UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 21, 2023

AEGLEA BIOTHERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37722 | 46-4312787 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 805 Las Cimas Parkway Suite 100 Austin, TX |

78746 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (512) 942-2935

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common stock, $0.0001 Par Value | AGLE | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

Agreement and Plan of Merger

On June 22, 2023, Aeglea BioTherapeutics, Inc., a Delaware corporation (the “Company” or “Aeglea”), acquired Spyre Therapeutics, Inc., a Delaware corporation (“Spyre”), in accordance with the terms of the Agreement and Plan of Merger, dated June 22, 2023 (the “Merger Agreement”), by and among the Company, Aspen Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“First Merger Sub”), Sequoia Merger Sub II, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company (“Second Merger Sub”), and Spyre. Pursuant to the Merger Agreement, First Merger Sub merged with and into Spyre, pursuant to which Spyre was the surviving corporation and became a wholly owned subsidiary of the Company (the “First Merger”). Immediately following the First Merger, Spyre merged with and into Second Merger Sub, pursuant to which Second Merger Sub was the surviving entity (together with the First Merger, the “Merger”). The Merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

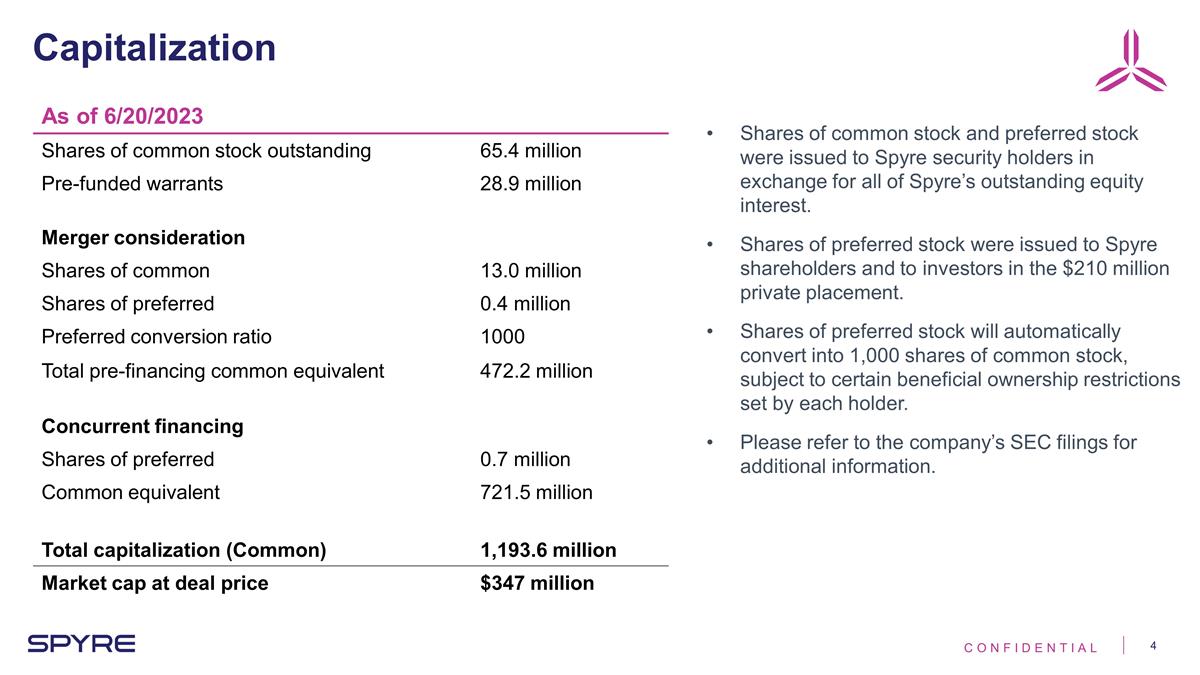

Under the terms of the Merger Agreement, following the closing of the Merger (the “Closing”), the Company will issue to the stockholders of Spyre 13,013,636 shares of the common stock of the Company, par value $0.0001 per share (the “Common Stock”) and 364,889 shares of Series A Preferred Stock (as described below), each share of which is convertible into 1,000 shares of Common Stock, subject to certain conditions described below.

Reference is made to the discussion of the Series A Preferred Stock in Item 5.03 of this Current Report on Form 8-K, which is incorporated into this Item 1.01 by reference.

Pursuant to the Merger Agreement, the Company has agreed to hold a stockholders’ meeting to submit the following matters to its stockholders for their consideration: (i) the approval of the conversion of the Series A Preferred Stock into shares of Common Stock in accordance with Nasdaq Stock Market Rules (the “Conversion Proposal”), and (ii), if deemed necessary or appropriate by the Company or as otherwise required by law, the approval of an amendment to the certificate of incorporation of the Company to authorize sufficient shares of Common Stock for the conversion of the Series A Preferred Stock issued pursuant to the Merger Agreement (as described below) and/or to effectuate a reverse stock split of all outstanding shares of Parent Common Stock at a reverse stock split ratio to be reasonably determined by Parent for the purpose of maintaining compliance with Nasdaq listing standards (the “Charter Amendment Proposal,” and together with the Conversion Proposal, the “Meeting Proposals”). In connection with these matters, the Company intends to file with the Securities and Exchange Commission (the “SEC”) a proxy statement and other relevant materials.

The Board of Directors of the Company (the “Board”) approved the Merger Agreement and the related transactions, and the consummation of the Merger was not subject to approval of the Company stockholders.

The foregoing description of the Merger and the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Merger Agreement has been included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about the Company or Spyre. The Merger Agreement contains representations, warranties and covenants that the Company and Spyre made to each other as of specific dates. The assertions embodied in those representations, warranties and covenants were made solely for purposes of the Merger Agreement between the Company and Spyre and may be subject to important qualifications and limitations agreed to by the Company and Spyre in connection with negotiating its terms, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Merger Agreement. Moreover, the representations and warranties may be subject to a contractual standard of materiality that may be different from what may be viewed as material to investors or securityholders, or may have been used for the purpose of allocating risk between the Company and Spyre rather than establishing matters as facts. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. For the foregoing reasons, no person should rely on the representations and warranties as statements of factual information at the time they were made or otherwise.

Support Agreements

In connection with the execution of the Merger Agreement, the Company and Spyre entered into stockholder support agreements (the “Support Agreements”) with certain of the Company’s officers and directors. The Support Agreements provide that, among other things, each of the parties thereto has agreed to vote or cause to be voted all of the shares of Common Stock owned by such stockholder in favor of the Meeting Proposals at the Company stockholders’ meeting to be held in connection therewith.

The foregoing description of the Support Agreements does not purport to be complete and is qualified in its entirety by reference to the form of the Support Agreement, which is provided as Exhibit E to the Merger Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Lock-up Agreements

Concurrently and in connection with the execution of the Merger Agreement, certain Spyre stockholders as of immediately prior to the Merger, and certain of the directors and officers of the Company as of immediately prior to the Merger entered into lock-up agreements with the Company and Spyre, pursuant to which each such stockholder will be subject to a 180-day lockup on the sale or transfer of shares of Common Stock held by each such stockholder at the Closing, including those shares received by Spyre stockholders in the Merger (the “Lock-up Agreements”).

The foregoing description of the Lock-up Agreements does not purport to be complete and is qualified in its entirety by reference to the form of the Lock-up Agreement, which is provided as Exhibit B to the Merger Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Contingent Value Rights Agreement

The Merger Agreement contemplates that within 30 days following the Closing, the Company and the Rights Agent (as defined therein) will execute and deliver a contingent value rights agreement (the “CVR Agreement”), pursuant to which each holder of Common Stock as of the applicable record time shall be entitled to one (1) contractual contingent value right issued by the Company, subject to and in accordance with the terms and conditions of the CVR Agreement, for each share of Common Stock held by such holder. Each contingent value right shall entitle the holder thereof to receive certain cash payments from the net proceeds, if any, related to the disposition of the Company’s legacy programs following the Closing. The contingent value rights are not transferable, except in certain limited circumstances as will be provided in the CVR Agreement, will not be certificated or evidenced by any instrument and will not be registered with the SEC or listed for trading on any exchange.

The foregoing description of the CVR Agreement does not purport to be complete and is qualified in its entirety by reference to the form of the CVR Agreement, which is provided as Exhibit D to the Merger Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Private Placement and Securities Purchase Agreement

On June 22, 2023, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the purchasers named therein (the “Investors”).

Pursuant to the Purchase Agreement, the Company agreed to sell an aggregate of 721,452 shares of Series A Preferred Stock (the “PIPE Securities”) for an aggregate purchase price of approximately $210,000,000 (collectively, the “Financing”). Each share of Series A Preferred Stock is convertible into 1,000 shares of Common Stock, as described below. The powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series A Preferred Stock are set forth in the Certificate of Designations (as described below).

The closing of the Financing is expected to occur on June 26, 2023 (the “Financing Closing Date”).

The foregoing summary of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Registration Rights Agreement

On June 22, 2023, in connection with the Purchase Agreement, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors. Pursuant to the Registration Rights Agreement, the Company is required to prepare and file a resale registration statement with the SEC within 45 calendar days following the Financing Closing Date (the “Filing Deadline”). The Company shall use its commercially reasonable efforts to cause this registration statement to be declared effective by the SEC within 30 calendar days of the Filing Deadline (or within 60 calendar days if the SEC reviews the registration statement).

The Company has also agreed to, among other things, indemnify the Investors, their officers, directors, members, employees, partners, managers, stockholders, affiliates, investment advisors and agents under the registration statement from certain liabilities and pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and selling commissions) incident to the Company’s obligations under the Registration Rights Agreement.

The Offering is exempt from registration pursuant to Section 4(a)(2) of the Securities Act promulgated thereunder, as a transaction by an issuer not involving a public offering, and Rule 506 of Regulation D. The Investors have acquired the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate legends have been affixed to the securities issued in this transaction.

The foregoing summary of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the form of Registration Rights Agreement, which is filed as Exhibit 10.2 to this Current Report on Form 8-K.

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

On June 22, 2023, the Company completed its business combination with Spyre. The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

| Item 3.02 | Unregistered Sales of Equity Securities |

The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The PIPE Securities were offered and sold in transactions exempt from registration under the Securities Act, in reliance on Section 4(a)(2) thereof and Rule 506 of Regulation D thereunder. Each of the Investors represented that it was an “accredited investor,” as defined in Regulation D, and is acquiring the Securities for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The PIPE Securities have not been registered under the Securities Act and such Securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws. Neither this Current Report on Form 8-K nor any of the exhibits attached hereto is an offer to sell or the solicitation of an offer to buy shares of Common Stock or any other securities of the Company.

Pursuant to the Merger Agreement, the Company issued shares of Common Stock and Series A Preferred Stock. The information contained in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. Such issuances were exempt from registration pursuant to Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Chief Operating Officer

On June 21, 2023, the Board approved the appointment of Cameron Turtle, age 33, to Chief Operating Officer of the Company, effective as of the Closing.

Dr. Turtle is an experienced leader in building, financing, and shaping biopharma organizations from preclinical development to late-stage clinical trials and commercialization. Dr. Turtle joins Aeglea from Spyre Therapeutics. Previously, he served as Venture Partner at Foresite Labs; Chief Strategy Officer of BridgeBio Pharma (NASDAQ: BBIO); and Chief Business Officer of Eidos Therapeutics (NASDAQ: EIDX), where he led business development, investor relations, and multiple operational functions as the company advanced an investigational medicine for a form of heart failure. Prior to joining Eidos, he was a consultant at McKinsey & Company, where he worked with pharmaceutical and medical device companies on topics including M&A, growth strategy, clinical trial strategy, and sales force optimization.

Dr. Turtle received his B.S. with honors in Bioengineering from the University of Washington and his DPhil in Cardiovascular Medicine from the University of Oxford, St. John’s College. He is the recipient of several awards, including a Rhodes Scholarship, Goldwater Scholarship, Forbes 30 Under 30, San Francisco Business Times 40 Under 40, and the Biocom Life Sciences Catalyst Award.

In connection with his appointment, Mr. Turtle entered into an offer letter with the Company pursuant to which he will receive: (i) an annual base salary of $450,000, (ii) a target annual bonus of 50% of his base salary (pro-rated for 2023), and (iii) a grant of 47,297,197 stock options as an inducement to accepting employment with the Company. In the event of a termination of Mr. Turtle’s employment without “cause” (as defined in the offer letter), subject to his execution and non-revocation of a release of claims, Mr. Turtle is eligible to receive the following severance payments and benefits: (a) an amount equal to 12 months of his base salary plus any earned but unpaid bonus for the preceding year, payable in installments over 12 months, (b) accelerated vesting of the time-based equity awards that would vest within the next 12 months following such termination, and (c) subsidized COBRA continuation for 12 months following such termination. In the event of a termination of Mr. Turtle’s employment without “cause” or his resignation for “good reason” (as defined in the offer letter) on or within 12 months of a change in control of the Company, subject to his execution and non-revocation of a release of claims, Mr. Turtle is eligible to receive the foregoing severance payments and benefits; however, all outstanding time-based equity awards will be fully accelerated.

Mr. Turtle has no family relationship with any of the executive officers or directors of the Company. There are no arrangements or understandings between Mr. Turtle and any other person pursuant to which he was appointed as an officer of the Company. Mr. Turtle is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Resignation of Directors

In accordance with the Merger Agreement, on June 22, 2023, immediately prior to the effective time of the merger (“Effective Time”), Armen Shanafelt, Ph.D., V. Bryan Lawlis, Ph.D. and Marcio Souza, M.B.A. resigned from the Board and any respective committee of the Board to which they were members. The resignations were not the result of any disagreements with the Company relating to the Company’s operations, policies or practices.

Appointment of Directors

In accordance with the Merger Agreement, on June 22, 2023, effective immediately after the Effective Time, Peter Harwin, Tomas Kiselak and Michael Henderson were appointed to the Board as directors.

Peter Harwin (Age 37). Peter Harwin is currently a managing member at Fairmount Funds Management LLC, a healthcare investment fund he co-founded in April 2016. Prior to Fairmount, Mr. Harwin served as a member of the investment team at Boxer Capital, LLC, part of the Tavistock Group, based in San Diego. Mr. Harwin serves on the board of Viridian Therapeutics, Inc. along with being chairman of the board of Cogent Biosciences, Inc. He is also a director of Paragon Therapeutics, Inc. and a member of the board of managers of Apogee Therapeutics, LLC. Peter holds a Bachelor of Business Administration from Emory University.

Tomas Kiselak (Age 37). Tomas Kiselak is currently a managing member at Fairmount Funds Management LLC, a healthcare investment fund he co-founded in April 2016. Prior to Fairmount, Mr. Kiselak served as a managing director at RA Capital Management LLC. Mr. Kiselak serves on the board of Viridian as its chairman as well as being a director for several private companies. He received a bachelor’s degree in Neuroscience and Economics from Amherst College.

Michael Henderson (Age 34). Dr. Henderson has served as a member of the board of directors of Apogee Therapeutics, Inc. since June 2023, as a member of the board of managers of Apogee Therapeutics, LLC since 2022 and as Apogee Therapeutics, Inc’s Chief Executive Officer since September 2022. Dr. Henderson is an experienced biotechnology executive with expertise in business leadership, drug development, and commercial strategy. He has overseen the creation of multiple companies, launched a significant number of drug development programs, and led teams to two FDA approvals, to date. Prior to joining Apogee, Dr. Henderson served as Chief Business Officer of BridgeBio Pharma, Inc. (Nasdaq: BBIO), a commercial-stage biopharmaceutical company, from January 2020 to September 2022, where he was responsible for furthering the overarching strategy of BridgeBio, identifying and investing in new technologies and running business development and operations. Prior to holding that position, he spent two years serving as BridgeBio’s Senior Vice President, Asset Acquisition, Strategy and Operations, where he was responsible for business development, strategy and operations. Dr. Henderson joined BridgeBio as Vice President of Asset Acquisition, Strategy and Operations in April 2016. Dr. Henderson also served as the Chief Executive Officer of a number of BridgeBio’s subsidiaries. Prior to BridgeBio, Dr. Henderson worked at McKinsey & Company, a global management consulting firm, from January 2015 to April 2016 and prior to that, he co-founded PellePharm, Inc., a biotechnology company, in August 2011. Dr. Henderson has served on the board of directors of ARYA Sciences Acquisition Corp IV (Nasdaq: ARYD), a special purpose acquisition company focused on the healthcare industry, since February 2021. Dr. Henderson received his B.A. in global health from Harvard University and his M.D. from Stanford University.

