UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: August 21, 2023

(Date of earliest event reported)

PERMIAN RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 001-37697 | 47-5381253 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

300 N. Marienfeld St., Suite 1000

Midland, Texas 79701

(Address of principal executive offices) (Zip Code)

(432) 695-4222

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

||

| Class A Common Stock, par value $0.0001 per share | PR | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On August 21, 2023, Permian Resources Corporation, a Delaware corporation (“Permian Resources”) and Earthstone Energy, Inc., a Delaware corporation (“Earthstone”), issued a joint press release announcing that they have entered into an Agreement and Plan of Merger pursuant to which Permian Resources will acquire Earthstone (the “Merger Agreement”). A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Attached as Exhibit 99.2 hereto and incorporated herein by reference is an investor presentation relating to the Merger Agreement and related matters.

The information contained in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference to such filing.

Forward-Looking Statements and Cautionary Statements

The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Permian Resources and Earthstone expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “would,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “strive,” “allow,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the proposed business combination between Permian Resources and Earthstone pursuant to the Merger Agreement (the “Transaction”), pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the possibility that stockholders of Permian Resources may not approve the issuance of new shares of common stock in the Transaction or that stockholders of Earthstone may not approve the Merger Agreement, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of Permian Resources’ common stock or Earthstone’s common stock, the risk that the Transaction and its announcement could have an adverse effect on the ability of Permian Resources and Earthstone to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending Transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Permian Resources’ and Earthstone’s control, including those detailed in Permian Resources’ annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at https://permianres.com and on the Securities Exchange Commission’s (the “SEC”) website at http://www.sec.gov, and those detailed in Earthstone’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at https://www.earthstoneenergy.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on assumptions that Permian Resources and Earthstone believe to be reasonable but that may not prove to be accurate.

2

Any forward-looking statement speaks only as of the date on which such statement is made, and Permian Resources and Earthstone undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

No Offer or Solicitation

This communication relates to the Transaction between Permian Resources and Earthstone. This communication is for informational purposes only and is not intended to and does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Important Additional Information

In connection with the Transaction, Permian Resources will file with the SEC, a registration statement on Form S-4 (the “Registration Statement”), that will include a joint proxy statement of Permian Resources and Earthstone and a prospectus of Permian Resources (the “Joint Proxy Statement/Prospectus”). The Transaction will be submitted to Permian Resource’s stockholders and Earthstone’s stockholders for their consideration. Permian Resources and Earthstone may also file other documents with the SEC regarding the Transaction. The definitive Joint Proxy Statement/Prospectus will be sent to the stockholders of Permian Resources and Earthstone. This document is not a substitute for the Registration Statement and Joint Proxy Statement/Prospectus that will be filed with the SEC or any other documents that Permian Resources and Earthstone may file with the SEC or send to stockholders of Permian Resources and Earthstone in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF PERMIAN RESOURCES AND EARTHSTONE ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PERMIAN RESOURCES AND EARTHSTONE, THE TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement/Prospectus (when available) and all other documents filed or that will be filed with the SEC by Permian Resources and Earthstone through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by Permian Resources will be made available free of charge on Permian Resources’ website at https://www.permianres.com under the “Investor Relations” tab or by directing a request to Investor Relations, Permian Resources Corporation, 300 N. Marienfeld Street, Suite 1000, Midland, TX 79701, Tel. No. (432) 695-4222. Copies of documents filed with the SEC by Earthstone will be made available free of charge on Earthstone’s website at https://www.earthstoneenergy.com, under the “Investors” tab, or by directing a request to Investor Relations, Earthstone Energy, Inc., 1400 Woodloch Forest Drive, Suite 300, The Woodlands, TX 77380, Tel. No. (281) 298-4246.

Participants in the Solicitation

Permian Resources, Earthstone and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect to the Transaction.

Information regarding Permian Resources’ executive officers and directors is contained in the proxy statement for Permian Resources’ 2023 Annual Meeting of Stockholders filed with the SEC on April 11, 2023 and certain of its Current Reports on Form 8-K. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing Permian Resources’ website at https://permianres.com. Information regarding Earthstone’s directors and executive officers is contained in the proxy statement for Earthstone’s 2023 Annual Meeting of Stockholders filed with the SEC on April 27, 2023, and certain of its Current Reports on Form 8-K. You can obtain a free copy of this document at the SEC’s website at http://www.sec.gov or by accessing Earthstone’s website at https://www.earthstoneenergy.com.

3

Investors may obtain additional information regarding the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, by reading the Registration Statement, Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding the Transaction when they become available. Stockholders of Permian Resources and Earthstone, potential investors and other readers should read the Joint Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit |

Description |

|

| 99.1 | Press Release, dated August 21, 2023. | |

| 99.2 | Investor Presentation, dated August 21, 2023. | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PERMIAN RESOURCES CORPORATION | ||

| By: | /s/ GUY M. OLIPHINT |

|

| Guy M. Oliphint | ||

| Executive Vice President and Chief Financial Officer | ||

| Date: | August 21, 2023 | |

Exhibit 99.1

|

|

Permian Resources to Acquire Earthstone Energy in All-Stock Transaction,

Creating a $14 Billion Premier Delaware Basin Independent E&P

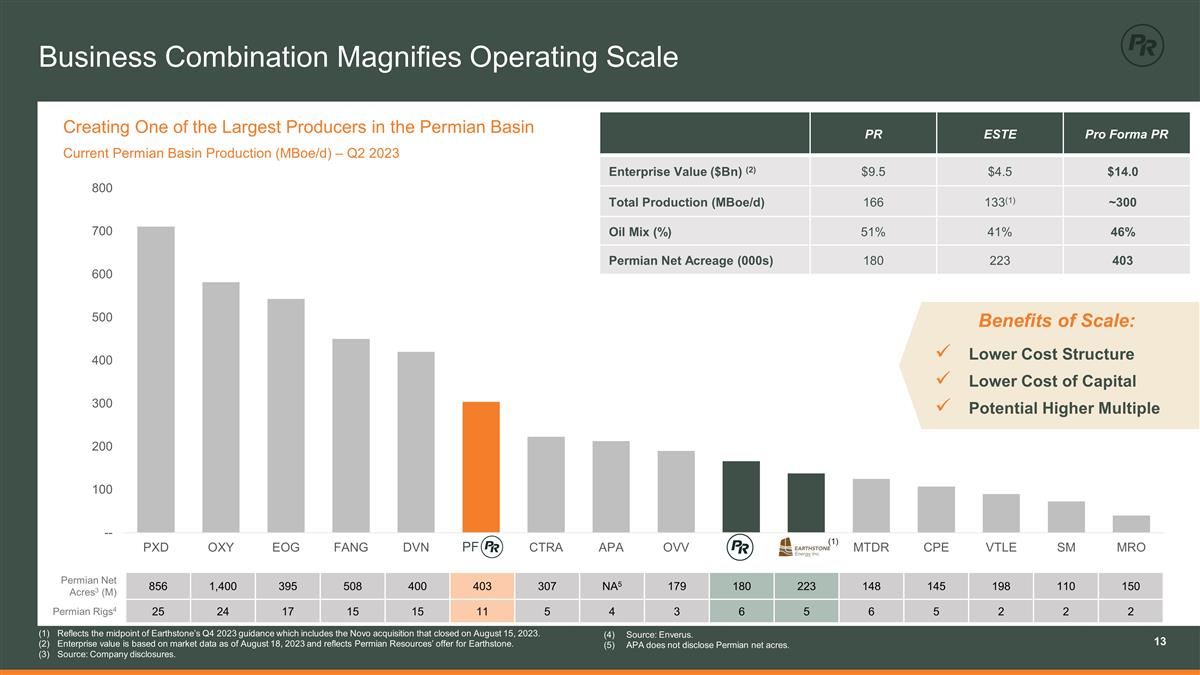

MIDLAND & THE WOODLANDS, Texas — August 21, 2023 (BUSINESS WIRE) — Permian Resources Corporation (“Permian Resources” or the “Company”) (NYSE: PR) and Earthstone Energy, Inc. (“Earthstone Energy” or “Earthstone”) (NYSE: ESTE) today announced that they have entered into a definitive agreement under which Permian Resources will acquire Earthstone in an all-stock transaction valued at approximately $4.5 billion, inclusive of Earthstone’s net debt. Under the terms of the transaction, each share of Earthstone common stock will be exchanged for a fixed ratio of 1.446 shares of Permian Resources common stock. The transaction strengthens Permian Resources’ position as a leading Delaware Basin independent E&P with over 400,000 Permian net acres, pro forma production of approximately 300,000 Boe/d1 and an enhanced free cash flow profile to increase returns to shareholders.

Key Highlights

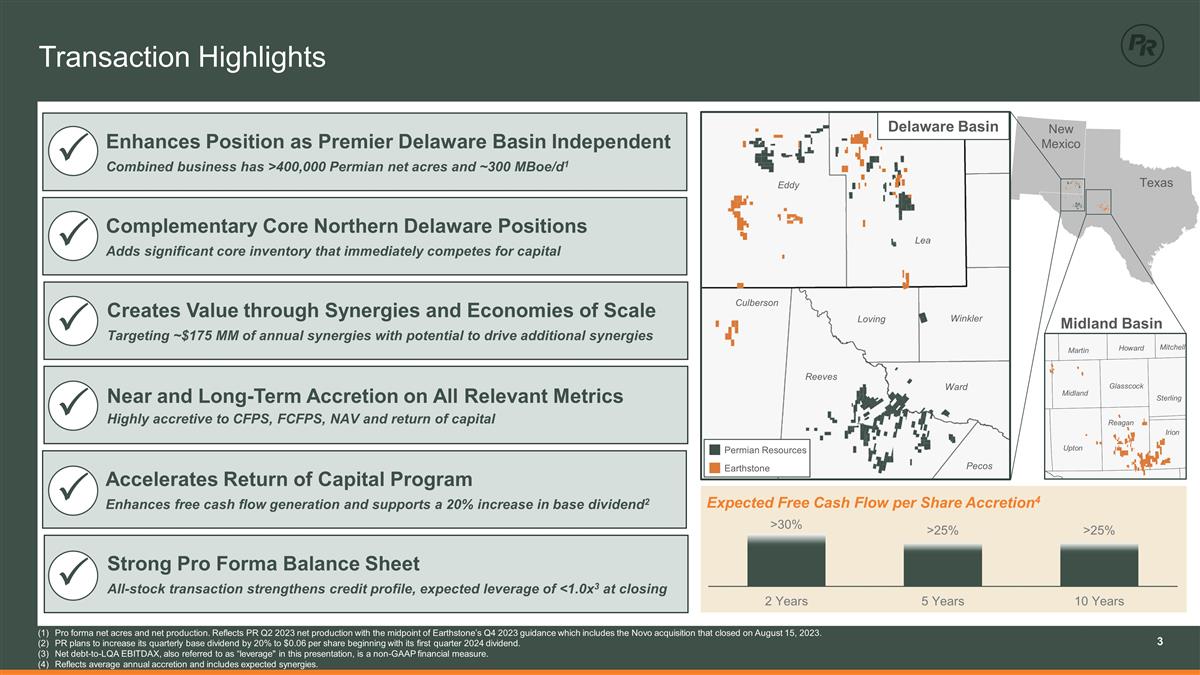

| • | Enhances leading position in the Delaware Basin and increases operating size and scale |

| • | Adds significant high-quality inventory offset the Company’s existing core acreage in New Mexico |

