UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2023

Coherent Corp.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 001-39375 | 25-1214948 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

375 Saxonburg Boulevard

Saxonburg, Pennsylvania 16056

(Address of Principal Executive Offices) (Zip Code)

(724) 352-4455

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading |

Name of each exchange on which registered |

||

| Common Stock, no par value | COHR | New York Stock Exchange | ||

| 6.00% Series A Mandatory Convertible Preferred Stock, no par value | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

A slide presentation to be used by senior management of the Company in connection with its discussions with investors is included in Exhibit 99.1 to this report and is being furnished in accordance with Regulation FD of the Securities and Exchange Commission.

The information in this Item 7.01 of this Current Report on Form 8-K, including the exhibit furnished pursuant to Item 9.01, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section. Furthermore, the information in this Item 7.01 of this Current Report on Form 8-K, including the exhibit furnished pursuant to Item 9.01, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description | |

| 99.1 | Investor Presentation | |

| 104.0 | Cover Page Interactive Data File (embedded within the inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Coherent Corp. | ||||||

| Date: September 18, 2023 | By: | /s/ Ronald Basso |

||||

| Ronald Basso | ||||||

| Chief Legal and Compliance Officer | ||||||

Exhibit 99.1 COMMUNICATIONS MARKET OVERVIEW Markets Day September 19, 2023 Paul Silverstein Vice President, Investor Relations & Corporate Communications Copyright 2023, Coherent. All rights reserved. 1

HOST Paul Silverstein Vice President, Investor Relations & Corporate Communications 2 Copyright 2023, Coherent. All rights reserved.

SPEAKERS Dr. Julie Sheridan Eng Dr. Lee Xu Dr. Beck Mason Paul Silverstein Dr. Sanjai Chief Technology Officer Executive Vice President, Executive Vice President, Vice President, Parthasarathi Telecommunications Datacom Transceivers Investor Relations & Chief Marketing Officer Corporate Communications 3 Copyright 2023, Coherent. All rights reserved.

FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements relating to future events and expectations, including our expectations (i) for our future financial and operational results (including expectations for future growth); (ii) regarding capital expenditures and the results of investments in research and design; (iii) regarding growth in the markets we serve including industrial, communications, electronics, and instrumentation; (iv) regarding the growth and opportunity in the datacom transceiver global market; (v) regarding our leadership position in the next five years for 800G/1.6T; and (vi) regarding AI preparedness and growth. The forward-looking statements are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and relate to the Company’s performance on a going-forward basis. The forward-looking statements in this investor presentation involve risks and uncertainties, which could cause actual results, performance or trends to differ materially from those expressed in the forward-looking statements herein or in previous disclosures. The Company believes that all forward-looking statements made by it in this presentation have a reasonable basis, but there can be no assurance that management’s expectations, beliefs, or projections as expressed in the forward-looking statements will actually occur or prove to be correct. In addition to general industry and global economic conditions, factors that could cause actual results to differ materially from those discussed in the forward-looking statements in this presentation include but are not limited to: (i) the failure of any one or more of the assumptions stated herein to prove to be correct; (ii) the risks relating to forward-looking statements and other “Risk Factors” discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and additional risk factors that may be identified from time to time in filings of the Company; (iii) the substantial indebtedness the Company incurred in connection with its acquisition of Coherent, Inc. (the “Transaction”), the need to generate sufficient cash flows to service and repay such debt and the Company’s ability to generate sufficient funds to meet its anticipated debt reduction goals; (iv) the possibility that the Company may not be able to continue its integration progress on and/or take other restructuring actions, or otherwise be able to achieve expected synergies, operating efficiencies, including greater scale, focus, resiliency, and lower operating costs, and other benefits within the expected time-frames or at all and ultimately to successfully fully integrate the operations of Coherent, Inc. (“Coherent”) with those of the Company; (v) the possibility that such integration and/or the restructuring actions may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the Transaction and/or the restructuring actions; (vi) any unexpected costs, charges or expenses resulting from the Transaction and/or the restructuring actions; (vii) the risk that disruption from the Transaction and/or the restructuring actions materially and adversely affects the respective businesses and operations of the Company and Coherent; (viii) potential adverse reactions or changes to business relationships resulting from the completion of the Transaction and/or the restructuring actions; (ix) the ability of the Company to retain and hire key employees; (x) the purchasing patterns of customers and end users; (xi) the timely release of new products, and acceptance of such new products by the market; (xii) the introduction of new products by competitors and other competitive responses; (xiii) the Company’s ability to assimilate other recently acquired businesses, and realize synergies, cost savings, and opportunities for growth in connection therewith, together with the risks, costs, and uncertainties associated with such acquisitions; (xiv) the Company’s ability to devise and execute strategies to respond to market conditions; (xv) the risks to realizing the benefits of investments in R&D and commercialization of innovations; (xvi) the risks that the Company’s stock price will not trade in line with industrial technology leaders; and/or (xvii) the risks of business and economic disruption related to the currently ongoing COVID-19 outbreak and any other worldwide health epidemics or outbreaks that may arise. The Company disclaims any obligation to update information contained in these forward-looking statements, whether as a result of new information, future events or developments, or otherwise. Unless otherwise indicated in this presentation, all information in this presentation is as of September 18, 2023. 4 Copyright 2023, Coherent. All rights reserved.

OUR MARKETS, COMMUNICATIONS MARKET Dr. Sanjai Parthasarathi, Chief Marketing Officer 5 Copyright 2023, Coherent. All rights reserved.

ALL OUR MARKETS ARE HEALTHY AND GROWING OVER THE LONG TERM Industrial Communications Electronics Instrumentation TAM: $22B TAM: $23B TAM: $14B TAM: $5B CAGR: 9% CAGR: 16% CAGR: 20% CAGR: 8% Combined CY23 TAM of $64B growing to $124B within five years 6 Copyright 2023, Coherent. All rights reserved.

OUR MARKET GROUPS AND VERTICALS Industrial Communications § Precision Manufacturing§ Datacom Components, Lasers and Systems Lasers and Transceivers § Semiconductor Capital Equipment§ Telecom Optics, Materials, and Lasers From Materials to Systems § Display Capital Equipment Optics, Materials and Lasers § Aerospace & Defense Optics, Materials and Lasers Instrumentation Electronics § Consumer Electronics§ Life Sciences Optics, Lasers, TEC and Lasers, Optics, and Materials for Subsystems Devices § Scientific Instrumentation § Automotive Lasers for Research SiC Devices, Lasers and Materials § Wireless SiC Substrates for RF devices 7 Copyright 2023, Coherent. All rights reserved.

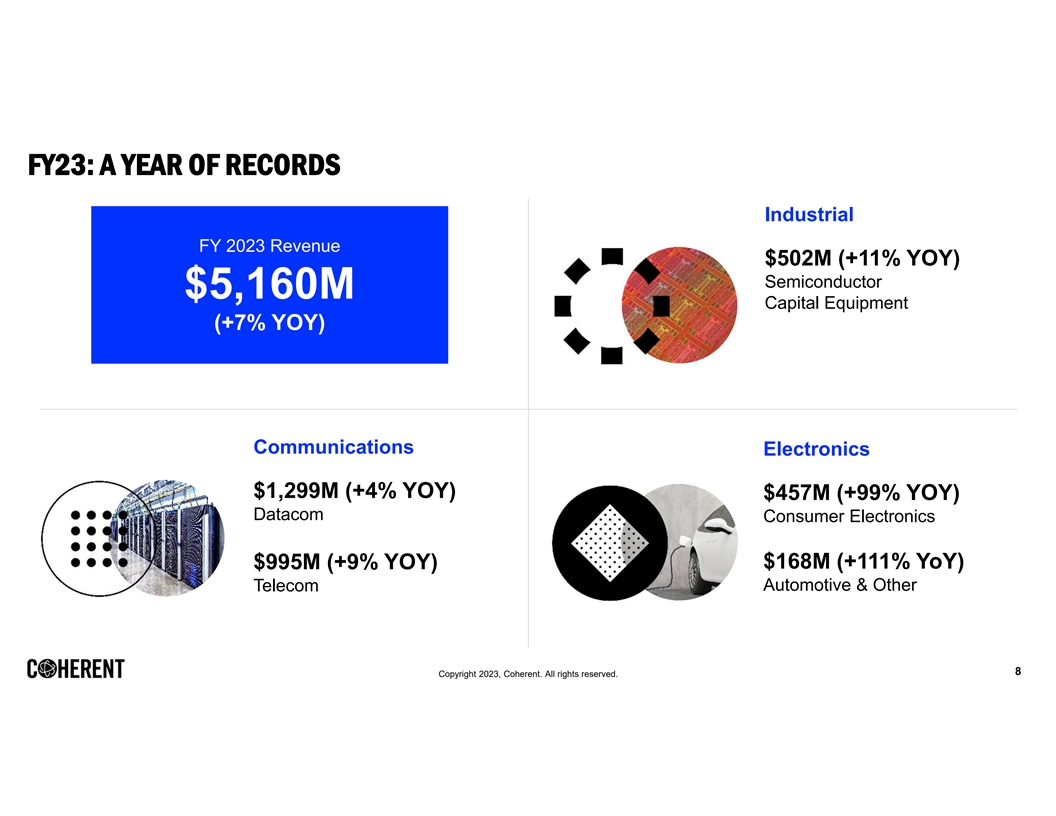

FY23: A YEAR OF RECORDS Industrial FY 2023 Revenue $502M (+11% YOY) Semiconductor $5,160M Capital Equipment (+7% YOY) Communications Electronics $1,299M (+4% YOY) $457M (+99% YOY) Datacom Consumer Electronics $995M (+9% YOY) $168M (+111% YoY) Automotive & Other Telecom 8 Copyright 2023, Coherent. All rights reserved.

