UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 14, 2023

Patterson-UTI Energy, Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 1-39270 | 75-2504748 | ||

| (State or Other Jurisdiction of Incorporation ) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 10713 W. Sam Houston Pkwy N., | ||||

| Suite 800, Houston, Texas | 77064 | |||

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 281-765-7100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

||

| Common Stock, $0.01 Par Value | PTEN | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

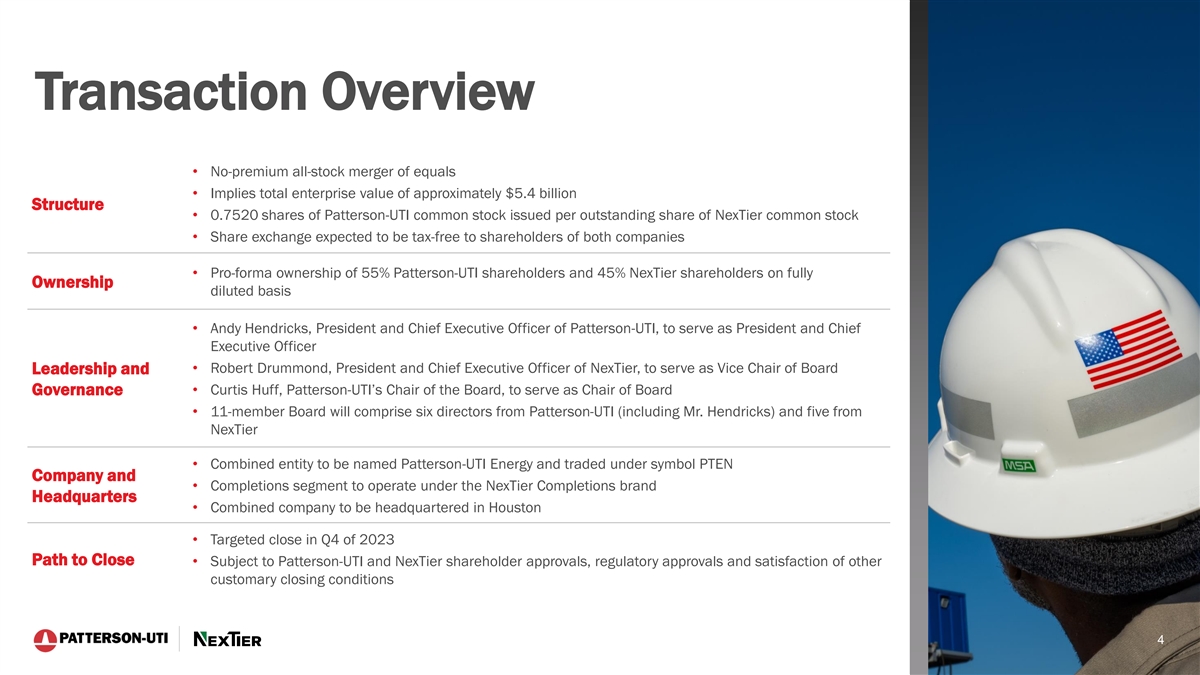

Merger Agreement

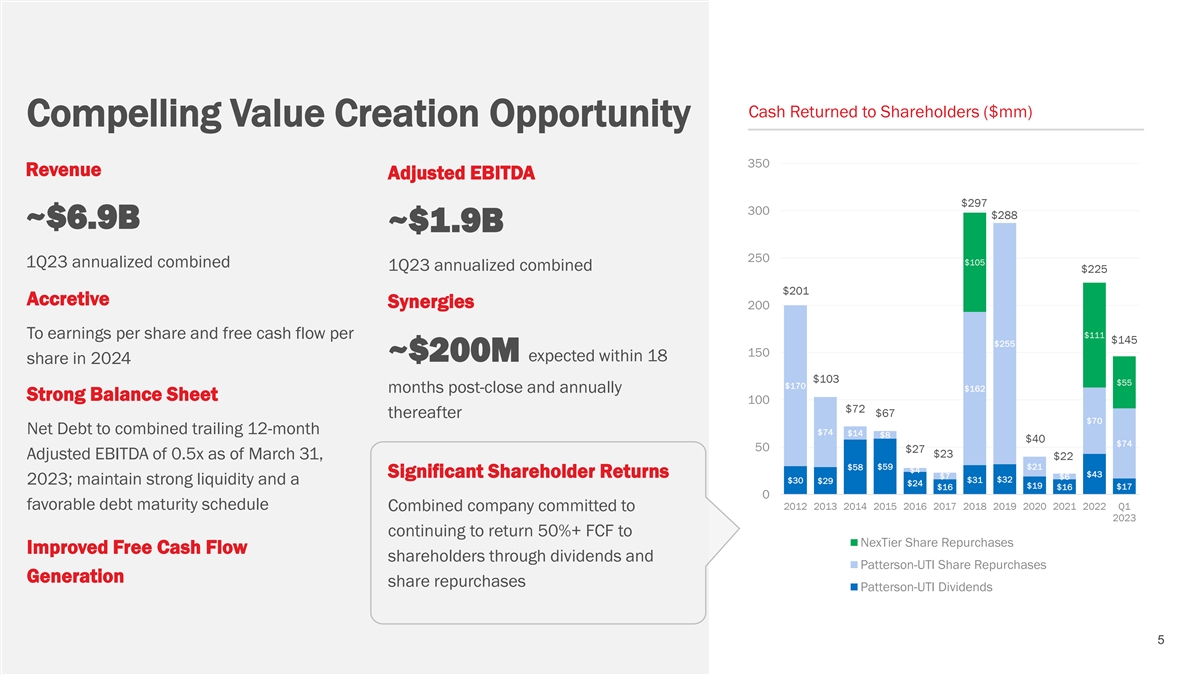

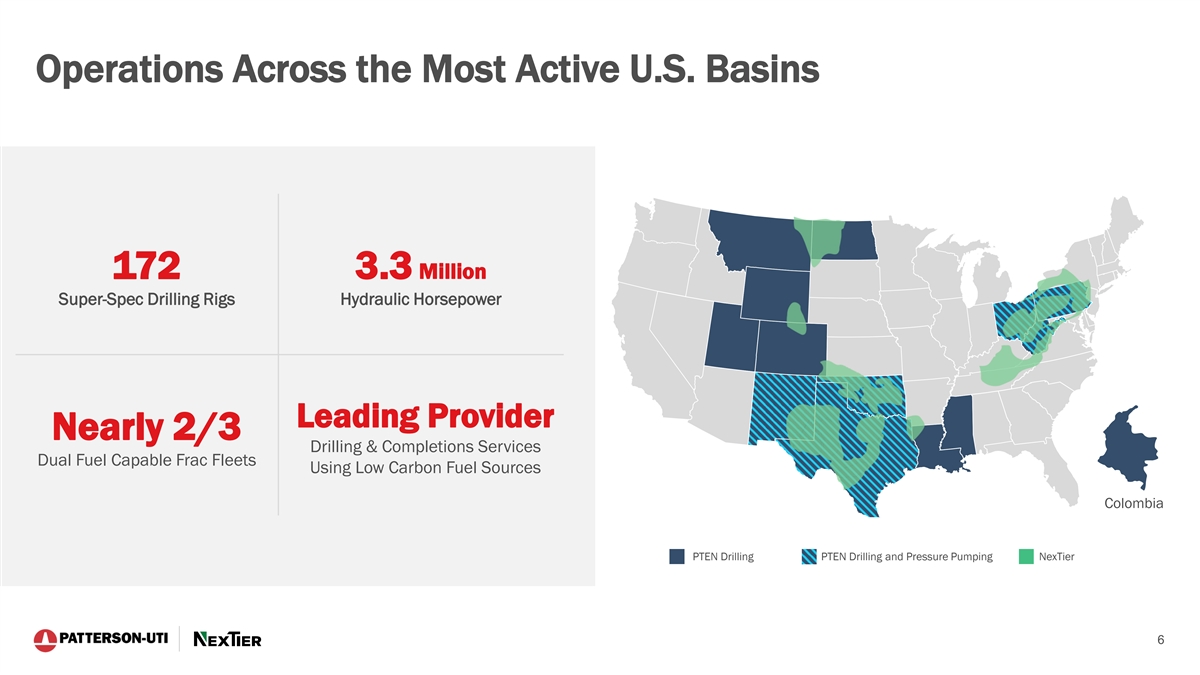

On June 14, 2023, Patterson-UTI Energy, Inc., a Delaware corporation (“Patterson-UTI”), Pecos Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of Patterson-UTI (“Merger Sub Inc.”), and Pecos Second Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Patterson-UTI (“Merger Sub LLC”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with NexTier Oilfield Solutions Inc., a Delaware corporation (“NexTier”), pursuant to which, upon the terms and subject to the conditions set forth therein, (i) Merger Sub Inc. will merge with and into NexTier, with NexTier continuing as the surviving entity (the “Surviving Corporation”) (the “First Company Merger”) and (ii) immediately following the First Company Merger, the Surviving Corporation will merge with and into Merger Sub LLC, with Merger Sub LLC continuing as the surviving entity (the “Second Company Merger” and, together with the First Company Merger, the “Mergers”). Under the terms of the Merger Agreement and as more fully described below, at the effective time of the Mergers (the “Effective Time”), subject to certain exceptions, each share of common stock, par value $0.01 per share, of NexTier (“NexTier Common Stock”) then issued and outstanding immediately prior to the Effective Time (including outstanding restricted shares) will be converted into the right to receive 0.7520 shares of common stock, par value $0.01 per share, of Patterson-UTI (“Patterson-UTI Common Stock”). Each share of NexTier Common Stock held in treasury by NexTier or owned directly or indirectly by Patterson-UTI, Merger Sub Inc. or Merger Sub LLC will be automatically cancelled and will cease to exist, and no consideration will be issued therefor. Upon consummation of the Mergers and the other transactions contemplated by the Merger Agreement (the “Transactions”), NexTier will be a wholly owned subsidiary of Patterson-UTI.

The board of directors of Patterson-UTI (the “Patterson-UTI Board”) unanimously (a) determined that the Merger Agreement and the Transactions are fair to, and in the best interests of, Patterson-UTI and the holders of shares of Patterson-UTI Common Stock, (b) approved and declared advisable the Merger Agreement, an amendment to the Restated Certificate of Incorporation of Patterson-UTI, dated as of October 14, 1993, as amended from time to time, to increase the authorized number of shares of Patterson-UTI Common Stock from 400,000,000 to 800,000,000 shares (the “Patterson-UTI Charter Amendment”) and the Transactions, on the terms and subject to the conditions set forth in the Merger Agreement, (c) directed that the issuance of Patterson-UTI Common Stock in connection with the Merger (the “Share Issuance”) and the Patterson-UTI Charter Amendment be submitted to the holders of shares of Patterson-UTI Common Stock for their approval and (d) resolved to recommend that the holders of shares of Patterson-UTI Common Stock vote in favor of the Share Issuance and the Patterson-UTI Charter Amendment. The board of directors of NexTier (the “NexTier Board”) unanimously (a) determined that the Merger Agreement and the Transactions are fair to, and in the best interests of, NexTier and the holders of shares of NexTier Common Stock, (b) approved and declared advisable the Merger Agreement and the Transactions on the terms and subject to the conditions set forth in the Merger Agreement, (c) directed that the Merger Agreement be submitted to the holders of shares of NexTier Common Stock for their adoption and (d) resolved to recommend that the holders of shares of NexTier Common Stock vote in favor of the adoption of the Merger Agreement.

