UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October 2023

Commission File Number 001-16139

Wipro Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Karnataka, India

(Jurisdiction of incorporation or organization)

Doddakannelli

Sarjapur Road

Bangalore, Karnataka 560035, India +91-80-2844-0011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ☐ No ☒

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ☐ No ☒

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DISCLOSURE OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

Wipro Limited, a company organized under the laws of the Republic of India (the “Company”), hereby furnishes the Commission with the following information concerning our public disclosures regarding our results of operations for the quarter ended September 30, 2023. The following information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On October 18, 2023, we announced our results of operations for the quarter ended September 30, 2023. We issued a press release announcing our results under IFRS, a copy of which is attached to this Form 6-K as Item 99.1.

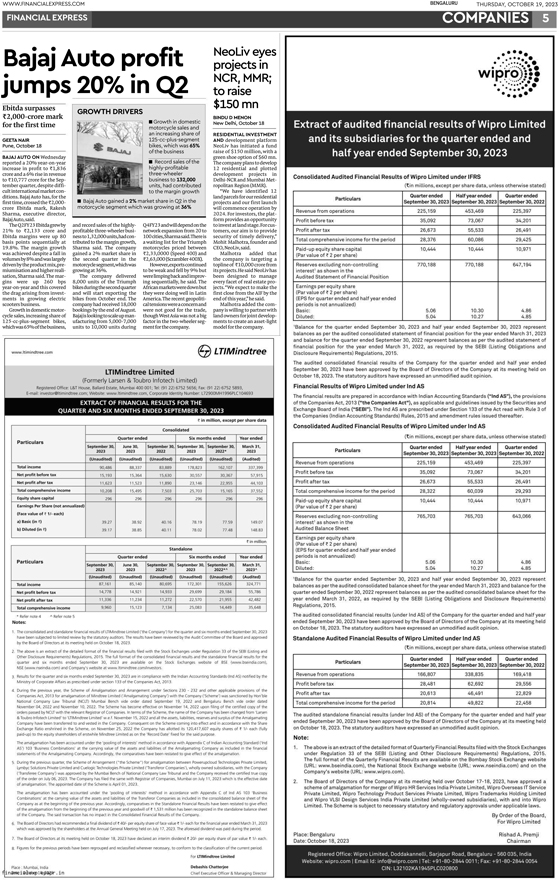

We placed advertisements in certain Indian newspapers concerning our results of operations for the quarter ended September 30, 2023, under IFRS. A copy of the form of this advertisement is attached to this Form 6-K as Item 99.2.

We made available on our website the Condensed Consolidated Interim Financial Statements as of and for the three months ended September 30, 2023, under IFRS. A copy of such financial statements is attached to this Form 6K as Item 99.3.

We filed with stock exchanges in India a statement of statutorily audited consolidated financial results for the three months ended September 30, 2023, under IFRS. A copy of such financial statements is attached to this Form 6K as Item 99.4.

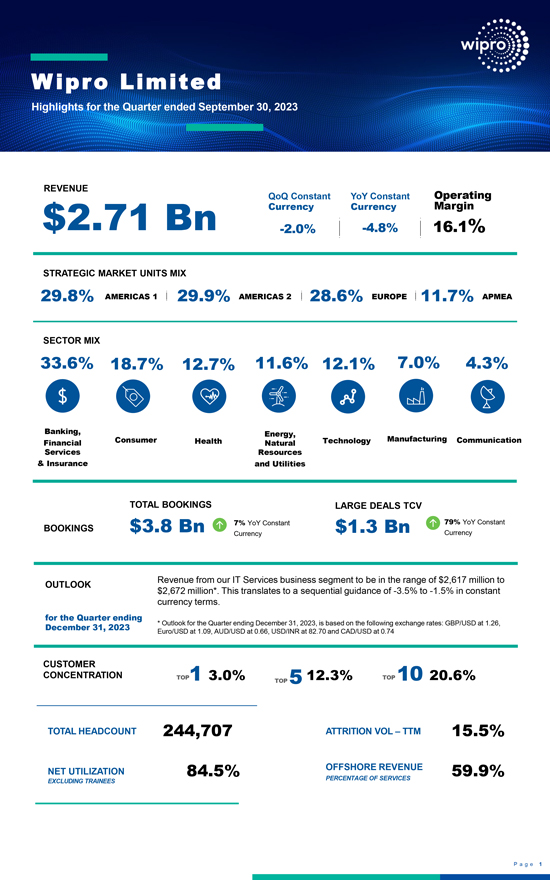

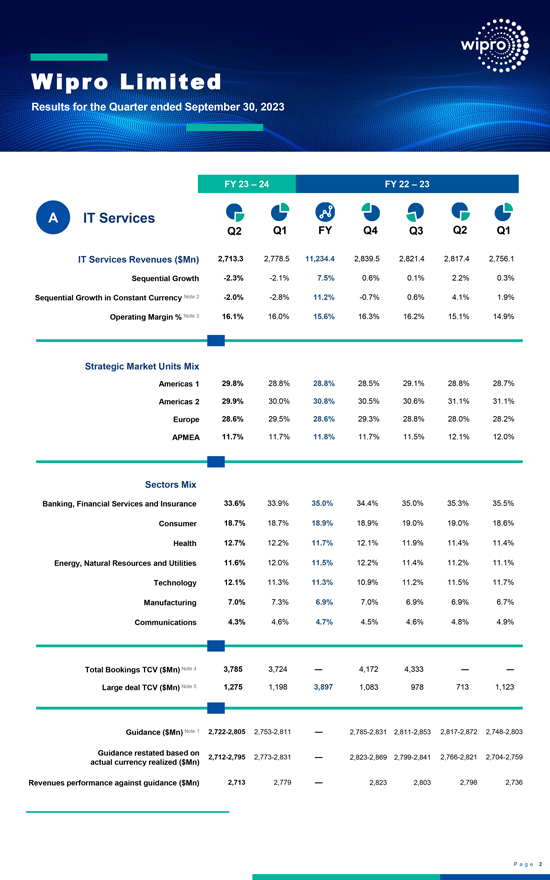

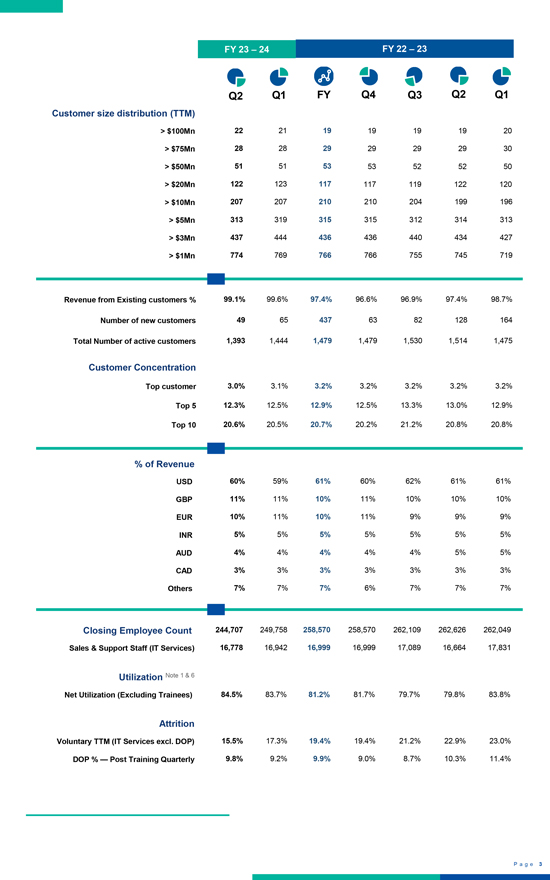

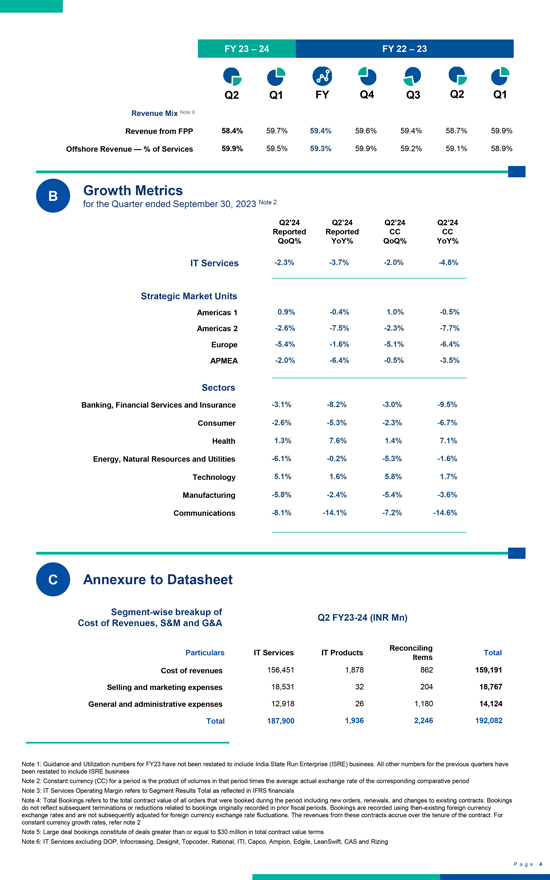

We filed with stock exchanges in India a datasheet containing operating metrics for the quarter ended September 30, 2023. A copy of such data sheet is attached to this Form 6-K as Item 99.5.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly organized.

