UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

September 26, 2023

BHP GROUP LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE, VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): n/a

BHP Notice of Meeting 2023 Bringing people and resources together to build a better world

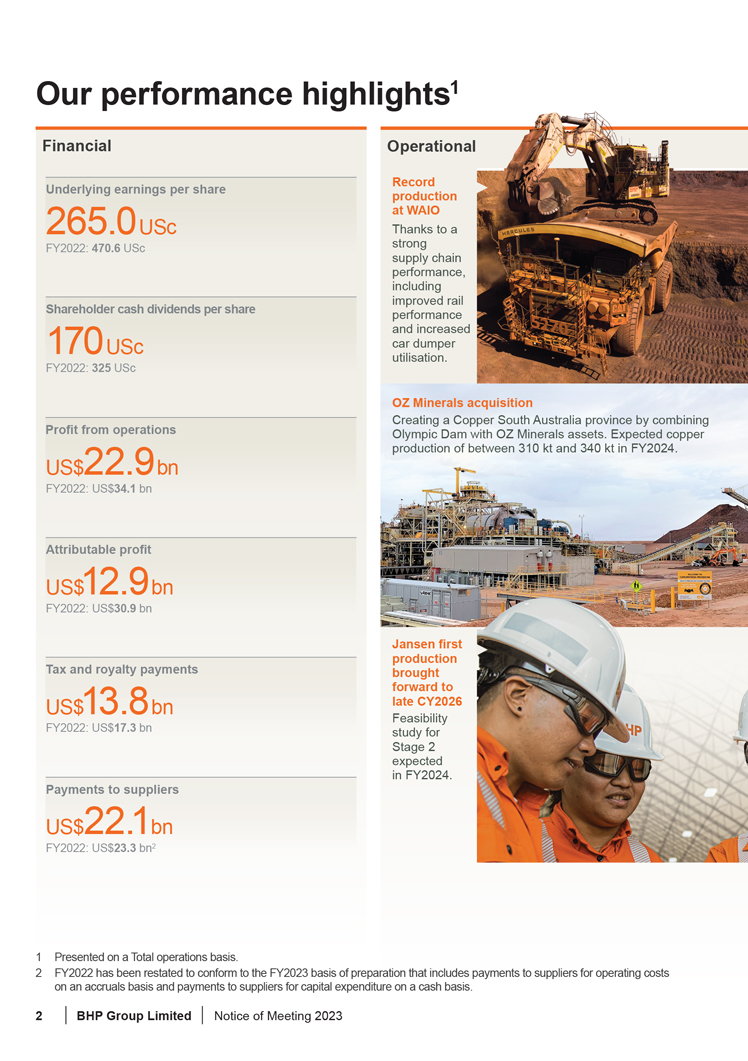

Our performance highlights1 Financial Underlying . earnings 0 per share 265 USc FY2022: 470.6 USc Shareholder cash dividends per share 170 USc FY2022: 325 USc Profit from operations US$22.9 bn FY2022: US$34.1 bn Attributable profit US$12.9 bn FY2022: US$30.9 bn Tax and royalty payments US$13.8 bn FY2022: US$17.3 bn Payments 22 to suppliers .1 US$ bn FY2022: US$23.3 bn2 Operational Record production at WAIO Thanks to a strong supply chain performance, including improved rail performance and increased car dumper utilisation. OZ Minerals acquisition Creating a Copper South Australia province by combining Olympic Dam with OZ Minerals assets. Expected copper production of between 310 kt and 340 kt in FY2024. Jansen first production brought forward to late CY2026 Feasibility study for Stage 2 expected in FY2024. 1 Presented on a Total operations basis. 2 FY2022 has been restated to conform to the FY2023 basis of preparation that includes payments to suppliers for operating costs on an accruals basis and payments to suppliers for capital expenditure on a cash basis. 2 BHP Group Limited Notice of Meeting 2023

Strong performance in copper Group copper production increased 9% to 1716.5 kt following strong performances at Escondida, Spence and Olympic Dam. Nickel production up 4% Longer term, we believe nickel will be a core beneficiary of the electrification megatrend and that nickel sulphides will be particularly attractive. Sustainability and Social value Decarbonisation Operational greenhouse (GHG) emissions 11% on FY2022 On track to meet out FY2030 target3 Healthy environment Natural Capital Accounting (NCA) Pilot case study a mining industry first on NCA at our closed Beenup site Indigenous partnerships Indigenous procurement US$ 332.6 m 122% on FY2022 Safe, inclusive and future-ready workforce Female employee workforce representation4 35.2% FY2022: 32.3% Thriving, empowered communities Total economic contribution5 US$ 54.2 bn FY2022: US$82.5 bn2,6 Responsible supply chains Standards and certifications BHP Responsible Minerals Program7 commenced 3 For more information on our decarbonisation targets and goals efer to the BHP Operating and Financial Review 6.12 in the Annual Report 2023, released 22August 2023. 4 Female workforce participation is employees only, as at 30 June 2023. 5 This includes contribution to suppliers, wages and benefits foremployees, dividends, taxes, royalties and voluntary social investment. For more information refer to the Economic Contribution Report 2023, released 22August 2023. 6 This includes the US$19.6 billion in specie dividend in connection with the merger of BHP Petroleum with Woodside. 7 For more information on the BHP Responsible Minerals Program refer to bhp.com/responsiblemineralspolicy. BHP Group Limited Notice of Meeting 2023 3

Contents Invitation from the Chair 4 Notice of Annual General Meeting 6 Explanatory Notes 7 Participating and Voting 23 Invitation from the Chair 25 September 2023 Dear Shareholders, I am pleased to invite you to the 2023 Annual General Meeting (AGM) of BHP Group Limited (BHP). The AGM will be held on Wednesday 1 November 2023 at 10:00am (Adelaide time). I am delighted that we will meet with shareholders in person again this year. For those shareholders not able to join us in person, we invite you to participate in the meeting by submitting questions and your proxy vote in advance of the meeting, and watching the webcast live online at bhp.com/agm. Details can be found in this Notice of Meeting. FY2023 and our priorities In FY2023, we achieved strong performance and made progress towards our social value and sustainability commitments, targets and goals. However, these achievements were overshadowed by the tragic deaths of our colleagues Jody Byrne at our Western Australia Iron Ore operations in February 2023 and Nathan Scholz at Olympic Dam in April 2023. We are determined to learn from these events and prevent them from happening again. During FY2023, our key priority areas were safety, culture and capability, capital discipline, portfolio and social value. I am confident our ongoing delivery against these key areas will position BHP to continue to grow long-term value for our shareholders and create social value with our partners and stakeholders. We continue to reshape our portfolio to align with the global megatrends of decarbonisation, electrification, urbanisation and a rising population. BHP Group Limited ABN 49 004 028 077 is registered in Australia. Registered office: 171 Collins Street, Melbourne, Victoria 3000, Australia. 4 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting We acquired OZ Minerals in May 2023, adding complementary copper and nickel assets in Australia to Olympic Dam and Nickel West, and we are integrating the copper assets from OZ Minerals and Olympic Dam to create a new copper province in South Australia, with exciting potential for synergies and growth. We are consolidating our metallurgical coal portfolio to focus on higher-quality coals preferred by our steelmaking customers, and the Jansen Potash Project in Canada is progressing, with first production now expected in late CY2026. The Board determined dividends totalling US$8.6 billion to shareholders for the year, taking the total amount in cash dividends for the past three years to over US$40 billion. Board succession In September 2023, we announced that Terry Bowen will retire from the BHP Board at the conclusion of the AGM. Terry joined the Board in 2017 and I would like to thank Terry for his outstanding contribution to the Board and commitment to value creation for BHP shareholders. Terry has been instrumental to our ongoing success, in particular in recent years as we have reshaped our portfolio and positioned BHP to continue to accelerate growth in future-facing commodities. We are pleased that each of the remaining Non-executive Directors on the Board will seek re-election at the 2023 AGM. Our approach to Board succession is ongoing and we will continue to apply a structured renewal process that allows the Board to continue to be fit for purpose and have a balance of experience and fresh perspectives. Board recommendation The Board considers that the resolutions in Items 2 to 11 are in the best interests of BHP shareholders and recommends that you vote in favour of those Items. Thank you for your continued support of BHP. I encourage you to join us at the AGM and look forward to meeting our shareholders on the day. Yours sincerely Ken MacKenzie Chair “During FY2023, our key priority areas were safety, culture and capability, capital discipline, portfolio and social value.” BHP Group Limited Notice of Meeting 2023 5

