UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-14930

HSBC Holdings plc

8 Canada Square, London E14 5HQ, England

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F).

Form 20-F ☒ Form 40-F ☐

This Report on Form 6-K is hereby incorporated by reference in the following HSBC Holdings plc registration statement: file number 333-253632 HSBC Holdings plc (the “Registrant”) hereby incorporates by reference the following exhibits to this report on Form 6-K into its registration statement: file number 333-253632.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| HSBC Holdings plc | ||||||

| Date: September 14, 2023 | ||||||

| By: | /s/ Georges Elhedery |

|||||

| Name: | Georges Elhedery | |||||

| Title: | Group Chief Financial Officer | |||||

[Signature Page to Form 6-K]

Exhibit 4.1

HSBC HOLDINGS PLC,

as Issuer

THE BANK OF NEW YORK MELLON, LONDON BRANCH,

as Trustee

HSBC BANK USA, NATIONAL ASSOCIATION,

as Paying Agent, Registrar and Calculation Agent

THIRTIETH SUPPLEMENTAL INDENTURE

Dated as of September 14, 2023

To the Senior Indenture, dated as of August 26, 2009,

among the Issuer, the Trustee and the Paying Agent, Registrar and Exchange Rate Agent

£1,000,000,000 6.800% Fixed Rate/Floating Rate Senior Unsecured Notes due 2031

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 DEFINITIONS |

3 | |||||

| SECTION 1.01. |

Definition of Terms | 3 | ||||

| SECTION 1.02. |

Supplemental Definitions | 4 | ||||

| ARTICLE 2 THE NOTES |

8 | |||||

| SECTION 2.01. |

Terms Relating to Principal and Interest on the Notes | 8 | ||||

| SECTION 2.02. |

General Terms Applicable to the Notes | 8 | ||||

| SECTION 2.03. |

Make-Whole Redemption | 10 | ||||

| SECTION 2.04. |

Redemption Upon Loss Absorption Disqualification Event | 10 | ||||

| ARTICLE 3 INTEREST CALCULATION IN RESPECT OF THE NOTES |

11 | |||||

| SECTION 3.01. |

Interest Rate Periods on the Notes | 11 | ||||

| SECTION 3.02. |

Interest Rate on the Notes | 11 | ||||

| SECTION 3.03. |

Calculation of Compounded Daily SONIA and Fallback | 13 | ||||

| ARTICLE 4 AMENDMENTS TO THE BASE INDENTURE APPLICABLE TO THE NOTES ONLY |

18 | |||||

| SECTION 4.01. |

Definitions | 18 | ||||

| SECTION 4.02. |

Notice of Redemption | 18 | ||||

| SECTION 4.03. |

Optional Redemption of Debt Securities | 19 | ||||

| SECTION 4.04. |

Events of Default and Defaults | 20 | ||||

| SECTION 4.05. |

Additional Amounts | 21 | ||||

| SECTION 4.05. |

Execution, Authentication, Delivery and Dating | 22 | ||||

| ARTICLE 5 MISCELLANEOUS |

23 | |||||

| SECTION 5.01. |

Effect of this Supplemental Indenture; Ratification and Integral Part | 23 | ||||

| SECTION 5.02. |

Priority | 23 | ||||

| SECTION 5.03. |

Successors and Assigns | 24 | ||||

| SECTION 5.04. |

Subsequent Holders’ Agreement | 24 | ||||

| SECTION 5.05. |

Compliance | 24 | ||||

| SECTION 5.06. |

Relation to Calculation Agent Agreement | 24 | ||||

| SECTION 5.07. |

Governing Law | 24 | ||||

| SECTION 5.08. |

Counterparts | 24 | ||||

| SECTION 5.09. |

Entire Agreement | 24 | ||||

| EXHIBIT A – Form of 6.800% Fixed Rate/Floating Rate Global Security |

|

|||||

THIRTIETH SUPPLEMENTAL INDENTURE, dated as of September 14, 2023 (this “Supplemental Indenture”), by and among HSBC Holdings plc, a public limited company duly organized and existing under the laws of England and Wales (the “Company”), having its principal office at 8 Canada Square, London E14 5HQ, England, The Bank of New York Mellon, London Branch, a New York banking corporation, as trustee (the “Trustee”), having its principal corporate trust office at 160 Queen Victoria Street, London, EC4V 4LA, United Kingdom and HSBC Bank USA, National Association, as Paying Agent, Registrar and Calculation Agent (together, the “Agent”), having its principal office at 452 Fifth Avenue, New York, New York 10018.

W I T N E S S E T H:

WHEREAS, the Company, the Trustee and the Agent have executed and delivered an indenture dated as of August 26, 2009 (as amended and supplemented from time to time, the “Base Indenture” and, together with this Supplemental Indenture, the “Indenture”), to provide for the issuance of the Company’s Debt Securities;

WHEREAS, Section 9.01(5) of the Base Indenture provides that the Company and the Trustee may enter into a supplemental indenture to establish the forms or terms of the Debt Securities of any series without the consent of the Holders as permitted under Sections 2.01 and 3.01 of the Base Indenture;

WHEREAS, the Company desires to issue a series of Debt Securities under the Base Indenture (as supplemented and amended by this Supplemental Indenture), the £1,000,000,000 6.800% Fixed Rate/Floating Rate Senior Unsecured Notes due 2031 (such series of Debt Securities, the “Notes”), such series to be issued pursuant to this Supplemental Indenture;

WHEREAS, all conditions and requirements necessary to make this Supplemental Indenture a valid and binding instrument in accordance with the terms of the Base Indenture have been performed and fulfilled and the execution and delivery hereof have been in all respects duly authorized;

NOW, THEREFORE, each party agrees as follows for the benefit of the other parties and the equal and ratable benefit of the Holders.

ARTICLE 1

DEFINITIONS

SECTION 1.01. Definition of Terms. For all purposes of this Supplemental Indenture:

(a) capitalized terms used herein but not otherwise defined shall have the meanings assigned to them in the Base Indenture;

(b) all other terms used herein that are defined in the Trust Indenture Act, either directly or by reference therein, have the meanings assigned to them therein;

(c) the singular includes the plural and vice versa;

(d) the use of “or” is not intended to be exclusive unless expressly indicated otherwise;

(e) the section headings herein are for convenience only and shall not affect the construction of this Supplemental Indenture; (f) wherever the words “include,” “includes” or “including” are used in this Supplemental Indenture, they shall be deemed to be followed by the words “without limitation”;

3

(g) the words “herein,” “hereof” and “hereunder” and other words of similar import refer to this Indenture as a whole and not to any particular Article, Section or other subdivision; and

(h) references herein to a specific Section, Article or Exhibit refer to Sections or Articles of, or an Exhibit to, this Supplemental Indenture, unless otherwise specified.

SECTION 1.02. Supplemental Definitions. The following definitions shall apply to the Notes only:

(a) “Administrator/Benchmark Event” has the meaning set forth in Section 3.03(a);

(b) “Administrator/Benchmark Event Date” has the meaning set forth in Section 3.03(a);

(c) “Agent” has the meaning set forth in the introduction to this Supplemental Indenture;

(d) “Applicable Currency” means Pounds Sterling;

(e) “Applicable Fallback Effective Date” has the meaning set forth in Section 3.03(a);

(f) “Banking Act” means the UK Banking Act 2009, as amended;

(g) “Business Day” means a day on which commercial banks and foreign exchange markets settle payments and are open for general business (including dealings in foreign exchange and foreign currency deposits) in London, England, and in the City of New York, United States;

(h) “Calculation Agent” means HSBC Bank USA, National Association, or its successor appointed by the Company pursuant to the Calculation Agent Agreement;

(i) “Calculation Agent Agreement” means the calculation agent agreement dated as of the Issue Date between the Company and the Calculation Agent;

(j) “Clearing Systems” means Clearstream Luxembourg and Euroclear;

(k) “Clearstream Luxembourg” means Clearstream Banking S.A. in Luxembourg;

(l) “Common Depositary” means HSBC Bank plc, or any successor in such capacity, as common depositary for the Clearing Systems;

(m) “Company” has the meaning set forth in the introduction to this Supplemental Indenture;