| WIPRO LIMITED | ||

| By: | /s/ Aparna Chandrashekar Iyer |

|

| Aparna Chandrashekar Iyer | ||

| Chief Financial Officer | ||

| Dated: October 23, 2023 | ||

INDEX TO EXHIBITS

| Item | ||

| 99.1 | IFRS Press Release | |

| 99.2 | Form of Advertisement Placed in Indian Newspapers | |

| 99.3 | Consolidated Interim Financial Statements under IFRS | |

| 99.4 | Statutorily Audited Consolidated Financial Results filed with stock exchanges in India | |

| 99.5 | Data sheet containing operating metrics filed with stock exchanges in India | |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Wipro Announces Results for the Quarter-Ended September 30, 2023

Large deal bookings reach $1.3 billion, an increase of 79% YoY and 6% QoQ

Total bookings of $3.8 billion, mark a 6% YoY increase

IT services segment EBIT increases 6% YoY. EPS increases 4.1% YoY

Operating cash flows at 145% of net income

EAST BRUNSWICK, N.J. | BANGALORE, India – October 18, 2023: Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO), a leading technology services and consulting company, announced financial results under International Financial Reporting Standards (IFRS) for the quarter-ended September 30, 2023.

Highlights of the Results

Results for the Quarter ended September 30, 2023:

| 1. | Gross revenue reached ₹225.2 billion ($2.7 billion1), a decrease of 0.1% YoY. |

| 2. | IT services segment revenue was at $2,713.3 million, a decrease of 2.3% QoQ. |

| 3. | Non-GAAP2 constant currency IT Services segment revenue decreased 2.0% QoQ. |

| 4. | Total bookings3 was at $3.8 billion, up by 6% YoY and large deal bookings4 was at $1.3 billion, up by 79.0% YoY. |

| 5. | IT services segment EBIT for the quarter was ₹36.1 billion ($434.0 million1), an increase of 6% YoY. |

| 6. | IT services operating margin5 for the quarter was at 16.1%, up 10 bps QoQ and 100 bps YoY. |

| 7. | Earnings per share for the quarter was at ₹5.06 ($0.061), an increase of 4.1% YoY. |

| 8. | Net income for the quarter was at ₹26.5 billion ($318.5 million1), a decrease of 0.5% YoY. |

| 9. | Operating cash flows at 145% of Net Income for the quarter was at ₹38.6 billion ($465.0 million1). |

| 10. | Voluntary attrition6 has continued to moderate QoQ, coming in at 9-quarter low of 13.4% in Q2’24. |

Outlook for the Quarter ending December 31, 2023

We expect revenue from our IT Services business segment to be in the range of $2,617 million to $2,672 million*. This translates to sequential guidance of -3.5% to -1.5% in constant currency terms.

| * | Outlook for the Quarter ending December 31, 2023, is based on the following exchange rates: GBP/USD at 1.26, Euro/USD at 1.09, AUD/USD at 0.66, USD/INR at 82.70 and CAD/USD at 0.74 |

1

Performance for the Quarter ended September 30, 2023

“We continue to win in the market despite the uncertain macro environment,” said Thierry Delaporte, CEO and Managing Director. “We ended the second quarter with 22 accounts above the $100M range, which is double the number we had in FY’21. Our large deal total contract value reached $1.3 billion—highest in the last nine quarters.”

“Against a challenging environment, we continue to take the bold decisions needed to realize our long-term ambitions. We are investing in our technology infrastructure and streamlining our operations and delivery to drive profitable growth. We are training and reskilling our people so they can be ready for an AI-driven future. The investments we made in our ai360 strategy are helping us realize significant efficiencies across our organization and creating an early leadership position in this fast-evolving space. We are confident that these investments will keep us resilient and competitive in an ever shifting business and economic landscape.”

Aparna C. Iyer, Chief Financial Officer, said, “We remain focused on profitable growth despite a challenging market. Our disciplined approach to improve efficiency, productivity and utilization has led to an increase of 100 bps YoY in our IT services operating margins. Our absolute IT services segment EBIT grew 6% YoY. We generated strong operating cash flow of 145% of net income for the quarter.”

IT Products

| 1. | IT Products segment revenue for the quarter was ₹1.47 billion ($17.7 million1) |

| 2. | IT Products segment results for the quarter was a loss of ₹0.47 billion ($5.6 million1) |

Please refer to the table on page 11 for reconciliation between IFRS IT Services Revenue and IT Services Revenue on a non-GAAP constant currency basis.

| 1. | For the convenience of the readers, the amounts in Indian Rupees in this release have been translated into United States Dollars at the certified foreign exchange rate of US$1 = ₹83.08, as published by the Federal Reserve Board of Governors on September 30, 2023. However, the realized exchange rate in our IT Services business segment for the quarter ended September 30, 2023, was US$1= ₹82.54 |

| 2. | Constant currency for a period is the product of volumes in that period times the average actual exchange rate of the corresponding comparative period. |

| 3. | Total Bookings refers to the total contract value of all orders that were booked during the period including new orders, renewals, and increases to existing contracts. Bookings do not reflect subsequent terminations or reductions related to bookings originally recorded in prior fiscal periods. Bookings are recorded using then-existing foreign currency exchange rates and are not subsequently adjusted for foreign currency exchange rate fluctuations. The revenues from these contracts accrue over the tenure of the contract. For constant currency growth rates, refer note 2. |

| 4. | Large deal bookings consist of deals greater than or equal to $30 million in total contract value. |

| 5. | IT Services Operating Margin refers to Segment Results Total as reflected in IFRS financials. |

| 6. | Voluntary attrition is in IT Services computed on a quarterly annualised basis and excludes DOP. |

| 7. | Effective April 1, 2023, we merged our ISRE segment with our IT Services segment. The YoY growth rates for the quarter ended September 30, 2023 were computed by rebase lining Q2’23 numbers. |

2

Highlights of Strategic Deal Wins

In the second quarter, Wipro continued to win large and strategic deals across industries. Key highlights include:

| 1. | US-based multinational clothing company has selected Wipro to accelerate digital innovation, drive business growth, and enhance long term profitability. Leveraging its expertise in Generative AI, Cloud transformation, and Intelligent Automation, Wipro will help the client optimize current global operations and provide scale for new lines of business. The deal will include a range of services including application support, analytics, cybersecurity, automation, and consulting with the goal of driving improved process maturity, faster incident resolution, and better time to market for the client. |

| 2. | A global leader in technology has selected Wipro for comprehensive silicon engineering services from chip definition to design verification to tapeout. Wipro will provide services for the client’s broad portfolio of products including end point management, observability, and cloud. This strategic partnership will provide the client with increased speed-to-market of their products, improve their reliability, and reduce their total cost of ownership. |

| 3. | An American food service distributor has selected Wipro to undertake a multi-year IT transformation and modernization project. The Wipro team worked with the client to increase cloud usage by up to 80% through native development of several business-critical applications. This included building a cloud enablement platform, creating a transformation blueprint, and setting up a Project Management Office to manage the client’s cloud and IT estate transformation. In addition, Wipro also setup an internal academy to perform a skill gap analysis and provide additional resource training across the business. The client has so far seen a cost reduction of up to 15%, as well as additional savings through marketplace optimization, increased customer satisfaction, and a more scalable operation. |

| 4. | A multinational consumer electronics company selected Wipro to improve their overall customer experience. To achieve this, the Wipro team created a cross-functional customer service transformation program with bespoke analytics and reporting. The project also included automated visualization of performance management, fraud prevention, and gamified learning and training modules for client-facing staff. This program will increase Net Promoter Scores (NPS), improve customer service agent knowledge, and reduce average call times. |

| 5. | Wipro was selected by a global leader in medical technology, services, and solutions to enhance its service desk and improve its employee experience. Wipro developed a bespoke Global IT Service Desk solution, with significant AI-led automation and self-service capabilities including self-help content development and delivery. The solution will be integrated into existing critical systems and will deliver a cost reduction of up to 30%. |

| 6. | One of the largest energy and utilities companies in Brazil has selected Wipro to modernize their billing process. Wipro will implement and support this transformation covering everything from billing to analytics, leveraging cloud infrastructure to streamline the client’s operations. The client can expect a more resilient billing management platform, cost reduction, as well as alignment with their sustainability goals as the process will be paperless. |

