| 200 Bay Street Royal Bank Plaza Toronto, Ontario Canada M5J 2J5 Attention: Senior Vice-President, Associate General Counsel & Secretary |

1 Place Ville Marie Montreal, Quebec Canada H3B 3A9 Attention: Senior Vice-President, Associate General Counsel & Secretary |

ROYAL BANK OF CANADA | ||||||

| Date: May 25, 2023 |

By: |

/s/ Nadine Ahn | ||||

| Name: |

Nadine Ahn | |||||

| Title: |

Chief Financial Officer | |||||

| Exhibit |

Description of Exhibit | |

99.1 |

Second Quarter 2023 Earnings Release | |

99.2 |

Second Quarter 2023 Report to Shareholders (which includes management’s discussion and analysis and unaudited interim condensed consolidated financial statements) | |

99.3 |

Return on Equity and Assets Ratios | |

Rule 13a-14(a)/15d-14(a) | ||

31.1 |

- Certification of the Registrant’s Chief Executive Officer | |

31.2 |

- Certification of the Registrant’s Chief Financial Officer | |

101 |

Interactive Data File (formatted as Inline XBRL) | |

104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |

| Exhibit 99.1 | ||

|

SECOND QUARTER 2023 EARNINGS RELEASE |

|

| ROYAL BANK OF CANADA REPORTS SECOND QUARTER 2023 RESULTS |

All amounts are in Canadian dollars and are based on financial statements presented in compliance with International Accounting Standard 34 Interim Financial Reporting, unless otherwise noted. Our Q2 2023 Report to Shareholders and Supplementary Financial Information are available at: http://www.rbc.com/investorrelations.

| Net Income

$3.6 Billion

Down 14% YoY

|

Diluted EPS1

$2.58

Down 13% YoY

|

Total PCL2

$600 Million

PCL on loans ratio3 up 5 bps4 QoQ

|

ROE5

14.4%

Down from 18.4%

last year |

CET1 Ratio6

13.7%

Well above regulatory requirements

|

| Adjusted Net Income7

$3.8 Billion

Down 13% YoY |

Adjusted Diluted EPS7

$2.65

Down 11% YoY

|

Total ACL8

$4.8 Billion

ACL on loans ratio9 up 3 bps QoQ

|

Adjusted ROE7

14.9%

Down from 18.6%

last year |

LCR10

135%

Up from 130% last quarter

|

TORONTO, May 25, 2023 — Royal Bank of Canada11 (RY on TSX and NYSE) today reported net income of $3.6 billion for the quarter ended April 30, 2023, down $604 million or 14% from the prior year. Diluted EPS was $2.58, down 13% over the same period. Adjusted net income7 and adjusted EPS7 of $3.8 billion and $2.65 were down 13% and 11% from the prior year, respectively.

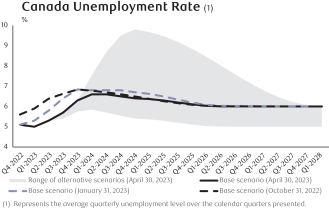

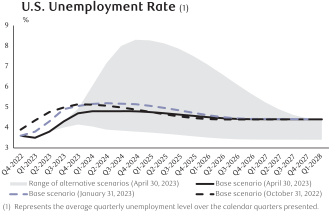

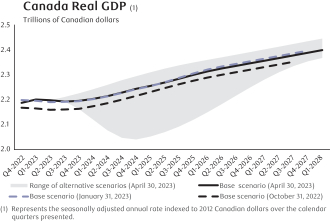

Results this quarter reflected higher provisions for credit losses, with a PCL on loans ratio of 30 bps, mainly attributable to provisions taken on performing loans in the current quarter, largely driven by unfavourable changes in our credit quality and macroeconomic outlook, as compared to releases in the prior year which reflected reduced uncertainty from the COVID-19 pandemic. The current quarter also reflected higher provisions on impaired loans.

Pre-provision, pre-tax earnings7 of $5 billion were up $54 million or 1% from a year ago, mainly reflecting higher net interest income driven by higher interest rates and strong loan growth in Canadian Banking and Wealth Management. Higher Corporate & Investment Banking revenue in Capital Markets also contributed to the increase. These factors were partially offset by higher expenses, mainly due to higher staff-related costs, including from headcount growth, as well as stock-based compensation. Higher professional fees (including technology investments) and higher discretionary costs to support strong client-driven growth also contributed to higher expenses.

Today we declared a quarterly dividend of $1.35 per share reflecting an increase of $0.03 or 2%.

Our balance sheet strength coupled with a robust capital position, with a CET1 ratio of 13.7%, supported solid volume growth and $1.8 billion in common share dividends. We have a strong average LCR of 135%. We also continue to operate with a prudent ACL ratio, which included $173 million of provisions taken on performing loans in the current quarter.

Compared to last quarter, net income was up 14% reflecting the impact of the Canada Recovery Dividend (CRD) and other tax related adjustments in the prior quarter. Adjusted net income7 was down 13% with lower results in Capital Markets, Personal & Commercial Banking, Wealth Management and Insurance.

|

“As our second quarter results demonstrate, RBC will never compromise on doing right by our clients and delivering sustainable, long-term value to them, our communities and shareholders. Our focused growth strategy, prudent risk and capital management, and diversified business mix exemplify our strength and stability amidst a complex macro environment. As we continue to realize the benefits of our strategic investments in technology and our incredible talent, we are confident in our ability to slow expense growth and drive greater efficiencies while supporting our clients’ needs.” – Dave McKay, RBC President and Chief Executive Officer |

|

|

||||||||

| Q2 2023 Compared to Q2 2022 |

Reported: • Net income of $3,649 million • Diluted EPS of $2.58 • ROE of 14.4% • CET1 ratio of 13.7% |

i 14% i 13% i 400 bps h 50 bps |

Adjusted7: • Net income of $3,758 million • Diluted EPS of $2.65 • ROE of 14.9% |

i 13% i 11% i 370 bps |

||||

|

|

||||||||

| Q2 2023 Compared to Q1 2023 |

• Net income of $3,649 million • Diluted EPS of $2.58 • ROE of 14.4% • CET1 ratio of 13.7% |

h 14% h 13% h 180 bps h 100 bps |

• Net income of $3,758 million • Diluted EPS of $2.65 • ROE of 14.9% |

i 13% i 15% i 220 bps |

||||

|

|

||||||||

| YTD 2023 Compared to YTD 2022 |

• Net income of $6,863 million • Diluted EPS of $4.86 • ROE of 13.5% |

i 18% i 16% i 440 bps |

• Net income of $8,101 million • Diluted EPS of $5.76 • ROE of 16.0% |

i 4% i 2% i 210 bps |

||||

|

|

||||||||

| 1 | Earnings per share (EPS). |

| 2 | Provision for credit losses (PCL). |

| 3 | PCL on loans ratio is calculated as PCL on loans as a percentage of average net loans and acceptances. |

| 4 | Basis points (bps). |

| 5 | Return on equity (ROE). For further information, refer to the Key performance and non-GAAP measures section on page 3 and 4 of this Earnings Release. |

| 6 | This ratio is calculated by dividing Common Equity Tier 1 (CET1) by risk-weighted assets, in accordance with OSFI’s Basel III Capital Adequacy Requirements guideline. |

| 7 | This is a non-GAAP measure. For further information, including a reconciliation, refer to the Key performance and non-GAAP measures section on page 3 and 4 of this Earnings Release. |

| 8 | Allowance for credit losses (ACL). |

| 9 | ACL on loans ratio is calculated as ACL on loans as a percentage of total loans and acceptances. |

| 10 | Liquidity coverage ratio (LCR). |

| 11 | When we say “we”, “us”, “our”, or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. |

- 1 -

| Personal & Commercial Banking

|

Net income of $1,915 million decreased $319 million or 14% from a year ago, primarily attributable to higher PCL mainly reflecting provisions taken on performing loans in the current quarter as compared to releases of provisions on performing loans in the prior year. Higher staff and technology related costs, including higher full-time employees and digital initiatives, as well as a higher effective tax rate reflecting the 1.5% increase in the Canadian corporate tax rate also contributed to the decrease. These factors were partially offset by higher net interest income reflecting higher spreads and average volume growth of 8% in deposits and loans in Canadian Banking.

Compared to last quarter, net income decreased $211 million or 10%, primarily attributable to lower net interest income due to three less days in the current quarter and lower spreads, largely reflecting changes in product mix. Lower card service revenue also contributed to the decrease.

| Wealth Management

|

Net income of $742 million decreased $67 million or 8% from a year ago, mainly due to lower average fee-based client assets driven by unfavourable market conditions and gains on the sale of certain non-core affiliates in the same quarter last year. Higher PCL, professional fees and staff costs also contributed to the decrease. These factors were partially offset by an increase in net interest income driven by higher spreads reflecting higher interest rates, which also drove an increase in revenue from sweep deposits.

Compared to last quarter, net income decreased $106 million or 13%, primarily due to lower net interest income as higher funding costs and the impact of changes in product mix more than offset the benefit from increased interest rates. Lower transactional revenue also contributed to the decrease.

| Insurance

|

Net income of $139 million decreased $67 million or 33% from a year ago, primarily due to higher capital funding costs.