(n) “Compounded Daily SONIA” has the meaning set forth in Section 3.03(a); (o) “d” has the meaning set forth in Section 3.03(a);

4

(p) “d0” has the meaning set forth in Section 3.03(a);

(q) “Determination Agent” means an investment bank or financial institution of international standing selected by the Company (which may be the Calculation Agent or an Affiliate of the Company);

(r) “Euroclear” means Euroclear Bank SA/NV;

(s) “EUWA” means the European Union (Withdrawal) Act 2018, as amended;

(t) “Fallback Conforming Changes” has the meaning set forth in Section 3.04(a);

(u) “Final Fallback Rate” has the meaning set forth in Section 3.03(a);

(v) “Fixed Rate Period” means the period from (and including) the Issue Date to (but excluding) September 14, 2030;

(w) “Fixed Rate Period Interest Payment Date” means, during the Fixed Rate Period, September 14 of each year, beginning on September 14, 2024;

(x) “Floating Rate Interest Period” means, during the Floating Rate Period, the period beginning on (and including) a Floating Rate Period Interest Payment Date and ending on (but excluding) the next succeeding Floating Rate Period Interest Payment Date; provided that the first Floating Rate Interest Period shall begin on (and include) September 14, 2030 and shall end on (but exclude) the first Floating Rate Period Interest Payment Date;

(y) “Floating Rate Period” means the period from (and including) September 14, 2030 to (but excluding) the Maturity Date;

(z) “Floating Rate Period Interest Payment Date” means December 14, 2030, March 14, 2031, June 14, 2031 and September 14, 2031;

(aa) “Gross Redemption Yield” means, with respect to a security, the gross redemption yield on such security, expressed as a percentage and calculated by the Determination Agent on the basis set out by the United Kingdom Debt Management Office in the paper “Formulae for Calculating Gilt Prices from Yields”, page 5, Section One: Price/Yield Formulae “Conventional Gilts; Double-dated and Undated Gilts with Assumed (or Actual) Redemption on a Quasi-Coupon Date” (published on 8 June 1998 and updated on 15 January 2002 and 16 March 2005, and as further amended, updated, supplemented or replaced from time to time) on a semi-annual compounding basis (converted to an annualized yield and rounded up (if necessary) to four decimal places) or, if such formula does not reflect generally accepted market practice at the time of redemption, a gross redemption yield calculated in accordance with generally accepted market practice at such time as determined by the Company following consultation with an investment bank or financial institution determined to be appropriate by the Company (which, for the avoidance of doubt, could be the Determination Agent, if applicable);

(bb) “HSBC Group” or “HSBC” means the Company together with its subsidiary undertakings;

(cc) “i” has the meaning set forth in Section 3.03(a);

5

(dd) “Index Cessation Event” has the meaning set forth in Section 3.03(a);

(ee) “Index Cessation Effective Date” has the meaning set forth in Section 3.03(a);

(ff) “Initial Interest Rate” means 6.800% per annum;

(gg) “Interest Determination Date” means the fifth SONIA Business Day preceding the applicable Interest Payment Date;

(hh) “Interest Payment Date” means any of the Fixed Rate Period Interest Payment Dates or the Floating Rate Period Interest Payment Dates, as applicable;

(ii) “Issue Date” means September 14, 2023;

(jj) “Loss Absorption Disqualification Event” has the meaning set forth in Section 2.04(b);

(kk) “Loss Absorption Disqualification Event Redemption Option” has the meaning set forth in Section 2.04(a);

(ll) “Loss Absorption Regulations” means, at any time, the laws, regulations, requirements, guidelines, rules, standards and policies from time to time relating to minimum requirements for own funds and eligible liabilities and/or loss absorbing capacity instruments in effect in the UK and applicable to the Company from time to time, including, without limitation to the generality of the foregoing, the Banking Act and UK CRR (whether or not such requirements, guidelines or policies are applied generally or specifically to the Company or to the Company and any of its holding or subsidiary companies or any subsidiary of any such holding company) in each case as amended, supplemented or replaced from time to time;

(mm) “Make-Whole Redemption” has the meaning set forth in Section 2.03;

(nn) “Make-Whole Redemption Period” means the period beginning on (and including) March 14, 2024 (six months following the Issue Date) to (but excluding) the Par Redemption Date; provided that if any additional notes of the same series as the Notes are issued after the Issue Date, the Make-Whole Redemption Period for such additional notes shall begin on (and include) the date that is six months following the issue date for such additional notes;

(oo) “Margin” means 2.124% per annum;

(pp) “Maturity Date” means September 14, 2031;

(qq) “ni” has the meaning set forth in Section 3.03(a);

(rr) “Notes” has the meaning set forth in the recitals to this Supplemental Indenture;

(ss) “Observation Period” has the meaning set forth in Section 3.03(a);

(tt) “Par Redemption Date” means September 14, 2030;

(uu) “PRA” means the UK Prudential Regulation Authority or any successor entity; (vv) “Quotation Time” means 11:00 a.m. (London time);

6

(ww) “Recommended Rate” has the meaning set forth in Section 3.03(a);

(xx) “Reference Bond” means the selected government security or securities agreed between the Company and an investment bank or financial institution determined by the Company to be appropriate (which, for the avoidance of doubt, could be the Determination Agent, if applicable) as having an actual or interpolated maturity comparable with the remaining term to the Par Redemption Date, that would be used, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities denominated in the Applicable Currency and of a comparable maturity to the remaining term to the Par Redemption Date;

(yy) “Reference Date” means the date which is two Business Days prior to the giving of a notice of redemption by the Company;

(zz) “Relevant Regulator” means the PRA or any successor entity or other entity primarily responsible for the prudential supervision of the Company;

(aaa) “Relevant Screen Page” has the meaning set forth in Section 3.03(a);

(bbb) “Relevant Supervisory Consent” means, in relation to any redemption or purchase of the Notes, any required permission of the Relevant Regulator applicable to the Company or the Relevant UK Resolution Authority (as applicable). For the avoidance of doubt, Relevant Supervisory Consent will not be required if either (i) none of the Notes qualify as part of the Company’s regulatory capital, or own funds and eligible liabilities or loss absorbing capacity instruments, as the case may be, each pursuant to the Loss Absorption Regulations, (ii) the relevant Notes are repurchased for market-making purposes in accordance with any permission given by the Relevant Regulator pursuant to the Loss Absorption Regulations within the limits prescribed in such permission or (iii) the relevant Notes are being redeemed or repurchased pursuant to any general prior permission granted by the Relevant Regulator or the Relevant UK Resolution Authority (as applicable) pursuant to the Loss Absorption Regulations within the limits prescribed in such permission;

(ccc) “Relevant UK Resolution Authority” means any authority with the ability to exercise a UK Bail-in Power;

(ddd) “SONIA” has the meaning set forth in Section 3.03(a);

(eee) “SONIAi” has the meaning set forth in Section 3.03(a);

(fff) “SONIA Business Day” has the meaning set forth in Section 3.03(a);

(ggg) “Trustee” has the meaning set forth in the introduction to this Supplemental Indenture;

7

(hhh) “UK Bail-in Legislation” means Part I of the Banking Act and any other law or regulation applicable in the UK relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (otherwise than through liquidation, administration or other insolvency proceedings); (iii) “UK Bail-in Power” means the powers under the UK Bail-in Legislation to cancel, transfer or dilute shares issued by a person that is a bank or investment firm or affiliate of a bank or investment firm, to cancel, write-down, transfer, reduce, modify or change the form of a liability of such a person or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability; and

(jjj) “UK CRR” means Regulation (EU) No. 575/2013 on prudential requirements for credit institutions and investment firms of the European Parliament and of the Council of 26 June 2013, as amended or supplemented, as it forms part of domestic law in the UK by virtue of the EUWA.

ARTICLE 2

THE NOTES

SECTION 2.01. Terms Relating to Principal and Interest on the Notes.