Notice of Annual General Meeting Notice is given that the 2023 Annual General Meeting (AGM) of BHP Group Limited (BHP) will be held at the Adelaide Convention Centre, North Terrace, Adelaide, South Australia on Wednesday 1 November 2023, starting at 10:00am (Adelaide time). If it is necessary or appropriate for BHP to make changes to the AGM arrangements or to give further updates, information will be provided on BHP’s website and lodged with the relevant stock exchanges. The Explanatory Notes and information about participating and voting form part of this Notice of Meeting and provide important information regarding the items of business to be considered at the AGM. Items of business Item 1 Financial Statements and reports To consider the Financial Statements for BHP Group Limited and the reports of the Directors and the Auditor for the year ended 30 June 2023. Items 2 to 9 Re-election of Non-executive Directors Item 2 To re-elect Xiaoqun Clever as a Director of BHP Group Limited. Item 3 To re-elect Ian Cockerill as a Director of BHP Group Limited. Item 4 To re-elect Gary Goldberg as a Director of BHP Group Limited. Item 5 To re-elect Michelle Hinchliffe as a Director of BHP Group Limited. Item 6 To re-elect Ken MacKenzie as a Director of BHP Group Limited. Item 7 To re-elect Christine O’Reilly as a Director of BHP Group Limited. Item 8 To re-elect Catherine Tanna as a Director of BHP Group Limited. Item 9 To re-elect Dion Weisler as a Director of BHP Group Limited. Item 10 Adoption of the Remuneration Report To adopt the Remuneration Report for BHP Group Limited for the year ended 30 June 2023. This is a non-binding advisory vote. A voting exclusion applies to this resolution. Item 11 Approval of equity grants to the Chief Executive Officer To approve the grant of awards to the Chief Executive Officer, Mike Henry, under the Group’s Cash and Deferred Plan (CDP) and Long-Term Incentive Plan (LTIP) as set out in the Explanatory Notes to this Notice of Meeting. A voting exclusion applies to this resolution. Items 12 Renewal of approval of potential leaving entitlements To approve, for all purposes, including sections 200B and 200E of the Corporations Act 2001 (Cth) (Corporations Act), the giving of benefits to any current or future holder of a managerial or executive office in BHP Group Limited or a Group entity to which sections 200B and 200E of the Corporations Act apply, in connection with the person ceasing to hold that office, as set out in the Explanatory Notes to this Notice of Meeting. A voting exclusion applies to this resolution. The resolutions in Items 2–12 are ordinary resolutions. Ordinary resolutions require a simple majority of votes cast by shareholders entitled to vote on the resolution. 6 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting Explanatory Notes Item 1 Financial Statements and reports The Corporations Act requires BHP to lay before the AGM its financial report, Directors’ Report and Auditor’s Report for the financial year ended 30 June 2023. Shareholders are not required to vote on this Item, but shareholders will be given a reasonable opportunity as a whole to ask questions or make comments about the management of BHP. BHP’s Auditor will also be present at the meeting. Shareholders as a whole will be given a reasonable opportunity to ask the Auditor questions about the conduct of the audit, the preparation and content of the Auditor’s Report, the accounting policies adopted by BHP in relation to the preparation of the Financial Statements, and the independence of the Auditor in relation to the conduct of the audit. The reports are contained in BHP’s Annual Report 2023, which is available on BHP’s website at bhp.com/investors/annual-reporting. Items 2 to 9 Re-election of Non-executive Directors Each of the Non-executive Directors submit themselves for re-election, except for Terry Bowen who will retire at the conclusion of the 2023 AGM and will not seek re-election. The biographical details, relevant qualifications, experience and skills of each Non-executive Director seeking re-election are set out on the following pages. Under BHP’s Constitution, at least one-third of Directors must retire (and may seek re-election) at each AGM. However, the Board has adopted a policy under which all Non-executive Directors must seek re-election annually. The Board annually reviews the performance of each Director seeking election or re-election at the AGM. The Nomination and Governance Committee has also reviewed the composition of the Board. Based on these reviews and for the reasons outlined on the following pages, the Board considers that all Directors seeking re-election demonstrate commitment to their role. The contribution of each Director is and continues to be important to BHP’s long-term sustainable success. The Board as a whole has an appropriate mix of skills, backgrounds, knowledge, experience and diversity to operate effectively. All Non-executive Directors are considered by the Board to be independent, on the basis that they are independent of management and any business, interest or other relationship that could or could be perceived to materially interfere with the exercise of their objective, unfettered or independent judgement or their ability to act in the best interests of BHP. The Corporate Governance Statement 2023 contains more information on the independence of Directors. The Board (with the relevant Director seeking re-election abstaining) recommends shareholders vote in favour of Items 2 to 9 for the reasons set out on the following pages. BHP Group Limited Notice of Meeting 2023 7

Explanatory Notes continued Item 2 Xiaoqun Clever Diploma in Computer Science and International Marketing, MBA Independent Non-executive Director Appointment Independent Non-executive Director since October 2020 Skills and experience Xiaoqun Clever has over 20 years’ experience in technology with a focus on software engineering, data and AI, cybersecurity and digitalisation. Xiaoqun was formerly Chief Technology Officer of Ringier AG and ProSiebenSat.1 Media SE and Chief Operating Officer of Technology and Innovation at SAP and President of SAP Labs China. Xiaoqun brings significant expertise in the development, selection and implementation of business transforming technology, innovation and assessment of opportunities and risks in digital disruption. She has knowledge and relationships across the technology and innovation start-up sector across Europe, Asia and North America and brings depth to the Board’s review of managing cybersecurity risks as well as assessment of opportunities to invest in proven and emerging technologies in the discovery of new mineral deposits, safer and more cost-effective processing, and technologies to reduce GHG emissions and support the energy transition. Current appointments Xiaoqun is a Non-executive Director of Amadeus IT Group SA (since June 2020) and on the Supervisory Board of Infineon Technologies AG (since February 2020). Xiaoqun is also the Co-Founder and Chief Executive Officer of LuxNova Suisse GmbH (since April 2018). Committee membership Risk and Audit Committee Item 3 Ian Cockerill MSc (Mining and Mineral Engineering), BSc (Hons.) (Geology), AMP – Oxford Templeton College Independent Non-executive Director Appointment Independent Non-executive Director since April 2019 Skills and experience Ian Cockerill has 48 years’ experience in mining beginning his career as a geologist in 1975, converting to a mining engineering career in 1976, followed by extensive experience in operational, project and executive roles around the world. Ian was formerly the Chair of both Polymetal International plc and BlackRock World Mining Trust plc, Lead Independent Director of Ivanhoe Mines Ltd, Non-executive Director of Orica Limited (from July 2010 to August 2019) and Endeavour Mining Corporation (from September 2013 to March 2019). Ian previously held several senior positions at Anglo American Corporation, including Technical Director of Gold and Uranium Division, which included responsibility for African and international operations, and was the Chief Executive Officer of Gold Fields from 2002 to 2008. Ian’s technical and management experience globally across a range of commodities, together with his experiences as an operational leader and investor in numerous mining jurisdictions, bring a unique focus to understanding the risks and reward of prospective resources, cost of development and operations and valued input into the assessment of opportunities to strengthen the portfolio of world class and sustainable assets. Current appointments Ian is currently Senior Independent Director of Endeavour Mining Corporation (since May 2022), the Chair of Cornish Lithium Ltd (since April 2022) and a Non-executive Director of I-Pulse Inc (since September 2010). Ian is also a Director of the Leadership for Conservation in Africa. Committee membership Risk and Audit Committee, Sustainability Committee 8 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting Item 4 Gary Goldberg BS (Mining Engineering), MBA Independent Non-executive Director and Senior Independent Director Appointment Independent Non-executive Director since February 2020 Senior Independent Director since 21 December 2020 Skills and experience Gary Goldberg has over 35 years’ global executive experience, including deep experience in mining, strategy, risk, commodity value chain, capital allocation discipline and public policy. Gary was the Chief Executive Officer of Newmont Corporation (from 2013 to 2019), and prior to that, President and Chief Executive Officer of Rio Tinto Minerals. Gary has also been a Non-executive Director of Port Waratah Coal Services Limited and Rio Tinto Zimbabwe, and served as Vice Chair of the World Gold Council, Treasurer of the International Council on Mining and Metals, and Chair of the National Mining Association in the United States. Gary is recognised for his leadership in bringing the mining industry together to raise standards in safety and environmental performance in conjunction with community and government partnerships in America and around the world. He has management experience in implementing strategies focused on safety, decarbonisation and transformational investment for commodities with long-dated cycles, along with his contribution to policy development in environmental management globally. Current appointments Gary is a Director of Imperial Oil Limited (since May 2023). Committee membership Nomination and Governance Committee, Sustainability Committee (Chair) Item 5 Michelle Hinchliffe BCom, FCA, ACA Independent Non-executive Director Appointment Independent Non-executive Director since March 2022 Skills and experience Michelle Hinchliffe has over 20 years’ experience as a partner in KPMG’s financial services division. Michelle was formerly a partner of KPMG and held a number of roles, including as the UK Chair of Audit, a member of the KPMG UK Executive Committee, and led KPMG’s financial services practice in Australia and was a member of the KPMG Australia Board. Michelle has expertise and experience in understanding the complexities of multi-national firms operating in multiple reporting and regulatory frameworks across Europe, the Americas, Asia and African continents. Her financial expertise and audit experience across a range of industries and businesses, including Australia, bring insights to the Board on BHP’s assessment of risk, returns and its long-term capital plan to create financial strength and support BHP’s future growth. Current appointments Michelle is a Non-executive Director of Santander UK plc and Santander UK Group Holdings Plc (since June 2023) and Macquarie Group Limited and Macquarie Bank Limited (since March 2022). Committee membership Risk and Audit Committee BHP Group Limited Notice of Meeting 2023 9

