UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- .

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE PROSPECTUS FORMING A PART OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-266555) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: May 15, 2023 | ||

| Mizuho Financial Group, Inc. | ||

| By: | /s/ Takefumi Yonezawa |

|

| Name: | Takefumi Yonezawa | |

| Title: | Senior Executive Officer / Group CFO | |

May 15, 2023

Company: Mizuho Financial Group, Inc.

Representative: Masahiro Kihara, President & Group CEO

Head Office: 1-5-5 Otemachi, Chiyoda-ku, Tokyo

Stock code: 8411 (Tokyo Stock Exchange Prime Market)

Revision of the Corporate Identity and launch of the new medium-term business plan

Mizuho Financial Group, Inc. (President & CEO: Masahiro Kihara) is pleased to announce revisions to Mizuho’s Corporate Identity, effective today, as well as the launch of a new medium-term business plan, starting from FY2023.

Over the last few years, significant changes have been taking place in the business environment around us. There have been qualitative changes in globalization, increased attention to the necessity of ensuring economic security and a sustainable society, and rapid adoption of AI and other technology across business areas. We have also been witnessing the advancement of inflation worldwide, which has resulted in rapid monetary tightening and financial instability in Europe and the US. This has further led to changes in people’s behaviors, values, and awareness of various issues. Irreversible structural changes in the economy and society are underway and customer behavior and corporate activities are changing fast.

In light of the drastic changes in and increasing complexity of the external and internal business environments, we reflected on Mizuho’s raison d’être and held numerous discussions on ways that we can resolve the challenges facing our clients and society while also realizing growth. As a result of this process, we decided to redefine the Corporate Identity, the foundation of what it means to be a Mizuho employee. In addition, we decided to establish a new medium-term business plan (FY2023 to 2025) beginning one year before the originally scheduled completion of the 5-Year Business Plan (FY2019 to 2023). The targets of the new medium-term business plan are based on the assumption that the 5-Year Business Plan’s final year targets will have been met.

The new medium-term business plan puts forth Mizuho’s long-term vision for the world, centering on personal well-being and the achievement of a sustainable society and economy to support it. We used backcasting to determine our aim for the world in 10 years and then identified the strategies that should be the focus of our attention in order for us to attain our long-term vision.

1

The three years of the new medium-term business plan will be focused on connecting the initiatives being carried out across Mizuho and creating new solutions to the challenges facing our clients and society as a whole. During this period, our basic policy will be to contribute to the revitalization of Japan and to sustainable global growth. Through this policy, we will build the cornerstone of future prosperity, centering on sustainability, together with our clients and society.

2

| I. | Revision of the Corporate Identity |

We revised the Corporate Philosophy, Vision, and Mizuho Values that made up the previous Corporate Identity. Alongside introducing our Purpose, we made changes to the content of our Corporate Philosophy and the Values.

| 1. | Corporate Philosophy... Mizuho’s unchanging and fundamental approach to corporate activities |

Operating responsibly and transparently with foresight, Mizuho is deeply committed to serving client needs, enabling our people to flourish, and helping to improve society and the communities where we do business.

| 2. | Purpose... Mizuho’s role and raison d’être in society |

Proactively innovate together with our clients for a prosperous and sustainable future.

Mizuho’s Purpose expresses our determination to operate with foresight, capture client and societal changes, and challenge ourselves while growing together with our clients and supporting their endeavors.

| 3. | Values... Mizuho’s ideal stance and action principles designed to realize the Purpose |

|

Be a catalyst for change. |

||

| - Integrity - Passion - Agility - Creativity - Empathy |

Act as a trusted partner by always upholding solid moral principles. Work with enthusiasm and dedication. Adapt to change and take prompt action. Drive innovation and think outside the box. Embrace diverse perspectives and collaboration to gain new insight. |

|

3

| II. | The new medium-term business plan |

Having concluded our 5-Year Business Plan one year ahead of schedule, we have established a new medium-term business plan for the three years starting from FY2023. In establishing this new medium-term business plan one year early, we set FY2023 financial targets under the assumption that the targets in the previous 5-Year Business Plan will have been met.

