UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2022

EverQuote, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-38549 | 26-3101161 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 210 Broadway Cambridge, Massachusetts |

02139 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (855) 522-3444

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered |

||

| Class A Common Stock, $0.001 par value per share | EVER | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On August 1, 2022, EverQuote, Inc. (the “Company”) issued a press release reporting financial results for the fiscal quarter ended June 30, 2022. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 7.01 | Regulation FD Disclosure. |

On August 1, 2022, the Company posted an investor presentation to its website (www.everquote.com). A copy of the investor presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information contained in Item 7.01 in this Current Report on Form 8-K (including Exhibit 99.2) shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

EXHIBIT INDEX

| Exhibit No. |

Description |

|

| 99.1 | Press release dated August 1, 2022 | |

| 99.2 | Investor Presentation dated August 2022 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| EVERQUOTE, INC. | ||||||

| Date: August 1, 2022 | By: | /s/ John Wagner |

||||

| John Wagner | ||||||

| Chief Financial Officer and Treasurer | ||||||

Exhibit 99.1

EverQuote Announces Second Quarter 2022 Financial Results

| • | Performance Exceeds Guidance on Key Financial Metrics |

| • | Total Revenue of $101.9 million |

| • | Variable Marketing Margin of $33.1 million |

| • | DTCA Operations Generated 13% of Total Revenue |

CAMBRIDGE, Mass., August 1, 2022 (GLOBE NEWSWIRE) — EverQuote, Inc. (Nasdaq: EVER), a leading online insurance marketplace, today announced financial results for the quarter ended June 30, 2022.

“In the second quarter, we exceeded guidance expectations across our three primary financial KPIs delivering revenue of $101.9 million and Variable Marketing Margin, or VMM, of $33.1 million, and generated positive Adjusted EBITDA,” said Jayme Mendal, CEO of EverQuote. “We are effectively reacting to a rapidly changing market environment, altering our cost structure and modifying our bidding strategy to navigate continued volatility and increased headwinds in the auto insurance industry. We are also benefiting from our multi-year effort to diversify our distribution into agent channels. Our Direct-to-Consumer-Agency, or DTCA, continued to perform well in the second quarter as we drove improving unit economics and cash efficiency of our operations.

“We continue to make progress towards our long-term vision to become the largest online source of insurance policies by combining data, tech, and knowledgeable advisors to make insurance simpler, more affordable and personalized. As auto carrier demand recovers, we continue to expect that EverQuote will be well-positioned to return to our historic trend of strong revenue growth and expanding Adjusted EBITDA.”

Second Quarter 2022 Financial Highlights:

(All comparisons are relative to the second quarter of 2021):

| • | Total revenue of $101.9 million, a decrease of 3%. |

| • | Automotive insurance vertical revenue of $81.4 million, a decrease of 6%. |

| • | Revenue from other insurance verticals, which includes home and renters, life, and health insurance, increased 10% to $20.5 million. |

| • | Variable Marketing Margin of $33.1 million, an increase of 1%. |

| • | GAAP net loss increased to $3.8 million, compared to GAAP net loss of $1.9 million. |

| • | Adjusted EBITDA decreased to $1.4 million, compared to Adjusted EBITDA of $6.6 million. |

| • | DTCA operations generated $13.1 million in revenue, or 13% of total revenue. |

Third Quarter and Full-Year 2022 Guidance:

EverQuote anticipates Revenue, Variable Marketing Margin and Adjusted EBITDA to be in the following ranges:

Third Quarter 2022:

| • | Revenue of $90 - $95 million. |

| • | Variable Marketing Margin of $24 - $27 million. |

| • | Adjusted EBITDA of ($6) - ($3) million. |

Full Year 2022:

| • | Revenue of $400 - $410 million. |

| • | Variable Marketing Margin of $116 - $122 million. |

| • | Adjusted EBITDA of ($7) - ($1) million. |

With respect to the Company’s expectations under “Third Quarter and Full Year 2022 Guidance” above, the Company has not reconciled the non-GAAP measure Adjusted EBITDA to the GAAP measure net income (loss) in this press release because the Company does not provide guidance for stock-based compensation expense, depreciation and amortization expense, acquisition-related costs, legal settlement, one-time severance charges, interest income, and income taxes on a consistent basis as the Company is unable to quantify these amounts without unreasonable efforts, which would be required to include a reconciliation of Adjusted EBITDA to GAAP net income (loss). In addition, the Company believes such a reconciliation would imply a degree of precision that could be confusing or misleading to investors.

Conference Call and Webcast Information

EverQuote will host a conference call and live webcast to discuss its second quarter 2022 financial results at 4:30 p.m. Eastern Time today, August 1, 2022. To access the conference call, dial Toll Free: (844) 200-6205 for the US, or (929) 526-1599 for international callers, and provide conference ID 515022. The live webcast and replay will be available on the Investors section of the Company’s website at https://investors.everquote.com.

Safe Harbor Statement

Any statements in this press release about future expectations, plans and prospects for EverQuote, Inc. (“EverQuote” or the “Company”), including statements about future results of operations or the future financial position of the Company, including financial targets, business strategy, plans and objectives for future operations and other statements containing the words “anticipates,” “believes,” “expects,” “plans,” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: (1) the Company’s ability to attract and retain consumers and insurance providers using the Company’s marketplace; (2) the Company’s ability to maintain or increase the amount providers spend per quote request; (3) the impact on the Company and the insurance industry of the COVID-19 pandemic; (4) the effectiveness of the Company’s growth strategies and its ability to effectively manage growth; (5) the Company’s ability to maintain and build its brand; (6) the Company’s reliance on its third-party service providers; (7) the Company’s ability to develop new and enhanced products and services to attract and retain consumers and insurance providers, and the Company’s ability to successfully monetize them; (8) the impact of competition in the Company’s industry and innovation by the Company’s competitors; (9) the expected recovery of the auto insurance industry; (10) developments regarding the insurance industry and the transition to online marketing; (11) the Company’s ability to successfully integrate PolicyFuel; (12) the Company’s ability to successfully remediate the material weaknesses identified in the Company’s internal controls over financial reporting; (13) the possible impacts of inflation; and (14) other factors discussed in the “Risk Factors” section of the Company’s most recent Quarterly Report on Form 10-Q, which is on file with the Securities and Exchange Commission. In addition, the forward-looking statements included in this press release represent the Company’s views as of the date of this press release. The Company anticipates that subsequent events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this press release.

