UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 22, 2022

Talos Energy Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38497 | 82-3532642 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 333 Clay Street, Suite 3300 Houston, Texas |

77002 | |||

| (Address of principal executive offices) | (Zip Code) |

(713) 328-3000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading |

Name of Each Exchange on Which Registered |

||

| Common Stock | TALO | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

Merger Agreement

On September 21, 2022, Talos Energy Inc., a Delaware corporation (“Talos”), Talos Production Inc., a Delaware corporation and an indirect wholly owned subsidiary of Talos, Tide Merger Sub I Inc., a Delaware corporation and a directly wholly owned subsidiary of Talos, Tide Merger Sub II LLC, a Delaware limited liability company and a directly wholly owned subsidiary of Talos, Tide Merger Sub III LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Talos Production, EnVen Energy Corporation, a Delaware corporation (“EnVen”), and BCC EnVen Investments, L.P., a Delaware limited partnership, in its capacity as the representative of the equityholders of EnVen, entered into an Agreement and Plan of Merger, pursuant to which Talos will acquire EnVen (the “Transaction”).

Copies of the investor presentation and transcript of the investor call held on September 22, 2022 regarding the Transaction are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated into this Item 7.01 by reference, and can also be reviewed on Talos’s website at www.talosenergy.com under the “Investor Relations” tab. Information on Talos’s website does not constitute a part of this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Current Report on Form 8-K under Item 7.01 and set forth in the attached Exhibit 99.1 and Exhibit 99.2 are deemed to be “furnished” solely pursuant to Item 7.01 of Form 8-K and will not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor will such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing. The submission of the information set forth in this Item 7.01 will not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented in Exhibit 99.1 and Exhibit 99.2, that are provided solely in connection with Regulation FD.

Additional Information and Where To Find It

In connection with the proposed merger (the “Proposed Transaction”) between Talos Energy Inc. (“Talos”) and EnVen Energy Corporation (“EnVen”), Talos intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) to register the shares of Talos’s common stock to be issued in connection with the Proposed Transaction. The Registration Statement will include a document that serves as a prospectus and proxy statement of Talos and a consent solicitation statement of EnVen (the “proxy statement/consent solicitation statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTORS AND SECURITY HOLDERS OF TALOS AND ENVEN ARE URGED TO CAREFULLY AND THOROUGHLY READ, WHEN THEY BECOME AVAILABLE, THE REGISTRATION STATEMENT, THE PROXY STATEMENT/CONSENT SOLICITATION STATEMENT/PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY TALOS AND ENVEN WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TALOS AND ENVEN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

After the Registration Statement has been declared effective, a definitive proxy statement/consent solicitation statement/prospectus will be mailed to shareholders of each of Talos and EnVen. Investors will be able to obtain free copies of the Registration Statement and the proxy statement/consent solicitation statement/prospectus, as each may be amended from time to time, and other relevant documents filed by Talos and EnVen with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by Talos, including the proxy statement/consent solicitation statement/prospectus (when available), will be available free of charge from Talos’s website at www.talosenergy.com under the “Investor Relations” tab.

Participants in the Solicitation

Talos, EnVen and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Talos’s stockholders and the solicitation of written consents from EnVen’s stockholders, in each case with respect to the Proposed Transaction. Information about Talos’s directors and executive officers is available in Talos’s Annual Report on Form 10-K for the 2021 fiscal year filed with the SEC on February 25, 2022, and its definitive proxy statement for the 2022 annual meeting of stockholders filed with the SEC on April 6, 2022.

1

Information about EnVen’s directors and executive officers is available via EnVen’s website at www.enven.com. Other information regarding the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement, the proxy statement/consent solicitation statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they become available. Security holders, potential investors and other readers should read the proxy statement/consent solicitation statement/prospectus carefully when it becomes available before making any voting or investment decisions.

No Offer or Solicitation

This Current Report on Form 8-K is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”).

Forward Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact included in this Current Report on Form 8-K, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this communication, the words “will,” “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “forecast,” “may,” “objective,” “plan” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements include, but are not limited to, (1) Talos’s future production and capital expenditures and (2) statements regarding the Proposed Transaction with EnVen described herein and as adjusted descriptions of the combined company and its operations, integration, debt levels, acreage, well performance, development plans, per unit costs, ability to maintain production within cash flow, production, cash flows, synergies, type curves, opportunities and anticipated future performance. Information adjusted for the Proposed Transaction should not be considered a forecast of future results. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this Current Report on Form 8-K. These include the possibility that Talos stockholders may not approve the issuance of new shares of Talos common stock in the Proposed Transaction or that stockholders of EnVen may not approve the Merger Agreement; the risk that a condition to closing of the Proposed Transaction may not be satisfied, that either party may terminate the Merger Agreement or that the closing of the Proposed Transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Proposed Transaction; the parties do not receive regulatory approval of the Proposed Transaction; the risk that changes in Talos’s capital structure and governance could have adverse effects on the market value of its securities; the ability of Talos to retain customers and retain and hire key personnel and maintain relationships with its suppliers and customers and on Talos’s operating results and business generally; the risk that the Proposed Transaction could distract management from ongoing business operations or cause Talos to incur substantial costs; the risk that Talos does not realize expected benefits of its hedges; the success of our carbon capture and sequestration projects; commodity price volatility due to the continued impact of the coronavirus disease 2019 (“COVID-19”), including any new strains or variants, and governmental measures related thereto on global demand for oil and natural gas and on the operations of our business; the ability or willingness of OPEC and other state-controlled oil companies (“OPEC Plus”), such as Saudi Arabia and Russia, to set and maintain oil production levels; the impact of any such actions; the lack of a resolution to the war in Ukraine and its impact on certain commodity markets; lack of transportation and storage capacity as a result of oversupply, government and regulations; lack of availability of drilling and production equipment and services; adverse weather events, including tropical storms, hurricanes and winter storms; cybersecurity threats; inflation; environmental risks; failure to find, acquire or gain access to other discoveries and prospects or to successfully develop and produce from our current discoveries and prospects; geologic risk; drilling and other operating risks; well control risk; regulatory changes; the uncertainty inherent in estimating reserves and in projecting future rates of production; cash flow and access to capital; the timing of development expenditures; potential adverse reactions or competitive responses to our acquisitions and other transactions, generally, including those discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021 filed on February 25, 2022 and in our Quarterly Reports on Form 10-Q that are available on Talos’s website at www.talosenergy.com and on the website of the SEC at www.sec.gov.

2

All forward-looking statements are based on assumptions that Talos believes to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and Talos undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

Description of Exhibit |

|

| 99.1 | Investor Presentation, dated September 22, 2022. | |

| 99.2 | Transcript of Investor Call, dated September 22, 2022. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

| # | The exhibits and schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K and will be provided to the Securities and Exchange Commission upon request. |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Talos has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 22, 2022

| TALOS ENERGY INC. | ||

| By: | /s/ William S. Moss III |

|

| Name: | William S. Moss III | |

| Title: | Executive Vice President, General Counsel and Secretary | |

4

Exhibit 99.1 September 2022 Acquisition of EnVen Energy

Important Information for Investors and Shareholders Important Information for Investors and Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed Merger, Talos will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4, which will include a proxy statement/prospectus of Talos and a consent solicitation statement of EnVen. Talos also plans to file other documents with the SEC regarding the proposed transaction. After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to Talos shareholders and a definitive consent solicitation statement will be mailed to EnVen shareholders. INVESTORS AND SHAREHOLDERS OF TALOS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED MERGER THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus/consent solicitation statement and other documents containing important information about Talos and EnVen once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Participants in the Solicitation Talos, EnVen and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Talos shareholders in connection with the proposed transaction. Information about the directors and executive officers of Talos is set forth in Talos’s Definitive Proxy Statement on Schedule 14A for its 2022 Annual Meeting of Stockholders, which was filed with the SEC on April 6, 2022. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus/consent solicitation and other relevant materials to be filed with the SEC when they become available. 2

