| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| Delaware | 38-1886260 | |||||||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.001 par value per share | JBL | New York Stock Exchange | ||||||

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||||||||||

| Emerging growth company | ☐ | |||||||||||||

| Part I. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Part III. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Part IV. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

Apple, Inc. |

17 | % | 19 | % | 22 | % | |||||||||||

| Region | Number of Employees | |||||||

| Asia | 167 | |||||||

| Americas | 52 | |||||||

| Europe | 17 | |||||||

Total(1) |

236 | |||||||

| Location | Approximate Square Footage |

||||

Asia(1) |

34 | ||||

| Americas | 14 | ||||

| Europe | 4 | ||||

Total(2)(3) |

52 | ||||

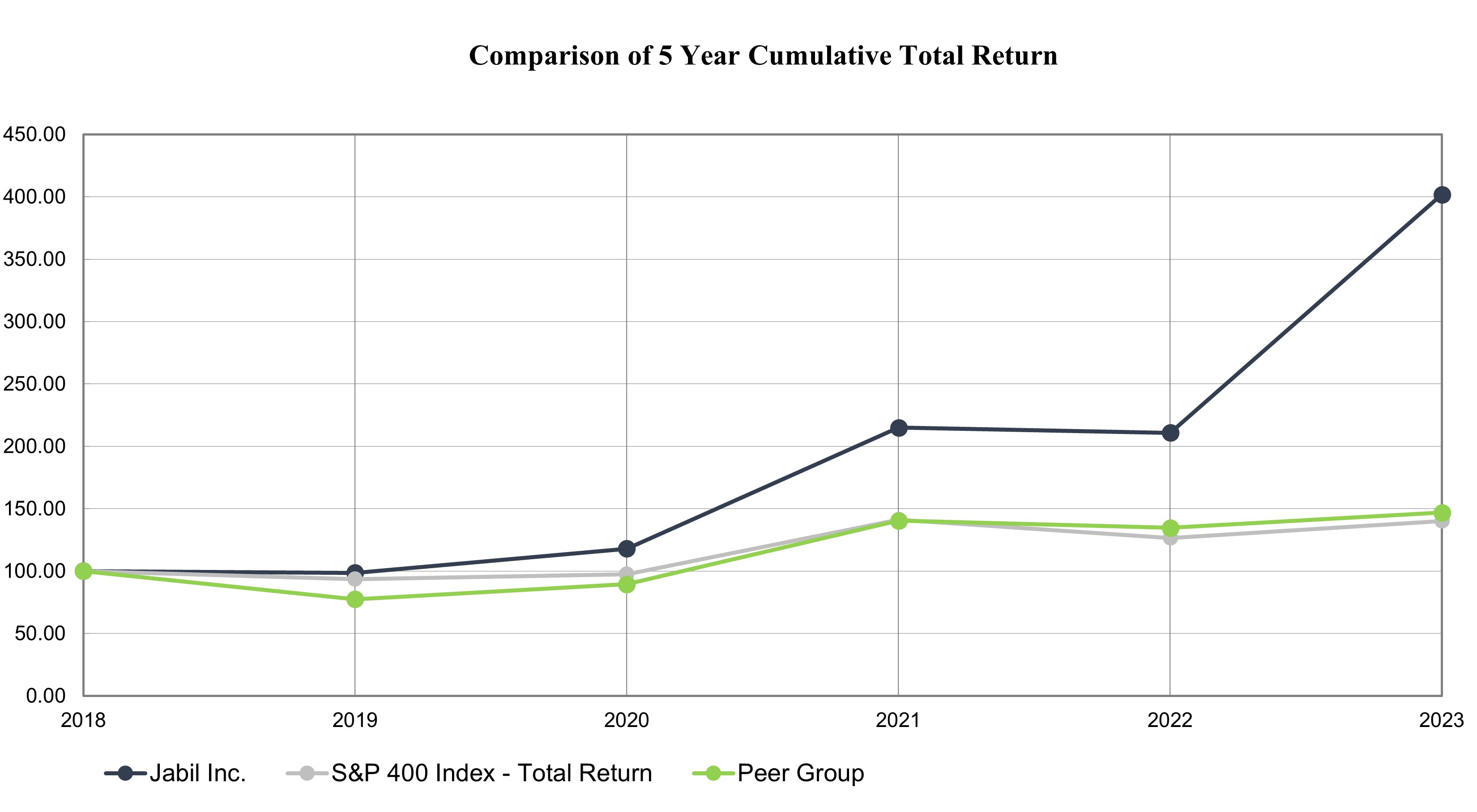

| August 31 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |||||||||||||||||||||||||||||

| Jabil Inc. | $ | 100 | $ | 99 | $ | 118 | $ | 215 | $ | 211 | $ | 402 | |||||||||||||||||||||||

| S&P MidCap 400 Index – Total Returns | $ | 100 | $ | 94 | $ | 98 | $ | 141 | $ | 127 | $ | 140 | |||||||||||||||||||||||

| Peer Group | $ | 100 | $ | 77 | $ | 90 | $ | 140 | $ | 135 | $ | 147 | |||||||||||||||||||||||

| Period |

Total Number

of Shares

Purchased(1)

|

Average Price Paid per Share |

Total Number of

Shares Purchased

as Part of Publicly

Announced Program(2)

|

Approximate

Dollar Value of

Shares that May

Yet Be Purchased

Under the Program

(in millions)(2)

|

|||||||||||||||||||

June 1, 2023 – June 30, 2023 |

470,447 | $ | 96.14 | 470,447 | $ | 776 | |||||||||||||||||

July 1, 2023 – July 31, 2023 |

257 | $ | 112.57 | — | $ | 776 | |||||||||||||||||

August 1, 2023 – August 31, 2023 |

— | $ | — | — | $ | 776 | |||||||||||||||||

| Total | 470,704 | $ | 96.15 | 470,447 | |||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Net revenue | $ | 34,702 | $ | 33,478 | $ | 29,285 | |||||||||||

| Gross profit | $ | 2,867 | $ | 2,632 | $ | 2,359 | |||||||||||

Operating income |

$ | 1,537 | $ | 1,393 | $ | 1,055 | |||||||||||

Net income attributable to Jabil Inc. |

$ | 818 | $ | 996 | $ | 696 | |||||||||||

Earnings per share – basic |

$ | 6.15 | $ | 7.06 | $ | 4.69 | |||||||||||

Earnings per share – diluted |

$ | 6.02 | $ | 6.90 | $ | 4.58 | |||||||||||

| Three Months Ended | |||||||||||||||||

August 31, 2023(1) |

May 31, 2023 | August 31, 2022 | |||||||||||||||

Sales cycle(2) |

43 days | 48 days | 32 days | ||||||||||||||

Inventory turns (annualized)(3) |

5 turns | 4 turns | 5 turns | ||||||||||||||

Days in accounts receivable(4) |

40 days | 38 days | 40 days | ||||||||||||||

Days in inventory(5) |

80 days | 84 days | 79 days | ||||||||||||||

Days in accounts payable(6) |

77 days | 74 days | 87 days | ||||||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (dollars in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

| Net revenue | $ | 34,702 | $ | 33,478 | $ | 29,285 | 3.7 | % | 14.3 | % | |||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| EMS | 48 | % | 50 | % | 47 | % | |||||||||||

| DMS | 52 | % | 50 | % | 53 | % | |||||||||||

| Total | 100 | % | 100 | % | 100 | % | |||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Foreign source revenue | 85.8 | % | 83.9 | % | 83.6 | % | |||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| (dollars in millions) | 2023 | 2022 | 2021 | ||||||||||||||

| Gross profit | $ | 2,867 | $ | 2,632 | $ | 2,359 | |||||||||||

| Percent of net revenue | 8.3 | % | 7.9 | % | 8.1 | % | |||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

Selling, general and administrative |

$ | 1,206 | $ | 1,154 | $ | 1,213 | $ | 52 | $ | (59) | |||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| (dollars in millions) | 2023 | 2022 | 2021 | ||||||||||||||

| Research and development | $ | 34 | $ | 33 | $ | 34 | |||||||||||

| Percent of net revenue | 0.1 | % | 0.1 | % | 0.1 | % | |||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

| Amortization of intangibles | $ | 33 | $ | 34 | $ | 47 | $ | (1) | $ | (13) | |||||||||||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

| Restructuring, severance and related charges | $ | 57 | $ | 18 | $ | 10 | $ | 39 | $ | 8 | |||||||||||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

| Loss on debt extinguishment | $ | — | $ | 4 | $ | — | $ | (4) | $ | 4 | |||||||||||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

Gain on securities |

$ | — | $ | — | $ | (2) | $ | — | $ | 2 | |||||||||||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

Other expense (income) |

$ | 69 | $ | 12 | $ | (11) | $ | 57 | $ | 23 | |||||||||||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | ||||||||||||||||||||||||

| Interest expense, net | $ | 206 | $ | 146 | $ | 124 | $ | 60 | $ | 22 | |||||||||||||||||||

| Fiscal Year Ended August 31, | Change | ||||||||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2023 vs. 2022 | 2022 vs. 2021 | |||||||||||||||||||||||||

| Effective income tax rate | 35.2 | % | 19.1 | % | 26.0 | % | 16.1 | % | (6.9) | % | |||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| (in millions, except for per share data) | 2023 | 2022 | 2021 | ||||||||||||||

Operating income (U.S. GAAP) |

$ | 1,537 | $ | 1,393 | $ | 1,055 | |||||||||||

| Amortization of intangibles | 33 | 34 | 47 | ||||||||||||||

| Stock-based compensation expense and related charges | 95 | 81 | 102 | ||||||||||||||

Restructuring, severance and related charges(1) |

57 | 18 | 10 | ||||||||||||||

Net periodic benefit cost(2) |

11 | 17 | 24 | ||||||||||||||

| Business interruption and impairment charges, net | — | — | (1) | ||||||||||||||

| Acquisition and integration charges | — | — | 4 | ||||||||||||||

| Adjustments to operating income | 196 | 150 | 186 | ||||||||||||||

| Core operating income (Non-GAAP) | $ | 1,733 | $ | 1,543 | $ | 1,241 | |||||||||||

Net income attributable to Jabil Inc. (U.S. GAAP) |

$ | 818 | $ | 996 | $ | 696 | |||||||||||

| Adjustments to operating income | 196 | 150 | 186 | ||||||||||||||

| Loss on debt extinguishment | — | 4 | — | ||||||||||||||

Gain on securities |

— | — | (2) | ||||||||||||||

Net periodic benefit cost(2) |

(11) | (17) | (24) | ||||||||||||||

Adjustment for taxes(3) |

169 | (28) | (3) | ||||||||||||||

| Core earnings (Non-GAAP) | $ | 1,172 | $ | 1,105 | $ | 853 | |||||||||||

Diluted earnings per share (U.S. GAAP) |

$ | 6.02 | $ | 6.90 | $ | 4.58 | |||||||||||

Diluted core earnings per share (Non-GAAP) |

$ | 8.63 | $ | 7.65 | $ | 5.61 | |||||||||||

| Diluted weighted average shares outstanding (U.S. GAAP and Non-GAAP) | 135.9 | 144.4 | 152.1 | ||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| (in millions) | 2023 | 2022 | 2021 | ||||||||||||||

