UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 26, 2023

REPLIGEN CORPORATION

(Exact name of registrant as specified in charter)

| Delaware | 000-14656 | 04-2729386 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

41 Seyon Street, Bldg. 1, Suite 100, Waltham, MA 02453

(Address of Principal Executive Offices) (Zip Code)

(781) 250-0111

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered |

||

| Common Stock, par value $0.01 per share | RGEN | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On September 26, 2023, Repligen Corporation (the “Company”) issued a press release announcing the Company’s entry into an agreement to consummate the Metenova Acquisition described in Item 8.01 of this Current Report on Form 8-K. A copy of this press release is attached to this Current Report on Form 8-K and furnished as Exhibit 99.1.

On September 26, 2023, the Company made available an Investor Presentation relating to the Metenova Acquisition described in Item 8.01 of this Current Report on Form 8-K. A copy of this Investor Presentation is attached to this Current Report on Form 8-K and furnished as Exhibit 99.2.

The information in this Item 7.01 of this Form 8-K and Exhibits 99.1 and 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall any of it be deemed incorporated by reference in any filing under the Securities Act of 1933, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 8.01. | Other Events. |

On September 23, 2023, the Company executed a Share Sale and Purchase Agreement (the “Purchase Agreement”), with Metenova Holding AB (“Metenova”), certain other individuals and legal entities party to the Purchase Agreement (collectively with Metenova, the “Sellers”), and Repligen Sweden AB, a subsidiary of the Company (the “Buyer”), pursuant to which the Buyer, subject to the satisfaction or waiver of the conditions set forth in the Purchase Agreement, will purchase all of the outstanding equity interests of Metenova for cash and equity consideration (the “Metenova Acquisition”). The Metenova Acquisition is expected to close during the fourth quarter of 2023.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Press Release by Repligen Corporation, dated September 26, 2023. | |

| 99.2 | Investor Presentation furnished by Repligen Corporation. | |

| 104 | Cover page from this Current Report on Form 8-K, formatted in Inline XBRL | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| REPLIGEN CORPORATION | ||||||

| Dated: September 26, 2023 | By: | /s/ Tony J. Hunt |

||||

| Tony J. Hunt | ||||||

| President and Chief Executive Officer | ||||||

Exhibit 99.1

|

|

Repligen Corporation 41 Seyon Street Building #1, Suite 100 Waltham, Massachusetts 02453 |

REPLIGEN ANNOUNCES AGREEMENT TO ACQUIRE

FLUID MANAGEMENT INNOVATOR METENOVA

| • | Proposed acquisition adds market leading magnetic mixing technology for upstream and downstream bioprocess applications |

| • | Expands Repligen’s Fluid Management portfolio, complements single-use bag offering |

WALTHAM, Mass., September 26, 2023 — Repligen Corporation (NASDAQ:RGEN), a life sciences company focused on bioprocessing technology leadership, today announced that it has entered into a definitive agreement to acquire privately-held Metenova AB (Metenova) of Mölndal, Sweden. Metenova is projected to generate revenues of $24 million to $25 million for fiscal year 2023, led by the success of its magnetic mixing and drive train technologies that are widely used by global biopharmaceutical companies and contract development and manufacturing organizations (CDMOs). The company recently entered the single-use mixing market with the launch of its MixOne platform, leveraging the success of its existing stainless steel (repeat-use) product line.

Metenova is expected to contribute approximately $5 million in revenue to Repligen in the fourth quarter of 2023, and to contribute $25 million to $27 million in revenue in 2024, with 20%-25% revenue growth in 2025 forward. The acquisition is anticipated to be accretive to Repligen’s adjusted gross and operating margins in 2024, and to be accretive to adjusted earnings per share in 2025.

Over the past decade, Metenova has established market leadership through design innovation in magnetic mixing, with a state-of-the-art suite of both stainless steel and single-use impellers (mixer heads) and drive trains – key components of mixing vessels. The company offers a broad range of products, including high power solutions for efficient media and buffer preparation, and low shear solutions for gentle mixing of sensitive proteins. Metenova’s high performance aseptic mixing technologies are designed to minimize product damage and improve product yield and product consistency, contributing to improved ROI for customers. The company’s solutions are applicable to a wide range of small molecule and large molecule therapeutics and vaccines, including monoclonal antibodies, recombinant proteins, and cell and gene therapies.

