UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of June, 2023

Commission File Number: 001-09246

Barclays PLC

(Name of Registrant)

1 Churchill Place

London E14 5HP

England

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM F-3 (NO. 333-253693) OF BARCLAYS PLC AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

The Report comprises the following:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BARCLAYS PLC (Registrant) |

||||||

| Date: June 27, 2023 | By: | /s/ Garth Wright | ||||

| Name: Garth Wright | ||||||

| Title: Assistant Secretary | ||||||

Exhibit 1.2

Execution version

Pricing Agreement

June 20, 2023

Barclays Capital Inc.

As representative of the several Underwriters

named in Schedule I (the “Representative”)

Ladies and Gentlemen:

Barclays PLC (the “Company”) proposes to issue $1,500,000,000 aggregate principal amount of 7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034 (the “notes”). Each of the Underwriters hereby undertakes to purchase at the subscription price set forth in Schedule II hereto, the amount of notes set forth opposite the name of such Underwriter in Schedule I hereto, such payment to be made at the Time of Delivery set forth in Schedule II hereto. The obligations of the Underwriters hereunder are several but not joint.

Each of the provisions of the Underwriting Agreement—Standard Provisions, dated March 3, 2021 (the “Underwriting Agreement”), is incorporated herein by reference in its entirety, and shall be deemed to be a part of this Agreement to the same extent as if such provisions had been set forth in full herein; and each of the representations and warranties set forth therein shall be deemed to have been made at and as of the date of this Agreement, except that each representation and warranty with respect to the Prospectus in Section 2 of the Underwriting Agreement shall be deemed to be a representation and warranty as of the date of the Prospectus and also a representation and warranty as of the date of this Agreement in relation to the Prospectus as amended or supplemented relating to the notes. Each reference to the Representatives herein and in the provisions of the Underwriting Agreement so incorporated by reference shall be deemed to refer to you. Unless otherwise defined herein, terms defined in the Underwriting Agreement are used herein as therein defined. The Representative designated to act on behalf of each of the Underwriters of the Designated Securities pursuant to Section 14 of the Underwriting Agreement and the address referred to in such Section 14 is set forth in Schedule II hereto.

An amendment to the Registration Statement, or a supplement to the Prospectus, as the case may be, relating to the Designated Securities, in the form heretofore delivered to you, is now proposed to be filed with the Commission.

The Applicable Time for purposes of this Pricing Agreement is 3:20 p.m. New York time on June 20, 2023. The “free writing prospectus” as defined in Rule 405 under the Securities Act for which each party hereto has received consent to use in accordance with Section 7 of the Underwriting Agreement is listed in Schedule III hereto and is attached as Exhibit A hereto.

Singapore Securities and Futures Act Product Classification

Solely for the purposes of its obligations pursuant to sections 309B(1)(a) and 309B(1)(c) of the Securities and Futures Act 2001 of Singapore (the “SFA”), the Company has determined, and hereby notifies all relevant persons (as defined in Section 309A of the SFA) that the notes are “prescribed capital markets products” (as defined in the Securities and Futures (Capital Markets Products) Regulations 2018).

If the foregoing is in accordance with your understanding, please sign and return to us the counterpart hereof, and upon acceptance hereof by you, on behalf of each of the Underwriters, this letter and such acceptance hereof, including the provisions of the Underwriting Agreement incorporated herein by reference, shall constitute a binding agreement between each of the Underwriters on the one hand and the Company on the other.

[Signature Page Follows]

| Very truly yours, |

| BARCLAYS PLC |

| /s/ Stuart Frith |

| Name: Stuart Frith Title: Director, Capital Markets Execution |

| Accepted as of the date hereof at New York, New York |

| On behalf of itself and each of the other Underwriters |

| BARCLAYS CAPITAL INC. |

| /s/ Thomas Boone |

| Name: Thomas Boone Title: Director |

[Signature Page to Pricing Agreement]

SCHEDULE I

| Underwriters |

Principal Amount of the notes | |||

| Barclays Capital Inc. |

$ | 954,375,000 | ||

| BBVA Securities Inc. |

$ | 28,125,000 | ||

| CIBC World Markets Corp. |

$ | 28,125,000 | ||

| ING Financial Markets LLC |

$ | 28,125,000 | ||

| Intesa Sanpaolo S.p.A. |

$ | 28,125,000 | ||

| Lloyds Securities Inc. |

$ | 28,125,000 | ||

| Natixis Securities Americas LLC |

$ | 28,125,000 | ||

| Nomura Securities International, Inc. |

$ | 28,125,000 | ||

| Nordea Bank Abp |

$ | 28,125,000 | ||

| RBC Capital Markets, LLC |

$ | 28,125,000 | ||

| RB International Markets (USA) LLC |

$ | 28,125,000 | ||

| Santander US Capital Markets LLC |

$ | 28,125,000 | ||

| SMBC Nikko Securities America, Inc. |

$ | 28,125,000 | ||

| TD Securities (USA) LLC |

$ | 28,125,000 | ||

| Bancroft Capital, LLC |

$ | 11,250,000 | ||

| Bankinter SA |

$ | 11,250,000 | ||

| Capital One Securities, Inc. |

$ | 11,250,000 | ||

| CastleOak Securities, L.P. |

$ | 11,250,000 | ||

| Citizens Capital Markets, Inc. |

$ | 11,250,000 | ||

| C.L. King & Associates, Inc. |

$ | 11,250,000 | ||

| DBS Bank Ltd. |

$ | 11,250,000 | ||

| DZ Financial Markets LLC |

$ | 11,250,000 | ||

| Falcon Square Capital LLC |

$ | 11,250,000 | ||

| Multi-Bank Securities, Inc. |

$ | 11,250,000 | ||

| nabSecurities, LLC |

$ | 11,250,000 | ||

| PNC Capital Markets LLC |

$ | 11,250,000 | ||

| Rabo Securities USA, Inc. |

$ | 11,250,000 | ||

| SG Americas Securities, LLC |

$ | 11,250,000 | ||

| Truist Securities, Inc. |

$ | 11,250,000 | ||

| U.S. Bancorp Investments, Inc. |

$ | 11,250,000 | ||

| Total |

$ | 1,500,000,000 | ||

SCHEDULE II

Title of Designated Securities:

$1,500,000,000 7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034

Price to Public:

100.000% of principal amount

Subscription Price by Underwriters:

99.550% of principal amount

Form of Designated Securities:

The notes will be represented by one or more global notes registered in the name of Cede & Co., as nominee of The Depository Trust Company issued pursuant to the Dated Subordinated Debt Securities Indenture dated May 9, 2017 (as heretofore amended and supplemented) between Barclays PLC and The Bank of New York Mellon, London Branch, as trustee (the “Trustee”), as amended and supplemented by the Fifth Supplemental Indenture to be dated on or about June 27, 2023, among Barclays PLC, the Trustee and The Bank of New York Mellon SA/NV, Luxembourg Branch, as Dated Subordinated Debt Security Registrar.

Securities Exchange, if any:

The New York Stock Exchange

Maturity Date:

The stated maturity of the principal of the notes will be June 27, 2034 (the “Maturity Date”).

Interest Rate:

From (and including) the Issue Date to (but excluding) June 27, 2033 (the “Par Redemption Date”) (the “Fixed Rate Period”), the notes will bear interest at a rate of 7.119% per annum.