Net cash provided by operating activities (U.S. GAAP) |

$ | 1,734 | $ | 1,651 | $ | 1,433 | |||||||||||

Acquisition of property, plant and equipment (“PP&E”)(1) |

(1,030) | (1,385) | (1,159) | ||||||||||||||

Proceeds and advances from sale of PP&E(1) |

322 | 544 | 366 | ||||||||||||||

| Adjusted free cash flow (Non-GAAP) | $ | 1,026 | $ | 810 | $ | 640 | |||||||||||

| Three Months Ended | |||||||||||

| (in millions, except for per share data) | August 31, 2023 | August 31, 2022 | |||||||||

| Net revenue | $ | 8,458 | $ | 9,030 | |||||||

| Gross profit | $ | 766 | $ | 729 | |||||||

Operating income |

$ | 441 | $ | 409 | |||||||

Net income |

$ | 155 | $ | 315 | |||||||

Net income attributable to Jabil Inc. |

$ | 155 | $ | 315 | |||||||

Earnings per share attributable to the stockholders of Jabil Inc.: |

|||||||||||

| Basic | $ | 1.18 | $ | 2.30 | |||||||

| Diluted | $ | 1.15 | $ | 2.25 | |||||||

| (in millions) | 4.700% Senior Notes |

4.900%

Senior

Notes(1)

|

3.950% Senior Notes |

3.600% Senior Notes |

3.000% Senior Notes |

1.700% Senior Notes |

4.250% Senior Notes |

5.450%

Senior

Notes(1)

|

Borrowings

under

revolving

credit

facilities(2)(3)

|

Borrowings under loans |

Total notes payable and credit facilities |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance as of August 31, 2021 |

$ | 499 | $ | 300 | $ | 496 | $ | 495 | $ | 591 | $ | 496 | $ | — | $ | — | $ | — | $ | 1 | $ | 2,878 | |||||||||||||||||||||||||||||||||||||||||||

| Borrowings | — | — | — | — | — | — | 498 | — | 3,269 | — | 3,767 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payments | (500) | — | — | — | — | — | — | — | (3,269) | (1) | (3,770) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 1 | — | 1 | 1 | 1 | 1 | (5) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance as of August 31, 2022 |

— | 300 | 497 | 496 | 592 | 497 | 493 | — | — | — | 2,875 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Borrowings | — | — | — | — | — | — | — | 298 | 3,749 | — | 4,047 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payments | — | (300) | — | — | — | — | — | — | (3,747) | — | (4,047) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | — | — | — | — | 1 | 1 | 2 | (2) | (2) | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance as of August 31, 2023 |

$ | — | $ | — | $ | 497 | $ | 496 | $ | 593 | $ | 498 | $ | 495 | $ | 296 | $ | — | $ | — | $ | 2,875 | |||||||||||||||||||||||||||||||||||||||||||

| Maturity Date | Sep 15, 2022 | Jul 14, 2023 | Jan 12, 2028 | Jan 15, 2030 | Jan 15, 2031 | Apr 15, 2026 | May 15, 2027 | Feb 1, 2029 | Jan 22, 2025 and Jan 22, 2027 | Jul 31, 2026 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Original Facility/ Maximum Capacity(2) |

$500 million | $300 million | $500 million | $500 million | $600 million | $500 million | $500 million | $300 million | $3.8 billion(3) |

$1 million |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Program | Maximum Amount(1) |

Type of Facility |

Expiration Date |

|||||||||||||||||

A |

$ | 700 | Uncommitted |

December 5, 2025(2) |

||||||||||||||||

B |

$ | 120 | Uncommitted |

(2) |

||||||||||||||||

C |

400 | CNY |

Uncommitted |

August 31, 2023(2) |

||||||||||||||||

D |

$ | 150 | Uncommitted |

May 4, 2028(2) |

||||||||||||||||

E |

$ | 150 | Uncommitted |

(3) |

||||||||||||||||

F |

$ | 50 | Uncommitted |

(3) |

||||||||||||||||

G |

$ | 100 | Uncommitted |

(2) |

||||||||||||||||

H |

$ | 600 | Uncommitted |

December 5, 2024(2) |

||||||||||||||||

I |

$ | 135 | Uncommitted |

April 11, 2025(2) |

||||||||||||||||

J |

100 | CHF |

Uncommitted |

December 5, 2025(2) |

||||||||||||||||

K |

8,100 | INR |

Uncommitted |

(2) |

||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

Net cash provided by operating activities |

$ | 1,734 | $ | 1,651 | $ | 1,433 | |||||||||||

Net cash used in investing activities |

(723) | (858) | (851) | ||||||||||||||

Net cash used in financing activities |

(680) | (888) | (413) | ||||||||||||||

Effect of exchange rate changes on cash and cash equivalents |

(5) | 6 | 4 | ||||||||||||||

Net increase (decrease) in cash and cash equivalents |

$ | 326 | $ | (89) | $ | 173 | |||||||||||

Dividends Paid(1) |

Share Repurchases(2) |

Total | |||||||||||||||

Fiscal years 2016 – 2020 |

$ | 283 | $ | 1,468 | $ | 1,751 | |||||||||||

| Fiscal year 2021 | $ | 50 | $ | 428 | $ | 478 | |||||||||||

| Fiscal year 2022 | $ | 48 | $ | 696 | $ | 744 | |||||||||||

| Fiscal year 2023 | $ | 45 | $ | 487 | $ | 532 | |||||||||||

| Total | $ | 426 | $ | 3,079 | $ | 3,505 | |||||||||||

| Payments due by period (in millions) | |||||||||||||||||||||||||||||

| Total | Less than 1 year |

1-3 years | 3-5 years | After 5 years | |||||||||||||||||||||||||

| Notes payable and long-term debt | $ | 2,875 | $ | — | $ | 498 | $ | 992 | $ | 1,385 | |||||||||||||||||||

Future interest on notes payable and long-term debt(1) |

525 | 102 | 201 | 148 | 74 | ||||||||||||||||||||||||

Operating lease obligations(2) |

532 | 138 | 178 | 100 | 116 | ||||||||||||||||||||||||

Finance lease obligations(2)(3) |

314 | 93 | 203 | 8 | 10 | ||||||||||||||||||||||||

Non-cancelable purchase order obligations(4) |

663 | 464 | 185 | 14 | — | ||||||||||||||||||||||||

Pension and postretirement contributions and payments(5) |

62 | 29 | 6 | 6 | 21 | ||||||||||||||||||||||||

Other(6) |

32 | 14 | 18 | — | — | ||||||||||||||||||||||||

Total contractual obligations(7) |

$ | 5,003 | $ | 840 | $ | 1,289 | $ | 1,268 | $ | 1,606 | |||||||||||||||||||

| Incorporated by Reference Herein | |||||||||||||||||||||||||||||

| Exhibit No. | Description | Form | Exhibit | Filing Date/ Period End | |||||||||||||||||||||||||

| 3.1 | 10-Q | 3.1 | 5/31/2017 | ||||||||||||||||||||||||||

| 3.2 | 10-K | 3.2 | 8/31/2022 | ||||||||||||||||||||||||||

| 4.1 | Form of Certificate for Shares of the Registrant’s Common Stock. (P) | S-1 | 1 | 3/17/1993 | |||||||||||||||||||||||||

| 4.2 | 8-K | 4.2 | 1/17/2008 | ||||||||||||||||||||||||||

| 4.3 | 8-K | 4.1 | 5/4/2022 | ||||||||||||||||||||||||||

| 4.4 | 8-K | 4.1 | 4/13/2023 | ||||||||||||||||||||||||||

| 4.5 | 8-K | 4.1 | 1/17/2018 | ||||||||||||||||||||||||||

| 4.6 | 8-K | 4.1 | 1/15/2020 | ||||||||||||||||||||||||||

| 4.7 | 8-K | 4.1 | 7/13/2020 | ||||||||||||||||||||||||||

| 4.8 | 8-K | 4.1 | 4/14/2021 | ||||||||||||||||||||||||||

| 4.9 | 8-K | 4.1 | 5/4/2022 | ||||||||||||||||||||||||||

| 4.10 | 8-K | 4.1 | 4/13/2023 | ||||||||||||||||||||||||||

| 4.11 | 10-K | 4.9 | 8/31/2021 | ||||||||||||||||||||||||||

| 10.1† | Restated cash or deferred profit sharing plan under section 401(k). (P) | S-1 | 3/3/1993 | ||||||||||||||||||||||||||

| 10.2† | Form of Indemnification Agreement between the Registrant and its Officers and Directors. (P) | S-1 | 3/3/1993 | ||||||||||||||||||||||||||