Cautionary Statement Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements” for purposes of the federal securities laws. All statements, other than statements of historical fact included in this presentation, regarding the proposed transaction with EnVen, including our ability to satisfy the conditions to closing and the expected timing and benefits of the transaction, our strategy, future operations, the impact of regulatory changes, financial position, estimated capital expenditures, production, revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, the success of our carbon capture and sequestration projects; commodity price volatility due to the continued impact of the coronavirus disease 2019 (“COVID-19), including any new strains or variants, and governmental measures related thereto on global demand for oil and natural gas and on the operations of our business; the lack of a resolution to the war in Ukraine and its impact on certain commodity markets; the ability or willingness of the Organization of Petroleum Exporting Countries (“OPEC”) and non-OPEC countries, such as Saudi Arabia and Russia, to set and maintain oil production levels and the impact of any such actions, lack of transportation and storage capacity as a result of oversupply, government regulations and actions or other factors, sustained inflation and the impact of central bank policy responses thereto, lack of availability of drilling and production equipment and services, environmental risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures, the possibility that the anticipated benefits of recent or proposed acquisitions (including the proposed transaction discussed herein) are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of such acquisitions, our ability to satisfy the conditions to closing to the proposed EnVen transaction as well as other factors discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, Quarterly Report on Form 10-Q for the period ended June 30, 2022 and other filings with the SEC. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All forward-looking statements speak only as of the date hereof. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, to reflect events or circumstances after the date of this presentation. Reserve Information Reserve engineering is a process of estimating underground accumulations of oil, natural gas and NGLs. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions upward or downward of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered. Investors are urged to consider closely the disclosures and risk factors in the reports we file with the SEC. Estimates for our future production volumes are based on assumptions of capital expenditure levels and the assumption that market demand and prices for oil and gas will continue at levels that allow for economic production of these products. The production, transportation and marketing of oil and gas are subject to disruption due to transportation and processing availability, mechanical failure, human error, hurricanes, global political and macroeconomic events and numerous other factors. Our estimates are based on certain other assumptions, such as well performance, which may vary significantly from those assumed. Therefore, we can give no assurance that our future production volumes will be as estimated. Use of Non-GAAP Financial Measures This presentation includes the use of certain measures that have not been calculated in accordance with U.S. generally acceptable accounting principles (GAAP), including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Leverage. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Use of Projections This presentation contains projections, including production volumes, capital expenditures, Adjusted EBITDA, Free Cash Flow and cost-savings via synergies. Our independent auditors have not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being indicative of future results. The assumptions and estimates underlying the projected information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected information. Even if our assumptions and estimates are correct, projections are inherently uncertain due to a number of factors outside our control. Accordingly, there can be no assurance that the projected results are indicative of our future performance after completion of the transaction or that actual results will not differ materially from those presented in the projected information. Inclusion of the projected information in this presentation should not be regarded as a representation by any person that the results contained in the projected information will be achieved. Industry and Market Data; Trademarks and Trade Names This presentation has been prepared by us and includes market data and other statistical information from sources we believe to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the independent sources described above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with us or an endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. 3

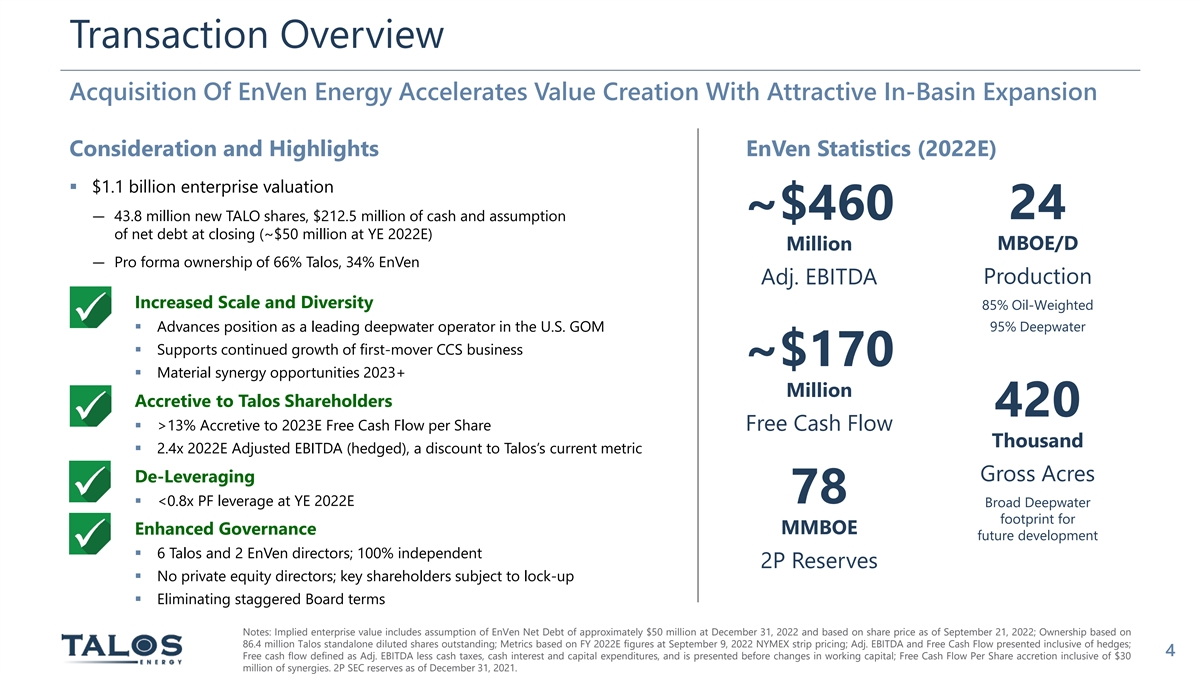

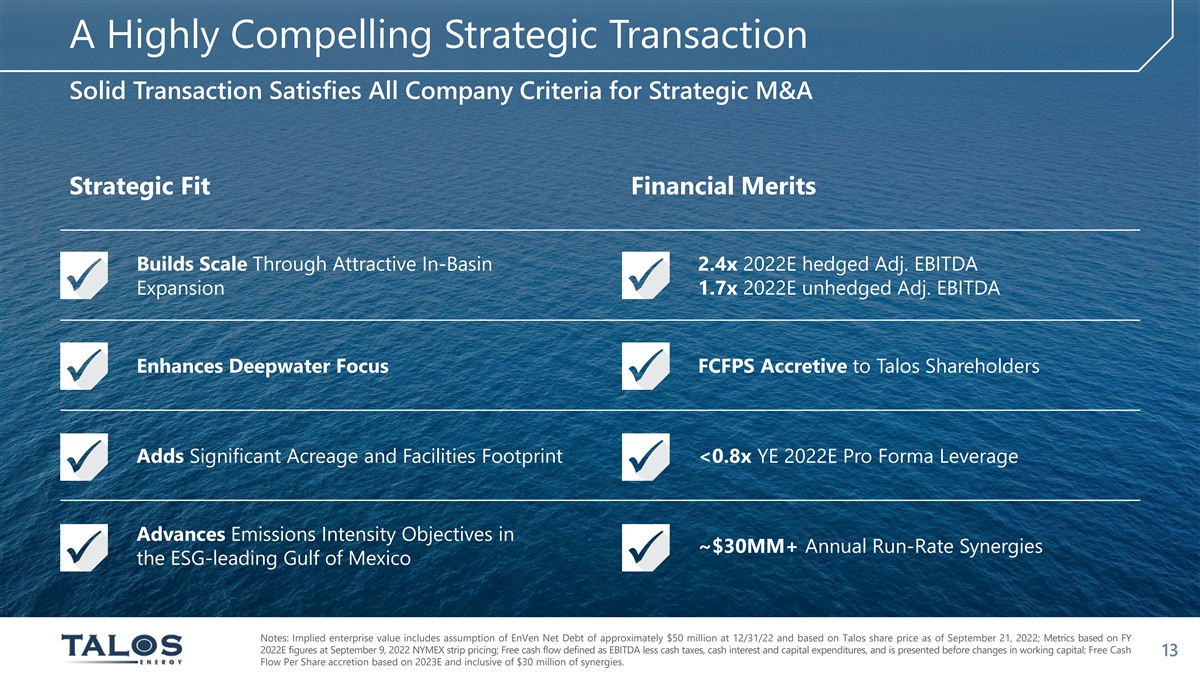

Transaction Overview Acquisition Of EnVen Energy Accelerates Value Creation With Attractive In-Basin Expansion Consideration and Highlights EnVen Statistics (2022E) § $1.1 billion enterprise valuation ~$460 24 ― 43.8 million new TALO shares, $212.5 million of cash and assumption of net debt at closing (~$50 million at YE 2022E) MBOE/D Million ― Pro forma ownership of 66% Talos, 34% EnVen Production Adj. EBITDA Increased Scale and Diversity 85% Oil-Weighted 95% Deepwater § Advances position as a leading deepwater operator in the U.S. GOM § Supports continued growth of first-mover CCS business ~$170 § Material synergy opportunities 2023+ Million Accretive to Talos Shareholders 420 § >13% Accretive to 2023E Free Cash Flow per Share Free Cash Flow Thousand § 2.4x 2022E Adjusted EBITDA (hedged), a discount to Talos’s current metric Gross Acres De-Leveraging 78 § <0.8x PF leverage at YE 2022E Broad Deepwater footprint for Enhanced Governance MMBOE future development § 6 Talos and 2 EnVen directors; 100% independent 2P Reserves § No private equity directors; key shareholders subject to lock-up § Eliminating staggered Board terms Notes: Implied enterprise value includes assumption of EnVen Net Debt of approximately $50 million at December 31, 2022 and based on share price as of September 21, 2022; Ownership based on 86.4 million Talos standalone diluted shares outstanding; Metrics based on FY 2022E figures at September 9, 2022 NYMEX strip pricing; Adj. EBITDA and Free Cash Flow presented inclusive of hedges; 4 Free cash flow defined as Adj. EBITDA less cash taxes, cash interest and capital expenditures, and is presented before changes in working capital; Free Cash Flow Per Share accretion inclusive of $30 million of synergies. 2P SEC reserves as of December 31, 2021.