The following terms relating to principal and interest on the Notes are hereby established:

(a) the title of the Notes shall be “6.800% Fixed Rate/Floating Rate Senior Unsecured Notes due 2031”;

(b) the aggregate principal amount of the Notes that may be authenticated and delivered under the Indenture shall not initially exceed £1,000,000,000 (except as otherwise provided in the Indenture);

(c) the principal on the Notes shall be payable on the Maturity Date; and

(d) during the Fixed Rate Period, interest on the Notes shall be payable at the Initial Interest Rate and annually in arrear on each Fixed Rate Period Interest Payment Date. During the Floating Rate Period, interest on the Notes shall be payable at a rate per annum determined in accordance with Article Three and quarterly in arrear on each Floating Rate Period Interest Payment Date. Accrual and computation of interest on the Notes shall be determined in accordance with Article Three.

SECTION 2.02. General Terms Applicable to the Notes

The following terms relating to the Notes are hereby established:

(a) the Notes shall be issued on the Issue Date;

(b) principal of, and any interest on, the Notes shall be paid to the Holder through the Agent in its capacity as Paying Agent, having offices in New York City, New York;

(c) the Notes shall not be redeemable except as provided in Sections 2.03, 2.04, or Article Eleven of the Base Indenture, as amended by Sections 4.02 and 4.03. The Notes shall not be redeemable at the option of the Holders at any time. Notwithstanding anything to the contrary in the Indenture or the Notes, including Section 11.01 of the Base Indenture, the Company may only redeem or repurchase the Notes prior to the Maturity Date pursuant to Sections 2.03, 2.04 or Article Eleven of the Base Indenture, as amended by Sections 4.02 and 4.03, if the Company has obtained any Relevant Supervisory Consent;

8

(d) the Notes are not issued as Discount Debt Securities or as Indexed Securities and payment obligations under the Notes are not subject to a solvency condition that the Company is able to make such payment and remain able to pay its debts as they fall due and that its assets continue to exceed its liabilities (other than subordinated liabilities);

(e) the Company shall have no obligation to redeem or purchase the Notes pursuant to any sinking fund or analogous provision;

(f) the Notes shall be issued only in denominations of £100,000 and integral multiples of £1,000 in excess thereof;

(g) the Notes shall be denominated in the Applicable Currency;

(h) the payment of principal of, and interest on, the Notes shall be payable only in the coin or currency in which the Notes are denominated which, pursuant to clause (g) above, shall be in the Applicable Currency;

(i) the Notes shall not be converted into or exchanged at the option of the Company or otherwise for stock or other securities of the Company pursuant to Article Twelve of the Base Indenture;

(j) the Notes shall be issued in the form of one or more global securities in registered form, without coupons attached, and the initial Holder with respect to each such global security shall be HSBC Issuer Services Common Depository Nominee (UK) Limited, a nominee of the Common Depositary. Any proposed transfer of an interest in Notes held in the form of a global security deposited with the Common Depositary shall be effected in the ordinary way following the applicable rules and operating procedures of Clearstream Luxembourg and/or Euroclear;

(k) except in limited circumstances, the Notes will not be issued in definitive form;

(l) the Notes shall be evidenced by one or more global securities in registered form substantially in the form of Exhibit A;

(m) to the fullest extent permitted by law, the Holders and the Trustee, in respect of any claims of such Holders to payment of any principal, premium or interest in respect of the Notes, by their acceptance of the Notes, shall be deemed to have waived any right of set-off or counterclaim that such Holders or, as the case may be, the Trustee in such respect, might otherwise have;

(n) members of the HSBC Group other than the Company may purchase or otherwise acquire any of the Notes then Outstanding at the same or differing prices in the open market, negotiated transactions or otherwise without giving prior notice to or obtaining any consent from Holders, in accordance with the Loss Absorption Regulations and, if required, subject to obtaining any Relevant Supervisory Consent; and

(o) the Regular Record Dates for the Notes will be the 15th calendar day preceding each Interest Payment Date, whether or not a Business Day.

9

SECTION 2.03. Make-Whole Redemption.

(a) Subject to the provisions of Article Eleven of the Base Indenture (as amended by Sections 4.02 and 4.03), the Company may, in its sole discretion, redeem the Notes during the Make-Whole Redemption Period, in whole at any time during such period or in part from time to time during such period, at a Redemption Price equal to the greater of: (i) 100% of the principal amount of the Notes to be redeemed; and (ii) as determined by the Determination Agent, the principal amount of the Notes to be redeemed multiplied by the price (expressed as a percentage), as reported in writing to the Company and the Trustee by the Determination Agent at which the Gross Redemption Yield on such Notes on the Reference Date (assuming for this purpose that the Notes are to be redeemed at 100% of their principal amount on the Par Redemption Date) is equal to the Gross Redemption Yield (determined by reference to the middle market price) at the Quotation Time on the Reference Date of the Reference Bond, plus 35 basis points; in each case, plus any accrued and unpaid interest on the Notes to be redeemed to (but excluding) the applicable Redemption Date (each, a “Make-Whole Redemption”).

(b) If the Company determines, in its sole discretion, that the inclusion of the Make-Whole Redemption provisions in the terms of the Indenture and the Notes could reasonably be expected to prejudice the qualification of the Notes as eligible liabilities or loss absorbing capacity instruments for the purposes of the Loss Absorption Regulations, then the provisions relating to the Make-Whole Redemption shall be deemed not to apply for all purposes relating to the Notes and the Company shall not have any right to redeem the Notes pursuant to a Make-Whole Redemption. In such circumstances, the Company shall promptly provide notice to the Trustee, the Paying Agent, the Calculation Agent and the Holders that the Make-Whole Redemption does not apply; provided that failure to provide such notice will have no impact on the effectiveness of, or otherwise invalidate, any such determination. No action taken in accordance with this paragraph shall be deemed to be an amendment requiring the consent of Holders under Section 9.02 of the Base Indenture.

SECTION 2.04. Redemption Upon Loss Absorption Disqualification Event

(a) Subject to the provisions of Article Eleven of the Base Indenture (as amended by Sections 4.02 and 4.03), following the occurrence of a Loss Absorption Disqualification Event, the Company may, within 90 days of the occurrence of the relevant Loss Absorption Disqualification Event, in its sole discretion, redeem the Notes in whole, but not in part (such option to redeem being referred to herein as a “Loss Absorption Disqualification Event Redemption Option”), at a Redemption Price equal to 100% of their principal amount, plus any accrued and unpaid interest to (but excluding) the applicable Redemption Date.

(b) A “Loss Absorption Disqualification Event” shall be deemed to have occurred if the Notes become fully or partially ineligible to meet the Company’s and/or the HSBC Group’s minimum requirements for (A) eligible liabilities and/or (B) loss absorbing capacity instruments, in each case as determined in accordance with and pursuant to the relevant Loss Absorption Regulations applicable to the Company and/or the HSBC Group, as a result of any (i) Loss Absorption Regulation becoming effective after the Issue Date; or (ii) amendment to, or change in, any Loss Absorption Regulation, or any change in the application or official interpretation of any Loss Absorption Regulation, in any such case becoming effective on or after the Issue Date; provided, however, that a Loss Absorption Disqualification Event shall not occur where the exclusion of the Notes from the relevant minimum requirement(s) is due to the remaining maturity of the Notes being less than any period prescribed by any applicable eligibility criteria for such minimum requirement(s) under the relevant Loss Absorption Regulations effective with respect to the Company and/or the HSBC Group on the Issue Date.

10

(c) If the Company determines, in its sole discretion, that the inclusion of the Loss Absorption Disqualification Event Redemption Option provisions in the terms of the Indenture and the Notes could reasonably be expected to cause a Loss Absorption Disqualification Event to occur, then the provisions relating to the Loss Absorption Disqualification Event Redemption Option shall be deemed not to apply for all purposes relating to the Notes and the Company shall not have any right to redeem the Notes pursuant to a Loss Absorption Disqualification Event Redemption Option. In such circumstances, the Company shall promptly provide notice to the Trustee, the Paying Agent, the Calculation Agent and the Holders that the Loss Absorption Disqualification Event Redemption Option does not apply; provided that failure to provide such notice will have no impact on the effectiveness of, or otherwise invalidate, any such determination. No action taken in accordance with this paragraph shall be deemed to be an amendment requiring the consent of Holders under Section 9.02 of the Base Indenture.

