UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 20, 2023

JACOBS SOLUTIONS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | File No. 1-7463 | 88-1121891 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||

| 1999 Bryan Street, Suite 3500, Dallas, Texas | 75201 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

(Registrant’s Telephone Number, Including Area Code) (214) 583-8500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class |

Trading |

Name of Exchange |

||

| Common Stock, $1 par value | J | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement |

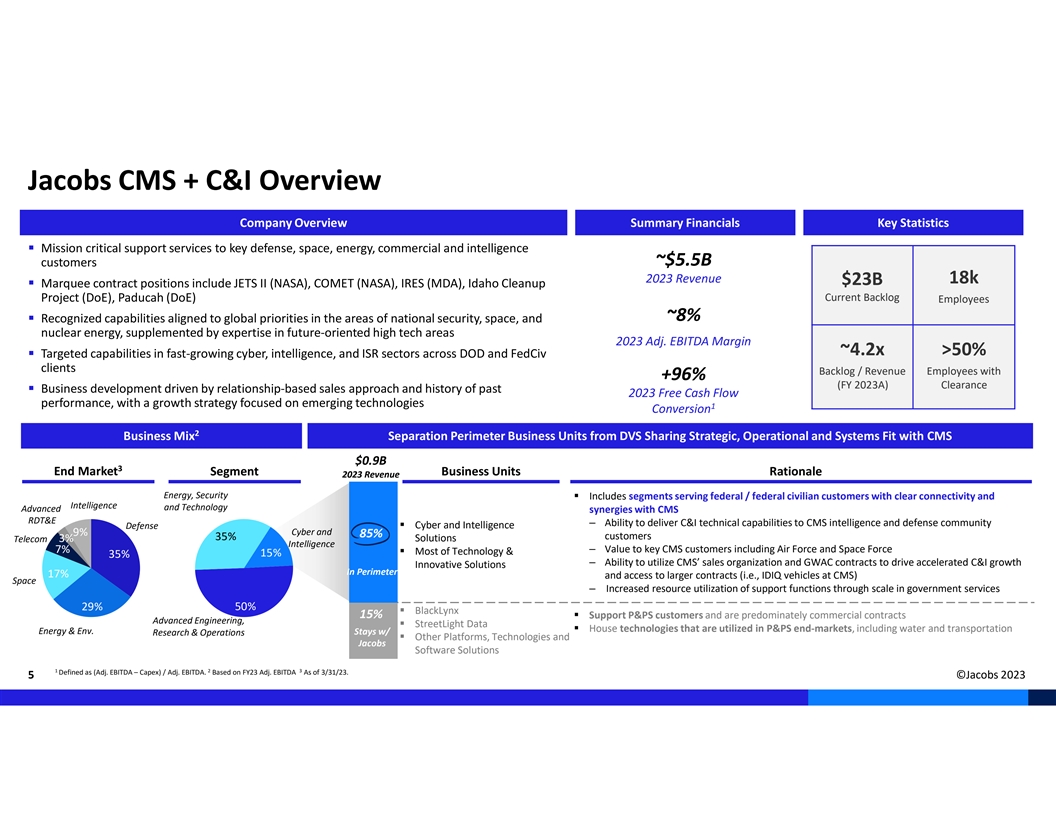

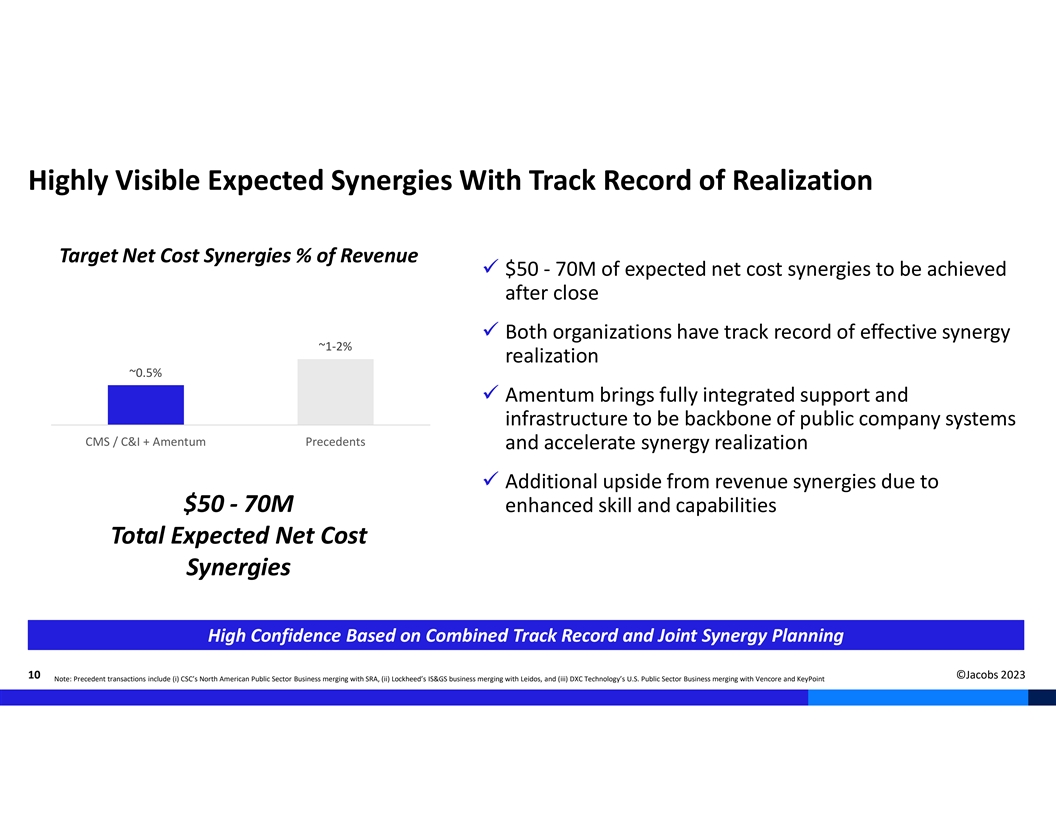

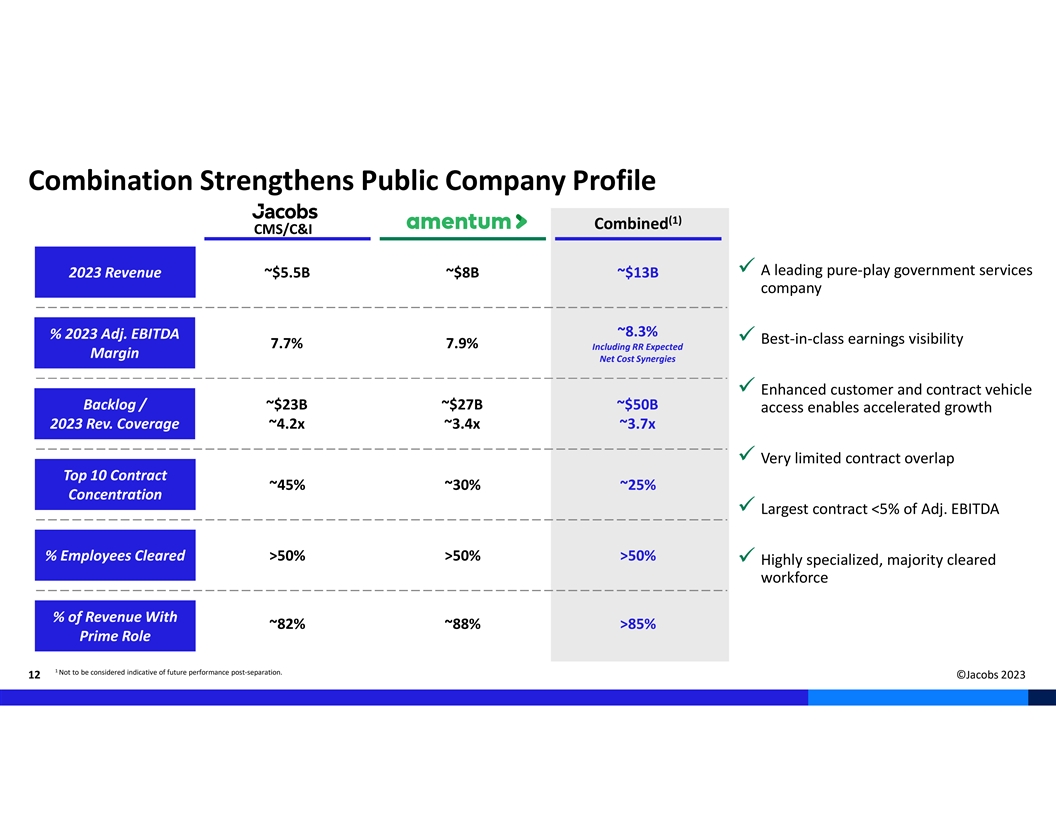

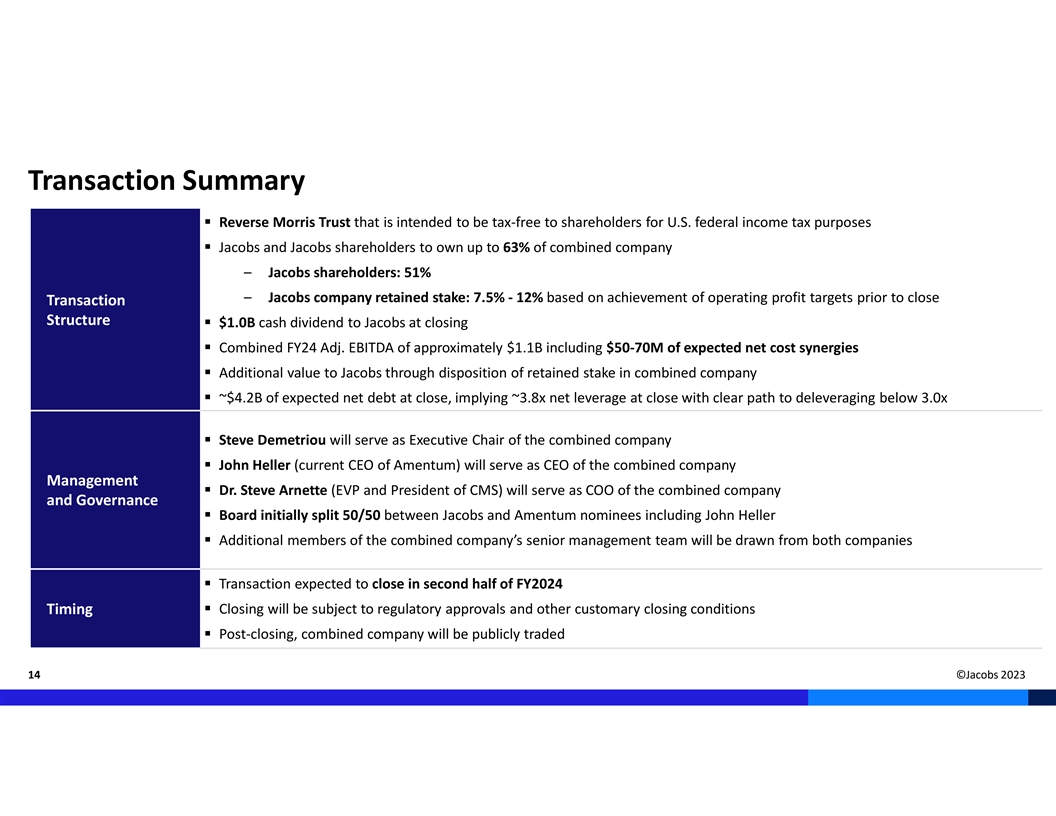

On November 20, 2023 (the “Signing Date”), Jacobs Solutions Inc. (the “Company”), Amazon Holdco Inc., a wholly owned subsidiary of the Company (“SpinCo”), Amentum Parent Holdings LLC (“Amentum”) and Amentum Joint Venture LP, the sole equityholder of Amentum (“Amentum Equityholder”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which the Company will spin off and combine its Critical Mission Solutions and Cyber & Intelligence government services businesses (collectively, the “SpinCo Business”) with Amentum in a Reverse Morris Trust transaction.

Immediately prior to the Merger (as defined below) and pursuant to a Separation and Distribution Agreement, dated as of November 20, 2023, among the Company, SpinCo, Amentum and Amentum Equityholder (the “Separation Agreement”), the Company will, among other things, and subject to the terms and conditions of the Separation Agreement, transfer the SpinCo Business to SpinCo and its subsidiaries (the “Reorganization”) in exchange for the issuance by SpinCo of shares of common stock, par value $0.01 per share, of SpinCo (the “SpinCo Common Stock”) and a cash payment of $1,000,000,000, subject to adjustment based on the levels of cash, debt and working capital in the SpinCo Business at closing (the “SpinCo Payment”). Thereafter, the Company will distribute shares of SpinCo Common Stock to the Company’s stockholders without consideration on a pro rata basis (the “Distribution”), and a portion of the outstanding shares of SpinCo Common Stock will be retained by a subsidiary of the Company (such subsidiary, the “Contributing Subsidiary” and such shares, the “Retained Shares”).

Following the Distribution, in accordance with and subject to the terms and conditions of the Merger Agreement, Amentum will merge with and into SpinCo (the “Merger”), with SpinCo surviving the Merger. As a result of the Distribution and the Merger, Jacobs and its shareholders will own between 58.5% and 63% of SpinCo’s outstanding shares of common stock, consisting of at least 51% held by Jacobs’ shareholders with Jacobs retaining 7.5% to 12%, and Amentum Equityholder will own no less than 37% of SpinCo’s outstanding shares.

Agreement and Plan of Merger

Upon consummation of the Merger, the Amentum equity interests will be converted into the right to receive the Base Consideration and, if applicable, the Additional Merger Consideration. The “Base Merger Consideration” is a number of shares of SpinCo Common Stock equal to 37% of the total number of outstanding SpinCo shares immediately following the consummation of the Merger. The “Additional Merger Consideration” is a number of shares of SpinCo Common Stock that, together with the Base Merger Consideration, will equal between 37% and 41.5% of the total number of outstanding SpinCo shares following the issuance of the Additional Merger Consideration. The Additional Merger Consideration may be issued at or after the closing, and the amount will be determined based on the extent to which the SpinCo Business meets certain operating profit targets in fiscal year 2024.

The Merger Agreement contains customary representations and warranties made by each of the Company, SpinCo, Amentum and Amentum Equityholder. The parties have also agreed to various covenants in the Merger Agreement, including, among other things, covenants (i) to use reasonable best efforts to conduct their respective operations in all material respects in the ordinary course of business (with respect the Company, solely related to the SpinCo Business) and (ii) not to take certain actions prior to the Closing without the consent of the other party. In addition, the parties have agreed to cooperate with one another and use their reasonable best efforts to obtain regulatory approvals required to consummate the transactions.