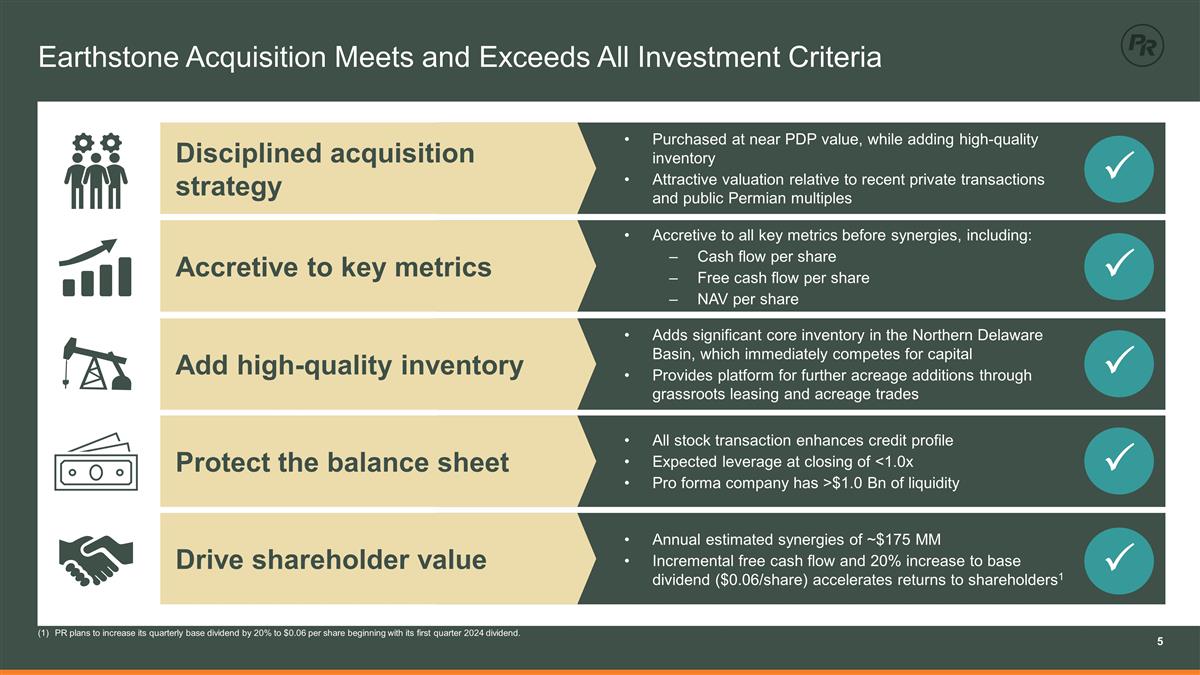

| • | Highly accretive to key financial metrics before synergies, including operating cash flow, free cash flow and net asset value per share |

| • | Expected to be accretive to free cash flow per share by an average of >30% per year during the next two years and >25% per year during the next five and ten years |

| • | Expect to achieve synergies that will drive ~$175 million of annual cash flow improvement |

| • | Improved free cash flow profile supports 20% increase to base dividend per share and higher future variable shareholder returns |

| • | Meets and exceeds all of Permian Resources’ rigorous investment criteria |

| • | Maintains strong balance sheet with expected leverage2 of less than 1.0x at closing |

| • | Represents an 8% premium to the exchange ratio based on the 20-day volume weighted average share prices |

Management Commentary

“We believe the acquisition of Earthstone represents a compelling value proposition for our shareholders and strengthens our position as a premier Delaware Basin independent E&P. Earthstone’s Northern Delaware position brings high-quality acreage with core inventory that immediately competes for capital within our portfolio,” said Will Hickey, Co-CEO of Permian Resources. “Additionally, we have identified numerous ways to leverage our deep Delaware Basin experience and incremental scale to improve upon these assets across the board, including approximately $175 million of annual synergies. Permian Resources has a proven integration track record, and we believe the successful execution of these cost savings will create incremental value for both Permian Resources and Earthstone stakeholders.”

“We are very pleased to announce this transaction with Permian Resources and believe the combination of the two companies’ top-tier assets and history of success will create an even stronger large-cap E&P company which is uniquely positioned to drive profitable growth and development in the world-class Permian Basin. We believe this all-stock transaction provides Earthstone’s shareholders with excellent value for their investment now and in the future,” said Robert Anderson, President and Chief Executive Officer of Earthstone. “In less than three years, we have grown Earthstone from a small-cap E&P company producing approximately 15,000 Boe per day to one with a production base of over 130,000 Boe per day, delivering significant value enhancement for shareholders along the way.

Our success directly reflects our outstanding employees’ dedication, hard work and perseverance. I personally thank each and every one of our employees. I could not be prouder of the Earthstone team and the company we have built together.”

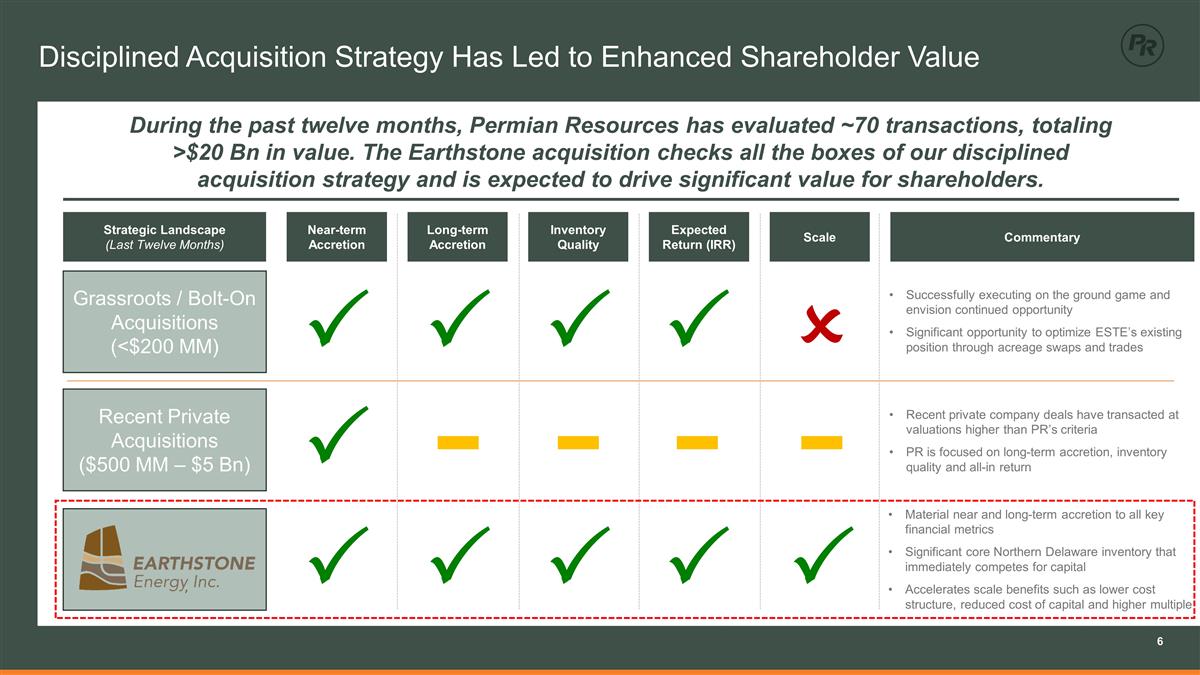

“As significant owners of the business, our primary goal is to drive value for our investors, and the Earthstone transaction is another example of value creation for shareholders. We expect the transaction to be accretive across all key financial metrics before synergies and significantly accretive including synergies, both over the short and long-term,” said James Walter, Co-CEO of Permian Resources. “After evaluating over $20 billion of potential transactions during the past twelve months, we firmly believe the acquisition of Earthstone represented the best transaction for Permian Resources. It checks all the boxes, enhancing shareholder value while improving upon an already best-in-class company.”

Strategic and Financial Benefits

| • | Accretive to All Key Financial Metrics Over the Long-Term. The transaction is expected to be accretive to all relevant per share metrics before synergies, including operating cash flow, free cash flow and net asset value per share. The Company expects the transaction to deliver accretion to free cash flow per share of over 30% per year during the next two years and over 25% during the next five and ten-year periods. This is consistent with the Company’s disciplined acquisition strategy, pursuing transactions which provide significant accretion to all relevant per share metrics over both the short and long-term. |

| • | Acceleration of Cash Returns to Shareholders. The accretive nature of this transaction immediately improves Permian Resources’ current return of capital program. The Company plans to increase its quarterly base dividend by 20% to $0.06 per share beginning with its first quarter 2024 dividend. Permian Resources’ variable return program remains unchanged, distributing at least 50% of free cash flow after the base dividend through a variable dividend, share repurchases or a combination of both. |

| • | Extensive, High Rate of Return Combined Inventory. The transaction adds significant core inventory and bolsters Permian Resources’ position in highly productive areas within the Northern Delaware Basin, characterized by proven stacked-pay intervals and low-cost operating environment. Earthstone’s New Mexico acreage position is highly complementary to Permian Resources’ existing high-return asset base, which has generated repeatable strong results. Additionally, this transaction provides the ability to high grade the combined company’s capital allocation across a broader asset base, improving capital efficiency. |

