UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- .

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE PROSPECTUS FORMING A PART OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-266555) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: May 15, 2023 | ||

| Mizuho Financial Group, Inc. | ||

| By: | /s/ Takefumi Yonezawa |

|

| Name: | Takefumi Yonezawa | |

| Title: | Senior Executive Officer / Group CFO | |

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. Mizuho Financial Group, Inc. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

May 15, 2023

| Company: Mizuho Financial Group, Inc. Representative: Masahiro Kihara, President & Group CEO Head Office: 1-5-5 Otemachi, Chiyoda-ku, Tokyo Stock code: 8411 (Tokyo Stock Exchange Prime Market) |

Opinion of Mizuho’s Board of Directors on Shareholder Proposal

Regarding the agenda of the 21st Ordinary General Meeting of Shareholders scheduled to be held on June 23, 2023, Mizuho Financial Group, Inc. (President & CEO: Masahiro Kihara) has received a document stating shareholders’ intentions to exercise their proposal rights. Mizuho hereby announces that at its Board of Directors meeting held today, it has resolved to oppose the shareholder proposal.

| 1. | Proposing Shareholders |

Joint proposal by three shareholders

* As some of the proposing shareholders are individuals, the names are withheld.

| 2. | The Shareholder Proposal |

Please refer to the Appendix 1.

| 3. | Opinion of the Board of Directors on the Shareholder Proposals and the Reasons therefor |

| (1) | Opinion of the Board of Directors |

The Board of Directors opposes this proposal.

| (2) | Reasons for the Opposition |

We established a transition plan that aims at achieving net-zero GHG* emissions in our financing and investment portfolio (Scope 3) by 2050 and are promoting an integrated approach (the transition plan includes mid-term targets for Scope 3 reduction in the electric power, oil & gas and thermal coal mining sectors, supporting client transition through engagement, implementation and review of financing and investment policies for sectors recognized as facing transition risk at particularly high levels, and risk controls in carbon-related sectors. Reduction targets were set by using scenarios aligned with net-zero by 2050). The progress status of the transition plan and the targets are disclosed in our integrated report and other materials. We will continue to actively promote our initiatives and disclosures.

In addition, in respect of the Articles of Incorporation, which should contain stipulations on corporate organization and other basic items, it would be inappropriate to insert stipulations pertaining to individual business execution therein and doing so may hinder our ability to respond flexibly and promptly.

Accordingly, the Board of Directors is of the opinion that it is unnecessary to add what this proposal requires to the Articles of Incorporation.

Please see the Appendix 2 for details of our group’s initiatives and opposition regarding the shareholder proposal (The following “Details of the proposal” and “Reasons for the proposal” are an English translation of the original text described in a form submitted by the shareholders.)

(Appendix 1)

The Shareholder Proposal

Partial amendment to the Articles of Incorporation (issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050)

| 1. | Details of the proposal |

The following clause shall be added to the Articles of Incorporation:

Chapter: “Transition Plan (Portfolio Alignment)”

Clause: “Issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050”

| 1. | In order to fulfil the Company’s commitment to net zero emissions by 2050 in its lending and investment portfolios, the Company shall set and disclose a transition plan to align its portfolios, in the short-, medium- and long-term, with credible pathways to net zero emissions by 2050 or sooner, including strategic policy commitments and targets for significant GHG-intensive sectors within its portfolios, considering the full range of Scope 3 value chain emissions. |

| 2. | The Company shall report on its progress against such a transition plan and targets in its annual reporting. |

| 2. | Reasons for the proposal |

This proposal requests that the Company disclose information required for shareholders to determine the integrity of the Company’s plans to achieve its net zero emissions by 2050 commitment, and for the Company to appropriately manage climate change risks, and maintain and increase the Company’s long-term corporate value.

The Company is exposed to substantial financial risk, given its significant involvement in carbon-intensive sectors such as fossil fuels. However, the Company has not set and disclosed sufficient targets or policy commitments to align its exposures to the most GHG-intensive sectors with a net zero emissions by 2050 pathway.

It is, therefore, critical for the Company to ensure the integrity of its climate goals and transition plans by setting and disclosing such targets and strategic policy commitments, which should align with the trajectories and key conclusions of credible net zero emissions by 2050 scenarios, such as the International Energy Agency’s. Global peers of the Company are already disclosing this type of information.

The disclosure this proposal seeks is commonly expected among investors through the Task Force on Climate-related Financial Disclosures (TCFD), and international standard setting initiatives such as the Net Zero Banking Alliance.

