UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-41562

NewAmsterdam Pharma Company N.V.

(Exact name of registrant as specified in its charter)

Gooimeer 2-35

1411 DC Naarden

The Netherlands

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On September 25, 2023, NewAmsterdam Pharma Company N.V. (the “Company”) posted an updated corporate investor presentation on its website (https://www.newamsterdampharma.com/). A copy of the corporate investor presentation is furnished as Exhibit 99.1 to this Report on Form 6-K. The information contained on, or that can be accessed from, the Company’s website is not incorporated into, and does not constitute a part of, this Report on Form 6-K.

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | NewAmsterdam Pharma Company N.V. Corporate Presentation | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NewAmsterdam Pharma Company N.V. |

||||||

| September 25, 2023 |

By: |

/s/ Michael Davidson |

||||

| Name: Michael Davidson Title: Chief Executive Officer |

||||||

Exhibit 99.1 September 2023

Disclaimer This presentation (together with oral statements made in connection herewith, this “Presentation”) is for informational purposes only. This Presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. Forward Looking Statements Certain statements included in this Presentation that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward- looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements by NewAmsterdam Pharma Company N.V. (“NewAmsterdam” or the “Company”) regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity; expectations and timing related to the success, cost and timing of product development activities, including timing of initiation, completion and data readouts for clinical trials and the potential approval of the Company’s product candidate; the timing for enrolling patients; the timing and forums for announcing data; the size and growth potential of the markets for the Company’s product candidate; the therapeutic and curative potential of the Company’s product candidate; financing and other business milestones; the Company’s expected cash runway; and the Company’s plans for commercialization. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on as a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward- looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; risks related to the approval of NewAmsterdam’s product candidate and the timing of expected regulatory and business milestones; whether topline, initial or preliminary results from a particular clinical trial will be predictive of the final results of that trial and whether results of early clinical trials will be indicative of the results of later clinical trials; ability to negotiate definitive contractual arrangements with potential customers; the impact of competitive product candidates; ability to obtain sufficient supply of materials; global economic and political conditions, including the Russia-Ukraine conflict; the effects of competition on NewAmsterdam’s future business; and those factors discussed in documents filed by the Company with the SEC. Additional risks related to NewAmsterdam’s business include, but are not limited to: uncertainty regarding outcomes of the company’s ongoing clinical trials, particularly as they relate to regulatory review and potential approval for its product candidate; risks associated with the Company’s efforts to commercialize a product candidate; the Company’s ability to negotiate and enter into definitive agreements on favorable terms, if at all; the impact of competing product candidates on the Company’s business; intellectual property-related claims; the Company’s ability to attract and retain qualified personnel; and the Company’s ability to continue to source the raw materials for its product candidate, together with the risks described in the Company’s filings made with the U.S. Securities and Exchange Commission from time to time. If any of these risks materialize or NewAmsterdam’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that are presently unknown by the Company or that NewAmsterdam currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect NewAmsterdam’s expectations, plans, or forecasts of future events and views as of the date of this Presentation and are qualified in their entirety by reference to the cautionary statements herein. NewAmsterdam anticipates that subsequent events and developments will cause the Company’s assessments to change. These forward-looking statements should not be relied upon as representing NewAmsterdam’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Neither NewAmsterdam nor any of its affiliates undertakes any obligation to update these forward-looking statements, except as required by law. Market Data Certain information contained in this Presentation relates to or is based on third-party studies, publications, surveys and NewAmsterdam’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while NewAmsterdam believes its internal research is reliable, such research has not been verified by any independent source and NewAmsterdam cannot guarantee and makes no representation or warranty, express or implied, as to its accuracy and completeness. Trademarks This Presentation contains trademarks, service marks, trade names, and copyrights of NewAmsterdam and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade name or products in this Presentation is not intended to, and does not imply, a relationship with NewAmsterdam or an endorsement or sponsorship by or of NewAmsterdam. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the TM or SM symbols, but such references are not intended to indicate, in any way, that NewAmsterdam will not assert, to the fullest extent permitted under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. 2

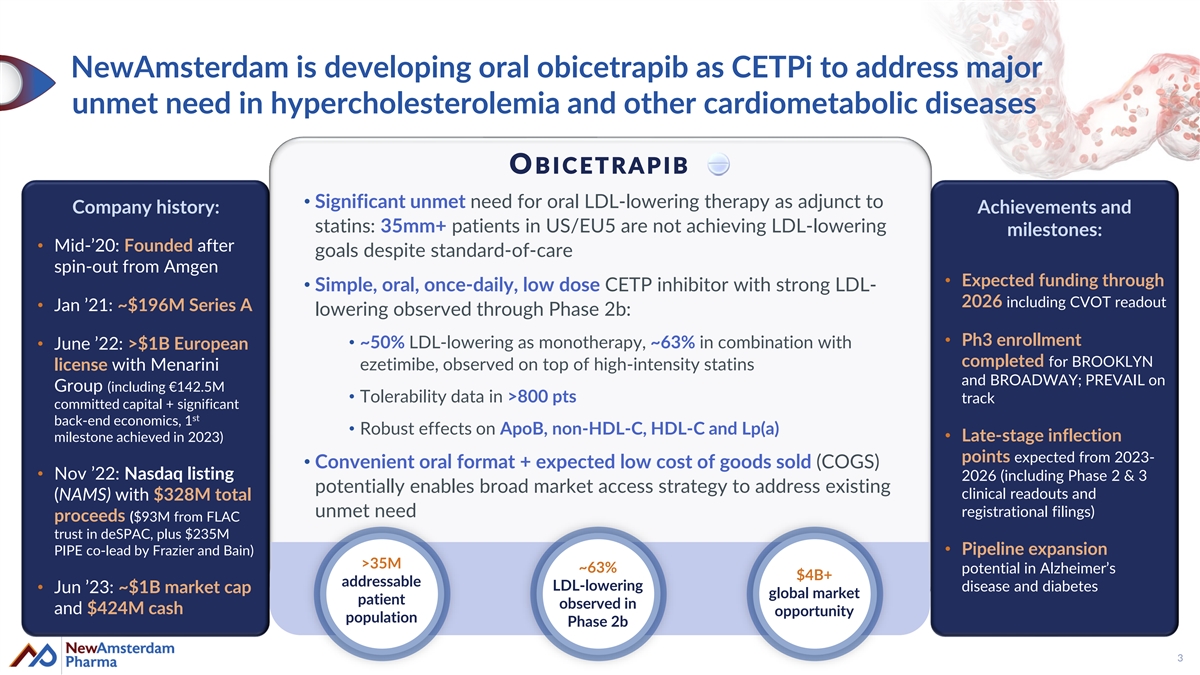

NewAmsterdam is developing oral obicetrapib as CETPi to address major unmet need in hypercholesterolemia and other cardiometabolic diseases OBICETRAPIB • Significant unmet need for oral LDL-lowering therapy as adjunct to Company history: Achievements and statins: 35mm+ patients in US/EU5 are not achieving LDL-lowering milestones: • Mid-’20: Founded after goals despite standard-of-care spin-out from Amgen • Expected funding through • Simple, oral, once-daily, low dose CETP inhibitor with strong LDL- 2026 including CVOT readout • Jan ’21: ~$196M Series A lowering observed through Phase 2b: • Ph3 enrollment • ~50% LDL-lowering as monotherapy, ~63% in combination with • June ’22: >$1B European completed for BROOKLYN ezetimibe, observed on top of high-intensity statins license with Menarini and BROADWAY; PREVAIL on Group (including €142.5M • Tolerability data in >800 pts track committed capital + significant st back-end economics, 1 • Robust effects on ApoB, non-HDL-C, HDL-C and Lp(a) • Late-stage inflection milestone achieved in 2023) points expected from 2023- • Convenient oral format + expected low cost of goods sold (COGS) • Nov ’22: Nasdaq listing 2026 (including Phase 2 & 3 potentially enables broad market access strategy to address existing clinical readouts and (NAMS) with $328M total unmet need registrational filings) proceeds ($93M from FLAC trust in deSPAC, plus $235M PIPE co-lead by Frazier and Bain)• Pipeline expansion >35M ~63% potential in Alzheimer’s $4B+ addressable LDL-lowering disease and diabetes • Jun ’23: ~$1B market cap global market patient observed in and $424M cash opportunity population Phase 2b 3

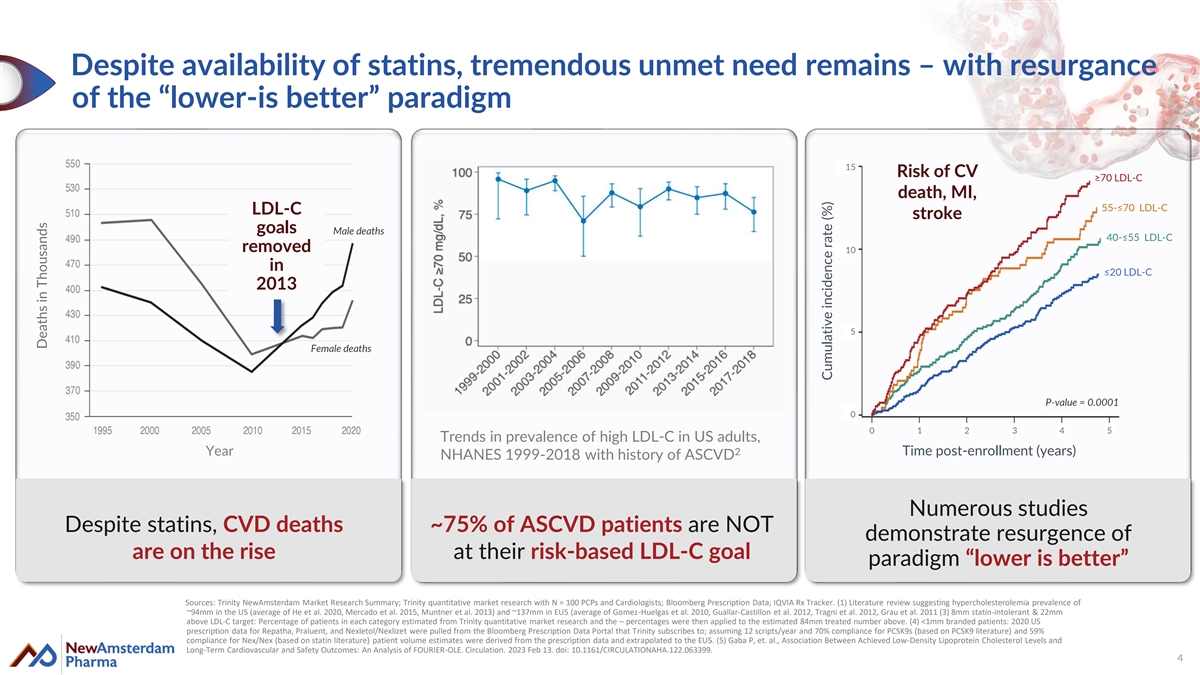

Despite availability of statins, tremendous unmet need remains – with resurgance of the “lower-is better” paradigm 15 Risk of CV ≥70 LDL-C death, MI, 55-≤70 LDL-C LDL-C stroke goals Male deaths 40-≤55 LDL-C removed 10 in ≤20 LDL-C 2013 5 Female deaths P-value = 0.0001 5 0 0 1 2 3 4 5 Trends in prevalence of high LDL-C in US adults, 2 Year Time post-enrollment (years) NHANES 1999-2018 with history of ASCVD Numerous studies Despite statins, CVD deaths ~75% of ASCVD patients are NOT demonstrate resurgence of are on the rise at their risk-based LDL-C goal paradigm “lower is better” Sources: Trinity NewAmsterdam Market Research Summary; Trinity quantitative market research with N = 100 PCPs and Cardiologists; Bloomberg Prescription Data; IQVIA Rx Tracker. (1) Literature review suggesting hypercholesterolemia prevalence of ~94mm in the US (average of He et al. 2020, Mercado et al. 2015, Muntner et al. 2013) and ~137mm in EU5 (average of Gomez-Huelgas et al. 2010, Guallar-Castillon et al. 2012, Tragni et al. 2012, Grau et al. 2011 (3) 8mm statin-intolerant & 22mm above LDL-C target: Percentage of patients in each category estimated from Trinity quantitative market research and the – percentages were then applied to the estimated 84mm treated number above. (4) <1mm branded patients: 2020 US prescription data for Repatha, Praluent, and Nexletol/Nexlizet were pulled from the Bloomberg Prescription Data Portal that Trinity subscribes to; assuming 12 scripts/year and 70% compliance for PCSK9s (based on PCSK9 literature) and 59% compliance for Nex/Nex (based on statin literature) patient volume estimates were derived from the prescription data and extrapolated to the EU5. (5) Gaba P, et. al., Association Between Achieved Low-Density Lipoprotein Cholesterol Levels and Long-Term Cardiovascular and Safety Outcomes: An Analysis of FOURIER-OLE. Circulation. 2023 Feb 13. doi: 10.1161/CIRCULATIONAHA.122.063399. 4 Deaths in Thousands Cumulative incidence rate (%)

