UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 11, 2023

WORTHINGTON INDUSTRIES, INC.

(Exact name of Registrant as Specified in Its Charter)

| Ohio | 001-08399 | 31-1189815 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 200 West Old Wilson Bridge Road Columbus, Ohio |

43085 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (614) 438-3210

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered |

||

| Common Shares, Without Par Value | WOR | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

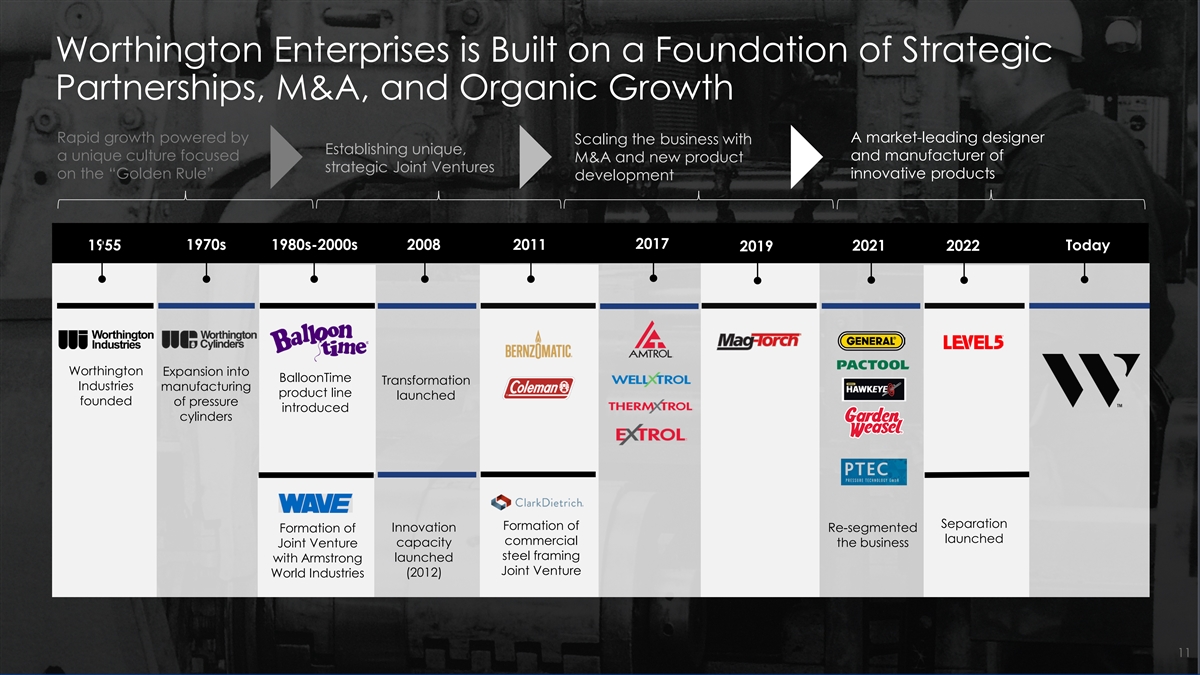

On October 11, 2023, Worthington Industries, Inc. (the “Company”), posted two investor presentations to the Company’s website, both of which relate to the Company’s previously announced plan to separate (the “Planned Separation”) into two independent, publicly traded companies – one company is expected to be comprised of the Company’s Steel Processing business (“Worthington Steel”), and the other company is expected to be comprised of the Company’s Consumer Products, Building Products and Sustainable Energy Solutions businesses (“Worthington Enterprises”). The presentation related to Worthington Steel is included with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by this reference. The presentation related to Worthington Enterprises is included with this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by this reference.

These presentations related to the Planned Separation will be shared at the Investor and Analyst Day event the Company is hosting on October 11, 2023 in New York City, and will be available on the Investor Relations section of the Company’s website at https://ir.worthingtonindustries.com. The Worthington Enterprises executive management team will deliver presentations beginning at 9:30 a.m. ET, with the Worthington Steel executive management team presenting at 1:00 p.m. ET.

Completion of the Planned Separation is subject to, among other things, general market conditions, finalization of the capital structure of the two companies, completion of steps necessary to qualify the Planned Separation as a tax-free transaction, receipt of regulatory approvals and final approval by the Company’s Board of Directors. The Company may, at any time and for any reason until the proposed transaction is complete, abandon the Planned Separation or modify or change its terms, including the individual businesses and components of each of the two companies. There can be no assurance regarding the ultimate timing of the Planned Separation or that the Planned Separation will ultimately occur.

The information furnished under Item 7.01 in this Current Report on Form 8-K (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933 or the Exchange Act, except as set forth by specific reference in such filing. This Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is being disclosed pursuant to Regulation FD.

Safe Harbor Statement

Selected statements contained in this Current Report on Form 8-K constitute “forward-looking statements,” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). The Company wishes to take advantage of the Safe Harbor provisions included in the Act. Forward-looking statements reflect the Company’s current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “should,” “would,” “intend,” “plan,” “will,” “likely,” “estimate,” “project,” “position,” “strategy,” “target,” “aim,” “seek,” “foresee,” or other similar words or phrases. These forward-looking statements include, without limitation, statements relating to: future or expected cash positions, liquidity and ability to access financial markets and capital; outlook, strategy or business plans; the intended separation (the “Separation”) of the Company’s Steel Processing business (“Worthington Steel”) from the Company’s other businesses (“New Worthington”); the timing and method of the Separation; the anticipated benefits of the Separation; the expected financial and operational performance of, and future opportunities for, each of the two independent, publicly-traded companies following the Separation; the tax treatment of the Separation transaction; the leadership of each of the two independent, publicly-traded companies following the Separation; the ever-changing effects of the novel coronavirus (“COVID-19”) pandemic and the various responses of governmental and nongovernmental authorities thereto (such as fiscal stimulus packages, quarantines, shut downs and other restrictions on travel and commercial, social or other activities) on economies (local, national and international) and markets, and on our customers, counterparties, employees and third-party service providers; future or expected growth, growth potential, forward momentum, performance, competitive position, sales, volumes, cash flows, earnings, margins, balance sheet strengths, debt, financial condition or other financial measures; pricing trends for raw materials and finished goods and the impact of pricing changes; the ability to improve or maintain margins; expected demand or demand trends for the Company or its markets; additions to product lines and opportunities to participate in new markets; expected benefits from transformation and innovation efforts; the ability to improve performance and competitive position at the Company’s operations; anticipated working capital needs, capital expenditures and asset sales; anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain and the results thereof; projected profitability potential; the ability to make acquisitions and the projected timing, results, benefits, costs, charges and expenditures related to acquisitions, joint ventures, headcount reductions and facility dispositions, shutdowns and consolidations; projected capacity and the alignment of operations with demand; the ability to operate profitably and generate cash in down markets; the ability to capture and maintain market share and to develop or take advantage of future opportunities, customer initiatives, new businesses, new products and new markets; expectations for Company and customer inventories, jobs and orders; expectations for the economy and markets or improvements therein; expectations for generating improving and sustainable earnings, earnings potential, margins or shareholder value; effects of judicial rulings; and other non-historical matters.

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow: obtaining final approval of the Separation by the Worthington Industries, Inc. Board of Directors; the uncertainty of obtaining regulatory approvals in connection with the Separation, including rulings from the Internal Revenue Service; the ability to satisfy the necessary closing conditions to complete the Separation on a timely basis, or at all; the Company’s ability to successfully separate the two independent companies and realize the anticipated benefits of the Separation; the risks, uncertainties and impacts, for both the Company’s business and the planned Separation, related to the United Auto Workers strikes against Ford, General Motors and Stellantis North America (the “Detroit Three automakers”), and the associated impact on companies that supply the Detroit Three automakers, the duration and scope of which are impossible to predict; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the risks, uncertainties and impacts related to the COVID-19 pandemic – the duration, extent and severity of which are impossible to predict, including the possibility of future resurgence in the spread of COVID-19 or variants thereof – and the availability, effectiveness and acceptance of vaccines, and other actual or potential public health emergencies and actions taken by governmental authorities or others in connection therewith; the effect of national, regional and global economic conditions generally and within major product markets, including significant economic disruptions from COVID-19, the actions taken in connection therewith and the implementation of related fiscal stimulus packages; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States (“U.S.”) withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing commodity prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of the COVID-19 pandemic and Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the U.S. Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability regulations and considerations; the impact of judicial rulings and governmental regulations, both in the U.S. and abroad, including those adopted by the U.S. Securities and Exchange Commission and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the effect of healthcare laws in the U.S. and potential changes for such laws, which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effects of tax laws in the U.S. and potential changes for such laws, which may increase the Company’s costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the filings of Worthington Industries, Inc. with the U.S. Securities and Exchange Commission, including those described in “Part I – Item 1A. – Risk Factors” of the Annual Report on Form 10-K of Worthington Industries, Inc. for the fiscal year ended May 31, 2023.

The Company notes these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, you should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Any forward-looking statements in this Current Report on Form 8-K are based on current information as of the date of this Current Report on Form 8-K, and the Company assumes no obligation to correct or update any such statements in the future, except as required by applicable law.

| Item 9.01 | Financial Statements and Exhibits. |

(a) through (c): Not applicable.

(d) Exhibits:

The following exhibits are included with this Current Report on Form 8-K:

| Exhibit |

Description |

|

| 99.1 | Worthington Steel Investor Presentation posted by Worthington Industries, Inc. on October 11, 2023 (furnished herewith) | |

| 99.2 | Worthington Enterprises Investor Presentation posted by Worthington Industries, Inc. on October 11, 2023 (furnished herewith) | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| WORTHINGTON INDUSTRIES, INC. | ||||||

| Date: October 11, 2023 | By: | /s/ Patrick J. Kennedy |

||||

| Patrick J. Kennedy, Vice President - General Counsel and Secretary |

||||||

Exhibit 99.1 Worthington Steel Investor Day 2023 | October 11, 2023 A premier, value-added steel processor with blue-chip customers and expanded opportunities in electrical steel and automotive lightweighting

Notes to Investors FORWARD LOOKING STATEMENTS. Worthington Industries, Inc. (“Worthington”) and Worthington Steel, Inc. (“Worthington Steel” or the “Company) wish to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements by Worthington and/or the Company relating to the intended separation of Worthington’s Steel Processing business; the timing and method of the separation; the anticipated benefits of the separation; the expected financial and operating performance of, and future opportunities for, each company following the separation; the tax treatment of the transaction; the leadership of each company following the separation; and other non- historical matters constitute “forward-looking statements” within the meaning of the Act. Forward-looking statements may be characterized by terms such as “believe,” “anticipate,” “should,” “would,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “targets,” “aims,” “seeks,” “sees” and similar expressions. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, the final approval of the separation by our board of directors; the uncertainty of obtaining regulatory approvals in connection with the separation; the ability to satisfy the necessary closing conditions to complete the separation on a timely basis, or at all; our ability to successfully separate the two companies and realize the anticipated benefits of the separation; the risks, uncertainties and impacts, for both Worthington and/or the Company’s business and the planned separation, related to the United Auto Workers strikes against Ford, General Motors and Stellantis North America (the “Detroit Three automakers”), and the associated impact on companies that supply the Detroit Three automakers, the duration and scope of which are impossible to predict; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting Worthington and/or the Company products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of Worthington and/or the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which Worthington and/or the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom Worthington and/or the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly- acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which Worthington and/or the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of Worthington and/or the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact Worthington and/or the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by Worthington and/or the Company in the application of its significant accounting policies; the level of imports and import prices in Worthington and/or the Company’s markets; 1

Notes to Investors the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit Worthington and/or the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability considerations or regulations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Act of 2021, and the Dodd-Frank Wall Street Reform and the Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, especially in light of the COVID-19 pandemic which may increase Worthington and/or the Company’s healthcare and other costs and negatively impact Worthington and/or the Company’s operations and financial results; the effect of tax laws in the U.S. and potential changes for such laws, which may increase Worthington and/or the Company's costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the filings of Worthington Industries, Inc. with the SEC, including those described in “Part I — Item 1A. — Risk Factors” of Worthington’s Annual Report on Form 10-K for the fiscal year ended May 31, 2023, and its subsequent filings with the SEC, and in the Registration Statement on Form 10 filed by Worthington Steel (the Form 10 ), including those described in Risk Factors , as may be further amended. Forward-looking statements should be construed in the light of such risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. Worthington and/or Company does not undertake, and hereby disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise. Market, Industry and Other Data: Unless otherwise indicated, information in this presentation concerning our industry, the industries we serve and the markets in which we operate, including our general expectations, market position, market opportunity and market share, is based on information from third-party sources and management estimates. Management estimates are derived from publicly available information and reports provided to us (including reports from S&P Global Mobility and other industry publications, surveys and forecasts), our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Management estimates have not been verified by any independent source. S&P reports, data and information referenced herein (the “S&P Materials”) are the copyrighted property of S&P Global Inc. and its subsidiaries (“S&P”). The S&P Materials are from sources considered reliable; however, the accuracy and completeness thereof are not warranted, nor are the opinions and analyses published by S&P representations of fact. The S&P Materials speak as of the original publication date thereof and are subject to change without notice. S&P and other trademarks appearing in this S&P Materials are the property of S&P or their respective owners. FINANCIAL INFORMATION. Unless otherwise specified, all financial data and operating metrics included in these materials are presented on a carve-out basis, as presented in the Form 10 of Worthington Steel, Inc., as filed with the Securities and Exchange Commission. The financial information included in this document may not necessarily reflect Worthington Steel’s financial position, results of operations and cash flows in the future, or what Worthington Steel’s financial position, results of operations and cash flows would have been had Worthington Steel been a standalone, independent, publicly-traded company during the periods presented. 2

Notes to Investors NON-GAAP MEASURES. These materials present certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles, or GAAP. Management believes these non-GAAP measures provide useful supplemental information on the performance of the Company’s ongoing operations and should not be considered as an alternative to the comparable GAAP measure. Additionally, management believes these non-GAAP measures allow for meaningful comparisons and analysis of trends in Worthington and/or the Company’s businesses and enables investors to evaluate operations and future prospects in the same manner as management. A reconciliation of each non-GAAP measure to its most directly comparable GAAP measure is included in the Appendix. The following provides an explanation of each non-GAAP measure presented in these materials: Adjusted EBITDA is defined as Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization, and consists of EBITDA (calculated by adding or subtracting, as appropriate, interest expense, income tax expense and depreciation and amortization to/from net earnings attributable to controlling interest), which is further adjusted to exclude impairment and restructuring charges (gains) as well as other items that management believes are not reflective of, and thus should not be included when evaluating the performance of its ongoing operations, including incremental costs associated with the planned separation. Impairment charges are excluded from adjusted EBITDA because they do not occur in the ordinary course of our ongoing business operations, are inherently unpredictable in timing and amount, and are non-cash, which we believe facilitates the comparison of historical, current and forecasted financial results Restructuring activities, which can result in both discrete gains and/or losses, consist of established programs that are not part of our ongoing operations, such as divestitures, closing or consolidating facilities, employee severance (including rationalizing headcount or other significant changes in personnel), and realignment of existing operations (including changes to management structure in response to underlying performance and/or changing market conditions). Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by net sales. Free Cash Flow is defined as operating cash flows less capital expenditures. This communication shall not constitute an offer of any securities for sale, nor shall there be any offer, sale or distribution of securities in any jurisdiction in which such offer, sale or distribution would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. For additional information with respect to Worthington Steel and the separation, please refer to the Form 10. The consummation of the separation is subject to customary conditions, as further described in the Form 10. 3