3

| 7. | A video hosting platform has selected Wipro to deploy a unique Quality-as-a-Service solution to help improve the client’s overall end-user experience, retention, and revenue. Wipro will build a customised assessment framework to audit and analyse the interactions between employees and end-users. This will provide actionable insights and recommendations that will improve audit completion, internal and customer experience, as well as operational efficiency. |

| 8. | A global technology company has selected Wipro to deliver high-quality digital designs to enhance their manufacturing process. Through the Technology Excellence Center model, Wipro Engineering Edge will implement hardware design verification for multiple business units in a cost-effective, scalable, and efficient manner. This will lead to a 20-25% reduction in total cost, faster time-to-market, high-quality delivery, and the ability to scale. |

| 9. | A leading workplace pension provider in the UK has selected Wipro to provide regulated Pensions Administration and Technology Services to the member of its Defined Contribution (DC) Pensions book. Through this engagement, the client will see enhanced member experience, faster time to market for new products, and significant cost reduction, while supporting 15% year-on-year business growth. |

| 10. | A North American financial institution has selected Wipro to digitize and streamline its loan origination systems and deliver a consistent omni-channel experience to its end-users. NetOxygen, Wipro’s award-winning enterprise loan origination solution, will improve the lending process through automation and cloud technology. This will ensure compliance and information security, as well as fully integrated bilingual support (in French and English). The client will see a reduction in their cost-per-loan of up to 30% and can expect an increase of up to 80% in digital self-generation loan requests. |

Analyst Recognition

| 1. | Wipro was positioned as a Leader in the 2023 Gartner® Magic Quadrant™ for Public Cloud IT Transformation Services |

| 2. | Wipro was rated a Leader in Everest Group’s Digital Twin Services PEAK Matrix® Assessment 2023 |

| 3. | Wipro was recognized as a Leader in ISG Provider Lens™ – Cybersecurity—Solutions and Services 2023—US, UK, France, Nordics (multiple quadrants) |

| 4. | Wipro was rated as a Leader in ISG Provider Lens™ – Google Cloud Partner Ecosystem 2023—US & Europe (all quadrants) |

| 5. | Wipro was rated as a Leader in Avasant’s High-Tech Industry Digital Services RadarView™ 2023—2024 |

| 6. | Wipro was positioned a Leader in Everest Group’s Oracle Cloud Applications Services PEAK Matrix® Assessment 2023 |

| 7. | Wipro was featured as a Leader in ISG Provider Lens™ – Retail & CPG Services 2023—US & Europe (all quadrants) |

| 8. | Wipro was recognized as a Leader in ISG Provider Lens™ – Customer Experience Services 2023—Europe (multiple quadrants) & US (Digital Operations) |

| 9. | Wipro was rated as a Leader in Whitelane’s IT Sourcing Study 2023—Switzerland |

| 10. | Wipro was featured as a Leader in Avasant’s Application Modernization Services RadarView™ 2023 |

| 11. | Wipro was recognized a Leader in Everest Group’s Network Transformation and Managed Services PEAK Matrix® Assessment – System Integrators (SIs) 2023 |

4

| 12. | Wipro was recognized as a Leader in Avasant’s Canada Digital and IT Services RadarView™ 2023—2024 |

Source & Disclaimer: *Gartner, “Magic Quadrant for Public Cloud IT Transformation Services”, Mark Ray, et al, 16 August 2023.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product, or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner’s research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this [type of filing]), and the opinions expressed in the Gartner Content are subject to change without notice.

About Key Metrics and Non-GAAP Financial Measures

This press release contains key metrics and non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that are adjusted to exclude or include amounts that are excluded or included, as the case may be, from the most directly comparable financial measure calculated and presented in accordance with IFRS.

The table on page 11 provides IT Services Revenue on a constant currency basis, which is a non-GAAP financial measure that is calculated by translating IT Services Revenue from the current reporting period into U.S. dollars based on the currency conversion rate in effect for the prior reporting period. We refer to growth rates in constant currency so that business results may be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of our business performance. Further, in the normal course of business, we may divest a portion of our business which may not be strategic. We refer to the growth rates in both reported and constant currency adjusting for such divestments in order to represent the comparable growth rates.

Our key metrics and non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, the most directly comparable financial measure calculated in accordance with IFRS and may be different from non-GAAP measures used by other companies. Our key metrics and non-GAAP financial measures are not comparable to, nor should be substituted for, an analysis of our revenue over time and involve estimates and judgments. In addition to our non-GAAP measures, the financial statements prepared in accordance with IFRS and the reconciliation of these non-GAAP financial measures with the most directly comparable IFRS financial measure should be carefully evaluated.

Results for the Quarter ended September 30, 2023, prepared under IFRS, along with individual business segment reports, are available in the Investors section of our website www.wipro.com/investors/ We will hold an earnings conference call today at 07:00 p.m. Indian Standard Time (9:30 a.m. U.S. Eastern Time) to discuss our performance for the quarter. The audio from the conference call will be available online through a webcast and can be accessed at the following link- https://links.ccwebcast.com/?EventId=WIP181023

5

Quarterly Conference Call

An audio recording of the management discussions and the question-and-answer session will be available online and will be accessible in the Investor Relations section of our website at www.wipro.com

About Wipro Limited

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) is a leading technology services and consulting company focused on building innovative solutions that address clients’ most complex digital transformation needs. Leveraging our holistic portfolio of capabilities in consulting, design, engineering, and operations, we help clients realize their boldest ambitions and build future-ready, sustainable businesses. With nearly 245,000 employees and business partners across 65 countries, we deliver on the promise of helping our clients, colleagues, and communities thrive in an ever-changing world. For additional information, visit us at www.wipro.com

| Contact for Investor Relations | Contact for Media & Press | |||

| Dipak Kumar Bohra | Abhishek Jain | |||

| Phone: +91-80-6142 7201 | Phone: +91-80-6142 6143 | Phone: +91-80-6142 6450 | ||

| dipak.bohra@wipro.com | abhishek.jain2@wipro.com | media-relations@wipro.com | ||

Forward-Looking Statements

The forward-looking statements contained herein represent Wipro’s beliefs regarding future events, many of which are by their nature, inherently uncertain and outside Wipro’s control. Such statements include, but are not limited to, statements regarding Wipro’s growth prospects, its future financial operating results, the benefits its customers experience and its plans, expectations and intentions. Wipro cautions readers that the forward-looking statements contained herein are subject to risks and uncertainties that could cause actual results to differ materially from the results anticipated by such statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties regarding fluctuations in our earnings, revenue and profits, our ability to generate and manage growth, complete proposed corporate actions, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which we make strategic investments, withdrawal of fiscal governmental incentives, political instability, war, legal restrictions on raising capital or acquiring companies outside India, unauthorized use of our intellectual property and general economic conditions affecting our business and industry.

Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission, including, but not limited to, Annual Reports on Form 20-F. These filings are available at www.sec.gov. We may, from time to time, make additional written and oral forward-looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf.

# # #

(Tables to follow)

6

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(₹ in millions, except share and per share data, unless otherwise stated)

| As at March 31, 2023 |

As at September 30, 2023 | |||||||||||

| Convenience translation into US dollar in millions Refer footnote in page 2 |

||||||||||||

| ASSETS |

||||||||||||

| Goodwill |

307,970 | 309,732 | 3,728 | |||||||||

| Intangible assets |

43,045 | 38,109 | 459 | |||||||||

| Property, plant and equipment |

88,659 | 83,086 | 1,000 | |||||||||

| Right-of-Use assets |

18,702 | 17,043 | 205 | |||||||||

| Financial assets |

||||||||||||

| Derivative assets |

29 | 151 | 2 | |||||||||

| Investments |

20,720 | 21,629 | 260 | |||||||||

| Trade receivables |

863 | 872 | 10 | |||||||||

| Other financial assets |

6,330 | 5,973 | 72 | |||||||||

| Investments accounted for using the equity method |

780 | 761 | 9 | |||||||||

| Deferred tax assets |

2,100 | 2,219 | 27 | |||||||||

| Non-current tax assets |

11,922 | 10,878 | 131 | |||||||||

| Other non-current assets |

13,606 | 10,834 | 130 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current assets |

514,726 | 501,287 | 6,033 | |||||||||

|

|

|

|

|

|

|

|||||||

| Inventories |

1,188 | 1,281 | 15 | |||||||||

| Financial assets |

||||||||||||

| Derivative assets |

1,844 | 1,999 | 24 | |||||||||

| Investments |

309,232 | 239,847 | 2,887 | |||||||||

| Cash and cash equivalents |

91,880 | 97,896 | 1,178 | |||||||||

| Trade receivables |

126,350 | 108,146 | 1,302 | |||||||||

| Unbilled receivables |

60,515 | 65,292 | 786 | |||||||||

| Other financial assets |

9,096 | 9,155 | 110 | |||||||||

| Contract assets |

23,001 | 24,464 | 295 | |||||||||

| Current tax assets |

5,091 | 5,017 | 60 | |||||||||

| Other current assets |

32,899 | 31,946 | 385 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current assets |