Strategic Rationale Acquisition Further Solidifies Talos As A Leading Independent In The Gulf of Mexico § 40% increase in production; increased diversity of key producing fields § ~$30mm annual synergies Scale and Diversity § Improves optionality for Upstream reinvestment, CCS growth, de-leveraging or return of capital § Operated, oil-weighted asset base in prolific deepwater regions § Numerous operated facilities with existing PHA partners enhances future capital allocation Asset Mix § 35% increase in gross acreage § ~$460mm of 2022E Adj. EBITDA (~$630mm unhedged) and ~$170mm of Free Cash Flow § Adds high-margin production – Adj. EBITDA margins >$70/boe (2Q 2022 unhedged) Financial Profile § <0.8x pro forma leverage at year-end 2022 § Favorable to Talos GHG Emissions Intensity § Increases production in Deepwater GOM – a globally leading ESG-friendly basin ESG § Enhances governance practices and increases Board diversity and technical expertise Notes: Financial profile metrics and pro forma leverage based on FY 2022E figures at September 9, 2022 NYMEX strip pricing. Free cash flow defined as Adj. EBITDA less cash taxes, cash interest and 5 capital expenditures, and is presented before changes in working capital. Synergies expected to be achieved by year-end 2023.

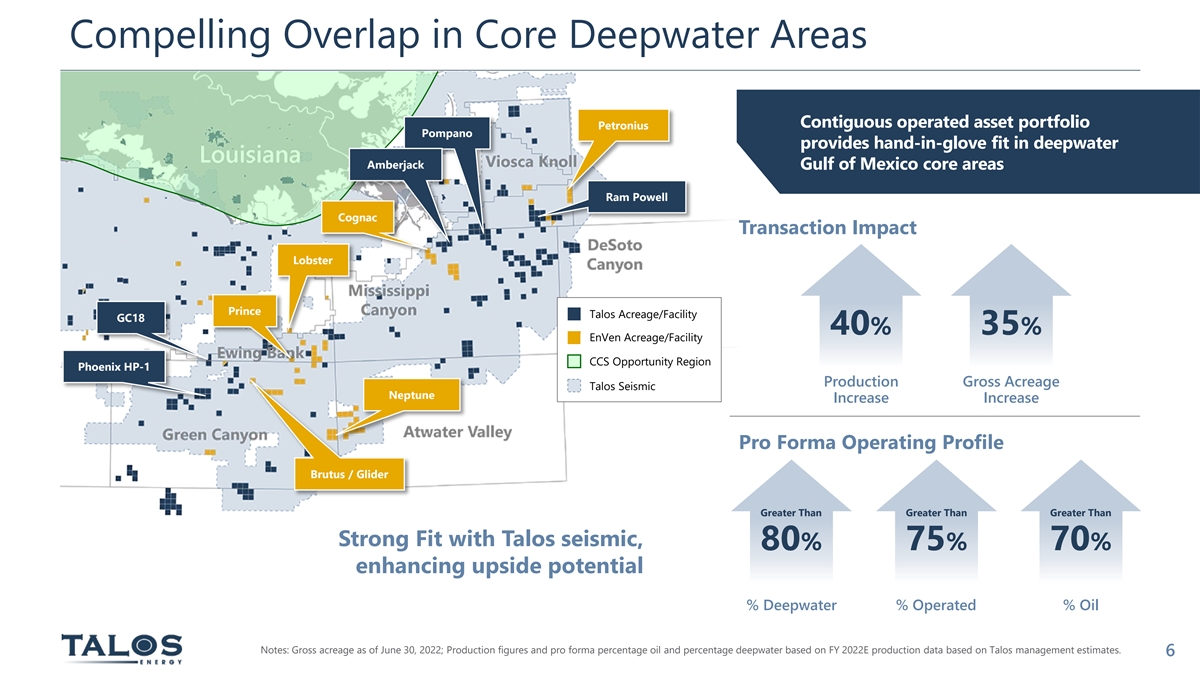

Compelling Overlap in Core Deepwater Areas Contiguous operated asset portfolio Petronius Pompano provides hand-in-glove fit in deepwater Amberjack Gulf of Mexico core areas Ram Powell Cognac Transaction Impact Lobster Prince Talos Acreage/Facility GC18 40% 35% EnVen Acreage/Facility CCS Opportunity Region Phoenix HP-1 Production Gross Acreage Talos Seismic Neptune Increase Increase Pro Forma Operating Profile Brutus / Glider Greater Than Greater Than Greater Than Strong Fit with Talos seismic, 80% 75% 70% enhancing upside potential % Deepwater % Operated % Oil Notes: Gross acreage as of June 30, 2022; Production figures and pro forma percentage oil and percentage deepwater based on FY 2022E production data based on Talos management estimates. 6

Key EnVen Deepwater Facilities Neptune Brutus / Glider (Operator, 100% WI) (Operator, 65% WI) § Gross oil capacity: 120,000 bbl/d § Gross oil capacity: 50,000 bbl/d § Water depth: 2,900’ / 3,243’ § Water depth: 4,250’ Prince Lobster (Operator, 100% WI) (Operator, 67% WI) § Gross oil capacity: 50,000 bbl/d § Gross oil capacity: 80,000 bbl/d § Water depth: 775’§ Water depth: 1,500’ Cognac Petronius (Operator, 63% WI) (Operator: Chevron, 50% WI) § Gross oil capacity: 30,000 bbl/d§ Gross oil capacity: 60,000 bbl/d § Water depth: 1,023’§ Water depth: 1,754’ 7

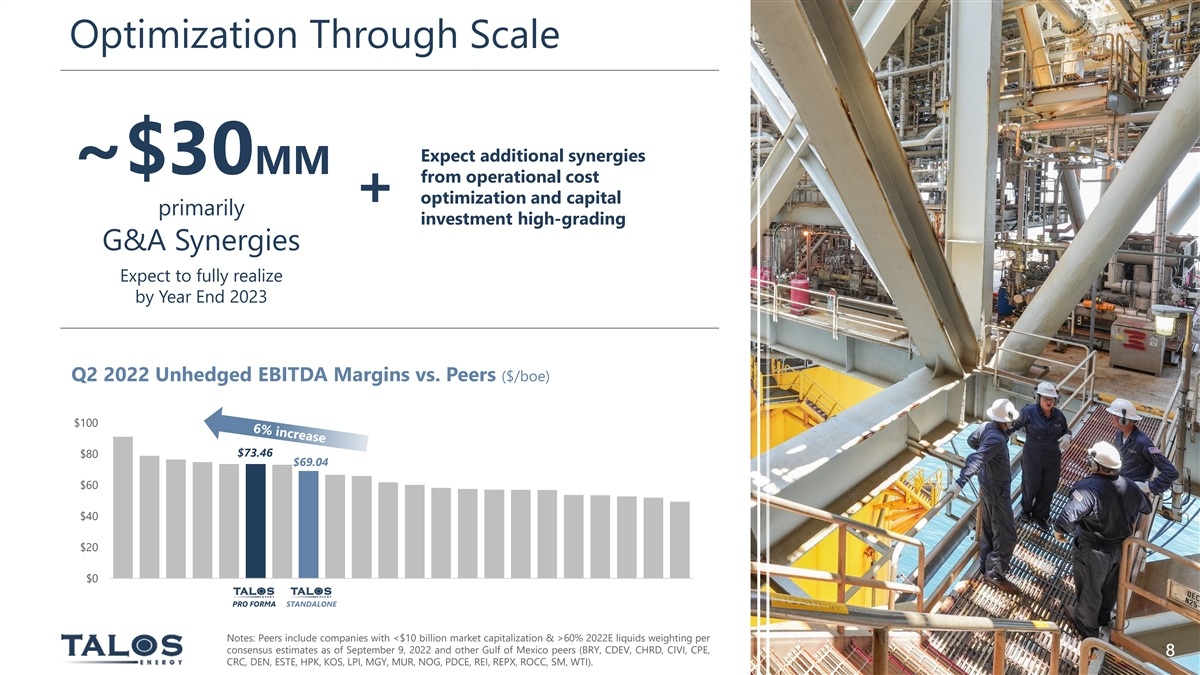

Optimization Through Scale Expect additional synergies ~$30MM from operational cost optimization and capital + primarily investment high-grading G&A Synergies Expect to fully realize by Year End 2023 Q2 2022 Unhedged EBITDA Margins vs. Peers ($/boe) $100 $73.46 $80 $69.04 $60 $40 $20 $0 PRO FORMA STANDALONE Notes: Peers include companies with <$10 billion market capitalization & >60% 2022E liquids weighting per consensus estimates as of September 9, 2022 and other Gulf of Mexico peers (BRY, CDEV, CHRD, CIVI, CPE, 8 CRC, DEN, ESTE, HPK, KOS, LPI, MGY, MUR, NOG, PDCE, REI, REPX, ROCC, SM, WTI).