About EverQuote

EverQuote operates a leading online insurance marketplace, connecting consumers with insurance providers. The company’s mission is to empower insurance shoppers to better protect life’s most important assets—their family, property, and future. Our vision is to become the largest online source of insurance policies by using data and technology to make insurance simpler, more affordable and personalized, ultimately reducing cost and risk.

For more information, visit everquote.com and follow on Twitter @everquotelife, Instagram @everquotepics, and LinkedIn https://www.linkedin.com/company/everquote/.

Investor Relations Contact:

Brinlea Johnson

The Blueshirt Group

415-489-2193

EVERQUOTE, INC.

STATEMENTS OF OPERATIONS

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (in thousands except per share) | (in thousands except per share) | |||||||||||||||

| Revenue |

$ | 101,915 | $ | 105,063 | $ | 212,596 | $ | 208,885 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost and operating expenses(1): |

||||||||||||||||

| Cost of revenue |

6,059 | 5,811 | 12,043 | 11,764 | ||||||||||||

| Sales and marketing |

87,854 | 85,610 | 184,004 | 173,179 | ||||||||||||

| Research and development |

8,245 | 9,053 | 16,441 | 17,626 | ||||||||||||

| General and administrative |

7,357 | 6,200 | 14,298 | 11,796 | ||||||||||||

| Acquisition-related |

(3,779 | ) | 265 | (4,671 | ) | 186 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost and operating expenses |

105,736 | 106,939 | 222,115 | 214,551 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(3,821 | ) | (1,876 | ) | (9,519 | ) | (5,666 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income (expense): |

||||||||||||||||

| Interest income |

37 | 10 | 45 | 24 | ||||||||||||

| Other income (expense), net |

28 | (15 | ) | 3 | (40 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other income (expense), net |

65 | (5 | ) | 48 | (16 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (3,756 | ) | $ | (1,881 | ) | $ | (9,471 | ) | $ | (5,682 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share, basic and diluted |

$ | (0.12 | ) | $ | (0.07 | ) | $ | (0.31 | ) | $ | (0.20 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding, basic and diluted |

31,519 | 28,895 | 31,027 | 28,665 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) Amounts include stock-based compensation expense, as follows: |

|

|||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||

| Cost of revenue |

$ | 95 | $ | 83 | $ | 154 | $ | 174 | ||||||||

| Sales and marketing |

2,964 | 2,459 | 6,174 | 5,850 | ||||||||||||

| Research and development |

2,650 | 2,321 | 5,061 | 4,648 | ||||||||||||

| General and administrative |

1,891 | 2,226 | 3,741 | 3,937 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 7,600 | $ | 7,089 | $ | 15,130 | $ | 14,609 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

EVERQUOTE, INC.

BALANCE SHEET DATA

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| (in thousands) | ||||||||

| Cash and cash equivalents |

$ | 41,269 | $ | 34,851 | ||||

| Working capital |

43,415 | 37,288 | ||||||

| Total assets |

160,989 | 143,607 | ||||||

| Total liabilities |

54,737 | 58,482 | ||||||

| Total stockholders’ equity |

106,252 | 85,125 | ||||||

EVERQUOTE, INC.

STATEMENTS OF CASH FLOWS

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||

| Cash flows from operating activities: |

||||||||||||||||

| Net loss |

$ | (3,756 | ) | $ | (1,881 | ) | $ | (9,471 | ) | $ | (5,682 | ) | ||||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

||||||||||||||||

| Depreciation and amortization expense |

1,405 | 1,136 | 2,916 | 2,310 | ||||||||||||

| Stock-based compensation expense |

7,600 | 7,089 | 15,130 | 14,609 | ||||||||||||

| Change in fair value of contingent consideration liabilities |

(3,780 | ) | (210 | ) | (4,672 | ) | (289 | ) | ||||||||

| Provision for (recovery of) bad debt |

2 | (4 | ) | 77 | (50 | ) | ||||||||||

| Unrealized foreign currency transaction (gains) losses |

(23 | ) | 8 | (16 | ) | 23 | ||||||||||

| Changes in operating assets and liabilities, net of effects from acquisition: |

||||||||||||||||

| Accounts receivable |

9,974 | 3,239 | (999 | ) | 297 | |||||||||||

| Prepaid expenses and other current assets |

(114 | ) | (264 | ) | (250 | ) | (92 | ) | ||||||||

| Operating lease right-of-use assets |

642 | 609 | 1,287 | 1,400 | ||||||||||||

| Other assets |

(5,691 | ) | 393 | (11,252 | ) | (340 | ) | |||||||||

| Accounts payable |

(9,883 | ) | (6,421 | ) | 3,413 | (7,123 | ) | |||||||||

| Accrued expenses and other current liabilities |

798 | 4,728 | (2,059 | ) | 7,538 | |||||||||||

| Deferred revenue |

(10 | ) | 24 | (122 | ) | (33 | ) | |||||||||

| Operating lease liabilities |

(692 | ) | (699 | ) | (1,355 | ) | (1,337 | ) | ||||||||

| Other long-term liabilities |

— | (32 | ) | — | 4 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by (used in) operating activities |

(3,528 | ) | 7,715 | (7,373 | ) | 11,235 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash flows from investing activities: |

||||||||||||||||

| Acquisition of property and equipment, including costs capitalized for development of internal-use software |

(1,308 | ) | (533 | ) | (1,989 | ) | (1,310 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash used in investing activities |

(1,308 | ) | (533 | ) | (1,989 | ) | (1,310 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash flows from financing activities: |

||||||||||||||||

| Proceeds from exercise of stock options |

50 | 452 | 608 | 1,724 | ||||||||||||

| Proceeds from private placement of common stock |

— | — | 15,000 | — | ||||||||||||

| Tax withholding payments related to net share settlement |

(51 | ) | — | (51 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided (used) by financing activities |

(1 | ) | 452 | 15,557 | 1,724 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

(22 | ) | — | (27 | ) | 1 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash |

(4,859 | ) | 7,634 | 6,168 | 11,650 | |||||||||||

| Cash, cash equivalents and restricted cash at beginning of period |

46,128 | 47,136 | 35,101 | 43,120 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash, cash equivalents and restricted cash at end of period |

$ | 41,269 | $ | 54,770 | $ | 41,269 | $ | 54,770 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

EVERQUOTE, INC.