661,096 | 585,043 | 7,042 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL ASSETS |

1,175,822 | 1,086,330 | 13,075 | |||||||||

|

|

|

|

|

|

|

|||||||

| EQUITY |

||||||||||||

| Share capital |

10,976 | 10,444 | 126 | |||||||||

| Share premium |

3,689 | 1,732 | 21 | |||||||||

| Retained earnings |

660,964 | 577,487 | 6,951 | |||||||||

| Share-based payment reserve |

5,632 | 6,023 | 72 | |||||||||

| Special Economic Zone re-investment reserve |

46,803 | 44,941 | 541 | |||||||||

| Other components of equity |

53,100 | 58,284 | 702 | |||||||||

|

|

|

|

|

|

|

|||||||

| Equity attributable to the equity holders of the Company |

781,164 | 698,911 | 8,413 | |||||||||

| Non-controlling interests |

589 | 823 | 10 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL EQUITY |

781,753 | 699,734 | 8,423 | |||||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES |

||||||||||||

| Financial liabilities |

||||||||||||

| Loans and borrowings |

61,272 | 61,971 | 746 | |||||||||

| Lease liabilities |

15,953 | 14,796 | 178 | |||||||||

| Derivative liabilities |

179 | 40 | ^ | |||||||||

| Other financial liabilities |

2,649 | 1,609 | 19 | |||||||||

| Deferred tax liabilities |

15,153 | 15,315 | 184 | |||||||||

| Non-current tax liabilities |

21,777 | 26,048 | 314 | |||||||||

| Other non-current liabilities |

9,333 | 11,025 | 133 | |||||||||

| Provisions |

^ | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current liabilities |

126,316 | 130,804 | 1,574 | |||||||||

|

|

|

|

|

|

|

|||||||

| Financial liabilities |

||||||||||||

| Loans, borrowings and bank overdrafts |

88,821 | 94,060 | 1,132 | |||||||||

| Lease liabilities |

8,620 | 8,348 | 100 | |||||||||

| Derivative liabilities |

2,825 | 1,582 | 19 | |||||||||

| Trade payables and accrued expenses |

89,054 | 78,857 | 949 | |||||||||

| Other financial liabilities |

4,141 | 2,712 | 33 | |||||||||

| Contract liabilities |

22,682 | 16,738 | 201 | |||||||||

| Current tax liabilities |

18,846 | 21,372 | 257 | |||||||||

| Other current liabilities |

30,215 | 29,873 | 360 | |||||||||

| Provisions |

2,549 | 2,250 | 27 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current liabilities |

267,753 | 255,792 | 3,078 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL LIABILITIES |

394,069 | 386,596 | 4,652 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL EQUITY AND LIABILITIES |

1,175,822 | 1,086,330 | 13,075 | |||||||||

|

|

|

|

|

|

|

|||||||

| ^ | Value is less than 1 |

7

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF INCOME

(₹ in millions, except share and per share data, unless otherwise stated)

| Three months ended September 30, | Six months ended September 30, | |||||||||||||||||||||||

| 2022 | 2023 | 2023 | 2022 | 2023 | 2023 | |||||||||||||||||||

| Convenience translation into US dollar in millions Refer footnote in page 2 |

Convenience translation into US dollar in millions Refer footnote in page 2 |

|||||||||||||||||||||||

| Revenues |

225,397 | 225,159 | 2,710 | 440,683 | 453,469 | 5,458 | ||||||||||||||||||

| Cost of revenues |

(163,835 | ) | (159,191 | ) | (1,916 | ) | (319,435 | ) | (320,452 | ) | (3,857 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

61,562 | 65,968 | 794 | 121,248 | 133,017 | 1,601 | ||||||||||||||||||

| Selling and marketing expenses |

(15,140 | ) | (18,767 | ) | (226 | ) | (30,499 | ) | (35,351 | ) | (426 | ) | ||||||||||||

| General and administrative expenses |

(14,976 | ) | (14,124 | ) | (170 | ) | (28,447 | ) | (30,011 | ) | (361 | ) | ||||||||||||

| Foreign exchange gains/(losses), net |

1,057 | 268 | 3 | 2,091 | 206 | 2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Results from operating activities |

32,503 | 33,345 | 401 | 64,393 | 67,861 | 816 | ||||||||||||||||||

| Finance expenses |

(2,270 | ) | (3,033 | ) | (37 | ) | (4,315 | ) | (6,119 | ) | (74 | ) | ||||||||||||

| Finance and other income |

4,040 | 4,810 | 58 | 7,730 | 11,352 | 137 | ||||||||||||||||||

| Share of net profit/ (loss) of associates accounted for using the equity method |

(72 | ) | (30 | ) | ^ | (87 | ) | (27 | ) | ^ | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit before tax |

34,201 | 35,092 | 422 | 67,721 | 73,067 | 879 | ||||||||||||||||||

| Income tax expense |

(7,710 | ) | (8,419 | ) | (101 | ) | (15,641 | ) | (17,534 | ) | (211 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit for the period |

26,491 | 26,673 | 321 | 52,080 | 55,533 | 668 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit attributable to: |

||||||||||||||||||||||||

| Equity holders of the Company |

26,590 | 26,463 | 318 | 52,226 | 55,164 | 664 | ||||||||||||||||||

| Non-controlling interests |

(99 | ) | 210 | 3 | (146 | ) | 369 | 4 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit for the period |

26,491 | 26,673 | 321 | 52,080 | 55,533 | 668 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings per equity share: |

||||||||||||||||||||||||

| Attributable to equity holders of the Company |

||||||||||||||||||||||||

| Basic |

4.86 | 5.06 | 0.06 | 9.55 | 10.30 | 0.12 | ||||||||||||||||||

| Diluted |

4.85 | 5.04 | 0.06 | 9.52 | 10.27 | 0.12 | ||||||||||||||||||

| Weighted average number of equity shares used in computing earnings per equity share |

||||||||||||||||||||||||

| Basic |

5,476,167,685 | 5,232,867,366 | 5,232,867,366 | 5,473,962,200 | 5,357,394,940 | 5,357,394,940 | ||||||||||||||||||

| Diluted |

5,484,785,054 | 5,245,641,198 | 5,245,641,198 | 5,486,081,940 | 5,370,078,563 | 5,370,078,563 | ||||||||||||||||||

| ^ | Value is less than 1 |

8

Additional Information:

| Particulars |

Three months ended | Six months ended | Year ended | |||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

March 31, 2023 |

|||||||||||||||||||

| Audited | Audited | Audited | Audited | Audited | Audited | |||||||||||||||||||

| Segment revenue |

||||||||||||||||||||||||

| IT Services |

||||||||||||||||||||||||

| Americas 1 |

66,813 | 65,607 | 65,350 | 132,420 | 127,052 | 261,270 | ||||||||||||||||||

| Americas 2 |

66,914 | 68,303 | 70,030 | 135,217 | 136,643 | 278,374 | ||||||||||||||||||

| Europe |

63,976 | 67,134 | 62,684 | 131,110 | 122,960 | 256,845 | ||||||||||||||||||

| APMEA |

26,255 | 26,510 | 27,141 | 52,765 | 52,924 | 106,812 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total of IT Services |

223,958 | 227,554 | 225,205 | 451,512 | 439,579 | 903,301 | ||||||||||||||||||

| IT Products |

1,469 | 694 | 1,249 | 2,163 | 3,195 | 6,047 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total segment revenue |

225,427 | 228,248 | 226,454 | 453,675 | 442,774 | 909,348 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Segment result |

||||||||||||||||||||||||

| IT Services |

||||||||||||||||||||||||

| Americas 1 |

15,287 | 13,537 | 12,954 | 28,824 | 24,524 | 51,555 | ||||||||||||||||||

| Americas 2 |

14,023 | 14,169 | 14,959 | 28,192 | 28,183 | 59,689 | ||||||||||||||||||

| Europe |

7,547 | 9,968 | 8,454 | 17,515 | 16,440 | 37,667 | ||||||||||||||||||

| APMEA |

2,985 | 2,800 | 2,670 | 5,785 | 4,739 | 10,681 | ||||||||||||||||||

| Unallocated |

(3,784 | ) | (3,957 | ) | (5,090 | ) | (7,741 | ) | (7,934 | ) | (18,368 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total of IT Services |

36,058 | 36,517 | 33,947 | 72,575 | 65,952 | 141,224 | ||||||||||||||||||

| IT Products |

(467 | ) | (161 | ) | (103 | ) | (628 | ) | (158 | ) | (176 | ) | ||||||||||||

| Reconciling Items |

(2,246 | ) | (1,840 | ) | (1,341 | ) | (4,086 | ) | (1,401 | ) | (1,442 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total segment result |

33,345 | 34,516 | 32,503 | 67,861 | 64,393 | 139,606 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Finance expenses |

(3,033 | ) | (3,086 | ) | (2,270 | ) | (6,119 | ) | (4,315 | ) | (10,077 | ) | ||||||||||||

| Finance and other Income |

4,810 | 6,542 | 4,040 | 11,352 | 7,730 | 18,185 | ||||||||||||||||||

| Share of net profit/ (loss) of associates accounted for using the equity method |

(30 | ) | 3 | (72 | ) | (27 | ) | (87 | ) | (57 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit before tax |

35,092 | 37,975 | 34,201 | 73,067 | 67,721 | 147,657 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

9

Effective April 1, 2023, we merged our India State Run Enterprise segment (“ISRE”) with our IT Services segment. Currently, the Company is organized into the following operating segments: IT Services and IT Products.