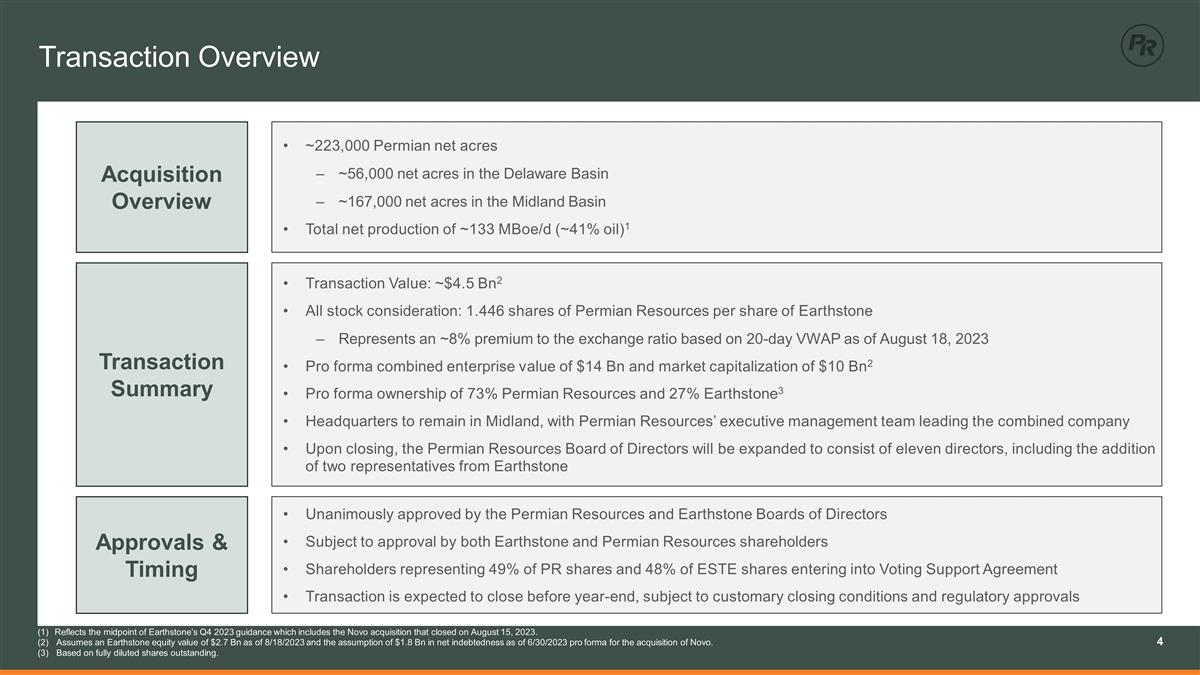

| • | Adds Significant Size and Scale. The transaction increases Permian Resources’ position in the Permian Basin by approximately 223,000 net acres to over 400,000 net acres with pro forma production of approximately 300,000 Boe/d1. In the Delaware Basin, the acquisition adds approximately 56,000 net acres of high-quality, stacked-pay reservoirs, largely offset to Permian Resources’ existing acreage in Lea and Eddy Counties. Earthstone’s remaining acreage is located in the Midland Basin, and the Company expects to primarily harvest free cash flow from this asset at current commodity prices. |

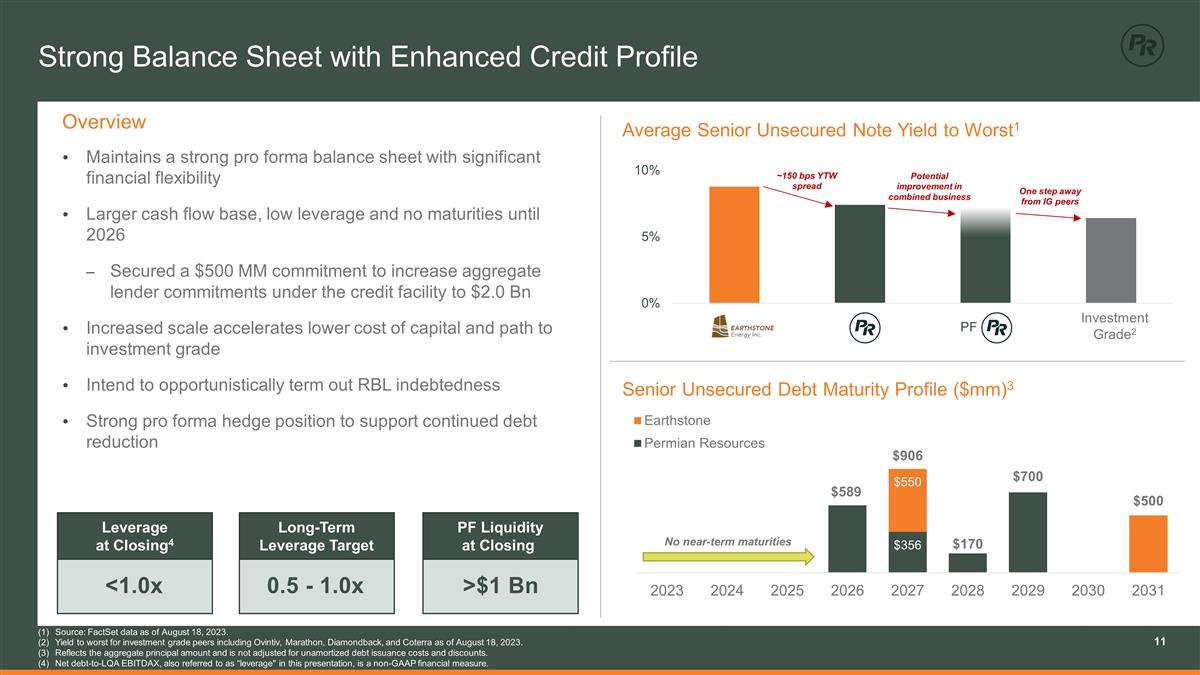

| • | Strong Balance Sheet. The Company expects to have a net debt-to-LQA EBITDAX2 ratio of less than 1.0x at closing, assuming strip prices. In conjunction with the transaction, the Company has secured a $500 million incremental commitment under its credit facility from Wells Fargo Bank, which will increase aggregate lender commitments thereunder to $2.0 billion. Permian Resources expects to have pro forma liquidity of over $1.0 billion at closing, providing significant financial flexibility. The combined company will also maintain a strong maturity profile, with its first debt maturity occurring in 2026. Lastly, the transaction is expected to enhance Permian Resources’ credit profile and decrease its overall cost of capital, as larger scale and higher production levels accelerate its path to investment grade. |

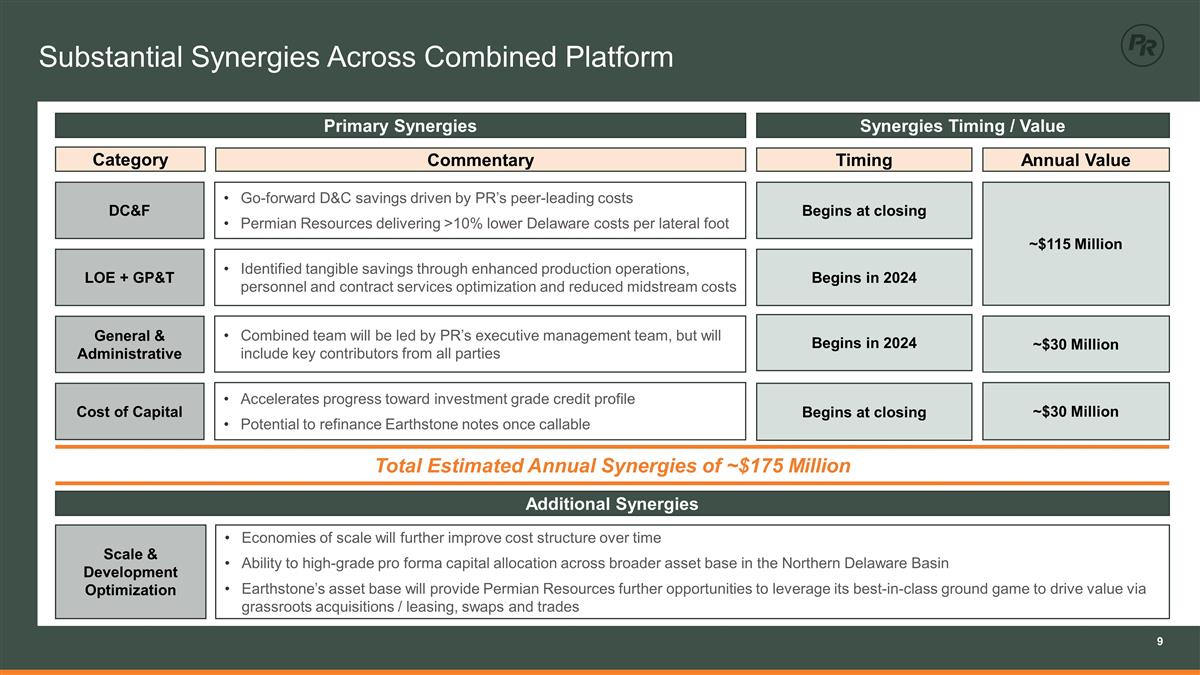

Tangible Operational and Financial Synergies

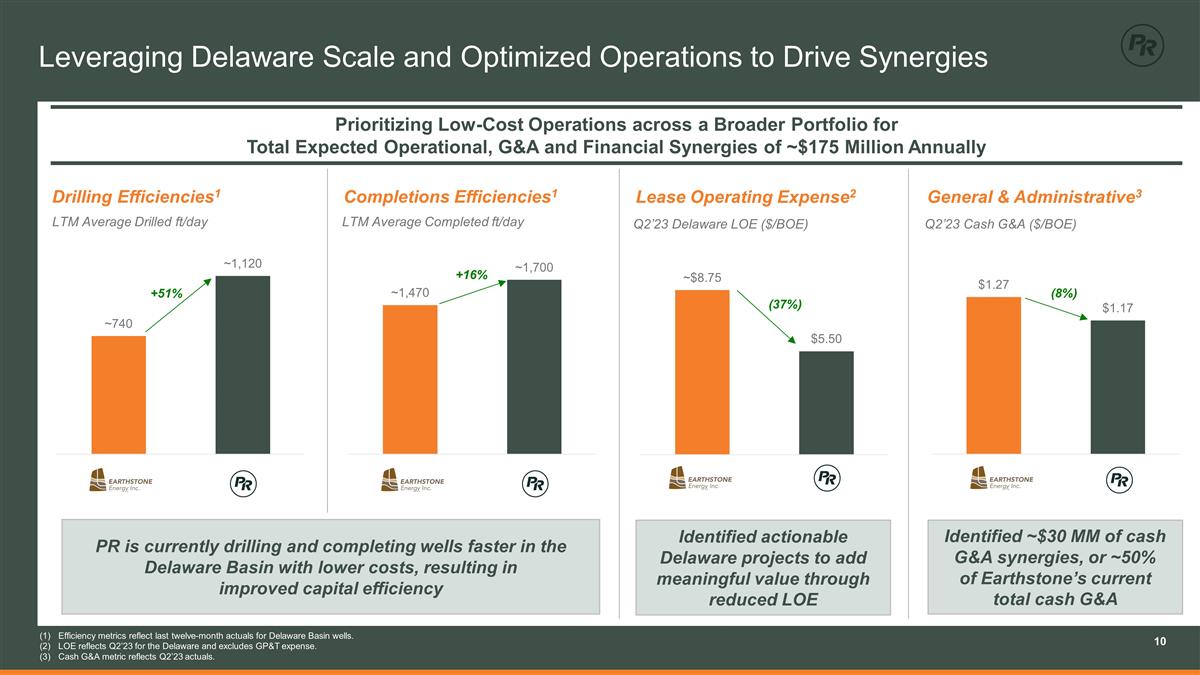

Total synergies resulting from the transaction are expected to drive approximately $175 million in annual cash flow improvements, which include $145 million of operational and G&A synergies expected to be fully realized by year-end 2024. Expected annual operational synergies total $115 million and are primarily associated with reduced drilling, completions and facilities (“DC&F”), lease operating and midstream costs. Permian Resources expects to realize significant DC&F savings in the Delaware Basin through improved efficiencies and lower cost structure. The Company expects to reduce LOE expense on a per unit basis through personnel and contract services optimization and enhanced production operations. Additionally, the combined company expects to leverage its enhanced size and scale to optimize pricing across completion, production and midstream operations.

