| For the month of: | August 2023 | Commission File Number: | 1-8481 | ||||||||

|

BCE Inc.

|

|||||

| By: | (signed) Glen LeBlanc | ||||

| Glen LeBlanc Executive Vice-President and Chief Financial Officer |

|||||

| Date: | August 3, 2023 | ||||

Exhibit 99.1

MD&A

Management’s discussion and analysis

Table of contents

| 1 |

Overview | 6 | ||||||

| 1.1 | Financial highlights | 6 | ||||||

| 1.2 | Key corporate and business developments | 8 | ||||||

| 1.3 | Assumptions | 9 | ||||||

| 2 |

Consolidated financial analysis | 10 | ||||||

| 2.1 | BCE consolidated income statements | 10 | ||||||

| 2.2 | Customer connections | 11 | ||||||

| 2.3 | Operating revenues | 12 | ||||||

| 2.4 | Operating costs | 13 | ||||||

| 2.5 | Net earnings | 14 | ||||||

| 2.6 | Adjusted EBITDA | 14 | ||||||

| 2.7 | Severance, acquisition and other costs | 15 | ||||||

| 2.8 | Depreciation and amortization | 15 | ||||||

| 2.9 | Finance costs | 15 | ||||||

| 2.10 | Impairment of assets | 15 | ||||||

| 2.11 | Other expense | 16 | ||||||

| 2.12 | Income taxes | 16 | ||||||

| 2.13 | Net earnings attributable to common shareholders and EPS | 16 | ||||||

| 3 |

Business segment analysis | 17 | ||||||

| 3.1 | Bell CTS | 17 | ||||||

| 3.2 | Bell Media | 24 | ||||||

| 4 |

Financial and capital management | 27 | ||||||

| 4.1 | Net debt | 27 | ||||||

| 4.2 | Outstanding share data | 27 | ||||||

| 4.3 | Cash flows | 28 | ||||||

| 4.4 | Post-employment benefit plans | 30 | ||||||

| 4.5 | Financial risk management | 31 | ||||||

| 4.6 | Credit ratings | 33 | ||||||

| 4.7 | Liquidity | 33 | ||||||

| 4.8 | Litigation | 33 | ||||||

| 5 |

Quarterly financial information | 34 | ||||||

| 6 |

Regulatory environment | 35 | ||||||

| 7 |

Accounting policies | 36 | ||||||

| 8 |

Non-GAAP financial measures, other financial measures and key performance indicators (KPIs) | 37 | ||||||

| 8.1 | Non-GAAP financial measures | 37 | ||||||

| 8.2 | Non-GAAP ratios | 40 | ||||||

| 8.3 | Total of segments measures | 40 | ||||||

| 8.4 | Capital management measures | 41 | ||||||

| 8.5 | Supplementary financial measures | 42 | ||||||

| 8.6 | KPIs | 42 | ||||||

| 9 |

Controls and procedures | 43 | ||||||

MD&A

Management’s discussion and analysis

In this management’s discussion and analysis (MD&A), we, us, our, BCE and the company mean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.

All amounts in this MD&A are in millions of Canadian dollars, except where noted. Please refer to section 8, Non-GAAP financial measures, other financial measures and key performance indicators (KPIs) for a list of defined non-GAAP financial measures, other financial measures and KPIs.

Please refer to BCE’s unaudited consolidated financial statements for the second quarter of 2023 (Q2 2023 Financial Statements) when reading this MD&A. We also encourage you to read BCE’s MD&A for the year ended December 31, 2022 dated March 2, 2023 (BCE 2022 Annual MD&A) as updated in BCE’s MD&A for the first quarter of 2023 dated May 3, 2023 (BCE 2023 First Quarter MD&A). In preparing this MD&A, we have taken into account information available to us up to August 2, 2023, the date of this MD&A, unless otherwise stated.

You will find additional information relating to BCE, including BCE’s annual information form for the year ended December 31, 2022 dated March 2, 2023 (BCE 2022 AIF) and recent financial reports, including the BCE 2022 Annual MD&A and the BCE 2023 First Quarter MD&A, on BCE’s website at BCE.ca, on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov.

Documents and other information contained in BCE’s website or in any other site referred to in BCE’s website or in this MD&A are not part of this MD&A and are not incorporated by reference herein.

This MD&A comments on our business operations, performance, financial position and other matters for the three months (Q2) and six months (YTD) ended June 30, 2023 and 2022.

Caution regarding forward-looking statements

This MD&A and, in particular, but without limitation, section 1.2, Key corporate and business developments, the section and sub-sections entitled Assumptions and section 4.7, Liquidity, contain forward-looking statements. These forward-looking statements include, without limitation, statements relating to the expectation that our available liquidity, 2023 estimated cash flows from operations and capital markets financing will permit us to meet our cash requirements in 2023, our environmental, social and governance (ESG) objectives, including our plan to achieve our science-based target (SBT) for operational greenhouse gas (GHG) emissions (Scope 1 and 2) reduction by 2030, BCE’s business outlook, objectives, plans and strategic priorities, and other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, project, strategy, target, commitment and other similar expressions or future or conditional verbs such as aim, anticipate, believe, could, expect, intend, may, plan, seek, should, strive and will. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the United States (U.S.) Private Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in this MD&A describe our expectations as at August 2, 2023 and, accordingly, are subject to change after that date. Except as may be required by applicable securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. These statements are not guarantees of future performance or events, and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in this MD&A for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

We have made certain economic, market, operational and other assumptions in preparing the forward-looking statements contained in this MD&A and, in particular, but without limitation, the forward-looking statements contained in the previously mentioned sections of this MD&A. These assumptions include, without limitation, the assumptions described in the section and sub-sections of this MD&A entitled Assumptions, which section and sub-sections are incorporated by reference in this cautionary statement. Subject to various factors including, without limitation, the future impacts of general economic conditions and of geopolitical events, which are difficult to predict, we believe that our assumptions were reasonable at August 2, 2023. If our assumptions turn out to be inaccurate, our actual results could be materially different from what we expect.

Important risk factors that could cause actual results or events to differ materially from those expressed in, or implied by, the previously-mentioned forward-looking statements and other forward-looking statements contained in this MD&A, include, but are not limited to: the negative effect of adverse economic conditions, including a potential recession, and related inflationary cost pressures, higher interest rates and financial and capital market volatility; the negative effect of adverse conditions associated with geopolitical events; a declining level of business and consumer spending, and the resulting negative impact on the demand for, and prices of, our products and services; regulatory initiatives, proceedings and decisions, government consultations and government positions that affect us and influence our business including, without limitation, concerning mandatory access to networks, spectrum auctions, the imposition of consumer-related codes of conduct, approval of acquisitions, broadcast and spectrum licensing, foreign ownership requirements, privacy and cybersecurity obligations and control of copyright piracy; the inability to implement enhanced compliance frameworks and to comply with legal and regulatory obligations; unfavourable resolution of legal proceedings; the intensity of competitive activity and the failure to effectively respond to evolving competitive dynamics; the combination of Rogers Communications Inc. and Shaw Communications Inc. creating a Canadian competitor with larger scale, and the acquisition of Freedom Mobile by Vidéotron Ltd. also increasing its scale with a likely change in competitive dynamics in several provinces; the level of technological substitution and the presence of alternative service providers contributing to disruptions and disintermediation in each of our business segments; changing customer behaviour and the expansion of cloud-based, over-the-top (OTT) and other alternative solutions; advertising market pressures from economic conditions, fragmentation and non-traditional/global digital services; rising content costs and challenges in our ability to acquire or develop key content; higher Canadian smartphone penetration and reduced or slower immigration flow; the inability to protect our physical and non-physical assets from events such as information security attacks, unauthorized access or entry, fire and natural disasters; the failure to implement effective data governance; the failure to evolve and transform our networks, systems and

