|

200 Bay Street Royal Bank Plaza Toronto, Ontario Canada M5J 2J5 Attention: Senior Vice-President, Associate General Counsel & Secretary |

1 Place Ville Marie Montreal, Quebec Canada H3B 3A9 Attention: Senior Vice-President, Associate General Counsel & Secretary |

ROYAL BANK OF CANADA |

||||||

Date: August 24, 2023 |

By: |

/s/ Nadine Ahn |

||||

Name: |

Nadine Ahn |

|||||

Title: |

Chief Financial Officer |

|||||

Exhibit |

Description of Exhibit |

|

99.1 |

Third Quarter 2023 Earnings |

|

99.2 |

Third Quarter 2023 Report to Shareholders (which includes management’s discussion and analysis and unaudited interim condensed consolidated financial statements) |

|

99.3 |

Return on Equity and Assets Ratios |

|

Rule 13a-14(a)/15d-14(a) |

||

31.1 |

- Certification of the Registrant’s Chief Executive Officer |

|

31.2 |

- Certification of the Registrant’s Chief Financial Officer |

|

101 |

Interactive Data File (formatted as Inline XBRL) |

|

104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

|

| Exhibit 99.1 | ||

|

THIRD QUARTER 2023 EARNINGS RELEASE |

|

| ROYAL BANK OF CANADA REPORTS THIRD QUARTER 2023 RESULTS |

All amounts are in Canadian dollars and are based on financial statements presented in compliance with International Accounting Standard 34 Interim Financial Reporting, unless otherwise noted. Our Q3 2023 Report to Shareholders and Supplementary Financial Information are available at: http://www.rbc.com/investorrelations.

| Net income

$3.9 Billion

Up 8% YoY

|

Diluted EPS1

$2.73

Up 9% YoY

|

Total PCL2

$616 Million

PCL on loans ratio3 down 1 bp4 QoQ

|

ROE5

14.6%

Flat YoY |

CET1 Ratio6

14.1%

Above regulatory requirements |

| Adjusted Net income7

$4.0 Billion

Up 11% YoY |

Adjusted Diluted EPS7

$2.84

Up 11% YoY

|

Total ACL8

$5.0 Billion

ACL on loans ratio9 up 2 bps4 QoQ

|

Adjusted ROE7

15.1%

Up 30 bps YoY |

LCR10

134%

Down slightly from 135% last quarter |

TORONTO, August 24, 2023 — Royal Bank of Canada11 (RY on TSX and NYSE) today reported net income of $3.9 billion for the quarter ended July 31, 2023, up $295 million or 8% from the prior year. Diluted EPS was $2.73, up 9% over the same period. Adjusted net income7 and adjusted EPS7 of $4.0 billion and $2.84, respectively, were both up 11% from the prior year.

Results this quarter reflected higher provisions for credit losses, with a PCL on loans ratio of 29 bps. Results benefitted from lower taxes reflecting a favourable shift in earnings mix.

Pre-provision, pre-tax earnings7 of $5.2 billion were up $353 million or 7% from a year ago, mainly due to higher revenue in Capital Markets reflecting higher revenue in Corporate and Investment Banking, including the impact of loan underwriting markdowns in the prior period, as well as in Global Markets. Higher net interest income driven by higher interest rates and strong volume growth in Canadian Banking also contributed to the increase. These factors were partially offset by higher staff-related expenses, mainly due to higher salaries as well as higher variable and stock-based compensation, and higher professional fees. Ongoing technology investments and higher discretionary costs to support strong client-driven growth also contributed to higher expenses.

Compared to last quarter, net income was up 6% reflecting higher results in Personal & Commercial Banking and Insurance. Capital Markets results were relatively flat. These factors were partially offset by lower results in Wealth Management. Adjusted net income7 was up 7% over the same period. Pre-provision, pre-tax earnings7 were up 5% as higher revenue more than offset expense growth.

The number of full-time equivalent (FTE) employees was down 1% from last quarter, and we expect to further reduce FTE by approximately 1-2% next quarter.

Our capital position remains robust, with a CET1 ratio of 14.1%, supporting solid volume growth and $1.9 billion in common share dividends. We also have a strong average LCR of 134%.

|

“Despite a complex operating environment, our Q3 results exemplify RBC’s ability to consistently deliver solid revenue and volume growth underpinned by prudent risk management. We remain focused on executing on our cost reduction strategy while leveraging our strong balance sheet and diversified business model to support our growth and bring long-term value to our clients, communities and shareholders.” – Dave McKay, President and Chief Executive Officer of Royal Bank of Canada |

|

|

||||||||

| Q3 2023 Compared to Q3 2022 |

Reported: • Net income of $3,872 million • Diluted EPS of $2.73 • ROE of 14.6% • CET1 ratio of 14.1% |

h 8% h 9% ® 0 bps h 100 bps |

Adjusted7: • Net income of $4,017 million • Diluted EPS of $2.84 • ROE of 15.1% |

h 11% h 11% h 30 bps |

||||

|

|

||||||||

| Q3 2023 Compared to Q2 2023 |

• Net income of $3,872 million • Diluted EPS of $2.73 • ROE of 14.6% • CET1 ratio of 14.1% |

h 6% h 6% h 20 bps h 40 bps |

• Net income of $4,017 million • Diluted EPS of $2.84 • ROE of 15.1% |

h 7% h 7% h 20 bps |

||||

|

|

||||||||

| YTD 2023 Compared to YTD 2022 |

• Net income of $10,735 million • Diluted EPS of $7.60 • ROE of 13.9% |

i 10% i 9% i 280 bps |

• Net income of $12,118 million • Diluted EPS of $8.59 • ROE of 15.7% |

® 0% h 2% i 120 bps |

||||

|

|

||||||||

| 1 | Earnings per share (EPS). |

| 2 | Provision for credit losses (PCL). |

| 3 | PCL on loans ratio is calculated as PCL on loans as a percentage of average net loans and acceptances. |

| 4 | Basis points (bps). |

| 5 | Return on equity (ROE). For further information, refer to the Key performance and non-GAAP measures section on page 3 and 4 of this Earnings Release. |

| 6 | This ratio is calculated by dividing Common Equity Tier 1 (CET1) by risk-weighted assets, in accordance with OSFI’s Basel III Capital Adequacy Requirements guideline. |

| 7 | This is a non-GAAP measure. For further information, including a reconciliation, refer to the Key performance and non-GAAP measures section on page 3 and 4 of this Earnings Release. |

| 8 | Allowance for credit losses (ACL). |

| 9 | ACL on loans ratio is calculated as ACL on loans as a percentage of total loans and acceptances. |

| 10 | Liquidity coverage ratio (LCR). |

| 11 | When we say “we”, “us”, “our”, “the bank” or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. |

- 1 -

| Personal & Commercial Banking

|

Net income of $2,134 million increased $111 million or 5% from a year ago, primarily attributable to higher net interest income reflecting higher spreads (as the benefit of higher interest rates more than offset changes in product mix) and average volume growth in Canadian Banking of 8% in deposits and 6% in loans (with strong double-digit loan growth in business lending and credit cards). Higher service charges and foreign exchange revenue driven by increased client activity also contributed to the increase. These factors were partially offset by the retrospective impact of harmonized sales tax (HST) on payment card clearing services ($66 million reduction in revenue), which was announced in the Government of Canada’s 2023 budget and enacted in the current quarter, as well as higher staff-related costs and ongoing technology investments.

Compared to last quarter, net income increased $219 million or 11%, primarily attributable to higher net interest income driven by the impact of three more days in the current quarter, higher spreads and average volume growth of 2% in Canadian Banking. Lower PCL on performing loans, primarily driven by favourable changes to our credit quality and macroeconomic outlook, and higher card service revenue also contributed to the increase. These factors were partially offset by the retrospective impact of HST on payment card clearing services as described above, as well as ongoing technology investments. The number of full-time equivalent employees was down 1% in Canadian Banking.

| Wealth Management

|

Net income of $674 million decreased $147 million or 18% from a year ago, mainly reflecting continued investments in the operational infrastructure of City National and higher PCL, partly offset by the gain on the sale of the European asset servicing activities of RBC Investor Services® and its associated Malaysian centre of excellence (the partial sale of RBC Investor Services operations). Wealth Management benefited from 17% growth in assets under management, including RBC Brewin Dolphin.

Compared to last quarter, net income decreased $68 million or 9%, primarily due to higher PCL on performing loans, largely driven by unfavourable changes to our macroeconomic and credit quality outlook. Lower net interest income, largely reflecting the impact of lower spreads and deposit volume and an increase in non-interest expenses also contributed to the decrease. These factors were partially offset by the gain on the partial sale of RBC Investor Services operations and higher average fee-based client assets reflecting market appreciation.

| Insurance

|

Net income of $227 million increased $41 million or 22% from a year ago, primarily due to higher favourable investment-related experience, partially offset by higher capital funding costs.

