SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May 2023

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

YPF SOCIEDAD ANONIMA

CONDENSED INTERIM CONSOLIDATED

FINANCIAL STATEMENTS AS OF MARCH 31, 2023

AND COMPARATIVE INFORMATION (UNAUDITED)

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

| Note |

Description |

Page | ||

| 1 | ||||

| 2 | ||||

| Condensed interim consolidated statements of financial position |

3 | |||

| Condensed interim consolidated statements of comprehensive income |

4 | |||

| Condensed interim consolidated statements of changes in shareholders’ equity |

5 | |||

| 7 | ||||

| Notes to the condensed interim consolidated financial statements: |

||||

| 1 | General information, structure and organization of the Group’s business |

8 | ||

| 2 | Basis of preparation of the condensed interim consolidated financial statements |

9 | ||

| 3 | 11 | |||

| 4 | 11 | |||

| 5 | 11 | |||

| 6 | 12 | |||

| 7 | 17 | |||

| 8 | 17 | |||

| 9 | 18 | |||

| 10 | 21 | |||

| 11 | 21 | |||

| 12 | 24 | |||

| 13 | 24 | |||

| 14 | 24 | |||

| 15 | 25 | |||

| 16 | 25 | |||

| 17 | 25 | |||

| 18 | 26 | |||

| 19 | 27 | |||

| 20 | 27 | |||

| 21 | 27 | |||

| 22 | 28 | |||

| 23 | 30 | |||

| 24 | 30 | |||

| 25 | 30 | |||

| 26 | 32 | |||

| 27 | 33 | |||

| 28 | 34 | |||

| 29 | 34 | |||

| 30 | 34 | |||

| 31 | 35 | |||

| 32 | 35 | |||

| 33 | 35 | |||

| 34 | 36 | |||

| 35 | 37 | |||

| 36 | 37 | |||

| 37 | 39 | |||

| 38 | 42 | |||

| 39 | 43 | |||

| 40 | 44 |

1

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA |

|

|

| CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS | ||

| AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

| Term |

Definition |

|

| ADR |

American Depositary Receipt | |

| ADS |

American Depositary Share | |

| AESA |

Subsidiary A-Evangelista S.A. | |

| AFIP |

Argentine Tax Authority (Administración Federal de Ingresos Públicos) | |

| ANSES |

National Administration of Social Security (Administración Nacional de la Seguridad Social) | |

| ASC |

Accounting Standards Codification | |

| Associate |

Company over which YPF has significant influence as provided for in IAS 28 | |

| B2B |

Business to Business | |

| B2C |

Business to Consumer | |

| BCRA |

Central Bank of the Argentine Republic (Banco Central de la República Argentina) | |

| BNA |

Argentine Nation Bank (Banco de la Nación Argentina) | |

| BO |

Official Gazette of the Argentine Republic (Boletín Oficial de la República Argentina) | |

| BONAR |

Argentine Treasury Bonds (Bonos de la Nación Argentina) | |

| CAMMESA |

Compañía Administradora del Mercado Mayorista Eléctrico S.A. | |

| CDS |

Associate Central Dock Sud S.A. | |

| CGU |

Cash-Generating Units | |

| CNDC |

Argentine Antitrust Authority (Comisión Nacional de Defensa de la Competencia) | |

| CNV |

Argentine Securities Commission (Comisión Nacional de Valores) | |

| CPI |

Consumer Price Index published by INDEC | |

| CSJN |

Argentine Supreme Court of Justice (Corte Suprema de Justicia de la Nación Argentina) | |

| CT Barragán |

Joint Venture CT Barragán S.A. | |

| Dollar |

United States Dollar | |

| Eleran |

Subsidiary Eleran Inversiones 2011 S.A.U. | |

| ENARGAS |

Argentine Gas Regulator (Ente Nacional Regulador del Gas) | |

| ENARSA |

Energía Argentina S.A. (formerly Integración Energética Argentina S.A. “IEASA”) | |

| FACPCE |

Argentine Federation of Professional Councils in Economic Sciences (Federación Argentina de Consejos Profesionales de Ciencias Económicas) | |

| FASB |

Financial Accounting Standards Board | |

| FOB |

Free on board | |

| GPA |

Associate Gasoducto del Pacífico (Argentina) S.A. | |

| Gas Austral |

Associate Gas Austral S.A. | |

| Group |

YPF and its subsidiaries | |

| IAS |

International Accounting Standard | |

| IASB |

International Accounting Standards Board | |

| IDS |

Associate Inversora Dock Sud S.A. | |

| IFRIC |

International Financial Reporting Interpretations Committee | |

| IFRS |

International Financial Reporting Standard | |

| IIBB |

Turnover tax (Impuesto a los ingresos brutos) | |

| INDEC |

National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos) | |

| JO |

Joint operation | |

| Joint venture |

Company jointly owned by YPF as provided for in IFRS 11 | |

| LGS |

General Corporations Law (Ley General de Sociedades) No. 19,550 (T.O. 1984), as amended | |

| LNG |

Liquified natural gas | |

| LPG |

Liquefied Petroleum Gas | |

| MBtu |

Million British thermal units | |

| MEGA |

Joint Venture Company Mega S.A. | |

| Metroenergía |

Subsidiary Metroenergía S.A. | |

| Metrogas |

Subsidiary Metrogas S.A. | |

| MINEM |

Former Ministry of Energy and Mining (Ministerio de Energía y Minería) | |

| NO |

Negotiable Obligations | |

| Oiltanking |

Associate Oiltanking Ebytem S.A. | |

| OLCLP |

Joint Venture Oleoducto Loma Campana – Lago Pellegrini S.A. | |

| Oldelval |

Associate Oleoductos del Valle S.A. | |

| OPESSA |

Subsidiary Operadora de Estaciones de Servicios S.A. | |

| OTA |

Joint Venture OleoductoTrasandino (Argentina) S.A. | |

| OTC |

Joint Venture OleoductoTrasandino (Chile) S.A. | |

| PEN |

National Executive Power (Poder Ejecutivo Nacional) | |

| Peso |

Argentine peso | |

| PIST |

Transportation system entry point (Punto de ingreso al sistema de transporte) | |

| Profertil |

Joint Venture Profertil S.A. | |

| Refinor |

Joint Venture Refinería del Norte S.A. | |

| ROD |

Record of decision | |

| RTI |

Integral Tariff Review (Revisión Tarifaria Integral) | |

| RTT |

Transitional Tariff Regime (Régimen Tarifario de Transición) | |

| SE |

Secretariat of Energy (Secretaría de Energía) | |

| SEC |

U.S. Securities and Exchange Commission | |

| SEE |

Secretariat of Electric Energy (Secretaría de Energía Eléctrica) | |

| SGE |

Government Secretariat of Energy (Secretaría de Gobierno de Energía) | |

| SRH |

Hydrocarbon Resources Secretariat (Secretaría de Recursos Hidrocarburíferos) | |

| SSHyC |

Under-Secretariat of Hydrocarbons and Fuels (Subsecretaría de Hidrocarburos y Combustibles) | |

