UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2023

Commission File Number 001-16139

Wipro Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Karnataka, India

(Jurisdiction of incorporation or organization)

Doddakannelli

Sarjapur Road

Bangalore, Karnataka 560035, India +91-80-2844-0011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☑

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ☐ No ☑

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

ANNOUNCEMENT OF SHARE BUYBACK COMPLETION

Wipro Limited, a company organized under the laws of the Republic of India (the “Company”), hereby furnishes the Commission with a copy of the following information relating to the completion of the buyback of its equity shares (the “Share Buyback Offer”). The following information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On July 6, 2023, the Company placed a public announcement (the “Public Announcement”) in certain Indian newspapers concerning the completion of its Share Buyback Offer. A copy of the form of this Public Announcement has been shared with the securities exchanges in India on which its securities are listed and the New York Stock Exchange. A copy of the form of this Public Announcement is attached to this Form 6-K as Item 99.1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly organized.

| WIPRO LIMITED |

||

| By: | /s/ Jatin Pravinchandra Dalal | |

| Jatin Pravinchandra Dalal |

||

| Chief Financial Officer |

||

Dated: July 7, 2023

INDEX TO EXHIBITS

| Item | ||

| 99.1 | Public Announcement placed in Indian newspapers on July 6, 2023 | |

Exhibit 99.1

| July 6, 2023

|

|

|

| The Manager - Listing | ||

| BSE Limited | ||

| (BSE: 507685) | ||

| The Manager - Listing | ||

| National Stock Exchange of India Limited | ||

| (NSE: WIPRO) | ||

| The Market Operations | ||

| NYSE, New York | ||

| (NYSE: WIT) | ||

| Dear Sir/Madam, | ||

Sub: Submission of Post-Buyback Public Announcement for buyback of equity shares of Wipro Limited (the “Company”)

Pursuant to regulation 24(vi) of the Securities and Exchange Board of India (Buyback of Securities) Regulations, 2018, as amended, the Company has published the Post-Buyback Public Announcement for the buyback of 26,96,62,921 (Twenty Six Crore Ninety Six Lakh Sixty Two Thousand Nine Hundred and Twenty One Only) fully paid up Equity Shares of the Company of face value of Rs. 2/- (Rupees Two only) each at a price of Rs. 445/- (Rupees Four Hundred and Forty Five Only) per equity share on a proportionate basis from the equity shareholders of the Company as on the Record date of June 16, 2023 through the tender offer process.

We are enclosing herewith copy of the Post-Buyback Public Announcement published on July 6, 2023 for your information and records.

Thanking you,

For Wipro Limited

| SANAULLA KHAN MOHAMMED | Digitally signed by SANAULLA KHAN MOHAMMED Date: 2023.07.06 17:43:40 +05‘30’ |