Compared to last quarter, net income increased $88 million or 63%, primarily due to higher favourable investment-related experience.

| Capital Markets

|

Net income of $938 million increased $339 million or 57% from a year ago, primarily driven by higher revenue in Corporate and Investment Banking, including the impact of loan underwriting markdowns in the prior year. Lower taxes reflecting changes in earnings mix and higher revenue in Global Markets, largely due to higher fixed income trading revenue across all regions, also contributed to the increase. These factors were partially offset by higher compensation on improved results and higher PCL.

Compared to last quarter, net income remained relatively flat as lower taxes reflecting changes in earnings mix and higher revenue, mainly reflecting higher equity and fixed income trading revenue, were offset by higher expenses and higher PCL on impaired loans in a few sectors.

| Capital, Liquidity and Credit Quality

|

Capital – As at July 31, 2023, our CET1 ratio was 14.1%, up 40 bps from last quarter, mainly reflecting net internal capital generation, share issuances under the Dividend reinvestment plan (DRIP) and the impact of the partial sale of RBC Investor Services operations.

Liquidity – For the quarter ended July 31, 2023, the average LCR was 134%, which translates into a surplus of approximately $97 billion, compared to 135% and a surplus of approximately $102 billion last quarter. LCR levels decreased compared to the prior quarter mainly due to the partial sale of RBC Investor Services operations and loan growth, partially offset by an increase in deposits.

The Net Stable Funding Ratio (NSFR) as at July 31, 2023 was 112%, which translates into a surplus of approximately $104 billion, compared to 113% and a surplus of approximately $110 billion last quarter. NSFR decreased compared to the prior quarter primarily due to loan growth and the partial sale of RBC Investor Services operations, partially offset by an increase in deposits and stable funding.

- 2 -

Credit Quality

Q3 2023 vs. Q3 2022

Total PCL increased $276 million or 81% from a year ago, primarily reflecting higher provisions in Capital Markets and Wealth Management. The PCL on loans ratio of 29 bps increased 12 bps. The PCL on impaired loans ratio of 23 bps increased 15 bps.

PCL on performing loans decreased $57 million or 32%, primarily reflecting lower provisions in our Canadian Banking retail portfolios, mainly driven by favourable changes to our macroeconomic outlook, including the impact of a favourable revision to our Canadian housing price forecast. This was partially offset by higher provisions in U.S. Wealth Management (including City National) and Capital Markets, reflecting unfavourable changes to our credit quality and macroeconomic outlook.

PCL on impaired loans increased $329 million, mainly due to provisions taken in Capital Markets in the current quarter in a few sectors, including the real estate and related, transportation and industrial products sectors, compared to recoveries in the same quarter last year. Higher provisions in our Canadian Banking retail portfolios also contributed to the increase.

Q3 2023 vs. Q2 2023

Total PCL increased $16 million or 3% from last quarter, primarily reflecting higher provisions in Wealth Management and Capital Markets, largely offset by lower provisions in Personal & Commercial Banking. The PCL on loans ratio decreased 1 bp. The PCL on impaired loans ratio increased 2 bps.

PCL on performing loans decreased $53 million or 31%, mainly due to lower provisions in our Canadian Banking retail portfolios, largely driven by favourable changes to our macroeconomic and credit quality outlook, including the impact of a favourable revision to our Canadian housing price forecast. This was partially offset by higher provisions in U.S. Wealth Management (including City National), primarily driven by unfavourable changes to our macroeconomic and credit quality outlook.

PCL on impaired loans increased $58 million or 13%, mainly due to higher provisions in Capital Markets in a few sectors.

| Key Performance and Non-GAAP Measures

|

Performance measures

We measure and evaluate the performance of our consolidated operations and each business segment using a number of financial metrics, such as net income and ROE. Certain financial metrics, including ROE, do not have a standardized meaning under generally accepted accounting principles (GAAP) and may not be comparable to similar measures disclosed by other financial institutions.

Non-GAAP measures

We believe that certain non-GAAP measures (including non-GAAP ratios) are more reflective of our ongoing operating results and provide readers with a better understanding of management’s perspective on our performance. These measures enhance the comparability of our financial performance for the three and nine months ended July 31, 2023 with the corresponding periods in the prior year and the three months ended April 30, 2023. Non-GAAP measures do not have a standardized meaning under GAAP and may not be comparable to similar measures disclosed by other financial institutions.

The following discussion describes the non-GAAP measures we use in evaluating our operating results.

Pre-provision, pre-tax earnings

Pre-provision, pre-tax earnings is calculated as income (Q3 2023: $3,872 million; Q2 2023: $3,649 million; Q3 2022: $3,577 million) before income taxes (Q3 2023: $761 million; Q2 2023: $771 million; Q3 2022: $979 million) and PCL (Q3 2023: $616 million; Q2 2023: $600 million; Q3 2022: $340 million). We use pre-provision, pre-tax earnings to assess our ability to generate sustained earnings growth outside of credit losses, which are impacted by the cyclical nature of the credit cycle.

Adjusted results

We believe that providing adjusted results and certain measures excluding the impact of the specified items discussed below and amortization of acquisition-related intangibles enhance comparability with prior periods and enables readers to better assess trends in the underlying businesses. Specified items impacting our results for the three and nine months ended July 31, 2023 and the three months ended April 30, 2023 are:

| • | Canada Recovery Dividend (CRD) and other tax related adjustments: reflects the impact of the CRD and the 1.5% increase in the Canadian corporate tax rate applicable to fiscal 2022, net of deferred tax adjustments, which were announced in the Government of Canada’s 2022 budget and enacted in the first quarter of 2023 |

| • | Transaction and integration costs relating to our planned acquisition of HSBC Bank Canada (HSBC Canada) |

- 3 -

The following table provides a reconciliation of adjusted results to our reported results and illustrates the calculation of adjusted measures presented. The adjusted results and measures presented below are non-GAAP measures.

Consolidated results, reported and adjusted

| As at or for the three months ended | As at or for the nine months ended | |||||||||||||||||||

| (Millions of Canadian dollars, except per share, number of and percentage amounts) |

