of (i) a Restatement (whether or not a Covered Leader has engaged in a Wrongful Act) or (ii) if the Covered Leader has been involved in any Wrongful Act, the Board will review all Incentive Compensation paid or granted to, received or earned by, or vested in favour of, Covered Leaders on the basis of having attained any Financial Reporting Measure during the period covered by the Restatement or Wrongful Act.

The Company shall promptly recoup any Incentive Compensation paid or granted to, received or earned by, or vested in favour of, any current or former Covered Leader, if and to the extent that the Company determines that the Covered Leader would not have been entitled, in whole or in part, to the Incentive Compensation if (i) a Restatement had not been required; or (ii) if the Covered Leader committed or was involved in a Wrongful Act that resulted, or that was a significant contributing factor to, the Covered Leader becoming entitled to all or part of such Incentive Compensation.

- 3 -

In the case of a Restatement, the amount of Incentive Compensation to be recouped under this Policy, as determined by the Board, is the amount of Incentive Compensation received by the Covered Leader that exceeds the amount of Incentive Compensation that would have been received by the Covered Leader had it been determined based on the restated amounts.

Any amounts recouped shall be calculated by the Board in accordance with the Rule 10D-1 Clawback Requirements (as defined below) and without regard to any taxes paid by the Covered Leader in respect of the erroneously awarded Incentive Compensation. The Company is authorized and directed pursuant to this Policy to recoup Incentive Compensation in compliance with this Policy unless an independent committee of the Board (or the independent members of the Board) has determined that recovery would be impracticable solely for the following limited reasons to the extent permitted by the New York Stock Exchange listing requirements (the “Rule 10D-1 Clawback Requirements”), and subject to the procedural and disclosure requirements set forth therein:

| ● | the direct costs of enforcing recovery would exceed the recoverable amount; or |

| ● | recovery would violate laws applicable in Canada. |

| 5. | Limitation on Recoupment Period |

Any recoupment under Section 4 of this Policy shall be in respect of Incentive Compensation received by any current or former Covered Leader during the three financial years immediately preceding the Restatement Date and shall be calculated in accordance with Section 4 above.

| 6. | Sources of Recoupment |

The Board shall determine, in its sole discretion, the timing and method of any recoupment under Section 4 of this Policy, which may be made from any of the following sources: (a) direct reimbursement from the Covered Leader, (b) deduction from salary, wages and/or future payments, grants or awards of Incentive Compensation to the Covered Leader, or (c) cancellation or forfeiture of vested or unvested share options, performance share units or any other share-based or option-based incentive awards held by the Covered Leader.

| 7. | Effective Date |

This Policy shall be effective as of November 7, 2023, the date on which it was approved by the Board of Directors. The terms of this Policy shall apply to any Incentive Compensation that is received by Covered Leaders on or after October 2, 2023 (the “Applicability Date”), even if such Incentive Compensation was approved, awarded, paid or granted to, earned by, or vested in favour of, Covered Leaders prior to the Applicability Date. This Policy and all determinations hereunder shall be interpreted and applied so as to comply with the Rule 10D-1 Clawback Requirements in addition to any other applicable laws.

- 4 -

| 8. | Additional Clawback Required by Section 304 of the Sarbanes-Oxley Act of 2002 |

In addition to the provisions described above, if the Company is required to prepare a Restatement, as a result of misconduct, with any financial reporting requirement under the securities laws, then, in accordance with Section 304 of the Sarbanes-Oxley Act of 2002, the Chief Executive Officer and Chief Financial Officer (at the time the financial document embodying such financial reporting requirement was originally issued) shall reimburse the Company for:

| ● | Any profit participation (or bonus) or other incentive-based or equity-based compensation received from the Company during the 12-month period following the first public issuance or filing with the Commission (whichever first occurs) of such financial document; and |

| ● | any capital gains realized from the sale of securities of the Company during that 12-month period. |

To the extent that the Rule 10D-1 Clawback Requirements would provide for recovery of incentive-based compensation recoverable by the Company pursuant to Section 304 of the Sarbanes-Oxley Act, in accordance with Section 8 of this policy (the “Sarbanes-Oxley Clawback Requirements”), and/or any other recovery obligations (including pursuant to employment agreements, or plan awards), the amount an applicable executive officer has already reimbursed the Company shall be credited to the required recovery under the Rule 10D-1 Clawback Requirements. Recovery pursuant to the Rule 10D-1 Clawback Requirements does not preclude recovery under the Sarbanes-Oxley Clawback Requirements, to the extent any applicable amounts have not been reimbursed to the Company.

| 9. | Board Authority |

Unless expressly stated in this Policy, all determinations, decisions and interpretations to be made under this Policy shall be made by the Board. Any determination, decision or interpretation made by the Board under this Policy shall be final, binding and conclusive on all parties. This Policy may be amended or terminated at any time by the Board.

| 10. | No Indemnification of Covered Leaders |

Notwithstanding the terms of any indemnification or insurance policy or any contractual arrangement with any Covered Leader that may be interpreted to the contrary, the Company shall not indemnify any Covered Leaders against any losses resulting from the erroneous payment, grant or award of Incentive Compensation to or received or earned by, or vested in favour of, any former or current Covered Leader, including any payment or reimbursement for the cost of third-party insurance purchased by the Covered Leaders to fund potential recoupment obligations under this Policy.

- 5 -

| 11. | No Impairment of Other Remedies |

This Policy does not preclude the Company from taking any other action to enforce a Covered Leader’s obligations to the Company, including termination of employment or institution of any proceedings.

| 12. | Successors |

This Policy shall be binding and enforceable against all Covered Leaders and their beneficiaries, heirs, executors, administrators, or other legal representatives.

Exhibit 99.1

Annual Information Form For the fiscal year ended September 30, 2023 December 4, 2023

| Table of Contents |

|

| CORPORATE STRUCTURE |

1 | |||

| INCORPORATION AND REGISTERED OFFICE |

1 | |||

| SUBSIDIARIES |

1 | |||

| CAPITAL STRUCTURE |

1 | |||

| Stock Splits |

1 | |||

| MARKET FOR SECURITIES, TRADING PRICE AND VOLUME |

2 | |||

| Normal Course Issuer Bid and Share Purchases for Cancellation |

2 | |||

| Credit Ratings |

2 | |||

| CORPORATE GOVERNANCE |

3 | |||

| BOARD AND STANDING COMMITTEE CHARTERS AND CODES OF ETHICS |

3 | |||

| AUDIT COMMITTEE INFORMATION |

3 | |||

| DIRECTORS AND OFFICERS |

3 | |||

| Directors |

3 | |||

| Executive Committee and Executive Officers |

3 | |||

| Ownership of Securities on the Part of Directors and Officers |

4 | |||

| DESCRIPTION OF CGI’S BUSINESS |

5 | |||

| MISSION, VISION AND STRATEGY |

5 | |||

| BUSINESS STRUCTURE |

6 | |||

| Services Offered by CGI |

7 | |||

| Markets for CGI’s Services |

8 | |||

| Intangible Properties |

8 | |||

| Human Resources |

8 | |||

| Specialized Skills and Knowledge |

8 | |||

| CGI Offices and Proximity and Global Delivery Models |

8 | |||

| Commercial Alliances |

9 | |||

| Quality Processes |

10 | |||

| THE IT SERVICES INDUSTRY |

10 | |||

| Trends and Outlook |

10 | |||

| COMPETITIVE ENVIRONMENT |

11 | |||

| SIGNIFICANT DEVELOPMENTS OF THE THREE MOST RECENT FISCAL YEARS |

11 | |||

| Key Performance Measures |

11 | |||

| Fiscal Year ended September 30, 2023 |

13 | |||

| Fiscal Year ended September 30, 2022 |

14 | |||

| Fiscal Year ended September 30, 2021 |

15 | |||

| FORWARD LOOKING INFORMATION AND RISKS AND UNCERTAINTIES |

17 | |||

| LEGAL PROCEEDINGS |

17 | |||

| TRANSFER AGENT AND REGISTRAR |

18 | |||

| INTERESTS OF EXPERTS |

18 | |||

| FEES OF THE EXTERNAL AUDITOR |

18 | |||

| ADDITIONAL INFORMATION |

18 | |||

| APPENDIX A |

19 | |||

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM i |

This Annual Information Form is dated December 4, 2023, and, unless specifically stated otherwise, all information disclosed in this form, is provided as at September 30, 2023, the end of CGI’s most recently completed fiscal year. All dollar amounts are in Canadian dollars, unless otherwise stated.