IT Services: As announced on November 12, 2020, effective January 1, 2021, we re-organized our IT Services segment into four Strategic Market Units (“SMUs”)—Americas 1, Americas 2, Europe and Asia Pacific Middle East Africa (“APMEA”).

Americas 1 and Americas 2 are primarily organized by industry sector, while Europe and APMEA are organized by countries.

Americas 1 includes Healthcare and Medical Devices, Consumer Goods and Lifesciences, Retail, Transportation and Services, Communications, Media and Information services, Technology Products and Platforms, in the United States of America and entire business of Latin America (“LATAM”). Americas 2 includes Banking, Financial Services and Insurance, Manufacturing, Hi-tech, Energy and Utilities industry sectors in the United States of America and entire business of Canada. Europe consists of United Kingdom and Ireland, Switzerland, Germany, Benelux, Nordics and Southern Europe. APMEA consists of Australia and New Zealand, India, Middle East, South East Asia, Japan and Africa.

IT Products: The Company is a value-added reseller of desktops, servers, notebooks, storage products, networking solutions and packaged software for leading international brands. In certain total outsourcing contracts of the IT Services segment, the Company delivers hardware, software products and other related deliverables. Revenue relating to the above items is reported as revenue from the sale of IT Products.

10

Reconciliation of selected GAAP measures to Non-GAAP measures

Reconciliation of Non-GAAP Constant Currency IT Services Revenue to IT Services Revenue as per IFRS ($Mn)

Three Months ended September 30, 2023

| IT Services Revenue as per IFRS |

$ | 2,713.3 | ||

| Effect of Foreign currency exchange movement |

$ | 10.0 | ||

|

|

|

|||

| Non-GAAP Constant Currency IT Services Revenue based on previous quarter exchange rates |

$ | 2,723.3 |

Three Months ended September 30, 2023

| IT Services Revenue as per IFRS |

$ | 2,713.3 | ||

| Effect of Foreign currency exchange movement |

$ | (29.7 | ) | |

|

|

|

|||

| Non-GAAP Constant Currency IT Services Revenue based on exchange rates of comparable period in previous year |

$ | 2,683.6 |

Reconciliation of Free Cash Flow for three months and six months ended September 30, 2023