M Sanaulla Khan

Company Secretary

Encl: As above

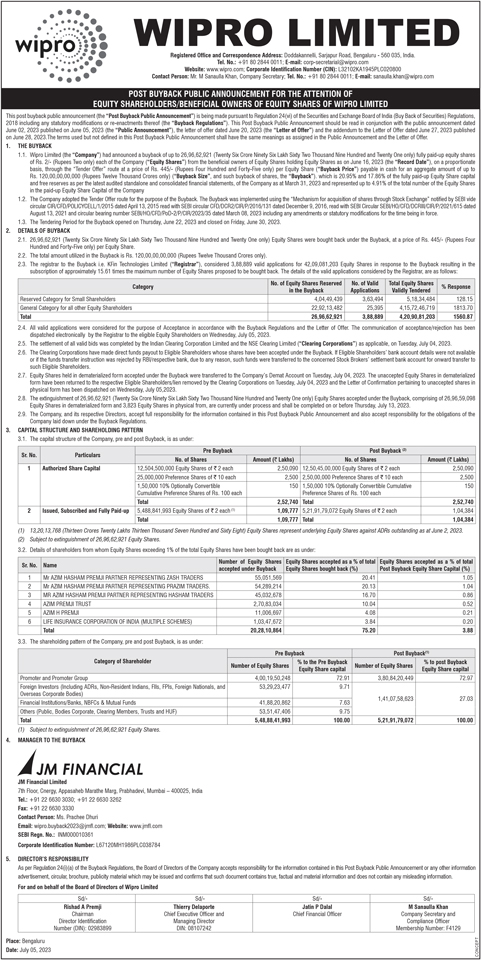

WIPRO LIMITED Registered Office and Correspondence Address: Doddakannelli, Sarjapur Road, Bengaluru - 560 035, India. Tel. No.: +91 80 2844 0011; E-mail: corp-secretarial@wipro.com Website: www.wipro.com; Corporate Identification Number (CIN): L32102KA1945PLC020800 Contact Person: Mr. M Sanaulla Khan, Company Secretary; Tel. No.: +91 80 2844 0011; E-mail: sanaulla.khan@wipro.com POST BUYBACK PUBLIC ANNOUNCEMENT FOR THE ATTENTION OF EQUITY SHAREHOLDERS/BENEFICIAL OWNERS OF EQUITY SHARES OF WIPRO LIMITED This post buyback public announcement (the “Post Buyback Public Announcement”) is being made pursuant to Regulation 24(vi) of the Securities and Exchange Board of India (Buy Back of Securities) Regulations, 2018 including any statutory modifications or re-enactments thereof (the “Buyback Regulations”). This Post Buyback Public Announcement should be read in conjunction with the public announcement dated June 02, 2023 published on June 05, 2023 (the “Public Announcement”), the letter of offer dated June 20, 2023 (the “Letter of Offer”) and the addendum to the Letter of Offer dated June 27, 2023 published on June 28, 2023.The terms used but not defined in this Post Buyback Public Announcement shall have the same meanings as assigned in the Public Announcement and the Letter of Offer. 1. THE BUYBACK 1.1. Wipro Limited (the “Company”) had announced a buyback of up to 26,96,62,921 (Twenty Six Crore Ninety Six Lakh Sixty Two Thousand Nine Hundred and Twenty One only) fully paid-up equity shares of Rs. 2/- (Rupees Two only) each of the Company (“Equity Shares”) from the beneficial owners of Equity Shares holding Equity Shares as on June 16, 2023 (the “Record Date”), on a proportionate basis, through the “Tender Offer” route at a price of Rs. 445/- (Rupees Four Hundred and Forty-Five only) per Equity Share (“Buyback Price”) payable in cash for an aggregate amount of up to Rs. 120,00,00,00,000 (Rupees Twelve Thousand Crores only) (“Buyback Size”, and such buyback of shares, the “Buyback”). which is 20.95% and 17.86% of the fully paid-up Equity Share capital and free reserves as per the latest audited standalone and consolidated financial statements, of the Company as at March 31, 2023 and represented up to 4.91% of the total number of the Equity Shares in the paid-up Equity Share Capital of the Company 1.2. The Company adopted the Tender Offer route for the purpose of the Buyback. The Buyback was implemented using the “Mechanism for acquisition of shares through Stock Exchange” notified by SEBI vide circular CIR/CFD/POLICYCELL/1/2015 dated April 13, 2015 read with SEBI circular CFD/DCR2/CIR/P/2016/131 dated December 9, 2016, read with SEBI Circular SEBI/HO/CFD/DCRIII/CIR/P/2021/615 dated August 13, 2021 and circular bearing number SEBI/HO/CFD/PoD-2/P/CIR/2023/35 dated March 08, 2023 including any amendments or statutory modifications for the time being in force. 1.3. The Tendering Period for the Buyback opened on Thursday, June 22, 2023 and closed on Friday, June 30, 2023. 2. DETAILS OF BUYBACK 2.1. 26,96,62,921 (Twenty Six Crore Ninety Six Lakh Sixty Two Thousand Nine Hundred and Twenty One only) Equity Shares were bought back under the Buyback, at a price of Rs. 445/- (Rupees Four Hundred and Forty-Five only) per Equity Share. 2.2. The total amount utilized in the Buyback is Rs. 120,00,00,00,000 (Rupees Twelve Thousand Crores only). 2.3. The registrar to the Buyback i.e. KFin Technologies Limited (“Registrar”), considered 3,88,889 valid applications for 42,09,081,203 Equity Shares in response to the Buyback resulting in the subscription of approximately 15.61 times the maximum number of Equity Shares proposed to be bought back. The details of the valid applications considered by the Registrar, are as follows: Category No. of Equity Shares Reserved in the Buyback No. of Valid Applications Total Equity Shares Validly Tendered % Response Reserved Category for Small Shareholders 4,04,49,439 3,63,494 5,18,34,484 128.15 General Category for all other Equity Shareholders 22,92,13,482 25,395 4,15,72,46,719 1813.70 Total 26,96,62,921 3,88,889 4,20,90,81,203 1560.87 2.4. All valid applications were considered for the purpose of Acceptance in accordance with the Buyback Regulations and the Letter of Offer. The communication of acceptance/rejection has been dispatched electronically by the Registrar to the eligible Equity Shareholders on Wednesday, July 05, 2023. 2.5. The settlement of all valid bids was completed by the Indian Clearing Corporation Limited and the NSE Clearing Limited (“Clearing Corporations”) as applicable, on Tuesday, July 04, 2023. 2.6. The Clearing Corporations have made direct funds payout to Eligible Shareholders whose shares have been accepted under the Buyback. If Eligible Shareholders’ bank account details were not available or if the funds transfer instruction was rejected by RBI/respective bank, due to any reason, such funds were transferred to the concerned Stock Brokers’ settlement bank account for onward transfer to such Eligible Shareholders. 