UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 13, 2023

Coherent Corp.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 001-39375 | 25-1214948 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

375 Saxonburg Boulevard

Saxonburg, Pennsylvania 16056

(Address of Principal Executive Offices) (Zip Code)

(724) 352-4455

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, no par value | COHR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

A slide presentation to be used by senior management of the Company in connection with its discussions with investors is included in Exhibit 99.1 to this report and is being furnished in accordance with Regulation FD of the Securities and Exchange Commission.

The information in this Item 7.01 of this Current Report on Form 8-K, including the exhibit furnished pursuant to Item 9.01, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section. Furthermore, the information in this Item 7.01 of this Current Report on Form 8-K, including the exhibit furnished pursuant to Item 9.01, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Investor Presentation | |

| 104.0 | Cover Page Interactive Data File (embedded within the inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Coherent Corp. | ||||||

| Date: December 13, 2023 | By: | /s/ Ronald Basso |

||||

| Ronald Basso | ||||||

| Chief Legal and Compliance Officer | ||||||

Exhibit 99.1 INDUSTRIAL MARKET OVERVIEW Markets Day December 14, 2023 Paul Silverstein Vice President, Investor Relations & Corporate Communications Copyright 2023, Coherent. All rights reserved. 1

HOST Paul Silverstein Vice President, Investor Relations & Corporate Communications 2 Copyright 2023, Coherent. All rights reserved.

FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements relating to future events and expectations, including our expectations (i) for our future financial and operational results (including expectations for future growth); (ii) regarding capital expenditures and the results of investments in research and design; (iii) regarding the health and growth in the markets we serve including industrial, communications, electronics and instrumentation; (iv) regarding market drivers, market sizing and dynamics in precision manufacturing; (v) regarding the growth and opportunities in the semiconductor industry and semiconductor capital equipment markets; in the display market; and the precision manufacturing market; (vii) growth driven by our excimer laser business and the drivers of that growth, each of which, is based on certain assumptions and contingencies. The forward-looking statements are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and relate to the Company’s performance on a going-forward basis. The forward-looking statements in this investor presentation involve risks and uncertainties, which could cause actual results, performance or trends to differ materially from those expressed in the forward-looking statements herein or in previous disclosures. The Company believes that all forward-looking statements made by it in this presentation have a reasonable basis, but there can be no assurance that management’s expectations, beliefs, or projections as expressed in the forward-looking statements will actually occur or prove to be correct. In addition to general industry and global economic conditions, factors that could cause actual results to differ materially from those discussed in the forward-looking statements in this presentation include but are not limited to: (i) the failure of any one or more of the assumptions stated herein to prove to be correct; (ii) the risks relating to forward-looking statements and other “Risk Factors” discussed in (x) the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023 related to the silicon carbide investment transaction and (y) in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and additional risk factors that may be identified from time to time in filings of the Company; (iii) the substantial indebtedness the Company incurred in connection with its acquisition of Coherent, Inc. (the “Transaction”), the need to generate sufficient cash flows to service and repay such debt and the Company’s ability to generate sufficient funds to meet its anticipated debt reduction goals; (iv) the possibility that the Company may not be able to continue its integration progress on and/or take other restructuring actions, or otherwise be able to achieve expected synergies, operating efficiencies, including greater scale, focus, resiliency, and lower operating costs, and other benefits within the expected time-frames or at all and ultimately to successfully fully integrate the operations of Coherent, Inc. (“Coherent”) with those of the Company; (v) the possibility that such integration and/or the restructuring actions may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the Transaction and/or the restructuring actions; (vi) any unexpected costs, charges or expenses resulting from the Transaction and/or the restructuring actions; (vii) the risk that disruption from the Transaction and/or the restructuring actions materially and adversely affects the respective businesses and operations of the Company and Coherent; (viii) potential adverse reactions or changes to business relationships resulting from the completion of the Transaction and/or the restructuring actions; (ix) the ability of the Company to retain and hire key employees; (x) the purchasing patterns of customers and end users; (xi) the timely release of new products, and acceptance of such new products by the market; (xii) the introduction of new products by competitors and other competitive responses; (xiii) the Company’s ability to assimilate other recently acquired businesses, and realize synergies, cost savings, and opportunities for growth in connection therewith, together with the risks, costs, and uncertainties associated with such acquisitions; (xiv) the Company’s ability to devise and execute strategies to respond to market conditions; (xv) the risks to realizing the benefits of investments in R&D and commercialization of innovations; (xvi) the risks that the Company’s stock price will not trade in line with industrial technology leaders; (xvii) the risks of business and economic disruption related to worldwide health epidemics or outbreaks that may arise and/or (xviii) the risk that the investments by DENSO and Mitsubishi in our Silicon Carbide business are not completed. The Company disclaims any obligation to update information contained in these forward-looking statements, whether as a result of new information, future events or developments, or otherwise. Unless otherwise indicated in this presentation, all information in this presentation is as of December 14, 2023 3 Copyright 2023, Coherent. All rights reserved.

SPEAKERS Dr. Kai Schmidt Martin Seifert Dr. Christopher Dorman Paul Silverstein Dr. Sanjai Senior Vice President and Vice President, Senior Vice President and Vice President, Parthasarathi General Manager General Manager High-Power Fiber Laser Investor Relations & Chief Marketing Officer Excimer Lasers Business Solid State Lasers Business Business Unit Corporate Communications Unit Unit, Europe 4 Copyright 2023, Coherent. All rights reserved.

INDUSTRIAL MARKET OVERVIEW Dr. Sanjai Parthasarathi – Chief Marketing Officer 5 Copyright 2023, Coherent. All rights reserved.

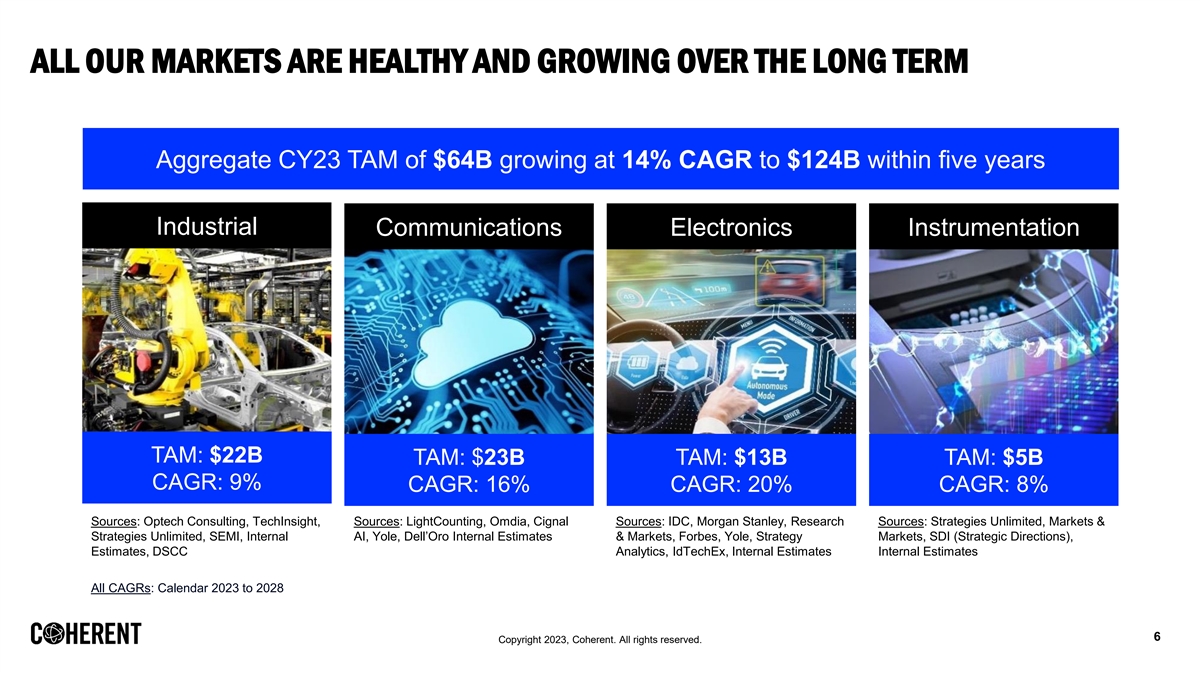

ALL OUR MARKETS ARE HEALTHY AND GROWING OVER THE LONG TERM Aggregate CY23 TAM of $64B growing at 14% CAGR to $124B within five years Industrial Communications Electronics Instrumentation TAM: $22B TAM: $23B TAM: $13B TAM: $5B CAGR: 9% CAGR: 16% CAGR: 20% CAGR: 8% Sources: Optech Consulting, TechInsight, Sources: LightCounting, Omdia, Cignal Sources: IDC, Morgan Stanley, Research Sources: Strategies Unlimited, Markets & Strategies Unlimited, SEMI, Internal AI, Yole, Dell’Oro Internal Estimates & Markets, Forbes, Yole, Strategy Markets, SDI (Strategic Directions), Estimates, DSCC Analytics, IdTechEx, Internal Estimates Internal Estimates All CAGRs: Calendar 2023 to 2028 6 Copyright 2023, Coherent. All rights reserved.

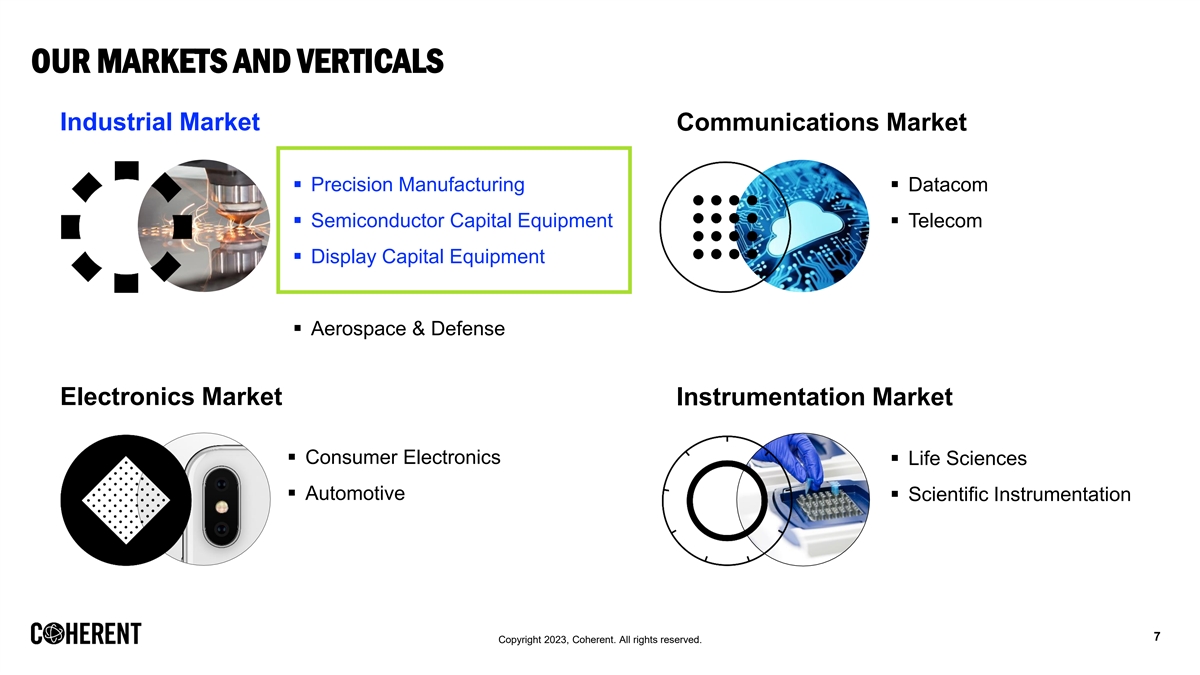

OUR MARKETS AND VERTICALS Industrial Market Communications Market ▪ Precision Manufacturing▪ Datacom ▪ Semiconductor Capital Equipment▪ Telecom ▪ Display Capital Equipment ▪ Aerospace & Defense Electronics Market Instrumentation Market ▪ Consumer Electronics ▪ Life Sciences ▪ Automotive ▪ Scientific Instrumentation 7 Copyright 2023, Coherent. All rights reserved.

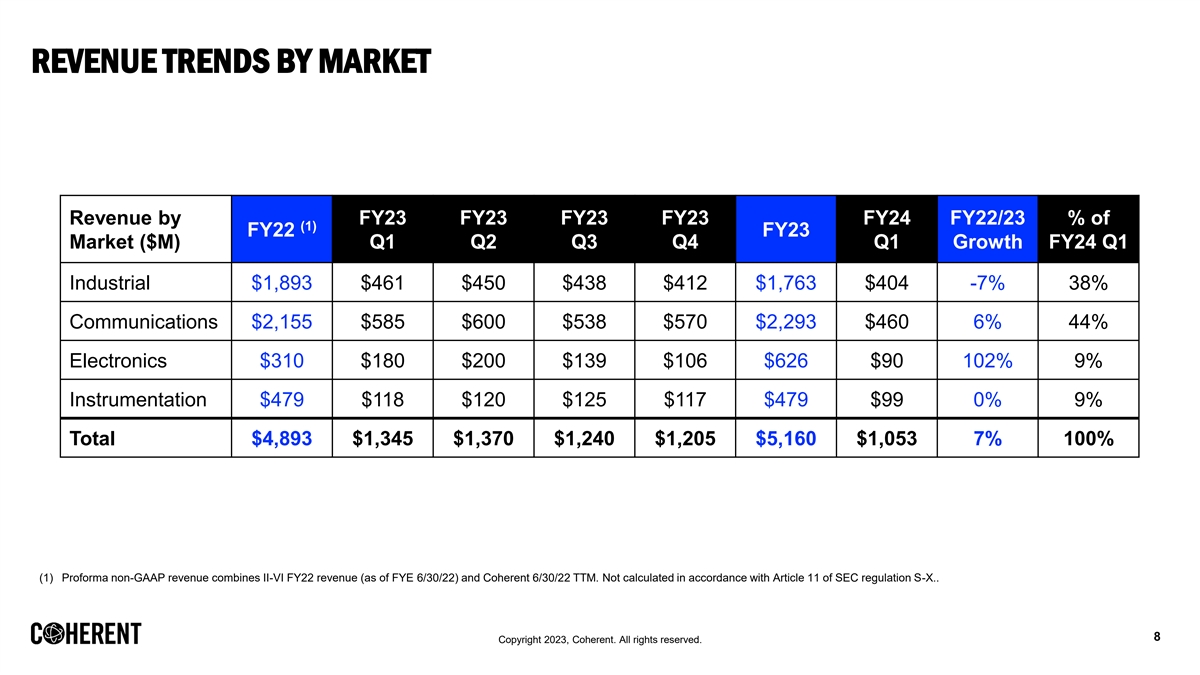

REVENUE TRENDS BY MARKET Revenue by FY23 FY23 FY23 FY23 FY24 FY22/23 % of (1) FY22 FY23 Market ($M) Q1 Q2 Q3 Q4 Q1 Growth FY24 Q1 Industrial $1,893 $461 $450 $438 $412 $1,763 $404 -7% 38% Communications $2,155 $585 $600 $538 $570 $2,293 $460 6% 44% Electronics $310 $180 $200 $139 $106 $626 $90 102% 9% Instrumentation $479 $118 $120 $125 $117 $479 $99 0% 9% Total $4,893 $1,345 $1,370 $1,240 $1,205 $5,160 $1,053 7% 100% (1) Proforma non-GAAP revenue combines II-VI FY22 revenue (as of FYE 6/30/22) and Coherent 6/30/22 TTM. Not calculated in accordance with Article 11 of SEC regulation S-X.. 8 Copyright 2023, Coherent. All rights reserved.

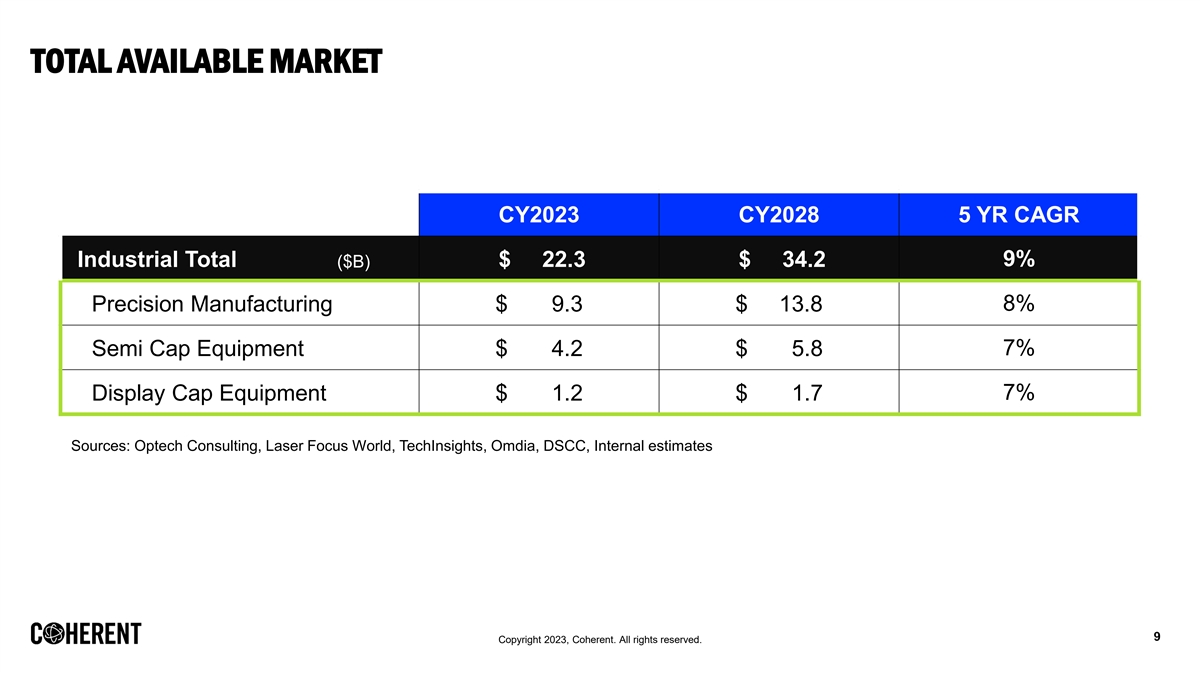

TOTAL AVAILABLE MARKET CY2023 CY2028 5 YR CAGR 9% Industrial Total ($B) $ 22.3 $ 34.2 Precision Manufacturing $ 9.3 $ 13.8 8% 7% Semi Cap Equipment $ 4.2 $ 5.8 7% Display Cap Equipment $ 1.2 $ 1.7 Sources: Optech Consulting, Laser Focus World, TechInsights, Omdia, DSCC, Internal estimates 9 Copyright 2023, Coherent. All rights reserved.

PRECISION MANUFACTURING VERTICAL 10 Copyright 2023, Coherent. All rights reserved.