Compared to last quarter, net income decreased $9 million or 6%, primarily due to the impact of an unfavourable actuarial adjustment in the current quarter.

| Capital Markets

|

Net income of $939 million increased $82 million or 10% from a year ago, primarily driven by a lower effective tax rate reflecting changes in earnings mix, higher revenue in Corporate & Investment Banking and the impact of foreign exchange translation. These factors were partially offset by higher PCL and lower revenue in Global Markets.

Compared to last quarter, net income decreased $284 million or 23%, largely driven by lower equity trading revenue across all regions, as well as lower fixed income trading revenue and M&A activity across most regions. These factors were partially offset by lower compensation on decreased results.

| Capital, Liquidity and Credit Quality

|

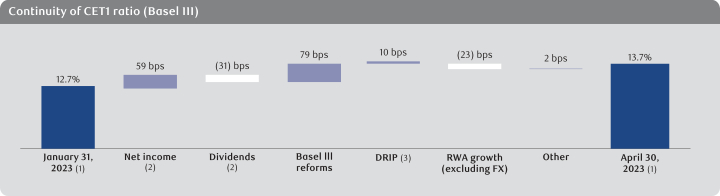

Capital – As at April 30, 2023, our CET1 ratio was 13.7%, up 100 bps from last quarter, mainly reflecting the favourable impact of the Basel III reforms, net internal capital generation and share issuances under the DRIP, partially offset by higher RWA from business growth.

Liquidity – For the quarter ended April 30, 2023, the average LCR was 135%, which translates into a surplus of approximately $102 billion, compared to 130% and a surplus of approximately $88 billion last quarter. LCR levels increased compared to the prior quarter primarily due to an increase in deposits and average wholesale funding balances, partially offset by loan growth.

The Net Stable Funding Ratio (NSFR) as at April 30, 2023 was 113%, which translates into a surplus of approximately $110 billion, compared to 112% and a surplus of approximately $100 billion last quarter. NSFR increased compared to the prior quarter primarily due to an increase in deposits and stable funding, partially offset by loan growth.

Credit Quality

Q2 2023 vs. Q2 2022

Total PCL was $600 million, compared to $(342) million a year ago, primarily reflecting provisions taken in the current quarter as compared to releases in the prior year in Personal & Commercial Banking and Capital Markets. The PCL on loans ratio of 30 bps increased 48 bps. The PCL on impaired loans ratio of 21 bps increased 12 bps.

PCL on performing loans was $173 million, compared to $(504) million a year ago, primarily reflecting provisions taken in the current quarter, largely driven by unfavourable changes in our credit quality and macroeconomic outlook, as compared to releases in the prior year which reflected reduced uncertainty from the COVID-19 pandemic, mainly in our Canadian Banking portfolios and Capital Markets.

PCL on impaired loans increased $267 million, primarily due to higher provisions in our Canadian Banking portfolios and Capital Markets, in a few sectors, including the consumer discretionary and real estate and related sectors.

- 2 -

Q2 2023 vs. Q1 2023

Total PCL increased $68 million or 13% from last quarter, primarily due to higher provisions in Capital Markets and Personal & Commercial Banking, partially offset by lower provisions in Wealth Management. The PCL on loans ratio increased 5 bps. The PCL on impaired loans ratio increased 4 bps.

PCL on performing loans of $173 million was flat as higher provisions in Capital Markets were offset by lower provisions in Wealth Management and Personal & Commercial Banking.

PCL on impaired loans increased $84 million or 24%, primarily due to higher provisions in Capital Markets, in a few sectors, including the consumer discretionary and real estate and related sectors, and in our Canadian Banking portfolios.

| Key Performance and Non-GAAP Measures

|

Performance measures

We measure and evaluate the performance of our consolidated operations and each business segment using a number of financial metrics, such as net income and ROE. Certain financial metrics, including ROE, do not have a standardized meaning under generally accepted accounting principles (GAAP) and may not be comparable to similar measures disclosed by other financial institutions.

Non-GAAP measures

We believe that certain non-GAAP measures (including non-GAAP ratios) are more reflective of our ongoing operating results and provide readers with a better understanding of management’s perspective on our performance. These measures enhance the comparability of our financial performance for the three and six months ended April 30, 2023 with the corresponding periods in the prior year and the three months ended January 31, 2023. Non-GAAP measures do not have a standardized meaning under GAAP and may not be comparable to similar measures disclosed by other financial institutions.

The following discussion describes the non-GAAP measures we use in evaluating our operating results.

Pre-provision, pre-tax earnings

Pre-provision, pre-tax earnings is calculated as income (Q2 2023: $3,649 million; Q2 2022: $4,253 million) before income taxes (Q2 2023: $771 million; Q2 2022: $1,055 million) and PCL (Q2 2023: $600 million; Q2 2022: $(342) million). We use pre-provision, pre-tax earnings to assess our ability to generate sustained earnings growth outside of credit losses, which are impacted by the cyclical nature of the credit cycle.

Adjusted results

We believe that providing adjusted results and certain measures excluding the impact of the specified items discussed below and amortization of acquisition-related intangibles enhance comparability with prior periods and enables readers to better assess trends in the underlying businesses. Specified items impacting our results for the three and six months ended April 30, 2023 and the three months ended January 31, 2023 are:

| • | CRD and other tax related adjustments: reflects the impact of the CRD and the 1.5% increase in the Canadian corporate tax rate applicable to fiscal 2022, net of deferred tax adjustments, which were announced in the Government of Canada’s 2022 budget and enacted in the first quarter of 2023 |

| • | Transaction and integration costs relating to our planned acquisition of HSBC Bank Canada (HSBC Canada) |

- 3 -

The following table provides a reconciliation of adjusted results to our reported results and illustrates the calculation of adjusted measures presented. The adjusted results and measures presented below are non-GAAP measures.

Consolidated results, reported and adjusted

| As at or for the three months ended | As at or for the six months ended | |||||||||||||||||||

| (Millions of Canadian dollars, except per share, number of and percentage amounts) |