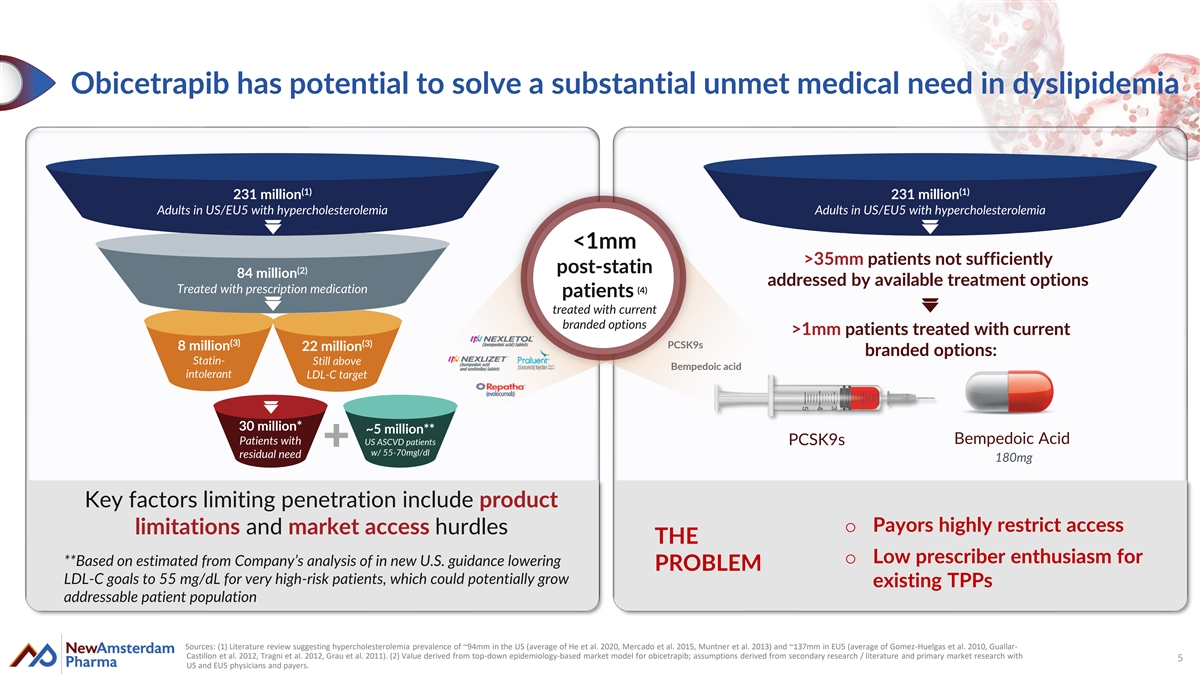

Obicetrapib has potential to solve a substantial unmet medical need in dyslipidemia (1) (1) 231 million 231 million Adults in US/EU5 with hypercholesterolemia Adults in US/EU5 with hypercholesterolemia <1mm >35mm patients not sufficiently (2) post-statin 84 million addressed by available treatment options Treated with prescription medication (4) patients treated with current branded options >1mm patients treated with current (3) (3) PCSK9s 8 million 22 million branded options: Statin- Still above Bempedoic acid intolerant LDL-C target 30 million* ~5 million** Bempedoic Acid Patients with US ASCVD patients PCSK9s w/ 55-70mgl/dl residual need 180mg Key factors limiting penetration include product o Payors highly restrict access limitations and market access hurdles THE o Low prescriber enthusiasm for **Based on estimated from Company’s analysis of in new U.S. guidance lowering PROBLEM LDL-C goals to 55 mg/dL for very high-risk patients, which could potentially grow existing TPPs addressable patient population Sources: (1) Literature review suggesting hypercholesterolemia prevalence of ~94mm in the US (average of He et al. 2020, Mercado et al. 2015, Muntner et al. 2013) and ~137mm in EU5 (average of Gomez-Huelgas et al. 2010, Guallar- Castillon et al. 2012, Tragni et al. 2012, Grau et al. 2011). (2) Value derived from top-down epidemiology-based market model for obicetrapib; assumptions derived from secondary research / literature and primary market research with 5 US and EU5 physicians and payers.

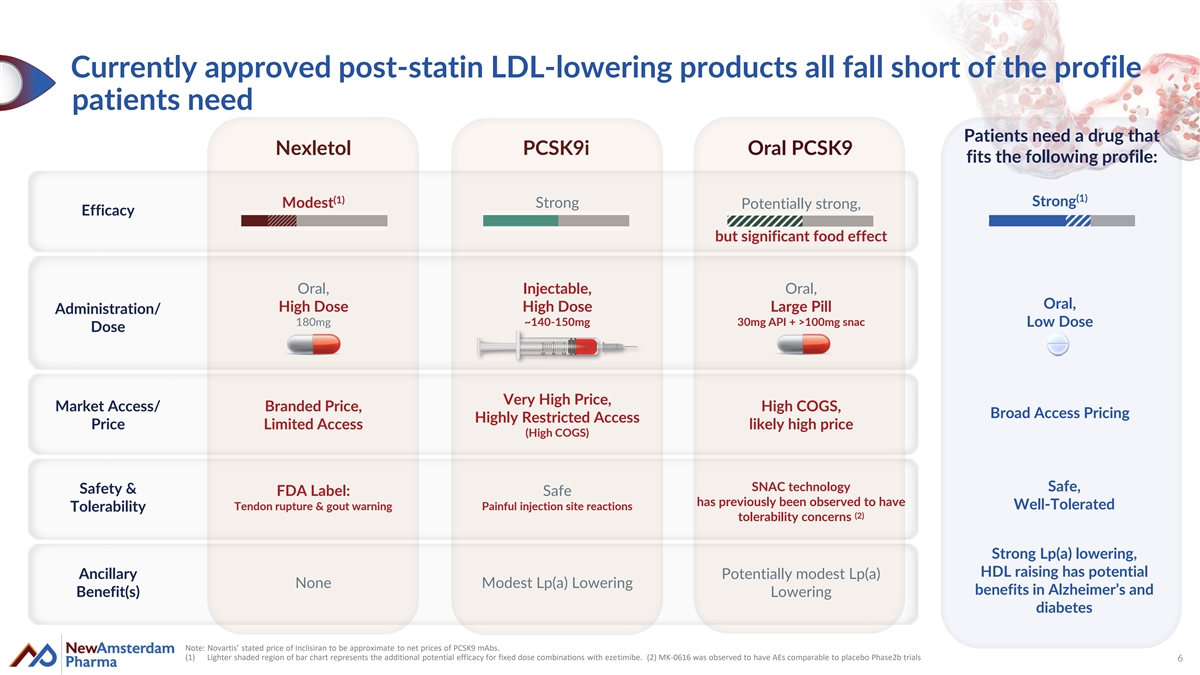

Currently approved post-statin LDL-lowering products all fall short of the profile patients need Patients need a drug that Nexletol PCSK9i Oral PCSK9 fits the following profile: (1) (1) Strong Modest Strong Potentially strong, Efficacy but significant food effect Oral, Injectable, Oral, Oral, High Dose High Dose Large Pill Administration/ 180mg ~140-150mg 30mg API + >100mg snac Low Dose Dose Very High Price, Market Access/ Branded Price, High COGS, Broad Access Pricing Highly Restricted Access Price Limited Access likely high price (High COGS) SNAC technology Safe, Safety & FDA Label: Safe has previously been observed to have Tendon rupture & gout warning Painful injection site reactions Well-Tolerated Tolerability (2) tolerability concerns Strong Lp(a) lowering, HDL raising has potential Ancillary Potentially modest Lp(a) None Modest Lp(a) Lowering benefits in Alzheimer’s and Benefit(s) Lowering diabetes Note: Novartis’ stated price of Inclisiran to be approximate to net prices of PCSK9 mAbs. (1) Lighter shaded region of bar chart represents the additional potential efficacy for fixed dose combinations with ezetimibe. (2) MK-0616 was observed to have AEs comparable to placebo Phase2b trials 6

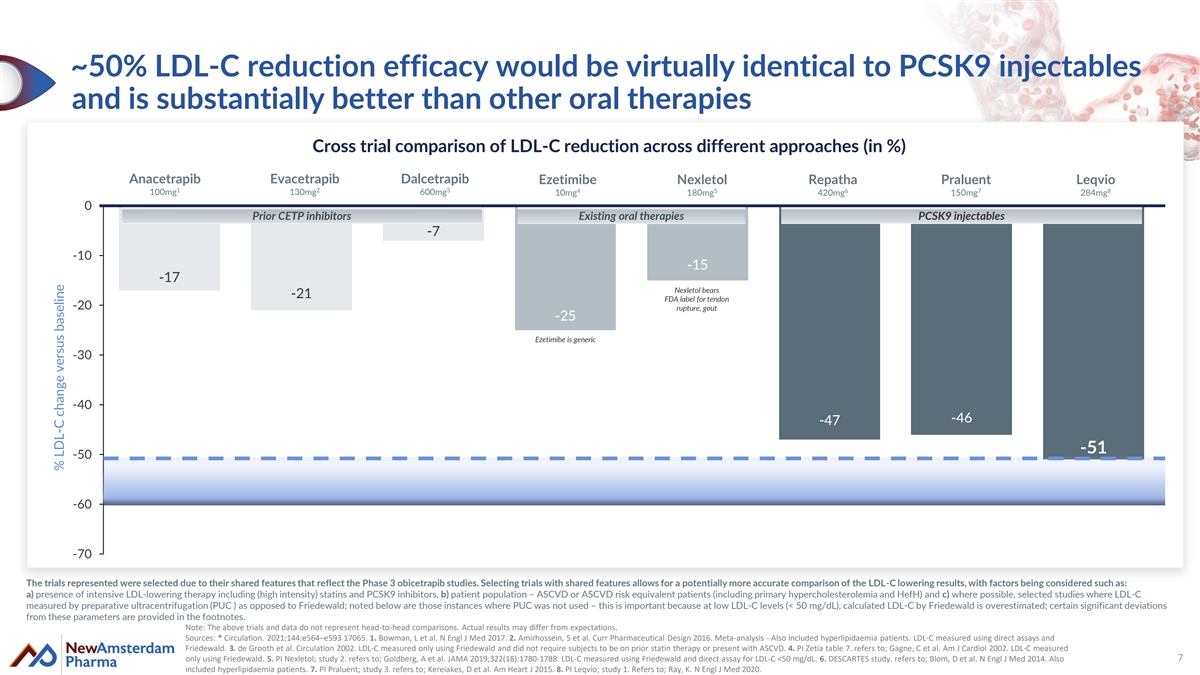

~50% LDL-C reduction efficacy would be virtually identical to PCSK9 injectables and is substantially better than other oral therapies Cross trial comparison of LDL-C reduction across different approaches (in %) Anacetrapib Evacetrapib Dalcetrapib Ezetimibe Nexletol Repatha Praluent Leqvio 1 2 3 4 5 6 7 8 100mg 130mg 600mg 10mg 180mg 420mg 150mg 284mg 0 Prior CETP inhibitors Existing oral therapies PCSK9 injectables -7 -10 -15 -17 Nexletol bears -21 FDA label for tendon -20 rupture, gout -25 Ezetimibe is generic -30 -40 -46 -47 -51 -50 -60 -70 The trials represented were selected due to their shared features that reflect the Phase 3 obicetrapib studies. Selecting trials with shared features allows for a potentially more accurate comparison of the LDL-C lowering results, with factors being considered such as: a) presence of intensive LDL-lowering therapy including (high intensity) statins and PCSK9 inhibitors, b) patient population – ASCVD or ASCVD risk equivalent patients (including primary hypercholesterolemia and HefH) and c) where possible, selected studies where LDL-C measured by preparative ultracentrifugation (PUC ) as opposed to Friedewald; noted below are those instances where PUC was not used – this is important because at low LDL-C levels (< 50 mg/dL), calculated LDL-C by Friedewald is overestimated; certain significant deviations from these parameters are provided in the footnotes. Note: The above trials and data do not represent head-to-head comparisons. Actual results may differ from expectations. Sources: * Circulation. 2021;144:e564–e593 17065. 1. Bowman, L et al. N Engl J Med 2017. 2. Amirhossein, S et al. Curr Pharmaceutical Design 2016. Meta-analysis - Also included hyperlipidaemia patients. LDL-C measured using direct assays and Friedewald. 3. de Grooth et al. Circulation 2002. LDL-C measured only using Friedewald and did not require subjects to be on prior statin therapy or present with ASCVD. 4. PI Zetia table 7. refers to; Gagne, C et al. Am J Cardiol 2002. LDL-C measured only using Friedewald. 5. PI Nexletol; study 2. refers to; Goldberg, A et al. JAMA 2019;322(18):1780-1788. LDL-C measured using Friedewald and direct assay for LDL-C <50 mg/dL. 6. DESCARTES study. refers to; Blom, D et al. N Engl J Med 2014. Also 7 included hyperlipidaemia patients. 7. PI Praluent; study 3. refers to; Kereiakes, D et al. Am Heart J 2015. 8. PI Leqvio; study 1. Refers to; Ray, K. N Engl J Med 2020. % LDL-C change versus baseline