| Amount in INR Mn | ||||||||

| Three months ended September 30, 2023 |

Six months ended September 30, 2023 |

|||||||

| Net Income for the period [A] |

26,673 | 55,533 | ||||||

| Computation of Free Cash Flow |

||||||||

| Net cash generated from operating activities [B] |

38,633 | 76,146 | ||||||

| Add/ (deduct) cash inflow/ (outflow) on: |

||||||||

| Purchase of property, plant and equipment |

(1,975 | ) | (4,184 | ) | ||||

| Proceeds from sale of property, plant and equipment |

3,193 | 4,223 | ||||||

|

|

|

|

|

|||||

| Free Cash Flow [C] |

39,851 | 76,185 | ||||||

|

|

|

|

|

|||||

| Operating Cash Flow as percentage of Net Income [B/A] |

144.8 | % | 137.1 | % | ||||

|

|

|

|

|

|||||

| Free Cash Flow as percentage of Net Income [C/A] |

149.4 | % | 137.2 | % | ||||

|

|

|

|

|

|||||

11

WWW.FINANCIALEXPRESS.COM BENGALURU THURSDAY, OCTOBER 19, 2023 FINANCIAL EXPRESS COMPANIES 5 Bajaj Auto profit jumps 20% in Q2 Ebitda surpasses 2,000-crore mark for the first time GROWTH DRIVERS GEETA NAIR Pune, October 18 BAJAJ AUTO ON Wednesday reported a 20%year-on-year increase in profit to 1,836 crore and a 6% rise in revenue to 10,777 crore for the September quarter, despite difficult international market conditions. Bajaj Auto has, for the first time, crossed the 2,000- crore Ebitda mark, Rakesh Sharma, executive director, BajajAuto,said. The Q2FY23 Ebitda grewby 21% to 2,133 crore and Ebitda margins were up 80 basis points sequentially at 19.8%. The margin growth was achieved despite a fall in volumes by 8% and was largely driven by the product mix,pre- miumisation and higher realisation, Sharma said. The margins were up 260 bps year-on-year and this covered the drag arising from investments in growing electric scooters business. Growth in domestic motorcycle sales, increasing share of 125-cc-plus-segment bikes, which was 65% of the business, Growth in domestic motorcycle sales and an increasing share of 125-cc-plus-segment bikes, which was 65% ofthe business Record sales ofthe highly-profitable three-wheeler business to 132,000 units, had contributed to the margin growth NeoLiv eyes projects in NCR, MMR; to raise $150 mn BINDU D MENON New Delhi, October 18 wiproyj . wvwv. I Li rti i nd tr ee.Co rn Bajaj Auto gained a 2% market share in Q2 in the motorcycle segment which was growing at 36% and record sales of the highly- profitable three-wheeler business to 1,32,000 units,had contributed to the margin growth, Sharma said. The company gained a 2% market share in the second quarter in the motorcycle segment,whichwas growingat36%. The company delivered 8,000 units of the Triumph bikes duringthe second quarter and will start exporting the bikes from October end. The company had received 18,000 bookings bythe end ofAugust. Bajaj is looking to scale up manufacturing from 5,000-7,000 units to 10,000 units during Q4FY2 3 andwill depend on the network expansion from 20 to 100 cities, Sharma said.There is awaiting list for the Triumph motorcycles priced between ^2,33,0000 (Speed 400) and ^2,63,000 (Scrambler400x). However,exports continued to be weak and fell by 9% but were limpingbackand improving sequentially, he said. The African marketswere downbut they were doing well in Latin America.The recent geopolitical tensions were a concern and were not good for the trade, though West Asia was not a big factor in the two-wheeler segment for the company. RESIDENTIAL INVESTMENT AND development platform NeoLiv has initiated a fund raise of $150 million, with a green shoe option of $60 mn. The company plans to develop 12 residential and plotted development projects in Delhi-NCR and Mumbai Metropolitan Region (MMR). “We have identified 12 land parcels for our residential projects and our first launch will commence operation by 2024. For investors, the platform provides an opportunity to invest at land stage. For customers, our aim is to provide security of timely delivery,” Mohit Malhotra, founder and CEO, NeoLiv, said. Malhotra added that the company is targeting a topline of ^10,000 crore from its projects. He said NeoLivhas been designed to manage every facet of real estate pro- jects.”We expect to make the first close from the AIF by the end of this year,” he said. Malhotra added the com- panyiswillingto partnerwith land owners for joint developments to create an asset-light model for the company. Extract of audited financial results of Wipro Limited and its subsidiaries for the quarter ended and half year ended September 30,2023 Consolidated Audited Financial Results of Wipro Limited under IFRS (Tin millions, except per share data, unless otherwise stated) Particulars Quarter ended September 30h 2023 Half ye ar ended September 30,2023 Quarter ended September 30,2022 Revenue from operations 225,15& 453,469 225,397 Profit before tax 35,092 73,067 34,201 Profit after tax 25,673 55,533 26,491 Total comprehensive income for the period 28,376 60,086 29,425 Paid-up equity share capital (Par value of 2 per share) 10.444 10,444 10,971 Reserves excluding non-controlling interest1 as shown in the Audited Statement of Financial Position 770,188 770,188 647,194 Earnings per equity share (Par value of 2 per share) (EPS for quarter ended and half year ended periods is not annualized) Basic: Diluted: 5.06 5.04 10.30 10.27 4.86 4.85 LTIMindtree LTIMindtree Limited (Formerly Larsen & Toubro Infotech Limited) Req stored Office; L£T House. Ballard Estate, Mu mt 3- 400 001; Tel: (91 22) 6752 5656; Fax: (91 22) 6752 5S93P E-mail Tivestor :i mi nd tree, corn; Weuyte www.ltim ndtree com, Corporate Identity Number’ L72900MH1996PLC104693 ‘Balance for the quarter ended September 30, 2023 and half year ended September 30, 2023 represent balances as per the audited consoSi dated statement of financial position for the year ended March 31, 2023 and balance for the quarter ended September 30, 2022 represent balances as per the audited statement of financial position for the year ended March 31, 2022, as required by the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. The audited consolidated financial results of the Company for the quarter ended and half year ended September 30, 2023 have been approved by the Board of Directors of the Company at its meeting held on October 18, 2023. The statutory auditors have expressed art unmodified audit opinion. EXTRACT OF FINANCIAL RESULTS FOR THE QUARTER AND SIX MONTHS ENDED SEPTEMBER 30, 2023 Financial Results of Wipro Limited under Ind AS The financial results are prepared in accordance with Indian Accounting Standards (“Ind AS”), the provisions of the Companies Act, 2013 (“the Companies Act”}, as applicable and guidelines issued by the Securities and Exchange Soard of India (“SEBI”). The Ind AS are prescribed under Section 133 of the Act read with Rule 3 of the Companies (Indian Accounting Standards) Rules, 2015 and amendment rules issued thereafter. Particulars ConsclicFaigd Quarter ended Six months ended Yean ended September 30, 2tK23 Jone 30, 2023 September 30, 2022 September 30, 2023 September 30, 2022* March 31, 2023 (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited) Total income 38,33 7 88,889 178,823 162,107 337,399 Net profit before tax 15,193 15,364 15,690 30,557 30,367 57,915 Net profit after tax 11.G23 11,523 1 1,890 23,146 22,955 44,103 Total comprehensive income 10,208 15.495 7,503 25,703 15,165 37.S52 Equity share capital 296 296 296 296 296 296 Earning per Share (not annualized) (Face value of 1/- each) a) Eaic (in 89.27 48.92 40.16 78 19 77.59 149.07 b) Diluted (in $ 29.17 88.8S 40 11 78 02 //.4B 148.33 in million, except per share data Consolidated Audited Financial Results of Wipro Limited under Ind AS ftin millions, except per share data, unless otherwise stated) Particulars Standalone Quarter ended Six months ended Year ended September 3-Q, 2023 June 30, 2023 September 30, 2022* September 30, 2023 September 30, 2022** March 31. 2023 (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited) Total in Lome 87,161 85,1 40 80,695 172,301 155,626 324.771 Net profit before tax 14,778 14,921 14,933 29,699 29,184 55,786 Net profit after tax 1 1,336 1 1,234 11,272 22,570 21.955 42,482 Total comprehensive income 9,960 15,123 7.134 25,083 14,449 35,648 in miHitjn * Refer note 4 A Refer note 5 Notes: Particulars Quarter ended September 30T 2023 Half year ended September 30,2023 Quarterended September 30,2022 Revenue from operations 225,159 453,469 225,397 Profit before tax 35.092 73,067 34,201 Profit after tax 26,673 55,533 26,491 Total comprehensive income for the period 28.322 60,039 29.293 Paid-up equity share capital (Par value of f 2 per share) 10,444 10,444 10,971 Reserves excluding non-ccntrclting interest1 as shown in the Audited Balance Sheet 765,703 765,703 643,066 Earnings per equity share (Par value of 2 per share) (EPS for quarter ended and half year ended periods is not annualized) Basic: Diluted; 5.06 5.04 10.30 10.27 4.86 4.85 ‘Balance for the quarter ended September 30, 2023 and half year ended September 30, 2023 represent balances as per the audited consolidated balance sheet for the year ended March 31,2023 and balance for the quarter ended September 30, 2022 represent balances as per the audited consolidated balance sheet for the year ended March 31, 2022, as required by the SEBI {Listing Obligations and Disclosure Requirements) Regulations, 2015. The audited consolidated financial results (under Ind AS) of the Company for the quarter ended and half year ended September 30, 2023 have been approved by the Board of Directors of the Company at its meeting held on October 18, 2023, The statutory auditors have expressed an unmodified audit opinion. k ne consolidated and standalone fmanc al results of L-lMmctree Limited (‘the Company) fei the quarter ar.d six months ended September 30, 2023 have been subjected to limited review by the statutory auditors. The results have beer- reviewed by the Audit Committee of the Board and approved bythe Board of Directors at its meeting held on October IS, 2023. 2 Thet adove is an extract of the detailed format of the financial results fifed with the Stodk Exchanges under Regulation 33 of the SEBI (Listing and Other Disclosure Requunnierits: Regulations, 201’j Th ful- format of the cunjci idated financial results and lf’H standalone financial insults ‘or th quarter and six months ended Septembei 30, 2023 a-e availaoe or the Stock Exchanges website of BSE (www.bsemcna.com), NSE (www.nseindia.tpm) and Company’s website at www.ltimindtiM com/iivestors. | Results for the quarter and six months ended September 30. 2023 are in compliance with the Indian Accounting Standards (:rd AS) notilic-d by the Ministry of Corporate Affairs as prescribed Ltnder section 133 ofthe sbrripanieS Act, 201B 4. During the previous year, the Scheme of Amalgamation and Arrangement under Sections 230 - 232 and other applicable provisions of the Companies Ar I, 7D13 fur aria gamatton of Mind! tee l mil nd (‘Amalga mat ng C uinpany’) wfi l fa Company (‘S: iiemej was sanctioned liyHon’iiie National Company Law fi.bunal (NCLT) Murnba Bench vide o*der dared September 19, 2022 and Bengalmu Bench vice cider dated November 04, 2022 and November 10, 2022. The Scheme has become effective on November 14, 2022 upon M ro of the certified copy of the orders passed by NCLT with the relevant Registrar of Companies In terms of the Scheme, the name of the Company nas been changed from ‘Larsen Toi .bro Infr iter i Lim td’ r I.TI Mi nd I re limited’ w e. f Noventip 15, 7022 and all : fie asset s, I abi h ties. eserves and su’ pl JS O’”1 I ie ArralgarT-ai ing Company have been transferred to and vested in the Company. Consequent on the Scheme coming into effect anu in accordance with the Shafe Exchange Ratio enshrined in the Scheme, on November 25, 2022 the Company has allotted its 120,417,607 equity shares of 1/- each (fully paid-up) to the equity shareholders of erstwhi e M^dtree Limited as on the ‘Record Date’ fined for the said purpose The amalgamation has been accounted under the ‘poohrg of interests’ method m accordance with Appendix C of Indiar Accounting Standard {‘Ind AS’) 103 ‘Business Combinations’ al if p carrying va.up of th assets anti liati lities of it Amalgamating Company as included m the financial stafements of the Amalgams ng Company. Accordingly, lhe compa-alives have been restated to give effect of the amalgamation. 5 During the previous quarter, the Scheme of Arrangement (‘the Scheme’) for a malqamation between Poweruadoud ‘echnologies Private Limited, Lymbyc Solutions Private Limited and Cucogic Technologies Private L mited ( Transferor Companies), wholly owned subsidiaries, with the Company (‘Transferee Company’) was approver by the Mumbai Sen ch of National Company Law Tn bun al and the Company received the certified true copy of theord’ on Inly 06, 2023. The Company has filed th same with Registrar of CpinpaiiHs, Mumbai on July 1 I. 2D23 wfirrh i$ the f fet. live riafe of amaiqamation. lhe appointed date of lhe Scheme s April 01, 2029. ‘he amalgamation has been accounted under the ‘pooling of interests method in accordance with Appendix C of Ind AS 102 ‘Business Combinations at the carrying value of the assets and hao lities of the Transferor Companies as included in the consolidatec balance sheet of the Company as at th beginning of the previous year Accordingly, comparatives in the Standalone Finance Results have been restated to g-ve effect of the dmalgarratian ftgrn Ui beginning of lire previous yp^i and goodwill of J 1,531 mil ion has bn rrogni7pd m the standalone balance sf’net of tfie Company. The sa d transact on has no Impact in the Consolidated Financial ResulLs of rhe Company. 6. The Board of U lectors had recommended a final dividend of 40V- per equity share of face value 7 1/ - each- tor the financial year ended March 31 r 2023 which was approved by the shareholders at the Annual General Meeting held on July 17, 2023 “he aforesaid divioenc was paid dur rg the per-txi. 7. The Board; ol Directors al its meeli.ig held on October 13. 2023 have declared a i interim div-dond 20/- pei equity share of par value 1/- each. 8 Figures for the previous periods have been regrouped ar.o recrassihed wherever necessary, to conform to tne classification of me current period For LTIMindtree Limited Standalone Audited Financial Results of Wipro Limited under Ind AS (tin mittions, except per share data, unless otherwise stated) Particulars Quarter ended September 30,2023 Half year ended September 30,2023 Quarter ended September 30,2022 Revenue from operations 166,807 338,835 169,418 Profit before tax 28,481 62,692 29,556 Profit after tax 20.613 46,491 22,829 Total comprehensive income for the period 20,814 49,822 22,458 The audited standalone financial results (under ind AS) of the Company for the quarter ended and half year ended September 30, 2023 have been approved by the Board of Directors of the Company at its meeting held on October 18, 2023. The statutory auditors have expressed an unmodified audit opinion. Note: 1. The above is an extract ofthe detailed format of Quarterly Financial Results filed with the Stock Exchanges under Regulation 33 of the SEBI (Listing and Other Disclosure Requirements) Regulations, 2015. The full format of the Quarterly Financial Results are available on the Bombay Stock Exchange website (URL; www.bseindia.com), the National Stock Exchange website (URL; www.nseindia.com) and on the Company’s website (URL: www.wipro.com). 2. The Board of Directors of the Company at its meeting held over October 17-18, 2023, have approved a scheme of amalgamation for merger of Wipro HR Services India Private Limited, Wipro Overseas IT Service Private Limited, Wipro Technology Product Services Private Limited, Wipro Trademarks Holding Limited and Wipro VLSI Design Services India Private Limited (wholly-owned subsidiaries), with and into Wipro Limited. The Scheme is subject to necessary statutory and regulatory approvals under applicable laws. By Order of the Board, For Wipro Limited Place: Bengaluru Date: October 18, 2023 Rishad A. Premji Chairman Place : Mumbai, lad a f inSnfici^eixpliepeip’r. In Debashis Chatterjee Ch ef Executive Officer Sc Maragmg Director Registered Office; Wipro Limited, Doddakannelli, Sarjapur Road, Bengaluru - 6B0 035, India Website; wipro.com I Email Id: mfo@wipro.com Tel; 4-91 -80-2844 0011; Fax: +91-80-2844 0054 CIN: L32102KA1945PLC020800