Corporate Structure

Incorporation and Registered Office

CGI Inc. (the “Company”, “CGI”, “we”, “us” or “our”) was incorporated on September 29, 1981, under Part IA of the Companies Act (Quebec), predecessor to the Business Corporations Act (Quebec), which came into force on February 14, 2011, and which now governs the Company. The Company continued the activities of Conseillers en gestion et informatique CGI Inc., which was originally founded in 1976. The executive and registered offices of the Company are located at 1350 René-Lévesque Boulevard West, 25th Floor, Montréal, Quebec, Canada, H3G 1T4. CGI became a public company on December 17, 1986, upon completing an initial public offering of its Class A subordinate voting shares (“Class A Shares”).

Subsidiaries

The activities of the Company are conducted either directly or through subsidiaries. The table below lists the principal subsidiaries of the Company as at September 30, 2023, each of which is directly or indirectly wholly-owned by the Company. The Company has other subsidiaries that have not been included in the table since they represented, individually, 10% or less of our consolidated assets or consolidated revenue as at September 30, 2023(a), and, in the aggregate, 20% or less of our consolidated assets or consolidated revenue as at September 30, 2023. This table also omits subsidiaries whose primary role is to hold investments in other CGI subsidiaries.

| Name of Subsidiary | Country of Incorporation | |

| Conseillers en gestion et informatique CGI Inc. |

Canada | |

| CGI Information Systems and Management Consultants Inc. |

Canada | |

| CGI Payroll Services Centre Inc. |

Canada | |

| CGI Technologies and Solutions Inc. |

United States | |

| CGI Federal Inc. |

United States | |

| CGI Suomi Oy |

Finland | |

| CGI Sverige AB |

Sweden | |

| CGI Nederland B.V. |

Netherlands | |

| CGI IT UK Limited |

United Kingdom | |

| CGI France SAS |

France | |

| CGI Deutschland B.V. & Co. KG |

Germany | |

Capital Structure

The Company’s authorized share capital consists of an unlimited number of Class A Shares carrying one vote per share and an unlimited number of Class B shares (multiple voting) (“Class B Shares”) carrying 10 votes per share, all without par value, of which, as of December 4, 2023, 206,144,671 Class A Shares and 26,445,706 Class B Shares, were issued and outstanding. These shares represent respectively 43.80% and 56.20% of the aggregate voting rights attached to the outstanding Class A Shares and Class B Shares. Two classes of preferred shares also form part of CGI’s authorized capital: an unlimited number of First Preferred Shares, issuable in series, and an unlimited number of Second Preferred Shares, also issuable in series. As of December 4, 2023, there were no preferred shares outstanding.

The Company incorporates by reference the disclosure contained under the headings Class A Subordinate Voting Shares and Class B Shares on page 5, and First Preferred Shares and Second Preferred Shares on page 6 of CGI’s Management Proxy Circular (“Circular”) dated December 4, 2023, which was filed with Canadian securities regulators and which is available at www.sedarplus.ca and on CGI’s website at www.cgi.com.

Stock Splits

As of December 4, 2023, the Company had proceeded with four subdivisions of its issued and outstanding Class A Shares as follows:

| • | August 12, 1997, on a two for one basis; |

| • | December 15, 1997, on a two for one basis; |

| • | May 21, 1998, on a two for one basis; and |

| • | January 7, 2000, on a two for one basis. |

| (a) | Based on the Company’s Annual Audited Consolidated Financial Statements for the fiscal years ended September 30, 2023 and 2022, filed with Canadian securities regulators and available at www.sedarplus.ca and on CGI’s website at www.cgi.com. |

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 1 |

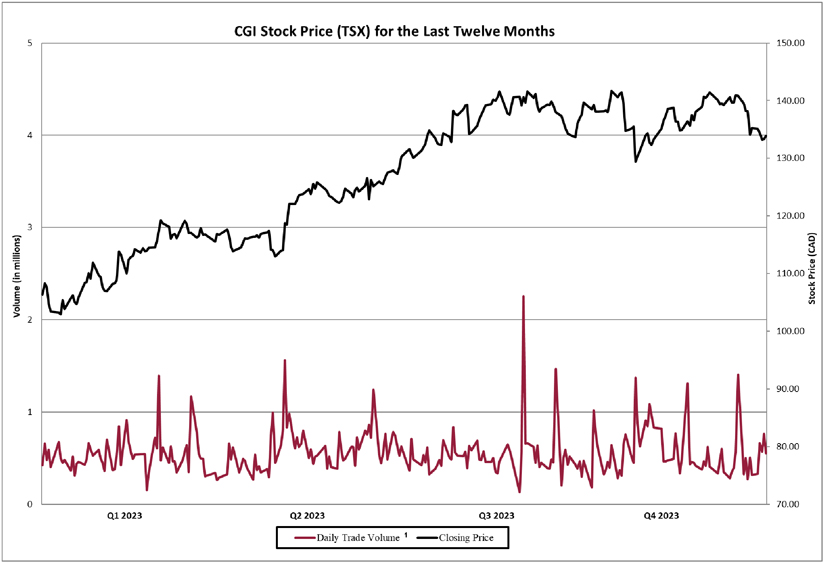

Market for Securities, Trading Price and Volume

The Class A Shares are listed for trading on the Toronto Stock Exchange (the “TSX”) under the symbol GIB.A and on the New York Stock Exchange under the symbol GIB. A total of 88,944,954 Class A Shares were traded on the TSX during the fiscal year ended September 30, 2023, as follows:

| Month |

High(a) ($) |

Low(a) ($) |

Volume | |||

| October 2022 |

112.00 | 100.74 | 5,951,666 | |||

| November 2022 |

117.47 | 105.88 | 8,362,241 | |||

| December 2022 |

120.82 | 115.16 | 6,836,410 | |||

| January 2023 |

118.82 | 112.32 | 6,037,808 | |||

| February 2023 |

125.96 | 115.05 | 7,965,411 | |||

| March 2023 |

130.75 | 122.01 | 9,827,104 | |||

| April 2023 |

138.60 | 128.78 | 6,245,310 | |||

| May 2023 |

142.31 | 134.07 | 7,834,133 | |||

| June 2023 |

141.69 | 133.10 | 7,010,397 | |||

| July 2023 |

142.07 | 127.73 | 7,054,164 | |||

| August 2023 |

141.94 | 130.74 | 9,003,813 | |||

| September 2023 |

142.23 | 131.65 | 6,816,497 | |||

| (a) | The high and low prices reflect the highest and lowest prices at which a board lot trade was executed in a trading session during the month. |

Normal Course Issuer Bid and Share Purchases for Cancellation

On January 31, 2023, CGI announced that it was renewing its normal course issuer bid (“NCIB”) to purchase for cancellation up to 10% of the Company’s public float of its issued and outstanding Class A Shares during the NCIB term that commenced on February 6, 2023, and will expire on February 5, 2024, at the latest. On February 27, 2023, the Company completed a private share purchase, which is considered within the annual aggregate limit that the Company is entitled to purchase under the NCIB. See Description of CGI’s Business – Significant developments of the Three Most Recent Fiscal Years – Fiscal Year ended September 30, 2023– Normal Course Issuer Bid later in this Annual Information Form.

Credit Ratings

Credit ratings are a way to assess the quality of a company’s credit and financial capacity. They are not a comment on the market price of a security or its suitability for an individual investor and are not recommendations to buy, hold or sell our securities. Credit ratings may be revised or withdrawn at any time by the assigning rating agency. Ratings are determined by the rating agencies based on criteria established from time to time by them, and they do not comment on market price or suitability for a particular investor. Each credit rating should be evaluated independently of any other credit rating.