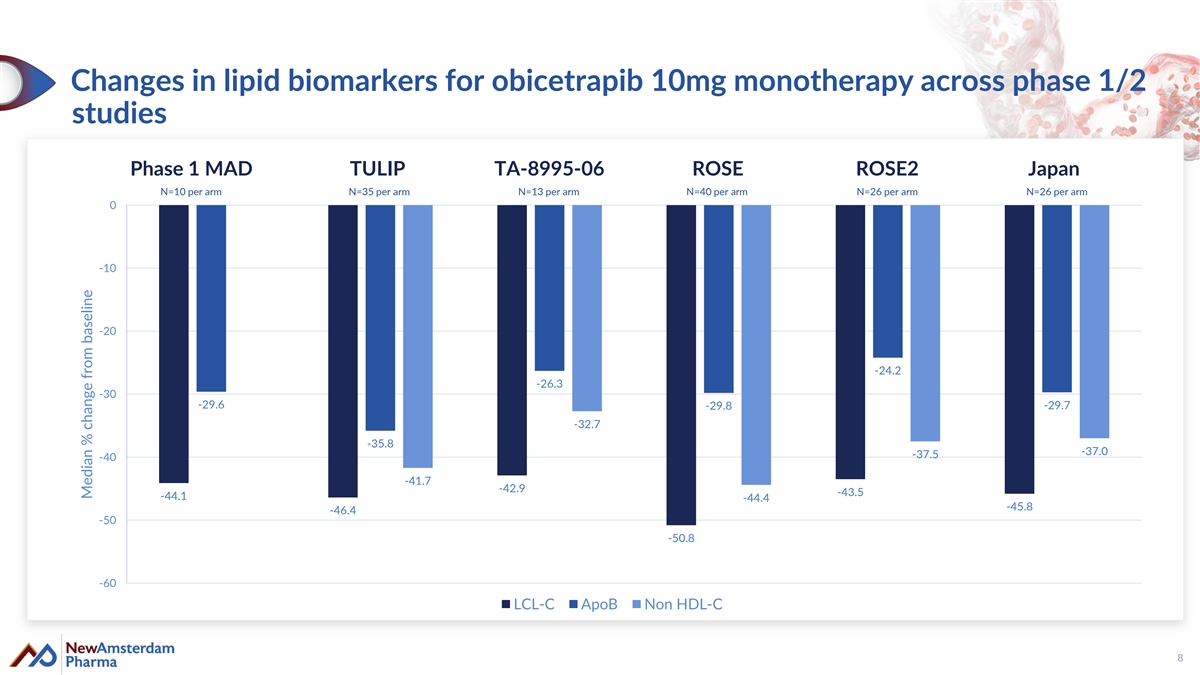

Changes in lipid biomarkers for obicetrapib 10mg monotherapy across phase 1/2 studies Phase 1 MAD TULIP TA-8995-06 ROSE ROSE2 Japan N=10 per arm N=35 per arm N=13 per arm N=40 per arm N=26 per arm N=26 per arm 0 -10 -20 -24.2 -26.3 -30 -29.6 -29.7 -29.8 -32.7 -35.8 -37.0 -37.5 -40 -41.7 -42.9 -43.5 -44.1 -44.4 -45.8 -46.4 -50 -50.8 -60 LCL-C ApoB Non HDL-C 8 Median % change from baseline

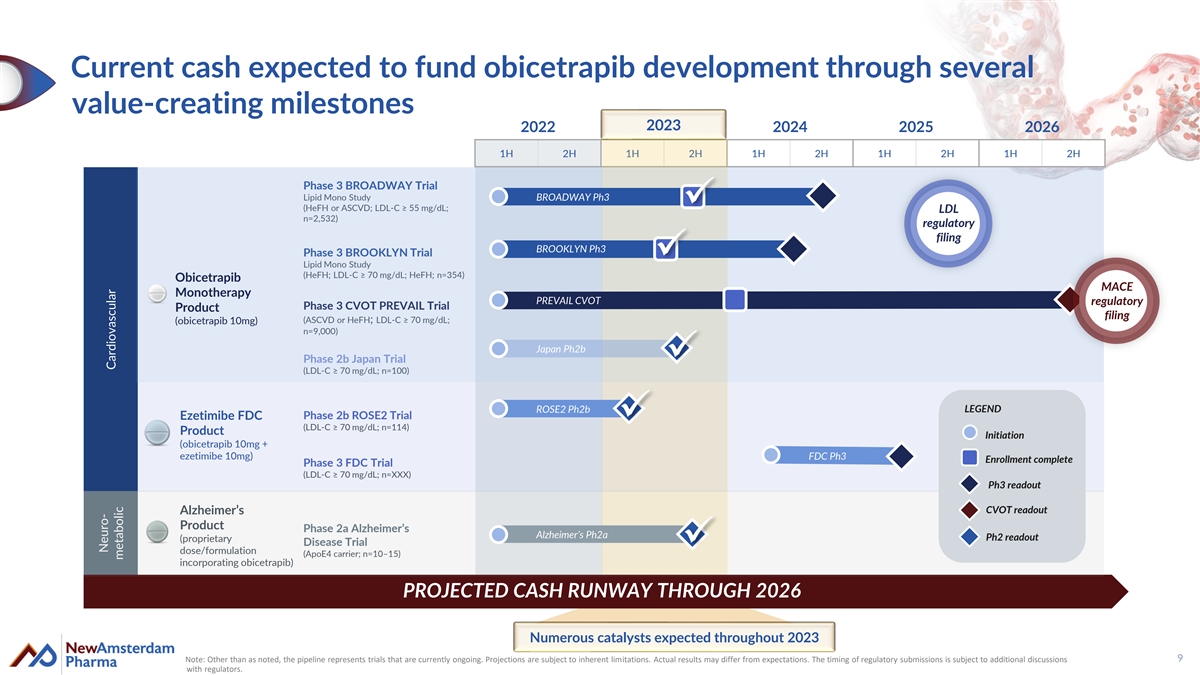

Current cash expected to fund obicetrapib development through several value-creating milestones 2023 2022 2023 2024 2025 2026 1H 2H 1H 2H 1H 2H 1H 2H 1H 2H Phase 3 BROADWAY Trial Lipid Mono Study BROADWAY Ph3 (HeFH or ASCVD; LDL-C ≥ 55 mg/dL; LDL n=2,532) regulatory filing BROOKLYN Ph3 Phase 3 BROOKLYN Trial Lipid Mono Study (HeFH; LDL-C ≥ 70 mg/dL; HeFH; n=354) Obicetrapib MACE Monotherapy PREVAIL CVOT regulatory Phase 3 CVOT PREVAIL Trial Product filing (ASCVD or HeFH; LDL-C ≥ 70 mg/dL; (obicetrapib 10mg) n=9,000) Japan Ph2b Phase 2b Japan Trial (LDL-C ≥ 70 mg/dL; n=100) ROSE2 Ph2b LEGEND Ezetimibe FDC Phase 2b ROSE2 Trial (LDL-C ≥ 70 mg/dL; n=114) Product Initiation (obicetrapib 10mg + ezetimibe 10mg) FDC Ph3 Enrollment complete Phase 3 FDC Trial (LDL-C ≥ 70 mg/dL; n=XXX) Ph3 readout CVOT readout Alzheimer’s Product Phase 2a Alzheimer’s Alzheimer’s Ph2a Ph2 readout (proprietary Disease Trial dose/formulation (ApoE4 carrier; n=10–15) incorporating obicetrapib) PROJECTED CASH RUNWAY THROUGH 2026 Numerous catalysts expected throughout 2023 9 Note: Other than as noted, the pipeline represents trials that are currently ongoing. Projections are subject to inherent limitations. Actual results may differ from expectations. The timing of regulatory submissions is subject to additional discussions with regulators. Neuro- Cardiovascular metabolic

Obicetrapib for Cardiovascular Disease 10

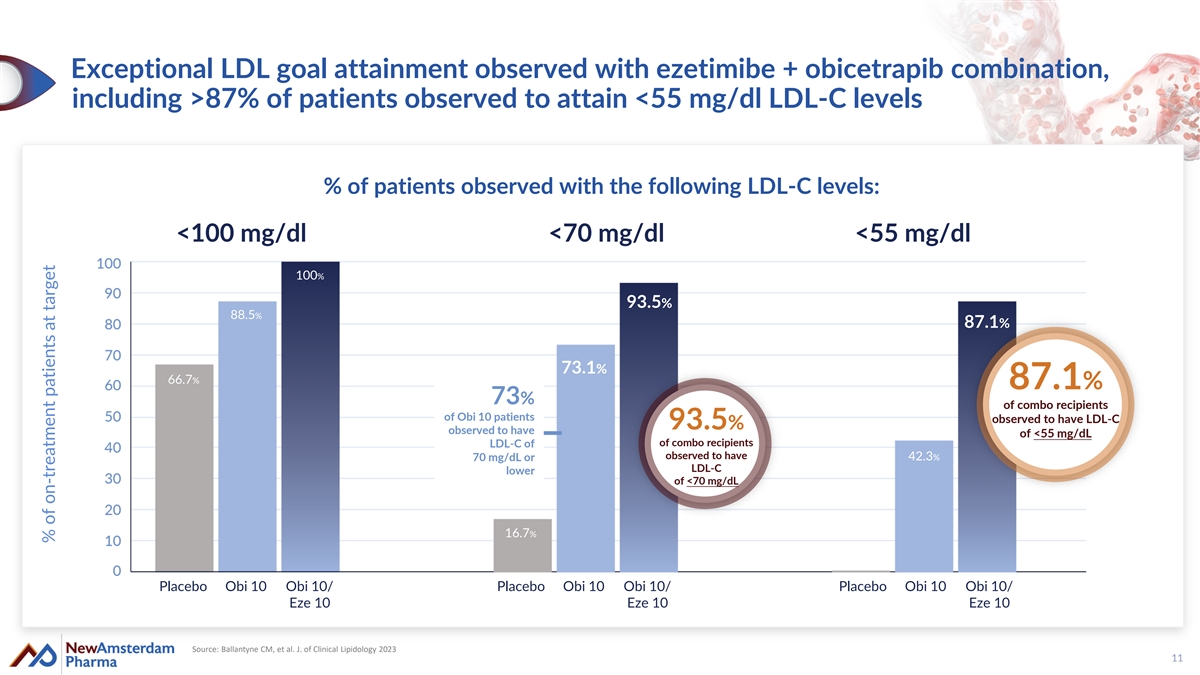

Exceptional LDL goal attainment observed with ezetimibe + obicetrapib combination, including >87% of patients observed to attain <55 mg/dl LDL-C levels % of patients observed with the following LDL-C levels: <100 mg/dl <70 mg/dl <55 mg/dl 100% 93.5% 88.5% 87.1% 73.1% 66.7% 87.1% 73% of combo recipients of Obi 10 patients observed to have LDL-C 93.5% observed to have of <55 mg/dL of combo recipients LDL-C of observed to have 70 mg/dL or 42.3% LDL-C lower of <70 mg/dL 16.7% Placebo Obi 10 Obi 10/ Placebo Obi 10 Obi 10/ Placebo Obi 10 Obi 10/ Eze 10 Eze 10 Eze 10 Source: Ballantyne CM, et al. J. of Clinical Lipidology 2023 11 % of on-treatment patients at target

