UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 14, 2023

Commercial Metals Company

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

| 1-4304 | 75-0725338 | |

| (Commission File Number) |

(IRS Employer Identification No.) |

| 6565 N. MacArthur Blvd. Irving, Texas |

75039 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(214) 689-4300

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading |

Name of Each Exchange on Which Registered |

||

| Common Stock, $0.01 par value | CMC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On December 14, 2023, Commercial Metals Company (the “Company”) issued a press release announcing a change in its segment reporting structure. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference. In addition, on December 14, 2023, the Company made available on its website the investor presentation furnished as Exhibit 99.2 hereto and incorporated herein by reference.

Beginning with its first fiscal quarter of 2024, the Company realigned its segment reporting structure to include three reportable segments: North America Steel Group, Europe Steel Group and Emerging Businesses Group. The Company will continue to report Corporate and Eliminations separately from its reportable segments.

| • | The North America Steel Group segment is primarily composed of all recycling, steel mill, rebar fabrication, fence post fabrication, and post-tension cable operations that were previously included within the Company’s former North America segment. |

| • | The Europe Steel Group segment is primarily composed of all recycling, steel mill, and steel fabrication operations that were previously included within the Company’s former Europe segment. |

| • | The Emerging Businesses Group segment is composed of all Tensar® geogrid and Geopier®, CMC Construction Services™, Performance Reinforcing Steel, CMC Anchoring Systems, and Impact Metals™ operations, all of which were previously reported as part of the Company’s former North America segment, with the exception of geogrid operations located outside of North America, which were previously included within the Company’s former Europe segment. |

The decision to realign the Company’s segment reporting structure was made to reflect (i) the evolution of the Company’s solutions offerings outside of traditional steel products, (ii) the growing importance of non-steel solutions to the Company’s financial results and future outlook, and (iii) the Company’s chief operating decision maker’s approach to performance assessment, strategic decision-making, and the allocation of capital resources.

The information in this Current Report on Form 8-K is presented for informational purposes only in connection with the above-described segment reporting change. The press release furnished as Exhibit 99.1 hereto includes recast unaudited historical financial information and operating statistics for fiscal years 2022 and 2023. The segment reporting change has no impact on the Company’s consolidated balance sheets and the consolidated statements of earnings, comprehensive income, cash flows and stockholders’ equity previously reported on the basis of accounting principles generally accepted in the United States. The recast historical financial information and operating statistics provided do not represent a restatement of previously issued financial information and operating statistics. The updated segment reporting structure will be reflected in the results reported in the Quarterly Report on Form 10-Q for the fiscal quarter ended November 30, 2023.

The information in this Item 7.01 of Form 8-K, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section and is not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| 99.1 | Press Release issued by Commercial Metals Company on December 14, 2023 | |

| 99.2 | Investor Presentation | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COMMERCIAL METALS COMPANY | ||||||

| Date: December 14, 2023 | ||||||

| By: | /s/ Paul J. Lawrence |

|||||

| Name: | Paul J. Lawrence | |||||

| Title: | Senior Vice President and Chief Financial Officer | |||||

Exhibit 99.1

| News Release |

|

CMC ANNOUNCES CHANGES TO SEGMENT REPORTING

Irving, TX – December 14, 2023—Commercial Metals Company (NYSE: CMC) (“CMC” or the “Company”) today announced that beginning with its first quarter of fiscal 2024, the Company will report financial results reflecting a realigned reporting structure, with three reportable segments: North America Steel Group, Europe Steel Group, and Emerging Businesses Group.

| • | North America Steel Group is primarily composed of all recycling, steel mill, rebar fabrication, fence post fabrication, and post-tension cable operations that were previously included within the Company’s former North America segment. |

| • | Europe Steel Group is primarily composed of all recycling, steel mill, and steel fabrication operations that were previously included within the Company’s former Europe segment. |

| • | Emerging Businesses Group is composed of the Company’s Tensar® geogrid and Geopier®, CMC Construction Services™, Performance Reinforcing Steel, CMC Anchoring Systems, and Impact Metals™ operations. These were previously reported as part of the Company’s former North America segment, with the exception of geogrid operations located outside of North America, which were included within the Company’s former Europe segment. |

| • | The Company’s reporting for Corporate and Eliminations is unchanged. |

Peter R. Matt, President and Chief Executive Officer, said, “Our realigned reporting structure better reflects how we view our operations and manage our Company, and provides important insights into the factors that drive value creation and the role of each segment within CMC’s strategy and future growth plans.”