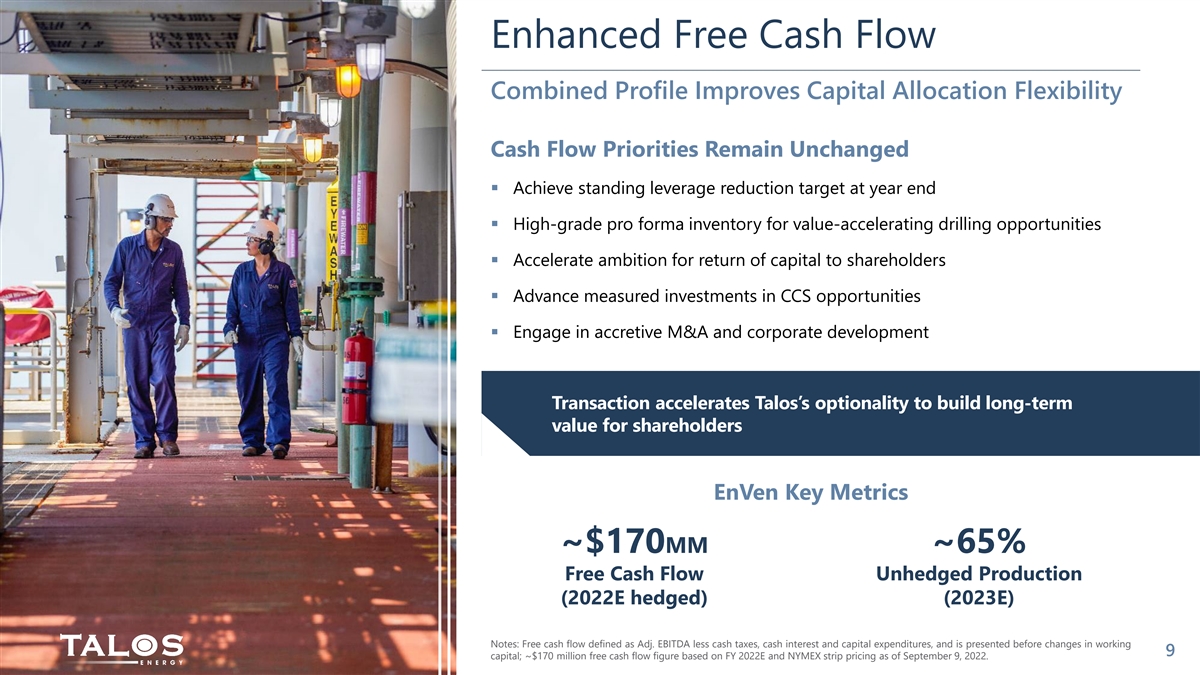

Enhanced Free Cash Flow Combined Profile Improves Capital Allocation Flexibility Cash Flow Priorities Remain Unchanged § Achieve standing leverage reduction target at year end § High-grade pro forma inventory for value-accelerating drilling opportunities § Accelerate ambition for return of capital to shareholders § Advance measured investments in CCS opportunities § Engage in accretive M&A and corporate development Transaction accelerates Talos’s optionality to build long-term value for shareholders EnVen Key Metrics ~$170MM ~65% Free Cash Flow Unhedged Production (2022E hedged) (2023E) Notes: Free cash flow defined as Adj. EBITDA less cash taxes, cash interest and capital expenditures, and is presented before changes in working 9 capital; ~$170 million free cash flow figure based on FY 2022E and NYMEX strip pricing as of September 9, 2022.

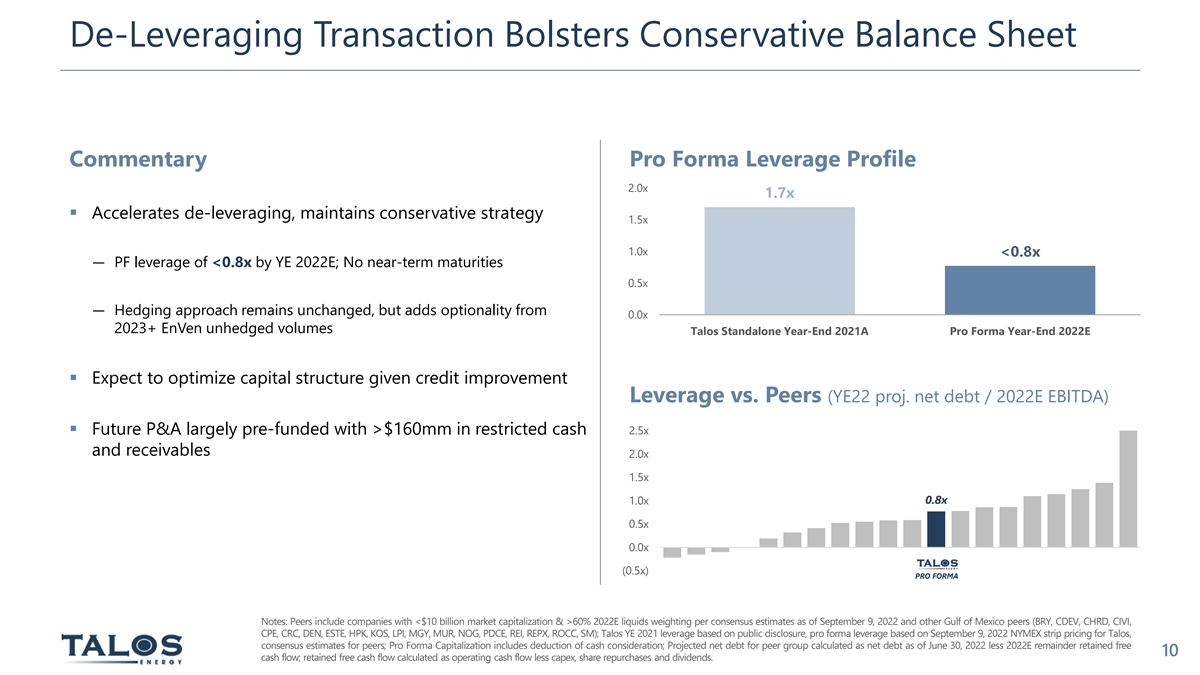

De-Leveraging Transaction Bolsters Conservative Balance Sheet Commentary Pro Forma Leverage Profile 2.0x 1.7x § Accelerates de-leveraging, maintains conservative strategy 1.5x 1.0x <0.8x ― PF leverage of <0.8x by YE 2022E; No near-term maturities 0.5x ― Hedging approach remains unchanged, but adds optionality from 0.0x 2023+ EnVen unhedged volumes Talos Standalone Year-End 2021A Pro Forma Year-End 2022E § Expect to optimize capital structure given credit improvement Leverage vs. Peers (YE22 proj. net debt / 2022E EBITDA) § Future P&A largely pre-funded with >$160mm in restricted cash 2.5x and receivables 2.0x 1.5x 0.8x 1.0x 0.5x 0.0x (0.5x) PRO FORMA Notes: Peers include companies with <$10 billion market capitalization & >60% 2022E liquids weighting per consensus estimates as of September 9, 2022 and other Gulf of Mexico peers (BRY, CDEV, CHRD, CIVI, CPE, CRC, DEN, ESTE, HPK, KOS, LPI, MGY, MUR, NOG, PDCE, REI, REPX, ROCC, SM); Talos YE 2021 leverage based on public disclosure, pro forma leverage based on September 9, 2022 NYMEX strip pricing for Talos, consensus estimates for peers; Pro Forma Capitalization includes deduction of cash consideration; Projected net debt for peer group calculated as net debt as of June 30, 2022 less 2022E remainder retained free 10 cash flow; retained free cash flow calculated as operating cash flow less capex, share repurchases and dividends.