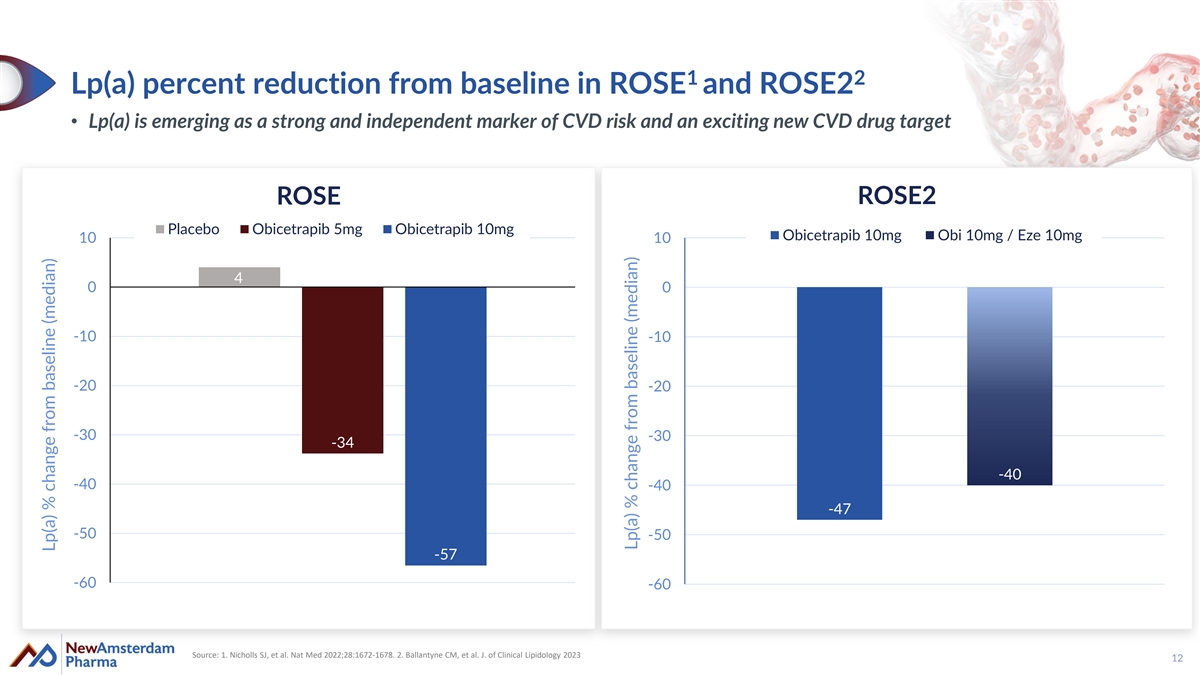

1 2 Lp(a) percent reduction from baseline in ROSE and ROSE2 • Lp(a) is emerging as a strong and independent marker of CVD risk and an exciting new CVD drug target ROSE2 ROSE Placebo Obicetrapib 5mg Obicetrapib 10mg Obicetrapib 10mg Obi 10mg / Eze 10mg 10 10 4 0 0 -10 -10 -20 -20 -30 -30 -34 -40 -40 -40 -47 -50 -50 -57 -60 -60 Source: 1. Nicholls SJ, et al. Nat Med 2022;28:1672-1678. 2. Ballantyne CM, et al. J. of Clinical Lipidology 2023 12 Lp(a) % change from baseline (median) Lp(a) % change from baseline (median)

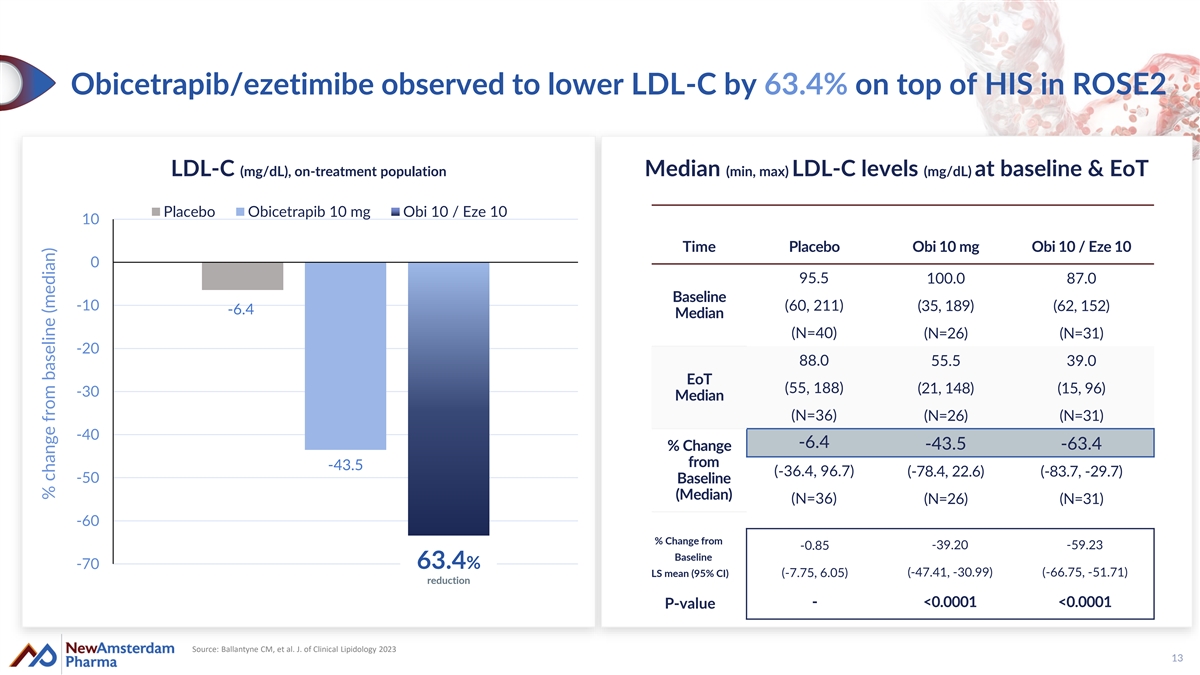

Obicetrapib/ezetimibe observed to lower LDL-C by 63.4% on top of HIS in ROSE2 LDL-C (mg/dL), on-treatment population Median (min, max) LDL-C levels (mg/dL) at baseline & EoT Placebo Obicetrapib 10 mg Obi 10 / Eze 10 10 Time Placebo Obi 10 mg Obi 10 / Eze 10 0 95.5 100.0 87.0 Baseline -10 (60, 211) (35, 189) (62, 152) -6.4 Median (N=40) (N=26) (N=31) -20 88.0 55.5 39.0 EoT (55, 188) (21, 148) (15, 96) -30 Median (N=36) (N=26) (N=31) -40 -6.4 -43.5 -63.4 % Change from -43.5 (-36.4, 96.7) (-78.4, 22.6) (-83.7, -29.7) -50 Baseline (Median) (N=36) (N=26) (N=31) -60 % Change from -0.85 -39.20 -59.23 Baseline -70 63.4% (-47.41, -30.99) (-66.75, -51.71) LS mean (95% CI) (-7.75, 6.05) reduction - <0.0001 <0.0001 P-value Source: Ballantyne CM, et al. J. of Clinical Lipidology 2023 13 % change from baseline (median)

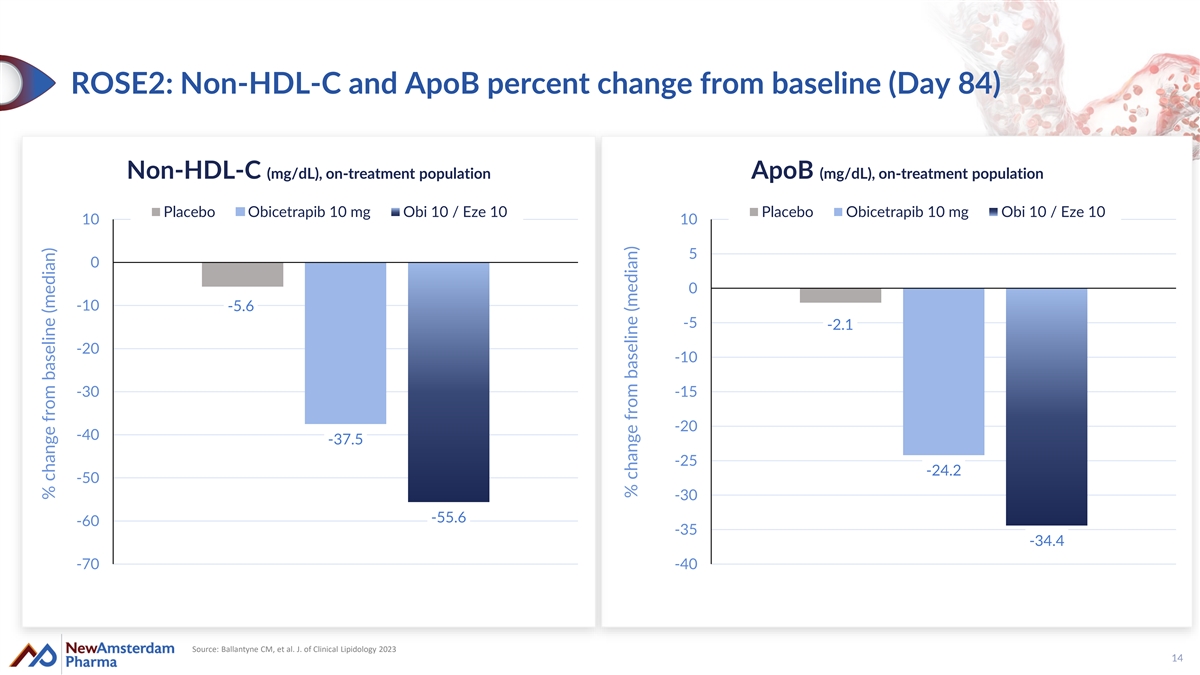

ROSE2: Non-HDL-C and ApoB percent change from baseline (Day 84) Non-HDL-C (mg/dL), on-treatment population ApoB (mg/dL), on-treatment population Placebo Obicetrapib 10 mg Obi 10 / Eze 10 Placebo Obicetrapib 10 mg Obi 10 / Eze 10 10 10 5 0 0 -10 -5.6 -5 -2.1 -20 -10 -30 -15 -20 -40 -37.5 -25 -24.2 -50 -30 -55.6 -60 -35 -34.4 -70 -40 Source: Ballantyne CM, et al. J. of Clinical Lipidology 2023 14 % change from baseline (median) % change from baseline (median)

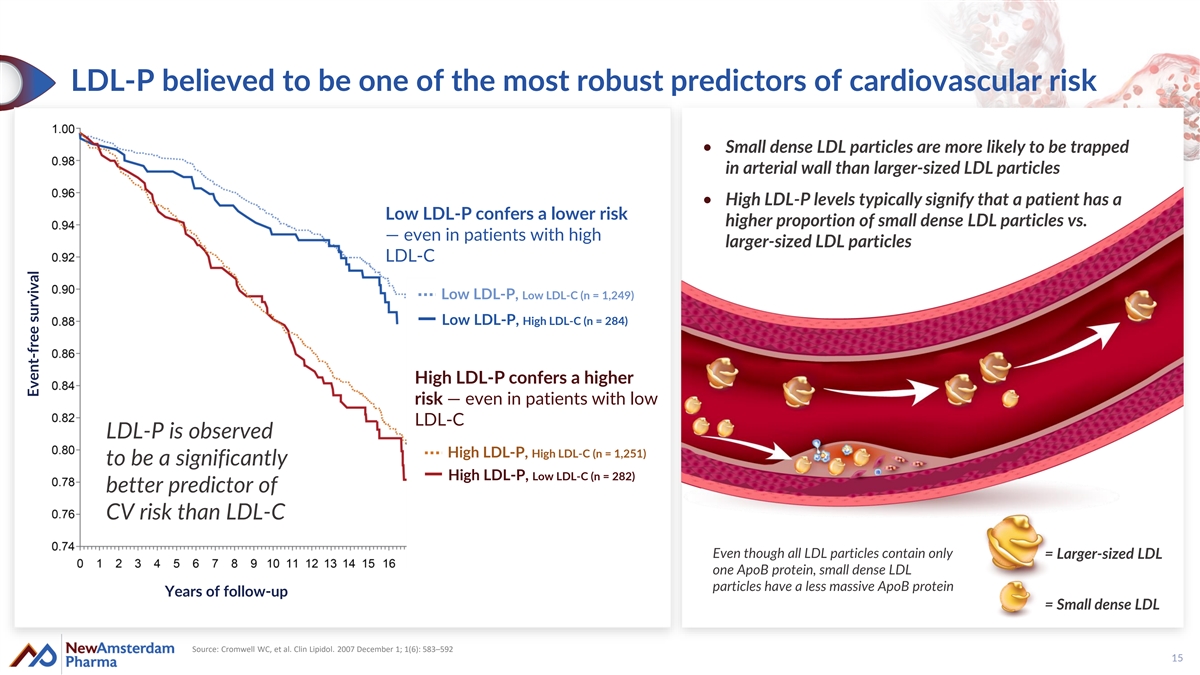

LDL-P believed to be one of the most robust predictors of cardiovascular risk • Small dense LDL particles are more likely to be trapped in arterial wall than larger-sized LDL particles • High LDL-P levels typically signify that a patient has a Low LDL-P confers a lower risk higher proportion of small dense LDL particles vs. — even in patients with high larger-sized LDL particles LDL-C Low LDL-P, Low LDL-C (n = 1,249) Low LDL-P, High LDL-C (n = 284) High LDL-P confers a higher risk — even in patients with low LDL-C LDL-P is observed High LDL-P, High LDL-C (n = 1,251) to be a significantly High LDL-P, Low LDL-C (n = 282) better predictor of CV risk than LDL-C Even though all LDL particles contain only = Larger-sized LDL one ApoB protein, small dense LDL particles have a less massive ApoB protein Years of follow-up = Small dense LDL Source: Cromwell WC, et al. Clin Lipidol. 2007 December 1; 1(6): 583–592 15 Event-free survival