From (and including) the Par Redemption Date to (but excluding) the Maturity Date (the “Floating Rate Period”), the applicable per annum interest rate will be equal to the Benchmark (as defined in the Preliminary Prospectus Supplement, such term subject to the provisions described under “Description of Subordinated Notes” in the Preliminary Prospectus Supplement) as determined on the applicable Interest Determination Date (as defined in the Preliminary Prospectus Supplement), plus the Margin (as defined in the Preliminary Prospectus Supplement).

Fixed Rate Period Interest Payment Dates:

During the Fixed Rate Period, interest will be payable semi-annually in arrear on June 27 and December 27 in each year, commencing on December 27, 2023.

Floating Rate Period Interest Payment Dates:

During the Floating Rate Period, interest will be payable quarterly in arrear on September 27, 2033, December 27, 2033, March 27, 2034 and the Maturity Date.

Day Count:

30/360, Following, Unadjusted, for the Fixed Rate Period.

Actual/360, Modified Following, Adjusted, for the Floating Rate Period.

Regular Record Dates:

The close of business on the Business Day immediately preceding each Interest Payment Date (or, if the notes are held in definitive form, the close of business on the 15th Business Day preceding each Interest Payment Date).

Sinking Fund Provisions:

No sinking fund provisions.

Optional Redemption:

The notes are redeemable as described under “Description of Subordinated Notes—Redemption Provisions—Optional Redemption” in the Preliminary Prospectus Supplement, as supplemented by the final term sheet dated June 20, 2023 for the notes.

Tax Redemption:

The notes are redeemable as described under “Description of Subordinated Notes—Redemption Provisions—Tax Redemption” in the Preliminary Prospectus Supplement.

Regulatory Event Redemption:

The notes are redeemable as described under “Description of Subordinated Notes—Redemption Provisions—Regulatory Event Redemption” in the Preliminary Prospectus Supplement.

Time of Delivery:

June 27, 2023 by 9:30 a.m. New York time.

Specified Funds for Payment of Subscription Price of Designated Securities:

By wire transfer to a bank account specified by the Company in same day funds.

Value Added Tax:

(a) If the Company is obliged to pay any sum to the Underwriters under this Agreement and any value added tax (“VAT”) is properly charged on such amount, the Company shall pay to the Underwriters an amount equal to such VAT on receipt of a valid VAT invoice;

(b) If the Company is obliged to pay a sum to the Underwriters under this Agreement for any fee, cost, charge or expense properly incurred under or in connection with this Agreement (the “Relevant Cost”) and no VAT is payable by the Company in respect of the Relevant Cost under paragraph (a) above, the Company shall pay to the Underwriters an amount which:

(i) if for VAT purposes the Relevant Cost is consideration for a supply of goods or services made to the Underwriters, is equal to any input VAT incurred by the Underwriters on that supply of goods and services, but only if and to the extent that the Underwriters are unable to recover such input VAT from HM Revenue & Customs (whether by repayment or credit) provided, however, that the Underwriters shall reimburse the Company for any amount paid by the Company in respect of irrecoverable input VAT pursuant to this paragraph (i) if and to the extent such input VAT is subsequently recovered from HM Revenue & Customs (whether by repayment or credit);

(ii) if for VAT purposes the Relevant Cost is a disbursement properly incurred by the Underwriters under or in connection with this Agreement as agent on behalf of the Company, is equal to any VAT paid on the Relevant Cost by the Underwriters provided, however, that the Underwriters shall use best endeavors to procure that the actual supplier of the goods or services which the Underwriters received as agent issues a valid VAT invoice to the Company.

Closing Location:

Linklaters LLP, One Silk Street, London EC2Y 8HQ, United Kingdom.

Name and address of Representative:

Designated Representative: Barclays Capital Inc.

Address for Notices:

Barclays Capital Inc.

745 Seventh Avenue

New York, NY 10019

Attn: Syndicate Registration

Selling Restrictions:

United Kingdom:

Each Underwriter represents, warrants and agrees with the Company that, in connection with the distribution of the notes, directly or indirectly, it: (1) has only communicated or caused to be communicated, and will only communicate or cause to be communicated, an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000, as amended (the “FSMA”)) received by it in connection with the issue or sale of the notes in circumstances in which Section 21(1) of the FSMA does not apply to the Company; and (2) has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the notes in, from or otherwise involving the United Kingdom.

Prohibition of Sales to United Kingdom Retail Investors:

Each Underwriter represents, warrants and agrees with the Company that it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available any notes to any retail investor in the United Kingdom. For the purposes of this provision, the expression “retail investor” means a person who is one (or more) of the following:

| i. | a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”); or |

| ii. | a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law of the United Kingdom by virtue of the EUWA. |

Prohibition of Sales to European Economic Area Retail Investors:

Each Underwriter represents, warrants and agrees with the Company that it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available any notes to any retail investor in the European Economic Area. For the purposes of this provision, the expression “retail investor” means a person who is one (or more) of the following:

| i. | a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or |

| ii. | a customer within the meaning of Directive (EU) 2016/97, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II. |

Canada:

Each Underwriter represents, warrants and agrees with the Company, with respect to sales of the notes in Canada, that, directly or indirectly, it shall sell the notes only to purchasers purchasing as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario) and “permitted clients” as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Hong Kong:

Each Underwriter represents, warrants and agrees that:

(i) it has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any notes other than (a) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “SFO”) and any rules made under the SFO; or (b) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and

(ii) it has not issued or had in its possession for the purposes of issue, and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the notes, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to notes which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the SFO and any rules made under the SFO.

Japan:

The notes have not been and will not be registered under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended, the “FIEA”) and accordingly, each Underwriter represents and agrees that it has not offered or sold and undertakes that it will not offer or sell any notes directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan or to others for re-offering or resale, directly or indirectly, in Japan or to any resident of Japan except pursuant to an exemption from the registration requirements of, and otherwise in compliance with the FIEA and other relevant laws and regulations of Japan. As used in this paragraph, “resident of Japan” means any person resident in Japan, including any corporation or other entity organized under the laws of Japan.

Singapore:

Each Underwriter acknowledges that the prospectus supplement, and the accompanying Base Prospectus, have not been and will not be registered as a prospectus with the Monetary Authority of Singapore. Accordingly, each Underwriter represents, warrants and agrees that it has not offered or sold any notes or caused the notes to be made the subject of an invitation for subscription or purchase and will not offer or sell any notes or cause the notes to be made the subject of an invitation for subscription or purchase, and has not circulated or distributed, nor will it circulate or distribute, the prospectus supplement and the accompanying Base Prospectus or any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the notes, whether directly or indirectly, to any person in Singapore other than (i) to an institutional investor (as defined in Section 4A of the SFA) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to Section 275(1A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the notes are subscribed or purchased under Section 275 of the SFA by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or (b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor,

securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the notes pursuant to an offer made under Section 275 of the SFA except:

1. to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA;

2. where no consideration is or will be given for the transfer;

3. where the transfer is by operation of law;

4. as specified in Section 276(7) of the SFA; or

5. as specified in Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.

