UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number: 001-40618

Stevanato Group S.p.A.

(Translation of registrant’s name into English)

Via Molinella 17

35017 Piombino Dese – Padua

Italy

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXPLANATORY NOTE

This report on Form 6-K (the “report”) and the exhibits to this report contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of Stevanato Group S.p.A. (“we”, “our”, “us”, “Stevanato Group” or the “Company”). These forward-looking statements include, or may include, words such as “raising”, “believe”, “potential”, “increased”, “future”, “remain”, “growing”, “expect”, “foreseeable”, “expected”, “to be”, “includes”, “estimated”, “assumes”, “would provide”, “anticipate”, “will”, “plan”, “may”, “forecast”, and other similar terminology. Forward-looking statements contained in this report and the exhibits to this report include, but are not limited to, statements about: our future financial performance, including our revenue, operating expenses and our ability to maintain profitability and operational and commercial capabilities; our expectations regarding the development of our industry and the competitive environment in which we operate; the expansion of our plants and our expectations to increase production capacity; the global supply chain and our committed orders; the global response to COVID-19 and our role in it; our geographical and industrial footprint; and our goals, strategies and investment plans. These statements are neither promise nor guarantee but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Stevanato Group’s actual results, performance or achievements to be materially different from its expectations expressed or implied by the forward-looking statements, including conditions in the U.S. capital markets, negative global economic conditions, inflation, potential negative developments in the COVID-19 pandemic, the impact of the conflict between Russia and Ukraine, supply chain challenges and other negative developments in Stevanato Group’s business or unfavorable legislative or regulatory developments. The following are some of the factors that could cause our actual results to differ materially from those expressed in or underlying our forward-looking statements: (i) our product offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; (ii) we must develop new products and enhance existing products, adapt to significant technological and innovative changes and respond to introductions of new products by competitors to remain competitive; (iii) our backlog might not accurately predict our future revenue, and we might not realize all or any part of the anticipated revenue reflected in our backlog; (iv) if we fail to maintain and enhance our brand and reputation, our business, results of operations and prospects may be materially and adversely affected; (v) we are highly dependent on our management and employees. Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees that we need to support our business and our intended future growth; (vi) our business, financial condition and results of operations depend upon maintaining our relationships with suppliers and service providers; (vii) our business, financial condition and results of operations depend upon the availability and price of high-quality materials and energy supply and our ability to contain production costs; (viii) the current conflict between Russia and Ukraine and the financial and economic sanctions imposed by the European Union, the U.S., the United Kingdom and other countries and organizations against officials, individuals, regions and industries in Russia and Belarus may negatively impact our ability to source gas at commercially reasonable terms or at all and could have a material adverse effect on our operations; (ix) significant interruptions in our operations could harm our business, financial condition and results of operations; (x) as a consequence of the COVID-19 pandemic, sales of syringes and vials to and for vaccination programs globally increased resulting in a revenue growth acceleration. The demand for such products may shrink, if the need for COVID-19 related solutions declines; (xi) our manufacturing facilities are subject to operating hazards which may lead to production curtailments or shutdowns and have an adverse effect on our business, results of operations, financial condition or cash flows; (xii) we may face significant competition in implementing our strategies for revenue growth in light of actions taken by our competitors; (xiii) our global operations are subject to international market risks that may have a material effect on our liquidity, financial condition, results of operations and cash flows; (xiv) we are required to comply with a wide variety of laws and regulations and are subject to regulation by various federal, state and foreign agencies; (xv) if relations between China and the United States deteriorate, our business in the United States and China could be materially and adversely affected; and (xvi) Cyber security risks and the failure to maintain the confidentiality, integrity and availability of our computer hardware, software and internet applications and related tools and functions, could result in damage to our reputation, data integrity and/or subject us to costs, fines or lawsuits under data privacy or other laws or contractual requirements. This list is not exhaustive.

These forward-looking statements speak only as at their dates. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible to predict all of these factors. Further, the Company cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statements. We caution you therefore against relying on these forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements.

For a description of certain additional factors that could cause the Company’s future results to differ from those expressed in any such forward-looking statements, refer to the risk factors discussed in our most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission and our other filings with the U.S. Securities and Exchange Commission.

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Stevanato Group S.p.A. | ||||

| Date: May 24, 2023 | By: | /s/ Franco Moro |

||

| Name: | Franco Moro | |||

| Title: | Chief Executive Officer | |||

|

|

Exhibit 99.1 |

Published on April 6, 2023

Convening Notice

to the Ordinary and Extraordinary General Meeting of Shareholders

On May 24, 2023

Shareholders of Stevanato Group S.p.A. (“Stevanato” or the “Company”) are invited to attend the ordinary and extraordinary shareholders’ meeting (the “Shareholders’ Meeting”) which will be held - in compliance with Article 106, fourth paragraph, second sentence, of the Italian Law Decree no. 18 of March 17, 2020, providing for “Measures to strengthen the National Health Service and provide economic support for families, workers and businesses connected with the COVID-19 epidemiological emergency”, as subsequently amended and extended, and Articles 10 and 11 of the Company’s bylaws (the “Bylaws”) - solely via teleconference, on May 24, 2023 at 4 p.m. CEST (10 a.m.- EDT) , on single call, to discuss and resolve on the following

Agenda

Ordinary session

| 1. | Approval of the financial statements for the financial year ended on December 31, 2022; presentation of the reports of the Board of Directors and of the External Auditor EY S.p.A.; presentation of the consolidated financial statements for the financial year ended on December 31, 2022; presentation of the consolidated non-financial statements (Sustainability Report) for the financial year ended on December 31, 2022; presentation of the reports of the Audit Committee, of the Compensation Committee, of the Nominating and Corporate Governance Committee; related resolutions. |

| 2. | Allocation of annual net profits and distribution of dividends to the shareholders; related resolutions. |

| 3. | Compensation of the members of the Board of Directors; related resolutions. |

| 4. | Appointment of the External Auditor for the auditing of the Company’s and the consolidated financial statements for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; related resolutions. |

| 5. | Authorization for the purchase and the disposal of ordinary and class A treasury shares; related resolutions. |

Extraordinary session

| 1. | Amendment to Article 11.3 of the Bylaws; related resolutions. |

* * *

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

|

|

I. Right to attend and vote at the Shareholders’ Meeting

Pursuant to Article 2355 of the Italian Civil Code and Articles 7.1, 7.6 and 11 of the Bylaws, the right to attend and/or vote at the Shareholders’ Meeting is regulated as follows:

| (i) | persons, other than Stevanato itself, being registered on the Company’s Shareholders’ Book (Libro Soci) as holders of Class A shares on the Shareholders’ Meeting date (such persons, the “Class A Shareholders”) are entitled to attend and vote at the Shareholders’ Meeting according to the modalities set out in paragraph II.1 below; |

| (ii) | persons, other than Stevanato itself, being registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) as holders of ordinary shares at the closing of the trading day (according to the New York time zone) falling on the twenty-fifth day preceding the Shareholders’ Meeting date (or, in case such day is not a trading day, on the preceding trading day), i.e. on April 28, 2023, at 4 p.m. EDT (10 p.m. CEST) (such date, the “Record Date”; such persons, the “Registered Shareholders”) are entitled to attend and vote at the Shareholders’ Meeting according to the modalities set out in paragraph II.1 below; |

| (iii) | persons, other than Stevanato itself, holding, directly or through brokers or other intermediaries, the beneficial ownership of the ordinary shares deposited at the Depositary Trust Company and registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) in the name of Cede & Co. (the “Holder of Record”) at the Record Date (such persons, the “Beneficial Shareholders”) are entitled to vote at the Shareholders’ Meeting collectively, through the Holder of Record, by giving voting instructions to Computershare S.p.A. (“Computershare IT”), in its capacity as substitute proxy specifically appointed by the Holder of Record, in relation to all or part of the items on the agenda, according to the modalities set out in paragraph II.2 below. |

For the sake of clarity, persons being registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) as holders of ordinary shares, or persons acquiring the beneficial ownership of the ordinary shares, after the Record Date shall not be entitled to attend and vote at the Shareholders’ Meeting.