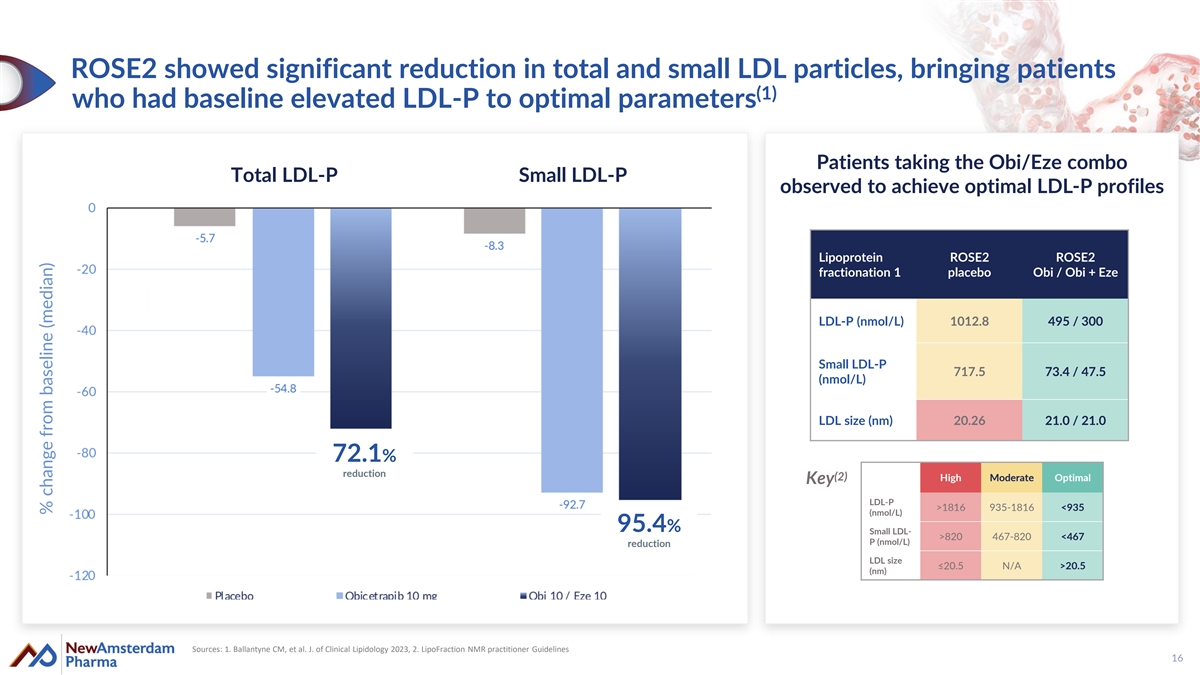

ROSE2 showed significant reduction in total and small LDL particles, bringing patients (1) who had baseline elevated LDL-P to optimal parameters Patients taking the Obi/Eze combo Total LDL-P Small LDL-P observed to achieve optimal LDL-P profiles Lipoprotein ROSE2 ROSE2 fractionation 1 placebo Obi / Obi + Eze LDL-P (nmol/L) 1012.8 495 / 300 Small LDL-P 717.5 73.4 / 47.5 (nmol/L) LDL size (nm) 20.26 21.0 / 21.0 72.1% reduction (2) High Moderate Optimal Key LDL-P >1816 935-1816 <935 (nmol/L) 95.4% Small LDL- >820 467-820 <467 P (nmol/L) reduction LDL size ≤20.5 N/A >20.5 (nm) Sources: 1. Ballantyne CM, et al. J. of Clinical Lipidology 2023, 2. LipoFraction NMR practitioner Guidelines 16 % change from baseline (median)

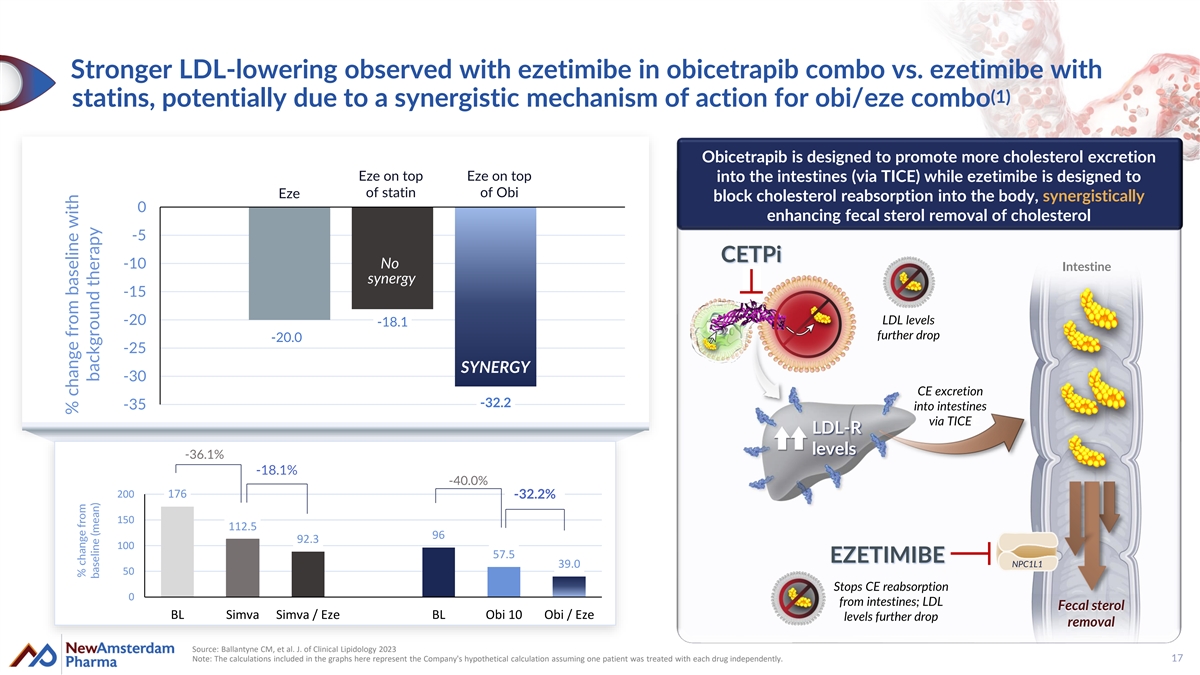

Stronger LDL-lowering observed with ezetimibe in obicetrapib combo vs. ezetimibe with (1) statins, potentially due to a synergistic mechanism of action for obi/eze combo Obicetrapib is designed to promote more cholesterol excretion Eze on top Eze on top into the intestines (via TICE) while ezetimibe is designed to of statin of Obi Eze block cholesterol reabsorption into the body, synergistically 0 enhancing fecal sterol removal of cholesterol -5 CETPi -10 No Intestine synergy -15 -20 LDL levels -18.1 further drop -20.0 -25 SYNERGY -30 CE excretion -32.2 -35 into intestines via TTI ICE CE LDL-R levels -36.1% -18.1% -40.0% 200 176 -32.2% 150 112.5 96 92.3 100 57.5 EZETIMIBE 39.0 NPC1L1 50 Stops CE reabsorption 0 from intestines; LDL Fecal sterol BL Simva Simva / Eze BL Obi 10 Obi / Eze levels further drop removal Source: Ballantyne CM, et al. J. of Clinical Lipidology 2023 Note: The calculations included in the graphs here represent the Company's hypothetical calculation assuming one patient was treated with each drug independently. 17 % change from baseline with % change from baseline (mean) background therapy

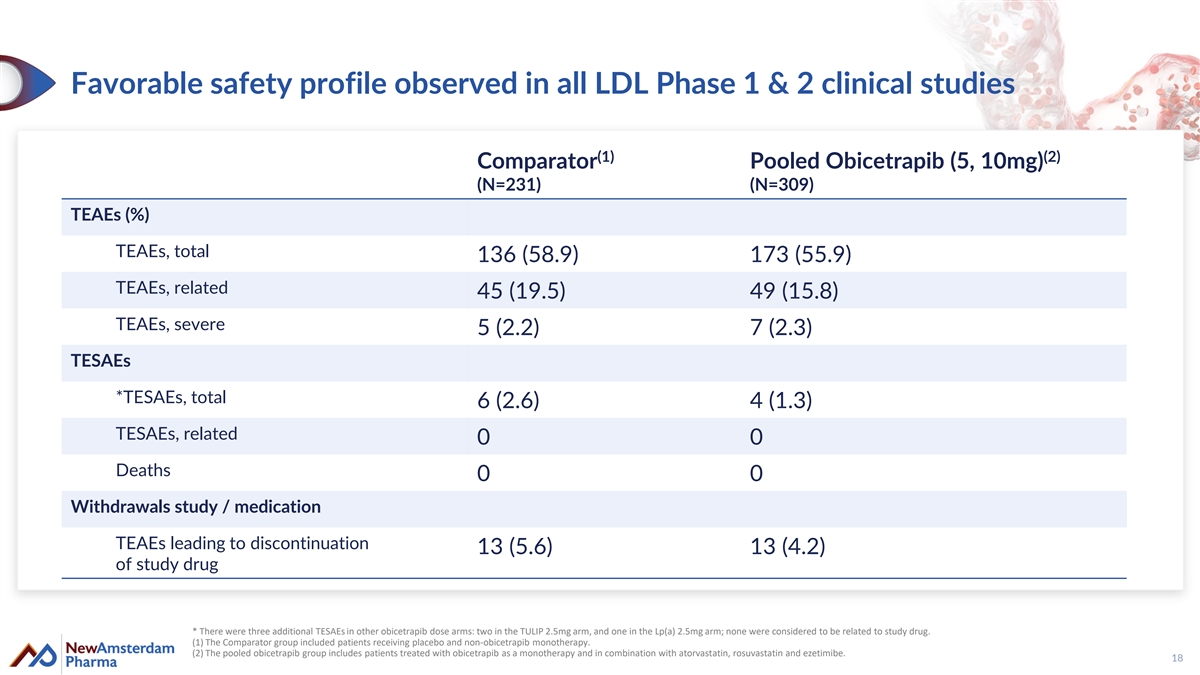

Favorable safety profile observed in all LDL Phase 1 & 2 clinical studies (1) (2) Comparator Pooled Obicetrapib (5, 10mg) (N=231) (N=309) TEAEs (%) TEAEs, total 136 (58.9) 173 (55.9) TEAEs, related 45 (19.5) 49 (15.8) TEAEs, severe 5 (2.2) 7 (2.3) TESAEs *TESAEs, total 6 (2.6) 4 (1.3) TESAEs, related 0 0 Deaths 0 0 Withdrawals study / medication TEAEs leading to discontinuation 13 (5.6) 13 (4.2) of study drug * There were three additional TESAEs in other obicetrapib dose arms: two in the TULIP 2.5mg arm, and one in the Lp(a) 2.5mg arm; none were considered to be related to study drug. (1) The Comparator group included patients receiving placebo and non-obicetrapib monotherapy. (2) The pooled obicetrapib group includes patients treated with obicetrapib as a monotherapy and in combination with atorvastatin, rosuvastatin and ezetimibe. 18