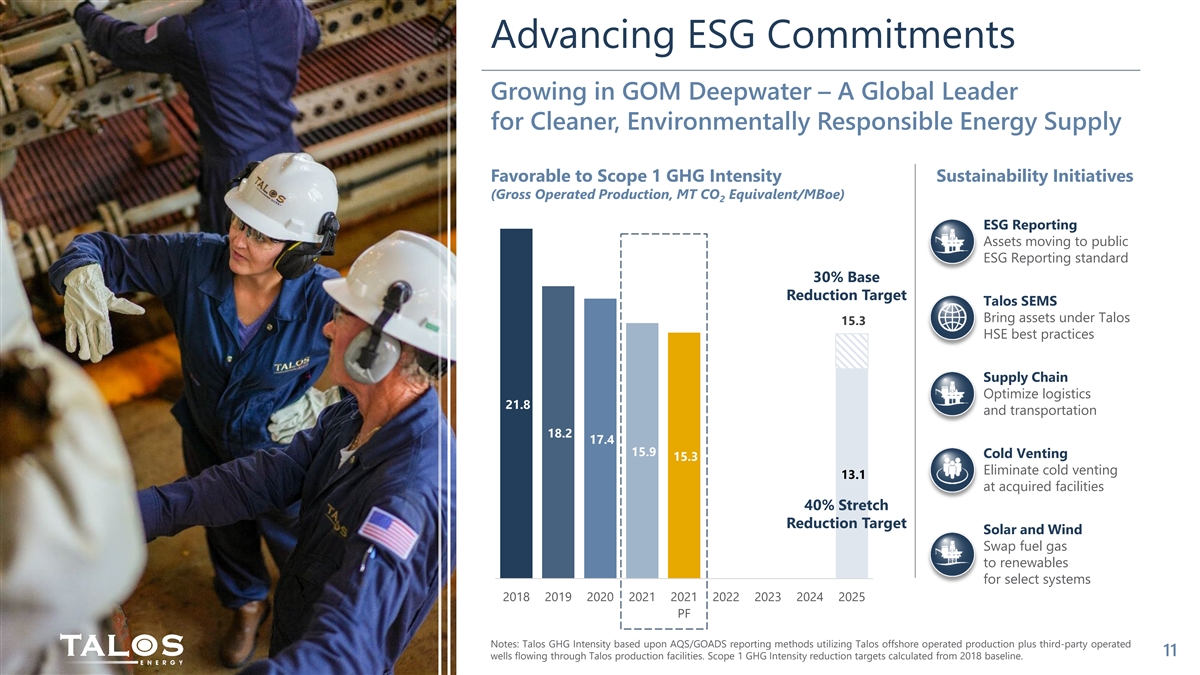

Advancing ESG Commitments Growing in GOM Deepwater – A Global Leader for Cleaner, Environmentally Responsible Energy Supply Favorable to Scope 1 GHG Intensity Sustainability Initiatives (Gross Operated Production, MT CO Equivalent/MBoe) 2 ESG Reporting Assets moving to public ESG Reporting standard 30% Base Reduction Target Talos SEMS Bring assets under Talos 15.3 HSE best practices Supply Chain Optimize logistics 21.8 and transportation 18.2 17.4 15.9 Cold Venting 15.3 Eliminate cold venting 13.1 at acquired facilities 40% Stretch Reduction Target Solar and Wind Swap fuel gas to renewables for select systems 2018 2019 2020 2021 2021 2022 2023 2024 2025 PF Notes: Talos GHG Intensity based upon AQS/GOADS reporting methods utilizing Talos offshore operated production plus third-party operated 11 wells flowing through Talos production facilities. Scope 1 GHG Intensity reduction targets calculated from 2018 baseline.

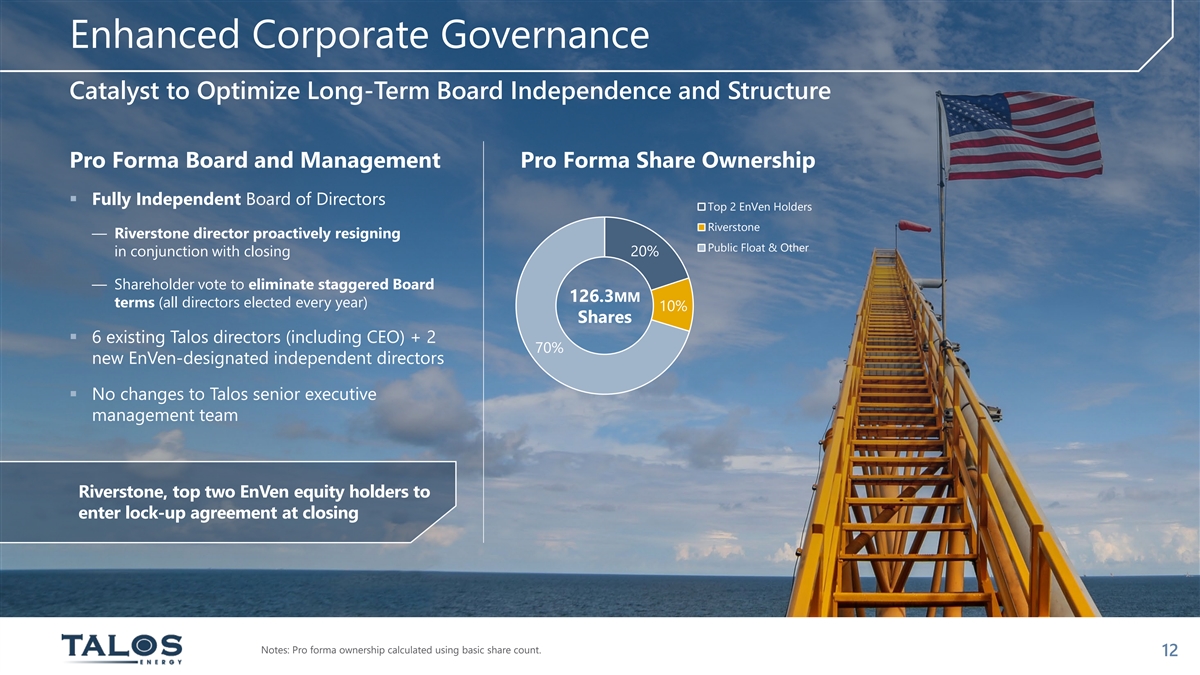

Enhanced Corporate Governance Catalyst to Optimize Long-Term Board Independence and Structure Pro Forma Board and Management Pro Forma Share Ownership § Fully Independent Board of Directors Top 2 EnVen Holders Riverstone ― Riverstone director proactively resigning Public Float & Other in conjunction with closing 20% ― Shareholder vote to eliminate staggered Board 126.3MM terms (all directors elected every year) 10% Shares § 6 existing Talos directors (including CEO) + 2 70% new EnVen-designated independent directors § No changes to Talos senior executive management team Riverstone, top two EnVen equity holders to enter lock-up agreement at closing Notes: Pro forma ownership calculated using basic share count. 12

A Highly Compelling Strategic Transaction Solid Transaction Satisfies All Company Criteria for Strategic M&A Strategic Fit Financial Merits Builds Scale Through Attractive In-Basin 2.4x 2022E hedged Adj. EBITDA Expansion 1.7x 2022E unhedged Adj. EBITDA Enhances Deepwater Focus FCFPS Accretive to Talos Shareholders Adds Significant Acreage and Facilities Footprint <0.8x YE 2022E Pro Forma Leverage Advances Emissions Intensity Objectives in ~$30MM+ Annual Run-Rate Synergies the ESG-leading Gulf of Mexico Notes: Implied enterprise value includes assumption of EnVen Net Debt of approximately $50 million at 12/31/22 and based on Talos share price as of September 21, 2022; Metrics based on FY 2022E figures at September 9, 2022 NYMEX strip pricing; Free cash flow defined as EBITDA less cash taxes, cash interest and capital expenditures, and is presented before changes in working capital; Free Cash 13 Flow Per Share accretion based on 2023E and inclusive of $30 million of synergies.

14

Exhibit 99.2

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

REFINITIV STREETEVENTS

PRELIM TRANSCRIPT

Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

EVENT DATE/TIME: SEPTEMBER 22, 2022 / 1:00PM GMT

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 1 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

CORPORATE PARTICIPANTS

Shannon E. Young Talos Energy Inc. - Executive VP & CFO

Timothy S. Duncan Talos Energy Inc. - Founder, President, CEO & Director

Unidentified Company Representative -

CONFERENCE CALL PARTICIPANTS

Jeffrey Woolf Robertson Water Tower Research LLC - MD

Leo Paul Mariani MKM Partners LLC, Research Division - MD

Subhasish Chandra The Benchmark Company, LLC, Research Division - Senior Equity Analyst

Unidentified Analyst -

PRESENTATION

Operator

Good day, and welcome to the Talos Energy Investor Call.

(Operator Instructions)

Please note, this event is being recorded. I would now like to turn the conference over to Jordan Keiser, Corporate Finance Manager. Please go ahead.

Unidentified Company Representative -

Thank you, operator. Before we begin, please let me draw attention to the securities law disclaimers included on Slides 2 and 3 of the presentation posted to our website, which discuss, among other things, the fact that we intend to file a registration statement on Form S-4 relating to this transaction, including a proxy statement regarding our special meeting and a consent solicitation statement for EnVen and which when filed, will include additional information that you should read in evaluating the transaction.

With that, I’ll turn the call over to Tim.

Timothy S. Duncan Talos Energy Inc. - Founder, President, CEO & Director

Thank you, Jordan, and good morning, everybody.

As Jordan read through some of the cautionary statements. I think we’re going to start on Page 4, and what I’m going to do for the next several minutes is work through these slides and talk about what are the key highlights in each of these slides and what gets us so excited about this deal. And then Shane Young and I are both available for Q&A when we get done walking through the presentation. And I’ll start by saying that we’ve been very patient in how we think about M&A. The last big deal we announced was in the end of 2019 that closed in early 2020, and although we’ve done some technical transactions, we’ve been very patient about trying to make sure we continue to find the right consolidation with the right set of assets.