|

April 30 2023 |

|

|

January 31 2023 |

|

|

April 30 2022 (1 |

) |

|

April 30 2023 |

|

|

April 30 2022 (1 |

) |

|||||

| Total revenue |

$ | 13,520 | $ | 15,094 | $ | 11,220 | $ | 28,614 | $ | 24,286 | ||||||||||

| PCL |

600 | 532 | (342 | ) | 1,132 | (237 | ) | |||||||||||||

| Non-interest expense |

7,494 | 7,675 | 6,434 | 15,169 | 13,014 | |||||||||||||||

| Income before income taxes |

4,420 | 5,342 | 5,308 | 9,762 | 10,692 | |||||||||||||||

| Income taxes |

771 | 2,128 | 1,055 | 2,899 | 2,344 | |||||||||||||||

| Net income |

$ | 3,649 | $ | 3,214 | $ | 4,253 | $ | 6,863 | $ | 8,348 | ||||||||||

| Net income available to common shareholders |

$ | 3,581 | $ | 3,168 | $ | 4,182 | $ | 6,749 | $ | 8,221 | ||||||||||

| Average number of common shares (thousands) |

1,388,388 | 1,382,754 | 1,409,702 | 1,385,525 | 1,415,855 | |||||||||||||||

| Basic earnings per share (in dollars) |

$ | 2.58 | $ | 2.29 | $ | 2.97 | $ | 4.87 | $ | 5.81 | ||||||||||

| Average number of diluted common shares (thousands) |

1,390,149 | 1,384,536 | 1,412,552 | 1,387,295 | 1,418,676 | |||||||||||||||

| Diluted earnings per share (in dollars) |

$ | 2.58 | $ | 2.29 | $ | 2.96 | $ | 4.86 | $ | 5.80 | ||||||||||

| ROE (2) |

14.4% | 12.6% | 18.4% | 13.5% | 17.9% | |||||||||||||||

| Effective income tax rate |

17.4% | 39.8% | 19.9% | 29.7% | 21.9% | |||||||||||||||

| Total adjusting items impacting net income (before-tax) |

$ | 138 | $ | 97 | $ | 63 | $ | 235 | $ | 126 | ||||||||||

| Specified item: HSBC Canada transaction and integration costs (3) |

56 | 11 | - | 67 | - | |||||||||||||||

| Amortization of acquisition-related intangibles (4) |

82 | 86 | 63 | 168 | 126 | |||||||||||||||

| Total income taxes for adjusting items impacting net income |

$ | 29 | $ | (1,032 | ) | $ | 17 | $ | (1,003 | ) | $ | 33 | ||||||||

| Specified item: CRD and other tax related adjustments (3), (5) |

- | (1,050 | ) | - | (1,050 | ) | - | |||||||||||||

| Specified item: HSBC Canada transaction and integration costs (3) |

13 | 3 | - | 16 | - | |||||||||||||||

| Amortization of acquisition-related intangibles (4) |

16 | 15 | 17 | 31 | 33 | |||||||||||||||

| Adjusted results (6) |

||||||||||||||||||||

| Income before income taxes - adjusted |

4,558 | 5,439 | 5,371 | 9,997 | 10,818 | |||||||||||||||

| Income taxes - adjusted |

800 | 1,096 | 1,072 | 1,896 | 2,377 | |||||||||||||||

| Net income - adjusted |

$ | 3,758 | $ | 4,343 | $ | 4,299 | $ | 8,101 | $ | 8,441 | ||||||||||

| Net income available to common shareholders - adjusted |

$ | 3,690 | $ | 4,297 | $ | 4,228 | $ | 7,987 | $ | 8,314 | ||||||||||

| Average number of common shares (thousands) |

1,388,388 | 1,382,754 | 1,409,702 | 1,385,525 | 1,415,855 | |||||||||||||||

| Basic earnings per share (in dollars) - adjusted |

$ | 2.66 | $ | 3.11 | $ | 3.00 | $ | 5.76 | $ | 5.87 | ||||||||||

| Average number of diluted common shares (thousands) |

1,390,149 | 1,384,536 | 1,412,552 | 1,387,295 | 1,418,676 | |||||||||||||||

| Diluted earnings per share (in dollars) - adjusted |

$ | 2.65 | $ | 3.10 | $ | 2.99 | $ | 5.76 | $ | 5.86 | ||||||||||

| ROE - adjusted |

14.9% | 17.1% | 18.6% | 16.0% | 18.1% | |||||||||||||||

| Adjusted effective income tax rate |

17.6% | 20.2% | 20.0% | 19.0% | 22.0% | |||||||||||||||

| (1) | There were no specified items for the three months ended April 30, 2022 or for the six months ended April 30, 2022. |

| (2) | ROE is based on actual balances of average common equity before rounding. |

| (3) | These amounts have been recognized in Corporate Support. |

| (4) | Represents the impact of amortization of acquisition-related intangibles (excluding amortization of software), and any goodwill impairment. |

| (5) | The impact of the CRD and other tax related adjustments does not include $0.2 billion recognized in other comprehensive income. |

| (6) | Effective the second quarter of 2023, we included HSBC Canada transaction and integration costs and amortization of acquisition-related intangibles as adjusting items for non-GAAP measures and non-GAAP ratios. Therefore, comparative adjusted results have been revised from those previously presented to conform to our basis of presentation for this non-GAAP measure. |

Additional information about ROE and other key performance and non-GAAP measures can be found under the Key performance and non-GAAP measures section of our Q2 2023 Report to Shareholders.

- 4 -

|

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

|

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this Earnings Release, in other filings with Canadian regulators or the SEC, in reports to shareholders, and in other communications, including statements by our President and Chief Executive Officer. Forward-looking statements in this document include, but are not limited to, statements relating to our financial performance objectives, vision and strategic goals. The forward-looking information contained in this Earnings Release is presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial position and results of operations as at and for the periods ended on the dates presented, as well as our financial performance objectives, vision and strategic goals, and may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as “believe”, “expect”, “foresee”, “forecast”, “anticipate”, “intend”, “estimate”, “goal”, “commit”, “target”, “objective”, “plan” and “project” and similar expressions of future or conditional verbs such as “will”, “may”, “might”, “should”, “could” or “would”.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, that our financial performance, environmental & social or other objectives, vision and strategic goals will not be achieved, and that our actual results may differ materially from such predictions, forecasts, projections, expectations or conclusions.

We caution readers not to place undue reliance on these statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. These factors – many of which are beyond our control and the effects of which can be difficult to predict – include: credit, market, liquidity and funding, insurance, operational, regulatory compliance (which could lead to us being subject to various legal and regulatory proceedings, the potential outcome of which could include regulatory restrictions, penalties and fines), strategic, reputation, competitive, model, legal and regulatory environment, systemic risks and other risks discussed in the risk sections of our annual report for the fiscal year ended October 31, 2022 (the 2022 Annual Report) and the Risk management section of our Q2 2023 Report to Shareholders; including business and economic conditions in the geographic regions in which we operate, Canadian housing and household indebtedness, information technology and cyber risks, geopolitical uncertainty, environmental and social risk (including climate change), digital disruption and innovation, privacy, data and third party related risks, regulatory changes, culture and conduct risks, the effects of changes in government fiscal, monetary and other policies, tax risk and transparency, and the emergence of widespread health emergencies or public health crises such as pandemics and epidemics, including the COVID-19 pandemic and its impact on the global economy, financial market conditions and our business operations, and financial results, condition and objectives. Additional factors that could cause actual results to differ materially from the expectations in such forward-looking statements can be found in the risk section of our 2022 Annual Report and the Risk management section of our Q2 2023 Report to Shareholders.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also adversely affect our results. When relying on our forward-looking statements to make decisions with respect to us, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Material economic assumptions underlying the forward-looking statements contained in this Earnings Release are set out in the Economic, market and regulatory review and outlook section and for each business segment under the Strategic priorities and Outlook sections in our 2022 Annual Report, as updated by the Economic, market and regulatory review and outlook section of our Q2 2023 Report to Shareholders. Except as required by law, we do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

Additional information about these and other factors can be found in the risk sections of our 2022 Annual Report and the Risk management section of our Q2 2023 Report to Shareholders. Information contained in or otherwise accessible through the websites mentioned does not form part of this Earnings Release. All references in this Earnings Release to websites are inactive textual references and are for your information only.

ACCESS TO QUARTERLY RESULTS MATERIALS

Interested investors, the media and others may review this quarterly Earnings Release, quarterly results slides, supplementary financial information and our Q2 2023 Report to Shareholders at rbc.com/investorrelations.

Quarterly conference call and webcast presentation

Our quarterly conference call is scheduled for May 25, 2023 at 8:30 a.m. (EDT) and will feature a presentation about our second quarter results by RBC executives. It will be followed by a question and answer period with analysts. Interested parties can access the call live on a listen-only basis at rbc.com/investorrelations/quarterly-financial-statements.html or by telephone (416-340-2217, 866-696-5910, passcode 6820081#). Please call between 8:20 a.m. and 8:25 a.m. (EDT).

Management’s comments on results will be posted on our website shortly following the call. A recording will be available by 5:00 p.m. (EDT) from May 25, 2023 until August 23, 2023 at rbc.com/investorrelations/quarterly-financial-statements.html or by telephone (905-694-9451 or 800-408-3053, passcode 1977175#).

Media Relations Contacts

Gillian McArdle, Senior Director, Corporate Communications, gillian.mcardle@rbccm.com, 416-842-4231

Christine Stewart, Director, Financial Communications, christine.stewart@rbc.com, 647-271-2821

Investor Relations Contacts

Asim Imran, Vice President, Head of Investor Relations, asim.imran@rbc.com, 416-955-7804

Marco Giurleo, Senior Director, Investor Relations, marco.giurleo@rbc.com, 437-239-5374

ABOUT RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 98,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our 17 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-social-impact.

® Registered Trademarks of Royal Bank of Canada.

|

|

- 5 -

|

Royal Bank of Canada second quarter 2023 results |

|

Net income $3.6 Billion Down 14% YoY |

Diluted EPS 1

$2.58 Down 13% YoY |

Total PCL 1

$600 Million PCL on loans ratio 1

up 5 bps 1 QoQ |

ROE 2

14.4% Down from 18.4% last year |

CET1 Ratio 1

13.7% Well above regulatory requirements |

||||||||||||

|

Adjusted Net income 3

$3.8 Billion Down 13% YoY |

Adjusted Diluted EPS 3

$2.65 Down 11% YoY |

Total ACL 1

$4.8 Billion ACL on loans ratio 1

up 3 bps QoQ |

Adjusted ROE 3

14.9% Down from 18.6% last year |

LCR 1

135% Up from 130% last quarter |

|

“As our second quarter results demonstrate, RBC will never compromise on doing right by our clients and delivering sustainable, long-term value to them, our communities and shareholders. Our focused growth strategy, prudent risk and capital management, and diversified business mix exemplify our strength and stability amidst a complex macro environment. As we continue to realize the benefits of our strategic investments in technology and our incredible talent, we are confident in our ability to slow expense growth and drive greater efficiencies while supporting our clients’ needs.” – Dave McKay, RBC President and Chief Executive Officer |

||

| Q2 2023 Compared to Q2 2022 |

Reported: • Net income of $3,649 million • Diluted EPS of $2.58 • ROE of 14.4% • CET1 ratio of 13.7% |