Treatment of Long Term Incentive Awards

Pursuant to the Merger Agreement, at the Effective Time, (a) each outstanding NexTier stock option will convert into a stock option relating to shares of Patterson-UTI Common Stock on the terms set forth in the Merger Agreement, (b) each outstanding NexTier performance share award will convert into a Patterson-UTI performance share award relating to shares of Patterson-UTI Common Stock on the terms set forth in the Merger Agreement, (c) each outstanding NexTier restricted stock unit award will convert into a Patterson-UTI restricted stock unit award relating to shares of common stock on the terms set forth in the Merger Agreement and (d) each outstanding NexTier restricted stock award will convert into a restricted stock award relating to shares of Patterson-UTI Common Stock on the terms set forth in the Merger Agreement.

The number of shares of NexTier Common Stock subject to NexTier performance share awards shall be deemed to be the number of shares subject to the NexTier performance share award based on actual performance attained through immediately prior to the date on which the closing of the Mergers actually occurs.

Post-Closing Governance

Patterson-UTI and NexTier have agreed to certain governance-related matters. At the Effective Time, the Patterson-UTI Board will have 11 members, including (a) six directors designated by Patterson-UTI, which will include the Chief Executive Officer of Patterson-UTI as of immediately prior to the Effective Time, and (b) five directors designated by NexTier, which will include the President and Chief Executive Officer of NexTier as of immediately prior to the Effective Time. The Chairman of the Board as of immediately prior to the Effective Time will serve as Chairman of the Board. The President and Chief Executive Officer of NextTier as of immediately prior to the Effective Time will serve as Vice Chairman of the Board. At the first two annual meetings following the Effective Time, the Patterson-UTI Board will re-nominate each Patterson-UTI and NexTier designee then serving on the Patterson-UTI Board for re-election by stockholders, subject to certain exceptions. In addition, at the Effective Time and for two years thereafter, (i) the Nominating and Corporate Governance Committee will have an equal number of Patterson-UTI and NexTier designees, (ii) all other committees will have at least one NexTier designee, such that the membership of all the committees (excluding the Executive Committee) of the Patterson-UTI Board, taken as a whole, will have an equal number of Patterson-UTI and NexTier designees and (iii) the Executive Committee will consist of the Chairman, Vice Chairman and Chief Executive Officer.

At the Effective Time, William A. Hendricks, Jr. will be appointed to serve as the chief executive officer of Patterson-UTI, C. Andrew Smith will be appointed to serve as the chief financial officer of Patterson-UTI, Kenneth Pucheu will be appointed to serve as the chief integration officer of Patterson-UTI, and Matthew Gillard will be appointed to serve as the head of the completions business unit of Patterson-UTI.

Conditions to the Merger

The closing of the Transactions is subject to the satisfaction or waiver of certain closing conditions, including, among others, (i) the adoption of the Merger Agreement by holders of a majority of the outstanding shares of NexTier Common Stock, (ii) the approval of the Patterson-UTI Charter Amendment by the holders of a majority of the outstanding shares of Patterson-UTI Common Stock, (iii) the approval of the Share Issuance by the holders of shares of Patterson-UTI Common Stock representing a majority of votes cast on the Share Issuance, (iv) the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act having expired or been terminated, and there being no written agreement in effect with any governmental entity not to consummate the Transactions, (v) there being no law, injunction or order by a governmental body prohibiting the consummation of the Mergers, (vi) the approval for listing of Patterson-UTI Common Stock to be issued in accordance with the terms of the Merger Agreement on the Nasdaq, (vii) the registration statement on Form S-4, to be filed with the United States Securities and Exchange Commission (the “SEC”) by Patterson-UTI, having been declared effective by the SEC, (viii) subject to specified materiality standards, the accuracy of the representations and warranties of the other party, and (ix) compliance by each other party in all material respects with their respective covenants.

Representations, Warranties and Covenants

The Merger Agreement contains customary representations and warranties of Patterson-UTI and NexTier relating to their respective businesses, financial statements and public filings, as applicable, in each case generally subject to customary materiality and knowledge qualifiers. Additionally, the Merger Agreement provides for customary pre-closing covenants of Patterson-UTI and NexTier, including covenants relating to conducting their respective businesses in the ordinary course and to refrain from taking certain actions without the consent of the other party. Patterson-UTI and NexTier also agreed to use their reasonable best efforts to cause the Merger to be consummated and to obtain regulatory approvals or expiration or termination of waiting periods.

The Merger Agreement provides that, during the period from the date of the Merger Agreement until the Effective Time, each of Patterson-UTI and NexTier will be subject to certain restrictions on its ability to solicit alternative Acquisition Proposals (as defined in the Merger Agreement) from third parties, to provide non-public information to third parties and to engage in discussions with third parties regarding alternative Acquisition Proposals, subject to customary exceptions.

Patterson-UTI is required to call a meeting of its stockholders to approve the Share Issuance and Patterson-UTI Charter Amendment and, subject to certain exceptions, to recommend that its stockholders vote to approve the Share Issuance and Patterson-UTI Charter Amendment. NexTier is required to call a meeting of its stockholders to vote upon the adoption of the Merger Agreement and, subject to certain exceptions, to recommend that its stockholders vote to adopt the Merger Agreement.

Termination

The Merger Agreement contains termination rights for each of Patterson-UTI and NexTier, including, among others, if the consummation of the Transactions does not occur on or before March 14, 2024, subject to a 90-day extension in certain circumstances for the sole purpose of obtaining regulatory clearances. Upon termination of the Merger Agreement under specified circumstances, including the termination by NexTier in the event of a Change of Recommendation (as defined in the Merger Agreement) by the Patterson-UTI Board, Patterson-UTI would be required to pay NexTier a termination fee of $72,980,000. In addition, upon termination of the Merger Agreement under reciprocal specified circumstances, including the termination by Patterson-UTI in the event of a Change of Recommendation by the NexTier Board, NexTier would be required to pay Patterson-UTI a termination fee of $60,875,000. In addition, if the Merger Agreement is terminated in specified circumstances, including because of a failure of Patterson-UTI’s stockholders approve the Share Issuance and the Patterson-UTI Charter Amendment or of NexTier’s stockholders to approve the adoption of the Merger Agreement, Patterson-UTI or NexTier, as applicable, may be required to reimburse the other party for its actual transaction expenses in an amount not to exceed $10,150,000. In no event will either party be entitled to receive more than one termination fee, net of any expense reimbursement.

The foregoing description is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached as Exhibit 2.1 to this Current Report on Form 8-K.

The representations, warranties and covenants contained in the Merger Agreement have been made solely for the benefit of the parties thereto. In addition, such representations, warranties and covenants (i) have been made only for purposes of the Merger Agreement, (ii) have been qualified by (a) matters specifically disclosed in any reports filed by Patterson-UTI or NexTier with the SEC prior to the date of the Merger Agreement (subject to certain exceptions) and (b) confidential disclosures made in confidential disclosure letters delivered in connection with the Merger Agreement, (iii) are subject to materiality qualifications contained in the Merger Agreement which may differ from what may be viewed as material by investors, (iv) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement and (v) have been included in the Merger Agreement for the purpose of allocating risk between the contracting parties rather than establishing matters as fact. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding the parties thereto or their respective businesses. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties to the Merger Agreement or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in Patterson-UTI’s public disclosures. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding Patterson-UTI and NexTier that is or will be contained in, or incorporated by reference into, the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents that Patterson-UTI or NexTier files with the SEC.

Support Agreement

In connection with the Merger Agreement, Keane Investor Holdings, LLC, a Delaware limited liability company (“Keane Investor”), which beneficially owns 32,330,828 shares of NexTier Common Stock, and Cerberus Capital Management, L.P., a Delaware limited partnership, have entered into a Support Agreement and Irrevocable Proxy (the “Support Agreement”), dated June 14, 2023, with Patterson-UTI. The Support Agreement includes covenants as to the voting of shares of NexTier Common Stock held by Keane Investor in a manner to facilitate the consummation of the Mergers.

The foregoing is qualified in its entirety by reference to the full text of the form of Support Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws. |

On June 14, 2023, the Board amended Patterson-UTI’s bylaws to add a new forum selection provision. The provision provides that, unless Patterson-UTI, in writing, selects or consents to the selection of an alternative forum: (a) the sole and exclusive forum for any complaint asserting any internal corporate claims (as defined below), to the fullest extent permitted by law, and subject to applicable jurisdictional requirements, shall be the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have, or declines to accept, jurisdiction, another state court or a federal court located within the State of Delaware); and (b) the sole and exclusive forum for any complaint asserting a cause of action arising under the Securities Act of 1933, to the fullest extent permitted by law, shall be the federal district courts of the United States of America. For purposes of this provision, internal corporate claims means claims, including claims in the right of Patterson-UTI: (a) that are based upon a violation of a duty by a current or former director, officer, employee or stockholder in such capacity, or (b) as to which the General Corporation Law of the State of Delaware confers jurisdiction upon the Court of Chancery. Any person or entity purchasing or otherwise acquiring or holding any interest in shares of stock of Patterson-UTI shall be deemed to have notice of and consented to this provision.

The foregoing description is qualified in its entirety by reference to the full text of the bylaws, as amended on June 14, 2023, which is attached as Exhibit 3.1 to this Current Report on Form 8-K.

| Item 7.01 | Regulation FD Disclosure. |

On June 15, 2023, Patterson-UTI and NexTier, issued a joint press release announcing the Merger Agreement. A copy of the press release containing the announcement is furnished herewith as Exhibit 99.1 and incorporated by reference herein.