Taiwan:

Each Underwriter represents, warrants and agrees with the Company that the notes have not been, and will not be, registered or filed with, or approved by, the Financial Supervisory Commission of Taiwan, the Republic of China (“Taiwan”) and/or other regulatory authority of Taiwan pursuant to applicable securities laws and regulations and may not be sold, offered or otherwise made available within Taiwan through a public offering or in circumstances which constitute an offer within the meaning of the Taiwan Securities and Exchange Act or relevant laws and regulations that requires a registration or filing with or the approval of the Financial Supervisory Commission of Taiwan and/or other regulatory authority of Taiwan. Each Underwriter further represents, warrants and agrees with the Company that no person or entity in Taiwan is authorized to offer, sell or otherwise make available any notes or the provision of information relating to the prospectus supplement and the Base Prospectus.

Other Terms and Conditions:

As set forth in the prospectus supplement dated June 20, 2023 relating to the notes (the “Preliminary Prospectus Supplement”), incorporating the Prospectus dated March 1, 2021 relating to the notes (the “Base Prospectus”).

SCHEDULE III

Issuer Free Writing Prospectus:

Final Term Sheet, dated June 20, 2023, attached hereto as Exhibit A.

EXHIBIT A

Final Term Sheet for the $1,500,000,000 7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034

| Free Writing Prospectus Filed pursuant to Rule 433 Registration Statement No. 333-253693 |

$1,500,000,000 7.119% FIXED-TO-FLOATING RATE SUBORDINATED CALLABLE NOTES DUE 2034

Barclays PLC

PRICING TERM SHEET

| Issuer: | Barclays PLC (the “Issuer”) | |

| Notes: | $1,500,000,000 7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034 (the “Notes”) | |

| Expected Issue Ratings1: | Baa1 (Moody’s) / BBB- (S&P) / BBB+ (Fitch) | |

| Status: | Dated Subordinated Debt / Unsecured / Tier 2 | |

| Legal Format: | SEC registered | |

| Principal Amount: | $1,500,000,000 | |

| Trade Date: | June 20, 2023 | |

| Settlement Date: | June 27, 2023 (T+5) (the “Issue Date”) | |

| Maturity Date: | June 27, 2034 (the “Maturity Date”) | |

| Fixed Rate Period Coupon: | From (and including) the Issue Date to (but excluding) the Par Redemption Date (as defined below) (the “Fixed Rate Period”), the Notes will bear interest at a rate of 7.119% per annum. | |

| Floating Rate Period Coupon: | From (and including) the Par Redemption Date to (but excluding) the Maturity Date (the “Floating Rate Period”), the applicable per annum interest rate will be equal to the Benchmark (as defined below, such term subject to the provisions described under “Description of Subordinated Notes” in the Preliminary Prospectus Supplement) as determined on the applicable Interest Determination Date (as defined below), plus the Margin (as defined below) (the “Floating Interest Rate”). The Floating Interest Rate will be calculated quarterly on each Interest Determination Date. | |

| During the Floating Rate Period, each interest period on the Notes will begin on (and include) a Floating Rate Period Interest Payment Date (as defined below) and end on (but exclude) the next succeeding Floating Rate Period Interest Payment Date (each, a “Floating Rate Interest Period”); provided that the first Floating Rate Interest Period will begin on (and include) the Par Redemption Date and will end on (but exclude) the first Floating Rate Period Interest Payment Date. | ||

| Par Redemption Date: | June 27, 2033 (the “Par Redemption Date”) | |

| Fixed Rate Period Interest Payment Dates: | During the Fixed Rate Period, interest will be payable semi-annually in arrear on June 27 and December 27 in each year, from (and including) December 27, 2023 up to (and including) the Par Redemption Date. | |

| 1 | Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. |

| Floating Rate Period Interest Payment Dates: | During the Floating Rate Period, interest will be payable quarterly in arrear on September 27, 2033, December 27, 2033, March 27, 2034 and the Maturity Date (each, a “Floating Rate Period Interest Payment Date”). | |

| Interest Determination Dates: | The second USGS business day preceding the applicable Floating Rate Period Interest Payment Date (each, an “Interest Determination Date”). | |

| Benchmark: | Compounded Daily SOFR (calculated as described under “Description of Subordinated Notes—Calculation of the Benchmark” in the Preliminary Prospectus Supplement), subject to the Benchmark Transition Provisions. | |

| Day Count: | 30/360, Following, Unadjusted, for the Fixed Rate Period. Actual/360, Modified Following, Adjusted, for the Floating Rate Period. |

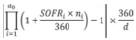

|

| Business Days: | Any weekday, other than one on which banking institutions are authorized or obligated by law, regulation or executive order to close in London, England or in the City of New York, United States. | |

| Preliminary Prospectus Supplement: | Preliminary Prospectus Supplement dated June 20, 2023 (the “Preliminary Prospectus Supplement,” incorporating the Prospectus dated March 1, 2021 relating to the Notes (the “Base Prospectus”)). If there is any discrepancy or contradiction between this Pricing Term Sheet and the Preliminary Prospectus Supplement, this Pricing Term Sheet shall prevail. | |

| U.K. Bail-in Power Acknowledgement: | Yes. See the section entitled “Description of Subordinated Notes—Agreement with Respect to the Exercise of U.K. Bail-in Power” in the Preliminary Prospectus Supplement and the section entitled “Description of Debt Securities—Agreement with Respect to the Exercise of U.K. Bail-in Power” in the Base Prospectus. | |

| Ranking: | The ranking of the Notes is described under “Description of Subordinated Notes—Ranking” in the Preliminary Prospectus Supplement. | |

| Optional Redemption: | The Notes are redeemable as described under “Description of Subordinated Notes—Redemption Provisions—Optional Redemption” in the Preliminary Prospectus Supplement. | |

| Tax Redemption: | The Notes are also redeemable as described under “Description of Subordinated Notes—Redemption Provisions—Tax Redemption” in the Preliminary Prospectus Supplement. | |

| Regulatory Event Redemption: | The Notes are also redeemable as described under “Description of Subordinated Notes—Redemption Provisions—Regulatory Event Redemption” in the Preliminary Prospectus Supplement. | |

| Margin: | 357 bps (the “Margin”) | |

| Benchmark Treasury: | UST 3.375% due May 15, 2033 | |

| Spread to Benchmark Treasury: | 340 bps | |

| Reoffer Yield: | 7.119% | |

| Issue Price: | 100.000% | |

| Underwriting Discount: | 0.450% | |

| Net Proceeds: | $1,493,250,000 | |

| Sole Bookrunner: | Barclays Capital Inc. | |

| Senior Co-Managers: | BBVA Securities Inc., CIBC World Markets Corp., ING Financial Markets LLC, Intesa Sanpaolo S.p.A., Lloyds Securities Inc., Natixis Securities Americas LLC, Nomura Securities International, Inc., Nordea Bank Abp, RBC Capital Markets, LLC, RB International Markets (USA) LLC, Santander US Capital Markets LLC, SMBC Nikko Securities America, Inc., TD Securities (USA) LLC | |

| Co-Managers: | Bancroft Capital, LLC, Bankinter SA, Capital One Securities, Inc., CastleOak Securities, L.P., Citizens Capital Markets, Inc., C.L. King & Associates, Inc., DBS Bank Ltd., DZ Financial Markets LLC, Falcon Square Capital LLC, Multi-Bank Securities, Inc., nabSecurities, LLC, PNC Capital Markets LLC, Rabo Securities USA, Inc., SG Americas Securities, LLC, Truist Securities, Inc., U.S. Bancorp Investments, Inc. | |

| Risk Factors: | An investment in the Notes involves risks. See “Risk Factors” section beginning on page S-22 of the Preliminary Prospectus Supplement. | |