¯ ¯ ¯ h |

Adjusted 3 :• Net income of $3,758 million • Diluted EPS of $2.65 • ROE of 14.9%

|

¯ ¯ ¯ |

||||||

| Q2 2023 Compared to Q1 2023 |

• Net income of $3,649 million • Diluted EPS of $2.58 • ROE of 14.4% • CET1 ratio of 13.7% |

h h h h |

• Net income of $3,758 million • Diluted EPS of $2.65 • ROE of 14.9% |

¯ ¯ ¯ |

||||||

| YTD 2023 Compared to YTD 2022 |

• Net income of $6,863 million • Diluted EPS of $4.86 • ROE of 13.5% |

¯ ¯ ¯ |

• Net income of $8,101 million • Diluted EPS of $5.76 • ROE of 16.0% |

¯ ¯ ¯ |

||||||

| (1) | See Glossary section of this Q2 2023 Report to Shareholders for composition of this measure. |

| (2) | Return on equity (ROE). This measure does not have a standardized meaning under generally accepted accounting principles (GAAP). For further information, refer to the Key performance and non-GAAP measures section of this Q2 2023 |

| (3) | This is a non-GAAP measure. For further information, including a reconciliation, refer to the Key performance and non-GAAP measures section of this Q2 2023 |

| (4) | When we say “we”, “us”, “our”, or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. |

| (5) | Pre-provision, pre-tax (PPPT) earnings is calculated as income (April 30, 2023: $3,649 million; April 30, 2022: $4,253 million) before income taxes (April 30, 2023: $771 million; April 30, 2022: $1,055 million) and PCL (April 30, 2023: $600 million; April 30, 2022: $(342) million). This is a non-GAAP measure. PPPT earnings do not have a standardized meaning under GAAP and may not be comparable to similar measures disclosed by other financial institutions. We use PPPT earnings to assess our ability to generate sustained earnings growth outside of credit losses, which are impacted by the cyclical nature of a credit cycle. We believe that certain non-GAAP measures are more reflective of our ongoing operating results and provide readers with a better understanding of management’s perspective on our performance. |

41 |

||||

46 |

||||

| 46 | Summary of accounting policies and estimates | |||

| 46 | Controls and procedures | |||

46 |

||||

47 |

||||

49 |

||||

50 |

(unaudited) |

|||

56 |

(unaudited) |

|||

78 |

||||

|

Management’s Discussion and Analysis |

|

Caution regarding forward-looking statements |

|

Overview and outlook |

|

About Royal Bank of Canada |

|

Personal & Commercial Banking |

Provides a broad suite of financial products and services in Canada, the Caribbean and the U.S. Our commitment to building and maintaining deep and meaningful relationships with our clients is underscored by the breadth of our product suite, our depth of expertise, and the features of our digital solutions. | |

|

Wealth Management |

Serves affluent, high net worth (HNW) and ultra-high net worth (UHNW) clients from our offices in key financial centres mainly in Canada, the U.S., the United Kingdom (U.K.), Europe, and Asia. We offer a comprehensive suite of investment, trust, banking, credit and other advice-based solutions. We also provide asset management products to institutional and individual clients through our distribution channels and third-party distributors. Asset and payment services are also provided to financial institutions and asset owners worldwide. | |

|

Insurance |

Offers a wide range of advice and solutions for individual and business clients including life, health, wealth, home, auto, travel, annuities and reinsurance. | |

|

Capital Markets |

Provides expertise in advisory & origination, sales & trading, and lending & financing, and transaction banking to corporations, institutional clients, asset managers, private equity firms and governments globally. We serve clients from 63 offices in 18 countries across North America, the U.K. & Europe, and Australia, Asia & other regions. | |

|

Corporate Support |

Corporate Support consists of Technology & Operations, which provides the technological and operational foundation required to effectively deliver products and services to our clients, Functions, which includes our finance, human resources, risk management, internal audit and other functional groups, as well as our Corporate Treasury function. |

|

Selected financial and other highlights |

| As at or for the three months ended | As at or for the six months ended | |||||||||||||||||||||

(Millions of Canadian dollars, except per share, number of and percentage amounts) |

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

|||||||||||||||||

Total revenue |

$ |

13,520 |

$ | 15,094 | $ | 11,220 | $ |

28,614 |

$ | 24,286 | ||||||||||||

Provision for credit losses (PCL) |

600 |

532 | (342 | ) | 1,132 |

(237 | ) | |||||||||||||||

Insurance policyholder benefits, claims and acquisition expense (PBCAE) |

1,006 |

1,545 | (180 | ) | 2,551 |

817 | ||||||||||||||||

Non-interest expense |

7,494 |

7,675 | 6,434 | 15,169 |

13,014 | |||||||||||||||||

Income before income taxes |

4,420 |

5,342 | 5,308 | 9,762 |

10,692 | |||||||||||||||||

Net income |

$ |

3,649 |

$ | 3,214 | $ | 4,253 | $ |

6,863 |

$ | 8,348 | ||||||||||||

Net income adjusted (1)

|

$ |

3,758 |

$ | 4,343 | $ | 4,299 | $ |

8,101 |

$ | 8,441 | ||||||||||||

Segments – net income |

||||||||||||||||||||||

Personal & Commercial Banking |

$ |

1,915 |

$ | 2,126 | $ | 2,234 | $ |

4,041 |

$ | 4,208 | ||||||||||||

Wealth Management (2)

|

742 |

848 | 809 | 1,590 |

1,630 | |||||||||||||||||

Insurance |

139 |

148 | 206 | 287 |

403 | |||||||||||||||||

Capital Markets (2)

|

939 |

1,223 | 857 | 2,162 |

1,979 | |||||||||||||||||

Corporate Support |

(86 |

) |

(1,131 | ) | 147 | (1,217 |

) |

128 | ||||||||||||||

Net income |

$ |

3,649 |

$ | 3,214 | $ | 4,253 | $ |

6,863 |

$ | 8,348 | ||||||||||||

Selected information |

||||||||||||||||||||||

Earnings per share (EPS) – basic |

$ |

2.58 |

$ | 2.29 | $ | 2.97 | $ |

4.87 |

$ | 5.81 | ||||||||||||

– diluted |

2.58 |

2.29 | 2.96 | 4.86 |

5.80 | |||||||||||||||||

Earnings per share (EPS) – basic adjusted (1)

|

2.66 |

3.11 | 3.00 | 5.76 |

5.87 | |||||||||||||||||

– diluted adjusted (1)

|

2.65 |

3.10 | 2.99 | 5.76 |

5.86 | |||||||||||||||||

Return on common equity (ROE) (3)

|

14.4% |

12.6% | 18.4% | 13.5% |

17.9% | |||||||||||||||||

Return on common equity (ROE) adjusted (1)

|

14.9% |

17.1% | 18.6% | 16.0% |

18.1% | |||||||||||||||||

Average common equity (3)

|

$ |

101,850 |

$ | 99,700 | $ | 93,300 | $ |

100,750 |

$ | 92,850 | ||||||||||||

Net interest margin (NIM) – on average earning assets, net (4)

|

1.53% |

1.47% | 1.45% | 1.50% |

1.42% | |||||||||||||||||

PCL on loans as a % of average net loans and acceptances |

0.30% |

0.25% | (0.18)% | 0.27% |

(0.06)% | |||||||||||||||||

PCL on performing loans as a % of average net loans and acceptances |

0.09% |

0.08% | (0.27)% | 0.08% |

(0.15)% | |||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.21% |

0.17% | 0.09% | 0.19% |

0.09% | |||||||||||||||||

Gross impaired loans (GIL) as a % of loans and acceptances |

0.34% |

0.31% | 0.27% | 0.34% |

0.27% | |||||||||||||||||

Liquidity coverage ratio (LCR) (5)

|

135% |

130% | 121% | 135% |

121% | |||||||||||||||||

Net stable funding ratio (NSFR) (5)

|

113% |

112% | 113% | 113% |

113% | |||||||||||||||||

Capital, Leverage and Total loss absorbing capacity (TLAC) ratios (6)

|

||||||||||||||||||||||

Common Equity Tier 1 (CET1) ratio |

13.7% |

12.7% | 13.2% | 13.7% |

13.2% | |||||||||||||||||

Tier 1 capital ratio |

14.9% |

13.9% | 14.4% | 14.9% |

14.4% | |||||||||||||||||

Total capital ratio |

16.8% |

15.7% | 16.0% | 16.8% |

16.0% | |||||||||||||||||

Leverage ratio |

4.2% |

4.4% | 4.7% | 4.2% |

4.7% | |||||||||||||||||

TLAC ratio (6)

|

31.0% |

28.2% | 27.0% | 31.0% |

27.0% | |||||||||||||||||

TLAC leverage ratio (6)

|

8.7% |

9.0% | 8.7% | 8.7% |

8.7% | |||||||||||||||||

Selected balance sheet and other information (7)

|

||||||||||||||||||||||

Total assets |

$ |

1,940,302 |

$ | 1,933,019 | $ | 1,848,572 | $ |

1,940,302 |

$ | 1,848,572 | ||||||||||||

Securities, net of applicable allowance |

319,828 |

320,553 | 298,315 | 319,828 |

298,315 | |||||||||||||||||

Loans, net of allowance for loan losses |

831,187 |

823,794 | 774,464 | 831,187 |

774,464 | |||||||||||||||||

Derivative related assets |

124,149 |

130,120 | 156,204 | 124,149 |

156,204 | |||||||||||||||||

Deposits |

1,210,053 |

1,203,842 | 1,151,597 | 1,210,053 |

1,151,597 | |||||||||||||||||

Common equity |

103,937 |

100,363 | 97,006 | 103,937 |

97,006 | |||||||||||||||||

Total risk-weighted assets (RWA) |

593,533 |

614,250 | 585,839 | 593,533 |

585,839 | |||||||||||||||||

Assets under management (AUM) (4)

|

1,083,600 |

1,051,300 | 958,200 | 1,083,600 |

958,200 | |||||||||||||||||

Assets under administration (AUA) (4), (8)