Explanatory Notes continued Item 6 Ken MacKenzie BEng, FIEA, FAICD Chair and Independent Non-executive Director Appointment Independent Non-executive Director since September 2016 Chair since 1 September 2017 Skills and experience Ken MacKenzie has global executive experience and a deeply strategic approach, with a focus on operational excellence, capital discipline and the creation of long-term shareholder value. Ken was the Managing Director and Chief Executive Officer of Amcor Limited, a global packaging company with operations in over 40 countries, from 2005 until 2015. Ken brings business management and leadership skills in global supply chains and governance gained during his career in developed and emerging markets in the Americas, Australia, Asia and Europe. Ken has experience in leading strategic transformation at a business and enterprise-wide level. His commitment to continuous learning and skills development provides valuable insights to Board deliberations and guidance to BHP’s leadership team in navigating the fast-changing dynamics of the global economy and markets. Current appointments Ken currently sits on the Advisory Board of American Securities Capital Partners LLC (since January 2016) and is a part-time adviser at Barrenjoey (since April 2021). Committee membership Nomination and Governance Committee (Chair) Item 7 Christine O’Reilly BBus Independent Non-executive Director Appointment Independent Non-executive Director since October 2020 Skills and experience Christine O’Reilly has over 30 years’ experience in the financial and infrastructure sectors, with deep financial and public policy expertise and experience in large-scale capital projects and transformational strategy. Christine was the Chief Executive Officer of the GasNet Australia Group and Co-Head of Unlisted Infrastructure Investments at Colonial First State Global Asset Management, following an early career in investment banking and audit at Price Waterhouse. Christine has also served as a Non-executive Director of Medibank Private Limited (from March 2014 to November 2021), Transurban Group (from April 2012 to October 2020), CSL Limited (from February 2011 to October 2020) and Energy Australia Holdings Limited (from September 2012 to August 2018). Christine has a deep understanding of financial drivers of the businesses and experience in capital allocation discipline across sectors that have long-dated paybacks for shareholders and stakeholders. Her insights into cost efficiency and cash flow as well as the impact of policy on innovation, investment and project development are key inputs for the Board. Current appointments Christine is a Non-executive Director of Australia and New Zealand Banking Group (since November 2021), Stockland Limited (since August 2018) and the Baker Heart and Diabetes Institute (since June 2013). Committee membership People and Remuneration Committee (Chair), Risk and Audit Committee, Nomination and Governance Committee 10 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting Item 8 Catherine Tanna LLB, Honorary Doctor of Business Independent Non-executive Director Appointment Independent Non-executive Director since April 2022 Skills and experience Catherine Tanna has more than 30 years’ experience in the resources, oil and gas, power generation and retailing sectors. Catherine was formerly Managing Director of Energy Australia between 2014 and 2021. Prior to this, she held senior executive roles with Shell and BG Group with responsibility for international operations across Africa, North Asia, Russia, North America, Latin America and Australia. Catherine was also a member of the Board of the Reserve Bank of Australia (from 2011 to 2021) and a Director of the Business Council of Australia (from 2016 to 2021). Catherine has a track record in leading cultural change and sponsoring gender equity, diversity and inclusion across business and more broadly. She brings an understanding of and contribution to complex regulatory and policy environments. Catherine’s experience in seeking to align customer and community expectations, particularly Indigenous communities, with those of the enterprise and regulators provides unique insight and input to the Board. Current appointments Catherine is a Non-executive Director at Bechtel Corporation (since May 2023), Senior Advisor at McKinsey & Company Inc (since April 2022), a member of the Advisory Board of Fujitsu Australia (since February 2022) and a Director of Australians for Indigenous Constitutional Recognition (since January 2023). Committee membership People and Remuneration Committee, Sustainability Committee Item 9 Dion Weisler BASc (Computing), Honorary Doctor of Laws Independent Non-executive Director Appointment Independent Non-executive Director since June 2020 Skills and experience Dion Weisler has extensive global executive experience, including transformation and commercial experience in the global information technology sector, with a focus on capital discipline and stakeholder engagement. Dion was formerly a Director and the President and Chief Executive Officer of HP Inc. (from 2015 to 2019) and continued as a Director and Senior Executive Adviser (until May 2020). Dion previously held a number of senior executive roles at Lenovo Group Limited, was General Manager Conferencing and Collaboration at Telstra Corporation and held various positions at Acer Inc., including as Managing Director, Acer UK. Dion brings experience in transforming megatrends into opportunities and growth and valuable insight on the power of innovation, technology and data. Dion’s experience also demonstrates insights into strategy development in the global energy transition, where safety, decarbonisation and stakeholder management are critical. Current appointments Dion is a Non-executive Director of Intel Corporation (since June 2020), a Non-executive Director of Thermo Fisher Scientific Inc. (since March 2017) and a Non-executive Director of Sapia & Co Ltd (since January 2022). Committee membership People and Remuneration Committee, Sustainability Committee BHP Group Limited Notice of Meeting 2023 11

Explanatory Notes continued Item 10 Adoption of the Remuneration Report The Remuneration Report is on pages 115-131 of BHP’s Annual Report 2023. It includes information about our remuneration framework and remuneration arrangements for our Key Management Personnel (KMP) during FY2023. The vote on this Item is advisory only and does not bind the Directors or BHP. However, the Board will take the outcome of the vote into account when reviewing BHP’s remuneration framework. Shareholders will have a reasonable opportunity as a whole to ask questions about or make comments on the Remuneration Report. Voting exclusion statement BHP will disregard any votes cast on Item 10: – by or on behalf of a member of BHP’s KMP who are named in BHP’s Remuneration Report for the year ended 30 June 2023 or their closely related parties, regardless of the capacity in which the vote is cast; or – as a proxy by a person who is a member of BHP’s KMP at the date of the AGM or their closely related parties, unless the vote is cast as proxy for a person entitled to vote on Item 10: – in accordance with a direction in the proxy form; or – by the Chair of the AGM pursuant to an express authorisation in the proxy form to exercise the proxy even though Item 10 is connected with the remuneration of the KMP. The Board recommends shareholders vote in favour of this Item. 12 BHP Group Limited Notice of Meeting 2023