| 4 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

MD&A

operations using next-generation technologies while lowering our cost structure; the inability to drive a positive customer experience; the failure to attract, develop and retain a diverse and talented team capable of furthering our strategic imperatives; the failure to adequately manage health and safety concerns; labour disruptions and shortages; the failure to maintain operational networks; the risk that we may need to incur significant capital expenditures to provide additional capacity and reduce network congestion; the inability to maintain service consistency due to network failures or slowdowns, the failure of other infrastructure, or disruptions in the delivery of services; service interruptions or outages due to legacy infrastructure and the possibility of instability as we transition towards converged wireline and wireless networks and newer technologies; the failure by us, or by other telecommunications carriers on which we rely to provide services, to complete planned and sufficient testing, maintenance, replacement or upgrade of our or their networks, equipment and other facilities, which could disrupt our operations including through network or other infrastructure failures; events affecting the functionality of, and our ability to protect, test, maintain, replace and upgrade, our networks, information technology (IT) systems, equipment and other facilities; the complexity of our operations; the failure to implement or maintain highly effective processes and IT systems; in-orbit and other operational risks to which the satellites used to provide our satellite television (TV) services are subject; our dependence on third-party suppliers, outsourcers, and consultants to provide an uninterrupted supply of the products and services we need; the failure of our vendor selection, governance and oversight processes, including our management of supplier risk in the areas of security, data governance and responsible procurement; the quality of our products and services and the extent to which they may be subject to defects or fail to comply with applicable government regulations and standards; reputational risks and the inability to meaningfully integrate ESG considerations into our business strategy and operations; the failure to take appropriate actions to adapt to current and emerging environmental impacts, including climate change; pandemics, epidemics and other health risks, including health concerns about radio frequency emissions from wireless communications devices and equipment; the inability to adequately manage social issues; the failure to develop and implement strong corporate governance practices; various internal and external factors could challenge our ability to achieve our ESG targets including, without limitation, those related to GHG emissions reduction and diversity, equity, inclusion and belonging; the inability to access adequate sources of capital and generate sufficient cash flows from operating activities to meet our cash requirements, fund capital expenditures and provide for planned growth; uncertainty as to whether dividends will be declared by BCE’s board of directors or whether the dividend on common shares will be increased; the inability to manage various credit, liquidity and market risks; the failure to reduce costs, as well as unexpected increases in costs; the failure to evolve practices to effectively monitor and control fraudulent activities; new or higher taxes due to new tax laws or changes thereto or in the interpretation thereof, and the inability to predict the outcome of government audits; the impact on our financial statements and estimates from a number of factors; and pension obligation volatility and increased contributions to post-employment benefit plans.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also materially adversely affect us. Please see section 9, Business risks of the BCE 2022 Annual MD&A for a more complete description of the above-mentioned and other risks, which section, and the other sections of the BCE 2022 Annual MD&A referred to therein, are incorporated by reference in this cautionary statement. In addition, please see section 4.8, Litigation in this MD&A for an update to the legal proceedings described in the BCE 2022 AIF, which section 4.8 is incorporated by reference in this cautionary statement. Please also see section 6, Regulatory environment in the BCE 2023 First Quarter MD&A and in this MD&A for an update to the regulatory initiatives and proceedings described in the BCE 2022 Annual MD&A, which sections 6 are incorporated by reference in this cautionary statement. Please also see section 7, Competitive environment in the BCE 2023 First Quarter MD&A for an update to the risk factors relating to our competitive environment described in the BCE 2022 Annual MD&A, which section 7 is incorporated by reference in this cautionary statement. Any of those risks could cause actual results or events to differ materially from our expectations expressed in, or implied by, the forward-looking statements set out in this MD&A. Except for the updates set out in section 6, Regulatory environment and in section 7, Competitive environment of the BCE 2023 First Quarter MD&A, as well as in section 4.8, Litigation and in section 6, Regulatory environment in this MD&A, the risks described in the BCE 2022 Annual MD&A remain substantially unchanged.

Forward-looking statements contained in this MD&A for periods beyond 2023 involve longer-term assumptions and estimates than forward-looking statements for 2023 and are consequently subject to greater uncertainty. In particular, our GHG emissions reduction targets are based on a number of assumptions including, without limitation, the following principal assumptions: implementation of various corporate and business initiatives to reduce our electricity and fuel consumption; no new corporate initiatives, business acquisitions, business divestitures or technologies that would materially change our anticipated levels of GHG emissions; our ability to purchase sufficient credible carbon credits and renewable energy certificates to offset or further reduce our GHG emissions, if and when required; no negative impact on the calculation of our GHG emissions from refinements in or modifications to international standards or the methodology we use for the calculation of such GHG emissions; and no required changes to our SBTs pursuant to the Science-Based Targets initiative (SBTi) methodology that would make the achievement of our updated SBTs more onerous or unachievable in light of business requirements.

Forward-looking statements for periods beyond 2023 further assume, unless otherwise indicated, that the risks described above and in section 9, Business risks of the BCE 2022 Annual MD&A will remain substantially unchanged during such periods, except for an assumed improvement in the risks related to the COVID-19 pandemic in future years.

Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition, liquidity, financial results or reputation. We regularly consider potential acquisitions, dispositions, mergers, business combinations, investments, monetizations, joint ventures and other transactions, some of which may be significant. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any such transactions or of special items that may be announced or that may occur after August 2, 2023. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way, or in the same way we present known risks affecting our business.

| 5 |

1 MD&A Overview

| 1 | Overview |

In 2022, we began modifying our internal and external reporting processes to align with organizational changes that were made to reflect an increasing strategic focus on multiproduct sales, the continually increasing technological convergence of our wireless and wireline telecommunications infrastructure and operations driven by the deployment of our Fifth Generation (5G) and fibre networks, and our digital transformation. These factors have made it increasingly difficult to distinguish between our wireless and wireline operations and resulted in changes in Q1 2023 to the financial information that is regularly provided to our chief operating decision maker to measure performance and allocate resources.

Effective with our Q1 2023 results, our previous Bell Wireless and Bell Wireline operating segments were combined to form a single reporting segment called Bell Communication and Technology Services (Bell CTS). Bell Media remains a distinct reportable segment and is unaffected. Our results are therefore reported in two segments: Bell CTS and Bell Media. As a result of our reporting changes, prior periods have been restated for comparative purposes.

| 1.1 | Financial highlights |

BCE Q2 2023 selected quarterly information

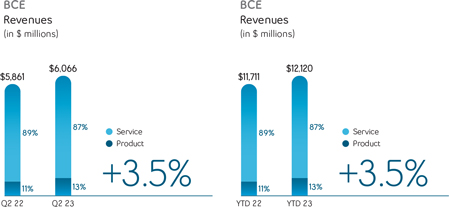

| Operating revenues | Net earnings | Adjusted EBITDA (1) | ||

| $6,066 | $397 | $2,645 | ||

| million | million | million | ||

| 3.5% vs. Q2 2022 | (39.3%) vs. Q2 2022 | 2.1% vs. Q2 2022 | ||

| Net earnings attributable | Adjusted net earnings (1) | Cash flows from | Free cash flow (1) | |||

| to common shareholders | operating activities | |||||

| $329 | $722 | $2,365 | $1,016 | |||

| million | million | million | million | |||

| (44.8%) vs. Q2 2022 | (8.7%) vs. Q2 2022 | (8.9%) vs. Q2 2022 | (23.8%) vs. Q2 2022 | |||

| BCE customer connections | ||||||

| Total mobile phones (3) | Retail high-speed | Retail TV (2) (5) | Retail residential network | |||

| Internet (2) (4) (5) | access services (NAS) lines (2) (5) | |||||

| +4.4% | +9.1% | — | (4.8%) | |||

| 10.0 million subscribers | 4.3 million subscribers | 2.7 million subscribers | 2.1 million subscribers | |||

| at June 30, 2023 | at June 30, 2023 | at June 30, 2023 | at June 30, 2023 | |||

| (1) | Adjusted EBITDA is a total of segments measure, and adjusted net earnings and free cash flow are non-GAAP financial measures. See section 8.3, Total of segments measures and section 8.1, Non-GAAP financial measures in this MD&A for more information on these measures. |

| (2) | In Q2 2023, our retail high-speed Internet, retail Internet protocol television (IPTV) and retail residential NAS lines subscriber bases increased by 35,080, 243 and 7,458 subscribers, respectively, as a result of small acquisitions. |

| (3) | In Q1 2023, we adjusted our mobile phone postpaid subscriber base to remove older non-revenue generating business subscribers of 73,229. |

| (4) | In Q1 2023, subsequent to a review of customer account records, our retail high-speed Internet subscriber base was reduced by 7,347 subscribers. |

| (5) | In Q4 2022, as a result of the acquisition of Distributel Communications Limited (Distributel), our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases increased by 128,065, 2,315 and 64,498 subscribers, respectively. |

| 6 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

1 MD&A Overview

BCE income statements – selected information

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

| Operating revenues |

||||||||||||||||||||||||||||||||

| Service |

5,303 | 5,233 | 70 | 1.3% | 10,525 | 10,410 | 115 | 1.1% | ||||||||||||||||||||||||

| Product |

763 | 628 | 135 | 21.5% | 1,595 | 1,301 | 294 | 22.6% | ||||||||||||||||||||||||

| Total operating revenues |

6,066 | 5,861 | 205 | 3.5% | 12,120 | 11,711 | 409 | 3.5% | ||||||||||||||||||||||||

| Operating costs |

(3,421 | ) | (3,271 | ) | (150 | ) | (4.6% | ) | (6,937 | ) | (6,537 | ) | (400 | ) | (6.1% | ) | ||||||||||||||||

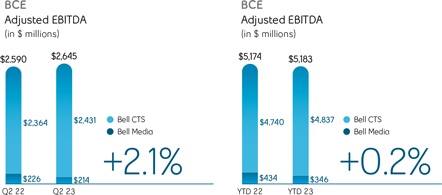

| Adjusted EBITDA |

2,645 | 2,590 | 55 | 2.1% | 5,183 | 5,174 | 9 | 0.2% | ||||||||||||||||||||||||

| Adjusted EBITDA margin (1) |

43.6% | 44.2% | (0.6) pts | 42.8% | 44.2% | (1.4) pts | ||||||||||||||||||||||||||

| Net earnings attributable to: |

||||||||||||||||||||||||||||||||

| Common shareholders |

329 | 596 | (267 | ) | (44.8% | ) | 1,054 | 1,473 | (419 | ) | (28.4% | ) | ||||||||||||||||||||

| Preferred shareholders |

46 | 35 | 11 | 31.4% | 92 | 69 | 23 | 33.3% | ||||||||||||||||||||||||

|

Non-controlling interest |

22 | 23 | (1 | ) | (4.3% | ) | 39 | 46 | (7 | ) | (15.2% | ) | ||||||||||||||||||||