|

July 31 2023 |

|

|

April 30 2023 |

|

|

July 31 2022 (1 |

) |

|

July 31 2023 |

|

|

July 31 2022 (1 |

) |

|||||

| Total revenue |

$ | 14,489 | $ | 13,520 | $ | 12,132 | $ | 43,103 | $ | 36,418 | ||||||||||

| PCL |

616 | 600 | 340 | 1,748 | 103 | |||||||||||||||

| Non-interest expense |

7,861 | 7,494 | 6,386 | 23,030 | 19,400 | |||||||||||||||

| Income before income taxes |

4,633 | 4,420 | 4,556 | 14,395 | 15,248 | |||||||||||||||

| Income taxes |

761 | 771 | 979 | 3,660 | 3,323 | |||||||||||||||

| Net income |

$ | 3,872 | $ | 3,649 | $ | 3,577 | $ | 10,735 | $ | 11,925 | ||||||||||

| Net income available to common shareholders |

$ | 3,812 | $ | 3,581 | $ | 3,517 | $ | 10,561 | $ | 11,738 | ||||||||||

| Average number of common shares (thousands) |

1,393,515 | 1,388,388 | 1,396,381 | 1,388,217 | 1,409,292 | |||||||||||||||

| Basic earnings per share (in dollars) |

$ | 2.74 | $ | 2.58 | $ | 2.52 | $ | 7.61 | $ | 8.33 | ||||||||||

| Average number of diluted common shares (thousands) |

1,394,939 | 1,390,149 | 1,398,667 | 1,389,857 | 1,411,934 | |||||||||||||||

| Diluted earnings per share (in dollars) |

$ | 2.73 | $ | 2.58 | $ | 2.51 | $ | 7.60 | $ | 8.31 | ||||||||||

| ROE (2) |

14.6% | 14.4% | 14.6% | 13.9% | 16.7% | |||||||||||||||

| Effective income tax rate |

16.4% | 17.4% | 21.5% | 25.4% | 21.8% | |||||||||||||||

| Total adjusting items impacting net income (before-tax) |

$ | 191 | $ | 138 | $ | 62 | $ | 426 | $ | 188 | ||||||||||

| Specified item: HSBC Canada transaction and integration costs (3) |

110 | 56 | - | 177 | - | |||||||||||||||

| Amortization of acquisition-related intangibles (4) |

81 | 82 | 62 | 249 | 188 | |||||||||||||||

| Total income taxes for adjusting items impacting net income |

$ | 46 | $ | 29 | $ | 16 | $ | (957 | ) | $ | 49 | |||||||||

| Specified item: CRD and other tax related adjustments (3), (5) |

- | - | - | (1,050 | ) | - | ||||||||||||||

| Specified item: HSBC Canada transaction and integration costs (3) |

26 | 13 | - | 42 | - | |||||||||||||||

| Amortization of acquisition-related intangibles (4) |

20 | 16 | 16 | 51 | 49 | |||||||||||||||

| Adjusted results (6) |

||||||||||||||||||||

| Income before income taxes - adjusted |

4,824 | 4,558 | 4,618 | 14,821 | 15,436 | |||||||||||||||

| Income taxes - adjusted |

807 | 800 | 995 | 2,703 | 3,372 | |||||||||||||||

| Net income - adjusted |

$ | 4,017 | $ | 3,758 | $ | 3,623 | $ | 12,118 | $ | 12,064 | ||||||||||

| Net income available to common shareholders - adjusted |

$ | 3,957 | $ | 3,690 | $ | 3,563 | $ | 11,944 | $ | 11,877 | ||||||||||

| Average number of common shares (thousands) |

1,393,515 | 1,388,388 | 1,396,381 | 1,388,217 | 1,409,292 | |||||||||||||||

| Basic earnings per share (in dollars) - adjusted |

$ | 2.84 | $ | 2.66 | $ | 2.55 | $ | 8.60 | $ | 8.43 | ||||||||||

| Average number of diluted common shares (thousands) |

1,394,939 | 1,390,149 | 1,398,667 | 1,389,857 | 1,411,934 | |||||||||||||||

| Diluted earnings per share (in dollars) - adjusted |

$ | 2.84 | $ | 2.65 | $ | 2.55 | $ | 8.59 | $ | 8.41 | ||||||||||

| ROE - adjusted |

15.1% | 14.9% | 14.8% | 15.7% | 16.9% | |||||||||||||||

| Adjusted effective income tax rate |

16.7% | 17.6% | 21.5% | 18.2% | 21.8% | |||||||||||||||

| (1) | There were no specified items for the three months ended July 31, 2022 or for the nine months ended July 31, 2022. |

| (2) | ROE is based on actual balances of average common equity before rounding. |

| (3) | These amounts have been recognized in Corporate Support. |

| (4) | Represents the impact of amortization of acquisition-related intangibles (excluding amortization of software), and any goodwill impairment. |

| (5) | The impact of the CRD and other tax related adjustments does not include $0.2 billion recognized in other comprehensive income. |

| (6) | Effective the second quarter of 2023, we included HSBC Canada transaction and integration costs and amortization of acquisition-related intangibles as adjusting items for non-GAAP measures and non-GAAP ratios. Therefore, comparative adjusted results have been revised from those previously presented to conform to our basis of presentation for this non-GAAP measure. |

Additional information about ROE and other key performance and non-GAAP measures can be found under the Key performance and non-GAAP measures section of our Q3 2023 Report to Shareholders.

- 4 -

|

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

|

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this Earnings Release, in other filings with Canadian regulators or the SEC, in reports to shareholders, and in other communications, including statements by our President and Chief Executive Officer. Forward-looking statements in this document include, but are not limited to, statements relating to our financial performance objectives, vision and strategic goals and expected cost containment measures. The forward-looking information contained in this Earnings Release is presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial position and results of operations as at and for the periods ended on the dates presented, as well as our financial performance objectives, vision and strategic goals, and may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as “believe”, “expect”, “foresee”, “forecast”, “anticipate”, “intend”, “estimate”, “goal”, “commit”, “target”, “objective”, “plan” and “project” and similar expressions of future or conditional verbs such as “will”, “may”, “might”, “should”, “could” or “would”.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, that our financial performance, environmental & social or other objectives, vision and strategic goals will not be achieved, and that our actual results may differ materially from such predictions, forecasts, projections, expectations or conclusions.

We caution readers not to place undue reliance on these statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. These factors – many of which are beyond our control and the effects of which can be difficult to predict – include: credit, market, liquidity and funding, insurance, operational, regulatory compliance (which could lead to us being subject to various legal and regulatory proceedings, the potential outcome of which could include regulatory restrictions, penalties and fines), strategic, reputation, competitive, model, legal and regulatory environment, systemic risks and other risks discussed in the risk sections of our annual report for the fiscal year ended October 31, 2022 (the 2022 Annual Report) and the Risk management section of our Q3 2023 Report to Shareholders; including business and economic conditions in the geographic regions in which we operate, Canadian housing and household indebtedness, information technology and cyber risks, geopolitical uncertainty, environmental and social risk (including climate change), digital disruption and innovation, privacy, data and third party related risks, regulatory changes, culture and conduct risks, the effects of changes in government fiscal, monetary and other policies, tax risk and transparency, and the emergence of widespread health emergencies or public health crises such as pandemics and epidemics, including the COVID-19 pandemic and its impact on the global economy, financial market conditions and our business operations, and financial results, condition and objectives. Additional factors that could cause actual results to differ materially from the expectations in such forward-looking statements can be found in the risk section of our 2022 Annual Report and the Risk management section of our Q3 2023 Report to Shareholders.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also adversely affect our results. When relying on our forward-looking statements to make decisions with respect to us, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Material economic assumptions underlying the forward-looking statements contained in this Earnings Release are set out in the Economic, market and regulatory review and outlook section and for each business segment under the Strategic priorities and Outlook sections in our 2022 Annual Report, as updated by the Economic, market and regulatory review and outlook section of our Q3 2023 Report to Shareholders. Except as required by law, we do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

Additional information about these and other factors can be found in the risk sections of our 2022 Annual Report and the Risk management section of our Q3 2023 Report to Shareholders. Information contained in or otherwise accessible through the websites mentioned does not form part of this Earnings Release. All references in this Earnings Release to websites are inactive textual references and are for your information only.

ACCESS TO QUARTERLY RESULTS MATERIALS

Interested investors, the media and others may review this quarterly Earnings Release, quarterly results slides, supplementary financial information and our Q3 2023 Report to Shareholders at rbc.com/investorrelations.

Quarterly conference call and webcast presentation

Our quarterly conference call is scheduled for August 24, 2023 at 8:00 a.m. (EDT) and will feature a presentation about our third quarter results by RBC executives. It will be followed by a question and answer period with analysts. Interested parties can access the call live on a listen-only basis at rbc.com/investorrelations/quarterly-financial-statements.html or by telephone (416-340-2217, 866-696-5910, passcode 5046546#). Please call between 7:50 a.m. and 7:55 a.m. (EDT).

Management’s comments on results will be posted on our website shortly following the call. A recording will be available by 5:00 p.m. (EDT) from August 24, 2023 until November 29, 2023 at rbc.com/investorrelations/quarterly-financial-statements.html or by telephone (905-694-9451 or 800-408-3053, passcode 8061913#).

Media Relations Contacts

Gillian McArdle, Senior Director, Corporate Communications, gillian.mcardle@rbccm.com, 416-842-4231

Fiona McLean, Director, Financial Communications, fiona.mclean@rbc.com, 437-778-3506

Investor Relations Contacts

Asim Imran, Vice President, Head of Investor Relations, asim.imran@rbc.com, 416-955-7804

Marco Giurleo, Senior Director, Investor Relations, marco.giurleo@rbc.com, 437-239-5374

ABOUT RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 97,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 17 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-social-impact.

® Registered Trademarks of Royal Bank of Canada.

|

|

- 5 -

|

Royal Bank of Canada third quarter 2023 results |

|

Net income $3.9 Billion Up 8% YoY |

Diluted EPS 1

$2.73 Up 9% YoY |

Total PCL 1

$616 Million PCL on loans ratio 1

down 1 bp 1 QoQ |

ROE 1, 2

14.6% Flat YoY |

CET1 Ratio 1

14.1% A bove regulatory requirements |

||||||||||||

|

Adjusted Net income 3

$4.0 Billion Up 11% YoY |

Adjusted Diluted EPS 3

$2.84 Up 11% YoY |

Total ACL 1

$5.0 Billion ACL on loans ratio 1

up 2 bps 1 QoQ |

Adjusted ROE 3

15.1% Up 30 bps YoY |

LCR 1

134% Down slightly from 135% last quarter |

|

“ Despite a complex operating environment, our Q3 results exemplify RBC’s ability to consistently deliver solid revenue and volume growth underpinned by prudent risk management. We remain focused on executing on our cost reduction strategy while leveraging our strong balance sheet and diversified business model to support our growth and bring long-term value to our clients, communities and shareholders.” – Dave McKay, President and Chief Executive Officer of Royal Bank of Canada |

||

|

Q3 2023 Compared to Q3 2022 |

Reported: • Net income of $3,872 million • Diluted EPS of $2.73 • ROE of 14.6% • CET1 ratio of 14.1% |

h h g h |

Adjusted 3 :• Net income of $4,017 million • Diluted EPS of $2.84 • ROE of 15.1% |

h h h |

||||||

|

Q3 2023 Compared to Q2 2023 |

• Net income of $3,872 million • Diluted EPS of $2.73 • ROE of 14.6% • CET1 ratio of 14.1% |

h h h h |

• Net income of $4,017 million • Diluted EPS of $2.84 • ROE of 15.1% |

h h h |

||||||

|

YTD 2023 Compared to YTD 2022 |

• Net income of $10,735 million • Diluted EPS of $7.60 • ROE of 13.9% |

¯ ¯ ¯ |

• Net income of $12,118 million • Diluted EPS of $8.59 • ROE of 15.7% |

® h ¯ |

||||||

| (1) | See Glossary section of this Q3 2023 Report to Shareholders for composition of this measure. |

| (2) | Return on equity (ROE). This measure does not have a standardized meaning under generally accepted accounting principles (GAAP). For further information, refer to the Key performance and non-GAAP measures section of this Q3 2023 |

| (3) | This is a non-GAAP measure. For further information, including a reconciliation, refer to the Key performance and non-GAAP measures section of this Q3 2023 |

| (4) | When we say “we”, “us”, “our”, ‘the bank” or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. |

| (5) | Pre-provision, pre-tax (PPPT) earnings is calculated as income (July 31, 2023: $3,872 million; July 31, 2022: $3,577 million) before income taxes (July 31, 2023: $761 million; July 31, 2022: $979 million) and PCL (July 31, 2023: $616 million; July 31, 2022: $340 million). This is a non-GAAP measure. PPPT earnings do not have a standardized meaning under GAAP and may not be comparable to similar measures disclosed by other financial institutions. We use PPPT earnings to assess our ability to generate sustained earnings growth outside of credit losses, which are impacted by the cyclical nature of a credit cycle. We believe that certain non-GAAP measures are more reflective of our ongoing operating results and provide readers with a better understanding of management’s perspective on our performance. |