Permian Resources has identified $30 million of annual general and administrative savings. The combined company is also expected to benefit from a lower overall cost of capital, leading to potential financial synergies of $30 million annually. Permian Resources has proven operational and integration track records and plans to leverage its best practices and lower corporate cost structure to advance cost reductions across all operating expenses and capital expenditures. The all-stock transaction structure allows for shareholders of both Permian Resources and Earthstone to benefit from the cost synergies and significant upside potential of the combined companies.

Transaction Details

The all-stock transaction will consist of 1.446 shares of Permian Resources common stock for each share of Earthstone common stock, representing an implied value to each Earthstone stockholder of $18.64 per share based on the closing price of Permian Resources common stock on August 18, 2023. Permian Resources will issue approximately 211 million shares of common stock in the transaction. After closing, existing Permian Resources shareholders will own approximately 73% of the combined company and existing Earthstone shareholders will own approximately 27% of the combined company.

The transaction has been unanimously approved by the Boards of Directors of both Permian Resources and Earthstone and is expected to close by year-end 2023, subject to customary closing conditions, regulatory approvals and shareholder approvals. Permian Resources’ and Earthstone’s largest shareholders, which currently own approximately 49% and 48% of each respective company’s outstanding shares, have executed a Voting and Support Agreement in connection with the transaction.

Upon closing of the transaction, Permian Resources’ Board of Directors will be expanded to consist of eleven directors, including the addition of two representatives from Earthstone. Permian Resources’ executive management team will lead the combined company with the headquarters remaining in Midland, Texas.

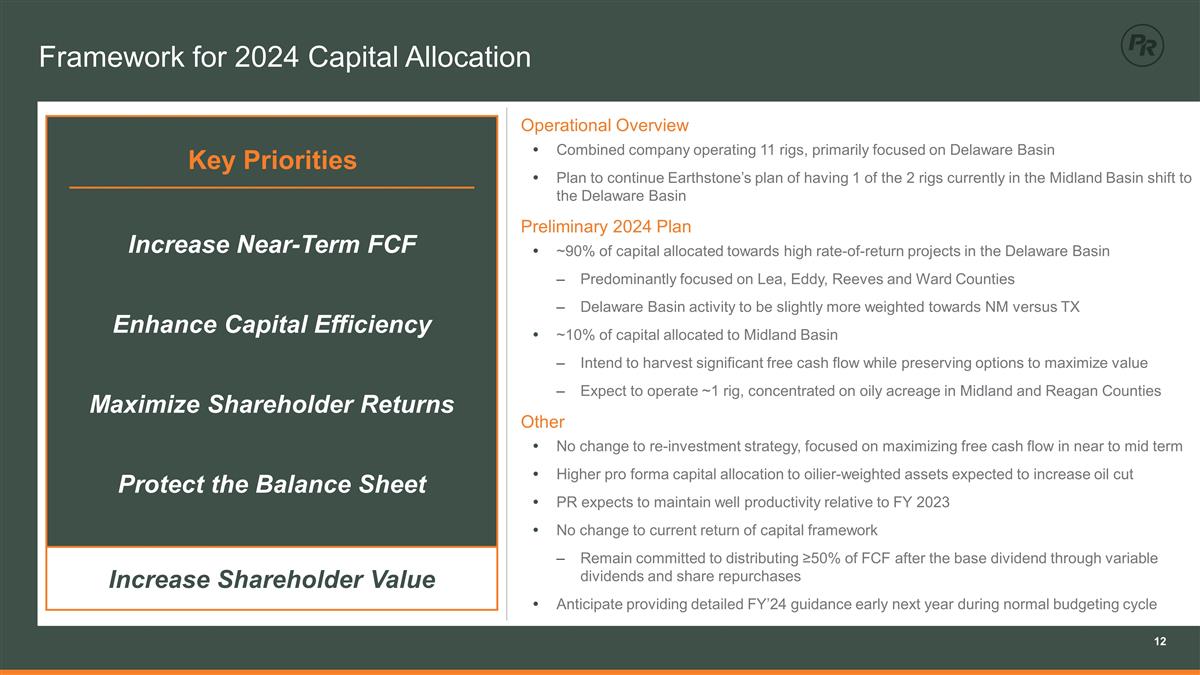

Preliminary Framework for 2024 Capital Allocation

Permian Resources and Earthstone are operating an eleven-rig drilling program in aggregate, primarily focused on the Delaware Basin. The combined company plans to allocate at least one of Earthstone’s two rigs currently in the Midland Basin to the Delaware Basin. During 2024, the combined company expects to allocate approximately 90% of capital to high rate-of-return projects in the Delaware Basin, predominantly focused on Lea, Eddy, Reeves and Ward Counties. Delaware Basin activity is expected to be weighted slightly more towards New Mexico, as a result of the transaction. The Company expects to maintain optionality from the low decline Midland Basin asset base, while harvesting significant free cash flow.

The Company expects to provide detailed forward-looking guidance for the full-year 2024 early next year and in accordance with its annual budgeting cycle. Permian Resources plans to deliver an operational plan that maximizes free cash flow during the near-term, depending on strip commodity prices and expected oilfield service costs. The Company remains committed to returning at least 50% of free cash flow after its base dividend through variable dividends and share repurchases.

Advisors

Jefferies LLC and Morgan Stanley & Co. LLC are serving as co-lead financial advisors and Kirkland & Ellis LLP is serving as legal advisor to Permian Resources. RBC Capital Markets, LLC and Wells Fargo Securities LLC are serving as financial advisors and Vinson & Elkins L.L.P. is serving as legal advisor to Earthstone.

Conference Call and Webcast

Permian Resources will host an investor conference call on Monday, August 21, 2023 at 7:30 a.m. Central (8:30 a.m. Eastern) to discuss the proposed transaction. Interested parties may join the webcast by visiting Permian Resources’ website at www.permianres.com and clicking on the webcast link or by dialing (888) 259-6580 (Conference ID: 11042970) at least 15 minutes prior to the start of the call. A replay of the call will be available on the Company’s website or by phone at (877) 674-7070 (Access Code: 042970) for a 14-day period following the call.

About The Companies

Headquartered in Midland, Texas, Permian Resources is an independent oil and natural gas company focused on the responsible acquisition, optimization and development of high-return oil and natural gas properties. The Company’s assets and operations are located in the core of the Delaware Basin. For more information, please visit www.permianres.com.

Earthstone Energy, Inc. is a growth-oriented, independent energy company engaged in acquisitions and the development and operation of oil and natural gas properties. Its primary assets are located in the Permian Basin of New Mexico and West Texas. Earthstone’s Class A Common Stock is listed on the New York Stock Exchange under the symbol “ESTE.” For more information, visit Earthstone’s website at www.earthstoneenergy.com.

1) Pro forma net production reflects second quarter 2023 actual results for Permian Resources and the midpoint of Earthstone’s fourth quarter 2023 guidance which includes the Novo acquisition that closed on August 15, 2023.

2) The Company does not provide guidance on the items used to reconcile between forecasted net debt-to-LQA EBITDAX (or “leverage”) to forecasted long-term debt, net, or forecasted net income due to the uncertainty regarding timing and estimates of certain items. Therefore, we cannot reconcile forecasted leverage to long-term debt, net, or net income without unreasonable effort.

Permian Resources Contacts:

Hays Mabry – Sr. Director, Investor Relations

Mae Herrington – Engineering Advisor, Investor Relations Clay Jeansonne – Investor Relations

(832) 240-3265

ir@permianres.com

Earthstone Contact:

(713) 379-3080

CJeansonne@earthstoneenergy.com

No Offer or Solicitation

This communication relates to a proposed business combination transaction (the “Transaction”) between Earthstone and Permian. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Additional Information

In connection with the Transaction, Permian will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, that will include a joint proxy statement of Earthstone and Permian and a prospectus of Permian. The Transaction will be submitted to Earthstone’s stockholders and Permian’s stockholders for their consideration. Earthstone and Permian may also file other documents with the SEC regarding the Transaction. The definitive joint proxy statement/prospectus will be sent to the stockholders of Permian and Earthstone. This document is not a substitute for the registration statement and joint proxy statement/prospectus that will be filed with the SEC or any other documents that Permian or Earthstone may file with the SEC or send to stockholders of Permian or Earthstone in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF EARTHSTONE AND PERMIAN ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS.

Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and all other documents filed or that will be filed with the SEC by Permian or Earthstone through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by Earthstone will be made available free of charge on Earthstone’s website at https://www.earthstoneenergy.com, under the “Investors” tab, or by directing a request to Investor Relations, Earthstone Energy, Inc., 1400 Woodloch Forest Drive, Suite 300, The Woodlands, TX 77380, Tel. No. (281) 298-4246. Copies of documents filed with the SEC by Permian will be made available free of charge on Permian’s website at https://www.permianres.com under the “Investor Relations” tab or by directing a request to Investor Relations, Permian Resources Corporation, 300 N. Marienfeld St., Ste. 1000, Midland, TX 79701, Tel. No. (432) 695-4222.

Participants in the Solicitation

Permian, Earthstone and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect to the Transaction.

Information regarding Earthstone’s directors and executive officers is contained in the proxy statement for Earthstone’s 2023 Annual Meeting of Stockholders filed with the SEC on April 27, 2023, and certain of its Current Reports on Form 8-K. You can obtain a free copy of this document at the SEC’s website at http://www.sec.gov or by accessing Earthstone’s website at https://www.earthstoneenergy.com. Information regarding Permian’s executive officers and directors is contained in the proxy statement for the Permian’s 2023 Annual Meeting of Stockholders filed with the SEC on April 11, 2023 and certain of its Current Reports on Form 8-K. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing the Permian’s website at https://www.permianres.com.

Investors may obtain additional information regarding the interests of those persons and other persons who may be deemed participants in the Transaction by reading the joint proxy statement/prospectus regarding the Transaction when it becomes available. You may obtain free copies of this document as described above.

Forward-Looking Statements and Cautionary Statements

The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Permian or Earthstone expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Transaction, pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that stockholders of Permian may not approve the issuance of new shares of common stock in the Transaction or that stockholders of Earthstone may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of Permian’s common stock or Earthstone’s common stock, the risk that the Transaction and its announcement could have an adverse effect on the ability of Permian and Earthstone to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending Transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies and other important factors that could cause actual results to differ materially from those projected.

