UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 18, 2023

U.S. BANCORP

(Exact name of registrant as specified in its charter)

1-6880

(Commission File Number)

| Delaware | 41-0255900 | |

| (State or other jurisdiction | (I.R.S. Employer Identification | |

| of incorporation) | Number) |

| 800 Nicollet Mall |

| Minneapolis, Minnesota 55402 |

| (Address of principal executive offices and zip code) |

(651) 466-3000

(Registrant’s telephone number, including area code)

(not applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 Under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, $.01 par value per share | USB | New York Stock Exchange | ||

| Depositary Shares (each representing 1/100th interest in a share of Series A Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrA | New York Stock Exchange | ||

| Depositary Shares (each representing 1/1,000th interest in a share of Series B Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrH | New York Stock Exchange | ||

| Depositary Shares (each representing 1/1,000th interest in a share of Series K Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrP | New York Stock Exchange | ||

| Depositary Shares (each representing 1/1,000th interest in a share of Series L Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrQ | New York Stock Exchange | ||

| Depositary Shares (each representing 1/1,000th interest in a share of Series M Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrR | New York Stock Exchange | ||

| Depositary Shares (each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrS | New York Stock Exchange | ||

| 0.850% Medium-Term Notes, Series X (Senior), due June 7, 2024 | USB/24B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule l2b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section l3(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

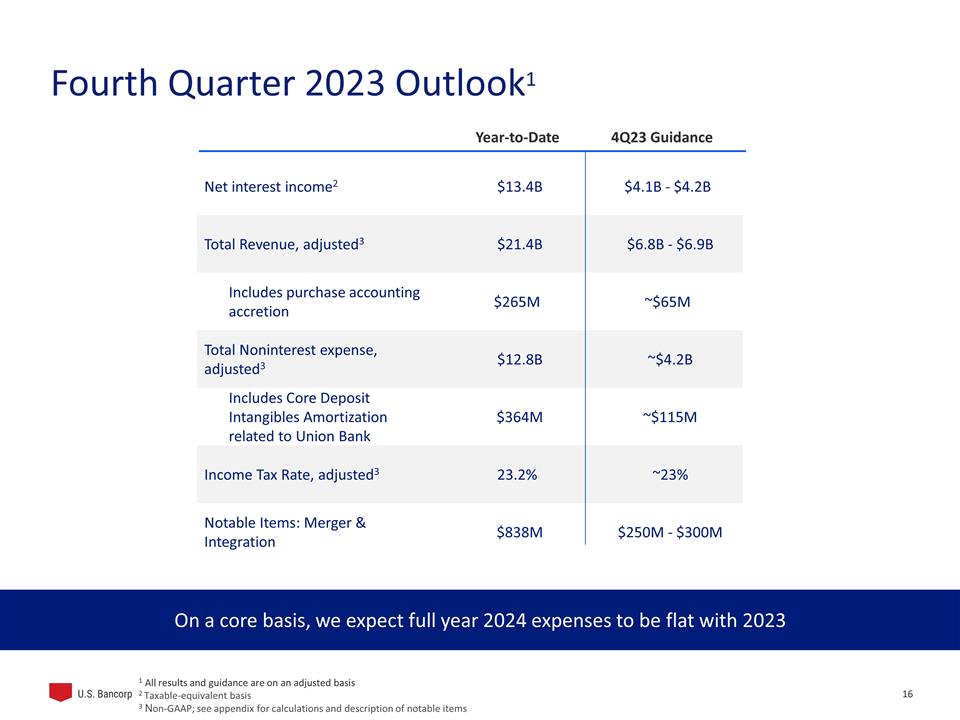

On October 18, 2023, U.S. Bancorp (the “Company”) issued a press release reporting quarter-ended September 30, 2023 results, and posted on its website its 3Q23 Earnings Conference Call Presentation, which contains certain additional historical and forward-looking information relating to the Company. The press release is included as Exhibit 99.1 hereto and is incorporated herein by reference. The information included in the press release is considered to be “filed” under the Securities Exchange Act of 1934. The 3Q23 Earnings Conference Call Presentation is included as Exhibit 99.2 hereto and is incorporated herein by reference. The information included in the 3Q23 Earnings Conference Call Presentation is considered to be “furnished” under the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference in any filings under the Securities Act of 1933. The press release and 3Q23 Earnings Conference Call Presentation contain forward-looking statements regarding the Company and each includes a cautionary statement identifying important factors that could cause actual results to differ materially from those anticipated.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

| 99.1 |

| 99.2 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| U.S. BANCORP |

| By /s/ Lisa R. Stark |

| Lisa R. Stark |

| Executive Vice President and Controller |

DATE: October 18, 2023

Exhibit 99.1

|

||

|

3Q23 Key Financial Data |

3Q23 Financial Highlights |

|

|

||||||||||||

| PROFITABILITY METRICS |

3Q23 | 2Q23 | 3Q22 | |||||||||

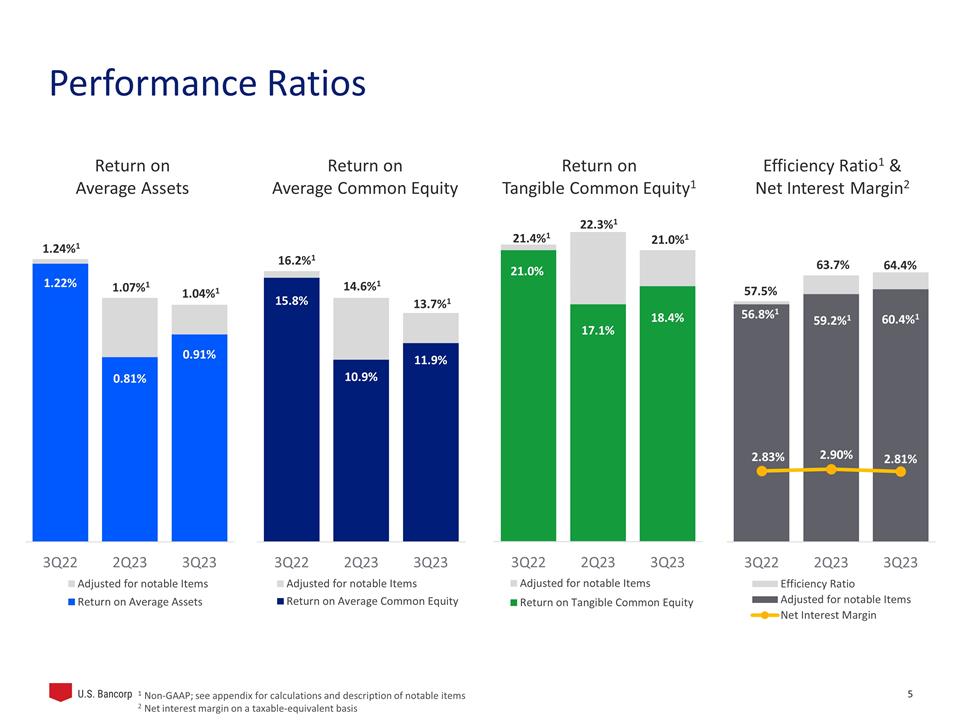

| Return on average assets (%) |

.91 | .81 | 1.22 | |||||||||

| Return on average common equity (%) |

11.9 | 10.9 | 15.8 | |||||||||

| Return on tangible common equity (%) (a) |

18.4 | 17.1 | 21.0 | |||||||||

| Net interest margin (%) |

2.81 | 2.90 | 2.83 | |||||||||

| Efficiency ratio (%) (a) |

64.4 | 63.7 | 57.5 | |||||||||

| Tangible efficiency ratio (%) (a)

|

|

62.1

|

|

|

61.5

|

|

|

56.8

|

|

|||

| INCOME STATEMENT (b) |

3Q23 | 2Q23 | 3Q22 | |||||||||

| Net interest income (taxable-equivalent basis) |

$4,268 | $4,449 | $3,857 | |||||||||

| Noninterest income |

$2,764 | $2,726 | $2,469 | |||||||||

| Net income attributable to U.S. Bancorp |

$1,523 | $1,361 | $1,812 | |||||||||

| Diluted earnings per common share |

$.91 | $.84 | $1.16 | |||||||||

| Dividends declared per common share

|

|

$.48

|

|

|

$.48

|

|

|

$.48

|

|

|||

| BALANCE SHEET (b) |

3Q23 | 2Q23 | 3Q22 | |||||||||

| Average total loans |

$376,877 | $388,817 | $336,778 | |||||||||

| Average total deposits |

$512,291 | $497,265 | $456,769 | |||||||||

| Net charge-off ratio |

.44% | .67% | .19% | |||||||||

| Book value per common share (period end) |

$29.74 | $30.14 | $27.39 | |||||||||

| Basel III standardized CET1 (c) |

9.7% | 9.1% | 9.7% | |||||||||

| (a) See Non-GAAP Financial Measures reconciliation on page 18 |

| (b) Dollars in millions, except per share data |

| (c) CET1 = Common equity tier 1 capital ratio |

|

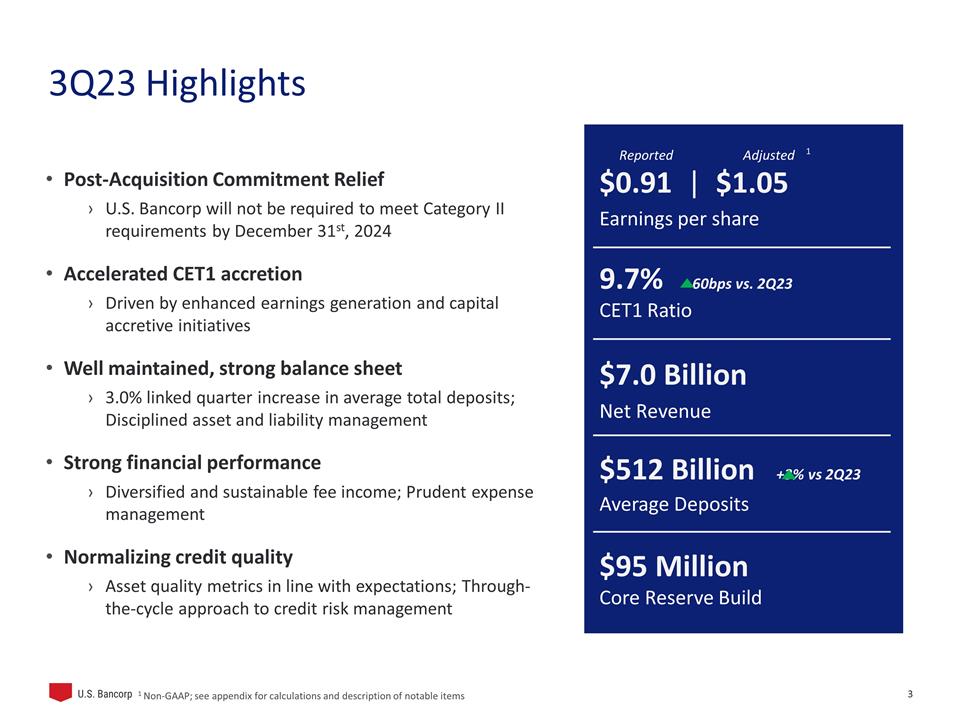

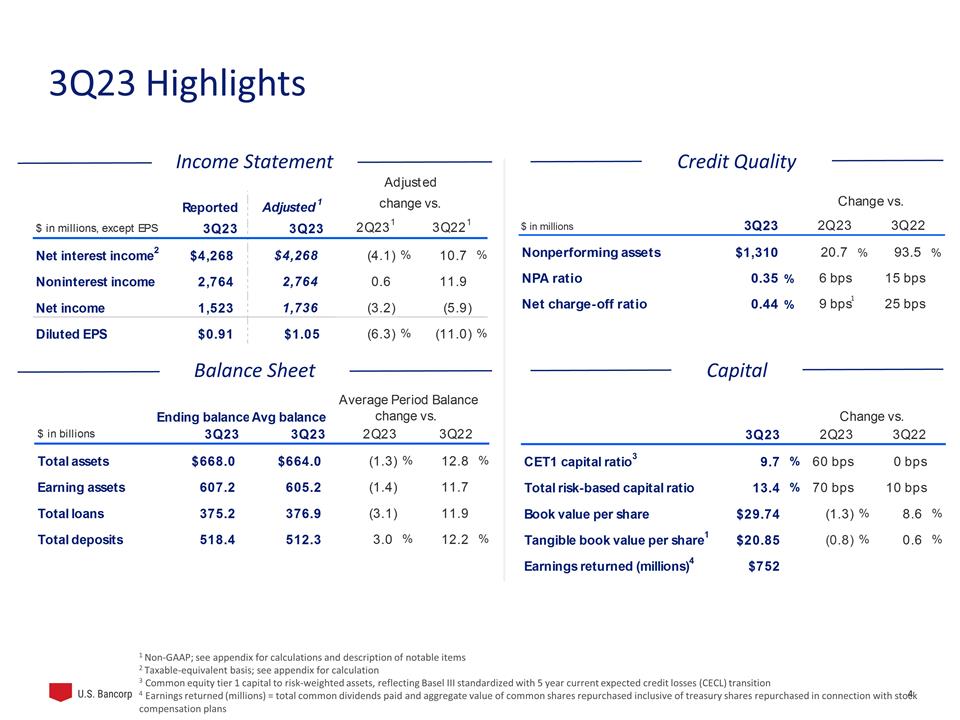

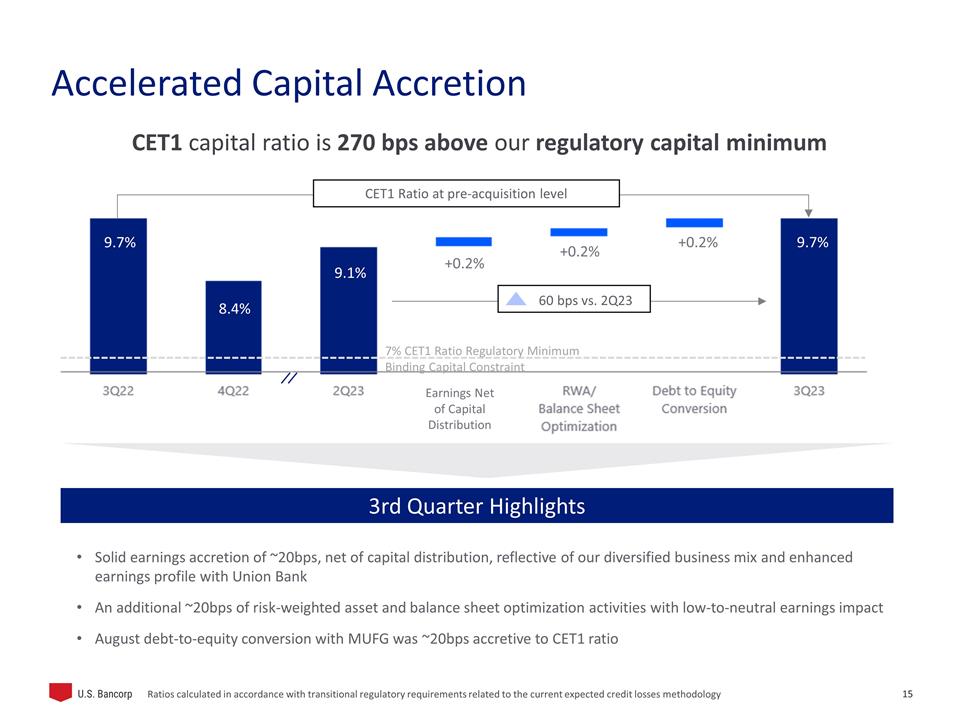

• CET1 capital ratio of 9.7% at September 30, 2023, compared with 9.1% at June 30, 2023

• Net income of $1,736 million and diluted earnings per common share of $1.05 as adjusted for merger and integration-related charges associated with the acquisition of MUFG Union Bank (“MUB”)

• Net revenue of $7,032 million including $4,268 million of net interest income on a taxable-equivalent basis and $2,764 million of noninterest income

• Reported results include merger and integration-related charges of $213 million net-of-tax, or $(0.14) per diluted common share

• Return on average assets of 1.04%, return on average common equity of 13.7%, and efficiency ratio of 60.4% as adjusted for merger and integration-related charges

• Net interest income on a taxable-equivalent basis increased 10.7% year-over-year due to the impact of the acquisition of MUB and rising interest rates on earning assets and decreased 4.1% linked quarter due to deposit mix and pricing