Consummation of the Merger is subject to satisfaction or waiver of a number of conditions, including (i) expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and receipt of other specified consents, approvals or clearances pursuant to applicable antitrust and foreign investment laws; (ii) completion of the Reorganization and the Distribution in accordance with the Separation Agreement; (iii) the effectiveness of SpinCo’s registration statement registering the SpinCo Common Stock to be issued in the Distribution (the “SpinCo Registration Statement”); (iv) the absence of legal restraints or prohibitions on the consummation of the Reorganization, the Distribution or the Merger; and (v) the approval for listing on the New York Stock Exchange of the shares of SpinCo Common Stock to be distributed in the Distribution. The obligation of each party to consummate the Merger is also conditioned upon the other party’s representations and warranties being true and correct (subject to certain exceptions) and the other party having performed in all material respects its obligations under the Merger Agreement.

The Merger Agreement provides for certain mutual termination rights of the Company and Amentum, including the right of either party to terminate the Merger Agreement: (i) if the Merger is not consummated by the date that is thirteen (13) months following November 20, 2023, which is subject to an automatic extension for two additional periods of three (3) months each (the “Outside Date”) if certain closing conditions have not been satisfied; and (ii) if a Governmental Authority has permanently prohibited, restrained, made illegal the consummation of the Merger. In addition, each party has the right to terminate the Merger Agreement in the event that the other party breaches its representations, warranties, covenants or other agreements in the Merger Agreement such that the related closing condition would not be satisfied by the Outside Date, subject to a 60-day cure right for breaches capable of being cured.

A term sheet attached to the Merger Agreement further provides that for two years following the Closing, Steve J. Demetriou, former Chief Executive Officer (“CEO”) of the Company, will serve as the Executive Chair of the combined company. John Heller, CEO of Amentum, will serve as the CEO of the combined company. Steve Arnette, EVP and President of the Company’s Critical Mission Solutions business, will serve as Chief Operating Officer of the combined company. Effective as of the Closing, the board of directors of the combined company will be comprised of fourteen directors (unless the parties determine that certain director designees employed by an affiliate of Lindsay Goldberg LLC or by American Securities LLC qualify as “independent,” in which case the board of the combined company will be comprised of twelve directors). In the event the initial board of directors of the combined company will be comprised of fourteen directors, each of the Company and Amentum will designate seven directors and in the event the initial board of directors of the combined company will be comprised of twelve directors, each of the Company and Amentum will designate six directors. The Company’s designees will include Steve J. Demetriou. Amentum’s designees will include John Heller and former Amentum CEO John Vollmer.

Separation Agreement

The Separation Agreement governs the rights and obligations of the Company, SpinCo, Amentum and Amentum Equityholder regarding the Reorganization, and provides, among other things, for the transfer by the Company to SpinCo of certain assets, and the assumption by SpinCo of certain liabilities, related to the SpinCo Business. The Separation Agreement also governs the rights and obligations of the Company and SpinCo regarding the Distribution. After the Distribution and the Merger, the Company will seek to transfer a portion of the Retained Shares to creditors in exchange for outstanding debt obligations of the Company (the “Debt-for-Equity Exchange”) or otherwise use a portion of the proceeds of the Debt-for-Equity Exchange for share repurchases. The transaction agreements also provide flexibility to dispose of the Retained Shares following the Distribution through one or more pro rata distributions to Company stockholders (any such distribution, a “Clean-Up Distribution”).

The Separation Agreement also sets forth other agreements among the Company, SpinCo, Amentum and Amentum Equityholder related to the Distribution, including provisions concerning the termination and settlement of intercompany accounts. The Separation Agreement also sets forth agreements that will govern certain aspects of the relationship between the Company, SpinCo, Amentum and Amentum Equityholder after the Distribution, including provisions with respect to release of claims, indemnification, access to financial and other information and access to and provision of records.