| Denominations: | $200,000 and integral multiples of $1,000 in excess thereof. | |

| ISIN/CUSIP: | US06738ECH62 / 06738E CH6 | |

| Legal Entity Identifier (“LEI”) Code: | 213800LBQA1Y9L22JB70 | |

| Settlement: | The Depository Trust Company; Book-entry; Transferable | |

| Documentation: | To be documented under the Issuer’s shelf registration statement on Form F-3 (No. 333-253693) and to be issued pursuant to the Dated Subordinated Debt Securities Indenture dated May 9, 2017 (as heretofore amended and supplemented), between the Issuer and The Bank of New York Mellon, London Branch, as trustee (the “Trustee”), as amended and supplemented by the Fifth Supplemental Indenture, to be entered into on or about the Issue Date, between the Issuer, the Trustee and The Bank of New York Mellon SA/NV, Luxembourg Branch, as Dated Subordinated Debt Security Registrar. | |

| Listing: | We will apply to list the Notes on the New York Stock Exchange. | |

| Calculation Agent: | The Bank of New York Mellon, New York, or its successor appointed by the Issuer. | |

| Governing Law: | New York law, except for the subordination provisions and the waiver of set-off provisions which will be governed by English law. | |

| Definitions: | Unless otherwise defined herein, all capitalized terms have the meaning set forth in the Preliminary Prospectus Supplement. | |

The Issuer has filed a registration statement (including the Base Prospectus) and the Preliminary Prospectus Supplement with the U.S. Securities and Exchange Commission (“SEC”) for this offering. Before you invest, you should read the Base Prospectus and the Preliminary Prospectus Supplement for this offering in that registration statement, and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by searching the SEC online database (EDGAR) at www.sec.gov. Alternatively, you may obtain a copy of the Base Prospectus and the Preliminary Prospectus Supplement from Barclays Capital Inc. by calling +1 888 603 5847.

It is expected that delivery of the Notes will be made for value on or about June 27, 2023, which will be the fifth (5th) business day in the United States following the date of pricing of the Notes. Under Rule 15c6-1 under the Securities Exchange Act of 1934, purchases or sales of Notes in the secondary market generally are required to settle within two (2) business days (T+2), unless the parties to any such transaction expressly agree otherwise. Accordingly, purchasers of the Notes who wish to trade the Notes on the date of the prospectus supplement or the next two (2) succeeding business days, will be required, because the Notes initially will settle within five (5) business days (T+5) in the United States, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade on the date of the prospectus supplement or the next two (2) succeeding business days should consult their own legal advisers.

No EEA or UK PRIIPs key information document (KID) has been prepared as the Notes are not available to retail in the EEA or the United Kingdom.

This communication is being distributed to, and is directed only at, persons in the United Kingdom in circumstances where section 21(1) of the Financial Services and Markets Act 2000, as amended, does not apply (such persons being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this communication or any of its contents. Any investment activity (including, but not limited to, any invitation, offer or agreement to subscribe, purchase or otherwise acquire securities) to which this communication relates will only be available to, and will only be engaged with, relevant persons.

Singapore Securities and Futures Act Product Classification—Solely for the purposes of its obligations pursuant to sections 309B(1)(a) and 309B(1)(c) of the Securities and Futures Act 2001 of Singapore (the “SFA”), the Issuer has determined, and hereby notifies all relevant persons (as defined in Section 309A of the SFA) that the Securities are “prescribed capital markets products” (as defined in the Securities and Futures (Capital Markets Products) Regulations 2018).

To the extent any underwriter that is not a U.S. registered broker-dealer intends to effect any offers or sales of any Notes in the United States, it will do so through one or more U.S. registered broker-dealers in accordance with the applicable U.S. securities laws and regulations.

Exhibit 4.4

Execution version

BARCLAYS PLC,

as Issuer,

THE BANK OF NEW YORK MELLON, LONDON BRANCH,

as Trustee and Paying Agent

and

THE BANK OF NEW YORK MELLON SA/NV, LUXEMBOURG BRANCH,

as Dated Subordinated Debt Security Registrar

FIFTH SUPPLEMENTAL INDENTURE

Dated as of June 27, 2023

To the Dated Subordinated Debt Securities Indenture, dated as of May 9, 2017, between

Barclays PLC and The Bank of New York Mellon, London Branch, as Trustee

$1,500,000,000 7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I |

|

|||||

| DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION |

|

|||||

| SECTION 1.01 |

Definitions | 2 | ||||

| SECTION 1.02 |

Effect of Headings | 7 | ||||

| SECTION 1.03 |

Separability Clause | 8 | ||||

| SECTION 1.04 |

Benefits of Instrument | 8 | ||||

| SECTION 1.05 |

Relation to Base Indenture | 8 | ||||

| SECTION 1.06 |

Construction and Interpretation | 8 | ||||

| ARTICLE II |

|

|||||

| 7.119% FIXED-TO-FLOATING RATE SUBORDINATED CALLABLE NOTES DUE 2034 |

|

|||||

| SECTION 2.01 |

Creation of Series; Establishment of Form | 9 | ||||

| SECTION 2.02 |

Interest | 10 | ||||

| SECTION 2.03 |

Payment of Principal, Interest and Other Amounts | 10 | ||||

| SECTION 2.04 |

Optional Redemption | 11 | ||||

| SECTION 2.05 |

Regulatory Event Redemption | 11 | ||||

| SECTION 2.06 |

Notice of Redemption | 11 | ||||

| SECTION 2.07 |

Additional Amounts and FATCA Withholding Tax | 12 | ||||

| SECTION 2.08 |

Acknowledgement with respect to Treatment of EEA BRRD Liabilities | 12 | ||||

| SECTION 2.09 |

Acknowledgement with Respect to Treatment of BRRD Liabilities | 13 | ||||

| ARTICLE III |

|

|||||

| AMENDMENTS TO THE BASE INDENTURE |

|

|||||

| SECTION 3.01 |

Amendments to the Base Indenture | 13 | ||||

| ARTICLE IV |

|

|||||

| MISCELLANEOUS PROVISIONS |

|

|||||

| SECTION 4.01 |

Effectiveness | 14 | ||||

| SECTION 4.02 |

Original Issue | 14 | ||||

| SECTION 4.03 |

Ratification and Integral Part | 15 | ||||

| SECTION 4.04 |

Priority | 15 | ||||

| SECTION 4.05 |

Not Responsible for Recitals or Issuance of Securities | 15 | ||||

| SECTION 4.06 |

Successors and Assigns | 15 | ||||

| SECTION 4.07 |

Counterparts | 15 | ||||

| SECTION 4.08 |

Governing Law | 15 | ||||

| ANNEX I – Interest Terms of the Securities |

I-1 | |||||

| EXHIBIT A – Form of Global Note |

A-1 | |||||

-i-

FIFTH SUPPLEMENTAL INDENTURE, dated as of June 27, 2023 (the “Fifth Supplemental Indenture”), among BARCLAYS PLC, a public limited company registered in England and Wales (herein called the “Company”), having its registered office at 1 Churchill Place, London E14 5HP, United Kingdom, THE BANK OF NEW YORK MELLON, LONDON BRANCH, a New York banking corporation, as Trustee (herein called the “Trustee”) and Paying Agent, having a Corporate Trust Office at 160 Queen Victoria Street, London EC4V 4LA, United Kingdom, and THE BANK OF NEW YORK MELLON SA/NV, LUXEMBOURG BRANCH, as Dated Subordinated Debt Security Registrar, having an office at 2-4 Rue Eugene Ruppert, Vertigo Building – Polaris, Luxembourg, 2453, Luxembourg, to the DATED SUBORDINATED DEBT SECURITIES INDENTURE, dated as of May 9, 2017, between the Company and the Trustee, as heretofore amended and supplemented (the “Base Indenture” and, together with this Fifth Supplemental Indenture, the “Indenture”).