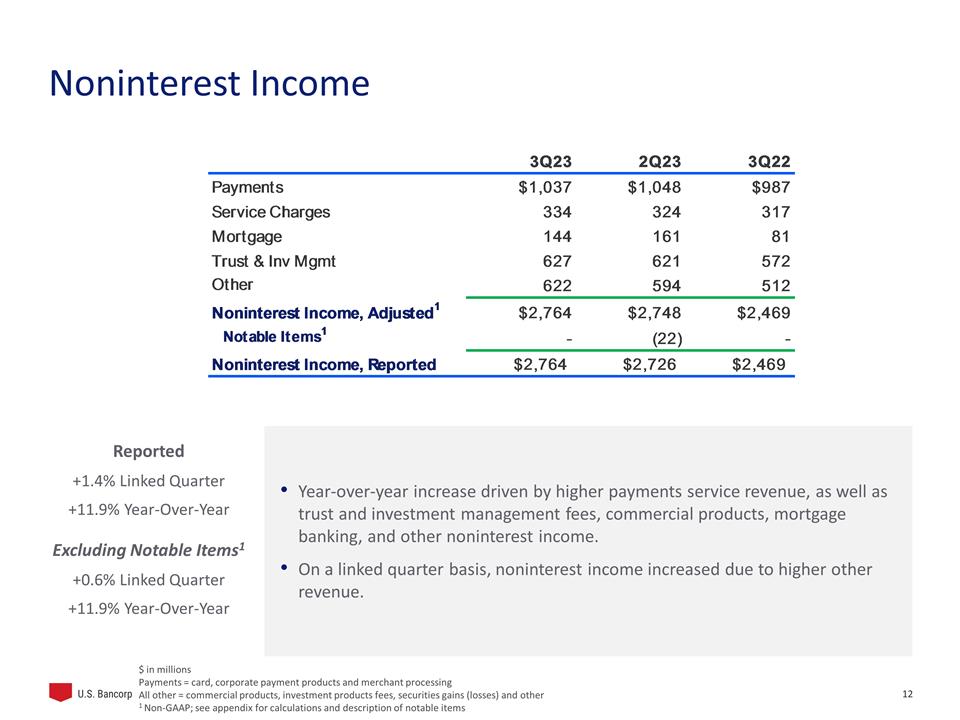

• Noninterest income increased 11.9% year-over-year and 0.6% on linked quarter basis, as adjusted for notable items

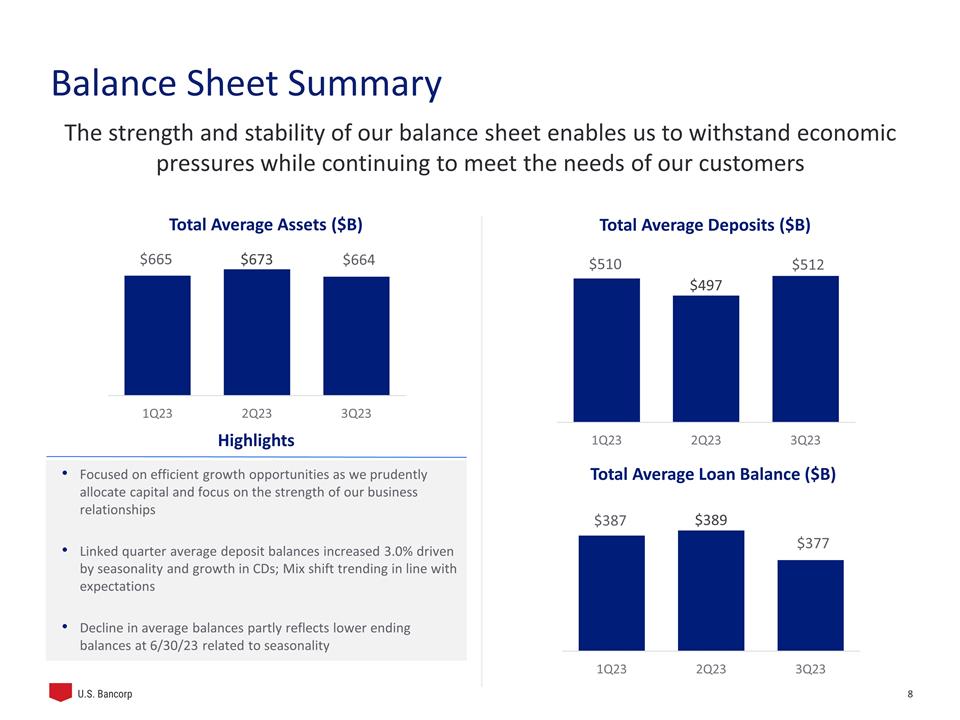

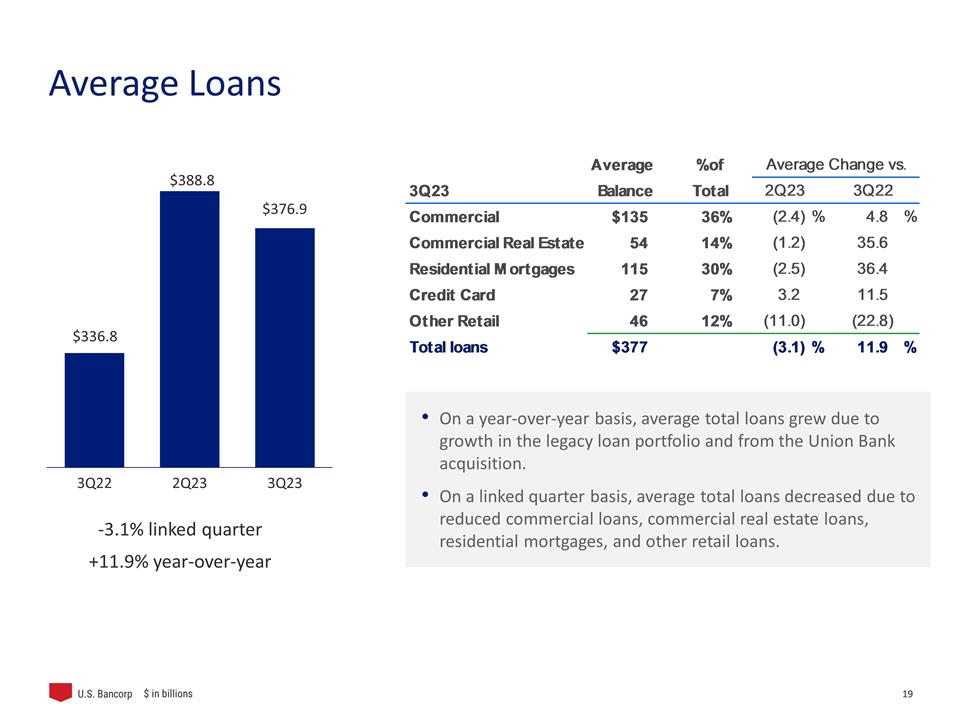

• Average total loan growth of 11.9% year-over-year and a decrease of 3.1% on a linked quarter basis (a decrease of 0.9% adjusted for balance sheet repositioning and capital management actions)

• Average total deposit growth of 12.2% year-over-year and 3.0% on linked quarter basis

|

| CEO Commentary

|

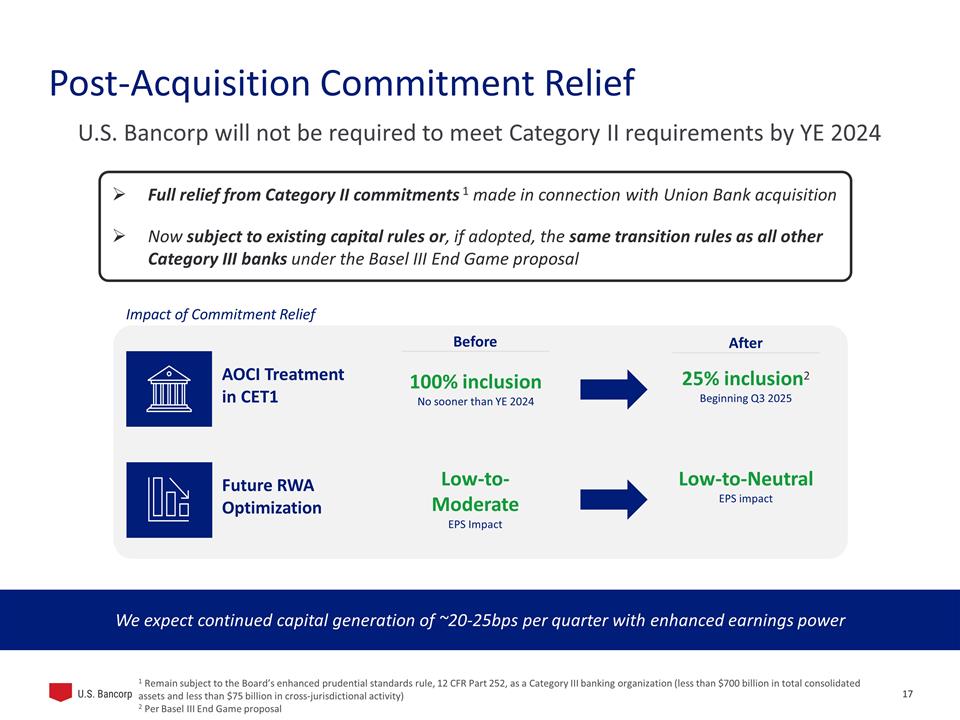

“In the third quarter we delivered earnings per diluted share of $1.05 and a return on tangible common equity of 21.0 percent, both as adjusted for merger and integration-related charges. This quarter our common equity tier 1 ratio increased 60 basis points to 9.7 percent, as we continued to build capital through enhanced earnings generation and capital accretive initiatives. Notably, on October 16th, the Federal Reserve granted us full relief from certain Category II commitments made in connection with the Union Bank acquisition and we are now subject to the same capital rules as all other Category III banks. While the challenging interest rate environment continues to impact net interest income growth for us and the industry, average total deposits increased 3.0 percent, to $512 billion, and third quarter profitability benefited from strength across our diversified fee businesses and disciplined expense management. Third quarter credit quality trends were in line with expectations and we continued to add to our reserve level reflecting prudent assessment of the evolving credit environment. I want to thank all of our employees for their dedication to helping our clients, communities, and shareholders.”

— Andy Cecere, Chairman, President and CEO, U.S. Bancorp

| Business and Other Highlights

|

Number One in Mobile Banking

We continue to lead the way in digital banking. U.S. Bank was ranked number one for mobile banking capabilities and customer experience by Keynova Group for the fifth time in a row, during the third quarter 2023.

Connected Partnership Network

During the quarter, we launched the Connected Partnership Network, an online marketplace of third-party payment and treasury solutions that enables our customers to be more fully integrated with U.S. Bank. The Connected Partnership Network helps corporate treasury teams easily identify and adopt payments capabilities, such as treasury management and working capital automation tools, in an integrated fashion with our banking services.

Notable Item Impacts 2Q23

| ($ in million, except per-share data) | Income Before Taxes |

Net Income Attributable to U.S. Bancorp |

Diluted Earnings Per Common Share |

|||||||||

| Reported |

$1,987 | $1,523 | $ .91 | |||||||||

| Notable items |

284 | 213 | .14 | |||||||||

| Adjusted |

$2,271 | $1,736 | $1.05 | |||||||||

| Notable Items | ||||||||||||

| ($ in millions) | 3Q23 | 2Q23 | 3Q22 | |||||||||

| Balance sheet optimization |

$ — | $22 | $ — | |||||||||

| Merger and integration charges |

284 | 310 | 42 | |||||||||

| Provision for credit losses |

— | 243 | — | |||||||||

| Total notable items |

$284 | $575 | $42 | |||||||||

Investor contact: George Andersen, 612.303.3620 | Media contact: Jeff Shelman, 612.303.9933

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| INCOME STATEMENT HIGHLIGHTS | ||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, except per-share data) | ADJUSTED (a) (b) | |||||||||||||||||||||||||||||||||||||||||

| Percent Change | Percent Change | |||||||||||||||||||||||||||||||||||||||||

| 3Q | 2Q | 3Q | 3Q23 vs | 3Q23 vs | 3Q | 2Q | 3Q | 3Q23 vs | 3Q23 vs | |||||||||||||||||||||||||||||||||

| 2023 | 2023 | 2022 | 2Q23 | 3Q22 | 2023 | 2023 | 2022 | 2Q23 | 3Q22 | |||||||||||||||||||||||||||||||||

| Net interest income |

$ | 4,236 | $ | 4,415 | $ | 3,827 | (4.1 | ) | 10.7 | $ | 4,236 | $ | 4,415 | $ | 3,827 | (4.1 | ) | 10.7 | ||||||||||||||||||||||||

| Taxable-equivalent adjustment |

32 | 34 | 30 | (5.9 | ) | 6.7 | 32 | 34 | 30 | (5.9 | ) | 6.7 | ||||||||||||||||||||||||||||||

| Net interest income (taxable-equivalent basis) |

4,268 | 4,449 | 3,857 | (4.1 | ) | 10.7 | 4,268 | 4,449 | 3,857 | (4.1 | ) | 10.7 | ||||||||||||||||||||||||||||||

| Noninterest income |

2,764 | 2,726 | 2,469 | 1.4 | 11.9 | 2,764 | 2,748 | 2,469 | .6 | 11.9 | ||||||||||||||||||||||||||||||||

| Total net revenue |

7,032 | 7,175 | 6,326 | (2.0 | ) | 11.2 | 7,032 | 7,197 | 6,326 | (2.3 | ) | 11.2 | ||||||||||||||||||||||||||||||

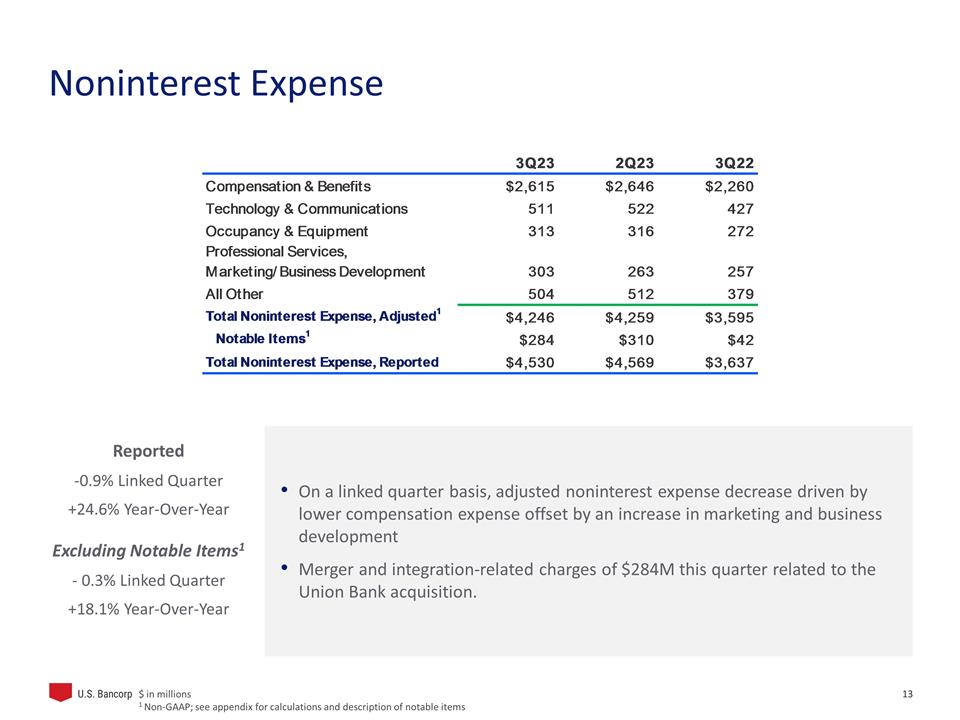

| Noninterest expense |

4,530 | 4,569 | 3,637 | (.9 | ) | 24.6 | 4,246 | 4,259 | 3,595 | (.3 | ) | 18.1 | ||||||||||||||||||||||||||||||

| Income before provision and income taxes |

2,502 | 2,606 | 2,689 | (4.0 | ) | (7.0 | ) | 2,786 | 2,938 | 2,731 | (5.2 | ) | 2.0 | |||||||||||||||||||||||||||||

| Provision for credit losses |

515 | 821 | 362 | (37.3 | ) | 42.3 | 515 | 578 | 362 | (10.9 | ) | 42.3 | ||||||||||||||||||||||||||||||

| Income before taxes |

1,987 | 1,785 | 2,327 | 11.3 | (14.6 | ) | 2,271 | 2,360 | 2,369 | (3.8 | ) | (4.1 | ) | |||||||||||||||||||||||||||||

| Income taxes and taxable-equivalent adjustment |

463 | 416 | 511 | 11.3 | (9.4 | ) | 534 | 559 | 520 | (4.5 | ) | 2.7 | ||||||||||||||||||||||||||||||

| Net income |

1,524 | 1,369 | 1,816 | 11.3 | (16.1 | ) | 1,737 | 1,801 | 1,849 | (3.6 | ) | (6.1 | ) | |||||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests |