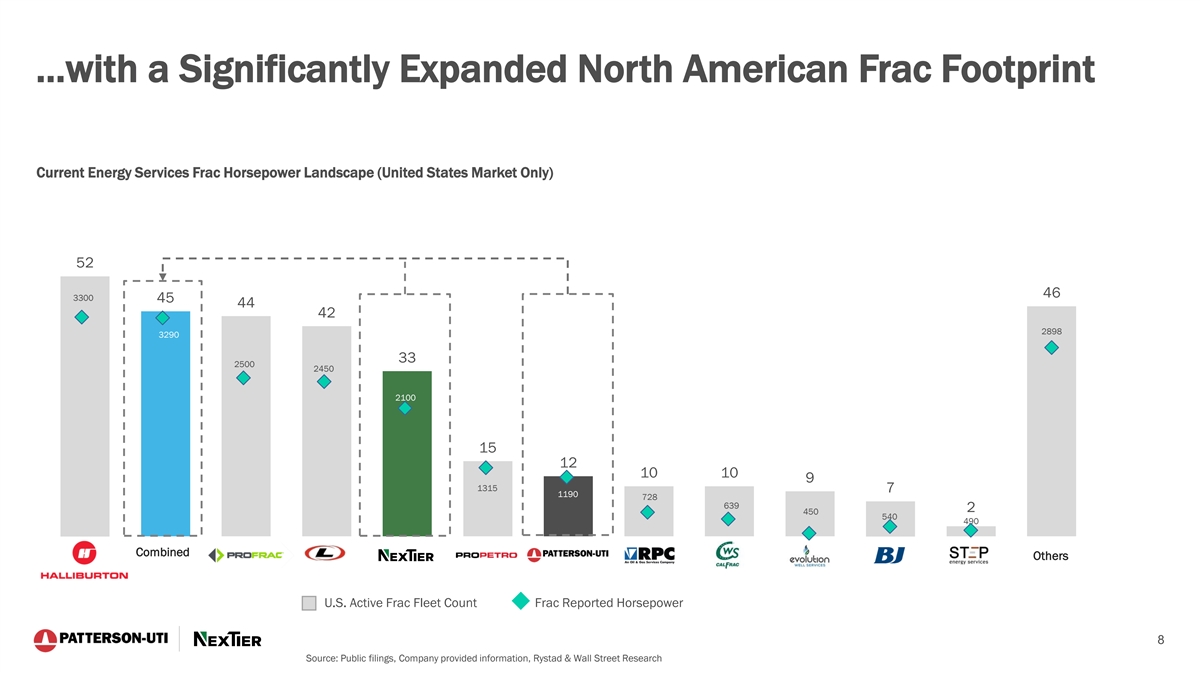

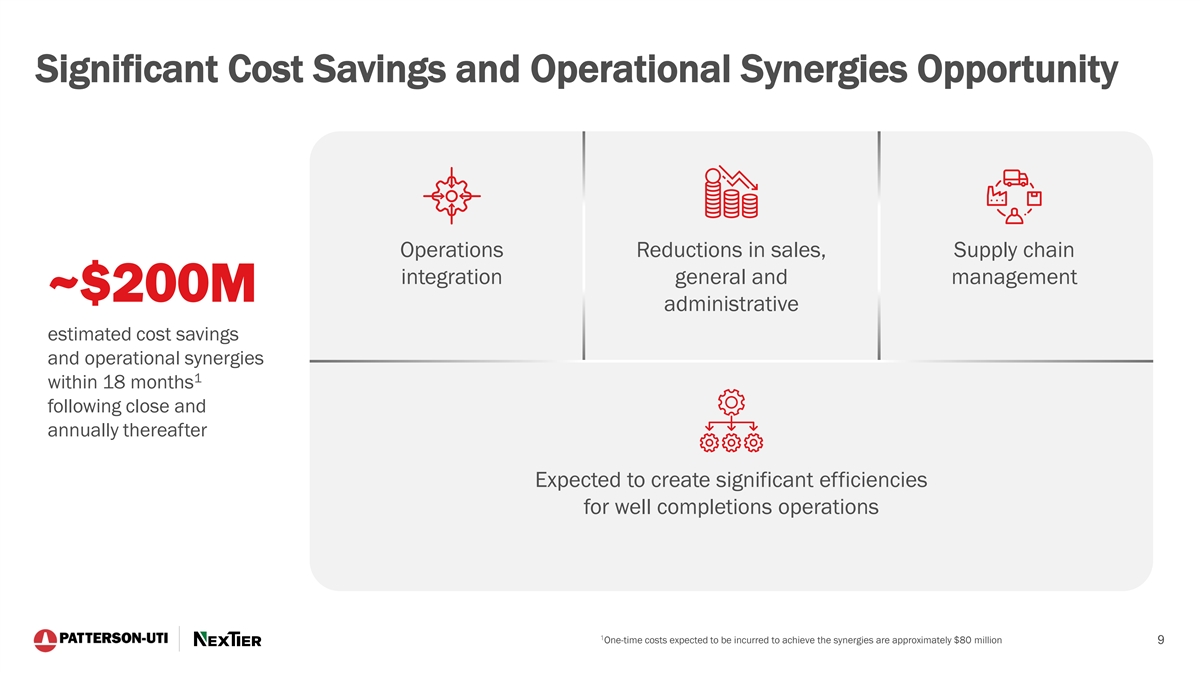

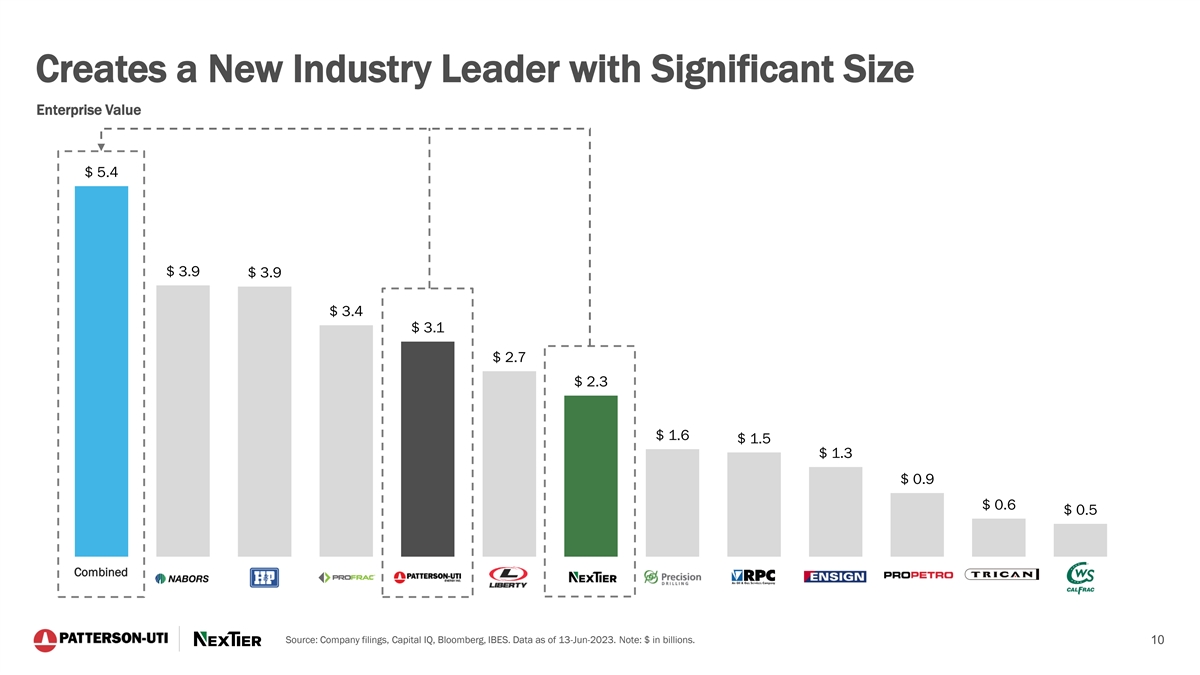

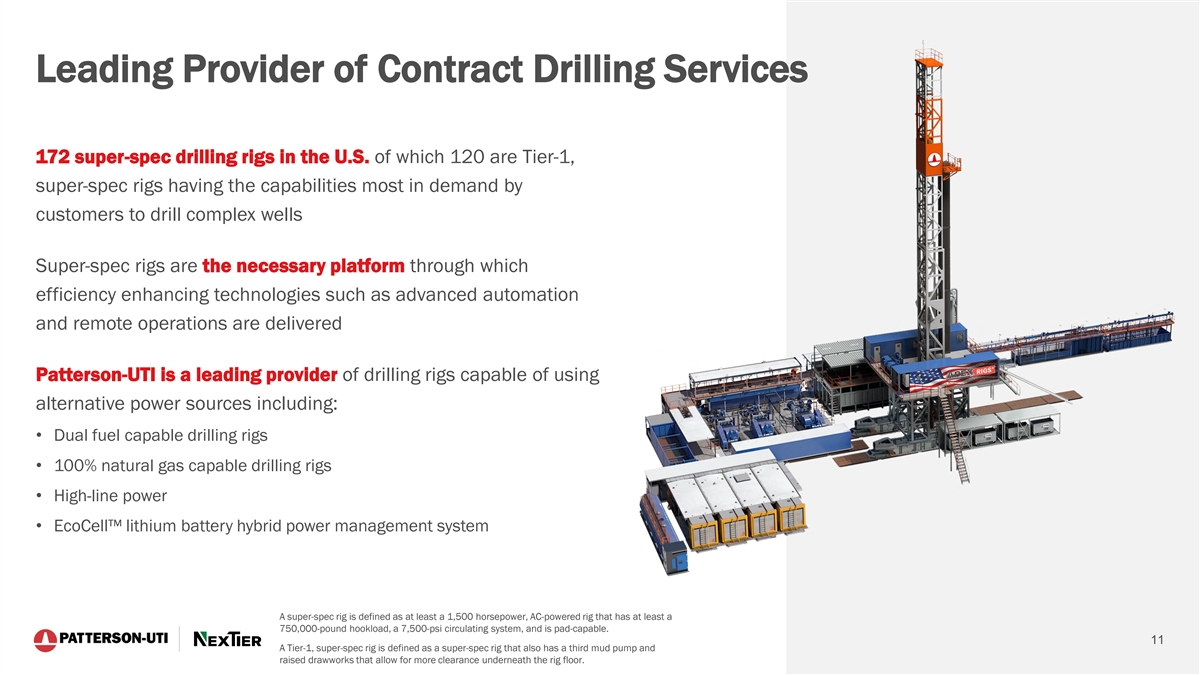

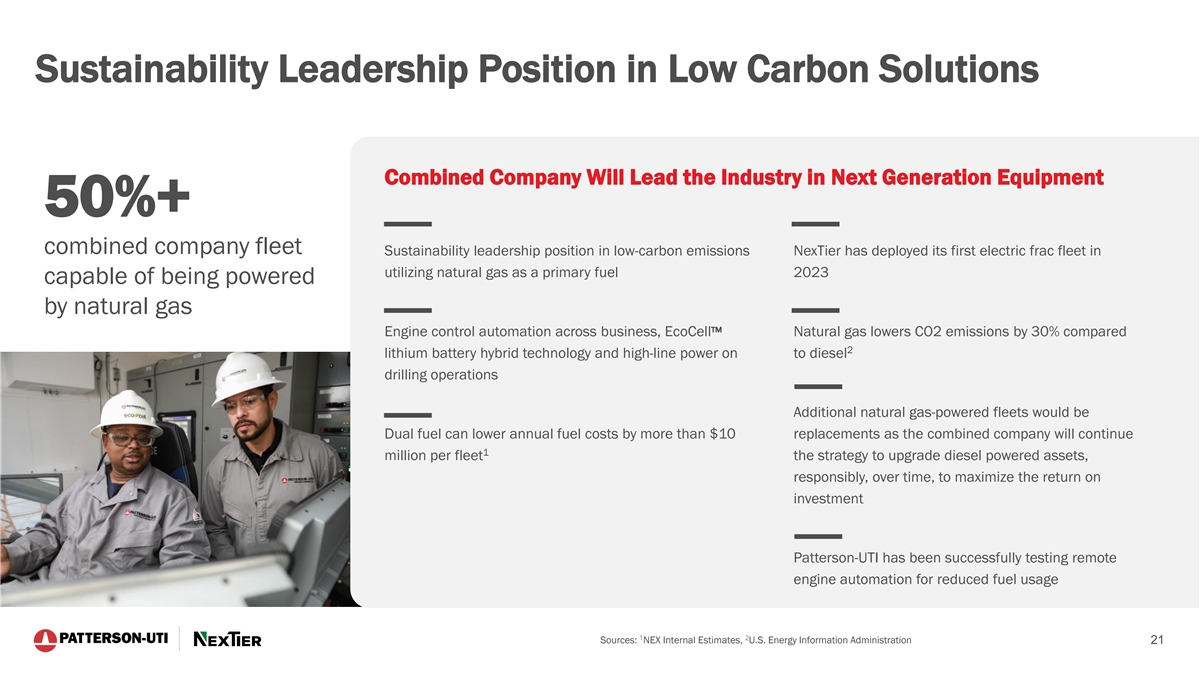

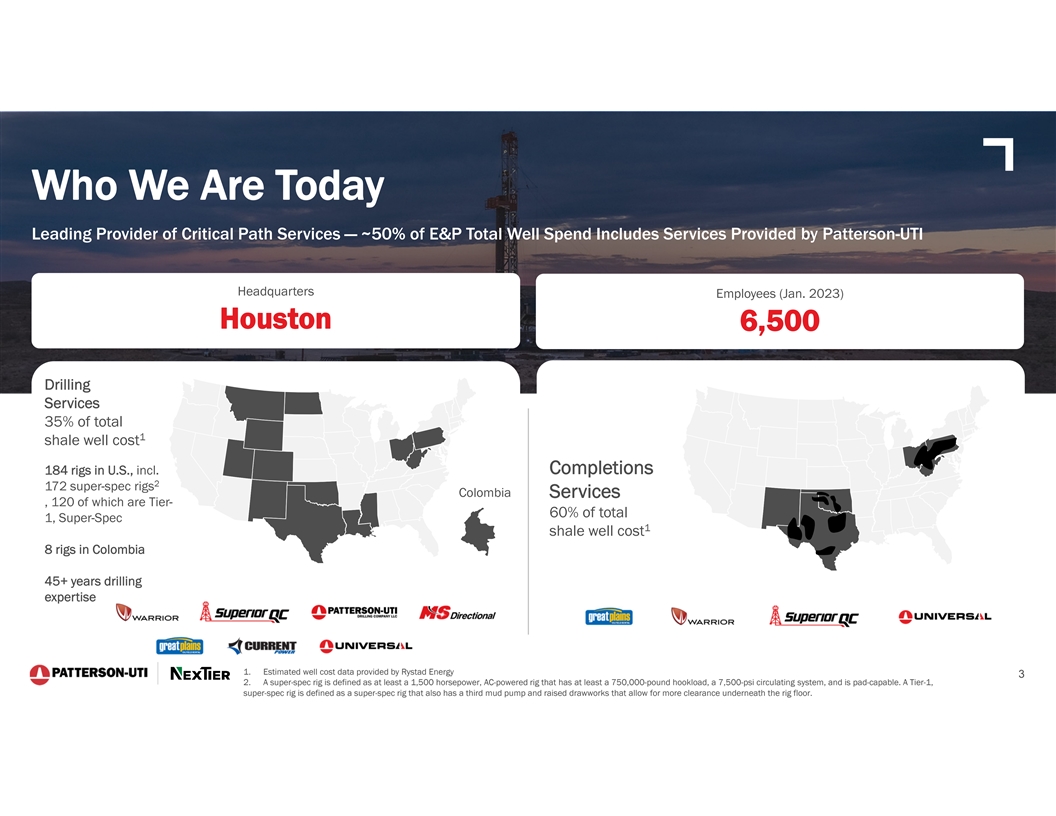

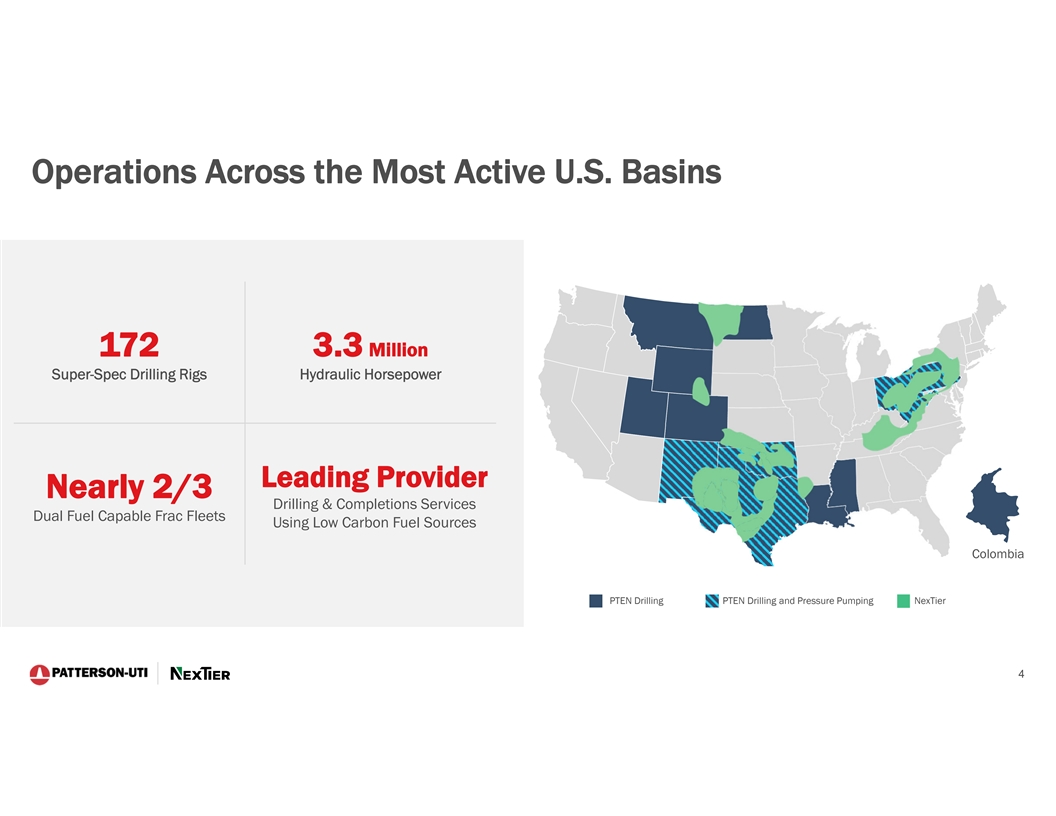

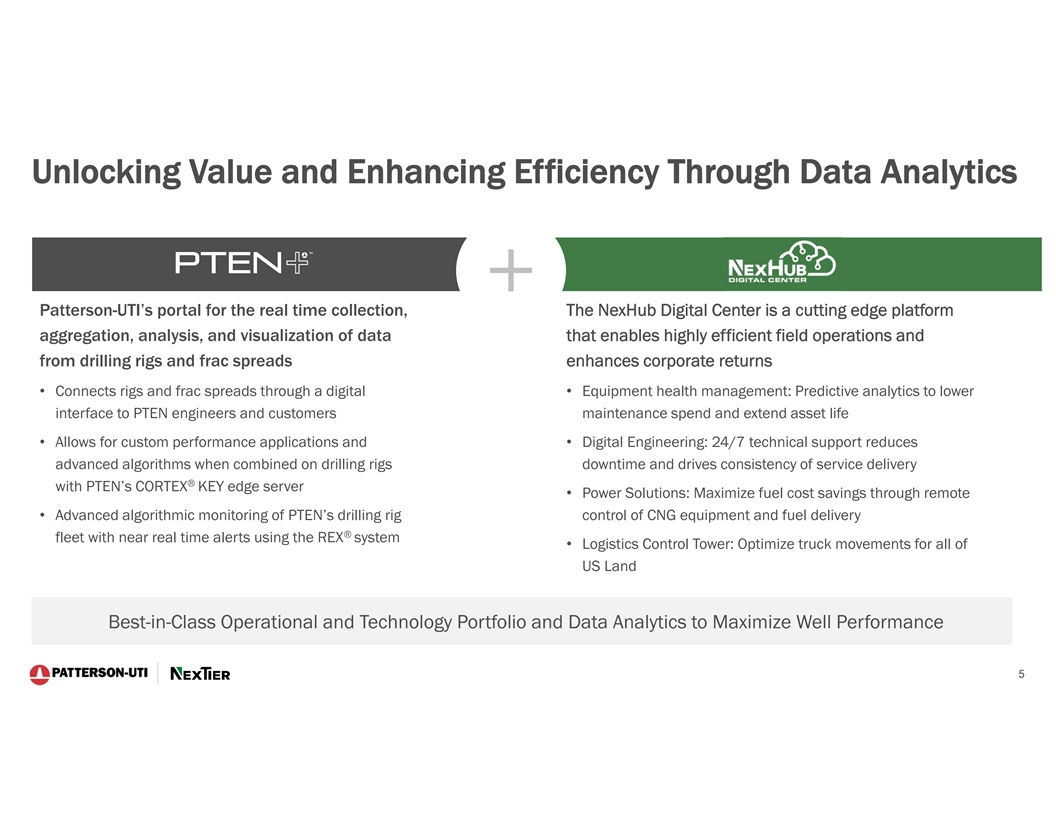

On June 15, 2023, Patterson-UTI and NexTier provided supplemental information regarding the Merger Agreement in a joint investor presentation published to their respective websites. A copy of the joint investor presentation is attached as Exhibit 99.2 hereto and is incorporated herein by reference.

The information furnished pursuant to Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, shall not otherwise be subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of this press release and these slides is not intended to constitute a representation that such information is required by Regulation FD or that the materials they contain include material information that is not otherwise publicly available.

| Item 8.01 | Other Events. |

In connection with the announcement of the Merger Agreement, Patterson-UTI sent certain written communications to its employees, which are filed as Exhibit 99.3, Exhibit 99.4 and Exhibit 99.5. To the extent required, the information included in Item 7.01 of this Current Report on Form 8-K is incorporated by reference into this Item 8.01.

Important Information for Stockholders

In connection with the proposed transaction, Patterson-UTI intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Patterson-UTI and NexTier that also constitutes a prospectus of Patterson-UTI. Each of Patterson-UTI and NexTier also plan to file other relevant documents with the SEC regarding the proposed transaction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Any definitive joint proxy statement/prospectus (if and when available) will be mailed to shareholders of Patterson-UTI and NexTier.

INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about Patterson-UTI and NexTier once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Patterson-UTI will be available free of charge on Patterson-UTI’s website at http://www.patenergy.com or by contacting Patterson-UTI’s Investor Relations Department by phone at (281) 765-7170. Copies of the documents filed with the SEC by NexTier will be available free of charge on NexTier’s website at https://nextierofs.com or by contacting NexTier’s Investor Relations Department by phone at (346) 242-0519.

Participants in the Solicitation

Patterson-UTI, NexTier and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Patterson-UTI is set forth in its proxy statement for its 2023 annual meeting of shareholders, which was filed with the SEC on April 11, 2023, and Patterson-UTI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 13, 2023. Information about the directors and executive officers of NexTier is set forth in its proxy statement for its 2023 annual meeting of shareholders, which was filed with the SEC on April 28, 2023, and NexTier’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 16, 2023. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Patterson-UTI or NexTier using the sources indicated above.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 15, 2023

| Patterson-UTI Energy, Inc. | ||

| By: | /s/ C. Andrew Smith |

|

| Name: | C. Andrew Smith | |

| Title: | Executive Vice President and Chief Financial Officer | |

Exhibit 2.1

Execution Version

AGREEMENT AND PLAN OF MERGER

among

PATTERSON-UTI ENERGY, INC.,

PECOS MERGER SUB INC.,

PECOS SECOND MERGER SUB LLC

and

NEXTIER OILFIELD SOLUTIONS INC.