| Subsidiary |

Company controlled by YPF in accordance with the provisions of IFRS 10. | |

| Sustentator |

Joint Venture Sustentator S.A. | |

| Termap |

Associate Terminales Marítimas Patagónicas S.A. | |

| TFN |

National Fiscal Tribunal (Tribunal Fiscal de la Nación) | |

| UNG |

Unaccounted Natural Gas | |

| US$ |

United States Dollar | |

| US$/Bbl |

Dollar per barrel | |

| UVA |

Unit of Purchasing Power | |

| VAT |

Value Added Tax | |

| YPF Brasil |

Subsidiary YPF Brasil Comercio Derivado de Petróleo Ltda. | |

| YPF Chile |

Subsidiary YPF Chile S.A. | |

| YPF EE |

Joint venture YPF Energía Eléctrica S.A. | |

| YPF Gas |

Associate YPF Gas S.A. | |

| YPF Holdings |

Subsidiary YPF Holdings, Inc. | |

| YPF International |

Subsidiary YPF International S.A. | |

| YPF or the Company |

YPF S.A. | |

| YPF Perú |

Subsidiary YPF E&P Perú S.A.C. | |

| YPF Ventures |

Subsidiary YPF Ventures S.A.U. | |

| YTEC |

Subsidiary YPF Tecnología S.A. | |

| Y-LUZ |

Subsidiary Y-LUZ Inversora S.A.U. controlled by YPF EE | |

| WEM |

Wholesale Electricity Market | |

| WI |

Working interest |

2

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA |

|

|

| CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS | ||

| AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

Legal address

Macacha Güemes 515 - Ciudad Autónoma de Buenos Aires, Argentina.

Fiscal year number 47

Beginning on January 1, 2023.

Principal business of the Company

The Company’s purpose shall be to perform, on its own, through third parties or in association with third parties, the study, exploration, development and production of oil, natural gas and other minerals and refining, commercialization and distribution of oil and petroleum products and direct and indirect petroleum derivatives, including petrochemicals, chemicals, including those derived from hydrocarbons, and non-fossil fuels, biofuels and their components, as well as production of electric power from hydrocarbons, through which it may manufacture, use, purchase, sell, exchange, import or export them. It shall also be the Company’s purpose to render, directly, through a subsidiary or in association with third parties, telecommunications services in all forms and modalities authorized by the legislation in force after applying for the relevant licenses as required by the regulatory framework, as well as the production, industrialization, processing, commercialization, conditioning, transportation and stockpiling of grains and products derived from grains, as well as any other activity complementary to its industrial and commercial business or any activity which may be necessary to attain its objective. In order to fulfill these objectives, the Company may set up, become associated with or have an interest in any public or private entity domiciled in Argentina or abroad, within the limits set forth in the Bylaws.

Filing with the Public Registry

Bylaws filed on February 5, 1991 under No. 404, Book 108, Volume A, Sociedades Anónimas, with the Public Registry of Buenos Aires City, in charge of the Argentine Registrar of Companies (Inspección General de Justicia); and Bylaws in substitution of previous Bylaws, filed on June 15, 1993, under No. 5,109, Book 113, Volume A, Sociedades Anónimas, with the above mentioned Registry.

Duration of the Company

Through June 15, 2093.

Last amendment to the Bylaws

April 30, 2021 registered with the Argentine Registrar of Companies (Inspección General de Justicia) on August 5, 2021 under No. 12,049, Book 103 of Corporations.

Capital structure

393,312,793 shares of common stock, $10 par value and 1 vote per share.

Subscribed, paid-in and authorized for stock exchange listing (in pesos)

3,933,127,930

| PABLO GERARDO GONZÁLEZ President |

3

English translation of the financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA |

|

|

| CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION | ||

| AS OF MARCH 31, 2023 AND DECEMBER 31, 2022 (UNAUDITED) | ||

| (Amounts expressed in millions of pesos) |

| Notes | March 31, 2023 |

December 31, 2022 |

||||||||||

| ASSETS |

||||||||||||

| Non-current assets |

||||||||||||

| Intangible assets |

8 | 79,182 | 68,052 | |||||||||

| Property, plant and equipment |

9 | 3,767,050 | 3,100,306 | |||||||||

| Right-of-use assets |

10 | 112,591 | 95,748 | |||||||||

| Investments in associates and joint ventures |

11 | 376,546 | 337,175 | |||||||||

| Deferred income tax assets, net |

18 | 3,341 | 3,010 | |||||||||

| Other receivables |

13 | 43,202 | 36,468 | |||||||||

| Trade receivables |

14 | 1,101 | 1,027 | |||||||||

| Investment in financial assets |

15 | 35,015 | 35,664 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current assets |

4,418,028 | 3,677,450 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Current assets |

||||||||||||

| Inventories |

12 | 389,389 | 307,766 | |||||||||

| Contract assets |

25 | 1,874 | 148 | |||||||||

| Other receivables |

13 | 134,489 | 143,231 | |||||||||

| Trade receivables |

14 | 275,518 | 266,201 | |||||||||

| Investment in financial assets |

15 | 58,878 | 56,489 | |||||||||

| Cash and cash equivalents |

16 | 211,905 | 136,874 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current assets |

1,072,053 | 910,709 | ||||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL ASSETS |

5,490,081 | 4,588,159 | ||||||||||

|

|

|

|

|

|

|

|||||||

| SHAREHOLDERS’ EQUITY |

||||||||||||

| Shareholders’ contributions |

6,411 | 6,306 | ||||||||||

| Retained earnings |

2,250,866 | 1,844,724 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Shareholders’ equity attributable to shareholders of the parent company |

|

2,257,277 | 1,851,030 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-controlling interest |

20,997 | 17,274 | ||||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL SHAREHOLDERS’ EQUITY |

2,278,274 | 1,868,304 | ||||||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES |

||||||||||||

| Non-current liabilities |

||||||||||||

| Provisions |

17 | 451,578 | 455,213 | |||||||||

| Deferred income tax liabilities, net |

18 | 330,402 | 306,708 | |||||||||

| Income tax liability |

18 | 4,318 | 4,588 | |||||||||

| Taxes payable |

19 | 177 | 185 | |||||||||

| Salaries and social security |

20 | 437 | 215 | |||||||||

| Lease liabilities |

21 | 55,850 | 48,224 | |||||||||

| Loans |

22 | 1,301,199 | 1,053,196 | |||||||||

| Other liabilities |

23 | 20,737 | 3,302 | |||||||||

| Accounts payable |

24 | 1,492 | 1,319 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current liabilities |

2,166,190 | 1,872,950 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Current liabilities |

||||||||||||

| Provisions |

17 | 102,946 | 34,981 | |||||||||

| Contract liabilities |

25 | 19,683 | 13,577 | |||||||||

| Income tax liability |

18 | 5,376 | 4,711 | |||||||||

| Taxes payable |

19 | 30,648 | 30,660 | |||||||||

| Salaries and social security |

20 | 44,250 | 52,622 | |||||||||

| Lease liabilities |

21 | 62,226 | 52,061 | |||||||||

| Loans |

22 | 231,479 | 201,808 | |||||||||

| Other liabilities |

23 | 11,743 | 2,359 | |||||||||

| Accounts payable |

24 | 537,266 | 454,126 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current liabilities |

