UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File Number 000-29716

CGI INC.

(Translation of registrant’s name into English)

1350 René-Lévesque Boulevard West

25th Floor

Montreal, Quebec

Canada H3G 1T4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

☐ Form 20-F ☒ Form 40-F Exhibits 99.1 and 99.2 to this Form 6-K shall be deemed incorporated by reference in the Registrant’s Registration Statements on Form S-8, Reg.

INCORPORATION BY REFERENCE

Nos. 333-197742, 333-220741, 333-261831 and 333-261832.

EXHIBIT INDEX

| Exhibit Number | Description | |

| 99.1 | ||

| 99.2 | ||

| 99.3 | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CGI INC. | ||||||

| (Registrant) | ||||||

| Date: July 26, 2023 | By: | /s/ Benoit Dubé |

||||

| Name: | Benoit Dubé | |||||

| Title: | Executive Vice-President, | |||||

| Legal and Economic Affairs, and | ||||||

| Corporate Secretary | ||||||

Exhibit 99.1

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

July 26, 2023

BASIS OF PRESENTATION

This Management’s Discussion and Analysis of the Financial Position and Results of Operations (MD&A) is a responsibility of management and has been reviewed and approved by the Board of Directors. This MD&A has been prepared in accordance with the rules and regulations of the Canadian Securities Administrators. The Board of Directors is ultimately responsible for reviewing and approving the MD&A. The Board of Directors carries out this responsibility mainly through its Audit and Risk Management Committee, which is appointed by the Board of Directors and is comprised entirely of independent and financially literate directors.

Throughout this document, CGI Inc. is referred to as “CGI”, “we”, “us”, “our” or “Company”. This MD&A provides information management believes is relevant to an assessment and understanding of the consolidated results of operations and financial condition of the Company. This document should be read in conjunction with the interim condensed consolidated financial statements and the notes thereto for the three and nine months ended June 30, 2023 and 2022. CGI’s accounting policies are in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). All dollar amounts are in Canadian dollars unless otherwise noted.

MATERIALITY OF DISCLOSURES

This MD&A includes information we believe is material to investors. We consider something to be material if it results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares, or if it is likely that a reasonable investor would consider the information to be important in making an investment decision.

FORWARD-LOOKING STATEMENTS

This MD&A contains “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbours. All such forward-looking information and statements are made and disclosed in reliance upon the safe harbour provisions of applicable Canadian and United States securities laws. Forward-looking information and statements include all information and statements regarding CGI’s intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “believe”, “estimate”, “expect”, “intend”, “anticipate”, “foresee”, “plan”, “predict”, “project”, “aim”, “seek”, “strive”, “potential”, “continue”, “target”, “may”, “might”, “could”, “should”, and similar expressions and variations thereof. These information and statements are based on our perception of historic trends, current conditions and expected future developments, as well as other assumptions, both general and specific, that we believe are appropriate in the circumstances. Such information and statements are, however, by their very nature, subject to inherent risks and uncertainties, of which many are beyond the control of the Company, and which give rise to the possibility that actual results could differ materially from our expectations expressed in, or implied by, such forward-looking information or forward-looking statements. These risks and uncertainties include but are not restricted to: risks related to the market such as the level of business activity of our clients, which is affected by economic and political conditions, additional external risks (such as pandemics, armed conflict, climate-related issues and inflation) and our ability to negotiate new contracts; risks related to our industry such as competition and our ability to develop and expand our services, to penetrate new markets, and to protect our intellectual property rights; risks related to our business such as risks associated with our growth strategy, including the integration of new operations, financial and operational risks inherent in worldwide operations, foreign exchange risks, income tax laws and other tax programs, the termination, modification, delay or suspension of our contractual agreements, our expectations regarding future revenue resulting from bookings and backlog, our ability to attract and retain qualified employees, to negotiate favourable contractual terms, to deliver our services and to collect receivables, to disclose, manage and implement environmental, social and governance (ESG) initiatives and standards, and to achieve ESG commitments and targets, including without limitation, our commitment to net-zero carbon emissions by 2030, as well as the reputational and financial risks attendant to cybersecurity breaches and other incidents, and financial risks such as liquidity needs and requirements, maintenance of financial ratios,

| © 2023 CGI Inc. | Page 1 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

interest rate fluctuations and the discontinuation of major interest rate benchmarks and changes in creditworthiness and credit ratings; as well as other risks identified or incorporated by reference in this MD&A and in other documents that we make public, including our filings with the Canadian Securities Administrators (on SEDAR+ at www.sedarplus.ca) and the U.S. Securities and Exchange Commission (on EDGAR at www.sec.gov). Unless otherwise stated, the forward-looking information and statements contained in this MD&A are made as of the date hereof and CGI disclaims any intention or obligation to publicly update or revise any forward-looking information or forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. While we believe that our assumptions on which these forward-looking information and forward-looking statements are based were reasonable as at the date of this MD&A, readers are cautioned not to place undue reliance on these forward-looking information or statements. Furthermore, readers are reminded that forward-looking information and statements are presented for the sole purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes. Further information on the risks that could cause our actual results to differ significantly from our current expectations may be found in section 8 - Risk Environment, which is incorporated by reference in this cautionary statement. We also caution readers that the risks described in the previously mentioned section and in other sections of this MD&A are not the only ones that could affect us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial could also have a material adverse effect on our financial position, financial performance, cash flows, business or reputation.

| © 2023 CGI Inc. | Page 2 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

KEY PERFORMANCE MEASURES

The reader should note that the Company reports its financial results in accordance with IFRS. However, we use a combination of GAAP, non-GAAP and supplementary financial measures and ratios to assess the Company’s performance. The non-GAAP measures used in this MD&A do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should be considered as supplemental in nature and not as a substitute for the related financial information prepared in accordance with IFRS.

The table below summarizes our most relevant key performance measures :

| Growth | Revenue prior to foreign currency impact (non-GAAP) – is a measure of revenue before foreign currency translation impacts. This is calculated by translating current period results in local currency using the conversion rates in the equivalent period from the prior year. Given that we have a strong presence globally and are affected by most major international currencies, management believes that it is helpful to adjust revenue to exclude the impact of currency fluctuations to facilitate period-to-period comparisons of business performance and that this measure is useful for investors for the same reason. A reconciliation of the revenue prior to foreign currency impact to its closest IFRS measure can be found in section 3.4. of the present document.

Constant currency revenue growth (non-GAAP) – is a measure of revenue growth before foreign currency translation impacts. This is calculated by translating current period results in local currency using the conversion rates in the equivalent period from the prior year. Management believes its use of this measure is helpful for investors to facilitate period-to-period comparisons of our business growth.

Bookings – are new binding contractual agreements including wins, extensions and renewals. In addition, our bookings are comprised of committed spend and estimates from management that are subject to change, including demand-driven usage, such as volume based and time and material contracts, as well as price indexation and options years and services. Management evaluates factors such as prices and past history to support its estimates. Management believes that it is a key indicator of the volume of our business over time and potential future revenue and that it is useful trend information to investors for the same reason. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our revenue. Additional information on bookings can be found in section 3.1. of the present document.

Backlog – includes bookings, backlog acquired through business acquisitions, backlog consumed during the period as a result of client work performed as well as the impact of foreign currencies to our existing contracts. Backlog incorporates estimates from management that are subject to change and are mainly driven from bookings. Backlog is reduced in the case of contract cancellation. Management tracks this measure as it is a key indicator of our best estimate of contracted revenue to be realized in the future and believes that this measure is useful trend information to investors for the same reason.

Book-to-bill ratio – is a measure of the proportion of the value of our bookings to our revenue in the quarter. This metric allows management to monitor the Company’s business development efforts during the quarter to ensure we grow our backlog and our business over time and management believes that this measure is useful for investors for the same reason.

Book-to-bill ratio trailing twelve months – is a measure of the proportion of the value of our bookings to our revenue over the last trailing twelve-month period as management believes that monitoring the Company’s bookings over a longer period is a more representative measure as the services and contract type, size and timing of bookings could cause this measurement to fluctuate significantly if taken for only a three-month period and as such is useful for investors for the same reason. Management’s objective is to maintain a target ratio greater than 100% over a trailing twelve-month period.

|

| © 2023 CGI Inc. | Page 3 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| Profitability | Specific items – include acquisition-related and integration costs. Acquisition-related costs mainly include third-party professional fees incurred to close acquisitions. Integration costs are mainly comprised of expenses due to redundancy of employment and contractual agreements, cancellation of acquired leased premises and costs related to the integration towards the CGI operating model such as training activities.