(1 | ) | (8 | ) | (4 | ) | 87.5 | 75.0 | (1 | ) | (8 | ) | (4 | ) | 87.5 | 75.0 | ||||||||||||||||||||||||||

| Net income attributable to U.S. Bancorp |

$ | 1,523 | $ | 1,361 | $ | 1,812 | 11.9 | (15.9 | ) | $ | 1,736 | $ | 1,793 | $ | 1,845 | (3.2 | ) | (5.9 | ) | |||||||||||||||||||||||

| Net income applicable to U.S. Bancorp common shareholders |

$ | 1,412 | $ | 1,281 | $ | 1,718 | 10.2 | (17.8 | ) | $ | 1,624 | $ | 1,710 | $ | 1,751 | (5.0 | ) | (7.3 | ) | |||||||||||||||||||||||

| Diluted earnings per common share |

$ | .91 | $ | .84 | $ | 1.16 | 8.3 | (21.6 | ) | $ | 1.05 | $ | 1.12 | $ | 1.18 | (6.3 | ) | (11.0 | ) | |||||||||||||||||||||||

| (a) 3Q23 excludes $284 ($213 million net-of-tax) of merger and integration-related charges. 2Q23 excludes $575 million ($432 million net-of-tax) of notable items including: $(22) million of noninterest income related to balance sheet repositioning and capital management actions, $310 million of merger and integration-related charges and $243 million of provision for credit losses related to balance sheet repositioning and capital management actions. 3Q22 excludes $42 million ($33 million net-of-tax) of merger and integration-related charges. |

|

|||||||||||||||||||||||||||||||||||||||||

| (b) See Non-GAAP Financial Measures reconciliation on page 18 |

|

|||||||||||||||||||||||||||||||||||||||||

| INCOME STATEMENT HIGHLIGHTS | ||||||||||||||||||||||||||

| ($ in millions, except per-share data) | ADJUSTED (c) (d) | |||||||||||||||||||||||||

| YTD | YTD | Percent | YTD | YTD | Percent | |||||||||||||||||||||

| 2023 | 2022 | Change | 2023 | 2022 | Change | |||||||||||||||||||||

| Net interest income |

$ | 13,285 | $ | 10,435 | 27.3 | $ | 13,285 | $ | 10,435 | 27.3 | ||||||||||||||||

| Taxable-equivalent adjustment |

100 | 86 | 16.3 | 100 | 86 | 16.3 | ||||||||||||||||||||

| Net interest income (taxable-equivalent basis) |

13,385 | 10,521 | 27.2 | 13,385 | 10,521 | 27.2 | ||||||||||||||||||||

| Noninterest income |

7,997 | 7,413 | 7.9 | 8,019 | 7,413 | 8.2 | ||||||||||||||||||||

| Total net revenue |

21,382 | 17,934 | 19.2 | 21,404 | 17,934 | 19.3 | ||||||||||||||||||||

| Noninterest expense |

13,654 | 10,863 | 25.7 | 12,816 | 10,624 | 20.6 | ||||||||||||||||||||

| Income before provision and income taxes |

7,728 | 7,071 | 9.3 | 8,588 | 7,310 | 17.5 | ||||||||||||||||||||

| Provision for credit losses |

1,763 | 785 | nm | 1,520 | 785 | 93.6 | ||||||||||||||||||||

| Income before taxes |

5,965 | 6,286 | (5.1 | ) | 7,068 | 6,525 | 8.3 | |||||||||||||||||||

| Income taxes and taxable-equivalent adjustment |

1,368 | 1,378 | (.7 | ) | 1,643 | 1,431 | 14.8 | |||||||||||||||||||

| Net income |

4,597 | 4,908 | (6.3 | ) | 5,425 | 5,094 | 6.5 | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests |

(15 | ) | (8 | ) | (87.5 | ) | (15 | ) | (8 | ) | (87.5 | ) | ||||||||||||||

| Net income attributable to U.S. Bancorp |

$ | 4,582 | $ | 4,900 | (6.5 | ) | $ | 5,410 | $ | 5,086 | 6.4 | |||||||||||||||

| Net income applicable to U.S. Bancorp common shareholders |

$ | 4,285 | $ | 4,648 | (7.8 | ) | $ | 5,107 | $ | 4,834 | 5.6 | |||||||||||||||

| Diluted earnings per common share |

$ | 2.79 | $ | 3.13 | (10.9 | ) | $ | 3.32 | $ | 3.25 | 2.2 | |||||||||||||||

| (c) 2023 excludes $1.1 billion ($828 million net-of-tax) of notable items including: $(22) million of noninterest income related to balance sheet repositioning and capital management actions, $838 million of merger and integration-related charges and $243 million of provision for credit losses related to balance sheet repositioning and capital management actions. 2022 excludes $239 million ($186 million net-of-tax) of merger and integration-related charges. |

|

|||||||||||||||||||||||||

| (d) See Non-GAAP Financial Measures reconciliation on page 18 |

|

|||||||||||||||||||||||||

2

|

|

U.S. Bancorp Third Quarter 2023 Results | |

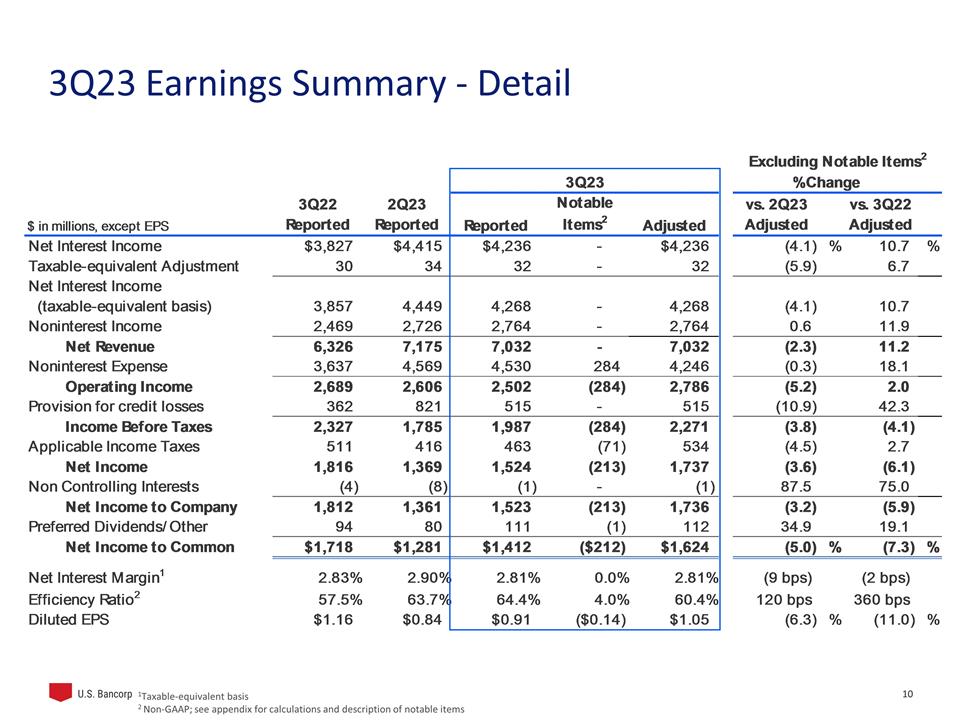

Net income attributable to U.S. Bancorp was $1,523 million for the third quarter of 2023, which was $289 million lower than the $1,812 million for the third quarter of 2022 and $162 million higher than the $1,361 million for the second quarter of 2023. Diluted earnings per common share was $0.91 in the third quarter of 2023, compared with $1.16 in the third quarter of 2022 and $0.84 in the second quarter of 2023. The third quarter of 2023 included $213 million, or $(0.14) per diluted common share, of merger and integration-related charges net-of-tax associated with the acquisition of MUB, compared with $33 million $(0.02) per diluted common share in the third quarter of 2022, and notable items net-of-tax of $432 million, or $(0.28) per diluted common share, in the second quarter of 2023. On an adjusted basis, excluding the impacts of these merger and integration-related charges and other notable items, net income applicable to common shareholders for the third quarter of 2023 was $1,624 million, which was $127 million lower than the third quarter of 2022 and $86 million lower than the second quarter of 2023. Adjusted diluted earnings per common share was $1.05 in the third quarter of 2023, representing a 11.0 percent decrease from the third quarter of 2022 and a 6.3 percent decrease from the second quarter of 2023.

The decrease in net income attributable to U.S. Bancorp year-over-year was driven by higher provision expense and noninterest expense, including the merger and integration-related charges, partially offset by higher total net revenue. Pretax income excluding merger and integration charges in the third quarter decreased 4.1 percent compared with a year ago. Net interest income increased 10.7 percent on a year-over-year taxable-equivalent basis due to the impact of rising interest rates on earning assets and the impact of the MUB acquisition. The net interest margin decreased to 2.81 percent in the third quarter of 2023 from 2.83 percent in the third quarter of 2022 primarily due to deposit mix and pricing, partially offset by the impact of higher rates on earning assets and the acquisition of MUB. Noninterest income increased 11.9 percent compared with a year ago driven by higher payment services revenue, trust and investment management fees, commercial products revenue, mortgage banking revenue and other noninterest income. Noninterest expense increased 24.6 percent (18.1 percent excluding merger and integration-related charges), primarily driven by MUB operating expenses, including core deposit intangible amortization expense, and higher compensation expense to support business growth. Provision for credit losses increased $153 million compared with the third quarter of 2022 driven by the acquisition of MUB, normalizing credit losses and continued economic uncertainty.

Net income attributable to U.S. Bancorp increased 11.9 percent on a linked quarter basis reflecting higher noninterest income and lower provision for credit losses, partially offset by lower net interest income. Pretax income excluding notable items decreased 3.8 percent on a linked quarter basis. Net interest income decreased 4.1 percent on a taxable-equivalent basis due to deposit mix and pricing, partially offset by the impact of rising interest rates on earning assets and balance sheet repositioning. The net interest margin decreased to 2.81 percent in the third quarter of 2023 from 2.90 percent in the second quarter of 2023 driven by similar factors. Noninterest income increased 1.4 percent (0.6 percent excluding notable items) compared with the second quarter of 2023 driven by higher other noninterest income. Noninterest expense decreased 0.9 percent on a linked quarter basis driven by lower merger and integration-related charges. Excluding merger and integration-related charges, noninterest expense decreased 0.3 percent due to prudent expense management. Provision for credit losses decreased $306 million ($63 million excluding prior quarter notable items) compared with the second quarter of 2023 primarily due to relative stability in the economic outlook, partially offset by commercial real estate credit quality and normalizing credit losses.

3

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| NET INTEREST INCOME | ||||||||||||||||||||||||||||||||

| (Taxable-equivalent basis; $ in millions) | Change | |||||||||||||||||||||||||||||||

| 2Q 2023 |

2Q 2023 |

3Q 2022 |

3Q23 vs 2Q23 |

3Q23 vs 3Q22 |

YTD 2023 |

YTD 2022 |

Change | |||||||||||||||||||||||||

| Components of net interest income |

||||||||||||||||||||||||||||||||

| Income on earning assets |

$7,788 | $7,562 | $4,759 | $226 | $3,029 | $22,349 | $12,058 | $10,291 | ||||||||||||||||||||||||

| Expense on interest-bearing liabilities |

3,520 | 3,113 | 902 | 407 | 2,618 | 8,964 | 1,537 | 7,427 | ||||||||||||||||||||||||

| Net interest income |

$4,268 | $4,449 | $3,857 | $(181) | $411 | $13,385 | $10,521 | $2,864 | ||||||||||||||||||||||||

| Average yields and rates paid |

||||||||||||||||||||||||||||||||

| Earning assets yield |

5.12% | 4.94% | 3.50% | .18% | 1.62% | 4.90% | 3.00% | 1.90% | ||||||||||||||||||||||||

| Rate paid on interest-bearing liabilities |

2.87 | 2.60 | .89 | .27 | 1.98 | 2.52 | .53 | 1.99 | ||||||||||||||||||||||||

| Gross interest margin |

2.25% | 2.34% | 2.61% | (.09)% | (.36)% | 2.38% | 2.47% | (.09)% | ||||||||||||||||||||||||

| Net interest margin |

2.81% | 2.90% | 2.83% | (.09)% | (.02)% | 2.94% | 2.62% | .32% | ||||||||||||||||||||||||

| Average balances |

||||||||||||||||||||||||||||||||

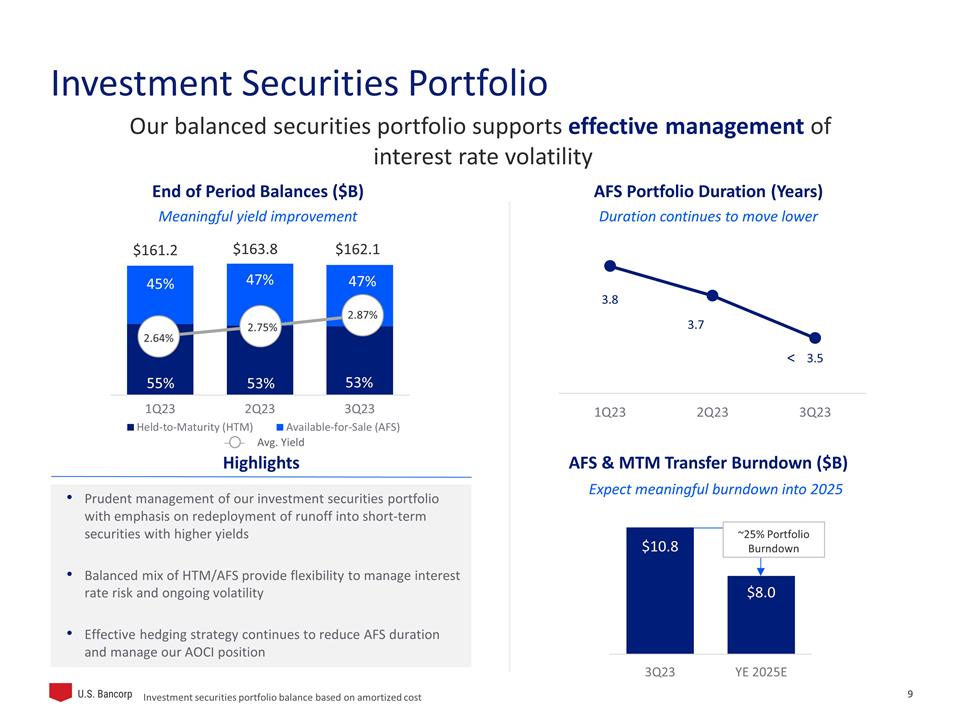

| Investment securities (a) |

$163,236 | $159,824 | $164,851 | $3,412 | $(1,615) | $163,051 | $170,267 | $(7,216) | ||||||||||||||||||||||||

| Loans |

376,877 | 388,817 | 336,778 | (11,940) | 40,099 | 384,112 | 324,731 | 59,381 | ||||||||||||||||||||||||

| Interest-bearing deposits with banks |

53,100 | 51,972 | 29,130 | 1,128 | 23,970 | 49,495 | 30,030 | 19,465 | ||||||||||||||||||||||||

| Earning assets |

605,245 | 613,839 | 541,666 | (8,594) | 63,579 | 608,891 | 536,131 | 72,760 | ||||||||||||||||||||||||

| Interest-bearing liabilities |

486,143 | 480,450 | 403,573 | 5,693 | 82,570 | 474,992 | 390,816 | 84,176 | ||||||||||||||||||||||||

| (a) Excludes unrealized gain (loss) | ||||||||||||||||||||||||||||||||

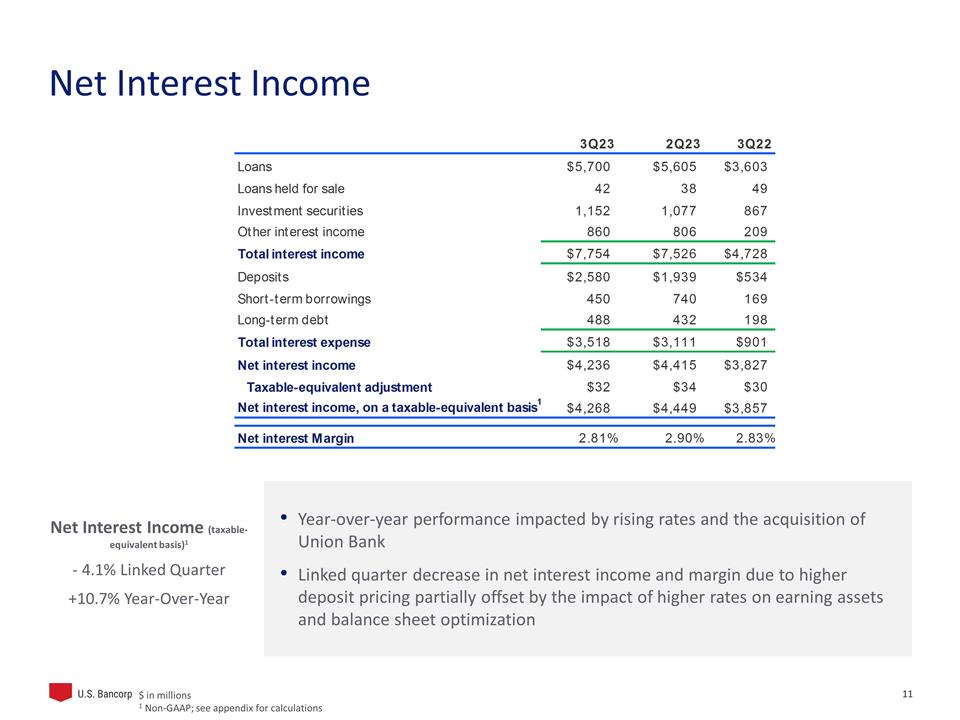

Net interest income on a taxable-equivalent basis in the third quarter of 2023 was $4,268 million, an increase of $411 million (10.7 percent) over the third quarter of 2022. The increase was primarily due to the impact of rising interest rates on earning assets and the acquisition of MUB. Average earning assets were $63.6 billion (11.7 percent) higher than the third quarter of 2022, reflecting increases of $40.1 billion (11.9 percent) in average total loans and $24.0 billion (82.3 percent) in average interest-bearing deposits with banks. Average investment securities decreased $1.6 billion (1.0 percent) reflecting balance sheet repositioning and liquidity management.