Credit ratings are subject to change, based on a number of factors including, but not limited to, our financial strength, competitive position, liquidity and other factors that are not completely within our control. A ratings downgrade could result in adverse consequences for our funding capacity or our ability to access the capital markets.

Credit rating agencies provide a range of services, including one-time ratings when the debt is issued, annual monitoring, and updates to ratings, among other things. In fiscal 2021, we paid Moody’s Investors Service, Inc. (Moody’s) and Standard & Poor’s (S&P) for the issuance of a long-term issuer credit rating, credit monitoring, and rating fees for the issuance of our senior unsecured notes described under Significant developments of the Three Most Recent Fiscal Years – Fiscal Year ended September 30, 2021 – Senior Unsecured Notes later in this Annual Information Form. In fiscal 2023, we paid Moody’s and S&P for annual credit monitoring.

Moody’s rates both our corporate credit and our senior unsecured notes. Their issuer ratings are forward-looking opinions of the ability of entities to honour senior unsecured financial obligations and contracts.

Moody’s long-term debt ratings are forward-looking opinions of relative credit risk of fixed income obligations with an original maturity of eleven months or more. These ratings address the possibility that a financial obligation will not be honoured as promised. Such ratings reflect both the likelihood of default and any financial loss suffered in the event of default.

S&P rates both our corporate credit and our senior unsecured notes. Their corporate credit rating is a forward-looking opinion of our overall financial capacity to pay our financial obligations. It focuses on our capacity and willingness to meet our financial commitments when they are due. It does not apply to any specific financial obligation or credit facility, as it does not take into account the nature of and provisions of the obligation, its standing in bankruptcy or liquidation, statutory preferences or the legality and enforceability of the obligation.

S&P’s senior unsecured note rating is a forward-looking opinion of our creditworthiness for a specific financial obligation, class of financial obligations or financial program. It considers the creditworthiness of guarantors, insurers or other forms of credit enhancement on the obligation and the currency of the obligation and may assess terms – like collateral security and subordination – that could affect ultimate payment in the event of a default. See Significant developments of the Three Most

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 2 |

Recent Fiscal Years – Fiscal Year ended September 30, 2021 – Senior Unsecured Notes later in this Annual Information Form.

The table below shows our long-term issuer credit ratings and the credit ratings assigned to our senior unsecured notes.

| Rating Agency |

Long-Term Issuer Credit Ratings 1,2 |

Senior Unsecured Notes 1,2

|

Credit Rating Description and Rank | |||

| Moody’s | Baa1

(stable outlook) |

Baa1 | Long-term debt rating scale ranges from Aaa to C. Numerical modifiers 1, 2, and 3 rank the investment within its generic category. An outlook of positive, negative, stable or developing ranks the potential direction of the rating over the medium term.

Baa is the eighth highest of 21 ratings. It means the investment is judged to be medium-grade and subject to moderate credit risk, and as such may possess certain speculative characteristics. A “1” modifier means that the investment is in the higher end of its generic category. |

|||

| S&P | BBB+

(stable outlook) |

BBB+ | Long-term debt rating scale ranges from AAA to D. Some ratings may be modified by a plus (+) or minus (-) sign to show relative standing within the major rating categories. An outlook of positive, stable, developing, or negative ranks the potential direction of the rating in the intermediate term, generally up to two years for investment grade.

BBB+ is the eighth highest of 22 ratings. It means that it exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to weaken the issuer’s capacity to meet its financial commitments on the obligation. |

|||

| 1 | As at September 30, 2023. |

| 2 | These credit ratings are not recommendations to buy, sell or hold any of the securities referred to, and they may be revised or withdrawn at any time by the assigning rating agency. Ratings are determined by the rating agencies based on criteria established from time to time by them, and they do not comment on market price or suitability for a particular investor. |

Corporate Governance

Board and Standing Committee Charters and Codes of Ethics

CGI’s Codes of Ethics, including its Code of Ethics and Business Conduct (which incorporates the CGI Anti-Corruption Policy) and its Executive Code of Conduct, the charter of the Board of Directors and the charters of the standing committees of the Board of Directors, including the charter of the Audit and Risk Management Committee, are annexed as Appendix A to this Annual Information Form.

Audit Committee Information

The Company incorporates by reference the disclosure contained under the heading Expertise and Financial and Operational Literacy on pages 43 and 44, and the disclosure contained under the heading Report of the Audit and Risk Management Committee, on pages 51 and following of CGI’s Circular dated December 4, 2023.

Directors and Officers

Directors

The Company incorporates by reference the disclosure under the heading Nominees for Election as Directors relating to the Company’s directors contained on pages 9 to 17, and the table on the Board of Directors committee membership on page 40 and 41 of CGI’s Circular dated December 4, 2023.

Executive Committee and Executive Officers

The following table states the names of CGI’s executive officers, their place of residence, their principal occupation within the Company as of December 4, 2023, and, where required, any other previously held positions in the last five years with the Company or one of its direct or indirect subsidiaries, or outside of the Company:

| Name and Residence | Principal Occupation with the Company |

Previously held position (last five years) |

||

| Rakesh V. Aerath Bangalore, Karnataka, India |

President, Asia Pacific Global Delivery Centers of Excellence | • Senior Vice-President and Chief Operating Officer for the Asia Pacific Global Delivery Centers of Excellence • Senior Vice-President and Business Unit Lead for Asia Pacific Financial Services Delivery Center |

||

| Jean-Michel Baticle Précy-sur-Oise, Oise, France |

President and Chief Operating Officer, and President, Western and Southern Europe | • President and Chief Operating Officer • President, Western and Southern Europe Operations • President, France, Luxembourg and Morocco Operations |

||

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 3 |

| Name and Residence | Principal Occupation with the Company |

Previously held position (last five years) |

||

| François Boulanger Westmount, Quebec, Canada |

President and Chief Operating Officer | • Executive Vice-President and Chief Financial Officer |

||

| Mark Boyajian Nashville, Tennessee, United States |

Executive Vice-President and Chief Business Engineering Officer |

• President, Canada Operations |

||

| Caroline de Grandmaison Rueil-Malmaison, France |

President, France and Luxembourg | • Senior Vice-President, WSE Paris Energy and Utilities, Communication, Retail and Manufacturing • Senior Vice-President, WSE Paris Retail, Manufacturing and Strasbourg |

||

| Dirk A. de Groot Voorschoten, Netherlands |

President, Northwest and Central-East Europe | • Senior Vice-President, Netherlands |

||

| Benoit Dubé |

Executive Vice-President, Legal and Economic Affairs, and Corporate Secretary |

– | ||

| Julie Godin Westmount, Quebec, Canada |

Co-Chair of the Board, Executive Vice-President, Strategic Planning and Corporate Development |

• Vice-Chair of the Board, |

||

| Serge Godin |

Founder and Executive Chairman of the Board | – | ||

| David L. Henderson |

President, Intelligent Solutions and Innovation | • President, Global IP Solutions • President, United States Operations, Commercial and State Government |

||

| Timothy J. Hurlebaus |

President, United States Operations, Commercial and State Government |

• President, United States Operations, Federal |

||

| André Imbeau(a) Beloeil, Quebec, Canada |

Founder and Advisor to the Executive Chairman of the Board |

– | ||

| Bernard Labelle Quebec City, Quebec, Canada |

Executive Vice-President and Chief Human Resources Officer |

• Senior Vice-President, Global Human Resources and Leadership Institute |

||

| Leena-Mari Lähteenmaa Helsinki, Uusimaa, Finland |

President, Finland, Poland and Baltics | • Senior Vice-President, Finland |

||

| Kevin M. Linder Burlington, Ontario, Canada |

Senior Vice-President, Investor Relations | • Senior Vice-President, Finance and Treasury, and Head of Investor Relations • Senior Vice-President, Finance and Treasury • Senior Vice-President and Corporate Controller |

||

| Tara McGeehan Flintham Newark, Nottinghamshire, United Kingdom |

President, United Kingdom and Australia | • President, United Kingdom Operations |

||

| Steve Perron Sainte-Julie, Quebec, Canada |

Executive Vice-President and Chief Financial Officer |

• Senior Vice-President and Corporate Controller • Senior Vice-President, Finance and Treasury |

||

| George D. Schindler |

President and Chief Executive Officer | – | ||

| Torsten Strass Wiesbaden, Hesse, Germany |

President, Scandinavia and Central Europe | • President, Central and Eastern Europe Operations |

||

| Guy Vigeant Deux-Montagnes, Quebec, Canada |

President, Canada Operations | • Senior Vice-President, Mergers and Acquisitions |

||

| (a) | Mr. Imbeau is a director and officer of the Company, and holds an interest in the Class B Shares. |

CGI’s global strategy is overseen by a management committee (“Executive Committee”) comprised of the Company’s executive officers and certain other key functional employees. The Executive Committee meets at least six times a year and is responsible for enterprise-wide strategy as well as all enterprise policies and operations oversight.