|

5,911,100 |

5,780,100 | 6,118,900 | 5,911,100 |

6,118,900 | |||||||||||||||||

Common share information |

||||||||||||||||||||||

Shares outstanding (000s) – average basic |

1,388,388 |

1,382,754 | 1,409,702 | 1,385,525 |

1,415,855 | |||||||||||||||||

– average diluted |

1,390,149 |

1,384,536 | 1,412,552 | 1,387,295 |

1,418,676 | |||||||||||||||||

– end of period |

1,389,730 |

1,382,818 | 1,401,800 | 1,389,730 |

1,401,800 | |||||||||||||||||

Dividends declared per common share |

$ |

1.32 |

$ | 1.32 | $ | 1.20 | $ |

2.64 |

$ | 2.40 | ||||||||||||

Dividend yield (4)

|

4.0% |

4.0% | 3.5% | 4.0% |

3.5% | |||||||||||||||||

Dividend payout ratio (4)

|

51% |

58% | 40% | 54% |

41% | |||||||||||||||||

Common share price (RY on TSX) (9)

|

$ |

134.51 |

$ | 136.16 | $ | 129.75 | $ |

134.51 |

$ | 129.75 | ||||||||||||

Market capitalization (TSX) (9)

|

186,933 |

188,284 | 181,884 | 186,933 |

181,884 | |||||||||||||||||

Business information |

||||||||||||||||||||||

Employees (full-time equivalent) (FTE) |

94,398 |

92,662 | 86,007 | 94,398 |

86,007 | |||||||||||||||||

Bank branches |

1,258 |

1,265 | 1,290 | 1,258 |

1,290 | |||||||||||||||||

Automated teller machines (ATMs) |

4,357 |

4,363 | 4,377 | 4,357 |

4,377 | |||||||||||||||||

Period average US$ equivalent of C$1.00 (10)

|

0.737 |

0.745 | 0.789 | 0.741 |

0.788 | |||||||||||||||||

Period-end US$ equivalent of C$1.00 |

0.738 |

0.752 | 0.778 | 0.738 |

0.778 | |||||||||||||||||

| (1) | This is a non-GAAP measure, which is calculated excluding the impact of the Canada Recovery Dividend (CRD) and other tax related adjustments, HSBC Canada transaction and integration costs (net of tax), as well as the after-tax impact of amortization of acquisition-related intangibles. Amounts have been revised from those previously presented to conform to our basis of presentation for this non-GAAP measure. For further details, including a reconciliation, refer to the Key performance and non-GAAP measures section. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (3) | Average amounts are calculated using methods intended to approximate the average of the daily balances for the period. This includes average common equity used in the calculation of ROE. For further details, refer to the Key performance and non-GAAP measures section. |

| (4) | See Glossary for composition of this measure. |

| (5) | The LCR and NSFR are calculated in accordance with the Office of the Superintendent of Financial Institutions’ (OSFI) Liquidity Adequacy Requirements (LAR) guideline. LCR is the average for the three months ended for each respective period. For further details, refer to the Liquidity and funding risk section. |

| (6) | Capital ratios are calculated using OSFI’s Capital Adequacy Requirements (CAR) guideline, the Leverage ratio is calculated using OSFI’s Leverage Requirements (LR) guideline, and both the TLAC and TLAC leverage ratios are calculated using OSFI’s TLAC guideline. The results for the period ended April 30, 2023 reflect our adoption of the revised CAR and LR guidelines as part of OSFI’s implementation of the Basel III reforms. For further details, refer to the Capital management section. |

| (7) | Represents period-end spot balances. |

| (8) | AUA includes $15 billion and $8 billion (January 31, 2023 – $15 billion and $6 billion; April 30, 2022 – $14 billion and $4 billion) of securitized residential mortgages and credit card loans, respectively. |

| (9) | Based on TSX closing market price at period-end. |

| (10) | Average amounts are calculated using month-end spot rates for the period. |

|

Economic, market and regulatory review and outlook – data as at May 24, 2023 |

|

1 |

Annualized rate |

|

Key corporate events |

|

Financial performance |

|

Overview |

| For the three months ended | For the six months ended | |||||||||||||||

(Millions of Canadian dollars, except per share amounts) |

Q2 2023 vs. Q2 2022 |

Q2 2023 vs. Q1 2023 |

Q2 2023 vs. Q2 2022 |

|||||||||||||

Increase (decrease): |

||||||||||||||||

Total revenue |

$ |

320 |

$ |

72 |

$ 535 |

|||||||||||

PCL |

8 |

1 |

15 |

|||||||||||||

Non-interest expense |

206 |

49 |

327 |

|||||||||||||

Income taxes |

2 |

1 |

10 |

|||||||||||||

Net income |

104 |

21 |

183 |

|||||||||||||

Impact on EPS |

||||||||||||||||

Basic |

$ |

0.08 |

$ |

0.02 |

$ 0.13 |

|||||||||||

Diluted |

0.08 |

0.02 |

0.13 |

|||||||||||||

| (Average foreign currency equivalent of C$1.00) (1) | For the three months ended | For the six months ended | ||||||||||||||||||||||

|

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

||||||||||||||||||||

U.S. dollar |

0.737 |

0.745 | 0.789 | 0.741 |

0.788 | |||||||||||||||||||

British pound |

0.599 |

0.612 | 0.605 | 0.605 |

0.595 | |||||||||||||||||||

Euro |

0.681 |

0.698 | 0.721 | 0.690 |

0.708 | |||||||||||||||||||

| (1) | Average amounts are calculated using month-end spot rates for the period. |

| (Millions of Canadian dollars, except percentage amounts) | For the three months ended | For the six months ended | ||||||||||||||||||||||

|

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

||||||||||||||||||||

Interest and dividend income |

$ |

20,318 |

$ | 19,337 | $ | 7,758 | $ |

39,655 |

$ | 15,136 | ||||||||||||||

Interest expense |

14,219 |

13,135 | 2,484 | 27,354 |

4,591 | |||||||||||||||||||

Net interest income |

$ |

6,099 |

$ | 6,202 | $ | 5,274 | $ |

12,301 |

$ | 10,545 | ||||||||||||||

NIM |

1.53% |

1.47% | 1.45% | 1.50% |

1.42% | |||||||||||||||||||

Insurance premiums, investment and fee income |

$ |

1,347 |

$ | 1,891 | $ | 234 | $ |

3,238 |

$ | 1,633 | ||||||||||||||

Trading revenue |

430 |

1,069 | 289 | 1,499 |

603 | |||||||||||||||||||

Investment management and custodial fees |

2,083 |

2,056 | 1,892 | 4,139 |

3,853 | |||||||||||||||||||

Mutual fund revenue |

1,000 |

1,015 | 1,086 | 2,015 |

2,251 | |||||||||||||||||||

Securities brokerage commissions |

377 |

361 | 389 | 738 |

788 | |||||||||||||||||||

Service charges |

511 |

511 | 480 | 1,022 |

965 | |||||||||||||||||||

Underwriting and other advisory fees |

458 |

512 | 507 | 970 |

1,208 | |||||||||||||||||||

Foreign exchange revenue, other than trading |

322 |

433 | 251 | 755 |

522 | |||||||||||||||||||

Card service revenue |

279 |

325 | 288 | 604 |

579 | |||||||||||||||||||

Credit fees |

357 |

379 | 398 | 736 |

874 | |||||||||||||||||||

Net gains on investment securities |

111 |

53 | 23 | 164 |

38 | |||||||||||||||||||

Share of profit in joint ventures and associates |

12 |

29 | 24 | 41 |

53 | |||||||||||||||||||

Other |

134 |

258 | 85 | 392 |

374 | |||||||||||||||||||

Non-interest income |

7,421 |

8,892 | 5,946 | 16,313 |

13,741 | |||||||||||||||||||

Total revenue |

$ |

13,520 |

$ | 15,094 | $ | 11,220 | $ |

28,614 |

$ | 24,286 | ||||||||||||||

Additional trading information |

||||||||||||||||||||||||

Net interest income (1)

|

$ |

469 |

$ | 186 | $ | 531 | $ |

655 |

$ | 1,156 | ||||||||||||||

Non-interest income |

430 |

1,069 | 289 | 1,499 |

603 | |||||||||||||||||||

Total trading revenue |

$ |

899 |

$ | 1,255 | $ | 820 | $ |

2,154 |

$ | 1,759 | ||||||||||||||

| (1) | Reflects net interest income arising from trading-related positions, including assets and liabilities that are classified or designated at fair value through profit or loss (FVTPL). |

| For the three months ended | For the six months ended | |||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) |