Dated as of June 14, 2023

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I THE MERGERS | 2 | |||||

| 1.1 |

The Mergers | 2 | ||||

| 1.2 |

Closing | 3 | ||||

| 1.3 |

Effects of the Mergers | 3 | ||||

| ARTICLE II MERGER CONSIDERATION; EFFECT OF THE MERGER ON CAPITAL STOCK | 3 | |||||

| 2.1 |

Merger Consideration; Conversion of Shares of Parent Sub Common Stock; Conversion of Shares of Company Common Stock | 3 | ||||

| 2.2 |

Cancellation of Shares of Company Common Stock | 4 | ||||

| 2.3 |

Treatment of Long Term Incentive Awards | 4 | ||||

| ARTICLE III DELIVERY OF MERGER CONSIDERATION; PROCEDURES FOR SURRENDER | 6 | |||||

| 3.1 |

Exchange Agent | 6 | ||||

| 3.2 |

Procedures for Surrender | 6 | ||||

| 3.3 |

Distributions with Respect to Unexchanged Shares of Company Common Stock | 8 | ||||

| 3.4 |

No Transfers | 8 | ||||

| 3.5 |

Fractional Shares | 8 | ||||

| 3.6 |

Termination of Exchange Fund | 9 | ||||

| 3.7 |

Lost, Stolen or Destroyed Certificates | 9 | ||||

| 3.8 |

Withholding Rights | 9 | ||||

| 3.9 |

Adjustments to Prevent Dilution | 9 | ||||

| 3.10 |

No Liability | 10 | ||||

| ARTICLE IV GOVERNANCE AND ADDITIONAL MATTERS | 10 | |||||

| 4.1 |

Governance and Additional Matters | 10 | ||||

| ARTICLE V MUTUAL REPRESENTATIONS AND WARRANTIES OF THE COMPANY AND PARENT | 14 | |||||

| 5.1 |

Organization Good Standing and Qualification | 14 | ||||

| 5.2 |

Subsidiaries | 14 | ||||

| 5.3 |

Corporate Authority; Approval | 14 | ||||

| 5.4 |

Governmental Filings; No Violations; Certain Contracts | 15 | ||||

| 5.5 |

Reports; Internal Controls | 16 | ||||

| 5.6 |

Financial Statements | 18 | ||||

| 5.7 |

Absence of Certain Changes or Events. | 18 | ||||

| 5.8 |

Litigation and Liabilities | 18 | ||||

| 5.9 |

Employee Benefits | 19 | ||||

| 5.10 |

Labor Matters | 21 | ||||

| 5.11 |

Compliance with Laws; Licenses | 21 | ||||

| 5.12 |

Takeover Statutes; Rights Plan | 23 | ||||

i

| 5.13 |

Environmental Matters | 23 | ||||

| 5.14 |

Tax Matters | 24 | ||||

| 5.15 |

Intellectual Property | 26 | ||||

| 5.16 |

Insurance | 27 | ||||

| 5.17 |

Material Contracts | 27 | ||||

| 5.18 |

Title to Assets | 30 | ||||

| 5.19 |

Real Property | 30 | ||||

| 5.20 |

Affiliate Transactions | 30 | ||||

| 5.21 |

Information Supplied | 31 | ||||

| 5.22 |

No Other Representations or Warranties; Non-Reliance | 31 | ||||

| ARTICLE VI INDIVIDUAL REPRESENTATIONS AND WARRANTIES OF THE COMPANY AND PARENT | 32 | |||||

| 6.1 |

Parent Capital Structure | 32 | ||||

| 6.2 |

Parent Recommendation and Fairness | 33 | ||||

| 6.3 |

Parent Voting Requirements | 33 | ||||

| 6.4 |

Merger Subs | 33 | ||||

| 6.5 |

Parent Brokers and Finders | 34 | ||||

| 6.6 |

Company Capital Structure | 34 | ||||

| 6.7 |

Company Recommendation and Fairness | 35 | ||||

| 6.8 |

Company Brokers and Finders | 35 | ||||

| 6.9 |

Company Voting Requirements | 35 | ||||

| ARTICLE VII COVENANTS | 36 | |||||

| 7.1 |

Interim Operations | 36 | ||||

| 7.2 |

Acquisition Proposals; Change of Recommendation | 41 | ||||

| 7.3 |

Proxy Statement/Prospectus Filing; Information Supplied | 46 | ||||

| 7.4 |

Stockholders Meetings | 47 | ||||

| 7.5 |

Cooperation; Efforts to Consummate | 49 | ||||

| 7.6 |

Status Notifications | 51 | ||||

| 7.7 |

Termination of Indebtedness | 52 | ||||

| 7.8 |

Information; Access and Reports | 52 | ||||

| 7.9 |

Stock Exchange Listing and Delisting | 53 | ||||

| 7.10 |

Publicity | 54 | ||||

| 7.11 |

Employee Benefits | 54 | ||||

| 7.12 |

Certain Tax Matters | 56 | ||||

| 7.13 |

Expenses | 57 | ||||

| 7.14 |

Indemnification; Directors’ and Officers’ Insurance | 57 | ||||

| 7.15 |

Takeover Statutes | 59 | ||||

| 7.16 |

Section 16 Matters | 59 | ||||

| 7.17 |

Stockholder Litigation | 60 | ||||

| 7.18 |

Parent Sub Stockholder Consent | 60 | ||||

| 7.19 |

Company Stockholders Agreement | 60 | ||||

| 7.20 |

Forum Selection Bylaw | 60 | ||||

ii

| ARTICLE VIII CONDITIONS | 60 | |||||

| 8.1 |

Conditions to Each Party’s Obligation to Effect the Mergers | 60 | ||||

| 8.2 |

Conditions to Obligations of the Parent Parties | 61 | ||||

| 8.3 |

Conditions to Obligation of the Company | 62 | ||||

| ARTICLE IX TERMINATION | 63 | |||||

| 9.1 |

Termination | 63 | ||||

| 9.2 |

Effect of Termination | 65 | ||||

| ARTICLE X MISCELLANEOUS AND GENERAL | 68 | |||||

| 10.1 |

Survival | 68 | ||||

| 10.2 |

Amendment; Waiver | 68 | ||||

| 10.3 |

Counterparts | 68 | ||||

| 10.4 |

Governing Law and Venue; Submission to Jurisdiction; Selection of Forum; Waiver of Trial by Jury | 68 | ||||

| 10.5 |

Specific Performance | 69 | ||||

| 10.6 |

Notices | 70 | ||||

| 10.7 |

Definitions | 71 | ||||

| 10.8 |

Entire Agreement | 83 | ||||

| 10.9 |

Third-Party Beneficiaries | 83 | ||||

| 10.10 |

Fulfillment of Obligations | 83 | ||||

| 10.11 |

Non-Recourse | 83 | ||||

| 10.12 |

Severability | 84 | ||||

| 10.13 |

Interpretation; Construction | 84 | ||||

| 10.14 |

Successors and Assigns | 85 | ||||

| 10.15 |

Disclosure Letters | 85 | ||||

| 10.16 |

Exclusive Remedy | 86 | ||||

| Exhibits |

||

| Exhibit A | Governance Policy | |

| Exhibit B | Forum Selection Bylaw | |

iii

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of June 14, 2023, is entered into by and among Patterson-UTI Energy, Inc., a Delaware corporation (“Parent”), Pecos Merger Sub Inc., a Delaware corporation and direct, wholly owned subsidiary of Parent (“Parent Sub”), Pecos Second Merger Sub LLC, a Delaware limited liability company and direct, wholly owned subsidiary of Parent (“LLC Sub” and, together with Parent and Parent Sub, the “Parent Parties”), and NexTier Oilfield Solutions Inc., a Delaware corporation (the “Company”). Each of Parent and the Company are referred to herein individually as a “Party” and collectively as the “Parties”.

RECITALS

WHEREAS, the Parties intend to effect: (a) at the Effective Time, the merger (the “First Company Merger”) of Parent Sub with and into the Company, with the Company continuing as the surviving entity (the “Surviving Corporation”), on the terms and subject to the conditions set forth herein; and (b) immediately following the First Company Merger, the merger (the “Second Company Merger” and, together with the First Company Merger, the “Mergers”) of the Surviving Corporation with and into LLC Sub, with LLC Sub continuing as the surviving entity (the “Surviving Company”), on the terms and subject to the conditions set forth herein;

WHEREAS, the board of directors of the Company (the “Company Board”) has unanimously (a) determined that this Agreement and the transactions contemplated by this Agreement, including the Mergers (the “Transactions”), are fair to, and in the best interests of, the Company and the holders of shares of the Company’s common stock, par value $0.01 per share (the “Company Common Stock”), (b) approved and declared advisable this Agreement and the Transactions on the terms and subject to the conditions set forth in this Agreement, (c) directed that this Agreement be submitted to the holders of shares of Company Common Stock for their adoption and (d) resolved to recommend that the holders of shares of Company Common Stock vote in favor of the adoption of this Agreement;

WHEREAS, the board of directors of Parent (the “Parent Board”) has unanimously (a) determined that this Agreement and the Transactions are fair to, and in the best interests of, Parent and the holders of shares of Parent common stock, par value $0.01 per share (the “Parent Common Stock”), (b) approved and declared advisable this Agreement, the Parent Charter Amendment and the Transactions, on the terms and subject to the conditions set forth in this Agreement, (c) directed that the Share Issuance and the Parent Charter Amendment be submitted to the holders of Parent Common Stock for their approval, and (d) resolved to recommend that the holders of shares of Parent Common Stock vote in favor of the Share Issuance and the Parent Charter Amendment;

WHEREAS, the board of directors of Parent Sub has unanimously (a) determined that this Agreement and the Transactions are fair to, and in the best interests of, Parent Sub and Parent, its sole stockholder, (b) approved and declared advisable this Agreement and the Transactions, on the terms and subject to the conditions set forth in this Agreement, (c) determined to submit the approval of the adoption of this Agreement to Parent, as sole stockholder of Parent Sub, and (d) resolved to recommend to Parent, as sole stockholder of Parent Sub, that Parent approve the adoption of this Agreement; WHEREAS, Parent (a) as the sole member of LLC Sub has approved and adopted this Agreement concurrently with its execution pursuant to Section 18-404 of the Limited Liability Company Act of the State of Delaware (the “DLLCA”), and (b) as the sole stockholder of Parent Sub will adopt this Agreement pursuant to Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”) immediately following the execution hereof (collectively, the “Parent Consents”);

WHEREAS, concurrently with the execution and delivery of this Agreement, and as a condition and inducement to Parent’s willingness to enter into this Agreement, each of Keane Investor Holdings LLC, a Delaware limited liability company, and Cerberus Capital Management, L.P., a Delaware limited partnership, has entered into a Support Agreement and Irrevocable Proxy with Parent, dated as of the date of this Agreement, whereby subject to the terms set forth therein, Keane Investor Holdings LLC has agreed to vote to adopt this Agreement;

WHEREAS, for U.S. federal income tax purposes, (a) it is intended that the Mergers, taken together, constitute an integrated plan and will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and (b) this Agreement is intended to constitute, and is hereby adopted as, a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a); and

WHEREAS, the parties hereto desire to make certain representations, warranties, covenants and agreements in connection with this Agreement and prescribe certain conditions to the Mergers as specified herein.

