UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 23, 2023

KOHL’S CORPORATION

(Exact name of registrant as specified in its charter)

| Wisconsin | 001-11084 | 39-1630919 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| N56 W17000 Ridgewood Drive Menomonee Falls, Wisconsin |

53051 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (262) 703-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, $.01 par value | KSS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On August 23, 2023, Kohl’s Corporation (the “Company”) issued a press release reporting its earnings for the quarter ended July 29, 2023 and provided earnings guidance for fiscal 2023. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein. A copy of the presentation materials for the August 23, 2023 quarterly earnings conference call is attached as Exhibit 99.2 and incorporated by reference herein.

| Item 7.01. | Regulation FD Disclosure. |

See Item 2.02.

The information in Items 2.02 and 7.01, including the exhibits attached hereto, is furnished solely pursuant to Items 2.02 and 7.01 of Form 8-K. Consequently, such information is not deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Further, the information in Items 2.02 and 7.01, including the exhibits, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933.

| Item 8.01. | Other Events. |

As previously announced, on August 8, 2023, the Board of Directors of the Company declared a quarterly cash dividend of $0.50 per share. The dividend will be paid on September 20, 2023, to all shareholders of record at the close of business on September 6, 2023.

Cautionary Statement Regarding Forward-Looking Information and Non-GAAP Measures

This current report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “intends,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which is expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and the Company undertakes no obligation to update them.

In the attached presentation materials, the Company provides information regarding free cash flow, which is not a recognized term under U.S. generally accepted accounting principles (“GAAP”) and does not purport to be an alternative to net income as a measure of operating performance. A reconciliation of free cash flow is provided in the presentation materials attached hereto as Exhibit 99.2. The Company believes that the use of this non-GAAP financial measure provides investors with enhanced visibility into its results with respect to the impact of certain costs. Because not all companies use identical calculations, this presentation may not be comparable to other similarly titled measures of other companies.

| Item 9.01. | Financial Statements and Exhibits. |

| Exhibit |

Description |

|

| 99.1 | Press Release dated August 23, 2023 | |

| 99.2 | Presentation Materials for August 23, 2023 Quarterly Earnings Conference Call | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| KOHL’S CORPORATION | ||||||

| Date: August 23, 2023 |

By: | /s/ Jennifer Kent |

||||

| Jennifer Kent | ||||||

| Senior Executive Vice President, | ||||||

| Chief Legal Officer and Corporate Secretary | ||||||

Exhibit 99.1

Kohl’s Reports Second Quarter Fiscal 2023 Financial Results

MENOMONEE FALLS, Wis.—(BUSINESS WIRE)—August 23, 2023— Kohl’s Corporation (NYSE:KSS) today reported results for the second quarter ended July 29, 2023.

| • | Net sales decreased 4.8% and comparable sales decreased 5.0% |

| • | Diluted earnings per share of $0.52 |

| • | Inventory declined 14% |

| • | Reaffirms full year 2023 financial outlook |

| • | Remains committed to strengthening balance sheet and to maintaining current dividend |

Tom Kingsbury, Kohl’s chief executive officer, said “Our second quarter earnings were in line with our expectations. We maintained strong sales momentum in Sephora at Kohl’s, reduced inventory by 14%, and managed expenses tightly. Further, solid cash flow generation allowed us to reduce our borrowings in the period.”

“Many of our strategic efforts are just underway, which we expect will contribute incrementally in the back half of the year, and even more so in 2024 and beyond. We have enhanced the store experience and recently opened an additional 200 Sephora at Kohl’s shops, and are taking steps to further optimize our assortment and simplify our value strategies. Looking ahead, we are reaffirming our 2023 guidance and remain confident in our longer-term opportunity. I want to thank the entire Kohl’s team for their efforts to support and drive improved Kohl’s performance,” Kingsbury continued.