COMMUNICATIONS MARKET DRIVERS AND DYNAMICS Optics contribution to hardware spend increases with data rate 100% 20% 50% 90% 80% 10 Tbps 1 Tbps 50% 10% Full parallax High-definition 6G holographic display 1G/10G 100G 400G Platform Pluggable Optics 9 Copyright 2023, Coherent. All rights reserved. Hardware spend (%)

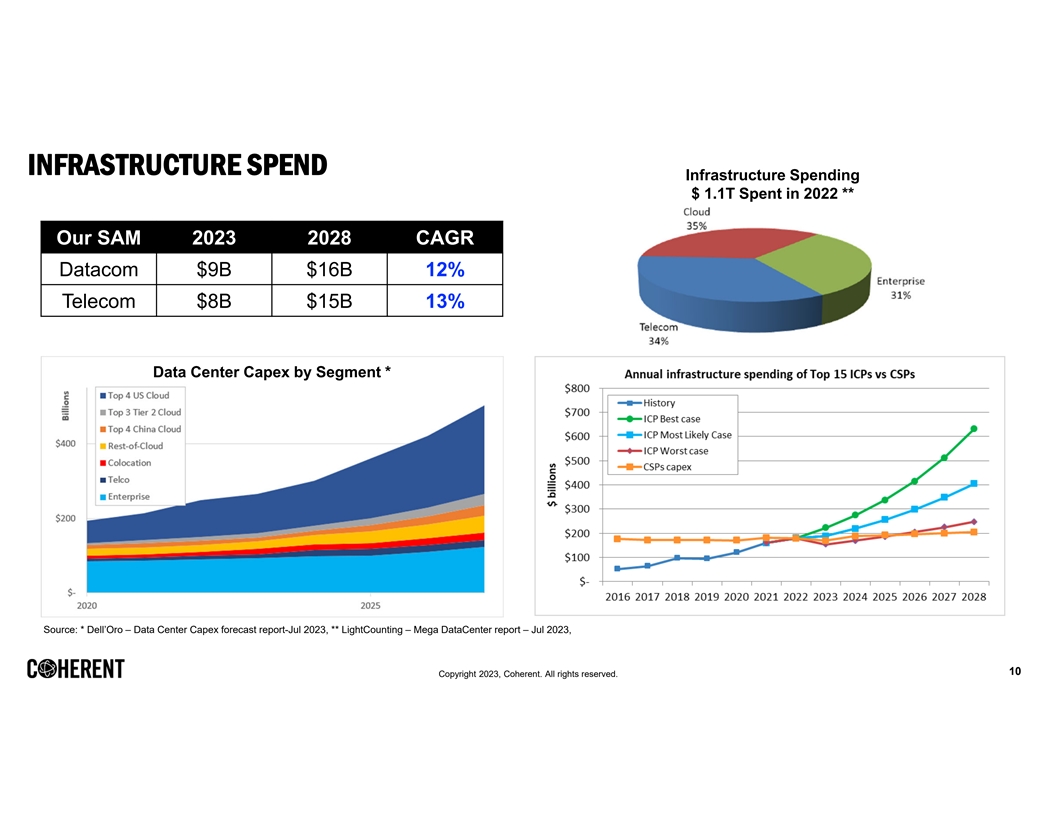

INFRASTRUCTURE SPEND Infrastructure Spending $ 1.1T Spent in 2022 ** Our SAM 2023 2028 CAGR Datacom $9B $16B 12% Telecom $8B $15B 13% Data Center Capex by Segment * Source: * Dell’Oro – Data Center Capex forecast report-Jul 2023, ** LightCounting – Mega DataCenter report – Jul 2023, 10 Copyright 2023, Coherent. All rights reserved.

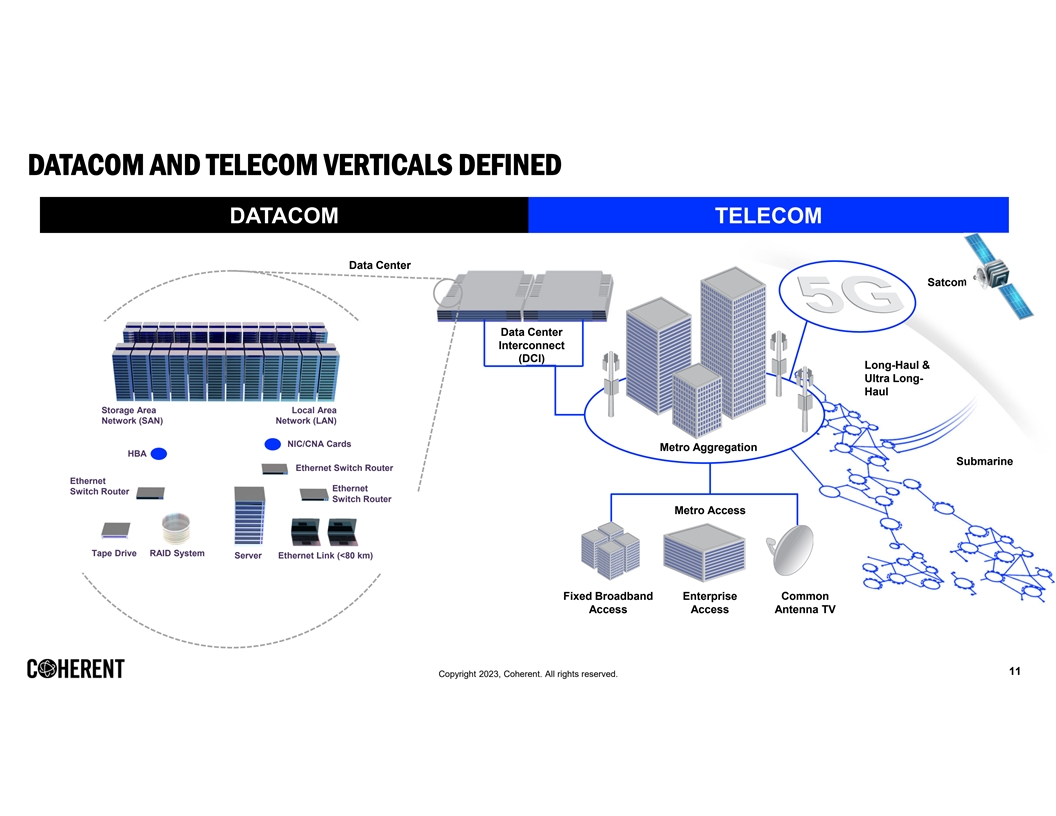

DATACOM AND TELECOM VERTICALS DEFINED DATACOM TELECOM Data Center Satcom Data Center Interconnect (DCI) Long-Haul & Ultra Long- Haul Storage Area Local Area Network (SAN) Network (LAN) NIC/CNA Cards Metro Aggregation HBA Submarine Ethernet Switch Router Ethernet Ethernet Switch Router Switch Router Metro Access Tape Drive RAID System Server Ethernet Link (<80 km) Fixed Broadband Enterprise Common Access Access Antenna TV 11 Copyright 2023, Coherent. All rights reserved.

AI CONNECTIVITY – DATACOM OPPORTUNITY AI systems integrated into data centers Time to reach one million users 5 days Level 1: Optical Interconnects, up to 500 m 2.5 months 10 months 2 years 3.5 years § Mainstream networking topology is giving way to a new topology to accommodate AI systems § Both Level 0 and Level 1 connectivity will drive optics growth § AI/ML networks add to compute and storage networks Level 0: Back end. GPU Fabric. Up to 50 meters. § AI/ML applications drive transceiver growth 12 Copyright 2023, Coherent. All rights reserved.

AI HAS RAPIDLY EMERGED AS A KEY CATALYST OF OUR LONG TERM GROWTH Datacom Transceivers § Generative AI trend § Datacom Transceivers for AI Only: 47% CAGR (’23 - ‘28) § All Datacom Transceivers: 18% CAGR § Driven primarily by 800G, 1.6T and 3.2T Source: LightCounting July ‘23 and internal estimates 13 Copyright 2023, Coherent. All rights reserved.

DATACOM TRANSCEIVER GLOBAL MARKET $M $1.3 billion Coherent Corp. sales in $10,000 datacom in FY23 $8,000 3.2T 1.6T 200G 800G $6,000 and higher data-rate transceivers 400G represent >65% of Coherent 200G Corp. total transceiver revenue in 100G $4,000 Q4 FY23 50G 40G $2,000 800G and higher data-rate $- transceivers will represent more 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 than 50% of the total available market by 2027 Source: LightCounting, Internal Estimates 14 Copyright 2023, Coherent. All rights reserved.

OUR DATACOM TRANSCEIVER MARKET OPPORTUNITY (AI AND TRADITIONAL) CY23 Transceiver Opportunity ($B) CY28 Transceiver Opportunity ($B) VCSEL AI DML - Other $0.3 6% $0.6 6% VCSEL AI $1.6 14% EML - Other DML - Other $1.0 9% VCSEL - Other $1.6 29% DML $1.5 27% $0.6 DML VCSEL VCSEL - Other VCSEL $1.6 $1.8 EML $1.7 14% $3.3 $3.0 CY23 EML AI CY28 Total $2.0 18% Total $5.1 B $11.4 B SiPho EML SiPho $0.8 $1.3 $4.6 SiPho AI EML - Other $0.2 3% SiPho - Other $0.7 12% SiPho AI $1.1 10% SiPho - Other $3.4 29% EML AI $0.6 11% $0.6 12% • Lasers are Critical to Transceivers • VCSELs are important for AI (short links to connect GPUs) • First leap will be 800G transceivers driven by our 100G VCSELs & EMLs • Second leap will be on 1.6T driven by our award winning 200G EML and DFB-MZ, and later 200G VCSELs 15 Copyright 2023, Coherent. All rights reserved.

OUR DATACOM LASER MARKET OPPORTUNITY (AI AND TRADITIONAL) CY23 Datacom Laser Opportunity ($M) CY28 Datacom Laser Opportunity ($M) VCSEL AI DML - Other $25 5% $68 6% DML AI VCSEL AI $0 0% $135 11% EML - Other DML - Other $122 10% VCSEL - Other $169 30% $124 22% DML $68 VCSEL VCSEL - Other VCSEL DML $149 $136 12% $271 $169 EML CY23 CY28 $369 Total Total EML AI $567 M $1,169 M SiPho SiPho AI $247 21% $19 3% DML AI $82 EML $0 0% SiPho $167 $460 SiPho - Other $64 11% SiPho AI EML - Other $346 30% $85 15% SiPho - Other EML AI $114 10% $81 14% • AI applications will require various laser types • Lasers for AI will increase from 22% today to 62% in CY 28 16 Copyright 2023, Coherent. All rights reserved.

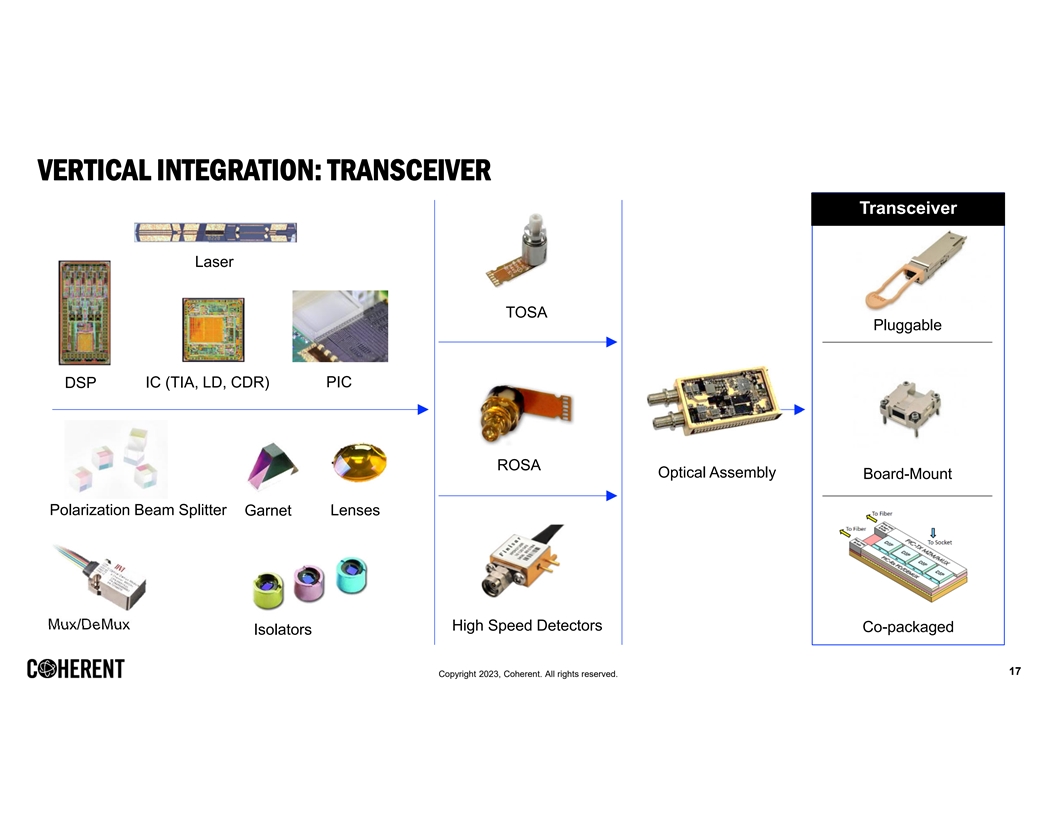

VERTICAL INTEGRATION: TRANSCEIVER Transceiver Laser TOSA Pluggable DSP IC (TIA, LD, CDR) PIC ROSA Optical Assembly Board-Mount Polarization Beam Splitter Garnet Lenses Mux/DeMux High Speed Detectors Co-packaged Isolators 17 Copyright 2023, Coherent. All rights reserved.