| 10.3† | 14A | B | 12/9/2020 | ||||||||||||||||||||||||||

| 10.4† | 14A | A | 12/9/2020 | ||||||||||||||||||||||||||

| 10.4a† | 10-Q | 10.2 | 2/28/2021 | ||||||||||||||||||||||||||

| 10.4b† | 10-Q | 10.3 | 2/28/2021 | ||||||||||||||||||||||||||

| 10.4c† | 10-Q | 10.4 | 2/28/2021 | ||||||||||||||||||||||||||

| 10.4d† | 10-Q | 10.5 | 2/28/2021 | ||||||||||||||||||||||||||

| 10.4e†** | 10-Q | 10.1 | 11/30/2021 | ||||||||||||||||||||||||||

| 10.4f†** | 10-Q | 10.2 | 11/30/2021 | ||||||||||||||||||||||||||

| 10.4g† | 10-Q | 10.3 | 11/30/2021 | ||||||||||||||||||||||||||

| 10.4h† | 10-Q | 10.5 | 11/30/2021 | ||||||||||||||||||||||||||

| 10.4i† | 10-Q | 10.1 | 5/31/2022 | ||||||||||||||||||||||||||

| 10.4j†** | 10-Q | 10.1 | 11/30/2022 | ||||||||||||||||||||||||||

| 10.4k†** | 10-Q | 10.2 | 11/30/2022 | ||||||||||||||||||||||||||

| 10.4l† | 10-Q | 10.3 | 11/30/2022 | ||||||||||||||||||||||||||

| 10.4m† | 10-Q | 10.4 | 11/30/2022 | ||||||||||||||||||||||||||

| 10.4n† | 10-Q | 10.5 | 11/30/2022 | ||||||||||||||||||||||||||

| 10.5† | S-8 | 4.1 | 2/25/2011 | ||||||||||||||||||||||||||

| 10.6 | 8-K | 1.1 | 5/4/2022 | ||||||||||||||||||||||||||

| 10.7 | 8-K | 1.1 | 4/13/2023 | ||||||||||||||||||||||||||

| 10.8†** | 8-K | 10.1 | 8/25/2023 | ||||||||||||||||||||||||||

| 10.9* *** | |||||||||||||||||||||||||||||

| 21.1* | |||||||||||||||||||||||||||||

| 23.1* | |||||||||||||||||||||||||||||

| 24.1* | |||||||||||||||||||||||||||||

| 31.1* | |||||||||||||||||||||||||||||

| 31.2* | |||||||||||||||||||||||||||||

| 32.1* | |||||||||||||||||||||||||||||

| 32.2* | |||||||||||||||||||||||||||||

| 101 | The following financial information from Jabil’s Annual Report on Form 10-K for the fiscal period ended August 31, 2023, formatted in Inline XBRL: (i) Consolidated Balance Sheets as of August 31, 2023 and August 31, 2022; (ii) Consolidated Statements of Operations for the fiscal years ended August 31, 2023, 2022 and 2021; (iii) Consolidated Statements of Comprehensive Income for the fiscal years ended August 31, 2023, 2022 and 2021; (iv) Consolidated Statements of Comprehensive Stockholders’ Equity for the fiscal years ended August 31, 2023, 2022 and 2021; (v) Consolidated Statements of Cash Flows for the fiscal years ended August 31, 2023, 2022 and 2021; and (vi) Notes to Consolidated Financial Statements. |

||||||||||||||||||||||||||||

| 104 | Cover Page Interactive Data File (Embedded within the inline XBRL Document in Exhibit 101). |

||||||||||||||||||||||||||||

| † | Indicates management compensatory plan, contract of arrangement. | ||||||||||||||||||||||||||||

| * | Filed or furnished herewith. | ||||||||||||||||||||||||||||

| ** | Certain portions of this exhibit have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K. Jabil agrees to furnish supplementally an unredacted copy of the exhibit to the Securities and Exchange Commission upon request. |

||||||||||||||||||||||||||||

| *** | Portions of the exhibit have been omitted. An unredacted copy of the agreement and a copy of any omitted schedule or exhibit will be furnished to the Securities and Exchange Commission upon request. | ||||||||||||||||||||||||||||

| Consolidated Financial Statements: | |||||

Consolidated Balance Sheets – August 31, 2023 and 2022 |

|||||

Consolidated Statements of Comprehensive Income – Fiscal years ended August 31, 2023, 2022, and 2021 |

|||||

Consolidated Statements of Stockholders’ Equity – Fiscal years ended August 31, 2023, 2022, and 2021 |

|||||

| Financial Statement Schedule: | |||||

| /s/ ERNST & YOUNG LLP | ||

| Uncertain Tax Positions | |||||

| Description of the Matter |

As disclosed in Note 15 to the consolidated financial statements, the Company operates in a complex multinational tax environment and is subject to laws and regulations in various jurisdictions regarding intercompany transactions. Uncertain tax positions may arise from interpretations and judgments made by the Company in the application of the relevant laws, regulations, and tax rulings. The Company uses significant judgment in (1) determining whether the technical merits of tax positions for certain intercompany transactions are more-likely-than-not to be sustained and (2) measuring the related amount of tax benefit that qualifies for recognition.

Auditing the tax positions related to certain intercompany transactions was challenging because the recognition and measurement of the tax positions is highly judgmental and is based on interpretations of laws, regulations and tax rulings.

|

||||

| How We Addressed the Matter in Our Audit |

We tested internal controls over the Company’s process to assess the technical merits of tax positions related to certain intercompany transactions and also tested internal controls over the Company’s process to determine the application of the relevant laws, regulations and tax rulings, including management’s process to recognize and measure the related tax positions.

In testing the recognition and measurement criteria, we involved tax professionals to assist in assessing the technical merits of the Company’s tax positions. In addition, we used our knowledge of and experience with the application of domestic and international income tax laws by the relevant tax authorities to evaluate the Company’s accounting for those tax positions. We also assessed the Company’s assumptions and data used to measure the amount of tax benefit that qualifies for recognition and tested the clerical accuracy of the calculations. Lastly, we evaluated the Company’s income tax disclosures included in Note 15 in relation to the Company’s uncertain tax positions.

|

||||

/s/ ERNST & YOUNG LLP |

||

| August 31, 2023 | August 31, 2022 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 1,804 | $ | 1,478 | |||||||

| Accounts receivable, net of allowance for credit losses | 3,647 | 3,995 | |||||||||

| Contract assets | 1,035 | 1,196 | |||||||||

| Inventories, net of reserve for excess and obsolete inventory | 5,206 | 6,128 | |||||||||

| Prepaid expenses and other current assets | 1,109 | 1,111 | |||||||||

| Assets held for sale | 1,929 | — | |||||||||

| Total current assets | 14,730 | 13,908 | |||||||||

| Property, plant and equipment, net of accumulated depreciation | 3,137 | 3,954 | |||||||||

| Operating lease right-of-use asset | 367 | 500 | |||||||||

| Goodwill | 621 | 704 | |||||||||

| Intangible assets, net of accumulated amortization | 142 | 158 | |||||||||

| Deferred income taxes | 159 | 199 | |||||||||

| Other assets | 268 | 294 | |||||||||

| Total assets | $ | 19,424 | $ | 19,717 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Current installments of notes payable and long-term debt | $ | — | $ | 300 | |||||||

| Accounts payable | 5,679 | 8,006 | |||||||||

| Accrued expenses | 5,515 | 5,272 | |||||||||

| Current operating lease liabilities | 104 | 119 | |||||||||

| Liabilities held for sale | 1,397 | — | |||||||||

| Total current liabilities | 12,695 | 13,697 | |||||||||

| Notes payable and long-term debt, less current installments | 2,875 | 2,575 | |||||||||

| Other liabilities | 319 | 272 | |||||||||

| Non-current operating lease liabilities | 269 | 417 | |||||||||

| Income tax liabilities | 131 | 182 | |||||||||

| Deferred income taxes | 268 | 122 | |||||||||

| Total liabilities | 16,557 | 17,265 | |||||||||

| Commitments and contingencies | |||||||||||

| Equity: | |||||||||||

| Jabil Inc. stockholders’ equity: | |||||||||||

Preferred stock, $0.001 par value, authorized 10,000,000 shares; no shares issued and outstanding |

— | — | |||||||||

Common stock, $0.001 par value, authorized 500,000,000 shares; 273,949,811 and 270,891,715 shares issued and 131,294,422 and 135,493,980 shares outstanding at August 31, 2023 and August 31, 2022, respectively |

— | — | |||||||||

| Additional paid-in capital | 2,795 | 2,655 | |||||||||

| Retained earnings | 4,412 | 3,638 | |||||||||

Accumulated other comprehensive loss |

(17) | (42) | |||||||||

Treasury stock at cost, 142,655,389 and 135,397,735 shares as of August 31, 2023 and August 31, 2022, respectively |

(4,324) | (3,800) | |||||||||

| Total Jabil Inc. stockholders’ equity | 2,866 | 2,451 | |||||||||

| Noncontrolling interests | 1 | 1 | |||||||||

| Total equity | 2,867 | 2,452 | |||||||||

| Total liabilities and equity | $ | 19,424 | $ | 19,717 | |||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Net revenue | $ | 34,702 | $ | 33,478 | $ | 29,285 | |||||||||||

| Cost of revenue | 31,835 | 30,846 | 26,926 | ||||||||||||||

| Gross profit | 2,867 | 2,632 | 2,359 | ||||||||||||||

| Operating expenses: | |||||||||||||||||

| Selling, general and administrative | 1,206 | 1,154 | 1,213 | ||||||||||||||

| Research and development | 34 | 33 | 34 | ||||||||||||||

| Amortization of intangibles | 33 | 34 | 47 | ||||||||||||||

| Restructuring, severance and related charges | 57 | 18 | 10 | ||||||||||||||

Operating income |

1,537 | 1,393 | 1,055 | ||||||||||||||

| Loss on debt extinguishment | — | 4 | — | ||||||||||||||

Gain on securities |

— | — | (2) | ||||||||||||||

Other expense (income) |

69 | 12 | (11) | ||||||||||||||

| Interest expense, net | 206 | 146 | 124 | ||||||||||||||

| Income before income tax | 1,262 | 1,231 | 944 | ||||||||||||||

Income tax expense |

444 | 235 | 246 | ||||||||||||||

Net income |

818 | 996 | 698 | ||||||||||||||

Net income attributable to noncontrolling interests, net of tax |

— | — | 2 | ||||||||||||||

Net income attributable to Jabil Inc. |

$ | 818 | $ | 996 | $ | 696 | |||||||||||

Earnings per share attributable to the stockholders of Jabil Inc.: |

|||||||||||||||||

| Basic | $ | 6.15 | $ | 7.06 | $ | 4.69 | |||||||||||

| Diluted | $ | 6.02 | $ | 6.90 | $ | 4.58 | |||||||||||

| Weighted average shares outstanding: | |||||||||||||||||

| Basic | 133.0 | 141.2 | 148.5 | ||||||||||||||

| Diluted | 135.9 | 144.4 | 152.1 | ||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

Net income |

$ | 818 | $ | 996 | $ | 698 | |||||||||||

| Other comprehensive income (loss): | |||||||||||||||||

| Change in foreign currency translation | 25 | (68) | 17 | ||||||||||||||

| Change in derivative instruments: | |||||||||||||||||

| Change in fair value of derivatives | (25) | 1 | 35 | ||||||||||||||

Adjustment for net losses (gains) realized and included in net income |

42 | 32 | (41) | ||||||||||||||

| Total change in derivative instruments | 17 | 33 | (6) | ||||||||||||||

Actuarial (loss) gain |

(19) | 14 | 17 | ||||||||||||||

Prior service credit (cost) |

2 | 4 | (19) | ||||||||||||||

Total other comprehensive income (loss) |

25 | (17) | 9 | ||||||||||||||

Comprehensive income |

$ | 843 | $ | 979 | $ | 707 | |||||||||||

Comprehensive income attributable to noncontrolling interests |

— | — | 2 | ||||||||||||||

Comprehensive income attributable to Jabil Inc. |

$ | 843 | $ | 979 | $ | 705 | |||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

