| For the fiscal year ended October 31, 2023 | Commission File Number 001-13928

|

| Canada | 6029 | Not Applicable | ||

| (Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number (if applicable)) |

| Joe Cumming Royal Bank of Canada 200 Bay Street Toronto, Ontario Canada M5J 2J5 Tel: (437) 779-7209

|

Donald R. Crawshaw Sullivan & Cromwell LLP 125 Broad Street New York, New York USA 10004-2498 Tel: (212) 558-4000 |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Shares |

RY |

New York Stock Exchange | ||

| Not Applicable |

||||

| (Title of Class) |

| Not Applicable |

||||

| (Title of Class) |

Common Shares |

1,402,372,572 |

|||

First Preferred Shares* |

||||

Series AZ |

20,000,000 |

|||

Series BB |

20,000,000 |

|||

Series BD |

24,000,000 |

|||

Series BF |

12,000,000 |

|||

Series BH |

6,000,000 |

|||

Series BI |

6,000,000 |

|||

Series BO |

14,000,000 |

|||

Series BQ |

1,750,000** |

|||

Series BR |

1,250,000** |

|||

Series BS |

1,000,000** |

|||

Series BT |

750,000*** |

|||

Series C-2 |

15,385**** |

| If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. | ☐ | |

| † The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. |

☒ | |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. |

☐ | |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b).

|

☐ | |

| ROYAL BANK OF CANADA | ||

| By: | /s/ David McKay |

|

| Name: | David McKay | |

| Title: | President and Chief Executive Officer | |

| Date: | November 30, 2023 | |

Exhibit |

Exhibit No. |

|

Royal Bank of Canada Annual Information Form dated November 29, 2023 |

1 | |

Financial Review |

2 | |

• Management’s Discussion and Analysis |

||

• Caution Regarding Forward-Looking Statements |

||

• Management’s Responsibility for Financial Reporting |

||

• Management’s Report on Internal Control over Financial Reporting |

||

• Report of Independent Registered Public Accounting Firm |

||

• Consolidated Financial Statements |

||

Consent of Independent Registered Public Accounting Firm |

3 | |

Code of Conduct |

4 | |

Return on Equity and Assets Ratios |

5 | |

Rule 13a-14(a)/15d-14(a) |

31 | |

|

• Certification of the Registrant’s Chief Executive Officer • Certification of the Registrant’s Chief Financial Officer |

||

Section 1350 Certifications |

32 | |

|

• Certification of the Registrant’s Chief Executive Officer • Certification of the Registrant’s Chief Financial Officer |

||

Royal Bank of Canada Policy for the Recovery of Erroneously Awarded Incentive-based Compensation from Executive Officers |

97 | |

Interactive Data File (formatted as Inline XBRL) |

101 | |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

104 | |

Exhibit 1

ROYAL BANK OF CANADA

ANNUAL

INFORMATION

FORM

November 29, 2023

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this 2023 Annual Information Form and in the documents incorporated by reference herein, in other filings with Canadian regulators or the United States (U.S.) Securities and Exchange Commission (SEC), in reports to shareholders, and in other communications. In addition, our representatives may communicate forward-looking statements orally to analysts, investors, the media and others. Forward-looking statements in this document and in the documents incorporated by reference herein include, but are not limited to, statements relating to our financial performance objectives, vision and strategic goals, the economic, market, and regulatory review and outlook for Canadian, U.S., U.K., European and global economies, the regulatory environment in which we operate, the implementation of IFRS 17 Insurance Contracts, the expected closing of the transaction involving HSBC Bank Canada, including plans for the combination of our operations with HSBC Bank Canada and the financial, operational and capital impacts of the transaction, the expected closing of the transaction involving the U.K. branch of RBC Investor Services Trust and the RBC Investor Services business in Jersey, the expected impact of the Federal Deposit Insurance Corporation’s special assessment, the Strategic priorities and Outlook sections for each of our business segments, as discussed in our 2023 Annual Report for the fiscal year ended October 31, 2023 (the 2023 Annual Report), the risk environment including our credit risk, market risk, liquidity and funding risk as set out in our 2023 Management’s Discussion and Analysis for the fiscal year ended October 31, 2023 (the 2023 Management’s Discussion and Analysis) as well as the effectiveness of our risk monitoring, our climate- and sustainability-related beliefs, targets and goals (including our net-zero and sustainable finance commitments) and related legal and regulatory developments as set out in our 2023 Management’s Discussion and Analysis, and includes statements made by our President and Chief Executive Officer and other members of management. The forward-looking statements contained in this Annual Information Form and in the documents incorporated by reference represent the views of management and are presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial position and results of operations as at and for the periods ended on the dates presented, as well as our financial performance objectives, vision, strategic goals and priorities and anticipated financial performance, and may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as “believe”, “expect”, “suggest”, “seek”, “foresee”, “forecast”, “schedule”, “anticipate”, “intend”, “estimate”, “goal”, “commit”, “target”, “objective”, “plan”, “outlook”, “timeline” and “project” and similar expressions of future or conditional verbs such as “will”, “may”, “might”, “should”, “could”, “can” or “would” or negative or grammatical variations thereof.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, both general and specific in nature, which give rise to the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, that our financial performance, environmental & social or other objectives, vision and strategic goals will not be achieved, and that our actual results may differ materially from such predictions, forecasts, projections, expectations or conclusions.

We caution readers not to place undue reliance on our forward-looking statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. These factors – many of which are beyond our control and the effects of which can be difficult to predict – include, but are not limited to: credit, market, liquidity and funding, insurance, operational, regulatory compliance (which could lead to us being subject to various legal and regulatory proceedings, the potential outcome of which could include regulatory restrictions, penalties and fines), strategic, reputation, legal and regulatory environment, competitive, model, systemic risks and other risks discussed in the risk sections of our 2023 Annual Report, including business and economic conditions in the geographic regions in which we operate, Canadian housing and household indebtedness, information technology, cyber and third-party risks, geopolitical uncertainty, environmental and social risk (including climate change), digital disruption and innovation, privacy and data related risks, regulatory changes, culture and conduct risks, the effects of changes in government fiscal, monetary and other policies, tax risk and transparency, and our ability to anticipate and successfully manage risks arising from all of the foregoing factors. Additional factors that could cause actual results to differ materially from the expectations in such forward-looking statements can be found in the risk sections of our 2023 Annual Report, as may be updated by subsequent quarterly reports.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also adversely affect our results. When relying on our forward-looking statements to make decisions with respect to us, investors and others should carefully consider the foregoing factors and other uncertainties and potential events, as well as the inherent uncertainty of forward-looking statements. Material economic assumptions underlying the forward-looking statements contained in this 2023 Annual Information Form are set out in the Economic, market and regulatory review and outlook section and for each business segment under the Strategic priorities and Outlook headings in our 2023 Annual Report, as such sections may be updated by subsequent quarterly reports. Except as required by law, we do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

Additional information about these and other factors can be found in the risk sections of our 2023 Management’s Discussion and Analysis contained in our 2023 Annual Report, as may be updated by subsequent quarterly reports.

