| Exhibits | Description | ||||

| 99.1 | 2023 Q2 Report Press Release dated August 8, 2023 | ||||

| 99.2 | Barrick Gold Corporation’s Comparative Unaudited Financial Statements prepared in accordance with International Financial Reporting Standards and the notes thereto for the three and six months ended June 30, 2023 and Management’s Discussion and Analysis for the same periods | ||||

| 101.INS | Inline XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document | ||||

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | ||||

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | ||||

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | ||||

| 101.LAB | Inline XBRL Taxonomy Extension Labels Linkbase Document | ||||

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase

Document |

||||

Exhibit 99.1

BARRICK PROGRESSES EXTENSION OF

LONG-TERM VALUE DELIVERY RUNWAY

| ALL AMOUNTS EXPRESSED IN U.S. DOLLARS

Toronto, August 8, 2023 — Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) is on target to meet its gold and copper production guidance for 2023 and continues to advance major projects which will drive value delivery in the long term through organic growth, president and chief executive Mark Bristow said today.

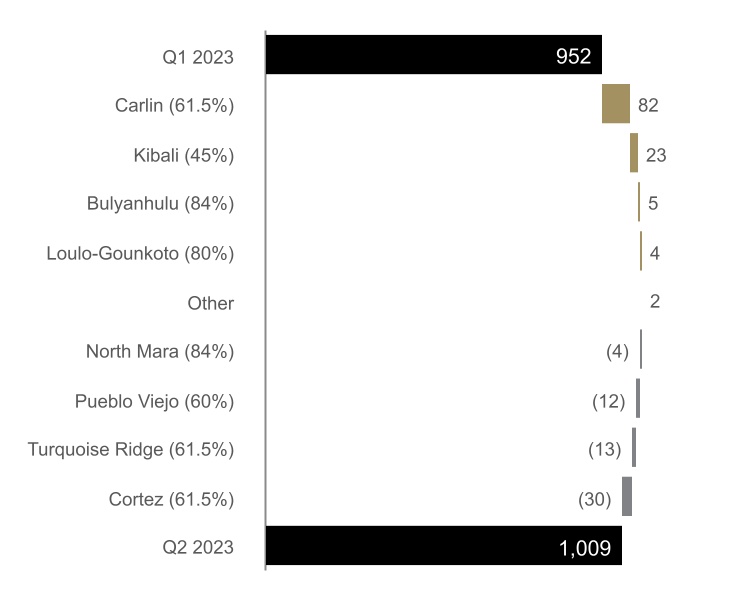

Commenting on the company’s Q2 results, Bristow said improved performances from the Carlin complex in Nevada, the Kibali gold mine in the Democratic Republic of Congo and the Lumwana copper mine in Zambia have laid a sound foundation for production in the second half of the year which, as guided, is expected to surpass the first. Key drivers of higher anticipated the H2 results are the Q2 completion of major maintenance projects at Nevada Gold Mines (“NGM”) and the commissioning of the plant expansion at the Pueblo Viejo gold mine in the Dominican Republic.

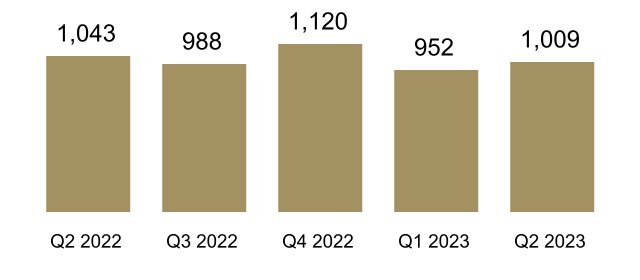

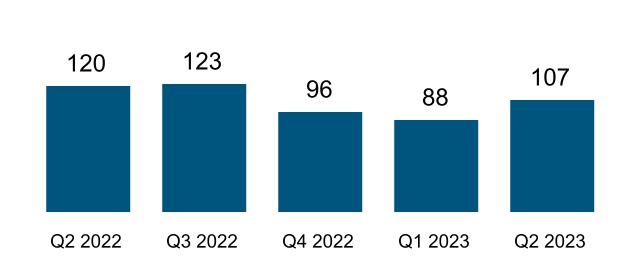

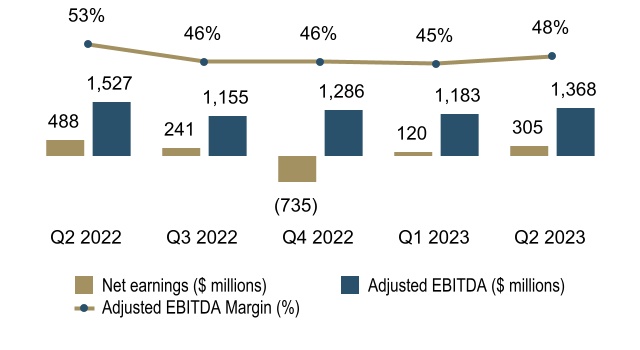

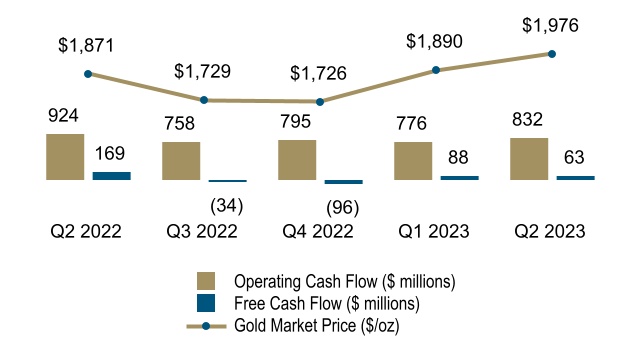

Compared to Q1, gold production in Q2 was up 6% at just over 1 million ounces1 while copper production increased by 22% to 107 million pounds.1 Operating cash flow rose by 7% to $832 million, net earnings increased by 143% to 17 cents per share, and adjusted net earnings2 increased by 36% to 19 cents per share. The quarterly dividend was maintained at 10 cents. Year-on-year, the total recordable injury frequency rate (“TRIFR”) was reduced by 8% and greenhouse gas emissions were reduced by 12%.3