Tony J. Hunt, President and Chief Executive Officer at Repligen said, “The addition of Metenova further strengthens our Fluid Management portfolio, with a product line that expands on the market success of our systems and fluid management assemblies and complements our recently acquired single-use bag business from FlexBiosys.

1

We are excited to welcome the Metenova team to Repligen and we look forward to further developing and integrating their differentiated magnetic mixing technologies into our portfolio.”

Johan Westman, Chief Executive Officer at Metenova said, “We have made tremendous progress over the last ten years, building a market leading mixing portfolio. We are now at a stage in our development where we can benefit from more rapid expansion into the single-use market where many of our customers are scaling today. Repligen is the ideal partner for us to take this next step of growth and we look forward to working with our colleagues at Repligen to drive additional global demand for our single-use mixing products, while continuing to advance innovative single-use solutions for the industry.”

Approvals and Financing

The transaction is expected to be completed in the coming weeks, subject to the satisfaction of customary closing conditions. The transaction is a combination of cash and equity; to fund the cash component of the transaction, Repligen intends to use a portion of its cash on hand, which totaled approximately $604 million at June 30, 2023. Perella Weinberg Partners LP is acting as financial advisor, with Advokatfirman Vinge KB and Goodwin Procter LLP serving as legal counsel to Repligen. J.P. Morgan Securities PLC is acting as the financial advisor and Setterwalls Advokatbyrå is serving as the legal counsel to Metenova for the transaction.

About Metenova AB

Metenova is a leading innovator and manufacturer of magnetic mixers for pharmaceutical and biotechnology use. We provide aseptic cutting-edge mixing technology for critical applications. Sales are mainly performed by distributors in over 30 countries with approximately one-third of sales in North America, one-third of sales in Europe and one-third of sales in Asia/ROW. Metenova recently entered the single-use mixing market with the launch of its MixOne platform, leveraging the success of its existing repeat-use (stainless steel) product line. Metenova is headquartered in Mölndal in the Gothenburg area and has approximately 50 employees. Read more at www.metenova.com.

About Repligen Corporation

Repligen Corporation is a global life sciences company that develops and commercializes highly innovative bioprocessing technologies and systems that enable efficiencies in the process of manufacturing biological drugs. We are “inspiring advances in bioprocessing” for the customers we serve; primarily biopharmaceutical drug developers and contract development and manufacturing organizations (CDMOs) worldwide. Our focus areas are Filtration and Fluid Management, Chromatography, Process Analytics and Proteins. Our corporate headquarters are in Waltham, Massachusetts, and the majority of our manufacturing sites are in the U.S., with additional key sites in Estonia, France, Germany, Ireland, the Netherlands and Sweden. For more information about the company see our website at www.repligen.com, and follow us on LinkedIn.

2

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Investors are cautioned that statements in this press release which are not strictly historical statements, including, without limitation, express or implied statements or guidance regarding the expected results of the proposed acquisition of Metenova AB (Metenova) on Repligen’s future financial performance, including the accretive nature and the timing of the accretive nature of the acquisition, expected synergies and revenue contribution following the closing of the Metenova acquisition, customer adoption of Metenova products and beliefs about the single-use market, the expected expansion of Repligen’s product lines, and other statements identified by words like “believe,” “expect,” “anticipate,” “may,” “will,” “should,” “targeted,” “seek,” or “could” and similar expressions, constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, without limitation, risks associated with: the risk that the proposed acquisition may not be completed in a timely manner, or at all; the occurrence of any event, change or other circumstance that could give rise to the termination of the acquisition; Repligen’s ability to integrate Metenova’s business and personnel and to achieve expected synergies and accretion; Repligen’s ability to maintain or expand Metenova’s historical sales; Repligen’s ability to accurately forecast the acquisition, related restructuring costs and allocation of the purchase price, goodwill and other intangibles acquisition related and other asset adjustments; and other risks detailed in Repligen’s most recent Annual Report on Form 10-K subsequently filed Quarterly Reports on Form-10-Q and Current Reports on Form 8-K on file with the Securities and Exchange Commission, and the other reports that Repligen periodically files with the Securities and Exchange Commission. Actual results may differ materially from those Repligen contemplated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. These forward-looking statements reflect management’s current views and are based only on information currently available to us. Repligen does not undertake to update, whether written or oral, any of these forward-looking statements to reflect a change in its views or events or circumstances, whether as a result of new information or otherwise, that occur after the date hereof except as required by law. The industry and market data contained in this presentation are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources are reliable, we have not independently verified the information.