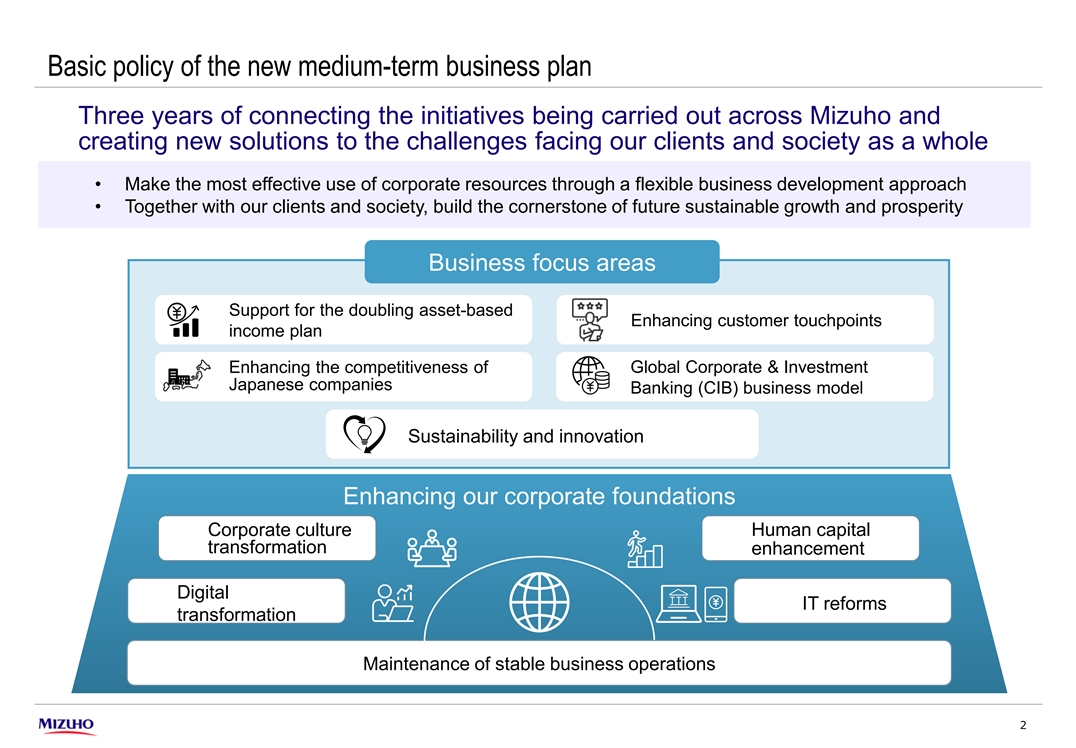

| 1. | Basic policy |

Three years of connecting the initiatives being carried out across Mizuho and creating new solutions to the challenges facing our clients and society as a whole

| • | Make the most effective use of corporate resources through a flexible business development approach |

| • | Together with our clients and society, build the cornerstone of future sustainable growth and prosperity |