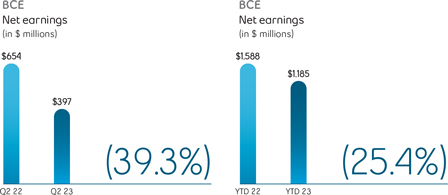

| Net earnings |

397 | 654 | (257 | ) | (39.3% | ) | 1,185 | 1,588 | (403 | ) | (25.4% | ) | ||||||||||||||||||||

| Adjusted net earnings |

722 | 791 | (69 | ) | (8.7% | ) | 1,494 | 1,602 | (108 | ) | (6.7% | ) | ||||||||||||||||||||

| Net earnings per common share (EPS) |

0.37 | 0.66 | (0.29 | ) | (43.9% | ) | 1.16 | 1.62 | (0.46 | ) | (28.4% | ) | ||||||||||||||||||||

| Adjusted EPS (2) |

0.79 | 0.87 | (0.08 | ) | (9.2% | ) | 1.64 | 1.76 | (0.12 | ) | (6.8% | ) | ||||||||||||||||||||

| (1) | Adjusted EBITDA margin is defined as adjusted EBITDA divided by operating revenues. |

| (2) | Adjusted EPS is a non-GAAP ratio. Refer to section 8.2, Non-GAAP ratios in this MD&A for more information on this measure. |

BCE statements of cash flows – selected information

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

| Cash flows from operating activities |

2,365 | 2,597 | (232 | ) | (8.9% | ) | 3,612 | 4,313 | (701 | ) | (16.3% | ) | ||||||||||||||||||||

| Capital expenditures |

(1,307 | ) | (1,219 | ) | (88 | ) | (7.2% | ) | (2,393 | ) | (2,178 | ) | (215 | ) | (9.9% | ) | ||||||||||||||||

| Free cash flow |

1,016 | 1,333 | (317 | ) | (23.8% | ) | 1,101 | 2,049 | (948 | ) | (46.3% | ) | ||||||||||||||||||||

Q2 2023 financial highlights

BCE operating revenues grew by 3.5% in Q2 2023, compared to the same period last year, driven by higher product and service revenues of 21.5% and 1.3%, respectively. The increase in product revenues reflected higher wireless product revenues coupled with strong wireline product sales to large business customers. The growth in service revenues was led by higher wireless and Internet revenues, along with the contribution from various small acquisitions and greater media subscriber revenues, partly offset by ongoing erosion in voice and satellite TV revenues, as well as reduced media advertising revenues, as a result of the current economic uncertainty.

Net earnings and net earnings attributable to common shareholders in the second quarter of 2023 decreased by $257 million and $267 million, respectively, compared to the same period last year, mainly due to higher other expense, higher interest expense, higher severance, acquisition and other costs and higher income taxes, partly offset by lower impairment of assets and higher adjusted EBITDA.

BCE’s adjusted EBITDA increased by 2.1% in the quarter, compared to the same period last year, due to growth from our Bell CTS segment, moderated by a decline in our Bell Media segment. The year-over-year growth in adjusted EBITDA was attributable to greater operating revenues, partly offset by higher operating expenses, mainly from increased cost of goods sold and expenses related to the small acquisitions. This resulted in a corresponding adjusted EBITDA margin of 43.6% in Q2 2023, down 0.6 pts over the same period last year, due to a higher proportion of low-margin product sales in our total revenue base, along with increased operating costs, partly offset by service revenue flow-through.

BCE’s EPS of $0.37 in Q2 2023 decreased by $0.29 compared to the same period last year.

In the second quarter of 2023, adjusted net earnings, which excludes the impact of severance, acquisition and other costs, net mark-to-market gains (losses) on derivatives used to economically hedge equity settled share-based compensation plans, net equity gains (losses) on investments in associates and joint ventures, net gains (losses) on investments, early debt redemption costs and impairment of assets, net of tax and NCI, was $722 million, or $0.79 per common share, compared to $791 million, or $0.87 per common share, for the same period last year.

Cash flows from operating activities in the second quarter of 2023 decreased by $232 million, compared to the same period last year, mainly due to lower cash from working capital due in part to timing of supplier payments, higher interest paid and higher income taxes paid, partly offset by higher adjusted EBITDA.

Free cash flow in Q2 2023 decreased by $317 million, compared to the same period last year, due to lower cash flows from operating activities, excluding cash from acquisition and other costs paid, and higher capital expenditures.

| 7 |

1 MD&A Overview

| 1.2 | Key corporate and business developments |

This section contains forward-looking statements, including relating to our ESG objectives. Refer to the section Caution regarding forward-looking statements at the beginning of this MD&A.

Curtis Millen to become Chief Financial Officer

On May 4, 2023, BCE announced that Glen LeBlanc, Executive Vice President and Chief Financial Officer of BCE and Bell Canada will retire as Chief Financial Officer (CFO) effective September 1, 2023. Curtis Millen, currently Senior Vice President (SVP), Corporate Strategy and Treasurer, will be promoted to CFO of BCE and Bell Canada. Curtis Millen joined Bell in 2008 as Director, Corporate Strategy and M&A and held successively senior positions, most recently as SVP, Corporate Strategy and Treasurer, head of Bell Ventures and President of Bimcor Inc., a wholly-owned subsidiary of Bell that is one of the largest private sector pension fund management companies in Canada. Curtis Millen will continue to be based at Bell’s headquarters in Montréal. Glen LeBlanc will maintain his position as Vice-Chair, Atlantic, Chair of Northwestel Inc., and as Board member and Chair of the Audit Committee for Maple Leaf Sports & Entertainment Ltd. He will also provide leadership and direction to ensure a smooth transition on BCE’s financial operations until the end of December 2023.

Public debt offering

On May 11, 2023, Bell Canada completed a public offering in the United States of US $850 million (Cdn $1,138 million) of notes in one series (the Notes). The US $850 million Series US-8 Notes will mature on May 11, 2033 and carry an annual interest rate of 5.100%. The Notes are fully and unconditionally guaranteed by BCE Inc. The net proceeds of the offering were used to repay short-term debt and for general corporate purposes.

Inaugural Sustainability-Linked Derivatives

Bell entered into its first Sustainability-Linked Derivatives (SLDs), leveraging Bell’s key performance indicators designed to measure performance on ESG targets and underscoring Bell’s commitment to ESG standards. The SLDs introduce a pricing adjustment that increases the derivatives’ cost based on Bell’s performance towards its SBT to reduce its operational GHG emissions (Scope 1 and 2) 58% by 2030 from a 2020 base year (1).

BCE ranked as one of Canada’s Best 50 Corporate Citizens

In June 2023, BCE was once again named to the Canada’s Best 50 Corporate Citizens list compiled by Corporate Knights, a sustainable-economy media and research company, ranking 20th overall. The annual ranking is based on a set of 25 ESG indicators that compares Canadian companies with a gross revenue of at least $1 billion (2). Driven by Bell’s sustainable investments, diversity and equity initiatives and sustainability pay link (senior executive compensation based on sustainability performance), our commitment to ESG standards has enabled BCE to retain a strong position on this year’s list.

In addition, for the seventh consecutive year, Bell was recognized as one of Canada’s Greenest Employers (3) by Canada’s Top Employers, an editorial competition organized by Mediacorp Canada Inc., a publisher of employment periodicals, in recognition of our ongoing environmental leadership.

| (1) | Our SBTs have been recalculated to reflect restated GHG emissions for our 2020 base year, in line with SBTi criteria and recommendations. The SBTi has approved our targets in 2022, prior to the recalculation. The recalculated targets will be submitted to SBTi later in 2023 for approval. The SBTi requires that targets be recalculated (following the most recent applicable SBTi criteria and recommendations) at least every five years, or more often if significant changes occur (e.g., business acquisitions/divestments). As a result, our SBTs may need to be adjusted again in the future. |

| (2) | All companies are scored on up to 25 key performance indicators covering resource management, employee management, financial management, sustainable revenue & sustainable investment and supplier performance in comparison to their peer group, with 50% of each company’s score assigned to sustainable revenue and sustainable investment. |

| (3) | Winners were announced in April 2023 and were selected and evaluated in terms of: the unique environmental initiatives and programs they have developed; the extent to which they have been successful in reducing the organization’s own environmental footprint; the degree to which their employees are involved in these programs and whether they contribute any unique skills; and the extent to which these initiatives have become linked to the employer’s public identity, attracting new employees and clients to the organization. |

| 8 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

1 MD&A Overview

| 1.3 | Assumptions |

As at the date of this MD&A, our forward-looking statements set out in the BCE 2022 Annual MD&A, as updated or supplemented in the BCE 2023 First Quarter MD&A and in this MD&A, are based on certain assumptions including, without limitation, the following assumptions as well as the various assumptions referred to under the sub-sections entitled Assumptions set out in section 3, Business segment analysis of this MD&A.