CONTINUED ON PAGE 3 |

|

Key Performance Indicators

Financial and Operating Highlights

|

Financial Results

|

Q2 2023

|

Q1 2023

|

Q2 2022

|

|||||||||

| Realized gold price1,4 ($ per ounce) |

1,972 | 1,902 | 1,861 | |||||||||

| Net earnings ($ millions) |

305 | 120 | 488 | |||||||||

| Adjusted net earnings2 ($ millions) |

336 | 247 | 419 | |||||||||

| Net cash provided by operating activities ($ millions) |

832 | 776 | 924 | |||||||||

| Free cash flow5 ($ millions) |

63 | 88 | 169 | |||||||||

| Net earnings per share ($) |

0.17 | 0.07 | 0.27 | |||||||||

| Adjusted net earnings per share2 ($) |

0.19 | 0.14 | 0.24 | |||||||||

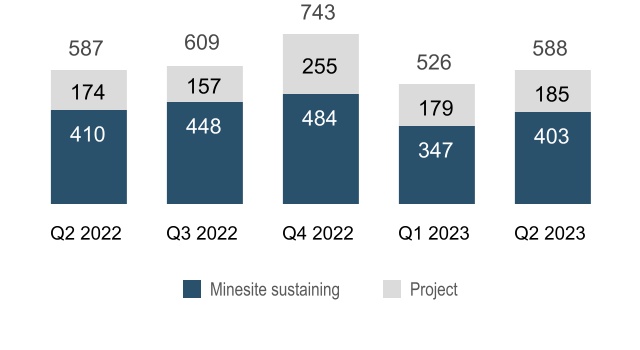

| Attributable capital expenditures6,7 ($ millions) |

588 | 526 | 587 | |||||||||

|

Operating Results

|

Q2 2023

|

Q1 2023

|

Q2 2022

|

|||||||||

| Gold |

||||||||||||

| Production1 (000s of ounces) |

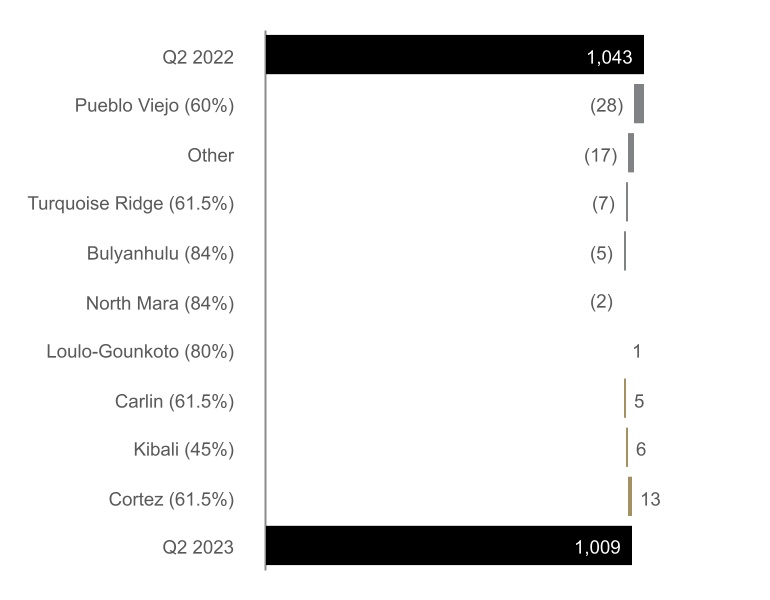

1,009 | 952 | 1,043 | |||||||||

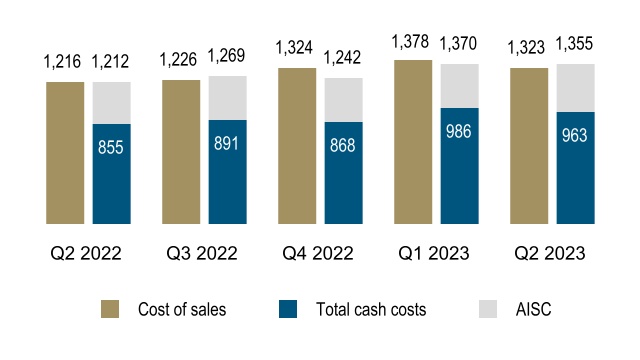

| Cost of sales1,8 ($ per ounce) |

1,323 | 1,378 | 1,216 | |||||||||

| Total cash costs1,9 ($ per ounce) |

963 | 986 | 855 | |||||||||

| All-in sustaining costs1,9 ($ per ounce) |

1,355 | 1,370 | 1,212 | |||||||||

| Copper |

||||||||||||

| Production1 (millions of pounds) |

107 | 88 | 120 | |||||||||

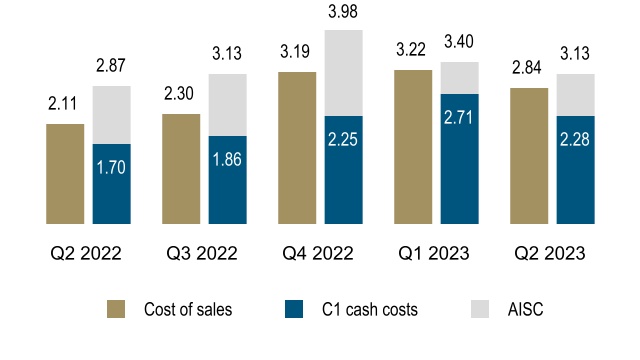

| Cost of sales1,8 ($ per pound) |

2.84 | 3.22 | 2.11 | |||||||||

| C1 cash costs1,10 ($ per pound) |

2.28 | 2.71 | 1.70 | |||||||||

| All-in sustaining costs1,10 ($ per pound) |

3.13 | 3.40 | 2.87 | |||||||||

Q2 2023 Results Presentation

Webinar and Conference Call

Mark Bristow will host a live presentation of the results today at 11:00 AM ET, with an interactive webinar linked to a conference call. Participants will be able to ask questions.

Go to the webinar

US and Canada (toll-free), 1 800 319 4610

UK (toll-free), 0808 101 2791

International (toll), +1 416 915 3239

The Q2 2023 presentation materials will be available on Barrick’s website at www.barrick.com and the webinar will remain on the website for later viewing.

Best Assets

| ∎ | Strong performances at Carlin, Kibali and Lumwana keep Barrick on track to deliver gold and copper production within annual guidance |

| ∎ | Stronger second half expected with completion of major shutdowns at NGM and Pueblo Viejo ramp-up in Q3 |

| ∎ | New equipment at Lumwana delivers 40% increase in copper production, 21% decrease in cost of sales and 26% decrease in C1 cash costs10 over Q1; more expected in H2 as we mine higher grade benches |

| ∎ | Solid Q2 production at Veladero places it firmly on track to deliver on full-year guidance |

| ∎ | Porgera continues to advance to restart, aided by settlement of legacy tax dispute and submission of new Special Mining Lease application |

| ∎ | Exploration progresses significant brownfields opportunities at Carlin, Cortez, Turquoise Ridge, Veladero, Loulo, Kibali and Lumwana while consolidating new prospective ground positions in USA, Canada, Dominican Republic, Peru, Chile, Tanzania and Côte d’Ivoire |

Leader in Sustainability

| ∎ | Pueblo Viejo receives environmental license for new tailings storage facility |

| ∎ | 8% reduction in TRIFR3 year-on-year |

| ∎ | 12% decrease in greenhouse gas emissions versus H1 2022 |

| ∎ | Successful reintroduction of 16 white rhinos into the Garamba National Park in DRC |

Delivering Value

| ∎ | 7% increase in operating cash flow over Q1 to $832 million |

| ∎ | 143% increase in net earnings per share over Q1 to $0.17 and 36% increase in adjusted net earnings per share2 to $0.19 for Q2 |

| ∎ | $0.10 per share dividend declared |

| BARRICK SECOND QUARTER 2023 | 2 | PRESS RELEASE |

CONTINUED FROM PAGE 1

The massive Pueblo Viejo expansion project is making significant progress with the process plant currently ramping up to full capacity. The plant expansion and associated new tailings storage facility will extend the Tier One11 mine’s life to beyond 2040 and is designed to sustain gold production above 800,000 ounces pear year (100% basis) going forward.12 In Papua New Guinea, the resolution of the tax dispute has allowed us to work toward the re-opening of the Porgera gold mine by the end of the year13, with a potential Tier One production profile, while the prefeasibility study on a Super Pit at Lumwana is driving its transformation into another Tier One asset, capable of producing into the 2060s.

In Pakistan, Barrick continues to make solid progress on the Reko Diq project. Reko Diq is targeting first production in 2028, at the same time that the Lumwana expansion is expected to be completed. Together, these projects will elevate Barrick into the premier league of copper producers, in line with its strategy of significantly expanding its copper portfolio.

Exploration, traditionally Barrick’s key growth driver, is advancing significant resource and reserve growth opportunities at Carlin, Cortez and Turquoise Ridge in Nevada, Veladero in Argentina and Loulo, Kibali and Lumwana in Africa. Barrick is also continuing to expand its global exploration footprint and has consolidated new prospective ground holdings in the USA, Canada, the Dominican Republic, Peru, Chile, Tanzania and Côte d’Ivoire.

“Our asset base is the best in the business and it gives us a platform from which we can clearly see and plan for the future, managing the challenges and maximizing the opportunities. At the halfway mark of this year, we’ve again advanced significantly towards our goal of building the world’s most valued gold and copper mining company, and we have the strategy, the means and the motivation to achieve that,” Bristow said.

BARRICK DECLARES Q2 DIVIDEND

Barrick today announced the declaration of a dividend of $0.10 per share for the second quarter of 2023.

The dividend is consistent with the company’s Performance Dividend Policy announced at the start of 2022.

The Q2 2023 dividend will be paid on September 15, 2023 to shareholders of record at the close of business on August 31, 2023.

“As a result of the continuing overall strength of our business and balance sheet, we have maintained the distribution of a robust base dividend to our shareholders, while our Performance Dividend Policy provides the potential for additional upside going forward,” said senior executive vice-president and chief financial officer Graham Shuttleworth.

THE POSITIVE IMPACT OF RESPONSIBLE MINING

Effective and equitable socio-economic development worldwide would not be possible without the transformative contribution of responsible mining, Mark Bristow said at the group’s third annual Sustainability Update on July 25.

Bristow said Barrick’s sustainability strategy was geared to the United Nations’ Sustainable Development Goals (SDGs), and in line with its commitment to transparency, its recently published Sustainability Report for 2022 showed how its operations contributed to or impacted on specific SDGs.

“We believe mining is the flywheel of development and therefore the entire industry is essential to the achievement of the SDGs,” he said.

Barrick’s Sustainability Executive, Grant Beringer, said the group was also making progress towards complete conformance with the latest best practices, including the International Council on Mining and Metals’ Performance Expectations, the World Gold Council’s Responsible Gold Mining Principles and the Global Industry Standard on Tailings Management. Barrick continues to meet or exceed its environmental targets, including recycling and reusing water — up to 83% from 80% in 2021 — and reducing greenhouse gas emissions by 12% year-on-year and 6% for 2022.

“We believe the mining industry is a catalyst for socioeconomic development through the infrastructure we build, the jobs we create, the businesses we support through our supply chains and the investments we make in local communities,” Beringer said.

The group’s current key focus areas are: using its purchasing power to drive down Scope 3 emissions from suppliers; developing a tool to measure its contribution to the conservation and regeneration of biodiversity; continuing to provide ESG raters with the latest sustainability-related information; and progressing the environmental and social studies at the giant Reko Diq project in Balochistan, Pakistan, where it is already delivering on its community development commitments, far ahead of the targeted first production in 2028.

“Done right, the mining industry is a powerful force for good in the global drive for social and economic development,” Bristow said.

| BARRICK SECOND QUARTER 2023 | 3 | PRESS RELEASE |

NGM’s operating muscle has been beefed up with the ahead-of-schedule commissioning of the first seven of a new 22-unit Komatsu 930 fleet due this year.

FOCUS ON FLEXIBILITY AT NEVADA

With the completion of major maintenance shutdowns at NGM, and a significantly improved performance from Carlin, the focus on driving flexibility and reducing production risk has intensified.

NGM chairman Mark Bristow says while the superb quality of the complex’s assets and its enormous untapped potential make Nevada the value foundation on which operator and majority shareholder Barrick is growing its business, it has processing constraints which need to be overcome by boosting operational flexibility.

“We see at each of the three Tier One assets (Carlin, Cortez and Turquoise Ridge) multiple opportunities to strengthen the life of mine with near-mine growth using the current infrastructure in the midterm (Leeville, Ren), new projects that can extend the use of the processing facilities (Robertson), and a long-term portfolio targeting significant brownfields and greenfields (Fourmile, Turquoise Ridge Underground) to sustain current production past the 15-year window.”

“We’re planning to achieve this by increasing processing and mining run times, stepping up development at all the underground mines, improving and standardizing

maintenance management, identifying and implementing efficiency initiatives, and tightening control of compliance with mine plans,” he says.

“Barrick’s mantra is that the best assets need to be managed by the best people so there’s been an equally strong focus on building a management team and a workforce with the skills and orientation required to make the most of the world’s largest gold mining complex. In this regard, it’s worth noting that the training center we established at NGM has already produced more than 170 frontline and support staff graduates.”

During the past quarter, NGM’s operating muscle was beefed up with the ahead-of-schedule commissioning of the first seven of a new 22-unit Komatsu 930 fleet due this year. The rest of a total of 62 are due to be commissioned over the next three years.

| BARRICK SECOND QUARTER 2023 | 4 | PRESS RELEASE |

WHERE WOMEN SHINE

On June 15, Barrick joined the rest of the industry in celebrating the International Day of Women in Mining. As Mark Bristow notes, however, acknowledging and encouraging the important role women should be playing in this traditionally male-dominated business is an everyday strategic priority for Barrick.

“People are the ultimate resource, and we invest the same amount of attention into finding and developing them as we do in exploring for mineral resources,” Bristow says. “There’s a strong commercial as well as a moral motivation to make gender diversity part of this strategy. The communities in which we operate include large numbers of capable and committed women who just need an opportunity to show what they can contribute.