Earnings before income taxes – is a measure of earnings generated for shareholders before income taxes.

Earnings before income taxes margin – is obtained by dividing our earnings before income taxes by our revenues. Management believes a percentage of revenue measure is meaningful for better comparability from period-to-period.

Adjusted EBIT (non-GAAP) – is a measure of earnings excluding specific items, net finance costs and income tax expense. Management believes its use of this measure which excludes items that are non-related to day-to-day operations, such as the impact of the capital structure, income taxes and specific items, is helpful to investors to better evaluate the Company’s core operating performance. This measure also allows for better comparability from period-to-period and trend analysis. A reconciliation of the adjusted EBIT to its closest IFRS measure can be found in section 3.7. of the present document.

Adjusted EBIT margin (non-GAAP) – is obtained by dividing our adjusted EBIT by our revenues. Management believes its use of this measure which evaluates our core operating performance before capital structure, income taxes and specific items when compared to the growth of our revenues is relevant to investors for better comparability from period-to-period. This measure demonstrates the Company’s ability to grow in a cost-effective manner, executing on our Build and Buy strategy. A reconciliation of the adjusted EBIT to its closest IFRS measure can be found in section 3.7. of the present document.

Net earnings – is a measure of earnings generated for shareholders.

Net earnings margin – is obtained by dividing our net earnings by our revenues. Management believes a percentage of revenue measure is meaningful for better comparability from period-to-period.

Diluted earnings per share (diluted EPS) – is a measure of net earnings generated for shareholders on a per share basis, assuming all dilutive elements are exercised. Please refer to note 5 of our interim condensed consolidated financial statements for additional information on earnings per share.

Net earnings excluding specific items (non-GAAP) – is a measure of net earnings excluding acquisition-related and integration costs. Management believes its use of this measure best demonstrates to investors the net earnings generated from our day-to-day operations by excluding specific items, for better comparability from period-to-period. A reconciliation of the net earnings excluding specific items to its closest IFRS measure can be found in section 3.8.3. of the present document.

Net earnings margin excluding specific items (non-GAAP) – is obtained by dividing our net earnings excluding specific items by our revenues. Management believes its use of this measure which evaluates our core operating performance when compared to the growth of our revenues is relevant to investors to assess their returns and for better comparability from period-to-period. This measure demonstrates the Company’s ability to grow in a cost-effective manner, executing on our Build and Buy strategy. A reconciliation of the net earnings excluding specific items to its closest IFRS measure can be found in section 3.8.3. of the present document.

|

| © 2023 CGI Inc. | Page 4 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| Diluted earnings per share excluding specific items (non-GAAP) – is defined as the net earnings excluding specific items on a per share basis. Management believes its use of this measure is useful for investors as excluding specific items best reflects the Company’s ongoing operating performance on a per share basis and allows for better comparability from period-to-period. The diluted earnings per share reported in accordance with IFRS can be found in section 3.8. of the present document while the basic and diluted earnings per share excluding specific items can be found in section 3.8.3. of the present document.

Effective tax rate excluding specific items (non-GAAP) – is obtained by dividing our income tax expense by earnings before income taxes, before specific items. Management uses this measure to analyze the impact of changes in income tax rate and profitability mix from day-to-day operations on its effective tax rate and is useful for investors for the same reason. A reconciliation of the effective tax rate excluding specific items to its closest IFRS measure can be found in section 3.8.3. of the present document.

|

||

| Liquidity | Cash provided by operating activities – is a measure of cash generated from managing our day-to-day business operations. Management believes strong operating cash flow is indicative of financial flexibility, allowing us to execute the Company’s strategy.

Cash provided by operating activities as a percentage of revenue – is obtained by dividing our cash provided by operating activities by our revenues. Management believes strong operating cash flow compared to our revenues is a key indicator of our financial flexibility to execute the Company’s growth strategy.

Days sales outstanding (DSO) – is the average number of days needed to convert our trade receivables and work in progress into cash. DSO is obtained by subtracting deferred revenue from trade accounts receivable and work in progress; the result is divided by our most recent quarter’s revenue over 90 days. Management tracks this metric closely to ensure timely collection and healthy liquidity. Management believes that this measure is useful for investors as it demonstrates the Company’s ability to timely convert its trade receivables and work in progress into cash.

|

|

| Capital Structure | Net debt (non-GAAP) – is obtained by subtracting from our debt and lease liabilities, our cash and cash equivalents, short-term investments, long-term investments and adjusting for fair value of foreign currency derivative financial instruments related to debt. Management believes its use of the net debt metric to monitor the Company’s financial leverage is useful for investors as it provides insight into its financial strength. A reconciliation of net debt to its closest IFRS measure can be found in section 4.5. of the present document.

Net debt to capitalization ratio (non-GAAP) – is a measure of our level of financial leverage and is obtained by dividing the net debt by the sum of shareholders’ equity and net debt. Management believes its use of the net debt to capitalization ratio is useful for investors as it monitors the proportion of debt versus capital used to finance the Company’s operations.

Return on invested capital (ROIC) (non-GAAP) – is a measure of the Company’s efficiency at allocating the capital under its control to profitable investments and is calculated as the proportion of the net earnings excluding net finance costs after-tax for the last twelve months, over the last four quarters’ average invested capital, which is defined as the sum of shareholders’ equity and net debt. Management believes its use of this ratio is useful for investors as it assesses how well it is using its capital to generate returns.

|

| © 2023 CGI Inc. | Page 5 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

REPORTING SEGMENTS

The Company is managed through the following nine operating segments: Western and Southern Europe (primarily France, Spain and Portugal); United States (U.S.) Commercial and State Government; Canada; U.S. Federal; Scandinavia and Central Europe (Germany, Sweden and Norway); United Kingdom (U.K.) and Australia; Finland, Poland and Baltics; Northwest and Central-East Europe (primarily Netherlands, Denmark and Czech Republic); and Asia Pacific Global Delivery Centers of Excellence (mainly India and Philippines) (Asia Pacific).

Please refer to sections 3.4. and 3.6. of the present document and to note 9 of our interim condensed consolidated financial statements for additional information on our segments. For the nine months ended June 30, 2023, the Company has restated the segmented information to conform to the new segmented information structure effective on April 1, 2022.

| © 2023 CGI Inc. | Page 6 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

MD&A OBJECTIVES AND CONTENTS

In this document, we:

| • | Provide a narrative explanation of the interim condensed consolidated financial statements through the eyes of management; |

| • | Provide the context within which the interim condensed consolidated financial statements should be analyzed, by giving enhanced disclosure about the dynamics and trends of the Company’s business; and |

| • | Provide information to assist the reader in ascertaining the likelihood that past performance may be indicative of future performance. |

In order to achieve these objectives, this MD&A is presented in the following main sections:

|

Section

|

Contents

|

Pages

|

||||

|

1. Corporate |

1.1. | About CGI | 9 | |||

|

Overview |

1.2. | Vision and Strategy | 10 | |||

| 1.3. | Competitive Environment | 10 | ||||

|

2. Highlights and

Key Performance

Measures |

2.1. | Selected Quarterly Information and Key Performance Measures | 11 | |||

| 2.2. | Stock Performance | 12 | ||||

| 3. Financial Review |

3.1. | Bookings and Book-to-Bill Ratio | 14 | |||

| 3.2. | Foreign Exchange | 15 | ||||

| 3.3. | Revenue Distribution | 16 | ||||

| 3.4. | Revenue by Segment | 17 | ||||

| 3.5. | Operating Expenses | 22 | ||||

| 3.6. | Adjusted EBIT by Segment | 24 | ||||

| 3.7. | Earnings Before Income Taxes | 27 | ||||

| 3.8. | Net Earnings and Earnings Per Share | 28 | ||||

|

4. Liquidity |

4.1. | Interim Condensed Consolidated Statements of Cash Flows | 30 | |||

| 4.2. | Capital Resources | 33 | ||||

| 4.3. | Contractual Obligations | 33 | ||||

| 4.4. | Financial Instruments and Hedging Transactions | 33 | ||||

| 4.5. | Selected Measures of Capital Resources and Liquidity | 34 | ||||

| 4.6. | Guarantees | 35 | ||||

| 4.7. | Capability to Deliver Results | 35 | ||||

|

5. Changes in

Accounting

Policies |

A summary of accounting standards adopted and future accounting changes. | 36 | ||||

|

6. Critical

Accounting

Estimates |

A discussion of the critical accounting estimates made in the preparation of the interim condensed consolidated financial statements. | 38 | ||||

| © 2023 CGI Inc. | Page 7 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

|

Section

|

Contents

|

Pages

|

||||

|

7. Integrity of

Disclosure |

A discussion of the existence of appropriate information systems, procedures and controls to ensure that information used internally and disclosed externally is complete and

reliable.

|

41

|

||||

|

8. Risk Environment |

8.1. | Risks and Uncertainties | 42 | |||

| 8.2. | Legal Proceedings | 56 | ||||

| © 2023 CGI Inc. | Page 8 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| 1. | Corporate Overview |

Founded in 1976 and headquartered in Montréal, Canada, CGI is a leading IT and business consulting services firm with approximately 91,500 consultants and professionals worldwide, whom are called members as they are also owners through our Share Purchase Plan. We use the power of technology to help clients accelerate their holistic digital transformation.