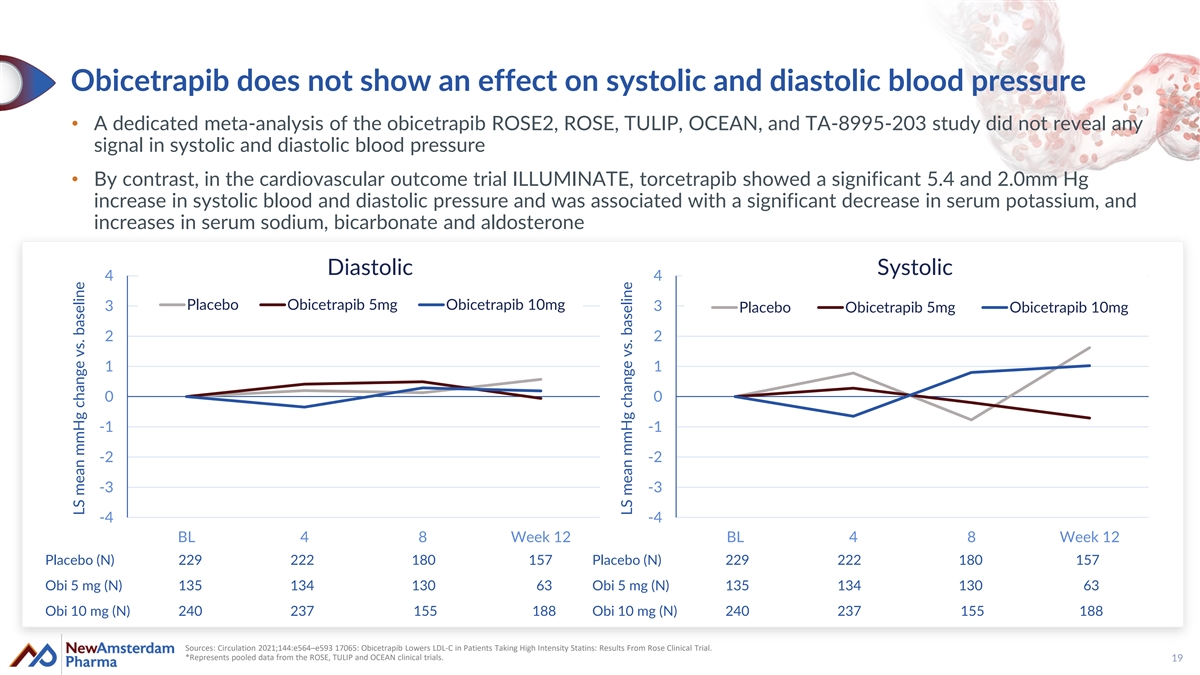

Obicetrapib does not show an effect on systolic and diastolic blood pressure • A dedicated meta-analysis of the obicetrapib ROSE2, ROSE, TULIP, OCEAN, and TA-8995-203 study did not reveal any signal in systolic and diastolic blood pressure • By contrast, in the cardiovascular outcome trial ILLUMINATE, torcetrapib showed a significant 5.4 and 2.0mm Hg increase in systolic blood and diastolic pressure and was associated with a significant decrease in serum potassium, and increases in serum sodium, bicarbonate and aldosterone Diastolic Systolic 4 4 Placebo Obicetrapib 5mg Obicetrapib 10mg 3 3 Placebo Obicetrapib 5mg Obicetrapib 10mg 2 2 1 1 0 0 -1 -1 -2 -2 -3 -3 -4 -4 BL 4 8 Week 12 BL 4 8 Week 12 Placebo (N) 229 222 180 157 Placebo (N) 229 222 180 157 Obi 5 mg (N) 135 134 130 63 Obi 5 mg (N) 135 134 130 63 Obi 10 mg (N) 240 237 155 188 Obi 10 mg (N) 240 237 155 188 Sources: Circulation 2021;144:e564–e593 17065: Obicetrapib Lowers LDL-C in Patients Taking High Intensity Statins: Results From Rose Clinical Trial. *Represents pooled data from the ROSE, TULIP and OCEAN clinical trials. 19 LS mean mmHg change vs. baseline LS mean mmHg change vs. baseline

Target biology and class overview: Key lessons learned 20

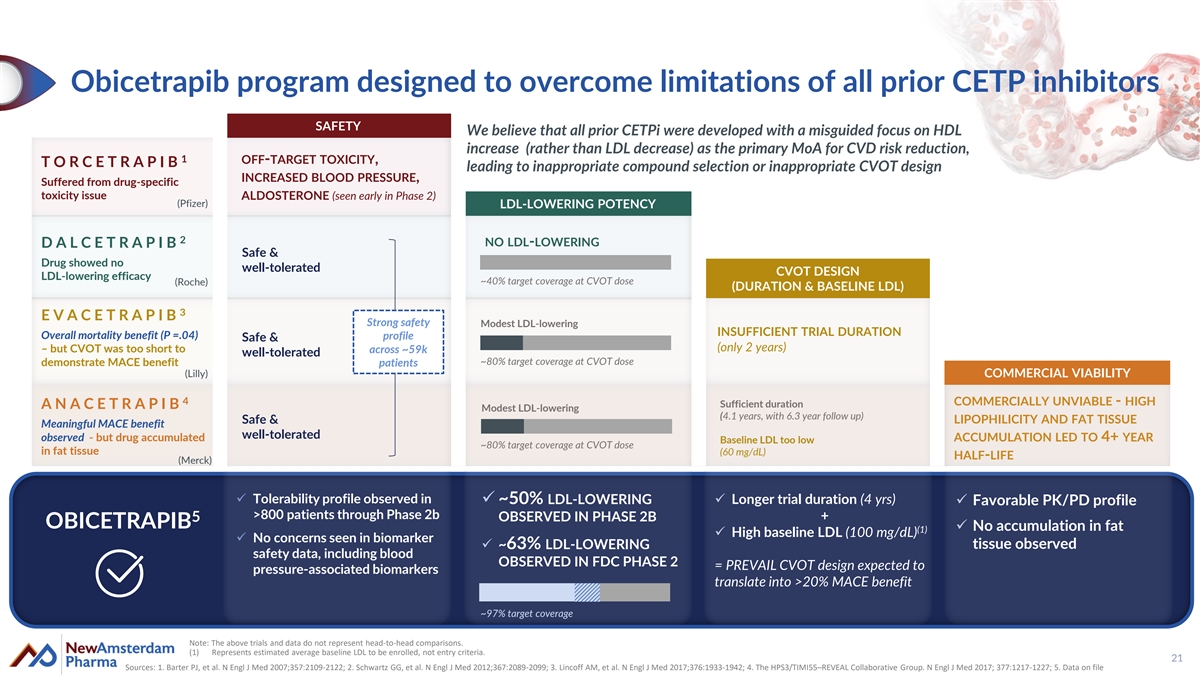

Obicetrapib program designed to overcome limitations of all prior CETP inhibitors SAFETY We believe that all prior CETPi were developed with a misguided focus on HDL increase (rather than LDL decrease) as the primary MoA for CVD risk reduction, 1 OFF-TARGET TOXICITY, T O R C E T R A P I B leading to inappropriate compound selection or inappropriate CVOT design INCREASED BLOOD PRESSURE, Suffered from drug-specific toxicity issue ALDOSTERONE (seen early in Phase 2) (Pfizer) LDL-LOWERING POTENCY 2 NO LDL-LOWERING D A L C E T R A P I B Safe & Drug showed no well-tolerated CVOT DESIGN LDL-lowering efficacy ~40% target coverage at CVOT dose (Roche) (DURATION & BASELINE LDL) 3 E V A C E T R A P I B Strong safety Modest LDL-lowering INSUFFICIENT TRIAL DURATION Overall mortality benefit (P =.04) profile Safe & (only 2 years) – but CVOT was too short to across ~59k well-tolerated ~80% target coverage at CVOT dose demonstrate MACE benefit patients (Lilly) COMMERCIAL VIABILITY 4 COMMERCIALLY UNVIABLE - HIGH Sufficient duration A N A C E T R A P I B Modest LDL-lowering (4.1 years, with 6.3 year follow up) Safe & LIPOPHILICITY AND FAT TISSUE Meaningful MACE benefit well-tolerated observed - but drug accumulated ACCUMULATION LED TO 4+ YEAR Baseline LDL too low ~80% target coverage at CVOT dose in fat tissue (60 mg/dL) HALF-LIFE (Merck) ✓ Tolerability profile observed in ✓ ~50% LDL-LOWERING ✓ Longer trial duration (4 yrs) ✓ Favorable PK/PD profile >800 patients through Phase 2b OBSERVED IN PHASE 2B + 5 OBICETRAPIB ✓ No accumulation in fat (1) ✓ High baseline LDL (100 mg/dL) ✓ No concerns seen in biomarker tissue observed ✓ ~63% LDL-LOWERING safety data, including blood OBSERVED IN FDC PHASE 2 = PREVAIL CVOT design expected to pressure-associated biomarkers translate into >20% MACE benefit ~97% target coverage Note: The above trials and data do not represent head-to-head comparisons. (1) Represents estimated average baseline LDL to be enrolled, not entry criteria. 21 Sources: 1. Barter PJ, et al. N Engl J Med 2007;357:2109-2122; 2. Schwartz GG, et al. N Engl J Med 2012;367:2089-2099; 3. Lincoff AM, et al. N Engl J Med 2017;376:1933-1942; 4. The HPS3/TIMI55–REVEAL Collaborative Group. N Engl J Med 2017; 377:1217-1227; 5. Data on file

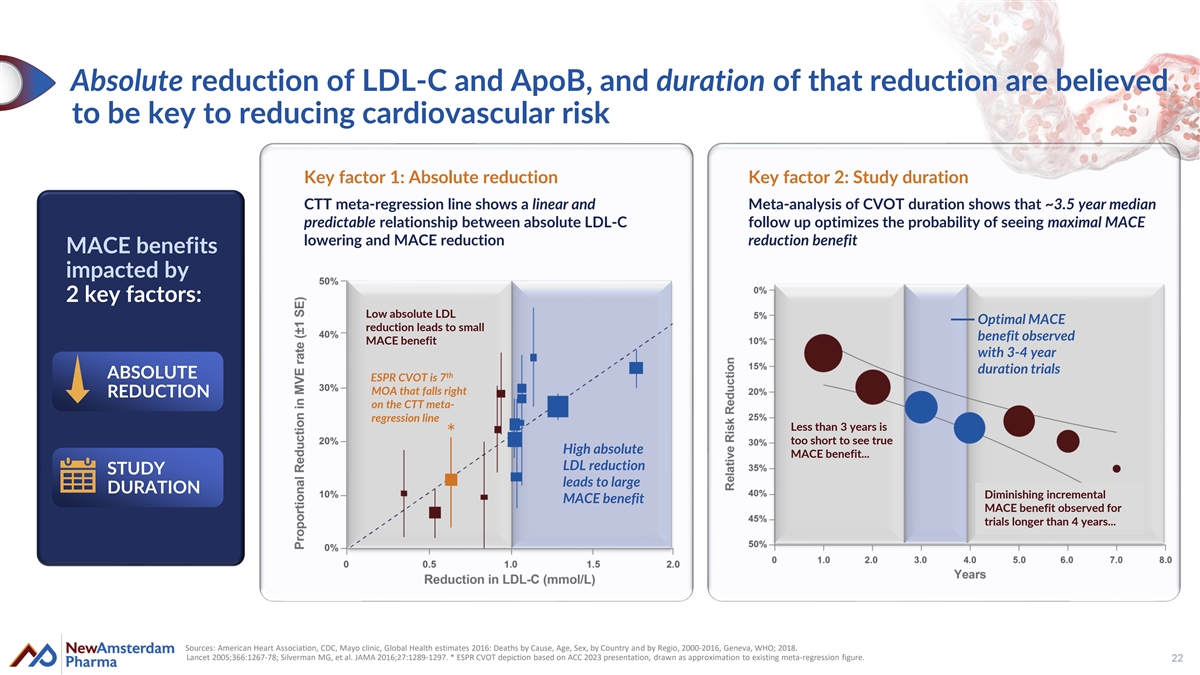

Absolute reduction of LDL-C and ApoB, and duration of that reduction are believed to be key to reducing cardiovascular risk Key factor 1: Absolute reduction Key factor 2: Study duration CTT meta-regression line shows a linear and Meta-analysis of CVOT duration shows that ~3.5 year median predictable relationship between absolute LDL-C follow up optimizes the probability of seeing maximal MACE lowering and MACE reduction reduction benefit MACE MACE benefits benefits impac impac ted ted by by 2 2 key key factors: factors: Low absolute LDL Optimal MACE reduction leads to small benefit observed MACE benefit with 3-4 year duration trials ABSOLUTE th ESPR CVOT is 7 MOA that falls right REDUCTION on the CTT meta- regression line Less than 3 years is * too short to see true High absolute MACE benefit... LDL reduction STUDY leads to large DURATION Diminishing incremental MACE benefit MACE benefit observed for trials longer than 4 years... Sources: American Heart Association, CDC, Mayo clinic, Global Health estimates 2016: Deaths by Cause, Age, Sex, by Country and by Regio, 2000-2016, Geneva, WHO; 2018. Lancet 2005;366:1267-78; Silverman MG, et al. JAMA 2016;27:1289-1297. * ESPR CVOT depiction based on ACC 2023 presentation, drawn as approximation to existing meta-regression figure. 22