COMMUNICATIONS: BROADEST, VERTICALLY INTEGRATED, END TO END PORTFOLIO Long Haul & Ultra-Long Haul Submarine Link Line cards Transceivers Coherent transceivers Gimbals Line Systems Amplifiers Transceivers Lasers Lasers Materials Integrated Module High Speed Detectors Optical Channel Monitor (OCM) Wavelength Selective Switch (WSS) Specialty Fiber Integrated Circuits Amplifiers Isolators Filters Pump lasers Pump lasers Filters GaN Devices Thermo Electric Transceivers Filters Optical Time Optical InP Laser + Modulator Tunable Laser Coolers Domain Channel Interferometer Monitor (OTDR) (OCM) SiC Substrates 18 Copyright 2023, Coherent. All rights reserved.

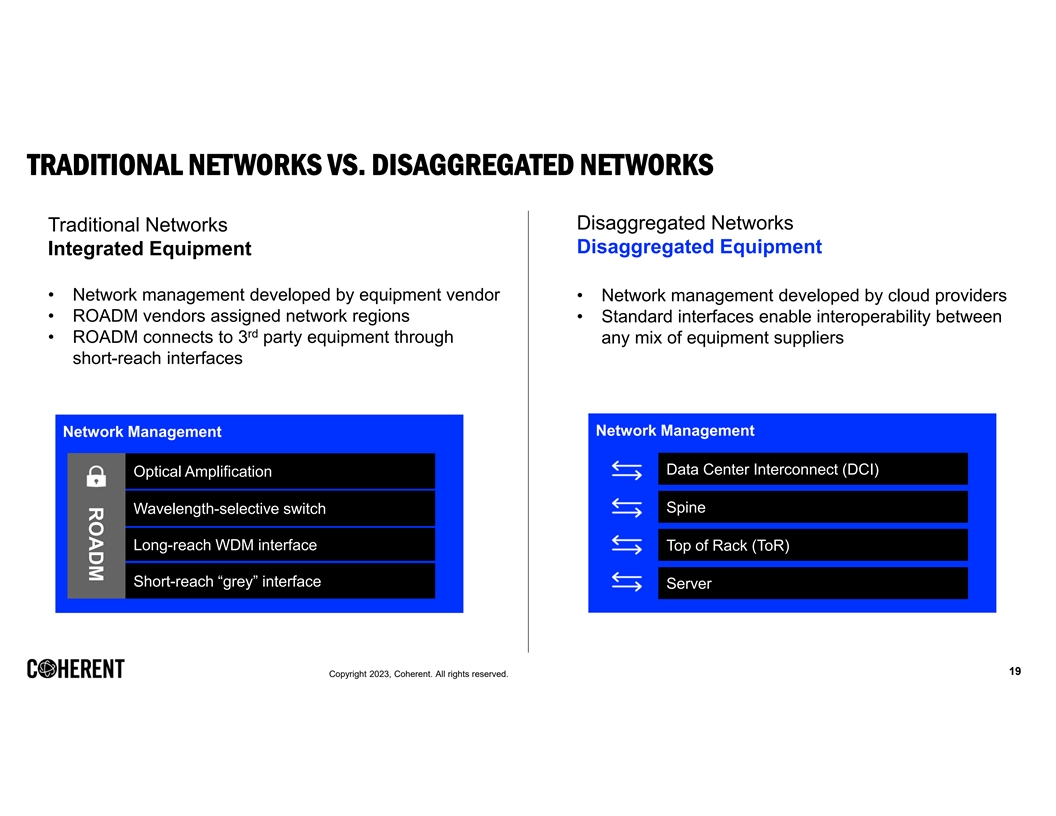

ROADM TRADITIONAL NETWORKS VS. DISAGGREGATED NETWORKS Disaggregated Networks Traditional Networks Disaggregated Equipment Integrated Equipment • Network management developed by equipment vendor • Network management developed by cloud providers • ROADM vendors assigned network regions • Standard interfaces enable interoperability between rd • ROADM connects to 3 party equipment through any mix of equipment suppliers short-reach interfaces Network Management Network Management Data Center Interconnect (DCI) Optical Amplification Spine Wavelength-selective switch Long-reach WDM interface Top of Rack (ToR) Short-reach “grey” interface Server 19 Copyright 2023, Coherent. All rights reserved.

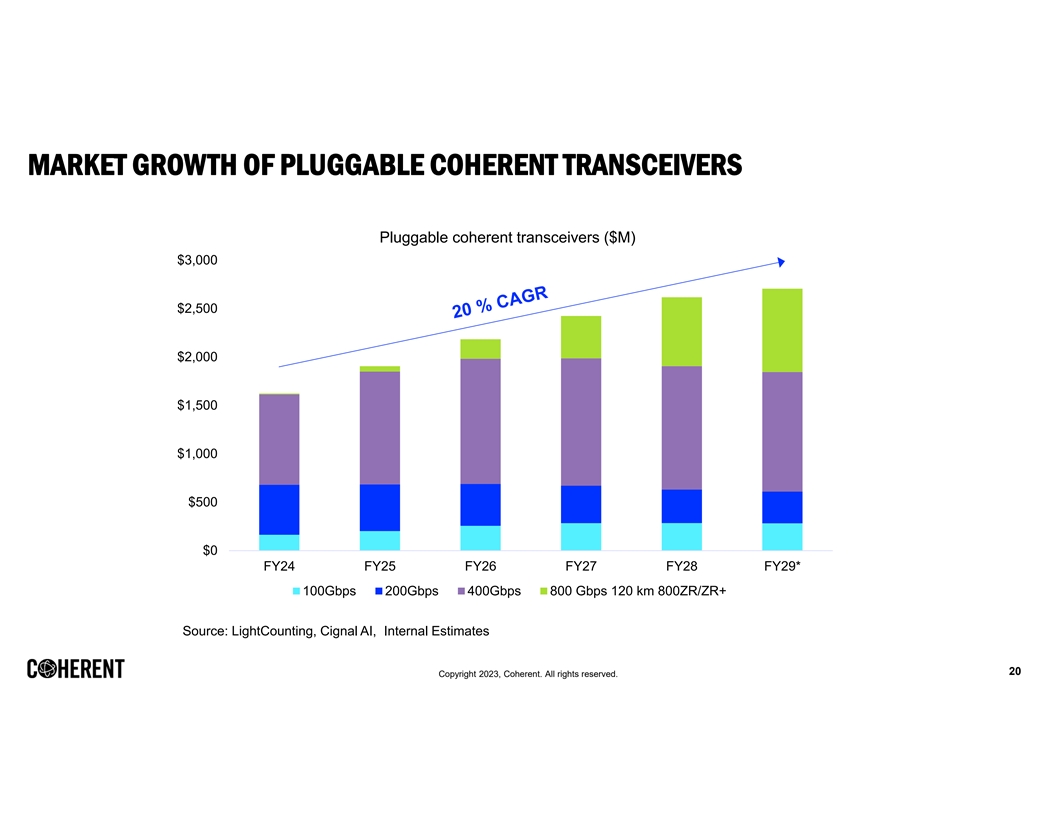

MARKET GROWTH OF PLUGGABLE COHERENT TRANSCEIVERS Pluggable coherent transceivers ($M) $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 FY24 FY25 FY26 FY27 FY28 FY29* 100Gbps 200Gbps 400Gbps 800 Gbps 120 km 800ZR/ZR+ Source: LightCounting, Cignal AI, Internal Estimates 20 Copyright 2023, Coherent. All rights reserved.

COHERENT MARKET SHARE AND MIND SHARE LEADERSHIP Recognition Of Leadership Across Multiple Verticals* Datacom Telecom Industrial Consumer #1 #2 #1 #1 $5.2B Telecom market $13.0B Components market $5.9B Datacom market Lumentum Coherent (II-VI) Other… Other 20.9% Other O-Net 18.1% Coherent (II-VI) 24.9% 29.9% Communications… 21.7% Hisense Innolight 1.5% Sumitomo Source HG 10.6% 2.6% Photonics Genuine… 2.6% Lumentu Marvell O-Net HG 2.0% m Communications Genuine Coherent (II- Macom 10.3% 3.3% 2.7% VI) 2.3% Accelink Innolight Hisense 18.3% HG Genuine 6.7% 21.0% 3.3% Sumitomo Broadcom 3.9% Acacia Acacia 3.9% Accelink Lumentum 5.4% 4.4% Hisense Broadcom O-Net 10.9% 7.9% Accelink 3.8% 4.8% 11.0% Communications 4.2% Intel Source: Omdia, June 2023 5.7% 4.4% * Cignal AI Optical Components, Revenue Leaderboard 1Q23, Lightcounting, The Optical Vendor Landscape: 2023 21 Copyright 2023, Coherent. All rights reserved.

OUR DATACOM BUSINESS Dr. Lee Xu, Executive Vice President, Datacom Transceivers 22 Copyright 2023, Coherent. All rights reserved.