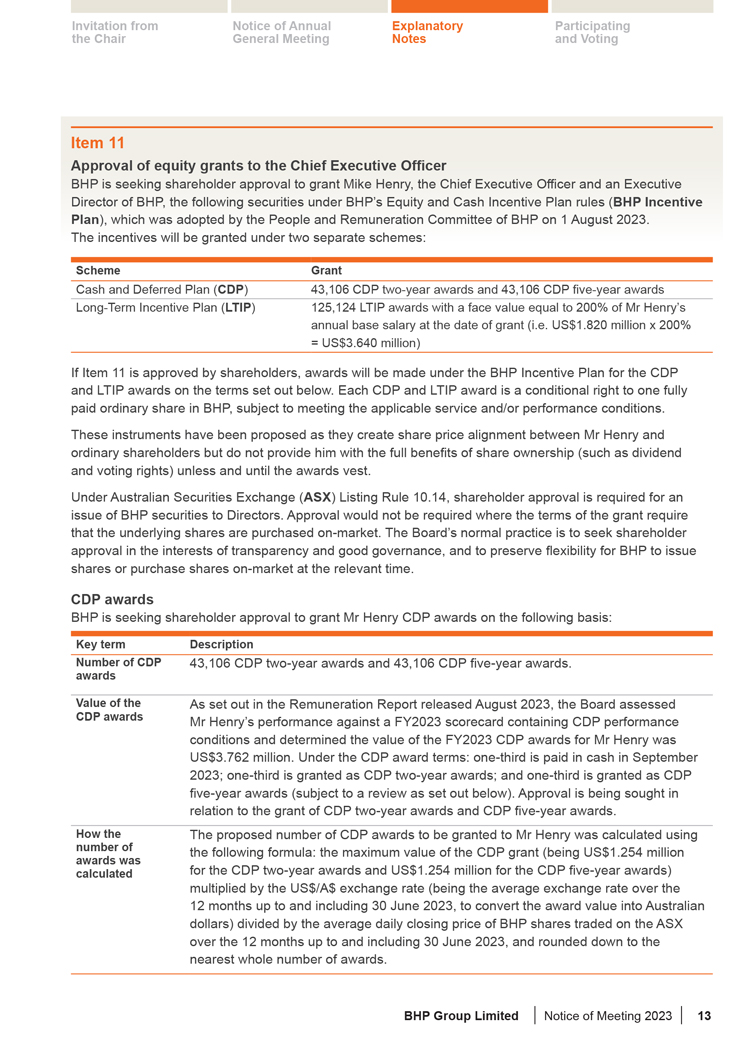

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting Item 11 Approval of equity grants to the Chief Executive Officer BHP is seeking shareholder approval to grant Mike Henry, the Chief Executive Officer and an Executive Director of BHP, the following securities under BHP’s Equity and Cash Incentive Plan rules (BHP Incentive Plan), which was adopted by the People and Remuneration Committee of BHP on 1 August 2023. The incentives will be granted under two separate schemes: Scheme Grant Cash and Deferred Plan (CDP) 43,106 CDP two-year awards and 43,106 CDP five-year awards Long-Term Incentive Plan (LTIP) 125,124 LTIP awards with a face value equal to 200% of Mr Henry’s annual base salary at the date of grant (i.e. US$1.820 million x 200% = US$3.640 million) If Item 11 is approved by shareholders, awards will be made under the BHP Incentive Plan for the CDP and LTIP awards on the terms set out below. Each CDP and LTIP award is a conditional right to one fully paid ordinary share in BHP, subject to meeting the applicable service and/or performance conditions. These instruments have been proposed as they create share price alignment between Mr Henry and ordinary shareholders but do not provide him with the full benefits of share ownership (such as dividend and voting rights) unless and until the awards vest. Under Australian Securities Exchange (ASX) Listing Rule 10.14, shareholder approval is required for an issue of BHP securities to Directors. Approval would not be required where the terms of the grant require that the underlying shares are purchased on-market. The Board’s normal practice is to seek shareholder approval in the interests of transparency and good governance, and to preserve flexibility for BHP to issue shares or purchase shares on-market at the relevant time. CDP awards BHP is seeking shareholder approval to grant Mr Henry CDP awards on the following basis: Key term Description Number of CDP 43,106 CDP two-year awards and 43,106 CDP five-year awards. awards Value of the As set out in the Remuneration Report released August 2023, the Board assessed CDP awards Mr Henry’s performance against a FY2023 scorecard containing CDP performance conditions and determined the value of the FY2023 CDP awards for Mr Henry was US$3.762 million. Under the CDP award terms: one-third is paid in cash in September 2023; one-third is granted as CDP two-year awards; and one-third is granted as CDP five-year awards (subject to a review as set out below). Approval is being sought in relation to the grant of CDP two-year awards and CDP five-year awards. How the The proposed number of CDP awards to be granted to Mr Henry was calculated using number of the following formula: the maximum value of the CDP grant (being US$1.254 million awards was calculated for the CDP two-year awards and US$1.254 million for the CDP five-year awards) multiplied by the US$/A$ exchange rate (being the average exchange rate over the 12 months up to and including 30 June 2023, to convert the award value into Australian dollars) divided by the average daily closing price of BHP shares traded on the ASX over the 12 months up to and including 30 June 2023, and rounded down to the nearest whole number of awards. BHP Group Limited Notice of Meeting 2023 13

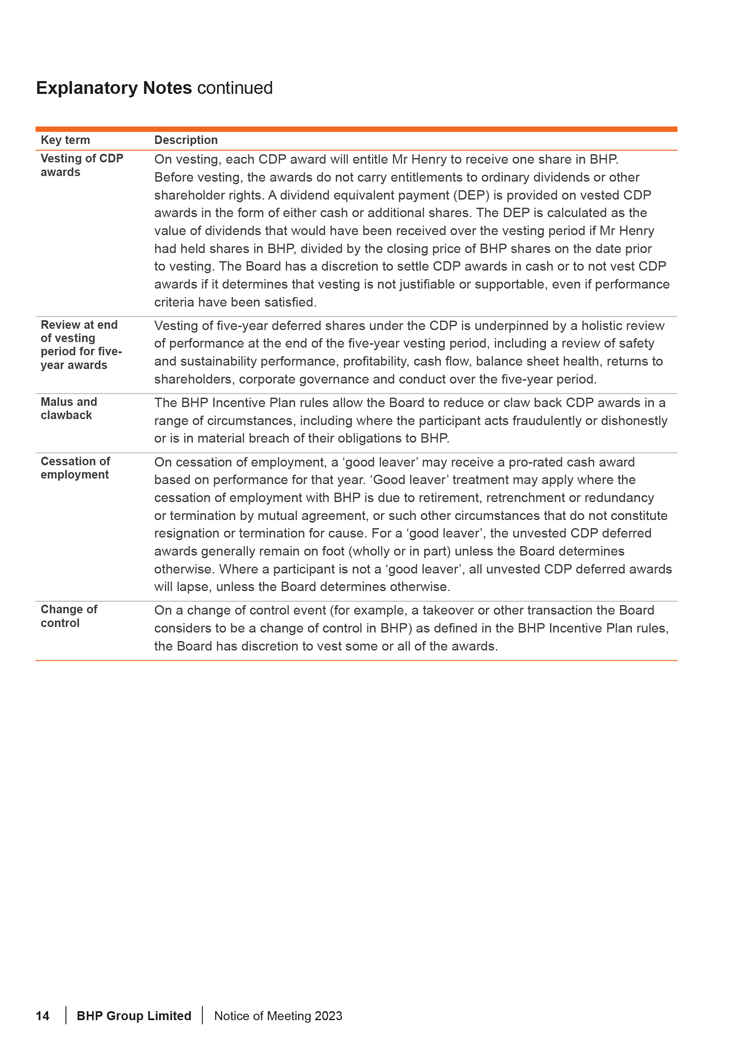

Explanatory Notes continued Key term Description Vesting of CDP awards On vesting, each CDP award will entitle Mr Henry to receive one share in BHP. Before vesting, the awards do not carry entitlements to ordinary dividends or other shareholder rights. A dividend equivalent payment (DEP) is provided on vested CDP awards in the form of either cash or additional shares. The DEP is calculated as the value of dividends that would have been received over the vesting period if Mr Henry had held shares in BHP, divided by the closing price of BHP shares on the date prior to vesting. The Board has a discretion to settle CDP awards in cash or to not vest CDP awards if it determines that vesting is not justifiable or supportable, even if performance criteria have been satisfied. Review at end of vesting period for five-year awards Vesting of five-year deferred shares under the CDP is underpinned by a holistic review of performance at the end of the five-year vesting period, including a review of safety and sustainability performance, profitability, cash flow, balance sheet health, returns to shareholders, corporate governance and conduct over the five-year period. Malus and clawback The BHP Incentive Plan rules allow the Board to reduce or claw back CDP awards in a range of circumstances, including where the participant acts fraudulently or dishonestly or is in material breach of their obligations to BHP. Cessation of employment On cessation of employment, a ‘good leaver’ may receive a pro-rated cash award based on performance for that year. ‘Good leaver’ treatment may apply where the cessation of employment with BHP is due to retirement, retrenchment or redundancy or termination by mutual agreement, or such other circumstances that do not constitute resignation or termination for cause. For a ‘good leaver’, the unvested CDP deferred awards generally remain on foot (wholly or in part) unless the Board determines otherwise. Where a participant is not a ‘good leaver’, all unvested CDP deferred awards will lapse, unless the Board determines otherwise. Change of control On a change of control event (for example, a takeover or other transaction the Board considers to be a change of control in BHP) as defined in the BHP Incentive Plan rules, the Board has discretion to vest some or all of the awards. 14 BHP Group Limited Notice of Meeting 2023