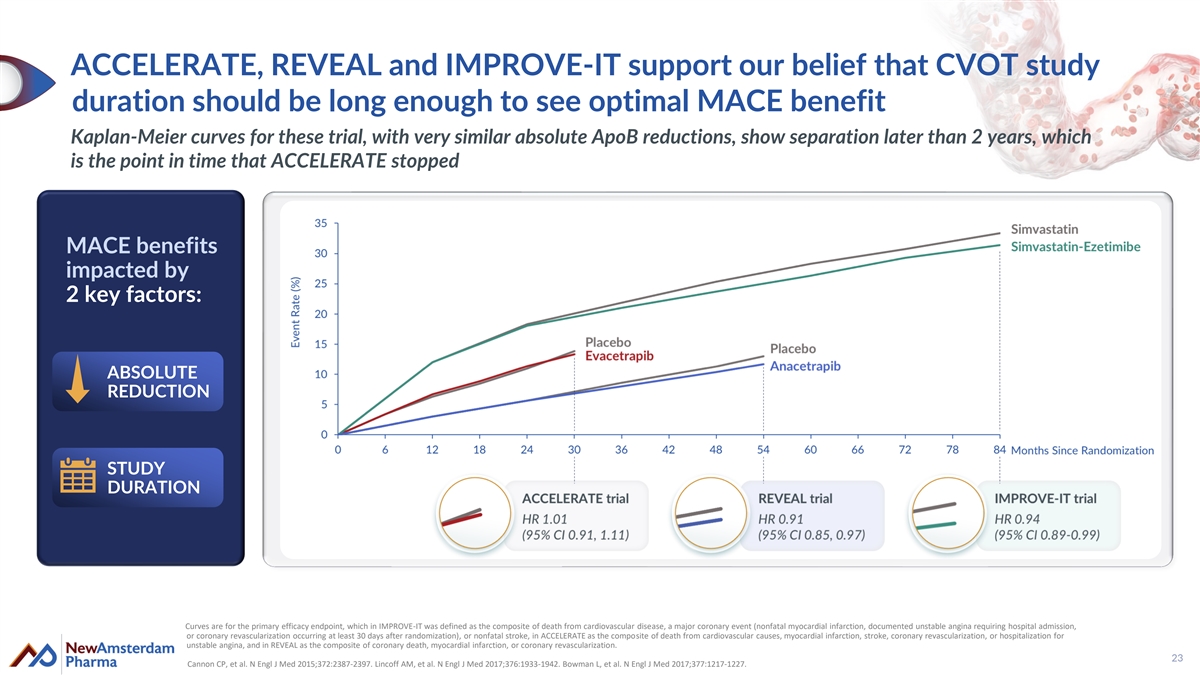

ACCELERATE, REVEAL and IMPROVE-IT support our belief that CVOT study duration should be long enough to see optimal MACE benefit Kaplan-Meier curves for these trial, with very similar absolute ApoB reductions, show separation later than 2 years, which is the point in time that ACCELERATE stopped MACE benefits impacted by 2 key factors: ABSOLUTE REDUCTION STUDY DURATION Curves are for the primary efficacy endpoint, which in IMPROVE-IT was defined as the composite of death from cardiovascular disease, a major coronary event (nonfatal myocardial infarction, documented unstable angina requiring hospital admission, or coronary revascularization occurring at least 30 days after randomization), or nonfatal stroke, in ACCELERATE as the composite of death from cardiovascular causes, myocardial infarction, stroke, coronary revascularization, or hospitalization for unstable angina, and in REVEAL as the composite of coronary death, myocardial infarction, or coronary revascularization. 23 Cannon CP, et al. N Engl J Med 2015;372:2387-2397. Lincoff AM, et al. N Engl J Med 2017;376:1933-1942. Bowman L, et al. N Engl J Med 2017;377:1217-1227.

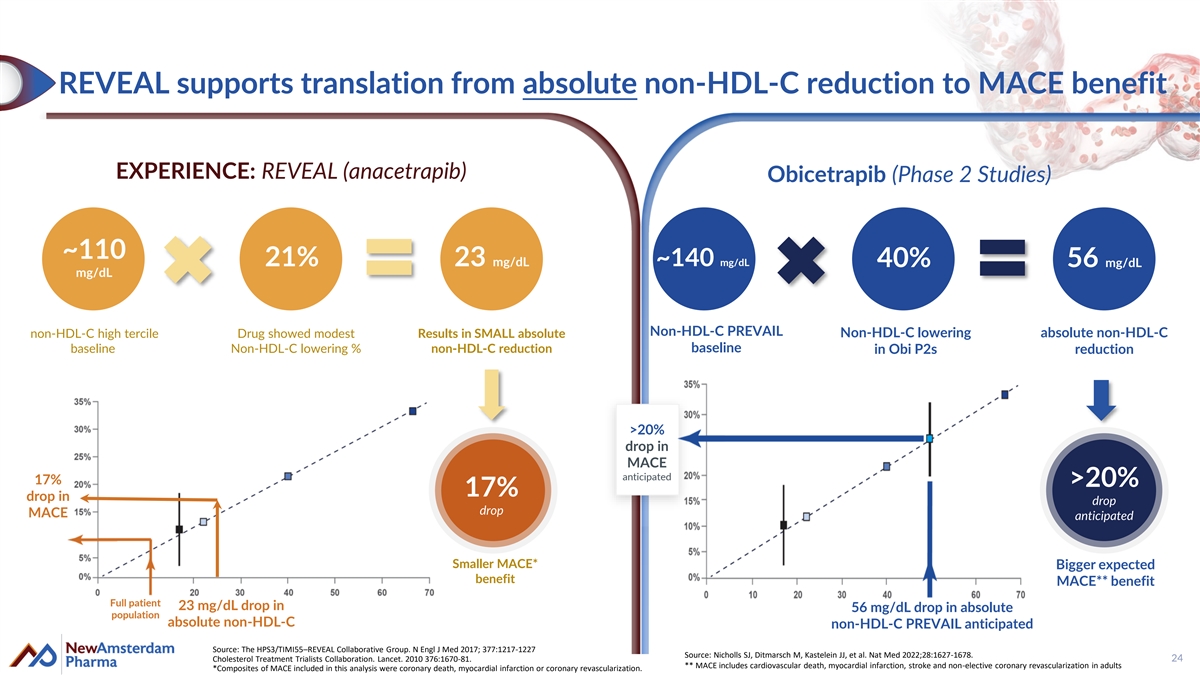

REVEAL supports translation from absolute non-HDL-C reduction to MACE benefit EXPERIENCE: REVEAL (anacetrapib) Obicetrapib (Phase 2 Studies) ~110 21% 23 mg/dL ~140 mg/dL 40% 56 mg/dL mg/dL Non-HDL-C PREVAIL non-HDL-C high tercile Drug showed modest Results in SMALL absolute Non-HDL-C lowering absolute non-HDL-C baseline Non-HDL-C lowering % non-HDL-C reduction baseline in Obi P2s reduction >20% drop in MACE anticipated 17% >20% 17% drop in drop drop MACE anticipated Smaller MACE* Bigger expected benefit MACE** benefit Full patient 23 mg/dL drop in 56 mg/dL drop in absolute population absolute non-HDL-C non-HDL-C PREVAIL anticipated Source: The HPS3/TIMI55–REVEAL Collaborative Group. N Engl J Med 2017; 377:1217-1227 Source: Nicholls SJ, Ditmarsch M, Kastelein JJ, et al. Nat Med 2022;28:1627-1678. 24 Cholesterol Treatment Trialists Collaboration. Lancet. 2010 376:1670-81. ** MACE includes cardiovascular death, myocardial infarction, stroke and non-elective coronary revascularization in adults *Composites of MACE included in this analysis were coronary death, myocardial infarction or coronary revascularization.

Obicetrapib for Alzheimer’s Disease 25

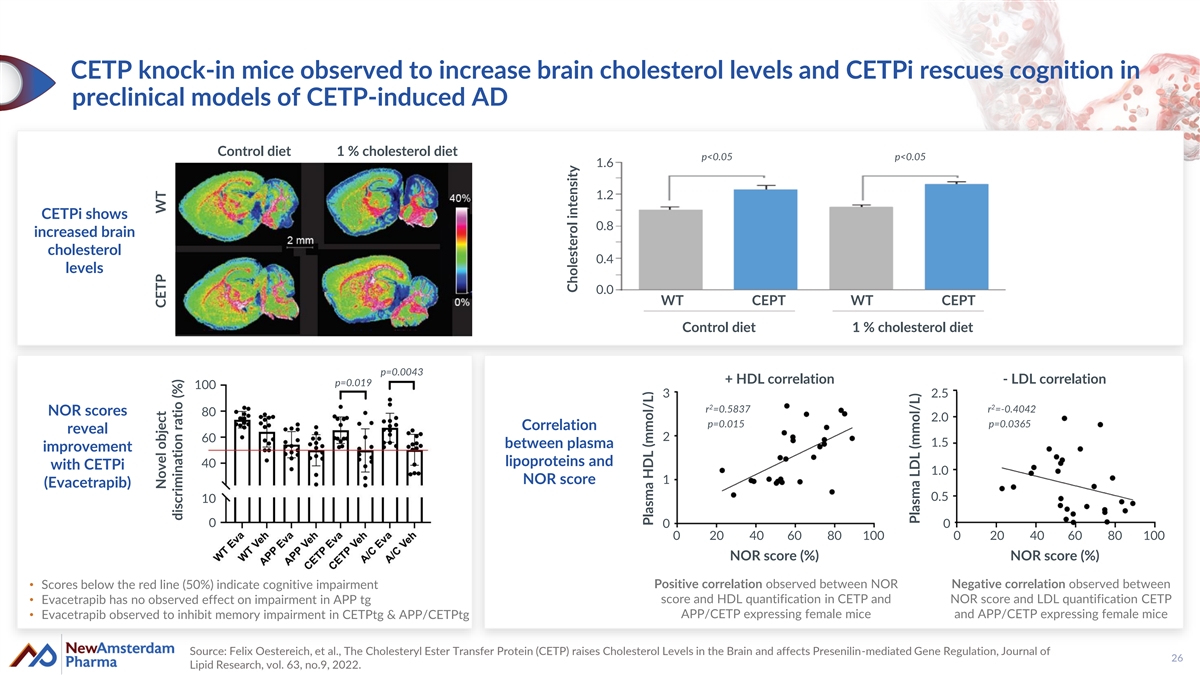

CETP knock-in mice observed to increase brain cholesterol levels and CETPi rescues cognition in preclinical models of CETP-induced AD Control diet 1 % cholesterol diet p<0.05 p<0.05 1.6 1.2 CETPi shows 0.8 increased brain cholesterol 0.4 levels 0.0 WT CEPT WT CEPT Control diet 1 % cholesterol diet p=0.0043 + HDL correlation - LDL correlation p=0.019 100 3 2.5 2 2 r =0.5837 r =-0.4042 NOR scores 80 2.0 p=0.015 p=0.0365 Correlation reveal 2 60 1.5 between plasma improvement lipoproteins and 40 with CETPi 1.0 NOR score 1 (Evacetrapib) 0.5 10 0 0 0 0 20 40 60 80 100 0 20 40 60 80 100 NOR score (%) NOR score (%) • Scores below the red line (50%) indicate cognitive impairment Positive correlation observed between NOR Negative correlation observed between • Evacetrapib has no observed effect on impairment in APP tg score and HDL quantification in CETP and NOR score and LDL quantification CETP • Evacetrapib observed to inhibit memory impairment in CETPtg & APP/CETPtg APP/CETP expressing female mice and APP/CETP expressing female mice Source: Felix Oestereich, et al., The Cholesteryl Ester Transfer Protein (CETP) raises Cholesterol Levels in the Brain and affects Presenilin-mediated Gene Regulation, Journal of 26 Lipid Research, vol. 63, no.9, 2022. Novel object CETP WT discrimination ratio (%) Cholesterol intensity Plasma HDL (mmol/L) Plasma LDL (mmol/L)

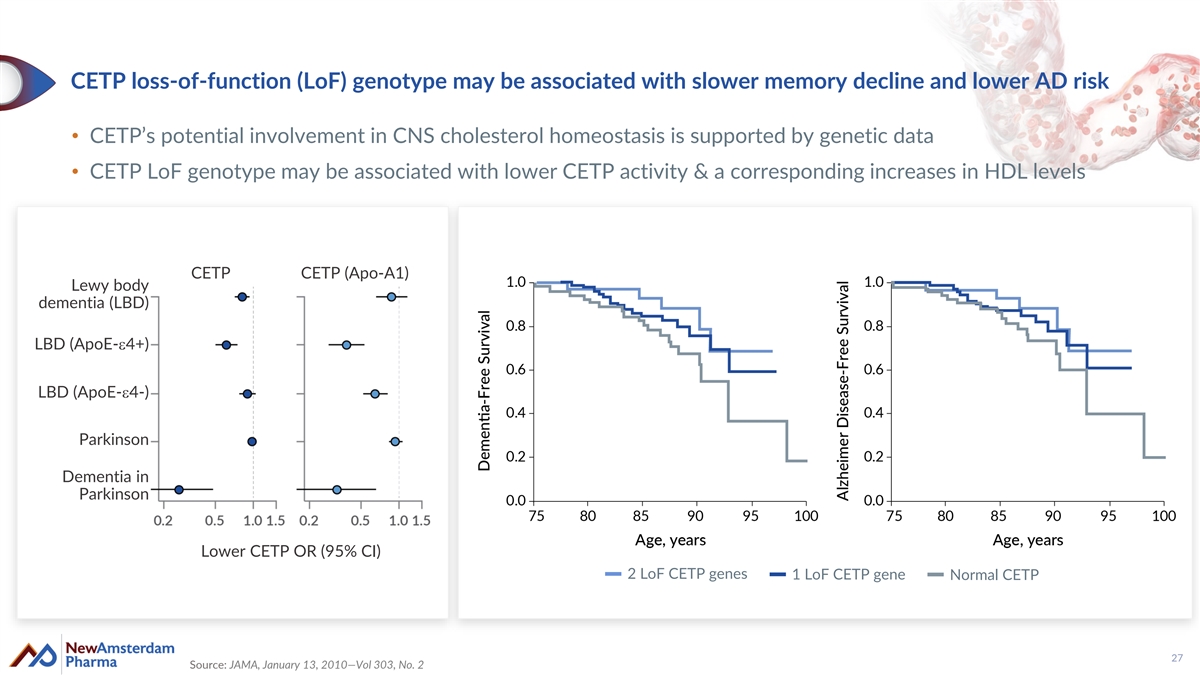

CETP loss-of-function (LoF) genotype may be associated with slower memory decline and lower AD risk • CETP’s potential involvement in CNS cholesterol homeostasis is supported by genetic data • CETP LoF genotype may be associated with lower CETP activity & a corresponding increases in HDL levels CETP CETP (Apo-A1) Lewy body dementia (LBD) LBD (ApoE-e4+) LBD (ApoE-e4-) Parkinson Dementia in Parkinson Lower CETP OR (95% CI) 2 LoF CETP genes 1 LoF CETP gene Normal CETP 27 Source: JAMA, January 13, 2010—Vol 303, No. 2