DATACOM § Our business history, status and strengths § AI-related products, differentiation, and growth 23 Copyright 2023, Coherent. All rights reserved. 23

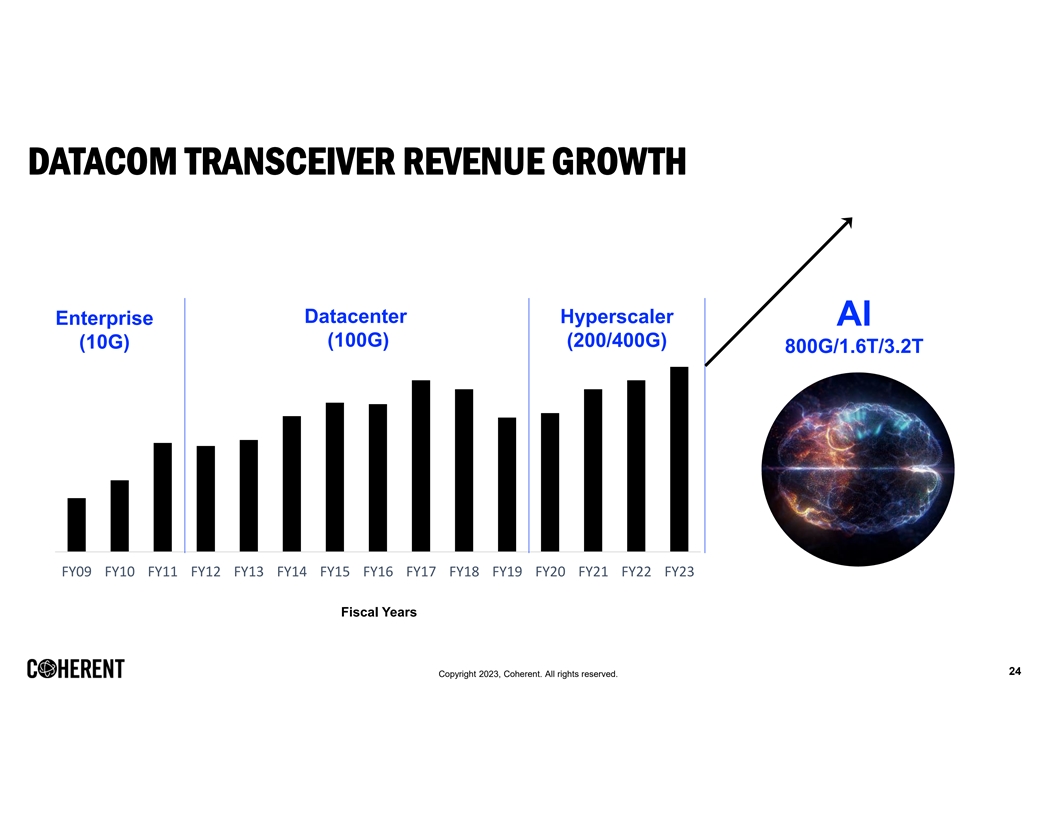

DATACOM TRANSCEIVER REVENUE GROWTH Datacenter Hyperscaler Enterprise AI (100G) (200/400G) (10G) 800G/1.6T/3.2T FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 Fiscal Years 24 Copyright 2023, Coherent. All rights reserved.

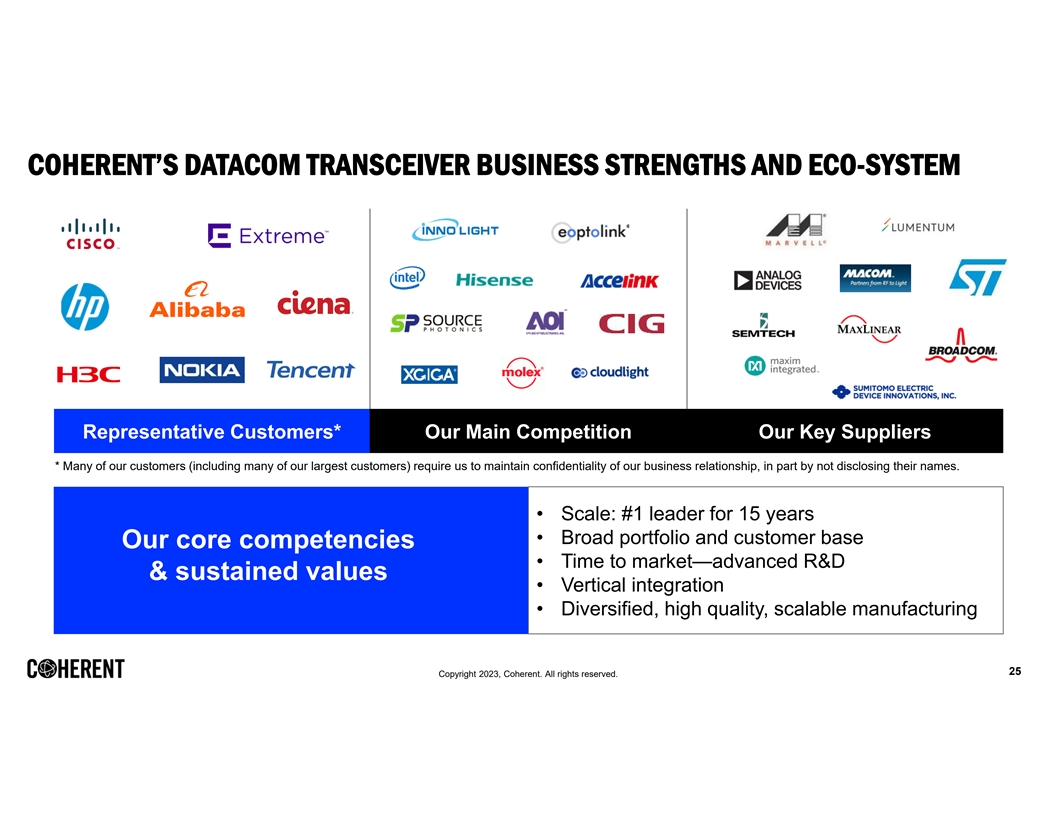

COHERENT’S DATACOM TRANSCEIVER BUSINESS STRENGTHS AND ECO-SYSTEM Representative Customers* Our Main Competition Our Key Suppliers * Many of our customers (including many of our largest customers) require us to maintain confidentiality of our business relationship, in part by not disclosing their names. • Scale: #1 leader for 15 years • Broad portfolio and customer base Our core competencies • Time to market—advanced R&D & sustained values • Vertical integration • Diversified, high quality, scalable manufacturing 25 Copyright 2023, Coherent. All rights reserved.

BROADEST TRANSCEIVER PORTFOLIO IN THE INDUSTRY Some Representative Transceiver BU Products • All major protocols: Ethernet, Fiber Channel, 100M 1G 10G 25G SFP SFF SFP+ BiDi SFP28 Infiniband, and SONET • All speeds: 100M to 800G 25G (1.6T coming soon) 10G 14G 40G SFP28 T-XFP Endurance QSFP+ AOC • All major form-factors: SFF to OSFP and everything in between 100G 100G 100G 200G QSFP28 QSFP28 CFP2 QSFP56 AOC 400G 300G 400G 800G QSFP-DD MBOM QSFP-DD OSFP DAC 26 Copyright 2023, Coherent. All rights reserved.

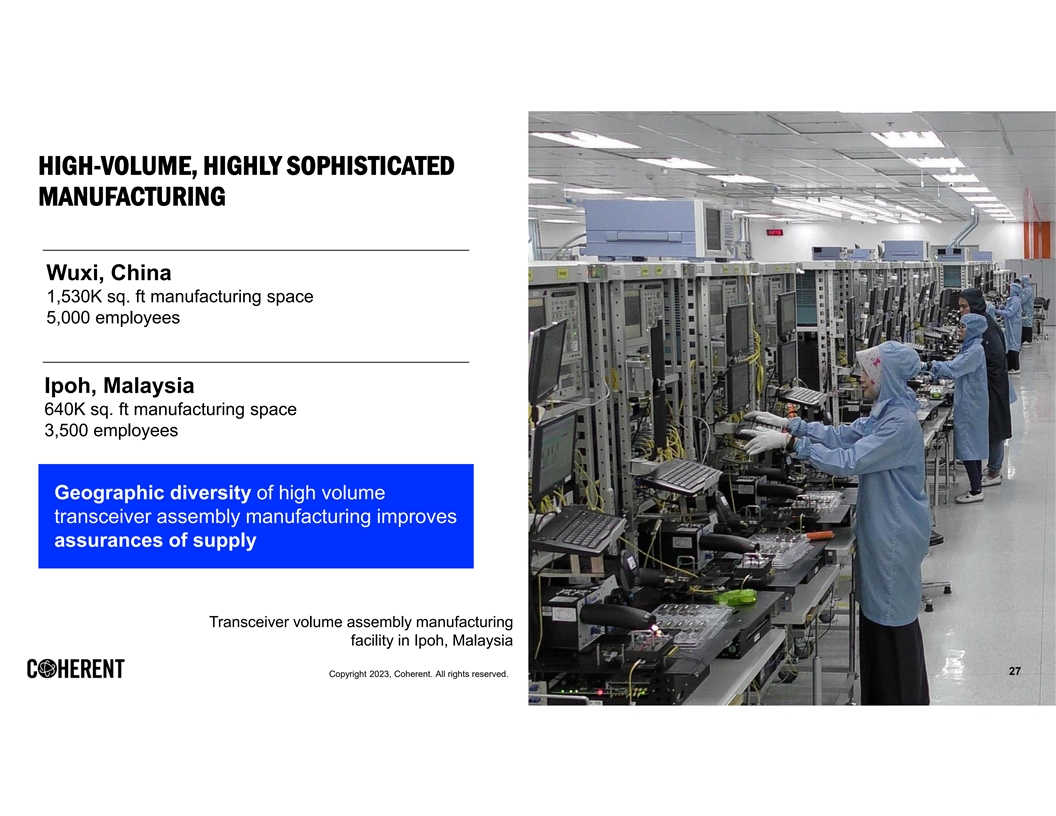

HIGH-VOLUME, HIGHLY SOPHISTICATED MANUFACTURING Ipoh, Malaysia Wuxi, China 1,530K sq. ft manufacturing space 5,000 employees ISO 9001 and 14001 certified Ipoh, Malaysia 640K sq. ft manufacturing space 3,500 employees Geographic diversity of high volume transceiver assembly manufacturing improves assurances of supply Transceiver volume assembly manufacturing facility in Ipoh, Malaysia 27 Copyright 2023, Coherent. All rights reserved.

OUR AUTOMATION, TEST DEVELOPMENT, AND PROCESS DEVELOPMENT § Strong process development capabilities to realize advanced optical designs (many technologies are industry first) § In-house automation stations for Coherent specific technologies and processes (1000+ stations developed) § In-house developed testers and burn-in systems (~900 testers and 200+ burn-in systems developed) In-house burn-in & tester In-house automation Process development Higher efficiency, better flexibility, less operator dependent, lower cost, and higher quality 28 Copyright 2023, Coherent. All rights reserved.