TABLE OF CONTENTS

| MD&A Incorporated by Reference |

||||||

| CORPORATE STRUCTURE |

1 | |||||

| Name, Address and Incorporation |

1 | |||||

| Intercorporate Relationships |

1 | |||||

| GENERAL DEVELOPMENT OF THE BUSINESS |

1 | |||||

| Three Year History |

1 | 23-26, 185* | ||||

| DESCRIPTION OF THE BUSINESS |

3 | |||||

| General Summary |

3 | 23-26, 32-57 | ||||

| Seasonality |

3 | 58-59 | ||||

| Competition |

3 | 32-57 | ||||

| Government Regulation and Supervision – Canada |

4 | |||||

| Government Regulation and Supervision – United States |

6 | |||||

| Risk Factors |

10 | 63-109 | ||||

| Environmental and Social Policies |

10 | 107-109 | ||||

| DESCRIPTION OF CAPITAL STRUCTURE |

10 | |||||

| General Description |

10 | 109-118, 214-216* | ||||

| Prior Sales |

13 | 109-118, 213-216* | ||||

| Constraints |

13 | |||||

| Ratings |

14 | 93 | ||||

| MARKET FOR SECURITIES |

16 | |||||

| Trading Price and Volume |

16 | |||||

| DIVIDENDS |

18 | 115-116, 214-216* | ||||

| SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER |

18 | |||||

| DIRECTORS AND EXECUTIVE OFFICERS |

19 | |||||

| Directors |

19 | |||||

| Committees of the Board |

20 | |||||

| Executive Officers |

20 | |||||

| Ownership of Securities |

22 | |||||

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions |

22 | |||||

| Conflicts of Interest |

23 | |||||

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

23 | 223-224* | ||||

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

23 | |||||

| TRANSFER AGENT AND REGISTRAR |

24 | |||||

| EXPERTS |

24 | |||||

| AUDIT COMMITTEE |

24 | |||||

| Audit Committee Mandate |

24 | |||||

| Composition of Audit Committee |

24 | |||||

| Relevant Education and Experience of Audit Committee Members |

24 | |||||

| Pre-Approval Policies and Procedures |

25 | |||||

| Independent Registered Public Accounting Firm Fees |

26 | |||||

| ADDITIONAL INFORMATION |

27 | |||||

| TRADEMARKS |

27 | |||||

| APPENDIX A – PRINCIPAL SUBSIDIARIES |

28 | |||||

| APPENDIX B – EXPLANATION OF RATINGS AND OUTLOOK |

29 | |||||

| APPENDIX C – AUDIT COMMITTEE MANDATE |

32 | |||||

| APPENDIX D – PRE-APPROVAL POLICIES AND PROCEDURES |

38 | |||||

*Notes 6, 19, 20 and 25 to the 2023 Annual Consolidated Financial Statements for the fiscal year ended October 31, 2023 (the 2023 Annual Consolidated Financial Statements) for Royal Bank of Canada are incorporated by reference herein.

INFORMATION IS AT OCTOBER 31, 2023, UNLESS OTHERWISE NOTED.

CORPORATE STRUCTURE

Name, Address and Incorporation1

Royal Bank of Canada is a Schedule I bank under the Bank Act (Canada), which constitutes its charter. The Bank was created as Merchants Bank in 1864 and was incorporated under the “Act to Incorporate the Merchants’ Bank of Halifax” assented to June 22, 1869. The Bank changed its name to The Royal Bank of Canada in 1901 and to Royal Bank of Canada in 1990.

The Bank’s corporate headquarters are located at Royal Bank Plaza, 200 Bay Street, Toronto, Ontario, Canada and its head office is located at 1 Place Ville-Marie, Montreal, Quebec, Canada.

Intercorporate Relationships

Information about intercorporate relationships with principal subsidiaries, including place of incorporation and percentage of securities owned by the Bank, is provided in Appendix A.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

Our business strategies and actions are guided by our vision, “To be among the world’s most trusted and successful financial institutions.” Our three strategic goals are:

| • | In Canada, to be the undisputed leader in financial services; |

| • | In the U.S., to be the preferred partner to institutional, corporate, commercial and high net worth clients and their businesses; and |

| • | In select global financial centres, to be a leading financial services partner valued for our expertise. |

In 2021, the Canadian economy showed growth and RBC reported net income of $16.1 billion, up 40% from the prior year. These results reflected higher earnings in Personal & Commercial Banking, Capital Markets, Wealth Management and Insurance, partially offset by lower earnings in Investor & Treasury Services, as well as releases of provisions on performing loans primarily driven by improvements in our macroeconomic and credit quality outlook.

In 2022, Canadian output growth was supported by recovery from the COVID-19 pandemic in the travel and hospitality sectors and increased activity in the oil and gas and mining sectors reflecting higher global commodity prices. In the U.S., while inflation rates began to decrease as global supply chain disruptions eased, and the price of gasoline declined from higher levels in the spring, price growth remained very high and broad-based. Bond yields increased substantially from the second calendar quarter of 2022 as central banks responded to high inflation.

In 2022, RBC reported net income of $15.8 billion, down 2% from 2021, reflecting lower results in Capital Markets and Insurance, partially offset by higher earnings in Personal & Commercial Banking, Wealth Management and Investor & Treasury Services. 2022 also reflected lower releases of provisions on performing loans.

1 When we say “we”, “us”, “our”, or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. References to “the Bank” mean Royal Bank of Canada without its subsidiaries.

In 2023, GDP growth slowed across most advanced economies as headwinds from higher interest rates continued to have a lagged impact. Global inflation pressures showed signs of easing. However, underlying price pressures are not expected to fully ease until there is a more pronounced slowdown in domestic demand and the economy. In Canada, output in early calendar 2023 was supported by strength in consumer spending and an unexpectedly strong rebound in housing market activity in the spring. Canadian gross domestic product declined slightly in the second quarter of 2023 as consumer spending slowed. The U.S. economy remained resilient with strong consumer spending despite rising interest rates, and employment has continued to increase. The Euro area economy is losing momentum as inflation is still high but has begun to slow. Bond yields increased substantially in 2023 as markets demand higher term premiums and expect central banks to hold policy interest rates higher for longer. Interest rates have increased to levels that most central banks view as sufficient to slow economic growth and reduce inflationary pressure over time, and are expected to remain significantly higher than pre-pandemic levels.

Effective the first quarter of 2023, we simplified our reporting structure by eliminating the Investor & Treasury Services segment and moving our Investor Services business to our Wealth Management segment and our Treasury Services and Transaction Banking businesses to our Capital Markets segment. Effective the fourth quarter of 2023, we moved the Investor Services lending business from our Wealth Management segment to our Capital Markets segment.

In 2023, RBC reported net income of $14.9 billion, down 6% from last year, reflecting lower earnings in Wealth Management, Personal & Commercial Banking and Insurance, which were partially offset by higher results in Capital Markets, and the impact of the Canada recovery dividend and other tax related adjustments in the current year. 2023 also reflects higher provisions on credit losses, reflecting higher provisions on impaired loans and provisions taken on performing loans as compared to releases of provisions on performing loans last year.

We continue to monitor and prepare for regulatory developments and changes in a manner that seeks to ensure compliance with new requirements, while mitigating adverse business or financial impacts. Such impacts could result from new or amended laws or regulations and the expectations of those who enforce them. A high level summary of the key regulatory changes that have the potential to increase or decrease our costs and the complexity of our operations is included in the Legal and regulatory environment risk section of our 2023 Annual Report. For a discussion on risk factors resulting from these and other developments which may affect our business and financial results, refer to the risk sections of our 2023 Annual Report. For further details on our framework and activities to manage risks, refer to the risk and Capital management sections of our 2023 Annual Report.

Our acquisitions and dispositions that have influenced the general development of our business over the past three years are summarized in the following table:

| Business Segment | Acquisition/Disposition |

Key Characteristics | ||

| Wealth Management |

Acquisition of Brewin Dolphin Holdings PLC (2022) | Creates a premier wealth manager in the U.K., Channel Islands and Ireland | ||

| Partial disposition of RBC Investor Services operations (2023) | Divests the European asset servicing activities of RBC Investor Services and its associated Malaysian centre of excellence to CACEIS, the asset servicing banking group of Crédit Agricole S.A. and Banco Santander, S.A. |

On November 29, 2022, we entered into an agreement to acquire 100% of the common shares of HSBC Bank Canada for an all-cash purchase price of $13.5 billion. We will also purchase all of the existing preferred shares and subordinated debt of HSBC Canada held directly or indirectly by HSBC Holdings plc at par value. The agreement includes an additional amount that accrues from August 30, 2023 to the closing date, which is calculated based on the all-cash purchase price for the common shares of HSBC Canada and the Canadian Overnight Repo Rate Average. The transaction is expected to close in the first calendar quarter of 2024 and is subject to the satisfaction of customary closing conditions, including regulatory approvals.

2

Additional information can also be found under “Overview and outlook” beginning on page 23 and under “Key corporate events” beginning on page 25 of our 2023 Management’s Discussion and Analysis and in Note 6 “Significant acquisitions and disposition” on page 185 of our 2023 Annual Consolidated Financial Statements, which sections and note are incorporated by reference herein.

DESCRIPTION OF THE BUSINESS

General Summary

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 94,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 17 million clients in Canada, the U.S. and 27 other countries.