CGI has a people-centered culture, operating where our clients live and work to build trusted relationships and to advance our shared communities. Our consultants are committed to providing actionable insights that help clients achieve business outcomes. They leverage global delivery centers that deliver scale, innovation and delivery excellence for every engagement.

End-to-end services and solutions

CGI delivers end-to-end services that help clients achieve the digital transformation of their value chains. Together, our end-to-end services and solutions help clients design, implement, run and operate the technology critical to achieving their business strategies. Our portfolio encompasses:

| i. | Business and strategic IT consulting and systems integration services: CGI helps clients create a path for future growth and sustainable value through business and strategic IT consulting services such as business strategy, business and operating model design, human-centered experience, customer value and operational excellence, organizational change management, sustainability and digital transformation. In the area of systems integration, we help clients accelerate the enterprise modernization of their legacy systems and adopt new technologies to drive innovation and deliver real-time and insight-driven customer and citizen services. |

| ii. | Managed IT and business process services: Working as an extension of our clients’ organizations, we take on full or partial responsibility for managing their IT functions, freeing them up to focus on their strategic business direction. Our services enable clients to reinvest, alongside CGI, in the successful execution of their digital transformation roadmaps. We help them increase agility, scalability and resilience; deliver operational efficiencies, innovations and reduced costs; and embed security and data privacy controls. Typical services include: application development, modernization and maintenance; holistic enterprise digitization, automation, hybrid and cloud management; and business process services. |

| iii. | Intellectual property (IP): CGI’s portfolio of IP solutions are highly configurable “business platforms as a service” that are embedded within our end-to-end service offerings and utilize integrated security, data privacy practices and provider-neutral cloud approaches. We invest in, and deliver, market-leading IP to drive business outcomes within each of our target industries. We also collaborate with clients to build and evolve IP-based solutions while enabling a higher degree of flexibility and customization for their unique modernization and digitization needs. |

Deep industry and technology expertise

CGI has long-standing and focused practices in all of its core industries, providing clients with a partner that is not only an expert in IT, but also an expert in their respective industries. This combination of business knowledge and digital technology expertise allows us to help our clients navigate complex challenges and focus on value creation. In the process, we evolve the services and solutions we deliver within our targeted industries and provide thought leadership, blueprints, frameworks and technical accelerators that help client evolve their ecosystems.

Our targeted industries include financial services (including banking and insurance), government (including space), manufacturing, retail and distribution (including consumer services, transportation and logistics), communications and utilities (including energy and media), and health (including life sciences). To help orchestrate our global posture across these industries, our leaders regularly participate in cabinet meetings and councils to advance the strategies, services and solutions we deliver to our clients.

| © 2023 CGI Inc. | Page 9 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

Helping clients leverage technology to its fullest

Macro trends such as supply chain reconfiguration, climate change and energy transition, and demographic shifts including aging populations and talent shortages require new business models and ways of working. At the same time, technology is reshaping our future and creating new opportunities.

Accelerating digitization provides the inclusive, economically vibrant, and sustainable future our clients’ customers and citizens demand. Leveraging technology to its fullest helps clients to lead within their industries. Our end-to-end digital services, industry and technology expertise, and operational excellence combine to help clients advance their holistic digital transformation.

Through our proprietary Voice of Our Clients research, we analyzed the characteristics of leading digital organizations and found three common attributes:

| • | They have highly agile business models and are better at operating as aligned teams between business and IT. |

| • | They have been faster in modernizing the entire IT environment - including through automation - while assuring security and data privacy. |

| • | They are addressing business transformation holistically, including culture change, ecosystem touchpoints, and the integration of sustainability objectives. |

Digital leaders across industries seek new ways to evolve their strategy and operational models and use technology and information to improve how they operate, deliver products and services, and create value.

CGI helps clients adopt leading digital attributes and design, manage, protect and evolve their digital value chains to accelerate business outcomes.

Quality processes

Our clients expect consistent service wherever and whenever they engage us. We have an outstanding track record of on-time, within-budget delivery as a result of our commitment to excellence and our robust governance model - CGI’s Management Foundation.

Our Management Foundation provides a common business language, frameworks and practices for managing operations consistently across the globe, driving continuous improvement. We also invest in rigorous quality and service delivery standards including the International Organization for Standardization (ISO) and Capability Maturity Model Integration (CMMI) certification programs, as well as a comprehensive Client Satisfaction Assessment Program, with signed client assessments, to ensure high satisfaction on an ongoing basis.

Our strategy has always been based on long-term fundamentals. For further details, please refer to section 1.2. of CGI’s MD&A for the years ended September 30, 2022 and 2021, which is available on CGI’s website at www.cgi.com and which was filed with Canadian securities regulators on SEDAR+ at www.sedarplus.ca and the U.S. Securities and Exchange Commission on EDGAR at www.sec.gov.

There have been no significant changes to our competitive environment since the end of Fiscal 2022. For further details, please refer to section 1.3. of CGI’s MD&A for the years ended September 30, 2022 and 2021 which is available on CGI’s website at www.cgi.com and which was filed with Canadian securities regulators on SEDAR+ at www.sedarplus.ca and the U.S. Securities and Exchange Commission on EDGAR at www.sec.gov.

| © 2023 CGI Inc. | Page 10 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| 2. | Highlights and Key Performance Measures |

2.1. SELECTED QUARTERLY INFORMATION & KEY PERFORMANCE MEASURES

| As at and for the three months ended | Jun. 30, 2023 |

Mar. 31, 2023 |

Dec. 31, 2022 |

Sep. 30, 2022 |

Jun. 30, 2022 |

Mar. 31, 2022 |

Dec. 31, 2021 |

Sep. 30, 2021 |

||||||||||||||||||||||||

| In millions of CAD unless otherwise noted |

||||||||||||||||||||||||||||||||

| Growth |

||||||||||||||||||||||||||||||||

|

Revenue |

3,623.4 | 3,715.3 | 3,450.3 | 3,247.2 | 3,258.6 | 3,268.9 | 3,092.4 | 3,007.5 | ||||||||||||||||||||||||

|

Year-over-year revenue growth |

11.2% | 13.7% | 11.6% | 8.0% | 7.9% | 6.2% | 2.4% | 2.8% | ||||||||||||||||||||||||

|

Constant currency revenue growth |

6.3% | 11.4% | 12.3% | 13.9% | 11.5% | 10.0% | 6.8% | 6.4% | ||||||||||||||||||||||||

|

Backlog1 |

25,633 | 25,241 | 25,011 | 24,055 | 23,238 | 23,144 | 23,577 | 23,059 | ||||||||||||||||||||||||

|

Bookings |

4,388 | 3,839 | 4,035 | 3,636 | 3,410 | 3,316 | 3,604 | 2,921 | ||||||||||||||||||||||||

| Book-to-bill ratio |

121.1% | 103.3% | 117.0% | 112.0% | 104.7% | 101.4% | 116.5% | 97.1% | ||||||||||||||||||||||||

| Book-to-bill ratio trailing twelve months |

113.3% | 109.1% | 108.9% | 108.5% | 104.9% | 108.7% | 115.2% | 114.2% | ||||||||||||||||||||||||

| Profitability |

||||||||||||||||||||||||||||||||

|

Earnings before income taxes |

559.0 | 564.5 | 516.5 | 485.9 | 489.0 | 498.8 | 493.3 | 464.4 | ||||||||||||||||||||||||

|

Earnings before income taxes margin |

15.4% | 15.2% | 15.0% | 15.0% | 15.0% | 15.3% | 16.0% | 15.4% | ||||||||||||||||||||||||