Ownership of Securities on the Part of Directors and Officers

The Company incorporates by reference the disclosure under the heading Principal Holders of Class A Subordinate Voting Shares and Class B Shares on page 7 of CGI’s Circular dated December 4, 2023. As of each of September 30, 2023, and December 4, 2023, the Company and its related subsidiaries are controlled by Mr. Serge Godin, the Founder and Executive Chairman of the Board.

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 4 |

Description of CGI’s Business

Mission, Vision and Strategy

The mission of CGI is to help its clients succeed through outstanding quality, competence and objectivity, providing thought leadership and delivering the best services and solutions to fully satisfy client objectives in information technology (“IT”), business processes, and management. In all we do, we are guided by our dream and living by our values to foster trusted relationships and meet our commitments now and in the future.

CGI is unique compared to most companies, as our vision is based on a dream: “To create an environment in which we enjoy working together and, as owners, contribute to building a company we can be proud of.” This dream has motivated us since our founding in 1976 and drives our vision: “To be a global, world-class end-to-end IT and business consulting services leader helping our clients succeed.”

In pursuing our dream and vision, CGI has been highly disciplined throughout its history in executing a Build and Buy profitable growth strategy comprised of four pillars that combine profitable organic growth (Build) and accretive acquisitions (Buy):

| • | Pillar 1: Win, renew and extend contracts |

| • | Pillar 2: New large managed IT and business process services contracts |

These first two pillars relate to driving profitable organic growth through the pursuit of contracts with new and existing clients in our targeted industries. As such, CGI engages with new and existing clients on four levers in our portfolio of end-to-end services and solutions: Business and Strategic IT Consulting, Systems Integration, Managed Services and IP-based services. Successes in these pillars reflect the strength of our end-to-end portfolio of capabilities, the depth of expertise of our consultants in business and IT, client satisfaction in our delivery excellence, and the appreciation of the proximity model by our clients, both existing and potential.

| • | Pillar 3: Metro market acquisitions |

| • | Pillar 4: Large, transformational acquisitions |

The third and fourth pillars focus on growth through accretive acquisitions. The third pillar for metro market acquisitions complements the proximity model and helps to provide a fuller range of end-to-end services. The fourth pillar for large transformational acquisitions helps to further expand our geographic footprint and reach the critical mass required to compete for large managed IT and business process services contracts and broaden our client relationships. Both the third and fourth pillars are supported by three levers. First, is our range of end-to-end services that allow us to consider a broad range of acquisitions. A second lever is CGI’s industry sector mix that helps us mirror the IT spend of each metro market over time. A final lever across pillars three and four focuses on IP-based services firms that offer consulting services and managed services that leverage their solutions.

CGI will continue to be a consolidator in the IT and business consulting services industry by being active across these four pillars.

Executing Our Strategy

CGI’s strategy is executed through a business model that combines client proximity with an extensive global delivery network to deliver the following benefits:

| • | Local relationships and accountability: We live and work near our clients to provide a high level of responsiveness, partnership, and innovation. Our local consultants and professionals speak our clients’ language, understand their business and industries, and collaborate to meet their goals and advance their business. |

| • | Global reach: Our local presence is complemented by an expansive global delivery network that is designed to ensure our clients have 24/7 access to best-fit digital capabilities and resources to meet their end-to-end needs. In addition, clients benefit from our unique combination of industry domain and technology expertise within our global delivery model. |

| • | Committed experts: One of our key strategic goals is to be our clients’ partner and expert of choice. To achieve this, we invest in developing and recruiting professionals with extensive industry, business and in-demand technology expertise. Individually and collectively, our experts embody partnership behaviors in all they do by being consultative and building trusted relationships with each other, our clients, shareholders, and within our communities. In addition, most of our consultants and professionals are also owners under our Share Purchase Plan, which, combined with the Profit Participation Plan, provide an added level of commitment to the success of our clients. |

| • | Everyday innovation: Our approach to client engagements is to continuously bring forward actionable insights that support clients’ ROI-led digitization priorities. Through our client satisfaction program, we regularly assess the degree to which clients find that CGI introduced applicable innovation to the engagements we deliver for them, including our ideas, processes, tools and offerings. We also scale innovative solutions co-created with clients via a global governance model. |

| • | Comprehensive quality processes: CGI’s investment in quality frameworks and rigorous client satisfaction assessments has resulted in a consistent track record of on-time and within-budget project delivery. With regular |

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 5 |

| reviews of engagements and transparency at all levels, the Company seeks to ensure that client objectives and its own quality objectives are consistently followed at all times. This thorough process enables CGI to generate continuous improvements for all stakeholders by applying corrective measures as soon as they are required. |

| • | Environmental, Social and Governance (ESG) strategy: At CGI, our ESG strategy is key to contributing to our strategic goal to be recognized by our stakeholders as an engaged, ethical and responsible corporate citizen within our communities. Our commitments align with the United Nations (UN) Global Compact’s 10 principles and we are recognized by leading international indices, including EcoVadis, Carbon Disclosure Project (CDP) and Dow Jones Sustainability Indices (DJSI). We prioritize partnerships with clients, while also collaborating with educational institutions and local organizations, on three global priorities: people, communities and climate. We demonstrate our commitment to a sustainable world by way of projects delivered in collaboration with clients as well as operating practices, supply chain management, and community service activities. |

Helping Clients Leverage Technology to its Fullest

Macro trends such as supply chain reconfiguration, climate change and energy transition, and demographic shifts including aging populations and talent shortages require new business models and ways of working. At the same time, technology is reshaping our future and creating new opportunities.

Accelerating digitization provides the inclusive, economically vibrant, and sustainable future our clients’ customers and citizens demand. Leveraging technology to its fullest helps clients to become more competitive within their industries. Our end-to-end digital services, industry and technology expertise, and operational excellence combine to help clients advance their holistic digital transformation.

Through our proprietary Voice of Our Clients research, we analyzed the characteristics of leading digital organizations and found three common attributes:

| • | They have highly agile business models to address digitization and to integrate new technology, are better at operating as aligned teams between business and IT, and extend their digital strategy to their external ecosystem. |

| • | They have been faster in modernizing the entire IT environment – including through automation – while assuring security and data privacy. |

| • | They are addressing business transformation holistically, including culture change, ecosystem touchpoints, and the integration of sustainability objectives. |

Digital leaders across industries seek new ways to evolve their strategy and operational models and use technology and information to improve how they operate, deliver products and services, and create value.

CGI helps clients adopt leading digital attributes and design, manage, protect and evolve their digital value chains to accelerate business outcomes.