Today’s Presenters Tim Adams Geoff Gilmore Jeff Klingler VP & President & EVP & Chief Financial Officer Chief Executive Officer Chief Operating Officer 4

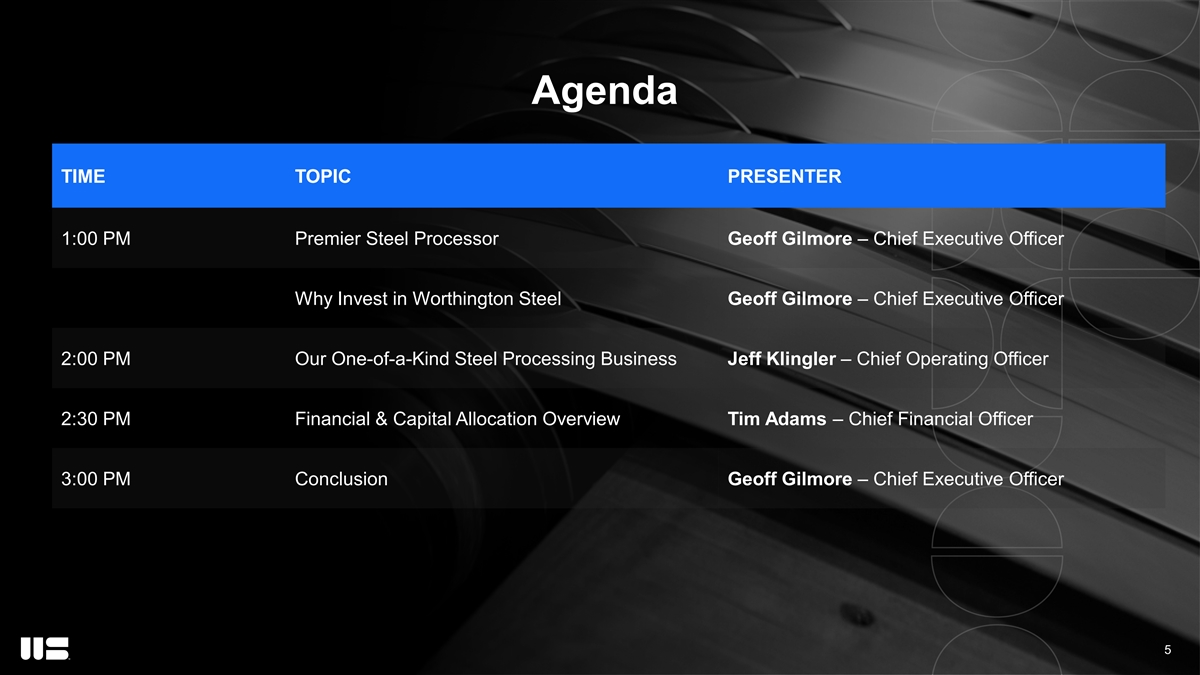

Agenda TIME TOPIC PRESENTER 1:00 PM Premier Steel Processor Geoff Gilmore – Chief Executive Officer Why Invest in Worthington Steel Geoff Gilmore – Chief Executive Officer 2:00 PM Our One-of-a-Kind Steel Processing Business Jeff Klingler – Chief Operating Officer 2:30 PM Financial & Capital Allocation Overview Tim Adams – Chief Financial Officer 3:00 PM Conclusion Geoff Gilmore – Chief Executive Officer 5

PREMIER STEEL PROCESSOR GEOFF GILMORE PRESIDENT & CHIEF EXECUTIVE OFFICER

1 NET SALES 4.0M OUR PHILOSOPHY 1 TONS DELIVERED $3.4B Our people-first philosophy is rooted in the Golden Rule: we treat our employees, customers, suppliers and shareholders as we would like to be treated 3 Net Sales by End-Market 4500 16% PEOPLE OUR VISION 3% 6% To boldly lead the metals industry into a sustainable 53% future by being the most trusted, most innovative and 10% most value-added metals processing partner in North 12% America and beyond 31 Automotive Agriculture Electrical 2 LOCATIONS Construction Heavy Truck Other (Inc. Toll) 1 2 3 TTM ended August 31, 2023; Includes JV people & locations; Sales exclude pro-rata share of unconsolidated JVs. 7

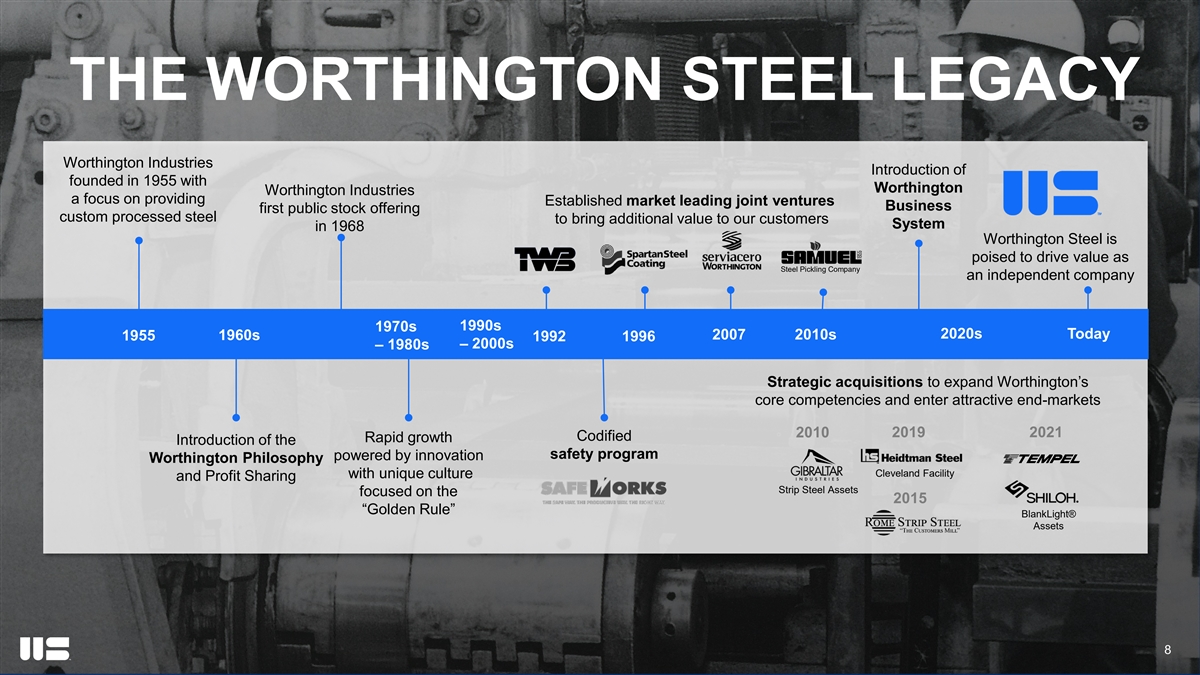

THE WORTHINGTON STEEL LEGACY Worthington Industries Introduction of founded in 1955 with Worthington Worthington Industries a focus on providing Established market leading joint ventures Business first public stock offering custom processed steel to bring additional value to our customers System in 1968 Worthington Steel is poised to drive value as Steel Pickling Company an independent company 1970s 1990s 2020s Today 1960s 2007 2010s 1955 1992 1996 – 2000s – 1980s Strategic acquisitions to expand Worthington’s core competencies and enter attractive end-markets 2010 2019 2021 Codified Rapid growth Introduction of the safety program powered by innovation Worthington Philosophy Cleveland Facility with unique culture and Profit Sharing Strip Steel Assets focused on the 2015 “Golden Rule” BlankLight® Assets 8

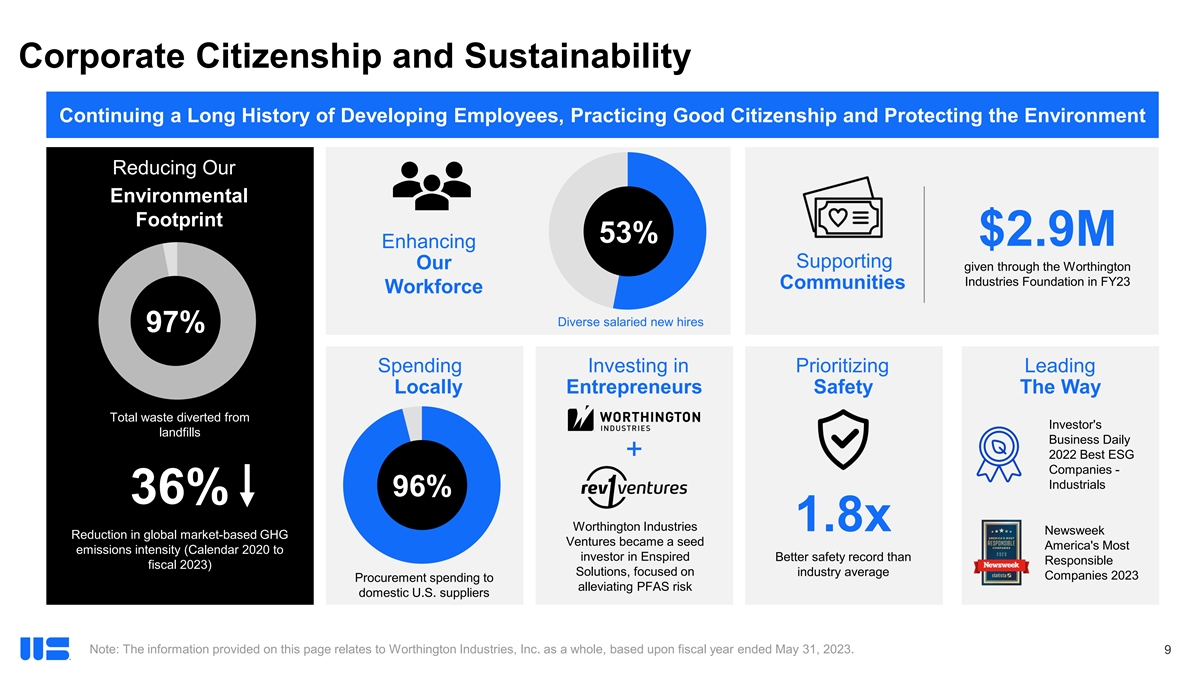

Corporate Citizenship and Sustainability Continuing a Long History of Developing Employees, Practicing Good Citizenship and Protecting the Environment Reducing Our Environmental Footprint 53% $2.9M Enhancing Supporting Our given through the Worthington Industries Foundation in FY23 Communities Workforce Diverse salaried new hires 97% Spending Investing in Prioritizing Leading Locally Entrepreneurs Safety The Way Total waste diverted from Investor's landfills Business Daily 2022 Best ESG + Companies - Industrials 96% 36% Worthington Industries 1.8x Newsweek Reduction in global market-based GHG Ventures became a seed America's Most emissions intensity (Calendar 2020 to investor in Enspired Better safety record than Responsible fiscal 2023) Solutions, focused on industry average Companies 2023 Procurement spending to alleviating PFAS risk domestic U.S. suppliers Note: The information provided on this page relates to Worthington Industries, Inc. as a whole, based upon fiscal year ended May 31, 2023. 9

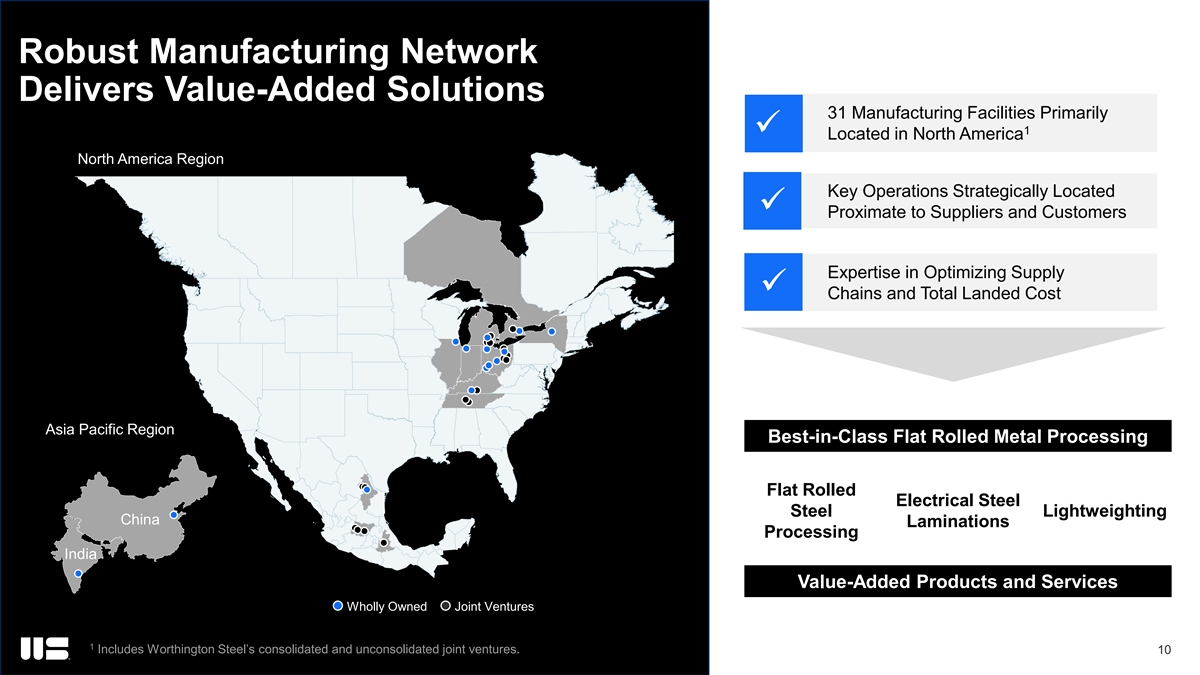

Robust Manufacturing Network Delivers Value-Added Solutions 31 Manufacturing Facilities Primarily 1 ü Located in North America North America Region Key Operations Strategically Located ü Proximate to Suppliers and Customers Expertise in Optimizing Supply ü Chains and Total Landed Cost Asia Pacific Region Best-in-Class Flat Rolled Metal Processing Flat Rolled Electrical Steel Steel Lightweighting China Laminations Processing India Value-Added Products and Services Wholly Owned Facilities Joint Venture Facilities Wholly Owned Joint Ventures 1 Includes Worthington Steel’s consolidated and unconsolidated joint ventures. 10