Consummation of the Distribution is subject to a number of conditions, including, among others, (i) the effectiveness of the SpinCo Registration Statement, (ii) the completion of the Reorganization, (iii) receipt of customary solvency and surplus opinions, (iv) the Company’s receipt of certain tax opinions, (v) the Company’s receipt of a private letter ruling from the Internal Revenue Service regarding certain U.S. federal income tax consequences of the transactions contemplated by the Merger Agreement and Separation Agreement, and (vi) the satisfaction or waiver of all conditions under the Merger Agreement (other than those conditions that are to be satisfied substantially contemporaneously with the Distribution and/or the Merger, provided that such conditions are capable of being satisfied at such time).

Employee Matters Agreement

On the Signing Date, the Company, SpinCo and Amentum also entered into an Employee Matters Agreement, which governs, among other things, the allocation of liabilities and responsibilities relating to employment matters, employee compensation and benefits plans, and other related matters. The Employee Matters Agreement generally provides that, from and after the Distribution, unless otherwise specified, each of the Company and SpinCo will be responsible for liabilities (whether arising before, on, or after the Distribution) associated with current employees of such party and its subsidiaries and former employees of such party’s business. The Employee Matters Agreement also provides for the treatment of Company equity-based awards held by certain SpinCo employees and directors and includes a requirement for SpinCo to maintain specified compensation and benefits levels for SpinCo employees for the first year following the Distribution.

Certain additional agreements have been or will be entered into in connection with the transactions contemplated by the Merger Agreement and the Separation Agreement, including, among others:

| • | a Transition Services Agreement among the Company and SpinCo, pursuant to which each of the Company and SpinCo (as applicable) will, on a transitional basis, provide the other party with certain support services and other assistance after Closing; |

| • | a Stockholders’ Agreement among SpinCo and Merger Partner Equityholder, pursuant to which the Merger Partner Equityholder will (i) receive certain customary registration and information rights as well as various governance rights, including the right to nominate up to six directors on the board of the combined company (with such nomination rights decreasing and falling away in the event that Merger Partner Equityholder decreases its ownership percentage below certain thresholds) and certain rights to membership on committees and (ii) be subject to certain standstill and lockup restrictions; |

| • | a Project Services Agreement among the Company and SpinCo, which will set forth the terms and conditions pursuant to which the Company and SpinCo will provide joint services to customers and other shared services contracts and will address treatment for certain contracts that cannot be transferred pursuant to the Reorganization; |

| • | a Tax Matters Agreement among the Company, SpinCo, Amentum and Amentum Equityholder, which governs, among other things, the parties’ respective rights, responsibilities and obligations with respect to taxes, tax attributes, the preparation and filing of tax returns, responsibility for and preservation of the expected tax-free status of the transactions contemplated by the Separation Agreement and Merger Agreement and certain other tax matters; |

Commitment Letter

On November 20, 2023, SpinCo entered into a commitment letter (the “Commitment Letter”) with JPMorgan Chase Bank, N.A. (“JPM”), Morgan Stanley Senior Funding, Inc. (“MSSF”) and Royal Bank of Canada (“Royal Bank” and, together with JPM and MSSF, the “Lenders”) pursuant to which the Lenders have committed to provide a senior secured first lien term loan facility (the “Term Loan Facility”) in an amount of $1.130 billion to SpinCo in connection with the transactions contemplated by the Merger Agreement and the Separation Agreement. The proceeds of any loans under the Term Loan Facility will be used by SpinCo to fund, in part, a cash transfer to the Company and to otherwise fund the other transactions contemplated by the Merger Agreement and the Separation Agreement and to pay related transaction fees and expenses. The commitments under the Commitment Letter are subject to customary closing conditions. Upon consummation of the Merger, SpinCo and its U.S. wholly-owned subsidiaries will, among other things, (i) assist Amentum in designating the Term Loan Facility as an incremental facility under Amentum’s existing debt facility and (ii) become guarantors under the Amentum’s existing debt facility and will pledge substantially all their assets to secure the obligations thereunder (in each case subject to certain customary exceptions).

The Merger Agreement, the Separation Agreement and Employee Matters Agreement have been filed, and the above descriptions have been included, to provide investors and securityholders with information regarding the terms of such agreements. They are not intended to provide any other factual information about the Company, SpinCo, Amentum, Amentum Equityholder, their respective subsidiaries or affiliates, or the SpinCo Business. The Merger Agreement and the Separation Agreement each contain representations and warranties that the Company and SpinCo, on the one hand, and Amentum and Amentum Equityholder on the other hand, made to each other as of specific dates. The assertions embodied in those representations and warranties were made solely for purposes of the contract between the parties to such agreements and may be subject to important qualifications and limitations agreed by the parties in connection with negotiating the terms of such agreements. Moreover, some of those representations and warranties may not be accurate or complete as of any specified date, may be subject to a contractual standard of materiality different from those generally applicable to stockholders, or may have been used for the purpose of allocating risk between the parties rather than establishing matters as facts. For the foregoing reasons, such representations and warranties should not be relied upon as statements of factual information.

The foregoing summary descriptions of the Merger Agreement, the Separation Agreement, the Employee Matters Agreement and the transactions contemplated thereby do not purport to be complete and are subject to and qualified in their entirety by reference to the Merger Agreement, the Separation Agreement and the Employee Matters Agreement, copies of which are attached hereto as Exhibit 2.1, Exhibit 2.2 and Exhibit 10.1, respectively, and the terms of which are incorporated herein by reference.

| Item 2.02. | Results of Operations and Financial Condition. |

The information set forth below under Item 7.01 of this Form 8-K is incorporated by reference into this Item 2.02.

| Item 7.01. | Regulation FD Disclosure. |

On November 20, 2023, the Company announced the execution of certain definitive agreements providing for a combination of the Company’s SpinCo Business with Amentum on the terms and conditions set forth in such agreements. Copies of the press release and investor presentation regarding such announcement are furnished as Exhibit 99.1 and Exhibit 99.2 to this Form 8-K.

Forward-Looking Statements

Certain statements contained in this communication constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that do not directly relate to any historical or current fact. When used herein, words such as “expects,” “anticipates,” “believes,” “seeks,” “estimates,” “plans,” “intends,” “future,” “will,” “would,” “could,” “can,” “may,” “target,” “goal” and similar words are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements we make concerning our plans to spin off and merge with Amentum the CMS business and the Cyber & Intelligence portions of our Divergent Solutions (DVS) business (hereinafter referred to collectively as the combined business or the combined company) in a proposed transaction that is intended to be tax-free to stockholders for U.S.

federal income taxes purposes, Jacobs’ and its stockholders respective ownership percentages in the combined company, the amount of cash proceeds and value to be derived by Jacobs from the transaction and the disposition of Jacobs’ retained stake in the combined company, the expected timing, structure and tax treatment of the proposed transaction, our intent to maintain Jacobs’ investment grade credit profile, the ability of the parties to complete the proposed transaction, the potential benefits and synergies of the proposed transaction, including future financial and operating results and strategic benefits, the description of the combined company’s anticipated revenue, business and growth opportunities, and the combined company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing.

Although such statements are based on Jacobs’ and Amentum’s current estimates and expectations, and/or currently available competitive, financial, and economic data, forward-looking statements are inherently uncertain, and you should not place undue reliance on such statements as actual results may differ materially. We caution the reader that there are a variety of risks, uncertainties and other factors that could cause actual results to differ materially from what is contained, projected or implied by our forward-looking statements.

Such factors include uncertainties as to the structure and timing of the proposed transaction, the impact of the proposed transaction on Jacobs and the combined company if the proposed transaction is completed, the possibility that the proposed transaction may not qualify for the expected tax treatment, the ability to obtain all required regulatory approvals, the possibility that closing conditions for the proposed transaction may not be satisfied or waived, on a timely basis or otherwise, the risk that any consents or approvals required in connection with the proposed transaction may not be received, the risk that the proposed transaction may not be completed on the terms or in the time-frame expected by the parties, unexpected costs, charges or expenses resulting from the proposed transaction, business and management strategies and the growth expectations of the combined entity, risk relating to the combination and integration of the businesses and the ability to implement its business strategy and realize the expected benefits, including the ability to realize the estimated synergies, the inability of Jacobs and the combined entity to retain and hire key personnel, customers or suppliers while the proposed transaction is pending or after it is completed, as well as other factors that may impact Jacobs or the combined business, such as competition from existing and future competitors in its target markets, financial market risks that may affect Jacobs or the combined business, including by affecting Jacobs’ or the combined business’ access to capital, as well as general economic conditions, including inflation and the actions taken by monetary authorities in response to inflation, changes in interest rates and foreign currency exchange rates, changes in capital markets, the impact of a possible recession or economic downturn on our results, prospects and opportunities, and geopolitical events and conflicts, the risk that disruptions from the proposed transaction will impact the Jacobs’ or Amentum’s business, the risk that the separation of the businesses from Jacobs may be more difficult than expected, a possible decrease in the trading price of Jacobs’ shares, as well as factors related to our business or detailed from time to time in Jacobs’ reports filed with the U.S. Securities and Exchange Commission (“SEC”). The foregoing factors and potential future developments are inherently uncertain, unpredictable and, in many cases, beyond our control. For a description of these and additional factors that may occur that could cause actual results to differ from our forward-looking statements see our Annual Report on Form 10-K for the year ended September 29, 2023, and in particular the discussions contained therein under Item 1 - Business; Item 1A - Risk Factors; Item 3 - Legal Proceedings; and Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations, our Quarterly Reports on Form 10-Q, as well as Jacobs’ other filings with the SEC. Jacobs is not under any duty to update any of the forward-looking statements after the date of this presentation to conform to actual results, except as required by applicable law. We encourage you to read carefully the risk factors, as well as the financial and business disclosures contained in our Annual Report on Form 10-K, our Quarterly Report on Form 10-Q and in other documents we file from time to time with the SEC.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| * | Schedules omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request, provided, however, that the Company may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act, as amended, for any schedule or exhibit so furnished. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 21, 2023