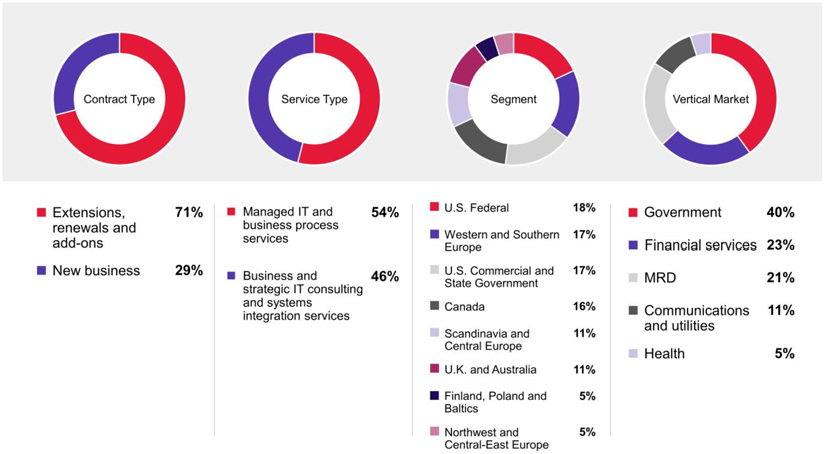

Business Structure

During the fiscal year ended September 30, 2023, the Company was managed through the following nine operating segments: Western and Southern Europe (primarily France, Spain and Portugal); United States (“U.S.”) Commercial and State Government; Canada; U.S. Federal; Scandinavia and Central Europe (Germany, Sweden and Norway); United Kingdom (“U.K.”) and Australia; Finland, Poland and Baltics; Northwest and Central-East Europe (primarily Netherlands, Denmark and Czech Republic); and Asia Pacific Global Delivery Centers of Excellence (mainly India and Philippines) (Asia Pacific).

For additional information on our segments, please refer to sections 3.4., 3.6., 5.4. and 5.5. of CGI’s Management’s Discussion and Analysis (“MD&A”) for the fiscal years ended September 30, 2023 and 2022, and to note 29 of our Annual Audited Consolidated Financial Statements for the fiscal years ended September 30, 2023 and 2022, which were filed with Canadian securities regulators and are available at www.sedarplus.ca and on CGI’s website at www.cgi.com.

The following table provides a summary of the year-over-year changes in our revenue, in total and by segment before eliminations, for the fiscal years ended September 30, 2023 and 2022:

| Reporting Segment Revenue (in thousands of CAD) |

2023 | 2022 | ||

| Western and Southern Europe |

2,605,926 | 2,152,113 | ||

| U.S. Commercial and State Government |

2,277,996 | 2,075,321 | ||

| Canada |

2,064,659 | 1,981,380 | ||

| U.S. Federal |

1,935,238 | 1,750,902 | ||

| Scandinavia and Central Europe |

1,648,356 | 1,571,118 | ||

| U.K. and Australia |

1,455,529 | 1,291,125 | ||

| Finland, Poland and Baltics |

828,951 | 729,024 | ||

| Northwest and Central-East Europe |

755,901 | 692,859 | ||

| Asia Pacific |

918,056 | 799,661 | ||

| Eliminations |

(194,252) | (176,302) | ||

| Total |

14,296,360 | 12,867,201 | ||

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 6 |

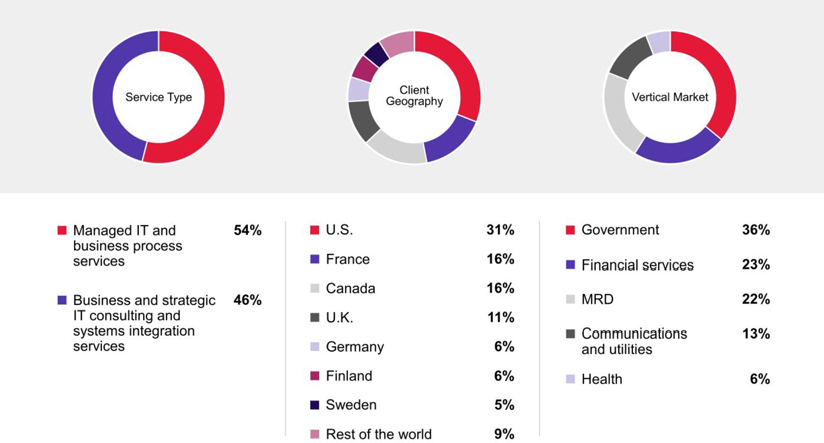

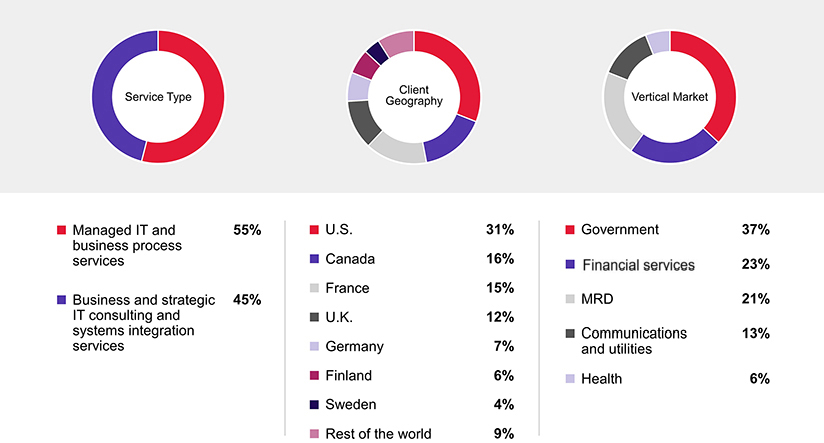

Services Offered by CGI

CGI delivers end-to-end services that help clients achieve the highest returns on their digital investments. We call this ROI-led digitization. Our insights-driven end-to-end services and solutions work together to help clients design, implement, run and operate the technology critical to achieving their business strategies.

Our portfolio encompasses:

| • | Business and strategic IT consulting, and systems integration services: CGI helps clients drive sustainable value in critical consulting areas, including strategy, organization and change management, core operations and technology. Within each of these areas, our consultants also deliver a broad range of business offerings to address client executives’ priorities, including designing and advancing strategies for the responsible use of artificial intelligence (AI), sustainable supply chain management, ESG, mergers and acquisitions, and more. In the area of systems integration, we help clients accelerate the enterprise modernization of their legacy systems and adopt new technologies to drive innovation and deliver real-time and insight-driven customer and citizen services. |

| • | Managed IT and business process services: Working as an extension of our clients’ organizations, we take on full or partial responsibility for managing their IT functions, freeing them up to focus on their strategic business direction. Our services enable clients to reinvest, alongside CGI, in the successful execution of their digital transformation roadmaps. We help them increase agility, scalability and resilience; deliver operational efficiencies, innovations and reduced costs; and embed security and data privacy controls. Typical services include: application development, modernization and maintenance; holistic enterprise digitization, automation, hybrid and cloud management; and business process services. |

| • | Intellectual property (“IP”): CGI’s portfolio of IP solutions are highly configurable “business platforms as a service” that are embedded within our end-to-end service offerings and utilize integrated security, data privacy practices, provider-neutral cloud approaches, and advanced AI capabilities to provide immediate benefits to clients. We invest in, and deliver, market-leading IP to drive business outcomes within each of our target industries. We also collaborate with clients to build and evolve IP-based solutions while enabling a higher degree of flexibility and customization for their unique modernization and digitization needs. Representative IP solutions include the following(a): |

| – | Momentum is an integrated enterprise resource planning (“ERP”) suite trusted by more than 100 organizations across the three branches of the U.S. federal government, including intelligence and defense organizations. Momentum is used by federally funded non-profit organizations as well. Momentum provides comprehensive capabilities to improve federal back-office operations. Its delivery options include on-premises implementation, managed services hosted in a CGI data center or publicly available cloud, or as a “software as a service” (“SaaS”) subscription-based offering. Momentum offers practical support for today’s financial, acquisitions and budgeting operations, combined with strategic solutions to position agencies and organizations for the rapidly changing environment of the future. |

| – | CGI Advantage is a leading ERP solution that helps state and local governments improve their back-office operations enabling digital insights through embedded analytics to better serve citizens and streamlining engagement through a mobile-first design and engaging user experience. Its full suite of ERP capabilities is designed specifically for the public-sector, including financial management, vendor self-service, grants management, performance budgeting, collections, human resources management, case management and procurement. CGI Advantage delivery options include on-premises implementation or managed services hosted in a private or publicly available cloud. |