Repligen Contact:

Sondra S. Newman

Global Head of Investor Relations

(781) 419-1881

investors@repligen.com

# # #

3

September 26, 2023 Repligen to Acquire Metenova AB Exhibit 99.2

Safe Harbor / Non-GAAP Financial Measures This press release contains forward-looking statements within the meaning of the federal securities laws. Investors are cautioned that statements in this press release which are not strictly historical statements, including, without limitation, express or implied statements or guidance regarding the expected results of the proposed acquisition of Metenova AB (Metenova) on Repligen’s future financial performance, including the accretive nature and the timing of the accretive nature of the acquisition, expected synergies and revenue contribution following the closing of the Metenova acquisition, customer adoption of Metenova products and beliefs about the single-use market, the expected expansion of Repligen’s product lines, and other statements identified by words like “believe,” “expect,” “anticipate,” “may,” “will,” “should,” “targeted,” “seek,” or “could” and similar expressions, constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, without limitation, risks associated with: the risk that the proposed acquisition may not be completed in a timely manner, or at all; the occurrence of any event, change or other circumstance that could give rise to the termination of the acquisition; Repligen’s ability to integrate Metenova’s business and personnel and to achieve expected synergies and accretion; Repligen’s ability to maintain or expand Metenova’s historical sales; Repligen’s ability to accurately forecast the acquisition, related restructuring costs and allocation of the purchase price, goodwill and other intangibles acquisition related and other asset adjustments; and other risks detailed in Repligen’s most recent Annual Report on Form 10-K subsequently filed Quarterly Reports on Form-10-Q and Current Reports on Form 8-K on file with the Securities and Exchange Commission, and the other reports that Repligen periodically files with the Securities and Exchange Commission. Actual results may differ materially from those Repligen contemplated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. These forward-looking statements reflect management’s current views and are based only on information currently available to us. Repligen does not undertake to update, whether written or oral, any of these forward-looking statements to reflect a change in its views or events or circumstances, whether as a result of new information or otherwise, that occur after the date hereof except as required by law. The industry and market data contained in this presentation are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources are reliable, we have not independently verified the information.