All such factors are difficult to predict and are beyond Permian’s or Earthstone’s control, including those detailed in Permian’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at https://www.permianres.com and on the SEC’s website at http://www.sec.gov, and those detailed in Earthstone’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Earthstone’s website at https://www.earthstoneenergy.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on assumptions that Permian or Earthstone believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and Permian and Earthstone undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

A Premier Delaware Basin Independent AUGUST 21, 2023 Exhibit 99.2

Important Information No Offer or Solicitation This communication relates to a proposed business combination transaction (the “Transaction”) between Earthstone and Permian. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Additional Information In connection with the Transaction, Permian will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, that will include a joint proxy statement of Earthstone and Permian and a prospectus of Permian. The Transaction will be submitted to Earthstone’s stockholders and Permian’s stockholders for their consideration. Earthstone and Permian may also file other documents with the SEC regarding the Transaction. The definitive joint proxy statement/prospectus will be sent to the stockholders of Permian and Earthstone. This document is not a substitute for the registration statement and joint proxy statement/prospectus that will be filed with the SEC or any other documents that Permian or Earthstone may file with the SEC or send to stockholders of Permian or Earthstone in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF EARTHSTONE AND PERMIAN ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and all other documents filed or that will be filed with the SEC by Permian or Earthstone through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by Earthstone will be made available free of charge on Earthstone’s website at https://www.earthstoneenergy.com, under the “Investors” tab, or by directing a request to Investor Relations, Earthstone Energy, Inc., 1400 Woodloch Forest Drive, Suite 300, The Woodlands, TX 77380, Tel. No. (281) 298-4246. Copies of documents filed with the SEC by Permian will be made available free of charge on Permian’s website at https://www.permianres.com under the “Investor Relations” tab or by directing a request to Investor Relations, Permian Resources Corporation, 300 N. Marienfeld St., Ste. 1000, Midland, TX 79701, Tel. No. (432) 695-4222. Participants in the Solicitation Permian, Earthstone and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect to the Transaction. Information regarding Earthstone’s directors and executive officers is contained in the proxy statement for Earthstone’s 2023 Annual Meeting of Stockholders filed with the SEC on April 27, 2023, and certain of its Current Reports on Form 8-K. You can obtain a free copy of this document at the SEC’s website at http://www.sec.gov or by accessing Earthstone’s website at https://www.earthstoneenergy.com. Information regarding Permian’s executive officers and directors is contained in the proxy statement for the Permian’s 2023 Annual Meeting of Stockholders filed with the SEC on April 11, 2023 and certain of its Current Reports on Form 8-K. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing the Permian’s website at https://www.permianres.com. Investors may obtain additional information regarding the interests of those persons and other persons who may be deemed participants in the Transaction by reading the joint proxy statement/prospectus regarding the Transaction when it becomes available. You may obtain free copies of this document as described above. Forward-Looking Statements and Cautionary Statements The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Permian or Earthstone expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Transaction, pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that stockholders of Permian may not approve the issuance of new shares of common stock in the Transaction or that stockholders of Earthstone may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of Permian’s common stock or Earthstone’s common stock, the risk that the Transaction and its announcement could have an adverse effect on the ability of Permian and Earthstone to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending Transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Permian’s or Earthstone’s control, including those detailed in Permian’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at https://www.permianres.com and on the SEC’s website at http://www.sec.gov, and those detailed in Earthstone’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Earthstone’s website at https://www.earthstoneenergy.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on assumptions that Permian or Earthstone believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and Permian and Earthstone undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, such as free cash flow, adjusted free cash flow, and net debt-to-LQA EBITDAX (or “leverage”). Please refer to the Appendix for a reconciliation of free cash flow and adjusted free cash flow to net cash provided by operating activities, the most comparable GAAP measure. We believe free cash flow and adjusted free cash flow are useful indicators of the Company’s ability to internally fund its exploration and development activities and to service or incur additional debt, without regard to the timing of settlement of either operating assets and liabilities or accounts payable related to capital expenditures. The Company believes that these measures, as so adjusted, present meaningful indicators of the Company’s actual sources and uses of capital associated with its operations conducted during the applicable period. Our computations of free cash flow and adjusted free cash flow may not be comparable to other similarly titled measures of other companies. Free cash flow and adjusted free cash flow should not be considered as alternatives to, or more meaningful than, cash provided by operating activities as determined in accordance with GAAP or as indicator of our operating performance or liquidity. Additionally, the Company does not provide guidance on the items used to reconcile between forecasted net debt-to-LQA EBITDAX to forecasted long-term debt, net, or forecasted net income due to the uncertainty regarding timing and estimates of certain items. Therefore, we cannot reconcile forecasted leverage to long-term debt, net, or net income without unreasonable effort.

Complementary Core Northern Delaware Positions Adds significant core inventory that immediately competes for capital Enhances Position as Premier Delaware Basin Independent Combined business has >400,000 Permian net acres and ~300 MBoe/d1 Transaction Highlights 245 / 126 / 42 119 / 120 / 123 295 / 192 / 0 New Mexico Texas P P Pro forma net acres and net production. Reflects PR Q2 2023 net production with the midpoint of Earthstone’s Q4 2023 guidance which includes the Novo acquisition that closed on August 15, 2023. PR plans to increase its quarterly base dividend by 20% to $0.06 per share beginning with its first quarter 2024 dividend. Net debt-to-LQA EBITDAX, also referred to as “leverage" in this presentation, is a non-GAAP financial measure. Reflects average annual accretion and includes expected synergies. Upton Reagan Irion Sterling Glasscock Midland Martin Howard Mitchell Midland Basin Eddy Lea Culberson Reeves Pecos Ward Winkler Loving Permian Resources Earthstone Near and Long-Term Accretion on All Relevant Metrics Highly accretive to CFPS, FCFPS, NAV and return of capital Accelerates Return of Capital Program Enhances free cash flow generation and supports a 20% increase in base dividend2 Strong Pro Forma Balance Sheet All-stock transaction strengthens credit profile, expected leverage of <1.0x3 at closing Creates Value through Synergies and Economies of Scale Targeting ~$175 MM of annual synergies with potential to drive additional synergies Expected Free Cash Flow per Share Accretion4 P P P P Delaware Basin

Transaction Overview Transaction Value: ~$4.5 Bn2 All stock consideration: 1.446 shares of Permian Resources per share of Earthstone Represents an ~8% premium to the exchange ratio based on 20-day VWAP as of August 18, 2023 Pro forma combined enterprise value of $14 Bn and market capitalization of $10 Bn2 Pro forma ownership of 73% Permian Resources and 27% Earthstone3 Headquarters to remain in Midland, with Permian Resources’ executive management team leading the combined company Upon closing, the Permian Resources Board of Directors will be expanded to consist of eleven directors, including the addition of two representatives from Earthstone Transaction Summary Unanimously approved by the Permian Resources and Earthstone Boards of Directors Subject to approval by both Earthstone and Permian Resources shareholders Shareholders representing 49% of PR shares and 48% of ESTE shares entering into Voting Support Agreement Transaction is expected to close before year-end, subject to customary closing conditions and regulatory approvals Approvals & Timing Reflects the midpoint of Earthstone’s Q4 2023 guidance which includes the Novo acquisition that closed on August 15, 2023. Assumes an Earthstone equity value of $2.7 Bn as of 8/18/2023 and the assumption of $1.8 Bn in net indebtedness as of 6/30/2023 pro forma for the acquisition of Novo. Based on fully diluted shares outstanding. ~223,000 Permian net acres ~56,000 net acres in the Delaware Basin ~167,000 net acres in the Midland Basin Total net production of ~133 MBoe/d (~41% oil)1 Acquisition Overview

63 / 80 / 72 245 / 126 / 42 119 / 120 / 123 188 / 192 / 190 233 / 204 / 183 202 / 202 / 203 295 / 192 / 0 236 / 220 / 172 Earthstone Acquisition Meets and Exceeds All Investment Criteria Purchased at near PDP value, while adding high-quality inventory Attractive valuation relative to recent private transactions and public Permian multiples Disciplined acquisition strategy Accretive to key metrics Add high-quality inventory Drive shareholder value P Accretive to all key metrics before synergies, including: Cash flow per share Free cash flow per share NAV per share Annual estimated synergies of ~$175 MM Incremental free cash flow and 20% increase to base dividend ($0.06/share) accelerates returns to shareholders1 P P P Adds significant core inventory in the Northern Delaware Basin, which immediately competes for capital Provides platform for further acreage additions through grassroots leasing and acreage trades Protect the balance sheet All stock transaction enhances credit profile Expected leverage at closing of <1.0x Pro forma company has >$1.0 Bn of liquidity P PR plans to increase its quarterly base dividend by 20% to $0.06 per share beginning with its first quarter 2024 dividend.

Disciplined Acquisition Strategy Has Led to Enhanced Shareholder Value Grassroots / Bolt-On Acquisitions (<$200 MM) Successfully executing on the ground game and envision continued opportunity Significant opportunity to optimize ESTE’s existing position through acreage swaps and trades Recent Private Acquisitions ($500 MM – $5 Bn) Recent private company deals have transacted at valuations higher than PR’s criteria PR is focused on long-term accretion, inventory quality and all-in return Material near and long-term accretion to all key financial metrics Significant core Northern Delaware inventory that immediately competes for capital Accelerates scale benefits such as lower cost structure, reduced cost of capital and higher multiple Strategic Landscape (Last Twelve Months) Near-term Accretion Long-term Accretion Expected Return (IRR) Scale Inventory Quality Commentary P P P P P P P O P P P During the past twelve months, Permian Resources has evaluated ~70 transactions, totaling >$20 Bn in value. The Earthstone acquisition checks all the boxes of our disciplined acquisition strategy and is expected to drive significant value for shareholders.