Assumptions about the Canadian economy

We have made certain assumptions concerning the Canadian economy. In particular, we have assumed:

| • | Moderating economic growth, given the Bank of Canada’s most recent estimated growth in Canadian gross domestic product of 1.8% in 2023, down from 3.4% in 2022 |

| • | Easing, but still elevated, consumer price index (CPI) inflation due to lower energy prices, improvements in global supply chains and the effects of higher interest rates moving through the economy |

| • | Ongoing tight labour market conditions, but with some easing as tighter monetary policy moderates the demand for labour |

| • | Slowing growth in household spending as demand for interest-rate-sensitive goods and services weakens and more households renew their mortgage at higher rates |

| • | Soft business investment growth due to slowing demand and high financing costs |

| • | Prevailing high interest rates expected to remain at or near current levels |

| • | Population growth resulting from strong immigration |

| • | Canadian dollar expected to remain near current levels. Further movements may be impacted by the degree of strength of the U.S. dollar, interest rates and changes in commodity prices |

Market assumptions

| • | A higher level of wireline and wireless competition in consumer, business and wholesale markets |

| • | Higher, but slowing, wireless industry penetration |

| • | A shrinking data and voice connectivity market as business customers migrate to lower-priced telecommunications solutions or alternative OTT competitors |

| • | The Canadian advertising market is experiencing a slowdown consistent with trends in the global advertising market, with improvement expected in the medium term, although visibility to the specific timing and pace of recovery is limited |

| • | Declines in broadcasting distribution undertaking (BDU) subscribers driven by increasing competition from the continued rollout of subscription video-on-demand (SVOD) streaming services together with further scaling of OTT aggregators |

Assumptions underlying expected reductions in 2023 annual contributions to our pension plans

| • | At the relevant time, our defined benefit (DB) pension plans will remain in funded positions with going concern surpluses and maintain solvency ratios that exceed the minimum legal requirements for a contribution holiday to be taken for applicable DB and defined contribution (DC) components |

| • | No significant declines in our DB pension plans’ financial position due to declines in investment returns or interest rates |

| • | No material experience losses from other events such as through litigation or changes in laws, regulations or actuarial standards |

| 9 |

2 MD&A Consolidated financial analysis

| 2 | Consolidated financial analysis |

This section provides detailed information and analysis about BCE’s performance in Q2 and YTD 2023 compared with Q2 and YTD 2022. It focuses on BCE’s consolidated operating results and provides financial information for our Bell CTS and Bell Media business segments. For further discussion and analysis of our business segments, refer to section 3, Business segment analysis.

| 2.1 | BCE consolidated income statements |

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

| Operating revenues |

||||||||||||||||||||||||||||||||

| Service |

5,303 | 5,233 | 70 | 1.3% | 10,525 | 10,410 | 115 | 1.1% | ||||||||||||||||||||||||

| Product |

763 | 628 | 135 | 21.5% | 1,595 | 1,301 | 294 | 22.6% | ||||||||||||||||||||||||

| Total operating revenues |

6,066 | 5,861 | 205 | 3.5% | 12,120 | 11,711 | 409 | 3.5% | ||||||||||||||||||||||||

| Operating costs |

(3,421 | ) | (3,271 | ) | (150 | ) | (4.6% | ) | (6,937 | ) | (6,537 | ) | (400 | ) | (6.1% | ) | ||||||||||||||||

| Adjusted EBITDA |

2,645 | 2,590 | 55 | 2.1% | 5,183 | 5,174 | 9 | 0.2% | ||||||||||||||||||||||||

| Adjusted EBITDA margin |

43.6% | 44.2% | (0.6) pts | 42.8% | 44.2% | (1.4) pts | ||||||||||||||||||||||||||

| Severance, acquisition and other costs |

(100 | ) | (40 | ) | (60 | ) | n.m. | (149 | ) | (53 | ) | (96 | ) | n.m. | ||||||||||||||||||

| Depreciation |

(936 | ) | (933 | ) | (3 | ) | (0.3% | ) | (1,854 | ) | (1,824 | ) | (30 | ) | (1.6% | ) | ||||||||||||||||

| Amortization |

(296 | ) | (266 | ) | (30 | ) | (11.3% | ) | (579 | ) | (526 | ) | (53 | ) | (10.1% | ) | ||||||||||||||||

| Finance costs |

||||||||||||||||||||||||||||||||

| Interest expense |

(359 | ) | (269 | ) | (90 | ) | (33.5% | ) | (703 | ) | (529 | ) | (174 | ) | (32.9% | ) | ||||||||||||||||

| Net return on post-employment benefit plans |

27 | 7 | 20 | n.m. | 54 | 25 | 29 | n.m. | ||||||||||||||||||||||||

| Impairment of assets |

– | (106 | ) | 106 | 100.0% | (34 | ) | (108 | ) | 74 | 68.5% | |||||||||||||||||||||

| Other expense |

(311 | ) | (97 | ) | (214 | ) | n.m. | (190 | ) | (4 | ) | (186 | ) | n.m. | ||||||||||||||||||

| Income taxes |

(273 | ) | (232 | ) | (41 | ) | (17.7% | ) | (543 | ) | (567 | ) | 24 | 4.2% | ||||||||||||||||||

| Net earnings |

397 | 654 | (257 | ) | (39.3% | ) | 1,185 | 1,588 | (403 | ) | (25.4% | ) | ||||||||||||||||||||

| Net earnings attributable to: |

||||||||||||||||||||||||||||||||

| Common shareholders |

329 | 596 | (267 | ) | (44.8% | ) | 1,054 | 1,473 | (419 | ) | (28.4% | ) | ||||||||||||||||||||

| Preferred shareholders |

46 | 35 | 11 | 31.4% | 92 | 69 | 23 | 33.3% | ||||||||||||||||||||||||

|

Non-controlling interest |

22 | 23 | (1 | ) | (4.3% | ) | 39 | 46 | (7 | ) | (15.2% | ) | ||||||||||||||||||||

| Net earnings |

397 | 654 | (257 | ) | (39.3% | ) | 1,185 | 1,588 | (403 | ) | (25.4% | ) | ||||||||||||||||||||

| Adjusted net earnings |

722 | 791 | (69 | ) | (8.7% | ) | 1,494 | 1,602 | (108 | ) | (6.7% | ) | ||||||||||||||||||||

| EPS |

0.37 | 0.66 | (0.29 | ) | (43.9% | ) | 1.16 | 1.62 | (0.46 | ) | (28.4% | ) | ||||||||||||||||||||

| Adjusted EPS |

0.79 | 0.87 | (0.08 | ) | (9.2% | ) | 1.64 | 1.76 | (0.12 | ) | (6.8% | ) | ||||||||||||||||||||

n.m.: not meaningful

| 10 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

2 MD&A Consolidated financial analysis

| 2.2 | Customer connections |

BCE net activations (losses)

| Q2 2023 | Q2 2022 | % change | YTD 2023 | YTD 2022 | % change | |||||||||||||||||||

| Mobile phone net subscriber activations (losses) |

125,539 | 110,761 | 13.3% | 152,174 | 142,937 | 6.5% | ||||||||||||||||||

| Postpaid |

111,282 | 83,197 | 33.8% | 154,571 | 117,427 | 31.6% | ||||||||||||||||||

| Prepaid |

14,257 | 27,564 | (48.3% | ) | (2,397 | ) | 25,510 | n.m. | ||||||||||||||||

| Mobile connected devices net subscriber activations |

79,537 | (344 | ) | n.m. | 150,279 | 48,533 | n.m. | |||||||||||||||||

| Retail high-speed Internet net subscriber activations |

24,934 | 22,620 | 10.2% | 52,208 | 48,644 | 7.3% | ||||||||||||||||||

| Retail TV net subscriber losses |

(14,404 | ) | (11,527 | ) | (25.0% | ) | (28,353 | ) | (19,888 | ) | (42.6% | ) | ||||||||||||

| Internet protocol television (IPTV) |

11,506 | 3,838 | n.m. | 22,405 | 16,098 | 39.2% | ||||||||||||||||||

| Satellite |

(25,910 | ) | (15,365 | ) | (68.6% | ) | (50,758 | ) | (35,986 | ) | (41.0% | ) | ||||||||||||

| Retail residential NAS lines net losses |

(49,608 | ) | (52,712 | ) | 5.9% | (96,489 | ) | (95,057 | ) | (1.5% | ) | |||||||||||||