Second Quarter 2023 Results

Comparisons refer to the 13-week period ended July 29, 2023 versus the 13-week period ended July 30, 2022

| • | Net sales decreased 4.8% year-over-year, to $3.7 billion, with comparable sales down 5.0%. |

| • | Gross margin as a percentage of net sales was 39.0%, a decrease of 61 basis points. |

| • | Selling, general & administrative (SG&A) expenses increased 1.6% year-over-year, to $1.3 billion. As a percentage of total revenue, SG&A expenses were 33.5%, an increase of 208 basis points year-over-year. |

| • | Operating income was $163 million compared to $266 million in the prior year. As a percentage of total revenue, operating income was 4.2%, a decrease of 233 basis points year-over-year. |

| • | Net income was $58 million, or $0.52 per diluted share. This compares to net income of $143 million, or $1.11 per diluted share in the prior year. |

| • | Inventory was $3.5 billion, a decrease of 14% year-over-year. |

| • | Operating cash flow was $430 million. |

Six Months Fiscal Year 2023 Results

Comparisons refer to the 26-week period ended July 29, 2023 versus the 26-week period ended July 30, 2022

| • | Net sales decreased 4.1% year-over-year, to $7.0 billion, with comparable sales down 4.7%. |

| • | Gross margin as a percentage of net sales was 39.0%, a decrease of 1 basis point. |

| • | Selling, general & administrative (SG&A) expenses decreased 1.3% year-over-year, to $2.5 billion. As a percentage of total revenue, SG&A expenses were 34.1%, an increase of 103 basis points year-over-year. |

| • | Operating income was $261 million compared to $348 million in the prior year. As a percentage of total revenue, operating income was 3.5%, a decrease of 96 basis points year-over-year. |

| • | Net income was $72 million, or $0.65 per diluted share. This compares to net income of $157 million, or $1.22 per diluted share in the prior year. |

| • | Operating cash flow was $228 million. |

2023 Financial and Capital Allocation Outlook

For the full year 2023, the Company reaffirms its financial outlook and currently expects the following:

| • | Net sales: A decrease of (2%) to (4%), includes the impact of the 53rd week which is worth approximately 1% year-over-year. |

| • | Operating margin: Approximately 4.0%. |

| • | Diluted earnings per share: In the range of $2.10 to $2.70, excluding any non-recurring charges. |

| • | Capital Expenditures: $600 million to $650 million, including expansion of its Sephora partnership and store refresh activity. |

| • | Dividend: On August 8, 2023, Kohl’s Board of Directors declared a quarterly cash dividend on the Company’s common stock of $0.50 per share. The dividend is payable September 20, 2023 to shareholders of record at the close of business on September 6, 2023. |

Second Quarter 2023 Earnings Conference Call

Kohl’s will host its quarterly earnings conference call at 9:00 am ET on August 23, 2023. A webcast of the conference call and the related presentation materials will be available via the Company’s web site at investors.kohls.com, both live and after the call.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and the Company undertakes no obligation to update them.

About Kohl’s

Kohl’s (NYSE: KSS) is a leading omnichannel retailer built on a foundation that combines great brands, incredible value and convenience for our customers. Kohl’s serves millions of families in our more than 1,100 stores in 49 states, online at Kohls.com, and through our Kohl’s App. For a list of store locations or to shop online, visit Kohls.com. For more information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com.

Contacts

Investor Relations:

Mark Rupe, (262) 703-1266, mark.rupe@kohls.com

Media:

Jen Johnson, (262) 703-5241, jen.johnson@kohls.com

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| (Dollars in Millions, Except per Share Data) | July 29, 2023 | July 30, 2022 | July 29, 2023 | July 30, 2022 | ||||||||||||

| Net sales |

$ | 3,678 | $ | 3,863 | $ | 7,033 | $ | 7,334 | ||||||||

| Other revenue |

217 | 224 | 433 | 468 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

3,895 | 4,087 | 7,466 | 7,802 | ||||||||||||

| Cost of merchandise sold |

2,242 | 2,332 | 4,289 | 4,472 | ||||||||||||

| Gross margin rate |

39.0 | % | 39.6 | % | 39.0 | % | 39.0 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general, and administrative |