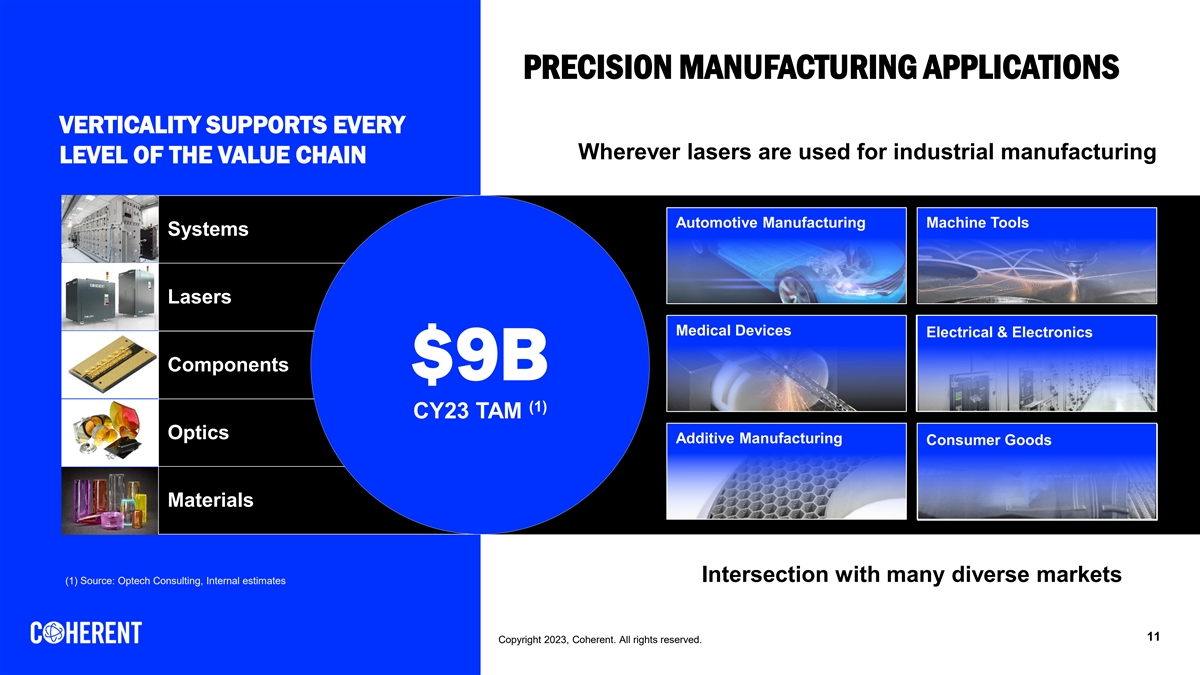

PRECISION MANUFACTURING APPLICATIONS VERTICALITY SUPPORTS EVERY Wherever lasers are used for industrial manufacturing LEVEL OF THE VALUE CHAIN Automotive Manufacturing Machine Tools Systems Lasers Industrial Electrical & Electronics Medical Devices Electrical & Electronics Components $9B (1) CY23 TAM Optics Additive Manufacturing Co Cons nsume umer r Goods Goods Materials Intersection with many diverse markets (1) Source: Optech Consulting, Internal estimates 11 Copyright 2023, Coherent. All rights reserved.

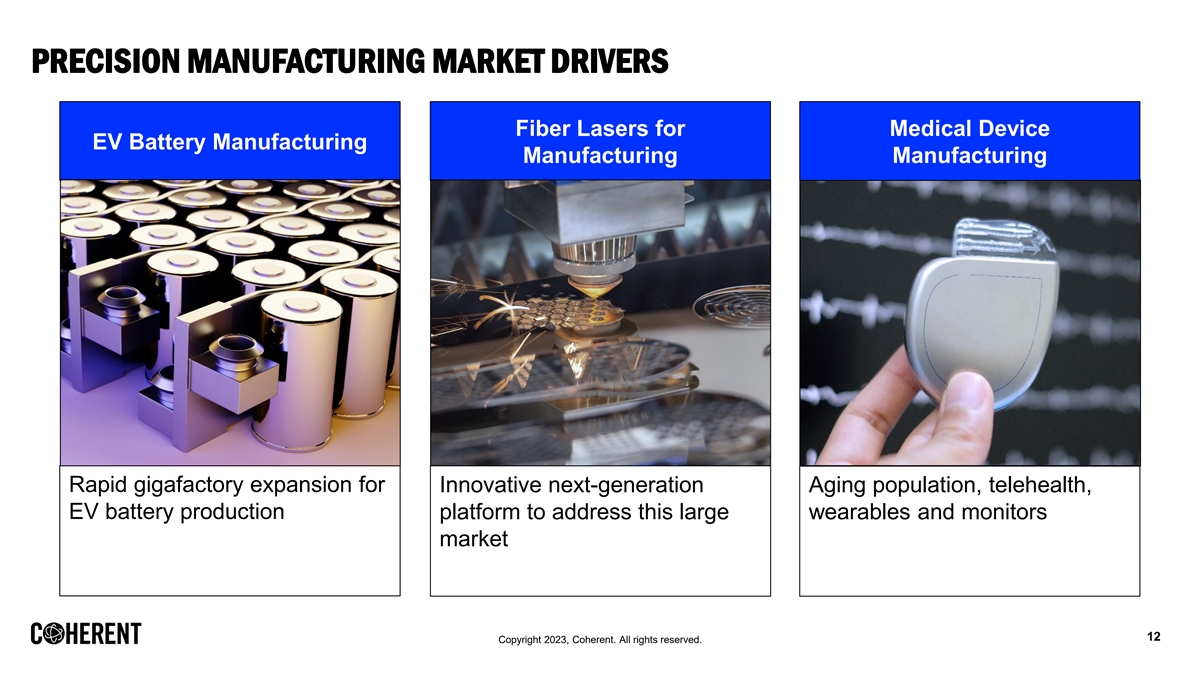

PRECISION MANUFACTURING MARKET DRIVERS Fiber Lasers for Medical Device EV Battery Manufacturing Manufacturing Manufacturing Rapid gigafactory expansion for Innovative next-generation Aging population, telehealth, EV battery production platform to address this large wearables and monitors market 12 Copyright 2023, Coherent. All rights reserved.

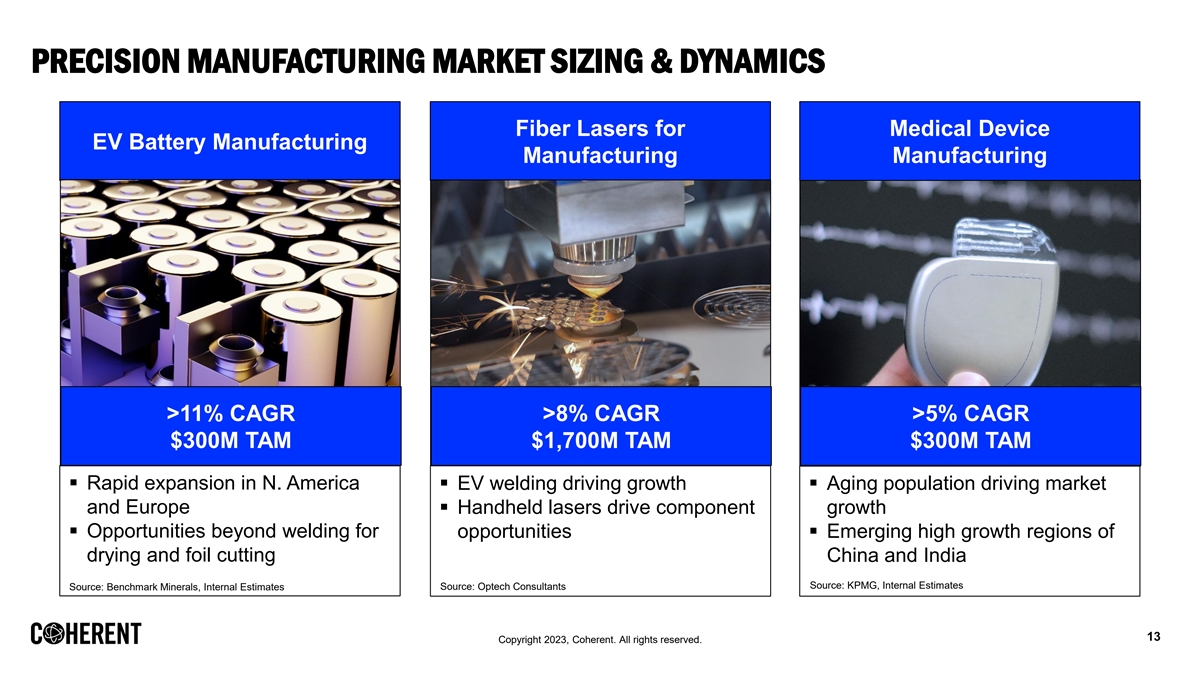

PRECISION MANUFACTURING MARKET SIZING & DYNAMICS Fiber Lasers for Medical Device EV Battery Manufacturing Manufacturing Manufacturing >11% CAGR >8% CAGR >5% CAGR $300M TAM $1,700M TAM $300M TAM ▪ Rapid expansion in N. America ▪ EV welding driving growth ▪ Aging population driving market and Europe▪ Handheld lasers drive component growth ▪ Opportunities beyond welding for opportunities ▪ Emerging high growth regions of drying and foil cutting China and India Source: KPMG, Internal Estimates Source: Optech Consultants Source: Benchmark Minerals, Internal Estimates 13 Copyright 2023, Coherent. All rights reserved.

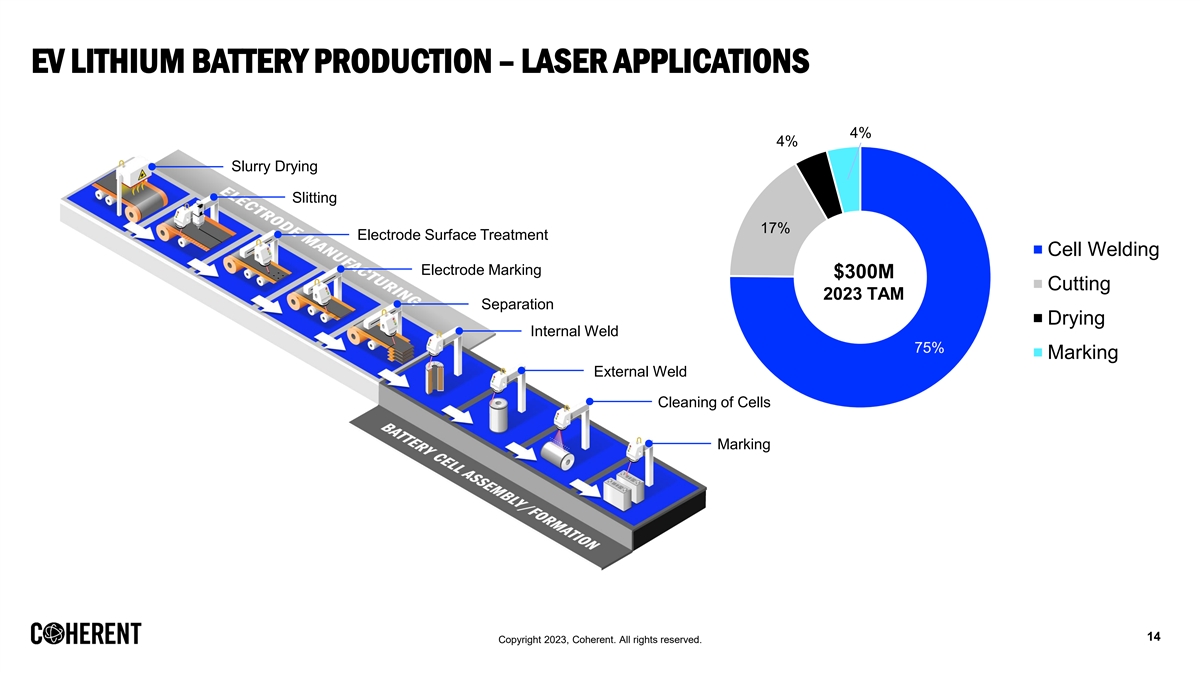

EV LITHIUM BATTERY PRODUCTION – LASER APPLICATIONS 4% 4% Slurry Drying Slitting 17% Electrode Surface Treatment Cell Welding Electrode Marking $300M Cutting 2023 TAM Separation Drying Internal Weld 75% Marking External Weld Cleaning of Cells Marking 14 Copyright 2023, Coherent. All rights reserved.

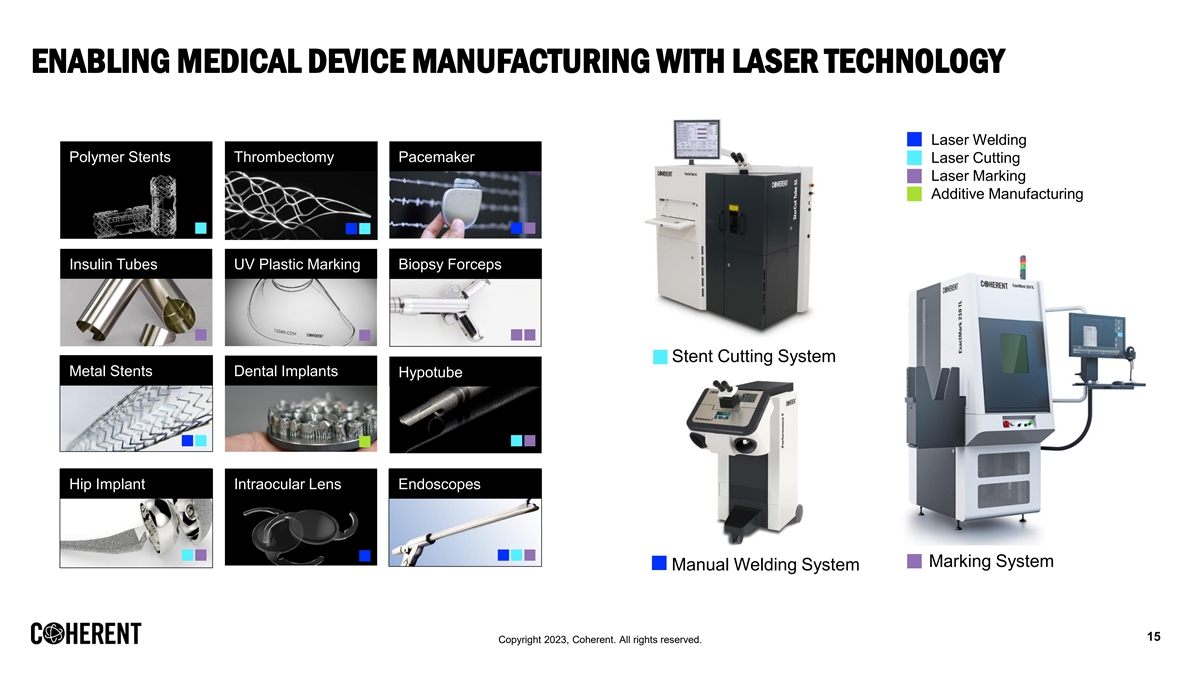

ENABLING MEDICAL DEVICE MANUFACTURING WITH LASER TECHNOLOGY Laser Welding Polymer Stents Thrombectomy Pacemaker Laser Cutting Laser Marking Additive Manufacturing Insulin Tubes UV Plastic Marking Biopsy Forceps Stent Cutting System Metal Stents Dental Implants Hypotube Hip Implant Intraocular Lens Endoscopes Marking System Manual Welding System 15 Copyright 2023, Coherent. All rights reserved.

SEMICONDUCTOR CAPITAL EQUIPMENT VERTICAL 16 Copyright 2023, Coherent. All rights reserved.

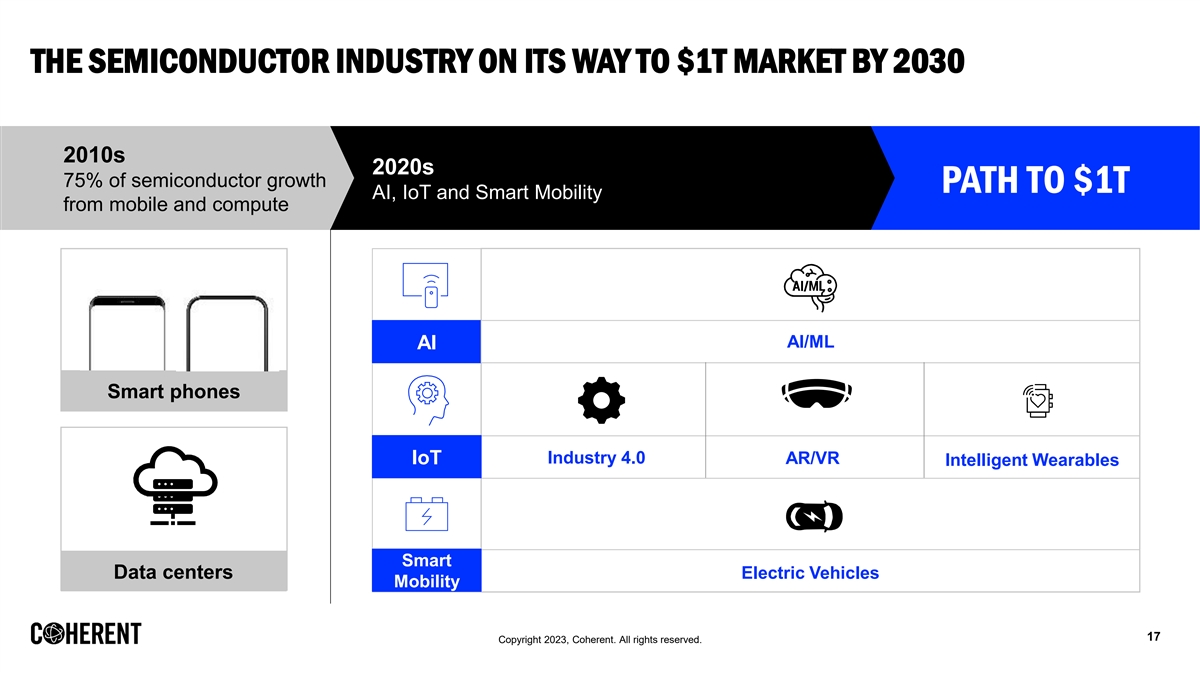

THE SEMICONDUCTOR INDUSTRY ON ITS WAY TO $1T MARKET BY 2030 2010s 2020s 75% of semiconductor growth PATH TO $1T AI, IoT and Smart Mobility from mobile and compute AI/ML AI Smart phones Industry 4.0 AR/VR IoT Intelligent Wearables Smart Data centers Electric Vehicles Mobility 17 Copyright 2023, Coherent. All rights reserved.