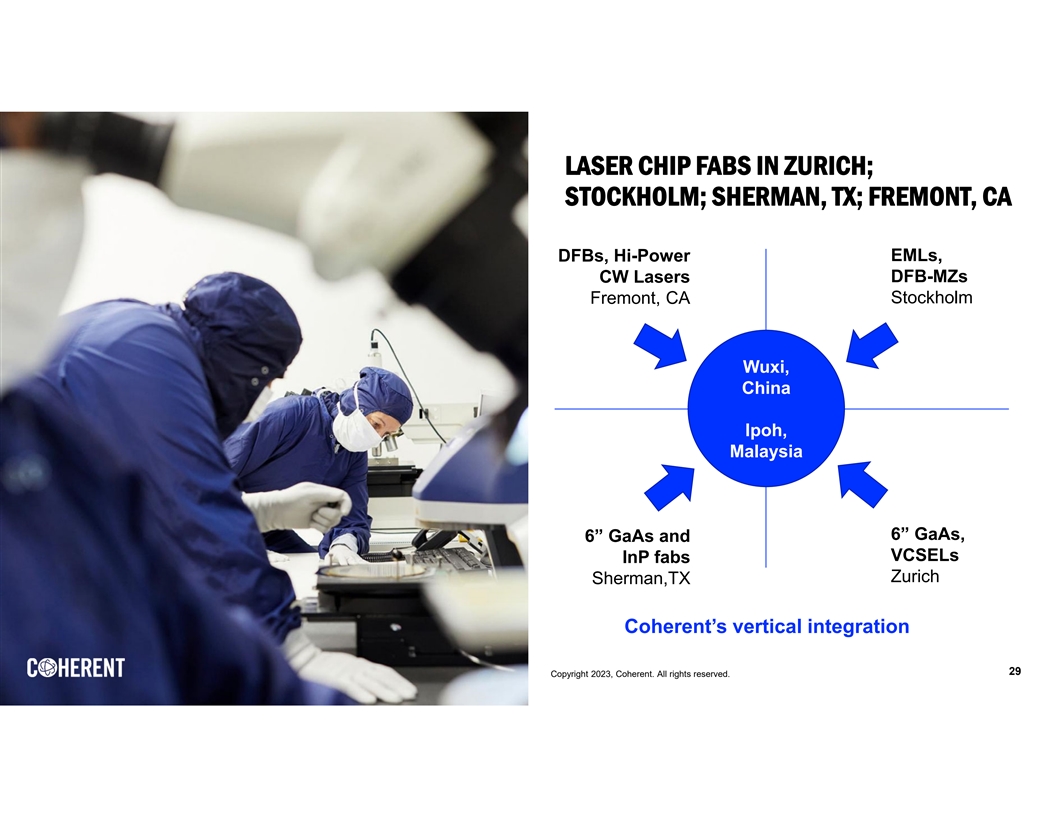

LASER CHIP FABS IN ZURICH; STOCKHOLM; SHERMAN, TX; FREMONT, CA DFBs, Hi-Power EMLs, CW Lasers DFB-MZs Fremont, CA Stockholm Wuxi, China Ipoh, Malaysia 6” GaAs, 6” GaAs and VCSELs InP fabs Zurich Sherman,TX Coherent’s vertical integration 29 Copyright 2023, Coherent. All rights reserved. Copyright 2023, Coherent. All rights reserved.

800G PRODUCTS FOR AI IN FY24 • FY1Q23: First shipments • FY4Q23: Design wins for every flavor of 800G products with all major volume customers • FY24: Substantial orders on hand; steep production and shipment ramp 800G product ramp-up trend in FY24 Q1 Q2 Q3 Q4 30 30 Copyright 2023, Coherent. All rights reserved.

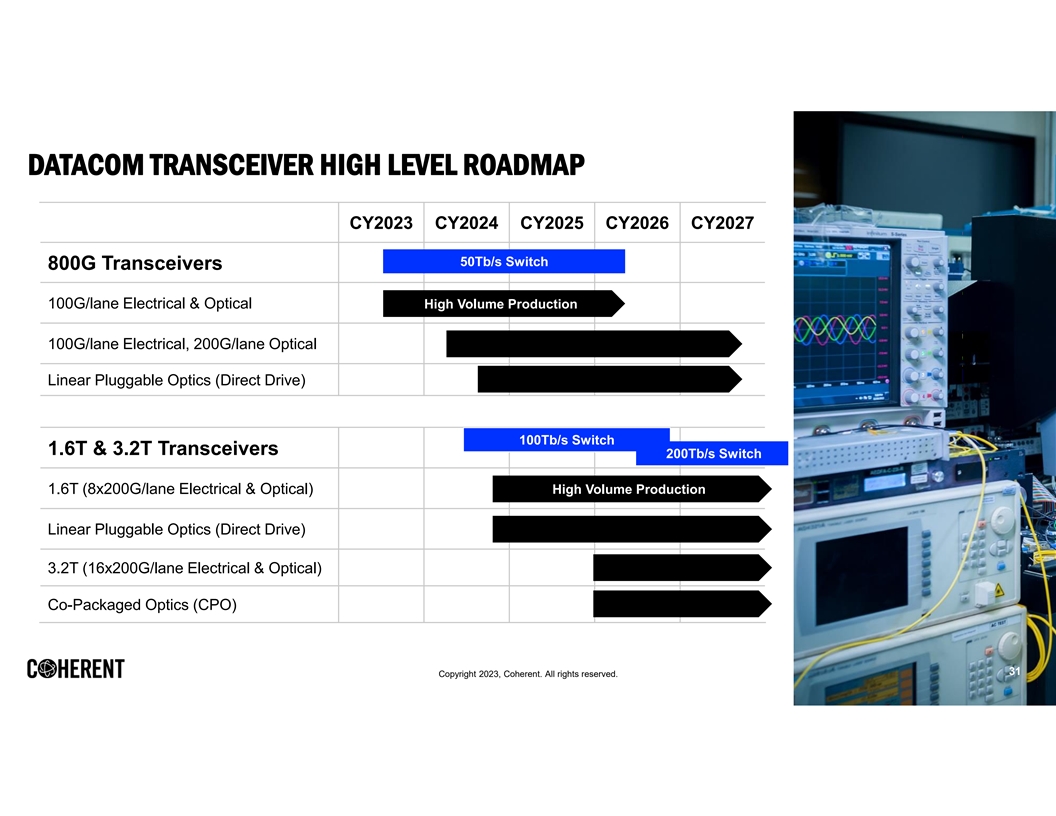

DATACOM TRANSCEIVER HIGH LEVEL ROADMAP CY2023 CY2024 CY2025 CY2026 CY2027 50Tb/s Switch 800G Transceivers Beta GA 100G/lane Electrical & Optical High Volume Production 100G/lane Electrical, 200G/lane Optical Linear Pluggable Optics (Direct Drive) 100Tb/s Switch 1.6T & 3.2T Transceivers 200Tb/s Switch 1.6T (8x200G/lane Electrical & Optical) High Volume Production Linear Pluggable Optics (Direct Drive) 3.2T (16x200G/lane Electrical & Optical) Co-Packaged Optics (CPO) 31 Copyright 2023, Coherent. All rights reserved.

DEVELOPMENT OF 1.6T/3.2T LASER/MODULATOR OPTIONS • EML is the technology choice for most customers • DFB-MZ (in development) is needed for 2-6 km • Silicon Photonics (SiPh) could address shorter distances (up to 500 m). Coherent’s internally-designed SiPh has demonstrated good performance for 200G/lane • A potential game-changer: 200G/lane VCSELs in development at Coherent 32 Copy Copyright right 2023, 2023, Coherent Coherent.. All All right rights s reserved. reserved.

OUR LEADERSHIP POSITION IN THE NEXT FIVE YEARS 200G per Lane • Will lead with new products for 800G/1.6T (800G, 1.6T, 3.2T) 800G LW & SW (100G per Lane) • Will differentiate leveraging our laser technologies and transceiver designs Better than industry average gross margins, despite bargaining power of hyperscalers. FY2023 FY2024 FY2025 FY2026 FY2027 FY2028 Other 8x100G LW 8x100G SW 200G per Lane 33 Copyright 2023, Coherent. All rights reserved.

SUMMARY § AI is an extraordinary opportunity for which we are well-prepared • Products: We have a broad portfolio of 800G products and a strong technology roadmap • Opportunity: Demand is already several hundreds of millions dollars and growing • Production: Ramping throughout FY24 § We expect AI to drive over 100% growth in our datacom transceiver revenue by FY28 34 Copyright 2023, Coherent. All rights reserved.

OUR TELECOM BUSINESS Dr. Beck Mason, Executive Vice President, Telecommunications 35 Copyright 2023, Coherent. All rights reserved.

OUR HERITAGE 30 YEARS 1990 Foundational TEC Passive Faraday Pump Laser, WSS Optical Transceivers InP Lasers IPs Technology Optical Rotators Amplifier and Platforms and Solutions Signal Monitoring Transmission Components Technology 36 Copyright 2023, Coherent. All rights reserved. 36

COMMUNICATIONS NETWORKS Edge Core Access Networks Transport Networks Datacenters •Metro • Video streaming •5G Wireless • Regional • Cloud services • Fiber-to-the-home • Long-haul • Social media • Broadband cable • Submarine • Big data/AI/ML • Low-orbit satellites 37 Copyright 2023, Coherent. All rights reserved.

BROAD PORTFOLIO OF TELECOM PRODUCTS We have the broadest portfolio of optical components We are leaders in the fundamental enabling and modules for transport applications technologies for optical transmission • Subsystems are more differentiated and enable us to sell on • IC and photonic chip technology enables us to differentiate features and capability our solutions, increase gross margins and gain better control over time to market • Our focus is on subsystem and system level solutions that maximize our share of the total value stream • Our focus is on go to market at the module and component level to maximize revenue and profit opportunity Systems Transceiver modules Subsystems Optical components Modules-Amps, WSS, OCM, … High speed IC and Coherent DSP Optical components Photonic chips InP and SiP 38 Copyright 2023, Coherent. All rights reserved.

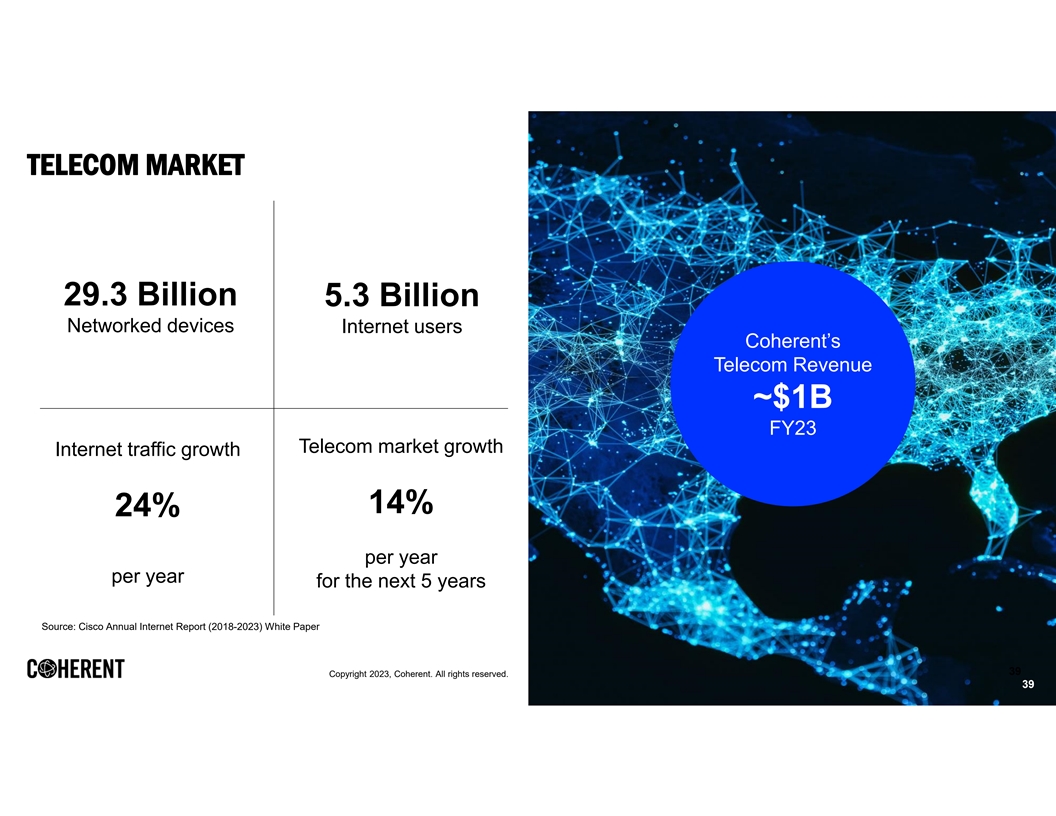

TELECOM MARKET 29.3 Billion 5.3 Billion Networked devices Internet users Coherent’s Telecom Revenue ~$1B FY23 Telecom market growth Internet traffic growth 14% 24% per year per year for the next 5 years Source: Cisco Annual Internet Report (2018-2023) White Paper 39 Copyright 2023, Coherent. All rights reserved. 39

COHERENT TRANSCEIVER TECHNOLOGY • Fully automated high volume manufacturing • Module design including embedded FW development • Optical subassembly design and manufacturing • High speed IC and coherent DSP development • Photonic chip design in InP and SiP and high volume manufacturing 800G InP fab in Järfälla, Sweden 40 Copy Copyright right 2023, 2023, Coherent Coherent.. All All right rights s reserved. reserved. 40

DSPs: KEY BUILDING BLOCKS IN COHERENT TRANSCEIVERS DSP Digital Signal Processor • DSP converts digital data from a switch or router into the complex analog modulation signals • Converts the received signal at the other end of the link back into digital data and compensates for any signal impairments 41 Copyright 2023, Coherent. All rights reserved.