There are no arrangements or understandings between Mr. Harwin, Mr. Kiselak or Dr. Henderson and any other person pursuant to which he was appointed as a director of the Company. None of Mr. Harwin, Mr. Kiselak or Dr. Henderson is a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Board Committees

Audit Committee

In connection with the Closing, Mr. Harwin was appointed to the audit committee of the Board.

Compensation Committee

In connection with the Closing, Mr. Kiselak and Dr. Henderson were appointed to the compensation committee of the Board.

Nominating and Corporate Governance Committee

In connection with the Closing, Mr. Harwin and Dr. Henderson were appointed to the nominating and corporate governance committee of the Board.

Indemnification Agreements

In connection with Mr. Harwin’s, Mr. Kiselak’s and Dr. Henderson’s appointment as directors and Dr. Turtle’s appointment as Chief Operating Officer, each of Mr. Harwin, Mr. Kiselak, Dr. Henderson and Dr. Turtle will enter into the Company’s standard form of indemnification agreement, a copy of which was filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q (File No. 001-37722) filed with the Securities and Exchange Commission on August 9, 2018.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On June 22, 2023, the Company filed a Certificate of Designation of Preferences, Rights and Limitations of the Series A Non-Voting Convertible Preferred Stock with the Secretary of State of the State of Delaware (the “Certificate of Designation”) in connection with the Merger and the Financing referenced in Item 1.01 above. The Certificate of Designation provides for the issuance of shares of the Company Series A Non-Voting Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”).

Holders of Series A Preferred Stock are entitled to receive dividends on shares of Series A Preferred Stock equal to, on an as-if-converted-to-Common-Stock basis, and in the same form as dividends actually paid on shares of the Common Stock. Except as otherwise required by law, the Series A Preferred Stock does not have voting rights. However, as long as any shares of Series A Preferred Stock are outstanding, the Company will not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series A Preferred Stock, (a) alter or change adversely the powers, preferences or rights given to the Series A Preferred Stock, (b) alter or amend the Certificate of Designation, (c) amend its certificate of incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series A Preferred Stock, (d) issue further shares of Series A Preferred Stock or increase or decrease (other than by conversion) the number of authorized shares of Series A Preferred Stock, (e) prior to the stockholder approval of the Conversion Proposal or at any time while at least 30% of the originally issued Series A Preferred Stock remains issued and outstanding, consummate either (A) a Fundamental Transaction (as defined in the Certificate of Designation) or (B) any merger or consolidation of the Company or other business combination in which the stockholders of the Company immediately before such transaction do not hold at least a majority of the capital stock of the Company immediately after such transaction, or (f) enter into any agreement with respect to any of the foregoing. The Series A Preferred Stock does not have a preference upon any liquidation, dissolution or winding-up of the Company.

Following stockholder approval of the Conversion Proposal, each share of Series A Preferred Stock will automatically convert into 1,000 shares of Common Stock, subject to certain limitations, including that a holder of Series A Preferred Stock is prohibited from converting shares of Series A Preferred Stock into shares of Common Stock if, as a result of such conversion, such holder, together with its affiliates, would beneficially own more than a specified percentage (to be established by the holder between 0% and 19.99%) of the total number of shares of Common Stock issued and outstanding immediately after giving effect to such conversion.

The foregoing description of the Series A Preferred Stock does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designation, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure. |