Critical Supplier to Customers and End Markets Diversified, Blue-Chip Customer Base With Multiple Decades-Long Relationships AUTOMOTIVE CONSTRUCTION ELECTRICAL AGRICULTURE OTHER ~53% OF SALES ~6% OF SALES ~12% OF SALES ~10% OF SALES ~19% OF SALES Note: Sales based on trailing twelve months ended August 31, 2023. 11

PLAY VIDEO 12

WHY INVEST IN WORTHINGTON STEEL GEOFF GILMORE PRESIDENT AND CHIEF EXECUTIVE OFFICER

Unique Steel Processor Well Positioned for Significant Growth 1 WHY Market-Leading Supplier to Attractive End Markets INVEST 2 WORTHINGTON STEEL Strategy Driven by Strong Leadership Team 3 14

Unique Steel Processor Well Positioned for Significant Growth 1 WHY Market-Leading Supplier to Attractive End Markets INVEST 2 WORTHINGTON STEEL Strategy Driven by Strong Leadership Team 3 15

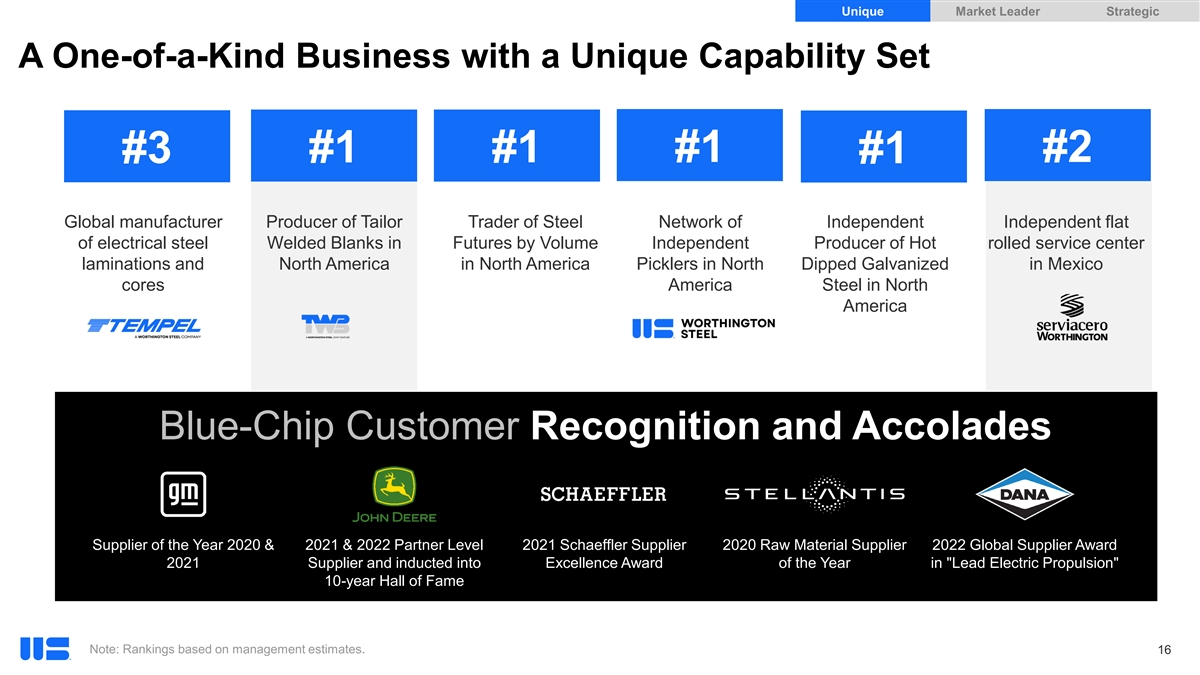

Unique Market Leader Strategic A One-of-a-Kind Business with a Unique Capability Set #1 #1 #1 #2 #3 #1 Global manufacturer Producer of Tailor Trader of Steel Network of Independent Independent flat of electrical steel Welded Blanks in Futures by Volume Independent Producer of Hot rolled service center laminations and North America in North America Picklers in North Dipped Galvanized in Mexico cores America Steel in North America Blue-Chip Customer Recognition and Accolades Supplier of the Year 2020 & 2021 & 2022 Partner Level 2021 Schaeffler Supplier 2020 Raw Material Supplier 2022 Global Supplier Award 2021 Supplier and inducted into Excellence Award of the Year in Lead Electric Propulsion 10-year Hall of Fame Note: Rankings based on management estimates. 16

Unique Market Leader Strategic Worthington Occupies a Unique Position in the Steel Supply Chain WHERE WE OPERATE Mills Service Centers Specialty Hot Roll Dimensional Melt Warehouse Processing Conversion Processing & Distribute Hot Roll Coil (HRC) Specialty cold rolling, Pickling / scale removal Slitting to Width temper pass, annealing, Hot dip galvanizing Cutting to Length heavy gauge blanking Electrical steel lamination manufacturing Tailor welded solutions Supply Chain Management Price Risk Management Why We Win The Breadth of Value-Added Processing Capabilities, End-to-End Supply Chain Management, and Price Risk Management Solutions Differentiates Worthington Steel From Competitors Across the Steel Supply Chain 17

Unique Market Leader Strategic Joint Ventures Expand Our Processing Capabilities and Reach 1 TWB Serviacero Worthington Spartan Steel Coating WSCP (55%) (50%) (52%) (63%) • Partner: BAOSteel Tailored • Partner: Serviacero • Partner: Cleveland-Cliffs • Partner: Samuel, Son & Co. Blanks • Operates 3 steel processing • Single facility in Michigan • Pickling and slitting for the • Tailor welded products for the facilities in Mexico automotive, fabrication and • A cold-rolled, hot-dipped automotive industry appliance markets • Only independent pickler in galvanizing line producing • Operates 11 facilities in US, Mexico galvanized, galvannealed, • Operates 2 pickling facilities Canada, Mexico and aluminized products in Ohio 300k Direct Tons 375k Direct Tons 400k Toll Tons 600k Toll Tons 100k Toll Tons 200k Toll Tons Note: Volumes shown are total tons shipped from the fiscal year ended May 31, 2023 presented on a 100% basis. 18 1 Worthington Samuel Coil Processing.

Unique Market Leader Strategic POWERED by the TRANSFORMATION Worthington Business System Leveraging Lean Practices and Technology • Systematic approach to business improvement • Optimizing working capital • Predictive analytics and automation enhance efficiency, reduce downtime and improve safety INNOVATION Tailored Customer Solutions • Cross-functional teams • Sophisticated supply chain solutions • Price risk management • Metallurgical expertise for customized solutions ACQUISITION Adding Capabilities for Above-Market Growth • Green energy transition: Tempel provides direct exposure to transportation and grid modernization industries • Automotive lightweighting: Acquisition of Shiloh BlankLight® expanded offerings for fuel-efficiency, safety performance and cost reduction 19

Unique Market Leader Strategic Leveraging Business Intelligence Price Risk Management Business intelligence minimizing risk across key inputs Pricing Mechanisms A portfolio of pricing mechanisms to align with customer needs Business Optimization Protect our margins and minimize working capital exposure by matching our selling and buying methodologies 20

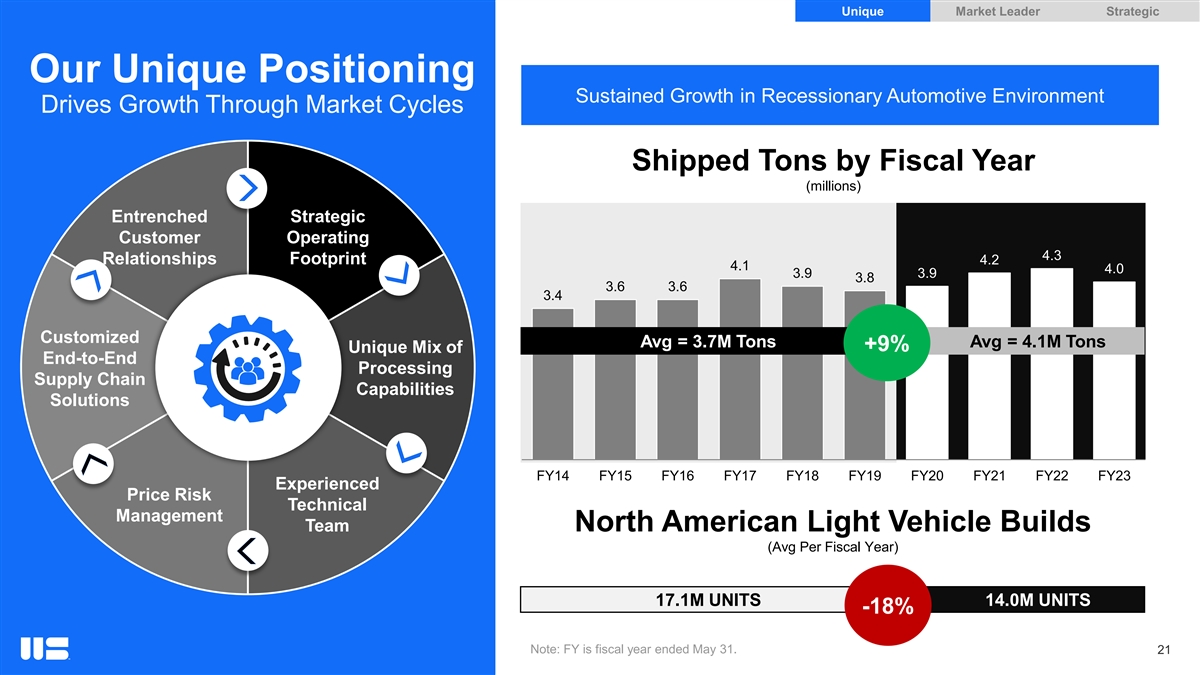

Unique Market Leader Strategic Our Unique Positioning Sustained Growth in Recessionary Automotive Environment Drives Growth Through Market Cycles Shipped Tons by Fiscal Year (millions) Entrenched Strategic Customer Operating 4.3 Relationships Footprint 4.2 4.1 4.0 3.9 3.9 3.8 3.6 3.6 3.4 Customized Avg = 3.7M Tons Avg = 4.1M Tons +9% Unique Mix of End-to-End Processing Supply Chain Capabilities Solutions FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 Experienced Price Risk Technical Management Team North American Light Vehicle Builds (Avg Per Fiscal Year) 17.1M UNITS 14.0M UNITS -18% Note: FY is fiscal year ended May 31. 21

Unique Steel Processor Well Positioned for Significant Growth 1 WHY Market-Leading Supplier to Attractive End Markets INVEST 2 WORTHINGTON STEEL Strategy Driven by Strong Leadership Team 3 22

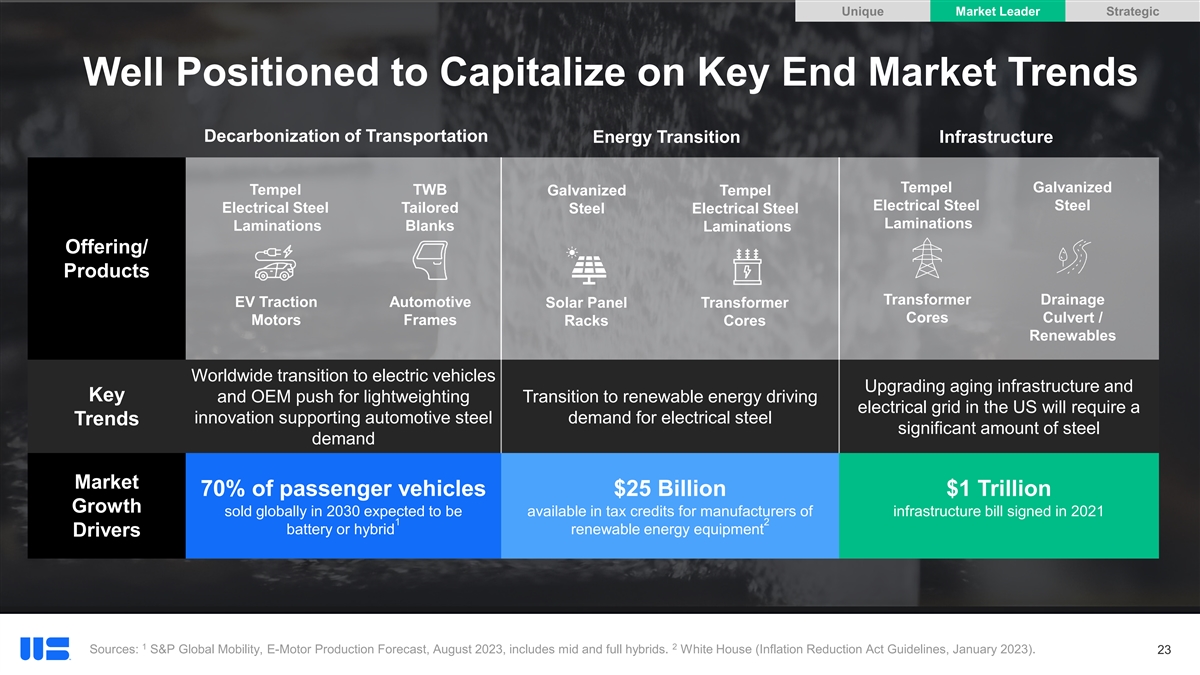

Unique Market Leader Strategic Well Positioned to Capitalize on Key End Market Trends Decarbonization of Transportation Energy Transition Infrastructure Tempel Galvanized Tempel TWB Galvanized Tempel Electrical Steel Steel Electrical Steel Tailored Steel Electrical Steel Laminations Laminations Blanks Laminations Offering/ Products Transformer Drainage EV Traction Automotive Solar Panel Transformer Cores Culvert / Motors Frames Racks Cores Renewables Worldwide transition to electric vehicles Upgrading aging infrastructure and Key and OEM push for lightweighting Transition to renewable energy driving electrical grid in the US will require a innovation supporting automotive steel demand for electrical steel Trends significant amount of steel demand Market 70% of passenger vehicles $25 Billion $1 Trillion Growth sold globally in 2030 expected to be available in tax credits for manufacturers of infrastructure bill signed in 2021 1 2 battery or hybrid renewable energy equipment Drivers 1 2 Sources: S&P Global Mobility, E-Motor Production Forecast, August 2023, includes mid and full hybrids. White House (Inflation Reduction Act Guidelines, January 2023). 23