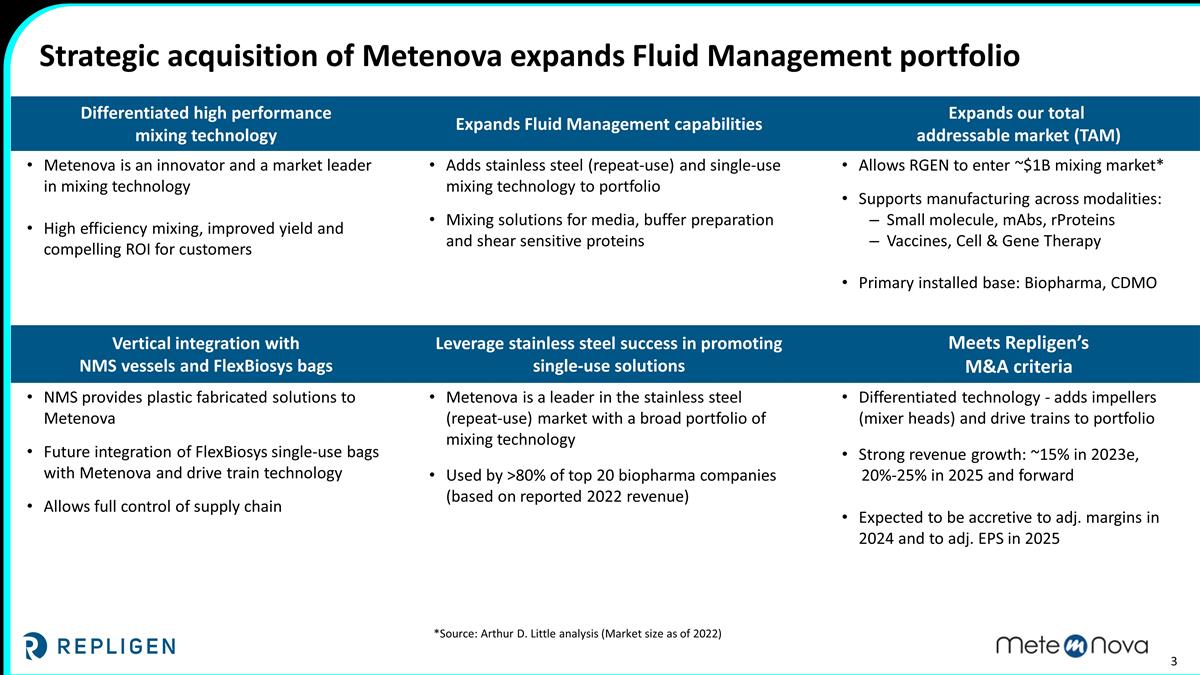

Differentiated high performance mixing technology Expands Fluid Management capabilities Expands our total addressable market (TAM) Metenova is an innovator and a market leader in mixing technology High efficiency mixing, improved yield and compelling ROI for customers Adds stainless steel (repeat-use) and single-use mixing technology to portfolio Mixing solutions for media, buffer preparation and shear sensitive proteins Allows RGEN to enter ~$1B mixing market* Supports manufacturing across modalities: Small molecule, mAbs, rProteins Vaccines, Cell & Gene Therapy Primary installed base: Biopharma, CDMO Vertical integration with NMS vessels and FlexBiosys bags Leverage stainless steel success in promoting single-use solutions Meets Repligen’s M&A criteria NMS provides plastic fabricated solutions to Metenova Future integration of FlexBiosys single-use bags with Metenova and drive train technology Allows full control of supply chain Metenova is a leader in the stainless steel (repeat-use) market with a broad portfolio of mixing technology Used by >80% of top 20 biopharma companies (based on reported 2022 revenue) Differentiated technology - adds impellers (mixer heads) and drive trains to portfolio Strong revenue growth: ~15% in 2023e, 20%-25% in 2025 and forward Expected to be accretive to adj. margins in 2024 and to adj. EPS in 2025 Strategic acquisition of Metenova expands Fluid Management portfolio *Source: Arthur D. Little analysis (Market size as of 2022)

