UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

July 20, 2023

BHP GROUP LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE, VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): n/a

| NEWS RELEASE |

|

| Release Time | IMMEDIATE | |

| Date | 20 July 2023 | |

| Release Number | 13/23 | |

BHP OPERATIONAL REVIEW

FOR THE YEAR ENDED 30 JUNE 2023

| • | There were two fatalities during the financial year. We are committed to sharing the learnings from these tragic events and remain resolute in our commitment to eliminating fatalities and serious injuries at BHP. |

| • | Full year production guidance was achieved for copper, iron ore, metallurgical coal and energy coal. Nickel achieved revised guidance and finished in line with the lower end of original guidance. |

| • | Annual production records at Western Australia Iron Ore (WAIO) of 285 Mt (100% basis), Spence of 240 kt, and Olympic Dam for both copper of 212 kt and refined gold of 186 troy koz. |

| • | Full year unit cost guidance1 is expected to be achieved at Escondida, WAIO and New South Wales Energy Coal (NSWEC). BHP Mitsubishi Alliance (BMA) is expected to be marginally above its revised guidance range. |

| • | Average realised prices for copper, iron ore and metallurgical coal products were lower in the 2023 financial year compared to the prior year. Nickel prices remained stable, while thermal coal prices were stronger, predominantly in the first half. |

| • | BHP completed the acquisition of OZ Minerals Ltd (OZL) on 2 May 20232. |

| • | BHP has continued to make strong progress at Oak Dam in South Australia. We have defined an Exploration Target3 and plan to increase the number of exploration drills from nine to eleven by the end of the 2023 calendar year. |

| • | In Australia, BHP released its sixth Reconciliation Action Plan, which was awarded Elevate status. |

BHP Chief Executive Officer, Mike Henry:

“The financial year was marked by the deaths of Jody Byrne and Nathan Scholz. These tragic events underscore the absolute importance of safety and we are resolute in our commitment to eliminating fatalities and serious injuries at BHP.

“BHP finished the year with a strong fourth quarter, increasing annual production across the board and achieving annual records at WAIO, Olympic Dam and Spence. WAIO shipped record volumes on the back of productivity in its supply chain, rail network and car dumpers, while South Flank completed its deployment of autonomous haul trucks in May and is on track to ramp up to full production in the next 12 months. Olympic Dam’s improved reliability and productivity delivered record annual output in copper, gold and silver, and the integration of OZ Minerals into our South Australian copper business is expected to lift production to between 310 and 340 kt in FY24. At Escondida, the team managed through operational challenges to deliver solid production and position the asset to increase output further in FY24. Our Queensland coal operations achieved strong underlying performance including the transition to autonomous fleets at Goonyella Riverside and Daunia, offsetting the impact of significant wet weather.

“Inflationary pressures impacted our business in the year, and we remain laser focused on safety and productivity to remain competitive. Competitiveness will be ever more important as we enter the new financial year and at a time when there are new challenges and opportunities to resource development and global economic volatility.

“BHP’s portfolio is geared towards high quality steelmaking and growth options in future facing commodities. The Jansen potash project in Canada remains ahead of plan and studies for Stage 2 are progressing. Through the year, BHP made strategic investments and exploration progress in copper and nickel prospects globally, including Kabanga in Tanzania, Oak Dam in Australia, Filo Mining with the Filo del Sol project in Argentina and Chile, and Ocelot in the United States, as well as Serbia and Peru.”

| BHP Operational Review for the year ended 30 June 2023 | 1 |

Summary

Operational performance

Production and guidance are summarised below.

| Production |

FY23 | Jun Q23 |

FY23 vs FY22 |

Jun Q23 vs Jun Q22 |

Jun Q23 vs Mar Q23 |

FY24 guidance |

FY24e vs FY23 |

|||||||||||||||||||||

| Copper (kt)i |

1,716.5 | 476.2 | 9 | % | 3 | % | 17 | % | 1,720 – 1,910 | 0% – 11 | % | |||||||||||||||||

| Escondida (kt) |

1055.3 | 293.0 | 5 | % | 1 | % | 16 | % | 1,080 – 1,180 | 2% – 12 | % | |||||||||||||||||

| Pampa Norte (kt) |

288.8 | 68.5 | 3 | % | (11 | %) | (6 | %) | 210 – 250 | ii | (27%) – (13 | %) | ||||||||||||||||

| Copper South Australia (kt)iii |

232.4 | 76.6 | 68 | % | 38 | % | 48 | % | 310 – 340 | 33% – 46 | % | |||||||||||||||||

| Antamina (kt) |

138.4 | 36.5 | (8 | %) | (8 | %) | 23 | % | 120 – 140 | (13%) – 1 | % | |||||||||||||||||

| Carajás (kt) |

1.6 | 1.6 | — | — | — | — | — | |||||||||||||||||||||

| Iron ore (Mt) |

257.0 | 65.3 | 1 | % | 2 | % | 9 | % | 254 – 264.5 | (1%) – 3 | % | |||||||||||||||||

| WAIO (Mt) |

252.5 | 64.1 | 1 | % | 1 | % | 9 | % | 250 – 260 | (1%) – 3 | % | |||||||||||||||||

| WAIO (100% basis) (Mt) |

285.3 | 72.7 | 1 | % | 1 | % | 10 | % | 282 – 294 | (1%) – 3 | % | |||||||||||||||||

| Samarco (Mt) |

4.5 | 1.2 | 11 | % | 22 | % | 17 | % | 4 – 4.5 | (11%) – 0 | % | |||||||||||||||||

| Metallurgical coal - BMA (Mt) |

29.0 | 8.5 | 0 | % | 4 | % | 22 | % | 28 – 31 | (4%) – 7 | % | |||||||||||||||||

| BMA (100% basis) (Mt) |

58.0 | 17.0 | 0 | % | 4 | % | 22 | % | 56 – 62 | (4%) – 7 | % | |||||||||||||||||

| Energy coal – NSWEC (Mt) |

14.2 | 4.8 | 3 | % | 22 | % | 21 | % | 13 – 15 | (8%) – 6 | % | |||||||||||||||||

| Nickel (kt) |

80.0 | 22.0 | 4 | % | 17 | % | 12 | % | 77 – 87 | (4%) – 9 | % | |||||||||||||||||

| i. | Includes contribution of 21.5 kt from operations acquired from OZL2. |

| ii. | Production guidance for FY24 is provided for Spence only. Cerro Colorado is expected to produce ~9 kt as it transitions to closure by 31 December 2023. |

| iii. | Comprised of Olympic Dam, Prominent Hill and Carrapateena. Refer to the production and sales report for more details. |

| Production |

FY23 (vs FY22) |

Jun Q23 (vs Mar Q23) |

Jun Q23 vs Mar Q23 commentary |

|||||||

| Copper (kt) |

|

1,716.5 9% |

|

|

476.2 17% |

|

Higher concentrate volumes at Escondida reflect the higher concentrate feed grade of 0.93 per cent, and higher volumes at Copper South Australia resulted in a BHP record for quarterly production from the refinery at Olympic Dam, and reflect the addition of Prominent Hill and Carrapateena. | |||

| Iron ore (Mt) |

|

257.0 1% |

|

|

65.3 9% |

|

Increased production at WAIO, despite unfavourable impacts from Tropical Cyclone Ilsa, due to strong supply chain performance and the prior period impacts from the temporary shutdown of operations following the fatality, as well as the tie-in activity of the Port Debottlenecking Project 1 (PDP1). | |||

| Metallurgical coal (Mt) |

|

29.0 0% |

|

|

8.5 22% |

|

Increased production driven by increased yield, improved truck productivity and favourable weather conditions, partially offset by the commencement of a second longwall move at Broadmeadow. | |||

| Energy coal (Mt) |

|

14.2 3% |

|

|

4.8 21% |

|

Higher volumes as a result of additional stripping volumes, decreased proportion of washed coal, favourable weather conditions, and improvement in truck productivity with record quarterly annualised truck hours. | |||

| Nickel (kt) |

|

80.0 4% |

|

|

22.0 12% |

|

Higher volumes due to improved mining performance at Mt Keith, increased third party purchases and inventory drawdowns enabling increased concentrate production, partially offset by a heavy rain event in April 2023. | |||

| BHP Operational Review for the year ended 30 June 2023 | 2 |

Summary of disclosures

BHP expects its financial results for the second half of the 2023 financial year to reflect certain items summarised in the table below. The table does not provide a comprehensive list of all items impacting the period. The financial statements are the subject of ongoing work that will not be finalised until the release of the financial results on 22 August 2023. Accordingly, the table below contains preliminary information that is subject to update and finalisation.