Net interest income on a taxable-equivalent basis decreased $181 million (4.1 percent) on a linked quarter basis primarily due to the impact of deposit mix and pricing, partially offset by higher rates on earning assets and balance sheet repositioning and liquidity management. Average earning assets were $8.6 billion (1.4 percent) lower on a linked quarter basis, reflecting a decrease of $11.9 billion (3.1 percent) in average total loans partially offset by an increase of $1.1 billion (2.2 percent) in average interest-bearing deposits with banks. Average investment securities increased $3.4 billion (2.1 percent) reflecting balance sheet repositioning and liquidity management.

The net interest margin in the third quarter of 2023 was 2.81 percent, compared with 2.83 percent in the third quarter of 2022 and 2.90 percent in the second quarter of 2023. The decrease in the net interest margin from the prior year was primarily due to deposit mix and pricing partially offset by higher rates on earning assets and the acquisition of MUB. The decrease in the net interest margin on a linked quarter basis reflected deposit mix and pricing, partially offset by the impact of rising interest rates on earning assets and balance sheet repositioning and liquidity management.

4

|

|

U.S. Bancorp Third Quarter 2023 Results | |

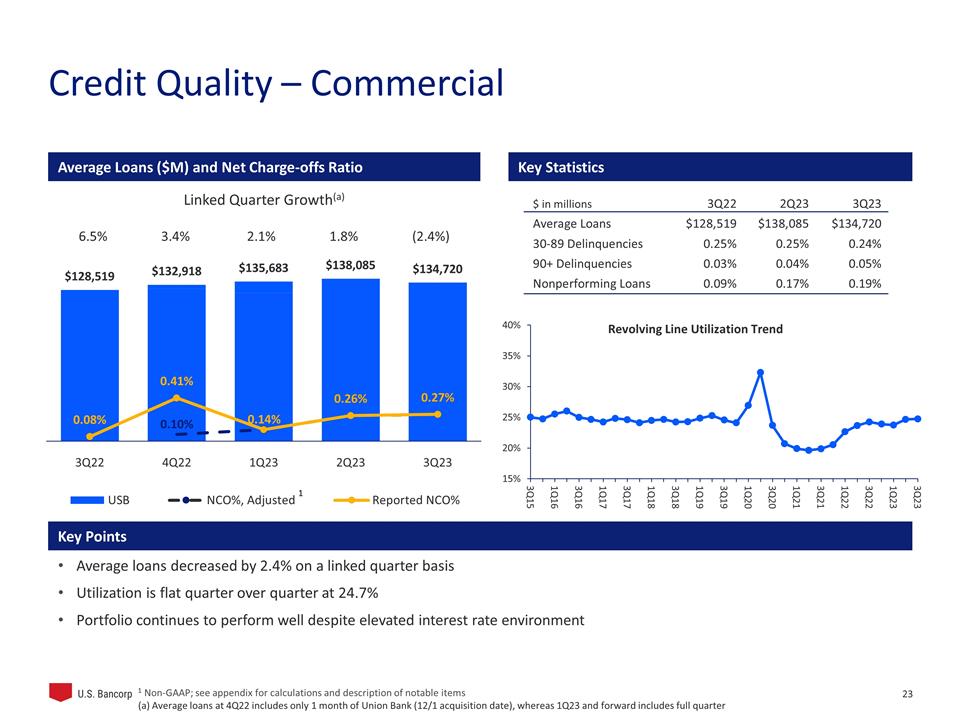

| AVERAGE LOANS | ||||||||||||||||||||||||||||||||

| ($ in millions) | Percent Change | |||||||||||||||||||||||||||||||

| 2Q 2023 |

2Q 2023 |

3Q 2022 |

3Q23 vs 2Q23 |

3Q23 vs 3Q22 |

YTD 2023 |

YTD 2022 |

Percent Change |

|||||||||||||||||||||||||

| Commercial |

$130,415 | $133,697 | $123,745 | (2.5 | ) | 5.4 | $ | 131,777 | $ | 115,832 | 13.8 | |||||||||||||||||||||

| Lease financing |

4,305 | 4,388 | 4,774 | (1.9 | ) | (9.8 | ) | 4,382 | 4,891 | (10.4 | ) | |||||||||||||||||||||

| Total commercial |

134,720 | 138,085 | 128,519 | (2.4 | ) | 4.8 | 136,159 | 120,723 | 12.8 | |||||||||||||||||||||||

| Commercial mortgages |

42,665 | 43,214 | 30,002 | (1.3 | ) | 42.2 | 43,165 | 29,506 | 46.3 | |||||||||||||||||||||||

| Construction and development |

11,588 | 11,720 | 10,008 | (1.1 | ) | 15.8 | 11,758 | 10,035 | 17.2 | |||||||||||||||||||||||

| Total commercial real estate |

54,253 | 54,934 | 40,010 | (1.2 | ) | 35.6 | 54,923 | 39,541 | 38.9 | |||||||||||||||||||||||

| Residential mortgages |

114,627 | 117,606 | 84,018 | (2.5 | ) | 36.4 | 116,167 | 80,589 | 44.1 | |||||||||||||||||||||||

| Credit card |

26,883 | 26,046 | 24,105 | 3.2 | 11.5 | 26,171 | 22,907 | 14.2 | ||||||||||||||||||||||||

| Retail leasing |

4,436 | 4,829 | 6,259 | (8.1 | ) | (29.1 | ) | 4,832 | 6,689 | (27.8 | ) | |||||||||||||||||||||

| Home equity and second mortgages |

12,809 | 12,753 | 11,142 | .4 | 15.0 | 12,779 | 10,757 | 18.8 | ||||||||||||||||||||||||

| Other |

29,149 | 34,564 | 42,725 | (15.7 | ) | (31.8 | ) | 33,081 | 43,525 | (24.0 | ) | |||||||||||||||||||||

| Total other retail |

46,394 | 52,146 | 60,126 | (11.0 | ) | (22.8 | ) | 50,692 | 60,971 | (16.9 | ) | |||||||||||||||||||||

| Total loans |

$376,877 | $388,817 | $336,778 | (3.1 | ) | 11.9 | $ | 384,112 | $ | 324,731 | 18.3 | |||||||||||||||||||||

Average total loans for the third quarter of 2023 were $40.1 billion (11.9 percent) higher than the third quarter of 2022. The increase was driven by growth in the Company’s legacy loan portfolio as well as from the MUB acquisition, which are primarily reflected in commercial loans, commercial mortgages and residential mortgages. Increases in total commercial loans (4.8 percent), total commercial real estate loans (35.6 percent), residential mortgages (36.4 percent) and credit card loans (11.5 percent) were partially offset by lower total other retail loans (22.8 percent). The increase in legacy portfolio commercial loans was due to higher utilization driven by working capital needs of corporate customers, slower pay-offs given higher volatility in the capital markets and core growth. The increase in legacy residential mortgages was driven by on-balance sheet loan activities and slower refinancing activity, partially offset by the sales late in the second quarter of 2023. The increase in credit card loans was primarily driven by higher spend volume and lower payment rates. The decrease in other retail loans was primarily due to balance sheet repositioning and capital management activities.

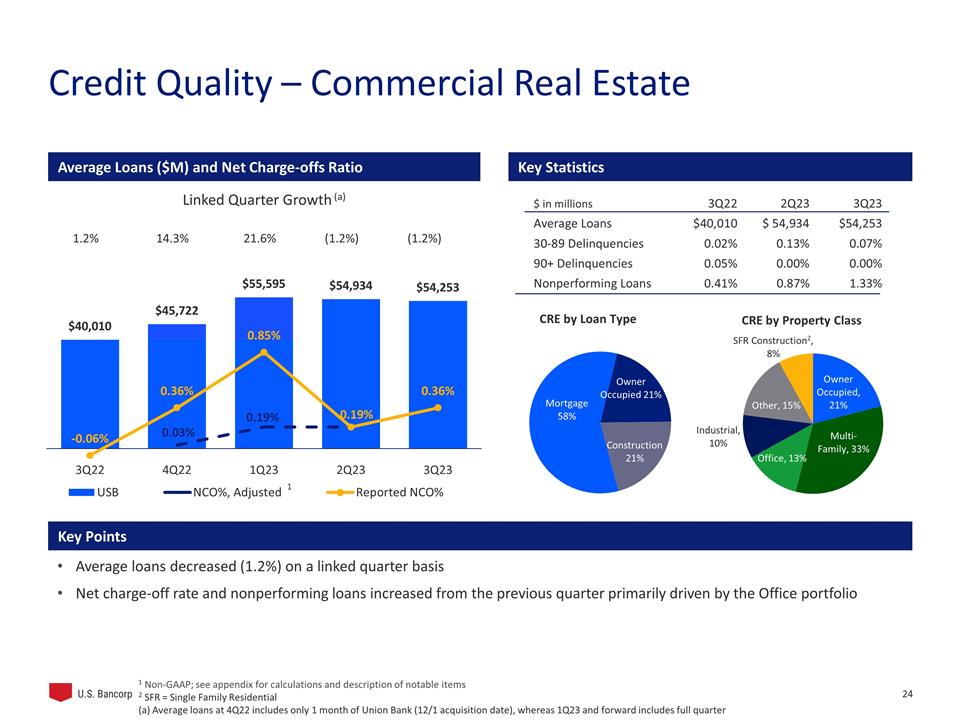

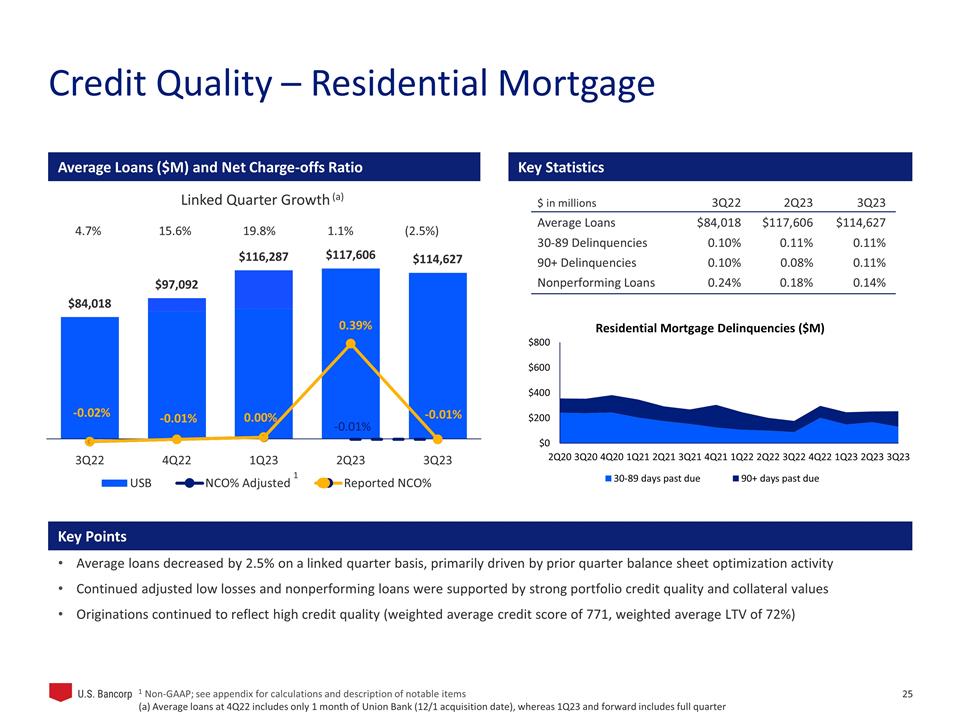

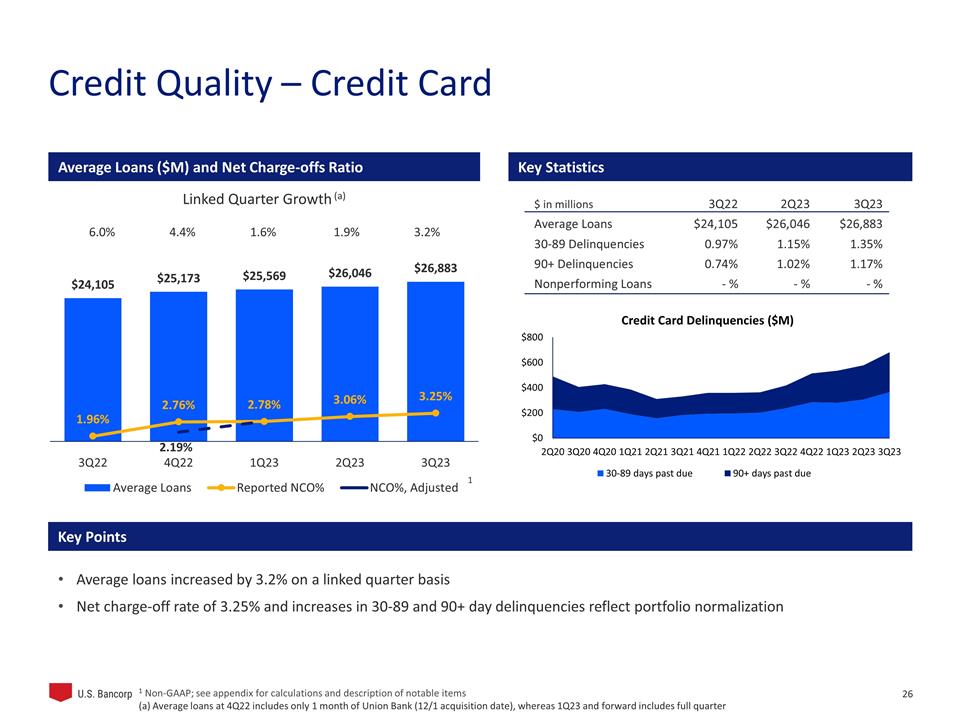

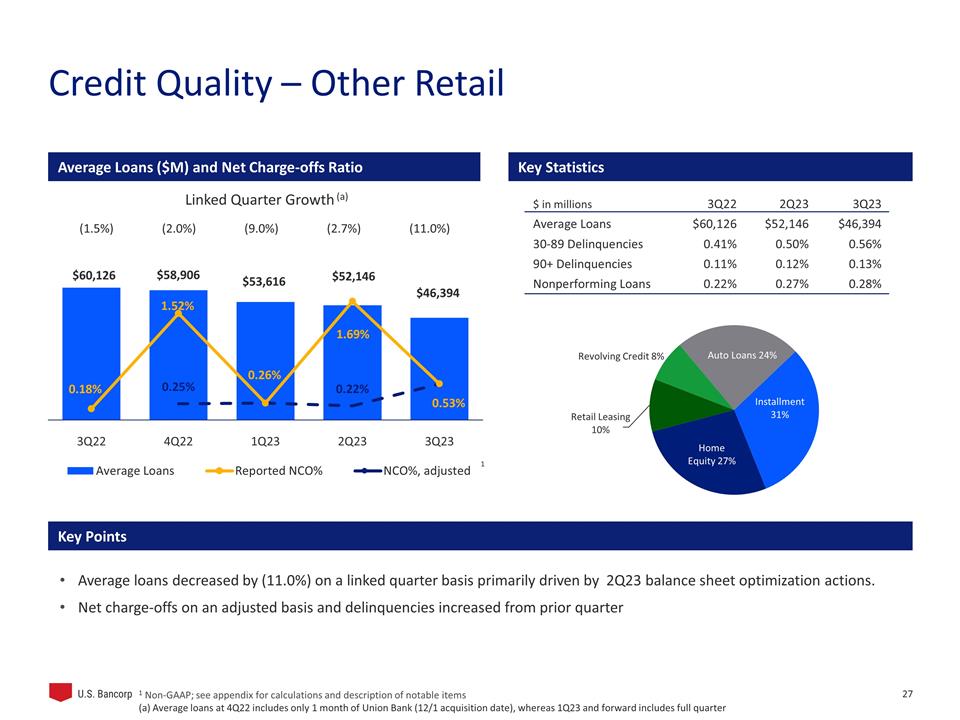

Average total loans were $11.9 billion (3.1 percent) lower than the second quarter of 2023, 0.9 percent lower when adjusted for balance sheet repositioning and capital management actions. Decreases in total commercial loans (2.4 percent), total commercial real estate loans (1.2 percent), residential mortgages (2.5 percent), and lower total other retail loans (11.0 percent) were partially offset by higher credit card loans (3.2 percent).