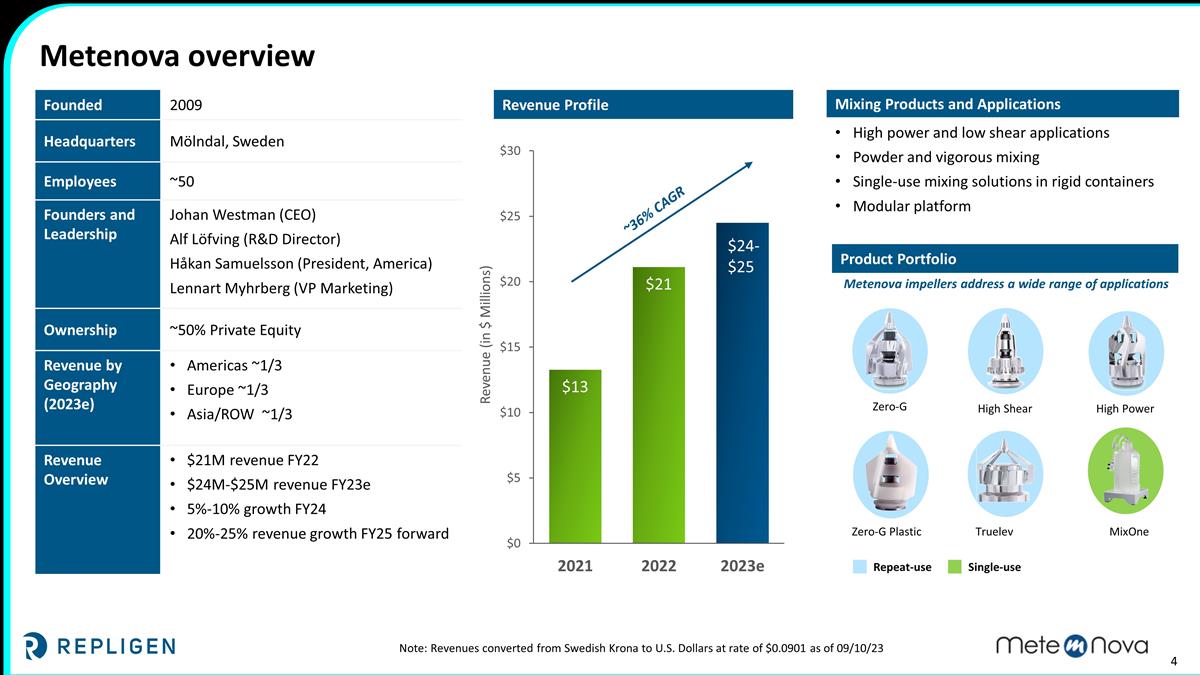

Mixing Products and Applications High power and low shear applications Powder and vigorous mixing Single-use mixing solutions in rigid containers Modular platform Founded 2009 Headquarters Mölndal, Sweden Employees ~50 Founders and Leadership Johan Westman (CEO) Alf Löfving (R&D Director) Håkan Samuelsson (President, America) Lennart Myhrberg (VP Marketing) Ownership ~50% Private Equity Revenue by Geography (2023e) Americas ~1/3 Europe ~1/3 Asia/ROW ~1/3 Revenue Overview $21M revenue FY22 $24M-$25M revenue FY23e 5%-10% growth FY24 20%-25% revenue growth FY25 forward Metenova impellers address a wide range of applications Revenue (in $ Millions) Revenue Profile Note: Revenues converted from Swedish Krona to U.S. Dollars at rate of $0.0901 as of 09/10/23 ~36% CAGR Product Portfolio Zero-G High Shear High Power Zero-G Plastic Truelev MixOne Repeat-use Single-use Metenova overview