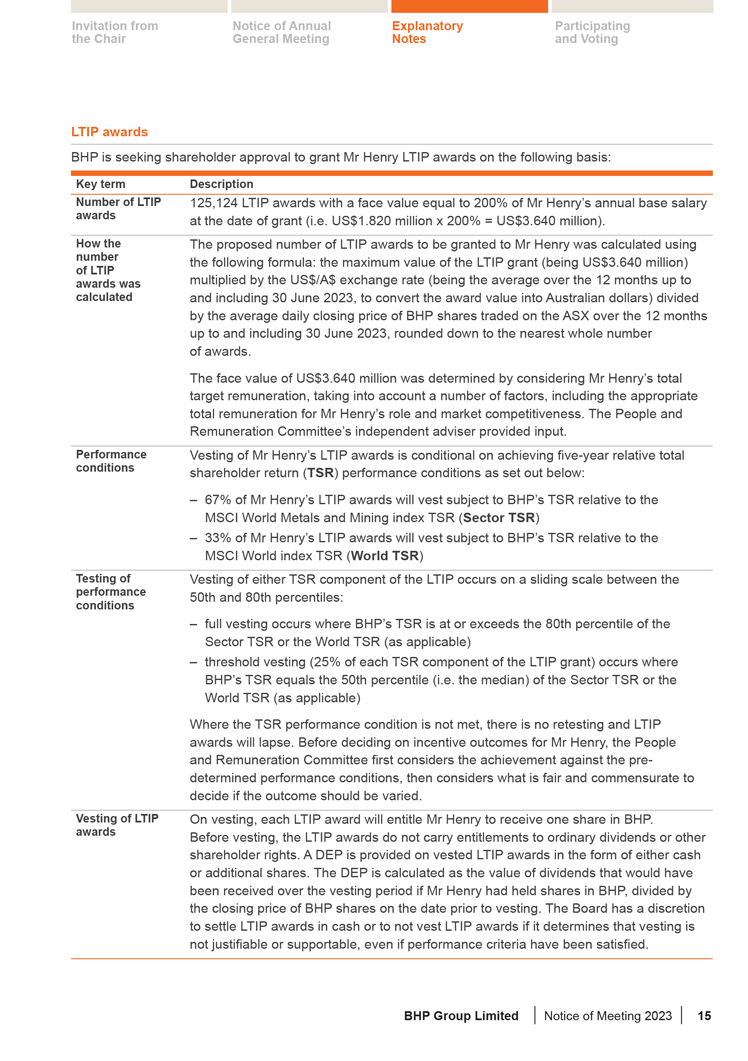

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting LTIP awards BHP is seeking shareholder approval to grant Mr Henry LTIP awards on the following basis: Key term Description Number of LTIP awards 125,124 LTIP awards with a face value equal to 200% of Mr Henry’s annual base salary at the date of grant (i.e. US$1.820 million x 200% = US$3.640 million). How the number of LTIP awards was calculated The proposed number of LTIP awards to be granted to Mr Henry was calculated using the following formula: the maximum value of the LTIP grant (being US$3.640 million) multiplied by the US$/A$ exchange rate (being the average over the 12 months up to and including 30 June 2023, to convert the award value into Australian dollars) divided by the average daily closing price of BHP shares traded on the ASX over the 12 months up to and including 30 June 2023, rounded down to the nearest whole number of awards. The face value of US$3.640 million was determined by considering Mr Henry’s total target remuneration, taking into account a number of factors, including the appropriate total remuneration for Mr Henry’s role and market competitiveness. The People and Remuneration Committee’s independent adviser provided input. Performance conditions Vesting of Mr Henry’s LTIP awards is conditional on achieving five-year relative total shareholder return (TSR) performance conditions as set out below: – 67% of Mr Henry’s LTIP awards will vest subject to BHP’s TSR relative to the MSCI World Metals and Mining index TSR (Sector TSR) – 33% of Mr Henry’s LTIP awards will vest subject to BHP’s TSR relative to the MSCI World index TSR (World TSR) Testing of performance conditions Vesting of either TSR component of the LTIP occurs on a sliding scale between the 50th and 80th percentiles:– full vesting occurs where BHP’s TSR is at or exceeds the 80th percentile of the Sector TSR or the World TSR (as applicable) – threshold vesting (25% of each TSR component of the LTIP grant) occurs where BHP’s TSR equals the 50th percentile (i.e. the median) of the Sector TSR or the World TSR (as applicable) Where the TSR performance condition is not met, there is no retesting and LTIP awards will lapse. Before deciding on incentive outcomes for Mr Henry, the People and Remuneration Committee first considers the achievement against the predetermined performance conditions, then considers what is fair and commensurate to decide if the outcome should be varied. Vesting of LTIP awards On vesting, each LTIP award will entitle Mr Henry to receive one share in BHP. Before vesting, the LTIP awards do not carry entitlements to ordinary dividends or other shareholder rights. A DEP is provided on vested LTIP awards in the form of either cash or additional shares. The DEP is calculated as the value of dividends that would have been received over the vesting period if Mr Henry had held shares in BHP, divided by the closing price of BHP shares on the date prior to vesting. The Board has a discretion to settle LTIP awards in cash or to not vest LTIP awards if it determines that vesting is not justifiable or supportable, even if performance criteria have been satisfied. BHP Group Limited Notice of Meeting 2023 15

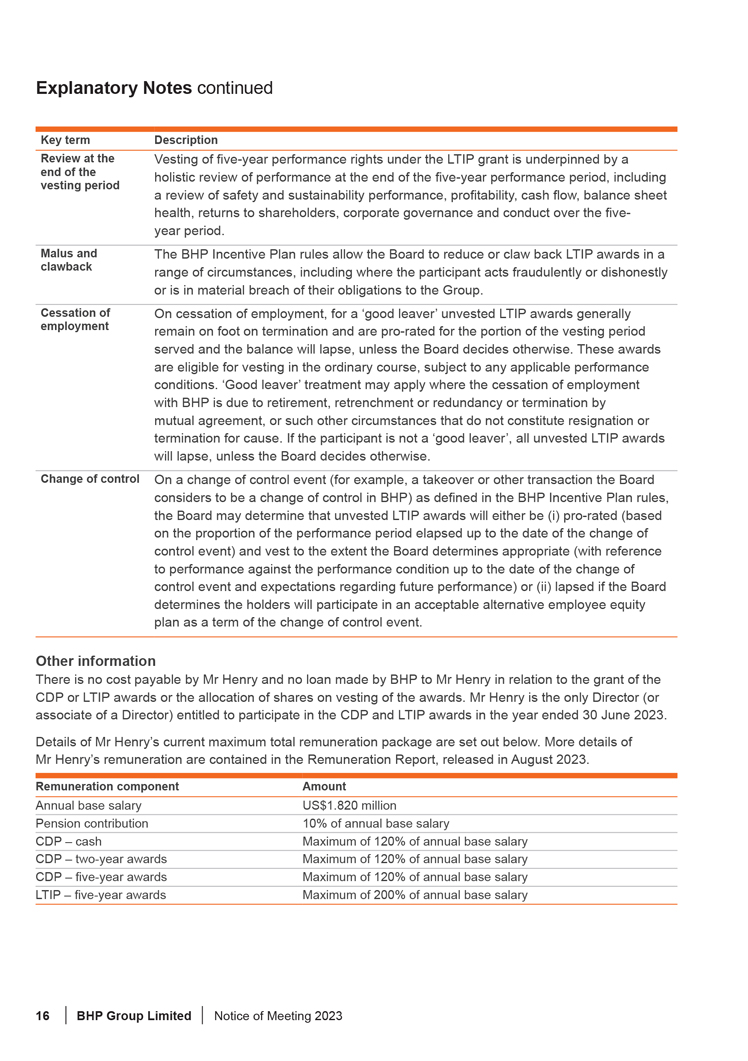

Explanatory Notes continued Key term Description Review at the end of the vesting period Vesting of five-year performance rights under the LTIP grant is underpinned by a holistic review of performance at the end of the five-year performance period, including a review of safety and sustainability performance, profitability, cash flow, balance sheet health, returns to shareholders, corporate governance and conduct over the five-year period. Malus and clawback The BHP Incentive Plan rules allow the Board to reduce or claw back LTIP awards in a range of circumstances, including where the participant acts fraudulently or dishonestly or is in material breach of their obligations to the Group. Cessation of employment On cessation of employment, for a ‘good leaver’ unvested LTIP awards generally remain on foot on termination and are pro-rated for the portion of the vesting period served and the balance will lapse, unless the Board decides otherwise. These awards are eligible for vesting in the ordinary course, subject to any applicable performance conditions. ‘Good leaver’ treatment may apply where the cessation of employment with BHP is due to retirement, retrenchment or redundancy or termination by mutual agreement, or such other circumstances that do not constitute resignation or termination for cause. If the participant is not a ‘good leaver’, all unvested LTIP awards will lapse, unless the Board decides otherwise. Change of control On a change of control event (for example, a takeover or other transaction the Board considers to be a change of control in BHP) as defined in the BHP Incentive Plan rules, the Board may determine that unvested LTIP awards will either be (i) pro-rated (based on the proportion of the performance period elapsed up to the date of the change of control event) and vest to the extent the Board determines appropriate (with reference to performance against the performance condition up to the date of the change of control event and expectations regarding future performance) or (ii) lapsed if the Board determines the holders will participate in an acceptable alternative employee equity plan as a term of the change of control event. Other information There is no cost payable by Mr Henry and no loan made by BHP to Mr Henry in relation to the grant of the CDP or LTIP awards or the allocation of shares on vesting of the awards. Mr Henry is the only Director (or associate of a Director) entitled to participate in the CDP and LTIP awards in the year ended 30 June 2023. Details of Mr Henry’s current maximum total remuneration package are set out below. More details of Mr Henry’s remuneration are contained in the Remuneration Report, released in August 2023. Remuneration component Amount Annual base salary US$1.820 million Pension contribution 10% of annual base salary CDP – cash Maximum of 120% of annual base salary CDP – two-year awards Maximum of 120% of annual base salary CDP – five-year awards Maximum of 120% of annual base salary LTIP – five-year awards Maximum of 200% of annual base salary 16 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting A total of 483,433 awards have been granted to Mr Henry under the previous CDP (including, in its previous format, the Short-Term Incentive Plan) (at no cost) as prior year short-term incentives. A total of 1,683,591 awards have been granted to Mr Henry under the previous LTIP (at no cost) as prior year long-term incentives. If shareholder approval is obtained, the CDP and LTIP awards that are the subject of this approval will be granted to Mr Henry following the AGM and prior to 1 November 2026. If shareholder approval is not obtained, the Board will consider alternative arrangements to appropriately remunerate and incentivise Mr Henry. Details of any securities issued under the BHP Incentive Plan will be published in the Remuneration Report 2024, along with a statement that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to participate in an issue of securities under the BHP Incentive Plan after the resolution is approved and who were not named in this Notice of Meeting will not participate until approval is obtained under that rule. For information on the CDP and LTIP refer to the Remuneration Report released in August 2023, available at bhp.com. Voting exclusion statement BHP will disregard any votes cast: – in favour of Item 11 by or on behalf of Mr Henry, or his associates, regardless of the capacity in which the vote is cast; or – on Item 11 as a proxy by a person who is a member of BHP’s KMP on the date of the AGM or their closely related parties. However, votes will not be disregarded if they are cast: – as proxy or attorney for a person entitled to vote on Item 11 in accordance with a direction given to the proxy or attorney to vote on Item 11 in that way; – by the Chair of the AGM as proxy for a person entitled to vote on Item 11, in accordance with an express authorisation to exercise undirected proxies as the Chair of the AGM decides; or – by a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: – the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on Item 11; and – the holder votes on Item 11 in accordance with directions given by the beneficiary to the holder to vote in that way. The Board, with Mr Henry abstaining, recommends shareholders vote in favour of this Item. BHP Group Limited Notice of Meeting 2023 17