Persons being registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) after the Record Date but prior to the opening of the Shareholders’ Meeting shall be regarded, respectively, as absent from the Shareholders’ Meeting and not voting in favor of the resolutions approved by the shareholders at the Shareholders’ Meeting for the purpose of challenging such resolutions pursuant to Article 2377 of the Italian Civil Code. However, Beneficial Shareholders being such on the Record Date and obtaining registration on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) prior to the Shareholders’ Meeting date shall be entitled to challenge the resolutions approved by the Shareholders’ Meeting pursuant to Article 2377 of the Italian Civil Code subject to providing proof not to have voted in favor of the relevant resolutions as Beneficial Shareholders.

II. Modalities of attendance and voting at the Shareholders’ Meeting

II.1 Class A Shareholders and Registered Shareholders

Class A Shareholders and Registered Shareholders have the right to attend and vote at the Shareholders’ Meeting either in person, via teleconference, or by a representative appointed, according to the provisions of Article 2372 of the Italian Civil Code, by means of a proxy granted in writing or through a document electronically signed pursuant to Italian Legislative Decree no. 82 of March 7, 2005 (such representative, the “Proxy”).

Computershare IT is available to serve as Proxy for Class A Shareholders and Registered Shareholders and vote at the Shareholders’ Meeting on their behalf, in relation to all or part of the items on the agenda, according to the instructions received, at no costs or expenses for Class A Shareholders and Registered Shareholders.

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

|

|

Without prejudice to the shareholders’ rights set forth by the applicable law, Class A Shareholders and Registered Shareholders are requested to inform the Company in advance of their intention to attend personally (or, if legal entities, by the legal representative or other attorney) the Shareholders’ Meeting via teleconference, to appoint a Proxy, or to give voting instructions to Computershare IT.

To this end, the holders of Class A shares as of the Record Date and Registered Shareholders will receive, respectively, from the Company or the Transfer Agent and Registrar Computershare Inc. (“Computershare US”), at the address resulting from the Shareholders’ Book (Libro Soci), (i) this notice, (ii) a form to be completed by the Class A Shareholders and Registered Shareholders intending to attend personally (or, if legal entities, by the legal representative or other attorney) the Shareholders’ Meeting to provide the participants’ relevant personal information (the “Participant Information Form”), and (iii) a form to be completed by the Class A Shareholders and Registered Shareholders in order to appoint Computershare IT or another Proxy to attend and vote at the Shareholders’ Meeting on their behalf and provide it with voting instructions on the items on the agenda (the “Proxy Card”). Instructions for completing and returning, as applicable, the Participant Information Form or the Proxy Card to the Company or Computershare US and joining the Shareholders’ Meeting via teleconference shall be included therein.

Class A Shareholders shall return, as applicable, the Participant Information Form or the Proxy Card, together with the required attachments, to the Company (or, in case Computershare IT is appointed as Proxy, to Computershare IT) preferably by May 19, 2023, at 4.30 p.m. EDT (10.30 p.m. CEST) .

Registered Shareholders shall return, as applicable, the Participant Information Form or the Proxy Card, together with the required attachments, to Computershare US by May 19, 2023, at 4.30 p.m. EDT (10.30 p.m. CEST).

Stevanato will provide Class A Shareholders and Registered Shareholders or Proxies attending personally the Shareholders’ Meeting with the teleconference access link no later than May 23, 2023 , at 4 p.m. EDT (10 p.m. CEST) [TBC], by notice sent to the e-mail address included to this purpose in the Participant Information Form or in the Proxy Card submitted by each Class A Shareholder and Registered Shareholder.

In order to be admitted to attend the Shareholders’ Meeting, if so requested by the Chairman of the Shareholders’ Meeting, Class A Shareholders, Registered Shareholders and Proxies shall identify themselves by presenting an identity document. Proxies shall also present, if so requested by the Chairman of the Shareholders’ Meeting, a copy of the Proxy Card or other proxy issued by the relevant Class A Shareholders and Registered Shareholders.

II.2 Beneficial Shareholders

Beneficial Shareholders have the right to give voting instructions to Computershare IT, in its capacity as substitute proxy specifically appointed by the Holder of Record, in relation to all or part of the items on the agenda of the Shareholders’ Meeting, at no costs or expenses for them.

To this end, Beneficial Shareholders shall receive by the respective brokers/intermediaries or by the voting service providers appointed by the latter the form to be used to provide Computershare IT with voting instructions in relation to the matters on the agenda at the Shareholders’ Meeting (the “Voting Instruction Form”), as well as instructions regarding the completion and transmission of the Voting Instruction Form.

III. Shareholders’ Meeting materials

In accordance with the applicable law provisions, the following documents will be made available, by the Record Date, to Class A Shareholders and Registered Shareholders, at the Company’s registered office, at Via Molinella, 17, 35017 Piombino Dese – Padua (Italy), and, also to Beneficial Shareholders and the public, on the Company’s website, section Corporate Governance – Shareholders’ Meeting 2023

https://ir.stevanatogroup.com/corporate-governance/2023-shareholders-meetings

| ● | this Convening Notice; |

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

|

|

| ● | Explanatory Report on the matters on the agenda of the Shareholders’ Meeting, including full texts of the resolutions to be proposed to the Shareholders’ Meeting; |

| ● | Stevanato’s Draft Financial Statements for the financial year ended on December 31, 2022; |

| ● | Directors’ Report for the financial year ended on December 31, 2022; |

| ● | Report of the External Auditor EY S.p.A. on the Stevanato’s Draft Financial Statements for the financial year ended on December 31, 2022; |

| ● | Stevanato’s Consolidated Financial Statements for the financial year ended on December 31, 2022; |

| ● | Sustainability Report for the financial year ended on December 31, 2022; |

| ● | Reports of the Audit Committee, of the Compensation Committee, and of the Nominating and Corporate Governance Committee for the financial year ended on December 31, 2022; |

| ● | Substantiated Proposal of the Audit Committee in relation to the appointment of the External Auditor for the auditing of the Company’s and the consolidated financial statements for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; |

| ● | Draft Restated Bylaws. |

The aforementioned documents may be examined at the Company’s registered office only if so permitted by the applicable laws.

* * *

The Executive Chairman of the Board of Directors

Franco Stevanato

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

|

|

Exhibit 99.2 |

STEVANATO GROUP S.P.A.