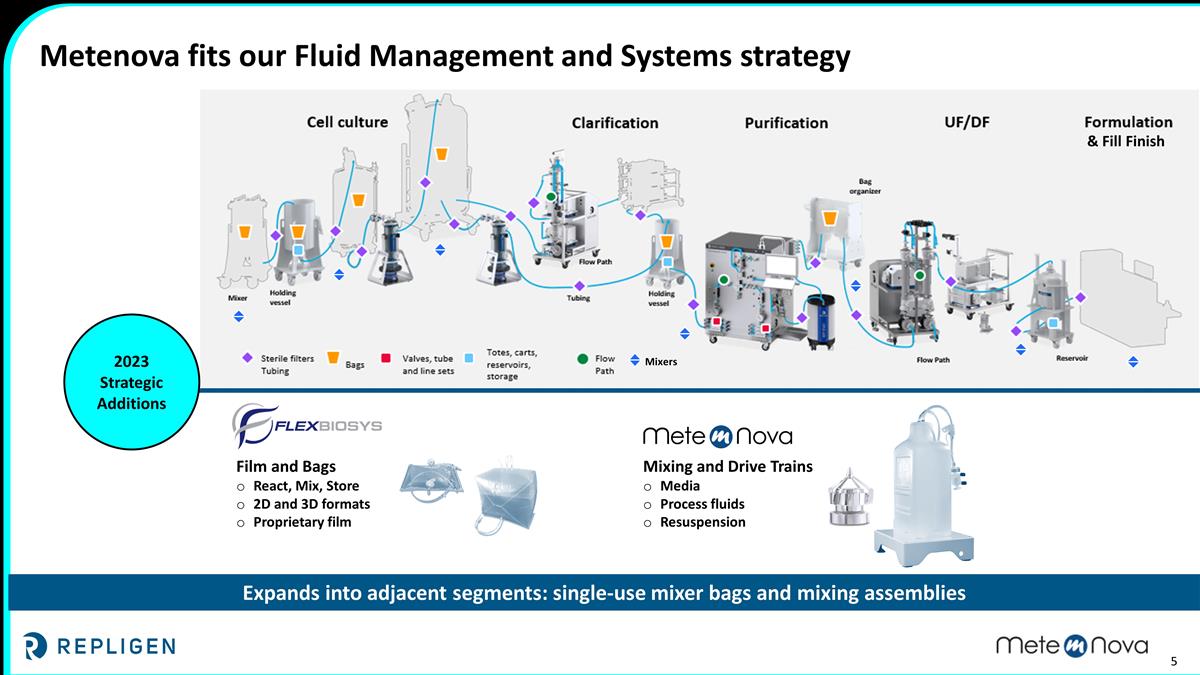

Metenova fits our Fluid Management and Systems strategy Film and Bags React, Mix, Store 2D and 3D formats Proprietary film Mixing and Drive Trains Media Process fluids Resuspension Expands into adjacent segments: single-use mixer bags and mixing assemblies Mixers & Fill Finish 2023 Strategic Additions