FINANCIAL AND OPERATING METRICS

Revenue by vertical:

| Three Months Ended June 30, | Change | |||||||||||

| 2022 | 2021 | % | ||||||||||

| (in thousands) | ||||||||||||

| Automotive |

$ | 81,375 | $ | 86,358 | -5.8 | % | ||||||

| Other |

20,540 | 18,705 | 9.8 | % | ||||||||

|

|

|

|

|

|||||||||

| Total Revenue |

$ | 101,915 | $ | 105,063 | -3.0 | % | ||||||

|

|

|

|

|

|||||||||

| Six Months Ended June 30, | Change | |||||||||||

| 2022 | 2021 | % | ||||||||||

| (in thousands) | ||||||||||||

| Automotive |

$ | 169,050 | $ | 170,839 | -1.0 | % | ||||||

| Other |

43,546 | 38,046 | 14.5 | % | ||||||||

|

|

|

|

|

|||||||||

| Total Revenue |

$ | 212,596 | $ | 208,885 | 1.8 | % | ||||||

|

|

|

|

|

|||||||||

Other financial and non-financial metrics:

| Three Months Ended June 30, | Change | |||||||||||

| 2022 | 2021 | % | ||||||||||

| (in thousands) | ||||||||||||

| Loss from operations |

$ | (3,821 | ) | $ | (1,876 | ) | 103.7 | % | ||||

| Net loss |

$ | (3,756 | ) | $ | (1,881 | ) | 99.7 | % | ||||

| Variable Marketing Margin |

$ | 33,091 | $ | 32,830 | 0.8 | % | ||||||

| Adjusted EBITDA(1) |

$ | 1,433 | $ | 6,599 | -78.3 | % | ||||||

| Six Months Ended June 30, | Change | |||||||||||

| 2022 | 2021 | % | ||||||||||

| (in thousands) | ||||||||||||

| Loss from operations |

$ | (9,519 | ) | $ | (5,666 | ) | 68.0 | % | ||||

| Net loss |

$ | (9,471 | ) | $ | (5,682 | ) | 66.7 | % | ||||

| Variable Marketing Margin |

$ | 67,355 | $ | 64,268 | 4.8 | % | ||||||

| Adjusted EBITDA(1) |

$ | 3,859 | $ | 11,399 | -66.1 | % | ||||||

| (1) |

Adjusted EBITDA is a non-GAAP measure. Please see “EverQuote, Inc. Reconciliation of Non-GAAP Measures to GAAP” below for more information. |

To supplement the Company’s financial statements presented in accordance with GAAP and to provide investors with additional information regarding EverQuote’s financial results, the Company has presented Adjusted. EBITDA as a non-GAAP financial measure. This non-GAAP financial measure is not based on any standardized methodology prescribed by GAAP and is not necessarily comparable to similarly titled measures presented by other companies.

The Company defines Adjusted EBITDA as net income (loss), excluding the impact of stock-based compensation expense; depreciation and amortization expense; acquisition-related costs; legal settlement; one-time severance charges; interest income; and income taxes. The most directly comparable GAAP measure is net income (loss). The Company monitors and presents Adjusted EBITDA because it is a key measure used by management and the board of directors to understand and evaluate operating performance, to establish budgets and to develop operational goals for managing EverQuote’s business. In particular, the Company believes that excluding the impact of these items in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of EverQuote’s core operating performance.

The Company’s non-GAAP financial measures are not prepared in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income (loss), which is the most directly comparable financial measure calculated and presented in accordance with GAAP. In addition, other companies may use other measures to evaluate their performance, which could reduce the usefulness of the Company’s non-GAAP financial measures as tools for comparison.

The following table reconciles Adjusted EBITDA to net income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP.

EVERQUOTE, INC.

RECONCILIATION OF NON-GAAP MEASURES TO GAAP

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||

| Net loss |

$ | (3,756 | ) | $ | (1,881 | ) | $ | (9,471 | ) | $ | (5,682 | ) | ||||

| Stock-based compensation |

7,600 | 7,089 | 15,130 | 14,609 | ||||||||||||

| Depreciation and amortization |

1,405 | 1,136 | 2,916 | 2,310 | ||||||||||||

| Acquisition-related |

(3,779 | ) | 265 | (4,671 | ) | 186 | ||||||||||

| Interest income |

(37 | ) | (10 | ) | (45 | ) | (24 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | 1,433 | $ | 6,599 | $ | 3,859 | $ | 11,399 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Exhibit 99.2

Investor Presentation August 2022 Proprietary Information Disclaimer This presentation contains forward-looking statements.

All statements other than statements of historical facts contained in this presentation, including statements regarding possible or assumed future results of operations, business strategies, development plans, regulatory activities, competitive position, potential growth opportunities, & the effects of competition are forward-looking statements. These statements involve known & unknown risks, uncertainties & other important factors that may cause actual results, performance or achievements of EverQuote, Inc. (“the Company”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expect,” “plan,” “project,” “estimate,” “guidance,” or “potential” or the negative of these terms or other similar expressions. The forward-looking statements in this presentation are only predictions. The Company has based these forward-looking statements largely on its current expectations & projections about future events & financial trends that it believes may affect the Company’s business, financial condition & results of operations. These forward-looking statements speak only as of the date of this presentation & are subject to a number ofrisks, uncertainties & assumptions, some of which cannot be predicted or quantified & some of which are beyond the Company’s control. The events & circumstances reflected in the Company’s forward-looking statements may not be achieved or occur, & actual results could differ materially from those projected in the forward-looking statements, including as a result of: (1) the Company’s ability to attract and retain consumers and insurance providers using the Company’s marketplace; (2) the Company’s ability to maintain or increase the amount providers spend per quote request; (3) the impact on the Company and the insurance industry of the COVID-19 pandemic; (4) the effectiveness of the Company’s growth strategies and its ability to effectively manage growth; (5) the Company’s ability to maintain and build its brand; (6) the Company’s reliance on its third-party service providers; (7) the Company’s ability to develop new and enhanced products and services to attract and retain consumers and insurance providers, and the Company’s ability to successfully monetize them; (8) the impact of competition in the Company’s industry and innovation by the Company’s competitors; (9) the expected recovery of the auto insurance industry; (10) developments regarding the insurance industry and the transition to online marketing; (11) the Company’s ability to successfully integrate PolicyFuel; (12) the Company’s ability to successfully remediate the material weaknesses identified in the Company’s internal controls over financial reporting; and (13) the possible impacts of inflation; (14)as a result of the risks described in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q & the other filings that the Company makes with the Securities & Exchange Commission from time to time. Moreover, new risk factors & uncertainties may emerge from time to time, & it is not possible for management to predict all risk factors & uncertainties that the Company may face. Except asrequired by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. The Company’s presentation also contains estimates, projections, & other information concerning the Company’s industry, the Company’s business & the markets for certain of the Company’s products & services, including data regarding the estimated size of those markets. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties & actual events or circumstances may differ materially from events & circumstances reflectedin this information. Unless otherwise expressly stated, the Company obtained this industry, business, market & other data from reports, research surveys, studies & similar data preparedbymarket research firms & other third parties, from industry, general publications, & from government data & similar sources. The Company presents Adjusted EBITDA as a non-GAAP measure, which is not a substitute for or superior to, other measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure is included in the Appendix to these slides. Proprietary Information 2 Our vision Become the largest online source of insurance policies by using data and technology to make insurance simpler, more affordable and personalized, ultimately reducing cost and risk.