NOW, THEREFORE, in consideration of the foregoing premises and the representations, warranties, covenants and agreements set forth in this Agreement, the Parties agree as follows:

ARTICLE I

THE MERGERS

1.1 The Mergers.

(a) Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the DGCL, at the Effective Time, Parent Sub shall be merged with and into the Company. Following the First Company Merger, the separate corporate existence of Parent Sub shall cease, and the Company shall continue as the Surviving Corporation and a direct, wholly owned Subsidiary of Parent. Upon the terms and subject to the provisions of this Agreement, as soon as practicable on the Closing Date, the applicable parties hereto shall file a certificate of merger (the “First Certificate of Merger”) with the Secretary of State of the State of Delaware (the “Delaware Secretary of State”), executed in accordance with the relevant provisions of the DGCL, to effect the First Company Merger. The First Company Merger shall become effective at such time on the Closing Date as the applicable parties hereto shall agree in writing and shall specify in the First Certificate of Merger (the time the First Company Merger becomes effective being the “Effective Time”).

2

(b) Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the DGCL and the DLLCA, at the Second Company Merger Effective Time, the Surviving Corporation shall be merged with and into LLC Sub. Following the Second Company Merger, the separate corporate existence of the Surviving Corporation shall cease, and LLC Sub shall be the Surviving Company and a direct, wholly owned Subsidiary of Parent. Upon the terms and subject to the provisions of this Agreement, as soon as practicable on the Closing Date, the applicable parties hereto shall file a certificate of merger (the “Second Certificate of Merger”) with the Delaware Secretary of State, executed in accordance with the relevant provisions of the DGCL and DLLCA, to effect the Second Company Merger. The Second Company Merger shall become effective one minute after the Effective Time (the time the Second Company Merger becomes effective being the “Second Company Merger Effective Time”), which the applicable parties hereto shall specify in the Second Certificate of Merger.

1.2 Closing. The closing of the Mergers (the “Closing”) shall take place at the offices of Gibson, Dunn & Crutcher LLP, 811 Main Street, Suite 3000, Houston, Texas 77002 at 9:00 a.m. (Eastern time) on the second Business Day following the day on which the last to be satisfied or (to the extent permissible) waived of the conditions set forth in Article VIII (other than those conditions that by their nature are to be satisfied or waived at the Closing, but subject to the satisfaction or (to the extent permissible) waiver of such conditions) shall be satisfied or (to the extent permissible) waived in accordance with this Agreement or at such other date, time or place (or by means of remote communication) as the Company and Parent may mutually agree in writing (the date on which the Closing actually occurs, the “Closing Date”).

1.3 Effects of the Mergers. The Mergers shall have the effects set forth in this Agreement and in the relevant provisions of the DGCL and the DLLCA, as applicable. Without limiting the generality of the foregoing, and subject thereto, (a) at the Effective Time, all the property, rights, privileges, powers and franchises of each of the Company and Parent Sub shall vest in the Surviving Corporation, and all debts, liabilities, obligations, restrictions, disabilities and duties of each of the Company and Parent Sub shall become the debts, liabilities, obligations, restrictions, disabilities and duties of the Surviving Corporation, and (b) at the Second Company Merger Effective Time, all the property, rights, privileges, powers and franchises of each of the Surviving Corporation and LLC Sub shall vest in the Surviving Company, and all debts, liabilities, obligations, restrictions, disabilities and duties of each of the Surviving Corporation and LLC Sub shall become the debts, liabilities, obligations, restrictions, disabilities and duties of the Surviving Company.

ARTICLE II

MERGER CONSIDERATION; EFFECT OF THE MERGER ON CAPITAL STOCK

2.1 Merger Consideration; Conversion of Shares of Parent Sub Common Stock; Conversion of Shares of Company Common Stock. At the Effective Time, by virtue of the First Company Merger and without any action on the part of any of the parties hereto or any holder of any capital stock of the Company, each share of common stock, par value $0.01 per share, of Parent Sub issued and outstanding immediately before the Effective Time shall be converted into and become one validly issued, fully paid and nonassessable share of common stock, par value $0.01 per share, of the Surviving Corporation, and each share of Company Common Stock issued and outstanding immediately prior to the Effective Time including each Company Restricted Stock Award but other than Excluded Shares (such shares of Company Common Stock, the “Eligible Shares”) shall automatically be converted into the right to receive that number of validly issued, fully paid and nonassessable shares of Parent Common Stock equal to 0.7520 (the “Exchange Ratio”) (such number of shares of Parent Common Stock, the “Merger Consideration”).

3

At the Effective Time, all Excluded Shares shall, as a result of the First Company Merger and without any action on the part of the parties hereto or any holder of such Excluded Shares, be cancelled and shall cease to exist, and no consideration shall be paid or delivered in exchange therefor.

2.2 Cancellation of Shares of Company Common Stock. At the Effective Time, by virtue of the First Company Merger and without any action on the part of the parties hereto or any holder of any capital stock of the Company, all of the Eligible Shares shall cease to be outstanding, shall be cancelled and shall cease to exist, and each certificate formerly representing any of the Eligible Shares (each, a “Certificate”) and each book-entry account formerly representing any non-certificated Eligible Shares (each, a “Book-Entry Share”) shall thereafter represent only the right to receive the Merger Consideration pursuant to this Article II and the right, if any, to receive pursuant to Section 3.5 cash in lieu of fractional shares into which such Eligible Shares have been converted pursuant to this Section 2.2 and any dividends or other distributions pursuant to Section 3.3; provided, that nothing in this Agreement (including this Article II and Article III) shall (a) affect the right of the holders of shares of Company Common Stock to receive any dividend or other distribution that was declared on Company Common Stock, and the record date of which occurred, prior to the Effective Time in accordance with the provisions of this Agreement or (b) give holders of Company Common Stock the right to receive any dividend or other distribution declared on Parent Common Stock, and the record date of which occurred, prior to the Effective Time in accordance with the provisions of this Agreement.

2.3 Treatment of Long Term Incentive Awards. This Section 2.3 shall govern the treatment of all Company Equity Awards in connection with the Transactions.

(a) Company Long Term Incentive Awards.

(i) Each Company Option Award, whether vested or unvested, that is outstanding immediately prior to the Effective Time shall, at the Effective Time, automatically and without any action on the part of the holder thereof, be assumed by Parent and remain subject to the same terms and conditions as were applicable to such Company Option Award, but shall be converted into an option to purchase that number of shares of Parent Common Stock (rounded down to the nearest whole share) equal to the product of (x) the number of shares of Company Common Stock subject to such Company Option Award immediately prior to the Effective Time and (y) the Exchange Ratio, at an exercise price per share of Parent Common Stock (rounded up to the nearest whole cent) equal to (A) the exercise price per share of such Company Option Award divided by (B) the Exchange Ratio (a “Converted Option Award”).

4

(ii) Each Company PSU Award that is outstanding immediately prior to the Effective Time shall, at the Effective Time, automatically and without any action on the part of the holder thereof, be assumed by Parent and remain subject to the same terms and conditions (including time-based vesting through the Time Vesting Date (as defined in the applicable award agreement pursuant to which the Company PSU Award was granted), vesting under any retirement programs and dividend equivalent rights, but excluding any continued performance-based vesting requirements) as were applicable to such Company PSU Award, but shall be converted into an award with respect to (or with Settlement Value (as defined in the applicable award agreement pursuant to which the Company PSU Award was granted) determined by reference to) a number of shares of Parent Common Stock (rounded up or down to the nearest whole share) equal to the product of (x) the number of shares of Company Common Stock subject to such Company PSU Award and (y) the Exchange Ratio (a “Converted PSU Award”). For purposes of the immediately preceding sentence, the number of shares of Company Common Stock subject to such Company PSU Award shall be deemed to be the number of shares subject to the Company PSU Award with performance deemed achieved at the level of actual performance attained through immediately prior to the Closing Date.

(iii) Each Company RSU Award that is outstanding immediately prior to the Effective Time shall, at the Effective Time, automatically and without any action on the part of the holders thereof, be assumed by Parent and remain subject to the same terms and conditions as were applicable to such Company RSU Award, but shall be converted into an award with respect to a number of shares of Parent Common Stock (rounded down to the nearest whole share) equal to the product of (x) the number of shares of Company Common Stock subject to such Company RSU Award and (y) the Exchange Ratio (a “Converted RSU Award”). Following the Effective Time, each Converted RSU Award shall continue to be governed by the same terms and conditions (including, as applicable, dividend equivalent rights and vesting and forfeiture terms, including vesting under any retirement programs) as were applicable to the Company RSU Award immediately prior to the Effective Time.

(b) Company Actions. At or prior to the Effective Time, the Company and the Company Board (and the compensation committee of the Company Board), as applicable, shall adopt any resolutions and take any actions that are necessary to effectuate the treatment of the Company Option Awards, Company RSU Awards and Company PSU Awards, (collectively, the “Company Equity Awards”) pursuant to Section 2.3(a).

(c) Parent Actions. Parent shall take all actions that are necessary for the treatment of Company Equity Awards pursuant to Section 2.3(a), including the reservation, issuance and listing of Parent Common Stock as necessary to effect the transactions contemplated by this Section 2.3. If registration of any plan interests in any Benefit Plan or the shares of Parent Common Stock issuable in satisfaction of any (i) Company Equity Awards or (ii) Converted Option Award, Converted PSU Awards, or Converted RSU Awards (collectively, “Converted Awards”) following the Effective Time (and giving effect to this Section 2.3) is required under the Securities Act of 1933, as amended (the “Securities Act”), Parent shall file with the Securities and Exchange Commission (the “SEC”) as soon as reasonably practicable on or after the Closing Date a registration statement on Form S-8 with respect to such shares of Parent Common Stock, and shall use its reasonable best efforts to maintain the effectiveness of such registration statement for so long as the relevant Company Stock Plans or other Company Benefit Plans, Company Equity Awards or Converted Awards, as applicable, remain outstanding or in effect and such registration of interests therein or the shares of Parent Common Stock issuable thereunder continues to be required.

5

ARTICLE III

DELIVERY OF MERGER CONSIDERATION; PROCEDURES FOR SURRENDER

3.1 Exchange Agent. Parent shall deposit or cause to be deposited with an exchange agent selected by Parent and reasonably acceptable to the Company (the “Exchange Agent”), for the benefit of the holders of Eligible Shares, (a) at or prior to the Effective Time, an aggregate number of shares of Parent Common Stock to be issued in non-certificated book-entry form sufficient to deliver the number of shares of Parent Common Stock required to be delivered in respect of Eligible Shares pursuant to Section 2.1 and (b) as promptly as reasonably practicable following the Effective Time, an aggregate amount of cash in U.S. Dollars sufficient to deliver the amounts required to be delivered in respect of Eligible Shares pursuant to Section 3.5. In addition, Parent shall deposit or cause to be deposited with the Exchange Agent, as necessary from time to time after the Effective Time, any dividends or other distributions, if any, to which the holders of Eligible Shares may be entitled pursuant to Section 3.3 with both a record and payment date after the Effective Time and prior to the surrender of such Eligible Shares (such shares of Parent Common Stock, cash and the amount of any dividends or other distributions deposited with the Exchange Agent pursuant to this Section 3.1 being the “Exchange Fund”). The Exchange Fund shall not be used for any purpose other than a purpose expressly provided for in this Agreement. The cash portion of the Exchange Fund may be deposited or invested by the Exchange Agent as directed by Parent; provided, that no such deposit or investment (or any loss resulting therefrom) shall affect the amount of cash payable to former holders of Eligible Shares pursuant to the provisions of this Article III. Any interest and other income resulting from such deposit may become part of the Exchange Fund, and any amounts in excess of the amounts payable pursuant to this Agreement shall be promptly returned to Parent.