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 2 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

And I would tell you, in vans a company we’ve admired for a long time. These are assets that we’ve always appreciated these are assets, frankly, that we had bid on in previous processes. And so there’s a lot of reasons this makes a lot of sense. And I’m going to walk through all of that in the slide deck. Now on Page 4, what I’d draw your attention to is right off the bat, this is a $1.1 billion deal. We’ve always been sensitive to the fact that if we’re going to use shares as part of the consideration, we need to make sure that we’re doing something that’s a discount to where we trade it’s going to be very accretive on a free cash flow per share basis that doesn’t get in the way of the deleveraging goals that we had, and I’m going to walk through all of that in the deck today.

And this checks all those boxes, which is what we’re talking about on the left side. It gives us a significant amount of free cash flow opportunity. We think there’s going to be significant synergies. When you look at exactly specifically what we’re buying on the right side of the page, this is a business that’s producing 24,000 barrels equivalent a day. It’s very oil-weighted. It’s weighted in deepwater as well.

So on a pro forma basis, be more oil-weighted and more weighted in deepwater from an asset perspective. We’ll talk about how these assets fit right into what we do every day. $460 million of adjusted EBITDA as an expected number for 2022 free cash flow number of about $170 million.

Now that’s hedged, as we get further into the presentation, we’ll talk about what that looks like on an unhedged basis and on a margin basis, which is unbelievably attractive. 78 million barrels on a 2P basis equivalent and 420,000 acres, and again, that gives us plenty of movement on how we think about allocating capital over the next several years.

We’re going to talk about, again, going back to the left side of the page and looking at the boxes we’re trying to check here. We’re going to go through all that and also talk about how we’re trying to enhance the governance profile of what we’re trying to do and why we think that’s important as we grow as a company.

So let’s go to Page 5. Again, more details. We’re going to see a 40% increase in our production and a more diversified asset set. Look, we think that’s important as we manage growing the company in the Gulf of Mexico, and we think it’s really important that you manage concentration and sometimes you have that when you’re lucky enough to have some success with the drill bit, which is something we did in tornado and something that we hope to do in our future drilling, it can add to the concentration profile. If you can diversify that with more assets, where you have seismic and where you have active operations, I think you build a healthier company, and this will do that for us.

Having those additional free cash flow and having this transaction be so accretive to how we think about free cash flow generation gives us more optionality on how we think about allocating capital and what we do, and we’re going to walk through some of that as well. It’s a great asset mix. It fits right in with what we’re doing. Their strategy is very similar to ours. We’re going to have more operated production facilities that have ample capacity as we think about subsea tiebacks. There’s going to be a tremendous

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 3 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

increase in acreage, which again, is helpful to us.

We’ve, I think, been a leader as an independent in our acreage set, and we’re just only going to add to that portfolio. I mentioned on the last slide, the EBITDA generation for this year of $460 million, just as a proxy as you think about this business. Well, on an unhedged basis, that was $630 million.

So like many companies, we have hedges that we all put on in late 2020 and early 2021. And as those hedges roll off, I think the margin story here on a hedge basis gets even better. Again, on an unhedged basis, these guys were — a netback margin was over $70 of BOE, very consistent what ours has been, and in fact, slightly better. We had a goal at the beginning of the year to get our leverage that down under 1x.

We’re still going to achieve that goal. If not, we expect to beat that goal. And this transaction actually is accretive to that goal. And so very important for us. And then on the ESG front, there’s a little bit of an environmental benefit, having more weighted deepwater assets. Their emissions intensity was slightly lower than ours. And so that’s going to be a positive when we put these businesses together, and we still always think there’s more low-hanging fruit as we continue to study that and figure out how we can improve our emissions intensity across our portfolio.

Then I think there’s some governance improvements here talked about in deals, particularly deals in small caps, and I’m proud of the fact that we have a Board that’s leaning in on getting the right governance structure.

So Page 6, I think, is really a compelling page. I mean — and this is where those who follow what we do and how we do it, will look at this page and say, look, this makes a ton of sense. And so there are a couple of things for us to point out.

If you go to Page 6 and you look at the map on the left side. So light blue is our seismic inventory. And as we’ve said in our Analyst Day and as I’ve continued to stay on the road, having regional seismic across the vast majority of the Gulf of Mexico, a lot of this has been picked up over the years, and then we localize our reprocessing efforts, our seismic reimaging efforts where we’re thinking about allocating capital in the next year or the next 2 to 3 years?

And this fits perfectly. It is — you can think about this from an operational synergy standpoint. You can think about this from more of a technology and a science and a seismic standpoint. And then you can think about this on how we think about growing our portfolio. You can also see, again, green just as a reference is where we have CCS opportunities and the Riverbend project is within that. And it gives us more of a presence around our stakeholders as we grow this company in the Gulf Coast region, just everything matches with what we’re trying to do and kind of who we’re trying to be in the Gulf Coast and being a leader as a counterparty there.

But if you think about our previous transactions, and I think this is some of the messaging that I want to

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 4 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

make sure you guys all receive is where we’ve had success over the last 10 years. The first transaction we did was in 2013 and that was in the — one of the assets was the Phoenix area.

Two years later, we had a discovery in the tornado area just to the south. We bought the Green Canyon 18 assets. Several years later, we redeveloped that asset. If you look at where our program is focused this year on the capital allocation side, it’s around the Ram Powell and Pompano areas, which are transactions that we did in the 2018 time frame. We fully expect that you’re going to see us allocate capital around their facilities as we launch reprocessing projects and they have their own portfolio.

This was a very healthy going concern. It was a company that was very well built. They have a deepwater rig program that’s starting up here in the near future and the first prospect out of the box called SunSpire is one that we’re very excited about.

So not only do they bring their own inventory, we think we bring our skill set as mature asset managers using the facilities and then probably launching some reprocessing projects around their facilities to see what else we can pull forward. When we think about that pulling all that together into pro forma company, I think we’re really excited about where we go from here. And again, on the right side of this page, on Page 6, you can see the percentage production increase, the gross acreage increase, the weighting on deepwater operations, oil weighting, all of that’s improved, and I think is a tremendous benefit.

So Page 7 just talks about some of those facilities. Again, similar to what our portfolio looks like. These were put in by many of these put in by the majors, they’ve been well taken care of. The EnVen team has done a tremendous job. They have a great track record on health, safety and compliance. Again, we’ve always admired the work they’ve done here. And we’re familiar with these assets. Budiselider is an example, Petronius. I mean I’m looking at assets that — I smile when I look at it because I know we tried to bid on them. And we were narrowly outbid, and they did a good job not only securing those, but then managing those after the transaction.

So it gave us a lot of familiarity, it gave us a lot of comfort. I think this is one of the reasons we feel really good about how we can execute this transaction. And then similar to our strategy, these not only are assets that we can work on their development plans, if there’s other things we think we can do to enhance some of the prospectivity around this acreage.

These facilities are available almost as midstream assets to host third-party discoveries. And then as we host that third-party production or maybe that’s a working interest partner on some of the things we’re trying to do that just adds another revenue stream to offset our operating costs and generally lower the overall operating cost structure of the business.

So similar strategy, similar asset set, again, something that we think we can execute well on. And that leads you to kind of how you think about synergies. And you go back a couple of slides ago and you look at the map, and you can kind of envision a lot of duplication in terms of how we think about services and

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 5 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

look, we share a financial auditor, how you can put together insurance packages, there’s a lot in the system when you do something in basin and particularly in the Gulf of Mexico that we think we can work on and add some synergies.

Some of those come through the G&A side, some of those come through the operation efficiency side. Now what the bottom chart shows is these were businesses running at a very high netback margin before we even think about these synergies. And part of that is because they’re oil weighted and the price and the premium we typically get on pricing in the Gulf of Mexico. So we had those benefits going in, put the synergies in with this, look at where this can go, and I think you’re looking at a top quartile, if not one of the leaders when we think about netback margin pre-hedged.

We get asked a lot before we even announced this transaction. Just being on the road, we were generating a tremendous amount of free cash flow this year, and it’s allowed us to really accelerate our debt repayment. I think Shane talked about on our last earnings call, that over the last 15 months, we have retired over $4.50 a share of debt retirement.

Here, that free cash flow profile goes up. And what that does for us, it’s going to give us optionality on how we think about capital allocation. We certainly want to continue the delevering. We think we all remember ‘15 and ‘16, we all remember 2020, we’re very proud of the fact we’ve never had financial distress and never want to think about that. And so getting that leverage debt under 1, getting that closer to half is something that we’re focused on. And it’s something we’re going to continue to do. And again, this transaction is accretive to where we think we’ll be in terms of our year-end leverage goals. But it also gives us more flexibility on how we can pro forma high grade the inventory on both companies.

How we think about returning capital to shareholders. And we’ve always been sensitive that, that’s a goal of ours. It’s an ambition of ours. So we’ve been cautious about how we think about the timing around when they do it. We have a lot to still work on. And again, we’re launching a CCS vertical, we think adds a tremendous amount of value to the company. And there’s other M&A ideas out there as well. But we’re not putting this in a particular order other than to say all those options are more on the table for us today than they were 6 months ago, and those options were available to us 6 months ago. And so again, everything we’re trying to do and all the goals we have, we think are improved by this transaction.