|

Adjusted EBIT2 |

584.8 | 600.8 | 554.1 | 521.7 | 519.9 | 523.6 | 521.5 | 493.3 | ||||||||||||||||||||||||

|

Adjusted EBIT margin |

16.1% | 16.2% | 16.1% | 16.1% | 16.0% | 16.0% | 16.9% | 16.4% | ||||||||||||||||||||||||

|

Net earnings |

415.0 | 419.4 | 382.4 | 362.4 | 364.3 | 372.0 | 367.4 | 345.9 | ||||||||||||||||||||||||

|

Net earnings margin |

11.5% | 11.3% | 11.1% | 11.2% | 11.2% | 11.4% | 11.9% | 11.5% | ||||||||||||||||||||||||

|

Diluted EPS (in dollars) |

1.75 | 1.76 | 1.60 | 1.51 | 1.51 | 1.53 | 1.49 | 1.39 | ||||||||||||||||||||||||

|

Net earnings excluding specific items2 |

425.7 | 435.0 | 398.2 | 373.1 | 371.2 | 374.1 | 369.4 | 346.9 | ||||||||||||||||||||||||

|

Net earnings margin excluding specific items |

11.7% | 11.7% | 11.5% | 11.5% | 11.4% | 11.4% | 11.9% | 11.5% | ||||||||||||||||||||||||

|

Diluted EPS excluding specific items (in dollars)2 |

1.80 | 1.82 | 1.66 | 1.56 | 1.54 | 1.53 | 1.50 | 1.40 | ||||||||||||||||||||||||

| Liquidity |

||||||||||||||||||||||||||||||||

|

Cash provided by operating activities |

409.1 | 469.1 | 605.3 | 488.9 | 419.2 | 472.6 | 484.3 | 526.9 | ||||||||||||||||||||||||

|

As a percentage of revenue |

11.3% | 12.6% | 17.5% | 15.1% | 12.9% | 14.5% | 15.7% | 17.5% | ||||||||||||||||||||||||

|

Days sales outstanding |

44 | 41 | 44 | 49 | 48 | 42 | 45 | 45 | ||||||||||||||||||||||||

| Capital structure |

||||||||||||||||||||||||||||||||

|

Long-term debt and lease liabilities3 |

3,765.9 | 3,852.7 | 3,876.4 | 3,976.2 | 3,840.1 | 3,733.5 | 3,823.1 | 4,178.6 | ||||||||||||||||||||||||

|

Net debt2 |

2,279.6 | 2,529.0 | 2,503.8 | 2,946.9 | 3,073.0 | 2,729.7 | 2,687.9 | 2,535.9 | ||||||||||||||||||||||||

|

Net debt to capitalization ratio |

21.7% | 24.0% | 24.1% | 28.8% | 30.6% | 28.7% | 27.8% | 26.6% | ||||||||||||||||||||||||

|

Return on invested capital |

15.7% | 15.6% | 15.5% | 15.7% | 15.8% | 15.7% | 15.3% | 14.9% | ||||||||||||||||||||||||

| Balance sheet |

||||||||||||||||||||||||||||||||

|

Cash and cash equivalents, and short-term investments |

1,471.9 | 1,285.5 | 1,331.1 | 972.6 | 784.1 | 1,059.4 | 1,185.7 | 1,700.2 | ||||||||||||||||||||||||

|

Total assets |

16,080.1 | 16,101.7 | 15,915.9 | 15,175.4 | 14,916.4 | 14,475.7 | 14,704.9 | 15,021.0 | ||||||||||||||||||||||||

|

Long-term financial liabilities4 |

2,885.2 | 2,946.1 | 2,971.6 | 3,731.3 | 3,581.8 | 3,523.5 | 3,608.2 | 3,659.8 | ||||||||||||||||||||||||

| 1 | Approximately $9.9 billion of our backlog as at June 30, 2023 is expected to be converted into revenue within the next twelve months, $8.7 billion within one to three years, $2.8 billion within three to five years and $4.2 billion in more than five years. |

| 2 | Please refer to sections 3.7., 3.8.3. and 4.5. of each quarter’s respective MD&A for the reconciliation of non-GAAP financial measures for the quarterly periods of 2022 and 2021. For Fiscal years ending 2021 and 2022, please refer to sections 5.6. and 5.6.1. |

| 3 | Long-term debt and lease liabilities include both the current and long-term portions of the long-term debt and lease liabilities. |

| 4 | Long-term financial liabilities include the long-term portion of the debt, long-term portion of lease liabilities and the long-term derivative financial instruments. |

| © 2023 CGI Inc. | Page 11 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

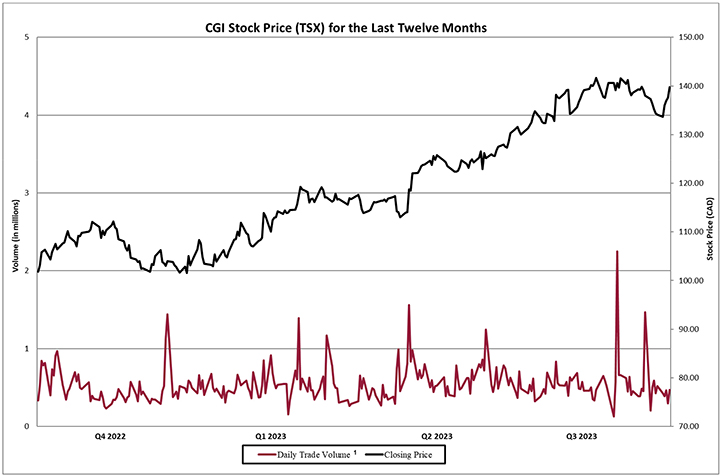

2.2.1. Q3 2023 Trading Summary

CGI’s shares are listed on the Toronto Stock Exchange (TSX) (stock quote – GIB.A) and the New York Stock Exchange (NYSE) (stock quote – GIB) and are included in key indices such as the S&P/TSX 60 Index.

| TSX |

(CAD) | NYSE | (USD) | |||||||||

| Open: |

129.48 | Open: | 96.00 | |||||||||

| High: |

142.31 | High: | 106.32 | |||||||||

| Low: |

128.78 | Low: | 95.11 | |||||||||

| Close: |

139.70 | Close: | 105.43 | |||||||||

| CDN average daily trading volumes1: |

534,117 | NYSE average daily trading volumes: | 143,754 | |||||||||

| 1 | Includes the average daily volumes of both the TSX and alternative trading systems. |

| © 2023 CGI Inc. | Page 12 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

2.2.2. Normal Course Issuer Bid (NCIB)

On January 31, 2023, the Company’s Board of Directors authorized and subsequently received regulatory approval from the TSX for the renewal of CGI’s NCIB which allows for the purchase for cancellation of up to 18,769,394 Class A subordinate voting shares (Class A Shares) representing 10% of the Company’s public float as of the close of business on January 24, 2023. Class A Shares may be purchased for cancellation under the NCIB commencing on February 6, 2023 until no later than February 5, 2024, or on such earlier date when the Company has either acquired the maximum number of Class A Shares allowable under the NCIB or elects to terminate the bid.

During the three months ended June 30, 2023, the Company purchased for cancellation 390,100 Class A Shares for a total consideration of $53.1 million, at a weighted average price of $136.02.

During the nine months ended June 30, 2023, the Company purchased for cancellation 3,735,096 Class A Shares under its current NCIB for a total consideration of $453.1 million, at a weighted average price of $121.30. The purchased shares included 3,344,996 Class A Shares purchased for cancellation from Caisse de dépôt et de placement du Québec, for a total consideration of $400.0 million. The purchase was made pursuant to an exemption order issued by the Autorité des marchés financiers and is considered within the annual aggregate limit that the Company is entitled to purchase under its current NCIB. In addition, during the nine months ended June 30, 2023, the Company paid for and cancelled 100,100 Class A Shares under the previous NCIB for a total consideration of $10.3 million, at a weighted average price of $102.81, which were purchased, or committed to be purchased, but not cancelled as at September 30, 2022.

As at June 30, 2023, the Company could purchase up to 15,034,298 Class A Shares for cancellation under the current NCIB.