40 |

||||

45 |

||||

| 45 | Summary of accounting policies and estimates | |||

| 46 | Controls and procedures | |||

46 |

||||

47 |

||||

49 |

||||

50 |

(unaudited) |

|||

56 |

(unaudited) |

|||

80 |

||||

|

Management’s Discussion and Analysis |

|

Caution regarding forward-looking statements |

|

Overview and outlook |

|

About Royal Bank of Canada |

|

Personal & Commercial Banking |

Provides a broad suite of financial products and services in Canada, the Caribbean and the U.S. Our commitment to building and maintaining deep and meaningful relationships with our clients is underscored by the breadth of our product suite, our depth of expertise, and the features of our digital solutions. | |

|

Wealth Management |

Serves affluent, high net worth (HNW) and ultra-high net worth (UHNW) clients from our offices in key financial centres mainly in Canada, the U.S., the United Kingdom (U.K.), Europe, and Asia. We offer a comprehensive suite of investment, trust, banking, credit and other advice-based solutions. We also provide asset management products to institutional and individual clients through our distribution channels and third-party distributors. Asset and payment services are also provided to financial institutions and asset owners worldwide. | |

|

Insurance |

Offers a wide range of advice and solutions for individual and business clients including life, health, wealth, home, auto, travel, annuities and reinsurance. | |

|

Capital Markets |

Provides expertise in advisory & origination, sales & trading, and lending & financing, and transaction banking to corporations, institutional clients, asset managers, private equity firms and governments globally. We serve clients from 63 offices in 18 countries across North America, the U.K. & Europe, and Australia, Asia & other regions. | |

|

Corporate Support |

Corporate Support consists of Technology & Operations, which provides the technological and operational foundation required to effectively deliver products and services to our clients, Functions, which includes our finance, human resources, risk management, internal audit and other functional groups, as well as our Corporate Treasury function. |

|

Selected financial and other highlights |

| As at or for the three months ended | As at or for the nine months ended | |||||||||||||||||||||

(Millions of Canadian dollars, except per share, number of and percentage amounts) |

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

|||||||||||||||||

Total revenue |

$ |

14,489 |

$ | 13,520 | $ | 12,132 | $ |

43,103 |

$ | 36,418 | ||||||||||||

Provision for credit losses (PCL) |

616 |

600 | 340 | 1,748 |

103 | |||||||||||||||||

Insurance policyholder benefits, claims and acquisition expense (PBCAE) |

1,379 |

1,006 | 850 | 3,930 |

1,667 | |||||||||||||||||

Non-interest expense |

7,861 |

7,494 | 6,386 | 23,030 |

19,400 | |||||||||||||||||

Income before income taxes |

4,633 |

4,420 | 4,556 | 14,395 |

15,248 | |||||||||||||||||

Net income |

$ |

3,872 |

$ | 3,649 | $ | 3,577 | $ |

10,735 |

$ | 11,925 | ||||||||||||

Net income adjusted (1)

|

$ |

4,017 |

$ | 3,758 | $ | 3,623 | $ |

12,118 |

$ | 12,064 | ||||||||||||

Segments – net income |

||||||||||||||||||||||

Personal & Commercial Banking |

$ |

2,134 |

$ | 1,915 | $ | 2,023 | $ |

6,175 |

$ | 6,231 | ||||||||||||

Wealth Management (2)

|

674 |

742 | 821 | 2,264 |

2,451 | |||||||||||||||||

Insurance |

227 |

139 | 186 | 514 |

589 | |||||||||||||||||

Capital Markets (2)

|

938 |

939 | 599 | 3,100 |

2,578 | |||||||||||||||||

Corporate Support |

(101 |

) |

(86 | ) | (52 | ) | (1,318 |

) |

76 | |||||||||||||

Net income |

$ |

3,872 |

$ | 3,649 | $ | 3,577 | $ |

10,735 |

$ | 11,925 | ||||||||||||

Selected information |

||||||||||||||||||||||

Earnings per share (EPS) – basic |

$ |

2.74 |

$ | 2.58 | $ | 2.52 | $ |

7.61 |

$ | 8.33 | ||||||||||||

– diluted |

2.73 |

2.58 | 2.51 | 7.60 |

8.31 | |||||||||||||||||

Earnings per share (EPS) – basic adjusted (1)

|

2.84 |

2.66 | 2.55 | 8.60 |

8.43 | |||||||||||||||||

– diluted adjusted (1)

|

2.84 |

2.65 | 2.55 | 8.59 |

8.41 | |||||||||||||||||

Return on common equity (ROE) (3)

|

14.6% |

14.4% | 14.6% | 13.9% |

16.7% | |||||||||||||||||

Return on common equity (ROE) adjusted (1)

|

15.1% |

14.9% | 14.8% | 15.7% |

16.9% | |||||||||||||||||

Average common equity (3)

|

$ |

103,850 |

$ | 101,850 | $ | 95,750 | $ |

101,800 |

$ | 93,850 | ||||||||||||

Net interest margin (NIM) – on average earning assets, net (4)

|

1.50% |

1.53% | 1.52% | 1.50% |

1.46% | |||||||||||||||||

PCL on loans as a % of average net loans and acceptances |

0.29% |

0.30% | 0.17% | 0.28% |

0.02% | |||||||||||||||||

PCL on performing loans as a % of average net loans and acceptances |

0.06% |

0.09% | 0.09% | 0.08% |

(0.07)% | |||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.23% |

0.21% | 0.08% | 0.20% |

0.09% | |||||||||||||||||

Gross impaired loans (GIL) as a % of loans and acceptances |

0.38% |

0.34% | 0.25% | 0.38% |

0.25% | |||||||||||||||||

Liquidity coverage ratio (LCR) (4), (5)

|

134% |

135% | 123% | 134% |

123% | |||||||||||||||||

Net stable funding ratio (NSFR) (4), (5)

|

112% |

113% | 113% | 112% |

113% | |||||||||||||||||

Capital, Leverage and Total loss absorbing capacity (TLAC) ratios (4), (6)

|

||||||||||||||||||||||

Common Equity Tier 1 (CET1) ratio |

14.1% |

13.7% | 13.1% | 14.1% |

13.1% | |||||||||||||||||

Tier 1 capital ratio |

15.4% |

14.9% | 14.3% | 15.4% |

14.3% | |||||||||||||||||

Total capital ratio |

17.3% |

16.8% | 15.9% | 17.3% |

15.9% | |||||||||||||||||

Leverage ratio |

4.2% |

4.2% | 4.6% | 4.2% |

4.6% | |||||||||||||||||

TLAC ratio |

30.9% |

31.0% | 27.6% | 30.9% |

27.6% | |||||||||||||||||

TLAC leverage ratio |

8.5% |

8.7% | 8.8% | 8.5% |

8.8% | |||||||||||||||||

Selected balance sheet and other information (7)

|

||||||||||||||||||||||

Total assets |

$ |

1,957,734 |

$ | 1,940,302 | $ | 1,842,092 | $ |

1,957,734 |

$ | 1,842,092 | ||||||||||||

Securities, net of applicable allowance |

372,625 |

319,828 | 298,795 | 372,625 |

298,795 | |||||||||||||||||

Loans, net of allowance for loan losses |

835,714 |

831,187 | 796,314 | 835,714 |

796,314 | |||||||||||||||||

Derivative related assets |

115,914 |

124,149 | 122,058 | 115,914 |

122,058 | |||||||||||||||||

Deposits |

1,215,671 |

1,210,053 | 1,178,604 | 1,215,671 |

1,178,604 | |||||||||||||||||

Common equity |

105,004 |

103,937 | 96,570 | 105,004 |

96,570 | |||||||||||||||||

Total risk-weighted assets (RWA) (4)

|

585,899 |

593,533 | 589,050 | 585,899 |

589,050 | |||||||||||||||||

Assets under management (AUM) (4)

|

1,095,400 |

1,083,600 | 937,700 | 1,095,400 |

937,700 | |||||||||||||||||

Assets under administration (AUA) (4), (8)