| Description |

H2 FY23 impact US$Mi |

Classificationii | ||||||

| For the 2023 financial year, unit costs at Escondida and WAIO are expected to be towards the upper end of guidance ranges, and unit costs at NSWEC are expected to be in line with the revised guidance range (at guidance exchange rates)

Unit costs at BMA are expected to be marginally above the revised guidance range (at guidance exchange rates)

Note: Australian dollar and Chilean peso were weaker than guidance rates in the periodiii

Unit costs will not include any costs relating to the review of employee entitlements and allowances. |

— | h Operating costs | ||||||

| Review of employee entitlements and allowances | ~280 | |

h Operating costs – Group and Unallocated |

|

||||

| Transaction and integration costs associated with the OZL acquisition | ~100 – 150 | |

h Operating costs - Group and Unallocated |

|

||||

| Increase to depreciation and amortisation expense relative to H1 FY23, predominantly at WAIO, and includes the contribution of the OZL assets acquired during the period. | ~100 – 200 | |

h Depreciation, amortisation and impairments |

|

||||

| The Group’s adjusted effective tax rate for the 2023 financial year is expected to be in the lower half of the guidance range of 30 to 35 per cent | — | Taxation expense | ||||||

| Working capital decrease relating to net price impacts, and provisions relating to employee entitlements and allowances | 950 – 1,050 | h Operating cash flow | ||||||

| Decrease in cash tax paid relative to H1 FY23 | 1,600 – 1,700 | h Operating cash flow | ||||||

| Gross dividends received from equity-accounted investments | ~250 | h Investing cash flow | ||||||

| Capital and exploration spend is expected to be approximately US$7.1 bn, below full year guidance of approximately US$7.6 bn, primarily driven by favourable FX | — | h Investing cash flow | ||||||

| Gross dividends paid to non-controlling interests | ~650 | i Financing cash flow | ||||||

| Payment of the H1 FY23 dividend | ~4,600 | i Financing cash flow | ||||||

| Acquisition of OZL | ~6,000 | i Investing cash flow | ||||||

| Net debt acquired through OZL acquisition | ~1,000 | h Net debt | ||||||

| The Group’s net debt balance at 30 June 2023 is expected to be between US$11 and US$11.5 bn and is expected to remain towards the upper end of our target range of US$5 to US$15 bn in the near term | — | Net debt | ||||||

| Financial impact on BHP Brasil of the Samarco dam failure

The financial impact is expected to primarily relate to amortisation of discounting on the provision and the impact of foreign exchange |

Refer footnote | iv | Exceptional item | |||||

| Revaluation of deferred tax balances following the substantive enactment of the Chilean Royalty Bill | ~250 – 300 | v | Exceptional item | |||||

| i | Numbers are not tax effected and comparisons are against the 31 December 2022 financial results, unless otherwise noted. |

| ii | There will be a corresponding balance sheet, cash flow and/or income statement impact as relevant, unless otherwise noted. |

| iii | Average exchange rates for FY23 of AUD/USD 0.67 (guidance rate AUD/USD 0.72) and USD/CLP 864 (guidance rate USD/CLP 830). |

| iv | Financial impact is the subject of ongoing work and is not yet finalised. See Iron ore section for further information on Samarco. |

| v | To reflect an increase to the mining tax rates in Chile. |

| BHP Operational Review for the year ended 30 June 2023 | 3 |

Average realised prices

The average realised prices achieved for our major commodities are summarised below.

| Average realised pricesi |

H2 FY23 | H1 FY23 | FY23 | FY22 | FY23 vs FY22 |

H2 FY23 vs H2 FY22 |

H2 FY23 vs H1 FY23 |

|||||||||||||||||||||

| Copper (US$/lb)ii |

3.80 | 3.49 | 3.65 | 4.16 | (12 | %) | (5 | %) | 9 | % | ||||||||||||||||||

| Iron ore (US$/wmt, FOB) |

99.88 | 85.46 | 92.54 | 113.10 | (18 | %) | (11 | %) | 17 | % | ||||||||||||||||||

| Metallurgical coal (US$/t) |

273.08 | 268.73 | 271.05 | 347.10 | (22 | %) | (36 | %) | 2 | % | ||||||||||||||||||

| Hard coking coal (US$/t)iii |

276.22 | 270.65 | 273.59 | 366.82 | (25 | %) | (37 | %) | 2 | % | ||||||||||||||||||

| Weak coking coal (US$/t)iii |

250.38 | 252.12 | 251.13 | 296.51 | (15 | %) | (35 | %) | (1 | %) | ||||||||||||||||||

| Thermal coal (US$/t)iv |

157.21 | 354.30 | 236.51 | 216.78 | 9 | % | (48 | %) | (56 | %) | ||||||||||||||||||

| Nickel metal (US$/t) |

23,652 | 24,362 | 24,021 | 23,275 | 3 | % | (14 | %) | (3 | %) | ||||||||||||||||||

| i | Based on provisional, unaudited estimates. Prices exclude sales from equity accounted investments, third party product and internal sales, and represent the weighted average of various sales terms (for example: FOB, CIF and CFR), unless otherwise noted. Includes the impact of provisional pricing and finalisation adjustments. |

| ii | Does not include sales from assets acquired through the purchase of OZL. |

| iii | Hard coking coal (HCC) refers generally to those metallurgical coals with a Coke Strength after Reaction (CSR) of 35 and above, which includes coals across the spectrum from Premium Coking to Semi Hard Coking coals, while weak coking coal (WCC) refers generally to those metallurgical coals with a CSR below 35. |

| iv | Export sales only. Includes thermal coal sales from metallurgical coal mines. |

The large majority of iron ore shipments were linked to index pricing for the month of shipment, with price differentials predominantly a reflection of market fundamentals and product quality. Iron ore sales for the June 2023 half year were based on an average moisture rate of 6.6 per cent. The large majority of metallurgical coal and energy coal exports were linked to index pricing for the month of scheduled shipment or priced on the spot market at fixed or index-linked prices, with price differentials reflecting product quality. The large majority of copper cathodes sales were linked to index price for quotation periods one month after month of shipment, and three to four months after month of shipment for copper concentrates sales with price differentials applied for location and treatment costs.

At 30 June 2023, the Group had 342 kt of outstanding copper sales that were revalued at a weighted average price of US$3.77 per pound. The final price of these sales will be determined in the 2024 financial year. In addition, 354 kt of copper sales from the 2022 financial year were subject to a finalisation adjustment in the 2023 financial year. The provisional pricing and finalisation adjustments will decrease Underlying EBITDA by US$243 million in the 2023 financial year and are included in the average realised copper price in the above table.

Corporate update

BHP released its sixth Reconciliation Action Plan in June 2023, which has been recognised with ‘Elevate’ status from Reconciliation Australia. Some examples of the commitments made in the plan include increasing Indigenous representation across our Australian workforce to a target of 9.7 per cent by the end of the 2027 financial year, and a target to achieve an A$1.5 billion spend with Traditional Owner and Indigenous businesses in aggregate across our Australian assets.

Portfolio

On 2 May 2023, BHP announced the completion of the OZL acquisition. The acquisition strengthens BHP’s portfolio in copper, nickel and uranium and is in line with our strategy to pursue value adding growth in future facing commodities. The cash payment by BHP was funded using a combination of BHP’s existing cash reserves and the proceeds of a debt facility.

In June 2023, BHP agreed to invest an additional C$30 million in Filo Mining Corp via a private placement. The proceeds from BHP’s investment will be used by Filo for exploration and development of the Filo del Sol project, located in San Juan Province, Argentina and adjacent Region III in Chile, and for working capital and general corporate purposes.

Decarbonisation

In the June 2023 quarter, BHP held a briefing updating on its progress and plans to achieve its medium and long-term operational decarbonisation target and goal and released two Prospects updates on the Pathways to decarbonisation which are available on the BHP website: The many, many roads to Paris and the electric smelting furnace.

| BHP Operational Review for the year ended 30 June 2023 | 4 |

Copper

Production

| FY23 | Jun Q23 | FY23 vs FY22 |

Jun Q23 vs Jun Q22 |

Jun Q23 vs Mar Q23 |

||||||||||||||||

| Copper (kt) |

1,716.5 | 476.2 | 9 | % | 3 | % | 17 | % | ||||||||||||

| Zinc (t) |

125,048 | 38,822 | 1 | % | 41 | % | 64 | % | ||||||||||||

| Uranium (t) |

3,406 | 813 | 43 | % | 5 | % | (2 | %) | ||||||||||||

Copper – Total copper production increased by nine per cent to 1,717 kt. Production for the 2024 financial year is expected to be between 1,720 and 1,910 kt.