1,304 | 1,283 | 2,542 | 2,576 | ||||||||||||

| As a percent of total revenue |

33.5 | % | 31.4 | % | 34.1 | % | 33.0 | % | ||||||||

| Depreciation and amortization |

186 | 206 | 374 | 406 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

163 | 266 | 261 | 348 | ||||||||||||

| Interest expense, net |

89 | 77 | 173 | 145 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

74 | 189 | 88 | 203 | ||||||||||||

| Provision for income taxes |

16 | 46 | 16 | 46 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 58 | $ | 143 | $ | 72 | $ | 157 | ||||||||

| Average number of shares: |

||||||||||||||||

| Basic |

110 | 127 | 110 | 127 | ||||||||||||

| Diluted |

111 | 128 | 111 | 129 | ||||||||||||

| Earnings per share: |

||||||||||||||||

| Basic |

$ | 0.52 | $ | 1.13 | $ | 0.65 | $ | 1.24 | ||||||||

| Diluted |

$ | 0.52 | $ | 1.11 | $ | 0.65 | $ | 1.22 | ||||||||

KOHL’S CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| (Dollars in Millions) | July 29, 2023 | July 30, 2022 | ||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 204 | $ | 222 | ||||

| Merchandise inventories |

3,474 | 4,034 | ||||||

| Other |

296 | 374 | ||||||

|

|

|

|

|

|||||

| Total current assets |

3,974 | 4,630 | ||||||

| Property and equipment, net |

7,945 | 8,228 | ||||||

| Operating leases |

2,493 | 2,296 | ||||||

| Other assets |

382 | 469 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 14,794 | $ | 15,623 | ||||

|

|

|

|

|

|||||

| Liabilities and Shareholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 1,376 | $ | 1,497 | ||||

| Accrued liabilities |

1,246 | 1,426 | ||||||

| Borrowings under revolving credit facility |

560 | 79 | ||||||

| Current portion of: |

||||||||

| Long-term debt |

111 | 164 | ||||||

| Finance leases and financing obligations |

84 | 96 | ||||||

| Operating leases |

93 | 108 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

3,470 | 3,370 | ||||||

| Long-term debt |

1,637 | 1,747 | ||||||

| Finance leases and financing obligations |

2,730 | 2,830 | ||||||

| Operating leases |

2,777 | 2,568 | ||||||

| Deferred income taxes |

121 | 194 | ||||||

| Other long-term liabilities |

324 | 370 | ||||||

| Shareholders’ equity: |

3,735 | 4,544 | ||||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | 14,794 | $ | 15,623 | ||||

|

|

|

|

|

|||||

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended | ||||||||

| (Dollars in Millions) | July 29, 2023 | July 30, 2022 | ||||||

| Operating activities |

||||||||

| Net income |

$ | 72 | $ | 157 | ||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

||||||||

| Depreciation and amortization |

374 | 406 | ||||||

| Share-based compensation |

20 | 26 | ||||||

| Deferred income taxes |

(7 | ) | (12 | ) | ||||

| Non-cash lease expense |

48 | 56 | ||||||

| Other non-cash items |

(2 | ) | 5 | |||||

| Changes in operating assets and liabilities: |

||||||||

| Merchandise inventories |

(283 | ) | (964 | ) | ||||

| Other current and long-term assets |

61 | (29 | ) | |||||

| Accounts payable |

46 | (185 | ) | |||||

| Accrued and other long-term liabilities |

(52 | ) | 51 | |||||

| Operating lease liabilities |

(49 | ) | (57 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by (used in) operating activities |

228 | (546 | ) | |||||

|

|

|

|

|

|||||

| Investing activities |

||||||||

| Acquisition of property and equipment |

(338 | ) | (548 | ) | ||||

| Proceeds from sale of real estate |

4 | 4 | ||||||

| Other |

(1 | ) | — | |||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(335 | ) | (544 | ) | ||||

|

|

|

|

|

|||||

| Financing activities |

||||||||

| Net borrowings under revolving credit facility |

475 | 79 | ||||||

| Treasury stock purchases |

— | (158 | ) | |||||

| Shares withheld for taxes on vested restricted shares |

(13 | ) | (20 | ) | ||||

| Dividends paid |

(110 | ) | (127 | ) | ||||

| Repayment of long-term borrowings |

(164 | ) | — | |||||

| Finance lease and financing obligation payments |

(47 | ) | (55 | ) | ||||

| Proceeds from financing obligations |

17 | 5 | ||||||

| Proceeds from stock option exercises |

— | 1 | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) financing activities |