|

4,415,700 |

5,911,100 | 5,748,900 | 4,415,700 |

5,748,900 | |||||||||||||||||

Common share information |

||||||||||||||||||||||

Shares outstanding (000s) – average basic |

1,393,515 |

1,388,388 | 1,396,381 | 1,388,217 |

1,409,292 | |||||||||||||||||

– average diluted |

1,394,939 |

1,390,149 | 1,398,667 | 1,389,857 |

1,411,934 | |||||||||||||||||

– end of period |

1,394,997 |

1,389,730 | 1,390,629 | 1,394,997 |

1,390,629 | |||||||||||||||||

Dividends declared per common share |

$ |

1.35 |

$ | 1.32 | $ | 1.28 | $ |

3.99 |

$ | 3.68 | ||||||||||||

Dividend yield (4)

|

4.2% |

4.0% | 3.9% | 4.1% |

3.7% | |||||||||||||||||

Dividend payout ratio (4)

|

49% |

51% | 51% | 53% |

44% | |||||||||||||||||

Common share price (RY on TSX) (9)

|

$ |

130.73 |

$ | 134.51 | $ | 124.86 | $ |

130.73 |

$ | 124.86 | ||||||||||||

Market capitalization (TSX) (9)

|

182,368 |

186,933 | 173,634 | 182,368 |

173,634 | |||||||||||||||||

Business information |

||||||||||||||||||||||

Employees (full-time equivalent) (FTE) |

93,753 |

94,398 | 88,541 | 93,753 |

88,541 | |||||||||||||||||

Bank branches |

1,257 |

1,258 | 1,283 | 1,257 |

1,283 | |||||||||||||||||

Automated teller machines (ATMs) |

4,353 |

4,357 | 4,364 | 4,353 |

4,364 | |||||||||||||||||

Period average US$ equivalent of C$1.00 (10)

|

0.750 |

0.737 | 0.783 | 0.744 |

0.786 | |||||||||||||||||

Period-end US$ equivalent of C$1.00 |

0.758 |

0.738 | 0.781 | 0.758 |

0.781 | |||||||||||||||||

| (1) | This is a non-GAAP measure, which is calculated excluding the impact of the Canada Recovery Dividend (CRD) and other tax related adjustments, HSBC Canada transaction and integration costs (net of tax), as well as the after-tax impact of amortization of acquisition-related intangibles. Amounts have been revised from those previously presented to conform to our basis of presentation for this non-GAAP measure. For further details, including a reconciliation, refer to the Key performance and non-GAAP measures section. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (3) | Average amounts are calculated using methods intended to approximate the average of the daily balances for the period. This includes average common equity used in the calculation of ROE. For further details, refer to the Key performance and non-GAAP measures section. |

| (4) | See Glossary for composition of this measure. |

| (5) | The LCR and NSFR are calculated in accordance with the Office of the Superintendent of Financial Institutions’ (OSFI) Liquidity Adequacy Requirements (LAR) guideline. LCR is the average for the three months ended for each respective period. For further details, refer to the Liquidity and funding risk section. |

| (6) | Capital ratios are calculated using OSFI’s Capital Adequacy Requirements (CAR) guideline, the Leverage ratio is calculated using OSFI’s Leverage Requirements (LR) guideline, and both the TLAC and TLAC leverage ratios are calculated using OSFI’s TLAC guideline. The results for the period ended July 31, 2023 and April 30, 2023 reflect our adoption of the revised CAR and LR guidelines that came into effect in Q2 2023 as part of OSFI’s implementation of the Basel III reforms. For further details, refer to the Capital management section. |

| (7) | Represents period-end spot balances. |

| (8) | AUA includes $13 billion and $7 billion (April 30, 2023 – $15 billion and $8 billion; July 31, 2022 – $14 billion and $5 billion) of securitized residential mortgages and credit card loans, respectively. |

| (9) | Based on TSX closing market price at period-end. |

| (10) | Average amounts are calculated using month-end spot rates for the period. |

|

Economic, market and regulatory review and outlook – data as at August 23, 2023 |

| 1 | Annualized rate |

|

Key corporate events |

|

Financial performance |

|

Overview |

| For the three months ended | For the nine months ended | |||||||||||||||

(Millions of Canadian dollars, except per share amounts) |

Q3 2023 vs. Q3 2022 |

Q3 2023 vs. Q2 2023 |

Q3 2023 vs. Q3 2022 |

|||||||||||||

Increase (decrease): |

||||||||||||||||

Total revenue |

$ |

277 |

$ |

(84 |

) |

$ 812 |

||||||||||

PCL |

10 |

(6 |

) |

25 |

||||||||||||

Non-interest expense |

187 |

(52 |

) |

515 |

||||||||||||

Income taxes |

(3 |

) |

– |

6 |

||||||||||||

Net income |

83 |

(26 |

) |

266 |

||||||||||||

Impact on EPS |

||||||||||||||||

Basic |

$ |

0.06 |

$ |

(0.02 |

) |

$ 0.19 |

||||||||||

Diluted |

0.06 |

(0.02 |

) |

0.19 |

||||||||||||

| For the three months ended | For the nine months ended | |||||||||||||||||||||||

(Average foreign currency equivalent of C$1.00) (1) |

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

|||||||||||||||||||

U.S. dollar |

0.750 |

0.737 | 0.783 | 0.744 |

0.786 | |||||||||||||||||||

British pound |

0.592 |

0.599 | 0.636 | 0.601 |

0.608 | |||||||||||||||||||

Euro |

0.690 |

0.681 | 0.747 | 0.690 |

0.721 | |||||||||||||||||||

| (1) | Average amounts are calculated using month-end spot rates for the period. |

| (Millions of Canadian dollars, except percentage amounts) | For the three months ended | For the nine months ended | ||||||||||||||||||||||

|

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

||||||||||||||||||||

Interest and dividend income |

$ |

22,834 |

$ | 20,318 | $ | 10,737 | $ |

62,489 |

$ | 25,873 | ||||||||||||||

Interest expense |

16,548 |

14,219 | 4,847 | 43,902 |

9,438 | |||||||||||||||||||

Net interest income |

$ |

6,286 |

$ | 6,099 | $ | 5,890 | $ |

18,587 |

$ | 16,435 | ||||||||||||||

NIM |

1.50% |

1.53% | 1.52% | 1.50% |

1.46% | |||||||||||||||||||

Insurance premiums, investment and fee income |

$ |

1,848 |

$ | 1,347 | $ | 1,233 | $ |

5,086 |

$ | 2,866 | ||||||||||||||

Trading revenue |

485 |

430 | (128 | ) | 1,984 |

475 | ||||||||||||||||||

Investment management and custodial fees |

2,099 |

2,083 | 1,857 | 6,238 |

5,710 | |||||||||||||||||||

Mutual fund revenue |

1,034 |

1,000 | 1,028 | 3,049 |

3,279 | |||||||||||||||||||

Securities brokerage commissions |

362 |

377 | 344 | 1,100 |

1,132 | |||||||||||||||||||

Service charges |

529 |

511 | 499 | 1,551 |

1,464 | |||||||||||||||||||

Underwriting and other advisory fees |

472 |

458 | 369 | 1,442 |

1,577 | |||||||||||||||||||

Foreign exchange revenue, other than trading |

289 |

322 | 250 | 1,044 |

772 | |||||||||||||||||||

Card service revenue |

334 |

279 | 314 | 938 |

893 | |||||||||||||||||||

Credit fees |

342 |

357 | 301 | 1,078 |

1,175 | |||||||||||||||||||

Net gains on investment securities |

27 |

111 | 28 | 191 |

66 | |||||||||||||||||||

Share of profit in joint ventures and associates |

(37 |

) |

12 | 33 | 4 |

86 | ||||||||||||||||||

Other |

419 |

134 | 114 | 811 |

488 | |||||||||||||||||||

Non-interest income |

8,203 |

7,421 | 6,242 | 24,516 |

19,983 | |||||||||||||||||||

Total revenue |

$ |

14,489 |

$ | 13,520 | $ | 12,132 | $ |

43,103 |

$ | 36,418 | ||||||||||||||

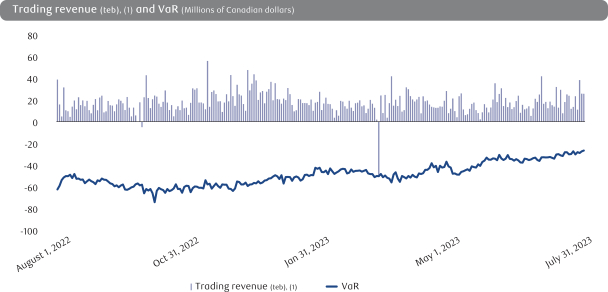

Additional trading information |

||||||||||||||||||||||||

Net interest income (1)

|

$ |

510 |

$ | 469 | $ | 465 | $ |

1,165 |

$ | 1,621 | ||||||||||||||

Non-interest income |

485 |

430 | (128 | ) | 1,984 |

475 | ||||||||||||||||||

Total trading revenue |

$ |

995 |

$ | 899 | $ | 337 | $ |

3,149 |

$ | 2,096 | ||||||||||||||

| (1) | Reflects net interest income arising from trading-related positions, including assets and liabilities that are classified or designated at fair value through profit or loss (FVTPL). |

| For the three months ended | For the nine months ended | |||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) |