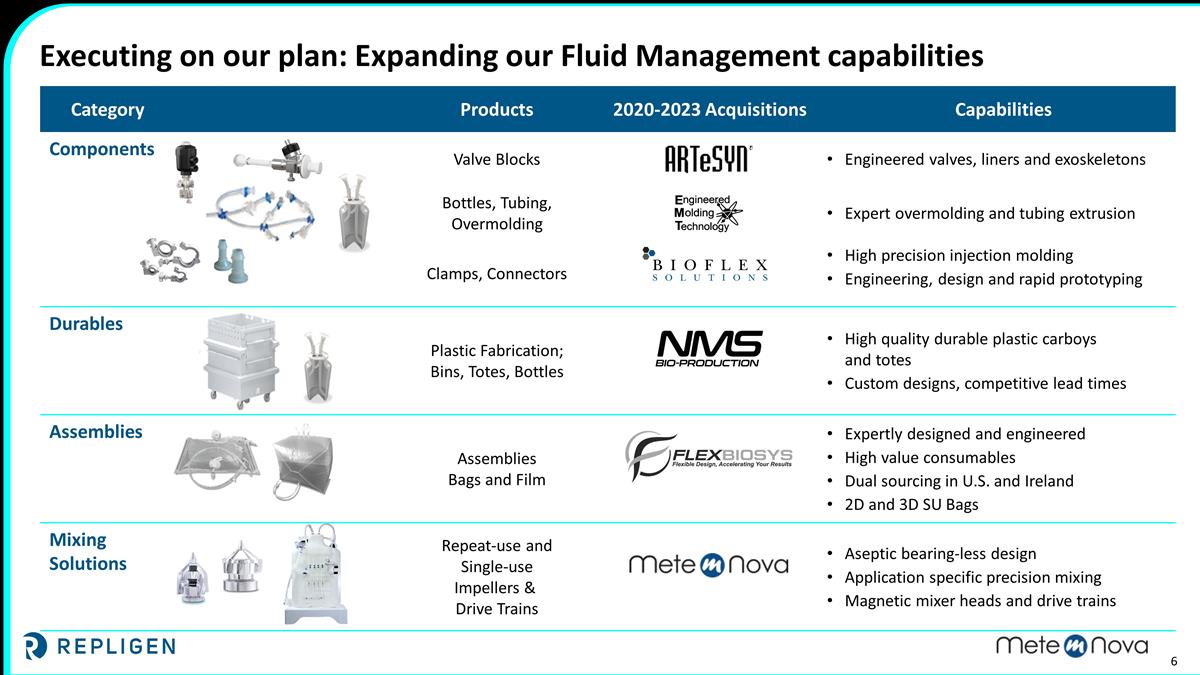

Executing on our plan: Expanding our Fluid Management capabilities Category Products 2020-2023 Acquisitions Capabilities Components Valve Blocks Engineered valves, liners and exoskeletons Bottles, Tubing, Overmolding Expert overmolding and tubing extrusion Clamps, Connectors High precision injection molding Engineering, design and rapid prototyping Durables Plastic Fabrication; Bins, Totes, Bottles High quality durable plastic carboys and totes Custom designs, competitive lead times Assemblies Assemblies Bags and Film Expertly designed and engineered High value consumables Dual sourcing in U.S. and Ireland 2D and 3D SU Bags Mixing Solutions Repeat-use and Single-use Impellers & Drive Trains Aseptic bearing-less design Application specific precision mixing Magnetic mixer heads and drive trains