| Total services net activations |

165,998 | 68,798 | n.m. | 229,819 | 125,169 | 83.6% | ||||||||||||||||||

|

n.m.: not meaningful

Total BCE customer connections

|

||||||||||||||||||||||||

| Q2 2023 | Q2 2022 | % change | ||||||||||||||||||||||

| Mobile phone subscribers (2) |

10,028,031 | 9,602,122 | 4.4% | |||||||||||||||||||||

| Postpaid (2) |

9,151,229 | 8,747,472 | 4.6% | |||||||||||||||||||||

| Prepaid |

876,802 | 854,650 | 2.6% | |||||||||||||||||||||

| Mobile connected devices subscribers (2) |

2,589,520 | 2,298,327 | 12.7% | |||||||||||||||||||||

| Retail high-speed Internet subscribers (1) (3) (4) |

4,338,511 | 3,977,387 | 9.1% | |||||||||||||||||||||

| Retail TV subscribers (1) (4) |

2,723,388 | 2,724,147 | – | |||||||||||||||||||||

| IPTV (1) (4) |

2,010,829 | 1,907,564 | 5.4% | |||||||||||||||||||||

| Satellite |

712,559 | 816,583 | (12.7% | ) | ||||||||||||||||||||

| Retail residential NAS lines (1) (4) |

2,101,740 | 2,207,004 | (4.8% | ) | ||||||||||||||||||||

| Total services subscribers |

21,781,190 | 20,808,987 | 4.7% | |||||||||||||||||||||

| (1) | In Q2 2023, our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases increased by 35,080, 243 and 7,458 subscribers, respectively, as a result of small acquisitions. |

| (2) | In Q1 2023, we adjusted our mobile phone postpaid and mobile connected device subscriber bases to remove older non-revenue generating business subscribers of 73,229 and 12,577, respectively. |

| (3) | In Q1 2023, subsequent to a review of customer account records, our retail high-speed Internet subscriber base was reduced by 7,347 subscribers. |

| (4) | In Q4 2022, as a result of the acquisition of Distributel, our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases increased by 128,065, 2,315 and 64,498 subscribers, respectively. |

BCE added 165,998 net retail subscriber activations in Q2 2023, up 97,200 compared to the same period last year. The net retail subscriber activations in Q2 2023 consisted of:

| • | 125,539 mobile phone net subscriber activations, along with 79,537 mobile connected device net subscriber activations |

| • | 24,934 retail high-speed Internet net subscriber activations |

| • | 14,404 retail TV net subscriber losses comprised of 25,910 retail satellite TV net subscriber losses, partly offset by 11,506 retail IPTV net subscriber activations |

| • | 49,608 retail residential NAS lines net losses |

In the first half of the year, BCE added 229,819 net retail subscriber activations, up 83.6% compared to the same period in 2022. The net retail subscriber activations in the first half of 2023 consisted of:

| • | 152,174 mobile phone net subscriber activations, along with 150,279 mobile connected device net subscriber activations |

| • | 52,208 retail high-speed Internet net subscriber activations |

| • | 28,353 retail TV net subscriber losses comprised of 50,758 retail satellite TV net subscriber losses, partly offset by 22,405 retail IPTV net subscriber activations |

| • | 96,489 retail residential NAS lines net losses |

At June 30, 2023, BCE’s retail subscriber connections totaled 21,781,190, up 4.7% year over year, and consisted of:

| • | 10,028,031 mobile phone subscribers, up 4.4% year over year, and 2,589,520 mobile connected device subscribers, up 12.7% year over year |

| • | 4,338,511 retail high-speed Internet subscribers, 9.1% higher year over year |

| • | 2,723,388 total retail TV subscribers, comprised of 2,010,829 retail IPTV subscribers, up 5.4% year over year, and 712,559 retail satellite TV subscribers, down 12.7% year over year |

| • | 2,101,740 retail residential NAS lines, down 4.8% year over year |

| 11 |

2 MD&A Consolidated financial analysis

| 2.3 | Operating revenues |

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

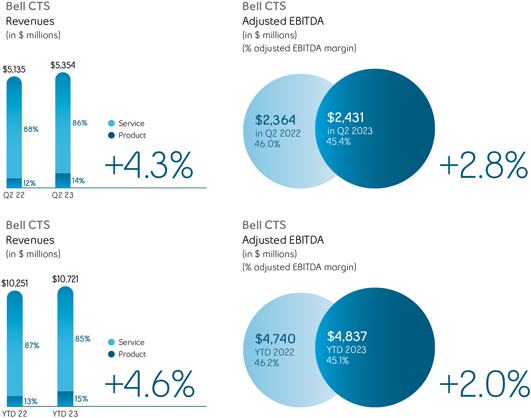

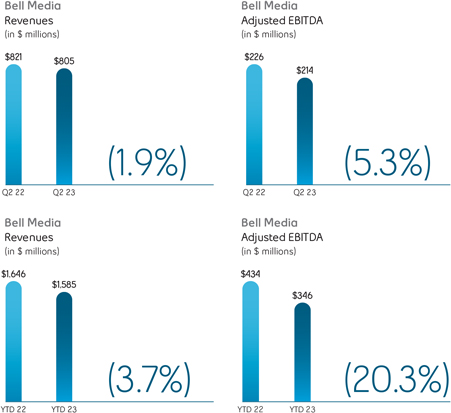

| Bell CTS |

5,354 | 5,135 | 219 | 4.3% | 10,721 | 10,251 | 470 | 4.6% | ||||||||||||||||||||||||

| Bell Media |

805 | 821 | (16 | ) | (1.9% | ) | 1,585 | 1,646 | (61 | ) | (3.7% | ) | ||||||||||||||||||||

| Inter-segment eliminations |

(93 | ) | (95 | ) | 2 | 2.1% | (186 | ) | (186 | ) | – | – | ||||||||||||||||||||

| Total BCE operating revenues |

6,066 | 5,861 | 205 | 3.5% | 12,120 | 11,711 | 409 | 3.5% | ||||||||||||||||||||||||

BCE

BCE operating revenues increased by 3.5% in both the second quarter and the first six months of the year, compared to the same periods in 2022, driven by higher service and product revenues. Service revenues of $5,303 million in Q2 2023 and $10,525 million year to date, increased 1.3% and 1.1%, respectively. Product revenues of $763 million in Q2 2023 and $1,595 million year to date, increased by 21.5% and 22.6%, respectively. The growth in operating revenues was due to higher revenues from our Bell CTS segment, partly offset by a decline in our Bell Media segment. Bell CTS operating revenues grew by 4.3% in Q2 2023 and by 4.6% in the first half of the year, compared to the same periods last year, due to higher product revenues of 21.5% and 22.6%, respectively, and higher service revenues of 1.9% and 2.0%, respectively, attributable to ongoing growth in wireless revenues and wireline data revenues, moderated by continued erosion in wireline voice revenues. Bell Media operating revenues declined by 1.9% in Q2 2023 and by 3.7% in the first half of the year, compared to the same periods last year, primarily reflecting lower advertising revenues.

| 12 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

2 MD&A Consolidated financial analysis

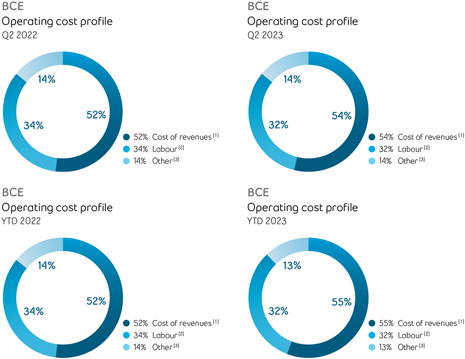

| 2.4 | Operating costs |

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

| Bell CTS |

(2,923 | ) | (2,771 | ) | (152 | ) | (5.5%) | (5,884 | ) | (5,511 | ) | (373 | ) | (6.8%) | ||||||||||||||||||

| Bell Media |

(591 | ) | (595 | ) | 4 | 0.7% | (1,239 | ) | (1,212 | ) | (27 | ) | (2.2%) | |||||||||||||||||||

| Inter-segment eliminations |

93 | 95 | (2 | ) | (2.1%) | 186 | 186 | – | – | |||||||||||||||||||||||

| Total BCE operating costs |

(3,421 | ) | (3,271 | ) | (150 | ) | (4.6%) | (6,937 | ) | (6,537 | ) | (400 | ) | (6.1%) | ||||||||||||||||||

| (1) | Cost of revenues includes costs of wireless devices and other equipment sold, network and content costs, and payments to other carriers. |

| (2) | Labour costs (net of capitalized costs) include wages, salaries and related taxes and benefits, post-employment benefit plans service cost, and other labour costs, including contractor and outsourcing costs. |

| (3) | Other operating costs include marketing, advertising and sales commission costs, bad debt expense, taxes other than income taxes, IT costs, professional service fees and rent. |

BCE

BCE operating costs increased by 4.6% in Q2 2023 and by 6.1% in the first half of the year, compared to the same periods last year, driven by higher expenses in Bell CTS of 5.5% and 6.8%, respectively. Additionally, in the first six months of the year, operating costs were unfavourably impacted by higher year-over-year Bell Media expenses of 2.2%.

| 13 |

2 MD&A Consolidated financial analysis

| 2.5 | Net earnings |

Net earnings in the second quarter of 2023 decreased by $257 million, compared to the same period last year, mainly due to higher other expense, higher interest expense, higher severance, acquisition and other costs and higher income taxes, partly offset by lower impairment of assets and higher adjusted EBITDA.