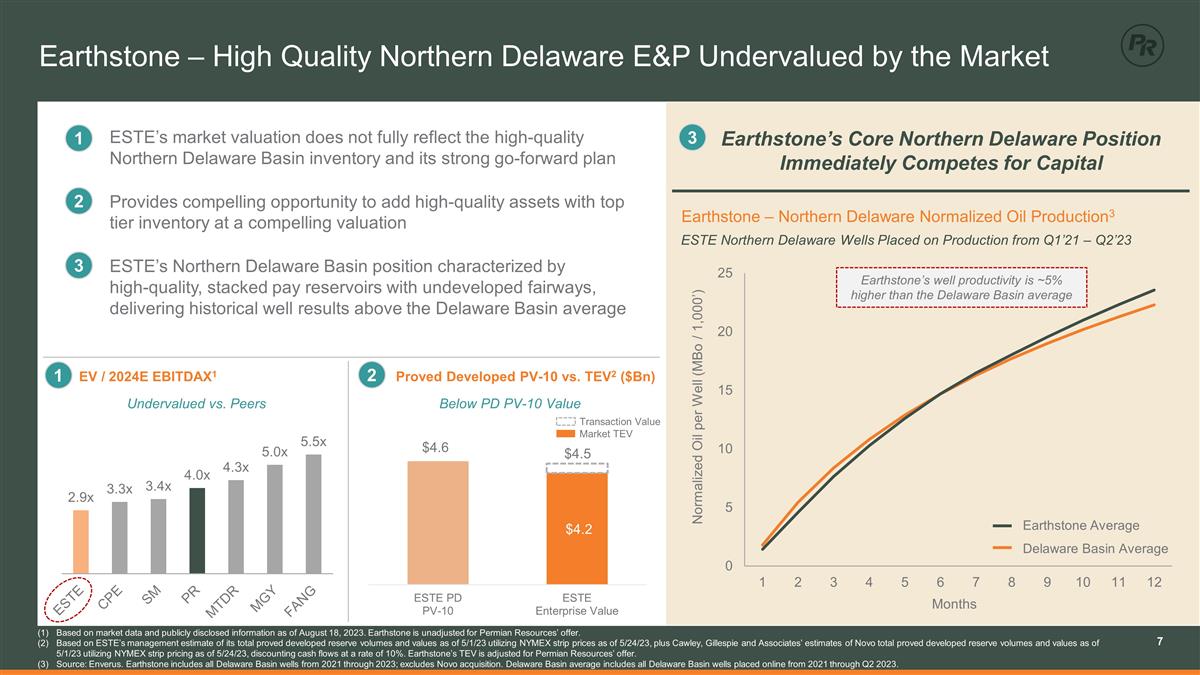

Earthstone’s well productivity is ~5% higher than the Delaware Basin average Earthstone – High Quality Northern Delaware E&P Undervalued by the Market ESTE’s market valuation does not fully reflect the high-quality Northern Delaware Basin inventory and its strong go-forward plan Provides compelling opportunity to add high-quality assets with top tier inventory at a compelling valuation ESTE’s Northern Delaware Basin position characterized by high-quality, stacked pay reservoirs with undeveloped fairways, delivering historical well results above the Delaware Basin average Earthstone – Northern Delaware Normalized Oil Production3 ESTE Northern Delaware Wells Placed on Production from Q1’21 – Q2’23 Proved Developed PV-10 vs. TEV2 ($Bn) Undervalued vs. Peers Below PD PV-10 Value EV / 2024E EBITDAX1 Based on market data and publicly disclosed information as of August 18, 2023. Earthstone is unadjusted for Permian Resources’ offer. Based on ESTE’s management estimate of its total proved developed reserve volumes and values as of 5/1/23 utilizing NYMEX strip prices as of 5/24/23, plus Cawley, Gillespie and Associates’ estimates of Novo total proved developed reserve volumes and values as of 5/1/23 utilizing NYMEX strip pricing as of 5/24/23, discounting cash flows at a rate of 10%. Earthstone’s TEV is adjusted for Permian Resources’ offer. Source: Enverus. Earthstone includes all Delaware Basin wells from 2021 through 2023; excludes Novo acquisition. Delaware Basin average includes all Delaware Basin wells placed online from 2021 through Q2 2023. Earthstone’s Core Northern Delaware Position Immediately Competes for Capital 1 2 3 1 2 3 Earthstone Average Delaware Basin Average Market TEV Transaction Value

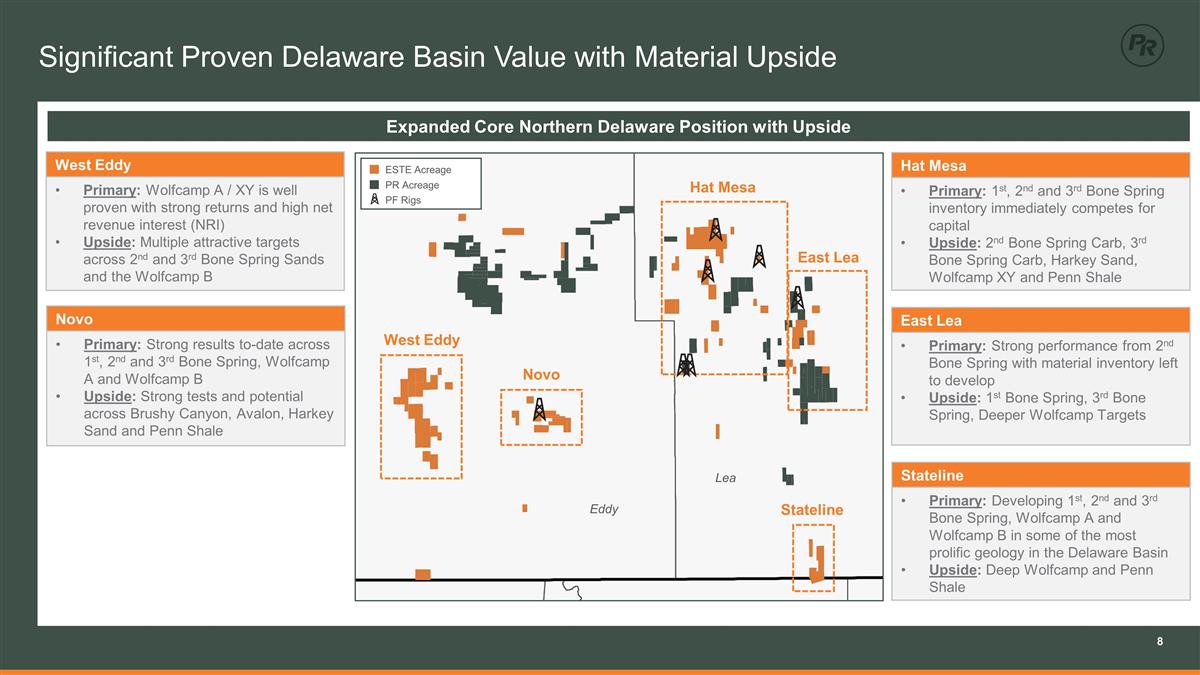

Eddy Lea West Eddy Hat Mesa East Lea Novo Significant Proven Delaware Basin Value with Material Upside Expanded Core Northern Delaware Position with Upside Hat Mesa Primary: 1st, 2nd and 3rd Bone Spring inventory immediately competes for capital Upside: 2nd Bone Spring Carb, 3rd Bone Spring Carb, Harkey Sand, Wolfcamp XY and Penn Shale ESTE Acreage PR Acreage PF Rigs Stateline Gross Net Proven Benches Upside Benches Low WPS Total DSUs Proven Locations Total Locations PDP Wells Proven Inventory Total Inventory WI, % Proven Locations Total Locations PDP Wells Proven Inventory Total Inventory West Eddy 2 2 4 20 160 320 19 141 301 60% 96 192 11 85 181 Novo 4 3 4 7 112 196 67 45 129 57% 64 112 38 26 73 Ranger 2 1 4 12 96 144 26 70 118 60% 58 86 16 42 71 East Lea 1 1 4 15 60 120 20 40 100 60% 36 72 12 24 60 Hat Mesa 1 1 4 8 32 64 36 - 28 60% 19 38 22 (2) 17 Stateline 5 2 4 5 100 140 36 64 104 60% 60 84 22 38 62 Total - - 360 780 212 464 East Lea Primary: Strong performance from 2nd Bone Spring with material inventory left to develop Upside: 1st Bone Spring, 3rd Bone Spring, Deeper Wolfcamp Targets Stateline Primary: Developing 1st, 2nd and 3rd Bone Spring, Wolfcamp A and Wolfcamp B in some of the most prolific geology in the Delaware Basin Upside: Deep Wolfcamp and Penn Shale West Eddy Primary: Wolfcamp A / XY is well proven with strong returns and high net revenue interest (NRI) Upside: Multiple attractive targets across 2nd and 3rd Bone Spring Sands and the Wolfcamp B Novo Primary: Strong results to-date across 1st, 2nd and 3rd Bone Spring, Wolfcamp A and Wolfcamp B Upside: Strong tests and potential across Brushy Canyon, Avalon, Harkey Sand and Penn Shale

Substantial Synergies Across Combined Platform Combined team will be led by PR’s executive management team, but will include key contributors from all parties Identified tangible savings through enhanced production operations, personnel and contract services optimization and reduced midstream costs Go-forward D&C savings driven by PR’s peer-leading costs Permian Resources delivering >10% lower Delaware costs per lateral foot ~$30 Million ~$115 Million Begins in 2024 Begins in 2024 Begins at closing Accelerates progress toward investment grade credit profile Potential to refinance Earthstone notes once callable Commentary Annual Value Timing ~$30 Million Begins at closing General & Administrative LOE + GP&T DC&F Category Scale & Development Optimization Cost of Capital Synergies Timing / Value Primary Synergies Additional Synergies Total Estimated Annual Synergies of ~$175 Million Economies of scale will further improve cost structure over time Ability to high-grade pro forma capital allocation across broader asset base in the Northern Delaware Basin Earthstone’s asset base will provide Permian Resources further opportunities to leverage its best-in-class ground game to drive value via grassroots acquisitions / leasing, swaps and trades

Leveraging Delaware Scale and Optimized Operations to Drive Synergies General & Administrative3 Lease Operating Expense2 Drilling Efficiencies1 Efficiency metrics reflect last twelve-month actuals for Delaware Basin wells. LOE reflects Q2’23 for the Delaware and excludes GP&T expense. Cash G&A metric reflects Q2’23 actuals. Completions Efficiencies1 +16% +51% Identified ~$30 MM of cash G&A synergies, or ~50% of Earthstone’s current total cash G&A Identified actionable Delaware projects to add meaningful value through reduced LOE PR is currently drilling and completing wells faster in the Delaware Basin with lower costs, resulting in improved capital efficiency Prioritizing Low-Cost Operations across a Broader Portfolio for Total Expected Operational, G&A and Financial Synergies of ~$175 Million Annually (37%) (8%)

63 / 80 / 72 245 / 126 / 42 119 / 120 / 123 188 / 192 / 190 233 / 204 / 183 202 / 202 / 203 295 / 192 / 0 236 / 220 / 172 Strong Balance Sheet with Enhanced Credit Profile Source: FactSet data as of August 18, 2023. Yield to worst for investment grade peers including Ovintiv, Marathon, Diamondback, and Coterra as of August 18, 2023. Reflects the aggregate principal amount and is not adjusted for unamortized debt issuance costs and discounts. Net debt-to-LQA EBITDAX, also referred to as “leverage" in this presentation, is a non-GAAP financial measure. Overview Maintains a strong pro forma balance sheet with significant financial flexibility Larger cash flow base, low leverage and no maturities until 2026 Secured a $500 MM commitment to increase aggregate lender commitments under the credit facility to $2.0 Bn Increased scale accelerates lower cost of capital and path to investment grade Intend to opportunistically term out RBL indebtedness Strong pro forma hedge position to support continued debt reduction Senior Unsecured Debt Maturity Profile ($mm)3 Average Senior Unsecured Note Yield to Worst1 Investment Grade2 ~150 bps YTW spread One step away from IG peers Potential improvement in combined business No near-term maturities Leverage at Closing4 Long-Term Leverage Target PF Liquidity at Closing <1.0x 0.5 - 1.0x >$1 Bn PF

Framework for 2024 Capital Allocation Operational Overview Combined company operating 11 rigs, primarily focused on Delaware Basin Plan to continue Earthstone’s plan of having 1 of the 2 rigs currently in the Midland Basin shift to the Delaware Basin Preliminary 2024 Plan ~90% of capital allocated towards high rate-of-return projects in the Delaware Basin Predominantly focused on Lea, Eddy, Reeves and Ward Counties Delaware Basin activity to be slightly more weighted towards NM versus TX ~10% of capital allocated to Midland Basin Intend to harvest significant free cash flow while preserving options to maximize value Expect to operate ~1 rig, concentrated on oily acreage in Midland and Reagan Counties Other No change to re-investment strategy, focused on maximizing free cash flow in near to mid term Higher pro forma capital allocation to oilier-weighted assets expected to increase oil cut PR expects to maintain well productivity relative to FY 2023 No change to current return of capital framework Remain committed to distributing ≥50% of FCF after the base dividend through variable dividends and share repurchases Anticipate providing detailed FY’24 guidance early next year during normal budgeting cycle Key Priorities Increase Shareholder Value Increase Near-Term FCF Enhance Capital Efficiency Maximize Shareholder Returns Protect the Balance Sheet

Business Combination Magnifies Operating Scale PR ESTE Pro Forma PR Enterprise Value ($Bn) (2) $9.5 $4.5 $14.0 Total Production (MBoe/d) 166 133(1) ~300 Oil Mix (%) 51% 41% 46% Permian Net Acreage (000s) 180 223 403 (1) Source: Enverus. APA does not disclose Permian net acres. Lower Cost Structure Lower Cost of Capital Potential Higher Multiple Benefits of Scale: Permian Net Acres3 (M) 856 1,400 395 508 400 403 307 NA5 179 180 223 148 145 198 110 150 Permian Rigs4 25 24 17 15 15 11 5 4 3 6 5 6 5 2 2 2 Creating One of the Largest Producers in the Permian Basin Current Permian Basin Production (MBoe/d) – Q2 2023 PF Reflects the midpoint of Earthstone’s Q4 2023 guidance which includes the Novo acquisition that closed on August 15, 2023. Enterprise value is based on market data as of August 18, 2023 and reflects Permian Resources’ offer for Earthstone. Source: Company disclosures.