ORDINARY AND EXTRAORDINARY

SHAREHOLDERS’ MEETING

ON MAY 24, 2023

EXPLANATORY REPORT ON THE ITEMS

ON THE AGENDA

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

|

|

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

2 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

This report (the “Explanatory Report”) was drafted by the board of directors of Stevanato Group S.p.A. (respectively, the “Board of Directors” and “Stevanato” or the “Company”) in relation to the ordinary and extraordinary meeting of the Company’s shareholders convened, on single call, on May 24, 2023, at 4:00 p.m. CEST (10:00 a.m. EDT), by notice published on April 6, 2023 (the “Convening Notice”), to discuss and resolve on the following agenda:

Ordinary session

| 1. | Approval of the financial statements for the financial year ended on December 31, 2022; presentation of the reports of the Board of Directors and of the External Auditor EY S.p.A.; presentation of the consolidated financial statements for the financial year ended on December 31, 2022; presentation of the consolidated non-financial statements (Sustainability Report) for the financial year ended on December 31, 2022; presentation of the reports of the Audit Committee, of the Compensation Committee, of the Nominating and Corporate Governance Committee; related resolutions. |

| 2. | Allocation of annual net profits and distribution of dividends to the shareholders; related resolutions. |

| 3. | Compensation of the members of the Board of Directors; related resolutions. |

| 4. | Appointment of the External Auditor for the auditing of the Company’s and the consolidated financial statements for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; related resolutions. |

| 5. | Authorization for the purchase and the disposal of ordinary and class A treasury shares; related resolutions. |

Extraordinary session

| 1. | Amendments to Article 11.3 of the Bylaws; related resolutions. |

(the “Agenda” and the “Shareholders’ Meeting”).

This Explanatory Report was drafted to the benefit of (i) the holders of Class A shares and of ordinary shares registered on the Company’s US Shareholders’ Register and/or on the Company’s Shareholders’ Book (Libro Soci) in the shareholders’ name, being entitled to attend and vote at the Shareholders’ Meeting as specified in the Convening Notice (respectively, the “Class A Shareholders” and the “Registered Shareholders”), and of (ii) the holders of the beneficial ownership of the ordinary shares deposited with the Depositary Trust Company and registered on the Company’s US Shareholders’ Register and on the Company’s Shareholders’ Book (Libro Soci) in the name of Cede&Co., being entitled to give voting instructions to Computershare S.p.A., in its capacity as substitute proxy specifically appointed by Cede&Co., in relation to all or part of the items on the Agenda, as specified by the Convening Notice (the “Beneficial Shareholders”), and includes certain information concerning the items on the Agenda and the proposals submitted to the Shareholders’ Meeting.

In particular, this Explanatory Report aims at providing Class A Shareholders, Registered Shareholders and Beneficial Shareholders with the information necessary - together with the reports of the Board of Directors, of the Committees and of the External Auditor EY S.p.A. referred to below – to fully and effectively exercise the respective voting rights.

Please note that Stevanato Group’s ordinary shares are exempt from the proxy rules of the United States Securities Exchange Act of 1934, as amended, and that this Explanatory Report does not constitute a proxy statement or a solicitation of proxies.

* * *

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

3 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

Ordinary session

| 1. | Approval of the financial statements for the financial year ended on December 31, 2022; presentation of the reports of the Board of Directors and of the External Auditor EY S.p.A.; presentation of the consolidated financial statements for the financial year ended on December 31, 2022; presentation of the consolidated non-financial statements (Sustainability Report) for the financial year ended on December 31, 2022; presentation of the reports of the Audit Committee, of the Compensation Committee, of the Nominating and Corporate Governance Committee; related resolutions. |

Pursuant to Italian law and to the Company’s by-laws (the “By-laws”), Stevanato Group’s shareholders shall annually resolve, at the ordinary shareholders’ meeting, on the approval of the Company’s individual financial statements for the previous financial year, within a six months term from its ending.

Therefore, we submit to Stevanato Group’s shareholders, for their examination and approval at the Shareholders’ Meeting, the Company’s Draft Financial Statements for the financial year ended on December 31, 2022, approved by the Board of Directors on April 5, 2023, which show net profits amounting to Euro 35,521,807.00.

Moreover, in compliance with the applicable Italian law provisions, we present to Stevanato Group’s shareholders, for their examination and acknowledgment, the following documents containing more information on the Company’s Draft Financial Statements, as well as on the Company’s current and prospective situation and on the activities carried out by Stevanato Group, individually and through its controlled companies, in the financial year ended on December 31, 2022:

| – | Stevanato Group’s Consolidated Financial Statements for the financial year ended on December 31, 2022, approved by the Board of Directors on April 5, 2023; |

| – | Sustainability Report for the financial year ended on December 31, 2022, approved by the Board of Directors on April 5, 2023; |

| – | Directors’ Report for the financial year ended on December 31, 2022, approved by the Board of Directors on April 5, 2023; and |

| – | Report of the External Auditor, to be issued by EY S.p.A. by April 28, 2023 (i.e., the Record Date). |

As provided for by the Charters of the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee, we also present to Stevanato Group’s shareholders, for their examination and acknowledgment, the following documents containing more information on the activities carried out by the mentioned Committees, as well as on the current directors’ and managers’ compensation structure and policy and on the current corporate governance system of the Company:

| – | Report of the Audit Committee for the financial year ended on December 31, 2022, approved by the Audit Committee on April 4, 2023; |

| – | Report of the Compensation Committee for the financial year ended on December 31, 2022, approved by the Compensation Committee on April 3, 2023; |

| – | Report of the Nominating and Corporate Governance Committee for the financial year ended on December 31, 2022, approved by the Nominating and Corporate Governance Committee on April 3, 2023. |

Stevanato Group’s Draft Financial Statements for the financial year ended on December 31, 2022, together with the other above mentioned documents, will be made available by the Record Date, to Class A Shareholders and Registered Shareholders, at the Company’s registered office, at Via Molinella, 17, 35017 Piombino Dese – Padua (Italy), and, also to Beneficial Shareholders and the public, on the Company’s website, section Corporate Governance – Shareholders’ Meeting 2023, at the address https://ir.stevanatogroup.com/corporate-governance/2023-shareholders-meetings

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

4 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

Based on the above, Stevanato Group’s shareholders are asked to approve the following resolution:

“The Shareholders’ Meeting

| – | having examined Stevanato Group’s Financial Statements for the financial year ended on December 31, 2022, in the draft presented by the Board of Directors, which show net profits amounting to Euro 35,521,807.00; |

| – | having examined the Directors’ Report; |

| – | having examined the Report of the External Auditor EY S.p.A.; |

| – | having examined Stevanato Group’s Consolidated Financial Statements for the financial year ended on December 31, 2022; |

| – | having examined Stevanato Group’s Sustainability Report for the financial year ended on December 31, 2022; |

| – | having examined the Reports presented by the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee, |

resolves

| 1. | to approve Stevanato Group’s Financial Statements for the financial year ended on December 31, 2022, which report net profits amounting to Euro 35,521,807.00; |

| 2. | to acknowledge the Directors’ Report presented by the Board of Directors; |

| 3. | to acknowledge Stevanato Group’s Consolidated Financial Statements for the financial year ended on December 31, 2022 presented by the Board of Directors; |

| 4. | to acknowledge Stevanato Group’s Sustainability Report for the financial year ended on December 31, 2022 presented by the Board of Directors; |

| 5. | to acknowledge the Reports presented by the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee”. |

| 2. | Allocation of annual net profits and distribution of dividends to the shareholders; related resolutions. |

Pursuant to Italian law, Stevanato Group’s shareholders shall resolve, at the Shareholders’ Meeting, on the allocation of the Company’s net profits resulting from the Financial Statements for the financial year ended on December 31, 2022.

The distribution of profits to shareholders is subject to the applicable limitations of law. In particular, the distribution of profits resulting from gains unrealized at the end of the accounting period, such as unrealized gains deriving from foreign currency exchange rates, is not allowed.

In addition, the Shareholders’ Meeting may resolve to distribute to shareholders all or part of the reserves the distribution of which is not prohibited by Italian law.

As indicated in paragraph 1 above, based on the Financial Statements for the financial year ended on December 31, 2022, the Company’s operations resulted in net profits of Euro 35,521,807.00.