2.2.3. Capital Stock and Options Outstanding

The following table provides a summary of the Capital Stock and Options Outstanding as at July 21, 2023:

| Capital Stock and Options Outstanding | As at July 21, 2023 | |||

|

Class A subordinate voting shares |

208,926,569 | |||

|

Class B multiple voting shares |

26,445,706 | |||

|

Options to purchase Class A subordinate voting shares |

5,405,159 | |||

| © 2023 CGI Inc. | Page 13 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| 3. | Financial Review |

3.1. BOOKINGS AND BOOK-TO-BILL RATIO

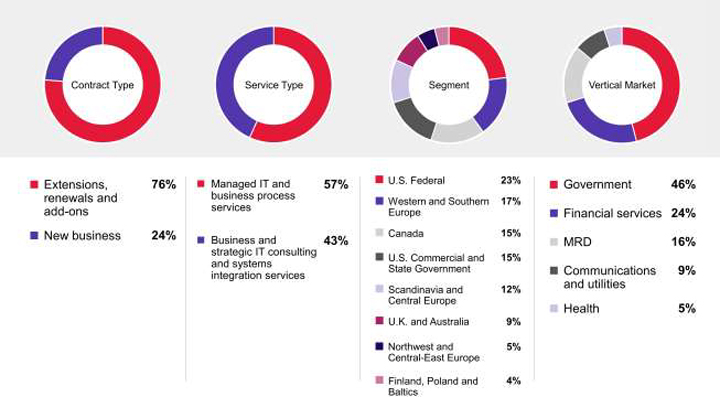

Bookings for the quarter were $4.4 billion representing a book-to-bill ratio of 121.1%. The breakdown of the new bookings signed during the quarter is as follows:

Information regarding our bookings is a key indicator of the volume of our business over time. Additional information on bookings can be found in the Key Performance Measures section of the present document. The following table provides a summary of the bookings and book-to-bill ratio by segment:

| In thousands of CAD except for percentages |

Bookings for the

three June 30, 2023 |

Bookings for the trailing |

Book-to-bill

ratio for the |

|||||||||

| Total CGI |

4,388,415 | 15,899,458 | 113.3% | |||||||||

|

U.S. Federal |

1,016,033 | 2,513,510 | 131.2% | |||||||||

|

Western and Southern Europe |

753,899 | 2,737,810 | 109.2% | |||||||||

|

Canada |

675,008 | 2,419,405 | 108.7% | |||||||||

|

U.S. Commercial and State Government |

634,170 | 2,750,537 | 111.8% | |||||||||

|

Scandinavia and Central Europe |

512,972 | 1,795,800 | 105.2% | |||||||||

|

U.K. and Australia |

410,906 | 1,979,612 | 122.5% | |||||||||

|

Northwest and Central-East Europe |

209,967 | 773,945 | 100.5% | |||||||||

|

Finland, Poland and Baltics |

175,460 | 928,839 | 111.3% | |||||||||

| © 2023 CGI Inc. | Page 14 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

The Company operates globally and is exposed to changes in foreign currency rates. Accordingly, as prescribed by IFRS, we value assets, liabilities and transactions that are measured in foreign currencies using various exchange rates. We report all dollar amounts in Canadian dollars.

Closing foreign exchange rates

| As at June 30, | 2023 | 2022 | Change | |||

|

U.S. dollar |

1.3235 | 1.2871 | 2.8% | |||

|

Euro |

1.4452 | 1.3474 | 7.3% | |||

|

Indian rupee |

0.0161 | 0.0163 | (1.2%) | |||

|

British pound |

1.6822 | 1.5653 | 7.5% | |||

|

Swedish krona |

0.1227 | 0.1257 | (2.4%) | |||

Average foreign exchange rates

| For the three months ended June 30, | For the nine months ended June 30, | |||||||||||

| 2023 | 2022 | Change | 2023 | 2022 | Change | |||||||

|

U.S. dollar |

1.3430 | 1.2769 | 5.2% | 1.3510 | 1.2680 | 6.5% | ||||||

|

Euro |

1.4620 | 1.3589 | 7.6% | 1.4334 | 1.4069 | 1.9% | ||||||

|

Indian rupee |

0.0163 | 0.0165 | (1.2%) | 0.0164 | 0.0167 | (1.8%) | ||||||

|

British pound |

1.6814 | 1.6024 | 4.9% | 1.6399 | 1.6668 | (1.6%) | ||||||

|

Swedish krona |

0.1275 | 0.1297 | (1.7%) | 0.1280 | 0.1359 | (5.8%) | ||||||

| © 2023 CGI Inc. | Page 15 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

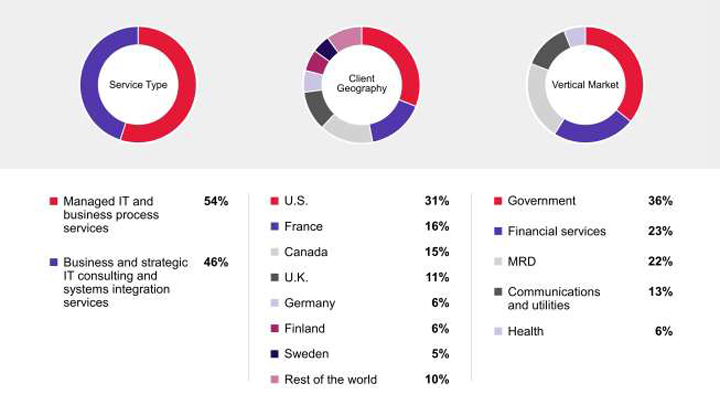

The following charts provide additional information regarding our revenue mix for the quarter:

3.3.1. Client Concentration

IFRS guidance on segment disclosures defines a single customer as a group of entities that are known to the reporting entity to be under common control. As a consequence, our work for the U.S. federal government including its various agencies represented 13.5% of our revenue for the three months ended June 30, 2023 as compared to 12.8% for the three months ended June 30, 2022.

For the nine months ended June 30, 2023 and 2022, we generated 13.3% and 13.0%, respectively, of our revenue from the U.S. federal government including its various agencies.

| © 2023 CGI Inc. | Page 16 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

Our segments are reported based on where the client’s work is delivered from within our geographic delivery model.

The table below provides a summary of the year-over-year changes in our revenue, in total and by segment before eliminations, separately showing the impacts of foreign currency exchange rate variations between Q3 2023 and Q3 2022. For the three and nine months ended June 30, 2022, revenues by segment were recorded reflecting the actual foreign exchange rates for the respective period. The foreign exchange impact is the difference between the current period’s actual results and the same period’s results converted with the prior year’s foreign exchange rates.

| In thousands of CAD except for percentages |

For the three months ended June 30,

|

For the nine months ended June 30,

|

||||||||||||||||||||||

| 2023 | 2022 | % | 2023 | 2022 | % | |||||||||||||||||||

|

Total CGI revenue |

3,623,428 | 3,258,638 | 11.2 | % | 10,789,024 | 9,619,980 | 12.2 | % | ||||||||||||||||

|

Constant currency revenue growth |

6.3% | 9.9% | ||||||||||||||||||||||

|

Foreign currency impact |

4.9% | 2.3% | ||||||||||||||||||||||

|

Variation over previous period |

11.2% | 12.2% | ||||||||||||||||||||||

| Western and Southern Europe | ||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

610,615 | 553,470 | 10.3 | % | 1,964,741 | 1,604,597 | 22.4 | % | ||||||||||||||||

|

Foreign currency impact |

46,181 | 34,657 | ||||||||||||||||||||||

|

Western and Southern Europe revenue |

656,796 | 553,470 | 18.7 | % | 1,999,398 | 1,604,597 | 24.6 | % | ||||||||||||||||

| U.S. Commercial and State Government | ||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

541,456 | 528,046 | 2.5 | % | 1,606,869 | 1,518,160 | 5.8 | % | ||||||||||||||||

|

Foreign currency impact |

28,373 | 103,860 | ||||||||||||||||||||||

|

U.S. Commercial and State Government revenue |

569,829 | 528,046 | 7.9 | % | 1,710,729 | 1,518,160 | 12.7 | % | ||||||||||||||||

| Canada | ||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

518,281 | 524,511 | (1.2 | %) | 1,554,150 | 1,485,331 | 4.6 | % | ||||||||||||||||

|

Foreign currency impact |

511 | 1,158 | ||||||||||||||||||||||

|

Canada revenue |

518,792 | 524,511 | (1.1 | %) | 1,555,308 | 1,485,331 | 4.7 | % | ||||||||||||||||

| U.S. Federal | ||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

467,699 | 432,667 | 8.1 | % | 1,355,656 | 1,287,808 | 5.3 | % | ||||||||||||||||

|

Foreign currency impact |

24,672 | 89,769 | ||||||||||||||||||||||

|

U.S. Federal revenue |

492,371 | 432,667 | 13.8 | % | 1,445,425 | 1,287,808 | 12.2 | % | ||||||||||||||||

| Scandinavia and Central Europe | ||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