Unique Market Leader Strategic Automotive Decarbonization Projected Vehicle Production by Propulsion System – 2022 vs. 2030 CY 2022 CY 2030 9% 7% 26% 65% 28% 65% CY 2022 CY 2030 CY 2022 CY 2030 6% 12% 22% 19% 28% Europe 49% 58% 13% 23% 65% 82% 23% North America Greater China Source: S&P Global Mobility, E-Motor Production Forecast, August 2023. 24 Internal Combustion Hybrid Electric Vehicle

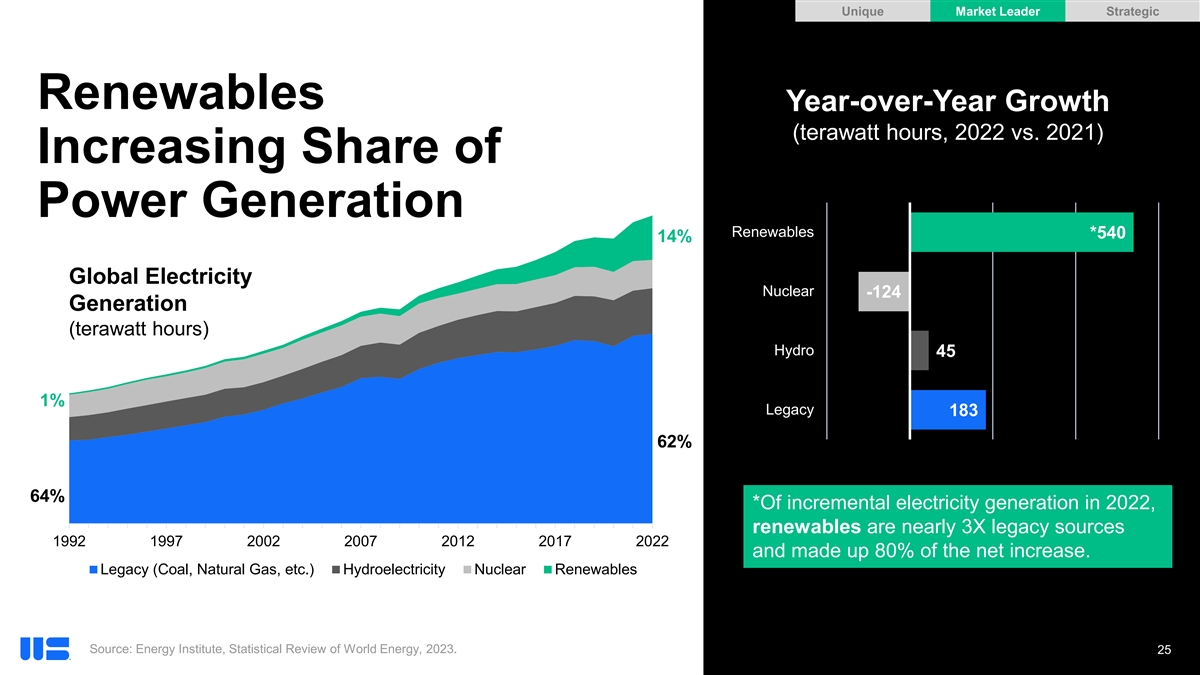

Unique Market Leader Strategic Renewables Year-over-Year Growth (terawatt hours, 2022 vs. 2021) Increasing Share of Power Generation Renewables *540 14% Global Electricity Nuclear -124 Generation (terawatt hours) Hydro 45 1% Legacy 183 62% 64% *Of incremental electricity generation in 2022, renewables are nearly 3X legacy sources 1992 1997 2002 2007 2012 2017 2022 and made up 80% of the net increase. Legacy (Coal, Natural Gas, etc.) Hydroelectricity Nuclear Renewables Source: Energy Institute, Statistical Review of World Energy, 2023. 25

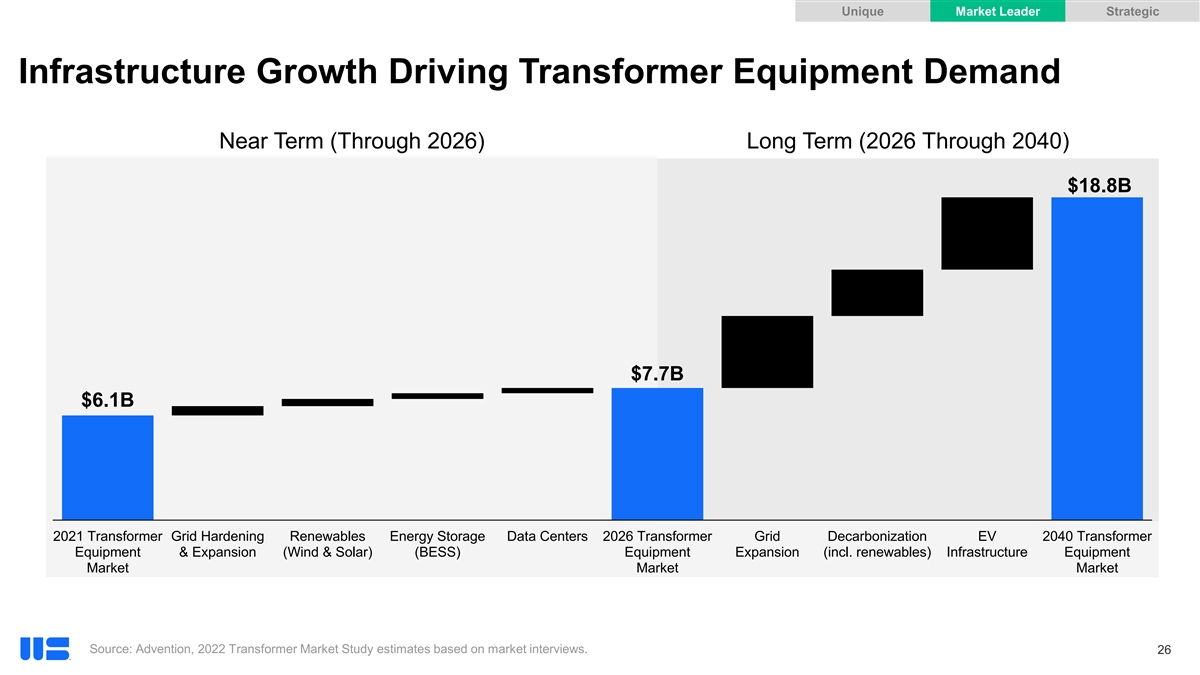

Unique Market Leader Strategic Infrastructure Growth Driving Transformer Equipment Demand Near Term (Through 2026) Long Term (2026 Through 2040) $18.8B $7.7B $6.1B 2021 Transformer Grid Hardening Renewables Energy Storage Data Centers 2026 Transformer Grid Decarbonization EV 2040 Transformer Equipment & Expansion (Wind & Solar) (BESS) Equipment Expansion (incl. renewables) Infrastructure Equipment Market Market Market Source: Advention, 2022 Transformer Market Study estimates based on market interviews. 26

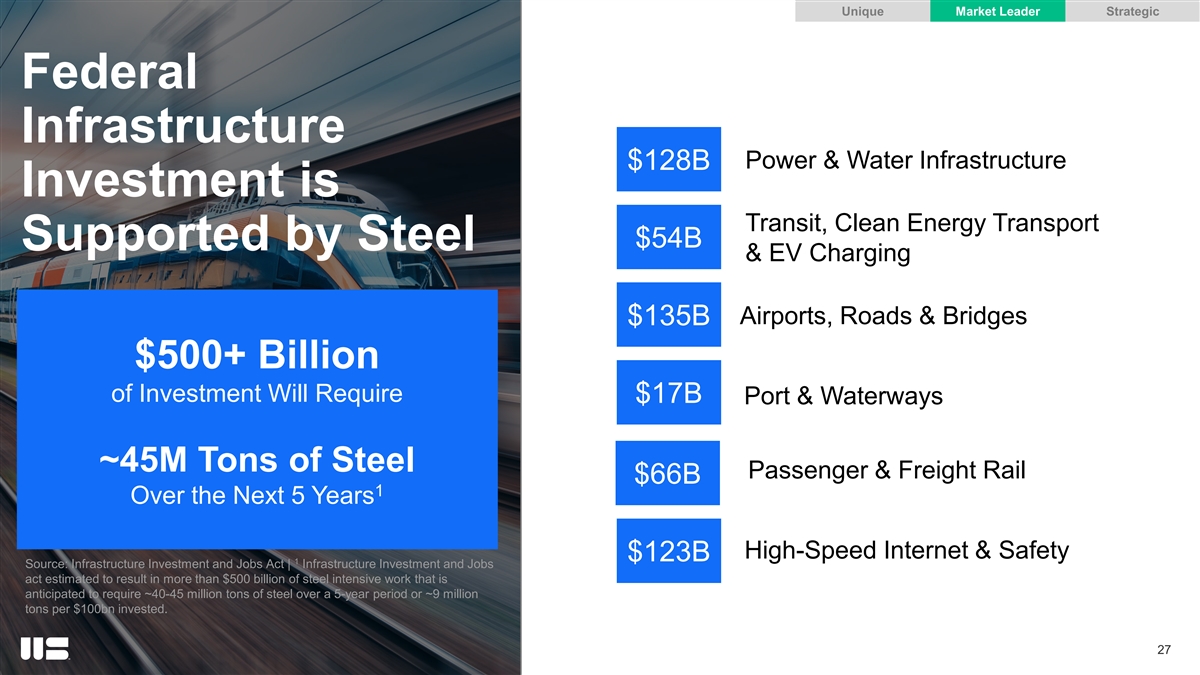

Unique Market Leader Strategic Federal Infrastructure Power & Water Infrastructure $128B Investment is Transit, Clean Energy Transport $54B Supported by Steel & EV Charging $135B Airports, Roads & Bridges $500+ Billion of Investment Will Require $17B Port & Waterways ~45M Tons of Steel Passenger & Freight Rail $66B 1 Over the Next 5 Years High-Speed Internet & Safety $123B 1 Source: Infrastructure Investment and Jobs Act | Infrastructure Investment and Jobs act estimated to result in more than $500 billion of steel intensive work that is anticipated to require ~40-45 million tons of steel over a 5-year period or ~9 million tons per $100bn invested. 27

Unique Steel Processor Well Positioned for Significant Growth 1 WHY Market-Leading Supplier to Attractive End Markets INVEST 2 WORTHINGTON STEEL Strategy Driven by Strong Leadership Team 3 28

Unique Market Leader Strategic Three Strategic Growth Pillars Expected to Drive Our Next Phase of Growth Focused, strategic investments Expand value-added offerings Drive continuous improvement in the rapidly growing electrical through disciplined strategic using the steel market capex and acquisitions Worthington Business System Grow existing portfolio of highly Attractive opportunities in electrical Worthington Business System technical electrical steel products to steel, tailor welded products, and enables higher profitability and is meet demand for infrastructure carbon flat-rolled steel unique among service centers improvements and EVs BUILDING ON A STRONG LEADERSHIP POSITION TO DRIVE SHAREHOLDER VALUE 29

Unique Market Leader Strategic Proven Management Team Focused on Value Creation Nearly 200 Combined Years of Experience Managing Through Steel Price Cycles and Shifting Macroeconomic Climates with Proven Ability to Execute M&A GEOFF GILMORE JEFF KLINGLER TIM ADAMS MICHAUNE TILLMAN MELISSA DYKSTRA President & Chief VP & Chief VP & General Counsel VP of Corporate Communications Executive VP & Executive Officer Chief Operating Officer Financial Officer 9 Years & Investor Relations 25 Years 25 Years 10 Years 30 Years NIKKI BALLINGER BRAD KERN CLIFF LARIVEY BILL WERTZ VP of Human Resources VP of Operations VP of Commercial, Purchasing VP of Transformation & Price Risk Mgmt & Chief Information Officer 12 Years 33 Years 25 Years 26 Years 30

OUR ONE-OF-A-KIND STEEL PROCESSING BUSINESS JEFF KLINGLER EVP & CHIEF OPERATING OFFICER

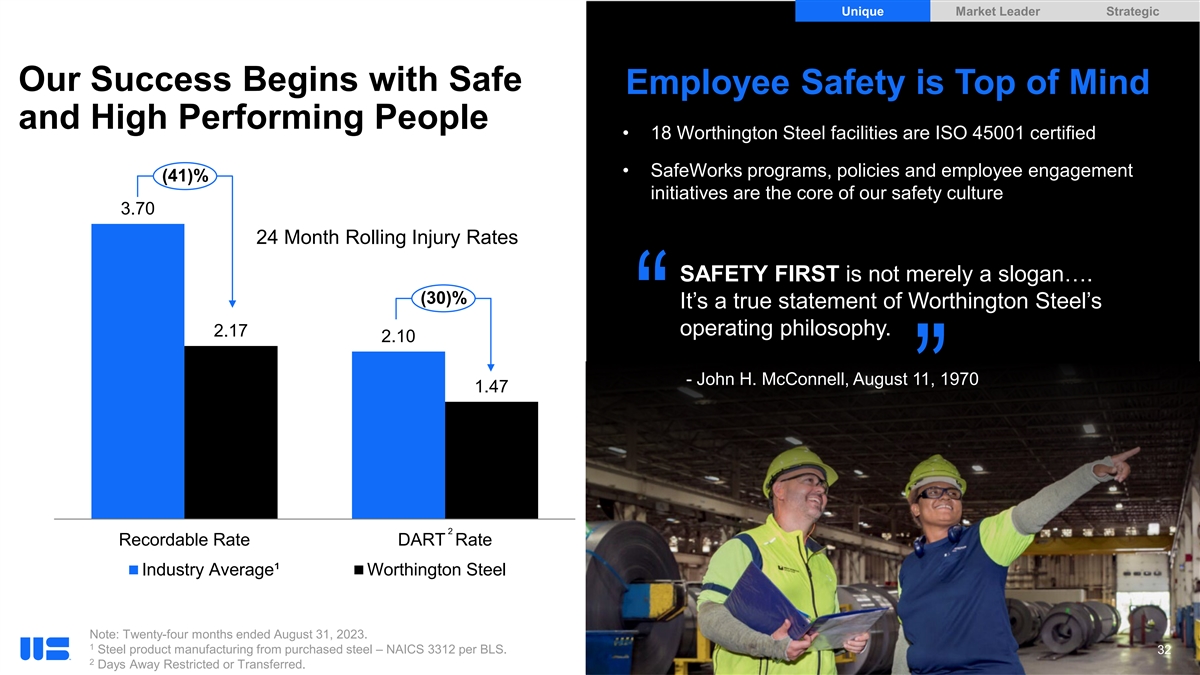

Unique Market Leader Strategic Our Success Begins with Safe Employee Safety is Top of Mind and High Performing People • 18 Worthington Steel facilities are ISO 45001 certified • SafeWorks programs, policies and employee engagement (41)% initiatives are the core of our safety culture 3.70 24 Month Rolling Injury Rates SAFETY FIRST is not merely a slogan…. (30)% It’s a true statement of Worthington Steel’s 2.17 operating philosophy. 2.10 “ - John H. McConnell, August 11, 1970 1.47 ” 2 Recordable Rate DART Rate Industry Average¹ Worthington Steel Note: Twenty-four months ended August 31, 2023. 1 Steel product manufacturing from purchased steel – NAICS 3312 per BLS. 32 2 Days Away Restricted or Transferred.