In light of the foregoing, we propose to the shareholders to:

| – | earmark an amount of Euro 788,853.00 of the Company’s net profits, as resulting from the Financial Statements for the financial year ended on December 31, 2022, to the special reserve named “Unrealized Exchange Rate Gains”; |

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

5 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

| – | earmark for distribution to the shareholders an amount of the Company’s net profits, as resulting from the Financial Statements for the financial year ended on December 31, 2022, corresponding to a gross dividend in cash of Euro 0.054 for each outstanding Class A and ordinary share of the Company, net of the treasury shares that will be held by the Company as of the Dividend Record Date (as defined hereinafter); |

| – | earmark the residual amount of the Company’s net profits, as resulting from the Financial Statements for the financial year ended on December 31, 2022, to the reserve named “extraordinary reserve”. |

Therefore, assuming that the Company continues to hold the current number of 30,840,555 treasury Class A shares at the Dividend Record Date, the amount of net profits to be used for distribution of dividends to shareholders would be equal to Euro 14,293,772.00.

In such connection, based on the resolution of the Board of Directors of April 5, 2023, and pursuant to Article 28.4 of the By-laws, we propose to set on June 6, 2023 the date for identifying the holders of the Class A shares of the Company and the registered holders and the beneficial holders of the ordinary shares of the Company entitled to receive payment of the dividends which the Shareholders’ Meeting should resolve to distribute (the “Dividend Record Date”).

Therefore, assuming that the Shareholders’ Meeting approves the proposals set out above, the ex-dividend date will fall on June 5, 2023 (Ex-Date), whereas it is expected that the dividends will be paid to the holders of Class A and ordinary shares as from July 17, 2023 (Payment Date).

Dividends will be paid to registered holders and beneficial holders of ordinary shares of the Company through the Transfer Agent and Registrar Computershare, Inc., in US dollars, based on the ECB daily foreign exchange reference rate as of the date of the Shareholders’ Meeting, i.e. May 24, 2023.

Based on the above, Stevanato Group’s shareholders are asked to approve the following resolution:

“The Shareholders’ Meeting

resolves

| 1. | to earmark an amount of Euro 788,853.00 of the Company’s net profits, as resulting from the Financial Statements for the financial year ended on December 31, 2022, to the special reserve named “Unrealized Exchange Rate Gains”; |

| 2. | to earmark for distribution to the shareholders an amount of the Company’s net profits, as resulting from the Financial Statements for the financial year ended on December 31, 2022, corresponding to a gross dividend in cash of Euro 0.054 for each outstanding Class A and ordinary share of the Company, net of the treasury shares that will be held by the Company as of the Dividend Record Date; |

| 3. | to earmark the residual amount of the Company’s net profits, as resulting from the Financial Statements for the financial year ended on December 31, 2022, to the reserve named “extraordinary reserve”; |

| 4. | to set the date for identifying the holders of Class A shares of the Company and the registered holders and the beneficial holders of ordinary shares of the Company entitled to receive payment of the aforementioned dividends on June 6, 2023 (Dividend Record Date), with the ex-dividend date (Ex-Date) falling on June 5, 2023; |

| 5. | to set the date for payment of the dividends, before withholding tax, if any, in execution of resolutions no. 2 and 4 above, as from July 17, 2023 (Payment Date); |

| 6. | to provide that dividends will be paid to registered holders and beneficial holders of ordinary shares of the Company as of the Dividend Record Date in US dollars, based on the ECB daily foreign exchange reference rate as of the date of the Shareholders’ Meeting, i.e. May 24, 2023; |

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

6 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

| 7. | to grant mandate to the Board of Directors and, on behalf of the latter, severally, to the Executive Chairman and the Chief Executive Officer to carry out all the activities related, consequent to or connected with the implementation of the resolution no. 5 and 6 above”. |

| 3. | Compensation of the members of the Board of Directors; related resolutions. |

Pursuant to Italian law and Article 19 of the Company’s By-laws, Stevanato Group’s shareholders shall establish the compensation of the directors for their office as members of the Board of Directors.

It must be noted that, without prejudice to the remuneration established by the shareholders’ meeting, the Board of Directors may provide an additional compensation of the directors entrusted with specific functions, which may consist of a fixed part and/or a variable part, related to the achievement of certain objectives, or of the right to subscribe for ordinary shares or other financial instruments of the Company at a given price.

Alternatively, shareholders may determine an aggregate amount for the compensation of all directors, including those holding specific functions, to be allocated by the Board of Directors.

In any event, the members of the Board of Directors shall also be entitled to reimbursement of expenses incurred in the performance of their duties.

At the meeting of May 28, 2021, the Company’s shareholders appointed the current directors for the period of three financial years and established the relevant compensation for the period of one financial year, thus until the approval of the Financial Statements for the financial year ended on December 31, 2021, as well as, pursuant to Article 19.4 of the By-laws, a fixed additional annual compensation of Euro 20,000.00 and of Euro 10,000.00 for, respectively, the chairman and each member of the Audit Committee, for their entire term of office.

At the meeting of June 1, 2022, the Company’s shareholders established the compensation for the current directors for the period of one financial year, thus until the approval of the Financial Statements for the financial year ended on December 31, 2022.

Therefore, at the Shareholders’ Meeting, Stevanato Group’s shareholders are asked to establish the compensation of the Company’s directors for their office as members of the Board of Directors or, alternatively, to determine an aggregate amount for the compensation of all directors, to be allocated by the Board of Directors, in each case for the period of one financial year.

In such respect, upon recommendation of the Compensation Committee, we propose to the shareholders to establish for all directors (with the exception of Mr. Franco Moro, for the reasons detailed below), as remuneration for their office as members of the Board of Directors, a fixed compensation to be paid partially in cash and partially in Company’s shares, as specified below, for the period elapsing from the Shareholders’ Meeting date to the date of the shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023 (i.e., until the end of their current term of office), determined in consideration of the market standards, of the practices of the Company’s main competitors, and of the Board of Directors members’ professional skills and experience.

In particular, without prejudice to the right of the Board of Directors to establish an additional compensation for the directors entrusted with specific functions, we propose to establish for each director (with the exception of Mr. Franco Moro), for the period elapsing from the date of the Shareholders’ Meeting to the date of the Company’s shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023, a gross total compensation of Euro 148,000.00, to be paid as follows:

| – | as to the gross amount of Euro 74,000.00 (i.e., 50 per cent of the total proposed compensation), in cash, in twelve equal monthly instalments; |

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

7 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

| – | as to the residual gross amount of Euro 74,000.00 (i.e., 50 per cent of the total proposed compensation), in kind, through the assignment of a number of Company’s ordinary shares to be determined by the Board of Directors by dividing such amount by the average closing market price of the Company’s ordinary shares during the 30 calendar day period preceding the Shareholders’ Meeting, based on the average Euro/USD exchange rate during such period; provided that (i) such compensation in kind shall not be paid to directors ceasing for any reason to hold office before expiration of the relevant term (i.e., the date of the shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023) and (ii) the number of ordinary shares so determined shall be transferred to the directors on the business day following the date of the shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023, within the limits of the authorization to the disposal of such ordinary shares which shall be granted to the Board of Directors pursuant to the resolution envisaged in the next item 5 of this Explanatory Report. |

As to Mr. Franco Moro, since the remuneration package granted by the Board of Directors to the latter in his capacity as Chief Executive Officer is intended to cover all services performed to the benefit of the Company, we propose not to establish any further remuneration for Mr. Moro’s service as member of the Board of Directors.