“That’s why we have recruitment drives and training programs specifically targeted at women as well as initiatives to raise awareness of the value of female economic empowerment in their communities.

“At our Pueblo Viejo mine in the Dominican Republic, for example, women represented 51% of new hires and 35% of internal promotions last year, and 23% of its workforce is now female. Across the group we had almost 3,000 female employees, representing 12% of our global workforce at the end of 2022, with 18% of management positions and 16% of senior management positions being held by women. We’re working hard to make that proportion larger.”

LUMWANA’S BURIED TREASURE

HOW BARRICK CREATES VALUE BY UNCOVERING POTENTIAL

Barrick’s post-merger focus on developing a clear understanding of the geological structures underlying its assets has unlocked enormous potential across the group, most recently at the 100% owned Lumwana copper mine in Zambia.

The transformation of this mine into a potential Tier One operation with a significant free cash flow and a life expectancy into the 2060s is well under way, with the accelerated pre-feasibility study scheduled for completion towards the end of next year. Pre-construction will start in 2025 with 2028 targeted for first production. Concurrent with the expansion, the existing process plant will be upgraded to support the new mine life.

“Resource conversion of the Chimiwungo Super Pit extension has started and the results to date have confirmed the deposit’s potential to provide the foundation for the Lumwana expansion project. Meanwhile resource definition drilling at the near-surface, low-strip Kamisengo deposit has shown that it can support the process plant feed during the stripping phase of the super pit,” says Sebastiaan Bock, chief operating officer of Barrick’s Africa & Middle East region.

Mark Bristow says when the new Lumwana and Reko Diq both come on stream, which is currently expected in 2028,

they will promote Barrick to the premier league of copper producers alongside its peerless gold portfolio.

“Both these projects demonstrate Barrick’s unique ability to extract every ounce or pound of value from assets already in its portfolio,” he says.

| BARRICK SECOND QUARTER 2023 | 5 | PRESS RELEASE |

ORGANIC GROWTH IN MINERAL RESERVES SUPPORTS

BARRICK’S 10-YEAR PRODUCTION PROFILE

Exploration continues to be the driving force that sets Barrick apart from its peers by delivering significant and sustained growth in attributable, proven and probable reserves.

“Since the 2019 merger with Randgold, we’ve replaced 125% of the gold depleted by mining (exclusive of divestments and acquisitions on a gold equivalent basis)14 by unlocking the full value of Barrick’s assets and successfully expanding the asset base through brownfields exploration,” says Simon Bottoms, mineral resource management and evaluation executive.

“One of the big advantages of having high-quality assets in the world’s most prospective regions is that we have a long replacement planning runway. A key group deliverable is the organic replacement of depletion on a rolling three-year basis. Our focus for the rest of this year is on building the mineral resources that will serve as the foundation for future conversion into reserves.”

In Nevada, Barrick continues to work on multiple Tier One targets that are expected to materially grow the resource and reserve potential of one of the world’s most endowed mining complexes. In the Africa & Middle East region, resource conversion drilling at Kibali, Yalea at Loulo-Gounkoto and Bulyanhulu is expected to again replace depletion this year.

“Looking ahead to 2024, the completion of the prefeasibility study on the Lumwana Super Pit expansion project and the updated feasibility study on the Reko Diq project in Pakistan is expected to deliver organic growth over and above annual depletion in the group’s mineral reserves. Next year’s reserve growth is also expected to be supported by the completion of conversion drilling in the greater Leeville complex and elsewhere at NGM,” says Bottoms.

| BARRICK SECOND QUARTER 2023 | 6 | PRESS RELEASE |

A PROUD HISTORY, A BRIGHT FUTURE

Barrick marked its 40th birthday this year, celebrating its growth from the modest, small-scale operation started by Canadian mining pioneer Peter Munk in the early 1980s.

When Barrick listed on the Toronto Stock Exchange on May 2, 1983, it had a market capitalization of C$100 million and produced 30,000 ounces of gold in its first full year of production. Since its merger with Randgold in 2019, the company aspires to be the world’s most valued gold and copper business with the best assets managed by the best people and delivering the best returns and benefits for all its stakeholders.

Barrick today has a multi billion dollar market capitalization and produced 4.1 million ounces of gold and 440 million pounds of copper in 20221 from a mine and project portfolio spanning 19 countries.

Ringing the closing bell of the Toronto Stock Exchange to commemorate Barrick’s 40th anniversary.

BRINGING BACK WHITE RHINOS TO THE DRC

Barrick was the sole donor in the recent translocation of 16 southern white rhinos to the Democratic Republic of the Congo’s Garamba National Park, near our Kibali Gold Mine, in collaboration with the Institut Congolais pour la Conservation de la Nature (ICCN), African Parks and &Beyond Phinda Private Game Reserve in Kwazulu-Natal, South Africa, from where the rhinos were sourced. Northern white rhinos were last seen in the park in 2006 and are now considered extinct.

This latest sustainability initiative forms part of Barrick’s longstanding partnership with African Parks and Garamba, which has seen the company provide more than $2.5 million for tracking collars, fuel for observation planes, rescue and rehabilitation programs as well as improvements to critical infrastructure such as roads and bridges.

Additionally, Barrick will fund the translocation of a further 60 white rhinos from South Africa to Garamba over the next three years. The project is aligned with Barrick’s biodiversity strategy which places importance on restoring and conserving areas with high conservation value and the species within those habitats.

| BARRICK SECOND QUARTER 2023 | 7 | PRESS RELEASE |

Barrick president and chief executive Mark Bristow and Pueblo Viejo president Juana Barceló speak to local media during a briefing on July 27.

A COMPREHENSIVE MULTI-YEAR PROCESS EXTENDS

THE LIFE OF PUEBLO VIEJO TO BEYOND 2040

The Barrick-operated Pueblo Viejo mine continues to advance the engineering design for the El Naranjo tailings storage facility (TSF) project which will extend its life to 2040 and beyond.12 The plant expansion and associated new TSF is designed to sustain gold production above 800,000 ounces per year (100% basis) going forward.12

Speaking at a local media briefing on July 27, Mark Bristow said that the comprehensive engineering, environmental and community process, conducted over several years, would enable Pueblo Viejo to double the enormous contribution it had already made to the Dominican Republic’s economy.

In line with its commitment to transparency, Bristow detailed the process leading up to the issuance of the environmental licence recently received for the new TSF. This started with a comprehensive site selection in line with the Global Industry Standard on Tailings Management (GISTM) and in consultation with the Government and communities.

Following the site selection process, an Environmental and Social Impact Assessment (ESIA) was completed which considered potential impacts associated with the preferred and alternative sites. This involved the completion of numerous specialist studies undertaken by independent in-

country and international experts, including an independent peer review.

The company consulted with interested and affected parties over the course of four years, including more than 3,000 community engagements and two open public participation meetings. In line with the company’s commitment to transparency and best practice, open public meetings were advertised in local and national media and allowed sufficient opportunity for all parties to raise concerns, questions and comments throughout the process.

“Mining is the driver for global development and to date, Pueblo Viejo has paid a total of $3.2 billion in direct and indirect taxes since commencing commercial production in 2013. The extension of the mine’s life will allow Pueblo Viejo to continue being a major creator of value for the Dominican Republic and its people far into the future,” Bristow said.

| BARRICK SECOND QUARTER 2023 | 8 | PRESS RELEASE |

TWIGA TRANSFORMS TANZANIAN MINING,

SETS STANDARD FOR INDUSTRY

Twiga Minerals, the joint venture between the Tanzanian government and Barrick, has revitalized the country’s gold mining industry through a partnership that should serve as a model for similar operations, particularly in developing regions, says Mark Bristow.

Briefing media at a visit to the North Mara mine in July, Bristow said, in 2019, when Barrick took control over North Mara and Bulyanhulu — the mines that now form the Twiga complex – both were rundown and at a virtual standstill due to a deadlocked dispute between the government and the previous operators.

“We settled the dispute and established Twiga as a 50:50 economic benefits sharing partnership, which also vested a 16% shareholding in each mine with the government. We reinvented the mines which now, as a combined complex, produce gold at a Tier One level. So successful are these operations that, since Barrick’s buyout of the minority shareholders, they have contributed more than $2.8 billion to the Tanzanian economy in the form of taxes, levies, dividends, salaries and payments to local suppliers,” Bristow said.

“Equally important, we have fixed the environmental, land claims and human rights issues that destroyed these mines’ reputations and have restored their social licence to operate as an integral member of their communities. Since its establishment, Twiga has invested more than $12.5 million in landmark projects — identified in collaboration with the community development committees we established at the mines — to provide access to quality healthcare, educational facilities, potable water and alternative sources of income. Among these is an irrigation system which is expected to substantially improve production for more than 2,350 farmers, as well as a potable water tower that provides water to nearly 35,000 residents.”

Twiga has also committed $30 million to a Future Forward School Program. In partnership with the government, it will build 1,090 classrooms and other facilities across 161 schools nationwide, to accommodate some 49,000 students who started their A-levels in July this year. In addition, it has pledged $40 million to construct a 73 kilometre road from Kahama to Kakola.

Operationally, Bristow said the Twiga complex was continuing its strong production performance and was well on track to achieve its guidance for the year. Both mines are maintaining a strong focus on the health and safety of their workers, and in April Bulyanhulu won the Overall Tanzanian OSHA1 Compliance Award for 2023 in the Mining Sector Category and North Mara was second runner-up.

Globally, Barrick has a policy of prioritizing local employment and at Twiga this has delivered a workforce which is 96% Tanzanian, with almost half drawn from the communities around the mines.

Bristow said conversion drilling at North Mara was successfully replacing the reserves depleted by mining and first ore was mined at the mine’s new Gena pit last quarter. Additional opportunities for resource conversion have been identified at both mines.

“Barrick is committed to expanding its presence in Tanzania from our base here. We are currently consolidating key prospecting licences in the country with a view to expanding our existing reserves and resources as well as to discovering new world-class gold deposits,” he said.

| BARRICK SECOND QUARTER 2023 | 9 | PRESS RELEASE |

KIBALI SET TO ROLL OUT NEW 10-YEAR PLAN

ON BACK OF PRODUCTION RAMP-UP

AND RESERVE REPLACEMENT

Africa’s biggest gold mine, Kibali, stepped up production significantly in the past quarter as part of its planned ramp-up and is well on track to achieve its annual guidance. At the same time, successful exploration is expected to more than replace reserves depleted by mining again this year.