Unique Market Leader Strategic Our Differentiated Business Model Drives Worthington Steel Forward Beginning with Material Worthington Steel Offers a Wide Range of Value-Added Serving Customers Across from our Mill Partners Processing Capabilities and Services Attractive End Markets Entrenched Strategic Customer Operating Relationships Footprint Automotive Renewable Power Customized Unique Mix of Steel End-to-End Infrastructure Processing Supply Chain Capabilities Solutions Agriculture Mills Construction Experienced Price Risk Heavy Truck Technical Management Team 33

Unique Market Leader Strategic Materials Support and Solutions Team Technical Service Offerings World Class Technical Team Consistent Quality 21 400+ Control & Years of Combined Experience Field & Plant Metallurgists Assurance Knowledge Product Experts Development “Cradle to 6 4 Grave” Material Scientists in the Testing Laboratories Providing Customer and Corporate Materials Laboratory Full Material Characterization Commercial Support State-of-the-Art Data & Analytics Sourcing Operational Process Simulation Driven Decision-Making Development Assistance Equipment Our Technical Services Team Ensures Consistency and Performance Throughout the Sales Process 34

Unique Market Leader Strategic CASE STUDY: Identifying and Solving for Pitted Steel SOLUTION ANALYSIS PROBLEM Defined optimized processing and Customer was paying for buffing and Microstructurally examined the microstructure parameters to maintain the polishing to reduce a rough appearance on steel and determined process surface quality and eliminate buffing and competitive product after forming controls to improve the appearance polishing costs for the customer Over 150,000 shipped tons during fiscal year 2023 tied directly to 35 technical customer development projects completed during the prior five years

Unique Market Leader Strategic The Worthington Business System Drives Continuous Improvement Goal: Margin Expansion Through Operational Excellence Focus: Columbus Tandem Mill Objectives • Improve gauge-reduction performance to reduce scrap and processing time • Leverage insights from various holistic data set and business intelligence tools to identify opportunities for improvement Approximate Savings Achieved $2M $315k Annually Annually Scrap Savings from Improved Performance Reduced / Optimized Footage and Reduced Processing Time 36

Carbon Flat Rolled Steel Processing Market leading provider of carbon flat-rolled steel – a key supplier across the value chain 37

Unique Market Leader Strategic High Quality Steel Processing for Hot Roll Conversion North American Customers 15 Manufacturing Locations Pickling Hot Dip Galvanizing Specialty Processing North America Region Cold Rolling Temper Passing Heavy Gauge Blanking Annealing Asia Pacific Region Dimensional Processing Value-Added Processing Other Processing Locations Slitting to Width Cutting to Length 1 Reflects volumes sold directly to customers in fiscal year ended May 31, 2023. 38 2 Reflects tons of steel customer material toll processed in fiscal year ended May 31, 2023.

Electrical Steel Laminations Tempel is a leading manufacturer of precision magnetic steel laminations for the automotive, transformer, industrial motor, and generator industries • Acquired Tempel Steel on December 1, 2021 39

Unique Market Leader Strategic Electric Motor Laminations Delivering Electrical Steel Laminations to Customers Globally 5 Manufacturing Locations North America Region North America Region Transformer Laminations Asia Pacific Region China India Electrical Steel Other Processing Locations 40

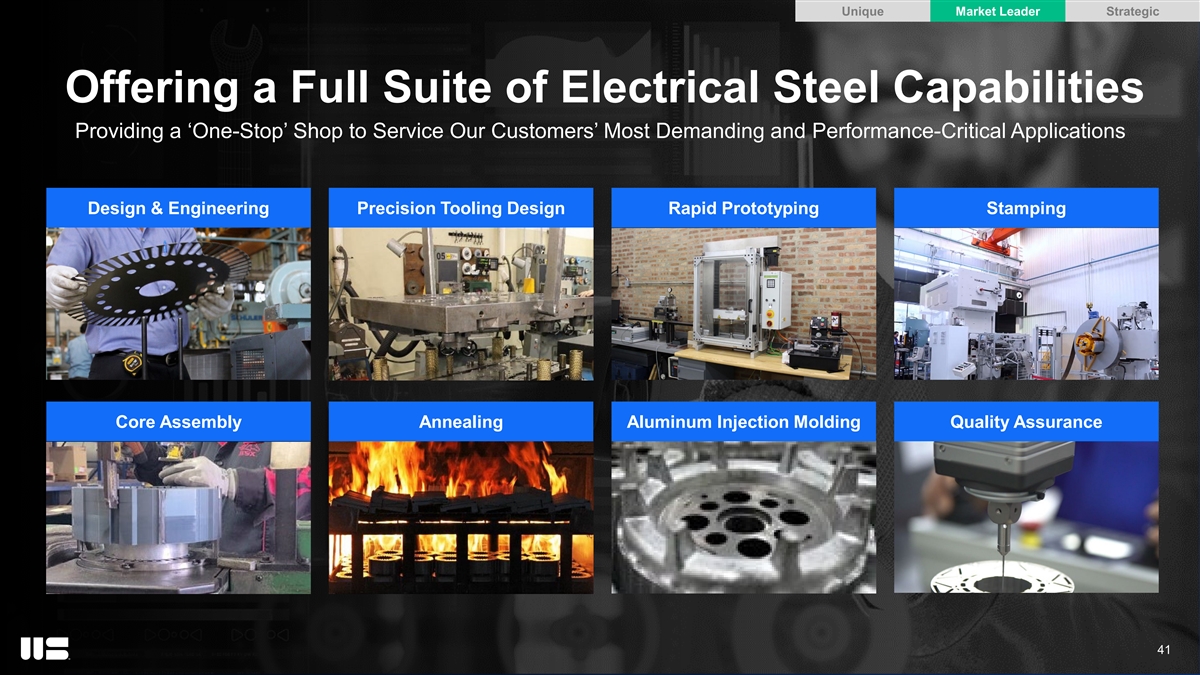

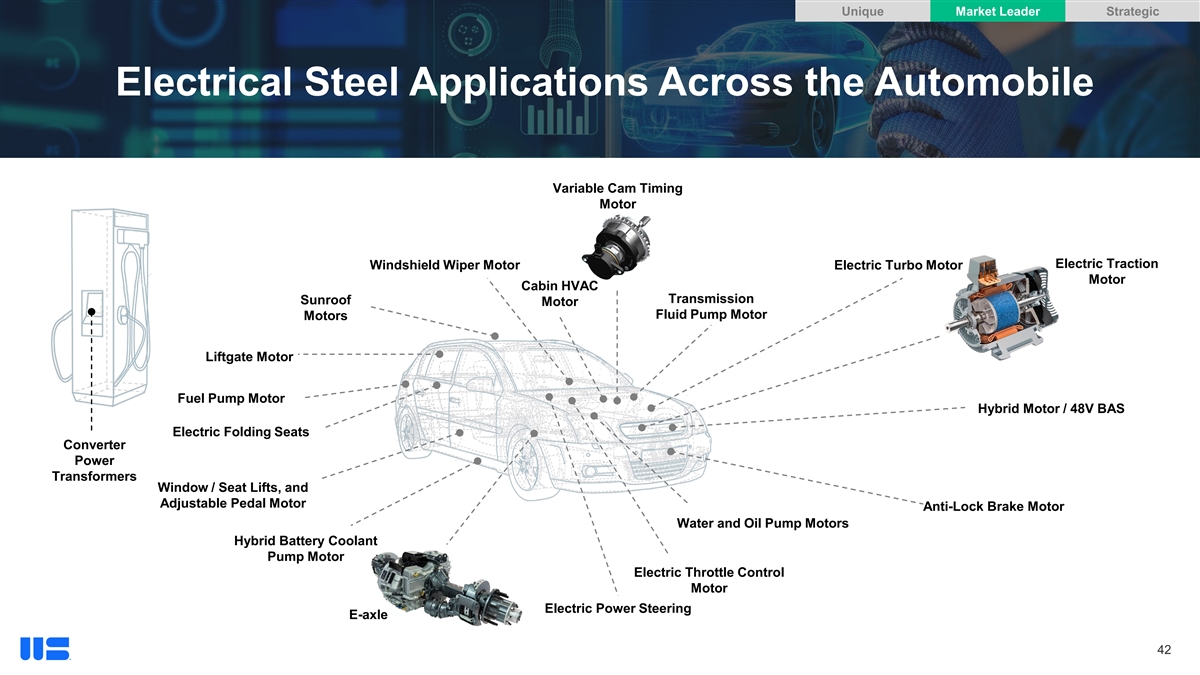

Unique Market Leader Strategic Offering a Full Suite of Electrical Steel Capabilities Providing a ‘One-Stop’ Shop to Service Our Customers’ Most Demanding and Performance-Critical Applications Design & Engineering Precision Tooling Design Rapid Prototyping Stamping Core Assembly Annealing Aluminum Injection Molding Quality Assurance 41

Unique Market Leader Strategic Electrical Steel Applications Across the Automobile Variable Cam Timing Motor Electric Traction Windshield Wiper Motor Electric Turbo Motor Motor Cabin HVAC Transmission Sunroof Motor Fluid Pump Motor Motors Liftgate Motor Fuel Pump Motor Hybrid Motor / 48V BAS Electric Folding Seats Converter Power Transformers Window / Seat Lifts, and Adjustable Pedal Motor Anti-Lock Brake Motor Water and Oil Pump Motors Hybrid Battery Coolant Pump Motor Electric Throttle Control Motor Electric Power Steering E-axle 42

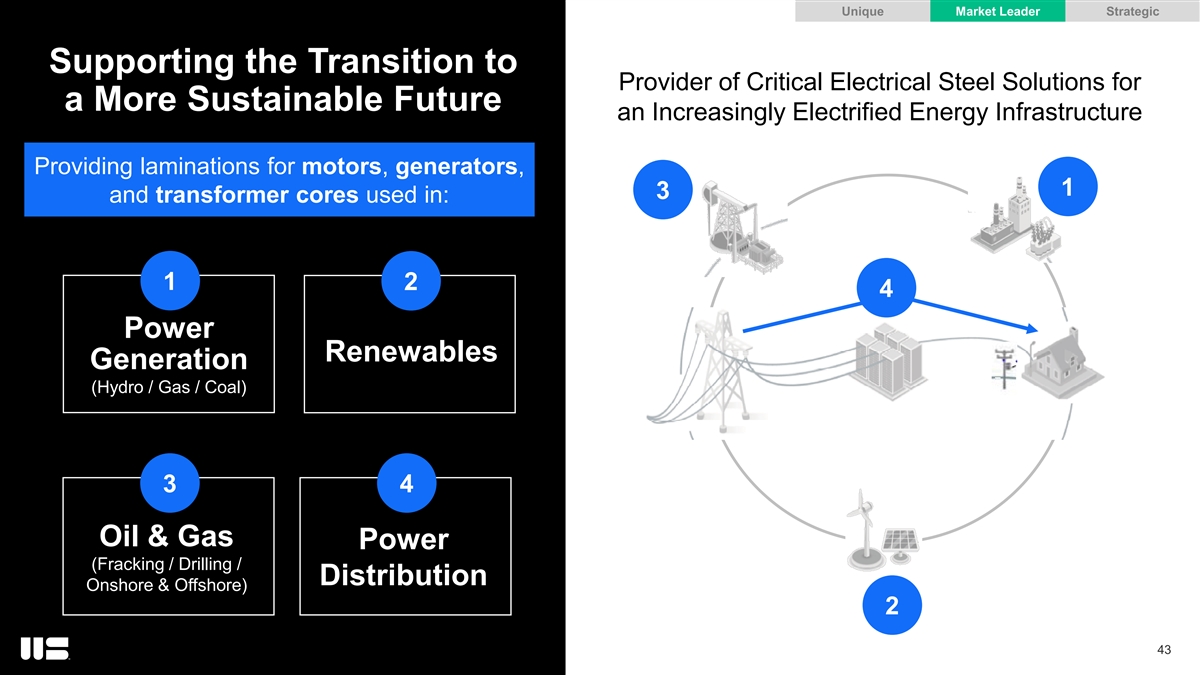

Unique Market Leader Strategic Supporting the Transition to Provider of Critical Electrical Steel Solutions for a More Sustainable Future an Increasingly Electrified Energy Infrastructure Providing laminations for motors, generators, 1 3 and transformer cores used in: 1 2 4 Power Renewables Generation (Hydro / Gas / Coal) 3 4 Oil & Gas Power (Fracking / Drilling / Distribution Onshore & Offshore) 2 43

Lightweighting The TWB Company is a North American leader in Tailor Welded Solutions with products used to reduce weight, lower cost, improve material utilization and consolidate parts • Formed in 1992, the TWB Company is a joint venture between Worthington Steel (55%) and BAOSteel Tailored Blanks (45%) 44

Unique Market Leader Strategic Lightweighting Solutions for We create value for our customers through North American Customers lightweighting, material utilization and cost management 11 Manufacturing Locations Tailor Welded Finished Part Blanks North America Region North America Region Asia Pacific Region Asia Pacific Region Lightweighting Other Processing Locations 45

Unique Market Leader Strategic New Product Development to Meet Evolving Customer Needs Driving Market Share Gains and Customer Intimacy Through a “Voice of Customer” Approach to New Product Development At the Forefront of EV Battery Box Design Continued Enhancements to Core Offerings 3rd Generation Advanced High Upper / Lower Structural Multi-Dimensional Welded Strength Steel Battery Covers Battery Tray Frame Rails Since 2000, we have successfully launched more than 500 production parts 46

A sophisticated business built on a legacy of customer-focused innovation. 47

FINANCIAL & CAPITAL ALLOCATION OVERVIEW TIM ADAMS VP & CHIEF FINANCIAL OFFICER

Unique Market Leader Strategic Financial Strong growth potential with exposure to fast growing end markets Highlights Well Positioned Balance sheet strength and ample liquidity to capitalize on market opportunities to Drive Strong Shareholder Value Creation. Disciplined strategic capital investments and acquisitions Lean operating model enables robust free cash flow generation 49

Unique Market Leader Strategic Key Financial Metrics Trailing Twelve Months ended August 31, 2023 Net Sales Volume Adjusted EBITDA $3.4B 4.0M tons $244M (7.1% EBITDA Margin) 1 2 Free Cash Flow Capex Net Debt $228M $52M $120M (1.5% of Net Sales) at separation Note: Metrics are presented as of the trailing twelve months ended August 31, 2023, except net debt, which represents estimates at separation. 50 1 2 Free Cash Flow defined as Operating Cash Flow less Capex. Net debt represents anticipated $150M of debt less $30M of cash at separation.