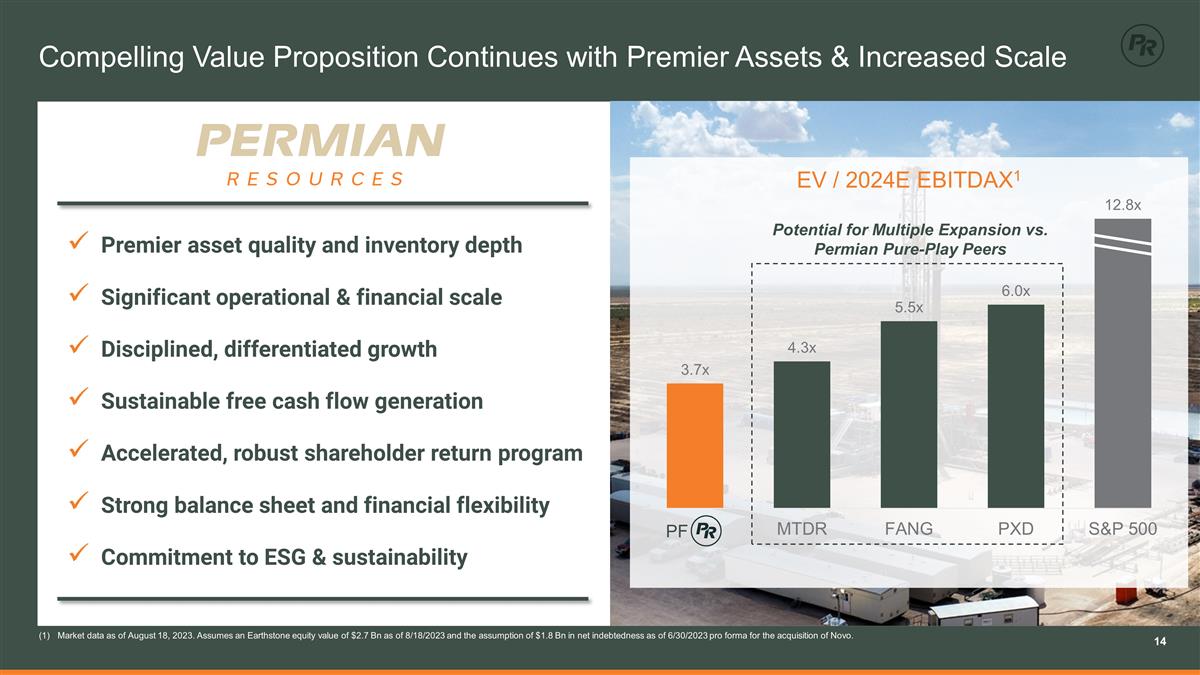

Compelling Value Proposition Continues with Premier Assets & Increased Scale Market data as of August 18, 2023. Assumes an Earthstone equity value of $2.7 Bn as of 8/18/2023 and the assumption of $1.8 Bn in net indebtedness as of 6/30/2023 pro forma for the acquisition of Novo. Premier asset quality and inventory depth Significant operational & financial scale Disciplined, differentiated growth Sustainable free cash flow generation Accelerated, robust shareholder return program Strong balance sheet and financial flexibility Commitment to ESG & sustainability Potential for Multiple Expansion vs. Permian Pure-Play Peers PF

Appendix

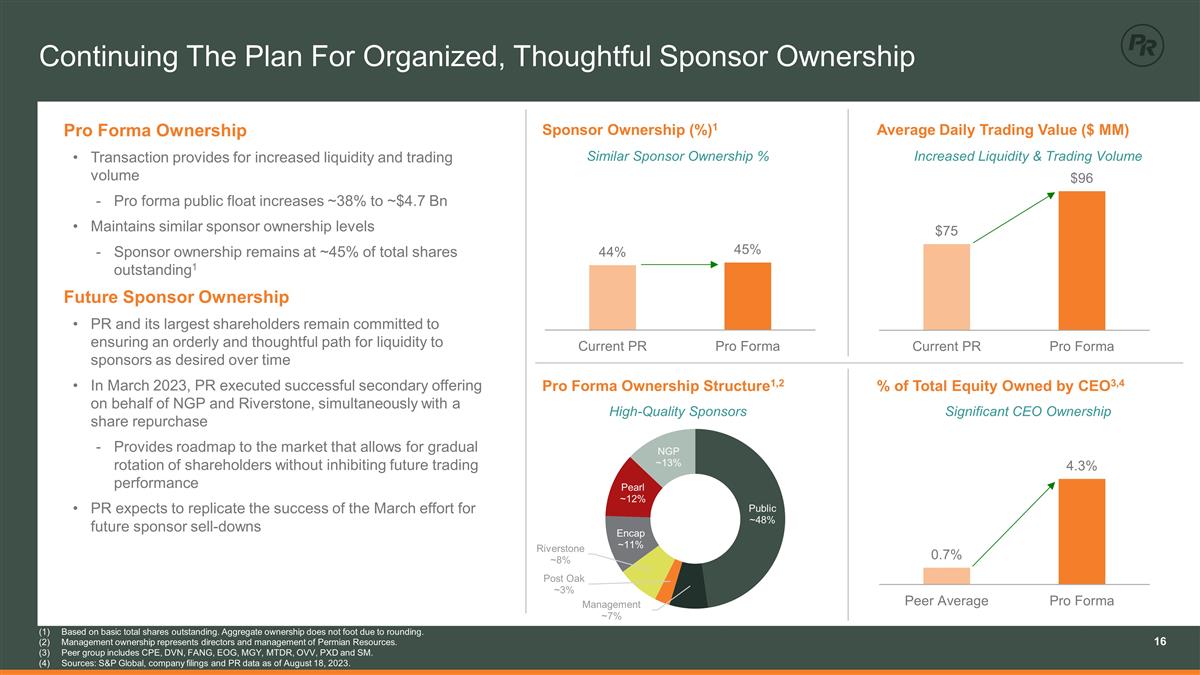

Continuing The Plan For Organized, Thoughtful Sponsor Ownership Average Daily Trading Value ($ MM) Similar Sponsor Ownership % Increased Liquidity & Trading Volume High-Quality Sponsors Significant CEO Ownership Sponsor Ownership (%)1 % of Total Equity Owned by CEO3,4 Pro Forma Ownership Structure1,2 Based on basic total shares outstanding. Aggregate ownership does not foot due to rounding. Management ownership represents directors and management of Permian Resources. Peer group includes CPE, DVN, FANG, EOG, MGY, MTDR, OVV, PXD and SM. Sources: S&P Global, company filings and PR data as of August 18, 2023. Pro Forma Ownership Transaction provides for increased liquidity and trading volume Pro forma public float increases ~38% to ~$4.7 Bn Maintains similar sponsor ownership levels Sponsor ownership remains at ~45% of total shares outstanding1 Future Sponsor Ownership PR and its largest shareholders remain committed to ensuring an orderly and thoughtful path for liquidity to sponsors as desired over time In March 2023, PR executed successful secondary offering on behalf of NGP and Riverstone, simultaneously with a share repurchase Provides roadmap to the market that allows for gradual rotation of shareholders without inhibiting future trading performance PR expects to replicate the success of the March effort for future sponsor sell-downs