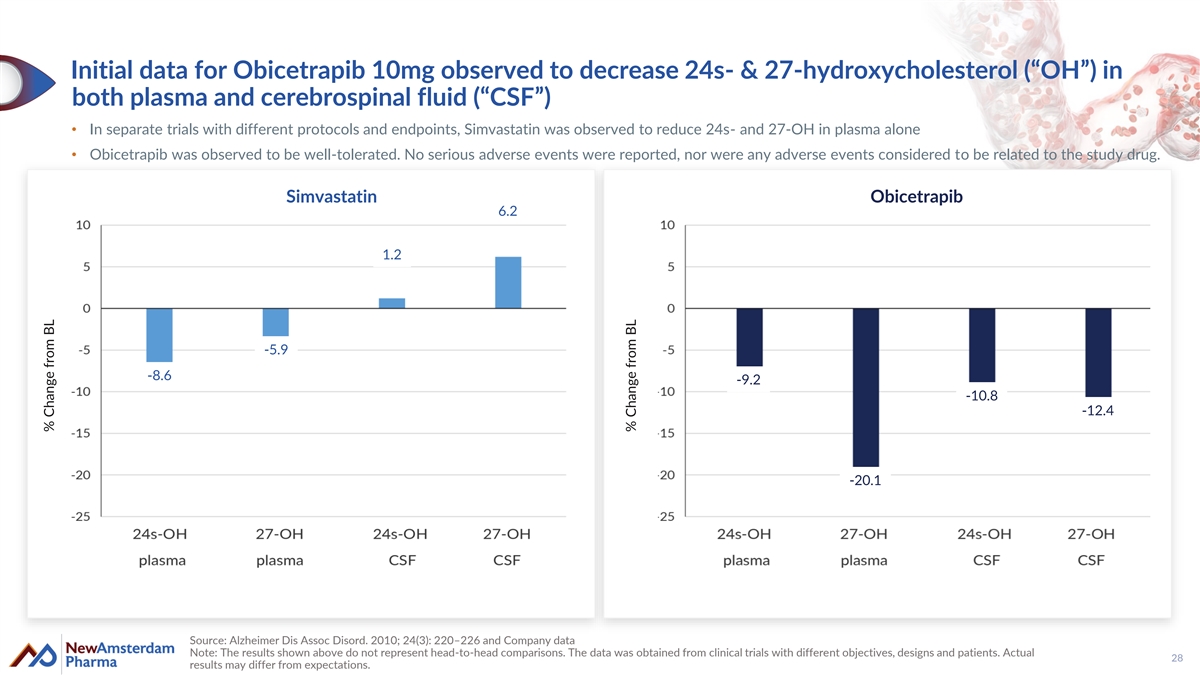

Initial data for Obicetrapib 10mg observed to decrease 24s- & 27-hydroxycholesterol (“OH”) in both plasma and cerebrospinal fluid (“CSF”) • In separate trials with different protocols and endpoints, Simvastatin was observed to reduce 24s- and 27-OH in plasma alone • Obicetrapib was observed to be well-tolerated. No serious adverse events were reported, nor were any adverse events considered to be related to the study drug. Simvastatin Obicetrapib 6.2 1.2 -5.9 -8.6 -9.2 -10.8 -12.4 -20.1 Source: Alzheimer Dis Assoc Disord. 2010; 24(3): 220–226 and Company data Note: The results shown above do not represent head-to-head comparisons. The data was obtained from clinical trials with different objectives, designs and patients. Actual 28 results may differ from expectations. % Change from BL % Change from BL

Clinical events and exclusivity timelines 29

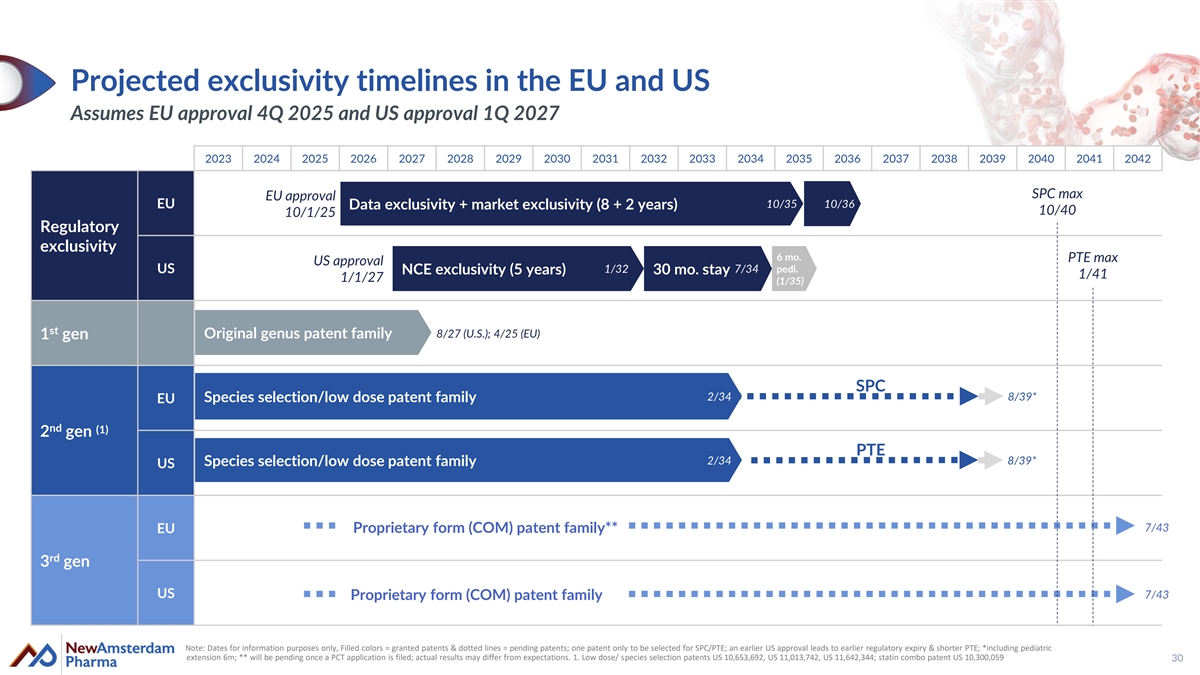

Projected exclusivity timelines in the EU and US Assumes EU approval 4Q 2025 and US approval 1Q 2027 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 SPC max EU approval 10/35 10/36 EU Data exclusivity + market exclusivity (8 + 2 years) 10/40 10/1/25 Regulatory exclusivity 6 mo. PTE max US approval 1/32 7/34 pedi. US NCE exclusivity (5 years) 30 mo. stay 1/41 1/1/27 (1/35) st 8/27 (U.S.); 4/25 (EU) Original genus patent family 1 gen SPC 2 2/ /3 34 4 8/39* Species selection/low dose patent family EU nd (1) 2 gen PTE 2/34 8/39* Species selection/low dose patent family US 7/43 Proprietary form (COM) patent family** EU rd 3 gen US 7/43 Proprietary form (COM) patent family Note: Dates for information purposes only, Filled colors = granted patents & dotted lines = pending patents; one patent only to be selected for SPC/PTE; an earlier US approval leads to earlier regulatory expiry & shorter PTE; *including pediatric extension 6m; ** will be pending once a PCT application is filed; actual results may differ from expectations. 1. Low dose/ species selection patents US 10,653,692, US 11,013,742, US 11,642,344; statin combo patent US 10,300,059 30

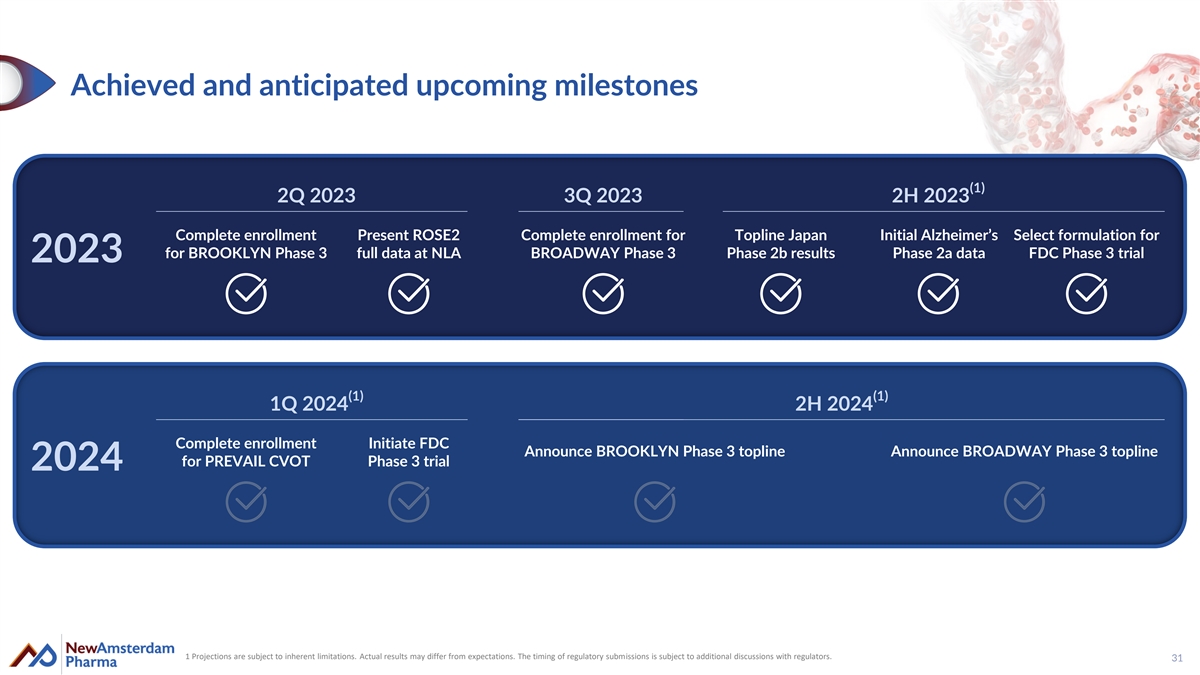

Achieved and anticipated upcoming milestones (1) 2Q 2023 3Q 2023 2H 2023 Complete enrollment Present ROSE2 Complete enrollment for Topline Japan Initial Alzheimer’s Select formulation for for BROOKLYN Phase 3 full data at NLA BROADWAY Phase 3 Phase 2b results Phase 2a data FDC Phase 3 trial 2023 (1) (1) 1Q 2024 2H 2024 Complete enrollment Initiate FDC Announce BROOKLYN Phase 3 topline Announce BROADWAY Phase 3 topline for PREVAIL CVOT Phase 3 trial 2024 1 Projections are subject to inherent limitations. Actual results may differ from expectations. The timing of regulatory submissions is subject to additional discussions with regulators. 31

Expert cardiometabolic leadership supported by top investors Michael Davidson, M.D. John Kastelein, M.D. Douglas Kling William ‘BJ’ Jones Louise Kooij Marc Ditmarsch, M.D. CEO CSO COO CCO CFO CDO SANDER JULIET JAMIE NICHOLAS LOU MICHAEL JOHN JOHN W. JANNEKE SEASONED SLOOTWEG AUDET TOPPER DOWNING LANGE DAVIDSON KASTELEIN SMITHER VAN DER KAMP BOARD OF Managing Partner, Partner, Managing Partner, Partner, Partner, CEO, NewAmsterdam CSO, NewAmsterdam Independent Independent DIRECTORS: Forbion Forbion Frazier Life Sciences Bain Capital Asset Management Pharma Pharma Ventures BACKED BY TOP TIER INVESTORS: 32