Our business segments are Personal & Commercial Banking, Wealth Management, Insurance and Capital Markets. Our business segments are supported by Corporate Support.

Additional information about our business and each segment (including segment results) can be found under “Overview and outlook” beginning on page 23 and under “Business segment results” beginning on page 32 of our 2023 Management’s Discussion and Analysis, which sections are incorporated by reference herein.

Seasonality

Information about seasonality is provided under “Quarterly results and trend analysis” beginning on page 58 of our 2023 Management’s Discussion and Analysis, which section is incorporated by reference herein.

Competition

Personal & Commercial Banking competes with other Schedule 1 banks, independent trust companies, foreign banks, credit unions, caisses populaires, auto financing companies, as well as emerging entrants to the financial services industry, in Canada; other banks, emerging digital banks, trust companies and investment management companies serving retail and corporate clients, as well as public institutions, in the Caribbean; and other Canadian banking institutions that have U.S. operations, in the U.S.

Our Canadian Wealth Management business competes with domestic banks and trust companies, investment counselling firms, bank-owned full-service brokerages and boutique brokerages, mutual fund companies and global private banks. In Canada, bank-owned wealth managers continue to be the major players. Our U.S. Wealth Management business (including City National Bank (CNB)) operates in a fragmented and highly competitive industry and competitors include other broker-dealers, commercial banks and other financial institutions that service high net worth and ultra-high net worth individuals, entrepreneurs and their businesses. Our Global Asset Management business faces competition in Canada from banks, insurance companies and asset management organizations; in the U.S. from independent asset management firms, as well as those that are part of national and international banks and insurance companies; and internationally from asset managers that are owned by international banks, as well as national and regional asset managers in the geographies where we serve clients. Competitors to our International Wealth Management business include global wealth managers, traditional private banks and domestic wealth managers. Competitors to our Investor Services business include domestic and international custodians with Canadian and U.K. operations.

3

In our Canadian Insurance business, many of our competitors specialize in either life and health, wealth or in property and casualty products. In our International Insurance business we compete in the global reinsurance market which is competitive as there are many participants. Market share is largely held by a small number of reinsurers, with RBC Insurance continuing to selectively pursue niche opportunities.

Our Capital Markets business is a market leader in Canada and competes with large global investment banks in the U.S. Outside North America, we have a targeted presence in the U.K. & Europe, Australia, Asia & other markets aligned with our global expertise.

Additional information about our competition can be found under “Business segment results” beginning on page 32 of our 2023 Management’s Discussion and Analysis, which section is incorporated by reference herein.

Government Regulation and Supervision – Canada

The Bank is a “Schedule I” bank under the Bank Act (Canada) (Bank Act), and, as such, is a federally regulated financial institution. It has Canadian insurance and trust and loan company subsidiaries that are also federally regulated financial institutions (FRFI Subsidiaries and, together with the Bank, FRFIs) governed by (respectively) the Insurance Companies Act (Canada) and the Trust and Loan Companies Act (Canada). The activities of the FRFI Subsidiaries are also regulated under provincial and territorial laws in respect of their activities in the provinces and territories. In certain provinces, some of the Bank’s capital markets and wealth management activities are regulated under provincial securities laws (which are administered and enforced by securities regulatory authorities).

The Office of the Superintendent of Financial Institutions (OSFI), an independent agency of the Government of Canada, reports to the Minister of Finance (the Minister) for the supervision of the FRFIs. OSFI is required, at least once a year, to examine the affairs and business of each FRFI for the purpose of determining whether the FRFI is complying with the provisions of its governing statute and it is in sound financial condition, and report to the Minister. The FRFIs are also required to make periodic filings and reports to OSFI.

The FRFIs are also subject to regulation under the Financial Consumer Agency of Canada Act (FCAC Act).2 The Financial Consumer Agency of Canada (Agency), among other things, enforces consumer-related provisions of the federal statutes which govern these financial institutions. The Commissioner of the Agency must report to the Minister on all matters connected with the administration of the FCAC Act and consumer provisions of other federal statutes, including the Bank Act, Trust and Loan Companies Act and Insurance Companies Act. The FRFIs are also subject to provincial and territorial laws of general application.

The Bank and the following subsidiaries are member institutions of the Canada Deposit Insurance Corporation (CDIC): Royal Trust Corporation of Canada, The Royal Trust Company, Royal Bank Mortgage Corporation and RBC Investor Services Trust. CDIC insures certain deposits held at its member institutions. Under the Bank Act, the Bank is prohibited from engaging in or carrying on any business other than the business of banking, except as permitted under that statute. The business of banking includes providing any financial services; acting as a financial agent; providing investment counselling services and portfolio management services; issuing payment, credit or charge cards; and operating payment, credit or charge card plans.

2 For the Bank’s trust subsidiaries, only their retail deposit taking activities are subject to regulation under the FCAC Act.

4

The Bank has broad powers to invest in securities, but is limited in making “substantial investments” in or in controlling certain types of entities. A “substantial investment” will arise through direct or indirect beneficial ownership of voting shares carrying more than 10 per cent of the voting rights attached to all outstanding voting shares of a corporation, shares representing more than 25 per cent of the shareholders’ equity in a corporation or interests representing more than 25 per cent of the ownership interests in any unincorporated entity. The Bank can make controlling, and in certain circumstances, non-controlling substantial investments in certain entities in accordance with the investment provisions under the Bank Act. Some substantial investments may be made only with the prior approval of the Minister or the Superintendent of Financial Institutions (the Superintendent).

Each FRFI is also required to maintain, in relation to its operations, adequate capital and liquidity, and OSFI may direct financial institutions to increase capital and/or to provide additional liquidity.

Bail-in Regime

Canada has a bank recapitalization regime (the Bail-in Regime) for domestic systemically important banks, including the Bank. Under the Canada Deposit Insurance Corporation Act, in circumstances where the Bank has ceased, or is about to cease, to be viable, the Governor in Council may, upon recommendation of the Minister that they are of the opinion that it is in the public interest to do so, by order:

| • | vest in CDIC the shares and subordinated debt of the Bank specified in the order (a vesting order); |

| • | appoint CDIC as receiver in respect of the Bank (a receivership order); |

| • | if a receivership order has been made, direct the Minister to incorporate a federal institution designated in the order as a bridge institution wholly-owned by CDIC and specifying the date and time as of which the Bank’s deposit liabilities are assumed (a bridge bank order); or |

| • | if a vesting order or receivership order has been made, direct CDIC to carry out a conversion, by converting or causing the Bank to convert, in whole or in part – by means of a transaction or series of transactions and in one or more steps – the shares and liabilities of the Bank that are subject to the Bail-in Regime into common shares of the Bank or any of its affiliates (a conversion order). |

Upon the making of a conversion order, prescribed shares and liabilities under the Bail-in Regime that are subject to that conversion order will, to the extent converted, be converted into common shares of the Bank or any of its affiliates, as determined by CDIC. Subject to certain exceptions, senior debt issued on or after September 23, 2018, with an initial or amended term to maturity (including explicit or embedded options) greater than 400 days, that is unsecured or partially secured and that has been assigned a CUSIP or ISIN or similar identification number is subject to a bail-in conversion. For a description of Canadian bank resolution powers and the consequent risk factors attaching to certain liabilities of the Bank reference is made to rbc.com/investor-relations/_assets-custom/pdf/bail-in-overview.pdf.

The Proceeds of Crime (Money Laundering) and Terrorist Financing Act (the PCMLTA) is applicable to all of our businesses in Canada. The PCMLTA implements specific measures designed to detect and deter money laundering and the financing of terrorist activities. Further, the PCMLTA sets out obligations related to deterring and detecting money laundering and terrorist financing from a global perspective, in order to minimize the possibility that RBC could become a party to these activities. RBC has enterprise-wide anti-money laundering policies and procedures which assist in reducing the risk of facilitating money laundering and terrorist financing activities.