405,586 | 388,071 | 4.5 | % | 1,283,972 | 1,205,715 | 6.5 | % | ||||||||||||||||

|

Foreign currency impact |

11,086 | (27,222) | ||||||||||||||||||||||

| Scandinavia and Central Europe revenue |

416,672 | 388,071 | 7.4 | % | 1,256,750 | 1,205,715 | 4.2 | % | ||||||||||||||||

| U.K. and Australia revenue | ||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

364,200 | 317,559 | 14.7 | % | 1,095,591 | 959,682 | 14.2 | % | ||||||||||||||||

|

Foreign currency impact |

17,313 | (15,802) | ||||||||||||||||||||||

|

U.K. and Australia revenue |

381,513 | 317,559 | 20.1 | % | 1,079,789 | 959,682 | 12.5 | % | ||||||||||||||||

| Finland, Poland and Baltics | ||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

195,904 | 181,960 | 7.7 | % | 623,465 | 564,548 | 10.4 | % | ||||||||||||||||

|

Foreign currency impact |

15,341 | 11,684 | ||||||||||||||||||||||

| Finland, Poland and Baltics revenue |

211,245 | 181,960 | 16.1 | % | 635,149 | 564,548 | 12.5 | % | ||||||||||||||||

| © 2023 CGI Inc. | Page 17 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| In thousands of CAD except for percentages |

For the three months ended June 30,

|

For the nine months ended June 30,

|

||||||||||||||||||||||

| 2023 | 2022 | % | 2023 | 2022 | % | |||||||||||||||||||

|

Northwest and Central-East Europe |

||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

178,675 | 171,632 | 4.1 | % | 555,057 | 537,105 | 3.3 | % | ||||||||||||||||

|

Foreign currency impact |

14,919 | 13,743 | ||||||||||||||||||||||

|

Northwest and Central-East Europe revenue |

193,594 | 171,632 | 12.8 | % | 568,800 | 537,105 | 5.9 | % | ||||||||||||||||

|

Asia Pacific |

||||||||||||||||||||||||

|

Revenue prior to foreign currency impact |

234,347 | 207,901 | 12.7 | % | 694,794 | 585,348 | 18.7 | % | ||||||||||||||||

|

Foreign currency impact |

(2,247) | (11,873) | ||||||||||||||||||||||

|

Asia Pacific revenue |

232,100 | 207,901 | 11.6 | % | 682,921 | 585,348 | 16.7 | % | ||||||||||||||||

|

Eliminations |

(49,484) | (47,179) | 4.9 | % | (145,245) | (128,314) | 13.2 | % | ||||||||||||||||

For the three months ended June 30, 2023, revenue was $3,623.4 million, an increase of $364.8 million, or 11.2% over the same period last year. On a constant currency basis, revenue increased by $203.8 million or 6.3%. The increase was mainly due to organic growth across most vertical markets, including an increase in IP-based revenues, and prior year’s business acquisitions. This was partially offset by less available days to bill, due to the timing of statutory holidays in Europe.

For the nine months ended June 30, 2023, revenue was $10,789.0 million, an increase of $1,169.0 million or 12.2% over the same period last year. On a constant currency basis, revenue increased by $954.9 million or 9.9%. The increase was mainly due to the same factors identified for the quarter.

3.4.1. Western and Southern Europe

For the three months ended June 30, 2023, revenue in the Western and Southern Europe segment was $656.8 million, an increase of $103.3 million or 18.7% over the same period last year. On a constant currency basis, revenue increased by $57.1 million or 10.3%. The increase in revenue was mainly due to prior year’s business acquisitions, as well as the result of organic growth across most vertical markets. This was partly offset by two less available days to bill in France.

For the nine months ended June 30, 2023, revenue in the Western and Southern Europe segment was $1,999.4 million, an increase of $394.8 million or 24.6% over the same period last year. On a constant currency basis, revenue increased by $360.1 million or 22.4%. The increase in revenue was mainly due to prior year’s business acquisitions, as well as the result of organic growth across all vertical markets. This was partly offset by two less available days to bill in France.

On a client geographic basis, the top two Western and Southern Europe vertical markets were MRD and financial services, generating combined revenues of approximately $407 million and $1,235 million for the three and nine months ended June 30, 2023, respectively.

3.4.2. U.S. Commercial and State Government

For the three months ended June 30, 2023, revenue in the U.S. Commercial and State Government segment was $569.8 million, an increase of $41.8 million or 7.9% over the same period last year. On a constant currency basis, revenue increased by $13.4 million or 2.5%. The increase was mainly due to organic growth across most vertical markets, partially offset by increased use of our Asia Pacific offshore delivery centers for client work and lower IP license sales as we experience a shift in demand towards a software-as-a-service delivery model.

For the nine months ended June 30, 2023, revenue in the U.S. Commercial and State Government segment was $1,710.7 million, an increase of $192.6 million or 12.7% over the same period last year. On a constant currency basis, revenue increased by $88.7 million or 5.8%. The increase was mainly due to organic growth across most vertical markets, partially offset by increased use of our Asia Pacific offshore delivery centers for client work.

| © 2023 CGI Inc. | Page 18 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

On a client geographic basis, the top two U.S. Commercial and State Government vertical markets were financial services and government, generating combined revenues of approximately $374 million and $1,082 million for the three and nine months ended June 30, 2023, respectively.

3.4.3. Canada

For the three months ended June 30, 2023, revenue in the Canada segment was $518.8 million, a decrease of $5.7 million or 1.1% compared to the same period last year. On a constant currency basis, revenue decreased by $6.2 million or 1.2%. The change was mainly due to lower utilization within the financial services vertical market and the successful completion of contracts within the MRD vertical market. This was partially offset by an increase in IP-based revenues within the financial services vertical market.

For the nine months ended June 30, 2023, revenue in the Canada segment was $1,555.3 million, an increase of $70.0 million or 4.7% compared to the same period last year. On a constant currency basis, revenue increased by $68.8 million or 4.6%. The increase was mainly due to organic growth across most vertical markets, including an increase in IP-based revenues within the financial services vertical market.

On a client geographic basis, the top two Canada vertical markets were financial services and communications and utilities, generating combined revenues of approximately $363 million and $1,091 million for the three and nine months ended June 30, 2023, respectively.

3.4.4. U.S. Federal

For the three months ended June 30, 2023, revenue in the U.S. Federal segment was $492.4 million, an increase of $59.7 million or 13.8% over the same period last year. On a constant currency basis, revenue increased by $35.0 million or 8.1%. The increase in revenue was mainly due to higher transaction volumes related to our IP business process services and organic growth in managed services engagements.

For the nine months ended June 30, 2023, revenue in the U.S. Federal segment was $1,445.4 million, an increase of $157.6 million or 12.2% over the same period last year. On a constant currency basis, revenue increased by $67.8 million or 5.3%. The increase was mainly due to the same factors identified for the quarter.

For the three and nine months ended June 30, 2023, 90% of revenues within the U.S. Federal segment were for federal civilian-based agencies for both periods.

3.4.5. Scandinavia and Central Europe

For the three months ended June 30, 2023, revenue in the Scandinavia and Central Europe segment was $416.7 million, an increase of $28.6 million or 7.4% over the same period last year. On a constant currency basis, revenue increased by $17.5 million or 4.5%. The increase was mainly driven by organic growth across most vertical markets, primarily within the government vertical market. This was partially offset by a favourable contract settlement in the prior year and one less available day to bill in Germany.

For the nine months ended June 30, 2023, revenue in the Scandinavia and Central Europe segment was $1,256.8 million, an increase of $51.0 million or 4.2% over the same period last year. On a constant currency basis, revenue increased by $78.3 million or 6.5%. The increase was mainly driven by organic growth across most vertical markets, primarily within the government vertical market. This was partially offset by one less available day to bill in Germany.

On a client geographic basis, the top two Scandinavia and Central Europe vertical markets were MRD and government, generating combined revenues of approximately $307 million and $925 million for the three and nine months ended June 30, 2023, respectively.

| © 2023 CGI Inc. | Page 19 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

3.4.6. U.K. and Australia

For the three months ended June 30, 2023, revenue in the U.K. and Australia segment was $381.5 million, an increase of $64.0 million or 20.1% over the same period last year. On a constant currency basis, revenue increased by $46.6 million or 14.7%. The increase was mainly due to organic growth across most vertical markets, predominantly within the government vertical market.