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

|||||||||||||||||||

Personal & Commercial Banking |

$ |

124 |

$ | 140 | $ | (419 | ) | $ |

264 |

$ | (482 | ) | ||||||||||||

Wealth Management (2)

|

2 |

24 | (31 | ) | 26 |

(44 | ) | |||||||||||||||||

Capital Markets (2)

|

47 |

9 | (55 | ) | 56 |

(59 | ) | |||||||||||||||||

Corporate Support and other (3)

|

– |

– | 1 | – |

1 | |||||||||||||||||||

PCL on performing loans |

173 |

173 | (504 | ) | 346 |

(584 | ) | |||||||||||||||||

Personal & Commercial Banking |

$ |

302 |

$ | 262 | $ | 147 | $ |

564 |

$ | 338 | ||||||||||||||

Wealth Management (2)

|

26 |

42 | – | 68 |

1 | |||||||||||||||||||

Capital Markets (2)

|

113 |

53 | 27 | 166 |

15 | |||||||||||||||||||

PCL on impaired loans |

441 |

357 | 174 | 798 |

354 | |||||||||||||||||||

PCL – Loans |

614 |

530 | (330 | ) | 1,144 |

(230 | ) | |||||||||||||||||

PCL – Other (4)

|

(14 |

) |

2 | (12 | ) | (12 |

) |

(7 | ) | |||||||||||||||

Total PCL |

$ |

600 |

$ | 532 | $ | (342 | ) | $ |

1,132 |

$ | (237 | ) | ||||||||||||

| PCL on loans is comprised of: | ||||||||||||||||||||||||

Retail |

$ |

97 |

$ | 134 | $ | (188 | ) | $ |

231 |

$ | (246 | ) | ||||||||||||

Wholesale |

76 |

39 | (316 | ) | 115 |

(338 | ) | |||||||||||||||||

PCL on performing loans |

173 |

173 | (504 | ) | 346 |

(584 | ) | |||||||||||||||||

Retail |

249 |

239 | 146 | 488 |

284 | |||||||||||||||||||

Wholesale |

192 |

118 | 28 | 310 |

70 | |||||||||||||||||||

PCL on impaired loans |

441 |

357 | 174 | 798 |

354 | |||||||||||||||||||

PCL – Loans |

$ |

614 |

$ | 530 | $ | (330 | ) | $ |

1,144 |

$ | (230 | ) | ||||||||||||

PCL on loans as a % of average net loans and acceptances |

0.30% |

0.25% | (0.18)% | 0.27% |

(0.06)% | |||||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.21% |

0.17% | 0.09% | 0.19% |

0.09% | |||||||||||||||||||

| (1) | Information on loans represents loans, acceptance and commitments. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (3) | Includes PCL recorded in Corporate Support and Insurance. |

| (4) | PCL – Other includes amounts related to debt securities measured at fair value through other comprehensive income (FVOCI) and amortized cost, accounts receivable, and financial and purchased guarantees. |

| For the three months ended | For the six months ended | |||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) |

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

|||||||||||||||||||

Salaries |

$ |

2,096 |

$ | 2,037 | $ | 1,748 | $ |

4,133 |

$ | 3,496 | ||||||||||||||

Variable compensation |

1,812 |

2,025 | 1,754 | 3,837 |

3,695 | |||||||||||||||||||

Benefits and retention compensation |

560 |

544 | 483 | 1,104 |

1,032 | |||||||||||||||||||

Share-based compensation |

132 |

270 | 17 | 402 |

64 | |||||||||||||||||||

Human resources |

4,600 |

4,876 | 4,002 | 9,476 |

8,287 | |||||||||||||||||||

Equipment |

589 |

569 | 513 | 1,158 |

1,014 | |||||||||||||||||||

Occupancy |

408 |

411 | 386 | 819 |

772 | |||||||||||||||||||

Communications |

317 |

282 | 258 | 599 |

486 | |||||||||||||||||||

Professional fees |

521 |

404 | 347 | 925 |

666 | |||||||||||||||||||

Amortization of other intangibles |

380 |

369 | 336 | 749 |

673 | |||||||||||||||||||

Other |

679 |

764 | 592 | 1,443 |

1,116 | |||||||||||||||||||

Non-interest expense |

$ |

7,494 |

$ | 7,675 | $ | 6,434 | $ |

15,169 |

$ | 13,014 | ||||||||||||||

Efficiency ratio (1)

|

55.4% |

50.8% | 57.3% | 53.0% |

53.6% | |||||||||||||||||||

Adjusted efficiency ratio (2), (3)

|

58.8% |

55.9% | 55.9% | 57.3% |

54.9% | |||||||||||||||||||

| (1) | Efficiency ratio is calculated as Non-interest expense divided by Total revenue. |

| (2) | This is a non-GAAP ratio. For further details, refer to the Key performance and non-GAAP measures section. |

| (3) | Effective Q2 2023, we revised the composition of this non-GAAP ratio. Comparative adjusted amounts have been revised to conform with this presentation. |

| For the three months ended | For the six months ended | |||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) |

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

|||||||||||||||||||

Income taxes |

$ |

771 |

$ | 2,128 | $ | 1,055 | $ |

2,899 |

$ | 2,344 | ||||||||||||||

Income before income taxes |

4,420 |

5,342 | 5,308 | 9,762 |

10,692 | |||||||||||||||||||

Effective income tax rate |

17.4% |

39.8% | 19.9% | 29.7% |

21.9% | |||||||||||||||||||

Adjusted effective income tax rate (1), (2)

|

17.6% |

20.2% | 20.0% | 19.0% |

22.0% | |||||||||||||||||||

| (1) | This is a non-GAAP measure. This measure excludes the impact of the CRD and other tax related adjustments, the impact of HSBC Canada transaction and integration costs as well as amortization of acquisition-related intangibles. For further details, including a reconciliation, refer to the Key performance and non-GAAP measures section. |

| (2) | Effective Q2 2023, we revised the composition of this non-GAAP measure to include the impact of HSBC Canada transaction and integration costs as well as amortization of acquisition-related intangibles. Comparative adjusted amounts have been revised to conform with this presentation. |

|

Business segment results |

|

How we measure and report our business segments |

|

Key performance and non-GAAP measures |

| For the three months ended | ||||||||||||||||||||||||||||||||||||

|

April 30 2023 |

January 31 2023 |

April 30 2022 |

||||||||||||||||||||||||||||||||||

|

(Millions of Canadian dollars, except percentage amounts) |

Personal & Commercial Banking |

Wealth Management |

Insurance |

Capital Markets |

Corporate Support |

Total |

Total | Total | ||||||||||||||||||||||||||||

Net income available to common shareholders |

$ |

1,894 |

$ |

727 |

$ |

138 |

$ |

922 |

$ |

(100 |

) |

$ |

3,581 |

$ | 3,168 | $ | 4,182 | |||||||||||||||||||

Total average common equity (1), (2)

|

29,300 |

24,550 |

2,100 |

27,650 |

18,250 |

101,850 |

99,700 | 93,300 | ||||||||||||||||||||||||||||

ROE (3)

|

26.5% |

12.1% |

26.9% |

13.7% |

n.m. |

14.4% |

12.6% | 18.4% | ||||||||||||||||||||||||||||

| For the six months ended | ||||||||||||||||||||||||||||||||||||

|

April 30 2023 |

April 30 2022 |

|||||||||||||||||||||||||||||||||||

|

(Millions of Canadian dollars, except percentage amounts) |

Personal & Commercial Banking |

Wealth Management |

Insurance |

Capital Markets |

Corporate Support |

Total |

Total | |||||||||||||||||||||||||||||

Net income available to common shareholders |

$ |

4,007 |

$ |

1,563 |

$ |

285 |

$ |

2,132 |

$ |

(1,238 |

) |

$ |

6,749 |

$ | 8,221 | |||||||||||||||||||||

Total average common equity (1), (2)

|

28,700 |

24,600 |

2,050 |

27,950 |

17,450 |

100,750 |

92,850 | |||||||||||||||||||||||||||||

ROE (3)

|

28.2% |

12.8% |

27.7% |

15.4% |

n.m. |

13.5% |

17.9% | |||||||||||||||||||||||||||||

| (1) | Total average common equity represents rounded figures. |

| (2) | The amounts for the segments are referred to as attributed capital. |

| (3) | ROE is based on actual balances of average common equity before rounding. |

| n.m. | not meaningful |

| • | CRD and other tax related adjustments: reflects the impact of the CRD and the 1.5% increase in the Canadian corporate tax rate applicable to fiscal 2022, net of deferred tax adjustments, which were announced in the Government of Canada’s 2022 budget and enacted in the first quarter of 2023 |

| • | Transaction and integration costs relating to our planned acquisition of HSBC Canada |

| As at or for the three months ended | As at or for the six months ended | |||||||||||||||||||||

| (Millions of Canadian dollars, except per share, number of and percentage amounts) |