Broker-Dealer/Investment Management Subsidiaries

The activities of certain of the Bank’s subsidiaries, such as RBC Dominion Securities Inc. (RBC DS), RBC Direct Investing Inc. (RBC DI), Royal Mutual Funds Inc. (RMFI), RBC Global Asset Management Inc., Phillips, Hager & North Investment Funds Ltd. (PH&N IF), RBC Phillips, Hager & North Investment Counsel Inc. and RBC InvestEase Inc., which act as securities dealers (including investment dealers, mutual fund dealers and exempt market dealers), advisors (portfolio manager) or investment fund managers are regulated in Canada under provincial and territorial securities laws (which are administered and enforced by the applicable securities regulatory authorities) and, for investment dealers and mutual fund dealers, by the rules of the applicable self-regulatory organization (the New Self-Regulatory Organization of Canada (New SRO) formed by the amalgamation of the Investment Industry Regulatory Organization of Canada and the Mutual Fund Dealers Association of Canada (MFDA) effective January 1, 2023 and renamed the Canadian Investment Regulatory Organization (CIRO) on June 1, 2023). Each of RBC DS, RBC DI, RMFI and PH&N IF are members of the Canadian Investor Protection Fund. The Canadian Investor Protection Fund protects customers’ accounts against certain losses of customer property held by an insolvent CIRO member within specified limits.

5

Insurance

The activities of the Bank’s regulated Canadian insurance subsidiaries, RBC Life Insurance Company (RBC Life) and RBC Insurance Company of Canada (RICC), are federally governed by the Insurance Companies Act and by provincial legislation in each province and territory in which they carry on business. In addition, the Bank Act sets out a framework for insurance activities that the Bank may or may not carry out. The Bank may administer, promote and provide advice in relation to certain authorized types of insurance and may conduct any aspect of the business of insurance, other than the underwriting of insurance, outside of Canada and in respect of risks outside Canada. However, in Canada, the Bank may not act as agent for any person in the placing of insurance. The Bank can promote an insurance company, agent or broker or non-authorized types of insurance (e.g. life and home and automobile insurance) to certain prescribed groups where the promotion takes place outside of physical bank branches. Additionally, and subject to applicable restrictions under the Bank Act, RBC Wealth Management Financial Services Inc., a wholly owned indirect subsidiary of the Bank, is licensed under applicable provincial and territorial laws to sell insurance products, including individual and group life and living benefits insurance along with money products such as annuities and segregated funds, for both related and independent insurance companies in Canada.

RBC Life is a member of Assuris, which is a not-for-profit organization that protects Canadian life insurance policyholders against loss of benefits due to the financial failure of a member company. RICC is a member of the Property and Casualty Insurance Compensation Corporation, which is the corporation protecting Canadian property and casualty policyholders against loss of benefits due to the financial failure of a member company.

RBC Insurance Agency Ltd. and RBC Commercial Insurance Agency Inc., wholly owned indirect Bank subsidiaries, are licensed insurance agencies that distribute insurance products underwritten by non-RBC entities. These products include home and auto insurance and commercial insurance that are underwritten by an unaffiliated insurance company.

Government Regulation and Supervision – United States

Banking

In the U.S., the Bank is characterized as a foreign banking organization (FBO). Generally, the operations of an FBO and its U.S. subsidiaries and offices are subject to the same comprehensive regulatory regime that governs the operations of U.S. domestic banking organizations. The Bank’s U.S. businesses are subject to supervision and oversight by various U.S. authorities, including federal and state regulators, as well as self-regulatory organizations. An FBO must meet several conditions in order to maintain “well managed” status for U.S. bank regulatory purposes: (i) the FBO must have received a composite regulatory rating of “satisfactory” or better for its U.S. branch, agency and commercial lending company operations following its last regulatory examination, (ii) the FBO’s home country supervisor must consent to it expanding its activities in the U.S. to include activities permissible for a financial holding company (FHC), (iii) the FBO’s management must meet standards comparable to those required for a U.S. bank subsidiary of an FHC and (iv) each U.S. depository institution subsidiary of the FBO and/or bank holding company (BHC) must be deemed to be “well managed”, which is based on regulatory examination ratings.

6

Under the International Banking Act of 1978, as amended (IBA) and the Bank Holding Company Act of 1956, as amended (BHCA), all of the Bank’s U.S. banking operations are subject to supervision and regulation by the Board of Governors of the Federal Reserve System (Federal Reserve). Under the IBA, the BHCA, and related regulations of the Federal Reserve, the Bank generally may not open a branch, agency or representative office in the U.S., nor acquire five per cent or more of the voting stock of any U.S. bank or BHC, without notice to or prior approval of the Federal Reserve. The Federal Reserve is the U.S. “umbrella regulator” responsible for supervision and oversight of the Bank’s consolidated U.S. activities. The Federal Reserve consults with and obtains information from other prudential and functional U.S. regulators that exercise supervisory authority over the Bank’s various U.S. operations. Reports of financial condition and other information relevant to the Bank’s U.S. businesses are regularly filed with the Federal Reserve.

In 2000, the Bank became a U.S. FHC, as authorized by the Federal Reserve. Pursuant to the Gramm-Leach-Bliley Act of 1999, as amended, an FHC may engage in, or acquire companies engaged in, a broader range of financial and related activities than are permitted to banking organizations that do not maintain FHC status. To qualify as an FHC, the Bank, as an FBO and BHC, must meet certain capital requirements and must be deemed to be “well managed” for U.S. bank regulatory purposes. In addition, any U.S. depository institution subsidiaries of the FBO or BHC must also meet certain capital requirements and be deemed to be “well managed” and must have at least a “satisfactory” rating under the Community Reinvestment Act of 1977, as amended. An FBO must meet several conditions in order to maintain “well managed” status for U.S. bank regulatory purposes: (i) the FBO must have received a composite regulatory rating of “satisfactory” or better for its U.S. branch, agency and commercial lending company operations following its last regulatory examination, (ii) the FBO’s home country supervisor must consent to it expanding its activities in the U.S. to include activities permissible for a financial holding company (FHC), (iii) the FBO’s management must meet standards comparable to those required for a U.S. bank subsidiary of an FHC and (iv) each U.S. depository institution subsidiary of the FBO and/or bank holding company (BHC) must be deemed to be “well managed”, which is based on regulatory examination ratings.

The Federal Reserve, however, has the authority to limit an FHC’s ability to conduct activities that would otherwise be permissible if the FHC or any of its U.S. depositary institution subsidiaries does not satisfactorily meet certain capital requirements or is not deemed to be “well managed”. In such cases, the Federal Reserve may impose corrective capital and/or managerial requirements, as well as additional limitations or conditions. If the deficiencies persist, the FHC may be required to divest its U.S. depository institution subsidiaries or to cease engaging in activities other than the business of banking and certain closely related activities. If any insured depository institution subsidiary of an FHC fails to maintain at least a “satisfactory” rating under the Community Reinvestment Act of 1977, as amended, the FHC would be subject to restrictions on certain new activities and acquisitions.

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) was enacted. The statute effected significant changes to U.S. financial regulations and required rulemaking by the U.S. financial regulators, with material cross-border implications. Section 165 of the Dodd-Frank Act required the Federal Reserve to establish Enhanced Prudential Standards for Foreign Banking Organizations (Regulation YY). Amongst other regulatory requirements, Regulation YY required the Bank to establish an intermediate holding company (IHC) organized under U.S. law. The IHC is required to hold, directly or indirectly, the Bank’s entire ownership interest in its U.S. insured depository institution subsidiaries and other U.S. subsidiaries (excluding so called section 2(h)(2) companies and branch subsidiaries acquired by debt previously contracted). The Bank has established a two-tier BHC structure in the U.S., consisting of RBC US Group Holdings LLC (RIHC), its top-tier BHC, as the Bank’s IHC and the parent of RBC USA Holdco Corporation, the parent of most of the Bank’s U.S. subsidiaries. Both RIHC and RBC USA Holdco Corporation are BHCs and FHCs. The Bank fulfills its Regulation YY regulatory requirements through RIHC, which include capital adequacy, capital planning and stress testing, risk management and governance, liquidity and liquidity stress testing, financial regulatory reporting and other requirements that are similar to, or the same as, those applicable to U.S. domestic BHCs that are similarly categorized under the rules that tailor enhanced prudential standards for FBOs and large U.S. banking organizations. In addition, the Bank is registered as a “Swap Dealer” with the U.S. Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) and as a “Security-Based Swap Dealer” with the SEC.