1,045,617 | 846,905 | ||||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL LIABILITIES |

3,211,807 | 2,719,855 | ||||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

5,490,081 | 4,588,159 | ||||||||||

|

|

|

|

|

|

|

|||||||

Accompanying notes are an integral part of these condensed interim consolidated financial statements.

| PABLO GERARDO GONZÁLEZ President |

4

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| For the three-month period ended

March 31, |

||||||||||||

| Notes | 2023 | 2022 | ||||||||||

| Net income |

||||||||||||

| Revenues |

25 | 820,325 | 401,451 | |||||||||

| Costs |

26 | (646,516) | (303,142) | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

173,809 | 98,309 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Selling expenses |

27 | (82,750) | (40,506) | |||||||||

| Administrative expenses |

27 | (30,970) | (14,774) | |||||||||

| Exploration expenses |

27 | (3,698) | (1,123) | |||||||||

| Other net operating results |

28 | (1,435) | (1,457) | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating profit |

54,956 | 40,449 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Income from equity interests in associates and joint ventures |

11 | 16,946 | 12,229 | |||||||||

| Financial income |

29 | 116,187 | 32,110 | |||||||||

| Financial costs |

29 | (135,742) | (43,037) | |||||||||

| Other financial results |

29 | 24,007 | 6,332 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net financial results |

29 | 4,452 | (4,595) | |||||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||||

| Net profit before income tax |

76,354 | 48,083 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Income tax |

18 | (17,754) | (21,666) | |||||||||

|

|

|

|

|

|

|

|||||||

| Net profit for the period |

58,600 | 26,417 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Other comprehensive income |

||||||||||||

| Items that may be reclassified subsequently to profit or loss: |

||||||||||||

| Translation effect from subsidiaries, associates and joint ventures |

(17,650) | (3,835) | ||||||||||

| Result from net monetary position in subsidiaries, associates and joint ventures (1) |

24,400 | 8,378 | ||||||||||

| Items that may not be reclassified subsequently to profit or loss: |

||||||||||||

| Translation differences from YPF |

344,515 | 71,406 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Other comprehensive income for the period |

351,265 | 75,949 | ||||||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive income for the period |

409,865 | 102,366 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Net profit / (loss) for the period attributable to: |

||||||||||||

| Shareholders of the parent company |

58,566 | 26,603 | ||||||||||

| Non-controlling interest |

34 | (186) | ||||||||||

| Other comprehensive income for the period attributable to: |

||||||||||||

| Shareholders of the parent company |

347,576 | 74,645 | ||||||||||

| Non-controlling interest |

3,689 | 1,304 | ||||||||||

| Total comprehensive income for the period attributable to: |

||||||||||||

| Shareholders of the parent company |

406,142 | 101,248 | ||||||||||

| Non-controlling interest |

3,723 | 1,118 | ||||||||||

| Earnings per share attributable to shareholders of the parent company: |

||||||||||||

| Basic and diluted |

32 | 149.60 | 67.69 | |||||||||

| (1) | Result associated to subsidiaries, associates and joint ventures with the peso as functional currency, see Note 2.b.1) to the annual consolidated financial statements. |

Accompanying notes are an integral part of these condensed interim consolidated financial statements.

| PABLO GERARDO GONZÁLEZ President |

5

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| For the three-month period ended March 31, 2023 | ||||||||||||||||||||||||||||||||||||||||

| Shareholders’ contributions | ||||||||||||||||||||||||||||||||||||||||

| Capital | Adjustment to capital |

Treasury shares |

Adjustment to treasury shares |

Share-based benefit plans |

Acquisition cost of treasury shares (2) |

Share trading premium |

Issuance premiums |

Total | ||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year |

3,915 | 6,072 | 18 | 29 | 289 | (4,499) | (158) | 640 | 6,306 | |||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) |

- | - | - | - | 109 | - | - | - | 109 | |||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans |

- | - | - | - | (1) | (2) | (1) | - | (4) | |||||||||||||||||||||||||||||||

| Other comprehensive income |

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

| Net profit for the period |

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Balance at the end of the period |

3,915 | 6,072 | 18 | 29 | 397 | (4,501) | (159) | 640 | 6,411 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Retained earnings | Equity attributable to | |||||||||||||||||||||||||||||||||||||||

| Legal reserve |

Reserve for future dividends |

Reserve for investments |

Reserve for purchase of treasury shares |

Other comprehensive income |

Unappropriated retained earnings and losses |

Shareholders of the parent company |

Non- controlling interest |

Total shareholders’ equity |

||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year |

139,275 | - | - | - | 704,235 | 1,001,214 | (4) | 1,851,030 | 17,274 | 1,868,304 | ||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) |

- | - | - | - | - | - | 109 | - | 109 | |||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans |

- | - | - | - | - | - | (4) | - | (4) | |||||||||||||||||||||||||||||||

| Other comprehensive income |

24,975 | - | - | - | 130,440 | 192,161 | 347,576 | 3,689 | 351,265 | |||||||||||||||||||||||||||||||

| Net profit for the period |

- | - | - | - | - | 58,566 | 58,566 | 34 | 58,600 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Balance at the end of the period |

164,250 | - | - | - | 834,675 | (1) | 1,251,941 | (4) | 2,257,277 | 20,997 | 2,278,274 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| (1) | Includes 934,904 corresponding to the effect of the translation of the shareholders’ contributions (see Note 36), (316,556) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the U.S. dollar (which includes (217,896) corresponding to the effect of the translation to YPF’s presentation currency) and 216,327 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency (which includes 105,942 corresponding to the effect of the translation to YPF’s presentation currency). See Note 2.b.1) to the annual consolidated financial statements and Note 2.b). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 38. |

| (4) | Includes 14,199 and 12,040 restricted to the distribution of unappropiated retained earnings and losses as of March 31, 2023 and December 31, 2022, respectively. See Note 2.b.16) to the annual consolidated financial statements. |

| PABLO GERARDO GONZÁLEZ President |

6

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA |

|

|

| CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY | ||

| FOR THE THREE-MONTH PERIOD ENDED MARCH 31, 2023 AND 2022 (UNAUDITED) (cont.) | ||

| (Amounts expressed in millions of pesos) |

| For the three-month period ended March 31, 2022 | ||||||||||||||||||||||||||||||||||||||||

| Shareholders’ contributions | ||||||||||||||||||||||||||||||||||||||||

| Capital | Adjustment to capital |

Treasury shares |

Adjustment to treasury shares |

Share-based benefit plans |

Acquisition cost of treasury shares (2) |

Share trading premium |

Issuance premiums |

Total | ||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year |

3,931 | 6,095 | 2 | 6 | 372 | (493) | (49) | 640 | 10,504 | |||||||||||||||||||||||||||||||

| Modification to the balance at the beginning of the fiscal year (4) |

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Balance at the beginning of the fiscal year modified |

3,931 | 6,095 | 2 | 6 | 372 | (493) | (49) | 640 | 10,504 | |||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) |

- | - | - | - | 53 | - | - | - | 53 | |||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans |

- | - | - | - | (9) | 1 | 6 | - | (2) | |||||||||||||||||||||||||||||||

| Other comprehensive income |

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

| Net profit / (loss) for the period |

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Balance at the end of the period |

3,931 | 6,095 | 2 | 6 | 416 | (492) | (43) | 640 | 10,555 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Retained earnings | Equity attributable to | |||||||||||||||||||||||||||||||||||||||

| Legal reserve |

Reserve for future dividends |

Reserve for investments |

Reserve for purchase of treasury shares |

Other comprehensive income |

Unappropriated retained earnings and losses |

Shareholders of the parent company |

Non- controlling interest |

Total shareholders’ equity |

||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year |

2,007 | - | - | - | 883,589 | (56,208) | 839,892 | 8,226 | 848,118 | |||||||||||||||||||||||||||||||

| Modification to the balance at the beginning of the fiscal year (4) |

78,714 | - | - | - | (486,589) | 407,875 | - | - | - | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Balance at the beginning of the fiscal year modified |

80,721 | - | - | - | 397,000 | 351,667 | 839,892 | 8,226 | 848,118 | |||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) |

- | - | - | - | - | - | 53 | - | 53 | |||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans |

- | - | - | - | - | - | (2) | - | (2) | |||||||||||||||||||||||||||||||

| Other comprehensive income |

6,521 | - | - | - | 36,529 | 31,595 | 74,645 | 1,304 | 75,949 | |||||||||||||||||||||||||||||||

| Net profit / (loss) for the period |

- | - | - | - | - | 26,603 | 26,603 | (186) | 26,417 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Balance at the end of the period |

87,242 | - | - | - | 433,529 | (1) | 409,865 | 941,191 | 9,344 | 950,535 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| (1) | Includes 492,422 corresponding to the effect of the translation of the shareholders’ contributions (see Note 36), (140,634) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the U.S. dollar (which includes (90,565) corresponding to the effect of the translation to YPF’s presentation currency) and 81,741 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency (which includes 31,765 corresponding to the effect of the translation to YPF’s presentation currency). See Note 2.b.1) to the annual consolidated financial statements and Note 2.b). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 38. |

| (4) | See Note 2.b). |

Accompanying notes are an integral part of these condensed interim consolidated financial statements.

| PABLO GERARDO GONZÁLEZ President |

7

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA |

|

|

| CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOW | ||

| FOR THE THREE-MONTH PERIOD ENDED MARCH 31, 2023 AND 2022 (UNAUDITED) | ||

| (Amounts expressed in millions of pesos) |

| For the three-month period ended

March 31, |

||||||||||

| 2023 | 2022 | |||||||||

| Cash flows from operating activities |

||||||||||

| Net profit for the period |

58,600 | 26,417 | ||||||||

| Adjustments to reconcile net loss to cash flows provided by operating activities: |

||||||||||

| Income from equity interests in associates and joint ventures |

(16,946) | (12,229) | ||||||||

| Depreciation of property, plant and equipment |

136,950 | 62,809 | ||||||||

| Amortization of intangible assets |

1,921 | 1,182 | ||||||||

| Depreciation of right-of-use assets |

10,703 | 5,391 | ||||||||

| Retirement of property, plant and equipment and intangible assets and consumption of materials |

16,090 | 9,103 | ||||||||

| Charge on income tax |

17,754 | 21,666 | ||||||||

| Net increase in provisions |

20,064 | 7,653 | ||||||||

| Effect of changes in exchange rates, interest and others |

3,222 | 765 | ||||||||

| Share-based benefit plans |

732 | 53 | ||||||||

| Changes in assets and liabilities: |

||||||||||

| Trade receivables |

19,878 | (12,073) | ||||||||

| Other receivables |

9,116 | 16,647 | ||||||||

| Inventories |

(23,786) | (285) | ||||||||

| Accounts payable |

24,968 | (1,942) | ||||||||

| Taxes payables |

(4,399) | 18,936 | ||||||||

| Salaries and social security |

(12,304) | (3,554) | ||||||||

| Other liabilities |

(2,713) | (2,024) | ||||||||

| Decrease in provisions included in liabilities due to payment/use |

(9,417) | (3,210) | ||||||||

| Contract assets |

(1,838) | (416) | ||||||||

| Contract liabilities |

6,024 | 17,882 | ||||||||

| Dividends received |

41,235 | - | ||||||||

| Proceeds from collection of profit loss insurance |

62 | 116 | ||||||||

| Income tax payments |

(270) | (256) | ||||||||

|

|

|

|

|

|

|

|||||

| Net cash flows from operating activities (1) (2) |

295,646 | 152,631 | ||||||||

|

|

|

|

|

|

|

|||||

| Investing activities: (3) |

||||||||||

| Acquisition of property, plant and equipment and intangible assets |

(247,158) | (83,629) | ||||||||

| Contributions and acquisitions of interests in associates and joint ventures |

(396) | - | ||||||||

| Proceeds from sales of financial assets |

24,859 | 3,473 | ||||||||

| Payments from purchase of financial assets |

(15,871) | (9,409) | ||||||||

| Interests received from financial assets |

5,110 | 89 | ||||||||

| Proceeds from sales of WI of areas and assets |

367 | 177 | ||||||||

|

|

|

|

|

|

|

|||||

| Net cash flows used in investing activities |

(233,089) | (89,299) | ||||||||

|

|

|

|

|

|

|

|||||

| Financing activities: (3) |

||||||||||

| Payments of loans |

(26,084) | (48,747) | ||||||||

| Payments of interests |

(29,915) | (18,474) | ||||||||

| Proceeds from loans |

88,027 | 37,730 | ||||||||

| Account overdraft, net |

(12,487) | (794) | ||||||||

| Payments of leases |

(17,694) | (9,075) | ||||||||

| Payments of interests in relation to income tax |

(551) | (47) | ||||||||

|

|

|

|

|

|

|

|||||

| Net cash flows from / (used in) financing activities |

1,296 | (39,407) | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

| Effect of changes in exchange rates on cash and cash equivalents |

11,178 | 1,607 | ||||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

| Increase in cash and cash equivalents |

75,031 | 25,532 | ||||||||

|

|

|

|

|

|

|

|||||

| Cash and cash equivalents at the beginning of the fiscal year |

136,874 | 62,678 | ||||||||

| Cash and cash equivalents at the end of the period |

211,905 | 88,210 | ||||||||

|

|

|

|

|

|

|

|||||

| Increase in cash and cash equivalents |

75,031 | 25,532 | ||||||||

|

|

|

|

|

|

|

|||||

| (1) | Does not include effect of changes in exchange rates generated by cash and cash equivalents, which is exposed separately in this statement. |

| (2) | Includes 11,476 and 5,648 for the three-month period ended March 31, 2023 and 2022, respectively, for payment of short-term leases and payments of the variable charge of leases related to the underlying asset use or performance. |

| (3) | The main investing and financing transactions that have not affected cash and cash equivalents correspond to: |

| For the three-month period ended

March 31, |

||||||||||

| 2023 | 2022 | |||||||||

| Unpaid acquisitions of property, plant and equipment |

107,188 | 30,542 | ||||||||

| Additions of right-of-use assets |

14,737 | 4,602 | ||||||||

| Capitalization of depreciation of right-of-use assets |

3,207 | 1,567 | ||||||||

| Capitalization of financial accretion for lease liabilities |

641 | 532 | ||||||||

Accompanying notes are an integral part of these condensed interim consolidated financial statements.

| PABLO GERARDO GONZÁLEZ President |

8

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

1. GENERAL INFORMATION, STRUCTURE AND ORGANIZATION OF THE GROUP’S BUSINESS

General information

YPF S.A. (“YPF” or the “Company”) is a stock corporation (sociedad anónima) incorporated under the Argentine laws, with a registered office at Macacha Güemes 515, in the City of Buenos Aires.