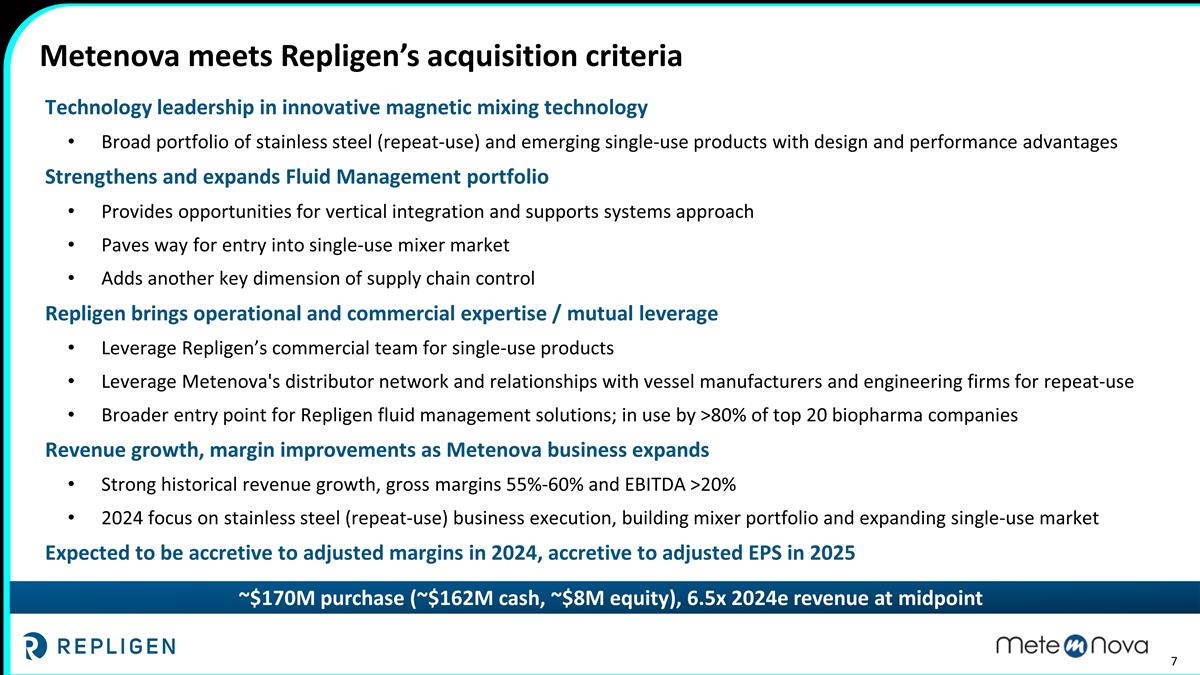

Metenova meets Repligen’s acquisition criteria Technology leadership in innovative magnetic mixing technology Broad portfolio of stainless steel (repeat-use) and emerging single-use products with design and performance advantages Strengthens and expands Fluid Management portfolio Provides opportunities for vertical integration and supports systems approach Paves way for entry into single-use mixer market Adds another key dimension of supply chain control Repligen brings operational and commercial expertise / mutual leverage Leverage Repligen’s commercial team for single-use products Leverage Metenova's distributor network and relationships with vessel manufacturers and engineering firms for repeat-use Broader entry point for Repligen fluid management solutions; in use by >80% of top 20 biopharma companies Revenue growth, margin improvements as Metenova business expands Strong historical revenue growth, gross margins 55%-60% and EBITDA >20% 2024 focus on stainless steel (repeat-use) business execution, building mixer portfolio and expanding single-use market Expected to be accretive to adjusted margins in 2024, accretive to adjusted EPS in 2025 ~$170M purchase (~$162M cash, ~$8M equity), 6.5x 2024e revenue at midpoint

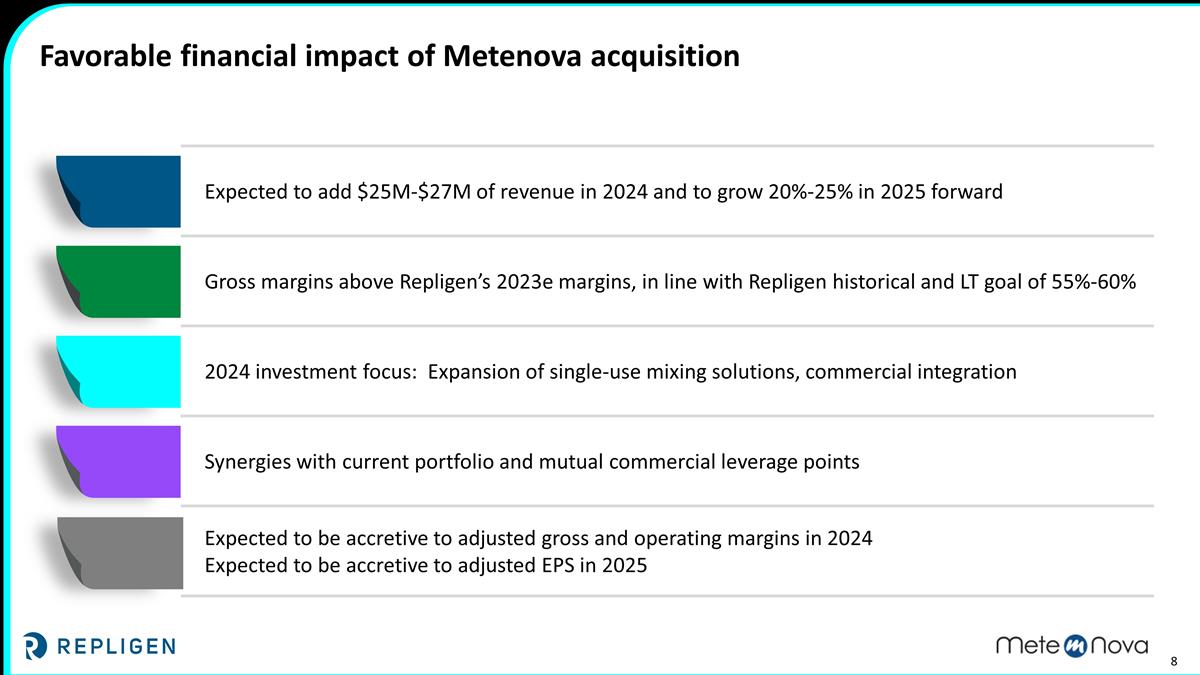

Favorable financial impact of Metenova acquisition Expected to add $25M-$27M of revenue in 2024 and to grow 20%-25% in 2025 forward Gross margins above Repligen’s 2023e margins, in line with Repligen historical and LT goal of 55%-60% 2024 investment focus: Expansion of single-use mixing solutions, commercial integration Synergies with current portfolio and mutual commercial leverage points Expected to be accretive to adjusted gross and operating margins in 2024 Expected to be accretive to adjusted EPS in 2025

Thank you! For questions, contact investors@repligen.com