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

|||||||||||||||||||

Personal & Commercial Banking |

$ |

2 |

$ | 124 | $ | 145 | $ |

266 |

$ | (337 | ) | |||||||||||||

Wealth Management (2)

|

64 |

2 | 13 | 90 |

(31 | ) | ||||||||||||||||||

Capital Markets (2)

|

54 |

47 | 20 | 110 |

(39 | ) | ||||||||||||||||||

Corporate Support and other (3)

|

– |

– | (1 | ) | – |

– | ||||||||||||||||||

PCL on performing loans |

120 |

173 | 177 | 466 |

(407 | ) | ||||||||||||||||||

Personal & Commercial Banking |

$ |

303 |

$ | 302 | $ | 185 | $ |

867 |

$ | 523 | ||||||||||||||

Wealth Management (2)

|

38 |

26 | 1 | 106 |

2 | |||||||||||||||||||

Capital Markets (2)

|

158 |

113 | (17 | ) | 324 |

(2 | ) | |||||||||||||||||

Corporate Support and other (3)

|

– |

– | 1 | – |

1 | |||||||||||||||||||

PCL on impaired loans |

499 |

441 | 170 | 1,297 |

524 | |||||||||||||||||||

PCL – Loans |

619 |

614 | 347 | 1,763 |

117 | |||||||||||||||||||

PCL – Other (4)

|

(3 |

) |

(14 | ) | (7 | ) | (15 |

) |

(14 | ) | ||||||||||||||

Total PCL |

$ |

616 |

$ | 600 | $ | 340 | $ |

1,748 |

$ | 103 | ||||||||||||||

| PCL on loans is comprised of: | ||||||||||||||||||||||||

Retail |

$ |

(1 |

) |

$ | 97 | $ | 133 | $ |

230 |

$ | (113 | ) | ||||||||||||

Wholesale |

121 |

76 | 44 | 236 |

(294 | ) | ||||||||||||||||||

PCL on performing loans |

120 |

173 | 177 | 466 |

(407 | ) | ||||||||||||||||||

Retail |

270 |

249 | 163 | 758 |

447 | |||||||||||||||||||

Wholesale |

229 |

192 | 7 | 539 |

77 | |||||||||||||||||||

PCL on impaired loans |

499 |

441 | 170 | 1,297 |

524 | |||||||||||||||||||

PCL – Loans |

$ |

619 |

$ | 614 | $ | 347 | $ |

1,763 |

$ | 117 | ||||||||||||||

PCL on loans as a % of average net loans and acceptances |

0.29% |

0.30% | 0.17% | 0.28% |

0.02% | |||||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.23% |

0.21% | 0.08% | 0.20% |

0.09% | |||||||||||||||||||

| (1) | Information on loans represents loans, acceptances and commitments. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (3) | Includes PCL recorded in Corporate Support and Insurance. |

| (4) | PCL – Other includes amounts related to debt securities measured at fair value through other comprehensive income (FVOCI) and amortized cost, accounts receivable, and financial and purchased guarantees. |

| For the three months ended | For the nine months ended | |||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) |

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

|||||||||||||||||||

Salaries |

$ |

2,190 |

$ | 2,096 | $ | 1,820 | $ |

6,323 |

$ | 5,316 | ||||||||||||||

Variable compensation |

1,815 |

1,812 | 1,473 | 5,652 |

5,168 | |||||||||||||||||||

Benefits and retention compensation |

546 |

560 | 497 | 1,650 |

1,529 | |||||||||||||||||||

Share-based compensation |

243 |

132 | 68 | 645 |

132 | |||||||||||||||||||

Human resources |

4,794 |

4,600 | 3,858 | 14,270 |

12,145 | |||||||||||||||||||

Equipment |

611 |

589 | 514 | 1,769 |

1,528 | |||||||||||||||||||

Occupancy |

411 |

408 | 381 | 1,230 |

1,153 | |||||||||||||||||||

Communications |

324 |

317 | 277 | 923 |

763 | |||||||||||||||||||

Professional fees |

592 |

521 | 373 | 1,517 |

1,039 | |||||||||||||||||||

Amortization of other intangibles |

369 |

380 | 342 | 1,118 |

1,015 | |||||||||||||||||||

Other |

760 |

679 | 641 | 2,203 |

1,757 | |||||||||||||||||||

Non-interest expense |

$ |

7,861 |

$ | 7,494 | $ | 6,386 | $ |

23,030 |

$ | 19,400 | ||||||||||||||

Efficiency ratio (1)

|

54.3% |

55.4% | 52.6% | 53.4% |

53.3% | |||||||||||||||||||

Adjusted efficiency ratio (2), (3)

|

58.5% |

58.8% | 56.1% | 57.7% |

55.3% | |||||||||||||||||||

| (1) | Efficiency ratio is calculated as Non-interest expense divided by Total revenue. |

| (2) | This is a non-GAAP ratio. For further details, refer to the Key performance and non-GAAP measures section. |

| (3) | Effective Q2 2023, we revised the composition of this non-GAAP ratio. Comparative adjusted amounts have been revised to conform with this presentation. |

| For the three months ended | For the nine months ended | |||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) |

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

|||||||||||||||||||

Income taxes |

$ |

761 |

$ | 771 | $ | 979 | $ |

3,660 |

$ | 3,323 | ||||||||||||||

Income before income taxes |

4,633 |

4,420 | 4,556 | 14,395 |

15,248 | |||||||||||||||||||

Effective income tax rate |

16.4% |

17.4% | 21.5% | 25.4% |

21.8% | |||||||||||||||||||

Adjusted effective income tax rate (1), (2)

|

16.7% |

17.6% | 21.5% | 18.2% |

21.8% | |||||||||||||||||||

| (1) | This is a non-GAAP measure. For further details, including a reconciliation, refer to the Key performance and non-GAAP measures section. |

| (2) | Effective Q2 2023, we revised the composition of this non-GAAP measure. Comparative adjusted amounts have been revised to conform with this presentation. |

|

Business segment results |

|

How we measure and report our business segments |

|

Key performance and non-GAAP measures |

| For the three months ended | ||||||||||||||||||||||||||||||||||||

|

July 31 2023 |

April 30 2023 |

July 31 2022 |

||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars, except percentage amounts) |

Personal & Commercial Banking |

Wealth Management |

Insurance |

Capital Markets |

Corporate Support |

Total |

Total | Total | ||||||||||||||||||||||||||||

Net income available to common shareholders |

$ |

2,115 |

$ |

661 |

$ |

226 |

$ |

923 |

$ |

(113 |

) |

$ |

3,812 |

$ | 3,581 | $ | 3,517 | |||||||||||||||||||

Total average common equity (1), (2)

|

29,900 |

24,200 |

2,200 |

27,500 |

20,050 |

103,850 |

101,850 | 95,750 | ||||||||||||||||||||||||||||

ROE (3)

|

28.1% |

10.8% |

40.7% |

13.3% |

n.m. |

14.6% |

14.4% | 14.6% | ||||||||||||||||||||||||||||

| For the nine months ended | ||||||||||||||||||||||||||||||||||||

|

July 31 2023 |

July 31 2022 |

|||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars, except percentage amounts) |

Personal & Commercial Banking |

Wealth Management |

Insurance |

Capital Markets |

Corporate Support |

Total |

Total | |||||||||||||||||||||||||||||

Net income available to common shareholders |

$ |

6,122 |

$ |

2,224 |

$ |

511 |

$ |

3,055 |

$ |

(1,351 |

) |

$ |

10,561 |

$ | 11,738 | |||||||||||||||||||||

Total average common equity (1), (2)

|

29,100 |

24,450 |

2,100 |

27,800 |

18,350 |

101,800 |

93,850 | |||||||||||||||||||||||||||||

ROE (3)

|

28.1% |

12.1% |

32.3% |

14.7% |

n.m. |

13.9% |

16.7% | |||||||||||||||||||||||||||||

| (1) | Total average common equity represents rounded figures. |

| (2) | The amounts for the segments are referred to as attributed capital. |

| (3) | ROE is based on actual balances of average common equity before rounding. |

| n.m. | not meaningful |

| • | CRD and other tax related adjustments: reflects the impact of the CRD and the 1.5% increase in the Canadian corporate tax rate applicable to fiscal 2022, net of deferred tax adjustments, which were announced in the Government of Canada’s 2022 budget and enacted in the first quarter of 2023 |

| • | Transaction and integration costs relating to our planned acquisition of HSBC Canada |

| As at or for the three months ended | As at or for the nine months ended | |||||||||||||||||||||

| (Millions of Canadian dollars, except per share, number of and percentage amounts) |