YPF and its subsidiaries (the “Group”) form the leading energy group in Argentina, which operates a fully integrated oil and gas chain with leading market positions across the domestic Upstream, Gas and Power, Industrialization and Commercialization businesses.

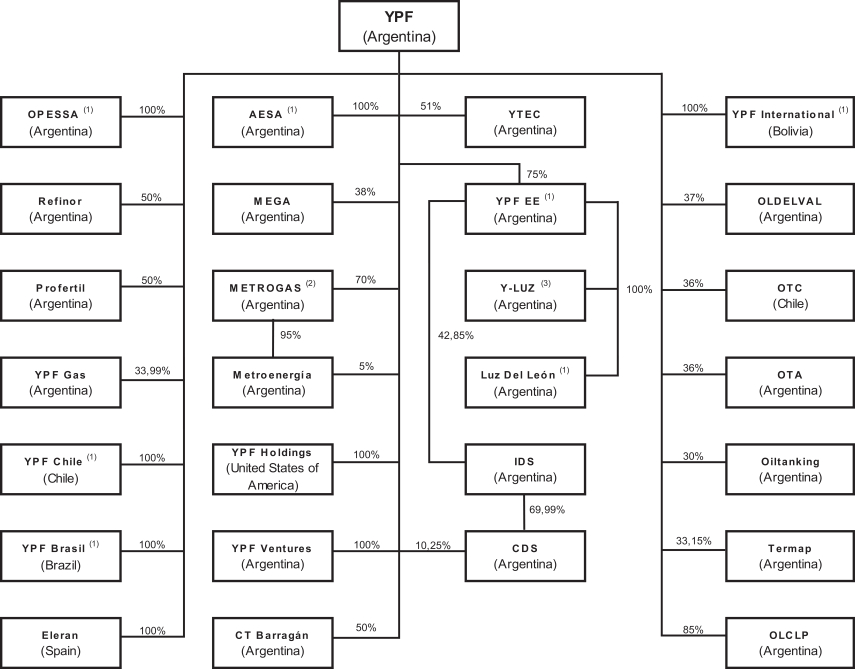

Structure and organization of the economic Group

The following chart shows the organizational structure, including the main companies of the Group, as of March 31, 2023:

| (1) | Held directly and indirectly. |

| (2) | See Note 35.c.3) to the annual consolidated financial statements. |

| (3) | On April 13, 2023, YPF EE, through its subsidiary Y-LUZ, completed the purchase from Enel Américas S.A. of 57.14% of common shares of IDS, taking control of IDS and its subsidiary CDS as of said date. |

9

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

1. GENERAL INFORMATION, STRUCTURE AND ORGANIZATION OF THE GROUP’S BUSINESS (cont.)

Organization of the business

As of March 31, 2023, the Group carries out its operations in accordance with the following structure:

| - | Upstream |

| - | Gas and Power |

| - | Industrialization |

| - | Commercialization |

| - | Central Administration and Others |

Activities covered by each business segment are detailed in Note 6.

The operations, properties and clients of the Group are mainly located in Argentina. However, the Group also holds participating interests in exploratory areas in Bolivia and sells jet fuel, natural gas, lubricants and derivatives in Chile and lubricants and derivatives in Brazil.

| 2. | BASIS OF PREPARATION OF THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS |

2.a) Basis of preparation

The condensed interim consolidated financial statements of the Group for the three-month period ended March 31, 2023 are presented in accordance with IAS No. 34 “Interim Financial Reporting”. Therefore, they should be read together with the annual consolidated financial statements of the Group as of December 31, 2022 (“annual consolidated financial statements”) presented in accordance with IFRS as issued by the IASB.

Moreover, some additional information required by the LGS and/or CNV’s regulations have been included.

These condensed interim consolidated financial statements were approved by the Board of Directors’ meeting and authorized to be issued on May 11, 2023.

These condensed interim consolidated financial statements corresponding to the three-month period ended March 31, 2023 are unaudited. The Company believes they have included all necessary adjustments to reasonably present the results of each period on a basis consistent with the audited annual consolidated financial statements. Net Income for the three-month period ended March 31, 2023 does not necessarily reflect the proportion of the Group’s full-year Net Income.

2.b) Significant Accounting Policies

The significant accounting policies are described in Note 2.b) to the annual consolidated financial statements.

The accounting policies adopted in the preparation of these condensed interim consolidated financial statements are consistent with those used in the preparation of the annual consolidated financial statements, except for the valuation policy for income tax detailed in Note 18.

Functional and presentation currency

As mentioned in Note 2.b.1) to the annual consolidated financial statements, YPF has defined the dollar as its functional currency. Additionally, in accordance with the provisions of the LGS and the regulation of the CNV, the Company must present its financial statements in pesos.

10

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

2. BASIS OF PREPARATION OF THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (cont.)

On October 28, 2022, CNV General Resolution No. 941/2022 was published in the BO, which introduced certain provisions for issuers whose functional currency differs from the local legal currency in Argentina, which for their own transactions develop presentation and disclosure accounting policies in which the translation differences originated in the retained earnings and reserves accounts are filed in line with the items originating them. As a consequence of this Resolution, from fiscal year ended December 31, 2022, the Company’s Board of Directors decided, as an accounting policy, to directly classify and accumulate translation differences generated by retained earnings at the beginning and end of the fiscal year in the legal reserves account, the reserve for future dividends, the reserve for investments, the reserve for purchase of treasury shares and retained earnings, within Shareholders’ Equity, in compliance with the provisions of Note 2.b.1) to the annual consolidated financial statements. For the sake of uniformity of the comparative information reported in the statements of changes in shareholders’ equity, translation differences accumulated in “Other comprehensive income” have been appropriated to the aforementioned equity items as of March 31, 2022, in compliance with IAS 8 “Accounting policies, changes in accounting estimates and errors”.

Effects of the translation of investments in subsidiaries, associates and joint ventures with a functional currency corresponding to a hyperinflationary economy

The results and financial position of subsidiaries with the peso as functional currency were translated into dollars by the following procedures: All amounts (i.e., assets, liabilities, stockholders’ equity items, expenditures and revenues) were translated at the exchange rate effective at the closing date of the financial statements, except for comparative amounts, which were presented as current amounts in the financial statements of the previous fiscal year (i.e., these amounts were not adjusted to reflect subsequent variations in price levels or exchange rates). Thus, the effect of the restatement of comparative amounts was recognized in “Other comprehensive income” in the consolidated statement of comprehensive income.

These criteria were also implemented by the Company for its investments in associates and joint ventures.