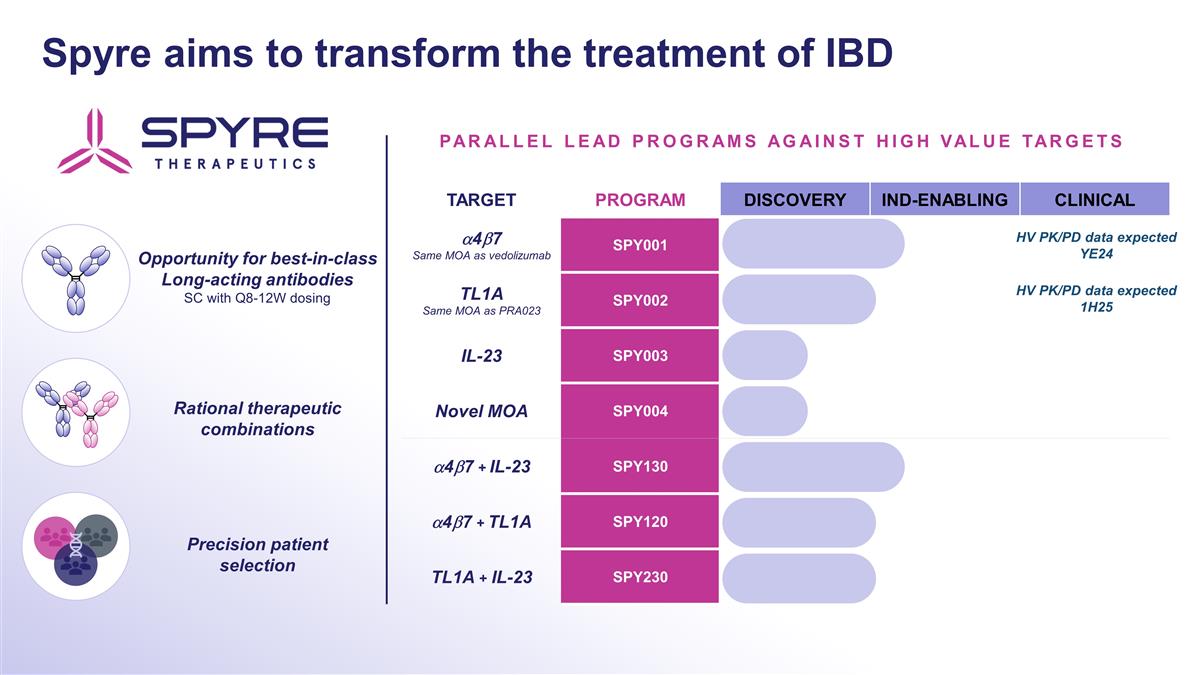

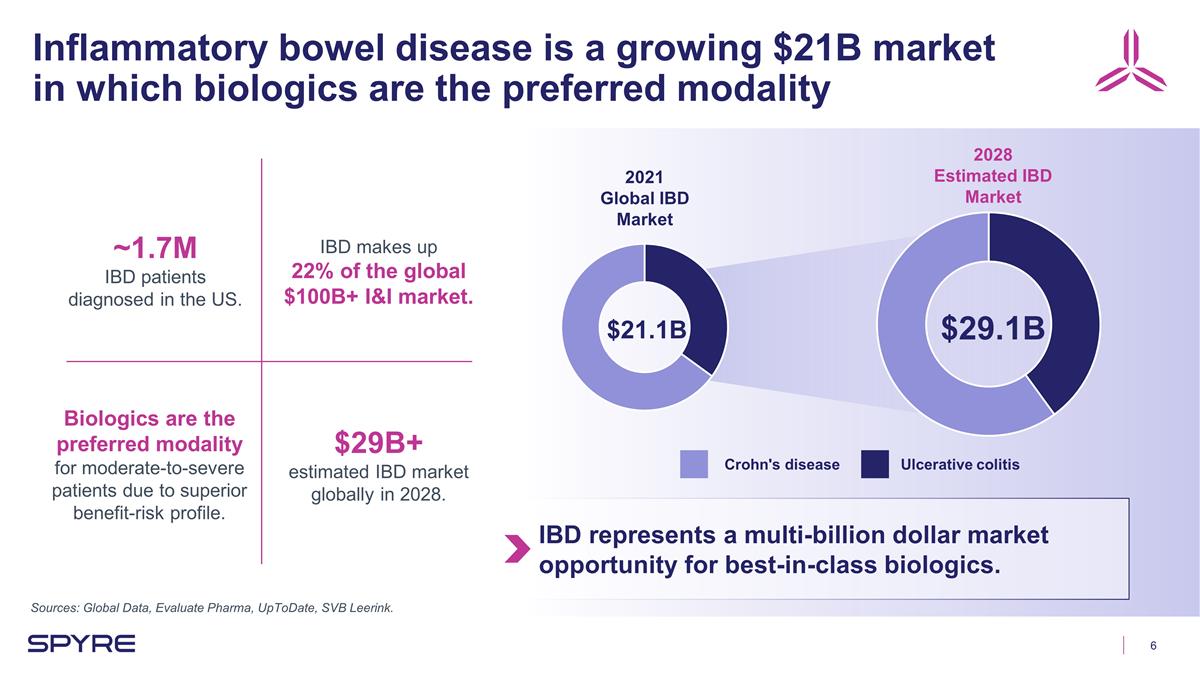

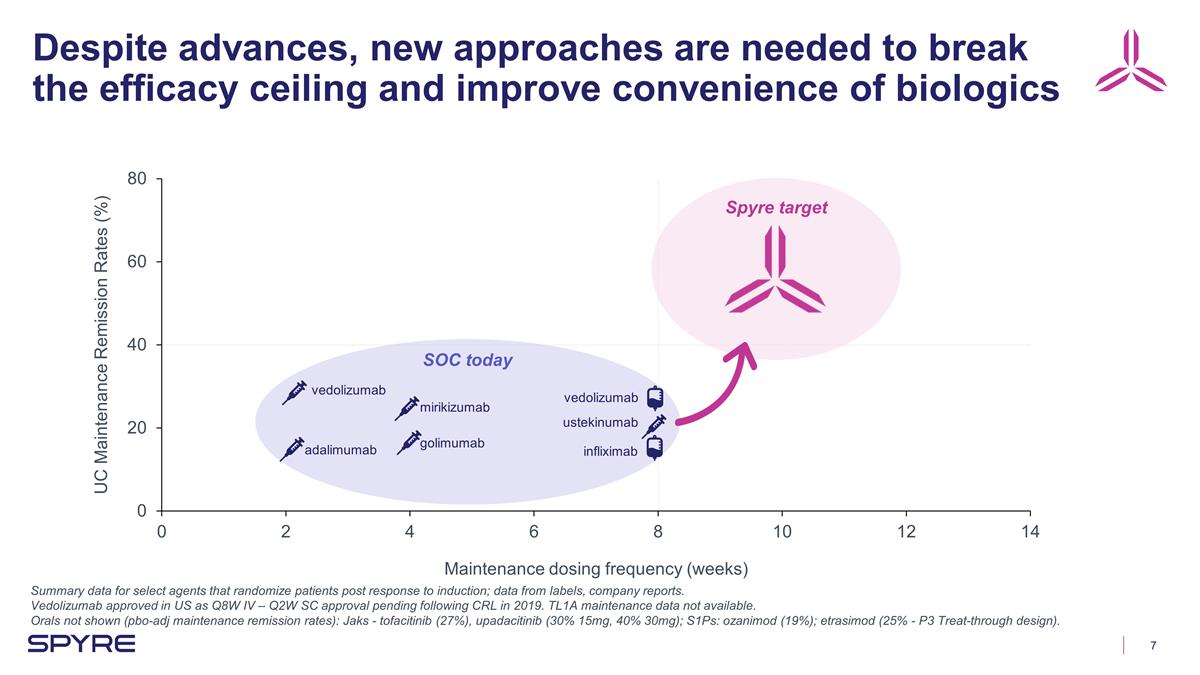

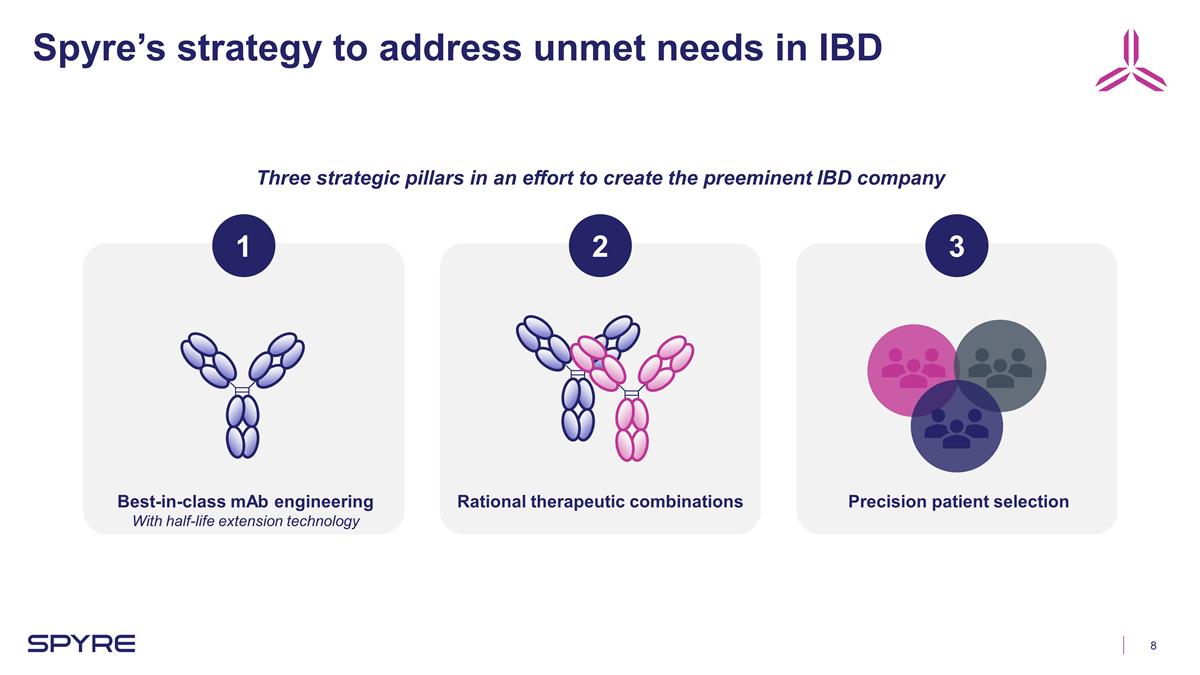

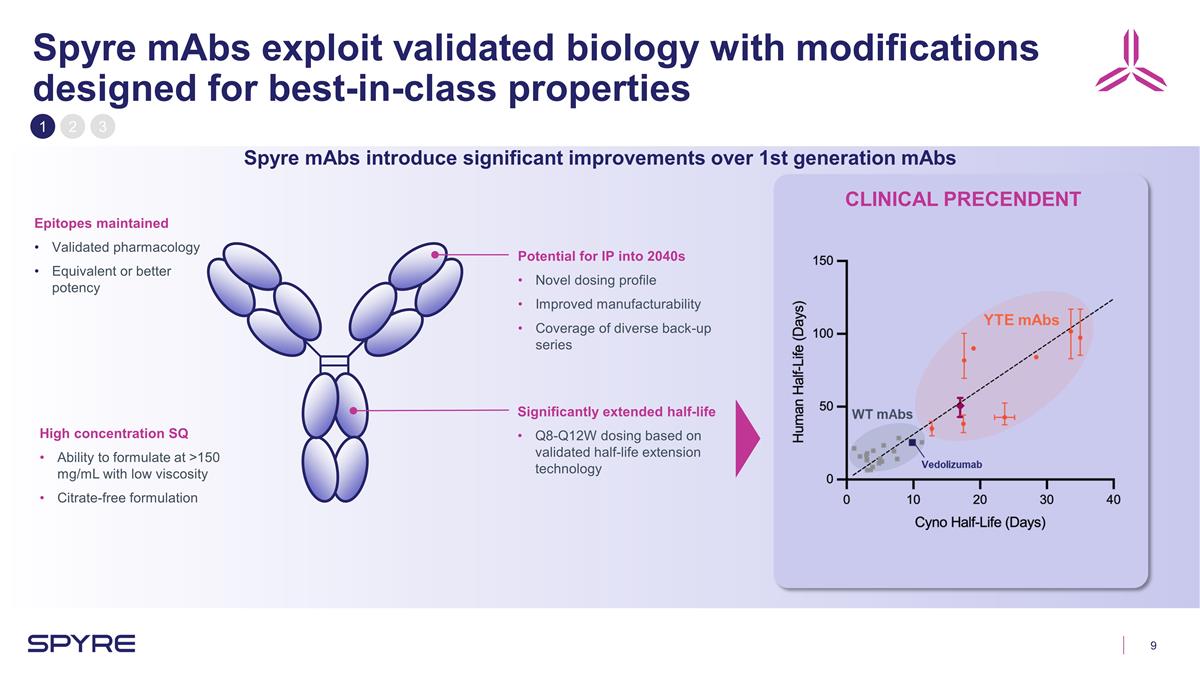

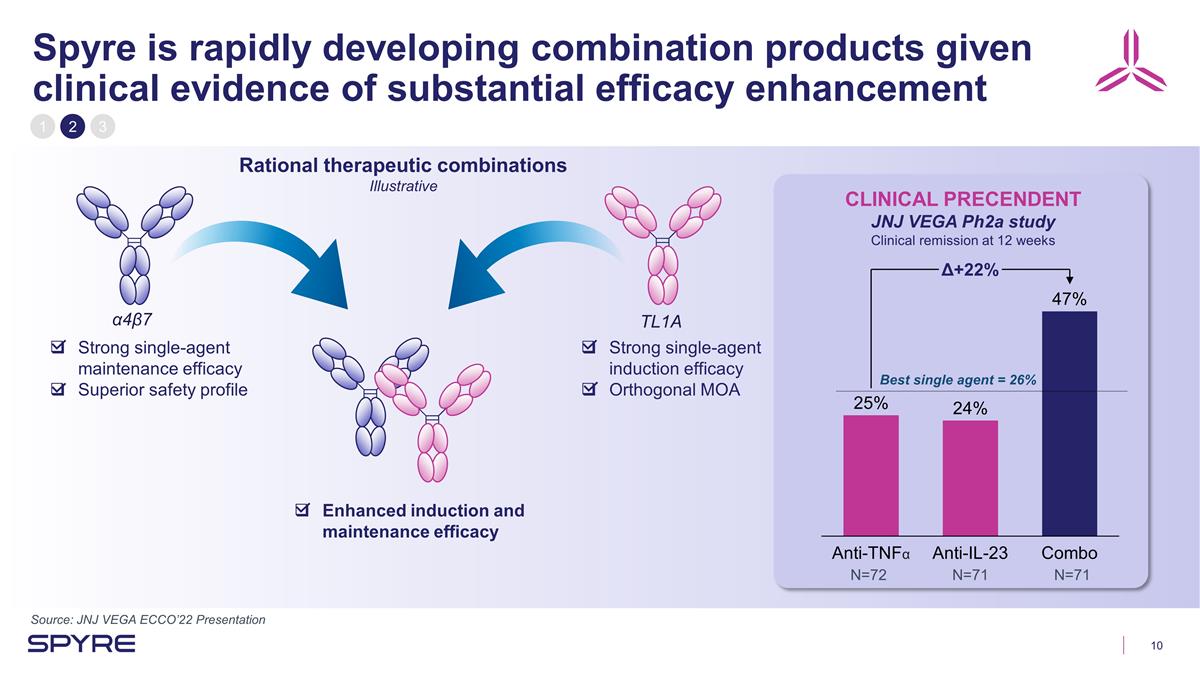

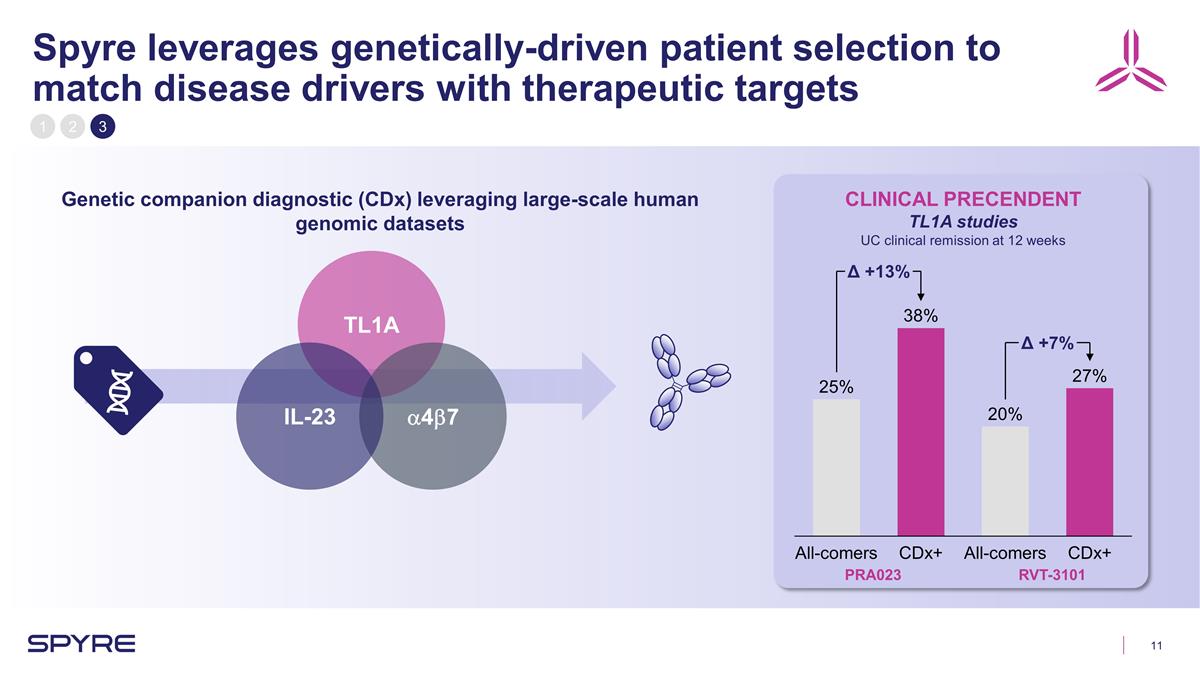

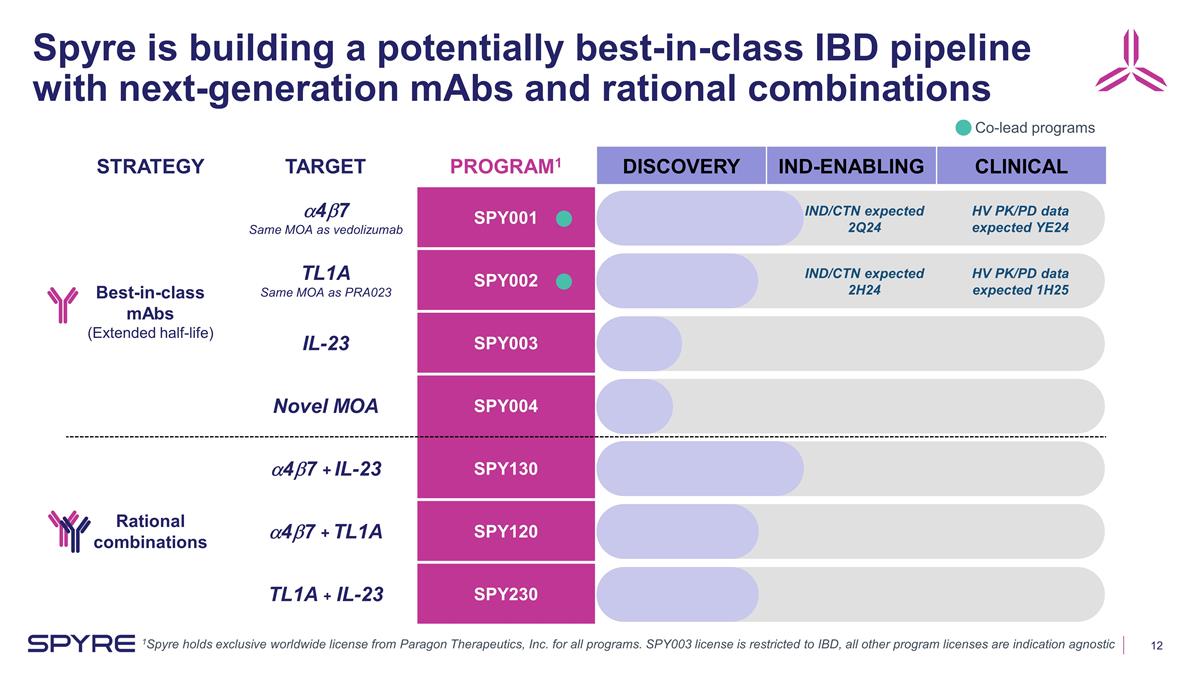

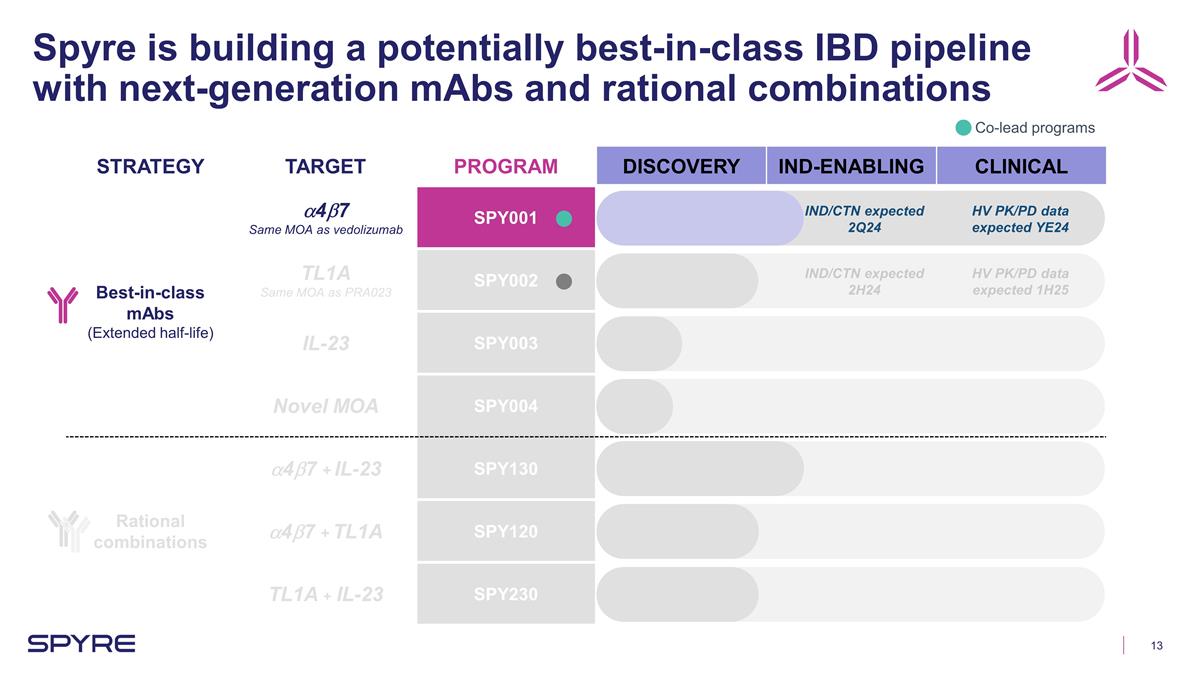

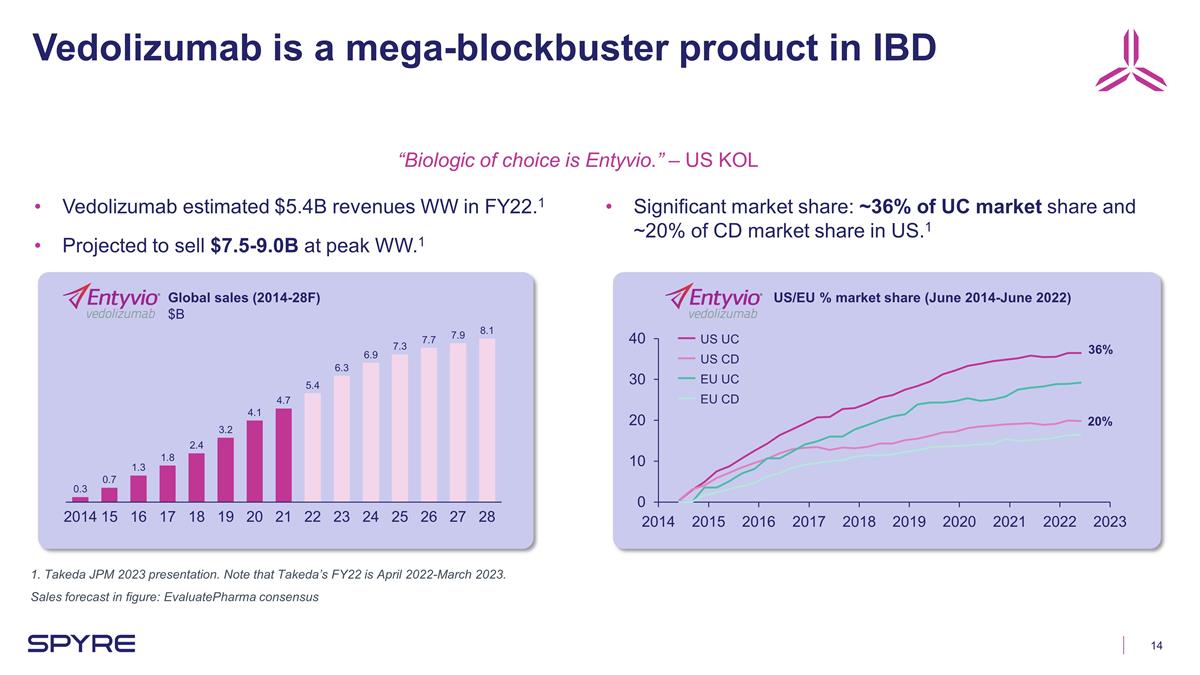

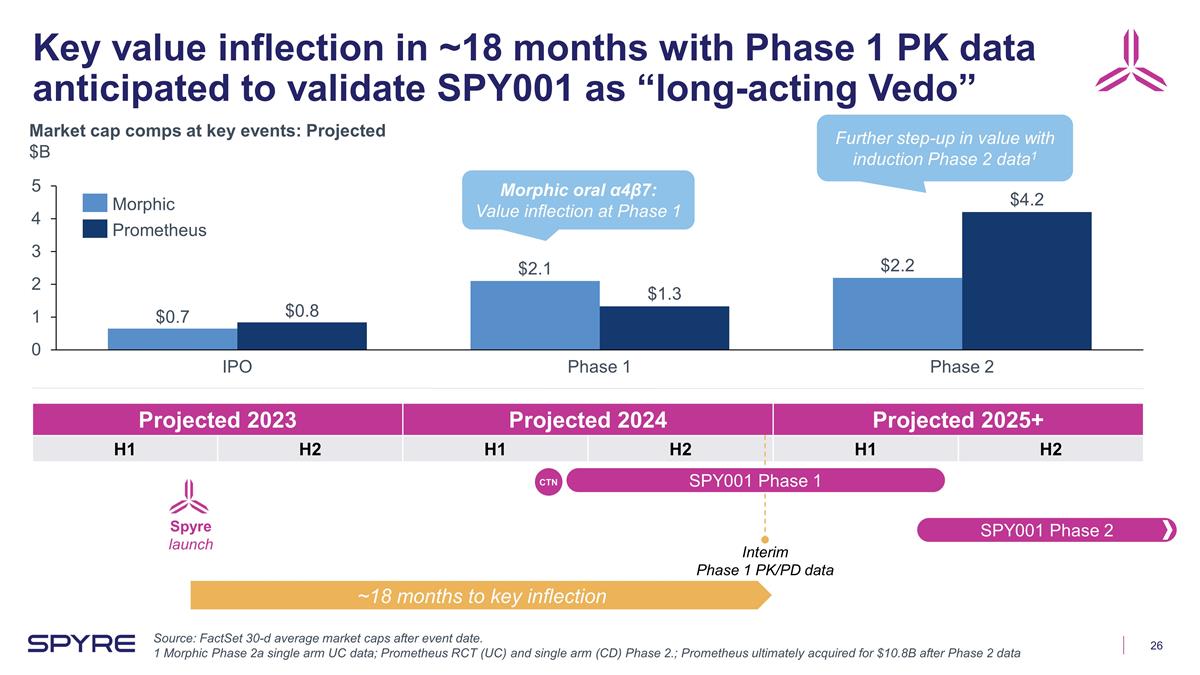

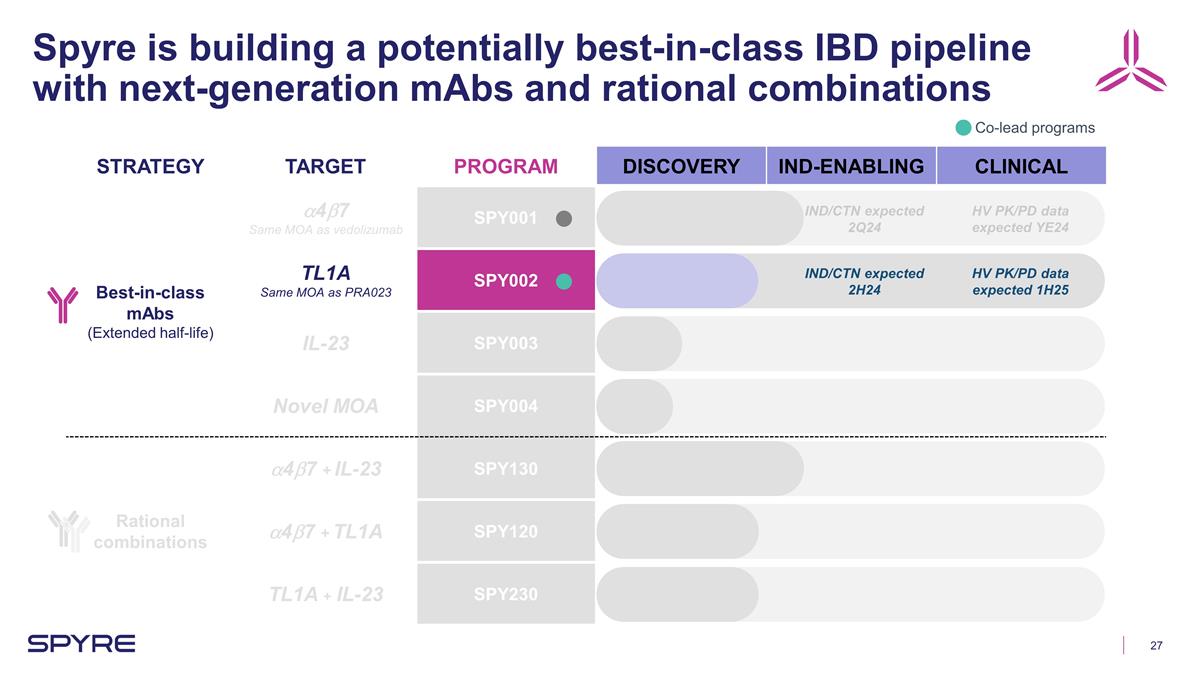

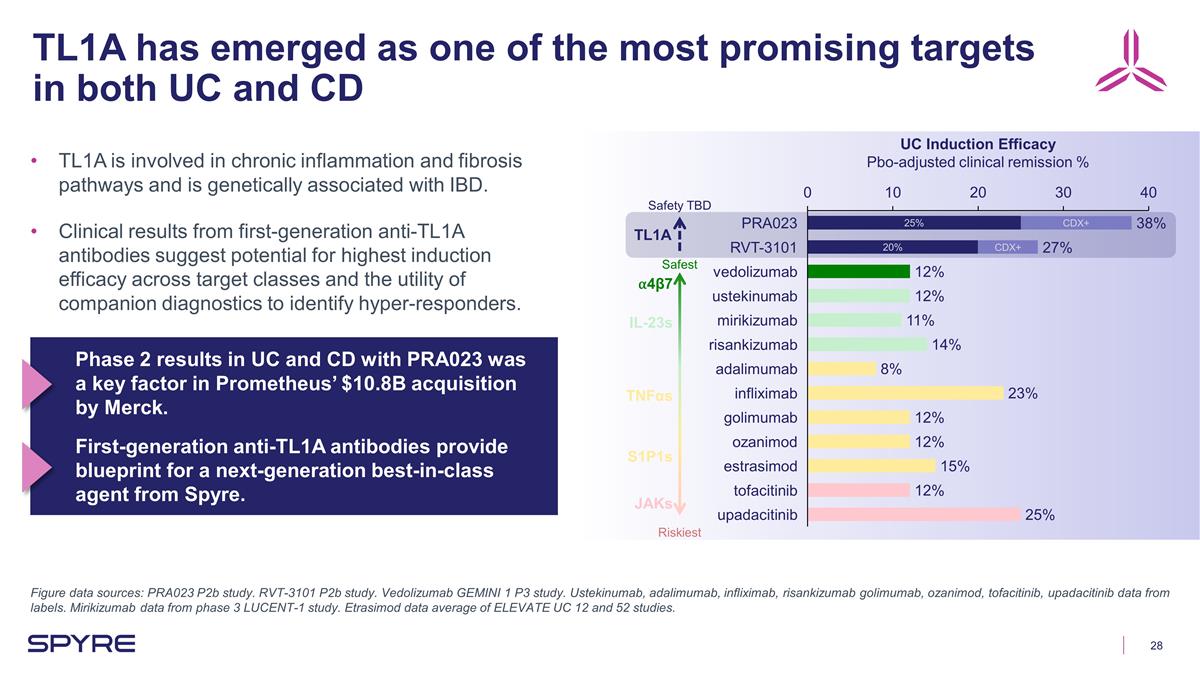

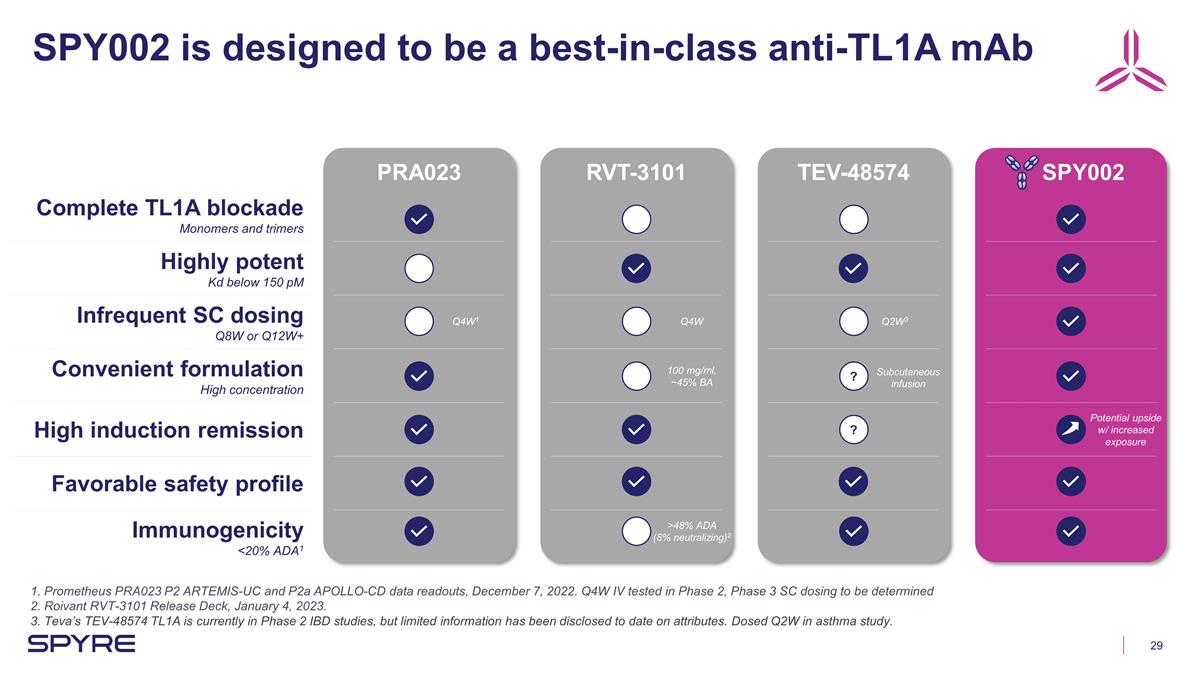

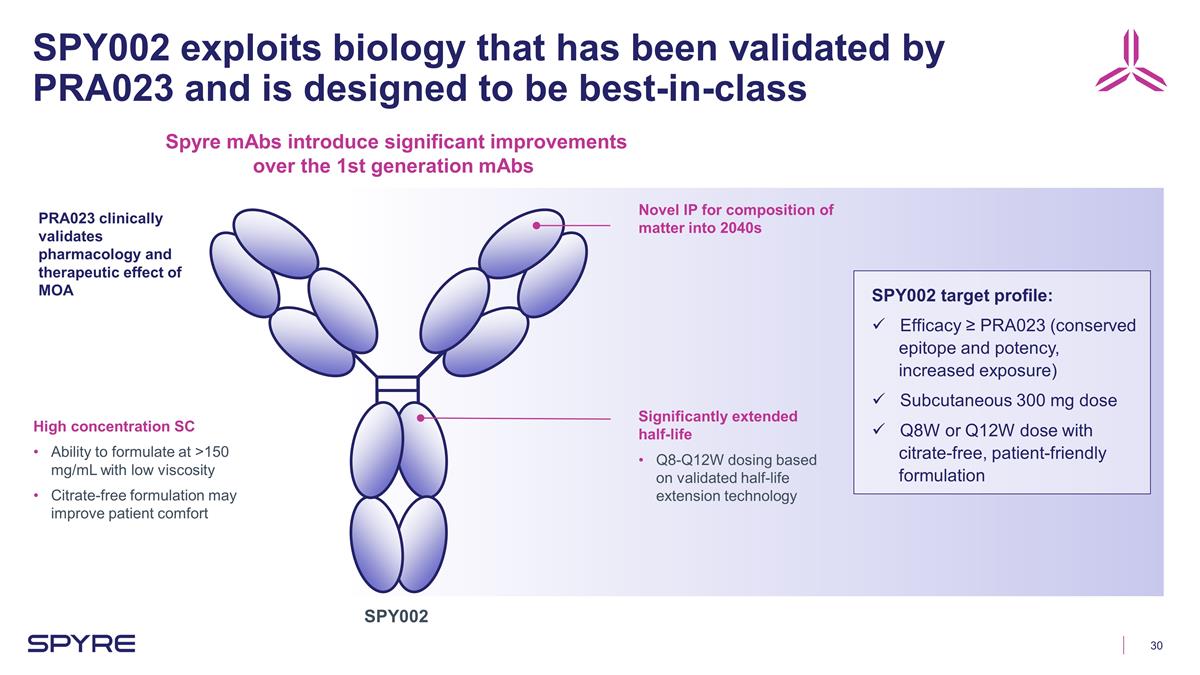

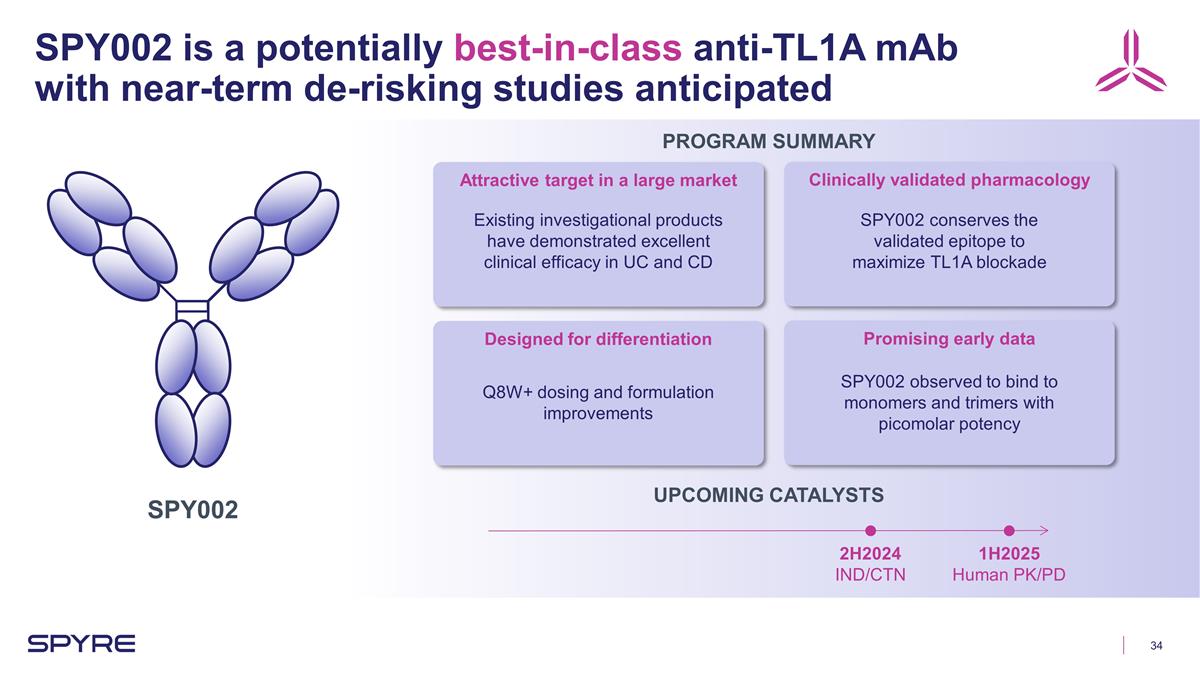

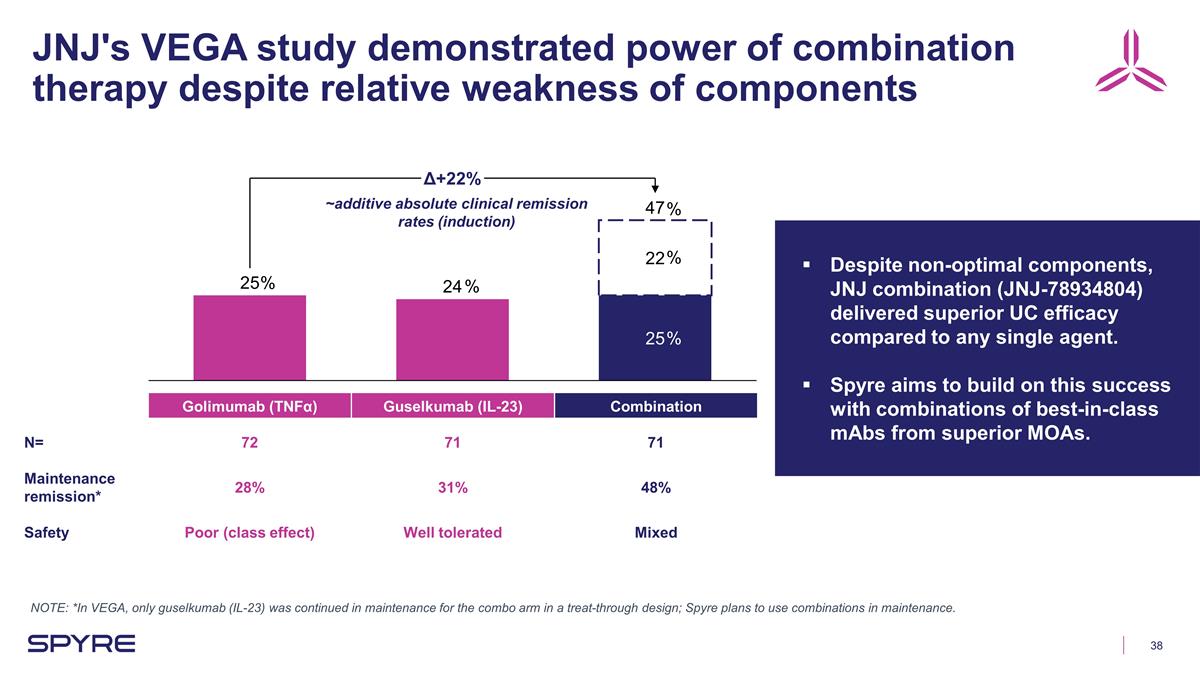

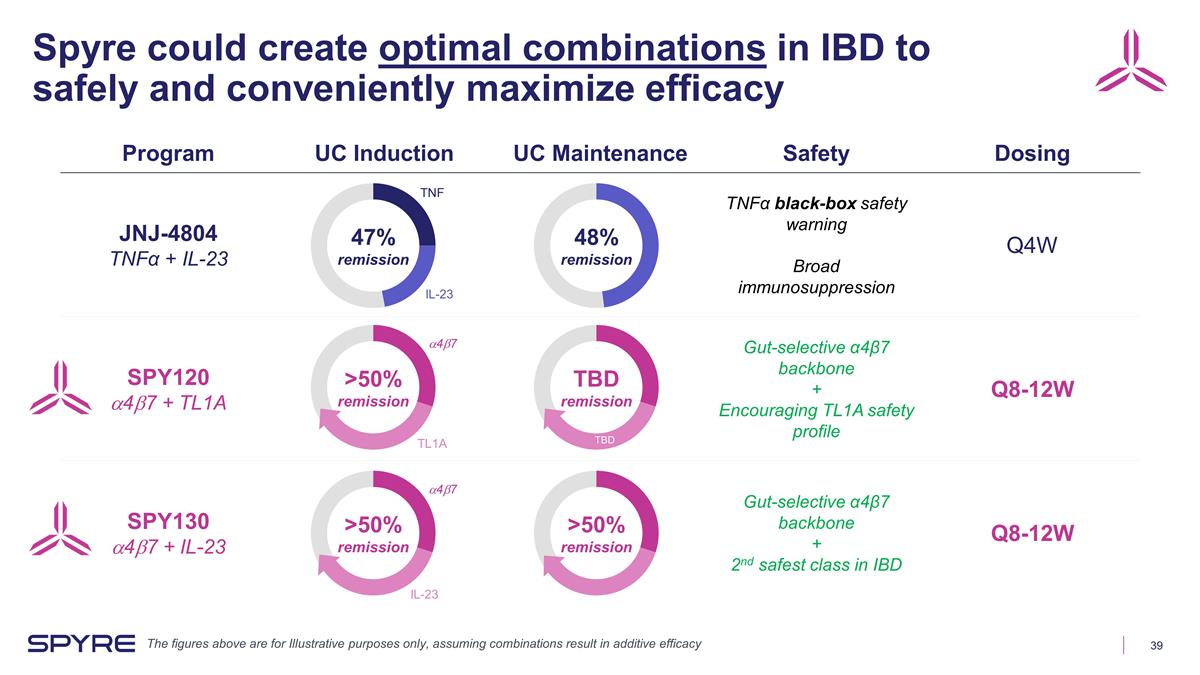

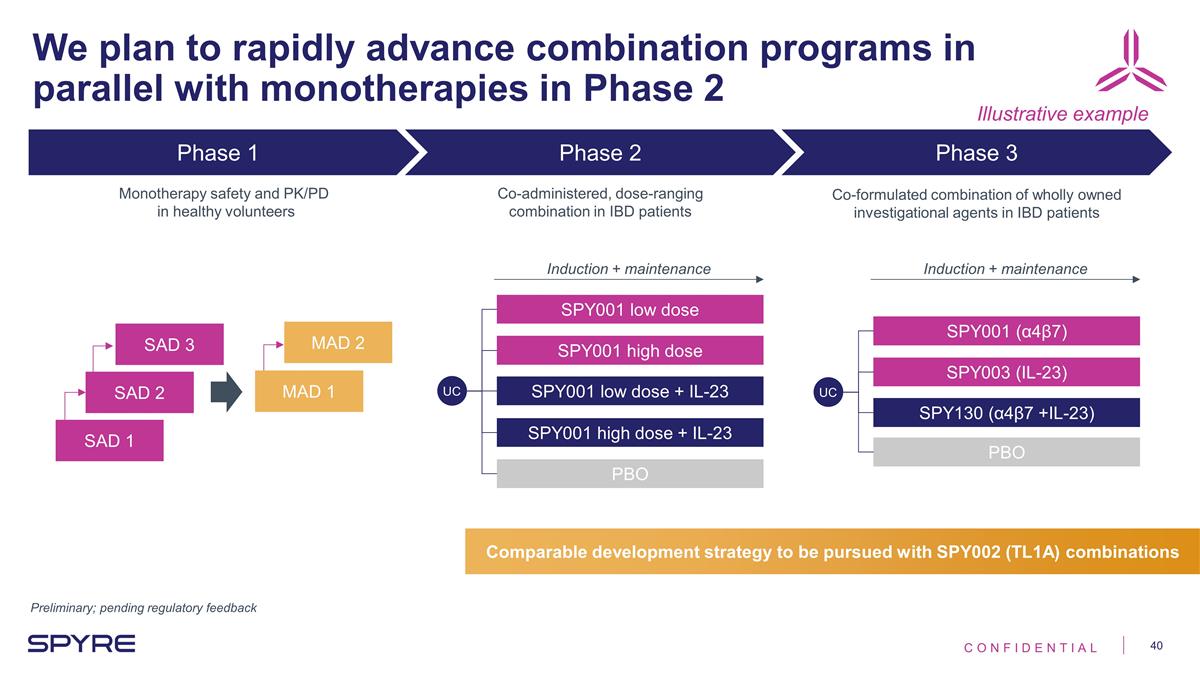

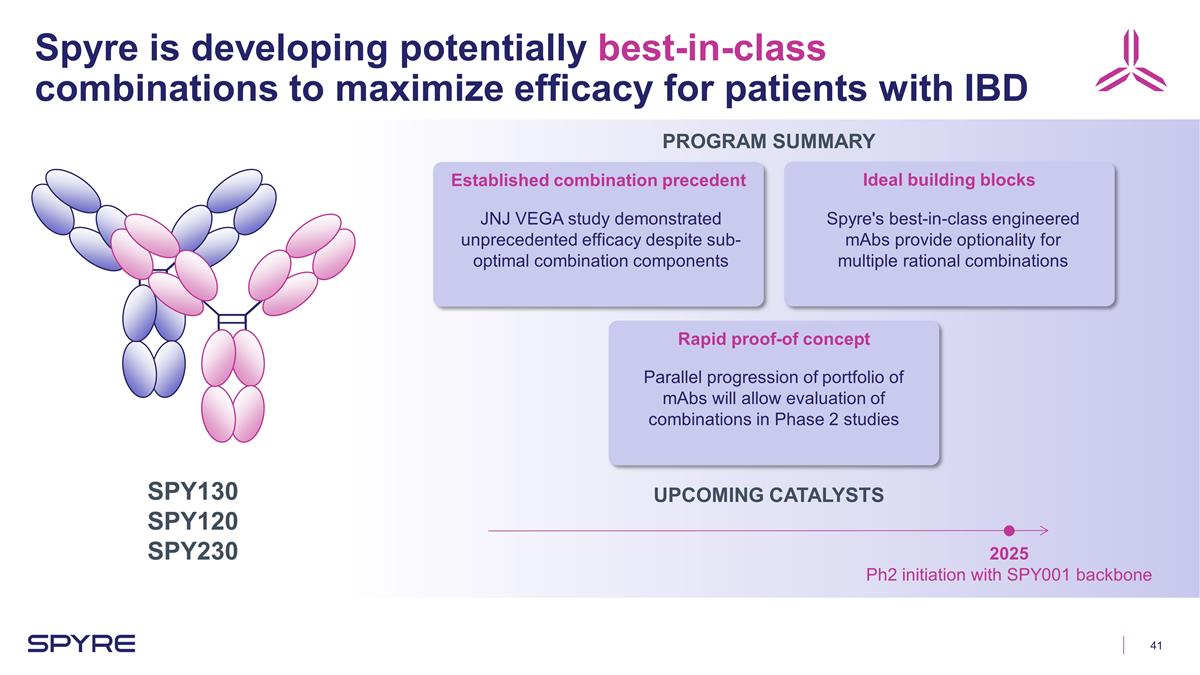

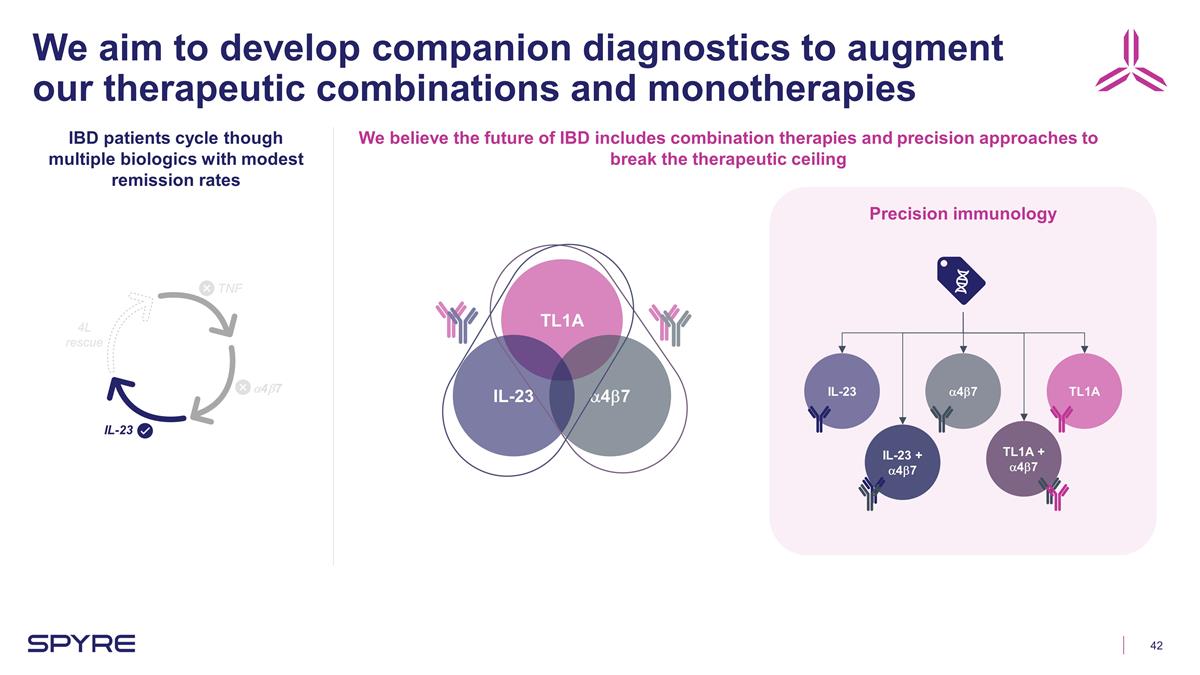

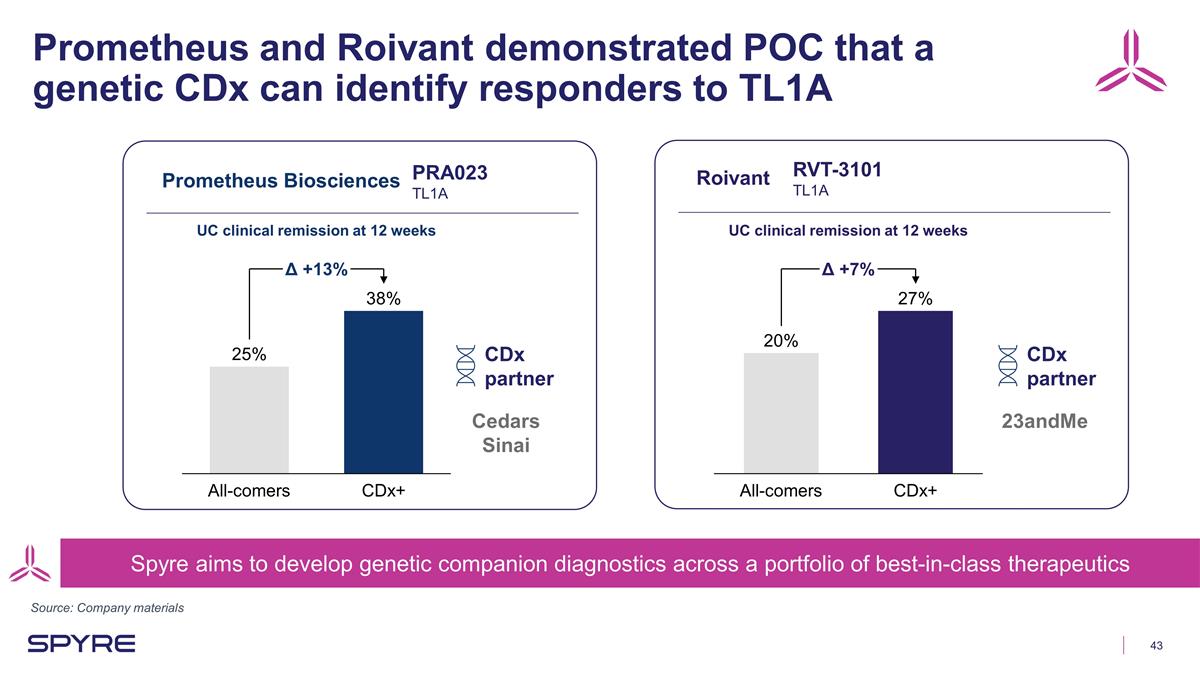

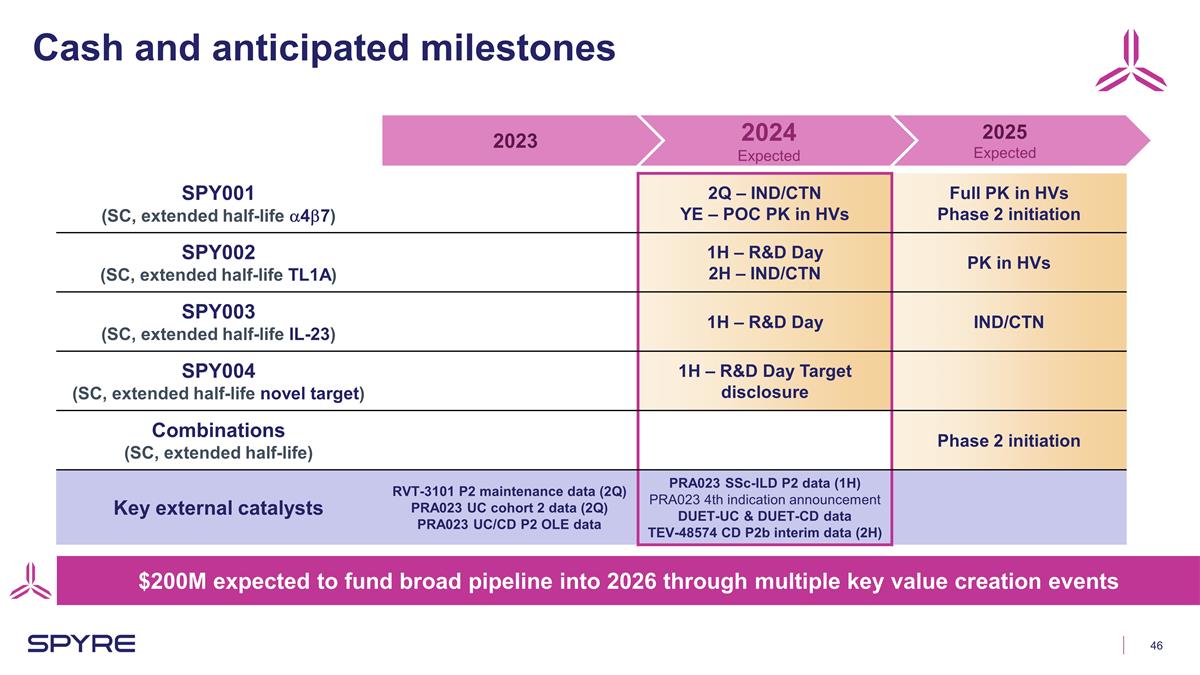

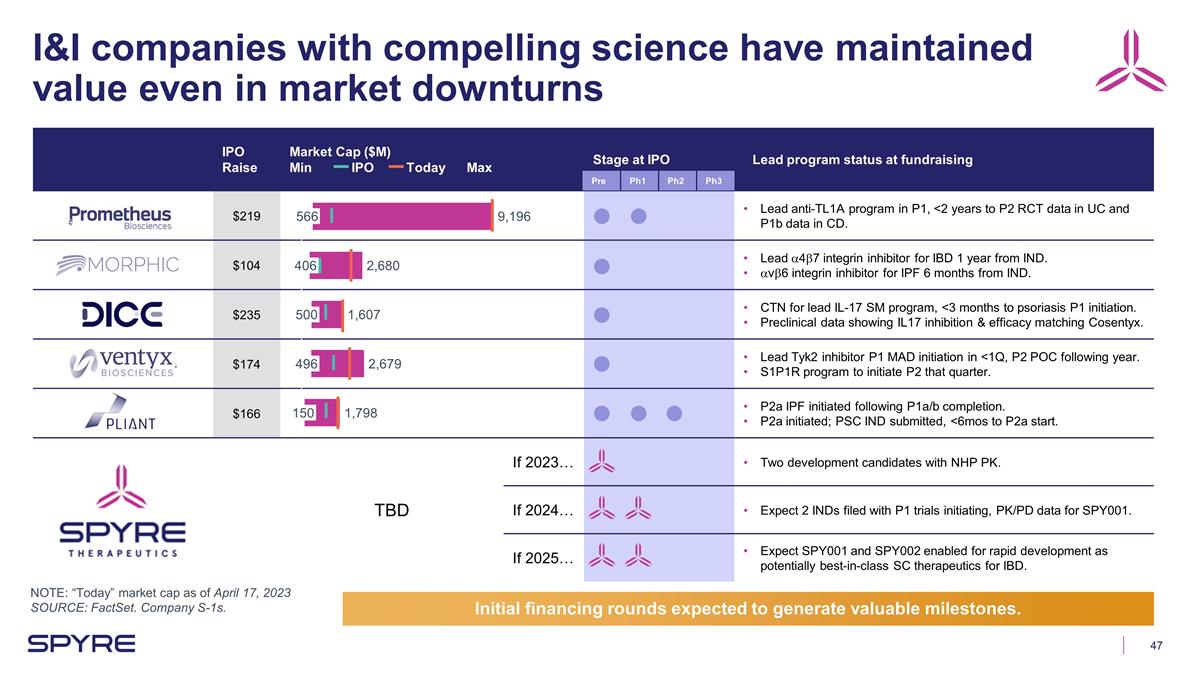

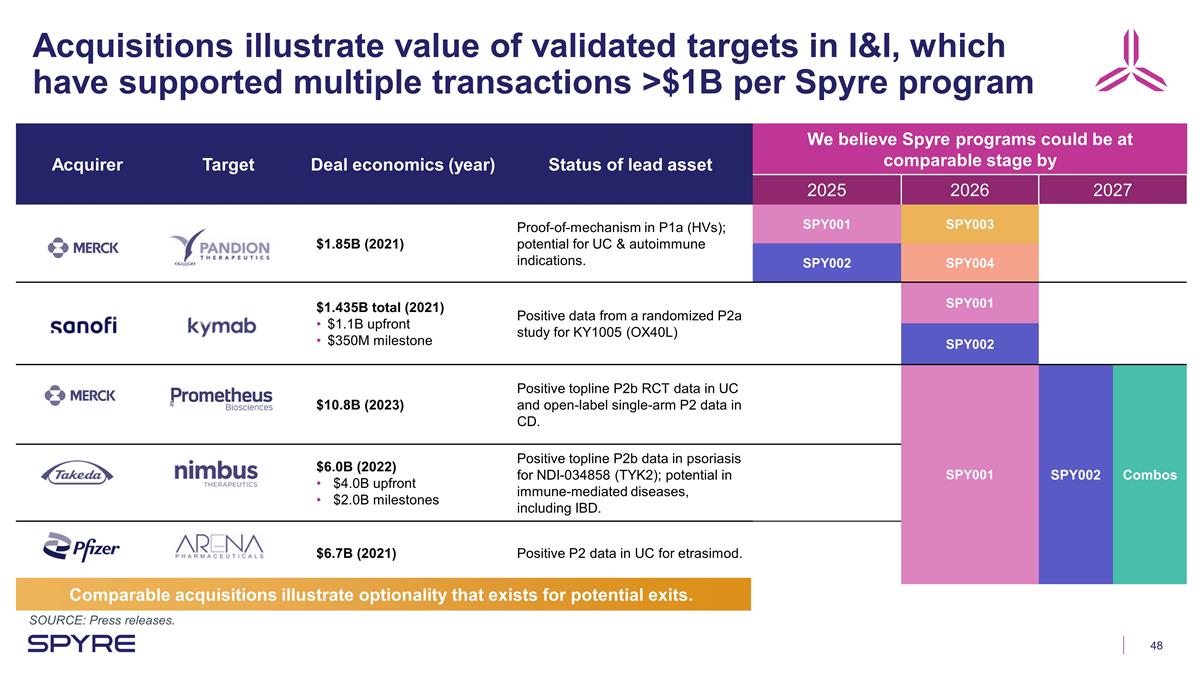

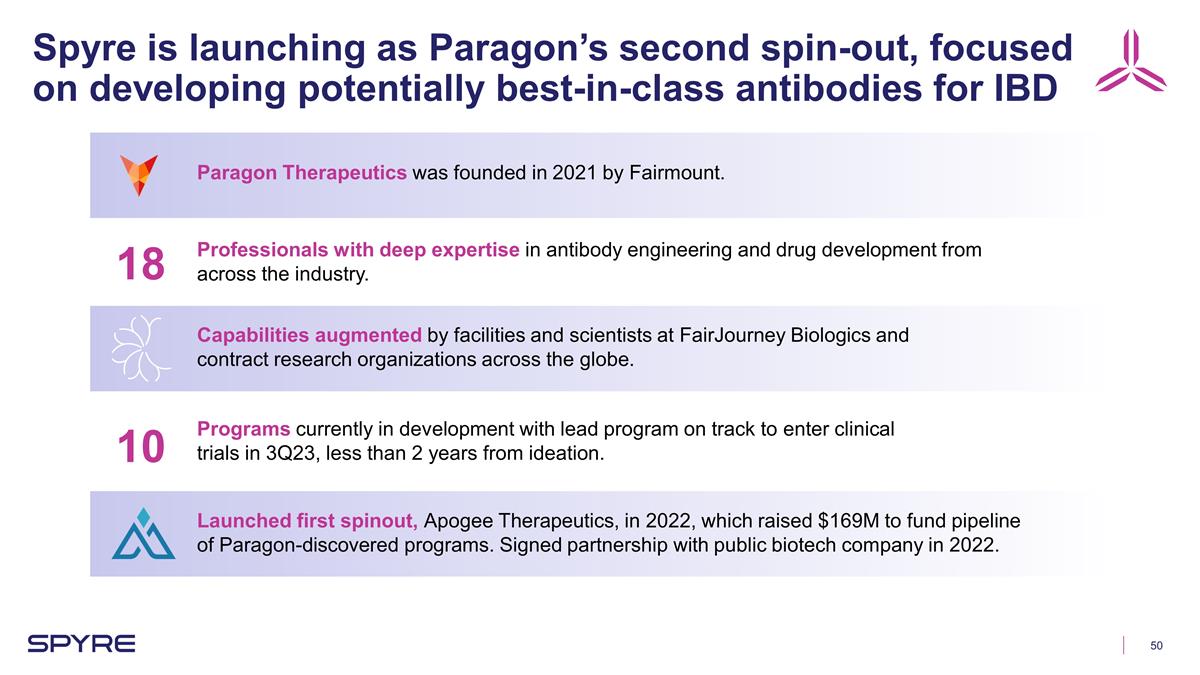

On June 22, 2023, the Company made available a presentation to be used with investors to discuss the Merger and the Financing. A copy of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 7.01 of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Furthermore, the information in Item 7.01 of this Current Report on Form 8-K, including the information in the presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, shall not be deemed to be incorporated by reference in the filings of the Company under the Securities Act of 1933, as amended.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding: stockholder approval of the conversion rights of the Series A Preferred Stock the filing of a resale registration statement pursuant to the Registration Rights Agreement, if any, and the timing thereof; the closing of the Financing, if any, and the timing thereof; and any future payouts under the CVR. The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words expressions are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on the Company’s current beliefs, expectations and assumptions regarding the future of its business, future plans and strategies, its clinical results and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. The Company may not actually achieve the forecasts disclosed in our forward-looking statements, and you should not place undue reliance on forward-looking statements. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to those set forth under the caption “Risk Factors” in the Company’s most recent Annual Report on Form 10-K filed with the SEC, as supplemented by its most recent Quarterly Report on Form 10-Q, as well as discussions of potential risks, uncertainties, and other important factors in the Company’s subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Neither the Company, nor its affiliates, advisors or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits

| (1) | Schedules have been omitted from this filing pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule to the SEC upon its request; provided, however, that the Company may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act for any schedule so furnished. Certain portions of this exhibit (indicated by “[***]”) have been omitted because they are both (i) not material and (ii) would be competitively harmful if publicly disclosed. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 23, 2023 | AEGLEA BIOTHERAPEUTICS, INC. | |||||

| By: | /s/ Jonathan Alspaugh |

|||||

| President and Chief Financial Officer | ||||||

Exhibit 2.1

Execution Version

AGREEMENT AND PLAN OF MERGER

by and among:

AEGLEA BIOTHERAPEUTICS, INC.,

a Delaware corporation;

ASPEN MERGER SUB I, INC.,

a Delaware corporation;

SEQUOIA MERGER SUB II, LLC,

a Delaware limited liability company;

and

SPYRE THERAPEUTICS, INC.,

a Delaware corporation

Dated as of June 22, 2023

TABLE OF CONTENTS

| Page | ||||||

| SECTION 1. |

DESCRIPTION OF TRANSACTION | 3 | ||||

| 1.1 |

The Merger | 3 | ||||

| 1.2 |

Effects of the Merger | 3 | ||||

| 1.3 |

Closing; First Effective Time; Second Effective Time | 3 | ||||

| 1.4 |

Certificate of Designation; Certificate of Incorporation and Bylaws; Directors and Officers | 3 | ||||

| 1.5 |

Merger Consideration; Effect of Merger on Company Capital Stock | 4 | ||||

| 1.6 |

Conversion of Shares | 5 | ||||

| 1.7 |

Closing of the Company’s Transfer Books | 6 | ||||

| 1.8 |

Exchange of Shares | 6 | ||||

| 1.9 |

Company Options | 7 | ||||

| 1.10 |

Contingent Value Right | 8 | ||||

| 1.11 |

Further Action | 8 | ||||

| 1.12 |

Withholding | 8 | ||||

| SECTION 2. |

REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 9 | ||||

| 2.1 |

Due Organization; Subsidiaries | 9 | ||||

| 2.2 |

Organizational Documents | 9 | ||||

| 2.3 |

Authority; Binding Nature of Agreement | 10 | ||||

| 2.4 |

Vote Required | 10 | ||||

| 2.5 |

Non-Contravention; Consents | 10 | ||||

| 2.6 |

Capitalization | 11 | ||||

| 2.7 |