ARTICLE 3

INTEREST CALCULATION IN RESPECT OF THE NOTES

SECTION 3.01. Interest Rate Periods on the Notes.

(a) From (and including) the Issue Date to (but excluding) September 14, 2030 (the “Fixed Rate Period”), interest on the Notes will be payable at a rate of 6.800% per annum (the “Initial Interest Rate”). During the Fixed Rate Period, interest on the Notes will be payable annually in arrear on each Fixed Rate Period Interest Payment Date.

(b) From (and including) September 14, 2030 to (but excluding) the Maturity Date (the “Floating Rate Period”), the interest rate on the Notes will be equal to Compounded Daily SONIA plus 2.124% per annum (the “Margin”). During the Floating Rate Period, interest on the Notes will be payable quarterly in arrear on each Floating Rate Period Interest Payment Date. The interest rate on the Notes will be calculated quarterly on each Interest Determination Date.

SECTION 3.02. Interest Rate on the Notes.

(a) Fixed Rate Period

(i) Where it is necessary to compute an amount of interest in respect of any Note for a period which is less than a complete interest period, the relevant day count fraction shall be determined on the basis of the number of days in the relevant period, from and including the date from which interest begins to accrue to, but excluding, the date on which it falls due, divided by the actual number of days in the interest period in which the relevant period falls (including the first such day but excluding the last).

(ii) If any scheduled Fixed Rate Period Interest Payment Date is not a Business Day, such Fixed Rate Period Interest Payment Date will be postponed to the next day that is a Business Day, but interest on that payment will not accrue during the period from and after the scheduled Fixed Rate Period Interest Payment Date.

(b) Floating Rate Period

11

(i) Notwithstanding Section 3.10 of the Base Indenture, interest on the Notes during the Floating Rate Period will be calculated on the basis of the actual number of days in the calculation period divided by 365 (or, if any portion of that calculation period falls in a leap year, the sum of (a) the actual number of days in that portion of the calculation period falling in a leap year, divided by 366 and (b) the actual number of days in that portion of the calculation period falling in a non-leap year, divided by 365).

(ii) Notwithstanding Section 1.13 of the Base Indenture, if any scheduled Floating Rate Period Interest Payment Date is not a Business Day, such Floating Rate Period Interest Payment Date will be postponed to the next day that is a Business Day; provided that if that Business Day falls in the next succeeding calendar month, such Floating Rate Period Interest Payment Date will be the immediately preceding Business Day. If any such Floating Rate Period Interest Payment Date is postponed or brought forward as described above, the payment of interest due on such postponed or brought forward Floating Rate Period Interest Payment Date will include interest accrued to but excluding such postponed or brought forward Floating Rate Period Interest Payment Date.

(iii) If the date of redemption or repayment of the Notes is not a Business Day, the Company may pay interest and principal on the next succeeding Business Day, but interest on that payment will not accrue during the period from and after the date of redemption or repayment of the Notes.

(iv) If a date of redemption or repayment of the Notes falls within the Floating Rate Period but does not occur on a Floating Rate Period Interest Payment Date, (A) the related Interest Determination Date shall be deemed to be the date that is five SONIA Business Days prior to such date of redemption or repayment, (B) the related Observation Period shall be deemed to end on (but exclude) the date falling five SONIA Business Days prior to such date of redemption or repayment, (C) the Floating Rate Interest Period will be deemed to be shortened accordingly and (D) corresponding adjustments will be deemed to be made to the Compounded Daily SONIA formula.

(c) General Provisions Relating to the Calculation of Interest on the Notes

(i) All determinations and any calculations made by the Company or the Calculation Agent for the purposes of calculating the applicable interest on the Notes will be conclusive and binding on the Holders, the Company, the Trustee and the Paying Agent, absent manifest error. If made by the Company, such determinations, decisions, elections and calculations will be made in consultation with the Calculation Agent, to the extent practicable. Notwithstanding anything to the contrary in the Indenture or the Notes, any determinations or calculations made in accordance with the terms of the Notes will become effective without consent from the Holders or any other party.

(ii) All percentages resulting from any calculation in connection with any interest rate on the Notes shall be rounded, if necessary, to the nearest one hundred thousandth of a percentage point, with five one-millionths of a percentage point rounded upward (for example, 9.876545% (or 0.09876545) would be rounded to 9.87655% (or 0.0987655)), and all Applicable Currency amounts would be rounded to the nearest pence, with one-half pence being rounded upward.

12

(iii) The interest rate on the Notes during the applicable Floating Rate Interest Period will in no event be higher than the maximum rate permitted by law or lower than 0% per annum.

SECTION 3.03. Calculation of Compounded Daily SONIA and Fallbacks.

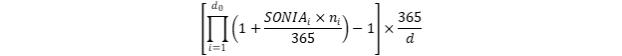

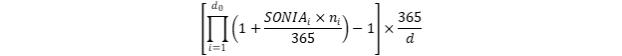

(a) “Compounded Daily SONIA” means, in relation to a Floating Rate Interest Period, the rate of return of a daily compound interest investment (with SONIA as reference rate for the calculation of interest) during the related Observation Period and will be calculated by the Calculation Agent on the related Interest Determination Date as follows:

Where:

“d” means, in relation to any Observation Period, the number of calendar days in such Observation Period;

“d0” means, in relation to any Observation Period, the number of SONIA Business Days in such Observation Period;

“i” means, in relation to any Observation Period, a series of whole numbers from one to d0, each representing the relevant SONIA Business Day in chronological order from (and including) the first SONIA Business Day in such Observation Period;

“ni” means, in relation to any SONIA Business Day “i” in the relevant Observation Period, the number of calendar days from (and including) such SONIA Business Day “i” up to (but excluding) the next following SONIA Business Day;

“Observation Period” means, in respect of each Floating Rate Interest Period, the period from (and including) the date which is the Interest Determination Date for the immediately preceding Interest Payment Date to (but excluding) the date which is the Interest Determination Date for such Floating Rate Interest Period (or the date falling five SONIA Business Days prior to such earlier date, if any, on which the Notes become due and payable); provided that the first Observation Period shall commence on (and include) the date that is five SONIA Business Days prior to the Par Redemption Date; (iii) if, in respect of any SONIA Business Day “i”, the rate specified in (i) above is not available on the Relevant Screen Page or has not otherwise been published by the relevant authorized distributors and the Company (in consultation, to the extent practicable, with the Calculation Agent) determines either that (A) both an Index Cessation Event and Index Cessation Effective Date have occurred or (B) both an Administrator/Benchmark Event and Administrator/Benchmark Event Date have occurred, in each case, in respect of SONIA, then:

“SONIA” means, in relation to any SONIA Business Day, the rate determined by the Calculation Agent in accordance with the following provisions:

(i) the daily Sterling Overnight Index Average (“SONIA”) rate for trades made on such SONIA Business Day as provided by the administrator of SONIA (or any successor administrator) to authorized distributors and as then published on the Relevant Screen Page (or, if the Relevant Screen Page is unavailable, as otherwise published by such authorized distributors) on the SONIA Business Day immediately following such SONIA Business Day;

13

(ii) if, in respect of any SONIA Business Day “i”, the rate specified in (i) above is not available on the Relevant Screen Page or has not otherwise been published by the relevant authorized distributors in respect of such SONIA Business Day “i” and neither (A) an Index Cessation Event and an Index Cessation Effective Date nor (B) an Administrator/Benchmark Event and an Administrator/Benchmark Event Date, in each case with respect to SONIA, have occurred, SONIAi in respect of such SONIA Business Day “i”, shall be the SONIA rate in respect of the last SONIA Business Day prior to such SONIA Business Day “i” for which SONIA was available on the Relevant Screen Page or was otherwise so published; or

(A) SONIAi in respect of each SONIA Business Day “i” falling on or after the Applicable Fallback Effective Date shall be calculated as if references to “SONIA” in the foregoing provisions were to the Recommended Rate;