2.7. Equity Shares held in dematerialized form accepted under the Buyback were transferred to the Company’s Demat Account on Tuesday, July 04, 2023. The unaccepted Equity Shares in dematerialized form have been returned to the respective Eligible Shareholders/lien removed by the Clearing Corporations on Tuesday, July 04, 2023 and the Letter of Confirmation pertaining to unaccepted shares in physical form has been dispatched on Wednesday, July 05,2023. 2.8. The extinguishment of 26,96,62,921 (Twenty Six Crore Ninety Six Lakh Sixty Two Thousand Nine Hundred and Twenty One only) Equity Shares accepted under the Buyback, comprising of 26,96,59,098 Equity Shares in dematerialized form and 3,823 Equity Shares in physical from, are currently under process and shall be completed on or before Thursday, July 13, 2023. 2.9. The Company, and its respective Directors, accept full responsibility for the information contained in this Post Buyback Public Announcement and also accept responsibility for the obligations of the Company laid down under the Buyback Regulations. 3. CAPITAL STRUCTURE AND SHAREHOLDING PATTERN 3.1. The capital structure of the Company, pre and post Buyback, is as under: Pre Buyback Post Buyback (2) Sr. No. Particulars No. of Shares Amount (₹Lakhs) No. of Shares Amount (₹Lakhs) 1 Authorized Share Capital 12,504,500,000 Equity Shares of ₹2 each 2,50,090 12,50,45,00,000 Equity Shares of ₹2 each 2,50,090 25,000,000 Preference Shares of ₹10 each 2,500 2,50,00,000 Preference Shares of ₹10 each 2,500 1,50,000 10% Optionally Convertible Cumulative Preference Shares of Rs. 100 each 150 1,50,000 10% Optionally Convertible Cumulative Preference Shares of Rs. 100 each 150 Total 2,52,740 Total 2,52,740 2 Issued, Subscribed and Fully Paid-up 5,488,841,993 Equity Shares of ₹2 each (1) 1,09,777 5,21,91,79,072 Equity Shares of ₹2 each 1,04,384 Total 1,09,777 Total 1,04,384 (1) 13,20,13,768 (Thirteen Crores Twenty Lakhs Thirteen Thousand Seven Hundred and Sixty Eight) Equity Shares represent underlying Equity Shares against ADRs outstanding as at June 2, 2023. (2) Subject to extinguishment of 26,96,62,921 Equity Shares. 3.2. Details of shareholders from whom Equity Shares exceeding 1% of the total Equity Shares have been bought back are as under: Sr. No. Name Number of Equity Shares accepted under Buyback Equity Shares accepted as a % of total Equity Shares bought back (%) Equity Shares accepted as a % of total Post Buyback Equity Share Capital (%) 1 Mr AZIM HASHAM PREMJI PARTNER REPRESENTING ZASH TRADERS 55,051,569 20.41 1.05 2 Mr AZIM HASHAM PREMJI PARTNER REPRESENTING PRAZIM TRADERS. 54,289,214 20.13 1.04 3 MR AZIM HASHAM PREMJI PARTNER REPRESENTING HASHAM TRADERS 45,032,678 16.70 0.86 4 AZIM PREMJI TRUST 2,70,83,034 10.04 0.52 5 AZIM H PREMJI 11,006,697 4.08 0.21 6 LIFE INSURANCE CORPORATION OF INDIA (MULTIPLE SCHEMES) 1,03,47,672 3.84 0.20 Total 20,28,10,864 75.20 3.88 3.3. The shareholding pattern of the Company, pre and post Buyback, is as under: Pre Buyback Post Buyback(1) Category of Shareholder Number of Equity Shares % to the Pre Buyback Equity Share capital Number of Equity Shares % to post Buyback Equity Share capital Promoter and Promoter Group 4,00,19,50,248 72.91 3,80,84,20,449 72.97 Foreign Investors (Including ADRs, Non-Resident Indians, FIIs, FPIs, Foreign Nationals, and Overseas Corporate Bodies) 53,29,23,477 9.71 Financial Institutions/Banks, NBFCs & Mutual Funds 41,88,20,862 7.63 1,41,07,58,623 27.03 Others (Public, Bodies Corporate, Clearing Members, Trusts and HUF) 53,51,47,406 9.75 Total 5,48,88,41,993 100.00 5,21,91,79,072 100.00 (1) Subject to extinguishment of 26,96,62,921 Equity Shares. 4. MANAGER TO THE BUYBACK JM Financial Limited 7th Floor, Cnergy, Appasaheb Marathe Marg, Prabhadevi, Mumbai – 400025, India Tel.: +91 22 6630 3030; +91 22 6630 3262 Fax: +91 22 6630 3330 Contact Person: Ms. Prachee Dhuri Email: wipro.buyback2023@jmfl.com; Website: www.jmfl.com SEBI Regn. No.: INM000010361 Corporate Identification Number: L67120MH1986PLC038784 5. DIRECTOR’S RESPONSIBILITY As per Regulation 24(i)(a) of the Buyback Regulations, the Board of Directors of the Company accepts responsibility for the information contained in this Post Buyback Public Announcement or any other information advertisement, circular, brochure, publicity material which may be issued and confirms that such document contains true, factual and material information and does not contain any misleading information. For and on behalf of the Board of Directors of Wipro Limited Sd/- Sd/- Sd/- Sd/- Rishad A Premji Chairman Director Identification Number (DIN): 02983899 Thierry Delaporte Chief Executive Officer and Managing Director DIN: 08107242 Jatin P Dalal Chief Financial Officer M Sanaulla Khan Company Secretary and Compliance Officer Membership Number: F4129 Place: Bengaluru Date: July 05, 2023 CONCEPT