April 30 2023 |

January 31 2023 |

April 30 2022 (1) |

April 30 2023 |

April 30 2022 (1) |

|||||||||||||||||

Total revenue |

$ |

13,520 |

$ | 15,094 | $ | 11,220 | $ |

28,614 |

$ | 24,286 | ||||||||||||

PCL |

600 |

532 | (342 | ) | 1,132 |

(237 | ) | |||||||||||||||

Non-interest expense |

7,494 |

7,675 | 6,434 | 15,169 |

13,014 | |||||||||||||||||

Income before income taxes |

4,420 |

5,342 | 5,308 | 9,762 |

10,692 | |||||||||||||||||

Income taxes |

771 |

2,128 | 1,055 | 2,899 |

2,344 | |||||||||||||||||

Net income |

$ |

3,649 |

$ | 3,214 | $ | 4,253 | $ |

6,863 |

$ | 8,348 | ||||||||||||

Net income available to common shareholders |

$ |

3,581 |

$ | 3,168 | $ | 4,182 | $ |

6,749 |

$ | 8,221 | ||||||||||||

Average number of common shares (thousands) |

1,388,388 |

1,382,754 | 1,409,702 | 1,385,525 |

1,415,855 | |||||||||||||||||

Basic earnings per share (in dollars) |

$ |

2.58 |

$ | 2.29 | $ | 2.97 | $ |

4.87 |

$ | 5.81 | ||||||||||||

Average number of diluted common shares (thousands) |

1,390,149 |

1,384,536 | 1,412,552 | 1,387,295 |

1,418,676 | |||||||||||||||||

Diluted earnings per share (in dollars) |

$ |

2.58 |

$ | 2.29 | $ | 2.96 | $ |

4.86 |

$ | 5.80 | ||||||||||||

ROE (2)

|

14.4% |

12.6% | 18.4% | 13.5% |

17.9% | |||||||||||||||||

Effective income tax rate |

17.4% |

39.8% | 19.9% | 29.7% |

21.9% | |||||||||||||||||

Total adjusting items impacting net income (before-tax)

|

$ |

138 |

$ | 97 | $ | 63 | $ |

235 |

$ | 126 | ||||||||||||

Specified item: HSBC Canada transaction and integration costs (3)

|

56 |

11 | – | 67 |

– | |||||||||||||||||

Amortization of acquisition-related intangibles (4)

|

82 |

86 | 63 | 168 |

126 | |||||||||||||||||

Total income taxes for adjusting items impacting net income |

$ |

29 |

$ | (1,032 | ) | $ | 17 | $ |

(1,003 |

) |

$ | 33 | ||||||||||

Specified item: CRD and other tax related adjustments (3), (5)

|

– |

(1,050 | ) | – | (1,050 |

) |

– | |||||||||||||||

Specified item: HSBC Canada transaction and integration costs (3)

|

13 |

3 | – | 16 |

– | |||||||||||||||||

Amortization of acquisition-related intangibles (4)

|

16 |

15 | 17 | 31 |

33 | |||||||||||||||||

Adjusted results (6)

|

||||||||||||||||||||||

Income before income taxes – adjusted |

4,558 |

5,439 | 5,371 | 9,997 |

10,818 | |||||||||||||||||

Income taxes – adjusted |

800 |

1,096 | 1,072 | 1,896 |

2,377 | |||||||||||||||||

Net income – adjusted |

$ |

3,758 |

$ | 4,343 | $ | 4,299 | $ |

8,101 |

$ | 8,441 | ||||||||||||

Net income available to common shareholders – adjusted |

$ |

3,690 |

$ | 4,297 | $ | 4,228 | $ |

7,987 |

$ | 8,314 | ||||||||||||

Average number of common shares (thousands) |

1,388,388 |

1,382,754 | 1,409,702 | 1,385,525 |

1,415,855 | |||||||||||||||||

Basic earnings per share (in dollars) – adjusted |

$ |

2.66 |

$ | 3.11 | $ | 3.00 | $ |

5.76 |

$ | 5.87 | ||||||||||||

Average number of diluted common shares (thousands) |

1,390,149 |

1,384,536 | 1,412,552 | 1,387,295 |

1,418,676 | |||||||||||||||||

Diluted earnings per share (in dollars) – adjusted |

$ |

2.65 |

$ | 3.10 | $ | 2.99 | $ |

5.76 |

$ | 5.86 | ||||||||||||

ROE – adjusted |

14.9% |

17.1% | 18.6% | 16.0% |

18.1% | |||||||||||||||||

Adjusted effective income tax rate |

17.6% |

20.2% | 20.0% | 19.0% |

22.0% | |||||||||||||||||

Adjusted efficiency ratio (7)

|

||||||||||||||||||||||

Total revenue |

$ |

13,520 |

$ | 15,094 | $ | 11,220 | $ |

28,614 |

$ | 24,286 | ||||||||||||

Less: PBCAE |

1,006 |

1,545 | (180 | ) | 2,551 |

817 | ||||||||||||||||

Total revenue – adjusted |

$ |

12,514 |

$ | 13,549 | $ | 11,400 | $ |

26,063 |

$ | 23,469 | ||||||||||||

Non-interest expense |

$ |

7,494 |

$ | 7,675 | $ | 6,434 | $ |

15,169 |

$ | 13,014 | ||||||||||||

Less specified item: HSBC Canada transaction and integration costs (before-tax) (3)

|

56 |

11 | – | 67 |

– | |||||||||||||||||

Less: Amortization of acquisition-related intangibles (before-tax)

(4)

|

82 |

86 | 63 | 168 |

126 | |||||||||||||||||

Non-interest expense – adjusted |

$ |

7,356 |

$ | 7,578 | $ | 6,371 | $ |

14,934 |

$ | 12,888 | ||||||||||||

Efficiency ratio |

55.4% |

50.8% | 57.3% | 53.0% |

53.6% | |||||||||||||||||

Efficiency ratio – adjusted |

58.8% |

55.9% | 55.9% | 57.3% |

54.9% | |||||||||||||||||

| (1) | There were no specified items for the three months ended April 30, 2022 or for the six months ended April 30, 2022. |

| (2) | ROE is based on actual balances of average common equity before rounding. |

| (3) | These amounts have been recognized in Corporate Support. |

| (4) | Represents the impact of amortization of acquisition-related intangibles (excluding amortization of software), and any goodwill impairment. |

| (5) | The impact of the CRD and other tax related adjustments does not include $0.2 billion recognized in other comprehensive income. |

| (6) | Effective the second quarter of 2023, we included HSBC Canada transaction and integration costs and amortization of acquisition-related intangibles as adjusting items for non-GAAP measures and non-GAAP ratios. Therefore, comparative adjusted results have been revised from those previously presented to conform to our basis of presentation for this non-GAAP measure. |

| (7) | Effective the second quarter of 2023, we revised the composition of this non-GAAP ratio, which is calculated based on adjusted Non-interest expense excluding HSBC Canada transaction and integration costs and amortization of acquisition-related intangibles divided by total revenue net of PBCAE. Therefore, comparative adjusted results have been revised from those previously presented to conform to our basis of presentation for this non-GAAP ratio. |

|

Personal & Commercial Banking |

| As at or for the three months ended | As at or for the six months ended | |||||||||||||||||||||

|

(Millions of Canadian dollars, except percentage amounts and as otherwise noted) |

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

|||||||||||||||||

Net interest income |

$ |

3,817 |

$ | 4,007 | $ | 3,234 | $ |

7,824 |

$ | 6,463 | ||||||||||||

Non-interest income |

1,481 |

1,534 | 1,505 | 3,015 |

3,079 | |||||||||||||||||

Total revenue |

5,298 |

5,541 | 4,739 | 10,839 |

9,542 | |||||||||||||||||

PCL on performing assets |

122 |

141 | (420 | ) | 263 |

(480 | ) | |||||||||||||||

PCL on impaired assets |

300 |

260 | 144 | 560 |

333 | |||||||||||||||||

PCL |

422 |

401 | (276 | ) | 823 |

(147 | ) | |||||||||||||||

Non-interest expense |

2,257 |

2,229 | 2,015 | 4,486 |

4,037 | |||||||||||||||||

Income before income taxes |

2,619 |

2,911 | 3,000 | 5,530 |

5,652 | |||||||||||||||||

Net income |

$ |

1,915 |

$ | 2,126 | $ | 2,234 | $ |

4,041 |

$ | 4,208 | ||||||||||||

Revenue by business |

||||||||||||||||||||||

Canadian Banking |

$ |

5,040 |

$ | 5,284 | $ | 4,531 | $ |

10,324 |

$ | 9,129 | ||||||||||||

Caribbean & U.S. Banking |

258 |

257 | 208 | 515 |

413 | |||||||||||||||||

Selected balance sheet and other information |

||||||||||||||||||||||

ROE |

26.5% |

29.8% | 34.4% | 28.2% |

32.0% | |||||||||||||||||

NIM |

2.70% |

2.76% | 2.46% | 2.73% |

2.43% | |||||||||||||||||

Efficiency ratio (1)

|

42.6% |

40.2% | 42.5% | 41.4% |

42.3% | |||||||||||||||||

Operating leverage (1)

|

(0.2)% |

5.2% | (0.5)% | 2.5% |

1.3% | |||||||||||||||||

Average total earning assets, net |

$ |

579,800 |

$ | 575,900 | $ | 540,100 | $ |

577,800 |

$ | 535,400 | ||||||||||||

Average loans and acceptances, net |

586,700 |

581,800 | 544,000 | 584,300 |

539,200 | |||||||||||||||||

Average deposits |

588,000 |

579,800 | 543,400 | 583,800 |

541,300 | |||||||||||||||||

AUA (2)

|

351,100 |

349,600 | 355,800 | 351,100 |

355,800 | |||||||||||||||||

Average AUA |

347,900 |

343,500 | 368,400 | 345,600 |

370,600 | |||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.21% |

0.18% | 0.11% | 0.19% |

0.13% | |||||||||||||||||

Other selected information – Canadian Banking |

||||||||||||||||||||||

Net income |

$ |

1,825 |

$ | 2,056 | $ | 2,140 | $ |

3,881 |

$ | 4,054 | ||||||||||||

NIM |

2.65% |

2.73% | 2.45% | 2.69% |

2.43% | |||||||||||||||||

Efficiency ratio |

41.4% |

39.0% | 41.2% | 40.2% |

41.0% | |||||||||||||||||

Operating leverage |

(0.6)% |

5.1% | (1.2)% | 2.3% |

0.8% | |||||||||||||||||

| (1) | See Glossary for composition of this measure. |

| (2) | AUA represents period-end spot balances and includes securitized residential mortgages and credit card loans as at April 30, 2023 of $15 billion and $8 billion, respectively (January 31, 2023 – $15 billion and $6 billion; April 30, 2022 – $14 billion and $4 billion). |

|

Wealth Management |

| As at or for the three months ended | As at or for the six months ended | |||||||||||||||||||||

|

(Millions of Canadian dollars, except number of, percentage amounts and as otherwise noted) |