| – | CGI CustomerAdvance is an end-to-end outsourcing solution with the ability to deliver individual components to support the needs of clients that require one or more specialized services, particularly those that would like to improve the customer experience using an omnichannel solution. It is used in five continents, more than 70 countries and in 39 languages, and its business process services include global call center support, fee processing, cash management and complex scheduling, all supported by a cloud-based customer relationship management software. |

| – | CGI Credit Studio powered by CGI’s CACS X, is the latest in market-leading credit management solutions, featuring an innovative cloud-native, event-driven architecture powered by data-driven AI and machine learning (“ML”) capabilities. Delivering the entire credit lifecycle from loan originations to servicing, collections, and recovery, CGI Credit Studio provides a comprehensive end-to-end experience. Its seamless integration with CGI PulseAI augments operational efficiency and increases customer satisfaction through AI and ML insights-driven automation. This approach empowers financial institutions to achieve their operational objectives with a robust and competitive credit management platform. |

| – | CGI Trade360 delivers all of the software, infrastructure and support resources necessary to power a bank’s global trade business. Delivered primarily as a SaaS offering, CGI Trade360 enables banks to provide the full range of traditional trade, supply chain (payables and receivables), and cash management services to their customers – anywhere, anytime – on a single, integrated and global platform. Built uniquely for multi-bank, multi-currency and multi-time zone processing. CGI Trade360’s Trade API Gateway seamlessly integrates with ecosystem partners, including Intelligent Automation platforms leveraging best-in-class AI solutions for trade. CGI Trade360 is used in 83 countries and in over 300 bank locations across the globe. |

| (a) | CACS, CGI Advantage, CGI Credit Studio, CGI CustomerAdvance, CGI Trade360 and Momentum are trademarks or registered trademarks of CGI or its subsidiaries. |

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 7 |

Markets for CGI’s Services

CGI has long-standing and focused practices in all of its core industries, providing clients with a partner that is not only an expert in IT, but also an expert in their respective industries. This combination of business knowledge and digital technology expertise allows us to help our clients navigate complex challenges and focus on value creation. In the process, we evolve the services and solutions we deliver within our targeted industries and provide thought leadership, blueprints, frameworks and technical accelerators that help clients evolve their ecosystems.

Our targeted industries include financial services (including banking and insurance), government (including space), manufacturing, retail and distribution (including consumer services, transportation and logistics), communications and utilities (including energy and media), and health (including life sciences). To help orchestrate our global posture across these industries, our leaders regularly participate in cabinet meetings and councils to advance the strategies, services and solutions we deliver to our clients.

Intangible Properties

We own and use various proprietary intangible assets that include, without limitation, brand names, trademarks, patents and patent applications, copyrights and copyrighted material, trade secrets, domain names, customer lists, know-how, tools, techniques, software, processes and methodologies. We derive value through the use of these assets in our business activities and they are central to our operations.

Our success depends, in part, on our ability to protect our proprietary intangible assets that we use to provide our services. We rely on a combination of contractual and licensing agreements and trademark, copyright, trade secret and patent laws to protect these assets against infringement.

Our general practice is to pursue trademark, patent, copyright or other appropriate IP protection that is timely and necessary to protect and leverage our IP assets for the longest possible period. We will continue to seek appropriate IP protection for our technology, software, methodologies, processes, know-how, tools, techniques and other proprietary intangible assets throughout the various countries within which CGI operates.

Human Resources

As of September 30, 2023, CGI employed approximately 91,500 consultants and professionals worldwide – whom we now call CGI Partners as 85% are shareholders. To encourage the high degree of commitment necessary to provide quality and continuity of client service, CGI Partners are offered a wide range of benefits, including the right to invest a percentage of their salary in the purchase of Class A Shares, which the Company will then match dollar for dollar up to a set maximum, the whole pursuant to our Share Purchase Plan. The Company also has a Profit Participation Plan, a short-term incentive plan that pays an annual cash bonus based on achievement of performance objectives and designed to provide CGI’s management and CGI Partners with an incentive to increase the profitability and growth of the Company, as well as a full range of other benefits. In addition, the Company also has long-term incentive plans, including a Share Option Plan and Performance Share Unit Plans, designed to ensure that its leaders’ interests are closely aligned with those of all shareholders.

Specialized Skills and Knowledge

The skills, expertise and competencies required by clients in the IT industry are constantly evolving. CGI strives to be one step ahead and adopts a proactive approach, not only by recruiting engaged and skilled professionals but, more importantly, by developing and retaining them to meet our clients’ needs. In addition to training and development activities and participation in professional associations, our talent management strategy includes stretch project assignments (local and abroad), job shadowing, coaching, mentoring and access to leadership and core competencies development programs through CGI’s Leadership Institute. Over the years, we have put in place multiple initiatives to meet our clients’ needs, fulfill our business plans, and maintain and develop professionals of very high calibre for the benefits of our clients, our CGI Partners, and our shareholders.

CGI Offices and Proximity and Global Delivery Models

CGI serves its clients from offices and through a network of global delivery locations across six continents: North America, South America, Europe, Africa, Asia and Australia. Through our proximity-based business model, CGI is deeply rooted in our clients’ businesses and communities. We are organized by metro markets in which clients have concentrated footprints, which empowers our local teams to build strong, trusted relationships, providing accountability for delivering client success.

CGI’s metro market teams augment their local expertise through skilled resources and experience from across our global operations to provide clients flexible delivery options that balance cost, quality and risk. Our delivery centers enable us to provide our clients with access to the right skills from the right locations at the right time and for the best price. This assures cultural alignment, while providing multilingual services across multiple time zones.

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 8 |

CGI’s main offices and delivery centers are listed below:

| Canada | ||||||

| Burnaby, BC | Halifax, NS‡ | Ottawa, ON | Sherbrooke, QC‡ | |||

| Calgary, AB | Markham, ON | Quebec City, QC‡ | Stratford, PEI‡ | |||

| Drummondville, QC‡ | Mississauga, ON‡ | Regina, SK | Toronto, ON | |||

| Edmonton, AB | Moncton, NB‡ | Saguenay, QC‡ | Victoria, BC | |||

| Fredericton, NB‡ | Montréal, QC‡ | Shawinigan, QC‡ | ||||

| United States | ||||||

| Albany, NY | Columbus, OH | Lebanon, VA‡ | Sacramento, CA | |||

| Arlington, VA | Dallas, TX | Los Angeles, CA | San Antonio, TX | |||

| Atlanta, GA | Denver, CO | Mobile, AL‡ | Sterling, VA | |||

| Baltimore, MD | Fairfax, VA | Montgomery, AL | Tampa, FL | |||

| Beavercreek, OH | Hartford, CT | New Brunswick, NJ | Troy, AL‡ | |||

| Belton, TX‡ | Hot Springs, AK | New York, NY | Tucson, AZ | |||

| Birmingham, AL | Houston, TX | North Charleston, SC | Walnut Creek, CA | |||

| Burlington, MA | Huntsville, AL | Oakland, CA | Waterville, ME‡ | |||

| Charlotte, NC | Knoxville, TN‡ | Phoenix, AZ‡ | Wausau, WI‡ | |||

| Cleveland, OH | Lafayette, LA‡ | Pittsburgh, PA | Westerville, OH | |||

| Columbia, SC | Lansing, MI | Plymouth Meeting, PA | ||||

| South America | ||||||

| Bogotá, Colombia‡ | ||||||

| Europe | ||||||

| Aarhus, Denmark | Clermont-Ferrand, France | Leatherhead, U.K. | Oulu, Finland | |||

| Aix-en-Provence, France | Cologne (Köln), Germany | Leinfelden-Echterdingen, Germany | Paris, France | |||

| Amiens, France‡ | Darmstadt, Germany | Lille, France | Pau, France | |||

| Amstelveen, Netherlands | Diegem, Belgium | Lisbon, Portugal‡ | Porto, Portugal‡ | |||

| Amsterdam, Netherlands‡ | Düsseldorf, Germany | Liverpool, U.K. | Prague, Czech Republic‡ | |||

| Arnhem, Netherlands | Edinburgh, U.K. | London, U.K. | Reading, U.K. | |||

| Ballerup, Denmark | Erfurt, Germany | Lyon, France‡ | Rennes, France‡ | |||

| Berlin, Germany | Espoo, Finland | Maastricht, Netherlands | Riga, Latvia‡ | |||