Financial Statements | 12 | ||||

| 2.8 |

Absence of Changes | 13 | ||||

| 2.9 |

Absence of Undisclosed Liabilities | 15 | ||||

| 2.10 |

Title to Assets | 15 | ||||

| 2.11 |

Real Property; Leasehold | 15 | ||||

| 2.12 |

Intellectual Property | 15 | ||||

| 2.13 |

Agreements, Contracts and Commitments | 17 | ||||

| 2.14 |

Compliance; Permits; Restrictions | 19 | ||||

| 2.15 |

Legal Proceedings; Orders | 19 | ||||

| 2.16 |

Tax Matters | 20 | ||||

| 2.17 |

Employee and Labor Matters; Benefit Plans | 21 | ||||

| 2.18 |

Environmental Matters | 24 | ||||

| 2.19 |

Insurance | 24 | ||||

| 2.20 |

No Financial Advisors | 24 | ||||

| 2.21 |

Transactions with Affiliates | 25 | ||||

| 2.22 |

Anti-Bribery | 25 | ||||

| 2.23 |

Disclaimer of Other Representations or Warranties | 25 | ||||

| SECTION 3. |

REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUBS | 25 | ||||

| 3.1 |

Due Organization; Subsidiaries | 26 | ||||

| 3.2 |

Organizational Documents | 26 | ||||

| 3.3 |

Authority; Binding Nature of Agreement | 27 | ||||

| 3.4 |

Vote Required | 27 | ||||

| 3.5 |

Non-Contravention; Consents | 27 | ||||

| 3.6 |

Capitalization | 28 | ||||

i

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 3.7 |

SEC Filings; Financial Statements | 30 | ||||

| 3.8 |

Absence of Changes | 32 | ||||

| 3.9 |

Absence of Undisclosed Liabilities | 34 | ||||

| 3.10 |

Title to Assets | 34 | ||||

| 3.11 |

Real Property; Leasehold | 34 | ||||

| 3.12 |

Intellectual Property | 34 | ||||

| 3.13 |

Agreements, Contracts and Commitments | 36 | ||||

| 3.14 |

Compliance; Permits | 38 | ||||

| 3.15 |

Legal Proceedings; Orders | 38 | ||||

| 3.16 |

Tax Matters | 39 | ||||

| 3.17 |

Employee and Labor Matters; Benefit Plans | 40 | ||||

| 3.18 |

Environmental Matters | 43 | ||||

| 3.19 |

Transactions with Affiliates | 43 | ||||

| 3.20 |

Insurance | 44 | ||||

| 3.21 |

Opinion of Financial Advisor | 44 | ||||

| 3.22 |

No Financial Advisors | 44 | ||||

| 3.23 |

Anti-Bribery | 44 | ||||

| 3.24 |

Valid Issuance | 44 | ||||

| 3.25 |

Disclaimer of Other Representations or Warranties | 44 | ||||

| SECTION 4. |

ADDITIONAL AGREEMENTS OF THE PARTIES | 45 | ||||

| 4.1 |

Parent Stockholders’ Meeting | 45 | ||||

| 4.2 |

Proxy Statement | 46 | ||||

| 4.3 |

Reservation of Parent Common Stock; Issuance of Shares of Parent Common Stock | 46 | ||||

| 4.4 |

Employee Benefits | 47 | ||||

| 4.5 |

Indemnification of Officers and Directors | 47 | ||||

| 4.6 |

Additional Agreements | 49 | ||||