Based on the above, Stevanato Group’s shareholders are asked to approve the following resolution:

“The Shareholders’ Meeting

resolves

| 1. | to establish for each Company’s director – with the exception of Mr. Franco Moro and without prejudice to the right of the Board of Directors to establish an additional compensation for the directors entrusted with specific functions under Article 2389 of the Italian Civil Code and Article 19.1 of the Company’s by-laws -, for the period elapsing from the date of this meeting to the date of the Company’s shareholders meeting approving the Financial Statements for the financial year ending on December 31, 2023, a gross total compensation of Euro 148,000.00, to be paid as follows: |

| – | as to the gross amount of Euro 74,000.00 (i.e., 50 per cent of the total proposed compensation), in cash, in twelve equal monthly instalments; |

| – | as to the residual gross amount of Euro 74,000.00 (i.e., 50 per cent of the total proposed compensation), in kind, through the assignment of a number of Company’s ordinary shares to be determined by the Board of Directors by dividing such amount by the average closing market price of the Company’s ordinary shares during the 30 calendar day period preceding the date of this meeting, based on the average Euro/USD exchange rate during such period; provided that: (i) such compensation in kind shall not be paid to directors ceasing for any reason to hold office before expiration of the relevant term (i.e., the date of the shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023) and (ii) the number of ordinary shares so determined shall be transferred to the directors on the business day following the date of the shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023, within the limits of the authorization to the disposal of such ordinary shares which shall be granted to the Board of Directors pursuant to the resolution adopted in relation to the next item 5 of the Agenda”. |

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

8 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

4. Appointment of the External Auditor for the auditing of the Company’s and the consolidated financial statements for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; related resolutions.

Pursuant to Italian law, Stevanato Group’s shareholders, upon substantiated proposal submitted by the Audit Committee, shall appoint the Company’s statutory External Auditor for a period of three financial years and establish the relevant compensation for the entire term of office.

Stevanato Group’s External Auditor is required to carry out the various tasks and activities provided for by Italian and US laws and regulations, which include: (i) auditing and quarterly review of the Company’s consolidated Financial Statements, prepared in accordance with International Financial Reporting Standards (IFRS) (as issued by the International Accounting Standards Board (IASB)), to be conducted according to the International Standards of Auditing (ISA Italia) (as issued by the International Auditing and Assurance Standards Board (IAASB)); (ii) review of the consolidated Financial Statements included in Form 20-F prepared in accordance with SEC regulations to be conducted in accordance with the auditing standards set out by the Public Company Accounting Oversight Board (PCAOB); (iii) auditing of the Financial Statements of Stevanato Group and of the Italian companies controlled by Stevanato Group; (iv) verification of the proper keeping of the company accounts and the correct recording of operating events in the accounting records of Stevanato Group and of its Italian controlled companies; (v) auditing of the Financial Statements of the non-Italian companies controlled by Stevanato Group prepared in accordance with local regulations, when required; (vi) auditing of the reporting packages prepared for the purpose of the opinion on the consolidated Financial Statements; (vii) activities preparatory to the signing of tax returns in accordance with Italian law; (viii) review and full auditing of the Company’s internal control system in compliance with US law (Sarbanes-Oxley Act (SOX)) requirements.

Since the appointment of the current External Auditor, EY S.p.A., expires on the date of the Shareholders’ Meeting, Stevanato Group’s shareholders are asked to appoint a new External Auditor for the performance of the tasks and activities referred to above for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025, and establish the relevant compensation.

In such connection, the Audit Committee – based on a comparative assessment conducted on the auditing companies presenting an offer to be appointed as Stevanato Group’s External Auditor in consideration of the auditing plan, specific skills, organizational structure, market reputation and proposed fees presented by such companies – proposes to the shareholders to appoint as External Auditor for the financial years 2023, 2024, and 2025 PricewaterhouseCoopers S.p.A., in accordance with the terms and conditions of the offer submitted by the same on December 27, 2022 (the “PwC Offer”).

In particular, based on the PwC Offer, the Audit Committee proposes to grant to PricewaterhouseCoopers S.p.A., in consideration for the performance of the tasks and activities summarized above in respect of the Company, an annual compensation amounting, as far as the Company alone is concerned, to: Euro for 591,000.00 the financial year 2023; Euro 595,000.00 for the financial year 2024; and Euro 621,000.00 for the financial year 2025, plus any applicable VAT and expenses.

More details on tasks and activities to be performed by the External Auditor, on the terms and conditions of the PwC Offer as well as on the comparative assessment carried out by the Audit Committee are included in substantiated proposal of the Audit Committee, available on the Company’s website, section Corporate Governance – Shareholders’ Meeting 2023 at the address https://ir.stevanatogroup.com/corporate-governance/2023-shareholders-meetings.

Based on the above, Stevanato Group’s shareholders are asked to approve, upon substantiated proposal presented by Audit Committee, the following resolution:

“The Shareholders’ Meeting

| – | pursuant to Article 13, par. 1, of Legislative Decree no. 39 of 27 January 2010; |

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

9 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

| – | based on the offer presented by PricewaterhouseCoopers S.p.A on December 27, 2022, and on the substantiated proposal presented by the Audit Committee; |

resolves

| 1. | to appoint PricewaterhouseCoopers S.p.A. as the Company’s External Auditor for the auditing of the Company’s and the consolidated Financial Statements and the performance of the further tasks and activities to be conducted by the External Auditor in compliance with Italian and US laws and regulations for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; |

| 2. | to grant to PricewaterhouseCoopers S.p.A., in consideration for the performance of the auditing of the Company’s and the consolidated Financial Statements and of the further tasks and activities referred to under resolution no. 1 above, the annual compensation amounting, as far as the Company alone is concerned, to Euro 591,000.00 for the financial year 2023, Euro 595,000.00 for the financial year 2024, Euro 621,000.00 for the financial year 2025, plus any applicable VAT and expenses, as specified in the offer presented by PricewaterhouseCoopers S.p.A. on December 27, 2022”. |

| 5. | Authorization for the purchase and the disposal of ordinary and class A treasury shares; related resolutions. |

Pursuant to Italian law, the purchase of treasury Class A and ordinary shares must be authorized by Stevanato Group’s shareholders, who shall establish the methods, the maximum number of shares to be purchased, the duration (not exceeding eighteen months) for which the authorization is granted, and the minimum and maximum purchase price.

In any case, Stevanato Group may not purchase treasury Class A and ordinary shares for a consideration exceeding the limits of the distributable net profits and reserves resulting from the latest Financial Statements approved by the shareholders’ meeting, provided that the nominal value of the treasury shares to be purchased shall not exceed one fifth (i.e., 20 per cent) of the Company’s share capital, taking into account also any Stevanato Group’s shares held by the subsidiaries.

Furthermore, it is provided that, upon purchase of treasury shares, (i) a negative reserve shall be entered and maintained in the Company’s Financial Statements for an amount equal to the purchase value of treasury shares, (ii) the voting rights connected to such shares shall be suspended as long as they are held in treasury and (iii) the dividends and other reserve or rights distributions pertaining to such treasury shares shall be allocated proportionally to the other shares.

Similarly, the Board of Directors may dispose of the shares held in treasury only upon authorization of the shareholder’s meeting, which shall also establish the relevant modalities of such dispositions.