Explanatory Notes continued Item 12 Renewal of approval of potential leaving entitlements Reason for seeking shareholder approval Australian law restricts the benefits that can be given, without shareholder approval, to individuals who hold or have held in the last three years a managerial or executive office on cessation of their employment or retirement from office with BHP Group Limited or another Group entity to which sections 200B and 200E of the Corporations Act apply. Shareholder approval was last obtained at the 2020 AGM for three years, to the conclusion of the 2023 AGM. Item 12 seeks to refresh this approval for a further three years and to the conclusion of BHP’s 2026 AGM. This approval seeks to preserve flexibility for the Board or a delegate of the Board, including the People and Remuneration Committee or Executive Leadership Team (which, for the purposes of the Explanatory Notes to this Item, will be referred to as the Board for simplicity) to determine the most appropriate leaving package under the relevant employment agreements, incentive plans and retirement plans in accordance with BHP’s policy of treating departing employees, executives and KMP appropriately and with applicable laws, market practice and company policy. To assist BHP meeting this policy objective, the Board considers it prudent to seek shareholder approval in respect of the potential leaving entitlements or benefits payable to any current or future employees or office holders who are members of BHP’s KMP (which includes Executive KMP and Directors of BHP) at the time of cessation of their employment or at any time in the three years prior to cessation of their employment, as outlined in these Explanatory Notes. Approval is also sought in relation to potential leaving entitlements for employees who are not KMP but who are directors of a Group entity to which sections 200B and 200E of the Corporations Act apply (Subsidiary Directors). As employees who fall within this category are sometimes based in foreign jurisdictions where the local requirements, policies and practices in relation to leaving entitlements are very different to those of Australia, the Board considers it appropriate and prudent to also seek shareholder approval in respect of the potential leaving entitlements or benefits payable to any current or future employees who are Subsidiary Directors at the time of cessation of their employment or at any time in the three years prior to cessation of their employment, as outlined in these Explanatory Notes. Approval is being sought for the following benefits or entitlements Shareholder approval is being sought for the purposes of sections 200B and 200E of the Corporations Act for any ‘termination benefits’ that may be provided to KMP or Subsidiary Directors. Shareholders are not being asked to approve any change or increase in the remuneration or benefits or entitlements for KMP or Subsidiary Directors, or any variations to the existing discretions of the Board. The potential leaving entitlements that may become payable to KMP and Subsidiary Directors and the discretions that may be exercised in respect of these are summarised below. Generally, these are benefits or entitlements arising under: – the relevant employment or service agreement – BHP’s incentive plans – defined contribution plans, defined benefit plans and other retirement plans – local laws, policy and practice as amended from time to time. 18 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting If shareholder approval is obtained, the Board intends that no other leaving entitlements will be provided to KMP or Subsidiary Directors in connection with their ceasing to hold a managerial or executive office, other than those within the scope of this approval or which are otherwise able to be provided without requiring approval under section 200B and 200E of the Corporations Act and the value of the benefits outlined in this resolution and Explanatory Notes will be disregarded when calculating the relevant KMP’s and Subsidiary Director’s termination benefits cap for the purpose of subsection 200F(2)(b) or subsection 200G(1)(c) of the Corporations Act. Employment agreement benefits All Executive KMP (which includes the Chief Executive Officer) are employed under agreements capable of termination by BHP on up to 12 months’ notice (depending on the individual employment agreement) or on up to 12 months’ notice by the Executive KMP. Subsidiary Directors are employed under agreements capable of termination by BHP or the Subsidiary Director on providing certain periods of notice (depending on the individual employment agreement) and do not exceed 12 months’ notice by either party. A payment may be made in lieu of some or all of the notice period (calculated by reference to base salary plus superannuation or pension contributions payable plus any other benefits under the employment agreement). Employment agreements for Executive KMP or Subsidiary Directors also provide for additional benefits to be paid if the person dies or becomes permanently disabled while in the employment of the Group, with such benefits being capped at four times base salary. Statutory payments and accrued contractual entitlements are also paid on cessation (such as days of leave accrued but not taken). Certain other benefits may continue to be provided for a period following cessation where the arrangements are provided for under the employment agreement which could include, but are not limited to, relocation or repatriation benefits. Outplacement services may be provided to Executive KMP or Subsidiary Directors. Additional benefits may be payable to KMP or Subsidiary Directors at law depending on the jurisdiction in which the KMP or Subsidiary Director is based at the time they cease employment or to hold office, and any changes in law that occur between the time the employment or service contract is entered into and the cessation date. This approval is intended to cover any such payments. Incentive plan entitlements The treatment of Executive KMP or Subsidiary Directors’ entitlements or awards under BHP incentive plans on ceasing employment with the Group will depend on the circumstances in which their employment ceases and the terms of the relevant offer. Good leaver treatment may apply where the reason for cessation of employment with the Group is due to death, disability, genuine retirement, redundancy, expiry of a fixed-term contract or termination by mutual agreement, or other circumstances determined by the Board in its discretion. Executive KMP or Subsidiary Directors who are not good leavers and cease employment as a result of resignation or termination for cause or misconduct will not be entitled to short-term incentives that have not yet been paid or granted and will forfeit all unvested short-term and long-term equity awards on cessation of their employment. BHP Group Limited Notice of Meeting 2023 19

Explanatory Notes continued For cash and equity awards made under BHP’s incentive plans, the typical treatment for good leavers is: – annual incentives that have not yet been paid or granted are delivered wholly in cash (with no deferral) and may be subject to pro-rating where an Executive KMP or Subsidiary Director has only served part of the performance period – depending on the terms of the grant: – unvested equity that is not subject to a performance condition (for example, deferred equity awards) generally remain on foot (wholly or in part) unless the Board determines otherwise – unvested equity that is subject to a performance condition (for example, long-term incentive equity awards) generally remain on foot on termination and is pro-rated for the portion of the vesting period served. These awards are eligible for vesting in the ordinary course, subject to any applicable performance conditions and, where applicable, become exercisable – vested but unexercised awards will be exercisable for the remaining exercise period following cessation, unless the Board determines a reduced period or that they will lapse – shares acquired under the BHP Global Employee Share Plan (Shareplus), through contributions from post-tax base salary, will be released on cessation of employment. The Executive KMP or Subsidiary Director may also be entitled to some or all of the matched shares under Shareplus Certain equity awards carry entitlements to receive dividend equivalent payments, which are provided in the form of cash or additional shares on vesting of relevant awards. Notwithstanding the typical treatment outlined above, approval is now being sought for the Board to retain and exercise discretion in relation to good leavers (to the extent permitted by the terms of the relevant incentive plan): – to vest or lapse (in part or in full) incentive awards with effect from the cessation date or such other date determined by the Board – to allow awards to remain on foot (in part or in full) and be eligible for vesting in the ordinary course – to award some or all of the matched shares under Shareplus Where employment ceases for any reason before an award of cash or equity is granted in respect of a performance year, there is no entitlement to those awards for that year. However, except in the case of misconduct or termination for cause, the Board may determine to pay the participant an amount in cash, equity or both, having regard to performance and the portion of the performance year served. All unvested and vested awards remain subject to malus and clawback. Retirement plan payments The annual retirement contributions payable to Executive KMP are calculated by reference to base salary and are currently 10 per cent of base salary. Participation is provided through a defined contribution plan, an International Retirement Plan, a self-managed superannuation fund and/or a cash payment in lieu. Subsidiary Directors may also be entitled to retirement benefits. Some employees, including those who may become Executive KMP in the future, are members of legacy defined benefit plans and will continue to accrue benefits in those plans for past and future service unless they elect to transfer to a defined contribution plan. In all circumstances, any benefit that may be provided under the terms of the plan represents a benefit arising in connection with the person’s retirement from office, being payment for past services rendered to BHP. No pension augmentation is provided by virtue of cessation and the benefits provided represent accrued benefits. Approval is being sought for payment of these potential benefits. 20 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting Other payments Circumstances may arise from time to time where it will be appropriate for BHP to make small incidental payments to a departing KMP or Subsidiary Director, including allowing them to retain certain property following cessation (such as phones or other electronic devices), or making reasonable retirement gifts to recognise the contribution they made to the Group. Approval is sought to grant such incidental benefits provided they are reasonable and have an aggregate value that is less than 5 per cent of the outgoing person’s fees or base salary (as applicable) at the cessation date. Similarly, there may be instances where BHP considers it appropriate to enter into arrangements with a departing KMP or Subsidiary Director in connection with their cessation that include payment in settlement of liabilities and the reimbursement of legal fees subject to appropriate conditions. Approval is being sought for payment of these potential benefits. Additional payments that may apply to Subsidiary Directors This approval is intended to cover other payments or benefits that may be payable where a Subsidiary Director ceases to hold office or ceases employment and either the payment (and amount of such payment) is in accordance with the local regulations, policy or market practice, or is made pursuant to BHP’s practices or policies (for example in relation to payments on redundancy) in the relevant jurisdiction. As BHP operates a global diversified business with hundreds of subsidiaries in different locations, it is not possible to ascertain the amount or value of these benefits in advance. On cessation, other than for cause, BHP may make a payment to a Subsidiary Director in consideration of the departing individual confirming, extending or entering into appropriate restrictive covenants to protect BHP and its shareholders. The amount of such payment is governed by the individual’s employment agreement and local regulations, policy or market practice, as well as BHP’s policies and practices in the relevant jurisdiction. The value of the potential benefits or entitlements The amount or value of the leaving entitlements that may be given to KMP or Subsidiary Directors is the maximum potential benefit that could be provided for each of the categories described. The amount and value of the leaving benefits or entitlements that may be provided cannot be ascertained in advance. This is because various matters, events and circumstances will or are likely to affect the calculation of that amount or value, including: – the circumstances in which the individual ceases to hold office or ceases employment and whether they serve all or part of any applicable notice period – their base salary at the time of cessation of employment – the length of their service with BHP and the portion of any relevant performance or qualification periods that have expired at the time of cessation – any change in the individual’s role, such as a redeployment – the number of unvested equity entitlements held by the individual at the time of cessation and the number determined to vest, lapse or remain on foot – the market price of BHP shares when the value of any equity-based leaving entitlement or benefit is determined – the individual’s particular entitlement to retirement benefits – the nature and value of any outplacement services provided to the individual – the value of any accrued pension entitlement arising over the period of service until the date of cessation – the value of any payment or contribution that may arise and be paid in respect of the notice period provided under the employment or service agreement BHP Group Limited Notice of Meeting 2023 21