Proprietary Information 3

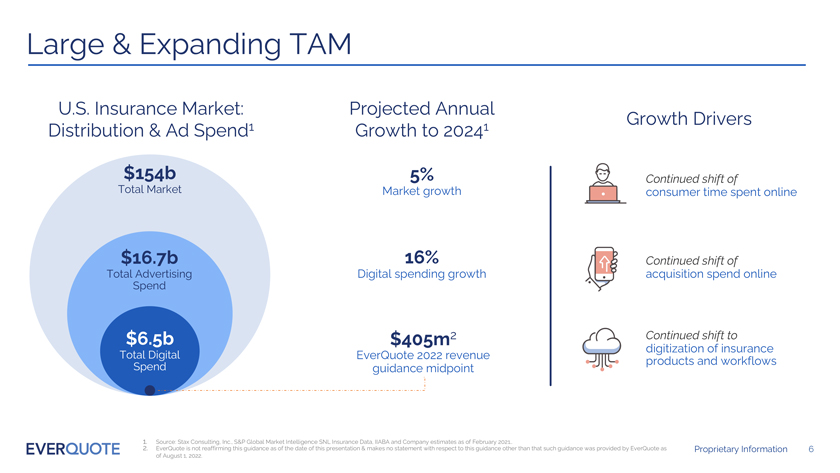

Key Investment Highlights Insurance Marketplace Leader Extensive Distribution Leading multi-vertical online insurance marketplace providing Extensive distribution channels with third-party marketplace compelling benefits for consumers and insurance providers (carriers and local agents) and first-party DTCA1 offerings Massive Market Opportunity Diversified Business Model $154b in annual insurance distribution and advertising spend in Multi-vertical insurance market with diversified distribution the early phases of shifting online provides multi-year tailwind channels creates resilience in business model Proprietary Tech and Data Compelling Financial Model Proprietary platforms built on highly integrated machine Targeting 20+% average annual revenue growth over the long-learning assets support rapid growth and drive network effects term with expanding Adjusted EBITDA margin2 1. “DTCA” refers to Direct-to-Consumer Agency 2. Based on the compound annual growth rate (CAGR) from 2016 –2021 of Revenue and Adjusted EBITDA of 28% and 37%, respectively. Company anticipates industry headwinds will result in Proprietary Information 4 current year growth below long-term targets.

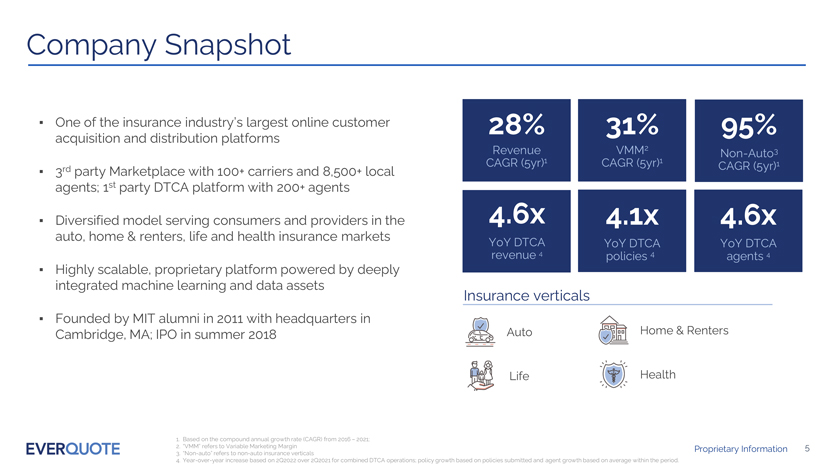

Company Snapshot One of the insurance industry’s largest online customer acquisition and distribution platforms 3rd party Marketplace with 100+ carriers and 8,500+ local agents; 1st party DTCA platform with 200+ agents Diversified model serving consumers and providers in the auto, home & renters, life and health insurance markets Highly scalable, proprietary platform powered by deeply integrated machine learning and data assets Founded by MIT alumni in 2011 with headquarters in Cambridge, MA; IPO in summer 2018 28% 31% 95% Revenue VMM2 Non-Auto3 CAGR (5yr)1 CAGR (5yr)1 CAGR (5yr)1 4.6x 4.1x 4.6x YoY DTCA YoY DTCA YoY DTCA revenue 4 policies 4 agents 4 Insurance verticals Auto Home & Renters Life Health 1. Based on the compound annual growth rate (CAGR) from 2016 – 2021; 2. “VMM” refers to Variable Marketing Margin Proprietary Information 5 3. “Non-auto” refers to non-auto insurance verticals 4. Year-over-year increase based on 2Q2022 over 2Q2021 for combined DTCA operations; policy growth based on policies submitted and agent growth based on average within the period.