Exhibit 99.3

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS UNDER IFRS

AS AT AND FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2023

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(₹ in millions, except share and per share data, unless otherwise stated)

| Notes | As at March 31, 2023 |

As at September 30, 2023 | ||||||||||||||

| Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

||||||||||||||||

| ASSETS |

||||||||||||||||

| Goodwill |

6 | 307,970 | 309,732 | 3,728 | ||||||||||||

| Intangible assets |

6 | 43,045 | 38,109 | 459 | ||||||||||||

| Property, plant and equipment |

4 | 88,659 | 83,086 | 1,000 | ||||||||||||

| Right-of-Use assets |

5 | 18,702 | 17,043 | 205 | ||||||||||||

| Financial assets |

||||||||||||||||

| Derivative assets |

17 | 29 | 151 | 2 | ||||||||||||

| Investments |

8 | 20,720 | 21,629 | 260 | ||||||||||||

| Trade receivables |

863 | 872 | 10 | |||||||||||||

| Other financial assets |

11 | 6,330 | 5,973 | 72 | ||||||||||||

| Investments accounted for using the equity method |

780 | 761 | 9 | |||||||||||||

| Deferred tax assets |

2,100 | 2,219 | 27 | |||||||||||||

| Non-current tax assets |

11,922 | 10,878 | 131 | |||||||||||||

| Other non-current assets |

12 | 13,606 | 10,834 | 130 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total non-current assets |

514,726 | 501,287 | 6,033 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Inventories |

9 | 1,188 | 1,281 | 15 | ||||||||||||

| Financial assets |

||||||||||||||||

| Derivative assets |

17 | 1,844 | 1,999 | 24 | ||||||||||||

| Investments |

8 | 309,232 | 239,847 | 2,887 | ||||||||||||

| Cash and cash equivalents |

10 | 91,880 | 97,896 | 1,178 | ||||||||||||

| Trade receivables |

126,350 | 108,146 | 1,302 | |||||||||||||

| Unbilled receivables |

60,515 | 65,292 | 786 | |||||||||||||

| Other financial assets |

11 | 9,096 | 9,155 | 110 | ||||||||||||

| Contract assets |

23,001 | 24,464 | 295 | |||||||||||||

| Current tax assets |

5,091 | 5,017 | 60 | |||||||||||||

| Other current assets |

12 | 32,899 | 31,946 | 385 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

661,096 | 585,043 | 7,042 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| TOTAL ASSETS |

1,175,822 | 1,086,330 | 13,075 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| EQUITY |

||||||||||||||||

| Share capital |

10,976 | 10,444 | 126 | |||||||||||||

| Share premium |

3,689 | 1,732 | 21 | |||||||||||||

| Retained earnings |

660,964 | 577,487 | 6,951 | |||||||||||||

| Share-based payment reserve |

5,632 | 6,023 | 72 | |||||||||||||

| Special Economic Zone re-investment reserve |

46,803 | 44,941 | 541 | |||||||||||||

| Other components of equity |

53,100 | 58,284 | 702 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Equity attributable to the equity holders of the Company |

781,164 | 698,911 | 8,413 | |||||||||||||

| Non-controlling interests |

589 | 823 | 10 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| TOTAL EQUITY |

781,753 | 699,734 | 8,423 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES |

||||||||||||||||

| Financial liabilities |

||||||||||||||||

| Loans and borrowings |

13 | 61,272 | 61,971 | 746 | ||||||||||||

| Lease liabilities |

15,953 | 14,796 | 178 | |||||||||||||

| Derivative liabilities |

17 | 179 | 40 | ^ | ||||||||||||

| Other financial liabilities |

14 | 2,649 | 1,609 | 19 | ||||||||||||

| Deferred tax liabilities |

15,153 | 15,315 | 184 | |||||||||||||

| Non-current tax liabilities |

21,777 | 26,048 | 314 | |||||||||||||

| Other non-current liabilities |

15 | 9,333 | 11,025 | 133 | ||||||||||||

| Provisions |

16 | ^ | — | — | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total non-current liabilities |

126,316 | 130,804 | 1,574 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Financial liabilities |

||||||||||||||||

| Loans, borrowings and bank overdrafts |

13 | 88,821 | 94,060 | 1,132 | ||||||||||||

| Lease liabilities |

8,620 | 8,348 | 100 | |||||||||||||

| Derivative liabilities |

17 | 2,825 | 1,582 | 19 | ||||||||||||

| Trade payables and accrued expenses |

89,054 | 78,857 | 949 | |||||||||||||

| Other financial liabilities |

14 | 4,141 | 2,712 | 33 | ||||||||||||

| Contract liabilities |

22,682 | 16,738 | 201 | |||||||||||||

| Current tax liabilities |

18,846 | 21,372 | 257 | |||||||||||||

| Other current liabilities |

15 | 30,215 | 29,873 | 360 | ||||||||||||

| Provisions |

16 | 2,549 | 2,250 | 27 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

267,753 | 255,792 | 3,078 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| TOTAL LIABILITIES |

394,069 | 386,596 | 4,652 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| TOTAL EQUITY AND LIABILITIES |

1,175,822 | 1,086,330 | 13,075 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| ^ | Value is less than 1 |

The accompanying notes form an integral part of these interim condensed consolidated financial statements

| As per our report of even date attached | For and on behalf of the Board of Directors | |||||

| for Deloitte Haskins & Sells LLP | Rishad A. Premji | Deepak M. Satwalekar | Thierry Delaporte | |||

| Chartered Accountants | Chairman | Director | Chief Executive Officer and | |||

| Firm’s Registration No: 117366W/W - 100018 | Managing Director | |||||

| Anand Subramanian | Aparna C. Iyer | M. Sanaulla Khan | ||||

| Partner | Chief Financial Officer | Company Secretary | ||||

| Membership No.: 110815 | ||||||

| Bengaluru | ||||||

| October 18, 2023 | ||||||

1

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF INCOME

(₹ in millions, except share and per share data, unless otherwise stated)

| Three months ended September 30, | Six months ended September 30, | |||||||||||||||||||||||||||

| Notes | 2022 | 2023 | 2023 | 2022 | 2023 | 2023 | ||||||||||||||||||||||

|

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|||||||||||||||||||||||

| Revenues |

20 | 225,397 | 225,159 | 2,710 | 440,683 | 453,469 | 5,458 | |||||||||||||||||||||

| Cost of revenues |

21 | (163,835 | ) | (159,191 | ) | (1,916 | ) | (319,435 | ) | (320,452 | ) | (3,857 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross profit |

61,562 | 65,968 | 794 | 121,248 | 133,017 | 1,601 | ||||||||||||||||||||||

| Selling and marketing expenses |

21 | (15,140 | ) | (18,767 | ) | (226 | ) | (30,499 | ) | (35,351 | ) | (426 | ) | |||||||||||||||

| General and administrative expenses |

21 | (14,976 | ) | (14,124 | ) | (170 | ) | (28,447 | ) | (30,011 | ) | (361 | ) | |||||||||||||||

| Foreign exchange gains/(losses), net |

23 | 1,057 | 268 | 3 | 2,091 | 206 | 2 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Results from operating activities |