Total stockholders’ equity, beginning balances |

$ | 2,452 | $ | 2,137 | $ | 1,825 | |||||||||||

| Common stock: | — | — | — | ||||||||||||||

Additional paid-in capital: |

|||||||||||||||||

Beginning balances |

2,655 | 2,533 | 2,414 | ||||||||||||||

| Shares issued under employee stock purchase plan | 51 | 45 | 39 | ||||||||||||||

| Purchase of noncontrolling interest | — | — | (14) | ||||||||||||||

Recognition of stock-based compensation |

89 | 77 | 94 | ||||||||||||||

Ending balances |

2,795 | 2,655 | 2,533 | ||||||||||||||

Retained earnings: |

|||||||||||||||||

Beginning balances |

3,638 | 2,688 | 2,041 | ||||||||||||||

Declared dividends |

(44) | (46) | (49) | ||||||||||||||

Net income attributable to Jabil Inc. |

818 | 996 | 696 | ||||||||||||||

Ending balances |

4,412 | 3,638 | 2,688 | ||||||||||||||

Accumulated other comprehensive loss: |

|||||||||||||||||

Beginning balances |

(42) | (25) | (34) | ||||||||||||||

Total other comprehensive income (loss) |

25 | (17) | 9 | ||||||||||||||

Ending balances |

(17) | (42) | (25) | ||||||||||||||

Treasury stock: |

|||||||||||||||||

Beginning balances |

(3,800) | (3,060) | (2,610) | ||||||||||||||

Purchases of treasury stock under employee stock plans |

(36) | (44) | (22) | ||||||||||||||

Treasury shares purchased |

(487) | (696) | (428) | ||||||||||||||

| Excise taxes related to treasury shares purchased | (1) | — | — | ||||||||||||||

Ending balances |

(4,324) | (3,800) | (3,060) | ||||||||||||||

Noncontrolling interests: |

|||||||||||||||||

Beginning balances |

1 | 1 | 14 | ||||||||||||||

Net income attributable to noncontrolling interests, net of tax |

— | — | 2 | ||||||||||||||

Purchase of noncontrolling interests |

— | — | (12) | ||||||||||||||

Declared dividends to noncontrolling interests |

— | — | (3) | ||||||||||||||

Ending balances |

1 | 1 | 1 | ||||||||||||||

Total stockholders’ equity, ending balances |

$ | 2,867 | $ | 2,452 | $ | 2,137 | |||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

Cash flows provided by operating activities: |

|||||||||||||||||

Net income |

$ | 818 | $ | 996 | $ | 698 | |||||||||||

Adjustments to reconcile net income to net cash provided by operating activities: |

|||||||||||||||||

| Depreciation and amortization | 924 | 925 | 876 | ||||||||||||||

| Restructuring and related charges | 5 | (1) | 5 | ||||||||||||||

Recognition of stock-based compensation expense and related charges |

95 | 81 | 102 | ||||||||||||||

| Deferred income taxes | 85 | (13) | (13) | ||||||||||||||

Loss on sale of property, plant and equipment |

— | — | 14 | ||||||||||||||

| Other, net | 13 | 10 | 17 | ||||||||||||||

Change in operating assets and liabilities, exclusive of net assets acquired: |

|||||||||||||||||

| Accounts receivable | 267 | (878) | (283) | ||||||||||||||

| Contract assets | 171 | (214) | 116 | ||||||||||||||

| Inventories | 370 | (1,725) | (1,276) | ||||||||||||||

| Prepaid expenses and other current assets | (214) | (367) | (90) | ||||||||||||||

| Other assets | 53 | (29) | (43) | ||||||||||||||

| Accounts payable, accrued expenses and other liabilities | (853) | 2,866 | 1,310 | ||||||||||||||

Net cash provided by operating activities |

1,734 | 1,651 | 1,433 | ||||||||||||||

Cash flows used in investing activities: |

|||||||||||||||||

| Acquisition of property, plant and equipment | (1,030) | (1,385) | (1,159) | ||||||||||||||

| Proceeds and advances from sale of property, plant and equipment | 322 | 544 | 366 | ||||||||||||||

| Cash paid for business and intangible asset acquisitions, net of cash | (29) | (18) | (50) | ||||||||||||||

| Proceeds from the divestiture of businesses | 50 | — | — | ||||||||||||||

| Repurchase of sold receivables | — | — | (99) | ||||||||||||||

| Cash receipts on repurchased receivables | — | 4 | 95 | ||||||||||||||

| Other, net | (36) | (3) | (4) | ||||||||||||||

Net cash used in investing activities |

(723) | (858) | (851) | ||||||||||||||

Cash flows used in financing activities: |

|||||||||||||||||

| Borrowings under debt agreements | 4,047 | 3,767 | 1,724 | ||||||||||||||

| Payments toward debt agreements | (4,204) | (3,890) | (1,613) | ||||||||||||||

| Payments to acquire treasury stock | (487) | (696) | (428) | ||||||||||||||

| Dividends paid to stockholders | (45) | (48) | (50) | ||||||||||||||

Net proceeds from exercise of stock options and issuance of common stock under employee stock purchase plan |

51 | 45 | 39 | ||||||||||||||

Treasury stock minimum tax withholding related to vesting of restricted stock |

(36) | (44) | (22) | ||||||||||||||

| Other, net | (6) | (22) | (63) | ||||||||||||||

Net cash used in financing activities |

(680) | (888) | (413) | ||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | (5) | 6 | 4 | ||||||||||||||

Net increase (decrease) in cash and cash equivalents |

326 | (89) | 173 | ||||||||||||||

| Cash and cash equivalents at beginning of period | 1,478 | 1,567 | 1,394 | ||||||||||||||

| Cash and cash equivalents at end of period | $ | 1,804 | $ | 1,478 | $ | 1,567 | |||||||||||

| Supplemental disclosure information: | |||||||||||||||||

| Interest paid, net of capitalized interest | $ | 211 | $ | 150 | $ | 124 | |||||||||||

| Income taxes paid, net of refunds received | $ | 319 | $ | 209 | $ | 211 | |||||||||||

| Asset Class | Estimated Useful Life | ||||

| Buildings | Up to 35 years |

||||

| Leasehold improvements | Shorter of lease term or useful life of the improvement | ||||

| Machinery and equipment | 2 to 10 years |

||||

| Furniture, fixtures and office equipment | 5 years | ||||

| Computer hardware and software | 3 to 7 years |

||||

| Transportation equipment | 3 years | ||||

| Foreign Currency Translation Adjustment |

Net Investment Hedges | Derivative Instruments |

Actuarial Gain (Loss) | Prior Service (Cost) Credit | Total | ||||||||||||||||||||||||||||||

Balance as of August 31, 2022 |

$ | (88) | $ | — | $ | (3) | $ | 65 | $ | (16) | $ | (42) | |||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | 29 | (4) | (25) | (5) | (2) | (7) | |||||||||||||||||||||||||||||

| Amounts reclassified from AOCI | — | — | 42 | (14) | 4 | 32 | |||||||||||||||||||||||||||||

Other comprehensive income (loss)(1) |

29 | (4) | 17 | (19) | 2 | 25 | |||||||||||||||||||||||||||||

Balance as of August 31, 2023 |

$ | (59) | $ | (4) | $ | 14 | $ | 46 | $ | (14) | $ | (17) | |||||||||||||||||||||||

| Fiscal Year Ended August 31, | ||||||||||||||||||||||||||

| Comprehensive Income Components | Financial Statement Line Item | 2023 | 2022 | 2021 | ||||||||||||||||||||||

Realized losses (gains) on derivative instruments:(1) |

||||||||||||||||||||||||||

| Foreign exchange contracts | Cost of revenue | $ | 44 | $ | 30 | $ | (44) | |||||||||||||||||||

| Interest rate contracts | Interest expense, net | (2) | 2 | $ | 3 | |||||||||||||||||||||

Actuarial gains |

(2) |

(14) | (14) | (16) | ||||||||||||||||||||||

Prior service costs |

(2) |

4 | 4 | 1 | ||||||||||||||||||||||

Total amounts reclassified from AOCI(3) |

$ | 32 | $ | 22 | $ | (56) | ||||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Restricted stock units | 383.1 | 209.4 | 655.0 | ||||||||||||||

| Program | Maximum Amount(1) |

Type of Facility |

Expiration Date |

|||||||||||||||||

A |

$ | 700 | Uncommitted |

December 5, 2025(2) |

||||||||||||||||

B |

$ | 120 | Uncommitted |

(2) |

||||||||||||||||

C |

400 | CNY |

Uncommitted |

August 31, 2023(2) |

||||||||||||||||

D |

$ | 150 | Uncommitted |

May 4, 2028(2) |

||||||||||||||||

E |

$ | 150 | Uncommitted |

(3) |

||||||||||||||||

F |

$ | 50 | Uncommitted |

(3) |

||||||||||||||||

G |

$ | 100 | Uncommitted |

(2) |

||||||||||||||||

H |

$ | 600 | Uncommitted |

December 5, 2024(2) |

||||||||||||||||

I |

$ | 135 | Uncommitted |

April 11, 2025(2) |

||||||||||||||||

J |

100 | CHF |

Uncommitted |

December 5, 2025(2) |

||||||||||||||||

K |

8,100 | INR |

Uncommitted |

(2) |

||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Trade accounts receivable sold | $ | 10,784 | $ | 8,513 | $ | 4,654 | |||||||||||

| Cash proceeds received | $ | 10,748 | $ | 8,504 | $ | 4,651 | |||||||||||

Pre-tax losses on sale of receivables(1) |

$ | 36 | $ | 9 | $ | 3 | |||||||||||

August 31, 2023(1) |

August 31, 2022 | ||||||||||

| Raw materials | $ | 4,804 | $ | 4,918 | |||||||

| Work in process | 217 | 687 | |||||||||

| Finished goods | 243 | 605 | |||||||||

| Reserve for excess and obsolete inventory | (58) | (82) | |||||||||

| Inventories, net | $ | 5,206 | $ | 6,128 | |||||||

August 31, 2023(1) |

August 31, 2022 | ||||||||||

| Land and improvements | $ | 107 | $ | 108 | |||||||

| Buildings | 1,281 | 1,191 | |||||||||

| Leasehold improvements | 676 | 1,362 | |||||||||

| Machinery and equipment | 4,362 | 5,627 | |||||||||

| Furniture, fixtures and office equipment | 229 | 241 | |||||||||

| Computer hardware and software | 840 | 860 | |||||||||

| Transportation equipment | 7 | 10 | |||||||||

| Construction in progress | 147 | 179 | |||||||||

| Property, plant and equipment | 7,649 | 9,578 | |||||||||

| Less accumulated depreciation and amortization | 4,512 | 5,624 | |||||||||

| Property, plant and equipment, net | $ | 3,137 | $ | 3,954 | |||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Depreciation expense | $ | 891 | $ | 891 | $ | 828 | |||||||||||