Briefing media in Kinshasa, Mark Bristow said the 10-year-old mine was now rolling out its business plan for the next decade, securing its status as one of the company’s elite portfolio of Tier One mines — those capable of producing 500,000 ounces or more of gold for at least 10 years at a cost below the industry average.

The mine draws most of its power from its three hydropower stations on the Kibali river. A planned 16MW solar farm, designed to back up the hydropower during the Democratic Republic of Congo’s (DRC’s) dry season, is expected to increase the renewable power contribution to the mine’s energy grid from 79% to 88%, with Kibali running entirely on renewables during the wet season.

Bristow said the creation of a world-class mine and a thriving local economy in one of the DRC’s remotest and least developed regions represented a triumph for the successful partnership between Barrick, the country’s government and its host communities.

“Our stakeholders in the DRC have benefited enormously from Kibali, which over the past 10 years has contributed

$4.6 billion to the country in the form of dividends, royalties and taxes. In line with our local procurement policy, Kibali gives preference to Congolese suppliers and contractors, who to date have received $2.5 billion from the mine,” Bristow said.

“Barrick’s commitment to the DRC is also evident from the extensive support we have given the Garamba National Park, contributing to the conservation of high value biodiversity. Most recently we led the drive to reintroduce white rhinos to the park, where they were last seen 17 years ago. Last month 16 of these rhinos were successfully introduced to Garamba with a further 60 scheduled for delivery over the next three years.”

Kibali’s Cahier des Charges program launched eleven projects in 2023 with seven of these scheduled for completion this July. The mine is investing $8.9 million in this program over five years. The community development fund is also implementing a number of new projects.

| BARRICK SECOND QUARTER 2023 | 10 | PRESS RELEASE |

SUCCESSFUL EXPLORATION CONTINUES

TO EXTEND TONGON’S LIFE OF MINE

Originally scheduled for closure in 2020, the life of Barrick’s Tongon gold mine continues to be extended through successful exploration campaigns.

Tongon general manager Hilaire Diarra says that since Tongon poured its first gold in 2010, the mine has contributed $2.2 billion to the Ivorian economy in the form of taxes, infrastructure development, salaries and payments to local suppliers.

“Extending its life will help ensure that Tongon is still able to share the value it creates with all its Ivorian stakeholders continuing its investment in community infrastructure development and income-generating projects. Exploration has further delivered the Seydou North, Tongon West and Djinni satellite targets adding to the life of mine. Barrick has

now also been awarded a new exploration permit for Boundiali and drilling is ongoing at the Fonondara conversion project,” he said.

“In spite of the fact that throughout its life Tongon has had to contend with serious operational issues, as well as a challenging socio-political environment, since pouring first gold it has never had an unprofitable quarter, which is a tribute to the dedication of the mine’s successive management teams. At the halfway mark of this year, it is on track to once again achieve its annual production guidance.”

| BARRICK SECOND QUARTER 2023 | 11 | PRESS RELEASE |

SUCCESSFUL PARTNERSHIP WILL

KEEP GOLD SHINING FOR MALI

The 26-year-long partnership between Barrick (previously Randgold) and the state of Mali has built the country’s gold mining industry into a world leader and positioned it strongly for further growth, says Mark Bristow.

Speaking at a media briefing at the Loulo-Gounkoto complex, Bristow said the complex was one of the world’s top 10 gold producers and the biggest business in terms of enterprise value in the whole of West Africa. Together with the Morila mine, the complex has contributed $9.3 billion to the Malian economy and accounted for between 5% and 10% of the country’s GDP over the past 10 years. Loulo-Gounkoto is one of Mali’s largest taxpayers and employers, with a workforce of some 7,000, 97% of whom are Malian nationals. Over the life of the complex the state has received more than 70% of the economic benefits it created.

“We are continuing to invest in the future of Loulo-Gounkoto. Successful exploration is more than replacing the ounces we mine as well as identifying new growth opportunities with the potential to deliver the next generation of major discoveries in the Loulo region. The new underground mine at Gounkoto – the complex’s third – has developed its first production stopes and the Yalea South cutback is ahead of plan,” Bristow said.

“We foresee that the complex will be a major contributor to the Malian economy for years to come. The achievement of that vision will require the continued commitment to the mutually rewarding partnership which has brought us this far

and delivered sustainable benefits to all stakeholders, including the country’s citizens.”

In line with Barrick’s global policy of local procurement, Malian suppliers accounted for 74% of the complex’s purchases, amounting to $298 million, during the first half of this year.

Turning to Loulo-Gounkoto’s operations, Bristow said the complex was continuing to perform strongly and was on track to achieve its production guidance for this year. It remains tightly focused on the safety of its workers and there were no lost-time injuries again during the past quarter.

As part of Barrick’s transition to renewable energy, the complex is extending its solar power installation by 48MW and battery storage system by 38MVA. The project is already feeding 10MW into the mines micro-grid and it is expected that its second phase will be commissioned well ahead of the current end-2024 completion date.

| BARRICK SECOND QUARTER 2023 | 12 | PRESS RELEASE |

HERITAGE FUND WILDLIFE ENDOWMENT SUPPORTS

HABITAT ENHANCEMENT AND RESTORATION PROJECTS

NGM has established a new Wildlife Endowment, created as an extension of the company’s non-profit employee giving program, the Heritage Fund.

The Wildlife Endowment was established in partnership with the Nevada Department of Wildlife (NDOW) as a sustainable environmental fund dedicated to wildlife habitat enhancement and restoration projects supporting wildland fire prevention, restoration, and riparian and stream health initiatives across Nevada.

The Heritage Fund recently approved $5 million of the $20 million commitment by NGM to be earmarked for Wildlife Endowment funding. Once fully funded in mid-2025, any environmental entity able to leverage qualified State or Federal matching grants whose efforts fit within fire prevention, restoration, and riparian and stream health categories will have the opportunity to request funding. One of the many benefits of the Wildlife Endowment is its accessibility to NGM employees, who will have the opportunity to easily donate to the fund and receive an additional 120% NGM match.

“We are very proud of this new environmental endowment, as it aligns with the Heritage Fund’s mission of supporting the sustainability of community programs and initiatives. It is a clear demonstration of our commitment to environmental stewardship alongside NDOW and other environmental agencies who are already doing great work in our communities and across the state,” says NGM executive managing director Peter Richardson.

Pictured left to right: Mikayla Morfin, NGM Heritage Fund Board Vice President; Alissa Wood, Barrick North America Head of Corporate Social Responsibility; Caleb McAdoo, NDOW Regional Supervisor; Peter Richardson, NGM Executive Managing Director; and Chris McAnany, NGM Manager of Corporate Social Responsibility.

VELADERO RECOGNIZED AS FIRST ARGENTINE MINE

TO IMPLEMENT TSM STANDARD

Veladero has become the first mine in Argentina to achieve compliance with the Towards Sustainable Mining (TSM) Standard, earning a special distinction from the Argentine Chamber of Mining (CAEM) during the Arminera 2023 summit, the industry’s flagship event in the country.

“Attaining TSM verification for Veladero is a testament to our commitment to society, especially our employees, neighbouring communities, and future generations, in developing sustainable mining practices. The transformation effort at Veladero spanned four years of intense work across all departments in the company. Veladero has confirmed its status as an open and transparent partner, fully accountable to society,” said Marcelo Álvarez, executive director of government relations for Barrick South America, upon receiving the special mention.

Towards Sustainable Mining is a standard developed by the Mining Association of Canada (MAC) that sets quality and control standards to ensure responsible and transparent mining operations. The system consists of protocols with ratings that cover the most relevant environmental and social aspects, including biodiversity conservation, community engagement, human rights, and mine closure, among others.

| BARRICK SECOND QUARTER 2023 | 13 | PRESS RELEASE |

BARRICK TARGETS 2028

FOR FIRST PRODUCTION FROM REKO DIQ

Mark Bristow says with the updated feasibility study on the giant Reko Diq copper-gold project making rapid progress, the company is aiming to start production in 2028.

Speaking at the inaugural session of Pakistan’s first Minerals Summit on August 1, Bristow said the signing of the New Reko Diq agreement last year was a landmark event in the development of a mining industry in Pakistan, a process which will be accelerated by the Minerals Summit.

“I hope the momentum created by this event will be sustained by successive efforts to unlock this sector’s full potential and build its capacity by attracting other foreign investors to follow Barrick, to the lasting benefit of Pakistan and its people,” he said.

“There is a growing demand for metals and minerals, especially copper, and the challenge for mining companies

and their host governments is to ensure that these resources are extracted in a responsible and equitable manner. Barrick believes in the principle of mutual advantage and shares the value its operations create with all stakeholders, including its host countries and communities.”

Bristow noted that Reko Diq was the latest manifestation of Barrick’s partnership model, already successfully applied elsewhere in its global portfolio. Barrick owns 50% of Reko Diq and is developing and will operate the mine. The Balochistan province, which hosts the deposit, has a 25% share and the federal government holds the other 25% through state-owned entities.15

Reko Diq Mining Company constitutes a 25-member Community Development Committee at Nokkundi in the Chagai district of Balochistan in May 2023.

Barrick continues its social investment program around the Reko Diq project area with the inauguration of a primary school at the Mashki Chah village.

REKO DIQ CONSTITUTES COMMUNITY DEVELOPMENT

COMMITTEE FOR LOCALLY DRIVEN DEVELOPMENT

The Reko Diq Mining Company has constituted a 25-member Community Development Committee (CDC) at Nokkundi, the nearest town to Reko Diq, in the Chagai district of Balochistan. The CDC comprises local stakeholders and community leaders who will guide the company’s social investment plan in the area.

Reko Diq country manager Ali Ehsan Rind said: “In all its operations worldwide, Barrick strives to be a good corporate citizen and a genuine partner of the host communities in locally led development. With the formation of this CDC, representing all the key local stakeholders, I am confident that our work will become a catalyst for the social development of the local communities.”