| 2. | Business focus areas |

| (1) | Support for the doubling of asset-based income |

| (2) | Enhancing customer touchpoints |

| (3) | Enhancing the competitiveness of Japanese companies |

| (4) | Sustainability and innovation |

| (5) | Global Corporate & Investment Banking (CIB) business model |

| 3. | Enhancing our corporate foundations |

| (6) | Corporate culture transformation |

| (7) | Human capital enhancement |

| (8) | Digital transformation |

| (9) | IT reforms |

| (10) | Maintenance of stable business operations (in support of Nos. 1 to 9) |

4

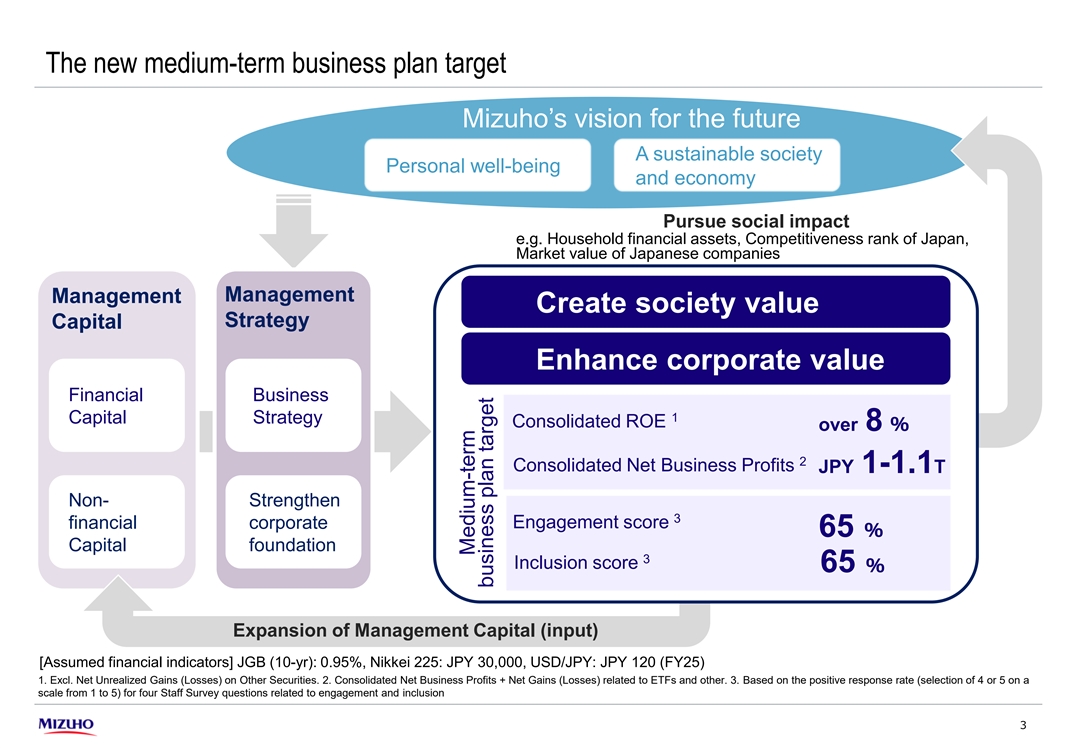

| 4. | Targets |

| • Consolidated ROE1 |

FY2025 | over 8% | ||

| • Consolidated Net Business Profits2 |

FY2025 | JPY 1 – 1.1 trillion | ||

| • Engagement score3 |

FY2025 | 65% | ||

|

• Inclusion score3 |

FY2025 | 65% | ||

| 1: | Excluding Net Unrealized Gains (Losses) on Other Securities |

| 2: | Consolidated Net Business Profits + Net Gains (Losses) related to ETFs (Mizuho Bank and Mizuho Trust & Banking) + Net Gains on Operating Investment Securities (Mizuho Securities consolidated) |

| 3: | Based on the positive response rate (selection of 4 or 5 on a scale from 1 to 5) for four Staff Survey questions related to engagement and inclusion |

| This report contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, including estimates, forecasts, targets, and plans. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. These forward-looking statements do not represent any guarantee by management of future performance. The figures listed above are based on the US GAAP accounting standards and the extent of the impact on the consolidated financial information is unspecified.

These statements reflect our current views with respect to future events and are subject to risks, uncertainties, and assumptions. These risks and uncertainties include, but are not limited to: incurrence of significant credit-related costs; declines in the value of our securities portfolio; changes in interest rates; foreign currency fluctuations; failure to comply with laws or regulations; the manifestation of operational risk or IT system risk; and the effect of changes in general economic conditions in Japan and elsewhere. For these reasons, there is no guarantee that forward-looking statements will match actual results. Further information regarding factors that could affect our results is included in a number of publicly available documents published by Mizuho. These include our annual securities report, Integrated Report, and “Item 3.D. Key Information—Risk Factors” in our most recent Form 20-F filed with the U.S. Securities and Exchange Commission, which is available in the Financial Information section of our web page at www.mizuhogroup.com and also at the SEC’s web site at www.sec.gov.

We do not intend to update our forward-looking statements. We are under no obligation, and disclaim any obligation, to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by the rules of the Tokyo Stock Exchange. |

5

Position of the new medium-term business plan n Backcasting from our vision for the future, we have revised our Corporate Identity and launched the new medium-term business plan 5-Year Business Plan New mid-term business plan The world we aim for Mizuho’s vision 1 year take up (FY19-FY23) (FY23-FY25) 10 years from now for the future Personal well-being Creating new solutions & making most effective use of corporate resources A sustainable society and economy Development towards an inclusive society Social widespread of innovative technology such as AI Improved commercial Three-pillar competitiveness & Business focus areas structural reform domestic economic (Finance structure, growth business structure and Enhancing our corporate corporate foundation) foundation which supports Global sustainability our growth Proactively innovate together with clients for a prosperous and sustainable future 1

Basic policy of the new medium-term business plan Three years of connecting the initiatives being carried out across Mizuho and creating new solutions to the challenges facing our clients and society as a whole • Make the most effective use of corporate resources through a flexible business development approach • Together with our clients and society, build the cornerstone of future sustainable growth and prosperity Business focus areas Support for the doubling asset-based Enhancing customer touchpoints income plan Enhancing the competitiveness of Global Corporate & Investment Japanese companies Banking (CIB) business model Sustainability and innovation Enhancing our corporate foundations Corporate culture Human capital transformation enhancement Digital IT reforms transformation Maintenance of stable business operations 2

The new medium-term business plan target Mizuho’s vision for the future A sustainable society Personal well-being and economy Pursue social impact e.g. Household financial assets, Competitiveness rank of Japan, Market value of Japanese companies Management Management Create society value Strategy Capital Enhance corporate value Financial Business 1 Capital Strategy Consolidated ROE over 8% 2 Consolidated Net Business Profits JPY 1-1.1T Non- Strengthen 3 Engagement score financial corporate 65% Capital foundation 3 Inclusion score 65% Expansion of Management Capital (input) [Assumed financial indicators] JGB (10-yr): 0.95%, Nikkei 225: JPY 30,000, USD/JPY: JPY 120 (FY25) 1. Excl. Net Unrealized Gains (Losses) on Other Securities. 2. Consolidated Net Business Profits + Net Gains (Losses) related to ETFs and other. 3. Based on the positive response rate (selection of 4 or 5 on a scale from 1 to 5) for four Staff Survey questions related to engagement and inclusion 3 Medium-term business plan target