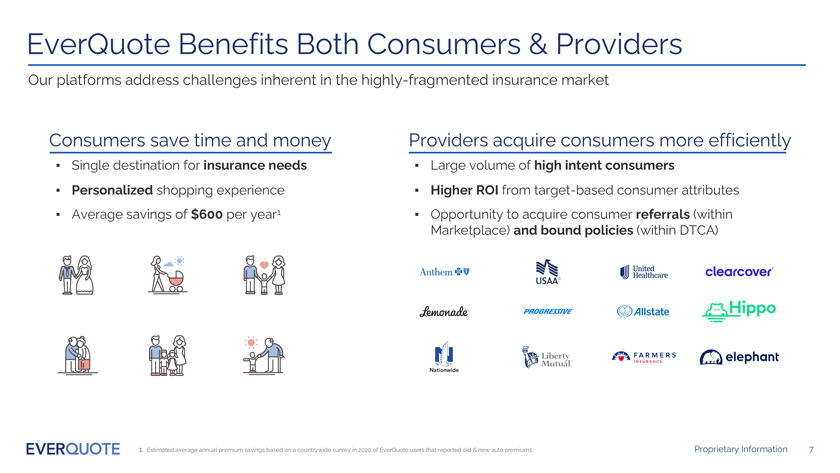

EverQuote Benefits Both Consumers & Providers Our platforms address challenges inherent in the highly-fragmented insurance market Consumers save time and money Providers acquire consumers more efficiently â–ª Single destination for insurance needs â–ª Large volume of high intent consumers â–ª Personalized shopping experience â–ª Higher ROI from target-based consumer attributes â–ª Average savings of $600 per year1 â–ª Opportunity to acquire consumer referrals (within Marketplace) and bound policies (within DTCA) 1. Estimated average annual premium savings based on a countrywide survey in 2020 of EverQuote users that reported old & new auto premiums.

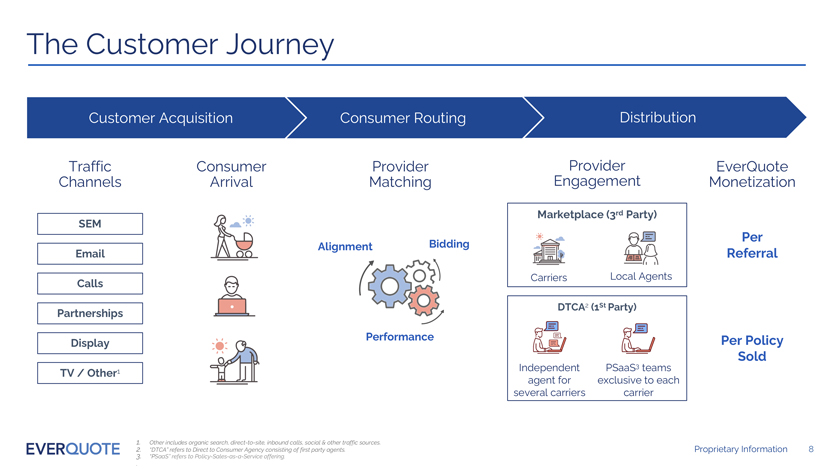

Proprietary Information 7 The Customer Journey Customer Acquisition Consumer Routing Marketplace Distribution Traffic Consumer Provider Provider EverQuote Channels Arrival Matching Engagement Monetization Marketplace (3rd Party) SEM Per Alignment Bidding Email Referral Carriers Local Agents Calls DTCA2 (1St Party) Partnerships Performance Per Policy Display Sold Independent PSaaS3 teams TV / Other1 agent for exclusive to each several carriers carrier 1. Other includes organic search, direct-to-site, inbound calls, social & other traffic sources. 2. “DTCA” refers to Direct to Consumer Agency consisting of first party agents. Proprietary Information 8 3. “PSaaS” refers to Policy-Sales-as-a-Service offering. .

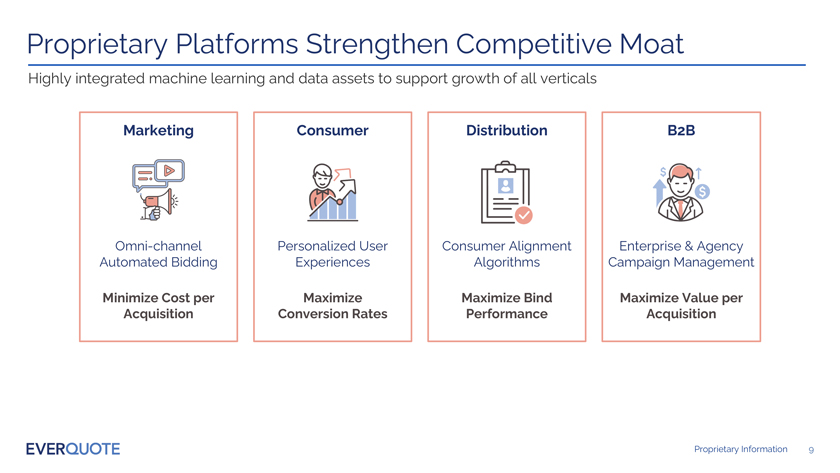

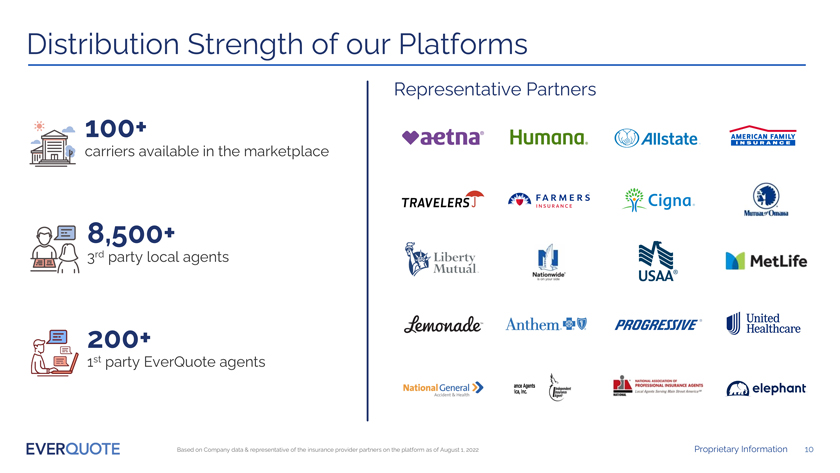

Proprietary Platforms Strengthen Competitive Moat Highly integrated machine learning and data assets to support growth of all verticals Marketing Consumer Distribution B2B Omni-channel Personalized User Consumer Alignment Enterprise & Agency Automated Bidding Experiences Algorithms Campaign Management Minimize Cost per Maximize Maximize Bind Maximize Value per Acquisition Conversion Rates Performance Acquisition Proprietary Information 9 Distribution Strength of our Platforms Representative Partners 100+ carriers available in the marketplace 8,500+ 3rd party local agents 200+ 1st party EverQuote agents Based on Company data & representative of the insurance provider partners on the platform as of August 1, 2022 Proprietary Information 10