10 talks a little bit about the leverage. I mean a couple of things I would highlight here. Again, you looked at where we were on a stand-alone basis at the beginning of the year on the right side of the page, where we think we end up at the end of the year. We’re focused on trying to get this into a very conservative place. And when we thought about sources and uses on this transaction, we thought about what’s the right mix of consideration never doing something accretive for the shareholder, but also making sure that we’re heading down that path of being delevering as well.

And so we think we try to optimize that the best we could and how we thought about not only the total

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 6 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

consideration, but the mix of consideration. From a hedging basis, we’re going to stay focused on how to continue to do that. We kind of manage that in terms of some of the requirements on the credit facility. There’s a lot of open exposure, which is a positive thing, I think, in 2023. And as we kind of continue on and look at managing the businesses, we’ll look at where to add I think 1 thing that’s pretty interesting and I would draw your attention to is the last bullet.

So on a P&A basis, and part of this is based on the timing in which the EnVen bought these assets, some of these assets were purchased in the 2015 and 2016 timeframe. And so the seller asked for requirements to put restricted cash away, prefund some of the P&A. So on a net liability basis, if you think about it from a BOE basis, it’s also accretive on that front as well. So they’ve got restricted cash to prefunds a lot of the P&A obligations with third-party sureties to the majors.

And so I think that’s a really nice benefit that we get. And again, part of that on the timing of when they bought it, but all that flows over to us, and it’s a very positive part of this transaction. We talked about ESG for the next couple of pages, and it’s not just the environmental, which is obviously important to all of us and something that is we’re very proud of not only what we’ve done with our assets over the years and what our goals are and our targets are and then obviously, what we’re launching downstream of our operations on the CCS side, but because we had more deepwater waiting here, we expect this to accelerate our own pro forma goals. And the other thing that I think is very important is consistent with the strategy when you have these deepwater facilities, it’s going to encourage more subsea tiebacks when we think about that next barrel.

And so, so much of how we think about emissions intensity isn’t just managing the emissions you have, it’s really focusing on how do you produce a low carbon barrel and what’s next for your asset, what’s next for your company? And just by the nature of this asset set by the nature of the unutilized capacity in these physical facilities. And when you think about how we allocate capital, owning and operating more of these facilities, not only do we think we’re a good steward and we’ll be a good owner of those facilities, we think it encourages more capital allocation, what we’re doing subsea tie back to these facilities. And then that barrel is going to be the lowest emitting barrel we can have in a subsea environment.

So ultimately, that’s going to lead us to continue to be aggressive and how we’re thinking about lowering our emissions intensity on these assets. And again, I think we’ve said this again and again, we think the deepwater Gulf of Mexico is the premier leader from an oil asset and mission intensity basis and we’re just going to improve on that story. But also, this deal has something, I think, a little bit unique, I hope, for companies our size.

And as you think about this and reflect on it, you’ll agree, and what we’re doing on the governance structure. So we’ve been public for years, and we became public through a reverse merger and there was a time when we first launched this company as a public company in 2018. That the insiders owned over 70% of the company. And there wasn’t a lot of liquidity in the stock.

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 7 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

We had a large private equity presence, which you would expect, and we had a staggered board. As we’ve matured as a company, as we rolled some of those owners off, we thought about how do we think about governance for where we’re trying to get to where we want to be as a company? And can we affect some of that in our next transaction.

And it’s something we had thought about. And then this is an opportunity to do it. And so we will have — Riverstone has been an unbelievable sponsor to us. They’ve been a dear friend in the business, and then it helped us tremendously. But as we close this transaction, the Riverstone (inaudible) director will proactively resign. EnVen will have 2 independent directors. We will keep our independent director group. And then obviously, I’ll still be here. And so that will set up I think the right governance approach will eliminate the stagger boards and have annual elections.

And these are the things that I think a maturing company needs to do. And if you can have a catalyst like this transaction to do it, I think it’s the right time to do it. And so you’re not seeing very expansive boards here. You’re not seeing some of the other things on expanding management teams, and we’re focused on synergies. We’re focused on the right governance, and I think that’s reflected in how we’re doing it in the transaction.

So to wrap up before I open it up to questions, again, we think this just checks a lot of boxes. We think scale is important in our basin, a diversity of assets importance in our base. And we think these assets lay right over our own operational footprint and kind of what we’re doing from a technology standpoint, the tremendous acreage set. We think we bought it at the right price. We’re proud of the fact that it’s going to be accretive and still be accretive on both free cash flow per share and on our leveraging goals, deleveraging goals, and we expect to affect the synergies. And so there’s going to be a lot to talk about as we integrate this.

We’re very proud of the team we’ve put together that focuses on business opportunities every day. There’s a lot of hard work in there. We’re excited to talk to their employees and see how they can fit in the pro forma company. And then look, we’re trying to build a leadership position in a basin that we know very well that will help us execute for the long haul. And this transaction helps us accomplish all those goals.

So with that, we’ll turn it over for questions.

QUESTIONS AND ANSWERS

Operator

(Operator Instructions)

The first question today comes from Leo Mariani with MKM Partners.

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 8 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

Leo Paul Mariani MKM Partners LLC, Research Division—MD

I wanted to ask a little bit about kind of use of free cash flow in 2023. You obviously putting some cash in the deal. It looks like you’re also assuming $50 million net debt. Just wanted to clarify if that’s just bank debt, and you would just put the $212 million in that $50 million onto the Talos revolver. And I guess just wanted to get a sense of do you kind of try to pay all that incremental acquisition debt off in 2023. You mentioned returning capital to shareholders.

I just wanted to get a sense on the priority there. Do you want to pay that debt off first before you initiate a return of capital program. And then just additionally, any comments about like an increase in the size of the credit facility post the deal?

Timothy S. Duncan Talos Energy Inc.—Founder, President, CEO & Director

Yes. Leo, I’m going to hand it over to Shane. I would tell you, we’ve been pretty measured. Shane’s going to walk through their balance sheet. We’ve been pretty measured on how we think about where to prioritize that. And — and I think as we get closer to closing and we think about rolling out next year’s budget, we’ll continue to focus on that. But Shane, why don’t we talk a little bit about their balance sheet and then we’ll kind of go back to other parts of this question.

Shannon E. Young Talos Energy Inc.—Executive VP & CFO

Yes, absolutely. Thanks, Leo. So look, yes, from the balance sheet perspective, look similar to us, where we’ve been focused on, Tim talked about sort of the leverage reduction strategy. Those guys have been every bit as part of that. In fact, even ahead of where we are on a leverage that. And that’s why when we blend all of this together, it’s still accretive to the credit. So just walking through it. At year-end, we expect that they’ll have $50 million of net debt. That comprises of a note that they have outstanding. It’s got a little amortization to it. It should be around $250 million at year-end, including some of that amortization that they’ve got. And then they’ll have, again, a cash balance that will build up to get you to that net debt of $50 million at that point in time.

So we’ll assume all of that over and then add the additional $212 million to that. So it’ll be — again, they’ll be bringing into the credit picture inclusive of the cash consideration, roughly $250 million of net debt to the picture.

And as Tim talked about, their EBITDA expectation for the year at $460 million, you can see you’ve got roughly $0.25 billion of net debt, including the cash consideration against just under $0.5 billion of EBITDA, so about half a turn to the total credit. But the goal here is to, again, consolidate these 2 credits upon the closing.

Timothy S. Duncan Talos Energy Inc.—Founder, President, CEO & Director

Yes. And then, look, I mean, in terms of when is the right time to launch the shareholder return policy. I think when you’ve lived what we’ve all lived than we were very lucky and certainly very proud of the fact that we manage both of the last downturns without a scratch, maybe slightly bruise, but without too big of a scratch. I mean I think you remember that, and you really want to focus that first priority in driving

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 9 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

the balance sheet to a spot where you think it’s healthy and can hold up to potentially another drop in prices. We want to do that. We want to finish that goal. And then as we think about these notes, although they’re callable, I mean we’ll have to be opportunistic in the market. When does it make sense to do that? It’s the market where we want it to be maybe at the end of the first quarter next year. And that drives a little bit of how we think about the shareholder return policy. I mean it’s a high cost of capital business. We want to lower that cost of capital.

But I’m more encouraged today that we’re getting closer to implementing those policies than maybe we would have been 3 months ago. We certainly, with this transaction, have more of that optionality than we otherwise would. And so we just have to sit down with the Board, look at all the things we’re doing as a firm. The one thing I’ve told you, Leo, is that I think our business has a lot of catalysts. I think we’ve got exploration catalysts, development catalysts, tieback catalysts, CCS catalyst and some of those need some funding. And so reallocating capital back into the business is also important. So these are all different priorities.

We’re going to address all of them with the pro forma Board as the companies come together. But I think just the fact that we have this much optionality is a huge benefit.