(B) if there is a Recommended Rate before the end of the first SONIA Business Day following the Applicable Fallback Effective Date, but neither the administrator of the Recommended Rate nor authorized distributors provide or publish the Recommended Rate in respect of any SONIA Business Day “i” for which the Recommended Rate is required, then, subject to paragraph (C) below, in respect of any SONIA Business Day “i” for which the Recommended Rate is required, references to the Recommended Rate will be deemed to be references to the last provided or published Recommended Rate prior to such SONIA Business Day “i”. If there is no last provided or published Recommended Rate, then in respect of any SONIA Business Day “i” for which the Recommended Rate is required, references to the Recommended Rate will be deemed to be references to the last provided or published SONIA rate (without taking into account any deemed changes to the term “SONIA” pursuant to provision (iii)(A) above prior to such SONIA Business Day “i”); and

(C) if:

1) there is no Recommended Rate before the end of the first SONIA Business Day following the Applicable Fallback Effective Date referred to in (A) and (B) above; or

2) there is a Recommended Rate and the Company (in consultation, to the extent practicable, with the Calculation Agent) determines either that (A) both an Index Cessation Event and Index Cessation Effective Date have occurred or (B) both an Administrator/Benchmark Event and Administrator/Benchmark Event Date have occurred, in each case with respect to the Recommended Rate, “Administrator/Benchmark Event” means that it has or will prior to the next Interest Determination Date become unlawful for the Calculation Agent or the Company to calculate any payments due to be made to any Holder using SONIA or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes (including, without limitation, under Regulation (EU) 2016/1011 as it forms part of domestic law in the United Kingdom by virtue of the EUWA, if applicable);

then SONIAi in respect of each SONIA Business Day “i”, falling on or after the Applicable Fallback Effective Date shall be calculated as if references to SONIA in the foregoing provisions pertaining to the calculation of SONIA were to the Final Fallback Rate. In respect of any day for which the Final Fallback Rate is required, references to the Final Fallback Rate will be deemed to be references to the last provided or published Final Fallback Rate as at close of business in London, England on that day;

14

“SONIAi” means, in relation to any SONIA Business Day “i” in the relevant Observation Period, SONIA in respect of such SONIA Business Day;

“SONIA Business Day” means any day on which commercial banks are open for general business (including dealing in foreign exchange and foreign currency deposits) in London;

“Administrator/Benchmark Event Date” means the date from which it becomes unlawful for the Calculation Agent or the Company to calculate any payments due to be made to any Holder using SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes);

“Applicable Fallback Effective Date” means in respect of SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) and an Index Cessation Event or an Administrator/Benchmark Event, the Index Cessation Effective Date or the Administrator/Benchmark Event Date, as applicable;

“Final Fallback Rate” means, in respect of any relevant day, the official bank rate as determined by the Monetary Policy Committee of the Bank of England and published by the Bank of England from time to time, in effect on that day;

“Index Cessation Event” means, in respect of SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes), the occurrence of one or more of the following events:

(i) a public statement or publication of information by or on behalf of the administrator of SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) announcing that it has ceased or will cease to provide SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) permanently or indefinitely, provided that, at the time of the statement or publication, there is no successor administrator or provider, as applicable, that will continue to provide SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes);

15

(ii) a public statement or publication of information by the regulatory supervisor for the administrator of SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes), the central bank for the currency of SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes), an insolvency official with jurisdiction over the administrator for SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes), a resolution authority with jurisdiction over the administrator for SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) or a court or an entity with similar insolvency or resolution authority over the administrator for SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes), which states that the administrator of SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) has ceased or will cease to provide SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator or provider that will continue to provide SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes); or

(iii) a public statement or publication of information by the regulatory supervisor for the administrator of SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) announcing that the regulatory supervisor has determined that SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) is no longer, or as of a specified future date will no longer be, representative of the underlying market and economic reality that SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) is intended to measure and that representativeness will not be restored;

“Index Cessation Effective Date” means:

(i) in the case of clauses (i) or (ii) of the definition of “Index Cessation Event”, the first date on which SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) would ordinarily have been published or provided and is no longer published or provided; or

(ii) in the case of clause (iii) of the definition of “Index Cessation Event”, the latest of (i) the date of such statement or publication and (ii) the date, if any, specified in such statement or publication as the date on which SONIA (or, if applicable, any subsequent fallback rate determined in accordance with the provisions of the Notes) will no longer be representative;

“Recommended Rate” means, in respect of any relevant day, the rate (inclusive of any spreads or adjustments) recommended as the replacement for SONIA by (i) the administrator of SONIA if the administrator of SONIA is a national central bank, or (ii) if the national central bank administrator of SONIA does not make a recommendation or the administrator of SONIA is not a national central bank, a committee designated for this purpose by one or both of the FCA (or any successor thereto) and the Bank of England and as provided by the then administrator or provider of that rate, or if that rate is not provided by the then administrator or provider thereof, published by an authorized distributor, in respect of that day; and

“Relevant Screen Page” means Reuters Screen SONIA Page or such other page, section or other part as may replace it as may be nominated by the person providing or sponsoring the information appearing there for the purpose of displaying rates or prices comparable to Compounded Daily SONIA.

(b) If the rate of interest cannot be determined in accordance with the foregoing provisions, the rate of interest shall be (A) the rate determined by the Calculation Agent as at the last preceding Interest Determination Date in relation to a Floating Rate Interest Period or (B) if there is no such preceding Interest Determination Date in relation to a Floating Rate Interest Period, the Initial Interest Rate.

16

SECTION 3.04. Fallback Conforming Changes

(a) In connection with the implementation of any fallback rate determined in accordance with the provisions of the Notes, the Company (in consultation, to the extent practicable, with the Calculation Agent) will have the right to make changes to (1) any Interest Determination Date, Floating Rate Period Interest Payment Date, SONIA Business Day, business day convention or Floating Rate Interest Period, (2) the manner, timing and frequency of determining the rate and amounts of interest that are payable on the Notes during any Floating Rate Period and the conventions relating to such determination and calculations with respect to interest, (3) rounding conventions, (4) tenors and (5) any other terms or provisions of the Notes during the Floating Rate Period, in each case that the Company (in consultation, to the extent practicable, with the Calculation Agent) determines, from time to time, to be appropriate to reflect the determination and implementation of such fallback rate in a manner substantially consistent with market practice (or, if the Company (in consultation, to the extent practicable, with the Calculation Agent) decides that implementation of any portion of such market practice is not administratively feasible or determines that no market practice for use of the relevant fallback rate exists, in such other manner as the Company (in consultation, to the extent practicable, with the Calculation Agent) determines is appropriate (acting in good faith)) (the “Fallback Conforming Changes”). Any Fallback Conforming Changes will apply to the Notes for all future Floating Rate Interest Periods.

(b) Notwithstanding any other provision set forth above, no fallback rate will be adopted, nor will any Fallback Conforming Changes be made if, in the Company’s determination, the same could reasonably be expected to prejudice the qualification of the Notes as eligible liabilities or loss absorbing capacity instruments for the purposes of the Loss Absorption Regulations.

(c) The Company will promptly give notice of the determination of a fallback and any Fallback Conforming Changes to the Trustee, the Paying Agent, the Calculation Agent and the Holders; provided that failure to provide such notice will have no impact on the effectiveness of, or otherwise invalidate, any such determination.

(d) By its acquisition of the Notes, each Holder (which, for these purposes, includes each beneficial owner) (i) will acknowledge, accept, consent and agree to be bound by the Company’s determination of an Index Cessation Event, an Administrator/Benchmark Event, an Applicable Fallback Effective Date and any Fallback Conforming Changes, including as may occur without any prior notice from the Company and without the need for the Company to obtain any further consent from such Holder, (ii) will waive any and all claims, in law and/or in equity, against the Trustee, the Paying Agent and the Calculation Agent for, agree not to initiate a suit against the Trustee, the Paying Agent or the Calculation Agent in respect of, and agree that none of the Trustee, the Paying Agent or the Calculation Agent will be liable for, the determination of or the failure to determine any Index Cessation Event, any Administrator/Benchmark Event, any Applicable Fallback Effective Date and any Fallback Conforming Changes, and any losses suffered in connection therewith and (iii) will agree that none of the Trustee, the Paying Agent or the Calculation Agent will have any obligation to determine any Index Cessation Event, any Administrator/Benchmark Event, any Applicable Fallback Effective Date and any Fallback Conforming Changes (including any adjustments thereto), including in the event of any failure by the Company to determine any Index Cessation Event, any Administrator/Benchmark Event, any Applicable Fallback Effective Date and any Fallback Conforming Changes.