| Bertrange, Luxembourg | Glasgow, U.K. | Madrid, Spain | Rotterdam, Netherlands | |||

| Bochum, Germany | Gloucester, U.K. | Málaga, Spain‡ | Saint Avertin, France | |||

| Bordeaux, France‡ | Göteborg, Sweden | Malmö, Sweden | Sintra, Portugal | |||

| Borlänge, Sweden | Grenoble, France‡ | Manchester, U.K. | Solihull, U.K. | |||

| Bratislava, Slovakia | Groningen, Netherlands | Milton Keynes, U.K. | Stockholm, Sweden | |||

| Braunschweig, Germany | Hamburg, Germany | Montpellier, France‡ | Strasbourg, France | |||

| Bremen, Germany‡ | Helsinki, Finland‡ | Munich, Germany | Sulzbach (Taunus), Germany |

|||

| Brest, France | Ivögatan, Sweden‡ | Nice, France | Sundsvall, Sweden | |||

| Bridgend, U.K.‡ | Karlstad, Sweden | Niort, France | Tallinn, Estonia | |||

| Bristol, U.K. | Kaunas, Lithuania‡ | Odivelas, Portugal | Tampere, Finland | |||

| Brno, Czech Republic‡ | Krakow, Poland‡ | Orléans, France | Toulouse, France‡ | |||

| Bucharest, Romania‡ | Lahti, Finland | Oslo, Norway‡ | Turku, Finland | |||

| Bromölla, Sweden‡ | Larmor-Plage, France | Östersund, Sweden‡ | Vilnius, Lithuania‡ | |||

| Chippenham, U.K. | Le Mans, France | Ostrava-Pustkovec, Czech Republic | Warsaw, Poland‡ | |||

| Africa | ||||||

| Casablanca, Morocco‡ | Fes, Morocco | Rabat, Morocco‡ | ||||

| Asia | ||||||

| Bangalore, India‡ | Hyderabad, India‡ | Manila, Philippines‡ | Pune, India | |||

| Chennai, India‡ | Kuala Lumpur, Malaysia‡ | Mumbai, India‡ | ||||

| Australia | ||||||

| Melbourne, Australia | ||||||

‡ Indicates locations where CGI operates delivery centers.

Commercial Alliances

CGI currently has commercial alliance agreements with various technology and business partners. These non-exclusive commercial agreements with technology platform providers allow the Company to provide its clients with high quality technology and related CGI professional services, often on advantageous commercial terms for our clients. CGI’s business partners include prominent hardware, software, cloud and AI service providers.

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 9 |

Quality Processes

CGI holds ISO quality certification for the management of its partnerships with each of its three major stakeholder groups: clients, CGI Partners, and shareholders.

CGI’s ISO 9001 certified operations that are reflected in its Client Partnership Management Framework, its Member Partnership Management Framework and its Shareholder Partnership Management Framework greatly contribute to clearly defining clients’ objectives, properly scoping projects and identifying and allocating necessary resources to meet objectives. Together, these frameworks allow CGI to more efficiently build clients’ requirements into its solutions: clients are constantly kept informed, their degree of satisfaction is regularly measured and assessed, and our CGI Partners’ interests are kept aligned with those of CGI’s clients and shareholders by providing incentive compensation to managers linked to CGI’s results and creating value through share ownership.

The Company began working towards obtaining ISO 9001 certification for the portion of its operations covered by its Project Management Framework (which now forms part of its Client Partnership Management Framework) in 1993 and CGI’s Quebec City office was granted ISO 9001 certification in June 1994, which allowed CGI to become North America’s first organization in the IT consulting field to receive ISO 9001 certification for the way in which it managed projects. Beginning in 1995, CGI expanded its ISO 9001 certification throughout its Canadian, U.S. and international offices as well as its corporate headquarters. In the context of CGI’s continued high growth rate, its ISO certified quality system has been a key ingredient in spreading its culture, in part because it helps to integrate our new CGI Partners successfully, and in maintaining a high degree of quality of services by applying the same processes into each business unit.

As clients grow and IT projects become increasingly complex, CGI strives to further refine its quality processes while allowing them to branch out across all its activities. CGI’s enhanced quality system is simpler and provides the Company’s business units with greater autonomy in a context of decentralized activities. Over the years, CGI has also obtained additional ISO certifications and other appraisals, including ISO 27001 certification, which supports its strong information security management system, in more than 90 locations, and CMMI Level 5 certification, which supports its application management and infrastructure management services in its India global delivery centers. Some of CGI’s strategic business units maintain additional ISO certifications in accordance with local requirements, including: ISO 20000 – Information technology – Service management; ISO 14001 – Environmental management system; ISO 27701 – Privacy information management; and ISO 22301 – Business continuity management system.

The IT Services Industry

Trends and Outlook

CGI will continue executing on our “Build and Buy” growth strategy, expanding through both profitable organic growth (Build) and accretive acquisitions (Buy).

No matter the industry and its associated trends, technology no longer is an enabler, it is a business driver—and, increasingly, it is becoming the business. Any new service, program or efficiency improvement brings the need for additional IT services.

As part of our annual strategic planning activities during the fiscal year ended September 30, 2023, we held 1,764 strategic conversations with business and technology executives in the industries and regions we serve.

In these Voice of Our Clients interviews, executives ranked cybersecurity as the highest impact trend across industries, with the need to be digital to meet customer and citizen expectations for digital services ranking second and, for the first time, sustainability ranking third. Customer experience and IT modernization also are among the top IT and business priorities, reflecting strong themes among executives globally.

In line with these trends and priorities is a continued focus on digital transformation. Of the executives we interviewed, 92% have a digitization strategy in place, with 30% citing that they reported they are producing expected results from such strategies, up from 25% last year.

Helping clients achieve the business results they need from digitization requires significant investments in scale, reach and capabilities. We believe that the potential remains strong to help organizations accelerate their performance with our end-to-end services and solutions – including business and strategic IT consulting, systems integration, managed IT and business process services, and intellectual property (IP).

As our clients develop and implement their strategies, we have good visibility into clients’ areas of focus based on our Voice of Our Clients interviews.

Clients are now heavily relying on managed services and IP to generate cost savings while implementing, optimizing, and managing their transformation programs to achieve the expected return on investment. In our research, two in five executives cited legacy systems among the key barriers to successful digitization. This demonstrates the need to ensure that solution strategies address the complexity of modernizing current systems and integrating with new systems and processing. Furthermore, 80% of our clients indicated they are having difficulty hiring IT talent—leading to more of our clients who plan to externalize their IT services work.

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 10 |

Many executives cite the challenging economic environment as a key driver for sharpening their focus. It is requiring them to prioritize cost savings while simultaneously advancing their digitization to improve competitiveness, resilience, and customer experience. This dual-digital agenda continues to generate demand for our end-to-end services and solutions.

Competitive Environment

As the market dynamics and industry trends continue to increase client demand for ROI-led digitization, CGI is well-positioned to serve as a digital partner and expert of choice. We work with clients across the globe to implement digital strategies, roadmaps and solutions that help clients transform the customer/citizen experience, drive the launch of new products and services, and deliver efficiencies and cost savings.

CGI’s competition is comprised of a variety of firms, from local companies providing specialized services and software, government pure-plays to global business consulting and IT services providers. All of these players are competing to deliver some or all of the services we provide.

Many factors distinguish the industry leaders, including the following:

| • | Depth and breadth of industry and technology expertise; |

| • | Local presence and strength of client relationships; |

| • | Extensive and flexible global delivery network, including onshore, nearshore and offshore options; |

| • | Breadth of digital IP solutions; |

| • | Total cost of services and value delivered; |

| • | Ability to deliver practical innovation for measurable results; and |

| • | Consistent, on-time, within-budget delivery everywhere the client operates. |

CGI is one of the leaders in the industry with respect to the combination of these factors. CGI is one of few firms with the scale, reach, insights and capabilities to meet clients’ enterprise business and technology needs.