Adoption of new standards and interpretations effective as from January 1, 2023

The Company has adopted all new and revised standards and interpretations, issued by the IASB, relevant to its operations which are of mandatory and effective application as of March 31, 2023, as described in Note 2.b.26) to the annual consolidated financial statements. New and revised standards and interpretations which had a significant impact on these condensed interim consolidated financial statements are described below:

• Amendments to IAS 12 - Deferred tax related to assets and liabilities arising from a single transaction

The amendments introduce an exception to the initial recognition exemption, with specifications on how entities should account for the income tax and the deferred tax in transactions in which the initial recognition of assets and liabilities give rise, at the same time, to equal amounts of taxable and deductible temporary differences. Therefore, in transactions where an asset and a liability are recognized, for example in relation to leases and abandonment or decommissioning obligations, the deferred tax generated by such transactions should be recognized.

On January 1, 2023, in compliance with the amendments mentioned above, the Group breaks down deferred tax assets and liabilities arising from right-of-use-assets and lease liabilities. Also, the comparative information for fiscal year ended December 31, 2022 has been restated in compliance with IAS amendments (see Note 18). However, this had no effect on initial retained earnings.

2.c) Accounting Estimates and Judgments

The preparation of financial statements at a certain date requires the Company to make estimates and assessments affecting the amount of assets and liabilities recorded, contingent assets and liabilities disclosed at such date, as well as income and expenses recorded during the period. Actual future results might differ from the estimates and assessments made as of the date of preparation of these condensed interim consolidated financial statements.

11

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

2. BASIS OF PREPARATION OF THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (cont.)

In preparing these condensed interim consolidated financial statements, significant estimates and judgments were made by the Company in applying the accounting policies and the main sources of uncertainty were consistent with those applied by the Group in the preparation of the annual consolidated financial statements, which are disclosed in Notes 2.b) and 2.c) to the annual consolidated financial statements, respectively.

Review of impairment indicators of property, plant and equipment

As explained in Notes 2.b.8) and 2.b.9) to the annual consolidated financial statements, as a general criteria, the method used to estimate the recoverable amount of property, plant and equipment consists of estimating the value-in-use based on the future expected cash flows arising from the use of such assets, discounted at a rate that reflects the weighted average cost of the capital employed.

Regarding interim periods, IAS 34 requires entities to apply the impairment testing of assets. When an entity has previously recognized impairment losses of assets, it is necessary to review the calculations made at the end of the period if the indicators that gave rise to such losses continue to remain present. To such end, the entity shall revise the existence of significant indicators of impairment or reversals since the end of the last fiscal year and determine whether it has to proceed or not with such impairment testing of assets.

2.d) Comparative information

Amounts and other information corresponding to the year ended December 31, 2022 and to the three-month period ended March 31, 2022 are an integral part of these condensed interim consolidated financial statements and are intended to be read only in relation to these financial statements. Likewise, changes in comparative figures as mentioned in Notes 2.b), 6 and 25 and certain additional disclosures of non-significant information have been made.

Additionally, as of the year ended December 31, 2022 the Group has made a change in the turnover tax charge presentation in the “Taxes, charges and contributions” line under “Selling expenses” (see Note 27), which was previously included in “Revenues”. The comparative information for the period ended March 31, 2022 has been restated. “Revenues” and “Selling expenses” increased by 13,282. This change had no effect on the Group’s statements of financial position, statements of changes in shareholders’ equity, statements of cash flows, operating profit or loss and net profit or loss.

Historically, the Group’s results have been subject to seasonal fluctuations throughout the year, particularly as a result of the increase in natural gas sales during the winter driven by the increased demand in the residential segment. Consequently, the Group is subject to seasonal fluctuations in its sales volumes and sales prices, with higher sales of natural gas during the winter at a higher price.

4. ACQUISITIONS AND DISPOSITIONS

During the three-month period ended March 31, 2023, there were no significant acquisitions and dispositions.

The Group’s activities expose it to a variety of financial risks: Market risk (including foreign currency risk, interest rate risk, and price risk), credit risk and liquidity risk. Within the Group, risk management functions are conducted in relation to financial risks associated to financial instruments to which the Group is exposed during a certain period or as of a specific date.

During the three-month period ended March 31, 2023, there were no significant changes in the administration or risk management policies implemented by the Group as described in Note 4 to the annual consolidated financial statements.

• Liquidity risk management

Most of the Group’s loans contain market-standard covenants for contracts of this nature, which include financial covenants in respect of the Group’s leverage ratio and debt service coverage ratio, and events of defaults triggered by materially adverse judgements, among others. See Notes 16, 32 and 33 to the annual consolidated financial statements.

12

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

5. FINANCIAL RISK MANAGEMENT (cont.)

The Group monitors compliance with covenants on a quaterly basis. As of March 31, 2023, the Group is in compliace with its covenants.

It should be noted that, under the terms and conditions of the loans that our subsidiary Metrogas has taken with Industrial and Commercial Bank of China Limited - Dubai Branch and Itaú Unibanco - Miami Branch, the interest coverage ratio would not have been complied with, which could have accelerated the maturities of these financial liabilities. However, the financial creditors formally accepted to waive Metrogas from complying with the contractual obligation related to such financial ratio, as of March 31, 2023.

6. BUSINESS SEGMENT INFORMATION

The different business segments in which the Group’s organization is structured consider the different activities from which the Group can obtain revenues and incur expenses. This organizational structure is based on the way in which the highest decision-making authority analyzes the main financial and operating magnitudes for making decisions about resource allocation and performance assessment, also considering the business strategy of the Group. Business segment information is presented consistently with the way of reporting the information used by the highest decision-making authority to allocate resources and assess business segment performance.

As mentioned in Note 5 to the annual consolidated financial statements, business segment information is presented in US dollars, the Company’s functional currency (see Note 2.b.1) to the annual consolidated financial statements).

Due to the division of the Downstream Vice Presidency into the Commercialization Vice Presidency and the Industrialization Vice Presidency, from this fiscal year the new management scope of these new business units has been defined. These organizational changes resulted in a modification of the business segment structure in accordance with the manner in which the highest-decision making authority allocates resources and assesses the performance of such segments, dividing the Downstream segment into the Commercialization segment and the Industrialization segment, which, in addition, implied readjustments in the composition and definition of the businesses of the other segments. These business segment changes did not affect the CGUs defined in Note 2.b.8) to the annual consolidated financial statements.

In consideration of the above paragraphs, the comparative information for fiscal year ended December 31, 2022, and the period ended March 31, 2022, has been restated.

The business segment structure is organized as follows:

• Upstream

The Upstream segment performs all activities related to field exploration and exploitation and production of oil and natural gas, and frac sand for well drilling purposes.

Its revenues are largely derived from: (i) the sale of the oil produced to the Industrialization and Commercialization segments; (ii) the sale of the natural gas produced to the Commercialization segment; and (iii) the sale of the natural gas retained in plant to the Gas and Power segment and the Commercialization segment.

It incurs all costs related to the activities mentioned above.