Upon resolution of the shareholders’ meeting of June 1, 2022, Stevanato Group’s Board of Directors was authorized, for the period elapsing from the date of that shareholder meeting to the date of the Company’s shareholders meeting approving the Financial Statements for the financial year ending on December 31, 2022, to:

| – | purchase up to a maximum number of Class A and/or ordinary shares equal to 2 per cent of the shares into which Stevanato Group’s share capital is divided (including the treasury shares at any time held by the Company), through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that from time to time the Board of Directors deems more appropriate in the Company’s interests, provided that (i) the purchases shall be made at a price not being more than 10 per cent higher or lower than the closing market price of the ordinary shares on the trading day preceding the day of each relevant transaction, (ii) the relevant transactions must be carried out in compliance with all applicable Italian and US or New York Stock Exchange (NYSE) law and regulatory provisions, and, following any such purchases, (iii) the overall value of the shares |

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

10 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

| held in treasury shall not exceed the amount of the distributable net profits and reserves resulting, from time to time, from the last Financial Statements approved by the shareholders’ meeting of the Company; and |

| - | dispose of a maximum number of 3,084,055 Class A and/or ordinary shares held in treasury (prior, where appropriate, conversion of the Class A shares into ordinary shares), in compliance with all applicable Italian and US or NYSE law and regulatory provisions, through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that the Board of Directors deems more appropriate in the Company’s interests. |

As of the date of this Explanatory Report, Stevanato Group holds in treasury no. 30,840,555 Class A shares, equal to approximately 10.43 per cent of the Company’s share capital.

In light of the above and, especially, of the time-limits to which the aforementioned authorizations are subject and of the Company’s interest that the Board of Directors be at any time vested with the authority to purchase Stevanato Group’s shares and dispose of the shares held in treasury with flexibility and for all transactions and purposes deemed to be advantageous for the Company, in consideration of the foreseeable necessities of the latter, we propose to the shareholders to grant to the Board of Directors a new authorization to purchase Company’s shares and dispose of the shares in treasury, at the terms and conditions detailed below, for the period elapsing from the date of the Shareholders’ Meeting to the date of the shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023.

In particular, the authorization is requested for:

| – | purchasing, within the time period referred to above, up to a maximum number of Class A and/or ordinary shares equal to 1 per cent of the shares into which Stevanato Group’s share capital is divided (including the treasury shares at any time held by the Company), through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that from time to time the Board of Directors deems more appropriate in the Company’s interests, provided that (i) the purchases shall be made at a price not being more than 10 per cent higher or lower than the closing market price of the ordinary shares on the trading day preceding the day of each relevant transaction, (ii) the relevant transactions must be carried out in compliance with all applicable Italian and US or NYSE law and regulatory provisions, and, following any such purchases, (iii) the overall value of the shares held in treasury shall not exceed the amount of the distributable net profits and reserves resulting, from time to time, from the last Financial Statements approved by the shareholders’ meeting of the Company; and |

| – | disposing, within the time period referred to above, of a maximum number of 1,000,000 Class A and/or ordinary shares held in treasury (prior, where appropriate, conversion of the Class A shares into ordinary shares), in compliance with all applicable Italian and US or NYSE law and regulatory provisions, through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that the Board of Directors deems more appropriate in the Company’s interests. |

The requested authorizations shall be granted to the Board of Directors for the purposes of (i) carrying out extraordinary transactions (such as the transfer, exchange, contribution or other act of disposal of such shares for, inter alia, the acquisition of shareholdings in other companies, of business operations, of real estate assets or other transactions instrumental to the pursuit of industrial projects or, in any event, of the corporate object of the Company), (ii) fulfilling the obligations deriving from option contracts or other agreements concerning the Company’s shares, (iii) assigning the shares to directors or employees of the Company or of its subsidiaries as compensation in kind or as benefit, bonus or other premium or incentive, without limitations (also in execution of the “Restricted Stock Grant Plan Stevanato Group S.p.A. 2021—2022”, of the “Restricted Stock Grant Plan Stevanato Group S.p.A. 2023 - 2027” and of the “Performance Stock Grant Plan Stevanato Group S.p.A. 2023 – 2027”, which have been reinstated or approved by the Board of

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

11 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

Directors on December 15, 2022, or any other stock option or incentives plans which should be approved by the Board of Directors), and (iv) supporting the market liquidity of the Company’s shares.

Upon purchase of Company’s shares and as long as such shares are held in treasury, the Company shall enter and maintain in the Financial Statements a negative reserve for an amount equal to the purchase value of treasury shares and shall not be allowed, in its capacity as holder of such shares, to vote at the shareholders’ meeting and to receive dividends, reserves or other rights being distributed, which shall be allocated proportionally to the other shares.

Based on the foregoing, Stevanato Group’s shareholders are invited to resolve as follows:

“The Shareholders’ Meeting

| - | having examined the proposal presented by the Board of Directors under point 5 of the Explanatory Report; |

resolves

| 1. | to authorize the Board of Directors, pursuant to Articles 2357 and 2357-ter of the Italian Civil Code, for the period elapsing from the date of this meeting to the date of the Company’s shareholders’ meeting approving the Financial Statements for the financial year ending on December 31, 2023, for the purposes referred to under point 5 of the Explanatory Report, to: |

| - | purchase up to a maximum number of Class A and/or ordinary shares equal to 1 per cent of the shares into which Stevanato Group’s share capital is divided (including the treasury shares at any time held by the Company), through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that from time to time the Board of Directors deems more appropriate in the Company’s interests, provided that (i) the purchases shall be made at a price not being more than 10 per cent higher or lower than the closing market price of the ordinary shares on the trading day preceding the day of each relevant transaction, (ii) the relevant transactions must be carried out in compliance with all applicable Italian and US or NYSE law and regulatory provisions, and, following any such purchases, (iii) the overall value of the shares held in treasury shall not exceed the amount of the distributable net profits and reserves resulting, from time to time, from the last Financial Statements approved by the shareholders’ meeting of the Company; and |

| - | dispose of a maximum number of 1,000,000 Class A and/or ordinary shares held in treasury (prior, where appropriate, conversion of the Class A shares into ordinary shares), in compliance with all applicable Italian and US or NYSE law and regulatory provisions, through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that the Board of Directors deems more appropriate in the Company’s interests; |

| 2. | to grant the Board of Directors with all power needed or useful in order to execute the resolutions as per the points above and carrying out all the activities that may be necessary, instrumental or otherwise connected thereto”. |

Extraordinary session

| 1. | Amendments to Article 11.3 of the By-laws; related resolutions. |

Pursuant to Italian law, the By-laws may be amended by resolution approved by the extraordinary shareholders’ meeting.

The current By-laws were adopted by the shareholders’ meeting of July 1, 2021, in connection with the approval of the application for admission of the Company’s ordinary shares to the listing on the NYSE.

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

12 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

Thereafter, based on an opinion issued by the Companies’ Committee of the Notaries’ Board of Milan (Commissione Società del Consiglio Notarile di Milano), it has become common practice to include in the bylaws’ of Italian companies clauses expressly allowing for meetings of shareholders – independently from the contingency measures currently in force pursuant to Italian Law Decree no. 18 of March 17, 2020, providing for “Measures to strengthen the National Health Service and provide economic support for families, workers and businesses connected with the COVID-19 epidemiological emergency”, as subsequently amended and extended - to be held exclusively by means of telecommunications, if so provided by the notice of call.

In light of such new practice and in consideration of the geographically diversified Company’s shareholders’ base and Board of Directors’ composition, we propose to the shareholders to amend Article 11.3 in order to expressly provide that the shareholders’ meetings may be held also exclusively by means of telecommunications, if so provided by the Board of Directors with the notice of call.