17

ARTICLE 4

AMENDMENTS TO THE BASE INDENTURE

APPLICABLE TO THE NOTES ONLY

SECTION 4.01. Definitions

(a) Any reference to “Depositary” in the Base Indenture and any amendment thereto shall be deemed to refer to the Clearing Systems.

(b) Any reference to “DTC” in the Base Indenture and any amendment thereto shall be deemed to refer to the Clearing Systems.

SECTION 4.02. Notice of Redemption

(a) With respect to the Notes only, Article Eleven of the Base Indenture is amended by amending and restating Section 11.04 in its entirety, which shall read as follows:

Section 11.04. Notice of Redemption. Notice of redemption shall be given in the manner provided in Section 1.06 not less than 10 nor more than 60 days prior to the Redemption Date, to each Holder of Debt Securities to be redeemed.

All notices of redemption shall state:

(a) the Redemption Date;

(b) the Redemption Price, or the manner in which the Redemption Price is to be determined;

(c) if less than all Outstanding Debt Securities of any series are to be redeemed, the identification and the principal amount (or, in the case of Principal Indexed Securities, face amount) of the particular Debt Securities to be redeemed;

(d) that on the Redemption Date the Redemption Price will become due and payable in respect of each such Debt Security to be redeemed, and that any interest thereon shall cease to accrue on and after said date;

(e) the Place or Places of Payment where such Debt Securities, together in the case of Bearer Securities with all Coupons, if any, appertaining thereto maturing after the Redemption Date, are to be surrendered for payment of the Redemption Price; and

(f) the CUSIP number or numbers, the Common Code, or the ISIN, if any, with respect to such Debt Securities.

18

A notice of redemption published as contemplated by Section 11.04 need not identify particular Registered Securities to be redeemed.

Notice of redemption of Debt Securities to be redeemed shall be prepared by the Company and at the election of the Company shall be given by the Company or, at the Company’s request, by the Trustee in the name and at the expense of the Company.

(b) With respect to the Notes only, Article Eleven of the Base Indenture is amended by amending and restating Section 11.08 in its entirety, which shall read as follows:

Section 11.08. Optional Redemption in the Event of Change in Tax Treatment. In addition to any redemption provisions that may be specified pursuant to Section 3.01 for the Debt Securities of any series, the Debt Securities are redeemable, as a whole but not in part, at the option of the Company, on not less than 10 nor more than 60 days’ notice, at any time at a Redemption Price equal to 100% of the principal amount, together with accrued but unpaid interest, if any, in respect of such Debt Securities to the date fixed for redemption (or, in the case of Discount Debt Securities, the accreted face amount thereof, together with accrued interest, if any, or, in the case of Principal Indexed Securities, the amount specified pursuant to Section 3.01), and any Debt Securities convertible into Dollar Preference Shares or Conversion Securities of the Company may, at the option of the Company, be converted as a whole, if, at any time, the Company shall determine that (a) in making payment under such Debt Securities in respect of principal (or premium, if any), interest or missed payment it has or will or would become obligated to pay Additional Amounts, provided such obligation to pay Additional Amounts results from a change in or amendment to the laws of the Taxing Jurisdiction, or any change in the official application or interpretation of such laws (including a decision of any court or tribunal), or any change in, or in the official application or interpretation of, or execution of, or amendment to, any treaty or treaties affecting taxation to which the United Kingdom is a party, which change, amendment or execution becomes effective on or after the date of original issuance of the Debt Securities of such series or (b) the payment of interest in respect of such Debt Securities has become or will or would be treated as a “distribution” within the meaning of Section 1000 of the Corporation Tax Act 2010 of the United Kingdom (or any statutory modification or re-enactment thereof for the time being), as a result of any change in or amendment to the laws of the Taxing Jurisdiction, or any change in the official application or interpretation of such laws including a decision of any court, which change or amendment becomes effective on or after the date of original issuance of the Debt Securities of such series; provided, however, that in the case of (a) above, no notice of redemption shall be given earlier than 90 days prior to the earliest date on which the Company would be obliged to pay Additional Amounts were a payment in respect of such Debt Securities then due.

SECTION 4.03. Par Redemption of Debt Securities.

(a) With respect to the Notes only, Article Eleven of the Base Indenture is amended by adding Section 11.09, which shall read as follows:

“Section 11.09. Par Redemption of the Notes. The Company may redeem each series of Debt Securities in whole (but not in part) in its sole discretion on the Par Redemption Date. The Redemption Price will be equal to 100% of their principal amount plus any accrued and unpaid interest to (but excluding) the Par Redemption Date.”

19

SECTION 4.04. Events of Default and Defaults.

With respect to the Notes only, Article Five of the Base Indenture is amended by amending and restating Section 5.01 in its entirety, which shall read as follows:

Section 5.01. Events of Default and Defaults.

(a) An “Event of Default” with respect to the Notes means any one of the following events:

(i) an order is made by an English court which is not successfully appealed within 30 days after the date such order was made for winding up of the Company other than in connection with a scheme of amalgamation or reconstruction not involving bankruptcy or insolvency; or

(ii) an effective resolution is validly adopted by the Company’s shareholders for winding up of the Company other than in connection with a scheme of amalgamation or reconstruction not involving bankruptcy or insolvency.

(b) A “Default” with respect to the Notes means any one of the following events:

(i) failure to pay principal or premium, if any, on the Notes at maturity, and such default continues for a period of 30 days; or

(ii) failure to pay any interest on the Notes when due and payable, which failure continues for 30 days.

(c) If a Default occurs, the Trustee may institute proceedings in England (but not elsewhere) for the Company’s winding-up; provided that the Trustee may not, upon the occurrence of a Default, accelerate the maturity of any Notes then Outstanding, unless an Event of Default has occurred and is continuing.

(d) Notwithstanding the foregoing, failure to make any payment in respect of the Notes shall not be a Default in respect of the Notes if such payment is withheld or refused:

(i) in order to comply with any fiscal or other law or regulation or with the order of any court of competent jurisdiction, in each case applicable to such payment; or

(ii) in case of doubt as to the validity or applicability of any such law, regulation or order, in accordance with advice given as to such validity or applicability at any time during the said grace period of 30 days by independent legal advisers acceptable to the Trustee;

provided, however, that the Trustee may, by notice to the Company, require the Company to take such action (including but not limited to proceedings for a declaration by a court of competent jurisdiction) as the Trustee may be advised in an opinion of counsel, upon which opinion the Trustee may conclusively rely, is appropriate and reasonable in the circumstances to resolve such doubt, in which case the Company shall forthwith take and expeditiously proceed with such action and shall be bound by any final resolution of the doubt resulting therefrom. If any such resolution determines that the relevant payment can be made without violating any applicable law, regulation or order then the preceding sentence shall cease to have effect and the payment shall become due and payable on the expiration of the relevant grace period of 30 days after the Trustee gives written notice to the Company informing the Company of such resolution.

20

(e) Agreements with Respect to the Events of Default and Defaults.

By its acquisition of the Notes, each Holder (which, for these purposes, includes each beneficial owner), to the extent permitted by the Trust Indenture Act, waives any and all claims, in law and/or in equity, against the Trustee for, agrees not to initiate a suit against the Trustee in respect of, and agrees that the Trustee will not be liable for, any action that the Trustee takes, or abstains from taking, in either case in accordance with the exercise of the limited remedies available under the Indenture and the Notes for a non-payment of principal and/or interest on the Notes.

SECTION 4.05. Additional Amounts. With respect to the Notes only, Article Ten of the Base Indenture is amended by amending and restating Section 10.04(a) in its entirety, which shall read as follows:

Section 10.04. Payment of Additional Amounts.