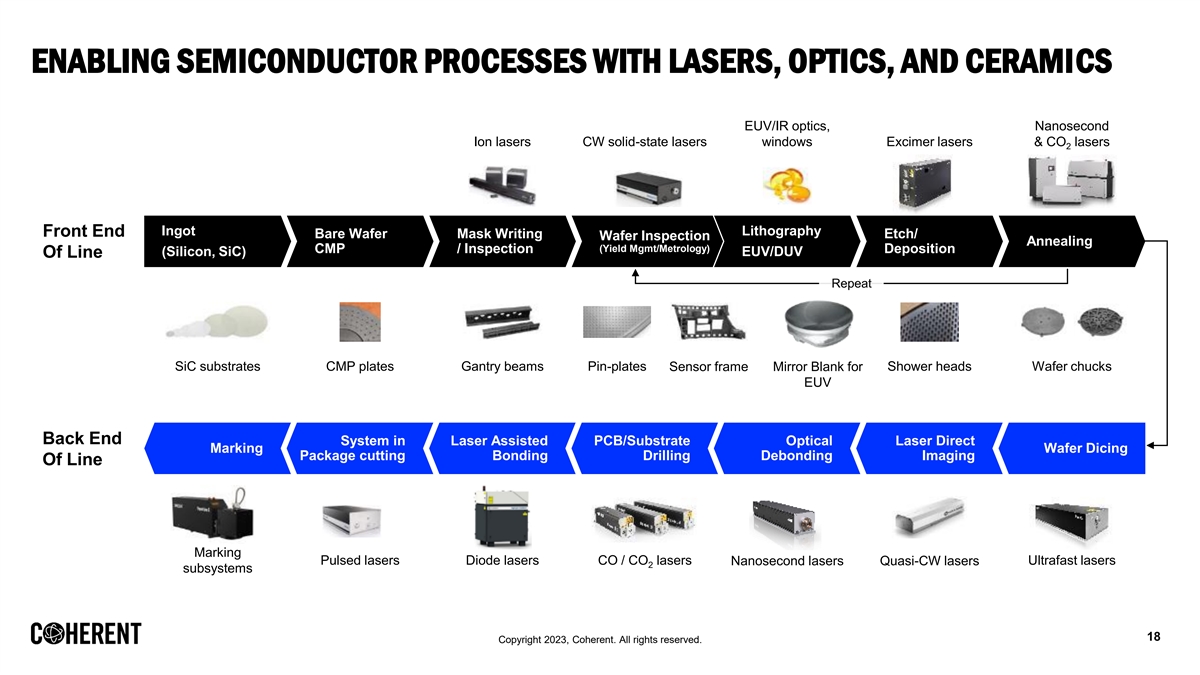

ENABLING SEMICONDUCTOR PROCESSES WITH LASERS, OPTICS, AND CERAMICS EUV/IR optics, Nanosecond Ion lasers CW solid-state lasers windows Excimer lasers & CO lasers 2 Ingot Lithography Front End Bare Wafer Mask Writing Etch/ Wafer Inspection Annealing (Yield Mgmt/Metrology) CMP / Inspection Deposition (Silicon, SiC) EUV/DUV Of Line Repeat SiC substrates CMP plates Gantry beams Pin-plates Sensor frame Mirror Blank for Shower heads Wafer chucks EUV Back End System in Laser Assisted PCB/Substrate Optical Laser Direct Marking Wafer Dicing Package cutting Bonding Drilling Debonding Imaging Of Line Marking Pulsed lasers Diode lasers CO / CO lasers Nanosecond lasers Quasi-CW lasers Ultrafast lasers 2 subsystems 18 Copyright 2023, Coherent. All rights reserved.

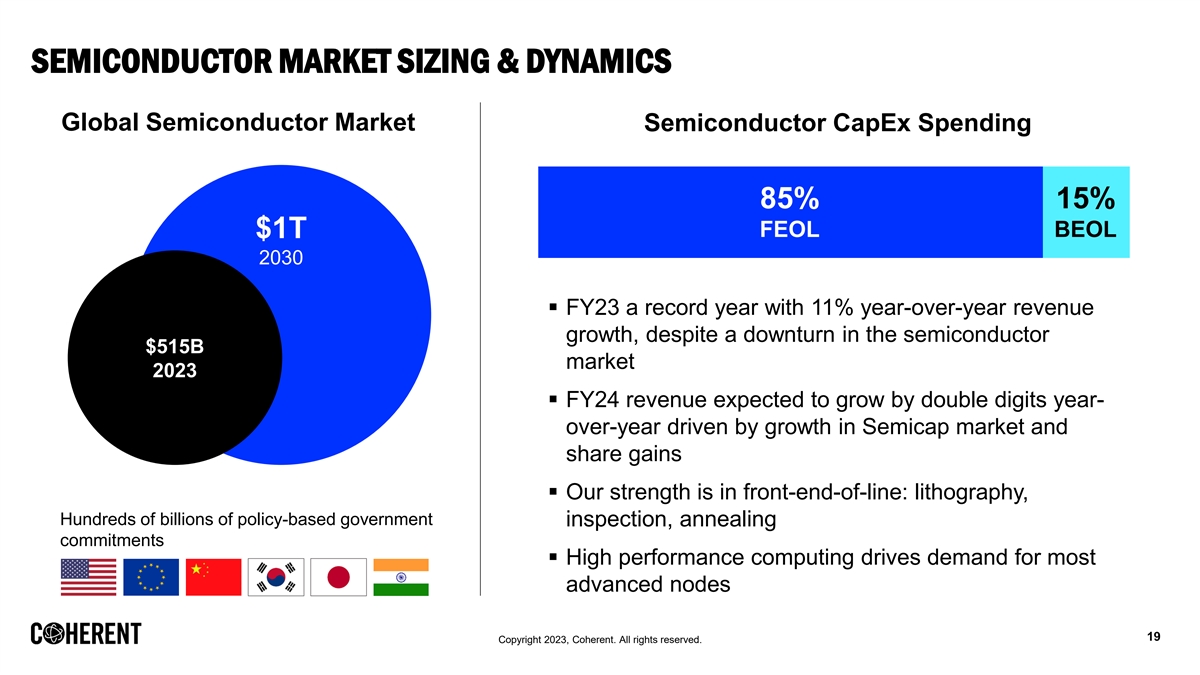

SEMICONDUCTOR MARKET SIZING & DYNAMICS Global Semiconductor Market Semiconductor CapEx Spending 85% 15% FEOL BEOL $1T 2030 ▪ FY23 a record year with 11% year-over-year revenue growth, despite a downturn in the semiconductor $515B market 2023 ▪ FY24 revenue expected to grow by double digits year- over-year driven by growth in Semicap market and share gains ▪ Our strength is in front-end-of-line: lithography, Hundreds of billions of policy-based government inspection, annealing commitments ▪ High performance computing drives demand for most advanced nodes 19 Copyright 2023, Coherent. All rights reserved.

DISPLAY CAPITAL EQUIPMENT VERTICAL 20 Copyright 2023, Coherent. All rights reserved.

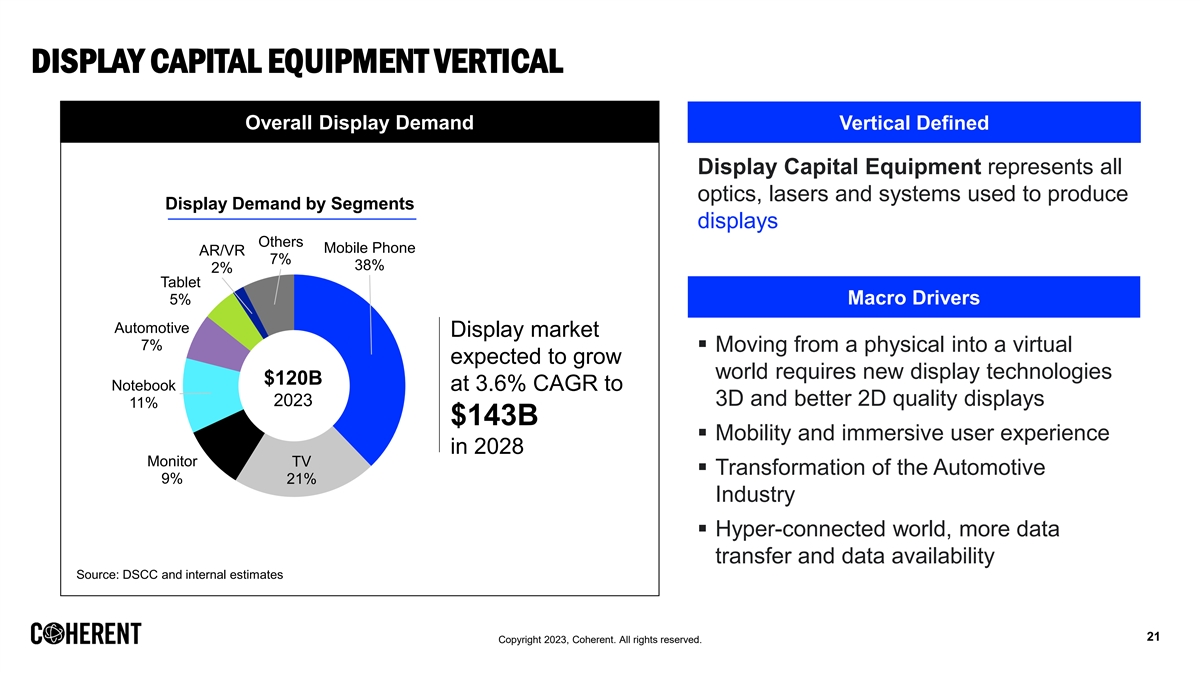

DISPLAY CAPITAL EQUIPMENT VERTICAL Overall Display Demand Vertical Defined Display Capital Equipment represents all optics, lasers and systems used to produce Display Demand by Segments displays Others Mobile Phone AR/VR 7% 38% 2% Tablet 5% Macro Drivers Automotive Display market 7% ▪ Moving from a physical into a virtual expected to grow world requires new display technologies $120B Notebook at 3.6% CAGR to 2023 3D and better 2D quality displays 11% $143B ▪ Mobility and immersive user experience in 2028 Monitor TV ▪ Transformation of the Automotive 9% 21% Industry ▪ Hyper-connected world, more data transfer and data availability Source: DSCC and internal estimates 21 Copyright 2023, Coherent. All rights reserved.

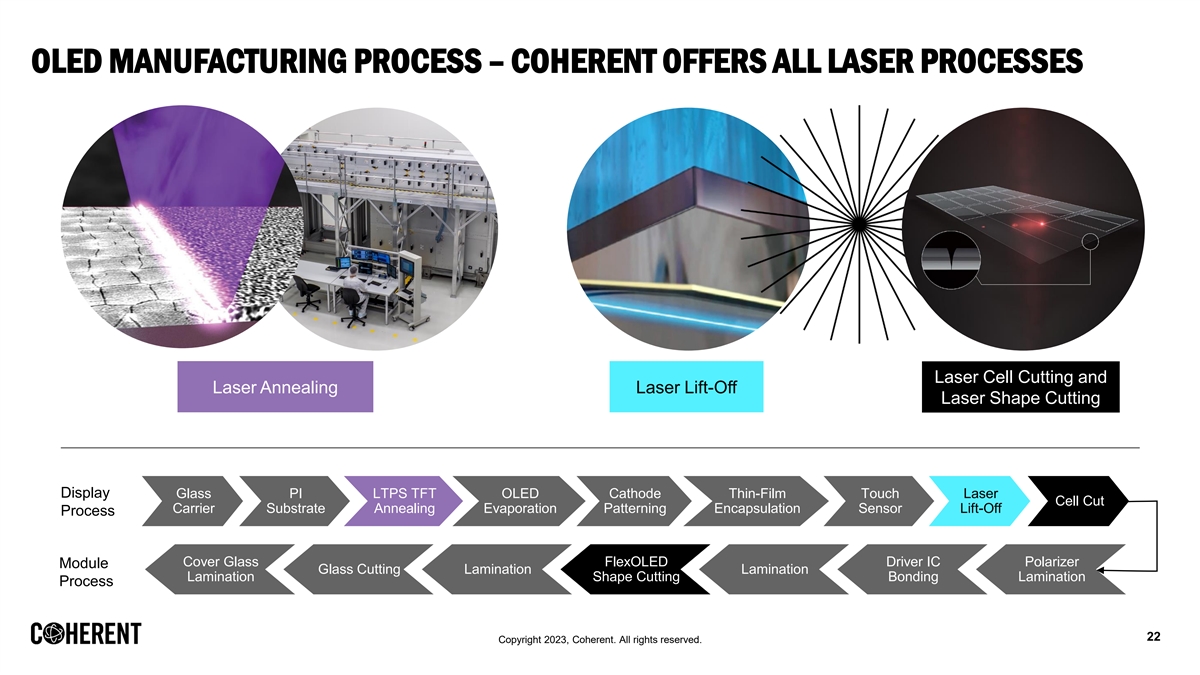

OLED MANUFACTURING PROCESS – COHERENT OFFERS ALL LASER PROCESSES Laser Cell Cutting and Laser Annealing Laser Lift-Off Laser Shape Cutting Display Glass PI LTPS TFT OLED Cathode Thin-Film Touch Laser Cell Cut Carrier Substrate Annealing Evaporation Patterning Encapsulation Sensor Lift-Off Process Cover Glass FlexOLED Driver IC Polarizer Module Glass Cutting Lamination Lamination Lamination Shape Cutting Bonding Lamination Process 22 Copyright 2023, Coherent. All rights reserved.

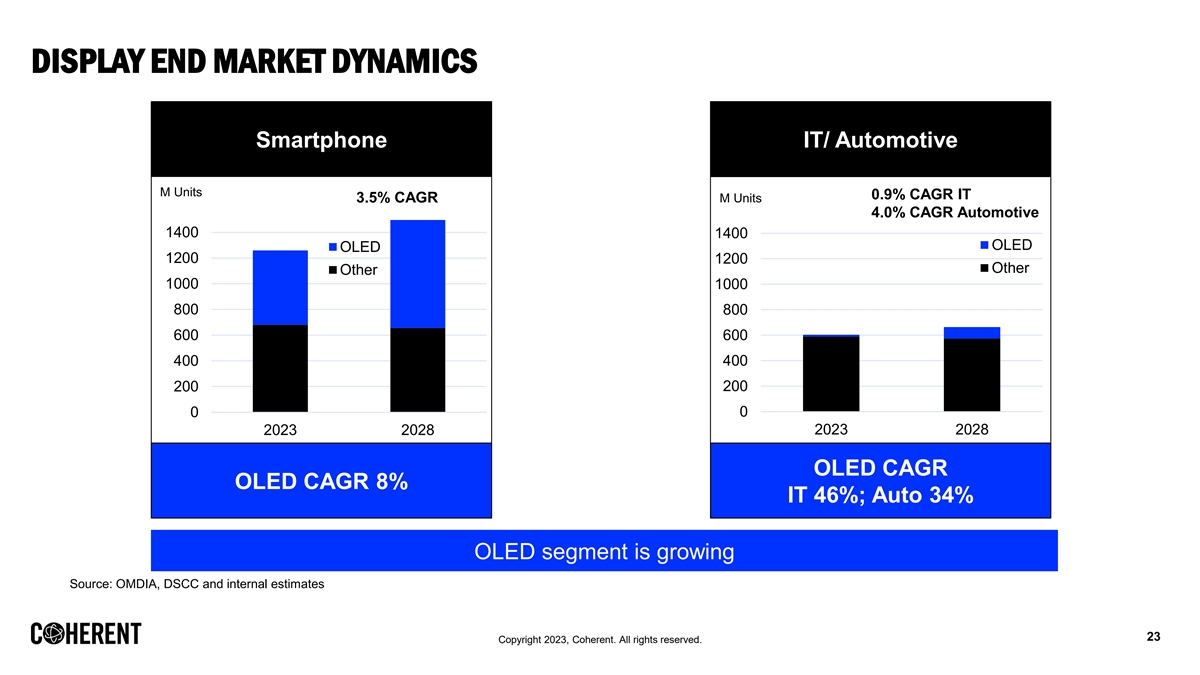

DISPLAY END MARKET DYNAMICS Smartphone IT/ Automotive M Units 0.9% CAGR IT 3.5% CAGR M Units 4.0% CAGR Automotive 1400 1400 OLED OLED 1200 1200 Other Other 1000 1000 800 800 600 600 400 400 200 200 0 0 2023 2028 2023 2028 OLED CAGR OLED CAGR 8% IT 46%; Auto 34% OLED segment is growing Source: OMDIA, DSCC and internal estimates 23 Copyright 2023, Coherent. All rights reserved.

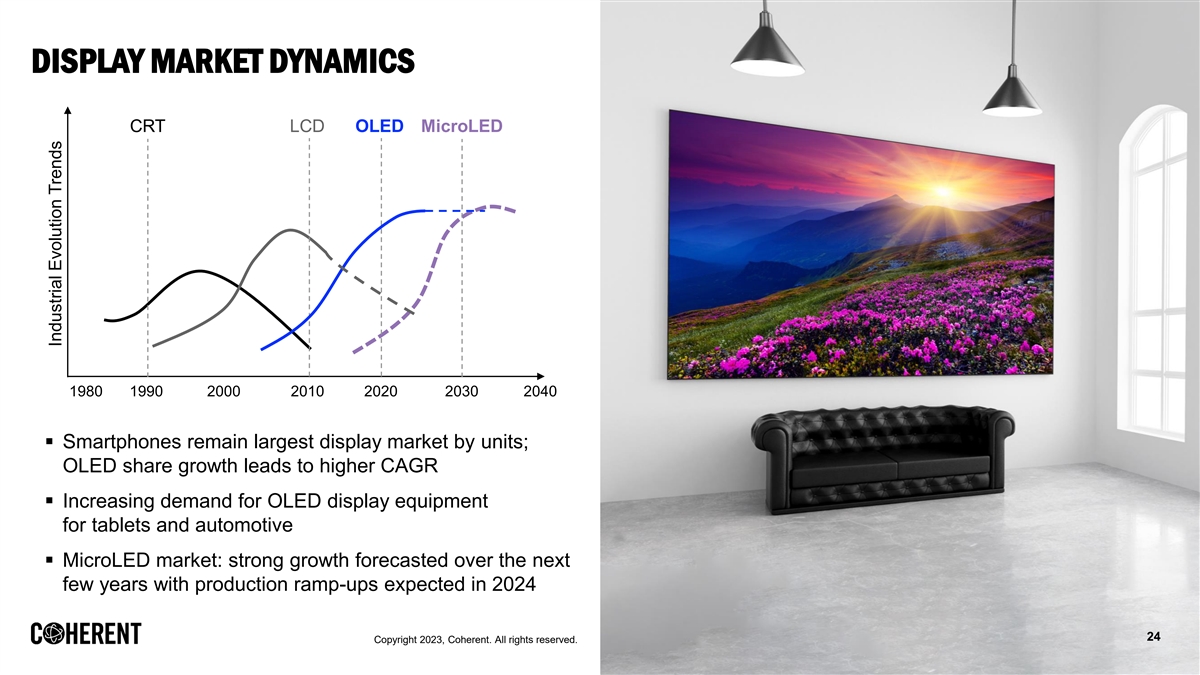

DISPLAY MARKET DYNAMICS CRT LCD OLED MicroLED 1980 1990 2000 2010 2020 2030 2040 ▪ Smartphones remain largest display market by units; OLED share growth leads to higher CAGR ▪ Increasing demand for OLED display equipment for tablets and automotive ▪ MicroLED market: strong growth forecasted over the next few years with production ramp-ups expected in 2024 24 Copyright 2023, Coherent. All rights reserved. Industrial Evolution Trends

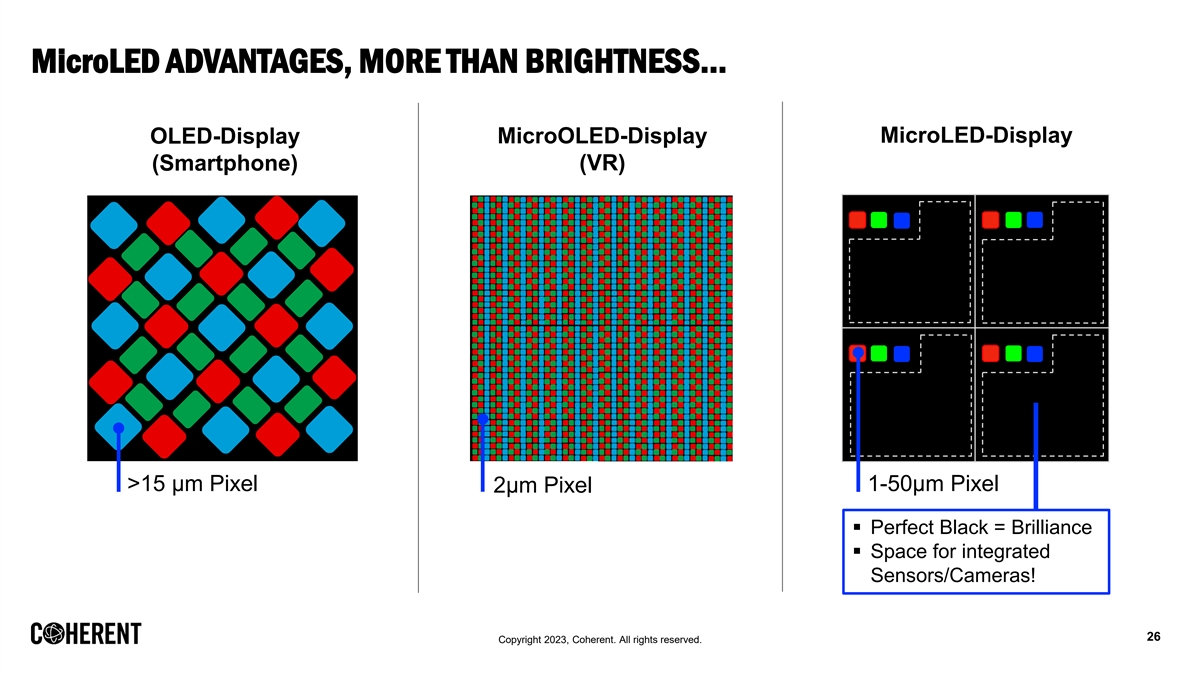

MicroLED ADVANTAGES, MORE THAN BRIGHTNESS… Integrated Micro Lens High Brightness Long Lifetime Array - Brightness Emitting & Sensing Smallest Pixel Size Robustness In-Display Plane Sensors 25 Copyright 2023, Coherent. All rights reserved.