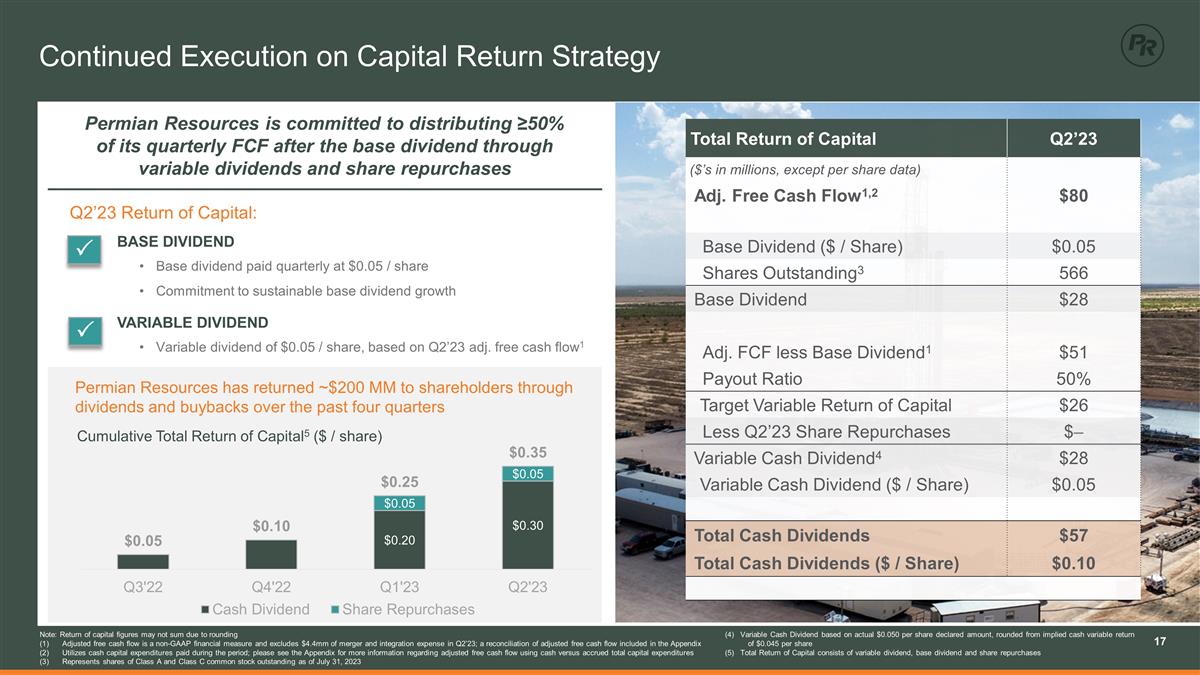

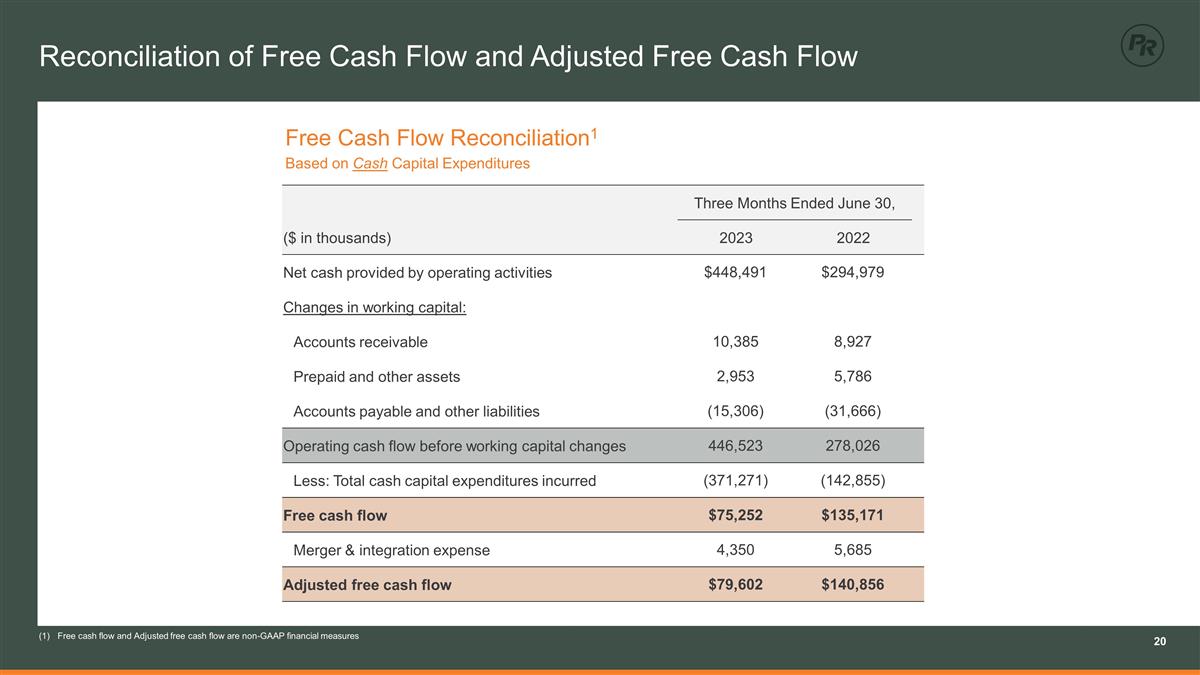

Continued Execution on Capital Return Strategy Total Return of Capital Q2’23 ($’s in millions, except per share data) Adj. Free Cash Flow1,2 $80 Base Dividend ($ / Share) $0.05 Shares Outstanding3 566 Base Dividend $28 Adj. FCF less Base Dividend1 $51 Payout Ratio 50% Target Variable Return of Capital $26 Less Q2’23 Share Repurchases $– Variable Cash Dividend4 $28 Variable Cash Dividend ($ / Share) $0.05 Total Cash Dividends $57 Total Cash Dividends ($ / Share) $0.10 Cumulative Total Return of Capital5 ($ / share) P P BASE DIVIDEND Base dividend paid quarterly at $0.05 / share Commitment to sustainable base dividend growth VARIABLE DIVIDEND Variable dividend of $0.05 / share, based on Q2’23 adj. free cash flow1 Permian Resources has returned ~$200 MM to shareholders through dividends and buybacks over the past four quarters Q2’23 Return of Capital: Note: Return of capital figures may not sum due to rounding Adjusted free cash flow is a non-GAAP financial measure and excludes $4.4mm of merger and integration expense in Q2’23; a reconciliation of adjusted free cash flow included in the Appendix Utilizes cash capital expenditures paid during the period; please see the Appendix for more information regarding adjusted free cash flow using cash versus accrued total capital expenditures Represents shares of Class A and Class C common stock outstanding as of July 31, 2023 (4) Variable Cash Dividend based on actual $0.050 per share declared amount, rounded from implied cash variable return of $0.045 per share (5) Total Return of Capital consists of variable dividend, base dividend and share repurchases Permian Resources is committed to distributing ≥50% of its quarterly FCF after the base dividend through variable dividends and share repurchases

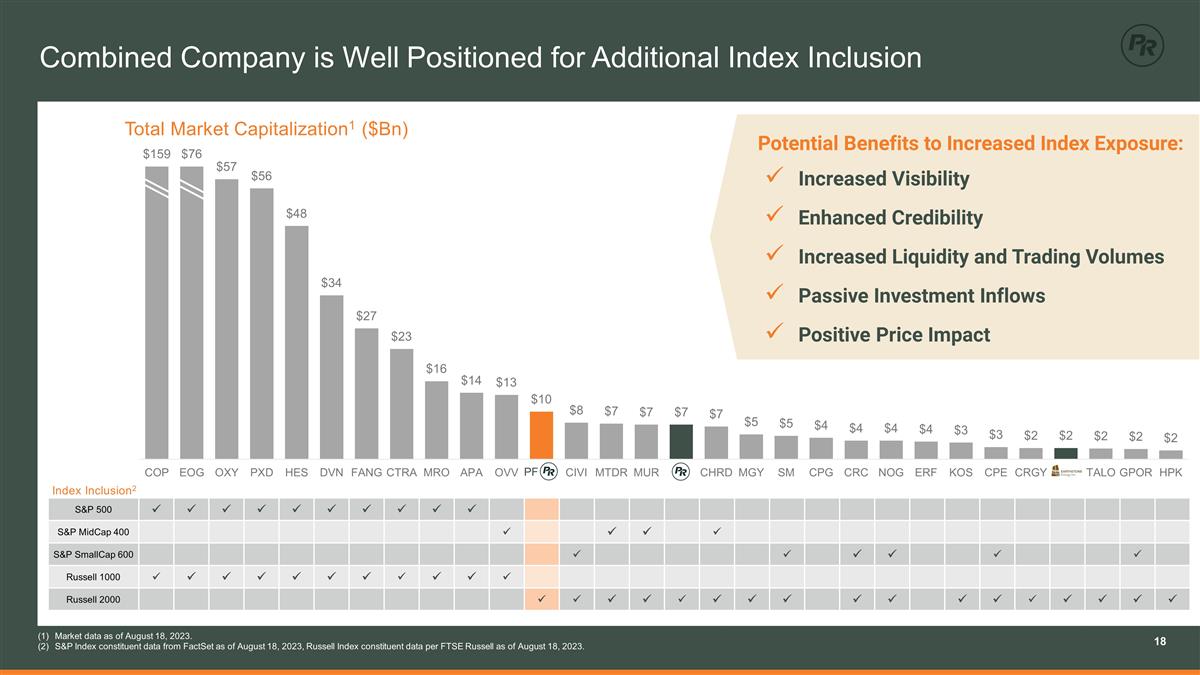

Combined Company is Well Positioned for Additional Index Inclusion Market data as of August 18, 2023. S&P Index constituent data from FactSet as of August 18, 2023, Russell Index constituent data per FTSE Russell as of August 18, 2023. Total Market Capitalization1 ($Bn) S&P 500 ü ü ü ü ü ü ü ü ü ü S&P MidCap 400 ü ü ü ü S&P SmallCap 600 ü ü ü ü ü ü Russell 1000 ü ü ü ü ü ü ü ü ü ü ü Russell 2000 ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü ü Index Inclusion2 Increased Visibility Enhanced Credibility Increased Liquidity and Trading Volumes Passive Investment Inflows Positive Price Impact Potential Benefits to Increased Index Exposure: PF

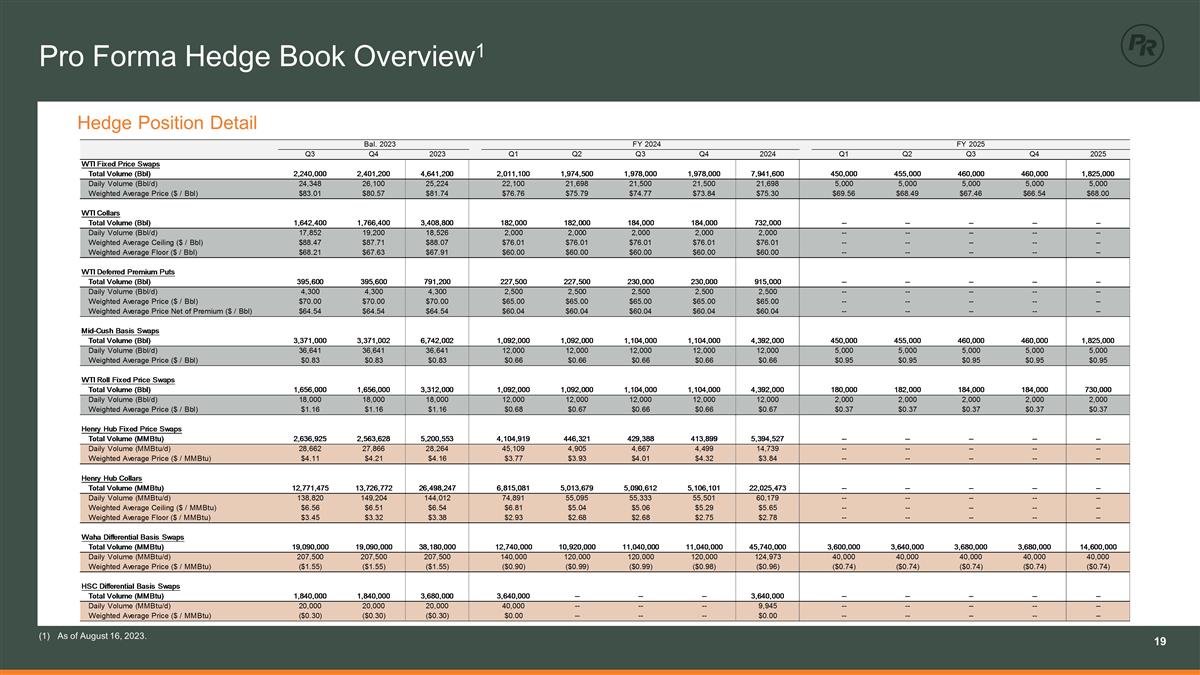

Pro Forma Hedge Book Overview1 As of August 16, 2023. Hedge Position Detail

Reconciliation of Free Cash Flow and Adjusted Free Cash Flow Free cash flow and Adjusted free cash flow are non-GAAP financial measures Free Cash Flow Reconciliation1 Based on Cash Capital Expenditures Three Months Ended June 30, ($ in thousands) 2023 2022 Net cash provided by operating activities $448,491 $294,979 Changes in working capital: Accounts receivable 10,385 8,927 Prepaid and other assets 2,953 5,786 Accounts payable and other liabilities (15,306) (31,666) Operating cash flow before working capital changes 446,523 278,026 Less: Total cash capital expenditures incurred (371,271) (142,855) Free cash flow $75,252 $135,171 Merger & integration expense 4,350 5,685 Adjusted free cash flow $79,602 $140,856