Unique Market Leader Strategic History of Resilient Performance Net Sales ($M) & Volumes (M Tons) Adjusted EBITDA ($M) | Margin (%) $4,069 $290 $3,608 $266 $3,439 $244 $206 Strategic Acquisitions: 13% $2,127 7% 7% 6% 4.3 4.2 4.0 4.0 FY2021A FY2022A FY2023A TTM (Aug) Adjusted EBITDA ($M) EBITDA Margin FY2021A FY2022A FY2023A TTM (Aug) Estimated Net Sales ($M) Shipped Tons Holding $75 $22 ($49) ($32) G/(L) Note: FY is fiscal year ended May 31, TTM is trailing twelve months ended August 31, 2023. 51

Unique Market Leader Strategic Margin Expansion Opportunities: Levers for Improved Performance Strategy to Target Double-Digit Adj. EBITDA Margins 10%+ 7% TTM (Aug) Adj. Worthington Business Product Mix New Products Acquisitions Long-Term Target EBITDA Margin System Adj. EBITDA Margin Strategy to Worthington Improving product Introduce higher Acquire margin Target 10%+ Business System mix with focus on margin new products accretive businesses drives out waste highest margin and processes Adj. EBITDA products Margin Note: TTM is trailing twelve months ended August 31, 2023. 52

Unique Market Leader Strategic Operating Cash Flow Generation 1 Operating Cash Flow ($M) Operating Working Capital ($M) $850 $1,600 $890 $865 $315 $646 $280 $551 $481 $396 $153 $39 FY2021A FY2022A FY2023A TTM (Aug) FY2021A FY2022A FY2023A TTM (Aug) Capex $29 $36 $45 $52 Steel Price ($/ton) Operating Working Capital ($M) ($M) Note: FY is fiscal year ended May 31. TTM is trailing twelve months ended August 31, 2023. 53 1 Operating Working Capital defined as accounts receivable plus inventory minus accounts payable.

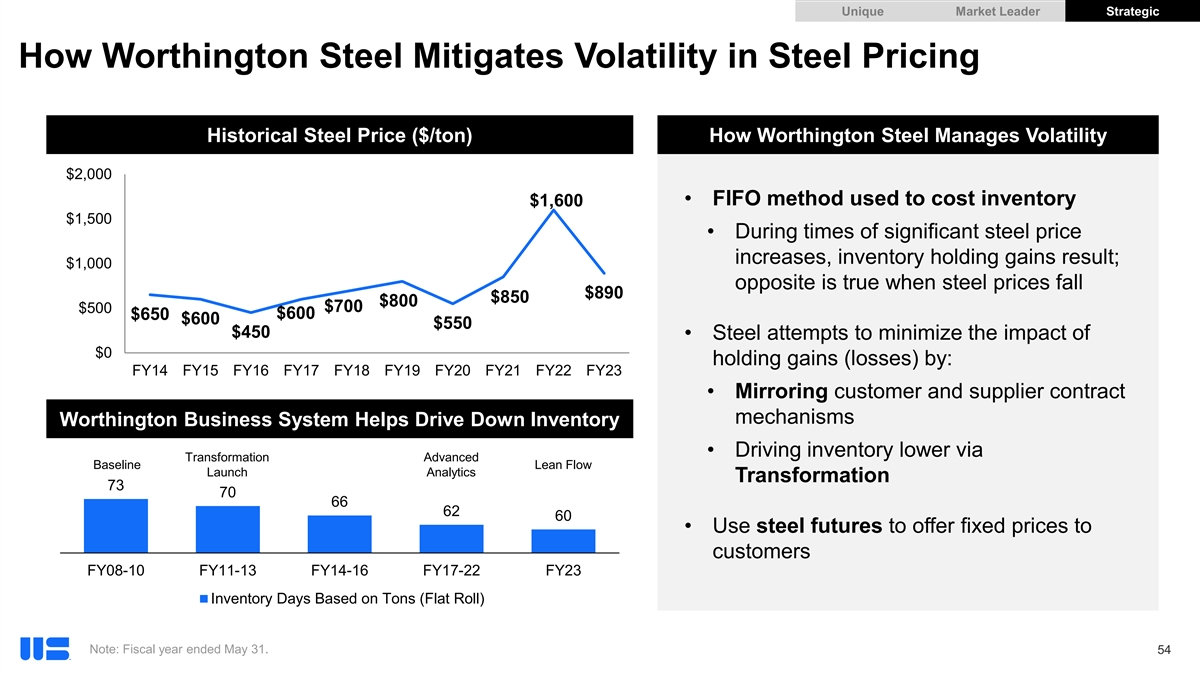

Unique Market Leader Strategic How Worthington Steel Mitigates Volatility in Steel Pricing Historical Steel Price ($/ton) How Worthington Steel Manages Volatility $2,000 • FIFO method used to cost inventory $1,600 $1,500 • During times of significant steel price increases, inventory holding gains result; $1,000 opposite is true when steel prices fall $890 $850 $800 $700 $500 $600 $650 $600 $550 $450 • Steel attempts to minimize the impact of $0 holding gains (losses) by: FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 • Mirroring customer and supplier contract mechanisms Worthington Business System Helps Drive Down Inventory • Driving inventory lower via Transformation Advanced Baseline Lean Flow Launch Analytics Transformation 73 70 66 62 60 • Use steel futures to offer fixed prices to customers FY08-10 FY11-13 FY14-16 FY17-22 FY23 Inventory Days Based on Tons (Flat Roll) Note: Fiscal year ended May 31. 54

Unique Market Leader Strategic Capital Investments Intended to Strengthen and Grow Market Position Capital Expenditures ($M) ~$35-40M / Year Expected Go Forward Run-Rate Maintenance Capex Spend Strategic Capital Investments $16 • Increasing Lightweighting Capabilities / Capacity $12 • Hot Galvanizing Line: produce Type 1 $8 aluminized steels for the automotive industry $13 • Laser Welding: support lightweighting targets for $36 $33 new Battery EV models $28 $16 • Scaling Global Presence through Strategic Projects FY2021 FY2022 FY2023 TTM • Electrical Steel Lamination Presses: bolster Maintenance Strategic electric vehicle market growth in Mexico, China, and India Capex as 1.4% 0.9% 1.3% 1.5% % of Sales Note: FY is fiscal year ended May 31. TTM is trailing twelve months ended August 31, 2023. 55

Unique Market Leader Strategic Focused Strategic Investments in Electrical Steel Mexico: Increase Capacity to Meet Growing xEV Demand • Expect to invest in a capacity expansion over 24-36 months • Adding ten new presses designed to produce electrical steel laminations used in xEV traction motors • Building expansion underway and placed order for first five presses Canada: Increase Capacity to Meet Transformer Demand • Expect to invest over 24-36 months to double current capacity to produce transformer cores from electrical steel • Significant growth expected in transformers due to age of power grid, increased xEV demand and use of renewable energy • Placed order for long-lead time equipment Expect steady state EBITDA margins to be accretive 56

Unique Market Leader Strategic • Focus on opportunities that are accretive to earnings & Expand margins Value-Added • Seek adjacent capabilities to broaden portfolio and Offerings enhance our strategic position Add zinc pot Through Capex shot • Acquisitions target businesses with potential for margin & Acquisitions enhancement via Transformation and analytics • Identify partners that complement and enhance existing products, customers, and geographic footprint • Enhance supply chain network and geographic coverage 57

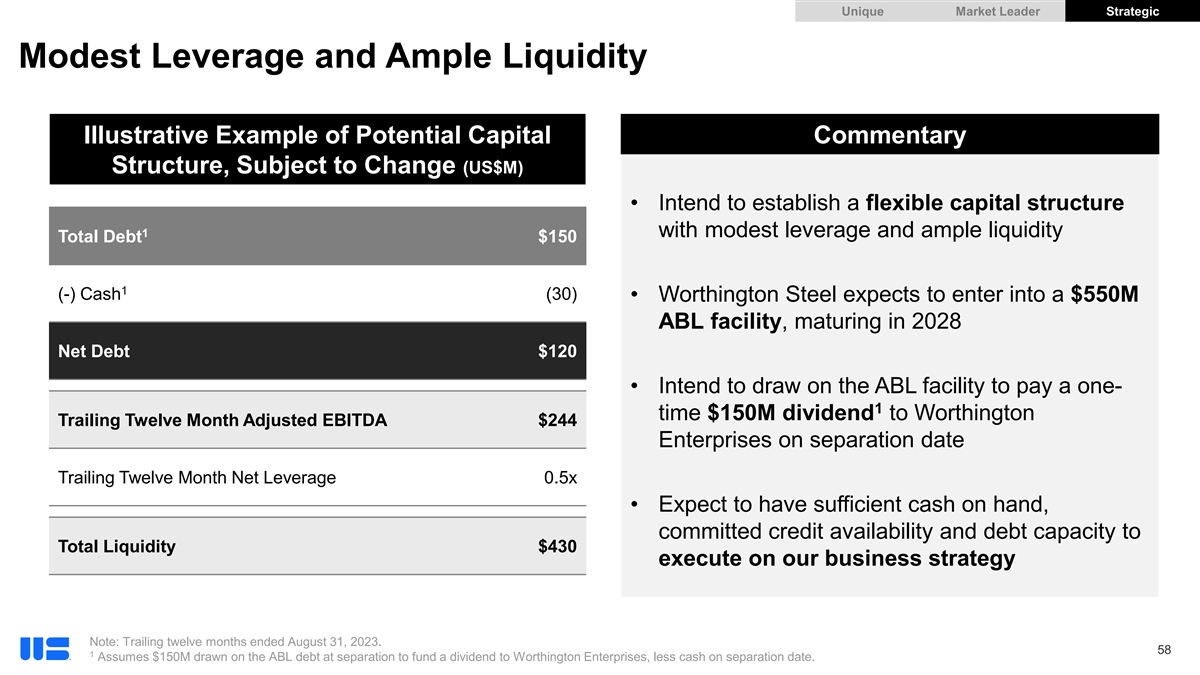

Unique Market Leader Strategic Modest Leverage and Ample Liquidity Illustrative Example of Potential Capital Commentary Structure, Subject to Change (US$M) • Intend to establish a flexible capital structure 1 with modest leverage and ample liquidity Total Debt $150 1 (-) Cash (30) • Worthington Steel expects to enter into a $550M ABL facility, maturing in 2028 Net Debt $120 • Intend to draw on the ABL facility to pay a one- 1 time $150M dividend to Worthington Trailing Twelve Month Adjusted EBITDA $244 Enterprises on separation date Trailing Twelve Month Net Leverage 0.5x • Expect to have sufficient cash on hand, committed credit availability and debt capacity to Total Liquidity $430 execute on our business strategy Note: Trailing twelve months ended August 31, 2023. 58 1 Assumes $150M drawn on the ABL debt at separation to fund a dividend to Worthington Enterprises, less cash on separation date.

Unique Market Leader Strategic Disciplined Framework Designed to Drive Shareholder Value Maintain Ample Liquidity and Financial Flexibility to Support Strategic Initiatives and Resiliency Through the Cycle Organic Strategic Shareholder Growth M&A Return • Maintain operations in • Target acquisition • Focus on maximizing market ready condition shareholder return opportunities that are expected to be immediately accretive to • Grow capacity to meet • Expect to pay a modest earnings electrical steel and dividend lightweighting demand • Leverage track record and skill set to integrate bolt- • Intend to pursue • Pursue high IRR on opportunities and opportunistic share capacity additions realize synergies buybacks 59

CONCLUDING REMARKS GEOFF GILMORE PRESIDENT AND CHIEF EXECUTIVE OFFICER

Unique Steel Processor Well Positioned for Significant Growth 1 REASONS Market-Leading Supplier to Attractive End Markets TO INVEST 2 IN WORTHINGTON STEEL Strategy Driven by Strong Leadership Team 3 61

QUESTIONS

Appendix

Update on Separation Into Two World-Class Companies Key Events Expected Timing Public Announcement of Separation September 29, 2022 Public Form 10 Filing October 4, 2023 Investor Day Presentation October 11, 2023 Target for Start of Regular Way Trading December 2023 Note: There can be no assurance that the spin-off will occur or, if it does occur, of its terms or timing. 64

Reconciliation of Non-GAAP Financial Measures The steel processing business of Worthington Industries, Inc. Fiscal Year Ended TTM (Worthington Steel) has provided in this presentation certain May 31, August 31, financial information that has not been prepared in accordance with (In millions) 2021 2022 2023 2023 accounting principles generally accepted in the United States of $ 2,127 $ 4,069 $ 3,608 $ 3,439 Net Sales America (“non-GAAP”). Non-GAAP measures should not be considered in isolation from, or as a substitute for, financial $ 171 $ 180 $ 87 $ 115 Net earnings attributable to controlling interest information calculated in accordance with GAAP. Interest expense, net - 3 3 2 Adjusted Earnings Before Interest, Taxes, Depreciation and Income tax expense 48 54 29 36 Amortization (Adjusted EBITDA). Adjusted EBITDA consists of Depreciation and amortization 45 60 70 69 EBITDA (calculated by adding or subtracting, as appropriate, EBITDA $ 264 $ 297 $ 189 $ 222 interest expense, income tax expense and depreciation and (1) Impairment of long-lived assets - 2 2 3 amortization to/from net earnings attributable to controlling (1) Restructuring and other (income) expense, net 2 (9) (2) (2) interest), which is further adjusted to exclude impairment and (2) Separation costs - - 17 21 restructuring expense (income) as well as other items that Adjusted EBITDA $ 266 $ 290 $ 206 $ 244 management believes are not reflective of, and thus should not be included when evaluating the performance of its ongoing Adjusted EBITDA margin 13% 7% 6% 7% operations, including incremental costs associated with the planned separation. (1) Excludes the impact of the noncontrolling interests. Free Cash Flows. Free cash flows is calculated by subtracting (2) Includes direct and incremental costs incurred in connection with the separation of Worthington Steel capital expenditures from operating cash flows. from Worthington Industries, Inc., including audit, legal, and other fees paid to third-party advisors as well as direct and incremental costs associated with the separation of shared corporate functions. TTM August 31 2023 Operating cash flow $ 280 Capital expenditures 52 Free cash flow $ 228 65