(Appendix 2)

Our Group’s Initiatives

| 1. | Transition Plan |

We are addressing climate change as a key management issue, and have established the Net Zero Transition Plan for the purpose of achieving net-zero by 2050 and to pursue efforts to limit the increase in global temperature to 1.5°C. We are promoting activities to address climate change.

<Establishment of the Net Zero Transition Plan and Revision thereof>

| April 2022 |

Formulation of Mizuho’s Approach to Achieving Net Zero by 2050

• Clarified our aim of achieving net-zero GHG emissions associated with our finance portfolio (Scope 3) by 2050 in order to limit the increase in global temperature to 1.5°C

• To this end, clearly stated to take actions including supporting client transition through engagement, and support for development and practical application of effective policies and next-generation technologies.

Establishment of the Net Zero Transition Plan

• Clarified the direction of initiatives for elements of net-zero GHG emissions, strengthening low-carbon business, improving climate-related risk management, and strengthening our structure. |

|

| April 2023 |

Revision of the Net Zero Transition Plan

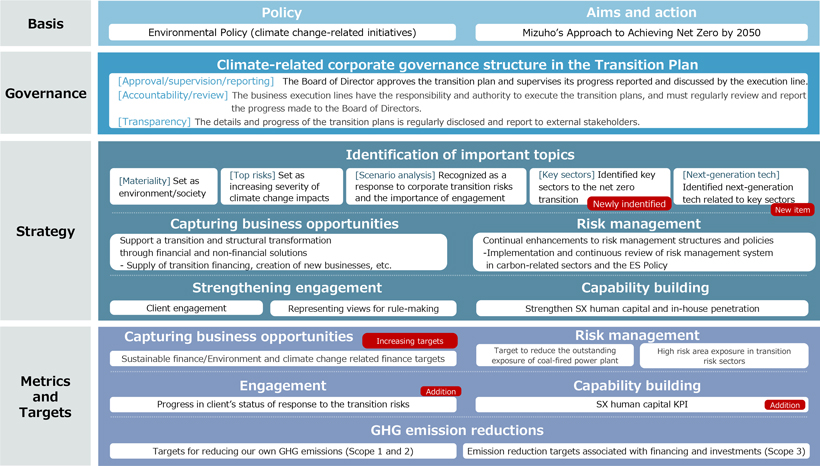

• Taking into account risk management, capturing of business opportunities, and promoting transition in the real economy, we have revised the Net Zero Transition Plan with the aim of promoting our response to climate change in a more integrated manner going forward.

• Based on the framework under the recommendations of the TCFD, specified the contents of each item of governance, strategy, and metrics & targets in the transition plan. |

|

<The Net ZeroTransition Plan – Overview -> For the following sectors, we have set mid-term targets for FY2030 using the scenarios aligned with net-zero by 2050.

| 2. | Setting GHG Emissions Reduction Targets associated with Financing and Investments |

We will continue to use the scenarios aligned with net-zero by 2050 to set targets for other sectors that are important in terms of emissions, such as the steel, automotive and maritime transportation sectors in due order. Although we have not set short-term targets for transition in high-emission sectors due to the need for time-consuming initiatives such as business structure transformation, we will regularly examine and disclose the results thereof.

<Mid-term Targets for Reducing GHG Emissions through Financing and Investments by Sector>

| Sector |

Scope |

Mid-term Target (FY2030) |

Benchmark Scenarios | Result for Base Year |

Prelim. Result for FY2021 (vs. Base Year) |

|||||||||

| Electric Power | Scope 1 | GHG emission intensity 138 to 232 (kgCO2e/MWh) |

IEA NZE IEA SDS |

388 | 353 (-9%) |

|||||||||

| Oil and Gas | Scope 1, 2 | GHG emission intensity 4.2 (gCO2e/MJ) |

IEA NZE | 6.6 | 6.5 (-2%) |

|||||||||

| Scope 3 |

Absolute GHG emissions (MtCO2e) -12% to -29% (in comparison to base year) |

IEA NZE IEA SDS |

60.6 | 43.2 (-29%) |

||||||||||

| Thermal Coal Mining |

Scope 1, 2, 3 | Absolute GHG emissions (MtCO2e) Zero balance by FY2030 for OECD economies Zero balance by FY2040 for non-OECD economies |

Following the approach of the IEA NZE scenario |

5.1 | 1.7 (-67%) |

|||||||||

| 3. | Financing and Investment Policy and Initiatives for Sectors with High Transition Risks |

| (1) | Risk Management |

We selected increasing severity of climate change impacts as one of our “top risks”, which are risks recognized by management as having a major potential impact on us. In addition, we recognize corporate customers’ responses to transition risks and the importance of engagement through scenario analysis, and continually strive to enhance risk management structures and policies.