5

|

|

U.S. Bancorp Third Quarter 2023 Results | |

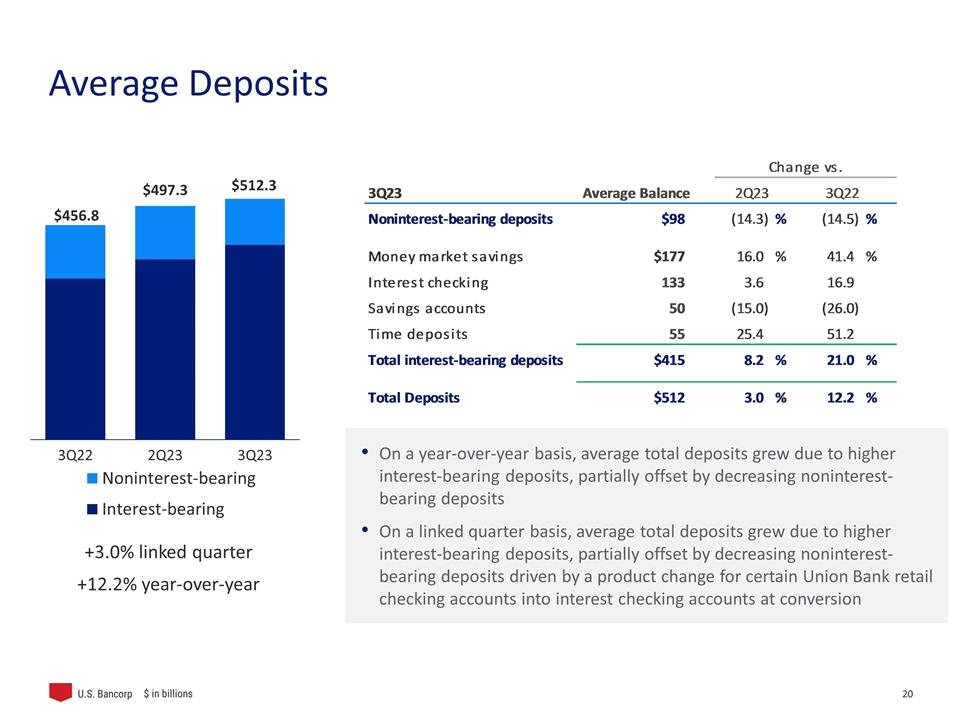

| AVERAGE DEPOSITS | ||||||||||||||||||||||||||||||||

| ($ in millions) | Percent Change | |||||||||||||||||||||||||||||||

| 3Q 2023 |

2Q 2023 |

3Q 2022 |

3Q23 vs 2Q23 |

3Q23 vs 3Q22 |

YTD 2023 |

YTD 2022 |

Percent Change |

|||||||||||||||||||||||||

| Noninterest-bearing deposits |

$ | 97,524 | $ | 113,758 | $ | 114,044 | (14.3 | ) | (14.5 | ) | $ | 113,556 | $ | 120,893 | (6.1 | ) | ||||||||||||||||

| Interest-bearing savings deposits |

||||||||||||||||||||||||||||||||

| Interest checking |

132,560 | 127,994 | 113,364 | 3.6 | 16.9 | 129,980 | 115,095 | 12.9 | ||||||||||||||||||||||||

| Money market savings |

177,340 | 152,893 | 125,389 | 16.0 | 41.4 | 159,178 | 122,943 | 29.5 | ||||||||||||||||||||||||

| Savings accounts |

50,138 | 58,993 | 67,782 | (15.0 | ) | (26.0 | ) | 59,251 | 67,632 | (12.4 | ) | |||||||||||||||||||||

| Total savings deposits |

360,038 | 339,880 | 306,535 | 5.9 | 17.5 | 348,409 | 305,670 | 14.0 | ||||||||||||||||||||||||

| Time deposits |

54,729 | 43,627 | 36,190 | 25.4 | 51.2 | 44,668 | 29,266 | 52.6 | ||||||||||||||||||||||||

| Total interest-bearing deposits |

414,767 | 383,507 | 342,725 | 8.2 | 21.0 | 393,077 | 334,936 | 17.4 | ||||||||||||||||||||||||

| Total deposits |

$ | 512,291 | $ | 497,265 | $ | 456,769 | 3.0 | 12.2 | $ | 506,633 | $ | 455,829 | 11.1 | |||||||||||||||||||

Average total deposits for the third quarter of 2023 were $55.5 billion (12.2 percent) higher than the third quarter of 2022, including the impact of the MUB acquisition. Average noninterest-bearing deposits decreased $16.5 billion (14.5 percent) driven by decreases within Wealth, Corporate, Commercial and Institutional Banking and Consumer and Business Banking, partially offset by the impact of the acquisition of MUB. Average total savings deposits were $53.5 billion (17.5 percent) higher year-over-year driven by increases within Wealth, Corporate, Commercial and Institutional Banking and Consumer and Business Banking, including the impact of the acquisition of MUB. Average time deposits were $18.5 billion (51.2 percent) higher than the prior year third quarter due to the acquisition of MUB partially offset by decreases in Wealth, Corporate, Commercial and Institutional Banking. Changes in time deposits are primarily related to those deposits managed as an alternative to other funding sources, based largely on relative pricing and liquidity characteristics.

Average total deposits increased $15.0 billion (3.0 percent) from the second quarter of 2023. On a linked quarter basis, average noninterest-bearing deposits decreased $16.2 billion (14.3 percent) driven by a product change for certain MUB retail checking accounts into interest checking accounts at conversion to create a better customer experience as well as pricing pressures from rising interest rates. Average total savings deposits increased $20.2 billion (5.9 percent) driven by increases within Wealth, Corporate, Commercial and Institutional Banking and Consumer and Business Banking. Average time deposits were $11.1 billion (25.4 percent) higher on a linked quarter basis mainly in Consumer and Business Banking. Changes in time deposits are primarily related to those deposits managed as an alternative to other funding sources, based largely on relative pricing and liquidity characteristics.

6

|

|

U.S. Bancorp Third Quarter 2023 Results | |

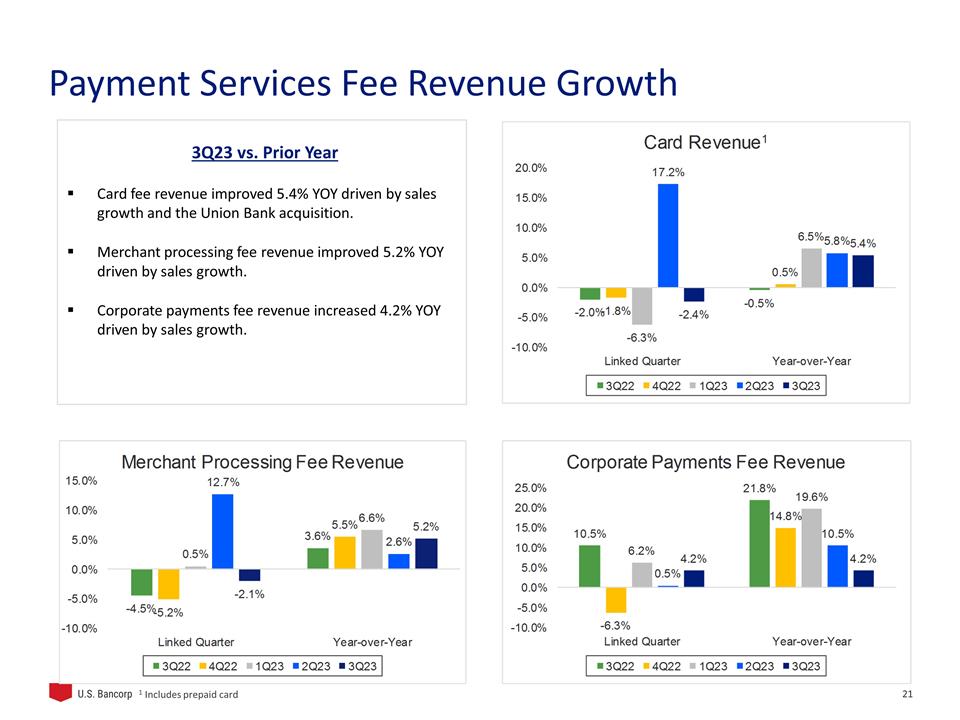

| NONINTEREST INCOME | ||||||||||||||||||||||||||||||||

| ($ in millions) | Percent Change | |||||||||||||||||||||||||||||||

| 3Q 2023 |

2Q 2023 |

3Q 2022 |

3Q23 vs 2Q23 |

3Q23 vs 3Q22 |

YTD 2023 |

YTD 2022 |

Percent Change |

|||||||||||||||||||||||||

| Card revenue |

$ | 412 | $ | 422 | $ | 391 | (2.4 | ) | 5.4 | $ | 1,194 | $ | 1,128 | 5.9 | ||||||||||||||||||

| Corporate payment products revenue |

198 | 190 | 190 | 4.2 | 4.2 | 577 | 520 | 11.0 | ||||||||||||||||||||||||

| Merchant processing services |

427 | 436 | 406 | (2.1 | ) | 5.2 | 1,250 | 1,194 | 4.7 | |||||||||||||||||||||||

| Trust and investment management fees |

627 | 621 | 572 | 1.0 | 9.6 | 1,838 | 1,638 | 12.2 | ||||||||||||||||||||||||

| Service charges |

334 | 324 | 317 | 3.1 | 5.4 | 982 | 984 | (.2 | ) | |||||||||||||||||||||||

| Commercial products revenue |

354 | 358 | 285 | (1.1 | ) | 24.2 | 1,046 | 841 | 24.4 | |||||||||||||||||||||||

| Mortgage banking revenue |

144 | 161 | 81 | (10.6 | ) | 77.8 | 433 | 423 | 2.4 | |||||||||||||||||||||||

| Investment products fees |

70 | 68 | 56 | 2.9 | 25.0 | 206 | 177 | 16.4 | ||||||||||||||||||||||||

| Securities gains (losses), net |

-- | 3 | 1 | nm | nm | (29 | ) | 38 | nm | |||||||||||||||||||||||

| Other |

198 | 165 | 170 | 20.0 | 16.5 | 522 | 470 | 11.1 | ||||||||||||||||||||||||

| Total before balance sheet optimization |

2,764 | 2,748 | 2,469 | .6 | 11.9 | 8,019 | 7,413 | 8.2 | ||||||||||||||||||||||||

| Balance sheet optimization |

-- | (22 | ) | -- | nm | nm | (22 | ) | -- | nm | ||||||||||||||||||||||

| Total noninterest income |

$ | 2,764 | $ | 2,726 | $ | 2,469 | 1.4 | 11.9 | $ | 7,997 | $ | 7,413 | 7.9 | |||||||||||||||||||

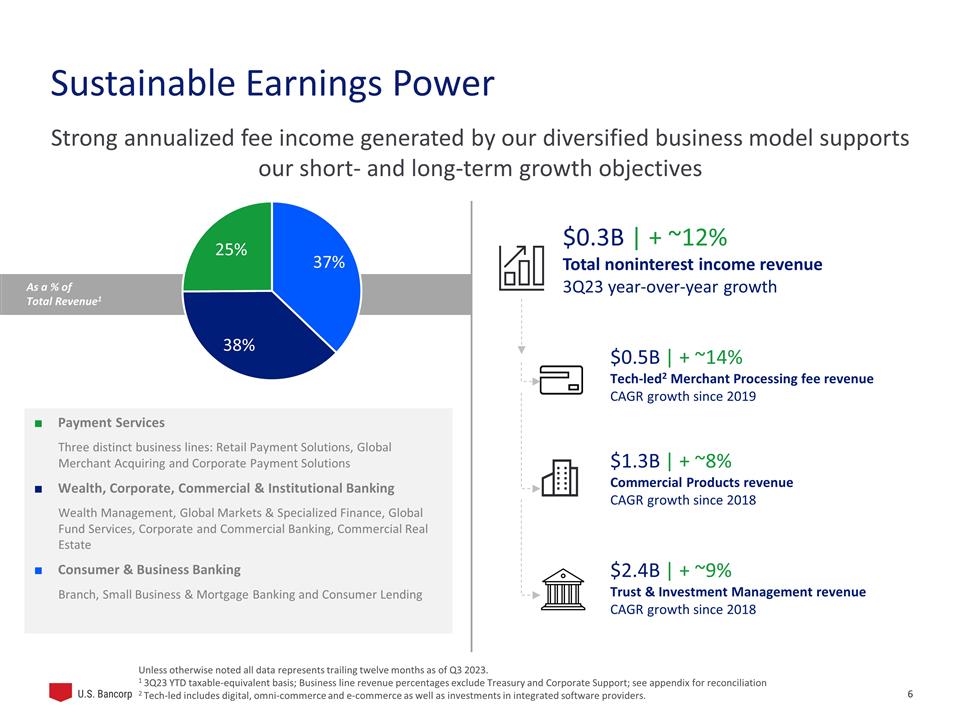

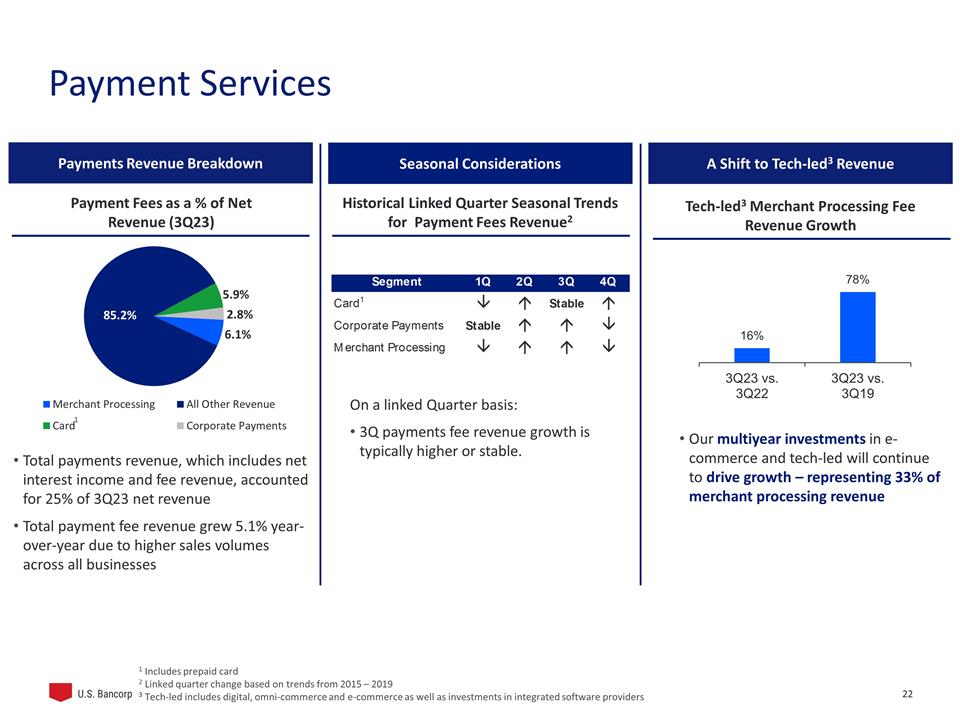

Third quarter noninterest income of $2,764 million was $295 million (11.9 percent) higher than the third quarter of 2022 driven by higher payment services revenue, trust and investment management fees, commercial products revenue, mortgage banking revenue, and other noninterest income. Payment services revenue increased $50 million (5.1 percent) compared with the third quarter of 2022. Within payment services, card revenue increased $21 million (5.4 percent) driven by higher spend volume and favorable rates, and merchant processing revenue increased $21 million (5.2 percent) due to higher sales volume. Trust and investment management fees increased $55 million (9.6 percent) driven by the acquisition of MUB and core business growth. Commercial products revenue increased $69 million (24.2 percent) driven by higher trading revenue and commercial loan fees. Mortgage banking revenue increased $63 million (77.8 percent) driven by higher gain on sale margins and a favorable change in the valuation of mortgage servicing rights, net of hedging activities. Other revenue increased $28 million (16.5 percent).

Noninterest income was $38 million (1.4 percent) higher in the third quarter of 2023 compared with the second quarter of 2023. Excluding notable items of $(22) million in the second quarter of 2023, third quarter noninterest income increased $16 million (0.6 percent) compared with the second quarter of 2023. The increase was primarily driven by higher other revenue.

7

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| NONINTEREST EXPENSE | ||||||||||||||||||||||||||||||||

| ($in millions) | Percent Change | |||||||||||||||||||||||||||||||

| 3Q | 2Q | 3Q | 3Q23 vs | 3Q23 vs | YTD | YTD | Percent | |||||||||||||||||||||||||

| 2023 | 2023 | 2022 | 2Q23 | 3Q22 | 2023 | 2022 | Change | |||||||||||||||||||||||||

| Compensation and employee benefits |

$ | 2,615 | $ | 2,646 | $ | 2,260 | (1.2 | ) | 15.7 | $ | 7,907 | $ | 6,755 | 17.1 | ||||||||||||||||||

| Net occupancy and equipment |

313 | 316 | 272 | (.9 | ) | 15.1 | 950 | 806 | 17.9 | |||||||||||||||||||||||

| Professional services |

127 | 141 | 131 | (9.9 | ) | (3.1 | ) | 402 | 356 | 12.9 | ||||||||||||||||||||||

| Marketing and business development |

176 | 122 | 126 | 44.3 | 39.7 | 420 | 312 | 34.6 | ||||||||||||||||||||||||

| Technology and communications |

511 | 522 | 427 | (2.1 | ) | 19.7 | 1,536 | 1,267 | 21.2 | |||||||||||||||||||||||

| Other intangibles |

161 | 159 | 43 | 1.3 | nm | 480 | 130 | nm | ||||||||||||||||||||||||

| Other |

343 | 353 | 336 | (2.8 | ) | 2.1 | 1,121 | 998 | 12.3 | |||||||||||||||||||||||

| Total before merger and integration |

4,246 | 4,259 | 3,595 | (.3 | ) | 18.1 | 12,816 | 10,624 | 20.6 | |||||||||||||||||||||||

| Merger and integration charges |

284 | 310 | 42 | (8.4 | ) | nm | 838 | 239 | nm | |||||||||||||||||||||||

| Total noninterest expense |

$ | 4,530 | $ | 4,569 | $ | 3,637 | (.9 | ) | 24.6 | $ | 13,654 | $ | 10,863 | 25.7 | ||||||||||||||||||

Third quarter noninterest expense of $4,530 million was $893 million (24.6 percent) higher than the third quarter of 2022. Excluding merger and integration-related charges of $284 million in the third quarter of 2023 and $42 million in the third quarter of 2022, third quarter noninterest expense increased $651 million (18.1 percent) compared with the third quarter of 2022, driven by the impact of MUB operating expenses, core deposit intangible amortization expense, and higher compensation expense. Compensation expense increased $355 million (15.7 percent) compared with the third quarter of 2022 primarily due to MUB expense as well as merit and hiring to support business growth. Intangible amortization increased $118 million driven by the core deposit intangible created as a result of the MUB acquisition.