Escondida copper production increased by five per cent to 1,055 kt primarily due to higher concentrator feed grade of 0.82 per cent, compared to 0.78 per cent in the 2022 financial year. The positive impact of the higher grade was partially offset by the impact of road blockades across Chile in the December 2022 quarter, which reduced availability of some key mine supplies. Full year production came in at the low end of revised guidance largely as a result of measures implemented to manage geotechnical events in a high grade section of the Escondida pit. These included a resequencing of the mine plan, resulting in lower than anticipated volumes of mined ore and increased processing of lower grade stockpiles through the concentrators. Production is expected to increase to between 1,080 and 1,180 kt for the 2024 financial year and reflects both an expected increase in concentrator feed grade and an expected increase in concentrator throughput compared to the 2023 financial year.

Pampa Norte copper production increased by three per cent to 289 kt including a record 240 kt at Spence and 49 kt at Cerro Colorado. This was largely a result of higher concentrator throughput at the Spence Growth Option (SGO), partially offset by lower production at Cerro Colorado as it transitions towards closure. The concentrator plant modifications, which commenced in August 2022, remain on track to be completed in the 2023 calendar year. Expected capital expenditure for the concentrator modification works remains unchanged at approximately US$100 million. Production for Spence is expected to be between 210 and 250 kt for the 2024 financial year, with planned higher concentrator grade and concentrator throughput but lower stacking grade for cathodes. Cerro Colorado continues to transition towards planned closure by December 2023, with production for the six months until closure expected to be approximately 9 kt. We are continuing to closely monitor previously identified Spence Tailings Storage Facility anomalies.

Following the completion of the acquisition of OZL, we have established the Copper South Australia business. Production from Copper South Australia was 232 kt, comprised of full year production from Olympic Dam of 212 kt and two months of production2 from Prominent Hill and Carrapateena of 8 kt and 12 kt respectively. Olympic Dam delivered record BHP copper production as a result of continued strong concentrator and smelter performance following the major smelter maintenance campaign (SCM21) in the prior year. Record annual gold and silver production was also achieved following the implementation of debottlenecking initiatives in the prior year, 27 per cent higher than the previous gold production record.

Integration activity is underway, including the transfer of small volumes of copper concentrate from Prominent Hill to Olympic Dam for processing. Copper South Australia production of between 310 and 340 kt is expected for the 2024 financial year.

Antamina copper production decreased by eight per cent to 138 kt reflecting the expected lower copper feed grades, partially offset by higher throughput. Zinc production was one per cent higher at 125 kt, reflecting higher throughput. Copper production of 120 to 140 kt and zinc production of between 85 and 105 kt is expected for the 2024 financial year.

Following the acquisition of OZL, Carajás produced 1.6 kt of copper and 1.2 troy koz of gold2.

| BHP Operational Review for the year ended 30 June 2023 | 5 |

Iron ore

Production

| FY23 | Jun Q23 | FY23 vs FY22 |

Jun Q23 vs Jun Q22 |

Jun Q23 vs Mar Q23 |

||||||||||||||||

| Iron ore (kt) |

257,043 | 65,295 | 1 | % | 2 | % | 9 | % | ||||||||||||

Iron ore – Total iron ore production increased by one per cent to 257 Mt. Production for the 2024 financial year is expected to be between 254 and 264.5 Mt.

WAIO achieved record production of 253 Mt (285 Mt on a 100 per cent basis), reflecting continued strong supply chain performance, including improved rail performance and increased car dumper utilisation. This was partially offset by the temporary suspension of operations following the fatality in February, unfavourable weather impacts from Tropical Cyclone Ilsa in the June 2023 quarter and the ongoing planned tie-in of PDP1, which remains on track to be completed in the 2024 calendar year.

South Flank remains on track to ramp up to full production capacity of 80 Mtpa (100 per cent basis) by the end of the 2024 financial year. Current year performance has contributed to record annual production at the Mining Area C hub and record WAIO lump sales. Additionally, the deployment of autonomous haul trucks at South Flank was completed in May 2023.

WAIO also achieved record shipments for the year, which was inclusive of sales of 249 Mt (281 Mt on a 100 per cent basis) and inventory in China of almost 4 Mt for portside sales.

WAIO production is expected to increase to between 250 and 260 Mt (282 and 294 Mt on a 100 per cent basis) in the 2024 financial year.

Samarco production increased by 11 per cent to 4.5 Mt (BHP share), as a result of higher concentrator throughput. Production for the 2024 financial year is expected to be between 4 and 4.5 Mt (BHP share).

In May 2023, Samarco announced it had agreed with its shareholders and a group of Samarco’s financial creditors to a restructure of the company’s financial debts. The agreement was entered into following a 2-month court-supervised settlement process. The proposed terms are subject to approval by a majority of Samarco’s creditors, ratification by the Judicial Reorganisation Court and the entry into definitive debt restructure documents. Samarco, BHP Brasil, Vale, and creditors are working together to implement the restructure terms to resolve Samarco’s judicial reorganisation process.

| BHP Operational Review for the year ended 30 June 2023 | 6 |

Coal

Production

| FY23 | Jun Q23 | FY23 vs FY22 |

Jun Q23 vs Jun Q22 |

Jun Q23 vs Mar Q23 |

||||||||||||||||

| Metallurgical coal (kt) |

29,020 | 8,477 | 0 | % | 4 | % | 22 | % | ||||||||||||

| Energy coal (kt) |

14,172 | 4,765 | 3 | % | 22 | % | 21 | % | ||||||||||||

Metallurgical coal – BMA production of 29 Mt (58 Mt on a 100 per cent basis) was in line with the prior period. The significant wet weather experienced in the first three quarters4 was offset by strong underlying operational performance, in particular, continued improvement in truck productivity at Goonyella and Daunia following the completion of their transitions to autonomous fleet. Production for the period was further supported by a drawdown of raw coal inventory and improved labour availability compared to the prior period.

Production for the 2024 financial year is expected to be between 28 and 31 Mt (56 and 62 Mt on a 100 per cent basis).

The near tripling of top end royalties by the Queensland Government makes Queensland the highest coal taxing regime in the world. Given the negative impact this has on investment economics and the increase in sovereign risk, we will not be investing in any further growth in Queensland, however we will sustain and optimise our existing operations.

Energy coal – NSWEC production increased by three per cent to 14.2 Mt driven by an improvement in weather conditions in the second half of the year and an uplift in truck productivity compared to the prior year. Additional deployed capacity into a new mining area also resulted in an uplift in prime stripping volumes. Production for the 2024 financial year is expected to be between 13 and 15 Mt.

Higher quality products made up 77 per cent of sales, compared to 89 per cent in the prior period, reflecting the impacts of the change in export market conditions and the commencement of domestic sales under the NSW Government Coal Market Price Emergency (Directions for Coal Mines) Notice in the June 2023 quarter. The reservation allocation for the 2024 financial year is expected to be 0.7 Mt in line with the Directions.

Other

Nickel production

| FY23 | Jun Q23 | FY23 vs FY22 |

Jun Q23 vs Jun Q22 |

Jun Q23 vs Mar Q23 |

||||||||||||||||

| Nickel (kt) |

80.0 | 22.0 | 4 | % | 17 | % | 12 | % | ||||||||||||

Nickel – Nickel West production increased by four per cent to 80 kt due to an increased proportion of concentrate and matte products and inventory drawdowns. This was partially offset by the slower than planned ramp up of the refinery following planned maintenance in the December 2022 quarter and a heavy rain event at the Mt Keith operations in early April 2023 impacting mine progression.

During the year, Nickel West has experienced ongoing issues with the quality and volume of ore deliveries from Mincor Resources containing high levels of arsenic, and in March advised that it would no longer accept off-specification product. In the second half, Nickel West purchased more third-party products compared to the first half, including higher cost third party concentrate to offset the impact of the ore supply issues.

Production is expected to be between 77 and 87 kt for the 2024 financial year, weighted to the second half of the year due to planned refinery maintenance in the first half.

The West Musgrave nickel project in Western Australia is in early stages of execution following the final investment decision by OZL in September 2022 (prior to the acquisition by BHP).