RECITALS OF THE COMPANY

WHEREAS, the Company and the Trustee are parties to the Base Indenture, which provides for the issuance by the Company from time to time of its Dated Subordinated Debt Securities in one or more series;

WHEREAS, Section 9.01 of the Base Indenture permits supplements thereto without the consent of Holders of Dated Subordinated Debt Securities to establish the form or terms of Dated Subordinated Debt Securities of any series as permitted by Sections 2.01 and 3.01 of the Base Indenture and to add to, change or eliminate any of the provisions of the Base Indenture with respect to Dated Subordinated Debt Securities issued on or after the date hereof;

WHEREAS, as contemplated by Section 3.01 of the Base Indenture, the Company intends to issue a new series of Dated Subordinated Debt Securities, to be known as the Company’s “7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034” (the “Securities”) under the Indenture;

WHEREAS, the Company and the Trustee desire to amend Section 1.15, Section 5.04(d), and Section 13.01(d) of the Base Indenture with respect to Dated Subordinated Debt Securities issued on or after the date hereof; and

WHEREAS, the Company has taken all necessary corporate action to authorize the execution and delivery of this Fifth Supplemental Indenture;

NOW, THEREFORE, THIS FIFTH SUPPLEMENTAL INDENTURE WITNESSETH:

For and in consideration of the premises and the other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company, the Trustee and the Dated Subordinated Debt Security Registrar mutually agree as follows with regard to the Securities:

-1-

ARTICLE I

DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION

SECTION 1.01 Definitions. Except as otherwise expressly provided or unless the context otherwise requires, all terms used in this Fifth Supplemental Indenture that are defined in the Base Indenture shall have the meanings ascribed to them in the Base Indenture.

The following terms used in this Fifth Supplemental Indenture have the following respective meanings with respect to the Securities only:

“2018 Order” means the U.K. Banks and Building Societies (Priorities on Insolvency) Order 2018, as may be amended or replaced from time to time.

“Bail-in Legislation” has the meaning set forth in Section 2.08 hereof.

“Base Indenture” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture.

“Benchmark” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by the Company or its designee (in consultation with the Company) as of the Benchmark Replacement Date:

(1) the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark for the applicable Corresponding Tenor (if any) and (b) the Benchmark Replacement Adjustment;

(2) the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; and

(3) the sum of: (a) the alternate rate of interest that has been selected by the Company or its designee (in consultation with the Company) as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to any industry-accepted rate of interest as a replacement for the then- current Benchmark for U.S. dollar-denominated floating rate notes at such time and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company or the Company’s designee (in consultation with the Company) as of the Benchmark Replacement Date:

(1) the spread adjustment (which may be a positive or negative value or zero) that has been (i) selected or recommended by the Relevant Governmental Body or (ii) determined by the Company or the Company’s designee (in consultation with the Company) in accordance with the method for calculating or determining such spread adjustment that has been selected or recommended by the Relevant Governmental Body, in each case for the applicable Unadjusted Benchmark Replacement; (2) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment;

-2-

(3) the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company or its designee (in consultation with the Company) giving due consideration to industry-accepted spread adjustments (if any), or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time.

“Benchmark Replacement Conforming Changes” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

(1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or

(2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

(1) a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark;

(2) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or

(3) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

-3-

“BRRD” has the meaning set forth in Section 2.08 hereof.

“BRRD Party” has the meaning set forth in Section 2.08 hereof.

“Business Day” means any weekday, other than one on which banking institutions are authorized or obligated by law, regulation or executive order to close in London, England or in the City of New York, United States.

“Calculation Agent” means The Bank of New York Mellon, New York, or its successor appointed by the Company.

“Capital Regulations” means, at any time, the laws, regulations, requirements, standards, guidelines and policies relating to capital adequacy and/or minimum requirement for own funds and eligible liabilities and/or loss absorbing capacity for credit institutions of either (i) the PRA and/or (ii) any other national or European authority, in each case then in effect in the United Kingdom (or in such other jurisdiction in which the Company may be organized or domiciled) and applicable to the Group including, U.K. CRD.

“Company” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture, and includes any successor entity.

“Compounded Daily SOFR” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Corresponding Tenor” with respect to a Benchmark Replacement means a tenor (including overnight) having approximately the same length (disregarding business day adjustments) as the applicable tenor for the then-current Benchmark.

“designee” means an affiliate or any other agent of the Company.

“DTC” means The Depository Trust Company, or any successor clearing system.

“EEA Bail-in Power” has the meaning set forth in Section 2.08 hereof.

“EEA BRRD Liability” has the meaning set forth in Section 2.08 hereof.

“EU Bail-in Legislation Schedule” has the meaning set forth in Section 2.08 hereof.

“EU CRD” means: (i) Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investments firms, as amended before IP completion day; and (ii) Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC, as amended before IP completion day.

“Fifth Supplemental Indenture” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture.

-4-

“Fixed Rate Period Interest Payment Date” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Floating Rate Period Interest Payment Date” has the meaning set forth in Annex I of this Fifth Supplemental Indenture.

“Indenture” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture.

“Interest Determination Date” means the second USGS Business Day (as defined below) preceding the applicable Floating Rate Period Interest Payment Date.

“Interest Payment Date” means any of the Fixed Rate Period Interest Payment Dates or the Floating Rate Period Interest Payment Dates, as applicable.

“ISDA” means the International Swaps and Derivatives Association, Inc. or any successor thereto.

“ISDA Definitions” means the 2006 ISDA Definitions published by ISDA as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“IP completion day” has the meaning given in the U.K. European Union (Withdrawal Agreement) Act 2020.

“Issue Date” has the meaning set forth in Section 2.01(f) hereof.

“Junior Obligations” means the obligations of the Company (as issuer or borrower, as the case may be) in respect of the 5.875% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 7.750% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities (issued in 2019), the 7.125% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 6.375% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 6.125% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 4.375% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8.875% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8.3% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, the 8% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities (issued in 2022), the 9.250% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities and the 7.300% Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, for the time being outstanding and any other obligations of the Company which rank or are expressed to rank pari passu with any of such obligations.

-5-

“NY Federal Reserve’s Website” means the website of the Federal Reserve Bank of New York at http://www.newyorkfed.org (or any successor website).

“Par Redemption Date” means June 27, 2033.