Specifically, we have established exposure control policies and implemented risk controls in high-risk areas among sectors that we have recognized as facing transition risk at particularly high levels (carbon-related sectors).

Further, for the purpose of avoiding and mitigating adverse environmental and social impacts resulting from our financing and investment activity, our Environmental and Social Management Policy for Financing and Investment Activity sets a financing and investment policy for, among others, coal-fired power generation, oil & gas and thermal coal mining sectors, and we implement and enhance it continuously.

(Environmental and Social Management Policy for Financing and Investment Activity (excerpt))

| Transition Risk Sectors | • Target:

• Policy:

|

Companies whose primary businesses are in power generation (coal-fired, oil-fired, gas-fired), coal mining, oil and gas, steel, or cement.

Proactively undertake engagement to support transition to a low-carbon society.

Check at least once per year on the status of transition risk responses.

We carefully consider whether or not to continue our business with a client in the event that the client is not willing to address transition risk and has not formulated a transition strategy even after one year has lapsed since the initial engagement. |

||||||||

| Specific Industrial Sectors |

Weapons |

Coal-fired power |

Thermal coal |

Oil and gas |

||||

| Large-scale hydropower |

Large-scale agriculture |

Palm oil | Lumber and pulp | |||||

| Specific Industrial Sectors |

Financing and Investment Policy (* Underlined portions show revisions in March 2023) |

|

| Coal-fired Power Generation |

✓ Prohibition on providing financing or investment to companies with which we have no current financing transactions and investment activity if the primary business of these companies is coal-fired power generation.

✓ Prohibition on providing financing or investment which will be used for new construction of coal-fired power plants or the expansion of existing facilities. (However, we will simultaneously continue to support development of innovative, clean, and also efficient next-generation technology that will contribute to the expansion of sustainable energy, as well as other initiatives for the transition to a low-carbon society.) |

|

| Oil and Gas |

✓ Assessing that sufficient GHG emission reduction measures are being taken in the case of financing and investment which will be used for oil and gas exploration projects.

✓ When providing financing or investment that will be used for oil or gas extraction in the Arctic, for oil sands, shale oil, and shale gas extraction, and for pipelines, we carry out appropriate environmental and social risk assessments, taking into account specific risks. |

|

| Thermal Coal Mining |

✓ Prohibition on providing financing or investment to companies with which we have no current financing transactions and investment activity if the primary business of these companies is the mining of thermal coal or infrastructure linked with the mining of thermal coal.

✓ Prohibition on providing financing or investment which will be used for new thermal coal mining projects or related infrastructure or for expansion of existing projects or related infrastructure. |

|

| (2) | Promotion of Sustainable Finance and Environment & Climate Change-related Finance |

By undertaking engagement while considering clients’ sustainable growth, improved corporate value, and strengthened industrial competitiveness over the medium to long term, we support clients’ initiatives to transition to a low-carbon society. In April 2023, we increased our sustainable finance target to JPY 100 trillion (of which the target for environment and climate change-related finance is JPY 50 trillion)*. We will create further money flow aimed at solving environmental and social issues.

| * | Amounts representing total accumulated financing from FY2019 to FY2030. The previous target for sustainable finance was JPY 25 trillion (of which the target for environmental finance was JPY 12 trillion). |

| 4. | Disclosure |

We disclosed our efforts to address climate change, including our transition plan and our performance against metrics and targets, in our integrated reports, TCFD reports, our FY2022 Sustainability Progress - Initiatives addressing Climate Change, and other materials. We will continue to actively disclose information from the perspective of improving transparency and communicating with stakeholders.

This proposal requires inserting into the Articles of Incorporation stipulations pertaining to specific and individual business execution, such as the formulation of transition plans and disclosure thereof. We will flexibly review the transition plan and promptly implement it, taking into account rapidly changing circumstances in response to the urgent issue of climate change. However, since an amendment to the Articles of Incorporation requires a special resolution at a general meeting of shareholders, should this proposal be adopted, it may hinder our ability to respond flexibly and promptly.

Under the current Articles of Incorporation, we will make serious efforts to respond to climate change, taking into account the opinions of our stakeholders, and will pursue efforts to limit the increase in global temperature to 1.5°C.