158 | (275 | ) | |||||

| Net increase (decrease) in cash and cash equivalents |

51 | (1,365 | ) | |||||

| Cash and cash equivalents at beginning of period |

153 | 1,587 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 204 | $ | 222 | ||||

|

|

|

|

|

|||||

Exhibit 99.2 Q2 2023 Results Presentation August 23, 2023

Cautionary Statement Regarding Forward-Looking Information This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Forward-looking statements include, but are not limited to, comments about Kohl’s future financial plans, capital generation, management and deployment strategies, adequacy of capital resources and the competitive environment. Such statements are subject to certain risks and uncertainties, which could cause the Company's actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Any number of risks and uncertainties could cause actual results to differ materially from those Kohl’s expresses in its forward-looking statements, including macroeconomic conditions such as inflation and the long-term impact of COVID-19 on the economy and the pace of recovery thereafter. Forward-looking statements relate to the date initially made, and Kohl’s undertakes no obligation to update them. Non-GAAP Financial Measures In addition, this presentation contains non-GAAP financial measures, including Free Cash Flow. Reconciliations of all non-GAAP measures to the most directly comparable GAAP measures are included in the Appendix of this presentation. 2

Our 2023 Priorities 7 2023 Outlook & 11 Long-Term Strategy Q2 2023 Results 15 3

“Our second quarter earnings were in line with our expectations. We maintained strong sales momentum in Sephora at Kohl’s, reduced inventory by 14%, and managed expenses tightly. Further, solid cash flow generation allowed us to reduce our borrowings in the period.” “Many of our strategic efforts are just underway, which we expect will contribute incrementally in the back half of the year, and even more so in 2024 and beyond. We have enhanced the store experience and recently opened an additional 200 Sephora at Kohl’s shops, and are taking steps to further optimize our assortment and simplify our value strategies. Looking ahead, we are reaffirming our 2023 guidance and remain confident in our longer-term opportunity. I want to thank the entire Kohl’s team for their efforts to support and drive improved Kohl’s performance.” Tom Kingsbury Chief Executive Officer 4

Kohl's has built a solid foundation for growth Customers Stores Stores Stores in 49 states Active Customers 65M+ 1,171 as of Q2 2023 Loyalty Members 30M+ Stores with Sephora 800+ as of Q2 2023 Of Americans live Accessible and within 15 miles of 80% Aspirational Brand a Kohl’s store Portfolio Digital Of digital sales Digital sales ~35% fulfilled by stores 32% penetration Website visits 1.6B Active App users 20M Digital sales CAGR 8% over the last 5 years 5 All figures 2022 unless otherwise noted

Long-standing focus on ESG stewardship Environmental, Social, and Governance stewardship is a key component of our strategy and our vision, and guides how we interact with our customers, employees, and our communities Culture Community Climate ~100,000 $845M Net Zero by 2050 Associates donations through Kohl’s Cares committed to reducing GHG emissions 8 5.5M+ 164 Business Resource Groups volunteer hours served by Kohl’s associates solar and wind locations 169 EV charging locations Member of Dow Jones Sustainability Indices Powered by the S&P Global CSA All figures as of year end 2022 6 Note: See Kohl’s 2022 ESG Report for a thorough overview of the company’s efforts

Our 2023 Priorities 7

Our 2023 Priorities Enhance the Accelerate and Manage Inventory Strengthen the Customer Simplify Our and Expenses Balance Sheet Experience Value Strategies with Discipline 8 8

FOCUSED ON FOUR OVERARCHING PRIORITIES TO Drive Improved Sales and Profitability Enhance the Accelerate and Manage Inventory Customer Simplify Our and Expenses Strengthen the Experience Value Strategies with Discipline Balance Sheet • Simplified pricing • Heightened focus on • $1.5B ABL enhances • Sephora growth and inventory control processes liquidity position and expansion • Greater consistency in our to increase inventory turns flexibility marketing offers • Optimize assortment to • Planning inventory down • Debt reduction in 2023 reflect customer interests • Leverage industry leading mid-single digits % to loyalty program (Kohl’s • Remain committed to • Create an exciting in-store increase ability to chase Cash, Kohl’s Rewards, long-term leverage target experience Kohl’s Card) • Marketing efficiency of 2.5x • Focus on home, gifting, and • Co-brand credit card • Benefit from organization • Lower capital spend in impulse launch realignment 2023 • Drive digital growth 9