April 30 2023 |

January 31 2023 |

April 30 2022

(1)

|

April 30 2023 |

April 30 2022

(1)

|

|||||||||||||||||

Net interest income |

$ |

1,096 |

$ | 1,225 | $ | 878 | $ |

2,321 |

$ | 1,731 | ||||||||||||

Non-interest income |

3,328 |

3,360 | 3,123 | 6,688 |

6,288 | |||||||||||||||||

Total revenue |

4,424 |

4,585 | 4,001 | 9,009 |

8,019 | |||||||||||||||||

PCL on performing assets |

2 |

24 | (31 | ) | 26 |

(44 | ) | |||||||||||||||

PCL on impaired assets |

26 |

42 | – | 68 |

1 | |||||||||||||||||

PCL |

28 |

66 | (31 | ) | 94 |

(43 | ) | |||||||||||||||

Non-interest expense |

3,447 |

3,434 | 2,971 | 6,881 |

5,915 | |||||||||||||||||

Income before income taxes |

949 |

1,085 | 1,061 | 2,034 |

2,147 | |||||||||||||||||

Net income |

$ |

742 |

$ | 848 | $ | 809 | $ |

1,590 |

$ | 1,630 | ||||||||||||

Revenue by business |

||||||||||||||||||||||

Canadian Wealth Management |

$ |

1,094 |

$ | 1,111 | $ | 1,071 | $ |

2,205 |

$ | 2,143 | ||||||||||||

U.S. Wealth Management (including City National) |

2,005 |

2,128 | 1,775 | 4,133 |

3,502 | |||||||||||||||||

U.S. Wealth Management (including City National) (US$ millions) |

1,477 |

1,585 | 1,399 | 3,062 |

2,758 | |||||||||||||||||

Global Asset Management |

634 |

683 | 678 | 1,317 |

1,414 | |||||||||||||||||

International Wealth Management |

323 |

288 | 81 | 611 |

159 | |||||||||||||||||

Investor Services (2)

|

368 |

375 | 396 | 743 |

801 | |||||||||||||||||

Selected balance sheet and other information |

||||||||||||||||||||||

ROE |

12.1% |

13.5% | 16.6% | 12.8% |

16.7% | |||||||||||||||||

NIM |

2.44% |

2.63% | 2.25% | 2.53% |

2.15% | |||||||||||||||||

Pre-tax margin (3)

|

21.5% |

23.7% | 26.5% | 22.6% |

26.8% | |||||||||||||||||

Number of advisors (4)

|

6,246 |

6,199 | 5,623 | 6,246 |

5,623 | |||||||||||||||||

Average total earning assets, net |

$ |

184,000 |

$ | 185,200 | $ | 160,000 | $ |

184,800 |

$ | 162,000 | ||||||||||||

Average loans and acceptances, net |

121,600 |

122,300 | 105,600 | 122,000 |

103,900 | |||||||||||||||||

Average deposits |

158,600 |

185,600 | 198,000 | 172,400 |

201,000 | |||||||||||||||||

AUA (5)

|

5,540,900 |

5,412,000 | 5,745,700 | 5,540,900 |

5,745,700 | |||||||||||||||||

U.S. Wealth Management (including City National) (5)

|

737,500 |

713,100 | 681,600 | 737,500 |

681,600 | |||||||||||||||||

U.S. Wealth Management (including City National) (US$ millions) (5)

|

544,300 |

536,100 | 530,400 | 544,300 |

530,400 | |||||||||||||||||

Investor Services (5)

|

4,067,800 |

3,974,100 | 4,443,800 | 4,067,800 |

4,443,800 | |||||||||||||||||

AUM (5)

|

1,074,900 |

1,042,900 | 949,800 | 1,074,900 |

949,800 | |||||||||||||||||

Average AUA |

5,499,000 |

5,423,100 | 5,841,500 | 5,460,500 |

5,927,300 | |||||||||||||||||

Average AUM |

1,060,300 |

1,027,300 | 980,300 | 1,043,600 |

1,001,100 | |||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances |

0.09% |

0.13% | 0.00% | 0.11% |

0.00% | |||||||||||||||||

|

Estimated impact of U.S. dollar, British pound and Euro translation on key income statement items (Millions of Canadian dollars, except percentage amounts) |

For the three months ended |

For the six months ended |

||||||||||||||

Q2 2023 vs. Q2 2022 |

Q2 2023 vs. Q1 2023 |

Q2 2023 vs. Q2 2022 |

||||||||||||||

Increase (decrease): |

||||||||||||||||

Total revenue |

$ |

154 |

$ |

37 |

$ |

249 |

||||||||||

PCL |

2 |

– |

5 |

|||||||||||||

Non-interest expense |

129 |

30 |

204 |

|||||||||||||

Net income |

18 |

6 |

31 |

|||||||||||||

Percentage change in average U.S. dollar equivalent of C$1.00 |

(7)% |

(1)% |

(6)% |

|||||||||||||

Percentage change in average British pound equivalent of C$1.00 |

(1)% |

(2)% |

2% |

|||||||||||||

Percentage change in average Euro equivalent of C$1.00 |

(6)% |

(2)% |

(3)% |

|||||||||||||

| (1) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (2) | Effective Q1 2023, we entered into a definitive agreement to sell the European asset servicing activities of RBC Investor Services ® and its associated Malaysian centre of excellence. For further details, refer to Note 6 of our Condensed Financial Statements. |

| (3) |

Pre-tax margin is defined as Income before income taxes divided by Total revenue. |

| (4) | Represents client-facing advisors across all of our Wealth Management businesses. |

| (5) | Represents period-end spot balances. |

|

Insurance |

| As at or for the three months ended | As at or for the six months ended | |||||||||||||||||||||

|

(Millions of Canadian dollars, except percentage amounts and as otherwise noted) |

April 30 2023 |

January 31 2023 |

April 30 2022 |

April 30 2023 |

April 30 2022 |

|||||||||||||||||

Non-interest income |

||||||||||||||||||||||

Net earned premiums |

$ |

1,195 |

$ | 1,042 | $ | 1,210 | $ |

2,237 |

$ | 2,809 | ||||||||||||

Investment income, gains/(losses) on assets supporting insurance policyholder liabilities (1)

|

103 |

798 | (1,022 | ) | 901 |

(1,274 | ) | |||||||||||||||

Fee income |

49 |

51 | 46 | 100 |

98 | |||||||||||||||||

Total revenue |

1,347 |

1,891 | 234 | 3,238 |

1,633 | |||||||||||||||||

Insurance policyholder benefits and claims (1)

|

923 |

1,465 | (261 | ) | 2,388 |

653 | ||||||||||||||||

Insurance policyholder acquisition expense |

83 |

80 | 81 | 163 |

164 | |||||||||||||||||

Non-interest expense |

159 |

156 | 145 | 315 |

292 | |||||||||||||||||

Income before income taxes |

182 |

190 | 269 | 372 |

524 | |||||||||||||||||

Net income |

$ |

139 |

$ | 148 | $ | 206 | $ |

287 |

$ | 403 | ||||||||||||

Revenue by business |

||||||||||||||||||||||

Canadian Insurance |

$ |

695 |

$ | 1,297 | $ | (507 | ) | $ |

1,992 |

$ | 186 | |||||||||||

International Insurance |

652 |

594 | 741 | 1,246 |

1,447 | |||||||||||||||||

Selected balances and other information |

||||||||||||||||||||||

ROE |

26.9% |

28.6% | 34.6% | 27.7% |

33.5% | |||||||||||||||||

Premiums and deposits (2)

|

$ |

1,419 |

$ | 1,239 | $ | 1,458 | $ |

2,658 |

$ | 3,272 | ||||||||||||

Fair value changes on investments backing policyholder liabilities (1)

|

12 |

663 | (1,133 | ) | 675 |

(1,563 | ) | |||||||||||||||

| (1) | Includes unrealized gains and losses on investments backing policyholder liabilities attributable to fluctuation of assets designated as FVTPL. The investments which support actuarial liabilities are predominantly fixed income assets designated as FVTPL. Consequently, changes in the fair values of these assets are recorded in Insurance premiums, investment and fee income in the Consolidated Statements of Income and are largely offset by changes in the fair value of the actuarial liabilities, the impact of which is reflected in PBCAE. |