100G COHERENT TRANSCEIVERS 100ZR QSFP28 DCO Purpose-built power- • World’s first Digital Coherent Optics (DCO) module in Steelerton™ DSP optimized tunable laser QSFP28 form factor purpose-built for small size and low • 100G capacity, 300 km reach power consumption • Based on Coherent 7 nm digital signal processor (DSP), Highly integrated silicon silicon photonics transmitter/receiver, and tunable laser photonics PIC • Serves metro-edge and high-volume edge access markets 42 Copy Copy Copyright right right 2023, 2023, 2023, Coherent Coherent Coherent... All All All right right rights s s reserved. reserved. reserved. 42

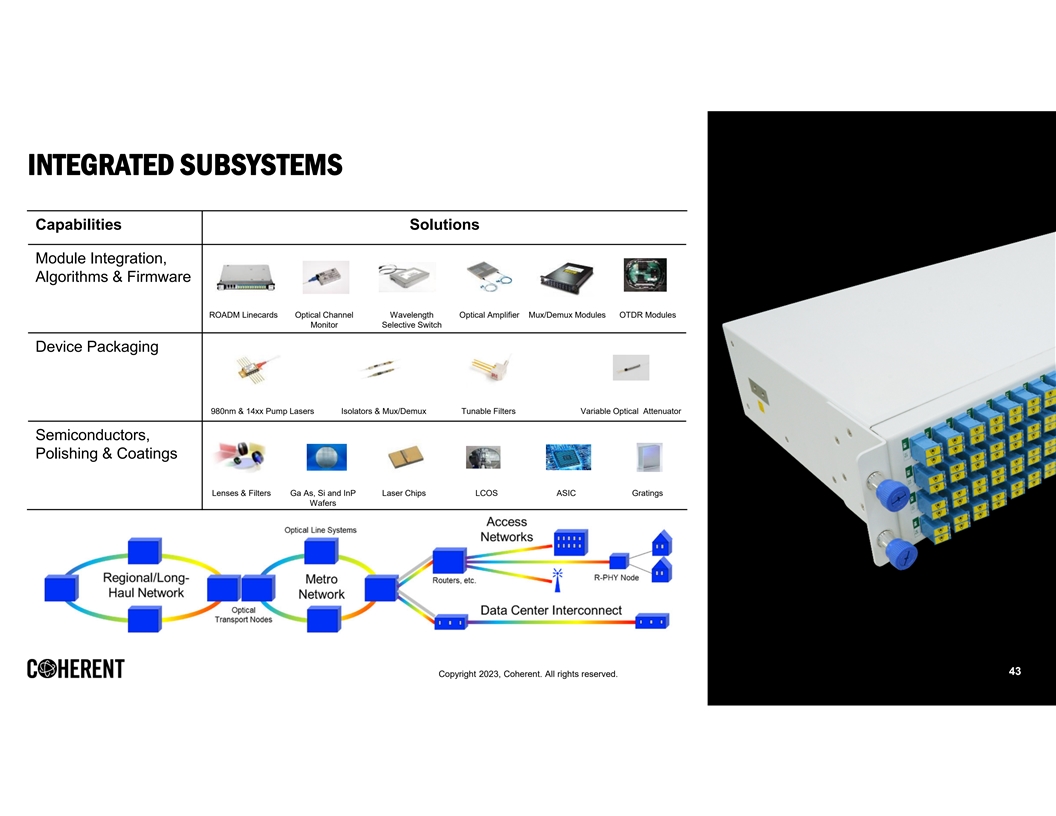

INTEGRATED SUBSYSTEMS Capabilities Solutions Module Integration, Algorithms & Firmware ROADM Linecards Optical Channel Wavelength Optical Amplifier Mux/Demux Modules OTDR Modules Monitor Selective Switch Device Packaging 980nm & 14xx Pump Lasers Isolators & Mux/Demux Tunable Filters Variable Optical Attenuator Semiconductors, Polishing & Coatings Lenses & Filters Ga As, Si and InP Laser Chips LCOS ASIC Gratings Wafers 43 Copyright 2023, Coherent. All rights reserved.

PLUGGABLE OPTICAL LINE SUBSYSTEM (POLS) • Bi-directional, dual erbium-doped fiber amplifier (EDFA) in QSFP pluggable module • Booster amplifier for transmit direction • Pre-amplifier for receive direction • External DWDM Mux/Demux cable assembly. Applications QSFP Dual EDFA module • IP-over-DWDM point-to-point • Access networks Mux/Demux cable assembly 44 Copyright 2023, Coherent. All rights reserved.

TELECOM TECHNOLOGY EVOLUTION Wavelength Selective Amplifier Optical Channel Monitoring Pump Laser Switch 2x C&L bands channels Higher power pump Enables a single device to The highest power per capability to deliver more cover both C&L bands pump emitter efficient amplifiers together 45 Copyright 2023, Coherent. All rights reserved. 45

MANUFACTURING ADVANTAGE Shenzhen Fuzhou Wuxi China China China Geographic Ipoh Philippines Malaysia Diversity Vietnam Thailand Others Pump Laser Photonic components Transceiver Passive optics Amplifiers line cards Other subsystem 46 Copyright 2023, Coherent. All rights reserved.

ASSEMBLY OPERATIONS AND AUTOMATION • Internally developed automation • Assembly and test automation • Consistent product quality • Better manufacturing efficiency and cost Reliability Example Liquid crystal WSS platform A mean time to failure +4000 years Based on 8 billion cumulative hours of device operation. 47 Copy Copyright right 2023, 2023, Coherent Coherent.. All All right rights s reserved. reserved. 47

HOW WE WIN Telecom components Telecom Modules Telecom Subsystems Terrestrial pump lasers EDFA Linecards Submarine pump lasers High port count WSS Node-on-a-blade Sbbmarine components Submarine WSS Pluggable optical line systems Specialty fiber Edge WSS Optical monitoring system Thermoelectric coolers High res OCM Ultracompact components Wideband OCM Isolators OTDR 48 Copyright 2023, Coherent. All rights reserved. 48

ENABLING TECHNOLOGIES Dr. Julie Sheridan Eng, Chief Technology Officer 49 Copyright 2023, Coherent. All rights reserved.

COMPONENTS FOR AI/ML Artificial Intelligence and Machine Learning is accelerating the pace of innovation in optical components 50 Copyright 2023, Coherent. All rights reserved.

OUR VERTICAL INTEGRATION IN LASERS, DETECTORS, INTEGRATED CIRCUITS, AND PASSIVE OPTICS IS A DIFFERENTIATOR Lasers Detectors Integrated Circuits Passive Optical Components 51 Copyright 2023, Coherent. All rights reserved.

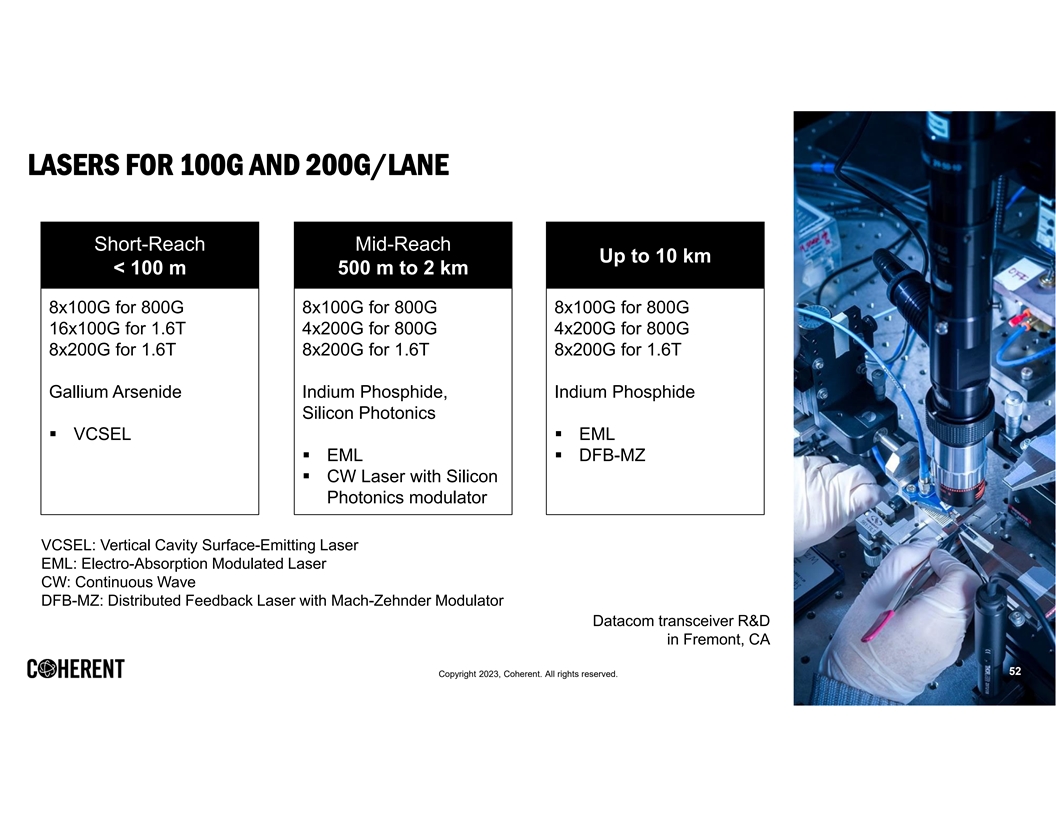

LASERS FOR 100G AND 200G/LANE Short-Reach Mid-Reach Up to 10 km < 100 m 500 m to 2 km 8x100G for 800G 8x100G for 800G 8x100G for 800G 16x100G for 1.6T 4x200G for 800G 4x200G for 800G 8x200G for 1.6T 8x200G for 1.6T 8x200G for 1.6T Gallium Arsenide Indium Phosphide, Indium Phosphide Silicon Photonics § VCSEL§ EML § EML§ DFB-MZ § CW Laser with Silicon Photonics modulator VCSEL: Vertical Cavity Surface-Emitting Laser EML: Electro-Absorption Modulated Laser CW: Continuous Wave DFB-MZ: Distributed Feedback Laser with Mach-Zehnder Modulator Datacom transceiver R&D in Fremont, CA 52 Copyright 2023, Coherent. All rights reserved.