7

The USA PATRIOT Act of 2001, as amended, which amended the Bank Secrecy Act of 1970, as amended (the Act), requires U.S. banks and certain other financial institutions with U.S. operations to maintain appropriate policies, procedures and controls reasonably designed to comply with the Act, including, as applicable, anti-money laundering compliance programs, suspicious activity and currency transaction reporting and other obligations including due diligence on customers to prevent, detect and report individuals and entities involved in money laundering and the financing of terrorism. In January 2021, the Anti-Money Laundering Act of 2020 (AMLA), which also amended the Act, was enacted. The AMLA is intended to comprehensively reform and modernize U.S. anti-money laundering laws. In September 2022, the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a final rule implementing the beneficial ownership information (BOI) reporting requirements under the Corporate Transparency Act, which was part of the AMLA. The BOI rule, which goes into effect January 1, 2024, implements sweeping beneficial owner disclosure requirements applicable to all U.S. companies and foreign companies doing business in the U.S., subject to certain exceptions. The BOI rule is the first of three related rulemakings. The remaining rulemakings will address (i) access to the BOI collected under a registry being developed by FinCEN; and (ii) required revisions to FinCEN’s Customer Due Diligence rule. Several other provisions of the AMLA require additional rulemakings, reports and other measures.

The Bank maintains two branches in New York that are licensed and supervised as full federal branches with fiduciary licenses by the Office of the Comptroller of the Currency (OCC), the U.S. supervisor of national banks. In general, the Bank’s branches may exercise the same rights and privileges, and are subject to the same restrictions, as would apply to a U.S. national bank at the same location(s). The Bank’s branches may accept wholesale deposits, but may not take U.S. domestic retail deposits outside of an available exemption. Deposits in the Bank’s branches are not insured by the Federal Deposit Insurance Corporation (FDIC). The Bank also maintains a limited federal branch in Jersey City, New Jersey which may exercise the same rights and privileges as the Bank’s New York federal branches except that it generally can only take deposits from non-U.S. sources.

The OCC examines and supervises the Bank’s U.S. branch office/agency’s activities and operations. In addition, the Bank’s U.S. branches are required to maintain a capital equivalency deposit in their state(s) of residence, which deposits are pledged to the OCC. Furthermore, the Bank’s U.S. branch offices are subject to supervisory guidance based on the examiners’ assessment of risk management, operational controls, compliance and asset quality.

The Bank also maintains a state-licensed agency in Texas and state-licensed representative offices in California, Delaware and Texas. In general, the activities conducted at the Bank’s agency include a broad range of banking powers, including lending and maintaining credit balances, but agencies are limited in their ability to accept deposits from citizens or residents of the U.S. Further limitations may be placed on such agencies’ activities based on state laws. The activities conducted at the representative offices are limited to representational and administrative functions; such representative offices do not have authority to make credit decisions and may not solicit or contract for any deposit or deposit-like liability. The representative offices are examined and assessed by both the Federal Reserve and state regulators and are required to adhere to any applicable state regulations.

Banking activities are also conducted at CNB and RBC Bank (Georgia), National Association (RBC Bank), both of which are national banking associations chartered by the OCC. CNB and RBC Bank are members of the Federal Reserve. The OCC serves as the primary federal prudential regulator of CNB and RBC Bank. As U.S. banks, CNB and RBC Bank are allowed to take retail deposits, and they offer retail and commercial banking services, including deposit and credit services, such as consumer lending products (including credit card and mortgage loans), and business and commercial loans. CNB and RBC Bank are subject to capital requirements, dividend restrictions, limitations on investments and subsidiaries, limitations on transactions with affiliates (including the Bank and its branches), deposit reserve requirements and other requirements administered by the OCC and the Federal Reserve. Deposits at CNB and RBC Bank are FDIC-insured to the extent applicable. CNB and RBC Bank are also required to comply with applicable consumer protection laws and regulations such as those promulgated by the Consumer Financial Protection Bureau, an independent agency created under the Dodd-Frank Act. As an OCC chartered U.S. national bank, CNB also has fiduciary powers and offers trust and investment management services.

8

CNB also conducts trust and investment management activities through CNB’s wholly-owned subsidiary, RBC Trust Company (Delaware) Limited (RBC Trust). RBC Trust is a Delaware trust company chartered and supervised by the Delaware State Banking Commission and, as a BHC subsidiary, is subject to oversight by the Federal Reserve. RBC Trust is subject to dividend restrictions, limitations on investments and other applicable state banking law requirements.

Broker-Dealer Activities and Broker-Dealer Subsidiaries

The securities brokerage, trading and investment banking activities are conducted by and through the following U.S.-registered broker-dealer subsidiaries:

| • | RBC Capital Markets, LLC (RBC CM LLC), |

| • | RBC CMA LLC, |

| • | City National Securities, Inc., |

| • | CNR Securities, LLC (formerly RIM Securities LLC) and |

| • | Symphonic Securities LLC. |

The SEC, state securities regulators, the Financial Industry Regulatory Authority and other self-regulatory organizations regulate these broker-dealer subsidiaries. Certain activities of RBC CM LLC and RBC CMA LLC are also subject to regulation by the CFTC and the NFA. Pursuant to the Dodd-Frank Act, RBC CM LLC is registered as a “Swaps Firm” with the NFA. Certain activities of RBC CM LLC are subject to regulation by the Municipal Securities Rulemaking Board.

Investment Management and Other Fiduciary Activities

The Bank’s New York branches have fiduciary powers, under which these branches conduct investment management and custody activities for certain customers. In addition, other affiliates are involved in the business of investment management. In many cases, these activities require that the affiliates be registered with the SEC as investment advisers under the U.S. Investment Advisers Act of 1940, as amended (Advisers Act). The Advisers Act and related rules regulate the registration and activities of investment advisers. Although the regulatory regime for investment advisers is similar in some ways to that for broker-dealers, the standard of conduct is higher due to the advisers’ status as fiduciaries.

The following entities are the Bank’s subsidiaries that are registered as “investment advisers” with the SEC:

| • | RBC CM LLC, |

| • | RBC Global Asset Management (U.S.) Inc. (GAM), |

| • | RBC Global Asset Management (UK) Limited (GAM UK), |

| • | RBC Private Counsel (USA) Inc., |

| • | City National Rochdale, LLC (CNR), |

| • | City National Securities, Inc. and |

| • | Symphonic Financial Advisors LLC. |

GAM and CNR also each sponsor and act as the adviser to U.S. mutual funds. The U.S. Investment Company Act of 1940, as amended, and related rules regulate the registration and operation of mutual funds and certain activities of the funds’ advisers and other affiliates and certain of the funds’ other service providers. Certain activities of GAM UK and GAM are also subject to regulation by the CFTC and the NFA.

ERISA and the Internal Revenue Code

The U.S. Employee Retirement Income Security Act of 1974, as amended (ERISA), and its related rules regulate, among other things, the activities of the financial services industry with respect to pension plan clients. Similarly, the U.S. Internal Revenue Code and the regulations implemented thereunder impose requirements with respect to such clients and also individual retirement accounts (IRAs). Brokers, dealers and investment advisers to pension plans and IRAs must conduct their business in compliance with both ERISA and applicable tax regulations.

9

Risk Factors

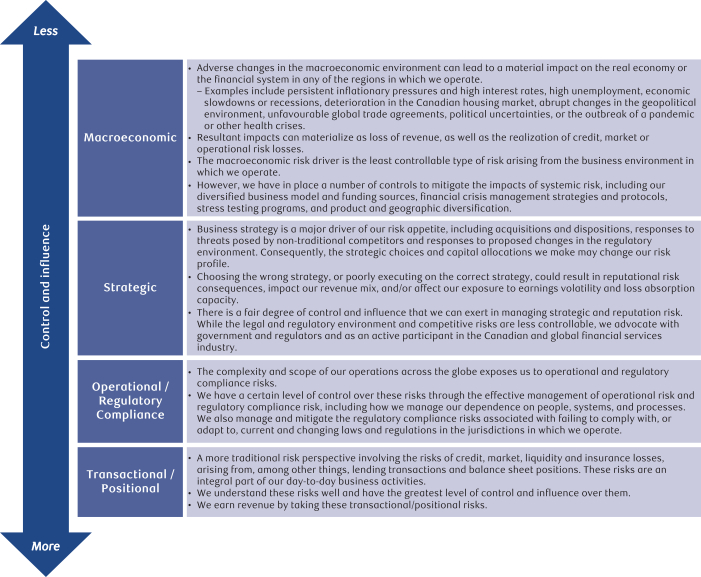

A discussion of risks affecting us and our businesses appears under the headings “Risk management”, “Transactional/positional risk drivers”, “Operational/regulatory compliance risk drivers”, “Strategic risk drivers”, “Macroeconomic risk drivers” and “Overview of other risks” from pages 63-109 of our 2023 Management’s Discussion and Analysis, which discussions are incorporated by reference herein.