Leo Paul Mariani MKM Partners LLC, Research Division—MD

Okay. That’s helpful. Then just picking on a couple of financial questions here for you. You guys clearly talked about how there’s some underwater hedges for EnVen in 2022. Can you give us a sense on ‘23 and ‘24? Is EnVen pretty unhedged for those years? You guys maybe kind of suggested that a little bit on the slides here. And then just on the $30 million of G&A synergies, it sounds like it’s mostly G&A. Is that roughly equivalent to what the G&A with EnVen is, and you kind of pretty much expect to eliminate all that? Just any help you can offer there would be great.

Shannon E. Young Talos Energy Inc.—Executive VP & CFO

Leo, I’ll fill the hedges here quickly for you. So look, as I say, they’ve got some hedge losses in 2022. We’ve got some hedge losses in 2022 as well. Both of us did a refinancing of our notes around the same time and put hedges in place really to help support those refinancings and we’re sort of rolling off the tail end of those as we get through the end of this year. So that’s good. their policy very has been historically very similar to ours. And I would say both entities open up a lot of capacity starting in 2023 and certainly beyond. And at the same time, I think we’ve been following our historical patterns around adding in some incremental hedges on a quarterly basis and I wouldn’t be surprised if they were doing something similar.

Timothy S. Duncan Talos Energy Inc.—Founder, President, CEO & Director

And then on the synergy yes, I’m sorry, let me get back to you, Leo, the synergy question that you asked. Look, it’s in basin. And we’ve talked about, as we’ve been looking at M&A deals over the last couple of years, even though we’ve looked at some things that are in other offshore basins, internationally, we were focused on trying to get one done in basin because it does impact the synergies. It helps us grow the operational footprint, make it more efficient. It gives us some economies of scale. It gives us I think,

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 10 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

some purchasing power and things of that nature.

So I think the synergy aspect that just feels important, I think being in basin allows us to be effective there, and we expect to be. And so we’ll look at everything, both operationally from a G&A standpoint where do we have duplicating costs and things of that nature and standard stuff you would expect in a deal, we have a full integration team ready to go, and we’ll work really hard to make sure we realize all that.

Leo Paul Mariani MKM Partners LLC, Research Division—MD

All right. And then you guys also talked about 1 exploration prospect that you’re excited about. Just wanted to get a sense of are there other material exploration prospects as well in the EnVen portfolio and provide a little bit more color around that. And then just lastly, how does this combination affect CCS initiatives? Is it just kind of give you more scale to be more competitive on CCS sort of going forward? Just any more thoughts around that?

Timothy S. Duncan Talos Energy Inc.—Founder, President, CEO & Director

Yes. Well, look, they absolutely have their own inventory. They have at least 35 to 40 different ideas on subsea tiebacks rolling through their inventory, and we we acknowledge all of that. I think we want to pull it together and look at everything. And as we kind of think about how to plan ‘23 and ‘24 and ‘25 rig programs, where do we think that we can launch some more reprocessing, but they’ve built a very healthy business or they wouldn’t be here. And so we’re excited about putting all that together.

Now as they pull a rig program into their operations right now and so they’ve got 1 coming that will start here soon and go through the first quarter of next year, we like exactly what they’re doing right out of the box. And so it’s always good, particularly in the Gulf of Mexico, this isn’t similar to somebody unconventional basins where everyone is familiar with the rock. It’s aggregated in just a couple of counties, add a rig, lose a rig. You really have to think about the entire landscape of the Gulf of Mexico.

And hey, what are they doing around their assets they may be in the Mississippi Canyon area, Green Canyon area, in bank area. What are we doing around our assets. And as we step into their business, we really like what they’re doing right out of the box. And then we’ll continue to kind of high-grade the pro forma portfolio going forward.

Now one thing this does, Leo, for us is there are times where we have a prospect and we think about where we’re allocating capital, and we can raise a little bit of that capital allocation. So it can free us up depending on what level of working interest we own, depending on what the dry hole cost might be and the drilling cost might be on a prospect, to shift more capital and be more aggressive on our own inventory. So you get multiple benefits. You get the pro forma inventory and then you get the additional scale of free cash flow to potentially accelerate what you do on your side.

So all that’s positive. On the CCS front, look, I think it’s really important that we are showing how committed we are to the Gulf of Mexico and the Gulf Coast, whether that be where we’re operating,

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 11 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

whether that’s where our employees live and work, the whole spirit around CCS is lowering emissions broadly in the places where we live and work. And being trying to be a service provider and a benefit to that downstream petroleum products and the things that we do that affect emissions. And I think being a bigger company allows us to be a better counterparty, I think it allows us to become a better partner of choice, I think it makes us more visible with all the stakeholders that are participating in CCS. And I think those are all net adds.

And so — and then obviously, just from a free cash flow benefit, we have more available to think about how we allocate back into the CGS business. So it’s just — I think it’s pros across the board on that front.

Operator

The next question comes from Subhasish Chandra with Benchmark Company.

Subhasish Chandra The Benchmark Company, LLC, Research Division—Senior Equity Analyst

Congrats, everybody. Was curious, Tim or Shane, if you had a PV-10 number associated with this transaction. Did they — have they disclosed theirs?

Shannon E. Young Talos Energy Inc.—Executive VP & CFO

I think — well, certainly had their — well, they have done it publicly, that they have to their noteholders and they had a year-end number, but nothing since then.

Timothy S. Duncan Talos Energy Inc.—Founder, President, CEO & Director

Yes. Here’s what I would tell you. We obviously — we bought this well inside proved reserves. And we’ll think about trying to disclose that maybe potentially in future presentations. But I would say the entirety of the transaction, all of the acreage every benefit that I’ve just talked about on this call was well inside kind of the proved reserves. And I would say at a good — an appropriate discount rate relative to our cost of capital as we think about how we bid on this inside those proved reserves. And so well, let us think about the appropriate time to disclose all that, and I’m sure we will soon.

But just kind of what might be on your mind is how do you think about bidding this? I think we did it the right way relative to our cost of capital and where that hits on the discount rate all inside proved. And I think that’s one of the benefits being in the Gulf of Mexico,

Subhasish, we’ve always said that if you do this right in the Gulf, you get a lot of these extra benefits that typically some folks might think about paying for on the onshore side, we’re trying not to pay for in the Gulf of Mexico and they just come with the deal.

And again, I go back to Stone as an example of that, and the success we’ve had in Puma West and we hope to continue to have as we appraise that, that was acreage that wasn’t — had no value allocation in the Stone transaction.

Shannon E. Young Talos Energy Inc.—Executive VP & CFO

And Subhasish, I would just tell you, from their own presentation on their own website, as of the

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

|

|

| 12 |

SEPTEMBER 22, 2022 / 1:00PM GMT, Talos Energy Inc Announces Strategic Acquisition of EnVen Energy Corp

beginning of the year with the beginning of the year strip, they had $1.5 billion — $1.5 billion of (inaudible), Tim.

Timothy S. Duncan Talos Energy Inc.—Founder, President, CEO & Director

Yes. And that’s a script from the beginning — the beginning of the year, yes.

Subhasish Chandra The Benchmark Company, LLC, Research Division—Senior Equity Analyst

Okay. Got it. And the — so it sounds like, okay, you got an integration team but — and there will be things you’re going to tweak and work around. But pretty safe to say that the EnVen program that they had planned for ‘23 is what you’re going to run with it might be a little late in the day change that? And was that program a maintenance program, (inaudible)? Or have they not really got to what ‘23 was going to look like?

Timothy S. Duncan Talos Energy Inc.—Founder, President, CEO & Director

Yes. So their businesses is not too dissimilar to ours. I mean they think they have the right approach on how they think about where do we have development opportunities. So take their lobster assets. It’s been a tremendous transaction for them. It’s been a tremendous asset for them. And they have a platform rig on that asset, and they look for development opportunities on that asset. They’ve kept a consistent rig program over the last several years, and that rig program is still ongoing. And so some of the capital we’re allocating is towards that rig program. And then they’re allocating capital to a couple of new kind of tieback opportunities similar to what we’re trying to do in our lime rock and our Vinis and our Rigolese prospects and our program. And so they have those teed up and ready to go and we recognize what they’re doing in both of those.

And so we’re just going to step in and execute that plan. And that’s — I would call that the beginning building block for 2023. Now as we work over the next couple of months towards closing and we think about ‘23 and then into ‘24. The question will be, hey, do we think about extending these programs, do we allocate more capital on our side, while we continue to study theirs and then integrate more of theirs in the ‘24 program, we’ll have all that optionality. But there’s nothing we need to change in what they’re doing. I think they’re allocating capital the right way. They’re focused on the right risk and rewards similar to we are. I think we just want to enhance our familiarity with the assets. But I think the optionality it provides a tremendous.

Subhasish Chandra The Benchmark Company, LLC, Research Division—Senior Equity Analyst

And finally, so January is fast approaching, and you kind of refer to this with the high-yield market — credit markets look like, et cetera, et cetera. But with — what are the scenarios towards refi at this point? And I guess, the amortizing notes that EnVen has, I mean, do you sort of expect that to take care of itself? Or is that something you can package into a broader refi with your own 12% early in the year?