Noninterest expense decreased $39 million (0.9 percent) on a linked quarter basis. Excluding merger and integration-related charges of $284 million in the third quarter of 2023 and $310 million in the second quarter of 2023, third quarter noninterest expense decreased $13 million (0.3 percent) from the second quarter of 2023 driven by lower compensation expense offset by an increase in marketing and business development. Compensation expense decreased $31 million (1.2 percent) compared to the second quarter of 2023 primarily due to prudent expense management and continued focus on operational efficiency. Marketing and business development expense increased $54 million (44.3 percent) as the Company continues to invest in its national brand and global reach.

Provision for Income Taxes

The provision for income taxes for the third quarter of 2023 resulted in a tax rate of 23.3 percent on a taxable-equivalent basis (effective tax rate of 22.0 percent), compared with 22.0 percent on a taxable-equivalent basis (effective tax rate of 20.9 percent) in the third quarter of 2022, and a tax rate of 23.3 percent on a taxable-equivalent basis (effective tax rate of 21.8 percent) in the second quarter of 2023.

8

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| ALLOWANCE FOR CREDIT LOSSES | ||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | 3Q | 2Q | 1Q | 4Q | 3Q | |||||||||||||||||||||||||||||||||||

| 2023 | % (a) | 2023 | % (a) | 2023 | % (a) | 2022 | % (a) | 2022 | % (a) | |||||||||||||||||||||||||||||||

| Balance, beginning of period |

$ | 7,695 | $ | 7,523 | $ | 7,404 | $ | 6,455 | $ | 6,255 | ||||||||||||||||||||||||||||||

| Change in accounting principle (b) |

-- | -- | (62 | ) | -- | -- | ||||||||||||||||||||||||||||||||||

| Allowance for acquired credit losses (c) |

-- | -- | 127 | 336 | -- | |||||||||||||||||||||||||||||||||||

| Net charge-offs |

||||||||||||||||||||||||||||||||||||||||

| Total excluding acquisition and optimization impacts |

420 | .44 | 340 | .35 | 282 | .30 | 210 | .23 | 162 | .19 | ||||||||||||||||||||||||||||||

| Balance sheet optimization impact |

-- | 309 | -- | 189 | -- | |||||||||||||||||||||||||||||||||||

| Acquisition impact |

-- | -- | 91 | 179 | -- | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total net charge-offs |

420 | .44 | 649 | .67 | 373 | .39 | 578 | .64 | 162 | .19 | ||||||||||||||||||||||||||||||

| Provision for credit losses |

||||||||||||||||||||||||||||||||||||||||

| Total excluding acquisition and optimization impacts |

515 | 578 | 427 | 401 | 362 | |||||||||||||||||||||||||||||||||||

| Balance sheet optimization impact |

-- | 243 | -- | 129 | -- | |||||||||||||||||||||||||||||||||||

| Acquisition impact of initial provision |

-- | -- | -- | 662 | -- | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total provision for credit losses |

515 | 821 | 427 | 1,192 | 362 | |||||||||||||||||||||||||||||||||||

| Other changes |

-- | -- | -- | (1 | ) | -- | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Balance, end of period |

$ | 7,790 | $ | 7,695 | $ | 7,523 | $ | 7,404 | $ | 6,455 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Components |

||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses |

$ | 7,218 | $ | 7,164 | $ | 7,020 | $ | 6,936 | $ | 6,017 | ||||||||||||||||||||||||||||||

| Liability for unfunded credit commitments |

572 | 531 | 503 | 468 | 438 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total allowance for credit losses |

$ | 7,790 | $ | 7,695 | $ | 7,523 | $ | 7,404 | $ | 6,455 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Allowance for credit losses as a percentage of |

||||||||||||||||||||||||||||||||||||||||

| Period-end loans (%) |

2.08 | 2.03 | 1.94 | 1.91 | 1.88 | |||||||||||||||||||||||||||||||||||

| Nonperforming loans (%) |

615 | 739 | 660 | 762 | 1,025 | |||||||||||||||||||||||||||||||||||

| Nonperforming assets (%) |

595 | 709 | 637 | 729 | 953 | |||||||||||||||||||||||||||||||||||

| (a) Annualized and calculated on average loan balances (b) Effective January 1, 2023, the Company adopted accounting guidance which removed the separate recognition and measurement of troubled debt restructurings (c) Allowance for purchased credit deteriorated and charged-off loans acquired from MUB |

|

|||||||||||||||||||||||||||||||||||||||

| SUMMARY OF NET CHARGE-OFFS | ||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | 3Q | 2Q | 1Q | 4Q | 3Q | |||||||||||||||||||||||||||||||||||

| 2023 | % (a) | 2023 | % (a) | 2023 | % (a) | 2022 | % (a) | 2022 | % (a) | |||||||||||||||||||||||||||||||

| Net charge-offs |

||||||||||||||||||||||||||||||||||||||||

| Commercial |

$ | 86 | .26 | $ | 87 | .26 | $ | 42 | .13 | $ | 133 | .41 | $ | 24 | .08 | |||||||||||||||||||||||||

| Lease financing |

6 | .55 | 3 | .27 | 5 | .46 | 5 | .43 | 3 | .25 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total commercial |

92 | .27 | 90 | .26 | 47 | .14 | 138 | .41 | 27 | .08 | ||||||||||||||||||||||||||||||

| Commercial mortgages |

49 | .46 | 26 | .24 | 115 | 1.07 | 25 | .28 | (6 | ) | (.08 | ) | ||||||||||||||||||||||||||||

| Construction and development |

-- | -- | -- | -- | 2 | .07 | 17 | .63 | -- | -- | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total commercial real estate |

49 | .36 | 26 | .19 | 117 | .85 | 42 | .36 | (6 | ) | (.06 | ) | ||||||||||||||||||||||||||||

| Residential mortgages |

(3 | ) | (.01 | ) | 114 | .39 | (1 | ) | -- | (3 | ) | (.01 | ) | (5 | ) | (.02 | ) | |||||||||||||||||||||||

| Credit card |

220 | 3.25 | 199 | 3.06 | 175 | 2.78 | 175 | 2.76 | 119 | 1.96 | ||||||||||||||||||||||||||||||

| Retail leasing |

2 | .18 | 1 | .08 | 1 | .08 | 1 | .07 | 1 | .06 | ||||||||||||||||||||||||||||||

| Home equity and second mortgages |

1 | .03 | (1 | ) | (.03 | ) | (1 | ) | (.03 | ) | -- | -- | (2 | ) | (.07 | ) | ||||||||||||||||||||||||

| Other |

59 | .80 | 220 | 2.55 | 35 | .40 | 225 | 2.17 | 28 | .26 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total other retail |

62 | .53 | 220 | 1.69 | 35 | .26 | 226 | 1.52 | 27 | .18 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total net charge-offs |

$ | 420 | .44 | $ | 649 | .67 | $ | 373 | .39 | $ | 578 | .64 | $ | 162 | .19 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Gross charge-offs |

$ | 508 | $ | 755 | $ | 469 | $ | 669 | $ | 275 | ||||||||||||||||||||||||||||||

| Gross recoveries |

$ | 88 | $ | 106 | $ | 96 | $ | 91 | $ | 113 | ||||||||||||||||||||||||||||||

| (a) Annualized and calculated on average loan balances |

|

|||||||||||||||||||||||||||||||||||||||

9

|

|

U.S. Bancorp Third Quarter 2023 Results | |

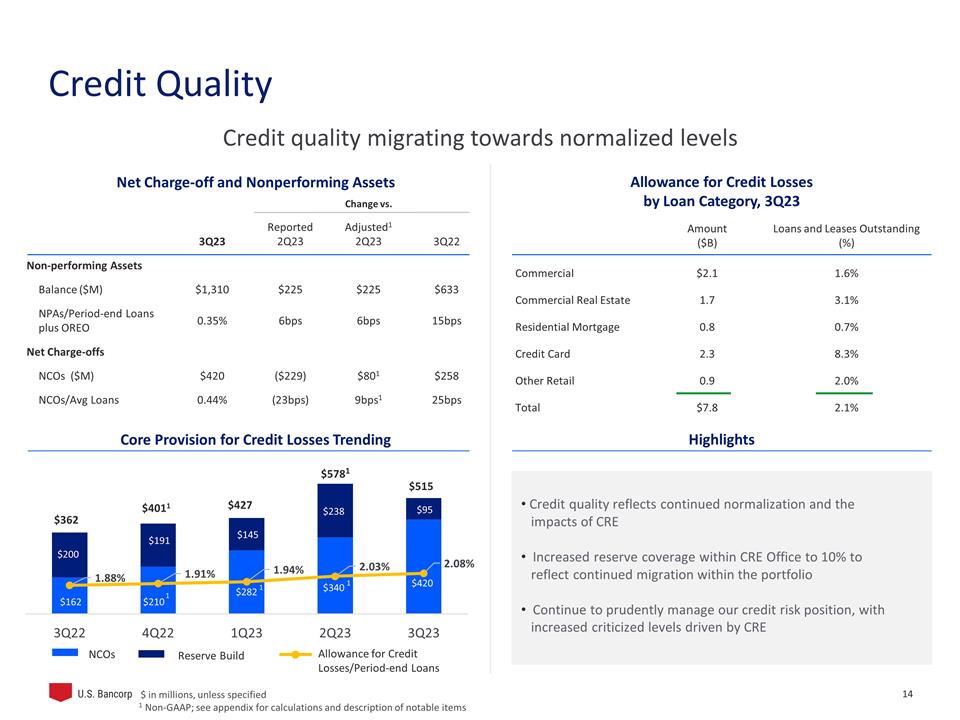

The Company’s provision for credit losses for the third quarter of 2023 was $515 million, compared with $821 million in the second quarter of 2023 and $362 million in the third quarter of 2022. The third quarter of 2023 provision was $306 million (37.3 percent) lower than the second quarter of 2023 and $153 million (42.3 percent) higher than the third quarter of 2022. Excluding the second quarter of 2023 notable item related to balance sheet optimization activities, the provision for credit losses for the third quarter of 2023 decreased $63 million (10.9 percent) compared with the second quarter of 2023. During 2022 and continuing into 2023, economic uncertainty and recession risk have increased due to rising interest rates, inflationary concerns, market volatility, and pressure on corporate earnings related to these factors. Expected loss estimates consider various factors including customer specific information impacting changes in risk ratings, projected delinquencies, and the impact of economic deterioration on borrowers’ liquidity and ability to repay. While these credit quality factors have continued to perform better than pre-pandemic levels, changing economic conditions have contributed to increased provision for credit losses. Consumer portfolio credit losses are normalizing amid rising delinquencies and lower collateral values. Some stress in commercial portfolios is anticipated as the impact of rising interest rates filters through companies’ financials. Commercial real estate valuations are also affected by rising interest rates and the changing demand for office properties.

Total net charge-offs in the third quarter of 2023 were $420 million, compared with $649 million in the second quarter of 2023 and $162 million in the third quarter of 2022. Net charge-offs for the second quarter of 2023 included $309 million of charge-offs related to balance sheet optimization activities. The net charge-off ratio was 0.44 percent in the third quarter of 2023, compared with 0.67 percent in the second quarter of 2023 (0.35 percent excluding the impact of the balance sheet optimization activities) and 0.19 percent in the third quarter of 2022. Net charge-offs, excluding the impact of the second quarter of 2023 balance sheet optimization activities, increased $80 million (23.5 percent) on a linked quarter basis reflecting higher charge-offs in most loan categories consistent with normalizing credit conditions and adverse conditions in commercial real estate.

The allowance for credit losses was $7,790 million at September 30, 2023, compared with $7,695 million at June 30, 2023, and $6,455 million at September 30, 2022. The linked quarter increase in the allowance for credit losses was primarily driven by normalizing credit losses and commercial real estate credit quality, partially offset by relative stability in economic conditions. The ratio of the allowance for credit losses to period-end loans was 2.08 percent at September 30, 2023, compared with 2.03 percent at June 30, 2023, and 1.88 percent at September 30, 2022. The ratio of the allowance for credit losses to nonperforming loans was 615 percent at September 30, 2023, compared with 739 percent at June 30, 2023, and 1,025 percent at September 30, 2022.

Nonperforming assets were $1,310 million at September 30, 2023, compared with $1,085 million at June 30, 2023, and $677 million at September 30, 2022. The ratio of nonperforming assets to loans and other real estate was 0.35 percent at September 30, 2023, compared with 0.29 percent at June 30, 2023, and 0.20 percent at September 30, 2022. The increase in nonperforming assets on a linked quarter basis was primarily due to higher commercial real estate nonperforming loans, partially offset by lower nonperforming residential mortgages. The year-over-year increase in nonperforming assets primarily reflected nonperforming assets acquired from MUB, along with higher commercial real estate nonperforming loans. Accruing loans 90 days or more past due were $569 million at September 30, 2023, compared with $474 million at June 30, 2023, and $393 million at September 30, 2022.

10

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| DELINQUENT LOAN RATIOS AS A PERCENT OF ENDING LOAN BALANCES | ||||||||||||||||||||

| (Percent) | Sep 30 2023 |

Jun 30 2023 |

Mar 31 2023 |

Dec 31 2022 |

Sep 30 2022 |

|||||||||||||||

| Delinquent loan ratios - 90 days or more past due |

|

|||||||||||||||||||

| Commercial |

.05 | .04 | .05 | .07 | .03 | |||||||||||||||

| Commercial real estate |

-- | -- | .01 | .01 | .05 | |||||||||||||||

| Residential mortgages |

.11 | .08 | .08 | .08 | .10 | |||||||||||||||

| Credit card |

1.17 | 1.02 | 1.00 | .88 | .74 | |||||||||||||||

| Other retail |

.13 | .12 | .12 | .12 | .11 | |||||||||||||||

| Total loans |

.15 | .12 | .13 | .13 | .11 | |||||||||||||||

| Delinquent loan ratios - 90 days or more past due and nonperforming loans |

|

|||||||||||||||||||

| Commercial |

.24 | .21 | .18 | .19 | .12 | |||||||||||||||

| Commercial real estate |

1.33 | .87 | .98 | .62 | .46 | |||||||||||||||

| Residential mortgages |

.25 | .26 | .33 | .36 | .35 | |||||||||||||||

| Credit card |

1.17 | 1.02 | 1.01 | .88 | .74 | |||||||||||||||

| Other retail |

.41 | .39 | .37 | .37 | .32 | |||||||||||||||

| Total loans |

.49 | .40 | .42 | .38 | .30 | |||||||||||||||

|

|

||||||||||||||||||||

| ASSET QUALITY (a) | ||||||||||||||||||||

| ($ in millions) | ||||||||||||||||||||

| Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | ||||||||||||||||

| 2023 | 2023 | 2023 | 2022 | 2022 | ||||||||||||||||

| Nonperforming loans |

||||||||||||||||||||

| Commercial |

$ | 231 | $ | 204 | $ | 150 | $ | 139 | $ | 92 | ||||||||||

| Lease financing |

25 | 27 | 28 | 30 | 30 | |||||||||||||||

| Total commercial |

256 | 231 | 178 | 169 | 122 | |||||||||||||||

| Commercial mortgages |

566 | 361 | 432 | 251 | 110 | |||||||||||||||

| Construction and development |

155 | 113 | 103 | 87 | 57 | |||||||||||||||

| Total commercial real estate |

721 | 474 | 535 | 338 | 167 | |||||||||||||||

| Residential mortgages |

161 | 207 | 292 | 325 | 211 | |||||||||||||||

| Credit card |

-- | -- | 1 | 1 | -- | |||||||||||||||

| Other retail |

129 | 129 | 133 | 139 | 130 | |||||||||||||||

| Total nonperforming loans |

1,267 | 1,041 | 1,139 | 972 | 630 | |||||||||||||||

| Other real estate |

25 | 25 | 23 | 23 | 24 | |||||||||||||||

| Other nonperforming assets |

18 | 19 | 19 | 21 | 23 | |||||||||||||||

| Total nonperforming assets |

$ | 1,310 | $ | 1,085 | $ | 1,181 | $ | 1,016 | $ | 677 | ||||||||||

| Accruing loans 90 days or more past due |

$ | 569 | $ | 474 | $ | 494 | $ | 491 | $ | 393 | ||||||||||

| Nonperforming assets to loans plus ORE (%) |

.35 | .29 | .30 | .26 | .20 | |||||||||||||||

| (a) Throughout this document, nonperforming assets and related ratios do not include accruing loans 90 days or more past due |

|

|||||||||||||||||||

11

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| COMMON SHARES | ||||||||||||||||||||

| (Millions) | 3Q 2023 |

2Q 2023 |

1Q 2023 |

4Q 2022 |

3Q 2022 |

|||||||||||||||

| Beginning shares outstanding |

1,533 | 1,533 | 1,531 | 1,486 | 1,486 | |||||||||||||||

| Shares issued for stock incentive plans, acquisitions and other corporate purposes |