| Maintenance and repair expense | $ | 431 | $ | 395 | $ | 381 | |||||||||||

| Financial Statement Line Item | August 31, 2023(1) |

August 31, 2022 | ||||||||||||||||||

| Assets | ||||||||||||||||||||

Operating lease assets(2) |

Operating lease right-of-use assets | $ | 367 | $ | 500 | |||||||||||||||

Finance lease assets(3) |

Property, plant and equipment, net | 310 | 368 | |||||||||||||||||

| Total lease assets | $ | 677 | $ | 868 | ||||||||||||||||

| Liabilities | ||||||||||||||||||||

| Current | ||||||||||||||||||||

| Operating lease liabilities | Current operating lease liabilities | $ | 104 | $ | 119 | |||||||||||||||

| Finance lease liabilities | Accrued expenses | 74 | 120 | |||||||||||||||||

| Non-current | ||||||||||||||||||||

| Operating lease liabilities | Non-current operating lease liabilities | 269 | 417 | |||||||||||||||||

| Finance lease liabilities | Other liabilities | 212 | 198 | |||||||||||||||||

| Total lease liabilities | $ | 659 | $ | 854 | ||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Operating lease cost | $ | 147 | $ | 143 | |||||||

| Finance lease cost | |||||||||||

| Amortization of leased assets | 89 | 70 | |||||||||

| Interest on lease liabilities | 9 | 6 | |||||||||

| Other | 15 | 22 | |||||||||

Net lease cost(1) |

$ | 260 | $ | 241 | |||||||

| August 31, 2023 | August 31, 2022 | ||||||||||||||||||||||

| Weighted-average remaining lease term | Weighted-average discount rate | Weighted-average remaining lease term | Weighted-average discount rate | ||||||||||||||||||||

| Operating leases | 5.2 years | 3.55 | % | 5.3 years | 3.19 | % | |||||||||||||||||

| Finance leases | 2.1 years | 3.84 | % | 2.6 years | 2.84 | % | |||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash paid for amounts included in the measurement of lease liabilities: | |||||||||||

Operating cash flows for operating leases(1) |

$ | 135 | $ | 123 | |||||||

Operating cash flows for finance leases(1) |

$ | 9 | $ | 6 | |||||||

Financing activities for finance leases(2) |

$ | 157 | $ | 120 | |||||||

| Non-cash right-of-use assets obtained in exchange for new lease liabilities: | |||||||||||

| Operating leases | $ | 110 | $ | 229 | |||||||

| Finance leases | $ | 131 | $ | 127 | |||||||

| Fiscal Year Ended August 31, | Operating Leases(1) |

Finance Leases(1)(2) |

Total | ||||||||||||||

2024 |

$ | 138 | $ | 93 | $ | 231 | |||||||||||

2025 |

101 | 102 | 203 | ||||||||||||||

2026 |

77 | 101 | 178 | ||||||||||||||

2027 |

58 | 6 | 64 | ||||||||||||||

2028 |

42 | 2 | 44 | ||||||||||||||

| Thereafter | 116 | 10 | 126 | ||||||||||||||

| Total minimum lease payments | $ | 532 | $ | 314 | $ | 846 | |||||||||||

| Less: Interest | (56) | (17) | (73) | ||||||||||||||

| Present value of lease liabilities | $ | 476 | $ | 297 | $ | 773 | |||||||||||

| EMS | DMS | Total | |||||||||||||||

Balance as of August 31, 2021 |

$ | 74 | $ | 641 | $ | 715 | |||||||||||

| Acquisitions and adjustments | 6 | 1 | 7 | ||||||||||||||

| Change in foreign currency exchange rates | (1) | (17) | (18) | ||||||||||||||

Balance as of August 31, 2022 |

79 | 625 | 704 | ||||||||||||||

| Acquisitions and adjustments | — | 24 | 24 | ||||||||||||||

| Change in foreign currency exchange rates | 1 | 9 | 10 | ||||||||||||||

| Goodwill classified as held for sale | — | (117) | (117) | ||||||||||||||

Balance as of August 31, 2023 |

$ | 80 | $ | 541 | $ | 621 | |||||||||||

| August 31, 2023 | August 31, 2022 | ||||||||||||||||||||||

|

Gross

Carrying

Amount(1)

|

Accumulated Impairment |

Gross Carrying Amount |

Accumulated Impairment |

||||||||||||||||||||

| Goodwill | $ | 1,641 | $ | 1,020 | $ | 1,724 | $ | 1,020 | |||||||||||||||

| Weighted Average Amortization Period (in years) |

August 31, 2023 | August 31, 2022 | |||||||||||||||||||||||||||||||||||||||

| Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

||||||||||||||||||||||||||||||||||||

Contractual agreements and customer relationships |

12 | $ | 320 | $ | (251) | $ | 69 | $ | 302 | $ | (231) | $ | 71 | ||||||||||||||||||||||||||||

| Intellectual property | 9 | 198 | (177) | 21 | 198 | (173) | 25 | ||||||||||||||||||||||||||||||||||

| Finite-lived trade names | Not applicable | 79 | (78) | 1 | 78 | (67) | 11 | ||||||||||||||||||||||||||||||||||

| Trade names | Indefinite | 51 | — | 51 | 51 | — | 51 | ||||||||||||||||||||||||||||||||||

| Total intangible assets | 11 | $ | 648 | $ | (506) | $ | 142 | $ | 629 | $ | (471) | $ | 158 | ||||||||||||||||||||||||||||

| Fiscal Year Ended August 31, | |||||

2024 |

$ | 20 | |||

2025 |

17 | ||||

2026 |

14 | ||||

2027 |

14 | ||||

2028 |

12 | ||||

| Thereafter | 14 | ||||

| Total | $ | 91 | |||

| Maturity Date | August 31, 2023 | August 31, 2022 | |||||||||||||||

4.900% Senior Notes(1)(3) |

Jul 14, 2023 | $ | — | $ | 300 | ||||||||||||

3.950% Senior Notes(1)(2) |

Jan 12, 2028 | 497 | 497 | ||||||||||||||

3.600% Senior Notes(1)(2) |

Jan 15, 2030 | 496 | 496 | ||||||||||||||

3.000% Senior Notes(1)(2) |

Jan 15, 2031 | 593 | 592 | ||||||||||||||

1.700% Senior Notes(1)(2) |

Apr 15, 2026 | 498 | 497 | ||||||||||||||

4.250% Senior Notes(1)(2)(5) |

May 15, 2027 | 495 | 493 | ||||||||||||||

5.450% Senior Notes(1)(2)(3) |

Feb 1, 2029 | 296 | — | ||||||||||||||

Borrowings under credit facilities(4)(6) |

Jan 22, 2025 and Jan 22, 2027 | — | — | ||||||||||||||

| Borrowings under loans | Jul 31, 2026 | — | — | ||||||||||||||

| Total notes payable and long-term debt | 2,875 | 2,875 | |||||||||||||||

Less current installments of notes payable and long-term debt |

— | 300 | |||||||||||||||

Notes payable and long-term debt, less current installments |

$ | 2,875 | $ | 2,575 | |||||||||||||

| Fiscal Year Ended August 31, | |||||

2024 |

$ | — | |||

2025 |

— | ||||

2026 |

498 | ||||

2027 |

495 | ||||

2028 |

497 | ||||

| Thereafter | 1,385 | ||||

| Total | $ | 2,875 | |||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021(3) |

|||||||||||||||

| Trade accounts receivable sold | $ | 4,101 | $ | 3,932 | $ | 4,222 | |||||||||||

Cash proceeds received(1) |

$ | 4,061 | $ | 3,919 | $ | 4,202 | |||||||||||

| Proceeds due from bank | $ | — | $ | — | $ | 10 | |||||||||||

Pre-tax losses on sale of receivables(2) |

$ | 40 | $ | 13 | $ | 10 | |||||||||||

August 31, 2023(1) |

August 31, 2022 | ||||||||||

| Inventory deposits | $ | 1,839 | $ | 1,586 | |||||||

Contract liabilities(2) |

886 | 796 | |||||||||

| Accrued compensation and employee benefits | 743 | 806 | |||||||||

| Other accrued expenses | 2,047 | 2,084 | |||||||||

| Accrued expenses | $ | 5,515 | $ | 5,272 | |||||||

| Fiscal Year Ended August 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Change in PBO | |||||||||||

| Beginning PBO | $ | 432 | $ | 587 | |||||||

| Service cost | 18 | 25 | |||||||||

| Interest cost | 12 | 4 | |||||||||

Actuarial gain |

(23) | (119) | |||||||||

Settlements paid from plan assets(1) |

(27) | (28) | |||||||||

| Total benefits paid | (16) | (13) | |||||||||

| Plan participants’ contributions | 22 | 21 | |||||||||

| Effect of conversion to U.S. dollars | 43 | (45) | |||||||||

| Ending PBO | $ | 461 | $ | 432 | |||||||

| Change in plan assets | |||||||||||

| Beginning fair value of plan assets | 459 | 576 | |||||||||

| Actual return on plan assets | (16) | (68) | |||||||||

Settlements paid from plan assets(1) |

(27) | (28) | |||||||||

| Employer contributions | 18 | 16 | |||||||||

| Benefits paid from plan assets | (15) | (12) | |||||||||

| Plan participants’ contributions | 22 | 21 | |||||||||

| Effect of conversion to U.S. dollars | 45 | (46) | |||||||||

| Ending fair value of plan assets | $ | 486 | $ | 459 | |||||||

| Funded status | $ | 25 | $ | 27 | |||||||

| Amounts recognized in the Consolidated Balance Sheets | |||||||||||

| Accrued benefit liability, current | $ | 1 | $ | 1 | |||||||

| Accrued benefit asset, noncurrent | $ | 26 | $ | 28 | |||||||

Accumulated other comprehensive loss(2) |

|||||||||||

Actuarial gain, before tax |

$ | (71) | $ | (85) | |||||||

Prior service cost, before tax |

$ | 16 | $ | 18 | |||||||

| August 31, 2023 | August 31, 2022 | ||||||||||

| ABO | $ | 441 | $ | 417 | |||||||

| Plans with ABO in excess of plan assets | |||||||||||

| ABO | $ | 41 | $ | 41 | |||||||

| Fair value of plan assets | $ | 15 | $ | 19 | |||||||

| Plans with PBO in excess of plan assets | |||||||||||

| PBO | $ | 52 | $ | 51 | |||||||

| Fair value of plan assets | $ | 15 | $ | 19 | |||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