July 31 2023 |

April 30 2023 |

July 31 2022 (1) |

July 31 2023 |

July 31 2022 (1) |

|||||||||||||||||

Total revenue |

$ |

14,489 |

$ | 13,520 | $ | 12,132 | $ |

43,103 |

$ | 36,418 | ||||||||||||

PCL |

616 |

600 | 340 | 1,748 |

103 | |||||||||||||||||

Non-interest expense |

7,861 |

7,494 | 6,386 | 23,030 |

19,400 | |||||||||||||||||

Income before income taxes |

4,633 |

4,420 | 4,556 | 14,395 |

15,248 | |||||||||||||||||

Income taxes |

761 |

771 | 979 | 3,660 |

3,323 | |||||||||||||||||

Net income |

$ |

3,872 |

$ | 3,649 | $ | 3,577 | $ |

10,735 |

$ | 11,925 | ||||||||||||

Net income available to common shareholders |

$ |

3,812 |

$ | 3,581 | $ | 3,517 | $ |

10,561 |

$ | 11,738 | ||||||||||||

Average number of common shares (thousands) |

1,393,515 |

1,388,388 | 1,396,381 | 1,388,217 |

1,409,292 | |||||||||||||||||

Basic earnings per share (in dollars) |

$ |

2.74 |

$ | 2.58 | $ | 2.52 | $ |

7.61 |

$ | 8.33 | ||||||||||||

Average number of diluted common shares (thousands) |

1,394,939 |

1,390,149 | 1,398,667 | 1,389,857 |

1,411,934 | |||||||||||||||||

Diluted earnings per share (in dollars) |

$ |

2.73 |

$ | 2.58 | $ | 2.51 | $ |

7.60 |

$ | 8.31 | ||||||||||||

ROE (2)

|

14.6% |

14.4% | 14.6% | 13.9% |

16.7% | |||||||||||||||||

Effective income tax rate |

16.4% |

17.4% | 21.5% | 25.4% |

21.8% | |||||||||||||||||

Total adjusting items impacting net income (before-tax)

|

$ |

191 |

$ | 138 | $ | 62 | $ |

426 |

$ | 188 | ||||||||||||

Specified item: HSBC Canada transaction and integration costs (3)

|

110 |

56 | – | 177 |

– | |||||||||||||||||

Amortization of acquisition-related intangibles (4)

|

81 |

82 | 62 | 249 |

188 | |||||||||||||||||

Total income taxes for adjusting items impacting net income |

$ |

46 |

$ | 29 | $ | 16 | $ |

(957 |

) |

$ | 49 | |||||||||||

Specified item: CRD and other tax related adjustments (3), (5)

|

– |

– | – | (1,050 |

) |

– | ||||||||||||||||

Specified item: HSBC Canada transaction and integration costs (3)

|

26 |

13 | – | 42 |

– | |||||||||||||||||

Amortization of acquisition-related intangibles (4)

|

20 |

16 | 16 | 51 |

49 | |||||||||||||||||

Adjusted results (6)

|

||||||||||||||||||||||

Income before income taxes – adjusted |

4,824 |

4,558 | 4,618 | 14,821 |

15,436 | |||||||||||||||||

Income taxes – adjusted |

807 |

800 | 995 | 2,703 |

3,372 | |||||||||||||||||

Net income – adjusted |

$ |

4,017 |

$ | 3,758 | $ | 3,623 | $ |

12,118 |

$ | 12,064 | ||||||||||||

Net income available to common shareholders – adjusted |

$ |

3,957 |

$ | 3,690 | $ | 3,563 | $ |

11,944 |

$ | 11,877 | ||||||||||||

Average number of common shares (thousands) |

1,393,515 |

1,388,388 | 1,396,381 | 1,388,217 |

1,409,292 | |||||||||||||||||

Basic earnings per share (in dollars) – adjusted |

$ |

2.84 |

$ | 2.66 | $ | 2.55 | $ |

8.60 |

$ | 8.43 | ||||||||||||

Average number of diluted common shares (thousands) |

1,394,939 |

1,390,149 | 1,398,667 | 1,389,857 |

1,411,934 | |||||||||||||||||

Diluted earnings per share (in dollars) – adjusted |

$ |

2.84 |

$ | 2.65 | $ | 2.55 | $ |

8.59 |

$ | 8.41 | ||||||||||||

ROE – adjusted |

15.1% |

14.9% | 14.8% | 15.7% |

16.9% | |||||||||||||||||

Adjusted effective income tax rate |

16.7% |

17.6% | 21.5% | 18.2% |

21.8% | |||||||||||||||||

Adjusted efficiency ratio (7)

|

||||||||||||||||||||||

Total revenue |

$ |

14,489 |

$ | 13,520 | $ | 12,132 | $ |

43,103 |

$ | 36,418 | ||||||||||||

Less: PBCAE |

1,379 |

1,006 | 850 | 3,930 |

1,667 | |||||||||||||||||

Total revenue – adjusted |

$ |

13,110 |

$ | 12,514 | $ | 11,282 | $ |

39,173 |

$ | 34,751 | ||||||||||||

Non-interest expense |

$ |

7,861 |

$ | 7,494 | $ | 6,386 | $ |

23,030 |

$ | 19,400 | ||||||||||||

Less specified item: HSBC Canada transaction and integration costs (before-tax) (3)

|

110 |

56 | – | 177 |

– | |||||||||||||||||

Less: Amortization of acquisition-related intangibles (before-tax)

(4)

|

81 |

82 | 62 | 249 |

188 | |||||||||||||||||

Non-interest expense – adjusted |

$ |

7,670 |

$ | 7,356 | $ | 6,324 | $ |

22,604 |

$ | 19,212 | ||||||||||||

Efficiency ratio |

54.3% |

55.4% | 52.6% | 53.4% |

53.3% | |||||||||||||||||

Efficiency ratio – adjusted |

58.5% |

58.8% | 56.1% | 57.7% |

55.3% | |||||||||||||||||

| (1) | There were no specified items for the three months ended July 31, 2022 or for the nine months ended July 31, 2022. |

| (2) | ROE is based on actual balances of average common equity before rounding. |

| (3) | These amounts have been recognized in Corporate Support. |

| (4) | Represents the impact of amortization of acquisition-related intangibles (excluding amortization of software), and any goodwill impairment. |

| (5) | The impact of the CRD and other tax related adjustments does not include $0.2 billion recognized in other comprehensive income. |

| (6) | Effective the second quarter of 2023, we included HSBC Canada transaction and integration costs and amortization of acquisition-related intangibles as adjusting items for non-GAAP measures and non-GAAP ratios. Therefore, comparative adjusted results have been revised from those previously presented to conform to our basis of presentation for this non-GAAP measure. |

| (7) | Effective the second quarter of 2023, we revised the composition of this non-GAAP ratio, which is calculated based on adjusted Non-interest expense excluding HSBC Canada transaction and integration costs and amortization of acquisition-related intangibles divided by total revenue net of PBCAE. Therefore, comparative adjusted results have been revised from those previously presented to conform to our basis of presentation for this non-GAAP ratio. |

|

Personal & Commercial Banking |

| As at or for the three months ended | As at or for the nine months ended | |||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts and as otherwise noted) |

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

|||||||||||||||||

Net interest income |

$ |

4,062 |

$ | 3,817 | $ | 3,655 | $ |

11,886 |

$ | 10,118 | ||||||||||||

Non-interest income |

1,501 |

1,481 | 1,527 | 4,516 |

4,606 | |||||||||||||||||

Total revenue |

5,563 |

5,298 | 5,182 | 16,402 |

14,724 | |||||||||||||||||

PCL on performing assets |

5 |

122 | 141 | 268 |

(339 | ) | ||||||||||||||||

PCL on impaired assets |

300 |

300 | 183 | 860 |

516 | |||||||||||||||||

PCL |

305 |

422 | 324 | 1,128 |

177 | |||||||||||||||||

Non-interest expense |

2,319 |

2,257 | 2,130 | 6,805 |

6,167 | |||||||||||||||||

Income before income taxes |

2,939 |

2,619 | 2,728 | 8,469 |

8,380 | |||||||||||||||||

Net income |

$ |

2,134 |

$ | 1,915 | $ | 2,023 | $ |

6,175 |

$ | 6,231 | ||||||||||||

Revenue by business |

||||||||||||||||||||||

Canadian Banking |

$ |

5,292 |

$ | 5,040 | $ | 4,974 | $ |

15,616 |

$ | 14,103 | ||||||||||||

Caribbean & U.S. Banking |

271 |

258 | 208 | 786 |

621 | |||||||||||||||||

Selected balance sheet and other information |

||||||||||||||||||||||

ROE |

28.1% |

26.5% | 29.2% | 28.1% |

31.0% | |||||||||||||||||

NIM |

2.74% |

2.70% | 2.61% | 2.73% |

2.50% | |||||||||||||||||

Efficiency ratio (1)

|

41.7% |

42.6% | 41.1% | 41.5% |

41.9% | |||||||||||||||||

Operating leverage (1)

|

(1.5)% |

(0.2)% | 4.8% | 1.1% |

2.5% | |||||||||||||||||

Average total earning assets, net |

$ |

588,400 |

$ | 579,800 | $ | 555,400 | $ |

581,400 |

$ | 542,100 | ||||||||||||

Average loans and acceptances, net |

596,000 |

586,700 | 560,300 | 588,200 |

546,300 | |||||||||||||||||

Average deposits |

601,100 |

588,000 | 555,300 | 589,600 |

546,000 | |||||||||||||||||

AUA (2)