Environmental and Social Policies

Each year the Bank publishes its Environmental, Social and Governance (ESG) Performance Report outlining how the Bank is addressing ESG issues. This report is part of a suite of ESG reporting, including the Bank’s annual Climate Report which highlights how the Bank is managing climate-related risks and opportunities. These reports and other related information are available on the Bank’s website at rbc.com/community-social-impact/reporting-performance/index.html. Additional information about our environmental and social risk policies, including information about factors that could materially adversely affect our ability to achieve our climate and sustainable-finance-related commitments, goals and targets, can be found under “Overview of other risks – Environmental and social risk” beginning on page 107 of our 2023 Management’s Discussion and Analysis, which section is incorporated by reference herein.

DESCRIPTION OF CAPITAL STRUCTURE

General Description

The Bank’s authorized share capital consists of an unlimited number of common shares without nominal or par value and an unlimited number of first preferred shares and second preferred shares without nominal or par value, issuable in series; provided that the maximum aggregate consideration for all first preferred shares outstanding at any time may not exceed $30 billion, and for all second preferred shares that may be issued may not exceed $5 billion.

The Bank may also issue an unlimited amount of Limited Resource Capital Notes (LRCNs), which are compound instruments with both equity and liability features. The following summary of share capital and LRCNs is qualified in its entirety by the Bank’s by-laws and the actual terms and conditions of such shares and LRCNs.

Common Shares

The holders of the Bank’s common shares are entitled to vote at all meetings of shareholders, except meetings at which only holders of a specified class, other than common shares, or series of shares are entitled to vote. The holders of common shares are entitled to receive dividends as and when declared by the board of directors, subject to the preference of the preferred shares. After payment to the holders of the preferred shares of the amount or amounts to which they may be entitled, and after payment of all outstanding debts, the holders of the common shares will be entitled to receive any remaining property upon liquidation, dissolution or winding-up.

10

Preferred Shares

First preferred shares may be issued, from time to time, in one or more series with such rights, privileges, restrictions and conditions as the board of directors may determine, subject to the Bank Act and to the Bank’s by-laws. The first preferred shares are entitled to preference over any second preferred shares (discussed below) and common shares and over any other shares ranking junior to the first preferred shares with respect to the payment of dividends and in the distribution of property in the event of liquidation, dissolution or winding-up.

As at November 29, 2023, Non-Cumulative First Preferred Shares Series AZ, BB, BD, BF, BH, BI, BO, BQ, BR, BS and BT are outstanding. The Non-Cumulative First Preferred Shares Series AZ, BB, BD, BF, BH, BI and BO are listed on the Toronto Stock Exchange. The Non-Cumulative First Preferred Shares Series BQ, BR, BS and BT are not listed on an exchange. On November 7, 2023, we redeemed all of our issued and outstanding Non-Cumulative First Preferred Shares Series C-2 (the Series C-2 Preferred Shares). The Bank’s Depositary Shares representing interests in the Series C-2 Preferred Shares were listed on the New York Stock Exchange.

Effective January 1, 2013, in accordance with capital adequacy requirements adopted by OSFI, non-common capital instruments issued after January 1, 2013, including first preferred shares, must include terms providing for the full and permanent conversion of such securities into common shares upon the occurrence of certain trigger events relating to financial viability (the Non-Viability Contingent Capital requirements) in order to qualify as regulatory capital. As of January 1, 2013, all outstanding capital instruments that do not meet the Non-Viability Contingent Capital requirements are considered non-qualifying capital instruments and are to be phased out beginning January 1, 2013 at the rate of 10 per cent each year for 10 years. The Non-Cumulative First Preferred Shares Series AZ, BB, BD, BF, BH, BI, BO, BQ, BR, BS and BT contain non-viability contingent capital provisions necessary to qualify as Tier 1 regulatory capital under Basel III and are therefore convertible into common shares upon the occurrence of a non-viability contingent capital trigger event.

We are prohibited by the Bank Act from declaring or paying any dividends on our preferred or common shares when we are, or would be placed as a result of the declaration, in contravention of the capital adequacy and liquidity regulations or any regulatory directives issued under the Bank Act. We may not pay dividends on our common shares or redeem, purchase or otherwise retire common shares or preferred shares at any time without the approval of the holders of outstanding first preferred shares unless all dividends to which first preferred shareholders are then entitled have been declared and paid or set apart for payment.

The Non-Cumulative First Preferred Shares Series BT were issued on November 5, 2021 to certain institutional investors.

The Non-Cumulative First Preferred Shares Series BQ, BR and BS (the LRCN Preferred Shares) were respectively issued on July 28, 2020, November 2, 2020 and June 8, 2021 in connection with the Bank’s concurrent issuances of LRCNs. The LRCN Preferred Shares are held by Computershare Trust Company of Canada as trustee (the Trustee) for Leo LRCN Limited Recourse Trust™ (the Limited Recourse Trust). In certain circumstances, including non-payment of interest on, principal of or redemption price for the LRCNs when due, or the occurrence of an event of default or a non-viability contingent capital trigger event, the Trustee of the Limited Recourse Trust will deliver to holders of LRCNs their proportionate share of the Limited Recourse Trust’s assets, which will consist of the LRCN Preferred Shares except in limited circumstances, in full satisfaction of the Bank’s obligations under the LRCNs.

For so long as the LRCN Preferred Shares are held by the Trustee on behalf of the Limited Recourse Trust, such shares will not be entitled to receive dividends.

On November 2, 2015, in connection with the merger of CNB with and into RBC USA Holdco Corporation, the Bank issued Non-Cumulative First Preferred Shares Series C-1 and C-2 in exchange for two series of outstanding CNB preferred stock. Neither series remains outstanding as of November 29, 2023.

11

In the event the Bank failed to pay, declare or set aside for payment, dividends on any of the Series C-2 Preferred Shares or any other series of preferred shares of the Bank for six quarterly dividend periods, or their equivalent, whether or not consecutive, the number of directors of the board of directors would have been increased by two at the Bank’s first annual meeting of shareholders held thereafter. The holders of the Series C-2 Preferred Shares had the right, together with holders of any shares that, by their terms, expressly provided that they rank pari passu with the Series C-2 Preferred Shares (together, the Series C-2 Parity Shares) and that have similar voting rights, if any, to elect, as a class together, such additional two members to the Bank’s board of directors for a term of one year. Upon the payment, or the declaration and setting aside for payment, in full, of all the cumulative dividends payable for all past dividend periods and continuous noncumulative dividends for at least one year on all outstanding preferred shares of the Bank, the terms of such two directors would have terminated, the number of directors of the Bank’s board of directors would have been reduced by two and the voting rights of the holders of the Series C-2 Preferred Shares and the Series C-2 Parity Shares would have ceased (subject to the revesting of such voting rights in the event of each and every additional failure in the payment of dividends for six quarterly dividend periods).

Second preferred shares may be issued, from time to time, in one or more series with such rights, privileges, restrictions and conditions as the board of directors may determine, subject to the Bank Act and to the Bank’s by-laws. There are no second preferred shares currently outstanding. Second preferred shares would rank junior to the first preferred shares. Second preferred shares would be entitled to preference over the common shares and over any other shares ranking junior to the second preferred shares with respect to the payment of dividends and in the distribution of property in the event of our liquidation, dissolution or winding-up.

Except as outlined above with respect to the Series C-2 Preferred Shares and the Series C-2 Parity Shares, holders of the first and second preferred shares are not entitled to any voting rights as a class except as provided under the Bank Act or the Bank’s by-laws. Under the Bank Act, the Bank may not create any other class of shares ranking equal with or superior to a particular class of preferred shares, increase the authorized number of, or amend the rights, privileges, restrictions or conditions attaching to such class of preferred shares, without the approval of the holders of that class of preferred shares.