| 4.7 |

Listing | 49 | ||||

| 4.8 |

Tax Matters | 49 | ||||

| 4.9 |

Legends | 49 | ||||

| 4.10 |

Directors and Officers | 50 | ||||

| 4.11 |

Section 16 Matters | 50 | ||||

| 4.12 |

Cooperation | 50 | ||||

| 4.13 |

Closing Certificates | 50 | ||||

| 4.14 |

Takeover Statutes | 50 | ||||

| 4.15 |

Obligations of Merger Subs | 51 | ||||

| 4.16 |

Private Placement | 51 | ||||

| SECTION 5. |

CONDITIONS PRECEDENT TO OBLIGATIONS OF EACH PARTY | 51 | ||||

| 5.1 |

No Restraints | 51 | ||||

| 5.2 |

Certificate of Designation | 51 | ||||

| 5.3 |

Parent Financing | 51 | ||||

| SECTION 6. |

CLOSING DELIVERIES OF THE COMPANY | 52 | ||||

| 6.1 |

Documents | 52 | ||||

| 6.2 |

FIRPTA Certificate | 52 | ||||

| 6.3 |

Company Lock-Up Agreements | 52 | ||||

ii

TABLE OF CONTENTS

(continued)

| Page | ||||||

| SECTION 7. |

CLOSING DELIVERIES OF PARENT | 52 | ||||

| 7.1 |

Documents | 52 | ||||

| 7.2 |

Parent Lock-Up Agreements | 52 | ||||

| SECTION 8. |

MISCELLANEOUS PROVISIONS | 52 | ||||

| 8.1 |

Non-Survival of Representations and Warranties | 52 | ||||

| 8.2 |

Amendment | 53 | ||||

| 8.3 |

Waiver | 53 | ||||

| 8.4 |

Entire Agreement; Counterparts; Exchanges by Electronic Transmission | 53 | ||||

| 8.5 |

Applicable Law; Jurisdiction | 53 | ||||

| 8.6 |

Attorneys’ Fees | 54 | ||||

| 8.7 |

Assignability | 54 | ||||

| 8.8 |

Notices | 54 | ||||

| 8.9 |

Cooperation | 55 | ||||

| 8.10 |

Severability | 55 | ||||

| 8.11 |

Other Remedies; Specific Performance | 55 | ||||

| 8.12 |

No Third-Party Beneficiaries | 55 | ||||

| 8.13 |

Construction | 55 | ||||

| 8.14 |

Expenses | 57 | ||||

iii

Exhibits:

| Exhibit A | Definitions | A-1 | ||

| Exhibit B | Form of Lock-Up Agreement | B-1 | ||

| Exhibit C | Form of Certificate of Designation | C-1 | ||

| Exhibit D | Form of CVR Agreement | D-1 | ||

| Exhibit E | Form of Parent Support Agreement | E-1 | ||

iv

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER is made and entered into as of June 22, 2023, by and among AEGLEA BIOTHERAPEUTICS, INC., a Delaware corporation (“Parent”), ASPEN MERGER SUB I, INC., a Delaware corporation and wholly owned subsidiary of Parent (“First Merger Sub”), SEQUOIA MERGER SUB II, LLC, a Delaware limited liability company and wholly owned subsidiary of Parent (“Second Merger Sub” and together with First Merger Sub, “Merger Subs”), and SPYRE THERAPEUTICS, INC., a Delaware corporation (the “Company”). Certain capitalized terms used in this Agreement are defined in Exhibit A.