Creating a World-Class DTCA Platform EVER agents serve consumers in all of our insurance verticals $13.1m 13% $7.5m PSaaS model for Auto and Home verticals; EVER 2Q22 revenue 2Q22 revenue; 2Q22 Health agents dedicated exclusively to selling a specific % of total revenue carrier’s policies Independent agent model in Life and Health verticals; 4.6x 4.1x +84 EVER advisors work with multiple carriers YoY revenue 2 YoY policies 2 NPS3 Broadens access to the $137b commission TAM1 component of insurance distribution spend shifting online Opportunity to improve shopping experience, build Representative DTCA Customer Review lifetime consumer relationships and enhance “I can’t thank Erica enough for her patience, kindness, and monetization compassion she extended to me as I set up a new health care Started in 2020 with in-house effort; by plan for my family. Also, the ability to call and email back and complemented work with the same person who is familiar with you and what acquiring CrossPointe Insurance, which we renamed you need is outstanding!! Great customer service, looking Eversurance, and PolicyFuel forward to a long professional relationship.” - Stephen 1. Source: Stax Consulting, Inc., S&P Global Market Intelligence SNL Insurance Data, IIABA and Company estimates. 2. Year-over-year increase based on 2Q2022 over 2Q2021 inclusive of revenue resulting from acquisition of PolicyFuel. Proprietary Information 11 3. Net Promoter Score based on surveys (Nov 2021 – Jan 2022) of consumers who submitted policies through our DTCA, the health Annual Enrollment Period in 4Q21.

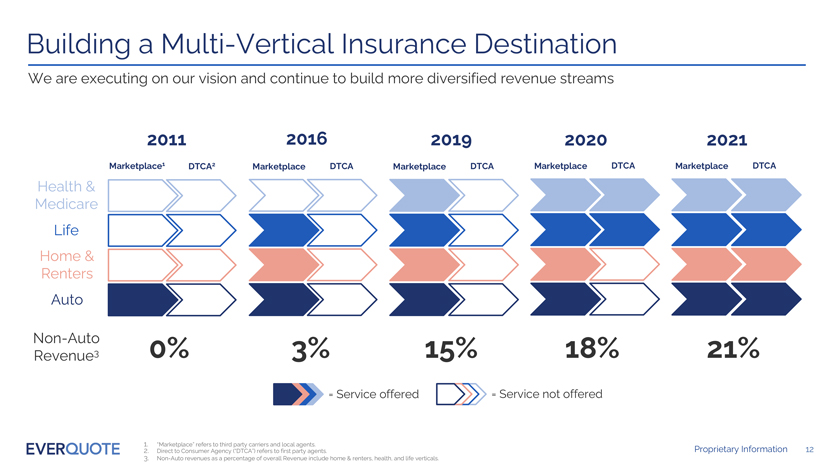

Building a Multi-Vertical Insurance Destination We are executing on our vision and continue to build more diversified revenue streams 2011 2016 2019 2020 2021 Marketplace1 DTCA2 Marketplace DTCA Marketplace DTCA Marketplace DTCA Marketplace DTCA Health & Medicare Life Home & Renters Auto Non-Auto 0% 3% 15% 18% 21% Revenue3 = Service offered = Service not offered 1. “Marketplace” refers to third party carriers and local agents. 2. Direct to Consumer Agency (“DTCA”) refers to first party agents. Proprietary Information 12 3. Non-Auto revenues as a percentage of overall Revenue include home & renters, health, and life verticals.

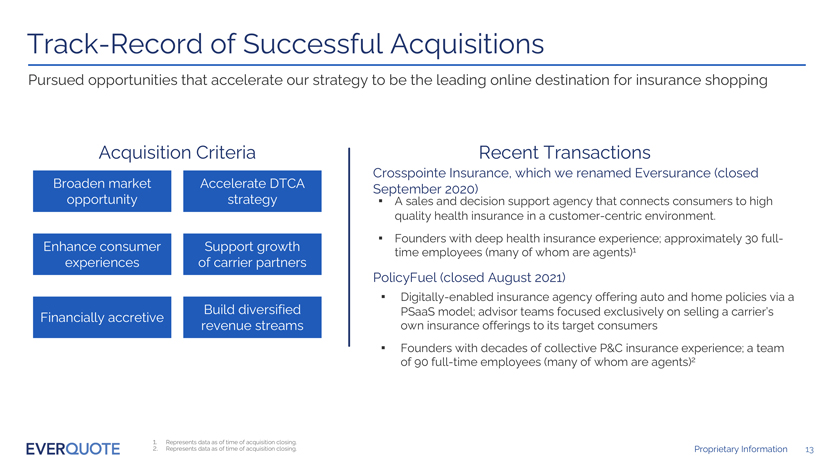

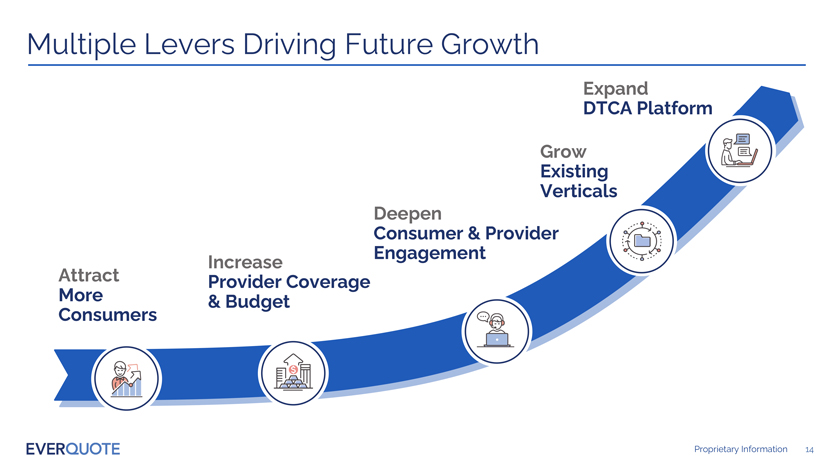

Track-Record of Successful Acquisitions Pursued opportunities that accelerate our strategy to be the leading online destination for insurance shopping Acquisition Criteria Recent Transactions Crosspointe Insurance, which we renamed Eversurance (closed Broaden market Accelerate DTCA September 2020) opportunity strategy â–ª A sales and decision support agency that connects consumers to high quality health insurance in a customer-centric environment. â–ª Founders with deep health insurance experience; approximately 30 full-Enhance consumer Support growth time employees (many of whom are agents)1 experiences of carrier partners PolicyFuel (closed August 2021) â–ª Digitally-enabled insurance agency offering auto and home policies via a Build diversified PSaaS model; advisor teams focused exclusively on selling a carrier’s Financially accretive revenue streams own insurance offerings to its target consumers â–ª Founders with decades of collective P&C insurance experience; a team of 90 full-time employees (many of whom are agents)2 1. Represents data as of time of acquisition closing. 2. Represents data as of time of acquisition closing. Proprietary Information 13 Multiple Levers Driving Future Growth Expand DTCA Platform Grow Existing Verticals Deepen Consumer & Provider Engagement Increase Attract Provider Coverage More & Budget Consumers Proprietary Information 14