24 | -- | 3 | 45 | -- | |||||||||||||||

| Shares repurchased |

-- | -- | (1 | ) | -- | -- | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ending shares outstanding |

1,557 | 1,533 | 1,533 | 1,531 | 1,486 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| CAPITAL POSITION | Preliminary Data | |||||||||||||||||||

| ($in millions) | Sep 30 2023 |

Jun 30 2023 |

Mar 31 2023 |

Dec 31 2022 |

Sep 30 2022 |

|||||||||||||||

| Total U.S. Bancorp shareholders’ equity |

$ | 53,113 | $ | 53,019 | $ | 52,989 | $ | 50,766 | $ | 47,513 | ||||||||||

| Basel III Standardized Approach (a) |

||||||||||||||||||||

| Common equity tier 1 capital |

$ | 44,655 | $ | 42,944 | $ | 42,027 | $ | 41,560 | $ | 44,094 | ||||||||||

| Tier 1 capital |

51,906 | 50,187 | 49,278 | 48,813 | 51,346 | |||||||||||||||

| Total risk-based capital |

61,737 | 60,334 | 59,920 | 59,015 | 60,738 | |||||||||||||||

| Common equity tier 1 capital ratio |

9.7 | % | 9.1 | % | 8.5 | % | 8.4 | % | 9.7 | % | ||||||||||

| Tier 1 capital ratio |

11.2 | 10.6 | 10.0 | 9.8 | 11.2 | |||||||||||||||

| Total risk-based capital ratio |

13.4 | 12.7 | 12.1 | 11.9 | 13.3 | |||||||||||||||

| Leverage ratio |

7.9 | 7.5 | 7.5 | 7.9 | 8.7 | |||||||||||||||

| Tangible common equity to tangible assets (b) |

5.0 | 4.8 | 4.8 | 4.5 | 5.2 | |||||||||||||||

| Tangible common equity to risk-weighted assets (b) |

7.0 | 6.8 | 6.5 | 6.0 | 6.7 | |||||||||||||||

| Common equity tier 1 capital to risk-weighted assets, reflecting the full implementation of the current expected credit losses methodology (b) |

9.5 | 8.9 | 8.3 | 8.1 | 9.4 | |||||||||||||||

| (a) Amounts and ratios calculated in accordance with transitional regulatory requirements related to the current expected credit losses methodology |

|

|||||||||||||||||||

| (b) See Non-GAAP Financial Measures reconciliation on page 18 |

||||||||||||||||||||

Total U.S. Bancorp shareholders’ equity was $53.1 billion at September 30, 2023, compared with $53.0 billion at June 30, 2023 and $47.5 billion at September 30, 2022. The third quarter of 2023 reflects the impact of the issuance of 24 million shares of common stock to Mitsubishi UFG Financial Group, Inc. (“MUFG”), for which the proceeds from the issuance were used to repay a portion of the debt obligation with MUFG for the acquisition of MUB. The Company suspended all common stock repurchases at the beginning of the third quarter of 2021, except for those done exclusively in connection with its stock-based compensation programs, due to the acquisition of MUB. The Company will evaluate its share repurchases in connection with the potential capital requirements given the proposed regulatory capital rules and related landscape.

All regulatory ratios continue to be in excess of “well-capitalized” requirements. The common equity tier 1 capital to risk-weighted assets ratio using the Basel III standardized approach was 9.7 percent at September 30, 2023, compared with 9.1 percent at June 30, 2023, and 9.7 percent at September 30, 2022. The common equity tier 1 capital to risk-weighted assets ratio, reflecting the full implementation of the current expected credit losses methodology was 9.5 percent at September 30, 2023, compared with 8.9 percent at June 30, 2023, and 9.4 percent at September 30, 2022.

12

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| Investor Conference Call |

On Wednesday, October 18, 2023 at 7 a.m. CT, Chairman, President and Chief Executive Officer Andy Cecere and Senior Executive Vice President and Chief Financial Officer John Stern will host a conference call to review the financial results. The live conference call will be available online or by telephone. To access the webcast and presentation, visit the U.S. Bancorp website at usbank.com and click on “About Us”, “Investor Relations” and “Webcasts & Presentations.” To access the conference call from locations within the United States and Canada, please dial 877-692-8955. Participants calling from outside the United States and Canada, please dial 234-720-6979. The access code for all participants is 6030554. For those unable to participate during the live call, a replay will be available at approximately 10 a.m. CT on Wednesday, October 18, 2023. To access the replay, please visit the U.S. Bancorp website at usbank.com and click on “About Us”, “Investor Relations” and “Webcasts & Presentations.”

| About U.S. Bancorp |

U.S. Bancorp, with approximately 75,000 employees and $668 billion in assets as of September 30, 2023, is the parent company of U.S. Bank National Association. Headquartered in Minneapolis, the company serves millions of customers locally, nationally and globally through a diversified mix of businesses including consumer banking, business banking, commercial banking, institutional banking, payments and wealth management. U.S. Bancorp has been recognized for its approach to digital innovation, community partnerships and customer service, including being named one of the 2023 World’s Most Ethical Companies and Fortune’s most admired superregional bank. To learn more, please visit the U.S. Bancorp website at usbank.com and click on “About Us.”

| Forward-looking Statements |

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

This press release contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, future economic conditions and the anticipated future revenue, expenses, financial condition, asset quality, capital and liquidity levels, plans, prospects and operations of U.S. Bancorp. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “projects,” “forecasts,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.”

Forward-looking statements involve inherent risks and uncertainties that could cause actual results to differ materially from those set forth in forward-looking statements, including the following risks and uncertainties:

| • | Deterioration in general business and economic conditions or turbulence in domestic or global financial markets, which could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities, reduce the availability of funding to certain financial institutions, lead to a tightening of credit, and increase stock price volatility; |

| • | Turmoil and volatility in the financial services industry, including failures or rumors of failures of other depository institutions, which could affect the ability of depository institutions, including U.S. Bank National Association, to attract and retain depositors, and could affect the ability of financial services providers, including U.S. Bancorp, to borrow or raise capital; |

| • | Increases in Federal Deposit Insurance Corporation (“FDIC”) assessments due to bank failures; |

| • | Actions taken by governmental agencies to stabilize the financial system and the effectiveness of such actions; |

| • | Changes to regulatory capital, liquidity and resolution-related requirements applicable to large banking organizations in response to recent developments affecting the banking sector; |

| • | Changes to statutes, regulations, or regulatory policies or practices, including capital and liquidity requirements, and the enforcement and interpretation of such laws and regulations, and U.S. Bancorp’s ability to address or satisfy those requirements and other requirements or conditions imposed by regulatory entities; |

| • | Changes in interest rates; |

| • | Increases in unemployment rates; |

| • | Deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; |

| • | Risks related to originating and selling mortgages, including repurchase and indemnity demands, and related to U.S. Bancorp’s role as a loan servicer; |

13

|

|

U.S. Bancorp Third Quarter 2023 Results | |

| • | Impacts of current, pending or future litigation and governmental proceedings; |

| • | Increased competition from both banks and non-banks; |

| • | Effects of climate change and related physical and transition risks; |

| • | Changes in customer behavior and preferences and the ability to implement technological changes to respond to customer needs and meet competitive demands; |

| • | Breaches in data security; |

| • | Failures or disruptions in or breaches of U.S. Bancorp’s operational, technology or security systems or infrastructure, or those of third parties; |

| • | Failures to safeguard personal information; |

| • | Impacts of pandemics, including the COVID-19 pandemic, natural disasters, terrorist activities, civil unrest, international hostilities and geopolitical events; |

| • | Impacts of supply chain disruptions, rising inflation, slower growth or a recession; |

| • | Failure to execute on strategic or operational plans; |

| • | Effects of mergers and acquisitions and related integration; |

| • | Effects of critical accounting policies and judgments; |

| • | Effects of changes in or interpretations of tax laws and regulations; |

| • | Management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputation risk; and |

| • | The risks and uncertainties more fully discussed in the section entitled “Risk Factors” of U.S. Bancorp’s Form 10-K for the year ended December 31, 2022, and subsequent filings with the Securities and Exchange Commission. |

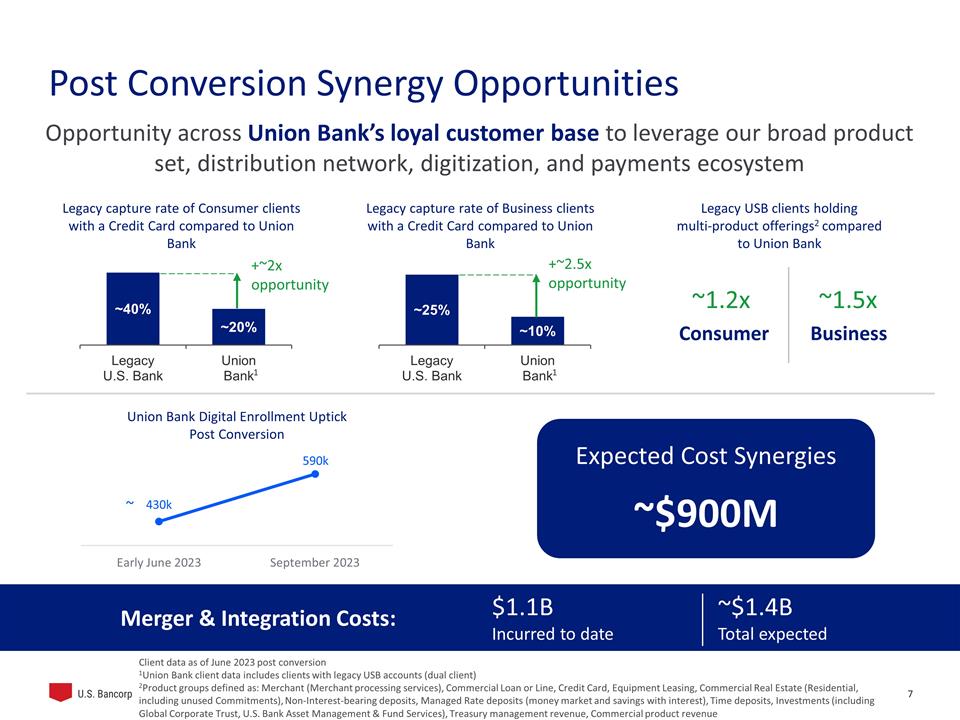

In addition, U.S. Bancorp’s acquisition of MUB presents risks and uncertainties, including, among others: the risk that the cost savings, any revenue synergies and other anticipated benefits of the acquisition may not be realized or may take longer than anticipated to be realized; and the possibility that the combination of MUB with U.S. Bancorp, including the integration of MUB, may be more costly or difficult to complete than anticipated or have unanticipated adverse results.

In addition, factors other than these risks also could adversely affect U.S. Bancorp’s results, and the reader should not consider these risks to be a complete set of all potential risks or uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events.