The Nokkundi CDC, formed after an extensive consultation process, has the responsibility to identify social investment initiatives to be undertaken by the company. It is a concrete step to ensuring that Reko Diq delivers social investment projects of significant and lasting benefit to the local communities among whom it will operate.

Reko Diq will be a multi-generational mine with a life of at least 40 years. During peak construction the project is expected to employ 7,500 people and once in production it will create some 4,000 long-term jobs. Barrick’s policy of prioritizing local employment and suppliers will have a positive impact on the local economy.

The company plans to complete the Reko Diq feasibility study update by the end of 2024, with 2028 targeted for first production from the giant copper-gold mine in the country’s Balochistan province. The new Reko Diq agreement ensures that benefits from the project start accruing to the people of Balochistan well before the mine goes into production through advancing royalties and social development investments.

| BARRICK SECOND QUARTER 2023 | 14 | PRESS RELEASE |

APPENDIX

2023 Operating and Capital Expenditure Guidance

GOLD PRODUCTION AND COSTS

| 2023 forecast attributable production (000s oz) |

2023 forecast cost of sales8 ($/oz)

|

2023 forecast total

|

2023 forecast all-in

|

|||||||

| Carlin (61.5%) |

910 - 1,000 | 1,030 - 1,110 | 820 - 880 | 1,250 - 1,330 | ||||||

| Cortez (61.5%)16 |

580 - 650 | 1,080 - 1,160 | 680 - 740 | 930 - 1,010 | ||||||

| Turquoise Ridge (61.5%) |

300 - 340 | 1,290 - 1,370 | 900 - 960 | 1,170 - 1,250 | ||||||

| Phoenix (61.5%) |

100 - 120 | 1,860 - 1,940 | 880 - 940 | 1,110 - 1,190 | ||||||

| Long Canyon (61.5%) |

0 - 10 | 2,120 - 2,200 | 730 - 790 | 1,080 - 1,160 | ||||||

| Nevada Gold Mines (61.5%) |

1,900 - 2,100 | 1,140 - 1,220 | 790 - 850 | 1,140 - 1,220 | ||||||

| Hemlo |

150 - 170 | 1,400 - 1,480 | 1,210 - 1,270 | 1,590 - 1,670 | ||||||

| North America |

2,100 - 2,300 | 1,160 - 1,240 | 820 - 880 | 1,170 - 1,250 | ||||||

| Pueblo Viejo (60%) |

470 - 520 | 1,130 - 1,210 | 710 - 770 | 960 - 1,040 | ||||||

| Veladero (50%) |

160 - 180 | 1,630 - 1,710 | 1,060 - 1,120 | 1,550 - 1,630 | ||||||

| Porgera (47.5%)13 |

— | — | — | — | ||||||

| Latin America & Asia Pacific |

630 - 700 | 1,260 - 1,340 | 800 - 860 | 1,110 - 1,190 | ||||||

| Loulo-Gounkoto (80%) |

510 - 560 | 1,100 - 1,180 | 750 - 810 | 1,070 - 1,150 | ||||||

| Kibali (45%) |

320 - 360 | 1,080 - 1,160 | 710 - 770 | 880 - 960 | ||||||

| North Mara (84%) |

230 - 260 | 1,120 - 1,200 | 900 - 960 | 1,240 - 1,320 | ||||||

| Bulyanhulu (84%) |

160 - 190 | 1,230 - 1,310 | 880 - 940 | 1,160 - 1,240 | ||||||

| Tongon (89.7%) |

180 - 210 | 1,260 - 1,340 | 1,070 - 1,130 | 1,240 - 1,320 | ||||||

| Africa & Middle East |

1,450 - 1,600 | 1,130 - 1,210 | 820 - 880 | 1,080 - 1,160 | ||||||

| Total Attributable to Barrick17,18,19 |

4,200 - 4,600 | 1,170 - 1,250 | 820 - 880 | 1,170 - 1,250 | ||||||

|

COPPER PRODUCTION AND COSTS |

||||||||||

| 2023 forecast attributable production (Mlbs) |

2023 forecast cost of sales8 ($/lb) |

2023 forecast C1 cash costs9 ($/lb) |

2023 forecast

all-in sustaining costs9 ($/lb) |

|||||||

| Lumwana |

260 - 290 | 2.45 - 2.75 | 2.00 - 2.20 | 3.20 - 3.50 | ||||||

| Zaldívar (50%) |

100 - 110 | 3.40 - 3.70 | 2.60 - 2.80 | 2.90 - 3.20 | ||||||

| Jabal Sayid (50%) |

65 - 75 | 1.80 - 2.10 | 1.50 - 1.70 | 1.60 - 1.90 | ||||||

| Total Attributable to Barrick19 |

420 - 470 | 2.60 - 2.90 | 2.05 - 2.25 | 2.95 - 3.25 | ||||||

ATTRIBUTABLE CAPITAL EXPENDITURES

| ($ millions) | ||||

| Attributable minesite sustaining6 |

1,450 - 1,700 | |||

| Attributable project6 |

750 - 900 | |||

| Total attributable capital expenditures6 |

2,200 - 2,600 | |||

2023 OUTLOOK ASSUMPTIONS AND ECONOMIC SENSITIVITY ANALYSIS

| 2023 Guidance Assumption |

Hypothetical Change | Impact on EBITDA20 (millions) |

Impact on TCC and AISC9,10 |

|||||||

| Gold price sensitivity | $1,650/oz | +/- $100/oz | +/-$590 | +/-$5/oz | ||||||

| Copper price sensitivity | $3.50/lb | +/- $0.25/lb | +/- $110 | +/-$0.01/lb | ||||||

| BARRICK SECOND QUARTER 2023 | 15 | PRESS RELEASE |

Production and Cost Summary - Gold

| For the three months ended | ||||||||||||||||||||

| 6/30/23 | 3/31/23 | % Change | 6/30/22 | % Change | ||||||||||||||||

| Nevada Gold Mines LLC (61.5%)a |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

458 | 416 | 10 % | 462 | (1)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

744 | 676 | 10 % | 751 | (1)% | |||||||||||||||

| Cost of sales ($/oz) |

1,357 | 1,461 | (7)% | 1,171 | 16 % | |||||||||||||||

| Total cash costs ($/oz)b |

1,009 | 1,074 | (6)% | 856 | 18 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,388 | 1,436 | (3)% | 1,238 | 12 % | |||||||||||||||

| Carlin (61.5%)c |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

248 | 166 | 49 % | 243 | 2 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

403 | 270 | 49 % | 394 | 2 % | |||||||||||||||

| Cost of sales ($/oz) |

1,240 | 1,449 | (14)% | 1,042 | 19 % | |||||||||||||||

| Total cash costs ($/oz)b |

1,013 | 1,215 | (17)% | 862 | 18 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,407 | 1,689 | (17)% | 1,192 | 18 % | |||||||||||||||

| Cortez (61.5%)c |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

110 | 140 | (21)% | 97 | 13 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

178 | 226 | (21)% | 158 | 13 % | |||||||||||||||

| Cost of sales ($/oz) |

1,346 | 1,324 | 2 % | 1,168 | 15 % | |||||||||||||||

| Total cash costs ($/oz)b |

972 | 913 | 6 % | 850 | 14 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,453 | 1,233 | 18 % | 1,538 | (6)% | |||||||||||||||

| Turquoise Ridge (61.5%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

68 | 81 | (16)% | 75 | (9)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

112 | 131 | (16)% | 122 | (9)% | |||||||||||||||

| Cost of sales ($/oz) |

1,466 | 1,412 | 4 % | 1,289 | 14 % | |||||||||||||||

| Total cash costs ($/oz)b |

1,088 | 1,034 | 5 % | 928 | 17 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,302 | 1,271 | 2 % | 1,195 | 9 % | |||||||||||||||

| Phoenix (61.5%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

29 | 27 | 7 % | 26 | 12 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

46 | 45 | 7 % | 43 | 12 % | |||||||||||||||

| Cost of sales ($/oz) |

2,075 | 2,380 | (13)% | 2,114 | (2)% | |||||||||||||||

| Total cash costs ($/oz)b |

948 | 1,198 | (21)% | 895 | 6 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,132 | 1,365 | (17)% | 1,152 | (2)% | |||||||||||||||

| Long Canyon (61.5%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

3 | 2 | 50 % | 21 | (86)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

5 | 4 | 50 % | 34 | (86)% | |||||||||||||||

| Cost of sales ($/oz) |

1,640 | 1,621 | 1 % | 1,280 | 28 % | |||||||||||||||

| Total cash costs ($/oz)b |

637 | 579 | 10 % | 450 | 42 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

677 | 629 | 8 % | 459 | 47 % | |||||||||||||||

| Pueblo Viejo (60%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

77 | 89 | (13)% | 105 | (27)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

128 | 149 | (13)% | 175 | (27)% | |||||||||||||||

| Cost of sales ($/oz) |

1,344 | 1,241 | 8 % | 1,154 | 16 % | |||||||||||||||

| Total cash costs ($/oz)b |

840 | 714 | 18 % | 724 | 16 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,219 | 1,073 | 14 % | 1,024 | 19 % | |||||||||||||||

| BARRICK SECOND QUARTER 2023 | 16 | PRESS RELEASE |

Production and Cost Summary - Gold (continued)

| For the three months ended | ||||||||||||||||||||

| 6/30/23 | 3/31/23 | % Change | 6/30/22 | % Change | ||||||||||||||||

| Loulo-Gounkoto (80%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

141 | 137 | 3 % | 140 | 1 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

176 | 172 | 3 % | 175 | 1 % | |||||||||||||||

| Cost of sales ($/oz) |

1,150 | 1,275 | (10)% | 1,093 | 5 % | |||||||||||||||

| Total cash costs ($/oz)b |

801 | 855 | (6)% | 730 | 10 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,245 | 1,190 | 5 % | 1,013 | 23 % | |||||||||||||||

| Kibali (45%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

87 | 64 | 36 % | 81 | 7 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

195 | 141 | 36 % | 180 | 7 % | |||||||||||||||

| Cost of sales ($/oz) |

1,269 | 1,367 | (7)% | 1,164 | 9 % | |||||||||||||||

| Total cash costs ($/oz)b |

797 | 987 | (19)% | 738 | 8 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