| JACOBS SOLUTIONS INC. | ||

| By: | /s/ Bob Pragada |

|

| Name: | Bob Pragada | |

| Title: | Chief Executive Officer | |

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

dated as of November 20, 2023

by and among

JACOBS SOLUTIONS INC.,

AMAZON HOLDCO INC.,

AMENTUM PARENT HOLDINGS LLC

and

AMENTUM JOINT VENTURE LP

TABLE OF CONTENTS

| Page | ||||||||

| Article I DEFINITIONS |

2 | |||||||

|

|

Section 1.1 | Definitions | 2 | |||||

| Section 1.2 |

Cross References |

20 | ||||||

| Section 1.3 |

Interpretation |

22 | ||||||

| Article II THE MERGER |

24 | |||||||

| Section 2.1 |

Pre-Closing Contribution; the Merger |

24 | ||||||

| Section 2.2 |

Closing |

24 | ||||||

| Section 2.3 |

Effective Time |

24 | ||||||

| Section 2.4 |

Certificate of Incorporation and Bylaws of the Surviving Entity |

24 | ||||||

| Section 2.5 |

Governance Matters |

25 | ||||||

| Article III CONVERSION OF EQUITY INTERESTS |

25 | |||||||

| Section 3.1 |

Effect on Equity Interests |

25 | ||||||

| Section 3.2 |

Exchange of Interests |

27 | ||||||

| Section 3.3 |

Additional Merger Consideration |

28 | ||||||

| Article IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY RELATING TO THE COMPANY |

28 | |||||||

| Section 4.1 |

Organization of the Company |

28 | ||||||

| Section 4.2 |

Due Authorization |

29 | ||||||

| Section 4.3 |

Consents and Approvals; No Violations |

29 | ||||||

| Section 4.4 |

Litigation |

30 | ||||||

| Section 4.5 |

Brokers |

30 | ||||||

| Article V REPRESENTATIONS AND WARRANTIES OF THE COMPANY AND SPINCO RELATING TO SPINCO |

30 | |||||||

| Section 5.1 |

Organization of the SpinCo Entities |

31 | ||||||

| Section 5.2 |

Due Authorization |

31 | ||||||

| Section 5.3 |

Capitalization of the SpinCo Entities |

32 | ||||||

| Section 5.4 |

Consents and Approvals; No Violations |

32 | ||||||

| Section 5.5 |

Financial Statements; Undisclosed Liabilities |

33 | ||||||

| Section 5.6 |

Absence of Certain Changes or Events |

34 | ||||||

| Section 5.7 |

National Security Matters |

34 | ||||||

| Section 5.8 |

Security Clearances |

34 | ||||||

| Section 5.9 |

Sufficiency of the SpinCo Assets |

34 | ||||||

| Section 5.10 |

Litigation |

35 | ||||||

| Section 5.11 |

Property |

35 | ||||||

| Section 5.12 |

Tax Matters |

36 | ||||||

| Section 5.13 |

Material Contracts |

37 | ||||||

| Section 5.14 |

Intercompany Arrangements |

39 | ||||||

| Section 5.15 |

Labor Relations |

39 | ||||||

| Section 5.16 |

Compliance with Law; Permits |

40 | ||||||

| Section 5.17 |

SpinCo Benefit Plans |

40 | ||||||

| Section 5.18 |

Intellectual Property |

42 | ||||||

| Section 5.19 |

Environmental Matters |

44 | ||||||

| Section 5.20 |

Affiliate Matters |

45 | ||||||

| Section 5.21 |

Registration Statement |

45 | ||||||

| Section 5.22 |

Board and Stockholder Approval |

46 | ||||||

| Section 5.23 |

SpinCo Financing |

46 | ||||||

| Section 5.24 |

Government Contracts |

47 | ||||||

| Section 5.25 |

Export Control Laws |

47 | ||||||

| Section 5.26 |

Data Privacy |

48 | ||||||

|

|

Section 5.27 |

No Other Representations and Warranties |

49 | |||||

| Article VI REPRESENTATIONS AND WARRANTIES OF MERGER PARTNER AND MERGER PARTNER EQUITYHOLDER |

51 | |||||||

| Section 6.1 |

Organization |

51 | ||||||

| Section 6.2 |

Due Authorization |

51 | ||||||

| Section 6.3 |

Capitalization |

52 | ||||||

| Section 6.4 |

Consents and Approvals; No Violations |

52 | ||||||

| Section 6.5 |

National Security Matters |

53 | ||||||

| Section 6.6 |

Security Clearances |

53 | ||||||

| Section 6.7 |

Financial Statements; Undisclosed Liabilities |

54 | ||||||

| Section 6.8 |

Litigation |

54 | ||||||

| Section 6.9 |

Property |

54 | ||||||

| Section 6.10 |

Tax Matters |

55 | ||||||

| Section 6.11 |

Absence of Certain Changes or Events |

56 | ||||||

| Section 6.12 |

Material Contracts |

57 | ||||||

| Section 6.13 |

Labor Relations |

58 | ||||||

| Section 6.14 |

Compliance with Law; Permits |

59 | ||||||

| Section 6.15 |

Merger Partner Benefit Plans |

59 | ||||||

| Section 6.16 |

Intellectual Property |

61 | ||||||

| Section 6.17 |

Environmental Matters |

63 | ||||||

| Section 6.18 |

Brokers |

64 | ||||||

| Section 6.19 |

Registration Statement |

64 | ||||||

| Section 6.20 |

Government Contracts |

64 | ||||||

| Section 6.21 |

Export Control Laws |

65 | ||||||

| Section 6.22 |

Board and Merger Partner Equityholder Approval |

66 | ||||||

| Section 6.23 |

Equityholder Approval Required |

66 | ||||||

| Section 6.24 |

No Public Sale or Distribution |

66 | ||||||

| Section 6.25 |

Reliance on Exemptions |

67 | ||||||

| Section 6.26 |

Accredited Investor Status |

67 | ||||||

| Section 6.27 |

Transfer or Resale |

67 | ||||||

| Section 6.28 |

No General Solicitation |

68 | ||||||

| Section 6.29 |

Capital Stock of the Company and SpinCo |

68 | ||||||

| Section 6.30 |

No Antitakeover Law |

68 | ||||||

| Section 6.31 |

Data Privacy |

68 | ||||||

| Section 6.32 |

Merger Partner Leakage |

69 | ||||||

| Section 6.33 |

Equity Financing |

69 | ||||||

| Section 6.34 |

Affiliate Matters |

70 | ||||||

| Section 6.35 |

No Other Representations and Warranties |

70 | ||||||

| Article VII COVENANTS |

71 | |||||||

| Section 7.1 |

Conduct of Business |

71 | ||||||

| Section 7.2 |

Tax Matters |

79 | ||||||

| Section 7.3 |

Preparation of the Registration Statement |

82 | ||||||

| Section 7.4 |

Reasonable Best Efforts |

83 | ||||||

| Section 7.5 |

Financing |

85 | ||||||

| Section 7.6 |

Access to Information |

91 | ||||||

| Section 7.7 |

Processing of Personal Information |

92 | ||||||

| Section 7.8 |

D&O Indemnification and Insurance |

92 | ||||||

|

|

Section 7.9 |

Public Announcements |

93 | |||||

| Section 7.10 |

Employee Non-Solicitation |

94 | ||||||

| Section 7.11 |

Defense of Litigation |

95 | ||||||

| Section 7.12 |

Section 16 Matters |

95 | ||||||

| Section 7.13 |

Control of Other Party’s Business |

96 | ||||||

| Section 7.14 |

SpinCo Share Issuance |

96 | ||||||

| Section 7.15 |

Transaction Documents |

96 | ||||||

| Section 7.16 |

Takeover Statutes |

96 | ||||||

| Section 7.17 |

Obligations of the Company and Merger Partner |

96 | ||||||

| Section 7.18 |

Works Council Matters |

97 | ||||||

| Section 7.19 |

Section 280G Approval |

97 | ||||||

| Section 7.20 |

Further Assurances |

97 | ||||||

| Section 7.21 |

SpinCo Stockholder Approval |

98 | ||||||

| Section 7.22 |

Financial Statements |

98 | ||||||

| Section 7.23 |

No Solicitation of Competing Proposals |

99 | ||||||

| Section 7.24 |

Resignations |

100 | ||||||

| Section 7.25 |

Merger Partner Leakage |

100 | ||||||

| Section 7.26 |

Termination of Affiliate Contracts |

101 | ||||||

| Article VIII CONDITIONS TO THE MERGER |

101 | |||||||

| Section 8.1 |

Conditions to the Obligations of SpinCo, the Company and Merger Partner to Effect the Merger |