3.2 Procedures for Surrender.

(a) With respect to Certificates, as promptly as reasonably practicable (but in any event within five Business Days) after the Effective Time, Parent shall cause the Exchange Agent to mail to each holder of record of each such Certificate (i) a letter of transmittal in customary form specifying that delivery shall be effected, and risk of loss and title to a Certificate shall pass, only upon delivery of the Certificate (or affidavit of loss in lieu of a Certificate as provided in Section 3.7) to the Exchange Agent or transfer of Book-Entry Shares not held through DTC (each, a “Non-DTC Book-Entry Share”) to the Exchange Agent (including customary provisions with respect to delivery of an “agent’s message” with respect to Non-DTC Book-Entry Shares and such other provisions as Parent or the Exchange Agent may reasonably specify) (the “Letter of Transmittal”) and (ii) instructions for surrendering a Certificate (or affidavit of loss in lieu of a Certificate as provided in Section 3.7) in exchange for the aggregate Merger Consideration payable in respect thereof to the Exchange Agent. Upon surrender to the Exchange Agent of a Certificate (or affidavit of loss in lieu of a Certificate as provided in Section 3.7) together with a duly completed and validly executed Letter of Transmittal in accordance with the instructions thereto, and such other documents as may reasonably be required pursuant to such instructions, Parent shall cause the Exchange Agent to mail to each holder of record of any such Certificate in exchange therefore, as promptly as reasonably practicable thereafter, (A) a statement reflecting the number of whole shares of Parent Common Stock, if any, that such holder is entitled to receive in non-certificated book-entry form pursuant to Article II in the name of such record holder and (B) a check in the amount (after giving effect to any required Tax withholdings as provided in Section 3.8) of (x) any cash in lieu of fractional shares that such holder is entitled to receive pursuant to Section 3.5 plus (y) any unpaid cash dividends and any other dividends or other distributions that such holder has the right to receive pursuant to this Article III. Any Certificate that has been so surrendered shall be cancelled by the Exchange Agent.

6

(b) With respect to Non-DTC Book-Entry Shares, as promptly as reasonably practicable (but in any event within five Business Days) after the Effective Time, Parent shall cause the Exchange Agent to mail to each holder of record of a Non-DTC Book-Entry Share (i) a Letter of Transmittal and (ii) instructions for transferring the Non-DTC Book-Entry Shares in exchange for the aggregate Merger Consideration payable in respect thereof to the Exchange Agent. Upon surrender to the Exchange Agent of Non-DTC Book-Entry Shares by book-receipt of an “agent’s message” by the Exchange Agent in accordance with the terms of the Letter of Transmittal and accompanying instructions, Parent shall cause the Exchange Agent to mail to each holder of record of any such Non-DTC Book-Entry Shares in exchange therefore, as promptly as reasonably practicable (but in any event within five Business Days) after the Effective Time, (A) a statement reflecting the number of whole shares of Parent Common Stock, if any, that such holder is entitled to receive in non-certificated book-entry form pursuant to Article II in the name of such record holder and (B) a check in the amount (after giving effect to any required Tax withholdings as provided in Section 3.8) of (x) any cash in lieu of fractional shares that such holder is entitled to receive pursuant to Section 3.5, plus (y) any unpaid cash dividends and any other dividends or other distributions that such holder has the right to receive pursuant to this Article III.

(c) With respect to Book-Entry Shares held through DTC, the Company and Parent shall cooperate to establish procedures with the Exchange Agent and DTC to ensure that the Exchange Agent will transmit to DTC or its nominees as soon as practicable after the Effective Time, upon surrender of Eligible Shares held of record by DTC or its nominees in accordance with DTC’s customary surrender procedures, the aggregate Merger Consideration issuable and payable in respect thereof, cash in lieu of fractional shares that such holder is entitled to receive pursuant to Section 3.5, if any, and any unpaid cash dividends and any other dividends or other distributions, in each case, that such holder has the right to receive pursuant to this Article III.

(d) No interest will be paid or accrued on any amount payable for Eligible Shares pursuant to this Article III.

(e) If payment of the Merger Consideration is to be made to a Person other than the Person in whose name the surrendered Certificate or Book-Entry Share is registered, it shall be a condition of payment that such Certificate so surrendered shall be properly endorsed or shall be otherwise in proper form for transfer or such Book-Entry Share shall be properly transferred and that the Person requesting such payment shall have paid any transfer and other Taxes required by reason of the payment of the Merger Consideration to a Person other than the registered holder of such Certificate or Book-Entry Share or shall have established to the satisfaction of Parent that such Tax is not payable.

7

3.3 Distributions with Respect to Unexchanged Shares of Company Common Stock. All shares of Parent Common Stock to be issued pursuant to the First Company Merger shall be deemed issued and outstanding as of the Effective Time and whenever a dividend or other distribution is declared by Parent in respect of Parent Common Stock, the record date for which is at or after the Effective Time, that declaration shall include dividends or other distributions in respect of all shares of Parent Common Stock issuable pursuant to this Agreement. No dividends or other distributions in respect of shares of Parent Common Stock with a record date at or after the Effective Time shall be paid to any holder of any unsurrendered Certificate until the Certificate (or affidavit of loss in lieu of a Certificate as provided in Section 3.7) is surrendered for exchange in accordance with this Article III. Subject to applicable Law, there shall be issued or paid to the holder of record of the whole shares of Parent Common Stock issued in exchange for Eligible Shares in accordance with Article II, without interest, (a) at the time of such surrender, the dividends or other distributions with a record date at or after the Effective Time theretofore payable with respect to such whole shares of Parent Common Stock and not paid, and (b) at the appropriate payment date, the dividends or other distributions payable with respect to such whole shares of Parent Common Stock with a record date at or after the Effective Time and prior to surrender but with a payment date subsequent to surrender.

3.4 No Transfers. From and after the Effective Time, there shall be no transfers on the stock transfer books of the Company of the shares of Company Common Stock that were outstanding immediately prior to the Effective Time. From and after the Effective Time, the holders of Certificates or Book-Entry Shares shall cease to have any rights with respect to such shares of Company Common Stock except as otherwise provided herein or by applicable Law. If, after the Effective Time, Certificates are presented to Parent for any reason, they shall be cancelled and exchanged as provided in this Agreement.

3.5 Fractional Shares. Notwithstanding anything in this Agreement to the contrary, no fractional shares of Parent Common Stock will be issued upon the conversion of shares of Company Common Stock pursuant to Section 2.1. All fractional shares of Parent Common Stock that a holder of Eligible Shares would be otherwise entitled to receive pursuant to Section 2.1 but for this Section 3.5, shall be aggregated and such holder shall be entitled to receive a cash payment, without interest, in lieu of any such fractional share, equal to the product (rounded to the nearest whole cent) of (a) the amount of such fractional share interest in a share of Parent Common Stock to which such holder would, but for this Section 3.5, be entitled under Section 2.1, and (b) an amount equal to the average of the daily volume weighted average price per share of Parent Common Stock on the Nasdaq (as such daily volume weighted average price per share is reported by Bloomberg L.P. or, if not reported therein, in another authoritative source mutually selected by Parent and the Company) calculated for the ten consecutive Trading Days ending on the second full Trading Day immediately prior to (and not including) the Closing Date. No holder of Eligible Shares shall be entitled by virtue of the right to receive cash in lieu of fractional shares of Parent Common Stock described in this Section 3.5 to any dividends, voting rights or any other rights in respect of any fractional share interests in a share of Parent Common Stock to which such holder would, but for this Section 3.5, be entitled under Section 2.1. The Parties acknowledge that the payment of cash in lieu of fractional shares of Parent Common Stock is not a separately bargained-for consideration but merely represents a mechanical rounding-off of the fractions in the exchange.

8

3.6 Termination of Exchange Fund. Any portion of the Exchange Fund (including the proceeds of any deposit of the Exchange Fund and any shares of Parent Common Stock) that remains unclaimed as of the date that is 12 months after the Closing Date shall be delivered to Parent. Any holder of Eligible Shares who has not theretofore complied with this Article III shall thereafter look only to Parent for delivery of the Merger Consideration, cash in lieu of fractional shares of Parent Common Stock, if any, and any unpaid cash dividends and any other dividends or other distributions, in each case, that such holder has the right to receive pursuant to this Article III.

3.7 Lost, Stolen or Destroyed Certificates. In the event that any Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such Certificate to be lost, stolen or destroyed and the posting by such Person of a bond in customary amount and upon such terms as may be required as indemnity against any claim that may be made against it with respect to such Certificate, the Exchange Agent will issue in exchange for such lost, stolen or destroyed Certificate, the Merger Consideration, cash in lieu of fractional shares of Parent Common Stock, if any, and any unpaid cash dividends and any other dividends or other distributions, in each case, payable or issuable pursuant to this Article III, as if such lost, stolen or destroyed Certificate had been surrendered.

3.8 Withholding Rights. Each of Parent, the Surviving Corporation, the Surviving Company, the Company and the Exchange Agent, and any other withholding agent, shall be entitled to deduct and withhold, or cause to be deducted and withheld, from the consideration otherwise payable pursuant to this Agreement to any holder of shares of Eligible Shares and Company Equity Awards, or any other Person pursuant to the terms of this Agreement, such amounts as it is required to deduct and withhold with respect to the making of such payment under the Code or any other applicable state, local or non-U.S. Tax Law (and, for the avoidance of doubt, to the extent deduction and withholding is required in respect of the delivery of any Parent Common Stock pursuant to this Agreement, a portion of the Parent Common Stock otherwise deliverable hereunder may be withheld). To the extent that amounts are so deducted or withheld, and paid over to the appropriate Governmental Entity, such deducted or withheld amounts shall be treated for all purposes of this Agreement as having been paid to the holder of Eligible Shares and Company Equity Awards, as applicable, in respect of which such deduction or withholding was made, and, if a portion of the Parent Common Stock otherwise deliverable to a Person is withheld hereunder, the relevant withholding party shall be treated as having delivered such Parent Common Stock to such Person, sold such Parent Common Stock on behalf of such Person for an amount of cash equal to the fair market value thereof at the time of the required withholding (which fair market value shall be deemed to be the closing price of shares of Parent Common Stock on the Nasdaq on the Closing Date) and having paid such cash proceeds to the appropriate Governmental Entity.