The realignment of CMC’s operating segment structure corresponds directly to recent structural changes made within the organization. The decision to adjust segment reporting was made to better reflect: (i) the evolution of the Company’s solutions offerings outside of traditional steel products, (ii) the growing importance of non-steel solutions to CMC’s financial results and future outlook, and (iii) the Company’s chief operating decision maker’s approach to performance assessment, strategic decision-making, and the allocation of capital resources.

(CMC Segment Financial and Operating Statistics (Recast for Segment Realignment) - 2)

The announced realignment impacts only the Company’s segment reporting, and does not affect CMC’s previous consolidated results. Operational and financial statistics for fiscal years 2022 and 2023 under the new reporting structure can be found on pages 3 and 4 of this release.

For additional resources outlining the announced changes, please follow this link (https://ir.cmc.com/ir-toolkit), or visit our Investor Relations website at cmc.com/investors.

About CMC

CMC is an innovative solutions provider helping build a stronger, safer, and more sustainable world. Through an extensive manufacturing network principally located in the United States and Central Europe, we offer products and technologies to meet the critical reinforcement needs of the global construction sector. CMC’s solutions support construction across a wide variety of applications, including infrastructure, non-residential, residential, industrial, and energy generation and transmission.

(CMC Segment Financial and Operating Statistics (Recast for Segment Realignment) - 3)

COMMERCIAL METALS COMPANY

FINANCIAL & OPERATING STATISTICS (UNAUDITED)

| Three Months Ended | ||||||||||||||||||||||||||||||||

| (in thousands, except per ton amounts) |

8/31/2023 | 5/31/2023 | 2/28/2023 | 11/30/2022 | 8/31/2022 | 5/31/2022 | 2/28/2022 | 11/30/2021 | ||||||||||||||||||||||||

| North America Steel Group |

|

|||||||||||||||||||||||||||||||

| Net sales from external customers |

$ | 1,717,979 | $ | 1,818,391 | $ | 1,503,774 | $ | 1,664,161 | $ | 1,821,993 | $ | 1,894,928 | $ | 1,518,644 | $ | 1,562,840 | ||||||||||||||||

| Adjusted EBITDA |

336,843 | 367,561 | 274,240 | 349,787 | 343,054 | 357,010 | 523,771 | 258,832 | ||||||||||||||||||||||||

| External tons shipped |

||||||||||||||||||||||||||||||||

| Raw materials |

344 | 409 | 321 | 316 | 359 | 353 | 329 | 334 | ||||||||||||||||||||||||

| Rebar |

542 | 539 | 425 | 461 | 451 | 505 | 407 | 442 | ||||||||||||||||||||||||

| Merchant bar and other |

215 | 249 | 235 | 243 | 249 | 274 | 244 | 257 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Steel products |

757 | 788 | 660 | 704 | 700 | 779 | 651 | 699 | ||||||||||||||||||||||||

| Downstream products |

387 | 382 | 315 | 382 | 433 | 399 | 327 | 400 | ||||||||||||||||||||||||

| Average selling price per ton |

||||||||||||||||||||||||||||||||

| Raw materials |

$ | 838 | $ | 833 | $ | 868 | $ | 824 | $ | 950 | $ | 1,207 | $ | 1,103 | $ | 1,034 | ||||||||||||||||

| Steel products |

932 | 979 | 985 | 1,020 | 1,104 | 1,110 | 1,041 | 976 | ||||||||||||||||||||||||

| Downstream products |

1,428 | 1,452 | 1,421 | 1,399 | 1,348 | 1,244 | 1,169 | 1,092 | ||||||||||||||||||||||||