101 | ||||||

| Section 8.2 |

Additional Conditions to the Obligations of the Company and SpinCo |

102 | ||||||

| Section 8.3 |

Additional Conditions to the Obligations of Merger Partner |

103 | ||||||

| Article IX TERMINATION |

104 | |||||||

| Section 9.1 |

Termination |

104 | ||||||

| Section 9.2 |

Effect of Termination |

106 | ||||||

| Section 9.3 |

Fees and Expenses |

106 | ||||||

| Article X MISCELLANEOUS |

106 | |||||||

| Section 10.1 |

Non-Survival of Representations, Warranties and Agreements |

106 | ||||||

| Section 10.2 |

Governing Law; Submission; Jurisdiction |

107 | ||||||

| Section 10.3 |

Notices |

107 | ||||||

|

|

Section 10.4 |

Headings |

109 | |||||

| Section 10.5 |

Entire Agreement |

109 | ||||||

| Section 10.6 |

Amendments and Waivers |

110 | ||||||

| Section 10.7 |

Assignment; Parties in Interest; Non-Parties |

110 | ||||||

| Section 10.8 |

Specific Performance |

111 | ||||||

| Section 10.9 |

WAIVER OF JURY TRIAL |

111 | ||||||

| Section 10.10 |

Severability |

112 | ||||||

| Section 10.11 |

Counterparts |

112 | ||||||

| Section 10.12 |

Certain Financing Provisions |

112 |

| Annexes | ||

| Annex I | Additional Merger Consideration | |

| Annex II | Governance Term Sheet | |

| EXHIBITS | ||

| Exhibit A | Form of Project Services Agreement | |

| Exhibit B | Form of Tax Matters Agreement | |

| Exhibit C | Form of Transition Services Agreement | |

| Exhibit D | Form of SpinCo Stockholder Approval | |

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER, dated as of November 20, 2023, is entered into by and among Jacobs Solutions Inc., a Delaware corporation (the “Company”), Amazon Holdco Inc., a Delaware corporation and wholly owned Subsidiary of the Company (“SpinCo”), Amentum Parent Holdings LLC, a Delaware limited liability company (“Merger Partner”), and Amentum Joint Venture LP, a Delaware limited partnership and the sole equityholder of Merger Partner (“Merger Partner Equityholder”). Each of the foregoing parties is sometimes referred to herein as a “Party” and collectively as the “Parties.” Capitalized terms that are used but not otherwise defined in the recitals shall have the respective meanings ascribed to such terms in Section 1.1.

WHEREAS:

(1) SpinCo is a wholly owned, indirect Subsidiary of the Company;

(2) Merger Partner Equityholder is the sole equityholder of Merger Partner and owns, beneficially and of record, 100% of the Interests of Merger Partner (the “Merger Partner Equity Interests”);

(3) contemporaneously with the execution of this Agreement, the Company, SpinCo, Merger Partner and Merger Partner Equityholder are entering into the Separation and Distribution Agreement, pursuant to which the Company will, upon the terms and conditions set forth therein and in accordance with the Reorganization, separate the SpinCo Business such that, as of the Distribution, the SpinCo Business is held by SpinCo;

(4) prior to the Distribution, in consideration of the transfer to SpinCo of the SpinCo Assets contemplated by the Reorganization, SpinCo will make a cash payment to a Subsidiary of the Company in an aggregate amount equal to the SpinCo Payment;

(5) the Company will distribute at least 80.1% of the outstanding shares of the common stock, $0.01 par value per share, of SpinCo (the “SpinCo Common Stock”) to the Company’s stockholders without consideration on a pro rata basis (the “Distribution”), and up to 19.9% of the outstanding shares of SpinCo Common Stock will be retained by a Subsidiary of the Company (such shares, the “Retained Shares”);

(6) the Distribution together with the Reorganization is referred to as the “Separation”;

(7) following the Separation and prior to the Effective Time, Merger Partner Equityholder will cause the Merger Partner Equityholder Contribution to occur and, at the Effective Time, the Parties will effect the merger of Merger Partner with and into SpinCo, with SpinCo continuing as the Surviving Entity, all upon the terms and subject to the conditions set forth herein;

(8) each of (i) Merger Partner Equityholder, as sole member and manager of Merger Partner and (ii) the board of managers of the General Partner of Merger Partner Equityholder, has approved this Agreement and the transactions contemplated hereby, including the Merger; (9) the board of directors of SpinCo (the “SpinCo Board”) has (i) approved this Agreement, the Separation and Distribution Agreement and the other Transaction Documents, (ii) approved the transactions contemplated hereby and thereby and (iii) declared each of the matters in each of the foregoing clauses (i) and (ii) advisable, fair to and in the best interests of SpinCo and the Company, as SpinCo’s sole stockholder;

(10) the board of directors of the Company (the “Company Board”) has approved this Agreement and the transactions contemplated hereby, subject to such further action by the Company Board required, if applicable, to determine the structure of the Distribution, establish the Record Date and the Distribution Date, and declare the Distribution (the effectiveness of which will be subject to the satisfaction or, to the extent permitted by applicable Law, waiver of the conditions set forth in the Separation and Distribution Agreement); and

(11) it is the intention of the Parties that, for U.S. federal income Tax purposes: (a) the Contribution and the related distribution by a Subsidiary of the Company to the Company of at least 80.1% of SpinCo Common Stock by means of a pro rata distribution, taken together and together with any Debt-for-Equity Exchange or Clean-Up Distribution by such Subsidiary of the Company, qualify as a “reorganization” under Sections 368(a)(1)(D) and 355(a) of the Code; (b) the Distribution, taken together with any Clean-Up Distribution by the Company, qualify as a transaction described in Section 355(a) of the Code; (c) the Merger qualify as a “reorganization” within the meaning of Section 368(a) of the Code; and (d) each of this Agreement and the Separation and Distribution Agreement constitute a “plan of reorganization” for purposes of Section 368 of the Code.

NOW, THEREFORE:

In consideration of the premises and mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

ARTICLE I

DEFINITIONS

Section 1.1 Definitions. As used herein, the following terms have the following meanings:

(1) “Action” has the meaning set forth in the Separation and Distribution Agreement.

(2) “Additional Entities” has the meaning set forth in the Separation and Distribution Agreement.

(3) “Adverse Law Event” means (a) the enactment of any Law, issuance of any judicial determination or proposal or promulgation of any administrative authority or pronouncement (including any interpretation of Law) which would materially adversely affect the likelihood the Transactions qualify for Tax-Free Status, (b) the approval by either house of the U.S. Congress or the U.S. executive branch of any legislation which would if enacted and signed into Law, or would reasonably be expected to if enacted and signed into Law, materially adversely affect the likelihood the Transactions qualify for Tax-Free Status, (c) the refusal by the IRS to issue any ruling requested in the IRS Ruling Request or (d) the refusal by Cravath to give the Merger Partner Merger Tax Opinion or by WLRK or Company Accounting Firm to give any of the Company Tax Opinions (as applicable).

2

(4) “Affiliate” means, with respect to any Person, any other Person that, directly or indirectly, controls, is controlled by, or is under common control with, such Person, through one or more intermediaries or otherwise.

(5) “Agreement” means this Agreement and Plan of Merger, including all Annexes, Exhibits and Schedules hereto (including the Disclosure Schedules), as it may be amended, restated, modified or supplemented from time to time in accordance with its terms.

(6) “Alternative Escrow Arrangement” has the meaning set forth in Annex I.

(7) “Antitrust Laws” means the Sherman Act, as amended, the Clayton Act, as amended, the Federal Trade Commission Act, as amended, the HSR Act and any other federal, state, foreign or supranational Law that is designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or lessening of competition through merger or acquisition.

(8) “Base Merger Consideration” shall mean a number of shares of SpinCo Common Stock (rounded to the nearest whole share) equal to (a) the aggregate number of shares of SpinCo Common Stock issued and outstanding immediately prior to the Effective Time, divided by (b) the Company Valuation Percentage, multiplied by (c) the Merger Partner Valuation Percentage.

(9) “Benefit Plan” means each “employee benefit plan” (within the meaning of Section 3(3) of ERISA but regardless of whether such plan is subject to ERISA) and each employee benefit or compensation plan, program, agreement or arrangement, including each pension, retirement, profit sharing, 401(k), severance, health and welfare, disability, deferred compensation, employment, termination, change-in-control, retention, fringe benefit, stock purchase, cash bonus or equity-based incentive or other benefit plan, program, agreement, policy or other arrangement, in each case, that is maintained for the benefit of current and/or former directors, officers, consultants or employees, excluding any plan, program or arrangement that is sponsored, maintained or administered by any Governmental Authority and any Multiemployer Plan.

(10) “Books and Records” has the meaning set forth in the Separation and Distribution Agreement.

(11) “Business Day” means any day that is not a Saturday, a Sunday or other day on which banking institutions are authorized or obligated by Law to be closed in New York, New York.

(12) “Clean-Up Distribution” has the meaning set forth in the Separation and Distribution Agreement.

(13) “Code” means the Internal Revenue Code of 1986, as amended.

3

(14) “Collective Bargaining Agreement” means each written Contract with a labor union, labor organization, works council or other labor organization.

(15) “Company Accounting Firm” means a nationally recognized accounting firm reasonably acceptable to the Company.