In particular, we propose to the shareholders to amend Article 11.3 of the By-laws as follows:

|

By-laws in force |

By-laws amended | |

|

Italian version |

||

|

11.3 L’intervento in Assemblea può avvenire anche tramite mezzi di telecomunicazione, se previsto dall’avviso di convocazione, con le modalità stabilite dall’avviso stesso. |

11.3 L’intervento in Assemblea può avvenire anche tramite mezzi di telecomunicazione, se previsto dall’avviso di convocazione, con le modalità stabilite dall’avviso stesso. Resta fermo che l’avviso di convocazione può stabilire che la riunione si tenga esclusivamente mediante mezzi di telecomunicazione, omettendo l’indicazione del luogo fisico di svolgimento della riunione. |

|

|

English courtesy translation |

||

|

11.3 Participation in the shareholders’ meeting may also take place by means of telecommunications, if provided for in the notice of call, in accordance with the procedures set out in the notice itself. |

11.3 Participation in the shareholders’ meeting may also take place by means of telecommunications, if provided for in the notice of call, in accordance with the procedures set out in the notice itself. It is understood that the notice of call may provide that the meeting is held exclusively by means of telecommunications, omitting any reference to the physical location where the meeting shall be held.

|

|

Based on the foregoing, Stevanato Group’s shareholders are invited to resolve as follows:

“The Shareholders’ Meeting

- having examined the proposal presented by the Board of Directors under point 1 of the Explanatory Report – Extraordinary session;

resolves

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

13 |

|

|

Stevanato Group S.p.A.

Ordinary and Extraordinary Shareholders’ Meeting on May 24, 2023 Explanatory Report on the Items on the Agenda

|

to amend Article 11.3 of the Company’s by-laws according to the text set out under point 1 of the Explanatory Report – Extraordinary Session, hereby authorizing each director, separately from each other, to provide for the legal publications of this resolution, with the power to make any further modifications or additions that may be required for the registration in the Companies’ Register”.

* * *

Piombino Dese, April 6, 2023

The Executive Chairman of the Board of Directors

Franco Stevanato

|

stevanatogroup.com Ph. +39 049 931 8111 F. +39 049 936 6151 |

Stevanato Group S.p.A. Via Molinella, 17 • 35017 Piombino Dese, Padova, Italy Cap. Soc. € 21.698.480,00 i.v. • C.f. e P. IVA: 01487430280 / VAT code: IT01487430280 • R.I. Padova n. 01487430280 • REA n. 164290 |