OUR PHILOSOPHY adopted in 1961, is the foundation of our culture EARNINGS SUPPLIERS § The first corporate goal for Worthington Industries is to earn money for its § We cannot operate profitably without those who supply the quality materials we shareholders and increase the value of their investment. need. § We believe that the best measurement of the accomplishment of our goal is § We ask that suppliers be competitive in the marketplace with regard to quality, consistent growth in earnings per share. pricing, delivery and volume purchased. § We are a loyal customer to suppliers who meet our quality and service requirements through all market conditions. OUR GOLDEN RULE § We treat our customers, employees, investors and suppliers, as we would like to ORGANIZATION be treated. § We believe in a divisionalized organizational structure with responsibility for performance resting with the head of each operation. PEOPLE § All managers are given the operating latitude and authority to accomplish their § We are dedicated to the belief that people are our most important asset. responsibilities within our corporate goals and objectives. § We believe people respond to recognition, opportunity to grow and fair § In keeping with this philosophy, we do not create excessive corporate compensation. procedures. If procedures are necessary within a particular company operation, § We believe that compensation should be directly related to job performance and that manager creates them. therefore use incentives, profit sharing or otherwise, in every possible situation. § We believe in a small corporate staff and support group to service the needs of § From employees we expect an honest day's work for an honest day's pay our shareholders and operating units as requested. § We believe in the philosophy of § continued employment for all Worthington people. § In filling job openings, every effort is expended to find candidates within COMMUNICATION Worthington, its divisions or subsidiaries.§ We communicate through every possible channel with our customers, employees, shareholders, suppliers and financial community. CUSTOMERS CITIZENSHIP § Without the customer and their need for our products and services we have nothing.§ Worthington Steel practices good citizenship at all levels. We conduct our § We will exert every effort to see that the customer’s quality and service business in a professional and ethical manner. requirements are met.§ We encourage all our people to actively participate in community affairs § Once a commitment is made to a customer, every effort is made to fulfill that § We support worthwhile community causes. obligation. 66

ibdroot\projects\IBD-NY\trillium2020\664375_1\16. Investor Day Presentations\03. WOR Enterprises\2023.09.29 - Exhibit 99.2 Investor Day - WOR Enterprises Shell_v78.pptx INVESTOR DAY OCTOBER 11, 2023 A m ar k et - l ead i ng designer and manufacture r o f i nno v at i v e B u i l d i ng P rod uc t s, C on sum e r P rod uc t s, a n d S u s t ai nab l e E ner g y S o l u t i o ns

Notes to Investors FORWARD LOOKING STATEMENTS. Worthington Industries, Inc. (the “Company” or “Worthington”) wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements by the Company relating to the intended separation of Worthington’s Steel Processing business; the timing and method of the separation; the anticipated benefits of the separation; the expected financial and operating performance of, and future opportunities for, each company following the separation; the tax treatment of the transaction; the leadership of each company following the separation; and other non-historical matters constitute “forward-looking statements” within the meaning of the Act. Forward-looking statements may be characterized by terms such as “believe,” “anticipate,” “should,” “would,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “targets,” “aims,” “seeks,” “sees” and similar expressions. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, the final approval of the separation by our board of directors; the uncertainty of obtaining regulatory approvals in connection with the separation; the ability to satisfy the necessary closing conditions to complete the separation on a timely basis, or at all; our ability to successfully separate the two companies and realize the anticipated benefits of the separation; the risks, uncertainties and impacts, for both the Company’s business and the planned separation, related to the United Auto Workers strikes against Ford, General Motors and Stellantis North America (the “Detroit Three automakers”), and the associated impact on companies that supply the Detroit Three automakers, the duration and scope of which are impossible to predict; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability considerations or regulations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Act of 2021, and the Dodd-Frank Wall Street Reform and the Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, especially in light of the COVID-19 pandemic which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effect of tax laws in the U.S. and potential changes for such laws, which may increase the Company's costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the filings of Worthington Industries, Inc. with the SEC, including those described in “Part I — Item 1A. — Risk Factors” of Worthington’s Annual Report on Form 10-K for the fiscal year ended May 31, 2023, and its subsequent filings with the SEC. Forward-looking statements should be construed in the light of such risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. Worthington does not undertake, and hereby disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise. 2

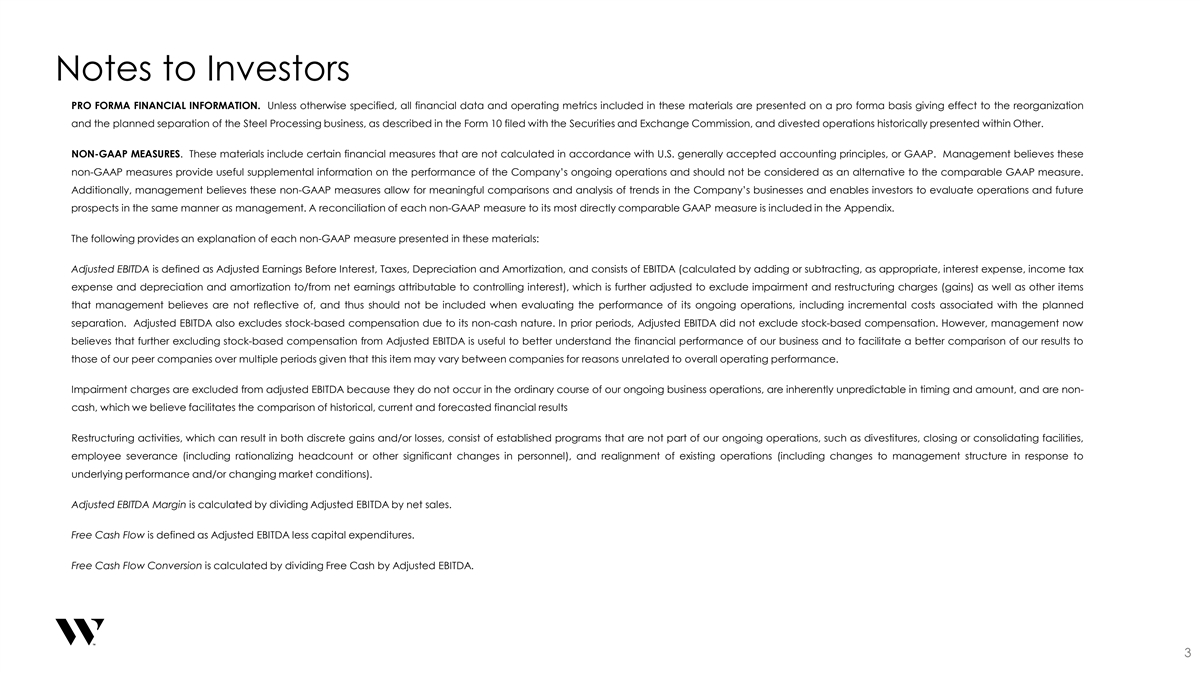

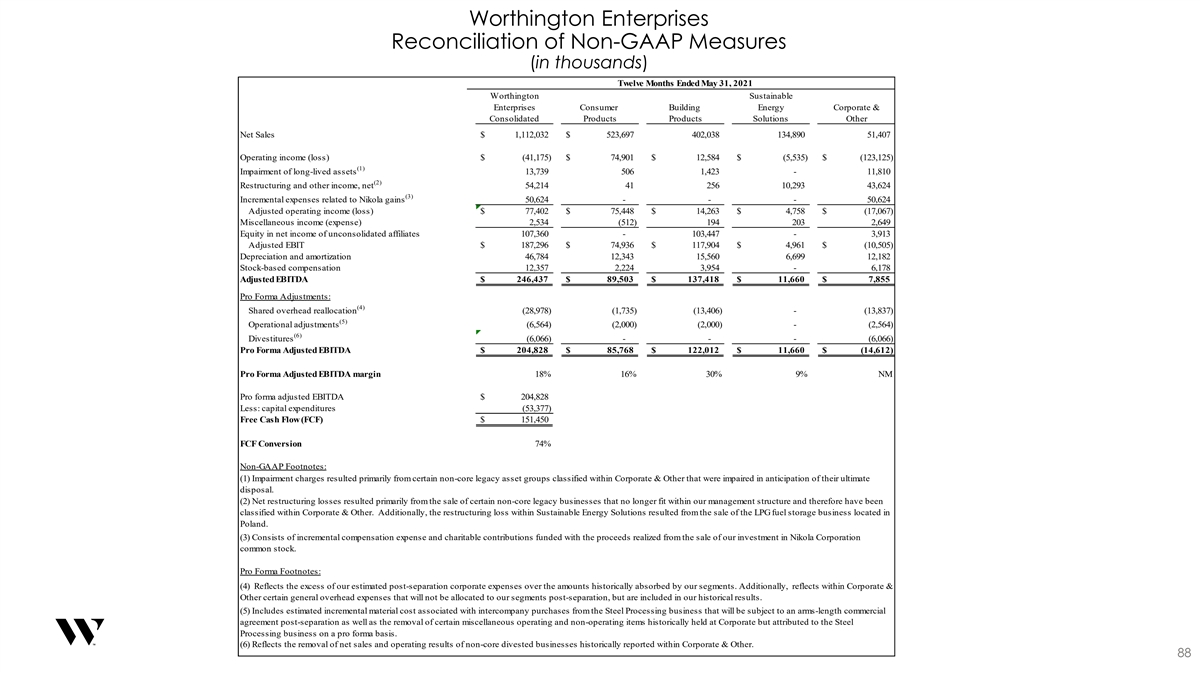

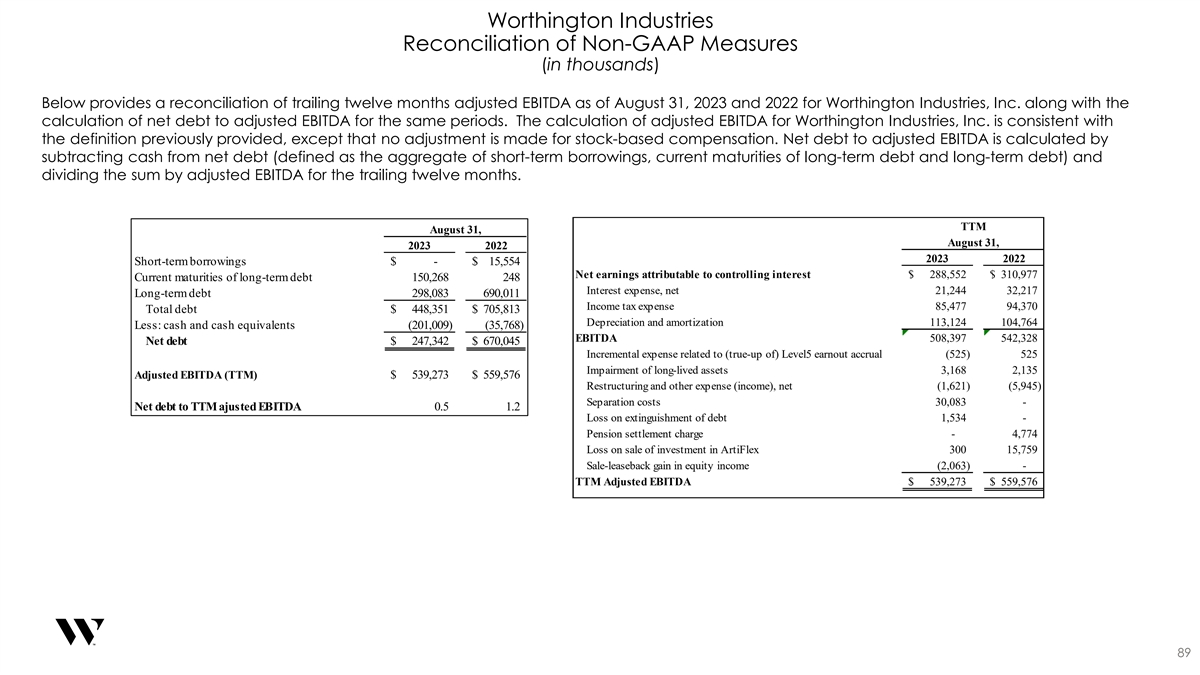

Notes to Investors PRO FORMA FINANCIAL INFORMATION. Unless otherwise specified, all financial data and operating metrics included in these materials are presented on a pro forma basis giving effect to the reorganization and the planned separation of the Steel Processing business, as described in the Form 10 filed with the Securities and Exchange Commission, and divested operations historically presented within Other. NON-GAAP MEASURES. These materials include certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles, or GAAP. Management believes these non-GAAP measures provide useful supplemental information on the performance of the Company’s ongoing operations and should not be considered as an alternative to the comparable GAAP measure. Additionally, management believes these non-GAAP measures allow for meaningful comparisons and analysis of trends in the Company’s businesses and enables investors to evaluate operations and future prospects in the same manner as management. A reconciliation of each non-GAAP measure to its most directly comparable GAAP measure is included in the Appendix. The following provides an explanation of each non-GAAP measure presented in these materials: Adjusted EBITDA is defined as Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization, and consists of EBITDA (calculated by adding or subtracting, as appropriate, interest expense, income tax expense and depreciation and amortization to/from net earnings attributable to controlling interest), which is further adjusted to exclude impairment and restructuring charges (gains) as well as other items that management believes are not reflective of, and thus should not be included when evaluating the performance of its ongoing operations, including incremental costs associated with the planned separation. Adjusted EBITDA also excludes stock-based compensation due to its non-cash nature. In prior periods, Adjusted EBITDA did not exclude stock-based compensation. However, management now believes that further excluding stock-based compensation from Adjusted EBITDA is useful to better understand the financial performance of our business and to facilitate a better comparison of our results to those of our peer companies over multiple periods given that this item may vary between companies for reasons unrelated to overall operating performance. Impairment charges are excluded from adjusted EBITDA because they do not occur in the ordinary course of our ongoing business operations, are inherently unpredictable in timing and amount, and are non- cash, which we believe facilitates the comparison of historical, current and forecasted financial results Restructuring activities, which can result in both discrete gains and/or losses, consist of established programs that are not part of our ongoing operations, such as divestitures, closing or consolidating facilities, employee severance (including rationalizing headcount or other significant changes in personnel), and realignment of existing operations (including changes to management structure in response to underlying performance and/or changing market conditions). Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by net sales. Free Cash Flow is defined as Adjusted EBITDA less capital expenditures. Free Cash Flow Conversion is calculated by dividing Free Cash by Adjusted EBITDA. 3