(16) “Company Business” has the meaning set forth in the Separation and Distribution Agreement.

(17) “Company Combined Tax Return” shall mean any combined, consolidated, affiliated or unitary Tax Return that includes the Company or any of its Affiliates (other than the SpinCo Entities), on the one hand, and any of SpinCo or the SpinCo Subsidiaries, on the other hand, it being understood that a Tax Return claiming group relief or similar sharing of Tax losses or other attributes (or surrendering) shall not, by virtue of such claiming, be considered a Company Combined Tax Return.

(18) “Company Common Stock” means the common stock, par value $1.00 per share, of the Company.

(19) “Company Distribution Tax Representations” means the representations of an officer of the Company, dated as of the Closing Date, in form and substance reasonably satisfactory to Company Accounting Firm and WLRK, delivered to Company Accounting Firm and WLRK in connection with the Distribution Tax Opinions.

(20) “Company Group” has the meaning set forth in the Separation and Distribution Agreement.

(21) “Company Material Adverse Effect” means any change, event, development, condition, occurrence or effect that has or would reasonably be expected to prevent, materially impair or materially delay the ability of the Company to perform by the Outside Date its obligations hereunder or under the Separation and Distribution Agreement or to consummate the transactions contemplated hereby and thereby, including the Merger and the Separation, by the Outside Date.

(22) “Company SEC Documents” means all forms, reports, Schedules, statements and other documents required to be filed or furnished by the Company or SpinCo with the SEC since January 1, 2021.

(23) “Company Tax Opinions” means the Distribution Tax Opinions and the Company Merger Tax Opinion.

(24) “Company Valuation Percentage” means one (1) minus the Merger Partner Valuation Percentage.

4

(25) “Competing Merger Partner Proposal” means any inquiry, proposal or offer for, or indication of interest in, any (a) direct or indirect acquisition, exclusive license or purchase of any business or assets of Merger Partner or any of the Merger Partner Subsidiaries that, individually or in the aggregate, constitutes 20% or more of the assets of the Merger Partner Business, taken as a whole, (b) direct or indirect acquisition or purchase of 20% or more of any class of any Interests or representing 20% or more of the outstanding voting power of Merger Partner, or (c) merger, consolidation, business combination, stock exchange, joint venture, partnership or similar transaction involving any business of Merger Partner or any Merger Partner Subsidiaries that constitutes 20% or more of the assets of the Merger Partner Business, taken as a whole. None of the Transactions shall be a Competing Merger Partner Proposal.

(26) “Competing SpinCo Proposal” means any inquiry, proposal or offer for, or indication of interest in, any (a) direct or indirect acquisition, exclusive license or purchase of any business or assets of the Company or any of its Subsidiaries that, individually or in the aggregate, constitutes 20% or more of the assets of the SpinCo Business, taken as a whole, (b) direct or indirect acquisition or purchase of 20% or more of any class of any Interests or representing 20% or more of the outstanding voting power of SpinCo, (c) merger, consolidation, business combination, stock exchange, joint venture, partnership or similar transaction involving any business of the Company or any of its Subsidiaries that constitutes 20% or more of the assets of the SpinCo Business, taken as a whole. None of the Transactions shall be a Competing SpinCo Proposal.

(27) “Confidentiality Agreement” means that certain Confidentiality Agreement, by and between Merger Partner OpCo and the Company, dated as of June 29, 2023, as amended, restated or supplemented from time to time, including any addendum thereto.

(28) “Consent” means any consent, clearance, expiration or termination of a waiting period, approval, exemption, waiver, authorization, filing, registration or notification.

(29) “Contract” means any binding contract, agreement, understanding, arrangement, loan or credit agreement, note, bond, indenture, lease, warranty, accepted purchase order with outstanding performance obligations at the applicable time of determination, sublicense or license or other instrument, but excluding any Benefit Plan.

(30) “Contributing Subsidiary” has the meaning set forth in the Separation and Distribution Agreement.

(31) “Contribution” has the meaning set forth in the Separation and Distribution Agreement.

(32) “Controlled Group Liability” means any and all liabilities (1) under Title IV of ERISA, (2) under Section 302 of ERISA, (3) under Sections 412 and 4971 of the Code, or (4) as a result of a failure to comply with the continuing coverage requirements of Section 601 et seq. of ERISA and Section 4980B of the Code.

(33) “COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or related or associated epidemics, pandemics or disease outbreaks.

(34) “COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester, workplace safety or similar Law, directive, guidelines or recommendations promulgated by any industry group or any Governmental Authority, including the Centers for Disease Control and Prevention and the World Health Organization, in each case, in connection with or in response to COVID-19, including the CARES Act and Families First Act.

5

(35) “Cravath” means Cravath, Swaine & Moore LLP.

(36) “Debt-for-Equity Exchange” means a transfer of all or a portion of the Retained Shares by the Contributing Subsidiary to its creditors in exchange for outstanding debt obligations of the Contributing Subsidiary.

(37) “DGCL” means the Delaware General Corporation Law.

(38) “Disclosure Schedules” means, collectively, the Merger Partner Disclosure Schedule and the SpinCo Disclosure Schedule.

(39) “Distribution Date” has the meaning set forth in the Separation and Distribution Agreement.

(40) “Distribution Time” has the meaning set forth in the Separation and Distribution Agreement.

(41) “DLLCA” means the Delaware Limited Liability Company Act.

(42) “Employee Matters Agreement” means the Employee Matters Agreement dated as of the date hereof among the Company, SpinCo and Merger Partner.

(43) “Environmental Laws” has the meaning set forth in the Separation and Distribution Agreement.

(44) “Environmental Liabilities” has the meaning set forth in the Separation and Distribution Agreement.

(45) “ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

(46) “ERISA Affiliate” means, with respect to any entity, trade or business, any other entity, trade or business that is a member of a group described in Section 414(b), (c), (m) or (o) of the Code or Section 4001(b)(1) of ERISA that includes the first entity, trade or business, or that is a member of the same “controlled group” as the first entity, trade or business pursuant to Section 4001(a)(14) of ERISA.

(47) “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations of the SEC thereunder, all as the same shall be in effect at the time that reference is made.

(48) “Excluded Assets” has the meaning set forth in the Separation and Distribution Agreement.

6

(49) “Excluded Liabilities” has the meaning set forth in the Separation and Distribution Agreement.

(50) “Foreign Benefit Plan” means any Benefit Plan that is maintained primarily for the benefit of employees outside the United States (whether or not subject to U.S. Laws).

(51) “Foreign Investment Law” means any federal, state, foreign, or supranational Law that is designed or intended to screen, prohibit, restrict or regulate investments on cultural, public order or safety, privacy, or national or economic security grounds.

(52) “Former SpinCo Employee” has the meaning set forth in the Employee Matters Agreement.

(53) “Fraud” means any actual and intentional misrepresentation of a material fact by a Party in making the representations and warranties set forth in Article IV, Article V or Article VI, as applicable, or in the certificate contemplated by Section 8.2(c) and Section 8.3(c), as applicable, that constitutes actual common law fraud under the Laws of the State of Delaware, but does not include fraud based on constructive knowledge, negligent misrepresentation, recklessness or a similar theory, equitable fraud, promissory fraud or any other fraud or torts based on recklessness or negligence.

(54) “French Companies” has the meaning set forth in the Separation and Distribution Agreement.

(55) “GAAP” means generally accepted accounting principles in the United States.

(56) “Governance Term Sheet” means the Governance Term Sheet attached hereto as Annex II.

(57) “Government Bid” means any offer, quotation, bid or proposal (solicited or unsolicited) which, if accepted or awarded, would reasonably be expected to lead to a Government Contract.

(58) “Government Contract” means (a) with respect to the Company, and with respect to SpinCo prior to the Effective Time, any Contract between the Company (or any Subsidiary thereof, including any SpinCo Entity), on the one hand, and (i) the U.S. federal government or other Governmental Authority, (ii) any prime contractor to the U.S. federal government or other Governmental Authority in its capacity as a prime contractor, or (iii) any subcontractor with respect to any Contract described in clause (i) or clause (ii) above, on the other hand, in the cases of each of clauses (i) through (iii), primarily relating to the operation of the SpinCo Business, and (b) with respect to Merger Partner, and with respect to SpinCo on or following the Effective Time, any Contract between Merger Partner (or any Subsidiary thereof), on the one hand, and (i) the U.S. federal government or other Governmental Authority, (ii) any prime contractor to the U.S. federal government or other Governmental Authority in its capacity as a prime contractor, or (iii) any subcontractor with respect to any Contract described in clause (i) or clause (ii) above, on the other hand, in the cases of each of clauses (a) and (b), for the sale of goods or services for which the period of performance has not expired or terminated or for which final payment has not yet been received as of the date hereof. A task, purchase or delivery order under a Government Contract shall not constitute a separate Government Contract, for purposes of this definition, but shall be part of the Government Contract to which it relates.

7

(59) “Governmental Authority” has the meaning set forth in the Separation and Distribution Agreement.

(60) “Hazardous Substance” has the meaning set forth in the Separation and Distribution Agreement.

(61) “HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder.

(62) “Intellectual Property” has the meaning set forth in the Separation and Distribution Agreement.

(63) “Interests” means shares, partnership interests, limited liability company interests or any other equity interest in any Person.

(64) “Internet Properties” has the meaning set forth in the Separation and Distribution Agreement.