| Cost of raw materials per ton |

$ | 606 | $ | 619 | $ | 639 | $ | 598 | $ | 717 | $ | 908 | $ | 834 | $ | 766 | ||||||||||||||||

| Cost of ferrous scrap utilized per ton |

$ | 338 | $ | 384 | $ | 346 | $ | 325 | $ | 387 | $ | 472 | $ | 436 | $ | 428 | ||||||||||||||||

| Steel products metal margin per ton |

$ | 594 | $ | 595 | $ | 639 | $ | 695 | $ | 717 | $ | 638 | $ | 605 | $ | 548 | ||||||||||||||||

| Europe Steel Group |

||||||||||||||||||||||||||||||||

| Net sales from external customers |

$ | 273,961 | $ | 330,767 | $ | 337,560 | $ | 386,503 | $ | 393,858 | $ | 474,523 | $ | 395,349 | $ | 328,562 | ||||||||||||||||

| Adjusted EBITDA |

(30,081 | ) | 5,837 | 11,469 | 61,248 | 63,580 | 120,098 | 81,149 | 79,832 | |||||||||||||||||||||||

| External tons shipped |

||||||||||||||||||||||||||||||||

| Rebar |

151 | 146 | 183 | 204 | 177 | 170 | 172 | 103 | ||||||||||||||||||||||||

| Merchant bar and other |

238 | 283 | 253 | 269 | 251 | 306 | 278 | 262 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Steel products |

389 | 429 | 436 | 473 | 428 | 476 | 450 | 365 | ||||||||||||||||||||||||

| Average selling price per ton |

||||||||||||||||||||||||||||||||

| Steel products |

$ | 682 | $ | 753 | $ | 756 | $ | 792 | $ | 888 | $ | 967 | $ | 851 | $ | 869 | ||||||||||||||||

| Cost of ferrous scrap utilized per ton |

$ | 398 | $ | 427 | $ | 389 | $ | 366 | $ | 435 | $ | 530 | $ | 444 | $ | 434 | ||||||||||||||||

| Steel products metal margin per ton |

$ | 284 | $ | 326 | $ | 367 | $ | 426 | $ | 453 | $ | 437 | $ | 407 | $ | 435 | ||||||||||||||||

| Emerging Businesses Group |

|

|||||||||||||||||||||||||||||||

| Net sales from external customers |

$ | 208,559 | $ | 189,055 | $ | 153,598 | $ | 170,534 | $ | 191,459 | $ | 147,695 | $ | 95,580 | $ | 90,782 | ||||||||||||||||

| Adjusted EBITDA |

42,612 | 38,395 | 26,551 | 31,427 | 27,978 | 23,221 | 11,692 | 9,692 | ||||||||||||||||||||||||

(CMC Segment Financial and Operating Statistics (Recast for Segment Realignment) - 4)

COMMERCIAL METALS COMPANY

FINANCIAL & OPERATING STATISTICS (UNAUDITED)