(a) Unless otherwise specified as contemplated by Section 3.01, all payments made under or with respect to Debt Securities shall be paid by the Company, without deduction or withholding for, or on account of, any and all present and future taxes, levies, imposts, duties, charges, fees, deductions or withholdings whatsoever imposed, levied, collected, withheld or assessed by or on behalf of the United Kingdom or any political subdivision or taxing authority thereof or therein having the power to tax (each, a “Taxing Jurisdiction”), unless required by law. If such deduction or withholding shall at any time be required by the law of the Taxing Jurisdiction, the Company shall pay such additional amounts in respect of payments of interest only (and not principal) on such Debt Securities (“Additional Amounts”) as may be necessary so that the net amounts (including Additional Amounts) paid to the Holders, after such deduction or withholding, will be equal to the respective amounts of interest which the Holders would have been entitled to receive in respect of such Debt Securities in the absence of such deduction or withholding, provided that the foregoing shall not apply to any such tax, levy, impost, duty, charge, fee, deduction or withholding which:

(i) would not be payable or due but for the fact that the Holder or the beneficial owner of the Debt Security is domiciled in, or is a national or resident of, or engaging in business or maintaining a permanent establishment or being physically present in, the Taxing Jurisdiction or otherwise has some connection or former connection with the Taxing Jurisdiction other than the holding or ownership of a Debt Security, or the collection of interest payments on, or the enforcement of, any Debt Security;

(ii) would not be payable or due but for the fact that the certificate representing the relevant Debt Securities (x) is presented for payment in the Taxing Jurisdiction or (y) is presented for payment more than 30 days after the date payment became due or was provided for, whichever is later, except to the extent that the Holder would have been entitled to such Additional Amount on presenting the same for payment at the close of such 30 day period;

21

(iii) would not have been imposed if presentation for payment of the certificate representing the relevant Debt Securities had been made to a paying agent other than the paying agent to which the presentation was made; (iv) is imposed in respect of a Holder that is not the sole beneficial owner of the interest, or a portion thereof, or that is a fiduciary or partnership, but only to the extent that a beneficiary or settlor with respect to the fiduciary, a beneficial owner or member of the partnership would not have been entitled to the payment of an Additional Amount had the beneficiary, settlor, beneficial owner or member received directly its beneficial or distributive share of the payment;

(v) is imposed because of the failure to comply by the Holder or the beneficial owner of any payment on such Debt Securities with a request from the Company addressed to the Holder or the beneficial owner, including a written request from the Company related to a claim for relief under any applicable double tax treaty (x) to provide information concerning the nationality, residence, identity or connection with a taxing jurisdiction of the Holder or the beneficial owner or (y) to make any declaration or other similar claim to satisfy any information or reporting requirement, if the information or declaration is required or imposed by a statute, treaty, regulation, ruling or administrative practice of the Taxing Jurisdiction as a precondition to exemption from withholding or deduction of all or part of the tax, duty, assessment or other governmental charge;

(vi) is imposed in respect of any estate, inheritance, gift, sale, transfer, personal property, wealth or similar tax, duty, assessment or other governmental charge; or

(vii) is imposed in respect of any combination of the above items.

Whenever in this Indenture there is mentioned, in any context, the payment of any interest on, or in respect of, any Debt Security of any series or the net proceeds received on the sale or exchange of any Debt Security of any series, such mention shall be deemed to include mention of the payment of Additional Amounts provided for in this Section to the extent that, in such context, Additional Amounts are, were or would be payable in respect thereof pursuant to the provisions of this Section and express mention of the payment of Additional Amounts (if applicable) in any provisions hereof shall not be construed as excluding Additional Amounts in those provisions hereof where such express mention is not made.

SECTION 4.05. Execution, Authentication, Delivery and Dating.

(a) With respect to the Notes only, Article Three of the Base Indenture is amended by amending and restating Section 3.03(f) in its entirety, which shall read as follows:

(f) No Debt Security or Coupon attached thereto shall be entitled to any benefit under this Indenture or be valid or obligatory for any purpose unless there appears on such Debt Security a certificate of authentication substantially in the form provided for herein duly executed by the Trustee by signature of one of its authorized signatories, and such certificate of authentication upon any Debt Security shall be conclusive evidence, and the only evidence, that such Debt Security has been duly authenticated and delivered hereunder and is entitled to the benefits of this Indenture. Except as permitted by Section 3.05 or Section 3.06, neither the Trustee nor the Authenticating Agent shall authenticate and deliver any Bearer Security unless all appurtenant Coupons for interest then matured have been detached and cancelled.

22

(b) With respect to the Notes only, Article Three of the Base Indenture is amended by adding Section 3.03(g), which shall read as follows:

(g) The words “execution,” “executed,” “signed,” “signature,” and words of like import in this Indenture, the Debt Securities or in any other certificate, agreement or document related to this Indenture or the offering and sale of the Debt Securities shall include images of manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf”, “tif” or “jpg”) and other electronic signatures (including, without limitation, DocuSign and AdobeSign or any other electronic process or digital signature provider as specified in writing to the Trustee and agreed to by the Trustee in its sole discretion ). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act. Each party agrees that this Indenture, the Debt Securities and any other documents to be delivered in connection herewith may be electronically or digitally signed using DocuSign (or any other electronic process or digital signature provider as specified in writing to the Trustee and agreed to by the Trustee in its sole discretion), and that any such electronic or digital signatures appearing on this Indenture, the Debt Securities or such other documents are the same as manual signatures for the purposes of validity, enforceability and admissibility. The Company agrees to assume all risks arising out of the use of electronic or digital signatures and electronic methods to submit any communications to Trustee, including without limitation the risk of the Trustee acting on unauthorized instructions, and the risk of interception and misuse by third parties.

ARTICLE 5

MISCELLANEOUS

SECTION 5.01. Effect of this Supplemental Indenture; Ratification and Integral Part. This Supplemental Indenture shall become effective upon its execution and delivery.

Except as hereby amended, the Base Indenture is in all respects ratified and confirmed and all the terms, provisions and conditions thereof (including any prior amendments thereto) shall be, and remain, in full force and effect, including, without limitation, Section 4.01 of the second supplemental indenture dated May 25, 2016 (amending Section 6.07 of the Base Indenture) and Section 5.01 of the twenty-seventh supplemental indenture dated November 3, 2022 (amending and restating Article 15 of the Base Indenture). This Supplemental Indenture shall be deemed an integral part of the Base Indenture in the manner and to the extent herein and therein provided.

SECTION 5.02. Priority. This Supplemental Indenture shall be deemed part of the Base Indenture in the manner and to the extent herein and therein provided. The provisions of this Supplemental Indenture shall, with respect to the Notes and as otherwise provided herein and subject to the terms hereof, supersede the provisions of the Base Indenture to the extent the Base Indenture is inconsistent herewith.

23

SECTION 5.03. Successors and Assigns. All covenants and agreements in the Base Indenture, as supplemented and amended by this Supplemental Indenture, by the Company shall bind its successors and assigns, whether so expressed or not.

SECTION 5.04. Subsequent Holders’ Agreement. Any Holder (which, for these purposes, includes each beneficial owner of the Notes) that acquires the Notes in the secondary market and any successors, assigns, heirs, executors, administrators, trustees in bankruptcy and legal representatives of any Holder or beneficial owner of the Notes will be deemed to acknowledge, accept, agree to be bound by and consent to the same provisions specified herein to the same extent as the Holders or beneficial owners of the Notes that acquire the Notes upon their initial issuance, including, without limitation, with respect to the acknowledgement and agreement to be bound by and consent to the terms of the Notes related to the UK Bail-in Power, Compounded Daily SONIA and the limited remedies available under the Indenture and the Notes for a non-payment of principal and/or interest on the Notes.

SECTION 5.05. Compliance. The Agent shall be entitled to take any action or to refuse to take any action which the Agent regards as necessary for the Agent to comply with any applicable law, regulation or fiscal requirement, court order, or the rules, operating procedures or market practice of any relevant stock exchange or other market or clearing system.

SECTION 5.06. Relation to Calculation Agent Agreement. In the event of any conflict between the Indenture and the Calculation Agent Agreement relating to the rights or obligations of the Calculation Agent in the Indenture in connection with the calculation of the interest rate on the Notes, the relevant terms of the Calculation Agent Agreement shall govern such rights and obligations.

SECTION 5.07. Governing Law. This Supplemental Indenture and the Notes shall be governed by, and construed in accordance with, the laws of the State of New York.