(65) “IRS” means the United States Internal Revenue Service.

(66) “IRS Ruling” means a private letter ruling from the IRS received after the date hereof, in form and substance reasonably acceptable to the Company, (i) to the effect that the D Reorganization (as defined in the Tax Matters Agreement), the Distribution by the Company, any Clean-Up Distribution (as defined in the Separation and Distribution Agreement) and the SpinCo Payment (as defined in the Separation and Distribution Agreement) qualify for Tax-Free Status, (ii) to the effect that any other Distributions and Contributions (each, as defined in the Tax Matters Agreement) that are part of the Reorganization and are included in the IRS Ruling Request qualify for Tax-Free Status, and (iii) regarding such other or related matters germane to the U.S. federal income Tax consequences of the Transactions as the Company may reasonably determine in good faith consultation with Merger Partner acting reasonably as included in the initial formal request (as distinguished from any pre-submission conference memorandum) for such private letter ruling submitted by the Company pursuant to Section 7.2(g) (or any supplemental request with respect to modifications requested by, or needed or appropriate to accommodate or respond to, the IRS after such initial formal request); provided that, notwithstanding the foregoing, the Company shall not be permitted to assert that the IRS Ruling is not reasonably acceptable due to the failure of the IRS Ruling to include (A) a ruling that the Contributing Subsidiary may use the proceeds of the SpinCo Payment or the Debt-for-Equity Exchange in a manner other than repayment of indebtedness of the Company, (B) a ruling providing an alternative to a Debt-for-Equity Exchange and Clean-Up Distribution under which Retained Shares would be sold to third parties in a taxable sale within a specified period of years after the Distribution, (C) a ruling in relation to a Debt-for-Equity Exchange regarding variable pricing mechanisms to allocate pricing risk on the disposition of the Retained Shares, or (D) a ruling to the effect that the Alternative Escrow Arrangement does not result in the recognition of any gain, loss, income or deduction for U.S. federal income Tax purposes to the Company, the Contributing Subsidiary (as defined in the Separation and Distribution Agreement) or the affiliated group, for U.S. federal income Tax purposes, of which they are a member (it being agreed and understood that this clause (D) shall not prevent the Company from asserting that a ruling has not been obtained, or that a ruling that has been obtained is not reasonably acceptable, for purposes of Section 10 of Annex I).

8

(67) “IRS Ruling Request” means the request for the IRS Ruling and such other rulings that the Company determines are necessary or appropriate (which, for the avoidance of doubt, shall include a ruling to the effect that the Alternative Escrow Arrangement does not result in the recognition of any gain, loss, income or deduction for U.S. federal income Tax purposes to the Company, the Contributing Subsidiary (as defined in the Separation and Distribution Agreement) or the affiliated group, for U.S. federal income Tax purposes, of which they are a member) that will be submitted by the Company to the IRS.

(68) “Knowledge” means (a) with respect to the Company, the actual knowledge of the Persons set forth in Section 1.1(a) of the SpinCo Disclosure Schedule, after reasonable inquiry, and (b) with respect to Merger Partner, the actual knowledge of the Persons set forth in Section 1.1(a) of the Merger Partner Disclosure Schedule, after reasonable inquiry.

(69) “Law” has the meaning set forth in the Separation and Distribution Agreement.

(70) “Liability” has the meaning set forth in the Separation and Distribution Agreement.

(71) “Lien” means any mortgage, deed of trust, pledge, hypothecation, encumbrance, easement, exclusive license, purchase option, right of first offer or refusal, security interest or other lien of any kind.

(72) “Locked Box Date” has the meaning set forth in the Separation and Distribution Agreement.

(73) “Losses” means any and all Liabilities, claims, losses, damages, costs, expenses, interest, awards, judgments and penalties (including reasonable attorneys’ and consultants’ fees and expenses).

(74) “Merger Consideration” means the Base Merger Consideration and any Additional Merger Consideration.

(75) “Merger Partner Affiliate Contract” means any Contract, whether or not in writing, (a) between Merger Partner or any of its Subsidiaries, on the one hand, and any present or former officer or director of Merger Partner or any of its Subsidiaries or “immediate family member” thereof (as defined in Rule 16a-1 under the Exchange Act), on the other hand, or (b) between Merger Partner or any of its Subsidiaries, on the one hand, and Merger Partner Equityholder, any Merger Partner Sponsor or any of their respective Affiliates (other than the Merger Partner or any of its Subsidiaries), on the other hand, except in the case of clause (a) above with respect to compensation, benefits or severance received as employees or former employees in the ordinary course of business.

9

(76) “Merger Partner Benefit Plan” means each Benefit Plan that is or has been maintained, sponsored, contributed to or entered into, or is required to be maintained, sponsored, contributed to or entered into, by Merger Partner or any of its Subsidiaries for the benefit of their respective current or former employees.

(77) “Merger Partner Business” means the businesses of Merger Partner and its Subsidiaries as conducted as of the date hereof.

(78) “Merger Partner Credit Agreement Accession Requirements” means the requirements under the Merger Partner Credit Agreements with respect to the SpinCo Entities becoming guarantors under, and providing collateral to secure obligations under, the Merger Partner Credit Agreements, in each case, upon the consummation of the Merger and the related transactions on the Closing Date.

(79) “Merger Partner Credit Agreements” means (a) the First Lien Credit Agreement dated as of January 31, 2020, as amended as of November 20, 2020, February 15, 2022 and May 25, 2023, among Merger Partner, Merger Partner OpCo, Amentum Government Services Holdings LLC, a Delaware limited liability company, Amentum N&E Holdings LLC, a Delaware limited liability company, the borrowing subsidiaries from time to time party thereto, the lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as administrative agent and collateral agent, and (b) the Second Lien Term Loan Agreement dated as of January 31, 2020, as amended as of February 15, 2022, March 18, 2022 and May 25, 2023, among Merger Partner, Merger Partner OpCo, Amentum Government Services Holdings LLC, a Delaware limited liability company, Amentum N&E Holdings LLC, a Delaware limited liability company, the lenders from time to time party thereto and Royal Bank of Canada, as administrative agent and collateral agent, in each case, as amended, restated, supplemented or otherwise modified from time to time in accordance with this Agreement.

(80) “Merger Partner Datasite” means the datasite established by Merger Partner for purposes of due diligence of Merger Partner and the Merger Partner Subsidiaries and their respective businesses (including any “clean room” or similar subset of a datasite or folders in which access is restricted to certain Representatives of the Company).

(81) “Merger Partner Disclosure Schedule” means the Disclosure Schedule to this Agreement delivered by Merger Partner to the Company and SpinCo on the date hereof and identified as such.

(82) “Merger Partner Distribution Tax Representations” means the representations of an officer of Merger Partner (and the representations of officers of members of the Merger Partner Equityholder Group, as applicable), dated as of the Closing Date, in form and substance reasonably satisfactory to Company Accounting Firm and WLRK, delivered to Company Accounting Firm and WLRK in connection with the Distribution Tax Opinions.

(83) “Merger Partner Equityholder Group” means Merger Partner Equityholder, ASP Amentum Investco LP and LG Amentum Holdings LP and each of their respective Affiliates (excluding, for the avoidance of doubt, SpinCo and its Subsidiaries).

10

(84) “Merger Partner Intellectual Property” means the Intellectual Property owned by Merger Partner or any of its Subsidiaries.

(85) “Merger Partner IT Assets” means all systems, networks, hardware, and Software, including computers, servers, workstations, tablets, phones, servers, blades, peripheral devices, data centers, and equipment and infrastructure related to the foregoing, in each case, of Merger Partner and its Subsidiaries.

(86) “Merger Partner Leakage Amount” has the meaning set forth in the Separation and Distribution Agreement.

(87) “Merger Partner Material Adverse Effect” means any change, event, development, condition, occurrence or effect that (a) has, or would reasonably be expected to have, individually or in the aggregate with any other changes, events, developments, conditions, occurrences or effects, a material adverse effect on the business, financial condition or results of operations of Merger Partner and the Merger Partner Subsidiaries, taken as a whole; provided, however, that none of the following shall be deemed in themselves, either alone or in combination, to constitute, and none of the following shall be taken into account in determining whether there has been or would reasonably be expected to be, individually or in the aggregate, a Merger Partner Material Adverse Effect for purposes of this clause (a): (i) any changes resulting from general market, economic, financial, capital markets or regulatory conditions, (ii) any general changes in the credit, debt, financial or capital markets or changes in interest or exchange rates, (iii) any changes in applicable Law or GAAP (or, in each case, authoritative interpretations thereof), (iv) any changes resulting from any hurricane, flood, tornado, earthquake, or other natural disaster or weather-related events, or other force majeure events, or any worsening thereof, (v) any changes resulting from local, national or international political conditions, including the outcome of any elections, the outbreak or escalation of any military conflict, declared or undeclared war, armed hostilities, cyberattacks, acts of foreign or domestic terrorism or civil unrest, or changes in governmental budgeting or spending, (vi) any changes generally affecting the industries in which Merger Partner and the Merger Partner Subsidiaries operate, (vii) any changes resulting from the execution of this Agreement or the Separation and Distribution Agreement or the announcement or the pendency of the Merger or the Separation, including, to the extent resulting therefrom, actions of Governmental Authorities, or any actions of or loss of customers, suppliers, distributors, employees or other material business relationships or partnerships (including any cancellation or delay in customer orders or any termination of or adverse changes to any Contract effected or proposed by any customer, supplier, distributor or other counterparty) (provided that this clause (vii) shall not apply to any representation or warranty to the extent the purpose of such representation or warranty is to address, as applicable, the consequences resulting from the execution of this Agreement or the Separation and Distribution Agreement or the announcement or the pendency of the Merger or the Separation), (viii) any changes resulting from any action required to be taken by the terms of this Agreement (other than pursuant to Section 7.1), (ix) the failure to meet internal expectations, projections or results of operations (but not, in each case, the underlying cause of any such changes, unless such underlying cause would otherwise be excepted by another clause of this definition) or (x) any changes resulting from any epidemics, pandemics or disease (including COVID-19 or any COVID-19 Measures); provided that, in the case of clauses (i), (ii), (iii), (iv), (v) and (vi), if such changes, events, developments, conditions, occurrences or effects disproportionately impact Merger Partner and the Merger Partner Subsidiaries, taken as a whole, as compared to other participants in the industries in which Merger Partner and the Merger Partner Subsidiaries operate, only the incremental disproportionate impact thereof may be taken into account in determining whether a Merger Partner Material Adverse Effect has occurred or would reasonably be expected to occur; or (b) has or would reasonably be expected to materially impair or materially delay the ability of Merger Partner to perform by the Outside Date its obligations hereunder or under the Separation and Distribution Agreement or to consummate the Transactions by the Outside Date.