RECITALS

A. Parent and the Company desire to enter into a business combination as contemplated by this Agreement based on the mutually agreed values of each Parent and the Company, and following the Closing, the aggregate percentage ownership will be based upon an agreed valuation for the Company of $110 million and an agreed valuation for Parent of $35 million, assuming certain minimum cash of Target at the Closing.

B. Parent and the Company intend to effect a merger of First Merger Sub with and into the Company (the “First Merger”) in accordance with this Agreement and the DGCL. Upon consummation of the First Merger, First Merger Sub will cease to exist and the Company will become a wholly owned subsidiary of Parent.

C. Immediately following the First Merger and as part of the same overall transaction as the First Merger, the Company will merge with and into Second Merger Sub (the “Second Merger” and, together with the First Merger, the “Merger”), with Second Merger Sub being the surviving entity of the Second Merger;

D. The Parties intend that, (i) the First Merger and the Second Merger, taken together, will constitute an integrated transaction described in Rev. Rul. 2001-46, 2001-2 C.B. 321 that qualifies as a “reorganization” within the meaning of Section 368(a) of the Code, and (ii) this Agreement will constitute, and is hereby adopted as, a plan of reorganization within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a).

E. The Parent Board has (i) determined that the Contemplated Transactions are fair to, advisable and in the best interests of Parent and its stockholders, (ii) approved and declared advisable this Agreement and the Contemplated Transactions, including the issuance of the Parent Common Stock Payment Shares and the Parent Preferred Stock Payment Shares to the stockholders of the Company pursuant to the terms of this Agreement, and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Parent vote to approve the Parent Stockholder Matters at the Parent Stockholders’ Meeting to be convened following the Closing.

F. The First Merger Sub Board has (i) determined that the Contemplated Transactions are fair to, advisable, and in the best interests of First Merger Sub and its sole stockholder, (ii) approved and declared advisable this Agreement and the Contemplated Transactions and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholder of First Merger Sub votes to adopt this Agreement and thereby approve the Contemplated Transactions.

1

G. The sole member of the Second Merger Sub has (i) determined that the Contemplated Transactions are fair to, advisable, and in the best interests of Second Merger Sub and its sole member, (ii) approved and declared advisable this Agreement and the Contemplated Transactions and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the sole member of Second Merger Sub votes to adopt this Agreement and thereby approve the Contemplated Transactions.

H. The Company Board has (i) determined that the Contemplated Transactions are fair to, advisable and in the best interests of the Company and its stockholders, (ii) approved and declared advisable this Agreement and the Contemplated Transactions and (iii) recommended, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Company vote to approve the Company Stockholder Matters (the “Board Approval”).

I. Subsequent to the Board Approval, but prior to the execution and delivery of this Agreement, the requisite Company stockholders by written consent and in accordance with the Company’s certificate of incorporation, the Company’s bylaws and the DGCL (i) approved and adopted this Agreement and the Contemplated Transactions, (ii) acknowledged that the approval given thereby is irrevocable and that such stockholder is aware of its rights to demand appraisal for its shares pursuant to Section 262 of the DGCL, a true and correct copy of which was attached thereto, and that such stockholder has received and read a copy of Section 262 of the DGCL, and (iii) acknowledged that by its approval of the Merger it is not entitled to appraisal rights with respect to its shares in connection with the Merger and thereby waives any rights to receive payment of the fair value of its capital stock under the DGCL (such matters, the “Company Stockholder Matters” and the consent, the “Stockholder Written Consent”), and the Stockholder Written Consent is to become effective by its terms immediately following the execution of this Agreement by the parties hereto.

J. Concurrently with the execution and delivery of this Agreement and as a condition and inducement to each of Parent and the Company’s willingness to enter into this Agreement, all of the directors, all of the officers and the stockholders of Parent listed in Section A-1 of the Parent Disclosure Schedule (solely in their capacity as stockholders of Parent) (the “Parent Signatories”) and the stockholders of the Company listed in Section A of the Company Disclosure Schedule (the “Company Signatories”) (solely in their capacity as stockholders of the Company) are executing lock-up agreements in substantially the form attached as Exhibit B (each, a “Lock-Up Agreement”).

K. Concurrently with the execution and delivery of this Agreement, certain investors have executed a Securities Purchase Agreement among Parent and the Persons named therein (representing an aggregate commitment no less than the Concurrent Investment Amount of $150,000,000), pursuant to which such Persons will have agreed to purchase the number of shares of Parent Convertible Preferred Stock set forth therein concurrently with the Closing in connection with the Parent Financing (the “Securities Purchase Agreement”).

L. Concurrently with the execution and delivery of this Agreement and as a condition and inducement to the Company’s willingness to enter into this Agreement, certain stockholders set forth on Section A-2 of the Parent Disclosure Schedule (solely in their capacity as stockholders) are executing support agreements in favor of the Company in substantially the form attached hereto as Exhibit E (the “Parent Stockholder Support Agreement”), pursuant to which such Persons have, subject to the terms and conditions set forth therein, agreed to vote all of their shares of capital stock of Parent in favor of the Parent Stockholder Matters.

M. Immediately following the execution and delivery of this Agreement, but prior to the filing of the Certificate of Merger, Parent will file the Certificate of Designation with the office of the Secretary of State of the State of Delaware.

2

AGREEMENT

The Parties, intending to be legally bound, agree as follows:

SECTION 1. DESCRIPTION OF TRANSACTION

1.1 The Merger. Upon the terms and subject to the conditions set forth in this Agreement, at the First Effective Time, First Merger Sub shall be merged with and into the Company, and the separate existence of First Merger Sub shall cease. As a result of the First Merger, the Company will continue as the surviving corporation in the First Merger (the “First Step Surviving Corporation”). Upon the terms and subject to the conditions set forth in this Agreement, at the Second Effective Time, the First Step Surviving Corporation will merge with and into Second Merger Sub, and the separate existence of the First Step Surviving Corporation shall cease. As a result of the Second Merger, Second Merger Sub will continue as the surviving entity in the Second Merger (the “Surviving Entity”).

1.2 Effects of the Merger. At and after the First Effective Time, the First Merger shall have the effects set forth in this Agreement, the First Certificate of Merger and in the applicable provisions of the DGCL. As a result of the First Merger, the First Step Surviving Corporation will become a wholly owned subsidiary of Parent. At and after the Second Effective Time, the Second Merger shall have the effects set forth in this Agreement, the Second Certificate of Merger and in the applicable provisions of the DGCL and the DLLCA.

1.3 Closing; First Effective Time; Second Effective Time. The consummation of the Merger (the “Closing”) is being consummated remotely via the electronic exchange of documents and signatures substantially simultaneously with the execution and delivery of this Agreement, or at such other time, date and place as Parent and the Company may mutually agree in writing. The date on which the Closing actually takes place is referred to as the “Closing Date.” At the Closing, (i) the Parties shall cause the First Merger to be consummated by executing and filing with the Secretary of State of the State of Delaware a certificate of merger with respect to the First Merger, satisfying the applicable requirements of the DGCL and in form and substance to be agreed upon by the Parties (the “First Certificate of Merger”) and (ii) the Parties shall cause the Second Merger to be consummated by executing and filing with the Secretary of State of the State of Delaware a certificate of merger with respect to the Second Merger, satisfying the applicable requirements of the DGCL and the DLLCA and in form and substance to be agreed upon by the Parties (the “Second Certificate of Merger” and together with the First Certificate of Merger, the “Certificates of Merger”). The First Merger shall become effective at the time of the filing of such First Certificate of Merger with the Secretary of State of the State of Delaware or at such later time as may be specified in such First Certificate of Merger with the consent of Parent and the Company (the time as of which the First Merger becomes effective being referred to as the “First Effective Time”). The Second Merger shall become effective at the time of the filing of such Second Certificate of Merger with the Secretary of State of the State of Delaware or at such later time as may be specified in such Second Certificate of Merger with the consent of Parent and the Company (the time as of which the Second Merger becomes effective being referred to as the “Second Effective Time”).

1.4 Certificate of Designation; Certificate of Incorporation and Bylaws; Directors and Officers.

(a) Prior to the First Effective Time, Parent will file the Certificate of Designation with the office of the Secretary of State of the State of Delaware.

3

(b) At the First Effective Time:

(i) the certificate of incorporation of the First Step Surviving Corporation shall be amended and restated as set forth in an exhibit to the First Certificate of Merger, until thereafter amended as provided by the DGCL and such certificate of incorporation;

(ii) the bylaws of the First Step Surviving Corporation shall be amended and restated in their entirety to read identically to the bylaws of the Company as in effect immediately prior to the First Effective Time, until thereafter amended as provided by the DGCL and such bylaws; and

(iii) the directors and officers of the First Step Surviving Corporation, each to hold office in accordance with the certificate of incorporation and bylaws of the First Step Surviving Corporation, shall be such persons as shall be mutually agreed upon by Parent and the Company.

(c) At the Second Effective Time:

(i) the certificate of formation of the Surviving Entity shall be the certificate of formation of Second Merger Sub as in effect immediately prior to the Second Effective Time, until thereafter amended as provided by the DLLCA and such certificate of formation; provided, however, that at the Second Effective Time (as part of the Second Certificate of Merger), the certificate of formation shall be amended to (A) change the name of the Surviving Entity to “Spyre Therapeutics, LLC,” (B) comply with Section 4.5, and (C) make such other changes as are mutually agreed to by Parent and the Company;

(ii) the limited liability company agreement of the Surviving Entity shall be amended and restated in its entirety to read identically to the limited liability company agreement of Second Merger Sub as in effect immediately prior to the Second Effective Time, until thereafter amended as provided by the DLLCA and such limited liability company agreement; provided, however, that following the Second Effective Time (but as soon thereafter as practicable), the limited liability company agreement shall be amended to (A) comply with Section 4.5 and (B) change the name of the Surviving Entity to “Spyre Therapeutics, LLC”;

(iii) the managers and officers of the Surviving Entity, each to hold office in accordance with the certificate of formation and limited liability company agreement of the Surviving Entity, shall be such persons as shall be mutually agreed upon by Parent and the Company; and

(iv) the certificate of incorporation of Parent shall be identical to the certificate of incorporation of Parent immediately prior to the Second Effective Time, until thereafter amended as provided by the DGCL and such certificate of incorporation, provided, however, that following the Second Effective Time, the certificate of incorporation shall be amended to (A) change the corporate name of Parent to “Spyre Therapeutics, Inc.”, (B) effect the Nasdaq Reverse Split, if deemed necessary, and (C) make such other changes as are mutually agreed to by Parent and the Company.

1.5 Merger Consideration; Effect of Merger on Company Capital Stock. The aggregate merger consideration (the “Merger Consideration”) to be paid by Parent for all of the outstanding shares of Company Capital Stock at the Closing and amounts reserved for Company Options shall be (a) 13,013,636 shares of Parent Common Stock (“Parent Common Stock Payment Shares”), which shares shall represent a number of shares equal to no more than 19.9% of the outstanding shares of Parent Common Stock as of immediately before the First Effective Time (the “Parent Common Stock Consideration Cap”), and (b) in the event the aggregate number of shares of Parent Common Stock Payment Shares issued to any Company stockholder at Closing would result in the issuance of shares of Parent Common Stock in an amount in excess of the Parent Common Stock Consideration Cap, Parent shall issue to such Company stockholders shares of Parent Common Stock up to the Parent Common Stock Consideration Cap and shall issue the remaining balance to such stockholders a total of 364,889 shares of Parent Convertible Preferred Stock (“Parent Preferred Stock Payment Shares”).

4

Each Parent Preferred Stock Payment Share shall be convertible into 1,000 shares of Parent Common Stock, subject to and contingent upon the affirmative vote of a majority of the Parent Common Stock present or represented and entitled to vote at a meeting of stockholders of Parent to approve, for purposes of the Nasdaq Stock Market Rules, the issuance of shares of Parent Common Stock to the stockholders of the Company upon conversion of any and all shares of Parent Convertible Preferred Stock in accordance with the terms of the Certificate of Designation in substantially the form attached hereto as Exhibit C (the “Preferred Stock Conversion Proposal”).

1.6 Conversion of Shares.

(a) At the First Effective Time, by virtue of the First Merger and without any further action on the part of Parent, Merger Subs, the Company or any stockholder of the Company or Parent:

(i) any shares of Company Common Stock held as treasury stock or held or owned by the Company or any wholly owned Subsidiary of the Company immediately prior to the First Effective Time shall be canceled and retired and shall cease to exist, and no consideration shall be delivered in exchange therefor; and

(ii) subject to Section 1.5 and Section 1.6(c), each share of Company Capital Stock outstanding immediately prior to the First Effective Time (excluding shares to be canceled pursuant to Section 1.6(a)(i) and excluding Dissenting Shares) shall be automatically converted solely into the right to receive a number of Parent Common Stock Payment Shares equal to the Exchange Ratio as set forth on the Allocation Certificate.

(b) If any shares of Company Common Stock outstanding immediately prior to the First Effective Time are subject to a repurchase option or a risk of forfeiture under any applicable restricted stock purchase agreement or other similar agreement with the Company, such shares of Company Common Stock shall no longer be subject to any right of repurchase, risk of forfeiture or other such conditions.

(c) No fractional shares of Parent Common Stock and Parent Convertible Preferred Stock shall be issued in connection with the First Merger, and no certificates or scrip for any such fractional shares shall be issued and no cash shall be paid for any such fractional shares. Any fractional shares of Parent Common Stock that a holder of Company Common Stock would otherwise be entitled to receive shall be aggregated with all fractional shares of Parent Common Stock issuable to such holder) or a fraction of a share of Parent Convertible Preferred Stock issuable to such holder and any remaining fractional shares shall be rounded up to the nearest whole share.

(d) At the First Effective Time, by virtue of the First Merger and without any further action on the part of Parent, Merger Subs, the Company or any member of the Company or stockholder of Parent, each share of common stock of First Merger Sub issued and outstanding immediately prior to the First Effective Time shall be converted into and exchanged for one share of common stock of the First Step Surviving Corporation. If applicable, each stock certificate of First Merger Sub evidencing ownership of any such shares shall, as of the First Effective Time, evidence ownership of such shares of common stock of the First Step Surviving Corporation.

5

(e) If, between the date of this Agreement and the First Effective Time, the outstanding shares of Company Common Stock or Parent Common Stock or Parent Convertible Preferred Stock shall have been changed into, or exchanged for, a different number of shares or a different class, by reason of any stock dividend, subdivision, reclassification, recapitalization, split, combination or exchange of shares or other like change, the Exchange Ratio shall, to the extent necessary, be equitably adjusted to reflect such change to the extent necessary to provide the holders of Company Common Stock and Parent Common Stock and Parent Convertible Preferred Stock, with the same economic effect as contemplated by this Agreement prior to such stock dividend, subdivision, reclassification, recapitalization, split, combination or exchange of shares or other like change; provided, however, that nothing herein will be construed to permit the Company or Parent to take any action with respect to Company Common Stock or Parent Common Stock or Parent Convertible Preferred Stock, respectively, that is prohibited or not expressly permitted by the terms of this Agreement.