Potash – Our major potash project under development at Jansen is tracking to the accelerated plan with first production still targeted for the end of the 2026 calendar year, compared to the initial target of the 2027 calendar year. In the June 2023 quarter, we completed all piling activities for the mill and storage facilities. During the 2024 financial year, we will transition from civil works into steel and equipment installation on the surface and underground, as well as continuing with equipment procurement. Port construction will also continue. The feasibility study for Jansen Stage 2 continues to progress and is on track to be completed during the 2024 financial year.

| BHP Operational Review for the year ended 30 June 2023 | 7 |

Projects

| Project and ownership |

Capital expenditure US$M |

Initial production target date |

Capacity |

Progress |

||||||||

| Jansen Stage 1 (Canada) 100% |

5,723 | End-CY26 | Design, engineering and construction of an underground potash mine and surface infrastructure, with capacity to produce 4.35 Mtpa. | Project is 26% complete | ||||||||

Minerals exploration

Minerals exploration and evaluation expenditure increased by 37 per cent for the year ended 30 June 2023 to US$350 million, of which US$294 million was expensed.

At BHP’s recently identified copper porphyry mineralised system, Ocelot, located in the Miami-Globe copper district of the United States, the final hole of a 6-hole program was completed in May 2023. The project remains at an early exploration stage and data from the recent drill program will be used to update the overall resource range estimation at Ocelot.

At Oak Dam in South Australia, we have defined an Exploration Target3 (refer to Appendix 1) and commenced the next phase of drilling as we work towards defining a first Mineral Resource5. In line with the environmental approvals received in March 2023, we plan to increase from nine drill rigs to eleven and to establish core processing facilities and an accommodation camp of up to 150 rooms by the end of the 2023 calendar year. We are continuing community and stakeholder engagement in preparation for submission of our application to convert the Oak Dam tenement from an exploration licence to a retention lease, enabling progression of an early access decline.

In addition, we have commenced exploratory drilling beneath the Olympic Dam mine, at depths between 900m and 1,500m, with nine surface exploration rigs.

In June 2023, BHP signed a Sales and Purchase Agreement to acquire 100 per cent of Ragnar Metals Sweden AB, for a cash payment of A$9.8 million. Ragnar’s assets include the Granmuren Nickel project, an early-stage nickel-copper tenement package located 110 km north-west of Stockholm, Sweden. BHP intends to undertake additional drilling to determine whether the known mineralisation has continuous high grade nickel sulphide and to test additional targets.

The inaugural BHP Xplor accelerator program was completed, with a number of the early-stage mineral exploration companies selected for further investment. Applications for the program’s second year will open at the end of August 2023.

Elsewhere, we continue to progress exploration activities in Australia, Canada, Chile, Ecuador, Peru, Serbia and the United States.

Variance analysis relates to the relative performance of BHP and/or its operations during the 12 months ended June 2023 compared with the 12 months ended June 2022, unless otherwise noted. Production volumes, sales volumes and capital and exploration expenditure from subsidiaries are reported on a 100 per cent basis; production and sales volumes from equity accounted investments and other operations are reported on a proportionate consolidation basis. Numbers presented may not add up precisely to the totals provided due to rounding.

The following footnotes apply to this Operational Review:

| 1 | 2023 financial year unit cost guidance: Escondida US$1.25-1.45/lb, WAIO US$18-19/t, BMA US$100-105/t and NSWEC US$84-91/t; based on exchange rates of AUD/USD 0.72 and USD/CLP 830. |

| 2 | Throughout this report, production volumes for the operations acquired from OZL are for the period of 1 May to 30 June 2023, whilst the acquisition completion date was 2 May 2023. |

| 3 | An Exploration Target is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. |

| 4 | 803mm of rainfall recorded at Moranbah for the year ended 30 June 2023 compared to 648mm in the prior year. |

| 5 | The potential quantity and grade of an Exploration Target is conceptual in nature and as such there has been insufficient exploration to estimate a Mineral Resource, and it is uncertain if further exploration or analysis will result in the estimation of a Mineral Resource. |

The following abbreviations may have been used throughout this report: cost and freight (CFR); cost, insurance and freight (CIF); dry metric tonne unit (dmtu); free on board (FOB); grams per tonne (g/t); kilograms per tonne (kg/t); kilometre (km); megawatt (MW); metre (m); millimetre (mm); million tonnes (Mt); million tonnes per annum (Mtpa); ounces (oz); pounds (lb); thousand ounces (koz); thousand tonnes (kt); thousand tonnes per annum (ktpa); thousand tonnes per day (ktpd); tonnes (t); and wet metric tonnes (wmt).

| BHP Operational Review for the year ended 30 June 2023 | 8 |

In this release, the terms ‘BHP’, the ‘Group’, ‘BHP Group’, ‘we’, ‘us’, ‘our’ and ‘ourselves’ are used to refer to BHP Group Limited and, except where the context otherwise requires, our subsidiaries. Refer to note 28 ‘Subsidiaries’ of the Financial Statements in BHP’s 30 June 2022 Appendix 4E for a list of our significant subsidiaries. Those terms do not include non-operated assets. On and from 2 May, the BHP Group includes OZ Minerals Limited and its subsidiaries referred to in note 17 of their Financial Statements in its Annual Report for the year ended 30 December 2022. Notwithstanding that this release may include production, financial and other information from non-operated assets, non-operated assets are not included in the BHP Group and, as a result, statements regarding our operations, assets and values apply only to our operated assets unless stated otherwise. Our non-operated assets include Antamina and Samarco. BHP Group cautions against undue reliance on any forward-looking statement or guidance in this release, particularly in light of the current economic climate and significant volatility, uncertainty and disruption arising in connection with COVID-19. These forward-looking statements are based on information available as at the date of this release and are not guarantees or predictions of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control and which may cause actual results to differ materially from those expressed in the statements contained in this release.

Further information on BHP can be found at: bhp.com

Authorised for lodgement by:

Stefanie Wilkinson

Group Company Secretary

| Media Relations | Investor Relations | |

| Email: media.relations@bhp.com | Email: investor.relations@bhp.com | |

| Australia and Asia | Australia and Asia | |

| Gabrielle Notley | John-Paul Santamaria | |

| Tel: +61 3 9609 3830 Mobile: +61 411 071 715 | Mobile: +61 499 006 018 | |

| Europe, Middle East and Africa | Europe, Middle East and Africa | |

| Neil Burrows | James Bell | |

| Tel: +44 20 7802 7484 Mobile: +44 7786 661 683 | Tel: +44 20 7802 7144 Mobile: +44 7961 636 432 | |

| Americas | Americas | |

| Renata Fernandez | Monica Nettleton | |

| Mobile: +56 9 8229 5357 | Mobile: +1 416 518 6293 | |

BHP Group Limited ABN 49 004 028 077

LEI WZE1WSENV6JSZFK0JC28

Registered in Australia

Registered Office: Level 18, 171 Collins Street

Melbourne Victoria 3000 Australia

Tel +61 1300 55 4757 Fax +61 3 9609 3015

BHP Group is headquartered in Australia

Follow us on social media

| BHP Operational Review for the year ended 30 June 2023 | 9 |

Production summary

| Quarter ended | Year to date | |||||||||||||||||||||||||||||||

| BHP interest |

Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Jun 2023 |

Jun 2022 |

|||||||||||||||||||||||||

| Copper1 |

||||||||||||||||||||||||||||||||

| Copper |

||||||||||||||||||||||||||||||||

| Payable metal in concentrate (kt) |

||||||||||||||||||||||||||||||||

| Escondida2 |

57.5 | % | 233.5 | 203.1 | 208.3 | 200.8 | 220.5 | 832.7 | 802.6 | |||||||||||||||||||||||

| Pampa Norte3 |

100 | % | 28.2 | 28.6 | 32.5 | 32.0 | 32.2 | 125.3 | 111.2 | |||||||||||||||||||||||

| Copper South Australia4 |

100 | % | 19.9 | 19.9 | ||||||||||||||||||||||||||||

| Antamina |

33.8 | % | 39.6 | 37.1 | 35.2 | 29.6 | 36.5 | 138.4 | 149.9 | |||||||||||||||||||||||

| Carajas5 |

100 | % | 1.6 | 1.6 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

301.3 | 268.8 | 276.0 | 262.4 | 310.7 | 1,117.9 | 1,063.7 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Cathode (kt) |

||||||||||||||||||||||||||||||||

| Escondida2 |

57.5 | % | 55.8 | 49.6 | 49.7 | 50.8 | 72.5 | 222.6 | 201.4 | |||||||||||||||||||||||

| Pampa Norte3 |

100 | % | 49.0 | 42.0 | 44.2 | 41.0 | 36.3 | 163.5 | 170.0 | |||||||||||||||||||||||

| Copper South Australia4 |

100 | % | 55.7 | 49.7 | 54.4 | 51.7 | 56.7 | 212.5 | 138.4 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