Net earnings on a year-to-date basis in 2023 decreased by $403 million, compared to the same period last year, mainly due to higher other expense, higher interest expense, higher severance, acquisition and other costs and higher depreciation and amortization, partly offset by lower impairment of assets.

| 2.6 | Adjusted EBITDA |

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

| Bell CTS |

2,431 | 2,364 | 67 | 2.8% | 4,837 | 4,740 | 97 | 2.0% | ||||||||||||||||||||||||

| Bell Media |

214 | 226 | (12 | ) | (5.3%) | 346 | 434 | (88 | ) | (20.3%) | ||||||||||||||||||||||

| Total BCE adjusted EBITDA |

2,645 | 2,590 | 55 | 2.1% | 5,183 | 5,174 | 9 | 0.2% | ||||||||||||||||||||||||

BCE

BCE’s adjusted EBITDA grew by 2.1% in Q2 2023 and by 0.2% in the first half of the year, compared to the same periods last year, driven by an increase in Bell CTS of 2.8% and 2.0%, respectively, moderated by a decline in Bell Media of 5.3% and 20.3%, respectively. The increase in BCE’s adjusted EBITDA was driven by higher operating revenues, partly offset by greater operating expenses. Adjusted EBITDA margin of 43.6% in Q2 2023 and 42.8% year to date, decreased by 0.6 pts and 1.4 pts, respectively, over the same periods in 2022, due to a greater proportion of low-margin product sales in our total revenue base, coupled with greater operating costs, mitigated in part by service revenue flow-through.

| 14 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

2 MD&A Consolidated financial analysis

| 2.7 | Severance, acquisition and other costs |

2023

Severance, acquisition and other costs of $100 million in the second quarter of 2023 and $149 million on a year-to-date basis included:

| • | Severance costs of $80 million in Q2 2023 and $109 million on a year-to-date basis related to involuntary and voluntary employee terminations |

| • | Acquisition and other costs of $20 million in Q2 2023 and $40 million on a year-to-date basis |

2022

Severance, acquisition and other costs of $40 million in the second quarter of 2022 and $53 million on a year-to-date basis included:

| • | Severance costs of $38 million in Q2 2022 and $56 million on a year-to-date basis related to involuntary and voluntary employee terminations |

| • | Acquisition and other costs of $2 million in Q2 2022 and a recovery of $3 million on a year-to-date basis |

| 2.8 | Depreciation and amortization |

Depreciation

Depreciation in the second quarter and on a year-to-date basis in 2023 increased by $3 million and $30 million, respectively, compared to the same periods in 2022, mainly due to a higher asset base as we continued to invest in our broadband and wireless networks.

Amortization

Amortization in the second quarter and on a year-to-date in 2023 increased by $30 million and $53 million, respectively, compared to the same periods in 2022, mainly due to a higher asset base.

| 2.9 | Finance costs |

Interest expense

Interest expense in the second quarter of 2023 increased by $90 million, compared to the same period last year, mainly due to higher average debt balances and higher interest rates.

Interest expense on a year-to-date basis in 2023 increased by $174 million, compared to the same period last year, mainly due to higher average debt balances and higher interest rates.

Net return on post-employment benefit plans

Net return on our post-employment benefit plans is based on market conditions that existed at the beginning of the year as well as the net post-employment benefit plan asset (liability). On January 1, 2023, the discount rate was 5.3% compared to 3.2% on January 1, 2022.

In the second quarter and on a year-to-date basis in 2023, net return on post-employment benefit increased by $20 million and $29 million, respectively, compared to the same periods last year, as a result of a higher discount rate in 2023 and a higher net asset position.

The impacts of changes in market conditions during the year are recognized in other comprehensive (loss) income (OCI).

| 2.10 | Impairment of assets |

Impairment charges for the second quarter and on a year-to-date basis in 2023 decreased by $106 million and $74 million, respectively, compared to the same periods last year and relate mainly to right-of-use assets for certain office spaces we ceased using as part of our real estate optimization strategy as a result of our hybrid work policy.

| 15 |

2 MD&A Consolidated financial analysis

| 2.11 | Other expense |

2023

Other expense of $311 million in the second quarter of 2023 included losses on our equity investments in associates and joint ventures which included a loss on BCE’s share of an obligation to repurchase at fair value the minority interest in one of BCE’s joint ventures, losses on retirements and disposals of property, plant and equipment and intangible assets, partly offset by gains on our investments as a result of the sale of our 63% ownership in certain production studios.

Other expense of $190 million on a year-to-date basis in 2023 included losses on our equity investments in associates and joint ventures which included a loss on BCE’s share of an obligation to repurchase at fair value the minority interest in one of BCE’s joint ventures, partly offset by gains on our investments as a result of the sale of our 63% ownership in certain production studios, gains on retirements and disposals of property, plant and equipment and intangible assets related to the sale of land as part of our real estate optimization strategy, higher interest income, income on operations from our equity investments and net mark-to-market gains on derivatives used to economically hedge equity settled share-based compensation plans.

2022

Other expense of $97 million in the second quarter of 2022 included net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans and losses on our equity investments which included a loss on BCE’s share of an obligation to repurchase at fair value the minority interest in one of BCE’s joint ventures, partly offset by a gain on investment related to an obligation to repurchase at fair value the minority interest in one of our subsidiaries.

Other expense of $4 million on a year-to-date basis in 2022 was due to losses on our equity investments which included a loss on BCE’s share of an obligation to repurchase at fair value the minority interest in one of BCE’s joint ventures and early debt redemption costs, partly offset by gains on investments related to the sale of our wholly-owned subsidiary, 6362222 Canada Inc. (Createch), and an obligation to repurchase at fair value the minority interest in one of our subsidiaries.

| 2.12 | Income taxes |

Income taxes in the second quarter of 2023 increased by $41 million compared to the same period in 2022, mainly due to higher taxable income.

Income taxes on a year-to-date basis in 2023 decreased by $24 million, compared to the same period in 2022, mainly due to lower taxable income.

| 2.13 | Net earnings attributable to common shareholders and EPS |

Net earnings attributable to common shareholders in the second quarter of 2023 of $329 million, decreased by $267 million, compared to the same period last year, mainly due to higher other expense, higher interest expense, higher severance, acquisition and other costs and higher income taxes, partly offset by lower impairment of assets and higher adjusted EBITDA.

Net earnings attributable to common shareholders on a year-to-date basis in 2023 of $1,054 million, decreased by $419 million due to higher other expense, higher interest expense, higher severance, acquisition and other costs and higher depreciation and amortization, partly offset by lower impairment of assets and lower income taxes.

BCE’s EPS of $0.37 in Q2 2023 decreased by $0.29 compared to the same period last year. BCE’s EPS of $1.16 on a year-to-date basis in 2023 decreased by $0.46 compared to the same period last year.

In the second quarter of 2023, adjusted net earnings, which excludes the impact of severance, acquisition and other costs, net mark-to-market gains (losses) on derivatives used to economically hedge equity settled share-based compensation plans, net equity gains (losses) on investments in associates and joint ventures, net gains (losses) on investments, early debt redemption costs and impairment of assets, net of tax and NCI, was $722 million, or $0.79 per common share, compared to $791 million, or $0.87 per common share, for the same period last year. Adjusted net earnings in the first half of 2023 was $1,494 million, or $1.64 per common share, compared to $1,602 million, or $1.76 per common share, for the first six months of 2022.

| 16 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

3 MD&A Business segment analysis

| 3 | Business segment analysis |

| 3.1 | Bell CTS |

Key business developments

Acquisition of cloud-services company FX Innovation

On June 1, 2023, Bell acquired FX Innovation, a Montréal-based provider of cloud-focused managed and professional services and workflow automation solutions for business clients, for cash consideration of $157 million, of which $12 million is payable within two years, and an estimated $6 million of additional cash consideration contingent on the achievement of certain performance objectives. This contingent consideration is expected to be settled by 2027 and the maximum amount payable is $7 million. This acquisition combines FX Innovation’s agility, start-up culture, and cloud services expertise with Bell’s next-generation fibre and 5G networks, resources, and scale to deliver leading-edge technology solutions for Canadian businesses. The results of FX Innovation are included in our Bell CTS segment.

Virgin Plus brand repositioning and launch of unlimited and 5G wireless plans

Virgin Plus unveiled a fresh new look with more affordable service offerings for everyone, including those new to Canada, along with a new brand campaign and updated member benefits. The service offerings include the introduction of unlimited nationwide rate plans and access to 5G at an affordable price with no zones for members across Canada. These new offerings join the already-stacked lineup of affordable Virgin Plus service offerings including high speed internet and app-based TV service for members in Ontario and Québec.