| Twelve Months Ended August 31, | ||||||||

| (in thousands, except per ton amounts) |

2023 | 2022 | ||||||

| North America Steel Group |

||||||||

| Net sales from external customers |

$ | 6,704,305 | $ | 6,798,405 | ||||

| Adjusted EBITDA |

1,328,431 | 1,482,667 | ||||||

| External tons shipped |

||||||||

| Raw materials |

1,390 | 1,375 | ||||||

| Rebar |

1,967 | 1,805 | ||||||

| Merchant bar and other |

942 | 1,024 | ||||||

|

|

|

|

|

|||||

| Steel products |

2,909 | 2,829 | ||||||

| Downstream products |

1,466 | 1,559 | ||||||

| Average selling price per ton |

||||||||

| Raw materials |

$ | 840 | $ | 1,073 | ||||

| Steel products |

977 | 1,059 | ||||||

| Downstream products |

1,425 | 1,218 | ||||||

| Cost of raw materials per ton |

$ | 615 | $ | 807 | ||||

| Cost of ferrous scrap utilized per ton |

$ | 349 | $ | 431 | ||||

| Steel products metal margin per ton |

$ | 628 | $ | 628 | ||||

| Europe Steel Group | ||||||||

| Net sales from external customers |

$ | 1,328,791 | $ | 1,592,292 | ||||

| Adjusted EBITDA |

48,473 | 344,659 | ||||||

| External tons shipped |

||||||||

| Rebar |

684 | 622 | ||||||

| Merchant bar and other |

1,043 | 1,097 | ||||||

|

|

|

|

|

|||||

| Steel products |

1,727 | 1,719 | ||||||

| Average selling price per ton |

||||||||

| Steel products |

$ | 749 | $ | 896 | ||||

| Cost of ferrous scrap utilized per ton |

$ | 395 | $ | 463 | ||||

| Steel products metal margin per ton |

$ | 354 | $ | 433 | ||||

| Emerging Businesses Group |

||||||||

| Net sales from external customers |

$ | 721,746 | $ | 525,516 | ||||

| Adjusted EBITDA |

138,985 | 72,583 | ||||||

(CMC Segment Financial and Operating Statistics (Recast for Segment Realignment) - 5)

Media Contact:

Susan Gerber

214.689.4300

Exhibit 99.2 Resegmentation Summary December 2023

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws with respect to the impact of recent structural changes on our ability to execute our strategy and optimize operational and commercial functions, and the expected benefits of the new reporting structure, including with respect to providing insight into value-driving factors and facilitating discussions with the investment community. The statements in this presentation that are not historical statements, are forward-looking statements. These forward-looking statements can generally be identified by phrases such as we or our management expects, future, intends, will, outlook or other similar words or phrases, as well as by discussions of strategy, plans, or intentions. Our forward-looking statements are based on management’s expectations and beliefs as of the date of this presentation. Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in our filings with the Securities and Exchange Commission, including, but not limited to, in Part I, Item 1A, Risk Factors of our annual report on Form 10-K for the fiscal year ended August 31, 2023 and Part II, Item 1A, “Risk Factors” of our most recent quarterly report on 10-Q, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of our downstream contracts due to rising commodity pricing; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing; the impact of the Russian invasion of Ukraine on the global economy, inflation, energy supplies and raw materials; increased attention to environmental, social and governance (“ESG”) matters, including any targets or other ESG or environmental justice initiatives; operating and commissioning risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; impacts from global health crises on the economy, demand for our products, global supply chain and on our operations; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non- compliance of their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our share repurchase program; financial and non- financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions and realize any or all of the anticipated synergies or other benefits of acquisitions; the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third party consents and approvals; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; impact of goodwill or other indefinite lived intangible asset impairment charges; impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; ability to hire and retain key executives and other employees; our ability to successfully execute leadership transitions; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots. Resegmentation Summary 2

Topics Summary of Reporting Changes Rationale for Changes Businesses in Realigned Segments

Summary of Reporting Changes Ø Realigned reporting structure from two reportable segments to three Ø Three reportable segments: North America Steel Group, Europe Steel Group, and Emerging Businesses Group • Corporate and Eliminations will continue to be reported separately from segments Ø North America Steel Group is primarily composed of all recycling, steel mill, rebar fabrication, fence post fabrication, and post-tension cable operations that were previously included within the Company’s former North America segment Ø Europe Steel Group is primarily composed of all recycling, steel mill, and steel fabrication operations that were previously included within the Company’s former Europe segment ® ® Ø Emerging Businesses Group is composed of all Tensar geogrid and Geopier , CMC Construction Services™, Performance Reinforcing Steel, CMC Anchoring Systems, and CMC Impact Metals™ operations • Largely carved out of CMC’s former North America segment and includes businesses that offer solutions that are complementary to the Company’s traditional steel products Ø This change has no impact on CMC’s previously reported consolidated financial statements Recast segment financial information and other resources are posted within the Investor Toolkit on CMC’s Investor Relations website (https://www.cmc.com/en-us/investors) Resegmentation Summary 4