“Parity Obligations” means the obligations of the Company (as issuer or borrower, as the case may be) in respect of the 4.375% Fixed Rate Subordinated Notes due 2024, the 5.20% Fixed Rate Subordinated Notes due 2026, the 4.836% Fixed Rate Subordinated Callable Notes due 2028, the Singapore dollar-denominated 3.750% Fixed Rate Resetting Subordinated Callable Notes due 2030, the 5.088% Fixed-to-Floating Rate Subordinated Notes due 2030, the sterling-denominated 3.750% Fixed Rate Resetting Subordinated Callable Notes due 2030, the 1.125% Fixed Rate Resetting Subordinated Callable Notes due 2031, the 8.407% Fixed Rate Resetting Subordinated Callable Notes due 2032, the 3.564% Fixed Rate Resetting Subordinated Callable Notes due 2035 and the 3.811% Fixed Rate Resetting Subordinated Callable Notes due 2042 of the Company for the time being outstanding and any other obligations of the Company which rank or are expressed to rank pari passu with any of such obligations.

“Reference Time” means (1) if the Benchmark is Compounded Daily SOFR, for each USGS Business Day, 3:00 p.m. (New York time) on the next succeeding USGS Business Day, and (2) if the Benchmark is not Compounded Daily SOFR, the time determined by the Company or its designee (in consultation with the Company) in accordance with the Benchmark Replacement Conforming Changes.

“Regular Record Date” means the close of business on the Business Day immediately preceding each Interest Payment Date (or, if the Securities are held in definitive form, the close of business on the 15th Business Day preceding each Interest Payment Date).

“Relevant EEA Resolution Authority” has the meaning set forth in Section 2.08 hereof.

“Relevant Governmental Body” means the Federal Reserve and/or the Federal Reserve Bank of New York (“NY Federal Reserve”), or a committee officially endorsed or convened by the Federal Reserve and/or the NY Federal Reserve or any successor thereto.

“secondary non-preferential debts” shall have the meaning given to it in the 2018 Order and any other law or regulation applicable to the Company which is amended by the 2018 Order, as each may be amended or replaced from time to time.

“Securities” has the meaning set forth in the Recitals to this Fifth Supplemental Indenture.

-6-

“Senior Creditors” means creditors of the Company: (i) who are unsubordinated creditors; (ii) who are subordinated creditors (whether in the event of a winding-up or administration of the Company or otherwise) other than (x) those whose claims by law rank, or by their terms are expressed to rank, pari passu with or junior to the claims of the holders of the Securities or (y) those whose claims are in respect of Parity Obligations or Junior Obligations; or (iii) who are creditors in respect of any secondary non-preferential debts.

“Stated Maturity” has the meaning set forth in Section 2.01(g) hereof.

“Tier 2 Capital” means Tier 2 Capital for the purposes of the Capital Regulations;

“Trustee” has the meaning set forth in the first paragraph of this Fifth Supplemental Indenture, and includes any successor entity.

“U.K. CRD” means the legislative package consisting of:

(i) the U.K. CRD Regulation;

(ii) the law of the United Kingdom or any part of it (as amended or replaced in accordance with domestic law from time to time), which immediately before IP completion day implemented Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC and its implementing measures, such Directive as amended before IP completion day; and

(iii) direct EU legislation (as defined in the Withdrawal Act), which immediately before IP completion day implemented EU CRD as it forms part of domestic law of the United Kingdom by virtue of the Withdrawal Act and as the same may be amended or replaced in accordance with domestic law from time to time.

“U.K. CRD Regulation” means Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investments firms, as amended before IP completion day, as it forms part of domestic law of the United Kingdom by virtue of the Withdrawal Act and as the same may be further amended or replaced in accordance with domestic law from time to time.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

“USGS Business Day” means any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association or any successor thereto (“SIFMA”) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

“Withdrawal Act” means the United Kingdom European Union (Withdrawal) Act 2018, as amended.

SECTION 1.02 Effect of Headings. The Article and Section headings herein are for convenience only and shall not affect the construction hereof.

-7-

SECTION 1.03 Separability Clause. In case any provision in this Fifth Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

SECTION 1.04 Benefits of Instrument. Nothing in this Fifth Supplemental Indenture, express or implied, shall give to any Person, other than the parties hereto and their successors hereunder and the Holders, any benefit or any legal or equitable right, remedy or claim under the Indenture.

SECTION 1.05 Relation to Base Indenture. This Fifth Supplemental Indenture constitutes an integral part of the Base Indenture. Except for the provisions set out in Article III, all provisions of this Fifth Supplemental Indenture are expressly and solely for the benefit of the Holders and Beneficial Owners of the Securities and the Trustee and any such provisions shall not be deemed to apply to any other Dated Subordinated Debt Securities issued under the Base Indenture and shall not be deemed to amend, modify or supplement the Base Indenture for any purpose other than with respect to the Securities. The provisions set out in Article III apply to Dated Subordinated Debt Securities authenticated, delivered and issued on or after the date of this Fifth Supplemental Indenture.

SECTION 1.06 Construction and Interpretation. Unless the context otherwise requires:

(a) the words “hereof”, “herein” and “hereunder” and words of similar import, when used in this Fifth Supplemental Indenture, refer to this Fifth Supplemental Indenture as a whole and not to any particular provision of this Fifth Supplemental Indenture;

(b) the terms defined in the singular have a comparable meaning when used in the plural, and vice versa;

(c) the terms “U.S. dollars” and “$” refer to the lawful currency for the time being of the United States;

(d) references herein to a specific Section, Article or Exhibit refer to Sections or Articles of, or an Exhibit to, this Fifth Supplemental Indenture;

(e) wherever the words “include”, “includes” or “including” are used in this Fifth Supplemental Indenture, they shall be deemed to be followed by the words “without limitation;”

(f) references to a Person are also to its successors and permitted assigns; and

(g) the use of “or” is not intended to be exclusive unless expressly indicated otherwise.

-8-

ARTICLE II

7.119% FIXED-TO-FLOATING RATE SUBORDINATED CALLABLE NOTES DUE

2034

SECTION 2.01 Creation of Series; Establishment of Form.

(a) There is hereby established a new series of Dated Subordinated Debt Securities under the Base Indenture entitled the “7.119% Fixed-to-Floating Rate Subordinated Callable Notes due 2034”.

(b) The Securities shall be issued initially in the form of one or more registered Global Securities that shall be deposited with DTC on the Issue Date. The Global Securities shall be registered in the name of Cede & Co. and executed and issued in substantially the form attached hereto as Exhibit A.

(c) The Company shall issue the Securities in an aggregate principal amount of $1,500,000,000. The Company may from time to time, without the consent of the Holders of the Securities, issue additional securities of such series having the same ranking and same interest rate, Stated Maturity, redemption terms and other terms as the Securities described in this Fifth Supplemental Indenture, except for the price to the public and Issue Date. Any such additional securities subsequently issued shall rank equally and ratably with the Securities in all respects, so that such further securities shall be consolidated and form a single series with the applicable series of the Securities.

(d) Any proposed transfer of an interest in Securities held in the form of a Global Security shall be effected through the book-entry system maintained by DTC.

(e) The Securities shall not have a sinking fund.

(f) The Securities shall be issued on June 27, 2023 (the “Issue Date”).

(g) The stated maturity of the principal of the Securities shall be June 27, 2034 (the “Stated Maturity”).

(h) The Securities shall be redeemable prior to their Stated Maturity in accordance with Section 11.09 of the Base Indenture and Sections 2.04 and 2.05 hereof.

(i) Section 11.09 of the Base Indenture shall apply to the Securities.

(j) The Securities shall be issued in minimum denominations of $200,000 in principal amount and integral multiples of $1,000 in excess thereof.