MicroLED ADVANTAGES, MORE THAN BRIGHTNESS… MicroLED-Display OLED-Display MicroOLED-Display (VR) (Smartphone) >15 µm Pixel 1-50µm Pixel 2µm Pixel ▪ Perfect Black = Brilliance ▪ Space for integrated Sensors/Cameras! 26 Copyright 2023, Coherent. All rights reserved.

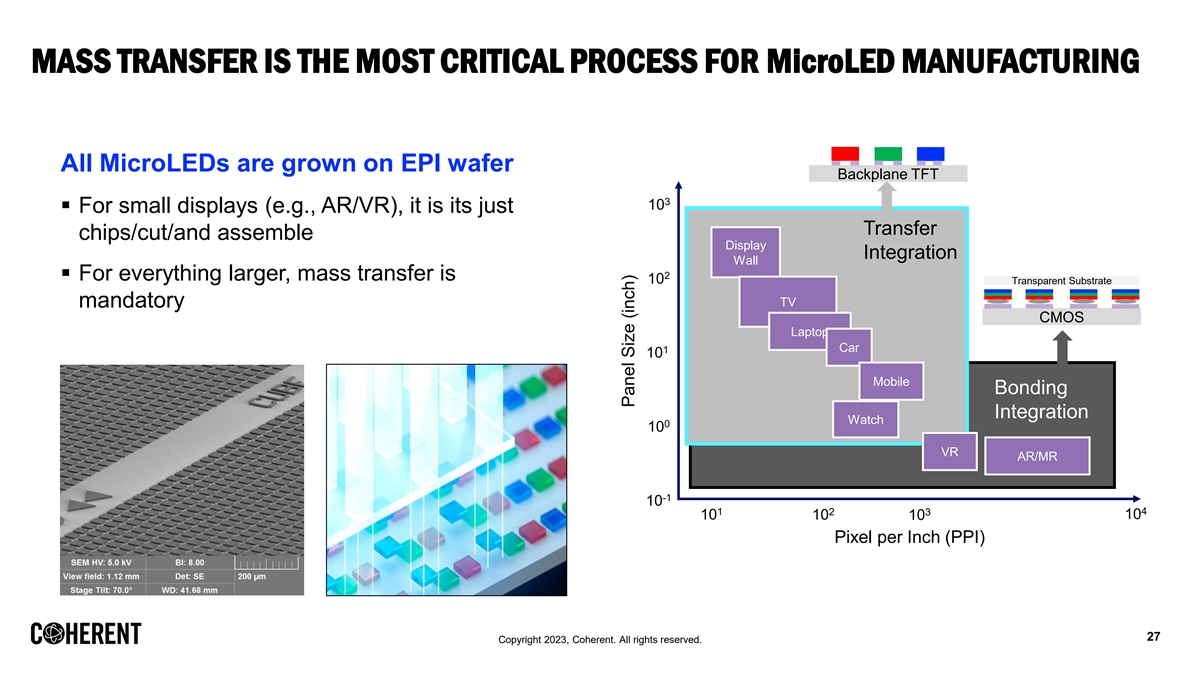

MASS TRANSFER IS THE MOST CRITICAL PROCESS FOR MicroLED MANUFACTURING All MicroLEDs are grown on EPI wafer Backplane TFT 3 10 ▪ For small displays (e.g., AR/VR), it is its just Transfer chips/cut/and assemble Display Integration Wall 2 ▪ For everything larger, mass transfer is 10 Transparent Substrate TV mandatory CMOS Laptop Car 1 10 Mobile Bonding Integration Watch 0 10 VR AR/MR -1 10 1 2 4 3 10 10 10 10 Pixel per Inch (PPI) 27 Copyright 2023, Coherent. All rights reserved. Panel Size (inch)

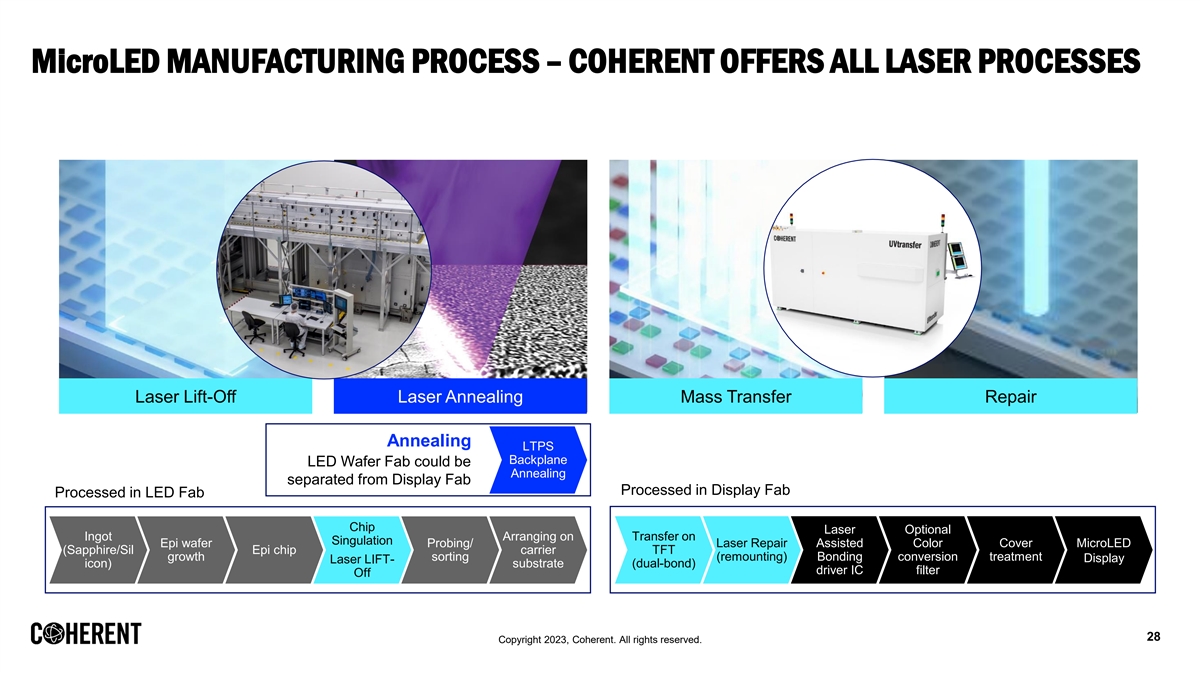

MicroLED MANUFACTURING PROCESS – COHERENT OFFERS ALL LASER PROCESSES Laser Lift-Off Laser Annealing Mass Transfer Repair Annealing LTPS Backplane LED Wafer Fab could be Annealing separated from Display Fab Processed in Display Fab Processed in LED Fab Chip Laser Optional Ingot Arranging on Transfer on Singulation Epi wafer Probing/ Laser Repair Assisted Color Cover MicroLED (Sapphire/Sil Epi chip carrier TFT growth sorting (remounting) Bonding conversion treatment Display Laser LIFT- icon) substrate (dual-bond) driver IC filter Off 28 Copyright 2023, Coherent. All rights reserved.

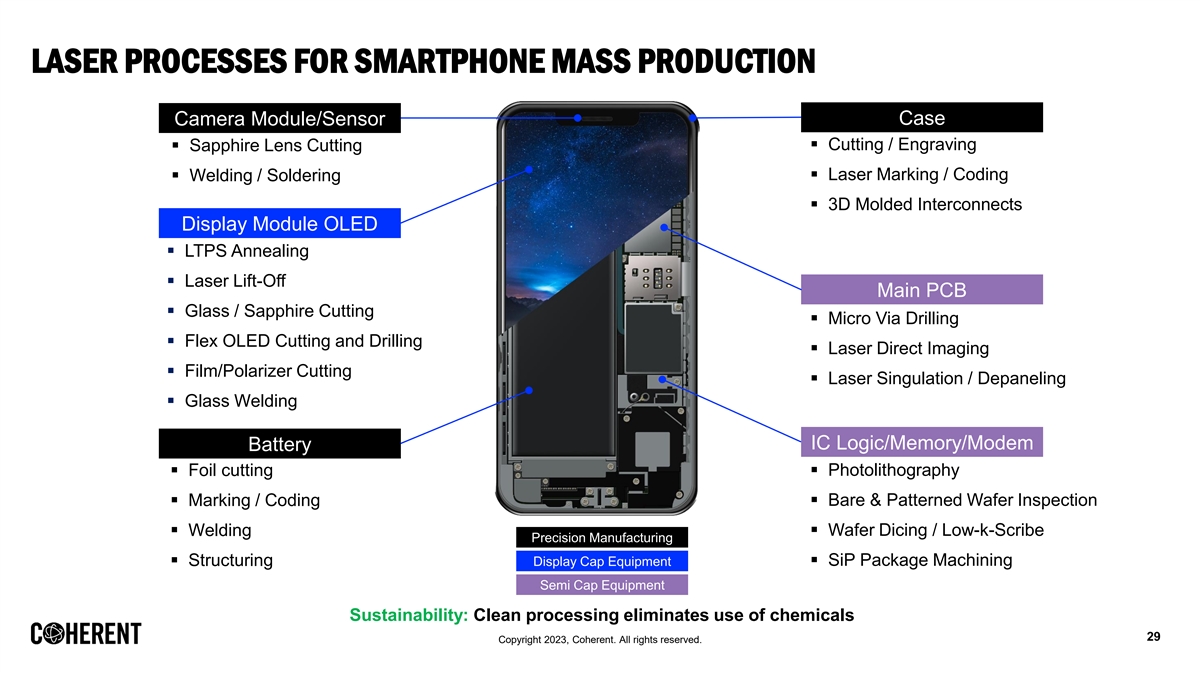

LASER PROCESSES FOR SMARTPHONE MASS PRODUCTION Case Camera Module/Sensor ▪ Cutting / Engraving ▪ Sapphire Lens Cutting ▪ Laser Marking / Coding ▪ Welding / Soldering ▪ 3D Molded Interconnects Display Module OLED ▪ LTPS Annealing ▪ Laser Lift-Off Main PCB ▪ Glass / Sapphire Cutting ▪ Micro Via Drilling ▪ Flex OLED Cutting and Drilling ▪ Laser Direct Imaging ▪ Film/Polarizer Cutting ▪ Laser Singulation / Depaneling ▪ Glass Welding IC Logic/Memory/Modem Battery ▪ Foil cutting▪ Photolithography ▪ Marking / Coding▪ Bare & Patterned Wafer Inspection ▪ Welding▪ Wafer Dicing / Low-k-Scribe Precision Manufacturing ▪ Structuring Display Cap Equipment▪ SiP Package Machining Semi Cap Equipment Sustainability: Clean processing eliminates use of chemicals 29 Copyright 2023, Coherent. All rights reserved.

PRECISION MANUFACTURING WITH HIGH POWER FIBER LASERS Martin Seifert – Vice President, High Power Fiber Laser Business Unit 30 Copyright 2023, Coherent. All rights reserved.

PRECISION MANUFACTURING APPLICATIONS Automotive Consumer Goods Manufacturing PRECISION Additive Machine Tools Manufacturing MANUFACTURING Medical Device Industrial Electrical & Electronics Manufacturing 31 Copyright 2023, Coherent. All rights reserved.

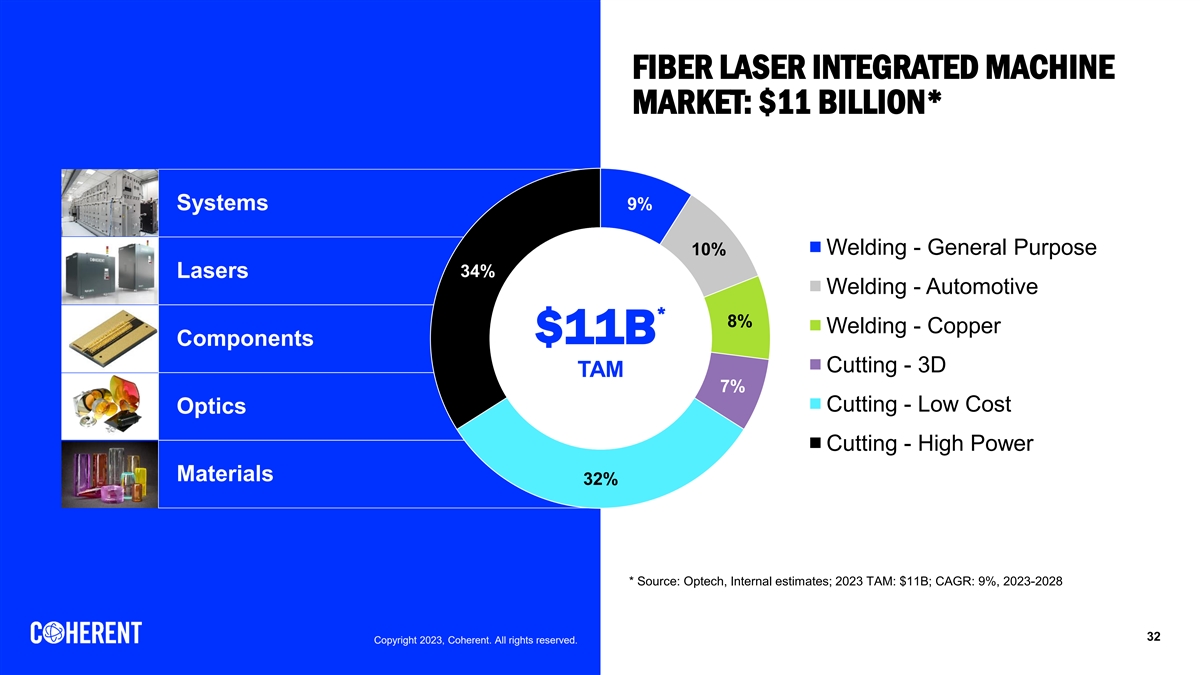

FIBER LASER INTEGRATED MACHINE MARKET: $11 BILLION* Systems 9% 10% Welding - General Purpose 34% Lasers Welding - Automotive * 8% Welding - Copper $11B Components Cutting - 3D TAM 7% Cutting - Low Cost Optics Cutting - High Power Materials 32% * Source: Optech, Internal estimates; 2023 TAM: $11B; CAGR: 9%, 2023-2028 32 C Co op py yr righ ightt 2 20 02 23 3,, C Co oh he er re en ntt.. A All ll r righ ightts s r re es se er rv ve ed d..

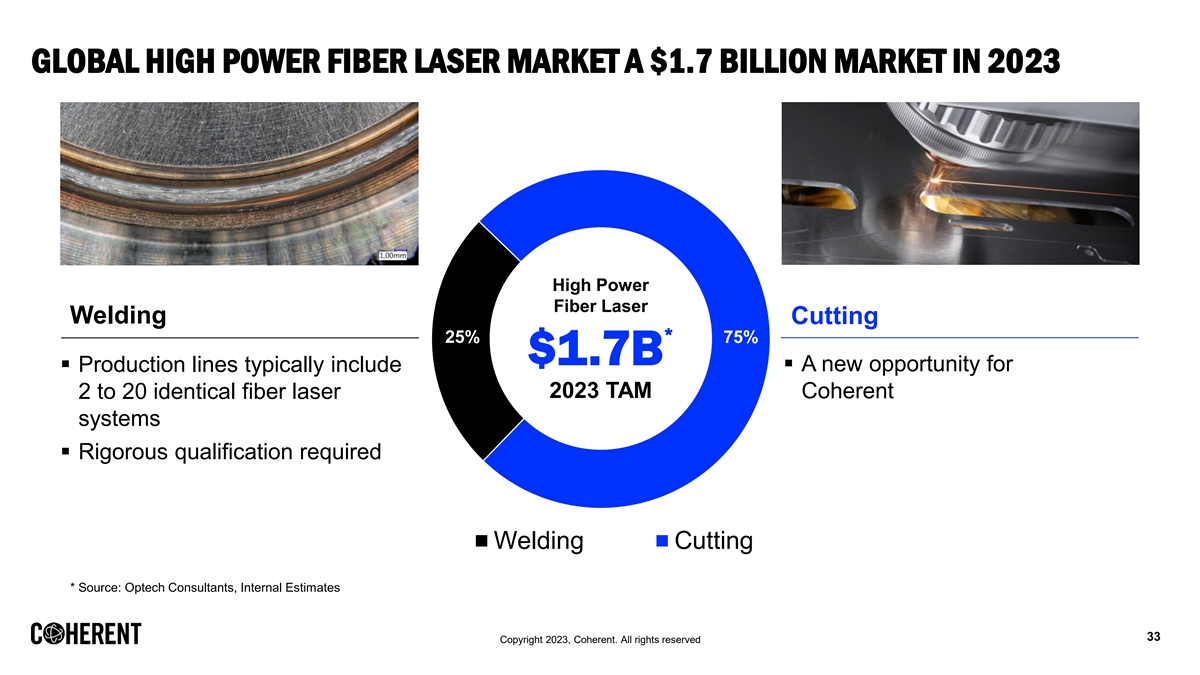

GLOBAL HIGH POWER FIBER LASER MARKET A $1.7 BILLION MARKET IN 2023 High Power Fiber Laser Welding Cutting * 25% 75% $1.7B ▪ A new opportunity for ▪ Production lines typically include 2 to 20 identical fiber laser 2023 TAM Coherent systems ▪ Rigorous qualification required Welding Cutting * Source: Optech Consultants, Internal Estimates 33 Copyright 2023, Coherent. All rights reserved

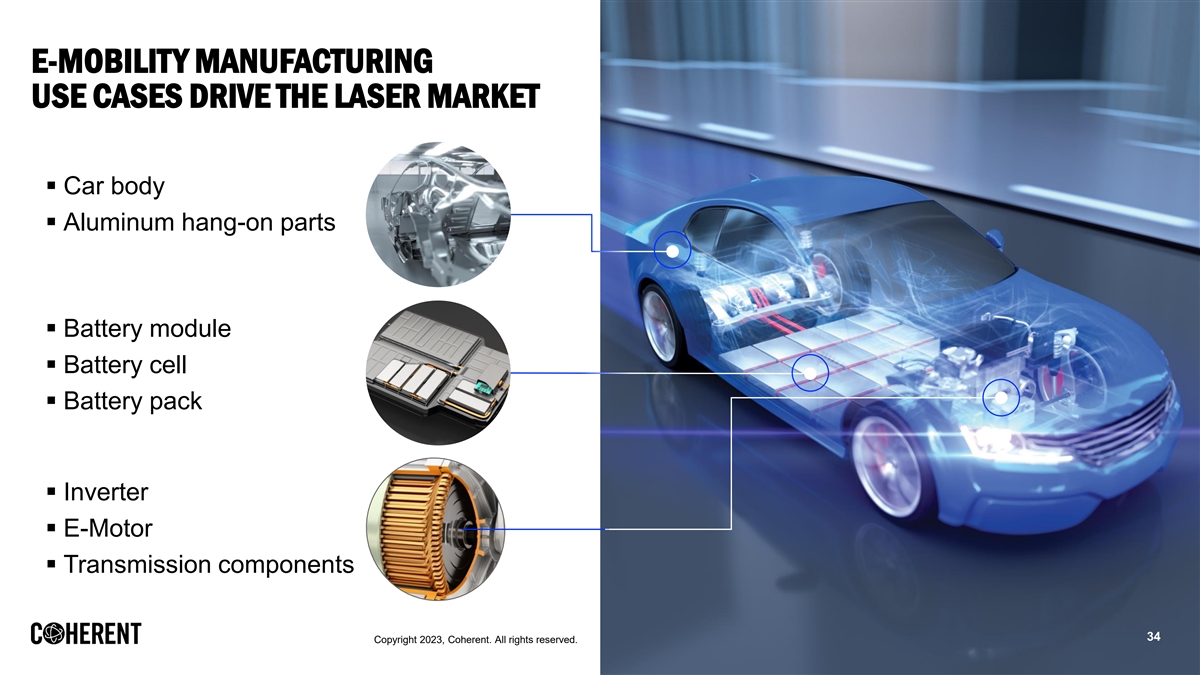

E-MOBILITY MANUFACTURING USE CASES DRIVE THE LASER MARKET ▪ Car body ▪ Aluminum hang-on parts ▪ Battery module ▪ Battery cell ▪ Battery pack ▪ Inverter ▪ E-Motor ▪ Transmission components 34 Copyright 2023, Coherent. All rights reserved.