Service cost(1) |

$ | 18 | $ | 25 | $ | 25 | |||||||||||

Interest cost(2) |

12 | 4 | 5 | ||||||||||||||

Expected long-term return on plan assets(2) |

(17) | (17) | (16) | ||||||||||||||

Recognized actuarial gain(2) |

(7) | (6) | (10) | ||||||||||||||

Amortization of actuarial gains(2)(3) |

(7) | (8) | (6) | ||||||||||||||

Net settlement loss(2) |

— | 1 | 1 | ||||||||||||||

Amortization of prior service costs(2) |

4 | 4 | 1 | ||||||||||||||

Net periodic benefit cost |

$ | 3 | $ | 3 | $ | — | |||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Net periodic benefit cost: | |||||||||||||||||

Expected long-term return on plan assets(1) |

3.6 | % | 3.0 | % | 2.9 | % | |||||||||||

| Rate of compensation increase | 2.1 | % | 2.2 | % | 2.1 | % | |||||||||||

| Discount rate | 2.6 | % | 0.7 | % | 0.8 | % | |||||||||||

| PBO: | |||||||||||||||||

| Expected long-term return on plan assets | 3.7 | % | 3.6 | % | 3.0 | % | |||||||||||

| Rate of compensation increase | 1.9 | % | 2.1 | % | 2.2 | % | |||||||||||

Discount rate(2) |

2.8 | % | 2.6 | % | 0.7 | % | |||||||||||

| August 31, 2023 | August 31, 2022 | ||||||||||||||||||||||||||||

| Fair Value Hierarchy |

Fair Value | Asset Allocation |

Fair Value | Asset Allocation |

|||||||||||||||||||||||||

| Asset Category | |||||||||||||||||||||||||||||

Cash and cash equivalents(1) |

Level 1 | $ | 17 | 3 | % | $ | 13 | 3 | % | ||||||||||||||||||||

| Equity Securities: | |||||||||||||||||||||||||||||

Global equity securities(2)(3) |

Level 2 | 213 | 44 | % | 197 | 43 | % | ||||||||||||||||||||||

| Debt Securities: | |||||||||||||||||||||||||||||

Corporate bonds(3) |

Level 2 | 216 | 45 | % | 203 | 44 | % | ||||||||||||||||||||||

Government bonds(3) |

Level 2 | 30 | 6 | % | 34 | 7 | % | ||||||||||||||||||||||

| Other Investments: | |||||||||||||||||||||||||||||

Insurance contracts(4) |

Level 3 | 10 | 2 | % | 12 | 3 | % | ||||||||||||||||||||||

Fair value of plan assets |

$ | 486 | 100 | % | $ | 459 | 100 | % | |||||||||||||||||||||

| Fiscal Year Ended August 31, | Amount | ||||

2024 |

$ | 34 | |||

2025 |

$ | 29 | |||

2026 |

$ | 29 | |||

2027 |

$ | 33 | |||

2028 |

$ | 31 | |||

2029 through 2033 |

$ | 156 | |||

| Maturity date | August 31, 2023 | August 31, 2022 | |||||||||

| September 2023 | $ | 34 | $ | — | |||||||

| October 2023 | 96 | — | |||||||||

| January 2024 | 96 | — | |||||||||

| April 2024 | 68 | — | |||||||||

| July 2024 | 102 | — | |||||||||

| Total | $ | 396 | $ | — | |||||||

| Derivatives Not Designated as Hedging Instruments Under ASC 815 | Location of (Loss) Gain on Derivatives Recognized in Net Income | Amount of (Loss) Gain Recognized in Net Income on Derivatives | ||||||||||||||||||||||||

| Fiscal Year Ended August 31, | ||||||||||||||||||||||||||

| 2023 | 2022 | 2021 | ||||||||||||||||||||||||

Forward foreign exchange contracts(1) |

Cost of revenue | $ | (111) | $ | (71) | $ | 140 | |||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Restricted stock units | $ | 81 | $ | 67 | $ | 91 | |||||||||||

| Employee stock purchase plan | 14 | 14 | 11 | ||||||||||||||

| Total | $ | 95 | $ | 81 | $ | 102 | |||||||||||

| Shares Available for Grant | |||||

Balance as of August 31, 2022 |

9,974,294 | ||||

Restricted stock units granted, net of forfeitures(1) |

(1,510,561) | ||||

Balance as of August 31, 2023 |

8,463,733 | ||||

| Shares | Weighted-Average Grant-Date Fair Value |

||||||||||

Outstanding as of August 31, 2022 |

4,412,994 | $ | 49.87 | ||||||||

| Changes during the period | |||||||||||

Shares granted(1) |

1,673,925 | $ | 66.33 | ||||||||

| Shares vested | (2,014,802) | $ | 45.98 | ||||||||

| Shares forfeited | (163,364) | $ | 56.92 | ||||||||

Outstanding as of August 31, 2023 |

3,908,753 | $ | 58.70 | ||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Fair value of restricted stock units vested | $ | 93 | $ | 72 | $ | 69 | |||||||||||

Tax benefit for stock compensation expense(1) |

$ | 2 | $ | 2 | $ | 1 | |||||||||||

| Unrecognized stock-based compensation expense — restricted stock units | $ | 43 | |||||||||||||||

| Remaining weighted-average period for restricted stock units expense | 1.4 years | ||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Expected dividend yield | 0.3 | % | 0.3 | % | 0.5 | % | |||||||||||

| Risk-free interest rate | 3.4 | % | 0.1 | % | 0.1 | % | |||||||||||

Expected volatility(1) |

37.4 | % | 29.6 | % | 32.9 | % | |||||||||||

| Expected life | 0.5 years | 0.5 years | 0.5 years | ||||||||||||||

| (in millions, except for per share data) | Dividend Declaration Date |

Dividend per Share |

Total of Cash Dividends Declared |

Date of Record for Dividend Payment |

Dividend Cash Payment Date |

||||||||||||||||||||||||

Fiscal Year 2023 |

October 20, 2022 | $ | 0.08 | $ | 12 | November 15, 2022 | December 2, 2022 | ||||||||||||||||||||||

| January 26, 2023 | $ | 0.08 | $ | 10 | February 15, 2023 | March 2, 2023 | |||||||||||||||||||||||

| April 20, 2023 | $ | 0.08 | $ | 11 | May 15, 2023 | June 2, 2023 | |||||||||||||||||||||||

| July 20, 2023 | $ | 0.08 | $ | 11 | August 15, 2023 | September 5, 2023 | |||||||||||||||||||||||

Fiscal Year 2022 |

October 21, 2021 | $ | 0.08 | $ | 12 | November 15, 2021 | December 1, 2021 | ||||||||||||||||||||||

| January 20, 2022 | $ | 0.08 | $ | 12 | February 15, 2022 | March 2, 2022 | |||||||||||||||||||||||

| April 21, 2022 | $ | 0.08 | $ | 12 | May 16, 2022 | June 2, 2022 | |||||||||||||||||||||||

| July 21, 2022 | $ | 0.08 | $ | 11 | August 15, 2022 | September 2, 2022 | |||||||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

Common stock outstanding: |

|||||||||||||||||

Beginning balances |

135,493,980 | 144,496,077 | 150,330,358 | ||||||||||||||

Shares issued upon exercise of stock options |

— | — | 9,321 | ||||||||||||||

Shares issued under employee stock purchase plan |

1,043,294 | 970,480 | 1,288,397 | ||||||||||||||

Vesting of restricted stock |

2,014,802 | 2,503,143 | 2,290,104 | ||||||||||||||

Purchases of treasury stock under employee stock plans |

(571,606) | (713,667) | (622,703) | ||||||||||||||

Treasury shares purchased(1)(2) |

(6,686,048) | (11,762,053) | (8,799,400) | ||||||||||||||

Ending balances |

131,294,422 | 135,493,980 | 144,496,077 | ||||||||||||||

| Percentage of Net Revenue Fiscal Year Ended August 31, |

Percentage of Accounts Receivable as of August 31, |

|||||||||||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2023 | 2022 | ||||||||||||||||||||||||||||

Apple, Inc.(1) |

17 | % | 19 | % | 22 | % | * | * | ||||||||||||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| EMS | DMS | Total | EMS | DMS | Total | EMS | DMS | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Timing of transfer | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Point in time | $ | 5,094 | $ | 6,453 | $ | 11,547 | $ | 6,112 | $ | 6,818 | $ | 12,930 | $ | 4,464 | $ | 7,183 | $ | 11,647 | |||||||||||||||||||||||||||||||||||

| Over time | 11,655 | 11,500 | 23,155 | 10,625 | 9,923 | 20,548 | 9,440 | 8,198 | 17,638 | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 16,749 | $ | 17,953 | $ | 34,702 | $ | 16,737 | $ | 16,741 | $ | 33,478 | $ | 13,904 | $ | 15,381 | $ | 29,285 | |||||||||||||||||||||||||||||||||||

| Fiscal Year Ended August 31, | ||||||||||||||||||||

| 2023 | 2022 | 2021 | ||||||||||||||||||

| Segment income and reconciliation of income before income tax | ||||||||||||||||||||

| EMS | $ | 837 | $ | 727 | $ | 509 | ||||||||||||||

| DMS | 896 | 816 | 732 | |||||||||||||||||

| Total segment income | $ | 1,733 | $ | 1,543 | $ | 1,241 | ||||||||||||||

| Reconciling items: | ||||||||||||||||||||

| Amortization of intangibles | (33) | (34) | (47) | |||||||||||||||||

| Stock-based compensation expense and related charges | (95) | (81) | (102) | |||||||||||||||||

| Restructuring, severance and related charges | (57) | (18) | (10) | |||||||||||||||||