SECTION 5.08. Counterparts. This Supplemental Indenture may be executed manually, by facsimile or by electronic signature in any number of counterparts, each of which shall be an original, but such counterparts shall together constitute but one and the same instrument.

SECTION 5.09. Entire Agreement. This Supplemental Indenture constitutes the entire agreement of the parties hereto with respect to the Notes and the amendments to the Base Indenture set forth herein.

24

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed as of the date first stated above.

| HSBC HOLDINGS PLC, as Issuer |

||

| By: | /s/ James Murphy |

|

| Name: | James Murphy | |

| Title: | Global Head of Markets Treasury | |

| THE BANK OF NEW YORK MELLON, LONDON BRANCH, | ||

| as Trustee | ||

| By: | /s/ Michael Lee |

|

| Name: | Michael Lee | |

| Title: | Authorised Signatory | |

| HSBC BANK USA, NATIONAL ASSOCIATION, | ||

| as Paying Agent, Registrar and Calculation Agent | ||

| By: | /s/ F. Acebedo |

|

| Name: | F. Acebedo | |

| Title: | Vice President | |

[Signature Page to the Thirtieth Supplemental Indenture]

EXHIBIT A

FORM OF 6.800% FIXED RATE/FLOATING RATE GLOBAL SECURITY

CUSIP No.: 404280 EB1

ISIN: XS2685873908

No.: [•]

THIS SECURITY IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. THIS GLOBAL SECURITY MAY NOT BE EXCHANGED IN WHOLE OR IN PART FOR A SECURITY REGISTERED, AND NO TRANSFER OF THIS SECURITY IN WHOLE OR IN PART MAY BE REGISTERED, IN THE NAME OF ANY PERSON OTHER THAN SUCH DEPOSITARY OR A NOMINEE THEREOF, EXCEPT IN THE LIMITED CIRCUMSTANCES DESCRIBED IN THE INDENTURE.

BY ITS ACQUISITION OF THE DEBT SECURITIES REPRESENTED BY THIS GLOBAL SECURITY, EACH HOLDER (WHICH, FOR THESE PURPOSES, INCLUDES EACH BENEFICIAL OWNER OF THE DEBT SECURITIES) ACKNOWLEDGES, ACCEPTS, CONSENTS AND AGREES, NOTWITHSTANDING ANY OTHER TERM OF THE DEBT SECURITIES, THE INDENTURE OR ANY OTHER AGREEMENTS, ARRANGEMENTS OR UNDERSTANDINGS BETWEEN THE ISSUER AND ANY HOLDER, TO BE BOUND BY (I) THE EFFECT OF THE EXERCISE OF ANY UK BAIL-IN POWER BY THE RELEVANT UK RESOLUTION AUTHORITY IN RELATION TO ANY DEBT SECURITIES THAT (WITHOUT LIMITATION) MAY INCLUDE AND RESULT IN ANY OF THE FOLLOWING, OR SOME COMBINATION THEREOF: (A) THE REDUCTION OF ALL, OR A PORTION, OF THE AMOUNTS DUE (AS DEFINED ON THE REVERSE OF THIS GLOBAL SECURITY); (B) THE CONVERSION OF ALL, OR A PORTION, OF THE AMOUNTS DUE INTO THE ISSUER’S OR ANOTHER PERSON’S ORDINARY SHARES, OTHER SECURITIES OR OTHER OBLIGATIONS (AND THE ISSUE TO, OR CONFERRAL ON, THE HOLDER OF SUCH ORDINARY SHARES, OTHER SECURITIES OR OTHER OBLIGATIONS), INCLUDING BY MEANS OF AN AMENDMENT, MODIFICATION OR VARIATION OF THE TERMS OF THE DEBT SECURITIES OR THE INDENTURE; (C) THE CANCELLATION OF THE DEBT SECURITIES; AND/OR (D) THE AMENDMENT OR ALTERATION OF THE MATURITY OF THE DEBT SECURITIES OR AMENDMENT OF THE AMOUNT OF INTEREST PAYABLE ON THE DEBT SECURITIES, OR THE INTEREST PAYMENT DATES, INCLUDING BY SUSPENDING PAYMENT FOR A TEMPORARY PERIOD; AND (II) THE VARIATION OF THE TERMS OF THE DEBT SECURITIES OR THE INDENTURE, IF NECESSARY, TO GIVE EFFECT TO THE EXERCISE OF ANY UK BAIL-IN POWER BY THE RELEVANT UK RESOLUTION AUTHORITY.

THERE IS NO RIGHT OF ACCELERATION IN THE CASE OF NON-PAYMENT OF PRINCIPAL AND/OR INTEREST ON THE DEBT SECURITIES OR OF THE ISSUER’S FAILURE TO PERFORM ANY OF ITS OBLIGATIONS UNDER OR IN RESPECT OF THE DEBT SECURITIES. PAYMENT OF THE PRINCIPAL AMOUNT, TOGETHER WITH ACCRUED AND UNPAID PAYMENTS WITH RESPECT TO THE OUTSTANDING DEBT SECURITIES, MAY BE ACCELERATED ONLY UPON CERTAIN EVENTS OF A WINDING UP AS SET FORTH IN THE INDENTURE.

A-1

GLOBAL SECURITY

HSBC Holdings plc

£[•]

6.800% FIXED RATE/FLOATING RATE SENIOR UNSECURED NOTES DUE 2031

This is a Global Security in respect of a duly authorized issue by HSBC Holdings plc (the “Issuer,” which term includes any successor Person under the Indenture hereinafter referred to) of debt securities, designated as specified in the title hereof, in the aggregate face amount of £[•] (the “Debt Securities”).

The Issuer, for value received, hereby promises to pay HSBC Issuer Services Common Depository Nominee (UK) Limited, or registered assigns on September 14, 2031 (the “Maturity Date”) or on such earlier date as this Global Security may be redeemed, the principal amount hereof and to pay interest on the said principal amount from September 14, 2023 (the “Issue Date”) or the most recent Interest Payment Date on which interest has been paid or duly provided for until maturity:

(i) from (and including) the Issue Date or the most recent Interest Payment Date during the Fixed Rate Period on which interest has been paid or duly provided for to (but excluding) September 14, 2030, annually in arrear on September 14 of each year, beginning on September 14, 2024 (each, a “Fixed Rate Period Interest Payment Date”), at a rate of 6.800% per annum (the “Initial Interest Rate”); and

(ii) from (and including) September 14, 2030 or the most recent Interest Payment Date during the Floating Rate Period on which interest has been paid or duly provided for to (but excluding) the Maturity Date, quarterly in arrear on December 14, 2030, March 14, 2031, June 14, 2031 and September 14, 2031 (each, a “Floating Rate Period Interest Payment Date”), at a floating rate equal to Compounded Daily SONIA plus 2.124% per annum (the “Margin”). The interest rate during the Floating Rate Period on this Global Security shall be calculated quarterly on each Interest Determination Date.

“Fixed Rate Period” means the period from (and including) the Issue Date, to (but excluding) September 14, 2030.

“Floating Rate Period” means the period from (and including) September 14, 2030 to (but excluding) the Maturity Date.

“Interest Payment Date” means any Fixed Rate Period Interest Payment Date or Floating Rate Period Interest Payment Date.

“Compounded Daily SONIA” means, in relation to a Floating Rate Interest Period, the rate of return of a daily compound interest investment (with SONIA as reference rate for the calculation of interest) during the related Observation Period and will be calculated by the Calculation Agent on the related Interest Determination Date as follows:

Where:

A-2

“Calculation Agent” means HSBC Bank USA, National Association, or its successor appointed by the Issuer pursuant to the Calculation Agent Agreement;

“Calculation Agent Agreement” means the calculation agent agreement dated as of the Issue Date between the Issuer and the Calculation Agent;

“d” means, in relation to any Observation Period, the number of calendar days in such Observation Period;

“d0” means, in relation to any Observation Period, the number of SONIA Business Days in such Observation Period;

“i” means, in relation to any Observation Period, a series of whole numbers from one to d0, each representing the relevant SONIA Business Day in chronological order from (and including) the first SONIA Business Day in such Observation Period;