955 | 1,177 | (19)% | 946 | 1 % | |||||||||||||||

| Veladero (50%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

54 | 43 | 26 % | 58 | (7)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

108 | 86 | 26 % | 116 | (7)% | |||||||||||||||

| Cost of sales ($/oz) |

1,424 | 1,587 | (10)% | 1,369 | 4 % | |||||||||||||||

| Total cash costs ($/oz)b |

999 | 1,035 | (3)% | 861 | 16 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,599 | 1,761 | (9)% | 1,461 | 9 % | |||||||||||||||

| Porgera (47.5%)d |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

— | — | — % | — | — % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

— | — | — % | — | — % | |||||||||||||||

| Cost of sales ($/oz) |

— | — | — % | — | — % | |||||||||||||||

| Total cash costs ($/oz)b |

— | — | — % | — | — % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

— | — | — % | — | — % | |||||||||||||||

| Tongon (89.7%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

44 | 50 | (12)% | 41 | 7 % | |||||||||||||||

| Gold produced (000s oz 100% basis) |

49 | 55 | (12)% | 46 | 7 % | |||||||||||||||

| Cost of sales ($/oz) |

1,514 | 1,453 | 4 % | 2,025 | (25)% | |||||||||||||||

| Total cash costs ($/oz)b |

1,380 | 1,182 | 17 % | 1,558 | (11)% | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,465 | 1,284 | 14 % | 1,655 | (11)% | |||||||||||||||

| Hemlo |

||||||||||||||||||||

| Gold produced (000s oz) |

35 | 41 | (15)% | 36 | (3)% | |||||||||||||||

| Cost of sales ($/oz) |

1,562 | 1,486 | 5 % | 1,698 | (8)% | |||||||||||||||

| Total cash costs ($/oz)b |

1,356 | 1,291 | 5 % | 1,489 | (9)% | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,634 | 1,609 | 2 % | 1,804 | (9)% | |||||||||||||||

| North Mara (84%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

64 | 68 | (6)% | 66 | (3)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

77 | 81 | (6)% | 79 | (3)% | |||||||||||||||

| Cost of sales ($/oz) |

1,208 | 987 | 22 % | 1,060 | 14 % | |||||||||||||||

| Total cash costs ($/oz)b |

942 | 759 | 24 % | 756 | 25 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,355 | 1,137 | 19 % | 957 | 42 % | |||||||||||||||

| BARRICK SECOND QUARTER 2023 | 17 | PRESS RELEASE |

Production and Cost Summary - Gold (continued)

| For the three months ended | ||||||||||||||||||||

| 6/30/23 | 3/31/23 | % Change | 6/30/22 | % Change | ||||||||||||||||

| Bulyanhulu (84%) |

||||||||||||||||||||

| Gold produced (000s oz attributable basis) |

49 | 44 | 11 % | 54 | (9)% | |||||||||||||||

| Gold produced (000s oz 100% basis) |

58 | 53 | 11 % | 65 | (9)% | |||||||||||||||

| Cost of sales ($/oz) |

1,231 | 1,358 | (9)% | 1,163 | 6 % | |||||||||||||||

| Total cash costs ($/oz)b |

850 | 982 | (13)% | 836 | 2 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,105 | 1,332 | (17)% | 1,094 | 1 % | |||||||||||||||

| Total Attributable to Barricke |

||||||||||||||||||||

| Gold produced (000s oz) |

1,009 | 952 | 6 % | 1,043 | (3)% | |||||||||||||||

| Cost of sales ($/oz)f |

1,323 | 1,378 | (4)% | 1,216 | 9 % | |||||||||||||||

| Total cash costs ($/oz)b |

963 | 986 | (2)% | 855 | 13 % | |||||||||||||||

| All-in sustaining costs ($/oz)b |

1,355 | 1,370 | (1)% | 1,212 | 12 % | |||||||||||||||

| a. | These results represent our 61.5% interest in Carlin, Cortez, Turquoise Ridge, Phoenix and Long Canyon. |

| b. | Further information on these non-GAAP financial performance measures, including detailed reconciliations, is included in the endnotes to this press release. |

| c. | Includes Goldrush. |

| d. | As Porgera was placed on care and maintenance on April 25, 2020, no operating data or per ounce data is provided. |

| e. | Excludes Pierina, which is producing incidental ounces while in closure. |

| f. | Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). |

| BARRICK SECOND QUARTER 2023 | 18 | PRESS RELEASE |

Production and Cost Summary - Copper

| For the three months ended | ||||||||||||||||||||

| 6/30/23 | 3/31/23 | % Change | 6/30/22 | % Change | ||||||||||||||||

| Lumwana |

||||||||||||||||||||

| Copper production (Mlbs) |

67 | 48 | 40 % | 75 | (11)% | |||||||||||||||

| Cost of sales ($/lb) |

2.80 | 3.56 | (21)% | 2.01 | 39 % | |||||||||||||||

| C1 cash costs ($/lb)a |

2.30 | 3.09 | (26)% | 1.68 | 37 % | |||||||||||||||

| All-in sustaining costs ($/lb)a |

3.29 | 3.98 | (17)% | 3.28 | — % | |||||||||||||||

| Zaldívar (50%) |

||||||||||||||||||||

| Copper production (Mlbs attributable basis) |

22 | 22 | 0 % | 25 | (12)% | |||||||||||||||

| Copper production (Mlbs 100% basis) |

43 | 44 | 0 % | 50 | (12)% | |||||||||||||||

| Cost of sales ($/lb) |

3.89 | 3.73 | 4 % | 2.88 | 35 % | |||||||||||||||

| C1 cash costs ($/lb)a |

3.02 | 2.86 | 6 % | 2.17 | 39 % | |||||||||||||||

| All-in sustaining costs ($/lb)a |

3.73 | 3.22 | 16 % | 2.65 | 41 % | |||||||||||||||

| Jabal Sayid (50%) |

||||||||||||||||||||

| Copper production (Mlbs attributable basis) |

18 | 18 | 0 % | 20 | (10)% | |||||||||||||||

| Copper production (Mlbs 100% basis) |

35 | 37 | 0 % | 40 | (10)% | |||||||||||||||

| Cost of sales ($/lb) |

1.61 | 1.53 | 5 % | 1.45 | 11 % | |||||||||||||||

| C1 cash costs ($/lb)a |

1.26 | 1.39 | (9)% | 1.09 | 16 % | |||||||||||||||

| All-in sustaining costs ($/lb)a |

1.42 | 1.61 | (12)% | 1.19 | 19 % | |||||||||||||||

| Total Attributable to Barrick |

||||||||||||||||||||

| Copper production (Mlbs) |

107 | 88 | 22 % | 120 | (11)% | |||||||||||||||

| Cost of sales ($/lb)b |

2.84 | 3.22 | (12)% | 2.11 | 35 % | |||||||||||||||

| C1 cash costs ($/lb)a |

2.28 | 2.71 | (16)% | 1.70 | 34 % | |||||||||||||||

| All-in sustaining costs ($/lb)a |

3.13 | 3.40 | (8)% | 2.87 | 9 % | |||||||||||||||

| a. | Further information on these non-GAAP financial performance measures, including detailed reconciliations, is included in the endnotes to this press release. |

| b. | Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share). |

| BARRICK SECOND QUARTER 2023 | 19 | PRESS RELEASE |

Financial and Operating Highlights

| For the three months ended | For the six months ended | |||||||||||||||||||||||||||||||

| 6/30/23 | 3/31/23 | % Change | 6/30/22 | % Change | 6/30/23 | 6/30/22 | % Change | |||||||||||||||||||||||||

| Financial Results ($ millions) |

||||||||||||||||||||||||||||||||

| Revenues |

2,833 | 2,643 | 7 % | 2,859 | (1)% | 5,476 | 5,712 | (4)% | ||||||||||||||||||||||||

| Cost of sales |

1,937 | 1,941 | 0 % | 1,850 | 5 % | 3,878 | 3,589 | 8 % | ||||||||||||||||||||||||

| Net earningsa |

305 | 120 | 154 % | 488 | (38)% | 425 | 926 | (54)% | ||||||||||||||||||||||||

| Adjusted net earningsb |

336 | 247 | 36 % | 419 | (20)% | 583 | 882 | (34)% | ||||||||||||||||||||||||

| Adjusted EBITDAb |

1,368 | 1,183 | 16 % | 1,527 | (10)% | 2,551 | 3,172 | (20)% | ||||||||||||||||||||||||

| Adjusted EBITDA marginc |

48 % | 45 % | 7 % | 53 % | (9)% | 47 % | 56 % | (16)% | ||||||||||||||||||||||||

| Minesite sustaining capital expendituresb,d |

524 | 454 | 15 % | 523 | 0 % | 978 | 943 | 4 % | ||||||||||||||||||||||||

| Project capital expendituresb,d |

238 | 226 | 5 % | 226 | 5 % | 464 | 412 | 13 % | ||||||||||||||||||||||||

| Total consolidated capital expendituresd,e |

769 | 688 | 12 % | 755 | 2 % | 1,457 | 1,366 | 7 % | ||||||||||||||||||||||||

| Net cash provided by operating activities |

832 | 776 | 7 % | 924 | (10)% | 1,608 | 1,928 | (17)% | ||||||||||||||||||||||||

| Net cash provided by operating activities marginf |

29 % | 29 % | 0 % | 32 % | (9)% | 29 % | 34 % | (15)% | ||||||||||||||||||||||||

| Free cash flowb |

63 | 88 | (28)% | 169 | (63)% | 151 | 562 | (73)% | ||||||||||||||||||||||||

| Net earnings per share (basic and diluted) |

0.17 | 0.07 | 143 % | 0.27 | (37)% | 0.24 | 0.52 | (54)% | ||||||||||||||||||||||||

| Adjusted net earnings (basic)b per share |

0.19 | 0.14 | 36 % | 0.24 | (21)% | 0.33 | 0.50 | (34)% | ||||||||||||||||||||||||

| Weighted average diluted common shares (millions of shares) |

1,755 | 1,755 | 0 % | 1,777 | (1)% | 1,755 | 1,778 | (1)% | ||||||||||||||||||||||||