160.5 | 141.3 | 148.3 | 143.5 | 165.5 | 598.6 | 509.8 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total copper (kt) |

461.8 | 410.1 | 424.3 | 405.9 | 476.2 | 1,716.5 | 1,573.5 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Lead |

||||||||||||||||||||||||||||||||

| Payable metal in concentrate (t) |

||||||||||||||||||||||||||||||||

| Antamina |

33.8 | % | 181 | 228 | 114 | 169 | 146 | 657 | 1,118 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

181 | 228 | 114 | 169 | 146 | 657 | 1,118 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Zinc |

||||||||||||||||||||||||||||||||

| Payable metal in concentrate (t) |

||||||||||||||||||||||||||||||||

| Antamina |

33.8 | % | 27,576 | 32,685 | 29,929 | 23,612 | 38,822 | 125,048 | 123,200 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

27,576 | 32,685 | 29,929 | 23,612 | 38,822 | 125,048 | 123,200 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Gold |

||||||||||||||||||||||||||||||||

| Payable metal in concentrate (troy oz) |

||||||||||||||||||||||||||||||||

| Escondida2 |

57.5 | % | 45,770 | 38,236 | 48,402 | 48,954 | 53,503 | 189,095 | 166,972 | |||||||||||||||||||||||

| Pampa Norte3 |

100 | % | 8,198 | 5,521 | 3,875 | 8,152 | 9,263 | 26,811 | 28,870 | |||||||||||||||||||||||

| Copper South Australia4 |

100 | % | 32,736 | 32,736 | ||||||||||||||||||||||||||||

| Carajas5 |

100 | % | 1,153 | 1,153 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

53,968 | 43,757 | 52,277 | 57,106 | 96,655 | 249,795 | 195,842 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Refined gold (troy oz) |

||||||||||||||||||||||||||||||||

| Copper South Australia4 |

100 | % | 26,080 | 47,184 | 43,280 | 49,086 | 46,479 | 186,029 | 119,517 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

26,080 | 47,184 | 43,280 | 49,086 | 46,479 | 186,029 | 119,517 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total gold (troy oz) |

80,048 | 90,941 | 95,557 | 106,192 | 143,134 | 435,824 | 315,359 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Silver |

||||||||||||||||||||||||||||||||

| Payable metal in concentrate (troy koz) |

||||||||||||||||||||||||||||||||

| Escondida2 |

57.5 | % | 1,311 | 1,210 | 1,510 | 1,346 | 1,008 | 5,074 | 5,334 | |||||||||||||||||||||||

| Pampa Norte3 |

100 | % | 262 | 252 | 245 | 409 | 412 | 1,318 | 1,011 | |||||||||||||||||||||||

| Copper South Australia4 |

100 | % | 201 | 201 | ||||||||||||||||||||||||||||

| Antamina |

33.8 | % | 1,212 | 1,190 | 923 | 801 | 971 | 3,885 | 5,078 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

2,785 | 2,652 | 2,678 | 2,556 | 2,592 | 10,478 | 11,423 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Refined silver (troy koz) |

||||||||||||||||||||||||||||||||

| Copper South Australia4 |

100 | % | 145 | 295 | 261 | 277 | 256 | 1,089 | 743 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

145 | 295 | 261 | 277 | 256 | 1,089 | 743 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total silver (troy koz) |

2,930 | 2,947 | 2,939 | 2,833 | 2,848 | 11,567 | 12,166 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Uranium |

||||||||||||||||||||||||||||||||

| Payable metal in concentrate (t) |

||||||||||||||||||||||||||||||||

| Copper South Australia4 |

100 | % | 776 | 817 | 943 | 833 | 813 | 3,406 | 2,375 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

776 | 817 | 943 | 833 | 813 | 3,406 | 2,375 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Molybdenum |

||||||||||||||||||||||||||||||||

| Payable metal in concentrate (t) |

||||||||||||||||||||||||||||||||

| Pampa Norte3 |

100 | % | 71 | 34 | 216 | 407 | 333 | 990 | 71 | |||||||||||||||||||||||

| Antamina |

33.8 | % | 249 | 262 | 348 | 229 | 333 | 1,172 | 798 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

320 | 296 | 564 | 636 | 666 | 2,162 | 869 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| BHP Operational Review for the year ended 30 June 2023 | 10 |

Production summary

| Quarter ended | Year to date | |||||||||||||||||||||||||||||||

| BHP interest |

Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Jun 2023 |

Jun 2022 |

|||||||||||||||||||||||||

| Iron Ore |

||||||||||||||||||||||||||||||||

| Iron Ore |

||||||||||||||||||||||||||||||||

| Production (kt)6 |

||||||||||||||||||||||||||||||||

| Newman |

85 | % | 14,063 | 14,053 | 16,172 | 11,925 | 14,795 | 56,945 | 57,041 | |||||||||||||||||||||||

| Area C Joint Venture |

85 | % | 27,685 | 26,971 | 26,302 | 25,284 | 28,818 | 107,375 | 94,431 | |||||||||||||||||||||||

| Yandi Joint Venture |

85 | % | 6,409 | 5,497 | 5,613 | 4,941 | 5,359 | 21,410 | 38,922 | |||||||||||||||||||||||

| Jimblebar7 |

85 | % | 15,005 | 17,404 | 17,720 | 16,575 | 15,102 | 66,801 | 58,782 | |||||||||||||||||||||||

| Samarco |

50 | % | 1,000 | 1,148 | 1,095 | 1,048 | 1,221 | 4,512 | 4,071 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

64,162 | 65,073 | 66,902 | 59,773 | 65,295 | 257,043 | 253,247 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Coal |

||||||||||||||||||||||||||||||||

| Metallurgical coal |

||||||||||||||||||||||||||||||||

| Production (kt)8 |

||||||||||||||||||||||||||||||||

| BHP Mitsubishi Alliance (BMA) |

50 | % | 8,183 | 6,662 | 6,952 | 6,929 | 8,477 | 29,020 | 29,142 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

8,183 | 6,662 | 6,952 | 6,929 | 8,477 | 29,020 | 29,142 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Energy coal |

||||||||||||||||||||||||||||||||

| Production (kt) |

||||||||||||||||||||||||||||||||

| NSW Energy Coal |

100 | % | 3,919 | 2,622 | 2,851 | 3,934 | 4,765 | 14,172 | 13,701 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

3,919 | 2,622 | 2,851 | 3,934 | 4,765 | 14,172 | 13,701 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Other |

||||||||||||||||||||||||||||||||

| Nickel |

||||||||||||||||||||||||||||||||

| Saleable production (kt) |

||||||||||||||||||||||||||||||||

| Nickel West |

100 | % | 18.8 | 20.7 | 17.7 | 19.6 | 22.0 | 80.0 | 76.8 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

18.8 | 20.7 | 17.7 | 19.6 | 22.0 | 80.0 | 76.8 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Cobalt |

||||||||||||||||||||||||||||||||

| Saleable production (t) |

||||||||||||||||||||||||||||||||

| Nickel West |

100 | % | 110 | 238 | 93 | 175 | 246 | 752 | 632 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

110 | 238 | 93 | 175 | 246 | 752 | 632 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| 1 | Metal production is reported on the basis of payable metal. |

| 2 | Shown on a 100% basis. BHP interest in saleable production is 57.5%. |

| 3 | Includes Spence and Cerro Colorado. Refer to the Production and Sales Report for more details. |

| 4 | Includes Olympic Dam and two months of production from Prominent Hill and Carrapateena from 1 May 2023, following the acquisition of OZL on 2 May 2023. Refer to the Production and Sales Report for more details. |

| 5 | Includes two months of production from 1 May 2023, following the acquisiton of OZL on 2 May 2023. |

| 6 | Iron ore production is reported on a wet tonnes basis. |

| 7 | Shown on a 100% basis. BHP interest in saleable production is 85%. |

| 8 | Metallurgical coal production is reported on the basis of saleable product. Production figures may include some thermal coal. |

Throughout this report figures in italics indicate that this figure has been adjusted since it was previously reported.