3.9 Adjustments to Prevent Dilution. Notwithstanding anything in this Agreement to the contrary, if, from the date of this Agreement to the earlier of the Effective Time and termination in accordance with Article IX, the issued and outstanding shares of Company Common Stock or securities convertible or exchangeable into or exercisable for shares of Company Common Stock or the issued and outstanding shares of Parent Common Stock or securities convertible or exchangeable into or exercisable for shares of Parent Common Stock, shall have been changed into a different number of shares or securities or a different class by reason of any reclassification, stock split (including a reverse stock split), stock dividend or distribution, recapitalization, merger, issuer tender or exchange offer, or other similar transaction, or a stock dividend or rights offering with a record date within such period shall have been declared, then the Merger Consideration shall be equitably adjusted to provide the holders of shares of Company Common Stock and Parent Common Stock the same economic effect as contemplated by this Agreement prior to such event, and such items, so adjusted shall, from and after the date of such event, be the Merger Consideration.

9

Nothing in this Section 3.9 shall be construed to permit the Parties to take any action except to the extent consistent with, and not otherwise prohibited by, the terms of this Agreement.

3.10 No Liability. None of the Company, the Parent Parties, or the Exchange Agent shall be liable to any Person in respect of any portion of the Merger Consideration delivered to a public official pursuant to any applicable abandoned property, escheat or similar Law. If any Certificates or Book-Entry Shares shall not have been exchanged prior to two years after the Effective Time (or immediately prior to such earlier date on which the related Merger Consideration would otherwise escheat to or become the property of any Governmental Entity), any such shares, cash, dividends or other distributions in respect of such Certificate or Book-Entry Share shall, to the extent permitted by applicable Law, become the property of the Surviving Company, free and clear of all claims or interest of any Person previously entitled thereto.

ARTICLE IV

GOVERNANCE AND ADDITIONAL MATTERS

4.1 Governance and Additional Matters.

(a) Governing Documents.

(i) At the Effective Time, by virtue of the First Company Merger and without any further action on the part of Parent, the Company, Parent Sub or any other Person, (x) the certificate of incorporation of the Company shall be amended so that it reads in its entirety the same as the certificate of incorporation of Parent Sub as in effect immediately prior to the Effective Time (except that all references therein to Parent Sub shall be automatically amended to become references to the Surviving Corporation and the provisions naming the initial director(s) or incorporator(s) of Parent Sub shall be omitted), and as so amended shall be the certificate of incorporation of the Surviving Corporation until thereafter amended in accordance with its terms and as provided by applicable Law and (y) the bylaws of the Company shall be amended so that they read in their entirety the same as the bylaws of Parent Sub as in effect immediately prior to the Effective Time (except that all references therein to Parent Sub shall be automatically amended to become references to the Surviving Corporation), and as so amended shall be the bylaws of the Surviving Corporation until thereafter amended in accordance with their terms and the certificate of incorporation of the Surviving Corporation and as provided by applicable Law.

10

(ii) As of the Second Company Merger Effective Time, by virtue of the Second Company Merger and without any further action on the part of Parent, the Surviving Corporation, LLC Sub or any other Person, the certificate of formation and limited liability company agreement of LLC Sub in effect as of immediately prior to the Second Company Merger Effective Time shall be the certificate of formation and limited liability company agreement, respectively, of the Surviving Company from and after the Second Company Merger Effective Time until thereafter amended as provided therein or by applicable Law.

(b) Board of Directors of the Surviving Corporation. From and after the Effective Time, until their respective successors are duly elected or appointed and qualified in accordance with applicable Law, the directors of Parent Sub immediately prior to the Effective Time shall be the directors of the Surviving Corporation.

(c) Officers of the Surviving Corporation. From and after the Effective Time, until their respective successors are duly elected or appointed and qualified in accordance with applicable Law, the officers of Parent Sub immediately prior to the Effective Time shall be the officers of the Surviving Corporation.

(d) Board of Directors of Parent. Prior to the Effective Time, Parent and the Company shall take all actions necessary (including by securing and causing to be delivered to Parent and the Company (with evidence thereof provided to Parent and the Company, as applicable) the resignations of then-serving directors of the Parent Board who are not Parent Designees and of the Company Board) to cause, in each case, effective as of the Effective Time: (i) the number of directors constituting the full board of directors of Parent (the “New Board”) to be 11 members; (ii) the New Board to be composed of: (A) six directors from among the members of the Parent Board as of the date of this Agreement designated by mutual agreement of the individuals to be appointed as the Chairman and the Vice Chairman of the New Board prior to the mailing of the Proxy Statement/Prospectus, which shall include the Chief Executive Officer of Parent as of immediately prior to the Effective Time (the “Parent Designees”); and (B) five directors from among the members of the Company Board as of the date of this Agreement designated by mutual agreement of the individuals to be appointed as the Chairman and the Vice Chairman of the New Board prior to the mailing of the Proxy Statement/Prospectus, which shall include the President and Chief Executive Officer of the Company as of immediately prior to the Effective Time (the “Company Designees”); (iii) all of the Parent Designees and the Company Designees to be appointed, elected and approved as directors of the New Board by a vote of at least a majority of the Parent Board in office as of immediately prior to the Effective Time; and (iv) (x) the Chairman of the Parent Board as of immediately prior to the Effective Time shall be appointed to serve as Chairman of the New Board and (y) the President and Chief Executive Officer of the Company as of immediately prior to the Effective Time shall be appointed to serve as Vice Chairman of the New Board. If, prior to the Effective Time, any Parent Designee is unwilling or unable to serve (or to continue to serve) as a director on the New Board following the Effective Time as a result of illness, death, resignation or any other reason, then any replacement for such individual shall be selected by the mutual agreement of the individuals to be appointed as the Chairman and the Vice Chairman of the New Board from the individuals who are members of the Parent Board as of the date of this Agreement, and such replacement shall constitute a Parent Designee for all purposes under this Agreement. If, prior to the Effective Time, any Company Designee is unwilling or unable to serve as a director on the New Board following the Effective Time as a result of illness, death, resignation or any other reason, then any replacement for such individual shall be selected by the mutual agreement of the individuals to be appointed as the Chairman and the Vice Chairman of the New Board from the individuals who are members of the Company Board as of the date of this Agreement and such replacement shall constitute a Company Designee for all purposes under this Agreement.

11

At least five of the Parent Designees and at least four of the Company Designees shall meet the independence standards of the Nasdaq as may be applicable with respect to Parent as of the Effective Time.

(e) Officers of Parent. Prior to the Effective Time, Parent shall take all actions necessary to cause, effective as of the Effective Time, William A. Hendricks, Jr. to be appointed to serve as the chief executive officer of Parent, C. Andrew Smith to be appointed to serve as the chief financial officer of Parent, Kenneth Pucheu to be appointed to serve as the chief integration officer of Parent, and Matthew Gillard to be appointed to serve as the head of the completions business unit of Parent. If, prior to the Effective Time, any individual to be appointed pursuant to the preceding sentence is unable or unwilling to serve as a member of executive management of Parent in the capacity set forth in this Agreement, then a substitute individual shall be selected by mutual agreement of Parent and the Company. Prior to the Effective Time, the Company and Parent shall take all actions necessary to cause, effective as of the Effective Time, the executive officers (other than the officers specified in the preceding sentences) of Parent and its Subsidiaries to be those individuals selected by the Chief Executive Officer of Parent on a merit basis, after consultation with the President and Chief Executive Officer of the Company and the Chief Financial Officers of the Company and Parent and without consideration of whether the persons selected serve as officers or employees of the Company or Parent prior to the Effective Time.

(f) Pre-Closing Integration Planning. From and after the date of this Agreement until the Effective Time, each of the Company and Parent shall, and shall cause each of its respective Subsidiaries to, subject to applicable Law, cooperate with the other Party in connection with planning the integration of the businesses of the Company and Parent, the identification of synergies and the adoption of best practices for Parent and its Subsidiaries following the Effective Time. In furtherance of the foregoing, promptly following the date of this Agreement, the respective Chief Executive Officers and Chief Financial Officers of the Company and Parent shall mutually develop an integration plan with the assistance of an integration team, the members of which shall be persons selected by the respective Chief Executive Officers and Chief Financial Officers of the Company and Parent, and such integration team shall meet at least every other week (unless otherwise determined by the respective Chief Executive Officers and Chief Financial Officers of the Company and Parent) prior to the Closing Date (subject to applicable Law and the approval of their respective legal counsels) and as otherwise reasonably requested by the Company or Parent to conduct transition and integration planning.

(g) Post-Closing Integration. From and after the Effective Time, the chief integration officer of Parent and the chief financial officer of Parent shall, until the integration of Parent and the Company is substantially complete, lead an integration team (and each shall report directly to the Chief Executive Officer of Parent), the members of which shall (with the approval of the Chief Executive Officer of Parent) be persons selected by the chief integration officer of Parent and the chief financial officer of Parent.

12

(h) Committees of the New Board. Parent shall take all actions necessary to, effective as of the Effective Time, in each case selected with mutual agreement by Parent and the Company, (i) cause the Nominating and Corporate Governance Committee of the New Board to consist of an equal number of Parent Designees and Company Designees and (ii) cause each other committee of the New Board to consist of at least one Company Designee, such that the membership of all committees (excluding the Executive Committee) of the New Board, taken as a whole, consists of an equal number of Parent Designees and Company Designees.

(i) Name and Trading Symbol. The name and the ticker symbol of Parent as of the Effective Time shall be the name and the ticker symbol of Parent as of the date hereof.

(j) Headquarters. As of the Effective Time, Parent’s principal executive offices and headquarters will be located at Parent’s existing principal executive offices and headquarters in Houston, Texas.

(k) Governance Period. At or prior to the Closing, Parent shall take all actions (including holding a meeting of the Parent Board (or a duly authorized committee thereof)) to approve and adopt the governance policy set forth on Exhibit A (the “Governance Policy”). For a period of two years following the Effective Time (the “Governance Period”), unless required by applicable Law or stock exchange rule (as determined in good faith by the Parent Board after consultation with outside legal counsel), Parent shall not amend, modify or terminate or agree to amend, modify or terminate the Governance Policy or take any action, or agree to take any action that would have the effect of causing Parent to no longer be bound by the Governance Policy, except as approved by at least 75% of the number of directors then serving on the Parent Board. Throughout the duration of the Governance Period, unless required by applicable Law or stock exchange rule (as determined in good faith by the Parent Board after consultation with outside legal counsel), Parent shall comply in all material respects with the Governance Policy. It is expressly agreed that, notwithstanding any other provision of this Agreement that may be to the contrary, (i) each non-management Parent Designee and each Company Designee shall be an express third-party beneficiary of Section 4.1(d), Section 4.1(e), Section 4.1(g), Section 4.1(h) and this Section 4.1(k) and (ii) Section 4.1(d), Section 4.1(e), Section 4.1(g), Section 4.1(h) and this Section 4.1(k) shall survive consummation of the Transaction until the expiration of the Governance Period and shall be enforceable by any of such non-management Parent Designee and each Company Designee against Parent and its successors and assigns; provided, however, that none of such persons shall be entitled to bring any claim for damages or other remedies at law or equity except for claims for injunctive relief to specifically perform the actions contemplated by Section 4.1(d), Section 4.1(e), Section 4.1(g), Section 4.1(h) and this Section 4.1(k); provided, further, that any and all fees, costs and expenses incurred by any Parent Designee or Company Designee in enforcing Section 4.1(d), Section 4.1(e), Section 4.1(g), Section 4.1(h) and this Section 4.1(k) shall be paid for by Parent.

13

ARTICLE V

MUTUAL REPRESENTATIONS AND WARRANTIES OF THE COMPANY AND PARENT