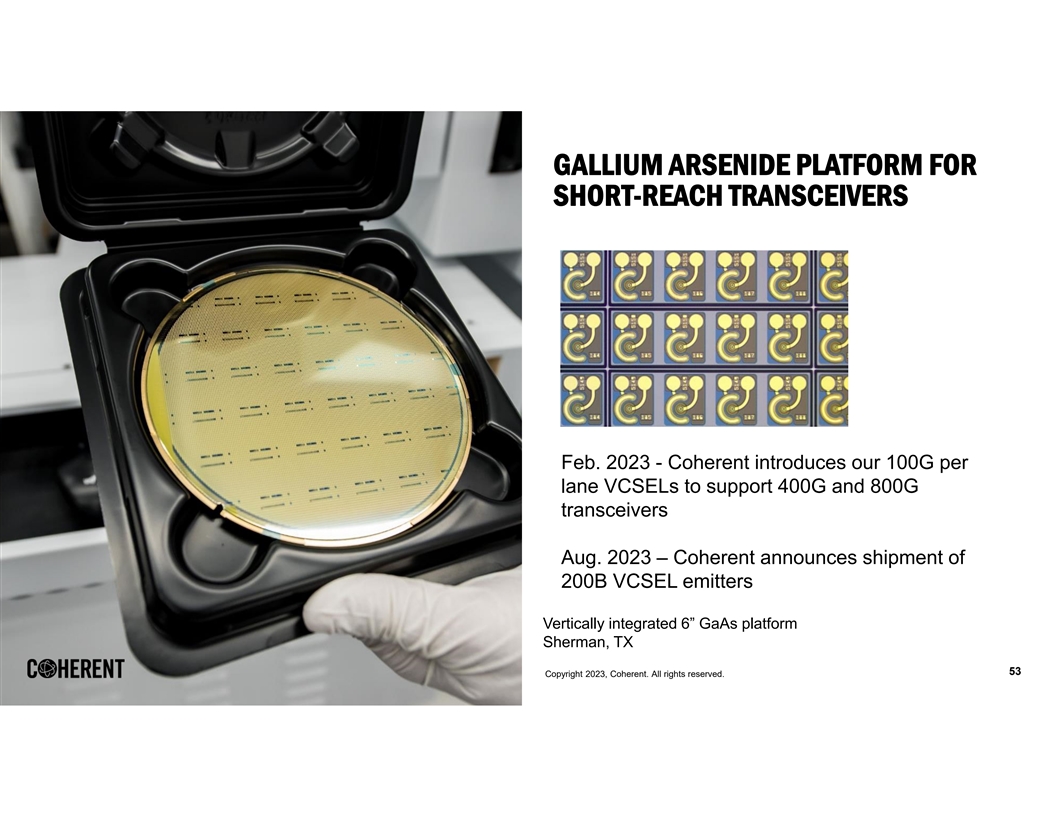

GALLIUM ARSENIDE PLATFORM FOR SHORT-REACH TRANSCEIVERS Feb. 2023 - Coherent introduces our 100G per lane VCSELs to support 400G and 800G transceivers Aug. 2023 – Coherent announces shipment of 200B VCSEL emitters Vertically integrated 6” GaAs platform Sherman, TX 53 Copyright 2023, Coherent. All rights reserved. Copyright 2023, Coherent. All rights reserved.

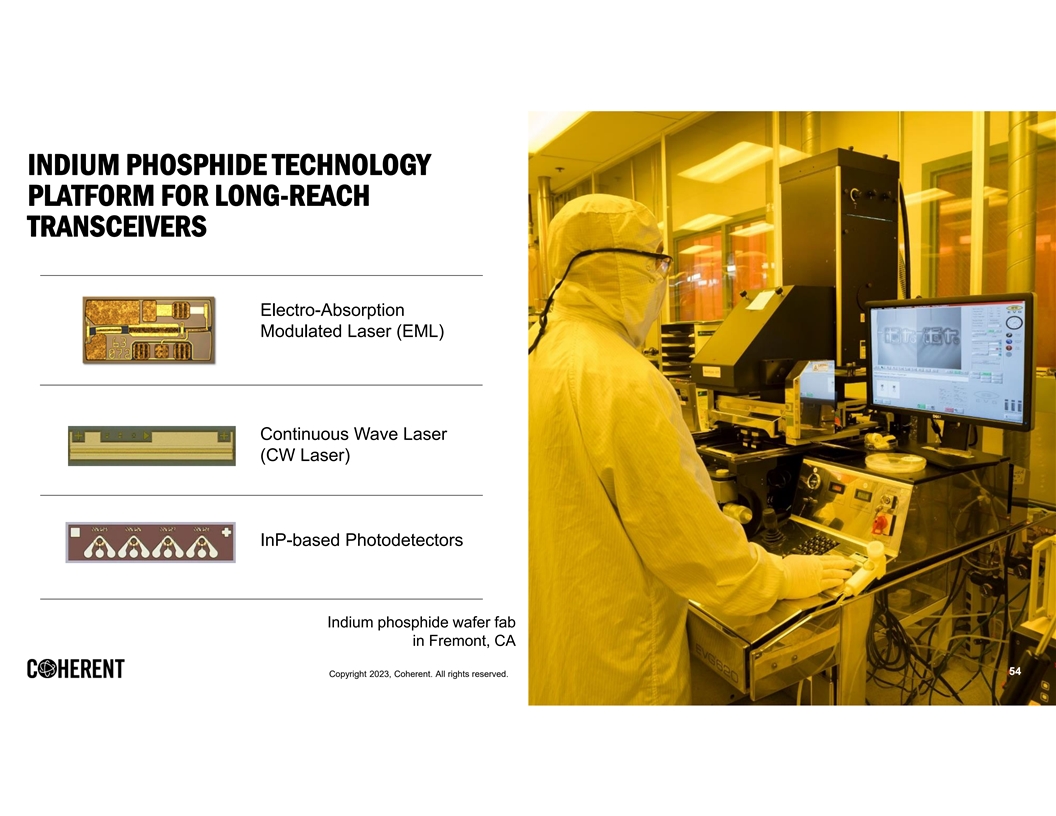

INDIUM PHOSPHIDE TECHNOLOGY PLATFORM FOR LONG-REACH TRANSCEIVERS Electro-Absorption Modulated Laser (EML) Continuous Wave Laser (CW Laser) InP-based Photodetectors Indium phosphide wafer fab in Fremont, CA 54 Copyright 2023, Coherent. All rights reserved.

INTEROPERATION BETWEEN SILICON PHOTONICS-BASED 800G DR8 AND EML-BASED 800G DR8 • Interoperation between EML-based DR8 and SiPh- based DR8 demonstrated in ECOC2022 • Silicon Photonics-based DR8 • Coherent-designed highly integrated Silicon Photonics chip, manufactured at Tier 1 silicon foundry • Coherent designed and manufactured CW laser • EML-based DR8 • Coherent designed and manufactured EML and photodetector 55 Copy Copyright right 2023, 2023, Coherent Coherent.. All All right rights s reserved. reserved.

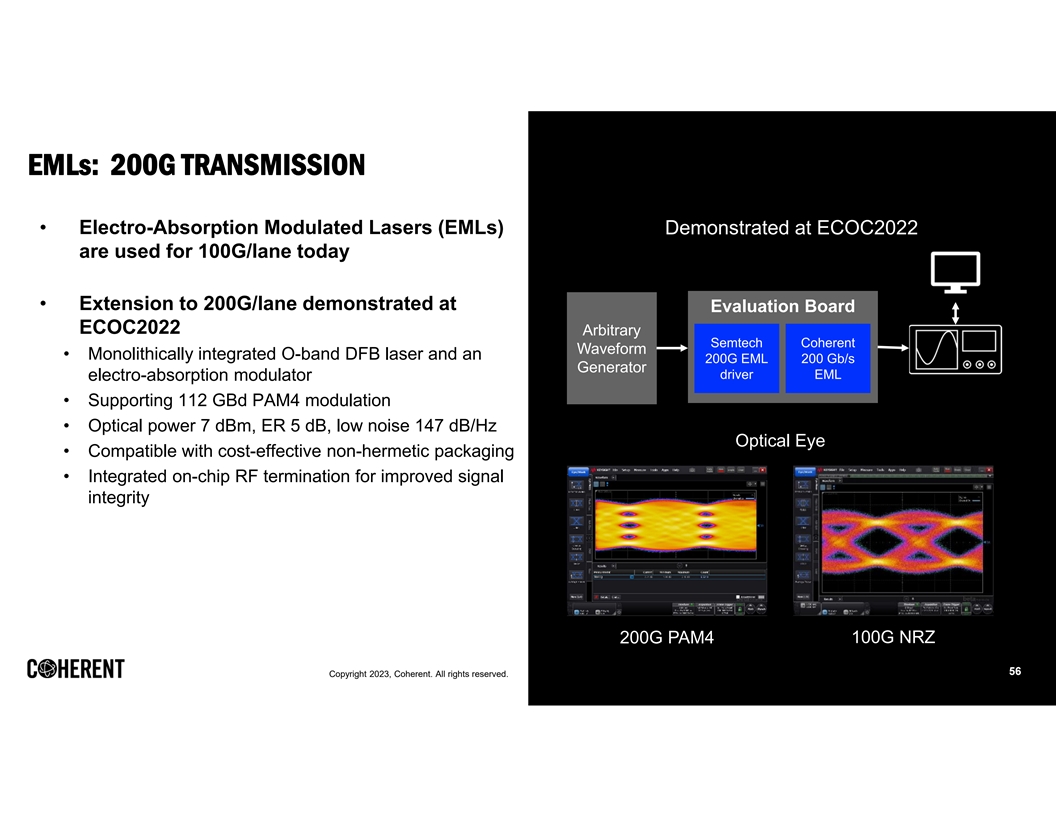

EMLs: 200G TRANSMISSION • Electro-Absorption Modulated Lasers (EMLs) Demonstrated at ECOC2022 are used for 100G/lane today • Extension to 200G/lane demonstrated at Evaluation Board ECOC2022 Arbitrary Semtech Coherent Waveform • Monolithically integrated O-band DFB laser and an 200G EML 200 Gb/s Generator driver EML electro-absorption modulator • Supporting 112 GBd PAM4 modulation • Optical power 7 dBm, ER 5 dB, low noise 147 dB/Hz Optical Eye • Compatible with cost-effective non-hermetic packaging • Integrated on-chip RF termination for improved signal integrity 200G PAM4 100G NRZ 56 Copyright 2023, Coherent. All rights reserved.