Explanatory Notes continued – in respect of any dividend equivalent payment, the amount of any dividends paid on BHP shares over the relevant vesting period – in respect of any matched shares provided to the individual under Shareplus, the number of acquired shares held by the individual on ceasing employment – any other factors that the Board determines to be relevant when exercising its discretions (such as the assessment of the performance of the individual up to the cessation date) – the nature and value of any payment required to settle liabilities or reimburse legal fees – the jurisdiction and location in which the individual is based at the time they cease to hold office or cease employment, and the applicable local laws, regulations, policy or market practice (including BHP’s practices or policies) in that jurisdiction – any changes in law between the date BHP enters into an employment or service agreement with the individual and the date the individual ceases to hold office or employment Approval is sought for a three-year period If shareholder approval is obtained, it will be effective from the date the resolution is passed until the conclusion of the 2026 AGM. Voting exclusion statement If any shareholder is a current or potential holder of a managerial or executive office (that is, if they are or are likely to be appointed as a Director of a Group entity or as a member of BHP Group Limited’s KMP) and wishes to preserve their ability to receive benefits under this approval, then that shareholder and their associates should not vote on Item 12 in any capacity. Further, BHP will disregard any vote cast as a proxy on Item 12 by a member of BHP’s KMP on the date of the AGM and their closely related parties. However, BHP will accept a vote cast on Item 12 by any person as a proxy for a person entitled to vote on Item 12 in accordance with a direction on the proxy form. Unlike the other resolutions, the Chair of the AGM will not be able to vote undirected proxies on Item 12, even if the proxy appointment expressly authorises the Chair of the AGM to exercise the proxy, as he is a person who may be entitled to receive a benefit under Item 12. Because they have a personal interest in the subject of this Item, the Directors have abstained from making a recommendation to shareholders in relation to this Item. By order of the Board Stefanie Wilkinson Group Company Secretary 22 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting Participating and Voting If you are a shareholder and hold your BHP Group Limited shares directly, you can: Ask questions Before the meeting: Submit your questions by Wednesday 25 October 2023 online at bhp.com/agm. At the meeting: Attend the meeting in person at the Adelaide Convention Centre, North Terrace, Adelaide, South Australia. Vote Before the meeting: Appoint a proxy by submitting your proxy form no later than 10:00am (Adelaide time) on Monday 30 October 2023 electronically, by hand delivery, post or by fax. You can also appoint a corporate representative or attorney to vote on your behalf. At the meeting: Attend the meeting in person at the Adelaide Convention Centre, North Terrace, Adelaide, South Australia. If you have appointed a proxy, corporate representative or attorney, they will be able to vote on your behalf at the meeting. Watch In person: Attend the meeting in person at the Adelaide Convention Centre, North Terrace, Adelaide, South Australia. Online: Watch a live webcast of the AGM at bhp.com/agm. BHP Group Limited Notice of Meeting 2023 23

Participating and Voting continued This section provides information on participating and voting if you are a shareholder and hold your BHP Group Limited shares directly. 1 Am I eligible to vote at the AGM? In accordance with Regulation 7.11.37 of the Corporations Regulations 2001 (Cth), persons who are registered holders of shares in BHP as at 6:30pm (Adelaide time) on Monday 30 October 2023 will be entitled to attend and vote at the AGM as shareholders. Share transfers registered after that time will be disregarded in determining entitlements to attend and vote at the AGM. If more than one joint holder of shares is present at the AGM (whether personally, by proxy or by attorney or by representative) and tender a vote, only the vote of the joint holder whose name appears first on the register will be counted. All items of business set out in the Notice of Meeting will be decided by way of a poll. On a poll, shareholders have one vote for every fully paid ordinary share held (subject to the restrictions on voting set out in this Notice of Meeting). 2 person How can or I watch attend the the AGM AGM online? in If you are attending in person, you must register at the AGM. The registration desks will be open from 9:00am (Adelaide time) and we ask you arrive at least 30 minutes before proceedings start to allow sufficient time to complete registration. The proxy form you receive with your Notice of Meeting contains a personalised barcode, which can be scanned to register your attendance at the AGM. Bring your proxy form with you to the AGM to make the registration process simpler. You can also watch a live webcast online as a guest at bhp.com/agm. You will not be able to ask questions or vote online when using the webcast facility. 3 How at the do AGM? I ask questions Shareholders as a whole will have a reasonable opportunity to make comments and ask questions on all the items of business set out in this Notice of Meeting during the AGM (including a reasonable opportunity to ask questions of the Auditor). If you would like to make a comment or ask a question at the AGM, please follow the instructions we provide to shareholders on the day. Please note that there may not be sufficient time available during the meeting to address all of the comments and questions raised. 4 How before do the I ask AGM? questions of BHP We encourage shareholders to ask questions or make comments in advance of the AGM online at bhp.com/agm by Wednesday 25 October 2023. The Chair of the AGM will endeavour to address the key themes raised during the AGM. However, there may not be sufficient time available during the meeting to address all questions or comments raised. Note that individual responses will not be sent to shareholders. 5 How Auditor do before I ask questions the AGM? of the Shareholders can submit written questions to BHP’s Auditor regarding the content of the Auditor’s Report or the conduct of its audit of the annual financial report for the year ended 30 June 2023. Shareholders can submit questions to the Auditor in advance of the AGM online at bhp.com/agm by Wednesday 25 October 2023. The Auditor is not required to provide individual responses to shareholders. 24 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting 6 How do I vote by proxy? Appointing a proxy Shareholders entitled to attend and vote at the meeting can appoint a proxy to attend and vote for them. The proxy does not need to be a shareholder and can be an individual or a body corporate. Shareholders holding two or more shares can appoint either one or two proxies. If two proxies are appointed, the appointing shareholder can specify the proportion or number of votes that each proxy can exercise. If no proportion or number is specified, each proxy can exercise half the shareholder’s votes. Shareholders who wish to indicate how their proxy should vote should mark the appropriate boxes on the proxy form. If a proxy is not directed how to vote on an Item of business, or should any resolution other than those specified in this Notice of Meeting be proposed at the AGM, the appointing shareholder is authorising the proxy to vote as they decide, subject to any applicable voting exclusions. Shareholders who return their proxy forms with a direction on how to vote but do not nominate the identity of their proxy will be taken to have appointed the Chair of the AGM as their proxy to vote on their behalf. Proxy voting on Items 10 to 12 BHP’s KMP (which includes each of the Directors and executives named in BHP’s 2023 Remuneration Report) and their closely related parties will not be able to vote as proxy on Items 10 to 12 unless you direct them how to vote (or if the Chair of the AGM is your proxy – refer to the next paragraph). If you intend to appoint any of those persons as your proxy, ensure you direct them how to vote on Items 10 to 12, as otherwise, they will not be able to cast a vote as your proxy on the relevant Item. If you appoint the Chair of the AGM as your proxy, you can direct the Chair of the AGM how to vote. If you appoint the Chair of the AGM as your proxy, or the Chair of the AGM is appointed as your proxy by default, but you do not mark a box next to Item 10 or 11, then by signing and submitting the proxy form, you will be expressly authorising the Chair of the AGM to vote as he decides in respect of the relevant Item, even though the Items are connected with the remuneration of BHP’s KMP. Unlike the other resolutions, the Chair of the AGM will not be able to vote undirected proxies on Item 12, even if the proxy appointment expressly authorises the Chair of the AGM to exercise the proxy, as he is a person who may be entitled to receive a benefit under Item 12. If you do not direct the Chair of the AGM how to vote on Item 12, he will not be able to cast a vote as your proxy on that Item. Proxy voting on a poll All Items will be decided by poll. On a poll, any directed proxies that are not voted at the meeting will automatically default to the Chair of the AGM, who is required to vote proxies as directed. Note that for proxies without voting instructions that are exercisable by the Chair of the AGM, the Chair of the AGM intends to vote all available proxies in favour of Items 2 to 11. The Chair of the AGM will not be voting undirected proxies on Item 12. 7 How do I submit a proxy form? To appoint a proxy, submit the proxy form no later than 10:00am (Adelaide time) on Monday 30 October 2023. BHP encourages you to register your voting or proxy instructions online via the Share Registry website at www.investorvote.com.au. Only registered BHP shareholders may access this facility. You will need your Control Number and your HIN or SRN and postcode for your shareholding. Alternatively you may: – hand deliver or post to BHP Share Registrar Computershare Investor Services Pty Limited Yarra Falls, 452 Johnston Street, Abbotsford VIC 3067. Postal address: GPO Box 782, Melbourne VIC 3001 Australia – fax to 1800 783 447 (within Australia) or +61 3 9473 2555 (outside Australia) – for Intermediary Online users only (custodians): submit at intermediaryonline.com BHP Group Limited Notice of Meeting 2023 25