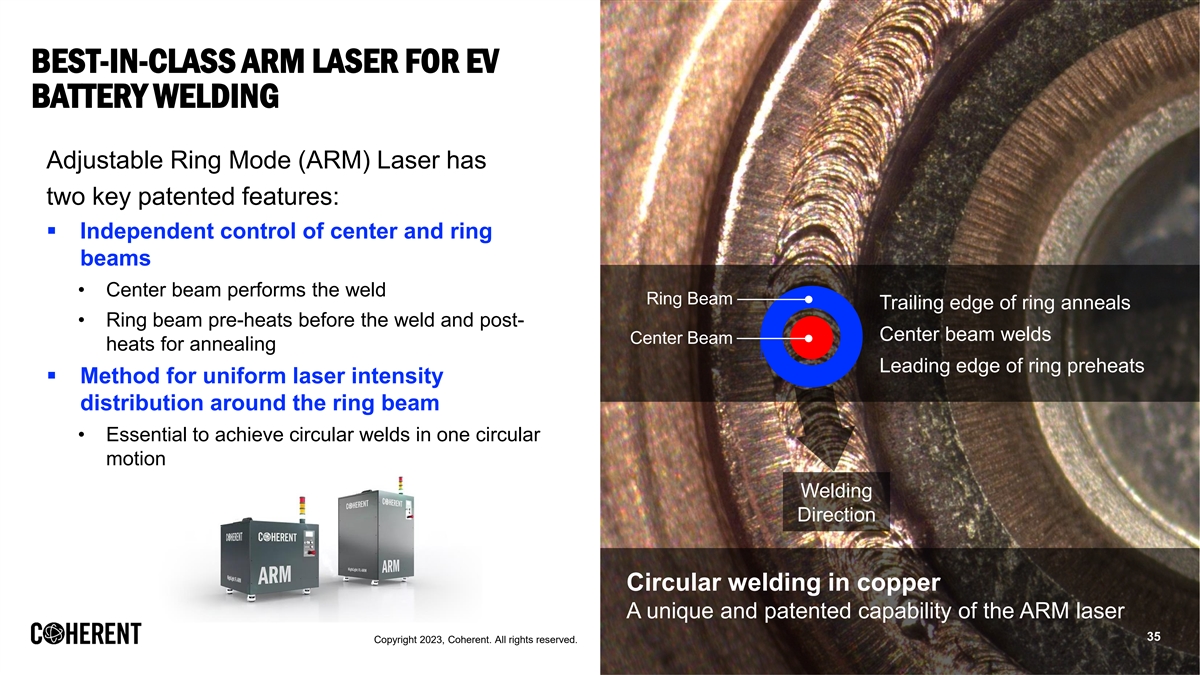

BEST-IN-CLASS ARM LASER FOR EV BATTERY WELDING Adjustable Ring Mode (ARM) Laser has two key patented features: ▪ Independent control of center and ring beams • Center beam performs the weld Ring Beam Trailing edge of ring anneals • Ring beam pre-heats before the weld and post- Center beam welds Center Beam heats for annealing Leading edge of ring preheats ▪ Method for uniform laser intensity distribution around the ring beam • Essential to achieve circular welds in one circular motion Welding Direction Circular welding in copper A unique and patented capability of the ARM laser 35 Copyright 2023, Coherent. All rights reserved.

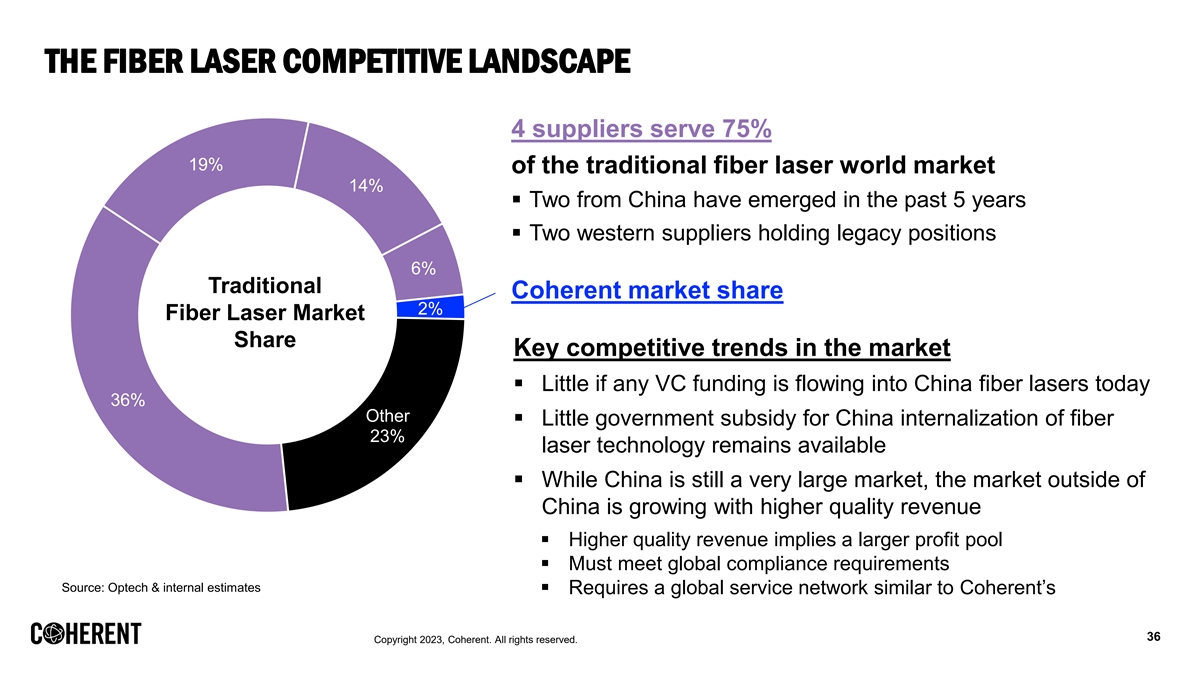

THE FIBER LASER COMPETITIVE LANDSCAPE 4 suppliers serve 75% 19% of the traditional fiber laser world market 14% ▪ Two from China have emerged in the past 5 years ▪ Two western suppliers holding legacy positions 6% Traditional Coherent market share 2% Fiber Laser Market Share Key competitive trends in the market ▪ Little if any VC funding is flowing into China fiber lasers today 36% Other ▪ Little government subsidy for China internalization of fiber 23% laser technology remains available ▪ While China is still a very large market, the market outside of China is growing with higher quality revenue ▪ Higher quality revenue implies a larger profit pool ▪ Must meet global compliance requirements Source: Optech & internal estimates ▪ Requires a global service network similar to Coherent’s 36 Copyright 2023, Coherent. All rights reserved.

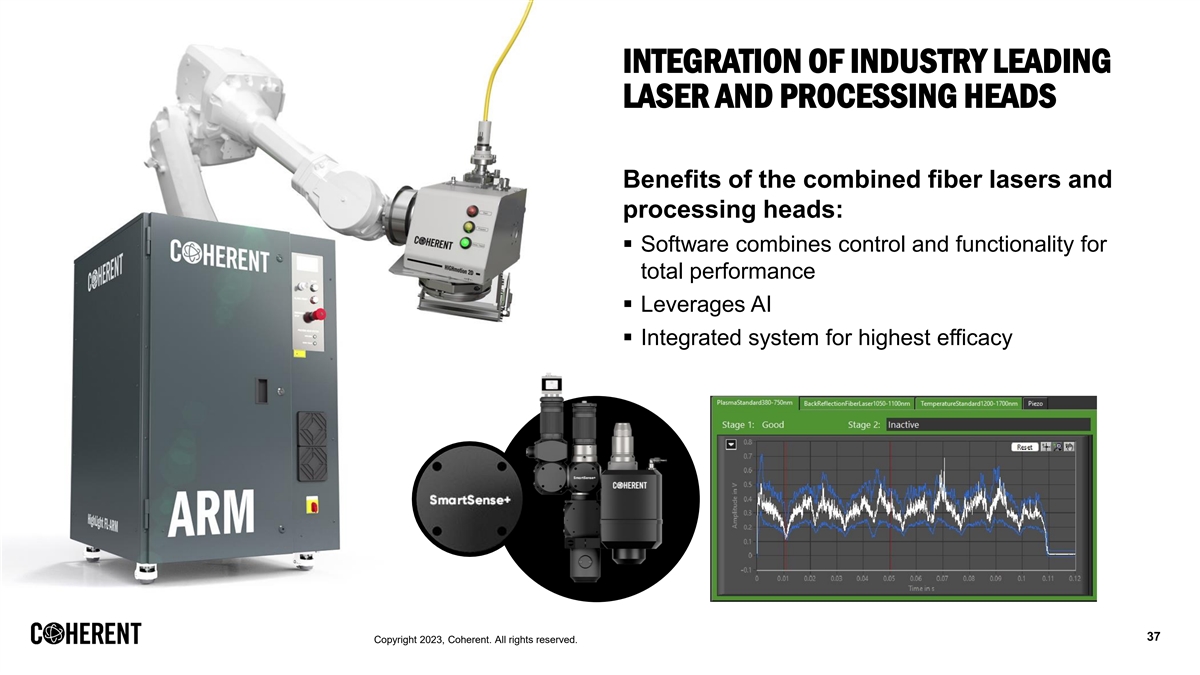

INTEGRATION OF INDUSTRY LEADING LASER AND PROCESSING HEADS Benefits of the combined fiber lasers and processing heads: ▪ Software combines control and functionality for total performance ▪ Leverages AI ▪ Integrated system for highest efficacy 37 Copyright 2023, Coherent. All rights reserved.

NEW FIBER LASER BUSINESS UNIT TO ACCELERATE GROWTH Our opportunity to grow in the welding market is due to the combination of three key factors 1. Leader in copper welding for prismatic and cylindrical batteries for e-mobility 2. Leader in the market for fine welding of legacy, new, and difficult materials 3. In a great position to enter the laser cutting market due to the merger of II-VI and Coherent, Inc. 38 Copyright 2023, Coherent. All rights reserved.

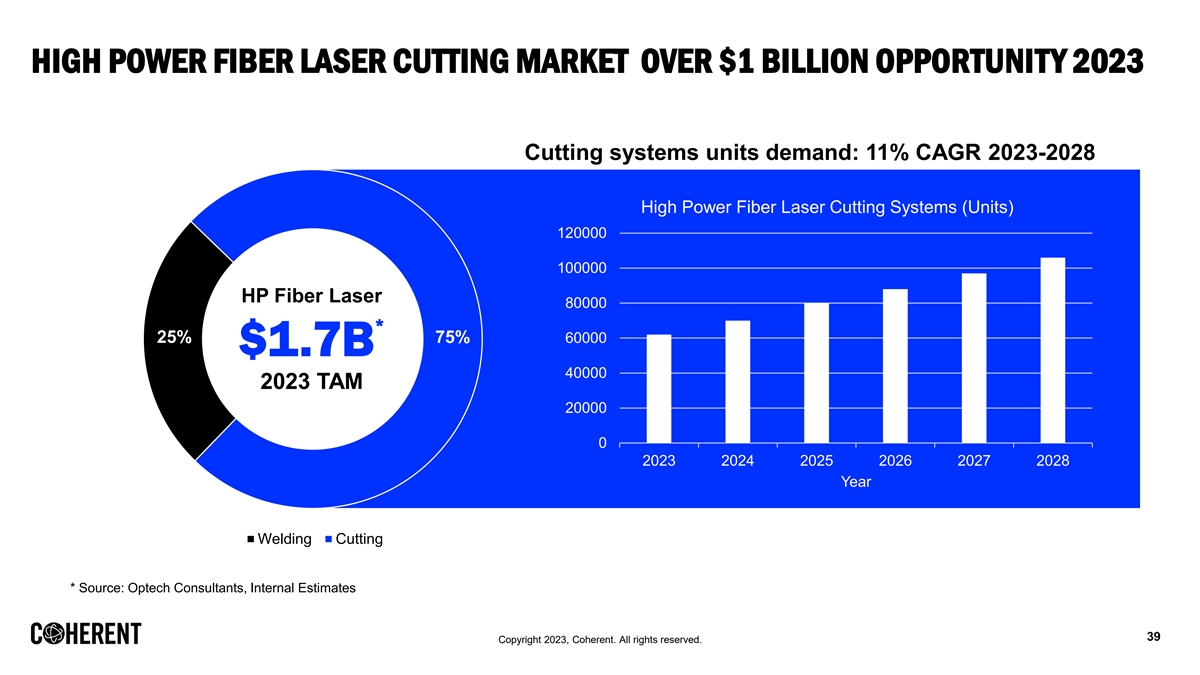

HIGH POWER FIBER LASER CUTTING MARKET OVER $1 BILLION OPPORTUNITY 2023 Cutting systems units demand: 11% CAGR 2023-2028 High Power Fiber Laser Cutting Systems (Units) 120000 100000 HP Fiber Laser 80000 * 25% 75% 60000 $1.7B 40000 2023 TAM 20000 0 2023 2024 2025 2026 2027 2028 Year Welding Cutting * Source: Optech Consultants, Internal Estimates 39 Copyright 2023, Coherent. All rights reserved.

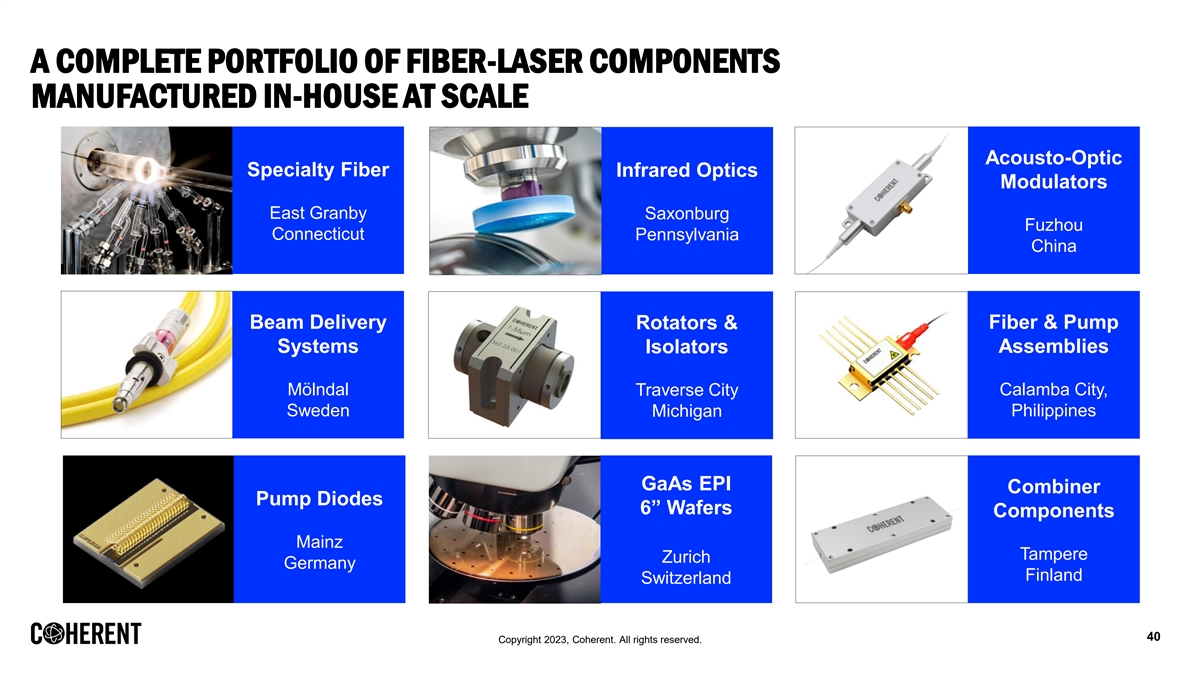

A COMPLETE PORTFOLIO OF FIBER-LASER COMPONENTS MANUFACTURED IN-HOUSE AT SCALE Acousto-Optic Specialty Fiber Infrared Optics Modulators East Granby Saxonburg Fuzhou Connecticut Pennsylvania China Beam Delivery Fiber & Pump Rotators & Systems Assemblies Isolators Mölndal Calamba City, Traverse City Sweden Philippines Michigan GaAs EPI Combiner Pump Diodes 6” Wafers Components Mainz Tampere Zurich Germany Finland Switzerland 40 Copyright 2023, Coherent. All rights reserved.