(k) The Securities shall constitute the Company’s direct, unsecured and subordinated obligations and shall at all times rank pari passu without any preference among themselves. In the event of a winding-up or administration of the Company, the claims of the Trustee (on behalf of the Holders of the Securities but not the rights and claims of the Trustee in its personal capacity under the Indenture) and the Holders of the Securities against the Company, in respect of such Securities (including any damages or other amounts (if payable)) shall: (i) be subordinated to the claims of all Senior Creditors; (ii) rank at least pari passu with the claims in respect of Parity Obligations and with the claims of all other subordinated creditors of the Company (if any) which in each case by law rank, or by their terms are expressed to rank, pari passu with the Securities; and (iii) rank senior to the Company’s ordinary shares, preference shares and any junior subordinated obligations (including Junior Obligations) or other securities which in each case either by law rank, or by their terms are expressed to rank, junior to the Securities.

-9-

SECTION 2.02 Interest.

(a) The interest rate on the Securities shall be, or shall be determined, as set forth in Annex I hereto.

(b) The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date shall, as provided in the Indenture, be paid to the Person in whose name the relevant Security (or any Predecessor Dated Subordinated Security) is registered at the close of business on the Regular Record Date for such interest.

(c) By acquiring the Securities, each Holder and Beneficial Owner (i) acknowledges, accepts, consents and agrees to be bound by the Company’s or its designee’s determination of a Benchmark Transition Event, a Benchmark Replacement Date, the Benchmark Replacement, the Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes, including as may occur without any prior notice from the Company and without the need for the Company to obtain any further consent from such Holder or Beneficial Owner, (ii) waives any and all claims, in law and/or in equity, against the Trustee, any paying agent and the Calculation Agent or the Company’s designee for, agree not to initiate a suit against the Trustee, any paying agent and the Calculation Agent or the Company’s designee in respect of, and agree that none of the Trustee, any paying agent or the Calculation Agent or the Company’s designee will be liable for, the determination of or the failure to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes, and any losses suffered in connection therewith and (iii) agrees that none of the Trustee, any paying agent or the Calculation Agent or the Company’s designee will have any obligation to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes (including any adjustments thereto), including in the event of any failure by the Company to determine any Benchmark Transition Event, any Benchmark Replacement Date, any Benchmark Replacement, any Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes.

SECTION 2.03 Payment of Principal, Interest and Other Amounts.

(a) Payments of principal of and interest on the Securities shall be made in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts and such payments on Securities represented by a Global Security shall be made through one or more Paying Agents appointed under the Base Indenture to DTC or its nominee, as the Holder or Holders of the Global Security. Initially, the Paying Agent for the Securities shall be The Bank of New York Mellon, London Branch, 160 Queen Victoria Street, London EC4V 4LA, United Kingdom and the Place of Payment in respect of the Securities shall be the Corporate Trust Office of the Trustee, which as of the date hereof is hereby designated for purposes of the Securities initially as the office or agency of the Trustee located at said address. The Dated Subordinated Debt Security Registrar shall initially be The Bank of New York Mellon SA/NV, Luxembourg Branch, 2-4 Rue Eugene Ruppert, Vertigo Building – Polaris, Luxembourg, 2453, Luxembourg (which location shall also be a Place of Payment for purposes of Section 3.05(a) of the Base

-10-

Indenture). The Company at any time and from time to time may change the Paying Agent, the Dated Subordinated Debt Security Registrar or, subject to Section 9.01 of the Base Indenture, the Place of Payment, without prior notice to the Holders of the Securities, and in such an event the Company may act as Paying Agent or Dated Subordinated Debt Security Registrar.

(b) Payments of principal of and interest on the Securities represented by a Global Security shall be made by wire transfer of immediately available funds; provided, however, that in the case of payments of principal, such Global Security is first surrendered to the Paying Agent. If a date of redemption or repayment or the Stated Maturity is not a Business Day, the Company may pay interest and principal and/or any amount payable upon redemption or repayment of the Securities on the next succeeding Business Day, but interest on that payment will not accrue during the period from and after the date of redemption or repayment or such Stated Maturity.

SECTION 2.04 Optional Redemption. Subject to Section 2.06 of this Fifth Supplemental Indenture and Sections 11.10 and 11.11 of the Base Indenture, the Company may, at the Company’s option, redeem the Securities then Outstanding, in whole but not in part, on the Par Redemption Date at a redemption price equal to 100% of their principal amount, together with accrued but unpaid interest, if any, on the principal amount of the Securities to be redeemed to (but excluding) the date fixed for redemption.

SECTION 2.05 Regulatory Event Redemption. Subject to Section 2.06 of this Fifth Supplemental Indenture and Sections 11.10 and 11.11 of the Base Indenture, the Company may, at the Company’s option, at any time, redeem the Securities, in whole but not in part, at a redemption price equal to 100% of their principal amount, together with accrued but unpaid interest, if any, on the principal amount of the Securities to be redeemed to (but excluding) the date fixed for redemption, if, on or after the Issue Date, there occurs a change in the regulatory classification of the Securities that results in, or would be likely to result in the whole or any part of the outstanding aggregate principal amount of the Securities at any time being excluded from or ceasing to count towards, the Group’s Tier 2 Capital.

SECTION 2.06 Notice of Redemption.

(a) Before the Company may redeem the Securities pursuant to Section 11.09 of the Base Indenture and/or pursuant to Sections 2.04 and 2.05 hereof, the Company shall deliver via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Dated Subordinated Debt Security Register) prior notice of not less than fifteen (15) days, nor more than sixty (60) days, to the Holders of the Securities. The Company shall deliver written notice of such redemption of the Securities to the Trustee at least five (5) Business Days prior to the date on which the relevant notice of redemption is sent to Holders (unless a shorter notice period shall be satisfactory to the Trustee). Such notice shall specify the Company’s election to redeem the Securities and the date fixed for such redemption and shall be irrevocable except in the limited circumstances described in paragraph (b) of this Section 2.06.

(b) If the Company has delivered a notice of redemption pursuant to paragraph (a) of this Section 2.06, but prior to the payment of the redemption amount with respect to such redemption the Relevant U.K. Resolution Authority exercises its U.K. Bail-in Power with respect to the Securities, such redemption notice shall be automatically rescinded and shall be of no force and effect, and no payment in respect of the redemption amount shall be due and payable.

-11-

(c) If the event specified in paragraph (b) of this Section 2.06 occurs, the Company shall promptly deliver notice to the Holders of the Securities via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the shown on the Dated Subordinated Debt Security Register) and to the Trustee directly, specifying the occurrence of the relevant event.

SECTION 2.07 Additional Amounts and FATCA Withholding Tax. The Company agrees, to the extent the Company has actual knowledge of such information, to provide the Paying Agent with sufficient information about any modification to the terms of the Securities for the purposes of determining whether FATCA Withholding Tax applies to any payment of principal or interest on the Securities.