Financial Overview Proprietary Information 15

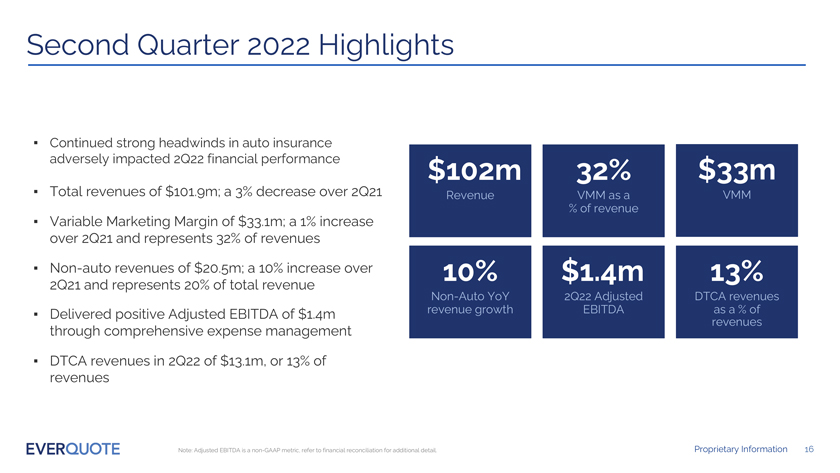

SecondQuarter2022 Highlights â–ª Continued strong headwinds in auto insurance adversely impacted 2Q22 financial performance $102m 32% $33m â–ª Total revenues of $101.9m; a 3% decrease over 2Q21 Revenue VMM as a VMM % of revenue â–ª Variable Marketing Margin of $33.1m; a 1% increase over 2Q21 and represents 32% of revenues â–ª Non-auto revenues of $20.5m; a 10% increase over 10% $1.4m 13% 2Q21 and represents 20% of total revenue Non-Auto YoY 2Q22 Adjusted DTCA revenues â–ª Delivered positive Adjusted EBITDA of $1.4m revenue growth EBITDA as a % of revenues through comprehensive expense management â–ª DTCA revenues in 2Q22of $13.1m, or 13% of revenues Note: Adjusted EBITDA is a non-GAAP metric, refer to financial reconciliation for additional detail.

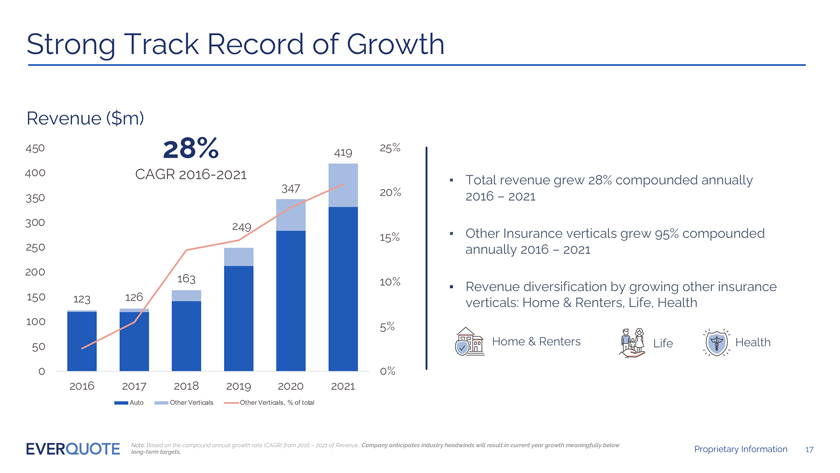

Proprietary Information 16 Strong Track Record Track Record of Growth of Strong Growth Revenue ($m) 450 28% 419 25% 400 CAGR 2016-2021 â–ª Total revenue grew 28% compounded annually 347 20% 350 2016 –2021 300 249 15% â–ª Other Insurance verticals grew 95% compounded 250 annually 2016 –2021 200 163 10% â–ª Revenue diversification by growing other insurance 150 123 126 verticals: Home & Renters, Life, Health 100 5% 50 Home & Renters Life Health 0 0% 2016 2017 2018 2019 2020 2021 Auto Other Verticals Other Verticals, % of total Note: Based on the compound annual growth rate (CAGR) from 2016 –2021 of Revenue.. Company anticipates industry headwinds will result in current year growth meaningfully below Proprietary Information 17 long-term targets.

Delivering Incremental Variable Marketing Margin Variable Marketing Margin ($m) 32% 31% 31.3% 129.6 31.0% CAGR 2016-2021 31% 108.6 â–ª VMM grew 31% compounded annually 2016 –2021 30% 29.5% â–ª Proprietary platforms have driven increasing VMM as a percentage of revenue (VMM%) since 2016 73.3 29% 28.3% 28.2% 28% â–ª Auto insurance headwinds in 2H21 adversely 27.4% 46.1 impacted VMM and associated % 33.6 35.8 27% â–ª Potential for incremental improvement in VMM% from higher VMM margins associated DTCA and 26% customer cross-selling 25% 2016 2017 2018 2019 2020 2021 Variable Marketing Margin % Note: Beginning in the first quarter of 2019, we revised our definition of variable marketing margin, or VMM. The VMM displayed above reflects our revised definition of VMM for all years Proprietary Information 18 presented. Refer to Key Metrics Definitions in the Appendix for a definition of VMM.