For the nine months ended June 30, 2023, revenue in the U.K. and Australia segment was $1,079.8 million, an increase of $120.1 million or 12.5% over the same period last year. On a constant currency basis, revenue increased by $135.9 million or 14.2%. The increase was mainly due to organic growth across most vertical markets, predominantly within the government vertical market, as well as a prior year’s business acquisition.

On a client geographic basis, the top two U.K. and Australia vertical markets were government and communications and utilities, generating combined revenues of $321 million and $898 million for the three and nine months ended June 30, 2023, respectively.

3.4.7. Finland, Poland and Baltics

For the three months ended June 30, 2023, revenue in the Finland, Poland and Baltics segment was $211.2 million, an increase of $29.3 million or 16.1% over the same period last year. On a constant currency basis, revenue increased by $13.9 million or 7.7%. The increase was mainly due to organic growth across most vertical markets, partially offset by one less available day to bill.

For the nine months ended June 30, 2023, revenue in the Finland, Poland and Baltics segment was $635.1 million, an increase of $70.6 million or 12.5% over the same period last year. On a constant currency basis, revenue increased by $58.9 million or 10.4%. The increase was mainly due to organic growth across most vertical markets, including an increase in IP-based revenues.

On a client geographic basis, the top two Finland, Poland and Baltics vertical markets were financial services and government, generating combined revenues of approximately $130 million and $400 million for the three and nine months ended June 30, 2023, respectively.

3.4.8. Northwest and Central-East Europe

For the three months ended June 30, 2023, revenue in the Northwest and Central-East Europe segment was $193.6 million, an increase of $22.0 million or 12.8% over the same period last year. On a constant currency basis, revenue increased by $7.0 million or 4.1%. The increase was mainly due to organic growth within most vertical markets, partially offset by two less available days to bill in Czech Republic.

For the nine months ended June 30, 2023, revenue in the Northwest and Central-East Europe segment was $568.8 million, an increase of $31.7 million or 5.9% over the same period last year. On a constant currency basis, revenue increased by $18.0 million or 3.3%. The increase was mainly due to organic growth within most vertical markets, partially offset by one less available day to bill across the segment.

On a client geographic basis, the top two Northwest and Central-East Europe vertical markets were MRD and government, generating combined revenues of approximately $126 million and $381 million for the three and nine months ended June 30, 2023, respectively.

3.4.9. Asia Pacific

For the three months ended June 30, 2023, revenue in the Asia Pacific segment was $232.1 million, an increase of $24.2 million or 11.6% over the same period last year. On a constant currency basis, revenue increased by $26.4 million or 12.7%. The increase was mainly driven by the continued demand for our offshore delivery centers across all commercial vertical markets.

| © 2023 CGI Inc. | Page 20 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

For the nine months ended June 30, 2023, revenue in the Asia Pacific segment was $682.9 million, an increase of $97.6 million or 16.7% over the same period last year. On a constant currency basis, revenue increased by $109.4 million or 18.7%. The increase was mainly driven by the same factors identified for the quarter.

| © 2023 CGI Inc. | Page 21 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| In thousands of CAD

except for percentages |

For the three months ended June 30,

|

For the nine months ended June 30,

|

||||||||||||||

| 2023

|

% of revenue

|

2022

|

% of revenue

|

2023

|

% of revenue

|

2022

|

% of revenue

|

|||||||||

|

Costs of services, selling and administrative |

3,037,083 | 83.8% | 2,738,041 | 84.0% | 9,050,008 | 83.9% | 8,054,424 | 83.7% | ||||||||

|

Foreign exchange loss (gain) |

1,524 | —% | 727 | —% | (686) | —% | 616 | —% | ||||||||

3.5.1. Costs of Services, Selling and Administrative

Costs of services include the costs of our members serving our clients, which mainly consist of salaries, performance based compensation and other member costs, including travel expenses, net of tax credits. These also mainly include professional fees and other contracted labour costs, as well as hardware, software and delivery center related costs.

Costs of selling and administrative mainly include salaries, performance based compensation and other member costs for administrative and management members, office space, internal solutions and business development related costs such as travel expenses.

For the three months ended June 30, 2023, costs of services, selling and administrative expenses amounted to $3,037.1 million, an increase of $299.0 million over the same period last year. As a percentage of revenue, costs of services, selling and administrative expenses decreased to 83.8% from 84.0%.

As a percentage of revenue, costs of services increased compared to the same period last year, mainly due to the impact of less available days to bill, due to the timing of statutory holidays in Europe, and the expected increase in travel to support client delivery growth. This was partially offset by growth within most vertical markets and lower performance based compensation accruals.

As a percentage of revenue, costs of selling and administrative decreased compared to the same period last year, mainly due to lower performance based compensation accruals, which was partially offset by the increase in business development efforts, including the expected increase in travel to support growing our business.

For the nine months ended June 30, 2023, costs of services, selling and administrative expenses amounted to $9,050.0 million, an increase of $995.6 million over the same period last year. As a percentage of revenue, costs of services, selling and administrative expenses increased to 83.9% from 83.7%.

As a percentage of revenue, costs of services increased compared to the same period last year, mainly due to the same factors identified for the quarter, as well as due to a favorable supplier contract adjustment that did not repeat this year and the planned temporary dilutive impact of the prior year’s business acquisitions.

As a percentage of revenue, costs of selling and administrative decreased compared to the same period last year, mainly due to the same factors identified for the quarter, which was partially offset by the planned temporary dilutive impact of the prior year’s business acquisitions.

During the three months ended June 30, 2023, the translation of the results of our foreign operations from their local currencies to the Canadian dollar unfavourably impacted costs by $128.6 million, which was offset by the favourable translation impact of $161.0 million on our revenue.

During the nine months ended June 30, 2023, the translation of the results of our foreign operations from their local currencies to the Canadian dollar unfavourably impacted costs by $160.5 million, which was offset by the favourable translation impact of $214.2 million on our revenue.

| © 2023 CGI Inc. | Page 22 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

3.5.2. Foreign Exchange Loss (Gain)

During the three months ended June 30, 2023, CGI incurred $1.5 million of foreign exchange losses and during the nine months ended June 30, 2023, recognized $0.7 million of foreign exchange gains, mainly driven by the timing of payments combined with the volatility of foreign exchange rates. The Company, in addition to its natural hedges, uses derivatives as a strategy to manage its exposure, to the extent possible.

| © 2023 CGI Inc. | Page 23 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