Driving continued growth through Sephora at Kohl’s Delivering incremental $2 billion sales and traffic sales goal* and acquiring new customers • Achieved significant total beauty sales growth of nearly 90% in Q2 2023, with greater than 20% comparable beauty sales growth in the Sephora shops opened in 2021 and 2022 Highly • Nearly 200 full size Sephora shops were opened in Q2 2023, 900 with another ~50 planned to open in Q3. In addition, we are accretive opening 50 smaller format Sephora shops by the end of 2023, Sephora shops with plan to roll out to the remainder of chain by 2025 operating by year end 2023 • Significant return on investment with expected payback period margin of less than 3.5 years 10 * By 2025

2023 Outlook & Long-Term Strategy 11

2023 Outlook METRIC FULL YEAR GUIDANCE Net Sales (2%) to (4%) vs. 2022, includes a 1% benefit from the 53rd week Operating Margin Approx. 4.0% Diluted EPS $2.10 to $2.70 12

Focused on returning balance sheet to historical strength through balanced capital allocation strategy • Committed to rebuilding cash balance and reducing leverage to our long-term target of 2.5x • Will continue to prioritize investments in the business, followed by our commitment to the dividend with excess cash deployed for debt reduction and share repurchases • We remain firmly committed to the health of our balance sheet and capital allocation decisions going forward will continue to reflect this priority Recent Actions and Forward Commitments Strategic Investment Commitment to Share in the Business the Dividend Revolver Debt Reduction Repurchases Planning to invest $600 Will continue to prioritize Replaced and upsized Retired $164 million of Not planning on • • • • • million to $650 million current dividend, which revolver in January 2023 to February 2023 bond repurchasing any additional through capex in 2023 represents a healthy yield $1.5 billion secured facility, maturities in early Q1 2023, shares until our balance for our shareholders enhancing our liquidity and and expect to retire an sheet is strengthened on a flexibility additional $111 million of path towards our long-term Key investments include • December 2023 bond leverage target of 2.5x ~250 Sephora shops, a On August 8, the Board • maturities later this year smaller Sephora format in declared a quarterly cash Reduced revolver • 50 additional stores, store dividend of $0.50 per share borrowings by $205 million refreshes, as well as 7 new payable to shareholders on in Q2, and will sequentially stores, including one September 20, 2023 work the balance down with relocation no anticipated borrowings at year-end 13

Committed to Creating Long-Term Value Kohl’s Long-term Financial Framework SALES GROWTH OPERATING MARGIN EPS GROWTH Low-Single Mid-to-High 7% to 8% + = Digits % Single Digits % Capital Allocation Principles Strong Significant Capital Invest in Growth Balance Sheet Returns 14

Q2 2023 Results 15

Q2 2023 Summary Key Takeaways Q2 2023 • Net sales declined (4.8%) versus Q2 2022 & comparable sales declined (5.0%) • Second quarter earnings were in line with our expectations despite macroeconomic • Gross margin decreased (61) bps compared to last year driven by product cost inflation and headwinds continuing to pressure our higher shrink, partially offset by lower freight expense and digital-related cost of shipping customers • SG&A expense increased 1.6% primarily driven by higher store expenses, partially offset by lower marketing and distribution costs • Sephora at Kohl’s drove a total beauty • Operating income of $163 million and net income of $58 million, or $0.52 per diluted share sales increase of nearly 90%, with greater than 20% comparable beauty sales growth • Inventory decreased (14%) year-over-year in the Sephora shops opened in 2021 and 2022 • Solid inventory management and expense discipline drove operating cash flow of $430 million and free cash flow of $176 million in the quarter • Reduced revolver borrowings by $205 million in Q2 16 16 (1) - Free Cash Flow is a non-GAAP financial measures. Please refer to the reconciliation included in the Appendix for more information.