On January 1, 2023 certain assets related to the exploration, exploitation and production of frac sand for well-drilling, which were formerly included in Central Administration and Others, were assigned to the Upstream segment. In addition, the comparative information for fiscal year ended December 31, 2022 and the period ended March 31, 2022, has been restated.

13

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

6. BUSINESS SEGMENT INFORMATION (cont.)

• Gas and Power

The Gas and Power segment performs activities related to: (i) commercial and technical operation of the LNG regasification terminals in Escobar and Bahía Blanca, by hiring regasification vessels; (ii) transportation, conditioning and processing of natural gas retained in plant for the separation and fractionation of gasoline, propane and butane; (iii) distribution of natural gas through its subsidiary Metrogas; and (iv) the storage of the natural gas produced. Also, through its investments in associates and joint ventures, it undertakes activities related to: (i) separation of natural gas liquids and their fractionation, storage and transportation for the production of ethane, propane, butane and gasolines; (ii) generation of conventional thermal electric power and renewable energy; and (iii) production, storage, distribution and sale of fertilizers.

Its revenues are largely derived from the distribution of natural gas through its subsidiary Metrogas, the sale of propane, butane and, marginally, the sale of natural gas produced and storaged to the Commercialization segment, the sale of gasoline to the Industrialization segment and the provision of LNG regasification services.

This segment incurs all costs related to the activities mentioned above, including the purchase of natural gas retained in plant from the Upstream segment and natural gas from the Commercialization segment for the distribution of natural gas through its subsidiary Metrogas.

On January 1, 2023, as a consequence of the organizational changes described above, the activities related to the sale of natural gas as producers were assigned to the Commercialization segment. In addition, the comparative information for fiscal year ended December 31, 2022, and the period ended March 31, 2022, has been restated.

• Industrialization

The Industrialization segment performs activities related to: (i) crude oil refining and petrochemical production, and (ii) logistics related to the transportation of crude oil to refineries and the transportation and distribution of refined and petrochemical products to be marketed at the different sales channels.

Its revenues are derived primarily from the sale of refined and petrochemical products to the Commercialization segment and, marginally, from their sale to third parties.

This segment incurs all costs related to the activities mentioned above, including the purchase of crude oil from the Upstream segment and third parties, the purchase of gasoline from the Gas and Power segment and of natural gas to be consumed in the refinery and petrochemical industrial complexes from the Commercialization segment.

As of January 1, 2023, as a result of the organizational changes mentioned above, the Downstream segment is divided into the Commercialization segment and the Industrialization segment. Besides, the comparative information for the fiscal year ended December 31, 2022, and the period ended March 31, 2022, has been restated.

• Commercialization

The Commercialization segment develops activities related to: (i) customer portfolio management; (ii) commercialization of refined and petrochemical products; (iii) sale of natural gas, as producers, to third parties and to the Gas and Power and Industrialization segments; (iv) the purchase from third parties of specialties for the agribusiness industry; and (v) commercialization of specialties for the agribusiness industry and of grains and their by-products.

Its revenues are largely derived from the commercialization of refined and petrochemical products, natural gas as producers, specialties for the agribusiness sector, and grains and their by-products. These operations are performed through the businesses of B2C (Retail), B2B (Industry, Agro, Lubricants and Specialties and Business Networks), LPG, Natural Gas, Chemicals, International Trade and Transportation.

This segment incurs all expenses related to the activities mentioned above, including the purchase of refined products from the Industrialization segment and third parties, petrochemicals from the Industrialization segment, propane and butane from the Gas and Power segment, and oil and natural gas from the Upstream segment, and the transportation of these products to the different sales channels.

14

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

6. BUSINESS SEGMENT INFORMATION (cont.)

As of January 1, 2023, as result of the organizational changes described above, the Downstream segment is divided into the Commercialization segment and the Industrialization segment, and all activities related to the commercialization of natural gas as producers, formerly performed by the Gas and Power segment, were assigned to the Commercialization segment. In addition, the comparative information for fiscal year ended December 2022 and the period ended March 31, 2022, has been restated.

• Central Administration and Others

This segment covers other activities performed by the Group not falling under the business segments mentioned above and which are not reporting business segments, mainly comprising corporate administrative expenses and assets and construction activities.

Sales between business segments were made at internal transfer prices established by the Group, which generally seek to approximate domestic market prices.

Operating profit/loss and assets of each business segment have been determined after consolidation adjustments.

15

English translation of the condensed interim consolidated financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the condensed interim consolidated financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

6. BUSINESS SEGMENT INFORMATION (cont.)

| In millions of dollars | In millions of pesos |

|||||||||||||||||||||||||||||||||

| Upstream | Gas and Power |

Industrialization | Commercialization | Central Administration and Others |

Consolidation Adjustments (1) |

Total | Total | |||||||||||||||||||||||||||

| For the three-month period ended March 31, 2023 |

||||||||||||||||||||||||||||||||||

| Revenues |

43 | 98 | 58 | 3,975 | 64 | - | 4,238 | 820,325 | ||||||||||||||||||||||||||

| Revenues from intersegment sales |

1,785 | 47 | 3,046 | 41 | 246 | (5,165) | - | - | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Revenues |

1,828 | 145 | 3,104 | 4,016 | 310 | (5,165) | 4,238 | 820,325 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating profit / (loss) |

144 | (3) | (27) | 188 | 70 | (64) | 24 | 335 | 54,956 | |||||||||||||||||||||||||

|

Income from equity interests in associates and joint ventures |

- | 82 | 7 | - | - | - | 89 | 16,946 | ||||||||||||||||||||||||||

| Net financial results |

2 | 4,452 | ||||||||||||||||||||||||||||||||

| Net profit before income tax |

426 | 76,354 | ||||||||||||||||||||||||||||||||

| Income tax |

(85) | (17,754) | ||||||||||||||||||||||||||||||||

| Net profit for the period |

341 | 58,600 | ||||||||||||||||||||||||||||||||

| Acquisitions of property, plant and equipment |

1,015 | 52 | 202 | 12 | 17 | - | 1,298 | 264,595 | ||||||||||||||||||||||||||

| Acquisitions of right-of-use assets |

49 | - | 4 | 17 | - | - | 70 | 14,737 | ||||||||||||||||||||||||||

| Other income statement items |

||||||||||||||||||||||||||||||||||

| Depreciation of property, plant and equipment (2) |

568 | 12 | 102 | 12 | 15 | - | 709 | 136,950 | ||||||||||||||||||||||||||

| Amortization of intangible assets |

- | 3 | 7 | - | - | - | 10 | 1,921 | ||||||||||||||||||||||||||

| Depreciation of right-of-use assets |

34 | - | 15 | 7 | - | - | 56 | 10,703 | ||||||||||||||||||||||||||

| Balance as of March 31, 2023 | ||||||||||||||||||||||||||||||||||

| Assets |

12,121 | 2,781 | 7,078 | 2,425 | 2,033 | (146) | 26,292 | 5,490,081 | ||||||||||||||||||||||||||

16

English translation of the financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