Significant Developments of the Three Most Recent Fiscal Years

Key Performance Measures

The Company reports its financial results in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. However, we use a combination of GAAP, non-GAAP and supplementary financial measures and ratios to assess the Company’s performance. The non-GAAP measures used to report our financial results do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with IFRS.

The table below summarizes our most relevant key performance measures used in this Annual Information Form:

| Growth |

Revenue prior to foreign currency impact (non-GAAP) – is a measure of revenue before foreign currency translation impacts. This is calculated by translating current period results in local currency using the conversion rates in the equivalent period from the prior year. Given that we have a strong presence globally and are affected by most major international currencies, management believes that it is helpful to adjust revenue to exclude the impact of currency fluctuations to facilitate period-to-period comparisons of business performance and that this measure is useful for investors for the same reason. A reconciliation of the revenue prior to foreign currency impact to its closest IFRS measure can be found in sections 3.4. and 5.4. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022.

Constant currency revenue growth (non-GAAP) – is a measure of revenue growth before foreign currency translation impacts. This is calculated by translating current period results in local currency using the conversion rates in the equivalent period from the prior year. Management believes its use of this measure is helpful for investors to facilitate period-to-period comparisons of our business growth.

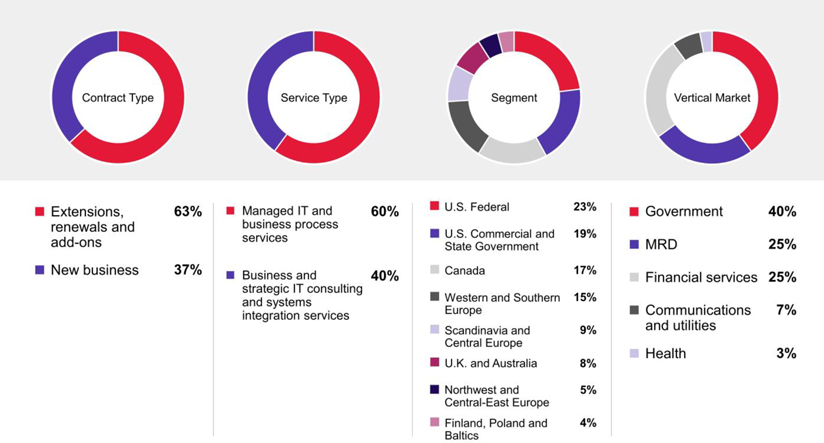

Bookings – are new binding contractual agreements including wins, extensions and renewals. In addition, our bookings are comprised of committed spend and estimates from management that are subject to change, including demand-driven usage, such as volume based and time and material contracts, as well as price indexation and options years and services. Management evaluates factors such as prices and past history to support its estimates. Management believes that it is a key indicator of the volume of our business over time and potential future revenue and that it is useful trend information to investors for the same reason. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our revenue. Additional information on bookings can be found in sections 3.1. and 5.1. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022.

Backlog – includes bookings, backlog acquired through business acquisitions, backlog consumed during the period as a result of client work performed as well as the impact of foreign currencies to our existing contracts. Backlog incorporates estimates from management that are subject to change and are mainly driven from bookings. Backlog is reduced when a client decision decreases |

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 11 |

| contractual commitment such as through contract cancellation. Management tracks this measure as it is a key indicator of our best estimate of contracted revenue to be realized in the future and believes that this measure is useful trend information to investors for the same reason.

Book-to-bill ratio – is a measure of the proportion of the value of our bookings to our revenue in the quarter. This metric allows management to monitor the Company’s business development efforts during the quarter to grow our backlog and our business over time and management believes that this measure is useful for investors for the same reason.

Book-to-bill ratio trailing twelve months – is a measure of the proportion of the value of our bookings to our revenue over the last trailing twelve-month period as management believes that monitoring the Company’s bookings over a longer period is a more representative measure as the services and contract type, size and timing of bookings could cause this measurement to fluctuate significantly if taken for only a three-month period and as such is useful for investors for the same reason. Management’s objective is to maintain a target ratio greater than 100% over a trailing twelve-month period. |

||

| Profitability |

Specific items – include cost optimization program and acquisition-related and integration costs. Cost optimization program mainly includes cost related to vacated leased premises and termination of employment. Acquisition-related costs mainly include third-party professional fees incurred to close acquisitions. Integration costs are mainly comprised of expenses due to redundancy of employment and contractual agreements, cancellation of acquired leased premises and costs related to the integration towards the CGI operating model such as training activities.

Earnings before income taxes – is a measure of earnings generated for shareholders before income taxes.

Earnings before income taxes margin – is obtained by dividing our earnings before income taxes by our revenues. Management believes a percentage of revenue measure is meaningful for better comparability from period-to-period.

Adjusted EBIT (non-GAAP) – is a measure of earnings excluding specific items, net finance costs and income tax expense. Management believes its use of this measure, which excludes items that are non-related to day-to-day operations, such as the impact of specific items, capital structure and income taxes, is helpful to investors to better evaluate the Company’s core operating performance. This measure also allows for better comparability from period-to-period and trend analysis. A reconciliation of the adjusted EBIT to its closest IFRS measure can be found in sections 3.7. and 5.6. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022.

Adjusted EBIT margin (non-GAAP) – is obtained by dividing our adjusted EBIT by our revenues. Management believes its use of this measure, which evaluates our core operating performance before specific items, capital structure and income taxes when compared to the growth of our revenues, is relevant to investors for better comparability from period-to-period. This measure demonstrates the Company’s ability to grow in a cost-effective manner, executing on our Build and Buy strategy. A reconciliation of the adjusted EBIT to its closest IFRS measure can be found in sections 3.7. and 5.6. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022.

Net earnings – is a measure of earnings generated for shareholders.

Net earnings margin – is obtained by dividing our net earnings by our revenues. Management believes a percentage of revenue measure is meaningful for better comparability from period-to-period.

Diluted earnings per share (diluted EPS) – is a measure of net earnings generated for shareholders on a per share basis, assuming all dilutive elements are exercised. Please refer to note 21 of CGI’s Annual Audited Consolidated Financial Statements for the fiscal years ended September 30, 2023 and 2022, for additional information on earnings per share.

Net earnings excluding specific items (non-GAAP) – is a measure of net earnings excluding the cost optimization program and acquisition-related and integration costs. Management believes its use of this measure best demonstrates to investors the net earnings generated from our day-to-day operations by excluding specific items, for better comparability from period-to-period. A reconciliation of the net earnings excluding specific items to its closest IFRS measure can be found in sections 3.8.3. and 5.6.1. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022.

Net earnings margin excluding specific items (non-GAAP) – is obtained by dividing our net earnings excluding specific items by our revenues. Management believes its use of this measure, which evaluates our core operating performance when compared to the growth of our revenues, is relevant to investors to assess their returns and for better comparability from period-to-period. This measure demonstrates the Company’s ability to grow in a cost-effective manner, executing on our Build and Buy strategy. A reconciliation of the net earnings excluding specific items to its closest |

|

| © CGI Inc. |

2023 ANNUAL INFORMATION FORM 12 |

| IFRS measure can be found in sections 3.8.3. and 5.6.1. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022.

Diluted earnings per share excluding specific items (non-GAAP) – is defined as the net earnings excluding specific items on a per share basis. Management believes its use of this measure is useful for investors as excluding specific items best reflects the Company’s ongoing operating performance on a per share basis and allows for better comparability from period-to-period. The diluted earnings per share reported in accordance with IFRS can be found in sections 3.8. and 5.6. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022, while the basic and diluted earnings per share excluding specific items can be found in sections 3.8.3. and 5.6.1. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022.

Effective tax rate excluding specific items (non-GAAP) – is obtained by dividing our income tax expense by earnings before income taxes, before specific items. Management uses this measure to analyze the impact of changes in income tax rate and profitability mix from day-to-day operations on its effective tax rate and is useful for investors for the same reason. A reconciliation of the effective tax rate excluding specific items to its closest IFRS measure can be found in sections 3.8.3. and 5.6.1. of CGI’s MD&A for the fiscal years ended September 30, 2023 and 2022. |

||

| Liquidity |