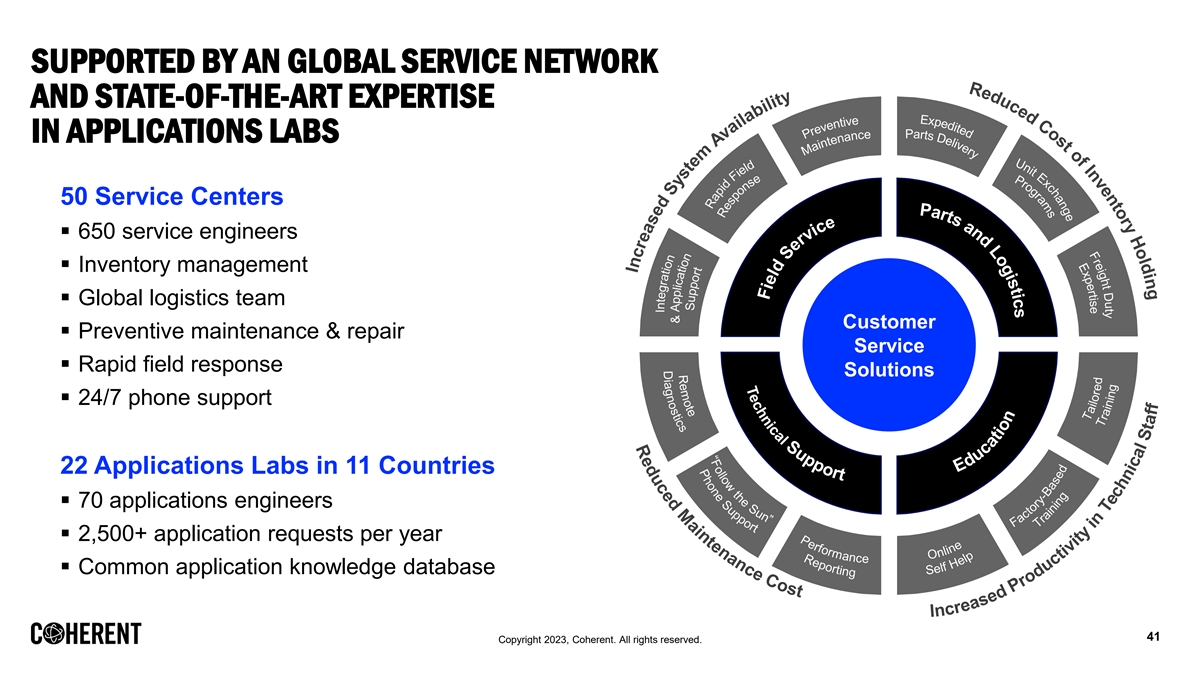

SUPPORTED BY AN GLOBAL SERVICE NETWORK AND STATE-OF-THE-ART EXPERTISE IN APPLICATIONS LABS 50 Service Centers ▪ 650 service engineers ▪ Inventory management ▪ Global logistics team Customer ▪ Preventive maintenance & repair Service ▪ Rapid field response Solutions ▪ 24/7 phone support 22 Applications Labs in 11 Countries ▪ 70 applications engineers ▪ 2,500+ application requests per year ▪ Common application knowledge database 41 Copyright 2023, Coherent. All rights reserved.

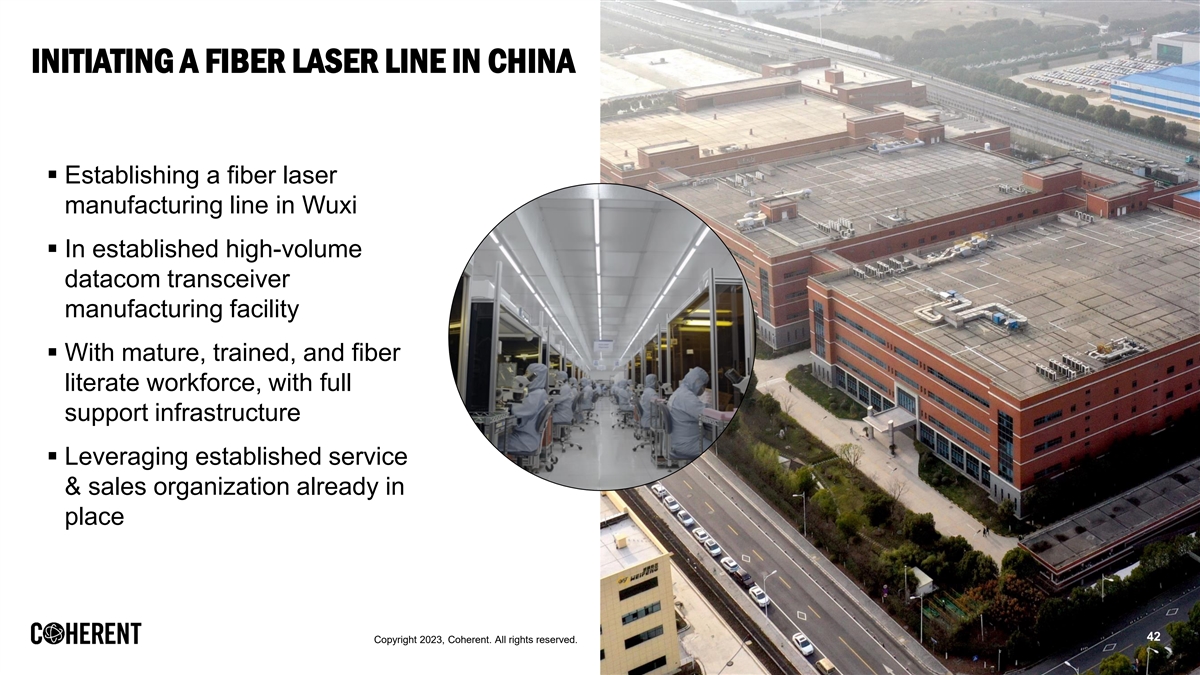

INITIATING A FIBER LASER LINE IN CHINA ▪ Establishing a fiber laser manufacturing line in Wuxi ▪ In established high-volume datacom transceiver manufacturing facility ▪ With mature, trained, and fiber literate workforce, with full support infrastructure ▪ Leveraging established service & sales organization already in place 42 Copyright 2023, Coherent. All rights reserved.

SUMMARY ▪ Lasers are increasingly used in precision manufacturing ▪ Coherent is growing and gaining share in welding applications for automotive. EVs are increasing the number of use cases ▪ We created a dedicated Business Unit to add focus and speed up time to market ▪ Coherent is planning to enter the laser cutting market; this was in fact one of the sales synergies envisioned from the merger of II-VI and Coherent, Inc. ▪ We believe that success with a low-cost platform in cutting will help us in welding, creating a virtuous cycle of winning in fiber lasers ▪ Our improved competitiveness and economies of scale from the larger volumes in cutting will contribute to healthy margins 43 Copyright 2023, Coherent. All rights reserved.

SEMICONDUCTOR CAPITAL EQUIPMENT VERTICAL Dr. Chris Dorman – Executive Vice President, Lasers Business 44 Copyright 2023, Coherent. All rights reserved.

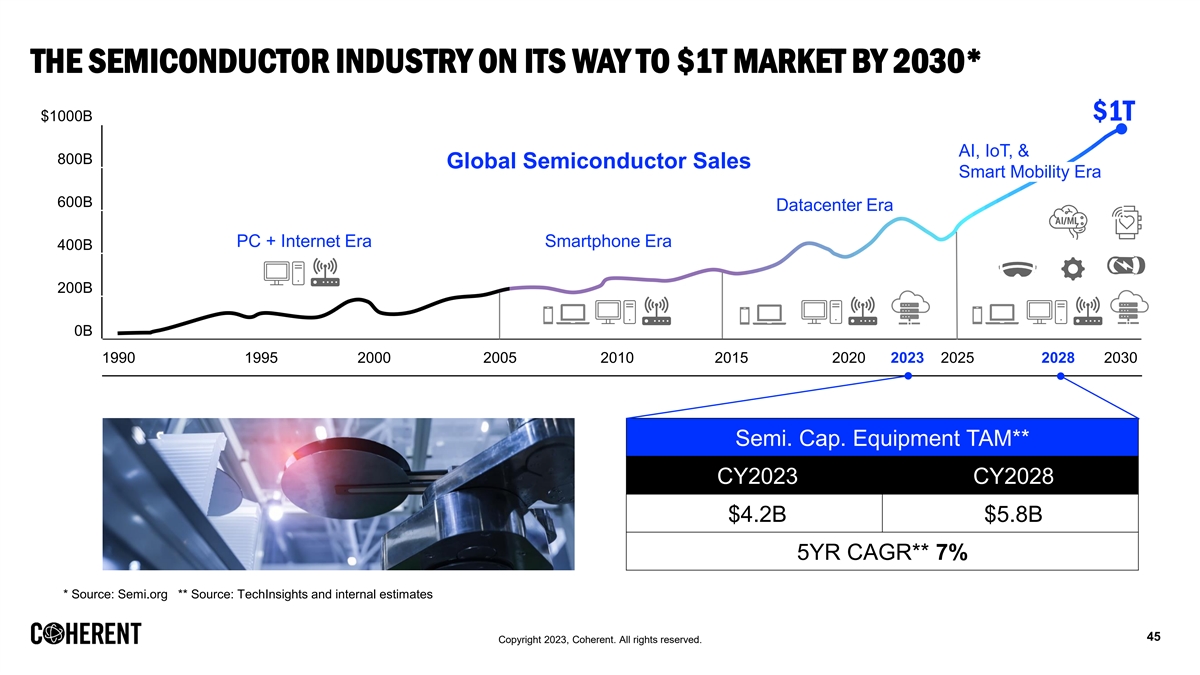

THE SEMICONDUCTOR INDUSTRY ON ITS WAY TO $1T MARKET BY 2030* $1000B $1T AI, IoT, & 800B Global Semiconductor Sales Smart Mobility Era 600B Datacenter Era PC + Internet Era Smartphone Era 400B 200B 0B 1990 1995 2000 2005 2010 2015 2020 2023 2025 2028 2030 Semi. Cap. Equipment TAM** CY2023 CY2028 $4.2B $5.8B 5YR CAGR** 7% * Source: Semi.org ** Source: TechInsights and internal estimates 45 Copyright 2023, Coherent. All rights reserved.

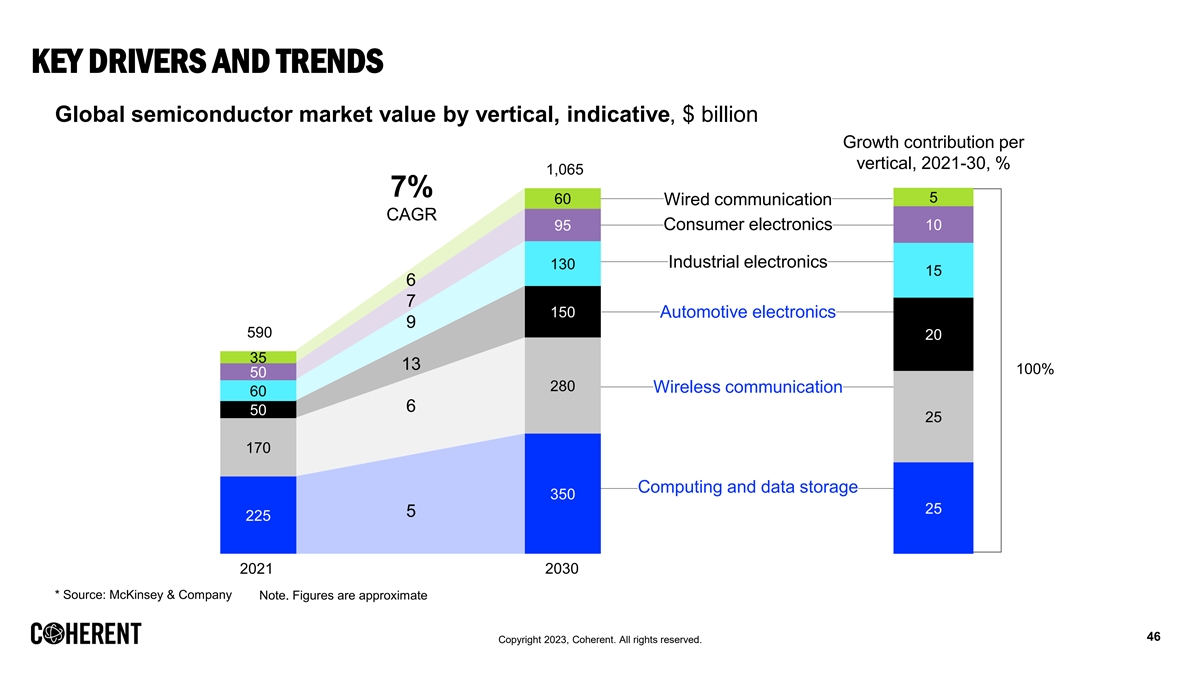

KEY DRIVERS AND TRENDS Global semiconductor market value by vertical, indicative, $ billion Growth contribution per vertical, 2021-30, % 1,065 7% 5 60 Wired communication CAGR Consumer electronics 10 95 Industrial electronics 130 15 6 7 150 Automotive electronics 9 590 20 35 13 100% 50 280 Wireless communication 60 6 50 25 170 Computing and data storage 350 25 5 225 2021 2030 * Source: McKinsey & Company Note. Figures are approximate 46 Copyright 2023, Coherent. All rights reserved.

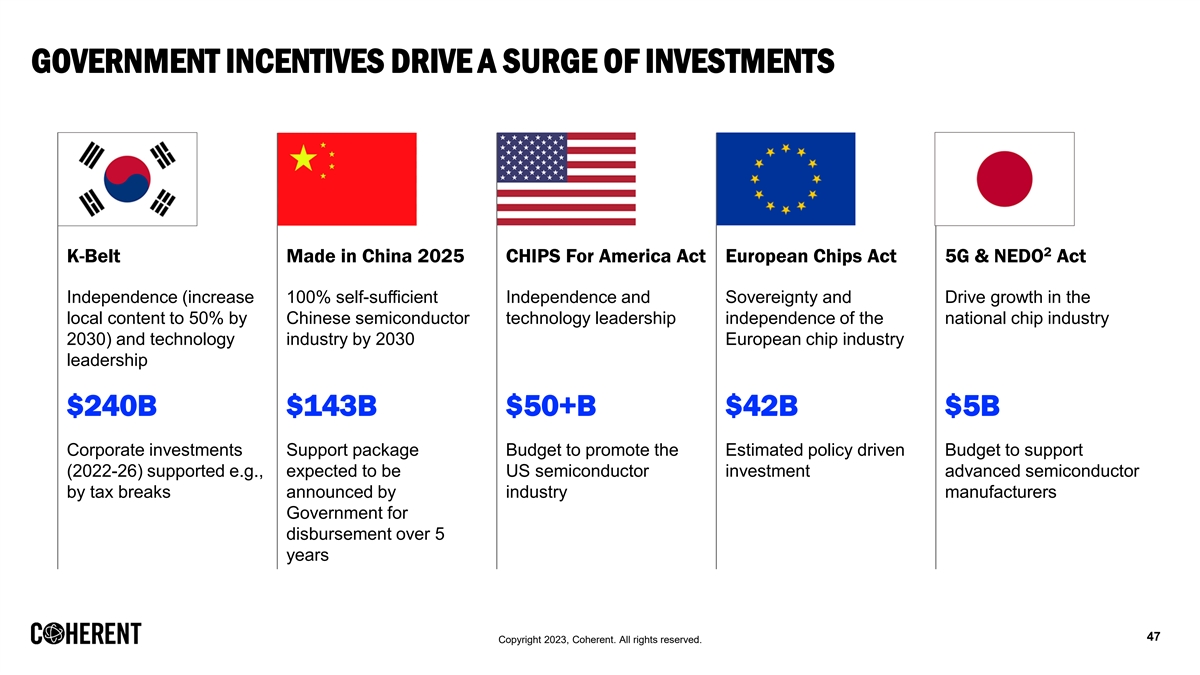

GOVERNMENT INCENTIVES DRIVE A SURGE OF INVESTMENTS 2 K-Belt Made in China 2025 CHIPS For America Act European Chips Act 5G & NEDO Act Independence (increase 100% self-sufficient Independence and Sovereignty and Drive growth in the local content to 50% by Chinese semiconductor technology leadership independence of the national chip industry 2030) and technology industry by 2030 European chip industry leadership $240B $143B $50+B $42B $5B Corporate investments Support package Budget to promote the Estimated policy driven Budget to support (2022-26) supported e.g., expected to be US semiconductor investment advanced semiconductor by tax breaks announced by industry manufacturers Government for disbursement over 5 years 47 Copyright 2023, Coherent. All rights reserved.

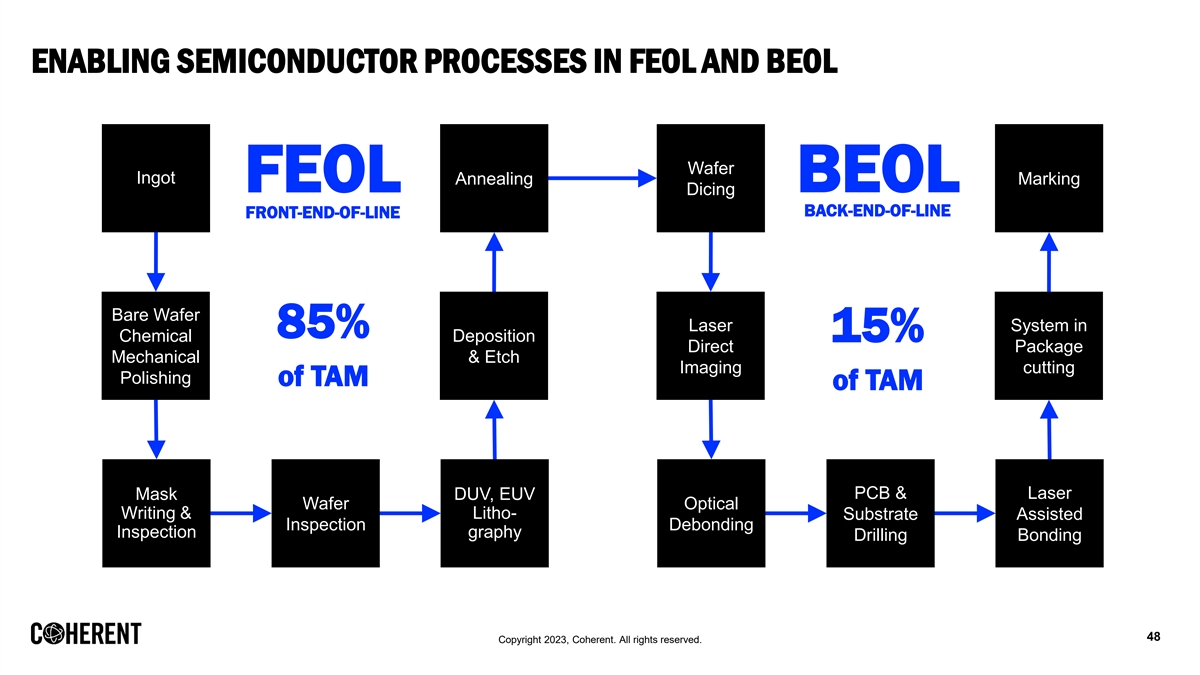

ENABLING SEMICONDUCTOR PROCESSES IN FEOL AND BEOL Wafer Ingot Annealing Marking FEOL BEOL Dicing BACK-END-OF-LINE FRONT-END-OF-LINE Bare Wafer Laser System in 85% 15% Chemical Deposition Direct Package Mechanical & Etch Imaging cutting Polishing of TAM of TAM PCB & Laser Mask DUV, EUV Wafer Optical Writing & Litho- Substrate Assisted Inspection Debonding Inspection graphy Drilling Bonding 48 Copyright 2023, Coherent. All rights reserved.