Business interruption and impairment charges, net |

— | — | 1 | |||||||||||||||||

| Acquisition and integration charges | — | — | (4) | |||||||||||||||||

| Loss on debt extinguishment | — | (4) | — | |||||||||||||||||

Gain on securities |

— | — | 2 | |||||||||||||||||

| Other expense (net of periodic benefit cost) | (80) | (29) | (13) | |||||||||||||||||

| Interest expense, net | (206) | (146) | (124) | |||||||||||||||||

| Income before income tax | $ | 1,262 | $ | 1,231 | $ | 944 | ||||||||||||||

| August 31, 2023 | August 31, 2022 | |||||||||||||

| Total assets: | ||||||||||||||

| EMS | $ | 4,859 | $ | 5,402 | ||||||||||

| DMS | 6,802 | 8,881 | ||||||||||||

Assets held for sale(1) |

1,929 | — | ||||||||||||

| Other non-allocated assets | 5,834 | 5,434 | ||||||||||||

| Total | $ | 19,424 | $ | 19,717 | ||||||||||

| Fiscal Year Ended August 31, | ||||||||||||||||||||

| 2023 | 2022 | 2021 | ||||||||||||||||||

| External net revenue: | ||||||||||||||||||||

Singapore |

$ | 7,385 | $ | 7,916 | $ | 7,943 | ||||||||||||||

Mexico |

6,083 | 5,630 | 4,323 | |||||||||||||||||

China |

5,868 | 5,272 | 4,666 | |||||||||||||||||

Malaysia |

2,779 | 2,709 | 2,121 | |||||||||||||||||

India |

1,596 | 591 | 549 | |||||||||||||||||

Other |

6,056 | 5,971 | 4,868 | |||||||||||||||||

| Foreign source revenue | 29,767 | 28,089 | 24,470 | |||||||||||||||||

| U.S. | 4,935 | 5,389 | 4,815 | |||||||||||||||||

| Total | $ | 34,702 | $ | 33,478 | $ | 29,285 | ||||||||||||||

| August 31, 2023 | August 31, 2022 | |||||||||||||

| Long-lived assets: | ||||||||||||||

China(1) |

$ | 684 | $ | 1,758 | ||||||||||

Mexico |

574 | 492 | ||||||||||||

Malaysia |

358 | 328 | ||||||||||||

Switzerland |

238 | 208 | ||||||||||||

Singapore |

131 | 138 | ||||||||||||

Hungary |

109 | 114 | ||||||||||||

Taiwan |

97 | 101 | ||||||||||||

Vietnam |

88 | 104 | ||||||||||||

Other |

628 | 553 | ||||||||||||

| Long-lived assets related to foreign operations | 2,907 | 3,796 | ||||||||||||

U.S. |

993 | 1,020 | ||||||||||||

| Total | $ | 3,900 | $ | 4,816 | ||||||||||

| Fiscal Year Ended August 31, | ||||||||||||||||||||

2023(1) |

2022(1) |

2021(2) |

||||||||||||||||||

| Employee severance and benefit costs | $ | 48 | $ | 18 | $ | 5 | ||||||||||||||

| Lease costs | — | — | (1) | |||||||||||||||||

| Asset write-off costs | 5 | — | 5 | |||||||||||||||||

| Other costs | 4 | — | 1 | |||||||||||||||||

Total restructuring, severance and related charges(3) |

$ | 57 | $ | 18 | $ | 10 | ||||||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Domestic | $ | (315) | $ | (116) | $ | (271) | |||||||||||

| Foreign | 1,577 | 1,347 | 1,215 | ||||||||||||||

| Total | $ | 1,262 | $ | 1,231 | $ | 944 | |||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Current: | |||||||||||||||||

| Domestic - federal | $ | 1 | $ | 7 | $ | 7 | |||||||||||

| Domestic - state | 2 | 2 | 3 | ||||||||||||||

| Foreign | 350 | 239 | 252 | ||||||||||||||

| Total current | 353 | 248 | 262 | ||||||||||||||

| Deferred: | |||||||||||||||||

| Domestic - federal | (2) | (25) | 2 | ||||||||||||||

| Domestic - state | 4 | — | — | ||||||||||||||

Foreign |

89 | 12 | (18) | ||||||||||||||

| Total deferred | 91 | (13) | (16) | ||||||||||||||

| Total income tax expense | $ | 444 | $ | 235 | $ | 246 | |||||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| U.S. federal statutory income tax rate | 21.0 | % | 21.0 | % | 21.0 | % | |||||||||||

| State income taxes, net of federal tax benefit | 0.2 | 0.7 | 0.2 | ||||||||||||||

Impact of foreign tax rates(1) |

(1.8) | (4.0) | (4.6) | ||||||||||||||

| Permanent differences | (0.5) | 1.2 | (0.4) | ||||||||||||||

Income tax credits(1) |

(0.5) | (0.5) | (0.4) | ||||||||||||||

Valuation allowance(2) |

1.1 | (3.3) | 1.3 | ||||||||||||||

| Equity compensation | 0.5 | (0.5) | 0.6 | ||||||||||||||

| Impact of intercompany charges and dividends | 2.4 | 3.6 | 4.4 | ||||||||||||||

| Global Intangible Low-Taxed Income | 0.8 | 1.1 | 3.0 | ||||||||||||||

Change in indefinite reinvestment assertion(3) |

11.7 | — | — | ||||||||||||||

| Other, net | 0.3 | (0.2) | 0.9 | ||||||||||||||

| Effective income tax rate | 35.2 | % | 19.1 | % | 26.0 | % | |||||||||||

August 31, 2023(1) |

August 31, 2022 | ||||||||||

| Deferred tax assets: | |||||||||||

| Net operating loss carryforwards | $ | 196 | $ | 176 | |||||||

| Receivables | 4 | 4 | |||||||||

| Inventories | 16 | 16 | |||||||||

| Compensated absences | 16 | 13 | |||||||||

| Accrued expenses | 116 | 106 | |||||||||

| Property, plant and equipment | 17 | 66 | |||||||||

| Domestic tax credits | 22 | 11 | |||||||||

| Foreign jurisdiction tax credits | 4 | 4 | |||||||||

| Equity compensation | 8 | 10 | |||||||||

| Domestic interest carryforwards | 10 | 4 | |||||||||

| Capital loss carryforwards | 19 | 20 | |||||||||

| Revenue recognition | 29 | 32 | |||||||||

| Operating and finance lease liabilities | 39 | 72 | |||||||||

| Other | 24 | 27 | |||||||||

| Total deferred tax assets before valuation allowances | 520 | 561 | |||||||||

| Less valuation allowances | (303) | (281) | |||||||||

| Net deferred tax assets | $ | 217 | $ | 280 | |||||||

| Deferred tax liabilities: | |||||||||||

| Unremitted earnings of foreign subsidiaries | $ | 201 | $ | 57 | |||||||

| Intangible assets | 24 | 25 | |||||||||

| Operating lease assets | 85 | 111 | |||||||||

| Other | 16 | 10 | |||||||||

| Total deferred tax liabilities | $ | 326 | $ | 203 | |||||||

| Net deferred tax (liabilities) assets | $ | (109) | $ | 77 | |||||||

| Last Fiscal Year of Expiration | Amount | ||||||||||

Income tax net operating loss carryforwards:(1) |

|||||||||||

| Domestic - federal | 2038 or indefinite | $ | 11 | ||||||||

| Domestic - state | 2042 or indefinite | $ | 55 | ||||||||

| Foreign | 2038 or indefinite | $ | 646 | ||||||||

Tax credit carryforwards:(1) |

|||||||||||

| Domestic - federal | 2043 | $ | 18 | ||||||||

| Domestic - state | 2027 or indefinite | $ | 4 | ||||||||

Foreign(2) |

Indefinite | $ | 4 | ||||||||

| Tax capital loss carryforwards: | |||||||||||

| Domestic - federal | 2028 | $ | 75 | ||||||||

| Fiscal Year Ended August 31, | |||||||||||||||||

| 2023 | 2022 | 2021 | |||||||||||||||

| Beginning balance | $ | 253 | $ | 241 | $ | 190 | |||||||||||

| Additions for tax positions of prior years | 1 | 22 | 15 | ||||||||||||||

| Reductions for tax positions of prior years | (7) | (21) | (3) | ||||||||||||||

Additions for tax positions related to current year(1) |

23 | 36 | 36 | ||||||||||||||

| Cash settlements | (3) | (3) | — | ||||||||||||||

| Reductions from lapses in statutes of limitations | (8) | (3) | (2) | ||||||||||||||

| Reductions from non-cash settlements with taxing authorities | (2) | (9) | — | ||||||||||||||

| Foreign exchange rate adjustment | — | (10) | 5 | ||||||||||||||

| Ending balance | $ | 257 | $ | 253 | $ | 241 | |||||||||||

Unrecognized tax benefits that would affect the effective tax rate (if recognized) |

$ | 150 | $ | 150 | $ | 139 | |||||||||||

| August 31, 2023 | |||||

| Assets held for sale: | |||||

| Accounts receivable, net of allowance for credit losses | $ | 96 | |||

| Inventories, net of reserve for excess and obsolete inventory | 559 | ||||

| Prepaid expenses and other current assets | 220 | ||||

| Property, plant and equipment, net of accumulated depreciation | 724 | ||||

| Operating lease right-of-use asset | 112 | ||||

| Goodwill | 117 | ||||

| Deferred income taxes | 96 | ||||

| Liabilities held for sale: | |||||

| Accounts payable | $ | 876 | |||

| Accrued expenses | 364 | ||||

| Non-current operating lease liabilities | 83 | ||||

| Fair Value Hierarchy | August 31, 2023 | August 31, 2022 | ||||||||||||||||||

| Assets: | ||||||||||||||||||||

| Cash and cash equivalents: | ||||||||||||||||||||

| Cash equivalents | Level 1 | (1) |

$ | — | $ | 14 | ||||||||||||||

| Prepaid expenses and other current assets: | ||||||||||||||||||||

| Short-term investments | Level 1 | 25 | 16 | |||||||||||||||||

| Forward foreign exchange contracts: | ||||||||||||||||||||

Derivatives designated as hedging instruments (Note 11) |

Level 2 | (2) |

4 | 3 | ||||||||||||||||

Derivatives not designated as hedging instruments (Note 11) |

Level 2 | (2) |

20 | 13 | ||||||||||||||||

| Net investment hedges: | ||||||||||||||||||||

Derivatives designated as hedging instruments (Note 11) |

Level 2 | (2) |

9 | — | ||||||||||||||||

| Other assets: | ||||||||||||||||||||

| Forward interest rate swap: | ||||||||||||||||||||

Derivatives designated as hedging instruments (Note 11) |

Level 2 | (3) |

— | 13 | ||||||||||||||||

| Liabilities: | ||||||||||||||||||||

| Accrued expenses: | ||||||||||||||||||||

| Forward foreign exchange contracts: | ||||||||||||||||||||

Derivatives designated as hedging instruments (Note 11) |

Level 2 | (2) |

$ | 17 | $ | 32 | ||||||||||||||

Derivatives not designated as hedging instruments (Note 11) |

Level 2 | (2) |

64 | 76 | ||||||||||||||||

| Net investment hedges: | ||||||||||||||||||||

Derivatives designated as hedging instruments (Note 11) |

Level 2 | (2) |

1 | — | ||||||||||||||||

| August 31, 2023 | August 31, 2022 | |||||||||||||||||||||||||||||||

| Fair Value Hierarchy | Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||||||||||||||||||