Any approval to be given by the holders of the first and second preferred shares may be given in writing by the holders of not less than all of the outstanding preferred shares of each class or by a resolution carried by the affirmative vote of not less than 662⁄3 per cent of the votes cast at a meeting of holders of each class of preferred shares at which a quorum is represented. A quorum at any meeting of holders of each class of preferred shares is 51 per cent of the shares entitled to vote at such meeting, except that at an adjourned meeting there is no quorum requirement.

Limited Recourse Capital Notes

LRCNs are the Bank’s direct unsecured obligations constituting subordinated indebtedness for the purpose of the Bank Act and are intended to qualify as our additional Tier 1 capital within the meaning of the regulatory capital adequacy requirements to which we are subject. The LRCNs are not deposits insured under the Canada Deposit Insurance Corporation Act or any other deposit insurance regime designed to ensure the payment of all or a portion of a deposit upon the insolvency of a deposit taking institution.

In the event of a non-payment by the Bank of the principal amount of, interest on or redemption price for the LRCNs when due, the sole remedy of holders of LRCNs shall be the delivery of the LRCN Preferred Shares held by the Trustee for the Limited Recourse Trust.

If the Bank becomes insolvent or is wound-up, the LRCNs will rank (i) subordinate in right of payment to the prior payment in full of all outstanding deposit liabilities of the Bank including certain subordinated indebtedness (within the meaning of the Bank Act); and (ii) in right of payment equally with and not prior to the Bank’s indebtedness which by its terms ranks equally in right of payment with, or is subordinate to, the LRCNs (other than the Bank’s indebtedness which by its terms ranks subordinate to the LRCNs) and will be subordinate in right of payment to the claims of our depositors and other unsubordinated creditors, provided that in any such case and in case of the Bank’s non-payment of the principal amount of, interest on or redemption price for the LRCNs when due, the sole remedy of the holders of the LRCNs shall be the delivery of the LRCN Preferred Shares held by the Trustee for the Limited Recourse Trust.

12

Holders of LRCNs are not entitled to any voting rights, other than in certain limited circumstances.

Additional information about the Bank’s share capital can be found under “Capital management” beginning on page 109 of our 2023 Management’s Discussion and Analysis and in Note 20 “Equity” beginning on page 214 of our 2023 Annual Consolidated Financial Statements, which section and note are incorporated by reference herein.

Prior Sales

From time to time, the Bank issues principal at risk notes, securities for which the amount payable at maturity is determined by reference to the price, value or level of an underlying interest such as a stock index, an exchange traded fund or a notional portfolio of equities or other securities. In addition, the Bank periodically issues subordinated debt, preferred shares and other equity instruments which are not listed or quoted on a marketplace.

For information about the Bank’s issuances of subordinated debentures, Limited Recourse Capital Notes and other equity instruments since October 31, 2022, see the “Capital management” section beginning on page 109 of our 2023 Management’s Discussion and Analysis, Note 19 “Subordinated debentures” on page 213 and Note 20 “Equity” beginning on page 214 of our 2023 Annual Consolidated Financial Statements, which section and notes are incorporated by reference herein.

Constraints

The Bank Act contains restrictions on the issue, transfer, acquisition, beneficial ownership and voting of shares of a chartered bank. The following is a summary of several key restrictions.

Subject to certain exceptions contained in the Bank Act, no person may be a major shareholder of a bank having equity of $12 billion or more (which includes the Bank). A person is a major shareholder if:

| (a) | the aggregate of the shares of any class of voting shares of the Bank beneficially owned by that person, by entities controlled by that person and by any person associated or acting jointly or in concert with that person is more than 20 per cent of the outstanding shares of that class of voting shares, or |

| (b) | the aggregate of shares of any class of non-voting shares of the Bank beneficially owned by that person, by entities controlled by that person and by any person associated or acting jointly or in concert with that person is more than 30 per cent of the outstanding share of that class of non-voting shares. |

Additionally, no person may have a significant interest in any class of shares of a bank (including the Bank) unless the person first receives the approval of the Minister. For purposes of the Bank Act, a person has a significant interest in a class of shares of a bank where the aggregate of any shares of the class beneficially owned by that person, by entities controlled by that person and by any person associated or acting jointly or in concert with that person exceeds 10 per cent of all of the outstanding shares of that class of shares of such bank.

The Bank Act also prohibits a bank from purchasing or redeeming any of its shares or paying any dividends if there are reasonable grounds for believing the bank is, or the payment would cause the bank to be, in contravention of the Bank Act requirement to maintain, in relation to its operations, adequate capital and appropriate forms of liquidity and to comply with any regulations or directions of the Superintendent in relation thereto. Under the Bank Act, the Bank cannot redeem or purchase any shares for cancellation unless the prior consent of the Superintendent has been obtained.

13

Subject to certain exceptions, the Bank Act also prohibits the registration of a transfer or issue of any shares of a Canadian bank to any government or government agency of Canada or any province of Canada, or to any government of any foreign country, or any political subdivision, or agency of any foreign country.

Ratings

Our ability to access unsecured funding markets and to engage in certain collateralized business activities on a cost-effective basis is primarily dependent upon maintaining competitive credit ratings. Credit ratings and outlooks provided by rating agencies reflect their views and methodologies. Our credit ratings are largely determined by the rating agencies’ assessment of the quality of our earnings, the adequacy of our capital and the effectiveness of our risk management programs. Ratings are subject to change, based on a number of factors including, but not limited to, our financial strength, competitive position, liquidity and other factors not completely within our control. There can be no assurance that our credit ratings and rating outlooks will not be lowered or that rating agencies will not issue adverse commentaries about us, potentially resulting in adverse consequences for our funding capacity or access to capital markets.

A lowering of our credit ratings may also affect our ability, and the cost, to enter into normal course derivative or hedging transactions and may require us to post additional collateral under certain contracts. However, we estimate, based on periodic reviews of ratings triggers embedded in our existing businesses and of our funding capacity sensitivity, that a minor downgrade would not materially influence our liability composition, funding access, collateral usage and associated costs.

14

As at November 29, 2023, RBC had the following ratings from the rating agencies listed below:

| RATING CLASS* | RATING | RANK** | ||||

| Moody’s Investors Service |

Legacy Senior Long-term Debt1 | Aa1 |

2 of 21 | |||

| Senior Long-term Debt2 | A1 |

5 of 21 | ||||

| Short-term Debt | P-1 |

1 of 4 | ||||

| Subordinated Debt | A3 |

7 of 21 | ||||

| NVCC Subordinated Debt | A3 (hyb) |

7 of 21 | ||||

| Preferred Shares | Baa2 (hyb) |

9 of 21 | ||||

| NVCC Preferred Shares | Baa2 (hyb) |

9 of 21 | ||||

| NVCC Limited Recourse Capital Notes | Baa2 (hyb) |

9 of 21 | ||||

| Outlook – Stable | ||||||

| Standard & Poor’s |

Legacy Senior Long-term Debt1 | AA- |

4 of 22 | |||

| Senior Long-term Debt2 | A |

6 of 22 | ||||

| Short-term Debt | A-1+ |

1 of 7 | ||||

| Subordinated Debt | A |

6 of 22 | ||||

| NVCC Subordinated Debt | A- |

7 of 22 | ||||

| Preferred Shares | BBB+ |

8 of 22 | ||||

| NVCC Preferred Shares | BBB |

9 of 22 | ||||

| NVCC Limited Recourse Capital Notes | BBB |

9 of 22 | ||||

| Outlook – Stable | ||||||

| Fitch Ratings |

Legacy Senior Long-term Debt1 | AA |

3 of 23 | |||

| Senior Long-term Debt2 | AA- |

4 of 23 | ||||

| Short-term Debt | F1+ |

1 of 8 | ||||

| Subordinated Debt | A |

6 of 23 | ||||

| NVCC Subordinated Debt | A |

6 of 23 | ||||

| Preferred Shares | BBB+ |

8 of 23 | ||||

| NVCC Preferred Shares | BBB+ |

8 of 23 | ||||

| NVCC Limited Recourse Capital Notes | BBB+ |

8 of 23 | ||||

| Outlook – Stable | ||||||

| DBRS |

Legacy Senior Long-term Debt1 | AA (high) |

2 of 23 | |||

| Senior Long-term Debt2 | AA |

3 of 23 | ||||

| Short-term Debt | R-1 (high) |

1 of 10 | ||||

| Subordinated Debt | AA (low) |

4 of 23 | ||||

| NVCC Subordinated Debt | A |

6 of 23 | ||||

| Preferred Shares | Pfd-1 (low) |

3 of 16 | ||||

| NVCC Preferred Shares | Pfd-2 (high) |

4 of 16 | ||||

| NVCC Limited Recourse Capital Notes | A (low) |

7 of 23 | ||||

| Outlook – Stable |

| * | Our rating classes may differ from the rating category nomenclatures used by the rating agencies. |