11

(88) “Merger Partner Merger Tax Representations” means the representations of an officer of Merger Partner (and the representations of officers of members of the Merger Partner Equityholder Group, as applicable), dated as of the Closing Date, in form and substance reasonably satisfactory to WLRK and Cravath, delivered to WLRK and Cravath in connection with the Merger Tax Opinions.

(89) “Merger Partner OpCo” means Amentum Holdings LLC, a Delaware limited liability company and wholly owned Subsidiary of Merger Partner.

(90) “Merger Partner Operating Model” means, collectively, the “contract waterfall analyses” made available to the Company at Merger Partner Datasite locations 13.1.1, 13.1.4 and 13.1.6.

(91) “Merger Partner Related Financing” means any amendment, extension, refinancing or replacement of, or any incurrence or establishment of, any indebtedness and/or commitments under any of the Merger Partner Credit Agreements, in each case, that is announced or commenced by Merger Partner or any of its Subsidiaries in connection with, or that otherwise relates to, the transactions contemplated by this Agreement, so long as such amendment, extension, refinancing, replacement, incurrence or establishment is not prohibited by Section 7.1(d). For the avoidance of doubt, the SpinCo Financing does not constitute Merger Partner Related Financing.

(92) “Merger Partner Sponsor” has the meaning set forth in the Separation and Distribution Agreement.

(93) “Merger Partner Subsidiaries” means all direct and indirect Subsidiaries of Merger Partner.

(94) “Merger Partner Tax Representations” means the Merger Partner Distribution Tax Representations and the Merger Partner Merger Tax Representations.

(95) “Merger Partner Valuation Percentage” means 0.37.

(96) “Merger Tax Opinions” means the Company Merger Tax Opinion and the Merger Partner Merger Tax Opinion.

(97) “Multiemployer Plan” means any “multiemployer plan” within the meaning of Section 3(37) or Section 4001(a)(3) of ERISA.

12

(98) “NYSE” means the New York Stock Exchange.

(99) “Open Source Software” means (a) any Software used under a license identified as an open source license by the Open Source Initiative (www.opensource.org) and (b) any other Software that is distributed as freeware, or under similar licensing or distribution models.

(100) “Organizational Documents” means (a) with respect to any corporation, its articles or certificate of incorporation and bylaws; (b) with respect to any limited liability company, its articles or certificate of organization or formation and its operating agreement or limited liability company agreement or documents of similar substance; (c) with respect to any limited partnership, its certificate of limited partnership and partnership agreement or governing or organizational documents of similar substance; and (d) with respect to any other entity, governing or organizational documents of similar substance to any of the foregoing, in the case of each of the foregoing clauses (a) through (d), as may be in effect from time to time.

(101) “Overhead and Shared Services” has the meaning set forth in the Separation and Distribution Agreement.

(102) “Permits” has the meaning set forth in the Separation and Distribution Agreement.

(103) “Permitted Liens” means (a) statutory Liens arising by operation of Law with respect to a Liability incurred in the ordinary course of business and which is not delinquent or is being contested in good faith by appropriate proceedings; (b) requirements and restrictions of zoning, licensing, permitting, building and other similar land-use Laws which are not violated by the present use or occupancy of the real property subject thereto; (c) Liens for Taxes or mechanics’, construction contractor’s, materialmen’s and similar Liens arising or incurred in the ordinary course of business and with respect to any amounts, in each case (i) not yet overdue by more than sixty (60) days or (ii) which are being contested in good faith by appropriate proceedings and for which adequate reserves have been established in accordance with GAAP; (d) non-exclusive license rights to Intellectual Property granted in the ordinary course of business consistent with past practice; (e) all encroachments, overlaps, overhangs, variations in area or measurement, servitudes or easements (including conservation easements and public trust easements, rights-of-way, covenants, conditions, restrictions, reservations, licenses and other similar non-monetary matters) of public record or any other similar matters not of record which would be disclosed by an accurate survey or physical inspection of the applicable real property (provided, however, that any of the foregoing, individually and in the aggregate, do not materially impair or interfere with the operation or use of such real property in the operation of the business currently conducted thereon); (f) purchase money Liens and Liens securing rental payments under capital lease agreements; (g) liens arising under conditional sales Contracts and equipment leases with third parties entered into in the ordinary course of business; (h) pledges or deposits to secure public or statutory obligations unrelated to any default or violation of any Law; (i) Liens arising under or created by this Agreement or any Transaction Document (other than as a result of a breach or default under such Contracts); (j) Liens securing the SpinCo Financing; (k) restrictions on transfer resulting from securities Laws; (l) Liens encumbering customary initial deposits and margin deposits and other Liens in the ordinary course of business, in each case securing interest rate swap agreements, interest rate cap agreements, interest rate collar agreements, forward contracts, options, futures contracts, futures options, equity hedges or similar agreements or arrangements designed to protect from fluctuations in interest rates, currencies, equities or the price of commodities; (m) Liens associated with a sale or discount of accounts receivable; (n) pledges or deposits made in the ordinary course of business consistent with past practice in connection with workers’ compensation, unemployment insurance and other types of social security (other than pursuant to Section 303(k) or 4068 of ERISA or Section 430(k) of the Code) or to secure the performance of tenders, statutory obligations, surety and appeal bonds, bids, performance and return of money bonds and similar obligations; and (o) Liens described on Section 1.1(b) of the SpinCo Disclosure Schedule or Section 1.1(b) of the Merger Partner Disclosure Schedule.

13

(104) “Person” has the meaning set forth in the Separation and Distribution Agreement.

(105) “Personal Information” means all information in any form or media that identifies, could be used to identify or is otherwise related to an individual person (including any current, prospective, or former customer, end user or employee), in addition to any definition for “personal information” or any similar term provided by applicable Law or by the Company or Merger Partner, as applicable, in any of their respective privacy policies, notices or contracts (e.g., “personal data,” “personally identifiable information” or “PII”).

(106) “Privacy Laws” means any and all applicable Laws, legal requirements and self-regulatory guidelines (including of any applicable foreign jurisdiction) relating to the receipt, collection, compilation, use, storage, processing, sharing, safeguarding, security (technical, physical or administrative), disposal, destruction, disclosure or transfer (including cross-border) of any Personal Information, including, but not limited to, the Federal Trade Commission Act, California Consumer Privacy Act, Payment Card Industry Data Security Standard, EU General Data Protection Regulation, any and all applicable Laws relating to breach notification, the use of biometric identifiers, and the use of Personal Information for marketing purposes.

(107) “Privacy Requirements” means all applicable Privacy Laws and all of the Company’s and Merger Partner’s, as applicable, policies, notices, and contractual obligations relating to the receipt, collection, compilation, use, storage, processing, sharing, safeguarding, security (technical, physical and administrative), disposal, destruction, disclosure, or transfer (including cross-border) of Personal Information.

(108) “Project Services Agreement” means a Project Services Agreement in substantially the form attached hereto as Exhibit A.

(109) “Qualified SpinCo Common Stock” means SpinCo Common Stock received by holders of Company Common Stock pursuant to the Distribution, except for any SpinCo Common Stock that is acquired, directly or indirectly, pursuant to a plan (or series of related transactions) that includes the Distribution, within the meaning of Section 355(e) of the Code and the Treasury Regulations promulgated thereunder. This definition (and the application thereof) is intended to monitor compliance with Section 355(e) of the Code and shall be interpreted accordingly.

(110) “Real Property Separation Plan” has the meaning set forth in the Separation and Distribution Agreement.

14

(111) “Record Date” means the close of business on the date determined by the Company Board or a committee thereof as the record date for determining stockholders of the Company entitled to receive shares of SpinCo Common Stock in the Distribution.

(112) “Registered IP” has the meaning set forth in the Separation and Distribution Agreement.

(113) “Release” has the meaning set forth in the Separation and Distribution Agreement.

(114) “Reorganization” has the meaning set forth in the Separation and Distribution Agreement.