| In thousands of CAD except for percentages |

For the three months ended June 30,

|

For the nine months ended June 30,

|

||||||||||||||||||||||

|

2023

|

2022

|

Change

|

2023

|

2022

|

Change

|

|||||||||||||||||||

|

Western and Southern Europe |

80,778 | 70,107 | 15.2% | 277,510 | 233,817 | 18.7% | ||||||||||||||||||

|

As a percentage of segment revenue |

12.3% | 12.7% | 13.9% | 14.6% | ||||||||||||||||||||

|

U.S. Commercial and State Government |

98,365 | 75,637 | 30.0% | 244,782 | 219,391 | 11.6% | ||||||||||||||||||

|

As a percentage of segment revenue |

17.3% | 14.3% | 14.3% | 14.5% | ||||||||||||||||||||

|

Canada |

115,843 | 113,617 | 2.0% | 350,117 | 341,201 | 2.6% | ||||||||||||||||||

|

As a percentage of segment revenue |

22.3% | 21.7% | 22.5% | 23.0% | ||||||||||||||||||||

|

U.S. Federal |

87,125 | 78,553 | 10.9% | 232,135 | 208,396 | 11.4% | ||||||||||||||||||

|

As a percentage of segment revenue |

17.7% | 18.2% | 16.1% | 16.2% | ||||||||||||||||||||

|

Scandinavia and Central Europe |

29,027 | 31,082 | (6.6% | ) | 106,634 | 94,999 | 12.2% | |||||||||||||||||

|

As a percentage of segment revenue |

7.0% | 8.0% | 8.5% | 7.9% | ||||||||||||||||||||

|

U.K. and Australia |

55,526 | 42,359 | 31.1% | 155,879 | 146,954 | 6.1% | ||||||||||||||||||

|

As a percentage of segment revenue |

14.6% | 13.3% | 14.4% | 15.3% | ||||||||||||||||||||

|

Finland, Poland and Baltics |

22,740 | 22,529 | 0.9% | 83,200 | 70,515 | 18.0% | ||||||||||||||||||

|

As a percentage of segment revenue |

10.8% | 12.4% | 13.1% | 12.5% | ||||||||||||||||||||

|

Northwest and Central East-Europe |

23,158 | 22,098 | 4.8% | 75,400 | 69,192 | 9.0% | ||||||||||||||||||

|

As a percentage of segment revenue |

12.0% | 12.9% | 13.3% | 12.9% | ||||||||||||||||||||

|

Asia Pacific |

72,259 | 63,888 | 13.1% | 214,045 | 180,475 | 18.6% | ||||||||||||||||||

|

As a percentage of segment revenue |

31.1% | 30.7% | 31.3% | 30.8% | ||||||||||||||||||||

| Adjusted EBIT |

584,821 | 519,870 | 12.5% | 1,739,702 | 1,564,940 | 11.2% | ||||||||||||||||||

|

Adjusted EBIT margin |

16.1% | 16.0% | 16.1% | 16.3% | ||||||||||||||||||||

For the three months ended June 30, 2023, adjusted EBIT margin increased to 16.1% from 16.0% for the same period last year. The increase in adjusted EBIT margin was mostly due to the lower performance based compensation accruals and profitable growth within most vertical markets. This was partially offset by less available days to bill, due to the timing of statutory holidays in Europe, and the increase in business development efforts, including the expected increase in travel.

For the nine months ended June 30, 2023, adjusted EBIT margin decreased to 16.1% from 16.3% for the same period last year. The change in adjusted EBIT margin was mostly due to the increase in business development efforts, including the expected increase in travel, the planned temporary dilutive impact of the prior year’s business acquisitions, less available days to bill and a favourable supplier contract adjustment that did not repeat this year. This was partially offset by profitable growth within most vertical markets and lower performance based compensation accruals.

3.6.1. Western and Southern Europe

For the three months ended June 30, 2023, adjusted EBIT in the Western and Southern Europe segment was $80.8 million, an increase of $10.7 million when compared to the same period last year. Adjusted EBIT margin decreased to 12.3% from 12.7%. The change in adjusted EBIT margin was mainly due to two less available days to bill in France and the expected increase in travel to support growing our business, partially offset by lower performance based compensation accruals.

For the nine months ended June 30, 2023, adjusted EBIT in the Western and Southern Europe segment was $277.5 million, an increase of $43.7 million when compared to the same period last year. Adjusted EBIT margin decreased to 13.9% from 14.6%. The change in adjusted EBIT margin was mainly due to the planned temporary dilutive impact of the prior year’s business acquisitions, two less available days to bill in France, the expected increase in travel to support

| © 2023 CGI Inc. | Page 24 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

growing our business and prior year’s additional employee-related government incentive that did not repeat this year. This was partly offset by profitable organic growth within all vertical markets.

3.6.2. U.S. Commercial and State Government

For the three months ended June 30, 2023, adjusted EBIT in the U.S. Commercial and State Government segment was $98.4 million, an increase of $22.7 million when compared to the same period last year. Adjusted EBIT margin increased to 17.3% from 14.3%. The increase in adjusted EBIT margin was mainly due to lower performance based compensation accruals, the impact of a favorable supplier contract settlement and organic growth across most vertical markets. This was partially offset by lower IP license sales as we experience a shift in demand towards a software-as-a-service delivery model.

For the nine months ended June 30, 2023, adjusted EBIT in the U.S. Commercial and State Government segment was $244.8 million, an increase of $25.4 million when compared to the same period last year. Adjusted EBIT margin decreased to 14.3% from 14.5%. The change in adjusted EBIT margin was mainly due to less higher profitability IP-based revenues and the impact of temporarily lower utilization due to successful completion of projects. This was partially offset by organic growth across most vertical markets and the impact of a favorable supplier contract settlement.

3.6.3. Canada

For the three months ended June 30, 2023, adjusted EBIT in the Canada segment was $115.8 million, an increase of $2.2 million when compared to the same period last year. Adjusted EBIT margin increased to 22.3% from 21.7%. The increase in adjusted EBIT margin was mainly due to lower performance based compensation accruals. This was partially offset by the impact of temporarily lower utilization, primarily in the financial services vertical market.

For the nine months ended June 30, 2023, adjusted EBIT in the Canada segment was $350.1 million, an increase of $8.9 million when compared to the same period last year. Adjusted EBIT margin decreased to 22.5% from 23.0%. The change in adjusted EBIT margin was mainly due to the impact of temporarily lower utilization primarily within the financial services vertical market and a prior year’s favorable supplier contract adjustment that did not repeat this year. This was partially offset by lower performance based compensation accruals.

3.6.4. U.S. Federal

For the three months ended June 30, 2023, adjusted EBIT in the U.S. Federal segment was $87.1 million, an increase of $8.6 million when compared to the same period last year. Adjusted EBIT margin decreased to 17.7% from 18.2%. The change in adjusted EBIT margin was mainly due to an increase in business development efforts, including the expected increase in travel, higher performance based compensation accruals. This was partially offset by higher transaction volumes related to our IP business process services and non-renewal of low margin contracts in the prior year.

For the nine months ended June 30, 2023, adjusted EBIT in the U.S. Federal segment was $232.1 million, an increase of $23.7 million when compared to the same period last year. Adjusted EBIT margin decreased to 16.1% from 16.2%. The change in adjusted EBIT margin was mainly due to an increase in business development efforts, including the expected increase in travel, and higher performance based compensation accruals. This was mainly offset by higher transaction volumes related to our IP business process services.

3.6.5. Scandinavia and Central Europe

For the three months ended June 30, 2023, adjusted EBIT in the Scandinavia and Central Europe segment was $29.0 million, a decrease of $2.1 million when compared to the same period last year. Adjusted EBIT margin decreased to 7.0% from 8.0%. The change in adjusted EBIT margin was mainly due to a favorable client contract settlement in the prior year, one less available day to bill in Germany, the impact of temporarily lower utilization within the communications and utilities vertical market and the expected increase in travel to support growing our business. This was partially offset by lower performance based compensation accruals.

| © 2023 CGI Inc. | Page 25 |

| Management’s Discussion and Analysis | For the three and nine months ended June 30, 2023 and 2022 |

For the nine months ended June 30, 2023, adjusted EBIT in the Scandinavia and Central Europe segment was $106.6 million, an increase of $11.6 million when compared to the same period last year. Adjusted EBIT margin increased to 8.5% from 7.9%. The increase in adjusted EBIT margin was mainly due to lower performance based compensation accruals and organic growth across most vertical markets. This was partially offset by one less available day to bill in Germany.

3.6.6. U.K. and Australia

For the three months ended June 30, 2023, adjusted EBIT in the U.K. and Australia segment was $55.5 million, an increase of $13.2 million when compared to the same period last year. Adjusted EBIT margin increased to 14.6% from 13.3%. The increase in adjusted EBIT margin was mainly due to profitable organic growth within the government vertical market.

For the nine months ended June 30, 2023, adjusted EBIT in the U.K. and Australia segment was $155.9 million, an increase of $8.9 million when compared to the same period last year. Adjusted EBIT margin decreased to 14.4% from 15.3%. The change in adjusted EBIT margin was mainly due to the expected increase in travel to support growing our business and an increase in energy costs.

3.6.7. Finland, Poland and Baltics

For the three months ended June 30, 2023, adjusted EBIT in the Finland, Poland and Baltics segment was $22.7 million, an increase of $0.2 million, when compared to the same period last year. Adjusted EBIT margin decreased to 10.8% from 12.4%. The change in adjusted EBIT margin was mainly due to costs associated with the ramp up of managed IT services contracts, one less available day to bill and the expected increase in travel to support growing our business. This was partially offset by organic growth across most vertical markets.

For the nine months ended June 30, 2023, adjusted EBIT in the Finland, Poland and Baltics segment was $83.2 million, an increase of $12.7 million, when compared to the same period last year. Adjusted EBIT margin increased to 13.1% from 12.5%. The increase in adjusted EBIT margin is primarily due to organic growth across most vertical markets, including an increase in IP-based revenues. This was partially offset by the costs associated with the ramp up of managed IT services contracts and the expected increase in travel to support growing our business.

3.6.8. Northwest and Central-East Europe