6. BUSINESS SEGMENT INFORMATION (cont.)

| In millions of dollars | In millions of pesos |

|||||||||||||||||||||||||||||||||

| Upstream | Gas and Power |

Industrialization | Commercialization | Central Administration and Others |

Consolidation Adjustments (1) |

Total | Total | |||||||||||||||||||||||||||

| For the three-month period ended March 31, 2022 | ||||||||||||||||||||||||||||||||||

| Revenues |

35 | 100 | 54 | 3,509 | 62 | - | 3,760 | 401,451 | ||||||||||||||||||||||||||

| Revenues from intersegment sales |

1,563 | 49 | 2,510 | 68 | 145 | (4,335) | - | - | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Revenues |

1,598 | 149 | 2,564 | 3,577 | 207 | (4,335) | 3,760 | 401,451 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating profit / (loss) |

232 | (3) | (4) | 220 | 103 | (56) | (91) | 404 | 40,449 | |||||||||||||||||||||||||

| Income from equity interests in associates and joint ventures |

- | 109 | 6 | - | - | - | 115 | 12,229 | ||||||||||||||||||||||||||

| Net financial results |

(55) | (4,595) | ||||||||||||||||||||||||||||||||

| Net profit before income tax |

464 | 48,083 | ||||||||||||||||||||||||||||||||

| Income tax |

(197) | (21,666) | ||||||||||||||||||||||||||||||||

| Net profit for the period |

267 | 26,417 | ||||||||||||||||||||||||||||||||

| Acquisitions of property, plant and equipment |

599 | 5 | 97 | 6 | 23 | - | 730 | 79,636 | ||||||||||||||||||||||||||

| Acquisitions of right-of-use assets |

25 | - | - | 16 | - | - | 41 | 4,602 | ||||||||||||||||||||||||||

| Other income statement items |

||||||||||||||||||||||||||||||||||

| Depreciation of property, plant and equipment (2) |

446 | 14 | 99 | 13 | 17 | - | 589 | 62,809 | ||||||||||||||||||||||||||

| Amortization of intangible assets |

- | 3 | 7 | - | 1 | - | 11 | 1,182 | ||||||||||||||||||||||||||

| Depreciation of right-of-use assets |

31 | 6 | 2 | 13 | - | (1) | 51 | 5,391 | ||||||||||||||||||||||||||

| Balance as of December 31, 2022 | ||||||||||||||||||||||||||||||||||

| Assets |

11,528 | 2,797 | 6,732 | 3,216 | 1,807 | (168) | 25,912 | 4,588,159 | ||||||||||||||||||||||||||

| (1) | Corresponds to the elimination among business segments of the Group. |

| (2) | Includes depreciation of charges for impairment of property, plant and equipment. |

| (3) | Includes US$ (6) million and US$ (5) million of unproductive exploratory drillings as of March 31, 2023 and 2022. |

17

English translation of the financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

7. FINANCIAL INSTRUMENTS BY CATEGORY

Fair value measurements

Fair value measurements are described in Note 6 to the annual consolidated financial statements.

The tables below show the Group’s financial assets measured at fair value as of March 31, 2023 and December 31, 2022, and their allocation to their fair value levels:

| As of March 31, 2023 | ||||||||||||||||

| Financial Assets |

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in financial assets: (1) |

||||||||||||||||

| - Public securities |

16,405 | - | - | 16,405 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| 16,405 | - | - | 16,405 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| Cash and cash equivalents: |

||||||||||||||||

| - Mutual funds |

121,255 | - | - | 121,255 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| 121,255 | - | - | 121,255 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| 137,660 | - | - | 137,660 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| As of December 31, 2022 | ||||||||||||||||

| Financial Assets |

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in financial assets: (1) |

||||||||||||||||

| - Public securities |

13,029 | - | - | 13,029 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| 13,029 | - | - | 13,029 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| Cash and cash equivalents: |

||||||||||||||||

| - Mutual funds |

59,524 | - | - | 59,524 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| 59,524 | - | - | 59,524 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| 72,553 | - | - | 72,553 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| (1) | See Note 15. |

The Group has no financial liabilities measured at fair value with changes in results.

Fair value estimates

During the three-month period ended March 31, 2023, there have been no changes in macroeconomic circumstances that significantly affect the Group’s financial instruments measured at fair value.

During the three-month period ended March 31, 2023, there were no transfers between the different hierarchies used to determine the fair value of the Group’s financial instruments.

Fair value of financial assets and financial liabilities measured at amortized cost

The estimated fair value of loans, considering unadjusted listed prices (Level 1) for NO and interest rates offered to the Group (Level 3) for the other financial loans remaining, amounted to 1,279,317 and 1,029,019 as of March 31, 2023 and December 31, 2022, respectively.

The fair value of other receivables, trade receivables, investment in financial assets, cash and cash equivalents, other liabilities and accounts payable at amortized cost, do not differ significantly from their book value.

| March 31, 2023 | December 31, 2022 | |||||||

| Net book value of intangible assets |

87,477 | 75,086 | ||||||

| Provision for impairment of intangible assets |

(8,295) | (7,034) | ||||||

|

|

|

|

|

|

|

|||

| 79,182 | 68,052 | |||||||

|

|

|

|

|

|

|

|||

18

English translation of the financial statements originally filed in Spanish with the CNV.

In case of discrepancy, the financial statements filed with the CNV prevail over this translation.

| YPF SOCIEDAD ANONIMA NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2023 AND COMPARATIVE INFORMATION (UNAUDITED) |

|

8. INTANGIBLE ASSETS (cont.)

The evolution of the Group’s intangible assets for the three-month period ended March 31, 2023 and as of the year ended December 31, 2022 is as follows:

| Service concessions |

Exploration rights |

Other intangibles |

Total | |||||||||||||

| Cost |

93,124 | 14,010 | 45,705 | 152,839 | ||||||||||||

| Accumulated amortization |

66,452 | - | 38,913 | 105,365 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| Balance as of December 31, 2021 |

26,672 | 14,010 | 6,792 | 47,474 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| Cost |

||||||||||||||||

| Increases |

3,483 | - | 691 | 4,174 | ||||||||||||

| Translation effect |

68,572 | 9,893 | 27,427 | 105,892 | ||||||||||||

| Adjustment for inflation (1) |

- | - | 6,363 | 6,363 | ||||||||||||

| Decreases, reclassifications and other movements |

- | (4,346) | - | (4,346) | ||||||||||||

| Accumulated amortization |

||||||||||||||||

| Increases |

3,560 | - | 2,692 | 6,252 | ||||||||||||

| Translation effect |

49,484 | - | 26,628 | 76,112 | ||||||||||||

| Adjustment for inflation (1) |

- | - | 2,107 | 2,107 | ||||||||||||

| Decreases, reclassifications and other movements |

- | - | - | - | ||||||||||||

| Cost |

165,179 | 19,557 | 80,186 | 264,922 | ||||||||||||

| Accumulated amortization |

119,496 | - | 70,340 | 189,836 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| Balance as of December 31, 2022 |

45,683 | 19,557 | 9,846 | 75,086 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

| Cost |

||||||||||||||||

| Increases |

666 | - | 89 | 755 | ||||||||||||

| Translation effect |

29,656 | 3,501 | 11,926 | 45,083 | ||||||||||||

| Adjustment for inflation (1) |

- | - | 2,980 | 2,980 | ||||||||||||