Bell pure fibre ranked as Canada’s fastest Internet and Wi-Fi

Bell pure fibre Internet was awarded fastest in Canada in Ookla’s Q1-Q2 Speedtest Awards report (1), the biannual analysis of wireline and wireless performance across the country. Based on Speedtest results independently collected and analyzed by Ookla, the Q1-Q2 Speedtest Awards recognizes the best speed of Canada’s major providers. The report also ranks Bell pure fibre Wi-Fi as fastest in the country. With the addition of previous recognition won by Bell such as PCMag Best Major ISP for Gaming (2) and BrandSpark’s Most Trusted ISP (3), Bell is Canada’s most awarded Internet service provider (4).

| (1) | Based on analysis by Ookla, a web testing and network diagnostics company, of Speedtest Intelligence data for Q1-Q2 2023. Ookla compared 13,671,040 user-initiated tests that are taken on various Speedtest applications connected to a fixed network, including tests taken on mobile phones over a Wi-Fi connection. |

| (2) | PCMag delivers labs-based, independent reviews of the latest technology products and services. Bell was named the top ISP among Canada’s major providers for gaming for the second year in a row in PCMag’s Best Gaming ISPs Canada 2023 report based on PCMag’s Quality Index (speed, latency and jitter) comparing major Canadian ISPs from December 1, 2021, to December 5, 2022. |

| (3) | Bell was voted most trusted High Speed Internet Provider brand by Canadian shoppers based on the 2023 BrandSpark Canadian Trust Study conducted by BrandSpark, a research and consulting firm. Winners were determined by a national survey of 15,878 Canadian shoppers who gave their top-of-mind, unaided answers as to which brands they trust most and why in categories they have recently shopped. |

| (4) | Most awarded based on Bell competitive analysis. Bell awards include Ookla Q1-Q2 2023 Speedtest Awards, PCMag Best Major ISP for Gaming 2023, and BrandSpark Most Trusted ISP 2023. |

| 17 |

3 MD&A Business segment analysis

Financial performance analysis

Q2 2023 performance highlights

| Total mobile phone subscriber growth (2) |

Mobile phone postpaid net subscriber activations |

Mobile phone prepaid net subscriber activations |

Mobile phone postpaid churn in Q2 2023 |

Mobile phone blended average revenue per user (ARPU) (3) per month |

||||

| +4.4% | 111,282 | 14,257 | 0.94% | — | ||||

| Q2 2023 vs. Q2 2022 |

Increased 33.8% vs. Q2 2022 |

in Q2 2023 |

increased 0.19 pts vs. Q2 2022 |

Q2 2023: $59.16 |

||||

| Q2 2022: $59.17 |

| Retail high-speed Internet subscriber growth (1) (4) (5) | Retail high-speed Internet net subscriber activations in Q2 2023 |

Retail TV subscriber growth (1) (5) | ||

| +9.1% | 24,934 | — | ||

| Q2 2023 vs. Q2 2022 |

Increased 10.2% vs. Q2 2022 |

Q2 2023 vs. Q2 2022 |

| Retail IPTV net subscriber activations in Q2 2023 | Retail residential NAS lines subscriber decline (1) (5) | |

| 11,506 | (4.8%) | |

| Increased 7,668 vs. Q2 2022 |

Q2 2023 vs. Q2 2022 |

|

| (1) | In Q2 2023, our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases increased by 35,080, 243 and 7,458 subscribers, respectively, as a result of small acquisitions. |

| (2) | In Q1 2023, we adjusted our mobile phone postpaid subscriber base to remove older non-revenue generating business subscribers of 73,229. |

| (3) | Effective Q1 2023, as a result of the segment reporting changes impacting intersegment eliminations, ARPU has been updated and is defined as Bell CTS wireless external services revenues (previously wireless operating service revenues) divided by the average mobile phone subscriber base for the specified period, expressed as a dollar unit per month. |

| (4) | In Q1 2023, subsequent to a review of customer account records, our retail high-speed Internet subscriber base was reduced by 7,347 subscribers. |

| (5) | In Q4 2022, as a result of the acquisition of Distributel, our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases increased by 128,065, 2,315 and 64,498 subscribers, respectively. |

| 18 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

3 MD&A Business segment analysis

Bell CTS results

Revenues

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

| Wireless |

1,766 | 1,692 | 74 | 4.4% | 3,489 | 3,327 | 162 | 4.9% | ||||||||||||||||||||||||

| Wireline data |

2,021 | 1,974 | 47 | 2.4% | 4,022 | 3,927 | 95 | 2.4% | ||||||||||||||||||||||||

| Wireline voice |

722 | 756 | (34 | ) | (4.5% | ) | 1,448 | 1,527 | (79 | ) | (5.2% | ) | ||||||||||||||||||||

| Other wireline services |

75 | 78 | (3 | ) | (3.8% | ) | 153 | 155 | (2 | ) | (1.3% | ) | ||||||||||||||||||||

| External service revenues |

4,584 | 4,500 | 84 | 1.9% | 9,112 | 8,936 | 176 | 2.0% | ||||||||||||||||||||||||

| Inter-segment service revenues |

7 | 7 | – | – | 14 | 14 | – | – | ||||||||||||||||||||||||

| Operating service revenues |

4,591 | 4,507 | 84 | 1.9% | 9,126 | 8,950 | 176 | 2.0% | ||||||||||||||||||||||||

| Wireless |

626 | 542 | 84 | 15.5% | 1,252 | 1,105 | 147 | 13.3% | ||||||||||||||||||||||||

| Wireline |

137 | 86 | 51 | 59.3% | 343 | 196 | 147 | 75.0% | ||||||||||||||||||||||||

| External/Operating product revenues |

763 | 628 | 135 | 21.5% | 1,595 | 1,301 | 294 | 22.6% | ||||||||||||||||||||||||

| Total external revenues |

5,347 | 5,128 | 219 | 4.3% | 10,707 | 10,237 | 470 | 4.6% | ||||||||||||||||||||||||

| Total operating revenues |

5,354 | 5,135 | 219 | 4.3% | 10,721 | 10,251 | 470 | 4.6% | ||||||||||||||||||||||||

Bell CTS operating revenues increased by 4.3% in Q2 2023 and by 4.6% in the first half of the year, compared to the same periods last year, driven by growth in both product and service revenues. The increase in service revenues was primarily due to higher wireless revenues and wireline data revenues, moderated by ongoing erosion in wireline voice revenues.

Bell CTS operating service revenues increased by 1.9% in the quarter and by 2.0% in the first six months of the year, compared to the same periods in 2022.

| • | Wireless revenues increased by 4.4% in Q2 2023 and by 4.9% in the first six months of the year, compared to the same periods last year, driven by: |

| • | Continued growth in our mobile phone and connected device subscriber bases |

| • | Flow-through of rate increases |

| • | Higher roaming revenues due to increased international travel |

These factors were partly offset by:

| • | Impact of competitive pricing pressures |

| • | Lower data overages driven by greater customer adoption of monthly plans with higher data thresholds, including unlimited plans |

| • | Wireline data revenues grew by 2.4% in both Q2 2023 and the first six months of the year, compared to the same periods last year, driven by: |

| • | Higher retail Internet and IPTV subscriber bases, coupled with the flow-through of residential rate increases |

| • | The acquisitions of Distributel in December 2022 and FX Innovation in June 2023, and other small acquisitions made during the quarter |

These factors were partly offset by:

| • | Increased acquisition, retention and bundle discounts on residential services |

| • | Continued decline in our satellite TV subscriber base |

Additionally, in the first half of the year, compared to the same period last year, business solutions services revenues were unfavourably impacted by the sale of our wholly-owned subsidiary Createch in March 2022.

| • | Wireline voice revenues declined by 4.5% in Q2 2023 and by 5.2% in the first six months of the year, compared to the same periods last year, driven by: |

| • | Continued retail residential NAS line erosion, combined with business voice declines, driven by technological substitution to wireless and Internet-based services |

| • | Reduced sales of international wholesale long distance minutes |

These factors were partly offset by:

| • | Flow-through of residential rate increases |

| • | The acquisition of Distributel in December 2022 and other small acquisitions made during the quarter |

Bell CTS operating product revenues grew by 21.5% in Q2 2023 and by 22.6% in the first six months of the year, over the same periods last year.

| • | Wireless operating product revenues increased by 15.5% in Q2 2023 and by 13.3% in the first half of the year, compared to the same periods last year, due to greater sales mix of premium mobile phones and more disciplined pricing |

| • | Wireline operating product revenues grew by 59.3% in Q2 2023 and by 75.0% in the first half of the year, compared to the same periods in 2022, from strong sales to large business customers, reflecting alleviating year-over-year impact from global supply chain challenges |

| 19 |

3 MD&A Business segment analysis

Operating costs and adjusted EBITDA

| Q2 2023 | Q2 2022 | $ change | % change | YTD 2023 | YTD 2022 | $ change | % change | |||||||||||||||||||||||||

| Operating costs |

(2,923 | ) | (2,771 | ) | (152 | ) | (5.5% | ) | (5,884 | ) | (5,511 | ) | (373 | ) | (6.8% | ) | ||||||||||||||||

| Adjusted EBITDA |

2,431 | 2,364 | 67 | 2.8% | 4,837 | 4,740 | 97 | 2.0% | ||||||||||||||||||||||||

| Adjusted EBITDA margin |

45.4% | 46.0% | (0.6) pts | 45.1% | 46.2% | (1.1) pts | ||||||||||||||||||||||||||

Bell CTS operating costs increased by 5.5% in Q2 2023 and by 6.8% in the first half of the year, compared to the same periods in 2022, due to:

| • | Higher cost of goods sold associated with the higher revenues |

| • | Greater costs related to the acquisitions of Distributel in December 2022 and FX Innovation in June 2023, and other small acquisitions made during the quarter |

| • | Higher network operating costs including the continued deployment of our mobile 5G network |

These factors were partly offset by:

| • | Pension savings, driven by lower DB expense due to higher year-over-year discount rate |

| • | Reduced labour cost reflecting headcount reductions and vendor contract savings |

Additionally, during the first six months of the year, compared to the same period last year, operating costs were unfavourably impacted by higher year-over-year TV programming and content costs, along with increased labour expenses and inflationary cost pressures, which have subsided year over year in Q2 2023. This was partly offset by lower costs due to the sale of our wholly-owned subsidiary Createch in March 2022.