(f) At the Second Effective Time, by virtue of the Second Merger and without any action on the part of Parent, the First Step Surviving Corporation, Second Merger Sub or their respective stockholders, each share of the First Step Surviving Corporation issued and outstanding immediately prior to the Second Effective Time shall be canceled and extinguished without any conversion thereof and no payment or distribution shall be made with respect thereto.

1.7 Closing of the Company’s Transfer Books. At the First Effective Time: (a) all holders of (i) certificates representing shares of Company Capital Stock and (ii) book-entry shares representing shares of Company Capital Stock (“Book-Entry Shares”), in each case, that were outstanding immediately prior to the First Effective Time shall cease to have any rights as stockholders of the Company; and (b) the stock transfer books of the Company shall be closed with respect to all shares of Company Capital Stock outstanding immediately prior to the First Effective Time. No further transfer of any such shares of Company Capital Stock shall be made on such stock transfer books after the First Effective Time. If, after the first Effective Time, a valid certificate previously representing any shares of Company Capital Stock outstanding immediately prior to the First Effective Time (a “Company Stock Certificate”) is presented to the Exchange Agent or to the Surviving Entity, such Company Stock Certificate shall be canceled and shall be exchanged as provided in Sections 1.6 and 1.8.

1.8 Exchange of Shares.

(a) On or prior to the Closing Date, Parent and the Company shall agree upon and select a reputable bank, transfer agent or trust company to act as exchange agent in the Merger (the “Exchange Agent”). At the First Effective Time, Parent shall deposit with the Exchange Agent certificates or evidence of book-entry shares representing the Parent Common Stock and Parent Convertible Preferred Stock issuable pursuant to Section 1.6(a). The Parent Common Stock and Parent Convertible Preferred Stock so deposited with the Exchange Agent, together with any dividends or distributions received by the Exchange Agent with respect to such shares, are referred to collectively as the “Exchange Fund.”

(b) As soon as reasonably practicable after the record date for the CVR, the Exchange Agent shall issue book-entry shares representing the Merger Consideration (in a number of whole shares of Parent Common Stock and Parent Convertible Preferred Stock) that each holder of Company Common Stock has the right to receive pursuant to the provisions of Section 1.6(a) and each Company Stock Certificate or Book-Entry Share formerly held by each such holder shall be deemed, from and after the First Effective Time, to represent only the right to receive book-entry shares of Parent Common Stock and Parent Convertible Preferred Stock representing the Merger Consideration and, following issuance of book-entry shares representing the Merger Consideration, shall be canceled. The Merger Consideration and any dividends or other distributions as are payable pursuant to Section 1.8(d) shall be deemed to have been in full satisfaction of all rights pertaining to Company Capital Stock formerly represented by such Company Stock Certificates or Book-Entry Shares.

6

(c) No dividends or other distributions declared or made with respect to Parent Common Stock or Parent Convertible Preferred Stock with a record date on or after the First Effective Time shall be paid to the holder of any unsurrendered Company Stock Certificate or Book-Entry Shares with respect to the shares of Parent Common Stock and/or Parent Convertible Preferred Stock that such holder has the right to receive in the Merger until such holder surrenders such Company Stock Certificate or transfers such Book-Entry Shares or provides an affidavit of loss or destruction in lieu thereof in accordance with this Section 1.8 (at which time (or, if later, on the applicable payment date) such holder shall be entitled, subject to the effect of applicable abandoned property, escheat or similar Laws, to receive all such dividends and distributions, without interest); provided, however, that in no event shall holders of Company Capital Stock receiving the Merger Consideration be entitled to receive the CVR.

(d) Any portion of the Exchange Fund that remains unclaimed by holders of shares of Company Capital Stock as of the date that is one year after the Closing Date shall be delivered to Parent upon demand, and any holders of Company Stock Certificates or Book-Entry Shares who have not theretofore surrendered their Company Stock Certificates or transferred their Book-Entry Shares in accordance with this Section 1.8 shall thereafter look only to Parent as general creditors for satisfaction of their claims for Parent Common Stock and Parent Convertible Preferred Stock and any dividends or distributions with respect to shares of Parent Common Stock and Parent Convertible Preferred Stock.

(e) No Party shall be liable to any holder of any shares of Company Capital Stock or to any other Person with respect to any shares of Parent Common Stock or Parent Convertible Preferred Stock (or dividends or distributions with respect thereto) or for any cash amounts delivered to any public official pursuant to any applicable abandoned property Law, escheat Law or similar Law. Any portion of the Exchange Fund that remains unclaimed by holders of shares of Company Capital Stock as of the date that is two years after the Closing Date (or immediately prior to such earlier date on which the related Exchange Funds (and all dividends or other distributions in respect thereof) would otherwise escheat to or become the property of any Governmental Body) shall, to the extent permitted by applicable Law, become the property of the Surviving Entity, free and clear of all claims or interest of any Person previously entitled thereto.

1.9 Company Options.

(a) At the First Effective Time, each Company Option that is outstanding and unexercised immediately prior to the First Effective Time under the Company Plan, whether or not vested, shall be converted into and become an option to purchase Parent Common Stock, and Parent shall assume the Company Plan and each such Company Option in accordance with the terms (as in effect as of the date of this Agreement) of the Company Plan and the terms of the stock option agreement by which such Company Option is evidenced (but with changes to such documents as Parent in good faith determines are necessary to reflect the substitution of the Company Options by Parent to purchase shares of Parent Common Stock). All rights with respect to Company Common Stock under Company Options assumed by Parent shall thereupon be converted into rights with respect to Parent Common Stock.

7

Accordingly, from and after the First Effective Time: (i) each Company Option assumed by Parent may be exercised solely for shares of Parent Common Stock; (ii) the number of shares of Parent Common Stock subject to each Company Option assumed by Parent shall be determined by multiplying (A) the number of shares of Company Common Stock that were subject to such Company Option, as in effect immediately prior to the First Effective Time, by (B) the Exchange Ratio, and rounding the resulting number down to the nearest whole number of shares of Parent Common Stock; (iii) the per share exercise price for the Parent Common Stock issuable upon exercise of each Company Option assumed by Parent shall be determined by dividing (A) the per share exercise price of Company Common Stock subject to such Company Option, as in effect immediately prior to the First Effective Time, by (B) the Exchange Ratio and rounding the resulting exercise price up to the nearest whole cent; and (iv) any restriction on the exercise of any Company Option assumed by Parent shall continue in full force and effect and the term, exercisability, vesting schedule and other provisions of such Company Option shall otherwise remain unchanged; provided, that, (I) in the case of any Company Option to which Section 421 of the Code applies as of the First Effective Time by reason of its qualification under Section 422 of the Code, the exercise price, the number of shares of Parent Common Stock subject to such option and the terms and conditions of exercise of such option shall be determined in a manner consistent with the requirements of Section 424(a) of the Code; and (II) the exercise price, the number of shares of Parent Common Stock subject to, and the terms and conditions of exercise of each option to purchase Parent Common Stock shall also be determined in a manner consistent with the requirements of Section 409A of the Code; provided, further, that: (x) Parent may amend the terms of the Company Options and the Company Plan as may be necessary to reflect Parent’s substitution of the Company Options with options to purchase Parent Common Stock (such as by making any change in control or similar definition relate to Parent and having any provision that provides for the adjustment of Company Options upon the occurrence of certain corporate events relate to corporate events that relate to Parent and/or Parent Common Stock); and (y) the Parent Board or a committee thereof shall succeed to the authority and responsibility of the Company Board or any committee thereof with respect to each Company Option assumed by Parent.

(b) Parent shall file with the SEC, promptly after the First Effective Time (and in any evert, not later than thirty (30) days thereafter), a registration statement on Form S-8 (or any successor form), if available for use by Parent, relating to the shares of Parent Common Stock issuable with respect to Company Options assumed by Parent in accordance with Section 1.10.

1.10 Contingent Value Right.

(a) Holders of Parent Common Stock of record as of immediately prior to the First Effective Time shall be entitled to one contractual contingent value right (a “CVR”) issued by Parent subject to and in accordance with the terms and conditions of the CVR Agreement, attached hereto as Exhibit D (the “CVR Agreement”), for each share of Parent Common Stock held by such holders (less applicable withholding Taxes).

(b) Within thirty (30) days of the First Effective Time, Parent shall authorize and duly adopt, execute and deliver, and will ensure that Exchange Agent executes and delivers, the CVR Agreement, subject to any reasonable revisions to the CVR Agreement that are requested by such Exchange Agent (provided that such revisions are not, individually or in the aggregate, detrimental or adverse, taken as a whole, to any holder of a CVR). Parent and the Company shall cooperate, including by making changes to the form of CVR Agreement, as necessary to ensure that the CVRs are not subject to registration under the Securities Act, the Exchange Act or any applicable state securities or “blue sky” laws.

(c) Parent and the Exchange Agent shall, within thirty (30) days of the First Effective Time, duly authorize, execute and deliver the CVR Agreement.

1.11 Further Action. If, at any time after the First Effective Time, any further action is determined by the Surviving Entity to be necessary or desirable to carry out the purposes of this Agreement or to vest the Surviving Entity with full right, title and possession of and to all rights and property of the Company, then the officers and directors of the Surviving Entity shall be fully authorized, and shall use their and its reasonable best efforts (in the name of the Company, in the name of Merger Subs, in the name of the Surviving Entity and otherwise) to take such action.

1.12 Withholding.

8

The Parties and the Exchange Agent (each, a “Withholding Agent”) shall be entitled to deduct and withhold from the consideration otherwise payable pursuant to this Agreement (including the CVR Agreement) to any holder of Company Capital Stock or any other Person such amounts as such Party or the Exchange Agent is required to deduct and withhold under the Code or any other Law with respect to the making of such payment; provided, however, that if a Withholding Agent determines that any payment to any stockholder of the Company hereunder is subject to deduction and/or withholding, then, except with respect to compensatory payments, or as a result of a failure to deliver the certificate described in Section 6.2, such Withholding Agent shall (i) provide notice to such stockholder as soon as reasonably practicable after such determination (and no later than three (3) Business Days prior to undertaking such deduction and/or withholding), and (ii) use commercially reasonable efforts to cooperate with such stockholder prior to Closing to reduce or eliminate any such deduction and/or withholding. To the extent that amounts are so withheld and paid over to the appropriate Governmental Body, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of whom such deduction and withholding was made.

SECTION 2. REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Subject to Section 8.13(h), except as set forth in the disclosure schedule delivered by the Company to Parent (the “Company Disclosure Schedule”), the Company represents and warrants to Parent and Merger Subs as follows:

2.1 Due Organization; Subsidiaries.

(a) The Company is a corporation duly incorporated, validly existing and in good standing under the Laws of Delaware and has all necessary corporate power and authority: (i) to conduct its business in the manner in which its business is currently being conducted; (ii) to own or lease and use its property and assets in the manner in which its property and assets are currently owned or leased and used; and (iii) to perform its obligations under all Contracts by which it is bound.

(b) The Company is duly licensed and qualified to do business, and is in good standing (to the extent applicable in such jurisdiction), under the Laws of all jurisdictions where the nature of its business requires such licensing or qualification other than in jurisdictions where the failure to be so qualified individually or in the aggregate would not be reasonably expected to have a Company Material Adverse Effect.

(c) The Company has no Subsidiaries and the Company does not own any capital stock of, or any equity, ownership or profit-sharing interest of any nature in, or controls directly or indirectly, any other Entity.

(d) The Company is not nor has ever been, directly or indirectly, a party to, member of or participant in any partnership, joint venture or similar business entity. The Company has not agreed to, and is not obligated to make, nor is bound by any Contract under which it may become obligated to make, any future investment in or capital contribution to any other Entity. The Company has not, at any time, been a general partner of, or has otherwise been liable for any of the debts or other obligations of, any general partnership, limited partnership or other Entity.

2.2 Organizational Documents. The Company has made available to Parent accurate and complete copies of the Organizational Documents of the Company in effect as of the date of this Agreement. The Company is not in breach or violation of its respective Organizational Documents.

9

2.3 Authority; Binding Nature of Agreement.

(a) The Company has all necessary corporate power and authority to enter into and to perform its obligations under this Agreement and, subject to receipt of the Required Company Stockholder Vote, to consummate the Contemplated Transactions. The Company Board (at meetings duly called and held or by unanimous written consent) has (i) determined that the Contemplated Transactions are fair to, advisable and in the best interests of the Company and its stockholders, (ii) authorized, approved and declared advisable this Agreement and the Contemplated Transactions and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Company vote in favor of the Company Stockholder Matters.

(b) This Agreement has been duly executed and delivered by the Company and, assuming the due authorization, execution and delivery by Parent and Merger Subs, constitutes the legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, subject to the Enforceability Exceptions.

2.4 Vote Required. The affirmative vote (or written consent) of the holders of a majority of the shares of Company Common Stock outstanding on the record date for the Stockholder Written Consent and entitled to vote thereon, voting as a single class (the “Required Company Stockholder Vote”), is the only vote (or written consent) of the holders of any class or series of Company Capital Stock necessary to adopt and approve this Agreement and approve the Contemplated Transactions. The Stockholder Written Consent became effective upon the execution of this Agreement by the parties hereto and provided the Required Company Stockholder Vote. No other corporate proceedings by the Company are necessary to authorize this Agreement or to consummate the Contemplated Transactions.

2.5 Non-Contravention; Consents. Subject to obtaining the required Company Stockholder Vote, the filing of the Certificates of Merger required by the DGCL, and the filing of the Certificate of Designation, neither (x) the execution, delivery or performance of this Agreement by the Company, nor (y) the consummation of the Contemplated Transactions, will directly or indirectly (with or without notice or lapse of time):

(a) contravene, conflict with or result in a violation of any of the provisions of the Company’s Organizational Documents;

(b) contravene, conflict with or result in a violation of, or give any Governmental Body or other Person the right to challenge the Contemplated Transactions or to exercise any remedy or obtain any relief under, any Law or any order, writ, injunction, judgment or decree to which the Company, or any of the assets owned or used by the Company, is subject, except as would not reasonably be expected to be material to the Company or its business;

(c) contravene, conflict with or result in a violation of any of the terms or requirements of, or give any Governmental Body the right to revoke, withdraw, suspend, cancel, terminate or modify, any Governmental Authorization that is held by the Company, except as would not reasonably be expected to be material to the Company or its business;

(d) contravene, conflict with or result in a violation or breach of, or result in a default under, any provision of any Company Material Contract, or give any Person the right to: (i) declare a default or exercise any remedy under any Company Material Contract; (ii) any material payment, rebate, chargeback, penalty or change in delivery schedule under any Company Material Contract; (iii) accelerate the maturity or performance of any Company Material Contract; or (iv) cancel, terminate or modify any term of any Company Material Contract, except in the case of any non-material breach, default, penalty or modification; or

(e) result in the imposition or creation of any Encumbrance upon or with respect to any asset owned or used by the Company (except for Permitted Encumbrances).

10

Except for (i) any Consent set forth in Section 2.5 of the Company Disclosure Schedule under any Company Contract, (ii) the Required Company Stockholder Vote, (iii) the filing of the Certificates of Merger with the Secretary of State of the State of Delaware pursuant to the DGCL, (iv) the filing of the Certificate of Designation with the Secretary of State of the State of Delaware pursuant to the DGCL and (v) such consents, waivers, approvals, orders, authorizations, registrations, declarations and filings as may be required under applicable federal and state securities Laws, the Company is not required to make any filing with or give any notice to, or to obtain any Consent from, any Person in connection with (A) the execution, delivery or performance of this Agreement, or (B) the consummation of the Contemplated Transactions. The Company Board has taken and will take all actions necessary to ensure that the restrictions applicable to business combinations contained in Section 203 of the DGCL are, and will be, inapplicable to the execution, delivery and performance of this Agreement, the Lock-Up Agreements and to the consummation of the Contemplated Transactions. No other state takeover statute or similar Law applies or purports to apply to the Merger, this Agreement, the Lock-Up Agreements or any of the Contemplated Transactions.

2.6 Capitalization.