Rationale for Changes Ø CMC’s new segment reporting structure corresponds directly to recent structural changes made within the organization that were intended to facilitate execution of the Company’s strategy and support optimization of operational and commercial functions Ø The decision was made to realign CMC’s operating segment structure in order to reflect: i. The evolution of the Company’s solutions offerings outside of traditional steel products ii. The growing importance of non-steel solutions to CMC’s financial results and future outlook iii. CMC’s chief operating decision maker’s approach to performance assessment, strategic decision- making, and the allocation of capital resources The new segment reporting structure is expected to provide enhanced insights into factors that drive value creation for CMC, as well as support discussions with the investment community regarding strategy, future growth plans, and capital allocation. Resegmentation Summary 5

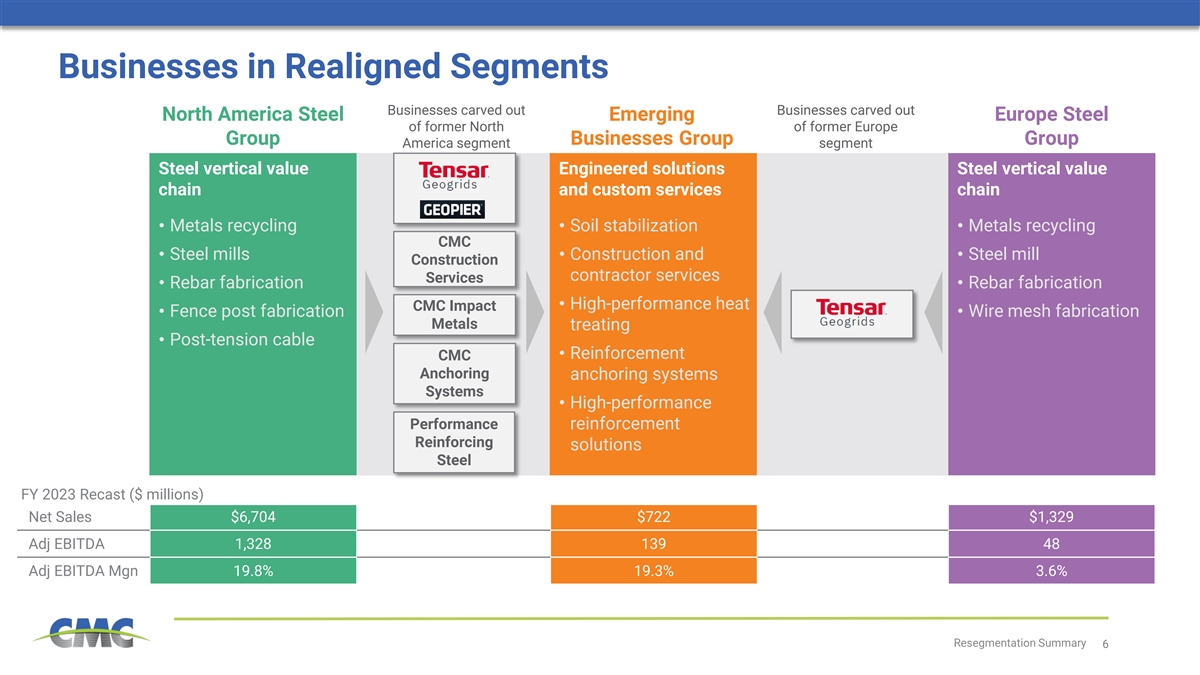

Businesses in Realigned Segments Businesses carved out Businesses carved out North America Steel Emerging Europe Steel of former North of former Europe Group Businesses Group Group America segment segment Steel vertical value Engineered solutions Steel vertical value chain and custom services chain • Metals recycling • Soil stabilization • Metals recycling CMC • Steel mills • Construction and • Steel mill Construction contractor services Services • Rebar fabrication • Rebar fabrication • High-performance heat CMC Impact • Fence post fabrication • Wire mesh fabrication Metals treating • Post-tension cable • Reinforcement CMC Anchoring anchoring systems Systems • High-performance Performance reinforcement Reinforcing solutions Steel FY 2023 Recast ($ millions) Net Sales $6,704 $722 $1,329 Adj EBITDA 1,328 139 48 Adj EBITDA Mgn 19.8% 19.3% 3.6% Resegmentation Summary 6

CMC.COM