| ** | Relative rank of each rating within the organization’s overall classification system. |

| 1 | Includes senior long-term debt issued prior to September 23, 2018 and senior long-term debt issued on or after September 23, 2018, which is excluded from the Bail-in Regime. |

| 2 | Includes senior long-term debt issued on or after September 23, 2018, which is subject to conversion under the Bail-in Regime. |

A definition of the categories of each rating as at November 29, 2023 has been obtained from the respective rating agency’s website and is outlined in Appendix B, and a more detailed explanation may be obtained from the applicable rating agency.

On June 20, 2023, Fitch Ratings affirmed our ratings with a stable outlook.

On May 12, 2023, DBRS affirmed our ratings with a stable outlook.

On May 25, 2023, Standard & Poor’s affirmed our ratings with a stable outlook.

On November 6, 2023, Moody’s affirmed our ratings with a stable outlook.

Credit ratings, including stability or provisional ratings (collectively, Ratings) are not recommendations to purchase, sell or hold a financial obligation inasmuch as they do not comment on market price or suitability for a particular investor. Ratings may not reflect the potential impact of all risks on the value of securities. In addition, real or anticipated changes in the rating assigned to a security will generally affect the market value of that security. Ratings are determined by the rating agencies based on criteria established from time to time by them and are subject to revision or withdrawal at any time by the rating organization. Each Rating listed in the table above should be evaluated independently of any other Rating applicable to our debt and preferred shares. As is customary, RBC pays rating agencies to assign Ratings for the parent company as well as our subsidiaries, and for certain other services.

15

Additional information about Ratings is provided under “Transactional/positional risk drivers – Liquidity and funding risk – Credit ratings” on page 93 of our 2023 Management’s Discussion and Analysis, which section is incorporated by reference herein.

MARKET FOR SECURITIES

Trading Price and Volume

The Bank’s common shares are listed on the Toronto Stock Exchange (TSX) in Canada and the New York Stock Exchange (NYSE) in the U.S. The Bank’s Non-Cumulative First Preferred Shares Series AZ, BB, BD, BF, BH, BI and BO are listed on the TSX.

The following table sets out the price range and trading volumes of the common shares on the TSX and the US Composite for the periods indicated. Prices are based on the reported amounts from TSX InfoSuite and NYSE Connect.

| Common Shares (TSX) | Common Shares (NYSE) | |||||||||||||||||||||||

| Month | High ($) | Low ($) | Volume (Millions) | High (US$) | Low (US$) | Volume | ||||||||||||||||||

|

November 2022 |

135.69 | 124.65 | 71.11 | 101.43 | 90.33 | 13,388,872 | ||||||||||||||||||

|

December 2022 |

135.45 | 126.35 | 54.03 | 100.96 | 92.36 | 23,036,085 | ||||||||||||||||||

|

January 2023 |

136.30 | 127.36 | 126.69 | 102.43 | 93.31 | 20,009,132 | ||||||||||||||||||

|

February 2023 |

140.18 | 135.14 | 78.69 | 104.69 | 98.95 | 12,323,592 | ||||||||||||||||||

|

March 2023 |

137.78 | 125.32 | 77.29 | 101.23 | 90.99 | 21,585,639 | ||||||||||||||||||

|

April 2023 |

135.40 | 129.36 | 120.16 | 100.56 | 96.00 | 18,729,095 | ||||||||||||||||||

| May 2023 |

135.35 | 120.10 | 83.13 | 100.01 | 88.03 | 17,764,875 | ||||||||||||||||||

|

June 2023 |

126.88 | 120.97 | 53.17 | 96.11 | 89.30 | 12,222,637 | ||||||||||||||||||

|

July 2023 |

132.70 | 124.78 | 120.44 | 100.83 | 93.66 | 22,836,318 | ||||||||||||||||||

|

August 2023 |

130.50 | 119.64 | 72.48 | 98.49 | 88.14 | 21,061,344 | ||||||||||||||||||

|

September 2023 |

124.23 | 117.11 | 52.68 | 92.08 | 86.65 | 17,090,385 | ||||||||||||||||||

|

October 2023 |

119.01 | 107.92 | 118.03 | 87.26 | 77.90 | 34,151,919 | ||||||||||||||||||

16

The following tables provide the price range and trading volumes of the first preferred shares on the TSX for the periods indicated. Prices are based on the reported amounts from TSX InfoSuite.

| Series AZ | Series BB | Series BD | ||||||||||||||||||||||||||||||||||

| Month | High ($) | Low ($) | Volume | High ($) | Low ($) | Volume | High ($) | Low ($) | Volume | |||||||||||||||||||||||||||

|

November 2022 |

18.73 | 17.07 | 252,552 | 19.00 | 17.30 | 201,695 | 19.20 | 18.20 | 573,191 | |||||||||||||||||||||||||||

|

December 2022 |

18.01 | 17.00 | 404,915 | 18.00 | 17.05 | 276,990 | 19.49 | 18.50 | 380,356 | |||||||||||||||||||||||||||

|

January 2023 |

19.30 | 17.29 | 208,798 | 19.60 | 17.25 | 251,018 | 20.66 | 18.50 | 266,485 | |||||||||||||||||||||||||||

|

February 2023 |

18.54 | 17.06 | 288,316 | 18.65 | 18.11 | 193,555 | 20.43 | 19.19 | 188,670 | |||||||||||||||||||||||||||

|

March 2023 |

18.16 | 16.56 | 363,886 | 18.30 | 16.60 | 246,083 | 19.48 | 17.35 | 272,041 | |||||||||||||||||||||||||||

|

April 2023 |

18.13 | 17.13 | 226,039 | 18.29 | 17.05 | 209,412 | 19.11 | 17.89 | 358,975 | |||||||||||||||||||||||||||

| May 2023 |

17.77 | 16.44 | 211,976 | 17.48 | 16.46 | 178,978 | 18.34 | 17.01 | 437,149 | |||||||||||||||||||||||||||

|

June 2023 |

17.74 | 16.61 | 242,424 | 17.80 | 16.70 | 512,902 | 18.79 | 17.50 | 384,998 | |||||||||||||||||||||||||||

|

July 2023 |

18.31 | 17.245 | 328,509 | 18.28 | 17.15 | 227,238 | 19.30 | 18.21 | 244,913 | |||||||||||||||||||||||||||

|

August 2023 |

18.00 | 17.00 | 575,143 | 17.85 | 16.93 | 479,184 | 19.18 | 17.29 | 224,806 | |||||||||||||||||||||||||||

|

September 2023 |

18.29 | 17.03 | 342,576 | 18.10 | 16.90 | 233,797 | 18.10 | 17.23 | 432,288 | |||||||||||||||||||||||||||

|

October 2023 |

18.70 | 17.53 | 305,171 | 18.17 | 17.11 | 244,364 | 18.29 | 16.83 | 259,669 | |||||||||||||||||||||||||||

| Series BF | Series BH | Series BI | ||||||||||||||||||||||||||||||||||

| Month | High ($) | Low ($) | Volume | High ($) | Low ($) | Volume | High ($) | Low ($) | Volume | |||||||||||||||||||||||||||

|

November 2022 |

19.10 | 17.55 | 163,676 | 21.95 | 20.12 | 118,525 | 22.00 | 20.30 | 96,724 | |||||||||||||||||||||||||||

|

December 2022 |