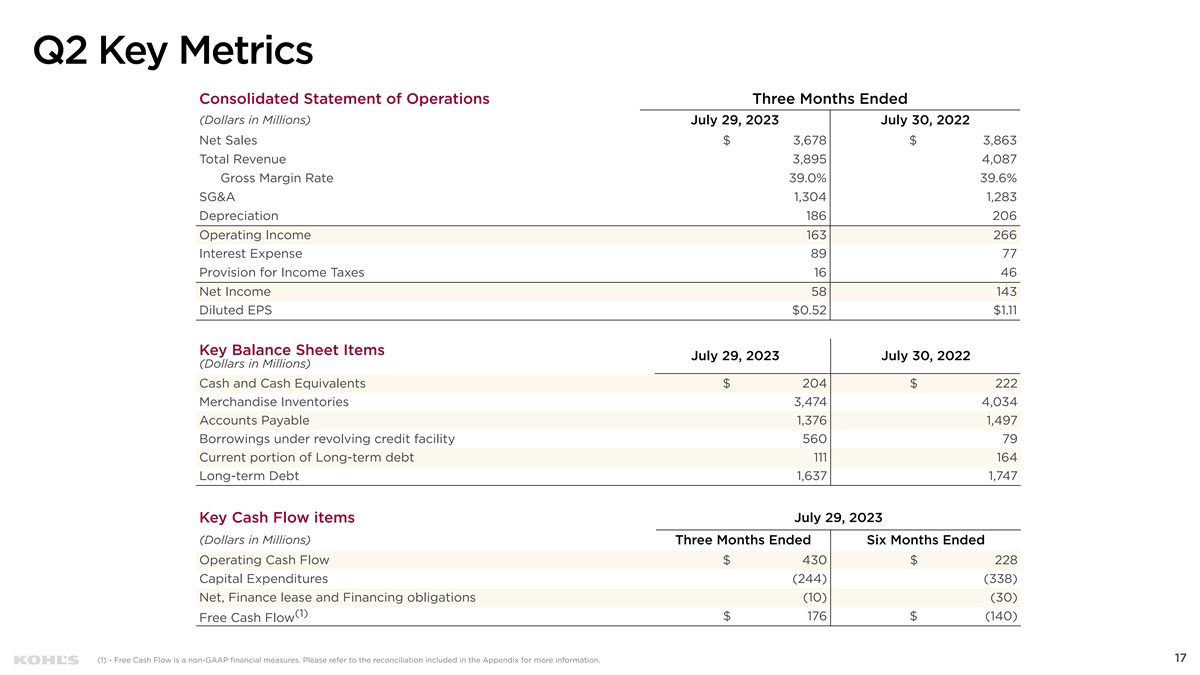

Q2 Key Metrics Consolidated Statement of Operations Three Months Ended (Dollars in Millions) July 29, 2023 July 30, 2022 Net Sales $ 3,678 $ 3,863 Total Revenue 3,895 4,087 Gross Margin Rate 39.0% 39.6% SG&A 1,304 1,283 Depreciation 186 206 Operating Income 163 266 Interest Expense 89 77 Provision for Income Taxes 16 46 Net Income 58 143 Diluted EPS $0.52 $1.11 Key Balance Sheet Items July 29, 2023 July 30, 2022 (Dollars in Millions) Cash and Cash Equivalents $ 204 $ 222 Merchandise Inventories 3,474 4,034 Accounts Payable 1,376 1,497 Borrowings under revolving credit facility 560 79 Current portion of Long-term debt 111 164 Long-term Debt 1,637 1,747 July 29, 2023 Key Cash Flow items (Dollars in Millions) Three Months Ended Six Months Ended Operating Cash Flow $ 430 $ 228 Capital Expenditures (244) (338) Net, Finance lease and Financing obligations (10) (30) (1) $ 176 $ (140) Free Cash Flow 17 (1) - Free Cash Flow is a non-GAAP financial measures. Please refer to the reconciliation included in the Appendix for more information.

Q2 2023 Gross Margin & SG&A Expense Performance Gross Margin SG&A Expense Deleveraged (208) bps vs. Q2 2022 Decreased (61) bps vs. Q2 2022 $1,304M 39.6% $1,283M 39.0% % Total 31.4% 33.5% Revenue Q2 2022 Q2 2023 Q2 2022 Q2 2023 Q2 2023 Gross Margin Takeaways Q2 2023 SG&A Takeaways • Higher product costs driven by inflation • Higher store expenses driven by Sephora openings, wage inflation, and in-store strategies • Elevated shrink • Disciplined expense management across organization; lower • Lower freight expense and digital-related cost of shipping marketing and distribution costs 18

Appendix 19

Reconciliations Free Cash Flow July 29, 2023 ($ in millions) Three Months Ended Six Months Ended Net cash provided by operating activities $ 430 $ 228 Acquisition of property and equipment (244) (338) Finance lease and financing obligation payments (22) (47) Proceeds from financing obligations 12 17 Free Cash Flow $ 176 $ (140) 20