| Operating Results |

||||||||||||||||||||||||||||||||

| Gold production (thousands of ounces)g |

1,009 | 952 | 6 % | 1,043 | (3)% | 1,961 | 2,033 | (4)% | ||||||||||||||||||||||||

| Gold sold (thousands of ounces)g |

1,001 | 954 | 5 % | 1,040 | (4)% | 1,955 | 2,033 | (4)% | ||||||||||||||||||||||||

| Market gold price ($/oz) |

1,976 | 1,890 | 5 % | 1,871 | 6 % | 1,932 | 1,874 | 3 % | ||||||||||||||||||||||||

| Realized gold priceb,g ($/oz) |

1,972 | 1,902 | 4 % | 1,861 | 6 % | 1,938 | 1,868 | 4 % | ||||||||||||||||||||||||

| Gold cost of sales (Barrick’s share)g,h ($/oz) |

1,323 | 1,378 | (4)% | 1,216 | 9 % | 1,350 | 1,203 | 12 % | ||||||||||||||||||||||||

| Gold total cash costsb,g ($/oz) |

963 | 986 | (2)% | 855 | 13 % | 974 | 844 | 15 % | ||||||||||||||||||||||||

| Gold all-in sustaining costsb,g ($/oz) |

1,355 | 1,370 | (1)% | 1,212 | 12 % | 1,362 | 1,188 | 15 % | ||||||||||||||||||||||||

| Copper production (millions of pounds)g |

107 | 88 | 22 % | 120 | (11)% | 195 | 221 | (12)% | ||||||||||||||||||||||||

| Copper sold (millions of pounds)g |

101 | 89 | 13 % | 113 | (11)% | 190 | 226 | (16)% | ||||||||||||||||||||||||

| Market copper price ($/lb) |

3.84 | 4.05 | (5)% | 4.32 | (11)% | 3.95 | 4.43 | (11)% | ||||||||||||||||||||||||

| Realized copper priceb,g ($/lb) |

3.70 | 4.20 | (12)% | 3.72 | (1)% | 3.93 | 4.20 | (6)% | ||||||||||||||||||||||||

| Copper cost of sales (Barrick’s share)g,i ($/lb) |

2.84 | 3.22 | (12)% | 2.11 | 35 % | 3.02 | 2.16 | 40 % | ||||||||||||||||||||||||

| Copper C1 cash costsb,g ($/lb) |

2.28 | 2.71 | (16)% | 1.70 | 34 % | 2.48 | 1.75 | 42 % | ||||||||||||||||||||||||

| Copper all-in sustaining costsb,g ($/lb) |

3.13 | 3.40 | (8)% | 2.87 | 9 % | 3.26 | 2.86 | 14 % | ||||||||||||||||||||||||

| As at 6/30/23 |

As at 3/31/23 |

% Change | As at 6/30/22 |

% Change | ||||||||||||||||||||||||||||

| Financial Position ($ millions) |

||||||||||||||||||||||||||||||||

| Debt (current and long-term) |

4,774 | 4,777 | 0 % | 5,144 | (7)% | |||||||||||||||||||||||||||

| Cash and equivalents |

4,157 | 4,377 | (5)% | 5,780 | (28)% | |||||||||||||||||||||||||||

| Debt, net of cash |

617 | 400 | 54 % | (636) | 197 % | |||||||||||||||||||||||||||

| a. | Net earnings represents net earnings attributable to the equity holders of the Company. |

| b. | Further information on these non-GAAP financial performance measures, including detailed reconciliations, is included in the endnotes to this press release. |

| c. | Represents adjusted EBITDA divided by revenue. |

| d. | Amounts presented on a consolidated cash basis. Project capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs. |

| e. | Total consolidated capital expenditures also includes capitalized interest of $7 million and $15 million, respectively, for the three and six month periods ended June 30, 2023 (March 31, 2023: $8 million and June 30, 2022: $6 million and $11 million, respectively). |

| f. | Represents net cash provided by operating activities divided by revenue. |

| g. | On an attributable basis. |

| h. | Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick’s ownership share). |

| i. | Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick’s ownership share). |

| BARRICK SECOND QUARTER 2023 | 20 | PRESS RELEASE |

Consolidated Statements of Income

| Barrick Gold Corporation (in millions of United States dollars, except per share data) (Unaudited) |

Three months ended June 30, |

Six months ended June 30, |

||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Revenue (notes 4 and 5) |

$2,833 | $2,859 | $5,476 | $5,712 | ||||||||||||

| Costs and expenses (income) |

||||||||||||||||

| Cost of sales (notes 4 and 6) |

1,937 | 1,850 | 3,878 | 3,589 | ||||||||||||

| General and administrative expenses |

28 | 30 | 67 | 84 | ||||||||||||

| Exploration, evaluation and project expenses |

101 | 100 | 172 | 167 | ||||||||||||

| Impairment charges (notes 8b and 12) |

22 | 3 | 23 | 5 | ||||||||||||

| (Gain) loss on currency translation |

(12 | ) | 6 | 26 | 9 | |||||||||||

| Closed mine rehabilitation |

(13 | ) | (128 | ) | 9 | (125 | ) | |||||||||

| Income from equity investees (note 11) |

(58 | ) | (89 | ) | (111 | ) | (188 | ) | ||||||||

| Other expense (income) (note 8a) |

18 | 2 | 70 | (9 | ) | |||||||||||

| Income before finance costs and income taxes |

$810 | $1,085 | $1,342 | $2,180 | ||||||||||||

| Finance costs, net |

(44 | ) | (89 | ) | (102 | ) | (177 | ) | ||||||||

| Income before income taxes |

$766 | $996 | $1,240 | $2,003 | ||||||||||||

| Income tax expense (note 9) |

(264 | ) | (279 | ) | (469 | ) | (580 | ) | ||||||||

| Net income |

$502 | $717 | $771 | $1,423 | ||||||||||||

| Attributable to: |

||||||||||||||||

| Equity holders of Barrick Gold Corporation |

$305 | $488 | $425 | $926 | ||||||||||||

| Non-controlling interests (note 15) |

$197 | $229 | $346 | $497 | ||||||||||||

| Earnings per share data attributable to the equity holders of Barrick Gold Corporation (note 7) |

||||||||||||||||

| Net income |

||||||||||||||||

| Basic |

$0.17 | $0.27 | $0.24 | $0.52 | ||||||||||||

| Diluted |

$0.17 | $0.27 | $0.24 | $0.52 | ||||||||||||

The notes to these unaudited condensed interim financial statements, which are contained in the Second Quarter Report 2023 available on our website, are an integral part of these consolidated financial statements.

| BARRICK SECOND QUARTER 2023 | 21 | PRESS RELEASE |

Consolidated Statements of Comprehensive Income

| Barrick Gold Corporation (in millions of United States dollars) (Unaudited) |

Three months ended June 30, |

Six months ended June 30, |

||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Net income |

$502 | $717 | $771 | $1,423 | ||||||||||||

| Other comprehensive income (loss), net of taxes |

||||||||||||||||

| Items that may be reclassified subsequently to profit or loss: |

||||||||||||||||

| Currency translation adjustments, net of tax $nil, $nil, $nil and $nil |

— | 1 | (3 | ) | 1 | |||||||||||

| Items that will not be reclassified to profit or loss: |

||||||||||||||||

| Actuarial loss on post employment benefit obligations, net of tax $nil, $nil, $nil and $nil |

— | (1 | ) | — | (1 | ) | ||||||||||

| Net change on equity investments, net of tax $(1), $2, $(1) and $(6) |

(5 | ) | (26 | ) | (5 | ) | 32 | |||||||||

| Total other comprehensive (loss) income |

(5 | ) | (26 | ) | (8 | ) | 32 | |||||||||

| Total comprehensive income |

$497 | $691 | $763 | $1,455 | ||||||||||||

| Attributable to: |

||||||||||||||||

| Equity holders of Barrick Gold Corporation |

$300 | $462 | $417 | $958 | ||||||||||||

| Non-controlling interests |

$197 | $229 | $346 | $497 | ||||||||||||

The notes to these unaudited condensed interim financial statements, which are contained in the Second Quarter Report 2023 available on our website, are an integral part of these consolidated financial statements.