|

353,400 |

351,100 | 346,500 | 353,400 |

346,500 | |||||||||||||||||

Average AUA |

349,100 |

347,900 | 343,500 | 346,800 |

361,400 | |||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.20% |

0.21% | 0.13% | 0.20% |

0.13% | |||||||||||||||||

Other selected information – Canadian Banking |

||||||||||||||||||||||

Net income |

$ |

2,043 |

$ | 1,825 | $ | 1,971 | $ |

5,924 |

$ | 6,025 | ||||||||||||

NIM |

2.68% |

2.65% | 2.60% | 2.69% |

2.49% | |||||||||||||||||

Efficiency ratio |

40.5% |

41.4% | 39.7% | 40.3% |

40.6% | |||||||||||||||||

Operating leverage |

(2.0)% |

(0.6)% | 4.5% | 0.8% |

2.1% | |||||||||||||||||

| (1) | See Glossary for composition of this measure. |

| (2) | AUA represents period-end spot balances and includes securitized residential mortgages and credit card loans as at July 31, 2023 of $13 billion and $7 billion, respectively (April 30, 2023 – $15 billion and $8 billion; July 31, 2022 – $14 billion and $5 billion). |

|

Wealth Management |

| As at or for the three months ended | As at or for the nine months ended | |||||||||||||||||||||

(Millions of Canadian dollars, except number of, percentage amounts and as otherwise noted) |

July 31 2023 |

April 30 2023 |

July 31 2022

(1)

|

July 31 2023 |

July 31 2022

(1)

|

|||||||||||||||||

Net interest income |

$ |

1,007 |

$ | 1,096 | $ | 1,051 | $ |

3,328 |

$ | 2,782 | ||||||||||||

Non-interest income |

3,411 |

3,328 | 2,971 | 10,099 |

9,259 | |||||||||||||||||

Total revenue |

4,418 |

4,424 | 4,022 | 13,427 |

12,041 | |||||||||||||||||

PCL on performing assets |

64 |

2 | 13 | 90 |

(31 | ) | ||||||||||||||||

PCL on impaired assets |

38 |

26 | 1 | 106 |

2 | |||||||||||||||||

PCL |

102 |

28 | 14 | 196 |

(29 | ) | ||||||||||||||||

Non-interest expense |

3,498 |

3,447 | 2,929 | 10,379 |

8,844 | |||||||||||||||||

Income before income taxes |

818 |

949 | 1,079 | 2,852 |

3,226 | |||||||||||||||||

Net income |

$ |

674 |

$ | 742 | $ | 821 | $ |

2,264 |

$ | 2,451 | ||||||||||||

Revenue by business |

||||||||||||||||||||||

Canadian Wealth Management |

$ |

1,111 |

$ | 1,094 | $ | 1,070 | $ |

3,316 |

$ | 3,213 | ||||||||||||

U.S. Wealth Management (including City National) |

1,969 |

2,005 | 1,878 | 6,102 |

5,380 | |||||||||||||||||

U.S. Wealth Management (including City National) (US$ millions) |

1,477 |

1,477 | 1,470 | 4,539 |

4,228 | |||||||||||||||||

Global Asset Management |

635 |

634 | 609 | 1,952 |

2,023 | |||||||||||||||||

International Wealth Management |

324 |

323 | 98 | 935 |

257 | |||||||||||||||||

Investor Services (2)

|

379 |

368 | 367 | 1,122 |

1,168 | |||||||||||||||||

Selected balance sheet and other information |

||||||||||||||||||||||

ROE |

10.8% |

12.1% | 15.7% | 12.1% |

16.3% | |||||||||||||||||

NIM |

2.29% |

2.44% | 2.59% | 2.46% |

2.30% | |||||||||||||||||

Pre-tax margin (3)

|

18.5% |

21.5% | 26.8% | 21.2% |

26.8% | |||||||||||||||||

Number of advisors (4)

|

6,239 |

6,246 | 5,622 | 6,239 |

5,622 | |||||||||||||||||

Average total earning assets, net |

$ |

174,200 |

$ | 184,000 | $ | 161,300 | $ |

181,200 |

$ | 161,800 | ||||||||||||

Average loans and acceptances, net |

119,300 |

121,600 | 111,600 | 121,100 |

106,500 | |||||||||||||||||

Average deposits (2)

|

154,300 |

158,600 | 194,600 | 166,300 |

198,800 | |||||||||||||||||

AUA (2), (5)

|

4,043,600 |

5,540,900 | 5,385,000 | 4,043,600 |

5,385,000 | |||||||||||||||||

U.S. Wealth Management (including City National) (5)

|

756,300 |

737,500 | 683,400 | 756,300 |

683,400 | |||||||||||||||||

U.S. Wealth Management (including City National) (US$ millions) (5)

|

573,500 |

544,300 | 533,600 | 573,500 |

533,600 | |||||||||||||||||

Investor Services (5)

|

2,544,500 |

4,067,800 | 4,089,900 | 2,544,500 |

4,089,900 | |||||||||||||||||

AUM (5)

|

1,086,800 |

1,074,900 | 929,600 | 1,086,800 |

929,600 | |||||||||||||||||

Average AUA (2)

|

4,987,300 |

5,499,000 | 5,540,800 | 5,301,000 |

5,797,100 | |||||||||||||||||

Average AUM |

1,074,600 |

1,060,300 | 922,000 | 1,054,000 |

974,400 | |||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.13% |

0.09% | 0.00% | 0.12% |

0.00% | |||||||||||||||||

|

Estimated impact of U.S. dollar, British pound and Euro translation on key income statement items (Millions of Canadian dollars, except percentage amounts) |

For the three months ended |

For the nine months ended |

||||||||||||||

|

Q3 2023 vs. Q3 2022 |

Q3 2023 vs. Q2 2023 |

Q3 2023 vs. Q3 2022 |

||||||||||||||

Increase (decrease): |

||||||||||||||||

Total revenue |

$ |

131 |

$ |

(34 |

) |

$ |

380 |

|||||||||

PCL |

3 |

(3 |

) |

8 |

||||||||||||

Non-interest expense |

111 |

(30 |

) |

315 |

||||||||||||

Net income |

15 |

(1 |

) |

46 |

||||||||||||

Percentage change in average U.S. dollar equivalent of C$1.00 |

(4)% |

2% |

(5)% |

|||||||||||||

Percentage change in average British pound equivalent of C$1.00 |

(7)% |

(1)% |

(1)% |

|||||||||||||

Percentage change in average Euro equivalent of C$1.00 |

(8)% |

1% |

(4)% |

|||||||||||||

| (1) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (2) | On July 3, 2023, we completed the partial sale of RBC Investor Services operations. The completion of the sale of the business of the U.K. branch of RBC Investor Services Trust and the RBC Investor Services business in Jersey remains subject to customary closing conditions, including regulatory approvals. For further details, refer to Note 6 of our Condensed Financial Statements. |

| (3) |

Pre-tax margin is defined as Income before income taxes divided by Total revenue. |

| (4) | Represents client-facing advisors across all of our Wealth Management businesses. |

| (5) | Represents period-end spot balances. |

|

Insurance |

| As at or for the three months ended | As at or for the nine months ended | |||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts and as otherwise noted) |

July 31 2023 |

April 30 2023 |

July 31 2022 |

July 31 2023 |

July 31 2022 |

|||||||||||||||||

Non-interest income |

||||||||||||||||||||||

Net earned premiums |

$ |

1,773 |

$ | 1,195 | $ | 936 | $ |

4,010 |

$ | 3,745 | ||||||||||||

Investment income, gains/(losses) on assets supporting insurance policyholder liabilities (1)

|

18 |

103 | 245 | 919 |

(1,029 | ) | ||||||||||||||||

Fee income |

57 |

49 | 52 | 157 |

150 | |||||||||||||||||

Total revenue |

1,848 |

1,347 | 1,233 | 5,086 |

2,866 | |||||||||||||||||

Insurance policyholder benefits and claims (1)

|

1,295 |

923 | 773 | 3,683 |

1,426 | |||||||||||||||||

Insurance policyholder acquisition expense |

84 |

83 | 77 | 247 |

241 | |||||||||||||||||

Non-interest expense |

165 |

159 | 139 | 480 |

431 | |||||||||||||||||

Income before income taxes |

304 |

182 | 244 | 676 |

768 | |||||||||||||||||

Net income |

$ |

227 |

$ | 139 | $ | 186 | $ |

514 |

$ | 589 | ||||||||||||

Revenue by business |

||||||||||||||||||||||

Canadian Insurance |

$ |

1,184 |

$ | 695 | $ | 597 | $ |

3,176 |

$ | 783 | ||||||||||||

International Insurance |

664 |

652 | 636 | 1,910 |

2,083 | |||||||||||||||||

Selected balances and other information |

||||||||||||||||||||||

ROE |

40.7% |