| BHP Operational Review for the year ended 30 June 2023 | 11 |

Production and sales report

| Quarter ended | Year to date | |||||||||||||||||||||||||||||

| Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Jun 2023 |

Jun 2022 |

||||||||||||||||||||||||

| Copper |

||||||||||||||||||||||||||||||

| Metals production is payable metal unless otherwise stated. |

||||||||||||||||||||||||||||||

| Escondida, Chile 1 |

||||||||||||||||||||||||||||||

| Material mined |

(kt) | 115,409 | 110,248 | 101,987 | 106,170 | 95,451 | 413,856 | 454,243 | ||||||||||||||||||||||

| Concentrator throughput |

(kt) | 34,318 | 32,894 | 33,911 | 33,309 | 30,750 | 130,864 | 133,868 | ||||||||||||||||||||||

| Average copper grade - concentrator |

(%) | 0.88 | % | 0.83 | % | 0.76 | % | 0.78 | % | 0.93 | % | 0.82 | % | 0.78 | % | |||||||||||||||

| Production ex mill |

(kt) | 239.5 | 214.6 | 212.8 | 210.0 | 228.9 | 866.3 | 835.8 | ||||||||||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 233.5 | 203.1 | 208.3 | 200.8 | 220.5 | 832.7 | 802.6 | ||||||||||||||||||||||

| Copper cathode (EW) |

(kt) | 55.8 | 49.6 | 49.7 | 50.8 | 72.5 | 222.6 | 201.4 | ||||||||||||||||||||||

| - Oxide leach |

(kt) | 17.5 | 15.2 | 17.6 | 14.7 | 29.3 | 76.8 | 57.6 | ||||||||||||||||||||||

| - Sulphide leach |

(kt) | 38.3 | 34.4 | 32.1 | 36.1 | 43.2 | 145.8 | 143.8 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total copper |

(kt) | 289.3 | 252.7 | 258.0 | 251.6 | 293.0 | 1,055.3 | 1,004.0 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Payable gold concentrate |

(troy oz) | 45,770 | 38,236 | 48,402 | 48,954 | 53,503 | 189,095 | 166,972 | ||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 1,311 | 1,210 | 1,510 | 1,346 | 1,008 | 5,074 | 5,334 | ||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 230.4 | 196.7 | 216.0 | 197.3 | 220.3 | 830.3 | 798.1 | ||||||||||||||||||||||

| Copper cathode (EW) |

(kt) | 58.9 | 45.9 | 53.5 | 43.8 | 78.0 | 221.2 | 202.5 | ||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 45,770 | 38,236 | 48,402 | 48,954 | 53,503 | 189,095 | 166,972 | ||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 1,311 | 1,210 | 1,510 | 1,346 | 1,008 | 5,074 | 5,334 | ||||||||||||||||||||||

| 1 | Shown on a 100% basis. BHP interest in saleable production is 57.5%. |

| Pampa Norte, Chile |

||||||||||||||||||||||||||||||

| Cerro Colorado |

||||||||||||||||||||||||||||||

| Material mined |

(kt) | 3,604 | 3,179 | 583 | 172 | 145 | 4,079 | 17,280 | ||||||||||||||||||||||

| Ore stacked |

(kt) | 4,259 | 4,373 | 4,119 | 3,567 | 3,928 | 15,987 | 15,035 | ||||||||||||||||||||||

| Average copper grade - stacked |

(%) | 0.55 | % | 0.54 | % | 0.56 | % | 0.57 | % | 0.53 | % | 0.55 | % | 0.58 | % | |||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Copper cathode (EW) |

(kt) | 14.7 | 12.8 | 12.2 | 12.0 | 12.2 | 49.2 | 55.0 | ||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Copper cathode (EW) |

(kt) | 16.2 | 13.3 | 12.2 | 10.9 | 14.1 | 50.5 | 54.8 | ||||||||||||||||||||||

| Spence |

||||||||||||||||||||||||||||||

| Material mined |

(kt) | 26,749 | 26,956 | 26,980 | 24,858 | 25,622 | 104,416 | 95,968 | ||||||||||||||||||||||

| Ore stacked |

(kt) | 5,099 | 5,577 | 5,155 | 4,947 | 5,625 | 21,304 | 20,483 | ||||||||||||||||||||||

| Average copper grade - stacked |

(%) | 0.66 | % | 0.70 | % | 0.66 | % | 0.60 | % | 0.58 | % | 0.64 | % | 0.66 | % | |||||||||||||||

| Concentrator throughput |

(kt) | 6,311 | 6,433 | 7,602 | 7,290 | 6,927 | 28,252 | 24,843 | ||||||||||||||||||||||

| Average copper grade - concentrator |

(%) | 0.66 | % | 0.63 | % | 0.60 | % | 0.61 | % | 0.61 | % | 0.61 | % | 0.64 | % | |||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 28.2 | 28.6 | 32.5 | 32.0 | 32.2 | 125.3 | 111.2 | ||||||||||||||||||||||

| Copper cathode (EW) |

(kt) | 34.3 | 29.2 | 32.0 | 29.0 | 24.1 | 114.3 | 115.0 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total copper |

(kt) | 62.5 | 57.8 | 64.5 | 61.0 | 56.3 | 239.6 | 226.2 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Payable gold concentrate |

(troy oz) | 8,198 | 5,521 | 3,875 | 8,152 | 9,263 | 26,811 | 28,870 | ||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 262 | 252 | 245 | 409 | 412 | 1,318 | 1,011 | ||||||||||||||||||||||

| Payable molybdenum |

(t) | 71 | 34 | 216 | 407 | 333 | 990 | 71 | ||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 28.1 | 26.0 | 22.0 | 38.7 | 38.6 | 125.3 | 109.5 | ||||||||||||||||||||||

| Copper cathode (EW) |

(kt) | 35.4 | 29.1 | 33.4 | 25.1 | 28.3 | 115.9 | 114.5 | ||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 8,198 | 5,521 | 3,875 | 8,152 | 9,263 | 26,811 | 28,870 | ||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 262 | 252 | 245 | 409 | 412 | 1,318 | 1,011 | ||||||||||||||||||||||

| Payable molybdenum |

(t) | 25 | 25 | 216 | 492 | 367 | 1,100 | 25 | ||||||||||||||||||||||

| BHP Operational Review for the year ended 30 June 2023 | 12 |

Production and sales report

| Quarter ended | Year to date | |||||||||||||||||||||||||||||

| Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Jun 2023 |

Jun 2022 |

||||||||||||||||||||||||

| Copper (continued) |

||||||||||||||||||||||||||||||

| Metals production is |

||||||||||||||||||||||||||||||

| Copper South Australia |

||||||||||||||||||||||||||||||

| Olympic Dam |

||||||||||||||||||||||||||||||

| Material mined 1 |

(kt) | 2,477 | 2,412 | 2,264 | 2,317 | 2,356 | 9,349 | 8,834 | ||||||||||||||||||||||

| Ore milled |

(kt) | 2,436 | 2,570 | 2,687 | 2,433 | 2,755 | 10,445 | 7,687 | ||||||||||||||||||||||

| Average copper grade |

(%) | 2.15 | % | 2.13 | % | 2.08 | % | 1.95 | % | 2.00 | % | 2.04 | % | 2.14 | % | |||||||||||||||

| Average uranium grade |

(kg/t) | 0.56 | 0.58 | 0.58 | 0.59 | 0.55 | 0.58 | 0.57 | ||||||||||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Copper cathode (ER and EW) |

(kt) | 55.7 | 49.7 | 54.4 | 51.7 | 56.7 | 212.5 | 138.4 | ||||||||||||||||||||||

| Payable uranium |

(t) | 776 | 817 | 943 | 833 | 813 | 3,406 | 2,375 | ||||||||||||||||||||||

| Refined gold |

(troy oz) | 26,080 | 47,184 | 43,280 | 49,086 | 46,479 | 186,029 | 119,517 | ||||||||||||||||||||||

| Refined silver |

(troy koz) | 145 | 295 | 261 | 277 | 256 | 1,089 | 743 | ||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Copper cathode (ER and EW) |