14

|

|

U.S. Bancorp Third Quarter 2023 Results | |

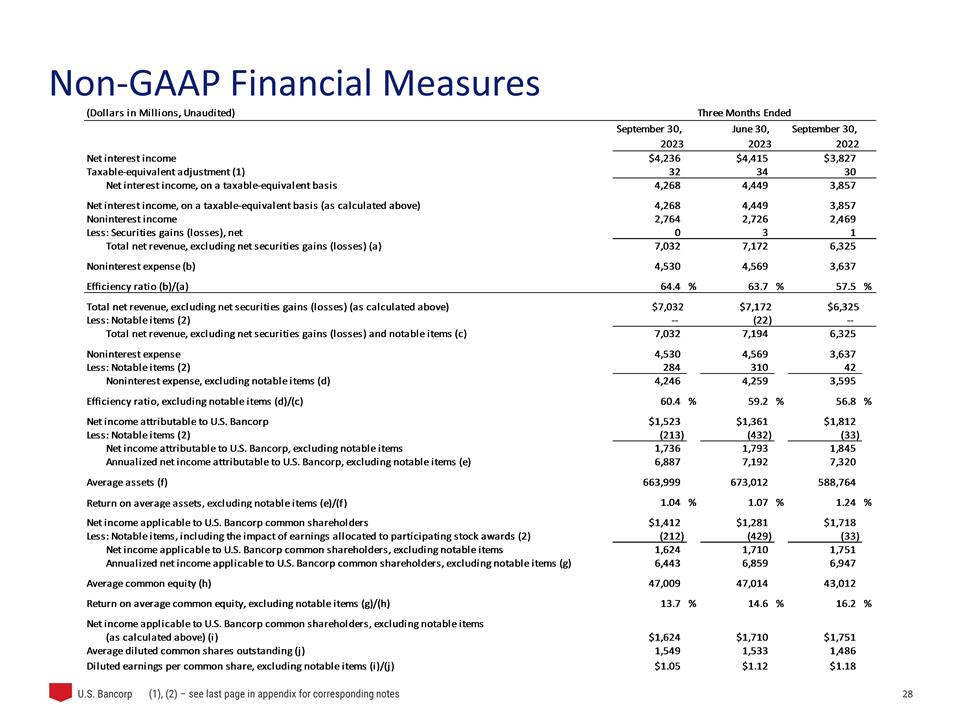

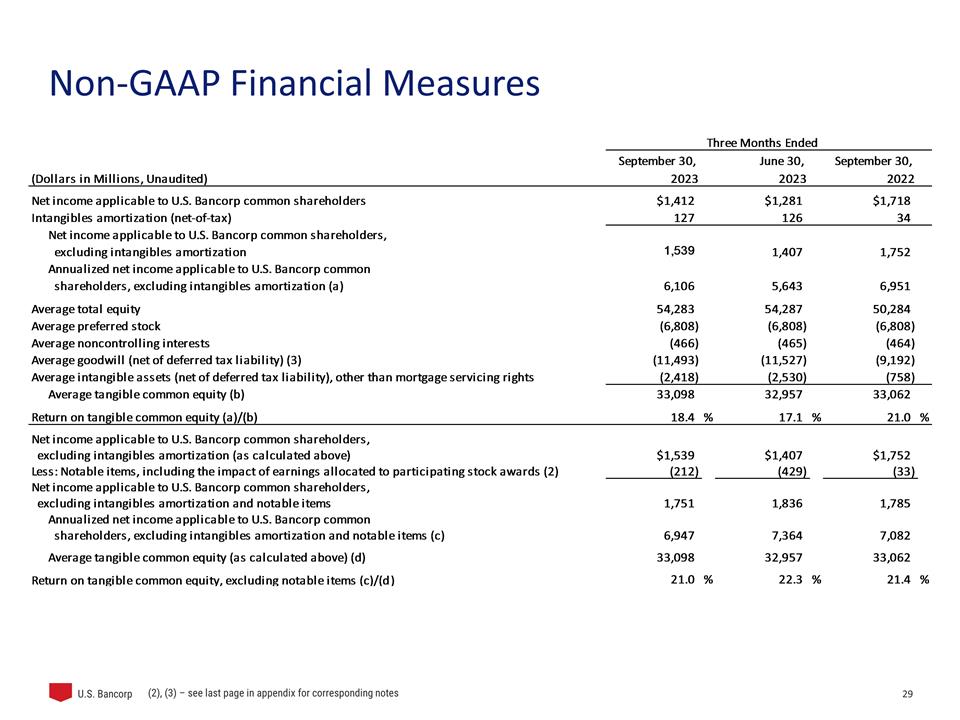

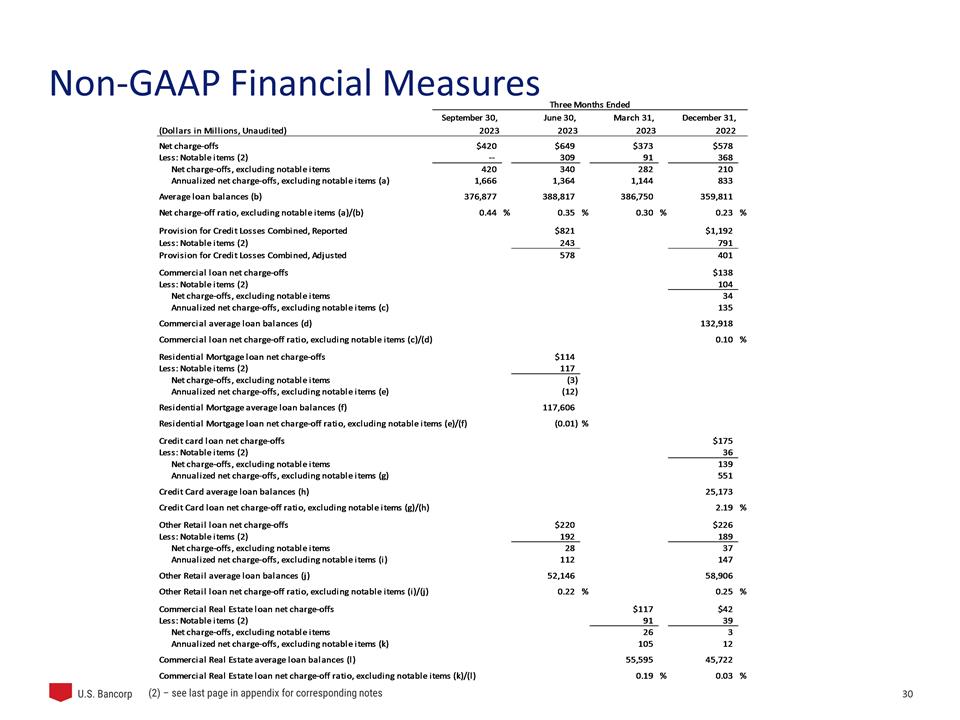

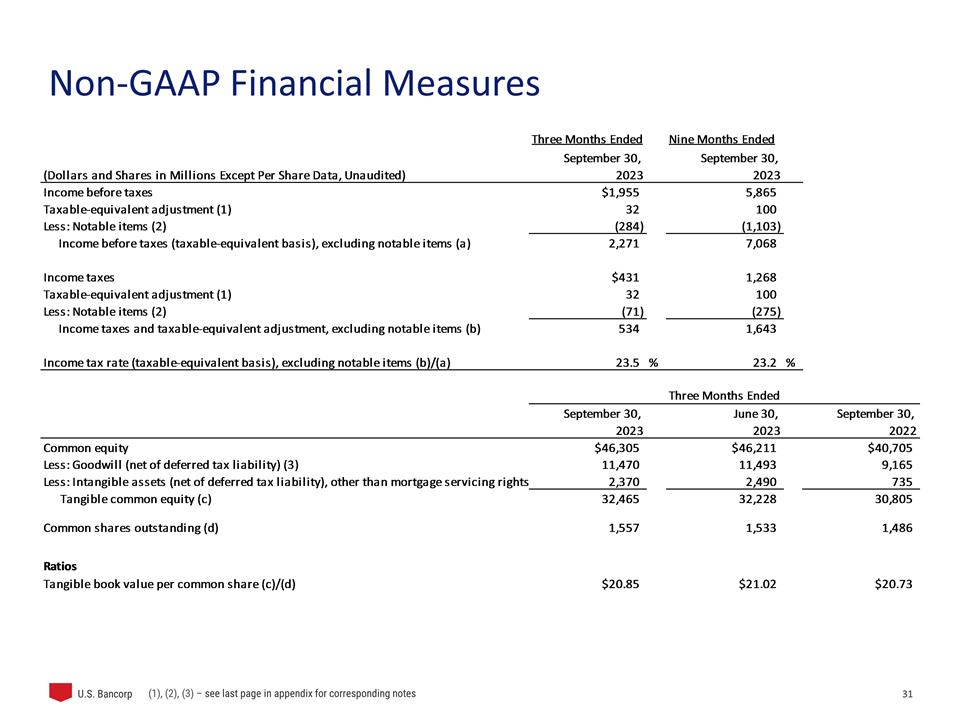

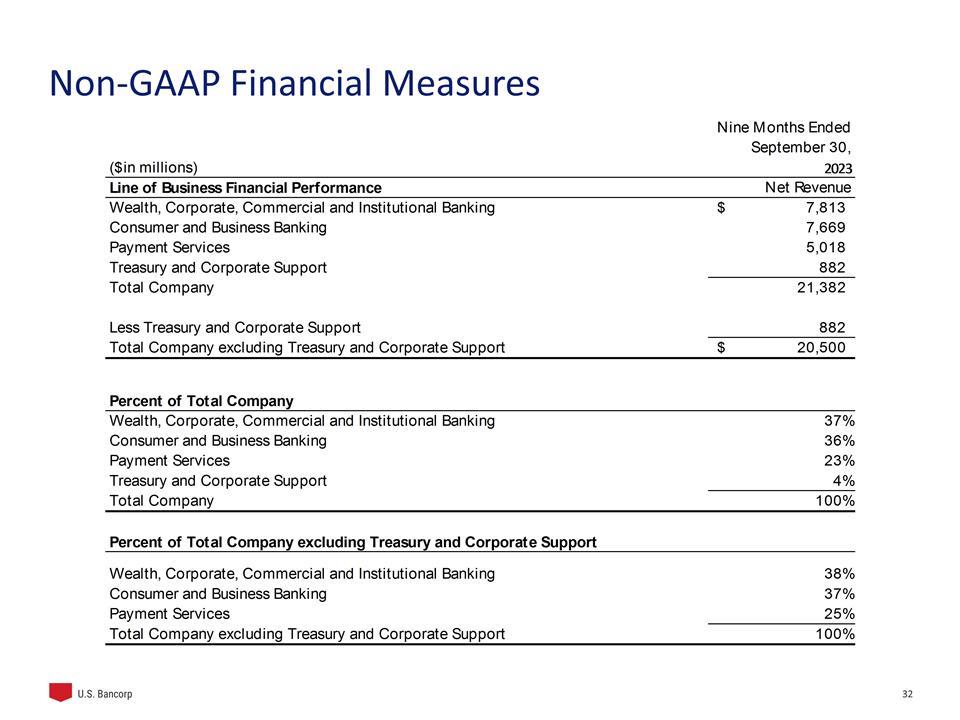

| Non-GAAP Financial Measures |

In addition to capital ratios defined by banking regulators, the Company considers various other measures when evaluating capital utilization and adequacy, including:

| • | Tangible common equity to tangible assets |

| • | Tangible common equity to risk-weighted assets |

| • | Common equity tier 1 capital to risk-weighted assets, reflecting the full implementation of the current expected credit losses methodology, and |

| • | Return on tangible common equity. |

These measures are viewed by management as useful additional methods of evaluating the Company’s utilization of its capital held and the level of capital available to withstand unexpected negative market or economic conditions. Additionally, presentation of these measures allows investors, analysts and banking regulators to assess the Company’s capital position and use of capital relative to other financial services companies. These measures are not defined in generally accepted accounting principles (“GAAP”), or are not currently effective or defined in banking regulations. In addition, certain of these measures differ from currently effective capital ratios defined by banking regulations principally in that the currently effective ratios, which are subject to certain transitional provisions, temporarily exclude the impact of the 2020 adoption of accounting guidance related to impairment of financial instruments based on the current expected credit losses methodology. As a result, these measures disclosed by the Company may be considered non-GAAP financial measures. Management believes this information helps investors assess trends in the Company’s capital utilization and adequacy.

The Company also discloses net interest income and related ratios and analysis on a taxable-equivalent basis, which may also be considered non-GAAP financial measures. The Company believes this presentation to be the preferred industry measurement of net interest income as it provides a relevant comparison of net interest income arising from taxable and tax-exempt sources. In addition, certain performance measures, including the efficiency ratio, tangible efficiency ratio and net interest margin, utilize net interest income on a taxable-equivalent basis.

The adjusted return on average assets, adjusted return on average common equity, adjusted efficiency ratio, adjusted return on tangible common equity, adjusted net income and adjusted diluted earnings per common share exclude notable items related to the acquisition of MUB, and other balance sheet repositioning and capital management actions taken by the Company. Management uses these measures in their analysis of the Company’s performance and believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods.

There may be limits in the usefulness of these measures to investors. As a result, the Company encourages readers to consider the consolidated financial statements and other financial information contained in this press release in their entirety, and not to rely on any single financial measure. A table follows that shows the Company’s calculation of these non-GAAP financial measures.

15

|

|

| CONSOLIDATED STATEMENT OF INCOME | ||||||||||||||||

| (Dollars and Shares in Millions, Except Per Share Data) | Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| (Unaudited) | 2023 | 2022 | 2023 | 2022 | ||||||||||||

| Interest Income |

||||||||||||||||

| Loans |

$5,700 | $3,603 | $16,582 | $9,071 | ||||||||||||

| Loans held for sale |

42 | 49 | 111 | 163 | ||||||||||||

| Investment securities |

1,152 | 867 | 3,303 | 2,390 | ||||||||||||

| Other interest income |

860 | 209 | 2,248 | 347 | ||||||||||||

| Total interest income |

7,754 | 4,728 | 22,244 | 11,971 | ||||||||||||

| Interest Expense |

||||||||||||||||

| Deposits |

2,580 | 534 | 6,024 | 791 | ||||||||||||

| Short-term borrowings |

450 | 169 | 1,639 | 247 | ||||||||||||

| Long-term debt |

488 | 198 | 1,296 | 498 | ||||||||||||

| Total interest expense |

3,518 | 901 | 8,959 | 1,536 | ||||||||||||

| Net interest income |

4,236 | 3,827 | 13,285 | 10,435 | ||||||||||||

| Provision for credit losses |

515 | 362 | 1,763 | 785 | ||||||||||||

| Net interest income after provision for credit losses |

3,721 | 3,465 | 11,522 | 9,650 | ||||||||||||

| Noninterest Income |

||||||||||||||||

| Card revenue |

412 | 391 | 1,194 | 1,128 | ||||||||||||

| Corporate payment products revenue |

198 | 190 | 577 | 520 | ||||||||||||

| Merchant processing services |

427 | 406 | 1,250 | 1,194 | ||||||||||||

| Trust and investment management fees |

627 | 572 | 1,838 | 1,638 | ||||||||||||

| Service charges |

334 | 317 | 982 | 984 | ||||||||||||

| Commercial products revenue |

354 | 285 | 1,046 | 841 | ||||||||||||

| Mortgage banking revenue |

144 | 81 | 403 | 423 | ||||||||||||

| Investment products fees |

70 | 56 | 206 | 177 | ||||||||||||

| Securities gains (losses), net |

-- | 1 | (29 | ) | 38 | |||||||||||

| Other |

198 | 170 | 530 | 470 | ||||||||||||

| Total noninterest income |

2,764 | 2,469 | 7,997 | 7,413 | ||||||||||||

| Noninterest Expense |

||||||||||||||||

| Compensation and employee benefits |

2,615 | 2,260 | 7,907 | 6,755 | ||||||||||||

| Net occupancy and equipment |

313 | 272 | 950 | 806 | ||||||||||||

| Professional services |

127 | 131 | 402 | 356 | ||||||||||||

| Marketing and business development |

176 | 126 | 420 | 312 | ||||||||||||

| Technology and communications |

511 | 427 | 1,536 | 1,267 | ||||||||||||

| Other intangibles |

161 | 43 | 480 | 130 | ||||||||||||

| Merger and integration charges |

284 | 42 | 838 | 239 | ||||||||||||

| Other |

343 | 336 | 1,121 | 998 | ||||||||||||

| Total noninterest expense |

4,530 | 3,637 | 13,654 | 10,863 | ||||||||||||

| Income before income taxes |

1,955 | 2,297 | 5,865 | 6,200 | ||||||||||||

| Applicable income taxes |

431 | 481 | 1,268 | 1,292 | ||||||||||||

| Net income |

1,524 | 1,816 | 4,597 | 4,908 | ||||||||||||

| Net (income) loss attributable to noncontrolling interests |

(1 | ) | (4 | ) | (15 | ) | (8 | ) | ||||||||

| Net income attributable to U.S. Bancorp |

$1,523 | $1,812 | $4,582 | $4,900 | ||||||||||||

| Net income applicable to U.S. Bancorp common shareholders |

$1,412 | $1,718 | $4,285 | $4,648 | ||||||||||||

| Earnings per common share |

$.91 | $1.16 | $2.79 | $3.13 | ||||||||||||

| Diluted earnings per common share |

$.91 | $1.16 | $2.79 | $3.13 | ||||||||||||

| Dividends declared per common share |

$.48 | $.48 | $1.44 | $1.40 | ||||||||||||

| Average common shares outstanding |

1,548 | 1,486 | 1,538 | 1,485 | ||||||||||||

| Average diluted common shares outstanding |

1,549 | 1,486 | 1,538 | 1,486 | ||||||||||||

16

|

|

| CONSOLIDATED ENDING BALANCE SHEET | ||||||||||||

| (Dollars in Millions) | September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|||||||||

| Assets |

(Unaudited | ) | (Unaudited | ) | ||||||||

| Cash and due from banks |

$64,354 | $53,542 | $41,652 | |||||||||

| Investment securities |

||||||||||||

| Held-to-maturity |

85,342 | 88,740 | 85,574 | |||||||||

| Available-for-sale |

67,207 | 72,910 | 68,523 | |||||||||

| Loans held for sale |

2,336 | 2,200 | 3,647 | |||||||||

| Loans |

||||||||||||

| Commercial |

133,319 | 135,690 | 131,687 | |||||||||

| Commercial real estate |

54,131 | 55,487 | 40,329 | |||||||||

| Residential mortgages |

115,055 | 115,845 | 86,274 | |||||||||

| Credit card |

27,080 | 26,295 | 24,538 | |||||||||

| Other retail |

45,649 | 54,896 | 59,880 | |||||||||

| Total loans |

375,234 | 388,213 | 342,708 | |||||||||

| Less allowance for loan losses |

(7,218 | ) | (6,936 | ) | (6,017 | ) | ||||||

| Net loans |

368,016 | 381,277 | 336,691 | |||||||||

| Premises and equipment |

3,616 | 3,858 | 3,155 | |||||||||

| Goodwill |

12,472 | 12,373 | 10,125 | |||||||||

| Other intangible assets |

6,435 | 7,155 | 4,604 | |||||||||

| Other assets |

58,261 | 52,750 | 47,002 | |||||||||

| Total assets |

$668,039 | $674,805 | $600,973 | |||||||||

| Liabilities and Shareholders’ Equity |

||||||||||||

| Deposits |

||||||||||||

| Noninterest-bearing |

$98,006 | $137,743 | $115,206 | |||||||||

| Interest-bearing |

420,352 | 387,233 | 355,942 | |||||||||

| Total deposits |

518,358 | 524,976 | 471,148 | |||||||||

| Short-term borrowings |

21,900 | 31,216 | 25,066 | |||||||||

| Long-term debt |

43,074 | 39,829 | 32,228 | |||||||||

| Other liabilities |

31,129 | 27,552 | 24,553 | |||||||||

| Total liabilities |

614,461 | 623,573 | 552,995 | |||||||||

| Shareholders’ equity |

||||||||||||

| Preferred stock |

6,808 | 6,808 | 6,808 | |||||||||

| Common stock |

21 | 21 | 21 | |||||||||

| Capital surplus |

8,684 | 8,712 | 8,590 | |||||||||

| Retained earnings |

74,023 | 71,901 | 71,782 | |||||||||

| Less treasury stock |

(24,168 | ) | (25,269 | ) | (27,188 | ) | ||||||

| Accumulated other comprehensive income (loss) |

(12,255 | ) | (11,407 | ) | (12,500 | ) | ||||||

| Total U.S. Bancorp shareholders’ equity |

53,113 | 50,766 | 47,513 | |||||||||

| Noncontrolling interests |

465 | 466 | 465 | |||||||||

| Total equity |

53,578 | 51,232 | 47,978 | |||||||||

| Total liabilities and equity |

$668,039 | $674,805 | $600,973 | |||||||||

17

|

|

| NON-GAAP FINANCIAL MEASURES | ||||||||||||||||||||

| (Dollars in Millions, Unaudited) | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

September 30, 2022 |

|||||||||||||||

| Total equity |

$53,578 | $53,484 | $53,454 | $51,232 | $47,978 | |||||||||||||||

| Preferred stock |

(6,808 | ) | (6,808 | ) | (6,808 | ) | (6,808 | ) | (6,808 | ) | ||||||||||

| Noncontrolling interests |

(465 | ) | (465 | ) | (465 | ) | (466 | ) | (465 | ) | ||||||||||

| Goodwill (net of deferred tax liability) (1) |

(11,470 | ) | (11,493 | ) | (11,575 | ) | (11,395 | ) | (9,165 | ) | ||||||||||

| Intangible assets (net of deferred tax liability), other than mortgage servicing rights |

(2,370 | ) | (2,490 | ) | (2,611 | ) | (2,792 | ) | (735 | ) | ||||||||||

| Tangible common equity (a) |

32,465 | 32,228 | 31,995 | 29,771 | 30,805 | |||||||||||||||

| Common equity tier 1 capital, determined in accordance with transitional regulatory capital requirements related to the current expected credit losses methodology implementation |

44,655 | 42,944 | 42,027 | 41,560 | 44,094 | |||||||||||||||

| Adjustments (2) |

(867 | ) | (866 | ) | (866 | ) | (1,299 | ) | (1,300 | ) | ||||||||||

| Common equity tier 1 capital, reflecting the full implementation of the current expected credit losses methodology (b) |

43,788 | 42,078 | 41,161 | 40,261 | 42,794 | |||||||||||||||

| Total assets |

668,039 | 680,825 | 682,377 | 674,805 | 600,973 | |||||||||||||||