Our Presenter ANDY ROSE President & Chief Executive Officer Worthington Enterprises 4

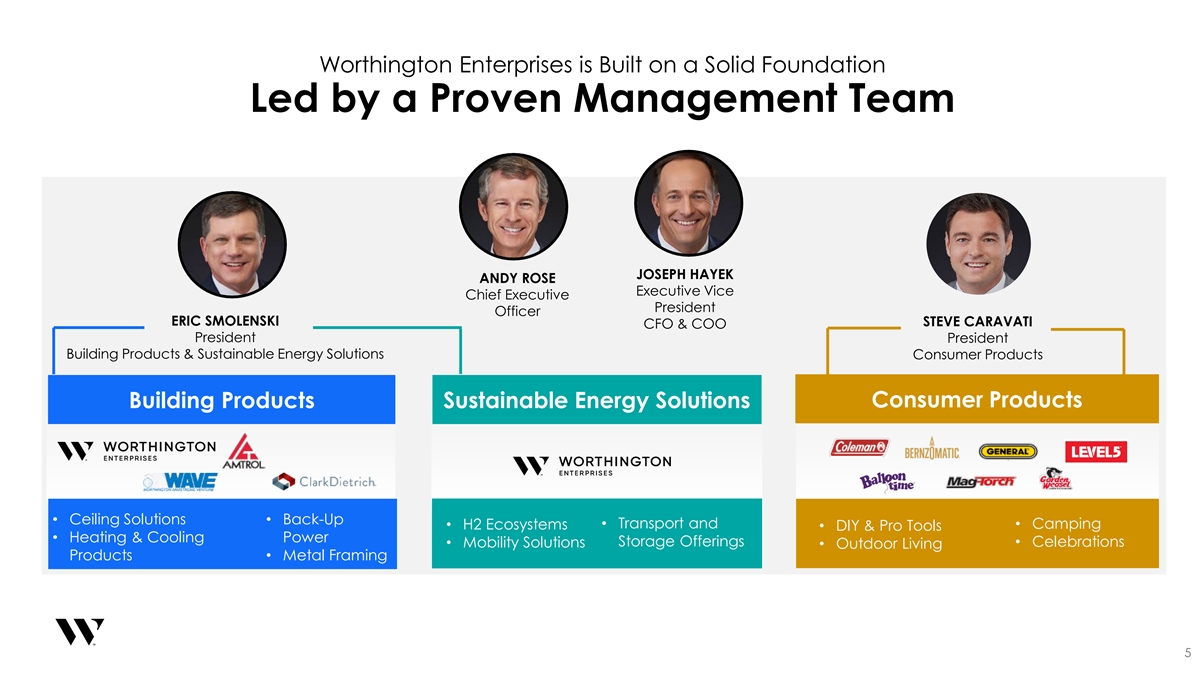

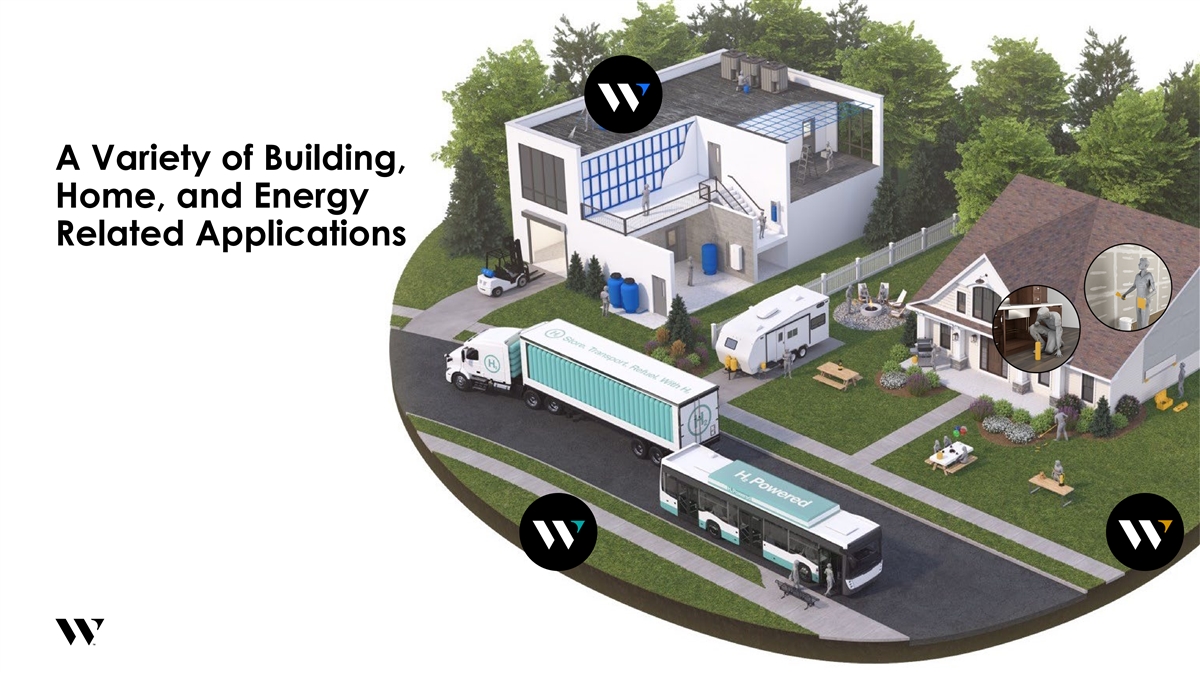

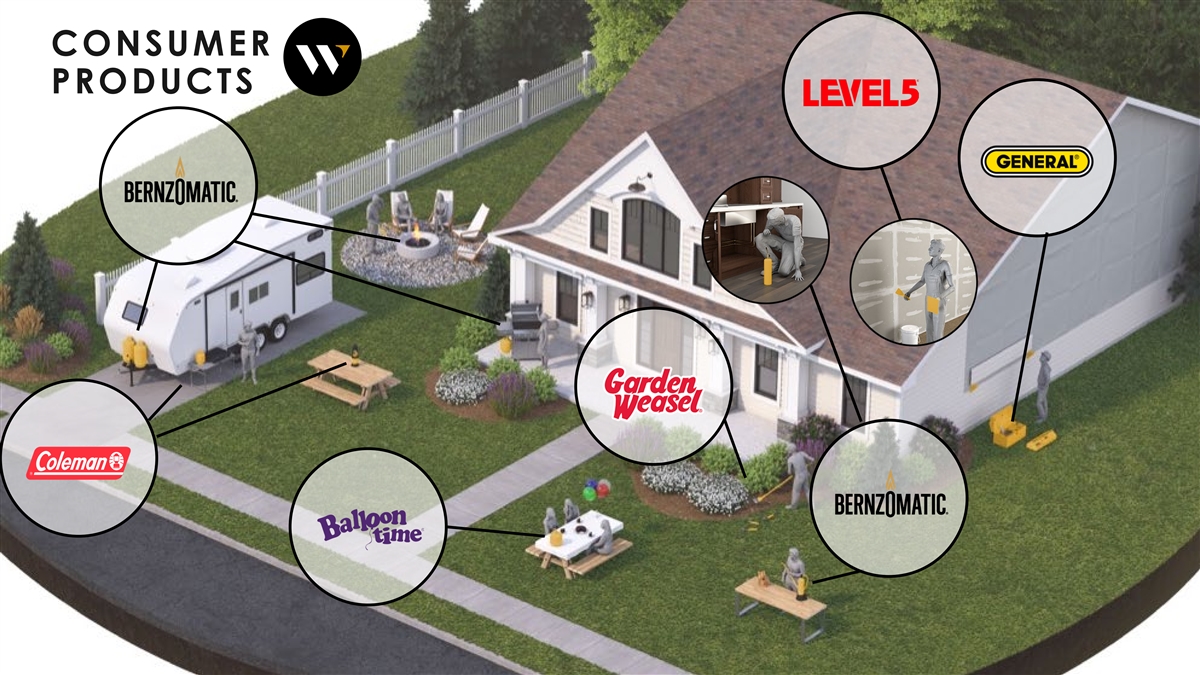

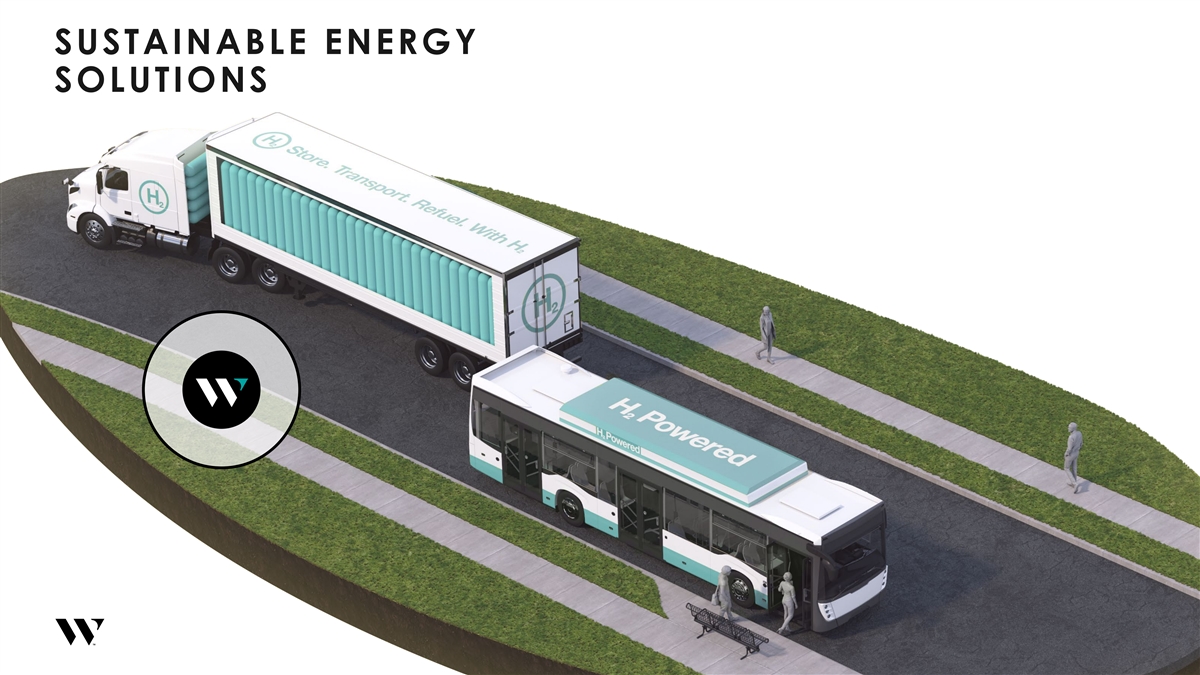

Worthington Enterprises is Built on a Solid Foundation Led by a Proven Management Team JOSEPH HAYEK ANDY ROSE Executive Vice Chief Executive President Officer ERIC SMOLENSKI STEVE CARAVATI CFO & COO President President Building Products & Sustainable Energy Solutions Consumer Products Consumer Products Building Products Sustainable Energy Solutions • Ceiling Solutions • Back-Up • Transport and • Camping • H2 Ecosystems • Transport & Storage • DIY & Pro Tools • Heating & Cooling Power Storage Offerings • Mobility Solutions Off•erC ing elsebrations • Outdoor Living Products • Metal Framing 5

ibdroot\projects\IBD-NY\trillium2020\664375_1\16. Investor Day Presentations\03. WOR Enterprises\2023.09.29 - Investor Day - WOR Enterprises Shell_v78.pptx Today’s Agenda • TIME TOPIC PRESENTER 9:30 – 9:35 Welcome and Agenda Marcus Rogier, Treasurer & Investor Relations Officer 9:35 – 9:55 Why Invest in Worthington Enterprises Andy Rose, President & CEO Andy Rose, Doug Cadle, President & CEO, WAVE, 9:55 – 10:35 Overview of Building Products Jimmy Bowes, VP, NA Building Products Steve Caravati, President, Consumer Products 10:35 – 10:50 Overview of Consumer Products 10:50 – 11:00 Overview of Sustainable Energy Solutions Timo Snoeren, VP, Sustainable Energy Solutions 11:00 – 11:15 Break 11:15 – 11:35 The Path Forward & Financial Overview Joe Hayek, EVP, CFO & COO 11:35 – 11:40 Closing Comments Andy Rose, President & CEO All 11:40 – Noon Q&A Noon – 1:00 Lunch 6

The Planned Separation Will Create Two Market-Leading, Independent Public Companies WORTHINGTON STEEL WORTHINGTON ENTERPRISES Joseph Hayek Tim Adams Andy Rose Geoff Gilmore Chief Financial Officer Chief Executive Officer Chief Financial Officer Chief Executive Officer ü A best-in-class, value-added steel processor with a blue-chip ü ü A market-leader with premier brands in attractive end markets ü customer base in growing end-markets in Consumer Products, Building Products, and Sustainable Energy Solutions ü A market-leader in electrical steel laminations and automotive ü lightweighting solutions capitalizing on electrification, sustainability üü High margins and asset-light business model enable strong cash and infrastructure spending flow generation üü Sophisticated supply chain and pricing solutions to manage ü Growth strategy driven by focus on sustainable, technology- ü complex programs for customers, grow market share and increase enabled solutions disrupting mature markets margins Improved Strategic Focus and Differentiated Investment Theses 7

Worthington Enterprises is a …and Now is the Compelling Standalone Right Time to Separate Investment Story…. Strategic Focus Enhanced focus on strategic priorities We have now achieved the scale, financial strength and capabilities to operate on a Timing standalone basis Differentiation Compelling and distinct growth strategy Flexibility Tailored decision-making and strategic capital allocation decisions Clear-cut value proposition and differentiated investment thesis with comparable company Aligned Investor Base peers Tailored Capital Structures Strong balance sheet and free cash flow to execute on strategic M&A Worthington Enterprises is positioned to deliver long-term growth and sustainable value creation 8

ibdroot\projects\IBD-NY\trillium2020\664375_1\16. Investor Day Presentations\03. WOR Enterprises\2023.09.29 - Investor Day - WOR Enterprises Shell_v78.pptx WORTHINGTON ENTERPRISES A market - le ad in g de s i gne r a nd m anuf ac t ure r of innovative Building Products, Consumer Products, and Sustainable Energy Solutions