| BARRICK SECOND QUARTER 2023 | 22 | PRESS RELEASE |

Consolidated Statements of Cash Flow

| Barrick Gold Corporation (in millions of United States dollars) (Unaudited) |

Three months ended June 30, |

Six months ended June 30, |

||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| OPERATING ACTIVITIES |

||||||||||||||||

| Net income |

$502 | $717 | $771 | $1,423 | ||||||||||||

| Adjustments for the following items: |

||||||||||||||||

| Depreciation |

480 | 476 | 975 | 936 | ||||||||||||

| Finance costs, net1 |

44 | 89 | 102 | 177 | ||||||||||||

| Impairment charges (notes 8b and 12) |

22 | 3 | 23 | 5 | ||||||||||||

| Income tax expense (note 9) |

264 | 279 | 469 | 580 | ||||||||||||

| Income from equity investees (note 11) |

(58 | ) | (89 | ) | (111 | ) | (188 | ) | ||||||||

| Gain on sale of non-current assets |

(3 | ) | (20 | ) | (6 | ) | (22 | ) | ||||||||

| (Gain) loss on currency translation |

(12 | ) | 6 | 26 | 9 | |||||||||||

| Change in working capital (note 10) |

(45 | ) | (34 | ) | (251 | ) | (165 | ) | ||||||||

| Other operating activities (note 10) |

(51 | ) | (126 | ) | 1 | (203 | ) | |||||||||

| Operating cash flows before interest and income taxes |

1,143 | 1,301 | 1,999 | 2,552 | ||||||||||||

| Interest paid |

(130 | ) | (129 | ) | (153 | ) | (152 | ) | ||||||||

| Interest received1 |

51 | 12 | 100 | 22 | ||||||||||||

| Income taxes paid2 |

(232 | ) | (260 | ) | (338 | ) | (494 | ) | ||||||||

| Net cash provided by operating activities |

832 | 924 | 1,608 | 1,928 | ||||||||||||

| INVESTING ACTIVITIES |

||||||||||||||||

| Property, plant and equipment |

||||||||||||||||

| Capital expenditures (note 4) |

(769 | ) | (755 | ) | (1,457 | ) | (1,366 | ) | ||||||||

| Sales proceeds |

3 | 22 | 6 | 23 | ||||||||||||

| Investment sales |

— | 122 | — | 382 | ||||||||||||

| Dividends received from equity method investments (note 11) |

18 | 310 | 85 | 669 | ||||||||||||

| Shareholder loan repayments from equity method investments (note 11) |

5 | — | 5 | — | ||||||||||||

| Net cash used in investing activities |

(743 | ) | (301 | ) | (1,361 | ) | (292 | ) | ||||||||

| FINANCING ACTIVITIES |

||||||||||||||||

| Lease repayments |

(4 | ) | (4 | ) | (8 | ) | (10 | ) | ||||||||

| Dividends |

(174 | ) | (353 | ) | (349 | ) | (531 | ) | ||||||||

| Share buyback program |

— | (173 | ) | — | (173 | ) | ||||||||||

| Funding from non-controlling interests (note 15) |

10 | — | 10 | — | ||||||||||||

| Disbursements to non-controlling interests (note 15) |

(162 | ) | (232 | ) | (224 | ) | (499 | ) | ||||||||

| Pueblo Viejo JV partner shareholder loan |

21 | 35 | 41 | 80 | ||||||||||||

| Net cash used in financing activities |

(309 | ) | (727 | ) | (530 | ) | (1,133 | ) | ||||||||

| Effect of exchange rate changes on cash and equivalents |

— | (3 | ) | — | (3 | ) | ||||||||||

| Net increase (decrease) in cash and equivalents |

(220 | ) | (107 | ) | (283 | ) | 500 | |||||||||

| Cash and equivalents at the beginning of period |

4,377 | 5,887 | 4,440 | 5,280 | ||||||||||||

| Cash and equivalents at the end of period |

$4,157 | $5,780 | $4,157 | $5,780 | ||||||||||||

| 1 | 2022 figures have been restated to reflect the change in presentation to present interest received ($12 million for the three months ended and $22 million for the six months ended June 30, 2022) separately from finance costs. |

| 2 | Income taxes paid excludes $28 million (2022: $10 million) for the three months ended June 30, 2023 and $56 million (2022: $36 million) for the six months ended June 30, 2023 of income taxes payable that were settled against offsetting value added tax (“VAT”) receivables. |

The notes to these unaudited condensed interim financial statements, which are contained in the Second Quarter Report 2023 available on our website, are an integral part of these consolidated financial statements.

| BARRICK SECOND QUARTER 2023 | 23 | PRESS RELEASE |

Consolidated Balance Sheets

| Barrick Gold Corporation (in millions of United States dollars) (Unaudited) |

As at June 30, 2023 |

As at December 31, 2022 |

||||||

| ASSETS |

||||||||

| Current assets |

||||||||

| Cash and equivalents |

$4,157 | $4,440 | ||||||

| Accounts receivable |

603 | 554 | ||||||

| Inventories |

1,868 | 1,781 | ||||||

| Other current assets (note 13b) |

742 | 1,690 | ||||||

| Total current assets |

$7,370 | $8,465 | ||||||

| Non-current assets |

||||||||

| Equity in investees (note 11) |

4,004 | 3,983 | ||||||

| Property, plant and equipment |

26,311 | 25,821 | ||||||

| Goodwill |

3,581 | 3,581 | ||||||

| Intangible assets |

149 | 149 | ||||||

| Deferred income tax assets |

19 | 19 | ||||||

| Non-current portion of inventory |

2,765 | 2,819 | ||||||

| Other assets |

1,087 | 1,128 | ||||||

| Total assets |

$45,286 | $45,965 | ||||||

| LIABILITIES AND EQUITY |

||||||||

| Current liabilities |

||||||||

| Accounts payable |

$1,525 | $1,556 | ||||||

| Debt |

13 | 13 | ||||||

| Current income tax liabilities |

320 | 163 | ||||||

| Other current liabilities (note 13b) |

412 | 1,388 | ||||||

| Total current liabilities |

$2,270 | $3,120 | ||||||

| Non-current liabilities |

||||||||

| Debt |

4,761 | 4,769 | ||||||

| Provisions |

2,181 | 2,211 | ||||||

| Deferred income tax liabilities |

3,286 | 3,247 | ||||||

| Other liabilities |

1,303 | 1,329 | ||||||

| Total liabilities |

$13,801 | $14,676 | ||||||

| Equity |

||||||||

| Capital stock (note 14) |

$28,116 | $28,114 | ||||||

| Deficit |

(7,208 | ) | (7,282 | ) | ||||

| Accumulated other comprehensive income (loss) |

18 | 26 | ||||||

| Other |

1,913 | 1,913 | ||||||

| Total equity attributable to Barrick Gold Corporation shareholders |

$22,839 | $22,771 | ||||||

|

Non-controlling interests (note 15) |

8,646 | 8,518 | ||||||

| Total equity |

$31,485 | $31,289 | ||||||

| Contingencies and commitments (notes 4 and 16) |

||||||||

| Total liabilities and equity |

$45,286 | $45,965 | ||||||

The notes to these unaudited condensed interim financial statements, which are contained in the Second Quarter Report 2023 available on our website, are an integral part of these consolidated financial statements.

| BARRICK SECOND QUARTER 2023 | 24 | PRESS RELEASE |

Consolidated Statements of Changes in Equity

| Barrick Gold Corporation | Attributable to equity holders of the company | |||||||||||||||||||||||||||||||

| (in millions of United States dollars) (Unaudited) |

Common Shares (in thousands) |

Capital stock |

Retained earnings (deficit) |

Accumulated other comprehensive income (loss)1 |

Other2 | Total equity attributable to shareholders |

Non- controlling interests |

Total equity |

||||||||||||||||||||||||

| At January 1, 2023 |

1,755,350 | $28,114 | ($7,282 | ) | $26 | $1,913 | $22,771 | $8,518 | $31,289 | |||||||||||||||||||||||

| Net income |

— | — | 425 | — | — | 425 | 346 | 771 | ||||||||||||||||||||||||

| Total other comprehensive loss |

— | — | — | (8 | ) | — | (8 | ) | — | (8 | ) | |||||||||||||||||||||

| Total comprehensive income (loss) |

— | — | 425 | (8 | ) | — | 417 | 346 | 763 | |||||||||||||||||||||||

| Transactions with owners |

||||||||||||||||||||||||||||||||

| Dividends |

— | — | (349 | ) | — | — | (349 | ) | — | (349 | ) | |||||||||||||||||||||

| Funding from non-controlling interests (note 15) |

— | — | — | — | — | — | 10 | 10 | ||||||||||||||||||||||||

| Disbursements to non-controlling interests (note 15) |

— | — | — | — | — | — | (228 | ) | (228 | ) | ||||||||||||||||||||||

| Dividend reinvestment plan (note 14) |

118 | 2 | (2 | ) | — | — | — | — | — | |||||||||||||||||||||||

| Total transactions with owners |

118 | 2 | (351 | ) | — | — | (349 | ) | (218 | ) | (567 | ) | ||||||||||||||||||||

| At June 30, 2023 |

1,755,468 | $28,116 | ($7,208 | ) | $18 | $1,913 | $22,839 | $8,646 | $31,485 | |||||||||||||||||||||||

| At January 1, 2022 |

1,779,331 | $28,497 | ($6,566 | ) | ($23 | ) | $1,949 | $23,857 | $8,450 | $32,307 | ||||||||||||||||||||||

| Net income |

— | — | 926 | — | — | 926 | 497 | 1,423 | ||||||||||||||||||||||||

| Total other comprehensive income |

— | — | — | 32 | — | 32 | — | 32 | ||||||||||||||||||||||||

| Total comprehensive income |

— | — | 926 | 32 | — | 958 | 497 | 1,455 | ||||||||||||||||||||||||

| Transactions with owners |

||||||||||||||||||||||||||||||||

| Dividends |

— | — | (531 | ) | — | — | (531 | ) | — | (531 | ) | |||||||||||||||||||||

| Disbursements to non-controlling interests |

— | — | — | — | — | — | (524 | ) | (524 | ) | ||||||||||||||||||||||

| Dividend reinvestment plan |

105 | 2 | (2 | ) | — | — | — | — | — | |||||||||||||||||||||||

| Share buyback program |

(8,500 | ) | (136 | ) | — | — | (37 | ) | (173 | ) | — | (173 | ) | |||||||||||||||||||

| Total transactions with owners |

(8,395 | ) | (134 | ) | (533 | ) | — | (37 | ) | (704 | ) | (524 | ) | (1,228 | ) | |||||||||||||||||

| At June 30, 2022 |

1,770,936 | $28,363 | ($6,173 | ) | $9 | $1,912 | $24,111 | $8,423 | $32,534 | |||||||||||||||||||||||

| 1 | Includes cumulative translation losses at June 30, 2023: $95 million (December 31, 2022: $93 million; June 30, 2022: $93 million). |

| 2 | Includes additional paid-in capital as at June 30, 2023: $1,875 million (December 31, 2022: $1,875 million; June 30, 2022: $1,874 million). |

The notes to these unaudited condensed interim financial statements, which are contained in the Second Quarter Report 2023 available on our website, are an integral part of these consolidated financial statements.

| BARRICK SECOND QUARTER 2023 | 25 | PRESS RELEASE |

Technical Information

The scientific and technical information contained in this press release has been reviewed and approved by Craig Fiddes, SME-RM, Lead, Resource Modeling, Nevada Gold Mines; Chad Yuhasz, P.Geo, Mineral Resource Manager, Latin America & Asia Pacific; Richard Peattie, MPhil, FAusIMM, Mineral Resources Manager: Africa and Middle East; Simon Bottoms, CGeol, MGeol, FGS, FAusIMM, Mineral Resource Management and Evaluation Executive; John Steele, CIM, Metallurgy, Engineering and Capital Projects Executive; and Joel Holliday, FAusIMM, Executive Vice-President, Exploration — each a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

All mineral reserve and mineral resource estimates are estimated in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Unless otherwise noted, such mineral reserve and mineral resource estimates are as of December 31, 2022.

Endnotes

Endnote 1

On an attributable basis.

Endnote 2