Notes payable and long-term debt: (Note 7) |

||||||||||||||||||||||||||||||||

4.900% Senior Notes |

Level 3 | (1) |

$ | — | $ | — | $ | 300 | $ | 300 | ||||||||||||||||||||||

3.950% Senior Notes |

Level 2 | (2) |

$ | 497 | $ | 468 | $ | 497 | $ | 471 | ||||||||||||||||||||||

3.600% Senior Notes |

Level 2 | (2) |

$ | 496 | $ | 448 | $ | 496 | $ | 440 | ||||||||||||||||||||||

3.000% Senior Notes |

Level 2 | (2) |

$ | 593 | $ | 502 | $ | 592 | $ | 500 | ||||||||||||||||||||||

1.700% Senior Notes |

Level 2 | (2) |

$ | 498 | $ | 452 | $ | 497 | $ | 446 | ||||||||||||||||||||||

4.250% Senior Notes |

Level 2 | (2) |

$ | 495 | $ | 478 | $ | 493 | $ | 483 | ||||||||||||||||||||||

5.450% Senior Notes |

Level 2 | (2) |

$ | 296 | $ | 297 | $ | — | $ | — | ||||||||||||||||||||||

| JABIL INC. Registrant |

||||||||

Date: October 20, 2023 |

By: | /s/ KENNETH S. WILSON |

||||||

| Kenneth S. Wilson Chief Executive Officer |

||||||||

| Signature | Title | Date | ||||||||||||

| By: | /s/ MARK T. MONDELLO |

Chairman of the Board of Directors |

October 20, 2023 | |||||||||||

| Mark T. Mondello | ||||||||||||||

| By: | /s/ STEVEN A. RAYMUND |

Lead Independent Director | October 20, 2023 | |||||||||||

| Steven A. Raymund | ||||||||||||||

| By: | /s/ THOMAS A. SANSONE |

Vice Chairman of the Board of Directors | October 20, 2023 | |||||||||||

| Thomas A. Sansone | ||||||||||||||

| By: | /s/ KENNETH S. WILSON |

Chief Executive Officer and Director (Principal Executive Officer) |

October 20, 2023 | |||||||||||

| Kenneth S. Wilson | ||||||||||||||

| By: | /s/ MICHAEL DASTOOR |

Chief Financial Officer (Principal Financial and Accounting Officer) |

October 20, 2023 | |||||||||||

| Michael Dastoor | ||||||||||||||

| By: | /s/ ANOUSHEH ANSARI |

Director | October 20, 2023 | |||||||||||

| Anousheh Ansari | ||||||||||||||

| By: | /s/ CHRISTOPHER S. HOLLAND |

Director | October 20, 2023 | |||||||||||

| Christopher S. Holland | ||||||||||||||

| By: | /s/ JOHN C. PLANT |

Director | October 20, 2023 | |||||||||||

| John C. Plant | ||||||||||||||

| By: | /s/ DAVID M. STOUT |

Director | October 20, 2023 | |||||||||||

| David M. Stout | ||||||||||||||

| By: | /s/ KATHLEEN A. WALTERS |

Director | October 20, 2023 | |||||||||||

| Kathleen A. Walters | ||||||||||||||

| Balance at Beginning of Period |

Additions and Adjustments Charged to Costs and Expenses |

Additions/

(Reductions)

Charged

to Other Accounts(1)

|

Write-offs | Balance at End of Period |

||||||||||||||||||||||||||||

Reserve for excess and obsolete inventory: |

||||||||||||||||||||||||||||||||

| Fiscal year ended August 31, 2023 | $ | 82 | $ | 34 | $ | (27) | $ | (31) | $ | 58 | ||||||||||||||||||||||

| Fiscal year ended August 31, 2022 | $ | 85 | $ | 23 | $ | — | $ | (26) | $ | 82 | ||||||||||||||||||||||

| Fiscal year ended August 31, 2021 | $ | 85 | $ | 33 | $ | — | $ | (33) | $ | 85 | ||||||||||||||||||||||

| Balance at Beginning of Period |

Additions Charged to Costs and Expenses |

Additions/ (Reductions) Charged to Other Accounts |

Reductions Charged to Costs and Expenses |

Balance at End of Period |

||||||||||||||||||||||||||||

| Valuation allowance for deferred taxes: | ||||||||||||||||||||||||||||||||

| Fiscal year ended August 31, 2023 | $ | 281 | $ | 28 | $ | 9 | $ | (15) | $ | 303 | ||||||||||||||||||||||

| Fiscal year ended August 31, 2022 | $ | 353 | $ | 19 | $ | (31) | $ | (60) | $ | 281 | ||||||||||||||||||||||

| Fiscal year ended August 31, 2021 | $ | 341 | $ | 18 | $ | — | $ | (6) | $ | 353 | ||||||||||||||||||||||

Exhibit 10.9

Certain identified information has been excluded from this exhibit because

it is both (i) not material and (ii) treated as confidential by the Registrant.

EXECUTION VERSION

September 26, 2023

BYD ELECTRONIC (INTERNATIONAL) COMPANY LIMITED

and

JABIL CIRCUIT (SINGAPORE) PTE. LTD.

AGREEMENT

FOR THE SALE AND PURCHASE OF

SHARES IN

JUNO NEWCO TARGET HOLDCO SINGAPORE PTE. LTD.

AND CERTAIN ASSETS OF

JABIL CIRCUIT (SINGAPORE) PTE. LTD.

CONTENTS

| Clause |

Page | |||||

| 1. |

DEFINITIONS AND INTERPRETATION | 2 | ||||

| 2. |

SALE AND PURCHASE OF THE SHARES AND SPECIFIED SINGAPORE ASSETS | 16 | ||||

| 3. |

DEPOSIT AND CONSIDERATION | 17 | ||||

| 4. |

CONDITIONS PRECEDENT | 20 | ||||

| 5. |

PRE-CLOSING UNDERTAKINGS | 22 | ||||

| 6. |

COMPLETION | 35 | ||||

| 7. |

SELLER WARRANTIES | 36 | ||||

| 8. |

PURCHASER WARRANTIES | 37 | ||||

| 9. |

ADDITIONAL UNDERTAKINGS | 37 | ||||

| 10. |

TAX MATTERS | 42 | ||||

| 11. |

EMPLOYEE MATTERS | 45 | ||||

| 12. |

TERMINATION | 49 | ||||

| 13. |

ANNOUNCEMENTS | 51 | ||||

| 14. |

CONFIDENTIALITY | 51 | ||||

| 15. |

NOTICES | 53 | ||||

| 16. |

ASSIGNMENT | 53 | ||||

| 17. |

COSTS AND EXPENSES | 54 | ||||

| 18. |

SEVERABILITY | 54 | ||||

| 19. |

THIRD PARTY RIGHTS | 54 | ||||

| 20. |

COUNTERPARTS | 55 | ||||

| 21. |

VARIATION AND WAIVER | 55 | ||||

| 22. |

ENTIRE AGREEMENT | 55 | ||||

| 23. |

FURTHER ASSURANCE | 56 | ||||

| 24. |

GOVERNING LAW; DISPUTE RESOLUTION | 58 | ||||

| 25. |

SPECIFIC PERFORMANCE | 58 | ||||

| 26. |

MISCELLANEOUS | 59 | ||||

| SCHEDULE 1 SELLER REORGANIZATION |

S-1-1 | |||||

| SCHEDULE 2 CONDUCT OF BUSINESS PRIOR TO CLOSING |

S-2-1 | |||||

| SCHEDULE 3 COMPLETION |

S-3-1 | |||||

| PART 1 ACTIONS TO BE TAKEN BY SELLER |

S-3-1 | |||||

| PART 2 ACTIONS TO BE TAKEN BY PURCHASER |

S-3-3 | |||||

| SCHEDULE 4 SELLER WARRANTIES |

S-4-1 | |||||

| SCHEDULE 5 PURCHASER WARRANTIES |

S-5-1 | |||||

| SCHEDULE 6 CLOSING STATEMENTS |

S-6-1 | |||||

| PART 1 CERTAIN DEFINITIONS AND PRINCIPLES OF CLOSING STATEMENTS |

S-6-1 | |||||

| PART 2 PREPARATION OF THE FINAL CLOSING STATEMENT |

S-6-2 | |||||

| PART 3 ACCOUNTING PRINCIPLES |

S-6-7 | |||||

| SCHEDULE 7 LIMITATION OF LIABILITIES |

S-7-1 | |||||

| SCHEDULE 8 REORGANIZATION TAXES AND BULLETIN 7 PROCEDURES |

S-8-1 | |||||

| SCHEDULE 9 SUBSIDY ENTITLEMENT |

S-9-1 | |||||

i

| EXHIBIT A TRANSITION SERVICES AGREEMENT | E-A-1 | |

| EXHIBIT B IP LICENSE AGREEMENT | E-B-1 | |

| EXHIBIT C PURCHASER PARENT SHAREHOLDER APPROVAL | E-C-1 | |

| EXHIBIT D LOAN AGREEMENT | E-D-1 | |

| EXHIBIT E ESCROW AGREEMENT | E-E-1 | |

| EXHIBIT F ASSIGNMENT AND ASSUMPTION AGREEMENT | E-F-1 |

ii

INDEX OF DEFINED TERMS

| Accounting Principles |

1.1 | |||

| Affiliate |

1.1 | |||

| Affiliate Contract |

1.1 | |||

| Agreement |

1.1 | |||

| Annual Severance Payment |

11.4.3 | |||

| Anti-Bribery Laws |

Schedule 4 | |||

| Antitrust Laws |

1.1 | |||

| Assignment and Assumption Agreement |

2.3.3 | |||

| Assumed Incentive Amount |

11.3.1 | |||

| Assumed Liabilities |

2.3.2 | |||

| Audited Entity Financial Information |

Schedule 4 | |||

| Basket |

Schedule 7 | |||

| Benchmark Time |

1.1 | |||

| Benefit Plan |

1.1 | |||

| Bulletin 7 |

10.8 | |||

| Business |

1.1 | |||

| Business Day |

1.1 | |||

| Business Employee |

1.1 | |||

| Business IP |

1.1 | |||

| Cash |

1.1 | |||

| Cause |

1.1 | |||

| Claim |

1.1 | |||

| Closing |

6.1 | |||

| Closing Conditions |

1.1 | |||

| Closing Date |

6.1 | |||

| Closing Purchase Price |

3.3 | |||

| Code |

1.1 | |||

| Company |

Recitals | |||

| Company Benefit Plan |

1.1 | |||

| Confidentiality Agreement |

1.1 | |||

| Consent |

1.1 | |||

| Consolidated Return |

1.1 | |||

| Consultation Period |

Schedule 6 | |||

| Contagion Event |

1.1 | |||

| Continuation Period |

11.2.1 | |||

| Contract |

1.1 | |||

| Copyrights |

1.1 | |||

| Corporate Functions |

1.1 | |||

| COVID-19 |

1.1 | |||

| COVID-19 Measures |

1.1 | |||

| CTU |

1.1 | |||

| Cutoff Time |

1.1 | |||

| Cyber Security and Data Protection Related Laws |

1.1 | |||