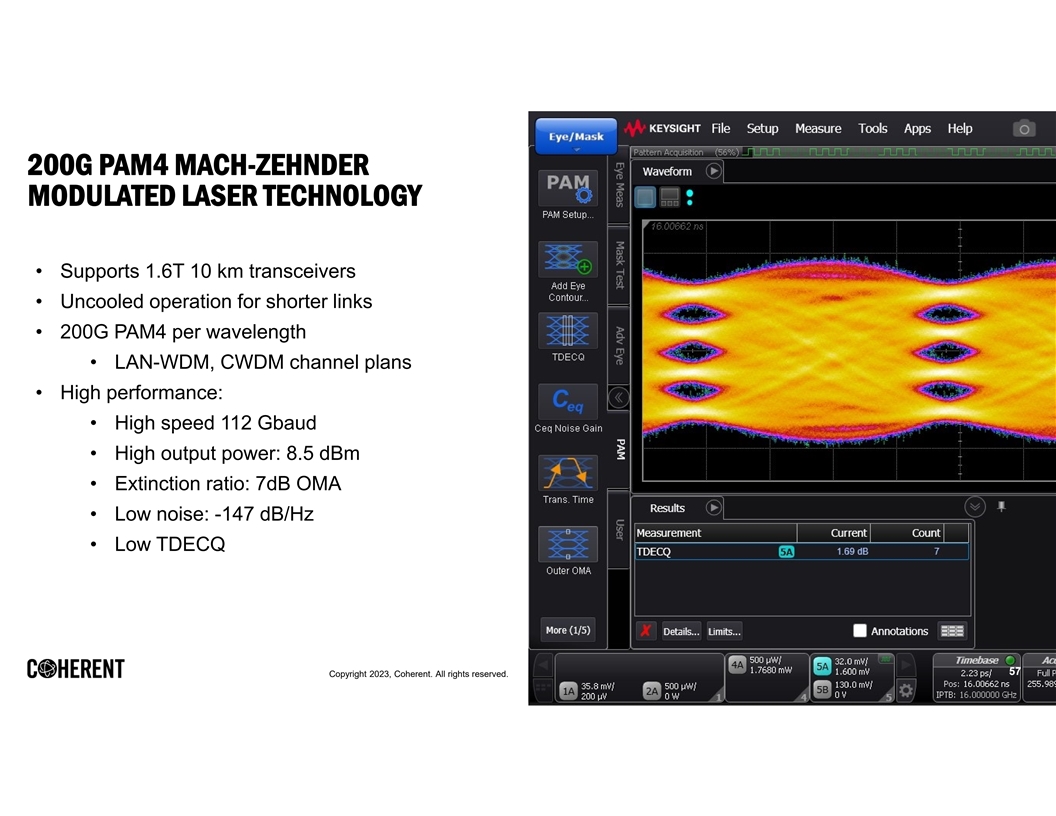

200G PAM4 MACH-ZEHNDER MODULATED LASER TECHNOLOGY • Supports 1.6T 10 km transceivers • Uncooled operation for shorter links • 200G PAM4 per wavelength • LAN-WDM, CWDM channel plans • High performance: • High speed 112 Gbaud • High output power: 8.5 dBm • Extinction ratio: 7dB OMA • Low noise: -147 dB/Hz • Low TDECQ 57 Copyright 2023, Coherent. All rights reserved.

FEB. 2022: THE INDUSTRY’S FIRST 400G ZR+ IN QSFP-DD FORM FACTOR Network engineer at Windstream Wholesale network lab holds a pluggable 400G ZR+ transceiver from Coherent Photo courtesy of Windstream Wholesale 58 Copyright 2023, Coherent. All rights reserved.

COHERENT TRANSCEIVER TECHNOLOGY FOR ACCESS NETWORKS 100ZR QSFP-28 DCO Purpose-built power- Steelerton™ DSP optimized tunable laser purpose-built for small size and low power consumption Highly integrated silicon photonics PIC 59 Copyright 2023, Coherent. All rights reserved.

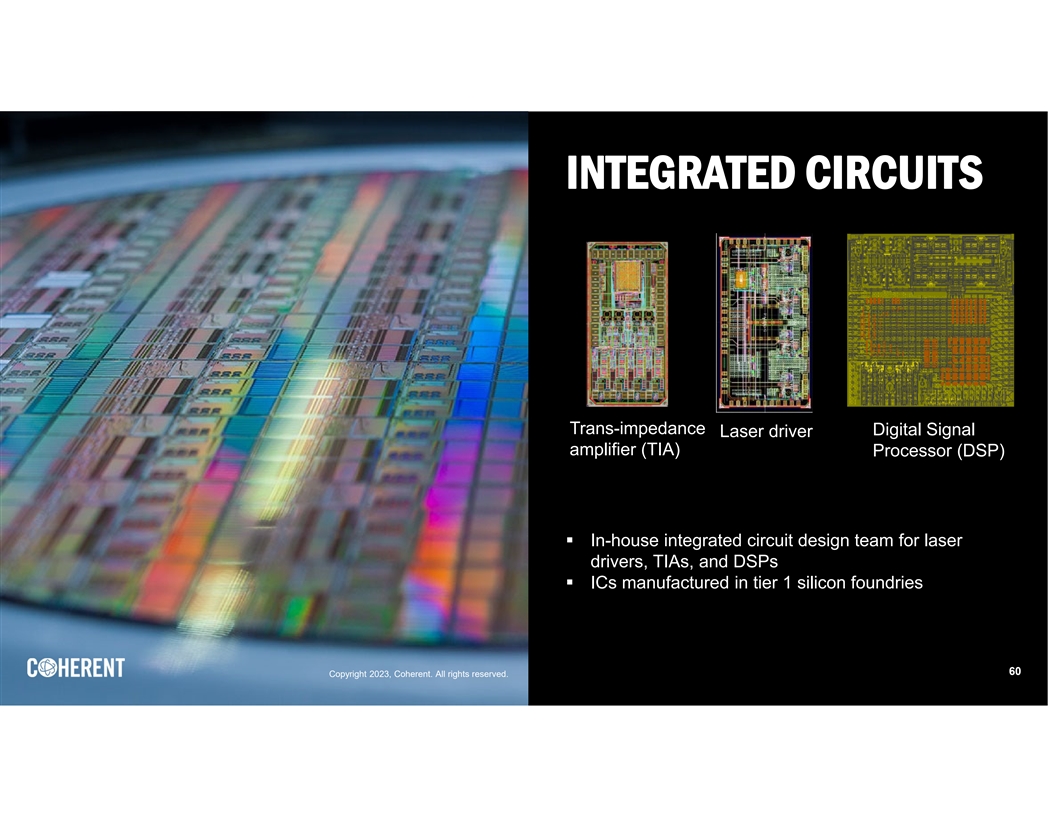

INTEGRATED CIRCUITS Trans-impedance Digital Signal Laser driver amplifier (TIA) Processor (DSP) § In-house integrated circuit design team for laser drivers, TIAs, and DSPs § ICs manufactured in tier 1 silicon foundries 60 Copy Copyright right 2023, 2023, Coherent Coherent.. All All right rights s reserved. reserved.

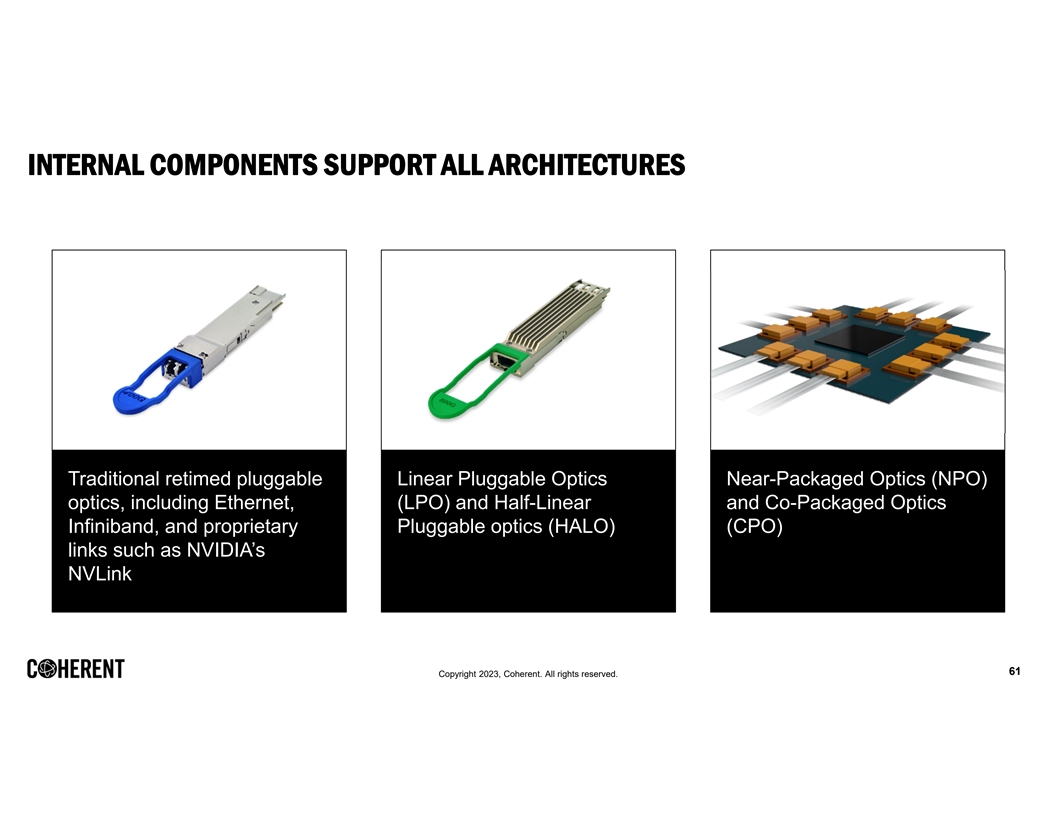

INTERNAL COMPONENTS SUPPORT ALL ARCHITECTURES Traditional retimed pluggable Linear Pluggable Optics Near-Packaged Optics (NPO) optics, including Ethernet, (LPO) and Half-Linear and Co-Packaged Optics Infiniband, and proprietary Pluggable optics (HALO) (CPO) links such as NVIDIA’s NVLink 61 Copyright 2023, Coherent. All rights reserved.

#1 IN TRANSCEIVERS FOR TWO DECADES Deep expertise in internal components including • Gallium Arsenide and Indium Phosphide semiconductor lasers • Silicon Photonics •IC’s • Passive Optical Components 62 Copy Copyright right 2023, 2023, Coherent Coherent.. All All right rights s reserved. reserved.

TRANSFORMATIONS IN THE OPTICAL NETWORK Protocol agnostic 100G 800G • Ethernet Per Lane Transceiver • Infiniband • NVLink 200G 1.6T Per Lane Transceiver 63 Copyright 2023, Coherent. All rights reserved.

A LEADER AND INNOVATOR IN TRANSCEIVERS HELPING TO BRING FORTH THE POWER OF AI AND ML 64 Copyright 2023, Coherent. All rights reserved.

Q&A Dr. Julie Sheridan Eng Dr. Lee Xu Dr. Beck Mason Paul Silverstein Dr. Sanjai Chief Technology Officer Executive Vice President, Executive Vice President, Vice President, Parthasarathi Telecommunications Datacom Transceivers Investor Relations & Chief Marketing Officer Corporate Communications Copyright 2023, Coherent. All rights reserved.