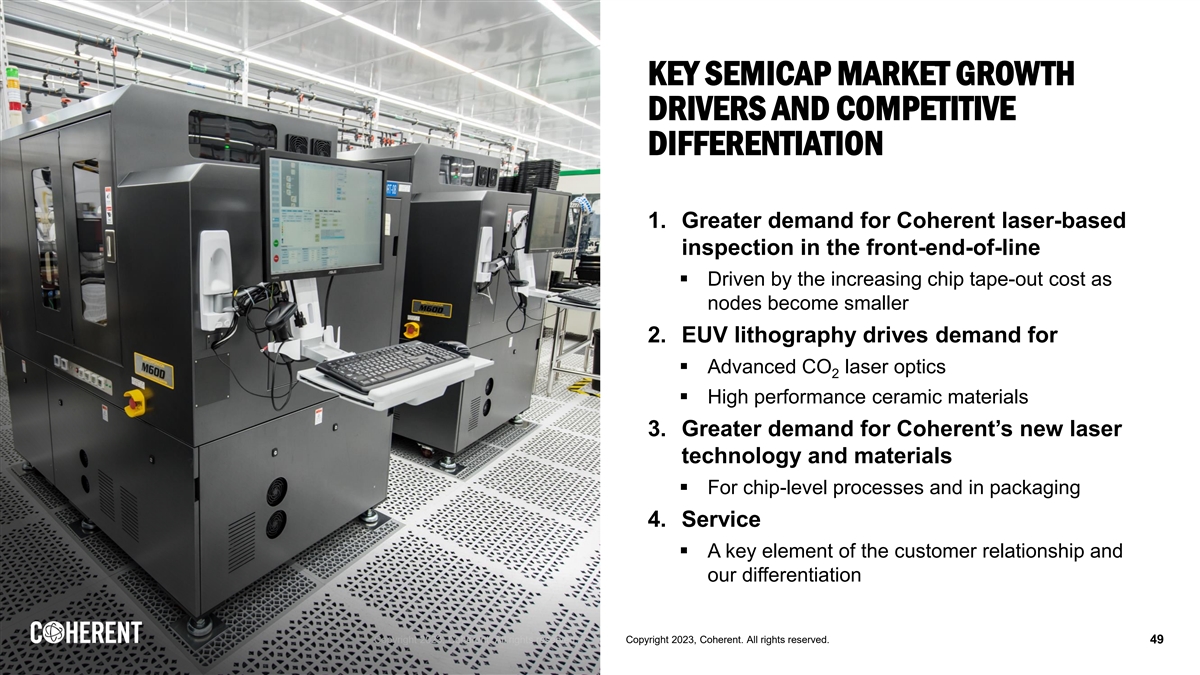

KEY SEMICAP MARKET GROWTH DRIVERS AND COMPETITIVE DIFFERENTIATION 1. Greater demand for Coherent laser-based inspection in the front-end-of-line ▪ Driven by the increasing chip tape-out cost as nodes become smaller 2. EUV lithography drives demand for ▪ Advanced CO laser optics 2 ▪ High performance ceramic materials 3. Greater demand for Coherent’s new laser technology and materials ▪ For chip-level processes and in packaging 4. Service ▪ A key element of the customer relationship and our differentiation C Co op py yr righ ightt 2 20 02 23 3,, C Co oh he er re en ntt.. A All ll r righ ightts s r re es se er rv ve ed d.. Copyright 2023, Coherent. All rights reserved. 49

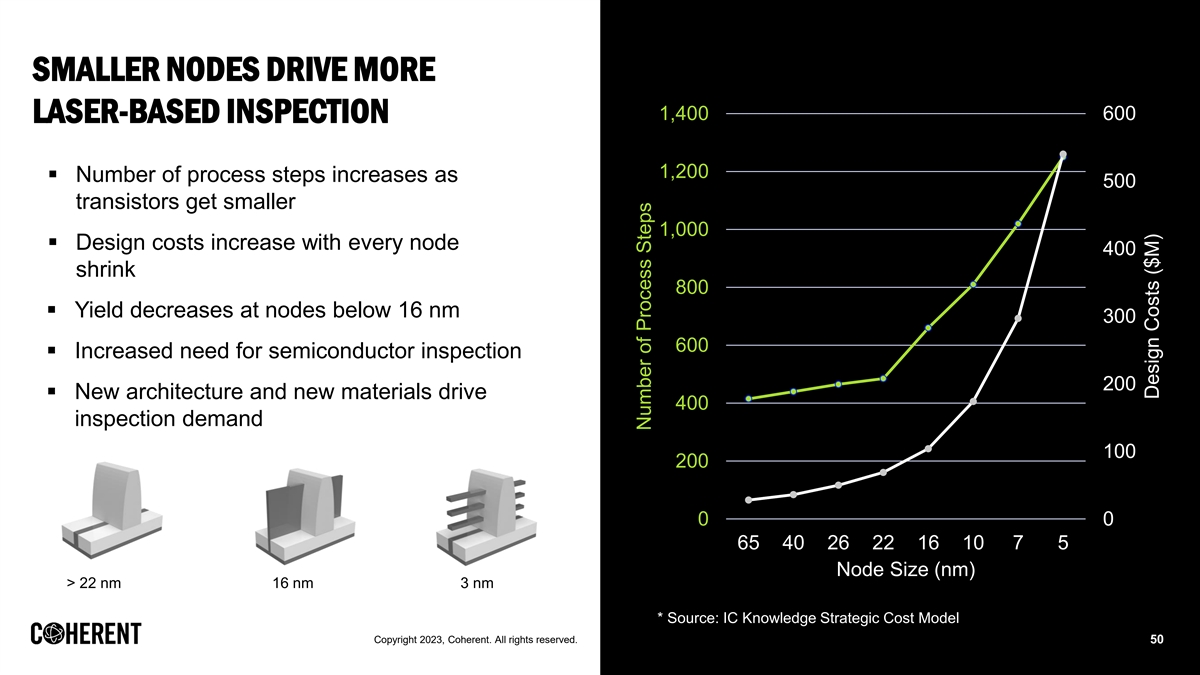

SMALLER NODES DRIVE MORE 1,400 600 LASER-BASED INSPECTION 1,200 ▪ Number of process steps increases as 500 transistors get smaller 1,000 ▪ Design costs increase with every node 400 shrink 800 ▪ Yield decreases at nodes below 16 nm 300 600 ▪ Increased need for semiconductor inspection 200 ▪ New architecture and new materials drive 400 inspection demand 100 200 0 0 65 40 26 22 16 10 7 5 Node Size (nm) > 22 nm 16 nm 3 nm * Source: IC Knowledge Strategic Cost Model Copyright 2023, Coherent. All rights reserved. 50 Number of Process Steps Design Costs ($M)

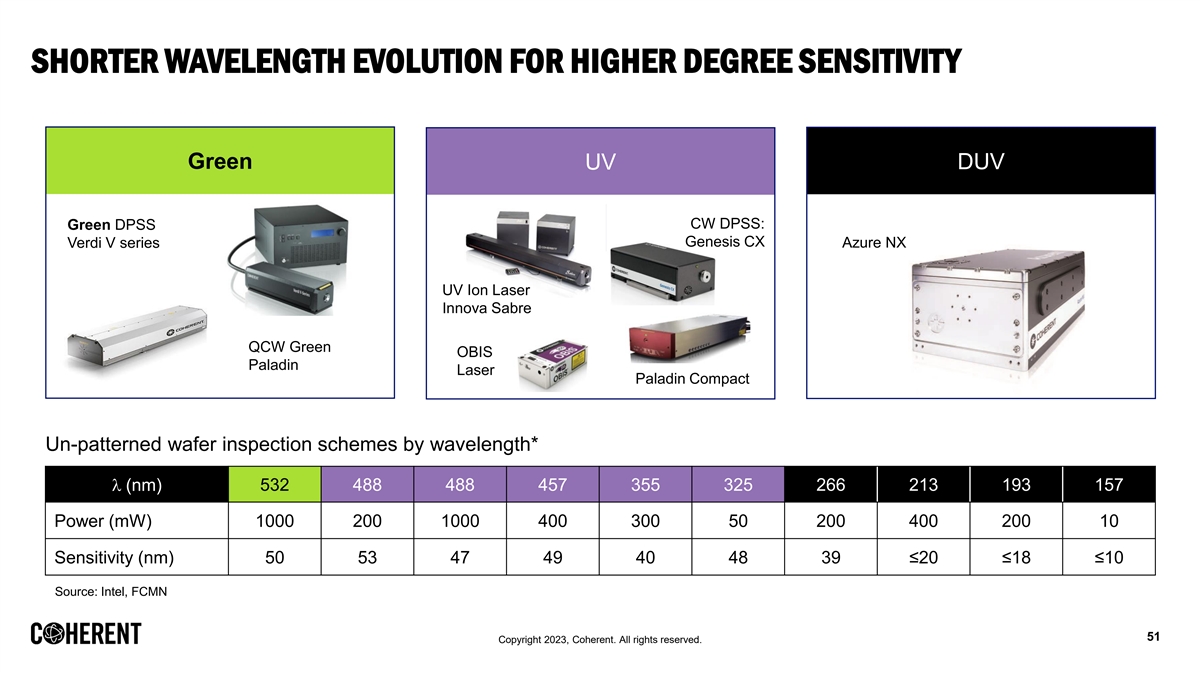

SHORTER WAVELENGTH EVOLUTION FOR HIGHER DEGREE SENSITIVITY Green UV DUV CW DPSS: Green DPSS Genesis CX Verdi V series Azure NX UV Ion Laser Innova Sabre QCW Green OBIS Paladin Laser Paladin Compact Un-patterned wafer inspection schemes by wavelength* l (nm) 532 488 488 457 355 325 266 213 193 157 Power (mW) 1000 200 1000 400 300 50 200 400 200 10 Sensitivity (nm) 50 53 47 49 40 48 39 ≤20 ≤18 ≤10 Source: Intel, FCMN 51 Copyright 2023, Coherent. All rights reserved.

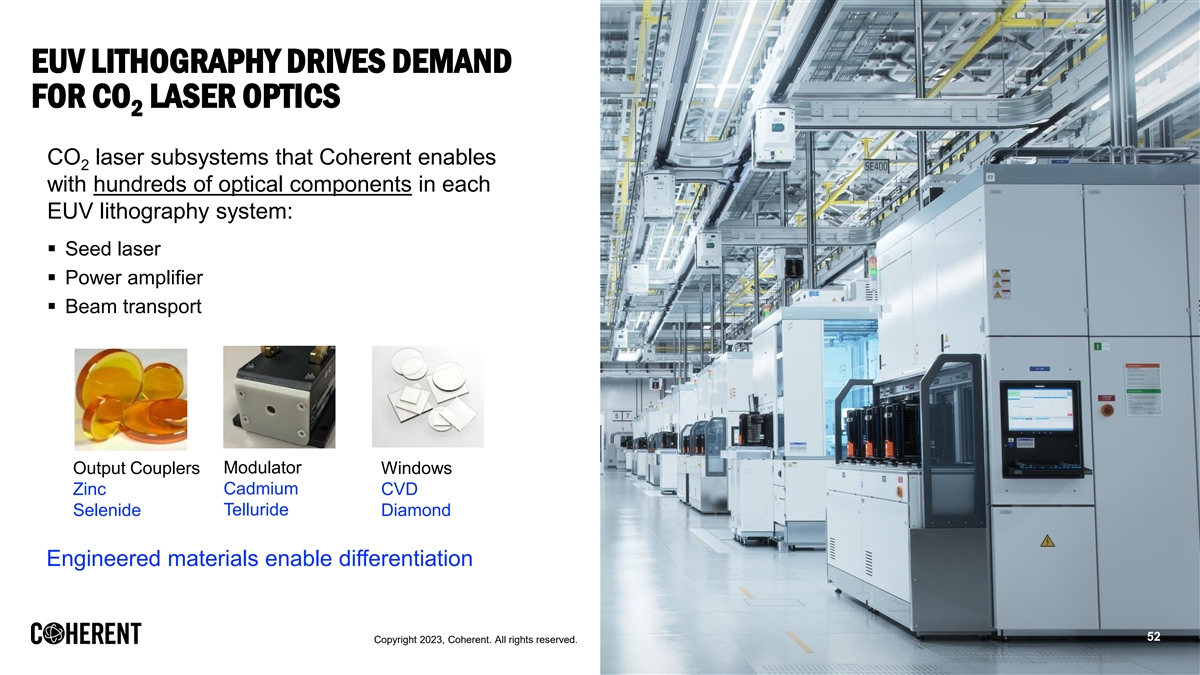

EUV LITHOGRAPHY DRIVES DEMAND FOR CO LASER OPTICS 2 CO laser subsystems that Coherent enables 2 with hundreds of optical components in each EUV lithography system: ▪ Seed laser ▪ Power amplifier ▪ Beam transport Output Couplers Modulator Windows Zinc Cadmium CVD Selenide Telluride Diamond Engineered materials enable differentiation 52 Copyright 2023, Coherent. All rights reserved.

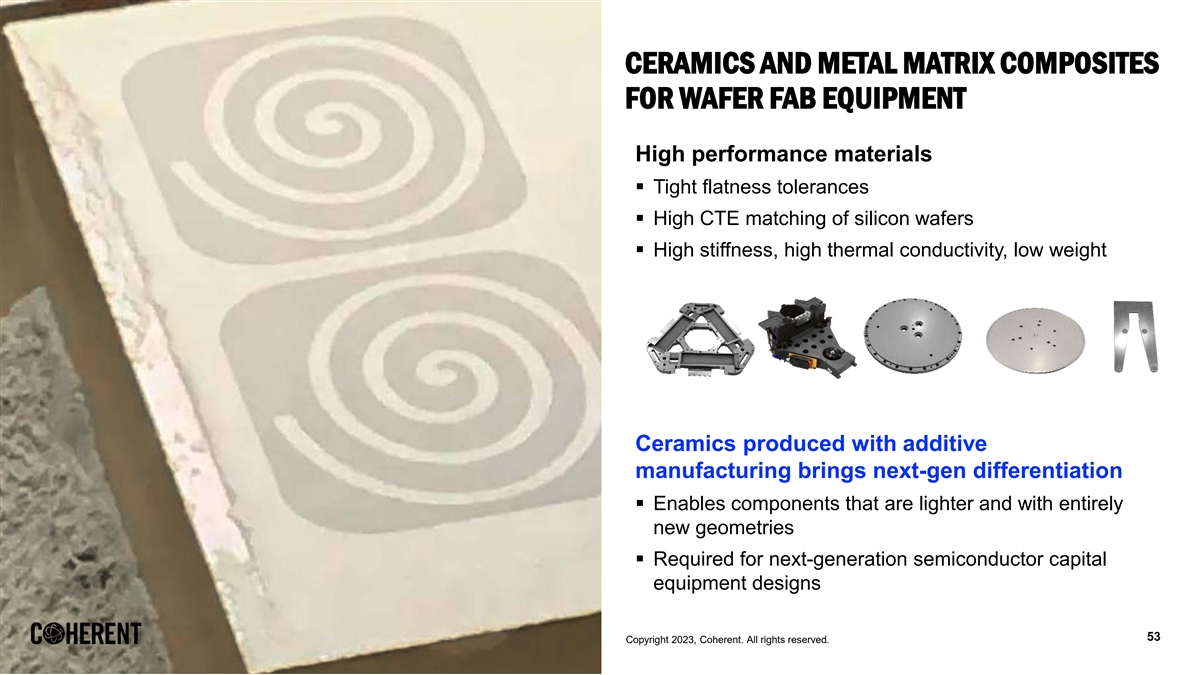

CERAMICS AND METAL MATRIX COMPOSITES FOR WAFER FAB EQUIPMENT High performance materials ▪ Tight flatness tolerances ▪ High CTE matching of silicon wafers ▪ High stiffness, high thermal conductivity, low weight Ceramics produced with additive manufacturing brings next-gen differentiation ▪ Enables components that are lighter and with entirely new geometries ▪ Required for next-generation semiconductor capital equipment designs 53 Copyright 2023, Coherent. All rights reserved. Copyright 2023, Coherent. All rights reserved.

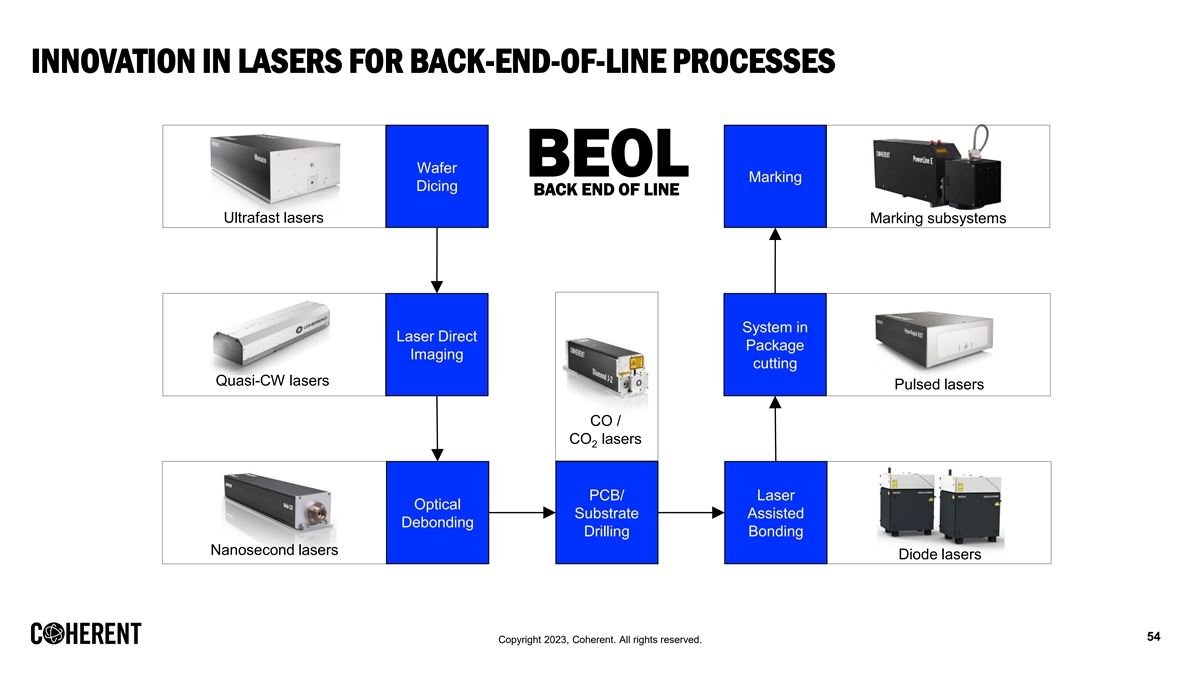

INNOVATION IN LASERS FOR BACK-END-OF-LINE PROCESSES Wafer BEOL Marking Dicing BACK END OF LINE Ultrafast lasers Marking subsystems System in Laser Direct Package Imaging cutting Quasi-CW lasers Pulsed lasers CO / CO lasers 2 PCB/ Laser Optical Substrate Assisted Debonding Drilling Bonding Nanosecond lasers Diode lasers 54 Copyright 2023, Coherent. All rights reserved.

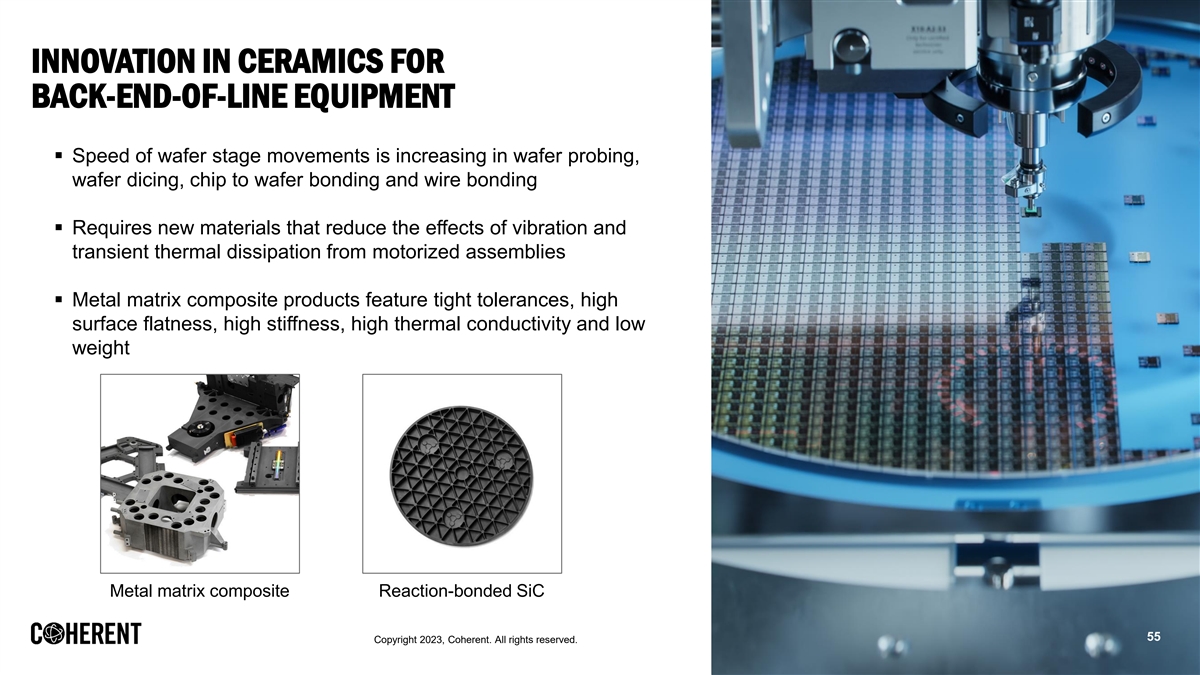

INNOVATION IN CERAMICS FOR BACK-END-OF-LINE EQUIPMENT ▪ Speed of wafer stage movements is increasing in wafer probing, wafer dicing, chip to wafer bonding and wire bonding ▪ Requires new materials that reduce the effects of vibration and transient thermal dissipation from motorized assemblies ▪ Metal matrix composite products feature tight tolerances, high surface flatness, high stiffness, high thermal conductivity and low weight Metal matrix composite Reaction-bonded SiC 55 Copyright 2023, Coherent. All rights reserved.