Participating and Voting continued 8 Icorporate am a representative shareholder of . a How can I attend and vote? A body corporate that is a shareholder or has been appointed as a proxy may appoint an individual to act as its representative at the AGM. The appointment must comply with the requirements of section 250D of the Corporations Act. The representative should bring evidence of their appointment to the AGM, including any authority that it was signed under, unless it has previously been given to BHP. 9 I have a power of attorney from a shareholder . How can I attend and vote? A shareholder entitled to attend and vote may appoint an attorney to act on their behalf at the AGM. The attorney does not need to be a shareholder. Attorneys must submit the instrument appointing the attorney and the authority that the instrument is signed under or a certified copy of the authority, in the same way and by the same time as outlined for proxy forms, unless it has previously been given to BHP. 10 If Shareplus, I hold shares how through do I vote? BHP The Shareplus administrator will email you information on how to vote at the AGM. You must submit your vote by Monday 23 October 2023. 11 IHow am not can a I shareholder watch the meeting? . Non-shareholders (who are not proxy holders, corporate representatives or attorneys) may be admitted to the AGM at the discretion of BHP as guests and are requested to register by 5:00pm (Adelaide time) Tuesday 31 October 2023 by emailing their details to BHPAGMattendance@computershare.com.au. Non-shareholders may also watch a live webcast online at bhp.com/agm. You will not be able to ask questions or vote online when using the webcast facility. At BHP, we aim to provide a healthy, safe and inclusive workplace, free from harassment and bullying. We want all of our people to be treated fairly, respectfully and with dignity. In this spirit, we ask shareholders and guests attending the AGM to be courteous and respectful to others. The Chair of the AGM reserves right to ensure the meeting is conducted in this way. Security measures will be in place to ensure your safety. Please note bag searches will be in operation and any large or inappropriate items may be required to be stored in the cloakroom until the end of the event. 26 BHP Group Limited Notice of Meeting 2023

Invitation the Chair from General Notice of Meeting Annual Notes Explanatory and Participating Voting If you hold BHP shares that are traded on an international exchange If you hold BHP shares that are traded on an international exchange, you can attend the meeting in person if you pre-register as a guest (in which case you are requested to register by 5:00pm (Adelaide time) on Tuesday 31 October 2023 by emailing your details to BHPAGMattendance@computershare.com.au), or you can watch the webcast online at bhp.com/agm. If you would like to vote, you should do so in advance of the meeting following the instructions set out below. For more information about your shareholdings or how to participate in the meeting, contact BHP’s registrar Computershare via www.investorcentre.com/contact or by phone on 1300 656 780 (within Australia) or +61 3 9415 4020 (outside Australia). If you hold UK depositary interests via CREST, you can vote online via I hold depositary the CREST system at www.investorcentre.co.uk/eproxy or via the Form of interests (through Instruction by instructing Computershare how to exercise voting rights. CREST) Submit your Form of Instruction by 26 October 2023 at 12 noon (London time). If you hold UK depositary interests via the Corporate Sponsored Nominee I hold depositary Facility, you can vote online at www.investorcentre.co.uk/eproxy or interests (through via the Form of Direction by directing Computershare how to exercise the CSN Facility) voting rights. Submit your Form of Direction by 25 October 2023 at 12 noon (London time). Shareholders registered on the South African section of the register whose I hold shares in shares are held in the Strate Proprietary Limited system for electronic dematerialised form clearing and settlement and holding of uncertificated securities via a Central Securities Depositary Participant (CSDP) or broker should provide through STRATE their voting instruction to the CSDP or broker (as applicable) in sufficient time to permit the CSDP or broker to advise the registrar. Contact your CSDP or broker for instructions and timing requirements for voting instruction lodgements. If you hold American Depositary Shares, you should contact the registered I hold American holder of the underlying shares, the custodian or broker or whoever Depositary Shares administers the investment on your behalf in relation to exercising voting and/or participation rights that may be applicable to the American Depositary Shares. The Depositary for the American Depositary Shares is Citibank, N.A., and can be contacted at 1-877-CITI-ADR (877-248-4237 or for those outside of the United States at 1-781-575-4555 Monday to Friday, 8:30am–6:00pm EST). BHP Group Limited Notice of Meeting 2023 27

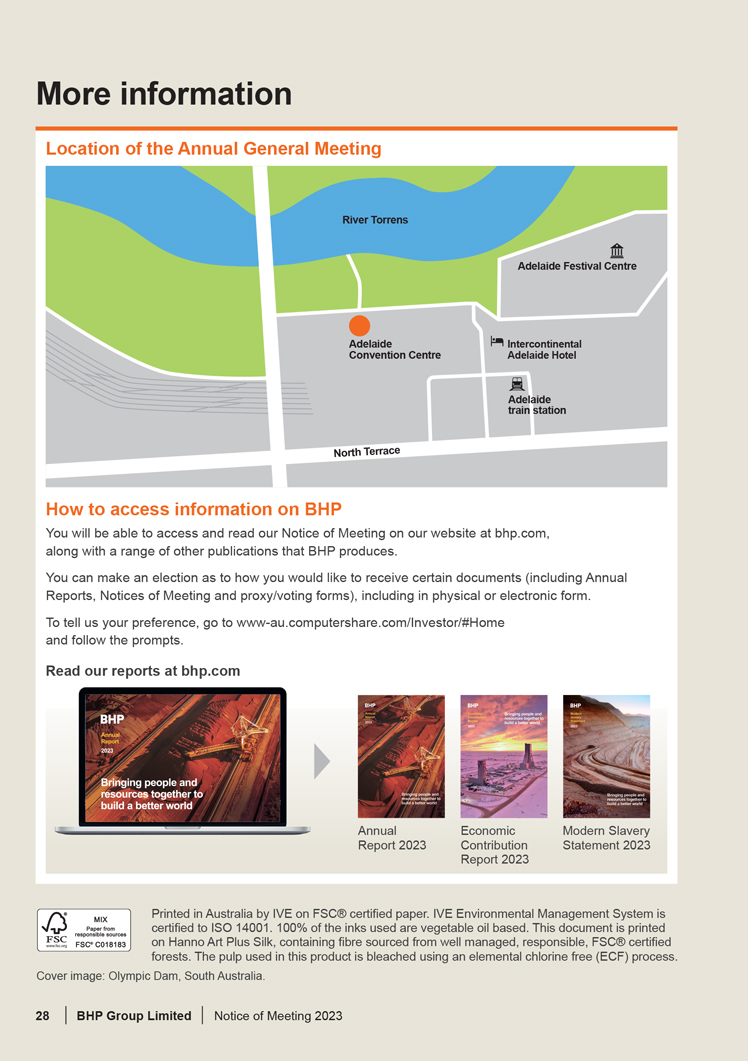

More information Location of the Annual General Meeting River Torrens Adelaide Festival Centre Adelaide Convention Centre Intercontinental Adelaide Hotel train Adelaide station North Terrace How to access information on BHP You will be able to access and read our Notice of Meeting on our website at bhp.com, along with a range of other publications that BHP produces. You can make an election as to how you would like to receive certain documents (including Annual Reports, Notices of Meeting and proxy/voting forms), including in physical or electronic form. To tell us your preference, go to www-au.computershare.com/Investor/#Home and follow the prompts. Read our reports at bhp.com Annual Economic Modern Slavery Report 2023 Contribution Statement 2023 Report 2023 Printed in Australia by IVE on FSC® certified paper. IVE Environmental Management System is certified to ISO 14001. 100% of the inks used are vegetable oil based. This document is printed on Hanno Art Plus Silk, containing fibre sourced from well managed, responsible, FSC® certified forests. The pulp used in this product is bleached using an elemental chlorine free (ECF) process. Cover image: Olympic Dam, South Australia. 28 BHP Group Limited Notice of Meeting 2023

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BHP Group Limited | ||||||

| Date: September 26, 2023 | By: | /s/ Stefanie Wilkinson |

||||

| Name: | Stefanie Wilkinson | |||||

| Title: | Group Company Secretary | |||||