SECTION 2.08 Acknowledgement with respect to Treatment of EEA BRRD Liabilities. Notwithstanding and to the exclusion of any other term of the Base Indenture, this Fifth Supplemental Indenture or any other agreements, arrangements, or understanding between the BRRD Party, on the one hand, and the Company, on the other hand, the Company acknowledges and accepts that an EEA BRRD Liability arising under the Base Indenture and this Fifth Supplemental Indenture may be subject to the exercise of EEA Bail-in Powers by the Relevant EEA Resolution Authority, and acknowledges, accepts, and agrees to be bound by:

(a) the effect of the exercise of EEA Bail-in Powers by the Relevant EEA Resolution Authority in relation to any EEA BRRD Liability that (without limitation) may include and result in any of the following, or some combination thereof:

(i) the reduction of all, or a portion, of the EEA BRRD Liability or outstanding amounts due thereon;

(ii) the conversion of all, or a portion, of the EEA BRRD Liability into shares, other securities or other obligations of the BRRD Party or another person, and the issue to or conferral on the Company of such shares, securities or obligations;

(iii) the cancellation of the EEA BRRD Liability; or

(iv) the amendment or alteration of any interest, if applicable, thereon, the maturity or the dates on which any payments are due including by suspending payment for a temporary period.

(b) the variation of the terms of the Base Indenture or this Fifth Supplemental Indenture, as deemed necessary by the Relevant EEA Resolution Authority, to give effect to the exercise of EEA Bail-in Powers by the Relevant EEA Resolution Authority in respect of the BRRD Party.

For these purposes:

“Bail-in Legislation” means in relation to a member state of the European Economic Area which has implemented, or which at any time implements, the BRRD, the relevant implementing law, regulation, rule or requirement as described in the EU Bail-in Legislation Schedule from time to time.

-12-

“BRRD” means the EU Directive 2014/59/EU of the European Parliament and of the Council establishing a framework for the recovery and resolution of credit institutions and investment firms of May 15, 2014, as amended or replaced from time to time (including as amended by Directive (EU) 2019/879 of the European Parliament and of the Council of May 20, 2019).

“BRRD Party” means The Bank of New York Mellon SA/NV, Luxembourg Branch, solely and exclusively in its role as Dated Subordinated Debt Security Registrar under the Base Indenture and this Fifth Supplemental Indenture. For the avoidance of doubt, The Bank of New York Mellon, London Branch, as Trustee and Paying Agent and in any other capacity under the Base Indenture or this Fifth Supplemental Indenture is not a BRRD Party under the Base Indenture or this Fifth Supplemental Indenture.

“EEA Bail-in Power” means any Write-down and Conversion Powers as defined in the EU Bail-in Legislation Schedule, in relation to the relevant Bail-in Legislation.

“EEA BRRD Liability” means a liability of the BRRD Party to the Company under the Base Indenture or this Fifth Supplemental Indenture, if any, in respect of which the EEA Bail-in Power may be exercised.

“EU Bail-in Legislation Schedule” means the document described as such, then in effect, and published by the Loan Market Association (or any successor person) from time to time at http://www.lma.eu.com.

“Relevant EEA Resolution Authority” means the resolution authority with the ability to exercise any EEA Bail-in Powers in relation to the BRRD Party.

SECTION 2.09 Acknowledgement with Respect to Treatment of BRRD Liabilities. Any references to the “Trustee” in Section 13.02 of the Base Indenture shall be deemed to refer to the Trustee and The Bank of New York Mellon SA/NV, Luxembourg Branch.

ARTICLE III

AMENDMENTS TO THE BASE INDENTURE

SECTION 3.01 Amendments to the Base Indenture.

(a) Section 1.15 of the Base Indenture is hereby amended and restated in its entirety to read as follows:

“Section 1.15 Calculation Agent. If the Company appoints a Calculation Agent pursuant to Section 3.01 with respect to any series of Dated Subordinated Debt Securities, any determination of the interest rate on, or other amounts in relation to, such series of Dated Subordinated Debt Securities in accordance with the terms of such series of Dated Subordinated Debt Securities by such Calculation Agent shall (in the absence of manifest error) be binding on the Company, the Trustee, all Holders and all holders of Coupons and (in the absence of manifest error) no liability to the Holders or holders of Coupons shall attach to the Calculation Agent in connection with the exercise or non-exercise by it of its powers, duties and discretions. None of the Company, the Calculation Agent, the Trustee or any paying agent shall be responsible for determining whether manifest error has occurred or any liability therefor.”

-13-

(b) Section 5.04(d) of the Base Indenture is hereby amended and restated in its entirety to read as follows:

“(d) Subject to applicable law and except as otherwise provided as contemplated by Section 3.01 with respect to any series of Dated Subordinated Debt Securities, no Holder or Beneficial Owner may exercise, claim or plead any right of set-off, compensation, retention or netting in respect of any amount owed to it by the Company arising under, or in connection with, the Dated Subordinated Debt Securities and this Dated Subordinated Debt Securities Indenture or any supplemental indenture hereto and each Holder and Beneficial Owner shall, by virtue of its holding of any Dated Subordinated Debt Security, be deemed to have waived all such rights of set-off, compensation, retention and netting. Notwithstanding the foregoing, if any amounts due and payable to any Holder or Beneficial Owner of the Dated Subordinated Debt Securities by the Company in respect of, or arising under, the Dated Subordinated Debt Securities or this Dated Subordinated Debt Securities Indenture or any supplemental indenture hereto are discharged by set-off, compensation, retention or netting, such Holder or Beneficial Owner shall, subject to applicable law and except as otherwise provided as contemplated by Section 3.01 with respect to any series of Dated Subordinated Debt Securities, immediately pay to the Company an amount equal to the amount of such discharge (or, in the event of its winding-up or administration, the liquidator or administrator of the Company, as the case may be) and, until such time as payment is made, shall hold an amount equal to such amount in trust for the Company (or the liquidator or administrator of the Company, as the case may be) and, accordingly, any such discharge shall be deemed not to have taken place. By its acquisition of the Dated Subordinated Debt Securities, each Holder and Beneficial Owner agrees to be bound by these provisions relating to waiver of set-off, compensation, retention and netting.”

(a) Section 13.01(d) of the Base Indenture is hereby amended and restated in its entirety to read as follows:

“(d) Upon the exercise of the U.K. Bail-in Power by the Relevant U.K. Resolution Authority with respect to a particular series of Dated Subordinated Debt Securities, the Company shall provide a written notice to DTC as soon as practicable regarding such exercise of the U.K. Bail-in Power for purposes of notifying Holders and Beneficial Owners of such occurrence. The Company shall also deliver a copy of such notice to the Trustee for information purposes. Any delay or failure by the Company in delivering any notice referred to in this paragraph shall not affect the validity and enforceability of the U.K. Bail-in Power.”

ARTICLE IV

MISCELLANEOUS PROVISIONS

SECTION 4.01 Effectiveness. This Fifth Supplemental Indenture shall become effective upon its execution and delivery.

SECTION 4.02 Original Issue. The Securities may, upon execution of this Fifth Supplemental Indenture, be executed by the Company and delivered by the Company to the Trustee for authentication, and the Trustee shall, upon delivery of a Company Order, authenticate and deliver such Securities as in such Company Order provided.

-14-

SECTION 4.03 Ratification and Integral Part. The Base Indenture as supplemented and amended by this Fifth Supplemental Indenture, is in all respects ratified and confirmed, including without limitation all the rights, immunities and indemnities of the Trustee, and this Fifth Supplemental Indenture shall be deemed an integral part of the Base Indenture in the manner and to the extent herein and therein provided.

SECTION 4.04 Priority. This Fifth Supplemental Indenture shall be deemed part of the Base Indenture in the manner and to the extent herein and therein provided. The provisions of this Fifth Supplemental Indenture shall, with respect to the Securities and subject to the terms hereof, supersede the provisions of the Base Indenture to the extent the Base Indenture is inconsistent herewith.