SERVICE IS PART OF OUR OVERALL SEMICAP OPPORTUNITY Service revenue scales with ▪ Laser installed base ▪ Laser utilization Service strengthens customer intimacy ▪ Customers are assured that their large investments in semicap equipment can be serviced ▪ Drives long-term partner relationships: on the order of 20 years or more 56 CC op oy pry igh righ t 2 t 0 22 03 2,3 C , C oh oe hre ern etn . tA . ll A ll righ righ tst s re rs ee sre vre vd e.d.

NEAR-TERM AND LONGER-TERM OUTLOOK Recent performance ▪ Semicap revenue attained a new record level on the back of 11% year-over-year growth ▪ Revenue strength in front-end-of-line more than offset softness in back-end-of-line Outlook • In FY24 2Q, back-end-of-line business will moderate as production cuts have worked their way through the supply chain • In FY24, Semicap will reach a new record revenue 57 Copyright 2023, Coherent. All rights reserved.

EXCIMER LASERS: VERSATILE PLATFORM ADDRESSING NUMEROUS APPLICATIONS Dr. Kai Schmidt – Senior Vice President Coherent & General Manager Excimer Business Unit 58 Copyright 2023, Coherent. All rights reserved.

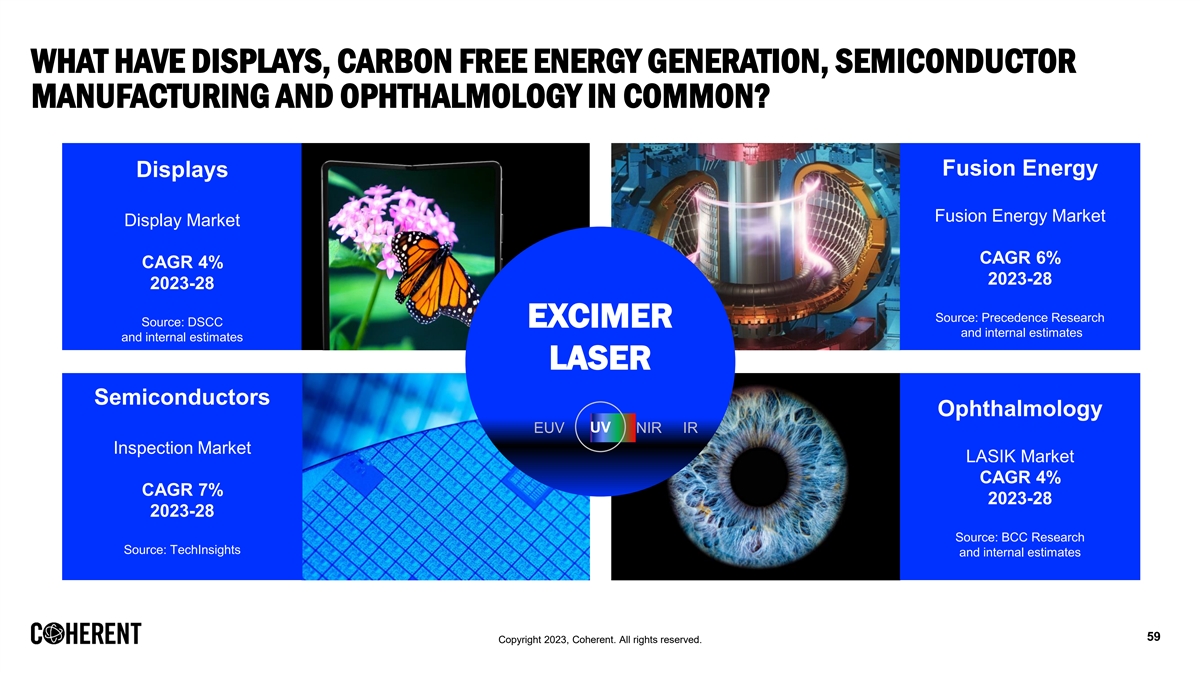

WHAT HAVE DISPLAYS, CARBON FREE ENERGY GENERATION, SEMICONDUCTOR MANUFACTURING AND OPHTHALMOLOGY IN COMMON? Fusion Energy Displays Fusion Energy Market Display Market CAGR 6% CAGR 4% 2023-28 2023-28 Source: Precedence Research Source: DSCC EXCIMER and internal estimates and internal estimates LASER Semiconductors Ophthalmology UV EUV NIR IR Inspection Market LASIK Market CAGR 4% CAGR 7% 2023-28 2023-28 Source: BCC Research Source: TechInsights and internal estimates 59 Copyright 2023, Coherent. All rights reserved.

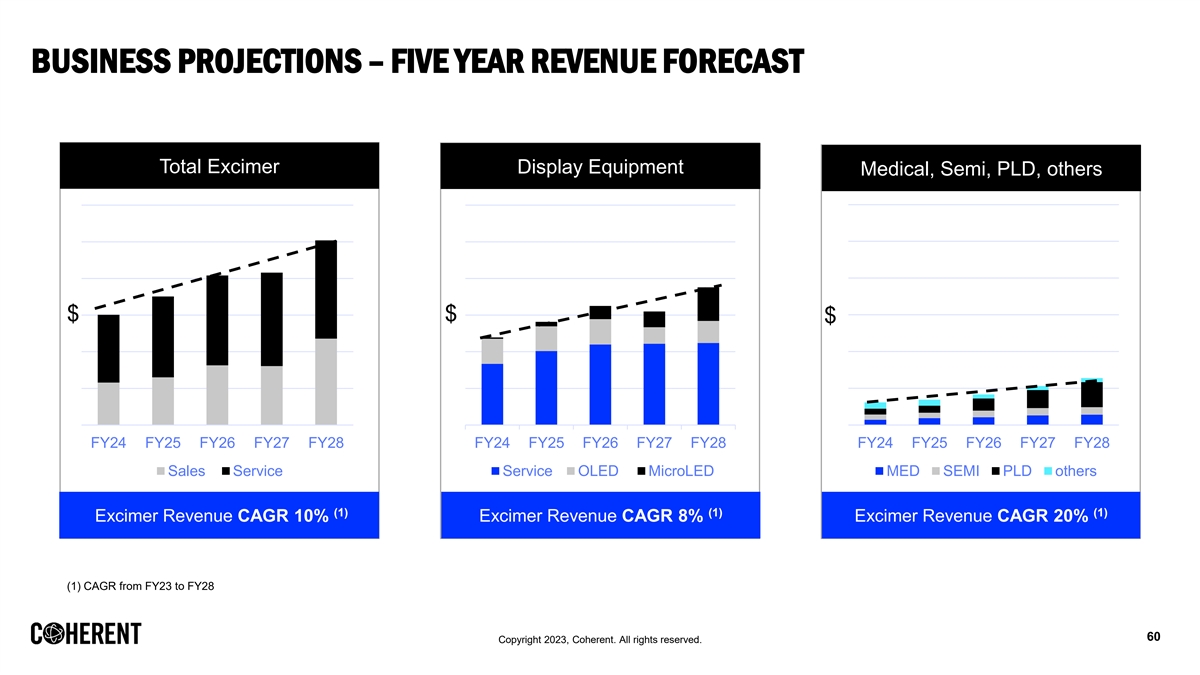

BUSINESS PROJECTIONS – FIVE YEAR REVENUE FORECAST Total Excimer Display Equipment Medical, Semi, PLD, others $ $ $ FY24 FY25 FY26 FY27 FY28 FY24 FY25 FY26 FY27 FY28 FY24 FY25 FY26 FY27 FY28 Sales Service Service OLED MicroLED MED SEMI PLD others (1) (1) (1) Excimer Revenue CAGR 10% Excimer Revenue CAGR 8% Excimer Revenue CAGR 20% (1) CAGR from FY23 to FY28 60 Copyright 2023, Coherent. All rights reserved.

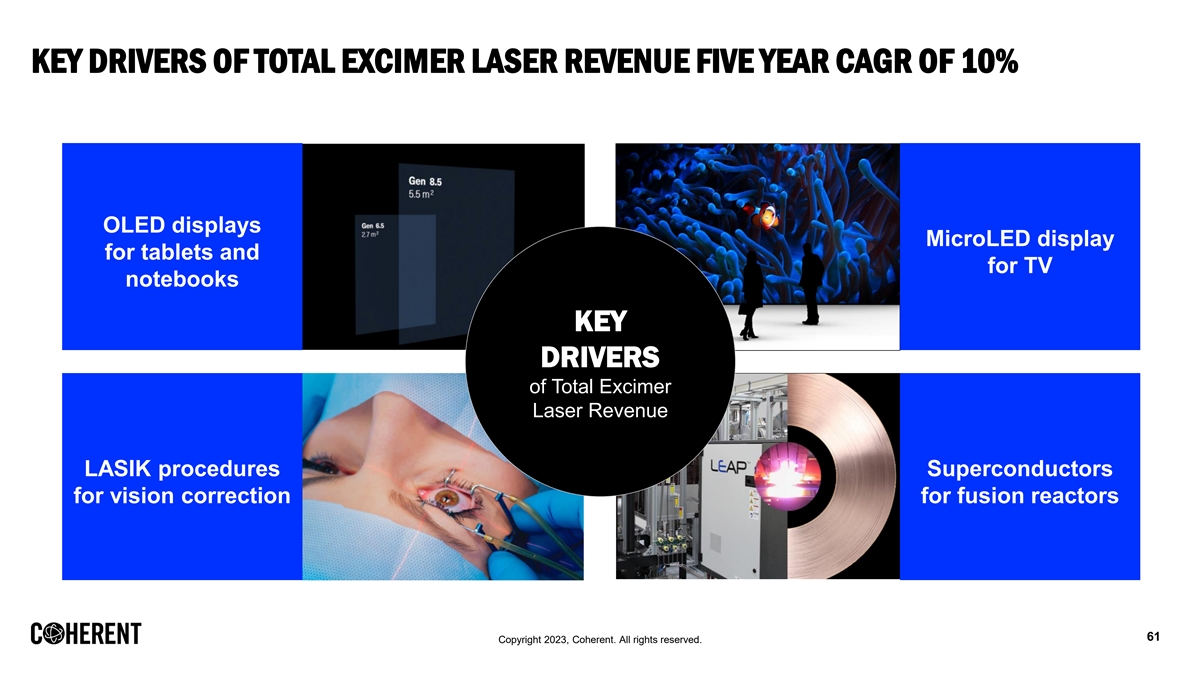

KEY DRIVERS OF TOTAL EXCIMER LASER REVENUE FIVE YEAR CAGR OF 10% OLED displays MicroLED display for tablets and for TV notebooks KEY DRIVERS of Total Excimer Laser Revenue LASIK procedures Superconductors for vision correction for fusion reactors 61 Copyright 2023, Coherent. All rights reserved.

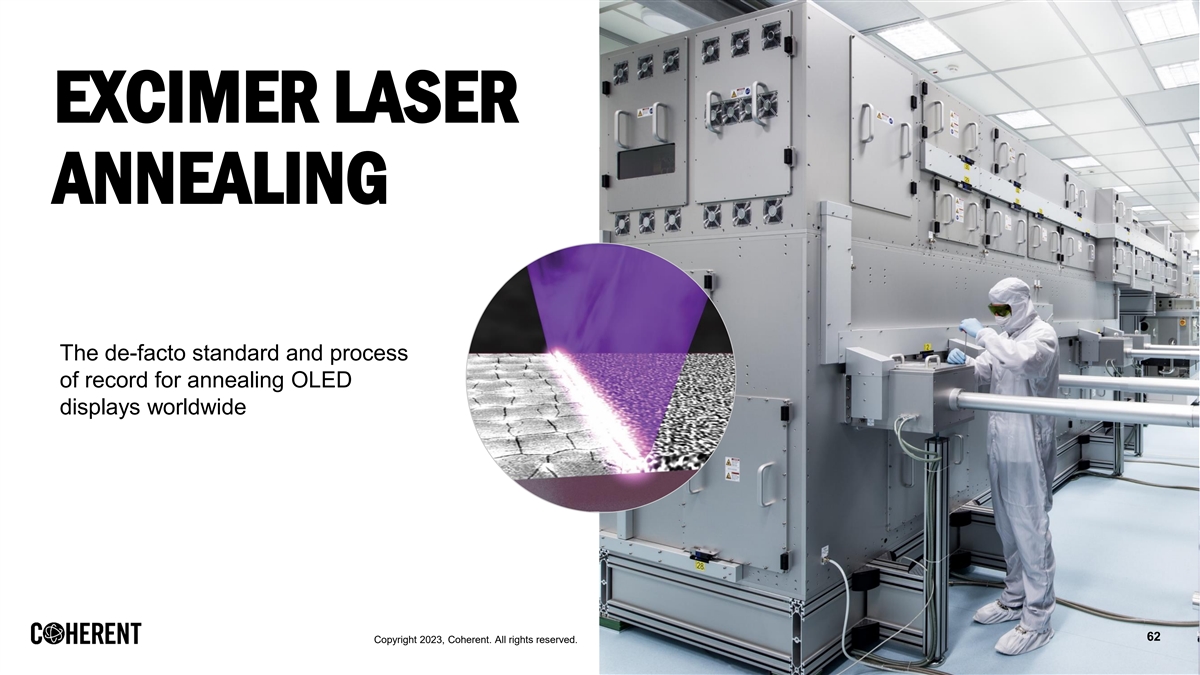

EXCIMER LASER ANNEALING The de-facto standard and process of record for annealing OLED displays worldwide 62 Copyright 2023, Coherent. All rights reserved.

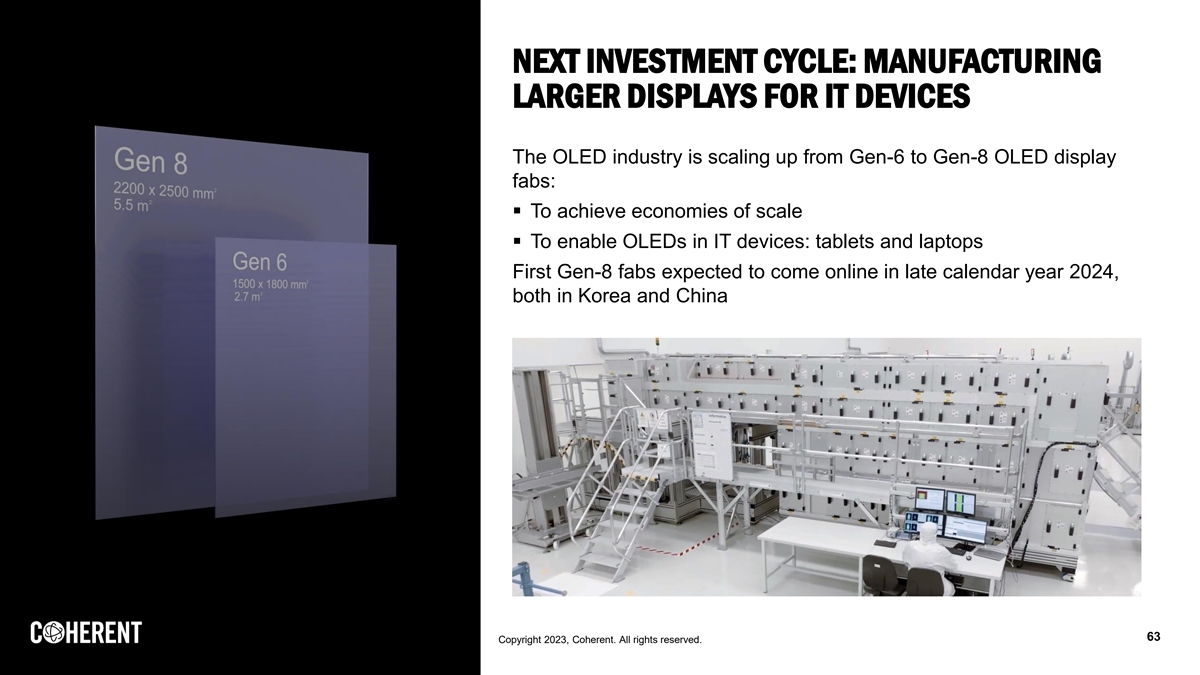

NEXT INVESTMENT CYCLE: MANUFACTURING LARGER DISPLAYS FOR IT DEVICES The OLED industry is scaling up from Gen-6 to Gen-8 OLED display fabs: ▪ To achieve economies of scale ▪ To enable OLEDs in IT devices: tablets and laptops First Gen-8 fabs expected to come online in late calendar year 2024, both in Korea and China 63 Copyright 2023, Coherent. All rights reserved.

FROM OLED TO microLED For very large TVs and tiny wearable displays Potential for $1 billion of incremental revenue over the next ten years assuming: • MicroLED TVs larger than 60-inch will represent 10% of TAM • Approximately 4M TVs on average annually 64 Copyright 2023, Coherent. All rights reserved.

LIFE SCIENCES, SEMICAP EQUIPMENT & PRECISION MANUFACTURING Wavelength: 193 nm VERTICALS Laser Vision Correction Inspection Diamond Marking 65 Copyright 2023, Coherent. All rights reserved.

WIRELESS ELECTRONICS AND ENERGY PLD PULSED LASER DEPOSITION Superconducting tapes for fusion reactor 20,000 km tape for every fusion reactor 5G/6G filters for 5G/6G smartphone antenna 50 billion antennas required by 2030 66 Copyright 2023, Coherent. All rights reserved. Copyright 2023, Coherent. All rights reserved.

OUR EXCIMER LASER SERVICE BUSINESS GLOBAL REACH LOCAL FOCUS ▪ Worldwide 24/7 customer service and support ▪ Customer-tailored maintenance and service contract ▪ Technical support Greater than Greater than ▪ Global logistics services ▪ Spare parts, certified accessories, options, and consumables 98% 200 Installed base Annealing systems in Asia supported 67 Copyright 2023, Coherent. All rights reserved.

Q&A Dr. Kai Schmidt Martin Seifert Dr. Christopher Dorman Paul Silverstein Dr. Sanjai Senior Vice President and Vice President, Senior Vice President and Vice President, Parthasarathi General Manager General Manager High-Power Fiber Laser Investor Relations & Chief Marketing Officer Excimer Lasers Business Solid State Lasers Business Business Unit Corporate Communications Unit Unit, Europe 68 Copyright 2023, Coherent. All rights reserved.