32,503 | 33,345 | 401 | 64,393 | 67,861 | 816 | ||||||||||||||||||||||

| Finance expenses |

22 | (2,270 | ) | (3,033 | ) | (37 | ) | (4,315 | ) | (6,119 | ) | (74 | ) | |||||||||||||||

| Finance and other income |

23 | 4,040 | 4,810 | 58 | 7,730 | 11,352 | 137 | |||||||||||||||||||||

| Share of net profit/ (loss) of associates accounted for using the equity method |

(72 | ) | (30 | ) | ^ | (87 | ) | (27 | ) | ^ | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Profit before tax |

34,201 | 35,092 | 422 | 67,721 | 73,067 | 879 | ||||||||||||||||||||||

| Income tax expense |

19 | (7,710 | ) | (8,419 | ) | (101 | ) | (15,641 | ) | (17,534 | ) | (211 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Profit for the period |

26,491 | 26,673 | 321 | 52,080 | 55,533 | 668 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Profit attributable to: |

||||||||||||||||||||||||||||

| Equity holders of the Company |

26,590 | 26,463 | 318 | 52,226 | 55,164 | 664 | ||||||||||||||||||||||

| Non-controlling interests |

(99 | ) | 210 | 3 | (146 | ) | 369 | 4 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Profit for the period |

26,491 | 26,673 | 321 | 52,080 | 55,533 | 668 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Earnings per equity share: |

24 | |||||||||||||||||||||||||||

| Attributable to equity holders of the Company |

||||||||||||||||||||||||||||

| Basic |

4.86 | 5.06 | 0.06 | 9.55 | 10.30 | 0.12 | ||||||||||||||||||||||

| Diluted |

4.85 | 5.04 | 0.06 | 9.52 | 10.27 | 0.12 | ||||||||||||||||||||||

| Weighted average number of equity shares used in computing earnings per equity share |

||||||||||||||||||||||||||||

| Basic |

5,476,167,685 | 5,232,867,366 | 5,232,867,366 | 5,473,962,200 | 5,357,394,940 | 5,357,394,940 | ||||||||||||||||||||||

| Diluted |

5,484,785,054 | 5,245,641,198 | 5,245,641,198 | 5,486,081,940 | 5,370,078,563 | 5,370,078,563 | ||||||||||||||||||||||

| ^ | Value is less than 1 |

The accompanying notes form an integral part of these interim condensed consolidated financial statements

| As per our report of even date attached | For and on behalf of the Board of Directors | |||||

| for Deloitte Haskins & Sells LLP | Rishad A. Premji | Deepak M. Satwalekar | Thierry Delaporte | |||

| Chartered Accountants | Chairman | Director | Chief Executive Officer and | |||

| Firm’s Registration No: 117366W/W - 100018 | Managing Director | |||||

| Anand Subramanian | Aparna C. Iyer | M. Sanaulla Khan | ||||

| Partner | Chief Financial Officer | Company Secretary | ||||

| Membership No.: 110815 | ||||||

| Bengaluru | ||||||

| October 18, 2023 | ||||||

2

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(₹ in millions, except share and per share data, unless otherwise stated)

| Three months ended September 30, | Six months ended September 30, | |||||||||||||||||||||||

| 2022 | 2023 | 2023 | 2022 | 2023 | 2023 | |||||||||||||||||||

|

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|||||||||||||||||||

| Profit for the period |

26,491 | 26,673 | 321 | 52,080 | 55,533 | 668 | ||||||||||||||||||

| Other comprehensive income (OCI) |

||||||||||||||||||||||||

| Items that will not be reclassified to profit or loss in subsequent periods |

||||||||||||||||||||||||

| Remeasurements of the defined benefit plans, net |

295 | 51 | ^ | 607 | 6 | ^ | ||||||||||||||||||

| Net change in fair value of investment in equity instruments measured at fair value through OCI |

180 | (124 | ) | (1 | ) | 1,513 | (108 | ) | (1 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 475 | (73 | ) | (1 | ) | 2,120 | (102 | ) | (1 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Items that will be reclassified to profit or loss in subsequent periods |

||||||||||||||||||||||||

| Foreign currency translation differences |

3,027 | 1,824 | 22 | 8,658 | 1,462 | 18 | ||||||||||||||||||

| Reclassification of foreign currency translation differences on liquidation of subsidiaries to statement of income |

(23 | ) | (183 | ) | (2 | ) | (23 | ) | (181 | ) | (2 | ) | ||||||||||||

| Net change in time value of option contracts designated as cash flow hedges |

(55 | ) | 211 | 3 | (301 | ) | 251 | 3 | ||||||||||||||||

| Net change in intrinsic value of option contracts designated as cash flow hedges |

(121 | ) | (311 | ) | (4 | ) | (327 | ) | 201 | 2 | ||||||||||||||

| Net change in fair value of forward contracts designated as cash flow hedges |

(517 | ) | (62 | ) | (1 | ) | (1,500 | ) | 1,586 | 19 | ||||||||||||||

| Net change in fair value of investment in debt instruments measured at fair value through OCI |

148 | 297 | 4 | (3,954 | ) | 1,336 | 16 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 2,459 | 1,776 | 22 | 2,553 | 4,655 | 56 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total other comprehensive income, net of taxes |

2,934 | 1,703 | 21 | 4,673 | 4,553 | 56 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income for the period |

29,425 | 28,376 | 342 | 56,753 | 60,086 | 724 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income attributable to: |

||||||||||||||||||||||||

| Equity holders of the Company |

29,512 | 28,169 | 340 | 56,863 | 59,809 | 721 | ||||||||||||||||||

| Non-controlling interests |

(87 | ) | 207 | 2 | (110 | ) | 277 | 3 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 29,425 | 28,376 | 342 | 56,753 | 60,086 | 724 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| ^ | Value is less than 1 |

The accompanying notes form an integral part of these interim condensed consolidated financial statements

| As per our report of even date attached | For and on behalf of the Board of Directors | |||||

| for Deloitte Haskins & Sells LLP | Rishad A. Premji | Deepak M. Satwalekar | Thierry Delaporte | |||

| Chartered Accountants | Chairman | Director | Chief Executive Officer and | |||

| Firm’s Registration No: 117366W/W - 100018 | Managing Director | |||||

| Anand Subramanian | Aparna C. Iyer | M. Sanaulla Khan | ||||

| Partner | Chief Financial Officer | Company Secretary | ||||

| Membership No.: 110815 | ||||||

| Bengaluru | ||||||

| October 18, 2023 | ||||||

3

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(₹ in millions, except share and per share data, unless otherwise stated)

| Special Economic Zone re-investment reserve |

Other components of equity | Equity attributable to the equity holders of the Company |

Non- controlling interests |

Total equity | ||||||||||||||||||||||||||||||||||||||||||||

| Particulars |

Number of shares (1) |

Share capital, fully paid-up |

Share premium |

Retained earnings |

Share- based payment reserve |

Foreign currency translation reserve (2) |

Cash flow hedging reserve (3) |

Other reserves (2) |

||||||||||||||||||||||||||||||||||||||||

| As at April 1, 2022 |

5,482,070,115 | 10,964 | 1,566 | 551,252 | 5,258 | 47,061 | 26,850 | 1,477 | 13,730 | 658,158 | 515 | 658,673 | ||||||||||||||||||||||||||||||||||||

| Adjustment on adoption of amendments to IAS 37 |

— | — | — | (51 | ) | — | — | — | — | — | (51 | ) | — | (51 | ) | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted balance as at April 1, 2022 |

5,482,070,115 | 10,964 | 1,566 | 551,201 | 5,258 | 47,061 | 26,850 | 1,477 | 13,730 | 658,107 | 515 | 658,622 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Comprehensive income for the period |

||||||||||||||||||||||||||||||||||||||||||||||||

| Profit for the period |

— | — | 52,226 | — | — | — | — | — | 52,226 | (146 | ) | 52,080 | ||||||||||||||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | 8,599 | (2,128 | ) | (1,834 | ) | 4,637 | 36 | 4,673 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total comprehensive income for the period |

— | — | 52,226 | — | — | 8,599 | (2,128 | ) | (1,834 | ) | 56,863 | (110 | ) | 56,753 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Issue of equity shares on exercise of options |

3,471,525 | 7 | 1,101 | — | (1,101 | ) | — | — | — | — | 7 | — | 7 | |||||||||||||||||||||||||||||||||||

| Issue of shares by controlled trust on exercise of options (1) |

— | — | 912 | (912 | ) | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Compensation cost related to employee share-based payment |

— | — | 6 | 2,574 | — | — | — | — | 2,580 | — | 2,580 | |||||||||||||||||||||||||||||||||||||

| Transferred to Special Economic Zone re-investment reserve |

— | — | (1,343 | ) | — | 1,343 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Others |

— | — | — | — | — | — | — | — | — | (77 | ) | (77 | ) | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Other transactions for the period |

3,471,525 | 7 | 1,101 | (425 | ) | 561 | 1,343 | — | — | — | 2,587 | (77 | ) | 2,510 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||