14 |

Exhibit 99.3

SUSTAINABILITY REPORT 2022 SG Stevanto Group

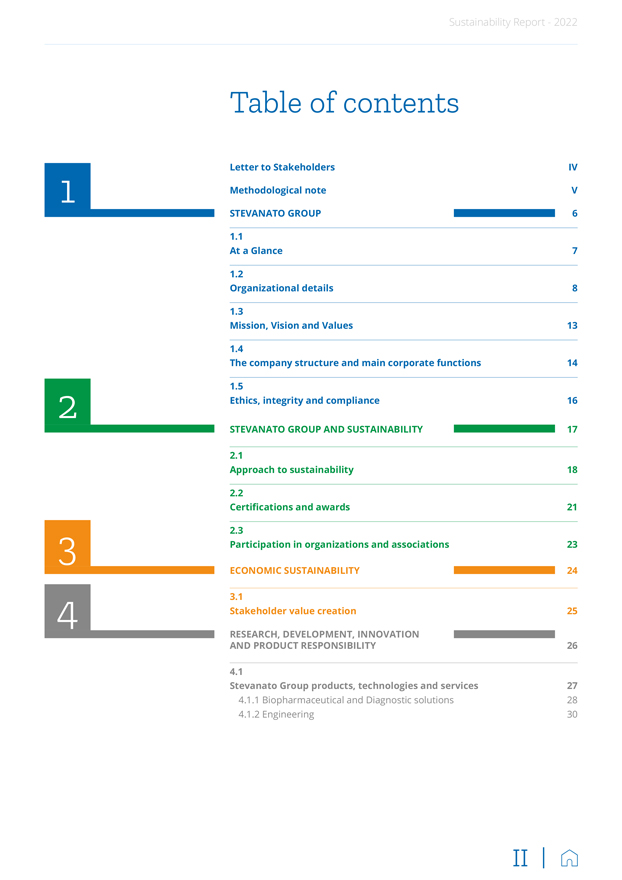

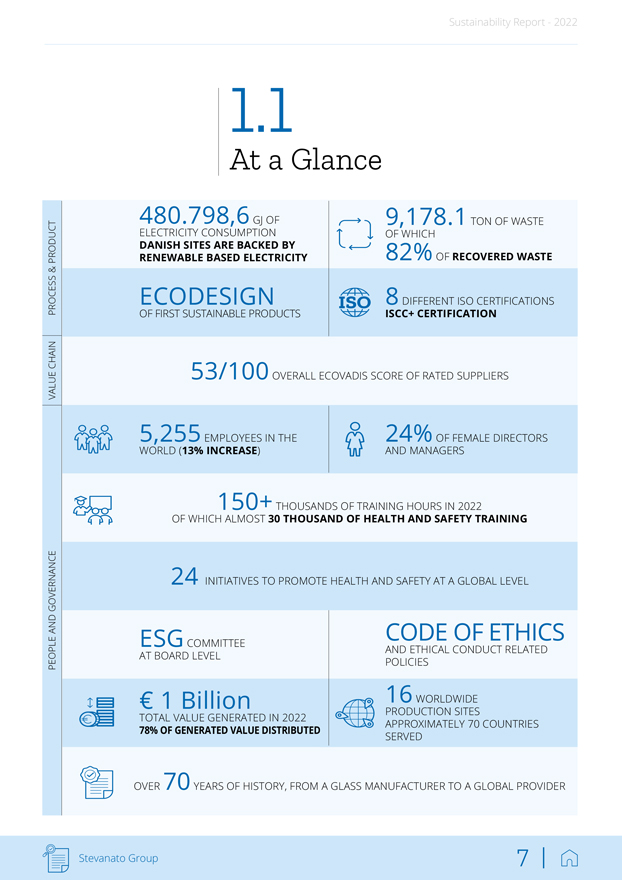

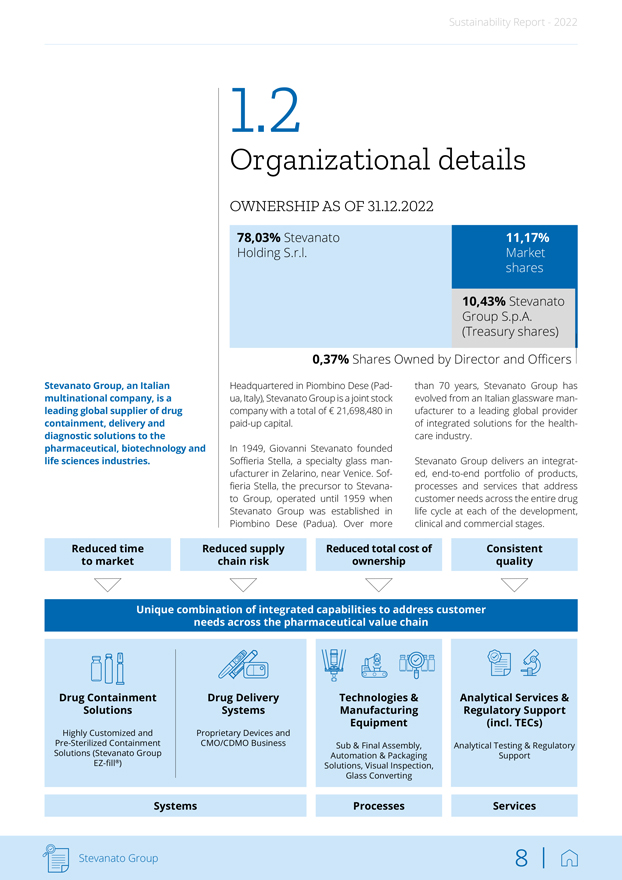

Sustainability Report - 2022 Table of contents Letter to Stakeholders IV Methodological note V 1 STEVANATO GROUP 6 1.1 At a Glance 7 1.2 Organizational details 8 1.3 Mission, Vision and Values 13 1.4 The company structure and main corporate functions 14 1.5 Ethics, integrity and compliance 16 2 STEVANATO GROUP AND SUSTAINABILITY 17 2.1 Approach to sustainability 18 2.2 Certifications and awards 21 2.3 Participation in organizations and associations 23 3 ECONOMIC SUSTAINABILITY 24 3.1 Stakeholder value creation 25 4 RESEARCH, DEVELOPMENT, INNOVATION AND PRODUCT RESPONSIBILITY 26 4.1 Stevanato Group products, technologies and services 27 4.1.1 Biopharmaceutical and Diagnostic solutions 28 4.1.2 Engineering 30 II

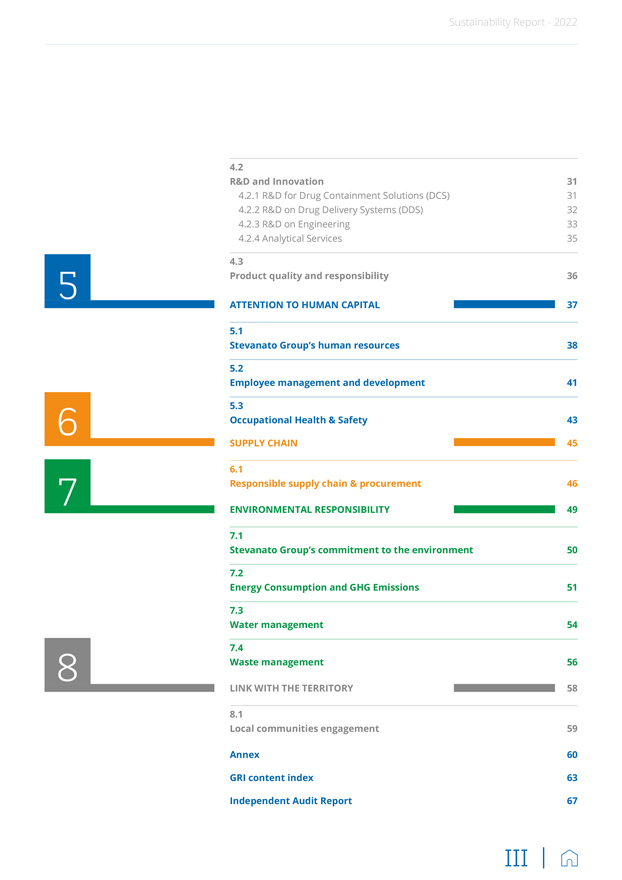

Sustainability Report - 2022 4.2 R&D and Innovation 31 4.2.1 R&D for Drug Containment Solutions (DCS) 31 4.2.2 R&D on Drug Delivery Systems (DDS) 32 4.2.3 R&D on Engineering 33 4.2.4 Analytical Services 35 ]4.3 Product quality and responsibility 36 5 ATTENTION TO HUMAN CAPITAL 37 5.1 Stevanato Group’s human resources 38 5.2 Employee management and development 41 5.3 Occupational Health & Safety 43 6 SUPPLY CHAIN 45 6.1 Responsible supply chain & procurement 46 7 ENVIRONMENTAL RESPONSIBILITY 49 7.1 Stevanato Group’s commitment to the environment 50 7.2 Energy Consumption and GHG Emissions 51 7.3 Water management 54 7.4 Waste management 56 8 LINK WITH THE TERRITORY 58 8.1 Local communities engagement 59 Annex 60 GRI content index 63 Independent Audit Report 67 III

Sustainability Report - 2022 Letter to Stakeholders Giovanni Stevanato had a dream and a vision. He wanted to create world-class glass manufacturing activities in Piombino Dese and set a standard of excellence. For over 70 years, we have been devoted to providing integrated solutions for the pharmaceutical and healthcare industry by constantly investing and acquiring skills in new technologies. A rich, international heritage has helped us become a global leader in drug containment, delivery, and diagnostic solutions. Our Vision is to create a reliable eco-system to empower our partners and enhance their ability to produce safe, easy-to-use and affordable treatments to improve patients’ lives. With this in mind, we invest in our business, our people, innovative solutions and scientific advancement, which we consider crucial to creating long-lasting value. In 2022, while facing global economic uncertainty and the war in Ukraine, we overcame inflation and supply chain constraints confronting most other companies by implementing diverse efficiency initiatives at all levels of the organization. In particular, we made progress in the expansion activities in Fishers (USA), Piombino Dese and Latina (Italy), and Zhangjiagang (China). We continued to seek growth in our mix of high-value solutions and fueled innovation by investing in R&D and partnering with other leading organizations. We also reviewed Stevanato’s organizational structure in an effort to provide better support to our international customers and continued to build a culture of internal control of our processes, which is required by our status as a public company, as well as strengthening our set of policies and procedures. Stevanato Group and its customers operate in a complex world. As a trusted partner, we help Biopharma and Diagnostics companies turn problems into solutions, managing complexity to deliver value for our clients, partners and the scientific community while keeping the customer, patient and stakeholders at the center of what we do. We strive to support our stakeholders while making a positive impact for the benefit of all. To this end, we regularly assess Environmental, Social and Governance impacts because we believe the ability to respond to such trends and risks may impact the long-term success of our company and society. Indeed, our goal is to pursue a regenerative business innovation journey while asserting our position as an interdependent and responsible member of the community in line with the United Nations’ Sustainable Development Goals. For our Group, sustainability is one of the primary means to tackling such complexity and we are committed to embedding it in our strategic plan, policies and practices. To safeguard the environment, we aim to reduce the impact of our processes and products starting with decarbonization and improvements in waste management. That same level of care applies to our people and is embodied by Stevanato’s Values and Guiding Principles and a workplace culture that fosters a culture that values both Health & Safety and Diversity, Equity & Inclusion. Finally, with reference to the Governance area, we aim to establish and maintain a sustainable corporate model through a dedicated governance structure and we are committed to regularly measure and report our progress on impacts using the GRI Standards criteria as a framework for transparency and accountability. In 2022, we were awarded a Bronze Medal by EcoVadis, an achievement that reflects the successful implementation of our sustainability strategy. The recognition acknowledges our ranking among the top 25% of companies in the “Manufacture of glass and glass products industry” and the top 34% of total companies rated by the platform. With the publication of Stevanato’s second Sustainability Report, our goal is to continue growing and supporting customers throughout our regenerative business innovation while making a positive impact everywhere we work and do business. We believe both our challenge and opportunity is to benefit from our know-how, resources, and enthusiasm to turn every project into an achievement while fostering health, wellbeing, and positive impacts for society and the planet. In close partnership with our stakeholders, we invest in sustainability today for a better tomorrow. Franco Stevanato Executive Chairman Stevanato Group S.p.A. Via Molinella 17, 35017 Piombino Dese · Padova · Italy Franco Moro Chief Executive Officer & Chief Operating Officer Stevanato Group S.p.A. Via Molinella 17, 35017 Piombino Dese · Padova · Italy IV