(kt) | 55.8 | 45.9 | 56.8 | 50.5 | 59.5 | 212.7 | 139.1 | ||||||||||||||||||||||

| Payable uranium |

(t) | 1,031 | 272 | 1,127 | 683 | 1,275 | 3,357 | 2,344 | ||||||||||||||||||||||

| Refined gold |

(troy oz) | 24,622 | 49,542 | 41,900 | 47,300 | 49,182 | 187,924 | 118,979 | ||||||||||||||||||||||

| Refined silver |

(troy koz) | 87 | 320 | 233 | 307 | 270 | 1,130 | 685 | ||||||||||||||||||||||

| Prominent Hill 2 |

||||||||||||||||||||||||||||||

| Material mined |

(kt) | 661 | 661 | |||||||||||||||||||||||||||

| Ore milled |

(kt) | 1,228 | 1,228 | |||||||||||||||||||||||||||

| Average copper grade |

(%) | 0.77 | % | 0.77 | % | |||||||||||||||||||||||||

| Production ex mill |

(kt) | 16.3 | 16.3 | |||||||||||||||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 8.2 | 8.2 | |||||||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 17,432 | 17,432 | |||||||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 44 | 44 | |||||||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 15.7 | 15.7 | |||||||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 28,856 | 28,856 | |||||||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 87 | 87 | |||||||||||||||||||||||||||

| Carrapateena 2 |

||||||||||||||||||||||||||||||

| Material mined |

(kt) | 880 | 880 | |||||||||||||||||||||||||||

| Ore milled |

(kt) | 856 | 856 | |||||||||||||||||||||||||||

| Average copper grade |

(%) | 1.52 | % | 1.52 | % | |||||||||||||||||||||||||

| Production ex mill |

(kt) | 30.1 | 30.1 | |||||||||||||||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 11.7 | 11.7 | |||||||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 15,304 | 15,304 | |||||||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 157 | 157 | |||||||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 11.9 | 11.9 | |||||||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 15,242 | 15,242 | |||||||||||||||||||||||||||

| Payable silver concentrate |

(troy koz) | 155 | 155 | |||||||||||||||||||||||||||

| 1 | Material mined refers to underground ore mined, subsequently hoisted or trucked to surface. |

| 2 | Includes two months of production and sales from 1 May 2023, following the acquisiton of OZL on 2 May 2023. |

| BHP Operational Review for the year ended 30 June 2023 | 13 |

Production and sales report

| Quarter ended | Year to date | |||||||||||||||||||||||||||||

| Jun | Sep | Dec | Mar | Jun | Jun | Jun | ||||||||||||||||||||||||

| 2022 | 2022 | 2022 | 2023 | 2023 | 2023 | 2022 | ||||||||||||||||||||||||

| Copper (continued) |

||||||||||||||||||||||||||||||

| Metals production is payable metal unless otherwise stated. |

||||||||||||||||||||||||||||||

| Antamina, Peru |

||||||||||||||||||||||||||||||

| Material mined (100%) |

(kt) | 64,026 | 63,865 | 68,750 | 57,939 | 62,894 | 253,448 | 246,904 | ||||||||||||||||||||||

| Concentrator throughput (100%) |

(kt) | 13,131 | 13,858 | 14,272 | 12,349 | 13,897 | 54,376 | 52,496 | ||||||||||||||||||||||

| Average head grades |

||||||||||||||||||||||||||||||

| - Copper |

(%) | 1.02 | % | 0.93 | % | 0.86 | % | 0.88 | % | 0.88 | % | 0.89 | % | 0.98 | % | |||||||||||||||

| - Zinc |

(%) | 1.05 | % | 1.09 | % | 0.99 | % | 1.06 | % | 1.25 | % | 1.10 | % | 1.11 | % | |||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 39.6 | 37.1 | 35.2 | 29.6 | 36.5 | 138.4 | 149.9 | ||||||||||||||||||||||

| Payable zinc |

(t) | 27,576 | 32,685 | 29,929 | 23,612 | 38,822 | 125,048 | 123,200 | ||||||||||||||||||||||

| Payable silver |

(troy koz) | 1,212 | 1,190 | 923 | 801 | 971 | 3,885 | 5,078 | ||||||||||||||||||||||

| Payable lead |

(t) | 181 | 228 | 114 | 169 | 146 | 657 | 1,118 | ||||||||||||||||||||||

| Payable molybdenum |

(t) | 249 | 262 | 348 | 229 | 333 | 1,172 | 798 | ||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 40.7 | 37.6 | 34.7 | 32.4 | 34.5 | 139.2 | 148.2 | ||||||||||||||||||||||

| Payable zinc |

(t) | 30,847 | 33,820 | 29,127 | 25,851 | 37,629 | 126,427 | 125,915 | ||||||||||||||||||||||

| Payable silver |

(troy koz) | 1,230 | 1,015 | 850 | 768 | 747 | 3,380 | 4,816 | ||||||||||||||||||||||

| Payable lead |

(t) | 363 | 130 | 91 | 181 | 143 | 545 | 1,208 | ||||||||||||||||||||||

| Payable molybdenum |

(t) | 205 | 250 | 298 | 297 | 227 | 1,072 | 660 | ||||||||||||||||||||||

| Carajas, Brazil 1 |

||||||||||||||||||||||||||||||

| Material mined |

(kt) | 103 | 103 | |||||||||||||||||||||||||||

| Ore milled |

(kt) | 100 | 100 | |||||||||||||||||||||||||||

| Average copper grade |

(%) | 1.71 | % | 1.71 | % | |||||||||||||||||||||||||

| Production ex mill |

(kt) | 6.6 | 6.6 | |||||||||||||||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 1.6 | 1.6 | |||||||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 1,153 | 1,153 | |||||||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Payable copper |

(kt) | 2.1 | 2.1 | |||||||||||||||||||||||||||

| Payable gold concentrate |

(troy oz) | 1,688 | 1,688 | |||||||||||||||||||||||||||

| 1 | Includes two months of production and sales from 1 May 2023, following the acquisiton of OZL on 2 May 2023. |

| BHP Operational Review for the year ended 30 June 2023 | 14 |

Production and sales report

| Quarter ended | Year to date | |||||||||||||||||||||||||||||

| Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Jun 2023 |

Jun 2022 |

||||||||||||||||||||||||

| Iron Ore |

||||||||||||||||||||||||||||||

| Iron ore production and sales are reported on a wet tonnes basis. |

|

|||||||||||||||||||||||||||||

| Western Australia Iron Ore, Australia |

||||||||||||||||||||||||||||||

| Production |

||||||||||||||||||||||||||||||

| Newman |

(kt) | 14,063 | 14,053 | 16,172 | 11,925 | 14,795 | 56,945 | 57,041 | ||||||||||||||||||||||

| Area C Joint Venture |

(kt) | 27,685 | 26,971 | 26,302 | 25,284 | 28,818 | 107,375 | 94,431 | ||||||||||||||||||||||

| Yandi Joint Venture |

(kt) | 6,409 | 5,497 | 5,613 | 4,941 | 5,359 | 21,410 | 38,922 | ||||||||||||||||||||||

| Jimblebar1 |

(kt) | 15,005 | 17,404 | 17,720 | 16,575 | 15,102 | 66,801 | 58,782 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total production |

(kt) | 63,162 | 63,925 | 65,807 | 58,725 | 64,074 | 252,531 | 249,176 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total production (100%) |

(kt) | 71,660 | 72,135 | 74,292 | 66,163 | 72,717 | 285,307 | 282,773 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||

| Lump |

(kt) | 20,006 | 19,561 | 20,375 | 18,021 | 20,022 | 77,979 | 72,345 | ||||||||||||||||||||||

| Fines |

(kt) | 44,308 | 42,696 | 44,121 | 41,183 | 42,904 | 170,904 | 178,343 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

(kt) | 64,314 | 62,257 | 64,496 | 59,204 | 62,926 | 248,883 | 250,688 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total sales (100%) |

(kt) | 72,796 | 70,276 | 72,688 | 66,580 | 71,172 | 280,716 | 283,943 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 1 | Shown on a 100% basis. BHP interest in saleable production is 85%. |

| Samarco, Brazil |

||||||||||||||||||||||||||||||||

| Production |

(kt | ) | 1,000 | 1,148 | 1,095 | 1,048 | 1,221 | 4,512 | 4,071 | |||||||||||||||||||||||

| Sales |

(kt | ) | 991 | 1,146 | 1,097 | 1,111 | 1,160 | 4,514 | 3,995 |

| BHP Operational Review for the year ended 30 June 2023 | 15 |

Production and sales report

| Quarter ended | Year to date | |||||||||||||||||||||||||||||||

| Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Jun 2023 |

Jun 2022 |

||||||||||||||||||||||||||

| Coal |

||||||||||||||||||||||||||||||||

| Coal production is reported on the basis of saleable product. |

|

|||||||||||||||||||||||||||||||

| BHP Mitsubishi Alliance (BMA), Australia |

||||||||||||||||||||||||||||||||

| Production1 |

||||||||||||||||||||||||||||||||

| Blackwater |

(kt | ) | 1,751 | 1,283 | 1,160 | 1,107 | 1,505 | 5,055 | 5,834 | |||||||||||||||||||||||

| Goonyella |

(kt | ) | 2,429 | 1,780 | 1,997 | 2,185 | 2,348 | 8,310 | 8,360 | |||||||||||||||||||||||

| Peak Downs |

(kt | ) | 1,366 | 1,325 | 1,480 | 1,251 | 1,424 | 5,480 | 4,944 | |||||||||||||||||||||||

| Saraji |

(kt | ) | 1,168 | 1,020 | 1,243 | 1,007 | 1,326 | 4,596 | 4,614 | |||||||||||||||||||||||

| Daunia |

(kt | ) | 472 | 324 | 441 | 607 | 617 | 1,989 | 1,491 | |||||||||||||||||||||||

| Caval Ridge |

(kt | ) | 997 | 930 | 631 | 772 | 1,257 | 3,590 | 3,899 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total production |