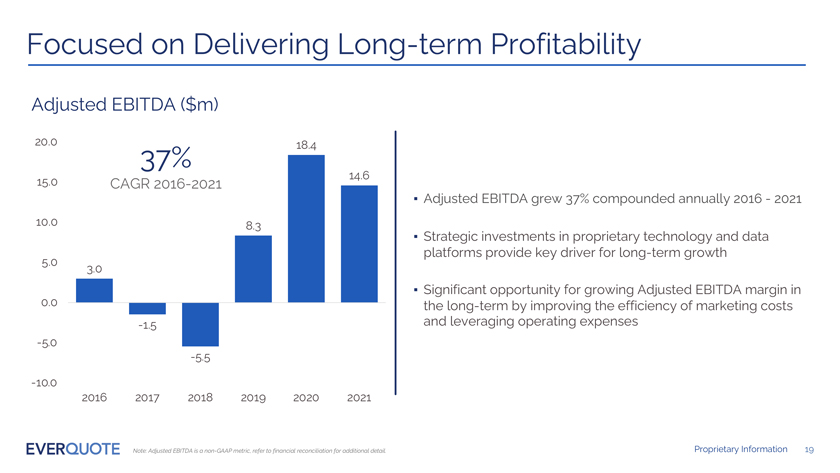

Focused on Delivering Long-term Profitability Adjusted EBITDA ($m) 20.0 37% 18.4 14.6 15.0 CAGR 2016-2021 â–ª Adjusted EBITDA grew 37% compounded annually 2016 -2021 10.0 8.3 â–ª Strategic investments in proprietary technology and data platforms provide key driver for long-term growth 5.0 3.0 2018 â–ª Significant opportunity for growing Adjusted EBITDA margin in 0.0 the long-term by improving the efficiency of marketing costs -1.5 and leveraging operating expenses -5.0 -5.5 -10.0 2016 2017 2018 2019 2020 2021 Note: Adjusted EBITDA is a non-GAAP metric, refer to financial reconciliation for additional detail. Proprietary Information 19 NASDAQ: EVER Proprietary Information 20

Appendix Proprietary Information 21

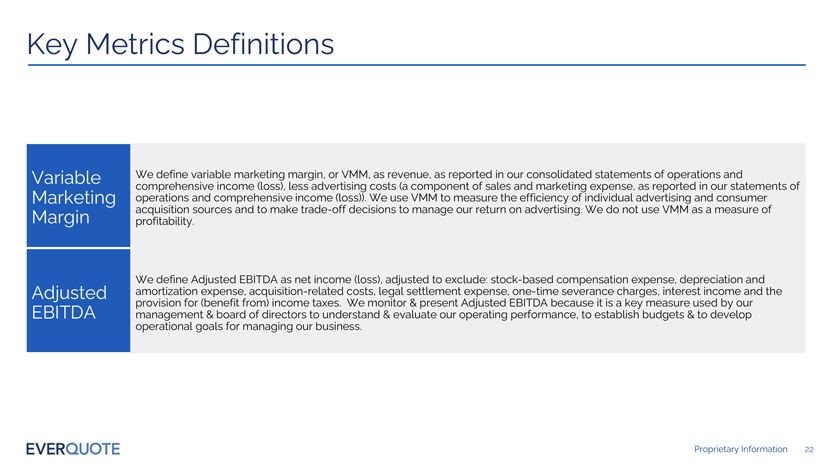

Key Metrics Definitions Variable We define variable marketing margin, or VMM, as revenue, as reported in our consolidated statements of operations and comprehensive income (loss), less advertising costs (a component of sales and marketing expense, as reported in our statements of Marketing operations and comprehensive income (loss)). We use VMM to measure the efficiency of individual advertising and consumer Margin acquisition sources and tomaketrade-offdecisionsto manage our return on advertising. We do not use VMM as a measure of profitability. We define Adjusted EBITDA as net income (loss), adjusted to exclude:stock-based compensation expense, depreciation and Adjusted amortization expense, acquisition-related costs, legal settlement expense, one-time severance charges, interest income and the provision for (benefit from) income taxes. We monitor & present Adjusted EBITDA because it is a key measure used by our EBITDA management & board of directors to understand & evaluate our operating performance, to establish budgets & to develop operational goals for managing our business.

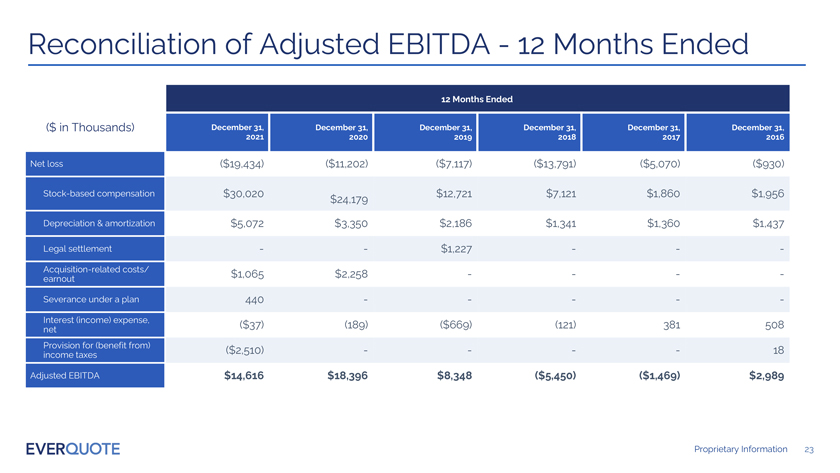

Proprietary Information 22 Reconciliation of Adjusted EBITDA -12 Months Ended 12 Months Ended ($ in Thousands) December 31, December 31, December 31, December 31, December 31, December 31, 2021 2020 2019 2018 2017 2016 Net loss ($19,434) ($11,202) ($7,117) ($13,791) ($5,070) ($930) Stock-based compensation $30,020 $12,721 $7,121 $1,860 $1,956 $24,179 Depreciation & amortization $5,072 $3,350 $2,186 $1,341 $1,360 $1,437 Legal settlement — $1,227 — -Acquisition-related costs/ $1,065 $2,258 — —earnout Severance under a plan 440 — —— Interest (income) expense, ($37) (189) ($669) (121) 381 508 net Provision for (benefit from) ($2,510) — — 18 income taxes Adjusted EBITDA $14,616 $18,396 $8,348 ($5,450) ($1,469) $2,989 Proprietary Information 23 Reconciliation of Adjusted EBITDA -3 Months Ended 3 Months Ended ($ in Thousands) June 30, March 31, December 31, September 30, June 30, 2022 2022 2021 2021 2021 Net loss ($3,756) ($5,715) ($8,480) ($5,272) ($1,881) Stock-based compensation $7,600 $7,530 $7,063 $8,348 $7,089 Depreciation & amortization $1,405 $1,511 $1,464 $1,298 $1,136 Legal settlement — — -Acquisition-related costs/ ($3,779) ($892) $60 $819 $265 earnout Severance under a plan — 440 — Interest expense, net ($37) ($8) ($4) ($9) ($10) Provision for (benefit from) ——($2,510) -income taxes Adjusted EBITDA $1,433 $2,426 $543 $2,674 $6,599 Proprietary Information 24