Bell CTS adjusted EBITDA increased by 2.8% in Q2 2023 and by 2.0% in the first half of the year, compared to the same periods last year, attributable to higher operating revenues, moderated by greater operating costs. Adjusted EBITDA margin of 45.4% in Q2 2023 and 45.1% in the first half of the year, decreased by 0.6 pts and 1.1pts, respectively, over the same periods in 2022, resulting from an increased proportion of low-margin product sales in our total revenue base, along with higher operating costs, partly offset by service revenue flow-through.

Bell CTS operating metrics

Wireless

| Q2 2023 | Q2 2022 | Change | % change | YTD 2023 | YTD 2022 | Change | % change | |||||||||||||||||||||||||

| Mobile phones |

||||||||||||||||||||||||||||||||

| Blended ARPU ($/month) |

59.16 | 59.17 | (0.01 | ) | – | 58.66 | 58.39 | 0.27 | 0.5% | |||||||||||||||||||||||

| Gross subscriber activations |

502,940 | 415,270 | 87,670 | 21.1% | 908,475 | 765,178 | 143,297 | 18.7% | ||||||||||||||||||||||||

| Postpaid |

347,746 | 266,600 | 81,146 | 30.4% | 620,355 | 497,313 | 123,042 | 24.7% | ||||||||||||||||||||||||

| Prepaid |

155,194 | 148,670 | 6,524 | 4.4% | 288,120 | 267,865 | 20,255 | 7.6% | ||||||||||||||||||||||||

| Net subscriber activations (losses) |

125,539 | 110,761 | 14,778 | 13.3% | 152,174 | 142,937 | 9,237 | 6.5% | ||||||||||||||||||||||||

| Postpaid |

111,282 | 83,197 | 28,085 | 33.8% | 154,571 | 117,427 | 37,144 | 31.6% | ||||||||||||||||||||||||

| Prepaid |

14,257 | 27,564 | (13,307 | ) | (48.3% | ) | (2,397 | ) | 25,510 | (27,907 | ) | n.m. | ||||||||||||||||||||

| Blended churn % (average per month) |

1.27% | 1.07% | (0.20) pts | 1.28% | 1.10% | (0.18) pts | ||||||||||||||||||||||||||

| Postpaid |

0.94% | 0.75% | (0.19) pts | 0.92% | 0.77% | (0.15) pts | ||||||||||||||||||||||||||

| Prepaid |

4.68% | 4.41% | (0.27) pts | 4.98% | 4.51% | (0.47) pts | ||||||||||||||||||||||||||

| Subscribers (1) |

10,028,031 | 9,602,122 | 425,909 | 4.4% | 10,028,031 | 9,602,122 | 425,909 | 4.4% | ||||||||||||||||||||||||

| Postpaid (1) |

9,151,229 | 8,747,472 | 403,757 | 4.6% | 9,151,229 | 8,747,472 | 403,757 | 4.6% | ||||||||||||||||||||||||

| Prepaid |

876,802 | 854,650 | 22,152 | 2.6% | 876,802 | 854,650 | 22,152 | 2.6% | ||||||||||||||||||||||||

| Mobile connected devices |

||||||||||||||||||||||||||||||||

| Net subscriber activations |

79,537 | (344 | ) | 79,881 | n.m. | 150,279 | 48,533 | 101,746 | n.m. | |||||||||||||||||||||||

| Subscribers (1) |

2,589,520 | 2,298,327 | 291,193 | 12.7% | 2,589,520 | 2,298,327 | 291,193 | 12.7% | ||||||||||||||||||||||||

n.m.: not meaningful

| (1) | In Q1 2023, we adjusted our mobile phone postpaid and mobile connected device subscriber bases to remove older non-revenue generating business subscribers of 73,229 and 12,577, respectively. |

Mobile phone blended ARPU of $59.16 in Q2 2023 was essentially stable year over year, decreasing by $0.01, compared to the same period last year, driven by:

| • | Impact of competitive pricing pressures |

| • | Lower data overages due to greater customer adoption of monthly plans with higher data thresholds, including unlimited plans |

These factors were partly offset by:

| • | Flow-through of rate increases |

| • | Higher roaming revenues due to increased international travel |

In the first half of the year, mobile phone blended ARPU of $58.66 increased by 0.5%, compared to the same period last year, as the rate increases and higher roaming revenues more than offset the competitive pricing pressures and lower data overages.

| 20 | BCE INC. 2023 SECOND QUARTER SHAREHOLDER REPORT |

3 MD&A Business segment analysis

Mobile phone gross subscriber activations grew by 21.1% in Q2 2023 and by 18.7% in the first half of the year, compared to the same periods last year, due to both higher postpaid and prepaid gross subscriber activations.

| • | Mobile phone postpaid gross subscriber activations increased by 30.4% in the second quarter and by 24.7%, in the first half of the year, compared to the same periods last year, driven by market growth primarily due to increased immigration, as well as reflecting continued 5G momentum and successful bundled service offerings |

| • | Mobile phone prepaid gross subscriber activations increased by 4.4% in Q2 2023 and by 7.6% in the first half of the year, compared to the same periods last year, due to increased market activity driven by higher immigration and travel to Canada |

Mobile phone net subscriber activations increased by 13.3% in Q2 2023 and by 6.5% in the first half of the year, compared to the same periods last year, due to higher postpaid net subscriber activations, partly offset by lower prepaid net subscriber activations.

| • | Mobile phone postpaid net subscriber activations increased by 33.8% in the second quarter and by 31.6% for the first half of the year, compared to the same periods last year, driven by higher gross activations and greater migrations from prepaid, partly offset by higher subscriber deactivations |

| • | Mobile phone prepaid net subscriber activations declined by 13,307 in Q2 2023 and by 27,907 in the first six months of the year, compared to the same periods last year, due to higher subscriber deactivations and greater migrations to postpaid, partly offset by higher gross activations |

Mobile phone blended churn of 1.27% in Q2 2023 and 1.28% year to date, increased by 0.20 pts and 0.18 pts, respectively, compared to the same periods last year.

| • | Mobile phone postpaid churn of 0.94% in the quarter and 0.92% in the first half of the year, increased by 0.19 pts and 0.15 pts, respectively, compared to the same periods last year, driven by greater promotional pricing offers in the market and higher market activity |

| • | Mobile phone prepaid churn of 4.68% in the quarter and 4.98% in the first half of the year, increased by 0.27 pts and 0.47 pts, respectively, compared to the same periods last year, due to greater market activity and more attractive promotional offers in the market on postpaid discount brands |

Mobile phone subscribers at June 30, 2023 totaled 10,028,031, an increase of 4.4%, from 9,602,122 subscribers reported at the end of Q2 2022. This consisted of 9,151,229 postpaid subscribers, an increase of 4.6% from 8,747,472 subscribers at the end of Q2 2022, and 876,802 prepaid subscribers, an increase of 2.6% from 854,650 subscribers at the end of Q2 2022.

Mobile connected device net subscriber activations increased by 79,881 in Q2 2023 and by 101,746 in the first six months of the year, compared to the same periods last year, due to higher business Internet of Things (IoT) net activations, higher connected car subscriptions and lower net losses from data devices, primarily fewer tablet deactivations.

Mobile connected device subscribers at June 30, 2023 totaled 2,589,520, an increase of 12.7% from 2,298,327 subscribers reported at the end of Q2 2022.

Wireline data

Retail high-speed Internet

| Q2 2023 | Q2 2022 | Change | % change | YTD 2023 | YTD 2022 | Change | % change | |||||||||||||||||||||||||

| Retail net subscriber activations |

24,934 | 22,620 | 2,314 | 10.2% | 52,208 | 48,644 | 3,564 | 7.3% | ||||||||||||||||||||||||

| Retail subscribers (1) (2) (3) |

4,338,511 | 3,977,387 | 361,124 | 9.1% | 4,338,511 | 3,977,387 | 361,124 | 9.1% | ||||||||||||||||||||||||

| (1) | In Q2 2023, our retail high-speed Internet subscriber base increased by 35,080 as a result of small acquisitions. |

| (2) | In Q1 2023, subsequent to a review of customer account records, our retail high-speed Internet subscriber base was reduced by 7,347 subscribers. |

| (3) | In Q4 2022, as a result of the acquisition of Distributel, our retail high-speed Internet subscriber base increased by 128,065. |

Retail high-speed Internet net subscriber activations increased by 10.2% in Q2 2023 and by 7.3% in the first half of the year, compared to the same periods in 2022, due to higher gross activations from the continued growth in our fibre-to-the-premise (FTTP) footprint, the contribution from Distributel and other small acquisitions made during the quarter, as well as successful bundled services offerings. This was partly offset by higher year-over-year competitive intensity, along with lower net activations in our non-FTTP service footprint.