(kt | ) | 8,183 | 6,662 | 6,952 | 6,929 | 8,477 | 29,020 | 29,142 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total production (100%) |

(kt | ) | 16,366 | 13,324 | 13,904 | 13,858 | 16,954 | 58,040 | 58,284 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||||

| Coking coal |

(kt | ) | 6,734 | 5,615 | 5,872 | 5,372 | 7,448 | 24,307 | 23,358 | |||||||||||||||||||||||

| Weak coking coal |

(kt | ) | 1,118 | 600 | 727 | 710 | 1,064 | 3,101 | 3,411 | |||||||||||||||||||||||

| Thermal coal |

(kt | ) | 765 | 267 | 428 | 104 | 364 | 1,163 | 2,280 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total sales |

(kt | ) | 8,617 | 6,482 | 7,027 | 6,186 | 8,876 | 28,571 | 29,049 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total sales (100%) |

(kt | ) | 17,234 | 12,964 | 14,054 | 12,372 | 17,752 | 57,142 | 58,098 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| 1 | Production figures include some thermal coal. |

| NSW Energy Coal, Australia |

||||||||||||||||||||||||||||||||

| Production |

(kt | ) | 3,919 | 2,622 | 2,851 | 3,934 | 4,765 | 14,172 | 13,701 | |||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||||

| Export |

(kt | ) | 3,923 | 2,441 | 2,862 | 3,667 | 4,693 | 13,663 | 14,124 | |||||||||||||||||||||||

| Domestic1 |

(kt | ) | — | — | — | — | 201 | 201 | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

(kt | ) | 3,923 | 2,441 | 2,862 | 3,667 | 4,894 | 13,864 | 14,124 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 | The domestic sales are made under the NSW Government Coal Market Price Emergency (Directions for Coal Mines) Notice 2023. |

| BHP Operational Review for the year ended 30 June 2023 | 16 |

Production and sales report

| Quarter ended | Year to date | |||||||||||||||||||||||||||||||

| Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Jun 2023 |

Jun 2022 |

||||||||||||||||||||||||||

| Other |

||||||||||||||||||||||||||||||||

| Nickel production is reported on the basis of saleable product |

|

|||||||||||||||||||||||||||||||

| Nickel West, Australia |

||||||||||||||||||||||||||||||||

| Mt Keith |

||||||||||||||||||||||||||||||||

| Nickel concentrate |

(kt | ) | 48.0 | 42.6 | 39.6 | 38.8 | 44.5 | 165.5 | 195.8 | |||||||||||||||||||||||

| Average nickel grade |

( | %) | 16.1 | 17.0 | 15.5 | 16.5 | 16.2 | 16.3 | 14.6 | |||||||||||||||||||||||

| Leinster |

||||||||||||||||||||||||||||||||

| Nickel concentrate |

(kt | ) | 76.0 | 66.8 | 47.9 | 68.4 | 71.1 | 254.2 | 305.2 | |||||||||||||||||||||||

| Average nickel grade |

( | %) | 10.3 | 9.9 | 9.4 | 8.6 | 8.5 | 9.1 | 9.3 | |||||||||||||||||||||||

| Saleable production |

||||||||||||||||||||||||||||||||

| Refined nickel1 |

(kt | ) | 11.7 | 17.5 | 10.8 | 13.2 | 13.1 | 54.6 | 57.6 | |||||||||||||||||||||||

| Nickel sulphate2 |

(kt | ) | 0.5 | 1.2 | 0.4 | 0.9 | 0.7 | 3.2 | 1.6 | |||||||||||||||||||||||

| Intermediates and nickel by-products3 |

(kt | ) | 6.6 | 2.0 | 6.5 | 5.5 | 8.2 | 22.2 | 17.6 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total nickel |

(kt | ) | 18.8 | 20.7 | 17.7 | 19.6 | 22.0 | 80.0 | 76.8 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Cobalt by-products |

(t | ) | 110 | 238 | 93 | 175 | 246 | 752 | 632 | |||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||||

| Refined nickel1 |

(kt | ) | 11.7 | 18.1 | 10.2 | 13.0 | 13.1 | 54.4 | 57.7 | |||||||||||||||||||||||

| Nickel sulphate2 |

(kt | ) | 0.5 | 0.8 | 0.5 | 0.9 | 0.8 | 3.0 | 1.3 | |||||||||||||||||||||||

| Intermediates and nickel by-products3 |

(kt | ) | 6.4 | 1.8 | 7.7 | 5.7 | 9.5 | 24.7 | 16.1 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total nickel |

(kt | ) | 18.6 | 20.7 | 18.4 | 19.6 | 23.4 | 82.1 | 75.1 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Cobalt by-products |

(t | ) | 110 | 238 | 93 | 175 | 246 | 752 | 632 | |||||||||||||||||||||||

| 1 | High quality refined nickel metal, including briquettes and powder. |

| 2 | Nickel sulphate crystals produced from nickel powder. |

| 3 | Nickel contained in matte and by-product streams. |

| BHP Operational Review for the year ended 30 June 2023 | 17 |

Appendix 1

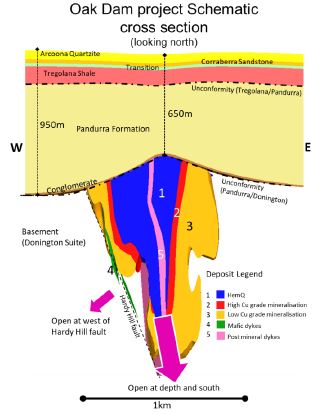

The Oak Dam Exploration Target, shown in Table 1, was determined using the BHP internal process of Range Analysis based on 49 drill roles (~61km of drilling). Refer to “BHP Results for the half year ended 31 December 2022, Appendix 1 – Explanatory Notes and JORC table 1” for previously reported Exploration Results.

Table 1: Oak Dam Exploration Target.

| Low | High | |||||||

| Tonnes (Mt) |

500 | 1,700 | ||||||

| Grade (Cu%) |

0.8 | 1.1 | ||||||

The potential quantity and grade of an Exploration Target is conceptual in nature and as such there has been insufficient exploration to estimate a Mineral Resource. It is uncertain if further exploration or analysis will result in the estimation of a Mineral Resource.

The target is interpreted as IOGC style of mineralisation based on exploration results from the Oak Dam project. Currently, drilling is at varying degrees of spacing.

Target ranges were compiled within a facilitated process called Range Analysis, in which potential volumes and grades are determined over a range of assumptions on continuity and extension that are consistent with available data and genetic models of IOCG copper style of mineralisation.

The target remains open at depth, to the south, and west of “Hardy Hill fault” as per cross section on figure 1 below.

Figure 1: Oak Dam geology schematic W-E cross section looking north showing mineralisation is open to the west of Hardy Hill fault, at depth and to the south.

Intended activities for exploration target testing

BHP is currently running nine drill rigs at Oak Dam, with eleven rigs expected by November 2023.

A 150-room camp, including a drilling core processing facility, will be constructed on the tenement in 2023 to support the drilling program.

| BHP Operational Review for the year ended 30 June 2023 | 17 |

Competent Persons Statement

The information in this report that relates to Exploration Targets is based on information compiled by Dr. Kathy Ehrig, a Competent Person who is a Fellow of The Australasian Institute of Mining and Metallurgy and a Fellow of the Australian Institute of Geoscientists.

Dr. Kathy Ehrig has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results. Dr. Kathy Ehrig consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

| BHP Operational Review for the year ended 30 June 2023 | 18 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BHP Group Limited | ||||||